-

@ c1e6505c:02b3157e

2025-05-27 01:11:45

@ c1e6505c:02b3157e

2025-05-27 01:11:45I spent Memorial Day swimming in the local river - something I try to do at least four times a week. It’s the best form of exercise imo, but it’s more than that. Swimming against the tide, feeling the water move around me... there’s something about it that keeps me grounded. Nature at her peak.

Today I brought my X-Pro2 with the 1959 Leica Summaron 35mm f/2.8. I'm still testing the lens wide open to get a feel for its character. My subject this time: the light playing on the ripples and waves.

While I was shooting, a kid randomly ran up to me and started telling me something about what he got for his dad while fishing, or something - I didn’t quite hear him - and then he asked what I was looking at. I told him, “The ripples. The way the light is refracting.” I had him sit exactly where I was so he could see it too.

He lit up. You could tell no one had ever pointed something like that out to him before. In that moment, I felt like maybe I was able to plant a little seed - a new way of seeing.

This is what I was looking at.

-

@ 5c26ee8b:a4d229aa

2025-05-26 16:10:05

@ 5c26ee8b:a4d229aa

2025-05-26 16:10:05In March 2022, I have introduced “VCPs”; (Virtual Currency points). So that the international transactions are made without relying on one currency or another and the financial crises are easily avoided.

You may have noticed that banks are increasing their gold reserves and that there are interests for local virtual currency and that was after the note was published.

The picture of the note showing its date will be in attachment to this post; I can’t edit it to avoid that its date gets changed. Here its content:

Conversion of international banking system: The “VCPs” system: * Each central bank would keep its assets and funds in homeland. * Establishing the value of one virtual currency point. I suggested that: 1 virtual currency point (VCP) = 0.1 gram of gold. * Virtual evaluation must be made to each currency, virtual currency points must be added to each currency’s market value. * International transfers and payments must use the virtual currency points, VCPs, assigned to each currency in international operations. * Daily, weekly, monthly or yearly the actual money corresponding to the virtual currency points used in payments and transfers will be sent by any chosen mean of transport to the banks that had completed the operations or to the corresponding central banks. In this way no currency would prevail in international payments as all currencies will be considered as VCPs. —————————————————————- Because of the need of more guidelines to start using VCPs I have published the following updates:

VCPs allowance updates:

- Not only gold, also precious stones or agreed minerals held in banks can be used to obtain the VCPs allowance (public VCPs allowances). At the same time what is registered and kept in circulation (of gold, precious stones and agreed minerals that belongs to the people) in the country as private VCPs allowances to increase the VCPs allowances. The people can use their personal VCPs along with their precious items for purchases; for example if they sell or use their own gold to buy something, they must give their VCPs registration receipt or card (if they didn’t register their gold to obtain VCPs allowance, they can get it registered at the moment they decide to sell it so it gets added to the private VCPs allowances of his/her country). However, the registered materials must be declared at all borders while traveling once exceeded an internationally agreed specific amount (such as the value of €10000). Therefore a registration method can be agreed with gold and jewelry shops. For instance, while evaluating the materials getting registered, an online VCPs account (for a first registration) can get made on the site that is getting ready and the registration can be combined with a physical/online card (VCPs allowance card. For registering other materials in a later moment, the same card can be used to access the same account. Note that the materials must be used with the private VCPs allowance card for buying or selling, while for public VCPs accounts it’s not necessary because the materials will be kept in the central bank or other banks) or a receipt with a serial number (and other methods to protect customers from fraud). Banks can buy private VCPs while buying gold or other agreed materials and make them public VCPs. And people can have public VCPs allowances corresponding to the value of money (currency) they have already in their accounts. While if people buy gold from the bank (with cash or any other payment method), the related public VCPs allowance will be transformed into private ones (the buyers must receive the actual gold with the private VCPs allowance).

- The agreed materials that can be used to obtain public VCPs must not be consumable (such as oil or natural gas) or used for industrial purposes (such as iron or lithium).

- The printed and online (used by credit or debit cards) currency kept in circulation of the concerned country must correspond to the value of public VCPs allowance that must correspond with the value of gold kept in the central bank (printing more money will decrease its own value internationally).

- Private banks in the same country can have a public VCPs agreement with the central bank so that each bank registers and declares how much gold or valuable materials it has and get its own share of public VCPs allowance and its related printed/online currency in circulation.

- Gems and gold kept in museums can have public VCPs allowances that correspond to their weights only not the archeological values.

- International trade can use public VCPs allowances and the physical payment must follow; either by a preferred currency or gold. However if two or more countries have a trade agreement they can barter goods using IVCPs (International VCPs Allowances; that does not need to have a deposited amount of gold although they will use the same reference as public or private VCPs because it’s a general way to evaluate goods of different types; so for example oil can be swapped for electronics based on how much IVCPs are agreed to be equally swapped each year; i.e. a gallon of oil that costs 50 IVCPs can be swapped for a device that costs 25 IVCPs and grains that cost 25 IVCPs in an International VCPs Allowance Agreement where all parties receives the agreed goods without transferring money or gold). The amount of IVCPs can be agreed per year or there could a multiple online account/s viewable by the countries/parties taking part in the agreement showing the balance of International VCPs that can still be used in bartering goods for each one of the participating countries/parties).

- Cryptocurrencies can be like International VCPs they won’t need to have a deposit of gold, however they must go through an evaluation process compared to their current comparative value and gold (i.e. the amount of bitcoin that must be paid to buy a 0.1g of gold now can become the fixed value) so that the Cryptocurrencies can still be used for trading or bartering for goods even after the release of VCPs. The Cryptocurrencies can sustain the deficiencies of amount of currency that can be used in the same country or internationally (because not everyone can have enough gold deposited to sustain the daily trade). However regulations on the amount of Cryptocurrency/ies exchanged in a country must be agreed with its own central bank or there could be an international agreement; this amount can’t be less than what’s already in use of a certain Cryptocurrency. Or Cryptocurrencies can be exchanged with IVCPs (to protect people’s money while keeping in mind their compared value with gold now) and an amount of International VCPs allowance can be used also for bartering goods in the same country through an agreement with its own central bank.

- Public VCPs must have printable cash allowance that can be in the country or overseas (registered in banks, exchange companies and at borders). Each bank can have registers of local or foreign cash.

- In order to avoid the devaluation of the currency, because the printed money will corrisponde to the gold or valuable minerals held by the country, the concerned country must retrieve the cash abroad and replace it either with another currency or IVCPs through a trade agreement.

- To compensate the deficit of VCPs necessary for daily use within a country and to make a proper distinction, locally, Local Virtual Points (LVCPs) can be used.

- The Local VCPs would be issued by local authorities.

Meanwhile, countries started using the free VCPs platform that is built by a talented web developer in JavaScript; fiatjaf. I insist though that the trade name for the virtual currency points stays “VCPs” and that the clients are made aware of its usage in their daily banking.

-

@ c9badfea:610f861a

2025-05-25 22:36:12

@ c9badfea:610f861a

2025-05-25 22:36:12- Install Notally (it's free and open source)

- Open the app, tap ≡, and select Settings

- Tap View and switch to Grid

- Return to the main screen

- Tap ☑ to create a task list and ✏️ to create a note

- Enjoy!

ℹ️ You can also add pictures and set reminders for notes and task lists

ℹ️ Add labels to the notes (e.g. "Diary", "Snippet" or "Knowledge")

ℹ️ Use emojis to enhance titles (e.g. "🛒 Purchases" and "🔗️ Links")

-

@ c9badfea:610f861a

2025-05-25 19:40:48

@ c9badfea:610f861a

2025-05-25 19:40:48- Install Currencies (it's free and open source)

- Launch the app, tap ⋮ and select Settings

- Enable the Foreign Transaction Fee to factor in conversion fees if necessary

- Tap Data Provider and choose another provider if necessary

- Enjoy ad-free conversion rates

ℹ️ Tap 📈 to open the exchange rate chart

-

@ 975e4ad5:8d4847ce

2025-05-25 10:43:35

@ 975e4ad5:8d4847ce

2025-05-25 10:43:35Selfishness as Bitcoin’s Engine

Bitcoin, created by Satoshi Nakamoto, operates on a clear mechanism: miners use computational power to solve complex mathematical puzzles, verifying transactions on the network. In return, they earn rewards in Bitcoin. This is pure self-interest—miners want to maximize their profits. But while pursuing personal gain, they inadvertently maintain the entire system. Each new block added to the blockchain makes the network more stable and resilient against attacks. The more miners join, the more decentralized the system becomes, rendering it nearly impossible to manipulate.

This mechanism is brilliant because it taps into human nature—the desire for personal gain—to create something greater. Bitcoin doesn’t rely on altruism or good intentions. It relies on rational self-interest, which drives individuals to act in their own favor, ultimately benefiting the entire community.

The World Works the Same Way

This concept isn’t unique to Bitcoin. The world is full of examples where personal interest leads to collective progress. When an entrepreneur creates a new product, they do so to make money, but in the process, they create jobs, advance technology, and improve people’s lives. When a scientist works on a breakthrough, they may be driven by fame or financial reward, but the result is often a discovery that changes the world. Even in everyday life, when we buy products or services for our own convenience, we support the economy and encourage innovation.

Of course, self-interest doesn’t always lead to positive outcomes. Technologies created with good intentions can be misused—for example, in wars or for fraud. But even these negative aspects don’t halt progress. Competition and the drive for survival push humanity to find solutions, learn from mistakes, and keep moving forward. This is the cycle of development: individual self-interest fuels innovations that make the world more technological and connected.

Nature and Bitcoin: The DNA Parallel

To understand this mechanism, let’s look to nature. Consider the cells in a living organism. Each cell operates independently, following the instructions encoded in its DNA—a code that dictates its actions. The cell doesn’t “know” about the entire body, nor does it care. It simply strives for its own survival, performing its functions. But when billions of cells work together, following this code, they create something greater—a living organism.

Bitcoin is like the DNA of a decentralized system. Each miner is like a cell, following the “instructions” of the protocol to survive (profit). They don’t think about the entire network, only their own reward. But when all miners act together, they create something bigger—a global, secure, and resilient financial system. This is the beauty of decentralization: everyone acts for themselves, but the result is collective.

Selfishness and Humanity

Humans are no different from cells. Each of us wants to thrive—to have security, comfort, and success. But in pursuing these goals, we contribute to society. A teacher educates because they want to earn a living, but they shape future generations. An engineer builds a bridge because it’s their job, but it facilitates transportation for millions. Even in our personal lives, when we care for our families, we strengthen the social bonds that make society stronger.

Of course, there are exceptions—people who act solely for personal gain without regard for consequences. But even these outliers don’t change the bigger picture. Selfishness, when channeled correctly, is a driver of progress. Bitcoin is proof of this—a technology that turns personal interest into global innovation.

Bitcoin is more than just a cryptocurrency; it’s a mirror of human nature and the way the world works. Its design harnesses selfishness to create something sustainable and valuable. Just like cells in a body or people in society, Bitcoin miners work for themselves but contribute to something greater. It’s a reminder that even in our pursuit of personal gain, we can make the world a better place—as long as we follow the right “code.”

-

@ 63d59db8:be170f6f

2025-05-23 12:53:00

@ 63d59db8:be170f6f

2025-05-23 12:53:00In a world overwhelmed by contradictions—climate change, inequality, political instability, and social disconnection—absurdity becomes an unavoidable lens through which to view the human condition. Inspired by Albert Camus' philosophy, this project explores the tension between life’s inherent meaninglessness and our persistent search for purpose.\ \ The individuals in these images embody a quiet defiance, navigating chaos with a sense of irony and authenticity. Through the act of revolt—against despair, against resignation—they find agency and resilience. These photographs invite reflection, not on solutions, but on our capacity to live meaningfully within absurdity.

Visit Katerina's website here.

Submit your work to the NOICE Visual Expression Awards for a chance to win a few thousand extra sats:

-

@ 04c915da:3dfbecc9

2025-05-20 15:53:48

@ 04c915da:3dfbecc9

2025-05-20 15:53:48This piece is the first in a series that will focus on things I think are a priority if your focus is similar to mine: building a strong family and safeguarding their future.

Choosing the ideal place to raise a family is one of the most significant decisions you will ever make. For simplicity sake I will break down my thought process into key factors: strong property rights, the ability to grow your own food, access to fresh water, the freedom to own and train with guns, and a dependable community.

A Jurisdiction with Strong Property Rights

Strong property rights are essential and allow you to build on a solid foundation that is less likely to break underneath you. Regions with a history of limited government and clear legal protections for landowners are ideal. Personally I think the US is the single best option globally, but within the US there is a wide difference between which state you choose. Choose carefully and thoughtfully, think long term. Obviously if you are not American this is not a realistic option for you, there are other solid options available especially if your family has mobility. I understand many do not have this capability to easily move, consider that your first priority, making movement and jurisdiction choice possible in the first place.

Abundant Access to Fresh Water

Water is life. I cannot overstate the importance of living somewhere with reliable, clean, and abundant freshwater. Some regions face water scarcity or heavy regulations on usage, so prioritizing a place where water is plentiful and your rights to it are protected is critical. Ideally you should have well access so you are not tied to municipal water supplies. In times of crisis or chaos well water cannot be easily shutoff or disrupted. If you live in an area that is drought prone, you are one drought away from societal chaos. Not enough people appreciate this simple fact.

Grow Your Own Food

A location with fertile soil, a favorable climate, and enough space for a small homestead or at the very least a garden is key. In stable times, a small homestead provides good food and important education for your family. In times of chaos your family being able to grow and raise healthy food provides a level of self sufficiency that many others will lack. Look for areas with minimal restrictions, good weather, and a culture that supports local farming.

Guns

The ability to defend your family is fundamental. A location where you can legally and easily own guns is a must. Look for places with a strong gun culture and a political history of protecting those rights. Owning one or two guns is not enough and without proper training they will be a liability rather than a benefit. Get comfortable and proficient. Never stop improving your skills. If the time comes that you must use a gun to defend your family, the skills must be instinct. Practice. Practice. Practice.

A Strong Community You Can Depend On

No one thrives alone. A ride or die community that rallies together in tough times is invaluable. Seek out a place where people know their neighbors, share similar values, and are quick to lend a hand. Lead by example and become a good neighbor, people will naturally respond in kind. Small towns are ideal, if possible, but living outside of a major city can be a solid balance in terms of work opportunities and family security.

Let me know if you found this helpful. My plan is to break down how I think about these five key subjects in future posts.

-

@ 04c915da:3dfbecc9

2025-05-16 17:59:23

@ 04c915da:3dfbecc9

2025-05-16 17:59:23Recently we have seen a wave of high profile X accounts hacked. These attacks have exposed the fragility of the status quo security model used by modern social media platforms like X. Many users have asked if nostr fixes this, so lets dive in. How do these types of attacks translate into the world of nostr apps? For clarity, I will use X’s security model as representative of most big tech social platforms and compare it to nostr.

The Status Quo

On X, you never have full control of your account. Ultimately to use it requires permission from the company. They can suspend your account or limit your distribution. Theoretically they can even post from your account at will. An X account is tied to an email and password. Users can also opt into two factor authentication, which adds an extra layer of protection, a login code generated by an app. In theory, this setup works well, but it places a heavy burden on users. You need to create a strong, unique password and safeguard it. You also need to ensure your email account and phone number remain secure, as attackers can exploit these to reset your credentials and take over your account. Even if you do everything responsibly, there is another weak link in X infrastructure itself. The platform’s infrastructure allows accounts to be reset through its backend. This could happen maliciously by an employee or through an external attacker who compromises X’s backend. When an account is compromised, the legitimate user often gets locked out, unable to post or regain control without contacting X’s support team. That process can be slow, frustrating, and sometimes fruitless if support denies the request or cannot verify your identity. Often times support will require users to provide identification info in order to regain access, which represents a privacy risk. The centralized nature of X means you are ultimately at the mercy of the company’s systems and staff.

Nostr Requires Responsibility

Nostr flips this model radically. Users do not need permission from a company to access their account, they can generate as many accounts as they want, and cannot be easily censored. The key tradeoff here is that users have to take complete responsibility for their security. Instead of relying on a username, password, and corporate servers, nostr uses a private key as the sole credential for your account. Users generate this key and it is their responsibility to keep it safe. As long as you have your key, you can post. If someone else gets it, they can post too. It is that simple. This design has strong implications. Unlike X, there is no backend reset option. If your key is compromised or lost, there is no customer support to call. In a compromise scenario, both you and the attacker can post from the account simultaneously. Neither can lock the other out, since nostr relays simply accept whatever is signed with a valid key.

The benefit? No reliance on proprietary corporate infrastructure.. The negative? Security rests entirely on how well you protect your key.

Future Nostr Security Improvements

For many users, nostr’s standard security model, storing a private key on a phone with an encrypted cloud backup, will likely be sufficient. It is simple and reasonably secure. That said, nostr’s strength lies in its flexibility as an open protocol. Users will be able to choose between a range of security models, balancing convenience and protection based on need.

One promising option is a web of trust model for key rotation. Imagine pre-selecting a group of trusted friends. If your account is compromised, these people could collectively sign an event announcing the compromise to the network and designate a new key as your legitimate one. Apps could handle this process seamlessly in the background, notifying followers of the switch without much user interaction. This could become a popular choice for average users, but it is not without tradeoffs. It requires trust in your chosen web of trust, which might not suit power users or large organizations. It also has the issue that some apps may not recognize the key rotation properly and followers might get confused about which account is “real.”

For those needing higher security, there is the option of multisig using FROST (Flexible Round-Optimized Schnorr Threshold). In this setup, multiple keys must sign off on every action, including posting and updating a profile. A hacker with just one key could not do anything. This is likely overkill for most users due to complexity and inconvenience, but it could be a game changer for large organizations, companies, and governments. Imagine the White House nostr account requiring signatures from multiple people before a post goes live, that would be much more secure than the status quo big tech model.

Another option are hardware signers, similar to bitcoin hardware wallets. Private keys are kept on secure, offline devices, separate from the internet connected phone or computer you use to broadcast events. This drastically reduces the risk of remote hacks, as private keys never touches the internet. It can be used in combination with multisig setups for extra protection. This setup is much less convenient and probably overkill for most but could be ideal for governments, companies, or other high profile accounts.

Nostr’s security model is not perfect but is robust and versatile. Ultimately users are in control and security is their responsibility. Apps will give users multiple options to choose from and users will choose what best fits their need.

-

@ 5c26ee8b:a4d229aa

2025-05-23 08:47:45

@ 5c26ee8b:a4d229aa

2025-05-23 08:47:45Generally mentioning God, Allah, by reciting/reading the Quran or performing Salat (compulsory prayer), for instance, brings tranquility to the heart of the believer. The Salat, other than being the first deed a Muslim would be questioned about on Judgement Day, it keeps the person away from the forbidden wrong deeds too. The Salat is sufficient for obtaining God’s provision as he decrees the means for it to reach the person. Wasting or missing performing the Salat or mentioning God (Allah) by reciting/reading the Quran or Tasbieh, can lead to following the desires only and a depressed life as well as punishment in the Thereafter.

13:28 Ar-Ra'd

الَّذِينَ آمَنُوا وَتَطْمَئِنُّ قُلُوبُهُمْ بِذِكْرِ اللَّهِ ۗ أَلَا بِذِكْرِ اللَّهِ تَطْمَئِنُّ الْقُلُوبُ

Those who have believed and whose hearts are assured (tranquillised) by the remembrance of Allah. Unquestionably, by the remembrance of Allah hearts are assured (tranquillised)."

29:45 Al-Ankaboot

اتْلُ مَا أُوحِيَ إِلَيْكَ مِنَ الْكِتَابِ وَأَقِمِ الصَّلَاةَ ۖ إِنَّ الصَّلَاةَ تَنْهَىٰ عَنِ الْفَحْشَاءِ وَالْمُنْكَرِ ۗ وَلَذِكْرُ اللَّهِ أَكْبَرُ ۗ وَاللَّهُ يَعْلَمُ مَا تَصْنَعُونَ

Recite, [O Muhammad], what has been revealed to you of the Book and establish prayer. Indeed, prayer prohibits immorality and wrongdoing, and the remembrance of Allah is greater. And Allah knows that which you do.

11:114 Hud

وَأَقِمِ الصَّلَاةَ طَرَفَيِ النَّهَارِ وَزُلَفًا مِنَ اللَّيْلِ ۚ إِنَّ الْحَسَنَاتِ يُذْهِبْنَ السَّيِّئَاتِ ۚ ذَٰلِكَ ذِكْرَىٰ لِلذَّاكِرِينَ

And establish prayer at the two ends of the day and at the approach of the night. Indeed, good deeds do away with misdeeds. That is a reminder for those who remember.

20:132 Taa-Haa

وَأْمُرْ أَهْلَكَ بِالصَّلَاةِ وَاصْطَبِرْ عَلَيْهَا ۖ لَا نَسْأَلُكَ رِزْقًا ۖ نَحْنُ نَرْزُقُكَ ۗ وَالْعَاقِبَةُ لِلتَّقْوَىٰ

And enjoin prayer upon your family [and people] and be steadfast therein. We ask you not for provision; We provide for you, and the [best] outcome is for [those of] righteousness.

20:124 Taa-Haa

وَمَنْ أَعْرَضَ عَنْ ذِكْرِي فَإِنَّ لَهُ مَعِيشَةً ضَنْكًا وَنَحْشُرُهُ يَوْمَ الْقِيَامَةِ أَعْمَىٰ

And whoever turns away from My remembrance - indeed, he will have a depressed life, and We will gather him on the Day of Resurrection blind."

20:125 Taa-Haa

قَالَ رَبِّ لِمَ حَشَرْتَنِي أَعْمَىٰ وَقَدْ كُنْتُ بَصِيرًا

He will say, "My Lord, why have you raised me blind while I was [once] seeing?"

20:126 Taa-Haa

قَالَ كَذَٰلِكَ أَتَتْكَ آيَاتُنَا فَنَسِيتَهَا ۖ وَكَذَٰلِكَ الْيَوْمَ تُنْسَىٰ

[Allah] will say, "Thus did Our signs come to you, and you forgot them; and thus will you this Day be forgotten."

20:127 Taa-Haa

وَكَذَٰلِكَ نَجْزِي مَنْ أَسْرَفَ وَلَمْ يُؤْمِنْ بِآيَاتِ رَبِّهِ ۚ وَلَعَذَابُ الْآخِرَةِ أَشَدُّ وَأَبْقَىٰ

And thus do We recompense he who transgressed and did not believe in the signs of his Lord. And the punishment of the Hereafter is more severe and more enduring.

20:128 Taa-Haa

أَفَلَمْ يَهْدِ لَهُمْ كَمْ أَهْلَكْنَا قَبْلَهُمْ مِنَ الْقُرُونِ يَمْشُونَ فِي مَسَاكِنِهِمْ ۗ إِنَّ فِي ذَٰلِكَ لَآيَاتٍ لِأُولِي النُّهَىٰ

Then, has it not become clear to them how many generations We destroyed before them as they walk among their dwellings? Indeed in that are signs for those of intelligence.

49:17 Al-Hujuraat

يَمُنُّونَ عَلَيْكَ أَنْ أَسْلَمُوا ۖ قُلْ لَا تَمُنُّوا عَلَيَّ إِسْلَامَكُمْ ۖ بَلِ اللَّهُ يَمُنُّ عَلَيْكُمْ أَنْ هَدَاكُمْ لِلْإِيمَانِ إِنْ كُنْتُمْ صَادِقِينَ

They consider it a favor to you that they have accepted Islam. Say, "Do not consider your Islam a favor to me. Rather, Allah has conferred favor upon you that He has guided you to the faith, if you should be truthful."

53:29 An-Najm

فَأَعْرِضْ عَنْ مَنْ تَوَلَّىٰ عَنْ ذِكْرِنَا وَلَمْ يُرِدْ إِلَّا الْحَيَاةَ الدُّنْيَا

So turn away from whoever turns his back on Our message and desires not except the worldly life.

53:30 An-Najm

ذَٰلِكَ مَبْلَغُهُمْ مِنَ الْعِلْمِ ۚ إِنَّ رَبَّكَ هُوَ أَعْلَمُ بِمَنْ ضَلَّ عَنْ سَبِيلِهِ وَهُوَ أَعْلَمُ بِمَنِ اهْتَدَىٰ

That is their sum of knowledge. Indeed, your Lord is most knowing of who strays from His way, and He is most knowing of who is guided.

53:62 An-Najm

فَاسْجُدُوا لِلَّهِ وَاعْبُدُوا ۩

So prostrate to Allah and worship [Him].

-

@ 975e4ad5:8d4847ce

2025-05-23 08:47:08

@ 975e4ad5:8d4847ce

2025-05-23 08:47:08Bitcoin Is Not Just an Asset

When Satoshi Nakamoto introduced Bitcoin in 2009, the vision was clear: a decentralized currency for everyday transactions, from buying coffee to paying bills. It was designed to bypass banks and governments, empowering individuals with financial freedom. But when Bitcoin is treated as “digital gold” and locked away in wallets, it fails to fulfill this vision. Instead of replacing fiat currencies, it becomes just another investment, leaving people reliant on dollars, euros, or other traditional currencies for their daily needs.

The Problem with HODLing and Loans

Some Bitcoin enthusiasts advocate holding their coins indefinitely and taking loans against them rather than spending. This approach may seem financially savvy—Bitcoin’s value often rises over time, and loans provide liquidity without selling. But this prioritizes personal gain over the broader goal of financial revolution. Someone who holds Bitcoin while spending fiat isn’t supporting Bitcoin’s mission; they’re merely using it to stay wealthy within the existing system. This undermines the dream of a decentralized financial future.

Lightning Network: Fast and Cheap Transactions

One common argument against using Bitcoin for daily purchases is the high fees and slow transaction times on the main blockchain. Enter the Lightning Network, a second-layer solution that enables near-instant transactions with minimal fees. Imagine paying for groceries or ordering a pizza with Bitcoin, quickly and cheaply. This technology makes Bitcoin practical for everyday use, paving the way for widespread adoption.

Why Using Bitcoin Matters

If Bitcoin is only hoarded and not spent, it will remain a niche asset that shields against inflation but doesn’t challenge the fiat system. For Bitcoin to become a true alternative currency, it must be used everywhere—in stores, online platforms, and peer-to-peer exchanges. The more people and businesses accept Bitcoin, the closer we get to a world where decentralized currency is the norm. This isn’t just an investment; it’s a movement for financial freedom.\ \ Bitcoin wasn’t created to sit idly in wallets or serve as collateral for loans. It’s a tool for change that demands active use. If we want a world where individuals control their finances, we must start using Bitcoin—not just to avoid poverty, but to build a new financial reality.

-

@ 90c656ff:9383fd4e

2025-05-27 11:27:26

@ 90c656ff:9383fd4e

2025-05-27 11:27:26Since its creation, Bitcoin has been a revolutionary asset, challenging the traditional financial system and proposing a new form of decentralized money. However, its future remains uncertain and the subject of intense debate. Among the possible outcomes, two extreme scenarios stand out: hyperbitcoinization-where Bitcoin becomes the dominant currency in the global economy—and obsolescence, where the network loses relevance and is replaced by other solutions.

- Hyperbitcoinization: The World Adopts Bitcoin as a Monetary Standard

01 - Loss of trust in fiat currencies: Due to excessive money printing by central banks, many economies face rampant inflation. Bitcoin, with its fixed supply of 21 million units, emerges as a more trustworthy alternative.

02 - Growing adoption by companies and governments: Some countries have already begun integrating Bitcoin into their economies, accepting it for payments and as a store of value. If this trend continues, Bitcoin’s legitimacy as a global currency will grow.

03 - Ease of global transactions: Bitcoin enables fast and low-cost international transfers, removing the need for financial intermediaries and reducing operational costs.

04 - Technological advancements: Scalability improvements, such as the Lightning Network, can make Bitcoin more efficient for daily use, encouraging mass adoption.

If hyperbitcoinization becomes reality, the world may witness a radical shift in the financial system—with greater decentralization, censorship resistance, and an economy based on sound, predictable money.

- Obsolescence: Bitcoin Loses Relevance and Is Replaced

01 - Restrictive government regulations: If major economic powers enforce strict regulations on Bitcoin, adoption could slow, reducing its utility.

02 - Technological shortcomings or lack of innovation: Despite its security and decentralization, Bitcoin may struggle to scale effectively. If superior solutions emerge and gain acceptance, Bitcoin could lose its leading position.

03 - Competition from faster, more user-friendly alternatives: Other forms of digital money may surpass Bitcoin in scalability and usability, potentially leading to a decline in Bitcoin adoption.

04 - Decreasing miner incentives: As new Bitcoin issuance halves every four years, miners will rely increasingly on transaction fees. If those fees are insufficient to sustain network security, long-term viability could be at risk.

In summary, Bitcoin’s future could unfold along multiple paths, depending on factors like innovation, global adoption, and resilience to external challenges. Hyperbitcoinization would represent an economic revolution—ushering in a decentralized, inflation-resistant monetary system. Yet, obsolescence remains a risk if the network fails to adapt to future demands. Regardless of the outcome, Bitcoin has already made its mark on financial history, paving the way for a new era of digital money and economic freedom.

Thank you very much for reading this far. I hope everything is well with you, and sending a big hug from your favorite Bitcoiner maximalist from Madeira. Long live freedom!

-

@ 21335073:a244b1ad

2025-05-09 13:56:57

@ 21335073:a244b1ad

2025-05-09 13:56:57Someone asked for my thoughts, so I’ll share them thoughtfully. I’m not here to dictate how to promote Nostr—I’m still learning about it myself. While I’m not new to Nostr, freedom tech is a newer space for me. I’m skilled at advocating for topics I deeply understand, but freedom tech isn’t my expertise, so take my words with a grain of salt. Nothing I say is set in stone.

Those who need Nostr the most are the ones most vulnerable to censorship on other platforms right now. Reaching them requires real-time awareness of global issues and the dynamic relationships between governments and tech providers, which can shift suddenly. Effective Nostr promoters must grasp this and adapt quickly.

The best messengers are people from or closely tied to these at-risk regions—those who truly understand the local political and cultural dynamics. They can connect with those in need when tensions rise. Ideal promoters are rational, trustworthy, passionate about Nostr, but above all, dedicated to amplifying people’s voices when it matters most.

Forget influencers, corporate-backed figures, or traditional online PR—it comes off as inauthentic, corny, desperate and forced. Nostr’s promotion should be grassroots and organic, driven by a few passionate individuals who believe in Nostr and the communities they serve.

The idea that “people won’t join Nostr due to lack of reach” is nonsense. Everyone knows X’s “reach” is mostly with bots. If humans want real conversations, Nostr is the place. X is great for propaganda, but Nostr is for the authentic voices of the people.

Those spreading Nostr must be so passionate they’re willing to onboard others, which is time-consuming but rewarding for the right person. They’ll need to make Nostr and onboarding a core part of who they are. I see no issue with that level of dedication. I’ve been known to get that way myself at times. It’s fun for some folks.

With love, I suggest not adding Bitcoin promotion with Nostr outreach. Zaps already integrate that element naturally. (Still promote within the Bitcoin ecosystem, but this is about reaching vulnerable voices who needed Nostr yesterday.)

To promote Nostr, forget conventional strategies. “Influencers” aren’t the answer. “Influencers” are not the future. A trusted local community member has real influence—reach them. Connect with people seeking Nostr’s benefits but lacking the technical language to express it. This means some in the Nostr community might need to step outside of the Bitcoin bubble, which is uncomfortable but necessary. Thank you in advance to those who are willing to do that.

I don’t know who is paid to promote Nostr, if anyone. This piece isn’t shade. But it’s exhausting to see innocent voices globally silenced on corporate platforms like X while Nostr exists. Last night, I wondered: how many more voices must be censored before the Nostr community gets uncomfortable and thinks creatively to reach the vulnerable?

A warning: the global need for censorship-resistant social media is undeniable. If Nostr doesn’t make itself known, something else will fill that void. Let’s start this conversation.

-

@ 90c656ff:9383fd4e

2025-05-27 11:22:10

@ 90c656ff:9383fd4e

2025-05-27 11:22:10Since its creation, Bitcoin has been much more than just an alternative to traditional money. With the ongoing digitalization of the global economy, Bitcoin has emerged as a foundational pillar for new forms of transactions, commerce, and value storage. Its decentralization, transparency, and censorship resistance make it a solid base for digital economies, where financial interactions occur without the need for traditional intermediaries.

- Bitcoin’s role in the digital economy

01 - Global, borderless transactions: Anyone with internet access can send and receive Bitcoin without needing a bank or government authorization.

02 - Limited and predictable supply: Unlike fiat currencies that can be inflated by central banks, Bitcoin has a fixed cap of 21 million units, making it a scarce and reliable asset.

03 - Security and transparency: The Bitcoin blockchain or timechain publicly records all transactions, ensuring a secure and auditable system.

04 - Censorship resistance: No government or institution can block Bitcoin transactions, enabling a freer and more accessible digital economy.

With these characteristics, Bitcoin is already transforming various economic sectors and driving new forms of commerce and investment.

- Bitcoin in digital commerce and the global economy

01 - E-commerce: Businesses and consumers can use Bitcoin for fast international transactions without exorbitant fees.

02 - International remittances: Workers sending money to their home countries can avoid high fees and long delays by using Bitcoin.

03 - Emerging economies: In countries with unstable currencies and unreliable banking systems, Bitcoin serves as a secure and decentralized alternative for storing wealth and conducting daily transactions.

Additionally, Bitcoin is being adopted by companies and even governments as a store of value, reinforcing its role as a foundation for the digital economy of the future.

- Challenges and adapting to the new economy

01 - Price volatility: Bitcoin’s fluctuating value can make it difficult to use as a daily medium of exchange.

02 - Regulations and governmental resistance: Some countries attempt to restrict or regulate Bitcoin to maintain control over the traditional financial system.

03 - Education and adoption: Many people still lack the knowledge to use Bitcoin safely and effectively.

In summary, Bitcoin is transforming the way the world interacts with money, offering a decentralized and transparent alternative for digital economies. As more individuals and businesses adopt Bitcoin for payments, savings, and global commerce, its impact becomes increasingly clear. Despite the challenges, Bitcoin continues to solidify its place as the foundation of a new economic paradigm—where financial freedom and technological innovation go hand in hand.

Thank you very much for reading this far. I hope everything is well with you, and sending a big hug from your favorite Bitcoiner maximalist from Madeira. Long live freedom!

-

@ ae1008d2:a166d760

2025-04-01 00:29:56

@ ae1008d2:a166d760

2025-04-01 00:29:56This is part one in a series of long-form content of my ideas as to what we are entering into in my opinion;The Roaring '20's 2.0 (working title). I hope you'll join me on this journey together.

"History does not repeat itself, but it often rhymes"; - Samuel Clemens, aka Mark Twain. My only class I received an A+ in high school was history, this opened up the opportunity for me to enroll in an AP (college level) history class my senior year. There was an inherent nature for me to study history. Another quote I found to live by; "If we do not study history, we are bound to repeat it", a paraphrased quote by the many great philosphers of old from Edmund Burke, George Santayana and even Winston Churchill, all pulling from the same King Solomon quote; "What has been will be again, what has been done will be done again; there is nothing new under the sun". My curiousity of human actions, psychological and therefore economical behavior, has benefitted me greatly throughout my life and career, at such a young age. Being able to 'see around the curves' ahead I thought was a gift many had, but was sorely mistaken. People are just built different. One, if not my hardest action for me is to share. I just do things; act, often without even thinking about writing down or sharing in anyway shape or form what I just did here with friends, what we just built or how we formed these startups, etc., I've finally made the time, mainly for myself, to share my thoughts and ideas as to where we are at, and what we can do moving forward. It's very easy for us living a sovereign-lifestyle in Bitcoin, Nostr and other P2P, cryptographically-signed sovereign tools and tech-stacks alike, permissionless and self-hostable, to take all these tools for granted. We just live with them. Use them everyday. Do you own property? Do you have to take care of the cattle everyday? To live a sovereign life is tough, but most rewarding. As mentioned above, I'm diving into the details in a several part series as to what the roaring '20's were about, how it got to the point it did, and the inevitable outcome we all know what came to be. How does this possibly repeat itself almost exactly a century later? How does Bitcoin play a role? Are we all really going to be replaced by AI robots (again, history rhymes here)? Time will tell, but I think most of us actually using the tools will also forsee many of these possible outcomes, as it's why we are using many of these tools today. The next parts of this series will be released periodically, maybe once per month, maybe once per quarter. I'll also be releasing these on other platforms like Medium for reach, but Nostr will always be first, most important and prioritized.

I'll leave you with one of my favorite quotes I've lived by from one of the greatest traders of all time, especially during this roaring '20's era, Jesse Livermore; "Money is made by sitting, not trading". -

@ 975e4ad5:8d4847ce

2025-05-22 14:30:53

@ 975e4ad5:8d4847ce

2025-05-22 14:30:53The Risks of Offline Storage

Keeping your seed phrase offline – on paper, in a safe, or on a USB drive – seems secure, but it comes with significant risks:

-

Fire or Flood: A disaster could destroy your home, along with the paper or device storing your seed phrase.

-

Theft: Someone could find your seed phrase in your safe or a hidden spot at home.

-

Natural Disasters or War: If you’re forced to leave your home, you might lose access to your seed phrase, effectively locking you out of your assets.

-

Human Error: You could accidentally lose, damage, or misplace the paper or device holding your seed phrase.

These vulnerabilities make offline storage less reliable, especially if you don’t have backups or can’t access them in an emergency.

The Benefits of Online Storage

When done right, online storage addresses these issues. The primary advantage is accessibility: you can retrieve your seed phrase from anywhere in the world as long as you have an internet connection and the necessary credentials. This is invaluable if you’re away from home or in a crisis.

The key to making online storage safe? Encryption.

How to Store Your Seed Phrase Online Securely

-

Choose a Secure Platform\ Upload your encrypted seed phrase to a reputable cloud storage service like Google Drive, Dropbox, or Proton Drive, which offers built-in encryption. Ensure you use a strong password and enable two-factor authentication (2FA) for your account.

-

Encrypt Your Seed Phrase\ Before uploading, encrypt your seed phrase using a tool with strong encryption, such as AES-256. Here are some easy options:

-

VeraCrypt: A free tool that lets you create an encrypted file or container. Save your seed phrase in a text file, add it to an encrypted container, and set a password only you know.

-

GPG (GnuPG): This tool allows you to encrypt text files using public and private keys. Generate a key pair and store the private key securely (e.g., on an offline USB drive).

-

7-Zip: A popular compression tool that supports AES-256 encryption. Create an encrypted archive with your seed phrase and set a strong password.

-

Keep the Decryption Key in Your Head\ The password or decryption key should be something only you know. Avoid writing it down to prevent unauthorized access.

-

Disguise the File\ Even if someone sees your encrypted file, they shouldn’t suspect what it contains. Name the file something generic, like “family_recipes.txt,” instead of “seed_phrase.txt.”

Why Encryption Matters

Encryption ensures that even if someone gains access to your file, they can’t read your seed phrase without the decryption key. AES-256, for example, is an industry-standard encryption method considered virtually unbreakable with a strong password. This means that even if a hacker accesses your cloud storage, they can’t use your seed phrase.

Practical Tips for Maximum Security

-

Split Your Seed Phrase: For added protection, divide your seed phrase into multiple parts and store them in separate encrypted files on different platforms.

-

Test Your Access: Periodically check that you can log into your cloud storage and decrypt your file to avoid surprises.

-

Use a Strong Password: Choose a password longer than 12 characters, combining letters, numbers, and special characters.

-

Create Backups: Store multiple encrypted copies on different platforms for extra redundancy.

Conclusion

Storing your seed phrase online isn’t reckless if you do it right. With proper encryption and a secure platform, you can combine the convenience of global access with a high level of protection. Offline methods have their risks, but secure online storage ensures your assets are safe and accessible, no matter where you are.

-

-

@ 58937958:545e6994

2025-05-22 12:25:49

@ 58937958:545e6994

2025-05-22 12:25:49Since it's Bitcoin Pizza Day, I made a Bitcoin pizza!

To give it a Japanese twist, I made it a mentaiko pizza (※ mentaiko = spicy cod roe, a popular Japanese ingredient often used in pasta or rice dishes). For the Bitcoin logo, I used a salmon terrine.

Salmon Terrine

I cut out the "B" logo using hanpen (※ hanpen = a soft, white Japanese fish cake made from fish paste and yam). Tip: You can also cut a colored plastic folder into the "B" shape and place it on top as a stencil — makes it easier!

I blended salmon, hanpen, milk, egg, and a bit of salt in a food processor, poured it into a container, and baked it in a water bath.

Pizza Dough

I mixed bread flour, dry yeast, salt, olive oil, and water, then kneaded it with determination! Let it rise for about an hour until fluffy.

Mentaiko Mayo Topping

I mixed mentaiko, mayonnaise, and soy sauce.

I spread out the dough, added the mentaiko mayo, cheese, and corn, then baked it. Halfway through, I added thin slices of mochi (rice cake). After baking, I topped it with seaweed and the salmon terrine to finish!

Lots to reflect on

About the Terrine

In the video, you’ll see I divided the terrine into two portions. I was worried that the salmon and hanpen parts might end up looking too similar in color, making the “B” logo hard to see.

So for one half, I added ketchup, thinking: “Maybe this will make the red more vibrant?” But even with the ketchup, it didn’t change much.

The Mochi

I accidentally bought thinly sliced mochi, but I realized it might burn too easily as a pizza topping. Regular mochi with standard thickness is probably better.

I added the mochi halfway through baking, opening the oven once, but now I’m thinking that might have lowered the oven temp too much.

Lessons Learned

This was my first and only attempt—no test run beforehand— so I ended up with a long list of lessons learned. In the future, I should definitely do a trial version first… But you know… salmon and mentaiko are expensive! (excuses, excuses)

Cheese

I wanted to do that Instagram-worthy cheese pull moment, but nope. No stretch. None at all. I think that kind of thing needs a totally different kind of cheese or prep. Will have to experiment more.

Taste Test

Actually really good. I usually don’t eat mentaiko mayo myself, and I’m a Margherita pizza fan at heart. But this was surprisingly nice. A little rich in flavor—made me crave a bowl of rice. Next time, I might skip the soy sauce to tone it down a bit.

nostr:nevent1qqsrhularycewltxz88e9wrwutkqu5pkylh3vxrmys2e0nuh7c2h06qgqp9zc

-

@ c1e6505c:02b3157e

2025-05-22 03:44:39

@ c1e6505c:02b3157e

2025-05-22 03:44:39This is day two of testing the Leica Summaron 35mm f2.8 on the Fujifilm X-Pro2.

The first part of this story you can find here on StackerNews**

TL;DR: I think I’m really enjoying this lens.

I went into it thinking I’d probably just sell it since it was gifted to me - assumed I wouldn’t like it. But after just a couple of days with it mounted on the X-Pro2, I’ve been surprisingly drawn to it.

Shooting wide open at f2.8 (which is how I’m testing it - to best reveal the lens’s character), the soft roll-off is really pleasing. It feels organic. The lens is over 50 years old, so I expected some quirks-but the quality feels natural, not overly “vintage". Takes the digital edge off.

The short focus throw is also really nice. Compared to the Summicron 35mm f2 v3 I usually shoot on my M262 (which has a longer throw), the Summaron feels tighter and more responsive when zone focusing.

One gripe: the infinity lock. It’s kind of annoying. I find myself accidentally locking it too often, but I’m getting used to holding the button down as I rotate the ring. I’ve read others complain about it, so I know I’m not alone there.

Most of these shots were from a bike ride to the river - about 6 miles out to swim and enjoy the sun. Perfect day for making a few photos.

This kind of work is honestly just fun. I enjoy the process, and even more so once I’m happy with the results and can share them.

Still building confidence in my work over time. I think I’m slowly refining my style - even if the subject matter is simple. Easier said than done, as any editor/curator knows (and I say this as one through NOICE Magazine).

Let me know what you think. I’ll try to upload higher resolution versions this time around (but not too high).

*Also, I use a program called Dehancer for creating the grain in these photographs. I highly recommend the program actually, I've been using it for a long time. If you would like to try it out, I have a promo code. Use "Pictureroom" for 10% off I believe.

You can further support me and my work by sending sats to colincz\@getalby.com. Thank you.

(note* this is being publised from the updated Primal reads client)

-

@ 866e0139:6a9334e5

2025-05-27 10:15:17

@ 866e0139:6a9334e5

2025-05-27 10:15:17Autor: Milosz Matuschek. Dieser Beitrag wurde mit dem Pareto-Client geschrieben. Sie finden alle Texte der Friedenstaube und weitere Texte zum Thema Frieden hier. Die neuesten Pareto-Artikel finden Sie auch in unserem Telegram-Kanal.

Die neuesten Artikel der Friedenstaube gibt es jetzt auch im eigenen Friedenstaube-Telegram-Kanal.

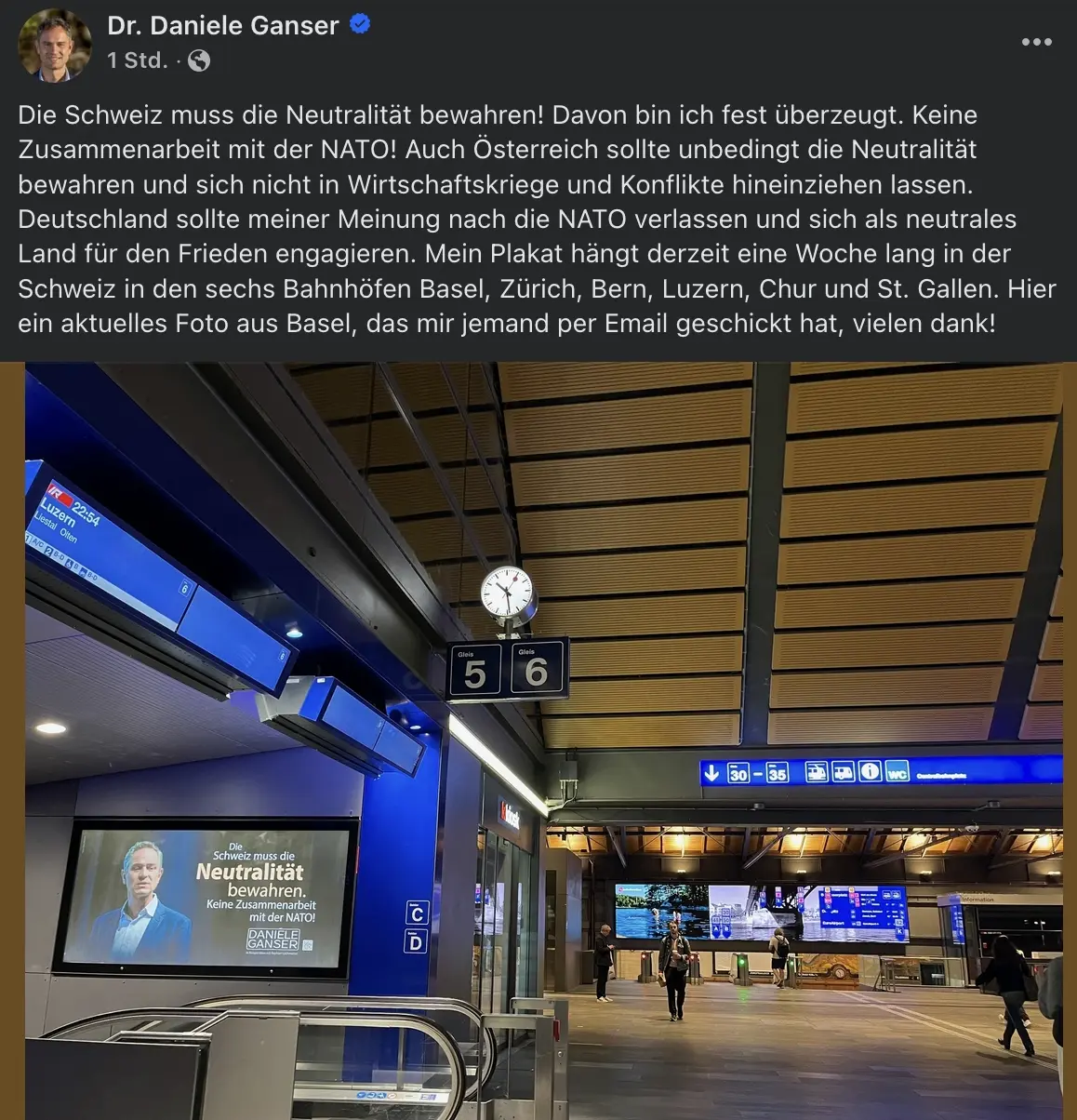

Der Schweizer Historiker Daniele Ganser startet eine Plakataktion. Auf Facebook schreibt er:

"Dieses Plakat habe ich ab heute an sechs Bahnhöfen in der Schweiz aufhängen lassen: Die Schweiz muss die Neutralität bewahren. Keine Zusammenarbeit mit der NATO!

Die Aktion läuft eine Woche. Das Plakat hängt in Basel (Gleis 5 und 7), Zürich (Gleis 9 und 12), Bern (Gleis 3 und 11), Luzern (Gleis 7 und 11), St. Gallen (Gleis 1 und 2) und Chur (Gleis 4 und Arosabahn).

Wenn jemand ein Plakat sieht und fotografiert und es mir per Email schickt freut mich das!

https://globalbridge.ch/die-schweiz-muss-die.../

Daniele Ganser kann man über folgende Seite kontaktieren.

LASSEN SIE DER FRIEDENSTAUBE FLÜGEL WACHSEN!

Hier können Sie die Friedenstaube abonnieren und bekommen die Artikel zugesandt.

Schon jetzt können Sie uns unterstützen:

- Für 50 CHF/EURO bekommen Sie ein Jahresabo der Friedenstaube.

- Für 120 CHF/EURO bekommen Sie ein Jahresabo und ein T-Shirt/Hoodie mit der Friedenstaube.

- Für 500 CHF/EURO werden Sie Förderer und bekommen ein lebenslanges Abo sowie ein T-Shirt/Hoodie mit der Friedenstaube.

- Ab 1000 CHF werden Sie Genossenschafter der Friedenstaube mit Stimmrecht (und bekommen lebenslanges Abo, T-Shirt/Hoodie).

Für Einzahlungen in CHF (Betreff: Friedenstaube):

Für Einzahlungen in Euro:

Milosz Matuschek

IBAN DE 53710520500000814137

BYLADEM1TST

Sparkasse Traunstein-Trostberg

Betreff: Friedenstaube

Wenn Sie auf anderem Wege beitragen wollen, schreiben Sie die Friedenstaube an: friedenstaube@pareto.space

Sie sind noch nicht auf Nostr and wollen die volle Erfahrung machen (liken, kommentieren etc.)? Zappen können Sie den Autor auch ohne Nostr-Profil! Erstellen Sie sich einen Account auf Start. Weitere Onboarding-Leitfäden gibt es im Pareto-Wiki.

-

@ 51bbb15e:b77a2290

2025-05-21 00:24:36

@ 51bbb15e:b77a2290

2025-05-21 00:24:36Yeah, I’m sure everything in the file is legit. 👍 Let’s review the guard witness testimony…Oh wait, they weren’t at their posts despite 24/7 survellience instructions after another Epstein “suicide” attempt two weeks earlier. Well, at least the video of the suicide is in the file? Oh wait, a techical glitch. Damn those coincidences!

At this point, the Trump administration has zero credibility with me on anything related to the Epstein case and his clients. I still suspect the administration is using the Epstein files as leverage to keep a lot of RINOs in line, whereas they’d be sabotaging his agenda at every turn otherwise. However, I just don’t believe in ends-justify-the-means thinking. It’s led almost all of DC to toss out every bit of the values they might once have had.

-

@ 39cc53c9:27168656

2025-05-27 09:21:53

@ 39cc53c9:27168656

2025-05-27 09:21:53The new website is finally live! I put in a lot of hard work over the past months on it. I'm proud to say that it's out now and it looks pretty cool, at least to me!

Why rewrite it all?

The old kycnot.me site was built using Python with Flask about two years ago. Since then, I've gained a lot more experience with Golang and coding in general. Trying to update that old codebase, which had a lot of design flaws, would have been a bad idea. It would have been like building on an unstable foundation.

That's why I made the decision to rewrite the entire application. Initially, I chose to use SvelteKit with JavaScript. I did manage to create a stable site that looked similar to the new one, but it required Jav aScript to work. As I kept coding, I started feeling like I was repeating "the Python mistake". I was writing the app in a language I wasn't very familiar with (just like when I was learning Python at that mom ent), and I wasn't happy with the code. It felt like spaghetti code all the time.

So, I made a complete U-turn and started over, this time using Golang. While I'm not as proficient in Golang as I am in Python now, I find it to be a very enjoyable language to code with. Most aof my recent pr ojects have been written in Golang, and I'm getting the hang of it. I tried to make the best decisions I could and structure the code as well as possible. Of course, there's still room for improvement, which I'll address in future updates.

Now I have a more maintainable website that can scale much better. It uses a real database instead of a JSON file like the old site, and I can add many more features. Since I chose to go with Golang, I mad e the "tradeoff" of not using JavaScript at all, so all the rendering load falls on the server. But I believe it's a tradeoff that's worth it.

What's new

- UI/UX - I've designed a new logo and color palette for kycnot.me. I think it looks pretty cool and cypherpunk. I am not a graphic designer, but I think I did a decent work and I put a lot of thinking on it to make it pleasant!

- Point system - The new point system provides more detailed information about the listings, and can be expanded to cover additional features across all services. Anyone can request a new point!

- ToS Scrapper: I've implemented a powerful automated terms-of-service scrapper that collects all the ToS pages from the listings. It saves you from the hassle of reading the ToS by listing the lines that are suspiciously related to KYC/AML practices. This is still in development and it will improve for sure, but it works pretty fine right now!

- Search bar - The new search bar allows you to easily filter services. It performs a full-text search on the Title, Description, Category, and Tags of all the services. Looking for VPN services? Just search for "vpn"!

- Transparency - To be more transparent, all discussions about services now take place publicly on GitLab. I won't be answering any e-mails (an auto-reply will prompt to write to the corresponding Gitlab issue). This ensures that all service-related matters are publicly accessible and recorded. Additionally, there's a real-time audits page that displays database changes.

- Listing Requests - I have upgraded the request system. The new form allows you to directly request services or points without any extra steps. In the future, I plan to enable requests for specific changes to parts of the website.

- Lightweight and fast - The new site is lighter and faster than its predecessor!

- Tor and I2P - At last! kycnot.me is now officially on Tor and I2P!

How?

This rewrite has been a labor of love, in the end, I've been working on this for more than 3 months now. I don't have a team, so I work by myself on my free time, but I find great joy in helping people on their private journey with cryptocurrencies. Making it easier for individuals to use cryptocurrencies without KYC is a goal I am proud of!

If you appreciate my work, you can support me through the methods listed here. Alternatively, feel free to send me an email with a kind message!

Technical details

All the code is written in Golang, the website makes use of the chi router for the routing part. I also make use of BigCache for caching database requests. There is 0 JavaScript, so all the rendering load falls on the server, this means it needed to be efficient enough to not drawn with a few users since the old site was reporting about 2M requests per month on average (note that this are not unique users).

The database is running with mariadb, using gorm as the ORM. This is more than enough for this project. I started working with an

sqlitedatabase, but I ended up migrating to mariadb since it works better with JSON.The scraper is using chromedp combined with a series of keywords, regex and other logic. It runs every 24h and scraps all the services. You can find the scraper code here.

The frontend is written using Golang Templates for the HTML, and TailwindCSS plus DaisyUI for the CSS classes framework. I also use some plain CSS, but it's minimal.

The requests forms is the only part of the project that requires JavaScript to be enabled. It is needed for parsing some from fields that are a bit complex and for the "captcha", which is a simple Proof of Work that runs on your browser, destinated to avoid spam. For this, I use mCaptcha.

-

@ c9badfea:610f861a

2025-05-20 17:05:41

@ c9badfea:610f861a

2025-05-20 17:05:41- Install YTDLnis (it's free and open source)

- Launch the app and allow notifications and storage access if prompted

- Go to any supported website or use the YouTube, Instagram, X, or Facebook app

- Tap Share on the post or website URL and select YTDLnis as the sharing destination

- Adjust the settings if desired and tap Download

- You'll be notified when the download finishes

- Enjoy uninterrupted watching!

ℹ️ This app uses

yt-dlpinternally and it's also available as a standalone CLI tool -

@ 04c915da:3dfbecc9

2025-05-20 15:47:16

@ 04c915da:3dfbecc9

2025-05-20 15:47:16Here’s a revised timeline of macro-level events from The Mandibles: A Family, 2029–2047 by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes.

Part One: 2029–2032

-

2029 (Early Year)\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor.

-

2029 (Mid-Year: The Great Renunciation)\ Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive.

-

2029 (Late Year)\ Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant.

-

2030–2031\ Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness.

-

2032\ By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured.

Time Jump: 2032–2047

- Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies.

Part Two: 2047

-

2047 (Early Year)\ The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum.

-

2047 (Mid-Year)\ Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency.

-

2047 (Late Year)\ The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society.

Key Differences

- Currency Dynamics: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control.

- Government Power: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities.

- Societal Outcome: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots.

This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory.

-

-

@ 6ad3e2a3:c90b7740

2025-05-20 13:49:50

@ 6ad3e2a3:c90b7740

2025-05-20 13:49:50I’ve written about MSTR twice already, https://www.chrisliss.com/p/mstr and https://www.chrisliss.com/p/mstr-part-2, but I want to focus on legendary short seller James Chanos’ current trade wherein he buys bitcoin (via ETF) and shorts MSTR, in essence to “be like Mike” Saylor who sells MSTR shares at the market and uses them to add bitcoin to the company’s balance sheet. After all, if it’s good enough for Saylor, why shouldn’t everyone be doing it — shorting a company whose stock price is more than 2x its bitcoin holdings and using the proceeds to buy the bitcoin itself?

Saylor himself has said selling shares at 2x NAV (net asset value) to buy bitcoin is like selling dollars for two dollars each, and Chanos has apparently decided to get in while the getting (market cap more than 2x net asset value) is good. If the price of bitcoin moons, sending MSTR’s shares up, you are more than hedged in that event, too. At least that’s the theory.

The problem with this bet against MSTR’s mNAV, i.e., you are betting MSTR’s market cap will converge 1:1 toward its NAV in the short and medium term is this trade does not exist in a vacuum. Saylor has described how his ATM’s (at the market) sales of shares are accretive in BTC per share because of this very premium they carry. Yes, we’ll dilute your shares of the company, but because we’re getting you 2x the bitcoin per share, you are getting an ever smaller slice of an ever bigger overall pie, and the pie is growing 2x faster than your slice is reducing. (I https://www.chrisliss.com/p/mstr how this works in my first post.)

But for this accretion to continue, there must be a constant supply of “greater fools” to pony up for the infinitely printable shares which contain only half their value in underlying bitcoin. Yes, those shares will continue to accrete more BTC per share, but only if there are more fools willing to make this trade in the future. So will there be a constant supply of such “fools” to keep fueling MSTR’s mNAV multiple indefinitely?

Yes, there will be in my opinion because you have to look at the trade from the prospective fools’ perspective. Those “fools” are not trading bitcoin for MSTR, they are trading their dollars, selling other equities to raise them maybe, but in the end it’s a dollars for shares trade. They are not selling bitcoin for them.

You might object that those same dollars could buy bitcoin instead, so they are surely trading the opportunity cost of buying bitcoin for them, but if only 5-10 percent of the market (or less) is buying bitcoin itself, the bucket in which which those “fools” reside is the entire non-bitcoin-buying equity market. (And this is not considering the even larger debt market which Saylor has yet to tap in earnest.)

So for those 90-95 percent who do not and are not presently planning to own bitcoin itself, is buying MSTR a fool’s errand, so to speak? Not remotely. If MSTR shares are infinitely printable ATM, they are still less so than the dollar and other fiat currencies. And MSTR shares are backed 2:1 by bitcoin itself, while the fiat currencies are backed by absolutely nothing. So if you hold dollars or euros, trading them for MSTR shares is an errand more sage than foolish.

That’s why this trade (buying BTC and shorting MSTR) is so dangerous. Not only are there many people who won’t buy BTC buying MSTR, there are many funds and other investment entities who are only able to buy MSTR.

Do you want to get BTC at 1:1 with the 5-10 percent or MSTR backed 2:1 with the 90-95 percent. This is a bit like medical tests that have a 95 percent accuracy rate for an asymptomatic disease that only one percent of the population has. If someone tests positive, it’s more likely to be a false one than an indication he has the disease*. The accuracy rate, even at 19:1, is subservient to the size of the respective populations.

At some point this will no longer be the case, but so long as the understanding of bitcoin is not widespread, so long as the dollar is still the unit of account, the “greater fools” buying MSTR are still miles ahead of the greatest fools buying neither, and the stock price and mNAV should only increase.

. . .

One other thought: it’s more work to play defense than offense because the person on offense knows where he’s going, and the defender can only react to him once he moves. Similarly, Saylor by virtue of being the issuer of the shares knows when more will come online while Chanos and other short sellers are borrowing them to sell in reaction to Saylor’s strategy. At any given moment, Saylor can pause anytime, choosing to issue convertible debt or preferred shares with which to buy more bitcoin, and the shorts will not be given advance notice.

If the price runs, and there is no ATM that week because Saylor has stopped on a dime, so to speak, the shorts will be left having to scramble to change directions and buy the shares back to cover. Their momentum might be in the wrong direction, though, and like Allen Iverson breaking ankles with a crossover, Saylor might trigger a massive short squeeze, rocketing the share price ever higher. That’s why he actually welcomes Chanos et al trying this copycat strategy — it becomes the fuel for outsized gains.

For that reason, news that Chanos is shorting MSTR has not shaken my conviction, though there are other more pertinent https://www.chrisliss.com/p/mstr-part-2 with MSTR, of which one should be aware. And as always, do your own due diligence before investing in anything.

* To understand this, consider a population of 100,000, with one percent having a disease. That means 1,000 have it, 99,000 do not. If the test is 95 percent accurate, and everyone is tested, 950 of the 1,000 will test positive (true positives), 50 who have it will test negative (false negatives.) Of the positives, 95 percent of 99,000 (94,050) will test negative (true negatives) and five percent (4,950) will test positive (false positives). That means 4,950 out of 5,900 positives (84%) will be false.

-

@ 6ad3e2a3:c90b7740

2025-05-20 13:44:28

@ 6ad3e2a3:c90b7740

2025-05-20 13:44:28I https://www.chrisliss.com/p/mstr a few months ago with the subtitle “The Only Stock,” and I’m starting to regret it. Now, it was trading at 396 on January 20 when I posted it and 404 now (even if it dipped 40 percent to 230 or so in between), but that’s not why I regret it. I pointed out it was not investable unless you’re willing to stomach large drawdowns, and anyone who bought then could exit with a small profit now had they not panic-sold along the way.

The reason I regret it is I don’t want to make public stock predictions because it adds stress to my life. I have not sold any of my shares yet, but something I’ve noticed recently has got me thinking about it, and stock tips are like a game of telephone wherein whoever is last in the chain might find out the wrong information and too late. And while every adult has agency and is responsible for his own financial decisions, I don’t want my readers losing money on account of anything I write.

My base case is still that MSTR becomes a trillion-dollar company, destroys the performance of the S&P, the Mag-7 and virtually any other equity portfolio most people would assemble. Michael Saylor is trading an infinitely-printable asset (his shares) for humanity’s best-ever, finite-supply digital gold, and that trade should be profitable for him and his shareholders in perpetuity.

I don’t know exactly what he plans to do when that trade is no longer available to him — either because no one takes fiat currency for bitcoin anymore or because his mNAV (market-cap-to-bitcoin-holding ratio) goes below one — but that’s not my main concern, either. At that point he’ll have so much bitcoin, he’ll probably become the world’s first and largest bitcoin bank and profit by making his pristine collateral available to individuals and institutions. Even at five percent interest, half a trillion in bitcoin would yield $25B in profits every year. Even at a modest 10x valuation, the stock would more than double from here.

I am also not overly concerned with Saylor’s present amount of convertible debt which is at low or zero rates and is only https://www.strategy.com/. He’s been conservative on that front and only issuing on favorable terms. I don’t doubt Saylor’s prescience, intelligence or business sense one bit.

What got me thinking were some Twitter posts by a former Salomon Brothers trader/prophet Josh Mandell https://x.com/JoshMandell6/status/1921597739458339193 recently. In November when bitcoin was mooning after the election, he predicted that on March 14th it would close at $84,000, and if it did it would then go on an epic run up to $444,000 this cycle.

A lot of people make predictions, a few of them come true, but rarely do they come true on the dot (it closed at exactly $84K according to some exchanges) and on such a specific timeframe. Now, maybe he just got lucky, or maybe he is a skilled trader who made one good prediction, but the reason he gave for his prediction, insofar as he gave one, was not some technical chart or quantitative analysis, but a memory he had from 30 years ago that got into his mind that he couldn’t shake. He didn’t get much more specific than that, other than that he was tuned into something that if he explained fully would make too many people think he had gone insane. And then the prediction came true on the dot months later.

Now I believe in the paranormal more than the average person. I do not think things are random, and insofar as they appear that way it’s only because we have incomplete information — even a coin toss is predictable if you knew the exact force and spin that was put on the coin. I think for whatever reason, this guy is plugged into something, and while I would never invest a substantial amount of money on that belief — not only are earnestly-made prophecies often delusions or even if correct wrongly interpreted — that he sold makes me think.

He gave more substantive reasons for selling than prophecy, by the way — he seems to think Saylor’s perpetual issuance of shares ATM (at the market) to buy more bitcoin is putting too much downward pressure on the stock. Obviously, selling shares — even if to buy the world’s most pristine collateral at a 2x-plus mNAV — reduces the short-term appreciation of those shares.

His thesis seems to be that Saylor is doing this even if he would be better off letting the price appreciate more, attracting more investors, squeezing more shorts, etc because he needs to improve his credit rating to tap into the convertible debt market to the extent he has promised ($42 billion more over the next few years) at favorable terms. But in doing this, he is souring common stock investors because they are not seeing the near-term appreciation they should on their holdings.

Now this is a trivial concern if over the long haul MSTR does what it has the last couple years which is to outperform by a wide margin not only every large cap stock and the S&P but bitcoin itself. And the bigger his stack of bitcoin, the more his stock should appreciate as bitcoin goes up. But markets do not operate linearly and rationally. Should he sour prospective buyers to a great enough extent, should he attract shorts (and supply them with available shares to borrow) to a great enough extent, perhaps there might be an mNAV-crushing cascade that drives people into other bitcoin treasury companies, ETFs or bitcoin itself.