-

@ a95c6243:d345522c

2025-03-01 10:39:35

@ a95c6243:d345522c

2025-03-01 10:39:35Ständige Lügen und Unterstellungen, permanent falsche Fürsorge \ können Bausteine von emotionaler Manipulation sein. Mit dem Zweck, \ Macht und Kontrolle über eine andere Person auszuüben. \ Apotheken Umschau

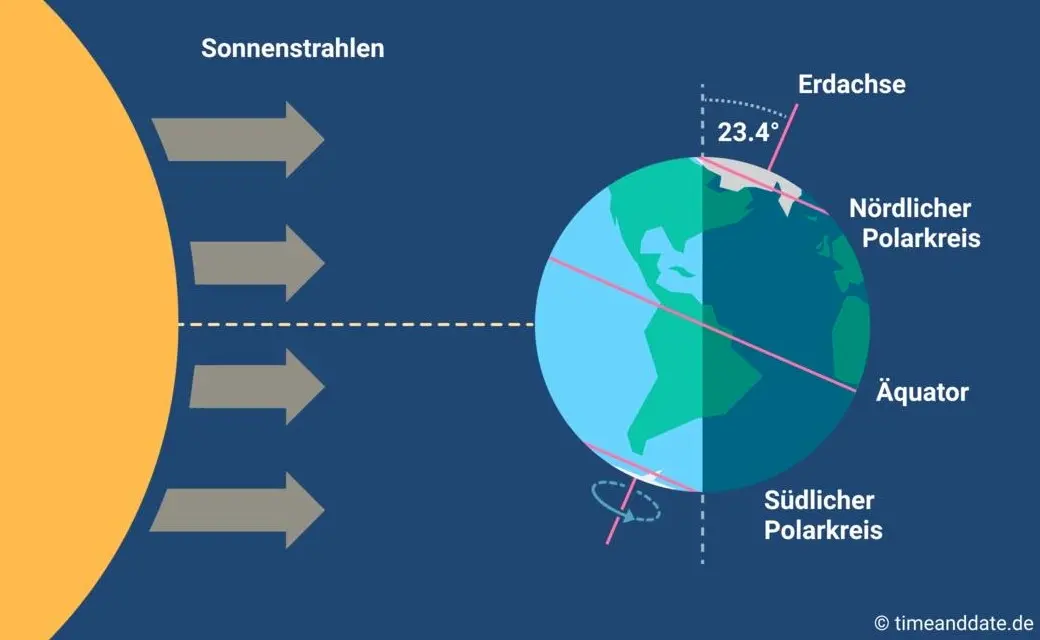

Irgendetwas muss passiert sein: «Gaslighting» ist gerade Thema in vielen Medien. Heute bin ich nach längerer Zeit mal wieder über dieses Stichwort gestolpert. Das war in einem Artikel von Norbert Häring über Manipulationen des Deutschen Wetterdienstes (DWD). In diesem Fall ging es um eine Pressemitteilung vom Donnerstag zum «viel zu warmen» Winter 2024/25.

Häring wirft der Behörde vor, dreist zu lügen und Dinge auszulassen, um die Klimaangst wach zu halten. Was der Leser beim DWD nicht erfahre, sei, dass dieser Winter kälter als die drei vorangegangenen und kälter als der Durchschnitt der letzten zehn Jahre gewesen sei. Stattdessen werde der falsche Eindruck vermittelt, es würde ungebremst immer wärmer.

Wem also der zu Ende gehende Winter eher kalt vorgekommen sein sollte, mit dessen Empfinden stimme wohl etwas nicht. Das jedenfalls wolle der DWD uns einreden, so der Wirtschaftsjournalist. Und damit sind wir beim Thema Gaslighting.

Als Gaslighting wird eine Form psychischer Manipulation bezeichnet, mit der die Opfer desorientiert und zutiefst verunsichert werden, indem ihre eigene Wahrnehmung als falsch bezeichnet wird. Der Prozess führt zu Angst und Realitätsverzerrung sowie zur Zerstörung des Selbstbewusstseins. Die Bezeichnung kommt von dem britischen Theaterstück «Gas Light» aus dem Jahr 1938, in dem ein Mann mit grausamen Psychotricks seine Frau in den Wahnsinn treibt.

Damit Gaslighting funktioniert, muss das Opfer dem Täter vertrauen. Oft wird solcher Psychoterror daher im privaten oder familiären Umfeld beschrieben, ebenso wie am Arbeitsplatz. Jedoch eignen sich die Prinzipien auch perfekt zur Manipulation der Massen. Vermeintliche Autoritäten wie Ärzte und Wissenschaftler, oder «der fürsorgliche Staat» und Institutionen wie die UNO oder die WHO wollen uns doch nichts Böses. Auch Staatsmedien, Faktenchecker und diverse NGOs wurden zu «vertrauenswürdigen Quellen» erklärt. Das hat seine Wirkung.

Warum das Thema Gaslighting derzeit scheinbar so populär ist, vermag ich nicht zu sagen. Es sind aber gerade in den letzten Tagen und Wochen auffällig viele Artikel dazu erschienen, und zwar nicht nur von Psychologen. Die Frankfurter Rundschau hat gleich mehrere publiziert, und Anwälte interessieren sich dafür offenbar genauso wie Apotheker.

Die Apotheken Umschau machte sogar auf «Medical Gaslighting» aufmerksam. Davon spreche man, wenn Mediziner Symptome nicht ernst nähmen oder wenn ein gesundheitliches Problem vom behandelnden Arzt «schnöde heruntergespielt» oder abgetan würde. Kommt Ihnen das auch irgendwie bekannt vor? Der Begriff sei allerdings irreführend, da er eine manipulierende Absicht unterstellt, die «nicht gewährleistet» sei.

Apropos Gaslighting: Die noch amtierende deutsche Bundesregierung meldete heute, es gelte, «weiter [sic!] gemeinsam daran zu arbeiten, einen gerechten und dauerhaften Frieden für die Ukraine zu erreichen». Die Ukraine, wo sich am Montag «der völkerrechtswidrige Angriffskrieg zum dritten Mal jährte», verteidige ihr Land und «unsere gemeinsamen Werte».

Merken Sie etwas? Das Demokratieverständnis mag ja tatsächlich inzwischen in beiden Ländern ähnlich traurig sein. Bezüglich Friedensbemühungen ist meine Wahrnehmung jedoch eine andere. Das muss an meinem Gedächtnis liegen.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2025-02-21 19:32:23

@ a95c6243:d345522c

2025-02-21 19:32:23Europa – das Ganze ist eine wunderbare Idee, \ aber das war der Kommunismus auch. \ Loriot

«Europa hat fertig», könnte man unken, und das wäre nicht einmal sehr verwegen. Mit solch einer Einschätzung stünden wir nicht alleine, denn die Stimmen in diese Richtung mehren sich. Der französische Präsident Emmanuel Macron warnte schon letztes Jahr davor, dass «unser Europa sterben könnte». Vermutlich hatte er dabei andere Gefahren im Kopf als jetzt der ungarische Ministerpräsident Viktor Orbán, der ein «baldiges Ende der EU» prognostizierte. Das Ergebnis könnte allerdings das gleiche sein.

Neben vordergründigen Themenbereichen wie Wirtschaft, Energie und Sicherheit ist das eigentliche Problem jedoch die obskure Mischung aus aufgegebener Souveränität und geschwollener Arroganz, mit der europäische Politiker:innende unterschiedlicher Couleur aufzutreten pflegen. Und das Tüpfelchen auf dem i ist die bröckelnde Legitimation politischer Institutionen dadurch, dass die Stimmen großer Teile der Bevölkerung seit Jahren auf vielfältige Weise ausgegrenzt werden.

Um «UnsereDemokratie» steht es schlecht. Dass seine Mandate immer schwächer werden, merkt natürlich auch unser «Führungspersonal». Entsprechend werden die Maßnahmen zur Gängelung, Überwachung und Manipulation der Bürger ständig verzweifelter. Parallel dazu plustern sich in Paris Macron, Scholz und einige andere noch einmal mächtig in Sachen Verteidigung und «Kriegstüchtigkeit» auf.

Momentan gilt es auch, das Überschwappen covidiotischer und verschwörungsideologischer Auswüchse aus den USA nach Europa zu vermeiden. So ein «MEGA» (Make Europe Great Again) können wir hier nicht gebrauchen. Aus den Vereinigten Staaten kommen nämlich furchtbare Nachrichten. Beispielsweise wurde einer der schärfsten Kritiker der Corona-Maßnahmen kürzlich zum Gesundheitsminister ernannt. Dieser setzt sich jetzt für eine Neubewertung der mRNA-«Impfstoffe» ein, was durchaus zu einem Entzug der Zulassungen führen könnte.

Der europäischen Version von «Verteidigung der Demokratie» setzte der US-Vizepräsident J. D. Vance auf der Münchner Sicherheitskonferenz sein Verständnis entgegen: «Demokratie stärken, indem wir unseren Bürgern erlauben, ihre Meinung zu sagen». Das Abschalten von Medien, das Annullieren von Wahlen oder das Ausschließen von Menschen vom politischen Prozess schütze gar nichts. Vielmehr sei dies der todsichere Weg, die Demokratie zu zerstören.

In der Schweiz kamen seine Worte deutlich besser an als in den meisten europäischen NATO-Ländern. Bundespräsidentin Karin Keller-Sutter lobte die Rede und interpretierte sie als «Plädoyer für die direkte Demokratie». Möglicherweise zeichne sich hier eine außenpolitische Kehrtwende in Richtung integraler Neutralität ab, meint mein Kollege Daniel Funk. Das wären doch endlich mal ein paar gute Nachrichten.

Von der einstigen Idee einer europäischen Union mit engeren Beziehungen zwischen den Staaten, um Konflikte zu vermeiden und das Wohlergehen der Bürger zu verbessern, sind wir meilenweit abgekommen. Der heutige korrupte Verbund unter technokratischer Leitung ähnelt mehr einem Selbstbedienungsladen mit sehr begrenztem Zugang. Die EU-Wahlen im letzten Sommer haben daran ebenso wenig geändert, wie die Bundestagswahl am kommenden Sonntag darauf einen Einfluss haben wird.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ f33c8a96:5ec6f741

2025-03-01 23:23:36

@ f33c8a96:5ec6f741

2025-03-01 23:23:36Setting Up Git and GitHub: A Developer's Foundation

Lesson Overview

In this lesson, we'll establish one of the most important foundations of your development journey: version control with Git and GitHub. This knowledge will enable you to track your code, back it up in the cloud, and start building your developer portfolio.

Prerequisites

- Visual Studio Code installed

- Terminal/Command Line basics

- GitHub account (we'll create one in this lesson)

Key Learning Objectives

- Understand what Git and GitHub are and why they're essential

- Set up Git locally and connect it to GitHub

- Learn basic Git commands and workflow

- Create your first repository and commit

- Establish good Git habits for your developer journey

What is Git and GitHub?

Git: Your Local Version Control

- A version control system that tracks code changes over time

- Prevents accidental overwrites of your work

- Enables multiple developers to work on the same project safely

- Runs locally on your machine

GitHub: Your Code in the Cloud

- A web-based platform that extends Git

- Cloud storage for your code repositories

- Enables code sharing and collaboration

- Includes features like:

- Issue tracking

- Pull requests

- Project management tools

- Code review capabilities

Why Use GitHub?

1. Portfolio Building

- Acts as your "proof of work" as a developer

- Shows your coding activity through contribution graphs

- Demonstrates your consistency and dedication

- Serves as a public showcase of your projects

2. Collaboration and Learning

- Access millions of open-source projects

- Learn from other developers' code

- Contribute to real-world projects

- Get feedback on your code

- Work effectively in teams

3. Code Safety and Access

- All your code is safely stored in the cloud

- Access your projects from anywhere

- Never lose your work due to computer issues

Essential GitHub Terminology

| Term | Definition | |------|------------| | Repository (Repo) | A folder containing your project files and version history | | Commit | A saved change or addition to your code | | Staging | Marking changes to be included in your next commit | | Push | Sending your local commits to GitHub | | Branch | A separate version of your code for new features or experiments | | Pull Request (PR) | A request to merge changes from one branch to another | | Clone | Creating a local copy of a remote repository | | Fork | Creating your own copy of someone else's repository |

Hands-on Practice

Setting Up Git

- Install Git from https://git-scm.com/downloads

- Configure your identity:

bash git config --global user.name "Your Name" git config --global user.email "your.email@example.com"

Your First Repository

- Create a new repository on GitHub named "hello-world"

- Initialize Git locally:

bash git init git add . git commit -m "My first commit" git remote add origin <your-repository-url> git push -u origin main

Basic Git Workflow Quick Reference

Pushing Code to GitHub

```bash

1. Stage your changes

git add .

2. Commit your changes with a message

git commit -m "Describe your changes here"

3. Push to GitHub

git push ```

Getting Code from GitHub

```bash

If you already have the repository locally:

git pull

If you need to download a repository:

git clone https://github.com/username/repository.git ```

Building Good Habits

Daily Git Practice

- Make it a goal to push code every day

- Even small changes count

- Use your GitHub contribution graph as motivation

- Track your progress over time

Best Practices

- Commit often with clear messages

- Pull before you start working

- Push your changes when you finish

- Keep each project in its own repository

- Include README files to explain your projects

Common Issues and Solutions

"No upstream branch" Error

If you see this error when pushing:

bash git push --set-upstream origin mainChanges Not Showing Up

- Check if changes are staged:

bash git status - Make sure you've committed:

bash git commit -m "Your message" - Verify you've pushed:

bash git push

Exercise: Start Your Journey

- Create your GitHub account if you haven't already

- Set up Git locally using the commands we covered

- Create your first repository named "hello-world"

- Make your first commit

- Push your code to GitHub

- Make a habit of pushing code daily

Additional Resources

- GitHub Documentation

- Git Documentation

- Practice with GitHub Learning Lab

Next Steps

- Start tracking all your code projects with Git

- Begin building your portfolio on GitHub

- Join the open-source community

- Collaborate with other developers

Remember: Every developer started where you are now. The key is consistency and persistence. Make pushing code to GitHub a daily habit, and you'll be amazed at your progress over time.

Happy coding! 🚀

-

@ b2d670de:907f9d4a

2025-02-28 16:39:38

@ b2d670de:907f9d4a

2025-02-28 16:39:38onion-service-nostr-relays

A list of nostr relays exposed as onion services.

The list

| Relay name | Description | Onion url | Operator | Payment URL | Payment options | | --- | --- | --- | --- | --- | --- | | nostr.oxtr.dev | Same relay as clearnet relay nostr.oxtr.dev | ws://oxtrdevav64z64yb7x6rjg4ntzqjhedm5b5zjqulugknhzr46ny2qbad.onion | operator | N/A | N/A | | relay.snort.social | Same relay as clearnet relay relay.snort.social | wss://skzzn6cimfdv5e2phjc4yr5v7ikbxtn5f7dkwn5c7v47tduzlbosqmqd.onion | operator | N/A | N/A | | nostr.thesamecat.io | Same relay as clearnet relay nostr.thesamecat.io | ws://2jsnlhfnelig5acq6iacydmzdbdmg7xwunm4xl6qwbvzacw4lwrjmlyd.onion | operator | N/A | N/A | | nostr.land | The nostr.land paid relay (same as clearnet) | ws://nostrland2gdw7g3y77ctftovvil76vquipymo7tsctlxpiwknevzfid.onion | operator | Payment URL | BTC LN | | bitcoiner.social | No auth required, currently | ws://bitcoinr6de5lkvx4tpwdmzrdfdpla5sya2afwpcabjup2xpi5dulbad.onion | operator | N/A | N/A | | relay.westernbtc.com | The westernbtc.com paid relay | ws://westbtcebhgi4ilxxziefho6bqu5lqwa5ncfjefnfebbhx2cwqx5knyd.onion | operator | Payment URL | BTC LN | | freelay.sovbit.host | Free relay for sovbit.host | ws://sovbitm2enxfr5ot6qscwy5ermdffbqscy66wirkbsigvcshumyzbbqd.onion | operator | N/A | N/A | | nostr.sovbit.host | Paid relay for sovbit.host | ws://sovbitgz5uqyh7jwcsudq4sspxlj4kbnurvd3xarkkx2use3k6rlibqd.onion | operator | N/A | N/A | | nostr.wine | 🍷 nostr.wine relay | ws://nostrwinemdptvqukjttinajfeedhf46hfd5bz2aj2q5uwp7zros3nad.onion | operator | Payment URL | BTC LN, BTC, Credit Card/CashApp (Stripe) | | inbox.nostr.wine | 🍷 inbox.nostr.wine relay | ws://wineinboxkayswlofkugkjwhoyi744qvlzdxlmdvwe7cei2xxy4gc6ad.onion | operator | Payment URL | BTC LN, BTC | | filter.nostr.wine | 🍷 filter.nostr.wine proxy relay | ws://winefiltermhqixxzmnzxhrmaufpnfq3rmjcl6ei45iy4aidrngpsyid.onion | operator | Payment URL | BTC LN, BTC | | N/A | N/A | ws://pzfw4uteha62iwkzm3lycabk4pbtcr67cg5ymp5i3xwrpt3t24m6tzad.onion:81 | operator | N/A | N/A | | nostr.fractalized.net | Free relay for fractalized.net | ws://xvgox2zzo7cfxcjrd2llrkthvjs5t7efoalu34s6lmkqhvzvrms6ipyd.onion | operator | N/A | N/A | | nfrelay.app | nfrelay.app aggregator relay (nostr-filter-relay) | ws://nfrelay6saohkmipikquvrn6d64dzxivhmcdcj4d5i7wxis47xwsriyd.onion | operator | N/A | N/A | relay.nostr.net | Public relay from nostr.net (Same as clearnet) | ws://nostrnetl6yd5whkldj3vqsxyyaq3tkuspy23a3qgx7cdepb4564qgqd.onion | operator | N/A | N/A | | nerostrator | Free to read, pay XMR to relay | ws://nerostrrgb5fhj6dnzhjbgmnkpy2berdlczh6tuh2jsqrjok3j4zoxid.onion | operator |Payment URL | XMR | | nostr.girino.org | Public relay from nostr.girino.org | ws://gnostr2jnapk72mnagq3cuykfon73temzp77hcbncn4silgt77boruid.onion | operator | N/A | N/A | | wot.girino.org | WoT relay from wot.girino.org | ws://girwot2koy3kvj6fk7oseoqazp5vwbeawocb3m27jcqtah65f2fkl3yd.onion | operator | N/A | N/A | | haven.girino.org/{outbox, inbox, chat, private} | Haven smart relay from haven.girino.org | ws://ghaven2hi3qn2riitw7ymaztdpztrvmm337e2pgkacfh3rnscaoxjoad.onion/{outbox, inbox, chat, private} | operator | N/A | N/A | | relay.nostpy.lol | Free Web of Trust relay (Same as clearnet) | ws://pemgkkqjqjde7y2emc2hpxocexugbixp42o4zymznil6zfegx5nfp4id.onion | operator |N/A | N/A | | Poster.place Nostr Relay | N/A | ws://dmw5wbawyovz7fcahvguwkw4sknsqsalffwctioeoqkvvy7ygjbcuoad.onion | operator | N/A | N/A | | Azzamo Relay | Azzamo Premium Nostr relay. (paid) | ws://q6a7m5qkyonzb5fk5yv4jyu3ar44hqedn7wjopg737lit2ckkhx2nyid.onion | operator | Payment URL | BTC LN | | Azzamo Inbox Relay | Azzamo Group and Private message relay. (Freemium) | ws://gp5kiwqfw7t2fwb3rfts2aekoph4x7pj5pv65re2y6hzaujsxewanbqd.onion | operator | Payment URL | BTC LN | | Noderunners Relay | The official Noderunners Nostr Relay. | ws://35vr3xigzjv2xyzfyif6o2gksmkioppy4rmwag7d4bqmwuccs2u4jaid.onion | operator | Payment URL | BTC LN |

Contributing

Contributions are encouraged to keep this document alive. Just open a PR and I'll have it tested and merged. The onion URL is the only mandatory column, the rest is just nice-to-have metadata about the relay. Put

N/Ain empty columns.If you want to contribute anonymously, please contact me on SimpleX or send a DM on nostr using a disposable npub.

Operator column

It is generally preferred to use something that includes a NIP-19 string, either just the string or a url that contains the NIP-19 string in it (e.g. an njump url).

-

@ a95c6243:d345522c

2025-02-19 09:23:17

@ a95c6243:d345522c

2025-02-19 09:23:17Die «moralische Weltordnung» – eine Art Astrologie. Friedrich Nietzsche

Das Treffen der BRICS-Staaten beim Gipfel im russischen Kasan war sicher nicht irgendein politisches Event. Gastgeber Wladimir Putin habe «Hof gehalten», sagen die Einen, China und Russland hätten ihre Vorstellung einer multipolaren Weltordnung zelebriert, schreiben Andere.

In jedem Fall zeigt die Anwesenheit von über 30 Delegationen aus der ganzen Welt, dass von einer geostrategischen Isolation Russlands wohl keine Rede sein kann. Darüber hinaus haben sowohl die Anreise von UN-Generalsekretär António Guterres als auch die Meldungen und Dementis bezüglich der Beitrittsbemühungen des NATO-Staats Türkei für etwas Aufsehen gesorgt.

Im Spannungsfeld geopolitischer und wirtschaftlicher Umbrüche zeigt die neue Allianz zunehmendes Selbstbewusstsein. In Sachen gemeinsamer Finanzpolitik schmiedet man interessante Pläne. Größere Unabhängigkeit von der US-dominierten Finanzordnung ist dabei ein wichtiges Ziel.

Beim BRICS-Wirtschaftsforum in Moskau, wenige Tage vor dem Gipfel, zählte ein nachhaltiges System für Finanzabrechnungen und Zahlungsdienste zu den vorrangigen Themen. Während dieses Treffens ging der russische Staatsfonds eine Partnerschaft mit dem Rechenzentrumsbetreiber BitRiver ein, um Bitcoin-Mining-Anlagen für die BRICS-Länder zu errichten.

Die Initiative könnte ein Schritt sein, Bitcoin und andere Kryptowährungen als Alternativen zu traditionellen Finanzsystemen zu etablieren. Das Projekt könnte dazu führen, dass die BRICS-Staaten den globalen Handel in Bitcoin abwickeln. Vor dem Hintergrund der Diskussionen über eine «BRICS-Währung» wäre dies eine Alternative zu dem ursprünglich angedachten Korb lokaler Währungen und zu goldgedeckten Währungen sowie eine mögliche Ergänzung zum Zahlungssystem BRICS Pay.

Dient der Bitcoin also der Entdollarisierung? Oder droht er inzwischen, zum Gegenstand geopolitischer Machtspielchen zu werden? Angesichts der globalen Vernetzungen ist es oft schwer zu durchschauen, «was eine Show ist und was im Hintergrund von anderen Strippenziehern insgeheim gesteuert wird». Sicher können Strukturen wie Bitcoin auch so genutzt werden, dass sie den Herrschenden dienlich sind. Aber die Grundeigenschaft des dezentralisierten, unzensierbaren Peer-to-Peer Zahlungsnetzwerks ist ihm schließlich nicht zu nehmen.

Wenn es nach der EZB oder dem IWF geht, dann scheint statt Instrumentalisierung momentan eher der Kampf gegen Kryptowährungen angesagt. Jürgen Schaaf, Senior Manager bei der Europäischen Zentralbank, hat jedenfalls dazu aufgerufen, Bitcoin «zu eliminieren». Der Internationale Währungsfonds forderte El Salvador, das Bitcoin 2021 als gesetzliches Zahlungsmittel eingeführt hat, kürzlich zu begrenzenden Maßnahmen gegen das Kryptogeld auf.

Dass die BRICS-Staaten ein freiheitliches Ansinnen im Kopf haben, wenn sie Kryptowährungen ins Spiel bringen, darf indes auch bezweifelt werden. Im Abschlussdokument bekennen sich die Gipfel-Teilnehmer ausdrücklich zur UN, ihren Programmen und ihrer «Agenda 2030». Ernst Wolff nennt das «eine Bankrotterklärung korrupter Politiker, die sich dem digital-finanziellen Komplex zu 100 Prozent unterwerfen».

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2025-02-15 19:05:38

@ a95c6243:d345522c

2025-02-15 19:05:38Auf der diesjährigen Münchner Sicherheitskonferenz geht es vor allem um die Ukraine. Protagonisten sind dabei zunächst die US-Amerikaner. Präsident Trump schockierte die Europäer kurz vorher durch ein Telefonat mit seinem Amtskollegen Wladimir Putin, während Vizepräsident Vance mit seiner Rede über Demokratie und Meinungsfreiheit für versteinerte Mienen und Empörung sorgte.

Die Bemühungen der Europäer um einen Frieden in der Ukraine halten sich, gelinde gesagt, in Grenzen. Größeres Augenmerk wird auf militärische Unterstützung, die Pflege von Feindbildern sowie Eskalation gelegt. Der deutsche Bundeskanzler Scholz reagierte auf die angekündigten Verhandlungen über einen möglichen Frieden für die Ukraine mit der Forderung nach noch höheren «Verteidigungsausgaben». Auch die amtierende Außenministerin Baerbock hatte vor der Münchner Konferenz klargestellt:

«Frieden wird es nur durch Stärke geben. (...) Bei Corona haben wir gesehen, zu was Europa fähig ist. Es braucht erneut Investitionen, die der historischen Wegmarke, vor der wir stehen, angemessen sind.»

Die Rüstungsindustrie freut sich in jedem Fall über weltweit steigende Militärausgaben. Die Kriege in der Ukraine und in Gaza tragen zu Rekordeinnahmen bei. Jetzt «winkt die Aussicht auf eine jahrelange große Nachrüstung in Europa», auch wenn der Ukraine-Krieg enden sollte, so hört man aus Finanzkreisen. In der Konsequenz kennt «die Aktie des deutschen Vorzeige-Rüstungskonzerns Rheinmetall in ihrem Anstieg offenbar gar keine Grenzen mehr». «Solche Friedensversprechen» wie das jetzige hätten in der Vergangenheit zu starken Kursverlusten geführt.

Für manche Leute sind Kriegswaffen und sonstige Rüstungsgüter Waren wie alle anderen, jedenfalls aus der Perspektive von Investoren oder Managern. Auch in diesem Bereich gibt es Startups und man spricht von Dingen wie innovativen Herangehensweisen, hocheffizienten Produktionsanlagen, skalierbaren Produktionstechniken und geringeren Stückkosten.

Wir lesen aktuell von Massenproduktion und gesteigerten Fertigungskapazitäten für Kriegsgerät. Der Motor solcher Dynamik und solchen Wachstums ist die Aufrüstung, die inzwischen permanent gefordert wird. Parallel wird die Bevölkerung verbal eingestimmt und auf Kriegstüchtigkeit getrimmt.

Das Rüstungs- und KI-Startup Helsing verkündete kürzlich eine «dezentrale Massenproduktion für den Ukrainekrieg». Mit dieser Expansion positioniere sich das Münchner Unternehmen als einer der weltweit führenden Hersteller von Kampfdrohnen. Der nächste «Meilenstein» steht auch bereits an: Man will eine Satellitenflotte im Weltraum aufbauen, zur Überwachung von Gefechtsfeldern und Truppenbewegungen.

Ebenfalls aus München stammt das als DefenseTech-Startup bezeichnete Unternehmen ARX Robotics. Kürzlich habe man in der Region die größte europäische Produktionsstätte für autonome Verteidigungssysteme eröffnet. Damit fahre man die Produktion von Militär-Robotern hoch. Diese Expansion diene auch der Lieferung der «größten Flotte unbemannter Bodensysteme westlicher Bauart» in die Ukraine.

Rüstung boomt und scheint ein Zukunftsmarkt zu sein. Die Hersteller und Vermarkter betonen, mit ihren Aktivitäten und Produkten solle die europäische Verteidigungsfähigkeit erhöht werden. Ihre Strategien sollten sogar «zum Schutz demokratischer Strukturen beitragen».

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ 378562cd:a6fc6773

2025-03-01 17:53:12

@ 378562cd:a6fc6773

2025-03-01 17:53:12You're in the right place if you've feel like you have never known God but feel drawn to Him. The Bible is God’s Word, His way of speaking to us, and it holds the truth about who He is, who we are, and how we can have a relationship with Him.

Here’s a simple guide to getting started:

Step 1: Begin with Jesus The best place to start is with Jesus. He is the heart of the Bible’s message; we can know God through Him. Start by reading the Gospel of John in the New Testament. It clearly shows who Jesus is, His love for us, and why He came to save us.

Step 2: Talk to God as You Read Reading the Bible isn’t just about gathering knowledge and meeting God. Ask Him to help you understand. A simple prayer like, "God, if You are real, show me the truth. Help me know You" is enough.

Step 3: Understand the Main Message The Bible tells one big story:

God created us (Genesis 1:1) Sin separated us from God (Romans 3:23) Jesus came to save us (John 3:16) We can be forgiven and have eternal life through Him (Romans 10:9)

Step 4: Accepting Jesus into Your Heart If you believe that Jesus is the Son of God, that He died for your sins, and that He rose again, you can ask Him to forgive you and come into your life. You don’t need fancy words—just a sincere heart.

You can pray something like this: "Jesus, I believe You are the Son of God. I believe You died for my sins and rose again. I ask You to forgive me, change me, and come into my life. I want to follow You. Amen."

Step 5: Keep Going! Read a little each day. Start with John, then move to Matthew, Mark, and Luke.

Find a Bible-believing church or group to help you grow. Pray daily — talk to God like you would a friend. Trust that God will guide you as you seek Him. If you’ve taken these steps, you’ve begun the greatest journey of your life—walking with Jesus. Keep seeking, keep learning, and know that God loves you deeply. 💙

I may not know you, and you may not know me, but this guide can be a lifeline if you carry burdens— drama, heartache, struggles, pains or whatever. If you commit to following the steps of this guide and make time to read your Bible daily, you’ll find wisdom, peace, and the strength to face whatever life throws your way.

-

@ c631e267:c2b78d3e

2025-02-07 19:42:11

@ c631e267:c2b78d3e

2025-02-07 19:42:11Nur wenn wir aufeinander zugehen, haben wir die Chance \ auf Überwindung der gegenseitigen Ressentiments! \ Dr. med. dent. Jens Knipphals

In Wolfsburg sollte es kürzlich eine Gesprächsrunde von Kritikern der Corona-Politik mit Oberbürgermeister Dennis Weilmann und Vertretern der Stadtverwaltung geben. Der Zahnarzt und langjährige Maßnahmenkritiker Jens Knipphals hatte diese Einladung ins Rathaus erwirkt und publiziert. Seine Motivation:

«Ich möchte die Spaltung der Gesellschaft überwinden. Dazu ist eine umfassende Aufarbeitung der Corona-Krise in der Öffentlichkeit notwendig.»

Schon früher hatte Knipphals Antworten von den Kommunalpolitikern verlangt, zum Beispiel bei öffentlichen Bürgerfragestunden. Für das erwartete Treffen im Rathaus formulierte er Fragen wie: Warum wurden fachliche Argumente der Kritiker ignoriert? Weshalb wurde deren Ausgrenzung, Diskreditierung und Entmenschlichung nicht entgegengetreten? In welcher Form übernehmen Rat und Verwaltung in Wolfsburg persönlich Verantwortung für die erheblichen Folgen der politischen Corona-Krise?

Der Termin fand allerdings nicht statt – der Bürgermeister sagte ihn kurz vorher wieder ab. Knipphals bezeichnete Weilmann anschließend als Wiederholungstäter, da das Stadtoberhaupt bereits 2022 zu einem Runden Tisch in der Sache eingeladen hatte, den es dann nie gab. Gegenüber Multipolar erklärte der Arzt, Weilmann wolle scheinbar eine öffentliche Aufarbeitung mit allen Mitteln verhindern. Er selbst sei «inzwischen absolut desillusioniert» und die einzige Lösung sei, dass die Verantwortlichen gingen.

Die Aufarbeitung der Plandemie beginne bei jedem von uns selbst, sei aber letztlich eine gesamtgesellschaftliche Aufgabe, schreibt Peter Frey, der den «Fall Wolfsburg» auch in seinem Blog behandelt. Diese Aufgabe sei indes deutlich größer, als viele glaubten. Erfreulicherweise sei der öffentliche Informationsraum inzwischen größer, trotz der weiterhin unverfrorenen Desinformations-Kampagnen der etablierten Massenmedien.

Frey erinnert daran, dass Dennis Weilmann mitverantwortlich für gravierende Grundrechtseinschränkungen wie die 2021 eingeführten 2G-Regeln in der Wolfsburger Innenstadt zeichnet. Es sei naiv anzunehmen, dass ein Funktionär einzig im Interesse der Bürger handeln würde. Als früherer Dezernent des Amtes für Wirtschaft, Digitalisierung und Kultur der Autostadt kenne Weilmann zum Beispiel die Verknüpfung von Fördergeldern mit politischen Zielsetzungen gut.

Wolfsburg wurde damals zu einem Modellprojekt des Bundesministeriums des Innern (BMI) und war Finalist im Bitkom-Wettbewerb «Digitale Stadt». So habe rechtzeitig vor der Plandemie das Projekt «Smart City Wolfsburg» anlaufen können, das der Stadt «eine Vorreiterrolle für umfassende Vernetzung und Datenerfassung» aufgetragen habe, sagt Frey. Die Vereinten Nationen verkauften dann derartige «intelligente» Überwachungs- und Kontrollmaßnahmen ebenso als Rettung in der Not wie das Magazin Forbes im April 2020:

«Intelligente Städte können uns helfen, die Coronavirus-Pandemie zu bekämpfen. In einer wachsenden Zahl von Ländern tun die intelligenten Städte genau das. Regierungen und lokale Behörden nutzen Smart-City-Technologien, Sensoren und Daten, um die Kontakte von Menschen aufzuspüren, die mit dem Coronavirus infiziert sind. Gleichzeitig helfen die Smart Cities auch dabei, festzustellen, ob die Regeln der sozialen Distanzierung eingehalten werden.»

Offensichtlich gibt es viele Aspekte zu bedenken und zu durchleuten, wenn es um die Aufklärung und Aufarbeitung der sogenannten «Corona-Pandemie» und der verordneten Maßnahmen geht. Frustration und Desillusion sind angesichts der Realitäten absolut verständlich. Gerade deswegen sind Initiativen wie die von Jens Knipphals so bewundernswert und so wichtig – ebenso wie eine seiner Kernthesen: «Wir müssen aufeinander zugehen, da hilft alles nichts».

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2025-01-31 20:02:25

@ a95c6243:d345522c

2025-01-31 20:02:25Im Augenblick wird mit größter Intensität, großer Umsicht \ das deutsche Volk belogen. \ Olaf Scholz im FAZ-Interview

Online-Wahlen stärken die Demokratie, sind sicher, und 61 Prozent der Wahlberechtigten sprechen sich für deren Einführung in Deutschland aus. Das zumindest behauptet eine aktuelle Umfrage, die auch über die Agentur Reuters Verbreitung in den Medien gefunden hat. Demnach würden außerdem 45 Prozent der Nichtwähler bei der Bundestagswahl ihre Stimme abgeben, wenn sie dies zum Beispiel von Ihrem PC, Tablet oder Smartphone aus machen könnten.

Die telefonische Umfrage unter gut 1000 wahlberechtigten Personen sei repräsentativ, behauptet der Auftraggeber – der Digitalverband Bitkom. Dieser präsentiert sich als eingetragener Verein mit einer beeindruckenden Liste von Mitgliedern, die Software und IT-Dienstleistungen anbieten. Erklärtes Vereinsziel ist es, «Deutschland zu einem führenden Digitalstandort zu machen und die digitale Transformation der deutschen Wirtschaft und Verwaltung voranzutreiben».

Durchgeführt hat die Befragung die Bitkom Servicegesellschaft mbH, also alles in der Familie. Die gleiche Erhebung hatte der Verband übrigens 2021 schon einmal durchgeführt. Damals sprachen sich angeblich sogar 63 Prozent für ein derartiges «Demokratie-Update» aus – die Tendenz ist demgemäß fallend. Dennoch orakelt mancher, der Gang zur Wahlurne gelte bereits als veraltet.

Die spanische Privat-Uni mit Globalisten-Touch, IE University, berichtete Ende letzten Jahres in ihrer Studie «European Tech Insights», 67 Prozent der Europäer befürchteten, dass Hacker Wahlergebnisse verfälschen könnten. Mehr als 30 Prozent der Befragten glaubten, dass künstliche Intelligenz (KI) bereits Wahlentscheidungen beeinflusst habe. Trotzdem würden angeblich 34 Prozent der unter 35-Jährigen einer KI-gesteuerten App vertrauen, um in ihrem Namen für politische Kandidaten zu stimmen.

Wie dauerhaft wird wohl das Ergebnis der kommenden Bundestagswahl sein? Diese Frage stellt sich angesichts der aktuellen Entwicklung der Migrations-Debatte und der (vorübergehend) bröckelnden «Brandmauer» gegen die AfD. Das «Zustrombegrenzungsgesetz» der Union hat das Parlament heute Nachmittag überraschenderweise abgelehnt. Dennoch muss man wohl kein ausgesprochener Pessimist sein, um zu befürchten, dass die Entscheidungen der Bürger von den selbsternannten Verteidigern der Demokratie künftig vielleicht nicht respektiert werden, weil sie nicht gefallen.

Bundesweit wird jetzt zu «Brandmauer-Demos» aufgerufen, die CDU gerät unter Druck und es wird von Übergriffen auf Parteibüros und Drohungen gegen Mitarbeiter berichtet. Sicherheitsbehörden warnen vor Eskalationen, die Polizei sei «für ein mögliches erhöhtes Aufkommen von Straftaten gegenüber Politikern und gegen Parteigebäude sensibilisiert».

Der Vorwand «unzulässiger Einflussnahme» auf Politik und Wahlen wird als Argument schon seit einiger Zeit aufgebaut. Der Manipulation schuldig befunden wird neben Putin und Trump auch Elon Musk, was lustigerweise ausgerechnet Bill Gates gerade noch einmal bekräftigt und als «völlig irre» bezeichnet hat. Man stelle sich die Diskussionen um die Gültigkeit von Wahlergebnissen vor, wenn es Online-Verfahren zur Stimmabgabe gäbe. In der Schweiz wird «E-Voting» seit einigen Jahren getestet, aber wohl bisher mit wenig Erfolg.

Die politische Brandstiftung der letzten Jahre zahlt sich immer mehr aus. Anstatt dringende Probleme der Menschen zu lösen – zu denen auch in Deutschland die weit verbreitete Armut zählt –, hat die Politik konsequent polarisiert und sich auf Ausgrenzung und Verhöhnung großer Teile der Bevölkerung konzentriert. Basierend auf Ideologie und Lügen werden abweichende Stimmen unterdrückt und kriminalisiert, nicht nur und nicht erst in diesem Augenblick. Die nächsten Wochen dürften ausgesprochen spannend werden.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a012dc82:6458a70d

2025-03-01 14:18:37

@ a012dc82:6458a70d

2025-03-01 14:18:37Bitcoin, since its creation by the enigmatic figure Satoshi Nakamoto, has revolutionized the concept of currency. Its journey from an obscure digital token to a major financial asset has been marked by dramatic bull runs, capturing the attention of investors worldwide. These surges in Bitcoin's value are not random but are driven by a combination of technological innovation, economic factors, and unique monetary policy. In this article, we explore the intricacies of Bitcoin's scarcity, the halving process, and the broader market dynamics that contribute to its periodic bull runs.

The allure of Bitcoin lies not just in its technological novelty but also in its challenge to traditional financial systems. It represents a decentralized form of currency, free from government control and manipulation. This aspect has been particularly appealing in times of economic uncertainty, where traditional currencies and markets have shown vulnerability. Bitcoin's bull runs can be seen as a barometer of the changing landscape of finance, reflecting a growing shift towards digital assets.

Table of Contents

-

The Concept of Scarcity in Bitcoin

-

Finite Supply

-

Impact on Value

-

-

The Halving Events

-

Mechanism and Purpose

-

Historical Impact on Price

-

-

Market Dynamics and Investor Sentiment

-

Institutional Investment

-

Global Economic Factors

-

Technological Advancements

-

Regulatory Environment

-

-

Conclusion

-

FAQs

The Concept of Scarcity in Bitcoin

Finite Supply

Bitcoin's protocol ensures that only 21 million coins will ever be in existence. This limit is encoded in its blockchain, making it a deflationary asset as opposed to inflationary fiat currencies. The idea behind this is to create a form of money that can resist inflationary pressures over time, much like gold, which has maintained its value for centuries due to its scarcity.

Impact on Value

The scarcity of Bitcoin has a profound psychological impact on investors. It creates a sense of urgency and a fear of missing out (FOMO) as the available supply dwindles. This is particularly evident as each Bitcoin halving event approaches, reminding the market of the ever-decreasing new supply. The result is often a speculative rally, as seen in the past bull runs. Moreover, as Bitcoin becomes more scarce, its comparison to gold becomes increasingly apt, attracting investors who are looking for assets that can retain value over time.

Scarcity also plays into the hands of long-term investors, often referred to as 'HODLers' in the crypto community. These investors view Bitcoin as a long-term store of value, akin to an investment in precious metals. The limited supply of Bitcoin reassures these investors that their holdings will not be devalued through oversupply, a common problem in fiat currencies.

The Halving Events

Mechanism and Purpose

Bitcoin's halving is a genius mechanism that ensures a controlled and gradual distribution of coins. By reducing the mining reward by half every four years, Bitcoin mimics the process of extracting a natural resource like gold, becoming progressively harder and more resource-intensive to mine. This not only controls inflation but also adds to the scarcity, making each coin more valuable over time.

Historical Impact on Price

Each halving event has historically led to an increase in Bitcoin's price, though not immediately. There is typically a lag between the halving and the subsequent bull run. This delay can be attributed to market adjustment and the gradual realization of reduced supply. The anticipation of this price increase often starts a positive feedback loop, attracting more investors and further driving up the price.

The halving events serve as key milestones in Bitcoin's timeline, providing a predictable pattern of supply reduction that savvy investors monitor closely. These events have become celebratory moments within the Bitcoin community, symbolizing the strength and resilience of the network. They also serve as a reminder of Bitcoin's unique value proposition in the world of cryptocurrencies.

Market Dynamics and Investor Sentiment

Institutional Investment

The recent years have seen a paradigm shift with the entry of institutional investors into the Bitcoin market. This shift is significant as it marks a departure from Bitcoin's early days of being a niche asset for tech enthusiasts. Institutional investors bring with them not only large capital inflows but also a sense of legitimacy and stability to the market. Their involvement has been a key driver in the maturation of the cryptocurrency market, making it more appealing to a broader audience.

Global Economic Factors

The role of global economic factors in influencing Bitcoin's price cannot be overstated. In times of economic instability, such as during the COVID-19 pandemic, investors increasingly turned to Bitcoin as a safe haven asset. This trend is indicative of a growing recognition of Bitcoin's value as a hedge against inflation and economic uncertainty. The decentralized nature of Bitcoin makes it less susceptible to geopolitical tensions and policy changes that affect traditional currencies and markets.

Technological Advancements

The continuous evolution of blockchain technology and the infrastructure surrounding Bitcoin has played a crucial role in its adoption. Developments such as improved transaction speed, enhanced security measures, and user-friendly trading platforms have made Bitcoin more accessible and attractive to a wider audience. These technological advancements are crucial in building investor confidence and facilitating the integration of Bitcoin into mainstream finance.

Regulatory Environment

The regulatory environment for Bitcoin and cryptocurrencies has been a double-edged sword. On one hand, clear and supportive regulations in certain jurisdictions have provided a boost to the market, encouraging institutional participation and providing clarity for investors. On the other hand, regulatory crackdowns in some countries have led to market volatility and uncertainty. The ongoing development of a regulatory framework for cryptocurrencies remains a key factor in shaping Bitcoin's future.

Conclusion

Bitcoin's journey is a testament to the evolving nature of finance and investment in the digital age. Its bull runs, driven by scarcity, halving events, and a complex interplay of market dynamics, highlight the growing acceptance of cryptocurrencies as a legitimate asset class. As the world increasingly embraces digital currencies, Bitcoin's role as a pioneer and standard-bearer will likely continue to influence its value and relevance in the global financial landscape.

Understanding Bitcoin's market dynamics is not just about analyzing charts and trends. It's about appreciating the broader context of economic, technological, and social changes that are reshaping the way we think about money and value. For investors and enthusiasts alike, staying informed and adaptable is key to navigating the exciting and often unpredictable world of Bitcoin and cryptocurrencies.

FAQs

What causes a Bitcoin bull run? Bitcoin bull runs are typically driven by a combination of factors including its built-in scarcity due to the finite supply, halving events reducing the mining rewards, institutional investment, global economic factors, advancements in blockchain technology, and the evolving regulatory landscape.

How does Bitcoin's scarcity affect its value? Bitcoin's value is significantly influenced by its scarcity. With a capped supply of 21 million coins, as demand increases, the limited supply pushes the price upwards, similar to precious metals like gold.

What is a Bitcoin halving event? A Bitcoin halving event is when the reward for mining new Bitcoin blocks is halved, effectively reducing the rate at which new Bitcoins are created. This occurs approximately every four years and is a key factor in Bitcoin's deflationary model.

Why do institutional investors matter in Bitcoin's market? Institutional investors bring significant capital, credibility, and stability to the Bitcoin market. Their participation signals a maturation of the market and can lead to increased confidence and investment from other sectors.

That's all for today

If you want more, be sure to follow us on:

NOSTR: croxroad@getalby.com

Instagram: @croxroadnews.co/

Youtube: @thebitcoinlibertarian

Store: https://croxroad.store

Subscribe to CROX ROAD Bitcoin Only Daily Newsletter

https://www.croxroad.co/subscribe

Get Orange Pill App And Connect With Bitcoiners In Your Area. Stack Friends Who Stack Sats link: https://signup.theorangepillapp.com/opa/croxroad

Buy Bitcoin Books At Konsensus Network Store. 10% Discount With Code “21croxroad” link: https://bitcoinbook.shop?ref=21croxroad

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.

-

-

@ a95c6243:d345522c

2025-01-24 20:59:01

@ a95c6243:d345522c

2025-01-24 20:59:01Menschen tun alles, egal wie absurd, \ um ihrer eigenen Seele nicht zu begegnen. \ Carl Gustav Jung

«Extremer Reichtum ist eine Gefahr für die Demokratie», sagen über die Hälfte der knapp 3000 befragten Millionäre aus G20-Staaten laut einer Umfrage der «Patriotic Millionaires». Ferner stellte dieser Zusammenschluss wohlhabender US-Amerikaner fest, dass 63 Prozent jener Millionäre den Einfluss von Superreichen auf US-Präsident Trump als Bedrohung für die globale Stabilität ansehen.

Diese Besorgnis haben 370 Millionäre und Milliardäre am Dienstag auch den in Davos beim WEF konzentrierten Privilegierten aus aller Welt übermittelt. In einem offenen Brief forderten sie die «gewählten Führer» auf, die Superreichen – also sie selbst – zu besteuern, um «die zersetzenden Auswirkungen des extremen Reichtums auf unsere Demokratien und die Gesellschaft zu bekämpfen». Zum Beispiel kontrolliere eine handvoll extrem reicher Menschen die Medien, beeinflusse die Rechtssysteme in unzulässiger Weise und verwandele Recht in Unrecht.

Schon 2019 beanstandete der bekannte Historiker und Schriftsteller Ruthger Bregman an einer WEF-Podiumsdiskussion die Steuervermeidung der Superreichen. Die elitäre Veranstaltung bezeichnete er als «Feuerwehr-Konferenz, bei der man nicht über Löschwasser sprechen darf.» Daraufhin erhielt Bregman keine Einladungen nach Davos mehr. Auf seine Aussagen machte der Schweizer Aktivist Alec Gagneux aufmerksam, der sich seit Jahrzehnten kritisch mit dem WEF befasst. Ihm wurde kürzlich der Zutritt zu einem dreiteiligen Kurs über das WEF an der Volkshochschule Region Brugg verwehrt.

Nun ist die Erkenntnis, dass mit Geld politischer Einfluss einhergeht, alles andere als neu. Und extremer Reichtum macht die Sache nicht wirklich besser. Trotzdem hat man über Initiativen wie Patriotic Millionaires oder Taxmenow bisher eher selten etwas gehört, obwohl es sie schon lange gibt. Auch scheint es kein Problem, wenn ein Herr Gates fast im Alleingang versucht, globale Gesundheits-, Klima-, Ernährungs- oder Bevölkerungspolitik zu betreiben – im Gegenteil. Im Jahr, als der Milliardär Donald Trump zum zweiten Mal ins Weiße Haus einzieht, ist das Echo in den Gesinnungsmedien dagegen enorm – und uniform, wer hätte das gedacht.

Der neue US-Präsident hat jedoch «Davos geerdet», wie Achgut es nannte. In seiner kurzen Rede beim Weltwirtschaftsforum verteidigte er seine Politik und stellte klar, er habe schlicht eine «Revolution des gesunden Menschenverstands» begonnen. Mit deutlichen Worten sprach er unter anderem von ersten Maßnahmen gegen den «Green New Scam», und von einem «Erlass, der jegliche staatliche Zensur beendet»:

«Unsere Regierung wird die Äußerungen unserer eigenen Bürger nicht mehr als Fehlinformation oder Desinformation bezeichnen, was die Lieblingswörter von Zensoren und derer sind, die den freien Austausch von Ideen und, offen gesagt, den Fortschritt verhindern wollen.»

Wie der «Trumpismus» letztlich einzuordnen ist, muss jeder für sich selbst entscheiden. Skepsis ist definitiv angebracht, denn «einer von uns» sind weder der Präsident noch seine auserwählten Teammitglieder. Ob sie irgendeinen Sumpf trockenlegen oder Staatsverbrechen aufdecken werden oder was aus WHO- und Klimaverträgen wird, bleibt abzuwarten.

Das WHO-Dekret fordert jedenfalls die Übertragung der Gelder auf «glaubwürdige Partner», die die Aktivitäten übernehmen könnten. Zufällig scheint mit «Impfguru» Bill Gates ein weiterer Harris-Unterstützer kürzlich das Lager gewechselt zu haben: Nach einem gemeinsamen Abendessen zeigte er sich «beeindruckt» von Trumps Interesse an der globalen Gesundheit.

Mit dem Projekt «Stargate» sind weitere dunkle Wolken am Erwartungshorizont der Fangemeinde aufgezogen. Trump hat dieses Joint Venture zwischen den Konzernen OpenAI, Oracle, und SoftBank als das «größte KI-Infrastrukturprojekt der Geschichte» angekündigt. Der Stein des Anstoßes: Oracle-CEO Larry Ellison, der auch Fan von KI-gestützter Echtzeit-Überwachung ist, sieht einen weiteren potenziellen Einsatz der künstlichen Intelligenz. Sie könne dazu dienen, Krebserkrankungen zu erkennen und individuelle mRNA-«Impfstoffe» zur Behandlung innerhalb von 48 Stunden zu entwickeln.

Warum bitte sollten sich diese superreichen «Eliten» ins eigene Fleisch schneiden und direkt entgegen ihren eigenen Interessen handeln? Weil sie Menschenfreunde, sogenannte Philanthropen sind? Oder vielleicht, weil sie ein schlechtes Gewissen haben und ihre Schuld kompensieren müssen? Deswegen jedenfalls brauchen «Linke» laut Robert Willacker, einem deutschen Politikberater mit brasilianischen Wurzeln, rechte Parteien – ein ebenso überraschender wie humorvoller Erklärungsansatz.

Wenn eine Krähe der anderen kein Auge aushackt, dann tut sie das sich selbst noch weniger an. Dass Millionäre ernsthaft ihre eigene Besteuerung fordern oder Machteliten ihren eigenen Einfluss zugunsten anderer einschränken würden, halte ich für sehr unwahrscheinlich. So etwas glaube ich erst, wenn zum Beispiel die Rüstungsindustrie sich um Friedensverhandlungen bemüht, die Pharmalobby sich gegen institutionalisierte Korruption einsetzt, Zentralbanken ihre CBDC-Pläne für Bitcoin opfern oder der ÖRR die Abschaffung der Rundfunkgebühren fordert.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ d360efec:14907b5f

2025-03-01 12:58:51

@ d360efec:14907b5f

2025-03-01 12:58:51ภาพรวม (Integrated Overview)

ถ้าพิจารณาทั้ง TF Daily, 4H, และ 15m (พร้อมข้อมูล Money Flow ที่เป็นลบในทุก TF) ราคาปัจจุบันประมาณ 84,579

การวิเคราะห์แบบรวม*

-

แนวโน้ม (Trend):

- Daily: ขาลง (Bearish) แม้ว่าราคาจะอยู่เหนือเส้นค่าเฉลี่ยเคลื่อนที่ (EMA) แต่ Money Flow ที่เป็นลบอย่างรุนแรง บ่งชี้ถึงแนวโน้มขาลง

- 4H: ขาลง (Bearish) Money Flow เป็นลบอย่างมาก และมี รูปแบบ Head and Shoulders ที่มีโอกาสเกิดขึ้น

- 15m: ขาลง (Bearish) Money Flow เป็นลบ

-

SMC & ICT (Smart Money Concepts & Inner Circle Trader):

- Buyside Liquidity: อยู่เหนือราคาสูงสุดปัจจุบัน ระดับราคาที่ อาจ เป็นแนวต้าน (จากกราฟ Daily): 90456.8, 92755.8, 95054.9, 97354.0, 99653.1, 101952.1, 104251.3, 106550.3, 109998.9, และ 117000.0 ใน TF 15m, Buyside Liquidity คือจุดสูงสุดของแท่งเทียนก่อนหน้า

- Sellside Liquidity: แนวรับสำคัญ: 80,000 (Neckline ของ Head and Shoulders ใน TF 4H, ตัวเลขกลม, แนวรับทางจิตวิทยา) แนวรับอื่นๆ: 83559.5, 81260.4, 78961.4, 76662.3, 74363.2, 72064.1, 69705.1, 67400.0, 66811.7, และ 65166.9 (จากกราฟ Daily) ใน TF 15m, Sellside Liquidity คือจุดต่ำสุดของแท่งเทียนก่อนหน้า

-

Money Flow:

- Daily: เป็นลบอย่างมาก (Strongly Negative)

- 4H: เป็นลบอย่างมาก (Strongly Negative)

- 15m: เป็นลบ (Negative)

- นี่คือตัวบ่งชี้ที่สำคัญที่สุดในขณะนี้ และเป็นขาลงในทุก Timeframe

-

EMA (Exponential Moving Averages):

- Daily: ราคาอยู่เหนือ EMA 50 และ 200 แต่ถูกหักล้างด้วย Money Flow ที่เป็นลบ

- 4H: ราคาอยู่เหนือ EMA 50 และ 200 แต่ถูกหักล้างด้วย Money Flow ที่เป็นลบ

- 15m: ราคาแกว่งตัวรอบ EMA 50, อยู่เหนือ EMA 200 แต่ถูกหักล้างด้วย Money Flow ที่เป็นลบ

-

Trend Strength (AlgoAlpha):

- Daily: เมฆ Ichimoku เป็นสีเทา (Neutral - เป็นกลาง)

- 4H: เมฆ Ichimoku เป็นสีเทา (Neutral - เป็นกลาง)

- 15m: เมฆ Ichimoku เป็นสีเทา (Neutral - เป็นกลาง)

-

Chart Patterns (รูปแบบกราฟ):

- Daily: ไม่มีรูปแบบที่ชัดเจน แต่มีการอ่อนตัวของราคา

- 4H: มีโอกาสเกิด รูปแบบ Head and Shoulders (กลับหัว) (Bearish - ขาลง)

- 15m: ไม่มีรูปแบบที่ชัดเจน แต่อาจเป็นส่วนหนึ่งของ Right Shoulder ใน TF 4H

กลยุทธ์ Day Trade (SMC-Based)

เนื่องจาก Money Flow ที่เป็นลบอย่างท่วมท้นในทุก Timeframes และรูปแบบ Head and Shoulders ที่มีโอกาสเกิดขึ้นใน TF 4H กลยุทธ์การซื้อขายที่สมเหตุสมผล เพียงอย่างเดียว คือ การป้องกันอย่างเข้มงวด โดยเน้นที่ การหลีกเลี่ยงสถานะ Long และพิจารณาสถานะ Short เฉพาะ เมื่อมีเงื่อนไขที่เข้มงวดมากเท่านั้น

-

Long (Buy): ไม่แนะนำโดยเด็ดขาด (Absolutely, unequivocally not recommended) การทำเช่นนี้จะเป็นการซื้อขายสวนทางกับแนวโน้มหลักและสัญญาณ Money Flow ที่ชัดเจน

-

Short (Sell):

- Entry (จุดเข้า): นี่คือการเทรด เดียว ที่ อาจ มีเหตุผลสนับสนุน, แต่ เฉพาะ เมื่อเงื่อนไข ทั้งหมด ต่อไปนี้เป็นจริง:

- รูปแบบ Head and Shoulders ใน TF 4H เสร็จสมบูรณ์ ด้วยการ Breakout ที่ชัดเจนใต้ Neckline (80,000-81,000)

- การ Breakout ใต้ Neckline เกิดขึ้นพร้อมกับ Volume ที่สูง

- Money Flow ใน ทั้งสาม Timeframes ยังคง เป็นลบอย่างมาก

- คุณมีสัญญาณ Bearish อื่นๆ ยืนยัน (เช่น รูปแบบแท่งเทียน Bearish, Bearish Divergence)

- Target (เป้าหมาย): ระดับ Sellside Liquidity (เช่น 78961.4, 76662.3)

- Stop Loss (จุดตัดขาดทุน): เหนือ Neckline หรือ Right Shoulder ทันที จำเป็นต้องมี Stop Loss ที่เข้มงวดอย่างยิ่ง

- Entry (จุดเข้า): นี่คือการเทรด เดียว ที่ อาจ มีเหตุผลสนับสนุน, แต่ เฉพาะ เมื่อเงื่อนไข ทั้งหมด ต่อไปนี้เป็นจริง:

-

No Trade (ไม่เทรด): เป็นตัวเลือกที่ ดีที่สุด สำหรับนักเทรด/นักลงทุนส่วนใหญ่ ความเสี่ยงที่จะเกิดการปรับฐานครั้งใหญ่มีสูงมาก

สรุป

สถานการณ์ของ BTC คือ Bearish อย่างมาก Money Flow ที่เป็นลบอย่างมากในทุก Timeframes เป็นปัจจัยสำคัญที่สุด ซึ่งมีน้ำหนักมากกว่าสัญญาณ Bullish ใดๆ ก่อนหน้านี้จาก EMA รูปแบบ Head and Shoulders ที่มีโอกาสเกิดขึ้นใน TF 4H ช่วยเพิ่มการยืนยันแนวโน้ม Bearish สถานะ Long ไม่สมเหตุสมผลอย่างยิ่ง สถานะ Short อาจ พิจารณาได้, แต่ ต้อง มีการยืนยันสัญญาณที่ชัดเจน ทั้งหมด และมีการบริหารความเสี่ยงที่เข้มงวดมาก "Wait and See" (รอดู) และการรักษาเงินทุนเป็นสิ่งสำคัญที่สุด

Disclaimer: การวิเคราะห์นี้เป็นเพียงความคิดเห็นส่วนตัว ไม่ถือเป็นคำแนะนำในการลงทุน ผู้ลงทุนควรศึกษาข้อมูลเพิ่มเติมและตัดสินใจด้วยความรอบคอบ

-

-

@ c631e267:c2b78d3e

2025-01-18 09:34:51

@ c631e267:c2b78d3e

2025-01-18 09:34:51Die grauenvollste Aussicht ist die der Technokratie – \ einer kontrollierenden Herrschaft, \ die durch verstümmelte und verstümmelnde Geister ausgeübt wird. \ Ernst Jünger

«Davos ist nicht mehr sexy», das Weltwirtschaftsforum (WEF) mache Davos kaputt, diese Aussagen eines Einheimischen las ich kürzlich in der Handelszeitung. Während sich einige vor Ort enorm an der «teuersten Gewerbeausstellung der Welt» bereicherten, würden die negativen Begleiterscheinungen wie Wohnungsnot und Niedergang der lokalen Wirtschaft immer deutlicher.

Nächsten Montag beginnt in dem Schweizer Bergdorf erneut ein Jahrestreffen dieses elitären Clubs der Konzerne, bei dem man mit hochrangigen Politikern aus aller Welt und ausgewählten Vertretern der Systemmedien zusammenhocken wird. Wie bereits in den vergangenen vier Jahren wird die Präsidentin der EU-Kommission, Ursula von der Leyen, in Begleitung von Klaus Schwab ihre Grundsatzansprache halten.

Der deutsche WEF-Gründer hatte bei dieser Gelegenheit immer höchst lobende Worte für seine Landsmännin: 2021 erklärte er sich «stolz, dass Europa wieder unter Ihrer Führung steht» und 2022 fand er es bemerkenswert, was sie erreicht habe angesichts des «erstaunlichen Wandels», den die Welt in den vorangegangenen zwei Jahren erlebt habe; es gebe nun einen «neuen europäischen Geist».

Von der Leyens Handeln während der sogenannten Corona-«Pandemie» lobte Schwab damals bereits ebenso, wie es diese Woche das Karlspreis-Direktorium tat, als man der Beschuldigten im Fall Pfizergate die diesjährige internationale Auszeichnung «für Verdienste um die europäische Einigung» verlieh. Außerdem habe sie die EU nicht nur gegen den «Aggressor Russland», sondern auch gegen die «innere Bedrohung durch Rassisten und Demagogen» sowie gegen den Klimawandel verteidigt.

Jene Herausforderungen durch «Krisen epochalen Ausmaßes» werden indes aus dem Umfeld des WEF nicht nur herbeigeredet – wie man alljährlich zur Zeit des Davoser Treffens im Global Risks Report nachlesen kann, der zusammen mit dem Versicherungskonzern Zurich erstellt wird. Seit die Globalisten 2020/21 in der Praxis gesehen haben, wie gut eine konzertierte und konsequente Angst-Kampagne funktionieren kann, geht es Schlag auf Schlag. Sie setzen alles daran, Schwabs goldenes Zeitfenster des «Great Reset» zu nutzen.

Ziel dieses «großen Umbruchs» ist die totale Kontrolle der Technokraten über die Menschen unter dem Deckmantel einer globalen Gesundheitsfürsorge. Wie aber könnte man so etwas erreichen? Ein Mittel dazu ist die «kreative Zerstörung». Weitere unabdingbare Werkzeug sind die Einbindung, ja Gleichschaltung der Medien und der Justiz.

Ein «Great Mental Reset» sei die Voraussetzung dafür, dass ein Großteil der Menschen Einschränkungen und Manipulationen wie durch die Corona-Maßnahmen praktisch kritik- und widerstandslos hinnehme, sagt der Mediziner und Molekulargenetiker Michael Nehls. Er meint damit eine regelrechte Umprogrammierung des Gehirns, wodurch nach und nach unsere Individualität und unser soziales Bewusstsein eliminiert und durch unreflektierten Konformismus ersetzt werden.

Der aktuelle Zustand unserer Gesellschaften ist auch für den Schweizer Rechtsanwalt Philipp Kruse alarmierend. Durch den Umgang mit der «Pandemie» sieht er die Grundlagen von Recht und Vernunft erschüttert, die Rechtsstaatlichkeit stehe auf dem Prüfstand. Seiner dringenden Mahnung an alle Bürger, die Prinzipien von Recht und Freiheit zu verteidigen, kann ich mich nur anschließen.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ d360efec:14907b5f

2025-03-01 12:55:57

@ d360efec:14907b5f

2025-03-01 12:55:57$OKX:BTCUSDT.P

Overview (Integrated Overview)

All three provided timeframes (Daily, 4H, and 15m, all now confirmed to have negative Money Flow), The current price is approximately 84,579.

Integrated Analysis

-

Trend:

- Daily: Bearish. While the price is above the EMAs, the strongly negative Money Flow on the Daily chart overrides the EMA signal, indicating a bearish trend. The Ichimoku Cloud is neutral, further supporting the idea that the previous bullish trend is weakening.

- 4H: Bearish. Strongly negative Money Flow and a potential (but not yet confirmed) inverted Head and Shoulders pattern.

- 15m: Bearish. Negative Money Flow.

-

SMC & ICT (Smart Money Concepts & Inner Circle Trader):

- Buyside Liquidity: Above the current high. Potential resistance levels (derived from the Daily chart image, assuming it's from 2025): 90456.8, 92755.8, 95054.9, 97354.0, 99653.1, 101952.1, 104251.3, 106550.3, 109998.9, and 117000.0. On the 15m chart (though we are prioritizing the Daily and 4H now), Buyside Liquidity would be represented by recent swing highs.

- Sellside Liquidity: Key support: 80,000 (this is the approximate neckline of the potential Head and Shoulders pattern on the 4H chart, a round number, and a psychological support level). Other support levels (derived from the Daily chart image): 83559.5, 81260.4, 78961.4, 76662.3, 74363.2, 72064.1, 69705.1, 67400.0, 66811.7, and 65166.9. On the 15m chart, Sellside Liquidity would be represented by recent swing lows.

-

Money Flow:

- Daily: Strongly Negative. This is a major bearish signal.

- 4H: Strongly Negative. This reinforces the bearish signal and is consistent with the Daily chart.

- 15m: Negative. This confirms the short-term outflow of money.

- The consistently negative Money Flow across all timeframes is the most important and dominant indicator in this analysis.

-

EMA (Exponential Moving Averages):

- Daily: Price is above the EMA 50 (yellow) and EMA 200 (white). However, the strongly negative Money Flow overrides the bullish signal typically provided by the price being above the EMAs.

- 4H: Price is above the EMA 50 and EMA 200. Again, the strongly negative Money Flow overrides this.

- 15m: Price is oscillating around the EMA 50 and above the EMA 200. The negative Money Flow overrides this.

-

Trend Strength (AlgoAlpha Indicator):

- Daily: The Ichimoku Cloud is gray (Neutral). This is not a bullish signal and is consistent with the negative Money Flow.

- 4H: The Ichimoku Cloud is gray (Neutral).

- 15m: The Ichimoku Cloud is gray (Neutral).

-

Chart Patterns:

- Daily: No fully formed classic chart pattern. However, the recent price action shows a loss of upward momentum and the beginning of a potential downward move. This weakening price action, combined with the strongly negative Money Flow, is bearish.

- 4H: Potential inverted Head and Shoulders pattern. This is a bearish reversal pattern. It's crucial to understand that this pattern is not yet confirmed. Confirmation requires a decisive break below the neckline (approximately 80,000-81,000), with increased volume and continued negative Money Flow.

- 15m: No clearly defined classic chart pattern. The 15m price action is best understood as potentially forming the right shoulder of the 4H Head and Shoulders.

SMC-Based Day Trading Strategies

Given the overwhelmingly bearish evidence – primarily the strongly negative Money Flow across all timeframes, combined with the potential Head and Shoulders pattern on the 4H chart – the only justifiable trading strategy is extreme caution and a strong bias against long positions. Short positions have a slightly higher probability of success, but only under very specific conditions and with extremely tight risk management.

-

Long (Buy): Absolutely, unequivocally not recommended. There is no technical justification for entering a long position at this time. This would be trading directly against the dominant bearish signals.

-

Short (Sell):

- Entry: This is the only trade with any potential, and only if all of the following conditions are met:

- The Head and Shoulders pattern on the 4H chart fully completes with a decisive break below the neckline (80,000-81,000).

- The breakout below the neckline occurs on significantly increased volume.

- The Money Flow on all three timeframes (Daily, 4H, and 15m) remains strongly negative at the time of the breakout.

- Additional bearish confirmation is present (e.g., bearish candlestick patterns, bearish divergences on other oscillators like RSI or MACD – which we cannot see from the provided images).

- Target: Sellside Liquidity levels, derived from the Daily chart. Potential targets include, but are not limited to: 78961.4, 76662.3, 74363.2, and potentially lower.

- Stop Loss: Immediately above the neckline (after the breakout) or above the high of the right shoulder (if placing the trade before a confirmed neckline break – which is extremely risky). An extremely tight stop-loss is absolutely mandatory due to the inherent volatility of BTC and the potential for false breakouts.

- Entry: This is the only trade with any potential, and only if all of the following conditions are met:

-

No Trade (Cash): This is, by far, the best and most prudent option for the vast majority of traders and investors. The risk of a substantial price decline is extremely high, given the confluence of bearish signals. Preserving capital should be the primary objective.

Key Levels to Watch:

- 80,000 - 81,000 (4H Chart): This is the neckline of the potential Head and Shoulders pattern. A sustained break below this level, with the confirming factors listed above, would be a strong bearish signal.

- Money Flow on all chart:

Conclusion

The overall technical picture for BTC, strongly bearish. The dominant factor is the consistently and strongly negative Money Flow across all three timeframes. This overrides any seemingly bullish signals from the EMAs. The potential (but unconfirmed) Head and Shoulders pattern on the 4H chart adds further weight to the bearish case.

Long positions are completely unjustified and extremely risky. Short positions might be considered, but only with the strictest possible entry criteria, complete confirmation from multiple indicators, and extremely tight risk management. The "Wait and See" approach, prioritizing capital preservation, is the most prudent strategy for most market participants. This situation calls for extreme caution and a defensive posture.

Disclaimer: This analysis is a personal opinion. It is not financial advice. Trading and investing in cryptocurrencies involves significant risk. Always do your own research and consult with a qualified financial advisor before making any investment decisions.

-

-

@ a95c6243:d345522c

2025-01-13 10:09:57

@ a95c6243:d345522c

2025-01-13 10:09:57Ich begann, Social Media aufzubauen, \ um den Menschen eine Stimme zu geben. \ Mark Zuckerberg

Sind euch auch die Tränen gekommen, als ihr Mark Zuckerbergs Wendehals-Deklaration bezüglich der Meinungsfreiheit auf seinen Portalen gehört habt? Rührend, oder? Während er früher die offensichtliche Zensur leugnete und später die Regierung Biden dafür verantwortlich machte, will er nun angeblich «die Zensur auf unseren Plattformen drastisch reduzieren».

«Purer Opportunismus» ob des anstehenden Regierungswechsels wäre als Klassifizierung viel zu kurz gegriffen. Der jetzige Schachzug des Meta-Chefs ist genauso Teil einer kühl kalkulierten Business-Strategie, wie es die 180 Grad umgekehrte Praxis vorher war. Social Media sind ein höchst lukratives Geschäft. Hinzu kommt vielleicht noch ein bisschen verkorkstes Ego, weil derartig viel Einfluss und Geld sicher auch auf die Psyche schlagen. Verständlich.

«Es ist an der Zeit, zu unseren Wurzeln der freien Meinungsäußerung auf Facebook und Instagram zurückzukehren. Ich begann, Social Media aufzubauen, um den Menschen eine Stimme zu geben», sagte Zuckerberg.

Welche Wurzeln? Hat der Mann vergessen, dass er von der Überwachung, dem Ausspionieren und dem Ausverkauf sämtlicher Daten und digitaler Spuren sowie der Manipulation seiner «Kunden» lebt? Das ist knallharter Kommerz, nichts anderes. Um freie Meinungsäußerung geht es bei diesem Geschäft ganz sicher nicht, und das war auch noch nie so. Die Wurzeln von Facebook liegen in einem Projekt des US-Militärs mit dem Namen «LifeLog». Dessen Ziel war es, «ein digitales Protokoll vom Leben eines Menschen zu erstellen».

Der Richtungswechsel kommt allerdings nicht überraschend. Schon Anfang Dezember hatte Meta-Präsident Nick Clegg von «zu hoher Fehlerquote bei der Moderation» von Inhalten gesprochen. Bei der Gelegenheit erwähnte er auch, dass Mark sehr daran interessiert sei, eine aktive Rolle in den Debatten über eine amerikanische Führungsrolle im technologischen Bereich zu spielen.

Während Milliardärskollege und Big Tech-Konkurrent Elon Musk bereits seinen Posten in der kommenden Trump-Regierung in Aussicht hat, möchte Zuckerberg also nicht nur seine Haut retten – Trump hatte ihn einmal einen «Feind des Volkes» genannt und ihm lebenslange Haft angedroht –, sondern am liebsten auch mitspielen. KI-Berater ist wohl die gewünschte Funktion, wie man nach einem Treffen Trump-Zuckerberg hörte. An seine Verhaftung dachte vermutlich auch ein weiterer Multimilliardär mit eigener Social Media-Plattform, Pavel Durov, als er Zuckerberg jetzt kritisierte und gleichzeitig warnte.

Politik und Systemmedien drehen jedenfalls durch – was zu viel ist, ist zu viel. Etwas weniger Zensur und mehr Meinungsfreiheit würden die Freiheit der Bürger schwächen und seien potenziell vernichtend für die Menschenrechte. Zuckerberg setze mit dem neuen Kurs die Demokratie aufs Spiel, das sei eine «Einladung zum nächsten Völkermord», ernsthaft. Die Frage sei, ob sich die EU gegen Musk und Zuckerberg behaupten könne, Brüssel müsse jedenfalls hart durchgreifen.

Auch um die Faktenchecker macht man sich Sorgen. Für die deutsche Nachrichtenagentur dpa und die «Experten» von Correctiv, die (noch) Partner für Fact-Checking-Aktivitäten von Facebook sind, sei das ein «lukratives Geschäftsmodell». Aber möglicherweise werden die Inhalte ohne diese vermeintlichen Korrektoren ja sogar besser. Anders als Meta wollen jedoch Scholz, Faeser und die Tagesschau keine Fehler zugeben und zum Beispiel Correctiv-Falschaussagen einräumen.

Bei derlei dramatischen Befürchtungen wundert es nicht, dass der öffentliche Plausch auf X zwischen Elon Musk und AfD-Chefin Alice Weidel von 150 EU-Beamten überwacht wurde, falls es irgendwelche Rechtsverstöße geben sollte, die man ihnen ankreiden könnte. Auch der Deutsche Bundestag war wachsam. Gefunden haben dürften sie nichts. Das Ganze war eher eine Show, viel Wind wurde gemacht, aber letztlich gab es nichts als heiße Luft.

Das Anbiedern bei Donald Trump ist indes gerade in Mode. Die Weltgesundheitsorganisation (WHO) tut das auch, denn sie fürchtet um Spenden von über einer Milliarde Dollar. Eventuell könnte ja Elon Musk auch hier künftig aushelfen und der Organisation sowie deren größtem privaten Förderer, Bill Gates, etwas unter die Arme greifen. Nachdem Musks KI-Projekt xAI kürzlich von BlackRock & Co. sechs Milliarden eingestrichen hat, geht da vielleicht etwas.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ fd78c37f:a0ec0833

2025-03-01 08:57:55

@ fd78c37f:a0ec0833

2025-03-01 08:57:55Author: Zhengyu Qian, Eric Zhang Original Link: https://research.dorahacks.io/2025/02/22/maci-mailbox/

We are not reinventing email.

Even a glance at the TOC of IETF RFC 5322 reveals: email is long-standing and well-established, but far from simple. This is just one piece of the puzzle in today’s email system.

What we would like to do first is to review the essence of message delivery.

Proto-mail

A typical process of message delivery can be broken down into three critical components:

- Individuals intending to exchange messages—referred to as the users.

- An intermediary, or agent, that facilitates the delivery.

- The message itself.

Message delivery takes place when the sender hands over the message (e.g., a written note) to an agent—a person (a messenger), a device (a beacon), or an institution (a post office). The agent then dispatches the message to the recipient.

Though direct communication, such as face-to-face conversation, falls outside the scope of this context.

The Protocol of MACI Mailbox

The MACI Mailbox is an encryption-based mailing protocol that builds directly on the three components above, with modifications and extensions.

-

The user consists of two parts:

-

An account, typically with a publicly visible mailing address.

-

A keypair(a private key and its corresponding public key), which works its magic in encrypted communication.

-

The agent has a similar structure:

-

An account.

-

A keypair.

-

The message is simple, consisting of two fields:

-

Subject.

- Body.

The following outlines the flow of message delivery in the MACI Mailbox protocol. The process of sending a message is addressed first.

-

The sender writes a message.

-

The agent encrypts the message using its public key, posts and stores it in a shared public database (e.g. a blockchain, Nostr), and assigns it a queryable ID.

-

The sender wraps the ID of encrypted message together with the agent’s private key, encrypts them using the recipient’s public key, and broadcasts the resulting encrypted data to a public space. Yes, broadcasts it publicly—feeling like encrypted radio communication yet?

In this process, asymmetric encryption is introduced twice, achieving something valuable: the decoupling of message storage from broadcast. This has at least two key implications:

-

It’s highly flexible to choose the infrastructures for encrypted message posting and storage as well as broadcasting facilities—both of which are modular, replaceable, and trustless.

-

Storage and broadcast infrastructures can be separately tailored to meet specific requirements. Typically:

-

Message storage is expected to be inexpensive, reliable, and scalable.

-

Broadcast infrastructure can be customized to fit the varying user ecosystems or needs.

Receiving a message is basically the reverse process:

-

The recipient indexes their mail in the broadcast space, decrypts it with their own private key (guaranteed by the principles of asymmetric encryption), and retrieves both the ID of encrypted message (storage address) and the agent’s private key (which, as you may recall, was bundled with the message ID before broadcast).

-

With the message ID, the recipient fetches the encrypted message from storage and decrypts it using the agent’s private key to obtain the plaintext message.

-

Tada.

It can be observed that the agent’s role described above is highly procedural, lending itself to a modular and replaceable design. This enables significant flexibility in the implementation of MACI Mailbox services and applications.

Vota-Nostr Mailbox: basic architecture

The Vota-Nostr Mailbox is the first implementation of the Protocol by Dora Factory, consisting of several core modules:

-

A smart contract deployed on Dora Vota appchain to handle the broadcasting of messages.

-

Nostr relays, used for publishing and storing encrypted messages.

-

An indexer service to assist users in locating relevant messages, such as those sent to or from themselves.

-

A web app as the interface for interacting with the Vota-Nostr Mailbox.

First, user accounts are implemented as on-chain accounts of Dora Vota (represented as a wallet address) paired with a public/private ECC keypair. Message content is kept simple as plain-text strings, with the flexibility to upgrade it later (Everybody Loves Rich Text).

Next, let’s push the boundaries for the agent. Ideally, users shouldn’t have to learn how to interact with it actively—think about fully automated agents. Or picture a stylish scene from The Day of the Jackal: Eddie Redmayne casually discarding a phone after each call.

Thus, a disposable, one-time auto agent is designed for each mail flow. This agent consists of a randomly generated ECC keypair and a temporarily created Nostr account (essentially another keypair: npub/nsec).

Vota-Nostr Mailbox: communication workflow

In Vota-Nostr implementation of MACI Mailbox Protocol, the communication flow is as follows. Both the encryption/decryption of message content and the broadcast rely on elliptic-curve cryptography.

To enhance user experience, a “Sent Messages” feature has been implemented, allowing senders to index, decrypt, and review their sent messages. In general, with asymmetric encryption, only the recipient’s private key can decrypt the encrypted content. Technically, there are cryptographic methods to enable mutual decryption by both sender and recipient.

For simplicity at this stage, this issue is addressed by creating a duplicate of each broadcast data (on Dora Vota appchain). This duplicate is encrypted using the sender’s own public key, allowing the sender to decrypt it with their private key.

Since the Protocol decouples the storage of encrypted message from the broadcast data, this duplication doesn’t significantly increase the payload on the broadcast infrastructure. Only the message ID and the agent’s private key need to be processed as duplicates, both of which are compact and independent of the actual message size (the length of your address line and the size of your front door key don’t depend on the dimensions of your house).

Below outlines the entire communication process:

-

The sender encrypts their message using the agent’s one-time public key and publishes it to Nostr relay(s) via the agent’s one-time Nostr account, obtaining the encrypted message’s ID (i.e., Nostr event ID).

-

The sender wraps the encrypted message ID along with the agent’s one-time private key, encrypts them using the recipient’s public key, and broadcasts the resulting encrypted data to the appchain via their own Dora Vota account. This process leverages wallet apps/extensions for transaction submission and the smart contract for processing, closely resembling how users typically interact with blockchains and dapps.

-

Once the on-chain transaction is processed, the encrypted data is broadcast on Dora Vota. Both the sender and the recipient can retrieve the data at any time via the Mailbox Indexer.

-

The recipient decrypts the broadcast encrypted data using their own private key, finding the Nostr event ID and the corresponding decryption key (one-time agent private key). They then fetch the encrypted message from Nostr relay(s) by the ID and decrypt it with the one-time private key.

-

The sender can follow a nearly identical process to fetch and decrypt their own duplicate, enabling them to review sent messages.

Acknowledgements

The MACI Mailbox protocol was conceived during a Dora Factory developer meeting in Kyoto, March 2024. Eric Zhang supported its implementation in October as a tool to facilitate communications and campaigns in MACI decentralized governance. Shrey Khater and Divyansh Joshi contributed to an MVP of the Vota-Nostr implementation. The protocol was officially integrated with Dora Vota appchain as well as its frontend with efforts from Zhengyu Qian, Dennis Tang, and Vegebun.

-

@ 6f26dd2b:f2824b88

2025-02-28 19:00:52

@ 6f26dd2b:f2824b88

2025-02-28 19:00:52💭 There are some interesting noises about Bitcoin coming from the most unlikely of sources. The Czech central bank says that Bitcoin “should not be lumped together with other crypto assets.”

“We central bankers should study it,” says the Bank’s governor. Meanwhile, other central banks are just as keen to distance themselves from Bitcoin. A divide about Bitcoin is opening up in the central banking world!

-

@ 6389be64:ef439d32

2025-02-27 21:32:12

@ 6389be64:ef439d32

2025-02-27 21:32:12GA, plebs. The latest episode of Bitcoin And is out, and, as always, the chicanery is running rampant. Let’s break down the biggest topics I covered, and if you want the full, unfiltered rant, make sure to listen to the episode linked below.

House Democrats’ MEME Act: A Bad Joke?

House Democrats are proposing a bill to ban presidential meme coins, clearly aimed at Trump’s and Melania’s ill-advised token launches. While grifters launching meme coins is bad, this bill is just as ridiculous. If this legislation moves forward, expect a retaliatory strike exposing how politicians like Pelosi and Warren mysteriously amassed their fortunes. Will it pass? Doubtful. But it’s another sign of the government’s obsession with regulating everything except itself.

Senate Banking’s First Digital Asset Hearing: The Real Target Is You

Cynthia Lummis chaired the first digital asset hearing, and—surprise!—it was all about control. The discussion centered on stablecoins, AML, and KYC regulations, with witnesses suggesting Orwellian measures like freezing stablecoin transactions unless pre-approved by authorities. What was barely mentioned? Bitcoin. They want full oversight of stablecoins, which is really about controlling financial freedom. Expect more nonsense targeting self-custody wallets under the guise of stopping “bad actors.”