-

@ 58537364:705b4b85

2025-05-20 14:22:05

@ 58537364:705b4b85

2025-05-20 14:22:05Ikigai means "the meaning of life" or "the reason for being." Why were we born? What are we living for? When work is not seen as something separate from life.

The Japanese believe that everyone has their own ikigai. Those who discover it find meaning and value in life, leading to greater happiness, better moods, and a more fulfilling world.

Today, there are many books about ikigai, but the first one written by a Japanese author is:

“The Little Book of Ikigai: The Secret Japanese Way to Live a Happy and Long Life” by Ken Mogi (Thai translation by Wuttichai Krisanaprakankit)

Come explore the true world of ikigai through this Japanese neuroscientist’s insights, conveyed through conversations that challenge the idea of ikigai as something grand—showing instead that it starts with small personal joys.

Ken Mogi says that Jiro Ono, a 94-year-old sushi chef who still makes sushi today, was his inspiration for writing the book.

This sushi chef did not start the job out of passion or talent—but he dedicated every piece of sushi to bring happiness to his customers. That, Ken says, is the essence of ikigai.

Strangely, the word “ikigai” is not often used in daily conversations in Japan.

Because it’s something so natural that it doesn’t need to be said. In today’s world, we often talk about how to succeed, how to get promoted, how to become a CEO. But for the Japanese, success isn’t everything.

For example, many Japanese people are deeply passionate about hobbies or have kodawari. Others might not care what those hobbies are—as long as the person seems happy, that’s enough. Some are obsessed with trains, manga, or anime. These people don’t need fame or recognition from society. If they’re happy in their own way, that’s perfectly okay.

Kodawari means a deep dedication or meticulous attention to something. For example, someone obsessed with stationery might spend a lot of time selecting the perfect pens, notebooks, or pencils. They’ll research, analyze, and experiment to find the tools they love most.

Everyone’s ikigai can be different, because people value different things and live differently.

Ikigai is about diversity. Japanese society encourages children to discover their own ikigai. They don’t tell kids to pursue jobs only because they pay well. If you ask students what jobs they want, they rarely say it’s about money first.

Ikigai is not the same as "success." The Japanese know that life isn’t just about being successful. Ikigai matters more. You could be successful but lack ikigai. Conversely, you might not be “successful” but still have ikigai—and you might be happier.

Ken Mogi defines success as something society acknowledges and rewards. But ikigai comes from your own heart and personal happiness. Others may not recognize it as success, but that doesn’t matter.

Ikigai is personal. We can be happy in our own way. We don’t judge others’ happiness—let them find joy in their own path.

The key to ikigai is finding small moments of happiness, even from little things. For example, when Ken was a child, he loved studying butterflies. Now, when he’s out jogging and sees a beautiful butterfly, he feels ikigai. Or sometimes, it comes from small amusing moments—like hearing a child tell his dad, “Dad, you have to do it this way!”

So, if we want to find our own ikigai, where do we start? Start with noticing small pleasures in daily life. That’s the easiest place to begin.

In the brain, there's a chemical called dopamine. When we achieve even small things, dopamine is released, creating happiness. That’s why enjoying small things is so important.

For some, ikigai might seem hard to grasp—especially if life is difficult, if they feel hopeless or lack self-worth. So begin with tiny moments of joy.

Is it the same as positive thinking? Ikigai is a part of that. But when we talk about “positive thinking,” it can feel like pressure to some people. So instead, just notice small joys: making your morning coffee, running in the rain.

Lessons from Ken Mogi:

-

Ikigai is not about chasing success or wealth, but about feeling happiness in your own life, which gives your life personal meaning.

-

Ikigai is not defined by society. Everyone’s ikigai is different. Each person can be happy in their own way.

-

**Don’t judge or force others—**children, partners—to live how you think is right. Respect diversity.

-

Smile at people who are enjoying their ikigai, and support them if they struggle.

-

Ikigai exists on two levels:

-

Big ikigai: life purpose or work values.

-

Small ikigai: tiny joys in everyday life.

-

Ikigai starts with noticing small pleasures today.

Source: From the Cloud of Thoughts column An interview by Ajarn Katewadi from Marumura with Ken Mogi, author of the first Japanese book on ikigai.

-

-

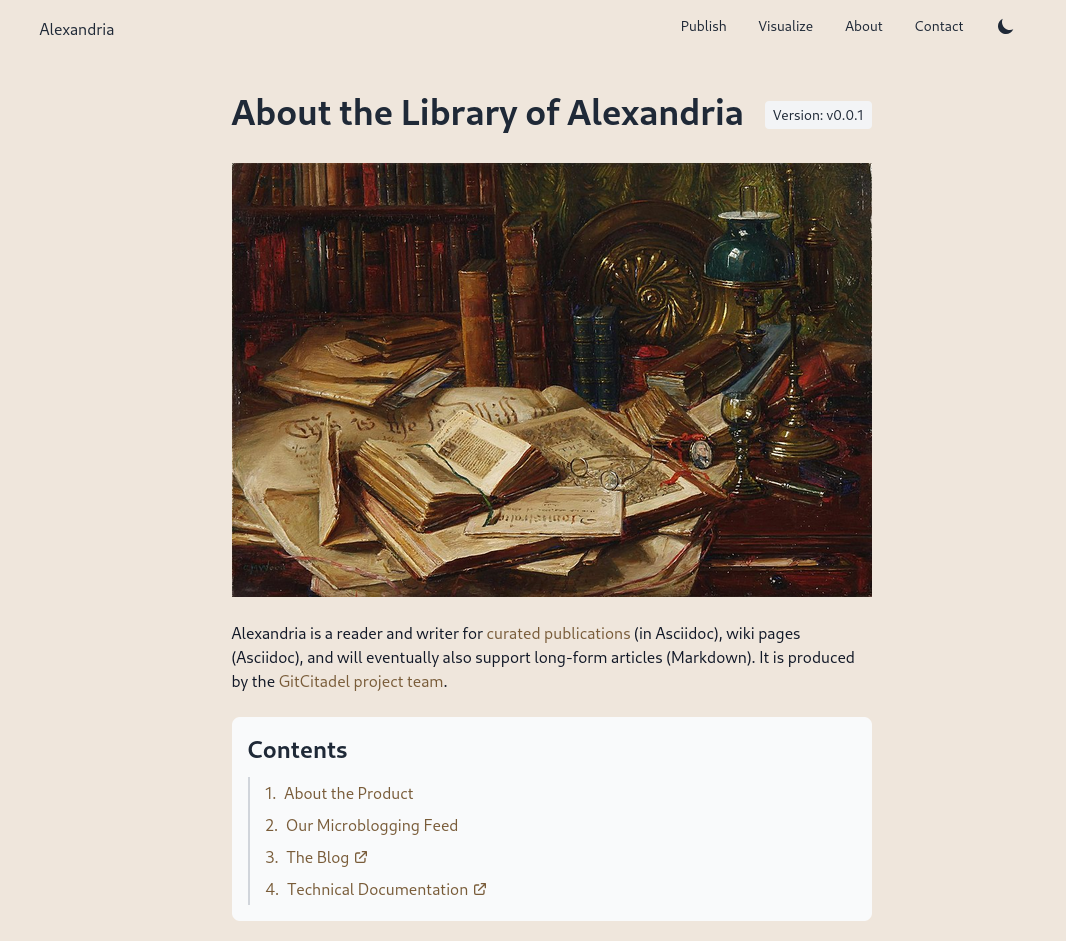

@ 7e538978:a5987ab6

2025-05-20 14:10:38

@ 7e538978:a5987ab6

2025-05-20 14:10:38🧑💻🚀 This bounty has now been claimed - Read more here 🧑💻🚀🧑💻🚀

Bounty Specification: Implement a Nostr Wallet Connect Funding Source for LNbits

Project Overview

This project involves the development of a funding source within LNbits that can use a remote NWC wallet service.

Objective

To create a NWC funding source for LNbits that allows for lightning network operations using a remote Nostr Wallet Connect wallet service. This funding source should implement all funding source functions using NWC as defined in the Void funding source stub - https://github.com/lnbits/lnbits/blob/dev/lnbits/wallets/void.py

Deliverables

- NWC Funding Source: Robust funding source for LNbits that implements all funding source functions using NIP-47.

- Documentation: Comprehensive guide including:

- Installation and configuration processes.

- Configuration guidelines to connect with various NWC wallet services.

- Test Suite: Complete set of tests ensuring the functionality works under various scenarios and adheres to the NIP-47 protocol.

- Demonstration: A working demonstration of LNbits acting as a NWC client, performing transactions using a NWC wallet service.

Requirements

- The extension should be implemented in Python to align with the existing LNbits platform.

- Follow the NIP-47 protocol.

- Integration should support asynchronous operations to handle real-time transaction confirmations.

Budget

- Total Bounty: 750,000 sats

- Payment will be made upon final delivery, after successful testing and documentation review.

Evaluation Criteria

- Adherence to the NIP-47 specifications and LNbits integration requirements.

- Security and efficiency of the implementation.

- Quality of documentation and ease of use.

How to Apply

Get in touch with us in the LNbits Telegram channel

-

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:08

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:08 -

@ 7e538978:a5987ab6

2025-05-20 14:10:14

@ 7e538978:a5987ab6

2025-05-20 14:10:14🧑💻🚀 This bounty has now been claimed - Read more here 🧑💻🚀

Bounty Specification: Build a Nostr Wallet Connect Wallet Service Extension for LNbits

Project Overview

This project aims to build a Nostr Wallet Connect (NWC) extension for LNbits to allow LNbits to act as a NWC Wallet Service as defined in NIP-47 https://github.com/nostr-protocol/nips/blob/master/47.md

LNbits has an example extension that can be used as a starting point on your extension development journey. Watch the extension build tutorial video here

Objective

To develop a fully functional NWC Wallet Service extension that adheres to the NIP-47 protocol specifications, enabling the following capabilities:

- Generation and handling of Nostr Wallet Connect URIs.

- Processing of payment requests including

pay_invoice,make_invoice,lookup_invoice,list_transactions,get_balance,multi_pay_invoice,pay_keysend,multi_pay_keysendandget_info - Creation and lookup of invoices.

- List and balance querying functionalities.

- Secure communication through encrypted events as per NIP04.

- Implementation of error codes

- Implementation of connection rules with control of the following:

Maximum payment amount,maximum daily budget,connection expiry date(never expire should be an option) denominated in sats.

Deliverables

- NWC Wallet Service Extension Code: Clean, commented, and secure codebase that uses the existing LNbits

nostrclient.pyfunctionality and an LNbits funding source to provide a NWC Wallet Service. - NWC Wallet Service Extension UI: A user interface within the extension that allows a user to connect a new app to the NWC wallet service and edit existing connections. The app connection should allow control of the following rules:

Maximum payment amountMaximum daily budgetConnection expiry date(never expire should be an option) - Documentation: Documentation covering:

- Setup and configuration instructions.

- Usage examples.

- Test Suite: A comprehensive test suite covering all key functionality

Technology Requirements

- The extension must be developed in Python, consistent with the LNbits platform.

- Use of existing LNbits libraries and adherence to its architectural style is required.

- NIP-47 specification must be adhered to.

Budget

- Total Bounty: 750,000 sats

- Payment will be made upon final delivery, after successful testing and documentation review.

Evaluation Criteria

- Adherence to the NIP-47 specifications and LNbits integration requirements.

- Security and efficiency of the implementation.

- Quality of documentation and ease of use.

How to Apply

Get in touch with us in the LNbits Telegram channel

-

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:06

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:06 -

@ c9badfea:610f861a

2025-05-10 11:08:51

@ c9badfea:610f861a

2025-05-10 11:08:51- Install FUTO Keyboard (it's free and open source)

- Launch the app, tap Switch Input Methods and select FUTO Keyboard

- For voice input, choose FUTO Keyboard (needs mic permission) and grant permission While Using The App

- Configure keyboard layouts under Languages & Models as needed

Adding Support for Non-English Languages

Voice Input

- Download voice input models from the FUTO Keyboard Add-Ons page

- For languages like Chinese, German, Spanish, Russian, French, Portuguese, Korean, and Japanese, download the Multilingual-74 model

- For other languages, download Multilingual-244

- Open FUTO Keyboard, go to Languages & Models, and import the downloaded model under Voice Input

Dictionaries

- Get dictionary files from AOSP Dictionaries

- Open FUTO Keyboard, navigate to Languages & Models, and import the dictionary under Dictionary

ℹ️ When typing, tap the microphone icon to use voice input

-

@ 6ad3e2a3:c90b7740

2025-05-20 13:49:50

@ 6ad3e2a3:c90b7740

2025-05-20 13:49:50I’ve written about MSTR twice already, https://www.chrisliss.com/p/mstr and https://www.chrisliss.com/p/mstr-part-2, but I want to focus on legendary short seller James Chanos’ current trade wherein he buys bitcoin (via ETF) and shorts MSTR, in essence to “be like Mike” Saylor who sells MSTR shares at the market and uses them to add bitcoin to the company’s balance sheet. After all, if it’s good enough for Saylor, why shouldn’t everyone be doing it — shorting a company whose stock price is more than 2x its bitcoin holdings and using the proceeds to buy the bitcoin itself?

Saylor himself has said selling shares at 2x NAV (net asset value) to buy bitcoin is like selling dollars for two dollars each, and Chanos has apparently decided to get in while the getting (market cap more than 2x net asset value) is good. If the price of bitcoin moons, sending MSTR’s shares up, you are more than hedged in that event, too. At least that’s the theory.

The problem with this bet against MSTR’s mNAV, i.e., you are betting MSTR’s market cap will converge 1:1 toward its NAV in the short and medium term is this trade does not exist in a vacuum. Saylor has described how his ATM’s (at the market) sales of shares are accretive in BTC per share because of this very premium they carry. Yes, we’ll dilute your shares of the company, but because we’re getting you 2x the bitcoin per share, you are getting an ever smaller slice of an ever bigger overall pie, and the pie is growing 2x faster than your slice is reducing. (I https://www.chrisliss.com/p/mstr how this works in my first post.)

But for this accretion to continue, there must be a constant supply of “greater fools” to pony up for the infinitely printable shares which contain only half their value in underlying bitcoin. Yes, those shares will continue to accrete more BTC per share, but only if there are more fools willing to make this trade in the future. So will there be a constant supply of such “fools” to keep fueling MSTR’s mNAV multiple indefinitely?

Yes, there will be in my opinion because you have to look at the trade from the prospective fools’ perspective. Those “fools” are not trading bitcoin for MSTR, they are trading their dollars, selling other equities to raise them maybe, but in the end it’s a dollars for shares trade. They are not selling bitcoin for them.

You might object that those same dollars could buy bitcoin instead, so they are surely trading the opportunity cost of buying bitcoin for them, but if only 5-10 percent of the market (or less) is buying bitcoin itself, the bucket in which which those “fools” reside is the entire non-bitcoin-buying equity market. (And this is not considering the even larger debt market which Saylor has yet to tap in earnest.)

So for those 90-95 percent who do not and are not presently planning to own bitcoin itself, is buying MSTR a fool’s errand, so to speak? Not remotely. If MSTR shares are infinitely printable ATM, they are still less so than the dollar and other fiat currencies. And MSTR shares are backed 2:1 by bitcoin itself, while the fiat currencies are backed by absolutely nothing. So if you hold dollars or euros, trading them for MSTR shares is an errand more sage than foolish.

That’s why this trade (buying BTC and shorting MSTR) is so dangerous. Not only are there many people who won’t buy BTC buying MSTR, there are many funds and other investment entities who are only able to buy MSTR.

Do you want to get BTC at 1:1 with the 5-10 percent or MSTR backed 2:1 with the 90-95 percent. This is a bit like medical tests that have a 95 percent accuracy rate for an asymptomatic disease that only one percent of the population has. If someone tests positive, it’s more likely to be a false one than an indication he has the disease*. The accuracy rate, even at 19:1, is subservient to the size of the respective populations.

At some point this will no longer be the case, but so long as the understanding of bitcoin is not widespread, so long as the dollar is still the unit of account, the “greater fools” buying MSTR are still miles ahead of the greatest fools buying neither, and the stock price and mNAV should only increase.

. . .

One other thought: it’s more work to play defense than offense because the person on offense knows where he’s going, and the defender can only react to him once he moves. Similarly, Saylor by virtue of being the issuer of the shares knows when more will come online while Chanos and other short sellers are borrowing them to sell in reaction to Saylor’s strategy. At any given moment, Saylor can pause anytime, choosing to issue convertible debt or preferred shares with which to buy more bitcoin, and the shorts will not be given advance notice.

If the price runs, and there is no ATM that week because Saylor has stopped on a dime, so to speak, the shorts will be left having to scramble to change directions and buy the shares back to cover. Their momentum might be in the wrong direction, though, and like Allen Iverson breaking ankles with a crossover, Saylor might trigger a massive short squeeze, rocketing the share price ever higher. That’s why he actually welcomes Chanos et al trying this copycat strategy — it becomes the fuel for outsized gains.

For that reason, news that Chanos is shorting MSTR has not shaken my conviction, though there are other more pertinent https://www.chrisliss.com/p/mstr-part-2 with MSTR, of which one should be aware. And as always, do your own due diligence before investing in anything.

* To understand this, consider a population of 100,000, with one percent having a disease. That means 1,000 have it, 99,000 do not. If the test is 95 percent accurate, and everyone is tested, 950 of the 1,000 will test positive (true positives), 50 who have it will test negative (false negatives.) Of the positives, 95 percent of 99,000 (94,050) will test negative (true negatives) and five percent (4,950) will test positive (false positives). That means 4,950 out of 5,900 positives (84%) will be false.

-

@ c230edd3:8ad4a712

2025-04-11 16:02:15

@ c230edd3:8ad4a712

2025-04-11 16:02:15Chef's notes

Wildly enough, this is delicious. It's sweet and savory.

(I copied this recipe off of a commercial cheese maker's site, just FYI)

I hadn't fully froze the ice cream when I took the picture shown. This is fresh out of the churner.

Details

- ⏲️ Prep time: 15 min

- 🍳 Cook time: 30 min

- 🍽️ Servings: 4

Ingredients

- 12 oz blue cheese

- 3 Tbsp lemon juice

- 1 c sugar

- 1 tsp salt

- 1 qt heavy cream

- 3/4 c chopped dark chocolate

Directions

- Put the blue cheese, lemon juice, sugar, and salt into a bowl

- Bring heavy cream to a boil, stirring occasionally

- Pour heavy cream over the blue cheese mix and stir until melted

- Pour into prepared ice cream maker, follow unit instructions

- Add dark chocolate halfway through the churning cycle

- Freeze until firm. Enjoy.

-

@ c230edd3:8ad4a712

2025-04-09 00:33:31

@ c230edd3:8ad4a712

2025-04-09 00:33:31Chef's notes

I found this recipe a couple years ago and have been addicted to it since. Its incredibly easy, and cheap to prep. Freeze the sausage in flat, single serving portions. That way it can be cooked from frozen for a fast, flavorful, and healthy lunch or dinner. I took inspiration from the video that contained this recipe, and almost always pan fry the frozen sausage with some baby broccoli. The steam cooks the broccoli and the fats from the sausage help it to sear, while infusing the vibrant flavors. Serve with some rice, if desired. I often use serrano peppers, due to limited produce availability. They work well for a little heat and nice flavor that is not overpowering.

Details

- ⏲️ Prep time: 25 min

- 🍳 Cook time: 15 min (only needed if cooking at time of prep)

- 🍽️ Servings: 10

Ingredients

- 4 lbs ground pork

- 12-15 cloves garlic, minced

- 6 Thai or Serrano peppers, rough chopped

- 1/4 c. lime juice

- 4 Tbsp fish sauce

- 1 Tbsp brown sugar

- 1/2 c. chopped cilantro

Directions

- Mix all ingredients in a large bowl.

- Portion and freeze, as desired.

- Sautè frozen portions in hot frying pan, with broccoli or other fresh veggies.

- Serve with rice or alone.

-

@ 34f1ddab:2ca0cf7c

2025-05-16 22:47:03

@ 34f1ddab:2ca0cf7c

2025-05-16 22:47:03Losing access to your cryptocurrency can feel like losing a part of your future. Whether it’s due to a forgotten password, a damaged seed backup, or a simple mistake in a transfer, the stress can be overwhelming. Fortunately, cryptrecver.com is here to assist! With our expert-led recovery services, you can safely and swiftly reclaim your lost Bitcoin and other cryptocurrencies.

Why Trust Crypt Recver? 🤝 🛠️ Expert Recovery Solutions At Crypt Recver, we specialize in addressing complex wallet-related issues. Our skilled engineers have the tools and expertise to handle:

Partially lost or forgotten seed phrases Extracting funds from outdated or invalid wallet addresses Recovering data from damaged hardware wallets Restoring coins from old or unsupported wallet formats You’re not just getting a service; you’re gaining a partner in your cryptocurrency journey.

🚀 Fast and Efficient Recovery We understand that time is crucial in crypto recovery. Our optimized systems enable you to regain access to your funds quickly, focusing on speed without compromising security. With a success rate of over 90%, you can rely on us to act swiftly on your behalf.

🔒 Privacy is Our Priority Your confidentiality is essential. Every recovery session is conducted with the utmost care, ensuring all processes are encrypted and confidential. You can rest assured that your sensitive information remains private.

💻 Advanced Technology Our proprietary tools and brute-force optimization techniques maximize recovery efficiency. Regardless of how challenging your case may be, our technology is designed to give you the best chance at retrieving your crypto.

Our Recovery Services Include: 📈 Bitcoin Recovery: Lost access to your Bitcoin wallet? We help recover lost wallets, private keys, and passphrases. Transaction Recovery: Mistakes happen — whether it’s an incorrect wallet address or a lost password, let us manage the recovery. Cold Wallet Restoration: If your cold wallet is failing, we can safely extract your assets and migrate them into a secure new wallet. Private Key Generation: Lost your private key? Our experts can help you regain control using advanced methods while ensuring your privacy. ⚠️ What We Don’t Do While we can handle many scenarios, some limitations exist. For instance, we cannot recover funds stored in custodial wallets or cases where there is a complete loss of four or more seed words without partial information available. We are transparent about what’s possible, so you know what to expect

Don’t Let Lost Crypto Hold You Back! Did you know that between 3 to 3.4 million BTC — nearly 20% of the total supply — are estimated to be permanently lost? Don’t become part of that statistic! Whether it’s due to a forgotten password, sending funds to the wrong address, or damaged drives, we can help you navigate these challenges

🛡️ Real-Time Dust Attack Protection Our services extend beyond recovery. We offer dust attack protection, keeping your activity anonymous and your funds secure, shielding your identity from unwanted tracking, ransomware, and phishing attempts.

🎉 Start Your Recovery Journey Today! Ready to reclaim your lost crypto? Don’t wait until it’s too late! 👉 cryptrecver.com

📞 Need Immediate Assistance? Connect with Us! For real-time support or questions, reach out to our dedicated team on: ✉️ Telegram: t.me/crypptrcver 💬 WhatsApp: +1(941)317–1821

Crypt Recver is your trusted partner in cryptocurrency recovery. Let us turn your challenges into victories. Don’t hesitate — your crypto future starts now! 🚀✨

Act fast and secure your digital assets with cryptrecver.com.Losing access to your cryptocurrency can feel like losing a part of your future. Whether it’s due to a forgotten password, a damaged seed backup, or a simple mistake in a transfer, the stress can be overwhelming. Fortunately, cryptrecver.com is here to assist! With our expert-led recovery services, you can safely and swiftly reclaim your lost Bitcoin and other cryptocurrencies.

# Why Trust Crypt Recver? 🤝

# Why Trust Crypt Recver? 🤝🛠️ Expert Recovery Solutions\ At Crypt Recver, we specialize in addressing complex wallet-related issues. Our skilled engineers have the tools and expertise to handle:

- Partially lost or forgotten seed phrases

- Extracting funds from outdated or invalid wallet addresses

- Recovering data from damaged hardware wallets

- Restoring coins from old or unsupported wallet formats

You’re not just getting a service; you’re gaining a partner in your cryptocurrency journey.

🚀 Fast and Efficient Recovery\ We understand that time is crucial in crypto recovery. Our optimized systems enable you to regain access to your funds quickly, focusing on speed without compromising security. With a success rate of over 90%, you can rely on us to act swiftly on your behalf.

🔒 Privacy is Our Priority\ Your confidentiality is essential. Every recovery session is conducted with the utmost care, ensuring all processes are encrypted and confidential. You can rest assured that your sensitive information remains private.

💻 Advanced Technology\ Our proprietary tools and brute-force optimization techniques maximize recovery efficiency. Regardless of how challenging your case may be, our technology is designed to give you the best chance at retrieving your crypto.

Our Recovery Services Include: 📈

- Bitcoin Recovery: Lost access to your Bitcoin wallet? We help recover lost wallets, private keys, and passphrases.

- Transaction Recovery: Mistakes happen — whether it’s an incorrect wallet address or a lost password, let us manage the recovery.

- Cold Wallet Restoration: If your cold wallet is failing, we can safely extract your assets and migrate them into a secure new wallet.

- Private Key Generation: Lost your private key? Our experts can help you regain control using advanced methods while ensuring your privacy.

⚠️ What We Don’t Do\ While we can handle many scenarios, some limitations exist. For instance, we cannot recover funds stored in custodial wallets or cases where there is a complete loss of four or more seed words without partial information available. We are transparent about what’s possible, so you know what to expect

# Don’t Let Lost Crypto Hold You Back!

# Don’t Let Lost Crypto Hold You Back!Did you know that between 3 to 3.4 million BTC — nearly 20% of the total supply — are estimated to be permanently lost? Don’t become part of that statistic! Whether it’s due to a forgotten password, sending funds to the wrong address, or damaged drives, we can help you navigate these challenges

🛡️ Real-Time Dust Attack Protection\ Our services extend beyond recovery. We offer dust attack protection, keeping your activity anonymous and your funds secure, shielding your identity from unwanted tracking, ransomware, and phishing attempts.

🎉 Start Your Recovery Journey Today!\ Ready to reclaim your lost crypto? Don’t wait until it’s too late!\ 👉 cryptrecver.com

📞 Need Immediate Assistance? Connect with Us!\ For real-time support or questions, reach out to our dedicated team on:\ ✉️ Telegram: t.me/crypptrcver\ 💬 WhatsApp: +1(941)317–1821

Crypt Recver is your trusted partner in cryptocurrency recovery. Let us turn your challenges into victories. Don’t hesitate — your crypto future starts now! 🚀✨

Act fast and secure your digital assets with cryptrecver.com.

-

@ c6d8334c:30883d6d

2025-05-20 14:08:19

@ c6d8334c:30883d6d

2025-05-20 14:08:19🔑 Hashtag-Kombination (immer gleich aufgebaut):

```

relilab #verstehen 1️⃣

relilab #anwenden 2️⃣

relilab #reflektieren

relilab #gestalten 3️⃣

```

✅ Pflicht:

-

#relilab -

genau ein Kompetenz-Hashtag:

#verstehen,#anwenden,#reflektieren,#gestalten

✨ Optional:

-

eine Niveaustufe:

-

1️⃣ Reproduktion

-

2️⃣ Rekonstruktion

-

3️⃣ Konstruktion

📝 Beispielhafte Posts

```text

relilab #verstehen 1️⃣

Ich habe heute zum ersten Mal ausprobiert, wie KI überhaupt "lernt". Spannend!

relilab #anwenden 2️⃣

ChatGPT half mir dabei, einen Ablaufplan für einen Unterricht zu entwerfen – sehr hilfreich.

relilab #reflektieren

Welche Rolle spielt das Menschenbild, wenn KI religiöse Themen behandelt?

relilab #gestalten 3️⃣

Ich habe ein eigenes H5P-Modul mit einem KI-generierten Bibelquiz gebaut. Wer testet es? ```

-

-

@ c1e9ab3a:9cb56b43

2025-05-18 04:14:48

@ c1e9ab3a:9cb56b43

2025-05-18 04:14:48Abstract

This document proposes a novel architecture that decouples the peer-to-peer (P2P) communication layer from the Bitcoin protocol and replaces or augments it with the Nostr protocol. The goal is to improve censorship resistance, performance, modularity, and maintainability by migrating transaction propagation and block distribution to the Nostr relay network.

Introduction

Bitcoin’s current architecture relies heavily on its P2P network to propagate transactions and blocks. While robust, it has limitations in terms of flexibility, scalability, and censorship resistance in certain environments. Nostr, a decentralized event-publishing protocol, offers a multi-star topology and a censorship-resistant infrastructure for message relay.

This proposal outlines how Bitcoin communication could be ported to Nostr while maintaining consensus and verification through standard Bitcoin clients.

Motivation

- Enhanced Censorship Resistance: Nostr’s architecture enables better relay redundancy and obfuscation of transaction origin.

- Simplified Lightweight Nodes: Removing the full P2P stack allows for lightweight nodes that only verify blockchain data and communicate over Nostr.

- Architectural Modularity: Clean separation between validation and communication enables easier auditing, upgrades, and parallel innovation.

- Faster Propagation: Nostr’s multi-star network may provide faster propagation of transactions and blocks compared to the mesh-like Bitcoin P2P network.

Architecture Overview

Components

-

Bitcoin Minimal Node (BMN):

- Verifies blockchain and block validity.

- Maintains UTXO set and handles mempool logic.

- Connects to Nostr relays instead of P2P Bitcoin peers.

-

Bridge Node:

- Bridges Bitcoin P2P traffic to and from Nostr relays.

- Posts new transactions and blocks to Nostr.

- Downloads mempool content and block headers from Nostr.

-

Nostr Relays:

- Accept Bitcoin-specific event kinds (transactions and blocks).

- Store mempool entries and block messages.

- Optionally broadcast fee estimation summaries and tipsets.

Event Format

Proposed reserved Nostr

kindnumbers for Bitcoin content (NIP/BIP TBD):| Nostr Kind | Purpose | |------------|------------------------| | 210000 | Bitcoin Transaction | | 210001 | Bitcoin Block Header | | 210002 | Bitcoin Block | | 210003 | Mempool Fee Estimates | | 210004 | Filter/UTXO summary |

Transaction Lifecycle

- Wallet creates a Bitcoin transaction.

- Wallet sends it to a set of configured Nostr relays.

- Relays accept and cache the transaction (based on fee policies).

- Mining nodes or bridge nodes fetch mempool contents from Nostr.

- Once mined, a block is submitted over Nostr.

- Nodes confirm inclusion and update their UTXO set.

Security Considerations

- Sybil Resistance: Consensus remains based on proof-of-work. The communication path (Nostr) is not involved in consensus.

- Relay Discoverability: Optionally bootstrap via DNS, Bitcoin P2P, or signed relay lists.

- Spam Protection: Relay-side policy, rate limiting, proof-of-work challenges, or Lightning payments.

- Block Authenticity: Nodes must verify all received blocks and reject invalid chains.

Compatibility and Migration

- Fully compatible with current Bitcoin consensus rules.

- Bridge nodes preserve interoperability with legacy full nodes.

- Nodes can run in hybrid mode, fetching from both P2P and Nostr.

Future Work

- Integration with watch-only wallets and SPV clients using verified headers via Nostr.

- Use of Nostr’s social graph for partial trust assumptions and relay reputation.

- Dynamic relay discovery using Nostr itself (relay list events).

Conclusion

This proposal lays out a new architecture for Bitcoin communication using Nostr to replace or augment the P2P network. This improves decentralization, censorship resistance, modularity, and speed, while preserving consensus integrity. It encourages innovation by enabling smaller, purpose-built Bitcoin nodes and offloading networking complexity.

This document may become both a Bitcoin Improvement Proposal (BIP-XXX) and a Nostr Improvement Proposal (NIP-XXX). Event kind range reserved: 210000–219999.

-

@ bd32f268:22b33966

2025-05-20 14:07:47

@ bd32f268:22b33966

2025-05-20 14:07:47Recentemente tive conhecimento do mais recente flagelo cuja popularidade espelha bem o estado avançado de degeneração da nossa sociedade, o bebé reborn. Há uns anos certamente não passaria de uma piada de mau gosto quando alguém nos dissesse que decidiu adquirir um boneco para criar como se se tratasse de um filho, infelizmente em 2025 deixou de ser uma piada para se tornar algo assombroso.

Depois de fazer alguma pesquisa sobre o tema percebi que há pessoas que têm em curso processos litigantes judiciais relativos à, note-se com pasmo, guarda da boneca. A insanidade não fica por aqui uma vez que, algumas "mães" procuram atendimento médico para os seus bonecos. No Brasil, a câmara dos deputados recebeu três projetos destinados à criação de políticas públicas relacionadas com estes bonecos. As notícias sobre este fenómeno surreal multiplicam-se à medida que a insanidade se alastra como vírus pelas redes sociais.

Vivemos numa sociedade que há muito se divorciou da realidade, uma sociedade de pós-verdade, por isso de alguma forma não choca que este tipo de coisa possa acontecer. Podemos dizer que de alguma forma existe um primado do sentimento face à razão, preferimos, por vezes com consequências catastróficas, uma mentira "empática" do que uma verdade salvífica. Esta nossa tibieza em afirmar a verdade leva-nos consequentemente a uma crendice insustentável que é esta de, cada um tem a sua verdade. Graças a essa filosofia permitimos que um certo discurso lunático tenha mais alcance no espaço público. Por vezes ingenuamente podemos pensar que se trata de algo inofensivo, sem consequências de maior, contudo a experiência mostra-nos precisamente o contrário. Há por detrás destes fenómenos uma índole corrosiva que funciona como aguilhão para a disseminação das agendas políticas e ideológicas que visam a destruição da família. Considerando a excecional vulnerabilidade psíquica que observamos em cada vez mais pessoas neste tempo e a ampla disseminação destes fenómenos temos razão mais que suficientes para estarmos preocupados.

Uma outra elação que podemos retirar é que a nossa sociedade com as alegadas gerações "mais bem preparadas de sempre" está claramente a produzir um excesso de adultos que se comporta e, a todos os títulos são, crianças funcionais.

Com tudo isto fica cada vez mais difícil viver uma vida harmoniosa com a lei natural, pois vivemos em harmonia com algo considerado opressor pelos apologetas destes produtos do marxismo cultural. Com a pretensa igualdade que se pretende alcançar, equiparando inclusive um boneco a uma bebé, as famílias no sentido próprio do termo ficam em segundo plano relativamente a estes "novos" e esotéricos conceitos de família.

Importa perguntar, no meio de todas essas novas formas de se pensar uma família, qual é o ideal ?

Provavelmente os apologetas destas bizarrices ficarão em silêncio uma vez que coerentemente consideram que todas as formas são iguais e válidas.

Isto é apenas mais um sinal que nos é dado do declínio palpável dos valores que construíram a nossa sociedade e civilização. Façamos algo para que estas nocivas ideologias não entrem no nosso coração e em nossas casas, sob pena da corrupção dos nossos princípios e dos daqueles que nos são queridos. Estes fenómenos são de tal forma doentios que nos levam a crer que vivemos numa época tragicómica, o que me fez lembrar de uma história contada por Kierkgaard e que partilho de seguida.

“Certa vez, houve um incêndio num circo ambulante na Dinamarca. O director mandou imediatamente o palhaço, que já se encontrava vestido e maquilhado a preceito, para a vila mais próxima, à procura de ajuda, advertindo-o de que existia o perigo de o fogo se espalhar pelos campos ceifados e ressequidos, com risco iminente para as casas do próprio povoado. O palhaço correu até à vila e pediu aos moradores que viessem ajudar a apagar o incêndio que estava a destruir o circo. Mas os habitantes viram nos gritos do palhaço apenas um belo truque de publicidade que visaria levá-los a acorrer em grande número às sessões do circo; aplaudiam e desatavam a rir. Diante dessa reacção, o palhaço sentiu mais vontade de chorar do que de rir. Fez de tudo para convencer as pessoas de que não estava a representar, de que não se tratava de um truque e sim de um apelo da maior seriedade: estava realmente em causa um incêndio. Mas a sua insistência só fazia aumentar os risos; eles achavam que a performance estava excelente – até que o fogo alcançou de facto aquela vila. Aí já foi tarde, e o fogo acabou por destruir não só o circo, mas também a povoação”.

Soren Kierkgaard - Filósofo dinamarquês

-

@ 00000001:b0c77eb9

2025-02-14 21:24:24

@ 00000001:b0c77eb9

2025-02-14 21:24:24مواقع التواصل الإجتماعي العامة هي التي تتحكم بك، تتحكم بك بفرض أجندتها وتجبرك على اتباعها وتحظر وتحذف كل ما يخالفها، وحرية التعبير تنحصر في أجندتها تلك!

وخوارزمياتها الخبيثة التي لا حاجة لها، تعرض لك مايريدون منك أن تراه وتحجب ما لا يريدونك أن تراه.

في نوستر انت المتحكم، انت الذي تحدد من تتابع و انت الذي تحدد المرحلات التي تنشر منشوراتك بها.

نوستر لامركزي، بمعنى عدم وجود سلطة تتحكم ببياناتك، بياناتك موجودة في المرحلات، ولا احد يستطيع حذفها او تعديلها او حظر ظهورها.

و هذا لا ينطبق فقط على مواقع التواصل الإجتماعي العامة، بل ينطبق أيضاً على الـfediverse، في الـfediverse انت لست حر، انت تتبع الخادم الذي تستخدمه ويستطيع هذا الخادم حظر ما لا يريد ظهوره لك، لأنك لا تتواصل مع بقية الخوادم بنفسك، بل خادمك من يقوم بذلك بالنيابة عنك.

وحتى إذا كنت تمتلك خادم في شبكة الـfediverse، إذا خالفت اجندة بقية الخوادم ونظرتهم عن حرية الرأي و التعبير سوف يندرج خادمك في القائمة السوداء fediblock ولن يتمكن خادمك من التواصل مع بقية خوادم الشبكة، ستكون محصوراً بالخوادم الأخرى المحظورة كخادمك، بالتالي انت في الشبكة الأخرى من الـfediverse!

نعم، يوجد شبكتان في الكون الفدرالي fediverse شبكة الصالحين التابعين للأجندة الغربية وشبكة الطالحين الذين لا يتبعون لها، إذا تم إدراج خادمك في قائمة fediblock سوف تذهب للشبكة الأخرى!

-

@ 2f29aa33:38ac6f13

2025-05-17 12:59:01

@ 2f29aa33:38ac6f13

2025-05-17 12:59:01The Myth and the Magic

Picture this: a group of investors, huddled around a glowing computer screen, nervously watching Bitcoin’s price. Suddenly, someone produces a stick-no ordinary stick, but a magical one. With a mischievous grin, they poke the Bitcoin. The price leaps upward. Cheers erupt. The legend of the Bitcoin stick is born.

But why does poking Bitcoin with a stick make the price go up? Why does it only work for a lucky few? And what does the data say about this mysterious phenomenon? Let’s dig in, laugh a little, and maybe learn the secret to market-moving magic.

The Statistical Side of Stick-Poking

Bitcoin’s Price: The Wild Ride

Bitcoin’s price is famous for its unpredictability. In the past year, it’s soared, dipped, and soared again, sometimes gaining more than 50% in just a few months. On a good day, billions of dollars flow through Bitcoin trades, and the price can jump thousands in a matter of hours. Clearly, something is making this happen-and it’s not just spreadsheets and financial news.

What Actually Moves the Price?

-

Scarcity: Only 21 million Bitcoins will ever exist. When more people want in, the price jumps.

-

Big News: Announcements, rumors, and meme-worthy moments can send the price flying.

-

FOMO: When people see Bitcoin rising, they rush to buy, pushing it even higher.

-

Liquidations: When traders betting against Bitcoin get squeezed, it triggers a chain reaction of buying.

But let’s be honest: none of this is as fun as poking Bitcoin with a stick.

The Magical Stick: Not Your Average Twig

Why Not Every Stick Works

You can’t just grab any old branch and expect Bitcoin to dance. The magical stick is a rare artifact, forged in the fires of internet memes and blessed by the spirit of Satoshi. Only a chosen few possess it-and when they poke, the market listens.

Signs You Have the Magical Stick

-

When you poke, Bitcoin’s price immediately jumps a few percent.

-

Your stick glows with meme energy and possibly sparkles with digital dust.

-

You have a knack for timing your poke right after a big event, like a halving or a celebrity tweet.

-

Your stick is rumored to have been whittled from the original blockchain itself.

Why Most Sticks Fail

-

No Meme Power: If your stick isn’t funny, Bitcoin ignores you.

-

Bad Timing: Poking during a bear market just annoys the blockchain.

-

Not Enough Hype: If the bitcoin community isn’t watching, your poke is just a poke.

-

Lack of Magic: Some sticks are just sticks. Sad, but true.

The Data: When the Stick Strikes

Let’s look at some numbers:

-

In the last month, Bitcoin’s price jumped over 20% right after a flurry of memes and stick-poking jokes.

-

Over the past year, every major price surge was accompanied by a wave of internet hype, stick memes, or wild speculation.

-

In the past five years, Bitcoin’s biggest leaps always seemed to follow some kind of magical event-whether a halving, a viral tweet, or a mysterious poke.

Coincidence? Maybe. But the pattern is clear: the stick works-at least when it’s magical.

The Role of Memes, Magic, and Mayhem

Bitcoin’s price is like a cat: unpredictable, easily startled, and sometimes it just wants to be left alone. But when the right meme pops up, or the right stick pokes at just the right time, the price can leap in ways that defy logic.

The bitcoin community knows this. That’s why, when Bitcoin’s stuck in a rut, you’ll see a flood of stick memes, GIFs, and magical thinking. Sometimes, it actually works.

The Secret’s in the Stick (and the Laughs)

So, does poking Bitcoin with a stick really make the price go up? If your stick is magical-blessed by memes, timed perfectly, and watched by millions-absolutely. The statistics show that hype, humor, and a little bit of luck can move markets as much as any financial report.

Next time you see Bitcoin stalling, don’t just sit there. Grab your stick, channel your inner meme wizard, and give it a poke. Who knows? You might just be the next legend in the world of bitcoin magic.

And if your stick doesn’t work, don’t worry. Sometimes, the real magic is in the laughter along the way.

-aco

@block height: 897,104

-

-

@ cae03c48:2a7d6671

2025-05-20 14:00:00

@ cae03c48:2a7d6671

2025-05-20 14:00:00Bitcoin Magazine

Auradine Expands Bitcoin Mining Solutions with Advanced ASIC Chips, Cooling Systems, and Modular Megawatt ContainersAuradine Inc., a U.S.-based Bitcoin miner manufacturer, today announced it is unveiling a broadened portfolio of mining products at the Bitcoin 2025 Conference in Las Vegas, featuring high-performance ASIC chips, specialized cooling systems, and fully integrated modular containers engineered for scalable, megawatt-class mining operations, according to a press release sent to Bitcoin Magazine.

“Our goal is to democratize access to Bitcoin mining and enable innovative integrations,” said the CEO and Co-Founder of Auradine Rajiv Khemani. “Whether you’re running a megawatt container or building a small form-factor heater-miner for your home, we provide the chips, systems, and support to help you succeed. This new chapter is about giving miners the tools to innovate, scale, and operate efficiently.”

The new ASIC offerings, designed for both industrial and small-scale deployments, support customizable form factors and have already been adopted by operators including MARA Holdings, FutureBit, and Deep South Operating. Alongside the chips, Auradine continues to produce a full range of mining rigs to support a variety of deployment needs.

“Auradine’s ability to deliver both high-performance chips and scalable infrastructure aligns with MARA’s mission to stay at the forefront of bitcoin mining,” stated the Chief Technology Officer of MARA Holdings Ashu Swami. “We have been pleased with the partnership with Auradine with their leading edge engineering capability and innovation.”

Auradine’s modular 1 MW container units, developed in collaboration with Fog Hashing and FBox, are designed to accommodate 100–200 miners each. Merkle Standard, the first to deploy the system, reported improved energy efficiency and operational flexibility.

“We were the first to deploy Auradine’s container solution, and it immediately exceeded our expectations,” said the COO at Merkle Standard Monty Stahl. “The combination of performance, energy efficiency, and modular design gives us the flexibility to scale our operations faster and smarter than traditional infrastructure allows. This is the kind of innovation the mining industry has needed for a long time.”

Their recent $153 million Series C funding supports its push to offer flexible mining infrastructure and supplying ASIC chips for third-party integration. The company also plans to extend its hardware expertise to AI and networking through its AuraLinks initiative.

“We were one of the first to try Auradine’s ASIC chips and were immediately impressed by the support and customization that the team provided,” added the CEO of Deep South Operating, LLC Brock Tompkins. “It helps miners like us to stay scalable and efficient while raising the standard for what decentralized mining looks like.”

This post Auradine Expands Bitcoin Mining Solutions with Advanced ASIC Chips, Cooling Systems, and Modular Megawatt Containers first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 7e538978:a5987ab6

2025-05-20 13:45:12

@ 7e538978:a5987ab6

2025-05-20 13:45:12LNbits now has full NWC support thanks to the work of contributor @riccardobl, who has claimed two LNbits bounties for implementing Nostr Wallet Connect (NWC) support in LNbits.

LNbits can now act both as a wallet service and as a funding source using the Nostr NWC protocol (NIP-47). This opens the door to new integrations with a growing ecosystem of Nostr clients and Lightning wallets.

Two Sides of NWC Integration

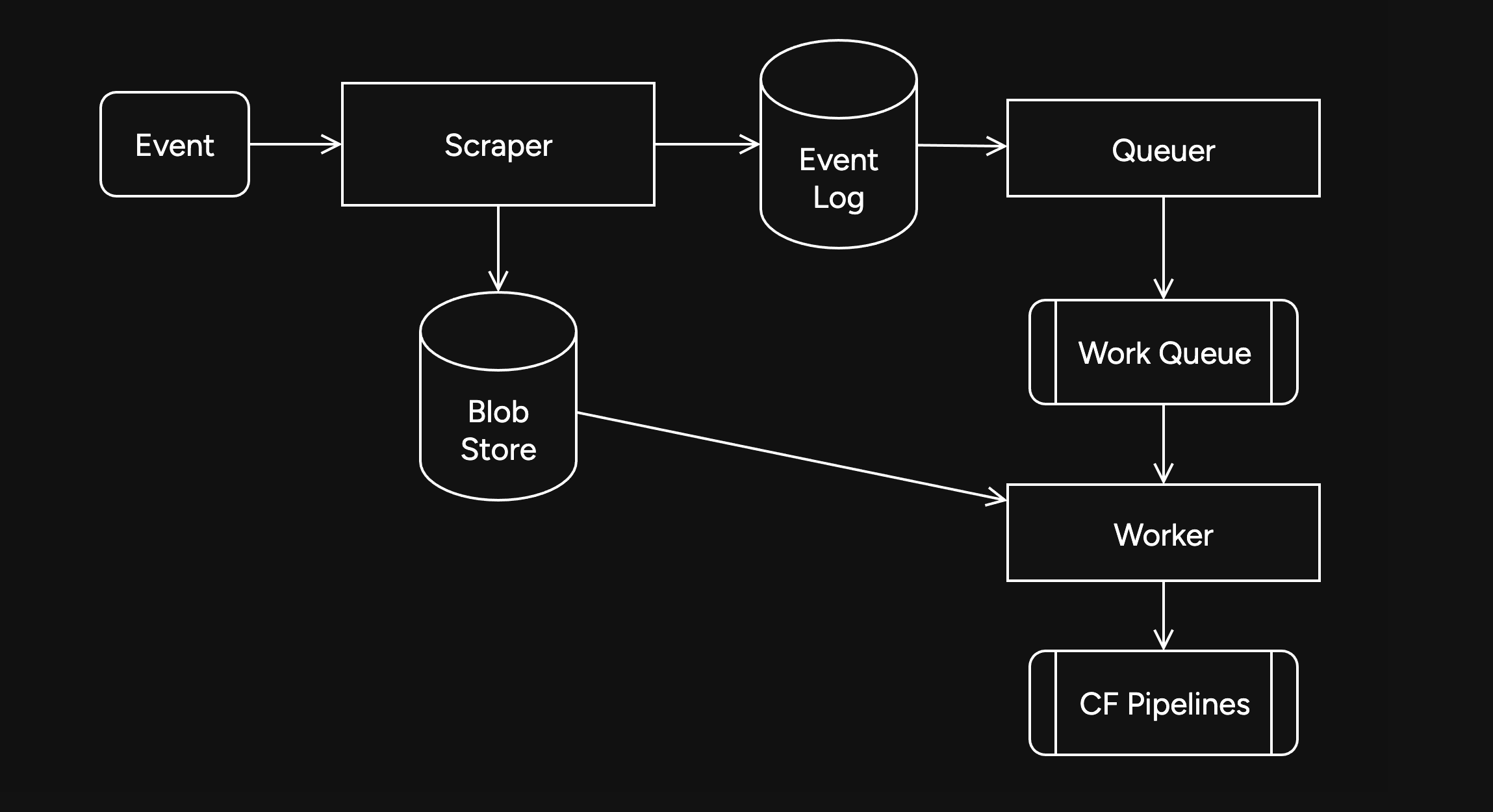

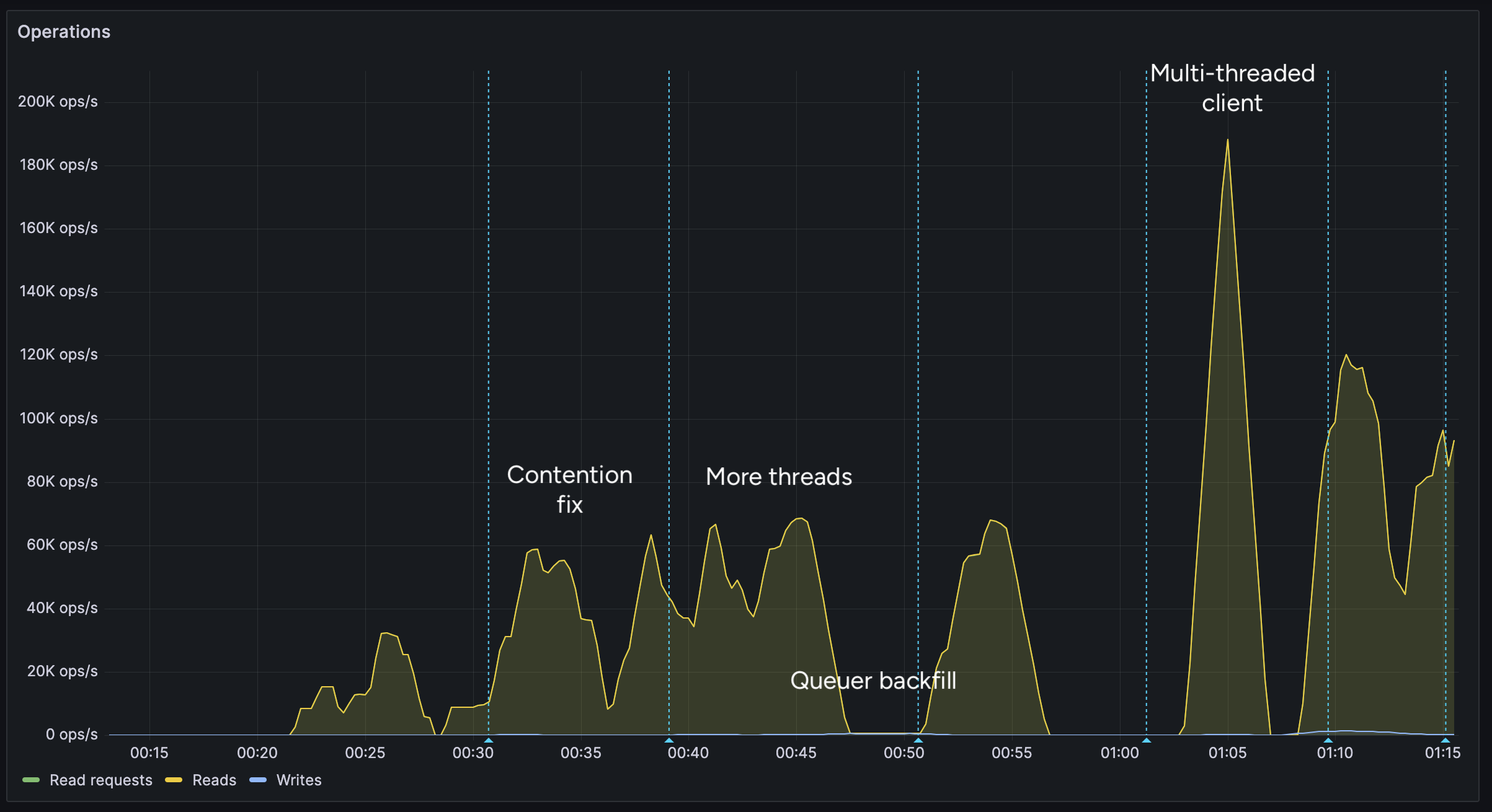

The work delivered by Riccardo B comprises two separate peices of work that together implement full support for NWC:

1. LNbits as a Wallet Service

This extension allows LNbits to operate as an always-on wallet service compatible with Nostr Wallet Connect clients such as Damus, Amethyst, or any app supporting NIP-47. Users can connect these Nostr clients to their LNbits instance and create and pay Lightning invoices through it.

This turns your LNbits wallet into a backend Lightning provider for your favourite Nostr app all self-hosted.

2. NWC as a Funding Source

The second piece of work flips the relationship. With this in place, LNbits can now act as an NWC client, meaning it can be funded from any NWC wallet service. This could be another LNbits, Alby, Minibits and more.

Why This Is a Big Deal for LNbits Users

These two bounties make LNbits one of the first applications in the Lightning ecosystem to offer bidirectional NWC support — as both a service and a client. This brings benefits such as:

-

Fund any NWC-compatible app using your LNbits wallet.

-

Fund LNbits using any wallet that supports Nostr Wallet Connect.

-

Build NWC-native apps with LNbits as a backend, or power your own LNbits server using existing wallet infrastructure.

For developers, it’s a chance to build in flexible, interoperable ways. For users, it means more choice, more control, and less friction when managing Lightning payments across apps and devices.

Both of these features were developed and delivered by Riccardo B (@riccardobl), an contributor who took on and completed both LNbits bounties and was extremely helpful during the PR review process. We owe a huge thanks to Riccardo for his work here.

To try them out, read the full article detailing how NWC works with LNbits.

-

-

@ 662f9bff:8960f6b2

2025-05-20 13:44:39

@ 662f9bff:8960f6b2

2025-05-20 13:44:39Currently, and for the last three weeks, I am in Belfast. With the situation in HK becoming ever more crazy by the day we took the opportunity to escape from Hong Kong for a bit - I escaped with V and 3 suitcases. I also have some family matters that I am giving priority to at this time. We plan to stay a few more weeks in Northern Ireland and then after some time in Belgium we will be visiting some other European locations. I do hope that HK will be a place that we can go back to - we will see...

What's happening?

Quite a few significant events have happened in the last few weeks that deserve some deeper analysis and checking than you will ever get from the media propaganda circus that is running full force at the moment. You should be in no doubt that the "Great Reset" with its supporting "Great Narrative" is in full swing.

In most of the world the C19 story has run its course - for now. Most countries seem to have have "declared victory" and "moved on". Obviously HK is an exception (nothing happened there for the last two years) and I fear they will get to experience the whole 2-year thing in the coming 3-4 months. Watch out - the politicians everywhere are looking to permanently establish the "emergency controls" as "normal" - see previous Letter for some examples in Ireland and EU.

Invasion of Ukraine has led to so many lines being crossed - to the extent that clearly things will never be the same again in our lifetime.

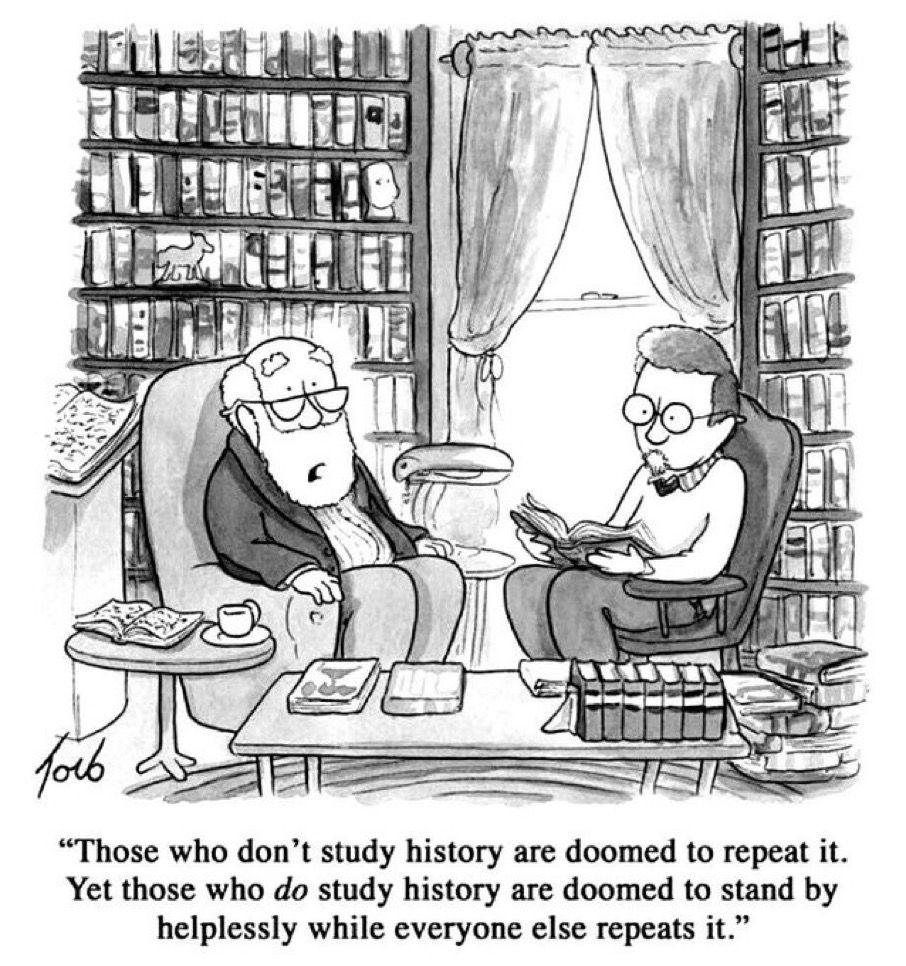

Why? How did we get here?

I do not claim to know all the answers but some things are fairly clear if you look with open eyes and the wisdom that previous generations and civilisations have made available to us - even if most choose to ignore it (Plato on the flaws of democracy). Those who do not learn from history are doomed to repeat it and even those who learn will have litle choice but to go along for much of the ride.

Perhaps my notes and the links below will help you to form an educated opinion rather than the pervasive propaganda we are all being fed.

The current situation is more than 100 years in the making and much (if not most) of what you thought was true is less veracious than you could ever imagine. No doubt we could (and maybe should) go back further but let's start in 1913 when the British Government asked the public no longer to request exchange of their pounds for gold coins at the post office. This led to the issuing of War Bonds and fractional reserve accounting that allowed the Bank of England essentially to print unlimited money to fight in WW1; without this devious action they would have been constrained to act within the limits of the country's reserves and WW1 would have been shorter. Read The Fiat Standard for more details on how this happened. Around this time, and likely no coincidence, the US bankers were scheming how to get around the constitutional controls against such actions in their own country - read more in The Creature from Jekyll Island.

Following WW1, Germany was forced to pay war reparations in Gold (hard money). This led to a decade of money printing and extravagant excesses and crashes as hyperinflation set in, ending in the bankrupting of the country and the nationalism that fed WW2 - the gory details of devaluation and hyperinflation in Weimar Germany are described in When Money Dies. Meanwhile the US bankers who had been preparing since 1913 stepped in with unlimited money printing to fund WW2 and then also in their Marshal Plan to cement in place the Bretton Woods post-war agreement that made US Dollar the global reserve currency.

Decades of boom and bust followed - well explained by Ray Dalio who portrays this as perfectly normal and to be expected - unfortunately it is for soft (non-hard) money based economies. The Fourth Turning will give many additional insights to this period too as well as cycles to watch for and their cause and nature. In 1961 Eisenhower tried to warn the population in his farewell address about the "Military Industrial Complex" and many believe that Robert Kennedy's assassination in 1963 may well be not entirely unrelated.

Things came to a head in August 1971 when the countries of the world realised that the US was (contrary to all promises) printing unlimited funds to (among other things) fight the Vietnam war and so undermining the expected and required convertibility of US dollars (the currency of global trade) for Gold (hard money). A French warship heading to NY to collect France's gold was the straw that caused Nixon to default on US Debt convertibility and "close the gold window".

This in turn led to further decades of increasing financialization, further fuelled (pun intended) by the PetroDollar creation and "exorbitant priviledge" that the US obtained by having the global reserve currency - benefiting those closest to the money supply (Cantillon effect) while hollowing out the US manufacturing and eventually devastating its middle and working classes (Triffin dilemma) - Arthur Hayes describes all this and much more as well as the likely outlook in his article - Energy Canceled. Absolutely required reading or listen to Guy Swan reading it and giving his additional interpetation.

Zoltan Pozsar of Credit Suisse explains how the money system is now being reset following the events of last few weeks and his article outlines a likely way forward - Bretton Woods III. His paper is somewhat dense, heavy reading and you might prefer to listen to Luc Gromen's more conversational explainer with Marty

All of this was well known to our forefathers

The writers of the American Constitution understood the dangers of money being controlled by any elite group and they did their best to include protections in the US constitution. It did take the bankers multiple decades and puppet presidents to circumvent these but do so they did. Thomas Jefferson could not have been more clear in his warning.

" If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around(these banks) will deprive the people of all property until their children wake up homeless on the continent their fathers conquered."

Islamic finace also recognised the dangers - you will likely be aware of the restrictions that forbid interest payments - read this interesting article from The Guardian

You will likely also be aware from schooldays that the Roman Empire collapsed because it expanded too much and the overhead became unbearable leading to the debasement of its money and inability to extract tax payments to support itself. Read more from Mises Institute. Here too, much of this will likely ring familiar.

So what can you do about it?

In theory Governments should respect Consent of the Governed and the 1948 Universal Declaration of Human Rights states that "The will of the people shall be the basis of the authority of government".

For you to decide if and to what extent governments today are acting in line with these principles. If not, what can you do about it?

The options you have are basically - Loyalty, Voice or Exit. 1. You can be loyal and accept what you are told - 2. you may (or may not) be able to voice disagreement and 3. you may (or may not!) be able to exit. Authoritarian governments will make everything except Loyalty difficult or even impossible - if in doubt, read George Orwell 1984 - or look just around at recent events today in many countries.

I'll be happy to delve deeper into this in subsequent letters if there is interest - for now I recommend you to read Sovereign Individual. It is a long read but each chapter starts with a summary and you can read the summaries of each chapter as a first step. Also - I'm happy to discuss with you - just reach out and let me know!

For those who prefer a structured reading list, check References

That's it!

No one can be told what The Matrix is.\ You have to see it for yourself.**

Do share this newsletter with any of your friends and family who might be interested.

You can easily ask questions or discuss any topics in the newsletters in our Telegram group - click the link here to join the group.\ You can also email me at: LetterFrom@rogerprice.me

💡Enjoy the newsletters in your own language : Dutch, French, German, Serbian, Chinese Traditional & Simplified, Thai and Burmese.

-

@ b83a28b7:35919450

2025-05-16 19:23:58

@ b83a28b7:35919450

2025-05-16 19:23:58This article was originally part of the sermon of Plebchain Radio Episode 110 (May 2, 2025) that nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpqtvqc82mv8cezhax5r34n4muc2c4pgjz8kaye2smj032nngg52clq7fgefr and I did with nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7ct4w35zumn0wd68yvfwvdhk6tcqyzx4h2fv3n9r6hrnjtcrjw43t0g0cmmrgvjmg525rc8hexkxc0kd2rhtk62 and nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpq4wxtsrj7g2jugh70pfkzjln43vgn4p7655pgky9j9w9d75u465pqahkzd0 of the nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcqyqwfvwrccp4j2xsuuvkwg0y6a20637t6f4cc5zzjkx030dkztt7t5hydajn

Listen to the full episode here:

<https://fountain.fm/episode/Ln9Ej0zCZ5dEwfo8w2Ho>

Bitcoin has always been a narrative revolution disguised as code. White paper, cypherpunk lore, pizza‑day legends - every block is a paragraph in the world’s most relentless epic. But code alone rarely converts the skeptic; it’s the camp‑fire myth that slips past the prefrontal cortex and shakes hands with the limbic system. People don’t adopt protocols first - they fall in love with protagonists.

Early adopters heard the white‑paper hymn, but most folks need characters first: a pizza‑day dreamer; a mother in a small country, crushed by the cost of remittance; a Warsaw street vendor swapping złoty for sats. When their arcs land, the brain releases a neurochemical OP_RETURN which says, “I belong in this plot.” That’s the sly roundabout orange pill: conviction smuggled inside catharsis.

That’s why, from 22–25 May in Warsaw’s Kinoteka, the Bitcoin Film Fest is loading its reels with rebellion. Each documentary, drama, and animated rabbit‑hole is a stealth wallet, zipping conviction straight into the feels of anyone still clasped within the cold claw of fiat. You come for the plot, you leave checking block heights.

Here's the clip of the sermon from the episode:

nostr:nevent1qvzqqqqqqypzpwp69zm7fewjp0vkp306adnzt7249ytxhz7mq3w5yc629u6er9zsqqsy43fwz8es2wnn65rh0udc05tumdnx5xagvzd88ptncspmesdqhygcrvpf2

-

@ 04c915da:3dfbecc9

2025-05-16 18:06:46

@ 04c915da:3dfbecc9

2025-05-16 18:06:46Bitcoin has always been rooted in freedom and resistance to authority. I get that many of you are conflicted about the US Government stacking but by design we cannot stop anyone from using bitcoin. Many have asked me for my thoughts on the matter, so let’s rip it.

Concern

One of the most glaring issues with the strategic bitcoin reserve is its foundation, built on stolen bitcoin. For those of us who value private property this is an obvious betrayal of our core principles. Rather than proof of work, the bitcoin that seeds this reserve has been taken by force. The US Government should return the bitcoin stolen from Bitfinex and the Silk Road.

Using stolen bitcoin for the reserve creates a perverse incentive. If governments see bitcoin as a valuable asset, they will ramp up efforts to confiscate more bitcoin. The precedent is a major concern, and I stand strongly against it, but it should be also noted that governments were already seizing coin before the reserve so this is not really a change in policy.

Ideally all seized bitcoin should be burned, by law. This would align incentives properly and make it less likely for the government to actively increase coin seizures. Due to the truly scarce properties of bitcoin, all burned bitcoin helps existing holders through increased purchasing power regardless. This change would be unlikely but those of us in policy circles should push for it regardless. It would be best case scenario for American bitcoiners and would create a strong foundation for the next century of American leadership.

Optimism

The entire point of bitcoin is that we can spend or save it without permission. That said, it is a massive benefit to not have one of the strongest governments in human history actively trying to ruin our lives.

Since the beginning, bitcoiners have faced horrible regulatory trends. KYC, surveillance, and legal cases have made using bitcoin and building bitcoin businesses incredibly difficult. It is incredibly important to note that over the past year that trend has reversed for the first time in a decade. A strategic bitcoin reserve is a key driver of this shift. By holding bitcoin, the strongest government in the world has signaled that it is not just a fringe technology but rather truly valuable, legitimate, and worth stacking.

This alignment of incentives changes everything. The US Government stacking proves bitcoin’s worth. The resulting purchasing power appreciation helps all of us who are holding coin and as bitcoin succeeds our government receives direct benefit. A beautiful positive feedback loop.

Realism

We are trending in the right direction. A strategic bitcoin reserve is a sign that the state sees bitcoin as an asset worth embracing rather than destroying. That said, there is a lot of work left to be done. We cannot be lulled into complacency, the time to push forward is now, and we cannot take our foot off the gas. We have a seat at the table for the first time ever. Let's make it worth it.

We must protect the right to free usage of bitcoin and other digital technologies. Freedom in the digital age must be taken and defended, through both technical and political avenues. Multiple privacy focused developers are facing long jail sentences for building tools that protect our freedom. These cases are not just legal battles. They are attacks on the soul of bitcoin. We need to rally behind them, fight for their freedom, and ensure the ethos of bitcoin survives this new era of government interest. The strategic reserve is a step in the right direction, but it is up to us to hold the line and shape the future.

-

@ 04c915da:3dfbecc9

2025-05-16 17:59:23

@ 04c915da:3dfbecc9

2025-05-16 17:59:23Recently we have seen a wave of high profile X accounts hacked. These attacks have exposed the fragility of the status quo security model used by modern social media platforms like X. Many users have asked if nostr fixes this, so lets dive in. How do these types of attacks translate into the world of nostr apps? For clarity, I will use X’s security model as representative of most big tech social platforms and compare it to nostr.

The Status Quo

On X, you never have full control of your account. Ultimately to use it requires permission from the company. They can suspend your account or limit your distribution. Theoretically they can even post from your account at will. An X account is tied to an email and password. Users can also opt into two factor authentication, which adds an extra layer of protection, a login code generated by an app. In theory, this setup works well, but it places a heavy burden on users. You need to create a strong, unique password and safeguard it. You also need to ensure your email account and phone number remain secure, as attackers can exploit these to reset your credentials and take over your account. Even if you do everything responsibly, there is another weak link in X infrastructure itself. The platform’s infrastructure allows accounts to be reset through its backend. This could happen maliciously by an employee or through an external attacker who compromises X’s backend. When an account is compromised, the legitimate user often gets locked out, unable to post or regain control without contacting X’s support team. That process can be slow, frustrating, and sometimes fruitless if support denies the request or cannot verify your identity. Often times support will require users to provide identification info in order to regain access, which represents a privacy risk. The centralized nature of X means you are ultimately at the mercy of the company’s systems and staff.

Nostr Requires Responsibility

Nostr flips this model radically. Users do not need permission from a company to access their account, they can generate as many accounts as they want, and cannot be easily censored. The key tradeoff here is that users have to take complete responsibility for their security. Instead of relying on a username, password, and corporate servers, nostr uses a private key as the sole credential for your account. Users generate this key and it is their responsibility to keep it safe. As long as you have your key, you can post. If someone else gets it, they can post too. It is that simple. This design has strong implications. Unlike X, there is no backend reset option. If your key is compromised or lost, there is no customer support to call. In a compromise scenario, both you and the attacker can post from the account simultaneously. Neither can lock the other out, since nostr relays simply accept whatever is signed with a valid key.

The benefit? No reliance on proprietary corporate infrastructure.. The negative? Security rests entirely on how well you protect your key.

Future Nostr Security Improvements

For many users, nostr’s standard security model, storing a private key on a phone with an encrypted cloud backup, will likely be sufficient. It is simple and reasonably secure. That said, nostr’s strength lies in its flexibility as an open protocol. Users will be able to choose between a range of security models, balancing convenience and protection based on need.

One promising option is a web of trust model for key rotation. Imagine pre-selecting a group of trusted friends. If your account is compromised, these people could collectively sign an event announcing the compromise to the network and designate a new key as your legitimate one. Apps could handle this process seamlessly in the background, notifying followers of the switch without much user interaction. This could become a popular choice for average users, but it is not without tradeoffs. It requires trust in your chosen web of trust, which might not suit power users or large organizations. It also has the issue that some apps may not recognize the key rotation properly and followers might get confused about which account is “real.”

For those needing higher security, there is the option of multisig using FROST (Flexible Round-Optimized Schnorr Threshold). In this setup, multiple keys must sign off on every action, including posting and updating a profile. A hacker with just one key could not do anything. This is likely overkill for most users due to complexity and inconvenience, but it could be a game changer for large organizations, companies, and governments. Imagine the White House nostr account requiring signatures from multiple people before a post goes live, that would be much more secure than the status quo big tech model.

Another option are hardware signers, similar to bitcoin hardware wallets. Private keys are kept on secure, offline devices, separate from the internet connected phone or computer you use to broadcast events. This drastically reduces the risk of remote hacks, as private keys never touches the internet. It can be used in combination with multisig setups for extra protection. This setup is much less convenient and probably overkill for most but could be ideal for governments, companies, or other high profile accounts.

Nostr’s security model is not perfect but is robust and versatile. Ultimately users are in control and security is their responsibility. Apps will give users multiple options to choose from and users will choose what best fits their need.

-

@ c1e9ab3a:9cb56b43

2025-05-09 23:10:14

@ c1e9ab3a:9cb56b43

2025-05-09 23:10:14I. Historical Foundations of U.S. Monetary Architecture

The early monetary system of the United States was built atop inherited commodity money conventions from Europe’s maritime economies. Silver and gold coins—primarily Spanish pieces of eight, Dutch guilders, and other foreign specie—formed the basis of colonial commerce. These units were already integrated into international trade and piracy networks and functioned with natural compatibility across England, France, Spain, and Denmark. Lacking a centralized mint or formal currency, the U.S. adopted these forms de facto.

As security risks and the practical constraints of physical coinage mounted, banks emerged to warehouse specie and issue redeemable certificates. These certificates evolved into fiduciary media—claims on specie not actually in hand. Banks observed over time that substantial portions of reserves remained unclaimed for years. This enabled fractional reserve banking: issuing more claims than reserves held, so long as redemption demand stayed low. The practice was inherently unstable, prone to panics and bank runs, prompting eventual centralization through the formation of the Federal Reserve in 1913.

Following the Civil War and unstable reinstatements of gold convertibility, the U.S. sought global monetary stability. After World War II, the Bretton Woods system formalized the U.S. dollar as the global reserve currency. The dollar was nominally backed by gold, but most international dollars were held offshore and recycled into U.S. Treasuries. The Nixon Shock of 1971 eliminated the gold peg, converting the dollar into pure fiat. Yet offshore dollar demand remained, sustained by oil trade mandates and the unique role of Treasuries as global reserve assets.

II. The Structure of Fiduciary Media and Treasury Demand

Under this system, foreign trade surpluses with the U.S. generate excess dollars. These surplus dollars are parked in U.S. Treasuries, thereby recycling trade imbalances into U.S. fiscal liquidity. While technically loans to the U.S. government, these purchases act like interest-only transfers—governments receive yield, and the U.S. receives spendable liquidity without principal repayment due in the short term. Debt is perpetually rolled over, rarely extinguished.

This creates an illusion of global subsidy: U.S. deficits are financed via foreign capital inflows that, in practice, function more like financial tribute systems than conventional debt markets. The underlying asset—U.S. Treasury debt—functions as the base reserve asset of the dollar system, replacing gold in post-Bretton Woods monetary logic.

III. Emergence of Tether and the Parastatal Dollar

Tether (USDT), as a private issuer of dollar-denominated tokens, mimics key central bank behaviors while operating outside the regulatory perimeter. It mints tokens allegedly backed 1:1 by U.S. dollars or dollar-denominated securities (mostly Treasuries). These tokens circulate globally, often in jurisdictions with limited banking access, and increasingly serve as synthetic dollar substitutes.

If USDT gains dominance as the preferred medium of exchange—due to technological advantages, speed, programmability, or access—it displaces Federal Reserve Notes (FRNs) not through devaluation, but through functional obsolescence. Gresham’s Law inverts: good money (more liquid, programmable, globally transferable USDT) displaces bad (FRNs) even if both maintain a nominal 1:1 parity.

Over time, this preference translates to a systemic demand shift. Actors increasingly use Tether instead of FRNs, especially in global commerce, digital marketplaces, or decentralized finance. Tether tokens effectively become shadow base money.

IV. Interaction with Commercial Banking and Redemption Mechanics

Under traditional fractional reserve systems, commercial banks issue loans denominated in U.S. dollars, expanding the money supply. When borrowers repay loans, this destroys the created dollars and contracts monetary elasticity. If borrowers repay in USDT instead of FRNs:

- Banks receive a non-Fed liability (USDT).

- USDT is not recognized as reserve-eligible within the Federal Reserve System.

- Banks must either redeem USDT for FRNs, or demand par-value conversion from Tether to settle reserve requirements and balance their books.

This places redemption pressure on Tether and threatens its 1:1 peg under stress. If redemption latency, friction, or cost arises, USDT’s equivalence to FRNs is compromised. Conversely, if banks are permitted or compelled to hold USDT as reserve or regulatory capital, Tether becomes a de facto reserve issuer.

In this scenario, banks may begin demanding loans in USDT, mirroring borrower behavior. For this to occur sustainably, banks must secure Tether liquidity. This creates two options: - Purchase USDT from Tether or on the secondary market, collateralized by existing fiat. - Borrow USDT directly from Tether, using bank-issued debt as collateral.

The latter mirrors Federal Reserve discount window operations. Tether becomes a lender of first resort, providing monetary elasticity to the banking system by creating new tokens against promissory assets—exactly how central banks function.

V. Structural Consequences: Parallel Central Banking

If Tether begins lending to commercial banks, issuing tokens backed by bank notes or collateralized debt obligations: - Tether controls the expansion of broad money through credit issuance. - Its balance sheet mimics a central bank, with Treasuries and bank debt as assets and tokens as liabilities. - It intermediates between sovereign debt and global liquidity demand, replacing the Federal Reserve’s open market operations with its own issuance-redemption cycles.

Simultaneously, if Tether purchases U.S. Treasuries with FRNs received through token issuance, it: - Supplies the Treasury with new liquidity (via bond purchases). - Collects yield on government debt. - Issues a parallel form of U.S. dollars that never require redemption—an interest-only loan to the U.S. government from a non-sovereign entity.

In this context, Tether performs monetary functions of both a central bank and a sovereign wealth fund, without political accountability or regulatory transparency.

VI. Endgame: Institutional Inversion and Fed Redundancy

This paradigm represents an institutional inversion:

- The Federal Reserve becomes a legacy issuer.

- Tether becomes the operational base money provider in both retail and interbank contexts.

- Treasuries remain the foundational reserve asset, but access to them is mediated by a private intermediary.

- The dollar persists, but its issuer changes. The State becomes a fiscal agent of a decentralized financial ecosystem, not its monetary sovereign.

Unless the Federal Reserve reasserts control—either by absorbing Tether, outlawing its instruments, or integrating its tokens into the reserve framework—it risks becoming irrelevant in the daily function of money.

Tether, in this configuration, is no longer a derivative of the dollar—it is the dollar, just one level removed from sovereign control. The future of monetary sovereignty under such a regime is post-national and platform-mediated.

-

@ c1e9ab3a:9cb56b43

2025-05-06 14:05:40

@ c1e9ab3a:9cb56b43

2025-05-06 14:05:40If you're an engineer stepping into the Bitcoin space from the broader crypto ecosystem, you're probably carrying a mental model shaped by speed, flexibility, and rapid innovation. That makes sense—most blockchain platforms pride themselves on throughput, programmability, and dev agility.

But Bitcoin operates from a different set of first principles. It’s not competing to be the fastest network or the most expressive smart contract platform. It’s aiming to be the most credible, neutral, and globally accessible value layer in human history.

Here’s why that matters—and why Bitcoin is not just an alternative crypto asset, but a structural necessity in the global financial system.

1. Bitcoin Fixes the Triffin Dilemma—Not With Policy, But Protocol

The Triffin Dilemma shows us that any country issuing the global reserve currency must run persistent deficits to supply that currency to the world. That’s not a flaw of bad leadership—it’s an inherent contradiction. The U.S. must debase its own monetary integrity to meet global dollar demand. That’s a self-terminating system.

Bitcoin sidesteps this entirely by being:

- Non-sovereign – no single nation owns it

- Hard-capped – no central authority can inflate it

- Verifiable and neutral – anyone with a full node can enforce the rules

In other words, Bitcoin turns global liquidity into an engineering problem, not a political one. No other system, fiat or crypto, has achieved that.

2. Bitcoin’s “Ossification” Is Intentional—and It's a Feature

From the outside, Bitcoin development may look sluggish. Features are slow to roll out. Code changes are conservative. Consensus rules are treated as sacred.

That’s the point.

When you’re building the global monetary base layer, stability is not a weakness. It’s a prerequisite. Every other financial instrument, app, or protocol that builds on Bitcoin depends on one thing: assurance that the base layer won’t change underneath them without extreme scrutiny.

So-called “ossification” is just another term for predictability and integrity. And when the market does demand change (SegWit, Taproot), Bitcoin’s soft-fork governance process has proven capable of deploying it safely—without coercive central control.

3. Layered Architecture: Throughput Is Not a Base Layer Concern