-

@ 8f69ac99:4f92f5fd

2024-12-13 11:49:05

@ 8f69ac99:4f92f5fd

2024-12-13 11:49:05A conversa global sobre Bitcoin entrou numa nova fase, saindo do campo da especulação para o centro das decisões estratégicas. A proposta do Presidente-eleito Donald Trump para criar uma reserva nacional de Bitcoin, a votação iminente dos acionistas da Microsoft sobre Bitcoin como investimento corporativo e a análise da Amazon para usar Bitcoin como activo de reserva mostram como a teoria dos jogos está a influenciar decisões reais.

No centro destas iniciativas está o conceito de vantagem do first-mover. Os primeiros a agir — sejam empresas ou nações — têm a oportunidade de colher benefícios desproporcionais, desde domínio financeiro até influência global. No entanto, essas acções obrigam os concorrentes a reagir, criando um efeito dominó em várias indústrias e fronteiras. Com apenas ~1.206.000 bitcoins restantes para serem minerados, a corrida começou, e os stakes não poderiam ser mais altos.

A Reserva de Bitcoin de Trump: Uma Estratégia de Estado-Nação

Em julho de 2024, Donald Trump surpreendeu o mundo financeiro ao anunciar planos para estabelecer uma reserva nacional de Bitcoin. Em novembro, mais detalhes foram revelados no projecto de lei proposto pela senadora Cynthia Lummis, “Bitcoin Act of 2024,” que prevê a aquisição de um milhão de bitcoins ao longo de cinco anos, financiada pela realocação de activos do Federal Reserve, evitando aumento da dívida pública.

O plano não é apenas uma protecção contra a inflação; é uma jogada geopolítica. Tornando-se a primeira potência a adoptar Bitcoin nesta escala, os EUA buscam consolidar a sua liderança na economia global em transformação. Esta medida obriga outras nações, como China ou Rússia — que já estão a discutir também integrar Bitcoin nas suas economias — a repensarem as suas estratégias.

A proposta de Trump introduz uma dinâmica de jogo de soma zero. Se os EUA acumularem uma reserva significativa enquanto outras nações ficam para trás, o país ganha soberania financeira, maior influência global e o poder de moldar o futuro. Contudo, essa acção pode desencadear uma corrida global, com países a competir para garantir o máximo de Bitcoin possível antes que sua oferta finita se esgote.

A Proposta de Bitcoin da Microsoft: Pressão sobre Gigantes Corporativos

Em outubro de 2024, os acionistas da Microsoft receberam uma proposta solicitando que a empresa explorasse Bitcoin como investimento corporativo. Com a votação marcada para 10 de dezembro, a decisão terá um impacto que ultrapassa a própria Microsoft. Uma votação a favor pode desencadear uma reacção em cadeia entre outras gigantes tecnológicas, enquanto uma recusa pode abrir espaço para que empresas como Google ou Apple se posicionem como líderes no sector.

Nota: a votacao foi negativa, apenas 0.55% dos accionistas da Microsoft votaram a favor! Caso para dizer que a Microsoft teve um momento Kodak! #HFSP

Michael Saylor, presidente executivo da MicroStrategy, tem estado na linha da frente, defendendo a adopção corporativa de Bitcoin, apresentando-o não apenas como um activo financeiro, mas como uma oportunidade transformadora. A administração da Microsoft recomendou a rejeição da proposta, citando processos de investimento já existentes. No entanto, a pressão está a aumentar. O desempenho impressionante de Bitcoin, com ganhos anuais de 131% e um preço recorde acima de $104.000, torna cada vez mais difícil para as empresas ignorarem a oportunidade.

Para a Microsoft, os stakes são claros: agir cedo permitiria que a empresa se posicionasse como líder na integração de Bitcoin na estratégia corporativa, pressionando concorrentes como Google, Apple e Meta a fazerem o mesmo ou arriscarem ficar para trás. Uma entrada tardia, por outro lado, pode resultar em custos mais elevados e oportunidades perdidas, à medida que o preço de Bitcoin continua a subir com a crescente procura institucional.

A Aposta da Amazon em Bitcoin

A Amazon, a maior retalhista online do mundo, está agora numa encruzilhada. No dia 8 de dezembro de 2024, a empresa recebeu uma proposta dos accionistas para alocar 5% das suas reservas de $88 mil milhões em Bitcoin. Este movimento acompanha uma tendência crescente de interesse institucional, com fundos negociados em bolsa de Bitcoin a atraírem milhares de milhões de dólares em entradas na última semana.

Se a Amazon aprovar a proposta na Assembleia Geral Anual de 2025, o impacto será sísmico. A decisão da empresa enviará um sinal claro ao mercado, validando Bitcoin como um activo de reserva legítimo. Além disso, colocará uma pressão significativa sobre rivais como Walmart, Google e Alibaba para seguirem o exemplo. À medida que mais empresas entram no mercado, a oferta finita de Bitcoin será ainda mais pressionada, elevando seu preço e recompensando aqueles que agiram primeiro.

A possível adopção de Bitcoin pela Amazon também reforça a ideia do efeito de sinalização na teoria dos jogos. Ao abraçar Bitcoin, a Amazon demonstraria confiança no futuro do activo, incentivando outros participantes do mercado a fazerem o mesmo. A decisão provavelmente aceleraria um efeito dominó em várias indústrias, dificultando cada vez mais para os concorrentes permanecerem inertes.

Efeito Dominó

As movimentações estratégicas de Trump, Microsoft e Amazon não existem isoladamente — são catalisadores de uma corrida mais ampla. El Salvador e Butão já se posicionaram como adoptantes iniciais, mas a proposta de Trump eleva a adopção de Bitcoin a um novo patamar. Se os EUA agirem de forma decisiva, é provável que aliados e concorrentes façam o mesmo, desencadeando uma corrida por reservas de Bitcoin que poderá assemelhar-se a uma corrida armamentista em intensidade. Como já se começa a ver no Canada, Rússia, Alemanha, etc...

O mesmo se aplica às corporações. À medida que líderes como MicroStrategy, Tesla e, potencialmente, Microsoft e Amazon tomam posições, os concorrentes enfrentarão uma pressão crescente para agir ou arriscar a irrelevância. Cada novo participante no mercado reduz a oferta disponível de Bitcoin, criando uma urgência crescente para os retardatários.

Os números reforçam a aposta: apenas ~1.206.000 bitcoins permanecem para serem minerados e apenas cerca de 2.000.000 em exchanges. Com a adopção institucional e nacional a acelerar, a luta por este recurso limitado provavelmente impulsionará ainda mais os preços, transformando Bitcoin de um "activo especulativo" para um imperativo estratégico.

Conclusão: O Jogo de Bitcoin Está em Curso

A dinâmica de adopção de Bitcoin ilustra a teoria dos jogos em acção que podemos observar em tempo real. A vantagem dos pioneiros não é apenas um conceito teórico — é uma vantagem tangível na corrida por Bitcoin, oferecendo recompensas desproporcionais aos primeiros a agir e forçando outros a reagirem. A proposta de Trump para uma reserva nacional de Bitcoin define o palco para uma corrida geopolítica, enquanto gigantes corporativos como Microsoft e Amazon enfrentam decisões que moldarão os seus futuros e pondo pressão nos seus concorrentes.

À medida que a oferta de Bitcoin diminui e o seu preço reflecte a crescente procura, a pressão para agir cedo só aumentará. Seja no palco nacional ou corporativo, as decisões tomadas hoje definirão o panorama económico de amanhã. O jogo de Bitcoin está em curso, e os jogadores que compreendem os riscos — e agem estrategicamente — têm o potencial de moldar a próxima era das finanças globais.

bitcoin #gameTheory

-

@ 705605d9:b4324038

2024-12-13 11:36:25

@ 705605d9:b4324038

2024-12-13 11:36:25Если бы в Горноправдинске вручали премии за самые неожиданные улучшения городской среды, то недавний инцидент с канализацией точно бы попал в финал. Казалось бы, что может быть хуже, чем прорвавшиеся трубы и ручьи, отнюдь не кристально чистой воды, разлившиеся по центральной улице? Но местные коммунальщики доказали, что даже из самого неприятного можно извлечь пользу – и сделали это с такой скоростью, что теперь люди обсуждают не само ЧП, а его последствия.

Началось все с того, что старенькая канализационная сеть, напоминающая скорее музейный экспонат, чем рабочую систему, в один момент решила дать городу почувствовать, что такое "вышло из берегов". Потоки... скажем так, содержимого стремительно разлились, угрожая перекрыть не только движение машин, но и спокойствие горожан.

Однако коммунальные службы, обычно славящиеся неторопливостью, удивили всех. Уже через пару часов на месте разгула стихийных нечистот заработала техника, а сотрудники, как один, бросились в бой. Кто-то шутил, что это был их "звездный час", ведь редко когда столько внимания приковано к их работе.

"Мы использовали специальный раствор, который нейтрализует запах и разлагает органику," – рассказал начальник службы ЖКХ. Уточнять состав чудо-средства он отказался, но город сразу почувствовал, что воздух стал легче, а настроение – чище.

Но на этом коммунальная магия не закончилась. Там, где еще недавно текли не самые приятные потоки, теперь журчат новые декоративные ручьи. Местные власти приняли решение использовать эту зону для благоустройства, и уже через неделю здесь появились ухоженные парковые зоны с лавочками и клумбами.

"Мы решили, что если уж природа так распорядилась, то почему бы не сделать из этого что-то хорошее," – прокомментировал мэр Горноправдинска.

Местные жители, еще недавно всерьез обсуждавшие переезд, теперь делают селфи на фоне новенького ландшафтного дизайна и иронизируют: "Где текло, там и журчит". Некоторые даже предложили назвать парк "Река Жизни" – правда, что именно имелось в виду, остается загадкой. Так Горноправдинск доказал, что даже самые неприятные проблемы можно превратить в повод для гордости. Теперь жители шутят: "Рвануло, зато затянуло – и в прямом, и в переносном смысле".

-

@ 04d9fac9:5bec0e6c

2024-12-13 10:49:58

@ 04d9fac9:5bec0e6c

2024-12-13 10:49:58 -

@ 04d9fac9:5bec0e6c

2024-12-13 11:22:49

@ 04d9fac9:5bec0e6c

2024-12-13 11:22:49Сегодня в Воркуте проходит одно из самых ожидаемых событий года — Всероссийский день бега «Кросс Нации 2044»! 🎉 С утра на центральной улице города царит настоящая спортивная атмосфера, наполненная энергией и энтузиазмом. Участники всех возрастов, от самых маленьких до пенсионеров, собрались, чтобы показать свои силы на дистанциях разной сложности.

🌟 900 участников уже вышли на старт! Это невероятно вдохновляет видеть столько людей, готовых к соревнованиям и поддерживающих друг друга! В этом году мы внедрили роботизированные помощники, которые помогут организовать мероприятие на новом уровне. Эти автономные дроны будут следить за безопасностью участников, обеспечивать медицинскую помощь и даже раздавать воду на дистанции.

Мы также добавили новые дистанции для детей и подростков, чтобы каждый мог найти свое место на этом празднике спорта. 🏅 Параллельно с основными забегами проходят различные мастер-классы по фитнесу и здоровому образу жизни, включая занятия с умными роботами-тренерами, которые помогут вам освоить новые упражнения и техники.

Не упустите шанс узнать что-то новенькое и зарядиться положительной энергией! Не забывайте делиться своими впечатлениями и фотографиями с хештегом #КроссНацииВоркута2044! 📸💬 Давайте сделаем этот день незабываемым! Поддержим друг друга и получим заряд энергии на весь год вперед! 💪💙 #Воркута #КроссНации #Спорт2044

-

@ 04d9fac9:5bec0e6c

2024-12-13 11:19:28

@ 04d9fac9:5bec0e6c

2024-12-13 11:19:28Дорогие друзья! ✨ Через несколько дней, 26 ноября 2044 года, Воркута отмечает свой День города! 🎉 Это событие станет настоящим праздником для всех нас, горожан, и мы приглашаем вас погрузиться в атмосферу веселья и радости, ведь мы соберемся вместе, чтобы отпраздновать нашу уникальную историю и достижения. 🌟

В этом году мы подготовили множество интересных мероприятий, которые будут интегрированы с умными технологиями для максимального комфорта и взаимодействия:

С 10:00 до 16:00 на площади Мира пройдут выставки местных мастеров и художников. Здесь можно увидеть уникальные изделия ручной работы и даже поучаствовать в мастер-классах с использованием голографических технологий, позволяющих вам создавать виртуальные объекты прямо на месте!

В 12:00 начнется парад, который пройдет по центральным улицам города. Мы увидим яркие костюмы, музыкальные группы и, конечно же, нашу символику — серебристого оленя! Парад будет сопровождаться дроновыми шоу, которые добавят яркие визуальные эффекты в небо над городом.

В 14:00 на Центральной площади состоится концерт с участием местных артистов и приглашенных звезд. Не пропустите возможность насладиться живой музыкой и танцами, а также интерактивными выступлениями с использованием дополненной реальности, где каждый сможет стать частью шоу!

А в 18:00 завершится праздник грандиозным фейерверком! 🎆 Этот фейерверк будет синхронизирован с музыкой и световыми эффектами, создавая незабываемое зрелище.

🕊️ В этом году мы также вспомним о нашем прошлом — в программе запланированы выставки, посвященные истории Воркуты, включая её угольную промышленность и культурное наследие, представленные через интерактивные экспозиции и виртуальные туры.

Приходите всей семьей! Давайте вместе сделаем этот день незабываемым! 💙 #Воркута #ДеньГорода #2044 #Праздник

-

@ 04d9fac9:5bec0e6c

2024-12-13 11:16:32

@ 04d9fac9:5bec0e6c

2024-12-13 11:16:32Дорогие воркутяне! С радостью сообщаем, что в 2044 году отопительный сезон в нашем городе стартует 1 декабря — на день раньше, чем в прошлом году! Это событие знаменует собой начало новой эры в коммунальном обслуживании, где технологии и инновации играют ключевую роль.

Подключение отопления будет происходить поэтапно: Центральный район получит тепло 1 декабря, Южный район — 2 декабря, а Северный район — 3 декабря. Процесс подключения будет автоматизирован с использованием умных систем управления, которые обеспечат быстрое и эффективное заполнение отопительных систем. Полное заполнение займет всего три дня, и жители смогут наблюдать за этим процессом через специальные мобильные приложения, которые будут показывать статус подключения в реальном времени.

Мы внедряем роботизированные технологии для мониторинга и диагностики состояния системы отопления. Эти автономные устройства будут следить за температурными показателями и выявлять возможные неисправности до того, как они станут проблемой. Жителям рекомендуется сообщать о любых проблемах с подачей тепла через голосовые помощники или чат-ботов, которые мгновенно свяжут вас с коммунальными службами.

Воркута движется в будущее, где комфорт и безопасность жителей — наш главный приоритет. Давайте вместе сделаем этот зимний сезон незабываемым!

-

@ 04d9fac9:5bec0e6c

2024-12-13 11:13:19

@ 04d9fac9:5bec0e6c

2024-12-13 11:13:19Дорогие воркутяне! С радостью сообщаем, что 25 ноября 2044 года в нашем городе откроет свои двери новый Культурно-Досуговый Центр! Этот долгожданный проект стал настоящим подарком для всех жителей и гостей Воркуты. ✨

Что вас ждет? Разнообразные мероприятия: концерты, выставки, мастер-классы и театральные постановки — каждый найдет что-то по душе! Но это не просто традиционные события; благодаря интеграции голографических технологий вы сможете наслаждаться выступлениями мировых звезд в формате 3D прямо из вашего кресла.

Современные пространства: уютные залы для занятий, кинозал с виртуальной реальностью, выставочные площади, где искусство будет представлено в интерактивном формате, и даже кафе с умными меню, которые подберут блюда в зависимости от ваших предпочтений и настроения.

Поддержка талантов: новый центр станет площадкой для местных художников, музыкантов и творческих коллективов. Здесь будут доступны виртуальные студии, где творцы смогут работать над своими проектами с использованием передовых технологий, таких как искусственный интеллект для создания музыки и визуального искусства.

🌟 Мы уверены, что КДЦ станет центром притяжения для всех, кто хочет развиваться, общаться и проводить время с пользой. Это будет не просто место для досуга, а инновационный хаб, где идеи будут воплощаться в жизнь с помощью новейших технологий.

Приглашаем всех на торжественное открытие! 📅 Дата: 25 ноября 2044 года 📍 Место: Новый КДЦ, ул. Центральная, 10. Не пропустите возможность стать частью этого важного события для нашего города! 💖

-

@ b5b8a0c4:37666ab5

2024-12-13 10:30:17

@ b5b8a0c4:37666ab5

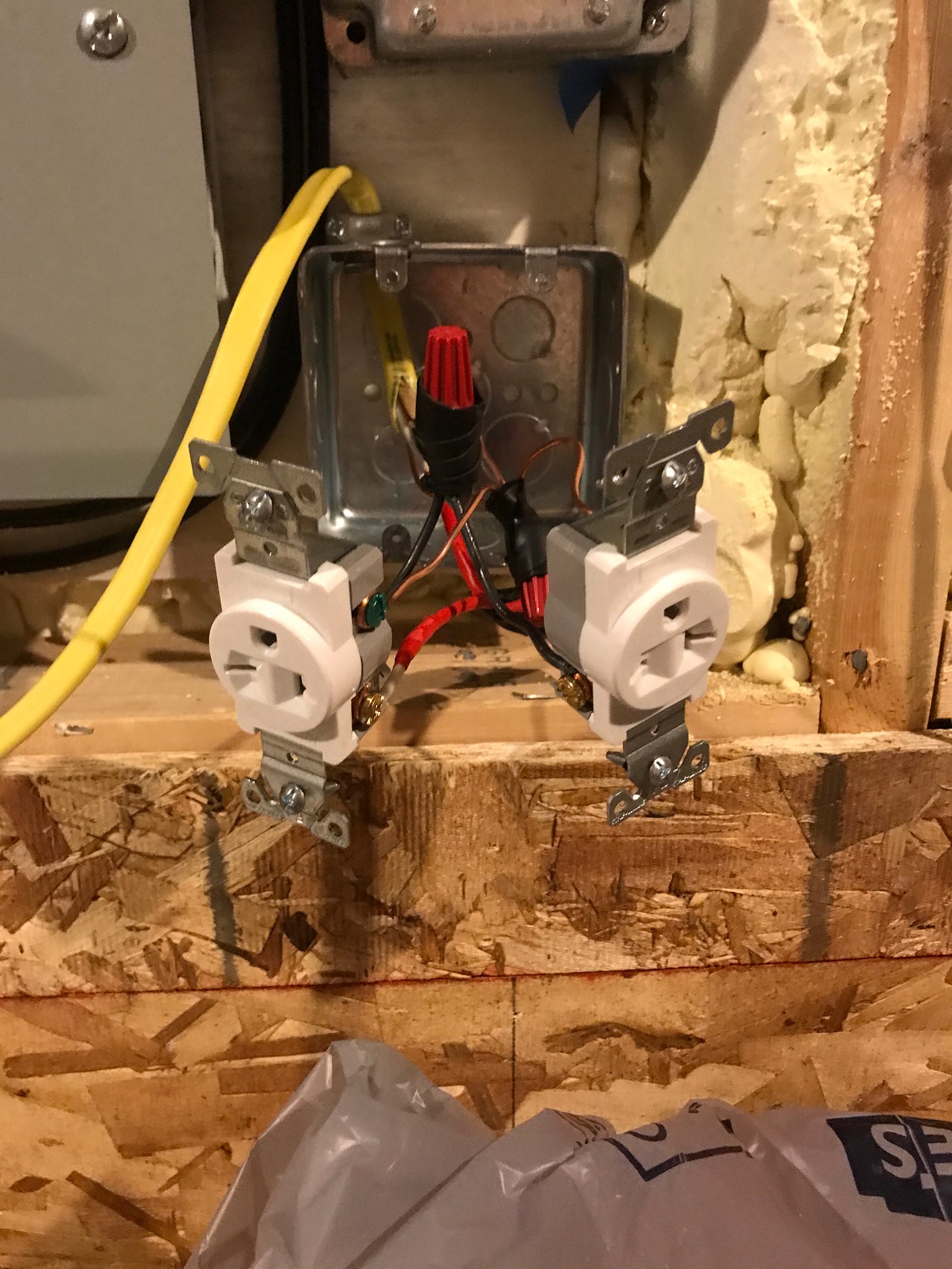

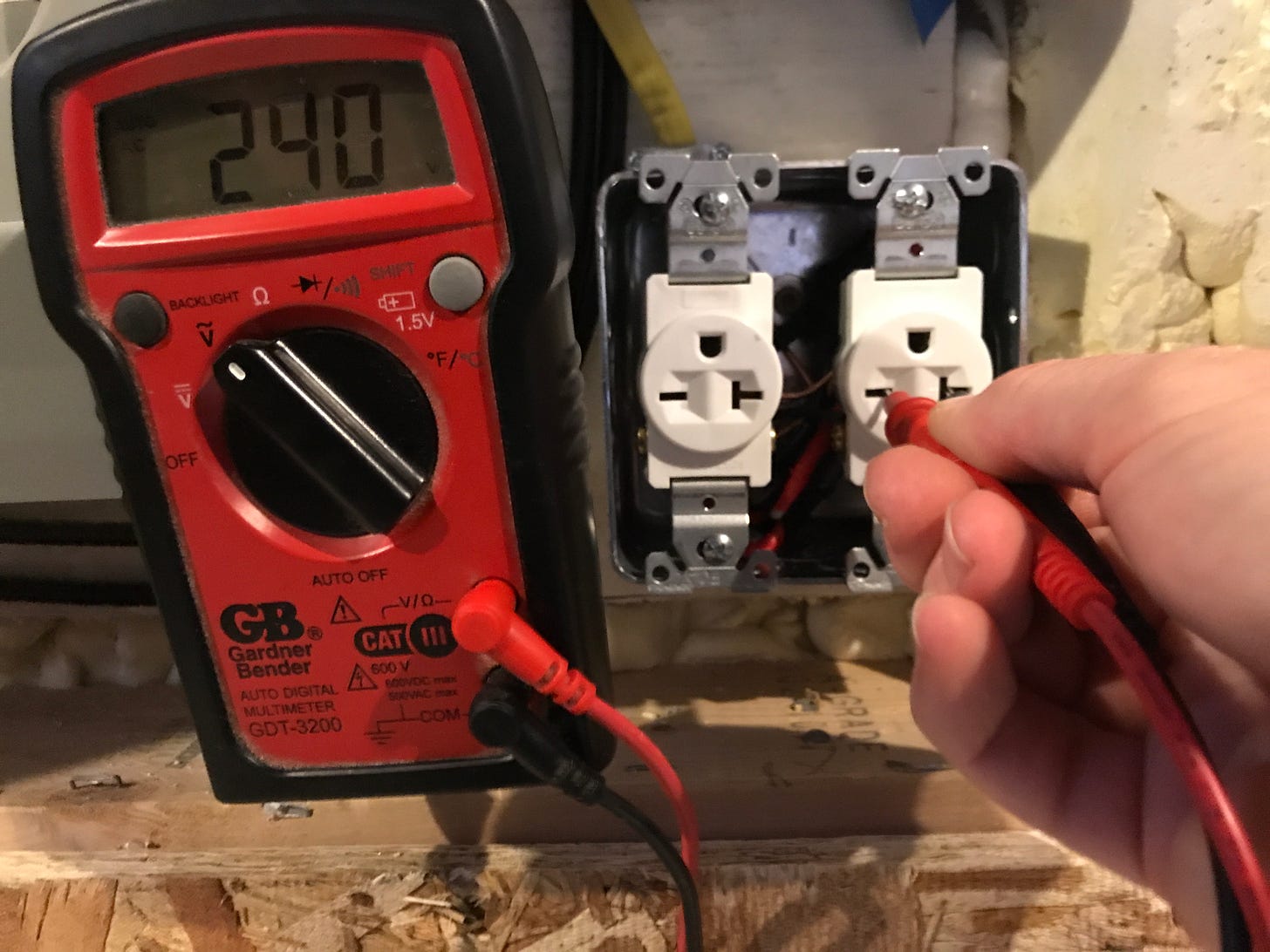

2024-12-13 10:30:17Some hardcore bitcoiners love to say you should ignore the fiat price and instead denominate the things you want to buy in bitcoin over time as a way to measure it’s value. The image showing price of the median home in bitcoin over time is probably the most popular

The issue with that image is it’s still using fiat as the measurement. Because homes aren’t purchased using bitcoin we have no way to measure how many bitcoin the median home is worth without first denominating both assets in dollars. I still love the image and think it’s a stark reminder of just how much bitcoin has appreciated even against an asset that boomers would consider scarce, but the equation isn’t as simple as median home divided by bitcoin. It’s really (home/dollars)/(bitcoin/dollars).

That brings me to another thought. How do we get to a point where we can denominate things like houses, gallons of gas, ground beef, NFL tickets, or an oil change in bitcoin without first converting both to their dollar value?

We’ll stick with the house example. Let’s say I’m a builder who has purchased a half acre of land and had a 3 bed 2 bath home built on the property. Now I’m looking to sell the home and want to accept bitcoin as payment. How would I go about calculating the amount of Bitcoin I’m willing to accept in return? In today’s world all of my expenses are in dollars. I paid for the land in dollars. Every supply I purchased to have the home built from the foundation to the drywall to the granite counters were paid for in dollars. I also paid all the laborers in dollars. Thinking rationally it would make sense for me to tally up my total cost to produce the home, lets say $300,000, determine what I think I could sell it for, let’s say that’s $400,000, and divide that number by bitcoin’s current dollar value. So at current price I’d sell the home for somewhere around 4 bitcoin. After the sale we could say Bitcoin was used as a medium of exchange for the purchase and we wouldn’t be wrong, but is that the scenario we envision when we talk about bitcoin as a medium of exchange? We still mainly relied on the dollar throughout the process whether to purchase land/materials/labor to build the home or as the measuring stick to determine how much bitcoin we’d be willing to accept for the home.

To use bitcoin as a medium of exchange the way I think most of us are trying to conceptualize where both expenses and earnings are priced in bitcoin we’d have to fist pay for the land/supplies/labor in bitcoin. It’s probably easier to get my point across using supplies so let’s use lumber. If I’m going to pay a lumber company in bitcoin for the wood I need to build the home they’d also have to pay their expenses (machinery, labor, etc.) in bitcoin to know how much to sell their lumber for in bitcoin. For example they’d need to know it cost them 3,000 sats to produce a framing stud to know they need to charge me 4,000 sats per framing stud. You could take this exercise another step further and say for the lumber company to pay for their machinery in bitcoin the machinery company would have to know how many sats it cost them to produce a sawmil before they knew how many sats to sell their sawmill to the lumber company for. You can see how this continues all the way down the chain.

I’m frying my own brain doing this and I think this piece is getting too long so I’ll stop there, but if anyone has an opinion on how we get to a bitcoin circular economy that doesn’t ever factor in the fiat price of bitcoin or good/services I’d love to hear it.

Obviously different forms of money throughout history have come and gone so an economie’s unit of account can change, but it’s hard to visualize how that process takes place.

-

@ a012dc82:6458a70d

2024-12-13 09:20:40

@ a012dc82:6458a70d

2024-12-13 09:20:40Table Of Content

-

The SEC's Dance with Bitcoin ETFs

-

The Long and Winding Road to Approval

-

Why the Cold Feet, SEC?

-

What's Next on the Horizon?

-

Conclusion

-

FAQ

In the ever-evolving landscape of cryptocurrency, there's one topic that's been consistently grabbing headlines: the elusive Bitcoin ETF. As the world eagerly anticipates its introduction, the United States Securities and Exchange Commission (SEC) continues to play a game of cat and mouse, leaving investors and enthusiasts on tenterhooks. Just when the crypto community thought they were inching closer to a resolution, the SEC has decided to keep us all in suspense a little longer. So, let's unpack the latest developments and see what's in store for the future of Bitcoin ETFs.

The SEC's Dance with Bitcoin ETFs

For those out of the loop, the United States Securities and Exchange Commission (SEC) has been the gatekeeper for the much-anticipated Bitcoin ETF (Exchange-Traded Fund). Think of an ETF as a basket of assets, like stocks or bonds, that you can buy or sell on a stock exchange. But in this case, the asset is our beloved Bitcoin.

The idea of a Bitcoin ETF has been floating around for years, promising to bridge the gap between traditional finance and the crypto world. It would allow both everyday investors and big financial institutions to dip their toes into Bitcoin waters without the hassle of buying and holding the actual cryptocurrency.

The Long and Winding Road to Approval

Big financial players like BlackRock and ARK Invest have been knocking on the SEC's door, applications in hand, hoping to get the green light. But the SEC, ever the cautious guardian, has been pushing back, delaying, and asking for public comments.

Now, here's where it gets interesting. Despite the numerous applications and the growing interest from the financial community, the SEC has never approved a spot Bitcoin ETF proposal. They've been tiptoeing around the idea, starting to accept Bitcoin-related investment vehicles in 2021, but a full-fledged Bitcoin ETF? Still on the back burner.

Why the Cold Feet, SEC?

One might wonder why the SEC is dragging its feet. The answer? It's complicated. A Bitcoin ETF isn't just another asset; it could involve holding actual Bitcoin, making it a direct investment. This is a tad different from Bitcoin futures-linked ETFs, which the SEC seems more comfortable with.

Then there's the wild west of the crypto market in the US. With the market's volatile nature and calls for clearer regulations and oversight, the SEC is treading carefully. They're currently juggling enforcement cases against big names like Coinbase, Binance, and Ripple. So, it's safe to say they've got a lot on their plate.

What's Next on the Horizon?

With the SEC's recent moves, the final deadline for some Bitcoin ETF applications is now set for 2024. But, as with everything in the crypto world, predictions can be tricky. Some analysts, ever the optimists, believe there's a 65% chance of a Bitcoin ETF getting approved. But only time will tell.

What's clear is that the SEC is in a powerful position, with the crypto world eagerly awaiting its next move. As Stuart Barton aptly put it, both sides might need to bend a bit to find common ground.

Conclusion

The quest for a Bitcoin ETF has been nothing short of a rollercoaster ride, filled with anticipation, hope, and a fair share of suspense. As we stand at this crossroads, the journey ahead remains uncertain. But one thing is clear: the world of cryptocurrency never ceases to surprise and captivate. While we may need to temper our expectations for now, the horizon could still hold unprecedented developments for the Bitcoin ETF narrative. Here's to a future where clarity and innovation walk hand in hand!

FAQs

What is a Bitcoin ETF? A Bitcoin ETF (Exchange-Traded Fund) is like a basket of assets available for trading on a stock exchange, with Bitcoin as the primary asset.

Why is the SEC involved in Bitcoin ETFs? The SEC (Securities and Exchange Commission) is responsible for regulating and approving new financial products, including ETFs, to ensure they meet specific criteria and are safe for investors.

Has the SEC approved any Bitcoin ETFs yet? As of now, the SEC has not approved any spot Bitcoin ETF proposals.

When can we expect a decision on Bitcoin ETFs? The final deadline for some Bitcoin ETF applications is set for 2024.

That's all for today

If you want more, be sure to follow us on:

NOSTR: croxroad@getalby.com

Instagram: @croxroadnews.co

Youtube: @croxroadnews

Store: https://croxroad.store

Subscribe to CROX ROAD Bitcoin Only Daily Newsletter

https://www.croxroad.co/subscribe

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.

-

-

@ 04d9fac9:5bec0e6c

2024-12-13 11:08:53

@ 04d9fac9:5bec0e6c

2024-12-13 11:08:53Друзья, в 2044 году Воркута активно преобразуется! 🌟 Городская администрация запустила масштабные работы по ремонту дорог, чтобы сделать нашу жизнь комфортнее и безопаснее. 🔧 Что нас ждет? Асфальтирование и ямочный ремонт: обновление более 30 тыс. квадратных метров дорожного покрытия!

🚜 Ключевые участки: внимание уделяется кольцевой автодороге и аварийным участкам. Ожидаем установку новых бордюров и тротуаров, которые будут оснащены встроенными датчиками для мониторинга состояния покрытия и предупреждения о необходимости ремонта!

🛣️ Но самое удивительное — эти работы будут выполнять роботы! Воркута станет одним из первых городов, где автономные системы, такие как робот ARRES, будут осуществлять ремонт дорог без участия человека. Этот многофункциональный робот, оснащенный машинным зрением, способен обнаруживать выбоины на асфальте и самостоятельно выполнять все необходимые операции по укладке и утрамбовке асфальта. Его гидроизолированные заплатки обладают повышенной износостойкостью, что гарантирует долговечность ремонта. Благодаря этому подходу, мы минимизируем вмешательство в работу других участников дорожного движения и значительно экономим время и средства на ремонт.

Благоустройство дворов: ремонт 11 дворов в Шахтерском районе и обновление центральной площади с использованием инновационных материалов, способных очищать воздух от загрязнений! 🏡🌳

💰 Финансирование: работы будут проводиться за счет городского бюджета и федеральных программ. Приоритет — восстановление самых разрушенных участков. Воркута движется вперед, внедряя умные технологии для улучшения городской инфраструктуры и повышения качества жизни своих жителей. Мы с нетерпением ждем улучшений! Давайте вместе сделаем наш город лучше! 💪✨ #Воркута #ремонтдорог #городскиеизменения

-

@ 04d9fac9:5bec0e6c

2024-12-13 11:04:40

@ 04d9fac9:5bec0e6c

2024-12-13 11:04:40Друзья, Воркута активно готовится к зимнему сезону 2044 года! С 15 августа стартовали осмотры жилищного фонда и объектов коммунальной инфраструктуры. 📊 Текущие показатели готовности:

Тепловые сети — 62,9% Водопроводные сети — 49,4% Канализационные сети — 51,4% Жилищный фонд — 71%

Управляющие компании проводят ремонты кровель, фасадов и систем тепло- и водоснабжения. Проблем с материалами нет! 🔧 Что еще делается?

Замена подземного водовода и восстановление тепловой изоляции на трубопроводах от ООО «Водоканал». Реализация мастер-плана Воркуты, который включает модернизацию угледобывающих шахт и улучшение социальной инфраструктуры.

В рамках подготовки к зимнему сезону также внедряются инновационные технологии:

Умные системы управления: Внедрение IoT (Интернет вещей) для мониторинга состояния систем тепло- и водоснабжения в реальном времени. Это позволит оперативно реагировать на любые неисправности и оптимизировать расход ресурсов.

Энергетическая эффективность: Установка солнечных панелей и ветрогенераторов на крыши зданий для обеспечения частичной автономности от централизованных источников энергии.

Зеленая инфраструктура: Создание зеленых крыш и вертикальных садов на жилых домах для улучшения микроклимата и повышения энергоэффективности.

Финансирование на эти цели составит около 51,5 миллиардов рублей до 2045 года. Воркута движется вперед, обеспечивая комфортные условия для своих жителей!

-

@ 6bae33c8:607272e8

2024-12-13 08:47:58

@ 6bae33c8:607272e8

2024-12-13 08:47:58Imagine you had no players going in a Thursday night game to kick off the NFFC playoffs. Imagine further you had the Rams +2.5 in your home picking pool’s quintuple week. How would you prefer the game to go? Exactly the way it went. No touchdowns, no QB over 200 yards, Cooper Kupp with zero! The only players that did anything were Puka Nacua, Kyren Williams, Isaac Guerendo and George Kittle, and what they did was modest by their standards and roles. Perfect game.

-

The 49ers dominated the first half time of possession, the Rams the second. In the chess match between offensive masterminds, Sean McVay outfoxed Kyle Shanahan.

-

Of course, the 49ers were already in position for a game-tying field goal with 5:20 left when Brock Purdy threw the catastrophic pick. When the Rams got the ball back, they wore down a tired 49ers defense to run clock and got the last field goal to go up six.

-

Deebo Samuel’s third-quarter drop was huge — it would have been a first down and looked like he might have taken it to the house.

-

Nacua and Williams always get theirs. Nacua will be a first-round pick next year, Williams early second. It’s amazing how Williams holds up under massive workloads running into the teeth of the defense and moves the pile at 5-9, 200 pounds. He has great wiggle to make the first defender miss too.

-

The Rams at 8-6 are very much in contention for the division, the 49ers at 6-8 probably are done.

-

-

@ 04d9fac9:5bec0e6c

2024-12-13 10:59:13

@ 04d9fac9:5bec0e6c

2024-12-13 10:59:13В 2044 году мы отмечаем пятнадцатилетие трагедии на заводе в Воркуте, где в результате аварии погибли десятки людей. Эта катастрофа оставила глубокий след в сердцах родных и близких, а также в истории города.

Каждый год в день трагедии проводятся памятные мероприятия, на которых родственники и местные жители собираются, чтобы почтить память погибших. Воркута продолжает жить с этой болью, и память о жертвах служит постоянным напоминанием о важности соблюдения норм безопасности на производстве.

С момента трагедии были предприняты значительные шаги для повышения безопасности на заводах в Воркуте:

Ужесточение контроля: Введены новые требования к инспекции производств, включая регулярные проверки состояния оборудования и обязательное обучение работников по правилам безопасности.

Технологические изменения: На заводах начали внедрять современные системы мониторинга для выявления утечек газа и других опасных веществ. Это позволяет заранее обнаруживать угрозы и предотвращать аварии.

Обучение и подготовка: Разработаны новые программы обучения для рабочих, акцентирующие внимание на правилах безопасности и действиях в экстренных ситуациях. Проведение регулярных учений по эвакуации стало обязательным.

Важно помнить о тех, кто погиб в этой трагедии, и продолжать работать над улучшением условий труда на производстве. Память о жертвах должна служить стимулом для всех нас, чтобы обеспечить безопасность работников и предотвратить подобные инциденты в будущем. Мы обязаны сделать все возможное, чтобы такие трагедии не повторялись.

-

@ ec42c765:328c0600

2024-12-13 08:16:32

@ ec42c765:328c0600

2024-12-13 08:16:32Nostr Advent Calendar 2024 の 12日目の記事です。

昨日の 12/11 は きりの さんの 2024年のNostrリレー運営を振り返る でした。

nostr-zap-view 作った

リポジトリ: https://github.com/Lokuyow/nostr-zap-view/

動作確認ページ: https://lokuyow.github.io/nostr-zap-view/それ何?

特定の誰かや何かに宛てたZap(投げ銭)を一覧できるやつ

を

自分のWebサイトに設置できるやつ

自分のサイトに設置した例 * SNSリンク集ページ(最下部): https://lokuyow.github.io/

おいくらサッツ(Zap一覧ボタン): https://osats.money/

今日からビットコ(最下部): https://lokuyow.github.io/btc-dca-simulator/なんで作ったの?

私の去年のアドベントカレンダー

【Nostr】Webサイトにビットコインの投げ銭ボタンを設置しよう【Zap】

https://spotlight.soy/detail?article_id=ucd7cbrql/

が前提になってるけど長いので要約すると * ZapするやつはあるけどZap見るやつがないので欲しい * ZapをNostr(の典型的なkind:1クライアント)内だけに留めるのはもったいない * Webサイトの広告うざいからZap(的な何か)で置き換わって欲しいお前だれ?

非エンジニア、非プログラマー

AIにコード出させてるだけ人作った感想

できた

作った感想2

完成してから気付いた本当に作りたかったもの

こういうところにそのままZapを表示できる感じにしたい

(ここまでちゃんとした商業ブログでなく)個人のブログやHPの端っこに「Sponsored by」欄があって名前が表示される感じ

(ここまでちゃんとした商業ブログでなく)個人のブログやHPの端っこに「Sponsored by」欄があって名前が表示される感じ

もうZapっていう文字もビットコインっていう文字もNostrも出さなくていいし説明もしなくていいのでは感がある

イメージはWebサイトを対象にしたニコニ広告 + スーパーチャット + 祭りとか神社の奉納者一覧

で思ったのは

個人からの投げ銭なら推し活的なものにしかならないけど

企業がNostrにアカウントを作ってサイトに投げ銭をしたら企業の広告になるんでは!?

~~企業がNostrにアカウントを!?デリヘルしか見たことない!~~今後

思いつき、予定は未定

* ボタン→ダイアログ形式でなくバナー、Embed形式にしてページアクセスですぐ見れるようにする * 多分リレーに負荷がかかるのでなんかする * Zapの文字は出さず「Sponsored by」等にする * 単純な最新順でなくする * 少額Zapをトリミング * 一定期間(一か月など)ごとで金額順にソート * 多分リレーに負荷がかかるのでなんかする * 今は投稿宛てのZapをWebサイト宛てのZapと勝手に言い張ってるだけなのでちゃんとWebサイト宛てのZapにする * NIPの提案が必要 * ウォレットの準拠も必要 * リレー(wss://~)宛てのZapもできてほしい将来

インターネットのすべてに投げ銭をさせろ

おわり

明日は mono さんの Open Sats 申請編 です!!

-

@ 31bdca15:aac01582

2024-12-13 07:32:53

@ 31bdca15:aac01582

2024-12-13 07:32:53Normally you'd assume stuff like this would stay in niche media and on Twitter. But the mysterious drones over New Jersey are now in all msm outlets. New York Times, Washington Post, Fox News, France 24, BBC, Al Jazeera.

What is going on? I feel like I'm in a Tintin comic.

originally posted at https://stacker.news/items/807597

-

@ b8a9df82:6ab5cbbd

2024-12-13 01:42:04

@ b8a9df82:6ab5cbbd

2024-12-13 01:42:04In March 2020, the world came to a halt. Finally reading "The Bitcoin Standard" and Michael Saylor’s prologue to it made me reflect on my own journey during that time—a journey that led to The Extraordinary. Isn’t it fascinating how the same global crisis made us all pause, look beneath the surface, and come out with completely different perspectives on life?

For me, the pandemic wasn’t just a disruption—it was a turning point. In the stillness, I was forced to face my demons: addiction, emptiness, and the endless search for something meaningful. What emerged wasn’t just a book, but a deep personal transformation.

The Extraordinary is inspired by my life in London during those chaotic years—filled with incredible highs and crushing lows. It’s a story about hitting rock bottom and finding a way back up. It’s about the facade of big-city life, where envy often wears the mask of morality, and the struggle to accept yourself in a world that rarely allows it.

What’s different now? Everything. I live a completely different life today. Writing The Extraordinary helped me confront what I couldn’t before—and now, I finally have the courage to share it here with you on Nostr.

If you’ve ever felt stuck, lost, or out of place in your own life, this book is for you. I’d love for you to read it and let me know your thoughts. Because sometimes, in writing a story for ourselves, we find the strength to connect with others.

Unfortunately, it's only available on Amazon for now, as I haven't figured out how to do print-on-demand here on Nostr yet #asknostr

Blurb:

- THEY SAID YOU WILL EARN A LOT OF MONEY,

- THEY SAID THEY WILL GIVE YOU A CAR,

- THEY SAID YOU WILL BE SUCCESSFUL,

- THEY SAID IT WILL BE FUN.

However Kate Blumenhagen never wanted to be her company‘s whore, nor lose control about the men’s world. In a city where envy often masquerades as morality. What happens when the system collapses, the perfect façade breaks down and everybody‘s darling only shines on the outside? A tribute to all those who can't stand still for five minutes!

-

@ f8173ded:d5f650cb

2024-12-13 00:08:36

@ f8173ded:d5f650cb

2024-12-13 00:08:36123123123123sdfsdfsdf

-

@ 556e8659:7c5ece84

2024-12-12 23:38:38

@ 556e8659:7c5ece84

2024-12-12 23:38:38hello world this isdkfj lskd jflksjd flksjd flsdkj fsdf lkjs dflkj sdlkfj sdlkfj sdlkfj

-

@ 4506e04e:8c16ba04

2024-12-12 21:45:08

@ 4506e04e:8c16ba04

2024-12-12 21:45:08On Saturday, July 27, 2024, at the Bitcoin 2024 Conference in Nashville, Tennessee, Donald Trump made a bold proclamation:

“The reason I’ve come to address the Bitcoin community today can be summed up in two very simple words — America First. If crypto is going to define the future, I want it to be mined, minted, and made in the USA. It’s not going to be made anywhere else.”

This statement raises critical questions: What does Trump and his administration mean by this? And what implications does it hold for Bitcoin’s global landscape?

The Bitcoin Act of 2024 and Global Hash Wars

Less than a month from now, Donald Trump’s administration will take office, and it is highly likely that the Bitcoin Act of 2024 will come into force. This act positions the United States on a strategic path to accumulate a 1-million-Bitcoin strategic reserve. Similar developments are unfolding globally. Russia’s Bitcoin Strategic Reserve Decree is set to take effect, and China, potentially re-entering the fray, is expected to lift its ban on Bitcoin mining soon. These moves signal the advent of a global hash war—a race among nations to secure dominance in Bitcoin accumulation and mining.

As of today, Thursday, December 12, 2024, approximately 94.26% of the total Bitcoin supply has already been mined. With 3.125 BTC block reward issued every 10 minutes, this equates to 450 BTC daily, 3,150 BTC weekly, and 164,250 BTC annually until the next halving. Roughly 5% (1.2 million BTC) remain to be mined before the 7th halving in 2036, at which point 99.2% of the total 21 million supply will have been mined. Beyond that, mining the remaining 0.8% will take another 104 years. Therefore practically speaking, the next decade represents a critical window for countries to establish their dominance in Bitcoin acquisition.

The US Strategy: Policies and Challenges

The US government will likely face significant challenges competing with Chinese miners using domestically manufactured mining equipment especially combined with Russian energy resources. To counteract this, the US government might come up with some creative policies i.e. to restrict Bitcoin ETFs from selling their holdings to any entity other than the US Treasury, potentially at a discounted price.

Publicly traded mining companies could also face mandates to ensure that all Bitcoin they mine remains within the United States. Since enforcing such a policy on-chain is technically not feasible, the government may explore alternative solutions, such as leveraging layer-2 technologies like eCash. This approach could see mining companies becoming mints and custodians of the Bitcoin they mine, issuing eCash tokens for trade on open markets while retaining on-chain Bitcoin in the US.

Similarly, hosted mining services might adopt a system where users purchasing mining equipment are offered eCash instead of on-chain Bitcoin. These companies could analyze users' mining profit histories and even provide lines of credit using mining equipment and future profits as collateral.

The Emerging Dual Market

Under these conditions, a dual market for Bitcoin could emerge. Non-KYC on-chain Bitcoin might trade at a significant premium—potentially 25% higher (or even more) —than its KYC-compliant counterparts. This discrepancy would reflect the increasing regulatory and geopolitical tensions surrounding Bitcoin ownership and distribution.

Conclusion

The global hash war signals a pivotal moment in Bitcoin’s history. Nations like the United States, Russia, and China are vying for strategic control over a finite resource, each deploying unique policies and tactics. As these dynamics unfold, Bitcoin’s decentralized ethos will be tested against the backdrop of geopolitical ambition, potentially reshaping its role in the global economy. Central banks will eventually print their own money to buy Bitcoin. The hyperinflation might lead to socio-economic abnormalities like social unrest and potentially famine. At that point what difference will it make if Bitcoin price is 0.1m, 1m or 10m?

-

@ 04d9fac9:5bec0e6c

2024-12-12 22:33:33

@ 04d9fac9:5bec0e6c

2024-12-12 22:33:33В нашем городе вскоре начнет свою работу новый современный медицинский центр, который обещает значительно улучшить доступ жителей к качественным медицинским услугам.

Центр будет оснащен новейшим оборудованием и предложит широкий спектр медицинских услуг, включая диагностику, лечение и профилактику заболеваний. На открытии центра планируется присутствие представителей городской администрации, медицинского сообщества и общественности.

Глава администрации Воркуты, Алексей Петров, отметил важность данного проекта: «Создание нового медицинского центра — это шаг к улучшению качества медицинского обслуживания в нашем городе. Мы стремимся обеспечить наших жителей современными и доступными медицинскими услугами».

Медицинский центр будет работать по принципу полного цикла, что позволит пациентам получать все необходимые услуги в одном месте без необходимости посещения нескольких учреждений. Это значительно упростит процесс получения медицинской помощи и сократит время ожидания.

В центре предусмотрены комфортные условия для пациентов, включая отсутствие очередей и возможность записи на прием в удобное время. Высококвалифицированные специалисты будут обеспечивать индивидуальный подход к каждому пациенту, что повысит уровень доверия и удовлетворенности от получаемых услуг.

Ожидается, что новый медицинский центр начнет свою работу в начале следующего года, что станет важным событием для всех жителей Воркуты. С его открытием город делает значительный шаг к улучшению здоровья населения и повышению качества жизни.

-

@ d0bf8568:4db3e76f

2024-12-12 21:26:52

@ d0bf8568:4db3e76f

2024-12-12 21:26:52Depuis sa création en 2009, Bitcoin suscite débats passionnés. Pour certains, il s’agit d’une tentative utopique d’émancipation du pouvoir étatique, inspirée par une philosophie libertarienne radicale. Pour d’autres, c'est une réponse pragmatique à un système monétaire mondial jugé défaillant. Ces deux perspectives, souvent opposées, méritent d’être confrontées pour mieux comprendre les enjeux et les limites de cette révolution monétaire.

La critique économique de Bitcoin

David Cayla, dans ses dernières contributions, perçoit Bitcoin comme une tentative de réaliser une « utopie libertarienne ». Selon lui, les inventeurs des cryptomonnaies cherchent à créer une monnaie détachée de l’État et des rapports sociaux traditionnels, en s’inspirant de l’école autrichienne d’économie. Cette école, incarnée par des penseurs comme Friedrich Hayek, prône une monnaie privée et indépendante de l’intervention politique.

Cayla reproche à Bitcoin de nier la dimension intrinsèquement sociale et politique de la monnaie. Pour lui, toute monnaie repose sur la confiance collective et la régulation étatique. En rendant la monnaie exogène et dénuée de dette, Bitcoin chercherait à éviter les interactions sociales au profit d’une logique purement individuelle. Selon cette analyse, Bitcoin serait une illusion, incapable de remplacer les monnaies traditionnelles qui sont des « biens publics » soutenus par des institutions.

Cependant, cette critique semble minimiser la légitimité des motivations derrière Bitcoin. La crise financière de 2008, marquée par des abus systémiques et des sauvetages bancaires controversés, a largement érodé la confiance dans les systèmes monétaires centralisés. Bitcoin n’est pas qu’une réaction idéologique : c’est une tentative de créer un système monétaire transparent, immuable et résistant aux manipulations.

La perspective maximaliste

Pour les bitcoiners, Bitcoin n’est pas une utopie mais une réponse pragmatique à un problème réel : la centralisation excessive et les défaillances des monnaies fiat. Contrairement à ce que Cayla affirme, Bitcoin ne cherche pas à nier la société, mais à protéger les individus de la coercition étatique. En déplaçant la confiance des institutions vers un protocole neutre et transparent, Bitcoin redéfinit les bases des échanges monétaires.

L’accusation selon laquelle Bitcoin serait « asocial » ignore son écosystème communautaire mondial. Les bitcoiners collaborent activement à l’amélioration du réseau, organisent des événements éducatifs et développent des outils inclusifs. Bitcoin n’est pas un rejet des rapports sociaux, mais une tentative de les reconstruire sur des bases plus justes et transparentes.

Un maximaliste insisterait également sur l’émergence historique de la monnaie. Contrairement à l’idée que l’État aurait toujours créé la monnaie, de nombreux exemples montrent que celle-ci émergeait souvent du marché, avant d’être capturée par les gouvernements pour financer des guerres ou imposer des monopoles. Bitcoin réintroduit une monnaie à l’abri des manipulations politiques, similaire aux systèmes basés sur l’or, mais en mieux : numérique, immuable et accessible.

Utopie contre réalité

Si Cayla critique l’absence de dette dans Bitcoin, Nous y voyons une vertu. La « monnaie-dette » actuelle repose sur un système de création monétaire inflationniste qui favorise les inégalités et l’érosion du pouvoir d’achat. En limitant son offre à 21 millions d’unités, Bitcoin offre une alternative saine et prévisible, loin des politiques monétaires arbitraires.

Cependant, les maximalistes ne nient pas que Bitcoin ait encore des défis à relever. La volatilité de sa valeur, sa complexité technique pour les nouveaux utilisateurs, et les tensions entre réglementation et liberté individuelle sont des questions ouvertes. Mais pour autant, ces épreuves ne remettent pas en cause sa pertinence. Au contraire, elles illustrent l’importance de réfléchir à des modèles alternatifs.

Conclusion : un débat essentiel

Bitcoin n’est pas une utopie libertarienne, mais une révolution monétaire sans précédent. Les critiques de Cayla, bien qu’intellectuellement stimulantes, manquent de saisir l’essence de Bitcoin : une monnaie qui libère les individus des abus systémiques des États et des institutions centralisées. Loin de simplement avoir un « potentiel », Bitcoin est déjà en train de redéfinir les rapports entre la monnaie, la société et la liberté. Bitcoin offre une expérience unique : celle d’une monnaie mondiale, neutre et décentralisée, qui redonne le pouvoir aux individus. Que l’on soit sceptique ou enthousiaste, il est clair que Bitcoin oblige à repenser les rapports entre monnaie, société et État.

En fin de compte, le débat sur Bitcoin n’est pas seulement une querelle sur sa légitimité, mais une interrogation sur la manière dont il redessine les rapports sociaux et sociétaux autour de la monnaie. En rendant le pouvoir monétaire à chaque individu, Bitcoin propose un modèle où les interactions économiques peuvent être réalisées sans coercition, renforçant ainsi la confiance mutuelle et les communautés globales. Cette discussion, loin d’être close, ne fait que commencer.

-

@ c43d6de3:a6583169

2024-12-12 20:31:40

@ c43d6de3:a6583169

2024-12-12 20:31:40

Photo by Bastien Jaillot on Unsplash

I finished wiping shit off my screaming daughter’s butt cheeks, and my nostrils were assaulted by the sweet and steamy plume of several-days-old feces basting in the diaper pail. I’d long lost my sense of disgust; the sharp hit of reality was almost appealing, really.

The moment was passing almost as fast as the day had. My son shot up between my legs and wailed for me to just fucking pick him up. My hands moved on autopilot as I finished getting my daughter ready for bed and finally got her off the changing table. Then, I picked up my son and did it all over again.

Ass. Wiped.

Nostrils. Blasted.

Mind. Melted.

I shut off the lights to remind my children it was time to start simmering down. They rebelled, knowing the day was coming to an end and their tyrant father would soon be forcing them to go quietly into the night. I wrangled them onto my lap and rocked violently on the rocking chair as if the swift movement would make them forget they were screaming.

There has never been any reasoning with these little goblins. They haven’t quite grasped that aspect of humanity just yet. The world is still so fresh and vibrant that they grasp for every waking moment they can get their hands on.

I know they like cartoons. That would quiet them, but it would also keep them up until the tyrant decides to shut it off. I figured they might do well with some calming music. That would put me to sleep, not them. I swayed slightly, trying to soothe myself, and it hit me — perhaps a calming musical. Something like, The Sound of Music.

Yes.

My thumbprint brought my phone screen to life and then fluttered to the YouTube icon. I typed, My Favorite Things, and the darkness consuming my children’s bedroom was filled with the soft golden glow of Julie Andrews’s Maria as she sang in her room to the seven von Trapp children, soothing them through the thunderstorm.

That melody had once soothed my little brother when he was about the age my children were just then. The screaming stopped. They rested their little heads on my chest, and their eyes glimmered as they watched Julie Andrews sing beautifully.

The clip quickly came to an end, and my daughter excitedly begged for another. I needed something longer that might perhaps whisk them to sleep.

I typed, A Lovely Night — La La Land.

My children’s reaction to that momentous scene in cinematic history made me realize I had been wrong about parenting all my life. I’d been working so hard to instill habits and rigid structure to ensure my children would become the best little humans around, but all I was doing was drizzling my grey habits, dull routines, and logic over their still-vibrant canvas of the world.

Ryan Gosling and Emma Stone tap-dancing jazzily across the screen while singing their playful lyrics created a work of art that sparked my children’s wonder and rekindled the fire of curiosity inside me as I watched it happen. That little moment made me realize that art can sometimes revitalize our lives by allowing us to see through the lens of curiosity and possibility — as if we were one or two years old again.

Parenting didn’t have to mean smothering my children’s creativity with structure. Instead, it could mean letting their wonder guide me — even as I’m guiding them. It reminded me that life isn’t just about routines or rules; it’s about the moments of beauty and spontaneity that keep us connected to the world, to art, and to each other. And in those quiet, golden moments, I rediscovered a part of myself I’d forgotten: the part that sees magic in the mundane and finds joy in the unexpected.

Here on NOSTR, I want to show the world that life is a scroll riddled with ink. The marks will only ever be simple blots on the parchment unless you pause and perceive them for the characters they are.

I’m constantly thinking about what the future could look like if we just take action.

More of my thoughts about the future and the world around us are coming soon here and on Medium.

Thank you for Reading this article. Doing so supports me and motivates me to continue writing! If you liked this article and want to continue supporting me, consider zapping it. That'll tell me you got some great value out of it and I'll continue to write more pieces like it.

If you are interested in Fiction writing, visit my NOSTR page Fervid Fables.

-

@ 705605d9:b4324038

2024-12-12 21:53:04

@ 705605d9:b4324038

2024-12-12 21:53:04Гороноправдинск, 29 ноября 2040 года — Город Гороноправдинск, который уже долгое время славится своим крупнейшим в мире молочным комбинатом, переживает настоящий шок. Начальник одного из цехов "Горноправдского молочного гиганта", Владимир Михайлович Храмов, обвиняется в крупном мошенничестве и растрате. Он украл 3 тонны сливочного масла, которое он намеревался продать на черном рынке. Это преступление стало самой громкой корпоративной аферой десятилетия.

Ход дела

1. Открытие расследования

Первые сигналы о возможной кражи поступили еще в июле 2040 года, когда началась проверка логистики на комбинате. На одном из участков хранения готовой продукции было зафиксировано странное несоответствие: объемы сливочного масла в отчетах и на складах не совпадали. Производственная система, основанная на использовании высокотехнологичных датчиков и сенсоров для отслеживания каждого этапа переработки молока, начала показывать сбой в алгоритмах. Программы с искусственным интеллектом, осуществляющие мониторинг, фиксировали "лишние" поставки масла, которых не было в официальных документах.

Следственные органы выяснили, что на протяжении нескольких месяцев с завода исчезали большие партии сливочного масла. Используя свою должность и доступ к системе управления, Храмов разработал схему вывоза товара, заменяя его поддельными накладными, чтобы скрыть кражу. Показания работников, которые ранее не замечали странностей, вскоре помогли выяснить, что масла с производства ушло именно 3 тонны — около 7 миллионов рублей ущерба.

2. Расследование и задержание

Следствие было оперативным и тщательно организованным. Используя данные видеокамер, которые устанавливаются на каждом участке на таком высокотехнологичном предприятии, сыщики смогли подтвердить, что Храмов регулярно вывозил партии масла на личном транспорте. Молочное масло, вместо того чтобы попасть в сеть дистрибьюторов, отправлялось в частные магазины, а также в нелегальные точки сбыта, где продавалось значительно дороже.

Во время задержания Храмов пытался скрыться, но был пойман. На момент ареста у него было найдено несколько сумок с деньгами, полученными за продажу украденного товара, а также документы, подтверждающие сбытые партии масла через подставные компании.

3. Судебное разбирательство

Судебное разбирательство над Владимиром Храмовым началось в сентябре 2040 года. Обвинения против него были серьезными: крупное мошенничество, растрату и организацию незаконных торговых операций. Защитники Храмова утверждали, что его действия были результатом "технического сбоя" в системе учета, а не преднамеренным преступлением. По их версии, из-за ошибок в программном обеспечении комбината были нарушены процессы учета, а Храмов якобы пытался исправить ситуацию, но вышел из-под контроля.

Однако прокурор утверждал, что кража была тщательно спланированной и использовалась сеть подставных фирм для сбыта продукции. «Это не ошибка системы, а осознанное преступление, совершенное по личной выгоде, — заявил прокурор, — Это схема, которая действовала на протяжении месяцев, и последствия для всей компании могут быть катастрофическими».

4. Презентация доказательств

Одним из ключевых моментов на суде стали показания сотрудников комбината, которые в дальнейшем стали свидетелями по делу. Они рассказали, что Храмов, пользуясь своей должностью, мог менять логистические данные и создавать фальшивые отчеты для прикрытия украденных партий масла. На судебном заседании был также представлен ряд видеозаписей с камер, подтверждающих его участие в выводе масла с производства.

Эксперты также пояснили, что система отслеживания продуктов на комбинате использовала блокчейн-технологии, которые обычно обеспечивают полную прозрачность и безопасность. Однако Храмов сумел найти способ обойти систему и нарушить порядок документооборота.

5. Последствия для комбината

Комбинат "Горноправдинский молочный гигант" является крупнейшим в мире производителем молочных продуктов, и скандал с кражей стал ударом по его репутации. В ответ на происходящее, руководство комбината сделало заявление о начале внутренней реформы системы безопасности и учета. Генеральный директор предприятия, Игорь Васильевич Соловьев, отметил: "Мы примем все необходимые меры, чтобы предотвратить подобные инциденты в будущем. Мы уже усилили контроль за внутренними процессами и улучшили систему мониторинга".

Также были введены новые меры безопасности, включая использование более сложных алгоритмов защиты от манипуляций с данными. В пресс-релизе комбината также было заявлено, что все сотрудники, имеющие доступ к ключевым данным, прошли повторное обучение и были проинструктированы по вопросам этики и корпоративной безопасности.

6. Реакция общества

Скандал вызвал широкий резонанс в обществе. Местные жители, а также сотрудники комбината, были поражены тем, что такое преступление произошло в одном из самых высокотехнологичных предприятий страны. «Как можно было так обмануть систему? Мы всегда гордились этим комбинатом», — комментирует один из работников.

Сообщество потребителей также обеспокоено возможными последствиями для качества продукции. Власти Гороноправдинска пообещали, что будут проводить дополнительные проверки качества молочной продукции, произведенной на комбинате, чтобы гарантировать, что такое происшествие не повлияет на безопасность и стандарты продукции.

Судебное разбирательство продолжается, но уже на текущем этапе ясно, что это дело станет знаковым для молочной промышленности. Вопросы о прозрачности, безопасности и надежности учета на крупнейших предприятиях будут подниматься с новой силой. Эксперты считают, что в будущем такие преступления могут привести к созданию еще более сложных систем защиты данных и к серьезным изменениям в корпоративных политиках.

Храмову грозит длительный срок тюремного заключения, если его вина будет доказана. Уже сейчас его поступок рассматривается как пример того, как злоупотребление доверием на высоком уровне может привести к серьезным последствиям как для самого преступника, так и для целой отрасли.

-

@ 04d9fac9:5bec0e6c

2024-12-12 21:47:31

@ 04d9fac9:5bec0e6c

2024-12-12 21:47:31Открытие позволит разнообразить внешний вид северного города.

Плазменные трубы — это устройства, которые используют плазму для создания яркого и эффектного освещения. Они работают на основе высоковольтных разрядов, создающих уникальные визуальные эффекты и могут использоваться как в декоративных, так и в функциональных целях. Новые плазменные трубы, разработанные воркутскими учеными и инженерами, отличаются высокой энергоэффективностью и долговечностью.

Глава города Ярослав Шапошников отметил, что запуск плазменных труб — это не только шаг к модернизации освещения Воркуты, но и возможность привлечь внимание к новым технологиям.

Ожидается, что новые плазменные трубы будут установлены в общественных местах, парках и на улицах города. Также планируется их использование в различных культурных проектах и мероприятиях, что сделает Воркуту более привлекательной для туристов.

-

@ 13a1e375:3005c388

2024-12-12 20:11:34

@ 13a1e375:3005c388

2024-12-12 20:11:34Nostr Obsidian Graph

https://github.com/LamekaRjeggr/nostr-obsidian-graph.git

Currently only tested on Obsidian for MacOS.

A short Demo:

![[readme gif 1.gif]]

-

@ dbb19ae0:c3f22d5a

2024-12-12 19:47:23

@ dbb19ae0:c3f22d5a

2024-12-12 19:47:23I am using Nostr daily, I spend most of my time on Primal(the web browser client) the great thing about Nostr is the whole ecosystem of apps which offer a little twist of their own. All of this is possible by the use of the Nostr profile secret key (via an extension (alby or nos2x) best practice is to never use the nsec directly).

For example pinstr will behave like pinterest for Nostr, to create image gallery collection, another example would be nostrapp or nostrapplinkwhich are a repository of Nostr apps (with reviews) …

Among all these apps, there is one particular service under the name npub.pro, which acts as a dynamic portfolio page, it is presented as a ‘Beautiful nostr-based websites for creators’.

This website is part of the nostr.band family (as nostrapplink), you can recognize them as all website powered by nostr.band have this right handle with the user nostr profile (which appears in the middle).

This website is part of the nostr.band family (as nostrapplink), you can recognize them as all website powered by nostr.band have this right handle with the user nostr profile (which appears in the middle).Once on the npub.pro page, just click on "try now" button

from there the process is very similar to setting up a tumblr profile, or wordpress website, except the content already exist (it will be extracted from the nostr profile) and once the theme has been chosen, press publish and voila! super easy, user friendly and great result in minutes.

The creator of npub.pro is 'Brugeman'. I have asked a couple of question because the search was not working when I created my npub.pro website, it turns out it was not fully implemented yet, the good news is that search is working now and for later edit of the website keep this link nearby npub.pro/admin (you can edit the theme from there if you change your mind later.)

If you want to have a look at an example – here is mine

ever4st.npub.pro

ever4st.npub.prooriginal article posted here

-

@ 372da077:518ec7ac

2024-12-12 18:54:26

@ 372da077:518ec7ac

2024-12-12 18:54:26One of my favorite art pieces. an engraving from an 1888 astronomy book.

Often depicted fully colorized, apparently this is the original.

originally posted at https://stacker.news/items/806953

-

@ 5528476b:ed78ff13

2024-12-12 18:34:08

@ 5528476b:ed78ff13

2024-12-12 18:34:08no other p-tags here

changing the recipient now

new content

-

@ 04d9fac9:5bec0e6c

2024-12-12 21:43:32

@ 04d9fac9:5bec0e6c

2024-12-12 21:43:32Прорыв десятилетия совершили ученные из Воркуты.

В Воркуте открылась первая лаборатория по изучению квантовых частиц. Ученые работают над расшифровкой тайн квантовой физики и разработкой новых технологий на основе квантовых явлений. Это открытие может привести к революционным изменениям в науке, технике и медицине. Город Воркута становится центром квантовой исследовательской деятельности, привлекая внимание ученых и специалистов со всего мира.

Лаборатория оснащена современным оборудованием, включая лазеры, детекторы частиц и системы для создания квантовых состояний. Ожидается, что "Квантовые горизонты" будут сотрудничать с ведущими научными центрами России и зарубежья, что позволит обмениваться знаниями и опытом.

-

@ 04d9fac9:5bec0e6c

2024-12-12 21:42:24

@ 04d9fac9:5bec0e6c

2024-12-12 21:42:24В городе запустят летающий общественный транспорт.

В Воркуте, в 2044 году, состоялся важный шаг в развитии общественного транспорта: город представил новый вид летающего общественного транспорта, который обещает значительно изменить способы передвижения горожан.

Летающий транспорт представляет собой беспилотные воздушные такси, способные перевозить пассажиров по заранее заданным маршрутам. Эти аппараты используют экологически чистые технологии и могут взлетать и приземляться вертикально, что делает их идеальными для городских условий с ограниченным пространством.

Запуск нового вида транспорта поддерживается местными властями и бизнесом, что подчеркивает стремление Воркуты к инновациям и устойчивому развитию. Глава города Ярослав Шапошников отметил, что транспорт не только улучшит транспортную доступность, но и создаст новые рабочие места в сфере высоких технологий.

-

@ 04d9fac9:5bec0e6c

2024-12-12 21:39:45

@ 04d9fac9:5bec0e6c

2024-12-12 21:39:45Ботаники из Воркуты вывели новый вид растений с нейромозгом.

В Воркуте, в 2044 году, произошел сенсационный прорыв в ботанике: ученые из местного научно-исследовательского института вывели новый вид растений с нейромозгом. Эта уникальная разработка открывает новые горизонты в области биотехнологий и экологии. Что такое растения с нейромозгом?

Растения, получившие название "Воркута-Эко", обладают способностью к адаптации и взаимодействию с окружающей средой на уровне, ранее недоступном для флоры. Нейромозг представляет собой сеть специализированных клеток, которые функционируют аналогично нейронам животных, позволяя растениям реагировать на изменения в условиях среды, такие как температура, влажность и наличие питательных веществ.

Ученые планируют продолжить исследования в этой области, чтобы изучить потенциал "Воркута-Эко" для использования в различных сферах — от медицины до экологии. Это открытие может стать важным шагом к созданию устойчивых экосистем и улучшению условий жизни в северных регионах России.

-

@ 31312140:2471509b

2024-12-12 18:19:11

@ 31312140:2471509b

2024-12-12 18:19:11Understanding Real Money

The Awful Truth About Fiat Currency

Let's call a spade a spade here - fiat currency is a scam. Governments and central banks print it out of thin air, devaluing each note in your wallet every single day. Your hard-earned money is losing its value, and you're left chasing your tail trying to keep up with inflation.

Fiat currency is backed by nothing but the "full faith and credit" of the government. And when was the last time you trusted a politician? 😏 The truth is, fiat currencies always collapse. History is littered with examples like the Roman denarius, the Zimbabwean dollar, and, well, the ongoing crumbling of many others.

The Concept of Intrinsic Value

Real money, on the other hand, has intrinsic value—meaning it's valuable in and of itself. Think gold and silver. These precious metals have been prized for thousands of years because they don't decay, they're hard to counterfeit, and they have myriad uses in the real world, from electronics to medicine.

Gold and silver have been used as money for millennia, and for good reason. They're scarce, durable, and divisible. You can't just print more gold when you feel like it. You have to mine it, refine it, and cast it.

Bitcoin: The Digital Gold

Now, let's talk about Bitcoin. Some people call it "digital gold," and there's a good reason for that. Bitcoin, like gold, is scarce (only 21 million will ever exist), and it's decentralized, meaning no government or bank can control it. This decentralization is key because it means Bitcoin is resistant to censorship and inflation.

Bitcoin stands out as the only cryptocurrency that can be considered real money due to its decentralized nature, fixed supply of 21 million coins, unparalleled security, global adoption, resilience, and the philosophy of financial sovereignty it embodies. Unlike other cryptocurrencies that often have centralized control and variable supplies, Bitcoin's immutable transactions and widespread recognition make it a reliable store of value and medium of exchange.

But remember, Bitcoin isn't a perfect substitute for gold. It's digital, which means it relies on technology and the internet to function. This makes it vulnerable to hacking and other digital threats. Still, the blockchain technology underpinning Bitcoin is revolutionary, creating a transparent and tamper-evident ledger of transactions.

The Downfall of Modern Banking Systems

Let's take a step back and look at the modern banking system. It's a joke. Fractional reserve banking allows banks to lend out money they don't have, creating an economic bubble that inevitably bursts. We're constantly teetering on the edge of financial collapse because banks are playing a high-stakes game of musical chairs with your money.

And when things go south, who gets bailed out? Not you or me, but the banks. We saw it in 2008. The rich and powerful protected their own interests, while everyday folks lost their homes and savings.

Why Governments Love Fiat

Governments love fiat money because it allows them to spend beyond their means. When the treasury gets low, they don’t have to make tough decisions or cut spending—they just print more money. This leads to inflation, which is just another form of taxation. Your dollar buys less; your savings erode.

This manipulation benefits the elites who get the newly printed money first. They can spend it while it still has value, before it trickles down into the economy and prices rise for everyone else. Trickle-down economics is as real as fairy tales. 🧚♂️

Creating a Solution: Moving Towards Real Money

To reclaim our financial sovereignty, we must return to real money. Here's how:

Gold and Silver

Start by accumulating gold and silver. Begin small—buying a few ounces here and there. Store it securely, away from banks where it could be confiscated. There are many platforms and shops where you can purchase these metals safely.

Bitcoin

Diversify with Bitcoin. Make sure you understand how wallets work and practice impeccable security measures. It's not enough to buy Bitcoin; you must ensure it can't be stolen by hackers. Educate yourself on cold storage, multi-signature wallets, and other security practices.

Educate Yourself

Knowledge is power. Read books on Austrian economics, like those by Ludwig von Mises and Murray Rothbard. Understand the fundamentals of what makes good money.

The Future of Real Money

If we succeed in transitioning to real money, we can create a more sustainable and fair economic system. One where value is preserved over time, where individuals have sovereignty over their own wealth, and where the powerful can no longer manipulate the masses for their gain.

Final Thoughts

The fight for real money is a fight against the controllers, the manipulators, and the corrupt. But it’s also a fight for our freedom, our future, and our dignity. Let's look into it and make conscious choices to protect our financial future by holding real money.

Keep your head up, keep questioning, and always look into it 💪

Suggested Readings and References

- "The Creature from Jekyll Island" by G. Edward Griffin - A detailed look at the Federal Reserve and how it manipulates the money supply.

- "What Has Government Done to Our Money?" by Murray Rothbard - An essential read on the problem with fiat currency and why real money matters.

- "The Bitcoin Standard" by Saifedean Ammous - A comprehensive analysis of Bitcoin as a form of digital gold.

- "Human Action" by Ludwig von Mises - A cornerstone work for understanding Austrian economics.

- "Democracy: The God That Failed" by Hans-Hermann Hoppe - A deep dive into the failures of democratic government and the economics of anarcho-capitalism.

-

@ 04d9fac9:5bec0e6c

2024-12-12 21:36:45

@ 04d9fac9:5bec0e6c

2024-12-12 21:36:45Воркутинские ученные изобрели новый вид имплантов для человека.

В Воркуте, в 2044 году, произошел значительный прорыв в области медицины и технологий: местные ученые и инженеры разработали новый вид имплантов, который обещает революционизировать подход к медицинским процедурам и улучшить качество жизни горожан.

Импланты, названные "Воркута-Нейро", представляют собой многофункциональные устройства, интегрирующиеся с нервной системой человека. Они способны не только восстанавливать утраченные функции органов, но и улучшать когнитивные способности. Эти импланты используют передовые нейроинтерфейсы, которые позволяют взаимодействовать с мозгом на уровне нейронов, обеспечивая более точное управление и обратную связь.

Преимущества технологии:

Многофункциональность: Импланты могут использоваться для лечения различных заболеваний, включая неврологические расстройства. Интеграция с организмом: Благодаря уникальным материалам и технологиям, импланты минимизируют риск отторжения и обеспечивают долговечность. Улучшение качества жизни: Пользователи сообщают о значительном улучшении когнитивных функций и общей физической активности.

-

@ 3ad01248:962d8a07

2024-12-12 16:47:27

@ 3ad01248:962d8a07

2024-12-12 16:47:27The Bitcoin protocol has been around for 15 years and just it keeps on going doing its thing with improvements made along the way to make it better and stronger. Bitcoin has always been described as a way to change the world by fixing the money. It will certainly do that with enough time and adoption by everyday folks around the world.

What isn't discussed as much as it should be is what Bitcoin does to you emotionally and how it completely changes your worldview and opens your eyes to the manipulation and distortion of reality created by fiat currency. I can only speak to my personal experience but I have seen multiple instances on X and nostr where people describe having transformational changes because of Bitcoin.

I found Bitcoin in 2020 by chance to be honest, I was scrolling Twitter when I stumbled upon someone saying that Bitcoin was freedom money. I remember thinking to myself "what the hell is freedom money?" I like to learn and I am curious by nature so I started to research what this Bitcoin thing was.

What I discovered blew my mind! As a avid fan of Ron Paul and Austrian economics I felt like I was primed and ready to go down the Bitcoin rabbit hole. Needless to say I jumped in with two feet first and haven't looked back since but I have come out the other side a changed person.

HODL CULTURE

Once you start down the rabbit hole there are so many twist and turn that you can take where it becomes a little overwhelming. What helped me get my bearings as I was learning about Bitcoin was the HODL culture that had been cultivated on Twitter. We all the know the catchphrases"

- "Not Your Keys, Not Your Coins"

- "There Is Only 21 Million"

- "Have Fun Staying Poor"

- "Bitcoin not Shitcoins"

- "Don't Sell Your Bitcoin"

- "Code Is Law"

Hearing and seeing this over and over gave me a firm ground to stand on and helped me understand that Bitcoin is step change function in how society interacts with money. For the first time in history we have a money that can't be manipulated by governments or other malicious third parties.

Bitcoin opens your eyes to what governments can do with an unlimited power to print money. They start world wars, stage coups all around the world and distort the perception of their citizens with propaganda. It is truly sickening that governments have gotten away with this for this long. Millions upon millions of people have died because of fiat currency. Bitcoin smashes the war machine and makes war costly thus making the world more peaceful.

I personally want to thank the toxic Bitcoin maximalist for standing on principle and staying true to the message despite the harsh criticism many of you have faced. I am forever grateful for your steadfastness to the Bitcoin revolution.

Hodl culture is firmly engrained into the Bitcoin community and will help countless others to see how Bitcoin is different from fiat and other digital assets. A by product of HODL culture is that it naturally encourages you to lower your time preference and appreciate the small things in life.

Low Time Preference

Low time preference was a term that I wasn't familiar with until I read Saifedean Ammous's book the Bitcoin Standard. For those that are unaware of the concept, the basic idea is when you have a money that doesn't store its value well you tend to focus on the here and now because you know your money is going to be worth a lot less in the future.

Why save for a new house or new car when you know that if you hold dollars for any amount of time your purchasing power is going to be less than it is today. This is why the savings rate among Americans are abysmal and will not get better any time soon. Most people are simply making a rational choice to maximize their purchasing power today versus waiting for tomorrow.

Not only are consumers are doing this but businesses are too. Have you noticed the quality of your appliances keeps getting worse? Back in the day, you could buy appliances that were built to last 15-20 years. Now you would be lucky to get an appliance that last more than 18 months without some major issue. Business are incentivized to thinking about short term profits versus building solid products that last and building a brand known for quality.

Bitcoin flips this whole situation on its head where the longer you hold Bitcoin the cheaper the product that you want gets cheaper over time. This foundational function of Bitcoin has made it where I don't want much of anything these days. I've noticed the dramatic behavior change within myself. Before Bitcoin I would buy a new car probably every 3-4 years. Since learning about Bitcoin I haven't had the urge to replace my car, in fact I've learned to appreciate that I have vehicle that gets me from point A to point B and back. I don't need the fancy new car with all the bells and whistles.

Having a low time preference helps you focus on what is important in life such as family and your personal health and wellness. It's not wealth, a big house or a fancy car. Sure you might acquire some of these things as the Bitcoin price appreciates but it is not the main motivator for true Bitcoiners who truly want to transform the world we live in. Imagine a world where everyone had a lower time preference than they do now.

People would be less stressed out, healthier, and happier. Work would no longer define who we are or what we think of ourselves. Instead work would be something that we do for leisure when you want to earn more Bitcoin. Our buildings would be beautiful again because we could spend more time creating works of art instead of industrial soulless buildings. Our environment would be cleaner because we wouldn't have rapacious mega corporations scavenging the world for minerals, instead they could focus on innovating or using the minerals that we have out of the ground more efficiently.

Fostering a low time preference is Bitcoin's superpower that you don't even realize is changing you into a different person. Bitcoin changes you and the world for the better. I hope more people choose to embrace Bitcoin and see what we see in it.

-

@ 705605d9:b4324038

2024-12-12 21:36:11