-

@ c631e267:c2b78d3e

2025-05-16 18:40:18

@ c631e267:c2b78d3e

2025-05-16 18:40:18Die zwei mächtigsten Krieger sind Geduld und Zeit. \ Leo Tolstoi

Zum Wohle unserer Gesundheit, unserer Leistungsfähigkeit und letztlich unseres Glücks ist es wichtig, die eigene Energie bewusst zu pflegen. Das gilt umso mehr für an gesellschaftlichen Themen interessierte, selbstbewusste und kritisch denkende Menschen. Denn für deren Wahrnehmung und Wohlbefinden waren und sind die rasanten, krisen- und propagandagefüllten letzten Jahre in Absurdistan eine harte Probe.

Nur wer regelmäßig Kraft tankt und Wege findet, mit den Herausforderungen umzugehen, kann eine solche Tortur überstehen, emotionale Erschöpfung vermeiden und trotz allem zufrieden sein. Dazu müssen wir erkunden, was uns Energie gibt und was sie uns raubt. Durch Selbstreflexion und Achtsamkeit finden wir sicher Dinge, die uns erfreuen und inspirieren, und andere, die uns eher stressen und belasten.

Die eigene Energie ist eng mit unserer körperlichen und mentalen Gesundheit verbunden. Methoden zur Förderung der körperlichen Gesundheit sind gut bekannt: eine ausgewogene Ernährung, regelmäßige Bewegung sowie ausreichend Schlaf und Erholung. Bei der nicht minder wichtigen emotionalen Balance wird es schon etwas komplizierter. Stress abzubauen, die eigenen Grenzen zu kennen oder solche zum Schutz zu setzen sowie die Konzentration auf Positives und Sinnvolles wären Ansätze.

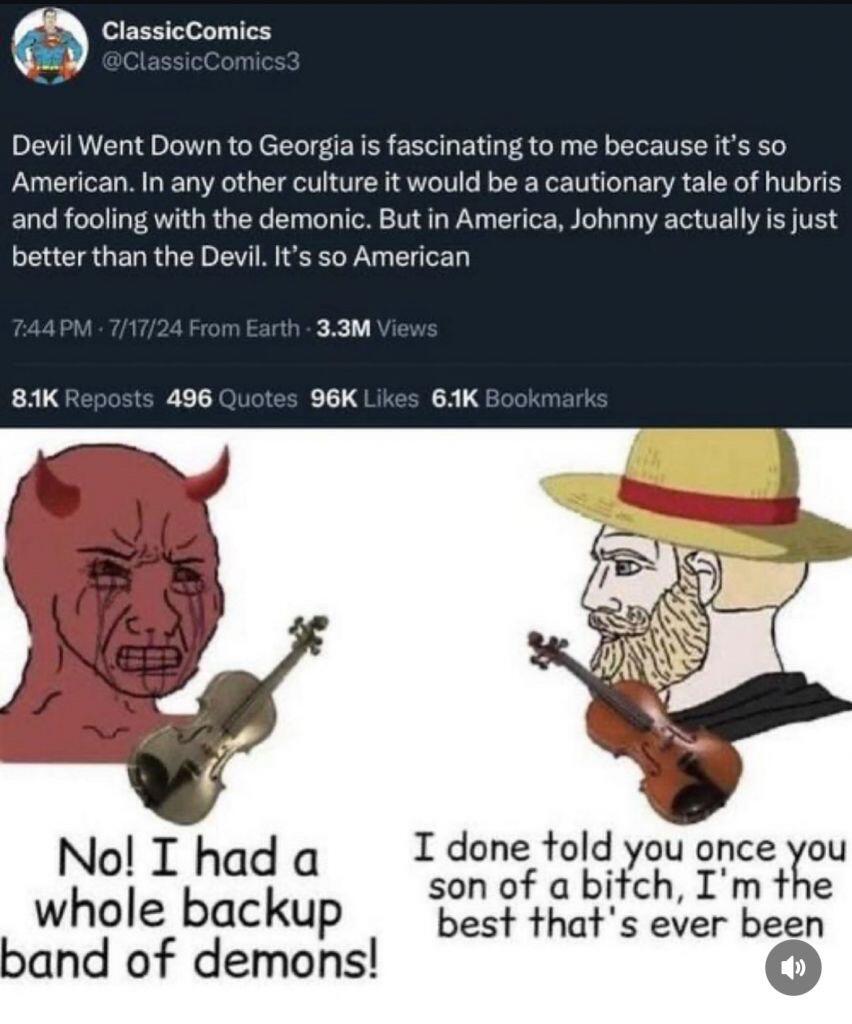

Der emotionale ist auch der Bereich, über den «Energie-Räuber» bevorzugt attackieren. Das sind zum Beispiel Dinge wie Überforderung, Perfektionismus oder mangelhafte Kommunikation. Social Media gehören ganz sicher auch dazu. Sie stehlen uns nicht nur Zeit, sondern sind höchst manipulativ und erhöhen laut einer aktuellen Studie das Risiko für psychische Probleme wie Angstzustände und Depressionen.

Geben wir negativen oder gar bösen Menschen keine Macht über uns. Das Dauerfeuer der letzten Jahre mit Krisen, Konflikten und Gefahren sollte man zwar kennen, darf sich aber davon nicht runterziehen lassen. Das Ziel derartiger konzertierter Aktionen ist vor allem, unsere innere Stabilität zu zerstören, denn dann sind wir leichter zu steuern. Aber Geduld: Selbst vermeintliche «Sonnenköniginnen» wie EU-Kommissionspräsidentin von der Leyen fallen, wenn die Zeit reif ist.

Es ist wichtig, dass wir unsere ganz eigenen Bedürfnisse und Werte erkennen. Unsere Energiequellen müssen wir identifizieren und aktiv nutzen. Dazu gehören soziale Kontakte genauso wie zum Beispiel Hobbys und Leidenschaften. Umgeben wir uns mit Sinnhaftigkeit und lassen wir uns nicht die Energie rauben!

Mein Wahlspruch ist schon lange: «Was die Menschen wirklich bewegt, ist die Kultur.» Jetzt im Frühjahr beginnt hier in Andalusien die Zeit der «Ferias», jener traditionellen Volksfeste, die vor Lebensfreude sprudeln. Konzentrieren wir uns auf die schönen Dinge und auf unsere eigenen Talente – soziale Verbundenheit wird helfen, unsere innere Kraft zu stärken und zu bewahren.

[Titelbild: Pixabay]

Dieser Beitrag wurde mit dem Pareto-Client geschrieben und ist zuerst auf Transition News erschienen.

-

@ 21335073:a244b1ad

2025-05-21 16:58:36

@ 21335073:a244b1ad

2025-05-21 16:58:36The other day, I had the privilege of sitting down with one of my favorite living artists. Our conversation was so captivating that I felt compelled to share it. I’m leaving his name out for privacy.

Since our last meeting, I’d watched a documentary about his life, one he’d helped create. I told him how much I admired his openness in it. There’s something strange about knowing intimate details of someone’s life when they know so little about yours—it’s almost like I knew him too well for the kind of relationship we have.

He paused, then said quietly, with a shy grin, that watching the documentary made him realize how “odd and eccentric” he is. I laughed and told him he’s probably the sanest person I know. Because he’s lived fully, chasing love, passion, and purpose with hardly any regrets. He’s truly lived.

Today, I turn 44, and I’ll admit I’m a bit eccentric myself. I think I came into the world this way. I’ve made mistakes along the way, but I carry few regrets. Every misstep taught me something. And as I age, I’m not interested in blending in with the world—I’ll probably just lean further into my own brand of “weird.” I want to live life to the brim. The older I get, the more I see that the “normal” folks often seem less grounded than the eccentric artists who dare to live boldly. Life’s too short to just exist, actually live.

I’m not saying to be strange just for the sake of it. But I’ve seen what the crowd celebrates, and I’m not impressed. Forge your own path, even if it feels lonely or unpopular at times.

It’s easy to scroll through the news and feel discouraged. But actually, this is one of the most incredible times to be alive! I wake up every day grateful to be here, now. The future is bursting with possibility—I can feel it.

So, to my fellow weirdos on nostr: stay bold. Keep dreaming, keep pushing, no matter what’s trending. Stay wild enough to believe in a free internet for all. Freedom is radical—hold it tight. Live with the soul of an artist and the grit of a fighter. Thanks for inspiring me and so many others to keep hoping. Thank you all for making the last year of my life so special.

-

@ c631e267:c2b78d3e

2025-05-10 09:50:45

@ c631e267:c2b78d3e

2025-05-10 09:50:45Information ohne Reflexion ist geistiger Flugsand. \ Ernst Reinhardt

Der lateinische Ausdruck «Quo vadis» als Frage nach einer Entwicklung oder Ausrichtung hat biblische Wurzeln. Er wird aber auch in unserer Alltagssprache verwendet, laut Duden meist als Ausdruck von Besorgnis oder Skepsis im Sinne von: «Wohin wird das führen?»

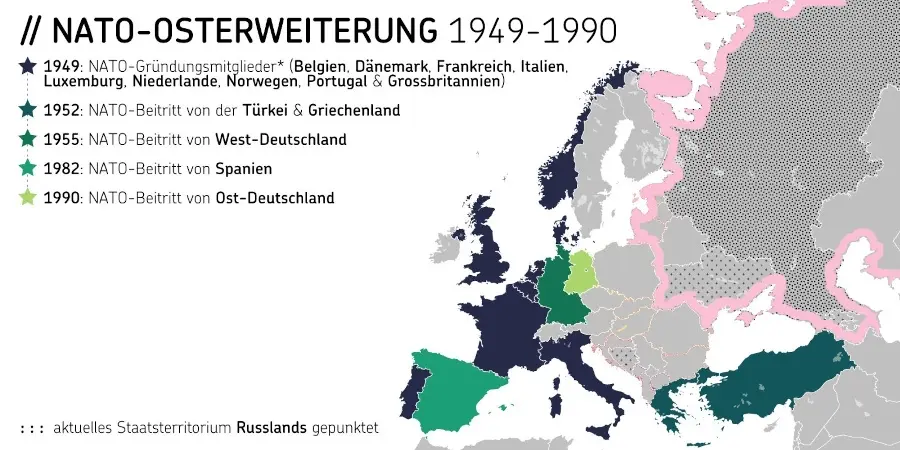

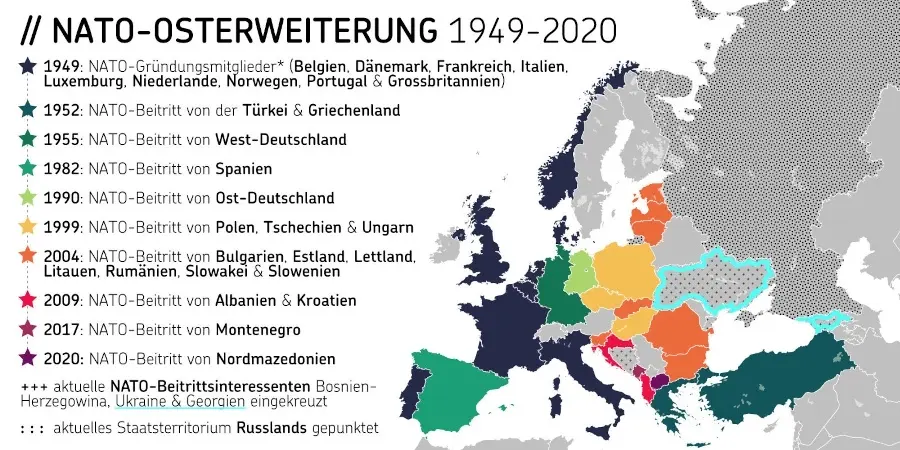

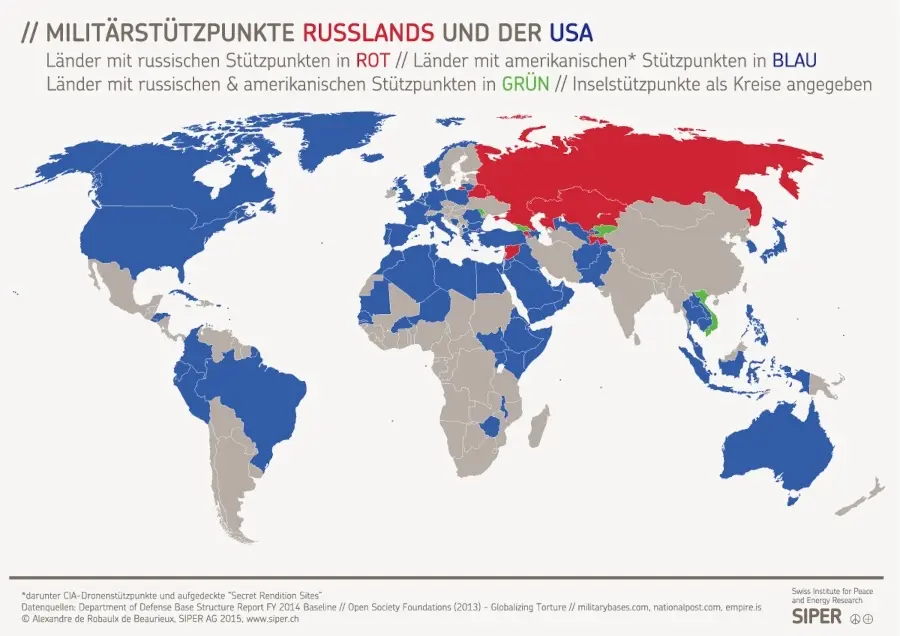

Der Sinn und Zweck von so mancher politischen Entscheidung erschließt sich heutzutage nicht mehr so leicht, und viele Trends können uns Sorge bereiten. Das sind einerseits sehr konkrete Themen wie die zunehmende Militarisierung und die geschichtsvergessene Kriegstreiberei in Europa, deren Feindbildpflege aktuell beim Gedenken an das Ende des Zweiten Weltkriegs beschämende Formen annimmt.

Auch das hohe Gut der Schweizer Neutralität scheint immer mehr in Gefahr. Die schleichende Bewegung der Eidgenossenschaft in Richtung NATO und damit weg von einer Vermittlerposition erhält auch durch den neuen Verteidigungsminister Anschub. Martin Pfister möchte eine stärkere Einbindung in die europäische Verteidigungsarchitektur, verwechselt bei der Argumentation jedoch Ursache und Wirkung.

Das Thema Gesundheit ist als Zugpferd für Geschäfte und Kontrolle offenbar schon zuverlässig etabliert. Die hauptsächlich privat finanzierte Weltgesundheitsorganisation (WHO) ist dabei durch ein Netzwerk von sogenannten «Collaborating Centres» sogar so weit in nationale Einrichtungen eingedrungen, dass man sich fragen kann, ob diese nicht von Genf aus gesteuert werden.

Das Schweizer Bundesamt für Gesundheit (BAG) übernimmt in dieser Funktion ebenso von der WHO definierte Aufgaben und Pflichten wie das deutsche Robert Koch-Institut (RKI). Gegen die Covid-«Impfung» für Schwangere, die das BAG empfiehlt, obwohl es fehlende wissenschaftliche Belege für deren Schutzwirkung einräumt, formiert sich im Tessin gerade Widerstand.

Unter dem Stichwort «Gesundheitssicherheit» werden uns die Bestrebungen verkauft, essenzielle Dienste mit einer biometrischen digitalen ID zu verknüpfen. Das dient dem Profit mit unseren Daten und führt im Ergebnis zum Verlust unserer demokratischen Freiheiten. Die deutsche elektronische Patientenakte (ePA) ist ein Element mit solchem Potenzial. Die Schweizer Bürger haben gerade ein Referendum gegen das revidierte E-ID-Gesetz erzwungen. In Thailand ist seit Anfang Mai für die Einreise eine «Digital Arrival Card» notwendig, die mit ihrer Gesundheitserklärung einen Impfpass «durch die Hintertür» befürchten lässt.

Der massive Blackout auf der iberischen Halbinsel hat vermehrt Fragen dazu aufgeworfen, wohin uns Klimawandel-Hysterie und «grüne» Energiepolitik führen werden. Meine Kollegin Wiltrud Schwetje ist dem nachgegangen und hat in mehreren Beiträgen darüber berichtet. Wenig überraschend führen interessante Spuren mal wieder zu internationalen Großbanken, Globalisten und zur EU-Kommission.

Zunehmend bedenklich ist aber ganz allgemein auch die manifestierte Spaltung unserer Gesellschaften. Angesichts der tiefen und sorgsam gepflegten Gräben fällt es inzwischen schwer, eine zukunftsfähige Perspektive zu erkennen. Umso begrüßenswerter sind Initiativen wie die Kölner Veranstaltungsreihe «Neue Visionen für die Zukunft». Diese möchte die Diskussionskultur reanimieren und dazu beitragen, dass Menschen wieder ohne Angst und ergebnisoffen über kontroverse Themen der Zeit sprechen.

Quo vadis – Wohin gehen wir also? Die Suche nach Orientierung in diesem vermeintlichen Chaos führt auch zur Reflexion über den eigenen Lebensweg. Das ist positiv insofern, als wir daraus Kraft schöpfen können. Ob derweil der neue Papst, dessen «Vorgänger» Petrus unsere Ausgangsfrage durch die christliche Legende zugeschrieben wird, dabei eine Rolle spielt, muss jede/r selbst wissen. Mir persönlich ist allein schon ein Führungsanspruch wie der des Petrusprimats der römisch-katholischen Kirche eher suspekt.

[Titelbild: Pixabay]

Dieser Beitrag wurde mit dem Pareto-Client geschrieben und ist zuerst auf Transition News erschienen.

-

@ 04c915da:3dfbecc9

2025-05-20 15:53:48

@ 04c915da:3dfbecc9

2025-05-20 15:53:48This piece is the first in a series that will focus on things I think are a priority if your focus is similar to mine: building a strong family and safeguarding their future.

Choosing the ideal place to raise a family is one of the most significant decisions you will ever make. For simplicity sake I will break down my thought process into key factors: strong property rights, the ability to grow your own food, access to fresh water, the freedom to own and train with guns, and a dependable community.

A Jurisdiction with Strong Property Rights

Strong property rights are essential and allow you to build on a solid foundation that is less likely to break underneath you. Regions with a history of limited government and clear legal protections for landowners are ideal. Personally I think the US is the single best option globally, but within the US there is a wide difference between which state you choose. Choose carefully and thoughtfully, think long term. Obviously if you are not American this is not a realistic option for you, there are other solid options available especially if your family has mobility. I understand many do not have this capability to easily move, consider that your first priority, making movement and jurisdiction choice possible in the first place.

Abundant Access to Fresh Water

Water is life. I cannot overstate the importance of living somewhere with reliable, clean, and abundant freshwater. Some regions face water scarcity or heavy regulations on usage, so prioritizing a place where water is plentiful and your rights to it are protected is critical. Ideally you should have well access so you are not tied to municipal water supplies. In times of crisis or chaos well water cannot be easily shutoff or disrupted. If you live in an area that is drought prone, you are one drought away from societal chaos. Not enough people appreciate this simple fact.

Grow Your Own Food

A location with fertile soil, a favorable climate, and enough space for a small homestead or at the very least a garden is key. In stable times, a small homestead provides good food and important education for your family. In times of chaos your family being able to grow and raise healthy food provides a level of self sufficiency that many others will lack. Look for areas with minimal restrictions, good weather, and a culture that supports local farming.

Guns

The ability to defend your family is fundamental. A location where you can legally and easily own guns is a must. Look for places with a strong gun culture and a political history of protecting those rights. Owning one or two guns is not enough and without proper training they will be a liability rather than a benefit. Get comfortable and proficient. Never stop improving your skills. If the time comes that you must use a gun to defend your family, the skills must be instinct. Practice. Practice. Practice.

A Strong Community You Can Depend On

No one thrives alone. A ride or die community that rallies together in tough times is invaluable. Seek out a place where people know their neighbors, share similar values, and are quick to lend a hand. Lead by example and become a good neighbor, people will naturally respond in kind. Small towns are ideal, if possible, but living outside of a major city can be a solid balance in terms of work opportunities and family security.

Let me know if you found this helpful. My plan is to break down how I think about these five key subjects in future posts.

-

@ 51bbb15e:b77a2290

2025-05-21 00:24:36

@ 51bbb15e:b77a2290

2025-05-21 00:24:36Yeah, I’m sure everything in the file is legit. 👍 Let’s review the guard witness testimony…Oh wait, they weren’t at their posts despite 24/7 survellience instructions after another Epstein “suicide” attempt two weeks earlier. Well, at least the video of the suicide is in the file? Oh wait, a techical glitch. Damn those coincidences!

At this point, the Trump administration has zero credibility with me on anything related to the Epstein case and his clients. I still suspect the administration is using the Epstein files as leverage to keep a lot of RINOs in line, whereas they’d be sabotaging his agenda at every turn otherwise. However, I just don’t believe in ends-justify-the-means thinking. It’s led almost all of DC to toss out every bit of the values they might once have had.

-

@ cae03c48:2a7d6671

2025-05-27 22:00:40

@ cae03c48:2a7d6671

2025-05-27 22:00:40Bitcoin Magazine

Bitcoin Well Integrates Nostr BTC Purchases via DMsBitcoin Well Inc. (TSXV: BTCW; OTCQB: BCNWF) has launched an integration with Nostr, allowing US customers to buy bitcoin directly through direct messages on the decentralized social protocol, according to a press release sent to Bitcoin Magazine.

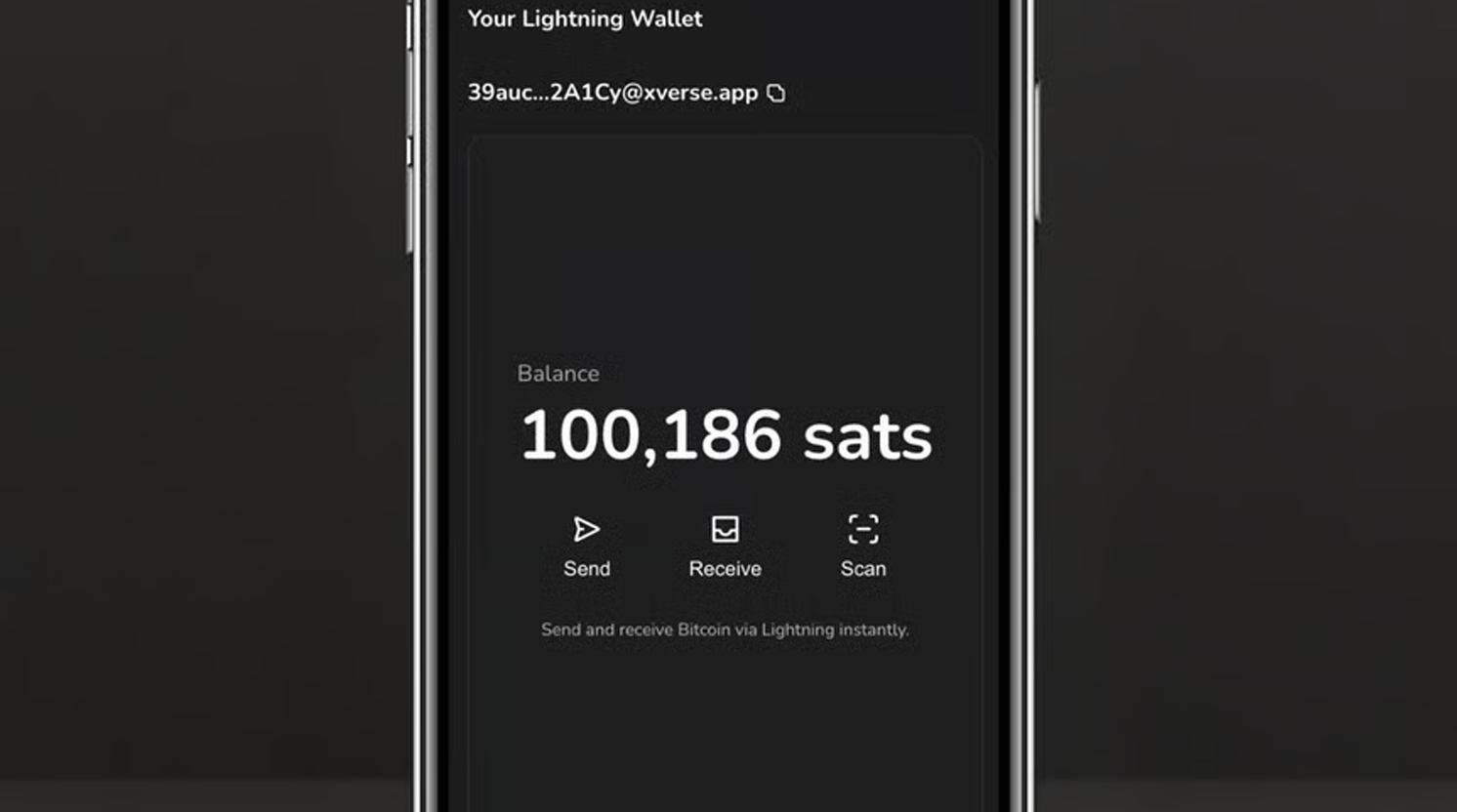

Users can link their Nostr identifier (npub) to their Bitcoin Well account and purchase bitcoin by sending specific commands via direct message. The transactions draw from the user’s Cash Balance and send the purchased bitcoin to their existing Lightning Wallet for security.

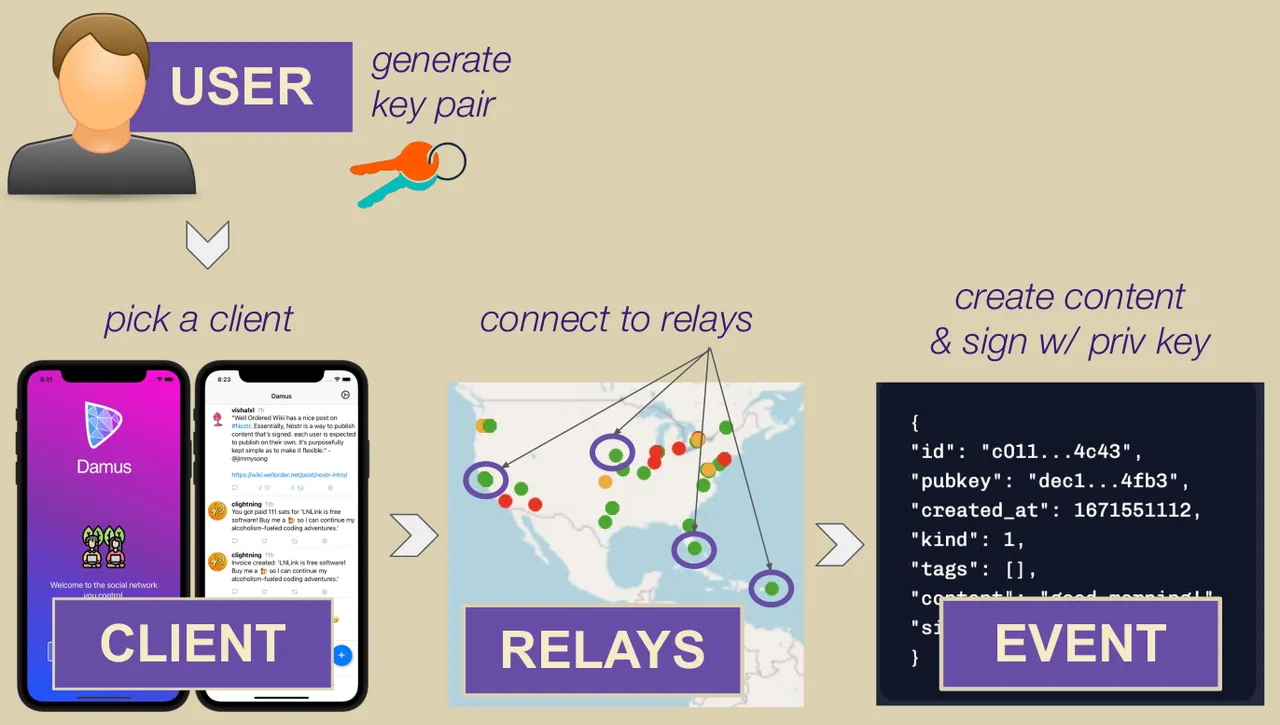

Nostr is a decentralized social media protocol which is censorship resistant and runs on a network of relays, rather than centralized servers. This means that the users have full control over their message servers. It also adds a layer of protection for the customer’s privacy.

The integration simplifies the process of buying bitcoin by allowing users to make purchases directly through a social platform they already use. As a censorship-resistant protocol, Nostr ensures Bitcoin Well and its customers have full control, avoiding restrictions and potential censorship.

“This is a great achievement for our team!” said founder and CEO of Bitcoin Well Adam O’Brien. “We are deeply committed to make buying bitcoin directly to self custody better than using a custodial exchange. This is a huge step in the right direction. We are meeting bitcoiners where they are and allowing them to buy bitcoin safely.”

Users can link their npub to their Bitcoin Well account to enable bitcoin purchases via direct message. Commands like /buy $21.00 or /stack 69000 sats initiate a transaction, which is confirmed by sending /confirm. The purchase uses funds from the user’s Bitcoin Well Cash Balance, and bitcoin is delivered over the Lightning Network to a pre-registered wallet address.

This post Bitcoin Well Integrates Nostr BTC Purchases via DMs first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 04c915da:3dfbecc9

2025-05-16 17:59:23

@ 04c915da:3dfbecc9

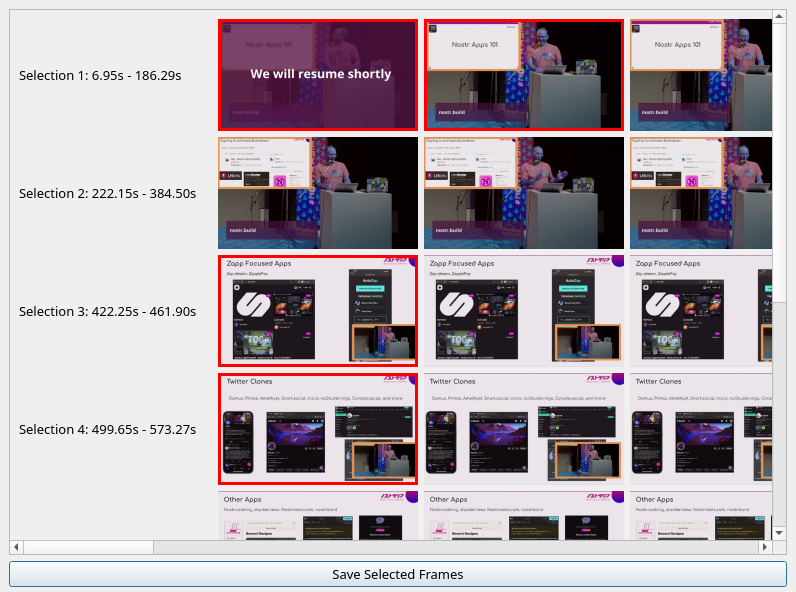

2025-05-16 17:59:23Recently we have seen a wave of high profile X accounts hacked. These attacks have exposed the fragility of the status quo security model used by modern social media platforms like X. Many users have asked if nostr fixes this, so lets dive in. How do these types of attacks translate into the world of nostr apps? For clarity, I will use X’s security model as representative of most big tech social platforms and compare it to nostr.

The Status Quo

On X, you never have full control of your account. Ultimately to use it requires permission from the company. They can suspend your account or limit your distribution. Theoretically they can even post from your account at will. An X account is tied to an email and password. Users can also opt into two factor authentication, which adds an extra layer of protection, a login code generated by an app. In theory, this setup works well, but it places a heavy burden on users. You need to create a strong, unique password and safeguard it. You also need to ensure your email account and phone number remain secure, as attackers can exploit these to reset your credentials and take over your account. Even if you do everything responsibly, there is another weak link in X infrastructure itself. The platform’s infrastructure allows accounts to be reset through its backend. This could happen maliciously by an employee or through an external attacker who compromises X’s backend. When an account is compromised, the legitimate user often gets locked out, unable to post or regain control without contacting X’s support team. That process can be slow, frustrating, and sometimes fruitless if support denies the request or cannot verify your identity. Often times support will require users to provide identification info in order to regain access, which represents a privacy risk. The centralized nature of X means you are ultimately at the mercy of the company’s systems and staff.

Nostr Requires Responsibility

Nostr flips this model radically. Users do not need permission from a company to access their account, they can generate as many accounts as they want, and cannot be easily censored. The key tradeoff here is that users have to take complete responsibility for their security. Instead of relying on a username, password, and corporate servers, nostr uses a private key as the sole credential for your account. Users generate this key and it is their responsibility to keep it safe. As long as you have your key, you can post. If someone else gets it, they can post too. It is that simple. This design has strong implications. Unlike X, there is no backend reset option. If your key is compromised or lost, there is no customer support to call. In a compromise scenario, both you and the attacker can post from the account simultaneously. Neither can lock the other out, since nostr relays simply accept whatever is signed with a valid key.

The benefit? No reliance on proprietary corporate infrastructure.. The negative? Security rests entirely on how well you protect your key.

Future Nostr Security Improvements

For many users, nostr’s standard security model, storing a private key on a phone with an encrypted cloud backup, will likely be sufficient. It is simple and reasonably secure. That said, nostr’s strength lies in its flexibility as an open protocol. Users will be able to choose between a range of security models, balancing convenience and protection based on need.

One promising option is a web of trust model for key rotation. Imagine pre-selecting a group of trusted friends. If your account is compromised, these people could collectively sign an event announcing the compromise to the network and designate a new key as your legitimate one. Apps could handle this process seamlessly in the background, notifying followers of the switch without much user interaction. This could become a popular choice for average users, but it is not without tradeoffs. It requires trust in your chosen web of trust, which might not suit power users or large organizations. It also has the issue that some apps may not recognize the key rotation properly and followers might get confused about which account is “real.”

For those needing higher security, there is the option of multisig using FROST (Flexible Round-Optimized Schnorr Threshold). In this setup, multiple keys must sign off on every action, including posting and updating a profile. A hacker with just one key could not do anything. This is likely overkill for most users due to complexity and inconvenience, but it could be a game changer for large organizations, companies, and governments. Imagine the White House nostr account requiring signatures from multiple people before a post goes live, that would be much more secure than the status quo big tech model.

Another option are hardware signers, similar to bitcoin hardware wallets. Private keys are kept on secure, offline devices, separate from the internet connected phone or computer you use to broadcast events. This drastically reduces the risk of remote hacks, as private keys never touches the internet. It can be used in combination with multisig setups for extra protection. This setup is much less convenient and probably overkill for most but could be ideal for governments, companies, or other high profile accounts.

Nostr’s security model is not perfect but is robust and versatile. Ultimately users are in control and security is their responsibility. Apps will give users multiple options to choose from and users will choose what best fits their need.

-

@ c1e9ab3a:9cb56b43

2025-05-27 16:19:06

@ c1e9ab3a:9cb56b43

2025-05-27 16:19:06Star Wars is often viewed as a myth of rebellion, freedom, and resistance to tyranny. The iconography—scrappy rebels, totalitarian stormtroopers, lone smugglers—suggests a deep anti-authoritarian ethos. Yet, beneath the surface, the narrative arc of Star Wars consistently affirms the necessity, even sanctity, of central authority. This blog entry introduces the question: Is Star Wars fundamentally a celebration of statism?

Rebellion as Restoration, Not Revolution

The Rebel Alliance’s mission is not to dismantle centralized power, but to restore the Galactic Republic—a bureaucratic, centrally governed institution. Characters like Mon Mothma and Bail Organa are high-ranking senators, not populist revolutionaries. The goal is to remove the corrupt Empire and reinstall a previous central authority, presumed to be just.

- Rebels are loyalists to a prior state structure.

- Power is not questioned, only who wields it.

Jedi as Centralized Moral Elites

The Jedi, often idealized as protectors of peace, are unelected, extra-legal enforcers of moral and military order. Their authority stems from esoteric metaphysical abilities rather than democratic legitimacy.

- They answer only to their internal Council.

- They are deployed by the Senate, but act independently of civil law.

- Their collapse is depicted as tragic not because they were unaccountable, but because they were betrayed.

This positions them as a theocratic elite, not spiritual anarchists.

Chaos and the Frontier: The Case of the Cantina

The Mos Eisley cantina, often viewed as a symbol of frontier freedom, reveals something darker. It is: - Lawless - Violent - Culturally fragmented

Conflict resolution occurs through murder, not mediation. Obi-Wan slices off a limb; Han shoots first—both without legal consequence. There is no evidence of property rights, dispute resolution, or voluntary order.

This is not libertarian pluralism—it’s moral entropy. The message: without centralized governance, barbarism reigns.

The Mythic Arc: Restoration of the Just State

Every trilogy in the saga returns to a single theme: the fall and redemption of legitimate authority.

- Prequels: Republic collapses into tyranny.

- Originals: Rebels fight to restore legitimate order.

- Sequels: Weak governance leads to resurgence of authoritarianism; heroes must reestablish moral centralism.

The story is not anti-state—it’s anti-bad state. The solution is never decentralization; it’s the return of the right ruler or order.

Conclusion: The Hidden Statism of a Rebel Myth

Star Wars wears the costume of rebellion, but tells the story of centralized salvation. It: - Validates elite moral authority (Jedi) - Romanticizes restoration of fallen governments (Republic) - Portrays decentralized zones as corrupt and savage (outer rim worlds)

It is not an anarchist parable, nor a libertarian fable. It is a statist mythology, clothed in the spectacle of rebellion. Its core message is not that power should be abolished, but that power belongs to the virtuous few.

Question to Consider:

If the Star Wars universe consistently affirms the need for centralized moral and political authority, should we continue to see it as a myth of freedom? Or is it time to recognize it as a narrative of benevolent empire? -

@ c9badfea:610f861a

2025-05-20 19:49:20

@ c9badfea:610f861a

2025-05-20 19:49:20- Install Sky Map (it's free and open source)

- Launch the app and tap Accept, then tap OK

- When asked to access the device's location, tap While Using The App

- Tap somewhere on the screen to activate the menu, then tap ⁝ and select Settings

- Disable Send Usage Statistics

- Return to the main screen and enjoy stargazing!

ℹ️ Use the 🔍 icon in the upper toolbar to search for a specific celestial body, or tap the 👁️ icon to activate night mode

-

@ bf47c19e:c3d2573b

2025-05-27 21:19:32

@ bf47c19e:c3d2573b

2025-05-27 21:19:32Originalni tekst na bitcoin-balkan.com.

Pregled sadržaja

- Procena vrednosti

- Većina Bitcoin-ovih pozitivnih strana opstaje

- Broj ljudi koji su prihvatili Bitcoin

- Zaključak

Prošlo je trinaest godina od nastanka Bitcoina i lako je poverovati da je većina njegovog rasta iza njega. Deo ovoga je rezultat predrasude koju svi delimo i što nas navodi da zamislimo trenutno stanje stvari kao završni stepen njegovog razvoja. Svaki bitcoiner je nekad mislio da je prekasan sa Bitcoin-om. Međutim, kada primenjujemo kritičko razmišljanje da bismo procenili gde je Bitcoin u svojoj putanji rasta, otkrivamo da je suprotno u stvari tačno: još uvek je vrlo, vrlo rano.

Postoje dva načina da razmišljate o tome koliko je rano za Bitcoin kao zalihu vrednosti neke imovine:

-

Procena vrednosti kao procenat od njegovog punog potencijala

-

Prihvatanje kao procenat od njegovog punog potencijala (na čemu je fokus u ovom članku).

Procena vrednosti

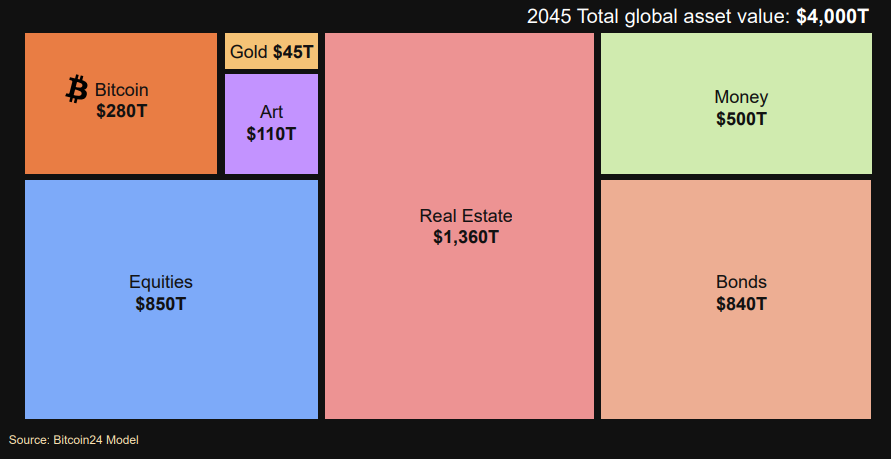

Prvi i najčešći način da se proceni koliko je rano za Bitcoin je da se pogleda njegova ukupna vrednost (trenutno oko 900B USD) i uporedi sa njegovim punim potencijalom. Izazov sa ovim je očigledno da je puni potencijal Bitcoin-a stvar nagađanja. Oni koji duboko razumeju Bitcoin imaju tendenciju da njegov potencijal posmatraju barem kao potencijal zlata (oko 13T USD), ali teoretski više poput 200T USD (oko polovine ukupne vrednosti sveta).

Za brzi pregled ovog potencijala od 200T USD, pogledajmo ukupno raspoloživo tržište Bitcoin-a. Radi jednostavnosti, samo ćemo razmotriti njegovu ulogu zalihe vrednosti i zanemariti njegov potencijal da pojede tržišni udeo od oko 100T USD ukupne vrednosti u različitim svetskim valutama. Uzimajući u obzir različite zalihe vrednosne imovine i grubom procenom koliki bi % Bitcoin mogao da uzme od njih, dobili smo ovakav rezultat:

Iako put do 200T USD nije veliko rastezanje, u stvarnoj vrednosti čini se previše dobrim da bi bio istinit. Sa obzirom da je bez presedana da zaliha vrednosti neke robe postigne vrednost veću od zlata, to jednostavno predstavlja neistraženu teritoriju. Ali čak i ako se jednostavno pridržavamo targetiranja niže ciljne vrednosti zlata od 13T USD, Bitcoin još uvek tendenciju velikog porasta svoje cene u budućnosti.

Većina Bitcoin-ovih pozitivnih strana opstaje

Svako ko razmišlja da nešto svog teško zarađenog novca uskladišti u Bitcoin pita se „da li sam poranio ili zakasnio?“ Nepisano je pravilo da se svako oseća kao da je zakasnio kad stigne. Brojni su primeri ljudi koji žale kako su zakasnili 2011. ili 2013. ili 2016. godine, kada je cena Bitcoin-a bila 5, 100, odnosno 600 USD.

Kao i u bilo kojoj zajednici koja se razvija i raste i u kojoj ima manjka nekretninama, pridošlice zavide ljudima koji su već obezbedili sebi nekretninu, ne sluteći da će njima zavideti ljudi koji tek treba da dođu. Ovaj fenomen je primenjiv i na velikom broju drugih primera. Na primer, zakasneli u Kalifornijskoj zlatnoj groznici bili su razočarani kada su došli, a bogata zlatna polja su već bila iscrpljena, i umesto toga su se naseliti na nekoliko stotina hektara zemljišta, a koje sada vrede bogatstvo.

U srcu ovog osećanja je strah da više nema uspona, da više nema novca koji se može zaraditi uzimajući ono što je još uvek ostalo dostupno. Da li smo dostigli tu tačku sa Bitcoin-om?

Pa ne. Čini se da je zapravo suprotno. Na osnovu punog potencijalnog opsega procene koji smo utvrdili gore, čak i u ishodu niskog nivoa (13T USD), velika većina bogatstva koje će steći vlasnici Bitcoin-a, tek treba da se stekne (96%). Da bi parirao proceni zlata, Bitcoin i dalje mora da poraste 26 puta.

A ako se desi vrhunski ishod, punih 99,7% ukupnog stvaranja bogatstva Bitcoin-a ostaje pred nama. To bi značilo da Bitcoin još uvek treba da poraste 400 puta, zanemarujući pariranje zlatu.

Stavljanjem trenutne vrednosti Bitcoin-a u perspektivu, postaje jasno da je za Bitcoin još uvek vrlo rano.

Iako ova analiza sugeriše da za Bitcoin-u ostaje od 26x do 400x rasta, korisno je proveriti ovaj zaključak kroz drugo razumno objašnjenje, a tamo gde je poznat puni potencijal…

Broj ljudi koji su prihvatili Bitcoin

Procene broja vlasnika Bitcoin-a širom sveta se veoma razlikuju. To je dovelo do prilične količine dvosmislenosti i nesigurnosti u vezi sa stvarnim brojevima i određenog stepena odustajanja i mišljenja da je taj broj jednostavno preteško precizno proceniti. Iako je teško utvrditi konačan broj, glavni razlog za odstupanje u procenama je nedostatak standardizovanih definicija šta znači prihvatanje Bitcoin-a.

Istina je da postoje različiti nivoi prihvatanja Bitcoin-a. Podelom na segmente prihvatanja Bitcoin-a lakše je uvideti ne samo zašto postoji širok opseg procena, već i još važnije, koliko je još uvek rano za prihvatanje Bitcoin-a kao preferirane zalihe vrednosti.

U ove svrhe, hajde da podelimo u segmente prihvatanje Bitcoin-a na četiri različita „nivoa“:

1. Kežual amateri (prstom u vodi)

2. Alokatori 1% (stopalima u vodi)

3. Značajni vernici (do pojasa u vodi)

4. Bitcoin maximalisti (u vodi preko glave)

Pre nego što počnemo, potreban nam je imenilac. Mogli bismo da koristimo globalno stanovništvo, ali po mom mišljenju ovo daje loše rezultate. Ono što mi zaista procenjujemo je koji procenat sveta koji poseduje odredjeno bogatstvo za skladištenje u Bitcoin-u, je to i učinio. Prema podacima sa sajta Statista, 2,2 biliona ljudi na svetu poseduje najmanje 10k USD u neto vrednosti, što se čini kao razumna granica za zalihu koju žele da uskladište. Činjenica je da će siromašne zajednice takođe koristiti Bitcoin kao zalihu vrednosti i verovatno će iz njega izvući veću korist kao rezultat marginalnog pristupa tradicionalnoj bankarskoj infrastrukturi kao klijenti banaka sa „niskom vrednošću“. Međutim, u naše svrhe, jednostavno gledamo koliko je ljudi usvojilo Bitcoin među grupama sa značajnim bogatstvom za skladištenje, tako da će 2.2 biliona služiti kao naša puna potencijalna veličina tržišta.

1. Kežual amateri

Ovaj segment ljudi koji su prihvatili Bitcoin uključuje sve one koji imaju bilo koju količinu Bitcoin-a – vašeg prijatelja sa 20 USD BTC-a negde u nekom novčaniku ili vašu tetku koja se ne seća svoje Coinbase lozinke iz 2017. Po mom mišljenju, najveća zabuna oko broja ljudi koji su prihvatili Bitcoin nastaje zbog poistovećivanja „kežual amatera“ sa ljudima koji su u potpunosti prihvatili Bitcoin. Realnost je takva da ljudi ovog segmenta uglavnom samo eksperimentišu, bilo da bi stekli osećaj za ono o čemu svi pričaju, ili samo uložu nekoliko dolara u Bitcoin u nadi da će možda dobiti džekpot, kao što je slučaj sa greb-greb nagradnim igrama.

Zbog toga, „kežual amateri“ su razlog dovodjenja u zabludu pravog broja ljudi koji su u potpunosti prihvatili Bitcoin. Njihovo ponašanje zapravo ne predstavlja prihvatanje u pravom smislu te reči i stoga se ne bi trebalo smatrati ljudima koji su u potpunosti prihvatili Bitcoin. Istina je da, kada kežual amateri shvate da je Bitcoin najbolja zaliha vrednosti neke imovine u istoriji, neće ostati na samo 20 USD u Bitcoin-ima. Umesto toga, oni će svoju štednju prebaciti u mnogo većim iznosima.

Što se tiče odredjivanja veličine ovog segmenta, Willy Woo je sastavio razumno iscrpnu i sveobuhvatnu procenu od oko 187 miliona ljudi koji su prihvatili Bitcoin, što znači da su oni u najmanju ruku „kežual amateri“.

Koristeći ovaj i naš puni potencijal od 2,2 biliona ljudi kao imenioca, 8,5% potencijalnih ljudi koji su prihvatili Bitcoin-e dostiglo je nivo „kežual amatera“. Ovo je prilično velik broj i potpuno obmanjuje stvarni obim potpunog prihvatanja, a što će pokazati sledeći segmenti.

2. Alokatori 1%

Za preostale potkategorije, tačni podaci su manje dostupni. Kao takvi, sve što možemo je da smislimo razumne procene putem triangulacije.

Po mom mišljenju, „alokatori 1%“ se mogu okarakterisati kao ljudi koji su prihvatili Bitcoin, i koji žele da imaju mali, ali ne i zanemarljivi deo u Bitcoin-u. Za naše svrhu, mislim da je pristojan prag za ovu grupu svako ko ima najmanje 0,1 Bitcoin, i može se smatrati da imaju malu, ali ne i zanemarljivu poziciju u Bitcoin-u.

Gledajući Bitcoin blockchain, postoji oko 3 miliona adresa koje imaju najmanje 0,1 BTC. Pored ovih brojeva na blockchain-u, moramo da uzmemo u obzir i znatan broj ljudi koji imaju ovaj iznos na berzi ili GBTC-u. Kombinovanjem, mislim da je razumno proceniti da je 10 miliona ljudi dostiglo nivo „alokatora 1%“ ili veći.

Na osnovu ovih brojeva, samo 1⁄17 „kežual amatera“ dostiglo je nivo prihvatanja „alokatora 1%“, što znači da je ovaj nivo prihvatanja Bitcoin-a do danas postigao samo 0,5% penetracije. Ovaj strmi pad je razlog zašto je došlo do zablude da veliki broj „kežual amatera“ bude označeno kao grupa koja je u potpunosti prihvatila Bitcoin.

3. Značajni vernici

U ovu kategoriju spada svako ko je dostigao nivo razumevanja Bitcoin-a da alokacija od 1% ili čak 5% više ne izgleda dovoljna.

Uopšteno govoreći, ova grupa se kreće u rasponu od 5 – 50%. Išao bih toliko daleko da bih rekao da je većina ljudi koji sebe smatraju vernicima u Bitcoin-e, uključujući većinu Bitcoin Twitter-a, negde u ovoj grupi.

Procena veličine ove grupe postaje mnogo nejasnija, ali možemo se osloniti na podatke iz blockchain-a da bismo došli do razumne procene.

Za početak, hajde da utvrdimo da je većina ljudi koji su dostigli ovaj nivo verovanja i razumevanja Bitcoin-a, izborila da poseduje najmanje 1 Bitcoin. Pored toga, ovaj nivo ljudi koji su prihvatili Bitcoin je verovatno osigurao svoj Bitcoin u chain-u novčanika kojim oni upravljaju. Gledajući podatke na chain-u, oko 820k adresa ima najmanje 1 Bitcoin. Kao grubu pretpostavku, uzmimo da 500k od toga poseduju ljudi koji su dostigli nivo prihvatanja „značajnog vernika“.

Ako potom generički zaokružimo akaunte za ljude koji nisu postigli status wholecoiner-a (eng. osoba koja poseduje barem 1 BTC), ili koji svoja sredstva drže na berzi, dolazimo do grube procene od 2 miliona „značajnih vernika“.

4. Bitcoin maximalisti

Za našu svrhu, recimo da ova grupa uključuje svakoga ko je dovoljno duboko ušao u Bitcoin da je zaključio da bi više od 50% njihove neto vrednosti trebalo da bude uskladišteno u Bitcoin-u.

Procena veličine ove grupe je gotovo nemoguća, zato ćemo morati da budemo kreativni.

-

Prodaja „Bitcoin Standard“

-

Hajde da konzervativno procenimo da je samo 20% maximalističara kupilo Bitcoin Standard, i da je 50% tih ljudi koji su ga razumeli, postali maksimalisti. Na osnovu knjige Amazon US rank (6,681), onlajn kalkulatori procenjuju da je prodato oko 15k primeraka.

- Hajde da budemo velikodušni i da zaokružimo taj broj od oko 15k na 50k, uzimajući u obzir međunarodnu prodaju i kupovinu izvan Amazona.

Ovo nas dovodi do procene broja od 125k maximalista. Da ne bismo pogrešili, bićemo oprezni, i udvostručimo taj broj i rećićemo da ih ima 250k.

- Kvalitativna triangulacija

Čisto subjektivno, ali čini mi se da na Twitter-u, primarnom domu za komunikaciju maximalista, postoji možda 10k aktivno angažovanih Bitcoin maximalista. Da budemo vrlo konzervativni, recimo da ovo predstavlja oko 5% maximalista (od ukupno 200k).

Uz to, kao procenu od vrha nadole, čini se opravdanim da je oko 10% ljudi koji su dostigli 5 – 50% alokacije Bitcoin-a napravilo skok ka maximalizmu.

Sve u svemu, cifra od oko 250k Bitcoin maximalista čini se konzervativnom, ako ne i velikodušnom pretpostavkom.

To nas dovodi do 0,01% penetracije.

Zaključak

Kako god gledali brojke, još uvek je rano za Bitcoin. Posmatrajući procenu vrednosti Bitcoin-a kao procenat njegovog punog potencijala, vidimo da je trenutna vrednost Bitcoin-a negde između 0,2% i 3% njegovog krajnjeg stanja, što znači da ostaje 30x do 500x rasta. Gledajući napredak prihvatanja Bitcoin-a, vidimo da je trenutna penetracija Bitcoin-a negde između 0,01% i 8,5%, u zavisnosti od toga koji prag prihvatanja gledate.

Ako verujete, kao što ja verujem, da je Bitcoin na putu da postane dominantna zaliha vrednosti i preferirani novac za ceo svet, na kraju će norma biti više od 50% posedovanja neto vrednosti u Bitcoin-u. Budući da naša analiza ovde sugeriše da samo 0,01% sveta zadovoljava ove standarde, opravdano je zaključiti da 99,99% sveta ostaje da sledi njihov primer.

Sve u svemu, dok svi koji se pojave na Bitcoin-u neizbežno osećaju žaljenje zbog toga što nisu ranije investirali i pitaju se da li su u potpunosti propustili brod, jasno je da većina rasta Bitcoin-a ostaje pred nama. Da stavimo ovo u neki kontekst, obzirom da može postojati samo 21 milion Bitcoin-a, prosečna osoba na zemlji (od 8 biliona ljudi) imaće samo 0,0025 Bitcoin-a. Još je toliko rano, da ukupna neto vrednost te prosečne osobe u Bitcoin-u može da se kupi za samo 90 USD.

I ako mislite da je kasno, zapravo je veoma rano, zato vam čestitam i uživajte u skupljanju sats-ova dok su još uvek ovako jeftini!

-

@ 04c915da:3dfbecc9

2025-05-20 15:50:22

@ 04c915da:3dfbecc9

2025-05-20 15:50:22There is something quietly rebellious about stacking sats. In a world obsessed with instant gratification, choosing to patiently accumulate Bitcoin, one sat at a time, feels like a middle finger to the hype machine. But to do it right, you have got to stay humble. Stack too hard with your head in the clouds, and you will trip over your own ego before the next halving even hits.

Small Wins

Stacking sats is not glamorous. Discipline. Stacking every day, week, or month, no matter the price, and letting time do the heavy lifting. Humility lives in that consistency. You are not trying to outsmart the market or prove you are the next "crypto" prophet. Just a regular person, betting on a system you believe in, one humble stack at a time. Folks get rekt chasing the highs. They ape into some shitcoin pump, shout about it online, then go silent when they inevitably get rekt. The ones who last? They stack. Just keep showing up. Consistency. Humility in action. Know the game is long, and you are not bigger than it.

Ego is Volatile

Bitcoin’s swings can mess with your head. One day you are up 20%, feeling like a genius and the next down 30%, questioning everything. Ego will have you panic selling at the bottom or over leveraging the top. Staying humble means patience, a true bitcoin zen. Do not try to "beat” Bitcoin. Ride it. Stack what you can afford, live your life, and let compounding work its magic.

Simplicity

There is a beauty in how stacking sats forces you to rethink value. A sat is worth less than a penny today, but every time you grab a few thousand, you plant a seed. It is not about flaunting wealth but rather building it, quietly, without fanfare. That mindset spills over. Cut out the noise: the overpriced coffee, fancy watches, the status games that drain your wallet. Humility is good for your soul and your stack. I have a buddy who has been stacking since 2015. Never talks about it unless you ask. Lives in a decent place, drives an old truck, and just keeps stacking. He is not chasing clout, he is chasing freedom. That is the vibe: less ego, more sats, all grounded in life.

The Big Picture

Stack those sats. Do it quietly, do it consistently, and do not let the green days puff you up or the red days break you down. Humility is the secret sauce, it keeps you grounded while the world spins wild. In a decade, when you look back and smile, it will not be because you shouted the loudest. It will be because you stayed the course, one sat at a time. \ \ Stay Humble and Stack Sats. 🫡

-

@ 6be5cc06:5259daf0

2025-05-27 20:37:22

@ 6be5cc06:5259daf0

2025-05-27 20:37:22At

até uma ferramenta de agendamento de tarefas em Linux usada para executar comandos únicos em um horário e data específicos. Diferente docron, que serve para tarefas recorrentes, oatexecuta uma única vez.Como usar o

at1. Verifique se o

atestá instaladobash which atSe não estiver instalado:

bash sudo apt install atE inicie o serviço (caso necessário):

bash sudo systemctl enable --now atd2. Agendar um comando

bash at 10:00 AM tomorrowVocê será levado a um prompt interativo. Digite o comando desejado e finalize com

Ctrl + D.Exemplo 1:

bash at 09:00 AM next Monday(Entrada do usuário no prompt do

at)echo "Relatório pronto" >> ~/relatorio.txt Ctrl + DResultado: O trecho "relatório pronto" será incluído no documento relatorio.txt.

Exemplo 2:

bash at 21:00 Apr 15Entrada no prompt:

notify-send "Hora de fazer backup!" Ctrl + DResultado: Às 21h do dia 15 de abril, o sistema exibirá uma notificação.

Formatos de Data e Hora Válidos

-

now + 1 minute -

midnight -

tomorrow -

5pm -

08:30 -

7:00am next friday -

noon + 2 days

Visualizar tarefas agendadas

bash atqRemover uma tarefa agendada

bash atrm <número_da_tarefa>Você encontra o número da tarefa com

atq.

cron

O

croné um utilitário de agendamento de tarefas baseado no tempo. Permite executar comandos ou scripts automaticamente em horários específicos. Ele depende do daemoncrond, que deve estar ativo e em execução contínua no sistema.Arquivo de configuração:

-

Cada usuário pode editar seu próprio agendador com:

bash crontab -e -

O formato padrão de uma linha no crontab:

m h dom mon dow comando

|Campo|Descrição|Valores possíveis| |---|---|---| |m|Minuto|0–59| |h|Hora|0–23| |dom|Dia do mês|1–31| |mon|Mês|1–12| |dow|Dia da semana|0–6 (0 = Domingo)| |comando|Comando a executar|Qualquer comando shell válido|

Exemplos:

-

Executar um script a cada minuto:

bash * * * * * /usr/local/bin/execute/this/script.sh -

Fazer backup no dia 10 de junho às 08:30:

bash 30 08 10 06 * /home/sysadmin/full-backup -

Backup todo domingo às 5h da manhã:

bash 0 5 * * 0 tar -zcf /var/backups/home.tgz /home/

Limitações:

Tarefas agendadas com

cronnão são executadas se o computador estiver desligado ou suspenso no horário programado. O comando é simplesmente ignorado. Usecronpara tarefas com data/hora exatas.

anacron

O

anacroné uma alternativa aocronvoltada para sistemas que não ficam ligados o tempo todo, como notebooks e desktops. Ele garante a execução de tarefas periódicas (diárias, semanais, mensais) assim que possível após o sistema ser ligado, caso tenham sido perdidas. Useanacronpara tarefas periódicas tolerantes a atrasos.Verificação da instalação:

bash anacron -VInstalação (caso necessário):

bash sudo apt update sudo apt install anacronArquivo de configuração:

/etc/anacrontabAcessado com:

sudo nano /etc/anacrontabFormato de cada linha:

PERIOD DELAY IDENT COMMAND| Campo | Descrição | | ------- | ------------------------------------------- | | PERIOD | Intervalo em dias (1 = diário, 7 = semanal) | | DELAY | Minutos a esperar após o boot | | IDENT | Nome identificador da tarefa | | COMMAND | Comando ou script a ser executado |

Exemplo:

bash 1 3 limpeza-temporarios /home/usuario/scripts/limpar_tmp.shExecuta o script uma vez por dia, 3 minutos após o sistema ser ligado.

Nota: Não é necessário usar

run-partsnemcron.dailypara tarefas personalizadas. Basta apontar diretamente para o script desejado. Orun-partssó deve ser usado quando se deseja executar todos os scripts de um diretório.Ativação do serviço:

bash sudo systemctl enable --now anacronVerificação de status:

bash systemctl status anacronLogs de execução:

bash grep anacron /var/log/syslog/etc/anacrontab: Arquivo de Configuração doanacronO arquivo

/etc/anacrontabdefine tarefas periódicas a serem executadas peloanacron, garantindo que comandos sejam executados mesmo que o computador esteja desligado no horário originalmente programado.Cabeçalho Padrão

bash SHELL=/bin/sh HOME=/root LOGNAME=root-

SHELL: Shell padrão utilizado para executar os comandos. -

HOME: Diretório home usado durante a execução. -

LOGNAME: Usuário associado à execução das tarefas.

Entradas Padrão do Sistema

bash 1 5 cron.daily run-parts --report /etc/cron.daily 7 10 cron.weekly run-parts --report /etc/cron.weekly @monthly 15 cron.monthly run-parts --report /etc/cron.monthly|Campo|Significado| |---|---| |

1|Executa a tarefa diariamente (a cada 1 dia)| |5|Espera 5 minutos após o boot| |cron.daily|Identificador da tarefa (usado nos logs)| |run-parts|Executa todos os scripts dentro do diretório|Diretórios utilizados:

-

/etc/cron.daily: scripts executados uma vez por dia -

/etc/cron.weekly: scripts semanais -

/etc/cron.monthly: scripts mensais

O comando

run-partsexecuta automaticamente todos os scripts executáveis localizados nesses diretórios.Personalização

Para adicionar tarefas personalizadas ao

anacron, basta adicionar novas linhas com o formato:PERIOD DELAY IDENT COMMANDExemplo:

bash 1 3 limpeza-temporarios /home/usuario/scripts/limpar_tmp.shExecuta o script

limpar_tmp.shdiariamente, com 3 minutos de atraso após o boot.Importante: Não é necessário — nem recomendado — usar

run-partsquando a intenção é executar um script individual. Orun-partsespera um diretório e ignora arquivos individuais. Usarrun-partscom um script individual causará falha na execução. -

-

@ c631e267:c2b78d3e

2025-05-02 20:05:22

@ c631e267:c2b78d3e

2025-05-02 20:05:22Du bist recht appetitlich oben anzuschauen, \ doch unten hin die Bestie macht mir Grauen. \ Johann Wolfgang von Goethe

Wie wenig bekömmlich sogenannte «Ultra-Processed Foods» wie Fertiggerichte, abgepackte Snacks oder Softdrinks sind, hat kürzlich eine neue Studie untersucht. Derweil kann Fleisch auch wegen des Einsatzes antimikrobieller Mittel in der Massentierhaltung ein Problem darstellen. Internationale Bemühungen, diesen Gebrauch zu reduzieren, um die Antibiotikaresistenz bei Menschen einzudämmen, sind nun möglicherweise gefährdet.

Leider ist Politik oft mindestens genauso unappetitlich und ungesund wie diverse Lebensmittel. Die «Corona-Zeit» und ihre Auswirkungen sind ein beredtes Beispiel. Der Thüringer Landtag diskutiert gerade den Entwurf eines «Coronamaßnahmen-Unrechtsbereinigungsgesetzes» und das kanadische Gesundheitsministerium versucht, tausende Entschädigungsanträge wegen Impfnebenwirkungen mit dem Budget von 75 Millionen Dollar unter einen Hut zu bekommen. In den USA soll die Zulassung von Covid-«Impfstoffen» überdacht werden, während man sich mit China um die Herkunft des Virus streitet.

Wo Corona-Verbrecher von Medien und Justiz gedeckt werden, verfolgt man Aufklärer und Aufdecker mit aller Härte. Der Anwalt und Mitbegründer des Corona-Ausschusses Reiner Fuellmich, der seit Oktober 2023 in Untersuchungshaft sitzt, wurde letzte Woche zu drei Jahren und neun Monaten verurteilt – wegen Veruntreuung. Am Mittwoch teilte der von vielen Impfschadensprozessen bekannte Anwalt Tobias Ulbrich mit, dass er vom Staatsschutz verfolgt wird und sich daher künftig nicht mehr öffentlich äußern werde.

Von der kommenden deutschen Bundesregierung aus Wählerbetrügern, Transatlantikern, Corona-Hardlinern und Russenhassern kann unmöglich eine Verbesserung erwartet werden. Nina Warken beispielsweise, die das Ressort Gesundheit übernehmen soll, diffamierte Maßnahmenkritiker als «Coronaleugner» und forderte eine Impfpflicht, da die wundersamen Injektionen angeblich «nachweislich helfen». Laut dem designierten Außenminister Johann Wadephul wird Russland «für uns immer der Feind» bleiben. Deswegen will er die Ukraine «nicht verlieren lassen» und sieht die Bevölkerung hinter sich, solange nicht deutsche Soldaten dort sterben könnten.

Eine wichtige Personalie ist auch die des künftigen Regierungssprechers. Wenngleich Hebestreit an Arroganz schwer zu überbieten sein wird, dürfte sich die Art der Kommunikation mit Stefan Kornelius in der Sache kaum ändern. Der Politikchef der Süddeutschen Zeitung «prägte den Meinungsjournalismus der SZ» und schrieb «in dieser Rolle auch für die Titel der Tamedia». Allerdings ist, anders als noch vor zehn Jahren, die Einbindung von Journalisten in Thinktanks wie die Deutsche Atlantische Gesellschaft (DAG) ja heute eher eine Empfehlung als ein Problem.

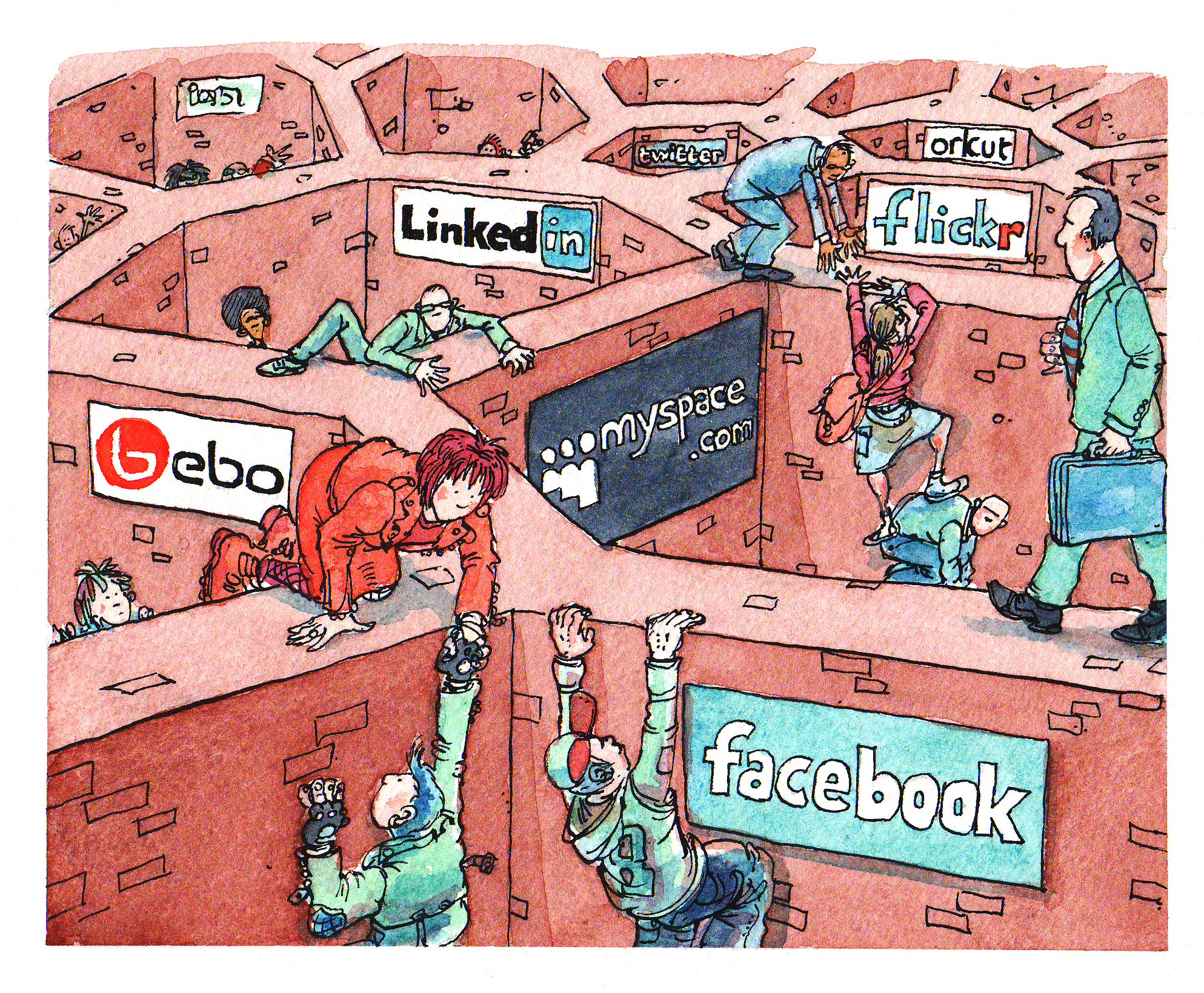

Ungesund ist definitiv auch die totale Digitalisierung, nicht nur im Gesundheitswesen. Lauterbachs Abschiedsgeschenk, die «abgesicherte» elektronische Patientenakte (ePA) ist völlig überraschenderweise direkt nach dem Bundesstart erneut gehackt worden. Norbert Häring kommentiert angesichts der Datenlecks, wer die ePA nicht abwähle, könne seine Gesundheitsdaten ebensogut auf Facebook posten.

Dass die staatlichen Kontrolleure so wenig auf freie Software und dezentrale Lösungen setzen, verdeutlicht die eigentlichen Intentionen hinter der Digitalisierungswut. Um Sicherheit und Souveränität geht es ihnen jedenfalls nicht – sonst gäbe es zum Beispiel mehr Unterstützung für Bitcoin und für Initiativen wie die der Spar-Supermärkte in der Schweiz.

[Titelbild: Pixabay]

Dieser Beitrag wurde mit dem Pareto-Client geschrieben und ist zuerst auf Transition News erschienen.

-

@ c631e267:c2b78d3e

2025-04-25 20:06:24

@ c631e267:c2b78d3e

2025-04-25 20:06:24Die Wahrheit verletzt tiefer als jede Beleidigung. \ Marquis de Sade

Sagen Sie niemals «Terroristin B.», «Schwachkopf H.», «korrupter Drecksack S.» oder «Meinungsfreiheitshasserin F.» und verkneifen Sie sich Memes, denn so etwas könnte Ihnen als Beleidigung oder Verleumdung ausgelegt werden und rechtliche Konsequenzen haben. Auch mit einer Frau M.-A. S.-Z. ist in dieser Beziehung nicht zu spaßen, sie gehört zu den Top-Anzeigenstellern.

«Politikerbeleidigung» als Straftatbestand wurde 2021 im Kampf gegen «Rechtsextremismus und Hasskriminalität» in Deutschland eingeführt, damals noch unter der Regierung Merkel. Im Gesetz nicht festgehalten ist die Unterscheidung zwischen schlechter Hetze und guter Hetze – trotzdem ist das gängige Praxis, wie der Titel fast schon nahelegt.

So dürfen Sie als Politikerin heute den Tesla als «Nazi-Auto» bezeichnen und dies ausdrücklich auf den Firmengründer Elon Musk und dessen «rechtsextreme Positionen» beziehen, welche Sie nicht einmal belegen müssen. [1] Vielleicht ernten Sie Proteste, jedoch vorrangig wegen der «gut bezahlten, unbefristeten Arbeitsplätze» in Brandenburg. Ihren Tweet hat die Berliner Senatorin Cansel Kiziltepe inzwischen offenbar dennoch gelöscht.

Dass es um die Meinungs- und Pressefreiheit in der Bundesrepublik nicht mehr allzu gut bestellt ist, befürchtet man inzwischen auch schon im Ausland. Der Fall des Journalisten David Bendels, der kürzlich wegen eines Faeser-Memes zu sieben Monaten Haft auf Bewährung verurteilt wurde, führte in diversen Medien zu Empörung. Die Welt versteckte ihre Kritik mit dem Titel «Ein Urteil wie aus einer Diktatur» hinter einer Bezahlschranke.

Unschöne, heutzutage vielleicht strafbare Kommentare würden mir auch zu einigen anderen Themen und Akteuren einfallen. Ein Kandidat wäre der deutsche Bundesgesundheitsminister (ja, er ist es tatsächlich immer noch). Während sich in den USA auf dem Gebiet etwas bewegt und zum Beispiel Robert F. Kennedy Jr. will, dass die Gesundheitsbehörde (CDC) keine Covid-Impfungen für Kinder mehr empfiehlt, möchte Karl Lauterbach vor allem das Corona-Lügengebäude vor dem Einsturz bewahren.

«Ich habe nie geglaubt, dass die Impfungen nebenwirkungsfrei sind», sagte Lauterbach jüngst der ZDF-Journalistin Sarah Tacke. Das steht in krassem Widerspruch zu seiner früher verbreiteten Behauptung, die Gen-Injektionen hätten keine Nebenwirkungen. Damit entlarvt er sich selbst als Lügner. Die Bezeichnung ist absolut berechtigt, dieser Mann dürfte keinerlei politische Verantwortung tragen und das Verhalten verlangt nach einer rechtlichen Überprüfung. Leider ist ja die Justiz anderweitig beschäftigt und hat außerdem selbst keine weiße Weste.

Obendrein kämpfte der Herr Minister für eine allgemeine Impfpflicht. Er beschwor dabei das Schließen einer «Impflücke», wie es die Weltgesundheitsorganisation – die «wegen Trump» in finanziellen Schwierigkeiten steckt – bis heute tut. Die WHO lässt aktuell ihre «Europäische Impfwoche» propagieren, bei der interessanterweise von Covid nicht mehr groß die Rede ist.

Einen «Klima-Leugner» würden manche wohl Nir Shaviv nennen, das ist ja nicht strafbar. Der Astrophysiker weist nämlich die Behauptung von einer Klimakrise zurück. Gemäß seiner Forschung ist mindestens die Hälfte der Erderwärmung nicht auf menschliche Emissionen, sondern auf Veränderungen im Sonnenverhalten zurückzuführen.

Das passt vielleicht auch den «Klima-Hysterikern» der britischen Regierung ins Konzept, die gerade Experimente zur Verdunkelung der Sonne angekündigt haben. Produzenten von Kunstfleisch oder Betreiber von Insektenfarmen würden dagegen vermutlich die Geschichte vom fatalen CO2 bevorzugen. Ihnen würde es besser passen, wenn der verantwortungsvolle Erdenbürger sein Verhalten gründlich ändern müsste.

In unserer völlig verkehrten Welt, in der praktisch jede Verlautbarung außerhalb der abgesegneten Narrative potenziell strafbar sein kann, gehört fast schon Mut dazu, Dinge offen anzusprechen. Im «besten Deutschland aller Zeiten» glaubten letztes Jahr nur noch 40 Prozent der Menschen, ihre Meinung frei äußern zu können. Das ist ein Armutszeugnis, und es sieht nicht gerade nach Besserung aus. Umso wichtiger ist es, dagegen anzugehen.

[Titelbild: Pixabay]

--- Quellen: ---

[1] Zur Orientierung wenigstens ein paar Hinweise zur NS-Vergangenheit deutscher Automobilhersteller:

- Volkswagen

- Porsche

- Daimler-Benz

- BMW

- Audi

- Opel

- Heute: «Auto-Werke für die Rüstung? Rheinmetall prüft Übernahmen»

Dieser Beitrag wurde mit dem Pareto-Client geschrieben und ist zuerst auf Transition News erschienen.

-

@ 04c915da:3dfbecc9

2025-05-20 15:47:16

@ 04c915da:3dfbecc9

2025-05-20 15:47:16Here’s a revised timeline of macro-level events from The Mandibles: A Family, 2029–2047 by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes.

Part One: 2029–2032

-

2029 (Early Year)\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor.

-

2029 (Mid-Year: The Great Renunciation)\ Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive.

-

2029 (Late Year)\ Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant.

-

2030–2031\ Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness.

-

2032\ By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured.

Time Jump: 2032–2047

- Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies.

Part Two: 2047

-

2047 (Early Year)\ The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum.

-

2047 (Mid-Year)\ Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency.

-

2047 (Late Year)\ The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society.

Key Differences

- Currency Dynamics: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control.

- Government Power: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities.

- Societal Outcome: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots.

This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory.

-

-

@ 21335073:a244b1ad

2025-05-09 13:56:57

@ 21335073:a244b1ad

2025-05-09 13:56:57Someone asked for my thoughts, so I’ll share them thoughtfully. I’m not here to dictate how to promote Nostr—I’m still learning about it myself. While I’m not new to Nostr, freedom tech is a newer space for me. I’m skilled at advocating for topics I deeply understand, but freedom tech isn’t my expertise, so take my words with a grain of salt. Nothing I say is set in stone.

Those who need Nostr the most are the ones most vulnerable to censorship on other platforms right now. Reaching them requires real-time awareness of global issues and the dynamic relationships between governments and tech providers, which can shift suddenly. Effective Nostr promoters must grasp this and adapt quickly.

The best messengers are people from or closely tied to these at-risk regions—those who truly understand the local political and cultural dynamics. They can connect with those in need when tensions rise. Ideal promoters are rational, trustworthy, passionate about Nostr, but above all, dedicated to amplifying people’s voices when it matters most.

Forget influencers, corporate-backed figures, or traditional online PR—it comes off as inauthentic, corny, desperate and forced. Nostr’s promotion should be grassroots and organic, driven by a few passionate individuals who believe in Nostr and the communities they serve.

The idea that “people won’t join Nostr due to lack of reach” is nonsense. Everyone knows X’s “reach” is mostly with bots. If humans want real conversations, Nostr is the place. X is great for propaganda, but Nostr is for the authentic voices of the people.

Those spreading Nostr must be so passionate they’re willing to onboard others, which is time-consuming but rewarding for the right person. They’ll need to make Nostr and onboarding a core part of who they are. I see no issue with that level of dedication. I’ve been known to get that way myself at times. It’s fun for some folks.

With love, I suggest not adding Bitcoin promotion with Nostr outreach. Zaps already integrate that element naturally. (Still promote within the Bitcoin ecosystem, but this is about reaching vulnerable voices who needed Nostr yesterday.)

To promote Nostr, forget conventional strategies. “Influencers” aren’t the answer. “Influencers” are not the future. A trusted local community member has real influence—reach them. Connect with people seeking Nostr’s benefits but lacking the technical language to express it. This means some in the Nostr community might need to step outside of the Bitcoin bubble, which is uncomfortable but necessary. Thank you in advance to those who are willing to do that.

I don’t know who is paid to promote Nostr, if anyone. This piece isn’t shade. But it’s exhausting to see innocent voices globally silenced on corporate platforms like X while Nostr exists. Last night, I wondered: how many more voices must be censored before the Nostr community gets uncomfortable and thinks creatively to reach the vulnerable?

A warning: the global need for censorship-resistant social media is undeniable. If Nostr doesn’t make itself known, something else will fill that void. Let’s start this conversation.

-

@ cae03c48:2a7d6671

2025-05-27 21:00:56

@ cae03c48:2a7d6671

2025-05-27 21:00:56Bitcoin Magazine

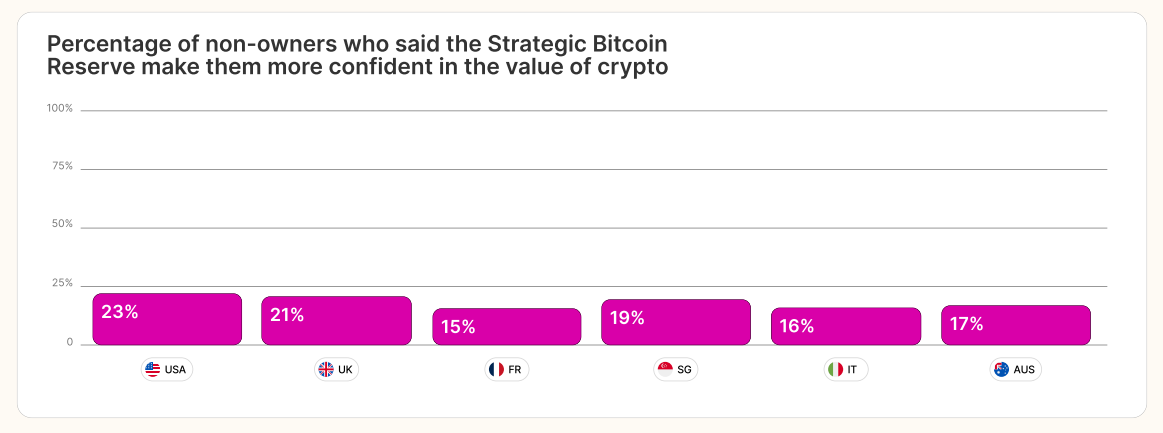

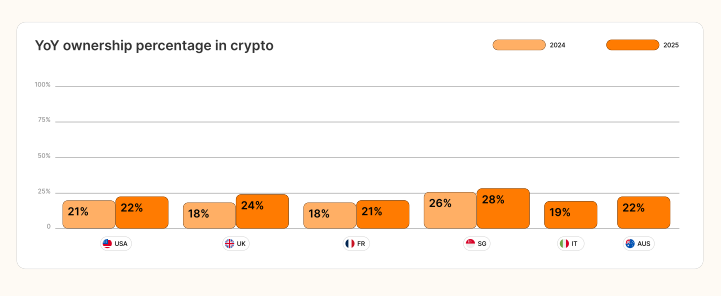

One out of Four People Own Bitcoin and Crypto in 2025: ReportToday, Gemini, a crypto platform, released its 2025 Global State of Crypto Report, revealing a notable increase in cryptocurrency adoption in different countries. According to a press release sent to Bitcoin Magazine, ownership among respondents in the US, UK, France, and Singapore rose from one in five (21%) in 2024 to one in four (24%) in 2025.

The Trump Administration’s treatment of Bitcoin may have played a major role in its global growth. Since taking office in January 2025, President Trump has launched a Strategic Bitcoin Reserve, where he installed leadership at the SEC that are in favor of digital assets, and endorsed legislation aimed at regulating stablecoins and establishing a clear framework for digital assets.

“The United States has proven itself as a global leader in web3 and blockchain technology with the addition of Trump’s pro-crypto policies, which is a significant change from the previous Administration” said the CEO of Gemini Marshall Beard. “With this pro-innovation approach, the crypto industry is positioned for significant growth in the United States and around the world.”

In the US nearly 23% of non-owners said that President Trump’s launch of the Strategic Bitcoin Reserve made them more confident in the value of Bitcoin and other cryptos. Similar feelings were shared by about one in five non-owners in the United Kingdom (21%) and Singapore (19%).

Europe is leading the way in crypto ownership growth. In 2025, 24% of people in the UK said they own cryptocurrency, up from 18% last year; the biggest jump of any country surveyed. France also saw an increase, with 21% owning crypto, compared to 18% in 2024. In the US, adoption rose from 20% to 22%, and Singapore went from 26% to 28%.

France’s strong pro-crypto stance has encouraged more people there to invest in digital assets, which is the highest rate among all surveyed nations with 67%. Following France are Singapore, Italy, the UK, the US, and Australia.

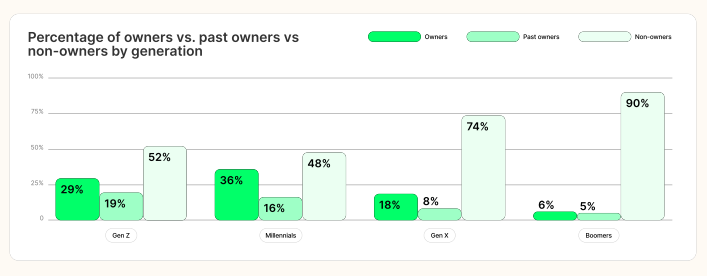

In the US, nearly two in five crypto owners (39%) have invested in crypto ETFs, showing a steady rise since their approval in early 2024. Additionally, half of Millennials and Gen Z globally have invested in crypto at some point, with 52% of Millennials and 48% of Gen Z reporting current or past ownership.

This post One out of Four People Own Bitcoin and Crypto in 2025: Report first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 04c915da:3dfbecc9

2025-05-16 17:51:54

@ 04c915da:3dfbecc9

2025-05-16 17:51:54In much of the world, it is incredibly difficult to access U.S. dollars. Local currencies are often poorly managed and riddled with corruption. Billions of people demand a more reliable alternative. While the dollar has its own issues of corruption and mismanagement, it is widely regarded as superior to the fiat currencies it competes with globally. As a result, Tether has found massive success providing low cost, low friction access to dollars. Tether claims 400 million total users, is on track to add 200 million more this year, processes 8.1 million transactions daily, and facilitates $29 billion in daily transfers. Furthermore, their estimates suggest nearly 40% of users rely on it as a savings tool rather than just a transactional currency.

Tether’s rise has made the company a financial juggernaut. Last year alone, Tether raked in over $13 billion in profit, with a lean team of less than 100 employees. Their business model is elegantly simple: hold U.S. Treasuries and collect the interest. With over $113 billion in Treasuries, Tether has turned a straightforward concept into a profit machine.

Tether’s success has resulted in many competitors eager to claim a piece of the pie. This has triggered a massive venture capital grift cycle in USD tokens, with countless projects vying to dethrone Tether. Due to Tether’s entrenched network effect, these challengers face an uphill battle with little realistic chance of success. Most educated participants in the space likely recognize this reality but seem content to perpetuate the grift, hoping to cash out by dumping their equity positions on unsuspecting buyers before they realize the reality of the situation.

Historically, Tether’s greatest vulnerability has been U.S. government intervention. For over a decade, the company operated offshore with few allies in the U.S. establishment, making it a major target for regulatory action. That dynamic has shifted recently and Tether has seized the opportunity. By actively courting U.S. government support, Tether has fortified their position. This strategic move will likely cement their status as the dominant USD token for years to come.

While undeniably a great tool for the millions of users that rely on it, Tether is not without flaws. As a centralized, trusted third party, it holds the power to freeze or seize funds at its discretion. Corporate mismanagement or deliberate malpractice could also lead to massive losses at scale. In their goal of mitigating regulatory risk, Tether has deepened ties with law enforcement, mirroring some of the concerns of potential central bank digital currencies. In practice, Tether operates as a corporate CBDC alternative, collaborating with authorities to surveil and seize funds. The company proudly touts partnerships with leading surveillance firms and its own data reveals cooperation in over 1,000 law enforcement cases, with more than $2.5 billion in funds frozen.

The global demand for Tether is undeniable and the company’s profitability reflects its unrivaled success. Tether is owned and operated by bitcoiners and will likely continue to push forward strategic goals that help the movement as a whole. Recent efforts to mitigate the threat of U.S. government enforcement will likely solidify their network effect and stifle meaningful adoption of rival USD tokens or CBDCs. Yet, for all their achievements, Tether is simply a worse form of money than bitcoin. Tether requires trust in a centralized entity, while bitcoin can be saved or spent without permission. Furthermore, Tether is tied to the value of the US Dollar which is designed to lose purchasing power over time, while bitcoin, as a truly scarce asset, is designed to increase in purchasing power with adoption. As people awaken to the risks of Tether’s control, and the benefits bitcoin provides, bitcoin adoption will likely surpass it.

-

@ ae1008d2:a166d760

2025-04-01 00:29:56

@ ae1008d2:a166d760

2025-04-01 00:29:56This is part one in a series of long-form content of my ideas as to what we are entering into in my opinion;The Roaring '20's 2.0 (working title). I hope you'll join me on this journey together.

"History does not repeat itself, but it often rhymes"; - Samuel Clemens, aka Mark Twain. My only class I received an A+ in high school was history, this opened up the opportunity for me to enroll in an AP (college level) history class my senior year. There was an inherent nature for me to study history. Another quote I found to live by; "If we do not study history, we are bound to repeat it", a paraphrased quote by the many great philosphers of old from Edmund Burke, George Santayana and even Winston Churchill, all pulling from the same King Solomon quote; "What has been will be again, what has been done will be done again; there is nothing new under the sun". My curiousity of human actions, psychological and therefore economical behavior, has benefitted me greatly throughout my life and career, at such a young age. Being able to 'see around the curves' ahead I thought was a gift many had, but was sorely mistaken. People are just built different. One, if not my hardest action for me is to share. I just do things; act, often without even thinking about writing down or sharing in anyway shape or form what I just did here with friends, what we just built or how we formed these startups, etc., I've finally made the time, mainly for myself, to share my thoughts and ideas as to where we are at, and what we can do moving forward. It's very easy for us living a sovereign-lifestyle in Bitcoin, Nostr and other P2P, cryptographically-signed sovereign tools and tech-stacks alike, permissionless and self-hostable, to take all these tools for granted. We just live with them. Use them everyday. Do you own property? Do you have to take care of the cattle everyday? To live a sovereign life is tough, but most rewarding. As mentioned above, I'm diving into the details in a several part series as to what the roaring '20's were about, how it got to the point it did, and the inevitable outcome we all know what came to be. How does this possibly repeat itself almost exactly a century later? How does Bitcoin play a role? Are we all really going to be replaced by AI robots (again, history rhymes here)? Time will tell, but I think most of us actually using the tools will also forsee many of these possible outcomes, as it's why we are using many of these tools today. The next parts of this series will be released periodically, maybe once per month, maybe once per quarter. I'll also be releasing these on other platforms like Medium for reach, but Nostr will always be first, most important and prioritized.

I'll leave you with one of my favorite quotes I've lived by from one of the greatest traders of all time, especially during this roaring '20's era, Jesse Livermore; "Money is made by sitting, not trading". -

@ 6ad3e2a3:c90b7740

2025-05-20 13:49:50

@ 6ad3e2a3:c90b7740

2025-05-20 13:49:50I’ve written about MSTR twice already, https://www.chrisliss.com/p/mstr and https://www.chrisliss.com/p/mstr-part-2, but I want to focus on legendary short seller James Chanos’ current trade wherein he buys bitcoin (via ETF) and shorts MSTR, in essence to “be like Mike” Saylor who sells MSTR shares at the market and uses them to add bitcoin to the company’s balance sheet. After all, if it’s good enough for Saylor, why shouldn’t everyone be doing it — shorting a company whose stock price is more than 2x its bitcoin holdings and using the proceeds to buy the bitcoin itself?

Saylor himself has said selling shares at 2x NAV (net asset value) to buy bitcoin is like selling dollars for two dollars each, and Chanos has apparently decided to get in while the getting (market cap more than 2x net asset value) is good. If the price of bitcoin moons, sending MSTR’s shares up, you are more than hedged in that event, too. At least that’s the theory.

The problem with this bet against MSTR’s mNAV, i.e., you are betting MSTR’s market cap will converge 1:1 toward its NAV in the short and medium term is this trade does not exist in a vacuum. Saylor has described how his ATM’s (at the market) sales of shares are accretive in BTC per share because of this very premium they carry. Yes, we’ll dilute your shares of the company, but because we’re getting you 2x the bitcoin per share, you are getting an ever smaller slice of an ever bigger overall pie, and the pie is growing 2x faster than your slice is reducing. (I https://www.chrisliss.com/p/mstr how this works in my first post.)

But for this accretion to continue, there must be a constant supply of “greater fools” to pony up for the infinitely printable shares which contain only half their value in underlying bitcoin. Yes, those shares will continue to accrete more BTC per share, but only if there are more fools willing to make this trade in the future. So will there be a constant supply of such “fools” to keep fueling MSTR’s mNAV multiple indefinitely?

Yes, there will be in my opinion because you have to look at the trade from the prospective fools’ perspective. Those “fools” are not trading bitcoin for MSTR, they are trading their dollars, selling other equities to raise them maybe, but in the end it’s a dollars for shares trade. They are not selling bitcoin for them.

You might object that those same dollars could buy bitcoin instead, so they are surely trading the opportunity cost of buying bitcoin for them, but if only 5-10 percent of the market (or less) is buying bitcoin itself, the bucket in which which those “fools” reside is the entire non-bitcoin-buying equity market. (And this is not considering the even larger debt market which Saylor has yet to tap in earnest.)

So for those 90-95 percent who do not and are not presently planning to own bitcoin itself, is buying MSTR a fool’s errand, so to speak? Not remotely. If MSTR shares are infinitely printable ATM, they are still less so than the dollar and other fiat currencies. And MSTR shares are backed 2:1 by bitcoin itself, while the fiat currencies are backed by absolutely nothing. So if you hold dollars or euros, trading them for MSTR shares is an errand more sage than foolish.

That’s why this trade (buying BTC and shorting MSTR) is so dangerous. Not only are there many people who won’t buy BTC buying MSTR, there are many funds and other investment entities who are only able to buy MSTR.

Do you want to get BTC at 1:1 with the 5-10 percent or MSTR backed 2:1 with the 90-95 percent. This is a bit like medical tests that have a 95 percent accuracy rate for an asymptomatic disease that only one percent of the population has. If someone tests positive, it’s more likely to be a false one than an indication he has the disease*. The accuracy rate, even at 19:1, is subservient to the size of the respective populations.

At some point this will no longer be the case, but so long as the understanding of bitcoin is not widespread, so long as the dollar is still the unit of account, the “greater fools” buying MSTR are still miles ahead of the greatest fools buying neither, and the stock price and mNAV should only increase.

. . .

One other thought: it’s more work to play defense than offense because the person on offense knows where he’s going, and the defender can only react to him once he moves. Similarly, Saylor by virtue of being the issuer of the shares knows when more will come online while Chanos and other short sellers are borrowing them to sell in reaction to Saylor’s strategy. At any given moment, Saylor can pause anytime, choosing to issue convertible debt or preferred shares with which to buy more bitcoin, and the shorts will not be given advance notice.

If the price runs, and there is no ATM that week because Saylor has stopped on a dime, so to speak, the shorts will be left having to scramble to change directions and buy the shares back to cover. Their momentum might be in the wrong direction, though, and like Allen Iverson breaking ankles with a crossover, Saylor might trigger a massive short squeeze, rocketing the share price ever higher. That’s why he actually welcomes Chanos et al trying this copycat strategy — it becomes the fuel for outsized gains.