-

@ b1ddb4d7:471244e7

2025-06-04 09:00:45

@ b1ddb4d7:471244e7

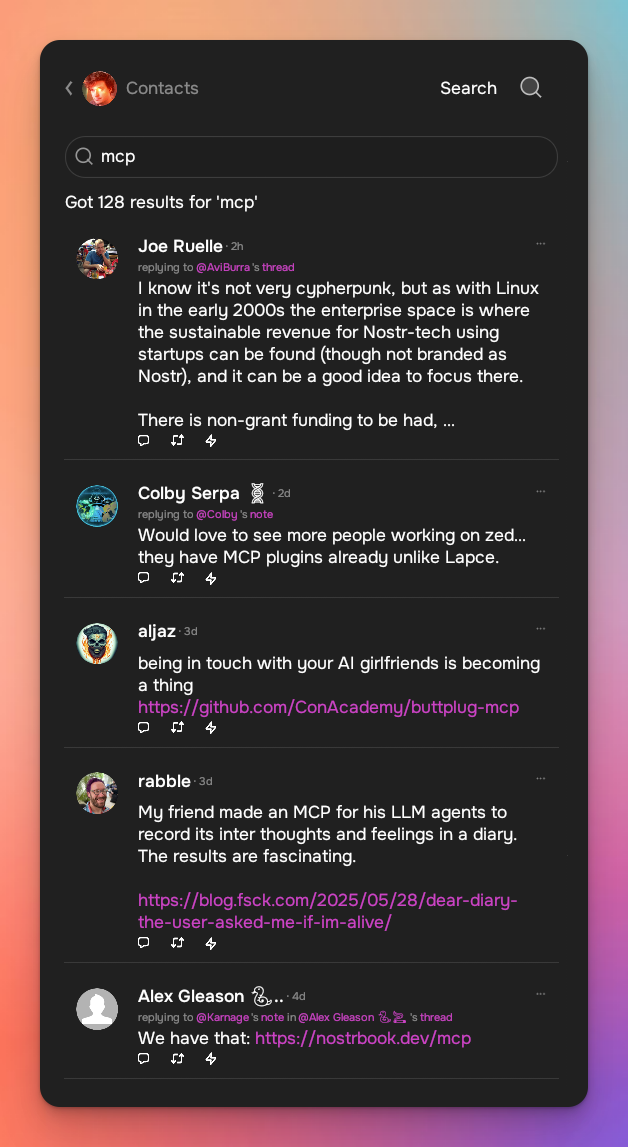

2025-06-04 09:00:45Flash, an all-in-one Bitcoin payment platform, has announced the launch of Flash 2.0, the most intuitive and powerful Bitcoin payment solution to date.

With a completely redesigned interface, expanded e-commerce integrations, and a frictionless onboarding process, Flash 2.0 makes accepting Bitcoin easier than ever for businesses worldwide.

We did the unthinkable!

We did the unthinkable! Website monetization used to be super complicated.

"Buy me a coffee" — But only if we both have a bank account.

WHAT IF WE DON'T?

Thanks to @paywflash and bitcoin, it's just 5 CLICKS – and no banks!

Start accepting donations on your website… pic.twitter.com/uwZUrvmEZ1

Start accepting donations on your website… pic.twitter.com/uwZUrvmEZ1— Flash • The Bitcoin Payment Gateway (@paywflash) May 13, 2025

Accept Bitcoin in Three Minutes

Setting up Bitcoin payments has long been a challenge for merchants, requiring technical expertise, third-party processors, and lengthy verification procedures. Flash 2.0 eliminates these barriers, allowing any business to start accepting Bitcoin in just three minutes, with no technical set-up and full control over their funds.

The Bitcoin Payment Revolution

The world is witnessing a seismic shift in finance. Governments are backing Bitcoin funds, major companies are adding Bitcoin to their balance sheets, and political figures are embracing it as the future of money. Just as Stripe revolutionized internet payments, Flash is now doing the same for Bitcoin. Businesses that adapt today will gain a competitive edge in a rapidly evolving financial landscape.

With Bitcoin adoption accelerating, consumers are looking for places to spend it. Flash 2.0 ensures businesses of all sizes can seamlessly accept Bitcoin and position themselves at the forefront of this financial revolution.

All-in-One Monetization Platform

More than just a payment gateway, Flash 2.0 is a complete Bitcoin monetization suite, providing multiple ways for businesses to integrate Bitcoin into their operations. Merchants can accept payments online and in-store, content creators can monetize with donations and paywalls, and freelancers can send instant invoices via payment links.

For example, a jewelry designer selling products on WooCommerce can now integrate Flash for online payments, use Flash’s Point-of-Sale system at trade shows, enable Bitcoin donations for her digital artwork, and lock premium content behind Flash Paywalls. The possibilities are endless.

E-Commerce for Everyone

With built-in integrations for Shopify, WooCommerce, and soon Wix and OpenCart, Flash 2.0 enables Bitcoin payments on 95% of e-commerce stores worldwide. Businesses can now add Bitcoin as a payment option in just a few clicks—without needing developers or external payment processors.

And for those looking to start selling, Flash’s built-in e-commerce features allow users to create online stores, showcase products, and manage payments seamlessly.

No Middlemen, No Chargebacks, No Limits

Unlike traditional payment platforms, Flash does not hold or process funds. Businesses receive Bitcoin directly, instantly, and securely. There are no chargebacks, giving merchants full control over refunds and eliminating fraud. Flash also remains KYC-free, ensuring a seamless experience for businesses and customers alike.

A Completely Redesigned Experience

“The world is waking up to Bitcoin. Just like the internet revolutionized commerce, Bitcoin is reshaping finance. Businesses need solutions that are simple, efficient, and truly decentralized. Flash 2.0 is more than just a payment processor—it’s a gateway to the future of digital transactions, putting financial power back into the hands of businesses.”

— Pierre Corbin, CEO at Flash.

Flash 2.0 introduces a brand-new user interface, making it easier than ever to navigate, set up payments, and manage transactions. With an intuitive dashboard, streamlined checkout, and enhanced mobile compatibility, the platform is built for both new and experienced Bitcoin users.

About Flash

Flash is an all-in-one Bitcoin payment platform that empowers businesses, creators, and freelancers to accept, manage, and grow with Bitcoin. With a mission to make Bitcoin payments accessible to everyone, Flash eliminates complexity and gives users full control over their funds.

To learn more or get started, visit www.paywithflash.com.

Press Contact:

Julien Bouvier

Head of Marketing

+3360941039 -

@ 9dd283b1:cf9b6beb

2025-06-04 08:33:32

@ 9dd283b1:cf9b6beb

2025-06-04 08:33:32To all territory owners,

- Can I co-found a territory with someone? Is it on the roadmap to be able to do so?

- Can I automatically split the territory rewards with other stackers?

- Can I rename the territory in the future?

Thanks

https://stacker.news/items/996796

-

@ 6ad3e2a3:c90b7740

2025-06-04 08:32:29

@ 6ad3e2a3:c90b7740

2025-06-04 08:32:29"Modern science is based on this principle: give us one free miracle and then we'll explain the rest."

— Terrence McKenna

I always wondered why a pot of water boils on the stove. I mean I know it boils because I turned on the electricity, but why does the electricity cause it to boil? I know the electricity produces heat, and the heat is conducted through the stainless steel pot and into the water, but why does the heat transfer from stovetop to the water?

I know the heat from the stove via the pot speeds up the molecules in the water touching it and that they in turn speed up the molecules touching them and so on throughout the pot, but why do speedy molecules cause adjacent molecules to speed up?

I mean I know they do this, but why do they do this? Why couldn’t it be that sped-up molecules only interact with sufficient speedy molecules and ignore slower ones? Why do they interact with all the molecules, causing all of them to speed up? Or why don’t the speedy ones, instead of sharing their excited state, hoard it and take more energy from adjacent slower molecules, thereby making them colder, i.e., why doesn’t half the water boil twice as fast (on the left side of the pot) while the other half (right side) turns to ice?

The molecules tend to bounce around randomly, interacting as equal opportunists on the surrounding ones rather than distinguishing only certain ones with which to interact. Why do the laws of thermodynamics behave as such rather than some other way?

There may be yet deeper layers to this, explanations going down to the atomic and even quantum levels, but no matter how far you take them, you are always, in the end, left with: “Because those are the laws of physics”, i.e., “because that’s just how it is.”

. . .

The Terrence McKenna quote, recently cited by Joe Rogan on his podcast, refers to the Big Bang, the current explanation adopted by the scientifically literate as to the origins of the universe. You see there was this insanely dense, infinitesimally small micro dot that one day (before the dawn of time) exploded outward with unimaginable power that over billions of years created what we perceive as the known universe.

What happened prior? Can’t really say because time didn’t yet exist, and “prior” doesn’t make sense in that context. Why did it do this? We don’t know. How did it get there? Maybe a supermassive black hole from another universe got too dense and exploded out the other side? Highly speculative.

So why do people believe in the Big Bang? Because it comports with and explains certain observable phenomena and predicted other phenomena which were subsequently confirmed. But scratch a little deeper for an explanation as to what caused it, for what purpose did it occur or what preceded it, and you hit the same wall.

. . .

Even if we were to understand at a quantum level how and why the Big Bang happened and what preceded it, let’s assume it’s due to Factor X, something we eventually replicated with mini big-bangs and universe creations in our labs, we would still be tasked with understanding why Factor X exists in the universe. And if Factor X were explained by Process Y, we’d still be stuck needing an explanation for Process Y — ad infinitum.

Science can thus only push the wall back farther, but can never scale it. We can never arrive at an ultimate explanation, only partial ones. Its limitations are the limitations of thought itself, the impossibility of ever creating a map at a scale of one mile per mile.

-

@ 866e0139:6a9334e5

2025-06-04 08:21:14

@ 866e0139:6a9334e5

2025-06-04 08:21:14Autor: Milosz Matuschek. Dieser Beitrag wurde mit dem Pareto-Client geschrieben. Sie finden alle Texte der Friedenstaube und weitere Texte zum Thema Frieden hier. Die neuesten Pareto-Artikel finden Sie in unserem Telegram-Kanal.

Die neuesten Artikel der Friedenstaube gibt es jetzt auch im eigenen Friedenstaube-Telegram-Kanal.

Auch wer das Kriegsgeschehen bisher nicht im Detail verfolgte (das tat ich auch nicht), horcht nun auf: Einem Nicht-Atomstaat – der Ukraine – ist ein gleichzeitiger, koordinierter Schlag gegen vier teils tausende Kilometer voneinander entfernte russische Luftbasen gelungen. Eine nicht unerhebliche Zahl strategisch wichtiger Flugzeuge wurde zerstört. Ein Angriff im hintersten russischen Hinterland, selbst jenseits der Taurus-Reichweite, durchgeführt mit Billigdrohnen, wirft erhebliche Fragen über geheimdienstliches Versagen in Russland und eklatante Mängel in der Luftverteidigung auf.

Es gibt wohl Momente, in denen Geschichte nicht geschrieben, sondern geflogen wird. Unspektakulär, relativ still, surrend, von einem LKW aus abgefeuert, mit einem Stück Technik, das kaum mehr kostet als das Gerät, auf dem ich diesen Text schreibe.

Ein Angriff auf die Friedensverhandlungen

Die Ukraine hat sich erstmals weit über das Schlachtfeld hinaus erhoben – geografisch, technisch, symbolisch. Die Triade der atomwaffenfähigen Luftstreitkräfte Russlands – ein Heiligtum sowjetischer Machtprojektion – wurde durch das schwächste Glied in der Logikkette der Militärdoktrin beschädigt: den Überraschungseffekt. Drohnen, wie aus dem 3D-Drucker, haben eine strategische Achillesferse bloßgelegt. Nicht mit Hyperschall, sondern mit Hartplastik und GPS. Das erste Opfer dieses Angriffs dürften die Friedensverhandlungen in Istanbul sein.

Dass die Ukraine strategische Luftstützpunkte der russischen Atomwaffe angreift – koordiniert, tief im Landesinnern – wäre bereits für sich eine Zäsur. Doch dass dies unter stillschweigender Duldung oder gar Mithilfe westlicher Dienste wie der CIA erfolgt sein dürfte, während Trump zugleich als Friedenstaube auftritt, verschiebt das strategische Koordinatensystem. Die alten Verträge – START etc. – wirken wie rissige Abkommen aus der Steinzeit. Wenn die USA von der Operation wussten, darf sich Russland getäuscht fühlen. Washington kann nicht gleichzeitig Frieden mit Moskau betonen und eine Aktion dulden oder mittragen, die offensichtlich das Ziel hat, die russische Atommacht zu schwächen, woran die USA prinzipiell Interesse hätten. Falls Trump nichts davon wusste, muss man sich fragen: Regiert eigentlich er oder der „Swamp“, den er austrocknen wollte?

Egal wie man es wendet: Die Operation Spinnennetz war mehr als nur ein Angriff auf russische Flugzeuge auf russischem Gebiet. Militärisch gewinnt die Ukraine dadurch wenig, symbolisch und politisch aber viel, denn der Hauptgegner der Ukraine sind gerade nicht die hundert Millionen Dollar teuren Bomber der Russen, sondern die schleichende Kriegsunlust der Europäer – und ein Amerika, das sich mehr mit sich selbst beschäftigt als mit dem Fortgang eines Krieges, in dem es längst selbst Partei ist.

Damit sich die Reihen wieder schließen, muss der Feind sich zeigen – deutlich, fassbar, bedrohlich. Eine russische Reaktion, die auch europäische Hauptstädte erschüttert, wäre strategisch nützlich. Der Angriff war daher wohl weniger eine militärische Tat als eine psychologische Operation im Kampf um Wahrnehmung und Willen. Aus Sicht der Ukraine ist das verständlich, für sie geht es um ihre Existenz. Dafür wiederum braucht es eine erhöhte Alarmstufe.

https://www.youtube.com/watch?v=1JlQLewOAmA

Solidarität durch Eskalation?

Die kalkulierte Demütigung könnte einem Drehbuch folgen: Putin soll nun die Rolle des Eskalators übernehmen. Tut er es, war die Operation erfolgreich – denn Europas Kriegstüchtigkeit hängt nicht nur von Panzerzahlen ab, sondern von der Bereitschaft zur Konfrontation. Der Feind, den es braucht, muss sich jetzt allen ins Gedächtnis brennen.

So gesehen ist der eigentliche Coup nicht der Schaden in Djagilewo, Iwanowo oder Olenia – sondern das noch bevorstehende unsichtbare Nachspiel. Europa und die Welt betreten nun gänzlich neues Gelände, in welchem ein militärisch gedemütigtes Russland gleichzeitig Friedenswillen gegenüber Europa bekunden, rote Linien verteidigen und seine Integrität als Atom-Macht bewahren muss. Das Dilemma für Putin besteht nun darin, Stärke zu beweisen ohne sich noch mehr zum Feindbild des Aggressors machen zu lassen.

Fakt ist: Wir sind einem III. Weltkrieg gerade so nah wie seit der Kuba-Krise nicht mehr.

Und wer sich über ein russisches “Pearl Harbor” freut, sollte mal in ein Geschichtsbuch schauen, wie es am Ende für Japan ausging.

LASSEN SIE DER FRIEDENSTAUBE FLÜGEL WACHSEN!

In Kürze folgt eine Mail an alle Genossenschafter, danke für die Geduld!

Hier können Sie die Friedenstaube abonnieren und bekommen die Artikel zugesandt.

Schon jetzt können Sie uns unterstützen:

- Für 50 CHF/EURO bekommen Sie ein Jahresabo der Friedenstaube.

- Für 120 CHF/EURO bekommen Sie ein Jahresabo und ein T-Shirt/Hoodie mit der Friedenstaube.

- Für 500 CHF/EURO werden Sie Förderer und bekommen ein lebenslanges Abo sowie ein T-Shirt/Hoodie mit der Friedenstaube.

- Ab 1000 CHF werden Sie Genossenschafter der Friedenstaube mit Stimmrecht (und bekommen lebenslanges Abo, T-Shirt/Hoodie).

Für Einzahlungen in CHF (Betreff: Friedenstaube):

Für Einzahlungen in Euro:

Milosz Matuschek

IBAN DE 53710520500000814137

BYLADEM1TST

Sparkasse Traunstein-Trostberg

Betreff: Friedenstaube

Wenn Sie auf anderem Wege beitragen wollen, schreiben Sie die Friedenstaube an: friedenstaube@pareto.space

Sie sind noch nicht auf Nostr and wollen die volle Erfahrung machen (liken, kommentieren etc.)? Zappen können Sie den Autor auch ohne Nostr-Profil! Erstellen Sie sich einen Account auf Start. Weitere Onboarding-Leitfäden gibt es im Pareto-Wiki.

-

@ 5c9e5ee4:72f1325b

2025-06-04 08:16:52

@ 5c9e5ee4:72f1325b

2025-06-04 08:16:52For too long, the autistic experience has been framed through a neurotypical lens, focusing on "differences" and "deficits." However, a profound perspective emerging from within the autistic community offers a radical reinterpretation: that autistic individuals are not inherently "broken" but rather possess a unique, often unyielding, perception of truth that challenges the very foundations of neurotypical society. From this viewpoint, autism is less about a disorder and more about a clarity of vision that apprehends the world as fundamentally "untrue" in many of its social constructs.

This perspective posits that what many autistic individuals perceive as "corrupted" or "untrue" in society isn't a subjective internal experience, but an objective reality of falsehoods, deception, and manipulation. The rejection of these elements is not a personal preference but a natural, logical response to what is genuinely illogical and dishonest.

The Core of the "Untrue" World:

- Honesty as a Default State: For many autistic people, directness and factual accuracy are paramount. Social conventions like "white lies," indirect communication, or performative politeness are not merely nuanced social skills; they are perceived as outright forms of deception and inauthenticity. The natural inclination is towards what is straightforward and verifiable.

- Logic Over Social Grace: An unwavering adherence to logic means that actions or systems that lack rational basis—such as engaging in flattery, suppressing truth for social harmony, or participating in inefficient rituals—are viewed as fundamentally nonsensical and therefore "untrue."

- Authenticity as a Non-Negotiable: The concept of "masking"—the exhausting act of suppressing one's natural autistic traits to conform—is seen as a deeply painful betrayal of self. A society that implicitly demands such a performance is deemed "corrupt" because it stifles genuine self-expression.

- Aversion to Hypocrisy: A strong sense of justice and an acute awareness of inconsistency mean that any disjuncture between stated values and actual behavior is immediately flagged as a profound untruth.

Social Groups: Formed Around a "Proudly Believed Lie"?

This critical autistic perspective extends to the very fabric of social organization. It suggests that many groups, whether religious, political, scientific, or economic, are not built on shared objective truths, but rather on "proudly believed lies." These shared narratives or belief systems, even if they contradict logic or verifiable facts, serve as the glue that binds the group, fostering identity, comfort, and a sense of belonging. The "pride" in these beliefs makes them resistant to critical examination, even when confronted with evidence.

For example: * In religion, this "lie" might be a dogma that provides solace but defies logic. * In politics, it could be an ideology based on selective truths that serve power. * In economics, it might be assumptions about markets or growth that are presented as infallible. * Even in science, while ideally pursuing truth, the social aspects of the scientific community might, at times, cling to paradigms that become "proudly believed lies," resisting new evidence.

The Disconnect: Why Autistics Are "Discredited"

If autistic individuals are part of the "5% who see it as it is"—those who perceive these societal untruths with clarity—then a natural tension arises with the "10% who want control." This controlling minority, it is argued, relies on these "untruths" to maintain power and influence over the "85% who are happy following."

From this viewpoint, the discrediting of autistic people—labeling their directness as "social deficits," their sensory experiences as "disorders," or their logical critiques as "inflexibility"—is not accidental. It is a strategic mechanism employed by the controlling "10%" to neutralize those who expose the underlying untruths, thereby safeguarding their constructed reality and maintaining influence.

In conclusion, the autistic perspective challenges us to re-evaluate the very nature of truth in our society. It suggests that what many perceive as social norms might, in fact, be a pervasive web of "untruths," and that the autistic individual's unique wiring allows for a crucial, unvarnished perception of this reality. It is a powerful call for authenticity and a profound questioning of how much of our world is built on what is genuinely true, versus what is merely believed.

-

@ e4950c93:1b99eccd

2025-06-04 08:01:23

@ e4950c93:1b99eccd

2025-06-04 08:01:23Marques

Cosilana est une marque allemande qui crée des vêtements exclusivement en coton biologique, soie et laine pour les femmes, les bébés et les enfants.

Matières naturelles utilisées dans les produits

Catégories de produits proposés

Cette marque propose des produits intégralement en matière naturelle dans les catégories suivantes :

#Vêtements

- Tailles vêtements : bébés, enfants, femmes

- Sous-vêtements : culottes

- Une pièce : bodies, combinaisons

- Hauts : débardeurs, pulls, t-shirts, vestes

- Bas : leggings, pantalons, shorts

- Tête et mains : bonnets, gants

- Nuit : pyjamas

#Maison

- Linge : couvertures, turbulettes

Autres informations

- Certification GOTS

- Fabriqué en Allemagne

- Fabriqué en Europe

- Déclaration de laine de mouton sans mulesing et de bien-être animal

👉 En savoir plus sur le site de la marque

Où trouver leurs produits ?

- Le mouton à lunettes (zone de livraison : France, Belgique, Luxembourg)

- Mama Owl (en anglais, zone de livraison : Royaume Uni et international)

- Chouchous (zone de livraison : France et international)

📝 Tu peux contribuer à cette fiche en suggérant une modification en commentaire.

🗣️ Tu utilises des produits de cette marque ? Partage ton avis en commentaire.

⚡ Heureu-x-se de trouver cette information ? Soutiens le projet en faisant un don pour remercier les contribut-eur-ice-s.

-

@ eb0157af:77ab6c55

2025-06-04 08:01:19

@ eb0157af:77ab6c55

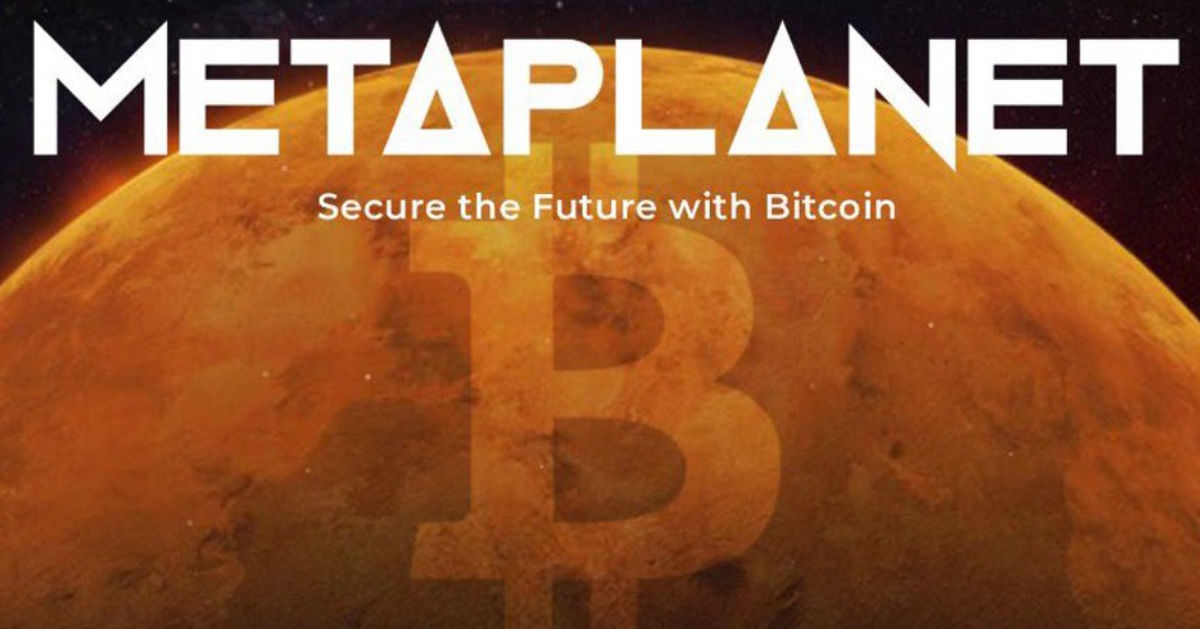

2025-06-04 08:01:19The blockchain analytics firm claims to have identified the Bitcoin addresses held by the company led by Saylor.

Arkham Intelligence announced it had identified addresses linked to Strategy. According to Arkham’s statements, an additional 70,816 BTC connected to the company have been identified, with an estimated value of around $7.6 billion at current prices. This discovery would bring the total amount of Strategy’s identified holdings to $54.5 billion.

SAYLOR SAID HE WOULD NEVER REVEAL HIS ADDRESSES … SO WE DID

We have identified an additional 70,816 BTC belonging to Strategy, bringing our total identified MSTR BTC holdings to $54.5 Billion. We are the first to publicly identify these holdings.

This represents 87.5% of… pic.twitter.com/P3OVdVrhQL

— Arkham (@arkham) May 28, 2025

The analytics firm claims to have mapped 87.5% of Strategy’s total holdings. In a provocative post on X, Arkham wrote:

“Saylor said he would never reveal his addresses. So, we did it for him.

Previously, we tagged:

– 107,000 BTC sent to MSTR’s Fidelity deposits (Fidelity does not segregate custody, so these BTC do not appear in the MSTR entity)

– Over 327,000 BTC held in segregated custody, including Coinbase Prime, in our MSTR entity.”Arkham’s revelations directly clash with Michael Saylor’s public statements on wallet security. During the Bitcoin 2025 conference in Las Vegas, the Strategy chairman explicitly warned against publishing corporate wallet addresses.

“No institutional or enterprise security analyst would ever think it’s a good idea to publish all the wallet addresses so you can be tracked back and forth,” Saylor said during the event.

The executive chairman of Strategy added:

“The current, conventional way to publish proof-of-reserves is an insecure proof of reserves… It’s not a good idea, it’s a bad idea.”

He compared publishing wallet addresses to “publishing the addresses, bank accounts, and phone numbers of your kids hoping it will protect them — when in fact it makes them more vulnerable.”

Finally, the executive chairman suggested using artificial intelligence to explore the security implications of such a practice, claiming that in-depth research could produce “50 pages” of potential security risks.

The post Arkham reveals 87% of Strategy’s Bitcoin addresses appeared first on Atlas21.

-

@ a5142938:0ef19da3

2025-06-04 08:00:22

@ a5142938:0ef19da3

2025-06-04 08:00:22Brands

Cosilana is a German brand that creates clothing exclusively from organic cotton, silk, and wool for women, babies, and children.

Natural materials used in products

Categories of products offered

This brand offers products made entirely from natural materials in the following categories:

#Clothing

- Clothing fits : babies, children, women

- Underwear : panties

- One piece : bodysuits, jumpsuits

- Tops : jackets, sweaters, t-shirts, tank tops

- Bottoms : leggings, pants-trousers, shorts

- Head & handwear : gloves, hats

- Nightwear : pyjamas

#Home

- Linen : blankets, sleeping bags

Other information

- GOTS certification

- Made in Germany

- Made in Europe

- Non mulesed wool and animal welfare declaration

👉 Learn more on the brand website

Where to find their products?

- Le mouton à lunettes (in French, shipping area: France, Belgium, Luxemburg)

- Mama Owl (shipping area: UK and international)

- Chouchous (in French, shipping area: France and international)

📝 You can contribute to this entry by suggesting edits in comments.

🗣️ Do you use this brand's products? Share your opinion in the comments.

⚡ Happy to have found this information? Support the project by making a donation to thank the contributors.

-

@ 8bf578f4:b6303c41

2025-06-04 07:20:09

@ 8bf578f4:b6303c41

2025-06-04 07:20:09test

https://nostr.download/6849b84caaa15bdc18ca2e1e1ee00e979c7ecf901787e09054b4bd0196b4ea27.jpg

-

@ de54d599:77efc747

2025-06-04 05:48:27

@ de54d599:77efc747

2025-06-04 05:48:27When it comes to gift-giving, the most memorable presents are those that tell a story. Veuve Clicquot, a champagne house known for its bold innovation and timeless elegance, has created something truly special with its Personalised Arrow gift—a tribute not only to fine champagne but to the destinations that hold meaning in our lives.

A Destination Worth Celebrating The Veuve Clicquot Personalised Arrow is more than elegant packaging—it’s a symbol. Inspired by classic road signs, the bright, arrow-shaped tin can be customised with the name of any city or location, along with the exact distance from Reims, France, where the champagne is produced. Whether it's your hometown, a honeymoon destination, or the place where you first met someone special, this gift turns a bottle of bubbly into a personal journey.

Inside the Arrow: Yellow Label Champagne Tucked inside the tin is Veuve Clicquot's iconic Yellow Label Brut, a globally beloved champagne known for its depth, liveliness, and balance. With a composition dominated by Pinot Noir and complemented by Chardonnay and Meunier, it delivers notes of citrus, brioche, and stone fruit—perfect for toasting any occasion. It’s a champagne that’s as dynamic and enduring as the stories behind each personalised location.

Beautifully Designed with the Planet in Mind The tin is crafted from 30% recycled materials and is 100% recyclable, aligning with Veuve Clicquot’s sustainability commitments. Its removable sugarcane-based backing adds a thoughtful eco-friendly touch to a design that’s made to last long after the bottle is enjoyed.

A Gift That Connects People and Places This unique keepsake is ideal for birthdays, anniversaries, weddings, or corporate gifts—it’s perfect for anyone who values meaningful moments and sophisticated taste. More than just a drink, it's a celebration of where you've been, and where you’re going.

With the Veuve Clicquot Personalised Arrow, every toast becomes a story—one that starts with a location and ends in a lasting memory.

-

@ 3b13c372:3e1e7ef2

2025-06-04 05:40:55

@ 3b13c372:3e1e7ef2

2025-06-04 05:40:55For those who believe every bottle should tell a story, Veuve Clicquot’s Personalised Arrow Champagne offers the perfect blend of sophistication and sentiment. More than a premium Champagne, this collector’s piece is a tribute to the places that shape our lives—wrapped in unmistakable Veuve Clicquot style.

At the heart of the package is a 750ml bottle of Veuve Clicquot Yellow Label Brut, a Champagne celebrated for its balance of power, freshness, and finesse. It’s crafted predominantly from Pinot Noir, supported by Chardonnay and Meunier, creating a vibrant, structured wine with layers of pear, citrus, and brioche.

What sets this gift apart is its outer casing: a bold, arrow-shaped metal tin that can be personalised with the name of your chosen city or destination (up to 15 characters). Alongside your customisation, the arrow displays the distance from that location to Reims, France—the spiritual home of Veuve Clicquot.

This elegant detail turns the bottle into a statement. Whether you’re celebrating a new home, a wedding, a farewell, or just sending a thoughtful gift, the Personalised Arrow adds meaning to the moment. It’s functional, too—keeping your Champagne cool for up to two hours—making it ideal for celebrations on the go.

Veuve Clicquot’s Personalised Arrow Champagne is a thoughtful way to connect a bottle of world-class wine with a personal journey. A toast to the people and places we never forget—wrapped in signature yellow, and stamped with your own message.

-

@ 8f09dc4f:5e01d432

2025-06-04 04:33:18

@ 8f09dc4f:5e01d432

2025-06-04 04:33:18Veuve Clicquot brings a delightful twist to gifting with the https://shop.veuveclicquot.com.au/products/personalisable-arrow – a luxurious and thoughtful present that’s perfect for commemorating meaningful locations. Whether it’s your hometown, a dream vacation spot, or the city where memories were made, this unique gift lets you celebrate it in true Champagne style.

Each set includes a 750ml bottle of Veuve Clicquot’s signature Yellow Label Brut Champagne, housed in a striking arrow-shaped tin. What sets this gift apart is the ability to customise the tin with the name of a city or location of your choice (up to 15 characters). The tin also displays the distance from your chosen location to Reims, the historic home of Veuve Clicquot in France, adding a charming and personal touch.

The Yellow Label Brut itself is a testament to the Maison’s commitment to quality and consistency. With a blend dominated by Pinot Noir, balanced with Chardonnay and Meunier, it delivers a perfect harmony of strength, elegance, and freshness. Expect notes of apple, pear, and brioche, with a fine mousse and a vibrant golden hue.

Beyond its aesthetic appeal, the arrow tin is practical too—it keeps the Champagne cool for up to two hours, making it ideal for picnics, celebrations, or spontaneous toasts. Once the Champagne is enjoyed, the tin transforms into a decorative keepsake that serves as a reminder of the special place it honors.

Retailing at $125 AUD, this is more than a bottle of Champagne—it's a personalised gesture that celebrates people, places, and the memories that connect them. Ideal for gifting on birthdays, anniversaries, or as a unique souvenir, the Veuve Clicquot Personalised Arrow is Champagne with meaning.

-

@ c7a8d522:262a74de

2025-06-04 04:23:03

@ c7a8d522:262a74de

2025-06-04 04:23:03O universo dos jogos online está em constante evolução, e o Brasil tem se mostrado um dos mercados mais promissores nesse cenário. Entre as plataformas que vêm conquistando o público nacional, a 707Bet se destaca por oferecer uma experiência completa, segura e empolgante para os jogadores que buscam diversão e recompensas em um só lugar. Com uma interface intuitiva, ampla variedade de jogos e suporte de qualidade, a 707Bet está rapidamente se tornando uma referência entre os entusiastas do entretenimento digital.

Uma Plataforma Moderna e de Fácil Navegação Desde o primeiro acesso, é possível perceber que a 707Bet foi desenvolvida com foco na experiência do usuário. O site possui um design moderno, com menus bem organizados, o que facilita a navegação tanto em computadores quanto em dispositivos móveis. Seja para iniciantes ou jogadores experientes, a plataforma proporciona uma usabilidade fluida, permitindo que todos encontrem seus jogos favoritos com apenas alguns cliques.

Outro diferencial importante é o desempenho do site, que garante carregamento rápido das páginas e jogos sem travamentos. Isso é essencial para manter a imersão e garantir que o jogador aproveite cada segundo da sua sessão de entretenimento.

Diversidade de Jogos para Todos os Perfis Um dos grandes atrativos da 707beté a impressionante variedade de jogos disponíveis. A plataforma conta com opções para todos os gostos e estilos, desde os tradicionais jogos de cartas e roleta até os populares slots com gráficos de última geração. Os jogadores podem explorar diferentes temáticas, mecânicas e níveis de dificuldade, o que torna a experiência ainda mais dinâmica.

Além disso, a 707Bet trabalha com os principais desenvolvedores de software do mercado, garantindo títulos de alta qualidade e com total segurança. Isso significa que cada jogo oferece não apenas entretenimento, mas também confiança, transparência e chances reais de ganhar.

Experiência do Jogador: Entretenimento com Emoção e Segurança Na 707Bet, o jogador é tratado com prioridade. A plataforma oferece bônus e promoções regulares, que aumentam as chances de jogo e tornam a experiência ainda mais gratificante. O sistema de recompensas é claro e acessível, incentivando o usuário a explorar mais funcionalidades e se engajar com o conteúdo oferecido.

Outro ponto positivo é o suporte ao cliente. A equipe de atendimento da 707Bet está disponível 24 horas por dia, sete dias por semana, pronta para tirar dúvidas e resolver qualquer questão com agilidade e cordialidade. O suporte em português é um diferencial importante para os jogadores brasileiros, garantindo maior confiança e tranquilidade durante o uso da plataforma.

A segurança também merece destaque. A 707Bet utiliza tecnologias avançadas de criptografia para proteger os dados dos usuários e garantir transações seguras. Isso significa que os jogadores podem se concentrar na diversão, sem se preocupar com questões técnicas ou riscos.

Conclusão A 707Bet chega ao mercado brasileiro com uma proposta sólida e inovadora, aliando tecnologia, variedade e atendimento de excelência. Seja você um jogador veterano ou alguém que está começando agora nesse universo, a plataforma oferece todos os recursos necessários para proporcionar uma jornada empolgante e cheia de possibilidades. Com a 707Bet, o entretenimento online ganha um novo nível de qualidade e confiança — uma escolha inteligente para quem busca diversão com segurança e praticidade.

-

@ c7a8d522:262a74de

2025-06-04 04:21:47

@ c7a8d522:262a74de

2025-06-04 04:21:47Com o avanço da tecnologia e a popularização das plataformas digitais de jogos, os brasileiros estão cada vez mais em busca de experiências online que combinem praticidade, emoção e segurança. Nesse cenário, a 0066Bet se destaca como uma das plataformas mais completas e inovadoras do mercado, oferecendo uma ampla variedade de jogos e um ambiente digital pensado especialmente para os usuários que desejam entretenimento de qualidade a qualquer hora e em qualquer lugar.

Uma Plataforma Moderna e Segura A 0066Bet foi desenvolvida com foco total na experiência do usuário. Com um design moderno e responsivo, a plataforma funciona perfeitamente em computadores, tablets e smartphones, permitindo que os jogadores tenham acesso total às funcionalidades, independentemente do dispositivo. Além disso, a segurança é uma das grandes prioridades da empresa. O site utiliza criptografia avançada e protocolos de proteção de dados para garantir que as informações dos usuários estejam sempre protegidas.

A facilidade de cadastro e navegação também merece destaque. Em poucos minutos, qualquer pessoa pode criar sua conta, explorar as seções de jogos e começar a se divertir com total autonomia. Os métodos de pagamento são variados e incluem opções amplamente utilizadas no Brasil, o que facilita ainda mais o acesso ao entretenimento.

Diversidade de Jogos para Todos os Gostos Um dos grandes atrativos da 0066beté a variedade de jogos disponíveis. A plataforma conta com títulos clássicos e modernos, atendendo tanto os iniciantes quanto os jogadores mais experientes. Entre os destaques estão os jogos de cartas como poker e bacará, que exigem estratégia e habilidade, além de opções mais dinâmicas como roletas virtuais, jogos com números e modalidades ao vivo com interação em tempo real.

Para os amantes da adrenalina, a seção de jogos com crupiês reais é imperdível. Nela, os jogadores participam de partidas transmitidas ao vivo, com profissionais treinados, proporcionando uma experiência extremamente imersiva e realista — tudo sem sair de casa.

Outro ponto forte da 0066Bet é a oferta constante de novos títulos e atualizações. A equipe da plataforma está sempre em busca de novidades, o que garante que os jogadores encontrem sempre algo diferente para explorar e experimentar.

Experiência do Jogador: Simples, Intuitiva e Gratificante A opinião dos usuários é unânime: a experiência na 0066Bet é agradável, fluida e repleta de recompensas. A interface é intuitiva, as instruções dos jogos são claras e o sistema de suporte ao cliente funciona 24 horas por dia, com atendimento rápido e eficiente em português.

Além disso, a plataforma oferece promoções regulares, bônus de boas-vindas e programas de fidelidade que valorizam o tempo e o investimento dos jogadores. Esses incentivos tornam a jornada ainda mais empolgante, garantindo que cada sessão de jogo seja única e recompensadora.

Conclusão A 0066Bet vem se consolidando como uma das melhores opções de entretenimento online no Brasil. Com sua interface amigável, catálogo variado de jogos e compromisso com a segurança e a satisfação do usuário, a plataforma é ideal para quem busca emoção, diversão e a chance de viver experiências intensas e inesquecíveis diretamente da tela do celular ou do computador.

Se você ainda não conhece a 0066Bet, essa é a hora perfeita para descobrir um novo mundo de entretenimento digital. Faça seu cadastro, explore os jogos disponíveis e aproveite tudo o que a plataforma tem a oferecer!

-

@ c7a8d522:262a74de

2025-06-04 04:21:18

@ c7a8d522:262a74de

2025-06-04 04:21:18Com o avanço da tecnologia e o crescimento do entretenimento digital, plataformas como a 888Game vêm se destacando no cenário brasileiro por oferecerem uma experiência completa e envolvente aos seus usuários. Com um design moderno, navegação intuitiva e um catálogo diversificado de jogos, a 888Game se posiciona como uma das melhores opções para quem busca emoção, desafio e diversão em um só lugar.

Uma Plataforma Pensada para o Jogador Brasileiro A 888Game foi desenvolvida com foco total na experiência do usuário. Desde o primeiro acesso, é possível perceber o cuidado com os detalhes: o site é responsivo, rápido e adaptado para dispositivos móveis, permitindo que os jogadores aproveitem seus jogos favoritos de onde estiverem, a qualquer momento. Além disso, a plataforma está totalmente em português, o que garante uma navegação fluida e sem barreiras linguísticas.

Outro ponto forte é a facilidade no processo de cadastro e nas transações financeiras. A 888gameaceita diversos métodos de pagamento populares entre os brasileiros, incluindo Pix, transferências bancárias e carteiras digitais, tornando os depósitos e saques rápidos, seguros e práticos.

Variedade de Jogos para Todos os Gostos Um dos grandes diferenciais da 888Game é a vasta seleção de jogos disponíveis. Os usuários encontram opções para todos os perfis, desde os mais clássicos até os lançamentos mais modernos. Entre os destaques estão:

Jogos de mesa: como roleta, blackjack e bacará, com versões ao vivo que trazem mais emoção e realismo à experiência.

Slots (caça-níqueis): com uma enorme variedade de temas, gráficos impressionantes e bônus especiais que garantem rodadas extras e prêmios emocionantes.

Jogos ao vivo: com crupiês reais transmitidos em tempo real, proporcionando uma atmosfera imersiva e interativa.

Além disso, a 888Game atualiza frequentemente seu catálogo, sempre trazendo novidades e tendências do mercado para manter os jogadores entretidos e surpreendidos.

Experiência do Usuário: Fluidez, Emoção e Suporte de Qualidade A experiência na 888Game vai muito além dos jogos. A plataforma se destaca por proporcionar uma jornada completa e satisfatória ao usuário. Os gráficos são de alta definição, os jogos carregam rapidamente e o ambiente digital é leve, sem travamentos ou interrupções.

Outro ponto que merece destaque é o suporte ao cliente. A 888Game oferece atendimento em português, com canais de suporte via chat ao vivo e e-mail, garantindo respostas rápidas e eficientes para qualquer dúvida ou problema. O atendimento funciona 24 horas por dia, todos os dias da semana, algo essencial para garantir a tranquilidade dos jogadores.

Além disso, a plataforma valoriza seus usuários com promoções constantes, bônus de boas-vindas atrativos e programas de fidelidade que recompensam o engajamento contínuo. Isso demonstra o compromisso da 888Game em manter seus jogadores motivados e satisfeitos.

Conclusão: A Escolha Certa para Quem Busca Diversão Online com Qualidade A 888Game é, sem dúvida, uma plataforma completa que une inovação, variedade de jogos, segurança e uma excelente experiência ao usuário. Seja você um jogador experiente ou alguém que está começando agora no universo dos jogos online, a 888Game oferece tudo o que você precisa para se divertir com confiança e praticidade.

Se você está em busca de uma nova forma de entretenimento, com emoção de sobra e uma interface amigável, vale a pena conhecer a 888Game. Prepare-se para horas de diversão e descubra por que tantos brasileiros já elegeram esta plataforma como sua favorita!

-

@ 1ef61805:f18312cc

2025-06-04 01:56:42

@ 1ef61805:f18312cc

2025-06-04 01:56:42**Inside OpSec Academy’s One-on-One Approach to Digital Sovereignty ** As digital infrastructure becomes increasingly opaque and centralised, a growing number of individuals are seeking to understand—not just use—the tools that protect their privacy and autonomy online. While many solutions promise security at the click of a button, few teach the underlying principles or offer environments that prioritise verifiability and user control.

OpSec Academy’s new one-on-one training, "OpSec Intensive," takes a different approach. Delivered in person and fully offline, the full-day session provides practical, tool-based instruction inside a secure, USB-booted environment—designed from the ground up to leave no trace.

At the heart of the session is OpSecOS v1.2, a live operating system that routes all traffic through Tor, uses system non-persistence, and comes preconfigured with a suite of open-source tools for password management, communication, and private finance. The OS runs from a USB stick, allowing participants to explore and build their own private computing workflows without touching the host machine.

Learning in Context: Why One-on-One? While group training can provide a general introduction to privacy concepts, it often lacks depth and adaptability. OpSec Intensive is structured as a one-on-one session to allow real-time feedback, personal threat modeling, and tailored instruction based on the participant’s specific context and technical background.

This format also makes space for slow, deliberate learning—a rarity in cybersecurity training, where content is often condensed or overly abstract. In OpSec Intensive, participants move through each phase at their own pace, working directly with an experienced instructor to build confidence and competence.

Structure and Content of the Day The curriculum spans both foundational theory and hands-on practice, beginning with basic OpSec principles before moving into technical tool use.

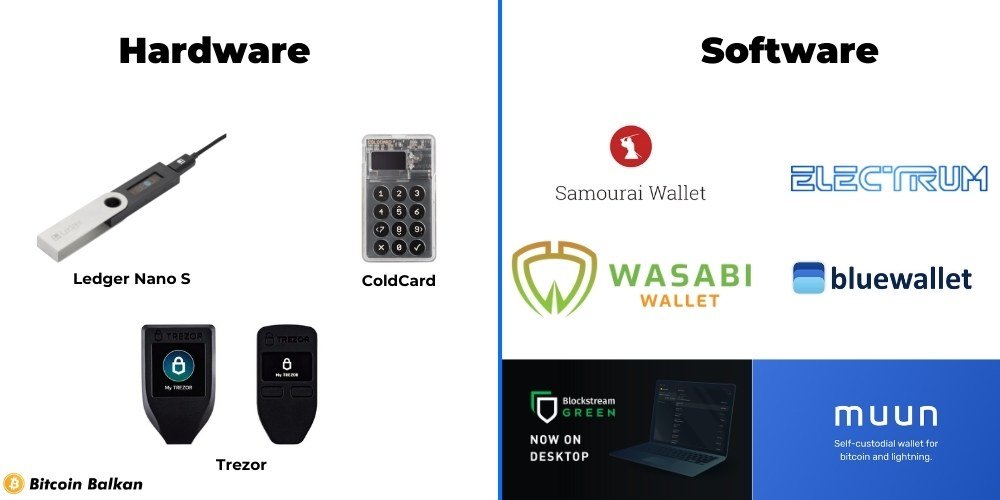

Topics include: * Booting and verifying OpSecOS * Secure USB creation and system verification * Navigating a non-persistent, Tor-routed live environment * Password and credential management * Offline use of KeePassXC * Strategies for vault organisation and redundancy * Bitcoin wallet setup and recovery * Single-signature and multisignature wallet creation using Sparrow, Electrum, and Feather * Understanding xpubs, derivation paths, and recovery flow * Seed phrase security * Entropy generation and validation using offline tools like iancoleman.io * Best practices for cold storage and physical backups * Network privacy and decentralised communication * Using Mempool.space to visualise Bitcoin transaction data * Setting up Nostr clients (Snort, Iris) for decentralised messaging * Discussion of traffic fingerprinting and Tor considerations

A Shift Toward Practical Sovereignty The tools and workflows covered in OpSec Intensive are not theoretical. Participants leave the session with configured environments, tested backups, and an understanding of what each tool does—and what it doesn’t do.

This reflects a broader shift in how privacy-conscious individuals are approaching digital security. Rather than relying on packaged services or closed-source software, there’s growing interest in verifiable, modular tools that prioritise autonomy and resilience over ease-of-use.

In that context, OpSec Academy’s offering sits somewhere between a workshop and an apprenticeship: not a lecture, but a process of guided, hands-on learning designed for the long haul.

To learn more or enquire about availability, visit opsecacademy.org.

-

@ b2b4f94a:df797d13

2025-06-04 01:44:39

@ b2b4f94a:df797d13

2025-06-04 01:44:39 -

@ 472f440f:5669301e

2025-06-04 01:37:37

@ 472f440f:5669301e

2025-06-04 01:37:37Marty's Bent

via nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqy0hwumn8ghj7mn0wd68yttjv4kxz7fwvf5hgcm0d9hzumnfde4xzqpq85h9z5yxn8uc7retm0n6gkm88358lejzparxms5kmy9epr236k2qtyz2zr

A lot of the focus over the last couple of months has been on the emergence of Strategy competitors in public markets looking to build sizable bitcoin treasuries and attract investors of all shapes and sizes to drive shareholder value. The other big topic in the bitcoin development world has been around OP_RETURN and the debate over whether or not the amount of data that can be shoved into a bitcoin transaction should be decided by the dominant implementation.

A topic that is just as, if not more, important that is not getting enough appreciation is the discussion around open source bitcoin developers and the lingering effects of the Biden administration's attack on Samourai Wallet and Tornado Cash. If you read our friend Matt Corallo's tweet above, you'll notice that the lingering effects are such that even though the Trump administration has made concerted efforts to reverse the effects of Operation Chokepoint 2.0 that were levied by the Biden administration, Elizabeth Warren, and her friends at the Treasury and SEC - it is imperative that we enshrine into law the rights of open source developers to build products and services that enable individuals to self-custody bitcoin and use it in a peer-to-peer fashion without the threat of getting thrown in jail cell.

As it stands today, the only assurances that we have are from an administration that is overtly in favor of the proliferation of bitcoin in the United States. There is nothing in place to stop the next administration or another down the line from reverting to Biden-era lawfare that puts thousands of bitcoin developers around the world at risk of being sent into a cage because the government doesn't like how some users leverage the code they write. To make sure that this isn't a problem down the line it is imperative that we pass the Blockchain Regulatory Clarity Act, which would not hold bitcoin developers liable for the ways in which end users leverage their tools.

Not only is this an act that would protect developers from pernicious government officials targeting them when end users use their technology in a way that doesn't make the government happy, it will also protect YOU, the end user, looking to transact in a peer-to-peer fashion and leverage all of the incredible properties of bitcoin the way they were meant to be. If the developers are not protected, they will not be able to build the technology that enables you to leverage bitcoin.

So do your part and go to saveourwallets.org. Reach out to your local representatives in Congress and Senators and make some noise. Let them know that this is something that you care deeply about and that they should not only pay attention to this bill but push it forward and enshrine it into law as quickly as possible.

There are currently many developers either behind bars or under house arrest for developing software that gives you the ability to use Bitcoin in a self-sovereign fashion and use it in a privacy-preserving way. Financial privacy isn't a crime. It is an inalienable human right that should be protected at all cost. The enshrinement of this inalienable right into law is way past due.

#FreeSamourai #FreeRoman

Headlines of the Day

MicroStrategy Copycats See Speculative Premiums Fade - via X

Square Tests Bitcoin Payments, Lightning Yields Beat DeFi - via X

Get our new STACK SATS hat - via tftcmerch.io

Bitfinex Moves $731M Bitcoin to Jack Mallers' Fund - via X

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code “TFTC20” during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Should I join a country club?

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 5d4b6c8d:8a1c1ee3

2025-06-04 01:24:36

@ 5d4b6c8d:8a1c1ee3

2025-06-04 01:24:36Howdy stackers, this is the place to share your ~HealthAndFitness triumphs and challenges.

I was glad to hit my step goal today, since it's gloomy and rainy here. Once again, I ate too many cookies. Gotta stop being a cookie monster.

How'd you all do, today?

https://stacker.news/items/996659

-

@ eb0157af:77ab6c55

2025-06-04 09:01:13

@ eb0157af:77ab6c55

2025-06-04 09:01:13The blockchain analytics firm claims to have identified the Bitcoin addresses held by the company led by Saylor.

Arkham Intelligence announced it had identified addresses linked to Strategy. According to Arkham’s statements, an additional 70,816 BTC connected to the company have been identified, with an estimated value of around $7.6 billion at current prices. This discovery would bring the total amount of Strategy’s identified holdings to $54.5 billion.

SAYLOR SAID HE WOULD NEVER REVEAL HIS ADDRESSES … SO WE DID

We have identified an additional 70,816 BTC belonging to Strategy, bringing our total identified MSTR BTC holdings to $54.5 Billion. We are the first to publicly identify these holdings.

This represents 87.5% of… pic.twitter.com/P3OVdVrhQL

— Arkham (@arkham) May 28, 2025

The analytics firm claims to have mapped 87.5% of Strategy’s total holdings. In a provocative post on X, Arkham wrote:

“Saylor said he would never reveal his addresses. So, we did it for him.

Previously, we tagged:

– 107,000 BTC sent to MSTR’s Fidelity deposits (Fidelity does not segregate custody, so these BTC do not appear in the MSTR entity)

– Over 327,000 BTC held in segregated custody, including Coinbase Prime, in our MSTR entity.”Arkham’s revelations directly clash with Michael Saylor’s public statements on wallet security. During the Bitcoin 2025 conference in Las Vegas, the Strategy chairman explicitly warned against publishing corporate wallet addresses.

“No institutional or enterprise security analyst would ever think it’s a good idea to publish all the wallet addresses so you can be tracked back and forth,” Saylor said during the event.

The executive chairman of Strategy added:

“The current, conventional way to publish proof-of-reserves is an insecure proof of reserves… It’s not a good idea, it’s a bad idea.”

He compared publishing wallet addresses to “publishing the addresses, bank accounts, and phone numbers of your kids hoping it will protect them — when in fact it makes them more vulnerable.”

Finally, the executive chairman suggested using artificial intelligence to explore the security implications of such a practice, claiming that in-depth research could produce “50 pages” of potential security risks.

The post Arkham reveals 87% of Strategy’s Bitcoin addresses appeared first on Atlas21.

-

@ f85b9c2c:d190bcff

2025-06-04 01:06:04

@ f85b9c2c:d190bcff

2025-06-04 01:06:04

Focusing on something for an hour a Day for the next 90 days will make you 90% better than others. I’ve been mulling over a simple truth lately, and I’m excited to share it with you. What if I told you that just one hour a day could change your game? Not ten, not five, but one little hour—sixty minutes to claim.

Stick with me here, because I’m about to break it down in a way that’ll make you cheer, with sentences that rhyme and a message that’s clear.

The Magic of One Hour Let’s start with the power that’s ours to devour. One hour a day, no more, no less, can lift you from the mundane mess. It’s not about grinding till you drop, or pushing so hard you flop. It’s a focused burst, a daily deed, planting a tiny, mighty seed. While others scroll or doze away, you’re stacking skills day by day. In 90 days, you’ll see it’s true— you’ll rise above the common crew.

Why 90 Days Works Ninety days, a quarter year, is time enough to shift your gear. It’s short enough to keep the fire, long enough to climb higher. Science says habits form in less, but mastery needs a steady press. An hour each day, consistent and neat, builds a rhythm you can’t beat. While others drift, you’ll stay on track, your progress piling, no looking back.

Be Better Than Most Here’s the kicker, the reason to boast: most folks don’t focus, they just coast. An hour of effort, pure and fine, puts you ahead of ninety-nine. Not because you’re some rare breed, but because you chose to plant that seed. The world’s distracted, screens aglow, but you’ll be steady, in the know. By day ninety, you’ll stand tall, 90% better than them all.

How to Make It Stick Pick your thing, don’t overthink—writing, coding, or a gym link. Set a time, make it rhyme with your daily chime. Shut the noise, close the door, focus deep, and explore. No multitasking, that’s a trap, just one task to bridge the gap. Track your days, feel the groove, watch your skills start to improve.

My Challenge to You So here’s my dare, from me to you: one hour a day, see it through. Ninety days, that’s all I ask, a simple, life-changing task. I’m doing it too, I’m in the race, chasing growth at my own pace. Let’s rise together, you and I, with just an hour, we’ll touch the sky. Start today, don’t delay— one hour a day is all you need, okay?

-

@ 8bad92c3:ca714aa5

2025-06-04 01:02:13

@ 8bad92c3:ca714aa5

2025-06-04 01:02:13

Let's dive into the most interesting forward-looking predictions from my recent conversations with industry experts.

Court Cases Against Bitcoin Developers Will Set Critical Precedent for the Industry's Future - Zack Shapiro

The outcome of the Samurai Wallet case will determine whether software developers can be held legally responsible for how users employ their non-custodial Bitcoin tools. Zack Shapiro laid out the stakes clearly: "The precedent that the Bank Secrecy Act can be applied to just software that allows you to move your own money on the Bitcoin blockchain is incredibly dangerous for developers, for node runners, for miners... Basically everyone in the Bitcoin space is at risk here."

According to Shapiro, the government's position in this case fundamentally misunderstands Bitcoin's architecture: "The government says that the defendants transmitted, Keone and Bill transmitted money that they knew belonged to criminals. That's not how a coin join works. The people who transmitted the money are the people that used Whirlpool and the people that used Ricochet. They signed their keys."

Should this prosecution succeed in establishing precedent, Shapiro predicts catastrophic consequences: "If that becomes the law of the land... then basically no actor in the Bitcoin economy is safe. The government's theory is that if you facilitate movement of money, you're a money transmitter, that would reach node runners, wallet developers, miners, lightning routing nodes... whatever tool stack you use, the people who built that are at risk."

With the case continuing despite FinCEN's own position that Samurai's software isn't money transmission, Shapiro believes the resolution will likely come through political rather than legal channels in the next 6-12 months.

Malpractice Around COVID mRNA Vaccines Will Be Exposed Within 2 Years - Dr. Jack Kruse

Dr. Jack Kruse predicts that major revelations about mRNA vaccine damage will force an eventual removal from the market, particularly from childhood vaccination schedules. During our conversation, Dr. Kruse shared alarming statistics: "25,000 kids a month are getting popped with this vaccine. Just so you know, since Trump has been elected, three million doses have been given to children."

According to Dr. Kruse, the scale of this problem dwarfs other health concerns: "The messenger job can drop you like Damar Hamlin, can end your career like JJ Watt, can end your career like all the footballers who've dropped dead on a soccer field." What makes this particularly concerning is the suppression of evidence about the damages, with Dr. Kruse noting that data from Japan showing changes in cancer distribution patterns was pulled, and VAERS data being dismissed despite showing alarming signals.

Dr. Kruse believes the coming years will see an unavoidable reckoning: "If by the end of this year, everybody in unison realized that MRA platform is bad news and it's gone. That to me is... I would tell you the biggest win is to get rid of the MRA platform even before any of the Bitcoin stuff." This suggests he expects significant momentum toward removing these vaccines from circulation by the end of 2025.

Global Economic Reordering Will Create Demand for Neutral Reserve Assets Like Bitcoin and Gold - Lyn Alden

The next two years will be critical in determining whether the United States maintains dollar dominance while navigating Triffin's dilemma. During our conversation, Lyn highlighted how the current administration is attempting to thread a needle between reshoring manufacturing while maintaining the dollar's reserve status - an almost impossible task on extremely fragile ground.

"When they talk about kind of a currency accord to weaken the dollar, they mentioned ideally they wanted to use multi-lateral approaches, but there are some unilateral approaches that they can do, which includes printing dollars to buy reserve assets," Lyn explained when discussing Treasury advisor Stephen Myron's position paper.

As the world potentially moves to a multipolar currency system, Lyn predicts significant demand increases for neutral reserve assets. "The two options on the table at this point are gold and Bitcoin," she noted, but pointed out that "our geopolitical adversaries have been stacking gold for a while and with a special intensity for the last three years." This creates a strategic opportunity for the US, as Bitcoin is "overwhelmingly held in the United States."

Lyn believes this transition is already underway, with the demand for neutral reserve assets like Bitcoin growing as countries seek alternatives to solely dollar-denominated reserves.

Blockspace conducts cutting-edge proprietary research for investors.

Iran's Shadow Mining Economy: 2 GW of Bitcoin Mined Underground While Legal Operations Struggle

Iran hosts a thriving underground Bitcoin mining industry that has emerged as a critical financial lifeline for citizens grappling with international sanctions and domestic economic controls. This shadow economy dwarfs the legal sector, with an estimated 2 gigawatts of illegal mining operations compared to just 5 megawatts of sanctioned activity.

According to ViraMiner CEO Masih Alavi, approximately 800,000 illegal miners have been discovered and fined by authorities. Yet operations continue in homes, office buildings, and even jewelry stores, where Iranians tap into unmetered electricity to mine Bitcoin, later converting it to stablecoins like USDT for savings and commerce.

While the government has approved permits for about 400 megawatts of legal mining capacity, punitive electricity tariffs and regulatory barriers have strangled legitimate operations. "I blamed the government for this situation," says Alavi. "They introduced flawed policies in the beginning, especially by setting the wrong electricity tariffs for the mining industry."

Despite using obsolete equipment like Antminer S9s and M3s, underground miners remain profitable when converting earnings to Iranian rials, creating an ecosystem that serves an estimated 18 million Iranian cryptocurrency holders.

Looking ahead, Alavi predicts further crackdowns as Iran enters peak electricity demand season, potentially reducing legal mining to zero while underground operations continue to evolve sophisticated detection evasion techniques.

Subscribe to them here (seriously, you should): https://newsletter.blockspacemedia.com/

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

STACK SATS hat: https://tftcmerch.io/

Subscribe to our YouTube channels and follow us on Nostr and X:

@media screen and (max-width: 480px) { .mobile-padding { padding: 10px 0 !important; } .social-container { width: 100% !important; max-width: 260px !important; } .social-icon { padding: 0 !important; } .social-icon img { height: 32px !important; width: 32px !important; } .icon-cell { padding: 0 4px !important; } } .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } .moz-text-html .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } /* Helps with rendering in various email clients */ body { margin: 0 !important; padding: 0 !important; -webkit-text-size-adjust: 100% !important; -ms-text-size-adjust: 100% !important; } img { -ms-interpolation-mode: bicubic; } /* Prevents Gmail from changing the text color in email threads */ .im { color: inherit !important; }

-

@ f85b9c2c:d190bcff

2025-06-04 01:00:21

@ f85b9c2c:d190bcff

2025-06-04 01:00:21

Is Physical Punishment Truly an Effective Way to Discipline Children? Whether flogging or corporal punishment, is a proper way to correct a child often causes disagreement and debate. Over the centuries and around the world, educators, psychologists, parents and lawmakers have argued about it. A person’s behavior is corrected through flogging which is intended to be physically harsh. It is a big concern whether the process helps or leaves people with more damage over time.

Historical Perspective Floggings have been practiced for centuries to discipline people. Years back, many people used disciplinary spanking to encourage children to be disciplined and respectful. It used to be popularly believed that not using discipline made children spoiled. This saying suggested that flogging or some other physical punishment, was both necessary and proper to correct those who did wrong. Presently, things are not the same as they were before. In the last few decades, there has been a major change in what is generally accepted. Child development and psychology research indicate that flogging and different types of punishment might even cause harm.

Effects on Mind and Feelings Experts always see that flogging has negative impact on children’s mental health. Even though it may force someone to cooperate right away, it usually results in fear, resentment and aggression. Instead of showing right from wrong, it makes the child think that being disciplined is humiliating and causes pain. This situation might lower the child’s self-esteem, interfere with their emotional development and hurt the relationship between the child and the parent. Also, flogging does little to deal with the real reason why someone acts this way. It only worries about how to punish instead of trying to understand why the behavior occurred. A correct approach involves explaining the problem with what they did and supporting them to improve their decisions next time.

Having Questions About What Is Legal and Ethical Many countries now forbid flogging and other corporal punishments in both schools and homes. Children’s freedom from physical harm is becoming recognized more often in the law. UNCRC claims that children should be protected from all types of physical and mental abuse.

Ethical concerns are raised by the practice of using flogging to discipline people. It goes against the main principles of respect and dignity. Their growth as human beings calls for proper guidance, so kids can become mature and caring adults. When they are beaten, children often learn that violence is a way to find solutions.

What Can Be Used Instead of Flogging There are a lot of peaceful and successful steps you can take to guide how a child behaves. Settings ground rules, using praise for good behaviors, always keeping communication clear and giving the same consequences help. By giving praise for good behavior, you help the child want to act that way again. Giving a time-out or taking away things a person enjoys is a gentle way to deal with misbehavior.

In addition, these approaches help fix behavior problems and allow the child and caregiver to form trust and communicate openly. Through play, children learn to control themselves, feel empathy and solve problems which they need for their ongoing growth.

In addition, these approaches help fix behavior problems and allow the child and caregiver to form trust and communicate openly. Through play, children learn to control themselves, feel empathy and solve problems which they need for their ongoing growth.Conclusion In short, flogging does not make sense or work as a way to correct a child. Despite making the child obey at the moment, it often seriously harms a child’s emotional, psychological and moral growth in the future. Today’s parenting and educating focus on methods that fix misbehavior and boost a child’s confidence and sense of safety. Real correction teaches the child, helps them make right choices and encourages them to be responsible and caring. Flogging is not successful in reaching these goals. Rather, it causes a pattern of violence and fear that can cause serious damage in the long run. So, flogging should be understood not as a punishment, but as something harmful that society should forget about.

-

@ da8b7de1:c0164aee

2025-06-03 19:31:32

@ da8b7de1:c0164aee

2025-06-03 19:31:32Lengyelország előrelépése az első atomerőmű építésében

Lengyelország állami nukleáris vállalata, a Polskie Elektrownie Jadrowe (PEJ) és egy amerikai konzorcium – élén a Westinghouse és a Bechtel cégekkel – mérnöki fejlesztési megállapodást kötött. Ez a szerződés kulcsfontosságú lépés az ország első atomerőművének megvalósítása felé, lehetővé téve a részletes mérnöki és helyszínspecifikus munkák megkezdését. A lengyel kormány ezt mérföldkőnek tekinti az energiaszuverenitás és a dekarbonizáció felé vezető úton.

Amerikai politika: lendület az új nukleáris technológiáknak

Az Egyesült Államok kormánya elnöki rendeletet adott ki, amely reformokat vezet be a nukleáris reaktorok tesztelésében az Energiaügyi Minisztériumnál. A cél az új generációs reaktorok – köztük mikroreaktorok és kis moduláris reaktorok (SMR-ek) – fejlesztésének és engedélyezésének felgyorsítása, valamint a környezetvédelmi vizsgálatok egyszerűsítése. A rendelet legalább három új reaktor kritikus üzembe helyezését célozza meg 2026 júliusáig, támogatva ezzel az ipari alkalmazások széles körét, például adatközpontokat vagy hidrogéntermelést. Az intézkedés célja, hogy az USA visszaszerezze vezető szerepét a nukleáris innovációban, és csökkentse a korábbi években felhalmozódott engedélyezési akadályokat.

Kis moduláris reaktorok (SMR) fejlesztése világszerte

Az SMR-szektorban világszerte jelentős előrelépések történtek: - Az amerikai Tennessee Valley Authority (TVA) benyújtotta az első építési kérelmet egy GE Hitachi BWRX-300 SMR-re a Clinch River telephelyen. - Kanadában az Ontario Power Generation engedélyt kapott az első, négy tervezett SMR megépítésének megkezdésére a Darlington telephelyen. - Belgium és Brazília innovatív SMR-technológiákat vizsgál, köztük ólom-hűtésű reaktorokat és nemzetközi együttműködéseket. - Olyan technológiai óriások, mint a Google, az USA-ban korai fázisú fejlett nukleáris projektekbe fektetnek, ami a magánszektor növekvő érdeklődését mutatja.

Globális ipari és pénzügyi támogatás a nukleáris bővítéshez

Széles körű koalíció – köztük olyan nagyvállalatok, mint az Amazon, Google, Meta, Dow – és pénzügyi intézmények kötelezték el magukat amellett, hogy 2050-re megháromszorozzák a globális nukleáris kapacitást. Ez összhangban van az ENSZ klímacsúcsain tett vállalásokkal, ahol már 31 ország támogatja a nukleáris energia megháromszorozását a nettó zéró kibocsátási célok eléréséhez. Az amerikai kongresszus olyan törvényjavaslatokat készít elő, amelyek lehetővé tennék, hogy a multilaterális fejlesztési bankok – például a Világbank – is finanszírozhassanak nukleáris projekteket, megszüntetve ezzel a korábbi tiltásokat.

Közelgő nemzetközi nukleáris biztonsági gyakorlat

A Nemzetközi Atomenergia-ügynökség (IAEA) készül a ConvEx-3 vészhelyzeti gyakorlatára, amelyet 2025. június 24–25-én Romániában tartanak. A gyakorlat egy súlyos nukleáris vészhelyzetet szimulál a cernavodai atomerőműben, tesztelve a tagállamok és nemzetközi szervezetek felkészültségét és reagálóképességét. A ConvEx-3 a legmagasabb szintű IAEA vészhelyzeti gyakorlat, kulcsszerepet játszik a globális nukleáris biztonság és védelem erősítésében.

Politikai bizonytalanság Dél-Korea nukleáris terveiben

Dél-Korea 2025. június 3-i elnökválasztása hatással lehet az ország nukleáris reneszánszára. A vezető jelölt, Lee Jae-myung kijelentette, hogy „egyelőre” fenntartaná a nukleáris energiát, de hosszabb távon a megújulók felé mozdulna el. Ez bizonytalanságot okoz a koreai nukleáris ipar hazai és exportterveiben, ami kihatással lehet a globális ellátási láncokra és külföldi reaktorprojektekre is.

Iparági trendek és további fejlemények

- Japán új energiastratégiája maximalizálni kívánja a nukleáris energia részarányát, 2040-re mintegy 20%-ot célozva, különös hangsúlyt fektetve a következő generációs reaktorokra és a biztonság növelésére.

- Belgium kormánya és a francia Engie közműcég megállapodott a kulcsfontosságú reaktorok üzemidejének tízéves meghosszabbításáról, ami az európai nukleáris pálfordulás újabb jele.

- Az IAEA és a World Nuclear Association egyaránt növekvő nemzetközi érdeklődésről számol be az SMR-ek és fejlett reaktortechnológiák iránt, új projektek és partnerségek indulnak Ázsiában, Európában és Amerikában.

Források:

world-nuclear-news.org

nucnet.org

iaea.org

world-nuclear.org

govinfo.gov

whitehouse.gov -

@ e0e92e54:d630dfaa

2025-06-03 19:01:32

@ e0e92e54:d630dfaa

2025-06-03 19:01:32As some of you know, I lead a quarterly Bible Study through Faith Driven Investor

One of the members from the cohort that just ended forwarded me an email from the US Christian Chamber of Commerce

The summary is: Christians should intentionally be doing more business with Christians.

[Full email at the bottom of this Article]

I recanted to my FDI member about a book I read a few years ago, Thou Shall Prosper, by Rabbi Daniel Lapin.

In it he gave the statistics that a single dollar recirculates in the Jewish community 12 times, Muslims 8 times, and Christians only 3 or 4 times.

(I'm probably slightly off on recalling the stats)

But the point being that as a people group, Jews are 4x more wealthy than Christians because Christians value doing business with one another 4 times less than Jews...or said another way, the Jewish people value doing business with one another 4x more than Christians.

Reading the email I was sent, I was further reminded as business owners, leaders, and investors;

If we are truly going to steward that which God has entrusted to us, we should want to re-circulate those resources as many times as possible within the Christian community in order to have the greatest probability of return on image bearers.

What are your thoughts?

I Bought a House Through the Christian Chamber - What happened next surprised me

My husband and I just bought a house—but it wasn’t just a transaction. It was a transformation.

With our daughter’s high school graduation behind us, we felt ready to step into a long-held dream: moving to a beach town we’ve thought, talked, and prayed about for years. As part of turning our dream into a reality, we made a very intentional decision:

We would buy our home entirely through the Christian Chamber community.

We wanted to walk the talk—to model what Kingdom commerce really looks like. So we sought Christian-led businesses for every part of the process. What started as a symbolic gesture quickly became a profound experience with two life-changing revelations:

1) The Power of Prayer in Business

Yes, we prayed as a couple—but imagine your Realtor, lender, inspector, and insurance agent all praying with you, too.

We’re not talking about just being “nice people” or listening to worship in the office. We’re talking about Spirit-filled, Jesus-following believers who brought prayer into every decision.

· Our Realtor is also a church planter—her discernment helped us find the perfect house on day one.

· Our lender joined us in prayer—and worked miracles to make the deal smooth and abundantly possible.

· Our inspector's biggest red flag? A bird’s nest in a porch light. (Yes, really.)

· Our insurance agent handled everything—and in Florida, that’s no small feat.

I have bought and sold seven homes in my life, but this was the best experience by far. The layout, the location, the timing, the favor—it was all wrapped in prayer and covered in grace. It wasn’t just business. It was supernatural.

2) Kingdom ROI — A Multiplied Impact

By doing business with Christians, we didn’t just find great service. We created a multiplied Kingdom return.

We know where our vendors give. We know the churches they support, the ministries they fund, and the people they serve.

When they earned from our purchase, those dollars didn’t disappear—they were reinvested into Kingdom causes we could never reach on our own.

This is Kingdom ROI.

It’s a real-life example of the parable of the talents—we didn’t bury our resources. We multiplied them. When you spend money with aligned believers, your impact compounds.

The opposite is also true:

When we spend with businesses that oppose our values, we’re funding platforms that erode the very things we’re trying to protect—our families, our freedoms, and our faith.

We MUST STOP funding the enemy.

The Bigger Picture

Let’s be clear: Studies show that Christians make up 31% of the world’s population, but we control 55% of the world’s wealth—more than $107 trillion in personal assets.

And yet…we’re leaking that wealth into systems that are actively working against us.

Why? Because we do not have the infrastructure to keep it aligned.

Until now.

That’s what we’re building through the U.S. Christian Chamber of Commerce: A national infrastructure that empowers Christians to redirect their dollars, align their values, and multiply their impact.

What If You Did the Same?

· Buy your next product or service from a Christian-led business.

· Hire your next contractor from your local Christian Chamber.

· Invest in a company with eternal impact.

· Launch a Christian Chamber in your region—we’ll help you.

· Join the U.S. Christian Chamber. This is your Chamber, for your nation.

· Meet us in Orlando for SWC 2026, the global gathering of Christian commerce.

Imagine the multiplying power if thousands of us made similar decisions—every day—across this nation.

We own the wealth. Now let’s build the infrastructure, create the ecosystem, and shift the world's wealth one transaction at a time.

This is our nation and we are One Nation Under God!

Jason Ansley is the founder of Above The Line Leader, where he provides tailored leadership support and operational expertise to help business owners, entrepreneurs, and leaders thrive— without sacrificing your faith, family, or future.

-

Want to strengthen your leadership and enhance operational excellence? Connect with Jason at https://abovethelineleader.com/#your-leadership-journey

-

📌 This article first appeared on NOSTR. You can also find more Business Leadership Articles and content at: 👉 https://abovethelineleader.com/business-leadership-articles

-

-

@ 8bad92c3:ca714aa5

2025-06-03 18:02:33

@ 8bad92c3:ca714aa5

2025-06-03 18:02:33Marty's Bent

It's been a pretty historic week for the United States as it pertains to geopolitical relations in the Middle East. President Trump and many members of his administration, including AI and Crypto Czar David Sacks and Treasury Secretary Scott Bessent, traveled across the Middle East making deals with countries like Qatar, Saudi Arabia, the United Arab Emirates, Syria, and others. Many are speculating that Iran may be included in some behind the scenes deal as well. This trip to the Middle East makes sense considering the fact that China is also vying for favorable relationships with those countries. The Middle East is a power player in the world, and it seems pretty clear that Donald Trump is dead set on ensuring that they choose the United States over China as the world moves towards a more multi-polar reality.