-

@ 71a4b7ff:d009692a

2025-01-10 06:56:00

@ 71a4b7ff:d009692a

2025-01-10 06:56:00FOMO is the anxiety that arises from the belief that the most interesting, important, or trending events are happening elsewhere while others gain unique experiences.

It’s widely believed that FOMO stems from unmet social connection needs and reflects our innate fear of ostracism. These fears—of being left behind or excluded—are amplified in the digital age, where our perception of reality is often skewed. This can escalate from mild unease to overwhelming fear, significantly impacting mental well-being.

FOMO consists of two key components:

- An unsettling feeling of missing out on something exciting or valuable.

- Obsessive behaviors aimed at resolving this anxiety, which paradoxically only intensify it.

In today’s hyper-connected world, we have unprecedented, instant access to what others are doing. Social feeds, channels, and chats bombard us with endless options on how to live, what we lack, and what to value. But the sheer volume of this information far exceeds what anyone can process, leading many to feel overwhelmed.

The curated nature of digital lives, constant upward social comparisons, unrealistic expectations, and ceaseless data streams erode self-esteem and emotional stability. Our fear of alienation and loneliness fuels this cycle, pushing us deeper into digital platforms. These platforms, designed to stimulate our brain’s reward system, trap us in a feedback loop of anxiety and fleeting gratification.

We’re drawn in by the promise of effortless connection—quick, low-risk, and convenient interactions via swipes, likes, emojis, texts, even zaps. In contrast, real-life relationships, with their inherent complexities, take time, effort, and risk. This shift is causing us to lose touch with essential social skills like commitment, empathy, and genuine communication.

Instead, we seek solace in a digital environment that offers the illusion of safety, excitement, and eternal connectivity. But this comes at a cost. By overloading our internal reward systems, we drain the joy and meaning from authentic experiences, replacing them with an endless stream of curated content—images and videos we compulsively scroll through.

We’re lured by promises of knowledge, vivid experiences, and truth, yet what we often get is an avalanche of life hacks, misinformation, and conspiracy theories. Gigabit technologies, addictive interfaces, and external agendas fan the flames of loneliness, anxiety, and stress in our ancient, slow-evolving brains. This relentless burn depletes our reserves, leaving behind doubt: Are we doing enough? Are we in the right place? Will we be accepted?

Our already complex lives risk being consumed by a bleak cycle of doomscrolling.

But there is hope.

Fighting FOMO is possible. The more time we spend in knowledge-consuming environments, the more susceptible we become to its effects. The key is self-awareness and limiting screen time. Ironically, the very devices and services that fuel FOMO can also help us combat it. With thoughtful use of technology and intentional boundaries, we can regain control.

This is where NOSTR steps into the spotlight. Our favorite protocol has the potential to not only draw lessons from the legacy web but also to evolve beyond mere mimicry. It can introduce innovative ways for people to connect and collaborate—across services, networks, and each other. I believe it’s one of the most promising spaces on the Internet today, and its future depends entirely on what we make of it.

Thanks for You Time. Geo

-

@ 68fa45dc:3d2a26ed

2025-01-10 04:29:57

@ 68fa45dc:3d2a26ed

2025-01-10 04:29:57Mit der rasanten Entwicklung von Wissenschaft und Technologie werden nach und nach einige Hilfsgeräte und Werkzeuge in das tägliche Leben integriert. Unter ihnen werden Signalstörsender als eine Art Ausrüstung mit großem Einfluss nicht nur im militärischen Bereich eingesetzt, sondern auch beginnen, im zivilen Bereich Probleme zu verursachen. Die Aufmerksamkeit der Leute. Ein Jammer Störsender ist ein Gerät, das Funkkommunikation blockiert oder stört. Seine Einführung und Anwendung haben das Leben und die Arbeit der Menschen erheblich erleichtert, aber auch eine Reihe von Diskussionen und Kontroversen ausgelöst.

Erstens spielen Störsender im militärischen Bereich eine entscheidende Rolle. Im Krieg sind die Sicherheit und Vertraulichkeit der Kommunikation von entscheidender Bedeutung. Die Signalstörungen des Feindes können das Kommunikationssystem unserer Armee stark beeinträchtigen und zum Durchsickern von Kampfplänen oder sogar zum Scheitern führen. Durch den Einsatz von handy frequenz jammer können die Kommunikationssignale des Feindes wirksam gestört und die Sicherheit unserer Kommunikation gewährleistet werden. Auf diese Weise wird die Kampfeffizienz verbessert und die nationalen Interessen geschützt. Aus diesem Grund werden Störsender in der modernen Kriegsführung häufig eingesetzt und sind aus dem militärischen Bereich nicht mehr wegzudenken.

Neben der militärischen Nutzung werden Störsender auch häufig im zivilen Bereich eingesetzt. Mit der Entwicklung der Mobilkommunikationstechnologie ist das Leben der Menschen untrennbar mit Mobiltelefonen und drahtlosen Netzwerken verbunden. In manchen Situationen, beispielsweise in Konferenzräumen, Prüfungsräumen, Theatern usw., können Störungen durch drahtlose Signale jedoch die normale Ordnung und die Arbeitsbedingungen beeinträchtigen. Störsender WLAN können in diesen Situationen drahtlose Kommunikationssignale abschirmen und so für Ruhe und Ordnung in der Umgebung sorgen. Darüber hinaus werden an manchen vertraulichen Orten, wie etwa in Regierungsbehörden, Forschungsinstituten usw., aus Gründen der Informationssicherheit auch Störsender benötigt, um den Diebstahl von Funksignalen zu verhindern und sicherzustellen, dass keine vertraulichen Informationen nach außen dringen.

Tragbare Detektor für DJI Drohnen

Allerdings hat der Einsatz von Störsendern auch zahlreiche Kontroversen ausgelöst. Manche Menschen befürchten, dass der übermäßige Einsatz von Störsendern die normalen Kommunikationsnetze stören und das normale Funktionieren der Gesellschaft beeinträchtigen könnte. Darüber hinaus nutzen manche Kriminelle GPS Tracker Jammer möglicherweise auch für illegale Zwecke, beispielsweise zur Blockierung von Notrufen oder zur Entführung von Flugzeugen, was eine potenzielle Gefahr für die soziale Sicherheit darstellt. Daher sind Aufsicht und vernünftige Verwendung von entscheidender Bedeutung.

Generell verändern Hochleistungs handy Störer als technische Geräte still und leise unser Leben. Im militärischen Bereich sorgt sie für die nationale Sicherheit, im zivilen Bereich sorgt sie für die Aufrechterhaltung der gesellschaftlichen Ordnung. Allerdings bedarf die Frage, wie der normale Betrieb der Gesellschaft sichergestellt werden kann, während sich Wissenschaft und Technologie weiterentwickeln, einer Lösung. Nur unter der Voraussetzung einer angemessenen Überwachung und Nutzung können Störsender besser zur Entwicklung und Sicherheit der menschlichen Gesellschaft beitragen.

https://www.jammer-store.de/H1B-D-tragbare-detektor-fuer-dji-drohnen.html

-

@ a012dc82:6458a70d

2025-01-10 03:49:50

@ a012dc82:6458a70d

2025-01-10 03:49:50Table Of Content

-

The Rising Tide of Bitcoin's Influence in China

-

China's Economic Struggles: A Closer Look

-

The Cryptocurrency Solution: A Beacon for Chinese Investors?

-

Historical Interplay: Bitcoin's Past Dance with China

-

A New Era: The Evolving Dynamics of Bitcoin in China

-

Conclusion

-

FAQ

In the intricate web of global finance, China's economic dynamics have consistently been a focal point for analysts and investors alike. Recently, the nation has been grappling with one of its most significant capital flights in years, raising questions about potential economic solutions. Amidst this backdrop, the decentralized cryptocurrency, Bitcoin, has emerged as a topic of interest. Could Bitcoin, with its global reach and decentralized nature, offer a viable alternative or solution to China's current economic challenges? This article delves deep into the potential symbiotic relationship between China's capital flight and the burgeoning world of Bitcoin.

The Rising Tide of Bitcoin's Influence in China

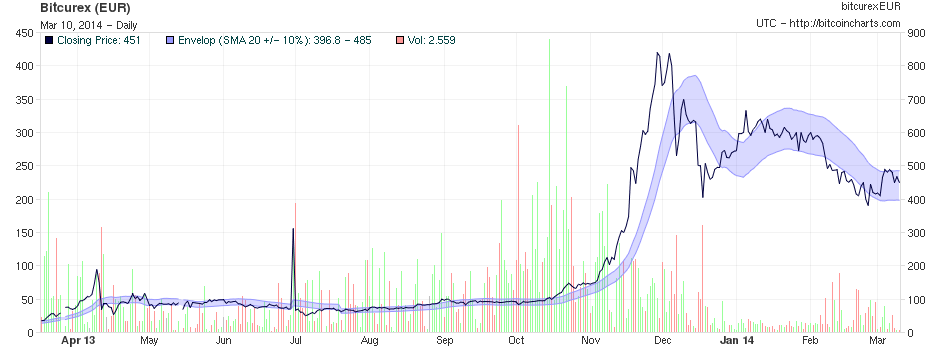

Bitcoin's allure in the Chinese market is not a new phenomenon, but recent economic challenges have amplified its significance. As the Chinese yuan faces depreciation amidst broader economic uncertainties, experts believe that Bitcoin might witness a substantial influx from Chinese investors. Markus Thielen, a prominent figure at Matrixport, underscores the potential of Bitcoin in these turbulent times. He suggests, "Given the current economic climate, the Chinese investors' familiarity and trust in Bitcoin could lead to substantial investments in the cryptocurrency over the next few months."

China's Economic Struggles: A Closer Look

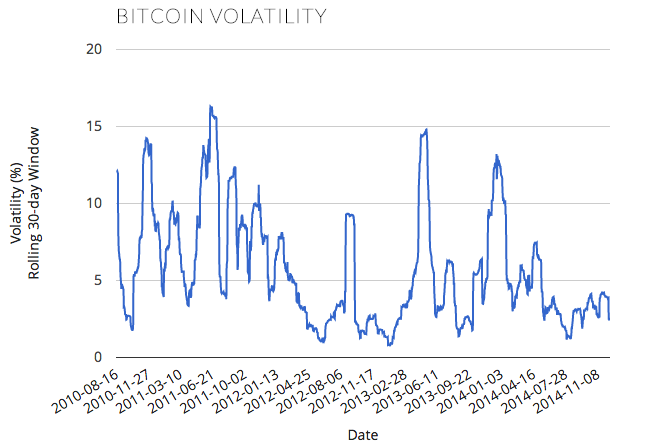

The economic landscape in China is undergoing a transformation. Recent data, sourced from reputable financial analysts at Bloomberg, paints a concerning picture. China's capital outflows have skyrocketed to an alarming $49 billion in August alone, a figure not seen since December 2015. This surge is more than just a statistic; it indicates the mounting pressure and dwindling confidence in the yuan. Thielen offers a deeper perspective on this trend, highlighting the stark economic disparities between the U.S. and China. He observes, "The current USD/CNY exchange rate, trading at a 17-year high, underscores the U.S. economy's robust expansion, casting a shadow on China's dwindling growth momentum."

The Cryptocurrency Solution: A Beacon for Chinese Investors?

The aftermath of the COVID-19 pandemic has left the Chinese economy in a state of flux. With the anticipated post-pandemic consumption rebound falling short of expectations and local companies grappling with diminishing profit margins, Chinese investors are in a quandary. They are actively seeking lucrative opportunities outside their homeland. However, China's stringent capital controls present formidable barriers. In this constrained financial environment, the allure of cryptocurrencies, especially Bitcoin, shines brightly. For many, Bitcoin and its peers represent a beacon of hope, potentially offering the alternative investment avenues that Chinese investors have been yearning for.

Historical Interplay: Bitcoin's Past Dance with China

The intricate relationship between Bitcoin and China is steeped in history. Rewinding to late 2016, there was a clear trend: Chinese investors, in large numbers, were turning to Bitcoin as a mechanism to move capital outside the restrictive borders of their country. The trading patterns from this era suggested a compelling link: as the Chinese yuan depreciated, Bitcoin's price surged, indicating a potential safe haven for Chinese capital.

A New Era: The Evolving Dynamics of Bitcoin in China

While history offers a treasure trove of insights, the present paints a nuanced picture. Edward Engel, a seasoned crypto analyst at Singular Research, believes that the dynamics between Bitcoin and China have undergone a transformation. Reflecting on the past, he states, "The last time I heard of such a trend was between 2017 and 2018 when underground banks leveraged Bitcoin for their operations. However, the CCP [Chinese Communist Party] has since taken stringent measures to curb such practices." Despite these changes, Thielen remains optimistic. He posits that innovative methods, such as leveraging domestic electricity for crypto mining or using over-the-counter trading platforms, might still offer avenues for moving Chinese capital in the face of restrictions.

Conclusion

China's multifaceted economic challenges, accentuated by its capital flight woes, present a conundrum that lacks easy solutions. In this complex scenario, Bitcoin emerges as a beacon, offering a potential lifeline to Chinese investors. Its decentralized nature and global appeal make it a contender for mitigating some of China's economic challenges. As we navigate the ever-evolving global financial landscape, the intricate dance between China's economy and the dynamic world of cryptocurrencies promises to be a riveting spectacle, deserving of our keen attention.

FAQ

What is China's capital flight? China's capital flight refers to the large-scale outflow of capital from the country, often due to economic uncertainties.

How is Bitcoin related to China's capital flight? With China's stringent capital controls and economic challenges, Bitcoin emerges as a potential alternative for investors to move and secure their capital.

Has Bitcoin historically been influenced by China's economic dynamics? Yes, in 2016, there was a trend of Chinese investors turning to Bitcoin as the yuan depreciated, indicating a potential correlation.

Are there restrictions on Bitcoin in China? While the Chinese government has taken measures to curb certain crypto practices, innovative methods still exist for Chinese investors to leverage cryptocurrencies.

Why is the Chinese yuan weakening? Economic challenges, post-COVID-19 consumption patterns, and broader global economic dynamics have contributed to the weakening of the yuan.

That's all for today

If you want more, be sure to follow us on:

NOSTR: croxroad@getalby.com

Instagram: @croxroadnews.co

Youtube: @croxroadnews

Store: https://croxroad.store

Subscribe to CROX ROAD Bitcoin Only Daily Newsletter

https://www.croxroad.co/subscribe

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.

-

-

@ f3df9bc0:a95119eb

2025-01-10 02:58:08

@ f3df9bc0:a95119eb

2025-01-10 02:58:08MPT Equations

Geometric Mean

$$ \bar{x} = (\prod_{i=1}^{n} x_i)^{1 \over n } $$

Covariance

$$ COV(x,y) = {1\over{n-1}} \sum_{i=1}^{n}{(x_i - \bar{x})(y_i - \bar{y})} $$

where $\bar{x}$ and $\bar{y}$ are the geometric mean.

Variance

$$ VAR(x) = {1\over{n-1}} \sum_{i=1}^{n}{(x_i - \bar{x})^2}

$$

Standard Deviation

$$ \sigma_x=\sqrt{VAR(x)} $$

Correlation Coefficient

$$ \rho_{xy} = {COV(x, y) \over \sigma_x\sigma_y} $$

Portfolio Variance

$$ VAR(P) = \sum_{ij}w_i w_j COV(i, j) $$

Where $w_i$ and $w_j$ are the normalized weight of the asset in the portfolio.

Note that this summation should include when $i = j$. In this case $COV(i, j) = VAR(i) = VAR(j)$

Expected Return

$$ E_P = \sum_{i}w_i E_i $$

Where $w_i$ is the normalized weight of the asset, and $E_i$ is the expected return of the individual asset.

-

@ 0b5faac9:12669905

2025-01-10 02:53:11

@ 0b5faac9:12669905

2025-01-10 02:53:11In modern society, signal jammers are increasingly used, especially in wireless communications and navigation. In certain application scenarios, they can have unexpected positive effects.

In a business environment, WiFi signal blocker can be used to protect corporate network security. For example, some companies may use WiFi jammers at important product launches or business meetings to prevent competitors from stealing information or eavesdropping. By limiting unnecessary wireless signals, such measures can effectively protect trade secrets.

GPS jammers can interfere with global positioning system signals, making it impossible for receiving devices to obtain accurate location data. In some cases, such as military operations, the use of GPS jammers can effectively prevent the enemy from using navigation systems for positioning and attack. This technology can provide tactical advantages to the military on the battlefield, ensuring the concealment and mobility of operations.

In addition, GPS jammers can also be used to protect privacy. In some specific scenarios, individuals or organizations may want to avoid being tracked or located. Using GPS jamming device can effectively prevent external devices from obtaining location, thereby protecting personal privacy and security.

High-power jammers are mainly used to interfere with signals with a wider range, and are usually used in the military and security fields. When defending important facilities, protecting military operations or conducting counter-terrorism activities, high-power jammers can effectively interfere with the enemy's communication and navigation systems to ensure the safety of one's own side.

For example, at important political meetings, international summits or major events, security departments may use high power jammer to prevent potential attacks or surveillance. By interfering with surrounding wireless signals, this equipment can provide a relatively safe environment for the scene.

With the continuous advancement and development of technology, the application scope of signal jammers may continue to expand. It is necessary for us to have a deep understanding of the functions and values of these technologies in order to better use them for our own use. Through the reasonable expression and understanding of data, we can look at the application prospects of these technologies more comprehensively.

-

@ fbf0e434:e1be6a39

2025-01-10 02:43:13

@ fbf0e434:e1be6a39

2025-01-10 02:43:13Hackathon 总结

由斯坦福区块链加速器、Nautilus Chain、Zebec 和 Rootz Labs 联合主办的“Boundless Hackathon @Stanford”圆满落幕,318名注册开发者参与了159个项目。本次活动聚焦于通过去中心化金融(DeFi)、游戏、NFT和基础设施开发等赛道推进Web3基础设施的建设。

本次黑客松得到了DoraHacks的支持,战略合作伙伴如IOBC Capital、Eclipse 和 OKX Wallet也做出了重要贡献。值得一提的是,Aspecta 在技术合作方面也发挥了积极作用。活动在斯坦福大学的闭幕式上圆满结束,顶级项目获得了来自总奖金池30万美元的奖励。一等奖获得者获得了10,000美元,并额外获得了包括亚马逊云信用在内的生态系统和技术奖金。

Boundless Hackathon促进了区块链社区的合作与创新,强调了跨区块链平台整合新技术的重要性。

Hackathon 获奖者

Main Prize Winners

- Hexlink:

Hexlink推出了一个模块化账户层,用于Web3,通过利用现有身份进行加密交易,模拟Web2体验。它消除了对种子短语的需求,通过在去中心化应用(dApps)中实现模块化身份认证,简化了入驻过程和安全性。 - Defi Board Options Exchange (DBOE):

DBOE提出了一种新型的链上中央限价订单簿(CLOB),结合先进的风险管理策略。这通过专用市场做市(DMM)系统,改善了市场基础设施,提高了价格发现和流动性。 - Nulink:

Nulink集成了用于dApp的隐私增强技术,采用基于加密学的共识机制,实现安全的应用开发,保障先进的数据隐私保护。

Sub-Award Winners

- Buff Network:

Buff Network是一个点对池衍生品交易平台,提供用户友好的界面以便高效执行交易。通过创新的交易解决方案,它提升了去中心化金融(DeFi)的参与度。 - PoseiSwap:

PoseiSwap通过扩展去中心化交易所(DEX)的功能,支持多种金融工具,实现DeFi和传统金融资产的无缝交换,从而改善了加密原生市场与传统市场的互操作性。

了解所有来自该黑客松的项目,请访问: https://dorahacks.io/hackathon/stanfordhack/buidl.

关于组织者:

斯坦福区块链加速器

斯坦福区块链加速器是由斯坦福大学学生和校友主办的非稀释性项目,隶属于斯坦福区块链俱乐部学生组织。该加速器为斯坦福的学生和校友团队提供5个月的孵化期,帮助他们建立、筹资并推出区块链项目。超过90%的毕业团队获得了领先基金的投资(累计筹集超过8000万美元),并且超过60%的团队在完成加速器项目后的6个月内实现了营收。

- Hexlink:

-

@ fbf0e434:e1be6a39

2025-01-10 02:42:43

@ fbf0e434:e1be6a39

2025-01-10 02:42:43Hackathon 总结

YQuantum 2024 Hackathon圆满结束,吸引了大量参与者和众多项目提交,被公认为一个充满活力的创新平台。300名注册者中,有现场参与者组建团队,参与了28个BUIDLs的开发,参与者在如QuEra Computing、IBM Quantum、Classiq、DoraHacks、SandboxAQ和Capgemini/The Hartford/Quantinuum等知名量子计算组织赞助的各个领域中挑战。

参与者在奖励的驱动下开发了突破性的量子计算解决方案,奖励包括量子云端积分、实习机会、社交机会以及潜在的演讲机会。大奖表彰了卓越项目,冠军获得了2000美元奖金,有机会在耶鲁大学研究人员面前进行展示,并参加耶鲁创新峰会。

Hackathon成功地培育了一个鼓励探索尖端技术和创意的合作环境,推动了量子计算领域的发展。YQuantum 2024强调了量子技术的潜力,并促进了参与者和赞助商之间的知识交流。

Hackathon 获奖者

于2024年4月13日举办的YQuantum首次活动吸引了来自10个国家的300名参与者,设有六个由行业赞助的挑战,并在一系列的著名奖项中进行竞争。

Institute Grand Prizes Winners

-

1st Place: Quantum Consortium: Case-Duke-Lehigh-Vandy Nexus 该项目采用绝热方法来准备反铁磁能量特征态,重点是量子多体伤痕状态和增强计算中的误差纠正。

-

2nd Place: Sparse Quantum State Preparation 团队利用Classiq的API开发了用于稀疏量子态准备的高效算法,优化了在量子数据管理中的可扩展性和效率执行。

-

3rd Place: QuBruin 该项目利用动态量子电路优化算法并增强误差纠正。团队通过基于Qiskit的模型改善了在噪声条件下的电路性能,提升了用户可访问性。

IBM Quantum Prize Winners

- Modified IBM Challenge

该项目探讨了基础的线性代数概念,强调核心原理的掌握。

QuEra Computing Prize Winners

- 3D Quantum Scars on 2D Tweezer Arrays

团队在一个投射到二维的三维晶格上研究量子伤痕状态,利用Julia和QuEra的Bloqade来模拟量子动力学。

Classiq Technologies Prize Winners

- YQuantum2024 Classiq Team 34 Wavefunction Wizards

项目聚焦于优化稀疏量子态准备,提高量子数据处理中的算法效率。

DoraHacks Prize Winners

- Spooner_QRNG_Classifier

项目使用Python脚本和梯度提升分类器,预测来自量子设备的随机二进制数据的来源,超越了基线预测准确率。

Capgemini // Quantinuum // The Hartford Prize Winners

-

Skittlez

该合作项目通过跨学科的专业知识解决量子计算挑战,设计创新的量子解决方案。 -

Honorable Mention: BB24 - Yale Quantum Monte Carlo 项目通过新的采样和编码方案增强了量子蒙特卡洛技术,提高了并行处理和计算效率。

SandboxAQ Prize Winners

-

QuantumQuails

项目通过量子化学改善了太阳能电池效率,利用变分量子本征求解器(VQE)建模太阳能吸收,以提高转换效果。 -

Honorable Mention: mRNA Sequence Design via Quantum Approximate Optimization Algorithm 项目通过QAOA优化了mRNA序列设计,利用密码子和核苷酸参数提高了蛋白质表达和结构稳定性。

在DoraHacks探索所有项目。

关于组织者:

YQuantum

YQuantum在技术和区块链领域中是一家知名实体,以其创新方法和战略举措而著称。YQuantum专注于利用量子计算能力,致力于推进技术前沿。虽然未具体列出项目,但YQuantum在塑造行业标准方面的作用,使其成为该领域的领导者。通过对尖端研究和开发的奉献,YQuantum继续推动量子技术的进步,致力于实现其促进全球科学和技术进步的使命。

-

-

@ fd06f542:8d6d54cd

2025-01-10 01:20:02

@ fd06f542:8d6d54cd

2025-01-10 01:20:02一直听说有个 nip50,但是没有太明白怎么用,今天测试了一下。明白了。 https://nos.today/search?q=client

wss://relay.noswhere.com/ wss://search.nos.today/ wss://relay.nostr.band/

支持搜索, 搜索事件:

{"kinds":[1],"search":"client","limit":100}测试代码: `import {WebSocket} from "ws" const relayUrl = 'wss://relay.nostr.band';

function sub(url,filter){ const relay = new WebSocket(url);

relay.onopen = () => { console.log('Connected to bootstrap relay'); // 查询中继列表 const query = ['REQ', 'subscription-id', filter]; relay.send(JSON.stringify(query)); };

relay.onmessage = (event) => { const data = JSON.parse(event.data); if (data[0] === 'EVENT' ) { const relayList = data[2].tags; console.log('Discovered relay list:', data[2].pubkey,relayList,data[2].content); // 连接到用户的中继 try{ relayList.forEach(([_, relayUrl]) => { const newRelay = new WebSocket(relayUrl); newRelay.onopen = () => { console.log(

Connected to relay: ${relayUrl}); }; }); } catch {}} };

} sub(relayUrl,{"kinds":[1],"search":"client","limit":100}) `

轻轻松松就出结果了。

-

@ 4ddeb0cf:94524453

2025-01-10 01:10:17

@ 4ddeb0cf:94524453

2025-01-10 01:10:17He'd fallen into a deep sleep when he felt something jolt his shoulder. "Richie, honey, you have to wake up. My boss will show up any minute and can't find you in here." Struggling to gain consciousness, he slowly peeled his eyes open and found the clock he'd remembered seeing when he lay down in a room behind the receptionist's office of Roosevelt Lodge. The kid could barely remember arriving, but fighting to stay awake after navigating the switchbacks down the western slope, he'd driven that drunkard and his truck as far as he could. He jumped out and hurried toward the light of the rustic building without knowing what to say to the maniac who'd offered him a ride from that Billings truck stop. Thank God she'd opened the door. It had been freezing when he knocked shortly after midnight. It appeared to be almost five in the morning. "I'm sorry honey, I know it's early, but I need this job, and he will not be happy if he sees you. You can use the trailhead to the north. It will get you to the closest highway, and you can maybe find a ride there. I would take you myself, but Okie likes me to stick around in the morning."

"Thank you, Ma'am. I really appreciate everything," the young man said, hurriedly putting on his Converse All-Stars. The two exchanged goodbyes as the lady went back to setting up. On his way out of the lodge's rear exit, he noticed a pack of Lucky Strikes sitting on a coffee table beside a copy of LIFE Magazine.

When Richie was eleven, he'd first had a cigarette on a dare from his little sister. They'd found a pack in their parent's room while playing hide and seek. After taking one and running outside with a matchbook, Sarah challenged him to smoke it. He remembered the first drag. While it was harsh, he'd watched his uncle smoke for years and once heard him sharing advice during a card game to inhale very softly at first until you got the hang of it. Uncle Joe had never meant for the lesson to ignite the habit in his nephew but had been too far gone into his bottle of Seagram's 7 to notice him listening.

Through the next few years, Richie became very smooth in taking a pack every few days from the drug store his grandfather had once owned. He'd be cautious to grab them after a larger crowd rolled through the store. The owner, an old friend of his now departed Grandpa, never noticed, and Richie would always leave the payment for them in the cash register.

The memory faded, and the reality of a Montana trailhead before sunrise refocused his concentration. Richie noticed only three cigarettes in the pack, reaching into his pocket to grab the loose change from the gas station incident. There were seven matches to work with. While he struggled to wake up, this find gave him a burst of excitement, and a smile came over his face. He dropped two nickels on the coffee stand and took the remaining pack.

Upon arriving at the trailhead, Richie buttoned his jacket in the chill morning air. It was near pitch black outside, with just enough moonlight to make out the pathway through the forest. He felt scared walking along, yet an air of confidence due to making it this far kept his steps moving forward. Richie began to wonder how far he'd walked when the rising sun put enough illumination through the treeline to make out the opening to a small parking lot adjoining a road. The morning was silent, and he began to yawn. The minimal sleep began to remind him of his exhaustion. The lady from the lodge, what was her name? She'd been so kind when he showed up in the middle of the night, still soaking wet from the melted ice picked up from the passage through the Rockies. As the events began to replay the prior evening's treacherous journey, Richie reached into his pocket to grab a smoke. He imagined his mother's gaze as he successfully ignited the first match and lit the tobacco. The moment was empowering. What were the other kids back in Ohio doing this morning? Though he couldn't ignore the dangerous risks he'd taken along the way, Richie Buckland felt genuine freedom for the first time in his life.

He sat down on a rock to enjoy his smoke and await an oncoming vehicle. Birds began to awaken, and their singing disrupted the silence in the air. His heart filled with gratitude for having dry clothes and a full canteen as he recognized how in sync he felt with the surrounding nature of Yellowstone National Park. That nice lady had even thrown a few Atomic Fireball candies in his knapsack. He still had the twenty dollars his Mom insisted he take with him, having no idea he'd intended to hitchhike to California. She'd known the entire family needed a breather after Richie's fight with his father that night. He thought about his last-second decision to punch the wall beside his father's head instead of hitting his face. That moment had been on his mind throughout this entire journey. Determined to get one last cigarette hit before giving his fingers a break from the closing heat, the birds suddenly began chirping more assertively and in greater numbers. It became alarmingly loud, then silent. As Richie started to reach toward the ground to put out the cigarette, he saw a shape emerge to the right. About twenty feet away, exiting the forest on the same side of the road, was what appeared to be a bear cub. As he took in the sight, another cub followed. Both were brown, and immediately behind them was the largest animal he'd ever seen. His parents had once taken the family to the zoo, but he'd not remembered anything like this. He sat in awe of the creature, followed by a third cub. As they began to cross the road, the large Grizzly paused and turned to look directly at him. Richie was determined to resist the instinctive surge of fear, but his body wouldn't have moved had he tried. Everything felt frozen as the gaze of the enormous animal seemed to determine Richie wasn't a threat. He didn't stare into the bear's eyes but didn't look away. After a few moments, the bears continued along their path until they were out of sight for a long time.

The sunrise of the new morning was breathtaking. After remaining seated on the rock for some time after the incident with the bears, Richie stood up. Taking a healthy drink of water from the canteen, he heard the shifting of gears in the distance. There was no need to look at the map; anywhere the next driver was heading worked. There was no way to know if Mama Grizzly would reevaluate what a human tasted like for breakfast. Richie couldn't wait to reach Sacramento and find Uncle Joe. The approaching Chevy Impala began to slow down upon seeing the teenager standing up, thumb extended.

-

@ df478568:2a951e67

2025-01-10 01:04:32

@ df478568:2a951e67

2025-01-10 01:04:32Note. I plan on publishing this on SubStack, but I will publish to nostr first.

Hello SubStack!

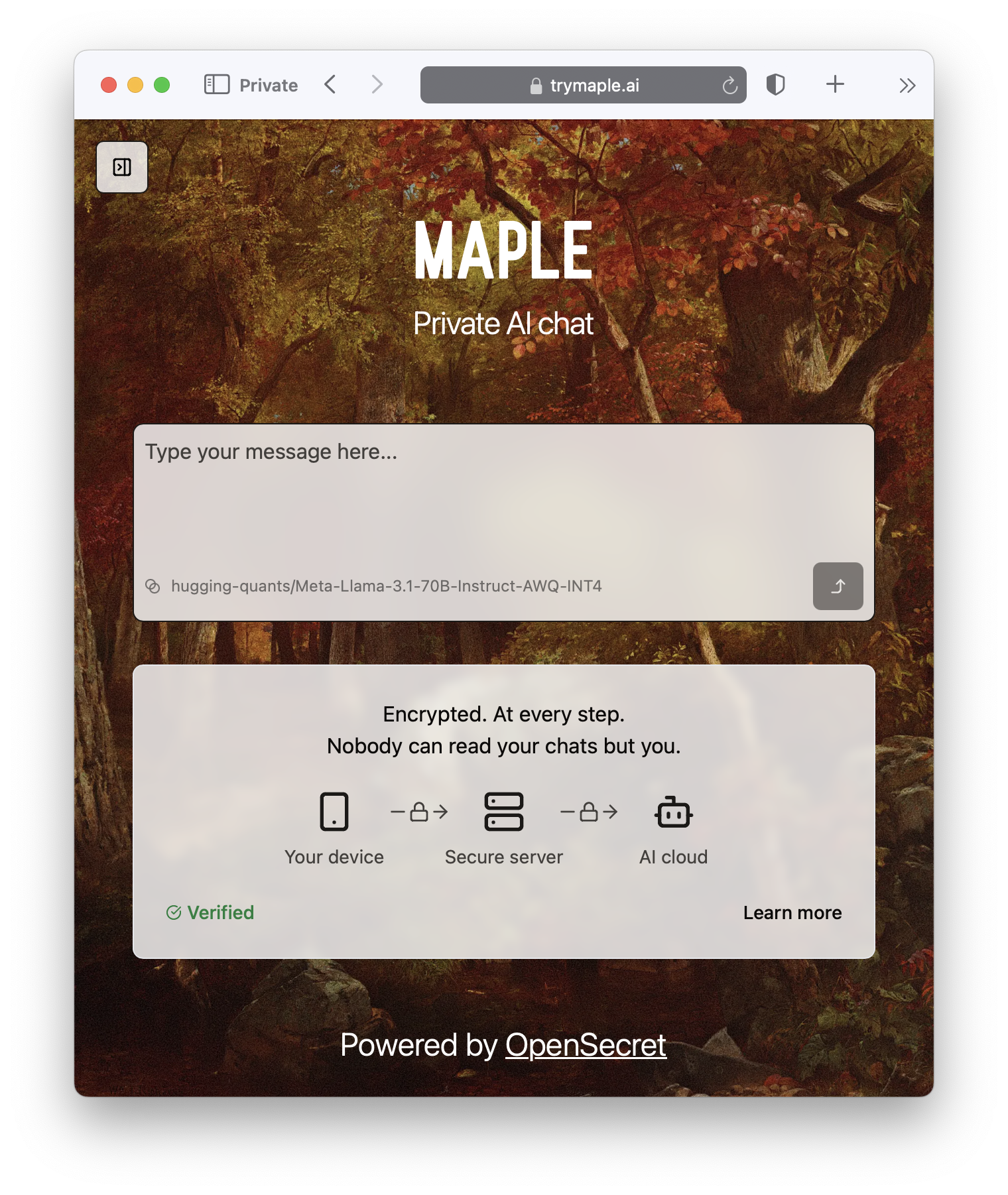

My government name is Marc. I write a blog about freedom tech on nostr. You can find this blog at npub.npub.pro. but I decided to cross post this blog on Substack because more people use Substack then habla.news. Here's a little more about the blog.

A Free And Open Source Blog

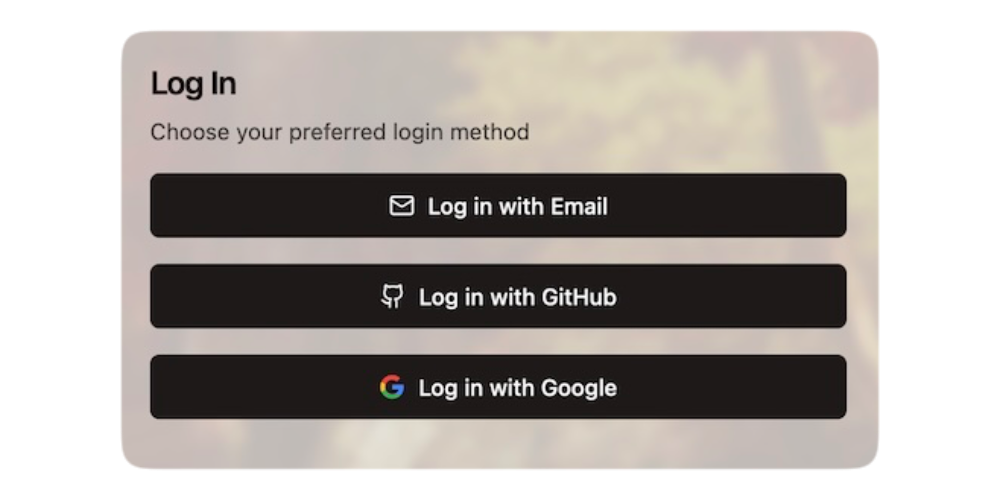

This blog is written using the Creative Commons 0 license. Since I write about free and open source software I call freedom tech. I thought it would be silly to keep my writing behind a paywall. I would rather my prose be available for free for all. This means all of my work is available for free, but to be honest, I like the subscription model. If SubStack gave me an option to charge sats, I would use their subscription service. Since they don't, I set up an account with Flash using Alby Hub.

Ads Suck, But Product Reviews Can Help Bootstrap The Circular Economy

Ads suck as much as paywalls, but I also wish to monetize this. Therefore, I have decided to try Jack Spirko's Membership Brigade model I learned about on The Side Hustle Show. I already was a member when I listened to this episode, bur the basic idea is ro charge $5.00 a month. For this price, Jack saves his listeners money by procuring discounts for products and services he uses and work great for him. He basically gives product reviews for his advertisers and his membership brigade receives discounts for those products and services. Since I'm just starting out, I don't have any discounts to offer yet, but I have some ideas. I also recommend free and open-source software that can save you money because it's free.

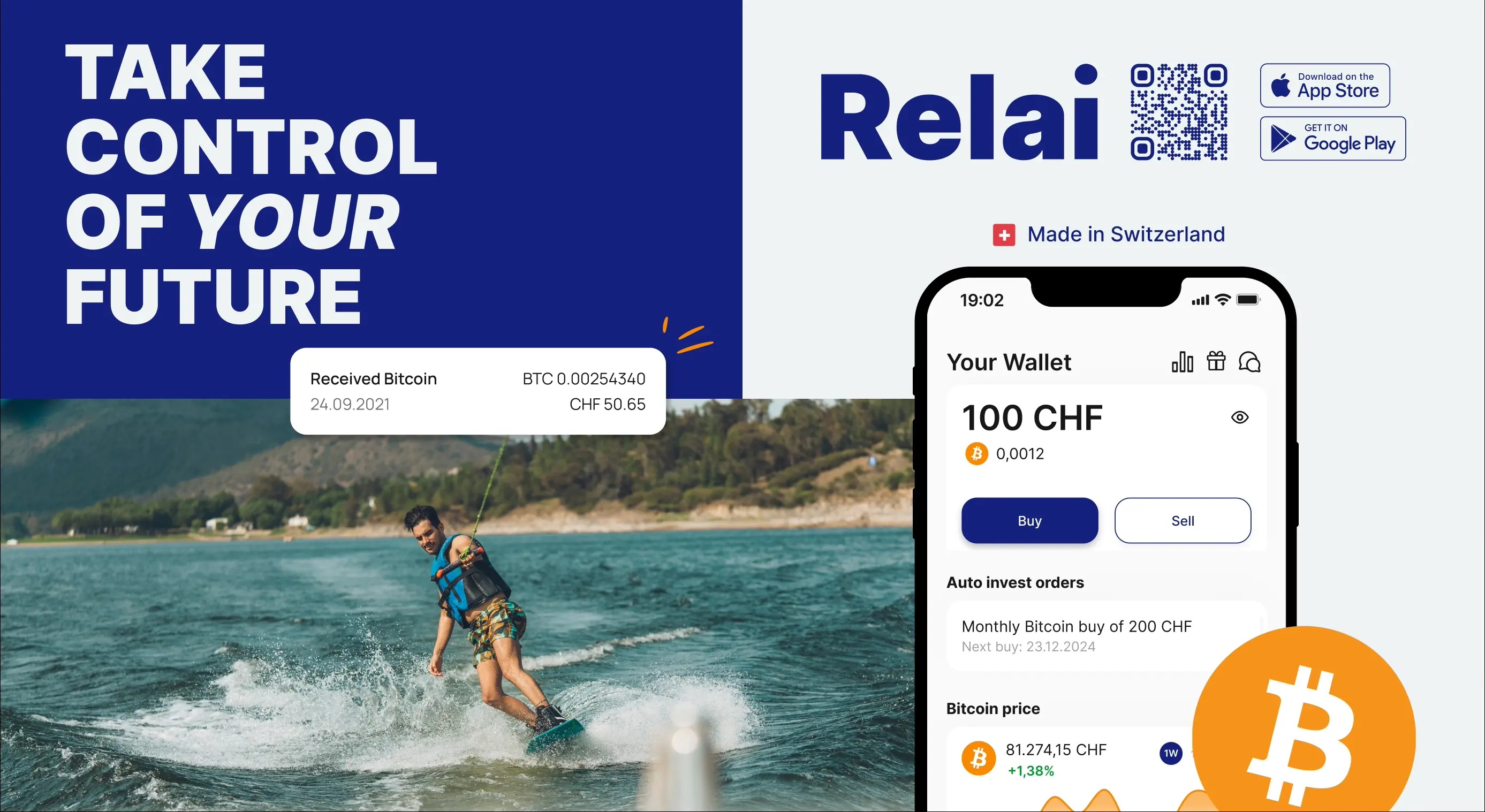

These are not ads. They are more like consumer reviews. There is a bitcoin circular economy developing on nostr. I want to recomend great products from this circular economy like LeatherMint's belts. They're not cheap, but very high quality. He hand crafts these belts to a size customized to yoir wasteline. He's from Canada and he sells these high quality belts for sats.

That was not an ad. It's my honest opinion. LeatherMint did not pay me to say this, but I wouldn't mind if he did. I give my recommendations to the Marc's Mention Members. The goal is to provide value by saving you sats. It's still a work in progress.

Shop Marc's Merch

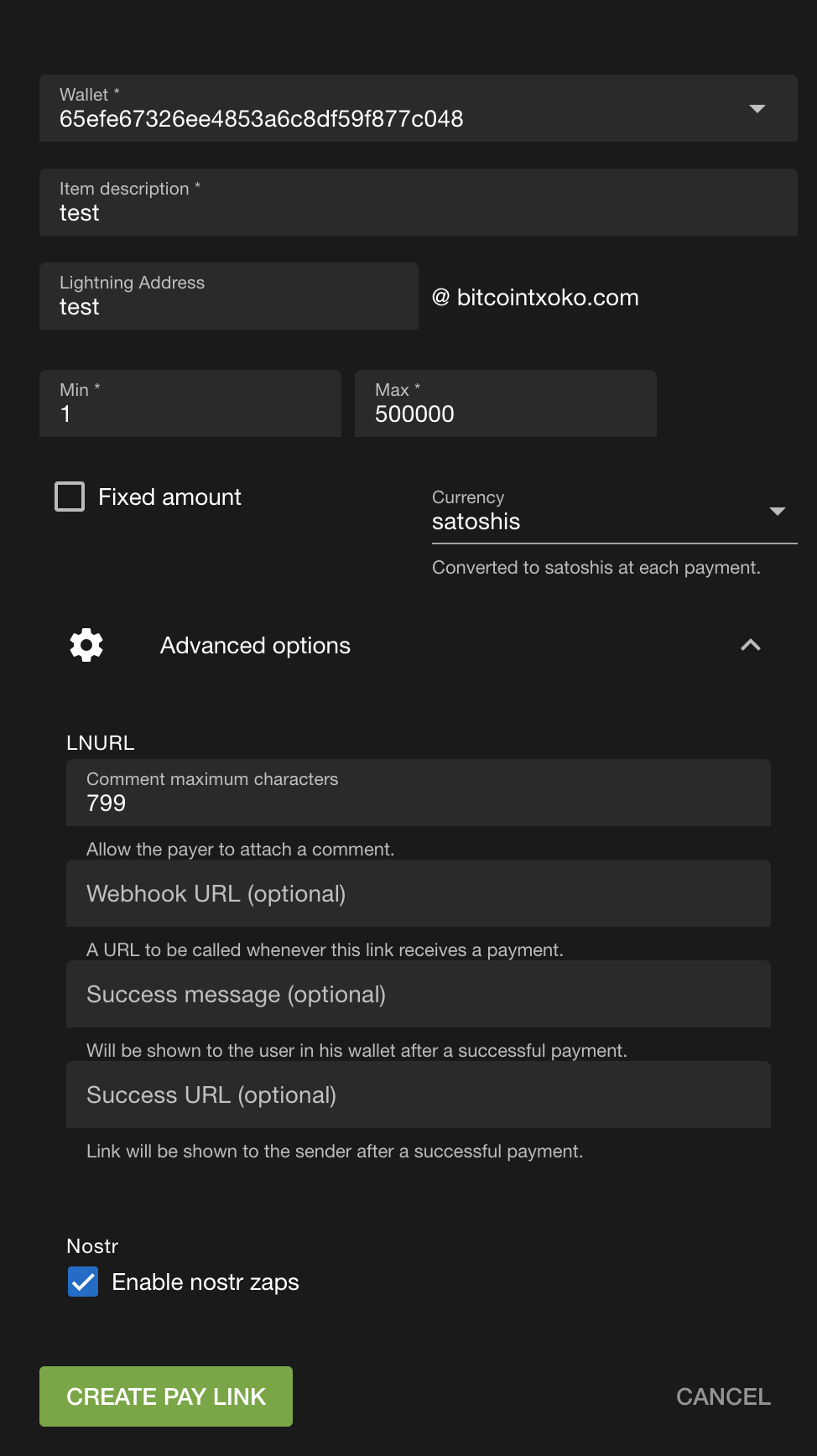

I also created a merch shop on shopstr.store. This is nostr-powered shopping, an online mall that uses the native currency of the Internet. This is a quintessential example of freedom tech. I don't have too many products, but my goal is to add more. I'm working on personalized coffee mugs, but I don't yet have a minimally viable product. Until then, I'll sell other stuff. I also must test it some more before I start taking real money. :)

Thanks for reading.

-

@ 4ddeb0cf:94524453

2025-01-10 01:00:15

@ 4ddeb0cf:94524453

2025-01-10 01:00:15He'd fallen into a deep sleep when he felt something jolt his shoulder. "Richie, honey, you have to wake up. My boss will show up any minute and can't find you in here." Struggling to gain consciousness, he slowly peeled his eyes open and found the clock he'd remembered seeing when he lay down in a room behind the receptionist's office of Roosevelt Lodge. The kid could barely remember arriving, but fighting to stay awake after navigating the switchbacks down the western slope, he'd driven that drunkard and his truck as far as he could. He jumped out and hurried toward the light of the rustic building without knowing what to say to the maniac who'd offered him a ride from that Billings diner. Thank God she'd opened the door. It had been freezing when he knocked shortly after midnight. It appeared to be almost five in the morning. "I'm sorry honey, I know it's early, but I need this job, and he will not be happy if he sees you. You can use the trailhead to the north. It will get you to the closest highway, and you can maybe find a ride there. I would take you myself, but Okie likes me to stick around in the morning."

"Thank you, Ma'am. I really appreciate everything," the young man said, hurriedly putting on his Converse All-Stars. The two exchanged goodbyes as the lady went back to setting up. On his way out of the lodge's rear exit, he noticed a pack of Lucky Strikes sitting on a coffee table beside a copy of LIFE Magazine.

When Richie was eleven, he'd first had a cigarette on a dare from his little sister. They'd found a pack in their parent's room while playing hide and seek. After taking one and running outside with a matchbook, Sarah challenged him to smoke it. He remembered the first drag. While it was harsh, he'd watched his uncle smoke for years and once heard him sharing advice during a card game to inhale very softly at first until you got the hang of it. Uncle Joe had never meant for the lesson to ignite the habit in his nephew but had been too far gone into his bottle of Seagram's 7 to notice him listening.

Through the next few years, Richie became very smooth in taking a pack every few days from the drug store his grandfather had once owned. He'd be cautious to grab them after a larger crowd rolled through the store. The owner, an old friend of his now departed Grandpa, never noticed, and Richie would always leave the payment for them in the cash register.

The memory faded, and the reality of a Montana trailhead before sunrise refocused his concentration. Richie noticed only three cigarettes in the pack, reaching into his pocket to grab the loose change from the gas station incident. There were seven matches to work with. While he struggled to wake up, this find gave him a burst of excitement, and a smile came over his face. He dropped two nickels on the coffee stand and took the remaining pack.

Upon arriving at the trailhead, Richie buttoned his jacket in the chill morning air. It was near pitch black outside, with just enough moonlight to make out the pathway through the forest. He felt scared walking along, yet an air of confidence due to making it this far kept his steps moving forward. Richie began to wonder how far he'd walked when the rising sun put enough illumination through the treeline to make out the opening to a small parking lot adjoining a road. The morning was silent, and he began to yawn. The minimal sleep began to remind him of his exhaustion. The lady from the lodge, what was her name? She'd been so kind when he showed up in the middle of the night, still soaking wet from the melted ice picked up from the passage through the Rockies. As the events began to replay the prior evening's treacherous journey, Richie reached into his pocket to grab a smoke. He imagined his mother's gaze as he successfully ignited the first match and lit the tobacco. The moment was empowering. What were the other kids back in Ohio doing this morning? Though he couldn't ignore the dangerous risks he'd taken along the way, Richie Buckland felt genuine freedom for the first time in his life.

He sat down on a rock to enjoy his smoke and await an oncoming vehicle. Birds began to awaken, and their singing disrupted the silence in the air. His heart filled with gratitude for having dry clothes and a full canteen as he recognized how in sync he felt with the surrounding nature of Yellowstone National Park. That nice lady had even thrown a few Atomic Fireball candies in his knapsack. He still had the twenty dollars his Mom insisted he take with him, having no idea he'd intended to hitchhike to California. She'd known the entire family needed a breather after Richie's fight with his father that night. He thought about his last-second decision to punch the wall beside his father's head instead of hitting his face. That moment had been on his mind throughout this entire journey. Determined to get one last cigarette hit before giving his fingers a break from the closing heat, the birds suddenly began chirping more assertively and in greater numbers. It became alarmingly loud, then silent. As Richie started to reach toward the ground to put out the cigarette, he saw a shape emerge to the right. About twenty feet away, exiting the forest on the same side of the road, was what appeared to be a bear cub. As he took in the sight, another cub followed. Both were brown, and immediately behind them was the largest animal he'd ever seen. His parents had once taken the family to the zoo, but he'd not remembered anything like this. He sat in awe of the creature, followed by a third cub. As they began to cross the road, the large Grizzly paused and turned to look directly at him. Richie was determined to resist the instinctive surge of fear, but his body wouldn't have moved had he tried. Everything felt frozen as the gaze of the enormous animal seemed to determine Richie wasn't a threat. He didn't stare into the bear's eyes but didn't look away. After a few moments, the bears continued along their path until they were out of sight for a long time.

The sunrise of the new morning was breathtaking. After remaining seated on the rock for some time after the incident with the bears, Richie stood up. Taking a healthy drink of water from the canteen, he heard the shifting of gears in the distance. There was no need to look at the map; anywhere the next driver was heading worked. There was no way to know if Mama Grizzly would reevaluate what a human tasted like for breakfast. Richie couldn't wait to reach Sacramento and find Uncle Joe. The approaching Chevy Impala began to slow down upon seeing the teenager standing up, thumb extended.

-

@ ae6ce958:d0f02c7d

2025-01-10 00:29:00

@ ae6ce958:d0f02c7d

2025-01-10 00:29:00In a strategic move to enhance accessibility and expand its reach, DamageBDD is proud to announce the listing of Damage Token (DAMAGE) on Coinstore, a leading centralized exchange (CEX). This step marks a significant milestone in our journey to provide seamless utility for our users while solidifying DamageBDD’s presence in the blockchain and verification ecosystem.

Why a Centralized Exchange (CEX)?

While DamageBDD has always championed decentralization and Bitcoin-first principles, we recognize the importance of meeting users where they are. Centralized exchanges play a pivotal role in the adoption curve by offering ease of use, robust liquidity, and a familiar interface for new and seasoned crypto enthusiasts alike. By listing on a CEX, DamageBDD lowers the entry barrier for users interested in leveraging Damage Token’s unique value proposition.

Why Coinstore?

The choice of Coinstore is intentional. Known for its user-friendly platform, broad global reach, and active engagement in emerging blockchain technologies, Coinstore aligns with DamageBDD’s vision of democratizing access to verification tools. Coinstore provides:

-

Wide User Base: Its growing community of traders ensures ample liquidity and market activity for Damage Token.

-

Security and Transparency: Coinstore's commitment to security mirrors our own principles of integrity and resilience.

-

Global Reach: With its focus on emerging markets, Coinstore allows DamageBDD to engage with a diverse and vibrant audience, including developers, investors, and enterprises who can benefit from DamageBDD’s verification features.

Utility Meets Accessibility

Listing on Coinstore is not about speculation but utility. Damage Token’s integration into the exchange allows developers, engineering managers, and organizations to acquire tokens effortlessly, unlocking the potential of DamageBDD for behavior-driven development (BDD) and milestone verification. This step enables smoother participation in our ecosystem while ensuring users can utilize Damage Tokens for real-world applications.

Bridging Fiat and Satoshis

Our strategy remains firmly rooted in bridging the fiat world with Bitcoin principles. By making Damage Token available on Coinstore, we provide a pathway for fiat-based users to access DamageBDD while continuing to uphold our Bitcoin-first ethos. This integration will help facilitate broader adoption, bringing the revolutionary capabilities of DamageBDD to a wider audience.

A Future of Greater Utility

This listing is just the beginning. DamageBDD is committed to continuously innovating and creating use cases that empower individuals and organizations. Whether through verifying software quality, enabling milestone-based payouts, or fostering a culture of accountability, Damage Token will remain a tool of pure utility in our collective pursuit of excellence.

The journey of DamageBDD is far from over, and we invite you to join us as we take this bold step forward. Together, let’s redefine the boundaries of development and verification, one token at a time.

Stay tuned for the official listing date and trading details on Coinstore.

-

-

@ bd4ae3e6:1dfb81f5

2025-01-09 21:44:14

@ bd4ae3e6:1dfb81f5

2025-01-09 21:44:14abstract

i'm writing this post to explain its title without me explaining it every time i talk about nostr or bitcoin and say im studying/working on them, and people immediately ask me about crypto. this would be helpful to clarify this for those overwhelmed with information from crypto projects advertising themselves as a decentralized system.

note: this post is not about financial markets and this stuff at all!

note 2: this post is not technical. i wrote it to make my life easier, and it may also make yours.

what happened?

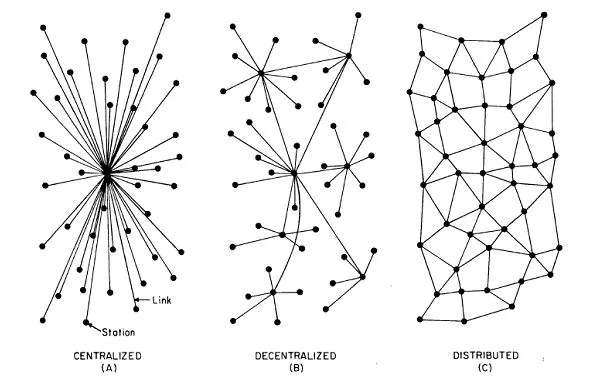

around 16 years ago a cypherpunk called satoshi nakamoto published a standard called bitcoin: a peer-to-peer electronic cash system. the purpose was to define a decentralized cash system in simple terms. he used a data structure called blockchain that links some blocks of data containing changes in the balance state in the current block and adds a new one to it every 10 minutes.

later some guys started creating copies of bitcoin called altcoins such as ethereum or litecoin and more. over time the word

decentralizedbecame a fancy word and they were able to earn a lot of money using it. so, more people did it.current state

these altocins have become more famous and more people are familiar with them. now here are some points that make all of these projects different from bitcoin:

-

bitcoin network has a lot of nodes running and validating network and checking transactions with a huge hash rate. anyone can join this network without any permissions. on the other hand, most crypto projects need a high-spec device and tokens to stake (since most of them are proof-of-stake or something similar) and there are a lot more tokens on hand of specific people so they can have more shares on voting. (since bitcoin is proof-of-work you won't need coins to have the right to vote)

-

decentralization is not only in a network of nodes. a decentralized system has no one in charge to check its security. when we run a bitcoin core node, there is some code running and this code will take actions which are our votes. bitcoin-core code is one of the most reviewed code bases and a lot of people will observe and review its changes. on the other hand, you can simply check all crypto projects and you can see how their code base is managed. you can see lots of changes are applied by a small group of people without any review.

-

there is a lot of pre-mined/minted coins controlled by teams, early users, vcs, and more in crypto projects. most of them can be mined or minted to infinity. which makes your coins lose their value over time since there is more of it out there, the same as fiat currency. but bitcoin is simple and fair: do work, get the reward. and coins are limited to 21 million. nobody doesn't have printed coins.

-

all crypto projects have a not anonymous team who are out there and the government has access to them. when this team or related people to it publish unexpected stuff on social, get arrested or anything like that, it will impact the whole ecosystem the things you hold which called coins. on the other hand the first guys behind bitcoin are gone now and we don't know him at all. and we don't have anything called bitcoin foundation officially. all of the people working on bitcoin are plebs such as me and you. so, there is now a central point of failure. for a better example search for the story of pavel durove and what happened to his project called

the open networkwhen france government arrested him.

so, they are not

blockchains? you may think anything referred to as a p2p network or a blockchain is decentralized. this is not true. in simple terms, a blockchain is a data structure that we can use to store and maintain data using it. a decentralized system is something that no one can control it directly or censor it. for example bitcoin is a decentralized blockchain (and the only one), but nostr is a decentralized protocol that is not a blockchain, or hyperledger fabric based projects are blockchain, but they are not decentralized.answer to you possible questions:

- q. bitcoin is slow and requires high fees, what should we do?

-

a: lighting is a layer-2 off-chin solution that help us to make zero-fee transactions with the speed of lightning.

note: lighting is not another blockchain or token, it's bitcoin itself.

-

q: there are no smart contracts on bitcoin, what should we do?

- a: to be honest we don't need them. 99% percent of smart contracts are solving issues made by themselves and they don't fix any real issues. they are just super fancy. most of the real use cases they claim they can have are not implemented and don't work. and the rest is possible with nostr, really decentralized, and it's working.

then what is nostr?

nostr is a protocol. it's a set of rules which defined for communication between servers and apps on the web, mobile, or desktop. developers can write software that follows these rules to create social media and more. the resulting app is not a platform or something like that. for example x, meta, bluesky, and more. you control your client and you have the right to connect to any server managed by different people even yourself. and non of the actors in this system won't need permission for this. this is something like http. you can see a lot of websites accessible using http protocol and you can access them using different browsers. the website knows how to return stuff when someone calls them using

http://....and your browser knows how to show this stuff to you. the website you or the owner don't need to ask for permissions from something called http platform. this is just a way to and the website can talk to each other.conclusion

crypto is not the same as bitcoin. nostr is not a blockchain. any blockchain is not decentralized and any decentralized thing is not a blockchain.

this article is draft-1. if you have any ideas for improvement, please tell me or add comments. but consider that i try my best to keep this short, simple, without technical words, and clear.

-

-

@ d830ee7b:4e61cd62

2025-01-08 07:56:25

@ d830ee7b:4e61cd62

2025-01-08 07:56:25การเผชิญหน้า (The Collision Point)

กลางปี 2017 ที่ร้านคราฟท์เบียร์เล็ก ๆ ในย่านเกาะเกร็ด นนทบุรี อากาศร้อนจนเครื่องปรับอากาศ (ที่ยังไม่มี) ในร้านทำงานหนักแทบไหม้ "แจ๊ก กู้ดเดย์" (Jakk Goodday) นั่งลงบนเก้าอี้ไม้ที่เจ้าของร้านกันไว้ให้เป็นประจำ ราวกับเขาเป็นลูกค้าขาประจำระดับวีไอพี

กลิ่นกาแฟคั่ว ลอยผสมกับไอความร้อนจากนอกหน้าต่าง (ผิดร้านหรือเปล่า?) เกิดเป็นบรรยากาศขมติดปลายลิ้นชวนให้คนจิบแล้วอยากถอนใจ

เขาเหลือบมองออกไปนอกหน้าต่าง.. เห็นแสงแดดแผดเผาราวกับมันรู้ว่าสงคราม Blocksize กำลังคุกรุ่นขึ้นอีกครั้ง

บรรยากาศนอกหน้าต่างกับใน ฟอรัม Bitcointalk ช่างเหมือนกันจนน่าขนลุก มันร้อนแรง ไร้ความปรานี

แจ๊กเปิดแล็ปท็อป กดเข้าเว็บฟอรัม พอเสียงแจ้งเตือน “—ติ๊ง” ดังขึ้น คิ้วของเขาก็ขมวดเล็กน้อย คล้ายได้กลิ่นดินปืนกลางสนามรบ

“โรเจอร์ แวร์ (Roger Ver) ไลฟ์เดือดลั่นเวที!” “ปีเตอร์ วูเล (Pieter Wuille) โต้กลับเรื่อง SegWit!” “Hard Fork ใกล้ถึงจุดปะทะแล้ว!”

แจ๊กคลิกเข้าไปในลิงก์ของไลฟ์ทันที เหมือนมือของเขาไม่ต้องการคำสั่งจากสมอง ความคุ้นเคยกับเหตุการณ์แบบนี้บอกเขาว่า นี่ไม่ใช่ดีเบตธรรมดา แต่มันอาจเปลี่ยนอนาคตของ Bitcoin ได้จริง ๆ

เห็นแค่พาดหัวสั้น ๆ แต่ความตึงเครียดก็ชัดเจนขึ้นเรื่อย ๆ ทุกข้อความเหมือนสุมไฟใส่ใจกองหนึ่งที่พร้อมระเบิดได้ทุกเมื่อ

โทรศัพท์ของแจ๊กดังพร้อมปรากฏชื่อ แชมป์ ‘PIGROCK’ ลอยขึ้นมา เขาหยิบขึ้นมารับทันที

“ว่าไงวะแชมป์… มีอะไรด่วนหรือเปล่า?” น้ำเสียงแจ๊กฟังดูเหมือนง่วง ๆ แต่จริง ๆ เขาพร้อมจะลุกมาวิเคราะห์สถานการณ์ให้ฟังทุกเมื่อ

“พี่แจ๊ก.. ผมอ่านดีเบตเรื่อง SegWit ในฟอรัมอยู่ครับ บางคนด่าว่ามันไม่ได้แก้ปัญหาจริง ๆ บ้างก็บอกถ้าเพิ่ม Blocksize ไปเลยจะง่ายกว่า... ผมเลยสงสัยว่า Hard Fork ที่เค้าพูดถึงกันนี่คืออะไร ใครคิดอะไรก็ Fork กันได้ง่าย ๆ เลยเหรอ"

"แล้วถ้า Fork ไปหลายสาย สุดท้ายเหรียญไหนจะเป็น ‘Bitcoin ที่แท้จริง’ ล่ะพี่?”

“แล้วการ Fork มันส่งผลกับนักลงทุนยังไงครับ? คนทั่วไปอย่างผมควรถือไว้หรือขายหนีตายดีล่ะเนี่ย?”

แจ๊กยิ้มมุมปาก ชอบใจที่น้องถามจี้จุด

“เอางี้… การ Fork มันเหมือนแบ่งถนนออกเป็นสองสาย ใครชอบกติกาเก่าก็วิ่งถนนเส้นเก่า ใครอยากแก้กติกาใหม่ก็ไปถนนเส้นใหม่"

"แต่ประเด็นคือ... นี่ไม่ใช่เรื่องเล็ก ๆ เพราะมีผลต่ออัตลักษณ์ของ Bitcoin ทั้งหมดเลยนะมึง—ใครจะยอมปล่อยผ่านง่าย ๆ”

"คิดดูสิ ถ้าครั้งนี้พวกเขา Fork จริง มันอาจไม่ได้เปลี่ยนแค่เครือข่าย แต่เปลี่ยนวิธีที่คนมอง Bitcoin ไปตลอดกาลเลยนะ"

"แล้วใครมันจะอยากลงทุนในระบบที่แตกแยกซ้ำแล้วซ้ำเล่าวะ?"

“งั้นหมายความว่าตอนนี้ก็มีสองแนวใหญ่ ๆ ชัวร์ใช่ไหมครับ?” แชมป์ถามต่อ

“ฝั่ง โรเจอร์ แวร์ ที่บอกว่าต้องเพิ่ม Blocksize ให้ใหญ่จุใจ กับฝั่งทีม Core อย่าง ปีเตอร์ วูเล ที่ยืนยันต้องใช้ SegWit ทำให้บล็อกเบา ไม่กระทบการกระจายอำนาจ?”

“ใช่เลย” แจ๊กจิบกาแฟดำเข้ม ๆ ผสมน้ำผึ้งไปหนึ่งอึก

“โรเจอร์นี่เขาเชื่อว่า Bitcoin ต้องเป็นเงินสดดิจิทัลที่ใช้จ่ายไว ค่าธรรมเนียมไม่แพง ส่วนปีเตอร์กับ Bitcoin Core มองว่าการเพิ่มบล็อกเยอะ ๆ มันจะไปฆ่า Node รายย่อย คนไม่มีทุนก็รัน Node ไม่ไหว สุดท้าย Bitcoin จะกลายเป็นระบบกึ่งรวมศูนย์ ซึ่งมันผิดหลักการเดิมของ ซาโตชิ ไงล่ะ”

“ฟังแล้วก็ไม่ใช่เรื่องง่ายนะพี่… งั้นที่ผมได้ยินว่า จิฮั่น อู๋ (Jihan Wu) เจ้าของ Bitmain ที่ถือ Hashrate เกินครึ่งนี่ก็มาอยู่ฝั่งเดียวกับโรเจอร์ใช่ไหม?"

"เพราะยิ่งบล็อกใหญ่ ค่าธรรมเนียมยิ่งเพิ่ม นักขุดก็ได้กำไรสูงขึ้นใช่ป่ะ?”

“ไอ้เรื่องกำไรก็ส่วนหนึ่ง...” แจ๊กถอนหายใจ

“แต่ที่สำคัญกว่านั้นคืออำนาจต่อรอง… ตอนประชุมลับที่ฮ่องกงเมื่อปีที่แล้ว พี่เองก็ถูกชวนให้เข้าไปในฐานะคนกลาง เลยเห็นภาพน่าขนลุกอยู่หน่อย ๆ"

"จิฮั่นนั่งไขว่ห้างด้วยสีหน้ามั่นใจมาก ด้วย Hashrate ราว 60% ของโลก สั่งซ้ายหันขวาหันเหมือนเป็นแม่ทัพใหญ่ได้เลย พอโรเจอร์ก็ไฟแรงอยู่แล้ว อยากให้ Bitcoin ครองโลกด้วยวิธีของเขา สองคนนี่จับมือกันทีจะเขย่าชุมชน Bitcoin ได้ทั้งกระดาน”

"พี่รู้สึกเหมือนนั่งอยู่ในศึกชิงบัลลังก์ยุคใหม่ คนหนึ่งยึดพลังขุด คนหนึ่งยึดความศรัทธาในชื่อ Bitcoin แต่สิ่งที่พี่สงสัยในตอนนั้นคือ… พวกเขาสู้เพื่อใครกันแน่?"

แชมป์เงียบไปครู่เหมือนกำลังประมวลผล “แล้วตอนนั้นพี่คิดยังไงบ้างครับ? รู้สึกกลัวหรือว่ายังไง?”

“จะไม่กลัวได้ไง!” แจ๊กหัวเราะแห้ง ๆ แวบหนึ่งก็นึกถึงสีหน้าที่ยิ้มเยาะของทั้งคู่ตอนประกาศความพร้อมจะ Fork

“พี่อดคิดไม่ได้ว่าถ้า Core ยังไม่ยอมขยายบล็อก พวกนั้นจะลากนักขุดทั้งกองทัพแฮชเรตไปทำเครือข่ายใหม่ให้เป็น ‘Bitcoin สายใหญ่’ แล้วทิ้งเครือข่ายเดิมให้ซวนเซ"

"แค่คิดก็นึกถึงสงครามกลางเมืองในหนังประวัติศาสตร์แล้วน่ะ.. แตกเป็นสองฝ่าย สุดท้ายใครแพ้ใครชนะ ไม่มีใครทำนายได้จริง ๆ”

พูดจบ.. เขาเปิดฟอรัมดูไลฟ์ดีเบตจากงานในปี 2017 ต่อ โรเจอร์ แวร์ กำลังพูดในโทนร้อนแรง

“Bitcoin ไม่ใช่ของคนรวย! ถ้าคุณไม่เพิ่ม Blocksize คุณก็ทำให้ค่าธรรมเนียมพุ่งจนคนธรรมดาใช้ไม่ได้!”

ขณะเดียวกัน ปีเตอร์ วูเล่ ยืนอยู่ฝั่งตรงข้าม สีหน้าเยือกเย็นราวกับตั้งรับมานาน “การเพิ่มบล็อกคือการทำลายโครงสร้าง Node รายย่อยในระยะยาว แล้วมันจะยังเรียกว่ากระจายอำนาจได้หรือ?”

"ถ้าคุณอยากให้ Bitcoin เป็นของคนรวยเพียงไม่กี่คน ก็เชิญขยายบล็อกไปเถอะนะ แต่ถ้าอยากให้มันเป็นระบบที่คนทุกระดับมีส่วนร่วมจริง ๆ ..คุณต้องฟังเสียง Node รายเล็กด้วย" ปีเตอร์กล่าว

เสียงผู้คนในงานโห่ฮากันอย่างแตกเป็นสองฝ่าย บ้างก็เชียร์ความตรงไปตรงมาของโรเจอร์ บ้างก็เคารพเหตุผลเชิงเทคนิคของปีเตอร์

ข้อความจำนวนมหาศาลในฟอรัมต่างโหมกระพือไปต่าง ๆ นานา มีทั้งคำด่าหยาบคายจนแจ๊กต้องเบือนหน้า ตลอดจนการวิเคราะห์ลึก ๆ ถึงอนาคตของ Bitcoin ที่อาจไม่เหมือนเดิม

ในระหว่างนั้น.. แชมป์ส่งข้อความ Discord กลับมาอีก

“พี่ ถ้า Fork จริง ราคาจะป่วนแค่ไหน? ที่เขาว่าคนถือ BTC จะได้เหรียญใหม่ฟรี ๆ จริงไหม? ผมกลัวว่าถ้าเกิดแบ่งเครือข่ายไม่รู้กี่สาย ตลาดอาจมั่วจนคนหายหมดก็ได้ ใช่ไหมครับ?”

"แล้วถ้าเครือข่ายใหม่ล้มเหลวล่ะครับ? จะส่งผลอะไรต่อชุมชน Bitcoin เดิม?"

"ไอ้แชมป์มึงถามรัวจังวะ!?" แจ๊กสบถเพราะเริ่มตั้งรับไม่ทัน

“ก็ขึ้นกับตลาดจะเชื่อว่าสายไหนเป็น ‘ของจริง’ อีกนั่นแหละ” แจ๊กพิมพ์กลับ

“บางคนถือไว้เผื่อได้เหรียญใหม่ฟรี บางคนขายหนีตายก่อน"

"พี่เองก็ยังไม่กล้าการันตีเลย แต่ที่แน่ ๆ สงครามนี้ไม่ได้มีแค่ผลกำไร มันกระทบศรัทธาของชุมชน Bitcoin ทั้งหมดด้วย"

"ถ้าชาวเน็ตเลิกเชื่อมั่น หรือคนนอกมองว่าพวกเราทะเลาะกันเองเหมือนเด็กแย่งของเล่น ต่อให้ฝั่งไหนชนะ ก็อาจไม่มีผู้ใช้เหลือให้ฉลอง”

แล้วสายตาแจ๊กก็ปะทะกับกระทู้ใหม่ที่เด้งขึ้นมาบนหน้าฟอรัม

“โรเจอร์ แวร์ ประกาศ: ถ้าไม่เพิ่ม Blocksize เราจะฟอร์กเป็น Bitcoin ที่แท้จริง!”

ตัวหนังสือหนาแปะอยู่ตรงนั้นส่งแรงสั่นสะเทือนราวกับจะดึงคนในวงการให้ต้องเลือกข้างกันแบบไม่อาจกลับหลังได้

แจ๊กเอื้อมมือปิดแล็ปท็อปช้า ๆ คล้ายยอมรับความจริงว่าหนทางประนีประนอมอาจไม่มีอีกแล้ว..

“สงครามนี่คงใกล้ระเบิดเต็มทีล่ะนะ” เขาลุกจากเก้าอี้ สะพายเป้ พึมพำกับตัวเองขณะมองกาแฟดำที่เหลือครึ่งแก้ว “ถ้าพวกเขาฟอร์กจริง โลกคริปโตฯ ที่เราเคยรู้จักอาจไม่มีวันเหมือนเดิมอีกต่อไป”

เขามองออกไปนอกหน้าต่าง แสงแดดที่แผดเผาราวกับกำลังบอกว่า.. อนาคตของ Bitcoin อยู่ในจุดที่เส้นแบ่งระหว่างชัยชนะกับความล่มสลายเริ่มพร่าเลือน... และอาจไม่มีทางย้อนกลับ

ก่อนเดินออกจากร้าน เขากดส่งข้อความสั้น ๆ ถึงแชมป์

“เตรียมใจกับความปั่นป่วนไว้ให้ดี ไม่แน่ว่าเราอาจจะได้เห็น Bitcoin แตกเป็นหลายสาย.. ใครจะอยู่ใครจะไปไม่รู้เหมือนกัน แต่เรื่องนี้คงไม่จบง่าย ๆ แน่”

แจ๊กผลักประตูออกไปพบกับแดดจัดที่เหมือนแผดเผากว่าเดิม พายุร้อนไม่ได้มาแค่ในรูปความร้อนกลางกรุง แต่มาในรูป “สงคราม Blocksize” ที่พร้อมจะฉีกชุมชนคริปโตออกเป็นฝักฝ่าย และอาจลามบานปลายจนกลายเป็นศึกประวัติศาสตร์

ทว่าสิ่งที่ค้างคาใจกลับเป็นคำถามนั้น…

เมื่อเครือข่ายแบ่งเป็นหลายสายแล้ว เหรียญไหนจะเป็น Bitcoin จริง?

หรือบางที... ในโลกที่ใครก็ Fork ได้ตามใจ เราจะไม่มีวันได้เห็น “Bitcoin หนึ่งเดียว” อีกต่อไป?

คำถามที่ไม่มีใครตอบได้ชัดนี้ส่องประกายอยู่ตรงปลายทาง ราวกับป้ายเตือนว่า “อันตรายข้างหน้า” และคนในชุมชนทั้งหมดกำลังจะต้องเผชิญ…

โดยไม่มีใครมั่นใจเลยว่าจะรอด หรือจะแตกสลายไปก่อนกันแน่...

สองเส้นทาง (The Forked Path)

กลางปี 2017 ท้องฟ้าเหนือบุรีรัมย์ยังคงคุกรุ่นด้วยไอแดดและความร้อนแรงของสงคราม Blocksize แจ๊ก กู้ดเดย์ ก้าวเข้ามาในคาเฟ่เล็ก ๆ แห่งหนึ่งในย่านเทศบาลด้วยสีหน้าครุ่นคิด เขาพยายามมองหามุมสงบสำหรับนั่งตั้งหลักในโลกความเป็นจริง ก่อนจะจมดิ่งสู่สงครามในโลกดิจิทัลบนฟอรัม Bitcointalk อีกครั้ง

กลิ่นกาแฟคั่วเข้มลอยกระทบจมูก แจ๊กสั่งกาแฟดำแก้วโปรดแล้วปลีกตัวมาที่โต๊ะริมกระจก กระจกบานนั้นสะท้อนแสงอาทิตย์จัดจ้า ราวกับจะบอกว่าวันนี้คงไม่มีใครหนีความร้อนที่กำลังแผดเผา ทั้งในอากาศและในชุมชน Bitcoin ได้พ้น

เขาเปิดแล็ปท็อปขึ้น ล็อกอินเข้า Bitcointalk.org ตามเคย ข้อความและกระทู้มากมายกระหน่ำแจ้งเตือน ไม่ต่างอะไรจากสมรภูมิคำพูดที่ไม่มีวันหลับ “Hong Kong Agreement ล้มเหลวจริงหรือ?” “UASF คือปฏิวัติโดย Node?” เหล่านี้ล้วนสะท้อนความไม่แน่นอนในชุมชน Bitcoin ที่ตอนนี้ ดูคล้ายจะถึงจุดแตกหักเต็มที...

“ทั้งที่ตอนนั้นเราก็พยายามกันแทบตาย…” แจ๊กพึมพำ มองจอด้วยสายตาเหนื่อยใจพร้อมภาพความทรงจำย้อนกลับเข้าในหัว เขายังจำการประชุมที่ฮ่องกงเมื่อต้นปี 2016 ได้แม่น ยามนั้นความหวังในการประนีประนอมระหว่าง Big Block และ Small Block ดูเป็นไปได้ หากแต่กลายเป็นละครฉากใหญ่ที่จบลงโดยไม่มีใครยอมถอย...

...การประชุม Hong Kong Agreement (2016)

ภายในห้องประชุมหรูของโรงแรมใจกลางย่านธุรกิจฮ่องกง บรรยากาศตึงเครียดยิ่งกว่าการเจรจาสงบศึกในสมัยโบราณ

โรเจอร์ แวร์ ยืนเสนอว่า “การเพิ่ม Blocksize สำคัญต่ออนาคตของ Bitcoin — เราอยากให้คนทั่วไปเข้าถึงได้โดยไม่ต้องจ่ายค่าธรรมเนียมแพง ๆ”

“จิฮั่น อู๋ (Jihan Wu)” จาก Bitmain นั่งฝั่งเดียวกับโรเจอร์ คอยเสริมว่าการเพิ่มบล็อกคือโอกาสสำหรับนักขุด และหากทีม Core ไม่ยอม พวกเขาก็พร้อม “ดัน Fork” ขึ้นได้ทุกเมื่อ ด้วย Hashrate มหาศาลที่พวกเขาคุมไว้

ฝั่ง ปีเตอร์ วูเล (Pieter Wuille) กับ เกร็ก แมกซ์เวลล์ (Greg Maxwell) จาก Bitcoin Core เถียงกลับอย่างใจเย็นว่า “การขยายบล็อกอาจดึงดูดทุนใหญ่ ๆ แล้วไล่ Node รายย่อยออกไป ชุมชนอาจไม่เหลือความกระจายอำนาจอย่างที่ Satoshi ตั้งใจ”

สุดท้าย บทสรุปที่เรียกว่า Hong Kong Agreement ลงนามได้ก็จริง แต่มันกลับเป็นแค่ลายเซ็นบนกระดาษที่ไม่มีฝ่ายไหนเชื่อใจใคร

แจ๊กเบือนสายตาออกนอกหน้าต่าง สังเกตเห็นผู้คนเดินขวักไขว่ บ้างก็ดูรีบร้อน บ้างเดินทอดน่องเหมือนว่างเปล่า นี่คงไม่ต่างอะไรกับชาวเน็ตในฟอรัมที่แบ่งฝ่ายกันใน “สงคราม Blocksize” อย่างไม่มีทีท่าจะหยุด

แค่ไม่กี่นาที... เสียงโทรศัพท์ก็ดังขึ้น ชื่อ แชมป์ ‘PIGROCK’ โชว์หราเต็มจออีกครั้ง

“ว่าไงเจ้าแชมป์?” แจ๊กกรอกเสียงในสายด้วยอารมณ์เหนื่อย ๆ ทว่าพร้อมจะอธิบายเหตุการณ์ตามสไตล์คนที่ชอบครุ่นคิด

“พี่แจ๊ก.. ผมเข้าใจแล้วว่าการประชุมฮ่องกงมันล้มเหลว ตอนนี้ก็มีคนแยกเป็นสองขั้ว Big Block กับ SegWit แต่ผมเจออีกกลุ่มในฟอรัมเรียกว่า UASF (User-Activated Soft Fork) ที่เหมือนจะกดดันพวกนักขุดให้ยอมรับ SegWit..."

"อยากรู้ว่าตกลง UASF มันสำคัญยังไงครับ? ทำไมใคร ๆ ถึงเรียกว่าเป็น การปฏิวัติโดย Node กัน?”

แจ๊กอมยิ้มก่อนจะวางแก้วกาแฟลง พูดด้วยน้ำเสียงจริงจังกว่าเดิม “UASF น่ะหรือ? มันเปรียบได้กับการที่ ‘ชาวนา’ หรือ ‘ประชาชนตัวเล็ก ๆ’ ออกมาประกาศว่า ‘ฉันจะไม่รับบล็อกของนักขุดที่ไม่รองรับ SegWit นะ ถ้าแกไม่ทำตาม ฉันก็จะตัดบล็อกแกทิ้ง!’ เสมือนเป็นการปฏิวัติที่บอกว่าแรงขุดมากแค่ไหนก็ไม่สำคัญ ถ้าคนรัน Node ไม่ยอม… เชนก็เดินต่อไม่ได้”

“โห… ฟังดูแรงจริง ๆ พี่ แล้วถ้านักขุดไม่ร่วมมือ UASF จะเกิดอะไรขึ้น?” แชมป์ถามต่อเสียงสั่นนิด ๆ

“ก็อาจเกิด ‘Chain Split’ ยังไงล่ะ"

"แยกเครือข่ายเป็นสองสาย สุดท้ายเครือข่ายเดิม กับเครือข่ายใหม่ที่รองรับ SegWit ไม่ตรงกัน คนอาจสับสนหนักยิ่งกว่า Hard Fork ปกติด้วยซ้ำ"

"แต่นั่นแหละ... มันแสดงพลังว่าผู้ใช้ทั่วไปก็มีสิทธิ์กำหนดทิศทาง Bitcoin ไม่ได้น้อยไปกว่านักขุดเลย”

“เข้าใจแล้วครับพี่… เหมือน การปฏิวัติโดยประชาชนตาดำ ๆ ที่จับมือกันค้านอำนาจทุนใหญ่ใช่ไหม?” แชมป์หยุดครู่หนึ่ง “ผมเคยคิดว่า Node รายย่อยน้อยรายจะไปสู้อะไรไหว แต่ตอนนี้ดูท่าจะเปลี่ยนเกมได้จริงว่ะพี่…”

“ใช่เลย” แจ๊กตอบ

“นี่เป็นความพิเศษของ Bitcoin ที่บอกว่า ‘เราคุมเครือข่ายร่วมกัน’ แม้แต่ Bitmain ที่มี Hashrate มากกว่า 50% ก็หนาวได้ถ้าผู้ใช้หรือ Node รายย่อยรวมพลังกันมากพอ”

แชมป์ฟังด้วยความตื่นเต้นปนกังวล “แล้วแบบนี้ เรื่อง SegWit กับ Blocksize จะจบยังไงครับ? เห็นข่าวว่าถ้านักขุดโดนกดดันมาก ๆ คนอย่าง จิฮั่น อู๋ อาจออกไปสนับสนุน Bitcoin Cash ที่จะเปิดบล็อกใหญ่”

แจ๊กเลื่อนดูฟีดข่าวในฟอรัม Bitcointalk อีกครั้ง ก็เห็นพาดหัวชัด ๆ

“Bitmain ประกาศกร้าวพร้อมหนุน BCH เต็มพิกัด!”

เขาถอนหายใจเฮือกหนึ่ง “ก็ใกล้เป็นจริงแล้วล่ะ… โรเจอร์ แวร์ เองก็ผลักดัน BCH ว่าคือ Bitcoin แท้ที่ค่าธรรมเนียมถูก ใช้งานได้จริง ส่วนฝั่ง BTC ที่ยึดเอา SegWit เป็นหลัก ก็ไม่ยอมให้ Blocksize เพิ่มใหญ่เกินจำเป็น.."

"ต่างคนต่างมีเหตุผล... แต่อุดมการณ์นี่คนละทางเลย”

“แล้วพี่คิดว่าใครจะเป็นฝ่ายชนะครับ?”

“เฮ้ย.. มึงถามยากไปหรือเปล่า” แจ๊กหัวเราะหึ ๆ “ทุกคนมีโอกาสได้หมด และก็มีโอกาสพังหมดเหมือนกัน ถ้า UASF กดดันนักขุดให้อยู่กับ Core ได้ พวกเขาอาจยอมแพ้ แต่ถ้า Bitmain เทใจไป BCH นักขุดรายใหญ่คนอื่น ๆ ก็คงตาม"

"แล้วถ้าฝั่ง BCH เริ่มได้เปรียบ... อาจดึงคนไปเรื่อย ๆ สุดท้ายจะเหลือไหมล่ะฝั่ง SegWit ตัวจริง?”

“งั้น Node รายย่อยจะยืนอยู่ตรงไหนล่ะครับพี่?” แชมป์ถามอย่างหนักใจ

“Node รายย่อยและชุมชนผู้ใช้นี่แหละ คือ ตัวแปรชี้ขาด ทุกวันนี้คนกลุ่ม UASF พยายามโชว์พลังว่าตัวเองมีสิทธิ์ตั้งกติกาเหมือนกัน ไม่ใช่แค่นักขุด"

"อย่างที่บอก.. มันคือการ ‘ลุกขึ้นปฏิวัติ’ โดยชาวนา ต่อสู้กับเจ้าที่ที่ถือ ‘แฮชเรต’ เป็นอาวุธ”

แจ๊กตบบ่าตัวเองเบา ๆ ก่อนจะหัวเราะเล็กน้อย

“นี่แหละความมันของ Bitcoin ไม่มีเจ้าไหนสั่งได้เบ็ดเสร็จจริง ๆ ทุกฝั่งต่างถือไพ่คนละใบ สงครามยังไม่รู้จะจบยังไง ถึงอย่างนั้นมันก็สะท้อนวิญญาณ ‘decentralization’ ที่แท้จริง กล้ายอมรับสิทธิ์ทุกฝ่ายเพื่อแข่งขันกันตามกติกา”

จู่ ๆ ในหน้าฟอรัมก็มีกระทู้ใหม่เด้งเด่น “Bitmain หนุน Bitcoin Cash ด้วย Hashrate กว่า 50%! สงครามเริ่มแล้ว?” ข้อความนั้นดังโครมครามเหมือนระเบิดลงกลางวง

แจ๊กนิ่งไปชั่วขณะ สัมผัสได้ถึงความปั่นป่วนที่กำลังปะทุขึ้นอีกครั้ง เหงื่อบางเบาซึมบนหน้าผากแม้อากาศในคาเฟ่จะเย็นฉ่ำ เขาหันมองโทรศัพท์ที่ยังค้างสายกับแชมป์ แล้วเอ่ยด้วยน้ำเสียงจริงจัง

“นี่ล่ะ.. จุดเริ่มของสองเส้นทางอย่างชัดเจน… บล็อกใหญ่จะไปกับ BCH ส่วน SegWit ก็อยู่กับ BTC แน่นอนว่าทั้งสองฝ่ายไม่คิดถอยง่าย ๆ นักขุดจะเลือกข้างไหน? Node รายย่อยจะยอมใคร?"

"เมื่อสงครามครั้งนี้นำไปสู่การแบ่งเครือข่าย ใครกันแน่จะเป็นผู้ชนะตัวจริง? หรืออาจไม่มีผู้ชนะเลยก็เป็นได้”

ปลายสายเงียบงัน มีแต่เสียงหายใจของแชมป์ที่สะท้อนความกังวลปนอยากรู้อย่างแรง

“พี่… สุดท้ายแล้วเรากำลังยืนอยู่บนรอยแยกที่พร้อมจะฉีกทุกอย่างออกเป็นชิ้น ๆ ใช่ไหมครับ?”

“อาจจะใช่ก็ได้... หรือถ้ามองอีกมุม อาจเป็นวัฏจักรที่ Bitcoin ต้องเจอเป็นระยะ ทุกคนมีสิทธิ์ Fork ได้ตามใจใช่ไหมล่ะ? ก็ขอให้โลกได้เห็นกันว่าชุมชนไหนแน่จริง” แจ๊กพูดทิ้งท้ายก่อนจะแย้มยิ้มเจือรอยอ่อนล้า

ภาพบนจอคอมพิวเตอร์ฉายกระทู้ถกเถียงกันไม่หยุด ประหนึ่งเวทีดีเบตที่ไม่มีวันปิดไฟ แจ๊กจิบกาแฟอึกสุดท้ายเหมือนจะเตรียมพร้อมใจก่อนเข้าสู่สนามรบครั้งใหม่ สงครามยังไม่จบ.. ซ้ำยังดูหนักข้อยิ่งขึ้นเรื่อย ๆ

เขาลุกขึ้นจากโต๊ะ ชำเลืองมองแสงแดดจัดจ้าที่สาดลงมาไม่หยุด เปรียบเหมือนไฟแห่งข้อขัดแย้งที่เผาผลาญทั้งชุมชน Bitcoin ไม่ว่าใครจะเลือกอยู่ฝั่งไหน กลุ่ม UASF, กลุ่ม Big Block, หรือ กลุ่ม SegWit ทางเดินข้างหน้าล้วนเต็มไปด้วยความไม่แน่นอน

“สุดท้ายแล้ว… เมื่อกระดานแบ่งเป็นสองเส้นทางอย่างเด่นชัด สงคราม Blocksize จะจบลงด้วยใครได้บทผู้ชนะ?"

"หรือบางที… มันอาจไม่มีผู้ชนะที่แท้จริงในระบบที่ใครก็ Fork ได้ตลอดเวลา”

คำถามนี้ลอยติดค้างอยู่ในบรรยากาศยามบ่ายที่ร้อนระอุ ชวนให้ใครก็ตามที่จับตาดูสงคราม Blocksize ต้องฉุกคิด

เมื่อไม่มีใครเป็นเจ้าของ Bitcoin อย่างสมบูรณ์ ทุกคนจึงมีสิทธิ์บงการและเสี่ยงต่อการแตกแยกได้ทุกเมื่อ แล้วท้ายที่สุด ชัยชนะ–ความพ่ายแพ้ อาจไม่ใช่จุดสิ้นสุดของโลกคริปโตฯ

แต่เป็นเพียงจุดเริ่มต้นของการวิวัฒน์ที่ไม่มีวันจบสิ้น…

เมาท์แถมเรื่อง UASF (User-Activated Soft Fork)

นี่สนามรบยุคกลางที่ดูเหมือนในหนังแฟนตาซี ทุกคนมีดาบ มีโล่ แต่จู่ ๆ คนตัวเล็กที่เราไม่เคยสังเกต—พวกชาวนา ช่างไม้ คนแบกน้ำ—กลับรวมตัวกันยกดาบบุกวังเจ้าเมือง พร้อมตะโกนว่า “พอเถอะ! เราก็มีสิทธิ์เหมือนกัน!”

มันอาจจะดูเวอร์ ๆ หน่อยใช่ไหมครับ?

แต่ในโลก Bitcoin ปี 2017 นี่คือสิ่งที่เกิดขึ้นในรูปแบบ “User-Activated Soft Fork” หรือ UASF การปฏิวัติด้วยพลังโหนด ซึ่งทำให้นักขุดยักษ์ใหญ่ตัวสั่นงันงกันมาแล้ว!

แล้ว UASF มันคืออะไรล่ะ?

“User-Activated Soft Fork” หรือเรียกย่อ ๆ ว่า “UASF” ไม่ใช่อัปเกรดซอฟต์แวร์สวย ๆ แต่เป็น “ดาบเล่มใหม่” ที่คนตัวเล็ก—หมายถึง โหนด รายย่อย—ใช้ต่อรองกับนักขุดรายใหญ่ โดยกติกาคือ.. ถ้านักขุดไม่ทำตาม (เช่น ไม่รองรับ SegWit) โหนดก็จะปฏิเสธบล็อกของพวกเขาอย่างไม่เกรงใจใคร

สมมุติว่าคุณคือโหนด..

คุณรันซอฟต์แวร์ Bitcoin คอยตรวจสอบธุรกรรม วันดีคืนดี คุณประกาศ “ต่อไปถ้าใครไม่รองรับ SegWit ฉันไม่ยอมรับบล็อกนะ!” นี่ล่ะครับ “UASF” ตัวเป็น ๆ

คำขวัญสุดฮิตของ UASF

“No SegWit, No Block”

หรือแปลว่าถ้าบล็อกไม่รองรับ SegWit ก็เชิญออกไปเลยจ้า..

มันเหมือนการที่ชาวนาโผล่มาตบโต๊ะอาหารท่านขุนว่า “นายใหญ่จะปลูกอะไรก็ปลูกไป แต่ไม่งั้นฉันไม่รับผลผลิตนายนะ!”

ความเชื่อมโยงกับ BIP 148

ถ้าจะพูดถึง UASF ต้องรู้จัก BIP 148 ไว้นิดนึง มันเปรียบเหมือน “ธงปฏิวัติ” ที่ตีตราว่าวันที่ 1 สิงหาคม 2017 คือเส้นตาย!

BIP 148 บอกไว้ว่า.. ถ้าถึงวันนั้นแล้วยังมีนักขุดหน้าไหนไม่รองรับ SegWit บล็อกที่ขุดออกมาก็จะถูกโหนดที่ใช้ UASF “แบน” หมด

ผลลัพธ์ที่ตั้งใจ นักขุดไม่อยากโดนแบนก็ต้องทำตาม UASF กล่าวคือ “นายต้องรองรับ SegWit นะ ไม่งั้นอด!”

หลายคนกลัวกันว่า “อ้าว ถ้านักขุดใหญ่ ๆ ไม่ยอมแล้วหันไปขุดสายอื่น จะไม่กลายเป็นแยกเครือข่าย (Chain Split) หรือ?”

ใช่ครับ.. มันอาจเกิดสงครามสายใหม่ทันทีไงล่ะ

ทำไม UASF ถึงสำคัญ?

ย้อนกลับไปก่อนปี 2017 Bitcoin มีปัญหาโลกแตกทั้งค่าธรรมเนียมแพง ธุรกรรมหน่วง บวกกับความขัดแย้งเรื่อง “จะเพิ่ม Blocksize ดีไหม?” ทางกลุ่มนักขุดรายใหญ่ (นำโดย Bitmain, Roger Ver ฯลฯ) รู้สึกว่า “SegWit ไม่ใช่ทางออกที่แท้จริง” แต่อีกฝั่ง (ทีม Core) ชี้ว่า “Blocksize ใหญ่มากไปจะรวมศูนย์นะ โหนดรายย่อยตายหมด”

UASF เลยโผล่มา เหมือนชาวนาตะโกนว่า

“หุบปากได้แล้วไอ้พวกที่สู้กัน! ถ้าพวกแกไม่รองรับ SegWit พวกข้า (โหนด) ก็จะไม่เอาบล็อกแก”

สาระก็คือ.. มันคือตัวบ่งชี้ว่าคนตัวเล็กอย่างโหนดรายย่อยก็มีพลังต่อรอง เป็นกลไกที่ดึงอำนาจจากมือทุนใหญ่กลับสู่มือชุมชน (Decentralization ที่แท้ทรู)

วิธีการทำงานของ UASF

ลองจินตนาการตาม..

-

การกำหนดเส้นตาย BIP 148 ประกาศไว้ “ถึงวันที่ 1 สิงหาคม 2017 ถ้านายยังไม่รองรับ SegWit โหนด UASF จะไม่รับบล็อกนาย”

-

ถ้าคุณเป็นนักขุด… คุณขุดบล็อกออกมา แต่ไม่ได้ตีธง “ฉันรองรับ SegWit” UASF โหนดเห็นปุ๊บ พวกเขาจะจับโยนทิ้งไปเลย

-

ผลกระทบ? นักขุดที่ไม่ยอมทำตามจะเจอปัญหา บล็อกที่ขุดออกมาไม่มีใครรับ—เสียแรงขุดฟรี

อาจเกิด Chain Split คือ แยกเครือข่ายเลย ถ้านักขุดเหล่านั้นไปตั้งสายใหม่

ความสำเร็จและความท้าทายของ UASF

ความสำเร็จ.. หลังการรวมพลังผู้ใช้ โหนดรายย่อยกดดันนักขุดได้ไม่น้อย จนกระทั่ง SegWit เปิดใช้งานจริงใน Bitcoin วันที่ 24 สิงหาคม 2017 ช่วยให้ธุรกรรมเร็วขึ้น แก้ Transaction Malleability และเปิดทางสู่ Lightning Network ในอนาคต

ความท้าทาย.. นักขุดบางค่ายไม่โอเค.. โดยเฉพาะ Bitmain ซึ่งคาดว่าจะสูญรายได้บางส่วน ก็นำไปสู่การสนับสนุน “Bitcoin Cash (BCH)” แยกสาย (Hard Fork) ของตัวเองตั้งแต่วันที่ 1 สิงหาคม 2017 นั่นเอง

ว่าแล้วก็เปรียบง่าย ๆ

UASF เหมือนปฏิบัติการยึดคฤหาสน์เจ้าเมืองมาเปิดให้ชาวบ้านเข้าอยู่ฟรี.. แต่อีกฝ่ายบอก

“งั้นฉันออกไปตั้งคฤหาสน์ใหม่ดีกว่า!”

บทเรียนสำคัญ UASF เป็นตัวอย่างชัดว่า “ผู้ใช้” หรือ โหนดรายย่อย สามารถสร้างแรงกดดันให้นักขุดต้องยอมเปลี่ยนได้จริง ๆ ไม่ใช่แค่ยอมรับเงื่อนไขที่ขุดกันมา

ผลกระทบระยะยาวหลังจากนั้นล่ะ?

SegWit ถูกใช้งาน ทำให้ค่าธรรมเนียมธุรกรรมลดลง (ช่วงหนึ่ง) เกิด Lightning Network เป็น Layer 2 สุเฟี้ยวของ Bitcoin เกิด BCH (Bitcoin Cash) เป็นสายแยกที่อ้างว่า Blocksize ใหญ่คือทางออก

สรุปแล้ว UASF ทำให้โลกได้รู้ว่า..

Bitcoin ไม่ใช่ของนักขุด หรือของฝ่ายพัฒนาใดฝ่ายเดียว แต่มันเป็นของทุกคน!

“Bitcoin เป็นของทุกคน”

ไม่มีใครมีอำนาจเบ็ดเสร็จ ไม่ว่าคุณจะถือ Hashrate มากแค่ไหน ถ้า Node ทั่วโลกไม่เอา ก็จบ!

“แรงขุดใหญ่แค่ไหน ก็แพ้ใจมวลชน!”

(น่าจะมีตอนต่อไปนะ.. ถ้าชอบก็ Zap โหด ๆ เป็นกำลังใจให้ด้วยนะครับ)

-

-

@ dd664d5e:5633d319

2025-01-09 21:39:15

@ dd664d5e:5633d319

2025-01-09 21:39:15Instructions

- Place 2 medium-sized, boiled potatoes and a handful of sliced leeks in a pot.

- Fill the pot with water or vegetable broth, to cover the potatoes twice over.

- Add a splash of white wine, if you like, and some bouillon powder, if you went with water instead of broth.

- Bring the soup to a boil and then simmer for 15 minutes.

- Puree the soup, in the pot, with a hand mixer. It shouldn't be completely smooth, when you're done, but rather have small bits and pieces of the veggies floating around.

- Bring the soup to a boil, again, and stir in one container (200-250 mL) of heavy cream.

- Thicken the soup, as needed, and then simmer for 5 more minutes.

- Garnish with croutons and veggies (here I used sliced green onions and radishes) and serve.

Guten Appetit!

- Place 2 medium-sized, boiled potatoes and a handful of sliced leeks in a pot.

-

@ 4d41a7cb:7d3633cc

2025-01-03 20:52:22

@ 4d41a7cb:7d3633cc

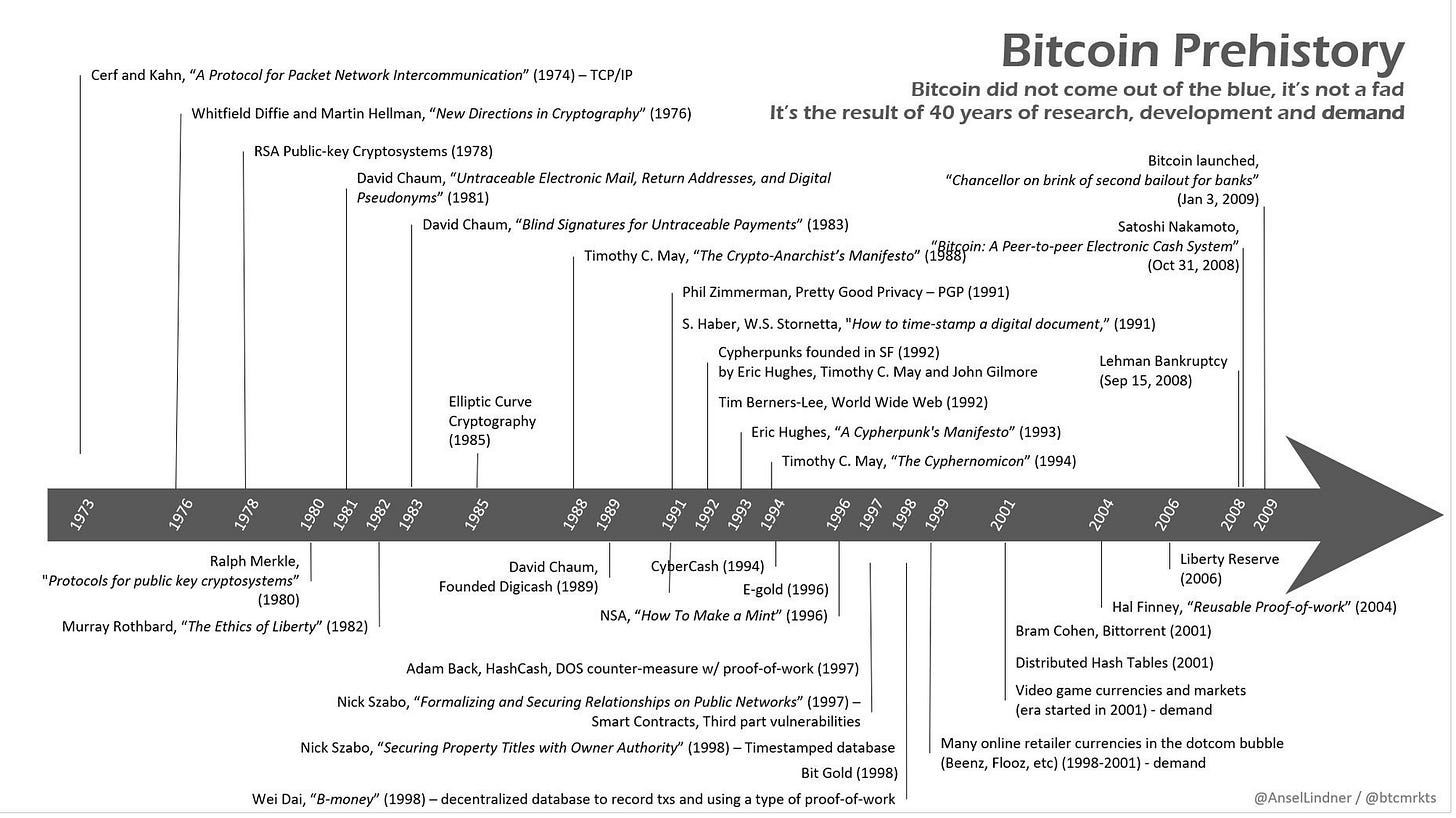

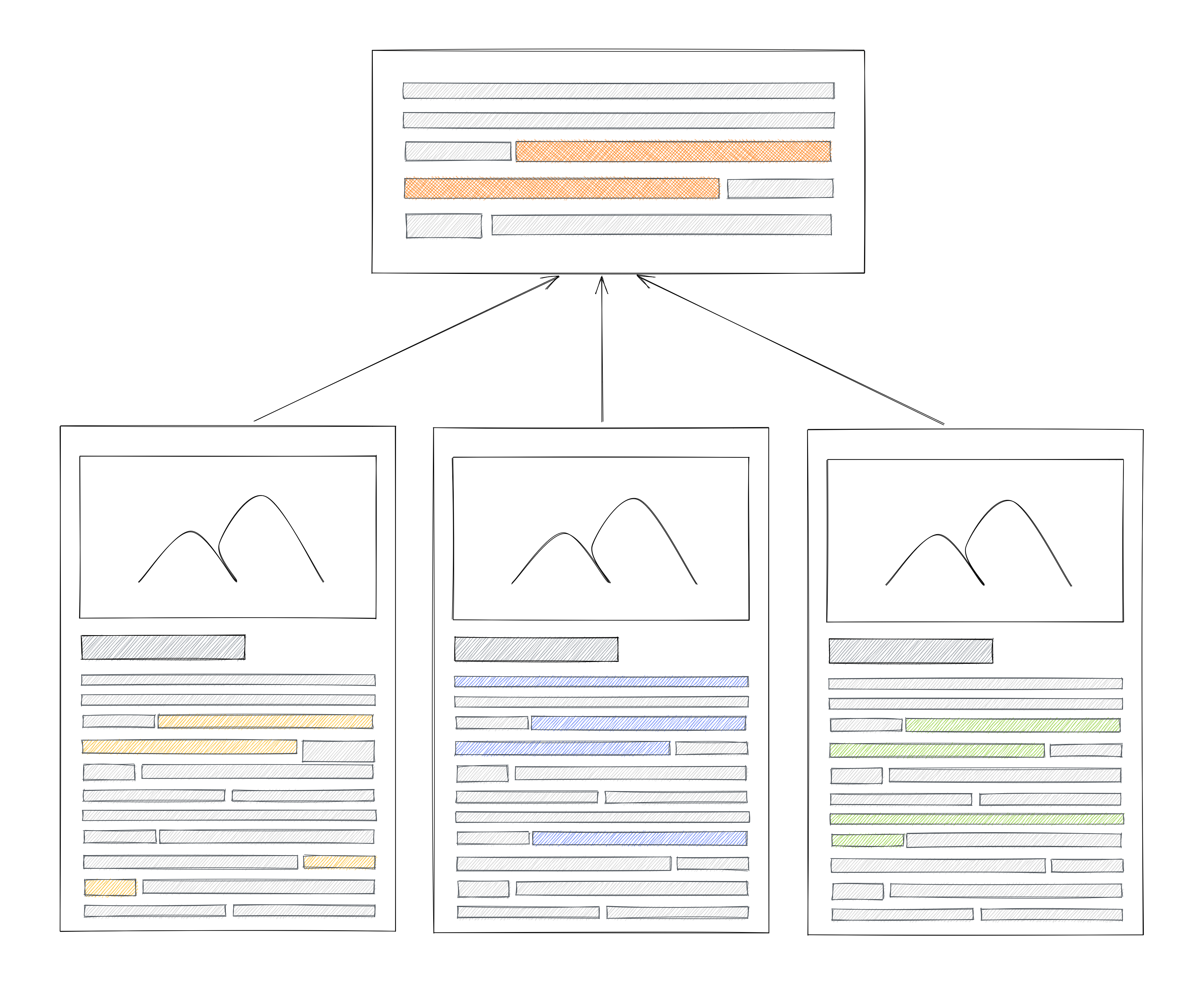

2025-01-03 20:52:22Today is Bitcoin genesis block day, literally Bitcoin’s birthday number 16th. The purpose of this article is to deep dive into Bitcoin's beginnings, what it was meant to be, what its creator's incentives were, why the collaborators were interested in contributing to its success, and what Bitcoin is achieving.

Bitcoin exists to solve a problem.

The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. Their massive overhead costs make micropayments impossible.

Satoshi Nakamoto, February 11, 2009

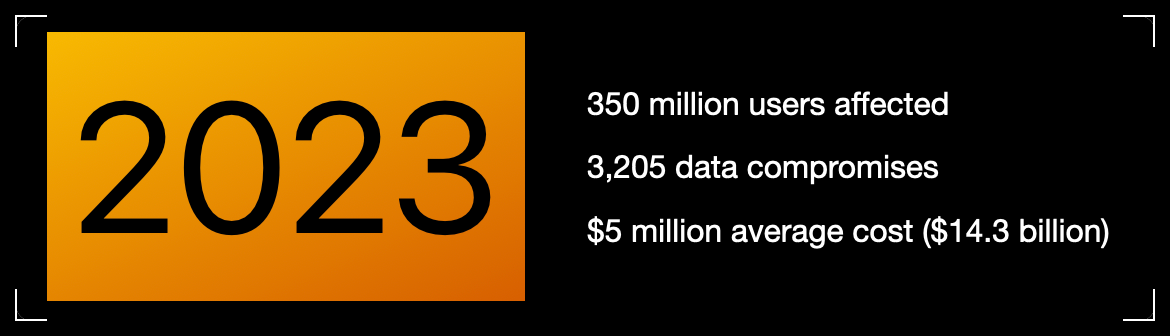

In this post, Satoshi reveals the main problem: central banking, how this institution has abused the trust we have put in them. Bitcoin is an alternative to a “broken” or corrupt monetary system that it’s been running and stealing from people for centuries, creating credit bubbles with their debt-based fractional reserve banking system

Ponzi nature of banking system

For those who don’t understand this system and its corrupt and inviable nature, think about it as a rigged musical chairs game.

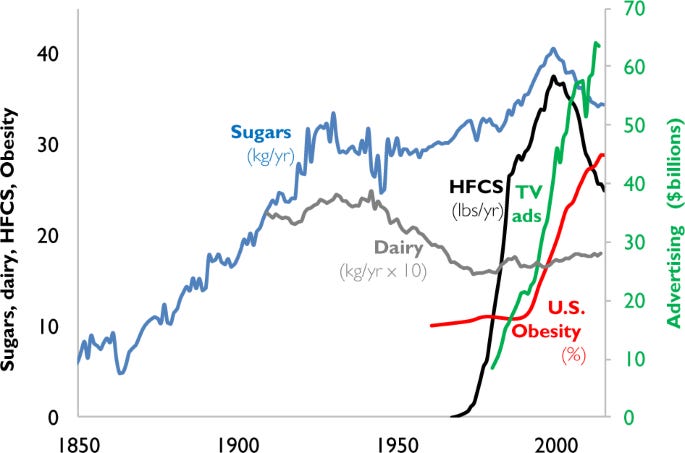

When the music (trust in the banking system and its currency) is on, everyone is happy playing the economic game. Economic activity is soaring; we see new businesses, new products, cheap credit, high lending, asset prices inflate, and people consuming more (thus pushing the economic numbers higher). Everything seems to be okay. But then something happens.

Under this monetary game, deposits are chairs and depositors are players; as the game goes on, there are always more players than chairs or depositors than deposits because banks “lend” currency that they don’t have. When the music (trust in the bank) is stopped, the game is over, and many people lose their chairs (their deposit), creating deflationary recessions and economic crises.

When this happens, everything starts trending the exact opposite way. The economic activity starts slowing down, debt problems arise, bankruptcies occur, people lose their jobs and consume less, asset prices deflate, until the central bank intervenes and the cycle starts again.

This is officially known as the “economic cycle,” and it's sold to us as a natural phenomenon. But the truth is this is a pure central bank–artificially created cycle by monetary manipulation, as we can learn from the Austrian school of economics.

I call the central bankers the market wizards because they hold the lever to manipulate the economic game. They are the money masters, the financial alchemists, the kings of the economic and financial game of commerce where all economic agents operate under.

Bitcoin is a revolution against the central bank monarch, but Satoshi was not shouting about this to the four winds. He didn’t want to get attention before Bitcoin was strong enough, because it would have implied a great risk to its success. Central banks are the most powerful institutions on earth; they literally have the power to create currency in unlimited amounts and buy anything they need to maintain their monopoly.

If we need a more clear confirmation of this, we can look into the encrypted message that Satoshi left in the genesis block. To understand the genesis block, imagine a bookkeeping ledger that adds new pages (blocks) daily and contains a record of all bitcoin transactions ever made. The very first page of this book is called the genesis block.

Chancellor on brink of second bailout for banks

Satoshi Nakamoto 03 January 2009

Here’s the newspaper cover he was making reference to.

In allusion to the bank bailouts that were taking place at the time, Satoshi included this intriguing line in the genesis block when he created Bitcoin during the Great Global Financial Crisis. In addition to providing the remedy, those who caused the issue (and profit from it) were making unprecedented profits. \

\

This game is about privatizing profits and socializing losses. This is the opposite of free markets and capitalism. It's clear that Satoshi Nakamoto, whomever he was, detested the established financial system. Since the Bank of England, which was the subject of this article, was established in 1694, we may trace the debt based fractional reserve banking system history back at least 331 years. \

\

This allusion to traditional banking's shortcomings was a declaration of what Bitcoin was trying to combat: fractional reserve banking and its consequences, which include debt, taxation, and inflation.

In allusion to the bank bailouts that were taking place at the time, Satoshi included this intriguing line in the genesis block when he created Bitcoin during the Great Global Financial Crisis. In addition to providing the remedy, those who caused the issue (and profit from it) were making unprecedented profits. \

\

This game is about privatizing profits and socializing losses. This is the opposite of free markets and capitalism. It's clear that Satoshi Nakamoto, whomever he was, detested the established financial system. Since the Bank of England, which was the subject of this article, was established in 1694, we may trace the debt based fractional reserve banking system history back at least 331 years. \

\

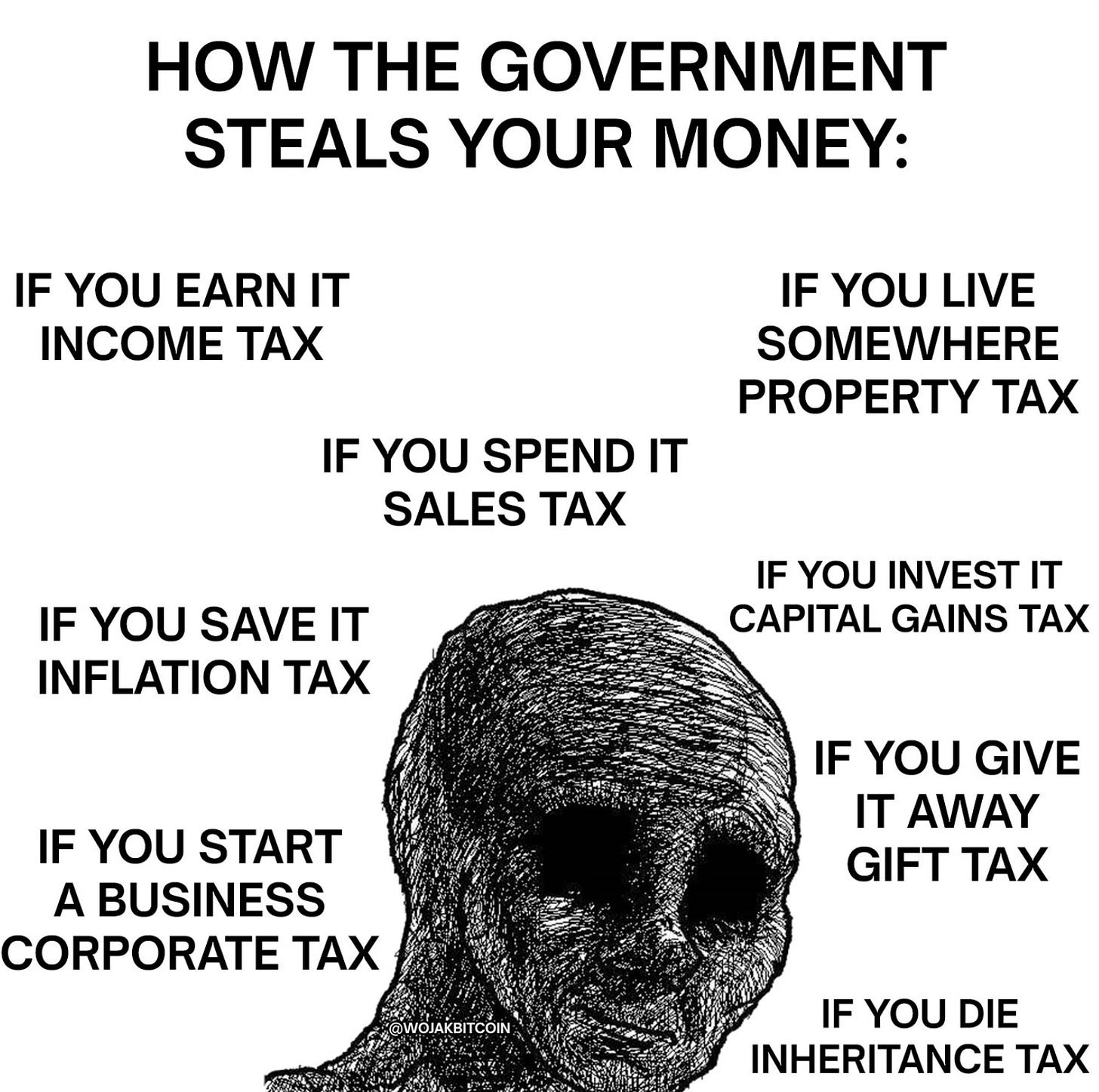

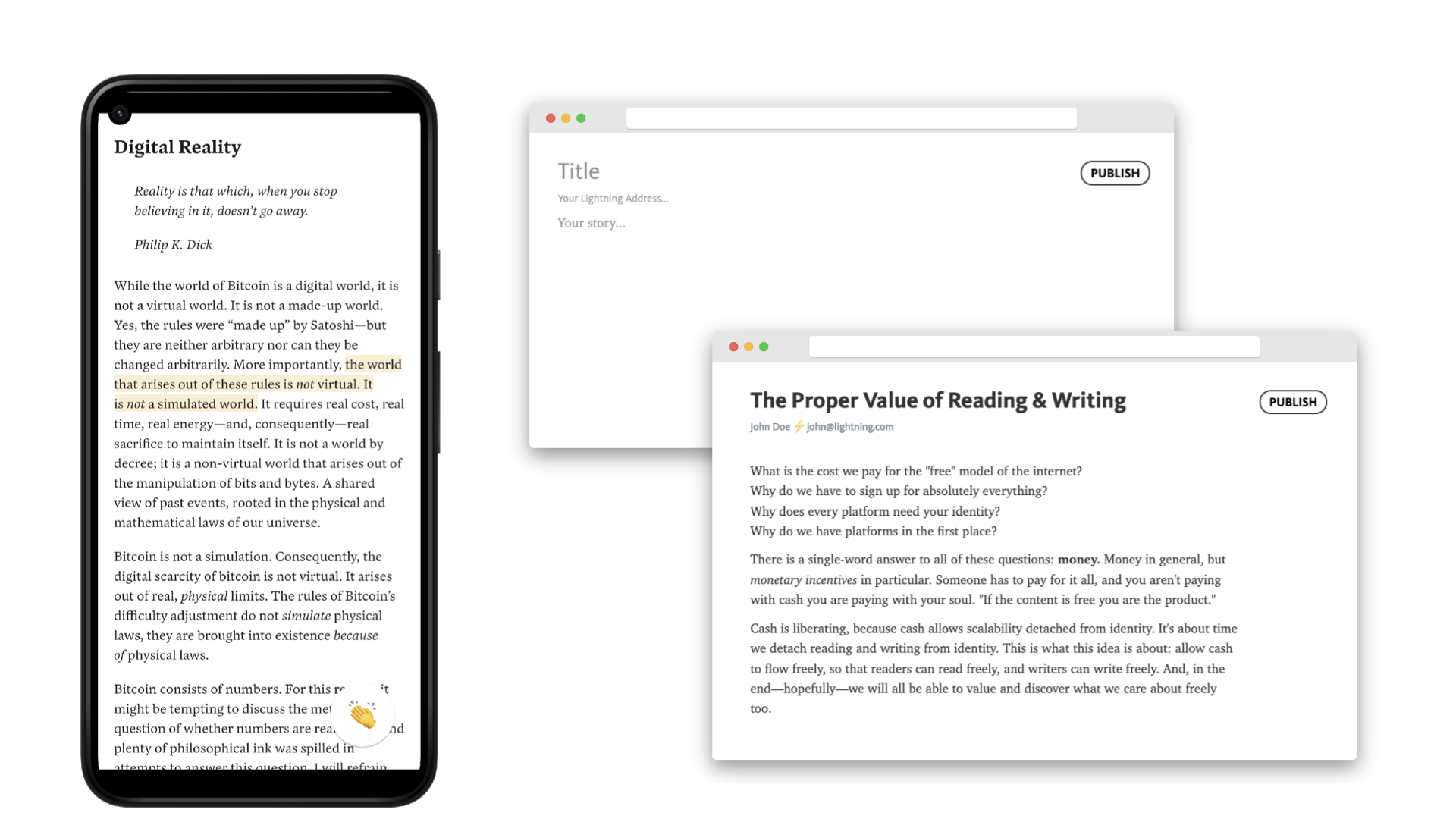

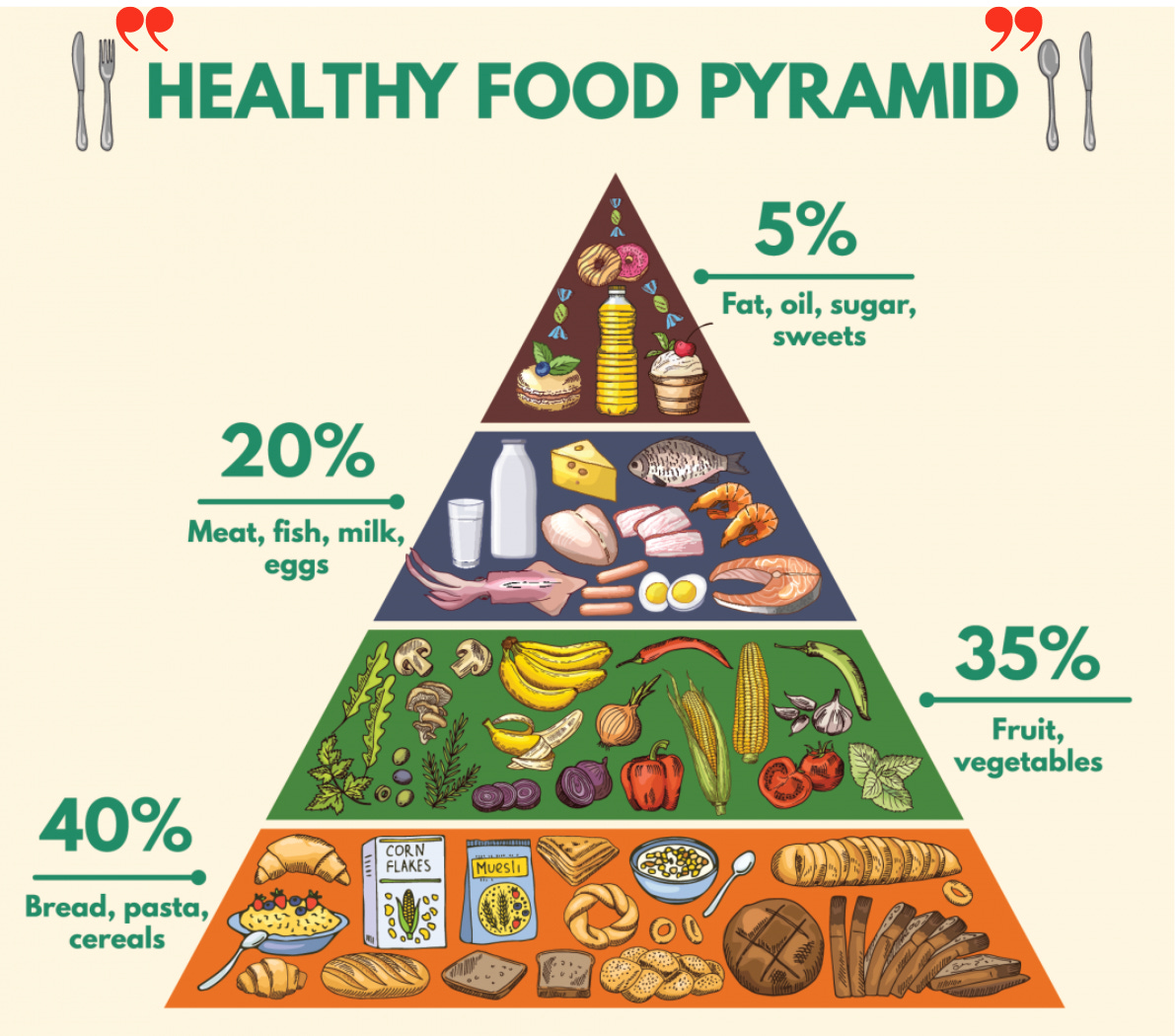

This allusion to traditional banking's shortcomings was a declaration of what Bitcoin was trying to combat: fractional reserve banking and its consequences, which include debt, taxation, and inflation.\ \ The bookkeepers \ \ In essence, banking and money management are bookkeeping, keeping track of who owns what and who owes what. Due to its revolutionary impact on accounting, Bitcoin has been dubbed "triple entry bookkeeping" by some. \ \ These days, banks are in charge of bookkeeping; they basically have the authority to make changes to the books and add new entries, or "print money." Inflation is basically a robber of time, energy, and wealth from everyone using that currency denomination, and banks are the ones who create it. Additionally, they have the ability to cause economic crises and market crashes for their own financial gain, making them deflation inductors. \ \ The incapacity of gold (real money) to meet the demands of a growing global economy gave banks this authority. They essentially became gold safe-keepers and gold IOU bookkeepers' ledgers because people trusted these organizations to provide scalability and lower the cost and risk of gold transactions. \ \ The purpose of banking was to enable credit and payments. Governments and banks did not create money. The free market determined the value of gold and silver, and people only trusted banknotes that were backed by gold. \ \ “Gold is money, everything else is credit" JP Morgan, 1912. \ \ Since banks began growing, they have sought to increase their size even more. When they discovered that the metal money system was restricting their ability to increase credit and bank profits, they literally plotted to seize control of the money market and overthrow governments by demonetizing these metals, effectively eliminating the demand for money in general and substituting it with debt and credit instruments. Essentially promissory notes issued by banks based on debt. \ \ "The borrower is a slave to the lender, and the wealthy dominate the poor”. Proverbs 22:7\ \ Human history is a chronicle of the literal plot by banks to enslave humanity, which resulted in hundreds of wars, thousands of assassinations, and the loss of millions of innocent lives in order to fulfill the banksters' objective of creating a global fractional reserve credit system. The currency that they decided to control? The term "U.S dollars" is frequently and incorrectly used to refer to Federal Reserve Notes. \ \ Slavery is essentially personified in this system. Slavery, in my opinion, is working for a currency that someone else can print without any effort or labor. This is the underlying cause of legal inequality. Theoretically, we live in a democracy and capitalist society where everyone is treated equally, but income taxes and central banking are vital components of the communist manifiesto. \ \ Where do we draw the boundary between a free human being and a slave citizen, given that this system directly violates private property rights? You are 100% slave when you pay 100% taxes, and 40% slave when you pay 40% taxes. It is being violently imposed upon you if it is not a voluntary business deal. Violence or the threat of losing your freedom are used to compel people to pay taxes. \ \ Natural law, often known as moral law, states that every person has the right to keep all of the fruits of their labor. However, this fraudulent financial system is robbing everyone of their means of trade, whether they are called coins, currencies, deposits, checks, etc. Furthermore, ceasing to feed a parasite is the only way to eradicate it. \ \ A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.

Satoshi Nakamoto, October 31, 2008\ \ \ \ What backs fiat currencies?\ \ The worst aspect of this system is that it views people as collateral cattle for the currency's purchasing power. In essence, "government currencies" are credits of their corresponding debts, or government bonds, which are effectively secured by the government's “authority” to impose taxes on its populace. In essence, the government's power to compel its people to give them X percent of their income without providing them with equal recompense.

In essence, citizens' wealth is "baking" the government's debts. Since the currency cannot be exchanged for wealth at a particular rate, it is inaccurate to state that it is backed, thus I said "baking." However, if we must identify a valuable component of the currency, it is as follows: wealth and labor (i.e., human time and energy).