-

@ 3f68dede:779bb81d

2025-05-14 11:25:17

@ 3f68dede:779bb81d

2025-05-14 11:25:17sdsdsdsd

-

@ 472f440f:5669301e

2025-05-14 01:15:12

@ 472f440f:5669301e

2025-05-14 01:15:12Marty's Bent

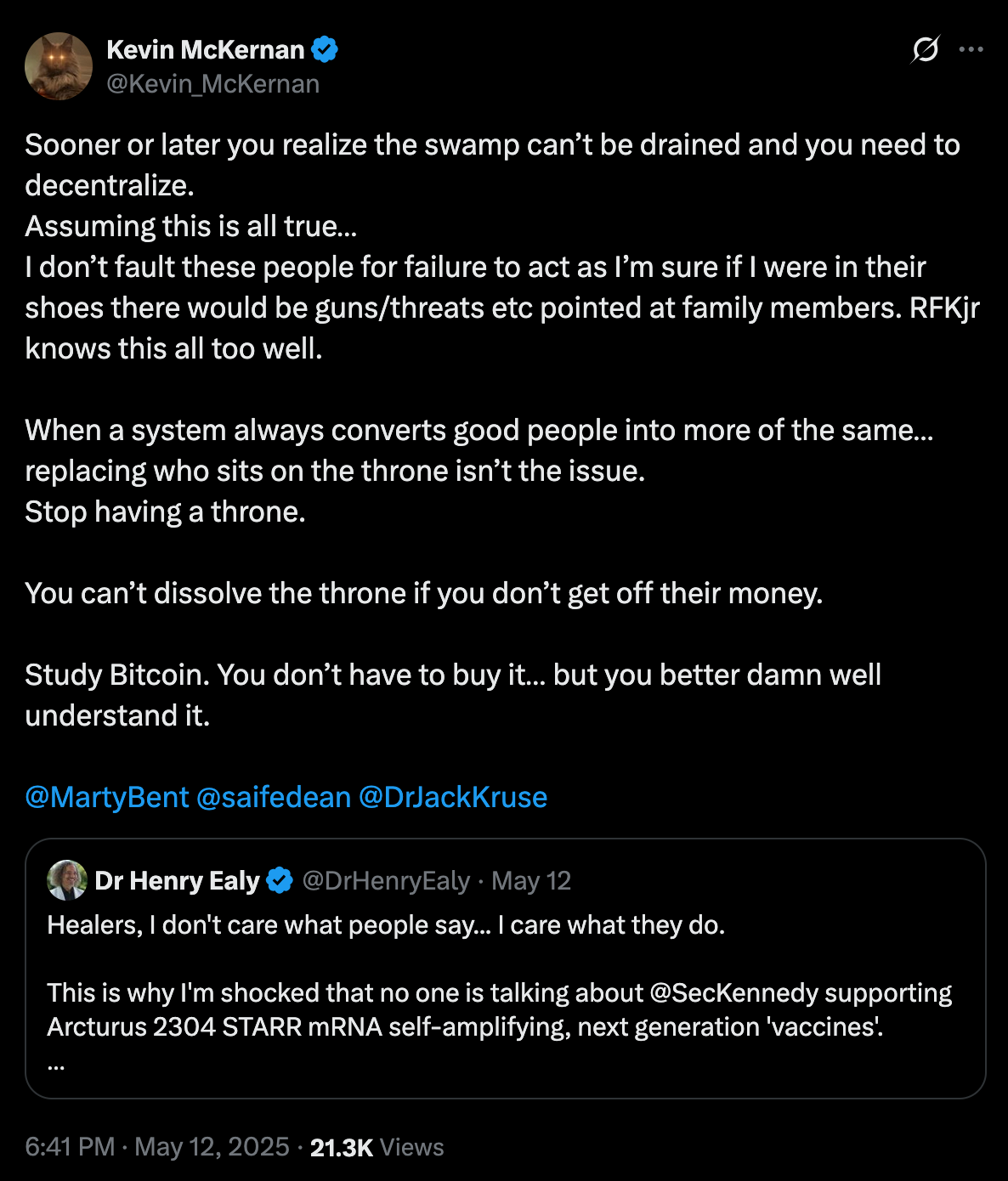

via Kevin McKernan

There's been a lot of discussion this week about Casey Means being nominated for Surgeon General of the United States and a broader overarching conversation about the effectiveness of MAHA since the inauguration and how effective it may or may not be moving forward. Many would say that President Trump won re-election due to Robert F. Kennedy Jr. and Nicole Shanahan deciding to reach across the aisle and join the Trump ticket, bringing with them the MAHA Moms, who are very focused on reorienting the healthcare system in the United States with a strong focus on the childhood vaccine schedule.

I'm not going to lie, this is something I'm passionate about as well, particularly after having many conversations over the years with doctors like Kevin McKernan, Dr. Jack Kruse, Dr. Mary Talley Bowden, Dr. Brooke Miller, Dr. Peter McCullough and others about the dangers of the COVID mRNA vaccines. As it stands today, I think this is the biggest elephant in the room in the world of healthcare. If you look at the data, particularly disability claims, life insurance claims, life expectancy, miscarriage rates, fertility issues and rates of turbo cancer around the world since the COVID vaccine was introduced in 2021, it seems pretty clear that there is harm being done to many of the people who have taken them.

The risk-reward ratio of the vaccines seems to be incredibly skewed towards risk over reward and children - who have proven to be least susceptible to COVID - are expected to get three COVID shots in the first year of their life if their parents follow the vaccine schedule. For some reason or another it seems that Robert F. Kennedy Jr. has shied away from this topic after becoming the head of Health and Human Services within the Trump administration. This is after a multi-year campaign during which getting the vaccines removed from the market war a core part of his platform messaging.

I'm still holding out hope that sanity will prevail. The COVID mRNA vaccines will be taken off the market in a serious conversation about the crimes against humanity that unfolded during the COVID years will take place. However, we cannot depend on that outcome. We must build with the assumption in mind that that outcome may never materialize. This leads to identifying where the incentives within the system are misconstrued. One area where I think it's pretty safe to say that the incentives are misaligned is the fact that 95% of doctors work for and answer to a corporation driven by their bottom line. Instead of listening to their patients and truly caring about the outcome of each individual, doctors forced to think about the monetary outcome of the corporation they work for first.

The most pernicious way in which these misaligned incentives emerge is the way in which the hospital systems and physicians are monetarily incentivized by big pharma companies to push the COVID vaccine and other vaccines on their patients. It is important to acknowledge that we cannot be dependent on a system designed in this way to change from within. Instead, we must build a new incentive system and market structure. And obviously, if you're reading this newsletter, you know that I believe that bitcoin will play a pivotal role in realigning incentives across every industry. Healthcare just being one of them.

Bitcoiners who have identified the need to become sovereign in our monetary matters, it probably makes sense to become sovereign when it comes to our healthcare as well. This means finding doctors who operate outside the corporate controlled system and are able to offer services that align incentives with the end patient. My family utilizes a combination of CrowdHealth and a private care physician to align incentives. We've even utilized a private care physician who allowed us to pay in Bitcoin for her services for a number of years. I think this is the model. Doctors accepting hard censorship resistant money for the healthcare and advice they provide. Instead of working for a corporation looking to push pharmaceutical products on their patients so they can bolster their bottom line, work directly with patients who will pay in bitcoin, which will appreciate in value over time.

I had a lengthy discussion with Dr. Jack Kruse on the podcast earlier today discussing these topic and more. It will be released on Thursday and I highly recommend you freaks check it out once it is published. Make sure you subscribe so you don't miss it.

How the "Exorbitant Privilege" of the Dollar is Undermining Our Manufacturing Base

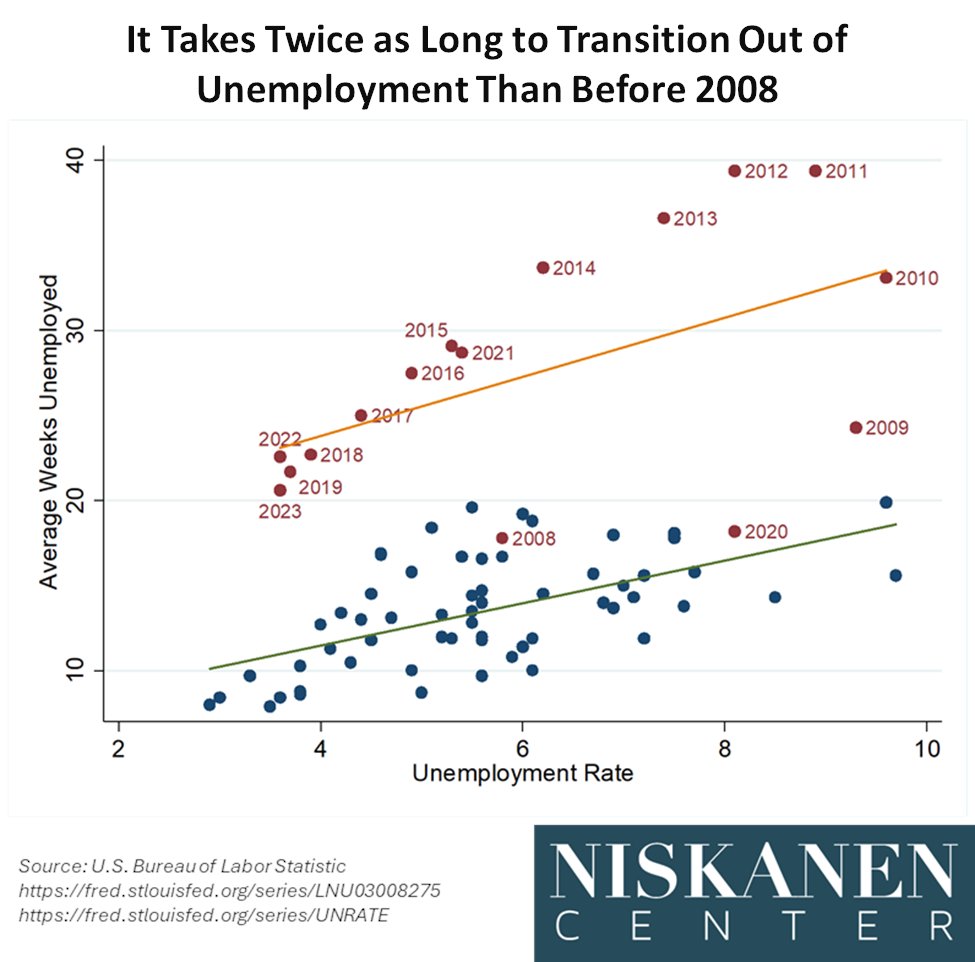

In my conversation with Lyn Alden, we explored America's fundamental economic contradiction. As Lyn expertly explained, maintaining the dollar's reserve currency status while attempting to reshore manufacturing presents a near-impossible challenge - what economists call Triffin's Dilemma. The world's appetite for dollars gives Americans tremendous purchasing power but simultaneously hollows out our industrial base. The overvalued dollar makes our exports less competitive, especially for lower-margin manufacturing, while our imports remain artificially strong.

"Having the reserve currency does come with a bunch of benefits, historically called an exorbitant privilege, but then it has certain costs to maintain it." - Lyn Alden

This dilemma forces America to run persistent trade deficits, as this is how dollars flow to the world. For over four decades, these deficits have accumulated, creating massive economic imbalances that can't be quickly reversed. The Trump administration's attempts to address this through tariffs showcase how difficult rebalancing has become. As Lyn warned, even if we successfully pivot toward reshoring manufacturing, we'll face difficult trade-offs: potentially giving up some reserve currency benefits to rebuild our industrial foundation. This isn't just economic theory - it's the restructuring challenge that will define America's economic future.

Check out the full podcast here for more on China's manufacturing dominance, the role of Bitcoin in monetary transitions, and energy production as the foundation for future industrial power.

Headlines of the Day

Coinbase to replace Discover in S\&P 500 on May 19 - via X

Mallers promises no rehypothecation in Strike Bitcoin loans - via X

Get our new STACK SATS hat - via tftcmerch.io

Missouri passes HB 594, eliminates Bitcoin capital gains tax - via X

The 2025 Bitcoin Policy Summit is set for June 25th—and it couldn’t come at a more important time. The Bitcoin industry is at a pivotal moment in Washington, with initiatives like the Strategic Bitcoin Reserve gaining rapid traction. Whether you’re a builder, advocate, academic, or policymaker—we want you at the table. Join us in DC to help define the future of freedom, money & innovation in the 21st century.

Ten31, the largest bitcoin-focused investor, has deployed 144,264 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

The 100+ degree days have returned to Austin, TX. Not mad about it... yet.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 3f68dede:779bb81d

2025-05-14 11:25:15

@ 3f68dede:779bb81d

2025-05-14 11:25:15 -

@ 0808d68b:10b2ef7d

2025-05-14 06:37:02

@ 0808d68b:10b2ef7d

2025-05-14 06:37:02{"coverurl":"https://nosto.re/1d092a684b2b4bad6c6bbb77976d0493b4e4aea475963f3652004d10869dcc97.jpeg","title":"澳门往事之二","author":"田思源"}

-

@ 2fb77d26:c47a6ee1

2025-05-14 05:57:34

@ 2fb77d26:c47a6ee1

2025-05-14 05:57:34Europäischer Tunnelblick

In unseren Breiten sprach man schon seit jeher gerne davon, dass »Amerika den Europäern immer voraus« ist. Dass »der alte Kontinent« stets zehn Jahre im Hintertreffen ist. In der Finanzbranche attestierte man auch gerne mal einen Rückstand von »20 Jahren«. Bemängelt wurde im Rahmen solcher Analysen zumeist die mangelnde Innovationskraft europäischer Unternehmen, die gemäß einschlägiger Experten vor allem auf die Regulierungswut der hiesigen Bürokratie zurückzuführen ist. Langwierige Genehmigungsprozesse, kompliziertes Steuerrecht, zu kleine Kapitalmärkte und komplexe Datenschutzanforderungen schrecken Gründer und Investoren ab. »Bürokraten regulieren Europa zu Tode«, bringt es der Ökonom und Unternehmer Dirk Specht am 29. November 2024 auf den Punkt. Aus Sicht des Entrepreneurs eine durchaus nachvollziehbare Einordnung.

Denn selbst wenn die Hürden der Unternehmensgründung einmal überwunden sind, machen Bürokratiekosten selbst in kleinen Firmen knapp drei Prozent vom Umsatz aus. Im industriellen Mittelstand übersteigen sie nicht selten die jährliche Bruttoumsatzrendite von durchschnittlich fünfeinhalb Prozent. Von den arbeitsrechtlichen Rahmenbedingungen – siehe Kündigungsschutz, Urlaubsanspruch und Lohnfortzahlung im Krankheitsfall – gar nicht erst anzufangen. In puncto Flexibilität ist Europa für Unternehmer also tatsächlich nur bedingt attraktiv.

Ganz anders die USA. Deregulierung, Seed-Capital en Masse und ein Arbeitsrecht, das den Slogan »Hire and fire« weltberühmt machte – gemäß Tagesschau vom 11. Februar 2025 übrigens ein Modell, das dank Microsoft, Meta und SAP langsam auch in Deutschland Einzug hält. Diese unternehmerische Freiheit – oder Zügellosigkeit – machte Amerika zum Start-up-Inkubator. Zum Gründerparadies. Wall Street, Motorcity, Silicon Valley, Hollywood, et cetera. Ein Mekka für Investoren. Und ein Alptraum für Arbeitnehmer.

Alles richtig. Oberflächlich betrachtet. Dass bei dieser sehr kurzsichtigen Analyse stets außer Acht gelassen wird, welchen Anteil die beiden Weltkriege, angloamerikanische Finanzdynastien, halbseidene NGO-Netzwerke und vor allem über ein Dutzend Geheimdienste an Amerikas Wirtschaftswachstum der vergangenen 100 Jahre haben, trübt den Blick der europäischen Unternehmergarde allerdings nachhaltig. Denn er negiert den historischen Kontext. Vermutlich läuft Roger Köppels Editorial für DIE WELTWOCHE vom 01. Mai 2025 deshalb immer noch ungeniert unter dem Titel »Hoffnungsträger Trump«.

Ich habe täglich Kontakt mit Geschäftspartnern in den USA – und bei denen ist von Hoffnung nicht (mehr) viel zu spüren. Begriffe wie Planungsprobleme, Stornierung, Unsicherheit oder Lieferengpass fallen dagegen immer häufiger. Investor’s Business Daily nannte den Zustand vor wenigen Stunden »ein Erdbeben«, weil Trumps »Handelskrieg-Tsunami« nun auch die Häfen der Vereinigten Staaten erreicht hat. Die laufen langsam leer. Frachter und Tanker mit Importwaren löschen ihre Ladung nicht. Oder kommen gar nicht mehr an. Die auf Basis von Strafzöllen zu erwartenden Lieferengpässe »könnten die Folgen der Covid-Krise übertreffen«, konstatiert das Investment-Magazin.

Was also passiert gerade in den Vereinigten Staaten? Sollte Europa tatsächlich neidisch auf die vermeintlichen Wettbewerbsvorteile Amerikas sein – oder gar auf die aktuellen politischen Entwicklungen? Auf Effizienzsteigerung der Marke DOGE? Nein, keinesfalls. Denn zum einen sorgen die turbokapitalistischen Exzesse im »Land der unbegrenzten Möglichkeiten« dafür, dass Arbeitnehmer endgültig zu Lohnsklaven degradiert werden, die den Launen von Märkten und Unternehmen relativ schutzlos ausgeliefert sind. Zum anderen beruht der Erfolg amerikanischer Konzerne keineswegs auf deren Innovationskraft, einem laxen Arbeitsrecht oder genialem Unternehmertum, sondern primär auf tiefenstaatlichem Interventionismus. Das gilt seit dem Jahrtausendwechsel vor allem für die Tech-Branche. Denn die USA sind nicht einfach eine Wirtschaftsmacht, sondern der militärische Arm des angloamerikanischen Empire.

Das zeigen die »Glorreichen Sieben« – Google, Microsoft, Apple, Amazon, Alphabet, Meta, Tesla und Nvidia – die allesamt erst durch Startfinanzierung seitens Militär und Geheimdiensten wurden, was sie heute sind: Die Speerspitze des technokratischen Totalitarismus. Nachdem selbst The Economist am 10. Dezember 2024 feststellte, dass mit der Wiederwahl von Donald Trump nun »die PayPal-Mafia die US-Regierung übernimmt«, sollte man in unseren Bereiten also eventuell etwas kritischer begutachten, was die entsprechenden Konzerne dort treiben. Denn es ist angesichts von Agenda 2030, aktuellen EU-Programmen, EZB-Planungen und einer Kriegswirtschaft kolportierenden Bundesregierung unter BlackRock-Merz nicht davon auszugehen, dass es dieses Mal zehn oder zwanzig Jahre dauert, bis diese Entwicklungen auch bei uns ankommen.

Palantir & DOGE

Das bezieht sich insbesondere auf Elon Musks DOGE – das »Department of Government Efficiency« – eine neu geschaffene Behörde, die sich auf Effizienzsteigerung in Sachen Regierungsgeschäfte konzentrieren soll. Dies selbstredend unter flächendeckender Zuhilfenahme von KI (Künstlicher Intelligenz), die wiederum auf entsprechende Datenpools angewiesen ist. Um solche kurzfristig zur Verfügung zu stellen, durchforstet, hackt und kapert Musks DOGE-Team die IT-Abteilungen, Server und Netzwerke von Ministerien und Bundesbehörden. Vor allem auf Finanzdaten hat man es abgesehen. An geltendes Recht hält sich DOGE dabei nicht. Datenschützer sind alarmiert. Und Whistleblower werden von Musks Team bedroht. All das passiert in enger Zusammenarbeit mit Oracle, einem weiteren von der CIA startfinanzierten IT-Riesen – und natürlich Palantir, dem von Peter Thiel gegründeten Spionage- und Killerkonzern.

So berichtete Reuters am 6. Mai 2025 beispielsweise über ein neues Gemeinschaftsprojekt von Elon Musks xAI und Palantir, das die Nutzung der jeweiligen KI-Lösungen im Finanzsektor vorantreiben will – dies, nachdem xAI, BlackRock und Microsoft bereits im März ein neues Konsortium zur Erweiterung von KI-Infrastruktur ins Leben riefen. Im Department of Homeland Security (DHS) ist DOGE aktuell damit beschäftigt, das IDENT-System des »Office of Biometric Identity Management« (OBIM) zu übernehmen – die weltweit größte Datenbank für biometrische Informationen, die von praktisch allen US-Behörden aber auch internationalen Partnern genutzt wird. Zusammengeführt werden sollen die von DOGE gekaperten Daten in HART (Homeland Advanced Recognition Technology System), einem neuen, mit über sechs Milliarden US-Dollar budgetierten Überwachungssystem des DHS, das in Kollaboration mit Palantir-Programmen die flächendeckende Überwachung der Bevölkerung analog zu China ermöglichen wird.

Palantir wurde 2003 gegründet und arbeitet seither, das belegt eine 2013 geleakte Kundenliste, für mindestens 12 US-Regierungseinrichtungen: CIA, DHS, NSA, FBI, CDC, Special Operations Command, et cetera. Schon vor knapp zehn Jahren häuften sich Berichte – wie zum Beispiel von WIRED am 9. August 2017 – die belegten, dass Palantir die vermeintlich vertraulichen Daten, die zum Beispiel Polizisten in Los Angeles seit 2009 in Datenbanken des Konzerns erfassen, kopiert, verkauft und zweckentfremdet. Dass Palantir das rechtsextreme, zionistische Regime von Benjamin Netanjahu bei seinem Genozid in Gaza unterstützt, ist ebenfalls kein Geheimnis mehr. Die strategische Partnerschaft zwischen Thiels Tötungsmaschine und den IDF wurde nach Berichten von Bloomberg vom 12. Januar 2024 gar ausgeweitet. Gideon Levy bescheinigt seinem Land in einem Beitrag der Haaretz vom 19. Januar 2025, in Gaza den »ersten faschistischen Krieg« seiner Geschichte zu führen. Womit wir wieder bei Palantir und den Vereinigten Staaten wären.

Denn wie ich bereits in meinem Artikel über Thiel vom 22. September 2024 in Aussicht gestellt hatte, kommt dem gebürtigen Frankfurter eine ganz besondere Rolle in Trumps neuer Regierung zu. Vom »Paten« der PayPal-Mafia und Geheimdienst-Frontmann zum Palantir-Boss und Bilderberg-Leitungsmitglied – und nun einflussreichsten Mann hinter der US-Regierung. Ohne Peter Thiels finanzielle Unterstützung wäre JD Vance weder Geschäftsmann noch Senator in Ohio oder US-Vizepräsident geworden. So verwundert es kaum, dass Palantir bereits 100 Tage nach Donald Trumps Amtsantritt Zugriff auf sämtliche Steuer-, Gesundheits- und Bewegungsdaten der US-Bevölkerung hat und diese in einer Datenbank zusammenführt, um seine KI darauf anzusetzen. Selbst die Speicher von Smartwatches und Fitness-Armbändern werden angezapft. Kein Datensatz ist mehr tabu.

Wie diese Daten künftig verwendet werden – und zwar gegen alles und jeden – zeigt eine von Palantir entwickelte Software namens »ImmigrationOS«. Ein System, das der US-Regierung hilft, das Leben von Migranten zu durchleuchten und permanent zu überwachen. Inklusive biografischer, biometrischer und Geolokationsdaten. Die auf Basis dieser Daten entwickelten Empfehlungen nutzt das ICE (Immigration and Customs Enforcement), um Menschen in die an Massentierhaltung erinnernden Supermax-Gefängnisse von El Salvador abzuschieben. Für Deportationen ohne Beweise, Anhörung, Gerichtsverhandlung und Rechtsgrundlage. Eine in dieser Form fraglos verfassungsfeindliche Ausweitung des »Catch and Revoke« Programms, dem anstelle illegaler Einwanderer nun auch Doktoranden, Studenten oder unbescholtene Arbeitnehmer zum Opfer fallen – siehe der Fall Kilmar Abrego Garcia – vor allem solche, die den Völkermord in Gaza kritisieren.

Es dürfte derweil nur eine Frage der Zeit sein, bis das zugrundliegende, am 30. April 2025 verabschiedete »Antisemitismus-Gesetz« auf weitere unliebsame Personenkreise angewendet wird. Der Bundesstaat Alabama lässt sich bereits von der fragwürdigen Deportationspraxis Washingtons inspirieren und kündigte in Person des Republikaners Chris Sells am 1. Mai 2025 an, selbst ein Gesetz erlassen zu wollen, das die Abschiebung verurteilter Personen ins Ausland ermöglicht. Gemäß Sells wolle man mit dem Gesetzesvorschlag nur ein Zeichen setzen. Mit einer Verabschiedung rechne man nicht. Trump verkündete unterdes, neben Migranten künftig auch US-Bürger und Ureinwohner nach El Salvador verfrachten zu wollen. Verfassungsrechtlich ein absolutes Tabu. Bisher.

The Atlantic nennt diese Entwicklungen am 27. April 2025 ein »amerikanisches Panoptikum«. Zu Recht. Denn Palantirs zentralisierter Datenpool wird sich zum mächtigsten Unterdrückungsinstrument der Zivilisationsgeschichte auswachsen – und in nicht allzu ferner Zukunft auch gegen jene MAGA-Anhänger eingesetzt werden, die solch faschistoide Vorgänge derzeit noch bejubeln. Gegen das, was da auf uns zukommt, waren Corona-Tracking und 2G-Segregation geradezu harmlos.

Entsprechend hellhörig sollte es machen, dass die NATO Palantirs KI-Lösungen – genauer: die »Maven AI« – künftig für militärische Planungszwecke einsetzt, wie eine Presseerklärung des »Verteidigungsbündnisses« vom 14. April 2025 ausführt. Denn »Project Maven« ist auf ein Memorandum des US-Verteidigungsministeriums vom 26. April 2017 zurückzuführen und hatte zum Ziel, ein »funktionsübergreifendes Team für algorithmische Kriegsführung« zu schaffen. Unterstützt wurde das US-Militär dabei zunächst von Google. Also dem Unternehmen, das einst unter dem Motto »Don’t be evil« – Sei nicht böse! – angetreten war. Begleitet wurde Googles Engagement für Project Maven von einem massiven Aufruhr in der Belegschaft und Artikelüberschriften wie »Hey Google, wen soll die US-Regierung heute töten?«. Offene Briefe an Google-Chef Sundar Pichai forderten 2018, der IT-Konzern solle die Partnerschaft mit dem Pentagon unverzüglich beenden. Und das tat Google auch.

Project Maven lief natürlich trotzdem weiter. Wie Breaking Defense am 27. April 2022 ausführte, wurde das Vorhaben nach Googles Rückzug der NGA (National Geospatial Intelligence Agency) unterstellt und gemäß Informationen des Forbes Magazine fortan von Eric Schmidt (Google, Bilderberg), Peter Thiel und James Murdoch, dem jüngeren Sohn von Rupert Murdoch finanziert. Maven AI ist das KI-Flaggschiff des US-Militärs – und wird jetzt als Palantir-Produkt weltweit ausgerollt. Vorboten sind in Hessen, Bayern und Nordrhein-Westfalen bereits im Einsatz und dürften angesichts der Iden des Merz wohl bald bundesweit Verwendung finden. Es ist also keineswegs übertrieben, wenn der US-Journalist Derrick Broze am 24. April 2025 von der »Palantir World Order« spricht – einem überstaatlichen Herrschaftssystem, das zuvorderst aufgrund seiner auf zwielichtigen bis illegalen Akkumulationsprozessen basierenden Deutungs- und Interventionshoheit in puncto Big Data fußt. Getreu dem Palantir-Slogan: »Die Software ist das Waffensystem«. Selbst eine in der ARD-Mediathek abrufbare Doku des NDR über Palantir von 10. Juni 2024 läuft unter dem eindeutigen Titel »Eine Software, die töten kann«.

Ja, das Geschäft mit dem industriell-digitalisierten Auftragsmord boomt. Denn internationale Konflikte nehmen zu und die Observationsökonomie erlebt einen Quantensprung. Entsprechend profitabel fiel das erste Quartal 2025 für Thiels Unternehmen aus. Stolze 884 Millionen US-Dollar stellte man Kunden in Rechnung. Ein Wachstum von 39 Prozent gegenüber dem Vorjahr und 21,7 Millionen mehr als prognostiziert. Am 5. Mai 2025 gab die Palantir Aktie zwar um 15 Prozent nach – laut Analysten könnte die Aktie aber auch um 70 Prozent fallen und wäre immer noch die teuerste Marke unter Softwareanbietern in diesem Segment.

Das sollte zu denken geben. Denn die USA durchlaufen eine Metamorphose – weg von demokratischen Strukturen und hin zur »Algokratie«. Die PayPal-Mafia hat das Weiße Haus gekapert und demonstriert dem Wertewesten, was er im Zuge der vierten industriellen Revolution zu erwarten hat: Tech-Feudalismus, dessen Oligarchen sich aufgrund vermeintlicher Sachzwänge schamlos über Recht und Gesetz hinwegsetzen. Nicht von ungefähr hat Donald Trump in seinen ersten 100 Amtstagen bereits 141 »Exekutive Orders« unterzeichnet. Ohne dabei auch nur einmal das Repräsentantenhaus einzubeziehen oder demokratische Prozesse zu respektieren. In diesem Lichte betrachtet erscheint das Cover des TIME Magazine vom Juni 2018, auf dem »The Donald« als König abgebildet war – Titel: »King me« – heute zeitgemäßer denn je.

Dunkle Aufklärung

Und das ist kein Zufall. Wirft man nämlich einen Blick auf die philosophischen Konzepte, die Menschen wie Peter Thiel, JD Vance oder Elon Musk inspirieren, zeigt sich, dass die entsprechenden Pamphlete genau das fordern: Eine postmoderne Version von Monarchie. Einen CEO, der das Land führt wie einen Großkonzern. Mittels KI – und auf Basis des amerikanischen Arbeitsrechts natürlich. Vielsagend, dass Donald Trump am 19. April 2025 auf Twitter ankündigte, exakt das tun zu wollen:

»Das ist gesunder Menschenverstand und wird ermöglichen, dass die Bundesregierung endlich „wie ein Unternehmen geführt wird“.«

Dass Trump den letzten Teil des Satzes in Anführungszeichen setzt, impliziert, dass er jemanden zitiert. Von wem die Phrase stammt, lässt er allerdings offen. Der US-Präsident scheint jedenfalls den Ratschlägen seines Vize JD Vance zu folgen, der bereits am 17. September 2021 in einem Interview mit dem Jack Murphy Podcast sagte:

»Was Trump tun sollte, wenn ich ihm einen Ratschlag geben dürfte: Feuere jeden einzelnen Bürokraten der mittleren Leitungsebene, jeden Beamten in der Verwaltung, und ersetze ihn mit unseren Leuten. Und wenn man dich dafür verklagt, wenn dich die Gerichte aufhalten wollen – denn man wird dich dafür verklagen – stell dich vor das Land, so wie Andrew Jackson, und sag den Menschen, dass der oberste Entscheidungsträger sein Urteil bereits gefällt hat. Jetzt lasst es ihn auch umsetzen.«

Und so geschah es. Denn als der Oberste Gerichtshof der Vereinigten Staaten am 19. April 2025 entschied, dass die juristisch fragwürdigen Deportationen zu stoppen sind, schrieb Donald Trump auf Twitter:

»Ich wurde unter anderem gewählt, um schlechte Menschen aus den Vereinigten Staaten zu entfernen. Ich muss meine Arbeit tun dürfen.«

Damit stellt sich Trump offen gegen die höchste juristische Instanz des Landes und fordert, trotz eines geltenden Urteils weitermachen zu können. Für dieses Vorgehen sucht er Rückhalt in der Bevölkerung. Er will die Gerichte unter Druck zu setzen, um regieren zu können wie ein Monarch. So, wie es die Vordenker der »Neoreaktionären Bewegung« (NRx) – zumeist »Dunkle Aufklärung« genannt – vorschlagen. Bei dieser politischen Philosophie handelt es sich selbst laut Wikipedia um ein »antidemokratisches, antiegalitäres, reaktionäres und neofeudales Konzept«. Geprägt wurde es von einem etwas kauzig anmutenden Blogger namens Curtis Yarvin, der auf seiner Webseite »Unqualified Reservations« ab 2007 und unter dem Pseudonym Mencius Moldbug Texte über das Versagen der Demokratie und Theorien zu alternativen Herrschaftsformen publizierte.

Weiterentwickelt wurden diese Konzepte unter anderem von Nick Land, einem britischen Schriftsteller, der als Vater des »Akzelerationismus« gilt und mit einem Blog-Beitrag aus dem Jahr 2013 auch den Begriff »Dunkle Aufklärung« für Yarvins Theorien aufbrachte. In seinen späteren Texten redete der Brite einem »wissenschaftlichen Rassismus«, der Eugenik und dem von ihm geprägten Begriff »Hyperrassismus« das Wort. Bei der rechtsnationalistischen bis rechtsextremen Alt-Right-Bewegung stieß er damit auf offene Ohren. Die deutsche Publikation »nd – Journalismus von Links« findet diesen »Philosophen der digitalen Entgrenzung« in einem Beitrag vom 21. Mai 2023 aber trotzdem »interessant«. Dass Nick Land gerne Amphetamin konsumiert und eine Weile im Haus des 1947 verstorbenen Satanisten Aleister Crowley lebte, scheint nd-Autor Konstantin Jahn eher Bewunderung abzuringen. Seinem ehemaligen Arbeitgeber, The New Center for Research & Practice, allerdings nicht – der setzte Land am 29. März 2017 wegen rassistischer Umtriebe vor die Tür.

Von Curtis Yarvin war nach der Einstellung seines Blogs im Jahr 2016 unterdes nicht mehr viel zu hören. Bis jetzt. Denn anno 2025 schreibt plötzlich die Financial Times über »die Philosophie hinter Trumps Dunkler Aufklärung«. Ebenso die New York Times, die Yarvin im Januar 2025 zum großen Interview für eine Titelstory bat. Selbst der Bayrische Rundfunk schrieb am 23. März 2025 über den einst nur Insidern bekannten Blogger. Und natürlich Politico, wo am 30. Januar 2025 ein Artikel über Yarvin erschien. Aufmacher: »Curtis Yarvins Ideen waren Randerscheinungen. Jetzt verbreiten sie sich in Trumps Washington«. Im Zuge seines Textes beschreibt Autor Ian Ward, wie Yarvin nach Washington reiste, um auf Einladung des Trump-Teams an der pompösen Inaugurationsfeier teilzunehmen, wo er unter anderem mit dem ehemaligen Thiel-Angestellten JD Vance sprach, der die politischen Theorien von Yarvin mehrfach bei öffentlichen Auftritten lobte, zitierte und als wichtigen Einfluss auf sein Denken nannte. Im Gespräch mit Ward führte Yarvin aus, dass er Trump gegenüber zunächst skeptisch gewesen sei, weil er sich nicht sicher war, ob Trump den von ihm empfohlenen Regimewechsel überhaupt durchziehen könne.

Zwischenzeitlich habe sich jedoch Optimismus eingestellt, so Yarvin, denn man könne in Trumps Kabinett eine »neugewonnene Selbstsicherheit und Aggressivität« spüren. Kein Wunder, besteht es doch in weiten Teilen aus Protegés, Kollegen, Geschäftspartnern und Freunden von Peter Thiel – zu letzteren gehört nach Aussage von Thiel übrigens auch der neue Chef der NIH (National Institutes of Health), Jay Bhattacharya, der zuvor unter anderem bei der Hoover Institution sowie der RAND Corporation tätig war. Aufgabenbereich: Demographie und Ökonomie von Gesundheit und Altern mit Schwerpunkt auf Regierungsprogrammen und biomedizinischer Innovation.

Wer sich mit Thiel beschäftigt hat, wird kaum überrascht sein, dass der in Frankfurt geborene Milliardär Anhänger der »Dunklen Aufklärung« ist. Schon im Mai 2016 schrieb Curtis Yarvin eine E-Mail an einen Bekannten und erklärte: »Ich coache Thiel«. Der brauche aber deutlich weniger politische Orientierungshilfe als gedacht, so Yarvin. »Ich habe die Wahlen in seinem Haus angeschaut. Ich glaube, mein Hangover dauerte bis Dienstag. Er (Thiel) ist völlig aufgeklärt, geht aber sehr vorsichtig vor«, konstatiert Yarvin in seiner Mail. Zu diesem Zeitpunkt stand der dunkle Aufklärer auch in Kontakt mit dem technischen Redakteur von Breitbart News, dem seinerzeit wichtigsten Sprachrohr von Trumps ehemaligem Chefstrategen Steve Bannon, »dem Medien-Baron der Alt-Right-Bewegung«, der sich ebenfalls an Yarvins Konzepten orientierte, dessen Bücher öffentlich empfahl und maßgeblich dazu beitrug, dass Donald Trump die Wahl gegen Hillary »Body Count« Clinton gewann.

Nach Angaben von BuzzFeed News stand auch Peter Thiel 2016 in Kontakt mit besagtem Breitbart-Redakteur. In einem Podcast auftreten, wollte er allerdings nicht. »Lass uns einfach Kaffee holen und dann schauen, was wir machen«, antwortete der Palantir-Gründer im Mai auf eine Interview-Einladung von Breitbart. Und im Juni lud Thiel den Breitbart-Mitarbeiter zum Abendessen in sein Haus in den Hollywood Hills ein. Man darf davon ausgehen, dass es bei diesen Gesprächen um finanzielle Unterstützung von Breitbart News, beziehungsweise der Alt-Right-Bewegung ging. Sprich, um Stimmungsmache für Trump.

Im Wahlkampf 2024 war Thiel weniger zurückhaltend. JD Vance hatte seinen Gönner ja auch bereits im August 2024 via Forbes Magazine dazu aufgerufen, »die Seitenlinie zu verlassen und für Trump zu spenden«. Kurz darauf überwies der Exil-Deutsche mindestens 1,25 Millionen Dollar. Die Betonung liegt auf mindestens. Denn als JD Vance 2022 für den Senat kandidierte, spendete Thiel ganze 15 Millionen US-Dollar für dessen Kampagne. Für manch einen vorausschauenden Journalisten war deshalb schon im Sommer 2024 klar: »Donald Trump ist Peter Thiels erfolgreichstes Investment«.

»Letztes Jahr veröffentlichte der Journalist Max Chafkin eine Biografie über Thiel (…), in der er Yarvin als den politischen Philosophen (…) für ein Netzwerk bezeichnete, das man als Thiel-Verse kennt. Das Buch erklärt, wie Thiel sowohl Cruz als auch Josh Hawley auf ihrem Weg in den Senat half. Es endet mit einem düsteren Bild des Milliardärs, der versucht, seinen politischen Einfluss immer offener auszuweiten (…). Masters und Vance unterscheiden sich von Hawley und Cruz, schreibt Chafkin – erstere sind verlängerte Arme von Thiel«.

Das konnte man in der Vanity Fair am 20. April 2022 über Thiels Bemühungen lesen, sich politischen Einfluss für Trumps zweite Amtsperiode zu sichern. Unter der Überschrift »Im Inneren der Neuen Rechten – wo Peter Thiel seine größten Einsätze platziert« erklärt das Blatt: »Sie sind nicht MAGA. Sie sind nicht QAnon. Curtis Yarvin und die aufstrebende Rechte entwickeln eine andere Form konservativer Politik«.

So stellt sich an dieser Stelle unweigerlich die Frage: Was für eine Politik soll das sein? Warum verkünden Thiel-Weggefährten wie Elon Musk stolz, »nicht nur MAGA, sondern Dark MAGA« zu sein? Was fordern »Akzelerationismus« und »Dunkle Aufklärung«? Wie sieht der von Yarvin, Land, Thiel, Vance, Trump, Musk und Co. avisierte Soll-Zustand aus?

Auf den Punkt bringt das ein Akronym, das Curtis Yarvin seit 2012 benutzt: RAGE. Es steht für »Retire All Government Employees«, übersetzt also dafür, alle Regierungsmitarbeiter zu entlassen. Auch der von Thiel finanzierte Republikaner Blake Masters nutzte das Akronym schon öffentlich. Nur so könne man das amerikanische »Regime« stürzen. »Was wir brauchen«, so Yarvin, »ist ein nationaler CEO – oder das, was man einen Diktator nennt«. Die Amerikaner müssten ihre »Diktatoren-Phobie« überwinden, damit das Land »wie ein Start-up geführt werden kann«. Nach Ansicht von The Brooklyn Rail ist das mittlerweile der Fall. Denn am 30. Januar 2025 veröffentlichte das Medienportal einen Artikel, in dem Autor David Levi Strauss erklärt, die US-Bevölkerung akzeptiere nun endlich »die Idee, dass das Land von einem CEO und wie ein Konzern oder eine Diktatur geführt werden müsse, weil sie – wie Peter Thiel schon 2009 erklärte – nicht mehr daran glauben, dass Freiheit und Demokratie kompatibel sind«.

Ob Akzelerationismus, Neoreaktionäre Bewegung oder Dunkle Aufklärung, sie alle plädieren für eine Rückkehr zu traditionellen gesellschaftlichen Konstrukten und Regierungsformen, inklusive des absoluten Monarchismus. Dafür soll der Staat in eine private Aktiengesellschaft umgewandelt werden, in welcher dem Geschäftsführer absolute Macht zukommt. Gleichheit lehnen alle drei Strömungen als politisches Ziel ab. Stattdessen verfolgt man rationalistische oder utilaristische Konzepte sozialer Schichtung, die auf Erbmerkmalen oder Leistungsprinzipien beruhen – sprich, auf den Grundgedanken der Eugenik.

Diese neue Regierungsform, »Gov-Corp«, wie der britische Journalist Iain Davis das Modell in seinen betreffenden Artikeln und einem lesenswerten Zweiteiler betitelt, wird aufgrund der ihr zur Verfügung stehenden Technologie eine nie gekannte Machtfülle besitzen – eine Machtfülle, die sich aufgrund genau dieser Technologie mit Leichtigkeit als liberale Marktwirtschaft vermarkten lässt. Als rationales, effizientes und individuelle Freiheit suggerierendes Modell zur Steuerung von Staat, Wirtschaft und Gesellschaft. Obwohl man als Bürger – oder sagt man besser Kunde, Mitarbeiter oder Bilanzposition? – vertraglich verpflichtet wird, seine Rechte an die herrschende Konzernstruktur zu übertragen. Analog zu den Bewohnern von Peter Thiels »Start-up City« Próspera – die derzeit versucht, ihr Gastland Honduras mit einer erfolgsversprechenden Klage im Wert von 10,7 Milliarden US-Dollar in den Staatsbankrott zu treiben.

Universelle Menschenrechte sind im Gov-Corp-Modell jedenfalls nicht vorgesehen. Wenn neoreaktionäre Theoretiker wie Curtis Yarvin von »Exit« sprechen, also vom Verlassen demokratischer Strukturen, stellen sie gleichzeitig eine »Opt-in-Society« in Aussicht. Was vordergründig erst einmal gut klingt, soll man sich die Serviceangebote des Staates doch nach eigenen Bedürfnissen konfigurieren dürfen, entpuppt sich schnell als totalitäres wie inhumanes Konstrukt. Als Tech-Feudalismus. Denn für diejenigen, die in der »sozialen Schichtung« untere Ränge bekleiden, sich die Serviceangebote von Gov-Corp nicht leisten können oder den Chef kritisieren, wird es rasch ungemütlich. Siehe Supermax-Gefängnisse.

Dementsprechend zurückhaltend sollte man sein, wenn verheißungsvolle Begriffe wie Freedom Cities, Charter Cities, Start-up Cities oder »Network State« fallen. Denn gerade letzterer steht für nichts anderes als die finale Ausbaustufe von Gov-Corp. Für ein Netzwerk autonomer Städte, die jeweils von einem eigenen CEO mit absolutistischer Macht geführt werden. Sprich, für einen Zusammenschluss kleiner Königreiche – oder Niederlassungen – eines Konzerns namens Regierung. Das Konzept Netzwerk-Staat ist in dieser Form Balaji Srinivasan zuzuschreiben, dem ehemaligen CTO von Coinbase und Partner von Andreessen Horowitz. Sein im Juli 2022 veröffentlichtes Buch »The Network State« beschreibt auf fast 500 Seiten, wie »der Nachfolger des Nationalstaats« aussehen soll. Eine unausgegorene Spinnerei ist das Ganze also nicht mehr. Im Gegenteil. Srinivasan gründete extra einen Fond, um das Konzept Netzwerk-Staat voranzutreiben und wird dabei von diversen Tech-Milliardären unterstützt.

Vor diesem Hintergrund verwundert es nicht, dass Netscape-Gründer Marc Andreessen bereits Anfang Oktober 2013 prognostizierte, dass »es in den kommenden Jahren doppelt so viele, oder drei oder vier Mal so viele Länder geben wird«. Andreessens »Techno-Optimist Manifesto« vom 16. Oktober 2023 erwähnt zwar weder Yarvin noch Land oder Srinivasan, aber es outet den Verfasser als eingefleischten Akzelerationisten – und als Fan des Transhumanisten Ray Kurzweil.

Für Außenstehende mag Srinivasans Konzept abseitig anmuten. Aber es zog Kreise. Selbst die New York Times berichtete am 28. Oktober 2013 über eine Rede des bekennenden Staatsfeinds bei der Silicon Valley »Startup School«. Der entsprechende Artikel eröffnet mit dem Worten: »Silicon Valley aufgeschreckt von Sezessionsruf. Erst die Sklavenhalter im Süden, jetzt das. Versucht Silicon Valley, sich von Amerika abzuspalten?«. Während das Nachrichtenportal TechCrunch die »Dunkle Aufklärung« Ende 2013 noch als Bewegung von Nerds abtat, die eine Monarchie fordern, sprach man beim britischen Telegraph im Januar 2014 bereits von »anspruchsvollem Neo-Faschismus«.

Die Granden der Big-Tech-Branche wissen seit über einem Jahrzehnt, dass ihr digital-finanzieller Komplex die Welt beherrscht und sie mittels Disruption jede andere Industrie zum Handlanger degradiert haben. Dementsprechend selbstbewusst treten ihre Vordenker, Theoretiker und Philosophen auf. Nicht umsonst teilt auch Patri Friedman, Enkel des Nobelpreisträgers Milton Friedman, neoreaktionäre Positionen – auch wenn er sich 2009 mit Yarvin überwarf, seither »eine politisch korrektere dunkle Aufklärung« fordert und nun eigene Freedom Cities auf schwimmenden Plattformen in internationalen Gewässern schaffen will. Dafür gründete er 2019 Pronomos Capital, ein Unternehmen, das über 13 Millionen US-Dollar von Thiel, Srinivasan und Andreessen erhielt, Próspera finanziert und ähnliche Projekte in Afrika, Südostasien und Palau im Portfolio hat.

Die omnipräsente Konstante: Peter Thiel – der nicht nur in Firmen von Yarvin, Srinivasan oder Friedman investiert, sondern Donald Trump auch bei der Auswahl von Kabinettsmitgliedern beriet. So kam es, dass Thiels Kumpel Srinivasan sogar im Gespräch für den Chefposten der FDA (Food and Drug Administration) war. Eine hochrangige Position im Staatsapparat. Erstaunlich, erinnert man sich an dessen staatsfeindliche Rede bei der »Startup School«. Die Japan Times findet am 19. Juni 2024 passende Worte für diese Vorgänge:

»Es wird immer deutlicher: Führende Techno-Libertäre (…) sind nur insoweit gegen den Staat, als er sie nicht persönlich bereichert. Angesichts der Aussicht, dass die Regierung zu einem Großkunden wird, löst sich der einst prinzipielle Widerstand gegen die Staatsmacht auf. Dieser Wandel lässt sich auch bei Thiel selbst beobachten. 2009 erklärte er, dass die große Aufgabe für Libertäre darin bestehe, Politik in all ihren Formen zu entkommen. Doch 2016 engagierte sich Thiel voll und ganz für Parteipolitik und hielt eine Rede auf dem Parteitag der Republikaner. Inzwischen ist Palantir, das von ihm mitgegründete Datenanalyseunternehmen, zu einem Giganten herangewachsen und profitiert von riesigen Regierungsaufträgen. Fast die Hälfte seiner Einnahmen stammt mittlerweile aus öffentlichen Mitteln.«

Keine Frage: Peter Thiel ist Dreh- und Angelpunkt hinter der neuen US-Regierung. Der Pate der PayPal-Mafia ist der mächtigste Mann in Washington und Palantir die treibende Kraft hinter dem digitalen Panoptikum, das sich dort derzeit formiert. Und was Elon Musk als DOGE verkauft, erinnert im Kern an RAGE. Selbst das TIME Magazine stellt anhand der bislang 30.000 gefeuerten Regierungsmitarbeiter fest, dass die Vorgehensweise von Trump und Co. keineswegs Zufall ist, sondern exakt der Programmatik von Yarvins »Dunkler Aufklärung« folgt. Nur in unseren Breiten tut man sich immer noch schwer damit, das zu erkennen – oder einräumen zu wollen.

Dafür gibt es zwei Gründe. Erstens: Bis dato hat kein deutschsprachiger Journalist ausführlich über diese Zusammenhänge berichtet und den notwendigen Kontext hergestellt. Zweitens: Ist man vom herrschenden System enttäuscht und stößt bei der Suche nach Alternativen auf die Analysen von Yarvin oder Srinivasan, wirken diese wie Balsam in den Ohren, geht man als Kritiker des übermächtigen und -griffigen Staates doch in weiten Teilen mit deren Einordnung aktueller Probleme konform. Selbst die Lösungsvorschläge der dunklen Aufklärer wirken plausibel. Zumindest theoretisch. Mehr Autonomie, Dezentralität, Effizienz, Prosperität – und viel weniger Staat. Klingt attraktiv. Vor allem im Vergleich mit dem kollektivistischen Wohlfahrtspaternalismus der vergangenen Dekaden.

Die Rattenfänger aus dem Silicon Valley erzählen dem enttäuschten und von Politik angewiderten Demos, was er hören will. Im Bereich Neuro-Linguistisches Programmieren (NLP) nennt man das die Echo-Technik. Sie sorgt dafür, dass sich das Gegenüber wahr- und ernstgenommen fühlt. Dass es sich öffnet. Das funktioniert erstaunlich gut. Bis man sich anschaut, woher das Geld kommt und wohin die Daten fließen. Bis man erkennt, dass solch ein System, die Algokratie, für deutlich mehr Zentralisierung steht – für mehr Staat, für Datenzentren von Tech-Despoten und interoperable Blockchain-Plattformen von Finanzkartellen. Für einen digitalen Gulag und Gewalt gegen Andersdenkende. Für die Abschaffung universeller Menschenrechte.

Sicher. Man weiß nicht, ob die »Dunkle Aufklärung«, ob Akzelerationismus und ein Netzwerk-Staat mit CEO – oder »Diktator« – nicht vielleicht besser funktionieren als Demokratie. Manch einer denkt, man könne es ja mal versuchen. Das wollte auch der Anarcho-Kapitalist Jeff Berwick, alias The Dollar Vigilante. Im März 2025 reiste er nach Honduras, um sich Próspera anzuschauen und anschließend für das Freedom-City-Projekt zu werben. Doch ein paar Tage vor der mit der Stadtverwaltung abgestimmten Visite und Führung erhielt er eine E-Mail vom Rechtsanwalt des Unternehmens, der ihm zu seiner Überraschung mitteilte, er dürfe nun doch nicht anreisen – und hätte ab sofort generelles Zutrittsverbot für das Gelände der »Sonderentwicklungszone«. Wahrscheinlich fand die Presseabteilung von Próspera bei der vorbereitenden Überprüfung seiner Person heraus, dass Jeff Berwick von Technokratie, Zionismus, Krieg, Trump, Vance und auch der PayPal-Mafia nicht allzu viel hält. Er bezeichnet sich nämlich als »Verschwörungsrealist« – und war auf der Suche nach Freiheit. Die ist aber offenbar auch in Próspera Mangelware.

-

@ 0808d68b:10b2ef7d

2025-05-14 05:30:31

@ 0808d68b:10b2ef7d

2025-05-14 05:30:31{"coverurl":"https://nosto.re/1d092a684b2b4bad6c6bbb77976d0493b4e4aea475963f3652004d10869dcc97.jpeg","title":"澳门往事","author":"田思源"}

-

@ 472f440f:5669301e

2025-05-12 23:29:50

@ 472f440f:5669301e

2025-05-12 23:29:50Marty's Bent

Last week we covered the bombshell developments in the Samourai Wallet case. For those who didn't read that, last Monday the world was made aware of the fact that the SDNY was explicitly told by FinCEN that the federal regulator did not believe that Samourai Wallet was a money services business six months before arresting the co-founders of Samourai Wallet for conspiracy to launder money and illegally operating a money services business. This was an obvious overstep by the SDNY that many believed would be quickly alleviated, especially considering the fact that the Trump administration via the Department of Justice has made it clear that they do not intend to rule via prosecution.

It seems that this is not the case as the SDNY responded to a letter sent from the defense to dismiss the case by stating that they fully plan to move forward. Stating that they only sought the recommendations of FinCEN employees and did not believe that those employees' comments were indicative of FinCEN's overall views on this particular case. It's a pretty egregious abuse of power by the SDNY. I'm not sure if the particular lawyers and judges within the Southern District of New York are very passionate about preventing the use of self-custody bitcoin and products that enable bitcoiners to transact privately, or if they're simply participating in a broader meta war with the Trump administration - who has made it clear to federal judges across the country that last Fall's election will have consequences, mainly that the Executive Branch will try to effectuate the policies that President Trump campaigned on by any legal means necessary - and Samouari Wallet is simply in the middle of that meta war.

However, one thing is pretty clear to me, this is an egregious overstep of power. The interpretation of that law, as has been laid out and confirmed by FinCEN over the last decade, is pretty clear; you cannot be a money services business if you do not control the funds that people are sending to each other, which is definitely the case with Samourai Wallet. People downloaded Samourai Wallet, spun up their own private-public key pairs and initiated transactions themselves. Samourai never custodied funds or initiated transactions on behalf of their users. This is very cut and dry. Straight to the point. It should be something that anyone with more than two brain cells is able to discern pretty quickly.

It is imperative that anybody in the industry who cares about being able to hold bitcoin in self-custody, to mine bitcoin, and to send bitcoin in a peer-to-peer fashion makes some noise around this case. None of the current administration's attempts to foster innovation around bitcoin in the United States will matter if the wrong precedent is set in this case. If the SDNY is successful in prosecuting Samourai Wallet, it will mean that anybody holding Bitcoin in self-custody, running a bitcoin fold node or mining bitcoin will have to KYC all of their users and counterparts lest they be labeled a money services business that is breaking laws stemming from the Bank Secrecy Act. This will effectively make building a self-custody bitcoin wallet, running a node, or mining bitcoin in tillegal in the United States. The ability to comply with the rules that would be unleashed if this Samourai case goes the wrong way, are such that it will effectively destroy the industry overnight.

It is yet to be seen whether or not the Department of Justice will step in to publicly flog the SDNY and force them to stop pursuing this case. This is the only likely way that the case will go away at this point, so it is very important that bitcoiners who care about being able to self-custody bitcoin, mine bitcoin, or send bitcoin in a peer-to-peer fashion in the United States make it clear to the current administration and any local politicians that this is an issue that you care deeply about. If we are too complacent, there is a chance that the SDNY could completely annihilate the bitcoin industry in America despite of all of the positive momentum we're seeing from all angles at the moment.

Make some noise!

Bitcoin Adoption by Power Companies: The Next Frontier

In my recent conversation with Andrew Myers from Satoshi Energy, he shared their ambitious mission to "enable every electric power company to use bitcoin by block 1,050,000" – roughly three years from now. This strategic imperative isn't just about creating new Bitcoin users; it's about sovereignty. Andrew emphasized that getting Bitcoin into the hands of energy companies who value self-sovereignty creates a more balanced future economic landscape. The excitement was palpable as he described how several energy companies are already moving beyond simply selling power to Bitcoin miners and are beginning to invest in mining operations themselves.

"You have global commodity companies being like, 'Oh, this is another commodity – we want to invest in this, we want to own this,'" - Andrew Myers

Perhaps most fascinating was Andrew's revelation about major energy companies in Texas developing Bitcoin collateral products for power contracts – a practical application that could revolutionize how energy transactions are settled. As energy companies continue embracing Bitcoin for both operations and collateral, we're witnessing the early stages of a profound shift in how critical infrastructure interfaces with sound money. The implications for both sectors could be transformative.

Check out the full podcast here for more on remote viewing, Nikola Tesla's predictions, and the convergence of Bitcoin and AI technology. We cover everything from humanoid robots to the energy demands of next-generation computing.

Headlines of the Day

Steak n Shake to Accept Bitcoin at All Locations May 16 - via X

Facebook Plans Crypto Wallets for 3B Users, Bitcoin Impact Looms - via X

Trump Urges Americans to Buy Stocks for Economic Boom - via X

UK Drops Tariffs, U.S. Farmers Set to Reap Major Benefits - via X

Looking for the perfect video to push the smartest person you know from zero to one on bitcoin? Bitcoin, Not Crypto is a three-part master class from Parker Lewis and Dhruv Bansal that cuts through the noise—covering why 21 million was the key technical simplification that made bitcoin possible, why blockchains don’t create decentralization, and why everything else will be built on bitcoin.

Ten31, the largest bitcoin-focused investor, has deployed 145,630 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Happy belated Mother's Day to all the moms out there.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 83279ad2:bd49240d

2025-05-14 03:58:40

@ 83279ad2:bd49240d

2025-05-14 03:58:40test nostr:nevent1qvzqqqqqqypzpqe8ntfgamz8sh3p88w99x5k2r7mksjrvm2xghju9qj00j75jfqdqyxhwumn8ghj77tpvf6jumt9qyghwumn8ghj7u3wddhk56tjvyhxjmcpr3mhxue69uhkummnw3ezucnfw33k76twv4ezuum0vd5kzmqpzemhxue69uhhyetvv9ujumn0wvh8xmmrd9skcqg5waehxw309aex2mrp0yhxgctdw4eju6t0qy28wumn8ghj7mn0wd68ytn00p68ytnyv4mqzrmhwden5te0dehhxarj9ekk7mgpp4mhxue69uhkummn9ekx7mqqyqknwtnxd4422ya9nh0qrcwfy6q3hhruyqaukvh2fpcu94es3tvu20tf7nt nostr:nevent1qvzqqqqqqypzpqe8ntfgamz8sh3p88w99x5k2r7mksjrvm2xghju9qj00j75jfqdqyxhwumn8ghj77tpvf6jumt9qyghwumn8ghj7u3wddhk56tjvyhxjmcpr3mhxue69uhkummnw3ezucnfw33k76twv4ezuum0vd5kzmqpzemhxue69uhhyetvv9ujumn0wvh8xmmrd9skcqg5waehxw309aex2mrp0yhxgctdw4eju6t0qy28wumn8ghj7mn0wd68ytn00p68ytnyv4mqzrmhwden5te0dehhxarj9ekk7mgpp4mhxue69uhkummn9ekx7mqqyqknwtnxd4422ya9nh0qrcwfy6q3hhruyqaukvh2fpcu94es3tvu20tf7nt

-

@ 472f440f:5669301e

2025-05-12 23:29:25

@ 472f440f:5669301e

2025-05-12 23:29:25Marty's Bent

Last week we covered the bombshell developments in the Samourai Wallet case. For those who didn't read that, last Monday the world was made aware of the fact that the SDNY was explicitly told by FinCEN that the federal regulator did not believe that Samourai Wallet was a money services business six months before arresting the co-founders of Samourai Wallet for conspiracy to launder money and illegally operating a money services business. This was an obvious overstep by the SDNY that many believed would be quickly alleviated, especially considering the fact that the Trump administration via the Department of Justice has made it clear that they do not intend to rule via prosecution.

It seems that this is not the case as the SDNY responded to a letter sent from the defense to dismiss the case by stating that they fully plan to move forward. Stating that they only sought the recommendations of FinCEN employees and did not believe that those employees' comments were indicative of FinCEN's overall views on this particular case. It's a pretty egregious abuse of power by the SDNY. I'm not sure if the particular lawyers and judges within the Southern District of New York are very passionate about preventing the use of self-custody bitcoin and products that enable bitcoiners to transact privately, or if they're simply participating in a broader meta war with the Trump administration - who has made it clear to federal judges across the country that last Fall's election will have consequences, mainly that the Executive Branch will try to effectuate the policies that President Trump campaigned on by any legal means necessary - and Samouari Wallet is simply in the middle of that meta war.

However, one thing is pretty clear to me, this is an egregious overstep of power. The interpretation of that law, as has been laid out and confirmed by FinCEN over the last decade, is pretty clear; you cannot be a money services business if you do not control the funds that people are sending to each other, which is definitely the case with Samourai Wallet. People downloaded Samourai Wallet, spun up their own private-public key pairs and initiated transactions themselves. Samourai never custodied funds or initiated transactions on behalf of their users. This is very cut and dry. Straight to the point. It should be something that anyone with more than two brain cells is able to discern pretty quickly.

It is imperative that anybody in the industry who cares about being able to hold bitcoin in self-custody, to mine bitcoin, and to send bitcoin in a peer-to-peer fashion makes some noise around this case. None of the current administration's attempts to foster innovation around bitcoin in the United States will matter if the wrong precedent is set in this case. If the SDNY is successful in prosecuting Samourai Wallet, it will mean that anybody holding Bitcoin in self-custody, running a bitcoin fold node or mining bitcoin will have to KYC all of their users and counterparts lest they be labeled a money services business that is breaking laws stemming from the Bank Secrecy Act. This will effectively make building a self-custody bitcoin wallet, running a node, or mining bitcoin in tillegal in the United States. The ability to comply with the rules that would be unleashed if this Samourai case goes the wrong way, are such that it will effectively destroy the industry overnight.

It is yet to be seen whether or not the Department of Justice will step in to publicly flog the SDNY and force them to stop pursuing this case. This is the only likely way that the case will go away at this point, so it is very important that bitcoiners who care about being able to self-custody bitcoin, mine bitcoin, or send bitcoin in a peer-to-peer fashion in the United States make it clear to the current administration and any local politicians that this is an issue that you care deeply about. If we are too complacent, there is a chance that the SDNY could completely annihilate the bitcoin industry in America despite of all of the positive momentum we're seeing from all angles at the moment.

Make some noise!

Bitcoin Adoption by Power Companies: The Next Frontier

In my recent conversation with Andrew Myers from Satoshi Energy, he shared their ambitious mission to "enable every electric power company to use bitcoin by block 1,050,000" – roughly three years from now. This strategic imperative isn't just about creating new Bitcoin users; it's about sovereignty. Andrew emphasized that getting Bitcoin into the hands of energy companies who value self-sovereignty creates a more balanced future economic landscape. The excitement was palpable as he described how several energy companies are already moving beyond simply selling power to Bitcoin miners and are beginning to invest in mining operations themselves.

"You have global commodity companies being like, 'Oh, this is another commodity – we want to invest in this, we want to own this,'" - Andrew Myers

Perhaps most fascinating was Andrew's revelation about major energy companies in Texas developing Bitcoin collateral products for power contracts – a practical application that could revolutionize how energy transactions are settled. As energy companies continue embracing Bitcoin for both operations and collateral, we're witnessing the early stages of a profound shift in how critical infrastructure interfaces with sound money. The implications for both sectors could be transformative.

Check out the full podcast here for more on remote viewing, Nikola Tesla's predictions, and the convergence of Bitcoin and AI technology. We cover everything from humanoid robots to the energy demands of next-generation computing.

Headlines of the Day

Steak n Shake to Accept Bitcoin at All Locations May 16 - via X

Facebook Plans Crypto Wallets for 3B Users, Bitcoin Impact Looms - via X

Trump Urges Americans to Buy Stocks for Economic Boom - via X

UK Drops Tariffs, U.S. Farmers Set to Reap Major Benefits - via X

Looking for the perfect video to push the smartest person you know from zero to one on bitcoin? Bitcoin, Not Crypto is a three-part master class from Parker Lewis and Dhruv Bansal that cuts through the noise—covering why 21 million was the key technical simplification that made bitcoin possible, why blockchains don’t create decentralization, and why everything else will be built on bitcoin.

Ten31, the largest bitcoin-focused investor, has deployed 145,630 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Happy belated Mother's Day to all the moms out there.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 615d5a95:c3b79c24

2025-05-14 10:49:22

@ 615d5a95:c3b79c24

2025-05-14 10:49:22HI365 ra đời như một nền tảng trực tuyến hoàn hảo, đáp ứng mọi nhu cầu giải trí và phát triển kỹ năng của người dùng trong một không gian số hiện đại. Với giao diện được thiết kế tinh tế, dễ sử dụng và tối ưu hóa cho mọi thiết bị, từ điện thoại di động đến máy tính để bàn, HI365 mang đến trải nghiệm mượt mà và đầy tiện ích cho người tham gia. Nền tảng này chú trọng vào việc mang lại sự linh hoạt trong việc truy cập và tương tác, giúp người dùng dễ dàng tìm kiếm và tham gia vào các hoạt động phù hợp với sở thích và nhu cầu cá nhân. Bên cạnh đó, HI365 cung cấp một hệ thống cá nhân hóa thông minh, cho phép người dùng tùy chỉnh trải nghiệm của mình sao cho phù hợp nhất, từ việc tham gia các hoạt động sáng tạo cho đến thử thách khả năng phân tích và quyết định. Những tính năng này giúp tạo nên một không gian trực tuyến không chỉ giải trí mà còn mang lại giá trị thực sự cho người tham gia.

Một trong những điểm mạnh của HI365 là cộng đồng người dùng thân thiện và năng động, nơi mọi người có thể chia sẻ những kinh nghiệm, học hỏi lẫn nhau và cùng nhau phát triển. Với hệ thống kết nối linh hoạt và các tính năng tương tác hiệu quả, HI365 không chỉ là nơi để giải trí mà còn là không gian để người dùng nâng cao kỹ năng và tư duy chiến lược. Các hoạt động tại HI365 được thiết kế khoa học, dễ tiếp cận nhưng không thiếu sự thử thách, giúp người dùng rèn luyện sự nhạy bén trong quyết định và khả năng phân tích tình huống. Cộng đồng tại HI365 luôn duy trì sự cạnh tranh lành mạnh và động viên lẫn nhau phát triển, từ đó tạo ra môi trường học hỏi và sáng tạo không ngừng. Những tính năng như bảng xếp hạng, sự kiện đặc biệt hay các cuộc thi trực tuyến giúp gia tăng tính hấp dẫn và thú vị, đồng thời thúc đẩy người dùng phát triển không chỉ về kỹ năng mà còn về mặt tư duy sáng tạo.

Không chỉ chú trọng đến trải nghiệm người dùng và sự phát triển cộng đồng, HI365 còn cam kết mang lại một môi trường an toàn và bảo mật cho tất cả người tham gia. Được trang bị hệ thống bảo mật tiên tiến, HI365 bảo vệ thông tin người dùng một cách tuyệt đối, giúp người tham gia yên tâm tận hưởng những hoạt động mà không phải lo lắng về các vấn đề bảo mật. Đội ngũ hỗ trợ khách hàng chuyên nghiệp luôn sẵn sàng giải đáp thắc mắc và hỗ trợ người dùng 24/7, đảm bảo mọi trải nghiệm tại nền tảng này luôn suôn sẻ và trọn vẹn. Với những tính năng liên tục được cải tiến, HI365 không ngừng nâng cao chất lượng dịch vụ để đáp ứng nhu cầu ngày càng cao của người dùng. Những cải tiến này không chỉ giúp tối ưu hóa trải nghiệm mà còn làm phong phú thêm các lựa chọn và hoạt động mà nền tảng mang lại. Nhờ vậy, HI365 không chỉ là một nền tảng giải trí mà còn là nơi giúp người dùng phát triển và rèn luyện những kỹ năng quan trọng trong cuộc sống.

-

@ af92154b:b59d671f

2025-05-14 03:19:09

@ af92154b:b59d671f

2025-05-14 03:19:09Since World War II, America has doubled down on the Car and the Jetplane as the primary mode of short- and long-range transportation respectively. The construction of the interstate highway system in the 1950's was ostensibly for civil and economic purposes, however the military applications of being able to move large numbers of soldiers and war material across the vast distance of the US mainland were not lost on the planners of the system. The development of civilian air travel industry followed a similar rationale, to promote a viable industrial base of aerospace manufacturers who could be easily re-tasked for war should the need arise.

Now in the 21st century we frequently forget these facts and provide convenient ex-post-facto justifications for why we drive and fly everywhere. "It's just more convenient... It must be that the market naturally arrived at this solution!"

Not quite. As a vast array of literature from academics like the late Donald Shoup has shown in works like The High Cost of Free Parking, American cities and suburbs were designed (in many cases, top-down, by fiat) around cars. And in turn, most Americans have designed their lives around cars, in such a way that they couldn't imagine living without their own personal 2-ton transportation machine in their garage.

But here I wanted to ask: What form of transportation actually aligns with the core values expressed in Bitcoin? What is most anonymous, permission-less, and decentralized form of mobility technology?

Breakdown of Mobility Modes

Here I will argue, perhaps counter-intuitively, that it's not the car. The following table is an entirely subjective, but I believe nonetheless reasonable, breakdown of 7 of the most commonly used modes of mobility in the developed world across three core values that I believe are expressed in Bitcoin culture:

| Mode | Range | Scheduled? | Anonymous? | Permission Level | | --- | --- | --- | --- | --- | | Walking | ~1 mi | No ✅| Yes ✅| None ✅| | Cycling | ~5 mi | No ✅| Yes ✅| None ✅| | E-Mobility | ~15 mi | No ✅| Yes ✅| None ✅| | Local Transit | ~25 mi | Maybe 🚧| Yes ✅| Low 🚧| | Driving | ~300 mi | No ✅| No 🛑| High 🛑| | Intercity Rail | ~1000 mi | Yes 🛑| Yes ✅| Low 🚧| | Passenger Jet | ~8000 mi | Yes 🛑| No 🛑| High 🛑|

My explanations for each category are below:

Scheduling: Go Anytime

To many, this is a core component of what they think of as "freedom" in mobility. This is the attraction to many of the car: go anytime.

However, it's important to note that this attribute is shared with walking, biking, and e-mobility. And, it should be mentioned, better public transit systems that have low headways (i.e. time between trains and buses) approach "go anytime" methods of travel. If you're only waiting ~5-10 minutes for the next bus or train, this becomes functionally equivalent to the "go anytime" convenience of cars, especially if one factors in traffic, parking, & etc.

Longer-distance travel, planes and trains, will obviously require some aspect of scheduling in advance.

Anonymity

What forms of transportation allow you to travel anonymously? Well, we can clearly strike cars and planes off that list. Car travel requires both you and your vehicle to be registered with the state. You literally carry a visible ID (license plate) with you every time you leave the house. Can you imagine having to strap a number to your back every time you walk out of the house? And things only get more stringent when stepping on a plane, especially with the implementation of RealID nationwide.

In contrast, police overreach notwithstanding, nobody is asking for your ID for simply walking on the sidewalk, biking or e-mobility. Neither do bikes or e-scooter devices generally need to be registered (although it's a good idea to use private registries for your bike in case it gets stolen).

Even intra- and inter-city rail systems generally allow for payments in cash, thus allowing for anonymous travel using these means. They certainly aren't checking ID's by default.

So we see that on anonymity, any means of transport other than cars or planes are superior.

Permissioned vs Permissionless Movement

Here again, Cars and Planes are clearly inferior to all other forms described. As we're all told in high school Driver's Ed, "driving is a privilege, not a right." The nature of car and plane travel is inherently subsidized, regulated, monitored, and most importantly permissioned by the State.

It's almost sad from a libertarian perspective to see how much "faux-individuality" is expressed by American car culture. We deck out our cars with custom decals, detail the interiors, and see them as some expression of our individuality and personal freedom. Meanwhile, practically every aspect of car travel, from the size and shape of the vehicles, the size and markings of roads, the guarantee (or at least reasonable expectation) that there will be available parking at both points of your journey... it's all a product of decades of subsidies, regulation, and Technocracy.

But I digress. No permission is needed to walk or ride a bike. And, assuming you pay your fare and are not violating the code of conduct, your permission to use public transit is assumed by default, rather than you needing to prove it, as is the case for both driving and flying.

Conclusion

Here I'm attempting to take stock of values that are important to many bitcoiners, as I perceive them (us?) as a group: Freedom, anonymity, and permissionless action. I've argued here that, applying these values to the mobility space, bitcoiners should focus on a combination of walking, biking, e-mobility, public transit, and trains over cars and air travel, as the former methods maximize these values over the latter.

I expect (if anyone's even reading this) there to be some cultural shock; the "modal" bitcoiner as I perceive them, much like the average libertarian, skews to the Right culturally (if not politically). And that might mean you're thinking "you'll pry my cold dead fingers off my F-150's steering wheel!" Or, maybe you're making (entirely reasonable) complaints: "But (bus system in my area) is non-existent or underfunded! But (street network in my area) doesn't even have sidewalks!"

All I'm saying is: convenience comes with a cost. You know what's convenient? The fiat system. Paying with your credit card. Driving everywhere. Freedom, like Bitcoin (heck like Nostr) is, at least for now, inconvenient. It takes effort to unlearn what you've learned, as Yoda put it. But the reward is a more free life.

-

@ 8b19a626:6da35f21

2025-05-14 09:07:19

@ 8b19a626:6da35f21

2025-05-14 09:07:19I did not arrive with loud words, just quiet prayers and a heart full of purpose. Queen Marvel looked beyond the surface, she saw not where I stood but where I could go to_ to perform in global stages. She believed in me when I was still uncertain, still learning how to grow. She didn't offer gold, she offered faith, a silent kind of power that says," I see you", even when the world doesn't yet. And now, there is a community behind me, Eyes full of hope, hearts whispering, do not forget us. I carry their dreams like sacred cargo. I talk Bitcoin but I live poetry, now am schooling folks with metaphors and memes. Dropping bars on blocks and dreams, telling kings and queens, you got value, you got choice. So here is to Bitcoin, the rebel code that broke my chains, that gave me freedom and these golden poetic veins. This is not hype, it is truth in rhyme Now I spit not for fame But to light other flames, cos if it unlocked mine, then you can do the same. MaKiNi

-

@ 57d1a264:69f1fee1

2025-05-14 09:48:43

@ 57d1a264:69f1fee1

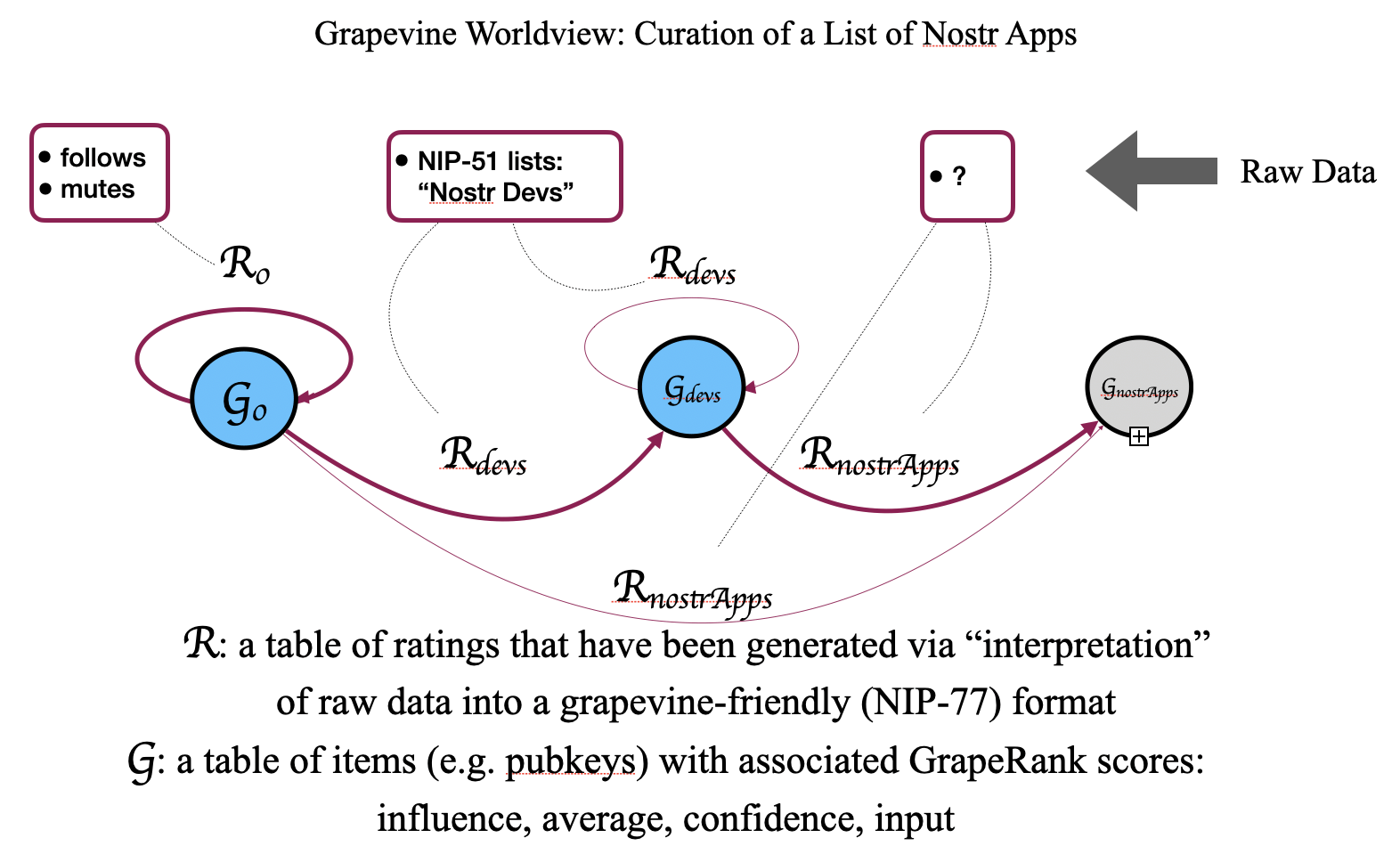

2025-05-14 09:48:43Just another Ecash nutsnote design is a ew template for brrr.gandlaf.com cashu tocken printing machine and honoring Ecash ideator David Lee Chaum. Despite the turn the initial project took, we would not have Ecash today without his pioneering approach in cryptography and privacy-preserving technologies.

A simple KISS (Keep It Super Simple) Ecash nutsnote delivered as SVG, nothing fancy, designed in PenPot, an open source design tool, for slides, presentations, mockups and interactive prototypes.

Here Just another Nutsnote's current state, together with some snapshots along the process. Your feedback is more than welcome.

https://design.penpot.app/#/view?file-id=749aaa04-8836-81c6-8006-0b29916ec156&page-id=749aaa04-8836-81c6-8006-0b29916ec157§ion=interactions&index=0&share-id=addba4d5-28a4-8022-8006-2ecc4316ebb2

originally posted at https://stacker.news/items/979728

-

@ 961e8955:d7fa53e4

2025-05-14 08:52:07

@ 961e8955:d7fa53e4

2025-05-14 08:52:07 Cryptocurrencies have become increasingly popular in recent years, and their impact on the world economy is a topic of much discussion. While there are many potential benefits to using cryptocurrencies, such as greater privacy and security, there are also several ways in which they may impact the global economy.

Cryptocurrencies have become increasingly popular in recent years, and their impact on the world economy is a topic of much discussion. While there are many potential benefits to using cryptocurrencies, such as greater privacy and security, there are also several ways in which they may impact the global economy.One potential impact of cryptocurrencies on the world economy is their ability to disrupt traditional financial systems. By enabling peer-to-peer transactions without the need for intermediaries such as banks or financial institutions, cryptocurrencies have the potential to lower transaction costs and increase efficiency. This could have a significant impact on industries such as remittances, where people send money across borders to their families.

However, the rise of cryptocurrencies has also brought concerns around their potential impact on monetary policy. Because cryptocurrencies are decentralized and not subject to government control, some fear that they could lead to increased volatility and instability in financial markets. Additionally, the use of cryptocurrencies could make it more difficult for central banks to control inflation and regulate the money supply.

Another potential impact of cryptocurrencies on the global economy is their ability to facilitate international trade. With the use of blockchain technology, cryptocurrencies could provide a secure and transparent means of conducting cross-border transactions. This could reduce the costs and time associated with traditional international payments, which could have a positive impact on global trade.

Finally, the growth of cryptocurrencies could also have an impact on wealth distribution. Because cryptocurrencies are accessible to anyone with an internet connection, they could provide new opportunities for people who have been excluded from traditional financial systems. However, there are also concerns that the concentration of wealth in the hands of early adopters and large cryptocurrency holders could exacerbate existing inequalities.

In conclusion, the impact of cryptocurrencies on the world economy is complex and multifaceted. While they have the potential to disrupt traditional financial systems and facilitate international trade, they also raise concerns around monetary policy and wealth distribution. As the use of cryptocurrencies continues to grow, it will be important to carefully monitor their impact on the global economy and take steps to address any potential risks.

-

@ 2e8970de:63345c7a

2025-05-14 06:51:45

@ 2e8970de:63345c7a

2025-05-14 06:51:45https://www.niskanencenter.org/the-bridge-for-workers-act-getting-people-back-into-jobs-fast/

originally posted at https://stacker.news/items/979654

-

@ 378562cd:a6fc6773

2025-05-14 00:10:58

@ 378562cd:a6fc6773

2025-05-14 00:10:58There’s something timeless about the question:

What does it mean to become a man?

It’s been asked around campfires, whispered in barns, shouted across football fields, and wrestled with in the quiet corners of growing hearts.

But the world today is noisy, fast, and confused. We’ve traded compass points for trending hashtags. And yet, the answer hasn’t changed. It’s not in a six-pack, a bank account, or a thousand followers. Manhood isn’t something you perform. It’s something you become. Slowly. Like iron in the fire.

So let’s bring it back. Dust off the old truths. Stir the ashes and tell the tales that forged generations before us.

-

Stand Before the Mirror Without Excuses The first lesson every boy must face is the hardest: You are responsible for yourself. No one else is going to do your pushups. No one else is going to fight your battles. Own your decisions. Own your failures. Own your growth. This isn’t toxic masculinity. It’s accountability. And it’s the foundation for everything else.

-

Work with Your Hands. Sweat with Purpose. You don’t need to be a mechanic or a farmer, but you do need to understand the dignity of labor. Build something. Fix something. Burn blisters into your palms and then look at them with pride. The boy complains about the work. The man shows up anyway, whether raining or shining, and gets it done.

“In the sweat of thy face shalt thou eat bread.” That wasn’t just instruction, it was initiation. A man earns not just his meal, but his manhood, in the honest work of his hands.

-

Learn to Say ‘No’ and Mean It A man who can’t say no will be dragged in every direction but his own. No to cowardice. No to laziness. No to temptation. No to treating people like tools. No to selling your soul for cheap applause. A real man draws lines. And he holds them even if he stands alone.

-

Protect the Vulnerable Your strength isn’t for domination. It’s for protection. The man shields his wife from the chaos, comforts his kids in the dark, and stands before evil, not behind someone else. The strong man doesn’t puff up his chest to impress. He lowers his voice and steadies the room.

And he never lets fear bully the innocent.

-

Speak Less. Do More. The best men I’ve ever met weren’t loud. They were present. They didn’t announce themselves. They didn’t boast. But you felt them in the room. They made eye contact. They kept their word. They listened before speaking. Being a man isn’t about barking orders, and it’s about earning respect quietly and carrying the weight without making others feel it.

-

Know When to Fight and When to Forgive Every young man dreams of being a warrior. But the real test? Knowing which battles matter. A fool fights everything. A coward fights nothing. A man chooses his ground and stands with conviction. But he also knows when to lay it down. To forgive. To rebuild. To let grace triumph over ego.

That’s not weakness. That’s legacy.

-

Seek Wisdom, Not Just Knowledge Read old books. Listen to old men. Ask questions that don’t fit into a TikTok clip. Ask God for wisdom. Wisdom isn’t information, it’s orientation. It’s the difference between knowing how to swing a sword and knowing when to sheath it. A man of wisdom becomes a man of peace. But that peace was earned, not inherited.

-

Be the Man You Needed When You Were a Boy One day, your own shadow will fall across someone smaller than you. A nephew. A son. A kid on the team. Be the man who shows up. The man who teaches gently. The man who isn’t afraid to apologize. You might be the only example they ever see. And you know how that story goes: The boy becomes the man. The man becomes the guide.

-

Walk with God The old path isn’t just about grit. It’s about grace. You were made by design. You were created with purpose. True manhood comes alive when you stop trying to build yourself into a god and instead walk humbly with the One who made you. A man fully submitted to God is a man fully alive. Not perfect. Not polished. But anchored.

Final Thought: The world doesn’t need more influencers. It needs more men. Men of courage. Men of character. Men of consistency. So if you’re reading this and wondering if you’re doing it right, start here:

Take responsibility, love deeply, protect fiercely, walk humbly, work hard, forgive quickly, speak truth, stand firm, and pass it on.

The fire’s still burning, my friend.

Grab an axe.

Become the man.

-

-

@ 57d1a264:69f1fee1

2025-05-14 06:48:45

@ 57d1a264:69f1fee1

2025-05-14 06:48:45Has the architect Greg Chasen considered it when rebuilding the house just one year before the catastrophe? Apparently not! Another of his projects was featured on the Value of Architecture as properties with design integrity.

This is a super interesting subject. The historic character, livability, and modern disaster-resistance is a triangle where you often have to pick just one or two, which leads to some tough decisions that have major impacts on families and communities. Like one of the things he mentions is that the architect completely eliminated plants from the property. That's great for fire resistance, but not so great for other things if the entire town decides to go the same route (which he does bring up later in the video). I don't think there's any objectively right answer, but definitely lots of good (and important) discussion points to be had.

https://www.youtube.com/watch?v=cbl_1qfsFXk

originally posted at https://stacker.news/items/979653

-

@ eab58da0:eebdafbf

2025-05-14 08:19:47

@ eab58da0:eebdafbf

2025-05-14 08:19:47By Unknownfx

As a writer with over 100 stories published on platforms like Medium, I’ve explored countless spaces to share my voice. Few, however, have captured my heart quite like YakiHonne. This platform blends the best of creative expression, community engagement, and versatility, making it a perfect fit for someone like me, whose work spans self-improvement articles and forex/crypto trading posts. Below, I’ll dive into why YakiHonne has become my go-to platform, from its seamless writing experience to its vibrant, X-like social features.

A Writer’s Paradise for Self-Improvement and Mental Health Writing about self-improvement and mental health requires a space that feels safe, inspiring, and receptive. YakiHonne delivers exactly that. The platform’s clean interface and intuitive design make it easy to craft long-form articles that resonate with readers. Whether I’m sharing strategies for managing anxiety or tips for personal growth, YakiHonne’s formatting tools allow me to structure my thoughts clearly with headings, lists, and emphasis—perfect for breaking down complex topics into digestible insights.