-

@ a95c6243:d345522c

2025-02-21 19:32:23

@ a95c6243:d345522c

2025-02-21 19:32:23Europa – das Ganze ist eine wunderbare Idee, \ aber das war der Kommunismus auch. \ Loriot

«Europa hat fertig», könnte man unken, und das wäre nicht einmal sehr verwegen. Mit solch einer Einschätzung stünden wir nicht alleine, denn die Stimmen in diese Richtung mehren sich. Der französische Präsident Emmanuel Macron warnte schon letztes Jahr davor, dass «unser Europa sterben könnte». Vermutlich hatte er dabei andere Gefahren im Kopf als jetzt der ungarische Ministerpräsident Viktor Orbán, der ein «baldiges Ende der EU» prognostizierte. Das Ergebnis könnte allerdings das gleiche sein.

Neben vordergründigen Themenbereichen wie Wirtschaft, Energie und Sicherheit ist das eigentliche Problem jedoch die obskure Mischung aus aufgegebener Souveränität und geschwollener Arroganz, mit der europäische Politiker:innende unterschiedlicher Couleur aufzutreten pflegen. Und das Tüpfelchen auf dem i ist die bröckelnde Legitimation politischer Institutionen dadurch, dass die Stimmen großer Teile der Bevölkerung seit Jahren auf vielfältige Weise ausgegrenzt werden.

Um «UnsereDemokratie» steht es schlecht. Dass seine Mandate immer schwächer werden, merkt natürlich auch unser «Führungspersonal». Entsprechend werden die Maßnahmen zur Gängelung, Überwachung und Manipulation der Bürger ständig verzweifelter. Parallel dazu plustern sich in Paris Macron, Scholz und einige andere noch einmal mächtig in Sachen Verteidigung und «Kriegstüchtigkeit» auf.

Momentan gilt es auch, das Überschwappen covidiotischer und verschwörungsideologischer Auswüchse aus den USA nach Europa zu vermeiden. So ein «MEGA» (Make Europe Great Again) können wir hier nicht gebrauchen. Aus den Vereinigten Staaten kommen nämlich furchtbare Nachrichten. Beispielsweise wurde einer der schärfsten Kritiker der Corona-Maßnahmen kürzlich zum Gesundheitsminister ernannt. Dieser setzt sich jetzt für eine Neubewertung der mRNA-«Impfstoffe» ein, was durchaus zu einem Entzug der Zulassungen führen könnte.

Der europäischen Version von «Verteidigung der Demokratie» setzte der US-Vizepräsident J. D. Vance auf der Münchner Sicherheitskonferenz sein Verständnis entgegen: «Demokratie stärken, indem wir unseren Bürgern erlauben, ihre Meinung zu sagen». Das Abschalten von Medien, das Annullieren von Wahlen oder das Ausschließen von Menschen vom politischen Prozess schütze gar nichts. Vielmehr sei dies der todsichere Weg, die Demokratie zu zerstören.

In der Schweiz kamen seine Worte deutlich besser an als in den meisten europäischen NATO-Ländern. Bundespräsidentin Karin Keller-Sutter lobte die Rede und interpretierte sie als «Plädoyer für die direkte Demokratie». Möglicherweise zeichne sich hier eine außenpolitische Kehrtwende in Richtung integraler Neutralität ab, meint mein Kollege Daniel Funk. Das wären doch endlich mal ein paar gute Nachrichten.

Von der einstigen Idee einer europäischen Union mit engeren Beziehungen zwischen den Staaten, um Konflikte zu vermeiden und das Wohlergehen der Bürger zu verbessern, sind wir meilenweit abgekommen. Der heutige korrupte Verbund unter technokratischer Leitung ähnelt mehr einem Selbstbedienungsladen mit sehr begrenztem Zugang. Die EU-Wahlen im letzten Sommer haben daran ebenso wenig geändert, wie die Bundestagswahl am kommenden Sonntag darauf einen Einfluss haben wird.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ ee603283:3bc79dec

2025-02-26 23:50:16

@ ee603283:3bc79dec

2025-02-26 23:50:16Source Article by the Bitkey team and Undine Rubeze: https://bitkey.build/inheritance-is-live-heres-how-it-works/

TLDR: You wrap your mobile key, and encrypted this wrapped key with your beneficiaries public key. Send this info to Bitkey's servers. Your beneficiary can trigger the inheritance process after your passing and wait 6-months before they can do anything.

6 months seems like a long-time to be able to access critical life-savings funds for your family. This should help you prioritize a 3-6 month emergency "cash" savings for your family. Cash can be in a savings account or physical cash. Additionally, it might be beneficial to setup a life-insurance plan (a simple term-life plan) where the immediate bills and expenses are covered.

bitcoin #nostr

devs I tried to import the url into highlighter but got this error: "The page is not reader-friendly"

-

@ a95c6243:d345522c

2025-02-19 09:23:17

@ a95c6243:d345522c

2025-02-19 09:23:17Die «moralische Weltordnung» – eine Art Astrologie. Friedrich Nietzsche

Das Treffen der BRICS-Staaten beim Gipfel im russischen Kasan war sicher nicht irgendein politisches Event. Gastgeber Wladimir Putin habe «Hof gehalten», sagen die Einen, China und Russland hätten ihre Vorstellung einer multipolaren Weltordnung zelebriert, schreiben Andere.

In jedem Fall zeigt die Anwesenheit von über 30 Delegationen aus der ganzen Welt, dass von einer geostrategischen Isolation Russlands wohl keine Rede sein kann. Darüber hinaus haben sowohl die Anreise von UN-Generalsekretär António Guterres als auch die Meldungen und Dementis bezüglich der Beitrittsbemühungen des NATO-Staats Türkei für etwas Aufsehen gesorgt.

Im Spannungsfeld geopolitischer und wirtschaftlicher Umbrüche zeigt die neue Allianz zunehmendes Selbstbewusstsein. In Sachen gemeinsamer Finanzpolitik schmiedet man interessante Pläne. Größere Unabhängigkeit von der US-dominierten Finanzordnung ist dabei ein wichtiges Ziel.

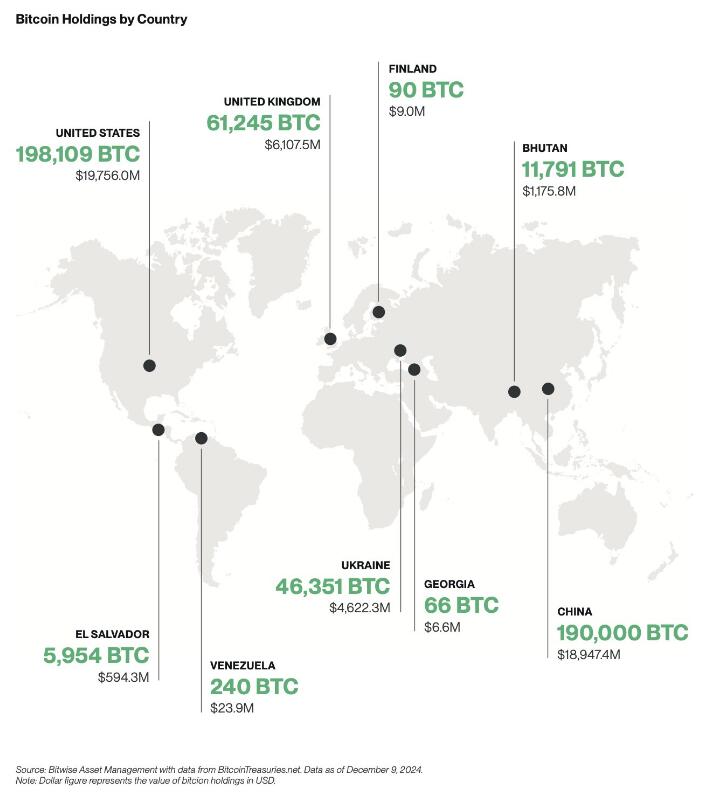

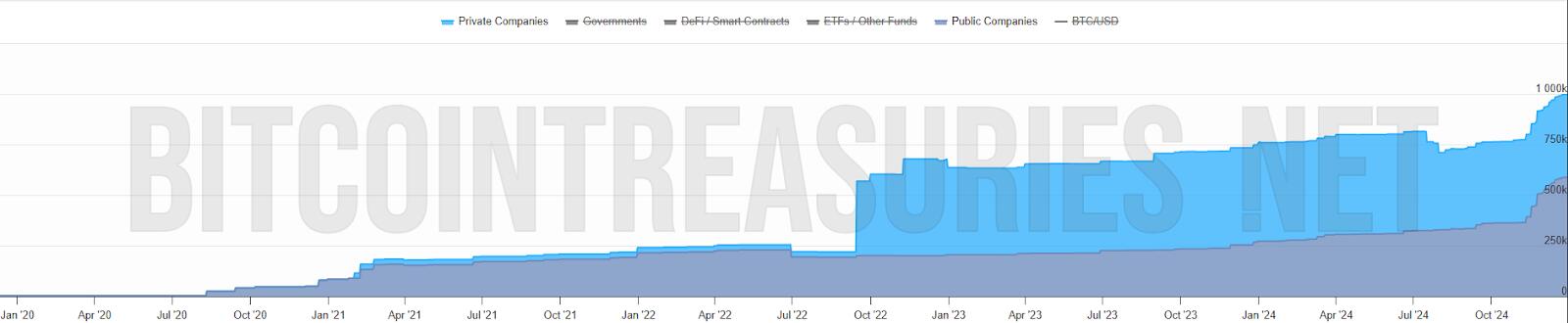

Beim BRICS-Wirtschaftsforum in Moskau, wenige Tage vor dem Gipfel, zählte ein nachhaltiges System für Finanzabrechnungen und Zahlungsdienste zu den vorrangigen Themen. Während dieses Treffens ging der russische Staatsfonds eine Partnerschaft mit dem Rechenzentrumsbetreiber BitRiver ein, um Bitcoin-Mining-Anlagen für die BRICS-Länder zu errichten.

Die Initiative könnte ein Schritt sein, Bitcoin und andere Kryptowährungen als Alternativen zu traditionellen Finanzsystemen zu etablieren. Das Projekt könnte dazu führen, dass die BRICS-Staaten den globalen Handel in Bitcoin abwickeln. Vor dem Hintergrund der Diskussionen über eine «BRICS-Währung» wäre dies eine Alternative zu dem ursprünglich angedachten Korb lokaler Währungen und zu goldgedeckten Währungen sowie eine mögliche Ergänzung zum Zahlungssystem BRICS Pay.

Dient der Bitcoin also der Entdollarisierung? Oder droht er inzwischen, zum Gegenstand geopolitischer Machtspielchen zu werden? Angesichts der globalen Vernetzungen ist es oft schwer zu durchschauen, «was eine Show ist und was im Hintergrund von anderen Strippenziehern insgeheim gesteuert wird». Sicher können Strukturen wie Bitcoin auch so genutzt werden, dass sie den Herrschenden dienlich sind. Aber die Grundeigenschaft des dezentralisierten, unzensierbaren Peer-to-Peer Zahlungsnetzwerks ist ihm schließlich nicht zu nehmen.

Wenn es nach der EZB oder dem IWF geht, dann scheint statt Instrumentalisierung momentan eher der Kampf gegen Kryptowährungen angesagt. Jürgen Schaaf, Senior Manager bei der Europäischen Zentralbank, hat jedenfalls dazu aufgerufen, Bitcoin «zu eliminieren». Der Internationale Währungsfonds forderte El Salvador, das Bitcoin 2021 als gesetzliches Zahlungsmittel eingeführt hat, kürzlich zu begrenzenden Maßnahmen gegen das Kryptogeld auf.

Dass die BRICS-Staaten ein freiheitliches Ansinnen im Kopf haben, wenn sie Kryptowährungen ins Spiel bringen, darf indes auch bezweifelt werden. Im Abschlussdokument bekennen sich die Gipfel-Teilnehmer ausdrücklich zur UN, ihren Programmen und ihrer «Agenda 2030». Ernst Wolff nennt das «eine Bankrotterklärung korrupter Politiker, die sich dem digital-finanziellen Komplex zu 100 Prozent unterwerfen».

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2025-02-15 19:05:38

@ a95c6243:d345522c

2025-02-15 19:05:38Auf der diesjährigen Münchner Sicherheitskonferenz geht es vor allem um die Ukraine. Protagonisten sind dabei zunächst die US-Amerikaner. Präsident Trump schockierte die Europäer kurz vorher durch ein Telefonat mit seinem Amtskollegen Wladimir Putin, während Vizepräsident Vance mit seiner Rede über Demokratie und Meinungsfreiheit für versteinerte Mienen und Empörung sorgte.

Die Bemühungen der Europäer um einen Frieden in der Ukraine halten sich, gelinde gesagt, in Grenzen. Größeres Augenmerk wird auf militärische Unterstützung, die Pflege von Feindbildern sowie Eskalation gelegt. Der deutsche Bundeskanzler Scholz reagierte auf die angekündigten Verhandlungen über einen möglichen Frieden für die Ukraine mit der Forderung nach noch höheren «Verteidigungsausgaben». Auch die amtierende Außenministerin Baerbock hatte vor der Münchner Konferenz klargestellt:

«Frieden wird es nur durch Stärke geben. (...) Bei Corona haben wir gesehen, zu was Europa fähig ist. Es braucht erneut Investitionen, die der historischen Wegmarke, vor der wir stehen, angemessen sind.»

Die Rüstungsindustrie freut sich in jedem Fall über weltweit steigende Militärausgaben. Die Kriege in der Ukraine und in Gaza tragen zu Rekordeinnahmen bei. Jetzt «winkt die Aussicht auf eine jahrelange große Nachrüstung in Europa», auch wenn der Ukraine-Krieg enden sollte, so hört man aus Finanzkreisen. In der Konsequenz kennt «die Aktie des deutschen Vorzeige-Rüstungskonzerns Rheinmetall in ihrem Anstieg offenbar gar keine Grenzen mehr». «Solche Friedensversprechen» wie das jetzige hätten in der Vergangenheit zu starken Kursverlusten geführt.

Für manche Leute sind Kriegswaffen und sonstige Rüstungsgüter Waren wie alle anderen, jedenfalls aus der Perspektive von Investoren oder Managern. Auch in diesem Bereich gibt es Startups und man spricht von Dingen wie innovativen Herangehensweisen, hocheffizienten Produktionsanlagen, skalierbaren Produktionstechniken und geringeren Stückkosten.

Wir lesen aktuell von Massenproduktion und gesteigerten Fertigungskapazitäten für Kriegsgerät. Der Motor solcher Dynamik und solchen Wachstums ist die Aufrüstung, die inzwischen permanent gefordert wird. Parallel wird die Bevölkerung verbal eingestimmt und auf Kriegstüchtigkeit getrimmt.

Das Rüstungs- und KI-Startup Helsing verkündete kürzlich eine «dezentrale Massenproduktion für den Ukrainekrieg». Mit dieser Expansion positioniere sich das Münchner Unternehmen als einer der weltweit führenden Hersteller von Kampfdrohnen. Der nächste «Meilenstein» steht auch bereits an: Man will eine Satellitenflotte im Weltraum aufbauen, zur Überwachung von Gefechtsfeldern und Truppenbewegungen.

Ebenfalls aus München stammt das als DefenseTech-Startup bezeichnete Unternehmen ARX Robotics. Kürzlich habe man in der Region die größte europäische Produktionsstätte für autonome Verteidigungssysteme eröffnet. Damit fahre man die Produktion von Militär-Robotern hoch. Diese Expansion diene auch der Lieferung der «größten Flotte unbemannter Bodensysteme westlicher Bauart» in die Ukraine.

Rüstung boomt und scheint ein Zukunftsmarkt zu sein. Die Hersteller und Vermarkter betonen, mit ihren Aktivitäten und Produkten solle die europäische Verteidigungsfähigkeit erhöht werden. Ihre Strategien sollten sogar «zum Schutz demokratischer Strukturen beitragen».

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ 6e0ea5d6:0327f353

2025-02-21 18:15:52

@ 6e0ea5d6:0327f353

2025-02-21 18:15:52"Malcolm Forbes recounts that a lady, wearing a faded cotton dress, and her husband, dressed in an old handmade suit, stepped off a train in Boston, USA, and timidly made their way to the office of the president of Harvard University. They had come from Palo Alto, California, and had not scheduled an appointment. The secretary, at a glance, thought that those two, looking like country bumpkins, had no business at Harvard.

— We want to speak with the president — the man said in a low voice.

— He will be busy all day — the secretary replied curtly.

— We will wait.

The secretary ignored them for hours, hoping the couple would finally give up and leave. But they stayed there, and the secretary, somewhat frustrated, decided to bother the president, although she hated doing that.

— If you speak with them for just a few minutes, maybe they will decide to go away — she said.

The president sighed in irritation but agreed. Someone of his importance did not have time to meet people like that, but he hated faded dresses and tattered suits in his office. With a stern face, he went to the couple.

— We had a son who studied at Harvard for a year — the woman said. — He loved Harvard and was very happy here, but a year ago he died in an accident, and we would like to erect a monument in his honor somewhere on campus.— My lady — said the president rudely —, we cannot erect a statue for every person who studied at Harvard and died; if we did, this place would look like a cemetery.

— Oh, no — the lady quickly replied. — We do not want to erect a statue. We would like to donate a building to Harvard.

The president looked at the woman's faded dress and her husband's old suit and exclaimed:

— A building! Do you have even the faintest idea of how much a building costs? We have more than seven and a half million dollars' worth of buildings here at Harvard.

The lady was silent for a moment, then said to her husband:

— If that’s all it costs to found a university, why don’t we have our own?

The husband agreed.

The couple, Leland Stanford, stood up and left, leaving the president confused. Traveling back to Palo Alto, California, they established there Stanford University, the second-largest in the world, in honor of their son, a former Harvard student."

Text extracted from: "Mileumlivros - Stories that Teach Values."

Thank you for reading, my friend! If this message helped you in any way, consider leaving your glass “🥃” as a token of appreciation.

A toast to our family!

-

@ 4857600b:30b502f4

2025-02-20 19:09:11

@ 4857600b:30b502f4

2025-02-20 19:09:11Mitch McConnell, a senior Republican senator, announced he will not seek reelection.

At 83 years old and with health issues, this decision was expected. After seven terms, he leaves a significant legacy in U.S. politics, known for his strategic maneuvering.

McConnell stated, “My current term in the Senate will be my last.” His retirement marks the end of an influential political era.

-

@ c631e267:c2b78d3e

2025-02-07 19:42:11

@ c631e267:c2b78d3e

2025-02-07 19:42:11Nur wenn wir aufeinander zugehen, haben wir die Chance \ auf Überwindung der gegenseitigen Ressentiments! \ Dr. med. dent. Jens Knipphals

In Wolfsburg sollte es kürzlich eine Gesprächsrunde von Kritikern der Corona-Politik mit Oberbürgermeister Dennis Weilmann und Vertretern der Stadtverwaltung geben. Der Zahnarzt und langjährige Maßnahmenkritiker Jens Knipphals hatte diese Einladung ins Rathaus erwirkt und publiziert. Seine Motivation:

«Ich möchte die Spaltung der Gesellschaft überwinden. Dazu ist eine umfassende Aufarbeitung der Corona-Krise in der Öffentlichkeit notwendig.»

Schon früher hatte Knipphals Antworten von den Kommunalpolitikern verlangt, zum Beispiel bei öffentlichen Bürgerfragestunden. Für das erwartete Treffen im Rathaus formulierte er Fragen wie: Warum wurden fachliche Argumente der Kritiker ignoriert? Weshalb wurde deren Ausgrenzung, Diskreditierung und Entmenschlichung nicht entgegengetreten? In welcher Form übernehmen Rat und Verwaltung in Wolfsburg persönlich Verantwortung für die erheblichen Folgen der politischen Corona-Krise?

Der Termin fand allerdings nicht statt – der Bürgermeister sagte ihn kurz vorher wieder ab. Knipphals bezeichnete Weilmann anschließend als Wiederholungstäter, da das Stadtoberhaupt bereits 2022 zu einem Runden Tisch in der Sache eingeladen hatte, den es dann nie gab. Gegenüber Multipolar erklärte der Arzt, Weilmann wolle scheinbar eine öffentliche Aufarbeitung mit allen Mitteln verhindern. Er selbst sei «inzwischen absolut desillusioniert» und die einzige Lösung sei, dass die Verantwortlichen gingen.

Die Aufarbeitung der Plandemie beginne bei jedem von uns selbst, sei aber letztlich eine gesamtgesellschaftliche Aufgabe, schreibt Peter Frey, der den «Fall Wolfsburg» auch in seinem Blog behandelt. Diese Aufgabe sei indes deutlich größer, als viele glaubten. Erfreulicherweise sei der öffentliche Informationsraum inzwischen größer, trotz der weiterhin unverfrorenen Desinformations-Kampagnen der etablierten Massenmedien.

Frey erinnert daran, dass Dennis Weilmann mitverantwortlich für gravierende Grundrechtseinschränkungen wie die 2021 eingeführten 2G-Regeln in der Wolfsburger Innenstadt zeichnet. Es sei naiv anzunehmen, dass ein Funktionär einzig im Interesse der Bürger handeln würde. Als früherer Dezernent des Amtes für Wirtschaft, Digitalisierung und Kultur der Autostadt kenne Weilmann zum Beispiel die Verknüpfung von Fördergeldern mit politischen Zielsetzungen gut.

Wolfsburg wurde damals zu einem Modellprojekt des Bundesministeriums des Innern (BMI) und war Finalist im Bitkom-Wettbewerb «Digitale Stadt». So habe rechtzeitig vor der Plandemie das Projekt «Smart City Wolfsburg» anlaufen können, das der Stadt «eine Vorreiterrolle für umfassende Vernetzung und Datenerfassung» aufgetragen habe, sagt Frey. Die Vereinten Nationen verkauften dann derartige «intelligente» Überwachungs- und Kontrollmaßnahmen ebenso als Rettung in der Not wie das Magazin Forbes im April 2020:

«Intelligente Städte können uns helfen, die Coronavirus-Pandemie zu bekämpfen. In einer wachsenden Zahl von Ländern tun die intelligenten Städte genau das. Regierungen und lokale Behörden nutzen Smart-City-Technologien, Sensoren und Daten, um die Kontakte von Menschen aufzuspüren, die mit dem Coronavirus infiziert sind. Gleichzeitig helfen die Smart Cities auch dabei, festzustellen, ob die Regeln der sozialen Distanzierung eingehalten werden.»

Offensichtlich gibt es viele Aspekte zu bedenken und zu durchleuten, wenn es um die Aufklärung und Aufarbeitung der sogenannten «Corona-Pandemie» und der verordneten Maßnahmen geht. Frustration und Desillusion sind angesichts der Realitäten absolut verständlich. Gerade deswegen sind Initiativen wie die von Jens Knipphals so bewundernswert und so wichtig – ebenso wie eine seiner Kernthesen: «Wir müssen aufeinander zugehen, da hilft alles nichts».

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2025-01-31 20:02:25

@ a95c6243:d345522c

2025-01-31 20:02:25Im Augenblick wird mit größter Intensität, großer Umsicht \ das deutsche Volk belogen. \ Olaf Scholz im FAZ-Interview

Online-Wahlen stärken die Demokratie, sind sicher, und 61 Prozent der Wahlberechtigten sprechen sich für deren Einführung in Deutschland aus. Das zumindest behauptet eine aktuelle Umfrage, die auch über die Agentur Reuters Verbreitung in den Medien gefunden hat. Demnach würden außerdem 45 Prozent der Nichtwähler bei der Bundestagswahl ihre Stimme abgeben, wenn sie dies zum Beispiel von Ihrem PC, Tablet oder Smartphone aus machen könnten.

Die telefonische Umfrage unter gut 1000 wahlberechtigten Personen sei repräsentativ, behauptet der Auftraggeber – der Digitalverband Bitkom. Dieser präsentiert sich als eingetragener Verein mit einer beeindruckenden Liste von Mitgliedern, die Software und IT-Dienstleistungen anbieten. Erklärtes Vereinsziel ist es, «Deutschland zu einem führenden Digitalstandort zu machen und die digitale Transformation der deutschen Wirtschaft und Verwaltung voranzutreiben».

Durchgeführt hat die Befragung die Bitkom Servicegesellschaft mbH, also alles in der Familie. Die gleiche Erhebung hatte der Verband übrigens 2021 schon einmal durchgeführt. Damals sprachen sich angeblich sogar 63 Prozent für ein derartiges «Demokratie-Update» aus – die Tendenz ist demgemäß fallend. Dennoch orakelt mancher, der Gang zur Wahlurne gelte bereits als veraltet.

Die spanische Privat-Uni mit Globalisten-Touch, IE University, berichtete Ende letzten Jahres in ihrer Studie «European Tech Insights», 67 Prozent der Europäer befürchteten, dass Hacker Wahlergebnisse verfälschen könnten. Mehr als 30 Prozent der Befragten glaubten, dass künstliche Intelligenz (KI) bereits Wahlentscheidungen beeinflusst habe. Trotzdem würden angeblich 34 Prozent der unter 35-Jährigen einer KI-gesteuerten App vertrauen, um in ihrem Namen für politische Kandidaten zu stimmen.

Wie dauerhaft wird wohl das Ergebnis der kommenden Bundestagswahl sein? Diese Frage stellt sich angesichts der aktuellen Entwicklung der Migrations-Debatte und der (vorübergehend) bröckelnden «Brandmauer» gegen die AfD. Das «Zustrombegrenzungsgesetz» der Union hat das Parlament heute Nachmittag überraschenderweise abgelehnt. Dennoch muss man wohl kein ausgesprochener Pessimist sein, um zu befürchten, dass die Entscheidungen der Bürger von den selbsternannten Verteidigern der Demokratie künftig vielleicht nicht respektiert werden, weil sie nicht gefallen.

Bundesweit wird jetzt zu «Brandmauer-Demos» aufgerufen, die CDU gerät unter Druck und es wird von Übergriffen auf Parteibüros und Drohungen gegen Mitarbeiter berichtet. Sicherheitsbehörden warnen vor Eskalationen, die Polizei sei «für ein mögliches erhöhtes Aufkommen von Straftaten gegenüber Politikern und gegen Parteigebäude sensibilisiert».

Der Vorwand «unzulässiger Einflussnahme» auf Politik und Wahlen wird als Argument schon seit einiger Zeit aufgebaut. Der Manipulation schuldig befunden wird neben Putin und Trump auch Elon Musk, was lustigerweise ausgerechnet Bill Gates gerade noch einmal bekräftigt und als «völlig irre» bezeichnet hat. Man stelle sich die Diskussionen um die Gültigkeit von Wahlergebnissen vor, wenn es Online-Verfahren zur Stimmabgabe gäbe. In der Schweiz wird «E-Voting» seit einigen Jahren getestet, aber wohl bisher mit wenig Erfolg.

Die politische Brandstiftung der letzten Jahre zahlt sich immer mehr aus. Anstatt dringende Probleme der Menschen zu lösen – zu denen auch in Deutschland die weit verbreitete Armut zählt –, hat die Politik konsequent polarisiert und sich auf Ausgrenzung und Verhöhnung großer Teile der Bevölkerung konzentriert. Basierend auf Ideologie und Lügen werden abweichende Stimmen unterdrückt und kriminalisiert, nicht nur und nicht erst in diesem Augenblick. Die nächsten Wochen dürften ausgesprochen spannend werden.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2025-01-24 20:59:01

@ a95c6243:d345522c

2025-01-24 20:59:01Menschen tun alles, egal wie absurd, \ um ihrer eigenen Seele nicht zu begegnen. \ Carl Gustav Jung

«Extremer Reichtum ist eine Gefahr für die Demokratie», sagen über die Hälfte der knapp 3000 befragten Millionäre aus G20-Staaten laut einer Umfrage der «Patriotic Millionaires». Ferner stellte dieser Zusammenschluss wohlhabender US-Amerikaner fest, dass 63 Prozent jener Millionäre den Einfluss von Superreichen auf US-Präsident Trump als Bedrohung für die globale Stabilität ansehen.

Diese Besorgnis haben 370 Millionäre und Milliardäre am Dienstag auch den in Davos beim WEF konzentrierten Privilegierten aus aller Welt übermittelt. In einem offenen Brief forderten sie die «gewählten Führer» auf, die Superreichen – also sie selbst – zu besteuern, um «die zersetzenden Auswirkungen des extremen Reichtums auf unsere Demokratien und die Gesellschaft zu bekämpfen». Zum Beispiel kontrolliere eine handvoll extrem reicher Menschen die Medien, beeinflusse die Rechtssysteme in unzulässiger Weise und verwandele Recht in Unrecht.

Schon 2019 beanstandete der bekannte Historiker und Schriftsteller Ruthger Bregman an einer WEF-Podiumsdiskussion die Steuervermeidung der Superreichen. Die elitäre Veranstaltung bezeichnete er als «Feuerwehr-Konferenz, bei der man nicht über Löschwasser sprechen darf.» Daraufhin erhielt Bregman keine Einladungen nach Davos mehr. Auf seine Aussagen machte der Schweizer Aktivist Alec Gagneux aufmerksam, der sich seit Jahrzehnten kritisch mit dem WEF befasst. Ihm wurde kürzlich der Zutritt zu einem dreiteiligen Kurs über das WEF an der Volkshochschule Region Brugg verwehrt.

Nun ist die Erkenntnis, dass mit Geld politischer Einfluss einhergeht, alles andere als neu. Und extremer Reichtum macht die Sache nicht wirklich besser. Trotzdem hat man über Initiativen wie Patriotic Millionaires oder Taxmenow bisher eher selten etwas gehört, obwohl es sie schon lange gibt. Auch scheint es kein Problem, wenn ein Herr Gates fast im Alleingang versucht, globale Gesundheits-, Klima-, Ernährungs- oder Bevölkerungspolitik zu betreiben – im Gegenteil. Im Jahr, als der Milliardär Donald Trump zum zweiten Mal ins Weiße Haus einzieht, ist das Echo in den Gesinnungsmedien dagegen enorm – und uniform, wer hätte das gedacht.

Der neue US-Präsident hat jedoch «Davos geerdet», wie Achgut es nannte. In seiner kurzen Rede beim Weltwirtschaftsforum verteidigte er seine Politik und stellte klar, er habe schlicht eine «Revolution des gesunden Menschenverstands» begonnen. Mit deutlichen Worten sprach er unter anderem von ersten Maßnahmen gegen den «Green New Scam», und von einem «Erlass, der jegliche staatliche Zensur beendet»:

«Unsere Regierung wird die Äußerungen unserer eigenen Bürger nicht mehr als Fehlinformation oder Desinformation bezeichnen, was die Lieblingswörter von Zensoren und derer sind, die den freien Austausch von Ideen und, offen gesagt, den Fortschritt verhindern wollen.»

Wie der «Trumpismus» letztlich einzuordnen ist, muss jeder für sich selbst entscheiden. Skepsis ist definitiv angebracht, denn «einer von uns» sind weder der Präsident noch seine auserwählten Teammitglieder. Ob sie irgendeinen Sumpf trockenlegen oder Staatsverbrechen aufdecken werden oder was aus WHO- und Klimaverträgen wird, bleibt abzuwarten.

Das WHO-Dekret fordert jedenfalls die Übertragung der Gelder auf «glaubwürdige Partner», die die Aktivitäten übernehmen könnten. Zufällig scheint mit «Impfguru» Bill Gates ein weiterer Harris-Unterstützer kürzlich das Lager gewechselt zu haben: Nach einem gemeinsamen Abendessen zeigte er sich «beeindruckt» von Trumps Interesse an der globalen Gesundheit.

Mit dem Projekt «Stargate» sind weitere dunkle Wolken am Erwartungshorizont der Fangemeinde aufgezogen. Trump hat dieses Joint Venture zwischen den Konzernen OpenAI, Oracle, und SoftBank als das «größte KI-Infrastrukturprojekt der Geschichte» angekündigt. Der Stein des Anstoßes: Oracle-CEO Larry Ellison, der auch Fan von KI-gestützter Echtzeit-Überwachung ist, sieht einen weiteren potenziellen Einsatz der künstlichen Intelligenz. Sie könne dazu dienen, Krebserkrankungen zu erkennen und individuelle mRNA-«Impfstoffe» zur Behandlung innerhalb von 48 Stunden zu entwickeln.

Warum bitte sollten sich diese superreichen «Eliten» ins eigene Fleisch schneiden und direkt entgegen ihren eigenen Interessen handeln? Weil sie Menschenfreunde, sogenannte Philanthropen sind? Oder vielleicht, weil sie ein schlechtes Gewissen haben und ihre Schuld kompensieren müssen? Deswegen jedenfalls brauchen «Linke» laut Robert Willacker, einem deutschen Politikberater mit brasilianischen Wurzeln, rechte Parteien – ein ebenso überraschender wie humorvoller Erklärungsansatz.

Wenn eine Krähe der anderen kein Auge aushackt, dann tut sie das sich selbst noch weniger an. Dass Millionäre ernsthaft ihre eigene Besteuerung fordern oder Machteliten ihren eigenen Einfluss zugunsten anderer einschränken würden, halte ich für sehr unwahrscheinlich. So etwas glaube ich erst, wenn zum Beispiel die Rüstungsindustrie sich um Friedensverhandlungen bemüht, die Pharmalobby sich gegen institutionalisierte Korruption einsetzt, Zentralbanken ihre CBDC-Pläne für Bitcoin opfern oder der ÖRR die Abschaffung der Rundfunkgebühren fordert.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ c631e267:c2b78d3e

2025-01-18 09:34:51

@ c631e267:c2b78d3e

2025-01-18 09:34:51Die grauenvollste Aussicht ist die der Technokratie – \ einer kontrollierenden Herrschaft, \ die durch verstümmelte und verstümmelnde Geister ausgeübt wird. \ Ernst Jünger

«Davos ist nicht mehr sexy», das Weltwirtschaftsforum (WEF) mache Davos kaputt, diese Aussagen eines Einheimischen las ich kürzlich in der Handelszeitung. Während sich einige vor Ort enorm an der «teuersten Gewerbeausstellung der Welt» bereicherten, würden die negativen Begleiterscheinungen wie Wohnungsnot und Niedergang der lokalen Wirtschaft immer deutlicher.

Nächsten Montag beginnt in dem Schweizer Bergdorf erneut ein Jahrestreffen dieses elitären Clubs der Konzerne, bei dem man mit hochrangigen Politikern aus aller Welt und ausgewählten Vertretern der Systemmedien zusammenhocken wird. Wie bereits in den vergangenen vier Jahren wird die Präsidentin der EU-Kommission, Ursula von der Leyen, in Begleitung von Klaus Schwab ihre Grundsatzansprache halten.

Der deutsche WEF-Gründer hatte bei dieser Gelegenheit immer höchst lobende Worte für seine Landsmännin: 2021 erklärte er sich «stolz, dass Europa wieder unter Ihrer Führung steht» und 2022 fand er es bemerkenswert, was sie erreicht habe angesichts des «erstaunlichen Wandels», den die Welt in den vorangegangenen zwei Jahren erlebt habe; es gebe nun einen «neuen europäischen Geist».

Von der Leyens Handeln während der sogenannten Corona-«Pandemie» lobte Schwab damals bereits ebenso, wie es diese Woche das Karlspreis-Direktorium tat, als man der Beschuldigten im Fall Pfizergate die diesjährige internationale Auszeichnung «für Verdienste um die europäische Einigung» verlieh. Außerdem habe sie die EU nicht nur gegen den «Aggressor Russland», sondern auch gegen die «innere Bedrohung durch Rassisten und Demagogen» sowie gegen den Klimawandel verteidigt.

Jene Herausforderungen durch «Krisen epochalen Ausmaßes» werden indes aus dem Umfeld des WEF nicht nur herbeigeredet – wie man alljährlich zur Zeit des Davoser Treffens im Global Risks Report nachlesen kann, der zusammen mit dem Versicherungskonzern Zurich erstellt wird. Seit die Globalisten 2020/21 in der Praxis gesehen haben, wie gut eine konzertierte und konsequente Angst-Kampagne funktionieren kann, geht es Schlag auf Schlag. Sie setzen alles daran, Schwabs goldenes Zeitfenster des «Great Reset» zu nutzen.

Ziel dieses «großen Umbruchs» ist die totale Kontrolle der Technokraten über die Menschen unter dem Deckmantel einer globalen Gesundheitsfürsorge. Wie aber könnte man so etwas erreichen? Ein Mittel dazu ist die «kreative Zerstörung». Weitere unabdingbare Werkzeug sind die Einbindung, ja Gleichschaltung der Medien und der Justiz.

Ein «Great Mental Reset» sei die Voraussetzung dafür, dass ein Großteil der Menschen Einschränkungen und Manipulationen wie durch die Corona-Maßnahmen praktisch kritik- und widerstandslos hinnehme, sagt der Mediziner und Molekulargenetiker Michael Nehls. Er meint damit eine regelrechte Umprogrammierung des Gehirns, wodurch nach und nach unsere Individualität und unser soziales Bewusstsein eliminiert und durch unreflektierten Konformismus ersetzt werden.

Der aktuelle Zustand unserer Gesellschaften ist auch für den Schweizer Rechtsanwalt Philipp Kruse alarmierend. Durch den Umgang mit der «Pandemie» sieht er die Grundlagen von Recht und Vernunft erschüttert, die Rechtsstaatlichkeit stehe auf dem Prüfstand. Seiner dringenden Mahnung an alle Bürger, die Prinzipien von Recht und Freiheit zu verteidigen, kann ich mich nur anschließen.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2025-01-13 10:09:57

@ a95c6243:d345522c

2025-01-13 10:09:57Ich begann, Social Media aufzubauen, \ um den Menschen eine Stimme zu geben. \ Mark Zuckerberg

Sind euch auch die Tränen gekommen, als ihr Mark Zuckerbergs Wendehals-Deklaration bezüglich der Meinungsfreiheit auf seinen Portalen gehört habt? Rührend, oder? Während er früher die offensichtliche Zensur leugnete und später die Regierung Biden dafür verantwortlich machte, will er nun angeblich «die Zensur auf unseren Plattformen drastisch reduzieren».

«Purer Opportunismus» ob des anstehenden Regierungswechsels wäre als Klassifizierung viel zu kurz gegriffen. Der jetzige Schachzug des Meta-Chefs ist genauso Teil einer kühl kalkulierten Business-Strategie, wie es die 180 Grad umgekehrte Praxis vorher war. Social Media sind ein höchst lukratives Geschäft. Hinzu kommt vielleicht noch ein bisschen verkorkstes Ego, weil derartig viel Einfluss und Geld sicher auch auf die Psyche schlagen. Verständlich.

«Es ist an der Zeit, zu unseren Wurzeln der freien Meinungsäußerung auf Facebook und Instagram zurückzukehren. Ich begann, Social Media aufzubauen, um den Menschen eine Stimme zu geben», sagte Zuckerberg.

Welche Wurzeln? Hat der Mann vergessen, dass er von der Überwachung, dem Ausspionieren und dem Ausverkauf sämtlicher Daten und digitaler Spuren sowie der Manipulation seiner «Kunden» lebt? Das ist knallharter Kommerz, nichts anderes. Um freie Meinungsäußerung geht es bei diesem Geschäft ganz sicher nicht, und das war auch noch nie so. Die Wurzeln von Facebook liegen in einem Projekt des US-Militärs mit dem Namen «LifeLog». Dessen Ziel war es, «ein digitales Protokoll vom Leben eines Menschen zu erstellen».

Der Richtungswechsel kommt allerdings nicht überraschend. Schon Anfang Dezember hatte Meta-Präsident Nick Clegg von «zu hoher Fehlerquote bei der Moderation» von Inhalten gesprochen. Bei der Gelegenheit erwähnte er auch, dass Mark sehr daran interessiert sei, eine aktive Rolle in den Debatten über eine amerikanische Führungsrolle im technologischen Bereich zu spielen.

Während Milliardärskollege und Big Tech-Konkurrent Elon Musk bereits seinen Posten in der kommenden Trump-Regierung in Aussicht hat, möchte Zuckerberg also nicht nur seine Haut retten – Trump hatte ihn einmal einen «Feind des Volkes» genannt und ihm lebenslange Haft angedroht –, sondern am liebsten auch mitspielen. KI-Berater ist wohl die gewünschte Funktion, wie man nach einem Treffen Trump-Zuckerberg hörte. An seine Verhaftung dachte vermutlich auch ein weiterer Multimilliardär mit eigener Social Media-Plattform, Pavel Durov, als er Zuckerberg jetzt kritisierte und gleichzeitig warnte.

Politik und Systemmedien drehen jedenfalls durch – was zu viel ist, ist zu viel. Etwas weniger Zensur und mehr Meinungsfreiheit würden die Freiheit der Bürger schwächen und seien potenziell vernichtend für die Menschenrechte. Zuckerberg setze mit dem neuen Kurs die Demokratie aufs Spiel, das sei eine «Einladung zum nächsten Völkermord», ernsthaft. Die Frage sei, ob sich die EU gegen Musk und Zuckerberg behaupten könne, Brüssel müsse jedenfalls hart durchgreifen.

Auch um die Faktenchecker macht man sich Sorgen. Für die deutsche Nachrichtenagentur dpa und die «Experten» von Correctiv, die (noch) Partner für Fact-Checking-Aktivitäten von Facebook sind, sei das ein «lukratives Geschäftsmodell». Aber möglicherweise werden die Inhalte ohne diese vermeintlichen Korrektoren ja sogar besser. Anders als Meta wollen jedoch Scholz, Faeser und die Tagesschau keine Fehler zugeben und zum Beispiel Correctiv-Falschaussagen einräumen.

Bei derlei dramatischen Befürchtungen wundert es nicht, dass der öffentliche Plausch auf X zwischen Elon Musk und AfD-Chefin Alice Weidel von 150 EU-Beamten überwacht wurde, falls es irgendwelche Rechtsverstöße geben sollte, die man ihnen ankreiden könnte. Auch der Deutsche Bundestag war wachsam. Gefunden haben dürften sie nichts. Das Ganze war eher eine Show, viel Wind wurde gemacht, aber letztlich gab es nichts als heiße Luft.

Das Anbiedern bei Donald Trump ist indes gerade in Mode. Die Weltgesundheitsorganisation (WHO) tut das auch, denn sie fürchtet um Spenden von über einer Milliarde Dollar. Eventuell könnte ja Elon Musk auch hier künftig aushelfen und der Organisation sowie deren größtem privaten Förderer, Bill Gates, etwas unter die Arme greifen. Nachdem Musks KI-Projekt xAI kürzlich von BlackRock & Co. sechs Milliarden eingestrichen hat, geht da vielleicht etwas.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2025-01-03 20:26:47

@ a95c6243:d345522c

2025-01-03 20:26:47Was du bist hängt von drei Faktoren ab: \ Was du geerbt hast, \ was deine Umgebung aus dir machte \ und was du in freier Wahl \ aus deiner Umgebung und deinem Erbe gemacht hast. \ Aldous Huxley

Das brave Mitmachen und Mitlaufen in einem vorgegebenen, recht engen Rahmen ist gewiss nicht neu, hat aber gerade wieder mal Konjunktur. Dies kann man deutlich beobachten, eigentlich egal, in welchem gesellschaftlichen Bereich man sich umschaut. Individualität ist nur soweit angesagt, wie sie in ein bestimmtes Schema von «Diversität» passt, und Freiheit verkommt zur Worthülse – nicht erst durch ein gewisses Buch einer gewissen ehemaligen Regierungschefin.

Erklärungsansätze für solche Entwicklungen sind bekannt, und praktisch alle haben etwas mit Massenpsychologie zu tun. Der Herdentrieb, also der Trieb der Menschen, sich – zum Beispiel aus Unsicherheit oder Bequemlichkeit – lieber der Masse anzuschließen als selbstständig zu denken und zu handeln, ist einer der Erklärungsversuche. Andere drehen sich um Macht, Propaganda, Druck und Angst, also den gezielten Einsatz psychologischer Herrschaftsinstrumente.

Aber wollen die Menschen überhaupt Freiheit? Durch Gespräche im privaten Umfeld bin ich diesbezüglich in der letzten Zeit etwas skeptisch geworden. Um die Jahreswende philosophiert man ja gerne ein wenig über das Erlebte und über die Erwartungen für die Zukunft. Dabei hatte ich hin und wieder den Eindruck, die totalitären Anwandlungen unserer «Repräsentanten» kämen manchen Leuten gerade recht.

«Desinformation» ist so ein brisantes Thema. Davor müsse man die Menschen doch schützen, hörte ich. Jemand müsse doch zum Beispiel diese ganzen merkwürdigen Inhalte in den Social Media filtern – zur Ukraine, zum Klima, zu Gesundheitsthemen oder zur Migration. Viele wüssten ja gar nicht einzuschätzen, was richtig und was falsch ist, sie bräuchten eine Führung.

Freiheit bedingt Eigenverantwortung, ohne Zweifel. Eventuell ist es einigen tatsächlich zu anspruchsvoll, die Verantwortung für das eigene Tun und Lassen zu übernehmen. Oder die persönliche Freiheit wird nicht als ausreichend wertvolles Gut angesehen, um sich dafür anzustrengen. In dem Fall wäre die mangelnde Selbstbestimmung wohl das kleinere Übel. Allerdings fehlt dann gemäß Aldous Huxley ein Teil der Persönlichkeit. Letztlich ist natürlich alles eine Frage der Abwägung.

Sind viele Menschen möglicherweise schon so «eingenordet», dass freiheitliche Ambitionen gar nicht für eine ganze Gruppe, ein Kollektiv, verfolgt werden können? Solche Gedanken kamen mir auch, als ich mir kürzlich diverse Talks beim viertägigen Hacker-Kongress des Chaos Computer Clubs (38C3) anschaute. Ich war nicht nur überrascht, sondern reichlich erschreckt angesichts der in weiten Teilen mainstream-geformten Inhalte, mit denen ein dankbares Publikum beglückt wurde. Wo ich allgemein hellere Köpfe erwartet hatte, fand ich Konformismus und enthusiastisch untermauerte Narrative.

Gibt es vielleicht so etwas wie eine Herdenimmunität gegen Indoktrination? Ich denke, ja, zumindest eine gestärkte Widerstandsfähigkeit. Was wir brauchen, sind etwas gesunder Menschenverstand, offene Informationskanäle und der Mut, sich freier auch zwischen den Herden zu bewegen. Sie tun das bereits, aber sagen Sie es auch dieses Jahr ruhig weiter.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2025-01-01 17:39:51

@ a95c6243:d345522c

2025-01-01 17:39:51Heute möchte ich ein Gedicht mit euch teilen. Es handelt sich um eine Ballade des österreichischen Lyrikers Johann Gabriel Seidl aus dem 19. Jahrhundert. Mir sind diese Worte fest in Erinnerung, da meine Mutter sie perfekt rezitieren konnte, auch als die Kräfte schon langsam schwanden.

Dem originalen Titel «Die Uhr» habe ich für mich immer das Wort «innere» hinzugefügt. Denn der Zeitmesser – hier vermutliche eine Taschenuhr – symbolisiert zwar in dem Kontext das damalige Zeitempfinden und die Umbrüche durch die industrielle Revolution, sozusagen den Zeitgeist und das moderne Leben. Aber der Autor setzt sich philosophisch mit der Zeit auseinander und gibt seinem Werk auch eine klar spirituelle Dimension.

Das Ticken der Uhr und die Momente des Glücks und der Trauer stehen sinnbildlich für das unaufhaltsame Fortschreiten und die Vergänglichkeit des Lebens. Insofern könnte man bei der Uhr auch an eine Sonnenuhr denken. Der Rhythmus der Ereignisse passt uns vielleicht nicht immer in den Kram.

Was den Takt pocht, ist durchaus auch das Herz, unser «inneres Uhrwerk». Wenn dieses Meisterwerk einmal stillsteht, ist es unweigerlich um uns geschehen. Hoffentlich können wir dann dankbar sagen: «Ich habe mein Bestes gegeben.»

Ich trage, wo ich gehe, stets eine Uhr bei mir; \ Wieviel es geschlagen habe, genau seh ich an ihr. \ Es ist ein großer Meister, der künstlich ihr Werk gefügt, \ Wenngleich ihr Gang nicht immer dem törichten Wunsche genügt.

Ich wollte, sie wäre rascher gegangen an manchem Tag; \ Ich wollte, sie hätte manchmal verzögert den raschen Schlag. \ In meinen Leiden und Freuden, in Sturm und in der Ruh, \ Was immer geschah im Leben, sie pochte den Takt dazu.

Sie schlug am Sarge des Vaters, sie schlug an des Freundes Bahr, \ Sie schlug am Morgen der Liebe, sie schlug am Traualtar. \ Sie schlug an der Wiege des Kindes, sie schlägt, will's Gott, noch oft, \ Wenn bessere Tage kommen, wie meine Seele es hofft.

Und ward sie auch einmal träger, und drohte zu stocken ihr Lauf, \ So zog der Meister immer großmütig sie wieder auf. \ Doch stände sie einmal stille, dann wär's um sie geschehn, \ Kein andrer, als der sie fügte, bringt die Zerstörte zum Gehn.

Dann müßt ich zum Meister wandern, der wohnt am Ende wohl weit, \ Wohl draußen, jenseits der Erde, wohl dort in der Ewigkeit! \ Dann gäb ich sie ihm zurücke mit dankbar kindlichem Flehn: \ Sieh, Herr, ich hab nichts verdorben, sie blieb von selber stehn.

Johann Gabriel Seidl (1804-1875)

-

@ a95c6243:d345522c

2024-12-21 09:54:49

@ a95c6243:d345522c

2024-12-21 09:54:49Falls du beim Lesen des Titels dieses Newsletters unwillkürlich an positive Neuigkeiten aus dem globalen polit-medialen Irrenhaus oder gar aus dem wirtschaftlichen Umfeld gedacht hast, darf ich dich beglückwünschen. Diese Assoziation ist sehr löblich, denn sie weist dich als unverbesserlichen Optimisten aus. Leider muss ich dich diesbezüglich aber enttäuschen. Es geht hier um ein anderes Thema, allerdings sehr wohl ein positives, wie ich finde.

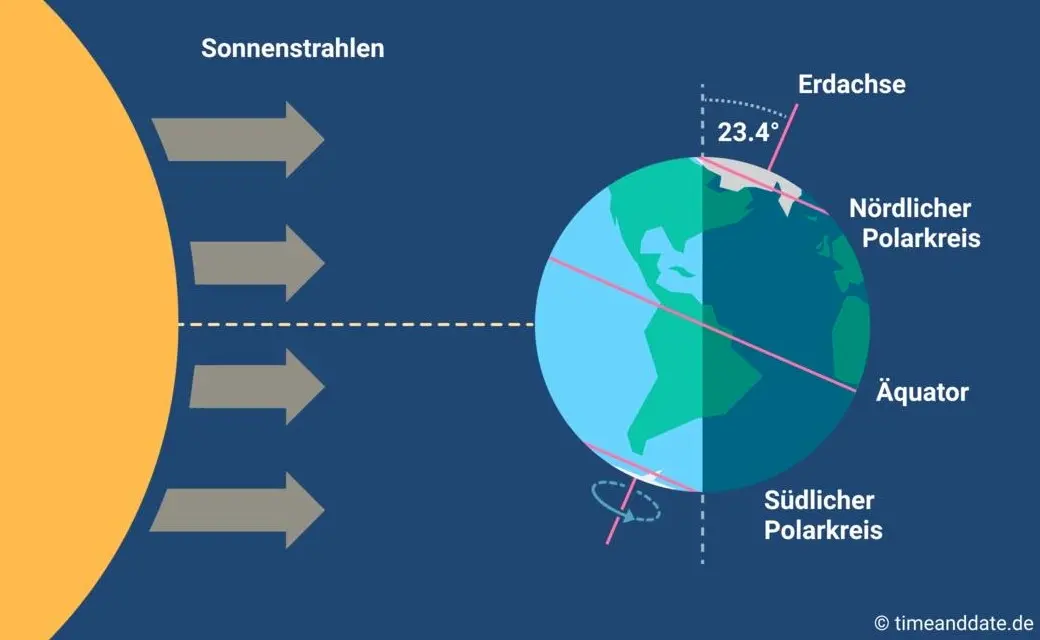

Heute ist ein ganz besonderer Tag: die Wintersonnenwende. Genau gesagt hat heute morgen um 10:20 Uhr Mitteleuropäischer Zeit (MEZ) auf der Nordhalbkugel unseres Planeten der astronomische Winter begonnen. Was daran so außergewöhnlich ist? Der kürzeste Tag des Jahres war gestern, seit heute werden die Tage bereits wieder länger! Wir werden also jetzt jeden Tag ein wenig mehr Licht haben.

Für mich ist dieses Ereignis immer wieder etwas kurios: Es beginnt der Winter, aber die Tage werden länger. Das erscheint mir zunächst wie ein Widerspruch, denn meine spontanen Assoziationen zum Winter sind doch eher Kälte und Dunkelheit, relativ zumindest. Umso erfreulicher ist der emotionale Effekt, wenn dann langsam die Erkenntnis durchsickert: Ab jetzt wird es schon wieder heller!

Natürlich ist es kalt im Winter, mancherorts mehr als anderswo. Vielleicht jedoch nicht mehr lange, wenn man den Klimahysterikern glauben wollte. Mindestens letztes Jahr hat Väterchen Frost allerdings gleich zu Beginn seiner Saison – und passenderweise während des globalen Überhitzungsgipfels in Dubai – nochmal richtig mit der Faust auf den Tisch gehauen. Schnee- und Eischaos sind ja eigentlich in der Agenda bereits nicht mehr vorgesehen. Deswegen war man in Deutschland vermutlich in vorauseilendem Gehorsam schon nicht mehr darauf vorbereitet und wurde glatt lahmgelegt.

Aber ich schweife ab. Die Aussicht auf nach und nach mehr Licht und damit auch Wärme stimmt mich froh. Den Zusammenhang zwischen beidem merkt man in Andalusien sehr deutlich. Hier, wo die Häuser im Winter arg auskühlen, geht man zum Aufwärmen raus auf die Straße oder auf den Balkon. Die Sonne hat auch im Winter eine erfreuliche Kraft. Und da ist jede Minute Gold wert.

Außerdem ist mir vor Jahren so richtig klar geworden, warum mir das südliche Klima so sehr gefällt. Das liegt nämlich nicht nur an der Sonne als solcher, oder der Wärme – das liegt vor allem am Licht. Ohne Licht keine Farben, das ist der ebenso simple wie gewaltige Unterschied zwischen einem deprimierenden matschgraubraunen Winter und einem fröhlichen bunten. Ein großes Stück Lebensqualität.

Mir gefällt aber auch die Symbolik dieses Tages: Licht aus der Dunkelheit, ein Wendepunkt, ein Neuanfang, neue Möglichkeiten, Übergang zu neuer Aktivität. In der winterlichen Stille keimt bereits neue Lebendigkeit. Und zwar in einem Zyklus, das wird immer wieder so geschehen. Ich nehme das gern als ein Stück Motivation, es macht mir Hoffnung und gibt mir Energie.

Übrigens ist parallel am heutigen Tag auf der südlichen Halbkugel Sommeranfang. Genau im entgegengesetzten Rhythmus, sich ergänzend, wie Yin und Yang. Das alles liegt an der Schrägstellung der Erdachse, die ist nämlich um 23,4º zur Umlaufbahn um die Sonne geneigt. Wir erinnern uns, gell?

Insofern bleibt eindeutig festzuhalten, dass “schräg sein” ein willkommener, wichtiger und positiver Wert ist. Mit anderen Worten: auch ungewöhnlich, eigenartig, untypisch, wunderlich, kauzig, … ja sogar irre, spinnert oder gar “quer” ist in Ordnung. Das schließt das Denken mit ein.

In diesem Sinne wünsche ich euch allen urige Weihnachtstage!

Dieser Beitrag ist letztes Jahr in meiner Denkbar erschienen.

-

@ a95c6243:d345522c

2024-12-13 19:30:32

@ a95c6243:d345522c

2024-12-13 19:30:32Das Betriebsklima ist das einzige Klima, \ das du selbst bestimmen kannst. \ Anonym

Eine Strategie zur Anpassung an den Klimawandel hat das deutsche Bundeskabinett diese Woche beschlossen. Da «Wetterextreme wie die immer häufiger auftretenden Hitzewellen und Starkregenereignisse» oft desaströse Auswirkungen auf Mensch und Umwelt hätten, werde eine Anpassung an die Folgen des Klimawandels immer wichtiger. «Klimaanpassungsstrategie» nennt die Regierung das.

Für die «Vorsorge vor Klimafolgen» habe man nun erstmals klare Ziele und messbare Kennzahlen festgelegt. So sei der Erfolg überprüfbar, und das solle zu einer schnelleren Bewältigung der Folgen führen. Dass sich hinter dem Begriff Klimafolgen nicht Folgen des Klimas, sondern wohl «Folgen der globalen Erwärmung» verbergen, erklärt den Interessierten die Wikipedia. Dabei ist das mit der Erwärmung ja bekanntermaßen so eine Sache.

Die Zunahme schwerer Unwetterereignisse habe gezeigt, so das Ministerium, wie wichtig eine frühzeitige und effektive Warnung der Bevölkerung sei. Daher solle es eine deutliche Anhebung der Nutzerzahlen der sogenannten Nina-Warn-App geben.

Die ARD spurt wie gewohnt und setzt die Botschaft zielsicher um. Der Artikel beginnt folgendermaßen:

«Die Flut im Ahrtal war ein Schock für das ganze Land. Um künftig besser gegen Extremwetter gewappnet zu sein, hat die Bundesregierung eine neue Strategie zur Klimaanpassung beschlossen. Die Warn-App Nina spielt eine zentrale Rolle. Der Bund will die Menschen in Deutschland besser vor Extremwetter-Ereignissen warnen und dafür die Reichweite der Warn-App Nina deutlich erhöhen.»

Die Kommunen würden bei ihren «Klimaanpassungsmaßnahmen» vom Zentrum KlimaAnpassung unterstützt, schreibt das Umweltministerium. Mit dessen Aufbau wurden das Deutsche Institut für Urbanistik gGmbH, welches sich stark für Smart City-Projekte engagiert, und die Adelphi Consult GmbH beauftragt.

Adelphi beschreibt sich selbst als «Europas führender Think-and-Do-Tank und eine unabhängige Beratung für Klima, Umwelt und Entwicklung». Sie seien «global vernetzte Strateg*innen und weltverbessernde Berater*innen» und als «Vorreiter der sozial-ökologischen Transformation» sei man mit dem Deutschen Nachhaltigkeitspreis ausgezeichnet worden, welcher sich an den Zielen der Agenda 2030 orientiere.

Über die Warn-App mit dem niedlichen Namen Nina, die möglichst jeder auf seinem Smartphone installieren soll, informiert das Bundesamt für Bevölkerungsschutz und Katastrophenhilfe (BBK). Gewarnt wird nicht nur vor Extrem-Wetterereignissen, sondern zum Beispiel auch vor Waffengewalt und Angriffen, Strom- und anderen Versorgungsausfällen oder Krankheitserregern. Wenn man die Kategorie Gefahreninformation wählt, erhält man eine Dosis von ungefähr zwei Benachrichtigungen pro Woche.

Beim BBK erfahren wir auch einiges über die empfohlenen Systemeinstellungen für Nina. Der Benutzer möge zum Beispiel den Zugriff auf die Standortdaten «immer zulassen», und zwar mit aktivierter Funktion «genauen Standort verwenden». Die Datennutzung solle unbeschränkt sein, auch im Hintergrund. Außerdem sei die uneingeschränkte Akkunutzung zu aktivieren, der Energiesparmodus auszuschalten und das Stoppen der App-Aktivität bei Nichtnutzung zu unterbinden.

Dass man so dramatische Ereignisse wie damals im Ahrtal auch anders bewerten kann als Regierungen und Systemmedien, hat meine Kollegin Wiltrud Schwetje anhand der Tragödie im spanischen Valencia gezeigt. Das Stichwort «Agenda 2030» taucht dabei in einem Kontext auf, der wenig mit Nachhaltigkeitspreisen zu tun hat.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2024-12-06 18:21:15

@ a95c6243:d345522c

2024-12-06 18:21:15Die Ungerechtigkeit ist uns nur in dem Falle angenehm,\ dass wir Vorteile aus ihr ziehen;\ in jedem andern hegt man den Wunsch,\ dass der Unschuldige in Schutz genommen werde.\ Jean-Jacques Rousseau

Politiker beteuern jederzeit, nur das Beste für die Bevölkerung zu wollen – nicht von ihr. Auch die zahlreichen unsäglichen «Corona-Maßnahmen» waren angeblich zu unserem Schutz notwendig, vor allem wegen der «besonders vulnerablen Personen». Daher mussten alle möglichen Restriktionen zwangsweise und unter Umgehung der Parlamente verordnet werden.

Inzwischen hat sich immer deutlicher herausgestellt, dass viele jener «Schutzmaßnahmen» den gegenteiligen Effekt hatten, sie haben den Menschen und den Gesellschaften enorm geschadet. Nicht nur haben die experimentellen Geninjektionen – wie erwartet – massive Nebenwirkungen, sondern Maskentragen schadet der Psyche und der Entwicklung (nicht nur unserer Kinder) und «Lockdowns und Zensur haben Menschen getötet».

Eine der wichtigsten Waffen unserer «Beschützer» ist die Spaltung der Gesellschaft. Die tiefen Gräben, die Politiker, Lobbyisten und Leitmedien praktisch weltweit ausgehoben haben, funktionieren leider nahezu in Perfektion. Von ihren persönlichen Erfahrungen als Kritikerin der Maßnahmen berichtete kürzlich eine Schweizerin im Interview mit Transition News. Sie sei schwer enttäuscht und verspüre bis heute eine Hemmschwelle und ein seltsames Unwohlsein im Umgang mit «Geimpften».

Menschen, die aufrichtig andere schützen wollten, werden von einer eindeutig politischen Justiz verfolgt, verhaftet und angeklagt. Dazu zählen viele Ärzte, darunter Heinrich Habig, Bianca Witzschel und Walter Weber. Über den aktuell laufenden Prozess gegen Dr. Weber hat Transition News mehrfach berichtet (z.B. hier und hier). Auch der Selbstschutz durch Verweigerung der Zwangs-Covid-«Impfung» bewahrt nicht vor dem Knast, wie Bundeswehrsoldaten wie Alexander Bittner erfahren mussten.

Die eigentlich Kriminellen schützen sich derweil erfolgreich selber, nämlich vor der Verantwortung. Die «Impf»-Kampagne war «das größte Verbrechen gegen die Menschheit». Trotzdem stellt man sich in den USA gerade die Frage, ob der scheidende Präsident Joe Biden nach seinem Sohn Hunter möglicherweise auch Anthony Fauci begnadigen wird – in diesem Fall sogar präventiv. Gibt es überhaupt noch einen Rest Glaubwürdigkeit, den Biden verspielen könnte?

Der Gedanke, den ehemaligen wissenschaftlichen Chefberater des US-Präsidenten und Direktor des National Institute of Allergy and Infectious Diseases (NIAID) vorsorglich mit einem Schutzschild zu versehen, dürfte mit der vergangenen Präsidentschaftswahl zu tun haben. Gleich mehrere Personalentscheidungen des designierten Präsidenten Donald Trump lassen Leute wie Fauci erneut in den Fokus rücken.

Das Buch «The Real Anthony Fauci» des nominierten US-Gesundheitsministers Robert F. Kennedy Jr. erschien 2021 und dreht sich um die Machenschaften der Pharma-Lobby in der öffentlichen Gesundheit. Das Vorwort zur rumänischen Ausgabe des Buches schrieb übrigens Călin Georgescu, der Überraschungssieger der ersten Wahlrunde der aktuellen Präsidentschaftswahlen in Rumänien. Vielleicht erklärt diese Verbindung einen Teil der Panik im Wertewesten.

In Rumänien selber gab es gerade einen Paukenschlag: Das bisherige Ergebnis wurde heute durch das Verfassungsgericht annuliert und die für Sonntag angesetzte Stichwahl kurzfristig abgesagt – wegen angeblicher «aggressiver russischer Einmischung». Thomas Oysmüller merkt dazu an, damit sei jetzt in der EU das Tabu gebrochen, Wahlen zu verbieten, bevor sie etwas ändern können.

Unsere Empörung angesichts der Historie von Maßnahmen, die die Falschen beschützen und für die meisten von Nachteil sind, müsste enorm sein. Die Frage ist, was wir damit machen. Wir sollten nach vorne schauen und unsere Energie clever einsetzen. Abgesehen von der Umgehung von jeglichem «Schutz vor Desinformation und Hassrede» (sprich: Zensur) wird es unsere wichtigste Aufgabe sein, Gräben zu überwinden.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2024-11-29 19:45:43

@ a95c6243:d345522c

2024-11-29 19:45:43Konsum ist Therapie.

Wolfgang JoopUmweltbewusstes Verhalten und verantwortungsvoller Konsum zeugen durchaus von einer wünschenswerten Einstellung. Ob man deswegen allerdings einen grünen statt eines schwarzen Freitags braucht, darf getrost bezweifelt werden – zumal es sich um manipulatorische Konzepte handelt. Wie in der politischen Landschaft sind auch hier die Etiketten irgendwas zwischen nichtssagend und trügerisch.

Heute ist also wieder mal «Black Friday», falls Sie es noch nicht mitbekommen haben sollten. Eigentlich haben wir ja eher schon eine ganze «Black Week», der dann oft auch noch ein «Cyber Monday» folgt. Die Werbebranche wird nicht müde, immer neue Anlässe zu erfinden oder zu importieren, um uns zum Konsumieren zu bewegen. Und sie ist damit sehr erfolgreich.

Warum fallen wir auf derartige Werbetricks herein und kaufen im Zweifelsfall Dinge oder Mengen, die wir sicher nicht brauchen? Pure Psychologie, würde ich sagen. Rabattschilder triggern etwas in uns, was den Verstand in Stand-by versetzt. Zusätzlich beeinflussen uns alle möglichen emotionalen Reize und animieren uns zum Schnäppchenkauf.

Gedankenlosigkeit und Maßlosigkeit können besonders bei der Ernährung zu ernsten Problemen führen. Erst kürzlich hat mir ein Bekannter nach einer USA-Reise erzählt, dass es dort offenbar nicht unüblich ist, schon zum ausgiebigen Frühstück in einem Restaurant wenigstens einen Liter Cola zu trinken. Gerne auch mehr, um das Gratis-Nachfüllen des Bechers auszunutzen.

Kritik am schwarzen Freitag und dem unnötigen Konsum kommt oft von Umweltschützern. Neben Ressourcenverschwendung, hohem Energieverbrauch und wachsenden Müllbergen durch eine zunehmende Wegwerfmentalität kommt dabei in der Regel auch die «Klimakrise» auf den Tisch.

Die EU-Kommission lancierte 2015 den Begriff «Green Friday» im Kontext der überarbeiteten Rechtsvorschriften zur Kennzeichnung der Energieeffizienz von Elektrogeräten. Sie nutzte die Gelegenheit kurz vor dem damaligen schwarzen Freitag und vor der UN-Klimakonferenz COP21, bei der das Pariser Abkommen unterzeichnet werden sollte.

Heute wird ein grüner Freitag oft im Zusammenhang mit der Forderung nach «nachhaltigem Konsum» benutzt. Derweil ist die Europäische Union schon weit in ihr Geschäftsmodell des «Green New Deal» verstrickt. In ihrer Propaganda zum Klimawandel verspricht sie tatsächlich «Unterstützung der Menschen und Regionen, die von immer häufigeren Extremwetter-Ereignissen betroffen sind». Was wohl die Menschen in der Region um Valencia dazu sagen?

Ganz im Sinne des Great Reset propagierten die Vereinten Nationen seit Ende 2020 eine «grüne Erholung von Covid-19, um den Klimawandel zu verlangsamen». Der UN-Umweltbericht sah in dem Jahr einen Schwerpunkt auf dem Verbraucherverhalten. Änderungen des Konsumverhaltens des Einzelnen könnten dazu beitragen, den Klimaschutz zu stärken, hieß es dort.

Der Begriff «Schwarzer Freitag» wurde in den USA nicht erstmals für Einkäufe nach Thanksgiving verwendet – wie oft angenommen –, sondern für eine Finanzkrise. Jedoch nicht für den Börsencrash von 1929, sondern bereits für den Zusammenbruch des US-Goldmarktes im September 1869. Seitdem mussten die Menschen weltweit so einige schwarze Tage erleben.

Kürzlich sind die britischen Aufsichtsbehörden weiter von ihrer Zurückhaltung nach dem letzten großen Finanzcrash von 2008 abgerückt. Sie haben Regeln für den Bankensektor gelockert, womit sie «verantwortungsvolle Risikobereitschaft» unterstützen wollen. Man würde sicher zu schwarz sehen, wenn man hier ein grünes Wunder befürchten würde.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2024-11-08 20:02:32

@ a95c6243:d345522c

2024-11-08 20:02:32Und plötzlich weißt du:

Es ist Zeit, etwas Neues zu beginnen

und dem Zauber des Anfangs zu vertrauen.

Meister EckhartSchwarz, rot, gold leuchtet es im Kopf des Newsletters der deutschen Bundesregierung, der mir freitags ins Postfach flattert. Rot, gelb und grün werden daneben sicher noch lange vielzitierte Farben sein, auch wenn diese nie geleuchtet haben. Die Ampel hat sich gerade selber den Stecker gezogen – und hinterlässt einen wirtschaftlichen und gesellschaftlichen Trümmerhaufen.

Mit einem bemerkenswerten Timing hat die deutsche Regierungskoalition am Tag des «Comebacks» von Donald Trump in den USA endlich ihr Scheitern besiegelt. Während der eine seinen Sieg bei den Präsidentschaftswahlen feierte, erwachten die anderen jäh aus ihrer Selbsthypnose rund um Harris-Hype und Trump-Panik – mit teils erschreckenden Auswüchsen. Seit Mittwoch werden die Geschicke Deutschlands nun von einer rot-grünen Minderheitsregierung «geleitet» und man steuert auf Neuwahlen zu.

Das Kindergarten-Gehabe um zwei konkurrierende Wirtschaftsgipfel letzte Woche war bereits bezeichnend. In einem Strategiepapier gestand Finanzminister Lindner außerdem den «Absturz Deutschlands» ein und offenbarte, dass die wirtschaftlichen Probleme teilweise von der Ampel-Politik «vorsätzlich herbeigeführt» worden seien.

Lindner und weitere FDP-Minister wurden also vom Bundeskanzler entlassen. Verkehrs- und Digitalminister Wissing trat flugs aus der FDP aus; deshalb darf er nicht nur im Amt bleiben, sondern hat zusätzlich noch das Justizministerium übernommen. Und mit Jörg Kukies habe Scholz «seinen Lieblingsbock zum Obergärtner», sprich: Finanzminister befördert, meint Norbert Häring.

Es gebe keine Vertrauensbasis für die weitere Zusammenarbeit mit der FDP, hatte der Kanzler erklärt, Lindner habe zu oft sein Vertrauen gebrochen. Am 15. Januar 2025 werde er daher im Bundestag die Vertrauensfrage stellen, was ggf. den Weg für vorgezogene Neuwahlen freimachen würde.

Apropos Vertrauen: Über die Hälfte der Bundesbürger glauben, dass sie ihre Meinung nicht frei sagen können. Das ging erst kürzlich aus dem diesjährigen «Freiheitsindex» hervor, einer Studie, die die Wechselwirkung zwischen Berichterstattung der Medien und subjektivem Freiheitsempfinden der Bürger misst. «Beim Vertrauen in Staat und Medien zerreißt es uns gerade», kommentierte dies der Leiter des Schweizer Unternehmens Media Tenor, das die Untersuchung zusammen mit dem Institut für Demoskopie Allensbach durchführt.

«Die absolute Mehrheit hat absolut die Nase voll», titelte die Bild angesichts des «Ampel-Showdowns». Die Mehrheit wolle Neuwahlen und die Grünen sollten zuerst gehen, lasen wir dort.

Dass «Insolvenzminister» Robert Habeck heute seine Kandidatur für das Kanzleramt verkündet hat, kann nur als Teil der politmedialen Realitätsverweigerung verstanden werden. Wer allerdings denke, schlimmer als in Zeiten der Ampel könne es nicht mehr werden, sei reichlich optimistisch, schrieb Uwe Froschauer bei Manova. Und er kenne Friedrich Merz schlecht, der sich schon jetzt rhetorisch auf seine Rolle als oberster Feldherr Deutschlands vorbereite.

Was also tun? Der Schweizer Verein «Losdemokratie» will eine Volksinitiative lancieren, um die Bestimmung von Parlamentsmitgliedern per Los einzuführen. Das Losverfahren sorge für mehr Demokratie, denn als Alternative zum Wahlverfahren garantiere es eine breitere Beteiligung und repräsentativere Parlamente. Ob das ein Weg ist, sei dahingestellt.

In jedem Fall wird es notwendig sein, unsere Bemühungen um Freiheit und Selbstbestimmung zu verstärken. Mehr Unabhängigkeit von staatlichen und zentralen Institutionen – also die Suche nach dezentralen Lösungsansätzen – gehört dabei sicher zu den Möglichkeiten. Das gilt sowohl für jede/n Einzelne/n als auch für Entitäten wie die alternativen Medien.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2024-10-26 12:21:50

@ a95c6243:d345522c

2024-10-26 12:21:50Es ist besser, ein Licht zu entzünden, als auf die Dunkelheit zu schimpfen. Konfuzius

Die Bemühungen um Aufarbeitung der sogenannten Corona-Pandemie, um Aufklärung der Hintergründe, Benennung von Verantwortlichkeiten und das Ziehen von Konsequenzen sind durchaus nicht eingeschlafen. Das Interesse daran ist unter den gegebenen Umständen vielleicht nicht sonderlich groß, aber es ist vorhanden.

Der sächsische Landtag hat gestern die Einsetzung eines Untersuchungsausschusses zur Corona-Politik beschlossen. In einer Sondersitzung erhielt ein entsprechender Antrag der AfD-Fraktion die ausreichende Zustimmung, auch von einigen Abgeordneten des BSW.

In den Niederlanden wird Bill Gates vor Gericht erscheinen müssen. Sieben durch die Covid-«Impfstoffe» geschädigte Personen hatten Klage eingereicht. Sie werfen unter anderem Gates, Pfizer-Chef Bourla und dem niederländischen Staat vor, sie hätten gewusst, dass diese Präparate weder sicher noch wirksam sind.

Mit den mRNA-«Impfstoffen» von Pfizer/BioNTech befasst sich auch ein neues Buch. Darin werden die Erkenntnisse von Ärzten und Wissenschaftlern aus der Analyse interner Dokumente über die klinischen Studien der Covid-Injektion präsentiert. Es handelt sich um jene in den USA freigeklagten Papiere, die die Arzneimittelbehörde (Food and Drug Administration, FDA) 75 Jahre unter Verschluss halten wollte.

Ebenfalls Wissenschaftler und Ärzte, aber auch andere Experten organisieren als Verbundnetzwerk Corona-Solution kostenfreie Online-Konferenzen. Ihr Ziel ist es, «wissenschaftlich, demokratisch und friedlich» über Impfstoffe und Behandlungsprotokolle gegen SARS-CoV-2 aufzuklären und die Diskriminierung von Ungeimpften zu stoppen. Gestern fand eine weitere Konferenz statt. Ihr Thema: «Corona und modRNA: Von Toten, Lebenden und Physik lernen».

Aufgrund des Digital Services Acts (DSA) der Europäischen Union sei das Risiko groß, dass ihre Arbeit als «Fake-News» bezeichnet würde, so das Netzwerk. Staatlich unerwünschte wissenschaftliche Aufklärung müsse sich passende Kanäle zur Veröffentlichung suchen. Ihre Live-Streams seien deshalb zum Beispiel nicht auf YouTube zu finden.

Der vielfältige Einsatz für Aufklärung und Aufarbeitung wird sich nicht stummschalten lassen. Nicht einmal der Zensurmeister der EU, Deutschland, wird so etwas erreichen. Die frisch aktivierten «Trusted Flagger» dürften allerdings künftige Siege beim «Denunzianten-Wettbewerb» im Kontext des DSA zusätzlich absichern.

Wo sind die Grenzen der Meinungsfreiheit? Sicher gibt es sie. Aber die ideologische Gleichstellung von illegalen mit unerwünschten Äußerungen verfolgt offensichtlich eher das Ziel, ein derart elementares demokratisches Grundrecht möglichst weitgehend auszuhebeln. Vorwürfe wie «Hassrede», «Delegitimierung des Staates» oder «Volksverhetzung» werden heute inflationär verwendet, um Systemkritik zu unterbinden. Gegen solche Bestrebungen gilt es, sich zu wehren.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ c631e267:c2b78d3e

2024-10-23 20:26:10

@ c631e267:c2b78d3e

2024-10-23 20:26:10Herzlichen Glückwunsch zum dritten Geburtstag, liebe Denk Bar! Wieso zum dritten? Das war doch 2022 und jetzt sind wir im Jahr 2024, oder? Ja, das ist schon richtig, aber bei Geburtstagen erinnere ich mich immer auch an meinen Vater, und der behauptete oft, der erste sei ja schließlich der Tag der Geburt selber und den müsse man natürlich mitzählen. Wo er recht hat, hat er nunmal recht. Konsequenterweise wird also heute dieser Blog an seinem dritten Geburtstag zwei Jahre alt.

Das ist ein Grund zum Feiern, wie ich finde. Einerseits ganz einfach, weil es dafür gar nicht genug Gründe geben kann. «Das Leben sind zwei Tage», lautet ein gängiger Ausdruck hier in Andalusien. In der Tat könnte es so sein, auch wenn wir uns im Alltag oft genug von der Routine vereinnahmen lassen.

Seit dem Start der Denk Bar vor zwei Jahren ist unglaublich viel passiert. Ebenso wie die zweieinhalb Jahre davor, und all jenes war letztlich auch der Auslöser dafür, dass ich begann, öffentlich zu schreiben. Damals notierte ich:

«Seit einigen Jahren erscheint unser öffentliches Umfeld immer fragwürdiger, widersprüchlicher und manchmal schier unglaublich - jede Menge Anlass für eigene Recherchen und Gedanken, ganz einfach mit einer Portion gesundem Menschenverstand.»

Wir erleben den sogenannten «großen Umbruch», einen globalen Coup, den skrupellose Egoisten clever eingefädelt haben und seit ein paar Jahren knallhart – aber nett verpackt – durchziehen, um buchstäblich alles nach ihrem Gusto umzukrempeln. Die Gelegenheit ist ja angeblich günstig und muss genutzt werden.

Nie hätte ich mir träumen lassen, dass ich so etwas jemals miterleben müsste. Die Bosheit, mit der ganz offensichtlich gegen die eigene Bevölkerung gearbeitet wird, war früher für mich unvorstellbar. Mein (Rest-) Vertrauen in alle möglichen Bereiche wie Politik, Wissenschaft, Justiz, Medien oder Kirche ist praktisch komplett zerstört. Einen «inneren Totalschaden» hatte ich mal für unsere Gesellschaften diagnostiziert.

Was mich vielleicht am meisten erschreckt, ist zum einen das Niveau der Gleichschaltung, das weltweit erreicht werden konnte, und zum anderen die praktisch totale Spaltung der Gesellschaft. Haben wir das tatsächlich mit uns machen lassen?? Unfassbar! Aber das Werkzeug «Angst» ist sehr mächtig und funktioniert bis heute.

Zum Glück passieren auch positive Dinge und neue Perspektiven öffnen sich. Für viele Menschen waren und sind die Entwicklungen der letzten Jahre ein Augenöffner. Sie sehen «Querdenken» als das, was es ist: eine Tugend.

Auch die immer ernsteren Zensurbemühungen sind letztlich nur ein Zeichen der Schwäche, wo Argumente fehlen. Sie werden nicht verhindern, dass wir unsere Meinung äußern, unbequeme Fragen stellen und dass die Wahrheit peu à peu ans Licht kommt. Es gibt immer Mittel und Wege, auch für uns.

Danke, dass du diesen Weg mit mir weitergehst!

-

@ a95c6243:d345522c

2024-10-19 08:58:08

@ a95c6243:d345522c

2024-10-19 08:58:08Ein Lämmchen löschte an einem Bache seinen Durst. Fern von ihm, aber näher der Quelle, tat ein Wolf das gleiche. Kaum erblickte er das Lämmchen, so schrie er:

"Warum trübst du mir das Wasser, das ich trinken will?"

"Wie wäre das möglich", erwiderte schüchtern das Lämmchen, "ich stehe hier unten und du so weit oben; das Wasser fließt ja von dir zu mir; glaube mir, es kam mir nie in den Sinn, dir etwas Böses zu tun!"

"Ei, sieh doch! Du machst es gerade, wie dein Vater vor sechs Monaten; ich erinnere mich noch sehr wohl, daß auch du dabei warst, aber glücklich entkamst, als ich ihm für sein Schmähen das Fell abzog!"

"Ach, Herr!" flehte das zitternde Lämmchen, "ich bin ja erst vier Wochen alt und kannte meinen Vater gar nicht, so lange ist er schon tot; wie soll ich denn für ihn büßen."

"Du Unverschämter!" so endigt der Wolf mit erheuchelter Wut, indem er die Zähne fletschte. "Tot oder nicht tot, weiß ich doch, daß euer ganzes Geschlecht mich hasset, und dafür muß ich mich rächen."

Ohne weitere Umstände zu machen, zerriß er das Lämmchen und verschlang es.

Das Gewissen regt sich selbst bei dem größten Bösewichte; er sucht doch nach Vorwand, um dasselbe damit bei Begehung seiner Schlechtigkeiten zu beschwichtigen.

Quelle: https://eden.one/fabeln-aesop-das-lamm-und-der-wolf

-

@ 8d34bd24:414be32b

2025-02-26 23:07:43

@ 8d34bd24:414be32b

2025-02-26 23:07:43My mind keeps chewing on these verses in Jeremiah. Maybe I can’t get it out of my head because it seems so contrary to everything I have believed regarding to prayer.

“As for you, do not pray for this people, and do not lift up cry or prayer for them, and do not intercede with Me; for I do not hear you. Do you not see what they are doing in the cities of Judah and in the streets of Jerusalem? The children gather wood, and the fathers kindle the fire, and the women knead dough to make cakes for the queen of heaven; and they pour out drink offerings to other gods in order to spite Me. Do they spite Me?” declares the Lord. “Is it not themselves they spite, to their own shame?” (Jeremiah 7:16-19) {emphasis mine}

Before continuing with this article, make sure you have read What? Do Not Pray For ..., so you have my background thoughts on this passage.

After writing the first post, I began thinking about how this verse applies to American Christians today in my post A Hard Question With an Uncomfortable Answer. In my first two articles, I basically came to the conclusion that we should not pray blessings on those who were sinning and rejecting God, but that praying for repentance and turning back to God would be an allowed and even honored prayer. Then today, while listening to a sermon from Revelation, I thought, “Is there a time we are called to not pray for someone or some nation because God has given them their choice and He is no longer calling them to Himself?”

When God Hardens a Heart

There are a lot of verses where God says that he hardened their heart. The most well known is regarding the hardened heart of the Egyptian Pharaoh in Exodus where we read a succession of verses about a hardened heart:

First Pharaoh hardens his own heart:

But when Pharaoh saw that there was relief, he hardened his heart and did not listen to them, as the Lord had said. (Exodus 8:15) {emphasis mine}

then he hardens his heart again:

But Pharaoh hardened his heart this time also, and he did not let the people go. (Exodus 8:32) {emphasis mine}

then he hardened his heart and his servants hearts:

But when Pharaoh saw that the rain and the hail and the thunder had ceased, he sinned again and hardened his heart, he and his servants. (Exodus 9:34) {emphasis mine}

then God hardens Pharaoh’s heart:

Then the Lord said to Moses, “Go to Pharaoh, for I have hardened his heart and the heart of his servants, that I may perform these signs of Mine among them, (Exodus 10:1) {emphasis mine}

God didn’t harden Pharaoh’s heart initially, but after repeated choices by Pharaoh, God gave Pharaoh the hardened heart he chose. Also, God hardened Pharaoh’s heart in order to perform signs that He wanted to perform to show Himself to the Israelites and the Egyptians. He did it to fulfill His will and His plan.

Once God chose to harden Pharaoh’s heart, would it be praying according to God’s will to ask that Pharaoh repent? As uncomfortable as this makes me, I don’t think it would be praying according to God’s will to pray for repentance for Pharaoh.

When God Declares His Judgment

In Jeremiah 27, God has stated that Babylon will conquer Judah, take away the people, and take the golden implements from the Temple. He says that those who want to live must submit to Babylon. This is God’s will. Many supposed prophets were prophesying that Babylon will not capture Judah and then after Judah was conquered, that they would be brought back after 2 years contrary to God’s will and declaration of 70 years of captivity.

Then I spoke to the priests and to all this people, saying, “Thus says the Lord: Do not listen to the words of your prophets who prophesy to you, saying, ‘Behold, the vessels of the Lord’s house will now shortly be brought again from Babylon’; for they are prophesying a lie to you. Do not listen to them; serve the king of Babylon, and live! Why should this city become a ruin? But if they are prophets, and if the word of the Lord is with them, let them now entreat the Lord of hosts that the vessels which are left in the house of the Lord, in the house of the king of Judah and in Jerusalem may not go to Babylon. (Jeremiah 27:16-18) {emphasis mine}

Regarding these so-called prophets, God says, “if the word of the Lord is with them, let them now entreat the Lord of hosts.” This sounds like they should pray thus only if “the word of the Lord is with them,” or basically if they are praying according to God’s will. Conversely, since the passage makes clear these “prophets” are not speaking God’s word, nor supporting God’s will, then God should not be entreated (asked in prayer) to act contrary to His will.

When God Gives Them Over to Their Sin

Similarly, in the New Testament it says of God:

For even though they knew God, they did not honor Him as God or give thanks, but they became futile in their speculations, and their foolish heart was darkened. Professing to be wise, they became fools, and exchanged the glory of the incorruptible God for an image in the form of corruptible man and of birds and four-footed animals and crawling creatures.

Therefore God gave them over in the lusts of their hearts to impurity, so that their bodies would be dishonored among them. For they exchanged the truth of God for a lie, and worshiped and served the creature rather than the Creator, who is blessed forever. Amen.

For this reason God gave them over to degrading passions; for their women exchanged the natural function for that which is unnatural, and in the same way also the men abandoned the natural function of the woman and burned in their desire toward one another, men with men committing indecent acts and receiving in their own persons the due penalty of their error.

And just as they did not see fit to acknowledge God any longer, God gave them over to a depraved mind, to do those things which are not proper, being filled with all unrighteousness, wickedness, greed, evil; full of envy, murder, strife, deceit, malice; they are gossips, slanderers, haters of God, insolent, arrogant, boastful, inventors of evil, disobedient to parents, without understanding, untrustworthy, unloving, unmerciful; and although they know the ordinance of God, that those who practice such things are worthy of death, they not only do the same, but also give hearty approval to those who practice them. (Romans 1:21-32) {emphasis mine}

There seems to come a point at which people have rebelled against God and His ordinances for so long that God gives them over to the desire of their hearts and the consequences of their actions.

Does This Mean We Are Not To Pray At All?

Is there a point at which God doesn’t want us to pray for their repentance? I’m not willing to say “definitely,” but it kind of looks like that may be the case. I don’t think this is a common situation that we need to be worried about. In most cases, even with very evil people who have done us great harm, we are definitely called to pray for their repentance and salvation. “But I say to you, love your enemies and pray for those who persecute you.” (Matthew 5:44) Still, there may be situations where God says, “I have given them over to the lusts and rebellion of their heart to the destruction of their soul.” There may be situations where a person or a nation has to be punished to fulfill God’s good plan. Praying against His will and plan would be fighting against God and not praying in alignment with His will.

In Ezekiel chapter 3, the passage is talking specifically about sharing God’s word and being a watchman to the people rather than specifically regarding prayer, but I think this verse is still helpful in determining God’s will for our prayers.

Moreover, I will make your tongue stick to the roof of your mouth so that you will be mute and cannot be a man who rebukes them, for they are a rebellious house. (Ezekiel 3:26)

In this occasion, God has given Ezekiel the role of watchman and warned him that he will be held accountable for warning the people, but their decision to obey is on their own heads. Then God tells Ezekiel that He will “make your tongue stick to the roof of your mouth so that you will be mute and cannot be a man who rebukes them.” I believe if God doesn’t want us to pray for someone or something and if we are seeking His will, He will make us mute so we cannot pray for them. Why would He do this? Either because the person, group, or nation are rebellious and/or because the prayer is contrary to His will. I believe God will help His devoted followers to pray according to His will.

I am still fleshing out this idea in my mind and trying to seek the truth. Let me know how you interpret these verses or especially if you have other verses that clarify this matter. I am trying to seek the truth.

I also want to be very careful with this idea. We are much more likely to NOT pray for repentance and salvation for people that we should be praying for than we are to pray for someone for whom we shouldn’t pray. I definitely don’t want anyone to use this post as an excuse to not pray for people or nations.

May our God and Creator guide us and use us for His good purpose and according to His will. May He guide our prayers in perfect alignment with His will and may He draw us closer to Him every day.

Trust Jesus

-

@ bf47c19e:c3d2573b

2025-02-26 21:07:23

@ bf47c19e:c3d2573b

2025-02-26 21:07:23Originalni tekst na dvadesetjedan.com.

Autor: Matt Corallo / Prevod na hrvatski: Davor