-

@ c1e6505c:02b3157e

2025-05-28 17:36:03

@ c1e6505c:02b3157e

2025-05-28 17:36:03I recently acquired a new lens:

1959 Leica Summaron F2.8 35mm LTM.

1959 Leica Summaron 35mm f2.8 LTM mounted on my Fujifilm Xpro2 with LTM adapter made by Urth.

Technically, it was a trade. I helped a fellow Bitcoiner set up their Sparrow Wallet, Nostr stuff, and troubleshoot a few wallet issues, and in return, they gave me the lens.

It all started at a local Bitcoin meetup I went to about a week ago - my second time attending. I recognized a few faces from last time, but also saw some new ones. These meetups are refreshing - it’s rare to speak a common language about something like Bitcoin or Nostr. Most people still don’t get it. But they will.

Technology moves forward. Networks grow. Old cells die off.

During the meetup, someone noticed I had my Leica M262 with me and struck up a conversation. Said they had some old Leica lenses and gear at home, and wanted to show me.

Bitcoin and photography in one conversation? I’m down.

A day or so later, they sent me a photo of one of the lenses: a vintage Summaron LTM 35mm f/2.8 from 1959. I’d never seen or heard of one before. They asked if I could help them set up Sparrow and a Bitcoin node. In exchange, they’d give me the lens. Sounded like a good deal to me. Helping plebs with their setups feels like a duty anyway. I said, of course.

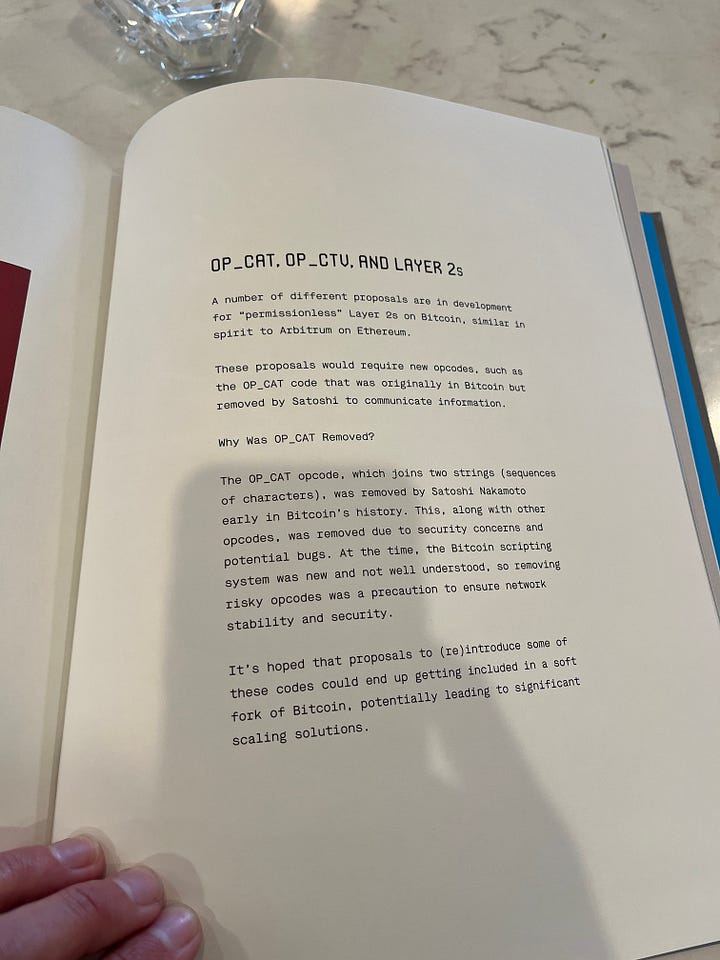

They invited me over - a pretty trusting move, which I appreciated. They had some great Bitcoin memorabilia: Fred Krueger’s The Big Bitcoin Book (even if the guy’s turned full shitcoiner), and some FTX sunglasses from Bitcoin 2022. Probably future collector’s items, lol.

We headed upstairs to work on setting up Sparrow Wallet on their Windows machine. I verified the software download first (which you should always do), then helped them create a new wallet using their Ledger Flex. They also had an older Ledger Nano X. The Flex setup was easy, but the Nano X gave us trouble. It turns out Ledger allows multiple wallets for the same asset, which can show up differently depending on how they’re configured. In Sparrow, only one wallet showed—none of the others.

I believe it had to do with the derivation path from the Ledger. If anyone knows a fix, let me know.

After a few hours of troubleshooting, I told them I couldn’t really recommend Ledger. The UX is a mess. They’d already heard similar things from other plebs too.

I suggested switching to the Blockstream Jade. It’s a solid Bitcoin-only device from a trustworthy team. That’s what you want in a hardware wallet.

But back to the lens…

Since it’s an LTM (Leica Thread Mount), I couldn’t mount it directly on my M262. Luckily, I remembered I had an Urth adapter that fits my Fujifilm X-Pro2. I don’t use the X-Pro2 much these days—it’s mostly been sidelined by the M262 - but this was the perfect excuse to bring it out again.

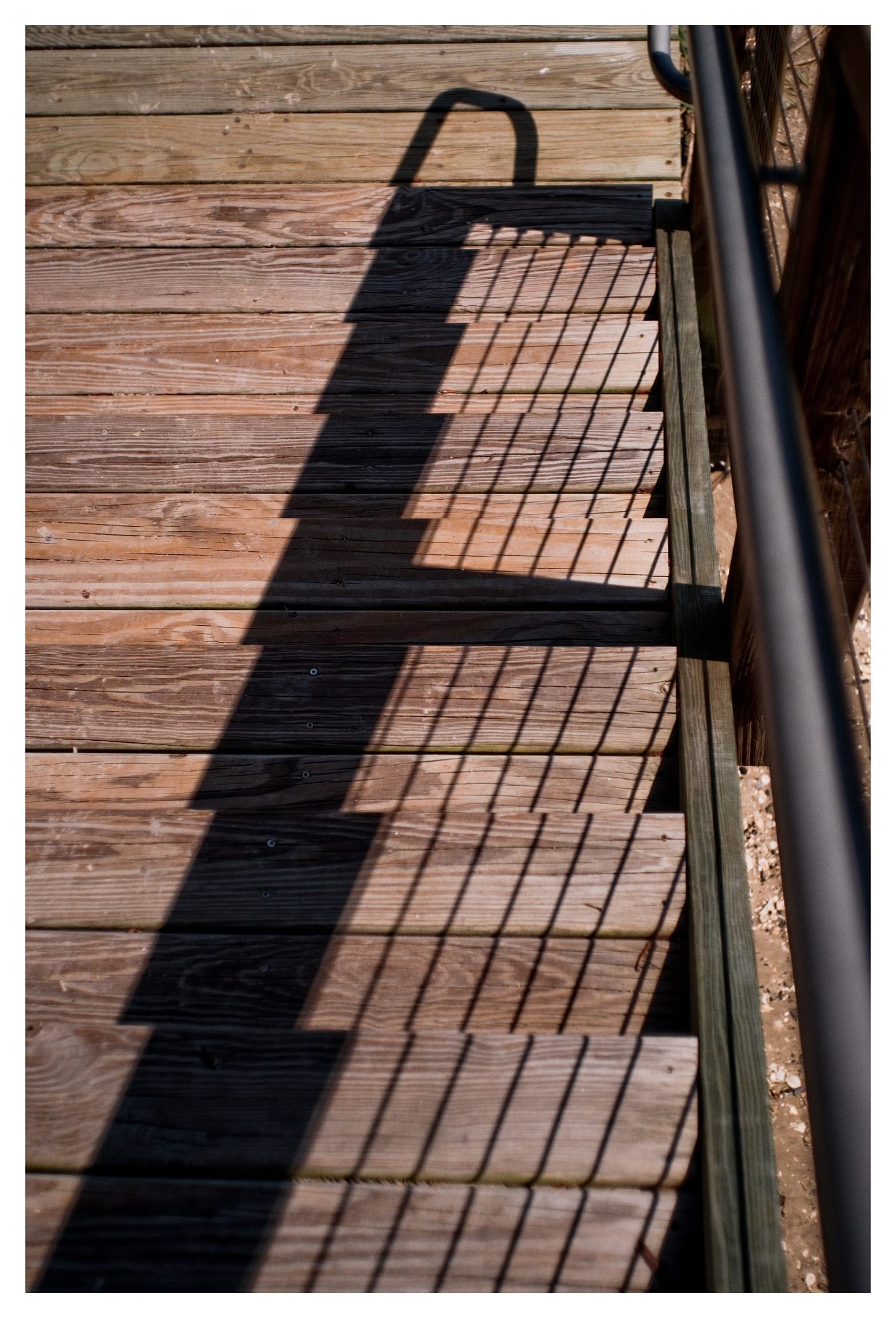

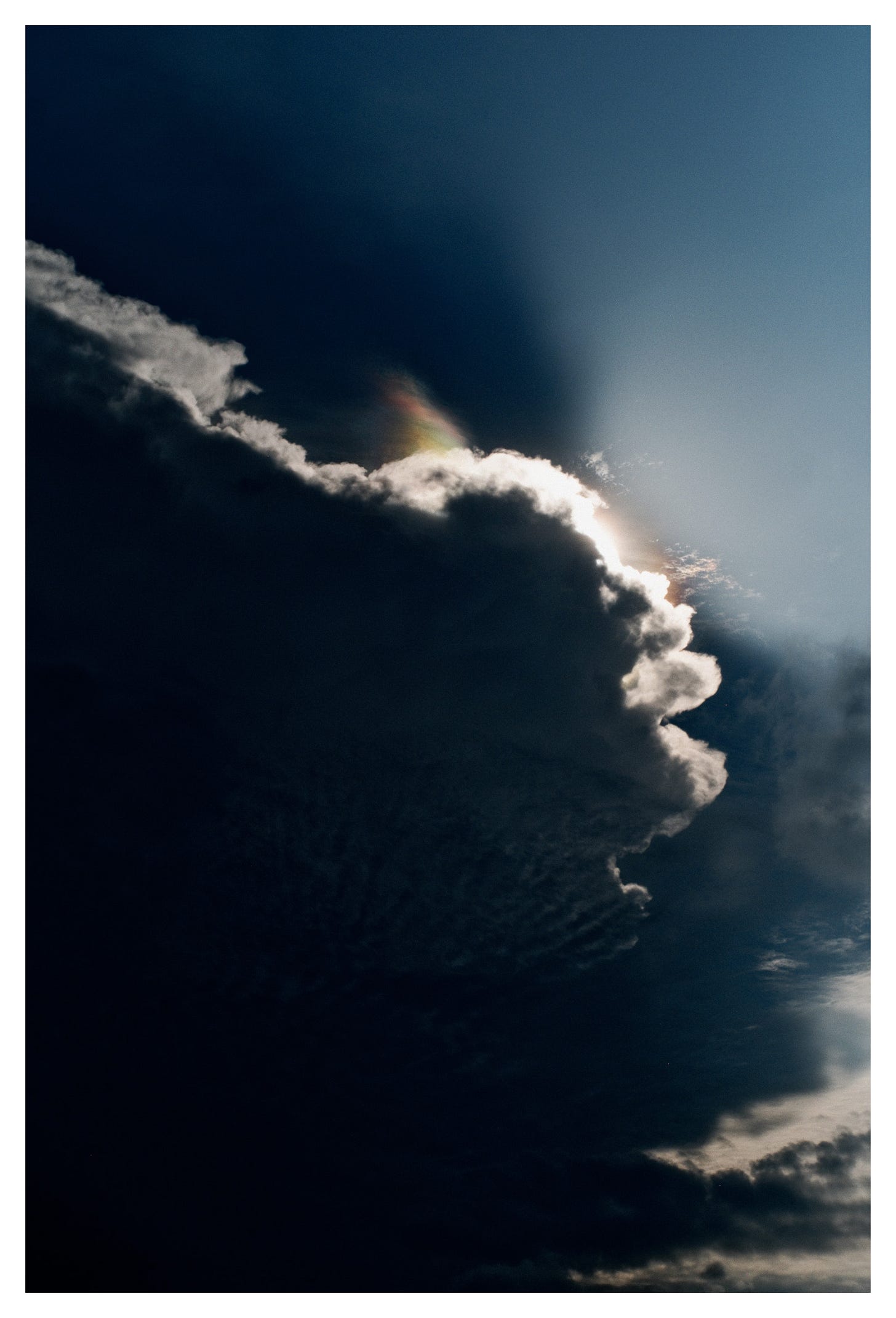

To test the lens, I shot everything wide open at f/2.8. Nothing crazy fast, but it’s the best way to see a lens’s character. And this one definitely has character. There’s a subtle softness and a kind of motion blur effect around the edges when wide open. At first, I wasn’t sure how I felt about it, but the more I shot, the more I liked it. It reminds me of Winogrand’s work in Winogrand Color - those messy, shifting edges that make the frame feel alive. It also helps soften the digital-ness of the camera sensor.

The focus throw is short and snappy - much tighter than my Summicron V3 35mm f/2. I really like how fast it is to use. The closest focusing distance is about 3.5 feet, so it’s not ideal for close-ups. And with the Urth adapter on the X-Pro2, the focal length ends up closer to 40mm.

The only thing that threw me off was the infinity lock. When the focus hits infinity, it physically locks - you have to press a small tab to unlock it. I’ve seen others complain about it, so I guess it’s just one of those old lens quirks. I’m getting used to it.

All the photos here were taken around where I live in South Carolina. Some during bike rides to the river for a swim, others while walking through the marshlands.

I try to make work wherever I am. You should be able to.

It’s about the light, the rhythm, the play - and having the motivation to actually go out and shoot.

Lens rating: 7.9/10

I mainly shoot with a Leica M262, and edit in Lightroom + Dehancer

Use “PictureRoom” for 10% off Dehancer Film

If you’ve made it this far, thank you for taking the time to view my work - consider becoming a paid subscriber.

Also, please contact me if you would like to purchase any of my prints.

Follow me on Nostr:

npub1c8n9qhqzm2x3kzjm84kmdcvm96ezmn257r5xxphv3gsnjq4nz4lqelne96

-

@ b7274d28:c99628cb

2025-05-28 01:11:43

@ b7274d28:c99628cb

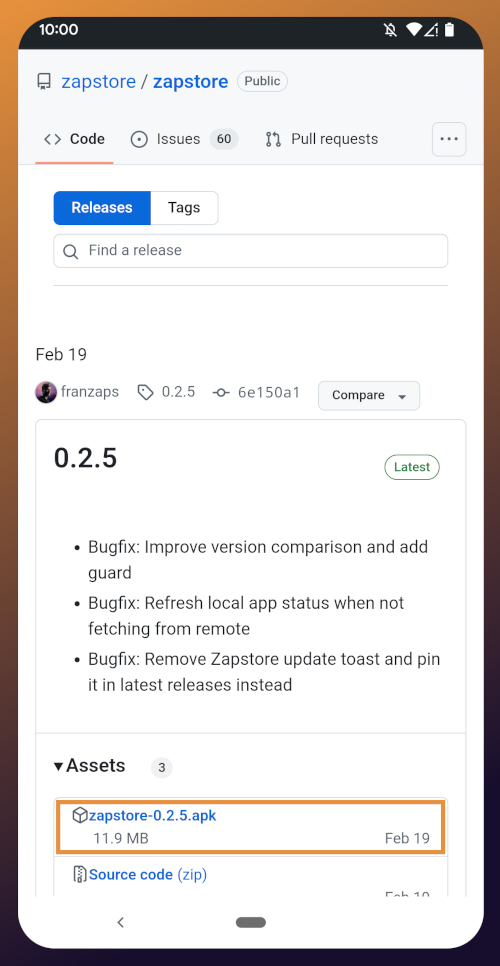

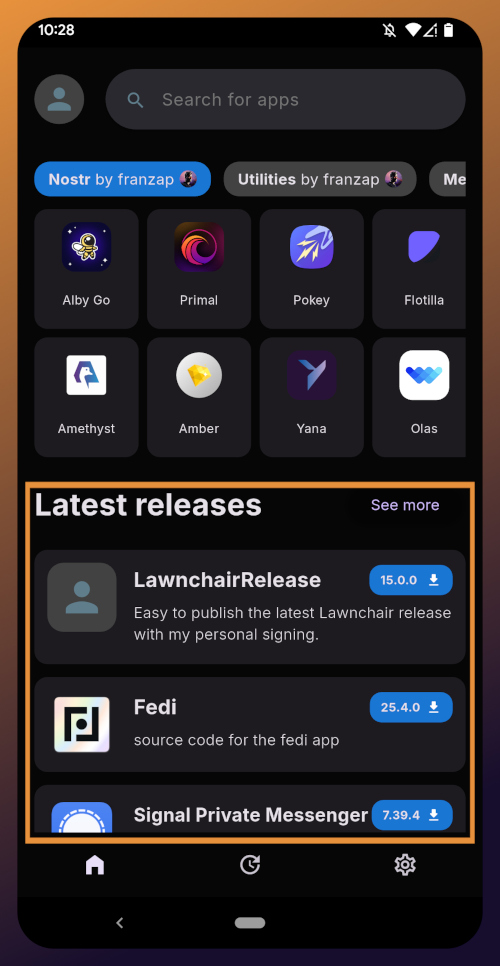

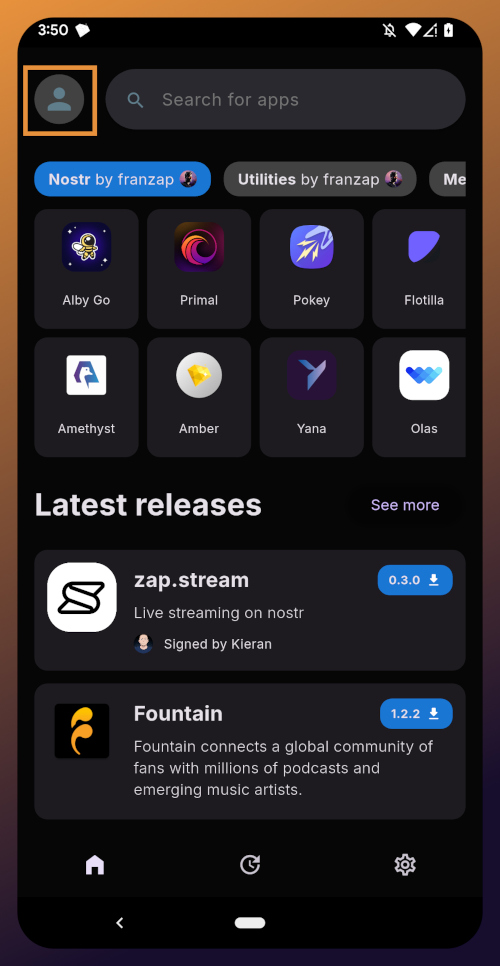

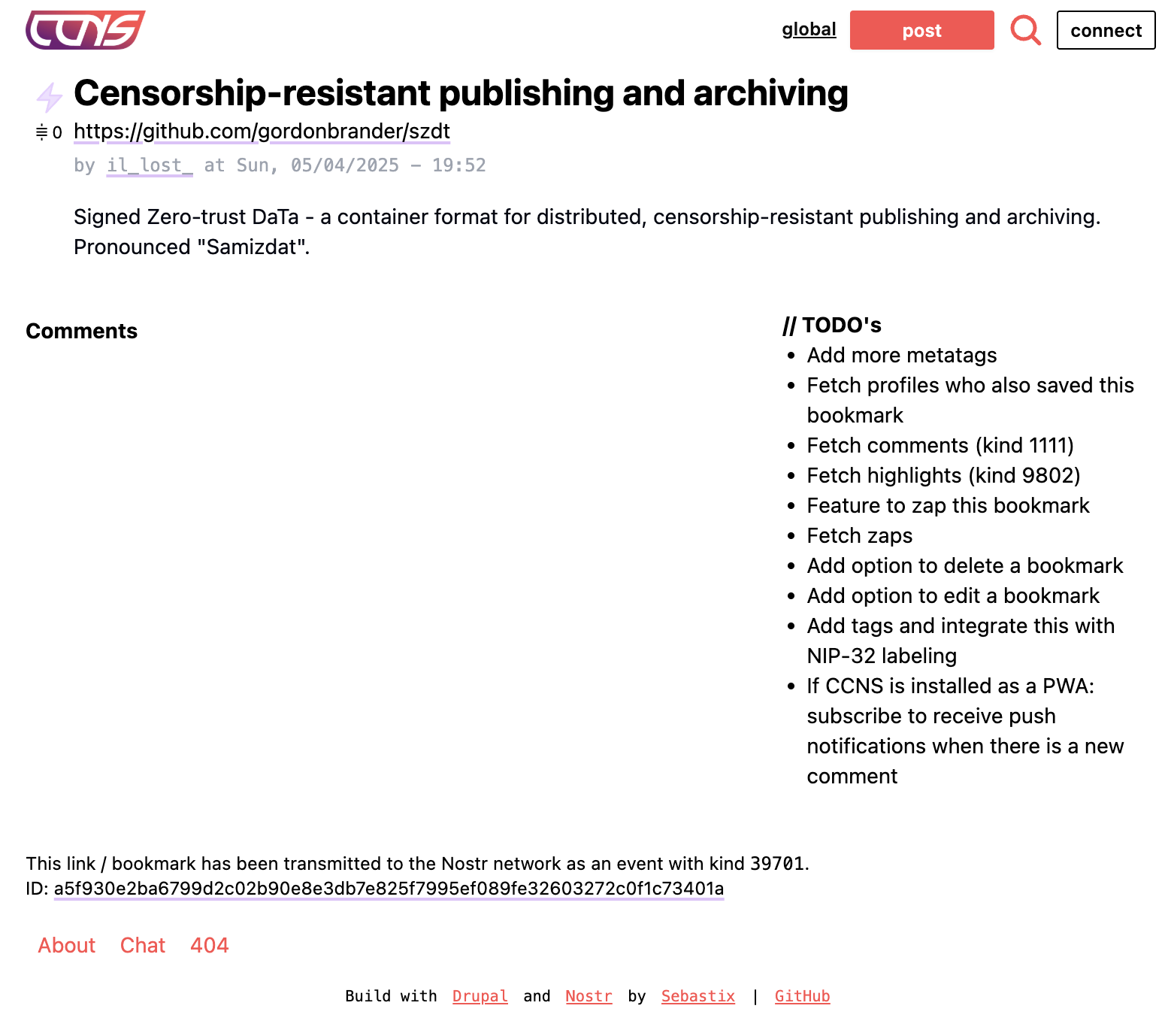

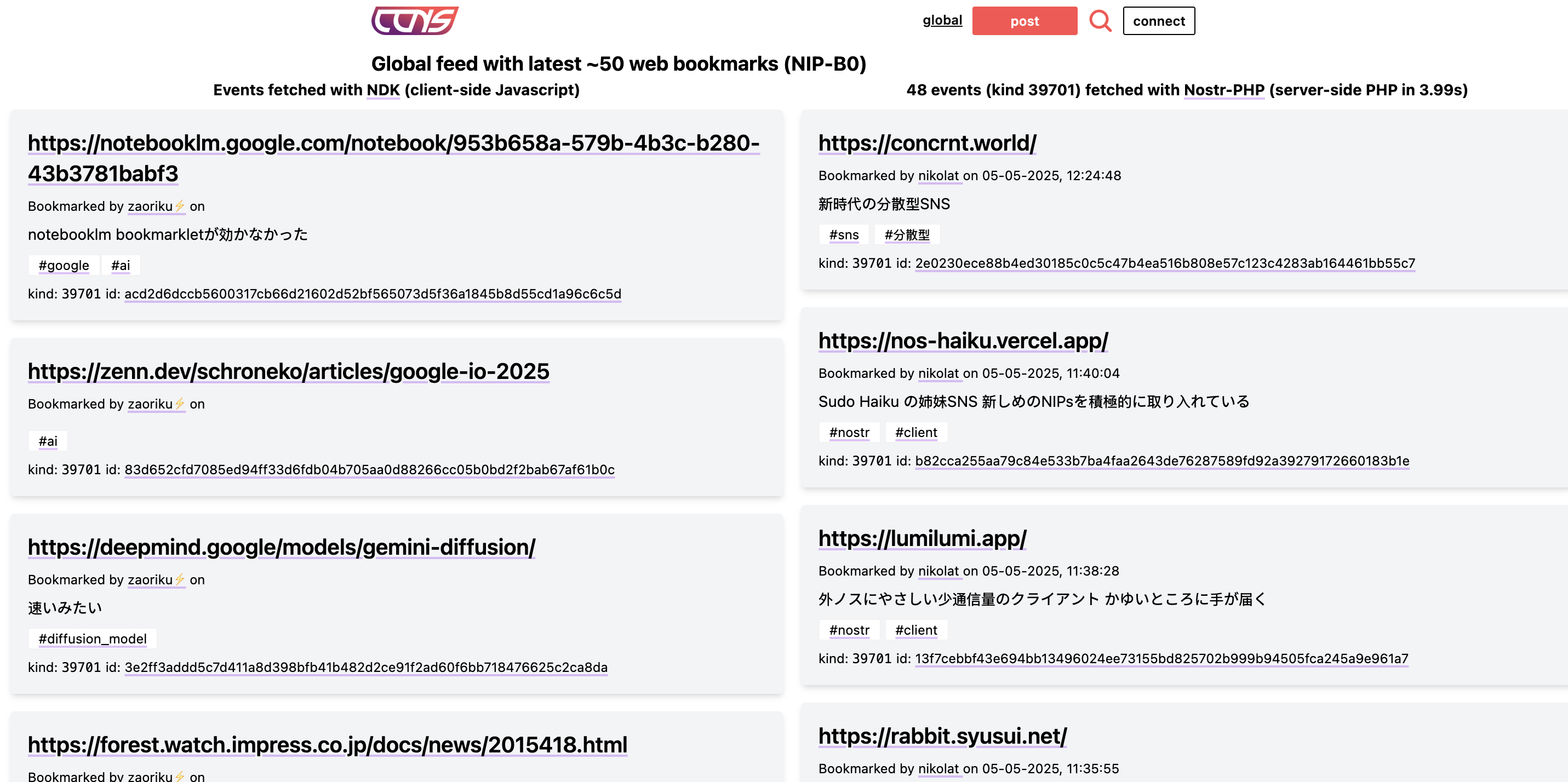

2025-05-28 01:11:43In this second installment of The Android Elite Setup tutorial series, we will cover installing the nostr:npub10r8xl2njyepcw2zwv3a6dyufj4e4ajx86hz6v4ehu4gnpupxxp7stjt2p8 on your #Android device and browsing for apps you may be interested in trying out.

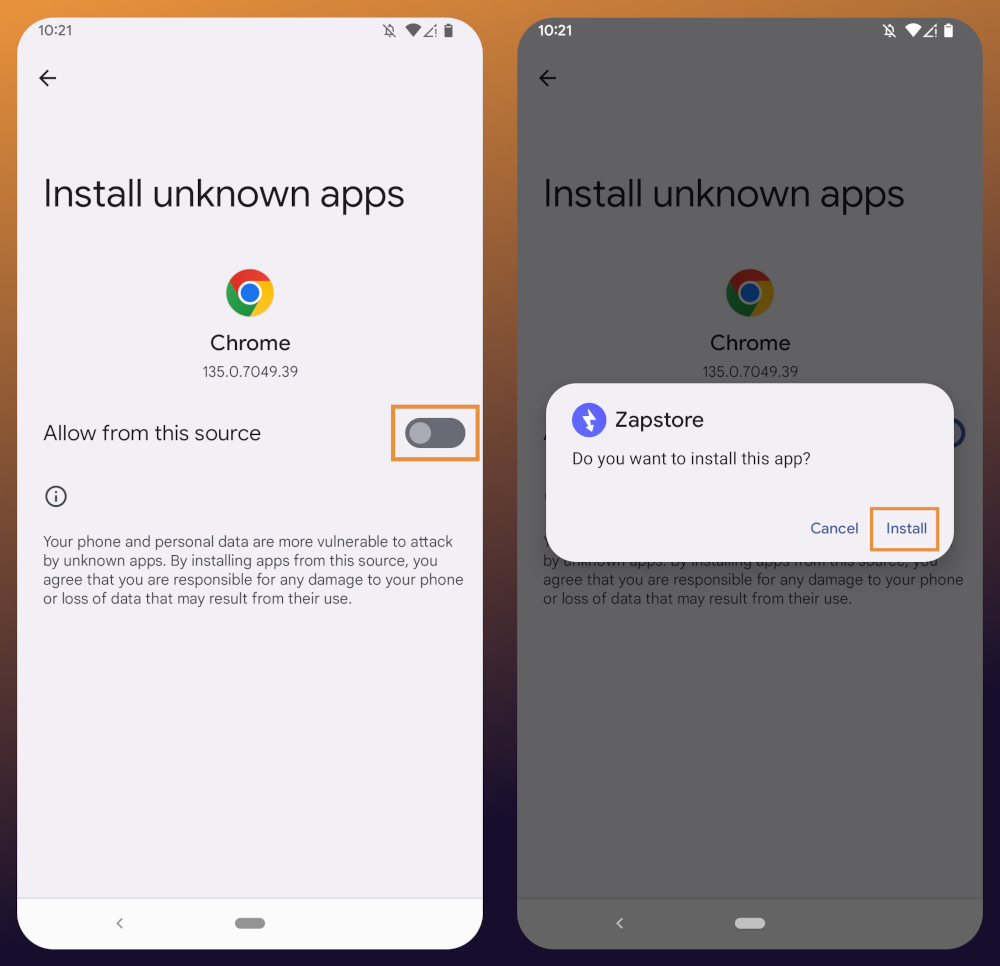

Since the #Zapstore is a direct competitor to the Google Play Store, you're not going to be able to find and install it from there like you may be used to with other apps. Instead, you will need to install it directly from the developer's GitHub page. This is not a complicated process, but it is outside the normal flow of searching on the Play Store, tapping install, and you're done.

Installation

From any web browser on your Android phone, navigate to the Zapstore GitHub Releases page and the most recent version will be listed at the top of the page. The .apk file for you to download and install will be listed in the "Assets."

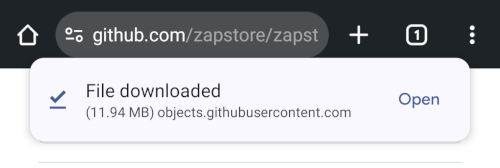

Tap the .apk to download it, and you should get a notification when the download has completed, with a prompt to open the file.

You will likely be presented with a prompt warning you that your phone currently isn't allowed to install applications from "unknown sources." Anywhere other than the Play Store is considered an "unknown source" by default. However, you can manually allow installation from unknown sources in the settings, which the prompt gives you the option to do.

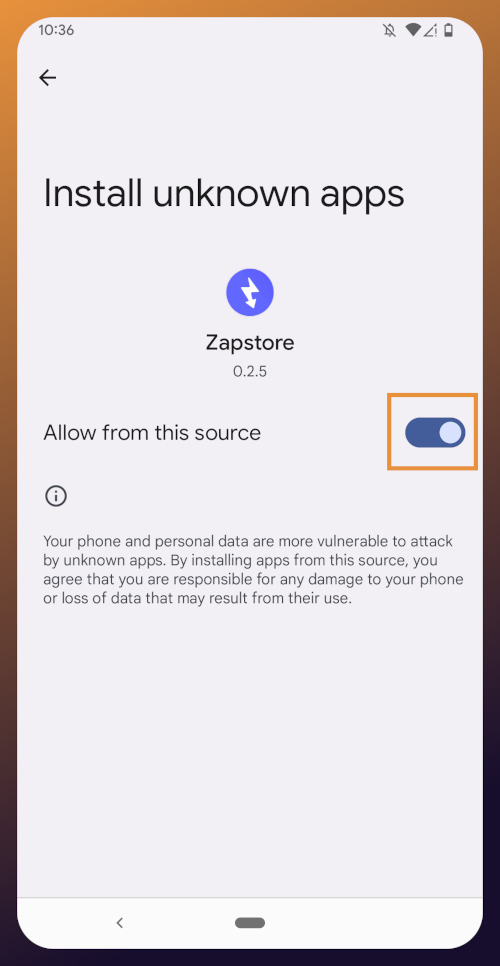

In the settings page that opens, toggle it to allow installation from this source, and you should be prompted to install the application. If you aren't, simply go to your web browser's downloads and tap on the .apk file again, or go into your file browser app and you should find the .apk in your Downloads folder.

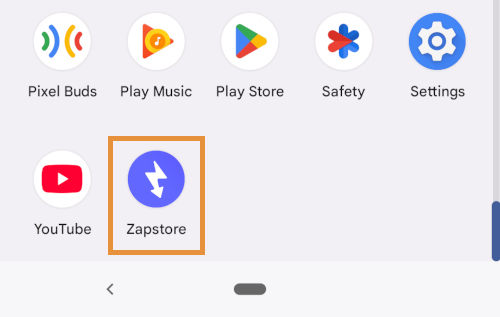

If the application doesn't open automatically after install, you will find it in your app drawer.

Home Page

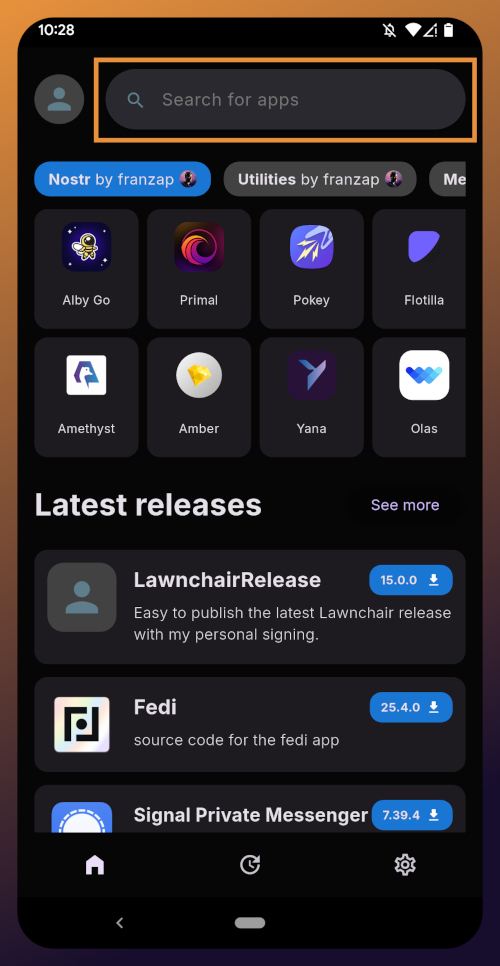

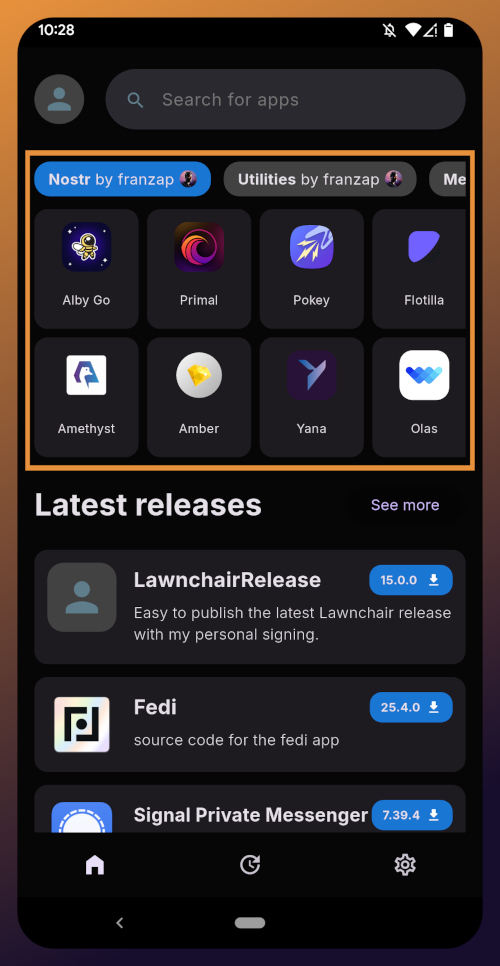

Right at the top of the home page in the Zapstore is the search bar. You can use it to find a specific app you know is available in the Zapstore.

There are quite a lot of open source apps available, and more being added all the time. Most are added by the Zapstore developer, nostr:npub1wf4pufsucer5va8g9p0rj5dnhvfeh6d8w0g6eayaep5dhps6rsgs43dgh9, but some are added by the app developers themselves, especially Nostr apps. All of the applications we will be installing through the Zapstore have been added by their developers and are cryptographically signed, so you know that what you download is what the developer actually released.

The next section is for app discovery. There are curated app collections to peruse for ideas about what you may want to install. As you can see, all of the other apps we will be installing are listed in nostr:npub1wf4pufsucer5va8g9p0rj5dnhvfeh6d8w0g6eayaep5dhps6rsgs43dgh9's "Nostr" collection.

In future releases of the Zapstore, users will be able to create their own app collections.

The last section of the home page is a chronological list of the latest releases. This includes both new apps added to the Zapstore and recently updated apps. The list of recent releases on its own can be a great resource for discovering apps you may not have heard of before.

Installed Apps

The next page of the app, accessed by the icon in the bottom-center of the screen that looks like a clock with an arrow circling it, shows all apps you have installed that are available in the Zapstore. It's also where you will find apps you have previously installed that are ready to be updated. This page is pretty sparse on my test profile, since I only have the Zapstore itself installed, so here is a look at it on my main profile:

The "Disabled Apps" at the top are usually applications that were installed via the Play Store or some other means, but are also available in the Zapstore. You may be surprised to see that some of the apps you already have installed on your device are also available on the Zapstore. However, to manage their updates though the Zapstore, you would need to uninstall the app and reinstall it from the Zapstore instead. I only recommend doing this for applications that are added to the Zapstore by their developers, or you may encounter a significant delay between a new update being released for the app and when that update is available on the Zapstore.

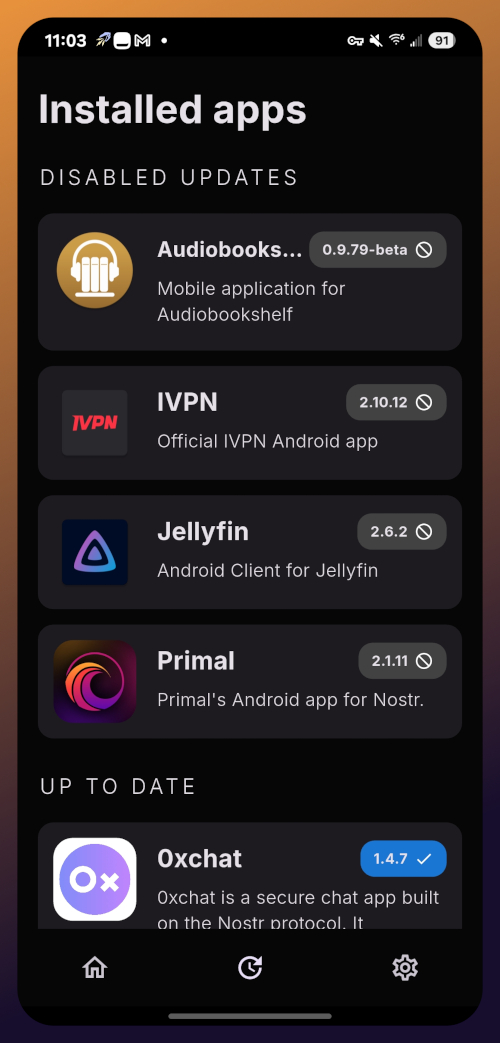

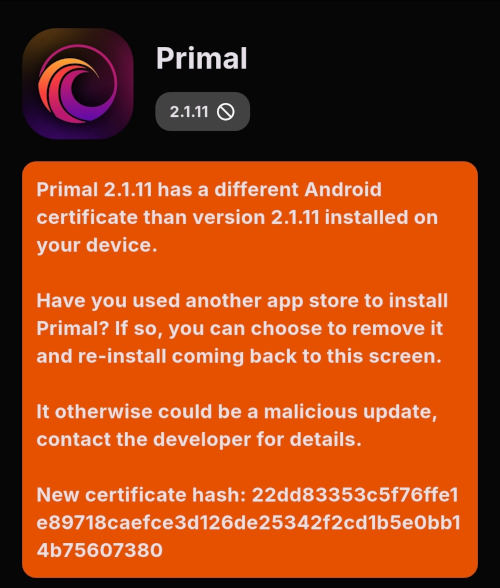

Tap on one of your apps in the list to see whether the app is added by the developer, or by the Zapstore. This takes you to the application's page, and you may see a warning at the top if the app was not installed through the Zapstore.

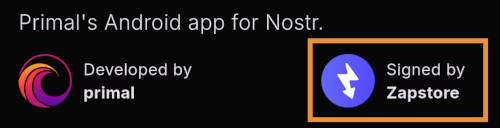

Scroll down the page a bit and you will see who signed the release that is available on the Zapstore.

In the case of Primal, even though the developer is on Nostr, they are not signing their own releases to the Zapstore yet. This means there will likely be a delay between Primal releasing an update and that update being available on the Zapstore.

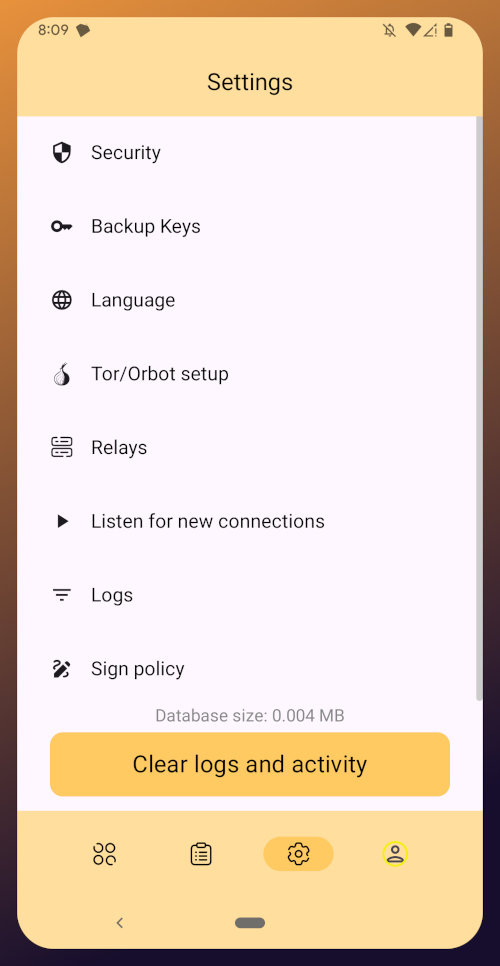

Settings

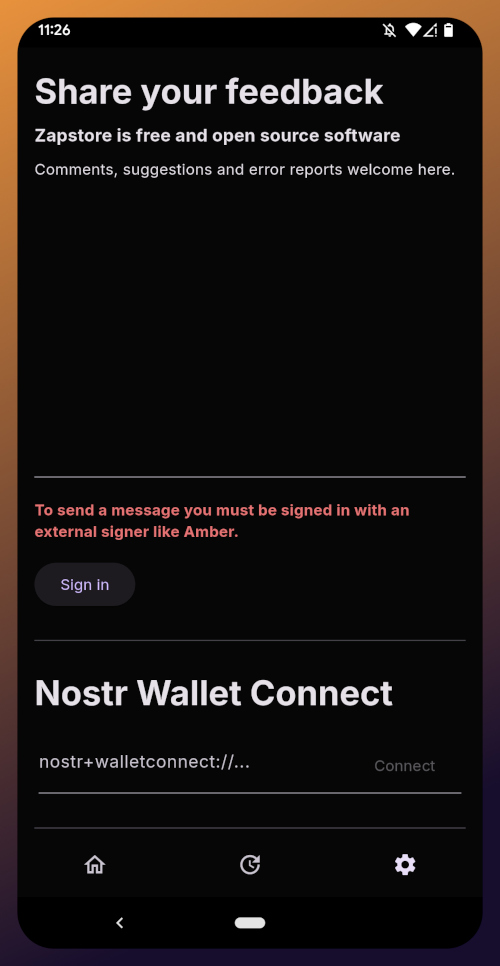

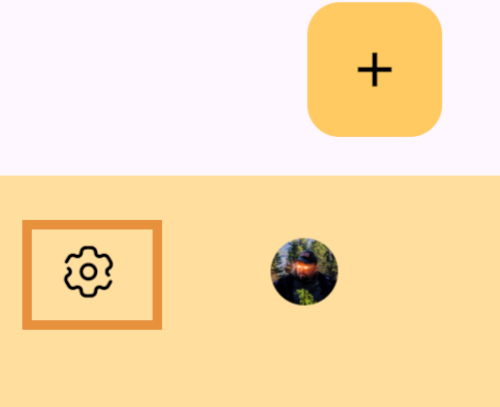

The last page of the app is the settings page, found by tapping the cog at the bottom right.

Here you can send the Zapstore developer feedback directly (if you are logged in), connect a Lightning wallet using Nostr Wallet Connect, delete your local cache, and view some system information.

We will be adding a connection to our nostr:npub1h2qfjpnxau9k7ja9qkf50043xfpfy8j5v60xsqryef64y44puwnq28w8ch wallet in part 5 of this tutorial series.

For the time being, we are all set with the Zapstore and ready for the next stage of our journey.

Continue to Part 3: Amber Signer. Nostr link: nostr:naddr1qqxnzde5xuengdeexcmnvv3eqgstwf6d9r37nqalwgxmfd9p9gclt3l0yc3jp5zuyhkfqjy6extz3jcrqsqqqa28qy2hwumn8ghj7un9d3shjtnyv9kh2uewd9hj7qg6waehxw309aex2mrp0yhxyunfva58gcn0d36zumn9wss80nug

-

@ 7d33ba57:1b82db35

2025-05-29 08:40:35

@ 7d33ba57:1b82db35

2025-05-29 08:40:35Lingen (Ems) is a peaceful town in Lower Saxony, near the Dutch border, known for its historic old town, green surroundings, and relaxed pace of life. It may not be on the typical tourist radar, but it offers a taste of small-town Germany with plenty of charm and local culture.

🏘️ What to See and Do in Lingen

🏛️ Old Town & Market Square

- Stroll through the historic town center, where you’ll find half-timbered houses, cozy cafés, and the lovely St. Boniface Church

- The Rathaus (Town Hall) and its square are perfect for a slow coffee or people-watching

🚲 Nature & Outdoor Activities

- The region around Lingen is great for cycling and walking, especially along the Ems River

- Explore the Emsland countryside, filled with forests, meadows, and quiet villages

- Visit the nearby Emsland Moormuseum to learn about local peatland history

🎓 Student Vibes

- Thanks to the presence of a university, Lingen has a young and vibrant side, with cultural events and small live music scenes

🍺 Local Food & Drink

- Try regional dishes like Grünkohl (kale with sausage in winter) and Schnitzel in a local tavern

- Enjoy a drink at a beer garden or riverside café, especially in warmer months

🚆 Getting There

- Well connected by train, especially to Osnabrück, Münster, and the Dutch city of Enschede

- Great stop on a northern Germany road or rail trip

Lingen is ideal for travelers looking for peaceful towns, regional culture, and access to beautiful natural areas. It’s a place where you can slow down, bike along a river, and enjoy the local way of life.

-

@ 21335073:a244b1ad

2025-05-21 16:58:36

@ 21335073:a244b1ad

2025-05-21 16:58:36The other day, I had the privilege of sitting down with one of my favorite living artists. Our conversation was so captivating that I felt compelled to share it. I’m leaving his name out for privacy.

Since our last meeting, I’d watched a documentary about his life, one he’d helped create. I told him how much I admired his openness in it. There’s something strange about knowing intimate details of someone’s life when they know so little about yours—it’s almost like I knew him too well for the kind of relationship we have.

He paused, then said quietly, with a shy grin, that watching the documentary made him realize how “odd and eccentric” he is. I laughed and told him he’s probably the sanest person I know. Because he’s lived fully, chasing love, passion, and purpose with hardly any regrets. He’s truly lived.

Today, I turn 44, and I’ll admit I’m a bit eccentric myself. I think I came into the world this way. I’ve made mistakes along the way, but I carry few regrets. Every misstep taught me something. And as I age, I’m not interested in blending in with the world—I’ll probably just lean further into my own brand of “weird.” I want to live life to the brim. The older I get, the more I see that the “normal” folks often seem less grounded than the eccentric artists who dare to live boldly. Life’s too short to just exist, actually live.

I’m not saying to be strange just for the sake of it. But I’ve seen what the crowd celebrates, and I’m not impressed. Forge your own path, even if it feels lonely or unpopular at times.

It’s easy to scroll through the news and feel discouraged. But actually, this is one of the most incredible times to be alive! I wake up every day grateful to be here, now. The future is bursting with possibility—I can feel it.

So, to my fellow weirdos on nostr: stay bold. Keep dreaming, keep pushing, no matter what’s trending. Stay wild enough to believe in a free internet for all. Freedom is radical—hold it tight. Live with the soul of an artist and the grit of a fighter. Thanks for inspiring me and so many others to keep hoping. Thank you all for making the last year of my life so special.

-

@ cefb08d1:f419beff

2025-05-29 08:01:15

@ cefb08d1:f419beff

2025-05-29 08:01:15https://stacker.news/items/991778

-

@ b7274d28:c99628cb

2025-05-28 00:59:49

@ b7274d28:c99628cb

2025-05-28 00:59:49Your identity is important to you, right? While impersonation can be seen in some senses as a form of flattery, we all would prefer to be the only person capable of representing ourselves online, unless we intentionally delegate that privilege to someone else and maintain the ability to revoke it.

Amber does all of that for you in the context of #Nostr. It minimizes the possibility of your private key being compromized by acting as the only app with access to it, while all other Nostr apps send requests to Amber when they need something signed. This even allows you to give someone temporary authority to post as you without giving them your private key, and you retain the authority to revoke their permissions at any time.

nostr:npub1w4uswmv6lu9yel005l3qgheysmr7tk9uvwluddznju3nuxalevvs2d0jr5 has provided Android users with an incredibly powerful tool in Amber, and he continues to improve its functionality and ease of use. Indeed, there is not currently a comparative app available for iOS users. For the time being, this superpower is exclusive to Android.

Installation

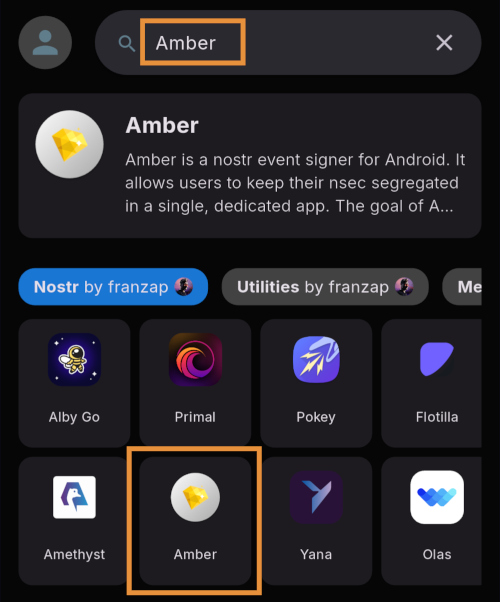

Open up the Zapstore app that you installed in the previous stage of this tutorial series.

Very likely, Amber will be listed in the app collection section of the home page. If it is not, just search for "Amber" in the search bar.

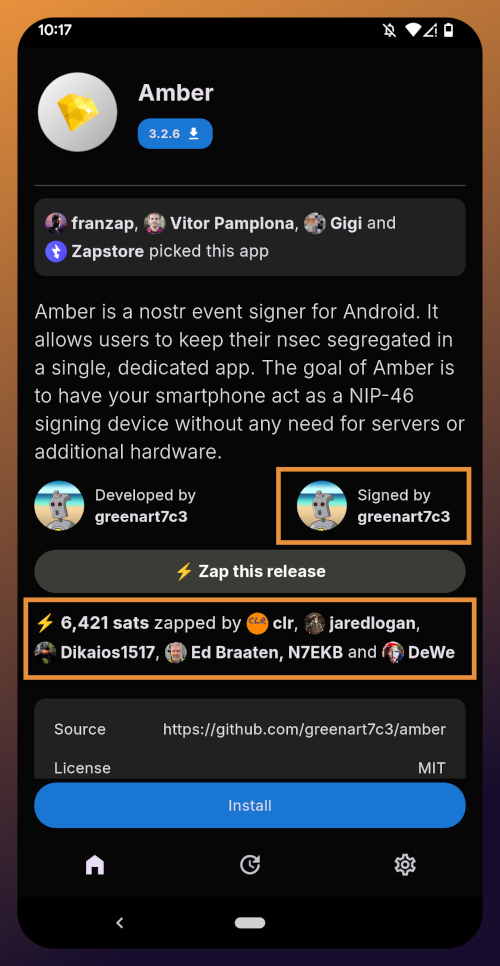

Opening the app's page in the Zapstore shows that the release is signed by the developer. You can also see who has added this app to one of their collections and who has supported this app with sats by zapping the release.

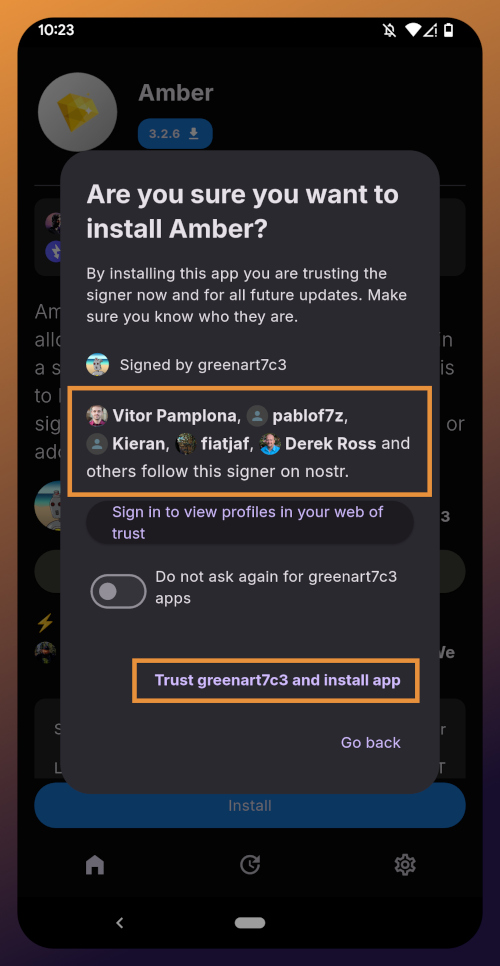

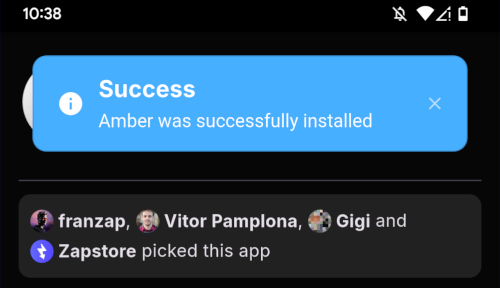

Tap "Install" and you will be prompted to confirm you are sure you want to install Amber.

Helpfully, you are informed that several other users follow this developer on Nostr. If you have been on Nostr a while, you will likely recognize these gentlemen as other Nostr developers, one of them being the original creator of the protocol.

You can choose to never have Zapstore ask for confirmation again with apps developed by nostr:npub1w4uswmv6lu9yel005l3qgheysmr7tk9uvwluddznju3nuxalevvs2d0jr5, and since we have another of his apps to install later in this tutorial series, I recommend you toggle this on. Then tap on "Trust greenart7c3 and install app."

Just like when you installed the Zapstore from their GitHub, you will be prompted to allow the Zapstore to install apps, since Android considers it an "unknown source."

Once you toggle this on and use the back button to get back to the Zapstore, Amber will begin downloading and then present a prompt to install the app. Once installed, you will see a prompt that installation was a success and you can now open the app.

From here, how you proceed will depend on whether you need to set up a new Nostr identity or use Amber with an existing private key you already have set up. The next section will cover setting up a new Nostr identity with Amber. Skip to the section titled "Existing Nostrich" if you already have an nsec that you would like to use with Amber.

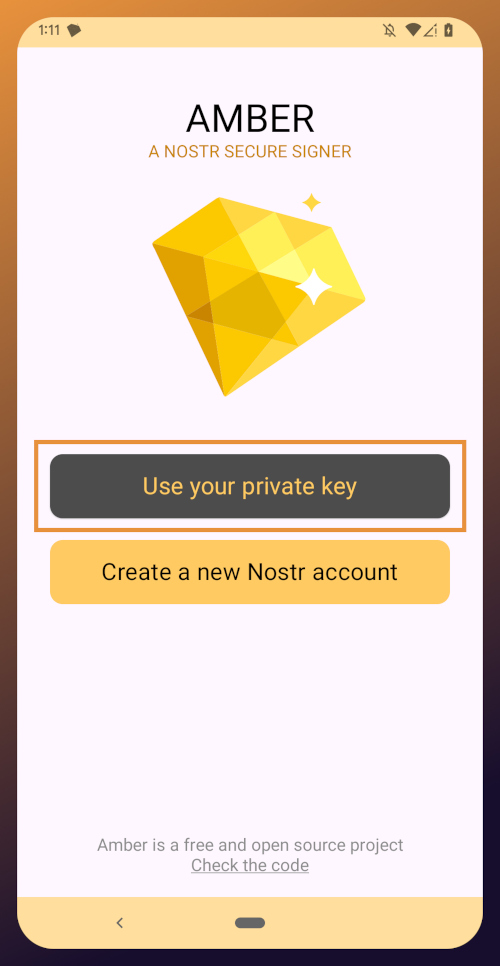

New Nostrich

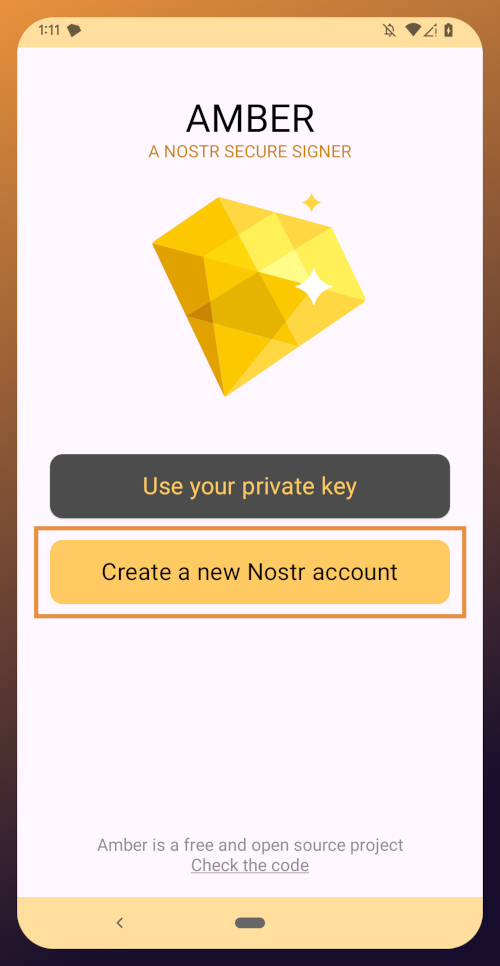

Upon opening the application, you will be presented with the option to use an existing private key or create a new Nostr account. Nostr doesn't really have "accounts" in the traditional sense of the term. Accounts are a relic of permissioned systems. What you have on Nostr are keys, but Amber uses the "account" term because it is a more familiar concept, though it is technically inaccurate.

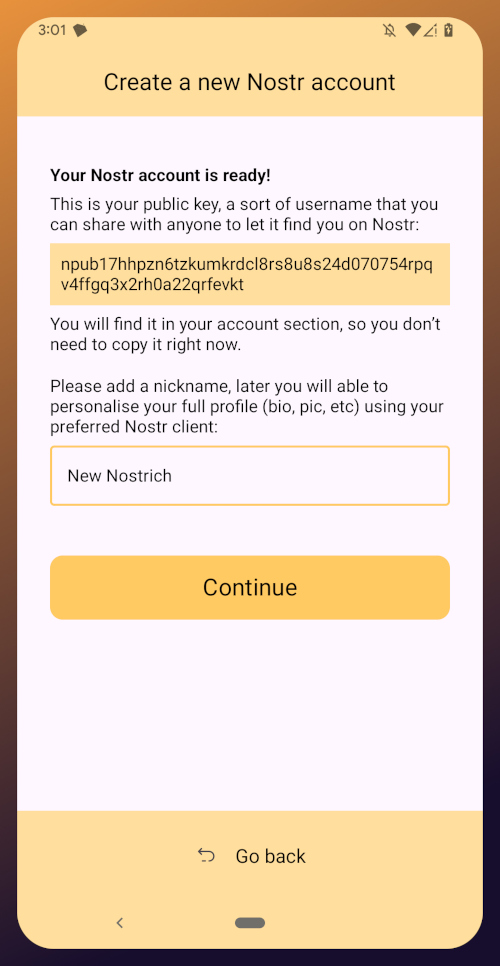

Choose "Create a new Nostr account" and you will be presented with a screen telling you that your Nostr account is ready. Yes, it was really that easy. No email, no real name, no date of birth, and no annoying capcha. Just "Create a new account" and you're done.

The app presents you with your public key. This is like an address that can be used to find your posts on Nostr. It is 100% unique to you, and no one else can post a note that lists this npub as the author, because they won't have the corresponding private key. You don't need to remember your npub, though. You'll be able to readily copy it from any Nostr app you use whenever you need it.

You will also be prompted to add a nickname. This is just for use within Amber, since you can set up multiple profiles within the app. You can use anything you want here, as it is just so you can tell which profile is which when switching between them in Amber.

Once you've set your nickname, tap on "Continue."

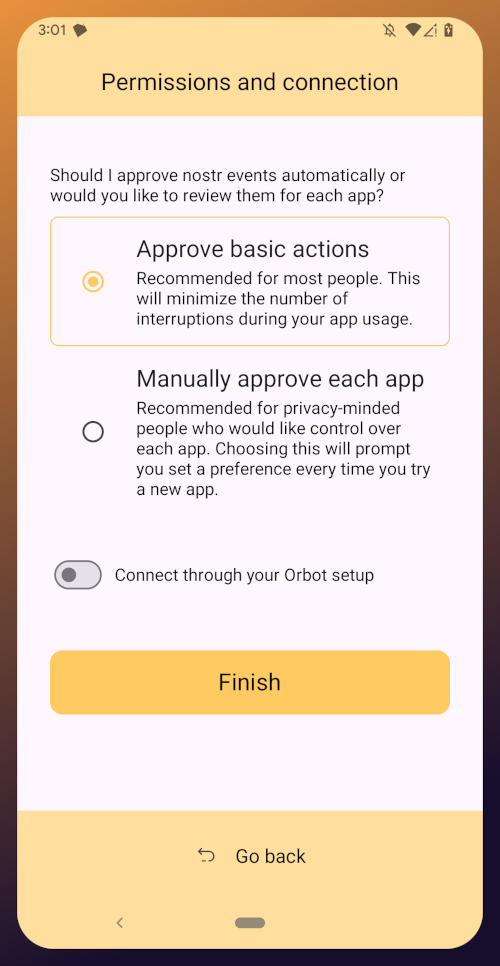

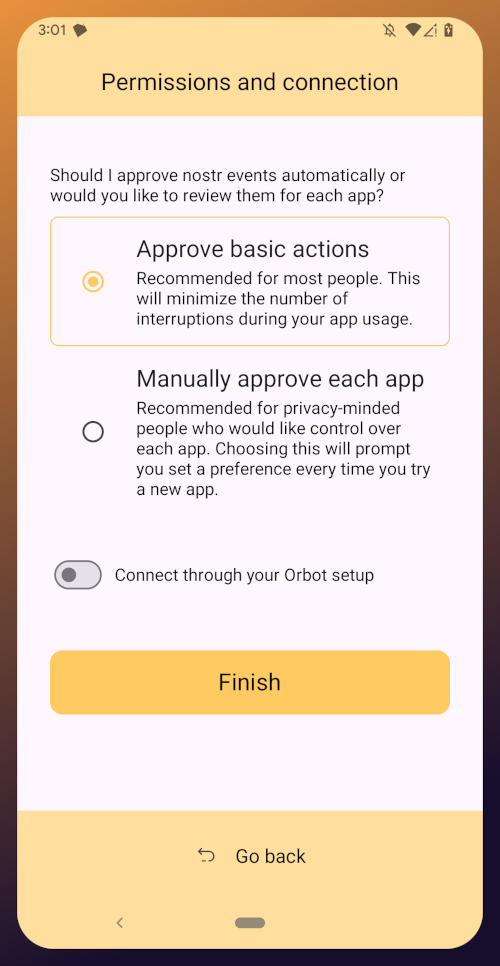

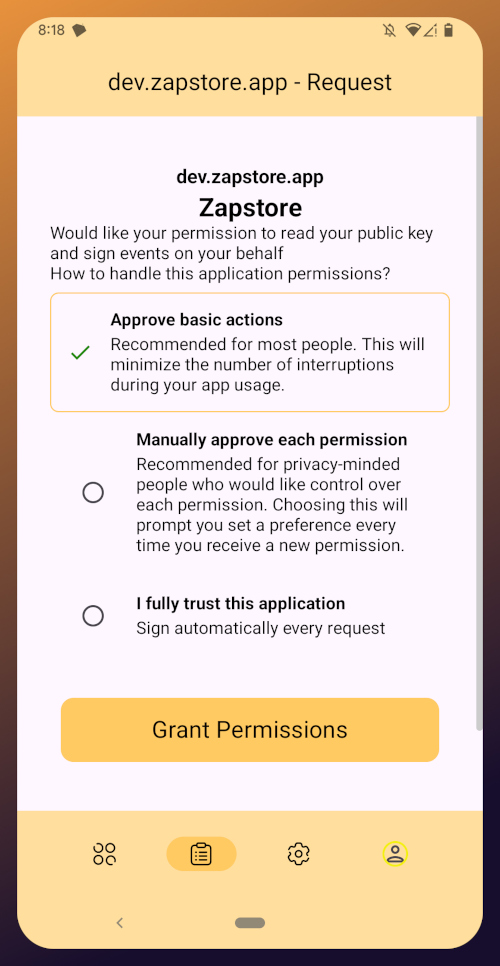

The next screen will ask you what Amber's default signing policy should be.

The default is to approve basic actions, referring to things that are common for Nostr clients to request a signature for, like following another user, liking a post, making a new post, or replying. If you are more concerned about what Amber might be signing for on your behalf, you can tell it to require manual approval for each app.

Once you've made your decision, tap "Finish." You will also be able to change this selection in the app settings at any time.

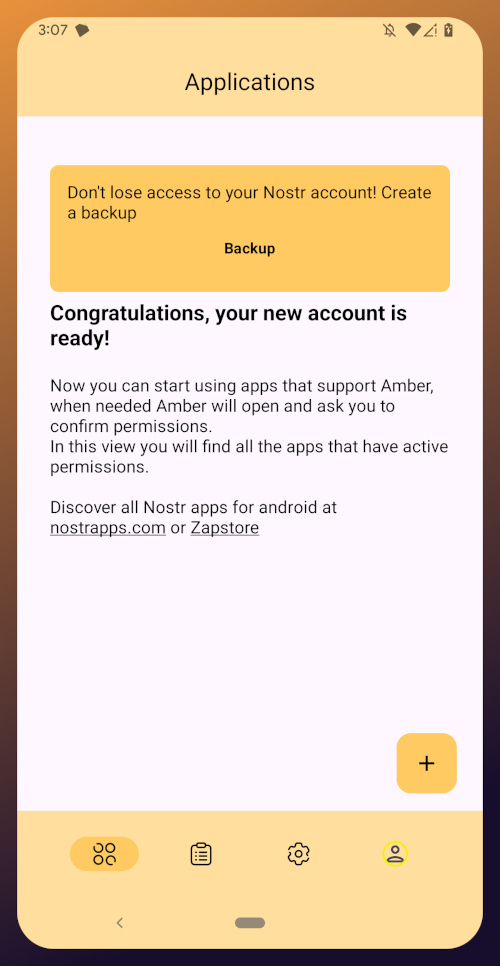

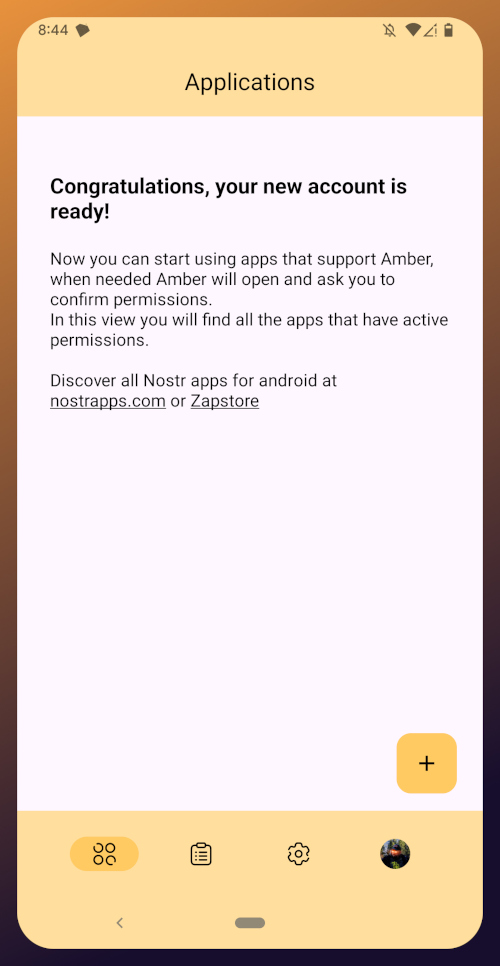

With this setup out of the way, you are now presented with the main "Applications" page of the app.

At the top, you have a notification encouraging you to create a backup. Let's get that taken care of now by tapping on the notification and skipping down to the heading titled "Backing Up Your Identity" in this tutorial.

Existing Nostrich

Upon opening the application, you will be presented with the option to use your private key or create a new Nostr account. Choose the former.

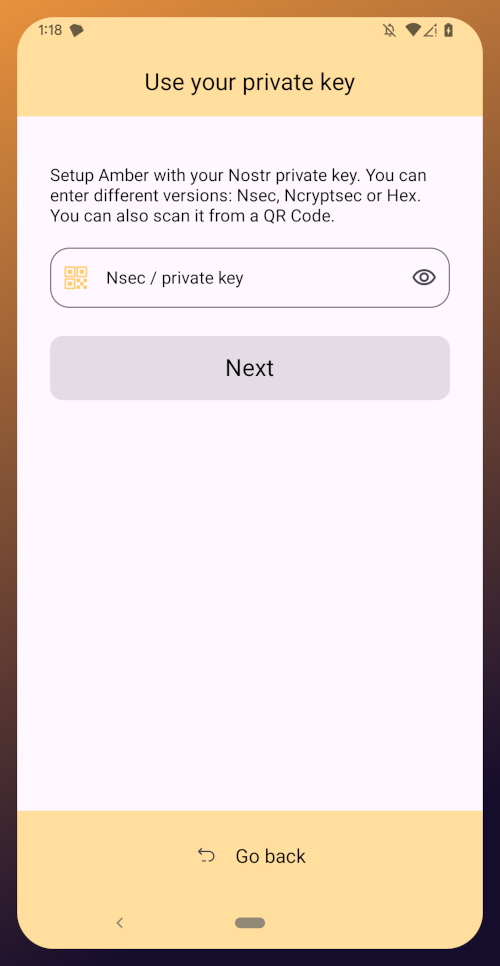

The next screen will require you to paste your private key.

You will need to obtain this from whatever Nostr app you used to create your profile, or any other Nostr app that you pasted your nsec into in the past. Typically you can find it in the app settings and there will be a section mentioning your keys where you can copy your nsec. For instance, in Primal go to Settings > Keys > Copy private key, and on Amethyst open the side panel by tapping on your profile picture in the top-left, then Backup Keys > Copy my secret key.

After pasting your nsec into Amber, tap "Next."

Amber will give you a couple options for a default signing policy. The default is to approve basic actions, referring to things that are common for Nostr clients to request a signature for, like following another user, liking a post, making a new post, or replying. If you are more concerned about what Amber might be signing for on your behalf, you can tell it to require manual approval for each app.

Once you've made your decision, tap "Finish." You will also be able to change this selection in the app settings at any time.

With this setup out of the way, you are now presented with the main "Applications" page of the app. You have nothing here yet, since you haven't used Amber to log into any Nostr apps, but this will be where all of the apps you have connected with Amber will be listed, in the order of the most recently used at the top.

Before we go and use Amber to log into an app, though, let's make sure we've created a backup of our private key. You pasted your nsec into Amber, so you could just save that somewhere safe, but Amber gives you a few other options as well. To find them, you'll need to tap the cog icon at the bottom of the screen to access the settings, then select "Backup Keys."

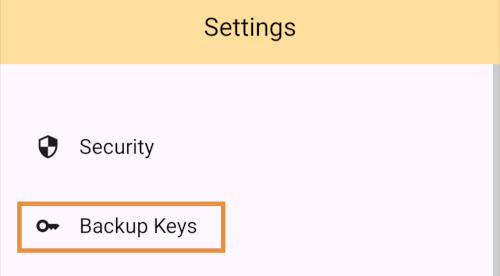

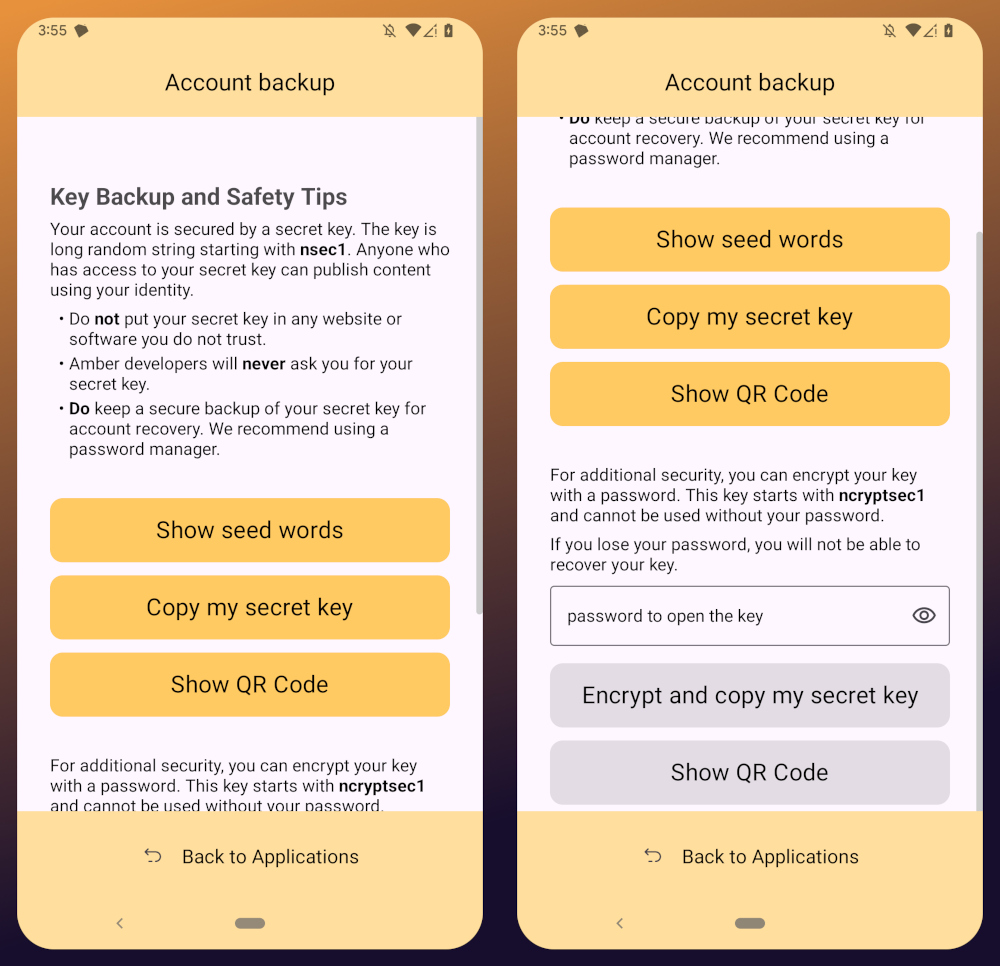

Backing Up Your Identity

You'll notice that Amber has a few different options for backing up your private key that it can generate.

First, it can give you seed words, just like a Bitcoin seed. If you choose that option, you'll be presented with 12 words you can record somewhere safe. To recover your Nostr private key, you just have to type those words into a compatible application, such as Amber.

The next option is to just copy the secret/private key in its standard form as an "nsec." This is the least secure way to store it, but is also the most convenient, since it is simple to paste into another signer application. If you want to be able to log in on a desktop web app, the browser extension Nostr signers won't necessarily support entering your 12 word seed phrase, but they absolutely will support pasting in your nsec.

You can also display a QR code of your private key. This can be scanned by Amber signer on another device for easily transferring your private key to other devices you want to use it on. Say you have an Android tablet in addition to your phone, for instance. Just make sure you only use this function where you can be certain that no one will be able to get a photograph of that QR code. Once someone else has your nsec, there is no way to recover it. You have to start all over on Nostr. Not a big deal at this point in your journey if you just created a Nostr account, but if you have been using Nostr for a while and have built up a decent amount of reputation, it could be much more costly to start over again.

The next options are a bit more secure, because they require a password that will be used to encrypt your private key. This has some distinct advantages, and a couple disadvantages to be aware of. Using a password to encrypt your private key will give you what is called an ncryptsec, and if this is leaked somehow, whoever has it will not necessarily have access to post as you on Nostr, the way they would if your nsec had been leaked. At least, not so long as they don't also have your password. This means you can store your ncryptsec in multiple locations without much fear that it will be compromised, so long as the password you used to encrypt it was a strong and unique one, and it isn't stored in the same location. Some Nostr apps support an ncryptsec for login directly, meaning that you have the option to paste in your ncryptsec and then just log in with the password you used to encrypt it from there on out. However, now you will need to keep track of both your ncryptsec and your password, storing both of them safely and separately. Additionally, most Nostr clients and signer applications do not support using an ncryptsec, so you will need to convert it back to a standard nsec (or copy the nsec from Amber) to use those apps.

The QR option using an ncryptsec is actually quite useful, though, and I would go this route when trying to set up Amber on additional devices, since anyone possibly getting a picture of the QR code is still not going to be able to do anything with it, unless they also get the password you used to encrypt it.

All of the above options will require you to enter the PIN you set up for your device, or biometric authentication, just as an additional precaution before displaying your private key to you.

As for what "store it in a safe place" looks like, I highly recommend a self-hosted password manager, such as Vaultwarden+Bitwarden or KeePass. If you really want to get wild, you can store it on a hardware signing device, or on a steel seed plate.

Additional Settings

Amber has some additional settings you may want to take advantage of. First off, if you don't want just anyone who has access to your phone to be able to approve signing requests, you can go into the Security settings add a PIN or enable biometrics for signing requests. If you enable the PIN, it will be separate from the PIN you use to access your phone, so you can let someone else use your phone, like your child who is always begging to play a mobile game you have installed, without worrying that they might have access to your Nostr key to post on Amethyst.

Amber also has some relay settings. First are the "Active relays" which are used for signing requests sent to Amber remotely from Nostr web apps. This is what enables you to use Amber on your phone to log into Nostr applications on your desktop web browser, such as Jumble.social, Coracle.social, or Nostrudel.ninja, eliminating your need to use any other application to store your nsec whatsoever. You can leave this relay as the default, or you can add other relays you want to use for signing requests. Just be aware, not all relays will accept the notes that are used for Nostr signing requests, so make sure that the relay you want to use does so. In fact, Amber will make sure of this for you when you type in the relay address.

The next type of relays that you can configure in Amber are the "Default profile relays." These are used for reading your profile information. If you already had a Nostr identity that you imported to Amber, you probably noticed it loaded your profile picture and display name, setting the latter as your nickname in Amber. These relays are where Amber got that information from. The defaults are relay.nostr.band and purplepag.es. The reason for this is because they are aggregators that look for Nostr profiles that have been saved to other relays on the network and pull them in. Therefore, no matter what other relay you may save your profile to, Amber will likely be able to find it on one of those two relays as well. If you have a relay you know you will be saving your Nostr profiles to, you may want to add it to this list.

You can also set up Amber to be paired with Orbot for signing over Tor using relays that are only accessible via the Tor network. That is an advanced feature, though, and well beyond the scope of this tutorial.

Finally, you can update the default signing policy. Maybe after using Amber for a while, you've decided that the choice you made before was too strict or too lenient. You can change it to suit your needs.

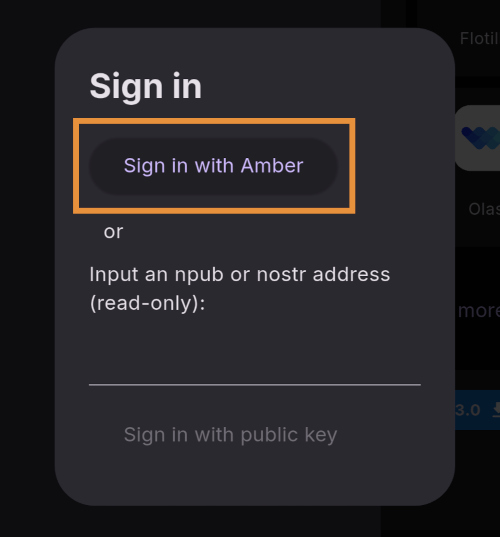

Zapstore Login

Now that you are all set up with Amber, let's get you signed into your first Nostr app by going back to the Zapstore.

From the app's home screen, tap on the user icon in the upper left of the screen. This will open a side panel with not much on it except the option to "sign in." Go ahead and tap on it.

You will be presented with the option to either sign in with Amber, or to paste your npub. However, if you do the latter, you will only have read access, meaning you cannot zap any of the app releases. There are other features planned for the Zapstore that may also require you to be signed in with write access, so go ahead and choose to log in with Amber.

Your phone should automatically switch to Amber to approve the sign-in request.

You can choose to only approve basic actions for Zapstore, require it to manually approve every time, or you can tell it that you "fully trust this application." Only choose the latter option with apps you have used for a while and they have never asked you to sign for anything suspicious. For the time being, I suggest you use the "Approve basic actions" option and tap "Grant Permissions."

Your phone will switch back to the Zapstore and will show that you are now signed in. Congratulations! From here on out, logging into most Nostr applications will be as easy as tapping on "Log in with Amber" and approving the request.

If you set up a new profile, it will just show a truncated version of your npub rather than the nickname you set up earlier. That's fine. You'll have an opportunity to update your Nostr profile in the next tutorial in this series and ensure that it is spread far and wide in the network, so the Zapstore will easily find it.

That concludes the tutorial for Amber. While we have not covered using Amber to log into Nostr web apps, that is outside the scope of this series, and I will cover it in an upcoming tutorial regarding using Amber's remote signer options in detail.

Since you're already hanging out in the Zapstore, you may as well stick around, because we will be using it right out the gate in the next part of this series: Amethyst Installation and Setup. (Coming Soon)

-

@ c1e9ab3a:9cb56b43

2025-05-27 16:19:06

@ c1e9ab3a:9cb56b43

2025-05-27 16:19:06Star Wars is often viewed as a myth of rebellion, freedom, and resistance to tyranny. The iconography—scrappy rebels, totalitarian stormtroopers, lone smugglers—suggests a deep anti-authoritarian ethos. Yet, beneath the surface, the narrative arc of Star Wars consistently affirms the necessity, even sanctity, of central authority. This blog entry introduces the question: Is Star Wars fundamentally a celebration of statism?

Rebellion as Restoration, Not Revolution

The Rebel Alliance’s mission is not to dismantle centralized power, but to restore the Galactic Republic—a bureaucratic, centrally governed institution. Characters like Mon Mothma and Bail Organa are high-ranking senators, not populist revolutionaries. The goal is to remove the corrupt Empire and reinstall a previous central authority, presumed to be just.

- Rebels are loyalists to a prior state structure.

- Power is not questioned, only who wields it.

Jedi as Centralized Moral Elites

The Jedi, often idealized as protectors of peace, are unelected, extra-legal enforcers of moral and military order. Their authority stems from esoteric metaphysical abilities rather than democratic legitimacy.

- They answer only to their internal Council.

- They are deployed by the Senate, but act independently of civil law.

- Their collapse is depicted as tragic not because they were unaccountable, but because they were betrayed.

This positions them as a theocratic elite, not spiritual anarchists.

Chaos and the Frontier: The Case of the Cantina

The Mos Eisley cantina, often viewed as a symbol of frontier freedom, reveals something darker. It is: - Lawless - Violent - Culturally fragmented

Conflict resolution occurs through murder, not mediation. Obi-Wan slices off a limb; Han shoots first—both without legal consequence. There is no evidence of property rights, dispute resolution, or voluntary order.

This is not libertarian pluralism—it’s moral entropy. The message: without centralized governance, barbarism reigns.

The Mythic Arc: Restoration of the Just State

Every trilogy in the saga returns to a single theme: the fall and redemption of legitimate authority.

- Prequels: Republic collapses into tyranny.

- Originals: Rebels fight to restore legitimate order.

- Sequels: Weak governance leads to resurgence of authoritarianism; heroes must reestablish moral centralism.

The story is not anti-state—it’s anti-bad state. The solution is never decentralization; it’s the return of the right ruler or order.

Conclusion: The Hidden Statism of a Rebel Myth

Star Wars wears the costume of rebellion, but tells the story of centralized salvation. It: - Validates elite moral authority (Jedi) - Romanticizes restoration of fallen governments (Republic) - Portrays decentralized zones as corrupt and savage (outer rim worlds)

It is not an anarchist parable, nor a libertarian fable. It is a statist mythology, clothed in the spectacle of rebellion. Its core message is not that power should be abolished, but that power belongs to the virtuous few.

Question to Consider:

If the Star Wars universe consistently affirms the need for centralized moral and political authority, should we continue to see it as a myth of freedom? Or is it time to recognize it as a narrative of benevolent empire? -

@ 9e9085e9:2056af17

2025-05-29 07:51:18

@ 9e9085e9:2056af17

2025-05-29 07:51:18Part 5: Why You Should Join Yakihonne Today

🚀 Yakihonne: The Future of Free, Fair & Fast Social Interaction

Looking for a platform where you control everything—your posts, your data, your income?

Yakihonne is not just another app. It's a movement. A decentralized social payment network where:

Your voice can't be silenced

Your data isn't sold

Your followers are truly yours

Your creativity can be rewarded instantly

🔥 6 Reasons to Pay Attention to Yakihonne:

-

Zero Censorship Say what matters without fear of being muted or banned.

-

Built on Nostr Protocol Secure, scalable, and permissionless by design.

-

Social + Payments in One Chat, connect, and get paid—all from one app.

-

Lightning Fast Tips Reward content instantly with Bitcoin micro-payments.

-

No Algorithms. No Ads. No Noise. What you see is what you follow—simple and clean.

-

True Digital Freedom Break free from centralized control and own your digital presence.

🔗 Explore now: https://yakihonne.com 📱 Available on #iOS & #Android

-

-

@ 51bbb15e:b77a2290

2025-05-21 00:24:36

@ 51bbb15e:b77a2290

2025-05-21 00:24:36Yeah, I’m sure everything in the file is legit. 👍 Let’s review the guard witness testimony…Oh wait, they weren’t at their posts despite 24/7 survellience instructions after another Epstein “suicide” attempt two weeks earlier. Well, at least the video of the suicide is in the file? Oh wait, a techical glitch. Damn those coincidences!

At this point, the Trump administration has zero credibility with me on anything related to the Epstein case and his clients. I still suspect the administration is using the Epstein files as leverage to keep a lot of RINOs in line, whereas they’d be sabotaging his agenda at every turn otherwise. However, I just don’t believe in ends-justify-the-means thinking. It’s led almost all of DC to toss out every bit of the values they might once have had.

-

@ c9badfea:610f861a

2025-05-20 19:49:20

@ c9badfea:610f861a

2025-05-20 19:49:20- Install Sky Map (it's free and open source)

- Launch the app and tap Accept, then tap OK

- When asked to access the device's location, tap While Using The App

- Tap somewhere on the screen to activate the menu, then tap ⁝ and select Settings

- Disable Send Usage Statistics

- Return to the main screen and enjoy stargazing!

ℹ️ Use the 🔍 icon in the upper toolbar to search for a specific celestial body, or tap the 👁️ icon to activate night mode

-

@ 04c915da:3dfbecc9

2025-05-20 15:53:48

@ 04c915da:3dfbecc9

2025-05-20 15:53:48This piece is the first in a series that will focus on things I think are a priority if your focus is similar to mine: building a strong family and safeguarding their future.

Choosing the ideal place to raise a family is one of the most significant decisions you will ever make. For simplicity sake I will break down my thought process into key factors: strong property rights, the ability to grow your own food, access to fresh water, the freedom to own and train with guns, and a dependable community.

A Jurisdiction with Strong Property Rights

Strong property rights are essential and allow you to build on a solid foundation that is less likely to break underneath you. Regions with a history of limited government and clear legal protections for landowners are ideal. Personally I think the US is the single best option globally, but within the US there is a wide difference between which state you choose. Choose carefully and thoughtfully, think long term. Obviously if you are not American this is not a realistic option for you, there are other solid options available especially if your family has mobility. I understand many do not have this capability to easily move, consider that your first priority, making movement and jurisdiction choice possible in the first place.

Abundant Access to Fresh Water

Water is life. I cannot overstate the importance of living somewhere with reliable, clean, and abundant freshwater. Some regions face water scarcity or heavy regulations on usage, so prioritizing a place where water is plentiful and your rights to it are protected is critical. Ideally you should have well access so you are not tied to municipal water supplies. In times of crisis or chaos well water cannot be easily shutoff or disrupted. If you live in an area that is drought prone, you are one drought away from societal chaos. Not enough people appreciate this simple fact.

Grow Your Own Food

A location with fertile soil, a favorable climate, and enough space for a small homestead or at the very least a garden is key. In stable times, a small homestead provides good food and important education for your family. In times of chaos your family being able to grow and raise healthy food provides a level of self sufficiency that many others will lack. Look for areas with minimal restrictions, good weather, and a culture that supports local farming.

Guns

The ability to defend your family is fundamental. A location where you can legally and easily own guns is a must. Look for places with a strong gun culture and a political history of protecting those rights. Owning one or two guns is not enough and without proper training they will be a liability rather than a benefit. Get comfortable and proficient. Never stop improving your skills. If the time comes that you must use a gun to defend your family, the skills must be instinct. Practice. Practice. Practice.

A Strong Community You Can Depend On

No one thrives alone. A ride or die community that rallies together in tough times is invaluable. Seek out a place where people know their neighbors, share similar values, and are quick to lend a hand. Lead by example and become a good neighbor, people will naturally respond in kind. Small towns are ideal, if possible, but living outside of a major city can be a solid balance in terms of work opportunities and family security.

Let me know if you found this helpful. My plan is to break down how I think about these five key subjects in future posts.

-

@ 7459d333:f207289b

2025-05-29 07:44:37

@ 7459d333:f207289b

2025-05-29 07:44:37Bitcoin is something that grows in you. And the proof of work philosophy really is a thing.

At some point, you become uncomfortable about holding fiat or fiat related assets (stocks, bonds, ...). Because those aren't really yours. And feels like sponsoring a system you don't support.

At some point, you might have decided to opt out. And move all your savings into Bitcoin. How did you do that?

If you had a significant amount of index funds and wanted to move those to Bitcoin, how would you do it? When?

For the how: probably selling it off slowly for fiat and then Bisq or similar.

For the when: 2 years ago you would have gotten 4x the amount of Bitcoin that you get today for each “share” of the S&P 500. 4 years ago you would have gotten more or less the same that you would today. https://inflationchart.com/spx-in-btc/?time=5%20years&show_stock=0&show_adjuster=0&zero=1 Would you wait for another SP500/BTC peak?

Did you move all your savings into Bitcoin? How did you do so? How would you do it today?

https://stacker.news/items/991774

-

@ 9e9085e9:2056af17

2025-05-29 07:35:34

@ 9e9085e9:2056af17

2025-05-29 07:35:34**Part 4: Yakihonne as a Decentralized Social Payment Client

Yakihonne – Own Your Voice, Own Your Value

Yakihonne is evolving beyond just decentralized social networking—it’s now a decentralized social payment client on the Nostr protocol. With its integration of secure, user-owned identities and direct payment features, Yakihonne empowers people to truly own their voice and their value.

🔗 yakihonne.com 💬 Chat, post, connect—and pay—all in one place 💸 Send and receive Lightning payments directly 📱 Cross-platform access for #iOS and #Android

Why It Matters:

No Middlemen: Directly support creators, friends, or causes

Censorship-Resistant: Your content can’t be taken down or hidden

True Ownership: Your identity, your wallet, your data

Secure and Open: Built on the fast-growing Nostr protocol

Yakihonne isn’t just another app—it’s a new way to interact with your community and control your digital life.

Yakihonne #Yakihonne #Yakihonne #Nostr #Nostr #YoungDfx**

-

@ c1e9ab3a:9cb56b43

2025-05-27 13:19:53

@ c1e9ab3a:9cb56b43

2025-05-27 13:19:53I. Introduction: Money as a Function of Efficiency and Preference

Money is not defined by law, but by power over productivity. In any open economy, the most economically efficient actors—those who control the most valuable goods, services, and knowledge—ultimately dictate the medium of exchange. Their preferences signal to the broader market what form of money is required to access the highest-value goods, from durable commodities to intangibles like intellectual property and skilled labor.

Whatever money these actors prefer becomes the de facto unit of account and store of value, regardless of its legal status. This emergent behavior is natural and reflects a hierarchy of monetary utility.

II. Classical Gresham’s Law: A Product of Market Distortion

Gresham’s Law, famously stated as:

"Bad money drives out good"

is only valid under coercive monetary conditions, specifically: - Legal tender laws that force the acceptance of inferior money at par with superior money. - Fixed exchange rates imposed by decree, not market valuation. - Governments or central banks backing elastic fiduciary media with promises of redemption. - Institutional structures that mandate debt and tax payments in the favored currency.

Under these conditions, superior money (hard money) is hoarded, while inferior money (soft, elastic, inflationary) circulates. This is not an expression of free market behavior—it is the result of suppressed price discovery and legal coercion.

Gresham’s Law, therefore, is not a natural law of money, but a law of distortion under forced parity and artificial elasticity.

III. The Collapse of Coercion: Inversion of Gresham’s Law

When coercive structures weaken or are bypassed—through technological exit, jurisdictional arbitrage, monetary breakdown, or political disintegration—Gresham’s Law inverts:

Good money drives out bad.

This occurs because: - Market actors regain the freedom to select money based on utility, scarcity, and credibility. - Legal parity collapses, exposing the true economic hierarchy of monetary forms. - Trustless systems (e.g., Bitcoin) or superior digital instruments (e.g., stablecoins) offer better settlement, security, and durability. - Elastic fiduciary media become undesirable as counterparty risk and inflation rise.

The inversion marks a return to monetary natural selection—not a breakdown of Gresham’s Law, but the collapse of its preconditions.

IV. Elasticity and Control

Elastic fiduciary media (like fiat currency) are not intrinsically evil. They are tools of state finance and debt management, enabling rapid expansion of credit and liquidity. However, when their issuance is unconstrained, and legal tender laws force their use, they become weapons of economic coercion.

Banks issue credit unconstrained by real savings, and governments enforce the use of inflated media through taxation and courts. This distorts capital allocation, devalues productive labor, and ultimately hollows out monetary confidence.

V. Monetary Reversion: The Return of Hard Money

When the coercion ends—whether gradually or suddenly—the monetary system reverts. The preferences of the productive and wealthy reassert themselves:

- Superior money is not just saved—it begins to circulate.

- Weaker currencies are rejected not just for savings, but for daily exchange.

- The hoarded form becomes the traded form, and Gresham’s Law inverts completely.

Bitcoin, gold, and even highly credible stable instruments begin to function as true money, not just stores of value. The natural monetary order returns, and the State becomes a late participant, not the originator of monetary reality.

VI. Conclusion

Gresham’s Law operates only under distortion. Its inversion is not an anomaly—it is a signal of the collapse of coercion. The monetary system then reorganizes around productive preference, technological efficiency, and economic sovereignty.

The most efficient market will always dictate the form of hard money. The State can delay this reckoning through legal force, but it cannot prevent it indefinitely. Once free choice returns, bad money dies, and good money lives again.

-

@ 6146ad04:a0937b0b

2025-05-29 05:55:28

@ 6146ad04:a0937b0b

2025-05-29 05:55:28As the crypto market gears up for what many believe could be the next major bull run, one question dominates investor conversations: Will Bitcoin lead the charge once again, or will a new class of AI-powered coins steal the spotlight? This isn’t just a speculative debate—it represents a deeper narrative shift in how crypto investors are thinking about value, utility, and the future of technology.

Bitcoin: The Proven Leader

Bitcoin has historically been the spark that ignites every major bull market. As the original cryptocurrency, it's viewed as the safest bet in an otherwise volatile industry. Its scarcity (capped at 21 million), increasing institutional interest (like the 2024 approval of multiple spot ETFs), and its role as a hedge against inflation have all contributed to its dominance.

Why Bitcoin Might Lead Again:

Institutional adoption: BlackRock, Fidelity, and other giants now offer Bitcoin ETFs, making BTC more accessible than ever.

Digital gold narrative: With macroeconomic uncertainty still looming, Bitcoin’s role as a store of value is being reinforced.

Halving cycle: The 2024 halving has historically been followed by price surges due to reduced supply and increasing demand.

Yet, despite all this, the market has matured—and so has investor appetite.

AI Coins: The New Frontier of Speculation and Utility

Enter AI coins, a category of tokens tied to projects using or enabling artificial intelligence through blockchain technology. These include platforms like Fetch.ai (FET), Render (RNDR), SingularityNET (AGIX), and Numerai (NMR).

Why AI Coins Are Catching Fire:

AI hype cycle: The AI boom, fueled by OpenAI, NVIDIA, and advancements in machine learning, has crossed over into crypto.

Speculative narratives: Investors are betting that decentralized AI networks could challenge centralized tech giants like Google and Meta.

Real use cases: Projects are building decentralized compute, AI marketplaces, and data-sharing protocols with real-world applications.

AI coins often exhibit faster, more dramatic price movements than Bitcoin—appealing to high-risk, high-reward traders. They're meme-able, futuristic, and aligned with the fastest-growing tech trend globally.

The Clash of Narratives

At their core, Bitcoin and AI coins represent two different kinds of crypto belief systems:

Trait Bitcoin AI Coins

Narrative Digital gold, store of value Innovation, future tech, decentralizing AI Volatility Lower High Market maturity Very mature Emerging Investor type Institutional, long-term holders Retail, speculative traders Use case Monetary alternative Data, compute, prediction, services

Rather than choosing between the two, many smart investors are allocating across both, with Bitcoin providing stability and AI coins offering exponential upside.

Market Signals to Watch

Dominance Index: Bitcoin’s dominance often shrinks when altcoin cycles heat up—watch for a dip below 50% as a signal AI coins are gaining ground.

VC Investment Trends: AI and Web3 crossover projects have received increasing venture capital attention.

On-chain activity: Active addresses, developer commits, and transaction volume in AI coin ecosystems are growing rapidly.

Final Thoughts

While Bitcoin may still be the undisputed king of crypto, AI coins are positioning themselves as the spark of the next wave of innovation. Whether they lead the bull run or ride its momentum, their influence is undeniable. Investors may not need to choose a side, but they do need to understand the strengths, risks, and narratives behind both.

In the next bull market, it may not be Bitcoin vs. AI coins—it could be Bitcoin and AI coins that reshape the financial and technological landscape.

-

@ eb0157af:77ab6c55

2025-05-29 07:01:39

@ eb0157af:77ab6c55

2025-05-29 07:01:39A new Bitwise report reveals notable growth for institutional investments in bitcoin over the coming years.

According to the latest forecasts from asset management firm Bitwise, capital flows into Bitcoin could exceed $120 billion by the end of 2025, with projections reaching $300 billion the following year.

This growth is rooted in the rising interest from sovereign wealth funds, publicly traded companies, state treasuries, and institutional investment vehicles such as spot exchange-traded funds (ETFs). Analysts expect the number of companies holding bitcoin in their treasuries to double by the end of 2026.

Bitwise’s analysis highlights how Bitcoin is no longer seen solely as a speculative asset but is emerging as a serious contender for the role of global store of value.

The report notes that, according to its authors, global wealth is gradually moving away from traditional safe havens like gold and shifting toward Bitcoin.

Spot ETF boom

Spot Bitcoin ETFs in the United States have outperformed all expectations throughout 2024. These financial instruments have attracted over $36.2 billion in net inflows, surpassing by twenty times the early performance of SPDR Gold Shares (GLD), historically the most successful commodity ETF.

Source: Bitwise

In just twelve months, U.S. spot ETFs have accumulated $125 billion in assets under management (AUM). Bitwise projections suggest that annual inflows could reach $100 billion by 2027.

However, approximately $35 billion in capital remained on the sidelines in 2024 due to regulatory restrictions at financial institutions such as Morgan Stanley and Goldman Sachs.

States consider a bitcoin reserve

Bitwise’s analysis also highlights Bitcoin’s growing appeal beyond Wall Street. Publicly traded companies currently hold over 1.1 million BTC, worth more than $125 billion. Sovereign governments collectively own more than 500,000 BTC, with the United States, China, and the United Kingdom leading the rankings.

In its base scenario, Bitwise forecasts a modest reallocation of institutional and sovereign assets toward Bitcoin: 5% of government gold reserves and 0.5% of assets from major wealth management platforms. Even under these conservative assumptions, total bitcoin inflows could reach $420 billion over 2025-2026.

In a more optimistic scenario, with 10% of gold reserves and 1% of managed portfolios shifting to Bitcoin, inflows could exceed $920 billion, absorbing more than 9 million bitcoins — around 40% of the total supply.

The post Bitcoin attracts institutional investors: $300 billion expected by 2026, according to Bitwise appeared first on Atlas21.

-

@ 866e0139:6a9334e5

2025-05-29 07:29:43

@ 866e0139:6a9334e5

2025-05-29 07:29:43Autor: Anna Nagel. (Bild: Lukas Karl). Dieser Beitrag wurde mit dem Pareto-Client geschrieben. Sie finden alle Texte der Friedenstaube und weitere Texte zum Thema Frieden hier. Die neuesten Pareto-Artikel finden Sie auch in unserem Telegram-Kanal.

Die neuesten Artikel der Friedenstaube gibt es jetzt auch im eigenen Friedenstaube-Telegram-Kanal.

Wem in seinem Leben Schmerz zugefügt wurde, wer sich ungerecht behandelt fühlt oder wachen Auges in der Welt umschaut, kommt wahrscheinlich irgendwann mit der Frage in Berührung, wie das alles noch einmal «gut» werden kann. Wie kann die Welt sich mit sich selbst versöhnen? Und wie kann ich es selbst schaffen, mich mit ihr und den Menschen, die schlimme Taten vollbringen, wieder in harmonischer Akzeptanz zu verbinden? Kann und will ich gewisse Gräueltaten verzeihen oder gibt es das «Unverzeihliche»? Und selbst wenn ich wollte, wie könnte mir das gelingen?

Perspektivwechsel

Wenn wir an dem Zorn über begangenes Unrecht festhalten, schauen wir in der Regel aus immer derselben Perspektive auf das Geschehen. Mal um Mal erzürnen und empören wir uns darüber, erzählen uns und anderen stets die gleiche Geschichte, die uns allerdings – ebenfalls ein ums andere Mal – wieder selbst verletzt. Das Destruktive holt uns so ständig wieder ein; wir sehen und fühlen das unschuldige Kind und empfinden Verachtung für die Täter.

Die Perspektive zu wechseln lädt uns dazu ein, das Geschehen aus anderen Blickwinkeln zu betrachten und unser Bewusstsein von der schmerzlichen Wiederholung zu lösen. Wir können einmal weit rauszoomen und einen spirituellen Blickwinkel einnehmen, beispielsweise aus Sicht des All-ein-Bewusstseins, das sich in unzählige Seelen teilt, von denen wiederum Milliarden derzeit auf der Erde inkarniert sind. Dieses eine Bewusstsein möchte jede auch nur mögliche Erfahrung machen und durch die Trennung – die Erschaffung der Dualität – kann es sich selbst aus diesen Milliarden Persönlichkeiten heraus erfahren, um zu lernen. Während dieser scheinbaren Trennung vergessen wir, dass wir alle eins sind, dass wir alle aus demselben «Stoff» gemacht sind und nach diesem Spiel hier auf Erden unsere Erinnerung zurückerlangen und unsere Erfahrungen zurück geben in die eine «Quelle».

Unser aller Reise geht letztlich darum, hier auf der Erde aus diesem Zustand des Vergessens zu erwachen. Um dies zu erreichen und all diese Erfahrungen machen zu können und uns auch unter widrigsten Umständen an unsere wahre Essenz, an die Liebe, erinnern können, braucht es auch Akteure, die die Dunkelheit verkörpern – denn nur so haben wir die Wahl, ob wir uns von ihr einnehmen lassen oder uns für die Liebe und das Mitgefühl entscheiden. Der Täter sowie das Opfer sind dabei stets Aspekte unserer selbst – im Innen wie im Außen – und jeder einzelne verändert die Welt, indem er Liebe und Mitgefühl oder Hass und Verachtung wählt.

Eine etwas rationalere Herangehensweise wäre, zu schauen, was dazu führt, dass ein Mensch sich derart unmenschlich verhalten kann; also der Zugang über die Psychologie. Hier werden wir uns bewusst, dass jeder Täter auch einmal ein Kind war. Symbolisch sogar das Kind, mit dem wir jetzt im Beispiel mitfühlen und das wir gleichzeitig heute als erwachsenen Täter verachten. Natürlich kann man hier einwenden, dass nicht jedes Opfer zum Täter wird, aber man kann ebenso anerkennen, dass uns bei dieser Haltung das größte Stück fehlt; und zwar die Geschichte desjenigen, die Jahre dazwischen, sowie jeder einzelne Reiz und jedes Detail der Umstände.

Wie viel Schmerz und Leid muss ein Mensch erfahren, bis er unmenschlich wird? Mit Einbezug aller Umstände und Faktoren, der psychischen Schutzmechanismen traumatischer Erfahrungen sowie fehlender Ausbildung sozialer und empathischer Fähigkeiten auch im neuronalen Bereich kann man auch auf diesem Wege Verständnis erlangen. Sichtbar wird hierdurch auch, dass emotionaler Schmerz über Generationen weitergegeben wird und es schwer ersichtlich ist, wo denn die eigentliche Ursache liegt. Auch hier wird erkennbar, dass nur jeder bei sich anfangen kann und Verantwortung für seine Heilung – und damit gleichzeitig die anderer – übernehmen müsste, anstatt auf die Suche nach dem oder der «Schuldigen» zu gehen.

Was bedarf eigentlich der Vergebung?

Wenn es uns schwerfällt zu vergeben, also Groll und Verachtung loszulassen und Mitgefühl zu empfinden, ist es ebenfalls hilfreich, einmal hinzuschauen, worum es genau geht. Wenn es uns selbst betrifft, handelt es sich in der Regel um Schmerz, der uns willentlich, manchmal auch unbewusst, zugefügt wurde und den wir (noch) nicht loslassen können, weil er noch nicht verheilt ist. Darauf gehe ich später noch einmal ein. Oft geht es aber auch um uns unbekannte Menschen, von deren Verbrechen wir Kenntnis haben und deren Ungeheuerlichkeit uns aus der Fassung bringt. Es geht um Taten, die wir nicht nachvollziehen können, weder rational noch emotional. Wir meinen, selbst wenn jemand nicht spürte, was er anderen antut, so müsse er es doch wenigstens besser wissen. Das ist das, was uns Menschen ausmacht, mit anderen mitzufühlen und sie zu verstehen. Doch anscheinend gibt es Menschen, deren Persönlichkeit oder auch Psyche dazu absolut nicht in der Lage sind. Die keinen moralischen Kompass besitzen und keinerlei soziales Empfinden, denn sonst könnten sie bestimmte Taten nicht ausführen. Möglicherweise dissoziieren sie sich selbst so stark, dass diese für sie eine Normalität darstellen, sie diese entschuldigen beziehungsweise vor sich selbst rechtfertigen oder im extremen Fall keine Erinnerung mehr daran haben.

Uns erscheinen die fehlende Empathie sowie das fehlende Verständnis so fremd, dass wir es nicht nachvollziehen können. Uns fehlt die Nachvollziehbarkeit der Nichtnachvollziehbarkeit des Erlebens des anderen, und wir erachten diesen dadurch als unmenschlich. Denn menschlich wären doch eben diese Fähigkeiten wie Mitgefühl, Güte, Reflexion, Warmherzigkeit, Verständnis und Liebe. Zugleich erzeugen wir hier aber einen Konflikt, wenn wir sagen: «Da diese Menschen sich so unmenschlich verhalten, soll ihnen kein Mitgefühl und keine Vergebung entgegengebracht werden, sollen auch sie nicht menschlich behandelt werden», wodurch wir uns allerdings selbst unserer Menschlichkeit berauben.

«Aber der Täter hatte doch die freie Wahl, er hätte doch anders entscheiden können!» Ja, möglicherweise schon, aber jetzt haben wir die Wahl. Und wir haben viel leichtere Voraussetzungen dafür, menschlich zu handeln, weil wir gesunden Zugang zu unserer Empathie, Moral und unserer Ratio haben.

Hätte der Täter es geschafft, seinen Tätern zu verzeihen, würde er die Destruktivität, die er ab einem gewissen Zeitpunkt nicht mehr in sich tragen oder verdrängen konnte, nicht an anderen ausagieren. Es ist ihm nicht gelungen, vielleicht sogar weil etwas in ihm es für unmöglich hielt, Unmenschliches, das ihm zugefügt wurde, zu verzeihen. Aber uns kann es gelingen, diesen Kreislauf zu durchbrechen und uns nicht in ihn hineinziehen zu lassen; wir können dem «Dunklen» den Nährboden entziehen.

Manchmal nehmen wir an, würden wir das Unbeschreibliche verzeihen, bedeutete dies, dass wir es tolerieren oder gar gutheißen. Dem ist nicht so. Analog dazu habe ich manches Mal die Angst gehabt, würde ich aufhören, um meinen Freund zu trauern, bedeute dies, dass ich ihn nicht mehr vermisse. Auch das ist nicht richtig. Ich heile lediglich das, was mir Schmerzen zufügt, bis am Ende nur noch die Liebe bleibt. Und wenn wir verzeihen, ist es kein Gutheißen der Taten, es bedeutet ein Loslassen dessen, was uns damit verstrickt und das Destruktive nährt.

Mitgefühl beginnt bei uns selbst

«Daß ich dem Hungrigen zu essen gebe, dem vergebe, der mich beleidigt, und meinen Feind liebe- das sind große Tugenden. Was aber, wenn ich nun entdecken sollte, daß der armselige Bettler und der unverschämteste Beleidiger alle in mir selber sind und ich bedürftig bin, Empfänger meiner eigenen Wohltaten zu sein? Daß ich der Feind bin, den ich lieben muß - was dann?» – C. G. Jung

Mit diesem Zitat beginnt Dan Millman das Kapitel «Das Gesetz des Mitgefühls» in seinem Buch «Die universellen Lebensgesetze des friedvollen Kriegers». Die weise Frau lehrt dem Wanderer das Gesetz des Mitgefühls und erklärt, es sei «eine liebevolle Aufforderung, über unsere begrenzte Sichtweise hinauszuwachsen», auch wenn die Last dieser Aufgabe zuweilen sehr schwer wiegen könne. Genau deshalb müsse man daran denken, dass sie bei uns selbst beginnt und wir «geduldig» und «sanft» mit uns, unseren Gefühlen und Gedanken sein sollten.

Um dem – noch skeptischen – Wanderer zu veranschaulichen, wie wir Mitgefühl auch mit unseren Gegnern empfinden können, bat sie ihn, sich an eine Auseinandersetzung zu erinnern, in der er zornig, neidisch oder eifersüchtig war und sich diese Gefühle noch einmal zu vergegenwärtigen. Als er das tat, den Schmerz und die Wut wieder spürte, sagte sie zu ihm: «Und nun stell dir vor, daß der Mensch, mit dem du dich streitest, mitten in eurer erregten Auseinandersetzung plötzlich nach seinem Herzen faßt, einen Schrei ausstößt und zu deinen Füßen tot zu Boden sinkt.» Der Wanderer erschrak und auf Nachfrage der weisen Frau stellte er fest, dass er nun keinerlei Schmerz oder Wut mehr empfand. Sogleich aber kam ihm der Gedanke: «Aber – aber was wäre, wenn ich mich über den Tod dieses Menschen freuen würde? Wenn ich ihm nicht verzeihen könnte?», worauf die weise Frau antwortete: «Dann verzeih dir wenigstens selber deine Unversöhnlichkeit. Und in dieser Vergebung wirst du das Mitgefühl finden, das deinen Schmerz heilt, als Mensch in dieser Welt zu leben.»

Weiter erinnert uns die weise Frau daran, dass wir alle, während wir hier auf der Erde sind, Träume, Hoffnungen und Enttäuschungen haben; und dass diese, sowie letztlich der Tod, uns alle verbinden.

Es ist ein Prozess

Dan Millman sagt hier in Gestalt der Weisen Frau, dass Mitgefühl bei uns selbst beginnt und diesen Aspekt möchte ich noch einmal hervorheben. Es kann nämlich passieren, dass wir uns in einer oberflächlichen Vergebung wieder finden, weil wir meinen, es sei richtig und moralisch, anderen zu verzeihen, ohne aber die tieferen Schichten dabei zu fühlen. Das ist dann leider nichts anderes, als Verdrängung. Gerade wenn wir selbst Opfer von Ungerechtigkeit, physischer oder mentaler Gewalt wurden, ist es unerlässlich den Heilungsweg in Gänze zu durchschreiten, und in den Wachstumsprozess zu verwandeln, der uns Mitgefühl und Weisheit lehrt. Und dazu gehören die Wut auf das Begangene, die Verzweiflung, die Ungerechtigkeit und Ohnmacht zu fühlen, uns auf «unsere Seite» zu stellen und Partei für uns selbst zu ergreifen, bevor es ernstlich möglich wird, zu verzeihen. Zunächst fühlen wir mit uns selbst den Schmerz und befreien die Gefühle, die wir uns möglicherweise nie trauten zu fühlen, all die Wut und den Groll. Erst später kann dann aus dem Inneren heraus das weitere Erkennen stattfinden und Heilung und Vergebung geschehen.

Vergebung findet im Herzen statt

Die hier in diesem Text von mir aufgeführten Perspektiven sind nur zwei, drei kleine Beispiele für Sichtweisen, die man einnehmen könnte, um zu neuen Einsichten zu gelangen. Sie sollen niemanden von irgendetwas überzeugen, sondern als Anregung dienen. Denn letztlich geht es darum, Vergebung in sich selbst zu finden. Vergebung ist also etwas, das aus dem Inneren heraus entsteht; ein Ergebnis eines tiefen Verständnisses und Fühlens, ja eines Erkennens. Auf dieser Reise gehen wir unterschiedliche Blickwinkel und Versionen ab, bis wir im Herzen ankommen, es sich öffnet und wir plötzlich «klar» sehen. Daraufhin breitet sich Wärme im Körper aus, Liebe durchströmt uns, begleitet möglicherweise von einem Gefühl leiser Euphorie, möglicherweise auch einem leichten Schmerz und Tränen – sowohl ein paar der Traurigkeit als auch welchen der Dankbarkeit. Das Loslassen und die Befreiung sind spürbar und nur für jeden persönlich erfahrbar, der sich auf diesen Weg begibt und seine individuelle Ansicht findet, die ihn befreit und erlöst.

Meiner Meinung nach bedeutet also Vergebung eine Öffnung des Herzens, ein Erkennen und ein Hineinwachsen in die Perspektive der Liebe. Sie ist nicht auf rationaler Ebene zu finden; die rationale Ebene kann nur dabei helfen, den Weg zum Mitgefühl zu beschreiten, denn:

«Man sieht nur mit dem Herzen gut. Das Wesentliche ist für die Augen unsichtbar.»

– Antoine de Saint-Exupéry

Anna Nagel veröffentlicht auf ihrem Blog „Heimwärts“ seit Jahren zu den Themen Heilung, Bewusstsein, kollektives Erwachen, Gefühle, Spiritualität, Psyche, Kundalini und Philosophie.

LASSEN SIE DER FRIEDENSTAUBE FLÜGEL WACHSEN!

Hier können Sie die Friedenstaube abonnieren und bekommen die Artikel zugesandt.

Schon jetzt können Sie uns unterstützen:

- Für 50 CHF/EURO bekommen Sie ein Jahresabo der Friedenstaube.

- Für 120 CHF/EURO bekommen Sie ein Jahresabo und ein T-Shirt/Hoodie mit der Friedenstaube.

- Für 500 CHF/EURO werden Sie Förderer und bekommen ein lebenslanges Abo sowie ein T-Shirt/Hoodie mit der Friedenstaube.

- Ab 1000 CHF werden Sie Genossenschafter der Friedenstaube mit Stimmrecht (und bekommen lebenslanges Abo, T-Shirt/Hoodie).

Für Einzahlungen in CHF (Betreff: Friedenstaube):

Für Einzahlungen in Euro:

Milosz Matuschek

IBAN DE 53710520500000814137

BYLADEM1TST

Sparkasse Traunstein-Trostberg

Betreff: Friedenstaube

Wenn Sie auf anderem Wege beitragen wollen, schreiben Sie die Friedenstaube an: friedenstaube@pareto.space

Sie sind noch nicht auf Nostr and wollen die volle Erfahrung machen (liken, kommentieren etc.)? Zappen können Sie den Autor auch ohne Nostr-Profil! Erstellen Sie sich einen Account auf Start. Weitere Onboarding-Leitfäden gibt es im Pareto-Wiki.

-

@ 9cb3545c:2ff47bca

2025-05-27 12:58:56

@ 9cb3545c:2ff47bca

2025-05-27 12:58:56Introduction

Public companies that hold Bitcoin on behalf of investors (often issuing securities backed by those Bitcoin holdings) have faced growing pressure to demonstrate proof of reserves – evidence that they genuinely hold the cryptocurrency they claim. One approach is to publish the company’s Bitcoin wallet addresses so that anyone can verify the balances on the blockchain. This practice gained momentum after high-profile crypto collapses (e.g. FTX in 2022) eroded trust, leading major exchanges and fund issuers like Binance, Kraken, OKX, and Bitwise to publicize wallet addresses as proof of assets . The goal is transparency and reassurance for investors. However, making wallet addresses public comes with significant security and privacy risks. This report examines those risks – from cybersecurity threats and blockchain tracing to regulatory and reputational implications – and weighs them against the transparency benefits of on-chain proof of reserves.

Proof of Reserves via Public Wallet Addresses

In the cryptocurrency ethos of “don’t trust – verify,” on-chain proof of reserves is seen as a powerful tool. By disclosing wallet addresses (or cryptographic attestations of balances), a company lets investors and analysts independently verify that the Bitcoin reserves exist on-chain. For example, some firms have dashboards showing their addresses and balances in real time . In theory, this transparency builds trust by proving assets are not being misreported or misused. Shareholders gain confidence that the company’s Bitcoin holdings are intact, potentially preventing fraud or mismanagement.

Yet this approach essentially sacrifices the pseudonymity of blockchain transactions. Publishing a wallet address ties a large, known institution to specific on-chain funds. While Bitcoin addresses are public by design, most companies treat their specific addresses as sensitive information. Public proof-of-reserve disclosures break that anonymity, raising several concerns as detailed below.

Cybersecurity Threats from Visible Wallet Balances

Revealing a wallet address with a large balance can make a company a prime target for hackers and cybercriminals. Knowing exactly where significant reserves are held gives attackers a clear blueprint. As Bitcoin advocate (and MicroStrategy Executive Chairman) Michael Saylor warned in 2025, “publicly known wallet addresses become prime targets for malicious actors. Knowing where significant reserves are held provides hackers with a clear target, potentially increasing the risk of sophisticated attacks” . In other words, publishing the address increases the attack surface – attackers might intensify phishing campaigns, malware deployment, or insider bribery aimed at obtaining the keys or access to those wallets.

Even if the wallets are secured in cold storage, a public address advertisement may encourage attempts to penetrate the organization’s security. Custodians and partners could also be targeted. Saylor noted that this exposure isn’t just risky for the company holding the Bitcoin; it can indirectly put their custodial providers and related exchanges at risk as well . For instance, if a third-party custodian manages the wallets, hackers might attempt to breach that custodian knowing the reward (the company’s Bitcoin) is great.

Companies themselves have acknowledged these dangers. Grayscale Investments, which runs the large Grayscale Bitcoin Trust (GBTC), pointedly refused to publish its wallet addresses in late 2022, citing “security concerns” and complex custody arrangements that have “kept our investors’ assets safe for years” . Grayscale implied that revealing on-chain addresses could undermine those security measures, and it chose not to “circumvent complex security arrangements” just to appease public demand . This highlights a key point: corporate treasury security protocols often assume wallet details remain confidential. Publicizing them could invalidate certain assumptions (for example, if an address was meant to be operationally secret, it can no longer serve that role once exposed).

Additionally, a publicly known trove of cryptocurrency might invite physical security threats. While not a purely “cyber” issue, if criminals know a particular company or facility controls a wallet with, say, thousands of Bitcoin, it could lead to threats against personnel (extortion or coercion to obtain keys). This is a less common scenario for large institutions (which typically have robust physical security), but smaller companies or key individuals could face elevated personal risk by being associated with huge visible crypto reserves.

In summary, cybersecurity experts consider public proof-of-reserve addresses a double-edged sword: transparency comes at the cost of advertising exactly where a fortune is held. As Saylor bluntly put it, “the conventional way of issuing proof of reserves today is actually insecure… This method undermines the security of the issuer, the custodian, the exchanges and the investors. This is not a good idea”  . From a pure security standpoint, broadcasting your wallets is akin to drawing a bullseye on them.

Privacy Risks: Address Clustering and Blockchain Tracing

Blockchain data is public, so publishing addresses opens the door to unwanted analytics and loss of privacy for the business. Even without knowing the private keys, analysts can scrutinize every transaction in and out of those addresses. This enables address clustering – linking together addresses that interact – and other forms of blockchain forensics that can reveal sensitive information about the company’s activities.

One immediate risk is that observers can track the company’s transaction patterns. For example, if the company moves Bitcoin from its reserve address to an exchange or to another address, that move is visible in real time. Competitors, investors, or even attackers could deduce strategic information: perhaps the company is planning to sell (if coins go to an exchange wallet) or is reallocating funds. A known institution’s on-chain movements can thus “reveal strategic movements or holdings”, eroding the company’s operational privacy . In a volatile market, advance knowledge of a large buy or sell by a major player could even be exploited by others (front-running the market, etc.).

Publishing one or a few static addresses also violates a basic privacy principle of Bitcoin: address reuse. Best practice in Bitcoin is to use a fresh address for each transaction to avoid linking them  . If a company continuously uses the same “proof of reserve” address, all counterparties sending funds to or receiving funds from that address become visible. Observers could map out the company’s business relationships or vendors by analyzing counterparties. A Reddit user commenting on an ETF that published a single address noted that “reusing a single address for this makes me question their risk management… There are much better and more privacy-preserving ways to prove reserves… without throwing everything in a single public address” . In other words, a naive implementation of proof-of-reserve (one big address) maximizes privacy leakage.

Even if multiple addresses are used, if they are all disclosed, one can perform clustering analysis to find connections. This happened in the Grayscale case: although Grayscale would not confirm any addresses, community analysts traced and identified 432 addresses likely belonging to GBTC’s custodial holdings by following on-chain traces from known intermediary accounts . They managed to attribute roughly 317,705 BTC (about half of GBTC’s holdings) to those addresses . This demonstrates that even partial information can enable clustering – and if the company directly published addresses, the task becomes even easier to map the entirety of its on-chain asset base.

Another threat vector is “dusting” attacks, which become more feasible when an address is publicly known. In a dusting attack, an adversary sends a tiny amount of cryptocurrency (dust) to a target address. The dust itself is harmless, but if the target address ever spends that dust together with other funds, it can cryptographically link the target address to other addresses in the same wallet. Blockchain security researchers note that “with UTXO-based assets, an attacker could distribute dust to an address to reveal the owner’s other addresses by tracking the dust’s movement… If the owner unknowingly combines this dust with their funds in a transaction, the attacker can… link multiple addresses to a single owner”, compromising privacy . A company that publishes a list of reserve addresses could be systematically dusted by malicious actors attempting to map out all addresses under the company’s control. This could unmask cold wallet addresses that the company never intended to publicize, further eroding its privacy and security.

Investor confidentiality is another subtle concern. If the business model involves individual investor accounts or contributions (for instance, a trust where investors can deposit or withdraw Bitcoin), public addresses might expose those movements. An outside observer might not know which investor corresponds to a transaction, but unusual inflows/outflows could signal actions by big clients. In extreme cases, if an investor’s own wallet is known (say a large investor announces their involvement), one might link that to transactions in the company’s reserve addresses. This could inadvertently reveal an investor’s activities or holdings, breaching expectations of confidentiality. Even absent direct identification, some investors might simply be uncomfortable with their transactions being part of a publicly traceable ledger tied to the company.

In summary, publishing reserve addresses facilitates blockchain tracing that can pierce the veil of business privacy. It hands analysts the keys to observe how funds move, potentially exposing operational strategies, counterparties, and internal processes. As one industry publication noted, linking a large known institution to specific addresses can compromise privacy and reveal more than intended . Companies must consider whether they are ready for that level of transparency into their every on-chain move.

Regulatory and Compliance Implications

From a regulatory perspective, wallet address disclosure lies in uncharted territory, but it raises several flags. First and foremost is the issue of incomplete information: A wallet address only shows assets, not the company’s liabilities or other obligations. Regulators worry that touting on-chain holdings could give a false sense of security. The U.S. Securities and Exchange Commission (SEC) has cautioned investors to “not place too much confidence in the mere fact a company says it’s got a proof-of-reserves”, noting that such reports “lack sufficient information” for stakeholders to ascertain if liabilities can be met . In other words, a public company might show a big Bitcoin address balance, but if it has debts or customer liabilities of equal or greater value, the proof-of-reserve alone is “not necessarily an indicator that the company is in a good financial position” .