-

@ 04c915da:3dfbecc9

2025-03-13 19:39:28

@ 04c915da:3dfbecc9

2025-03-13 19:39:28In much of the world, it is incredibly difficult to access U.S. dollars. Local currencies are often poorly managed and riddled with corruption. Billions of people demand a more reliable alternative. While the dollar has its own issues of corruption and mismanagement, it is widely regarded as superior to the fiat currencies it competes with globally. As a result, Tether has found massive success providing low cost, low friction access to dollars. Tether claims 400 million total users, is on track to add 200 million more this year, processes 8.1 million transactions daily, and facilitates $29 billion in daily transfers. Furthermore, their estimates suggest nearly 40% of users rely on it as a savings tool rather than just a transactional currency.

Tether’s rise has made the company a financial juggernaut. Last year alone, Tether raked in over $13 billion in profit, with a lean team of less than 100 employees. Their business model is elegantly simple: hold U.S. Treasuries and collect the interest. With over $113 billion in Treasuries, Tether has turned a straightforward concept into a profit machine.

Tether’s success has resulted in many competitors eager to claim a piece of the pie. This has triggered a massive venture capital grift cycle in USD tokens, with countless projects vying to dethrone Tether. Due to Tether’s entrenched network effect, these challengers face an uphill battle with little realistic chance of success. Most educated participants in the space likely recognize this reality but seem content to perpetuate the grift, hoping to cash out by dumping their equity positions on unsuspecting buyers before they realize the reality of the situation.

Historically, Tether’s greatest vulnerability has been U.S. government intervention. For over a decade, the company operated offshore with few allies in the U.S. establishment, making it a major target for regulatory action. That dynamic has shifted recently and Tether has seized the opportunity. By actively courting U.S. government support, Tether has fortified their position. This strategic move will likely cement their status as the dominant USD token for years to come.

While undeniably a great tool for the millions of users that rely on it, Tether is not without flaws. As a centralized, trusted third party, it holds the power to freeze or seize funds at its discretion. Corporate mismanagement or deliberate malpractice could also lead to massive losses at scale. In their goal of mitigating regulatory risk, Tether has deepened ties with law enforcement, mirroring some of the concerns of potential central bank digital currencies. In practice, Tether operates as a corporate CBDC alternative, collaborating with authorities to surveil and seize funds. The company proudly touts partnerships with leading surveillance firms and its own data reveals cooperation in over 1,000 law enforcement cases, with more than $2.5 billion in funds frozen.

The global demand for Tether is undeniable and the company’s profitability reflects its unrivaled success. Tether is owned and operated by bitcoiners and will likely continue to push forward strategic goals that help the movement as a whole. Recent efforts to mitigate the threat of U.S. government enforcement will likely solidify their network effect and stifle meaningful adoption of rival USD tokens or CBDCs. Yet, for all their achievements, Tether is simply a worse form of money than bitcoin. Tether requires trust in a centralized entity, while bitcoin can be saved or spent without permission. Furthermore, Tether is tied to the value of the US Dollar which is designed to lose purchasing power over time, while bitcoin, as a truly scarce asset, is designed to increase in purchasing power with adoption. As people awaken to the risks of Tether’s control, and the benefits bitcoin provides, bitcoin adoption will likely surpass it.

-

@ 04c915da:3dfbecc9

2025-02-25 03:55:08

@ 04c915da:3dfbecc9

2025-02-25 03:55:08Here’s a revised timeline of macro-level events from The Mandibles: A Family, 2029–2047 by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes.

Part One: 2029–2032

-

2029 (Early Year)\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor.

-

2029 (Mid-Year: The Great Renunciation)\ Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive.

-

2029 (Late Year)\ Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant.

-

2030–2031\ Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness.

-

2032\ By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured.

Time Jump: 2032–2047

- Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies.

Part Two: 2047

-

2047 (Early Year)\ The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum.

-

2047 (Mid-Year)\ Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency.

-

2047 (Late Year)\ The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society.

Key Differences

- Currency Dynamics: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control.

- Government Power: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities.

- Societal Outcome: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots.

This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory.

-

-

@ 472f440f:5669301e

2024-12-31 04:42:00

@ 472f440f:5669301e

2024-12-31 04:42:00I'm sure some of you are already tired of the discussion around the H-1B visa program that was started on Christmas Eve by Vivek Ramaswamy and escalated by Elon Musk and others as the "Silicon Valley MAGA" coalition began putting forth legal immigration policy proposals for the incoming Trump administration. Core to their policy is the expansion of the H-1B visa program so that America can "recruit the best talent in the world" to come build the American economy.

Unfortunately, as it stands today - according to the Silicon Valley cognescenti, Americans are either a.) not smart enough to fulfill the roles necessary to enable the United States to maintain its lead as economic super power of the world or b.) expect too much in compensation for the available roles. At least this is my reading from the commentary I've seen over the last week.

What seems abundantly clear to me is that the framing put forth by "Silicon Valley MAGA" crew is disingenuous and self-serving. It has been clear for awhile now that the H-1B visa program is being systematically abused to bring in cheap labor from other countries to help drive down labor costs for companies across the spectrum. Not just Silicon Valley tech companies. The system has a loophole in it and it is being exploited. Bring people to the US via H-1B visas to complete work for you at lower costs and your company's financials are likely to be better off (assuming the work being done is productive and a value add to the company). Now, this isn't to say that everyone who is in the US via an H-1B visa is here because these companies want to exploit the loophole that gives them the ability to spend less on head count. However, based off the data from the database of the H-1B visa program it is abundantly clear that the system is being taken advantage of. Egregiously and at the expense of American workers, who are most certainly not (all) "subtarded".

Herein lies the crux of the problem; companies are abusing this program to get away from the problem of Americans demanding higher wages to maintain lives of dignity in a country run by a government that is chronically addicted to debt backed by a central bank that will print money ex-nihilo and at will to monetize that debt. Americans are then being scapegoated as either "lazy", "stupid" or "delusional about their worth in the work force". A classic straw man argument that avoids the root issue at hand; the money is broken and the broken money has created perverse incentives throughout the economy while also stripping Americans of the ability to properly save the value of their labor.

We live in a high velocity trash economy that rewards grift and waste while disincentivizing hard work that is meaningful to the quality of life of the Common Man. Everything has been hyper-financialized to the point that one of the only ways to make it ahead is to speculate on the flow of capital into certain asset classes, which is often determined by the whims of central planners. Another is to build or speculate on tech "innovations" that typically materialize in the form of attention zapping apps and widgets that help people temporarily forget they live in a high-velocity trash economy.

The mass of men lead lives of quiet desperation and it is because they don't see a way out of the nihilistic rat race created (unknowingly to most) by the money printer.

The ability to print money out of nothing and throw it at everything creates misaligned incentives that result in the inability for the market to properly determine what is genuinely needed by the people instead of those who have learned how to game the broken system and its broken incentives.

One last point, I would be remiss not to acknowledge that many individuals in America aren't intellectually equipped to do some of the cutting edge work that may be necessary to produce the technologies and companies that will push the country forward. The high-velocity trash economy run on money printed out of nothing has completely corrupted the education system. People in the United States are literally dumber than they were five decades ago. That is a fact. But it is not only the fault of the American people themselves, but the corrupt system they have been born into that destroyed the education system with perverse incentives. And the overwhelming majority of the blame is on the system, not the people.

Even with that being said, the idea that we need to adopt a Tiger Mom mentality in the US - a culture of unrelenting devotion to studying STEM to the point that weekend sleepovers for kids are discouraged - is absolutely laughable and objectively un-American. There are plenty of incredibly intelligent, creative and driven young Americans who have contributed and will continue to contribute significantly to the American economy and they didn't need to shackle themselves to their desks to get that way. America isn't a country that was built by automatons. It's a country built by people who said, "Fuck you. Don't tell me what I can and cannot do. Watch this."

Despite the fact that a system has been erected that actively works against the average American system the American spirit lives on in the souls of many across the country. Miraculously. The American spirit is something that cannot simply be imported. It is ingrained in our culture. It is certainly beginning to dwindle as hope for a better future becomes more and more dim for the masses as the system works against them despite all their best efforts to succeed. It is imperative that we stoke the coals of the American spirit while it is still alive in those who are too stubborn to give up.

People need the ability to save their hard work in a money that cannot be debased. Opportunity cost needs to be reintroduced into the market so that things that actually add value and increase the quality of life for the Common Man are where hard money is allocated. And people need to start talking about the root of the problem more seriously instead of striking at branches with disingenuous straw man arguments.

Final thought... Ready to go surfing.

-

@ 472f440f:5669301e

2024-12-21 00:45:10

@ 472f440f:5669301e

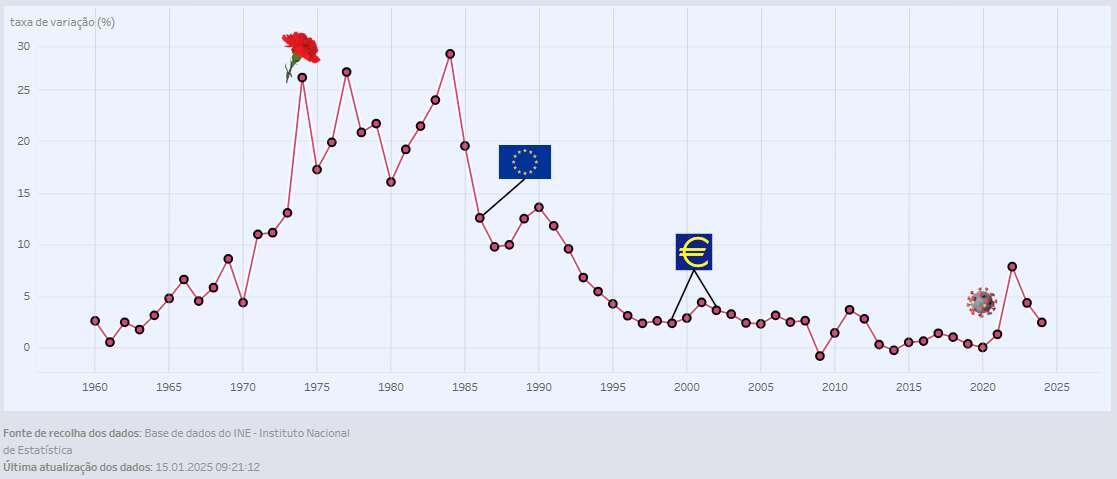

2024-12-21 00:45:10There was a bit of a rally in stock markets today, but this was a relief rally after taking a beating throughout the week. All eyes were on Federal Reserve Chairman Jerome Powell as he took the stage on Wednesday to announce the decisions made at the most recent FOMC meeting.

The market reacted negatively to another 0.25% cut from the Federal Reserve that many considered a "hawkish cut" due to the fact that Chairman Powell articulated that it is likely that there will be less rate cuts in 2025 than were previously expected. This is likely driven by the fact that inflation, as reported by the terribly inaccurate CPI, has been coming in higher than expectations. Signaling that the Fed does not, in fact, have inflation under control. Who could have seen that coming?

Here's how the US 10Y Treasury yield reacted to the announcement:

"Not great Bob!" The US 10Y Treasury yield is something that everyone should be paying attention to over the course of the next year. Since the Fed started cutting rates in September of this year, the 10Y yield has been acting anomalously compared to how it has acted historically after Fed interest rate decisions. Since September, the market has been calling the Fed's bluff on inflation and rates have been moving in the opposite direction compared to what would be expected if the Fed had things under control. The "hawkish cut" made on Wednesday is not a great sign. The Fed is being forced to recognize that it cut "too much too fast" before actually getting inflation under control.

One has to wonder why they made such aggressive moves in September. Why the need for a much more dovish stance as quickly as they moved? Do they see something behind the scenes of the banking system that makes them believe that another liquidity crisis was on the horizon and they needed to act to prevent yet another banking crisis? Now that it is clear that inflation isn't under control and if there really was a liquidity crisis on the horizon, what are the first two quarters of 2025 going to look like? Could we find ourselves in a situation where inflation is beginning to accelerate again, there is a liquidity crisis, and the Fed is forced to rush back ZIRP and QE only to further exacerbate inflation? Couple this potential scenario with the proposed economic policy from the incoming Trump administration and it isn't hard to see that we could be in for a period of economic pain.

One can only hope that the Fed and the incoming administration have the intestinal fortitude to let the market correct appropriately, reprice, clear out the bad assets and credit that exists in the system and let the cleanse happen relatively unperturbed. That has what has been desperately needed since 2008, arguably longer.

On that note, bitcoin is going through a bull market correction this week as well. Likely incited and/or exacerbated by the turmoil in traditional markets.

Many are proclaiming that the end of this bull market is here. Don't listen to those who have been hate tweeting bitcoin all the way up this year. They've been looking for a correction to bask in schadenfreude and confirm their biases. These types of corrections are to be expected when bitcoin runs by checks notes 100% over the course of less than three months. We're approaching the end of the year, which means that people are selling to prepare for taxes (which may be happening in the stock market as well). Add to this fact that long-term holders of bitcoin have taken the most profit they have since 2018 and it probably explains the recent pull back. Can't blame the long-term holders for seeing six-figure bitcoin and deciding to bolster their cash balances.

I couldn't be more bullish on bitcoin than I am right now. The fundamentals surrounding the market couldn't be more perfect. Despite what the Trump administration may have in store for us in terms of economic policy (I agree with most of the policies he has presented), I find it hard to believe that even he and the talented team of people he has surrounded himself with can overcome the momentum of the problems that have been building up in the system for the last 16-years.

The "find safety in sats" trade is going mainstream as the market becomes more familiar with bitcoin, its properties, and the fact that it is very unlikely that it is going to die. The fervor around bitcoin as a strategic reserve asset for nation states is only picking up. And if it catches on, we will enter territory for bitcoin that was considered utterly insane only a year ago.

On that note, Nic Carter made some buzz today with a piece he wrote for Bitcoin Magazine explaining why he believes a strategic bitcoin reserve is a bad idea for the US government.

https://bitcoinmagazine.com/politics/i-dont-support-a-strategic-bitcoin-reserve-and-neither-should-you

While I agree that the signal the US government could send by acquiring a bitcoin strategic reserve could be bad for the US treasuries market, I think it comes down to strategy. The Trump administration will have to think strategically about how they acquire their Strategic Bitcoin Reserve. If they ape in, it could send the wrong message and cause everyone to dump their treasuries, which are the most popular form of collateral in the global financial system. However, there are ways to acquire bitcoin slowly but surely from here into the future that ensure that the United States gets proper exposure to the asset to protect itself from the out-of-control debt problem while also providing itself with a way out of the problem. Many of these potential strategies were discussed in two recent episodes I recorded. One with Matthew Pines from the Bitcoin Policy Institute and another with Matthew Mežinskis from Porkopolis Economics. I highly recommend you all check those out (linked below).

https://youtu.be/xyyeEqFVjBY

https://youtu.be/6vgesP9LIXk

.---

Final thought...

I am the most locked in from a focus perspective while on flights. Even with two kids under 5. Merry Christmas, Freaks!

-

@ 472f440f:5669301e

2024-12-05 08:09:23

@ 472f440f:5669301e

2024-12-05 08:09:23The end of the first part of bitcoin's story has come to an end. Most of the story has yet to be written, but I feel confident in saying that reaching the $100,000 per bitcoin milestone is a clear demarcation between two distinct eras of bitcoin. Yes, we have hit the significant milestones of $1, $10, $100, $1,000, and $10,000 over the last fifteen years and they all felt significant. And they certainly were in their own right. However, hitting the "six figure" milestone feels a bit different.

One bitcoin is currently worth a respectable salary for an American citizen. Ten hunnid bands. Something that is impressive to the layman. This may not mean much to many who have been around bitcoin for some time. The idea of bitcoin hitting $100,000 was seen as a foregone conclusion for millions of people out there. Myself included. This price marker is simply an inevitability on the road to global reserve currency to us.

With that being said, it is important to put yourself in the shoes of those who have doubted bitcoin up to this point. For some reason or another, $100,000 bitcoin has been used as a price target that "will never be hit" for many of the naysayers.

"Bitcoin is a Ponzi scheme."

"Tulips."

"Governments will ban it if it hits that point."

"It can't scale."

"It will be 51% attacked."

"No one will trust bitcoin."

"It can't be the world's money."

And yet, despite all of the kvetching from the haters over the years, here we are. Sitting above $100,000. Taking a short rest at the latest checkpoint en route to the peak of the mountain. We hovered right under $100,000 for a couple of weeks. Nominally, where we stand today is much closer to where we were last week compared to where we were six months ago. But for some reason the price tipping over $100,000 has catapulted bitcoin to a new playing field. Where bitcoin stood yesterday and where it found itself six months ago seem miles below where it is today. Crossing over the event horizon of six figures forces people to think of bitcoin in a different light. Almost as if we have entered another dimension.

The last year has been filled with a lead up to this crossing over of the event horizon.

Financial institutions that have derided bitcoin for well over a decade were forced to bend the knee and offer bitcoin exposure to their clients. The mere offering of that exposure has resulted in the most successful ETFs in the history of this particular investment vehicle.

Governments around the world have been forced to reckon with the fact that bitcoin is here to stay and that they need to act accordingly. Thanks to the first mover actions taken by El Salvador and Bhutan, which have nonchalantly decided to go all in on bitcoin, others have taken notice. Will that be publicly acknowledged by the bigger governments? Probably not. But you'd be naive to think that politicians in the US seeing two very small countries making such big bets on bitcoin didn't induce at least a little bit of FOMO. Once the bitcoin FOMO seed is planted it's hard to uproot.

Combine this with the fact that it has become rather cool to be privy to the fact that the world's governments have become egregiously addicted to debt and money printing, that inflation is pervasive and inescapable, and that censorship and Orwellian control tactics are on the rise and it is easy to see why more people are more receptive to the idea of bitcoin.

All that was needed to create an all out frenzy - a slingshot effect up the S Curve of adoption - was a psychological trigger. Bitcoin crossing over six figures.

Well, here we are. The tropes against bitcoin that have been trotted out over the last sixteen years no longer have as much bite as they did in many people's eyes. Sure, there will be some butt hurt nocoiners and totalitarians who continue to trot them out, but crossing the chasm of six figure bitcoin will have an order of magnitude more people thinking, "I hear what you're saying, but reality seems to be saying something completely different. And, if I'm being honest with myself, reality is making much more sense than your screeching."

Unstoppable peer-to-peer digital cash with a hard capped supply has been around since January 3rd, 2009. December 5th, 2024 will be the day that it cemented itself as something that cannot be ignored. Part I of the bitcoin story has been written. The end of the beginning is behind us. On to Part II: the rapid monetization of bitcoin, which will cement it as the reserve currency of the world.

Final thought... I used some 2017-2020 era tactics to get into the writing mood tonight. 90210

-

@ 66675158:1b644430

2025-03-23 11:39:41

@ 66675158:1b644430

2025-03-23 11:39:41I don't believe in "vibe coding" – it's just the newest Silicon Valley fad trying to give meaning to their latest favorite technology, LLMs. We've seen this pattern before with blockchain, when suddenly Non Fungible Tokens appeared, followed by Web3 startups promising to revolutionize everything from social media to supply chains. VCs couldn't throw money fast enough at anything with "decentralized" (in name only) in the pitch deck. Andreessen Horowitz launched billion-dollar crypto funds, while Y Combinator batches filled with blockchain startups promising to be "Uber for X, but on the blockchain."

The metaverse mania followed, with Meta betting its future on digital worlds where we'd supposedly hang out as legless avatars. Decentralized (in name only) autonomous organizations emerged as the next big thing – supposedly democratic internet communities that ended up being the next scam for quick money.

Then came the inevitable collapse. The FTX implosion in late 2022 revealed fraud, Luna/Terra's death spiral wiped out billions (including my ten thousand dollars), while Celsius and BlockFi froze customer assets before bankruptcy.

By 2023, crypto winter had fully set in. The SEC started aggressive enforcement actions, while users realized that blockchain technology had delivered almost no practical value despite a decade of promises.

Blockchain's promises tapped into fundamental human desires – decentralization resonated with a generation disillusioned by traditional institutions. Evangelists presented a utopian vision of freedom from centralized control. Perhaps most significantly, crypto offered a sense of meaning in an increasingly abstract world, making the clear signs of scams harder to notice.

The technology itself had failed to solve any real-world problems at scale. By 2024, the once-mighty crypto ecosystem had become a cautionary tale. Venture firms quietly scrubbed blockchain references from their websites while founders pivoted to AI and large language models.

Most reading this are likely fellow bitcoiners and nostr users who understand that Bitcoin is blockchain's only valid use case. But I shared that painful history because I believe the AI-hype cycle will follow the same trajectory.

Just like with blockchain, we're now seeing VCs who once couldn't stop talking about "Web3" falling over themselves to fund anything with "AI" in the pitch deck. The buzzwords have simply changed from "decentralized" to "intelligent."

"Vibe coding" is the perfect example – a trendy name for what is essentially just fuzzy instructions to LLMs. Developers who've spent years honing programming skills are now supposed to believe that "vibing" with an AI is somehow a legitimate methodology.

This might be controversial to some, but obvious to others:

Formal, context-free grammar will always remain essential for building precise systems, regardless of how advanced natural language technology becomes

The mathematical precision of programming languages provides a foundation that human language's ambiguity can never replace. Programming requires precision – languages, compilers, and processors operate on explicit instructions, not vibes. What "vibe coding" advocates miss is that beneath every AI-generated snippet lies the same deterministic rules that have always governed computation.

LLMs don't understand code in any meaningful sense—they've just ingested enormous datasets of human-written code and can predict patterns. When they "work," it's because they've seen similar patterns before, not because they comprehend the underlying logic.

This creates a dangerous dependency. Junior developers "vibing" with LLMs might get working code without understanding the fundamental principles. When something breaks in production, they'll lack the knowledge to fix it.

Even experienced developers can find themselves in treacherous territory when relying too heavily on LLM-generated code. What starts as a productivity boost can transform into a dependency crutch.

The real danger isn't just technical limitations, but the false confidence it instills. Developers begin to believe they understand systems they've merely instructed an AI to generate – fundamentally different from understanding code you've written yourself.

We're already seeing the warning signs: projects cobbled together with LLM-generated code that work initially but become maintenance nightmares when requirements change or edge cases emerge.

The venture capital money is flowing exactly as it did with blockchain. Anthropic raised billions, OpenAI is valued astronomically despite minimal revenue, and countless others are competing to build ever-larger models with vague promises. Every startup now claims to be "AI-powered" regardless of whether it makes sense.

Don't get me wrong—there's genuine innovation happening in AI research. But "vibe coding" isn't it. It's a marketing term designed to make fuzzy prompting sound revolutionary.

Cursor perfectly embodies this AI hype cycle. It's an AI-enhanced code editor built on VS Code that promises to revolutionize programming by letting you "chat with your codebase." Just like blockchain startups promised to "revolutionize" industries, Cursor promises to transform development by adding LLM capabilities.

Yes, Cursor can be genuinely helpful. It can explain unfamiliar code, suggest completions, and help debug simple issues. After trying it for just an hour, I found the autocomplete to be MAGICAL for simple refactoring and basic functionality.

But the marketing goes far beyond reality. The suggestion that you can simply describe what you want and get production-ready code is dangerously misleading. What you get are approximations with:

- Security vulnerabilities the model doesn't understand

- Edge cases it hasn't considered

- Performance implications it can't reason about

- Dependency conflicts it has no way to foresee

The most concerning aspect is how such tools are marketed to beginners as shortcuts around learning fundamentals. "Why spend years learning to code when you can just tell AI what you want?" This is reminiscent of how crypto was sold as a get-rich-quick scheme requiring no actual understanding.

When you "vibe code" with an AI, you're not eliminating complexity—you're outsourcing understanding to a black box. This creates developers who can prompt but not program, who can generate but not comprehend.

The real utility of LLMs in development is in augmenting existing workflows:

- Explaining unfamiliar codebases

- Generating boilerplate for well-understood patterns

- Suggesting implementations that a developer evaluates critically

- Assisting with documentation and testing

These uses involve the model as a subordinate assistant to a knowledgeable developer, not as a replacement for expertise. This is where the technology adds value—as a sophisticated tool in skilled hands.

Cursor is just a better hammer, not a replacement for understanding what you're building. The actual value emerges when used by developers who understand what happens beneath the abstractions. They can recognize when AI suggestions make sense and when they don't because they have the fundamental knowledge to evaluate output critically.

This is precisely where the "vibe coding" narrative falls apart.

-

@ bcb80417:14548905

2025-03-30 14:40:40

@ bcb80417:14548905

2025-03-30 14:40:40President Donald Trump's recent policy initiatives have significantly impacted the cryptocurrency landscape, reflecting his administration's commitment to fostering innovation and positioning the United States as a global leader in digital assets.

A cornerstone of this approach is the aggressive deregulation agenda aimed at reversing many policies from the previous administration. Key areas of focus include slashing environmental regulations, easing bank oversight, and removing barriers to cryptocurrencies. The Environmental Protection Agency, for instance, announced 31 deregulatory actions in a single day, underscoring the breadth of these efforts. This push has led to rapid growth in the crypto industry, with increased investment and activity following the administration's moves to ease restrictions. citeturn0news10

In line with this deregulatory stance, the U.S. Securities and Exchange Commission (SEC) recently hosted its inaugural public meeting of the crypto task force. Led by Republican SEC Commissioner Hester Peirce, the task force is exploring the applicability of securities laws to digital assets and considering whether new regulatory frameworks are necessary. This initiative reflects a shift in regulatory approach under President Trump, who has pledged to reverse the previous administration's crackdown on crypto firms. citeturn0news11

Further demonstrating his support for the crypto industry, President Trump announced the inclusion of five cryptocurrencies—Bitcoin, Ethereum, Ripple (XRP), Solana (SOL), and Cardano (ADA)—into a proposed "crypto strategic reserve." This move led to significant price surges for these assets, highlighting the market's responsiveness to policy decisions. citeturn0search0

The administration's commitment extends to the development of stablecoins. World Liberty Financial, a cryptocurrency venture established by Donald Trump and his sons, plans to launch a stablecoin called USD1. This stablecoin will be entirely backed by U.S. treasuries, dollars, and cash equivalents, aiming to provide a reliable medium for cross-border transactions by sovereign investors and major institutions. The USD1 token will be issued on the Ethereum network and a blockchain developed by Binance. citeturn0news13

In the financial sector, Trump Media & Technology Group Corp. is collaborating with Crypto.com to introduce "Made in America" exchange-traded funds (ETFs) focusing on digital assets and securities. This initiative aligns with President Trump's pro-cryptocurrency stance and his ambition to make the U.S. a global crypto hub. The ETFs, supported by Crypto.com, will feature a combination of cryptocurrencies such as Bitcoin and are slated to launch later this year. citeturn0news12

These policy directions underscore President Trump's dedication to integrating cryptocurrencies into the national economic framework. By establishing strategic reserves, promoting stablecoins, and facilitating crypto-focused financial products, the administration aims to position the United States at the forefront of the digital asset revolution.

However, these initiatives are not without challenges. While deregulation has boosted investor confidence and stock prices, concerns arise regarding potential economic implications. The Federal Reserve warns that certain policies may lead to higher prices and adversely affect investment and growth. Additionally, the administrative and legal complexities of implementing widespread deregulation present further challenges, including potential staff cuts at agencies like the Environmental Protection Agency and legal challenges to some of the administration's actions. citeturn0news10

In summary, President Trump's recent policies reflect a strategic embrace of cryptocurrencies, aiming to foster innovation, attract investment, and establish the United States as a leader in the digital asset space. While these efforts present opportunities for economic growth and technological advancement, they also necessitate careful consideration of regulatory and economic impacts to ensure balanced and sustainable development in the crypto sector.

-

@ 472f440f:5669301e

2024-12-03 05:11:52

@ 472f440f:5669301e

2024-12-03 05:11:52Uber seed investor and executive producer of the All In podcast Jason Calacanis has been publicly sounding the alarm bell about Microstrategy's bitcoin treasury strategy and the cheer leading exhibited by the company's CEO, Michael Saylor. Calacanis believes that Microstrategy's bitcoin acquisition techniques are a Ponzi scheme waiting to implode. Going as far as to question whether or not Microstrategy is the next FTX.

Earlier today, Jason spent a section of an episode of This Week in Startups to discuss his worries about MSTR's bitcoin treasury strategy, Saylor's overt pumping of the strategy, and the fact that there are other companies like Marathon Holdings beginning to deploy similar convertible debt strategies. While I can see how this can be unnerving for many, I do think there is a fundamental misunderstanding of what Microstrategy is doing. Last week I explained the strategy in a tweet, which I'll reiterate here:

Whether you like it or not, Saylor and Microstrategy have found a way to give pools of liquidity (particularly pools with mandates to allocate to fixed income) exposure to bitcoin’s volatility via convertible notes. The converts are performing better than any other fixed income product on the market.

Other investors have noticed this and have piled into MSTR as well understanding that demand for the converts will increase and enable Microstrategy to accumulate more bitcoin. Those investors feel comfortable with the premium to mNAV MSTR is trading at because they believe the demand for a high performing fixed income product will remain high and likely increase.

Microstrategy can continue doing this until viable competition comes to market because there is no one else offering this type of bitcoin return exposure to fixed income investors at scale. Another important detail, the convertible notes have a duration of 5 years or more while bitcoin’s lowest 4-year CAGR is 26% and its 50th percentile 4-year CAGR is 91%. If you think this will continue then this is a pretty safe bet for Microstrategy and the convertible note holders.

In a world were central banks and governments have gone mad with currency debasement and debt expansion it is pretty safe to assume that bitcoin adoption will not only continue but accelerate from here. What do I think about Microstrategy accumulating this much bitcoin? It makes me a bit uneasy but there’s nothing I can do to stop it and bitcoin will survive in the long run. Even if Microstrategy blows up somehow (I don’t think this is likely). Bitcoin was designed to be anti-fragile.

This is a classic case of “don’t hate the player, hate the game”. Or better yet, join the game. After all, the only winning move is to play.

Essentially, Michael Saylor is taking a long-term bet on bitcoin's continued adoption/monetization and trying to accumulate as much as possible by issuing convertible notes with a 4+ year duration, which should increase the likelihood that Microstrategy is in the black on their bitcoin buys over time as history has shown that anyone who holds bitcoin for more than four years has performed well. This should, in turn, be reflected in their stock price, which should increase alongside bitcoin and convert the debt they've accrued into newly issued shares of MSTR. Through the process, if the strategy is executed successfully, increasing the amount of bitcoin per share for MSTR shareholders. (This is the only metric shareholders should care about in my opinion.)

Yes, this may seem crazy to many and extremely risky to most, but that is the nature of free markets. Every company takes calculated risks in an attempt to increase shareholder value. Michael Saylor and company are betting on the fact that bitcoin will continue to be adopted and are utilizing pools of capital that don't have the ability to buy bitcoin directly, but want exposure to its volatility to achieve their goals. To me it looks like a perfectly symbiotic relationship. Microstrategy is able to accumulate more bitcoin and increase their bitcoin per share while fixed income investors are able to access a product that performs well above their benchmark due to the embedded volatility of the exposure to bitcoin Microstrategy provides.

This won't be a surprise to any of you freaks, but I think it's a pretty smart bet to make. Bitcoin is almost 16-years old. It has established itself as a reserve asset for individuals, companies and countries. A reserve asset that is completely detached from the whims of central planners, transparent, predictable, scarce, and can be transmitted over the Internet. Bitcoin is an idea whose time has come. And more people are beginning to recognize this.

This is one of the beautiful aspects of the public company convertible-note-to-bitcoin strategy that Microstrategy has deployed over the last few years. They are able to harness the benefits of forces that are external to their core business to provide shareholders with value. Michael Saylor could stop buying bitcoin tomorrow and it wouldn't affect bitcoin's adoption in the medium to long-term. He continues to buy bitcoin, and encourages others to do the same, because he recognizes this.

Bitcoin is the apex predator of treasury assets for every individual, company, non-profit or government. The assets competing to be treasury assets are all centrally controlled, easily manipulable, and quickly losing favor. Earlier today, Federal Reserve Board Governor Christopher Waller came out and admitted that inflation is kicking the Fed's ass. They cannot tame it.

Waller may posture by saying that "submission is inevitable", but that doesn't make it true. There is simply too much debt and not enough dollars. The annual interest expense on the US Federal debt is now larger than our spending on national defense. The Fed, whether it wants to admit it or not, is going to have to monetize that debt via the debasement of the dollar. If you are using dollars as a treasury asset it is very important that you understand this and react accordingly by adopting a bitcoin strategy. This is what Michael Saylor is trying to make his peers in public markets understand.

Sure, his marketing tactics may seem a bit uncouth to many and the way in which he's expressing his belief through Microstrategy's accumulation strategy may seem risky, but it's hard to argue that his core thesis is flawed. Especially when you consider the fact that bitcoin has officially climbed to the strata of being seriously considered as a treasury asset for the most powerful nation state in the world. I listen to the All In podcast quite frequently and genuinely like the show. It is a good way to gain perspective on how Silicon Valley investors view the world. If I were to give Jason any advice it would be to take a step back and to apply one of the most frequently discussed topics of the last on his show, the emergence of AI and the importance of everyone to incorporate AI into their businesses and workflows as quickly as possible before they get left behind. The same mental model applies to the emergence of bitcoin as a dominant reserve asset.

It is imperative that every individual, company and government adopts a bitcoin treasury strategy if they want to be able to succeed moving forward without the inherent resistance that is introduced from storing the fruit of your labor in a money or money-like asset that does not preserve purchasing power over time. Just because Saylor has recognized this, moved aggressively to effectuate his understanding via his company's balance sheet, and vociferously markets the strategy to others doesn't mean he's wrong. As I said in my tweet last week, I personally prefer to hold actual bitcoin. That doesn't mean that Microstrategy and others haven't honed in on something unique and legitimate given their circumstances and access to certain financial tools.

Final thought... I apologize for the extended hiatus. I hit a hard wall of writer's block over the last month. I think the time away from the keyboard has been good for me and the quality of this rag moving forward.

-

@ c631e267:c2b78d3e

2025-03-21 19:41:50

@ c631e267:c2b78d3e

2025-03-21 19:41:50Wir werden nicht zulassen, dass technisch manches möglich ist, \ aber der Staat es nicht nutzt. \ Angela Merkel

Die Modalverben zu erklären, ist im Deutschunterricht manchmal nicht ganz einfach. Nicht alle Fremdsprachen unterscheiden zum Beispiel bei der Frage nach einer Möglichkeit gleichermaßen zwischen «können» im Sinne von «die Gelegenheit, Kenntnis oder Fähigkeit haben» und «dürfen» als «die Erlaubnis oder Berechtigung haben». Das spanische Wort «poder» etwa steht für beides.

Ebenso ist vielen Schülern auf den ersten Blick nicht recht klar, dass das logische Gegenteil von «müssen» nicht unbedingt «nicht müssen» ist, sondern vielmehr «nicht dürfen». An den Verkehrsschildern lässt sich so etwas meistens recht gut erklären: Manchmal muss man abbiegen, aber manchmal darf man eben nicht.

Dieses Beispiel soll ein wenig die Verwirrungstaktik veranschaulichen, die in der Politik gerne verwendet wird, um unpopuläre oder restriktive Maßnahmen Stück für Stück einzuführen. Zuerst ist etwas einfach innovativ und bringt viele Vorteile. Vor allem ist es freiwillig, jeder kann selber entscheiden, niemand muss mitmachen. Später kann man zunehmend weniger Alternativen wählen, weil sie verschwinden, und irgendwann verwandelt sich alles andere in «nicht dürfen» – die Maßnahme ist obligatorisch.

Um die Durchsetzung derartiger Initiativen strategisch zu unterstützen und nett zu verpacken, gibt es Lobbyisten, gerne auch NGOs genannt. Dass das «NG» am Anfang dieser Abkürzung übersetzt «Nicht-Regierungs-» bedeutet, ist ein Anachronismus. Das war vielleicht früher einmal so, heute ist eher das Gegenteil gemeint.

In unserer modernen Zeit wird enorm viel Lobbyarbeit für die Digitalisierung praktisch sämtlicher Lebensbereiche aufgewendet. Was das auf dem Sektor der Mobilität bedeuten kann, haben wir diese Woche anhand aktueller Entwicklungen in Spanien beleuchtet. Begründet teilweise mit Vorgaben der Europäischen Union arbeitet man dort fleißig an einer «neuen Mobilität», basierend auf «intelligenter» technologischer Infrastruktur. Derartige Anwandlungen wurden auch schon als «Technofeudalismus» angeprangert.

Nationale Zugangspunkte für Mobilitätsdaten im Sinne der EU gibt es nicht nur in allen Mitgliedsländern, sondern auch in der Schweiz und in Großbritannien. Das Vereinigte Königreich beteiligt sich darüber hinaus an anderen EU-Projekten für digitale Überwachungs- und Kontrollmaßnahmen, wie dem biometrischen Identifizierungssystem für «nachhaltigen Verkehr und Tourismus».

Natürlich marschiert auch Deutschland stracks und euphorisch in Richtung digitaler Zukunft. Ohne vernetzte Mobilität und einen «verlässlichen Zugang zu Daten, einschließlich Echtzeitdaten» komme man in der Verkehrsplanung und -steuerung nicht aus, erklärt die Regierung. Der Interessenverband der IT-Dienstleister Bitkom will «die digitale Transformation der deutschen Wirtschaft und Verwaltung vorantreiben». Dazu bewirbt er unter anderem die Konzepte Smart City, Smart Region und Smart Country und behauptet, deutsche Großstädte «setzen bei Mobilität voll auf Digitalisierung».

Es steht zu befürchten, dass das umfassende Sammeln, Verarbeiten und Vernetzen von Daten, das angeblich die Menschen unterstützen soll (und theoretisch ja auch könnte), eher dazu benutzt wird, sie zu kontrollieren und zu manipulieren. Je elektrischer und digitaler unsere Umgebung wird, desto größer sind diese Möglichkeiten. Im Ergebnis könnten solche Prozesse den Bürger nicht nur einschränken oder überflüssig machen, sondern in mancherlei Hinsicht regelrecht abschalten. Eine gesunde Skepsis ist also geboten.

[Titelbild: Pixabay]

Dieser Beitrag wurde mit dem Pareto-Client geschrieben. Er ist zuerst auf Transition News erschienen.

-

@ aa8de34f:a6ffe696

2025-03-21 12:08:31

@ aa8de34f:a6ffe696

2025-03-21 12:08:3119. März 2025

🔐 1. SHA-256 is Quantum-Resistant

Bitcoin’s proof-of-work mechanism relies on SHA-256, a hashing algorithm. Even with a powerful quantum computer, SHA-256 remains secure because:

- Quantum computers excel at factoring large numbers (Shor’s Algorithm).

- However, SHA-256 is a one-way function, meaning there's no known quantum algorithm that can efficiently reverse it.

- Grover’s Algorithm (which theoretically speeds up brute force attacks) would still require 2¹²⁸ operations to break SHA-256 – far beyond practical reach.

++++++++++++++++++++++++++++++++++++++++++++++++++

🔑 2. Public Key Vulnerability – But Only If You Reuse Addresses

Bitcoin uses Elliptic Curve Digital Signature Algorithm (ECDSA) to generate keys.

- A quantum computer could use Shor’s Algorithm to break SECP256K1, the curve Bitcoin uses.

- If you never reuse addresses, it is an additional security element

- 🔑 1. Bitcoin Addresses Are NOT Public Keys

Many people assume a Bitcoin address is the public key—this is wrong.

- When you receive Bitcoin, it is sent to a hashed public key (the Bitcoin address).

- The actual public key is never exposed because it is the Bitcoin Adress who addresses the Public Key which never reveals the creation of a public key by a spend

- Bitcoin uses Pay-to-Public-Key-Hash (P2PKH) or newer methods like Pay-to-Witness-Public-Key-Hash (P2WPKH), which add extra layers of security.

🕵️♂️ 2.1 The Public Key Never Appears

- When you send Bitcoin, your wallet creates a digital signature.

- This signature uses the private key to prove ownership.

- The Bitcoin address is revealed and creates the Public Key

- The public key remains hidden inside the Bitcoin script and Merkle tree.

This means: ✔ The public key is never exposed. ✔ Quantum attackers have nothing to target, attacking a Bitcoin Address is a zero value game.

+++++++++++++++++++++++++++++++++++++++++++++++++

🔄 3. Bitcoin Can Upgrade

Even if quantum computers eventually become a real threat:

- Bitcoin developers can upgrade to quantum-safe cryptography (e.g., lattice-based cryptography or post-quantum signatures like Dilithium).

- Bitcoin’s decentralized nature ensures a network-wide soft fork or hard fork could transition to quantum-resistant keys.

++++++++++++++++++++++++++++++++++++++++++++++++++

⏳ 4. The 10-Minute Block Rule as a Security Feature

- Bitcoin’s network operates on a 10-minute block interval, meaning:Even if an attacker had immense computational power (like a quantum computer), they could only attempt an attack every 10 minutes.Unlike traditional encryption, where a hacker could continuously brute-force keys, Bitcoin’s system resets the challenge with every new block.This limits the window of opportunity for quantum attacks.

🎯 5. Quantum Attack Needs to Solve a Block in Real-Time

- A quantum attacker must solve the cryptographic puzzle (Proof of Work) in under 10 minutes.

- The problem? Any slight error changes the hash completely, meaning:If the quantum computer makes a mistake (even 0.0001% probability), the entire attack fails.Quantum decoherence (loss of qubit stability) makes error correction a massive challenge.The computational cost of recovering from an incorrect hash is still incredibly high.

⚡ 6. Network Resilience – Even if a Block Is Hacked

- Even if a quantum computer somehow solved a block instantly:The network would quickly recognize and reject invalid transactions.Other miners would continue mining under normal cryptographic rules.51% Attack? The attacker would need to consistently beat the entire Bitcoin network, which is not sustainable.

🔄 7. The Logarithmic Difficulty Adjustment Neutralizes Threats

- Bitcoin adjusts mining difficulty every 2016 blocks (\~2 weeks).

- If quantum miners appeared and suddenly started solving blocks too quickly, the difficulty would adjust upward, making attacks significantly harder.

- This self-correcting mechanism ensures that even quantum computers wouldn't easily overpower the network.

🔥 Final Verdict: Quantum Computers Are Too Slow for Bitcoin

✔ The 10-minute rule limits attack frequency – quantum computers can’t keep up.

✔ Any slight miscalculation ruins the attack, resetting all progress.

✔ Bitcoin’s difficulty adjustment would react, neutralizing quantum advantages.

Even if quantum computers reach their theoretical potential, Bitcoin’s game theory and design make it incredibly resistant. 🚀

-

@ 83279ad2:bd49240d

2025-03-30 14:21:49

@ 83279ad2:bd49240d

2025-03-30 14:21:49Test

-

@ a95c6243:d345522c

2025-03-20 09:59:20

@ a95c6243:d345522c

2025-03-20 09:59:20Bald werde es verboten, alleine im Auto zu fahren, konnte man dieser Tage in verschiedenen spanischen Medien lesen. Die nationale Verkehrsbehörde (Dirección General de Tráfico, kurz DGT) werde Alleinfahrern das Leben schwer machen, wurde gemeldet. Konkret erörtere die Generaldirektion geeignete Sanktionen für Personen, die ohne Beifahrer im Privatauto unterwegs seien.

Das Alleinfahren sei zunehmend verpönt und ein Mentalitätswandel notwendig, hieß es. Dieser «Luxus» stehe im Widerspruch zu den Maßnahmen gegen Umweltverschmutzung, die in allen europäischen Ländern gefördert würden. In Frankreich sei es «bereits verboten, in der Hauptstadt allein zu fahren», behauptete Noticiastrabajo Huffpost in einer Zwischenüberschrift. Nur um dann im Text zu konkretisieren, dass die sogenannte «Umweltspur» auf der Pariser Ringautobahn gemeint war, die für Busse, Taxis und Fahrgemeinschaften reserviert ist. Ab Mai werden Verstöße dagegen mit einem Bußgeld geahndet.

Die DGT jedenfalls wolle bei der Umsetzung derartiger Maßnahmen nicht hinterherhinken. Diese Medienberichte, inklusive des angeblich bevorstehenden Verbots, beriefen sich auf Aussagen des Generaldirektors der Behörde, Pere Navarro, beim Mobilitätskongress Global Mobility Call im November letzten Jahres, wo es um «nachhaltige Mobilität» ging. Aus diesem Kontext stammt auch Navarros Warnung: «Die Zukunft des Verkehrs ist geteilt oder es gibt keine».

Die «Faktenchecker» kamen der Generaldirektion prompt zu Hilfe. Die DGT habe derlei Behauptungen zurückgewiesen und klargestellt, dass es keine Pläne gebe, Fahrten mit nur einer Person im Auto zu verbieten oder zu bestrafen. Bei solchen Meldungen handele es sich um Fake News. Teilweise wurde der Vorsitzende der spanischen «Rechtsaußen»-Partei Vox, Santiago Abascal, der Urheberschaft bezichtigt, weil er einen entsprechenden Artikel von La Gaceta kommentiert hatte.

Der Beschwichtigungsversuch der Art «niemand hat die Absicht» ist dabei erfahrungsgemäß eher ein Alarmzeichen als eine Beruhigung. Walter Ulbrichts Leugnung einer geplanten Berliner Mauer vom Juni 1961 ist vielen genauso in Erinnerung wie die Fake News-Warnungen des deutschen Bundesgesundheitsministeriums bezüglich Lockdowns im März 2020 oder diverse Äußerungen zu einer Impfpflicht ab 2020.

Aber Aufregung hin, Dementis her: Die Pressemitteilung der DGT zu dem Mobilitätskongress enthält in Wahrheit viel interessantere Informationen als «nur» einen Appell an den «guten» Bürger wegen der Bemühungen um die Lebensqualität in Großstädten oder einen möglichen obligatorischen Abschied vom Alleinfahren. Allerdings werden diese Details von Medien und sogenannten Faktencheckern geflissentlich übersehen, obwohl sie keineswegs versteckt sind. Die Auskünfte sind sehr aufschlussreich, wenn man genauer hinschaut.

Digitalisierung ist der Schlüssel für Kontrolle

Auf dem Kongress stellte die Verkehrsbehörde ihre Initiativen zur Förderung der «neuen Mobilität» vor, deren Priorität Sicherheit und Effizienz sei. Die vier konkreten Ansätze haben alle mit Digitalisierung, Daten, Überwachung und Kontrolle im großen Stil zu tun und werden unter dem Euphemismus der «öffentlich-privaten Partnerschaft» angepriesen. Auch lassen sie die transhumanistische Idee vom unzulänglichen Menschen erkennen, dessen Fehler durch «intelligente» technologische Infrastruktur kompensiert werden müssten.

Die Chefin des Bereichs «Verkehrsüberwachung» erklärte die Funktion des spanischen National Access Point (NAP), wobei sie betonte, wie wichtig Verkehrs- und Infrastrukturinformationen in Echtzeit seien. Der NAP ist «eine essenzielle Web-Applikation, die unter EU-Mandat erstellt wurde», kann man auf der Website der DGT nachlesen.

Das Mandat meint Regelungen zu einem einheitlichen europäischen Verkehrsraum, mit denen die Union mindestens seit 2010 den Aufbau einer digitalen Architektur mit offenen Schnittstellen betreibt. Damit begründet man auch «umfassende Datenbereitstellungspflichten im Bereich multimodaler Reiseinformationen». Jeder Mitgliedstaat musste einen NAP, also einen nationalen Zugangspunkt einrichten, der Zugang zu statischen und dynamischen Reise- und Verkehrsdaten verschiedener Verkehrsträger ermöglicht.

Diese Entwicklung ist heute schon weit fortgeschritten, auch und besonders in Spanien. Auf besagtem Kongress erläuterte die Leiterin des Bereichs «Telematik» die Plattform «DGT 3.0». Diese werde als Integrator aller Informationen genutzt, die von den verschiedenen öffentlichen und privaten Systemen, die Teil der Mobilität sind, bereitgestellt werden.

Es handele sich um eine Vermittlungsplattform zwischen Akteuren wie Fahrzeugherstellern, Anbietern von Navigationsdiensten oder Kommunen und dem Endnutzer, der die Verkehrswege benutzt. Alle seien auf Basis des Internets der Dinge (IOT) anonym verbunden, «um der vernetzten Gemeinschaft wertvolle Informationen zu liefern oder diese zu nutzen».

So sei DGT 3.0 «ein Zugangspunkt für einzigartige, kostenlose und genaue Echtzeitinformationen über das Geschehen auf den Straßen und in den Städten». Damit lasse sich der Verkehr nachhaltiger und vernetzter gestalten. Beispielsweise würden die Karten des Produktpartners Google dank der DGT-Daten 50 Millionen Mal pro Tag aktualisiert.

Des Weiteren informiert die Verkehrsbehörde über ihr SCADA-Projekt. Die Abkürzung steht für Supervisory Control and Data Acquisition, zu deutsch etwa: Kontrollierte Steuerung und Datenerfassung. Mit SCADA kombiniert man Software und Hardware, um automatisierte Systeme zur Überwachung und Steuerung technischer Prozesse zu schaffen. Das SCADA-Projekt der DGT wird von Indra entwickelt, einem spanischen Beratungskonzern aus den Bereichen Sicherheit & Militär, Energie, Transport, Telekommunikation und Gesundheitsinformation.

Das SCADA-System der Behörde umfasse auch eine Videostreaming- und Videoaufzeichnungsplattform, die das Hochladen in die Cloud in Echtzeit ermöglicht, wie Indra erklärt. Dabei gehe es um Bilder, die von Überwachungskameras an Straßen aufgenommen wurden, sowie um Videos aus DGT-Hubschraubern und Drohnen. Ziel sei es, «die sichere Weitergabe von Videos an Dritte sowie die kontinuierliche Aufzeichnung und Speicherung von Bildern zur möglichen Analyse und späteren Nutzung zu ermöglichen».

Letzteres klingt sehr nach biometrischer Erkennung und Auswertung durch künstliche Intelligenz. Für eine bessere Datenübertragung wird derzeit die Glasfaserverkabelung entlang der Landstraßen und Autobahnen ausgebaut. Mit der Cloud sind die Amazon Web Services (AWS) gemeint, die spanischen Daten gehen somit direkt zu einem US-amerikanischen «Big Data»-Unternehmen.

Das Thema «autonomes Fahren», also Fahren ohne Zutun des Menschen, bildet den Abschluss der Betrachtungen der DGT. Zusammen mit dem Interessenverband der Automobilindustrie ANFAC (Asociación Española de Fabricantes de Automóviles y Camiones) sprach man auf dem Kongress über Strategien und Perspektiven in diesem Bereich. Die Lobbyisten hoffen noch in diesem Jahr 2025 auf einen normativen Rahmen zur erweiterten Unterstützung autonomer Technologien.

Wenn man derartige Informationen im Zusammenhang betrachtet, bekommt man eine Idee davon, warum zunehmend alles elektrisch und digital werden soll. Umwelt- und Mobilitätsprobleme in Städten, wie Luftverschmutzung, Lärmbelästigung, Platzmangel oder Staus, sind eine Sache. Mit dem Argument «emissionslos» wird jedoch eine Referenz zum CO2 und dem «menschengemachten Klimawandel» hergestellt, die Emotionen triggert. Und damit wird so ziemlich alles verkauft.

Letztlich aber gilt: Je elektrischer und digitaler unsere Umgebung wird und je freigiebiger wir mit unseren Daten jeder Art sind, desto besser werden wir kontrollier-, steuer- und sogar abschaltbar. Irgendwann entscheiden KI-basierte Algorithmen, ob, wann, wie, wohin und mit wem wir uns bewegen dürfen. Über einen 15-Minuten-Radius geht dann möglicherweise nichts hinaus. Die Projekte auf diesem Weg sind ernst zu nehmen, real und schon weit fortgeschritten.

[Titelbild: Pixabay]

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ d560dbc2:bbd59238

2025-03-30 07:56:40

@ d560dbc2:bbd59238

2025-03-30 07:56:40We’ve all been there: that one task sitting on your to-do list, staring at you like a disappointed parent, and yet you keep pushing it off for absolutely no good reason. It’s not even that hard, urgent, or complicated—but somehow, it’s been haunting you for days, weeks, or maybe even months. Why do we do this to ourselves?

Why Do We Postpone Tasks for No Reason?

Procrastination is a sneaky beast. Even tasks that take 10 minutes, require minimal brainpower, and have no immediate deadline often get pushed aside. Here are some psychological reasons:

-

Emotional Avoidance:

Even if a task isn’t hard, a tiny emotional weight (like mild boredom or a vague “I don’t wanna”) can lead your brain to choose distractions—like scrolling through Instagram. -

Lack of Immediate Consequences:

Without a pressing deadline, your brain tends to deprioritize the task, even if completing it would make you feel great. -

The Zeigarnik Effect:

Unfinished tasks stick in our minds, creating mental tension. Ironically, that tension can make the task seem bigger and more daunting, encouraging further avoidance.

My Own “No-Reason” Procrastination Story

Let’s be real—I’ve been postponing something trivial, like organizing my desk drawer, for weeks. It’s a simple task that takes about 15 minutes. There’s no deadline, no special skill required—yet every time I open the drawer, I see the chaos of old receipts, random cables, and a half-eaten pack of gum (don’t judge!) and think, “I’ll do it later.” It’s not that I’m busy—I’ve had plenty of time to rewatch my favorite sitcom for the third time. But ignoring it has become my default, and that messy drawer now occupies mental space far beyond its physical size.

Why These Tasks Matter More Than We Think

Those little tasks we postpone might seem harmless, but they add up to create mental clutter. That messy desk drawer isn’t just a drawer—it’s a tiny stressor that pops into your head at the worst moments, disrupting your focus on important work or relaxation.

-

Mental Clutter:

Unfinished tasks can weigh on your mind, making it harder to focus on what truly matters. -

The Bigger Picture:

Tasks like “reply to that email” or “schedule that doctor’s appointment” may seem minor, but avoiding them can lead to unnecessary stress and lost opportunities.

How to Finally Tackle That Task

Here are a few strategies that have helped me break the cycle of “no-reason” procrastination:

1. The 20-Minute Rule (Thank You, Pomodoro!)

-

Commit to 20 Minutes:

Set a timer for just 20 minutes and start working on the task. You’d be surprised how much you can accomplish once you begin. -

Example:

For my desk drawer, I set a timer, got to work, and finished in 12 minutes. That small win made me feel like a productivity superhero.

2. Pin It and Get a Nudge

-

Use Reminders:

Pin that nagging task (like “Organize desk drawer”) as your top priority for the day. A gentle reminder can help break the cycle of avoidance. -

Result:

It’s like having a friend nudge you, “Hey, remember that thing you’ve been ignoring? Let’s do it now!”

3. Make It Fun (Yes, Really!)

-

Add a Reward:

Turn the task into something enjoyable by setting a reward. Play your favorite music, and promise yourself a treat once you’re done. -

Example:

For my desk drawer, I put on an upbeat playlist and treated myself to a piece of chocolate when finished. Suddenly, it wasn’t a chore—it became a mini dance party with a sweet reward.

4. Celebrate the Win

-

Acknowledge Completion:

Once you finish, take a moment to celebrate—even if it’s just a mental high-five. -

Why It Matters:

That sense of closure clears mental clutter and builds momentum for your next task.

Let’s Share and Motivate Each Other

What’s that one task you’ve been postponing for no reason? Maybe it’s cleaning out your fridge, replying to a friend’s text, or finally hanging that picture frame that’s been leaning against the wall for months. Whatever it is, share your story in the comments! Let’s motivate each other to tackle these tasks and turn procrastination into progress.

Bonus points if you’ve got a funny reason for your procrastination (like, “I didn’t schedule that appointment because my doctor’s office has the worst hold music in history”).

Ready to stop procrastinating? Let’s get real, take that first step, and clear that mental clutter—one small win at a time!

-

-

@ da0b9bc3:4e30a4a9

2025-03-30 07:40:58

@ da0b9bc3:4e30a4a9

2025-03-30 07:40:58Hello Stackers!

Welcome on into the ~Music Corner of the Saloon!

A place where we Talk Music. Share Tracks. Zap Sats.

So stay a while and listen.

🚨Don't forget to check out the pinned items in the territory homepage! You can always find the latest weeklies there!🚨

🚨Subscribe to the territory to ensure you never miss a post! 🚨

originally posted at https://stacker.news/items/929299

-

@ a95c6243:d345522c

2025-03-15 10:56:08

@ a95c6243:d345522c

2025-03-15 10:56:08Was nützt die schönste Schuldenbremse, wenn der Russe vor der Tür steht? \ Wir können uns verteidigen lernen oder alle Russisch lernen. \ Jens Spahn

In der Politik ist buchstäblich keine Idee zu riskant, kein Mittel zu schäbig und keine Lüge zu dreist, als dass sie nicht benutzt würden. Aber der Clou ist, dass diese Masche immer noch funktioniert, wenn nicht sogar immer besser. Ist das alles wirklich so schwer zu durchschauen? Mir fehlen langsam die Worte.

Aktuell werden sowohl in der Europäischen Union als auch in Deutschland riesige Milliardenpakete für die Aufrüstung – also für die Rüstungsindustrie – geschnürt. Die EU will 800 Milliarden Euro locker machen, in Deutschland sollen es 500 Milliarden «Sondervermögen» sein. Verteidigung nennen das unsere «Führer», innerhalb der Union und auch an «unserer Ostflanke», der Ukraine.

Das nötige Feindbild konnte inzwischen signifikant erweitert werden. Schuld an allem und zudem gefährlich ist nicht mehr nur Putin, sondern jetzt auch Trump. Europa müsse sich sowohl gegen Russland als auch gegen die USA schützen und rüsten, wird uns eingetrichtert.

Und während durch Diplomatie genau dieser beiden Staaten gerade endlich mal Bewegung in die Bemühungen um einen Frieden oder wenigstens einen Waffenstillstand in der Ukraine kommt, rasselt man im moralisch überlegenen Zeigefinger-Europa so richtig mit dem Säbel.

Begleitet und gestützt wird der ganze Prozess – wie sollte es anders sein – von den «Qualitätsmedien». Dass Russland einen Angriff auf «Europa» plant, weiß nicht nur der deutsche Verteidigungsminister (und mit Abstand beliebteste Politiker) Pistorius, sondern dank ihnen auch jedes Kind. Uns bleiben nur noch wenige Jahre. Zum Glück bereitet sich die Bundeswehr schon sehr konkret auf einen Krieg vor.

Die FAZ und Corona-Gesundheitsminister Spahn markieren einen traurigen Höhepunkt. Hier haben sich «politische und publizistische Verantwortungslosigkeit propagandistisch gegenseitig befruchtet», wie es bei den NachDenkSeiten heißt. Die Aussage Spahns in dem Interview, «der Russe steht vor der Tür», ist das eine. Die Zeitung verschärfte die Sache jedoch, indem sie das Zitat explizit in den Titel übernahm, der in einer ersten Version scheinbar zu harmlos war.

Eine große Mehrheit der deutschen Bevölkerung findet Aufrüstung und mehr Schulden toll, wie ARD und ZDF sehr passend ermittelt haben wollen. Ähnliches gelte für eine noch stärkere militärische Unterstützung der Ukraine. Etwas skeptischer seien die Befragten bezüglich der Entsendung von Bundeswehrsoldaten dorthin, aber immerhin etwa fifty-fifty.

Eigentlich ist jedoch die Meinung der Menschen in «unseren Demokratien» irrelevant. Sowohl in der Europäischen Union als auch in Deutschland sind die «Eliten» offenbar der Ansicht, der Souverän habe in Fragen von Krieg und Frieden sowie von aberwitzigen astronomischen Schulden kein Wörtchen mitzureden. Frau von der Leyen möchte über 150 Milliarden aus dem Gesamtpaket unter Verwendung von Artikel 122 des EU-Vertrags ohne das Europäische Parlament entscheiden – wenn auch nicht völlig kritiklos.

In Deutschland wollen CDU/CSU und SPD zur Aufweichung der «Schuldenbremse» mehrere Änderungen des Grundgesetzes durch das abgewählte Parlament peitschen. Dieser Versuch, mit dem alten Bundestag eine Zweidrittelmehrheit zu erzielen, die im neuen nicht mehr gegeben wäre, ist mindestens verfassungsrechtlich umstritten.

Das Manöver scheint aber zu funktionieren. Heute haben die Grünen zugestimmt, nachdem Kanzlerkandidat Merz läppische 100 Milliarden für «irgendwas mit Klima» zugesichert hatte. Die Abstimmung im Plenum soll am kommenden Dienstag erfolgen – nur eine Woche, bevor sich der neu gewählte Bundestag konstituieren wird.

Interessant sind die Argumente, die BlackRocker Merz für seine Attacke auf Grundgesetz und Demokratie ins Feld führt. Abgesehen von der angeblichen Eile, «unsere Verteidigungsfähigkeit deutlich zu erhöhen» (ausgelöst unter anderem durch «die Münchner Sicherheitskonferenz und die Ereignisse im Weißen Haus»), ließ uns der CDU-Chef wissen, dass Deutschland einfach auf die internationale Bühne zurück müsse. Merz schwadronierte gefährlich mehrdeutig:

«Die ganze Welt schaut in diesen Tagen und Wochen auf Deutschland. Wir haben in der Europäischen Union und auf der Welt eine Aufgabe, die weit über die Grenzen unseres eigenen Landes hinausgeht.»

[Titelbild: Tag des Sieges]

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a849beb6:b327e6d2

2024-11-23 15:03:47

@ a849beb6:b327e6d2

2024-11-23 15:03:47

\ \ It was another historic week for both bitcoin and the Ten31 portfolio, as the world’s oldest, largest, most battle-tested cryptocurrency climbed to new all-time highs each day to close out the week just shy of the $100,000 mark. Along the way, bitcoin continued to accumulate institutional and regulatory wins, including the much-anticipated approval and launch of spot bitcoin ETF options and the appointment of several additional pro-bitcoin Presidential cabinet officials. The timing for this momentum was poetic, as this week marked the second anniversary of the pico-bottom of the 2022 bear market, a level that bitcoin has now hurdled to the tune of more than 6x despite the litany of bitcoin obituaries published at the time. The entirety of 2024 and especially the past month have further cemented our view that bitcoin is rapidly gaining a sense of legitimacy among institutions, fiduciaries, and governments, and we remain optimistic that this trend is set to accelerate even more into 2025.

Several Ten31 portfolio companies made exciting announcements this week that should serve to further entrench bitcoin’s institutional adoption. AnchorWatch, a first of its kind bitcoin insurance provider offering 1:1 coverage with its innovative use of bitcoin’s native properties, announced it has been designated a Lloyd’s of London Coverholder, giving the company unique, blue-chip status as it begins to write bitcoin insurance policies of up to $100 million per policy starting next month. Meanwhile, Battery Finance Founder and CEO Andrew Hohns appeared on CNBC to delve into the launch of Battery’s pioneering private credit strategy which fuses bitcoin and conventional tangible assets in a dual-collateralized structure that offers a compelling risk/return profile to both lenders and borrowers. Both companies are clearing a path for substantially greater bitcoin adoption in massive, untapped pools of capital, and Ten31 is proud to have served as lead investor for AnchorWatch’s Seed round and as exclusive capital partner for Battery.

As the world’s largest investor focused entirely on bitcoin, Ten31 has deployed nearly $150 million across two funds into more than 30 of the most promising and innovative companies in the ecosystem like AnchorWatch and Battery, and we expect 2025 to be the best year yet for both bitcoin and our portfolio. Ten31 will hold a first close for its third fund at the end of this year, and investors in that close will benefit from attractive incentives and a strong initial portfolio. Visit ten31.vc/funds to learn more and get in touch to discuss participating.\ \ Portfolio Company Spotlight

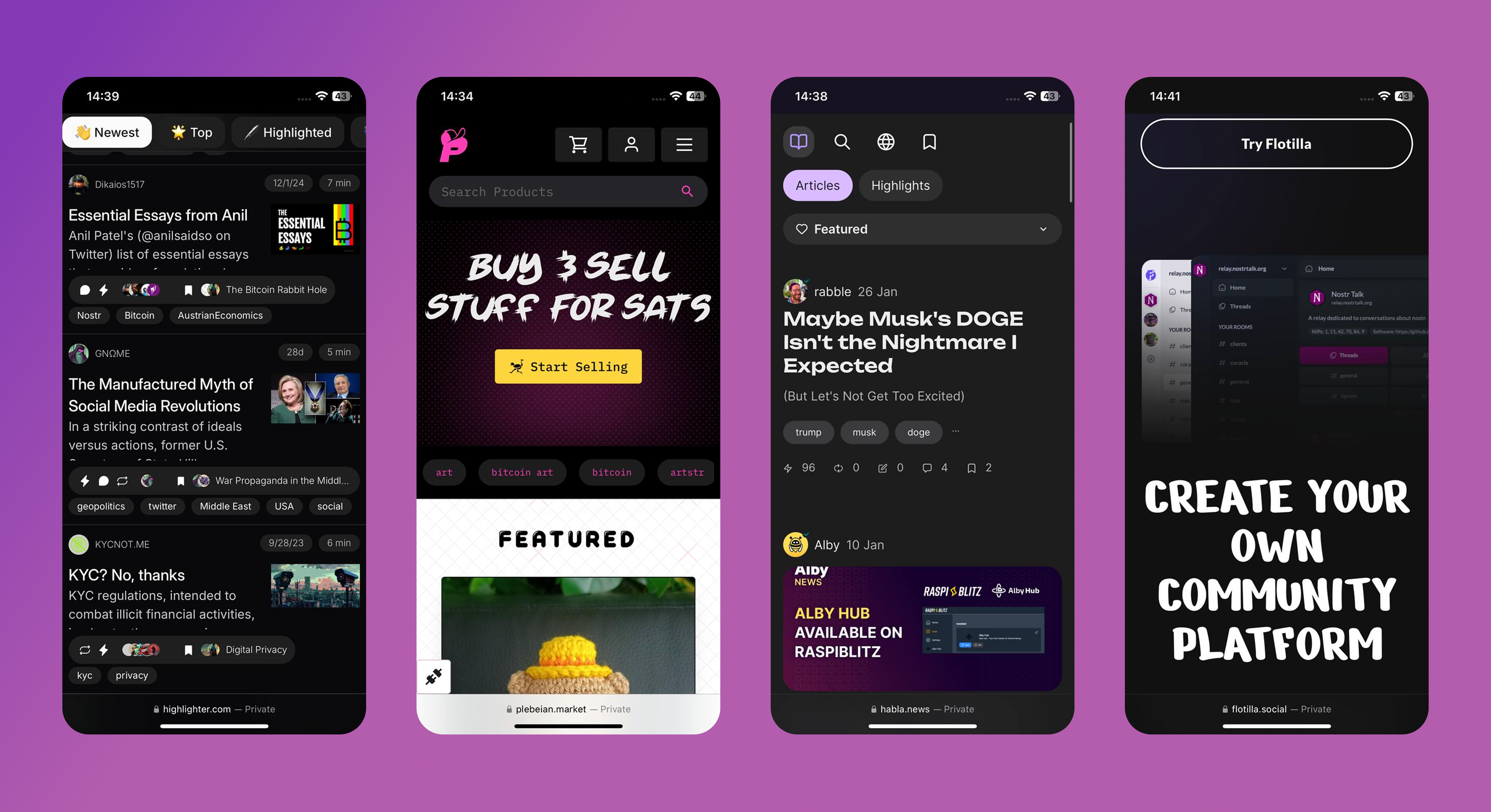

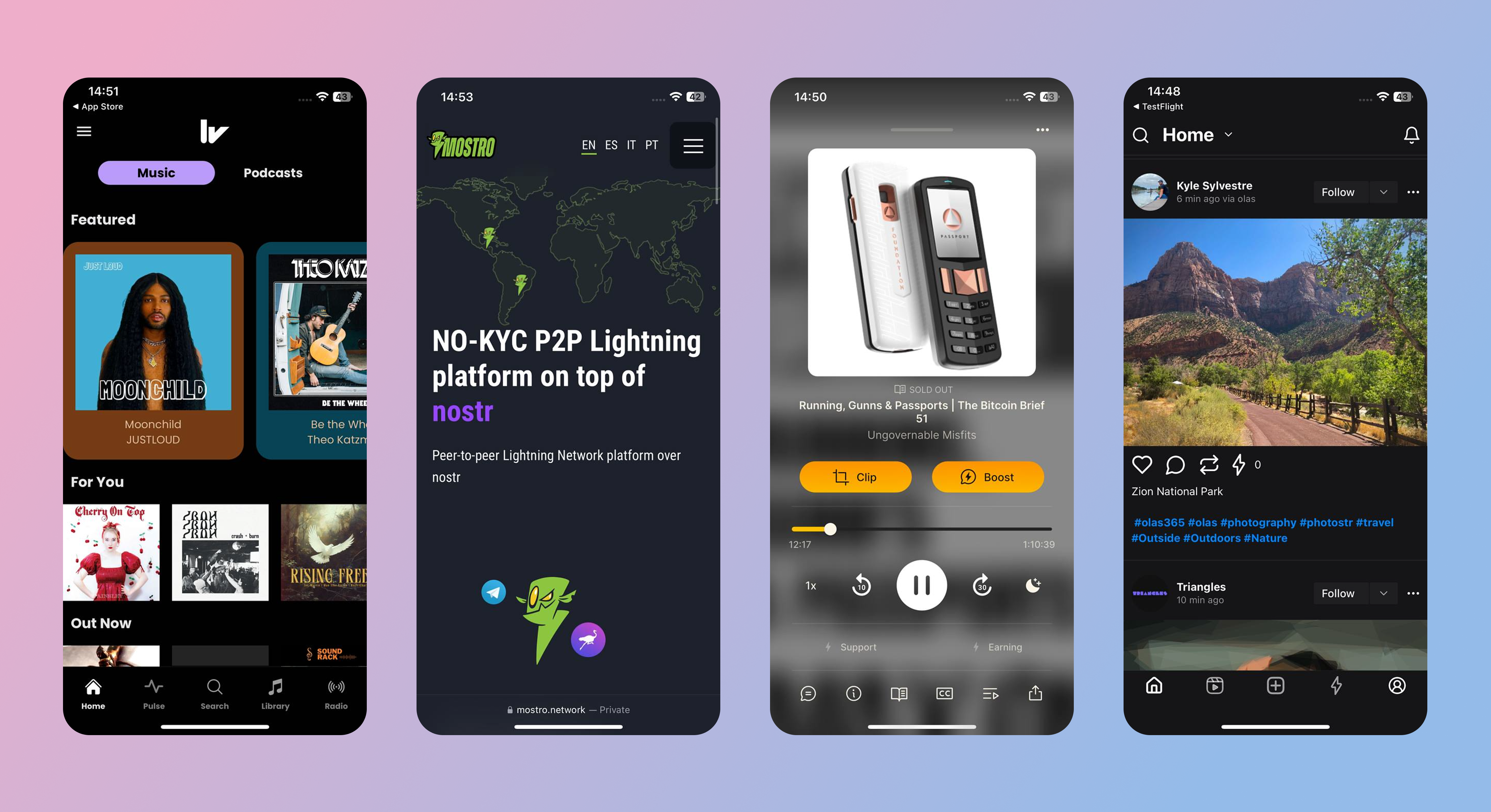

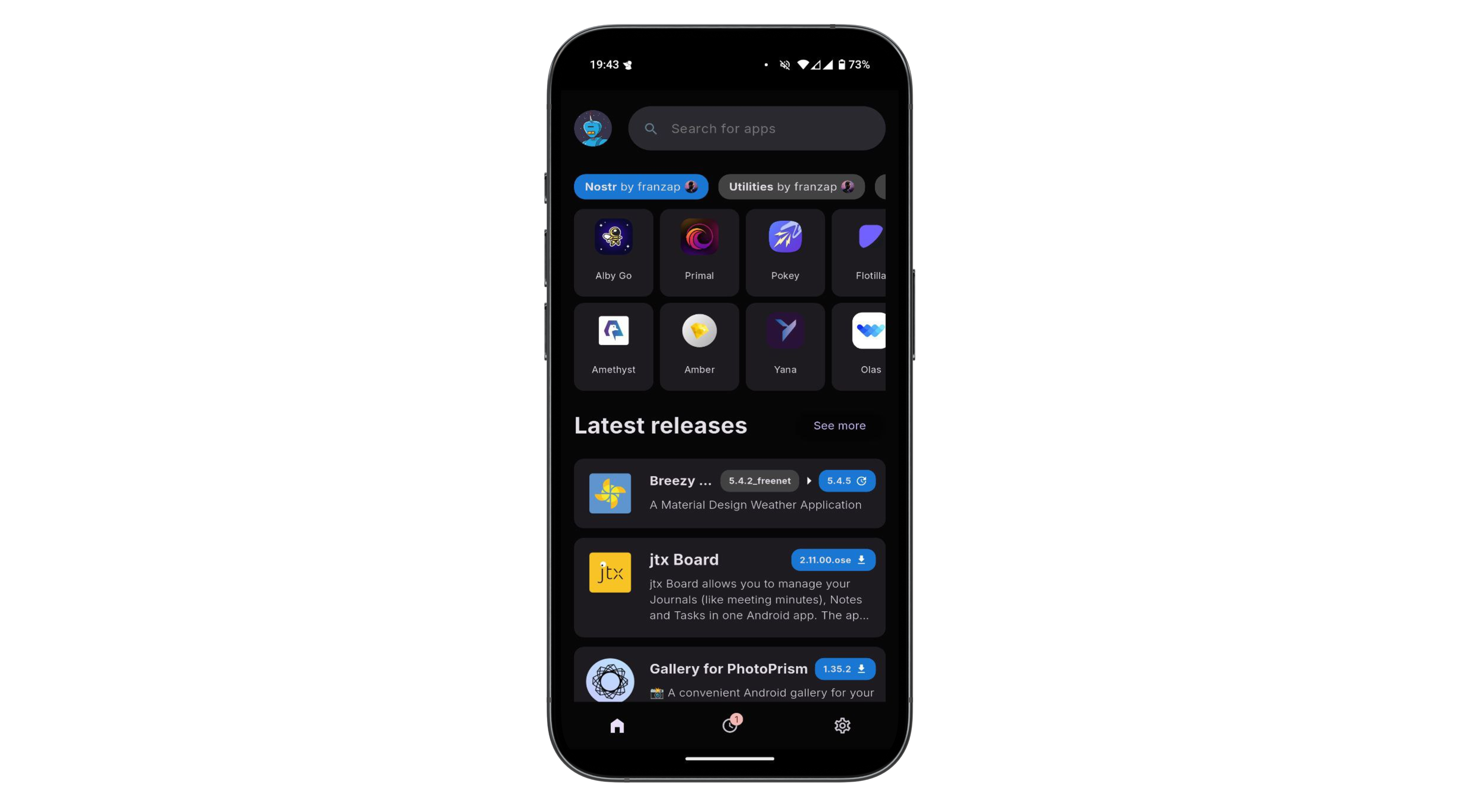

Primal is a first of its kind application for the Nostr protocol that combines a client, caching service, analytics tools, and more to address several unmet needs in the nascent Nostr ecosystem. Through the combination of its sleek client application and its caching service (built on a completely open source stack), Primal seeks to offer an end-user experience as smooth and easy as that of legacy social media platforms like Twitter and eventually many other applications, unlocking the vast potential of Nostr for the next billion people. Primal also offers an integrated wallet (powered by Strike BLACK) that substantially reduces onboarding and UX frictions for both Nostr and the lightning network while highlighting bitcoin’s unique power as internet-native, open-source money.

Selected Portfolio News

AnchorWatch announced it has achieved Llody’s Coverholder status, allowing the company to provide unique 1:1 bitcoin insurance offerings starting in December.\ \ Battery Finance Founder and CEO Andrew Hohns appeared on CNBC to delve into the company’s unique bitcoin-backed private credit strategy.

Primal launched version 2.0, a landmark update that adds a feed marketplace, robust advanced search capabilities, premium-tier offerings, and many more new features.

Debifi launched its new iOS app for Apple users seeking non-custodial bitcoin-collateralized loans.

Media

Strike Founder and CEO Jack Mallers joined Bloomberg TV to discuss the strong volumes the company has seen over the past year and the potential for a US bitcoin strategic reserve.

Primal Founder and CEO Miljan Braticevic joined The Bitcoin Podcast to discuss the rollout of Primal 2.0 and the future of Nostr.

Ten31 Managing Partner Marty Bent appeared on BlazeTV to discuss recent changes in the regulatory environment for bitcoin.

Zaprite published a customer testimonial video highlighting the popularity of its offerings across the bitcoin ecosystem.

Market Updates

Continuing its recent momentum, bitcoin reached another new all-time high this week, clocking in just below $100,000 on Friday. Bitcoin has now reached a market cap of nearly $2 trillion, putting it within 3% of the market caps of Amazon and Google.

After receiving SEC and CFTC approval over the past month, long-awaited options on spot bitcoin ETFs were fully approved and launched this week. These options should help further expand bitcoin’s institutional liquidity profile, with potentially significant implications for price action over time.

The new derivatives showed strong performance out of the gate, with volumes on options for BlackRock’s IBIT reaching nearly $2 billion on just the first day of trading despite surprisingly tight position limits for the vehicles.

Meanwhile, the underlying spot bitcoin ETF complex had yet another banner week, pulling in $3.4 billion in net inflows.

New reports suggested President-elect Donald Trump’s social media company is in advanced talks to acquire crypto trading platform Bakkt, potentially the latest indication of the incoming administration’s stance toward the broader “crypto” ecosystem.

On the macro front, US housing starts declined M/M again in October on persistently high mortgage rates and weather impacts. The metric remains well below pre-COVID levels.

Pockets of the US commercial real estate market remain challenged, as the CEO of large Florida developer Related indicated that developers need further rate cuts “badly” to maintain project viability.

US Manufacturing PMI increased slightly M/M, but has now been in contraction territory (<50) for well over two years.