-

@ 8bad92c3:ca714aa5

2025-06-09 02:01:46

@ 8bad92c3:ca714aa5

2025-06-09 02:01:46Key Takeaways

Michael Goldstein, aka Bitstein, presents a sweeping philosophical and economic case for going “all in” on Bitcoin, arguing that unlike fiat, which distorts capital formation and fuels short-term thinking, Bitcoin fosters low time preference, meaningful saving, and long-term societal flourishing. At the heart of his thesis is “hodling for good”—a triple-layered idea encompassing permanence, purpose, and the pursuit of higher values like truth, beauty, and legacy. Drawing on thinkers like Aristotle, Hoppe, and Josef Pieper, Goldstein redefines leisure as contemplation, a vital practice in aligning capital with one’s deepest ideals. He urges Bitcoiners to think beyond mere wealth accumulation and consider how their sats can fund enduring institutions, art, and architecture that reflect a moral vision of the future.

Best Quotes

“Let BlackRock buy the houses, and you keep the sats.”

“We're not hodling just for the sake of hodling. There is a purpose to it.”

“Fiat money shortens your time horizon… you can never rest.”

“Savings precedes capital accumulation. You can’t build unless you’ve saved.”

“You're increasing the marginal value of everyone else’s Bitcoin.”

“True leisure is contemplation—the pursuit of the highest good.”

“What is Bitcoin for if not to make the conditions for magnificent acts of creation possible?”

“Bitcoin itself will last forever. Your stack might not. What will outlast your coins?”

“Only a whale can be magnificent.”

“The market will sell you all the crack you want. It’s up to you to demand beauty.”

Conclusion

This episode is a call to reimagine Bitcoin as more than a financial revolution—it’s a blueprint for civilizational renewal. Michael Goldstein reframes hodling as an act of moral stewardship, urging Bitcoiners to lower their time preference, build lasting institutions, and pursue truth, beauty, and legacy—not to escape the world, but to rebuild it on sound foundations.

Timestamps

00:00 - Intro

00:50 - Michael’s BBB presentation Hodl for Good

07:27 - Austrian principles on capital

15:40 - Fiat distorts the economic process

23:34 - Bitkey

24:29 - Hodl for Good triple entendre

29:52 - Bitcoin benefits everyone

39:05 - Unchained

40:14 - Leisure theory of value

52:15 - Heightening life

1:15:48 - Breaking from the chase makes room for magnificence

1:32:32 - Nakamoto Institute’s missionTranscript

(00:00) Fiat money is by its nature a disturbance. If money is being continually produced, especially at an uncertain rate, these uh policies are really just redistribution of wealth. Most are looking for number to go up post hyper bitcoinization. The rate of growth of bitcoin would be more reflective of the growth of the economy as a whole.

(00:23) Ultimately, capital requires knowledge because it requires knowing there is something that you can add to the structures of production to lengthen it in some way that will take time but allow you to have more in the future than you would today. Let Black Rockck buy the houses and you keep the sats, not the other way around.

(00:41) You wait until later for Larry Frink to try to sell you a [Music] mansion. And we're live just like that. Just like that. 3:30 on a Friday, Memorial Day weekend. It's a good good good way to end the week and start the holiday weekend. Yes, sir. Yes, sir. Thank you for having me here. Thank you for coming. I wore this hat specifically because I think it's I think it's very apppropo uh to the conversation we're going to have which is I hope an extension of the presentation you gave at Bitblock Boom Huddle for good. You were working on

(01:24) that for many weeks leading up to uh the conference and explaining how you were structuring it. I think it's a very important topic to discuss now as the Bitcoin price is hitting new all-time highs and people are trying to understand what am I doing with Bitcoin? Like you have you have the different sort of factions within Bitcoin.

(01:47) Uh get on a Bitcoin standard, get on zero, spend as much Bitcoin as possible. You have the sailors of the world are saying buy Bitcoin, never sell, die with your Bitcoin. And I think you do a really good job in that presentation. And I just think your understanding overall of Bitcoin is incredible to put everything into context. It's not either or.

(02:07) It really depends on what you want to accomplish. Yeah, it's definitely there there is no actual one-sizefits-all um for I mean nearly anything in this world. So um yeah, I mean first of all I mean there was it was the first conference talk I had given in maybe five years. I think the one prior to that uh was um bit block boom 2019 which was my meme talk which uh has uh become infamous and notorious.

(02:43) So uh there was also a lot of like high expectations uh you know rockstar dev uh has has treated that you know uh that that talk with a lot of reference. a lot of people have enjoyed it and he was expecting this one to be, you know, the greatest one ever, which is a little bit of a little bit of a uh a burden to live up to those kinds of standards.

(03:08) Um, but you know, because I don't give a lot of talks. Um, you know, I I I like to uh try to bring ideas that might even be ideas that are common. So, something like hodling, we all talk about it constantly. uh but try to bring it from a little bit of a different angle and try to give um a little bit of uh new light to it.

(03:31) I alsove I've I've always enjoyed kind of coming at things from a third angle. Um whenever there's, you know, there's there's all these little debates that we have in in Bitcoin and sometimes it's nice to try to uh step out of it and look at it a little more uh kind of objectively and find ways of understanding it that incorporate the truths of of all of them.

(03:58) uh you know cuz I think we should always be kind of as much as possible after ultimate truth. Um so with this one um yeah I was kind of finding that that sort of golden mean. So uh um yeah and I actually I think about that a lot is uh you know Aristotle has his his concept of the golden mean. So it's like any any virtue is sort of between two vices um because you can you can always you can always take something too far.

(04:27) So you're you're always trying to find that right balance. Um so someone who is uh courageous you know uh one of the vices uh on one side is being basically reckless. I I can't remember what word he would use. Uh but effectively being reckless and just wanting to put yourself in danger for no other reason than just you know the thrill of it.

(04:50) Um and then on the other side you would just have cowardice which is like you're unwilling to put yourself um at any risk at any time. Um, and courage is right there in the middle where it's understanding when is the right time uh to put your put yourself, you know, in in the face of danger um and take it on. And so um in some sense this this was kind of me uh in in some ways like I'm obviously a partisan of hodling.

(05:20) Um, I've for, you know, a long time now talked about the, um, why huddling is good, why people do it, why we should expect it. Um, but still trying to find that that sort of golden mean of like yes, huddle, but also what are we hodling for? And it's not we're we're not hodddling just merely for the sake of hodddling.

(05:45) There there is a a purpose to it. And we should think about that. And that would also help us think more about um what are the benefits of of spending, when should we spend, why should we spend, what should we spend on um to actually give light to that sort of side of the debate. Um so that was that was what I was kind of trying to trying to get into.

(06:09) Um, as well as also just uh at the same time despite all the talk of hodling, there's always this perennial uh there's always this perennial dislike of hodlers because we're treated as uh as if um we're just free riding the network or we're just greedy or you know any of these things. And I wanted to show how uh huddling does serve a real economic purpose.

(06:36) Um, and it does benefit the individual, but it also does uh it it has actual real social um benefits as well beyond merely the individual. Um, so I wanted to give that sort of defense of hodling as well to look at it from um a a broader position than just merely I'm trying to get rich. Um uh because even the person who uh that is all they want to do um just like you know your your pure number grow up go up moonboy even that behavior has positive ramifications on on the economy.

(07:14) And while we might look at them and have uh judgments about their particular choices for them as an individual, we shouldn't discount that uh their actions are having positive positive effects for the rest of the economy. Yeah. So, let's dive into that just not even in the context of Bitcoin because I think you did a great job of this in the presentation.

(07:36) just you've done a good job of this consistently throughout the years that I've known you. Just from like a first principles Austrian economics perspective, what is the idea around capital accumulation, low time preference and deployment of that capital like what what like getting getting into like the nitty-gritty and then applying it to Bitcoin? Yeah, it's it's a big question and um in many ways I mean I I even I barely scratched the surface.

(08:05) uh I I can't claim to have read uh all the volumes of Bombber works, you know, capital and interest and and stuff like that. Um but I think there's some some sort of basic concepts that we can look at that we can uh draw a lot out. Um the first uh I guess let's write that. So repeat so like capital time preference. Yeah. Well, I guess getting more broad like why sav -

@ 9ca447d2:fbf5a36d

2025-06-09 02:01:26

@ 9ca447d2:fbf5a36d

2025-06-09 02:01:26El Salvador – June 3, 2025 — The grassroots Bitcoin community of El Salvador is proud to announce the return of Bitcoin Week, taking place this November with five dynamic events celebrating Bitcoin adoption, education, and community-led innovation.

Join us for a week of inspiration, collaboration, and impact.

Bitcoin Week 2025 calendar

📍 November 12 – Bitcoin Education Celebration Gala: Kick off the week in style with a luxurious and intimate evening at a high-class dinner, celebrating “proof of work” and the achievements of the Bitcoin education movement.

Expect major plans for the year(s) ahead but also a reflection to past proof-of-work—and don’t miss out on the Great Grassroots Giveaway, included with every ticket.📍 November 13 – Bitcoin Educators Unconference: Hosted for the third time in San Salvador at Cadejo Montaña, this sixth edition of the Educators Unconference embodies our commitment to provide a space for decentralized, community-led conversations.

Join educators and leaders shaping the global Bitcoin conversation!📍 November 14–15 – Adopting Bitcoin: The Network Effect: Now in its fifth year, Adopting Bitcoin returns with a powerful focus on real-world Bitcoin usage across global communities.

This year’s theme—The Network Effect—explores how interconnected local initiatives can spark exponential growth in adoption.📍 November 16 – Visit Bitcoin Beach, El Zonte: Make your way to Bitcoin Beach, the heart of El Salvador’s Bitcoin story. Enjoy a day of connection and discovery in this iconic beachside town. Full details coming soon.

📍 November 22–23 – Economía Bitcoin, Berlín: Head to the town of Berlín, El Salvador for the second edition of Economía Bitcoin, a powerful, small-scale conference and festival focused on circular economies and practical Bitcoin use.

Spend sats freely in town and see how local action drives global impact.With five unique events across three regions in Bitcoin Country, this edition of Bitcoin Week is your chance to experience El Salvador’s Bitcoin journey up close. Whether you’re an educator, builder, Bitcoiner, or simply curious—you’re invited.

Join us this November. Be part of the movement.

-

@ 81022b27:2b8d0644

2025-06-09 01:41:45

@ 81022b27:2b8d0644

2025-06-09 01:41:45a delicious meditation

Those of you who know me are aware that I worked in the fast-food industry before becoming a chiropractor. My first job was at a Hardee's restaurant when I was fifteen.

I wanted to buy a car, which is why I started working. Once I bought the car, I realized I needed to continue working to maintain it, pay for gas, insurance, and the occasional "going out" money.

In the restaurant business, if you work at a place long enough, someone hands you a set of keys and puts you in charge of something.

So here I was, running a restaurant and in charge of a bunch of people, when I could barely take care of myself. Anyway, I was making what I thought was decent money for a 19-year-old.

My bosses started a new restaurant venture, and little by little, they began poaching the old management staff from Hardee’s. Eventually, they asked me to come work for them.

My new job was running a Church's Chicken. The stores were small, mostly takeout. The menu was small, and we didn't have many employees to manage. We didn't have a good reputation in the community due to poor management.

The owners introduced new registers, and sales immediately jumped. I suppose all the food was now being rung up and accounted for!

We cleaned up the restaurant and made sure we were putting out a good product, and guess what?

Sales doubled.

So here I am, thinking I know what I'm doing because I'm getting recognition from my bosses.

I didn't have the interpersonal skills to manage people effectively.

One time, I got into it with an employee but couldn't confront him to fire him, so I deleted him from the time clock. Let someone else deal with that.

Dealing with customers was usually okay because if they had an issue, you could just fix the problem, and that was it. Handling employees was a bit more challenging for me.

On busy days-Fridays, Saturdays, and Mother's Day (they called that the day after the welfare checks came out)

The restaurant would get so busy that sometimes people would line up around the building, and I felt that everyone was staring at me, which made me feel uncomfortable.

The store had windows all around; it was like a fishbowl-everyone saw everything.

I could have gone to hide in the office, but I needed to help out. I liked to run a tight ship labor-wise, so I always counted myself as one of the staff needed.

I would ask the cook to let me make the chicken and assign them some other tasks.

Even though I was probably even more visible than before, I would get lost in the work.

Everything was hand-breaded and battered. To me, it was like a Japanese tea ceremony.

When it was busy, we cooked a full "stove," which was 4 chickens at a time:

8 legs, 8 thighs, 8 wings, and 8 breasts.

The process was:

-

Flour, dip in batter, flour again.

-

Start with the legs because they take the longest to cook.

-

Continue until everything is in the fryer.

Repeat,

and repeat,

and repeat.

I would get lost in the work. You couldn't really rush things. I made sure everything was done by the book.

Focusing on one task so intently that every concern, every worry just faded away. I knew people were watching me cook the chicken in this fishbowl, but I was so engrossed in my task that I didn’t care.

All my stress and anxiety just faded.

I still try to lose myself in my work, only now it’s not frying chicken-it’s adjusting spines.

Now that I think about it, same situation. I’m “on stage” in my adjusting space with clients sitting in the waiting area.

Sometimes, I get stressed when there are a lot of people waiting on me…but I’m gonna do my best work frying this chi…

oops!

I mean adjusting this spine.

Zen teaching often emphasizes simplicity, mindfulness in daily activities, and the notion that enlightenment can be achieved in the ordinary moments of life. The phrase "chop wood, carry water" reflects this idea of finding the sacred in the mundane.

I found my Zen.

Find Yours.

❤️

-

-

@ 81022b27:2b8d0644

2025-06-09 01:37:31

@ 81022b27:2b8d0644

2025-06-09 01:37:31Shopping for groceries is one of my least favorite tasks. However, it's got to be done.

If I am in a hurry, I like to shop at Aldi, not only because they have decent prices but also because I can get in and out quickly (and I don’t have to scan my own groceries).

They are definitely no-frills in many ways: You have to bag your own groceries, you should bring your own bags—otherwise, you have to buy them, and to get a shopping cart, you need a quarter to unlock it.

I'm trying to rush and be efficient when I realize I don’t have "the quarter" for the shopping cart!

Dammit!

I’m going to have to go back to the car to see if I have one.

I'm swearing under my breath, thinking about having to walk all the way back when…

I notice someone has placed a quarter on the wall next to the row of carts.

THANK YOU!

This little act of kindness took me from a state of "being mildly annoyed at the entire world because traffic didn’t clear a path in front of me trying to get here" to feeling great gratitude.

The fact that someone considered that doing this would make my life easier knocked my selfish, self-involved ass out of my body.

I finished my shopping in a more cheerful, mindful way. The people in the aisles didn't seem to annoy me as much.

I took way longer than usual.

It wasn't a race anymore.

I checked out, loaded the car, and when I went to return the cart—

I left a quarter.

-

@ 81022b27:2b8d0644

2025-06-09 01:31:29

@ 81022b27:2b8d0644

2025-06-09 01:31:29We were just talking today about first impressions when meeting people. Sometimes I get an instant “dislike” to someone upon meeting, even though they have never done or said anything bad to me. The older I get, the more I will usually go with my gut instincts and not engage the person any deeper if possible.

One of the reasons that was brought up is that people who are not congruent with their words, thoughts, and actions are usually the ones that “turn me off”

You know these people, too. They are the ones with all the advice-yet their lives are in shambles, the “preachy” ones that have their closets full of skeletons.

I’ve been accused of “not having a filter” or “being too transparent” at times… but not usually about my stance on things. I’m not confrontational…but I’m not above turning around and wailing away from someone I can’t stomach.

Anyway, the purpose of this rambling post if to encourage you to drop the facade, if you have one-and be more yourself.

-

@ 502ab02a:a2860397

2025-06-09 01:04:40

@ 502ab02a:a2860397

2025-06-09 01:04:40มีคนจำนวนไม่น้อยที่เข้าใจว่าเรื่อง “อาหารแห่งอนาคต” คืออะไรที่เพิ่งเกิด เป็นแนวคิดใหม่สำหรับโลกยุคใหม่ แต่จริงๆ แล้วไม่ใช่เลยครับ เฮียว่าเราถูกจัดโต๊ะอาหารอนาคตไว้ให้กินมานานมากแล้ว เพียงแต่ไม่รู้ตัว ต่างหาก

ช่วงปลายคริสต์ศตวรรษที่ 19 สิ่งที่เรียกว่าการ “ควบคุมอาหารมวลชน” ก็เริ่มต้นอย่างจริงจังแล้ว

ย้อนกลับไปปี 1863 ในห้องพักคนไข้ของโรงพยาบาล Battle Creek Sanitarium ที่รัฐมิชิแกน สหรัฐฯ มีชายคนหนึ่งชื่อ John Harvey Kellogg เขาเป็นหมอและเป็นหนึ่งในสาวกของกลุ่ม Seventh-day Adventist ที่เชื่อว่าการกินเนื้อสัตว์ทำให้คนกระด้างใจและเต็มไปด้วยตัณหา เกิดราคะ เขาจึงคิดค้น “อาหารเช้าที่ไม่มีเนื้อ” เพื่อส่งเสริมสุขลักษณะและลดกิเลสในร่างกายมนุษย์ สิ่งที่เขาทำในตอนนั้นคือการใช้ข้าวโพดบดอบแห้งจนกรอบ กลายเป็นสิ่งที่เรียกว่า “ซีเรียล” ในยุคเริ่มต้น ซึ่งภายหลังน้องชายของเขาคือ Will Keith Kellogg จะนำสูตรนั้นไปพัฒนาให้หวานขึ้น ใส่น้ำตาลเพิ่ม ใส่โฆษณาเพิ่ม แล้วก็วางขายในชื่อแบรนด์ Kellogg’s ที่เราเห็นกันทุกเช้านั่นแหละ เขาผลิตคอร์นเฟลกขึ้นมาด้วยความเชื่อว่าจะช่วยลดการช่วยตัวเองในวัยรุ่นได้! จากอาหารของกลุ่มศาสนา คอร์นเฟลกกลายเป็นอาหารที่เข้าสู่ครัวเรือนอเมริกันภายใต้แนวคิดว่า “อาหารเช้าคือมื้อสำคัญที่สุดของวัน” โดยไม่ได้มีหลักฐานรองรับอย่างจริงจังเลย

ช่วงต้นศตวรรษที่ 20 เป็นยุคที่อเมริกาเริ่มมีอำนาจในเชิงอุตสาหกรรมมากขึ้น แต่ก็เป็นยุคที่คนยังทำอาหารกินเองอยู่ในครัว เรื่องอาหารยังเป็นเรื่องของบ้าน ไม่ใช่ของแบรนด์ ยังไม่มีใครนึกว่า “สิทธิ์ในการกิน” จะกลายเป็นสินค้าสาธารณะในภายหลัง แต่แล้วก็เกิดจุดเปลี่ยนสำคัญเมื่อสงครามโลกครั้งที่ 1 และ 2 ทำให้รัฐจำเป็นต้องคิดเรื่องการเลี้ยงประชากรในภาวะขาดแคลน ต้องมีการเก็บอาหารได้นาน ขนส่งได้ง่าย และต้นทุนต่ำ นี่คือจุดเริ่มต้นของการผลักดัน “อาหารแปรรูป” หรือ processed food อย่างเป็นทางการ

ในปี 1911 มีบริษัทชื่อว่า Procter & Gamble เปิดตัว “Crisco” ซึ่งเป็นน้ำมันพืชไฮโดรเจนเนตที่ถูกออกแบบมาเพื่อเลียนแบบไขมันสัตว์ในราคาถูกกว่า Crisco ทำจากน้ำมันฝ้าย (cottonseed oil) ซึ่งตอนนั้นเป็นของเหลือจากอุตสาหกรรมสิ่งทอ ไม่มีใครคิดว่ามันจะกลายเป็นสิ่งที่ถูกโฆษณาว่า “ดีกว่าไขมันสัตว์” แต่เพราะการโฆษณาแบบมืออาชีพและการจับมือกับสมาคมแพทย์ Crisco ก็กลายเป็นของคู่ครัวแบบไม่รู้ตัว นี่คือจุดเริ่มต้นของ fiat fat ไขมันเทียมที่ถูกสถาปนาให้เป็นของจริง ทั้งที่จริงๆ มันคือของปลอมที่ห่อด้วยวิทยาศาสตร์ครึ่งใบ

ช่วงปี 1910s ถึง 1930s คือยุคที่อุตสาหกรรมอาหารเริ่มโตเต็มที่ สหรัฐฯ เริ่มผลิต นมข้นหวาน สำหรับทหารในสงครามกลางเมือง และต่อยอดใช้ในสงครามโลกครั้งที่ 1 นมชนิดนี้เก็บได้นาน ไม่เน่า และมีพลังงานสูง ทหารหลายคนติดใจในรสชาติหวานมันแบบไม่มีอะไรเทียบได้ ซึ่งต่อมาทำให้มันกลายเป็นวัตถุดิบหลักในหลายเมนูทั่วโลก รวมถึง “ชาเย็น” บ้านเราที่ต้องมีนมข้นหวานเท่านั้นถึงจะใช่

เข้าสู่ช่วง สงครามโลกครั้งที่ 2 (1939–1945) คือช่วงหัวเลี้ยวหัวต่อสำคัญของ Fiat Food หรืออาหารที่ถูกผลิตจากตรรกะจำเป็นเชิงยุทธศาสตร์มากกว่าธรรมชาติ เฮียว่าช่วงนี้มันเหมือนโรงเรียนประถมของ Ultra-Processed Food สมัยใหม่เลยล่ะ ตัวอย่างชัดเจนคือ Spam เนื้อหมูกระป๋องที่ออกแบบให้ทหารพกพาสะดวก ไม่ต้องแช่เย็น เก็บได้นาน และอุดมด้วยโซเดียม หลังสงครามจบ มันกลายเป็นอาหารยอดฮิตในประเทศที่เคยเป็นแนวหน้า เช่น ฮาวาย เกาหลี ฟิลิปปินส์ และอังกฤษ โดยถูกโฆษณาว่าเป็น “ของดีจากอเมริกา” ทั้งที่ทหารหลายคนก็เบื่อมันจนเอียน

ในช่วงเดียวกันนั้นเอง ช็อกโกแลต Hershey's ก็ถูกพัฒนาเป็น “Field Ration D” หรือแท่งช็อกโกแลตพลังงานสูงที่ไม่ละลายในอุณหภูมิสูง สำหรับแจกให้ทหารทุกคนคนละแท่งติดตัวไว้ในสนามรบ พอสงครามจบ Hershey’s ก็ปรับสูตรให้กินง่ายขึ้น แล้วขายในเชิงพาณิชย์จนกลายเป็นแบรนด์ระดับโลกแบบที่เราเห็นทุกวันนี้

โพรเซสชีส เช่น Kraft และ Velveeta ก็ถูกออกแบบให้เก็บได้นานไม่เน่า ชีสพวกนี้ผสมสารอิมัลซิไฟเออร์ ทำให้ไม่แยกชั้นเมื่อถูกความร้อน เหมาะกับการผลิตอาหารจำนวนมากแบบโรงครัวทหาร เมื่อสงครามจบ Kraft เอาเทคโนโลยีนี้มาทำ “ชีสแผ่น” สำหรับเบอร์เกอร์และแซนด์วิช เป็นต้นแบบของอาหารฟาสต์ฟู้ดยุคใหม่แบบไร้กลิ่นชีสแท้

นมผง และ ไขมันพืชไฮโดรจิเนต ก็เริ่มเข้ามามีบทบาทในสงคราม โดยนมผงแทนที่นมสดในสนามรบ และไขมันพืชใช้ทำเบเกอรี่โดยไม่ต้องใช้เนยสด ซึ่งแพงกว่า หลังสงคราม สารให้ความหวานเทียมอย่าง ซัคคาริน ก็เริ่มถูกนำเสนอว่าเหมาะกับคนลดน้ำหนัก ทั้งที่มันมีจุดเริ่มจากความจำเป็นยามขาดแคลนน้ำตาลในสงคราม

ปี 1950s-1960s โลกเข้าสู่ยุคสงครามเย็น เทคโนโลยีการเก็บอาหารพัฒนาไปพร้อมกับเทคโนโลยีอวกาศ และหนึ่งในผลิตภัณฑ์ระดับตำนานคือ Tang น้ำส้มผงของบริษัท General Foods ที่ถูกส่งขึ้นไปพร้อมนักบินอวกาศ John Glenn ในปี 1962 Tang กลายเป็นสัญลักษณ์ของ “อนาคตในแก้วน้ำ” ทั้งที่ไม่มีผลไม้จริงเลยสักหยดเดียว แต่การตลาดที่อ้างว่า NASA ใช้ ทำให้มันขายดีระเบิด

ในระหว่างนั้น ปี 1955 ประธานาธิบดีไอเซนฮาวร์หัวใจวายกลางสนามกอล์ฟ เป็นจุดเปลี่ยนอีกครั้งที่โลกเริ่มหันมาสนใจ “ไขมัน” ว่าอาจเป็นผู้ร้าย ทำให้ชายคนหนึ่งชื่อ Ancel Keys เสนอทฤษฎี “ไขมันคือเหตุแห่งโรคหัวใจ” พร้อมกับงานศึกษาที่ชื่อ Seven Countries Study ซึ่งต่อมาจะกลายเป็นที่มาของ “พีระมิดอาหาร” ในปี 1977 โดย USDA ในยุคของวุฒิสมาชิก George McGovern ทฤษฎีนี้ถูกวิจารณ์ภายหลังว่าตั้งต้นด้วยการ “เลือกข้อมูล” ที่สนับสนุนสมมุติฐานของตัวเอง และเมินประเทศที่ข้อมูลไม่เข้าเป้าออกไปเฉยๆ แล้วก็ปั้นพีระมิดที่บอกว่า คาร์โบไฮเดรตอยู่ฐานล่างสุด กินได้เยอะๆ ส่วนไขมันให้อยู่บนสุด กินน้อยๆ นี่คือการพลิกอำนาจอาหารครั้งใหญ่ที่สุดในศตวรรษ อาหารไม่ใช่สิ่งที่มาจากพื้นดิน แต่เป็นสิ่งที่มาจากกระดาษนโยบาย

ช่วงนี้แหละครับที่จุดเปลี่ยนที่ใหญ่สุดมาถึง เมื่อรัฐบาลสหรัฐประกาศใช้นโยบายอาหารใหม่โดยอิงกับคำแนะนำของ USDA ซึ่งภายหลังถูกเปิดโปงว่าปิรามิดอาหารที่ใช้จริงนั้น ผ่านการปรับจากต้นฉบับโดยนักวิทยาศาสตร์อย่างหนักเพื่อ “จัดสรรพื้นที่” ให้กับอาหารที่มี lobby สูง เช่น ข้าว ซีเรียล พาสต้า และน้ำมันพืช โดยให้ไขมันสัตว์ถูกตัดทิ้งไปเป็นตัวอันตราย เฮียว่าโมเมนต์นี้แหละคือจุดที่ "ฟู้ดฟิคชั่น" กลายเป็น "ฟู้ดโพย" สำหรับคนทั้งโลก

ระหว่างที่ USDA กำลังยึดพีระมิดอยู่นั้น อุตสาหกรรมอาหารแปรรูปก็กำลังเข้มข้นแบบใส่สปีดโบ๊ทเข้าไปอีก ข้าวโพดกลายเป็นพืชเศรษฐกิจอันดับหนึ่งของสหรัฐฯ ไม่ใช่เพราะคนกินข้าวโพดกันเยอะ แต่เพราะมันกลายเป็นวัตถุดิบของทุกอย่าง ตั้งแต่ high-fructose corn syrup ในน้ำอัดลม ยันฟิลเลอร์ในไส้กรอก และอาหารสัตว์ในฟาร์มปศุสัตว์ เชนร้านอาหารอย่าง McDonald’s ก็เริ่มเปลี่ยนมันฝรั่งทอดจากไขมันเนื้อวัวมาใช้น้ำมันพืชในยุค 1980s เพราะแรงกดดันจากกลุ่มต่อต้านไขมันอิ่มตัว ทั้งที่รสชาติเปลี่ยนและสุขภาพก็ไม่ได้ดีขึ้น

ปี 1980s-1990s เกิดสิ่งที่เฮียอยากเรียกว่า “การปฏิวัติแบบเนียน” คือผู้คนเริ่มเชื่อว่าอาหารแปรรูปคือความก้าวหน้า และอาหารธรรมชาตินั้นล้าหลัง วงการโภชนาการยังคงถูกขับเคลื่อนด้วยความเชื่อว่าคาร์บคือของดี ไขมันคือผู้ร้าย และโปรตีนต้องมาจากพืช บริษัทใหญ่ๆ อย่าง Nestlé, PepsiCo, และ Unilever เริ่มเข้าซื้อแบรนด์อาหารสุขภาพ พร้อมผลิตเวย์เทียม โปรตีนพืช และอาหารเสริมแทนอาหารจริง พร้อมแนวคิด “Meal Replacement” ที่เน้นขายแทนกิน เขาไม่ได้แค่นำเสนอสินค้า แต่พยายามกำหนดแนวคิดเรื่อง “อาหารเพื่อสุขภาพ” แบบที่คนทั่วไปไม่ต้องคิดเอง ขอแค่เชื่อฉลาก กับดูโลโก้รูปหัวใจสีเขียวก็พอ

ก่อนจะเข้าสู่ศตวรรษใหม่ในปี 2000 โลกก็เริ่มเห็นวี่แววของสิ่งที่เรียกว่า “อาหารแห่งอนาคต” อีกครั้ง ไม่ใช่เพราะเทคโนโลยีใหม่อย่างเดียว แต่เพราะระบบอาหารเดิมถูกบิดเบือนจนธรรมชาติเสียศูนย์ อาหารจริงถูกตีตราว่าอันตราย ส่วนอาหารสังเคราะห์ถูกสร้างเรื่องเล่าว่า "สะอาดกว่า ปลอดภัยกว่า และเป็นคำตอบของโลกอนาคต" ซึ่งในมุมของเฮีย มันคือการสืบทอดวิธีคิดแบบเดียวกับสมัยสงคราม คือการบังคับให้กินของที่ผลิตได้มาก ราคาถูก เก็บได้นาน โดยไม่สนว่าร่างกายต้องการหรือไม่ และทั้งหมดก็กลับมาที่จุดเดิม — การออกแบบอาหารให้เหมาะกับระบบ มากกว่าจะออกแบบระบบให้เหมาะกับร่างกายมนุษย์

นี่แหละเฮียถึงอยากเล่าซีรีส์ “อาหารอนาคต” เพราะในความจริงมันไม่ใช่อนาคตอะไรเลย แต่มันคืออดีตที่ถูกเล่าใหม่ด้วยคำพูดที่ฟังดูเท่ แต่ซ่อนไว้ด้วยตรวนของการควบคุมสิทธิในการกินของมนุษย์ เอาของปลอมมาสวมรอยธรรมชาติ แล้วทำให้เรารู้สึกผิดถ้าจะกินไขมันสัตว์ กินเนื้อ กินไข่ หรือไม่กินอาหารเช้าที่เต็มไปด้วยน้ำตาล เฮียว่า ถ้าไม่เล่าเรื่องพวกนี้ให้คนรู้ทัน ก็เหมือนปล่อยให้ลูกหลานกินอาหารที่ไม่มีใครรู้ว่า “ใครเป็นคนเขียนสูตรให้พวกเขากิน”

ดังนั้น ถ้าเราจะพูดถึง “อาหารแห่งอนาคต” เฮียว่า เราต้องกล้ากลับไปถามว่า อนาคตที่ว่านั่น ใครกันเป็นคนออกแบบ? แล้วเราอยู่ตรงไหนของโต๊ะ?

#pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr

-

@ 81022b27:2b8d0644

2025-06-09 00:23:26

@ 81022b27:2b8d0644

2025-06-09 00:23:26I’m a Chiropractor, Writer, Travel Nerd, Lover of Efficiency, Trekker and a Celebrity in Mexican Restaurants Hi, I’m Danny DeReuter, and I want to save the world. I’m an occasional writer-I’ve written some stuff.

Sometimes people think I’m funny. Maybe some time I’ll come up with a bit of courage and try my hand at stand-up. (seriously, that’s a thing on my vision board)

I’ve become somewhat of a social media expert managing my online presence. I help show people how to do social media more effectively.

I’m also a speaker. I prefer to speak on topics that I’m passionate about-like natural health, chiropractic, and social media. I also have a Podcast. Be nice and you can ask me to speak at your event.

-

@ cae03c48:2a7d6671

2025-06-09 01:01:57

@ cae03c48:2a7d6671

2025-06-09 01:01:57Bitcoin Magazine

Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in BitcoinMeanwhile Insurance Bitcoin (Bermuda) Limited (“Meanwhile”) announced it has become the first company in the world to release externally audited financial statements denominated entirely in Bitcoin. According to the announcement, the company reported 220.4 BTC in assets and 25.29 BTC in net income for 2024, a 300% year over year increase.

Today marks a global first & historic event for us, along with the public release of our 2024 audited financial statements, covering our 1st year of sales.

As the 1st company in the world to have Bitcoin-denominated financial statements externally audited, we are excited to…

— meanwhile | Bitcoin Life Insurance (@meanwhilelife) June 5, 2025

“We’ve just made history as the first company in the world to have Bitcoin-denominated financial statements externally audited,” said Zac Townsend, CEO of Meanwhile. “This is an important, foundational step in reimagining the financial system based on a single, global, decentralized standard outside the control of any one government.”

The financial statements were audited by Harris & Trotter LLP and its digital asset division ht.digital. Meanwhile’s financials also comply with Bermuda’s Insurance Act 1978, noting that their BTC denominated financials were approved and comply with official guidelines. The firm, fully licensed by the Bermuda Monetary Authority (BMA), operates entirely in BTC and is prohibited from liquidating Bitcoin assets except through policyholder claims, positioning it as a long term holder.

“As the first regulated Bitcoin life insurance company, we view the BTC held by Meanwhile as inherently long-term in nature—primarily held to support the Company’s insurance liabilities over decades,” Townsend added. “This makes it significantly ‘stickier’ and resistant to market pressures compared to the BTC held by other companies as part of their treasury management strategies.”

Meanwhile’s 2024 financials also revealed 23.02 BTC in net premiums and 4.35 BTC in investment income, showing that its model not only preserves Bitcoin, but earns it. The company’s reserves (also held in BTC) were reviewed and approved by Willis Towers Watson (WTW).

Meanwhile also offers a Bitcoin Whole Life insurance product that allows policyholders to save, borrow, and build legacy wealth—entirely in BTC, and has plans to expand globally in 2025.

“We are incredibly proud of today’s news as it underscores how Meanwhile is at the forefront of the next phase of the convergence between Bitcoin and institutional financial markets,” said Tia Beckmann, CFO of Meanwhile. “Now having generated net income in BTC, we have demonstrated that we are earning it through a sustainable insurance business model designed for the long term.”

This post Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in Bitcoin first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 5d4b6c8d:8a1c1ee3

2025-06-09 00:18:27

@ 5d4b6c8d:8a1c1ee3

2025-06-09 00:18:27Big day for me today: - @k00b convinced me to try OMAD. I did eat more than once today, but it was all within a four hour period. I'll try to tighten that up further tomorrow. - @gnilma and @398ja convinced me to try a cold shower. I eased into it, by starting it warm and gradually turning down the temperature. That was totally manageable.

How did you do today? What do you need to work on tomorrow?

https://stacker.news/items/1001161

-

@ b1ddb4d7:471244e7

2025-06-09 00:01:53

@ b1ddb4d7:471244e7

2025-06-09 00:01:53Hosted at the iconic Palace of Culture and Science—a prominent symbol of the communist era—the Bitcoin FilmFest offers a vibrant celebration of film through the lens of bitcoin. The venue itself provides a striking contrast to the festival’s focus, highlighting bitcoin’s core identity as a currency embodying independence from traditional financial and political systems.

𝐅𝐢𝐱𝐢𝐧𝐠 𝐭𝐡𝐞 𝐜𝐮𝐥𝐭𝐮𝐫𝐞 𝐰𝐢𝐭𝐡 𝐩𝐨𝐰𝐞𝐫𝐟𝐮𝐥 𝐦𝐮𝐬𝐢𝐜 𝐯𝐢𝐛𝐞𝐬.

Warsaw, Day Zero at #BFF25 (European Bitcoin Pizza Day) with @roger__9000, MadMunky and the @2140_wtf squad

pic.twitter.com/9ogVvWRReA

pic.twitter.com/9ogVvWRReA— Bitcoin FilmFest

(@bitcoinfilmfest) May 28, 2025

(@bitcoinfilmfest) May 28, 2025This venue represents an era when the state tightly controlled the economy and financial systems. The juxtaposition of this historical site with an event dedicated to bitcoin is striking and thought-provoking.

The event features a diverse array of activities, including engaging panel discussions, screenings of both feature-length and short films, workshops and lively parties. Each component designed to explore the multifaceted world of bitcoin and its implications for society, offering attendees a blend of entertainment and education.

The films showcase innovative narratives and insights into bitcoin’s landscape, while the panels facilitate thought-provoking discussions among industry experts and filmmakers.

Networking is a significant aspect of the festival, with an exceptionally open and friendly atmosphere that foster connections among participants. Participants from all over Europe gather to engage with like-minded individuals who share a passion for BTC and its implications for the future.

The open exchanges of ideas foster a sense of community, allowing attendees to forge new connections, collaborate on projects, and discuss the potential of blockchain technology implemented in bitcoin.

The organization of the festival is extraordinary, ensuring a smooth flow of information and an expertly structured schedule filled from morning until evening. Attendees appreciate the meticulous planning that allowed them to maximize their experience. Additionally, thoughtful touches such as gifts from sponsors and well-chosen locations for various events contribute to the overall positive atmosphere of the festival.

Overall, the Bitcoin FilmFest not only highlights the artistic expression surrounding bitcoin but also serves as a vital platform for dialogue—about financial freedom, the future of money, and individual sovereignty in a shifting world.

The event successfully bridges the gap between a historical symbol of control and a movement that celebrates freedom, innovation, and collaboration in the digital age, highlighting the importance of independence in financial systems while fostering a collaborative environment for innovation and growth.

Next year’s event is slated for June 5-7 2026. For further updates check: https://bitcoinfilmfest.com/

-

@ cae03c48:2a7d6671

2025-06-09 01:01:36

@ cae03c48:2a7d6671

2025-06-09 01:01:36Bitcoin Magazine

Mapping Bitcoin’s Bull Cycle PotentialBitcoin’s Market Value to Realized Value, or MVRV ratio, remains one of the most reliable on-chain indicators for identifying local and macro tops and bottoms across every BTC cycle. By isolating data across different investor cohorts and adapting historical benchmarks to modern market conditions, we can generate more accurate insights into where Bitcoin may be headed next.

The Bitcoin MVRV Ratio

The MVRV Ratio compares Bitcoin’s market price to its realized price, essentially the average cost basis for all coins in the network. As of writing, BTC trades around $105,000 while the realized price floats near $47,000, putting the raw MVRV at 2.26. The Z-Score version of MVRV standardizes this ratio based on historical volatility, enabling clearer comparisons across different market cycles.

Figure 1: Historically, the MVRV Ratio and the MVRV Z-Score have accurately identified cycle peaks and bottoms. View Live Chart

Short-Term Holders

Short-term holders, defined as those holding Bitcoin for 155 days or less, currently have a realized price near $97,000. This metric often acts as dynamic support in bull markets and resistance in bear markets. Notably, when the Short Term Holder MVRV hits 1.33, local tops have historically occurred, as seen several times in both the 2017 and 2021 cycles. So far in the current cycle, this threshold has already been touched four times, each followed by modest retracements.

Figure 2: Short Term Holder MVRV reaching 1.33 in more recent cycles has aligned with local tops. View Live Chart

Long-Term Holders

Long-term holders, who’ve held BTC for more than 155 days, currently have an average cost basis of just $33,500, putting their MVRV at 3.11. Historically, Long Term Holder MVRV values have reached as high as 12 during major peaks. That said, we’re observing a trend of diminishing multiples each cycle.

Figure 3: Achieving a Long Term Holder MVRV value of 8 could extrapolate to a BTC price in excess of $300,000. View Live Chart

A key resistance band now sits between 7.5 and 8.5, a zone that has defined bull tops and pre-bear retracements in every cycle since 2011. If the current growth of the realized price ($40/day) continues for another 140–150 days, matching previous cycle lengths, we could see it reach somewhere in the region of $40,000. A peak MVRV of 8 would imply a price near $320,000.

A Smarter Market Compass

Unlike static all-time metrics, the 2-Year Rolling MVRV Z-Score adapts to evolving market dynamics. By recalculating average extremes over a rolling window, it smooths out Bitcoin’s natural volatility decay as it matures. Historically, this version has signaled overbought conditions when reaching levels above 3, and prime accumulation zones when dipping below -1. Currently sitting under 1, this metric suggests that substantial upside remains.

Figure 4: The current 2-Year Rolling MVRV Z-Score suggests more positive price action ahead. View Live Chart

Timing & Targets

A view of the BTC Growth Since Cycle Lows chart illustrates that BTC is now approximately 925 days removed from its last major cycle low. Historical comparisons to previous bull markets suggest we may be around 140 to 150 days away from a potential top, with both the 2017 and 2021 peaks occurring around 1,060 to 1,070 days after their respective lows. While not deterministic, this alignment reinforces the broader picture of where we are in the cycle. If realized price trends and MVRV thresholds continue on current trajectories, late Q3 to early Q4 2025 may bring final euphoric moves.

Figure 5: Will the current cycle continue to exhibit growth patterns similar to those of the previous two cycles? View Live Chart

Conclusion

The MVRV ratio and its derivatives remain essential tools for analyzing Bitcoin market behavior, providing clear markers for both accumulation and distribution. Whether observing short-term holders hovering near local top thresholds, long-term holders nearing historically significant resistance zones, or adaptive metrics like the 2-Year Rolling MVRV Z-Score signaling plenty of runway left, these data points should be used in confluence.

No single metric should be relied upon to predict tops or bottoms in isolation, but taken together, they offer a powerful lens through which to interpret the macro trend. As the market matures and volatility declines, adaptive metrics will become even more crucial in staying ahead of the curve.

For more deep-dive research, technical indicators, real-time market alerts, and access to a growing community of analysts, visit BitcoinMagazinePro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

This post Mapping Bitcoin’s Bull Cycle Potential first appeared on Bitcoin Magazine and is written by Matt Crosby.

-

@ 8bad92c3:ca714aa5

2025-06-09 00:02:34

@ 8bad92c3:ca714aa5

2025-06-09 00:02:34Marty's Bent

via levelsio

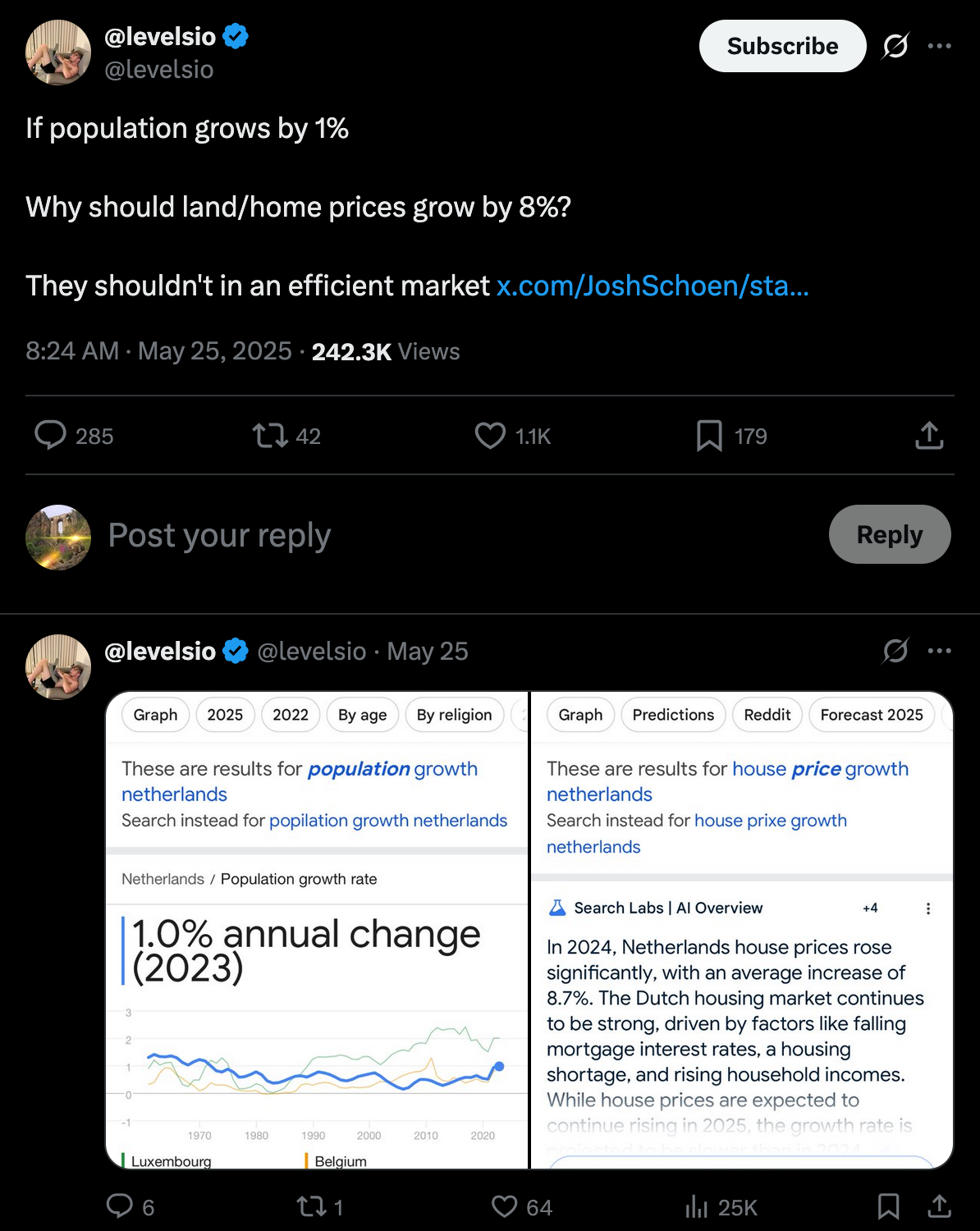

Over the weekend, prolific vibe coder levelsio took to X to complain about the state of housing affordability across Europe. Something that I was very happy to see considering the fact that there is a massive real estate affordability crisis across much of the world and it is important that people who are respected and have platforms speak out when they identify the problem as well. More eyes and focus on the problem is how something begins to get solved.

With that being said, I think levelsio is missing the forest for the trees by blaming institutionalized NIMBYism, burdensome regulations and governments hoarding land that should instead be given to developers to produce more housing supply. I quote tweeted this particular tweet on the subject from levelsio and wanted to take some time today to republish those thoughts here and expand on the topic.

It’s almost as if real estate is being used as a store of value asset instead of the consumable good that it is.

What @levelsio is observing here is called a “monetary premium”. A monetary premium is the value added on top of the consumable/aesthetic/location value of real estate.

This monetary premium exist because central banks and governments have distorted the market for money and people are forced to push value into assets that are scarce relative to dollars. Over the last 50 years real estate has been one of the relatively scarce assets of choice.

The housing affordability crisis is a negative externality of the market reaction to the corruption of money. It can only be fixed by re-introducing hard money into the economy that enables people to store value reliably. If that emerges they won’t have to store value in real estate, the monetary premium of real estate will dissolve and prices will correct to their proper valuations.

This is one of the problems that bitcoin solves.

It’s still early yet, but more and more people are recognizing the utility provided by a neutral reserve asset that can’t be manipulated by central planners. At scale, the effect on assets that have accumulated a monetary premium over decades will be material. All of these assets are significantly overvalued and their monetary premium are leaking into bitcoin.

Put another way, "It's the money, stupid." Now, this isn't to say that the supply of housing in certain areas being artificially restricted isn't having an effect on the price of housing. This is certainly true, especially in cities like San Francisco where there is a relatively strong demand because of the economic density of the area and the desire of many high agency and productive people to live there. But I would put forth that the monetary premium is still the bigger problem and no amount of de-regulation to enable the supply of housing to increase will solve the affordability crisis in the long-run. The only way to get to the root of this specific problem is via bitcoin's mainstream adoption as an apolitical uncontrollable asset with completely idiosyncratic risks when compared to any individual asset class.

Let's say the government did ease up regulations and local NIMBY sympathetics were shoved in a corner to allow new units to be built. This doesn't solve the problem in the short-run because there is a time-delay between when regulations are lifted and when new supply actually makes it to market. In the interim, governments and central banks are inevitably going to go further into debt and be forced to print money to monetize that debt. This will exacerbate inflation and even if new real estate units are brought to market, the builders/owners of those properties will likely have to demand elevated prices to attempt to keep up with inflation.

This also does nothing to solve the problem of real income and wage growth, which are significantly lagging real inflation. Even if prices came down because of a surge in supply, could the Common Man afford a down payment on the property? I'd be shocked if this was the case. And since it's likely not the case the only way to get people into these houses as "owners" would be to offer them zero-down financing, which makes people feel richer than they actually are and leads them to make financially ruinous decisions.

It's the money, stupid. People need a way to save so that they can buy in the first place. Fiat currency doesn't allow this and the only people who can save effectively are those who make enough money to funnel into substitute store of value assets like real estate.

As it stands today, the price-to-income ratio of real estate is 5.0x and the price-t0-rent index is 1.36. Up from 3.3x and 1.14x respectively where the metrics sat in the year 2000. The growth in these ratios is driven predominately via their monetary premium.

And guess what, it's about to get much worse. Donald Trump, Treasury Secretary Scott Bessent and Elon Musk have all signaled that the plan moving forward is to attempt to drive growth and productivity as high as possible while also letting deficits and the debt increase unabated, which means that inflation is likely to continue unabated and potentially increase.

It might make sense to get some bitcoin if that is the case.

via me

"Whale in the Pool" Risk That Could Destroy MSTY Investors

Jessy Gilger raised serious concerns about MSTY and similar derivative products that promise eye-popping yields. He pointed to the COVID crash where gold mining ETFs using derivatives collapsed 95% and never recovered, despite gold itself performing well. Jessy noted that while his team calculated reasonable MicroStrategy covered call yields of 16-22%, MSTY advertises 120% annualized distributions - a red flag that suggests these aren't sustainable dividends from profits, but potentially just returning investors' own capital.

"If a whale pees in the pool, everyone is affected." - Jessy Gilger

Jessy explained that when large investors need to exit these pooled products during market stress, they must sell derivative positions into illiquid markets with no buyers, potentially triggering catastrophic losses for all participants. His solution? Private pools through separately managed accounts that achieve similar income goals without the contagion risk of being trapped with panicking whales.

Check out the full podcast here for more on Gannett Trust's multi-sig solution, Bitcoin retirement planning and corporate treasury strategies.

Headlines of the Day

World's Largest Bitcoin Conference Starts Tomorrow- via X

Remixpoint to Buy Additional ¥1 Billion in Bitcoin - via X

Get our new STACK SATS hat - via tftcmerch.io

Marty to Judge Bitcoin World Record Try in Vegas - via X

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code *“TFTC20”* during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed 158,469 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Looking forward to a fun, productive and wholesome week in Las Vegas, Nevada.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

@media screen and (max-width: 480px) { .mobile-padding { padding: 10px 0 !important; } .social-container { width: 100% !important; max-width: 260px !important; } .social-icon { padding: 0 !important; } .social-icon img { height: 32px !important; width: 32px !important; } .icon-cell { padding: 0 4px !important; } } .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } .moz-text-html .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } /* Helps with rendering in various email clients */ body { margin: 0 !important; padding: 0 !important; -webkit-text-size-adjust: 100% !important; -ms-text-size-adjust: 100% !important; } img { -ms-interpolation-mode: bicubic; } /* Prevents Gmail from changing the text color in email threads */ .im { color: inherit !important; }

[

](https://youtube.com/@T

](https://youtube.com/@T -

@ ea181d3b:0fa4d7cd

2025-06-08 23:58:19

@ ea181d3b:0fa4d7cd

2025-06-08 23:58:19Author's Note: Post Bitcoin 2025 I couldn't be more excited for what the future has in store for us, all of us, in this new, decentralized world. I am going to start sharing my content here more and will begin by introducing myself with some of my writings previously shared on Mirror.xyz. As I catch up sharing some of my thoughts from the past month, I will continue to share here with Primal as my initial source of communication, before I share with x.com or mirror.xyz. Bitcoin isnt the future, it is the here and now, and Nostr is where I will continue to build my brand, and tell Canurta's story. I am excited to go up from here.\ \ — Originally shared here at Mirror.xyz/canurta.eth on April 30th, 2025

Today, I took a moment to verify Block 170—the first-ever recorded Bitcoin transaction—from our own Canurta Bitcoin node. It was a simple yet historic transfer of 10 BTC from Satoshi Nakamoto to Hal Finney, but its significance extends far beyond its numeric value.

Experiencing this directly, without intermediaries, felt like stepping into a new kind of wilderness—one governed by decentralization, transparency, and immutable truth. It took me back to my days at the University of Kent in Canterbury, where I first encountered the idea of the "state of nature". Historically, when humanity emerged from the wild, the rule of law was essential in building just societies capable of innovation and lasting prosperity.

Today, we find ourselves at the threshold of another "state of nature"—the digital state of nature. Just as human society once relied on law to guide and nurture civilization, this new digital world requires its own guiding principles. In the digital state of nature, decentralization, trustless verification, and incorruptible transparency must form the foundation upon which we build.

At Canurta, we are deliberately embracing this philosophical intersection of decentralization and biotechnology. By harnessing nature's profound innovations and coupling them with Bitcoin's decentralized principles, we forge a path that not only sustains our company but revolutionizes how innovation in human and animal health is financed and realized.

My undergraduate studies at the University of Ottawa in psychology and philosophy further shaped my perspective on how innovation, human behavior, and ethics intertwine. These disciplines taught me that sustainable innovation thrives best in an environment grounded in truth, transparency, and decentralized governance.

This is our unique commitment at Canurta—to unlock nature's power, guided by decentralized truth and verifiable digital energy, to fundamentally transform health outcomes.

We’re just getting started, but this is exactly the future we're ready to build.

— Akeem Gardner

CEO, Canurta Therapeutics

April 30, 2025

-

@ df478568:2a951e67

2025-06-08 23:58:37

@ df478568:2a951e67

2025-06-08 23:58:37NOTE: PLEASE DO NOT USE THIS METHOD UNTIL WE LEARN MORE ABOUT THIS nostr:nevent1qvzqqqqqqypzpw5qnyrxdmctda962pvng7ltzvjzjg09ge57dqqxfjn42ft2rcaxqqsfsg878u9luv2sxm6yahyjr4zpt745rdfpuu47wnn9t2dskgem52g9e9955

`About 156,000 blocks ago, I went to a Taco Shop for a bitcoin meetup. I asked my favorite question, “Do you accept bitcoin?”

“Yes," he said as he handed me a Toast Terminal with a BTCpayServer QR code.

]

]Awesome!

12,960 blocks later, I took my dad to the taco shop. We ordered food. I asked my favorite question once again.

“Uh…Yeah, but I don't know how to work the machine.”

"Dough!🤦"

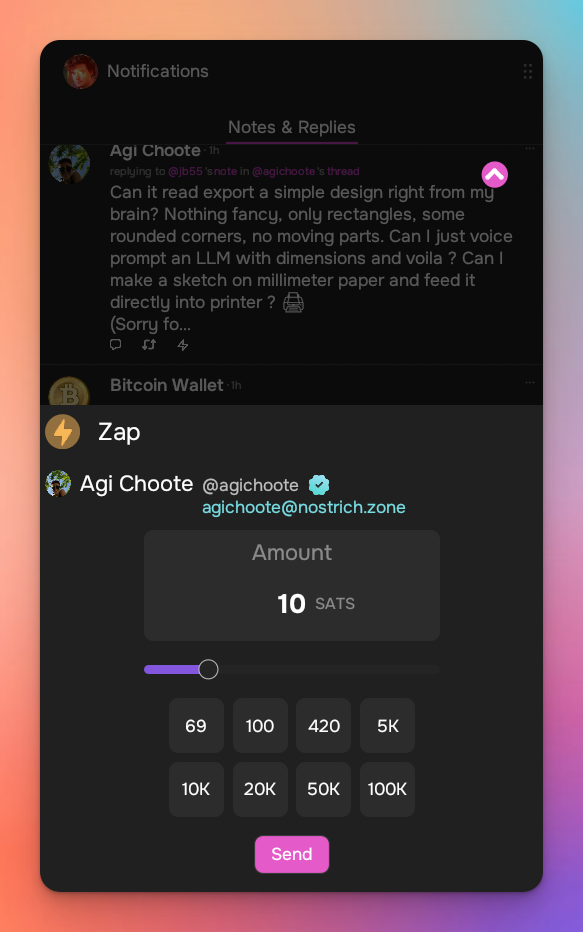

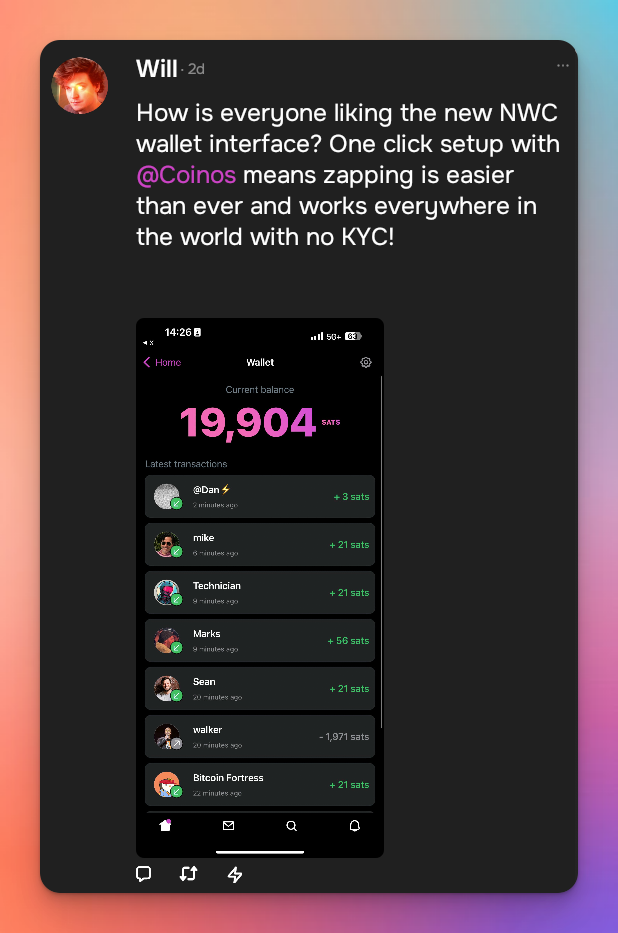

It's been a problem in the past, but now lightning payments are about to be ubiquitous. Steak N Shake is taking bitcoin using Speed Wallet and Block is implementing bitcoin payments by 2026 in all legal jurisdictions. I have tested both of these so you don't have to. Just kidding. I geek out on this stuff, but both work great. You can pay with your sats by scanning a screen on a QR code. The employees don't need to be bitcoin lightning network experts. You can just pay as easy as a credit card.

There were 35,000 people at the bitcoin conference, and 4,187 transactions were made. It was a world record. Wait, I thought they said there could only be 7 transactions per second! No, not anymore. Now we can use bitcoin for shopping. I can pay for tacos at taco trucks.

How You Can Accept Bitcoin At Your Business

Coinos is a simple bitcoin point of sale information that acts like a cash register. Bitcoin is peer-to-peer electronic cash. Coinos is a cash register and you should treat it as such. If you make a few hundred thousand sats at the end of the night, you should sweep the bitcoin into your own wallet.. You can use Aqua, AlbyHub, Bull Bitcoin wallet, or whatever your favorite lightning enabled wallet is to withdraw. You'll need a password. Do not lose this. I have tried the automatic withdraws, but it did not work for me. I'm no concerned because this is not a wallet I intend to keep a lot of sats in for a long time.

Here is my coinos payment terminal.

https://coinos.io/ZapthisBlog/receive

I made the QR code with libreqr.com/

Now I have an online bitcoin cash register. The Bitcoiners know how to pay for stuff with sats. They will be proud to show you too. If you're nerdy, you can use all the cool kid tools now, but we will just focus on the lightning address. Anyone can send you sats with a lightning address with just a QR code.

At the end of the night, you cash out to your own wallet. Again, this assumes you have an Aqua Wallet or any other lightning enabled wallet, but all it takes to accept bitcoin at your brick and mortar store is to create an account with Coinos and print out a QR code. It's a quick and easy way to start accepting bitcoin even if you don't expect many clients to shop with sats.

Tips

This is not just a cash register. Employees can also make their own Coinos wallet and receive tips from bitcoiners. Anyone can accept payments using this system. Your kids could use it to sell lemonade for sats. You are only limited by your imagination. When will you begin accepting bitcoin payments? It is easier than ever. You do not need to train employees. You do not need to be in the store. Bitcoin is peer-to-peer electronic cash so you can give it away like cash. I don't know what the tax rules on cash are. You need to verify that with your own jurisdiction. This is not financial or tax advice. This is for informational purposes only.

Remember, this is a custodial wallet. Not your keys not your bitcoin. Don't keep more sats than you are willing to lose on custodial wallets. Sweep your wallet early and often. Loss of funds is possible. There is a small fee for liquidity management too. Do your own research.`

-

@ eb0157af:77ab6c55

2025-06-08 23:02:12

@ eb0157af:77ab6c55

2025-06-08 23:02:12Romania’s national postal service embraces digital assets by installing the first Bitcoin ATM at its Tulcea branch.

Romania has witnessed the inauguration of the first Bitcoin ATM within the offices of Poșta Română, the country’s national postal service.

The installation took place at the Tulcea branch, the result of a strategic collaboration between Poșta Română and Bitcoin Romania (BTR), one of the country’s leading exchanges. According to the official announcement from the postal service, this marks only the first step in a broader project.

Source: Poșta Română

The next locations set to host these ATMs will be Alexandria, Piatra Neamț, Botoșani, and Nădlac, confirming the postal service’s commitment to widespread distribution of these devices.

The integration of Bitcoin ATMs in post offices is part of a wider strategy to modernize the existing infrastructure through cutting-edge digital technologies. The initiative also aims to expand the range of services available in areas of the country traditionally underserved.

Global adoption

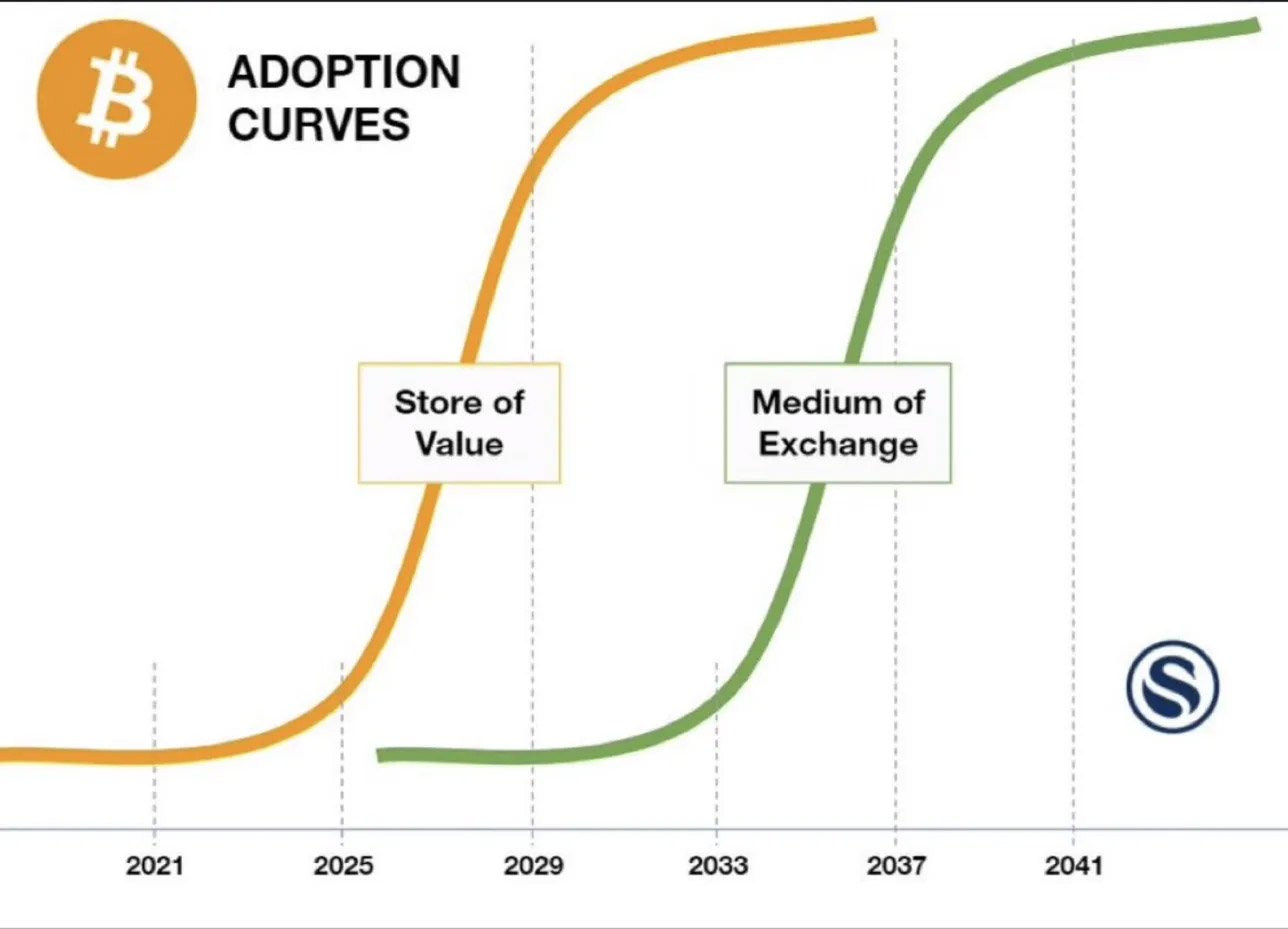

In recent months, global Bitcoin adoption has continued to grow through various channels: individual investors, companies accepting BTC as a payment method, corporations and institutions accumulating Bitcoin as a treasury asset, and nation-states acquiring BTC for strategic reserves.

According to Binance data from January, the number of Bitcoin wallets holding more than $100 in value reached nearly 30 million, marking a 25% year-on-year increase.

Despite this growth, overall Bitcoin adoption remains limited worldwide, even in countries with the highest adoption rates. A Q1 2025 report by River, a Bitcoin financial services company, found that only 4% of the global population owns Bitcoin.

The United States retains the highest concentration of Bitcoin holders, with around 14% of individuals holding BTC in 2025. The total addressable Bitcoin market remains below 1%, due to low retail adoption and under-allocation from institutions, the U.S.-based company noted.

According to River, Bitcoin could absorb 50% of the store-of-value market, equivalent to roughly $225 trillion in value. These asset classes include cash, stocks, real estate, precious metals, and art held for price appreciation or savings. With a current market capitalization slightly above $2 trillion, Bitcoin still has significant room for growth, River suggests.

The post Poșta Română launches the first Bitcoin ATM in post offices appeared first on Atlas21.

-

@ ea181d3b:0fa4d7cd

2025-06-08 23:57:13

@ ea181d3b:0fa4d7cd

2025-06-08 23:57:13Originally shared on Mirror.xyz/canurta.eth on May 6th, 2025

Hal Finney helped start the chain.

When he tweeted “Running Bitcoin” in 2009, he did more than launch a network—he became its first human node. He mined the first blocks. He received the first transaction. And then, not long after, he received an ALS diagnosis.

But here’s the part that never leaves me: he kept going.

Even as his body weakened, Hal kept coding with speech‑to‑text software. He stayed plugged in. He called Bitcoin “an exciting possibility.” He kept contributing because each new block gave him purpose—a signal that his energy was still shaping the future.

And now, it is.

At Canurta, we will pioneer the Satoshi Trials™, using the power of Bitcoin in our Corporate Treasury to fund R\&D. With every block, we’re moving closer to a world where we can show how nature can be harnessed as the best medicine. We’re translating block time into biological progress.

This isn’t metaphor. It’s design— with the deeper purpose to complete the loop: the same digital system that gave Hal hope will now help us fund and fuel ALS research. His energy—immortalized in the Bitcoin ledger—is powering a therapeutic frontier that could one day deliver on what he never got to see.

We believe in transparency. Like Bitcoin, our science will remain verifiable and open.

We believe in persistence. Like Bitcoin, our model compounds over time.

And we believe in decentralized resilience—because it will take more than one institution to solve ALS.

This ALS Awareness Month, we’re not just remembering Hal Finney.

We’re building with him.

One block at a time.

-- Akeem Gardner

-

@ eb0157af:77ab6c55

2025-06-08 22:02:36

@ eb0157af:77ab6c55

2025-06-08 22:02:36The adoption of Bitcoin as a corporate reserve asset is accelerating: public companies have doubled their holdings in just two months.

The use of Bitcoin as a corporate treasury strategy is reaching unprecedented levels. According to a recent report from Standard Chartered, shared with several industry outlets, 61 publicly traded companies collectively hold 3.2% of all bitcoin in circulation.

Geoff Kendrick, global head of digital asset research at Standard Chartered, revealed that these 61 public firms — out of a total of 124 — now own 673,897 BTC.

The report highlights that 58 of the 61 companies analyzed have net asset value (NAV) multiples above 1, indicating that their market valuations exceed the value of their net assets.

The Strategy copycats

A significant takeaway from the report is the speed at which companies are accumulating bitcoin. The 60 companies considered “Strategy copycats” have doubled their holdings in the past two months, from under 50,000 BTC to about 100,000 BTC. Over the same period, Strategy added 74,000 BTC, compared to the 47,000 acquired by the other firms.

This movement continues to expand as new companies announce Bitcoin purchase plans via debt issuance. On June 3, Canadian renewable energy developer SolarBank officially announced its Bitcoin treasury strategy, filing an application to open an account with Coinbase Prime to secure custody services, manage USDC, and set up a non-custodial wallet for its Bitcoin holdings.

Meanwhile, Paris-based Blockchain Group announced a $68 million Bitcoin acquisition, while Norwegian crypto brokerage K33 raised $6.2 million to purchase BTC at the end of May.

The post Bitcoin treasury: 61 publicly listed companies now hold over 3% of total supply appeared first on Atlas21.

-

@ ea181d3b:0fa4d7cd

2025-06-08 23:56:25

@ ea181d3b:0fa4d7cd

2025-06-08 23:56:25Originally shared on May 16th, 2025 on Mirror.xyz/canurta.eth

"Thus, the deluded Bankrupt raves; Puts all upon a desprate Bet; Then plunges in the Southern Waves; Dipt over Head and Ears—in Debt."

Life has a unique way of guiding us exactly where we need to be, often without us fully realizing it at the time. My journey led me to study law at the University of Kent, Canterbury, a path seemingly unrelated to my core passion—innovation and entrepreneurship. Yet, it was precisely in my Company Law class in October 2015 where I first encountered the fascinating saga of the South Sea Bubble of 1720, an event that profoundly reshaped society and laid the foundation of the very legal principles that govern our world today.

The South Sea Company promised unimaginable riches from the transatlantic slave trade, exploiting collective enthusiasm and lack of transparency—hallmarks of many historical bubbles. Jonathan Swift's poignant verses captured the turmoil and despair that ensued, as fortunes were lost overnight:

What struck me deeply was how history, if not understood, inevitably repeats itself. It was clear to me then, as it is now, that awareness of foundational rules—how company law, equity, and property rights emerged from natural principles—remains essential. Without grasping these fundamentals, we cannot truly participate, let alone thrive, in the intricate game of society and commerce.

Yet, history also teaches optimism. Even after devastating crashes, markets recover and soar higher, driven by human ingenuity, innovation, and the foundational trust enabled by clear and enforceable laws. Institutions like the Royal Exchange and London Assurance survived the South Sea catastrophe because they created lasting value—value born from integrity, vision, and disciplined governance.

At Canurta Therapeutics, we find ourselves on the brink of another profound shift—the "digital state of nature," guided by transparency, decentralization, longevity, and trust. Understanding our origins gives us clarity in navigating these emerging trends. It informs our commitment to building something that matters, something resilient enough to weather future storms and purposeful enough to leave lasting impacts on all stakeholders.

Great companies endure because they commit to principles deeper than profit alone—they create enduring value, empower communities, and foster confidence for the long term. This is the path we choose at Canurta.

The universe led me to law school, not by chance, but to prepare me to recognize patterns, anticipate change, and build with foresight. As we embark on this exciting next chapter, I remain deeply inspired by history's lessons and energized by the limitless possibilities ahead.

With gratitude and purpose,

Akeem Gardner

-

@ c11cf5f8:4928464d

2025-06-08 14:59:37

@ c11cf5f8:4928464d

2025-06-08 14:59:37Howdy stackers! Here we are again with our monthly Magnificent Seven, the summary giving you a hit of what you missed in the ~AGORA territory.

First thing first. let's check our top performing post Ads!

Top-Performing Ads

This month, the most engaging ones are:

-

01Bitcoin Magazine Launches V3 Limited Edition Bitcoin Crocs by @RideandSmile, no description, nor images provided. The title speak for the product itself. 31 sats \ 8 comments \ 15 May -

02Happy Pizza Day Jerky Offer (10k sats sale 5/22 ONLY) by @beejay, celebrating Bitcoin Pizza Day with a delicious offer for a handmade product. Offer is over but it still available on her online shop and IRL at next Twin Cities Outdoor Agora Market https://stacker.news/items/972209/r/AG 103 sats \ 3 comments \ 22 May -

03Lard Tallow lotion by @byzantine, sharing with us one of his preferred online shops that accept sats. Here other two: a Regenerative Farm in TX https://stacker.news/items/983695/r/AG and an artisanal lite roast coffee maker https://stacker.news/items/983668/r/AG 62 sats \ 4 comments \ 20 May -

04Bitaxe Gamma 601 for sale by @PictureRoom selling P2P, have you shipped it yet? 121 sats \ 12 comments \ 15 May -

05Built An Invisible Book Stage by @kr, he did well creating some expectations for this unique and durable product earlier https://stacker.news/items/903946/r/AG 124 sats \ 4 comments \ 21 May -

06"₿lack Market Money" T-Shirts by T&F by @BitcoinErrorLog, that had opened his online store with plenty of incredible products, including an Anti-Surveillance clothing line https://stacker.news/items/994555/r/AG stuff never seen before! 51 sats \ 3 comments \ 24 May -

07[SELL] Heatpunk 002 Tee by @thebullishbitcoiner, reviving the second edition of a t-shirt dedicated to home solo miners! 79 sats \ 1 comment \ 28 May

In case you missed

Here some interesting post, opening conversations and free speech about markets and business on the bitcoin circular economy:

- https://stacker.news/items/992449/r/AG - @Kontext is selling his beloved 2012 Jaguar XF 3.0 V6 Petrol [5M sats], great deal if paid in sats! Have you sold her?

- https://stacker.news/items/987241/r/AG - @RideandSmile shared the Freedom Issue: Letter From the Editor introducing a BM special edition

- https://stacker.news/items/999229/r/AG - @Solomonsatoshi was looking for Green Coffee Beans for DIY home roasting. Will @michaelbinary provide you some?

- https://stacker.news/items/992790/r/AG - @Rayo also introduce the P.A.Z.NIA Radio Network: 52 Hours of Liberation! An interesting livestream for all those interested in freedom.

- https://stacker.news/items/995163/r/AG welcome to @lunin, opening up on SN with Take it step by step and it will work! as part of a promising series: Founder's Thoughts. Here the second post https://stacker.news/items/999867/r/AG Startup according to Mozart

Hey sellers! Try Auctions

A quick reminder that now you can setup auctions here in the AGORA too! Learn how. The other feature released last month was the introduction of Shopfronts on SN. Check our SN Merch and SN Zine examples. Thank you all! Let's keep these trades coming and grow the P2P Bitcoin circular economy!

Active Professional Services accepting Bitcoin in the AGORA

Let us know if we miss any, here below the most memorable ones: - https://stacker.news/items/900208/r/AG - @unschooled offering Language Tutoring - https://stacker.news/items/813013/r/AG - @gpvansat's [OFFER][Graphic Design] From the paste editions (It's important to keep these offers available) - https://stacker.news/items/775383/r/AG - @TinstrMedia - Color Grading (Styling) Your Pictures as a Service - https://stacker.news/items/773557/r/AG - @MamaHodl, MATHS TUTOR 50K SATS/hour English global - https://stacker.news/items/684163/r/AG - @BTCLNAT's OFFER HEALTH COUNSELING [5K SAT/ consultation - https://stacker.news/items/689268/r/AG - @mathswithtess [SELL] MATHS TUTOR ONILINE, 90k sats per hour. Global but English only.

Let me know if I'm missing other stackers offering services around here!

Lost & Found in SN' Wild West Web

Stay with me, we're not done yet! I found plenty of other deals, offers and business related conversations in other territories too...

- BITCOIN... always fucking with my head... by @thecommoner (highly recommended read!)

- The Strange Moral Relativism of "Free Trade" by @Undisciplined (another highly recommended read!)

- What makes society thrive? by @aljaz

- Drop or proxy shipping services that take sats? by @lv99slacker

- Custom Bitcoin Nodes by @anon

- 23 Bitcoin Merch Shops That Sell Shirts For Sats by @hyperfree

- How to create an e-commerce website? by @Bitcoiner1

- Can You Outperform an Apple Tree? by @kr

- B2B Businesses in Bitcoin by @telcobert

Oh boy! Such exciting month! Now our latest weekly appointments:

🏷️ Spending Sunday

(LIVE TODAY)Share your most recent Bitcoin purchases of just check what other stackers are buying with their sats! Today's one open at https://stacker.news/items/1000477/r/AGAll series available here:

🤝 Sellers & Business Club

(UPCOMING EVERY TUESDAY)Here https://stacker.news/items/998773/r/AG wanted to introduce this new series, dedicated to our most active sellers^1. A room to talk about growing business and sales. You will join?📢 Thursday Talks: What have you sold for Bitcoin this week?

It is losing a bit of momentum, but it will still be opening every week for anyone interested to share sales tips, deals and offers around the Wild West Web! Latest one here https://stacker.news/items/997767/r/AG

Thanks all for reading until here, now... 🫡 Closing remarks as usual. See ya!

Create your Ads now!

Looking to start something new? Hit one of the links below to free your mind:

- 💬 TOPIC for conversation,

- [⚖️ SELL] anything! or,

- if you're looking for something, hit the [🛒 BUY]!

- [🧑💻 HIRE] any bitcoiner skill or stuff from bitcoiners

- [🖇 OFFER] any product or service and stack more sats

- [🧑⚖️ AUCTION] to let stackers decide a fair price for your item

- [🤝 SWAP] if you're looking to exchange anything with anything else

- [🆓 FREE] your space, make a gift!

- Start your own [SHOPFRONT] or simply...

- [⭐ REVIEW] any bitcoin product or LN service you recently bought or subscribed to.

Or contact @AGORA team on nostr DM, and we can help you publish a personalized post.

.

#nostr#bitcoin#stuff4sats#sell#buy#plebchain#grownostr#asknostr#market#businesshttps://stacker.news/items/1000715

-

-

@ 7f6db517:a4931eda

2025-06-08 22:02:55

@ 7f6db517:a4931eda

2025-06-08 22:02:55Will not live in a pod.

Will not eat the bugs.

Will not get the chip.

Will not get a blue check.

Will not use CBDCs.Live Free or Die.

Why did Elon buy twitter for $44 Billion? What value does he see in it besides the greater influence that undoubtedly comes with controlling one of the largest social platforms in the world? We do not need to speculate - he made his intentions incredibly clear in his first meeting with twitter employees after his takeover - WeChat of the West.

To those that do not appreciate freedom, the value prop is clear - WeChat is incredibly powerful and successful in China.

To those that do appreciate freedom, the concern is clear - WeChat has essentially become required to live in China, has surveillance and censorship integrated at its core, and if you are banned from the app your entire livelihood is at risk. Employment, housing, payments, travel, communication, and more become extremely difficult if WeChat censors determine you have acted out of line.

The blue check is the first step in Elon's plan to bring the chinese social credit score system to the west. Users who verify their identity are rewarded with more reach and better tools than those that do not. Verified users are the main product of Elon's twitter - an extensive database of individuals and complete control of the tools he will slowly get them to rely on - it is easier to monetize cattle than free men.

If you cannot resist the temptation of the blue check in its current form you have already lost - what comes next will be much darker. If you realize the need to resist - freedom tech provides us options.

If you found this post helpful support my work with bitcoin.

-

@ 9ca447d2:fbf5a36d

2025-06-08 22:02:16

@ 9ca447d2:fbf5a36d

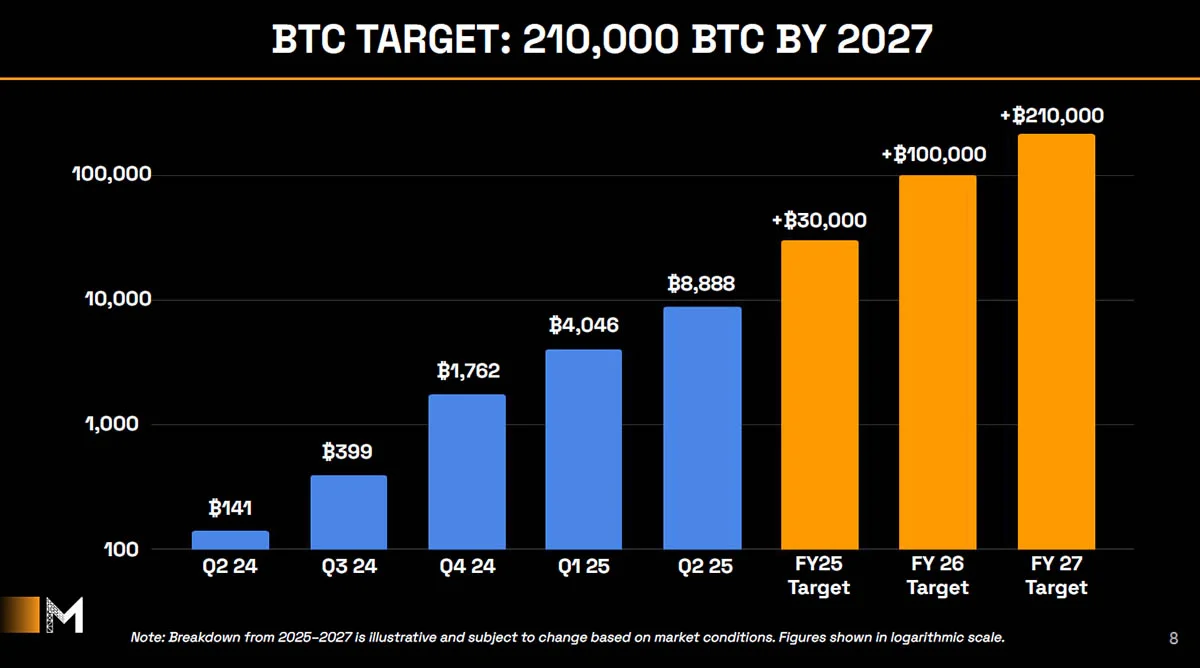

2025-06-08 22:02:16Japanese investment firm Metaplanet has announced a massive $5.4 billion plan to increase its bitcoin holdings to 210,000 BTC by the end of 2027 — that’s about 1% of the total bitcoin supply.

Metaplanet on X

The Tokyo-listed company is accelerating its already aggressive bitcoin plan, with CEO Simon Gerovich calling the initiative “Asia’s largest-ever equity raise to buy Bitcoin — again!”

The company’s new capital raise, called the “555 Million Plan”, involves issuing 555 million shares through moving strike warrants. That’s basically a type of option where people can buy shares later, and the price they pay depends on the stock’s price at that time.

So with moving strike warrants, the price at which people can buy the stock goes up or down depending on how the company’s stock is doing. It gives investors more flexibility — and it can make the warrants more attractive — because they don’t get stuck with a bad deal if the stock price drops.

This way the company can raise capital gradually over the next 2 years without impacting the stock market and existing shareholders.

The funds raised will be used to buy bitcoin, with some to redeem bonds and other income-generating strategies like selling put options.

This is a big step up from Metaplanet’s previous targets. Initially aiming to reach 10,000 BTC by the end of 2025, the company now plans to reach:

- 30,000 BTC by end of 2025

- 100,000 BTC by end of 2026

- 210,000 BTC by end of 2027

The Japanese investment firm hopes to be in the “Bitcoin 1% club” which means holding at least 1% of the total 21 million bitcoin supply.

Metaplanet bitcoin targets

Metaplanet is already making good progress. As of June 2025, the company holds 8,888 BTC, acquired at a cost of about ¥122.2 billion (around $849 million) and has already reached 89% of its original 10,000 BTC target for 2025.

This comes after the success of the company’s previous “210 Million Plan” which raised ¥93.3 billion ($650 million) in 60 trading days by issuing 210 million shares.

During that time, the company’s bitcoin holdings grew from 1,762 BTC to 7,800 BTC and the BTC Yield (a key performance metric showing growth in bitcoin per share) increased by 189%.

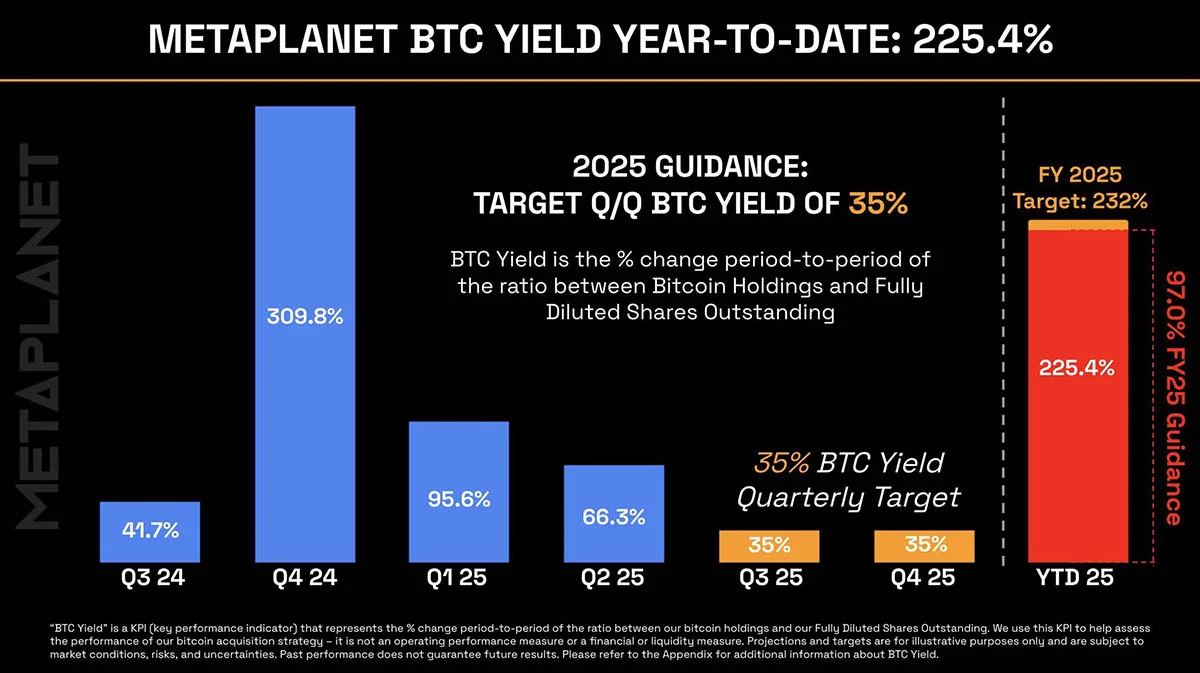

Year to date the BTC Yield is 225.4%.

Metaplanet’s BTC Yield graph

The stock has reflected this momentum, up 275% since early 2025 and 1,619% over the past year.

Metaplanet’s stock price chart — TradingView

Metaplanet is now one of the most actively traded stocks in Japan and has become a top-ten corporate bitcoin holder globally, recently surpassing Block Inc., the company founded by Jack Dorsey.

Metaplanet sees this as part of a bigger shift in capital markets.

By being a “bitcoin treasury vehicle” listed on the Tokyo Stock Exchange, it aims to offer investors exposure to bitcoin through regulated equity markets. This is especially useful in Japan where retail investors are often restricted from accessing bitcoin directly.

“Bitcoin is repricing the global cost of capital,” the company said in a statement. “Through our 555 Million Plan, Metaplanet is doubling down on a high-conviction, equity-driven capital markets strategy to accelerate our Bitcoin accumulation trajectory.”

-

@ 6e0ea5d6:0327f353

2025-06-08 21:03:49

@ 6e0ea5d6:0327f353

2025-06-08 21:03:49scolta bene... Ma ascolta bene, si?

Davvero, if there is one thing I can say after deep personal observation—from Palermo to Catania, from Sicily to Rome—it is this: A coward may strip everything from a righteous man, but after that… who can stop his revenge?

In this sense, amico mio, do not be fooled by the gentle ways of the just and humble man. His composure, his measured words, his restrained gestures, his patience and courtesy—all of it is merely the surface of a deep lake, where his wisdom guards unrest. While wrongdoers boast of their crimes and parade the streets with impunity, the man of honor watches in silence, bearing the world drop by drop.

Tuttavia, figlio mio, the day always comes when the final drop falls.

And then, it is not a gust of wind, nor a thunderclap—it is a dam breaking.

The fury that is born from a violated sense of justice is not loud like the brutes, nor blind like the fools; it is methodical, deliberate, devastating.

Sit here by my side and remember forever the advice of this old man, Antoni Salvatore: Never wrong a righteous man’s family, business, or honor! There is more danger in one upright man, when he finally rises for vengeance, than in a hundred armed scoundrels.

Do not deceive yourself into thinking every good man is also a fearful one! The wrath of the just—held back for so long—when it seeks reparation, carries with it the sacred vengeance permitted by the heavens...

Thank you for reading, my friend!

If this message resonated with you, consider leaving your "🥃" as a token of appreciation.

A toast to our family!

-

@ b1ddb4d7:471244e7

2025-06-08 21:01:41

@ b1ddb4d7:471244e7

2025-06-08 21:01:41Sati, a Bitcoin payments app and Lightning infrastructure provider, announced the launch of its Lightning integration with Xverse wallet.

Launched in 2025 with investors of the likes as Draper Associates and Ricardo Salinas, Sati powers Bitcoin payments on applications such as WhatsApp to fuel the next wave of adoption.

The Whatsapp bot allows users to send bitcoin via the messaging app through a special bot. After verifying their identity, the user selects the “send” option, chooses to pay to a Lightning address, enters the amount (1,000 sats), confirms with a PIN, and the transaction is completed, with the funds appearing instantly in the recipient wallet.

The new integration will now bring Lightning functionality to over 1.5 million people worldwide. Users can send and receive sats (Bitcoin’s smallest denomination) instantly over the Lightning Network all within the Xverse app,