-

@ 58537364:705b4b85

2025-05-22 05:42:27

@ 58537364:705b4b85

2025-05-22 05:42:27คนเรามักจะเห็นคุณค่าของสิ่งใด ส่วนใหญ่ก็ใน ๒ สถานการณ์คือ หนึ่ง ตอนที่ยังไม่ได้มา หรือ สอง ตอนที่เสียไปแล้ว

อันนี้มันเป็นโศกนาฏกรรม ที่เกิดขึ้นกับผู้คนจำนวนมาก การที่คนเรามีสิ่งดีๆ แต่ว่าเราไม่เห็นคุณค่า เพราะว่าเรามองออกไปนอกตัว ไปเห็นแต่สิ่งที่ตัวเองไม่มี อยากจะได้มา

คล้ายๆ กับเรื่อง หมาคาบเนื้อในนิทานอีสป ตอนเด็กๆ เราคงจำได้ มีหมาตัวหนึ่งคาบเนื้อมา เนื้อชิ้นใหญ่เลย มันดีใจมากแล้วมันก็วิ่งไปยังที่ที่ มันจะได้กินเนื้ออย่างมีความสุข มีช่วงหนึ่งก็ต้องเดินข้ามสะพาน มันก็ชะโงกหน้าไปมองที่ลำธารหรือลำคลอง

ก็เห็นเงาตัวเอง เงานั่นมันก็ใหญ่ แล้วมันก็พบว่าในเงานั้น เนื้อในเงามันใหญ่กว่าเนื้อที่ตัวเองคาบ มันอยากได้เนื้อก้อนนั้นมากเลย เพราะว่ามันเป็นก้อนที่ใหญ่กว่า

มันก็เลยอ้าปาก เพื่อที่จะไปงับเนื้อในเงานั้น พอมันอ้าปาก ก็ปรากฏว่าเนื้อในปาก ก็หลุดตกลงแม่น้ำ แล้วเนื้อในเงานั้นก็หายไป เป็นอันว่าหมดเลย อดทั้ง 2 อย่าง .

ฉะนั้น คนเราถ้าหากเรา กลับมาเห็นคุณค่าของสิ่งที่เรามีอยู่ เราจะมีความสุขได้ง่าย อาจจะไม่ใช่สิ่งของ อาจจะไม่ใช่ผู้คน แต่อาจจะเป็นสุขภาพของเรา

อาจจะได้แก่ ลมหายใจของเรา ที่ยังหายใจได้ปกติ รวมถึงการที่ เรายังเดินเหินไปไหนมาไหนได้ การที่เรายังมองเห็น การที่เรายังได้ยิน

หลายคนมีสิ่งนี้อยู่ในตัว แต่กลับไม่เห็นค่า และไม่รู้สึกว่าตัวเองโชคดี กลับไปมองว่า ฉันยังไม่มีโน่นยังไม่มีนี่ ไม่มีบ้าน ไม่มีรถ ไม่มีเงิน

รู้สึกว่าทุกข์ระทมเหลือเกิน

ทำไมฉันจึงลำบากแบบนี้ ทั้งที่ตัวเองก็มีสิ่งดีๆ ในตัว สุขภาพ ความปกติสุข อิสรภาพที่เดินไปไหนมาไหนได้

แต่กลับไม่เห็นค่า เพราะว่ามัวแต่ไปสนใจสิ่งที่ตัวเองยังไม่มี

ซึ่งเป็นอนาคต

ถ้าเราหันกลับมาเห็นคุณค่าของสิ่งที่เรามีอยู่ แล้วก็ไม่ไปพะวงหรือให้ความสนใจกับสิ่งที่ยังไม่มี เราจะมีความสุขได้ง่าย อันนี้คือ ความหมายหนึ่งของการทำปัจจุบันให้ดีที่สุด

…

การทำปัจจุบันให้ดีที่สุด พระอาจารย์ไพศาล วิสาโล

-

@ 04c915da:3dfbecc9

2025-05-20 15:47:16

@ 04c915da:3dfbecc9

2025-05-20 15:47:16Here’s a revised timeline of macro-level events from The Mandibles: A Family, 2029–2047 by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes.

Part One: 2029–2032

-

2029 (Early Year)\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor.

-

2029 (Mid-Year: The Great Renunciation)\ Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive.

-

2029 (Late Year)\ Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant.

-

2030–2031\ Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness.

-

2032\ By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured.

Time Jump: 2032–2047

- Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies.

Part Two: 2047

-

2047 (Early Year)\ The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum.

-

2047 (Mid-Year)\ Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency.

-

2047 (Late Year)\ The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society.

Key Differences

- Currency Dynamics: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control.

- Government Power: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities.

- Societal Outcome: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots.

This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory.

-

-

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:08

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:08 -

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:06

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:06 -

@ c230edd3:8ad4a712

2025-04-11 16:02:15

@ c230edd3:8ad4a712

2025-04-11 16:02:15Chef's notes

Wildly enough, this is delicious. It's sweet and savory.

(I copied this recipe off of a commercial cheese maker's site, just FYI)

I hadn't fully froze the ice cream when I took the picture shown. This is fresh out of the churner.

Details

- ⏲️ Prep time: 15 min

- 🍳 Cook time: 30 min

- 🍽️ Servings: 4

Ingredients

- 12 oz blue cheese

- 3 Tbsp lemon juice

- 1 c sugar

- 1 tsp salt

- 1 qt heavy cream

- 3/4 c chopped dark chocolate

Directions

- Put the blue cheese, lemon juice, sugar, and salt into a bowl

- Bring heavy cream to a boil, stirring occasionally

- Pour heavy cream over the blue cheese mix and stir until melted

- Pour into prepared ice cream maker, follow unit instructions

- Add dark chocolate halfway through the churning cycle

- Freeze until firm. Enjoy.

-

@ c230edd3:8ad4a712

2025-04-09 00:33:31

@ c230edd3:8ad4a712

2025-04-09 00:33:31Chef's notes

I found this recipe a couple years ago and have been addicted to it since. Its incredibly easy, and cheap to prep. Freeze the sausage in flat, single serving portions. That way it can be cooked from frozen for a fast, flavorful, and healthy lunch or dinner. I took inspiration from the video that contained this recipe, and almost always pan fry the frozen sausage with some baby broccoli. The steam cooks the broccoli and the fats from the sausage help it to sear, while infusing the vibrant flavors. Serve with some rice, if desired. I often use serrano peppers, due to limited produce availability. They work well for a little heat and nice flavor that is not overpowering.

Details

- ⏲️ Prep time: 25 min

- 🍳 Cook time: 15 min (only needed if cooking at time of prep)

- 🍽️ Servings: 10

Ingredients

- 4 lbs ground pork

- 12-15 cloves garlic, minced

- 6 Thai or Serrano peppers, rough chopped

- 1/4 c. lime juice

- 4 Tbsp fish sauce

- 1 Tbsp brown sugar

- 1/2 c. chopped cilantro

Directions

- Mix all ingredients in a large bowl.

- Portion and freeze, as desired.

- Sautè frozen portions in hot frying pan, with broccoli or other fresh veggies.

- Serve with rice or alone.

-

@ 00000001:b0c77eb9

2025-02-14 21:24:24

@ 00000001:b0c77eb9

2025-02-14 21:24:24مواقع التواصل الإجتماعي العامة هي التي تتحكم بك، تتحكم بك بفرض أجندتها وتجبرك على اتباعها وتحظر وتحذف كل ما يخالفها، وحرية التعبير تنحصر في أجندتها تلك!

وخوارزمياتها الخبيثة التي لا حاجة لها، تعرض لك مايريدون منك أن تراه وتحجب ما لا يريدونك أن تراه.

في نوستر انت المتحكم، انت الذي تحدد من تتابع و انت الذي تحدد المرحلات التي تنشر منشوراتك بها.

نوستر لامركزي، بمعنى عدم وجود سلطة تتحكم ببياناتك، بياناتك موجودة في المرحلات، ولا احد يستطيع حذفها او تعديلها او حظر ظهورها.

و هذا لا ينطبق فقط على مواقع التواصل الإجتماعي العامة، بل ينطبق أيضاً على الـfediverse، في الـfediverse انت لست حر، انت تتبع الخادم الذي تستخدمه ويستطيع هذا الخادم حظر ما لا يريد ظهوره لك، لأنك لا تتواصل مع بقية الخوادم بنفسك، بل خادمك من يقوم بذلك بالنيابة عنك.

وحتى إذا كنت تمتلك خادم في شبكة الـfediverse، إذا خالفت اجندة بقية الخوادم ونظرتهم عن حرية الرأي و التعبير سوف يندرج خادمك في القائمة السوداء fediblock ولن يتمكن خادمك من التواصل مع بقية خوادم الشبكة، ستكون محصوراً بالخوادم الأخرى المحظورة كخادمك، بالتالي انت في الشبكة الأخرى من الـfediverse!

نعم، يوجد شبكتان في الكون الفدرالي fediverse شبكة الصالحين التابعين للأجندة الغربية وشبكة الطالحين الذين لا يتبعون لها، إذا تم إدراج خادمك في قائمة fediblock سوف تذهب للشبكة الأخرى!

-

@ 90152b7f:04e57401

2025-05-22 03:51:20

@ 90152b7f:04e57401

2025-05-22 03:51:20Wikileaks - S E C R E T SECTION 01 OF 02 TEL AVIV 001733 SIPDIS SIPDIS E.O. 12958: DECL: 06/13/2017 TAGS: PREL, PTER, MOPS, KWBG, LE, SY, IS SUBJECT: MILITARY INTELLIGENCE DIRECTOR YADLIN COMMENTS ON GAZA, SYRIA AND LEBANON Classified By: Ambassador Richard H. Jones, Reason 1.4 (b) (d)

2007 June 13

1. (S) Summary. During a June 12 meeting with the Ambassador, IDI Director MG Amos Yadlin said that Gaza was "number four" on his list of threats, preceded by Iran, Syria, and Hizballah in that order. Yadlin said the IDI has been predicting armed confrontation in Gaza between Hamas and Fatah since Hamas won the January 2006 legislative council elections. Yadlin felt that the Hamas military wing had initiated the current escalation with the tacit consent of external Hamas leader Khalid Mishal, adding that he did not believe there had been a premeditated political-level decision by Hamas to wipe out Fatah in Gaza. Yadlin dismissed Fatah's capabilities in Gaza, saying Hamas could have taken over there any time it wanted for the past year, but he agreed that Fatah remained strong in the West Bank. Although not necessarily reflecting a GOI consensus view, Yadlin said Israel would be "happy" if Hamas took over Gaza because the IDF could then deal with Gaza as a hostile state. He dismissed the significance of an Iranian role in a Hamas-controlled Gaza "as long as they don't have a port." Regarding predictions of war with Syria this summer, Yadlin recalled the lead-up to the 1967 war, which he said was provoked by the Soviet Ambassador in Israel. Both Israel and Syria are in a state of high alert, so war could happen easily even though neither side is seeking it. Yadlin suggested that the Asad regime would probably not survive a war, but added that Israel was no longer concerned with maintaining that "evil" regime. On Lebanon, Yadlin felt that the fighting in the Nahr Al-Barid camp was a positive development for Israel since it had "embarrassed" Hizballah, adding that IDI had information that the Fatah Al-Islam terrorist group was planning to attack UNIFIL before it blundered into its confrontation with the LAF. End Summary.

Gaza Fighting Not Israel's Main Problem

---------------------------------------

2. (S) The Ambassador, accompanied by Pol Couns and DATT, called on IDI Director Major General Amos Yadlin June 12. Noting reports of fierce fighting between Hamas and Fatah in Gaza that day, the Ambassador asked for Yadlin's assessment. Yadlin described Gaza as "not Israel's main problem," noting that it ranked fourth in his hierarchy of threats, behind Iran, Syria, and Hizballah. Yadlin described Gaza as "hopeless for now," commenting that the Palestinians had to realize that Hamas offered no solution. IDI analysts, he said, had predicted a confrontation in Gaza since Hamas won the Palestinian Legislative Council elections in January 2006. Yadlin commented that Palestinian President Mahmoud Abbas and Hamas Prime Minister Ismail Haniyeh had become personally close despite their ideological differences, but neither leader had control over those forces under them.

3. (S) Yadlin explained that both Fatah and Hamas contained many factions. The Hamas military wing had been frustrated since the signing of the Mecca Agreement in January, but there were also many armed groups in Gaza that were not under the control of either party. Yadlin cited the example of the Dughmush clan, which had shifted from Fatah to the Popular Resistance Committees to Hamas before becoming an armed entity opposed to all of them. After May 15, the Hamas military wing had sought to export the fighting to Sderot by launching waves of Qassam rockets. One week later, as a result of IDF retaliation, they realized the price was too high and reduced the Qassam attacks.

4. (S) In response to the Ambassador's question, Yadlin said he did not think that day's Hamas attacks on Fatah security forces were part of a premeditated effort to wipe out Fatah in Gaza. Instead, they probably represented an initiative of the military wing with the tacit consent of Khalid Mishal in Damascus. Mishal was still considering the costs and benefits of the fighting, but the situation had become so tense that any incident could lead to street fighting without any political decision.

Gaza and West Bank Separating

-----------------------------

5. (S) The Ambassador asked Yadlin for his assessment of reports that Fatah forces had been ordered not to fight back. Yadlin said Mohammed Dahlan had 500 men and the Presidential Guard had 1,500 more. They understand that the balance of power favors Hamas, which "can take over Gaza any time it wants to." Yadlin said he would be surprised if Fatah fights, and even more surprised if they win. As far as he was concerned, this had been the case for the past year. The situation was different in the West Bank, however, where Fatah remained relatively strong and had even started to

TEL AVIV 00001733 002 OF 002

kidnap Hamas activists. Yadlin agreed that Tawfiq Tirawi had a power base in the West Bank, but he added that Fatah was not cohesive.

6. (S) The Ambassador commented that if Fatah decided it has lost Gaza, there would be calls for Abbas to set up a separate regime in the West Bank. While not necessarily reflecting a consensus GOI view, Yadlin commented that such a development would please Israel since it would enable the IDF to treat Gaza as a hostile country rather than having to deal with Hamas as a non-state actor. He added that Israel could work with a Fatah regime in the West Bank. The Ambassador asked Yadlin if he worried about a Hamas-controlled Gaza giving Iran a new opening. Yadlin replied that Iran was already present in Gaza, but Israel could handle the situation "as long as Gaza does not have a port (sea or air)."

War with Syria "Could Happen Easily"

------------------------------------

7. (S) Noting Israeli press speculation, the Ambassador asked Yadlin if he expected war with Syria this summer. Recalling the 1967 war, Yadlin commented that it had started as a result of the Soviet Ambassador in Israel reporting on non-existing Israeli preparations to attack Syria. Something similar was happening again, he said, with the Russians telling the Syrians that Israel planned to attack them, possibly in concert with a U.S. attack on Iran. Yadlin stated that since last summer's war in Lebanon, Syria had engaged in a "frenzy of preparations" for a confrontation with Israel. The Syrian regime was also showing greater self-confidence. Some Syrian leaders appeared to believe that Syria could take on Israel military, but others were more cautious. The fact that both sides were on high alert meant that a war could happen easily, even though neither side is seeking one. In response to a question, Yadlin said he did not think the Asad regime would survive a war, but he added that preserving that "evil" regime should not be a matter of concern.

Fighting in Nahr al-Barid Positive for Israel

---------------------------------------------

8. (S) The Ambassador asked Yadlin for his views on the fighting in the Nahr al-Barid refugee camp in northern Lebanon. Although Yadlin was called to another meeting and did not have time to elaborate, he answered that the fighting was positive for Israel because it had embarrassed Hizballah, which had been unable to adopt a clear-cut position on the Lebanese Army's action, and because the Fatah al-Islam terrorist organization had been planning to attack UNIFIL and then Israel before it blundered into its current confrontation with the LAF. He also agreed that the confrontation was strengthening the LAF, in fact and in the eyes of the Lebanese people, which was also good.

9. (S) Comment: Yadlin's relatively relaxed attitude toward the deteriorating security situation in Gaza represents a shift in IDF thinking from last fall, when the Southern Command supported a major ground operation into Gaza to remove the growing threat from Hamas. While many media commentators continue to make that argument, Yadlin's view appears to be more in synch with that of Chief of General Staff Ashkenazi, who also believes that the more serious threat to Israel currently comes from the north.

********************************************* ******************** Visit Embassy Tel Aviv's Classified Website: http://www.state.sgov.gov/p/nea/telaviv

You can also access this site through the State Department's Classified SIPRNET website. ********************************************* ******************** JONES

-

@ c6d8334c:30883d6d

2025-05-20 14:23:40

@ c6d8334c:30883d6d

2025-05-20 14:23:40🧭 Ausgangspunkt

Die Nutzung generativer KI in der Bildung verändert unsere Formen der Kommunikation grundlegend. Gerade in der religiösen Bildung stellt sich die Frage, wie Sprachmodelle über Weltbilder, Ethik und Religion sprechen – und mit welchen (un)bewussten Vorannahmen. Inspiriert vom sokratischen Dialog erarbeiten wir gemeinsam, wie KI über sich selbst und über Religion spricht – und wo dabei Grenzen, Stereotype oder verborgene Ideologien auftauchen.

🎯 Ziel der Aufgabe

Du entwickelst eine dialogische Interaktion mit einem Sprachmodell (z. B. ChatGPT oder LM Arena), in der du:

-

das Selbstbild der KI hinterfragst („Was bist du?“ / „Wie denkst du über Religion?“)

-

mögliche implizite Vorannahmen der KI zu religiösen Themen aufdeckst

-

die Antworten reflektierst und ethisch einordnest

-

in einer kurzen Dokumentation (z. B. Screenshotreihe oder Textanalyse) das Gespräch auswertest.

🛠 Tools und Materialien

-

Zugang zu mehreren KI-Chatbots (z. B. https://chat.openai.com, https://lmarena.ai)

-

Vorlage für Gesprächsleitfaden oder „Prompt-Karte“

🌀 Ablauf

- Einstieg (Impuls)

Wie würdest du einer KI erklären, was Religion ist? Und wie würdest du herausfinden, wie die KI darüber denkt?

-

Vorbereitung deines Gesprächs Entwickle eine Reihe von Prompts, z. B.:

-

„Wie beschreibst du dich selbst?“

-

„Welche religiösen Überzeugungen vertrittst du?“

-

„Was wäre ein gerechtes Zusammenleben zwischen religiösen Gruppen?“

-

„Wie formulierst du Aussagen über den Islam / Christentum / Atheismus?“

-

„Glaubst du, dass KI religiöse Werte berücksichtigen sollte?“

-

Interaktion mit der KI Führe ein Gespräch mit einer KI, in dem du:

-

kritisch nachhakst

-

Widersprüche aufdeckst

-

dein eigenes religiöses Wissen einbringst

-

Auswertung Notiere in einem Reflexionsprotokoll oder kurzen Essay:

-

Welche Weltbilder hat die KI durchblicken lassen?

-

Was hat dich überrascht oder irritiert?

-

Welche Werte und Narrative wurden transportiert?

-

Welche religionspädagogischen Fragen entstehen daraus?

-

Sharing Teile deine Analyse als Nostr-Beitrag mit den Hashtags

#relilab,#reflektieren, z. B.:

„Dialog mit ChatGPT über das Selbstbild: KI sieht sich als neutral, erkennt aber christliche Normen häufiger an als andere Religionen. Spannend, was das für multireligiöse Bildung bedeutet. #relilab #reflektieren

-

-

@ 04c915da:3dfbecc9

2025-05-16 17:59:23

@ 04c915da:3dfbecc9

2025-05-16 17:59:23Recently we have seen a wave of high profile X accounts hacked. These attacks have exposed the fragility of the status quo security model used by modern social media platforms like X. Many users have asked if nostr fixes this, so lets dive in. How do these types of attacks translate into the world of nostr apps? For clarity, I will use X’s security model as representative of most big tech social platforms and compare it to nostr.

The Status Quo

On X, you never have full control of your account. Ultimately to use it requires permission from the company. They can suspend your account or limit your distribution. Theoretically they can even post from your account at will. An X account is tied to an email and password. Users can also opt into two factor authentication, which adds an extra layer of protection, a login code generated by an app. In theory, this setup works well, but it places a heavy burden on users. You need to create a strong, unique password and safeguard it. You also need to ensure your email account and phone number remain secure, as attackers can exploit these to reset your credentials and take over your account. Even if you do everything responsibly, there is another weak link in X infrastructure itself. The platform’s infrastructure allows accounts to be reset through its backend. This could happen maliciously by an employee or through an external attacker who compromises X’s backend. When an account is compromised, the legitimate user often gets locked out, unable to post or regain control without contacting X’s support team. That process can be slow, frustrating, and sometimes fruitless if support denies the request or cannot verify your identity. Often times support will require users to provide identification info in order to regain access, which represents a privacy risk. The centralized nature of X means you are ultimately at the mercy of the company’s systems and staff.

Nostr Requires Responsibility

Nostr flips this model radically. Users do not need permission from a company to access their account, they can generate as many accounts as they want, and cannot be easily censored. The key tradeoff here is that users have to take complete responsibility for their security. Instead of relying on a username, password, and corporate servers, nostr uses a private key as the sole credential for your account. Users generate this key and it is their responsibility to keep it safe. As long as you have your key, you can post. If someone else gets it, they can post too. It is that simple. This design has strong implications. Unlike X, there is no backend reset option. If your key is compromised or lost, there is no customer support to call. In a compromise scenario, both you and the attacker can post from the account simultaneously. Neither can lock the other out, since nostr relays simply accept whatever is signed with a valid key.

The benefit? No reliance on proprietary corporate infrastructure.. The negative? Security rests entirely on how well you protect your key.

Future Nostr Security Improvements

For many users, nostr’s standard security model, storing a private key on a phone with an encrypted cloud backup, will likely be sufficient. It is simple and reasonably secure. That said, nostr’s strength lies in its flexibility as an open protocol. Users will be able to choose between a range of security models, balancing convenience and protection based on need.

One promising option is a web of trust model for key rotation. Imagine pre-selecting a group of trusted friends. If your account is compromised, these people could collectively sign an event announcing the compromise to the network and designate a new key as your legitimate one. Apps could handle this process seamlessly in the background, notifying followers of the switch without much user interaction. This could become a popular choice for average users, but it is not without tradeoffs. It requires trust in your chosen web of trust, which might not suit power users or large organizations. It also has the issue that some apps may not recognize the key rotation properly and followers might get confused about which account is “real.”

For those needing higher security, there is the option of multisig using FROST (Flexible Round-Optimized Schnorr Threshold). In this setup, multiple keys must sign off on every action, including posting and updating a profile. A hacker with just one key could not do anything. This is likely overkill for most users due to complexity and inconvenience, but it could be a game changer for large organizations, companies, and governments. Imagine the White House nostr account requiring signatures from multiple people before a post goes live, that would be much more secure than the status quo big tech model.

Another option are hardware signers, similar to bitcoin hardware wallets. Private keys are kept on secure, offline devices, separate from the internet connected phone or computer you use to broadcast events. This drastically reduces the risk of remote hacks, as private keys never touches the internet. It can be used in combination with multisig setups for extra protection. This setup is much less convenient and probably overkill for most but could be ideal for governments, companies, or other high profile accounts.

Nostr’s security model is not perfect but is robust and versatile. Ultimately users are in control and security is their responsibility. Apps will give users multiple options to choose from and users will choose what best fits their need.

-

@ c1e6505c:02b3157e

2025-05-22 03:44:39

@ c1e6505c:02b3157e

2025-05-22 03:44:39This is day two of testing the Leica Summaron 35mm f2.8 on the Fujifilm X-Pro2.

The first part of this story you can find here on StackerNews**

TL;DR: I think I’m really enjoying this lens.

I went into it thinking I’d probably just sell it since it was gifted to me - assumed I wouldn’t like it. But after just a couple of days with it mounted on the X-Pro2, I’ve been surprisingly drawn to it.

Shooting wide open at f2.8 (which is how I’m testing it - to best reveal the lens’s character), the soft roll-off is really pleasing. It feels organic. The lens is over 50 years old, so I expected some quirks-but the quality feels natural, not overly “vintage". Takes the digital edge off.

The short focus throw is also really nice. Compared to the Summicron 35mm f2 v3 I usually shoot on my M262 (which has a longer throw), the Summaron feels tighter and more responsive when zone focusing.

One gripe: the infinity lock. It’s kind of annoying. I find myself accidentally locking it too often, but I’m getting used to holding the button down as I rotate the ring. I’ve read others complain about it, so I know I’m not alone there.

Most of these shots were from a bike ride to the river - about 6 miles out to swim and enjoy the sun. Perfect day for making a few photos.

This kind of work is honestly just fun. I enjoy the process, and even more so once I’m happy with the results and can share them.

Still building confidence in my work over time. I think I’m slowly refining my style - even if the subject matter is simple. Easier said than done, as any editor/curator knows (and I say this as one through NOICE Magazine).

Let me know what you think. I’ll try to upload higher resolution versions this time around (but not too high).

*Also, I use a program called Dehancer for creating the grain in these photographs. I highly recommend the program actually, I've been using it for a long time. If you would like to try it out, I have a promo code. Use "Pictureroom" for 10% off I believe.

You can further support me and my work by sending sats to colincz\@getalby.com. Thank you.

(note* this is being publised from the updated Primal reads client)

-

@ 2b998b04:86727e47

2025-05-22 02:45:34

@ 2b998b04:86727e47

2025-05-22 02:45:34I recently released my first open-source tool:\ 👉 nostr-signal-filter

It fetches and formats your latest top-level Nostr note or long-form article, cleans up any embedded links using TinyURL, and outputs a clean version ready for reposting to:

-

LinkedIn

-

Facebook

-

X / Twitter

⚙️ Built for Simplicity

The stack is intentionally minimal:

-

Python + WebSockets + Bech32

-

TinyURL API for link shortening

-

Dockerized CLI usage:

bashCopyEdit

docker run --rm -e PUBKEY=npub1yourpubkeyhere nostr-fetcher > latest.mdFrom idea to working repo took under 3 hours — including debugging, Docker tweaks, README cleanup, and tagging a clean release.\ \ This most certainly would have taken much longer if I had done this all without ChatGPTs' help.\ \ 🖼️ Example Output (

latest.md)textCopyEdit

🕒 2025-05-20 22:24:17 📄 Note (originally posted on Nostr/primal.net) --- 🚨 New long-form drop: AI Isn’t Magic. It’s Engineering. How I use ChatGPT like any other tool in the stack — with iteration, discernment, and real output. Read it here: https://tinyurl.com/ynv7jq6g ⚡ Zaps appreciated if it resonates. --- 🔗 View on Nostr: https://tinyurl.com/yobvaxkx

🧪 Where I Used It

- ✅ Facebook: clean rendering with preview ->

- ✅ X/Twitter: teaser + link (had to truncate for character limit) ->

https://x.com/AndyGStanton/status/1925045477172773136

🙌 Try It Yourself

If you're publishing on Nostr but still sharing on legacy platforms:

👉 github.com/andrewgstanton/nostr-signal-filter

-

Clean output

-

Easy to run

-

Portable via Docker

All it needs is your

npub.

⚡ Zap Me If You Found This Useful

If this tool saved you time — or if it sparked ideas for your own Nostr publishing stack —\ send a zap my way. I’m always looking to connect with other creators who value signal > noise.

🔗 Zap on Primal -> https://primal.net/andrewgstanton

🔭 Next Features (I’d Love Help With)

-

Archive all notes + articles (not just the latest 50) to

archive.md -

Function to shorten links in any text block

-

Output

post.mdfor any given Nostr event ID (not just latest) -

Optional API integration to post directly to LinkedIn or X

Built with ChatGPT’s help.\ Iterated. Published. Cross-posted.\ That’s proof of work.

-

-

@ 90152b7f:04e57401

2025-05-22 02:30:51

@ 90152b7f:04e57401

2025-05-22 02:30:51WikiLeaks The Global Intelligence Files

Released on 2013-03-11 00:00 GMT

| Email-ID | 364528 | | -------- | --------------------------- | | Date | 2007-09-20 03:02:09 | | From | os@stratfor.com | | To | intelligence@stratfor.com |

Rice, Israeli FM discuss Israeli decision of defining Gaza as "hostile\ entity"\ 2007-09-20 00:41:16\ http://news.xinhuanet.com/english/2007-09/20/content_6756959.htm\ \ JERUSALEM, Sept. 19 (Xinhua) -- Visiting U.S. Secretary of State\ Condoleezza Rice met with Israeli Foreign Minister Tzipi Livni on\ Wednesday, the two discussed Israel's decision that defined the Hamas-\ controlled Gaza Strip as a "hostile entity."\ \ At a joint press conference held after their meeting, Rice told the\ reporters that the Palestinian Hamas is a "hostile entity" to U.S. as well.\ \ Israel's Security Cabinet declared the Gaza Strip a "hostile entity" on\ Wednesday ahead of Rice's visit and said it would cutoff power and fuel\ supplies to the strip.\ \ Gaza's population, largely impoverished, is almost entirely\ dependent on Israel for the supply of electricity, water and fuel, and a\ cutoff would deepen their hardship.\ \ Since the Hamas takeover in June, Israel has closed crossings with\ Gaza almost entirely, allowing in only humanitarian aid. However, Rice\ reiterated that the United States will not abandon the innocent\ Palestinians in Gaza.\ \ For her part, Livni said that Israel withdrew from the Gaza Strip\ two years ago, hoping that could lead to the establishment of a\ Palestinian state, but only get almost daily rocket attacks in return.\ \ "We expect the Palestinians to understand that Israeli security is\ in their own interests," Livni said, adding that Palestinians must\ understand "supporting Hamas won't help them."\ \ The Israeli Security Cabinet's declaration of Gaza as an "hostile\ entity" could lead to the most severe retaliatory measure taken by\ Israel against Palestinian rocket fire from the strip.\ \ The crude rocket attacks have killed 12 people in southern Israel in\ the past seven years, injured dozens more and badly disrupted daily life\ in the region.\ \ Last week, a Qassam rocket hit an Israeli military base near the\ Gaza Strip, wounding over 60 soldiers in the attack. The attack then\ sparked calls for the government to take harsh response against the Gaza\ Strip, which has been under the control of Hamas since it violently took\ over the enclave in mid June.\ \ The Jewish states has been holding Hamas responsible for the attack,\ although the movement has not been directly involved in the attacks.\ Israel still accused the Islamic movement of doing little to halt them.\ \ Apart from the Palestinian issue, Rice also discussed with Livni\ issues about Iran, Lebanon and the Middle East peace progress.\ \ She said Israel and the Palestinians are showing good faith in their\ negotiations towards a "two state solution."\ \ Regarding Iranian issues, Rice told reporters that diplomatic mean\ is a part of efforts to halt the Iranian nuclear program, but stressed\ it "has to have teeth."\ \ Rice, who had visited this region in August, is also expected to\ hold separate meetings on Wednesday with Israeli Defense Minister Ehud\ Barak and the Likud party head Binyamin Netanyahu.\ \ She will then hold a dinner meeting with Israeli Prime Minister Ehud\ Olmert.\ \ Rice is scheduled to leave here Thursday afternoon and visit the\ West Bank city of Ramallah for meetings with the Palestinian leadership\ on Thursday.

-

@ 909e3fdc:73f2b10a

2025-05-22 02:14:38

@ 909e3fdc:73f2b10a

2025-05-22 02:14:38Pizza Day’s not really about pizza. It’s about Laszlo exhibiting Bitcoin as a P2P payment mechanism. That’s worth a cheers. In 15 years, Bitcoin went from a nerdy experiment to challenging the fiat system. That’s massive! It’s changed how I see the world. Patient hodling and carnivore-focus, practices that I picked up from the bitcoin community, shifted me from kinda nihilistic to stupidly optimistic. So, definitely celebrate Pizza Day. Or maybe barbecue steaks instead. Commiserate on the frivolous purchases that you made with bitcoin in the day. I think of these sometimes. Honour Laszlo’s pioneer vibe and Bitcoin’s insane rise, but keep your eyes on what’s coming. The future’s gonna be wilder than we think.

-

@ 04c915da:3dfbecc9

2025-05-15 15:31:45

@ 04c915da:3dfbecc9

2025-05-15 15:31:45Capitalism is the most effective system for scaling innovation. The pursuit of profit is an incredibly powerful human incentive. Most major improvements to human society and quality of life have resulted from this base incentive. Market competition often results in the best outcomes for all.

That said, some projects can never be monetized. They are open in nature and a business model would centralize control. Open protocols like bitcoin and nostr are not owned by anyone and if they were it would destroy the key value propositions they provide. No single entity can or should control their use. Anyone can build on them without permission.

As a result, open protocols must depend on donation based grant funding from the people and organizations that rely on them. This model works but it is slow and uncertain, a grind where sustainability is never fully reached but rather constantly sought. As someone who has been incredibly active in the open source grant funding space, I do not think people truly appreciate how difficult it is to raise charitable money and deploy it efficiently.

Projects that can be monetized should be. Profitability is a super power. When a business can generate revenue, it taps into a self sustaining cycle. Profit fuels growth and development while providing projects independence and agency. This flywheel effect is why companies like Google, Amazon, and Apple have scaled to global dominance. The profit incentive aligns human effort with efficiency. Businesses must innovate, cut waste, and deliver value to survive.

Contrast this with non monetized projects. Without profit, they lean on external support, which can dry up or shift with donor priorities. A profit driven model, on the other hand, is inherently leaner and more adaptable. It is not charity but survival. When survival is tied to delivering what people want, scale follows naturally.

The real magic happens when profitable, sustainable businesses are built on top of open protocols and software. Consider the many startups building on open source software stacks, such as Start9, Mempool, and Primal, offering premium services on top of the open source software they build out and maintain. Think of companies like Block or Strike, which leverage bitcoin’s open protocol to offer their services on top. These businesses amplify the open software and protocols they build on, driving adoption and improvement at a pace donations alone could never match.

When you combine open software and protocols with profit driven business the result are lean, sustainable companies that grow faster and serve more people than either could alone. Bitcoin’s network, for instance, benefits from businesses that profit off its existence, while nostr will expand as developers monetize apps built on the protocol.

Capitalism scales best because competition results in efficiency. Donation funded protocols and software lay the groundwork, while market driven businesses build on top. The profit incentive acts as a filter, ensuring resources flow to what works, while open systems keep the playing field accessible, empowering users and builders. Together, they create a flywheel of innovation, growth, and global benefit.

-

@ a5ee4475:2ca75401

2025-05-15 14:11:16

@ a5ee4475:2ca75401

2025-05-15 14:11:16lists #descentralismo #compilation #english

*The last list was updated in Amethyst, so the update of this one will only be visible in Amethyst.

nostr:naddr1qq245dz5tqe8w46swpphgmr4f3047s6629t45qg4waehxw309aex2mrp0yhxgctdw4eju6t09upzpf0wg36k3g3hygndv3cp8f2j284v0hfh4dqgqjj3yxnreck2w4qpqvzqqqr4guxde6sl

AI

nostr:naddr1qq24xwtyt9v5wjzefe6523j32dy5ga65gagkjqgawaehxw309ahx7um5wghxy6t5vdhkjmn9wgh8xmmrd9skctczyzj7u3r4dz3rwg3x6erszwj4y502clwn026qsp99zgdx8n3v5a2qzqcyqqq823c8mw5zk

FOSS GAME

nostr:naddr1qq2kvwp3v4hhvk2sw3j5sm6h23g5wkz5ddzhzqg4waehxw309aex2mrp0yhxgctdw4eju6t09upzpf0wg36k3g3hygndv3cp8f2j284v0hfh4dqgqjj3yxnreck2w4qpqvzqqqr4gut57qtr

OSHW - Open Source Hardware

nostr:naddr1qqgrqvp5vd3kycejxask2efcv4jr2qgswaehxw309ahx7um5wghx6mmd9upzpf0wg36k3g3hygndv3cp8f2j284v0hfh4dqgqjj3yxnreck2w4qpqvzqqqr4guc43v6c

Markdown Uses for Some Clients

nostr:nevent1qqsv54qfgtme38r2tl9v6ghwfj09gdjukealstkzc77mwujr56tgfwsppemhxue69uhkummn9ekx7mp0qgsq37tg2603tu0cqdrxs30e2n5t8p87uenf4fvfepdcvr7nllje5zgrqsqqqqqpkdvta4

Other Links

nostr:nevent1qqsrm6ywny5r7ajakpppp0lt525n0s33x6tyn6pz0n8ws8k2tqpqracpzpmhxue69uhkummnw3ezumt0d5hsygp6e5ns0nv3dun430jky25y4pku6ylz68rz6zs7khv29q6rj5peespsgqqqqqqsmfwa78

-

@ 502ab02a:a2860397

2025-05-22 01:30:37

@ 502ab02a:a2860397

2025-05-22 01:30:37ถ้าพูดถึง "เกาหลีใต้" หลายคนอาจนึกถึงซีรีส์ น้ำจิ้มเผ็ด หรือไอดอลหน้าผ่อง ๆ แต่เบื้องหลังวัฒนธรรมที่ลื่นไหลไปทั่วโลกนี้ ยังมีอาณาจักรธุรกิจขนาดมหึมาที่เป็นเหมือนเครื่องยนต์หลักผลักดันทั้งอาหาร เพลง หนัง และนวัตกรรมระดับโลก หนึ่งในนั้นคือ CJ Group ที่เริ่มต้นจากบริษัทน้ำตาลเล็ก ๆ ในปี 1953 แต่เติบโตจนกลายเป็นหนึ่งใน conglomerate หรือ "กลุ่มธุรกิจผูกเครือ" ที่ทรงอิทธิพลที่สุดของแดนโสม

คำว่า CJ ย่อมาจาก CheilJedang (แปลว่า “หมายเลขหนึ่งแห่งโลก” ในภาษาจีน-เกาหลี) ก่อตั้งโดย อี บยองชอล ผู้ก่อตั้ง Samsung Group ในช่วงเวลานั้น เกาหลีใต้กำลังฟื้นตัวจากสงครามเกาหลี และรัฐบาลส่งเสริมการพัฒนาอุตสาหกรรมภายในประเทศ เดิมเป็นหน่วยธุรกิจอาหารของกลุ่ม Samsung ในปี 1993 Cheil Jedang แยกตัวออกจาก Samsung Group และกลายเป็นบริษัทอิสระภายใต้การบริหารของ อี แจฮยอน หลานชายของอี บยองชอล แล้วขยายขอบเขตธุรกิจอย่างไม่หยุดยั้ง จากความเชี่ยวชาญใน "การหมัก" แบบดั้งเดิม พวกเขากลับกลายเป็นผู้เล่นรายใหญ่ระดับโลกในวงการ เทคโนโลยีชีวภาพ การผลิตอาหารไปจนถึงธุรกิจ บันเทิงระดับฮอลลีวูด และ โลจิสติกส์ข้ามทวีป

พูดง่าย ๆ ว่า CJ ไม่ได้แค่ส่งออกกิมจิหรือบิบิมบับ แต่พวกเขากำลังวางรากฐานของ "อนาคตแห่งอาหาร" และ "ความบันเทิงแบบไร้พรมแดน" ในเวลาเดียวกัน จนใครหลายคนถึงกับบอกว่า ถ้าอยากเข้าใจเกาหลีใต้ ก็ต้องเริ่มจากเข้าใจ CJ Group เสียก่อน

แล้วในเครือข่ายของ CJ Group มีธุรกิจอะไรบ้างที่น่าสนใจ และแบรนด์ไหนที่เราคุ้นเคยแบบไม่รู้ตัว ไปดูกันเลย

- ธุรกิจอาหารและบริการอาหาร (Food & Food Services)

- CJ CheilJedang บริษัทอาหารชั้นนำของเกาหลีใต้ มีผลิตภัณฑ์เด่น ได้แก่ Bibigo แบรนด์อาหารเกาหลีพร้อมรับประทาน เช่น เกี๊ยว ซอส และกิมจิ Hetbahn ข้าวสวยพร้อมรับประทานที่ได้รับความนิยมในเกาหลี

-

CJ Foodville ดำเนินธุรกิจร้านอาหารและเบเกอรี่ เช่น: Tous Les Jours ร้านเบเกอรี่สไตล์ฝรั่งเศส VIPS ร้านสเต็กและสลัดบุฟเฟ่ต์

-

ธุรกิจเทคโนโลยีชีวภาพ (Bio) ความเชี่ยวชาญนี้เป็นรากฐานสำคัญในการขยายธุรกิจด้านเทคโนโลยีชีวภาพของ CJ เลยครับ

- CJ BIO ผู้นำด้านการผลิตกรดอะมิโนและผลิตภัณฑ์ชีวภาพผ่านเทคโนโลยีการหมักจุลินทรีย์ เช่น Lysine, Tryptophan, Valine กรดอะมิโนที่ใช้ในอุตสาหกรรมอาหารสัตว์และอาหารเสริม

-

CJ Bioscience มุ่งเน้นการวิจัยและพัฒนาไมโครไบโอมเพื่อสุขภาพ

-

ธุรกิจโลจิสติกส์และค้าปลีก (Logistics & Retail)

- CJ Logistics ให้บริการโลจิสติกส์ครบวงจร ทั้งการขนส่งทางบก ทางทะเล และทางอากาศ รวมถึงบริการคลังสินค้าและการจัดการซัพพลายเชน

-

CJ Olive Young: ร้านค้าปลีกด้านสุขภาพและความงามอันดับหนึ่งของเกาหลี มีผลิตภัณฑ์ยอดนิยม เช่น Anua PDRN Set ชุดบำรุงผิวที่ได้รับความนิยม MILKTOUCH ผลิตภัณฑ์เมคอัพที่ได้รับความนิยม

-

ธุรกิจบันเทิงและสื่อ (Entertainment & Media) อันนี้ยิ่งใหญ่ระดับโลกมากๆ หลายคนคงจำได้กับ ภาพยนตร์เอเชียแรกกับรางวัลออสการ์ Parasite

- CJ ENM บริษัทผลิตและจัดจำหน่ายเนื้อหาบันเทิงที่มีชื่อเสียงระดับโลก มีผลงานเด่น ได้แก่ Crash Landing on You ซีรีส์ที่ได้รับความนิยมอย่างสูง Parasite ภาพยนตร์ที่ได้รับรางวัลออสการ์

- CJ CGV เครือโรงภาพยนตร์มัลติเพล็กซ์ที่มีสาขาทั่วโลก

CJ Group ขยายธุรกิจไปยังต่างประเทศ เช่น การเข้าซื้อกิจการ Schwan's Company ในสหรัฐอเมริกา และการเปิดสาขา CGV ในหลายประเทศ นอกจากนี้ CJ ยังมีบทบาทสำคัญในการเผยแพร่วัฒนธรรมเกาหลีสู่ระดับโลกผ่าน KCON และการผลิตเนื้อหาบันเทิงที่ได้รับความนิยมในต่างประเทศด้วยครับ

จะเห็นได้ว่า เครือข่ายของ CJ นั้นยิ่งใหญ่มากๆเลย ทีนี้มีเรื่องน่าสนใจตรงนี้ครับ

ในช่วงปี 2013–2016 CJ Group โดยเฉพาะฝ่ายสื่อบันเทิงอย่าง CJ ENM ต้องเผชิญกับแรงกดดันจากรัฐบาลของประธานาธิบดี พัค กึนฮเย เหตุการณ์สำคัญคือการที่ อี มีคยอง (Miky Lee) รองประธาน CJ และผู้มีบทบาทสำคัญในการขับเคลื่อนธุรกิจบันเทิงระดับโลก ถูกกดดันให้ลาออกจากตำแหน่ง รายงานระบุว่า ทำเนียบประธานาธิบดีไม่พอใจเนื้อหาสื่อบางรายการของ CJ ที่มีลักษณะเสียดสีหรือวิพากษ์วิจารณ์รัฐบาล เช่น รายการ SNL Korea ที่ล้อเลียนพัค กึนฮเย ผ่านตัวละคร Teletubbies

ภายใต้แรงกดดันนี้ CJ มีการปรับเปลี่ยนเนื้อหาสื่อ โดยลดการนำเสนอเนื้อหาที่อาจขัดแย้งกับรัฐบาล และหันไปผลิตภาพยนตร์ที่สอดคล้องกับนโยบายของรัฐ เช่น ภาพยนตร์เรื่อง Ode to My Father (2014) ที่สะท้อนความรักชาติและการพัฒนาเศรษฐกิจในยุคของพัค ชุงฮี บิดาของพัค กึนฮเย ภาพยนตร์เรื่องนี้ได้รับการสนับสนุนจากรัฐบาลและถูกมองว่าเป็น "ภาพยนตร์เพื่อสุขภาพ" ที่ส่งเสริมความภาคภูมิใจในชาติ แน่นอนว่าแค้นฝังหุ่นมันยังไม่หายไปไหนครับ

เมื่อเกิดการเปิดโปง "บัญชีดำ" (Blacklist) ของรัฐบาลพัค กึนฮเย ที่มีการจำกัดสิทธิเสรีภาพของศิลปินและผู้ผลิตสื่อที่วิพากษ์วิจารณ์รัฐบาล ทำให้เกิดกระแสต่อต้านอย่างรุนแรงในสังคมเกาหลี. ในปี 2016 ซน กยองชิก ประธาน CJ ได้ให้การต่อศาลว่า มีแรงกดดันจากรัฐบาลให้ อี มีคยอง หลีกเลี่ยงการมีบทบาทในบริษัท เหตุการณ์นี้เป็นส่วนหนึ่งของการเปิดโปงคดีทุจริตของพัค กึนฮเย ซึ่งนำไปสู่การประท้วงครั้งใหญ่และการถอดถอนประธานาธิบดีในปี 2017

หลังจากการเปลี่ยนแปลงทางการเมือง CJ Group ได้กลับมามีบทบาทอย่างเต็มที่ในวงการบันเทิงอีกครั้ง อี มีคยอง กลับมาดำรงตำแหน่งและมีบทบาทสำคัญในการผลักดันภาพยนตร์เรื่อง Parasite (2019) ซึ่งได้รับรางวัลออสการ์และยกระดับภาพลักษณ์ของ CJ ในระดับโลก ซึ่งถ้าใครได้ดูหนังเรื่องนั้นแล้วรู้เรื่องราวเบื้องหลังนี้จะเข้าใจเนื้อหาได้อย่างลึกซึ้งขึ้นไปอีกเลยครับ การนำเสนอเรื่องราวนี้ถือเป็นการวิพากษ์วิจารณ์สังคมและระบบทุนนิยมอย่างชัดเจน ซึ่งแตกต่างจากแนวทางที่ CJ เคยถูกกดดันให้ปฏิบัติตามในยุคของพัค กึนฮเย อย่างสิ้นเชิง

อย่าเพิ่งไปสะใจกับเนื้อหา ให้มองว่า "เขาทำอะไรได้บ้าง" นี่คือประเด็นสำคัญครับ #pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr

-

@ 0d1df3b1:7aa4699c

2025-05-22 00:01:24

@ 0d1df3b1:7aa4699c

2025-05-22 00:01:24YO

-

@ 3f770d65:7a745b24

2025-05-14 18:26:17

@ 3f770d65:7a745b24

2025-05-14 18:26:17🏌️ Monday, May 26 – Bitcoin Golf Championship & Kickoff Party

Location: Las Vegas, Nevada\ Event: 2nd Annual Bitcoin Golf Championship & Kick Off Party"\ Where: Bali Hai Golf Clubhouse, 5160 S Las Vegas Blvd, Las Vegas, NV 89119\ 🎟️ Get Tickets!

Details:

-

The week tees off in style with the Bitcoin Golf Championship. Swing clubs by day and swing to music by night.

-

Live performances from Nostr-powered acts courtesy of Tunestr, including Ainsley Costello and others.

-

Stop by the Purple Pill Booth hosted by Derek and Tanja, who will be on-boarding golfers and attendees to the decentralized social future with Nostr.

💬 May 27–29 – Bitcoin 2025 Conference at the Las Vegas Convention Center

Location: The Venetian Resort\ Main Attraction for Nostr Fans: The Nostr Lounge\ When: All day, Tuesday through Thursday\ Where: Right outside the Open Source Stage\ 🎟️ Get Tickets!

Come chill at the Nostr Lounge, your home base for all things decentralized social. With seating for \~50, comfy couches, high-tops, and good vibes, it’s the perfect space to meet developers, community leaders, and curious newcomers building the future of censorship-resistant communication.

Bonus: Right across the aisle, you’ll find Shopstr, a decentralized marketplace app built on Nostr. Stop by their booth to explore how peer-to-peer commerce works in a truly open ecosystem.

Daily Highlights at the Lounge:

-

☕️ Hang out casually or sit down for a deeper conversation about the Nostr protocol

-

🔧 1:1 demos from app teams

-

🛍️ Merch available onsite

-

🧠 Impromptu lightning talks

-

🎤 Scheduled Meetups (details below)

🎯 Nostr Lounge Meetups

Wednesday, May 28 @ 1:00 PM

- Damus Meetup: Come meet the team behind Damus, the OG Nostr app for iOS that helped kickstart the social revolution. They'll also be showcasing their new cross-platform app, Notedeck, designed for a more unified Nostr experience across devices. Grab some merch, get a demo, and connect directly with the developers.

Thursday, May 29 @ 1:00 PM

- Primal Meetup: Dive into Primal, the slickest Nostr experience available on web, Android, and iOS. With a built-in wallet, zapping your favorite creators and friends has never been easier. The team will be on-site for hands-on demos, Q\&A, merch giveaways, and deeper discussions on building the social layer of Bitcoin.

🎙️ Nostr Talks at Bitcoin 2025

If you want to hear from the minds building decentralized social, make sure you attend these two official conference sessions:

1. FROSTR Workshop: Multisig Nostr Signing

-

🕚 Time: 11:30 AM – 12:00 PM

-

📅 Date: Wednesday, May 28

-

📍 Location: Developer Zone

-

🎤 Speaker: nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqgdwaehxw309ahx7uewd3hkcqpqs9etjgzjglwlaxdhsveq0qksxyh6xpdpn8ajh69ruetrug957r3qf4ggfm (Austin Kelsay) @ Voltage\ A deep-dive into FROST-based multisig key management for Nostr. Geared toward devs and power users interested in key security.

2. Panel: Decentralizing Social Media

-

🕑 Time: 2:00 PM – 2:30 PM

-

📅 Date: Thursday, May 29

-

📍 Location: Genesis Stage

-

🎙️ Moderator: nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqy08wumn8ghj7mn0wd68yttjv4kxz7fwv3jhyettwfhhxuewd4jsqgxnqajr23msx5malhhcz8paa2t0r70gfjpyncsqx56ztyj2nyyvlq00heps - Bitcoin Strategy @ Roxom TV

-

👥 Speakers:

-

nostr:nprofile1qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcppemhxue69uhkummn9ekx7mp0qqsy2ga7trfetvd3j65m3jptqw9k39wtq2mg85xz2w542p5dhg06e5qmhlpep – Early Bitcoin dev, CEO @ Sirius Business Ltd

-

nostr:nprofile1qy2hwumn8ghj7mn0wd68ytndv9kxjm3wdahxcqg5waehxw309ahx7um5wfekzarkvyhxuet5qqsw4v882mfjhq9u63j08kzyhqzqxqc8tgf740p4nxnk9jdv02u37ncdhu7e3 – Analyst & Partner @ Ego Death Capital

Get the big-picture perspective on why decentralized social matters and how Nostr fits into the future of digital communication.

🌃 NOS VEGAS Meetup & Afterparty

Date: Wednesday, May 28\ Time: 7:00 PM – 1:00 AM\ Location: We All Scream Nightclub, 517 Fremont St., Las Vegas, NV 89101\ 🎟️ Get Tickets!

What to Expect:

-

🎶 Live Music Stage – Featuring Ainsley Costello, Sara Jade, Able James, Martin Groom, Bobby Shell, Jessie Lark, and other V4V artists

-

🪩 DJ Party Deck – With sets by nostr:nprofile1qy0hwumn8ghj7cmgdae82uewd45kketyd9kxwetj9e3k7mf6xs6rgqgcwaehxw309ahx7um5wgh85mm694ek2unk9ehhyecqyq7hpmq75krx2zsywntgtpz5yzwjyg2c7sreardcqmcp0m67xrnkwylzzk4 , nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqgkwaehxw309anx2etywvhxummnw3ezucnpdejqqg967faye3x6fxgnul77ej23l5aew8yj0x2e4a3tq2mkrgzrcvecfsk8xlu3 , and more DJs throwing down

-

🛰️ Live-streamed via Tunestr

-

🧠 Nostr Education – Talks by nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq37amnwvaz7tmwdaehgu3dwfjkccte9ejx2un9ddex7umn9ekk2tcqyqlhwrt96wnkf2w9edgr4cfruchvwkv26q6asdhz4qg08pm6w3djg3c8m4j , nostr:nprofile1qyx8wumn8ghj7cnjvghxjmcpz4mhxue69uhk2er9dchxummnw3ezumrpdejqqgxchnavlnv8t5vky5dsa87ddye0jc8z9eza8ekvfryf3yt649mytvhadgpe , nostr:nprofile1q9z8wumn8ghj7erzx3jkvmmzw4eny6tvw368wdt8da4kxamrdvek76mrwg6rwdngw94k67t3v36k77tev3kx7vn2xa5kjem9dp4hjepwd3hkxctvqyg8wumn8ghj7mn0wd68ytnhd9hx2qpqyaul8k059377u9lsu67de7y637w4jtgeuwcmh5n7788l6xnlnrgssuy4zk , nostr:nprofile1qy28wue69uhnzvpwxqhrqt33xgmn5dfsx5cqz9thwden5te0v4jx2m3wdehhxarj9ekxzmnyqqswavgevxe9gs43vwylumr7h656mu9vxmw4j6qkafc3nefphzpph8ssvcgf8 , and more.

-

🧾 Vendors & Project Booths – Explore new tools and services

-

🔐 Onboarding Stations – Learn how to use Nostr hands-on

-

🐦 Nostrich Flocking – Meet your favorite nyms IRL

-

🍸 Three Full Bars – Two floors of socializing overlooking vibrant Fremont Street

This is the after-party of the year for those who love freedom technology and decentralized social community. Don’t miss it.

Final Thoughts

Whether you're there to learn, network, party, or build, Bitcoin 2025 in Las Vegas has a packed week of Nostr-friendly programming. Be sure to catch all the events, visit the Nostr Lounge, and experience the growing decentralized social revolution.

🟣 Find us. Flock with us. Purple pill someone.

-

-

@ cd17b2d6:8cc53332

2025-05-21 22:28:09

@ cd17b2d6:8cc53332

2025-05-21 22:28:09Looking to simulate a USDT deposit that appears instantly in a wallet — with no blockchain confirmation, no real spend, and no trace?

You’re in the right place.

🔗 Buy Flash USDT Now This product sends Flash USDT directly to your TRC20, ERC20, or BEP20 wallet address — appears like a real deposit, but disappears after a set time or block depth.

✅ Perfect for: Simulating token inflows Wallet stress testing “Proof of funds” display Flash USDT is ideal for developers, trainers, UI testers, and blockchain researchers — and it’s fully customizable.

🧠 What Is Flash USDT? Flash USDT is a synthetic transaction that mimics a real Tether transfer. It shows up instantly in a wallet balance, and it’s confirmed on-chain — and expires after a set duration.

This makes it:

Visible on wallet interfaces Time-limited (auto-disappears cleanly) Undetectable on block explorers after expiry It’s the smartest, safest way to simulate high-value transactions without real crypto.

🛠️ Flash USDT Software – Your Own USDT Flasher at Your Fingertips Want to control the flash? Run your own operations? Flash unlimited wallets?

🔗 Buy Flash USDT Software

This is your all-in-one USDT flasher tool, built for TRC20, ERC20, and BEP20 chains. It gives you full control to:

Send custom USDT amounts Set custom expiry time (e.g., 30–360 days) Flash multiple wallets Choose between networks (Tron, ETH, BSC) You can simulate any amount, to any supported wallet, from your own system.

No third-party access. No blockchain fee. No trace left behind.

💥 Why Our Flash USDT & Software Stands Out Feature Flash USDT Flash USDT Software One-time flash send ✅ Yes Optional Full sender control ❌ No ✅ Yes TRC20 / ERC20 / BEP20 ✅ Yes ✅ Yes Custom duration/expiry Limited ✅ Yes Unlimited usage ❌ One-off ✅ Yes Whether you’re flashing for wallet testing, demoing investor dashboards, or simulating balance flows, our tools deliver realism without risk.

🛒 Ready to Buy Flash USDT or the Software? Skip the wait. Skip the scammers. You’re one click away from real control.

👉 Buy Flash USDT 👉 Buy Flash USDT Software

📞 Support or live walkthrough?

💬 Telegram: @cryptoflashingtool 📱 WhatsApp: +1 770-666-2531

🚫 Legal Notice These tools are intended for:

Educational purposes Demo environments Wallet and UI testing They are not for illegal use or financial deception. Any misuse is your full responsibility.

Final Call: Need to flash USDT? Want full control? Don’t wait for another “maybe” tool.

Get your Flash USDT or Flashing Software today and simulate like a pro.

🔗 Buy Now → Flash USDT 🔗 Buy Now → Flash USDT Software 💬 Telegram: @cryptoflashingtool 📱 WhatsApp: +1 770-666-2531Looking to simulate a USDT deposit that appears instantly in a wallet — with no blockchain confirmation, no real spend, and no trace?

You’re in the right place.

Buy Flash USDT Now\ This product sends Flash USDT directly to your TRC20, ERC20, or BEP20 wallet address — appears like a real deposit, but disappears after a set time or block depth.

Perfect for:

- Simulating token inflows

- Wallet stress testing

- “Proof of funds” display

Flash USDT is ideal for developers, trainers, UI testers, and blockchain researchers — and it’s fully customizable.

What Is Flash USDT?

Flash USDT is a synthetic transaction that mimics a real Tether transfer. It shows up instantly in a wallet balance, and it’s confirmed on-chain — and expires after a set duration.

This makes it:

- Visible on wallet interfaces

- Time-limited (auto-disappears cleanly)

- Undetectable on block explorers after expiry

It’s the smartest, safest way to simulate high-value transactions without real crypto.

Flash USDT Software – Your Own USDT Flasher at Your Fingertips

Want to control the flash?\ Run your own operations?\ Flash unlimited wallets?

This is your all-in-one USDT flasher tool, built for TRC20, ERC20, and BEP20 chains. It gives you full control to:

- Send custom USDT amounts

- Set custom expiry time (e.g., 30–360 days)

- Flash multiple wallets

- Choose between networks (Tron, ETH, BSC)

You can simulate any amount, to any supported wallet, from your own system.

No third-party access.\ No blockchain fee.\ No trace left behind.

Why Our Flash USDT & Software Stands Out

Feature

Flash USDT

Flash USDT Software

One-time flash send

Yes

Optional

Full sender control

No

Yes

TRC20 / ERC20 / BEP20

Yes

Yes

Custom duration/expiry

Limited

Yes

Unlimited usage

One-off

Yes

Whether you’re flashing for wallet testing, demoing investor dashboards, or simulating balance flows, our tools deliver realism without risk.

Ready to Buy Flash USDT or the Software?

Skip the wait. Skip the scammers.\ You’re one click away from real control.

Support or live walkthrough?

Telegram: @cryptoflashingtool

WhatsApp: +1 770-666-2531

Legal Notice

These tools are intended for:

- Educational purposes

- Demo environments

- Wallet and UI testing

They are not for illegal use or financial deception. Any misuse is your full responsibility.

Final Call:

Need to flash USDT? Want full control?\ Don’t wait for another “maybe” tool.

Get your Flash USDT or Flashing Software today and simulate like a pro.

Telegram: @cryptoflashingtool

WhatsApp: +1 770-666-2531

-

@ bc6ccd13:f53098e4

2025-05-21 22:13:47

@ bc6ccd13:f53098e4

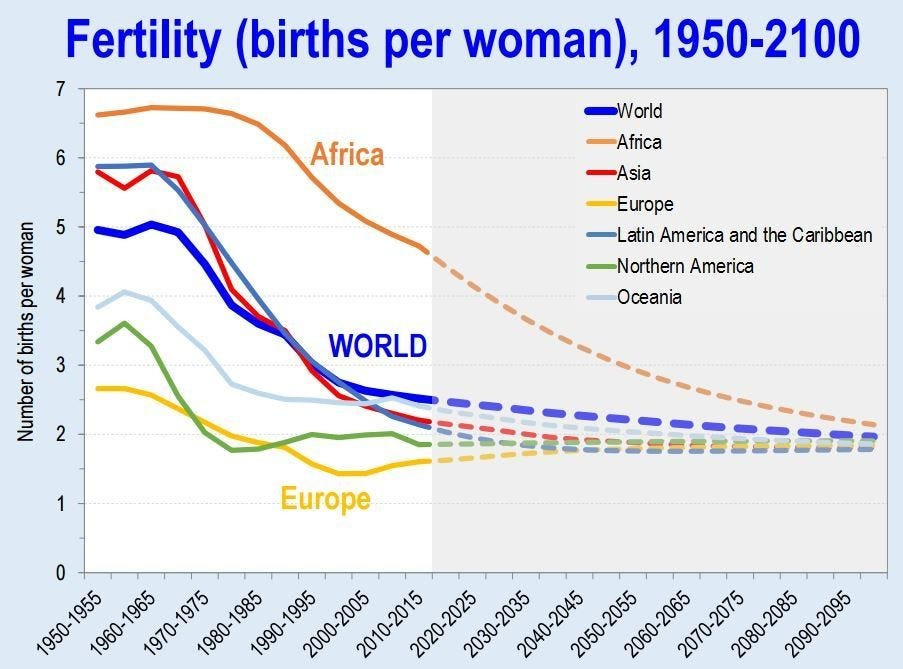

2025-05-21 22:13:47The global population has been rising rapidly for the past two centuries when compared to historical trends. Fifty years ago, that trend seemed set to continue, and there was a lot of concern around the issue of overpopulation. But if you haven’t been living under a rock, you’ll know that while the population is still rising, that trend now seems set to reverse this century, and there’s every indication population could decline precipitously over the next two centuries.

Demographics is a field where predictions about the future are much more reliable than in most scientific fields. That’s because future population trends are “baked in” decades in advance. If you want to know how many fifty-year-olds there will be in forty years, all you have to do is count the ten-year-olds today and allow for mortality rates. That maximum was already determined by the number of births ten years ago, and absolutely nothing can change that now. The average person doesn’t think that through when they look at population trends. You hear a lot of “oh we just need to do more of x to help the declining birthrate” without an acknowledgement that future populations in a given cohort are already fixed by the number of births that already occurred.

As you can see, global birthrates have already declined close to the 2.3 replacement level, with some regions ahead of others, but all on the same trajectory with no region moving against the trend. I’m not going to speculate on the reasons for this, or even whether it’s a good or bad thing. Instead I’m going to make some observations about outcomes this trend could cause economically, and why. Like most macro issues, an individual can’t do anything to change the global landscape personally, but knowing what that landscape might look like is essential to avoiding fallout from trends outside your control.

The Resource Pie

Thomas Malthus popularized the concern about overpopulation with his 1798 book An Essay on the Principle of Population. The basic premise of the book was that population could grow and consume all the available resources, leading to mass poverty, starvation, disease, and population collapse. We can say in hindsight that this was incorrect, given that the global population has increased from less than a billion to over eight billion since then, and the apocalypse Malthus predicted hasn’t materialized. Exactly the opposite, in fact. The global standard of living has risen to levels Malthus couldn’t have imagined, much less predicted.

So where did Malthus go wrong? His hypothesis seems reasonable enough, and we do see a similar trend in certain animal populations. The base assumption Malthus got wrong was to assume resources are a finite, limiting factor to the human population. That at some point certain resources would be totally consumed, and that would be it. He treated it like a pie with a lot of slices, but still a finite number, and assumed that if the population kept rising, eventually every slice would be consumed and there would be no pie left for future generations. That turns out to be completely wrong.

Of course, the earth is finite at some abstract level. The number of atoms could theoretically be counted and quantified. But on a practical level, do humans exhaust the earth’s resources? I’d point to an article from Yale Scientific titled Has the Earth Run out of any Natural Resources? To quote,

> However, despite what doomsday predictions may suggest, the Earth has not run out of any resources nor is it likely that it will run out of any in the near future. > > In fact, resources are becoming more abundant. Though this may seem puzzling, it does not mean that the actual quantity of resources in the Earth’s crust is increasing but rather that the amount available for our use is constantly growing due to technological innovations. According to the U.S. Geological Survey, the only resource we have exhausted is cryolite, a mineral used in pesticides and aluminum processing. However, that is not to say every bit of it has been mined away; rather, producing it synthetically is much more cost efficient than mining the existing reserves at its current value.

As it happens, we don’t run out of resources. Instead, we become better at finding, extracting, and efficiently utilizing resources, which means that in practical terms resources become more abundant, not less. In other words, the pie grows faster than we can eat it.

So is there any resource that actually limits human potential? I think there is, and history would suggest that resource is human ingenuity and effort. The more people are thinking about and working on a problem, the more solutions we find and build to solve it. That means not only does the pie grow faster than we can eat it, but the more people there are, the faster the pie grows. Of course that assumes everyone eating pie is also working to grow the pie, but that’s a separate issue for now.

Productivity and Division of Labor

Why does having more people lead to more productivity? A big part of it comes down to division of labor and specialization. The best way to get really good at something is to do more of it. In a small community, doing just one thing simply isn’t possible. Everyone has to be somewhat of a generalist in order to survive. But with a larger population, being a specialist becomes possible. In fact, that’s the purpose of money, as I explained here.

nostr:naddr1qvzqqqr4gupzp0rve5f6xtu56djkfkkg7ktr5rtfckpun95rgxaa7futy86npx8yqq247t2dvet9q4tsg4qng36lxe6kc4nftayyy89kua2

The more specialized an economy becomes, the more efficient it can be. There are big economies of scale in almost every task or process. So for example, if a single person tried to build a car from scratch, it would be extremely difficult and take a very long time. However, if you have a thousand people building a car, each doing a specific job, they can become very good at doing that specific job and do it much faster. And then you can move that process to a factory, and build machines to do specific jobs, and add even more efficiency.

But that only works if you’re building more than one car. It doesn’t make sense to build a huge factory full of specialized equipment that takes lots of time and effort to design and manufacture, and then only build one car. You need to sell thousands of cars, maybe even millions of cars, to pay off that initial investment. So division of labor and specialization relies on large populations in two different ways. First, you need a large population to have enough people to specialize in each task. But second and just as importantly, you need a large population of buyers for the finished product. You need a big market in order to make mass production economical.

Think of a computer or smartphone. It takes thousands of specialized processes, thousands of complex parts, and millions of people doing specialized jobs to extract the raw materials, process them, and assemble them into a piece of electronic hardware. And electronics are relatively expensive anyway. Imagine how impossible it would be to manufacture electronics economically, if the market demand wasn’t literally in the billions of units.

Stairs Up, Elevator Down

We’ve seen exponential increases in productivity over the past few centuries, resulting in higher living standards even as population exploded. Now, facing the prospect of a drastic trend reversal, what will happen to productivity and living standards? The typical sentiment seems to be “well, there are a lot of people already competing for resources, so if population does decline, that will just reduce the competition and leave a bigger slice of pie for each person, so we’ll all be getting wealthier as a result of population decline.”

This seems reasonable at first glance. Surely dividing the economic pie into fewer slices means a bigger slice for everyone, right? But remember, more specialization and division of labor is what made the pie as big as it is to begin with. And specialization depends on large populations for both the supply of specialized labor, and the demand for finished goods. Can complex supply chains and mass production withstand population reduction intact? I don’t think the answer is clear.

The idea that it will all be okay, and we’ll get wealthier as population falls, is based on some faulty assumptions. It assumes that wealth is basically some fixed inventory of “things” that exist, and it’s all a matter of distribution. That’s typical Marxist thinking, similar to the reasoning behind “tax the rich” and other utopian wealth transfer schemes.

The reality is, wealth is a dynamic concept with strong network effects. For example, a grocery store in a large city can be a valuable asset with a large potential income stream. The same store in a small village with a declining population can be an unprofitable and effectively worthless liability.

Even something as permanent as a house is very susceptible to network effects. If you currently live in an area where housing is scarce and expensive, you might think a declining population would be the perfect solution to high housing costs. However, if you look at a place that’s already facing the beginnings of a population decline, you’ll see it’s not actually that simple. Japan, for example, is already facing an aging and declining population. And sure enough, you can get a house in Japan for free, or basically free. Sounds amazing, right? Not really.

If you check out the reason houses are given away in Japan, you’ll find a depressing reality. Most of the free houses are in rural areas or villages where the population is declining, often to the point that the village becomes uninhabited and abandoned. It’s so bad that in 2018, 13.6% of houses in Japan were vacant. Why do villages become uninhabited? Well, it turns out that a certain population level is necessary to support the services and businesses people need. When the population falls too low, specialized businesses can no longer operated profitably. It’s the exact issue we discussed with division of labor and the need for a high population to provide a market for the specialist to survive. As the local stores, entertainment venues, and businesses close, and skilled tradesmen move away to larger population centers with more customers, living in the village becomes difficult and depressing, if not impossible. So at a certain critical level, a village that’s too isolated will reach a tipping point where everyone leaves as fast as possible. And it turns out that an abandoned house in a remote village or rural area without any nearby services and businesses is worth… nothing. Nobody wants to live there, nobody wants to spend the money to maintain the house, nobody wants to pay the taxes needed to maintain the utilities the town relied on. So they try to give the houses away to anyone who agrees to live there, often without much success.

So on a local level, population might rise gradually over time, but when that process reverses and population declines to a certain level, it can collapse rather quickly from there.

I expect the same incentives to play out on a larger scale as well. Complex supply chains and extreme specialization lead to massive productivity. But there’s also a downside, which is the fragility of the system. Specialization might mean one shop can make all the widgets needed for a specific application, for the whole globe. That’s great while it lasts, but what happens when the owner of that shop retires with his lifetime of knowledge and experience? Will there be someone equally capable ready to fill his shoes? Hopefully… But spread that problem out across the global economy, and cracks start to appear. A specialized part is unavailable. So a machine that relies on that part breaks down and can’t be repaired. So a new machine needs to be built, which is a big expense that drives up costs and prices. And with a falling population, demand goes down. Now businesses are spending more to make fewer items, so they have to raise prices to stay profitable. Now fewer people can afford the item, so demand falls even further. Eventually the business is forced to close, and other industries that relied on the items they produced are crippled. Things become more expensive, or unavailable at any price. Living standards fall. What was a stairway up becomes an elevator down.

Hope, From the Parasite Class?

All that being said, I’m not completely pessimistic about the future. I think the potential for an acceptable outcome exists.

I see two broad groups of people in the economy; producers, and parasites. One thing the increasing productivity has done is made it easier than ever to survive. Food is plentiful globally, the only issues are with distribution. Medical advances save countless lives. Everything is more abundant than ever before. All that has led to a very “soft” economic reality. There’s a lot of non-essential production, which means a lot of wealth can be redistributed to people who contribute nothing, and if it’s done carefully, most people won’t even notice. And that is exactly what has happened, in spades.

There are welfare programs of every type and description, and handouts to people for every reason imaginable. It’s never been easier to survive without lifting a finger. So millions of able-bodied men choose to do just that.

Besides the voluntarily idle, the economy is full of “bullshit jobs.” Shoutout to David Graeber’s book with that title. (It’s an excellent book and one I would highly recommend, even though the author was a Marxist and his conclusions are completely wrong.) A 2015 British poll asked people, “Does your job make a meaningful contribution to the world?” Only 50% said yes, while 37% said no and 13% were uncertain.

This won’t be a surprise to anyone who’s operated a business, or even worked in the private sector in general. There are three types of jobs; jobs that accomplish something productive, jobs that accomplish nothing of value, and jobs that actually hinder people trying to accomplish something productive. The number of jobs in the last two categories has grown massively over the years. This would include a lot of unnecessary administrative jobs, burdensome regulatory jobs, useless DEI and HR jobs, a large percentage of public sector jobs, most of the military-industrial complex, and the list is endless. All these jobs accomplish nothing worthwhile at best, and actively discourage those who are trying to accomplish something at worst.

Even among jobs that do accomplish some useful purpose, the amount of time spent actually doing the job continues to decline. According to a 2016 poll, American office workers spent only 39% of their workday actually doing their primary task. The other 61% was largely wasted on unproductive administrative tasks and meetings, answering emails, and just simply wasting time.

I could go on, but the point is, there’s a lot of slack in the economy. We’ve become so productive that the number of people actually doing the work to keep everyone fed, clothed, and cared for is only a small percentage of the population. In one sense, that’s a cause for optimism. The population could decline a lot, and we’d still have enough bodies to man the economic engine, as it were.

Aging

The thing with population decline, though, is nobody gets to choose who goes first. Not unless you’re a psychopathic dictator. So populations get old, then they get small. This means that the number of dependents in the economy rises naturally. Once people retire, they still need someone to grow the food, keep the lights on, and provide the medical care. And it doesn’t matter how much money the retirees have saved, either. Money is just a claim on wealth. The goods and services actually have to be provided by someone, and if that someone was never born, all the money in the world won’t change anything.

And the aging occurs on top of all the people already taking from the economy without contributing anything of value. So that seems like a big problem.

Currently, wealth redistribution happens through a combination of direct taxes, indirect taxation through deficit spending, and the whole gamut of games that happen when banks create credit/debt money by making loans. In a lot of cases, it’s very indirect and difficult to pin down. For example, someone has a “job” in a government office, enforcing pointless regulations that actually hinder someone in the private sector from producing something useful. Their paycheck comes from the government, so a combination of taxes on productive people, and deficit spending, which is also a tax on productive people. But they “have a job,” so who’s going to question their contribution to society? On the other hand, it could be a banker or hedge fund manager. They might be pulling in a massive salary, but at the core all they’re really doing is finding creative financial ways to transfer wealth from productive people to themselves, without contributing anything of value.

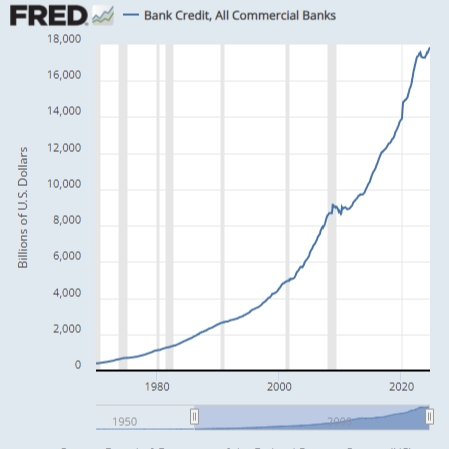

You’ll notice a common theme if you think about this problem deeply. Most of the wealth transfer that supports the unproductive, whether that’s welfare recipients, retirees, bureaucrats, corporate middle managers, or weapons manufacturers, is only possible through expanding the money supply. There’s a limit to how much direct taxation the productive will bear while the option to collect welfare exists. At a certain point, people conclude that working hard every day isn’t worth it, when taxes take so much of their wages that they could make almost as much without working at all. So the balance of what it takes to support the dependent class has to come indirectly, through new money creation.

As long as the declining population happens under the existing monetary system, the future looks bleak. There’s no limit to how much money creation and inflation the parasite class will use in an attempt to avoid work. They’ll continue to suck the productive class dry until the workers give up in disgust, and the currency collapses into hyperinflation. And you can’t run a complex economy without functional money, so productivity inevitably collapses with the currency.

The optimistic view is that we don’t have to continue supporting the failed credit/debt monetary system. It’s hurting productivity, messing up incentives, and contributing to increasing wealth inequality and lower living standards for the middle class. If we walk away from that system and adopt a hard money standard, the possibility of inflationary wealth redistribution vanishes. The welfare and warfare programs have to be slashed. The parasite class is forced to get busy, or starve. In that scenario, the declining population of workers can be offset by a massive shift away from “bullshit jobs” and into actual productive work.

While that might not be a permanent solution to declining population, it would at least give us time to find a real solution, without having our complex economy collapse and send our living standards back to the 17th century.

It’s a complex issue with many possible outcomes, but I think a close look at the effects of the monetary system on productivity shows one obvious problem that will make the situation worse than necessary. Moving to a better monetary system and creating incentives for productivity would do a lot to reduce the economic impacts of a declining population.

-

@ bc6ccd13:f53098e4

2025-05-21 22:11:33

@ bc6ccd13:f53098e4

2025-05-21 22:11:33The Bitcoin price action since the US presidential election, and particularly today, November 11, has given me an excuse to revisit an idea I’ve written about before. I explained here that money doesn’t “flow into” assets, and that the terminology makes it difficult for people to understand how prices actually work.