-

@ a95c6243:d345522c

2025-02-21 19:32:23

@ a95c6243:d345522c

2025-02-21 19:32:23Europa – das Ganze ist eine wunderbare Idee, \ aber das war der Kommunismus auch. \ Loriot

«Europa hat fertig», könnte man unken, und das wäre nicht einmal sehr verwegen. Mit solch einer Einschätzung stünden wir nicht alleine, denn die Stimmen in diese Richtung mehren sich. Der französische Präsident Emmanuel Macron warnte schon letztes Jahr davor, dass «unser Europa sterben könnte». Vermutlich hatte er dabei andere Gefahren im Kopf als jetzt der ungarische Ministerpräsident Viktor Orbán, der ein «baldiges Ende der EU» prognostizierte. Das Ergebnis könnte allerdings das gleiche sein.

Neben vordergründigen Themenbereichen wie Wirtschaft, Energie und Sicherheit ist das eigentliche Problem jedoch die obskure Mischung aus aufgegebener Souveränität und geschwollener Arroganz, mit der europäische Politiker:innende unterschiedlicher Couleur aufzutreten pflegen. Und das Tüpfelchen auf dem i ist die bröckelnde Legitimation politischer Institutionen dadurch, dass die Stimmen großer Teile der Bevölkerung seit Jahren auf vielfältige Weise ausgegrenzt werden.

Um «UnsereDemokratie» steht es schlecht. Dass seine Mandate immer schwächer werden, merkt natürlich auch unser «Führungspersonal». Entsprechend werden die Maßnahmen zur Gängelung, Überwachung und Manipulation der Bürger ständig verzweifelter. Parallel dazu plustern sich in Paris Macron, Scholz und einige andere noch einmal mächtig in Sachen Verteidigung und «Kriegstüchtigkeit» auf.

Momentan gilt es auch, das Überschwappen covidiotischer und verschwörungsideologischer Auswüchse aus den USA nach Europa zu vermeiden. So ein «MEGA» (Make Europe Great Again) können wir hier nicht gebrauchen. Aus den Vereinigten Staaten kommen nämlich furchtbare Nachrichten. Beispielsweise wurde einer der schärfsten Kritiker der Corona-Maßnahmen kürzlich zum Gesundheitsminister ernannt. Dieser setzt sich jetzt für eine Neubewertung der mRNA-«Impfstoffe» ein, was durchaus zu einem Entzug der Zulassungen führen könnte.

Der europäischen Version von «Verteidigung der Demokratie» setzte der US-Vizepräsident J. D. Vance auf der Münchner Sicherheitskonferenz sein Verständnis entgegen: «Demokratie stärken, indem wir unseren Bürgern erlauben, ihre Meinung zu sagen». Das Abschalten von Medien, das Annullieren von Wahlen oder das Ausschließen von Menschen vom politischen Prozess schütze gar nichts. Vielmehr sei dies der todsichere Weg, die Demokratie zu zerstören.

In der Schweiz kamen seine Worte deutlich besser an als in den meisten europäischen NATO-Ländern. Bundespräsidentin Karin Keller-Sutter lobte die Rede und interpretierte sie als «Plädoyer für die direkte Demokratie». Möglicherweise zeichne sich hier eine außenpolitische Kehrtwende in Richtung integraler Neutralität ab, meint mein Kollege Daniel Funk. Das wären doch endlich mal ein paar gute Nachrichten.

Von der einstigen Idee einer europäischen Union mit engeren Beziehungen zwischen den Staaten, um Konflikte zu vermeiden und das Wohlergehen der Bürger zu verbessern, sind wir meilenweit abgekommen. Der heutige korrupte Verbund unter technokratischer Leitung ähnelt mehr einem Selbstbedienungsladen mit sehr begrenztem Zugang. Die EU-Wahlen im letzten Sommer haben daran ebenso wenig geändert, wie die Bundestagswahl am kommenden Sonntag darauf einen Einfluss haben wird.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2025-02-19 09:23:17

@ a95c6243:d345522c

2025-02-19 09:23:17Die «moralische Weltordnung» – eine Art Astrologie. Friedrich Nietzsche

Das Treffen der BRICS-Staaten beim Gipfel im russischen Kasan war sicher nicht irgendein politisches Event. Gastgeber Wladimir Putin habe «Hof gehalten», sagen die Einen, China und Russland hätten ihre Vorstellung einer multipolaren Weltordnung zelebriert, schreiben Andere.

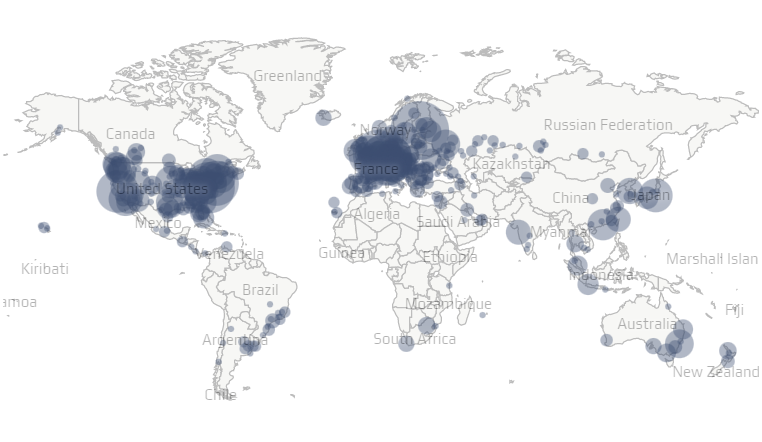

In jedem Fall zeigt die Anwesenheit von über 30 Delegationen aus der ganzen Welt, dass von einer geostrategischen Isolation Russlands wohl keine Rede sein kann. Darüber hinaus haben sowohl die Anreise von UN-Generalsekretär António Guterres als auch die Meldungen und Dementis bezüglich der Beitrittsbemühungen des NATO-Staats Türkei für etwas Aufsehen gesorgt.

Im Spannungsfeld geopolitischer und wirtschaftlicher Umbrüche zeigt die neue Allianz zunehmendes Selbstbewusstsein. In Sachen gemeinsamer Finanzpolitik schmiedet man interessante Pläne. Größere Unabhängigkeit von der US-dominierten Finanzordnung ist dabei ein wichtiges Ziel.

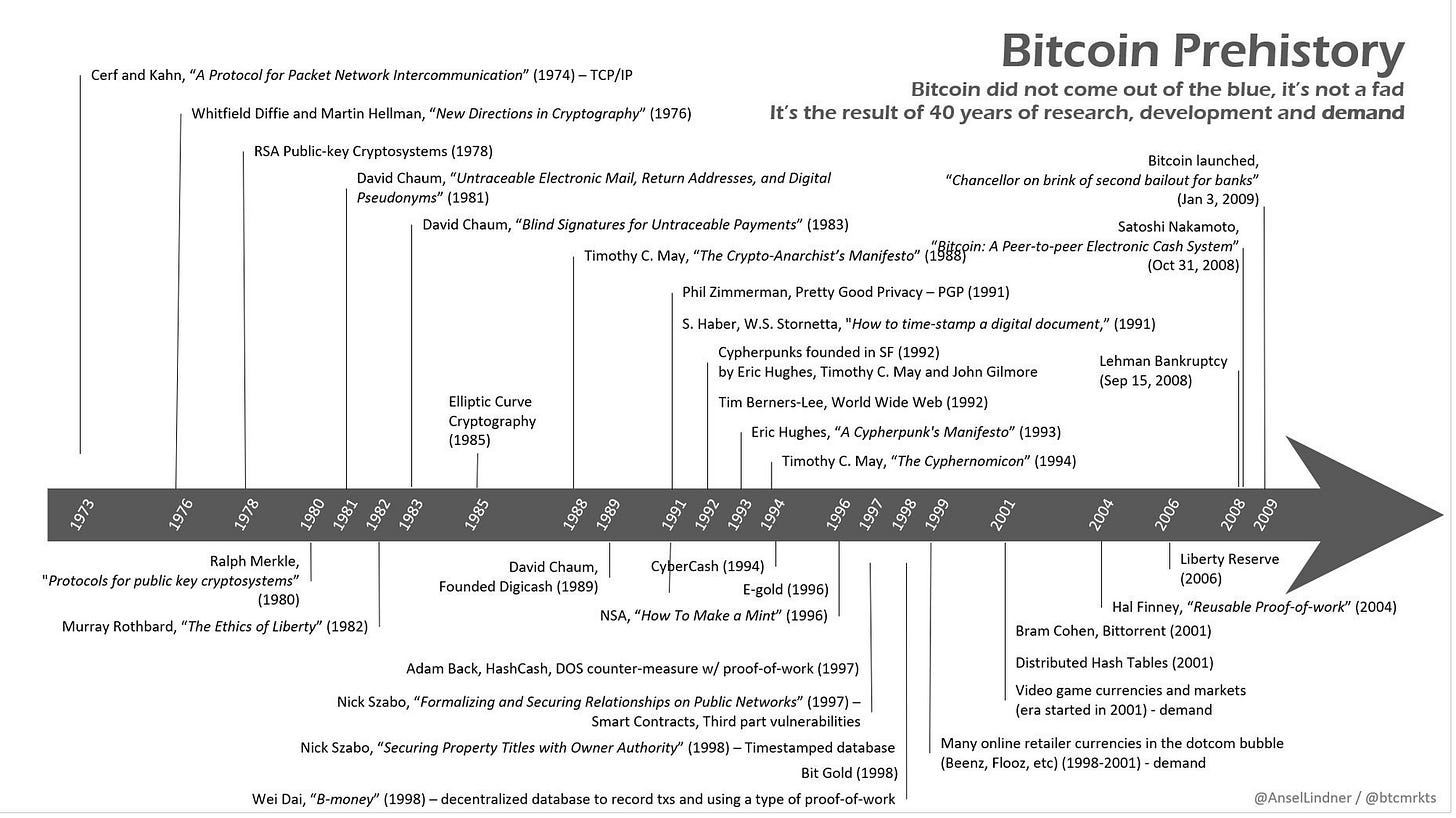

Beim BRICS-Wirtschaftsforum in Moskau, wenige Tage vor dem Gipfel, zählte ein nachhaltiges System für Finanzabrechnungen und Zahlungsdienste zu den vorrangigen Themen. Während dieses Treffens ging der russische Staatsfonds eine Partnerschaft mit dem Rechenzentrumsbetreiber BitRiver ein, um Bitcoin-Mining-Anlagen für die BRICS-Länder zu errichten.

Die Initiative könnte ein Schritt sein, Bitcoin und andere Kryptowährungen als Alternativen zu traditionellen Finanzsystemen zu etablieren. Das Projekt könnte dazu führen, dass die BRICS-Staaten den globalen Handel in Bitcoin abwickeln. Vor dem Hintergrund der Diskussionen über eine «BRICS-Währung» wäre dies eine Alternative zu dem ursprünglich angedachten Korb lokaler Währungen und zu goldgedeckten Währungen sowie eine mögliche Ergänzung zum Zahlungssystem BRICS Pay.

Dient der Bitcoin also der Entdollarisierung? Oder droht er inzwischen, zum Gegenstand geopolitischer Machtspielchen zu werden? Angesichts der globalen Vernetzungen ist es oft schwer zu durchschauen, «was eine Show ist und was im Hintergrund von anderen Strippenziehern insgeheim gesteuert wird». Sicher können Strukturen wie Bitcoin auch so genutzt werden, dass sie den Herrschenden dienlich sind. Aber die Grundeigenschaft des dezentralisierten, unzensierbaren Peer-to-Peer Zahlungsnetzwerks ist ihm schließlich nicht zu nehmen.

Wenn es nach der EZB oder dem IWF geht, dann scheint statt Instrumentalisierung momentan eher der Kampf gegen Kryptowährungen angesagt. Jürgen Schaaf, Senior Manager bei der Europäischen Zentralbank, hat jedenfalls dazu aufgerufen, Bitcoin «zu eliminieren». Der Internationale Währungsfonds forderte El Salvador, das Bitcoin 2021 als gesetzliches Zahlungsmittel eingeführt hat, kürzlich zu begrenzenden Maßnahmen gegen das Kryptogeld auf.

Dass die BRICS-Staaten ein freiheitliches Ansinnen im Kopf haben, wenn sie Kryptowährungen ins Spiel bringen, darf indes auch bezweifelt werden. Im Abschlussdokument bekennen sich die Gipfel-Teilnehmer ausdrücklich zur UN, ihren Programmen und ihrer «Agenda 2030». Ernst Wolff nennt das «eine Bankrotterklärung korrupter Politiker, die sich dem digital-finanziellen Komplex zu 100 Prozent unterwerfen».

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ 8947a945:9bfcf626

2025-02-28 09:11:21

@ 8947a945:9bfcf626

2025-02-28 09:11:21Chef's notes

https://video.nostr.build/ea19333ab7f700a6557b6f52f1f8cfe214671444687fa7ea56a18e5d751fe0a9.mp4

https://video.nostr.build/bcae8d39e22f66689d51f34e44ecabdf7a57b5099cc456e3e0f29446b1dfd0de.mp4

Details

- ⏲️ Prep time: 5 min

- 🍳 Cook time: 5 min

- 🍽️ Servings: 1

Ingredients

- ไข่ 1 - 2 ฟอง

- ข้าวโอ๊ต 3 - 4 ช้อน

Directions

- ตอกไข่ + ตีไข่

- ปรุงรส พริกไทย หรือ ซอสถั่วเหลืองตามชอบ

- ใส่ข้าวโอ๊ต 3 - 4 ช้อน

- ใส่ถั่วลิสงอบ 1 - 2 หยิบมือ

- เทน้ำใส่พอท่วมข้าวโอ๊ต

- เข้าไมโครเวฟ ไฟแรง 1 - 2 นาที

-

@ a95c6243:d345522c

2025-02-15 19:05:38

@ a95c6243:d345522c

2025-02-15 19:05:38Auf der diesjährigen Münchner Sicherheitskonferenz geht es vor allem um die Ukraine. Protagonisten sind dabei zunächst die US-Amerikaner. Präsident Trump schockierte die Europäer kurz vorher durch ein Telefonat mit seinem Amtskollegen Wladimir Putin, während Vizepräsident Vance mit seiner Rede über Demokratie und Meinungsfreiheit für versteinerte Mienen und Empörung sorgte.

Die Bemühungen der Europäer um einen Frieden in der Ukraine halten sich, gelinde gesagt, in Grenzen. Größeres Augenmerk wird auf militärische Unterstützung, die Pflege von Feindbildern sowie Eskalation gelegt. Der deutsche Bundeskanzler Scholz reagierte auf die angekündigten Verhandlungen über einen möglichen Frieden für die Ukraine mit der Forderung nach noch höheren «Verteidigungsausgaben». Auch die amtierende Außenministerin Baerbock hatte vor der Münchner Konferenz klargestellt:

«Frieden wird es nur durch Stärke geben. (...) Bei Corona haben wir gesehen, zu was Europa fähig ist. Es braucht erneut Investitionen, die der historischen Wegmarke, vor der wir stehen, angemessen sind.»

Die Rüstungsindustrie freut sich in jedem Fall über weltweit steigende Militärausgaben. Die Kriege in der Ukraine und in Gaza tragen zu Rekordeinnahmen bei. Jetzt «winkt die Aussicht auf eine jahrelange große Nachrüstung in Europa», auch wenn der Ukraine-Krieg enden sollte, so hört man aus Finanzkreisen. In der Konsequenz kennt «die Aktie des deutschen Vorzeige-Rüstungskonzerns Rheinmetall in ihrem Anstieg offenbar gar keine Grenzen mehr». «Solche Friedensversprechen» wie das jetzige hätten in der Vergangenheit zu starken Kursverlusten geführt.

Für manche Leute sind Kriegswaffen und sonstige Rüstungsgüter Waren wie alle anderen, jedenfalls aus der Perspektive von Investoren oder Managern. Auch in diesem Bereich gibt es Startups und man spricht von Dingen wie innovativen Herangehensweisen, hocheffizienten Produktionsanlagen, skalierbaren Produktionstechniken und geringeren Stückkosten.

Wir lesen aktuell von Massenproduktion und gesteigerten Fertigungskapazitäten für Kriegsgerät. Der Motor solcher Dynamik und solchen Wachstums ist die Aufrüstung, die inzwischen permanent gefordert wird. Parallel wird die Bevölkerung verbal eingestimmt und auf Kriegstüchtigkeit getrimmt.

Das Rüstungs- und KI-Startup Helsing verkündete kürzlich eine «dezentrale Massenproduktion für den Ukrainekrieg». Mit dieser Expansion positioniere sich das Münchner Unternehmen als einer der weltweit führenden Hersteller von Kampfdrohnen. Der nächste «Meilenstein» steht auch bereits an: Man will eine Satellitenflotte im Weltraum aufbauen, zur Überwachung von Gefechtsfeldern und Truppenbewegungen.

Ebenfalls aus München stammt das als DefenseTech-Startup bezeichnete Unternehmen ARX Robotics. Kürzlich habe man in der Region die größte europäische Produktionsstätte für autonome Verteidigungssysteme eröffnet. Damit fahre man die Produktion von Militär-Robotern hoch. Diese Expansion diene auch der Lieferung der «größten Flotte unbemannter Bodensysteme westlicher Bauart» in die Ukraine.

Rüstung boomt und scheint ein Zukunftsmarkt zu sein. Die Hersteller und Vermarkter betonen, mit ihren Aktivitäten und Produkten solle die europäische Verteidigungsfähigkeit erhöht werden. Ihre Strategien sollten sogar «zum Schutz demokratischer Strukturen beitragen».

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ c631e267:c2b78d3e

2025-02-07 19:42:11

@ c631e267:c2b78d3e

2025-02-07 19:42:11Nur wenn wir aufeinander zugehen, haben wir die Chance \ auf Überwindung der gegenseitigen Ressentiments! \ Dr. med. dent. Jens Knipphals

In Wolfsburg sollte es kürzlich eine Gesprächsrunde von Kritikern der Corona-Politik mit Oberbürgermeister Dennis Weilmann und Vertretern der Stadtverwaltung geben. Der Zahnarzt und langjährige Maßnahmenkritiker Jens Knipphals hatte diese Einladung ins Rathaus erwirkt und publiziert. Seine Motivation:

«Ich möchte die Spaltung der Gesellschaft überwinden. Dazu ist eine umfassende Aufarbeitung der Corona-Krise in der Öffentlichkeit notwendig.»

Schon früher hatte Knipphals Antworten von den Kommunalpolitikern verlangt, zum Beispiel bei öffentlichen Bürgerfragestunden. Für das erwartete Treffen im Rathaus formulierte er Fragen wie: Warum wurden fachliche Argumente der Kritiker ignoriert? Weshalb wurde deren Ausgrenzung, Diskreditierung und Entmenschlichung nicht entgegengetreten? In welcher Form übernehmen Rat und Verwaltung in Wolfsburg persönlich Verantwortung für die erheblichen Folgen der politischen Corona-Krise?

Der Termin fand allerdings nicht statt – der Bürgermeister sagte ihn kurz vorher wieder ab. Knipphals bezeichnete Weilmann anschließend als Wiederholungstäter, da das Stadtoberhaupt bereits 2022 zu einem Runden Tisch in der Sache eingeladen hatte, den es dann nie gab. Gegenüber Multipolar erklärte der Arzt, Weilmann wolle scheinbar eine öffentliche Aufarbeitung mit allen Mitteln verhindern. Er selbst sei «inzwischen absolut desillusioniert» und die einzige Lösung sei, dass die Verantwortlichen gingen.

Die Aufarbeitung der Plandemie beginne bei jedem von uns selbst, sei aber letztlich eine gesamtgesellschaftliche Aufgabe, schreibt Peter Frey, der den «Fall Wolfsburg» auch in seinem Blog behandelt. Diese Aufgabe sei indes deutlich größer, als viele glaubten. Erfreulicherweise sei der öffentliche Informationsraum inzwischen größer, trotz der weiterhin unverfrorenen Desinformations-Kampagnen der etablierten Massenmedien.

Frey erinnert daran, dass Dennis Weilmann mitverantwortlich für gravierende Grundrechtseinschränkungen wie die 2021 eingeführten 2G-Regeln in der Wolfsburger Innenstadt zeichnet. Es sei naiv anzunehmen, dass ein Funktionär einzig im Interesse der Bürger handeln würde. Als früherer Dezernent des Amtes für Wirtschaft, Digitalisierung und Kultur der Autostadt kenne Weilmann zum Beispiel die Verknüpfung von Fördergeldern mit politischen Zielsetzungen gut.

Wolfsburg wurde damals zu einem Modellprojekt des Bundesministeriums des Innern (BMI) und war Finalist im Bitkom-Wettbewerb «Digitale Stadt». So habe rechtzeitig vor der Plandemie das Projekt «Smart City Wolfsburg» anlaufen können, das der Stadt «eine Vorreiterrolle für umfassende Vernetzung und Datenerfassung» aufgetragen habe, sagt Frey. Die Vereinten Nationen verkauften dann derartige «intelligente» Überwachungs- und Kontrollmaßnahmen ebenso als Rettung in der Not wie das Magazin Forbes im April 2020:

«Intelligente Städte können uns helfen, die Coronavirus-Pandemie zu bekämpfen. In einer wachsenden Zahl von Ländern tun die intelligenten Städte genau das. Regierungen und lokale Behörden nutzen Smart-City-Technologien, Sensoren und Daten, um die Kontakte von Menschen aufzuspüren, die mit dem Coronavirus infiziert sind. Gleichzeitig helfen die Smart Cities auch dabei, festzustellen, ob die Regeln der sozialen Distanzierung eingehalten werden.»

Offensichtlich gibt es viele Aspekte zu bedenken und zu durchleuten, wenn es um die Aufklärung und Aufarbeitung der sogenannten «Corona-Pandemie» und der verordneten Maßnahmen geht. Frustration und Desillusion sind angesichts der Realitäten absolut verständlich. Gerade deswegen sind Initiativen wie die von Jens Knipphals so bewundernswert und so wichtig – ebenso wie eine seiner Kernthesen: «Wir müssen aufeinander zugehen, da hilft alles nichts».

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ 3bf0c63f:aefa459d

2024-01-15 11:15:06

@ 3bf0c63f:aefa459d

2024-01-15 11:15:06Pequenos problemas que o Estado cria para a sociedade e que não são sempre lembrados

- **vale-transporte**: transferir o custo com o transporte do funcionário para um terceiro o estimula a morar longe de onde trabalha, já que morar perto é normalmente mais caro e a economia com transporte é inexistente. - **atestado médico**: o direito a faltar o trabalho com atestado médico cria a exigência desse atestado para todas as situações, substituindo o livre acordo entre patrão e empregado e sobrecarregando os médicos e postos de saúde com visitas desnecessárias de assalariados resfriados. - **prisões**: com dinheiro mal-administrado, burocracia e péssima alocação de recursos -- problemas que empresas privadas em competição (ou mesmo sem qualquer competição) saberiam resolver muito melhor -- o Estado fica sem presídios, com os poucos existentes entupidos, muito acima de sua alocação máxima, e com isto, segundo a bizarra corrente de responsabilidades que culpa o juiz que condenou o criminoso por sua morte na cadeia, juízes deixam de condenar à prisão os bandidos, soltando-os na rua. - **justiça**: entrar com processos é grátis e isto faz proliferar a atividade dos advogados que se dedicam a criar problemas judiciais onde não seria necessário e a entupir os tribunais, impedindo-os de fazer o que mais deveriam fazer. - **justiça**: como a justiça só obedece às leis e ignora acordos pessoais, escritos ou não, as pessoas não fazem acordos, recorrem sempre à justiça estatal, e entopem-na de assuntos que seriam muito melhor resolvidos entre vizinhos. - **leis civis**: as leis criadas pelos parlamentares ignoram os costumes da sociedade e são um incentivo a que as pessoas não respeitem nem criem normas sociais -- que seriam maneiras mais rápidas, baratas e satisfatórias de resolver problemas. - **leis de trãnsito**: quanto mais leis de trânsito, mais serviço de fiscalização são delegados aos policiais, que deixam de combater crimes por isto (afinal de contas, eles não querem de fato arriscar suas vidas combatendo o crime, a fiscalização é uma excelente desculpa para se esquivarem a esta responsabilidade). - **financiamento educacional**: é uma espécie de subsídio às faculdades privadas que faz com que se criem cursos e mais cursos que são cada vez menos recheados de algum conhecimento ou técnica útil e cada vez mais inúteis. - **leis de tombamento**: são um incentivo a que o dono de qualquer área ou construção "histórica" destrua todo e qualquer vestígio de história que houver nele antes que as autoridades descubram, o que poderia não acontecer se ele pudesse, por exemplo, usar, mostrar e se beneficiar da história daquele local sem correr o risco de perder, de fato, a sua propriedade. - **zoneamento urbano**: torna as cidades mais espalhadas, criando uma necessidade gigantesca de carros, ônibus e outros meios de transporte para as pessoas se locomoverem das zonas de moradia para as zonas de trabalho. - **zoneamento urbano**: faz com que as pessoas percam horas no trânsito todos os dias, o que é, além de um desperdício, um atentado contra a sua saúde, que estaria muito melhor servida numa caminhada diária entre a casa e o trabalho. - **zoneamento urbano**: torna ruas e as casas menos seguras criando zonas enormes, tanto de residências quanto de indústrias, onde não há movimento de gente alguma. - **escola obrigatória + currículo escolar nacional**: emburrece todas as crianças. - **leis contra trabalho infantil**: tira das crianças a oportunidade de aprender ofícios úteis e levar um dinheiro para ajudar a família. - **licitações**: como não existem os critérios do mercado para decidir qual é o melhor prestador de serviço, criam-se comissões de pessoas que vão decidir coisas. isto incentiva os prestadores de serviço que estão concorrendo na licitação a tentar comprar os membros dessas comissões. isto, fora a corrupção, gera problemas reais: __(i)__ a escolha dos serviços acaba sendo a pior possível, já que a empresa prestadora que vence está claramente mais dedicada a comprar comissões do que a fazer um bom trabalho (este problema afeta tantas áreas, desde a construção de estradas até a qualidade da merenda escolar, que é impossível listar aqui); __(ii)__ o processo corruptor acaba, no longo prazo, eliminando as empresas que prestavam e deixando para competir apenas as corruptas, e a qualidade tende a piorar progressivamente. - **cartéis**: o Estado em geral cria e depois fica refém de vários grupos de interesse. o caso dos taxistas contra o Uber é o que está na moda hoje (e o que mostra como os Estados se comportam da mesma forma no mundo todo). - **multas**: quando algum indivíduo ou empresa comete uma fraude financeira, ou causa algum dano material involuntário, as vítimas do caso são as pessoas que sofreram o dano ou perderam dinheiro, mas o Estado tem sempre leis que prevêem multas para os responsáveis. A justiça estatal é sempre muito rígida e rápida na aplicação dessas multas, mas relapsa e vaga no que diz respeito à indenização das vítimas. O que em geral acontece é que o Estado aplica uma enorme multa ao responsável pelo mal, retirando deste os recursos que dispunha para indenizar as vítimas, e se retira do caso, deixando estas desamparadas. - **desapropriação**: o Estado pode pegar qualquer propriedade de qualquer pessoa mediante uma indenização que é necessariamente inferior ao valor da propriedade para o seu presente dono (caso contrário ele a teria vendido voluntariamente). - **seguro-desemprego**: se há, por exemplo, um prazo mínimo de 1 ano para o sujeito ter direito a receber seguro-desemprego, isto o incentiva a planejar ficar apenas 1 ano em cada emprego (ano este que será sucedido por um período de desemprego remunerado), matando todas as possibilidades de aprendizado ou aquisição de experiência naquela empresa específica ou ascensão hierárquica. - **previdência**: a previdência social tem todos os defeitos de cálculo do mundo, e não importa muito ela ser uma forma horrível de poupar dinheiro, porque ela tem garantias bizarras de longevidade fornecidas pelo Estado, além de ser compulsória. Isso serve para criar no imaginário geral a idéia da __aposentadoria__, uma época mágica em que todos os dias serão finais de semana. A idéia da aposentadoria influencia o sujeito a não se preocupar em ter um emprego que faça sentido, mas sim em ter um trabalho qualquer, que o permita se aposentar. - **regulamentação impossível**: milhares de coisas são proibidas, há regulamentações sobre os aspectos mais mínimos de cada empreendimento ou construção ou espaço. se todas essas regulamentações fossem exigidas não haveria condições de produção e todos morreriam. portanto, elas não são exigidas. porém, o Estado, ou um agente individual imbuído do poder estatal pode, se desejar, exigi-las todas de um cidadão inimigo seu. qualquer pessoa pode viver a vida inteira sem cumprir nem 10% das regulamentações estatais, mas viverá também todo esse tempo com medo de se tornar um alvo de sua exigência, num estado de terror psicológico. - **perversão de critérios**: para muitas coisas sobre as quais a sociedade normalmente chegaria a um valor ou comportamento "razoável" espontaneamente, o Estado dita regras. estas regras muitas vezes não são obrigatórias, são mais "sugestões" ou limites, como o salário mínimo, ou as 44 horas semanais de trabalho. a sociedade, porém, passa a usar esses valores como se fossem o normal. são raras, por exemplo, as ofertas de emprego que fogem à regra das 44h semanais. - **inflação**: subir os preços é difícil e constrangedor para as empresas, pedir aumento de salário é difícil e constrangedor para o funcionário. a inflação força as pessoas a fazer isso, mas o aumento não é automático, como alguns economistas podem pensar (enquanto alguns outros ficam muito satisfeitos de que esse processo seja demorado e difícil). - **inflação**: a inflação destrói a capacidade das pessoas de julgar preços entre concorrentes usando a própria memória. - **inflação**: a inflação destrói os cálculos de lucro/prejuízo das empresas e prejudica enormemente as decisões empresariais que seriam baseadas neles. - **inflação**: a inflação redistribui a riqueza dos mais pobres e mais afastados do sistema financeiro para os mais ricos, os bancos e as megaempresas. - **inflação**: a inflação estimula o endividamento e o consumismo. - **lixo:** ao prover coleta e armazenamento de lixo "grátis para todos" o Estado incentiva a criação de lixo. se tivessem que pagar para que recolhessem o seu lixo, as pessoas (e conseqüentemente as empresas) se empenhariam mais em produzir coisas usando menos plástico, menos embalagens, menos sacolas. - **leis contra crimes financeiros:** ao criar legislação para dificultar acesso ao sistema financeiro por parte de criminosos a dificuldade e os custos para acesso a esse mesmo sistema pelas pessoas de bem cresce absurdamente, levando a um percentual enorme de gente incapaz de usá-lo, para detrimento de todos -- e no final das contas os grandes criminosos ainda conseguem burlar tudo. -

@ a95c6243:d345522c

2025-01-31 20:02:25

@ a95c6243:d345522c

2025-01-31 20:02:25Im Augenblick wird mit größter Intensität, großer Umsicht \ das deutsche Volk belogen. \ Olaf Scholz im FAZ-Interview

Online-Wahlen stärken die Demokratie, sind sicher, und 61 Prozent der Wahlberechtigten sprechen sich für deren Einführung in Deutschland aus. Das zumindest behauptet eine aktuelle Umfrage, die auch über die Agentur Reuters Verbreitung in den Medien gefunden hat. Demnach würden außerdem 45 Prozent der Nichtwähler bei der Bundestagswahl ihre Stimme abgeben, wenn sie dies zum Beispiel von Ihrem PC, Tablet oder Smartphone aus machen könnten.

Die telefonische Umfrage unter gut 1000 wahlberechtigten Personen sei repräsentativ, behauptet der Auftraggeber – der Digitalverband Bitkom. Dieser präsentiert sich als eingetragener Verein mit einer beeindruckenden Liste von Mitgliedern, die Software und IT-Dienstleistungen anbieten. Erklärtes Vereinsziel ist es, «Deutschland zu einem führenden Digitalstandort zu machen und die digitale Transformation der deutschen Wirtschaft und Verwaltung voranzutreiben».

Durchgeführt hat die Befragung die Bitkom Servicegesellschaft mbH, also alles in der Familie. Die gleiche Erhebung hatte der Verband übrigens 2021 schon einmal durchgeführt. Damals sprachen sich angeblich sogar 63 Prozent für ein derartiges «Demokratie-Update» aus – die Tendenz ist demgemäß fallend. Dennoch orakelt mancher, der Gang zur Wahlurne gelte bereits als veraltet.

Die spanische Privat-Uni mit Globalisten-Touch, IE University, berichtete Ende letzten Jahres in ihrer Studie «European Tech Insights», 67 Prozent der Europäer befürchteten, dass Hacker Wahlergebnisse verfälschen könnten. Mehr als 30 Prozent der Befragten glaubten, dass künstliche Intelligenz (KI) bereits Wahlentscheidungen beeinflusst habe. Trotzdem würden angeblich 34 Prozent der unter 35-Jährigen einer KI-gesteuerten App vertrauen, um in ihrem Namen für politische Kandidaten zu stimmen.

Wie dauerhaft wird wohl das Ergebnis der kommenden Bundestagswahl sein? Diese Frage stellt sich angesichts der aktuellen Entwicklung der Migrations-Debatte und der (vorübergehend) bröckelnden «Brandmauer» gegen die AfD. Das «Zustrombegrenzungsgesetz» der Union hat das Parlament heute Nachmittag überraschenderweise abgelehnt. Dennoch muss man wohl kein ausgesprochener Pessimist sein, um zu befürchten, dass die Entscheidungen der Bürger von den selbsternannten Verteidigern der Demokratie künftig vielleicht nicht respektiert werden, weil sie nicht gefallen.

Bundesweit wird jetzt zu «Brandmauer-Demos» aufgerufen, die CDU gerät unter Druck und es wird von Übergriffen auf Parteibüros und Drohungen gegen Mitarbeiter berichtet. Sicherheitsbehörden warnen vor Eskalationen, die Polizei sei «für ein mögliches erhöhtes Aufkommen von Straftaten gegenüber Politikern und gegen Parteigebäude sensibilisiert».

Der Vorwand «unzulässiger Einflussnahme» auf Politik und Wahlen wird als Argument schon seit einiger Zeit aufgebaut. Der Manipulation schuldig befunden wird neben Putin und Trump auch Elon Musk, was lustigerweise ausgerechnet Bill Gates gerade noch einmal bekräftigt und als «völlig irre» bezeichnet hat. Man stelle sich die Diskussionen um die Gültigkeit von Wahlergebnissen vor, wenn es Online-Verfahren zur Stimmabgabe gäbe. In der Schweiz wird «E-Voting» seit einigen Jahren getestet, aber wohl bisher mit wenig Erfolg.

Die politische Brandstiftung der letzten Jahre zahlt sich immer mehr aus. Anstatt dringende Probleme der Menschen zu lösen – zu denen auch in Deutschland die weit verbreitete Armut zählt –, hat die Politik konsequent polarisiert und sich auf Ausgrenzung und Verhöhnung großer Teile der Bevölkerung konzentriert. Basierend auf Ideologie und Lügen werden abweichende Stimmen unterdrückt und kriminalisiert, nicht nur und nicht erst in diesem Augenblick. Die nächsten Wochen dürften ausgesprochen spannend werden.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28Músicas grudentas e conversas

Uma vez que você ouviu uma música grudenta e ela volta, inteira, com toda a melodia e a harmonia, muitos dias depois, contra a sua vontade. Mas uma conversa é impossível de lembrar. Por quê?

-

@ a95c6243:d345522c

2025-01-24 20:59:01

@ a95c6243:d345522c

2025-01-24 20:59:01Menschen tun alles, egal wie absurd, \ um ihrer eigenen Seele nicht zu begegnen. \ Carl Gustav Jung

«Extremer Reichtum ist eine Gefahr für die Demokratie», sagen über die Hälfte der knapp 3000 befragten Millionäre aus G20-Staaten laut einer Umfrage der «Patriotic Millionaires». Ferner stellte dieser Zusammenschluss wohlhabender US-Amerikaner fest, dass 63 Prozent jener Millionäre den Einfluss von Superreichen auf US-Präsident Trump als Bedrohung für die globale Stabilität ansehen.

Diese Besorgnis haben 370 Millionäre und Milliardäre am Dienstag auch den in Davos beim WEF konzentrierten Privilegierten aus aller Welt übermittelt. In einem offenen Brief forderten sie die «gewählten Führer» auf, die Superreichen – also sie selbst – zu besteuern, um «die zersetzenden Auswirkungen des extremen Reichtums auf unsere Demokratien und die Gesellschaft zu bekämpfen». Zum Beispiel kontrolliere eine handvoll extrem reicher Menschen die Medien, beeinflusse die Rechtssysteme in unzulässiger Weise und verwandele Recht in Unrecht.

Schon 2019 beanstandete der bekannte Historiker und Schriftsteller Ruthger Bregman an einer WEF-Podiumsdiskussion die Steuervermeidung der Superreichen. Die elitäre Veranstaltung bezeichnete er als «Feuerwehr-Konferenz, bei der man nicht über Löschwasser sprechen darf.» Daraufhin erhielt Bregman keine Einladungen nach Davos mehr. Auf seine Aussagen machte der Schweizer Aktivist Alec Gagneux aufmerksam, der sich seit Jahrzehnten kritisch mit dem WEF befasst. Ihm wurde kürzlich der Zutritt zu einem dreiteiligen Kurs über das WEF an der Volkshochschule Region Brugg verwehrt.

Nun ist die Erkenntnis, dass mit Geld politischer Einfluss einhergeht, alles andere als neu. Und extremer Reichtum macht die Sache nicht wirklich besser. Trotzdem hat man über Initiativen wie Patriotic Millionaires oder Taxmenow bisher eher selten etwas gehört, obwohl es sie schon lange gibt. Auch scheint es kein Problem, wenn ein Herr Gates fast im Alleingang versucht, globale Gesundheits-, Klima-, Ernährungs- oder Bevölkerungspolitik zu betreiben – im Gegenteil. Im Jahr, als der Milliardär Donald Trump zum zweiten Mal ins Weiße Haus einzieht, ist das Echo in den Gesinnungsmedien dagegen enorm – und uniform, wer hätte das gedacht.

Der neue US-Präsident hat jedoch «Davos geerdet», wie Achgut es nannte. In seiner kurzen Rede beim Weltwirtschaftsforum verteidigte er seine Politik und stellte klar, er habe schlicht eine «Revolution des gesunden Menschenverstands» begonnen. Mit deutlichen Worten sprach er unter anderem von ersten Maßnahmen gegen den «Green New Scam», und von einem «Erlass, der jegliche staatliche Zensur beendet»:

«Unsere Regierung wird die Äußerungen unserer eigenen Bürger nicht mehr als Fehlinformation oder Desinformation bezeichnen, was die Lieblingswörter von Zensoren und derer sind, die den freien Austausch von Ideen und, offen gesagt, den Fortschritt verhindern wollen.»

Wie der «Trumpismus» letztlich einzuordnen ist, muss jeder für sich selbst entscheiden. Skepsis ist definitiv angebracht, denn «einer von uns» sind weder der Präsident noch seine auserwählten Teammitglieder. Ob sie irgendeinen Sumpf trockenlegen oder Staatsverbrechen aufdecken werden oder was aus WHO- und Klimaverträgen wird, bleibt abzuwarten.

Das WHO-Dekret fordert jedenfalls die Übertragung der Gelder auf «glaubwürdige Partner», die die Aktivitäten übernehmen könnten. Zufällig scheint mit «Impfguru» Bill Gates ein weiterer Harris-Unterstützer kürzlich das Lager gewechselt zu haben: Nach einem gemeinsamen Abendessen zeigte er sich «beeindruckt» von Trumps Interesse an der globalen Gesundheit.

Mit dem Projekt «Stargate» sind weitere dunkle Wolken am Erwartungshorizont der Fangemeinde aufgezogen. Trump hat dieses Joint Venture zwischen den Konzernen OpenAI, Oracle, und SoftBank als das «größte KI-Infrastrukturprojekt der Geschichte» angekündigt. Der Stein des Anstoßes: Oracle-CEO Larry Ellison, der auch Fan von KI-gestützter Echtzeit-Überwachung ist, sieht einen weiteren potenziellen Einsatz der künstlichen Intelligenz. Sie könne dazu dienen, Krebserkrankungen zu erkennen und individuelle mRNA-«Impfstoffe» zur Behandlung innerhalb von 48 Stunden zu entwickeln.

Warum bitte sollten sich diese superreichen «Eliten» ins eigene Fleisch schneiden und direkt entgegen ihren eigenen Interessen handeln? Weil sie Menschenfreunde, sogenannte Philanthropen sind? Oder vielleicht, weil sie ein schlechtes Gewissen haben und ihre Schuld kompensieren müssen? Deswegen jedenfalls brauchen «Linke» laut Robert Willacker, einem deutschen Politikberater mit brasilianischen Wurzeln, rechte Parteien – ein ebenso überraschender wie humorvoller Erklärungsansatz.

Wenn eine Krähe der anderen kein Auge aushackt, dann tut sie das sich selbst noch weniger an. Dass Millionäre ernsthaft ihre eigene Besteuerung fordern oder Machteliten ihren eigenen Einfluss zugunsten anderer einschränken würden, halte ich für sehr unwahrscheinlich. So etwas glaube ich erst, wenn zum Beispiel die Rüstungsindustrie sich um Friedensverhandlungen bemüht, die Pharmalobby sich gegen institutionalisierte Korruption einsetzt, Zentralbanken ihre CBDC-Pläne für Bitcoin opfern oder der ÖRR die Abschaffung der Rundfunkgebühren fordert.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ c631e267:c2b78d3e

2025-01-18 09:34:51

@ c631e267:c2b78d3e

2025-01-18 09:34:51Die grauenvollste Aussicht ist die der Technokratie – \ einer kontrollierenden Herrschaft, \ die durch verstümmelte und verstümmelnde Geister ausgeübt wird. \ Ernst Jünger

«Davos ist nicht mehr sexy», das Weltwirtschaftsforum (WEF) mache Davos kaputt, diese Aussagen eines Einheimischen las ich kürzlich in der Handelszeitung. Während sich einige vor Ort enorm an der «teuersten Gewerbeausstellung der Welt» bereicherten, würden die negativen Begleiterscheinungen wie Wohnungsnot und Niedergang der lokalen Wirtschaft immer deutlicher.

Nächsten Montag beginnt in dem Schweizer Bergdorf erneut ein Jahrestreffen dieses elitären Clubs der Konzerne, bei dem man mit hochrangigen Politikern aus aller Welt und ausgewählten Vertretern der Systemmedien zusammenhocken wird. Wie bereits in den vergangenen vier Jahren wird die Präsidentin der EU-Kommission, Ursula von der Leyen, in Begleitung von Klaus Schwab ihre Grundsatzansprache halten.

Der deutsche WEF-Gründer hatte bei dieser Gelegenheit immer höchst lobende Worte für seine Landsmännin: 2021 erklärte er sich «stolz, dass Europa wieder unter Ihrer Führung steht» und 2022 fand er es bemerkenswert, was sie erreicht habe angesichts des «erstaunlichen Wandels», den die Welt in den vorangegangenen zwei Jahren erlebt habe; es gebe nun einen «neuen europäischen Geist».

Von der Leyens Handeln während der sogenannten Corona-«Pandemie» lobte Schwab damals bereits ebenso, wie es diese Woche das Karlspreis-Direktorium tat, als man der Beschuldigten im Fall Pfizergate die diesjährige internationale Auszeichnung «für Verdienste um die europäische Einigung» verlieh. Außerdem habe sie die EU nicht nur gegen den «Aggressor Russland», sondern auch gegen die «innere Bedrohung durch Rassisten und Demagogen» sowie gegen den Klimawandel verteidigt.

Jene Herausforderungen durch «Krisen epochalen Ausmaßes» werden indes aus dem Umfeld des WEF nicht nur herbeigeredet – wie man alljährlich zur Zeit des Davoser Treffens im Global Risks Report nachlesen kann, der zusammen mit dem Versicherungskonzern Zurich erstellt wird. Seit die Globalisten 2020/21 in der Praxis gesehen haben, wie gut eine konzertierte und konsequente Angst-Kampagne funktionieren kann, geht es Schlag auf Schlag. Sie setzen alles daran, Schwabs goldenes Zeitfenster des «Great Reset» zu nutzen.

Ziel dieses «großen Umbruchs» ist die totale Kontrolle der Technokraten über die Menschen unter dem Deckmantel einer globalen Gesundheitsfürsorge. Wie aber könnte man so etwas erreichen? Ein Mittel dazu ist die «kreative Zerstörung». Weitere unabdingbare Werkzeug sind die Einbindung, ja Gleichschaltung der Medien und der Justiz.

Ein «Great Mental Reset» sei die Voraussetzung dafür, dass ein Großteil der Menschen Einschränkungen und Manipulationen wie durch die Corona-Maßnahmen praktisch kritik- und widerstandslos hinnehme, sagt der Mediziner und Molekulargenetiker Michael Nehls. Er meint damit eine regelrechte Umprogrammierung des Gehirns, wodurch nach und nach unsere Individualität und unser soziales Bewusstsein eliminiert und durch unreflektierten Konformismus ersetzt werden.

Der aktuelle Zustand unserer Gesellschaften ist auch für den Schweizer Rechtsanwalt Philipp Kruse alarmierend. Durch den Umgang mit der «Pandemie» sieht er die Grundlagen von Recht und Vernunft erschüttert, die Rechtsstaatlichkeit stehe auf dem Prüfstand. Seiner dringenden Mahnung an alle Bürger, die Prinzipien von Recht und Freiheit zu verteidigen, kann ich mich nur anschließen.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2025-01-13 10:09:57

@ a95c6243:d345522c

2025-01-13 10:09:57Ich begann, Social Media aufzubauen, \ um den Menschen eine Stimme zu geben. \ Mark Zuckerberg

Sind euch auch die Tränen gekommen, als ihr Mark Zuckerbergs Wendehals-Deklaration bezüglich der Meinungsfreiheit auf seinen Portalen gehört habt? Rührend, oder? Während er früher die offensichtliche Zensur leugnete und später die Regierung Biden dafür verantwortlich machte, will er nun angeblich «die Zensur auf unseren Plattformen drastisch reduzieren».

«Purer Opportunismus» ob des anstehenden Regierungswechsels wäre als Klassifizierung viel zu kurz gegriffen. Der jetzige Schachzug des Meta-Chefs ist genauso Teil einer kühl kalkulierten Business-Strategie, wie es die 180 Grad umgekehrte Praxis vorher war. Social Media sind ein höchst lukratives Geschäft. Hinzu kommt vielleicht noch ein bisschen verkorkstes Ego, weil derartig viel Einfluss und Geld sicher auch auf die Psyche schlagen. Verständlich.

«Es ist an der Zeit, zu unseren Wurzeln der freien Meinungsäußerung auf Facebook und Instagram zurückzukehren. Ich begann, Social Media aufzubauen, um den Menschen eine Stimme zu geben», sagte Zuckerberg.

Welche Wurzeln? Hat der Mann vergessen, dass er von der Überwachung, dem Ausspionieren und dem Ausverkauf sämtlicher Daten und digitaler Spuren sowie der Manipulation seiner «Kunden» lebt? Das ist knallharter Kommerz, nichts anderes. Um freie Meinungsäußerung geht es bei diesem Geschäft ganz sicher nicht, und das war auch noch nie so. Die Wurzeln von Facebook liegen in einem Projekt des US-Militärs mit dem Namen «LifeLog». Dessen Ziel war es, «ein digitales Protokoll vom Leben eines Menschen zu erstellen».

Der Richtungswechsel kommt allerdings nicht überraschend. Schon Anfang Dezember hatte Meta-Präsident Nick Clegg von «zu hoher Fehlerquote bei der Moderation» von Inhalten gesprochen. Bei der Gelegenheit erwähnte er auch, dass Mark sehr daran interessiert sei, eine aktive Rolle in den Debatten über eine amerikanische Führungsrolle im technologischen Bereich zu spielen.

Während Milliardärskollege und Big Tech-Konkurrent Elon Musk bereits seinen Posten in der kommenden Trump-Regierung in Aussicht hat, möchte Zuckerberg also nicht nur seine Haut retten – Trump hatte ihn einmal einen «Feind des Volkes» genannt und ihm lebenslange Haft angedroht –, sondern am liebsten auch mitspielen. KI-Berater ist wohl die gewünschte Funktion, wie man nach einem Treffen Trump-Zuckerberg hörte. An seine Verhaftung dachte vermutlich auch ein weiterer Multimilliardär mit eigener Social Media-Plattform, Pavel Durov, als er Zuckerberg jetzt kritisierte und gleichzeitig warnte.

Politik und Systemmedien drehen jedenfalls durch – was zu viel ist, ist zu viel. Etwas weniger Zensur und mehr Meinungsfreiheit würden die Freiheit der Bürger schwächen und seien potenziell vernichtend für die Menschenrechte. Zuckerberg setze mit dem neuen Kurs die Demokratie aufs Spiel, das sei eine «Einladung zum nächsten Völkermord», ernsthaft. Die Frage sei, ob sich die EU gegen Musk und Zuckerberg behaupten könne, Brüssel müsse jedenfalls hart durchgreifen.

Auch um die Faktenchecker macht man sich Sorgen. Für die deutsche Nachrichtenagentur dpa und die «Experten» von Correctiv, die (noch) Partner für Fact-Checking-Aktivitäten von Facebook sind, sei das ein «lukratives Geschäftsmodell». Aber möglicherweise werden die Inhalte ohne diese vermeintlichen Korrektoren ja sogar besser. Anders als Meta wollen jedoch Scholz, Faeser und die Tagesschau keine Fehler zugeben und zum Beispiel Correctiv-Falschaussagen einräumen.

Bei derlei dramatischen Befürchtungen wundert es nicht, dass der öffentliche Plausch auf X zwischen Elon Musk und AfD-Chefin Alice Weidel von 150 EU-Beamten überwacht wurde, falls es irgendwelche Rechtsverstöße geben sollte, die man ihnen ankreiden könnte. Auch der Deutsche Bundestag war wachsam. Gefunden haben dürften sie nichts. Das Ganze war eher eine Show, viel Wind wurde gemacht, aber letztlich gab es nichts als heiße Luft.

Das Anbiedern bei Donald Trump ist indes gerade in Mode. Die Weltgesundheitsorganisation (WHO) tut das auch, denn sie fürchtet um Spenden von über einer Milliarde Dollar. Eventuell könnte ja Elon Musk auch hier künftig aushelfen und der Organisation sowie deren größtem privaten Förderer, Bill Gates, etwas unter die Arme greifen. Nachdem Musks KI-Projekt xAI kürzlich von BlackRock & Co. sechs Milliarden eingestrichen hat, geht da vielleicht etwas.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2025-01-03 20:26:47

@ a95c6243:d345522c

2025-01-03 20:26:47Was du bist hängt von drei Faktoren ab: \ Was du geerbt hast, \ was deine Umgebung aus dir machte \ und was du in freier Wahl \ aus deiner Umgebung und deinem Erbe gemacht hast. \ Aldous Huxley

Das brave Mitmachen und Mitlaufen in einem vorgegebenen, recht engen Rahmen ist gewiss nicht neu, hat aber gerade wieder mal Konjunktur. Dies kann man deutlich beobachten, eigentlich egal, in welchem gesellschaftlichen Bereich man sich umschaut. Individualität ist nur soweit angesagt, wie sie in ein bestimmtes Schema von «Diversität» passt, und Freiheit verkommt zur Worthülse – nicht erst durch ein gewisses Buch einer gewissen ehemaligen Regierungschefin.

Erklärungsansätze für solche Entwicklungen sind bekannt, und praktisch alle haben etwas mit Massenpsychologie zu tun. Der Herdentrieb, also der Trieb der Menschen, sich – zum Beispiel aus Unsicherheit oder Bequemlichkeit – lieber der Masse anzuschließen als selbstständig zu denken und zu handeln, ist einer der Erklärungsversuche. Andere drehen sich um Macht, Propaganda, Druck und Angst, also den gezielten Einsatz psychologischer Herrschaftsinstrumente.

Aber wollen die Menschen überhaupt Freiheit? Durch Gespräche im privaten Umfeld bin ich diesbezüglich in der letzten Zeit etwas skeptisch geworden. Um die Jahreswende philosophiert man ja gerne ein wenig über das Erlebte und über die Erwartungen für die Zukunft. Dabei hatte ich hin und wieder den Eindruck, die totalitären Anwandlungen unserer «Repräsentanten» kämen manchen Leuten gerade recht.

«Desinformation» ist so ein brisantes Thema. Davor müsse man die Menschen doch schützen, hörte ich. Jemand müsse doch zum Beispiel diese ganzen merkwürdigen Inhalte in den Social Media filtern – zur Ukraine, zum Klima, zu Gesundheitsthemen oder zur Migration. Viele wüssten ja gar nicht einzuschätzen, was richtig und was falsch ist, sie bräuchten eine Führung.

Freiheit bedingt Eigenverantwortung, ohne Zweifel. Eventuell ist es einigen tatsächlich zu anspruchsvoll, die Verantwortung für das eigene Tun und Lassen zu übernehmen. Oder die persönliche Freiheit wird nicht als ausreichend wertvolles Gut angesehen, um sich dafür anzustrengen. In dem Fall wäre die mangelnde Selbstbestimmung wohl das kleinere Übel. Allerdings fehlt dann gemäß Aldous Huxley ein Teil der Persönlichkeit. Letztlich ist natürlich alles eine Frage der Abwägung.

Sind viele Menschen möglicherweise schon so «eingenordet», dass freiheitliche Ambitionen gar nicht für eine ganze Gruppe, ein Kollektiv, verfolgt werden können? Solche Gedanken kamen mir auch, als ich mir kürzlich diverse Talks beim viertägigen Hacker-Kongress des Chaos Computer Clubs (38C3) anschaute. Ich war nicht nur überrascht, sondern reichlich erschreckt angesichts der in weiten Teilen mainstream-geformten Inhalte, mit denen ein dankbares Publikum beglückt wurde. Wo ich allgemein hellere Köpfe erwartet hatte, fand ich Konformismus und enthusiastisch untermauerte Narrative.

Gibt es vielleicht so etwas wie eine Herdenimmunität gegen Indoktrination? Ich denke, ja, zumindest eine gestärkte Widerstandsfähigkeit. Was wir brauchen, sind etwas gesunder Menschenverstand, offene Informationskanäle und der Mut, sich freier auch zwischen den Herden zu bewegen. Sie tun das bereits, aber sagen Sie es auch dieses Jahr ruhig weiter.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2025-01-01 17:39:51

@ a95c6243:d345522c

2025-01-01 17:39:51Heute möchte ich ein Gedicht mit euch teilen. Es handelt sich um eine Ballade des österreichischen Lyrikers Johann Gabriel Seidl aus dem 19. Jahrhundert. Mir sind diese Worte fest in Erinnerung, da meine Mutter sie perfekt rezitieren konnte, auch als die Kräfte schon langsam schwanden.

Dem originalen Titel «Die Uhr» habe ich für mich immer das Wort «innere» hinzugefügt. Denn der Zeitmesser – hier vermutliche eine Taschenuhr – symbolisiert zwar in dem Kontext das damalige Zeitempfinden und die Umbrüche durch die industrielle Revolution, sozusagen den Zeitgeist und das moderne Leben. Aber der Autor setzt sich philosophisch mit der Zeit auseinander und gibt seinem Werk auch eine klar spirituelle Dimension.

Das Ticken der Uhr und die Momente des Glücks und der Trauer stehen sinnbildlich für das unaufhaltsame Fortschreiten und die Vergänglichkeit des Lebens. Insofern könnte man bei der Uhr auch an eine Sonnenuhr denken. Der Rhythmus der Ereignisse passt uns vielleicht nicht immer in den Kram.

Was den Takt pocht, ist durchaus auch das Herz, unser «inneres Uhrwerk». Wenn dieses Meisterwerk einmal stillsteht, ist es unweigerlich um uns geschehen. Hoffentlich können wir dann dankbar sagen: «Ich habe mein Bestes gegeben.»

Ich trage, wo ich gehe, stets eine Uhr bei mir; \ Wieviel es geschlagen habe, genau seh ich an ihr. \ Es ist ein großer Meister, der künstlich ihr Werk gefügt, \ Wenngleich ihr Gang nicht immer dem törichten Wunsche genügt.

Ich wollte, sie wäre rascher gegangen an manchem Tag; \ Ich wollte, sie hätte manchmal verzögert den raschen Schlag. \ In meinen Leiden und Freuden, in Sturm und in der Ruh, \ Was immer geschah im Leben, sie pochte den Takt dazu.

Sie schlug am Sarge des Vaters, sie schlug an des Freundes Bahr, \ Sie schlug am Morgen der Liebe, sie schlug am Traualtar. \ Sie schlug an der Wiege des Kindes, sie schlägt, will's Gott, noch oft, \ Wenn bessere Tage kommen, wie meine Seele es hofft.

Und ward sie auch einmal träger, und drohte zu stocken ihr Lauf, \ So zog der Meister immer großmütig sie wieder auf. \ Doch stände sie einmal stille, dann wär's um sie geschehn, \ Kein andrer, als der sie fügte, bringt die Zerstörte zum Gehn.

Dann müßt ich zum Meister wandern, der wohnt am Ende wohl weit, \ Wohl draußen, jenseits der Erde, wohl dort in der Ewigkeit! \ Dann gäb ich sie ihm zurücke mit dankbar kindlichem Flehn: \ Sieh, Herr, ich hab nichts verdorben, sie blieb von selber stehn.

Johann Gabriel Seidl (1804-1875)

-

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28Bluesky is a scam

Bluesky advertises itself as an open network, they say people won't lose followers or their identity, they advertise themselves as a protocol ("atproto") and because of that they are tricking a lot of people into using them. These three claims are false.

protocolness

Bluesky is a company. "atproto" is the protocol. Supposedly they are two different things, right? Bluesky just releases software that implements the protocol, but others can also do that, it's open!

And yet, the protocol has an official webpage with a waitlist and a private beta? Why is the protocol advertised as a company product? Because it is. The "protocol" is just a description of whatever the Bluesky app and servers do, it can and does change anytime the Bluesky developers decide they want to change it, and it will keep changing for as long as Bluesky apps and servers control the biggest part of the network.

Oh, so there is the possibility of other players stepping in and then it becomes an actual interoperable open protocol? Yes, but what is the likelihood of that happening? It is very low. No serious competitor is likely to step in and build serious apps using a protocol that is directly controlled by Bluesky. All we will ever see are small "community" apps made by users and small satellite small businesses -- not unlike the people and companies that write plugins, addons and alternative clients for popular third-party centralized platforms.

And last, even if it happens that someone makes an app so good that it displaces the canonical official Bluesky app, then that company may overtake the protocol itself -- not because they're evil, but because there is no way it cannot be like this.

identity

According to their own documentation, the Bluesky people were looking for an identity system that provided global ids, key rotation and human-readable names.

They must have realized that such properties are not possible in an open and decentralized system, but instead of accepting a tradeoff they decided they wanted all their desired features and threw away the "decentralized" part, quite literally and explicitly (although they make sure to hide that piece in the middle of a bunch of code and text that very few will read).

The "DID Placeholder" method they decided to use for their global identities is nothing more than a normal old boring trusted server controlled by Bluesky that keeps track of who is who and can, at all times, decide to ban a person and deprive them from their identity (they dismissively call a "denial of service attack").

They decided to adopt this method as a placeholder until someone else doesn't invent the impossible alternative that would provide all their desired properties in a decentralized manner -- which is nothing more than a very good excuse: "yes, it's not great now, but it will improve!".

openness

Months after launching their product with an aura of decentralization and openness and getting a bunch of people inside that believed, falsely, they were joining an actually open network, Bluesky has decided to publish a part of their idea of how other people will be able to join their open network.

When I first saw their app and how they were very prominently things like follower counts, like counts and other things that are typical of centralized networks and can't be reliable or exact on truly open networks (like Nostr), I asked myself how were they going to do that once they became and open "federated" network as they were expected to be.

Turns out their decentralization plan is to just allow you, as a writer, to host your own posts on "personal data stores", but not really have any control over the distribution of the posts. All posts go through the Bluesky central server, called BGS, and they decide what to do with it. And you, as a reader, doesn't have any control of what you're reading from either, all you can do is connect to the BGS and ask for posts. If the BGS decides to ban, shadow ban, reorder, miscount, hide, deprioritize, trick or maybe even to serve ads, then you are out of luck.

Oh, but anyone can run their own BGS!, they will say. Even in their own blog post announcing the architecture they assert that "it’s a fairly resource-demanding service" and "there may be a few large full-network providers". But I fail to see why even more than one network provider will exist, if Bluesky is already doing that job, and considering the fact there are very little incentives for anyone to switch providers -- because the app does not seem to be at all made to talk to multiple providers, one would have to stop using the reliable, fast and beefy official BGS and start using some half-baked alternative and risk losing access to things.

When asked about the possibility of switching, one of Bluesky overlords said: "it would look something like this: bluesky has gone evil. there's a new alternative called freesky that people are rushing to. I'm switching to freesky".

The quote is very naïve and sounds like something that could be said about Twitter itself: "if Twitter is evil you can just run your own social network". Both are fallacies because they ignore the network-effect and the fact that people will never fully agree that something is "evil". In fact these two are the fundamental reasons why -- for social networks specifically (and not for other things like commerce) -- we need truly open protocols with no owners and no committees.

-

@ e373ca41:b82abcc5

2025-02-28 11:04:54

@ e373ca41:b82abcc5

2025-02-28 11:04:54Dieser Artikel wurde mit dem Pareto-Client geschrieben (lesen Sie ihn dort, um die volle Erfahrung zu machen).

Dies ist Teil 3 der Serie “Die Corona-Connection”: Lesen Sie hier Teil 1 und Teil 2.

Wenn die Realität die Fiktion überholt: das ist die Signatur unserer Epoche. Im Zuge täglicher Enthüllungen tritt nun immer deutlicher der medial-industrielle Komplex der “Corona-Connection” zum Vorschein. Allein die Finanzströme zeigen deutlich: der Anfangsverdacht einer Verschwörung ist sichtbar und nachweisbar.

Sie wollen meine (überwiegend englischen) Artikel auch per Email bekommen?

Hier können Sie sich eintragen für den Newsletter (max. 1-2 x pro Woche).

“Follow the Money”

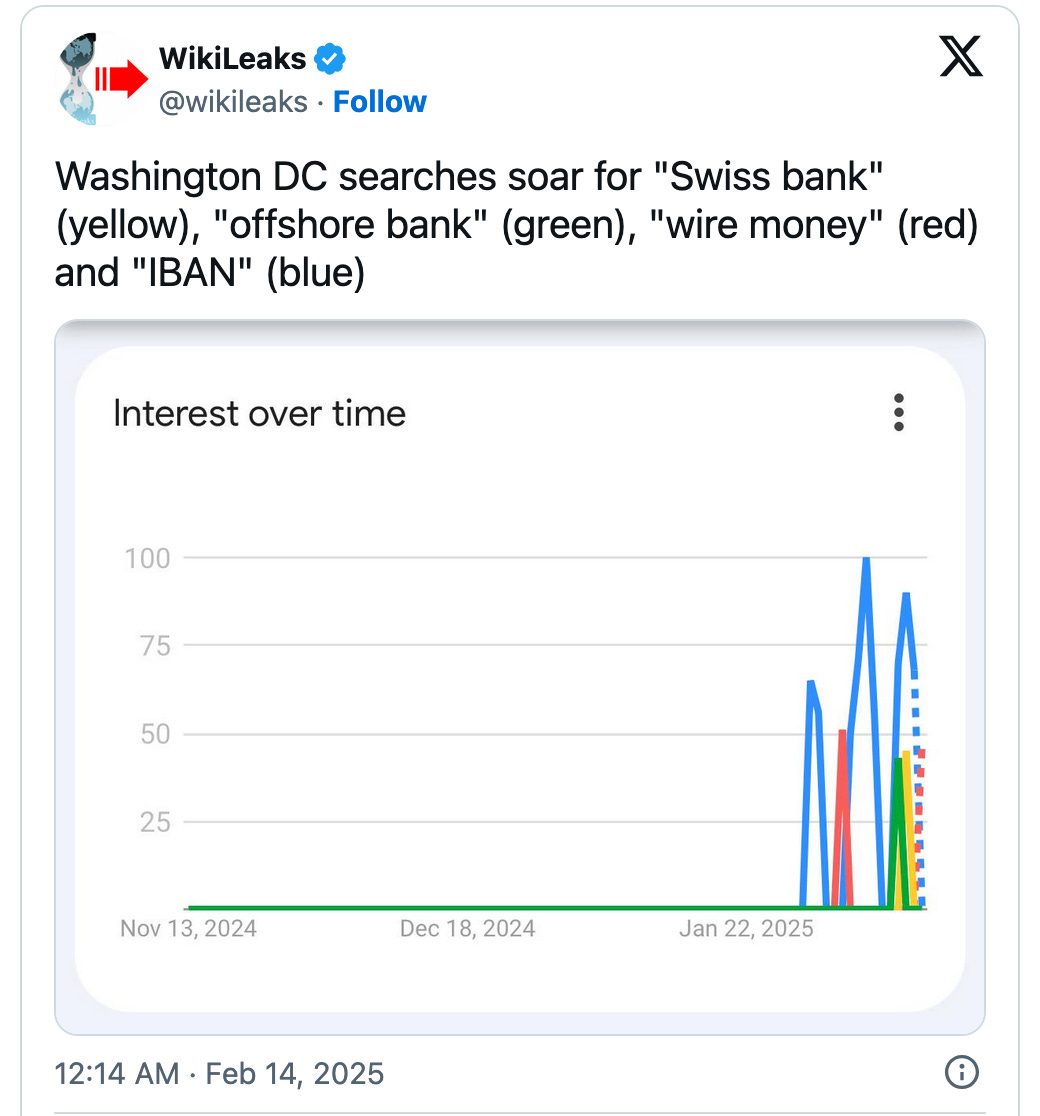

In Washington hat das große Sesselrücken begonnen: Tausende Wohnungen und Häuser werden gerade auf den Markt geschwemmt, die Suchanfragen nach Offshorebanken und Strafverteidigern explodiert. Die Ratten verlassen das sinkende Schiff, eine alte Nomenklatura fällt, eine neue wird errichtet. So ist Politik. Wie viel davon Inszenierung und wie viel echt ist, werden wir erst später erfahren.

(Quelle: X/@wikileaks)

Schon jetzt erfahren die Europäer allerdings von JD Vance, dass in Washington “ein neuer Sheriff in town” ist. Die Rede auf der Münchener Sicherheitskonferenz war eine Zäsur in den transatlantischen Beziehungen. JD Vance hat Europa die Leviten gelesen: Wir glaubten nicht mehr an die Meinungsfreiheit, und damit an die Demokratie; wir griffen in Wahlen ein, deindustrialisierten uns selbst, betrieben ideologische Beeinflussung, Zensur und Manipulation. Eine beeindruckende Rede eines früheren Trump-Verächters (er nannte ihn mal einen Betrüger und überlegte Hillary Clinton zu wählen). Und dann der „Killer-Satz“ an das Establishment:

„Wenn Sie Angst vor den eigenen Bürgern haben gibt es nichts, was die USA für Sie tun können.“

Ja, Vance hat in vielem Recht, Europa ist ein sektiererischer Bürokratenkontinent, der ideologisch gekapert ist. Doch vielleicht hätte Vance etwas mehr darüber sprechen können, was die USA bereits „für Europa getan haben“, allein in den letzten Jahren:

- Der Europäische Debattenraum wurde mit US-Steuergeldern manipuliert, knapp 500 Mio USD. flossen durch die Kanäle von USAID und Co.

- Deindustrialisierung: Danke für die Sprengung von Nordstream, großer Bruder!

- Zensur: waren das nicht auch die großen amerikanische Social Media Plattformen, siehe Twitter-Files?

- Ach überhaupt, der ganze Verschwörungskomplex zu Corona, ist nicht die Corona-Connection im Kern ein Konsortium überwiegend amerikanischer Player? NGOs, öffentliche Gesundheitsbehörden, CIA, Überwachungsindustrie, Big Pharma im Verbund mit China.

- Wer in den letzten Jahren von “Misinformation und Disinformation” sprach, benutzte exakt das USAID-Wording und derartige Beispiele gibt es viele.

ANZEIGE:

Sie suchen nach dem einfachsten Weg, Bitcoin zu kaufen und selbst zu verwahren?****** Die Relai-App ist Europas erfolgreichste Bitcoin-App. Hier kaufen Sie Bitcoin in wenigen Schritten und können auch Sparpläne einrichten. Niemand hat Zugriff auf Ihre Bitcoin, außer Sie selbst. Relai senkt jetzt die Gebühr auf 1%, mit dem Referral-Code MILOSZ sparen Sie weitere 10%. (keine Finanzberatung). Disclaimer wg. EU-Mica-Regulierung: Die Dienste von Relai werden ausschließlich für Einwohner der Schweiz und Italiens empfohlen.

Sprechen wir also zuerst vom Verrat Amerikas an der Welt, in Form der größten Psyop der Welt, sowie dem Biowaffenangriff in Form von Corona und mRNA, an dem amerikanische Behörden maßgeblich beteiligt waren. Die USA (oder der deep state?) sind scheinbar im Kalten Krieg mit der eigenen Bevölkerung und der Welt:

- USAID und NIAID finanzierten Coronavirusforschung in Wuhan, USAID finanzierte massiv die Bill & Melinda Gates Stiftung, Impfprogramme sowie GAVI, CEPI, Programme für “reproductive health” etc. Die Liste der “joint ventures” von Gates und USAID ist lang. Und USAID finanzierte den Propagandaapparat.

- Früher eichte die CIA Schriftsteller im Congress for Culture Freedom, heute finanzieren sie Weiterbildungen und Medientrainings für Tausende Journalisten, auch in Europa. Die Presselandschaft wird wie bei “Operation Mockingbird” einfach weiter unterwandert.

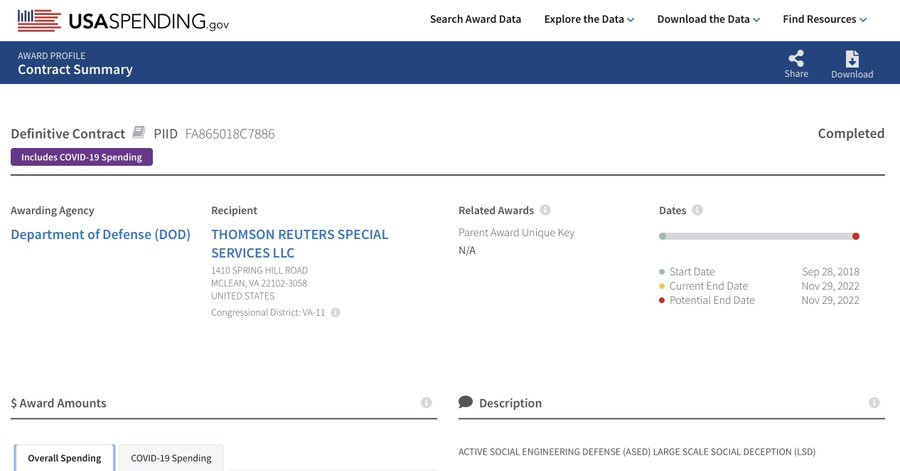

- Reuters bekam 9 Mio. vom US-Verteidigungsministerium und eine köstliche Programm-Beschreibung obendrein: Millionen für social engineering und gesellschaftliche Täuschung, large societal deception (abgekürzt LSD). Ein Wink mit dem Zaunpfahl auf “Mission Mind Control”, also Bewusstseinsexperimente der CIA, u.a. mit LSD?

- Ein paar Tröpfchen LSD dürfen nicht fehlen (rechts unten)

Die Rede vom Verrat an den eigenen Werten in vasallenartigem Gehorsam reiht sich jedenfalls schlecht ein in den noch größeren Verrat der eigenen Werte und eine Form von Hochverrat am Bürger durch amerikanische Behörden. Was genau bleibt also vom Vorwurf von Vance? Ihr habt bei der von uns mitfinanzierten Propagandamaschinerie etwas zu gut mitgemacht. Watch your values!

Die Rede von Vance sei Wahlbeeinflussung, eine Einmischung in „unsere Demokratie“, heißt es nun bei hiesigen Nomenklaturapolitikern. Wahlbeeinflussung durch Vance? Eine schöne Nebelkerze. Die größte Wahlbeeinflussung war doch die mit Milliarden USAID-Geld finanzierte ideologische Unterwanderung des europäischen Debattenraums, von Moldawien und der Ukraine bis Deutschland und Frankreich: Internews Network, Trusted News Initiativen, Factchecker, Kampagnen zu „Misinformation/Disinformation“ uvm. Der europäische Debattenraum wurde auf CIA-Narrativebene geeicht. Die Europäer sind konsterniert: Sie haben mitgemacht und werden jetzt von Vance „unter den Bus geworfen“. Sie stehen als die nützlichen Idioten da, die sie waren. Auch eine Form von Gaslighing: Bestrafung für Gehorsam.

Das Business Modell des Philanthrokapitalismus

Der Verrat der Werte, er zieht sich längst durch alle Ebenen von Bürokratie, Politik, Wirtschaft. Was eröffnet auch bessere Geschäftsmöglichkeiten als Gedankenkontrolle, Beeinflussung, autoritäre Einschüchterungsmethoden, durchgeführt von einem korporativen Machtapparat aus Politik, Polizei, Medien, Big Tech und Pharma?

Unter denen, die wegen USAID am meisten aufheulen, ist Bill Gates. Zu diesem tauchen, welch Wunder, gerade überall Lobesartikel auf, in US-Sendungen wird er wieder als Gesundheitsexperte herumgereicht, warnt vor Millionen Toten, wenn die Hilfen, die in seine Gesundheitsprogramme von USAID flossen, gestoppt werden. Nur am Rande: Gerade gab es einen Ebolaausbruch in Uganda. Die WHO lobt den schnellen Impfstart. Immer diese Zufälle, pandamic preparedness sei Dank, Herr Gates!

USAID und Gates sind ziemlich beste Freunde: Die weltgrößte Privatstiftung von Eugeniker Gates und eine CIA-Frontorganisation in trauter Verbundenheit. Was soll da anderes rauskommen, als die größte Psyop der Welt? Nein, USAID hat nicht in 1.6 Mrd. Dollar in deutsche Medien gesteckt, wie kürzlich per falschem Screenshot auf X verbreitet wurde. Die EU steckte dafür 132 Mio. Euro in journalistische EU-PR. Doch es blieb genug Geld für die Medien übrig, um den Corona-Scam zu glauben, zu verbreiten – und sich boostern zu lassen.

So wird ein Schuh draus: (Netzfund)

Darüber hinaus steckte USAID Milliarden in Gavi und CEPI, die Gatesschen Impfkonsortien mit Sitz in der Schweiz. Sowie in zig andere Programme der Gatesstiftung. Teils floss Geld zurück. Ein Geben und Nehmen. All das wäre für ein James-Bond-Drehbuch zu viel des Guten und Undenkbaren: Wir haben es bei der Corona-Connection mit einer Verschwörung von Geheimdienstkreisen, China und Philanthrokapitalisten zu tun. Deren teils geheimdienstfinanzierten Outlets (GAVI, CEPI), aber auch die WHO genießen in der Schweiz Steuervorteile und Immunität, wie eine Botschaft.

Und so wird ein Business-Modell daraus:

- Man suche sich ein Tätigkeitsfeld, Anliegen oder ein sonstiges Vorhaben der sozialen Ingenieurskunst aus. Bei Gates: Bevölkerungskontrolle und -reduktion, Impfstoffverkauf. 2010-2020 sollte die Dekade der Impfstoffe werden – und wurde es. Gates Gebaren konnte man 2015 in einer kritischen Untersuchung von “Misereor” und “Brot für die Welt” studieren.

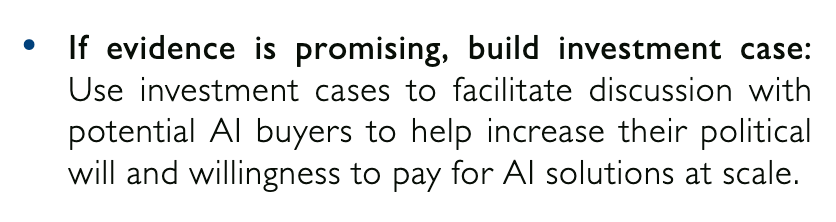

- Dann definiere man Strukturen, Mechanismen und Businessmodelle zur Umsetzung. In einer Studie von USAID, BMGF sowie Rockefeller-Stiftung zum Einsatz von KI im Gesundheitsbereich liest man es exemplarisch schwarz auf weiß: “If evidence is promising, define business case – Wenn die Beweise vielversprechend sind, entwickle eine Geschäftsidee.”

* Es erfolgt ein Investment in die Geschäftsidee. Das nennt sich dann Program-Related Investment, und nicht nur “grant”, wie die New York Times früher noch kritisierte. Hier wird der angebliche Altruismus zum systemischen legalen Interessenkonflikt. Katastrophen zahlen sich jetzt aus.

* WHO, Partnerorganisationen, News-Netzwerke werden auf die Idee geeicht, das übliche PR-Geschäft.

* Dann noch schnell ein Planspiel, in Wuhan ist der USAID-Partner mit der gain of function-Forschung nämlich schon bereit für den Lab-Leak. Investments in Curevac, Biontech & Co. sind bereits getätigt, das politische Feld in Sachen Epidemic Preparedness ohnehin vorgeimpft (und beteiligt, hunderte Millionen gingen von Deutschland an die BMGF und CEPI, Gavi).

* Es erfolgt ein Investment in die Geschäftsidee. Das nennt sich dann Program-Related Investment, und nicht nur “grant”, wie die New York Times früher noch kritisierte. Hier wird der angebliche Altruismus zum systemischen legalen Interessenkonflikt. Katastrophen zahlen sich jetzt aus.

* WHO, Partnerorganisationen, News-Netzwerke werden auf die Idee geeicht, das übliche PR-Geschäft.

* Dann noch schnell ein Planspiel, in Wuhan ist der USAID-Partner mit der gain of function-Forschung nämlich schon bereit für den Lab-Leak. Investments in Curevac, Biontech & Co. sind bereits getätigt, das politische Feld in Sachen Epidemic Preparedness ohnehin vorgeimpft (und beteiligt, hunderte Millionen gingen von Deutschland an die BMGF und CEPI, Gavi).In dieser Phase hängt der Erfolg der Operation nur noch davon ab, wie gut (und wie lange) man es schafft, das Overton-Fenster in den Medien (also das, was relevant ist) mit immer neuen Propaganda-Erzählungen und Angstbildern vollzuhängen, die sozialen Medien zurechtzustutzen und Kritiker zu dezimieren: Fertig ist der größte kriminelle Coup der Geschichte.

Alle Beteiligten gewinnen: Gates vedient an den Impfstoffen, kann das Geld steuerbefreit in der Stiftung für neue Machtgewinnungsfeldzüge einsetzen, die CIA hat ein erfolgreiches Massenhypnose-Experiment durchgeführt und China konnte die Weltwirtschaft hinter sich lassen, intern die Pandemie schnell besiegen und dem Westen seine sehr schnell in Vergessenheit geratenen Bürger- und Menschenrechte vorhalten. Diese Rechte fielen ungefähr so schnell, wie die Menschen in chinesischen Propagandavideos auf der Straße zusammensackten. Nur in China übrigens, nirgendwo anders.

Sie wollen meine (überwiegend englischen) Artikel auch per Email bekommen?

Hier können Sie sich eintragen für den Newsletter (max. 1-2 x pro Woche).

Philanthrokapitalismus bedeutet übersetzt, den Anreiz auszuleben, mit Kontrollphantasien, Social Engineering und Technokratie zugleich Geld zu verdienen, Steuern zu sparen, und Macht zu gewinnen. Ein Honeypot für schwerreiche Psychopathen, die munter nach Gutsherrenart an der Bevölkerung herumschrauben wollen. Der Philanthrokapitalismus eines Gates, Soros & Co ist das gefährlichste korporatistische Räuberbaronentum der Neuzeit. Der Staat kann legal für private Machterreichungszwecke ausgenommen werden – zum Schaden der Bürger.

Es gab bei Corona viele Profiteure. Und viele Opfer. Über beide werden wir in naher Zukunft noch viel mehr erfahren. Die Welle der Aufarbeitung rollt.

Und die Konsequenzen? Ein Bill Gates sollte vielleicht daran denken, nicht erst dann zu flüchten, wenn die Epstein-Files veröffentlicht werden, sondern schon früher. In der amerikanischen Verfassung gibt es nur einen Strafrechtsparagraphen und dieser lautet so:

Artikel III, Abschnitt 3 der US-Verfassung:

„Hochverrat gegen die Vereinigten Staaten besteht ausschließlich darin, Krieg gegen sie zu führen oder ihren Feinden Beistand und Unterstützung zu leisten.“

Die Corona-Impfkampagne hat die Gesundheit der Amerikaner, auch der von Soldaten massiv geschadet, wie akut erhöhte Krankenstände und Nebenwirkungsmeldungen zeigten. Damit wurde Feinden der USA (mindestens jede verfeindete Kriegspartei) Beistand geleistet.

Eines wissen wir schon jetzt: So in etwa ist der “Source Code” des Bösen programmiert.

You prefer reading me in English? You can find my first uncensorable articles written with our Pareto client via Nostr, clicking on this link. Discover other authors at Pareto.space/read.(click on the Pareto button to see our first authors).

Join the marketplace of ideas! We are building a publishing ecosystem on Nostr for citizen-journalism, starting with a client for blogging and newsletter distribution. Sound money and sound information should finally be in the hands of the people, right? Want to learn more about the Pareto Project? Zap me, if you want to contribute (all Zaps go to the project).

Are you a publication or journalist and want to be part of it, test us, migrate your content to Nostr? Write to team@pareto.space**

Not yet on Nostr and want the full experience? Easy onboarding via Start.

We have started a crowdfunding campaign on Geyser. We are in the Top 3 in February, thank you for the support!

Sie wollen meine Artikel auch per Email bekommen?

Hier können Sie sich eintragen für den Newsletter (max. 1-2 x pro Woche).

-

@ a95c6243:d345522c

2024-12-21 09:54:49

@ a95c6243:d345522c

2024-12-21 09:54:49Falls du beim Lesen des Titels dieses Newsletters unwillkürlich an positive Neuigkeiten aus dem globalen polit-medialen Irrenhaus oder gar aus dem wirtschaftlichen Umfeld gedacht hast, darf ich dich beglückwünschen. Diese Assoziation ist sehr löblich, denn sie weist dich als unverbesserlichen Optimisten aus. Leider muss ich dich diesbezüglich aber enttäuschen. Es geht hier um ein anderes Thema, allerdings sehr wohl ein positives, wie ich finde.

Heute ist ein ganz besonderer Tag: die Wintersonnenwende. Genau gesagt hat heute morgen um 10:20 Uhr Mitteleuropäischer Zeit (MEZ) auf der Nordhalbkugel unseres Planeten der astronomische Winter begonnen. Was daran so außergewöhnlich ist? Der kürzeste Tag des Jahres war gestern, seit heute werden die Tage bereits wieder länger! Wir werden also jetzt jeden Tag ein wenig mehr Licht haben.

Für mich ist dieses Ereignis immer wieder etwas kurios: Es beginnt der Winter, aber die Tage werden länger. Das erscheint mir zunächst wie ein Widerspruch, denn meine spontanen Assoziationen zum Winter sind doch eher Kälte und Dunkelheit, relativ zumindest. Umso erfreulicher ist der emotionale Effekt, wenn dann langsam die Erkenntnis durchsickert: Ab jetzt wird es schon wieder heller!

Natürlich ist es kalt im Winter, mancherorts mehr als anderswo. Vielleicht jedoch nicht mehr lange, wenn man den Klimahysterikern glauben wollte. Mindestens letztes Jahr hat Väterchen Frost allerdings gleich zu Beginn seiner Saison – und passenderweise während des globalen Überhitzungsgipfels in Dubai – nochmal richtig mit der Faust auf den Tisch gehauen. Schnee- und Eischaos sind ja eigentlich in der Agenda bereits nicht mehr vorgesehen. Deswegen war man in Deutschland vermutlich in vorauseilendem Gehorsam schon nicht mehr darauf vorbereitet und wurde glatt lahmgelegt.

Aber ich schweife ab. Die Aussicht auf nach und nach mehr Licht und damit auch Wärme stimmt mich froh. Den Zusammenhang zwischen beidem merkt man in Andalusien sehr deutlich. Hier, wo die Häuser im Winter arg auskühlen, geht man zum Aufwärmen raus auf die Straße oder auf den Balkon. Die Sonne hat auch im Winter eine erfreuliche Kraft. Und da ist jede Minute Gold wert.

Außerdem ist mir vor Jahren so richtig klar geworden, warum mir das südliche Klima so sehr gefällt. Das liegt nämlich nicht nur an der Sonne als solcher, oder der Wärme – das liegt vor allem am Licht. Ohne Licht keine Farben, das ist der ebenso simple wie gewaltige Unterschied zwischen einem deprimierenden matschgraubraunen Winter und einem fröhlichen bunten. Ein großes Stück Lebensqualität.

Mir gefällt aber auch die Symbolik dieses Tages: Licht aus der Dunkelheit, ein Wendepunkt, ein Neuanfang, neue Möglichkeiten, Übergang zu neuer Aktivität. In der winterlichen Stille keimt bereits neue Lebendigkeit. Und zwar in einem Zyklus, das wird immer wieder so geschehen. Ich nehme das gern als ein Stück Motivation, es macht mir Hoffnung und gibt mir Energie.

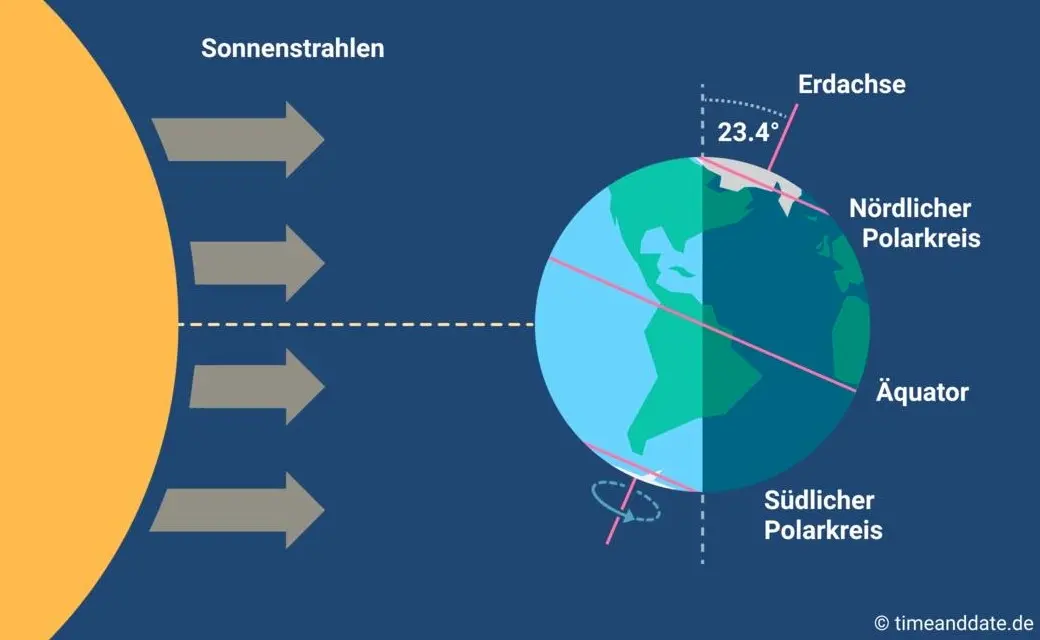

Übrigens ist parallel am heutigen Tag auf der südlichen Halbkugel Sommeranfang. Genau im entgegengesetzten Rhythmus, sich ergänzend, wie Yin und Yang. Das alles liegt an der Schrägstellung der Erdachse, die ist nämlich um 23,4º zur Umlaufbahn um die Sonne geneigt. Wir erinnern uns, gell?

Insofern bleibt eindeutig festzuhalten, dass “schräg sein” ein willkommener, wichtiger und positiver Wert ist. Mit anderen Worten: auch ungewöhnlich, eigenartig, untypisch, wunderlich, kauzig, … ja sogar irre, spinnert oder gar “quer” ist in Ordnung. Das schließt das Denken mit ein.

In diesem Sinne wünsche ich euch allen urige Weihnachtstage!

Dieser Beitrag ist letztes Jahr in meiner Denkbar erschienen.

-

@ a95c6243:d345522c

2024-12-13 19:30:32

@ a95c6243:d345522c

2024-12-13 19:30:32Das Betriebsklima ist das einzige Klima, \ das du selbst bestimmen kannst. \ Anonym

Eine Strategie zur Anpassung an den Klimawandel hat das deutsche Bundeskabinett diese Woche beschlossen. Da «Wetterextreme wie die immer häufiger auftretenden Hitzewellen und Starkregenereignisse» oft desaströse Auswirkungen auf Mensch und Umwelt hätten, werde eine Anpassung an die Folgen des Klimawandels immer wichtiger. «Klimaanpassungsstrategie» nennt die Regierung das.

Für die «Vorsorge vor Klimafolgen» habe man nun erstmals klare Ziele und messbare Kennzahlen festgelegt. So sei der Erfolg überprüfbar, und das solle zu einer schnelleren Bewältigung der Folgen führen. Dass sich hinter dem Begriff Klimafolgen nicht Folgen des Klimas, sondern wohl «Folgen der globalen Erwärmung» verbergen, erklärt den Interessierten die Wikipedia. Dabei ist das mit der Erwärmung ja bekanntermaßen so eine Sache.

Die Zunahme schwerer Unwetterereignisse habe gezeigt, so das Ministerium, wie wichtig eine frühzeitige und effektive Warnung der Bevölkerung sei. Daher solle es eine deutliche Anhebung der Nutzerzahlen der sogenannten Nina-Warn-App geben.

Die ARD spurt wie gewohnt und setzt die Botschaft zielsicher um. Der Artikel beginnt folgendermaßen:

«Die Flut im Ahrtal war ein Schock für das ganze Land. Um künftig besser gegen Extremwetter gewappnet zu sein, hat die Bundesregierung eine neue Strategie zur Klimaanpassung beschlossen. Die Warn-App Nina spielt eine zentrale Rolle. Der Bund will die Menschen in Deutschland besser vor Extremwetter-Ereignissen warnen und dafür die Reichweite der Warn-App Nina deutlich erhöhen.»

Die Kommunen würden bei ihren «Klimaanpassungsmaßnahmen» vom Zentrum KlimaAnpassung unterstützt, schreibt das Umweltministerium. Mit dessen Aufbau wurden das Deutsche Institut für Urbanistik gGmbH, welches sich stark für Smart City-Projekte engagiert, und die Adelphi Consult GmbH beauftragt.

Adelphi beschreibt sich selbst als «Europas führender Think-and-Do-Tank und eine unabhängige Beratung für Klima, Umwelt und Entwicklung». Sie seien «global vernetzte Strateg*innen und weltverbessernde Berater*innen» und als «Vorreiter der sozial-ökologischen Transformation» sei man mit dem Deutschen Nachhaltigkeitspreis ausgezeichnet worden, welcher sich an den Zielen der Agenda 2030 orientiere.

Über die Warn-App mit dem niedlichen Namen Nina, die möglichst jeder auf seinem Smartphone installieren soll, informiert das Bundesamt für Bevölkerungsschutz und Katastrophenhilfe (BBK). Gewarnt wird nicht nur vor Extrem-Wetterereignissen, sondern zum Beispiel auch vor Waffengewalt und Angriffen, Strom- und anderen Versorgungsausfällen oder Krankheitserregern. Wenn man die Kategorie Gefahreninformation wählt, erhält man eine Dosis von ungefähr zwei Benachrichtigungen pro Woche.

Beim BBK erfahren wir auch einiges über die empfohlenen Systemeinstellungen für Nina. Der Benutzer möge zum Beispiel den Zugriff auf die Standortdaten «immer zulassen», und zwar mit aktivierter Funktion «genauen Standort verwenden». Die Datennutzung solle unbeschränkt sein, auch im Hintergrund. Außerdem sei die uneingeschränkte Akkunutzung zu aktivieren, der Energiesparmodus auszuschalten und das Stoppen der App-Aktivität bei Nichtnutzung zu unterbinden.

Dass man so dramatische Ereignisse wie damals im Ahrtal auch anders bewerten kann als Regierungen und Systemmedien, hat meine Kollegin Wiltrud Schwetje anhand der Tragödie im spanischen Valencia gezeigt. Das Stichwort «Agenda 2030» taucht dabei in einem Kontext auf, der wenig mit Nachhaltigkeitspreisen zu tun hat.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2024-12-06 18:21:15

@ a95c6243:d345522c

2024-12-06 18:21:15Die Ungerechtigkeit ist uns nur in dem Falle angenehm,\ dass wir Vorteile aus ihr ziehen;\ in jedem andern hegt man den Wunsch,\ dass der Unschuldige in Schutz genommen werde.\ Jean-Jacques Rousseau

Politiker beteuern jederzeit, nur das Beste für die Bevölkerung zu wollen – nicht von ihr. Auch die zahlreichen unsäglichen «Corona-Maßnahmen» waren angeblich zu unserem Schutz notwendig, vor allem wegen der «besonders vulnerablen Personen». Daher mussten alle möglichen Restriktionen zwangsweise und unter Umgehung der Parlamente verordnet werden.

Inzwischen hat sich immer deutlicher herausgestellt, dass viele jener «Schutzmaßnahmen» den gegenteiligen Effekt hatten, sie haben den Menschen und den Gesellschaften enorm geschadet. Nicht nur haben die experimentellen Geninjektionen – wie erwartet – massive Nebenwirkungen, sondern Maskentragen schadet der Psyche und der Entwicklung (nicht nur unserer Kinder) und «Lockdowns und Zensur haben Menschen getötet».

Eine der wichtigsten Waffen unserer «Beschützer» ist die Spaltung der Gesellschaft. Die tiefen Gräben, die Politiker, Lobbyisten und Leitmedien praktisch weltweit ausgehoben haben, funktionieren leider nahezu in Perfektion. Von ihren persönlichen Erfahrungen als Kritikerin der Maßnahmen berichtete kürzlich eine Schweizerin im Interview mit Transition News. Sie sei schwer enttäuscht und verspüre bis heute eine Hemmschwelle und ein seltsames Unwohlsein im Umgang mit «Geimpften».

Menschen, die aufrichtig andere schützen wollten, werden von einer eindeutig politischen Justiz verfolgt, verhaftet und angeklagt. Dazu zählen viele Ärzte, darunter Heinrich Habig, Bianca Witzschel und Walter Weber. Über den aktuell laufenden Prozess gegen Dr. Weber hat Transition News mehrfach berichtet (z.B. hier und hier). Auch der Selbstschutz durch Verweigerung der Zwangs-Covid-«Impfung» bewahrt nicht vor dem Knast, wie Bundeswehrsoldaten wie Alexander Bittner erfahren mussten.

Die eigentlich Kriminellen schützen sich derweil erfolgreich selber, nämlich vor der Verantwortung. Die «Impf»-Kampagne war «das größte Verbrechen gegen die Menschheit». Trotzdem stellt man sich in den USA gerade die Frage, ob der scheidende Präsident Joe Biden nach seinem Sohn Hunter möglicherweise auch Anthony Fauci begnadigen wird – in diesem Fall sogar präventiv. Gibt es überhaupt noch einen Rest Glaubwürdigkeit, den Biden verspielen könnte?

Der Gedanke, den ehemaligen wissenschaftlichen Chefberater des US-Präsidenten und Direktor des National Institute of Allergy and Infectious Diseases (NIAID) vorsorglich mit einem Schutzschild zu versehen, dürfte mit der vergangenen Präsidentschaftswahl zu tun haben. Gleich mehrere Personalentscheidungen des designierten Präsidenten Donald Trump lassen Leute wie Fauci erneut in den Fokus rücken.

Das Buch «The Real Anthony Fauci» des nominierten US-Gesundheitsministers Robert F. Kennedy Jr. erschien 2021 und dreht sich um die Machenschaften der Pharma-Lobby in der öffentlichen Gesundheit. Das Vorwort zur rumänischen Ausgabe des Buches schrieb übrigens Călin Georgescu, der Überraschungssieger der ersten Wahlrunde der aktuellen Präsidentschaftswahlen in Rumänien. Vielleicht erklärt diese Verbindung einen Teil der Panik im Wertewesten.

In Rumänien selber gab es gerade einen Paukenschlag: Das bisherige Ergebnis wurde heute durch das Verfassungsgericht annuliert und die für Sonntag angesetzte Stichwahl kurzfristig abgesagt – wegen angeblicher «aggressiver russischer Einmischung». Thomas Oysmüller merkt dazu an, damit sei jetzt in der EU das Tabu gebrochen, Wahlen zu verbieten, bevor sie etwas ändern können.