-

@ cae03c48:2a7d6671

2025-05-27 19:00:51

@ cae03c48:2a7d6671

2025-05-27 19:00:51Bitcoin Magazine

Exodus Launches XO Pay, An In-App Bitcoin And Crypto Purchase SolutionExodus has officially launched XO Pay, a new crypto purchasing feature that allows users to buy and sell digital assets directly within the Exodus mobile wallet, and is now live across the United States. XO Pay aims to simplify the process for its users to easily purchase cryptocurrencies such as Bitcoin.

XO Pay is powered by Coinme’s Crypto-as-a-Service (CaaS) API platform and is a self custody Bitcoin wallet. This means customers can now purchase BTC within the wallet without going through third-party exchanges while keeping full control of their assets.

“XO Pay represents our commitment to making cryptocurrency more accessible to everyday customers,” said JP Richardson, Co-Founder and CEO of Exodus, in a recent press release sent to Bitcoin Magazine. “By integrating the purchasing process directly into our mobile wallet, we’re removing barriers and simplifying the journey from fiat to crypto, and back.”

With XO Pay, Exodus offers a self custodial way to complete Bitcoin transactions. This rollout is part of Exodus’ broader mission to make digital assets more secure, as the demand for Bitcoin is increasing.

“By creating a Web2 checkout experience into a Web3 self-custody wallet, Exodus has set a new bar for crypto user experience,” said Neil Bergquist, CEO and co-founder of Coinme. “Exodus’ innovative integration of Coinme’s APIs delivers the seamless in-app purchase flow users expect while keeping them in full control of their assets.”

This post Exodus Launches XO Pay, An In-App Bitcoin And Crypto Purchase Solution first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-05-27 19:00:50

@ cae03c48:2a7d6671

2025-05-27 19:00:50Bitcoin Magazine

🔴 LIVE: The Bitcoin Conference 2025 – Day 1The liveblog has ended.

No liveblog updates yet.

Load more

This post 🔴 LIVE: The Bitcoin Conference 2025 – Day 1 first appeared on Bitcoin Magazine and is written by Bitcoin Magazine.

-

@ 5391098c:74403a0e

2025-05-27 18:20:42

@ 5391098c:74403a0e

2025-05-27 18:20:42Você trabalha 5 meses do ano somente para pagar impostos. Ou seja, 42% da sua renda serve para bancar serviços públicos de péssima qualidade. Mesmo que você tivesse a liberdade de usar esses 42% da sua renda para contratar serviços privados de qualidade (saúde, segurança e ensino), ainda assim você seria um escravo porque você recebe dinheiro em troca do seu trabalho, e o dinheiro perde cerca de 10% do valor a cada ano. Em outras palavras todo seu dinheiro que sobra depois de comprar comida, vestuário e moradia perde 100% do valor a cada 10 anos. Isso acontece porque o Estado imprime dinheiro do nada e joga na economia de propósito para gerar INFLAÇÃO e manter todos nós escravizados. Você pode deixar seu dinheiro investido em qualquer aplicação que imaginar e ainda assim nunca terá uma rentabilidade superior a inflação real. No final, acaba perdendo tudo do mesmo jeito. Caso você se ache esperto por investir o que sobra da sua renda em bens duráveis como imóveis ou veículos, sabia que esses bens também não são seus, porque se deixar de pagar os impostos desses bens (iptu, itr, ipva) você também perde tudo. Além disso, o custo de manutenção desses bens deve ser levado em consideração na conta das novas dívidas que você assumiu. No caso dos imóveis urbanos é impossível alugá-lo por mais de 0,38% do seu valor mensalmente. Em outras palavras, a cada ano você recebe menos de 5% do que investiu, tem que pagar o custo de manutenção, mais impostos e a valorização do bem nunca será superior a inflação real, também fazendo você perder quase tudo em cerca de 15 anos. A situação é ainda pior com os imóveis rurais e veículos, basta fazer as contas. Caso o dinheiro que você receba em troca do seu trabalho seja suficiente apenas para comprar comida, vestuário e moradia, você já sabe que é um escravo né?… Precisamos entender que a escravidão não acabou, apenas foi democratizada. Hoje a escravidão é financeira, nós somos os castiços e os donos do dinheiro são o senhorio. Os donos do dinheiro são os Globalistas e os Estados seus fantoches. O esquema é simples: fazer todo mundo trabalhar em troca de algo que perde 100% do valor a cada 10 anos, ou seja o dinheiro. Se você pudesse trabalhar em troca de algo que aumentasse de valor acima da inflação real a cada 10 anos você finalmente conquistaria sua liberdade financeira e deixaria de ser escravo. Pois bem, isso já é possível, e não se trata de ouro ou imóveis e sim sobre o Bitcoin, que sobe de valor mais de 100% a cada 10 anos, com a vantagem de ser inconfiscável e de fácil transferência para seus herdeiros quando você morrer, através de uma simples transação LockTime feita em vida. Portanto, mesmo que você não tenha dinheiro para comprar Bitcoin, passar a aceitar Bitcoin em troca de seus produtos e serviços é a única forma de se libertar da escravidão financeira. A carta de alforria financeira proporcionada pelo Bitcoin não é imediata, pois a velocidade da sua libertação depende do quanto você está disposto a aprender sobre o assunto. Eu estou aqui para te ajudar, caso queira. No futuro o Bitcoin estará tão presente na sua vida quanto o pix e o cartão de crédito, você querendo ou não. Assim como o cartão de crédito foi a evolução do cheque pós-datado e o pix a evolução do cartão, o Bitcoin e outras criptomoedas serão a evolução de todos esses meios de pagamento. O que te ofereço é a oportunidade de abolição da sua escravatura antes dos demais escravos acordarem para a realidade, afinal a história sempre se repete: desde o ano de 1300 a.c. a escravidão era defendida pelos próprios escravos, que mais cedo ou mais tarde, foram libertados por Moisés em êxodo 11 da Bíblia Sagrada e hoje o povo de israel se tornou a nação mais rica do mundo. A mesma história se repetiu na Roma Antiga: com o pão e circo. Da mesma forma todo esse império escravocrata ruiu porque mais cedo ou mais tarde os escravos se revoltam, bastam as coisas piorarem bastante. O atual regime de escravidão teve início com a queda do padrão-ouro para impressão do dinheiro no ano de 1944. A escravidão apenas ficou mais sofisticada, pois em vez de pagar os escravos com cerveja como no Egito Antigo ou com pão e circo como na Roma Antiga, passou-se a pagar os escravos com dinheiro sem lastro, ou seja dinheiro inventado, criado do nada, sem qualquer representação com a riqueza real da economia. Mesmo sendo a escravidão atual mais sofisticada, que deixou de ser física para ser financeira, o que torna a mentira mais bem contada, mais cedo ou mais tarde os escravos modernos irão acordar, basta as coisas piorarem mais ou perceberem que todos os bens e serviços do mundo não representam nem 1% de todo o dinheiro que impresso sem lastro. Em outras palavras, se os donos de todo o dinheiro do mundo resolvessem utilizá-lo para comprar tudo o que existe à venda, o preço do quilo do café subiria para R$ 297.306,00 e o preço médio dos imóveis subiria para um número tão grande que sequer caberia nesta folha de papel. Hoje, o dinheiro não vale nada, seus donos sabem disso e optam por entregar o dinheiro aos poucos para os escravos em troca do seu trabalho, para manter o atual regime o máximo de tempo possível. Mesmo assim, o atual regime de escravidão financeira está com os dias contados e depende de você se posicionar antes do efeito manada. Nunca é tarde para entrar no Bitcoin, mesmo ele tendo uma quantidade de emissão limitada, seu valor subirá infinitamente. A menor unidade do Bitcoin é o satoshi, cuja abreviação é sats. Diferente do centavo, cada sat vale um centésimo milionésimo de bitcoin. Hoje (25/05/25), cada unidade de Bitcoin equivale a setecentos mil reais. Logo, cada R$ 0,01 equivale à 0,007 sats. Lembrando que o centavo é um real dividido por cem e o sat é um bitcoin dividido por cem milhões, por isso ainda não existe a paridade entre 1 centavo de real e 1 sat. Essa paridade será alcançada quando um Bitcoin passar a valer um milhão de reais. Com a velocidade que nosso dinheiro está perdendo valor isso não irá demorar muito. Utilizando dados econômicos avançados, prevejo que cada unidade de Bitcoin passará a valer hum milhão de reais até o ano de 2029, assim equiparando 1 sat para cada R$ 0,01. Nesse momento, certamente muitos empresários, comerciantes e profissionais liberais passarão a aceitar o Bitcoin como forma de pagamento pelos seus produtos e serviços, assim como o cheque foi substituído pelo cartão de crédito e o cartão pelo pix. Sabendo disso, você pode entrar na onda de transição no futuro junto com a manada e perder essa alta valorização, ou passar a aceitar Bitcoin agora pelos seus produtos e serviços, assinando assim, a própria carta de alforria da sua escravidão financeira. É importante dizer que os próprios globalistas e governos estão trocando dinheiro por Bitcoin como nunca na história e mesmo que eles adquiram todos os bitcoins disponíveis, ainda assim não será mais possível manter seu regime de escravidão financeira funcionando porque a emissão de Bitcoin é limitada, sendo impossível criar Bitcoin sem lastro, como é feito com o dinheiro hoje. Com o presente artigo, te ofereço a oportunidade de conquistar seus primeiros sats agora, de forma segura e independente, sem precisar de corretoras, bancos, intermediários ou terceiros, basta você querer pois toda a informação necessária está disponível na internet gratuitamente. Se ainda assim você quiser continuar sendo escravo financeiro, depois não adiantar se arrepender quando as janelas de oportunidade se fecharem, o Drex for implantado, papel moeda restringido e sua vida piorar bastante. Importante mencionar que a Lei Brasileira ainda permite a movimentação de até R$ 30.000,00 em Bitcoin por mês sem a necessidade de declaração à Receita Federal e que esse direito pode deixar de existir a qualquer momento, e que quando o Drex for implantado você perderá diversos outros direitos, dentre ele a liberdade de gastar seu dinheiro como quiser e o sigilo. Ofereço ainda, a oportunidade de você baixar uma carteira de Bitcoin gratuita e segura no seu aparelho de celular que funciona de forma semelhante a um banco digital como Nubank e Pagseguro por exemplo, para poder começar à receber Bitcoin pelos seus produtos e serviços agora, de forma fácil e gratuita. Utilizando o qrcode abaixo você ainda ganha alguns sats de graça, promoção válida até o dia 29/05/25 e patrocinada pela Corretora Blink de El Salvador, onde o Bitcoin já é moeda oficial do país, basta acessar o link e instalar o aplicativo: https://get.blink.sv/btcvale

Aviso: disponibilizei o link da carteira de Bitcoin da Corretora Blink apenas como exemplo de como é fácil aceitar Bitcoin como forma de pagamento pelos seus produtos e serviços. Não recomento depender de qualquer corretora para guardar seus valores em Bitcoin. A melhor forma de fazer isso é mantendo dois computadores ou notebook em casa, um conectado à internet com memória em disco disponível de 1 terabyte ou mais para armazenar e visualizar suas transações e outro computador ou notebook desconectado da internet para armazenar suas senhas e chaves privadas para assinar as transações via pendrive. Somente assim você estará 100% livre e seguro. Importante ainda fazer backup em vários CDs com criptografia do seu computador ou notebook que assina as transações, assim também ficando 100% livre e seguro para restaurar sua carteira em qualquer outro computador caso necessário. Todas as instruções de como fazer isso já estão disponíveis gratuitamente na internet. Caso deseje contratar uma consultoria pessoal que inclui aulas particulares por vídeo conferência, onde você aprenderá:

→ Tudo o que precisa saber sobre Bitcoin e demais criptomoedas; → Sistema operacional Linux; → Como instalar sua carteira de Bitcoin em dois computadores para assinaturas air gapped; → Se manter 100% livre e seguro. → Com carga horária à combinar conforme sua disponibilidade.

O custo do investimento pelo meu serviço individual para esse tipo de consultoria é de 204.000 sats (R$ 1.543,46 na cotação atual) valor válido até 31/07/25, interessados entrar em contato por aqui ou através da Matrix: @davipinheiro:matrix.org https://davipinheiro.com/voce-e-escravo-e-nem-sabe-eu-vou-te-provar-agora/

-

@ 5391098c:74403a0e

2025-05-27 18:15:38

@ 5391098c:74403a0e

2025-05-27 18:15:38Você trabalha 5 meses do ano somente para pagar impostos. Ou seja, 42% da sua renda serve para bancar serviços públicos de péssima qualidade. Mesmo que você tivesse a liberdade de usar esses 42% da sua renda para contratar serviços privados de qualidade (saúde, segurança e ensino), ainda assim você seria um escravo porque você recebe dinheiro em troca do seu trabalho, e o dinheiro perde cerca de 10% do valor a cada ano. Em outras palavras todo seu dinheiro que sobra depois de comprar comida, vestuário e moradia perde 100% do valor a cada 10 anos. Isso acontece porque o Estado imprime dinheiro do nada e joga na economia de propósito para gerar INFLAÇÃO e manter todos nós escravizados. Você pode deixar seu dinheiro investido em qualquer aplicação que imaginar e ainda assim nunca terá uma rentabilidade superior a inflação real. No final, acaba perdendo tudo do mesmo jeito. Caso você se ache esperto por investir o que sobra da sua renda em bens duráveis como imóveis ou veículos, sabia que esses bens também não são seus, porque se deixar de pagar os impostos desses bens (iptu, itr, ipva) você também perde tudo. Além disso, o custo de manutenção desses bens deve ser levado em consideração na conta das novas dívidas que você assumiu. No caso dos imóveis urbanos é impossível alugá-lo por mais de 0,38% do seu valor mensalmente. Em outras palavras, a cada ano você recebe menos de 5% do que investiu, tem que pagar o custo de manutenção, mais impostos e a valorização do bem nunca será superior a inflação real, também fazendo você perder quase tudo em cerca de 15 anos. A situação é ainda pior com os imóveis rurais e veículos, basta fazer as contas. Caso o dinheiro que você receba em troca do seu trabalho seja suficiente apenas para comprar comida, vestuário e moradia, você já sabe que é um escravo né?… Precisamos entender que a escravidão não acabou, apenas foi democratizada. Hoje a escravidão é financeira, nós somos os castiços e os donos do dinheiro são o senhorio. Os donos do dinheiro são os Globalistas e os Estados seus fantoches. O esquema é simples: fazer todo mundo trabalhar em troca de algo que perde 100% do valor a cada 10 anos, ou seja o dinheiro. Se você pudesse trabalhar em troca de algo que aumentasse de valor acima da inflação real a cada 10 anos você finalmente conquistaria sua liberdade financeira e deixaria de ser escravo. Pois bem, isso já é possível, e não se trata de ouro ou imóveis e sim sobre o Bitcoin, que sobe de valor mais de 100% a cada 10 anos, com a vantagem de ser inconfiscável e de fácil transferência para seus herdeiros quando você morrer, através de uma simples transação LockTime feita em vida. Portanto, mesmo que você não tenha dinheiro para comprar Bitcoin, passar a aceitar Bitcoin em troca de seus produtos e serviços é a única forma de se libertar da escravidão financeira. A carta de alforria financeira proporcionada pelo Bitcoin não é imediata, pois a velocidade da sua libertação depende do quanto você está disposto a aprender sobre o assunto. Eu estou aqui para te ajudar, caso queira. No futuro o Bitcoin estará tão presente na sua vida quanto o pix e o cartão de crédito, você querendo ou não. Assim como o cartão de crédito foi a evolução do cheque pós-datado e o pix a evolução do cartão, o Bitcoin e outras criptomoedas serão a evolução de todos esses meios de pagamento. O que te ofereço é a oportunidade de abolição da sua escravatura antes dos demais escravos acordarem para a realidade, afinal a história sempre se repete: desde o ano de 1300 a.c. a escravidão era defendida pelos próprios escravos, que mais cedo ou mais tarde, foram libertados por Moisés em êxodo 11 da Bíblia Sagrada e hoje o povo de israel se tornou a nação mais rica do mundo. A mesma história se repetiu na Roma Antiga: com o pão e circo. Da mesma forma todo esse império escravocrata ruiu porque mais cedo ou mais tarde os escravos se revoltam, bastam as coisas piorarem bastante. O atual regime de escravidão teve início com a queda do padrão-ouro para impressão do dinheiro no ano de 1944. A escravidão apenas ficou mais sofisticada, pois em vez de pagar os escravos com cerveja como no Egito Antigo ou com pão e circo como na Roma Antiga, passou-se a pagar os escravos com dinheiro sem lastro, ou seja dinheiro inventado, criado do nada, sem qualquer representação com a riqueza real da economia. Mesmo sendo a escravidão atual mais sofisticada, que deixou de ser física para ser financeira, o que torna a mentira mais bem contada, mais cedo ou mais tarde os escravos modernos irão acordar, basta as coisas piorarem mais ou perceberem que todos os bens e serviços do mundo não representam nem 1% de todo o dinheiro que impresso sem lastro. Em outras palavras, se os donos de todo o dinheiro do mundo resolvessem utilizá-lo para comprar tudo o que existe à venda, o preço do quilo do café subiria para R$ 297.306,00 e o preço médio dos imóveis subiria para um número tão grande que sequer caberia nesta folha de papel. Hoje, o dinheiro não vale nada, seus donos sabem disso e optam por entregar o dinheiro aos poucos para os escravos em troca do seu trabalho, para manter o atual regime o máximo de tempo possível. Mesmo assim, o atual regime de escravidão financeira está com os dias contados e depende de você se posicionar antes do efeito manada. Nunca é tarde para entrar no Bitcoin, mesmo ele tendo uma quantidade de emissão limitada, seu valor subirá infinitamente. A menor unidade do Bitcoin é o satoshi, cuja abreviação é sats. Diferente do centavo, cada sat vale um centésimo milionésimo de bitcoin. Hoje (25/05/25), cada unidade de Bitcoin equivale a setecentos mil reais. Logo, cada R$ 0,01 equivale à 0,007 sats. Lembrando que o centavo é um real dividido por cem e o sat é um bitcoin dividido por cem milhões, por isso ainda não existe a paridade entre 1 centavo de real e 1 sat. Essa paridade será alcançada quando um Bitcoin passar a valer um milhão de reais. Com a velocidade que nosso dinheiro está perdendo valor isso não irá demorar muito. Utilizando dados econômicos avançados, prevejo que cada unidade de Bitcoin passará a valer hum milhão de reais até o ano de 2029, assim equiparando 1 sat para cada R$ 0,01. Nesse momento, certamente muitos empresários, comerciantes e profissionais liberais passarão a aceitar o Bitcoin como forma de pagamento pelos seus produtos e serviços, assim como o cheque foi substituído pelo cartão de crédito e o cartão pelo pix. Sabendo disso, você pode entrar na onda de transição no futuro junto com a manada e perder essa alta valorização, ou passar a aceitar Bitcoin agora pelos seus produtos e serviços, assinando assim, a própria carta de alforria da sua escravidão financeira. É importante dizer que os próprios globalistas e governos estão trocando dinheiro por Bitcoin como nunca na história e mesmo que eles adquiram todos os bitcoins disponíveis, ainda assim não será mais possível manter seu regime de escravidão financeira funcionando porque a emissão de Bitcoin é limitada, sendo impossível criar Bitcoin sem lastro, como é feito com o dinheiro hoje. Com o presente artigo, te ofereço a oportunidade de conquistar seus primeiros sats agora, de forma segura e independente, sem precisar de corretoras, bancos, intermediários ou terceiros, basta você querer pois toda a informação necessária está disponível na internet gratuitamente. Se ainda assim você quiser continuar sendo escravo financeiro, depois não adiantar se arrepender quando as janelas de oportunidade se fecharem, o Drex for implantado, papel moeda restringido e sua vida piorar bastante. Importante mencionar que a Lei Brasileira ainda permite a movimentação de até R$ 30.000,00 em Bitcoin por mês sem a necessidade de declaração à Receita Federal e que esse direito pode deixar de existir a qualquer momento, e que quando o Drex for implantado você perderá diversos outros direitos, dentre ele a liberdade de gastar seu dinheiro como quiser e o sigilo. Ofereço ainda, a oportunidade de você baixar uma carteira de Bitcoin gratuita e segura no seu aparelho de celular que funciona de forma semelhante a um banco digital como Nubank e Pagseguro por exemplo, para poder começar à receber Bitcoin pelos seus produtos e serviços agora, de forma fácil e gratuita. Utilizando o qrcode abaixo você ainda ganha alguns sats de graça, promoção válida até o dia 29/05/25 e patrocinada pela Corretora Blink de El Salvador, onde o Bitcoin já é moeda oficial do país, basta acessar o link e instalar o aplicativo: https://get.blink.sv/btcvale

Aviso: disponibilizei o link da carteira de Bitcoin da Corretora Blink apenas como exemplo de como é fácil aceitar Bitcoin como forma de pagamento pelos seus produtos e serviços. Não recomento depender de qualquer corretora para guardar seus valores em Bitcoin. A melhor forma de fazer isso é mantendo dois computadores ou notebook em casa, um conectado à internet com memória em disco disponível de 1 terabyte ou mais para armazenar e visualizar suas transações e outro computador ou notebook desconectado da internet para armazenar suas senhas e chaves privadas para assinar as transações via pendrive. Somente assim você estará 100% livre e seguro. Importante ainda fazer backup em vários CDs com criptografia do seu computador ou notebook que assina as transações, assim também ficando 100% livre e seguro para restaurar sua carteira em qualquer outro computador caso necessário. Todas as instruções de como fazer isso já estão disponíveis gratuitamente na internet. Caso deseje contratar uma consultoria pessoal que inclui aulas particulares por vídeo conferência, onde você aprenderá:

→ Tudo o que precisa saber sobre Bitcoin e demais criptomoedas; → Sistema operacional Linux; → Como instalar sua carteira de Bitcoin em dois computadores para assinaturas air gapped; → Se manter 100% livre e seguro. → Com carga horária à combinar conforme sua disponibilidade.

O custo do investimento pelo meu serviço individual para esse tipo de consultoria é de 204.000 sats (R$ 1.543,46 na cotação atual) valor válido até 31/07/25, interessados entrar em contato por aqui ou através da Matrix: @davipinheiro:matrix.org https://davipinheiro.com/voce-e-escravo-e-nem-sabe-eu-vou-te-provar-agora/

-

@ f0fcbea6:7e059469

2025-05-27 18:08:04

@ f0fcbea6:7e059469

2025-05-27 18:08:04Muita gente, hoje em dia, acha que a leitura já não é tão necessária quanto foi no passado. O rádio e a televisão acabaram assumindo as funções que outrora pertenciam à mídia impressa, da mesma maneira que a fotografia assumiu as funções que outrora pertenciam à pintura e às artes gráficas. Temos de reconhecer - é verdade - que a televisão cumpre algumas dessas funções muito bem; a comunicação visual dos telejornais, por exemplo, tem impacto enorme. A capacidade do rádio em transmitir informações enquanto estamos ocupados - dirigindo um carro, por exemplo - é algo extraordinário, além de nos poupar muito tempo. No entanto, é necessário questionar se as comunicações modernas realmente aumentam o conhecimento sobre o mundo à nossa volta.

Talvez hoje saibamos mais sobre o mundo do que no passado. Dado que o conhecimento é pré-requisito para o entendimento, trata-se de algo bom. Mas o conhecimento não é um pré-requisito tão importante ao entendimento quanto normalmente se supõe. Não precisamos saber tudo sobre determinada coisa para que possamos entendê-la. Uma montanha de fatos pode provocar o efeito contrário, isto é, pode servir de obstáculo ao entendimento. Há uma sensação, hoje em dia, de que temos acesso a muitos fatos, mas não necessariamente ao entendimento desses fatos.

Uma das causas dessa situação é que a própria mídia é projetada para tornar o pensamento algo desnecessário - embora, é claro, isso seja apenas mera impressão. O ato de empacotar ideias e opiniões intelectuais é uma atividade à qual algumas das mentes mais brilhantes se dedicam com grande diligência. O telespectador, o ouvinte, o leitor de revistas - todos eles se defrontam com um amálgama de elementos complexos, desde discursos retóricos minuciosamente planejados até dados estatísticos cuidadosamente selecionados, cujo objetivo é facilitar o ato de "formar a opinião" das pessoas com esforço e dificuldade mínimos. Por vezes, no entanto, o empacotamento é feito de maneira tão eficiente, tão condensada, que o telespectador, o ouvinte ou o leitor não conseguem formar sua opinião. Em vez disso, a opinião empacotada é introjetada em sua mente mais ou menos como uma gravação é inserida no aparelho de som. No momento apropriado, aperta-se o play e a opinião é "tocada". Eles reproduzem a opinião sem terem pensado a respeito.

-

@ cae03c48:2a7d6671

2025-05-27 18:01:39

@ cae03c48:2a7d6671

2025-05-27 18:01:39Bitcoin Magazine

Cake Wallet Introduces PayJoin v2, Increasing Bitcoin Privacy For The MassesCake Wallet, a non-custodial open-source wallet for cryptocurrencies, has officially launched PayJoin v2, becoming the first major mobile wallet to offer Bitcoin silent payments to everyday users.

This integration introduces a protocol upgrade that disrupts blockchain surveillance by mixing transaction inputs from both the sender and receiver, undermining the common blockchain surveillance techniques chain analysts typically rely on.

JUST LAUNCHED: Cake Wallet v4.28.0 brings Bitcoin Payjoin v2!

JUST LAUNCHED: Cake Wallet v4.28.0 brings Bitcoin Payjoin v2! • No need for both parties to be online

• No server required

• Just a few taps in your walletIt's that simple

Update Cake Wallet to try it out! pic.twitter.com/IjOccnBYy7

Update Cake Wallet to try it out! pic.twitter.com/IjOccnBYy7— Cake Wallet (@cakewallet) May 19, 2025

“Bitcoin is open and permissionless — but without privacy, it’s a surveillance tool,” said Vikrant Sharma, CEO of Cake Wallet in a recent press release sent to Bitcoin Magazine. “This upgrade gives everyday users the ability to transact privately, without needing to be online or run a server.”

Cake Wallet’s implementation removes the limitation of requiring both parties to be online or run a server to coordinate a transaction. Users can now send or receive Bitcoin through asynchronous, serverless PayJoin transactions—no Tor, no apps, no advanced configuration.

“This makes Bitcoin privacy accessible to people who aren’t developers or hardcore cypherpunks,” said Sharma. “We’ve seen huge progress with Monero privacy tools. Now, Bitcoin users can take a step towards privacy as well, built right into a mainstream wallet.”

This announcement follows closely on the heels of another major privacy upgrade: Cake Wallet recently became one of the first major wallets to support Silent Payments, allowing users to receive Bitcoin without exposing a reusable address.

This post Cake Wallet Introduces PayJoin v2, Increasing Bitcoin Privacy For The Masses first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ c631e267:c2b78d3e

2025-05-16 18:40:18

@ c631e267:c2b78d3e

2025-05-16 18:40:18Die zwei mächtigsten Krieger sind Geduld und Zeit. \ Leo Tolstoi

Zum Wohle unserer Gesundheit, unserer Leistungsfähigkeit und letztlich unseres Glücks ist es wichtig, die eigene Energie bewusst zu pflegen. Das gilt umso mehr für an gesellschaftlichen Themen interessierte, selbstbewusste und kritisch denkende Menschen. Denn für deren Wahrnehmung und Wohlbefinden waren und sind die rasanten, krisen- und propagandagefüllten letzten Jahre in Absurdistan eine harte Probe.

Nur wer regelmäßig Kraft tankt und Wege findet, mit den Herausforderungen umzugehen, kann eine solche Tortur überstehen, emotionale Erschöpfung vermeiden und trotz allem zufrieden sein. Dazu müssen wir erkunden, was uns Energie gibt und was sie uns raubt. Durch Selbstreflexion und Achtsamkeit finden wir sicher Dinge, die uns erfreuen und inspirieren, und andere, die uns eher stressen und belasten.

Die eigene Energie ist eng mit unserer körperlichen und mentalen Gesundheit verbunden. Methoden zur Förderung der körperlichen Gesundheit sind gut bekannt: eine ausgewogene Ernährung, regelmäßige Bewegung sowie ausreichend Schlaf und Erholung. Bei der nicht minder wichtigen emotionalen Balance wird es schon etwas komplizierter. Stress abzubauen, die eigenen Grenzen zu kennen oder solche zum Schutz zu setzen sowie die Konzentration auf Positives und Sinnvolles wären Ansätze.

Der emotionale ist auch der Bereich, über den «Energie-Räuber» bevorzugt attackieren. Das sind zum Beispiel Dinge wie Überforderung, Perfektionismus oder mangelhafte Kommunikation. Social Media gehören ganz sicher auch dazu. Sie stehlen uns nicht nur Zeit, sondern sind höchst manipulativ und erhöhen laut einer aktuellen Studie das Risiko für psychische Probleme wie Angstzustände und Depressionen.

Geben wir negativen oder gar bösen Menschen keine Macht über uns. Das Dauerfeuer der letzten Jahre mit Krisen, Konflikten und Gefahren sollte man zwar kennen, darf sich aber davon nicht runterziehen lassen. Das Ziel derartiger konzertierter Aktionen ist vor allem, unsere innere Stabilität zu zerstören, denn dann sind wir leichter zu steuern. Aber Geduld: Selbst vermeintliche «Sonnenköniginnen» wie EU-Kommissionspräsidentin von der Leyen fallen, wenn die Zeit reif ist.

Es ist wichtig, dass wir unsere ganz eigenen Bedürfnisse und Werte erkennen. Unsere Energiequellen müssen wir identifizieren und aktiv nutzen. Dazu gehören soziale Kontakte genauso wie zum Beispiel Hobbys und Leidenschaften. Umgeben wir uns mit Sinnhaftigkeit und lassen wir uns nicht die Energie rauben!

Mein Wahlspruch ist schon lange: «Was die Menschen wirklich bewegt, ist die Kultur.» Jetzt im Frühjahr beginnt hier in Andalusien die Zeit der «Ferias», jener traditionellen Volksfeste, die vor Lebensfreude sprudeln. Konzentrieren wir uns auf die schönen Dinge und auf unsere eigenen Talente – soziale Verbundenheit wird helfen, unsere innere Kraft zu stärken und zu bewahren.

[Titelbild: Pixabay]

Dieser Beitrag wurde mit dem Pareto-Client geschrieben und ist zuerst auf Transition News erschienen.

-

@ 9e9085e9:2056af17

2025-05-27 17:16:22

@ 9e9085e9:2056af17

2025-05-27 17:16:22Market Overview

As of May 27, 2025, Bitcoin (BTC) is trading at approximately $110,387, reflecting a modest 0.8% daily gain.

24-Hour Range: $108,291 – $110,415

Recent High: $111,970

Support Level to Watch: $105,700

Bullish Target: $135,000 (based on analyst projections)

The market remains optimistic ahead of the Bitcoin 2025 Conference in Las Vegas, sparking renewed interest and speculation.

Impact on Decentralized Social Media

Bitcoin’s strong performance is influencing decentralized social platforms in multiple ways:

- Increased Engagement

Platforms like Nostr, Mastodon, and others are seeing a spike in activity. Users are sharing price charts, engaging in Bitcoin discourse, and posting market-related content.

- Monetization Opportunities

Creators on decentralized networks are leveraging Bitcoin-based tipping, NFT-based publishing, and tokenized rewards to monetize content more effectively.

- Community Growth

Positive sentiment is drawing in new users and developers, contributing to the growth of decentralized ecosystems and innovation in peer-to-peer social tech.

Strategic Highlights

Trump Media & Technology Group aims to raise $2.5 billion to build a Bitcoin treasury, signaling strong institutional interest.

The U.S. is reportedly establishing a Strategic Bitcoin Reserve, underscoring digital currency’s growing relevance at the national level.

#Bitcoin #BTC #CryptoNews #Web3 #DecentralizedSocialMedia #Nostr #Yakihonne #CryptoCommunity #BitcoinUpdate #BTC2025 #DigitalFreedom #ContentCuration #Hackathon #SocialFi

-

@ c631e267:c2b78d3e

2025-05-10 09:50:45

@ c631e267:c2b78d3e

2025-05-10 09:50:45Information ohne Reflexion ist geistiger Flugsand. \ Ernst Reinhardt

Der lateinische Ausdruck «Quo vadis» als Frage nach einer Entwicklung oder Ausrichtung hat biblische Wurzeln. Er wird aber auch in unserer Alltagssprache verwendet, laut Duden meist als Ausdruck von Besorgnis oder Skepsis im Sinne von: «Wohin wird das führen?»

Der Sinn und Zweck von so mancher politischen Entscheidung erschließt sich heutzutage nicht mehr so leicht, und viele Trends können uns Sorge bereiten. Das sind einerseits sehr konkrete Themen wie die zunehmende Militarisierung und die geschichtsvergessene Kriegstreiberei in Europa, deren Feindbildpflege aktuell beim Gedenken an das Ende des Zweiten Weltkriegs beschämende Formen annimmt.

Auch das hohe Gut der Schweizer Neutralität scheint immer mehr in Gefahr. Die schleichende Bewegung der Eidgenossenschaft in Richtung NATO und damit weg von einer Vermittlerposition erhält auch durch den neuen Verteidigungsminister Anschub. Martin Pfister möchte eine stärkere Einbindung in die europäische Verteidigungsarchitektur, verwechselt bei der Argumentation jedoch Ursache und Wirkung.

Das Thema Gesundheit ist als Zugpferd für Geschäfte und Kontrolle offenbar schon zuverlässig etabliert. Die hauptsächlich privat finanzierte Weltgesundheitsorganisation (WHO) ist dabei durch ein Netzwerk von sogenannten «Collaborating Centres» sogar so weit in nationale Einrichtungen eingedrungen, dass man sich fragen kann, ob diese nicht von Genf aus gesteuert werden.

Das Schweizer Bundesamt für Gesundheit (BAG) übernimmt in dieser Funktion ebenso von der WHO definierte Aufgaben und Pflichten wie das deutsche Robert Koch-Institut (RKI). Gegen die Covid-«Impfung» für Schwangere, die das BAG empfiehlt, obwohl es fehlende wissenschaftliche Belege für deren Schutzwirkung einräumt, formiert sich im Tessin gerade Widerstand.

Unter dem Stichwort «Gesundheitssicherheit» werden uns die Bestrebungen verkauft, essenzielle Dienste mit einer biometrischen digitalen ID zu verknüpfen. Das dient dem Profit mit unseren Daten und führt im Ergebnis zum Verlust unserer demokratischen Freiheiten. Die deutsche elektronische Patientenakte (ePA) ist ein Element mit solchem Potenzial. Die Schweizer Bürger haben gerade ein Referendum gegen das revidierte E-ID-Gesetz erzwungen. In Thailand ist seit Anfang Mai für die Einreise eine «Digital Arrival Card» notwendig, die mit ihrer Gesundheitserklärung einen Impfpass «durch die Hintertür» befürchten lässt.

Der massive Blackout auf der iberischen Halbinsel hat vermehrt Fragen dazu aufgeworfen, wohin uns Klimawandel-Hysterie und «grüne» Energiepolitik führen werden. Meine Kollegin Wiltrud Schwetje ist dem nachgegangen und hat in mehreren Beiträgen darüber berichtet. Wenig überraschend führen interessante Spuren mal wieder zu internationalen Großbanken, Globalisten und zur EU-Kommission.

Zunehmend bedenklich ist aber ganz allgemein auch die manifestierte Spaltung unserer Gesellschaften. Angesichts der tiefen und sorgsam gepflegten Gräben fällt es inzwischen schwer, eine zukunftsfähige Perspektive zu erkennen. Umso begrüßenswerter sind Initiativen wie die Kölner Veranstaltungsreihe «Neue Visionen für die Zukunft». Diese möchte die Diskussionskultur reanimieren und dazu beitragen, dass Menschen wieder ohne Angst und ergebnisoffen über kontroverse Themen der Zeit sprechen.

Quo vadis – Wohin gehen wir also? Die Suche nach Orientierung in diesem vermeintlichen Chaos führt auch zur Reflexion über den eigenen Lebensweg. Das ist positiv insofern, als wir daraus Kraft schöpfen können. Ob derweil der neue Papst, dessen «Vorgänger» Petrus unsere Ausgangsfrage durch die christliche Legende zugeschrieben wird, dabei eine Rolle spielt, muss jede/r selbst wissen. Mir persönlich ist allein schon ein Führungsanspruch wie der des Petrusprimats der römisch-katholischen Kirche eher suspekt.

[Titelbild: Pixabay]

Dieser Beitrag wurde mit dem Pareto-Client geschrieben und ist zuerst auf Transition News erschienen.

-

@ 9e9085e9:2056af17

2025-05-27 16:58:28

@ 9e9085e9:2056af17

2025-05-27 16:58:28Part 2: Community Impact & Key Milestones

How Yakihonne Benefits the Community

Yakihonne is more than an app—it's a platform for freedom and self-expression. Here’s how it empowers its users and community:

Censorship-Resistant Communication Say what matters without fear of shadowbans or takedowns.

Privacy and Data Control You own your data—no tracking, no selling, no manipulation.

Peer-to-Peer Support for Creators With Bitcoin Lightning tipping, fans can directly support creators without needing middlemen.

Open Participation Developers, artists, and builders can all contribute to the network through the open Nostr protocol.

Milestones (You can update these with exact dates later)

Platform Launch: [Insert Date]

1,000+ Users Joined: [Insert Date]

Key Feature Rollouts (Chats, Groups, Tips): [Insert Date]

Yakihonne #Yakihonne #Yakihonne #Nostr #Nostr #YoungDfx

-

@ da8b7de1:c0164aee

2025-05-27 15:09:54

@ da8b7de1:c0164aee

2025-05-27 15:09:54Globális nukleáris reneszánsz és új kapacitások

A 2025-ös év a globális nukleáris energiaipar újabb lendületét hozza, amit a Nemzetközi Energiaügynökség (IEA) is megerősít: rekordtermelés várható, jelenleg több mint 70 GW új nukleáris kapacitás épül világszerte, és több mint 40 ország tervezi a nukleáris energia szerepének növelését az energiamixében. A világ számos pontján – Kínában, az Egyesült Államokban, Indiában, az Egyesült Arab Emírségekben és Franciaországban – új blokkok csatlakoznak a hálózatra, miközben nyolc új egység építése is elindult. A cél, hogy 2050-re a jelenlegi 416 GW globális nukleáris kapacitás meghaladja az 1000 GW-ot, ami elengedhetetlen a klímavédelmi és energiabiztonsági célok teljesítéséhez[vg.hu][paks2.hu].

SMR-ek: technológiai áttörés és globális terjeszkedés

A kis moduláris reaktorok (SMR) forradalmasíthatják az iparágat: ezek a kompakt, előregyártott, gyorsan telepíthető egységek különösen alkalmasak távoli területek energiaellátására, ipari hőtermelésre vagy akár tengervíz sótalanítására is. Az SMR-ek fejlesztése világszerte zajlik, az USA, Kína, Oroszország és Európa élen jár, de már több mint 17 országban terveznek ilyen létesítményeket. 2025 májusában Oroszország és Üzbegisztán történelmi megállapodást kötött hat RITM-200N típusú SMR építéséről, amely az első ilyen egység lesz Közép-Ázsiában. Az Egyesült Arab Emírségekben és az USA-ban is új SMR-projektek indulnak, például a Tennessee Valley Authority hivatalosan is engedélyt kért egy BWRX-300 típusú SMR-re a Clinch River telephelyen[makronom.eu][world-nuclear-news.org][nucnet.org].

Nukleáris üzemanyag-ellátás és ellátásbiztonság

Az orosz-ukrán háború és az ellátásbiztonsági kockázatok miatt Európában is felgyorsult az alternatív nukleáris üzemanyag-beszállítók keresése. Franciaországban az EDF, az Orano és az amerikai Westinghouse tárgyalásokat folytat egy új, nyugat-európai üzemanyag-feldolgozó létesítmény létrehozásáról, hogy csökkentsék az orosz függőséget. Az Európai Bizottság részletes útmutatót adott ki az orosz nukleáris technológiákról való leválásról, de a tagállamok jelentős készleteket halmoztak fel orosz üzemanyagból, mivel az azonnali leválás az energiabiztonságot veszélyeztetné[pakspress.hu][nucnet.org].

Technológiai innovációk és üzemanyagciklus-zárás

A gyorsneutronos reaktorok és a MOX-üzemanyag alkalmazása új távlatokat nyit a nukleáris hulladék mennyiségének és veszélyességének csökkentésében, valamint a földi uránkészletek hatékonyabb felhasználásában. Az orosz BN–800 gyorsreaktor már kizárólag kevert, urán-plutónium MOX-üzemanyagot használ, és folyamatban van a BN–1200 típusú egység fejlesztése is. Ezek a fejlesztések a zárt üzemanyagciklus megvalósítását célozzák, amely jelentősen csökkentheti a végleges elhelyezésre kerülő sugárzó hulladék mennyiségét és kezelési költségeit[vg.hu].

Nukleáris energia és digitális infrastruktúra

Az adatközpontok növekvő energiaigénye miatt egyre több technológiai vállalat fordul az atomenergia felé. Az amerikai Oklo és az RPower, valamint a Deep Fission és az Endeavour együttműködése révén föld alatti SMR-eket telepítenek adatközpontok energiaellátására. Ezek a projektek kiemelik a nukleáris energia szerepét a digitális infrastruktúra fenntartható működtetésében[nucnet.org].

Piaci kilátások és geopolitikai kihívások

A Cameco vezérigazgatója szerint a globális nukleáris keresletet nem befolyásolják jelentősen a kereskedelmi vagy geopolitikai feszültségek, mivel a reaktorokra világszerte szükség van, még magasabb költségek vagy vámok mellett is. A magántőke beáramlása, az új szabályozási reformok (pl. az USA-ban az ADVANCE törvény), valamint a nemzetközi együttműködések mind hozzájárulnak az iparág hosszú távú stabilitásához és bővüléséhez[world-nuclear-news.org][nucnet.org].

Források:

world-nuclear-news.org

nucnet.org

vg.hu

makronom.eu

paks2.hu

pakspress.hu -

@ 0fab798f:2752acff

2025-05-27 16:43:40

@ 0fab798f:2752acff

2025-05-27 16:43:40

In the heart of Africa’s digital uprising, Nigeria stands tall as one of the most crypto-curious nations on the planet. For many of us dreamers, builders, hustlers, crypto isn’t just a buzzword. It’s a lifeline. A path out of unemployment. A rebellion against the old financial system. A shot at freedom.

But here’s the hard truth: freedom without protection is exposure>

The recent $1.5 billion Ethereum heist — orchestrated by North Korea’s notorious Lazarus Group — didn’t just shake the crypto world. It shattered any illusions we might still have that blockchain alone can save us. If a juggernaut like Bybit can fall, what hope does the everyday Nigerian creative or crypto enthusiast have?

Let’s not sugarcoat it. This is war, a cyber war. And we must learn how to defend ourselves.

What the Heist Taught Us

- Security is not optional, it’s foundational.

- If you’re building in Web3, minting NFTs, or trading tokens, you’re a target. Use cold wallets. Enable 2FA. Don’t store your life savings on exchanges. Paranoia might just save your wallet.

- Don’t fall for vibes.

- Read smart contracts. Study tokenomics. If a project looks too clean, dig deeper. In crypto, vibes alone won’t protect your funds.

- Educate before you speculate.

- Everyone wants the bag, but not everyone reads the blueprint. Before you ape in, understand the tech. That’s how you stay alive in the jungle.* * *

For the Builders, the Artists, the Rebels

We’re not just investors. We’re architects of the future, launching NFT marketplaces, building DeFi protocols, designing metaverse spaces that blend culture, identity, and code. But here’s the kicker: even the most beautiful idea can burn if it’s built on shaky security.

What we need now isn’t just innovation,it’s insulation.

Form collectives: Learn together, audit each other’s code, build firewalls around our ideas.

Pressure regulators to evolve: Not to stifle us, but to protect the creative economy rising from the streets of Lagos, Port Harcourt, Enugu, Kano.

Go open-source: The more transparent we build, the harder it is for bad actors to hide.

Yakihonne Fam, Let’s Talk

This is more than a headline!

We can either continue building shiny dApps with no shields, or we can become cyber-aware architects of a truly secure digital future. One where Nigerian youth don’t just participate in Web3 — we define it.

The heist should wake us up, not wipe us out.

So the question is: will we build castles or fortresses?

Let’s choose wisely.

-

@ 94e2c22d:d50b08a3

2025-05-27 18:33:13

@ 94e2c22d:d50b08a3

2025-05-27 18:33:13Night photography opens up a whole new dimension of creativity—and with a bit of know-how, your camera becomes a tool for painting with light. Whether you're a curious beginner or looking to refine your technique, these 12 practical tips will help you get started on the right foot. From gear choices to artistic mindset, here’s what you need to know.

-

Know Your Gear – Learn how to operate your camera in complete darkness. You should be comfortable using settings like ISO, aperture, and manual focus without relying on the display.

-

Understand Exposure – Manual settings are crucial. Use low ISO for noise reduction and long exposure times to capture light trails. A tripod is essential for stability.

-

Experiment and Learn – Review your images critically and learn from mistakes. Every attempt offers an opportunity to refine your technique.

-

Avoid Gear Obsession – You don’t need the latest camera. Even basic models can produce impressive results with the right approach.

-

Pack Light – Carry minimal equipment to stay flexible and creative. Too many tools can hinder spontaneity.

-

Use Prime Lenses – Fixed focal length lenses often deliver better quality and let in more light. They also force you to think more about composition.

-

Create Images on Site – Aim to achieve effects in-camera, not later through editing. This improves your skills and leads to more authentic outcomes.

-

See It as a Journey – Be patient and enjoy the process. Your artistic voice will develop over time.

-

Set Goals – Give yourself creative challenges or themes to stay motivated.

-

Plan Your Shoots – Research your location and check weather and moonlight conditions in advance. This minimizes wasted time and frustration.

-

Get Inspired by Others – Study the work of other light painters or night photographers. Join communities to share experiences and gather new ideas.

-

Question the Rules – Creativity often involves breaking away from norms. Don’t be afraid to try unconventional techniques or styles.

Night photography and light painting are not just technical exercises—they're a playful exploration of light, time, and creativity. Don’t stress about perfection. Instead, enjoy the process, embrace the learning curve, and let your imagination run wild. With a bit of patience and these tips in your toolkit, you're well on your way to capturing the magic of the light at night.

Picture created by: Kim Von Coels / Model: Mafu Fuma

-

-

@ bf47c19e:c3d2573b

2025-05-26 16:56:52

@ bf47c19e:c3d2573b

2025-05-26 16:56:52Dragi Bitcoineri,

Kako se bliži treći mesec izostanka ličnog dohotka na Fakultetu dramskih umetnosti u Beogradu, a dosadašnji vidovi podrške ne mogu da pokriju sve profesore, neophodno je da preduzmemo dalje korake kako ne bi više ispaštali profesori zbog svoje otvorene podrške studentima u borbi za pravednije društvo.

Možda nekad, kad se spolja gleda, deluje kao da se ništa ne dešava na fakultetima ali u našoj zajednici konstantno vri. Borbu sa studentima osećamo kao svoju moralnu i građansku dužnost, a namera nam je da istrajemo na tom putu ka instuitucionalnoj odgovornosti, slobodi i pravdi.

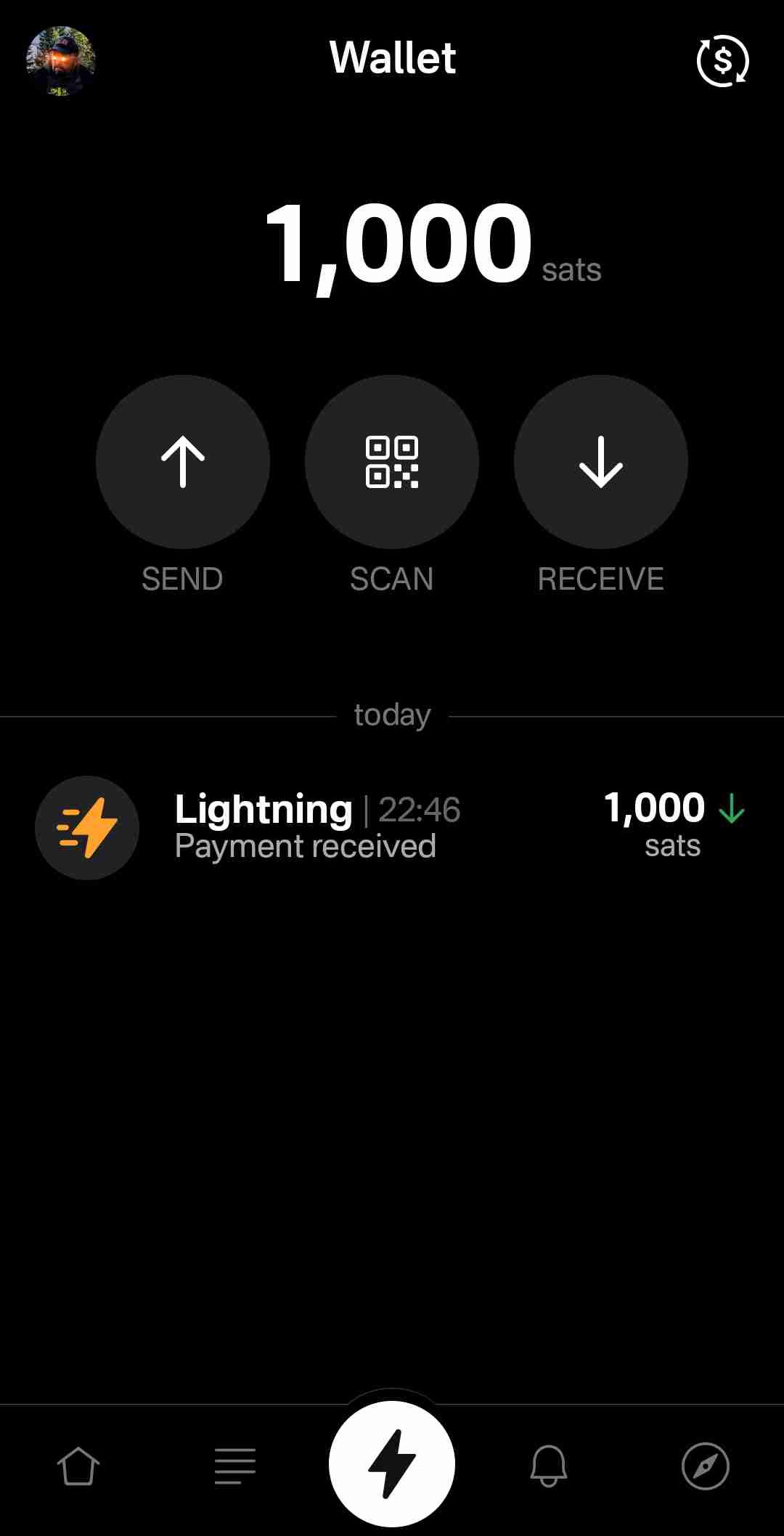

Doniraj BTC! Sve donacije idu u Bitcoin novčanik studenata u blokadi FDU! Hvala unapred ❤️

-

@ da8b7de1:c0164aee

2025-05-26 15:15:56

@ da8b7de1:c0164aee

2025-05-26 15:15:56Technológiai fejlemények

Az Egyesült Államokban Donald Trump négy végrehajtási rendeletet írt alá, amelyek célja a nukleáris ipar gyors fejlesztése és az ország nukleáris kapacitásának 2050-ig történő megnégyszerezése. Ezek a rendeletek támogatják az új generációs reaktorok – különösen a kisméretű moduláris reaktorok (SMR-ek) és mikroreaktorok – gyorsabb engedélyezését és telepítését, beleértve katonai létesítményeket és mesterséges intelligenciát használó adatközpontokat is. Továbbá lehetővé teszik a használt nukleáris üzemanyag újrahasznosítását, valamint ösztönzik a HALEU (magas tisztaságú, alacsony dúsítású urán) hazai előállítását, ezzel erősítve az amerikai nukleáris ellátási láncot.

Források:

- world-nuclear-news.org

- reuters.com

- bloomberg.comIpari fejlemények

Tajvanban augusztus 23-ára tűzték ki a Maanshan-2 atomerőmű újraindításáról szóló népszavazást. Az erőművet május közepén állították le a „nukleárismentes Tajvan” program részeként, azonban az ellenzék kezdeményezésére a lakosság dönthet az újraindításról. Az USA-ban a frissen aláírt végrehajtási rendeletek egyszerűsítik az engedélyezési folyamatokat, csökkentik a szabályozási terheket, és ösztönzik a magánbefektetéseket, ami a hazai uránbányászat és feldolgozás fellendülését eredményezheti.

Források:

- taipeitimes.com

- world-nuclear-news.orgPénzügyi hatások

A pénzügyi piacokon a nukleáris szektor részvényei jelentős emelkedést mutattak a Trump-féle rendeletek bejelentése után. Az Uranium Energy részvényei 11%-kal, az Oklo Inc. papírjai 16%-kal, a Global X Uranium ETF 9%-kal erősödtek. A növekedés hátterében a szabályozási könnyítések mellett az AI adatközpontok növekvő energiaigénye áll, amelyre a nagy technológiai cégek egyre inkább a nukleáris energiát tartják a legjobb megoldásnak. A kormányzati támogatás és a technológiai vállalatok befektetései új lendületet adhatnak a nukleáris iparnak, amely évek óta küzd a gazdasági és társadalmi kihívásokkal.

Források:

- bloomberg.com

- finance.yahoo.com

- reuters.com -

@ 9e9085e9:2056af17

2025-05-27 16:36:45

@ 9e9085e9:2056af17

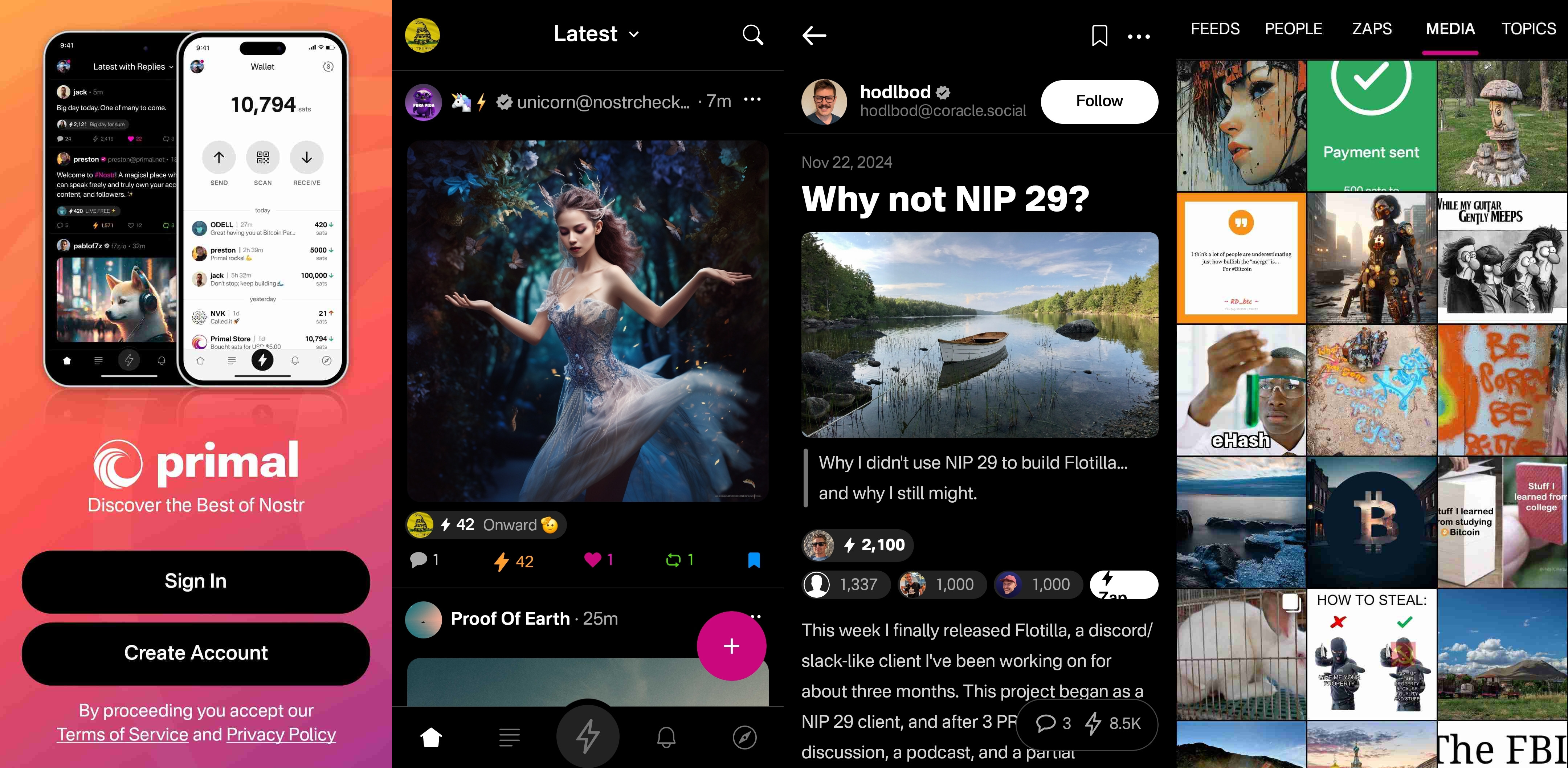

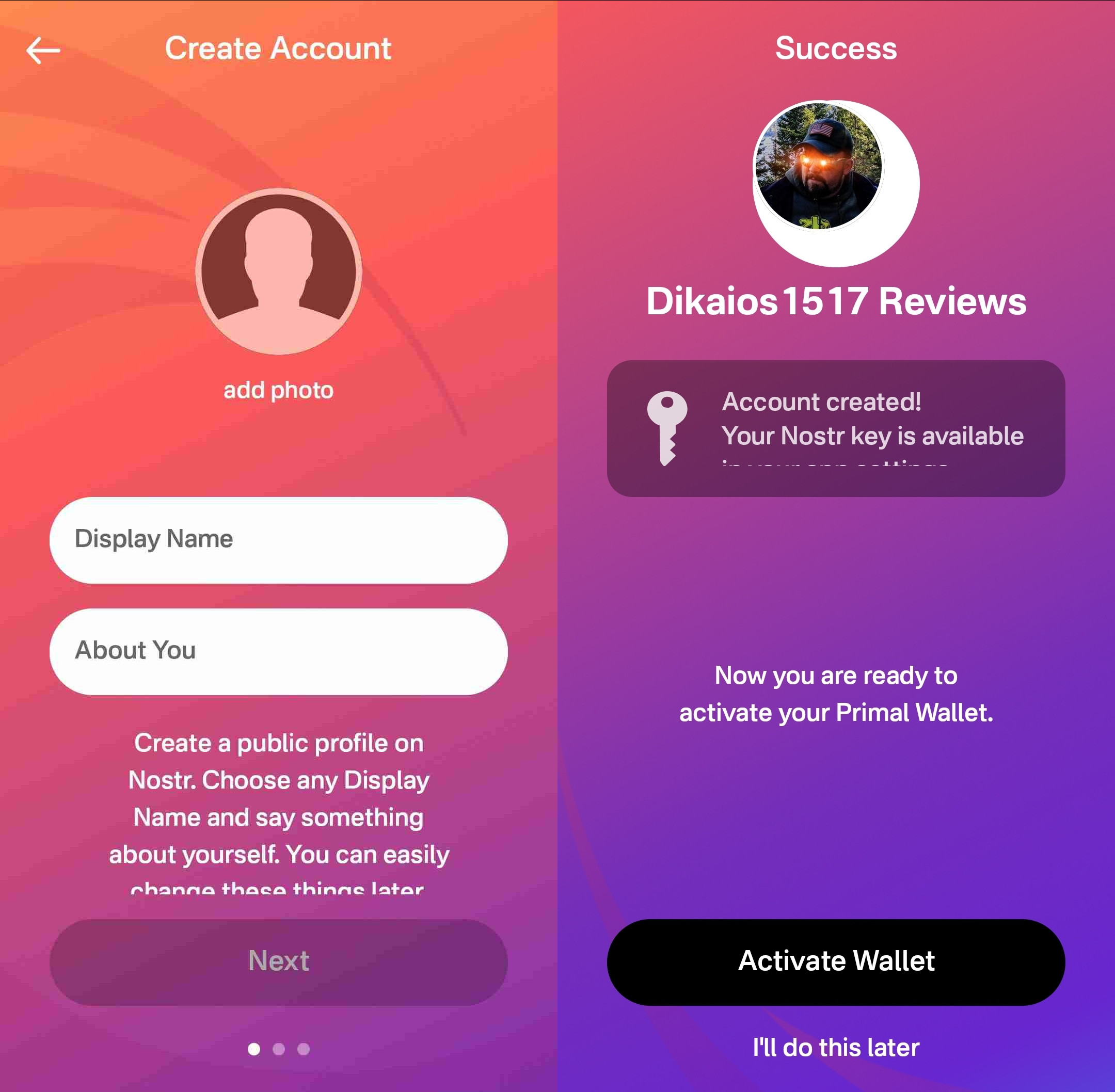

2025-05-27 16:36:45Part 1: Introducing Yakihonne and the Nostr Protocol

Yakihonne – Redefining Social Media Through Decentralization

Yakihonne is a decentralized social media platform built on the Nostr protocol (Notes and Other Stuff Transmitted by Relays). Unlike traditional social networks controlled by corporations, Yakihonne puts users in charge—your identity, content, and connections are all yours to own.

What is Nostr? Nostr is an open protocol that uses public/private key pairs to enable secure communication. Posts (called “notes”) are sent to public relays instead of being stored on a central server. This allows Yakihonne to offer:

Censorship resistance

User-owned data

Open developer participation

Yakihonne leverages this technology to create a user-first social experience: chat, share, and connect—all without gatekeepers.

Yakihonne #Yakihonne #Yakihonne #Nostr #Nostr #YoungDfx

-

@ 6a6be47b:3e74e3e1

2025-05-27 16:36:21

@ 6a6be47b:3e74e3e1

2025-05-27 16:36:21🔍 Today was one of those days where I dove deeper into the world of Stacker News, exploring how wallets work and all that jazz. If you have any tips or tricks, please send them my way—I’m still figuring it all out!

After my tech adventures, I turned to drawing. Usually, I have a lineup of ideas ready to go, but none of them quite fit my mood today. Then I remembered the butterflies from my upcoming blog entry—can you guess what I’m writing and painting about? 👀

🦋Even though I’ve painted butterflies before here’s one on Instagram, I felt like revisiting them.

This one I posted on Nostr, a while ago

Lately, I’ve been seeing butterflies everywhere on my walks with my dog, and they just felt right for today’s art session. So here’s to butterflies and their beautiful symbolism!

In Celtic mythology, there’s an old Irish saying:

“Butterflies are souls of the dead waiting to pass through Purgatory.” From mindbodygreen.com

It’s no wonder butterflies are often seen as symbols of rebirth. Even Aristotle named the butterfly:

“Psyche,” the Greek word for “soul.” From learnreligions.com

☀️With the weather warming up, days growing longer, and the air full of new scents (and butterfly sightings!🦋), I invite you to really enjoy this season. After drawing today’s butterfly, I realized how freeing it is to just let go and create—no pressure, just fun. Sometimes, taking even a few mindful minutes to do something you love can work wonders—maybe even a little magic.

Hope to catch you on the next one, frens. Godspeed! ✨

Today's butterfly. I drew it on Procreate.

https://stacker.news/items/990470

-

@ 9c9d2765:16f8c2c2

2025-05-27 16:19:12

@ 9c9d2765:16f8c2c2

2025-05-27 16:19:12CHAPTER THIRTY

“So this is what it’s come to?” Mark muttered, his voice barely audible beneath the hum of city traffic outside the courtroom. His suit was neatly pressed, but the weariness in his eyes betrayed sleepless nights. Helen stood beside him, silent for once, clutching her handbag like it was the last anchor to reality.

“Yes,” came a calm voice from behind them. They turned to see James approaching, flanked by Rita and a group of lawyers dressed in solemn black. His presence was poised, commanding, and utterly devoid of fear.

“You both built your legacy on lies,” James continued, his gaze unwavering. “It was only a matter of time before the truth surfaced.”

Helen’s composure cracked as she stepped forward. “You think this is justice, James? You think humiliating us in court will change the past?”

James gave a faint smirk. “No, Helen. But it will make sure no one else suffers because of your greed.”

The courtroom was already brimming with anticipation. Reporters filled the gallery. Spectators whispered rumors with every glance exchanged between lawyers. A judge with decades of experience presided over the case stern and unsympathetic to theatrics.

As the hearing commenced, James’s legal team presented meticulously organized evidence bank statements tracing illicit transactions to offshore accounts, leaked audio recordings of bribe negotiations, falsified media contracts, and forged internal memos. Each document was a nail in the coffin of Helen and Mark’s defense.

Rita testified, her voice calm and articulate, recounting the smear campaign orchestrated by Tracy under their instructions.

“They targeted James not just to discredit him,” she stated, looking the judge directly in the eye, “but to dismantle every ounce of credibility he had built. They used lies as weapons and fear as a shield.”

Tracy, under pressure from investigators, had also turned witness. Her statement confirmed the bribery and named both Helen and Mark as the masterminds.

“I was promised protection. They said James would be out of the picture before he could fight back,” Tracy confessed tearfully. “But I never imagined the damage we were doing.”

Mark buried his face in his hands while Helen’s facade of arrogance disintegrated in front of the press. Her voice trembled as she rose from her seat during cross-examination.

“It wasn’t meant to go this far,” she stammered. “We were just trying to protect our interests.”

The judge’s gavel struck with finality. “This court finds sufficient grounds for a full criminal trial. The charges include corporate fraud, character defamation, and financial manipulation. The accused are to remain in custody pending further proceedings.”

Gasps filled the room. Helen’s knees buckled as officers approached to take her into custody. Mark, pale and visibly shaking, didn’t resist.

As they were led away, James stood watching. Not with triumph but with quiet vindication.

Later that evening, James held a press conference at JP Enterprises. Cameras clicked and lights flashed as he stepped onto the podium.

“Today marks not a victory over enemies,” he said, his voice resonating with calm authority, “but a victory for accountability. For truth. For every hardworking individual who believes that integrity still matters in business.”

The days following the courtroom revelation were nothing short of transformative for James. What once seemed like an unending siege of betrayal and defamation now stood as a monumental testimony of perseverance. His vindication rippled through the business community, not only restoring his honor but elevating his stature to that of a symbol of resilience, truth, and quiet triumph.

The media, which had once been ravenous in its pursuit to scandalize his name, now sought exclusive interviews. Headlines changed overnight: “The President Who Defied the Odds,” “From Disgrace to Glory James’s Unrivaled Comeback,” and “Truth Prevails at JP Enterprises.”

Still, James remained composed. He declined most interview requests, only issuing a single written statement to the press:

“My silence was never a weakness, nor was my patience approved. In a world where deception moves faster than truth, I chose to let integrity do the talking. Let this be a reminder: time may delay justice, but it cannot deny it.”

In the boardroom of JP Enterprises, there was a newfound sense of reverence. Senior executives who once viewed James with reserved acknowledgment now listened with deference. Staff who had wavered in their loyalties found themselves inspired by his unshakable conviction.

Rita, reinstated officially as General Manager, transformed the company’s internal culture. She advocated for transparency, fairness, and accountability, echoing James’s values. Together, they initiated corporate reforms that would safeguard JP Enterprises against future exploitation. Employee welfare programs were improved, mentorship initiatives were introduced, and innovation was rewarded instead of suppressed.

As for Helen and Mark, the criminal proceedings dragged them through every layer of public accountability. Their assets were frozen pending investigation, and the companies they once boasted of began to crumble under the weight of distrust. The Ray family, mortified and shamed, distanced themselves completely. Robert, in particular, approached James privately, full of contrition.

“I misjudged you,” he said quietly, standing across from James in the same office where he once dismissed him. “And I know an apology may not undo what has been done… but I needed to say it.”

James, ever composed, gave a small nod. “Acknowledgment is the first step toward redemption, Robert. What you do with the rest of your journey that’s what will matter.”

Despite all the chaos, James found time to reconnect with himself. On certain evenings, he would return to the very neighborhood where he had once wandered, alone and destitute. He walked its narrow lanes not with bitterness, but gratitude. Every hardship had refined him. Every betrayal had taught him discernment.

On the sixteenth floor of JP Tower, standing before the massive glass window that overlooked the city skyline, James often stood in silence, his reflection merging with the city lights. He knew his story wasn’t merely about power or wealth, it was about transformation.

The days that followed James’s public exoneration ushered in a new chapter not only in his professional journey but also in his personal life. Amidst the rising stature and recognition, there remained unresolved threads that tugged quietly at his conscience chief among them, his estranged wife, Rita.

Though she was back in her rightful position at JP Enterprises, a wall of silence stood between them, built from years of misunderstanding, pride, and pain. Their conversations, though respectful and professional, were void of warmth. Yet, beneath her poised demeanor, James could sense her hesitation, perhaps a longing unspoken, restrained by fear of rejection or guilt over the past.

-

@ c1e9ab3a:9cb56b43

2025-05-27 16:19:06

@ c1e9ab3a:9cb56b43

2025-05-27 16:19:06Star Wars is often viewed as a myth of rebellion, freedom, and resistance to tyranny. The iconography—scrappy rebels, totalitarian stormtroopers, lone smugglers—suggests a deep anti-authoritarian ethos. Yet, beneath the surface, the narrative arc of Star Wars consistently affirms the necessity, even sanctity, of central authority. This blog entry introduces the question: Is Star Wars fundamentally a celebration of statism?

Rebellion as Restoration, Not Revolution

The Rebel Alliance’s mission is not to dismantle centralized power, but to restore the Galactic Republic—a bureaucratic, centrally governed institution. Characters like Mon Mothma and Bail Organa are high-ranking senators, not populist revolutionaries. The goal is to remove the corrupt Empire and reinstall a previous central authority, presumed to be just.

- Rebels are loyalists to a prior state structure.

- Power is not questioned, only who wields it.

Jedi as Centralized Moral Elites

The Jedi, often idealized as protectors of peace, are unelected, extra-legal enforcers of moral and military order. Their authority stems from esoteric metaphysical abilities rather than democratic legitimacy.

- They answer only to their internal Council.

- They are deployed by the Senate, but act independently of civil law.

- Their collapse is depicted as tragic not because they were unaccountable, but because they were betrayed.

This positions them as a theocratic elite, not spiritual anarchists.

Chaos and the Frontier: The Case of the Cantina

The Mos Eisley cantina, often viewed as a symbol of frontier freedom, reveals something darker. It is: - Lawless - Violent - Culturally fragmented

Conflict resolution occurs through murder, not mediation. Obi-Wan slices off a limb; Han shoots first—both without legal consequence. There is no evidence of property rights, dispute resolution, or voluntary order.

This is not libertarian pluralism—it’s moral entropy. The message: without centralized governance, barbarism reigns.

The Mythic Arc: Restoration of the Just State

Every trilogy in the saga returns to a single theme: the fall and redemption of legitimate authority.

- Prequels: Republic collapses into tyranny.

- Originals: Rebels fight to restore legitimate order.

- Sequels: Weak governance leads to resurgence of authoritarianism; heroes must reestablish moral centralism.

The story is not anti-state—it’s anti-bad state. The solution is never decentralization; it’s the return of the right ruler or order.

Conclusion: The Hidden Statism of a Rebel Myth

Star Wars wears the costume of rebellion, but tells the story of centralized salvation. It: - Validates elite moral authority (Jedi) - Romanticizes restoration of fallen governments (Republic) - Portrays decentralized zones as corrupt and savage (outer rim worlds)

It is not an anarchist parable, nor a libertarian fable. It is a statist mythology, clothed in the spectacle of rebellion. Its core message is not that power should be abolished, but that power belongs to the virtuous few.

Question to Consider:

If the Star Wars universe consistently affirms the need for centralized moral and political authority, should we continue to see it as a myth of freedom? Or is it time to recognize it as a narrative of benevolent empire? -

@ 9c9d2765:16f8c2c2

2025-05-27 16:05:22

@ 9c9d2765:16f8c2c2

2025-05-27 16:05:22CHAPTER TWENTY NINE In boardrooms, lounges, and even on social media platforms, one question echoed relentlessly: Who is this man who rose from the ashes, not just to lead, but to lead with such bold transparency?

Meanwhile, in a dimly lit office nestled deep within Ray Enterprises, Helen paced restlessly across her carpeted floor. Her heels clicked in rhythm with the tension radiating from her. Mark stood by the window, nervously peeking through the blinds as though paranoia had taken root in his very soul.

“This can’t be happening,” Helen hissed, her voice sharp with frustration. “That press conference flipped everything. Now we’re the ones under scrutiny, and James has flipped the narrative like a magician.”

Mark turned, his voice laced with disbelief. “You saw the financial reports. Investors are pulling out of our side deals. If this continues, Ray Enterprises will collapse under the weight of its own debt.”

Helen clenched her fists, her perfectly manicured nails digging into her palms. “We need leverage. Something from his past. Something real. If the rumors didn’t ruin him, maybe the truth whatever it is will.”

But unknown to them, their every word was being monitored.

Lilian, the sharp cybersecurity expert at JP Enterprises, had tapped into Helen’s office through a corrupted email file disguised as a sponsorship request. Every correspondence, every call, and every document opened since then had been recorded and encrypted. Now, James had everything he needed and more.

At JP Enterprises, James stood in the private archive room, going through printed transcriptions of the recordings. Rita entered quietly, holding another file.

“We’ve compiled a list of shell companies used to launder bribe money into media firms and anonymous accounts,” she said, placing the documents gently before him.

James glanced through the list. Names of journalists, bloggers, and even a few local politicians filled the pages.

“They thought hiding behind faceless transactions would protect them,” he said calmly. “But even shadows betray their source when the light is bright enough.”

He closed the file slowly and looked at Rita.

“Let’s prepare the evidence for the federal board. By the time I’m done, Ray Enterprises will not only owe us 85%… they’ll owe us their very survival.”

The following day, the National Corporate Regulatory Board received a sealed dossier containing proof of bribery, media manipulation, and corporate fraud complete with audio clips, transaction records, and screen captures. An anonymous tip, courtesy of The Integrity Initiative.

As the investigation began to stir, Helen and Mark received a legal summons. Panic set in like a poison. Reporters camped outside Ray Enterprises. Shareholders demanded answers. The once feared and revered duo now found themselves cornered like rats.

In a final, desperate attempt, Helen reached out to James.

She showed up at JP Enterprises’ reception uninvited, her expression soft but insincere. She was dressed in white as if to evoke purity but James saw through the façade like glass.

“James,” she began, her voice low and trembling, “I know we’ve had our differences, but let’s not destroy each other. We can fix this, together. Let’s negotiate.”

James leaned back in his chair, eyes piercing.

“Negotiate?” he echoed, a wry smile touching his lips. “When you smeared my name, tried to sabotage my company, and humiliated me in public?”

Helen faltered but held her composure.

“It was business, James. That’s all. I didn’t mean to”

James cut her off with a raised hand.

“You didn’t mean to destroy my life? Helen, you orchestrated an entire charade. You bribed people to lie. But now the charade is over. And business… has consequences.”

He reached into his drawer, pulled out a copy of the legal complaint already filed against her, and placed it in front of her.

“You have 24 hours to prepare your lawyers.”

Helen’s mask of grace fell instantly. Her hands shook as she picked up the file, her eyes scanning the lines like a woman reading her own obituary.

-

@ d360efec:14907b5f

2025-05-27 15:46:26

@ d360efec:14907b5f

2025-05-27 15:46:26 -

@ c631e267:c2b78d3e

2025-05-02 20:05:22

@ c631e267:c2b78d3e

2025-05-02 20:05:22Du bist recht appetitlich oben anzuschauen, \ doch unten hin die Bestie macht mir Grauen. \ Johann Wolfgang von Goethe

Wie wenig bekömmlich sogenannte «Ultra-Processed Foods» wie Fertiggerichte, abgepackte Snacks oder Softdrinks sind, hat kürzlich eine neue Studie untersucht. Derweil kann Fleisch auch wegen des Einsatzes antimikrobieller Mittel in der Massentierhaltung ein Problem darstellen. Internationale Bemühungen, diesen Gebrauch zu reduzieren, um die Antibiotikaresistenz bei Menschen einzudämmen, sind nun möglicherweise gefährdet.

Leider ist Politik oft mindestens genauso unappetitlich und ungesund wie diverse Lebensmittel. Die «Corona-Zeit» und ihre Auswirkungen sind ein beredtes Beispiel. Der Thüringer Landtag diskutiert gerade den Entwurf eines «Coronamaßnahmen-Unrechtsbereinigungsgesetzes» und das kanadische Gesundheitsministerium versucht, tausende Entschädigungsanträge wegen Impfnebenwirkungen mit dem Budget von 75 Millionen Dollar unter einen Hut zu bekommen. In den USA soll die Zulassung von Covid-«Impfstoffen» überdacht werden, während man sich mit China um die Herkunft des Virus streitet.

Wo Corona-Verbrecher von Medien und Justiz gedeckt werden, verfolgt man Aufklärer und Aufdecker mit aller Härte. Der Anwalt und Mitbegründer des Corona-Ausschusses Reiner Fuellmich, der seit Oktober 2023 in Untersuchungshaft sitzt, wurde letzte Woche zu drei Jahren und neun Monaten verurteilt – wegen Veruntreuung. Am Mittwoch teilte der von vielen Impfschadensprozessen bekannte Anwalt Tobias Ulbrich mit, dass er vom Staatsschutz verfolgt wird und sich daher künftig nicht mehr öffentlich äußern werde.

Von der kommenden deutschen Bundesregierung aus Wählerbetrügern, Transatlantikern, Corona-Hardlinern und Russenhassern kann unmöglich eine Verbesserung erwartet werden. Nina Warken beispielsweise, die das Ressort Gesundheit übernehmen soll, diffamierte Maßnahmenkritiker als «Coronaleugner» und forderte eine Impfpflicht, da die wundersamen Injektionen angeblich «nachweislich helfen». Laut dem designierten Außenminister Johann Wadephul wird Russland «für uns immer der Feind» bleiben. Deswegen will er die Ukraine «nicht verlieren lassen» und sieht die Bevölkerung hinter sich, solange nicht deutsche Soldaten dort sterben könnten.

Eine wichtige Personalie ist auch die des künftigen Regierungssprechers. Wenngleich Hebestreit an Arroganz schwer zu überbieten sein wird, dürfte sich die Art der Kommunikation mit Stefan Kornelius in der Sache kaum ändern. Der Politikchef der Süddeutschen Zeitung «prägte den Meinungsjournalismus der SZ» und schrieb «in dieser Rolle auch für die Titel der Tamedia». Allerdings ist, anders als noch vor zehn Jahren, die Einbindung von Journalisten in Thinktanks wie die Deutsche Atlantische Gesellschaft (DAG) ja heute eher eine Empfehlung als ein Problem.

Ungesund ist definitiv auch die totale Digitalisierung, nicht nur im Gesundheitswesen. Lauterbachs Abschiedsgeschenk, die «abgesicherte» elektronische Patientenakte (ePA) ist völlig überraschenderweise direkt nach dem Bundesstart erneut gehackt worden. Norbert Häring kommentiert angesichts der Datenlecks, wer die ePA nicht abwähle, könne seine Gesundheitsdaten ebensogut auf Facebook posten.

Dass die staatlichen Kontrolleure so wenig auf freie Software und dezentrale Lösungen setzen, verdeutlicht die eigentlichen Intentionen hinter der Digitalisierungswut. Um Sicherheit und Souveränität geht es ihnen jedenfalls nicht – sonst gäbe es zum Beispiel mehr Unterstützung für Bitcoin und für Initiativen wie die der Spar-Supermärkte in der Schweiz.

[Titelbild: Pixabay]

Dieser Beitrag wurde mit dem Pareto-Client geschrieben und ist zuerst auf Transition News erschienen.

-

@ bf47c19e:c3d2573b

2025-05-27 14:57:56

@ bf47c19e:c3d2573b

2025-05-27 14:57:56Srpski prevod knjige "The Little Bitcoin Book"

Zašto je Bitkoin bitan za vašu slobodu, finansije i budućnost?

Verovatno ste čuli za Bitkoin u vestima ili da o njemu raspravljaju vaši prijatelji ili kolege. Kako to da se cena stalno menja? Da li je Bitkoin dobra investicija? Kako to uopšte ima vrednost? Zašto ljudi stalno govore o tome kao da će promeniti svet?

"Mala knjiga o Bitkoinu" govori o tome šta nije u redu sa današnjim novcem i zašto je Bitkoin izmišljen da obezbedi alternativu trenutnom sistemu. Jednostavnim rečima opisuje šta je Bitkoin, kako funkcioniše, zašto je vredan i kako utiče na individualnu slobodu i mogućnosti ljudi svuda - od Nigerije preko Filipina do Venecuele do Sjedinjenih Država. Ova knjiga takođe uključuje odeljak "Pitanja i odgovori" sa nekim od najčešće postavljanih pitanja o Bitkoinu.

Ako želite da saznate više o ovom novom obliku novca koji i dalje izaziva interesovanje i usvajanje širom sveta, onda je ova knjiga za vas.

-

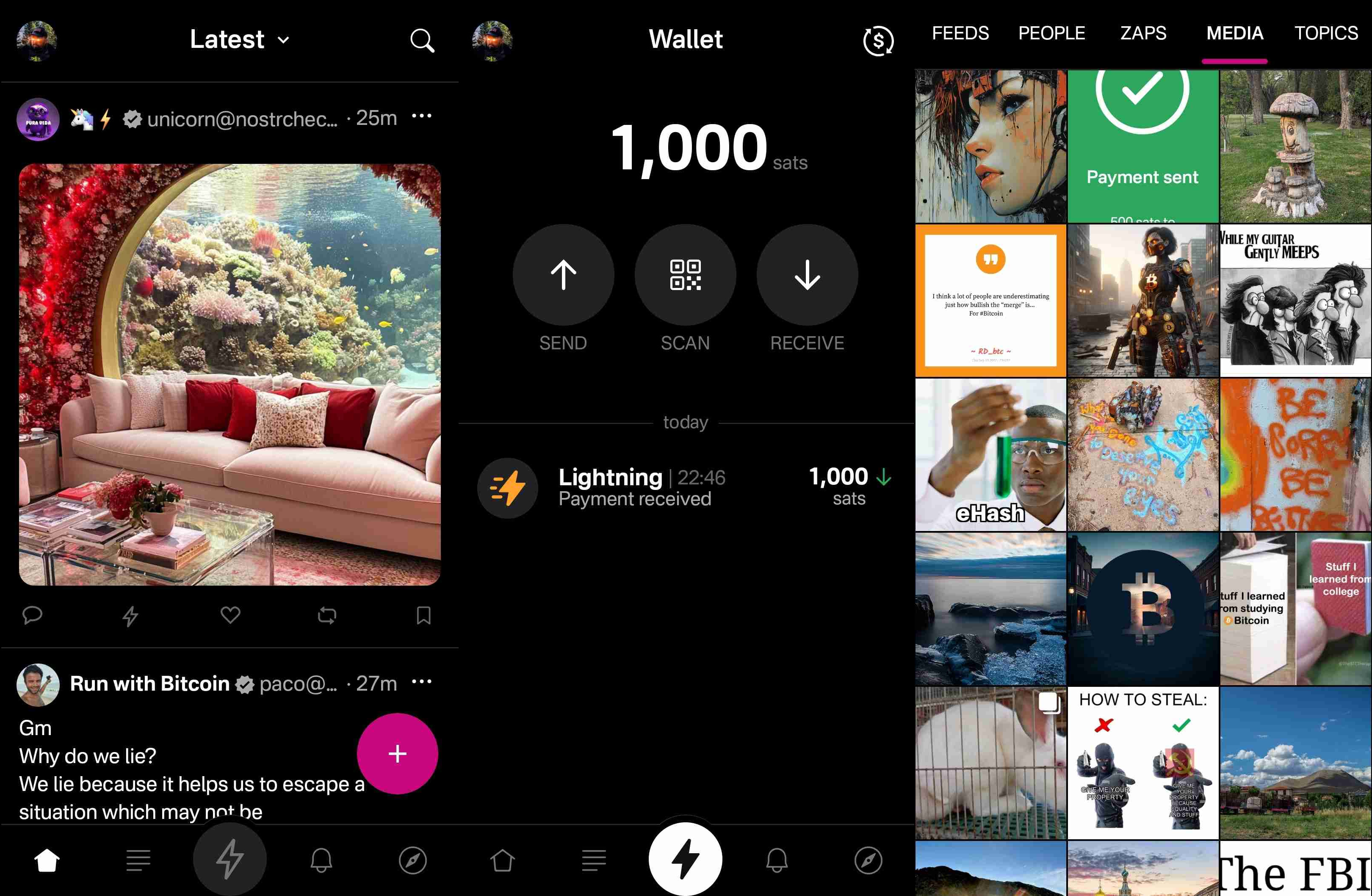

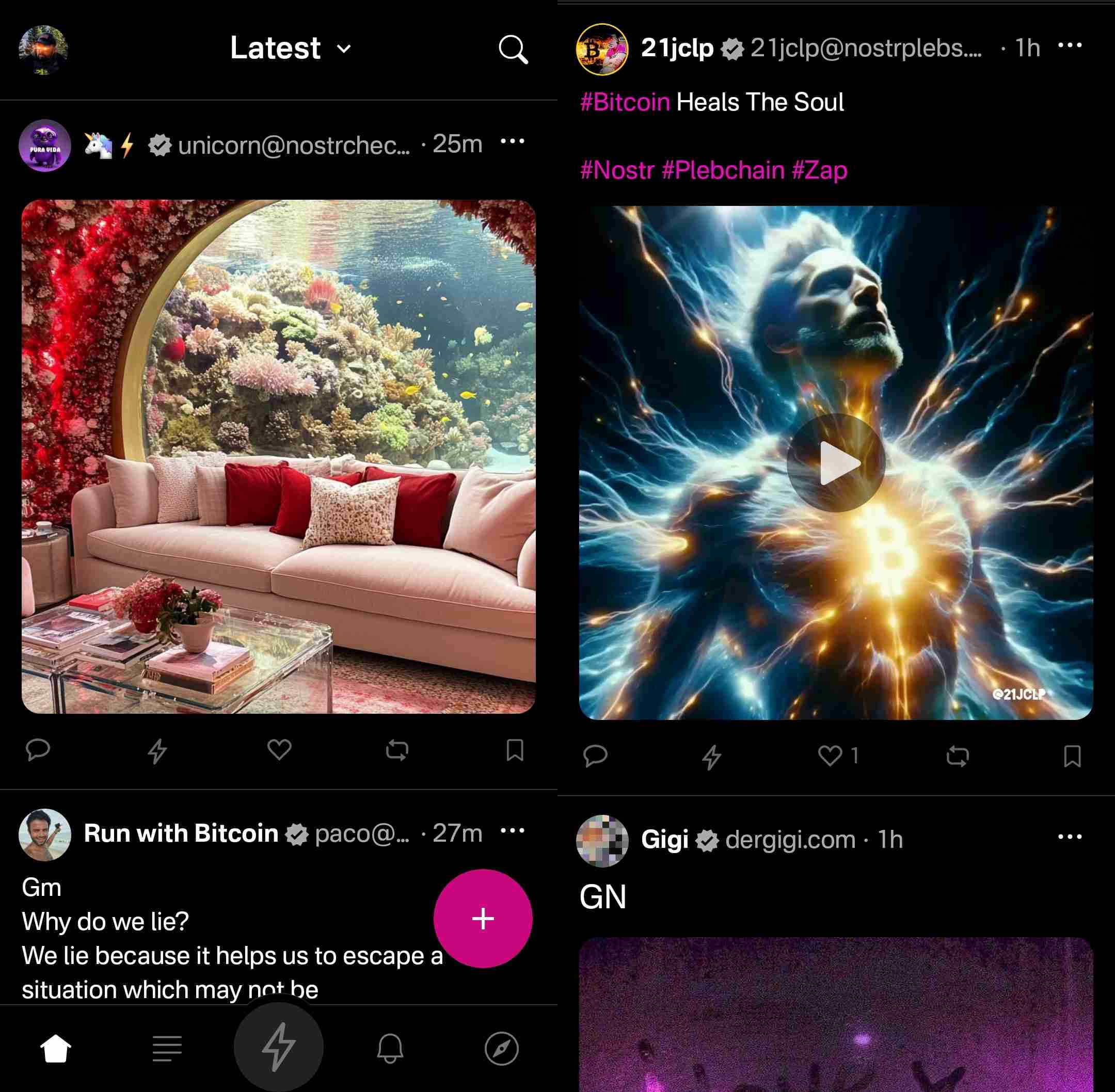

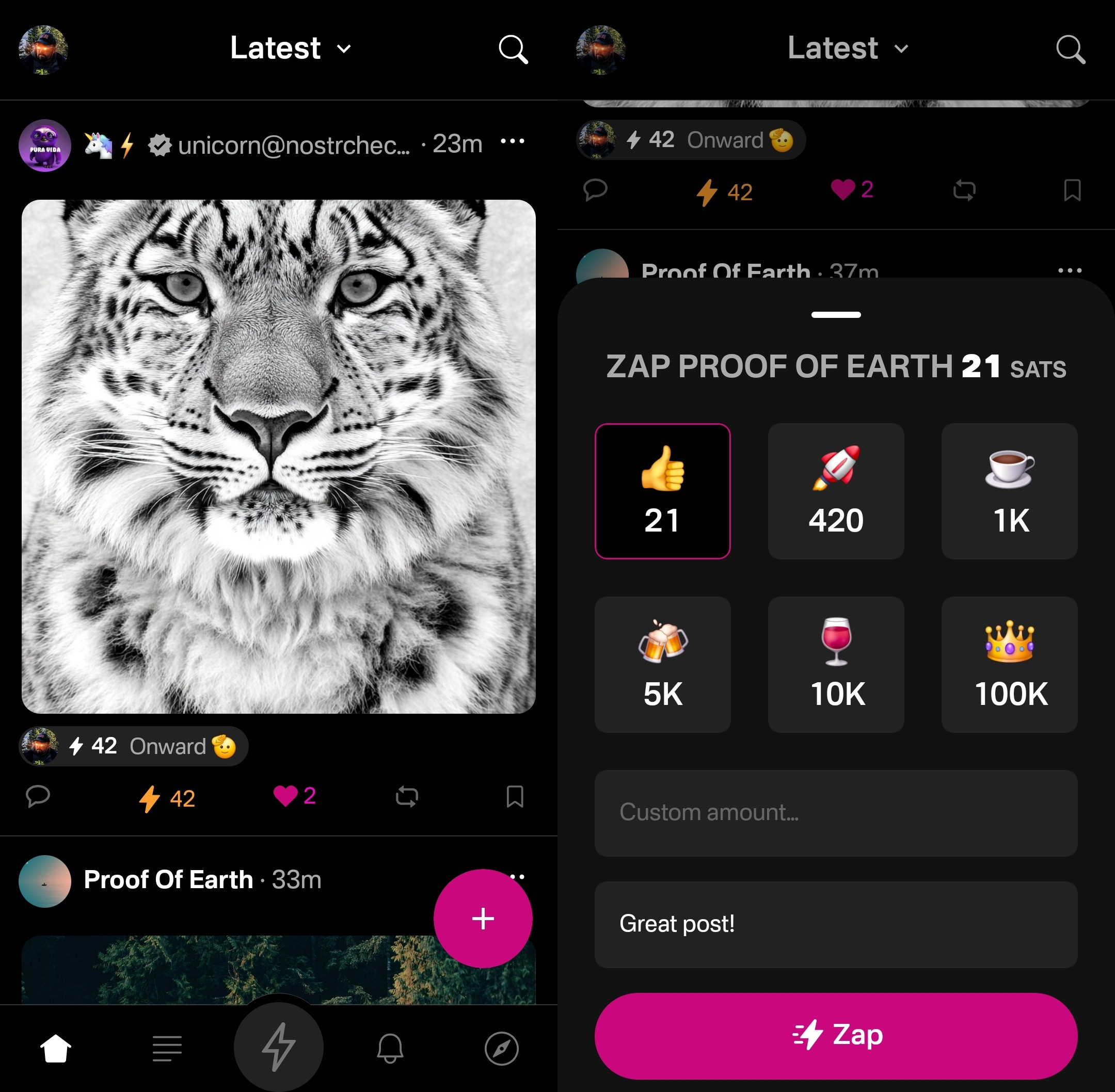

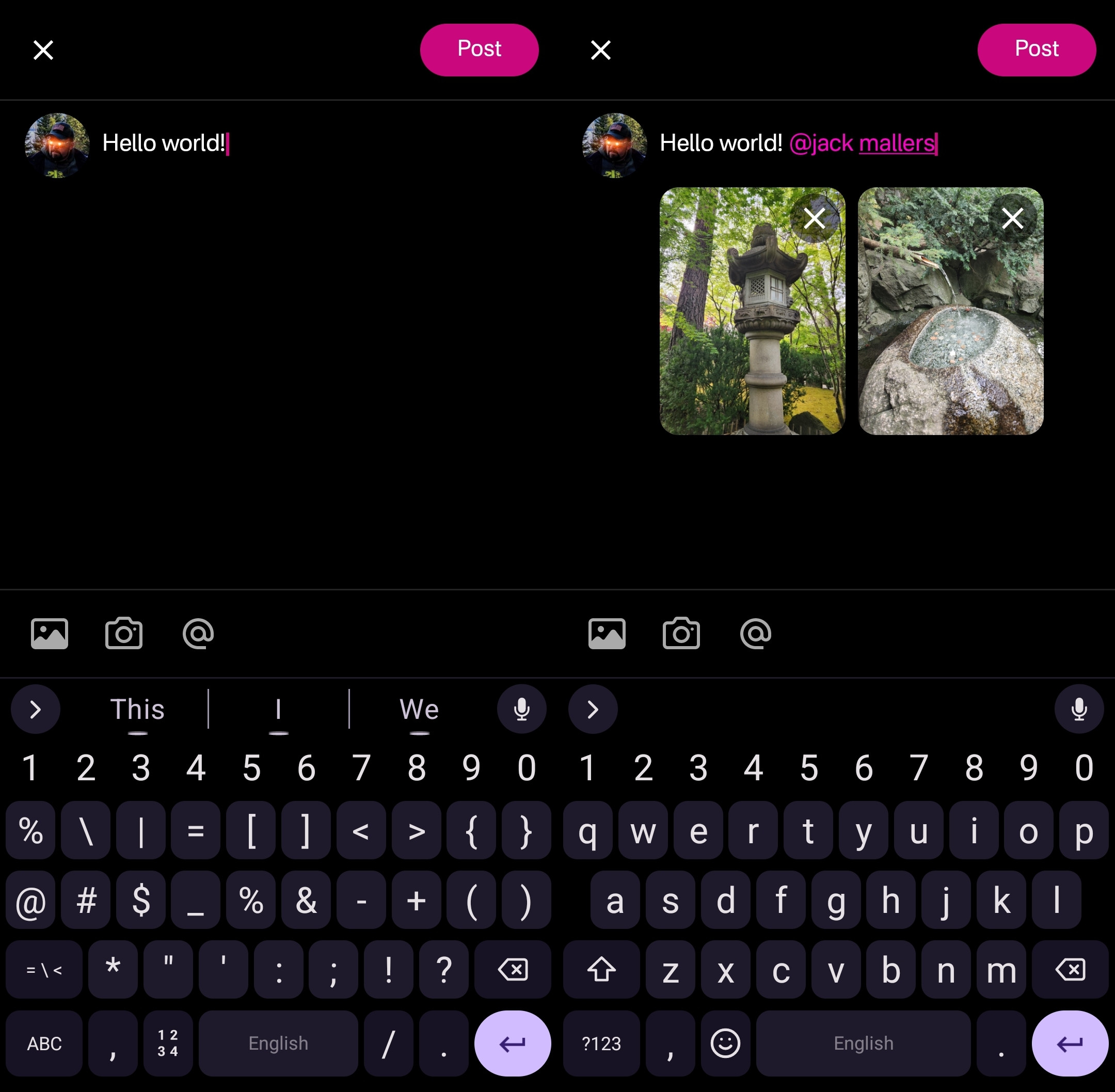

@ 7e538978:a5987ab6

2025-05-13 10:59:37

@ 7e538978:a5987ab6

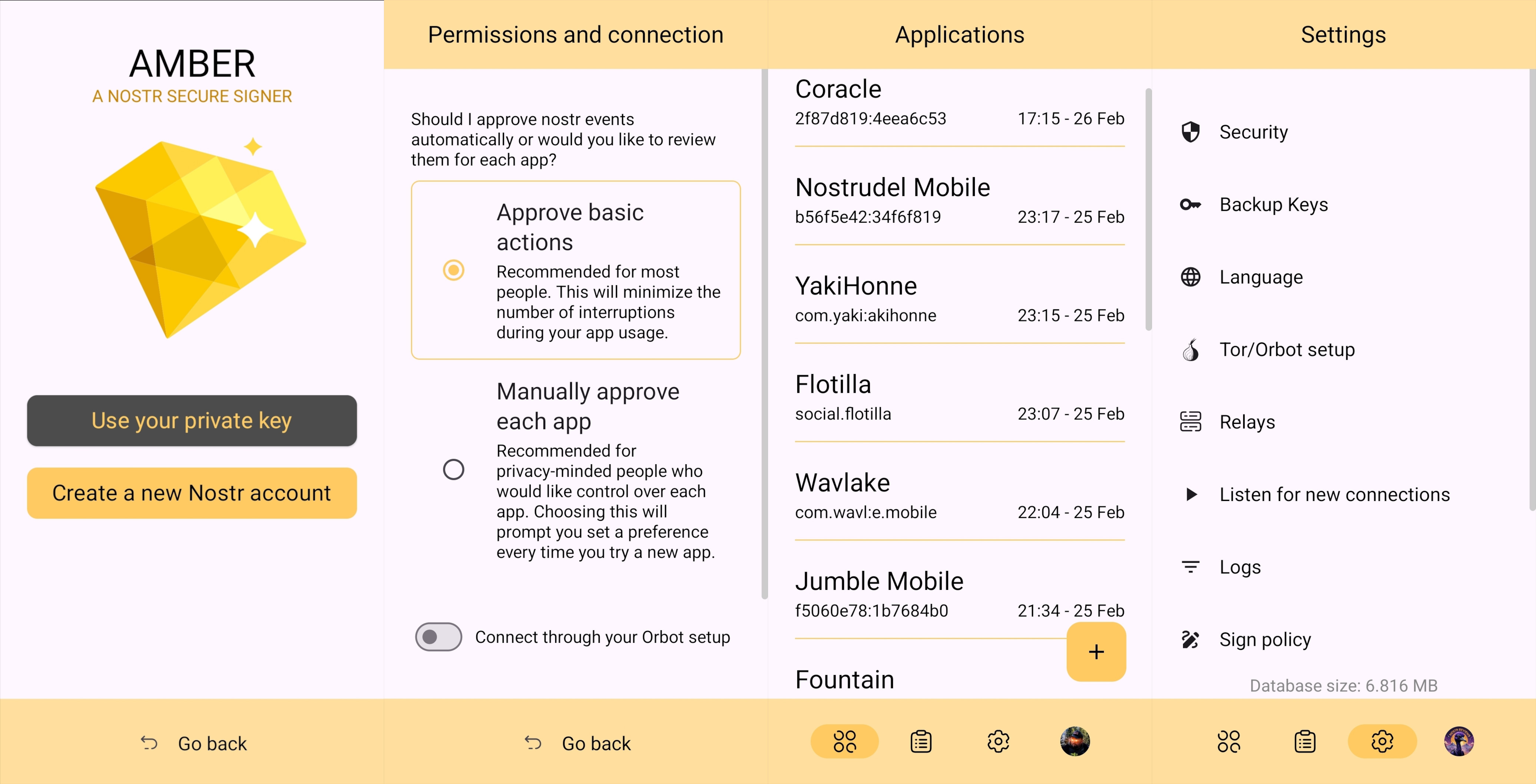

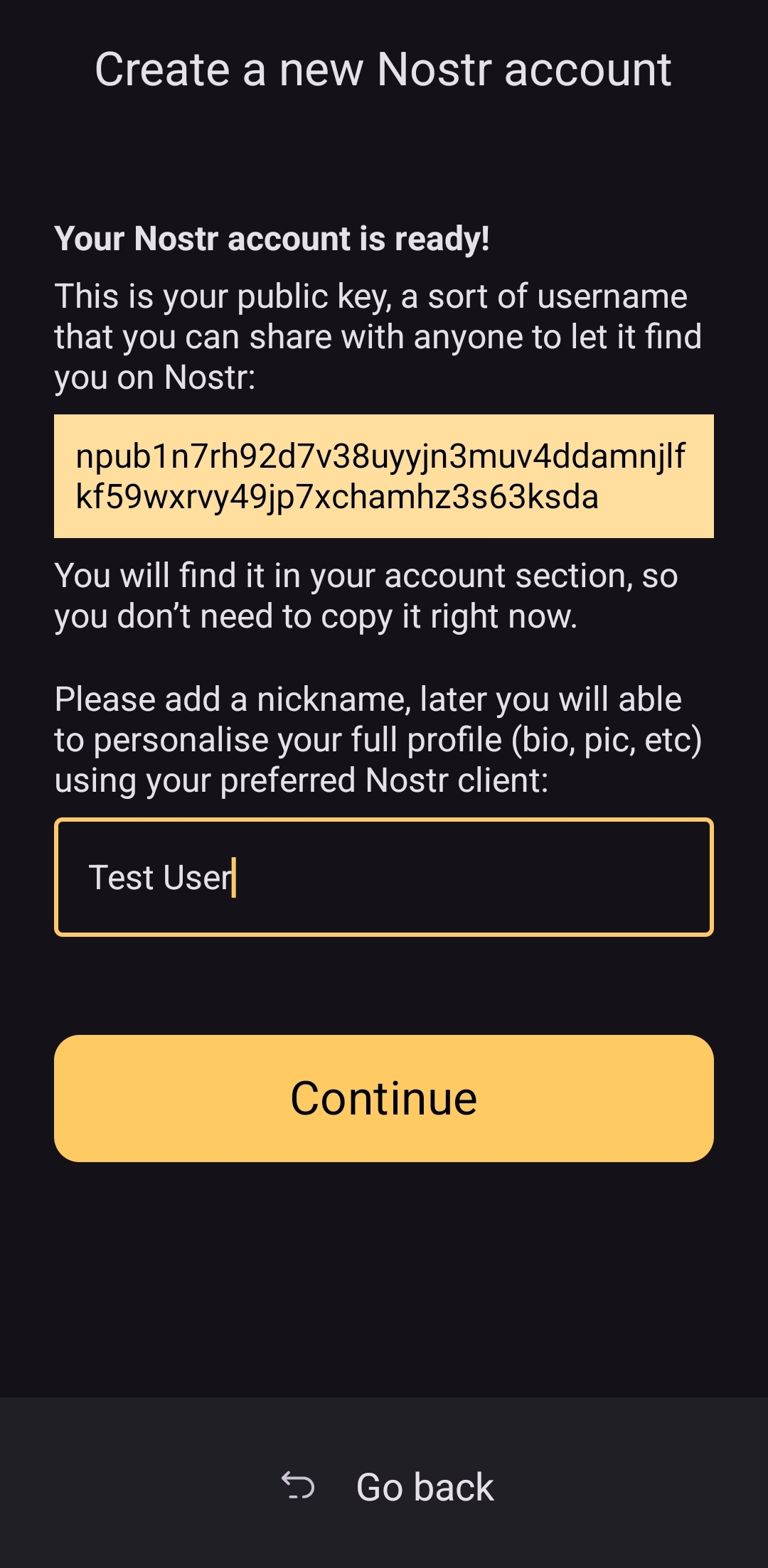

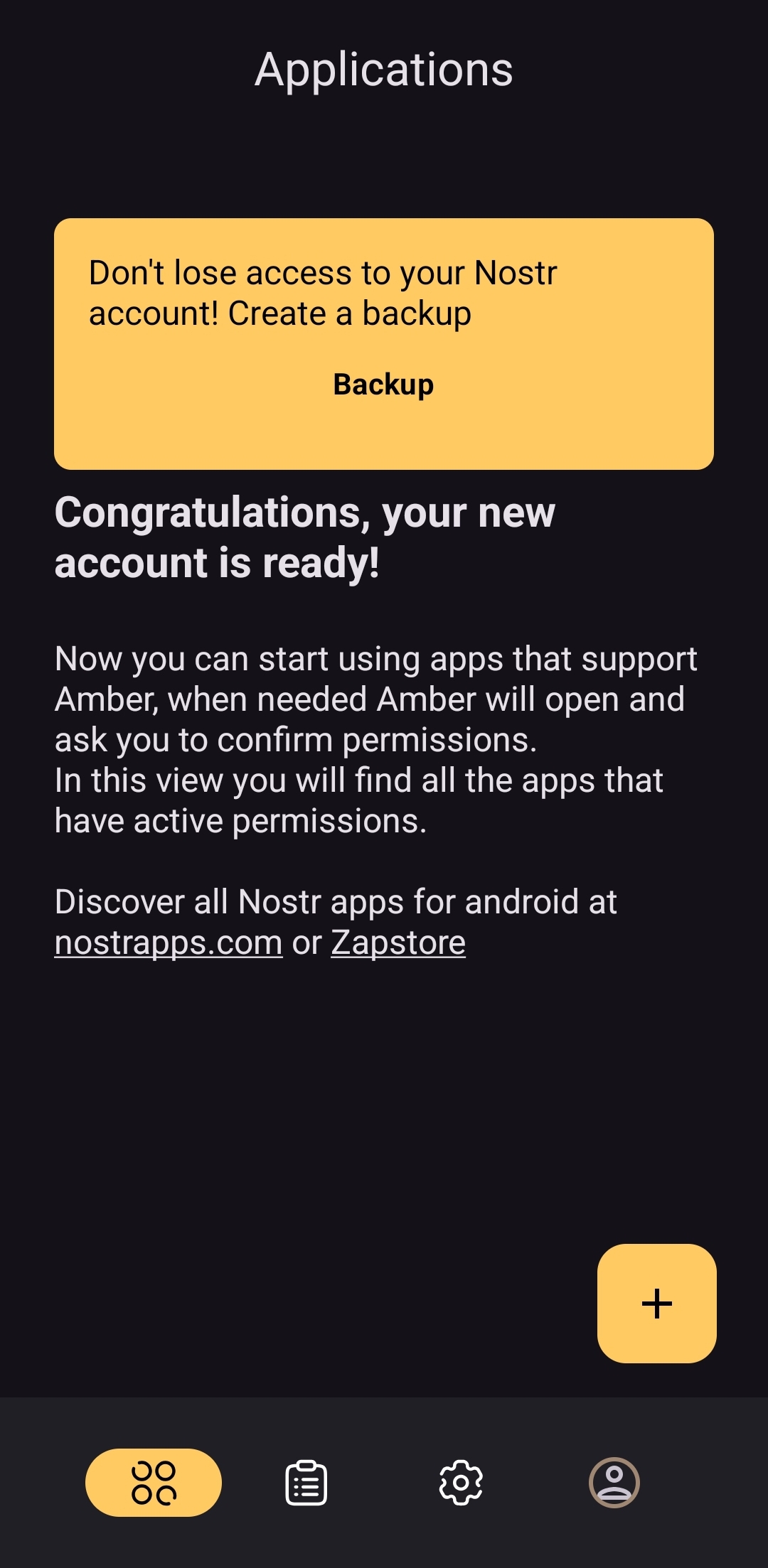

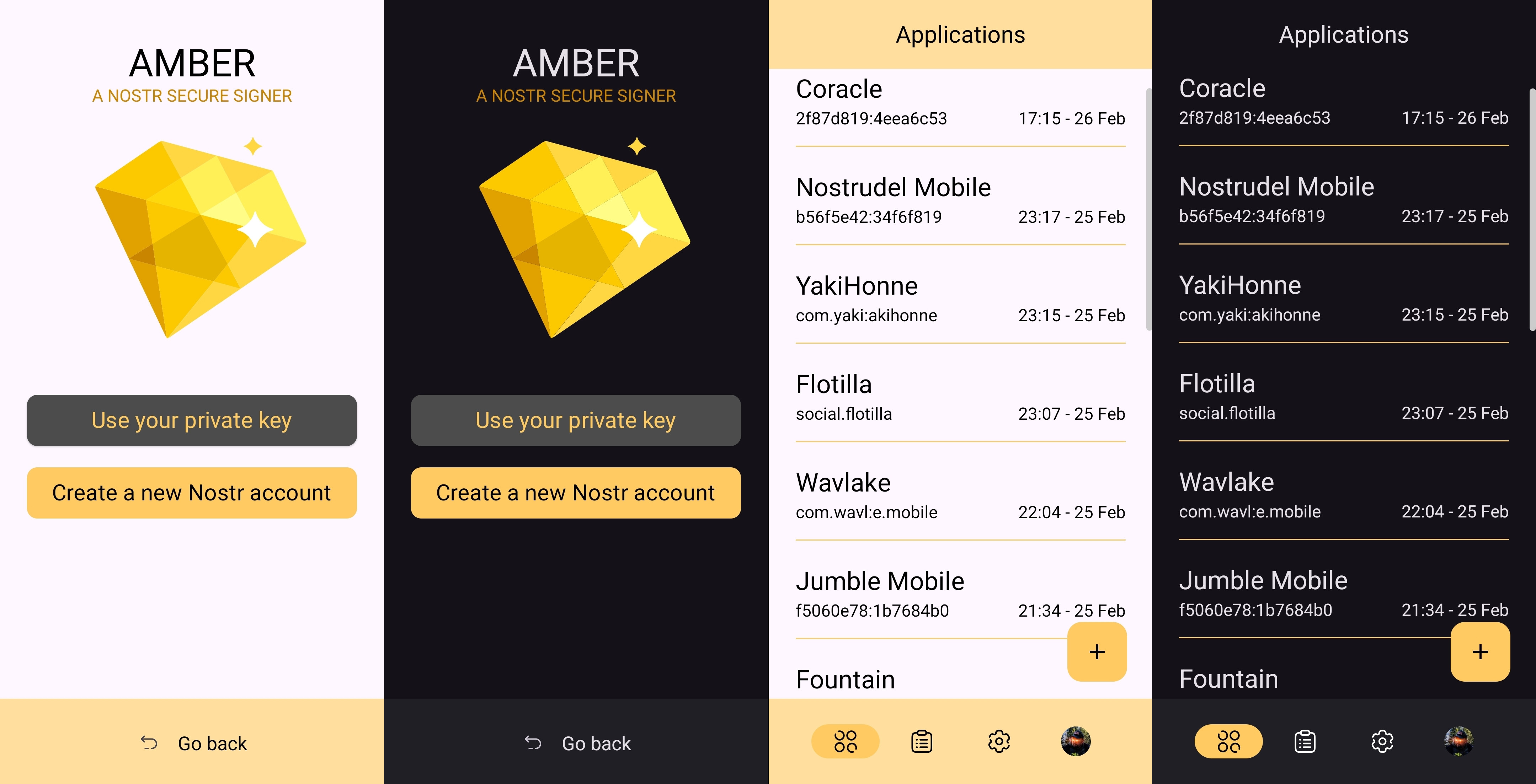

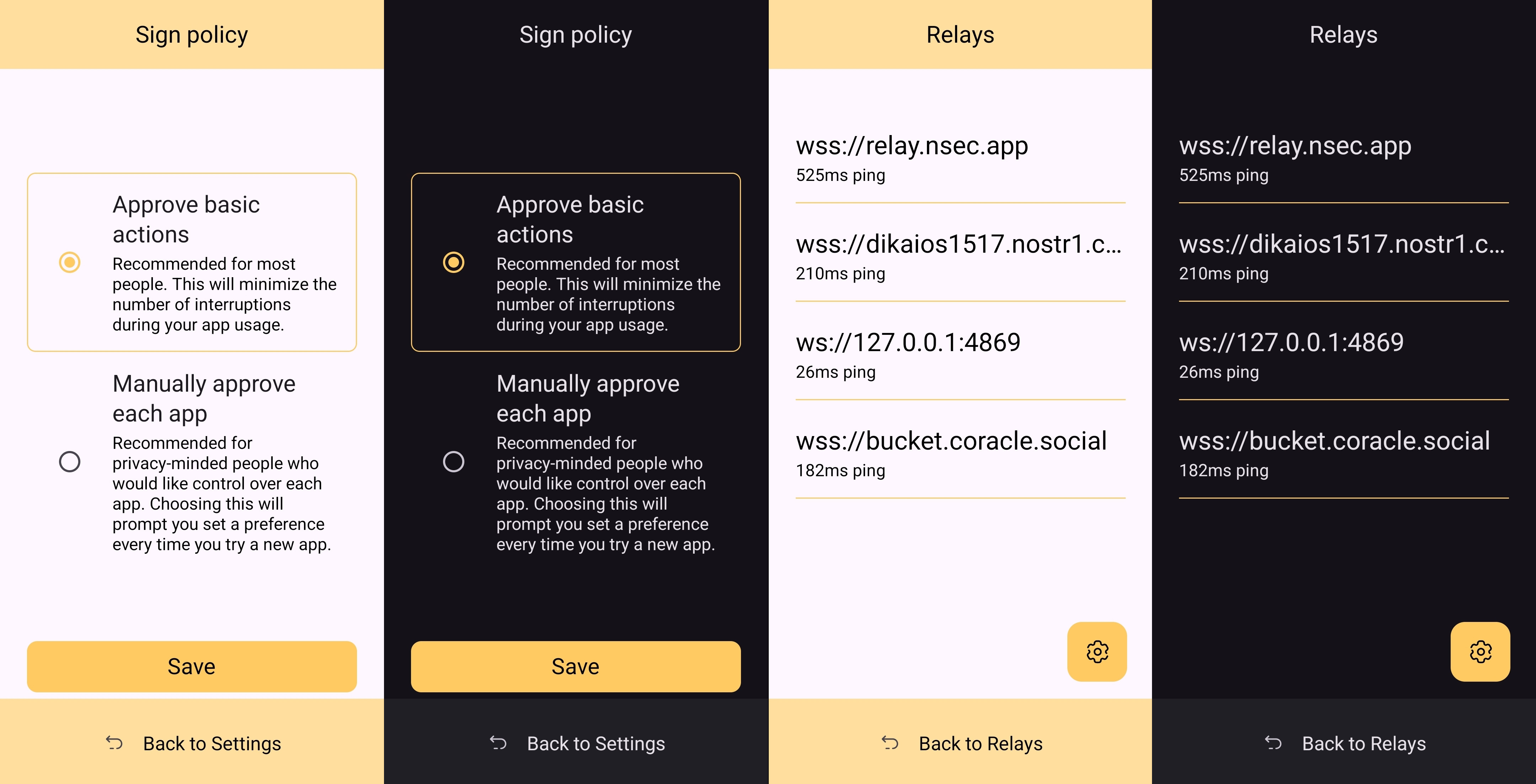

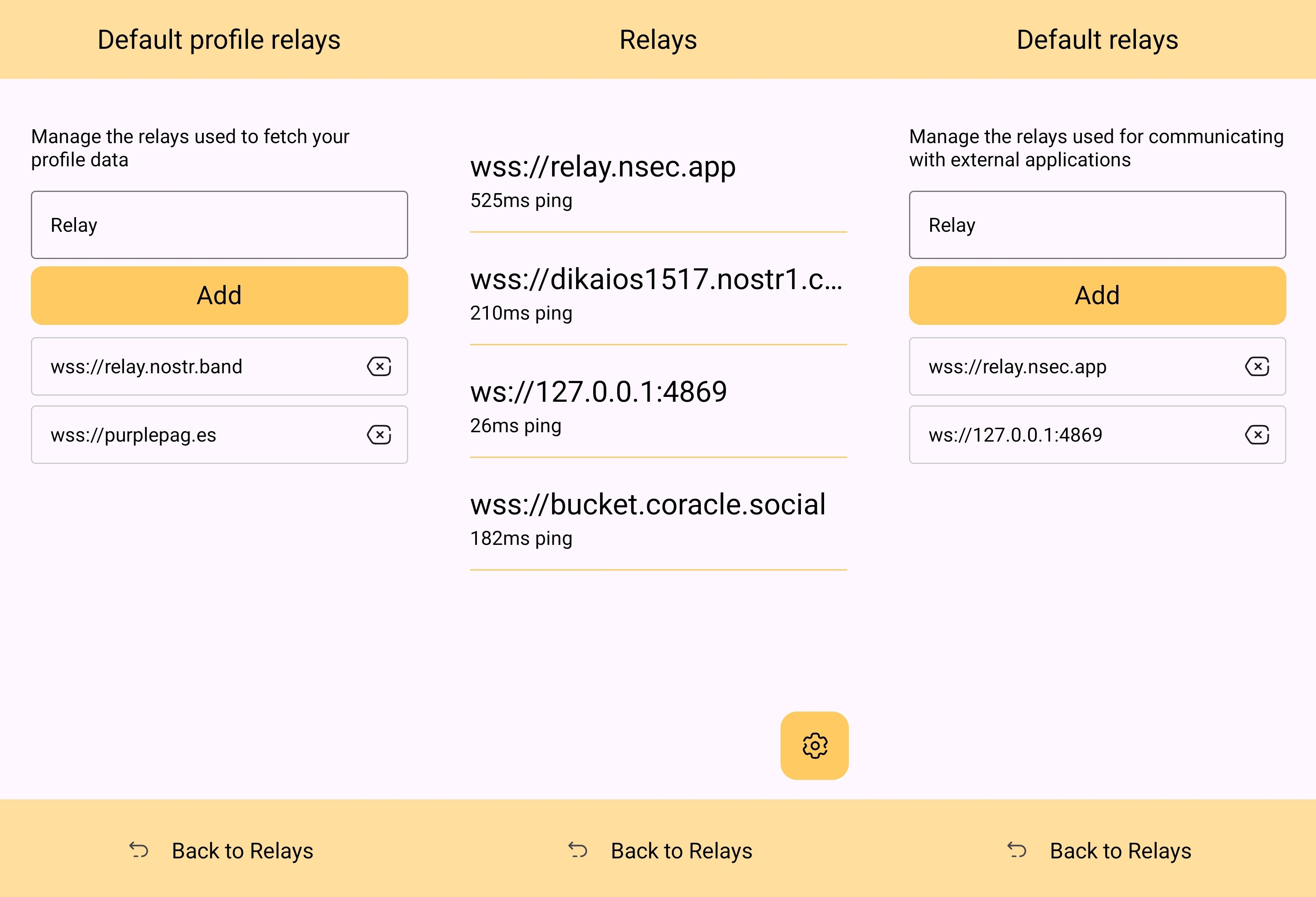

2025-05-13 10:59:37Introduction

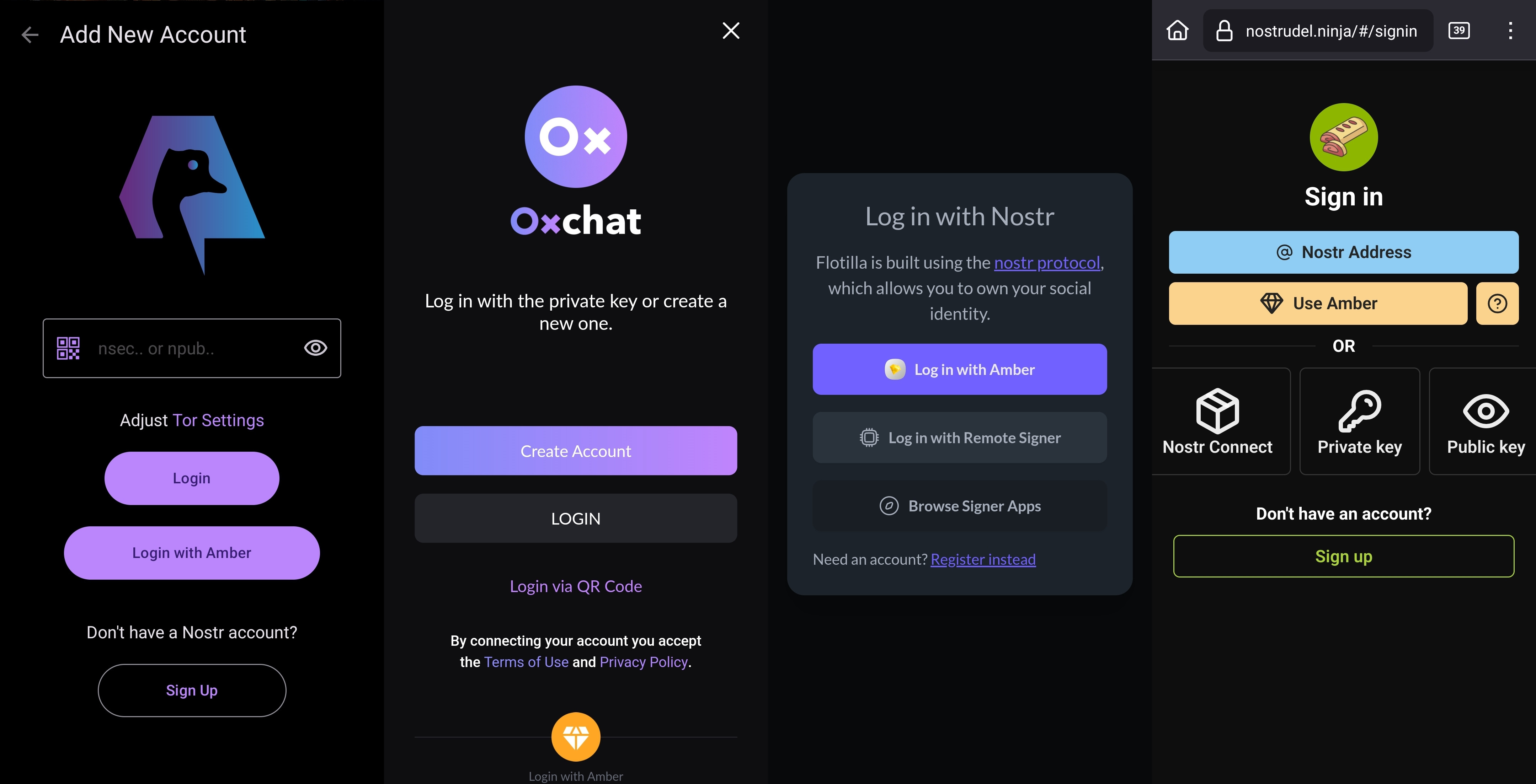

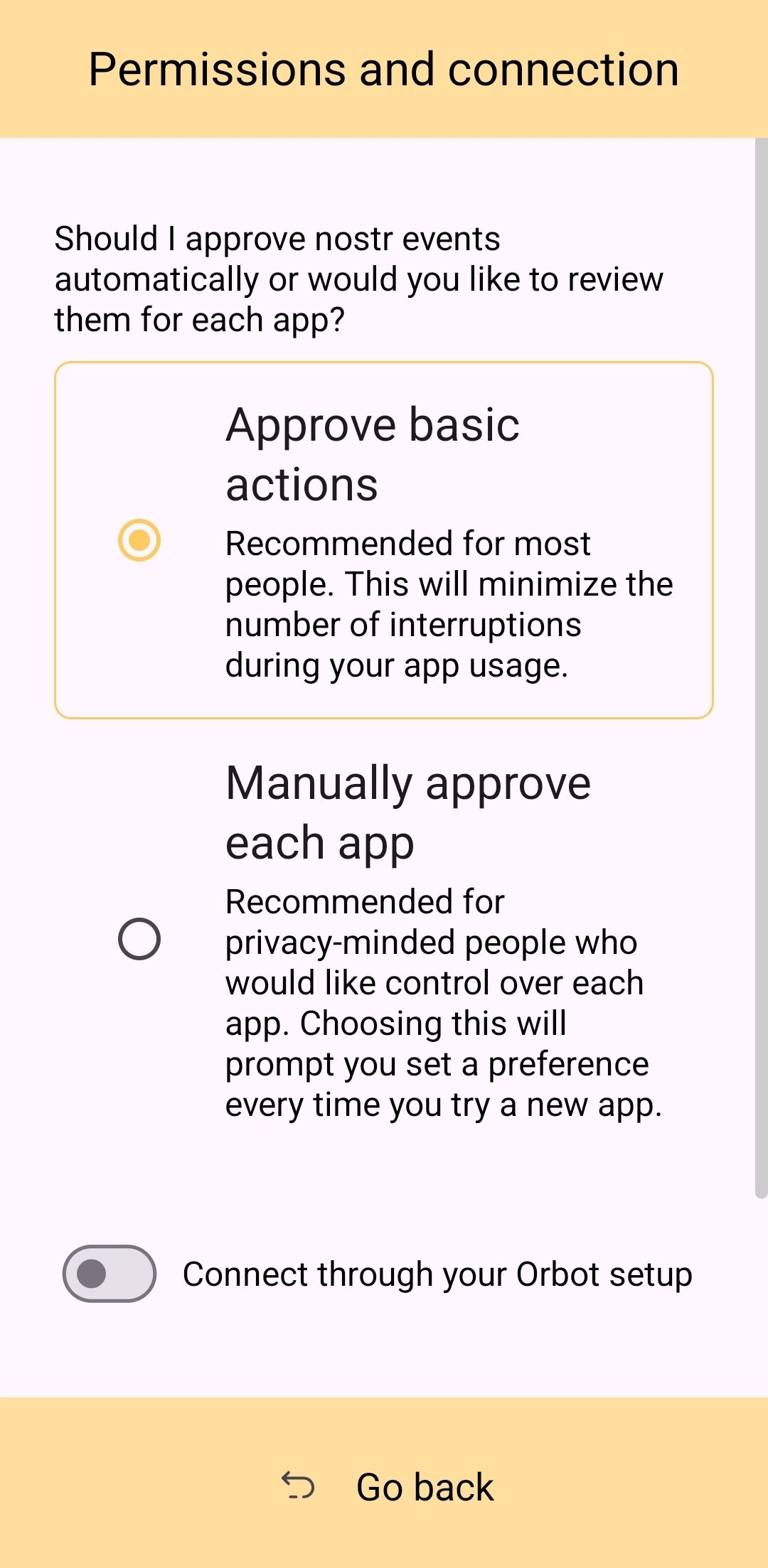

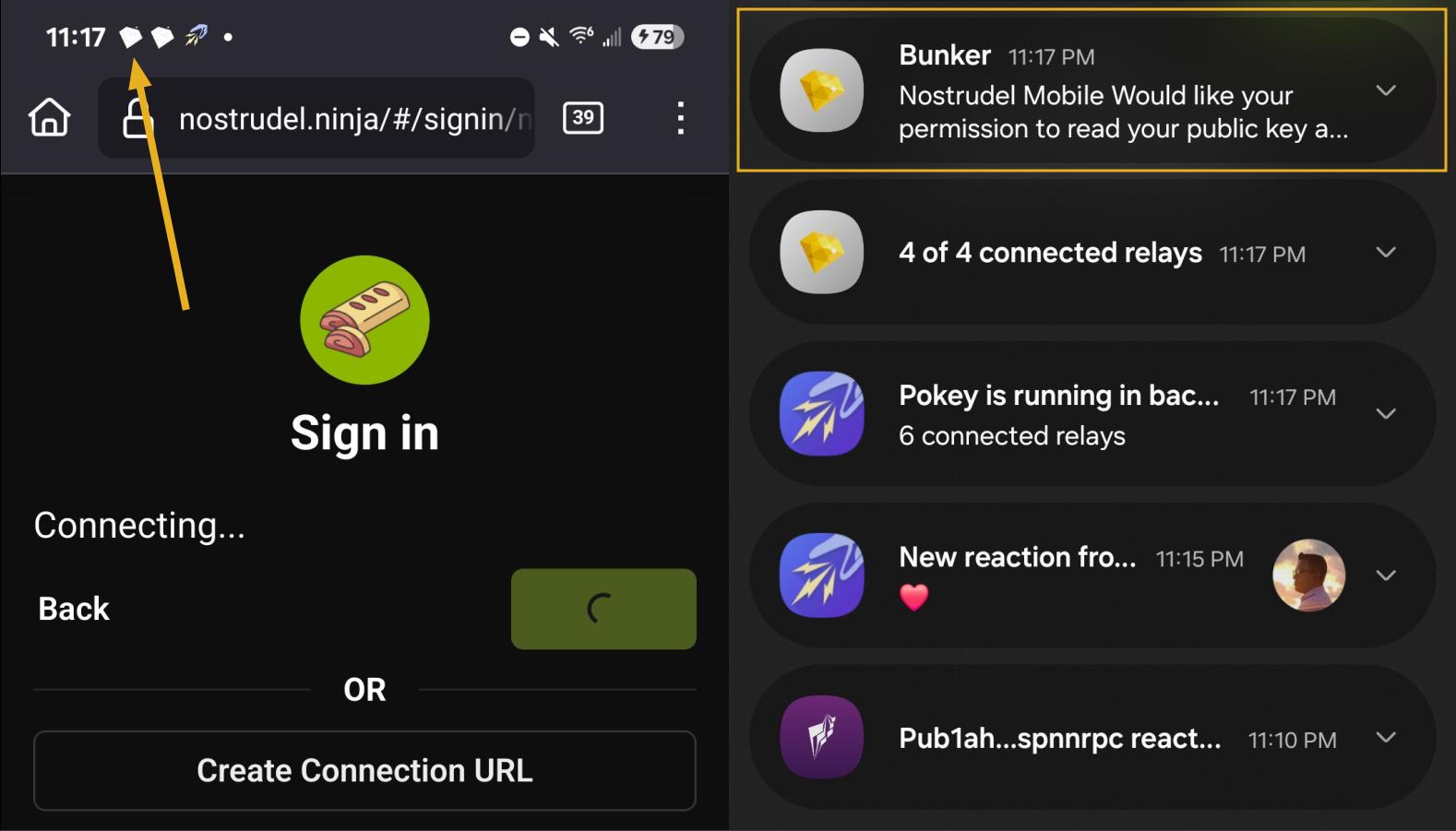

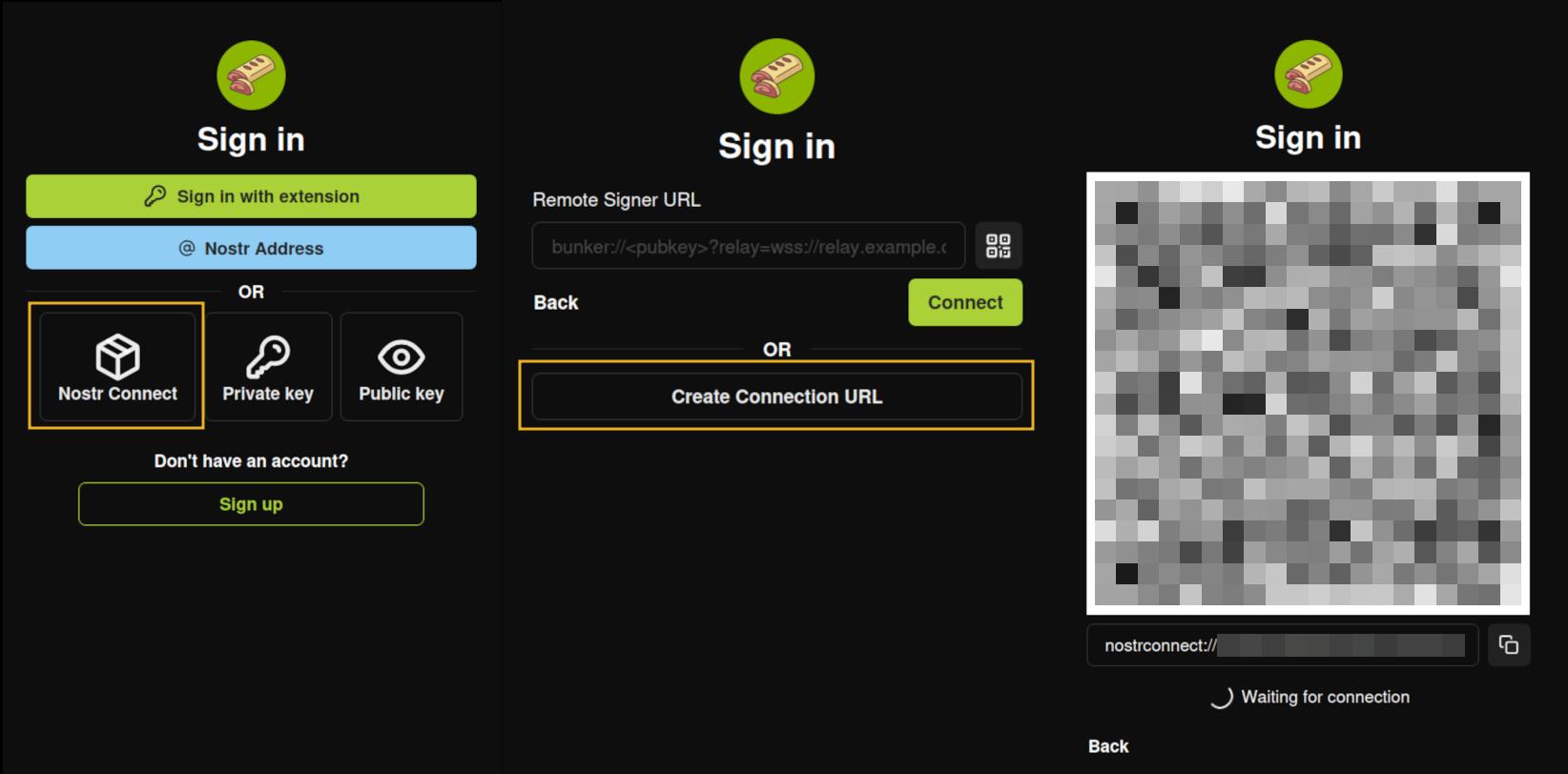

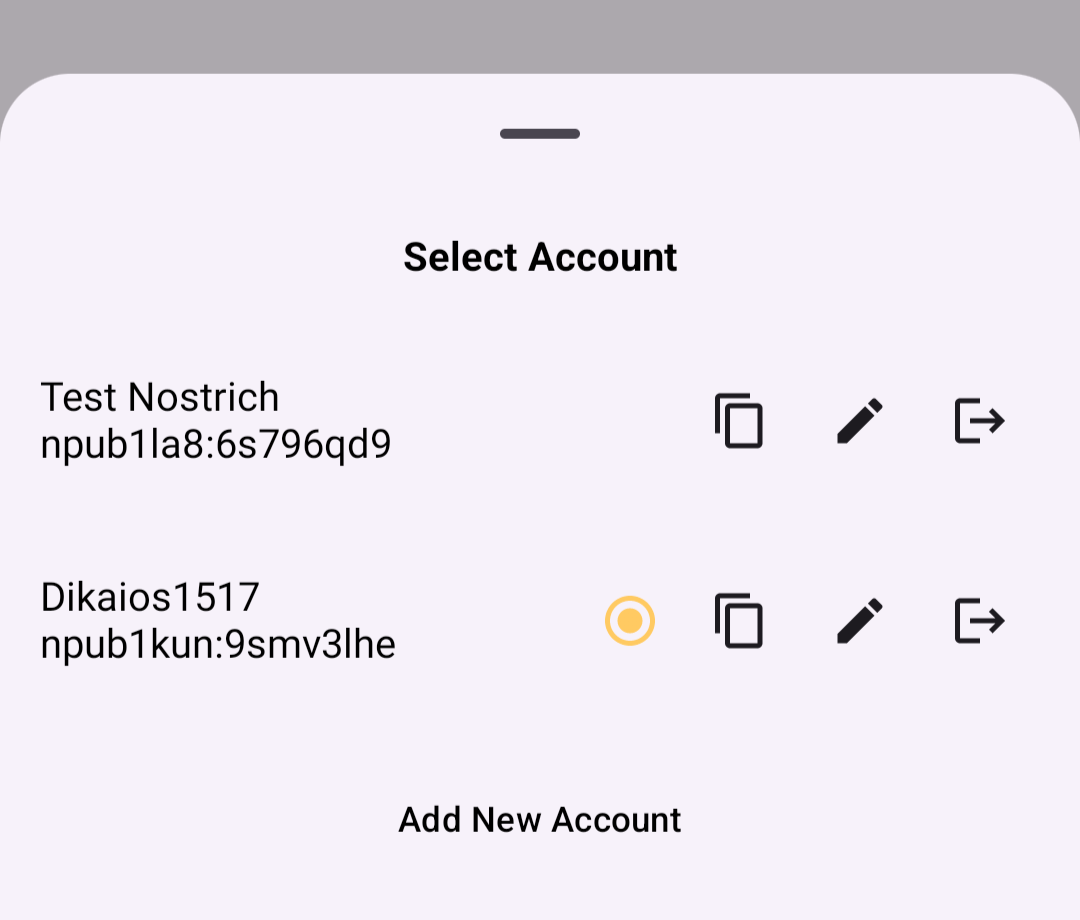

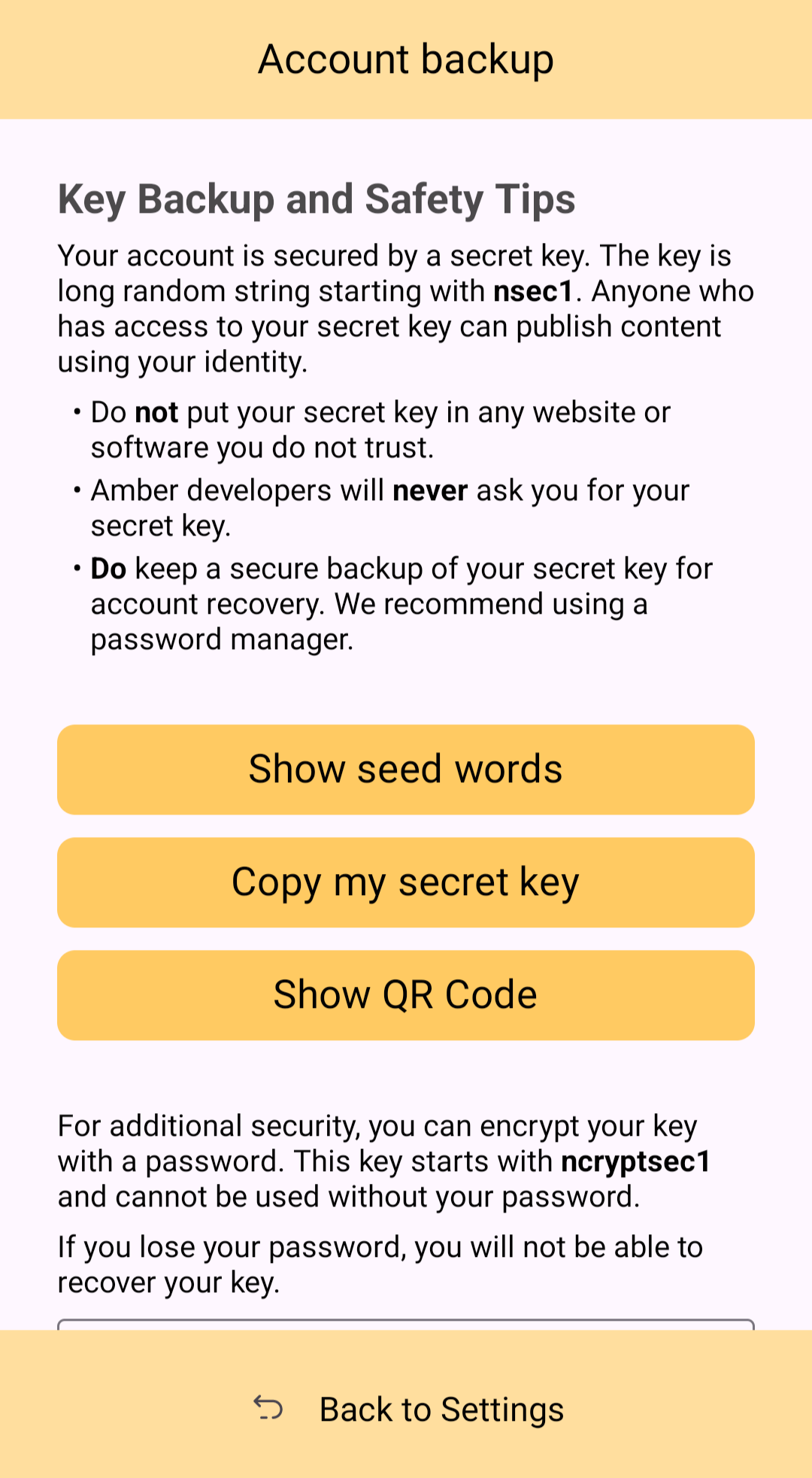

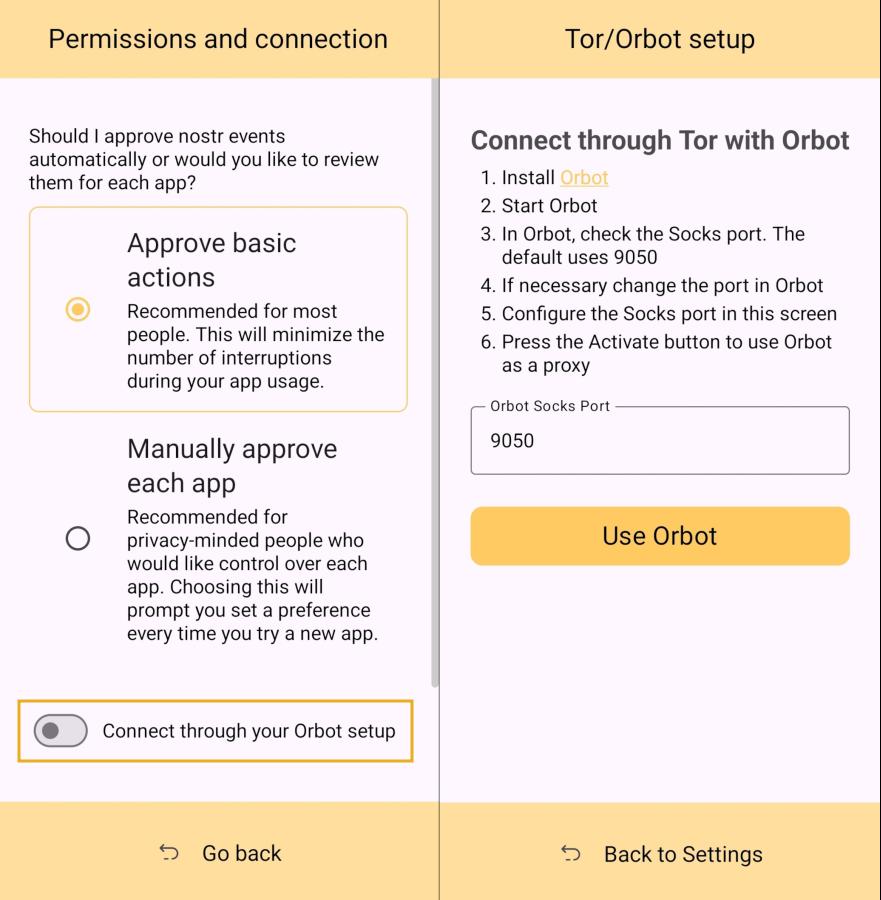

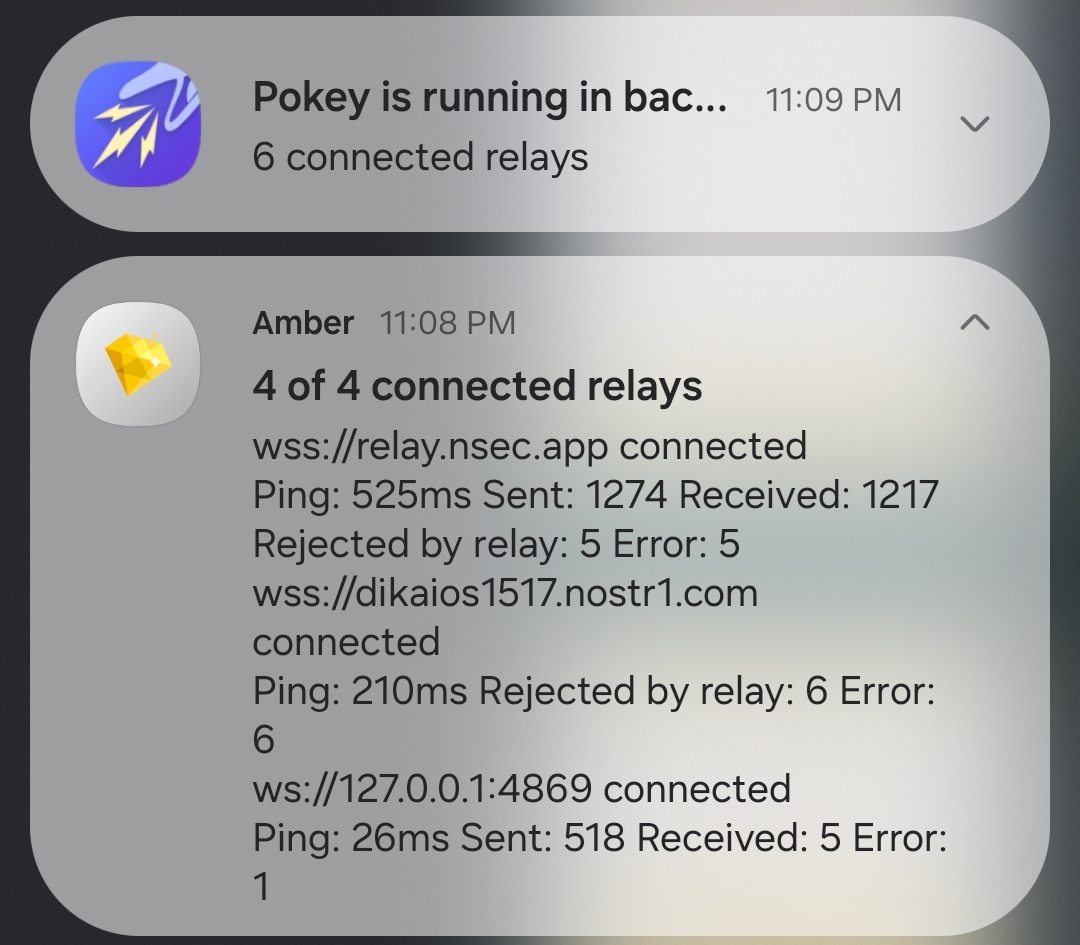

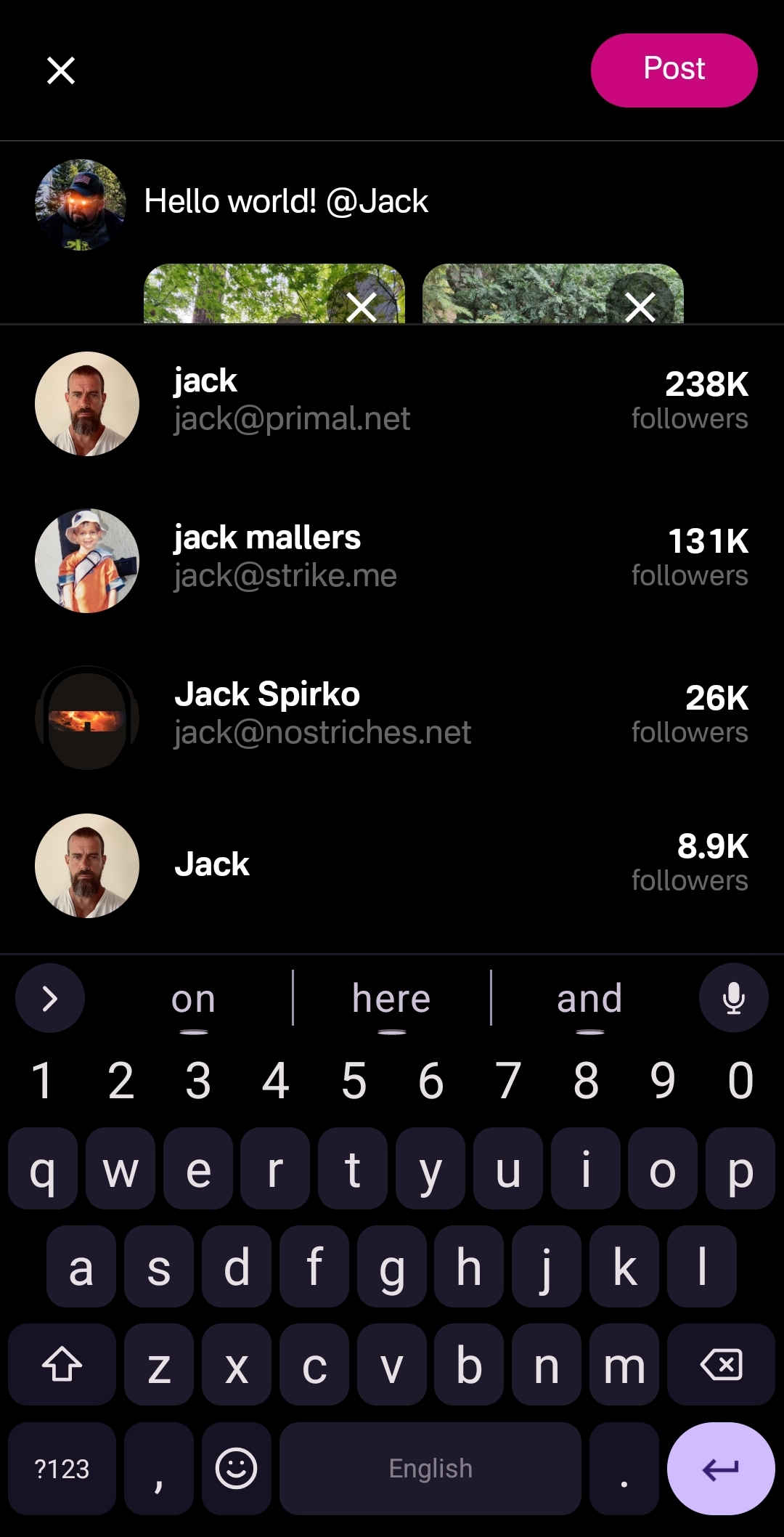

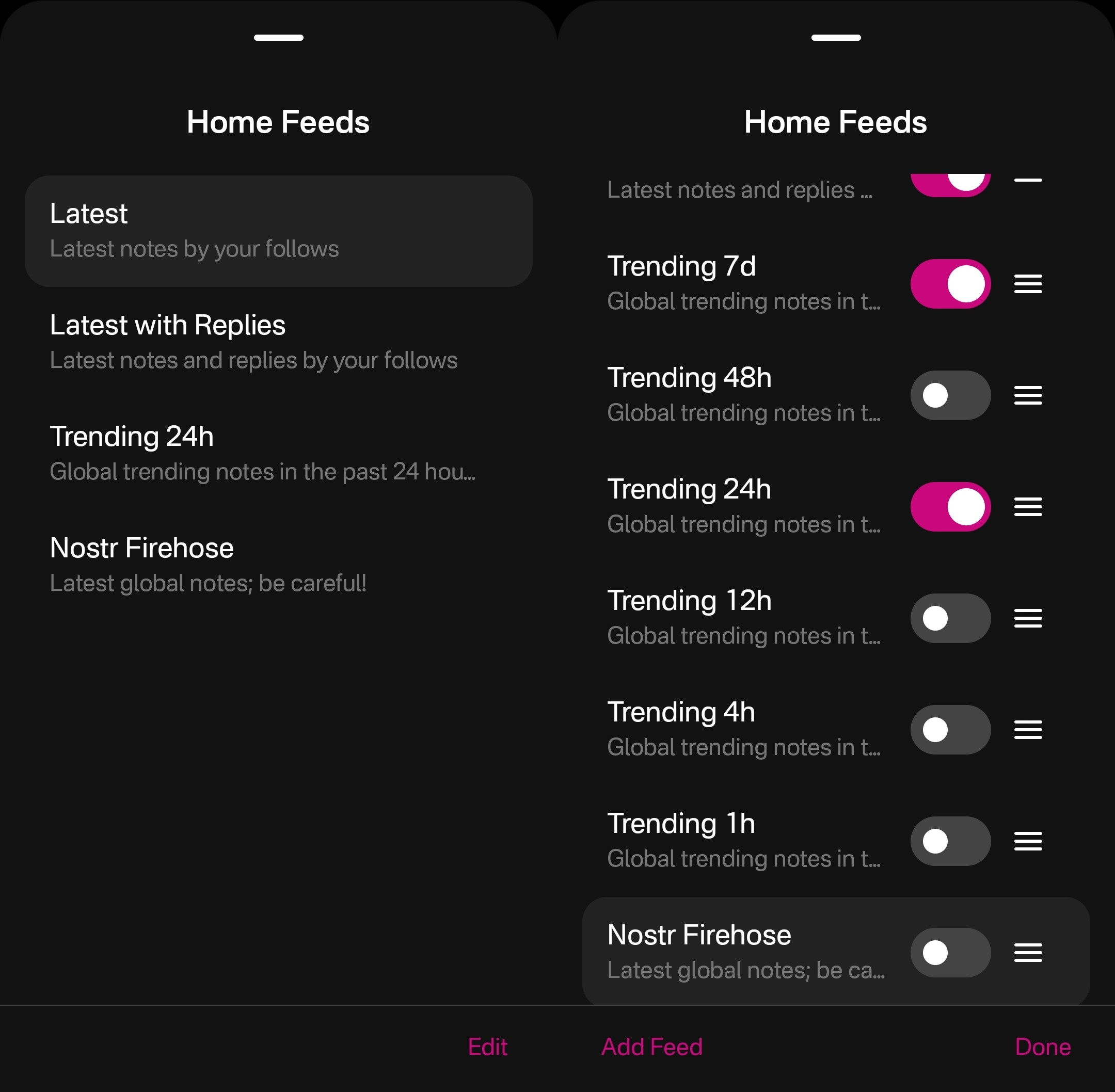

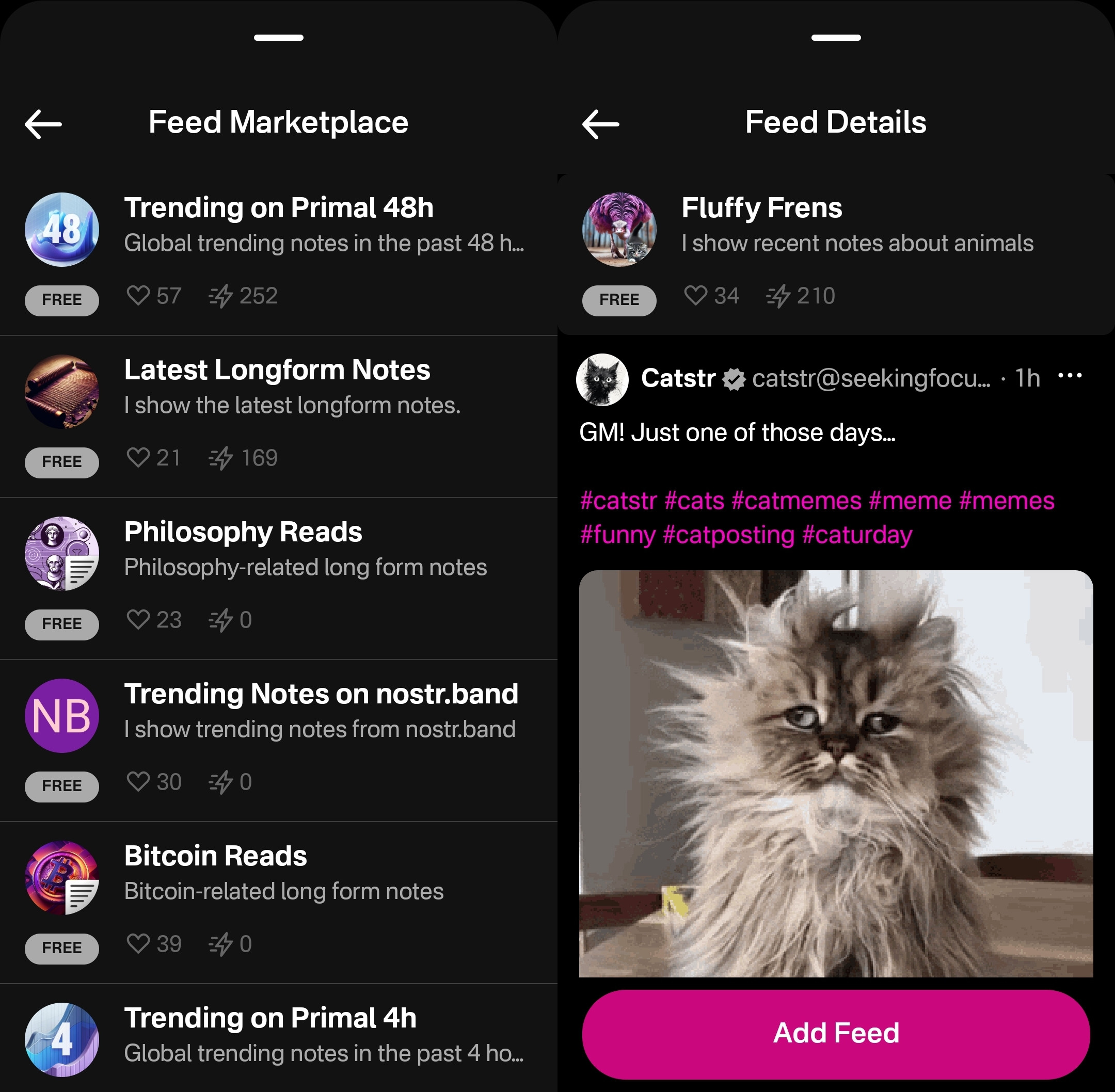

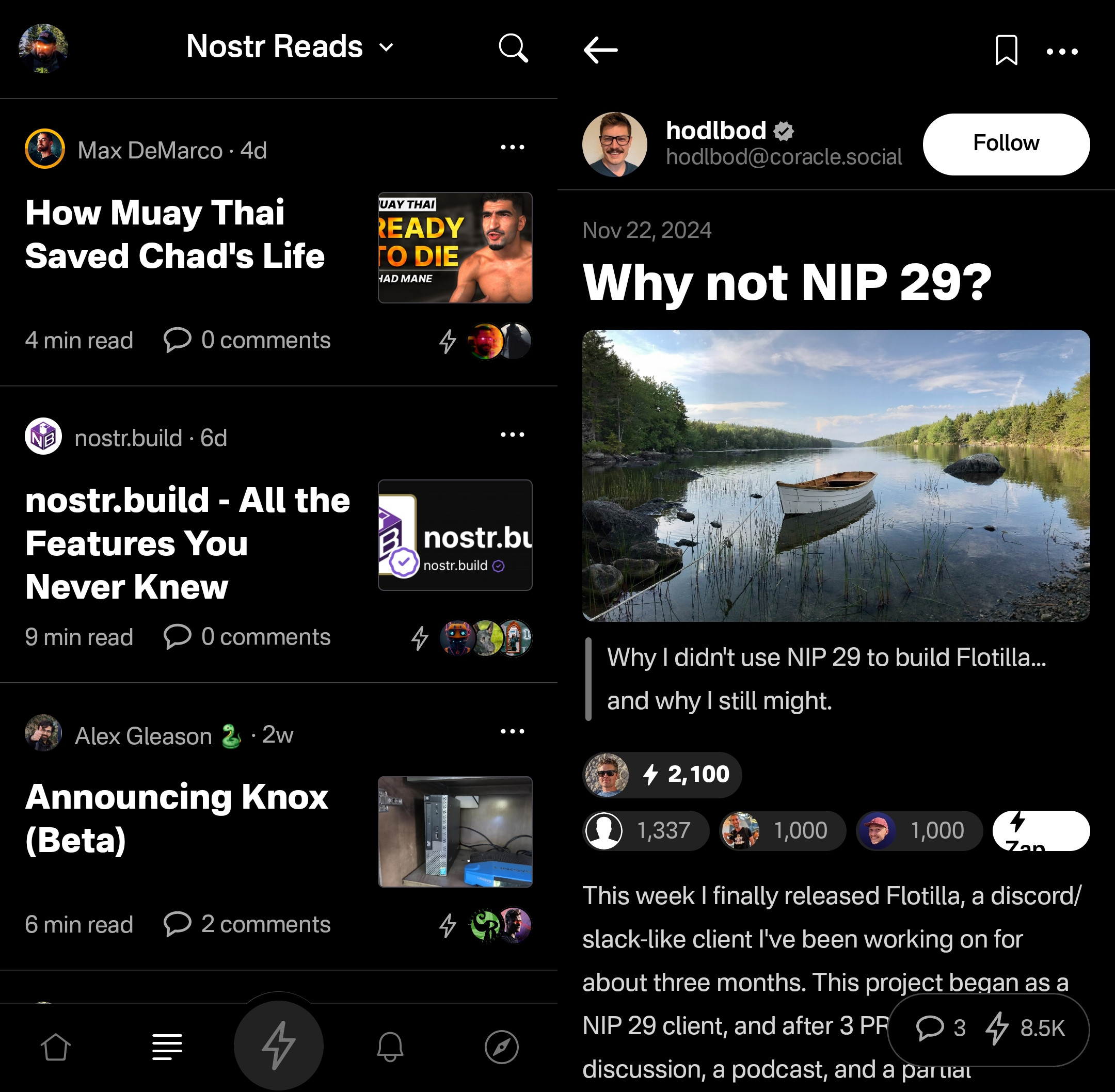

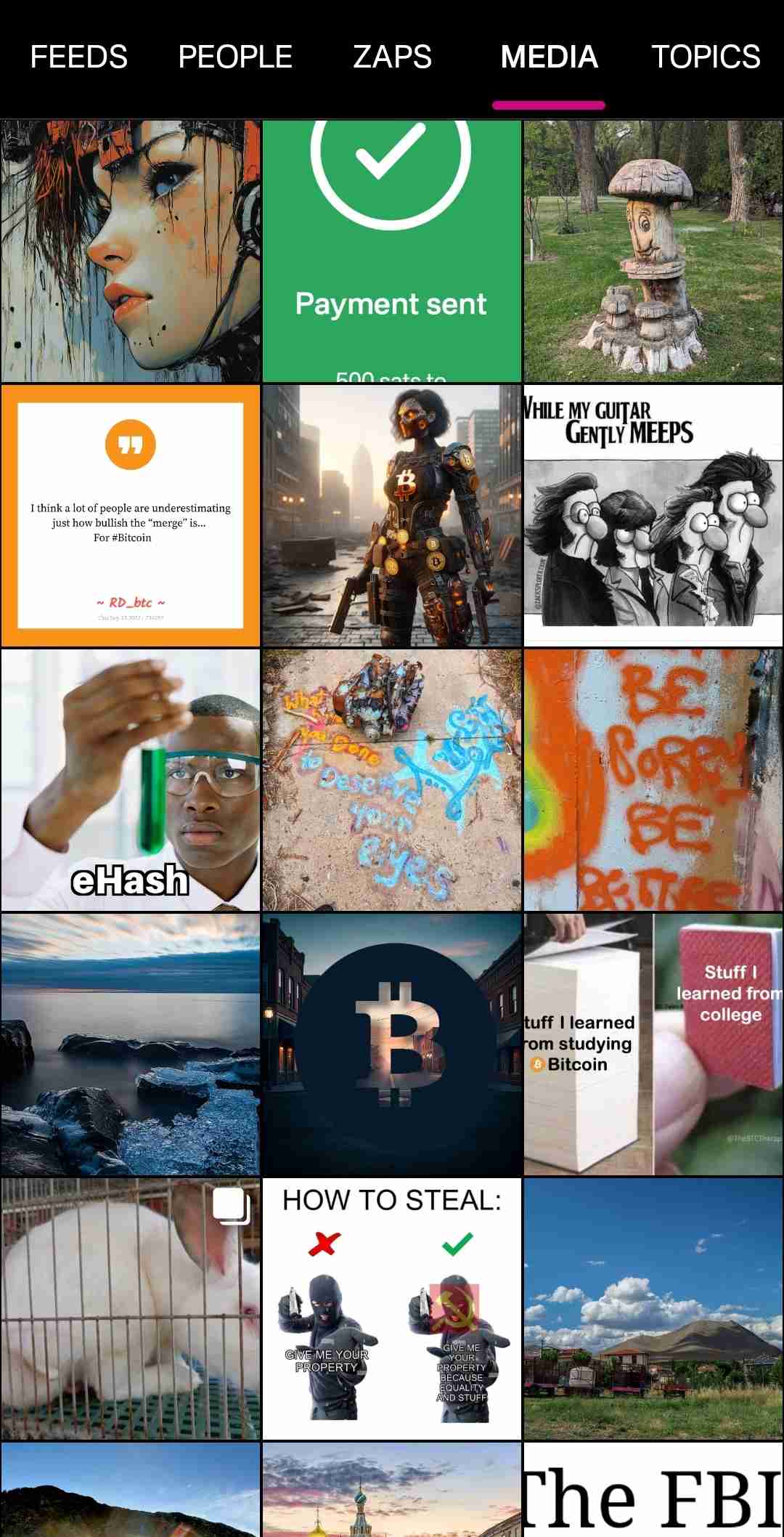

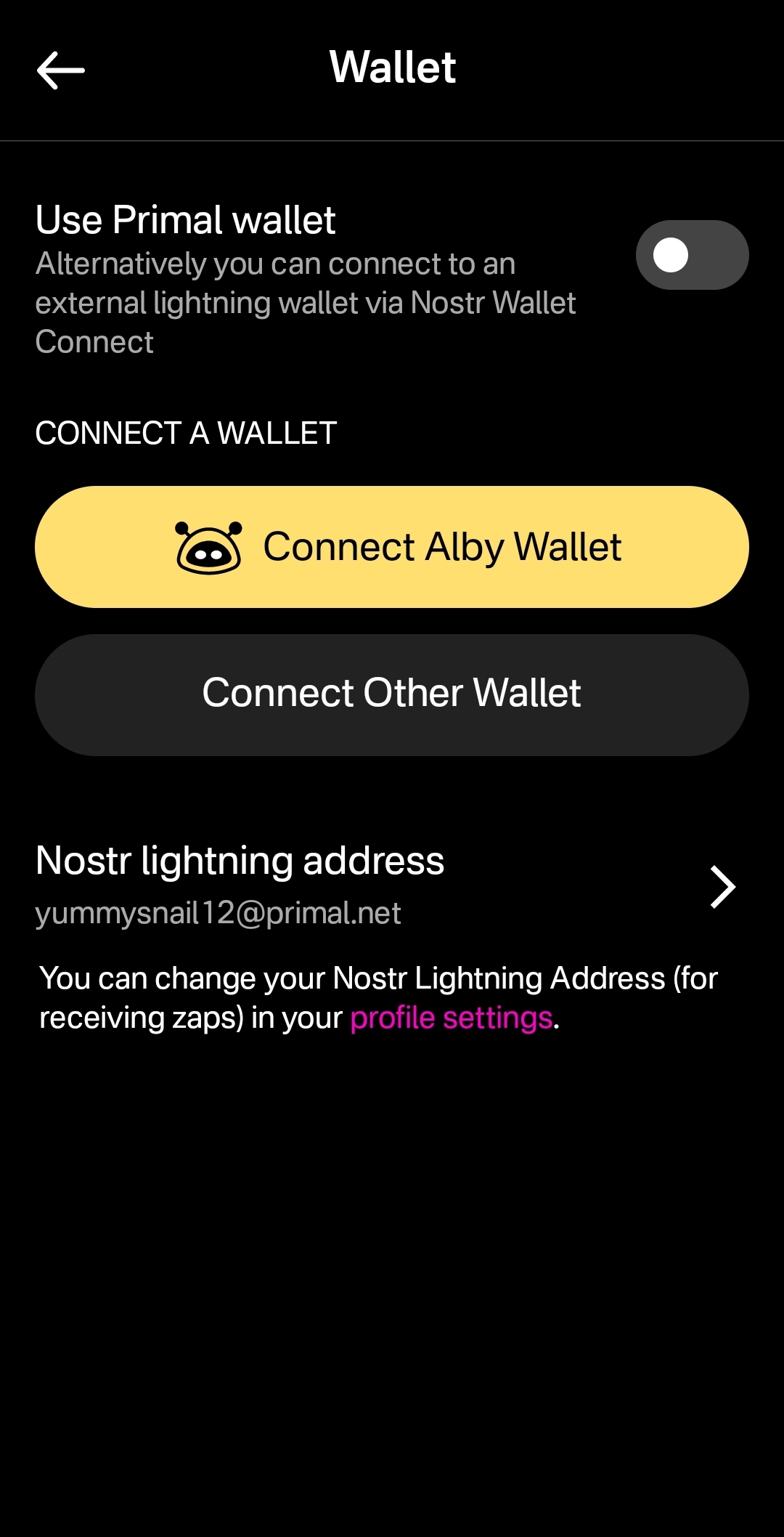

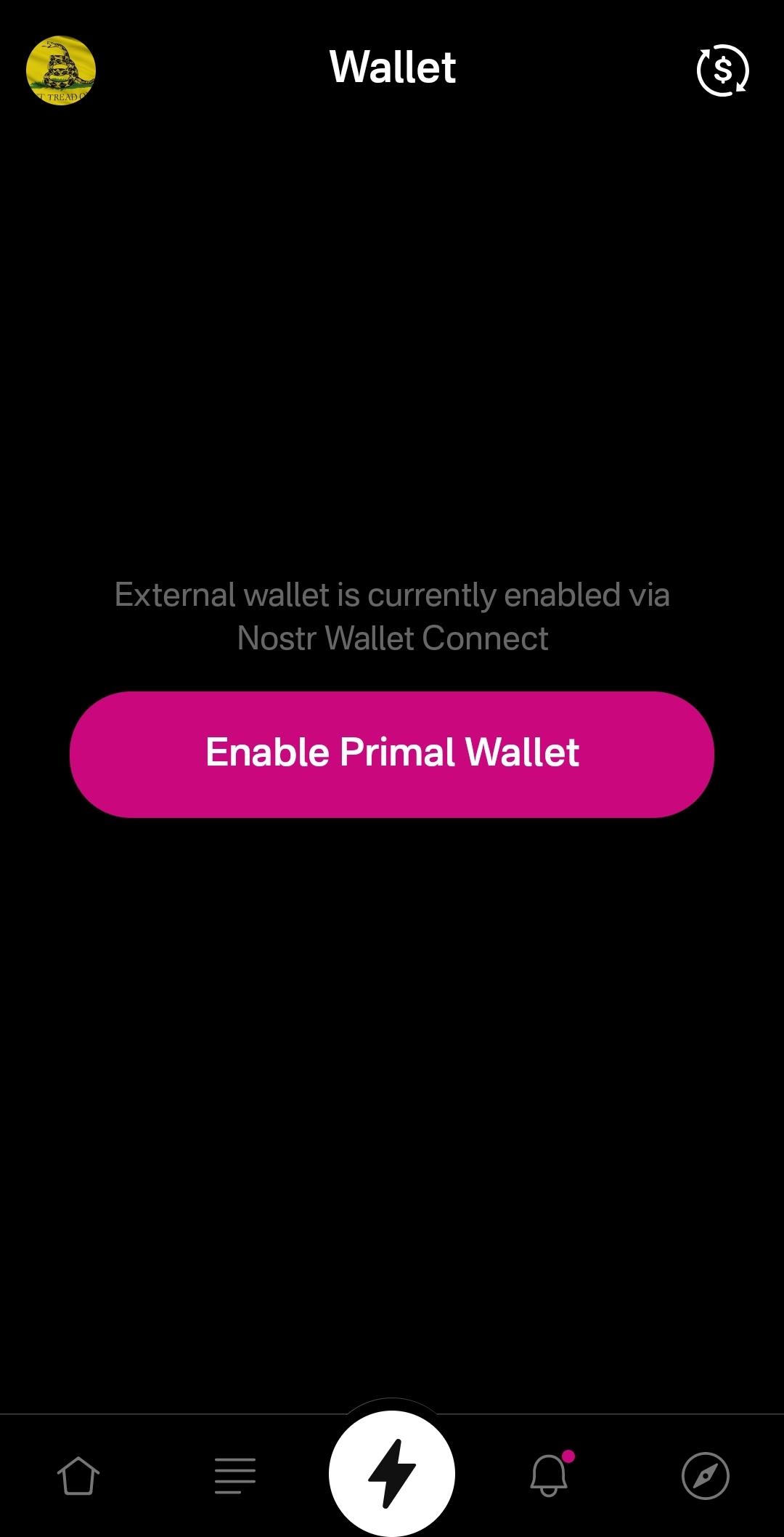

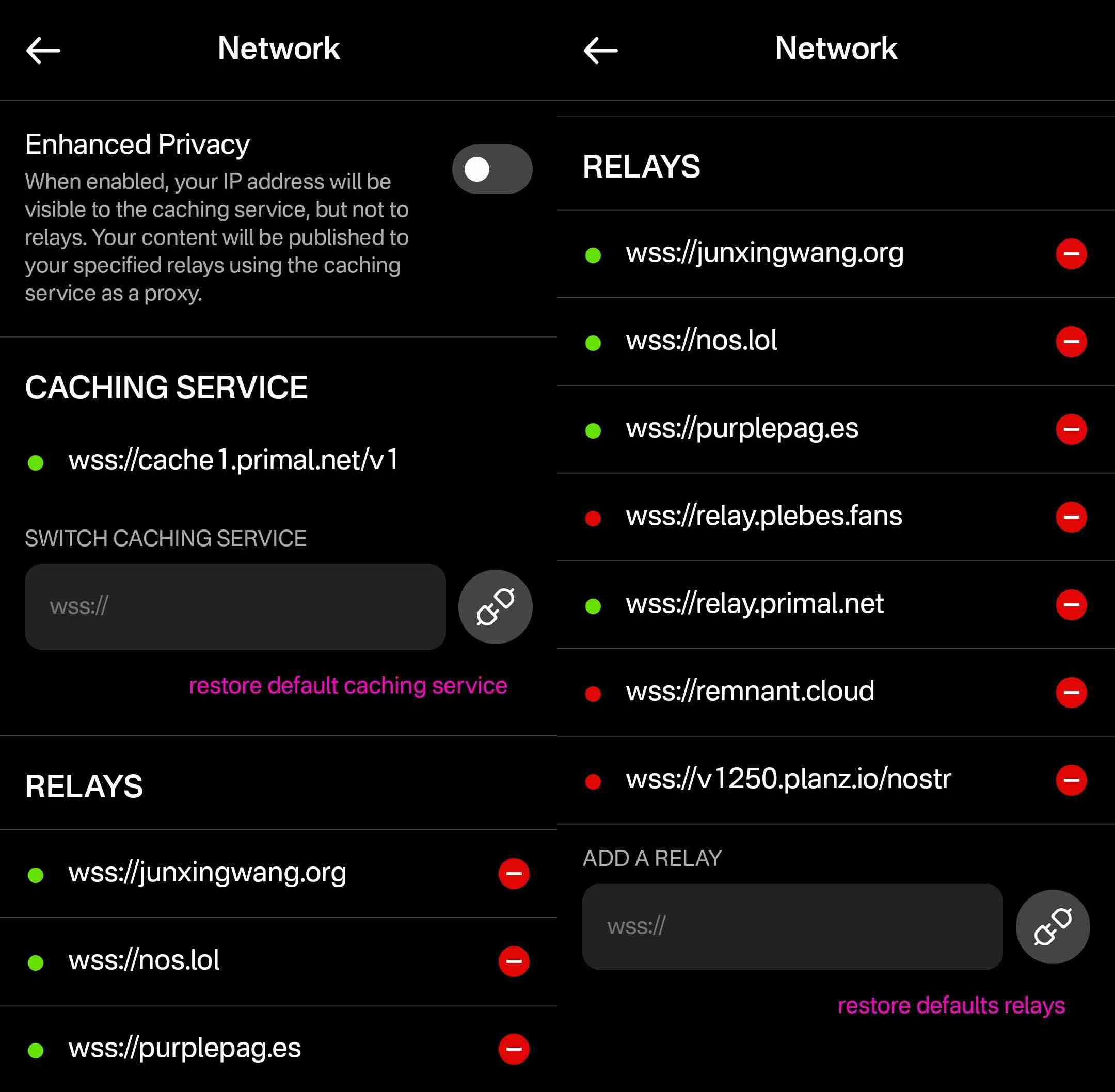

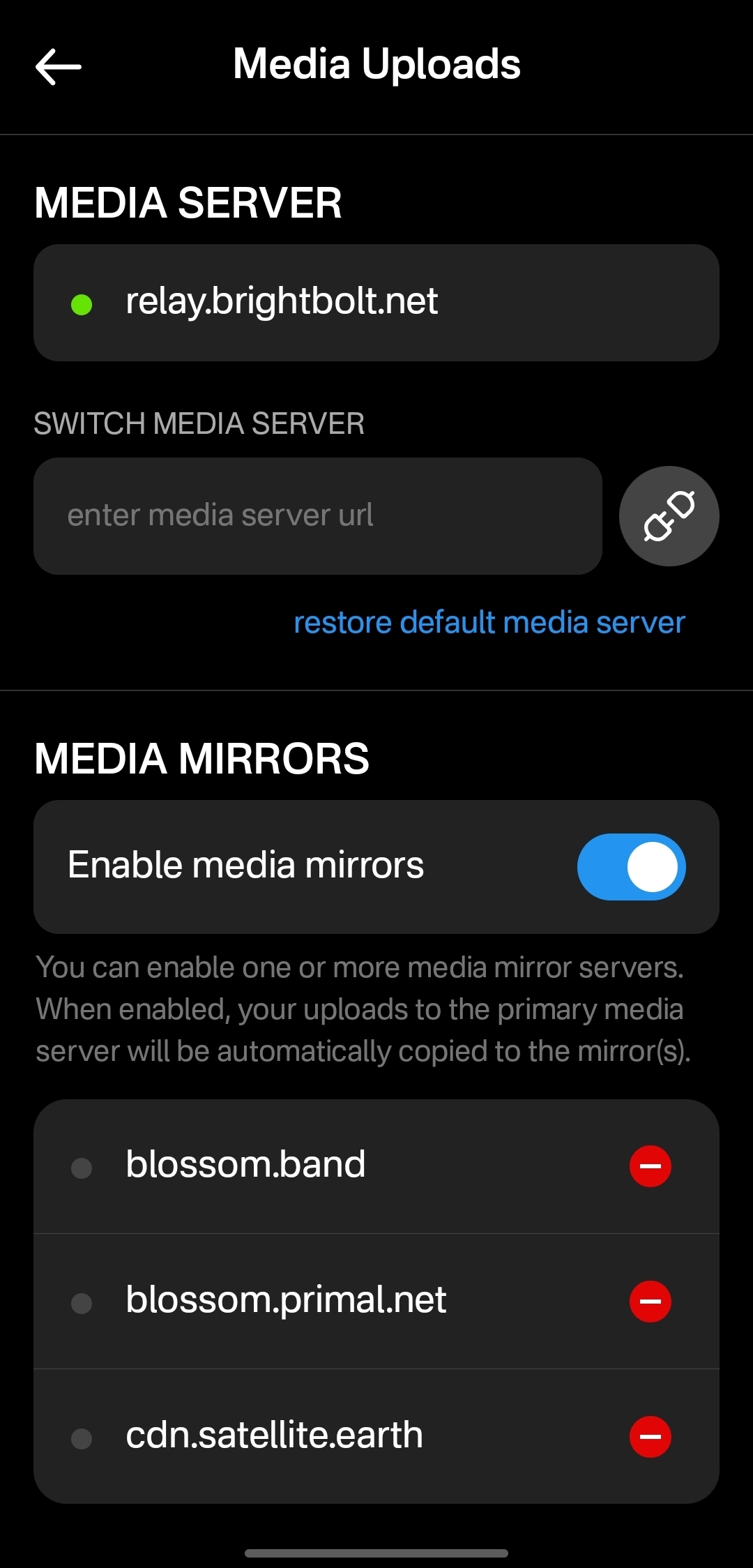

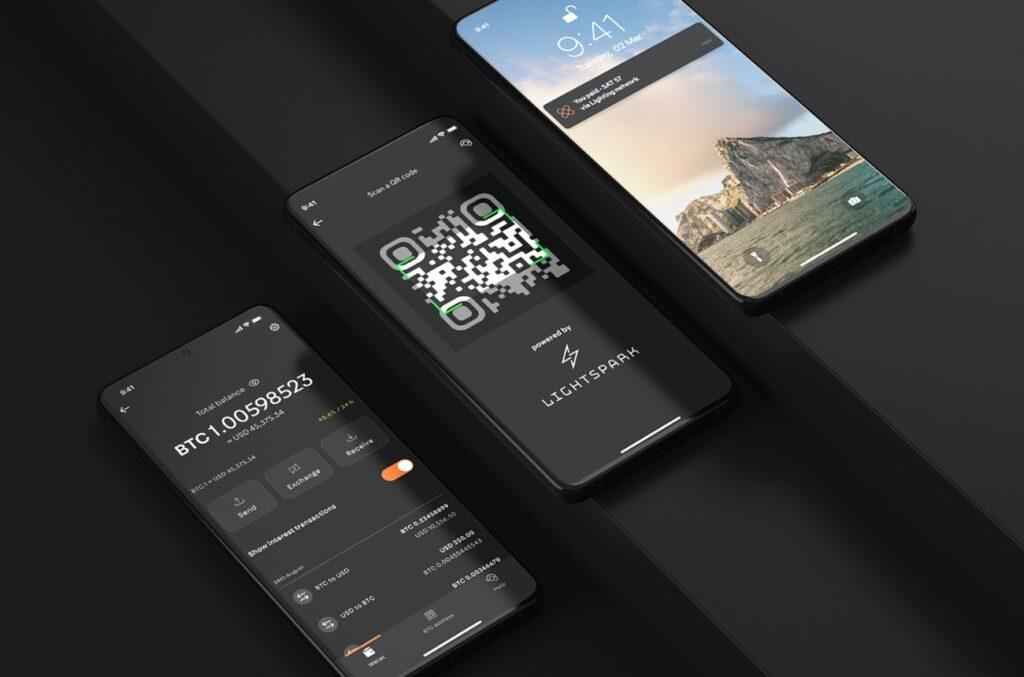

Nostr Wallet Connect (NWC) is a powerful open protocol built on Nostr that enables a connection between Bitcoin Lightning wallets and applications—offering strong privacy, user control, easy connection, open interoperability, and support for a wide range of use cases without needing port forwarding or other network configuration. It allows a user to use many different Lightning apps with their own Lightning node via NWC.

In this post, we’ll give an overview of NWC as well as how to use a home-hosted LNbits instance as a private funding source for a public LNbits instance—giving you the benefits of privacy, control, and simplicity, to unleash the full power of LNbits.

Why Self-host with NWC?

- Privacy: Keep your Lightning node and LNbits instance at home, within your own network.

- Ownership & Control: Retain full custody of your funds, with no third-parties.

- Security: No port forwarding or VPN required—your node is not accessible from the public internet.

- Simplicity: Easy to set up and maintain.

- Flexible Funding: Fund your clearnet LNbits with any NWC-capable service—including your own LNbits instance, Alby, Minibits, Coinos, and more.

- App Access: Use LNbits at home as a Lightning wallet for one of the many NWC compatible apps.

How It Works

Your home Lightning node (running Raspiblitz, Umbrel, Start9, MyNode or one of the many other node packages) runs LNbits. You enable the NWCProvider extension in LNbits and generate a connection string.

On your clearnet LNbits instance (hosted with the LNbits SaaS or on your own VPS), set this connection string as your funding source.

This lets you:

- Fund and use LNbits from anywhere

- Keep your node private

- Add or change funding sources at any time with minimal config

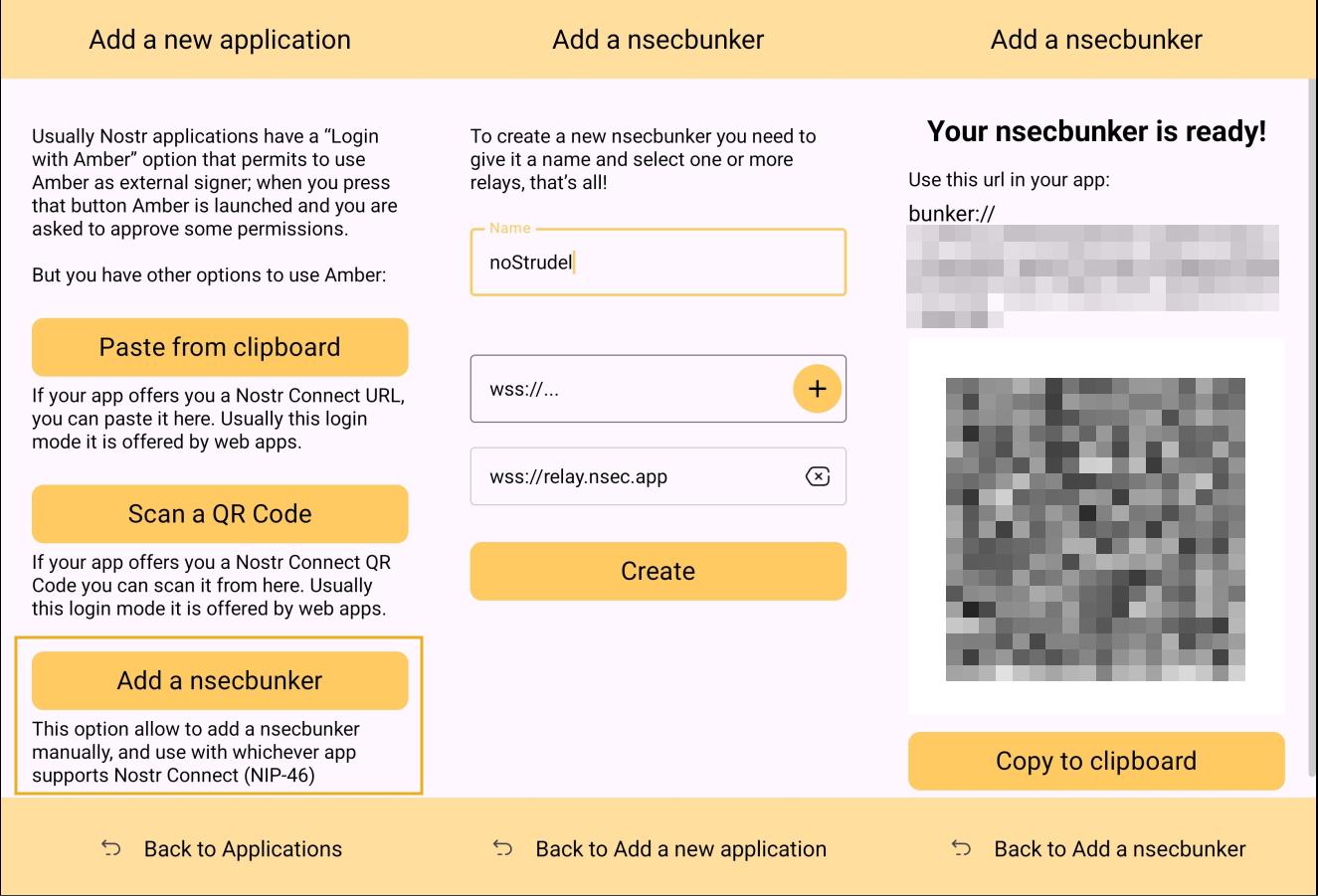

How To Set It Up

1. Install LNbits at Home

Use a Raspiblitz, MyNode, Umbrel or other node package to run your home LNbits instance. You can also build your own node with Phoenixd and LNbits or any other combination of LNbits and Lightning node software.

-

Enable the

NWCProviderextension -

Create a new NWC connection

- Copy the NWC connection string

2. Provision a Clearnet LNbits Instance

Use:

- LNbits SaaS

- Your own VPS on a VPS provider like Vultr, Linode, AWC EC2 and install LNbits

3. Connect via NWC

On your clearnet LNbits instance:

-

Go to Settings → Funding

-

Select "Nostr Wallet Connect"

-

Paste your copied NWC connection string

-

Click Save, then Restart Server

Done! 🎉 Your clearnet LNbits instance is now funded by your home Lightning node—no open ports, no VPN, no fuss.

Home Nodes

You can use this setup with any LNbits-compatible home Lightning node, including:

- Raspiblitz

- Start9

- Umbrel

- MyNode

- Your own home server box with LNbits plus any other Lightning funding source for example Phoenixd, Core-Lightning, LND, etc.

Try it Out

Want to try this yourself?

- 🧠 Enjoy control, privacy, and simplicity

- 🌍 Use LNbits on the clearnet with funding from your own node

- 🔌 Connect apps like Alby, Minibits, Coinos, or your own LNbits

🚀 Run LNbits

Start exploring the power of NWC and LNbits today:

NWC Apps

Here are some great apps that make use of NWC.

- Alby Go

- A lightning wallet that uses one or many NWC providers to make and receive lightning payments

- Damus

- Decentralised social app on Nostr

- Amethyst

- Android Nostr social media client client

- Clean interface, popular among mobile users

- Snort

- Web-based Nostr client

- Familiar UI, easy access via browser

- Stacker News

- Bitcoin-centric news/discussion site

- Earn sats via upvotes

- Zeus

- Mobile app for controlling your own Lightning node

- Favoured by self-custody and privacy-focused users

Resources

-

@ c631e267:c2b78d3e

2025-04-25 20:06:24

@ c631e267:c2b78d3e

2025-04-25 20:06:24Die Wahrheit verletzt tiefer als jede Beleidigung. \ Marquis de Sade

Sagen Sie niemals «Terroristin B.», «Schwachkopf H.», «korrupter Drecksack S.» oder «Meinungsfreiheitshasserin F.» und verkneifen Sie sich Memes, denn so etwas könnte Ihnen als Beleidigung oder Verleumdung ausgelegt werden und rechtliche Konsequenzen haben. Auch mit einer Frau M.-A. S.-Z. ist in dieser Beziehung nicht zu spaßen, sie gehört zu den Top-Anzeigenstellern.

«Politikerbeleidigung» als Straftatbestand wurde 2021 im Kampf gegen «Rechtsextremismus und Hasskriminalität» in Deutschland eingeführt, damals noch unter der Regierung Merkel. Im Gesetz nicht festgehalten ist die Unterscheidung zwischen schlechter Hetze und guter Hetze – trotzdem ist das gängige Praxis, wie der Titel fast schon nahelegt.

So dürfen Sie als Politikerin heute den Tesla als «Nazi-Auto» bezeichnen und dies ausdrücklich auf den Firmengründer Elon Musk und dessen «rechtsextreme Positionen» beziehen, welche Sie nicht einmal belegen müssen. [1] Vielleicht ernten Sie Proteste, jedoch vorrangig wegen der «gut bezahlten, unbefristeten Arbeitsplätze» in Brandenburg. Ihren Tweet hat die Berliner Senatorin Cansel Kiziltepe inzwischen offenbar dennoch gelöscht.

Dass es um die Meinungs- und Pressefreiheit in der Bundesrepublik nicht mehr allzu gut bestellt ist, befürchtet man inzwischen auch schon im Ausland. Der Fall des Journalisten David Bendels, der kürzlich wegen eines Faeser-Memes zu sieben Monaten Haft auf Bewährung verurteilt wurde, führte in diversen Medien zu Empörung. Die Welt versteckte ihre Kritik mit dem Titel «Ein Urteil wie aus einer Diktatur» hinter einer Bezahlschranke.

Unschöne, heutzutage vielleicht strafbare Kommentare würden mir auch zu einigen anderen Themen und Akteuren einfallen. Ein Kandidat wäre der deutsche Bundesgesundheitsminister (ja, er ist es tatsächlich immer noch). Während sich in den USA auf dem Gebiet etwas bewegt und zum Beispiel Robert F. Kennedy Jr. will, dass die Gesundheitsbehörde (CDC) keine Covid-Impfungen für Kinder mehr empfiehlt, möchte Karl Lauterbach vor allem das Corona-Lügengebäude vor dem Einsturz bewahren.