-

@ 9bcc5462:eb501d90

2025-01-10 19:42:28

@ 9bcc5462:eb501d90

2025-01-10 19:42:28Cuneiform is mankind’s first writing system created by the ancient Sumerians of Mesopotamia, what is now Iraq. (The word “Sumer” means land of civilized kings). Despite being developed 5,000 years ago, its parallels to Notes and Other Stuff Transmitted by Relays will blow your mind! The most striking is how both breakthroughs materialized from the fundamental need to track value exchange–from primal grain tallies to now exchanging bitcoin.

Let’s begin with the fact that the styluses used by these archaic scribes were crafted from reed plants. Their stems were strong because of attachment points called nodes! These were the resilient, ring-like parts of the stem that joined it together with the rest of the plant. Similarly, although symbolically, lightning nodes are powerful on nostr since they allow us to zap each other with sats. An approach stemming from the need to modernize how we interact on social media, trade in networks and conduct business—It’s not surprising cuneiform came about as a way for merchants and farmers to track economic transactions and agricultural inventories!

Another parallel involves how both share everlasting marks. The Sumerians used their styluses to press wedge-like symbols onto wet tablets. They then would bake them in the sun, leaving a permanent record of the documentation. If an error was made, it could not be changed. Likewise, on nostr there is no delete function. Once you publish a note, including any typos, it is preserved for history.

Lastly, the proto-writing that emerged in Mesopotamia which led to Cuneiform was in the form of bullae (bulla: singular). These were spherical clay envelopes encased with tokens representing a transaction. They were sealed with unique markings representing the parties involved for authentication. In other words, cuneiform cylinder seals were effectively early public key cryptography! The seal itself being the private key and its impression being the public key. Just as us nostriches use our nsec to sign our notes with integrity and verify value-for-value with our npub.

*Rare bulla seal (shout out to Conny Waters from ancientpages.com)*

*Sumerian cuneiform tablet (source: britannica.com)*At the end of the day, maybe we’re not so different from our ancestors after all. The evolution of our writing technology over the course of our history is more than innovation born of necessity. Across millennia, 3025 BCE to 2025 AD, it's man telling the universe– we will be remembered– beyond space and time. As our ancestors stacked their clay tablets, we’ll stack our sats! Onward nostr! The new land of civilized kings.

*Mankind's Innovations in Writing Technology by Learning Producers, Inc.* -

@ a95c6243:d345522c

2025-01-03 20:26:47

@ a95c6243:d345522c

2025-01-03 20:26:47Was du bist hängt von drei Faktoren ab: \ Was du geerbt hast, \ was deine Umgebung aus dir machte \ und was du in freier Wahl \ aus deiner Umgebung und deinem Erbe gemacht hast. \ Aldous Huxley

Das brave Mitmachen und Mitlaufen in einem vorgegebenen, recht engen Rahmen ist gewiss nicht neu, hat aber gerade wieder mal Konjunktur. Dies kann man deutlich beobachten, eigentlich egal, in welchem gesellschaftlichen Bereich man sich umschaut. Individualität ist nur soweit angesagt, wie sie in ein bestimmtes Schema von «Diversität» passt, und Freiheit verkommt zur Worthülse – nicht erst durch ein gewisses Buch einer gewissen ehemaligen Regierungschefin.

Erklärungsansätze für solche Entwicklungen sind bekannt, und praktisch alle haben etwas mit Massenpsychologie zu tun. Der Herdentrieb, also der Trieb der Menschen, sich – zum Beispiel aus Unsicherheit oder Bequemlichkeit – lieber der Masse anzuschließen als selbstständig zu denken und zu handeln, ist einer der Erklärungsversuche. Andere drehen sich um Macht, Propaganda, Druck und Angst, also den gezielten Einsatz psychologischer Herrschaftsinstrumente.

Aber wollen die Menschen überhaupt Freiheit? Durch Gespräche im privaten Umfeld bin ich diesbezüglich in der letzten Zeit etwas skeptisch geworden. Um die Jahreswende philosophiert man ja gerne ein wenig über das Erlebte und über die Erwartungen für die Zukunft. Dabei hatte ich hin und wieder den Eindruck, die totalitären Anwandlungen unserer «Repräsentanten» kämen manchen Leuten gerade recht.

«Desinformation» ist so ein brisantes Thema. Davor müsse man die Menschen doch schützen, hörte ich. Jemand müsse doch zum Beispiel diese ganzen merkwürdigen Inhalte in den Social Media filtern – zur Ukraine, zum Klima, zu Gesundheitsthemen oder zur Migration. Viele wüssten ja gar nicht einzuschätzen, was richtig und was falsch ist, sie bräuchten eine Führung.

Freiheit bedingt Eigenverantwortung, ohne Zweifel. Eventuell ist es einigen tatsächlich zu anspruchsvoll, die Verantwortung für das eigene Tun und Lassen zu übernehmen. Oder die persönliche Freiheit wird nicht als ausreichend wertvolles Gut angesehen, um sich dafür anzustrengen. In dem Fall wäre die mangelnde Selbstbestimmung wohl das kleinere Übel. Allerdings fehlt dann gemäß Aldous Huxley ein Teil der Persönlichkeit. Letztlich ist natürlich alles eine Frage der Abwägung.

Sind viele Menschen möglicherweise schon so «eingenordet», dass freiheitliche Ambitionen gar nicht für eine ganze Gruppe, ein Kollektiv, verfolgt werden können? Solche Gedanken kamen mir auch, als ich mir kürzlich diverse Talks beim viertägigen Hacker-Kongress des Chaos Computer Clubs (38C3) anschaute. Ich war nicht nur überrascht, sondern reichlich erschreckt angesichts der in weiten Teilen mainstream-geformten Inhalte, mit denen ein dankbares Publikum beglückt wurde. Wo ich allgemein hellere Köpfe erwartet hatte, fand ich Konformismus und enthusiastisch untermauerte Narrative.

Gibt es vielleicht so etwas wie eine Herdenimmunität gegen Indoktrination? Ich denke, ja, zumindest eine gestärkte Widerstandsfähigkeit. Was wir brauchen, sind etwas gesunder Menschenverstand, offene Informationskanäle und der Mut, sich freier auch zwischen den Herden zu bewegen. Sie tun das bereits, aber sagen Sie es auch dieses Jahr ruhig weiter.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ 746a245a:7a8d8b34

2025-01-10 17:57:04

@ 746a245a:7a8d8b34

2025-01-10 17:57:04

1. Self custody

Always. Send your BTC to cold storage. Don't hesitate because of high network fees when mempool activity is high. Rather pay 10% or more to secure your coins than risk loosing 100% of a cosiderable amount. If you have questions about self custody see this guide on the 5 Best Practices to Store Your Bitcoin.

2. Back up well

Restore a wallet at least once. Make sure you know how to get back your coins in a worst case scenario. (Also make sure your heirs are able to do it when time comes.)

3. Never try to time the market

DCA. Set it and forget it. Monthly, weekly, by-weekly or daily doesn't matter. Choose what best suits you. Do this for the majority of your BTC allocation. You can not time the bottom. Period. (But you can have a little pile of FIAT to buy dips when they occur.)

4. You can not time the top either

Never sell the majority of your Stack. Take a little profit if things go parabolic to reward yourself but always keep your main stack intact. It can be hard to get it back. And it will only go up with time. HODL and understand what you own.

5. Keep emotions out

Greed and fear are the main factors for people to get wrecked. Slow steady purchases, even tiny ones, all go to building a stack.

6. Never use leverage

Just don't. No, not even if BTC is below 10k. Make sure every sat you own truly belongs to you.

7. Every sat counts

Even if it's small amounts, just keep dca-ing and stacking sats. Little pieces add up. 0.001 BTC = $25 at the time of this writing. Do this 100 times and you have a tenth of a BTC. If you have very little FIAT, stack free sats. You can:

- use faucets (like freebitco.in or cointiply.com)

- do tasks (like microlancer.io)

- play games (like Bitcoin Miner)

- shop with services like lolli.com or foldapp.com

- listen to podcasts (with fountain.fm)

- educate yourself on Bitcoin (with BitcoinMagazine)

- or be active and provide value in communities like nostr, stacker.news or habla.news

Remember: Faucets used to give hundreds of Bitcoin per day. Now it's 5-250 sats 10 years later. In 10 years it may be 1-5 sats.

8. Don't go all in

Keep FIAT to survive hard times without being forced to sell BTC. (for example 6 months of monthly spending)

9. Enjoy life while stacking

There is only one thing that is more precious than Bitcoin. It is lifetime. Stack sats, but also stack moments. Be present and enjoy life. Every day. No amount of BTC can ever buy back lifetime. Remind yourself of this often.

10. Don't forget yourself

Always have a little fun money to maintain hobbys, traveling and to treat yourself. Otherwise you might burn out quickly.

11. Involve your significant other

Make sure he/she knows the reason why you do what you do. Otherwise you risk burning out him/her too.

12. Automate and relax

When you check your portfolio ten times a day or more think of automating things. Don't trade lifetime and serenity for small gains.

13. Don't do shitcoins

Most altcoins never reach their ATH again. BTC and BTC only.

14. Stay humble

Never get lured by offers that promise yield in exchange for holding your BTC. FTX was a recent example of how that can end.

15. You lost your keys in a boating accident

Never share how much Bitcoin you own. Better yet, don't share that you own any at all (exception: rule #11). The less is known about you having BTC, the less risk. Also consider buying non KYC. For example with robosats or bisq.

16. Don't rush. Be patient

It is a marathon, not a sprint. Time is on your side. You already own Bitcoin. You won. It isn't a race like with FIAT where you have to fight inflation. You preserve wealth.

17. Increase your FIAT earnings

Learn profitable skills to increase your buying power and generally grow as a person. Even if you loose all your wealth, nobody can take away your skills to accumulate it again.

18. Don't compare

Every stack of BTC is better than no stack of BTC. And even if you are a whale: there will always be a bigger fish somewhere in the sea ...

19. You don't need 1 full BTC

This was huge for me! The urge to have one full BTC is very FIAT minded thinking. Goals are cool but:

21 million BTC / 8 billion humans in the world =0,00262500 BTC

And not even that is possible because of the 1,1 m BTC wallet of Satoshi Nakamoto and lost coins. You can find out the exact amount every individual on earth could possibly own at satoshisperperson.com.

Not everyone needs a whole coin. About 225.000 sats = your little block of Bitcoin. ... That's roughly $55 at the time of this writing. Got that? Congratulations! 99% of people are still on zero. Safe your share and then slowly add more every pay check.

20. Change perspective

You can change settings in your wallet to display value in sats rather than BTC. This liberates from the feeling of shortage and the urge to fill that full BTC. It opens up the feeling of gratitude and abundance.

21. Always learn

Keep educating yourself about Bitcoin. The rabbit hole is deep ...

Thank you!

Thank you wonderful people who helped me gather those tips. I chose consciously to not give personal credit in this post because of rule #15 =)

Find me on Nostr

My Nostr npub:

npub1w34zgkkjznnf2209gnhc5snkd32lkc9hnncq45rypyzsx75d3v6qcz3ndd

What have i missed?

Do you agree with these tips? Did i miss any? Please let me know and help refine this set of rules so we can breed more an more whole coiners over time ... or let's rather call it 'satoshi millionaires' (see rule #19 ;-)

P.S. Feel free to tip me some sats or share this post if you find it helpful. Working on my own little stack too ;-)

-

@ a95c6243:d345522c

2025-01-01 17:39:51

@ a95c6243:d345522c

2025-01-01 17:39:51Heute möchte ich ein Gedicht mit euch teilen. Es handelt sich um eine Ballade des österreichischen Lyrikers Johann Gabriel Seidl aus dem 19. Jahrhundert. Mir sind diese Worte fest in Erinnerung, da meine Mutter sie perfekt rezitieren konnte, auch als die Kräfte schon langsam schwanden.

Dem originalen Titel «Die Uhr» habe ich für mich immer das Wort «innere» hinzugefügt. Denn der Zeitmesser – hier vermutliche eine Taschenuhr – symbolisiert zwar in dem Kontext das damalige Zeitempfinden und die Umbrüche durch die industrielle Revolution, sozusagen den Zeitgeist und das moderne Leben. Aber der Autor setzt sich philosophisch mit der Zeit auseinander und gibt seinem Werk auch eine klar spirituelle Dimension.

Das Ticken der Uhr und die Momente des Glücks und der Trauer stehen sinnbildlich für das unaufhaltsame Fortschreiten und die Vergänglichkeit des Lebens. Insofern könnte man bei der Uhr auch an eine Sonnenuhr denken. Der Rhythmus der Ereignisse passt uns vielleicht nicht immer in den Kram.

Was den Takt pocht, ist durchaus auch das Herz, unser «inneres Uhrwerk». Wenn dieses Meisterwerk einmal stillsteht, ist es unweigerlich um uns geschehen. Hoffentlich können wir dann dankbar sagen: «Ich habe mein Bestes gegeben.»

Ich trage, wo ich gehe, stets eine Uhr bei mir; \ Wieviel es geschlagen habe, genau seh ich an ihr. \ Es ist ein großer Meister, der künstlich ihr Werk gefügt, \ Wenngleich ihr Gang nicht immer dem törichten Wunsche genügt.

Ich wollte, sie wäre rascher gegangen an manchem Tag; \ Ich wollte, sie hätte manchmal verzögert den raschen Schlag. \ In meinen Leiden und Freuden, in Sturm und in der Ruh, \ Was immer geschah im Leben, sie pochte den Takt dazu.

Sie schlug am Sarge des Vaters, sie schlug an des Freundes Bahr, \ Sie schlug am Morgen der Liebe, sie schlug am Traualtar. \ Sie schlug an der Wiege des Kindes, sie schlägt, will's Gott, noch oft, \ Wenn bessere Tage kommen, wie meine Seele es hofft.

Und ward sie auch einmal träger, und drohte zu stocken ihr Lauf, \ So zog der Meister immer großmütig sie wieder auf. \ Doch stände sie einmal stille, dann wär's um sie geschehn, \ Kein andrer, als der sie fügte, bringt die Zerstörte zum Gehn.

Dann müßt ich zum Meister wandern, der wohnt am Ende wohl weit, \ Wohl draußen, jenseits der Erde, wohl dort in der Ewigkeit! \ Dann gäb ich sie ihm zurücke mit dankbar kindlichem Flehn: \ Sieh, Herr, ich hab nichts verdorben, sie blieb von selber stehn.

Johann Gabriel Seidl (1804-1875)

-

@ a95c6243:d345522c

2024-12-21 09:54:49

@ a95c6243:d345522c

2024-12-21 09:54:49Falls du beim Lesen des Titels dieses Newsletters unwillkürlich an positive Neuigkeiten aus dem globalen polit-medialen Irrenhaus oder gar aus dem wirtschaftlichen Umfeld gedacht hast, darf ich dich beglückwünschen. Diese Assoziation ist sehr löblich, denn sie weist dich als unverbesserlichen Optimisten aus. Leider muss ich dich diesbezüglich aber enttäuschen. Es geht hier um ein anderes Thema, allerdings sehr wohl ein positives, wie ich finde.

Heute ist ein ganz besonderer Tag: die Wintersonnenwende. Genau gesagt hat heute morgen um 10:20 Uhr Mitteleuropäischer Zeit (MEZ) auf der Nordhalbkugel unseres Planeten der astronomische Winter begonnen. Was daran so außergewöhnlich ist? Der kürzeste Tag des Jahres war gestern, seit heute werden die Tage bereits wieder länger! Wir werden also jetzt jeden Tag ein wenig mehr Licht haben.

Für mich ist dieses Ereignis immer wieder etwas kurios: Es beginnt der Winter, aber die Tage werden länger. Das erscheint mir zunächst wie ein Widerspruch, denn meine spontanen Assoziationen zum Winter sind doch eher Kälte und Dunkelheit, relativ zumindest. Umso erfreulicher ist der emotionale Effekt, wenn dann langsam die Erkenntnis durchsickert: Ab jetzt wird es schon wieder heller!

Natürlich ist es kalt im Winter, mancherorts mehr als anderswo. Vielleicht jedoch nicht mehr lange, wenn man den Klimahysterikern glauben wollte. Mindestens letztes Jahr hat Väterchen Frost allerdings gleich zu Beginn seiner Saison – und passenderweise während des globalen Überhitzungsgipfels in Dubai – nochmal richtig mit der Faust auf den Tisch gehauen. Schnee- und Eischaos sind ja eigentlich in der Agenda bereits nicht mehr vorgesehen. Deswegen war man in Deutschland vermutlich in vorauseilendem Gehorsam schon nicht mehr darauf vorbereitet und wurde glatt lahmgelegt.

Aber ich schweife ab. Die Aussicht auf nach und nach mehr Licht und damit auch Wärme stimmt mich froh. Den Zusammenhang zwischen beidem merkt man in Andalusien sehr deutlich. Hier, wo die Häuser im Winter arg auskühlen, geht man zum Aufwärmen raus auf die Straße oder auf den Balkon. Die Sonne hat auch im Winter eine erfreuliche Kraft. Und da ist jede Minute Gold wert.

Außerdem ist mir vor Jahren so richtig klar geworden, warum mir das südliche Klima so sehr gefällt. Das liegt nämlich nicht nur an der Sonne als solcher, oder der Wärme – das liegt vor allem am Licht. Ohne Licht keine Farben, das ist der ebenso simple wie gewaltige Unterschied zwischen einem deprimierenden matschgraubraunen Winter und einem fröhlichen bunten. Ein großes Stück Lebensqualität.

Mir gefällt aber auch die Symbolik dieses Tages: Licht aus der Dunkelheit, ein Wendepunkt, ein Neuanfang, neue Möglichkeiten, Übergang zu neuer Aktivität. In der winterlichen Stille keimt bereits neue Lebendigkeit. Und zwar in einem Zyklus, das wird immer wieder so geschehen. Ich nehme das gern als ein Stück Motivation, es macht mir Hoffnung und gibt mir Energie.

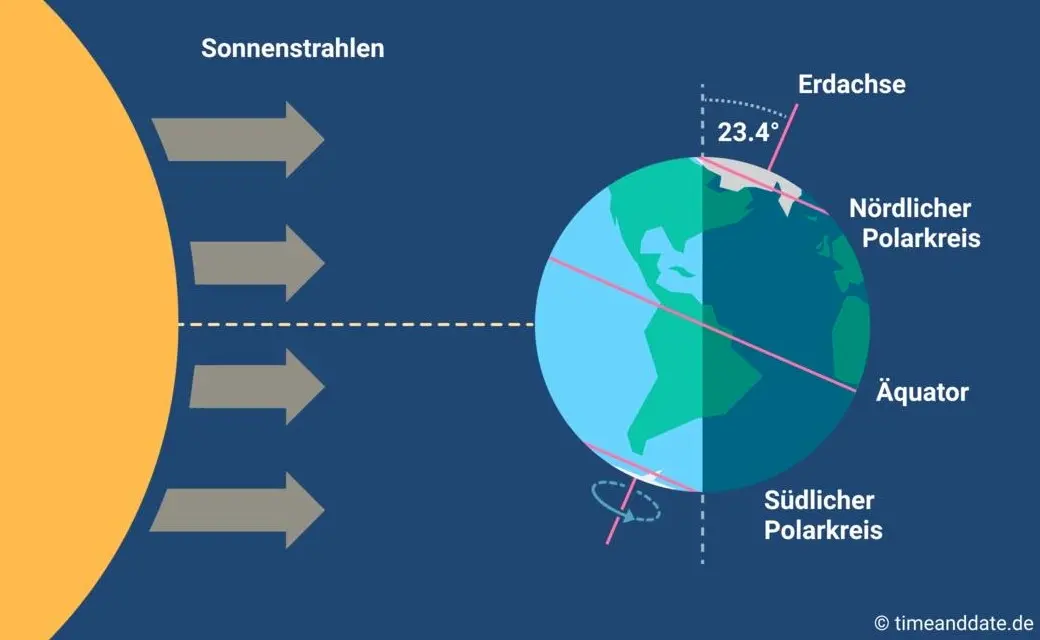

Übrigens ist parallel am heutigen Tag auf der südlichen Halbkugel Sommeranfang. Genau im entgegengesetzten Rhythmus, sich ergänzend, wie Yin und Yang. Das alles liegt an der Schrägstellung der Erdachse, die ist nämlich um 23,4º zur Umlaufbahn um die Sonne geneigt. Wir erinnern uns, gell?

Insofern bleibt eindeutig festzuhalten, dass “schräg sein” ein willkommener, wichtiger und positiver Wert ist. Mit anderen Worten: auch ungewöhnlich, eigenartig, untypisch, wunderlich, kauzig, … ja sogar irre, spinnert oder gar “quer” ist in Ordnung. Das schließt das Denken mit ein.

In diesem Sinne wünsche ich euch allen urige Weihnachtstage!

Dieser Beitrag ist letztes Jahr in meiner Denkbar erschienen.

-

@ a95c6243:d345522c

2024-12-13 19:30:32

@ a95c6243:d345522c

2024-12-13 19:30:32Das Betriebsklima ist das einzige Klima, \ das du selbst bestimmen kannst. \ Anonym

Eine Strategie zur Anpassung an den Klimawandel hat das deutsche Bundeskabinett diese Woche beschlossen. Da «Wetterextreme wie die immer häufiger auftretenden Hitzewellen und Starkregenereignisse» oft desaströse Auswirkungen auf Mensch und Umwelt hätten, werde eine Anpassung an die Folgen des Klimawandels immer wichtiger. «Klimaanpassungsstrategie» nennt die Regierung das.

Für die «Vorsorge vor Klimafolgen» habe man nun erstmals klare Ziele und messbare Kennzahlen festgelegt. So sei der Erfolg überprüfbar, und das solle zu einer schnelleren Bewältigung der Folgen führen. Dass sich hinter dem Begriff Klimafolgen nicht Folgen des Klimas, sondern wohl «Folgen der globalen Erwärmung» verbergen, erklärt den Interessierten die Wikipedia. Dabei ist das mit der Erwärmung ja bekanntermaßen so eine Sache.

Die Zunahme schwerer Unwetterereignisse habe gezeigt, so das Ministerium, wie wichtig eine frühzeitige und effektive Warnung der Bevölkerung sei. Daher solle es eine deutliche Anhebung der Nutzerzahlen der sogenannten Nina-Warn-App geben.

Die ARD spurt wie gewohnt und setzt die Botschaft zielsicher um. Der Artikel beginnt folgendermaßen:

«Die Flut im Ahrtal war ein Schock für das ganze Land. Um künftig besser gegen Extremwetter gewappnet zu sein, hat die Bundesregierung eine neue Strategie zur Klimaanpassung beschlossen. Die Warn-App Nina spielt eine zentrale Rolle. Der Bund will die Menschen in Deutschland besser vor Extremwetter-Ereignissen warnen und dafür die Reichweite der Warn-App Nina deutlich erhöhen.»

Die Kommunen würden bei ihren «Klimaanpassungsmaßnahmen» vom Zentrum KlimaAnpassung unterstützt, schreibt das Umweltministerium. Mit dessen Aufbau wurden das Deutsche Institut für Urbanistik gGmbH, welches sich stark für Smart City-Projekte engagiert, und die Adelphi Consult GmbH beauftragt.

Adelphi beschreibt sich selbst als «Europas führender Think-and-Do-Tank und eine unabhängige Beratung für Klima, Umwelt und Entwicklung». Sie seien «global vernetzte Strateg*innen und weltverbessernde Berater*innen» und als «Vorreiter der sozial-ökologischen Transformation» sei man mit dem Deutschen Nachhaltigkeitspreis ausgezeichnet worden, welcher sich an den Zielen der Agenda 2030 orientiere.

Über die Warn-App mit dem niedlichen Namen Nina, die möglichst jeder auf seinem Smartphone installieren soll, informiert das Bundesamt für Bevölkerungsschutz und Katastrophenhilfe (BBK). Gewarnt wird nicht nur vor Extrem-Wetterereignissen, sondern zum Beispiel auch vor Waffengewalt und Angriffen, Strom- und anderen Versorgungsausfällen oder Krankheitserregern. Wenn man die Kategorie Gefahreninformation wählt, erhält man eine Dosis von ungefähr zwei Benachrichtigungen pro Woche.

Beim BBK erfahren wir auch einiges über die empfohlenen Systemeinstellungen für Nina. Der Benutzer möge zum Beispiel den Zugriff auf die Standortdaten «immer zulassen», und zwar mit aktivierter Funktion «genauen Standort verwenden». Die Datennutzung solle unbeschränkt sein, auch im Hintergrund. Außerdem sei die uneingeschränkte Akkunutzung zu aktivieren, der Energiesparmodus auszuschalten und das Stoppen der App-Aktivität bei Nichtnutzung zu unterbinden.

Dass man so dramatische Ereignisse wie damals im Ahrtal auch anders bewerten kann als Regierungen und Systemmedien, hat meine Kollegin Wiltrud Schwetje anhand der Tragödie im spanischen Valencia gezeigt. Das Stichwort «Agenda 2030» taucht dabei in einem Kontext auf, der wenig mit Nachhaltigkeitspreisen zu tun hat.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2024-12-06 18:21:15

@ a95c6243:d345522c

2024-12-06 18:21:15Die Ungerechtigkeit ist uns nur in dem Falle angenehm,\ dass wir Vorteile aus ihr ziehen;\ in jedem andern hegt man den Wunsch,\ dass der Unschuldige in Schutz genommen werde.\ Jean-Jacques Rousseau

Politiker beteuern jederzeit, nur das Beste für die Bevölkerung zu wollen – nicht von ihr. Auch die zahlreichen unsäglichen «Corona-Maßnahmen» waren angeblich zu unserem Schutz notwendig, vor allem wegen der «besonders vulnerablen Personen». Daher mussten alle möglichen Restriktionen zwangsweise und unter Umgehung der Parlamente verordnet werden.

Inzwischen hat sich immer deutlicher herausgestellt, dass viele jener «Schutzmaßnahmen» den gegenteiligen Effekt hatten, sie haben den Menschen und den Gesellschaften enorm geschadet. Nicht nur haben die experimentellen Geninjektionen – wie erwartet – massive Nebenwirkungen, sondern Maskentragen schadet der Psyche und der Entwicklung (nicht nur unserer Kinder) und «Lockdowns und Zensur haben Menschen getötet».

Eine der wichtigsten Waffen unserer «Beschützer» ist die Spaltung der Gesellschaft. Die tiefen Gräben, die Politiker, Lobbyisten und Leitmedien praktisch weltweit ausgehoben haben, funktionieren leider nahezu in Perfektion. Von ihren persönlichen Erfahrungen als Kritikerin der Maßnahmen berichtete kürzlich eine Schweizerin im Interview mit Transition News. Sie sei schwer enttäuscht und verspüre bis heute eine Hemmschwelle und ein seltsames Unwohlsein im Umgang mit «Geimpften».

Menschen, die aufrichtig andere schützen wollten, werden von einer eindeutig politischen Justiz verfolgt, verhaftet und angeklagt. Dazu zählen viele Ärzte, darunter Heinrich Habig, Bianca Witzschel und Walter Weber. Über den aktuell laufenden Prozess gegen Dr. Weber hat Transition News mehrfach berichtet (z.B. hier und hier). Auch der Selbstschutz durch Verweigerung der Zwangs-Covid-«Impfung» bewahrt nicht vor dem Knast, wie Bundeswehrsoldaten wie Alexander Bittner erfahren mussten.

Die eigentlich Kriminellen schützen sich derweil erfolgreich selber, nämlich vor der Verantwortung. Die «Impf»-Kampagne war «das größte Verbrechen gegen die Menschheit». Trotzdem stellt man sich in den USA gerade die Frage, ob der scheidende Präsident Joe Biden nach seinem Sohn Hunter möglicherweise auch Anthony Fauci begnadigen wird – in diesem Fall sogar präventiv. Gibt es überhaupt noch einen Rest Glaubwürdigkeit, den Biden verspielen könnte?

Der Gedanke, den ehemaligen wissenschaftlichen Chefberater des US-Präsidenten und Direktor des National Institute of Allergy and Infectious Diseases (NIAID) vorsorglich mit einem Schutzschild zu versehen, dürfte mit der vergangenen Präsidentschaftswahl zu tun haben. Gleich mehrere Personalentscheidungen des designierten Präsidenten Donald Trump lassen Leute wie Fauci erneut in den Fokus rücken.

Das Buch «The Real Anthony Fauci» des nominierten US-Gesundheitsministers Robert F. Kennedy Jr. erschien 2021 und dreht sich um die Machenschaften der Pharma-Lobby in der öffentlichen Gesundheit. Das Vorwort zur rumänischen Ausgabe des Buches schrieb übrigens Călin Georgescu, der Überraschungssieger der ersten Wahlrunde der aktuellen Präsidentschaftswahlen in Rumänien. Vielleicht erklärt diese Verbindung einen Teil der Panik im Wertewesten.

In Rumänien selber gab es gerade einen Paukenschlag: Das bisherige Ergebnis wurde heute durch das Verfassungsgericht annuliert und die für Sonntag angesetzte Stichwahl kurzfristig abgesagt – wegen angeblicher «aggressiver russischer Einmischung». Thomas Oysmüller merkt dazu an, damit sei jetzt in der EU das Tabu gebrochen, Wahlen zu verbieten, bevor sie etwas ändern können.

Unsere Empörung angesichts der Historie von Maßnahmen, die die Falschen beschützen und für die meisten von Nachteil sind, müsste enorm sein. Die Frage ist, was wir damit machen. Wir sollten nach vorne schauen und unsere Energie clever einsetzen. Abgesehen von der Umgehung von jeglichem «Schutz vor Desinformation und Hassrede» (sprich: Zensur) wird es unsere wichtigste Aufgabe sein, Gräben zu überwinden.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2024-11-29 19:45:43

@ a95c6243:d345522c

2024-11-29 19:45:43Konsum ist Therapie.

Wolfgang JoopUmweltbewusstes Verhalten und verantwortungsvoller Konsum zeugen durchaus von einer wünschenswerten Einstellung. Ob man deswegen allerdings einen grünen statt eines schwarzen Freitags braucht, darf getrost bezweifelt werden – zumal es sich um manipulatorische Konzepte handelt. Wie in der politischen Landschaft sind auch hier die Etiketten irgendwas zwischen nichtssagend und trügerisch.

Heute ist also wieder mal «Black Friday», falls Sie es noch nicht mitbekommen haben sollten. Eigentlich haben wir ja eher schon eine ganze «Black Week», der dann oft auch noch ein «Cyber Monday» folgt. Die Werbebranche wird nicht müde, immer neue Anlässe zu erfinden oder zu importieren, um uns zum Konsumieren zu bewegen. Und sie ist damit sehr erfolgreich.

Warum fallen wir auf derartige Werbetricks herein und kaufen im Zweifelsfall Dinge oder Mengen, die wir sicher nicht brauchen? Pure Psychologie, würde ich sagen. Rabattschilder triggern etwas in uns, was den Verstand in Stand-by versetzt. Zusätzlich beeinflussen uns alle möglichen emotionalen Reize und animieren uns zum Schnäppchenkauf.

Gedankenlosigkeit und Maßlosigkeit können besonders bei der Ernährung zu ernsten Problemen führen. Erst kürzlich hat mir ein Bekannter nach einer USA-Reise erzählt, dass es dort offenbar nicht unüblich ist, schon zum ausgiebigen Frühstück in einem Restaurant wenigstens einen Liter Cola zu trinken. Gerne auch mehr, um das Gratis-Nachfüllen des Bechers auszunutzen.

Kritik am schwarzen Freitag und dem unnötigen Konsum kommt oft von Umweltschützern. Neben Ressourcenverschwendung, hohem Energieverbrauch und wachsenden Müllbergen durch eine zunehmende Wegwerfmentalität kommt dabei in der Regel auch die «Klimakrise» auf den Tisch.

Die EU-Kommission lancierte 2015 den Begriff «Green Friday» im Kontext der überarbeiteten Rechtsvorschriften zur Kennzeichnung der Energieeffizienz von Elektrogeräten. Sie nutzte die Gelegenheit kurz vor dem damaligen schwarzen Freitag und vor der UN-Klimakonferenz COP21, bei der das Pariser Abkommen unterzeichnet werden sollte.

Heute wird ein grüner Freitag oft im Zusammenhang mit der Forderung nach «nachhaltigem Konsum» benutzt. Derweil ist die Europäische Union schon weit in ihr Geschäftsmodell des «Green New Deal» verstrickt. In ihrer Propaganda zum Klimawandel verspricht sie tatsächlich «Unterstützung der Menschen und Regionen, die von immer häufigeren Extremwetter-Ereignissen betroffen sind». Was wohl die Menschen in der Region um Valencia dazu sagen?

Ganz im Sinne des Great Reset propagierten die Vereinten Nationen seit Ende 2020 eine «grüne Erholung von Covid-19, um den Klimawandel zu verlangsamen». Der UN-Umweltbericht sah in dem Jahr einen Schwerpunkt auf dem Verbraucherverhalten. Änderungen des Konsumverhaltens des Einzelnen könnten dazu beitragen, den Klimaschutz zu stärken, hieß es dort.

Der Begriff «Schwarzer Freitag» wurde in den USA nicht erstmals für Einkäufe nach Thanksgiving verwendet – wie oft angenommen –, sondern für eine Finanzkrise. Jedoch nicht für den Börsencrash von 1929, sondern bereits für den Zusammenbruch des US-Goldmarktes im September 1869. Seitdem mussten die Menschen weltweit so einige schwarze Tage erleben.

Kürzlich sind die britischen Aufsichtsbehörden weiter von ihrer Zurückhaltung nach dem letzten großen Finanzcrash von 2008 abgerückt. Sie haben Regeln für den Bankensektor gelockert, womit sie «verantwortungsvolle Risikobereitschaft» unterstützen wollen. Man würde sicher zu schwarz sehen, wenn man hier ein grünes Wunder befürchten würde.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2024-11-08 20:02:32

@ a95c6243:d345522c

2024-11-08 20:02:32Und plötzlich weißt du:

Es ist Zeit, etwas Neues zu beginnen

und dem Zauber des Anfangs zu vertrauen.

Meister EckhartSchwarz, rot, gold leuchtet es im Kopf des Newsletters der deutschen Bundesregierung, der mir freitags ins Postfach flattert. Rot, gelb und grün werden daneben sicher noch lange vielzitierte Farben sein, auch wenn diese nie geleuchtet haben. Die Ampel hat sich gerade selber den Stecker gezogen – und hinterlässt einen wirtschaftlichen und gesellschaftlichen Trümmerhaufen.

Mit einem bemerkenswerten Timing hat die deutsche Regierungskoalition am Tag des «Comebacks» von Donald Trump in den USA endlich ihr Scheitern besiegelt. Während der eine seinen Sieg bei den Präsidentschaftswahlen feierte, erwachten die anderen jäh aus ihrer Selbsthypnose rund um Harris-Hype und Trump-Panik – mit teils erschreckenden Auswüchsen. Seit Mittwoch werden die Geschicke Deutschlands nun von einer rot-grünen Minderheitsregierung «geleitet» und man steuert auf Neuwahlen zu.

Das Kindergarten-Gehabe um zwei konkurrierende Wirtschaftsgipfel letzte Woche war bereits bezeichnend. In einem Strategiepapier gestand Finanzminister Lindner außerdem den «Absturz Deutschlands» ein und offenbarte, dass die wirtschaftlichen Probleme teilweise von der Ampel-Politik «vorsätzlich herbeigeführt» worden seien.

Lindner und weitere FDP-Minister wurden also vom Bundeskanzler entlassen. Verkehrs- und Digitalminister Wissing trat flugs aus der FDP aus; deshalb darf er nicht nur im Amt bleiben, sondern hat zusätzlich noch das Justizministerium übernommen. Und mit Jörg Kukies habe Scholz «seinen Lieblingsbock zum Obergärtner», sprich: Finanzminister befördert, meint Norbert Häring.

Es gebe keine Vertrauensbasis für die weitere Zusammenarbeit mit der FDP, hatte der Kanzler erklärt, Lindner habe zu oft sein Vertrauen gebrochen. Am 15. Januar 2025 werde er daher im Bundestag die Vertrauensfrage stellen, was ggf. den Weg für vorgezogene Neuwahlen freimachen würde.

Apropos Vertrauen: Über die Hälfte der Bundesbürger glauben, dass sie ihre Meinung nicht frei sagen können. Das ging erst kürzlich aus dem diesjährigen «Freiheitsindex» hervor, einer Studie, die die Wechselwirkung zwischen Berichterstattung der Medien und subjektivem Freiheitsempfinden der Bürger misst. «Beim Vertrauen in Staat und Medien zerreißt es uns gerade», kommentierte dies der Leiter des Schweizer Unternehmens Media Tenor, das die Untersuchung zusammen mit dem Institut für Demoskopie Allensbach durchführt.

«Die absolute Mehrheit hat absolut die Nase voll», titelte die Bild angesichts des «Ampel-Showdowns». Die Mehrheit wolle Neuwahlen und die Grünen sollten zuerst gehen, lasen wir dort.

Dass «Insolvenzminister» Robert Habeck heute seine Kandidatur für das Kanzleramt verkündet hat, kann nur als Teil der politmedialen Realitätsverweigerung verstanden werden. Wer allerdings denke, schlimmer als in Zeiten der Ampel könne es nicht mehr werden, sei reichlich optimistisch, schrieb Uwe Froschauer bei Manova. Und er kenne Friedrich Merz schlecht, der sich schon jetzt rhetorisch auf seine Rolle als oberster Feldherr Deutschlands vorbereite.

Was also tun? Der Schweizer Verein «Losdemokratie» will eine Volksinitiative lancieren, um die Bestimmung von Parlamentsmitgliedern per Los einzuführen. Das Losverfahren sorge für mehr Demokratie, denn als Alternative zum Wahlverfahren garantiere es eine breitere Beteiligung und repräsentativere Parlamente. Ob das ein Weg ist, sei dahingestellt.

In jedem Fall wird es notwendig sein, unsere Bemühungen um Freiheit und Selbstbestimmung zu verstärken. Mehr Unabhängigkeit von staatlichen und zentralen Institutionen – also die Suche nach dezentralen Lösungsansätzen – gehört dabei sicher zu den Möglichkeiten. Das gilt sowohl für jede/n Einzelne/n als auch für Entitäten wie die alternativen Medien.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2024-10-26 12:21:50

@ a95c6243:d345522c

2024-10-26 12:21:50Es ist besser, ein Licht zu entzünden, als auf die Dunkelheit zu schimpfen. Konfuzius

Die Bemühungen um Aufarbeitung der sogenannten Corona-Pandemie, um Aufklärung der Hintergründe, Benennung von Verantwortlichkeiten und das Ziehen von Konsequenzen sind durchaus nicht eingeschlafen. Das Interesse daran ist unter den gegebenen Umständen vielleicht nicht sonderlich groß, aber es ist vorhanden.

Der sächsische Landtag hat gestern die Einsetzung eines Untersuchungsausschusses zur Corona-Politik beschlossen. In einer Sondersitzung erhielt ein entsprechender Antrag der AfD-Fraktion die ausreichende Zustimmung, auch von einigen Abgeordneten des BSW.

In den Niederlanden wird Bill Gates vor Gericht erscheinen müssen. Sieben durch die Covid-«Impfstoffe» geschädigte Personen hatten Klage eingereicht. Sie werfen unter anderem Gates, Pfizer-Chef Bourla und dem niederländischen Staat vor, sie hätten gewusst, dass diese Präparate weder sicher noch wirksam sind.

Mit den mRNA-«Impfstoffen» von Pfizer/BioNTech befasst sich auch ein neues Buch. Darin werden die Erkenntnisse von Ärzten und Wissenschaftlern aus der Analyse interner Dokumente über die klinischen Studien der Covid-Injektion präsentiert. Es handelt sich um jene in den USA freigeklagten Papiere, die die Arzneimittelbehörde (Food and Drug Administration, FDA) 75 Jahre unter Verschluss halten wollte.

Ebenfalls Wissenschaftler und Ärzte, aber auch andere Experten organisieren als Verbundnetzwerk Corona-Solution kostenfreie Online-Konferenzen. Ihr Ziel ist es, «wissenschaftlich, demokratisch und friedlich» über Impfstoffe und Behandlungsprotokolle gegen SARS-CoV-2 aufzuklären und die Diskriminierung von Ungeimpften zu stoppen. Gestern fand eine weitere Konferenz statt. Ihr Thema: «Corona und modRNA: Von Toten, Lebenden und Physik lernen».

Aufgrund des Digital Services Acts (DSA) der Europäischen Union sei das Risiko groß, dass ihre Arbeit als «Fake-News» bezeichnet würde, so das Netzwerk. Staatlich unerwünschte wissenschaftliche Aufklärung müsse sich passende Kanäle zur Veröffentlichung suchen. Ihre Live-Streams seien deshalb zum Beispiel nicht auf YouTube zu finden.

Der vielfältige Einsatz für Aufklärung und Aufarbeitung wird sich nicht stummschalten lassen. Nicht einmal der Zensurmeister der EU, Deutschland, wird so etwas erreichen. Die frisch aktivierten «Trusted Flagger» dürften allerdings künftige Siege beim «Denunzianten-Wettbewerb» im Kontext des DSA zusätzlich absichern.

Wo sind die Grenzen der Meinungsfreiheit? Sicher gibt es sie. Aber die ideologische Gleichstellung von illegalen mit unerwünschten Äußerungen verfolgt offensichtlich eher das Ziel, ein derart elementares demokratisches Grundrecht möglichst weitgehend auszuhebeln. Vorwürfe wie «Hassrede», «Delegitimierung des Staates» oder «Volksverhetzung» werden heute inflationär verwendet, um Systemkritik zu unterbinden. Gegen solche Bestrebungen gilt es, sich zu wehren.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ 746a245a:7a8d8b34

2025-01-10 17:50:10

@ 746a245a:7a8d8b34

2025-01-10 17:50:10In the past few years i have struggled a lot to find "the right" way to store bitcoin.

There is a lot of advice on this topic scattered around the web. I have consumed it, i have tested it and i have discussed it.

Here is what i found to be the best practices to store your bitcoin as a newbie or intermidiate.

I have split this up into two parts:

- Part 1: Essentials - The absolute bare minimum requirements you need to implement ASAP (this post)

- Part 2: Recommended - How to upgrade security and what mistakes to avoid (coming soon)

Let's start with the Essentials ...

Part 1: Essentials

I assume you already know a thing or two about bitcoin if you read this post, so i skip the obvious "No your keys not your coins" stuff.

These are the absolute minimum safety requiements. If you have not implemented these, stop everything you do and follow these steps immediately:

1. Use a hardware wallet

Hardware wallets are specificly built for one single purpose. To secure your private keys and thuss the access to your bitcoin.

Do i really need a hardware wallet?

Short answer: Yes.

Long Answer: It depends on your funds. If you only have bitcoin worth a few hundred bugs, it might not be necessary. A hardware wallet costs about $50-200. But as soon as you feel uncomfortable, you should get one. It is an individual decision. Like someone doesn’t bother running around with a few thousand dollars in his pocket and another one feels uncomfortable with even a few hundred. BUT it is good practice to treat the security of your funds right now as if they already were 10x. As a 10x can happen pretty quickly, as we have seen in the past two years, and you don’t want to do security upgrades in a rush and from a point where you feel unsafe. This leads to mistakes which can lead to total loss (for example sending to a wrong address). Self custody is the first an most important rule to follow if you want to keep your coins and become a whole coiner. If you can't afford a hardware wallet now, at least use a hotwallet ...

Can i use a hotwallet instead?

Hotwallets are wallets, that are connected to the internet, like Apps on your PC or smartphone. They are considered not to be as safe as harwarewallets (so called coldwallets), because if something has no connection to the internet, there is a huge part of risk being taken away. But hotwallets are still way better than leaving your funds on an exchange because with a hotwallet you get the keys to your funds. With exchanges you only get an IOU aka a promise from the exchange. And we have seen how that ends with MountGOX, FTX, Celsius, Blockfi and various others ... Use hotwallets rather on smartphone than on desktop device, as smartphones are a little more secure. A few good ones i could recommend are Blue Wallet, Green Wallet and Exodus but there are a lot of good solutions out there. Just make sure to get a 12 or 24 word seed recovery phrase when setting it up so you are really in full control of your funds. But if you can use a hardware wallet, rather choose that.

Which wallet should i get?

I did try a few but not all of them: - The one i would recommend the most at this point in time is the Blockstream Jade Classic as it comes with almost all possible features you could imagine for a very reasonable price. You can even use it completely airgapped wit QR codes and use it without keystorage like a SeedSigner. I will touch on those features later on in part 2. nostr:npub1jg552aulj07skd6e7y2hu0vl5g8nl5jvfw8jhn6jpjk0vjd0waksvl6n8n is also very active on nostr and provides good support for us plebs. - Coldcard is also a hardware wallet i hear a lot of good stuff about. - As well as the BitBox02 Bitcoin only edition. - Trezor has had some security issues regarding to not having a secure element. I am sure they implemented a solution in the meantime, but i am not up to date with this so i can not recommend it without any doubt. - Ledger devices were generally considered safe but they had multiple security related incidents such as leaking customer data or admiting to be able to extract your seed from the wallet. The fact that they allow to store other crypto currencies, also introduces a bigger attack surface. Thuss i don't recommend using a ledger. If you only have a ledger it's still better than leaving your coins on an exchange though. - SeedSigner, as described, is more for advanced users or if you really want to dig into it, in my opinion. You could also use the Blockstream Jade as a SeedSigner.

Where should i buy?

This is important: Order hardware wallets ONLY straight from the store of the manufacturer. Any middleman or additional steps in the delivery process increase the risk of your device being manipulated. If you are really paranoid about this stick with Coldcard or the new Jade Plus as these models have a build in mechanism to check if they have been tempered with. Also consider using a postbox or working address when you order a hardware wallet or any bitcoin related stuff in general. The less people know that you own bitcoin, the better.

2. Use single-sig wallets

Backup your 12 or 24 words seed phrase and store them in a secure place (safe from theft, fire, water AND CHILDREN etc. i will get to how to achieve this). Most cases in loss of bitcoin happen because of the loss of access to the keys. Not because of theft. So the biggest risk you should care for is that you don't lose access to your keys. And how do most people lose access to their keys? They either ...

1) make the backup too complex so that themselves or their heirs have no clue how to restore it or 2) they are too lazy with their backup so that a flooded basement, thrown away harddrive or deleted photo causes them to loose their bitcoin forever.

Yes there are usecases for multi-sig set-ups and yes it introduces a better level of safety but it also introduces a higher risk of loosing your funds because of complexity. As a newbie or intermediate you don't have to dig into this complexity. You can, but unless you understand very well what you are doing, i wouldn't recommend using multi-sig wallets. Remember: 99% of bitcoin losses don't accure because of theft. If you still feel the need to add a little more security for this aspect, i recommend using a passphrase instead, which has also it's own trade-offs, as we will discuss in the recommended techniques in part 2.

3. Secure your wallet with a good PIN

Don't choose your mother's birthday as your PIN or anything else that can be social engineered. The more random, the better. And the longer the better. If you use multiple hardware wallets, also use different PINs for them. PINs on their own are generally not a very good method to protect anything. A 4 digit PIN for example only gives 10,000 possible combinations (from 0000 to 9999). A modern computer can try these all out pretty fast. BUT fortunately most wallets have a solution for this: If you enter the wrong PIN multiple times in a row they will reset to default and erease the stored keys. Thuss an attacker has only a few tries. Wallets that i know of doing that are the Blockstream Jade or the Coldcard for example. Both also provide the option to set up a specific wallet erease PIN that clears the wallet when entered once. Maybe consider these factors when choosing a wallet.

4. Backup your seed WELL

Backup your seed phrase offline, with pen and paper. Better yet on steel (more on that in upcoming part 2). But make sure that your seed phrase is NEVER being put into or shown to a device other than your hardware wallet. NEVER EVER! Don't make a picture of it to store in your cloud, don't safe it in your notes, don't think you are safe storing it in an encrypted file. You are not. Do it offline and keep it offline. Always. Now let's talk material ...

What material should i use?

Paper can burn, suffer from contact with water, be blown or thrown away and be destroyed from all other sorts of things. I found the safest way to backup a seed phrase is by hammering it into a stainless steel plate. These steelwallets don't break the bank like some fancy Cryptotag or other known brand backup solutions do and in most cases they are even better. Espacially when it comes to the backup style:

What way to perform the backup?

Plain text, letter by letter, hammered onto a steel plate. See part 2 for more details on why this is the best method.

5. Test your backup

Every owner of a substantial amount of bitcoin should have restored his wallet at least once! Make sure you know how to get your funds back in case something goes wrong. Especially if you do more complex things like passphrases (which we will cover in part 2) but also if you only use the 12 or 24 word seeds. The way i like to do it is as follows:

- Step 1) When you have set up your wallet, send a small amount of sats to it. This is a good practice anyway to make sure everything works as intended before sending larger amounts.

- Step 2) After your wallet has recieved the small amount reset your device to default. That means completely whiping it. MAKE SURE YOU HAVE BACKED UP YOUR SEED WELL!

- Step 3) Restore your wallet with your backup.

- Step 4) [optional but recommended] Send that small amount of sats back to verify that you truly have full control over this wallet.

If you can access (and control) the small amount of sats, your backup works and you can now send larger amounts. This is also a good way to test if you have properly backed up your passphrase, in case you are setting up a passphrase wallet.

Now what?

When your funds grow bigger, eventually you will ask yourself: "Is this secure enough?" If you are in that position, the recommended methods in part 2 will help you upgrade your security and avoid common mistakes which could put your coins at risk (part 2 will be linked here as soon as it's available).

What have i missed?

Do you agree with these essentials on how to store bitcoin? Did i miss anything? Please let me know and help to refine this set of rules so we can help more and more people to become souverein bitcoin holders.

-

@ c631e267:c2b78d3e

2024-10-23 20:26:10

@ c631e267:c2b78d3e

2024-10-23 20:26:10Herzlichen Glückwunsch zum dritten Geburtstag, liebe Denk Bar! Wieso zum dritten? Das war doch 2022 und jetzt sind wir im Jahr 2024, oder? Ja, das ist schon richtig, aber bei Geburtstagen erinnere ich mich immer auch an meinen Vater, und der behauptete oft, der erste sei ja schließlich der Tag der Geburt selber und den müsse man natürlich mitzählen. Wo er recht hat, hat er nunmal recht. Konsequenterweise wird also heute dieser Blog an seinem dritten Geburtstag zwei Jahre alt.

Das ist ein Grund zum Feiern, wie ich finde. Einerseits ganz einfach, weil es dafür gar nicht genug Gründe geben kann. «Das Leben sind zwei Tage», lautet ein gängiger Ausdruck hier in Andalusien. In der Tat könnte es so sein, auch wenn wir uns im Alltag oft genug von der Routine vereinnahmen lassen.

Seit dem Start der Denk Bar vor zwei Jahren ist unglaublich viel passiert. Ebenso wie die zweieinhalb Jahre davor, und all jenes war letztlich auch der Auslöser dafür, dass ich begann, öffentlich zu schreiben. Damals notierte ich:

«Seit einigen Jahren erscheint unser öffentliches Umfeld immer fragwürdiger, widersprüchlicher und manchmal schier unglaublich - jede Menge Anlass für eigene Recherchen und Gedanken, ganz einfach mit einer Portion gesundem Menschenverstand.»

Wir erleben den sogenannten «großen Umbruch», einen globalen Coup, den skrupellose Egoisten clever eingefädelt haben und seit ein paar Jahren knallhart – aber nett verpackt – durchziehen, um buchstäblich alles nach ihrem Gusto umzukrempeln. Die Gelegenheit ist ja angeblich günstig und muss genutzt werden.

Nie hätte ich mir träumen lassen, dass ich so etwas jemals miterleben müsste. Die Bosheit, mit der ganz offensichtlich gegen die eigene Bevölkerung gearbeitet wird, war früher für mich unvorstellbar. Mein (Rest-) Vertrauen in alle möglichen Bereiche wie Politik, Wissenschaft, Justiz, Medien oder Kirche ist praktisch komplett zerstört. Einen «inneren Totalschaden» hatte ich mal für unsere Gesellschaften diagnostiziert.

Was mich vielleicht am meisten erschreckt, ist zum einen das Niveau der Gleichschaltung, das weltweit erreicht werden konnte, und zum anderen die praktisch totale Spaltung der Gesellschaft. Haben wir das tatsächlich mit uns machen lassen?? Unfassbar! Aber das Werkzeug «Angst» ist sehr mächtig und funktioniert bis heute.

Zum Glück passieren auch positive Dinge und neue Perspektiven öffnen sich. Für viele Menschen waren und sind die Entwicklungen der letzten Jahre ein Augenöffner. Sie sehen «Querdenken» als das, was es ist: eine Tugend.

Auch die immer ernsteren Zensurbemühungen sind letztlich nur ein Zeichen der Schwäche, wo Argumente fehlen. Sie werden nicht verhindern, dass wir unsere Meinung äußern, unbequeme Fragen stellen und dass die Wahrheit peu à peu ans Licht kommt. Es gibt immer Mittel und Wege, auch für uns.

Danke, dass du diesen Weg mit mir weitergehst!

-

@ a95c6243:d345522c

2024-10-19 08:58:08

@ a95c6243:d345522c

2024-10-19 08:58:08Ein Lämmchen löschte an einem Bache seinen Durst. Fern von ihm, aber näher der Quelle, tat ein Wolf das gleiche. Kaum erblickte er das Lämmchen, so schrie er:

"Warum trübst du mir das Wasser, das ich trinken will?"

"Wie wäre das möglich", erwiderte schüchtern das Lämmchen, "ich stehe hier unten und du so weit oben; das Wasser fließt ja von dir zu mir; glaube mir, es kam mir nie in den Sinn, dir etwas Böses zu tun!"

"Ei, sieh doch! Du machst es gerade, wie dein Vater vor sechs Monaten; ich erinnere mich noch sehr wohl, daß auch du dabei warst, aber glücklich entkamst, als ich ihm für sein Schmähen das Fell abzog!"

"Ach, Herr!" flehte das zitternde Lämmchen, "ich bin ja erst vier Wochen alt und kannte meinen Vater gar nicht, so lange ist er schon tot; wie soll ich denn für ihn büßen."

"Du Unverschämter!" so endigt der Wolf mit erheuchelter Wut, indem er die Zähne fletschte. "Tot oder nicht tot, weiß ich doch, daß euer ganzes Geschlecht mich hasset, und dafür muß ich mich rächen."

Ohne weitere Umstände zu machen, zerriß er das Lämmchen und verschlang es.

Das Gewissen regt sich selbst bei dem größten Bösewichte; er sucht doch nach Vorwand, um dasselbe damit bei Begehung seiner Schlechtigkeiten zu beschwichtigen.

Quelle: https://eden.one/fabeln-aesop-das-lamm-und-der-wolf

-

@ f9c0ea75:44e849f4

2025-01-10 17:47:02

@ f9c0ea75:44e849f4

2025-01-10 17:47:02As the world moves toward an era of centralized digital finance, Brazil is not staying behind. The Banco Central do Brasil (BCB) is pushing forward with DREX, the country’s official Central Bank Digital Currency (CBDC). Framed as a way to enhance financial inclusion, reduce costs, and improve transparency, DREX is being marketed as a technological leap toward modernizing Brazil’s monetary system.

However, behind the promises of efficiency and security, DREX is nothing more than a digital cage designed to tighten state control over financial transactions. While some will celebrate it as a step toward reducing corruption and simplifying the economy, it is, in reality, a massive expansion of governmental power.

From a sovereign individual perspective, DREX represents the opposite of financial freedom, privacy, and autonomy. It is a tool of state surveillance, censorship, and financial control. In this article, we will analyze the history of DREX, its technical framework, the government’s next steps, and why this CBDC is ultimately a dangerous escalation of state power.

The Evolution of DREX: From Concept to Implementation

DREX, originally known as the Digital Real, is Brazil’s response to the growing global trend of CBDCs. The BCB began discussions on launching a digital currency in 2020, shortly after China began rolling out the digital yuan (e-CNY) and the European Union started developing the digital euro.

The stated objectives of DREX are:

- Modernizing Brazil’s financial infrastructure.

- Increasing financial inclusion for the unbanked.

- Enhancing transparency in transactions.

- Reducing costs in financial intermediation.

While these objectives sound beneficial, history has shown that every expansion of financial control by the state—from fiat currency inflation to banking regulations—ends up benefiting the government and central banks, not the average citizen.

Technical Framework and Features

DREX operates on a permissioned blockchain, meaning it is not decentralized like Bitcoin or other public blockchains. Instead, it is fully controlled by the BCB and a consortium of selected financial institutions.

Key Features of DREX:

- Programmability: The government can restrict how money is spent (e.g., banning purchases of certain goods, enforcing expiration dates on funds).

- Full Traceability: Every transaction is recorded on a centralized ledger, allowing the BCB to monitor all financial activity in real time.

- Interoperability: DREX will integrate with PIX, Brazil’s instant payments system, ensuring full adoption by the population.

- Smart Contracts: The government can automatically enforce financial rules, including instant tax collection, fines, and spending restrictions. While these features are marketed as "efficiencies," they enable unprecedented levels of financial control, making censorship, surveillance, and direct government intervention easier than ever before.

Historical Context: The Rise of Financial Control

To understand why DREX is dangerous, we must recognize how governments have historically weaponized financial systems to control their populations.

-

Bretton Woods & Fiat Expansion (1944-1971): The transition from a gold-backed currency to fiat money allowed governments to inflate their currencies at will, leading to massive economic manipulation.

-

The Patriot Act & Financial Surveillance (2001): In response to terrorism, the U.S. expanded financial surveillance, giving banks and governments unprecedented control over monetary flows.

-

China’s Social Credit System & Digital Yuan (2014-Present): China’s digital yuan (e-CNY) is integrated with the Social Credit System, allowing the government to punish or restrict people based on their financial behaviors.

-

The Canadian Trucker Protests (2022): Canada froze bank accounts of individuals who donated to anti-government protests, proving how financial infrastructure can be weaponized against political dissent. DREX fits perfectly into this pattern: a government-controlled digital money system designed to expand state power while eliminating financial autonomy.

## Next Steps: DREX Implementation Timeline and Government Actions

The BCB has already laid out its roadmap for DREX, with critical milestones planned for the next two years.

- Pilot Phases and Testing

- Phase 1: Initial Testing (2023-2024) Focused on the fundamentals, including wholesale CBDC (wCBDC), tokenized deposits, and digital treasury bonds. Initial testing on issuance, transfers, and settlements.

- Phase 2: Smart Contracts & Advanced Features (2024-2025) The second phase, launched in late 2024, focuses on developing smart contract applications for financial services. Participants include Santander, Visa, Mastercard, and Google, working on credit systems, trade finance, and real estate integration.

- Key Dates and Obligations

- October 2024 - November 2024: Application period for financial institutions to join Phase 2 of the pilot.

- June 2025: Deadline for selected institutions to finalize smart contract development.

- Late 2025 - Early 2026: Projected nationwide rollout of DREX. 2026 and beyond: Gradual phase-out of cash transactions, forcing adoption of CBDC-based payments.

- Full Implementation & Adoption Strategy Mandatory Integration: Financial institutions will be required to adopt DREX, ensuring all transactions move to a CBDC-controlled system. Cash Restrictions: Physical cash transactions will become increasingly limited, eventually leading to a cashless society.

The Illusion of Convenience and the Death of Sovereignty

DREX is not a neutral technology—it is a massive expansion of government power under the guise of efficiency and financial modernization.

Many will embrace it without questioning its implications. They will:

Cheer as DREX automates tax collection. Applaud anti-corruption measures that allow the state to track every transaction. Celebrate how it "simplifies" payments, ignoring that it also simplifies financial censorship. But make no mistake:

DREX is not about efficiency—it is about control

Once fully implemented, the state will have the power to:

- Monitor all financial transactions in real-time.

- Restrict spending on certain goods or services.

- Enforce automatic taxation without consent.

- Freeze or seize funds instantly, without due process.

- Eliminate cash, ensuring full reliance on a government-controlled financial system.

The Leviathan is Awakening Philosopher Thomas Hobbes described the state as a Leviathan— "a massive entity that must be obeyed to maintain order. However, when the state controls money, it controls freedom itself."

DREX is the final piece of the puzzle in creating a fully monitored, fully controlled financial system where every transaction is dependent on government approval. By 2025, DREX will be a reality. By 2026, financial privacy may no longer exist for the commons in Brazil. However, Bitcoin exists for the sovereign individual.

-

@ e97aaffa:2ebd765d

2025-01-10 16:39:58

@ e97aaffa:2ebd765d

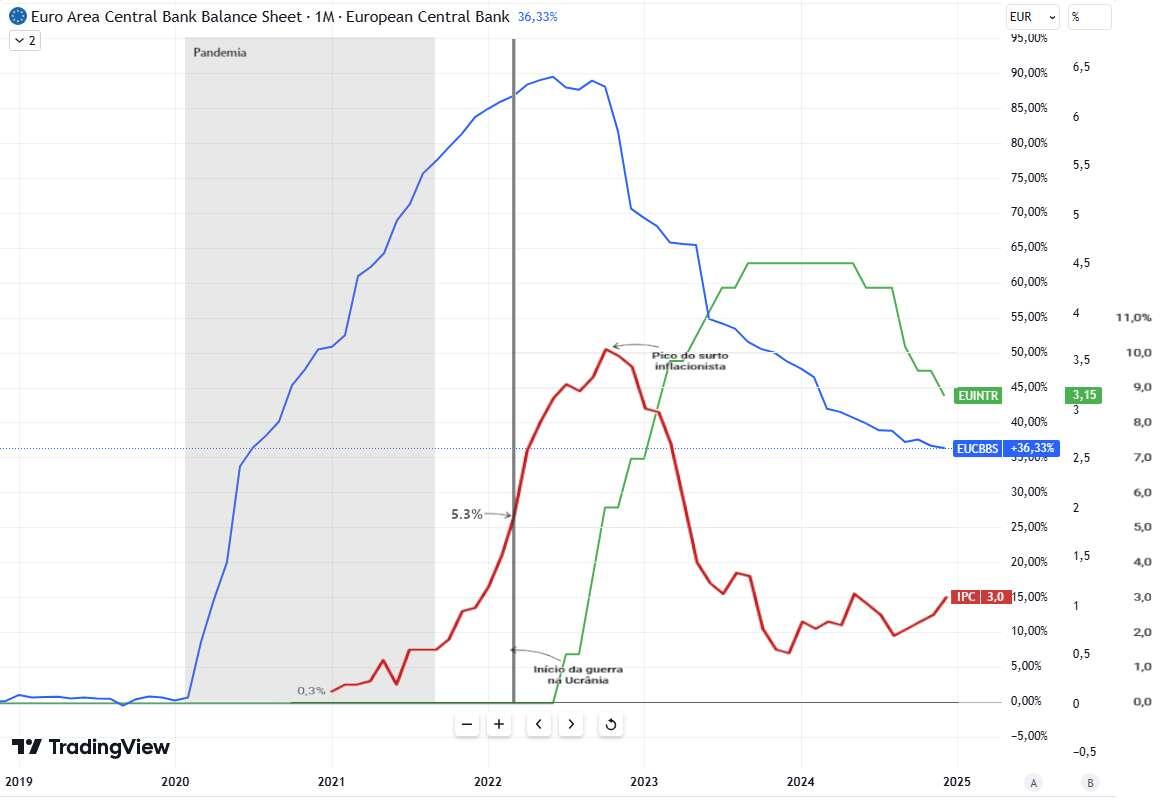

2025-01-10 16:39:58Adoro ver os fiduciários a publicarem dados, na qual desmente declarações ou atitudes dos próprios fiduciários no passado.

Quando estávamos em plena crise inflacionista, os políticos e economistas correram para as televisões e jornais a atribuir a responsabilidade da inflação, em exclusividade, à guerra da Ucrânia.

«A invasão da Ucrânia pela Rússia, há dois anos, alimentou uma escalada dos preços do gás natural e da eletricidade na Europa, e o disparo da inflação para níveis históricos.» – Expresso

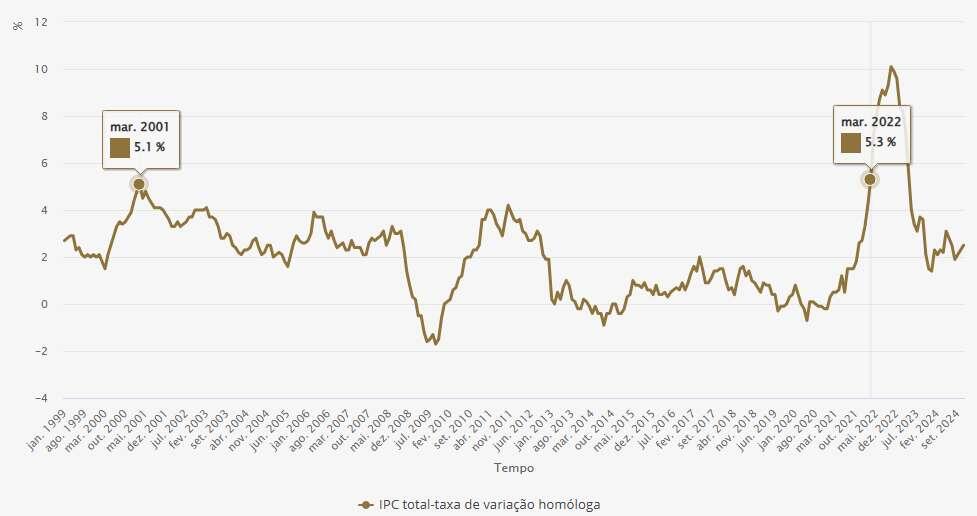

Mas antes de começar a guerra, a inflação(IPC) estava nos 5.3%, já em máximos históricos.

É claro que a guerra contribuiu para a subida de preço, mas não foi a principal razão.

A subida generalizada de preços, vulga inflação, pode acontecer por dois fatores distintos.

Ruptura na cadeia de abastecimento

Quando existe uma ruptura na cadeia de abastecimento, ou seja, um problema na oferta ou na demanda.

A guerra provocou uma ruptura na oferta, sobretudo na energia e nos cereais. Na pandemia houve uma ruptura na demanda, nas máscaras e no álcool gel.

Só que este tipo de inflação é temporária, de curto prazo, a longo prazo acaba por corrigir. Têm um impacto inicial, o preço dos produtos sobem rapidamente, depois a indústria ajusta-se e os preços acabam por corrigir.

Inflação monetária

Ao contrário da ruptura da cadeia de abastecimento que é temporária, a inflação monetária é persistente, nunca mais volta aos valores anteriores.

Esta inflação é gerada pelo bancos centrais ou bancos comerciais, através de políticas que aumentam a base monetária, para os leigos, os bancos imprimem dinheiro.

O aumento da base monetária não gera inflação de imediato na economia, esse processo é demorado, os fiduciários chamam-no de tempo de transmissão.

É um delay que existe, desde o momento em que se aplica uma mudança da política monetária e os seus efeitos a serem visíveis na economia real. Este delay pode variar entre 6 meses a 2 anos.

Observando o gráfico, a subida do IPC iniciou-se a Março de 2021, mas começou a acelerar 6 meses após, muito antes da guerra.

Se existe um delay na causa-efeito, logo a inflação é resultante de algo que aconteceu anteriormente, vamos ver o que aconteceu nos 2 anos anteriores.

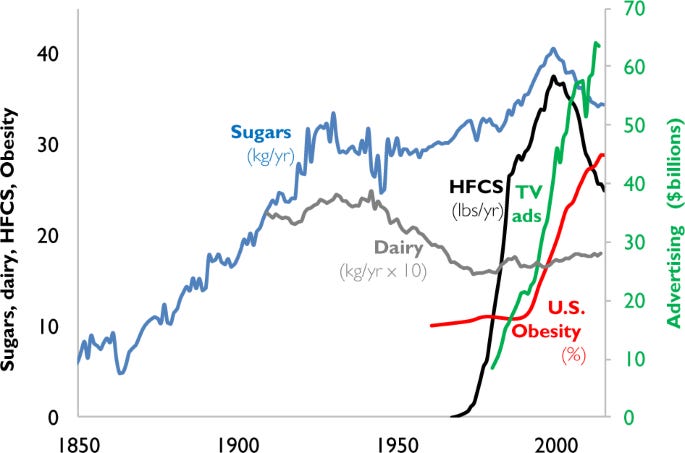

Nesse período aconteceu a pandemia e o BCE efetuou o maior aumento da base monetária, desde a criação da moeda única. O início foi no primeiro trimestre de 2020 e a inflação (IPC) começou a subir no primeiro trimestre de 2021, mais ou menos um ano, correspondente ao intervalo de tempo do tempo de transmissão. A semelhança entre a impressão do banco central (EUCBBS, em azul) e o IPC (em azul) é perfeita, apenas com um delay.

O BCE imprimiu (QE) ~4 triliões de euros, corresponde a um aumento de ~90% da base monetária(EUCBBS), no seu pico, em Setembro de 2022. Nesta mesma data, o IPC atingiu os 9%, o que levou o BCE a implementar medidas mais drásticas para combater a subida de preços, aplicou políticas de redução de recompras de obrigações do Tesouro e a subida das taxas diretoras.

As políticas surtiram efeito, o EUCBBS teve uma correção, de 8.84 triliões para 6.36 triliões, mas se compararmos de 2020 a 2024, houve um aumento de 1.7 triliões, ~37%, ou seja, o EUCBBS não voltou aos valores anterior.

Passados 2 anos após a guerra, os preços da energia e dos cereais, já baixaram, estão bastante abaixo do pico. Enquanto o EUCBBS está muito longe dos valores de 2020. Para que os produtos voltassem ao preço de 2021, o EUCBBS também necessitaria voltar para valores anteriores à guerra, mas isso nunca vai acontecer.

A inflação monetária não é temporária, é permanente.

-

@ 378562cd:a6fc6773

2025-01-10 16:37:38

@ 378562cd:a6fc6773

2025-01-10 16:37:38For many of us, reading isn’t just a pastime—it’s a deeply personal goal tied to self-growth, relaxation, and exploration. Yet, despite knowing its importance, we often struggle to make it happen. We start and stop, let books gather dust, and feel guilty for not finishing them. The truth? It’s not a time issue; it’s a mental barrier.

This guide is designed to help you break through those barriers with a structured, rewarding framework that keeps you interested, engaged, and building momentum. Let’s turn reading into a habit you love—and can sustain.

Step 1: Understand the Real Problem

Before diving into action, take a moment to reflect. The issue isn’t that you don’t have time—it’s that you haven’t made reading a priority. Life pulls us in countless directions, but we always find time for what matters most. Reading deserves that place in your life because it nourishes your mind, brings you joy, and inspires growth.

Ask Yourself:

- Why do I want to read more?

- How would my life improve if I prioritized reading?

Write down your answers and keep them visible. Let your 'why' guide you forward.

Step 2: Start Where You Are (Small and Simple Wins)

Many people fail because they set huge, overwhelming goals like finishing a book every week. The secret to success? Start small. Commit to just 5 minutes a day or a single page. Progress matters more than perfection.

Mini Challenge #1:

- Pick a book you’re genuinely excited about (not one you feel you should read).

- Read for 5 minutes today. Just 5 minutes.

When you complete this, check it off. That little win is the first step toward building momentum.

Step 3: Create a System That Fits Your Life

Habits thrive when they’re tied to something you already do. Look for natural openings in your day to read.

- Morning: Read while sipping coffee or tea.

- Lunch Break: Sneak in a few pages while eating.

- Evening: Replace 10 minutes of scrolling with reading before bed.

Make it impossible to forget by keeping books or an e-reader where you spend the most time: next to the bed, on the couch, or in your bag.

Mini Challenge #2:

- Set a specific time to read tomorrow. Write it down and stick to it.

Step 4: Make It Fun and Rewarding

Let’s face it—habits stick when they feel good. Build instant gratification into your reading routine.

- Gamify the Process: Create a simple list of mini challenges (like the ones here) and cross them off as you go.

- Set Rewards: For every milestone—like finishing a chapter or hitting a week of daily reading—treat yourself. It could be a fancy coffee, a cozy reading corner upgrade, or just the joy of marking progress.

Mini Challenge #3:

- Set a reward for finishing your first chapter or reading streak. Make it something exciting!

Step 5: Follow Your Interests, Not Rules

One of the biggest mental barriers is feeling like you have to finish every book you start. Forget that. Reading should be enjoyable, not a chore. If a book isn’t grabbing you, it’s okay to stop and try another. The key is to stay engaged, not stuck.

Mini Challenge #4:

- If you’re not loving a book after 50 pages, give yourself permission to move on.

Step 6: Build Momentum with Layered Challenges

To make reading exciting and natural, set challenges that grow progressively:

- Day 1–3: Read 5 minutes daily.

- Day 4–7: Extend to 10 minutes.

- Week 2: Finish a chapter or two from a book you love.

- Week 3: Try a new genre or author.

Each challenge builds on the last, creating a sense of accomplishment. By the time you finish the third week, you’ll likely be hooked.

Step 7: Track and Celebrate Progress

Progress tracking is one of the simplest yet most effective ways to build a habit. Create a log to note what you’ve read, even if it’s just a chapter or a short story. Seeing your progress motivates you to keep going.

Ideas for Tracking:

- Use a journal or app to list books and dates you started/finished.

- Jot down favorite quotes or lessons learned.

- Share your progress with friends or join a book club for accountability.

Mini Challenge #5:

- Start a reading journal and write down what you love about the book you’re currently reading.

Step 8: Stay Flexible and Forgive Yourself

Life gets busy, and you might miss a day (or week). That’s okay. Habits are built over time, not overnight. The key is to keep coming back to your reading routine without guilt. Remember, even a little reading is better than none.

Final Thoughts

Reading is a gift you give yourself. It’s not about how fast you finish or how many books you complete—it’s about the joy, knowledge, and escape it brings. By breaking your mental barriers, starting small, and creating a system of rewards and challenges, you can make reading a natural and deeply fulfilling part of your life.

So, grab a book, set a timer, and dive in. Your reading journey starts today.

-

@ 554ab6fe:c6cbc27e

2025-01-10 15:46:28

@ 554ab6fe:c6cbc27e

2025-01-10 15:46:28It is commonly understood that the ancient Greeks and alike used mythological tales to communicate philosophical teachings. Amazingly, these tales have lasted the test of time and are still told today. It seems stories with philosophical lessons and teachings have an intrinsic value to human civilization. This seems to be the case because we are still creating such stories, and those with great lessons become pop culture phenomena. One example, is the Star Wars saga. George Lucas was known to appreciate ancient tales with meaning. In my opinion, he made one of the most profound modern mythological tales. The tale of Star Wars holds many similarities to Daoism, and my understanding of WuWei (无为). Making it a beautiful tale of how the best way to combat evil in the world, is to be one of passivity, serenity, and nonviolence.

To articulate how Star Wars projects this lesson through its story, one must look at the overarching narrative of the first six episodes, the original movies written by George Lucas. I will refer to these as the original trilogy (episode 4,5, and 6) and the prequel trilogy (episodes 1,2, and 3).

The Jedi are the epitome of goodness. They practice compassion, live their lives in service of others, and strive for peace in the galaxy. Their teachings are clearly benevolent, and are such that we should take them into consideration of our own lives. Jedi are commonly advised to be mindful of their thoughts and feelings1,2. It also bears a striking resemblance to the practice of mindfulness meditation, where one trains the mind in being mindful on the present moment and taking a non-judgmental stance on all incoming emotions, sensations, stimuli, etc. Additionally, the very first lesson Yoda teaches young Anakin Skywalker is that a Jedi must let go of fear, anger, and hatred2. These three emotions lead one to the dark side in this tale, but are also detrimental to us in real life as well. They are the pillars to the way of the Jedi. However, the choice of the three words Yoda uses here is very important. We will see later that these teachings are incomplete. The flaw in this teaching, and the subsequent correction, is what sheds light onto the profound teaching of Star Wars.

Episode 1 begins with the Jedi being the rulers of the galaxy. However, all who know the story of Star Wars know that Darth Sidious/ Emperor Palpatine will one day take control over the galaxy. The entire prequel trilogy outlines the progress of how Darth Sidious manipulates everyone to create political conflict and war to drive the Jedi further into becoming soldiers. The dark emperor chooses this tactic because he knows that violence and conflict is the way of the Sith. The Jedi way is the opposite. As Macu Windu puts it, they are “keepers of the peace, not soldiers”1. However, though this is what Jedi ideally are, in practice they are not so. The three prequels are full of events where the Jedi intervene into political matters and conduct themselves as warriors in order to “keep the peace”. Here, the audience is able to recognize that the Jedi are hesitant to fight in wars. Regardless, the core teachings provided to Anakin in the first episode regarding letting go of fear, anger, and hate do not directly forbid the Jedi from using their fighting skills to keep the peace. So, the audience, and the Jedi council alike, allow the Jedi to conduct themselves in violent ways. During the same scene with Macu Windu, Yoda mentions that his vision is clouded by the dark side1. Why is his vision clouded by the dark side? Why do the Jedi not see Darth Sidious for who he truly is until it is too late? The answer to this is because the violence practiced by the Jedis causes them to lose their way. Evidence of this is brought forth in the original trilogy.

In the original trilogy, Yoda’s teachings to Luke change in comparison to the teachings he gave to his father Anakin. In Dagoba, Yoda tells Luke to let go of anger, hate, and aggression3. Notice how the word “hate” is replaced by “aggression”. This is not to say that hate is ok, but to say that aggression is what Yoda did not understand before, but now realizes as a key component of the Jedi way. The Jedi before used aggression all the time, in the name of peace. They fought evil people as warriors of justice, and Palpatine used this against them. Yoda’s vision was clouded by the dark side, because him, and all other Jedi were using a dark side related behavior: aggression. This is highlighted repeatedly throughout the original trilogy. Luke leaves his training early to go help his friends, and both Obi Wan and Yoda urge him not to do so3. They explain how Luke going off to fight Vader is what the enemy wants, and the best thing he could do was stay, train, and not fight. Yet, Luke departs anyway in the 5th episode and fights his father. This battle doesn’t end well for Luke, and he loses a hand. The hand is replaced with a robotic one, a symbol for lost humanity. In essence, he was punished for acting on his violent and fear driven urges, pushed further to the dark side. We continue to see how aggression is related to the dark side at the beginning of episode 6 when Luke enters Jaba’s palace. Here is referred to as a Jedi, yet acts the opposite: he walks into the palace in all black, and uses brute force to enter the palace by using a force choke on one of the guards4. Though we see him as our hero, he is acts and behaves more similar to a Sith.

The entire tale resolves itself in the final confrontation between Luke, his father, and Darth Sidious. During this encounter, the emperor continuously instills anger and hatred into Luke by threatening his friends, in hope that he will turn to aggression4. He even states that Luke should “strike [him] down, [so] his journey to the dark side [can] be complete”4.

Palpatine knows how to manipulate Jedi into acting upon tendencies that bring them to the dark side. It is how he came to power in the prequels. Luke goes to strike the emperor out of anger and Vader prevents the strike (Vader is saving his son from reaching a place of no return). They fight until Luke gains the upper hand and removes the hand of his father. In this moment, Luke notices that they both have these robotic hands. This is a realization of common humanity. Similar to the vision he had on Dagoba where he fights his father and beheads him, only to find that under the helmet was himself. A realization that they are not only family, but both human beings struggling with the same internal battle between the forces of good and evil. At this moment Luke has become enlightened, and becomes the truest Jedi in the entire series. He turns around and drops his lightsaber, and says “you failed your highness, I am a Jedi”4.

What is significant in this scene is after Luke’s clarifying realization, he drops his weapon, ending the violence while simultaneously claiming victory. He understands that the only way to defeat Palatine, is to not use the same methods of aggression. Rather than using violence, he should use passivity and non-violence to triumph over evil. It goes without saying that he is correct: Palpatine is defeated, and he is able to save his father. In the final scene between Luke and his father, one can see that the black outfit that Luke wears is becoming undone, and the inside fabric now revealed is white. Reiterating that now Luke, being one of non-violence has saved the galaxy and everyone he loves. Luke at this moment becomes a true Jedi, one that has surpassed all before him and becomes the ideal epitome of goodness for the audience to emulate.

This is a story of WuWei. Of how non-action, non-aggression, and effortless action is most effective, and perhaps only way of bettering the world. The Jedi were constantly fighting and resisting evil, unknowingly playing right into the hands of the evil forces in the world. Only when Luke turns to non-action, does the dominance of evil end. This wisdom is not only useful in a galaxy far far away, but is most applicable to the world we live in now. A modern mythological tale of the importance of Daoist philosophy. May the Force be with you.

References

- Lucas G. Star Wars: Episode II – Attack of the Clones.; 2002.

- Lucas G. Star Wars: Episode I – The Phantom Menacee.; 1999.

- Lucas G. Star Wars: Episode V - The Empire Strikes Back.; 1980.

- George Lucas. Star Wars: Episode VI - Return of the Jedi.; 1983.

-

@ 554ab6fe:c6cbc27e

2025-01-10 15:39:05

@ 554ab6fe:c6cbc27e

2025-01-10 15:39:05I was in high school during the 2008 Great Recession. The significance of that event made me critically question our current economic system. It made me very interested in how our system of money and banking works. This path of inquiry led me to research and understand the truly complicated and underdiscussed issue of fiat currencies, and the subsequent powers that gives government and bank in manipulating our economy. In my opinion, the modern world has a money problem. This money problem not only translates into issues of materialism, but also is represented in poor monetary policy on the part of the societal elites. Below is a paper I wrote in high school which discusses how the manipulation of interest rates, made possible by fiat currencies and fractional reserve banking, leads to dangerous business cycles that lead to the great economic collapses we have experienced.

How does the interest Rate Manipulation Work?

With the fractional reserve system in place, the Federal Reserve has three powers that they use to adjust the interest rates of banks to carry out their policies. The first conceptual milestone to be achieved in answering the question of the Federal Reserve’s effect on the business cycle is to understand how the fractional reserve banking system works. It is legally mandated that all banks must have a certain percentage of their reserves in the vaults at all time. Though this is a reserve requirement, banks historically never in the long run hold onto excess reserves because that would bring economic disadvantage with the other banks (until recently because the federal reserve no pays interest to banks who hold some excess reserves). Therefore, the reserve requirements end up being the universal ratio of cash a bank holds at a time. This also means, that banks historically have never have the total financial holdings of all their customers.