-

@ 66675158:1b644430

2025-03-23 11:39:41

@ 66675158:1b644430

2025-03-23 11:39:41I don't believe in "vibe coding" – it's just the newest Silicon Valley fad trying to give meaning to their latest favorite technology, LLMs. We've seen this pattern before with blockchain, when suddenly Non Fungible Tokens appeared, followed by Web3 startups promising to revolutionize everything from social media to supply chains. VCs couldn't throw money fast enough at anything with "decentralized" (in name only) in the pitch deck. Andreessen Horowitz launched billion-dollar crypto funds, while Y Combinator batches filled with blockchain startups promising to be "Uber for X, but on the blockchain."

The metaverse mania followed, with Meta betting its future on digital worlds where we'd supposedly hang out as legless avatars. Decentralized (in name only) autonomous organizations emerged as the next big thing – supposedly democratic internet communities that ended up being the next scam for quick money.

Then came the inevitable collapse. The FTX implosion in late 2022 revealed fraud, Luna/Terra's death spiral wiped out billions (including my ten thousand dollars), while Celsius and BlockFi froze customer assets before bankruptcy.

By 2023, crypto winter had fully set in. The SEC started aggressive enforcement actions, while users realized that blockchain technology had delivered almost no practical value despite a decade of promises.

Blockchain's promises tapped into fundamental human desires – decentralization resonated with a generation disillusioned by traditional institutions. Evangelists presented a utopian vision of freedom from centralized control. Perhaps most significantly, crypto offered a sense of meaning in an increasingly abstract world, making the clear signs of scams harder to notice.

The technology itself had failed to solve any real-world problems at scale. By 2024, the once-mighty crypto ecosystem had become a cautionary tale. Venture firms quietly scrubbed blockchain references from their websites while founders pivoted to AI and large language models.

Most reading this are likely fellow bitcoiners and nostr users who understand that Bitcoin is blockchain's only valid use case. But I shared that painful history because I believe the AI-hype cycle will follow the same trajectory.

Just like with blockchain, we're now seeing VCs who once couldn't stop talking about "Web3" falling over themselves to fund anything with "AI" in the pitch deck. The buzzwords have simply changed from "decentralized" to "intelligent."

"Vibe coding" is the perfect example – a trendy name for what is essentially just fuzzy instructions to LLMs. Developers who've spent years honing programming skills are now supposed to believe that "vibing" with an AI is somehow a legitimate methodology.

This might be controversial to some, but obvious to others:

Formal, context-free grammar will always remain essential for building precise systems, regardless of how advanced natural language technology becomes

The mathematical precision of programming languages provides a foundation that human language's ambiguity can never replace. Programming requires precision – languages, compilers, and processors operate on explicit instructions, not vibes. What "vibe coding" advocates miss is that beneath every AI-generated snippet lies the same deterministic rules that have always governed computation.

LLMs don't understand code in any meaningful sense—they've just ingested enormous datasets of human-written code and can predict patterns. When they "work," it's because they've seen similar patterns before, not because they comprehend the underlying logic.

This creates a dangerous dependency. Junior developers "vibing" with LLMs might get working code without understanding the fundamental principles. When something breaks in production, they'll lack the knowledge to fix it.

Even experienced developers can find themselves in treacherous territory when relying too heavily on LLM-generated code. What starts as a productivity boost can transform into a dependency crutch.

The real danger isn't just technical limitations, but the false confidence it instills. Developers begin to believe they understand systems they've merely instructed an AI to generate – fundamentally different from understanding code you've written yourself.

We're already seeing the warning signs: projects cobbled together with LLM-generated code that work initially but become maintenance nightmares when requirements change or edge cases emerge.

The venture capital money is flowing exactly as it did with blockchain. Anthropic raised billions, OpenAI is valued astronomically despite minimal revenue, and countless others are competing to build ever-larger models with vague promises. Every startup now claims to be "AI-powered" regardless of whether it makes sense.

Don't get me wrong—there's genuine innovation happening in AI research. But "vibe coding" isn't it. It's a marketing term designed to make fuzzy prompting sound revolutionary.

Cursor perfectly embodies this AI hype cycle. It's an AI-enhanced code editor built on VS Code that promises to revolutionize programming by letting you "chat with your codebase." Just like blockchain startups promised to "revolutionize" industries, Cursor promises to transform development by adding LLM capabilities.

Yes, Cursor can be genuinely helpful. It can explain unfamiliar code, suggest completions, and help debug simple issues. After trying it for just an hour, I found the autocomplete to be MAGICAL for simple refactoring and basic functionality.

But the marketing goes far beyond reality. The suggestion that you can simply describe what you want and get production-ready code is dangerously misleading. What you get are approximations with:

- Security vulnerabilities the model doesn't understand

- Edge cases it hasn't considered

- Performance implications it can't reason about

- Dependency conflicts it has no way to foresee

The most concerning aspect is how such tools are marketed to beginners as shortcuts around learning fundamentals. "Why spend years learning to code when you can just tell AI what you want?" This is reminiscent of how crypto was sold as a get-rich-quick scheme requiring no actual understanding.

When you "vibe code" with an AI, you're not eliminating complexity—you're outsourcing understanding to a black box. This creates developers who can prompt but not program, who can generate but not comprehend.

The real utility of LLMs in development is in augmenting existing workflows:

- Explaining unfamiliar codebases

- Generating boilerplate for well-understood patterns

- Suggesting implementations that a developer evaluates critically

- Assisting with documentation and testing

These uses involve the model as a subordinate assistant to a knowledgeable developer, not as a replacement for expertise. This is where the technology adds value—as a sophisticated tool in skilled hands.

Cursor is just a better hammer, not a replacement for understanding what you're building. The actual value emerges when used by developers who understand what happens beneath the abstractions. They can recognize when AI suggestions make sense and when they don't because they have the fundamental knowledge to evaluate output critically.

This is precisely where the "vibe coding" narrative falls apart.

-

@ 8ba93868:44bdde52

2025-04-09 12:42:31

@ 8ba93868:44bdde52

2025-04-09 12:42:31ola

-

@ eac63075:b4988b48

2025-01-04 19:41:34

@ eac63075:b4988b48

2025-01-04 19:41:34Since its creation in 2009, Bitcoin has symbolized innovation and resilience. However, from time to time, alarmist narratives arise about emerging technologies that could "break" its security. Among these, quantum computing stands out as one of the most recurrent. But does quantum computing truly threaten Bitcoin? And more importantly, what is the community doing to ensure the protocol remains invulnerable?

The answer, contrary to sensationalist headlines, is reassuring: Bitcoin is secure, and the community is already preparing for a future where quantum computing becomes a practical reality. Let’s dive into this topic to understand why the concerns are exaggerated and how the development of BIP-360 demonstrates that Bitcoin is one step ahead.

What Is Quantum Computing, and Why Is Bitcoin Not Threatened?

Quantum computing leverages principles of quantum mechanics to perform calculations that, in theory, could exponentially surpass classical computers—and it has nothing to do with what so-called “quantum coaches” teach to scam the uninformed. One of the concerns is that this technology could compromise two key aspects of Bitcoin’s security:

- Wallets: These use elliptic curve algorithms (ECDSA) to protect private keys. A sufficiently powerful quantum computer could deduce a private key from its public key.

- Mining: This is based on the SHA-256 algorithm, which secures the consensus process. A quantum attack could, in theory, compromise the proof-of-work mechanism.

Understanding Quantum Computing’s Attack Priorities

While quantum computing is often presented as a threat to Bitcoin, not all parts of the network are equally vulnerable. Theoretical attacks would be prioritized based on two main factors: ease of execution and potential reward. This creates two categories of attacks:

1. Attacks on Wallets

Bitcoin wallets, secured by elliptic curve algorithms, would be the initial targets due to the relative vulnerability of their public keys, especially those already exposed on the blockchain. Two attack scenarios stand out:

-

Short-term attacks: These occur during the interval between sending a transaction and its inclusion in a block (approximately 10 minutes). A quantum computer could intercept the exposed public key and derive the corresponding private key to redirect funds by creating a transaction with higher fees.

-

Long-term attacks: These focus on old wallets whose public keys are permanently exposed. Wallets associated with Satoshi Nakamoto, for example, are especially vulnerable because they were created before the practice of using hashes to mask public keys.

We can infer a priority order for how such attacks might occur based on urgency and importance.

Bitcoin Quantum Attack: Prioritization Matrix (Urgency vs. Importance)

Bitcoin Quantum Attack: Prioritization Matrix (Urgency vs. Importance)2. Attacks on Mining

Targeting the SHA-256 algorithm, which secures the mining process, would be the next objective. However, this is far more complex and requires a level of quantum computational power that is currently non-existent and far from realization. A successful attack would allow for the recalculation of all possible hashes to dominate the consensus process and potentially "mine" it instantly.

Satoshi Nakamoto in 2010 on Quantum Computing and Bitcoin Attacks

Satoshi Nakamoto in 2010 on Quantum Computing and Bitcoin AttacksRecently, Narcelio asked me about a statement I made on Tubacast:

https://x.com/eddieoz/status/1868371296683511969

If an attack became a reality before Bitcoin was prepared, it would be necessary to define the last block prior to the attack and proceed from there using a new hashing algorithm. The solution would resemble the response to the infamous 2013 bug. It’s a fact that this would cause market panic, and Bitcoin's price would drop significantly, creating a potential opportunity for the well-informed.

Preferably, if developers could anticipate the threat and had time to work on a solution and build consensus before an attack, they would simply decide on a future block for the fork, which would then adopt the new algorithm. It might even rehash previous blocks (reaching consensus on them) to avoid potential reorganization through the re-mining of blocks using the old hash. (I often use the term "shielding" old transactions).

How Can Users Protect Themselves?

While quantum computing is still far from being a practical threat, some simple measures can already protect users against hypothetical scenarios:

- Avoid using exposed public keys: Ensure funds sent to old wallets are transferred to new ones that use public key hashes. This reduces the risk of long-term attacks.

- Use modern wallets: Opt for wallets compatible with SegWit or Taproot, which implement better security practices.

- Monitor security updates: Stay informed about updates from the Bitcoin community, such as the implementation of BIP-360, which will introduce quantum-resistant addresses.

- Do not reuse addresses: Every transaction should be associated with a new address to minimize the risk of repeated exposure of the same public key.

- Adopt secure backup practices: Create offline backups of private keys and seeds in secure locations, protected from unauthorized access.

BIP-360 and Bitcoin’s Preparation for the Future

Even though quantum computing is still beyond practical reach, the Bitcoin community is not standing still. A concrete example is BIP-360, a proposal that establishes the technical framework to make wallets resistant to quantum attacks.

BIP-360 addresses three main pillars:

- Introduction of quantum-resistant addresses: A new address format starting with "BC1R" will be used. These addresses will be compatible with post-quantum algorithms, ensuring that stored funds are protected from future attacks.

- Compatibility with the current ecosystem: The proposal allows users to transfer funds from old addresses to new ones without requiring drastic changes to the network infrastructure.

- Flexibility for future updates: BIP-360 does not limit the choice of specific algorithms. Instead, it serves as a foundation for implementing new post-quantum algorithms as technology evolves.

This proposal demonstrates how Bitcoin can adapt to emerging threats without compromising its decentralized structure.

Post-Quantum Algorithms: The Future of Bitcoin Cryptography

The community is exploring various algorithms to protect Bitcoin from quantum attacks. Among the most discussed are:

- Falcon: A solution combining smaller public keys with compact digital signatures. Although it has been tested in limited scenarios, it still faces scalability and performance challenges.

- Sphincs: Hash-based, this algorithm is renowned for its resilience, but its signatures can be extremely large, making it less efficient for networks like Bitcoin’s blockchain.

- Lamport: Created in 1977, it’s considered one of the earliest post-quantum security solutions. Despite its reliability, its gigantic public keys (16,000 bytes) make it impractical and costly for Bitcoin.

Two technologies show great promise and are well-regarded by the community:

- Lattice-Based Cryptography: Considered one of the most promising, it uses complex mathematical structures to create systems nearly immune to quantum computing. Its implementation is still in its early stages, but the community is optimistic.

- Supersingular Elliptic Curve Isogeny: These are very recent digital signature algorithms and require extensive study and testing before being ready for practical market use.

The final choice of algorithm will depend on factors such as efficiency, cost, and integration capability with the current system. Additionally, it is preferable that these algorithms are standardized before implementation, a process that may take up to 10 years.

Why Quantum Computing Is Far from Being a Threat

The alarmist narrative about quantum computing overlooks the technical and practical challenges that still need to be overcome. Among them:

- Insufficient number of qubits: Current quantum computers have only a few hundred qubits, whereas successful attacks would require millions.

- High error rate: Quantum stability remains a barrier to reliable large-scale operations.

- High costs: Building and operating large-scale quantum computers requires massive investments, limiting their use to scientific or specific applications.

Moreover, even if quantum computers make significant advancements, Bitcoin is already adapting to ensure its infrastructure is prepared to respond.

Conclusion: Bitcoin’s Secure Future

Despite advancements in quantum computing, the reality is that Bitcoin is far from being threatened. Its security is ensured not only by its robust architecture but also by the community’s constant efforts to anticipate and mitigate challenges.

The implementation of BIP-360 and the pursuit of post-quantum algorithms demonstrate that Bitcoin is not only resilient but also proactive. By adopting practical measures, such as using modern wallets and migrating to quantum-resistant addresses, users can further protect themselves against potential threats.

Bitcoin’s future is not at risk—it is being carefully shaped to withstand any emerging technology, including quantum computing.

-

@ 8ba93868:44bdde52

2025-04-09 12:22:12

@ 8ba93868:44bdde52

2025-04-09 12:22:12primeira segunda

-

@ c631e267:c2b78d3e

2025-04-04 18:47:27

@ c631e267:c2b78d3e

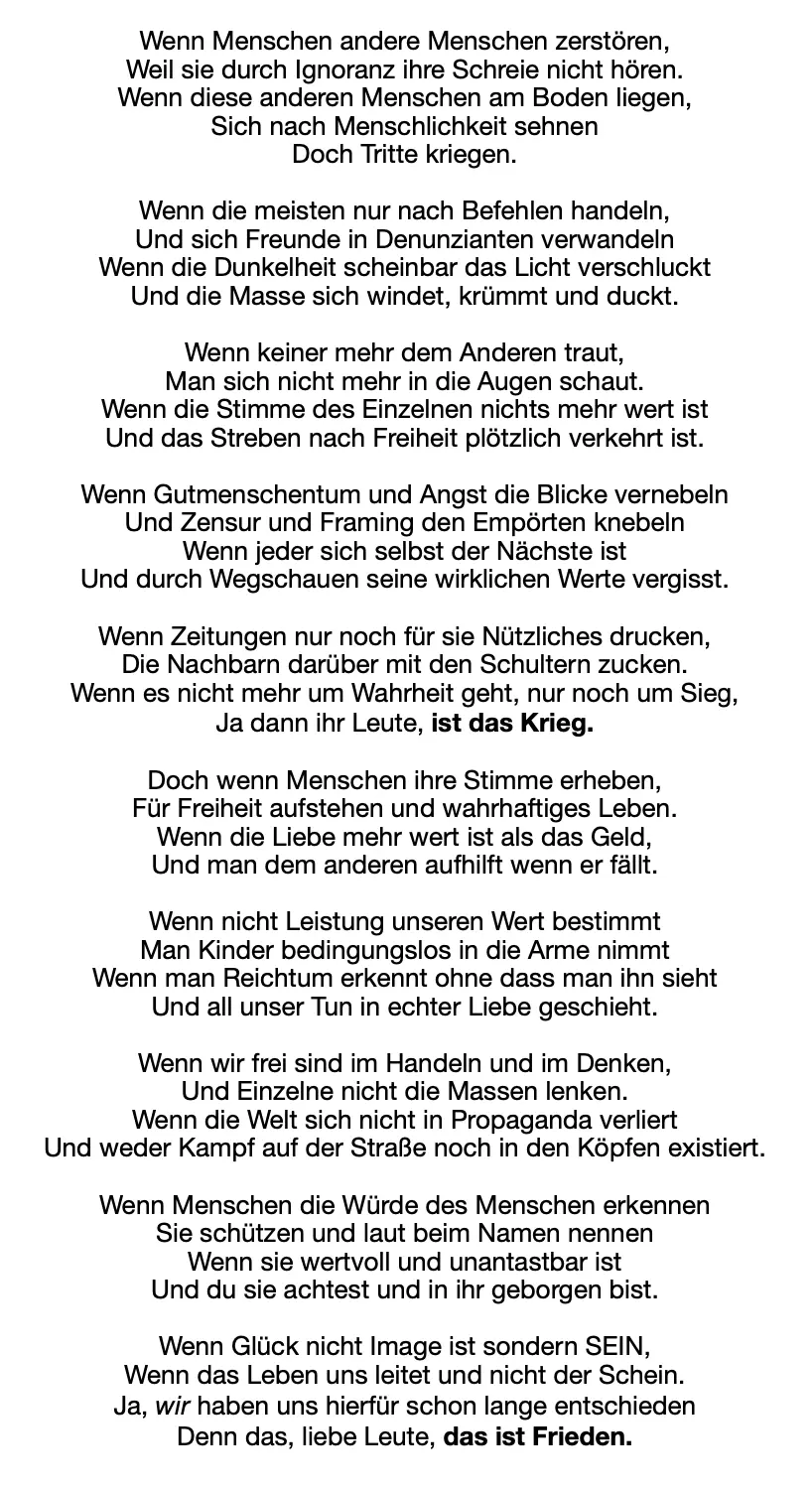

2025-04-04 18:47:27Zwei mal drei macht vier, \ widewidewitt und drei macht neune, \ ich mach mir die Welt, \ widewide wie sie mir gefällt. \ Pippi Langstrumpf

Egal, ob Koalitionsverhandlungen oder politischer Alltag: Die Kontroversen zwischen theoretisch verschiedenen Parteien verschwinden, wenn es um den Kampf gegen politische Gegner mit Rückenwind geht. Wer den Alteingesessenen die Pfründe ernsthaft streitig machen könnte, gegen den werden nicht nur «Brandmauern» errichtet, sondern der wird notfalls auch strafrechtlich verfolgt. Doppelstandards sind dabei selbstverständlich inklusive.

In Frankreich ist diese Woche Marine Le Pen wegen der Veruntreuung von EU-Geldern von einem Gericht verurteilt worden. Als Teil der Strafe wurde sie für fünf Jahre vom passiven Wahlrecht ausgeschlossen. Obwohl das Urteil nicht rechtskräftig ist – Le Pen kann in Berufung gehen –, haben die Richter das Verbot, bei Wahlen anzutreten, mit sofortiger Wirkung verhängt. Die Vorsitzende des rechtsnationalen Rassemblement National (RN) galt als aussichtsreiche Kandidatin für die Präsidentschaftswahl 2027.

Das ist in diesem Jahr bereits der zweite gravierende Fall von Wahlbeeinflussung durch die Justiz in einem EU-Staat. In Rumänien hatte Călin Georgescu im November die erste Runde der Präsidentenwahl überraschend gewonnen. Das Ergebnis wurde später annulliert, die behauptete «russische Wahlmanipulation» konnte jedoch nicht bewiesen werden. Die Kandidatur für die Wahlwiederholung im Mai wurde Georgescu kürzlich durch das Verfassungsgericht untersagt.

Die Veruntreuung öffentlicher Gelder muss untersucht und geahndet werden, das steht außer Frage. Diese Anforderung darf nicht selektiv angewendet werden. Hingegen mussten wir in der Vergangenheit bei ungleich schwerwiegenderen Fällen von (mutmaßlichem) Missbrauch ganz andere Vorgehensweisen erleben, etwa im Fall der heutigen EZB-Chefin Christine Lagarde oder im «Pfizergate»-Skandal um die Präsidentin der EU-Kommission Ursula von der Leyen.

Wenngleich derartige Angelegenheiten formal auf einer rechtsstaatlichen Grundlage beruhen mögen, so bleibt ein bitterer Beigeschmack. Es stellt sich die Frage, ob und inwieweit die Justiz politisch instrumentalisiert wird. Dies ist umso interessanter, als die Gewaltenteilung einen essenziellen Teil jeder demokratischen Ordnung darstellt, während die Bekämpfung des politischen Gegners mit juristischen Mitteln gerade bei den am lautesten rufenden Verteidigern «unserer Demokratie» populär zu sein scheint.

Die Delegationen von CDU/CSU und SPD haben bei ihren Verhandlungen über eine Regierungskoalition genau solche Maßnahmen diskutiert. «Im Namen der Wahrheit und der Demokratie» möchte man noch härter gegen «Desinformation» vorgehen und dafür zum Beispiel den Digital Services Act der EU erweitern. Auch soll der Tatbestand der Volksverhetzung verschärft werden – und im Entzug des passiven Wahlrechts münden können. Auf europäischer Ebene würde Friedrich Merz wohl gerne Ungarn das Stimmrecht entziehen.

Der Pegel an Unzufriedenheit und Frustration wächst in großen Teilen der Bevölkerung kontinuierlich. Arroganz, Machtmissbrauch und immer abstrusere Ausreden für offensichtlich willkürliche Maßnahmen werden kaum verhindern, dass den etablierten Parteien die Unterstützung entschwindet. In Deutschland sind die Umfrageergebnisse der AfD ein guter Gradmesser dafür.

[Vorlage Titelbild: Pixabay]

Dieser Beitrag wurde mit dem Pareto-Client geschrieben und ist zuerst auf Transition News erschienen.

-

@ 6152ca12:e3742e80

2025-04-09 11:53:16

@ 6152ca12:e3742e80

2025-04-09 11:53:16Uau estou aprendendo isso parece complicado mas vamos la; aos pouco pego o jeito hehe

-

@ c631e267:c2b78d3e

2025-04-03 07:42:25

@ c631e267:c2b78d3e

2025-04-03 07:42:25Spanien bleibt einer der Vorreiter im europäischen Prozess der totalen Überwachung per Digitalisierung. Seit Mittwoch ist dort der digitale Personalausweis verfügbar. Dabei handelt es sich um eine Regierungs-App, die auf dem Smartphone installiert werden muss und in den Stores von Google und Apple zu finden ist. Per Dekret von Regierungschef Pedro Sánchez und Zustimmung des Ministerrats ist diese Maßnahme jetzt in Kraft getreten.

Mit den üblichen Argumenten der Vereinfachung, des Komforts, der Effizienz und der Sicherheit preist das Innenministerium die «Innovation» an. Auch die Beteuerung, dass die digitale Variante parallel zum physischen Ausweis existieren wird und diesen nicht ersetzen soll, fehlt nicht. Während der ersten zwölf Monate wird «der Neue» noch nicht für alle Anwendungsfälle gültig sein, ab 2026 aber schon.

Dass die ganze Sache auch «Risiken und Nebenwirkungen» haben könnte, wird in den Mainstream-Medien eher selten thematisiert. Bestenfalls wird der Aspekt der Datensicherheit angesprochen, allerdings in der Regel direkt mit dem Regierungsvokabular von den «maximalen Sicherheitsgarantien» abgehandelt. Dennoch gibt es einige weitere Aspekte, die Bürger mit etwas Sinn für Privatsphäre bedenken sollten.

Um sich die digitale Version des nationalen Ausweises besorgen zu können (eine App mit dem Namen MiDNI), muss man sich vorab online registrieren. Dabei wird die Identität des Bürgers mit seiner mobilen Telefonnummer verknüpft. Diese obligatorische fixe Verdrahtung kennen wir von diversen anderen Apps und Diensten. Gleichzeitig ist das die Basis für eine perfekte Lokalisierbarkeit der Person.

Für jeden Vorgang der Identifikation in der Praxis wird später «eine Verbindung zu den Servern der Bundespolizei aufgebaut». Die Daten des Individuums werden «in Echtzeit» verifiziert und im Erfolgsfall von der Polizei signiert zurückgegeben. Das Ergebnis ist ein QR-Code mit zeitlich begrenzter Gültigkeit, der an Dritte weitergegeben werden kann.

Bei derartigen Szenarien sträuben sich einem halbwegs kritischen Staatsbürger die Nackenhaare. Allein diese minimale Funktionsbeschreibung lässt die totale Überwachung erkennen, die damit ermöglicht wird. Jede Benutzung des Ausweises wird künftig registriert, hinterlässt also Spuren. Und was ist, wenn die Server der Polizei einmal kein grünes Licht geben? Das wäre spätestens dann ein Problem, wenn der digitale doch irgendwann der einzig gültige Ausweis ist: Dann haben wir den abschaltbaren Bürger.

Dieser neue Vorstoß der Regierung von Pedro Sánchez ist ein weiterer Schritt in Richtung der «totalen Digitalisierung» des Landes, wie diese Politik in manchen Medien – nicht einmal kritisch, sondern sehr naiv – genannt wird. Ebenso verharmlosend wird auch erwähnt, dass sich das spanische Projekt des digitalen Ausweises nahtlos in die Initiativen der EU zu einer digitalen Identität für alle Bürger sowie des digitalen Euro einreiht.

In Zukunft könnte der neue Ausweis «auch in andere staatliche und private digitale Plattformen integriert werden», wie das Medienportal Cope ganz richtig bemerkt. Das ist die Perspektive.

[Titelbild: Pixabay]

Dazu passend:

Nur Abschied vom Alleinfahren? Monströse spanische Überwachungsprojekte gemäß EU-Norm

Dieser Beitrag wurde mit dem Pareto-Client geschrieben und ist zuerst auf Transition News erschienen.

-

@ eac63075:b4988b48

2024-11-09 17:57:27

@ eac63075:b4988b48

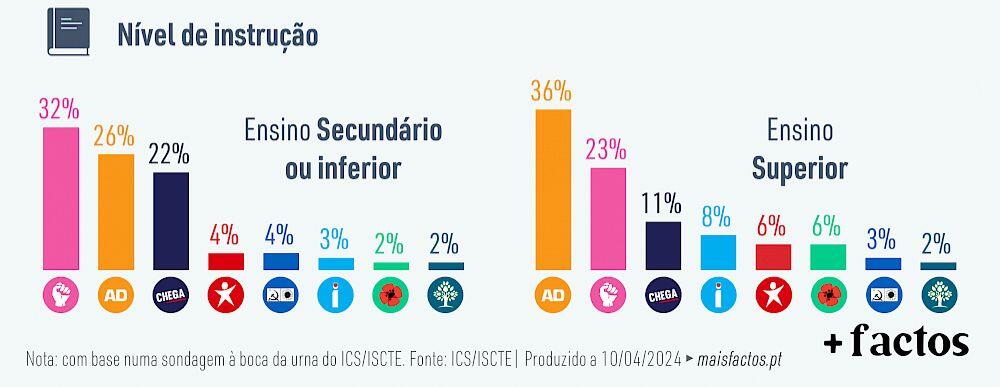

2024-11-09 17:57:27Based on a recent paper that included collaboration from renowned experts such as Lynn Alden, Steve Lee, and Ren Crypto Fish, we discuss in depth how Bitcoin's consensus is built, the main risks, and the complex dynamics of protocol upgrades.

Podcast https://www.fountain.fm/episode/wbjD6ntQuvX5u2G5BccC

Presentation https://gamma.app/docs/Analyzing-Bitcoin-Consensus-Risks-in-Protocol-Upgrades-p66axxjwaa37ksn

1. Introduction to Consensus in Bitcoin

Consensus in Bitcoin is the foundation that keeps the network secure and functional, allowing users worldwide to perform transactions in a decentralized manner without the need for intermediaries. Since its launch in 2009, Bitcoin is often described as an "immutable" system designed to resist changes, and it is precisely this resistance that ensures its security and stability.

The central idea behind consensus in Bitcoin is to create a set of acceptance rules for blocks and transactions, ensuring that all network participants agree on the transaction history. This prevents "double-spending," where the same bitcoin could be used in two simultaneous transactions, something that would compromise trust in the network.

Evolution of Consensus in Bitcoin

Over the years, consensus in Bitcoin has undergone several adaptations, and the way participants agree on changes remains a delicate process. Unlike traditional systems, where changes can be imposed from the top down, Bitcoin operates in a decentralized model where any significant change needs the support of various groups of stakeholders, including miners, developers, users, and large node operators.

Moreover, the update process is extremely cautious, as hasty changes can compromise the network's security. As a result, the philosophy of "don't fix what isn't broken" prevails, with improvements happening incrementally and only after broad consensus among those involved. This model can make progress seem slow but ensures that Bitcoin remains faithful to the principles of security and decentralization.

2. Technical Components of Consensus

Bitcoin's consensus is supported by a set of technical rules that determine what is considered a valid transaction and a valid block on the network. These technical aspects ensure that all nodes—the computers that participate in the Bitcoin network—agree on the current state of the blockchain. Below are the main technical components that form the basis of the consensus.

Validation of Blocks and Transactions

The validation of blocks and transactions is the central point of consensus in Bitcoin. A block is only considered valid if it meets certain criteria, such as maximum size, transaction structure, and the solving of the "Proof of Work" problem. The proof of work, required for a block to be included in the blockchain, is a computational process that ensures the block contains significant computational effort—protecting the network against manipulation attempts.

Transactions, in turn, need to follow specific input and output rules. Each transaction includes cryptographic signatures that prove the ownership of the bitcoins sent, as well as validation scripts that verify if the transaction conditions are met. This validation system is essential for network nodes to autonomously confirm that each transaction follows the rules.

Chain Selection

Another fundamental technical issue for Bitcoin's consensus is chain selection, which becomes especially important in cases where multiple versions of the blockchain coexist, such as after a network split (fork). To decide which chain is the "true" one and should be followed, the network adopts the criterion of the highest accumulated proof of work. In other words, the chain with the highest number of valid blocks, built with the greatest computational effort, is chosen by the network as the official one.

This criterion avoids permanent splits because it encourages all nodes to follow the same main chain, reinforcing consensus.

Soft Forks vs. Hard Forks

In the consensus process, protocol changes can happen in two ways: through soft forks or hard forks. These variations affect not only the protocol update but also the implications for network users:

-

Soft Forks: These are changes that are backward compatible. Only nodes that adopt the new update will follow the new rules, but old nodes will still recognize the blocks produced with these rules as valid. This compatibility makes soft forks a safer option for updates, as it minimizes the risk of network division.

-

Hard Forks: These are updates that are not backward compatible, requiring all nodes to update to the new version or risk being separated from the main chain. Hard forks can result in the creation of a new coin, as occurred with the split between Bitcoin and Bitcoin Cash in 2017. While hard forks allow for deeper changes, they also bring significant risks of network fragmentation.

These technical components form the base of Bitcoin's security and resilience, allowing the system to remain functional and immutable without losing the necessary flexibility to evolve over time.

3. Stakeholders in Bitcoin's Consensus

Consensus in Bitcoin is not decided centrally. On the contrary, it depends on the interaction between different groups of stakeholders, each with their motivations, interests, and levels of influence. These groups play fundamental roles in how changes are implemented or rejected on the network. Below, we explore the six main stakeholders in Bitcoin's consensus.

1. Economic Nodes

Economic nodes, usually operated by exchanges, custody providers, and large companies that accept Bitcoin, exert significant influence over consensus. Because they handle large volumes of transactions and act as a connection point between the Bitcoin ecosystem and the traditional financial system, these nodes have the power to validate or reject blocks and to define which version of the software to follow in case of a fork.

Their influence is proportional to the volume of transactions they handle, and they can directly affect which chain will be seen as the main one. Their incentive is to maintain the network's stability and security to preserve its functionality and meet regulatory requirements.

2. Investors

Investors, including large institutional funds and individual Bitcoin holders, influence consensus indirectly through their impact on the asset's price. Their buying and selling actions can affect Bitcoin's value, which in turn influences the motivation of miners and other stakeholders to continue investing in the network's security and development.

Some institutional investors have agreements with custodians that may limit their ability to act in network split situations. Thus, the impact of each investor on consensus can vary based on their ownership structure and how quickly they can react to a network change.

3. Media Influencers

Media influencers, including journalists, analysts, and popular personalities on social media, have a powerful role in shaping public opinion about Bitcoin and possible updates. These influencers can help educate the public, promote debates, and bring transparency to the consensus process.

On the other hand, the impact of influencers can be double-edged: while they can clarify complex topics, they can also distort perceptions by amplifying or minimizing change proposals. This makes them a force both of support and resistance to consensus.

4. Miners

Miners are responsible for validating transactions and including blocks in the blockchain. Through computational power (hashrate), they also exert significant influence over consensus decisions. In update processes, miners often signal their support for a proposal, indicating that the new version is safe to use. However, this signaling is not always definitive, and miners can change their position if they deem it necessary.

Their incentive is to maximize returns from block rewards and transaction fees, as well as to maintain the value of investments in their specialized equipment, which are only profitable if the network remains stable.

5. Protocol Developers

Protocol developers, often called "Core Developers," are responsible for writing and maintaining Bitcoin's code. Although they do not have direct power over consensus, they possess an informal veto power since they decide which changes are included in the main client (Bitcoin Core). This group also serves as an important source of technical knowledge, helping guide decisions and inform other stakeholders.

Their incentive lies in the continuous improvement of the network, ensuring security and decentralization. Many developers are funded by grants and sponsorships, but their motivations generally include a strong ideological commitment to Bitcoin's principles.

6. Users and Application Developers

This group includes people who use Bitcoin in their daily transactions and developers who build solutions based on the network, such as wallets, exchanges, and payment platforms. Although their power in consensus is less than that of miners or economic nodes, they play an important role because they are responsible for popularizing Bitcoin's use and expanding the ecosystem.

If application developers decide not to adopt an update, this can affect compatibility and widespread acceptance. Thus, they indirectly influence consensus by deciding which version of the protocol to follow in their applications.

These stakeholders are vital to the consensus process, and each group exerts influence according to their involvement, incentives, and ability to act in situations of change. Understanding the role of each makes it clearer how consensus is formed and why it is so difficult to make significant changes to Bitcoin.

4. Mechanisms for Activating Updates in Bitcoin

For Bitcoin to evolve without compromising security and consensus, different mechanisms for activating updates have been developed over the years. These mechanisms help coordinate changes among network nodes to minimize the risk of fragmentation and ensure that updates are implemented in an orderly manner. Here, we explore some of the main methods used in Bitcoin, their advantages and disadvantages, as well as historical examples of significant updates.

Flag Day

The Flag Day mechanism is one of the simplest forms of activating changes. In it, a specific date or block is determined as the activation moment, and all nodes must be updated by that point. This method does not involve prior signaling; participants simply need to update to the new software version by the established day or block.

-

Advantages: Simplicity and predictability are the main benefits of Flag Day, as everyone knows the exact activation date.

-

Disadvantages: Inflexibility can be a problem because there is no way to adjust the schedule if a significant part of the network has not updated. This can result in network splits if a significant number of nodes are not ready for the update.

An example of Flag Day was the Pay to Script Hash (P2SH) update in 2012, which required all nodes to adopt the change to avoid compatibility issues.

BIP34 and BIP9

BIP34 introduced a more dynamic process, in which miners increase the version number in block headers to signal the update. When a predetermined percentage of the last blocks is mined with this new version, the update is automatically activated. This model later evolved with BIP9, which allowed multiple updates to be signaled simultaneously through "version bits," each corresponding to a specific change.

-

Advantages: Allows the network to activate updates gradually, giving more time for participants to adapt.

-

Disadvantages: These methods rely heavily on miner support, which means that if a sufficient number of miners do not signal the update, it can be delayed or not implemented.

BIP9 was used in the activation of SegWit (BIP141) but faced challenges because some miners did not signal their intent to activate, leading to the development of new mechanisms.

User Activated Soft Forks (UASF) and User Resisted Soft Forks (URSF)

To increase the decision-making power of ordinary users, the concept of User Activated Soft Fork (UASF) was introduced, allowing node operators, not just miners, to determine consensus for a change. In this model, nodes set a date to start rejecting blocks that are not in compliance with the new update, forcing miners to adapt or risk having their blocks rejected by the network.

URSF, in turn, is a model where nodes reject blocks that attempt to adopt a specific update, functioning as resistance against proposed changes.

-

Advantages: UASF returns decision-making power to node operators, ensuring that changes do not depend solely on miners.

-

Disadvantages: Both UASF and URSF can generate network splits, especially in cases of strong opposition among different stakeholders.

An example of UASF was the activation of SegWit in 2017, where users supported activation independently of miner signaling, which ended up forcing its adoption.

BIP8 (LOT=True)

BIP8 is an evolution of BIP9, designed to prevent miners from indefinitely blocking a change desired by the majority of users and developers. BIP8 allows setting a parameter called "lockinontimeout" (LOT) as true, which means that if the update has not been fully signaled by a certain point, it is automatically activated.

-

Advantages: Ensures that changes with broad support among users are not blocked by miners who wish to maintain the status quo.

-

Disadvantages: Can lead to network splits if miners or other important stakeholders do not support the update.

Although BIP8 with LOT=True has not yet been used in Bitcoin, it is a proposal that can be applied in future updates if necessary.

These activation mechanisms have been essential for Bitcoin's development, allowing updates that keep the network secure and functional. Each method brings its own advantages and challenges, but all share the goal of preserving consensus and network cohesion.

5. Risks and Considerations in Consensus Updates

Consensus updates in Bitcoin are complex processes that involve not only technical aspects but also political, economic, and social considerations. Due to the network's decentralized nature, each change brings with it a set of risks that need to be carefully assessed. Below, we explore some of the main challenges and future scenarios, as well as the possible impacts on stakeholders.

Network Fragility with Alternative Implementations

One of the main risks associated with consensus updates is the possibility of network fragmentation when there are alternative software implementations. If an update is implemented by a significant group of nodes but rejected by others, a network split (fork) can occur. This creates two competing chains, each with a different version of the transaction history, leading to unpredictable consequences for users and investors.

Such fragmentation weakens Bitcoin because, by dividing hashing power (computing) and coin value, it reduces network security and investor confidence. A notable example of this risk was the fork that gave rise to Bitcoin Cash in 2017 when disagreements over block size resulted in a new chain and a new asset.

Chain Splits and Impact on Stakeholders

Chain splits are a significant risk in update processes, especially in hard forks. During a hard fork, the network is split into two separate chains, each with its own set of rules. This results in the creation of a new coin and leaves users with duplicated assets on both chains. While this may seem advantageous, in the long run, these splits weaken the network and create uncertainties for investors.

Each group of stakeholders reacts differently to a chain split:

-

Institutional Investors and ETFs: Face regulatory and compliance challenges because many of these assets are managed under strict regulations. The creation of a new coin requires decisions to be made quickly to avoid potential losses, which may be hampered by regulatory constraints.

-

Miners: May be incentivized to shift their computing power to the chain that offers higher profitability, which can weaken one of the networks.

-

Economic Nodes: Such as major exchanges and custody providers, have to quickly choose which chain to support, influencing the perceived value of each network.

Such divisions can generate uncertainties and loss of value, especially for institutional investors and those who use Bitcoin as a store of value.

Regulatory Impacts and Institutional Investors

With the growing presence of institutional investors in Bitcoin, consensus changes face new compliance challenges. Bitcoin ETFs, for example, are required to follow strict rules about which assets they can include and how chain split events should be handled. The creation of a new asset or migration to a new chain can complicate these processes, creating pressure for large financial players to quickly choose a chain, affecting the stability of consensus.

Moreover, decisions regarding forks can influence the Bitcoin futures and derivatives market, affecting perception and adoption by new investors. Therefore, the need to avoid splits and maintain cohesion is crucial to attract and preserve the confidence of these investors.

Security Considerations in Soft Forks and Hard Forks

While soft forks are generally preferred in Bitcoin for their backward compatibility, they are not without risks. Soft forks can create different classes of nodes on the network (updated and non-updated), which increases operational complexity and can ultimately weaken consensus cohesion. In a network scenario with fragmentation of node classes, Bitcoin's security can be affected, as some nodes may lose part of the visibility over updated transactions or rules.

In hard forks, the security risk is even more evident because all nodes need to adopt the new update to avoid network division. Experience shows that abrupt changes can create temporary vulnerabilities, in which malicious agents try to exploit the transition to attack the network.

Bounty Claim Risks and Attack Scenarios

Another risk in consensus updates are so-called "bounty claims"—accumulated rewards that can be obtained if an attacker manages to split or deceive a part of the network. In a conflict scenario, a group of miners or nodes could be incentivized to support a new update or create an alternative version of the software to benefit from these rewards.

These risks require stakeholders to carefully assess each update and the potential vulnerabilities it may introduce. The possibility of "bounty claims" adds a layer of complexity to consensus because each interest group may see a financial opportunity in a change that, in the long term, may harm network stability.

The risks discussed above show the complexity of consensus in Bitcoin and the importance of approaching it gradually and deliberately. Updates need to consider not only technical aspects but also economic and social implications, in order to preserve Bitcoin's integrity and maintain trust among stakeholders.

6. Recommendations for the Consensus Process in Bitcoin

To ensure that protocol changes in Bitcoin are implemented safely and with broad support, it is essential that all stakeholders adopt a careful and coordinated approach. Here are strategic recommendations for evaluating, supporting, or rejecting consensus updates, considering the risks and challenges discussed earlier, along with best practices for successful implementation.

1. Careful Evaluation of Proposal Maturity

Stakeholders should rigorously assess the maturity level of a proposal before supporting its implementation. Updates that are still experimental or lack a robust technical foundation can expose the network to unnecessary risks. Ideally, change proposals should go through an extensive testing phase, have security audits, and receive review and feedback from various developers and experts.

2. Extensive Testing in Secure and Compatible Networks

Before an update is activated on the mainnet, it is essential to test it on networks like testnet and signet, and whenever possible, on other compatible networks that offer a safe and controlled environment to identify potential issues. Testing on networks like Litecoin was fundamental for the safe launch of innovations like SegWit and the Lightning Network, allowing functionalities to be validated on a lower-impact network before being implemented on Bitcoin.

The Liquid Network, developed by Blockstream, also plays an important role as an experimental network for new proposals, such as OP_CAT. By adopting these testing environments, stakeholders can mitigate risks and ensure that the update is reliable and secure before being adopted by the main network.

3. Importance of Stakeholder Engagement

The success of a consensus update strongly depends on the active participation of all stakeholders. This includes economic nodes, miners, protocol developers, investors, and end users. Lack of participation can lead to inadequate decisions or even future network splits, which would compromise Bitcoin's security and stability.

4. Key Questions for Evaluating Consensus Proposals

To assist in decision-making, each group of stakeholders should consider some key questions before supporting a consensus change:

- Does the proposal offer tangible benefits for Bitcoin's security, scalability, or usability?

- Does it maintain backward compatibility or introduce the risk of network split?

- Are the implementation requirements clear and feasible for each group involved?

- Are there clear and aligned incentives for all stakeholder groups to accept the change?

5. Coordination and Timing in Implementations

Timing is crucial. Updates with short activation windows can force a split because not all nodes and miners can update simultaneously. Changes should be planned with ample deadlines to allow all stakeholders to adjust their systems, avoiding surprises that could lead to fragmentation.

Mechanisms like soft forks are generally preferable to hard forks because they allow a smoother transition. Opting for backward-compatible updates when possible facilitates the process and ensures that nodes and miners can adapt without pressure.

6. Continuous Monitoring and Re-evaluation

After an update, it's essential to monitor the network to identify problems or side effects. This continuous process helps ensure cohesion and trust among all participants, keeping Bitcoin as a secure and robust network.

These recommendations, including the use of secure networks for extensive testing, promote a collaborative and secure environment for Bitcoin's consensus process. By adopting a deliberate and strategic approach, stakeholders can preserve Bitcoin's value as a decentralized and censorship-resistant network.

7. Conclusion

Consensus in Bitcoin is more than a set of rules; it's the foundation that sustains the network as a decentralized, secure, and reliable system. Unlike centralized systems, where decisions can be made quickly, Bitcoin requires a much more deliberate and cooperative approach, where the interests of miners, economic nodes, developers, investors, and users must be considered and harmonized. This governance model may seem slow, but it is fundamental to preserving the resilience and trust that make Bitcoin a global store of value and censorship-resistant.

Consensus updates in Bitcoin must balance the need for innovation with the preservation of the network's core principles. The development process of a proposal needs to be detailed and rigorous, going through several testing stages, such as in testnet, signet, and compatible networks like Litecoin and Liquid Network. These networks offer safe environments for proposals to be analyzed and improved before being launched on the main network.

Each proposed change must be carefully evaluated regarding its maturity, impact, backward compatibility, and support among stakeholders. The recommended key questions and appropriate timing are critical to ensure that an update is adopted without compromising network cohesion. It's also essential that the implementation process is continuously monitored and re-evaluated, allowing adjustments as necessary and minimizing the risk of instability.

By following these guidelines, Bitcoin's stakeholders can ensure that the network continues to evolve safely and robustly, maintaining user trust and further solidifying its role as one of the most resilient and innovative digital assets in the world. Ultimately, consensus in Bitcoin is not just a technical issue but a reflection of its community and the values it represents: security, decentralization, and resilience.

8. Links

Whitepaper: https://github.com/bitcoin-cap/bcap

Youtube (pt-br): https://www.youtube.com/watch?v=rARycAibl9o&list=PL-qnhF0qlSPkfhorqsREuIu4UTbF0h4zb

-

-

@ aa8de34f:a6ffe696

2025-03-31 21:48:50

@ aa8de34f:a6ffe696

2025-03-31 21:48:50In seinem Beitrag vom 30. März 2025 fragt Henning Rosenbusch auf Telegram angesichts zunehmender digitaler Kontrolle und staatlicher Allmacht:

„Wie soll sich gegen eine solche Tyrannei noch ein Widerstand formieren können, selbst im Untergrund? Sehe ich nicht.“\ (Quelle: t.me/rosenbusch/25228)

Er beschreibt damit ein Gefühl der Ohnmacht, das viele teilen: Eine Welt, in der Totalitarismus nicht mehr mit Panzern, sondern mit Algorithmen kommt. Wo Zugriff auf Geld, Meinungsfreiheit und Teilhabe vom Wohlverhalten abhängt. Der Bürger als kontrollierbare Variable im Code des Staates.\ Die Frage ist berechtigt. Doch die Antwort darauf liegt nicht in alten Widerstandsbildern – sondern in einer neuen Realität.

-- Denn es braucht keinen Untergrund mehr. --

Der Widerstand der Zukunft trägt keinen Tarnanzug. Er ist nicht konspirativ, sondern transparent. Nicht bewaffnet, sondern mathematisch beweisbar. Bitcoin steht nicht am Rand dieser Entwicklung – es ist ihr Fundament. Eine Bastion aus physikalischer Realität, spieltheoretischem Schutz und ökonomischer Wahrheit. Es ist nicht unfehlbar, aber unbestechlich. Nicht perfekt, aber immun gegen zentrale Willkür.

Hier entsteht kein „digitales Gegenreich“, sondern eine dezentrale Renaissance. Keine Revolte aus Wut, sondern eine stille Abkehr: von Zwang zu Freiwilligkeit, von Abhängigkeit zu Selbstverantwortung. Diese Revolution führt keine Kriege. Sie braucht keine Führer. Sie ist ein Netzwerk. Jeder Knoten ein Individuum. Jede Entscheidung ein Akt der Selbstermächtigung.

Weltweit wachsen Freiheits-Zitadellen aus dieser Idee: wirtschaftlich autark, digital souverän, lokal verankert und global vernetzt. Sie sind keine Utopien im luftleeren Raum, sondern konkrete Realitäten – angetrieben von Energie, Code und dem menschlichen Wunsch nach Würde.

Der Globalismus alter Prägung – zentralistisch, monopolistisch, bevormundend – wird an seiner eigenen Hybris zerbrechen. Seine Werkzeuge der Kontrolle werden ihn nicht retten. Im Gegenteil: Seine Geister werden ihn verfolgen und erlegen.

Und während die alten Mächte um Erhalt kämpfen, wächst eine neue Welt – nicht im Schatten, sondern im Offenen. Nicht auf Gewalt gebaut, sondern auf Mathematik, Physik und Freiheit.

Die Tyrannei sieht keinen Widerstand.\ Weil sie nicht erkennt, dass er längst begonnen hat.\ Unwiderruflich. Leise. Überall.

-

@ eac63075:b4988b48

2024-10-26 22:14:19

@ eac63075:b4988b48

2024-10-26 22:14:19The future of physical money is at stake, and the discussion about DREX, the new digital currency planned by the Central Bank of Brazil, is gaining momentum. In a candid and intense conversation, Federal Deputy Julia Zanatta (PL/SC) discussed the challenges and risks of this digital transition, also addressing her Bill No. 3,341/2024, which aims to prevent the extinction of physical currency. This bill emerges as a direct response to legislative initiatives seeking to replace physical money with digital alternatives, limiting citizens' options and potentially compromising individual freedom. Let's delve into the main points of this conversation.

https://www.fountain.fm/episode/i5YGJ9Ors3PkqAIMvNQ0

What is a CBDC?

Before discussing the specifics of DREX, it’s important to understand what a CBDC (Central Bank Digital Currency) is. CBDCs are digital currencies issued by central banks, similar to a digital version of physical money. Unlike cryptocurrencies such as Bitcoin, which operate in a decentralized manner, CBDCs are centralized and regulated by the government. In other words, they are digital currencies created and controlled by the Central Bank, intended to replace physical currency.

A prominent feature of CBDCs is their programmability. This means that the government can theoretically set rules about how, where, and for what this currency can be used. This aspect enables a level of control over citizens' finances that is impossible with physical money. By programming the currency, the government could limit transactions by setting geographical or usage restrictions. In practice, money within a CBDC could be restricted to specific spending or authorized for use in a defined geographical area.

In countries like China, where citizen actions and attitudes are also monitored, a person considered to have a "low score" due to a moral or ideological violation may have their transactions limited to essential purchases, restricting their digital currency use to non-essential activities. This financial control is strengthened because, unlike physical money, digital currency cannot be exchanged anonymously.

Practical Example: The Case of DREX During the Pandemic

To illustrate how DREX could be used, an example was given by Eric Altafim, director of Banco Itaú. He suggested that, if DREX had existed during the COVID-19 pandemic, the government could have restricted the currency’s use to a 5-kilometer radius around a person’s residence, limiting their economic mobility. Another proposed use by the executive related to the Bolsa Família welfare program: the government could set up programming that only allows this benefit to be used exclusively for food purchases. Although these examples are presented as control measures for safety or organization, they demonstrate how much a CBDC could restrict citizens' freedom of choice.

To illustrate the potential for state control through a Central Bank Digital Currency (CBDC), such as DREX, it is helpful to look at the example of China. In China, the implementation of a CBDC coincides with the country’s Social Credit System, a governmental surveillance tool that assesses citizens' and companies' behavior. Together, these technologies allow the Chinese government to monitor, reward, and, above all, punish behavior deemed inappropriate or threatening to the government.

How Does China's Social Credit System Work?

Implemented in 2014, China's Social Credit System assigns every citizen and company a "score" based on various factors, including financial behavior, criminal record, social interactions, and even online activities. This score determines the benefits or penalties each individual receives and can affect everything from public transport access to obtaining loans and enrolling in elite schools for their children. Citizens with low scores may face various sanctions, including travel restrictions, fines, and difficulty in securing loans.

With the adoption of the CBDC — or “digital yuan” — the Chinese government now has a new tool to closely monitor citizens' financial transactions, facilitating the application of Social Credit System penalties. China’s CBDC is a programmable digital currency, which means that the government can restrict how, when, and where the money can be spent. Through this level of control, digital currency becomes a powerful mechanism for influencing citizens' behavior.

Imagine, for instance, a citizen who repeatedly posts critical remarks about the government on social media or participates in protests. If the Social Credit System assigns this citizen a low score, the Chinese government could, through the CBDC, restrict their money usage in certain areas or sectors. For example, they could be prevented from buying tickets to travel to other regions, prohibited from purchasing certain consumer goods, or even restricted to making transactions only at stores near their home.

Another example of how the government can use the CBDC to enforce the Social Credit System is by monitoring purchases of products such as alcohol or luxury items. If a citizen uses the CBDC to spend more than the government deems reasonable on such products, this could negatively impact their social score, resulting in additional penalties such as future purchase restrictions or a lowered rating that impacts their personal and professional lives.

In China, this kind of control has already been demonstrated in several cases. Citizens added to Social Credit System “blacklists” have seen their spending and investment capacity severely limited. The combination of digital currency and social scores thus creates a sophisticated and invasive surveillance system, through which the Chinese government controls important aspects of citizens’ financial lives and individual freedoms.

Deputy Julia Zanatta views these examples with great concern. She argues that if the state has full control over digital money, citizens will be exposed to a level of economic control and surveillance never seen before. In a democracy, this control poses a risk, but in an authoritarian regime, it could be used as a powerful tool of repression.

DREX and Bill No. 3,341/2024

Julia Zanatta became aware of a bill by a Workers' Party (PT) deputy (Bill 4068/2020 by Deputy Reginaldo Lopes - PT/MG) that proposes the extinction of physical money within five years, aiming for a complete transition to DREX, the digital currency developed by the Central Bank of Brazil. Concerned about the impact of this measure, Julia drafted her bill, PL No. 3,341/2024, which prohibits the elimination of physical money, ensuring citizens the right to choose physical currency.

“The more I read about DREX, the less I want its implementation,” says the deputy. DREX is a Central Bank Digital Currency (CBDC), similar to other state digital currencies worldwide, but which, according to Julia, carries extreme control risks. She points out that with DREX, the State could closely monitor each citizen’s transactions, eliminating anonymity and potentially restricting freedom of choice. This control would lie in the hands of the Central Bank, which could, in a crisis or government change, “freeze balances or even delete funds directly from user accounts.”

Risks and Individual Freedom

Julia raises concerns about potential abuses of power that complete digitalization could allow. In a democracy, state control over personal finances raises serious questions, and EddieOz warns of an even more problematic future. “Today we are in a democracy, but tomorrow, with a government transition, we don't know if this kind of power will be used properly or abused,” he states. In other words, DREX gives the State the ability to restrict or condition the use of money, opening the door to unprecedented financial surveillance.

EddieOz cites Nigeria as an example, where a CBDC was implemented, and the government imposed severe restrictions on the use of physical money to encourage the use of digital currency, leading to protests and clashes in the country. In practice, the poorest and unbanked — those without regular access to banking services — were harshly affected, as without physical money, many cannot conduct basic transactions. Julia highlights that in Brazil, this situation would be even more severe, given the large number of unbanked individuals and the extent of rural areas where access to technology is limited.

The Relationship Between DREX and Pix

The digital transition has already begun with Pix, which revolutionized instant transfers and payments in Brazil. However, Julia points out that Pix, though popular, is a citizen’s choice, while DREX tends to eliminate that choice. The deputy expresses concern about new rules suggested for Pix, such as daily transaction limits of a thousand reais, justified as anti-fraud measures but which, in her view, represent additional control and a profit opportunity for banks. “How many more rules will banks create to profit from us?” asks Julia, noting that DREX could further enhance control over personal finances.

International Precedents and Resistance to CBDC

The deputy also cites examples from other countries resisting the idea of a centralized digital currency. In the United States, states like New Hampshire have passed laws to prevent the advance of CBDCs, and leaders such as Donald Trump have opposed creating a national digital currency. Trump, addressing the topic, uses a justification similar to Julia’s: in a digitalized system, “with one click, your money could disappear.” She agrees with the warning, emphasizing the control risk that a CBDC represents, especially for countries with disadvantaged populations.

Besides the United States, Canada, Colombia, and Australia have also suspended studies on digital currencies, citing the need for further discussions on population impacts. However, in Brazil, the debate on DREX is still limited, with few parliamentarians and political leaders openly discussing the topic. According to Julia, only she and one or two deputies are truly trying to bring this discussion to the Chamber, making DREX’s advance even more concerning.

Bill No. 3,341/2024 and Popular Pressure

For Julia, her bill is a first step. Although she acknowledges that ideally, it would prevent DREX's implementation entirely, PL 3341/2024 is a measure to ensure citizens' choice to use physical money, preserving a form of individual freedom. “If the future means control, I prefer to live in the past,” Julia asserts, reinforcing that the fight for freedom is at the heart of her bill.

However, the deputy emphasizes that none of this will be possible without popular mobilization. According to her, popular pressure is crucial for other deputies to take notice and support PL 3341. “I am only one deputy, and we need the public’s support to raise the project’s visibility,” she explains, encouraging the public to press other parliamentarians and ask them to “pay attention to PL 3341 and the project that prohibits the end of physical money.” The deputy believes that with a strong awareness and pressure movement, it is possible to advance the debate and ensure Brazilians’ financial freedom.

What’s at Stake?

Julia Zanatta leaves no doubt: DREX represents a profound shift in how money will be used and controlled in Brazil. More than a simple modernization of the financial system, the Central Bank’s CBDC sets precedents for an unprecedented level of citizen surveillance and control in the country. For the deputy, this transition needs to be debated broadly and transparently, and it’s up to the Brazilian people to defend their rights and demand that the National Congress discuss these changes responsibly.

The deputy also emphasizes that, regardless of political or partisan views, this issue affects all Brazilians. “This agenda is something that will affect everyone. We need to be united to ensure people understand the gravity of what could happen.” Julia believes that by sharing information and generating open debate, it is possible to prevent Brazil from following the path of countries that have already implemented a digital currency in an authoritarian way.

A Call to Action

The future of physical money in Brazil is at risk. For those who share Deputy Julia Zanatta’s concerns, the time to act is now. Mobilize, get informed, and press your representatives. PL 3341/2024 is an opportunity to ensure that Brazilian citizens have a choice in how to use their money, without excessive state interference or surveillance.

In the end, as the deputy puts it, the central issue is freedom. “My fear is that this project will pass, and people won’t even understand what is happening.” Therefore, may every citizen at least have the chance to understand what’s at stake and make their voice heard in defense of a Brazil where individual freedom and privacy are respected values.

-

@ c631e267:c2b78d3e

2025-03-31 07:23:05

@ c631e267:c2b78d3e

2025-03-31 07:23:05Der Irrsinn ist bei Einzelnen etwas Seltenes – \ aber bei Gruppen, Parteien, Völkern, Zeiten die Regel. \ Friedrich Nietzsche

Erinnern Sie sich an die Horrorkomödie «Scary Movie»? Nicht, dass ich diese Art Filme besonders erinnerungswürdig fände, aber einige Szenen daraus sind doch gewissermaßen Klassiker. Dazu zählt eine, die das Verhalten vieler Protagonisten in Horrorfilmen parodiert, wenn sie in Panik flüchten. Welchen Weg nimmt wohl die Frau in der Situation auf diesem Bild?

Diese Szene kommt mir automatisch in den Sinn, wenn ich aktuelle Entwicklungen in Europa betrachte. Weitreichende Entscheidungen gehen wider jede Logik in die völlig falsche Richtung. Nur ist das hier alles andere als eine Komödie, sondern bitterernst. Dieser Horror ist leider sehr real.

Die Europäische Union hat sich selbst über Jahre konsequent in eine Sackgasse manövriert. Sie hat es versäumt, sich und ihre Politik selbstbewusst und im Einklang mit ihren Wurzeln auf dem eigenen Kontinent zu positionieren. Stattdessen ist sie in blinder Treue den vermeintlichen «transatlantischen Freunden» auf ihrem Konfrontationskurs gen Osten gefolgt.

In den USA haben sich die Vorzeichen allerdings mittlerweile geändert, und die einst hoch gelobten «Freunde und Partner» erscheinen den europäischen «Führern» nicht mehr vertrauenswürdig. Das ist spätestens seit der Münchner Sicherheitskonferenz, der Rede von Vizepräsident J. D. Vance und den empörten Reaktionen offensichtlich. Große Teile Europas wirken seitdem wie ein aufgescheuchter Haufen kopfloser Hühner. Orientierung und Kontrolle sind völlig abhanden gekommen.

Statt jedoch umzukehren oder wenigstens zu bremsen und vielleicht einen Abzweig zu suchen, geben die Crash-Piloten jetzt auf dem Weg durch die Sackgasse erst richtig Gas. Ja sie lösen sogar noch die Sicherheitsgurte und deaktivieren die Airbags. Den vor Angst dauergelähmten Passagieren fällt auch nichts Besseres ein und so schließen sie einfach die Augen. Derweil übertrumpfen sich die Kommentatoren des Events gegenseitig in sensationslüsterner «Berichterstattung».

Wie schon die deutsche Außenministerin mit höchsten UN-Ambitionen, Annalena Baerbock, proklamiert auch die Europäische Kommission einen «Frieden durch Stärke». Zu dem jetzt vorgelegten, selbstzerstörerischen Fahrplan zur Ankurbelung der Rüstungsindustrie, genannt «Weißbuch zur europäischen Verteidigung – Bereitschaft 2030», erklärte die Kommissionspräsidentin, die «Ära der Friedensdividende» sei längst vorbei. Soll das heißen, Frieden bringt nichts ein? Eine umfassende Zusammenarbeit an dauerhaften europäischen Friedenslösungen steht demnach jedenfalls nicht zur Debatte.

Zusätzlich brisant ist, dass aktuell «die ganze EU von Deutschen regiert wird», wie der EU-Parlamentarier und ehemalige UN-Diplomat Michael von der Schulenburg beobachtet hat. Tatsächlich sitzen neben von der Leyen und Strack-Zimmermann noch einige weitere Deutsche in – vor allem auch in Krisenzeiten – wichtigen Spitzenposten der Union. Vor dem Hintergrund der Kriegstreiberei in Deutschland muss eine solche Dominanz mindestens nachdenklich stimmen.

Ihre ursprünglichen Grundwerte wie Demokratie, Freiheit, Frieden und Völkerverständigung hat die EU kontinuierlich in leere Worthülsen verwandelt. Diese werden dafür immer lächerlicher hochgehalten und beschworen.

Es wird dringend Zeit, dass wir, der Souverän, diesem erbärmlichen und gefährlichen Trauerspiel ein Ende setzen und die Fäden selbst in die Hand nehmen. In diesem Sinne fordert uns auch das «European Peace Project» auf, am 9. Mai im Rahmen eines Kunstprojekts den Frieden auszurufen. Seien wir dabei!

[Titelbild: Pixabay]

Dieser Beitrag wurde mit dem Pareto-Client geschrieben und ist zuerst auf Transition News erschienen.

-

@ 04c195f1:3329a1da

2025-04-09 10:54:43

@ 04c195f1:3329a1da

2025-04-09 10:54:43The old world order is crumbling. What was once considered stable and unshakable—the American-led global framework established after World War II—is now rapidly disintegrating. From the fraying fabric of NATO to the self-serving protectionism of Trump’s renewed presidency, the signals are clear: the empire that once held the Western world together is retreating. And in the vacuum it leaves behind, a new power must emerge.

The question is: will Europe finally seize this moment?

For decades, Europe has relied on the illusion of safety under an American umbrella. This dependency allowed us to indulge in what can only be described as “luxury politics.” Instead of strengthening our core institutions—defense, infrastructure, energy independence—we poured our energy into ideological experiments: value-based governance, multiculturalism, aggressive climate goals, and endless layers of bureaucracy.

We let ourselves believe history had ended. That war, scarcity, and geopolitical struggle were things of the past. That our greatest challenges would be inclusivity, carbon credits, and data protection regulations.

But history, as always, had other plans.

Trump, Nationalist Hope and Hard Reality

Across Europe, many nationalists and conservatives initially welcomed Donald Trump. He rejected the tenets of liberal globalism, called out the absurdities of woke ideology, and promised a return to realism. In a world saturated by progressive conformity, he seemed like a disruptive breath of fresh air.

And to a certain extent, he was.

But history will likely remember his presidency not for culture wars or conservative rhetoric—but for something far more consequential: the dismantling of the American empire.

What we are witnessing under Trump is the accelerated withdrawal of the United States from its role as global enforcer. Whether by design or incompetence, the result is the same. American institutions are retracting, its alliances are fraying, and its strategic grip on Europe is loosening.

For Americans, this may seem like decline. For Europe, it is an opportunity—an uncomfortable, painful, but necessary opportunity.

This is our chance to break free from the American yoke and step into the world as a sovereign power in our own right.

The End of Illusions

Europe is not a weak continent. We have a population larger than the United States, an economy that outpaces Russia’s many times over, and centuries of civilizational strength behind us. But we have been kept fragmented, distracted, and dependent—by design.

Both Washington and Moscow have an interest in a divided, impotent Europe. American strategists see us as junior partners at best, liabilities at worst. Russian elites, like Sergey Karaganov, openly admit their goal is to push Europe off the global stage. China, for its part, eyes our markets while quietly maneuvering to undermine our autonomy.

But something is changing.

In Brussels, even the ideologically captured technocrats are beginning to see the writing on the wall. Overbearing regulations like GDPR are being reconsidered. The long-pushed Equal Treatment Directive—a pan-European anti-discrimination law—may finally be scrapped. These are small signs, but signs nonetheless. Europe is waking up.

From Fracture to Foundation

To build something new, the old must first fall. That collapse is now well underway.

The collapse of American hegemony does not mean the rise of chaos—it means the opening of a path. Europe has a choice: continue to drift, clinging to broken institutions and obsolete alliances, or embrace the challenge of becoming a serious actor in a multipolar world.

This does not mean copying the imperial ambitions of others. Europe’s strength will not come from domination, but from independence, coherence, and confidence. A strong Europe is not one ruled from Brussels, but one composed of strong, rooted nations acting together in strategic alignment. Not a federation, not an empire in the classical sense—but a civilization asserting its right to survive and thrive on its own terms.

At the same time, we must not fall into the trap of romantic isolationism. Some nationalists still cling to the idea that their nation alone can stand firm on the global stage, detached from continental collaboration. That vision no longer matches the geopolitical reality. The world has changed, and so must our strategy. In key areas—such as defense, border security, trade policy, and technological sovereignty—Europe must act with unity and purpose. This does not require dissolving national identities; it requires mature cooperation among free nations. To retreat into purely national silos would be to condemn Europe to irrelevance. Strengthening the right kind of European cooperation—while returning power in other areas to the national level—is not a betrayal of nationalism, but its necessary evolution.

A Third Position: Beyond East and West

As the American empire stumbles and Russia attempts to fill the void, Europe must not become a pawn in someone else’s game. Our task is not to shift allegiance from one master to another—but to step into sovereignty. This is not about trading Washington for Moscow, or Beijing. It is about rejecting all external domination and asserting our own geopolitical will.

A truly pro-European nationalism must recognize that our civilizational future lies not in nostalgia or subservience, but in strategic clarity. We must build a third position—a pole of stability and power that stands apart from the decaying empires of the past.

That requires sacrifice, but it also promises freedom.

Hope Through Action

There is a romantic notion among some European nationalists that decline is inevitable—that we are simply passengers on a sinking ship. But fatalism is not tradition. It is surrender.

Our ancestors did not build cathedrals, repel invaders, or chart the globe by giving in to despair. They acted—often against impossible odds—because they believed in a Europe worth fighting for.

We must now rediscover that spirit.

This is not a call for uniformity, but for unity. Not for empire, but for sovereignty. Not for nostalgia, but for renewal. Across the continent, a new consciousness is stirring. From the Alps to the Baltic, from Lisbon to Helsinki, there are voices calling for something more than submission to global markets and American whims.

They are calling for Europe.

The Hour Has Come

There may not be a second chance. The tide of history is turning, and the next ten years will determine whether Europe reclaims its role in the world—or becomes a museum piece, mourned by tourists and remembered by none.

This is not the end.

It is our beginning—if we are brave enough to seize it.

■

-

@ c631e267:c2b78d3e

2025-03-21 19:41:50

@ c631e267:c2b78d3e

2025-03-21 19:41:50Wir werden nicht zulassen, dass technisch manches möglich ist, \ aber der Staat es nicht nutzt. \ Angela Merkel

Die Modalverben zu erklären, ist im Deutschunterricht manchmal nicht ganz einfach. Nicht alle Fremdsprachen unterscheiden zum Beispiel bei der Frage nach einer Möglichkeit gleichermaßen zwischen «können» im Sinne von «die Gelegenheit, Kenntnis oder Fähigkeit haben» und «dürfen» als «die Erlaubnis oder Berechtigung haben». Das spanische Wort «poder» etwa steht für beides.

Ebenso ist vielen Schülern auf den ersten Blick nicht recht klar, dass das logische Gegenteil von «müssen» nicht unbedingt «nicht müssen» ist, sondern vielmehr «nicht dürfen». An den Verkehrsschildern lässt sich so etwas meistens recht gut erklären: Manchmal muss man abbiegen, aber manchmal darf man eben nicht.

Dieses Beispiel soll ein wenig die Verwirrungstaktik veranschaulichen, die in der Politik gerne verwendet wird, um unpopuläre oder restriktive Maßnahmen Stück für Stück einzuführen. Zuerst ist etwas einfach innovativ und bringt viele Vorteile. Vor allem ist es freiwillig, jeder kann selber entscheiden, niemand muss mitmachen. Später kann man zunehmend weniger Alternativen wählen, weil sie verschwinden, und irgendwann verwandelt sich alles andere in «nicht dürfen» – die Maßnahme ist obligatorisch.

Um die Durchsetzung derartiger Initiativen strategisch zu unterstützen und nett zu verpacken, gibt es Lobbyisten, gerne auch NGOs genannt. Dass das «NG» am Anfang dieser Abkürzung übersetzt «Nicht-Regierungs-» bedeutet, ist ein Anachronismus. Das war vielleicht früher einmal so, heute ist eher das Gegenteil gemeint.

In unserer modernen Zeit wird enorm viel Lobbyarbeit für die Digitalisierung praktisch sämtlicher Lebensbereiche aufgewendet. Was das auf dem Sektor der Mobilität bedeuten kann, haben wir diese Woche anhand aktueller Entwicklungen in Spanien beleuchtet. Begründet teilweise mit Vorgaben der Europäischen Union arbeitet man dort fleißig an einer «neuen Mobilität», basierend auf «intelligenter» technologischer Infrastruktur. Derartige Anwandlungen wurden auch schon als «Technofeudalismus» angeprangert.

Nationale Zugangspunkte für Mobilitätsdaten im Sinne der EU gibt es nicht nur in allen Mitgliedsländern, sondern auch in der Schweiz und in Großbritannien. Das Vereinigte Königreich beteiligt sich darüber hinaus an anderen EU-Projekten für digitale Überwachungs- und Kontrollmaßnahmen, wie dem biometrischen Identifizierungssystem für «nachhaltigen Verkehr und Tourismus».