-

@ 513d5051:8a622026

2025-01-08 01:19:55

@ 513d5051:8a622026

2025-01-08 01:19:55I've noticed some of my posts they become a kind 1 event while others become a kind 30023 event^1.

So if you see this post[^2] published as a note and has a bunch of markdown, and then another super simple post[^3] becomes an article.

How do you think it should behave?

I personally gravitate towards publishing everything as articles (kind 30023) since clients usually enable markdown to render them as we do, this is how we'll port the content to Nostr the closest to SN most of the time IMO.

[^2]: Complex post turned note [^3]: Simple post turned article

originally posted at https://stacker.news/items/841530

-

@ 513d5051:8a622026

2025-01-08 00:46:07

@ 513d5051:8a622026

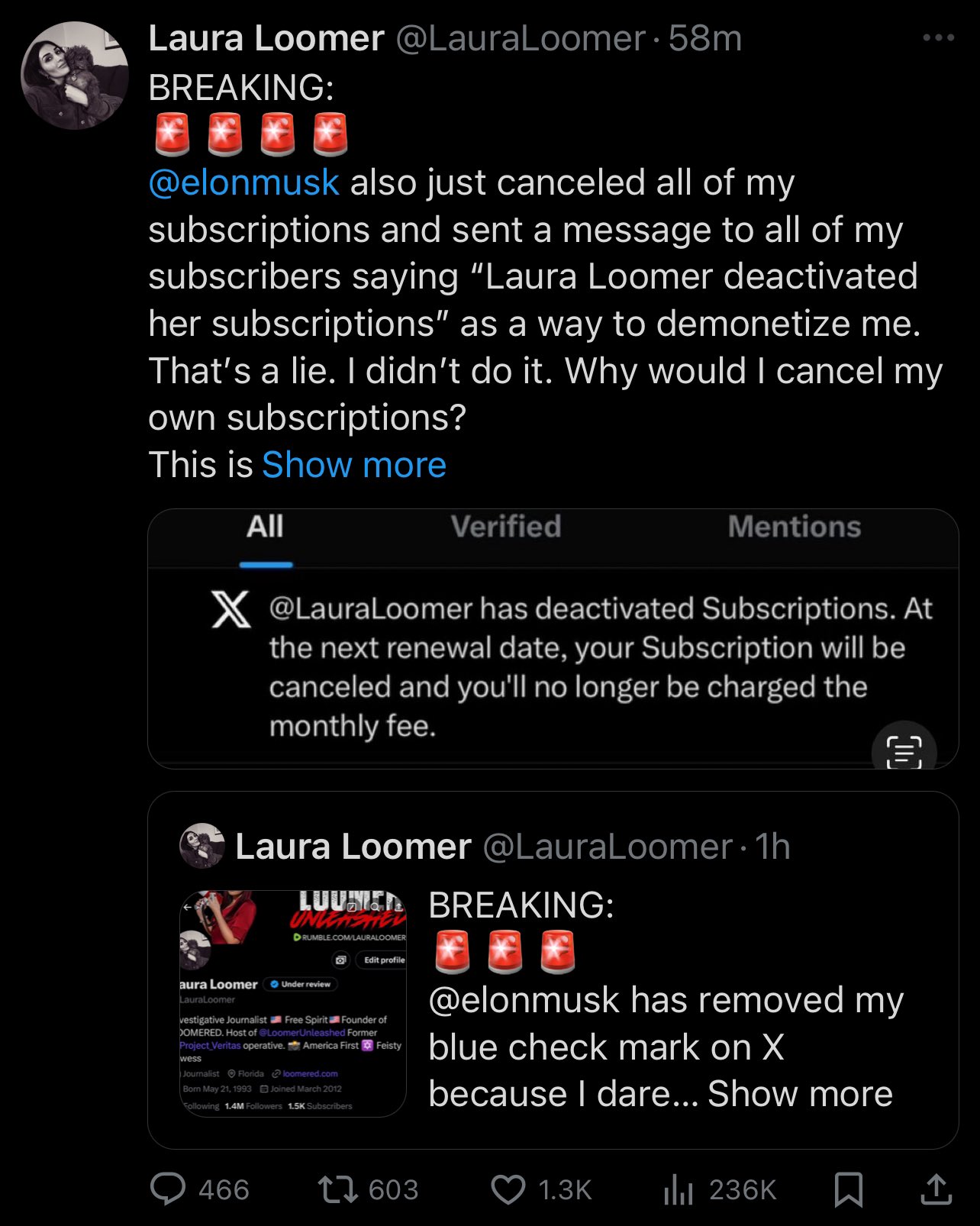

2025-01-08 00:46:07It angers me.

We just want freedom for fuck sake.

originally posted at https://stacker.news/items/841507

-

@ 000002de:c05780a7

2025-01-07 22:33:18

@ 000002de:c05780a7

2025-01-07 22:33:18Many years ago I read Linchpin: Are You Indispensable? by Seth Godin. It should be read by anyone entering their working years. Probably more relevant than ever.

The thing is, whether its machines or cheap labor we all are competing for work. Godin was the first person I heard explain how government schools are designed to create conformity and limit creativity. Reading this book opened by eyes to a new way of viewing work.

Using emotional energy in ANY job whether you are cleaning tables in a coffee shop, writing code, or fixing plumbing issues. Being human and caring are things that are hard to find because it takes work.

Doing good work in and of itself is rewarding. Phoning it in is not.

Great book.

originally posted at https://stacker.news/items/841353

-

@ 513d5051:8a622026

2025-01-07 22:13:27

@ 513d5051:8a622026

2025-01-07 22:13:27The Brazilian government has announced they have started monitoring every citizen's financials if their monthly accumulated movement (inflow + outflow) exceeds the equivalent to 819 dollars^1.

What is included in their surveillance: - All accounts (regular, savings, investment) balance, payments, cheques, transfers, yields, and redeems - Movement between accounts owned by the same person - Purchase and sale of foreign currencies - Investments credits, debits, purchase, sale, redeem, and liquidations - Pensions and insurances - Credit pools (often people do this to acquire expensive assets without paying too much interest)

Obviously this is a socialist/communist leaning government, so intervention and control is their bread and butter. They have introduced many new taxes after they came into power, but since they got some push back and our central bank isn't obeying them (they are independent but heavily pressured/influenced) to lower interest rates, they are trying to steal (through taxes) a lot more money from people to enable them to spend more and to help their accounts end every year less negative due to the consequences they've been suffering.

The only real answer would be to go full sovereign, close all accounts and only deal in Bitcoin or if I need fiat to keep the physical version instead. But that's too painful as you become isolated from the rest of the society.

What is the best answer?

originally posted at https://stacker.news/items/841315

-

@ 5d4b6c8d:8a1c1ee3

2025-01-07 21:09:20

@ 5d4b6c8d:8a1c1ee3

2025-01-07 21:09:20Am I only writing this post because I thought the name was dope?

Pretty much, but I'm also bored and it's been about a week since I joined the ownership group of ~Stacker_Sports, so let's take a look at how the territory's done this past week.

Territory Stats

| Posts | Comments| Stacking | Spending | Revenue | |-------|-------------|-----------|-----------|-----------| | 53 | 880! | 51k | 77.6k | 19.6k |

Awesome! We're well on our way to a profitable month.

Posts of the week

- by zaprank: Stacker Sports- Special Announcement

- by comments: NFL Weekly Pick 'em- Week 18

- by sats: NCAA College Football Playoff Points Challenge- SemiFinal Picks

I'm open to suggestions about what should go in these reports. Like I said at the top, I'm mostly doing this because I didn't want to waste the sweet ass name.

originally posted at https://stacker.news/items/841205

-

@ 000002de:c05780a7

2025-01-07 19:26:02

@ 000002de:c05780a7

2025-01-07 19:26:02I was listening to the No Agenda podcast a few weeks ago and they played a clip from a programmer who goes by the handle the Primagen. He's an entertaining guy. He actually has a lot of good takes on programming topics.

He started talking about Artificial general intelligence. His focus was Sam Altman's recent comments about AGI being just around the corner. The Primagen brought up a point I hadn't heard anyone mention.

Why would a company create an artificial general intelligence that can create apps and entire infrastructures from a prompt and just sell access to it?

Why wouldn't they keep it a trade secret and just use it themselves? If you believed in your AGI wouldn't that make more sense? So does Altman really believe what he is pitching or is it typical fiat hype? A company like Altman's could use AGI to basically destroy all the competition and take over the tech world? Could they not? Its a big if, but If they create an AGI that can just create things it thinks up why would you want to sell that as a service instead of just owning all the amazing things it creates?

Here's what I think. The AGI Altman is talking about is mostly hype. It will not be able to create the next Facebook or Google. It might be able to make some crappy copies of apps at best. Look at the LLM tools we have today like ChatGPT. They can mimic patterns. They can copy writing styles that were created by humans but the majority of what they produce is pretty easy to spot as AI crap. At least it has been for me up to this point. It tends to function better the more a writing style has consistent patterns. True innovation breaks from patterns in interesting ways but builds upon them.

Many people are just blown away by ChatGPT. I find these people tend to be anything but critical thinkers. They also tend to have little experience with software engineering. I'm impressed with many of these tools but the more I understand how they work the less magical it becomes and the more I see the OZ pulling the strings.

All that said, I do not believe AGI is not right around the corner. That's a myth. I've been hearing that for the last 10 years. It's always right around the corner. And yet, people seem to still fall for this. Sam Altman is a pitchmen. Pretty much any founder in Silicon Valley is as well. You really have to take everything they say with a grain of salt because they are all pitchmen, they are marketing their products trying to get fiat funding. They are trying to get eyeballs they can sell.

They're always going to paint everything in the most rosy light. And that's really what you have to understand. You have to be skeptical, because most of the time you're being hyped. I've been around technology and worked in tech field long enough to see the patterns repeat.

I'm not saying there won't be improvements to "AI". I'm not saying that it hasn't already improved. It's useful, but it is not a general intelligence, and it is not going to take the jobs and engineers any time soon. I hesitate to even say any time soon as I doubt it will ever take engineer's jobs because there is always going to be a need for people that know how things work. No matter how advanced artificial intelligence becomes, it is not actually intelligence. It is at best an algorithm that mimics human patterns. There is no creativity. There is only human creativity. There is our human creativity being used as the seed. But humans are weird. We're organic. We're not machines. As patterns form someone breaks out of the pattern in a new and interesting way.

I'd love to hear counter arguments. Why would it make more sense to sell access to AGI vs. using it for yourself?

originally posted at https://stacker.news/items/840982

-

@ 2e8970de:63345c7a

2025-01-07 17:01:49

@ 2e8970de:63345c7a

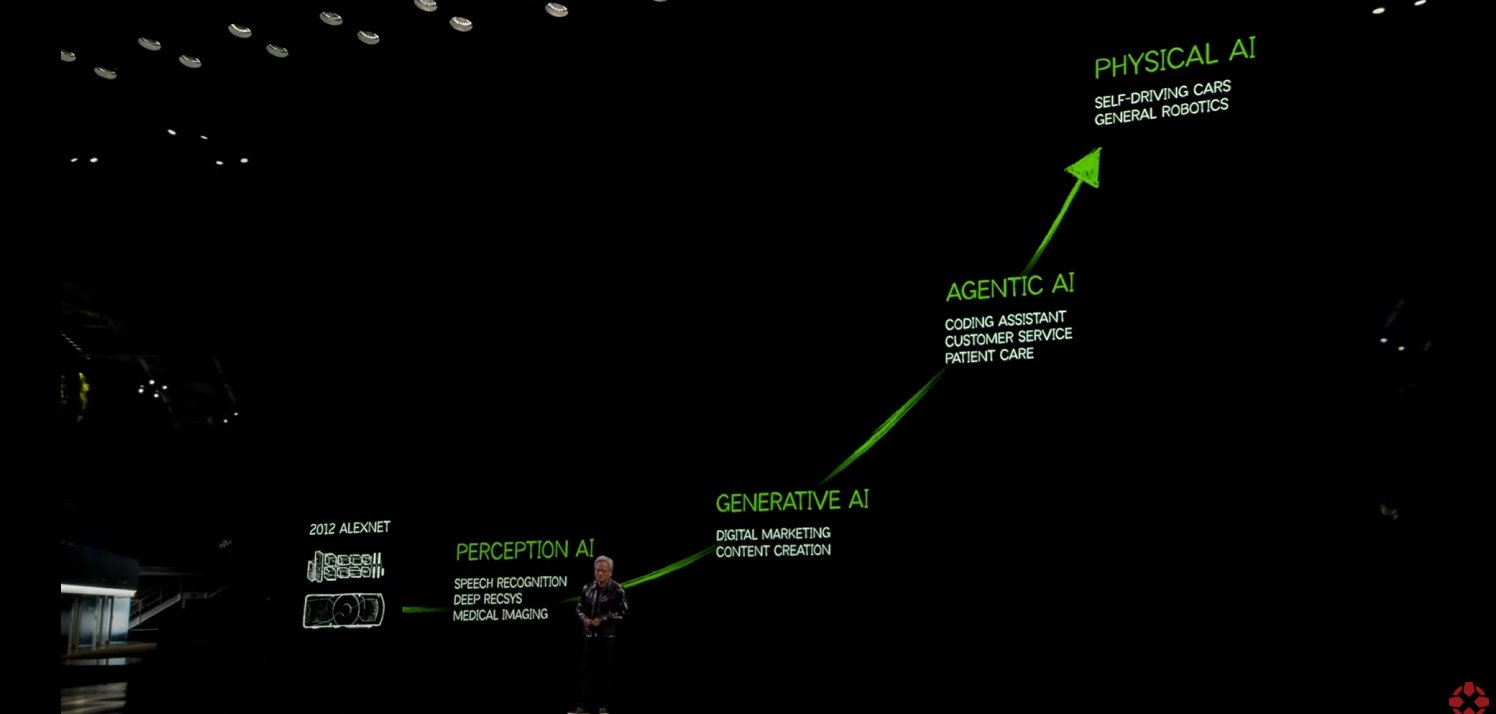

2025-01-07 17:01:49Besides the obvious nonsensical unlabeled Y-axis: It's an interesting narrative for sure but I do find it quite weird. I never saw robotics ("physical AI") as an evolution or the next step of other AI disciplines. Also "perception AI" like classification or regression as a lower evolutionary step of this field. I rather see it as another category to the side of it.

It also implies that all work on robotics before next gen chatbots are work in their infancy or stuff humankind wasted their time on because we weren't ready for it yet?

Curious - what do you think about this narrative?

originally posted at https://stacker.news/items/840769

-

@ 2e8970de:63345c7a

2025-01-07 16:29:41

@ 2e8970de:63345c7a

2025-01-07 16:29:41

https://www.nvidia.com/en-us/project-digits/

What do you think? I can't help but notice how the form factor is super similar to the new Mac Mini. Which is weird because the development time for such a project should be longer than between these two announcements. Also why are we seeing a comeback in desktops in 2024?

I can't help but feel like something is happening behind the scenes. Is this coordinated for something in the future to happen where desktops are needed again? Or a common reason instead of coordinated? Maybe this something is as simple as locally hosted chatbots. But then again: didn't desktops unambiguously move on to the iMac & Surface-Studio form factor? Is there some huge innovation in display tech just around the corner that they aren't telling us about yet? Are they planning on selling VR to the world?

I'm probably overthinking here, isn't it? On the other hand I cannot think of any reason why Nvidia would waste their time with desktop PCs now.

originally posted at https://stacker.news/items/840717

-

@ 2063cd79:57bd1320

2025-01-07 07:12:48

@ 2063cd79:57bd1320

2025-01-07 07:12:48Der letzte Artikel stand ganz im Zeichen von Mempool, Transaktionsgebühren, Ordinals, BRC-20 Tokens (aka Shitcoins auf Bitcoin) und Mining-Rewards. Der Mempool ist voller als der Hyde-Park in London am einzigen Sommertag mit Sonne im Jahr. Doch weil ich mich in letzter Zeit zu Genüge mit den vorgenannten Themen beschäftigt habe und man zur Zeit an jeder Ecke den Status des Mempools ungefragt eingeflößt bekommt, möchte ich mich diese Woche mit zwei Standpunkten beschäftigen, die entweder gegenläufig oder komplementär zueinander stehen (gibt es wirklich kein Antonym zum Wort komplementär?).

Ausschlaggebend für den Gedankengang, der mich zu dieswöchigem Artikel bewegt hat waren ein Artikel und eine Podcast-Episode, über die ich letzte Woche gestolpert bin. Bei dem Artikel handelt es sich um Jimmy Songs "How Fiat Money Broke the World" aus seiner Fixing the Incentives-Reihe im Bitcoin Magazine und bei der Podcast-Episode wurde ich von den Ausführungen von Peruvian Bull im TFTC Podcast Ausgabe 414: The Dollar Endgame von Marty Bent zum Nachdenken angeregt.

Prinzipiell stellt sich im Großen und Ganzen die Frage, wie eine großflächige Adaption von Bitcoin vonstatten gehen könnte. Hyperbitcoinization oder auch Bitcoin als gesetzliches Zahlungsmittel (wie z.B. in El Salvador, oder bald sogar in Indonesien und Mexiko (!)) sind dabei mögliche Szenarien. Der Nicht-Ghandi-Spruch “First they ignore you, then they laugh at you, then they fight you, then you win.” wird oft genutzt, um die soziologische Entwicklungsstufe, bzw. die öffentliche Wahrnehmung einer Idee, einer Erfindung oder eines Produkts in gewisse Entwicklungsstufen einzuordnen. Genauso wie bei Bitcoin. WIR SIND IN DER "THEN THEY FIGHT YOU" STUFE!!!11! kann man überall auf Bitcoin-Twitter, Nostr oder Reddit lesen.

Doch wer ist "THEY"? Wenn man nur von Nationalstaaten ausgeht und offizielle und inoffizielle (konspirative) multinationale Interessensgruppen außen vor lässt, stellt sich mir die Frage, welches Land / welcher Staat die meisten Gründe (politischer oder wirtschaftlicher Natur) hätte, Bitcoin zu adaptieren, bzw. zu bekämpfen. Natürlich kommen einem dabei als erstes die USA in den Sinn, immerhin das Land mit der höchsten kombinierten Bitcoin-Hashrate, mit den meisten Bitcoin-Infrastruktur-Anbietern, mit den größten Börsen (nach Handelsvolumen) und den meisten Bitcoin-Nutzer//innen in der Bevölkerung.

Doch macht das die USA zum größten potentiellen Gegner oder zum größten potentiellen Befürworter und Begünstigten von Bitcoin?

Jimmy Song "How Fiat Money Broke the World"

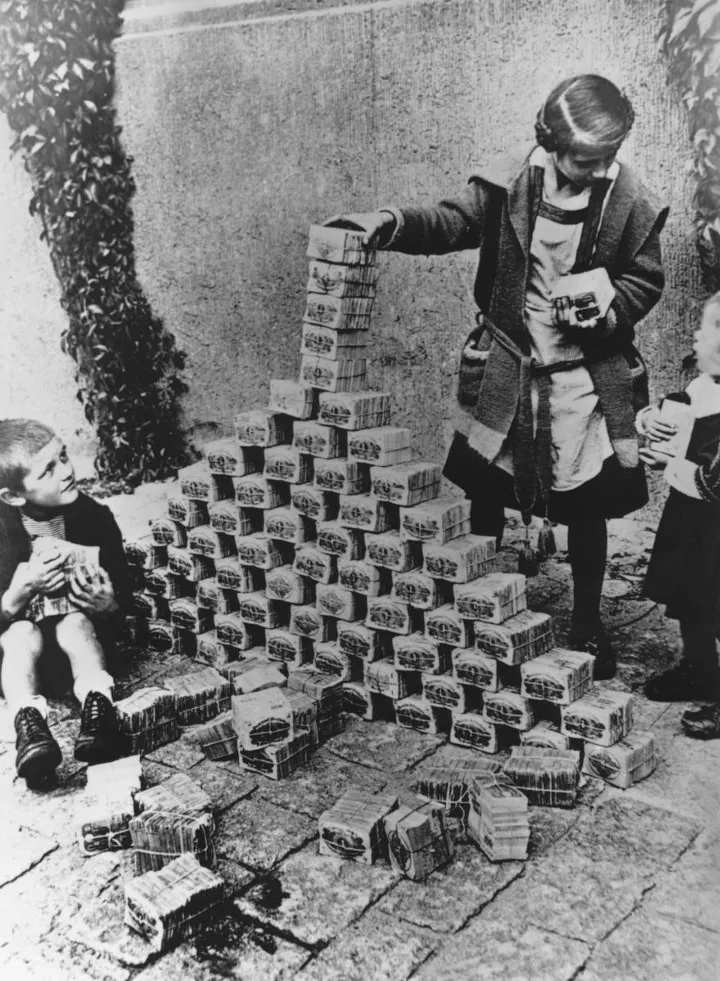

Jimmy Song baut seinen Artikel chronologisch auf. Es geht um die Entstehung des Fiat-Geld-Systems nach dem zweiten Weltkrieg und die damit einhergehende Abschaffung des Goldstandards. Mit der Errichtung des Bretton-Woods-Systems wurde eine neue Währungsordnung geschaffen, die den US Dollar als Ankerwährung bestimmte, der wiederum an Goldreserven gekoppelt werden sollte. So sollten flexible Wechselkurse innerhalb der verschiedenen Landeswährungen gewährleistet werden, während gleichzeitig die Sicherheit von Goldreserven existiert. Doch statt Gold für die internationale Handelsabwicklung zu verwenden, wurde nun der Dollar die Abwicklungswährung. Diese Entscheidung verhalf den USA zu einer hegemonialen Wirtschaftsmacht zu werden, denn die Fähigkeit, das Geld zu drucken, mit dem jedes andere Land seinen Handel abwickelte, gab den USA mehr Macht über den Rest der Welt.

Diese Dollar-Hegemonie begünstigte die USA deutlich im internationalen Handel, da sie zur Zentralbank für alle anderen Zentralbanken wurden. Nicht-US-Banken geben sogar Verbindlichkeiten in Dollar, und zwar nicht nur in Europa, sondern in vielen anderen Teilen der Welt. Infolgedessen halten andere Zentralbanken US Dollar als Reserve, die dann auf der Basis von Teilreserven verwendet werden können, um noch mehr Geld in Form von Krediten zu schaffen (das sogenannte Eurodollar-System).

Diese Dollar-Hegemonie begünstigte die USA deutlich im internationalen Handel, da sie zur Zentralbank für alle anderen Zentralbanken wurden. Nicht-US-Banken geben sogar Verbindlichkeiten in Dollar, und zwar nicht nur in Europa, sondern in vielen anderen Teilen der Welt. Infolgedessen halten andere Zentralbanken US Dollar als Reserve, die dann auf der Basis von Teilreserven verwendet werden können, um noch mehr Geld in Form von Krediten zu schaffen (das sogenannte Eurodollar-System).Diese Position der Stärke nutzten die USA weiter aus und erschufen, was heute als das Petrodollar-System bekannt ist. Dank einem Abkommen zwischen Saudi-Arabien und den USA in den 1970ern wird das von allen Mitgliedsstaaten der OPEC geförderte Öl in US Dollar gehandelt, im Gegenzug für militärischen Schutz durch die USA. Das sogenannte Petrodollar-System hat dem US Dollar somit einen enormen Wert und hohe Liquidität verliehen.

Die war auch nötig, denn teure Sozialprogramme wie Medicare und Medicaid als auch das Social Security Programm wurden gestartet. Aber auch sehr teure Stellvertreterkriege, wie z.B. in Korea und Vietnam, wollten finanziert werden. Dies taten die USA, indem sie das Geld hierfür einfach druckten, was wiederum die Zentralbanken der anderen Länder nervös machte und dazu brachte, mit dem Abzug ihrer Goldeinlagen bei der US-Notenbank zu drohen. Der damalige Präsident Tricky Dick (Richard Nixon) reagierte darauf, indem er die Goldbindung des US Dollar zunächst nur temporär für immer aufhob. Damit hatte er den Dollar vom Gold ent- und an das Öl der Saudis (bzw. an den militärisch-industriellen Komplex der USA) gekoppelt.

Die USA haben also das exorbitante Privileg, das Geld drucken zu können, das die Welt für die Abwicklung von Handel verwendet. Dies bedeutet unter anderem, dass die USA ihre gedruckten Dollars exportieren und Waren und Dienstleistungen aus anderen Ländern importieren können. Somit wird das gedruckte Geld im Allgemeinen zuerst in den USA ausgegeben (Cantillon-Effekt in Reinform), was dazu führt, dass Geschäftserfolg in den USA zu einer viel höheren monetären Belohnung führt, als in anderen Ländern. Vereinfacht gesagt: In den USA schwimmt mehr Geld umher und somit wird Erfolg besser belohnt. Folglich wollen mehr Menschen in die USA ziehen, und die USA können auswählen, wer hineinkommt und wer nicht. Gut für die USA - schlecht für die anderen.

Die ehrgeizigsten Menschen aus anderen Ländern immigrieren in die USA und verdienen mehr Geld und leben ein viel besseres Leben als in ihren Heimatländern. Der Braindrain bedeutet, dass andere Länder unterm Strich verlieren. Menschen im Allgemeinen versuchen immer in Länder einzuwandern, die in der Cantillon-Hierarchie höher stehen. Die reichen Länder werden somit reicher an Humankapital, während die armen Länder an Humankapital ärmer werden.

Die ehrgeizigsten Menschen aus anderen Ländern immigrieren in die USA und verdienen mehr Geld und leben ein viel besseres Leben als in ihren Heimatländern. Der Braindrain bedeutet, dass andere Länder unterm Strich verlieren. Menschen im Allgemeinen versuchen immer in Länder einzuwandern, die in der Cantillon-Hierarchie höher stehen. Die reichen Länder werden somit reicher an Humankapital, während die armen Länder an Humankapital ärmer werden.Die USA schaffen es, ihre Stellung als Neuzeit-Kolonialist vor allem mit Hilfe von Sonderorganisationen, internationalen Finanzinstitutionen und anderen Stiftungen wie dem IWF, der BIZ, des WEF oder der Weltbank zu zementieren. Diese supranationalen Banken und Organisationen leihen Entwicklungsländern und "Ländern des globalen Südens" Geld für den (Wieder-) Aufbau und andere Struktur-relevante Tätigkeiten, aber nur unter strengen Auflagen, die noch strenger werden, wenn diese Kredite nicht zurückgezahlt werden können. In diesen Fällen werden diese Länder dann von den Banken "gerettet", unter der Auflage, noch mehr Kontrolle über die eigene Finanzsuveränität abzugeben.

Im Wesentlichen tauschen sie dabei Kredite und längere Laufzeiten gegen organisatorische Kontrolle über den Staatshaushalt. Solche Beschränkungen können Punkte beinhalten, wie z.B. wieviel des nationalen Budgets für Infrastruktur ausgegeben werden kann. Oft müssen diese verschuldeten Regierungen eine eigene unabhängige Zentralbank gründen, die dazu verwendet werden kann, die Notwendigkeit einer staatlichen Genehmigung zu umgehen. So werden Länder dazu gebracht Staats-Ressourcen, wie Schürfrechte oder Ländereien an ausländische Unternehmen zu verkaufen.

Im Wesentlichen tauschen sie dabei Kredite und längere Laufzeiten gegen organisatorische Kontrolle über den Staatshaushalt. Solche Beschränkungen können Punkte beinhalten, wie z.B. wieviel des nationalen Budgets für Infrastruktur ausgegeben werden kann. Oft müssen diese verschuldeten Regierungen eine eigene unabhängige Zentralbank gründen, die dazu verwendet werden kann, die Notwendigkeit einer staatlichen Genehmigung zu umgehen. So werden Länder dazu gebracht Staats-Ressourcen, wie Schürfrechte oder Ländereien an ausländische Unternehmen zu verkaufen.Jimmy Song führt seinen Artikel noch etwas fort, doch die mir wichtigsten Punkte habe ich erwähnt. Kurz zusammengefasst: Die USA haben durch die de facto Kontrolle über das Geld eine Sonderposition in der Welt. Nicht nur sitzen sie am Gelddrucker - Geld drucken kann jeder, klappt eben nur unter bestimmten Voraussetzungen (zumindest zeitweise) - sondern haben durch diese Kontrollsituation weitere Vorteile: 1) Das größte Exportgut der USA ist der US Dollar. 2) Die US-Wirtschaft hat einen klaren Vorteil anderen Wirtschaften gegenüber, da das Unternehmertum dort besser belohnt wird. 3) Viele ehrgeizige und talentierte Menschen der ganzen Welt strömen in die USA, um von dieser Belohnung zu profitieren. 4) Die internationalen Buchstabensuppen-Finanzinstitutionen stärken den USA den Rücken.

Die USA haben also ein sehr großes (das gröte) Interesse daran, das globale Finanzmonopol in der aktuellen Form aufrechtzuerhalten.

Peruvian Bull "The Dollar Endgame"

Die Ausgangsthese von Peruvian Bull, einem Autor, der ein gleichnamiges Buch veröffentlicht hat (The Dollar Endgame) ist, dass viele Zeichen darauf hindeuten, dass der US Dollar als Leitwährung der Welt seine letzten Atemzüge macht. Er ist dabei recht pessimistisch und glaubt, dass wir schon in den nächten fünf bis sieben Jahren eine große Veränderung erleben werden.

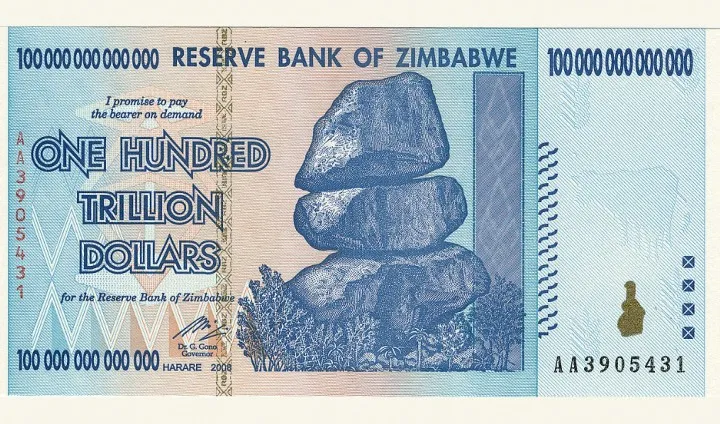

Allerdings sieht er eine große Chance für die USA, Bitcoin zu nutzen, um diesem Untergang entgegenzuwirken. Viele Länder und Institutionen außerhalb der westlichen Welt sehen den US Dollar kritisch und sind nicht besonders glücklich über die Vormachtstellung, die der Dollar den USA auf dem internationalen Finanzmarkt, dem globalen Handel und der geopolitischen Weltordnung verleiht. Die US-Notenbank wird immer mehr in die Ecke gedrängt und der einzige Ausweg aus der momentanen Schuldenspirale ist Hyperinflation.

Meine zwei Sats sind, dass eine Wahrscheinlichkeit natürlich immer besteht, allerdings bin ich persönlich davon überzeugt, dass der US Dollar, wenn überhaupt, die letzte Währung sein wird, die eine Hyperinflation erlebt, da vorher ganz andere Währungen das Zeitliche segnen müssten.

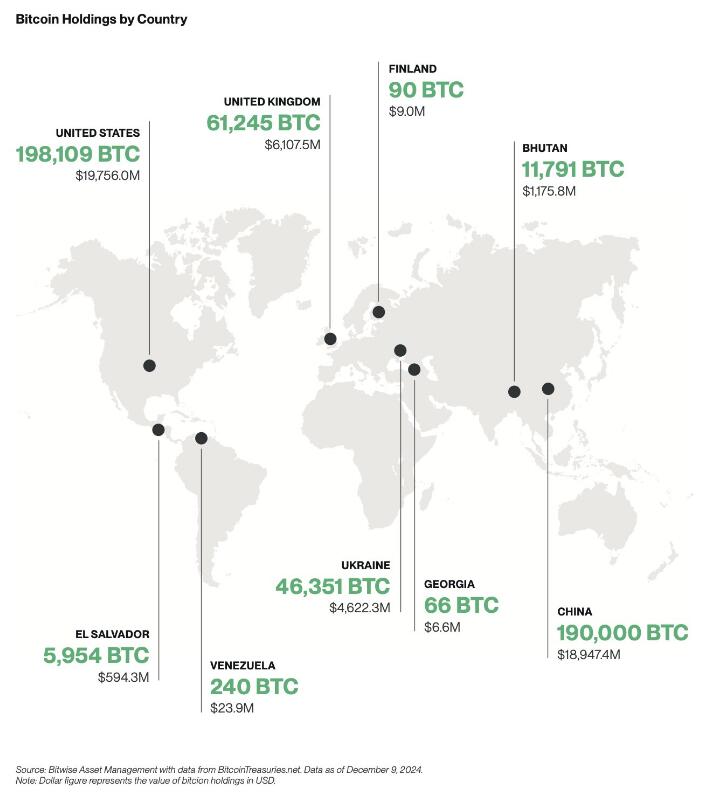

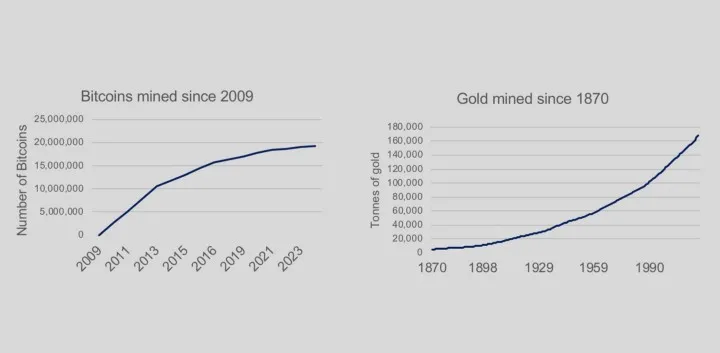

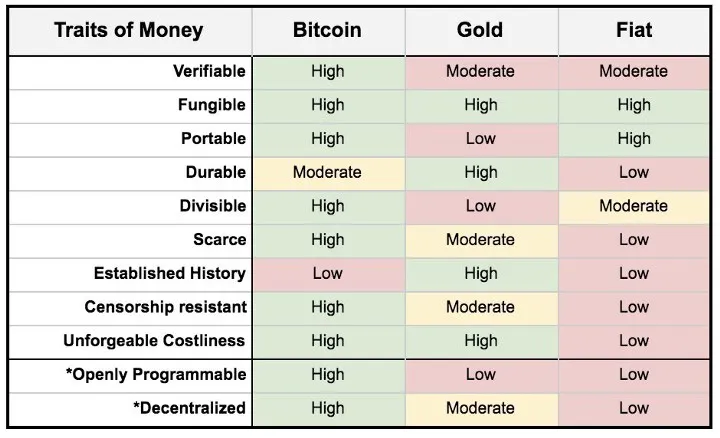

Meine zwei Sats sind, dass eine Wahrscheinlichkeit natürlich immer besteht, allerdings bin ich persönlich davon überzeugt, dass der US Dollar, wenn überhaupt, die letzte Währung sein wird, die eine Hyperinflation erlebt, da vorher ganz andere Währungen das Zeitliche segnen müssten.Doch um bei der These zu bleiben, bietet Bitcoin eine alternative Lösung zur Hyperinflation. Denn die USA könnten ihre Verluste reduzieren, indem sie auf eine Bitcoin-gestützte Leitwährung wechseln. Dazu sind die USA auch bestens aufgestellt: Die von Minern aufgebrachte Hashrate ist nirgendwo größer, als in den USA, Bitcoin-Bestände in Wallets sind nirgendwo größer als in den USA und die größten Bitcoin-Unternehmen, Unternehmen die Bitcoin fördern, oder Technologie entwickeln, die Bitcoin zugute kommt, sitzen in den USA.

Würden die USA, bzw. die US-Notenbank, zu einem Bitcoin-gestützten Währungssystem wechseln, müssten alle anderen Länder der Welt nachziehen, solange die USA diese (oben beschriebene) globale Vormachtstellung in der Weltwirtschaft noch innehaben. Dies würde den USA einen gewaltigen First-Mover-Vorteil bescheren, da nirgendwo sonst die Infrastruktur und der Zugang zu Bitcoin so stark ausgeprägt sind.

Es ist also nur eine politische Entscheidung, ob dieser First-Mover-Vorteil ausgenutzt wird oder nicht. Indem die Nutzung (institutioneller oder privater Art, Mining, Innovation, etc.) eingeschränkt wird, z.B. durch Verbote, Besteuerung, oder andere ungünstige Gesetze, wird die gesamte Branche und damit das technische Wissen, die Innovation und das damit verbundene Kapital ins Ausland verdrängt und die USA schießen sich ins eigene Bein.

Es wird sicherlich institutionellen Widerstand geben, da die derzeitigen institutionellen Akteure stark vom aktuellen System profitieren und daher nicht zu einem Bitcoin-Währungssystem wechseln wollen, in dem sie keine Zensurrechte und keine exklusiven Übertragungsrechte haben. Daher werden US-Institutionen wie die Notenbank und das Finanzministerium von diesem Ansatz nicht allzu begeistert sein, doch wenn sie es ernsthaft genug betrachten und erkennen, dass es sich hierbei um eine Form der geopolitischen, strategischen Kriegsführung handelt, könnten sie gezwungen sein, ihre Meinung zu ändern und sich auf ein neues System vorzubereiten, das den Idealen, wie Freiheit, Redefreiheit, Eigentumsrechten und solides Geld, treu bleibt, auf denen die USA gegründet wurden.

Peruvian Bull und Marty Bent führen in dieser Episode noch weitere Punkte aus, doch die mir wichtigsten Punkte habe ich wieder erwähnt. Kurz zusammengefasst: Die USA stehen davor, ihre globale Vormachtstellung zu verlieren. Ein Ausweg könnte die Adaption von Bitcoin als Retter des US Dollar sein. Die USA haben den fruchtbarsten Nährboden für eine solche Änderung des Systems, da sie heute schon die meiste Hashrate, das größte geistige Eigentum und Innovation, als auch das meiste Kapital bündeln.

Die USA hätten also in der Theorie ein sehr großes Interesse daran, Bitcoin als Lösung und zur Stützung ihres globalen Finanzmonopols zu adaptieren.

Zwei Theorien in zwei entgegengesetzte Richtungen 👈👉

Auf der einen Seite sehen wir ein Argument, weshalb den USA daran gelegen wäre, das aktuelle System so lange wie möglich aufrechtzuerhalten und dem alten Mann auf Krücken unter die Arme zu greifen. Auf der anderen Seite besteht ein Argument dafür, dass die USA ein gesteigertes Interesse daran haben sollten, das alte System so schnell wie möglich hinter sich zu lassen und die Pole Position, die die USA im Bereich Bitcoin haben - ohne Regierungs-seitig was dafür getan zu haben - für sich zu nutzen, um dem alten Mann auf Krücken zu einer Verjüngung zu verhelfen.

Es ist schwierig einzuschätzen, welchen Weg die USA gehen werden, da es immer noch keinen allgemeinen Konsens darüber gibt, wie Bitcoin zu betrachten ist. Der kürzlich vorgestellte DAME-Gesetzesentwurf (Digital Asset Mining Energy excise tax), also eine Verbrauchssteuer für Miner, der Biden-Regierung, würde von Bitcoin-Mining-Unternehmen verlangen, eine 30% Steuer auf die Stromkosten zu zahlen, die für das Mining von Bitcoin verwendet werden. Ein solches Gesetz würde die Mining Industrie aus dem Land drängen, da Miner heute schon auf sehr knappen Margen operieren und somit unprofitabel würden. Dies gleicht einer Bestrafung von Unternehmen für das Streben nach Innovation und technologischem Fortschritt.

Auf der anderen Seite gibt es aber auch die Ansicht, Bitcoin müsse ins Land geholt werden, da man es dort am besten kontrollieren kann, ganz nach dem Motto "Halte deine Freunde nah und deine Feinde noch näher". So z.B. Carole House, ehemalige Direktorin für Cybersicherheit des Nationalen Sicherheitsrates des Weißen Hauses. Sie sprach bei einem Event an der Universität von Princeton und sagte "sie würde lieber mehr Hashrate in den USA sehen, damit sie Miner zwingen können, das Netzwerk zu zensieren" und dass es "nicht nur darum ginge, Minern zu sagen, dass sie bestimmte Transaktionen nicht in Blöcke einbauen, sondern auch nicht auf Blöcken mit nicht konformen Transaktionen aufzubauen, damit diese Transaktionen nirgendwo in der Kette ankommen".

Wir sehen also, dass es selbst zwischen den Gegnern von Bitcoin keinen endgültigen Konsens gibt, wie das Thema in Zukunft angegangen werden soll. Da ist esnicht verwunderlich, dass auf Ebene eines Paradigmenwechsels, den die Adaption von Bitcoin von Seiten der Notenbank bedeuten würde, noch unklarer ist. Für mich sind beide Erklärungen logisch. Allerdings wissen wir nur zu gut, dass Regierungen es manchmal nicht so mit Logik und Vernunft haben.

🫳🎤

In diesem Sinne, 2... 1... Risiko!

-

@ 207ad2a0:e7cca7b0

2025-01-07 03:46:04

@ 207ad2a0:e7cca7b0

2025-01-07 03:46:04Quick context: I wanted to check out Nostr's longform posts and this blog post seemed like a good one to try and mirror. It's originally from my free to read/share attempt to write a novel, but this post here is completely standalone - just describing how I used AI image generation to make a small piece of the work.

Hold on, put your pitchforks down - outside of using Grammerly & Emacs for grammatical corrections - not a single character was generated or modified by computers; a non-insignificant portion of my first draft originating on pen & paper. No AI is ~~weird and crazy~~ imaginative enough to write like I do. The only successful AI contribution you'll find is a single image, the map, which I heavily edited. This post will go over how I generated and modified an image using AI, which I believe brought some value to the work, and cover a few quick thoughts about AI towards the end.

Let's be clear, I can't draw, but I wanted a map which I believed would improve the story I was working on. After getting abysmal results by prompting AI with text only I decided to use "Diffuse the Rest," a Stable Diffusion tool that allows you to provide a reference image + description to fine tune what you're looking for. I gave it this Microsoft Paint looking drawing:

and after a number of outputs, selected this one to work on:

The image is way better than the one I provided, but had I used it as is, I still feel it would have decreased the quality of my work instead of increasing it. After firing up Gimp I cropped out the top and bottom, expanded the ocean and separated the landmasses, then copied the top right corner of the large landmass to replace the bottom left that got cut off. Now we've got something that looks like concept art: not horrible, and gets the basic idea across, but it's still due for a lot more detail.

The next thing I did was add some texture to make it look more map like. I duplicated the layer in Gimp and applied the "Cartoon" filter to both for some texture. The top layer had a much lower effect strength to give it a more textured look, while the lower layer had a higher effect strength that looked a lot like mountains or other terrain features. Creating a layer mask allowed me to brush over spots to display the lower layer in certain areas, giving it some much needed features.

At this point I'd made it to where I felt it may improve the work instead of detracting from it - at least after labels and borders were added, but the colors seemed artificial and out of place. Luckily, however, this is when PhotoFunia could step in and apply a sketch effect to the image.

At this point I was pretty happy with how it was looking, it was close to what I envisioned and looked very visually appealing while still being a good way to portray information. All that was left was to make the white background transparent, add some minor details, and add the labels and borders. Below is the exact image I wound up using:

Overall, I'm very satisfied with how it turned out, and if you're working on a creative project, I'd recommend attempting something like this. It's not a central part of the work, but it improved the chapter a fair bit, and was doable despite lacking the talent and not intending to allocate a budget to my making of a free to read and share story.

The AI Generated Elephant in the Room

If you've read my non-fiction writing before, you'll know that I think AI will find its place around the skill floor as opposed to the skill ceiling. As you saw with my input, I have absolutely zero drawing talent, but with some elbow grease and an existing creative direction before and after generating an image I was able to get something well above what I could have otherwise accomplished. Outside of the lowest common denominators like stock photos for the sole purpose of a link preview being eye catching, however, I doubt AI will be wholesale replacing most creative works anytime soon. I can assure you that I tried numerous times to describe the map without providing a reference image, and if I used one of those outputs (or even just the unedited output after providing the reference image) it would have decreased the quality of my work instead of improving it.

I'm going to go out on a limb and expect that AI image, text, and video is all going to find its place in slop & generic content (such as AI generated slop replacing article spinners and stock photos respectively) and otherwise be used in a supporting role for various creative endeavors. For people working on projects like I'm working on (e.g. intended budget $0) it's helpful to have an AI capable of doing legwork - enabling projects to exist or be improved in ways they otherwise wouldn't have. I'm also guessing it'll find its way into more professional settings for grunt work - think a picture frame or fake TV show that would exist in the background of an animated project - likely a detail most people probably wouldn't notice, but that would save the creators time and money and/or allow them to focus more on the essential aspects of said work. Beyond that, as I've predicted before: I expect plenty of emails will be generated from a short list of bullet points, only to be summarized by the recipient's AI back into bullet points.

I will also make a prediction counter to what seems mainstream: AI is about to peak for a while. The start of AI image generation was with Google's DeepDream in 2015 - image recognition software that could be run in reverse to "recognize" patterns where there were none, effectively generating an image from digital noise or an unrelated image. While I'm not an expert by any means, I don't think we're too far off from that a decade later, just using very fine tuned tools that develop more coherent images. I guess that we're close to maxing out how efficiently we're able to generate images and video in that manner, and the hard caps on how much creative direction we can have when using AI - as well as the limits to how long we can keep it coherent (e.g. long videos or a chronologically consistent set of images) - will prevent AI from progressing too far beyond what it is currently unless/until another breakthrough occurs.

-

@ d34e832d:383f78d0

2025-01-06 23:44:40

@ d34e832d:383f78d0

2025-01-06 23:44:40Lets explore three key aspects of Bitcoin technology to enhance your engagement with the ecosystem:

- Running an Alby Hub Cloud Instance

- Setting Up a Nutshell Ecash Mint on an Affordable VPS

- Integrating Nostr Wallet Connect for Seamless Tipping

These components empower users to manage transactions, ensure privacy, and facilitate smooth interactions within the Bitcoin and Nostr communities.

1. Running an Alby Hub Cloud Instance

Purpose and Benefits:

Alby Hub is a self-custodial Lightning wallet that allows you to manage Bitcoin transactions efficiently. By running an Alby Hub instance in the cloud, you gain 24/7 online access to receive payments via a Lightning address, integrate with various applications, and maintain control over your funds without the need for personal hardware.

Setting Up Alby Hub in the Cloud:

-

Choose Alby Cloud: For a hassle-free setup, Alby offers a cloud service where you can start your own hub in just 2 minutes. Give it A Try: Alby Cloud

-

Subscription Benefits: Subscribing to Alby Cloud provides you with a self-custodial Lightning wallet, 24/7 online access, exclusive partner deals, priority support, and access to a subscriber community.

-

Getting Started: Visit the Alby Cloud page, select the subscription that suits you, and follow the guided setup process to have your hub up and running quickly.

- Alby Cloud page

For a visual guide on setting up Alby Hub, you can watch the following tutorial:

2. Setting Up a Nutshell Ecash Mint on an Affordable VPS

Purpose and Benefits:

Nutshell is an implementation of Ecash, a digital cash system that prioritizes privacy and anonymity. Setting up a Nutshell Ecash mint on a Virtual Private Server (VPS) allows you to operate your own mint, enhancing transaction privacy and providing a backup system for your Bitcoin transactions.

Setting Up on a $5 VPS:

-

Select a VPS Provider: Choose an affordable VPS provider that supports Bitcoin and Nostr communities. For instance, SatoshiHost offers VPS services tailored for such needs.

-

Install Nutshell: After setting up your VPS, install the Nutshell software by following the official installation guide.

- Nutshell

-

Configure the Mint: Set up the mint parameters, including denomination and security settings, to suit your requirements.

-

Secure the Server: Implement security measures such as firewalls and regular updates to protect your mint from potential threats.

- Recommendations

- Server Tips

3. Integrating Nostr Wallet Connect for Seamless Tipping

Purpose and Benefits:

Nostr Wallet Connect (NWC) is an open protocol that enables applications to interact with Bitcoin Lightning wallets. Integrating NWC allows for seamless tipping and payments within Nostr apps, enhancing user experience and promoting engagement.

Integration Steps:

-

Choose a Supporting App: Select a Nostr app that supports NWC, such as Amythystor Damus.

-

Connect Your Wallet: Use NWC to link your preferred Lightning wallet to the Nostr app. This connection facilitates seamless payments without the need to switch between applications.

-

Test the Integration: Perform a test transaction to ensure that the tipping functionality works as intended.

-

Maintain Security: Regularly update your wallet and Nostr app to incorporate the latest security features and improvements.

For a deeper understanding of Nostr Wallet Connect and its significance, you can watch the following discussion:

Final Thoughts On Setup

Implementing these components enhances your interaction with the Bitcoin ecosystem by providing efficient transaction management, improved privacy, and seamless integration with Nostr applications. By running an Alby Hub cloud instance, setting up a Nutshell Ecash mint on an affordable VPS, and integrating Nostr Wallet Connect, you contribute to a more robust and user-friendly Bitcoin environment.

Invitation for Feedback

I encourage you to share any questions or feedback regarding these topics. Let's continue the conversation to explore how we can further engage with and improve upon these technologies.

-

@ 3ffac3a6:2d656657

2025-01-06 23:42:53

@ 3ffac3a6:2d656657

2025-01-06 23:42:53Prologue: The Last Trade

Ethan Nakamura was a 29-year-old software engineer and crypto enthusiast who had spent years building his life around Bitcoin. Obsessed with the idea of financial sovereignty, he had amassed a small fortune trading cryptocurrencies, all while dreaming of a world where decentralized systems ruled over centralized power.

One night, while debugging a particularly thorny piece of code for a smart contract, Ethan stumbled across an obscure, encrypted message hidden in the blockchain. It read:

"The key to true freedom lies beyond. Burn it all to unlock the gate."

Intrigued and half-convinced it was an elaborate ARG (Alternate Reality Game), Ethan decided to follow the cryptic instruction. He loaded his entire Bitcoin wallet into a single transaction and sent it to an untraceable address tied to the message. The moment the transaction was confirmed, his laptop screen began to glitch, flooding with strange symbols and hash codes.

Before he could react, a flash of light engulfed him.

Chapter 1: A New Ledger

Ethan awoke in a dense forest bathed in ethereal light. The first thing he noticed was the HUD floating in front of him—a sleek, transparent interface that displayed his "Crypto Balance": 21 million BTC.

“What the…” Ethan muttered. He blinked, hoping it was a dream, but the numbers stayed. The HUD also showed other metrics:

- Hash Power: 1,000,000 TH/s

- Mining Efficiency: 120%

- Transaction Speed: Instant

Before he could process, a notification pinged on the HUD:

"Welcome to the Decentralized Kingdom. Your mining rig is active. Begin accumulating resources to survive."

Confused and a little terrified, Ethan stood and surveyed his surroundings. As he moved, the HUD expanded, revealing a map of the area. His new world looked like a cross between a medieval fantasy realm and a cyberpunk dystopia, with glowing neon towers visible on the horizon and villagers dressed in tunics carrying strange, glowing "crypto shards."

Suddenly, a shadow loomed over him. A towering beast, part wolf, part machine, snarled, its eyes glowing red. Above its head was the name "Feral Node" and a strange sigil resembling a corrupted block.

Instinct kicked in. Ethan raised his hands defensively, and to his shock, the HUD offered an option:

"Execute Smart Contract Attack? (Cost: 0.001 BTC)"

He selected it without hesitation. A glowing glyph appeared in the air, releasing a wave of light that froze the Feral Node mid-lunge. Moments later, it dissolved into a cascade of shimmering data, leaving behind a pile of "Crypto Shards" and an item labeled "Node Fragment."

Chapter 2: The Decentralized Kingdom

Ethan discovered that the world he had entered was built entirely on blockchain-like principles. The land was divided into regions, each governed by a Consensus Council—groups of powerful beings called Validators who maintained the balance of the world. However, a dark force known as The Central Authority sought to consolidate power, turning decentralized regions into tightly controlled fiefdoms.

Ethan’s newfound abilities made him a unique entity in this world. Unlike its inhabitants, who earned wealth through mining or trading physical crypto shards, Ethan could generate and spend Bitcoin directly—making him both a target and a potential savior.

Chapter 3: Allies and Adversaries

Ethan soon met a colorful cast of characters:

-

Luna, a fiery rogue and self-proclaimed "Crypto Thief," who hacked into ledgers to redistribute wealth to oppressed villages. She was skeptical of Ethan's "magical Bitcoin" but saw potential in him.

-

Hal, an aging miner who ran an underground resistance against the Central Authority. He wielded an ancient "ASIC Hammer" capable of shattering corrupted nodes.

-

Oracle Satoshi, a mysterious AI-like entity who guided Ethan with cryptic advice, often referencing real-world crypto principles like decentralization, trustless systems, and private keys.

Ethan also gained enemies, chief among them the Ledger Lords, a cabal of Validators allied with the Central Authority. They sought to capture Ethan and seize his Bitcoin, believing it could tip the balance of power.

Chapter 4: Proof of Existence

As Ethan delved deeper into the world, he learned that his Bitcoin balance was finite. To survive and grow stronger, he had to "mine" resources by solving problems for the people of the Decentralized Kingdom. From repairing broken smart contracts in towns to defending miners from feral nodes, every task rewarded him with shards and upgrades.

He also uncovered the truth about his arrival: the blockchain Ethan had used in his world was a prototype for this one. The encrypted message had been a failsafe created by its original developers—a desperate attempt to summon someone who could break the growing centralization threatening to destroy the world.

Chapter 5: The Final Fork

As the Central Authority's grip tightened, Ethan and his allies prepared for a final battle at the Genesis Block, the origin of the world's blockchain. Here, Ethan would face the Central Authority's leader, an amalgamation of corrupted code and human ambition known as The Miner King.

The battle was a clash of philosophies as much as strength. Using everything he had learned, Ethan deployed a daring Hard Fork, splitting the world’s blockchain and decentralizing power once again. The process drained nearly all of his Bitcoin, leaving him with a single satoshi—a symbolic reminder of his purpose.

Epilogue: Building the Future

With the Central Authority defeated, the Decentralized Kingdom entered a new era. Ethan chose to remain in the world, helping its inhabitants build fairer systems and teaching them the principles of trustless cooperation.

As he gazed at the sunrise over the rebuilt Genesis Block, Ethan smiled. He had dreamed of a world where Bitcoin could change everything. Now, he was living it.

-

@ 2e8970de:63345c7a

2025-01-06 19:07:27

@ 2e8970de:63345c7a

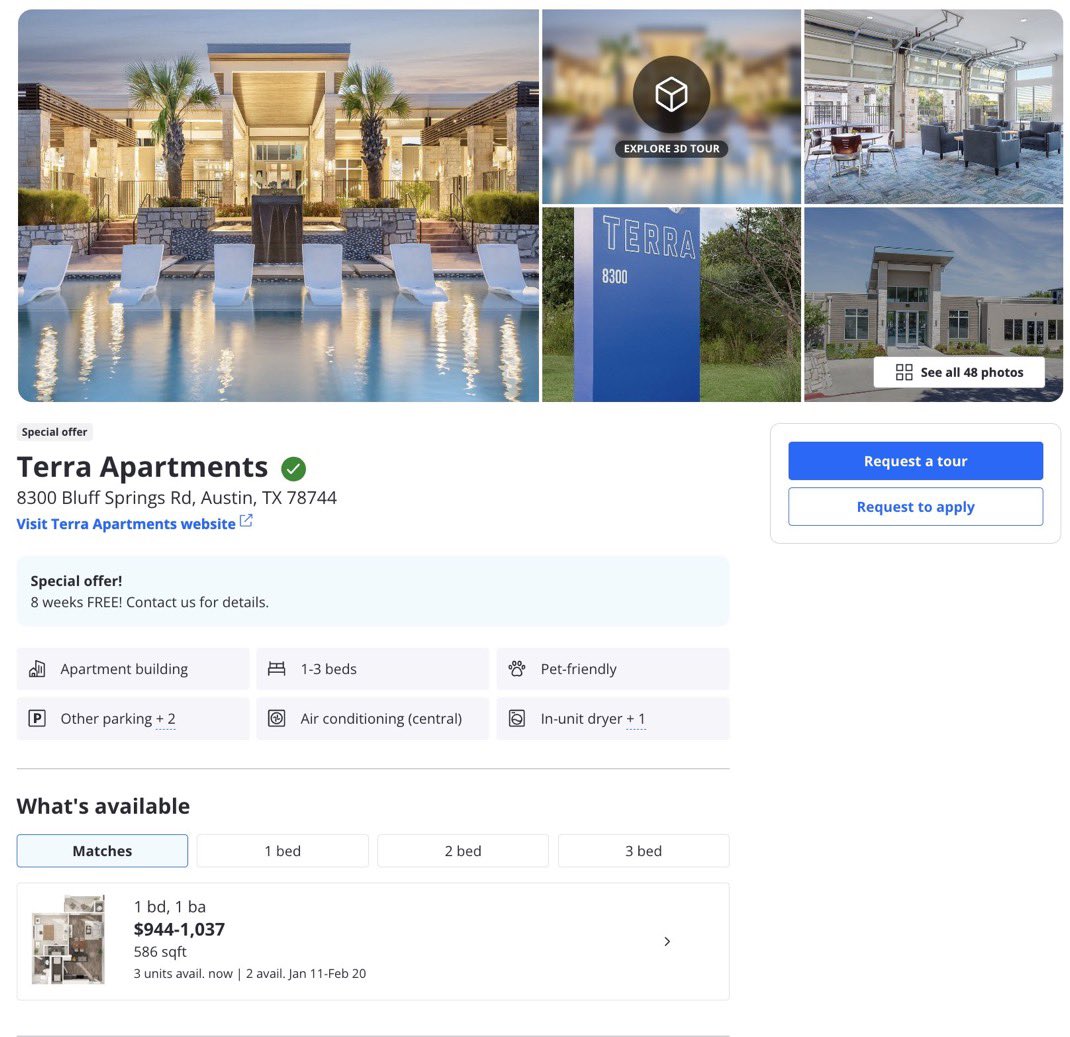

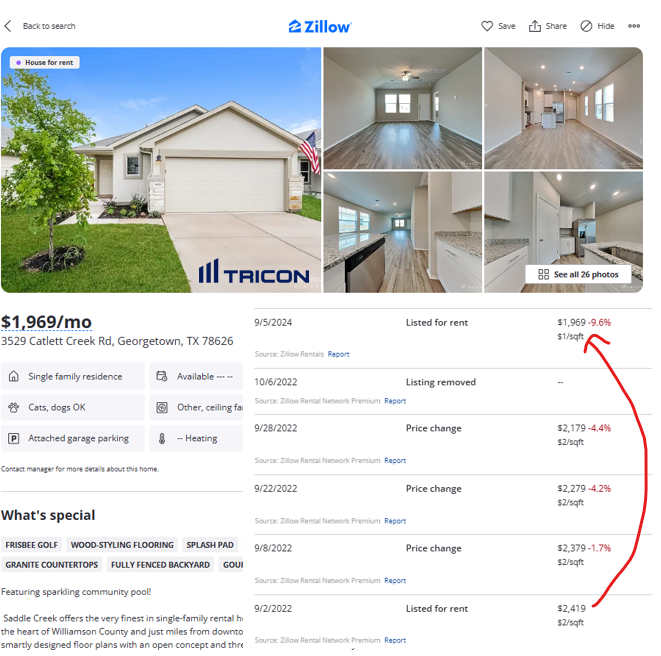

2025-01-06 19:07:27So it turns out that supply and demand actually do work. Who would have thought. Building building building payed out for developers in Austin. And for renters too.

Here is an anecdote about a woman from Austin getting her renewal for $200 less than the previous year. Probably the first time during her lifetime.

Another anecdote are these offers where landlord offer the first 8 weeks of renting for free:

Discussion about this offer on Twitter

Third anecdote: A suburban home on Zillow:

Longer article about that topic: Rent prices drop more than 12% in Austin

originally posted at https://stacker.news/items/839611

-

@ 000002de:c05780a7

2025-01-06 18:26:28

@ 000002de:c05780a7

2025-01-06 18:26:28I've been watching old movies and documentaries over the last month and last night my lady and I watched "You Can't Take it with You" which I'd never seen. I really enjoyed it.

Here's a clip where the grandpa in the story declares to the IRS man that he doesn't believe in taxes. Its a thing of beauty.

Here's some of the dialog.

Wilbur G. Henderson, IRS Agent : Now, Mr. Vanderhoff, that's a very serious thing, not filing an income tax return.

Grandpa Martin Vanderhoff : Now, suppose I do pay you this money; mind you, I don't say that I'm going to, but, just for the sake of argument; what's the government going to do with it?

Wilbur G. Henderson, IRS Agent : What do you mean?

Grandpa Martin Vanderhoff : Well, what do I get for my money? For instance, if I go into a department store and buy something, why, there it is! I can see it. Well, what are they gonna give me?

Wilbur G. Henderson, IRS Agent : Why the government gives you everything! It protects you!

Grandpa Martin Vanderhoff : From what?

Wilbur G. Henderson, IRS Agent : Well, invasion! How do you think the government's gonna keep up the army and navy with all those battleships?

Grandpa Martin Vanderhoff : Battleships? The last time we used battleships was in the Spanish-American War. And what did we get out of that? Cuba - and we gave that back. Why, I wouldn't mind paying for something sensible.

Wilbur G. Henderson, IRS Agent : Something sensible? What about Congress and the Supreme Court and the President? We gotta pay them, don't we?

Grandpa Martin Vanderhoff : Not with my money! No, sir.

You can watch the whole film for free on YouTube. The movie has some other good moments where is demonstrates how bankers pull strings and manipulate the economy, law enforcement, and politics. Most of all I love the free spirit of the family.

Sadly this is a film you wouldn't see made today. At least not without more overt Marxist propaganda.

originally posted at https://stacker.news/items/839559

-

@ 2063cd79:57bd1320

2025-01-06 17:46:01

@ 2063cd79:57bd1320

2025-01-06 17:46:01Der Mempool ist voll. Voller als das Rosenrot an Heiligabend. Dies bedeutet in erster Linie hohe Transaktionsgebühren für On-Chain-Transaktionen. Doch auch während der Mempool verstopft ist, wie der Gotthardtunnel in der Urlaubssaison, bietet Bitcoins Layer 2 Lösung - das Lightning Netzwerk - schnelle und günstige Zahlungen, um Bitcoins Skalierungsgrenze zu überbrücken. Gerade in Zeiten von hohen Transaktionsgebühren und einem Mempool, der voller ist als Til Schweiger nach 13 Uhr, werden kleine Zahlungen, die On-Chain getätigt werden, immer unökonomischer und Lightning Zahlungen dadurch attraktiver.

Doch nicht jede/r Nutzer//in möchte auch gleichzeitig eine Lightning-Node betreiben, um in den Genuss zu kommen Lightning zu benutzen. In diesem Fall bieten Lightning Service Provider (LSP) und verschiedene Apps Abhilfe. Es gibt viele verschiedene Anbieter und viele verschiedene Varianten das gleiche Problem umzusetzen: Der/die Nutzer//in möchte mit möglichst wenig Aufwand Lightning benutzen und muss dazu seine/ihre Lightning Wallet zunächst erstmal mit (On-Chain) Bitcoin füttern. Das Umwandeln von L1 Bitcoin zu L2 Bitcoin übernimmt dann die Software. Aber auch andersherum kann es sein, dass Nutzer//innen viele Lightning Zahlungen erhalten und die gesammelten Sats gerne in L1 Bitcoin tauschen möchten. Um diesen Tauschvorgang abzuwickeln gibt es verschiedene Methoden. Eine dieser Methoden sind sogenannte Submarine Swaps.

Erstmal vorab: Bitcoin ist Bitcoin, ob On-Chain auf der Basisschicht (Layer 1), oder Off-Chain auf der zweiten Schicht (Layer 2) in Form von Lightning. Man könnte es mit Bargeld vergleichen: Geld auf dem Konto kann problemlos hin- und hergeschoben werden, man kann es auf andere Konten schieben, Überweisungen tätigen oder Depots bezahlen. Wenn man allerdings Bargeld in der Tasche haben will, muss man eine Brücke von der digitalen Kontenwelt in die analoge Bargeldwelt schlagen. Diese Brücke stellen Bankautomaten, Supermarktkassen oder Bankschalter dar, oder eben jede Stelle, an der man Bargeld abheben kann. Das Geldmittel bleibt dabei das gleiche, es verändert nur seinen Aggregatzustand. So kann man Bitcoin in Lightning auch beschreiben, denn Bitcoin bleibt Bitcoin, es hat nur seinen Aggregatzustand temporär verändert. Auf der einen Seite sind also On-Chain-Transaktionen oder Layer 1 (L1) Zahlungen, auf der anderen Seite werde ich von Off-Chain- oder Lightning-Zahlungen oder Layer 2 (L2) und Sats sprechen.

Refresher

Im Bitcoin Stack gibt es verschiedene aufeinander aufbauende Layer und Bitcoin - das Netzwerk - bildet dabei die Grundschicht, das Fundament, auf dem weitere Schichten aufbauen. Bitcoin braucht zusätzlichen Protokolle und Netzwerke, um einen hohen Transaktionsdurchsatz und zukünftiges Wachstum zu gewährleisten. Das bedeutet ganz einfach, dass die Leistung und Geschwindigkeit der Blockchain und der darauf erfolgenden Transaktionen nicht darunter leidet, wenn mehr Nutzer//innen und höhere Transaktionsmengen hinzukommen. Denn Bitcoin selbst ist nicht skalierbar. Die Blockgröße ist begrenzt, die Blockzeit wird auf 10 Minuten geeicht und zusätzlich aufgewendete Energie verschnellert die Erstellung neuer Blöcke nicht, macht sie nicht günstiger und auch nicht effizienter.

Layer 2, also die zweite Schicht, beschreibt Anwendungen und Protokolle, die auf der Basis des ersten Layers, der originären Bitcoin Blockchain, aufbauen. Diese Anwendungen sind unabhängig von Bitcoin insofern, als dass sie den Ablauf und den Code von Bitcoin nicht direkt beeinflussen, das Bitcoin Protokoll bleibt dabei unangetastet. Allerdings erlauben sie dem/der Nutzer//in einen Umgang mit Bitcoin und Anwendungsmöglichkeiten, die über die nativen Funktionen von Bitcoin hinausgehen und fördern somit das Ökosystem rund um Bitcoin.

Lightning, die bekannteste Layer 2 Lösung, basiert auf einem Peer-to-Peer-System zur Durchführung von Mikrozahlungen über ein Mesh-Netzwerk von bidirektionalen Zahlungskanälen. Genau wie bei Bitcoin können bei Lightning eigene Netzwerkknoten betrieben und somit eigene Zahlungskanäle verwaltet werden.

Diese Zahlungskanäle ermöglichen es den Teilnehmer//innen, sich gegenseitig Geld zu überweisen, ohne alle ihre Transaktionen auf der Bitcoin-Blockchain öffentlich machen zu müssen. Zahlungskanäle werden geöffnet und die Blockchain sperrt in diesem Moment die verwendeten Bitcoins für die weitere Verwendung, und in Lightning wird nur der Gegenwert dieser Bitcoins gehandelt. Immer wenn Zahlungskanäle geschlossen werden, werden diese Transaktionen auf die Bitcoin Blockchain übertragen. Lightning-Zahlungen können auch über direkte Kanäle hinaus an andere Teilnehmer gesendet werden, da viele aufeinanderfolgende Kanäle miteinander verkettet werden können und sich eine Zahlung den besten Weg durch die Knotenpunkte dieses weitverzweigten P2P-Netzwerks sucht.

Anders als bei Bitcoin, muss der/die Betreiber//in eines Lightning-Knotens aktiv seine/ihre Kanäle und damit seine/ihre Liquidität managen. Es muss immer genug inbound (eingehend) und genug outbound (ausgehend) Liquidität zur Verfügung stehen, um Zahlungen sowohl zu tätigen als auch zu erhalten. Dies erfordert ein gewisses Verständnis und einen Verwaltungsaufwand, den nicht jede/r Nutzer//in bereit ist aufzubringen, da Kanäle (noch) jederzeit auf ihre Balance überwacht werden müssen.

Submarine Swaps erleichtern die Verwaltung der Liquidität dieser Lightning-Knoten. Sie können dabei helfen, eingehende Liquidität zu erhalten und Kanäle wieder aufzufüllen, wenn die Kapazität erschöpft ist, oder Tageseinnahmen in On-Chain Bitcoin umzuwandeln, um diese in Eigenverwahrung zu schützen.

Das Hauptproblem bei den verschiedenen Schichten im Bitcoin-Stack besteht darin, dass Transaktionen zwischen On-Chain-Bitcoin-Adressen (L1) und Off-Chain-Lightning-Adressen (L2) nicht direkt kompatibel sind. Man kann nicht einfach eine Lightning-Transaktion an jemanden senden, der Lightning nicht verwendet, sondern "nur" Bitcoin, oder umgekehrt. Diese Trennung schafft eine Barriere zwischen der Bitcoin-Blockchain und den Layer 2 Protokollen.

Submarine Swaps ermöglichen den direkten Austausch von Vermögenswerten zwischen Bitcoin (L1) und dem Lightning-Netzwerk (L2). Submarine Swaps sind eine spezielle Art von Atomic Swaps, die ohne Verwahrungsrisiko oder Counterparty Risk durchgeführt werden können.

Atomic Swaps

Atomic Swaps wurden eigentlich erfunden, um den Handel von Vermögenswerten zwischen zwei Blockchains mit unterschiedlichen Coins durchzuführen, heute bekannt als On-Chain Atomic Swap. Ein Beispiel wäre der direkte Austausch von Dogecoin oder Litecoin mit Bitcoin. Mit der Entwicklung und Einführung von Layer 2 Protokollen wurden Atomic Swaps schnell auch für Off-Chain-Transaktionen verwendet, ergo Off-Chain Atomic Swaps.

Was bedeutet dies in der Praxis? Ganz einfach dargestellt nehmen wir an, Person 1 und Person 2 wollen Bitcoin gegen Lightning-Bitcoin eintauschen. Person 1 hat einen bitcoin und bevorzugt 100.000.000 Sats im Lightning Netzwerk (🔗➡️⚡), da sie oft viele kleine Transaktionen tätigt, Person 2 hat 100.000.000 Sats im Lightning Netzwerk und würde gerne in On-Chain-Bitcoin tauschen (⚡➡️🔗), um ihr Erspartes in Selbstverwahrung zu verschieben. Wir nehmen auch an, dass Person 1 und Person 2 keine Lightning-Nodes oder Apps besitzen, die diesen Vorgang für sie automatisch übernehmen, es soll hier einfach die Transaktion verdeutlicht werden.

Um den Austausch durchzuführen, erstellt Person 2 zunächst eine Geheimzahl, einen Wert. Aus diesem Wert generiert sie dann auch einen Hash und sendet diesen Hash an Person 1, ohne den verborgenen Wert zu teilen. Dann erstellt Person 2 eine Transaktion und sperrt 100.000.000 Sats. Diese Sats können nur auf zwei Arten entsperrt werden. Entweder kann Person 1 mit Hilfe des ihr bekannten Werts die Sats einfordern, oder Person 2 kann ihre Sats nach Ablauf eines festgelegten Zeitraums (Anzahl von Blöcken) wieder zurückholen.

Im Moment können weder Person 1 noch Person 2 die Sats beanspruchen, da Person 1 den geheimen Wert nicht kennt (nur den Hash), und Person 2 kann die Sats nicht beanspruchen, da der Zeitraum noch nicht verstrichen ist. Diese zeitlich beschränkten Verträge nennt man Hash Time-Locked Contracts (HTLC).

Gleichzeitig erstellt Person 1 ihre Transaktion, die einen bitcoin sperrt. Der in dieser Transaktion gesperrte bitcoin kann auch wiederum nur auf zwei Arten eingefordert werden. Entweder kann Person 2 mit Hilfe des bekannten Werts den bitcoin einfordern, oder Person 1 holt sich ihren bitcoin zurück, nachdem der festgelegte Zeitraum verstrichen ist.

Beide Parteien haben also ihren jeweiligen Gegenwert für sich selbst gesperrt und für den anderen freigegeben, aber nur solange die Transaktion von beiden Seiten (in dem festgelegten Zeitraum) durchgeführt wird. Denn in dem Moment, in dem Person 2 den bitcoin einfordert, stellt sie Person 1 auch ihren geheimen Wert zur Verfügung, sodass sie die 100.000.000 Sats ausgezahlt bekommt. Für diese Transaktion zwischen zwei Parteien bedarf es keines Dritten. Lediglich die genutzten Smart-Contracts begünstigen diesen vertrauenslosen Handel, einen Atomic Swap zwischen dem Bitcoin-On-Chain und dem Bitcoin-Off-Chain-Lightning-Netzwerk.

Zurück zu Submarine Swaps

Ich möchte nochmal hervorheben, dass es sich um eine sehr vereinfachte Darstellung der Funktionsweise handelt, allerdings wollte ich auf abstrakte WEise erklären, wie diese SmartContracts funktionieren, ohne auf dem gleichen Protokoll zu laufen. Was bei Lightning-Lösungen zu Reibungen führt, ist das Verwalten von Kanälen, denn diese können aufgebraucht werden oder müssen neu ausbalanciert werden, wenn Nutzer//innen überwiegend Zahlungen empfangen oder versenden. Die größten Einschränkungen der aktuellen Lightning-Implementierung stellen das Öffnen und Schließen dieser Kanäle dar, da es dafür Transaktionsgebühren bedarf und eine gewisse Menge Bitcoin eingefroren wird, um einen Kanal zu öffnen. Dies bedeutet, dass ein Problem zwischen Lightning und On-Chain Bitcoin darin besteht, Gelder in und aus den beiden Umgebungen zu bekommen, ohne Kanäle öffnen und schließen zu müssen (um Kosten und Zeit zu sparen). Des Weiteren können Kanäle aufgebraucht werden, wenn Zahlungen hauptsächlich abfließen und es müssen neue Kanäle geöffnet werden, um die Nutzung fortzusetzen, obwohl im Wesentlichen unbegrenzte Transaktionen innerhalb eines Kanals gesendet werden können, solange die Netto Ein- und Ausgänge relativ stabil bleiben.

Die Verwaltung von Kanälen kostet On-Chain-Transaktionsgebühren und ist umso teurer, wenn der Mempool voller ist, als Johnny Depp nach der Trennung, was es unbequem, ineffizient und teuer macht, mehrere Kanäle wiederholt zu öffnen.

Submarine Swaps ermöglichen es, On-Chain Bitcoin in Off-Chain Bitcoin (🔗➡️⚡)- oder umgekehrt (⚡➡️🔗) - umzuwandeln. Sie basieren auf der gleichen Art von Bitcoin Smart-Contract wie Atomic Swaps, HTLCs, da diese sowohl On-Chain- als auch Off-Chain-Transaktionen umfassen können. Der Vorteil bei dieser Lösung liegt darin, dass HTLCs auch bei der Verkettung von Kanälen und Zahlungen verwendet werden und somit das Hauptkonstrukt für den Geldtransfer über das Lightning Netzwerk bilden. So wird Nutzer//innen und Wallet-Anbietern ermöglicht, Gelder vom Bitcoin-L1-Netzwerk direkt an das Lightning-Netzwerk oder andersrum vom Lightning-Netzwerk an das Bitcoin-L1-Netzwerk zu senden, ohne einen Drittanbieterdienst zu nutzen.

Damit bergen Submarine Swaps kein Counterparty Risiko und können ohne zusätzliche Barrieren wie Hintergrundprüfungen oder vertragliche Vereinbarungen durchgeführt werden. Entweder tauschen die beiden Parteien erfolgreich ihre Vermögenswerte aus, oder der Tausch findet nach Ablauf des festgelegten Zeitraums nicht statt. Aber zu keinem Zeitpunkt ist eine der Parteien in der Lage, mit den Einlagen der anderen Seite davonzukommen.

Die im Submarine Swap verwendete Form von HTLC-Smart-Contracts nennt man auch Swap-Provider und kann von einem Drittanbieter verwaltet werden, ist aber ein Smart Contract auf der Blockchain.Bekannte Implementierungen von Submarine Swaps direkt ins Endprodukt sind Lightning Wallets, wie Muun oder Breez.

Muun

Die Muun-Wallet ist notorisch dafür bekannt, eigentlich kein "echtes" Lightning-Wallet zu sein, denn alle Guthaben werden On-Chain in der Blockchain verwaltet. Die Muun-Wallet öffnet keine Kanäle für jeden Nutzer und verwendet stattdessen Submarine Swaps für Lightning-Zahlungen, was bedeutet, dass jedes Mal, wenn gesendet oder empfangen wird, eine On-Chain-Transaktion durchgeführt werden muss (und somit auch On-Chain-Gebühren anfallen). Dies bedeutet auch, dass Muun erstmal in Vorkasse geht, um schnelle Zahlungen aufrecht zu erhalten und ggf. Lightning-Zahlungen auf eine Blockbestätigung warten müssen, wenn Muun entscheidet, dass diese Transaktion ein zu hohes Risiko hat, unbestätigt ersetzt zu werden.

Der Vorteil dieses Ansatzes liegt darin, dass ein einheitlicher Kontostand dargestellt werden kann, der sowohl On-Chain- als auch Lightning-Transaktionen ermöglicht. Allerdings ist es nicht besonders einleuchtend, warum man sowohl L1 und L2 in einer Wallet verbinden muss, vor allem, wenn es bedeutet, dass sowohl Anbieter als auch Kunden potenziell höheren Gebühren ausgesetzt sind.

Breez

Ein weiterer Lightning-Wallet-Anbieter ist Breez. Auch hier werden Submarine Swaps genutzt, allerdings nur um Liquidität zu erzeugen. Denn obwohl L1-Bitcoin Zahlungen in Breez gespeichert werden können, bietet die Wallet die Möglichkeit, On-Chain-Bitcoin-Gelder über Submarine Swaps auf die Lightning-Wallet zu verschieben (🔗➡️⚡). Submarine Swaps werden in erster Linie verwendet, um eine einfache Benutzeroberfläche bereitzustellen. Das ermöglicht Breez vor allem auch, weniger Kanäle für seine Nutzer zu verwalten.

Das Lightning-Netzwerk, aber auch alle andere Layer 2 Lösungen, sind unabdinglich, wenn es darum geht Bitcoin als Zahlungsmittel möglichst reibungslos, benutzfreundlich und vorallem günstig zu gestalten. Allerdings besteht immernoch ein Reibungspunkt zwischen L1 und L2 und dem verschieben von Geldwerten zwischen diesen beiden Schichten. Submarine Swaps sind eine Methode diese Reibung zu verringern, da sie Entwicklern die Möglichkeit bieten benutzerfreundliche Konzepte umzusetzen, die es ermöglichen Lightning-Wallets und -Services so zu programmieren, dass dem/der Nutzer//in der Transfer von Aggregatszuständen nicht bewusst wird.

Natürlich besteht auch die Möglichkeit diese Swaps selbst durchzuführen. Dafür gibt es viele Dienste, mit denen man einen Handel (Swap) durchführen kann. Einige Anbieter können sogar genutzt werden, um ein wenig Profit zu erzielen, denn manche Anbieter lassen sich Vorabliquidität in Form von On-Chain Bitcoin etwas kosten.

🫳🎤

In diesem Sinne, 2... 1... Risiko!

-

@ 000002de:c05780a7

2025-01-06 17:05:46

@ 000002de:c05780a7

2025-01-06 17:05:46Apparently the Prime Clown in Canada is stepping down. Apparently the Orange Man beat the democrat machine. Are "we" winning? No.

I've had the illness of following politics for most of my life. I have never been less invested but I continue to see people missing the point. Several years ago there was an effort in California to remove Gavin Newsom from office. They call it a recall in the state.

When I hear people talk about Biden, or Newsom, or whoever you would think that all we need to do is vote the bum out and we are on the right path. That's way off. Trump's election isn't the goal but rather a sign of a minor shift in the culture and influence.

A mistake I see over and over again is focusing on the personalities. The puppets. The men. As if they are the problem. The problems are so much deeper. It's the culture, the programming, and the puppet masters. The problems are upstream of politicians. Remove one and another will replace them.

I don't so much care that Trump is less bad that Biden. Its that people make the mistake of focusing on the flag being blown by the wind than the wind itself. The politician is simply a result of many other more important factors.

Politicians work under an incentive structure that rewards promising things they cannot deliver. Even things that are not possible. Their only accountability is the voters and donors. The donors get what they want and the voters usually are to uninformed or dumb to realize what is going on. When they do realize it the other team is so demonized they either stick with their team or just don't vote.

The longer I look at democracy and the modern state the more absurd it appears to me. It's not that the men are bad or the government in power is bad. It's the whole incentive structure. There are almost no negative consequences pushing against this nonsense.

I have heard it said that the default view of political figures should be that of the tobacco executives. Today I think it should be the view of the medical insurance CEOs. The default view. There are exceptions but they are rare and work in spite of the system.

The solution is freedom and voluntary interaction. Removing the monopoly state. Remove the monopoly on violence. It would not be a utopia but IMO the incentives would be better.

The culture we create and the choices we make each day are making an impact. Remember that the flag doesn't control the wind. The wind controls the flag.

originally posted at https://stacker.news/items/839442

-

@ 513d5051:8a622026

2025-01-06 16:03:32

@ 513d5051:8a622026

2025-01-06 16:03:32Can someone please give me access to the API keys? I'm trying to build an app that will interact with SN but I can't generate the keys, it told me to ask for permission here.

originally posted at https://stacker.news/items/839325

-

@ 5d4b6c8d:8a1c1ee3

2025-01-06 15:14:32

@ 5d4b6c8d:8a1c1ee3

2025-01-06 15:14:32I'm putting some notes down, so I don't forget what happened in this game come podcast time.

This is most people's anticipated NBA Finals match up. The Thunder are still without Chet Holmgren and Alex Caruso, while the Celtics are fully intact.

The game was neck and neck for a while. It felt more like a Celtic (game: slower, low intensity) and the Celtics did build a little lead that they held for a while.

I was wondering why OKC wasn't playing with their normal defensive intensity and thinking they need to go back and watch how Miami was able to repeatedly dominate Boston in the playoffs. But then, OKC flipped the switch and were all over Boston: forcing turnovers, chase-down blocks, deflecting balls, etc.

Final score: 105-92 OKC

Takeaway: OKC is not the team Boston wants to play in the Finals

originally posted at https://stacker.news/items/839260

-

@ 5d4b6c8d:8a1c1ee3

2025-01-06 14:50:00

@ 5d4b6c8d:8a1c1ee3

2025-01-06 14:50:00It's officially the off-season for the Silver and Black. After several teams shot their draft position in the foot, the Raiders will be picking 6th.

That's high enough to try to trade up for one of the QB's, but I expect it won't be easy to pry those picks away from Tennessee or Cleveland, nor will it be easy to leap frog the Giants. So, let's see who we can get at 6th.

Mock Draft

6th Pick: DT Mason Graham 37th Pick: QB Jalen Milroe 68th Pick: WR Elic Ayomanor 73rd Pick: OT Grey Zabel 107th Pick: RB TreVeyon Henderson 142nd Pick: CB Mello Dotson 179th Pick: OG Jaeden Roberts 212th Pick: S Dante Trader Jr 216th Pick: QB Will Howard 222nd Pick: DE Kaimon Rucker

In lieu of a top QB, I'm going BPA with the first pick. The Raiders defensive line dramatically over-performed this season, considering the unbelievable injuries. Mason Graham will round out a line that also starts Maxx Crosby, Christian Wilkins, and Malcolm Koonce/Tyree Wilson. I hope we can keep the interim D-line coach, because he's done a great job and unearthed some promising rotation level talent.

For QB, I ended up going with the "heir and a spare" strategy. There's a lot of uncertainty around Milroe, so I took a flyer on the Ohio State QB in the 7th. The nice thing about having a competent high-end backup QB already is that drafting a day 1 starter isn't urgent. The Raiders can swing for the fences.

Otherwise, the focus was upgrading the offense and filling in depth on defense.

originally posted at https://stacker.news/items/839218

-

@ 513d5051:8a622026

2025-01-05 21:03:43

@ 513d5051:8a622026

2025-01-05 21:03:43Raspberry Pi 5 8GB RAM + Freenove's Hexapod Robot Kit + Raspberry Pi AI HAT + Ollama

mic drop

originally posted at https://stacker.news/items/838447

-

@ 3f770d65:7a745b24

2025-01-05 18:56:33

@ 3f770d65:7a745b24

2025-01-05 18:56:33New Year’s resolutions often feel boring and repetitive. Most revolve around getting in shape, eating healthier, or giving up alcohol. While the idea is interesting—using the start of a new calendar year as a catalyst for change—it also seems unnecessary. Why wait for a specific date to make a change? If you want to improve something in your life, you can just do it. You don’t need an excuse.

That’s why I’ve never been drawn to the idea of making a list of resolutions. If I wanted a change, I’d make it happen, without worrying about the calendar. At least, that’s how I felt until now—when, for once, the timing actually gave me a real reason to embrace the idea of New Year’s resolutions.

Enter Olas.

If you're a visual creator, you've likely experienced the relentless grind of building a following on platforms like Instagram—endless doomscrolling, ever-changing algorithms, and the constant pressure to stay relevant. But what if there was a better way? Olas is a Nostr-powered alternative to Instagram that prioritizes community, creativity, and value-for-value exchanges. It's a game changer.

Instagram’s failings are well-known. Its algorithm often dictates whose content gets seen, leaving creators frustrated and powerless. Monetization hurdles further alienate creators who are forced to meet arbitrary follower thresholds before earning anything. Additionally, the platform’s design fosters endless comparisons and exposure to negativity, which can take a significant toll on mental health.

Instagram’s algorithms are notorious for keeping users hooked, often at the cost of their mental health. I've spoken about this extensively, most recently at Nostr Valley, explaining how legacy social media is bad for you. You might find yourself scrolling through content that leaves you feeling anxious or drained. Olas takes a fresh approach, replacing "doomscrolling" with "bloomscrolling." This is a common theme across the Nostr ecosystem. The lack of addictive rage algorithms allows the focus to shift to uplifting, positive content that inspires rather than exhausts.

Monetization is another area where Olas will set itself apart. On Instagram, creators face arbitrary barriers to earning—needing thousands of followers and adhering to restrictive platform rules. Olas eliminates these hurdles by leveraging the Nostr protocol, enabling creators to earn directly through value-for-value exchanges. Fans can support their favorite artists instantly, with no delays or approvals required. The plan is to enable a brand new Olas account that can get paid instantly, with zero followers - that's wild.

Olas addresses these issues head-on. Operating on the open Nostr protocol, it removes centralized control over one's content’s reach or one's ability to monetize. With transparent, configurable algorithms, and a community that thrives on mutual support, Olas creates an environment where creators can grow and succeed without unnecessary barriers.

Join me on my New Year's resolution. Join me on Olas and take part in the #Olas365 challenge! It’s a simple yet exciting way to share your content. The challenge is straightforward: post at least one photo per day on Olas (though you’re welcome to share more!).

Download on Android or download via Zapstore.

Let's make waves together.

-

@ 30ceb64e:7f08bdf5

2025-01-05 16:11:46

@ 30ceb64e:7f08bdf5

2025-01-05 16:11:46Hey Freaks,

Another round of songs I've been listening to lately.

Un Sospiro slaps. Wind Tunnel hits me in the childhood.

https://music.youtube.com/watch?v=50A-Mssm6w8&si=OFa8UA-0o71k4ETK

https://music.youtube.com/watch?v=eMnxjdGTK4w&si=STFc4APblXLEp1Ig

https://music.youtube.com/watch?v=RpsN6b95DAQ&si=ixMQY5ZnyuPeum2O

https://music.youtube.com/watch?v=W91-jAQ2ijM&si=MhluAXuU1v_a86yW

https://music.youtube.com/watch?v=LMAhXhRsRXA&si=jo-UPFILXvZd8pS7

https://music.youtube.com/watch?v=53FDkWb7Mv4&si=lp4ikhtx39UqHzSA

https://music.youtube.com/watch?v=rrYMiAoGnVg&si=ya0qnGtbwCdyQ676

https://music.youtube.com/watch?v=Lk9Xwj0mnsI&si=OFMyBaXSO-Jyufxl

https://music.youtube.com/watch?v=057A1RdssoU&si=4lueg4C8Y3ac3LCE

https://music.youtube.com/watch?v=ghxzLw2wRis&si=wjgwjaPOJwo6-Cu2

https://music.youtube.com/playlist?list=PLmYfnnK_Qs5hOiZazXiwEoCdg1RiUvBBv&si=X4opO4goVt2K1T4D

Thanks, Hustle

originally posted at https://stacker.news/items/838006

-

@ e6817453:b0ac3c39

2025-01-05 14:29:17

@ e6817453:b0ac3c39

2025-01-05 14:29:17The Rise of Graph RAGs and the Quest for Data Quality

As we enter a new year, it’s impossible to ignore the boom of retrieval-augmented generation (RAG) systems, particularly those leveraging graph-based approaches. The previous year saw a surge in advancements and discussions about Graph RAGs, driven by their potential to enhance large language models (LLMs), reduce hallucinations, and deliver more reliable outputs. Let’s dive into the trends, challenges, and strategies for making the most of Graph RAGs in artificial intelligence.

Booming Interest in Graph RAGs

Graph RAGs have dominated the conversation in AI circles. With new research papers and innovations emerging weekly, it’s clear that this approach is reshaping the landscape. These systems, especially those developed by tech giants like Microsoft, demonstrate how graphs can:

- Enhance LLM Outputs: By grounding responses in structured knowledge, graphs significantly reduce hallucinations.

- Support Complex Queries: Graphs excel at managing linked and connected data, making them ideal for intricate problem-solving.

Conferences on linked and connected data have increasingly focused on Graph RAGs, underscoring their central role in modern AI systems. However, the excitement around this technology has brought critical questions to the forefront: How do we ensure the quality of the graphs we’re building, and are they genuinely aligned with our needs?

Data Quality: The Foundation of Effective Graphs

A high-quality graph is the backbone of any successful RAG system. Constructing these graphs from unstructured data requires attention to detail and rigorous processes. Here’s why:

- Richness of Entities: Effective retrieval depends on graphs populated with rich, detailed entities.

- Freedom from Hallucinations: Poorly constructed graphs amplify inaccuracies rather than mitigating them.

Without robust data quality, even the most sophisticated Graph RAGs become ineffective. As a result, the focus must shift to refining the graph construction process. Improving data strategy and ensuring meticulous data preparation is essential to unlock the full potential of Graph RAGs.

Hybrid Graph RAGs and Variations

While standard Graph RAGs are already transformative, hybrid models offer additional flexibility and power. Hybrid RAGs combine structured graph data with other retrieval mechanisms, creating systems that:

- Handle diverse data sources with ease.

- Offer improved adaptability to complex queries.

Exploring these variations can open new avenues for AI systems, particularly in domains requiring structured and unstructured data processing.

Ontology: The Key to Graph Construction Quality

Ontology — defining how concepts relate within a knowledge domain — is critical for building effective graphs. While this might sound abstract, it’s a well-established field blending philosophy, engineering, and art. Ontology engineering provides the framework for:

- Defining Relationships: Clarifying how concepts connect within a domain.

- Validating Graph Structures: Ensuring constructed graphs are logically sound and align with domain-specific realities.

Traditionally, ontologists — experts in this discipline — have been integral to large enterprises and research teams. However, not every team has access to dedicated ontologists, leading to a significant challenge: How can teams without such expertise ensure the quality of their graphs?

How to Build Ontology Expertise in a Startup Team

For startups and smaller teams, developing ontology expertise may seem daunting, but it is achievable with the right approach:

- Assign a Knowledge Champion: Identify a team member with a strong analytical mindset and give them time and resources to learn ontology engineering.

- Provide Training: Invest in courses, workshops, or certifications in knowledge graph and ontology creation.

- Leverage Partnerships: Collaborate with academic institutions, domain experts, or consultants to build initial frameworks.

- Utilize Tools: Introduce ontology development tools like Protégé, OWL, or SHACL to simplify the creation and validation process.

- Iterate with Feedback: Continuously refine ontologies through collaboration with domain experts and iterative testing.

So, it is not always affordable for a startup to have a dedicated oncologist or knowledge engineer in a team, but you could involve consulters or build barefoot experts.

You could read about barefoot experts in my article :

Even startups can achieve robust and domain-specific ontology frameworks by fostering in-house expertise.

How to Find or Create Ontologies

For teams venturing into Graph RAGs, several strategies can help address the ontology gap:

-

Leverage Existing Ontologies: Many industries and domains already have open ontologies. For instance:

-

Public Knowledge Graphs: Resources like Wikipedia’s graph offer a wealth of structured knowledge.

- Industry Standards: Enterprises such as Siemens have invested in creating and sharing ontologies specific to their fields.

-

Business Framework Ontology (BFO): A valuable resource for enterprises looking to define business processes and structures.

-

Build In-House Expertise: If budgets allow, consider hiring knowledge engineers or providing team members with the resources and time to develop expertise in ontology creation.

-

Utilize LLMs for Ontology Construction: Interestingly, LLMs themselves can act as a starting point for ontology development:

-

Prompt-Based Extraction: LLMs can generate draft ontologies by leveraging their extensive training on graph data.

- Domain Expert Refinement: Combine LLM-generated structures with insights from domain experts to create tailored ontologies.

Parallel Ontology and Graph Extraction

An emerging approach involves extracting ontologies and graphs in parallel. While this can streamline the process, it presents challenges such as:

- Detecting Hallucinations: Differentiating between genuine insights and AI-generated inaccuracies.

- Ensuring Completeness: Ensuring no critical concepts are overlooked during extraction.

Teams must carefully validate outputs to ensure reliability and accuracy when employing this parallel method.

LLMs as Ontologists

While traditionally dependent on human expertise, ontology creation is increasingly supported by LLMs. These models, trained on vast amounts of data, possess inherent knowledge of many open ontologies and taxonomies. Teams can use LLMs to: