-

@ f8e6c643:03328ca9

2023-04-19 18:00:27

@ f8e6c643:03328ca9

2023-04-19 18:00:27I’m changing my approach to zaps ⚡️ by upping my default zap amount and shifting my focus from quantity of zaps sent to quality of content zapped (except for during #zapathon of course, where quantity is the goal 🤙).

Why the change? Because I believe the honeymoon phase for #zaps + #nostr is over. We’ve proven zaps work, and while they will get better with additional functionality like splits and zaptags and self-custodial solutions, they are quite functional now in this value for value environment.

Despite #Nostr being new, there are people here already delivering high quality content. If I like what they share, and if I want them to continue sharing it here, then I ought to show them a meaningful amount of support when I consume or engage with their content. Why? Because I like being here instead of wherever else they might be sharing it.

Good content deserves a decent zap when I enjoy it. I’m not a fan of paywalls for this type of interaction because it turns the interaction into a sale, and I’m not very interested in being sold something I don’t even know if I will even like. There are uses for paywalls, but it’s a backwards approach for these types of interactions. #Zaps enable communicating back to someone that their content was appreciated/enjoyed, whether or not they even expected anything in return when they posted it.

Why quality over quantity? Isn’t it better to “spread the pura vida” and just zap hundreds of people 21 sats a time for anything and everything they post? That’s not for me to decide for you, but it is for me to decide for me. I don’t fully subscribe to the idea that zaps should replace likes, because I don’t think it’s natural to add a monetary component to every human interaction. Sometimes a 💜 or 🤙 or 🫂 communicate exactly what is appropriate in that interaction.

Money and time are scarce for all of us, and I consider it more meaningful to focus on giving of my scarce money where clearly you have given to me of your scarce time. A few hundred, or even a few thousand, sats for each of THOSE interactions costs me merely a few cents or dollars of my local currency, and while that is a small amount for me to spare, we all know how good it feels to receive a 3, 4, or 5-digit #zap. Enough of those can actually start adding up to a level of value that makes it worth someone’s time to continue creating and sharing more content here.

If #Nostr is to be a place where people want to give of their scarce time and talent, then it needs to be rewarding in ways that meaningfully encourage them to do so. #Zaps are one powerful way to accomplish this. Of course, people should only zap within their means, and in a way they are comfortable with. Maybe for some that does mean focusing on quantity. That’s for each person to decide.

As for me, I believe I will find it more meaningful to focus my #zaps on the higher quality content and engagement that leaves me feeling like my day was better than it was before. 💜🤙

-

@ a008def1:57a3564d

2023-04-19 16:12:07

@ a008def1:57a3564d

2023-04-19 16:12:07In The Bull Case for a GitHub Alternative on Nostr I outlined the opportunities for a thriving ecosystem for the software development collaboration experience over nostr.

I outlined 3 core features that must be enabled:

- Authoritative git repositories, updated exclusively by authorised maintainers.

- Platform to host the surround collaboration. Comments and interactions around PRs, issues, project tracking, etc.

- CI/CD pipeline integration with tools such as CicleCI, travis, Jenkins, etc.

This article outlines some of the key challenges that we should address to achieve this and how feature 2 could be achieved whilst avoiding may of these problems.

The Group Authorisation Problem

A central feature of Nostr is permission-less account creation and authorisation of user activity through public / private key cryptography.

A key challenge that cuts across core features 1 and 2 above is how the authorisation of a state can be trustlessly verified when the list of maintainers evolves over time. From a git repository perspective the state may be changed by merging a PR, squashing commits or removing a branch. From a collaboration feature perspective the state could be changed by updating the status of an issue or moving a story across a kanban board in scenarios where such actions require authorisation.

I will shortly be publishing a deep diver into the problem of group authorisation. It applies to many more usecases. The solution I will propose is Nostr Authorisation Groups.

The Conflicting Change Problem

How is consensus reached on which of two conflicting authorised changes is accepted?

Before we get excited about honey badgers and military generals we should consider the nostrian philosophy that values simplify and pragmatism. Given that maintainers trust each other* what is the simplest solution?

Here is a simple proposal: the nostr Authorisation Event (see below) with the later timestamp takes priority. When the timestamps are identical then the repository reverts to the previous state until a new authorisation event is issued.

*Changes to the list of Authorised maintainers requires a more robust solution as trust can break down, such as when keys are compromised.

The State Reversion Problem

There are scenarios where a state change needs to be reverted. For example, a relay processes an update and then receives either: * a conflicting change with an Authorisation Event that has an identical timestamp or * a delayed Nostr Authorisation Group event that revoked the signers authorisation and was dated before the change was made.

Assuming Rewriting Git History is supported, clients and relays running a standard git server may have purged data required to revert and would need a way of recovering it.

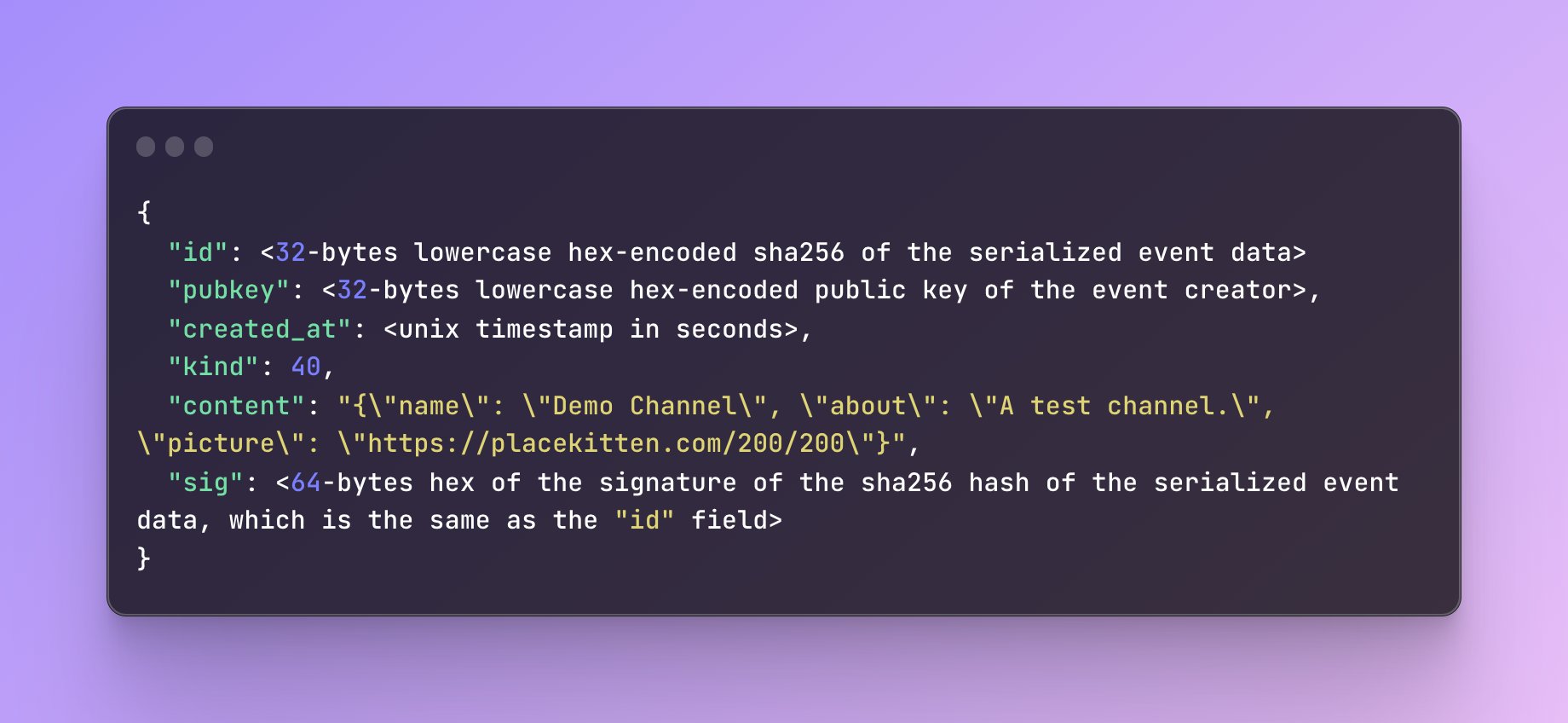

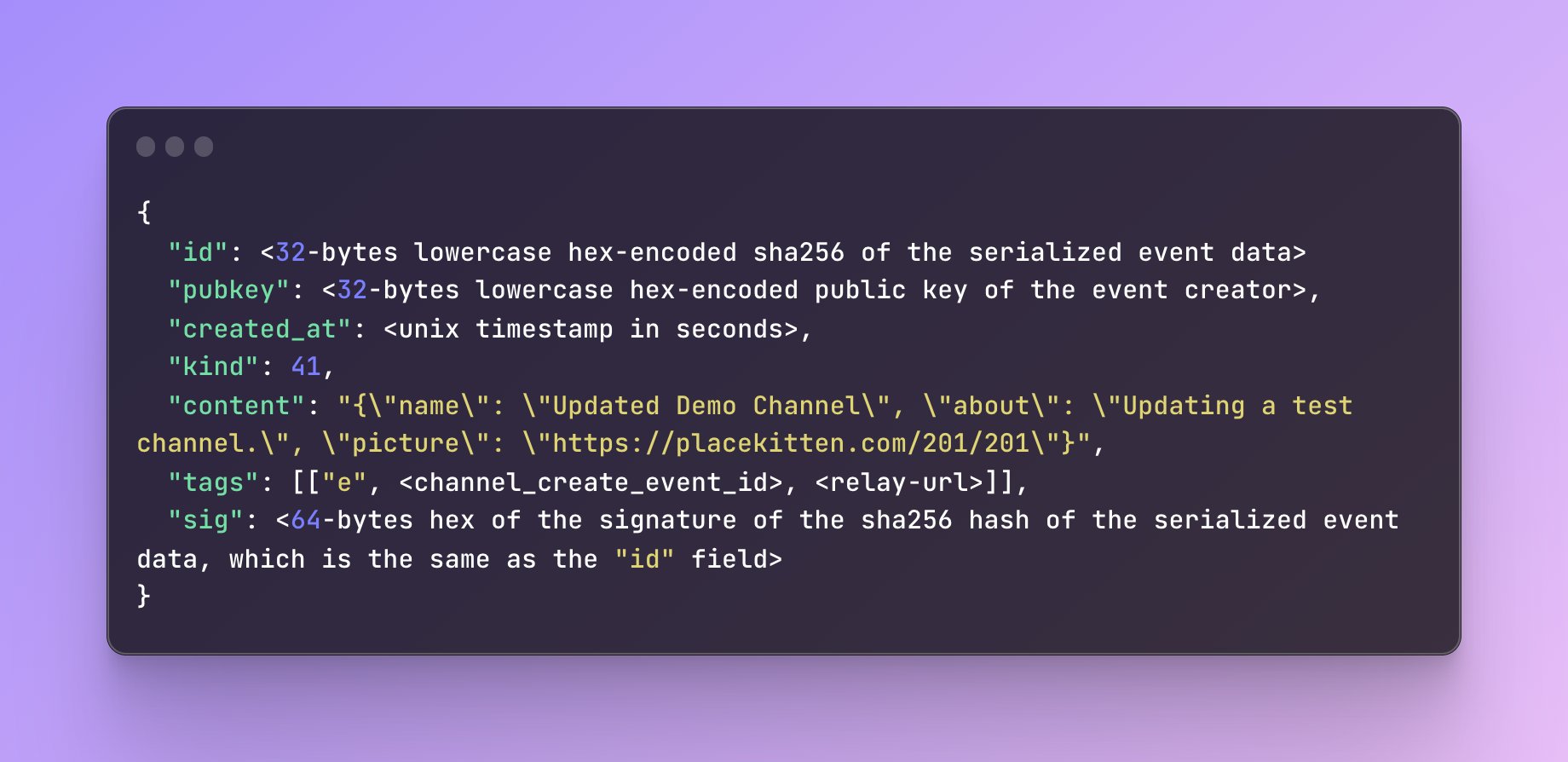

Constructing an Authorisation Event Standard

Authorisation events would need to enable efficient verification that the state reached after any of the following actions will be reflective of the latest authorised state:

- clone a repository

- a repository with the previous authorised state, pulls changes covered by a single Authorisation Event

- a repository with a previously authorised state, pulls changes covered by many Authorisation Events

The bandwidth efficient standard transport model that git uses to push and pull changes are excellent. There is value in preserving this.

Signing and verification would happen with by either a wrapper around the standard git client or a custom git client. This would analyse changes pulled from the git server and only allow changes verified by an Authorisation Event. Similarly it would sign Authorisation Event that reflects the changes which are being pushed to the git server. The Git Server enforces the Authorisation Event Standard and will only process the request once the Authorisation Event is received.

There is a trade-off between lightweight messages and providing useful metadata that could be used for, as an example, state reversion.

Constructing a Standard for Anchoring the Social Experience

Clients focusing on the social experience of software development would need to achor messages to elements both inside a git repository (lines of code, commits, etc) and outside the git repository (PRs, issues, kamban boards, etc).

Either a soft-standard or a NIP should be constructed to establish a referencing schema for a base set of elements.

The Data Storage Problem

There are no shortage of ideas about how storing and serving the underlying data in git repositories could be achieved. From NIP-81/94 filesharing to niche relays running a git server. From torrents to trusted centralised repositories.

This is good news as storage and bandwidth is expensive and the key challenge is finding a model that incentivises actors to provide this service whilst balancing other drivers such as: 1. Resiliency / censorship resistant 2. Reliability 3. Simplicity 4. Efficiency 5. UX impact

The Interoprablilty Problem

It would be beneficial for a number of these data storage models to be built and the market could decide which is best.

Some solutions may have relays run a standard git server that only accept changes that are authorised through nostr events. Clients would issue these events before pushing to the server. Others may store the entire git metadata, such as git refs and object trees, in nostr events and download files via torrents. They could all abstracted this behind a custom git client.

These implementations could be incompatable which would be bad for the wider git-on-noster project as it would lead to fragmentation.

Agreeing an NIP for an Authorisation Event Standard as described above would prevent that. Their could even be bridges built to enable repositories to operate using multiple data storage models simultaneously.

CI/CD Integration

CI/CD tools enable secrets to be stored and accessed by CI/CD runners. nostr keys can be stored in this manner to enable jobs to be run with the outputs posted on nostr.

Repositories that require tests to pass before a PR is merged could add branch protection. Clients would only accept a change as authorised if it had a Authorisation event signed by a maintainer and an event signed by the CI/CD user that both referenced the Authorisation event and confirmed the tests passed.

Work would be needed to remove the friction in setting up integration for project using a verify of CI/CDs.

Patch vs Pull Requests

The most commonly used model for integrating changes to a code base is the Pull Request model. A contributor forks a repository, makes some changes and creates a Pull Request. There is discussion, review and changes are made to the folk. When a maintainer is happy they pull the proposed changes into the main repository.

The alternative is the Patch model. Contributors pull the latest changes from an authoritative repository. They make some changes and package them into a patch, which is sent to maintainers, often via email mailing lists. Discussions and reviews take place, revised patches are issued and when a maintainer is happy they apply the path to the authoritative repository.

A Simpler Model with Decentralisation Trade-Offs

Most of the challenges discussed so far relate to how a git repository can be trustlessly verified as being in a state that is authorised by an evolving group of maintainers so that the reliance on a centralised repository is removed. This isn't actually a requirement to enable the collaboration surrounding a git repository to move onto nostr.

An interim, or even an alternative, approach could be to establish a standard for anchoring the social experience discussed above but avoid or minimise any reliance on an Authorisation Event Standard.

The anchoring standard could aim to make it easy for clients to create a similar user experience of interacting with a Pull Request and a change request submitted using a patch. This would enable projects to support both and bolster the censorship resistant qualities of without degrading the UX. A bot could even run to take a patch, create a fork on the centralised repository and create a PR so that other users can interact with all proposed changes in the same way.

Users who are either excluded from access to the centralised repository, or choose to minimise interaction with it, could use the patch model. Whereas other users would be free to use the PR model which they are more comfortable with.

jb55 produced a tool to send patches with blobs embedded over nostr. It may be possible to recreate a repository entirely from signed patches and avoid interaction with the centralised repository completely so long as branch maintenance and Rewriting Git History is never done. A git client warpper could be done to simulate cloning a repository by downloading every patch. This would be a bandwidth and storage inefficient which might not scale well. jb55 who created the wrapper doesn't "think there should only be patches on nostr".

Ultimately the patch only model feels like a quick and dirty solution that would enable progress on the social experience which would build moment for a decentralised git repository solution to emerge.

Concluding Thoughts

We have covered a lot of ground here yet we barely mentioned incentives or spoken about barriers to adoption. These topics are important but there is perhaps not room in this article to do them justice.

We have discussed a set of problems and challenges with decentralising repositories and software development collaboration usecase over nostr that solutions will need to either address or avoid. We have set out some of the groundwork for highlighting the standards which would need to be agreed in order to enable interoprable innovation across the usecase.

I would really value your feedback and pushback on any and all aspects of this. Specifically it appears that the community has been focusing on the patch model. I wonder the extent to which this is for ease of implementation or if its not really a priority to have a decentralised git repository enabled by trustless state verification. I also haven't seen many of the above challenges clearly articulated in relation to a Github Alternative on Nostr. Perhaps I am missing obvious reasons why these are not problems, or the solutions are so simple that they haven't been articulated, or I am not looking in the right places.

Reach out to me on nostr and let me know! DanConwayDev npub15qydau2hjma6ngxkl2cyar74wzyjshvl65za5k5rl69264ar2exs5cyejr DanConwayDev@Nostr-Check.com

-

@ d8a2c33f:76611e0c

2023-04-19 15:34:28

@ d8a2c33f:76611e0c

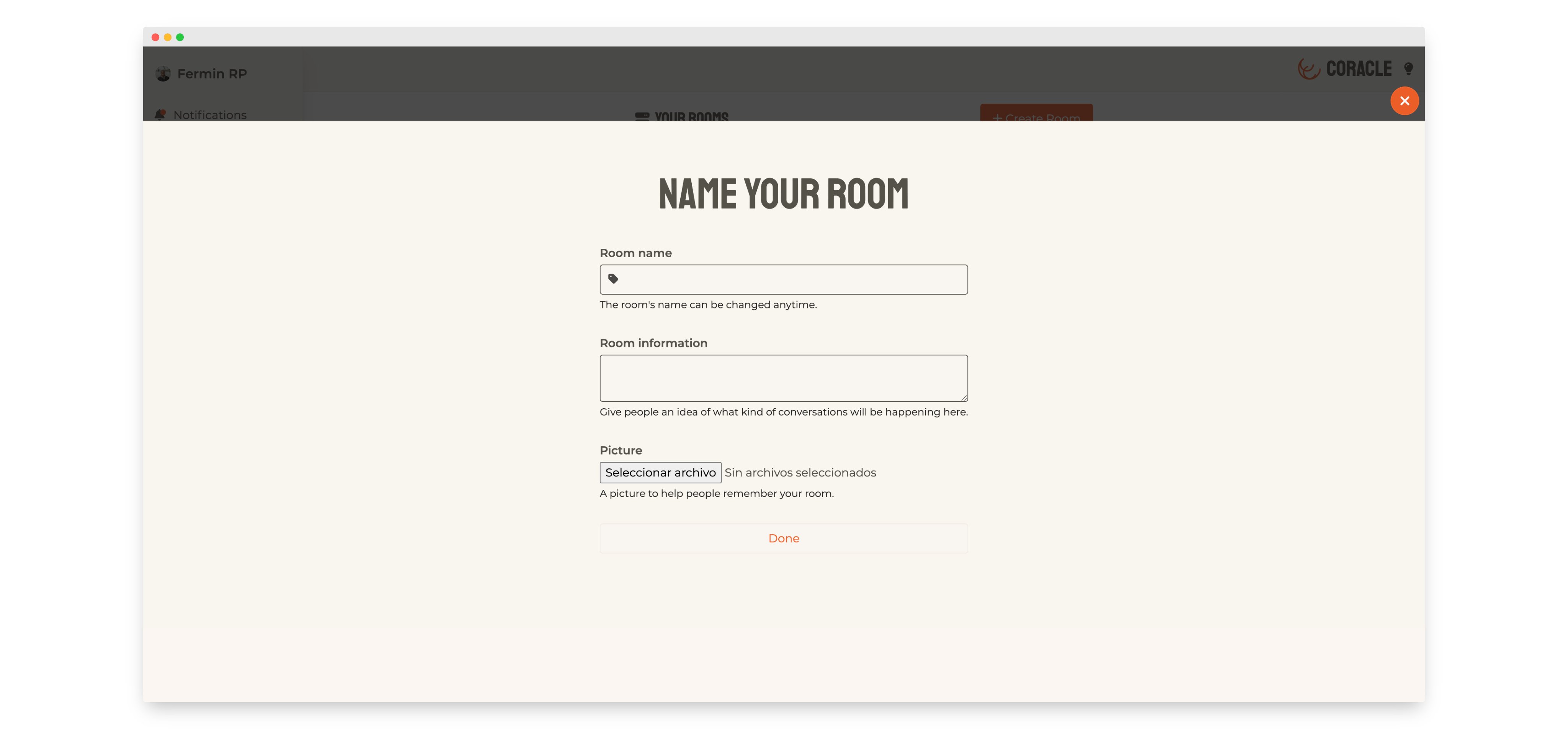

2023-04-19 15:34:28We've seen badges on numerous social media sites, typically awarded by the platform or accredited institutions. On Nostr, thanks to @cameri and NIP-58, anyone can create, award, and display them on their profiles. With https://badges.page/, creating and awarding badges has become easier for everyone. However, only a few Nostr clients, such as Amethyst and Snort.social, display them in profiles.

When we began designing the badge display feature for Current App, our goal was to simplify the process of accepting, activating, and organizing badges to make profiles stand out.

After building this functionality, I started testing it by browsing through profiles and badges. Unintentionally, I began badge surfing and found many unique, cringe-worthy, hilarious, and creative badges. Here are some that I discovered:

A great aspect of badges is that the profile owner must accept them before they appear on their profiles. So, while you can be awarded numerous badges, only the ones you activate will be displayed. We made this process incredibly easy in the Current App. Just go to the profile edit view, and you can pick, reorder, or delete the badges on your profile.

This also explains why many profiles don't display any badges. Nostr clients such as Damus still don't support profile badges. If your Nostr client doesn't support badges, visit badges.page or the Current App to view all the badges you've received.

Here's a quick video of how to set it up on Current App: https://i.current.fyi/current/app/Current-badges-demo.mp4

Additionally, I'm eager to discover more. If you find any new badges worth sharing, please add them to the comments!

-

@ 1967650e:73170f7f

2023-04-19 15:21:59

@ 1967650e:73170f7f

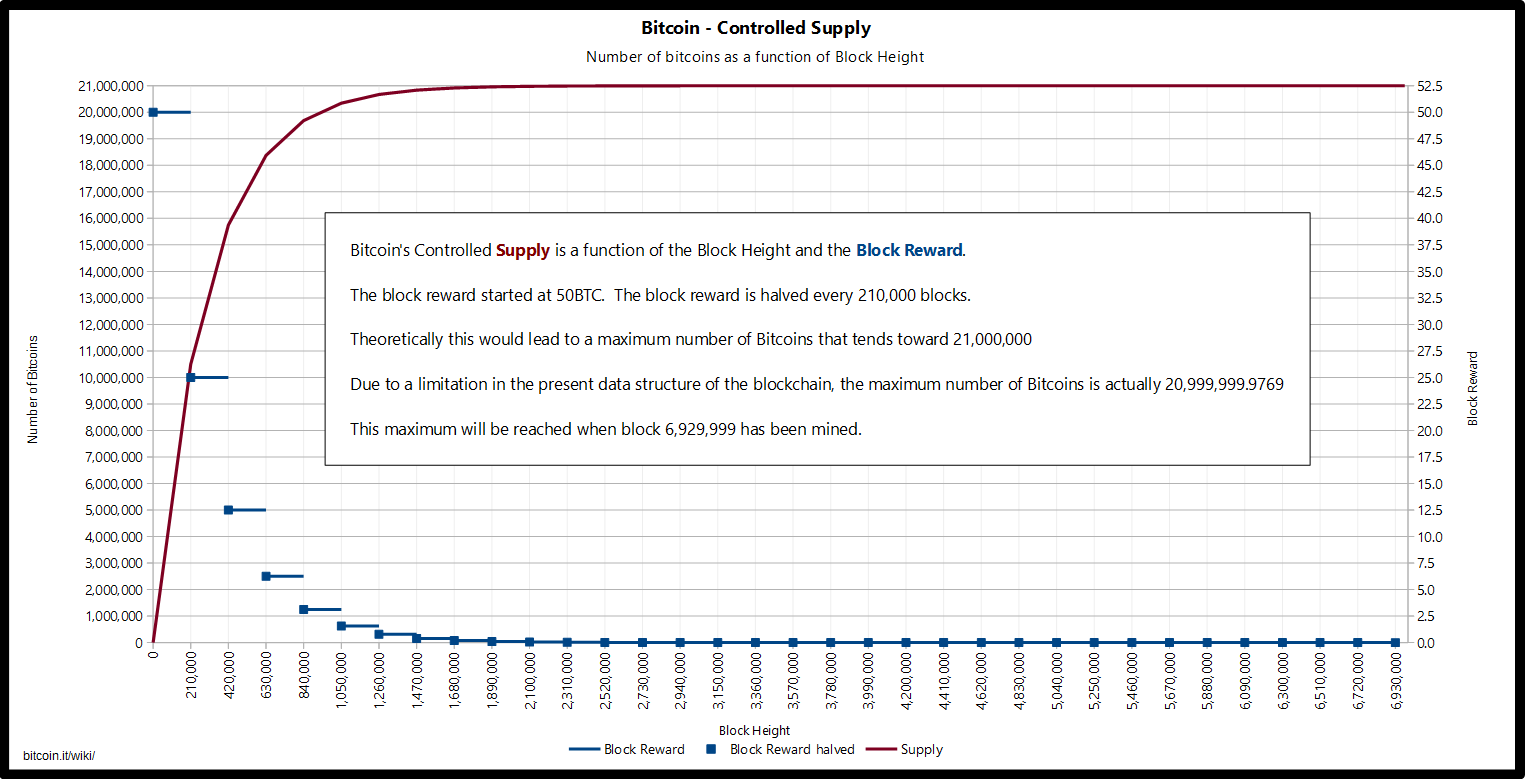

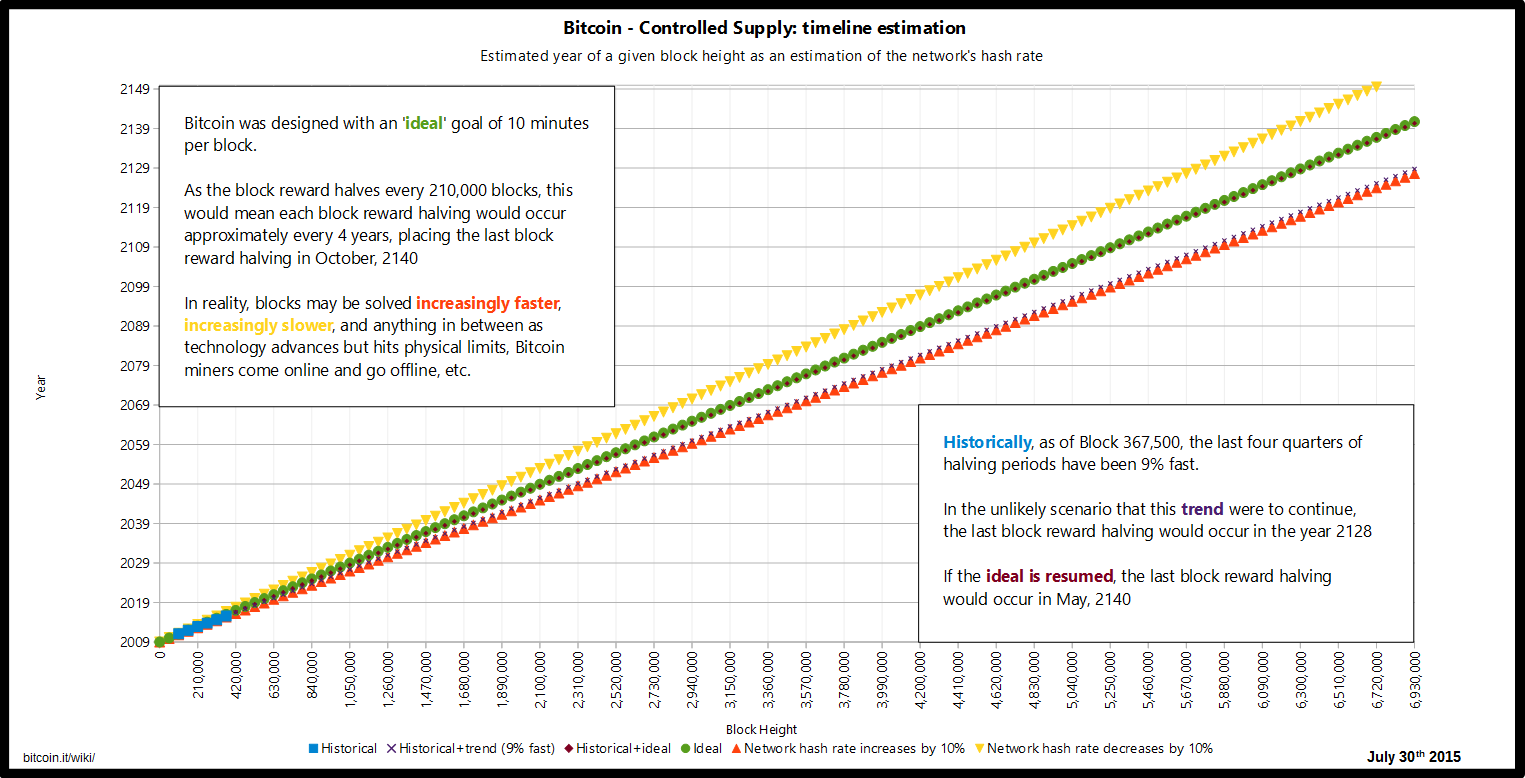

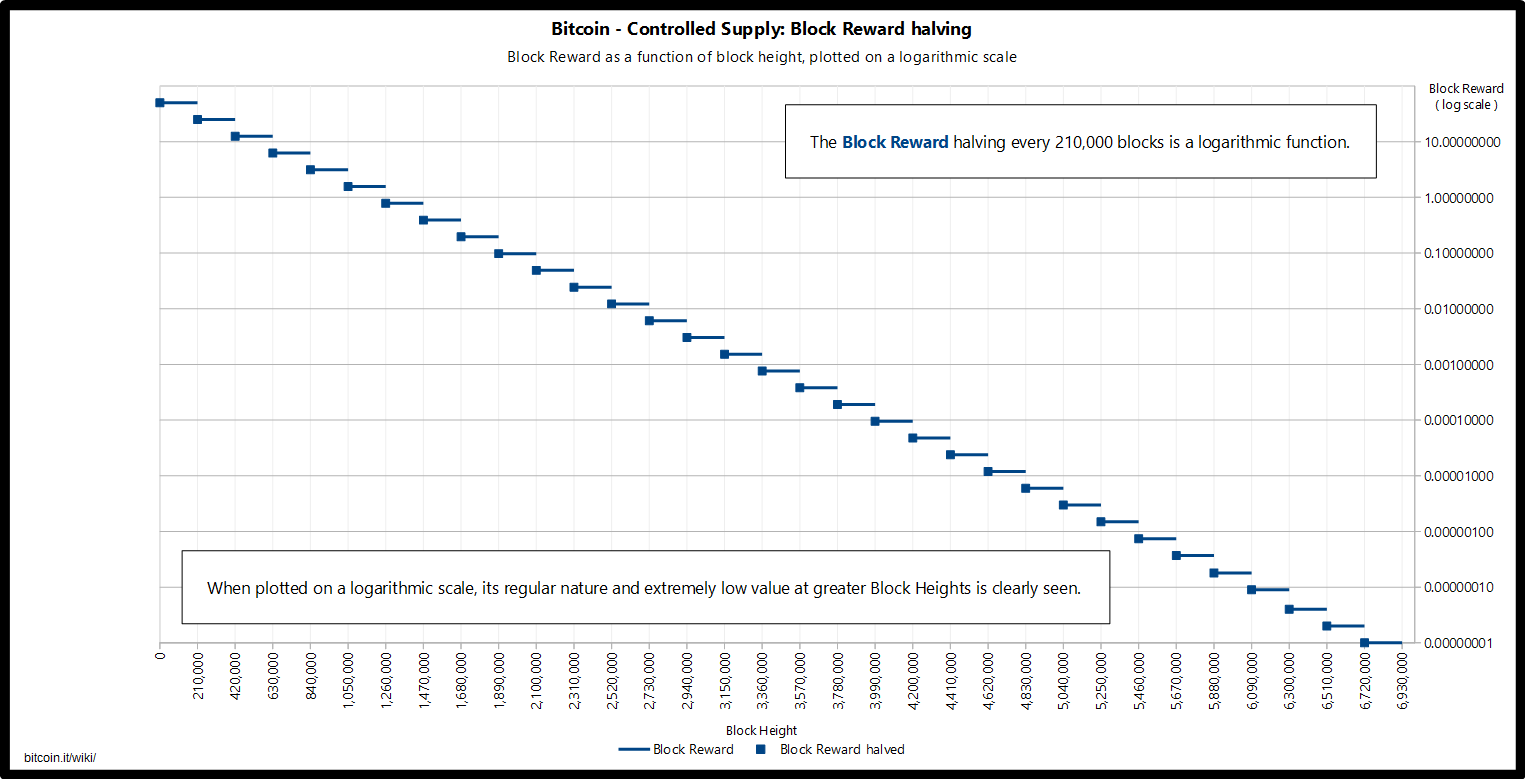

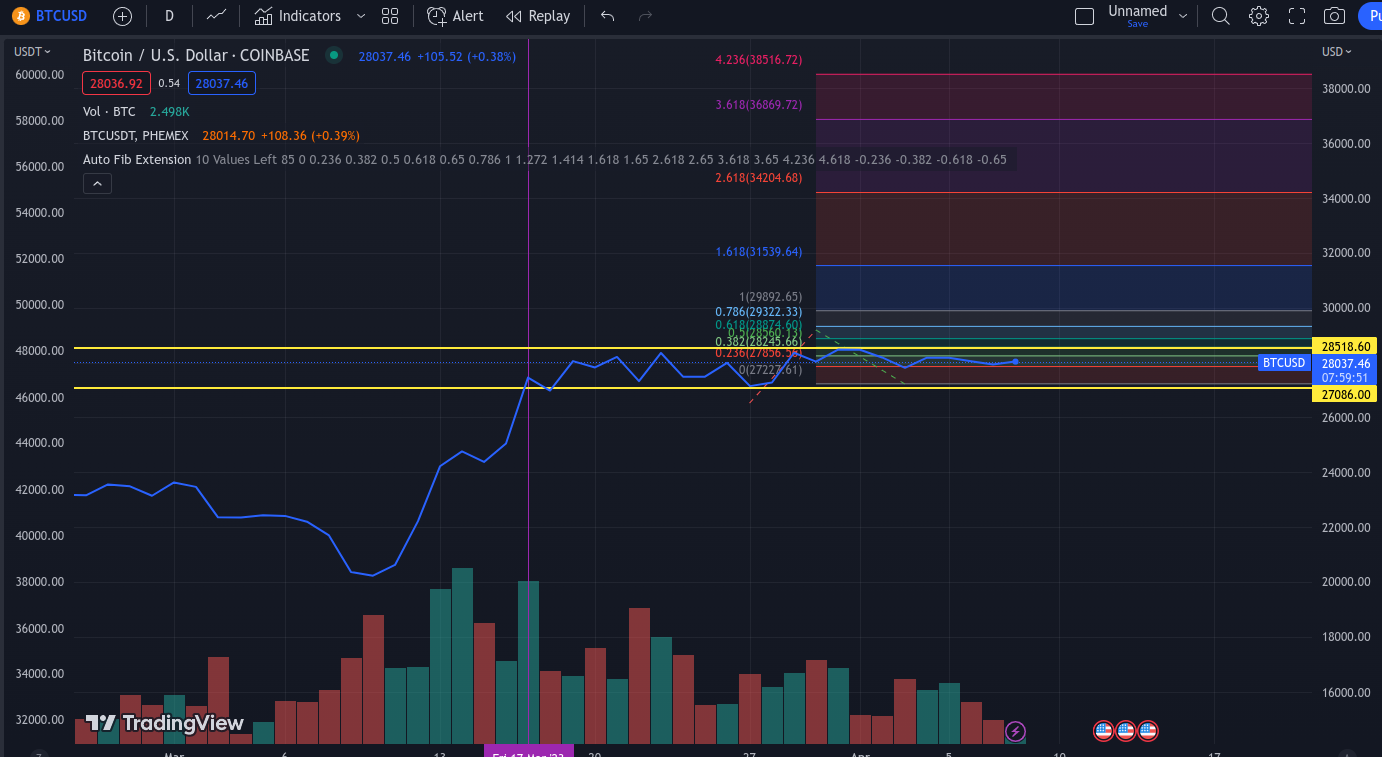

2023-04-19 15:21:59Predicting the price of cryptocurrencies like Bitcoin is an ongoing challenge due to the volatility and unpredictability of the market. In this article, we explore a Python-based price prediction pipeline that combines machine learning techniques and deep learning algorithms to forecast Bitcoin's closing price. The code for this pipeline can be found on GitHub at https://github.com/amar-muratovic/bitcoin-price-prediction-pipeline.

Key Components

-

Data Acquisition and Preprocessing: The pipeline uses the CCXT library to fetch historical price data for Bitcoin (BTC/USD) from the CryptoCompare API. The data is then preprocessed, resampled, and saved into a CSV file for further analysis.

-

Feature Engineering: The pipeline uses three input features - High, Low, and Open prices - and the target variable, which is the Close price.

-

Model Ensemble: The pipeline trains an ensemble of four models: Linear Regression, Bayesian Ridge, Support Vector Regression, and Random Forest Regressor. The predictions from these models are averaged to produce the final forecast.

-

Deep Learning: The pipeline also incorporates a neural network with two hidden layers and early stopping to prevent overfitting. The neural network is trained on a subset of the data.

-

Hyperparameter Tuning: Grid search and cross-validation are used to fine-tune the models and optimize their hyperparameters.

-

Model Evaluation: The pipeline evaluates the models using mean squared error (MSE) and R^2 score, which measure the accuracy of the predictions.

Implementation Details

The pipeline starts by importing necessary libraries and modules, followed by loading the Bitcoin price data from a CSV file. The data is preprocessed, resampled, and saved into a new CSV file. The input features and target variables are defined, and the data is split into training and testing sets.

An ensemble of machine learning models is trained on the data, and predictions are made using these models. The ensemble approach aims to combine the strengths of different models to produce more accurate predictions. The predictions from each model are averaged to produce the final forecast.

A neural network with two hidden layers is created and trained on a subset of the data. Early stopping is used to prevent overfitting by monitoring the validation loss and stopping the training when it stops improving.

Hyperparameter tuning is performed using grid search and cross-validation to optimize the models' performance. This process helps identify the best combination of hyperparameters for each model.

Finally, the models are evaluated using mean squared error (MSE) and R^2 score. These metrics help measure the accuracy of the predictions and the performance of the models.

Conclusion

The Bitcoin price prediction pipeline presented in this article combines various machine learning techniques and deep learning algorithms to forecast the closing price of Bitcoin. This ensemble approach aims to improve prediction accuracy by leveraging the strengths of different models. While predicting the price of cryptocurrencies remains a challenging task, this pipeline provides a solid foundation for further experimentation and improvements. To explore the code further, visit the GitHub repository at https://github.com/amar-muratovic/bitcoin-price-prediction-pipeline.

-

-

@ 73c6bb92:5c994c63

2023-04-19 11:34:26

@ 73c6bb92:5c994c63

2023-04-19 11:34:26*Why I’m Betting Big on Nostr*

Image generated with DALLE via micropay.ai

Nostr – the simple, decentralized messaging protocol with the potential to replace (and even integrate with) centralized apps like Twitter and WhatsApp – is going mainstream. And fast.

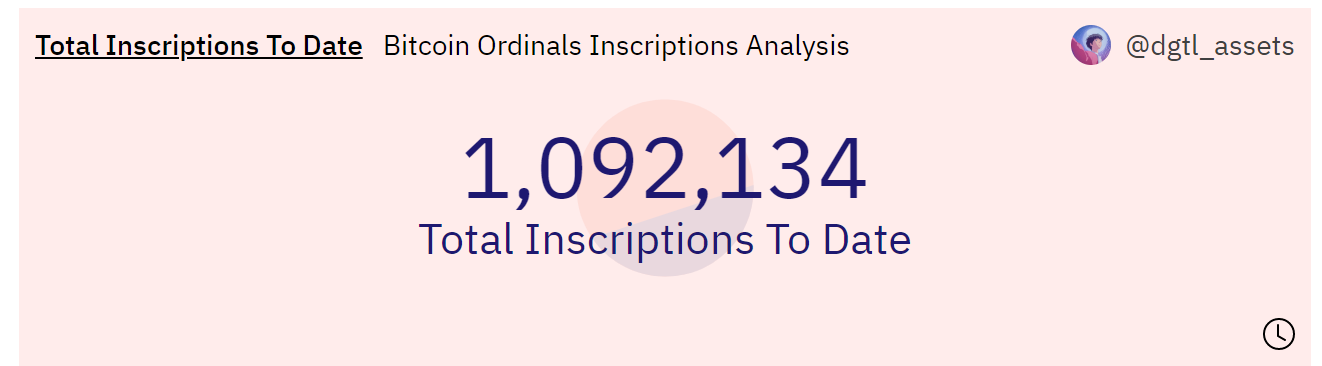

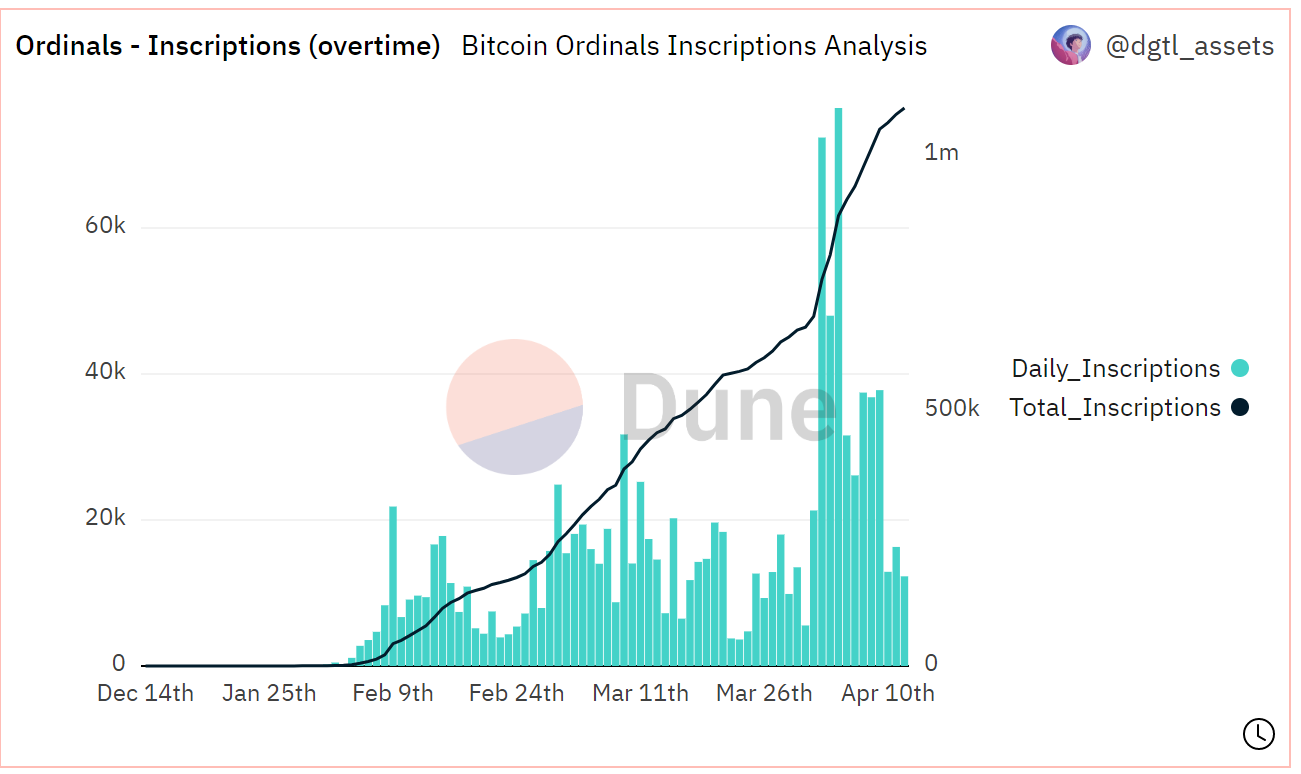

I’ve never seen anything quite like it. From December 13th to January 10th, the number of public key identities interacting with Nostr jumped from ~700 to ~250,000 👀 Yes, you read that right, the number of identities increased >30,000% 😯 And even if you only count individual users as identities with profiles in their bio, which is probably a more reliable indicator, user count still jumped >100x!

Stats courtesy of nostr.band/stats.html

The proximate cause of this recent explosion in usage was a Jack Dorsey tweet and Elon Musk ban (nothing buys publicity like prohibition).

But I believe this rapid uptake has much deeper roots which are destined to blossom into a new mainstream protocol that’s as widely adopted as HTTP for the web or SMTP for email, an analogy which DK paints nicely here.

The reasons are 2-fold:

-

Trust in social media platforms (and institutions more broadly) is at all time lows. People are increasingly aware of the value of free speech and dangers of letting any centralized platform decide what is and is not acceptable to say

-

Nostr has the perfect mix of ingredients to maximize rate of innovation: it’s open/permissionless, incredibly simple/flexible, and has a clear path to evolve

I won’t belabor the first point – the controversy over censorship on social media platforms is a well documented crux of the culture wars. But the second point is very important. I believe that open and permissionless systems inevitably win over closed competitors because open systems can marshal the collective resources of many more contributors than any individual business can employ. This is the central reason why our Internet continues to run on open standards (TCP/IP/HTTP), why Wikipedia and Linux dominate in their respective domains, and why the growth rate of open source software continues to outpace that of its closed counterparts.

But being open as a protocol is not necessarily enough. Many have raised the compelling counterpoint that open source protocols eventually ossify, allowing for closed platforms to innovate even faster on top (see here and here). But I don’t see that as much of an issue with Nostr because: A) it’s one of the simplest protocol specs ever – the only object type is a JSON blob with 7 fields. That simplicity leads to incredible flexibility, allowing for the design of all kinds of interoperable apps on top. B) Nostr has a clear path to evolve and improve via Nostr Improvement Possibilities (NIPs). Fountain founder, Oscar Merry, stressed to me the importance of having a clear path forward for protocol change by noting all of the recent activity we’ve seen around RSS for podcasting since Adam Curry and friends launched podcastindex.org + podcasting 2.0.

And we’re watching all of this theory play out in real time. Just look at how much got done across the Nostr ecosystem in a single day 🤯

Screenshot from nostr.band Nostr search engine

What’s more, all of this recent Nostr growth came while Damus, arguably the most well-known and polished Nostr iOS app, had to hard cap at 10k users (the limit for TestFlight) while waiting for Apple’s App Store to approve its official release. That limitation has, apparently, not done much to slow growth. Instead users are creating their Nostr identities with other apps like Alby, a browser extension for bitcoin lightning payments that also supports Nostr, and then interacting with Nostr through emerging web clients like astral.ninja, iris.to, nostr.rocks, blockcore notes, and branle.

Again, the killer feature here is that ALL of these apps are open and interoperable. I was able to successfully port my identity and social graph from Damus to Alby and then access each of the web clients above. Many have dreamed of Twitter enabling this sort of functionality by re-opening its API as it did in its earliest days. But while Twitter is a centralized company with an advertising driven revenue model, Nostr is a neutral protocol whose data stream will NEVER be shut to developers, because it CANNOT be shut to developers. Only individual clients and relays can restrict data. But then new ones will inevitably rise to augment and/or take their place. In fact, I would not be at all surprised to see Twitter itself become a major Nostr client in the coming year.

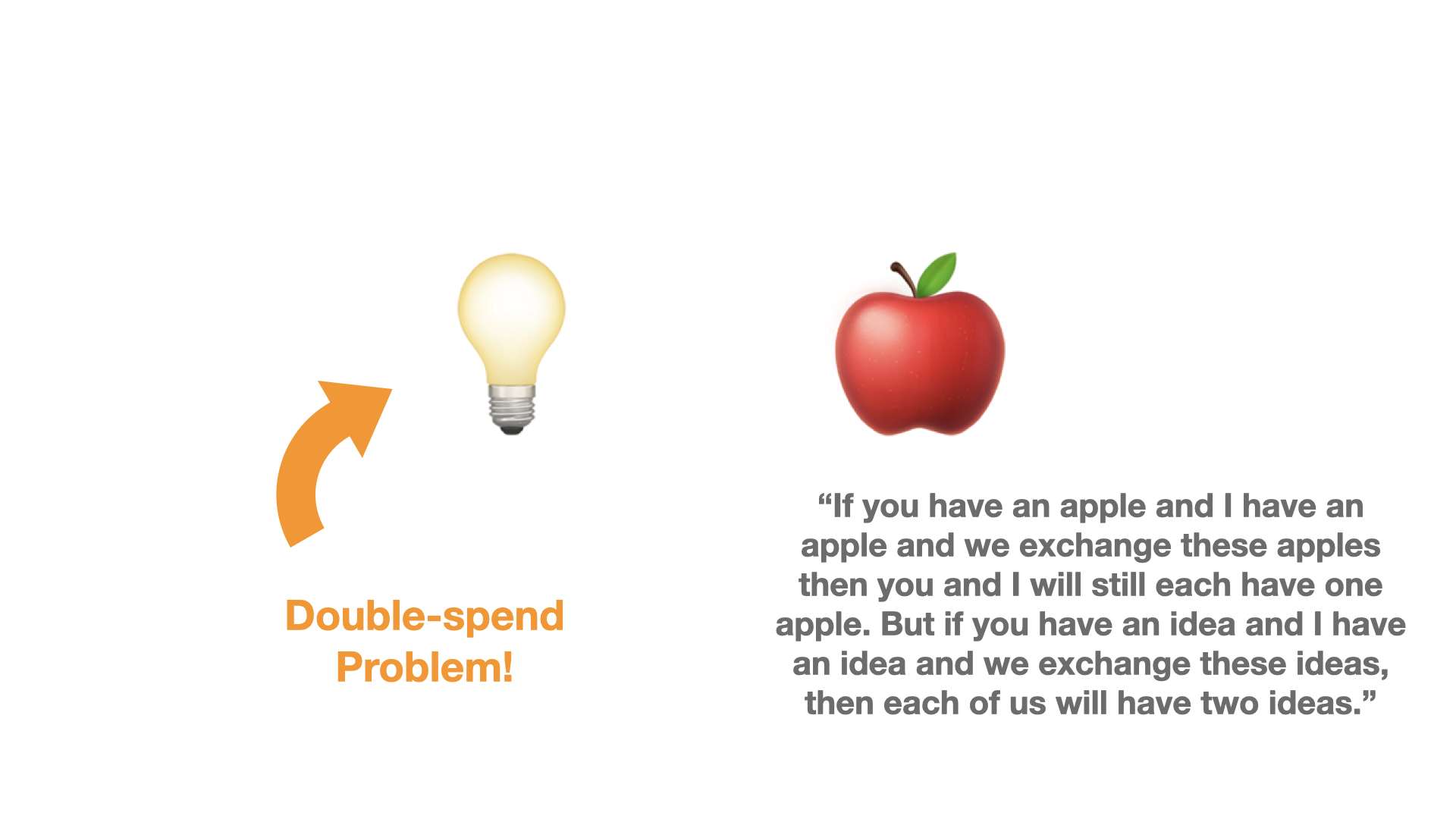

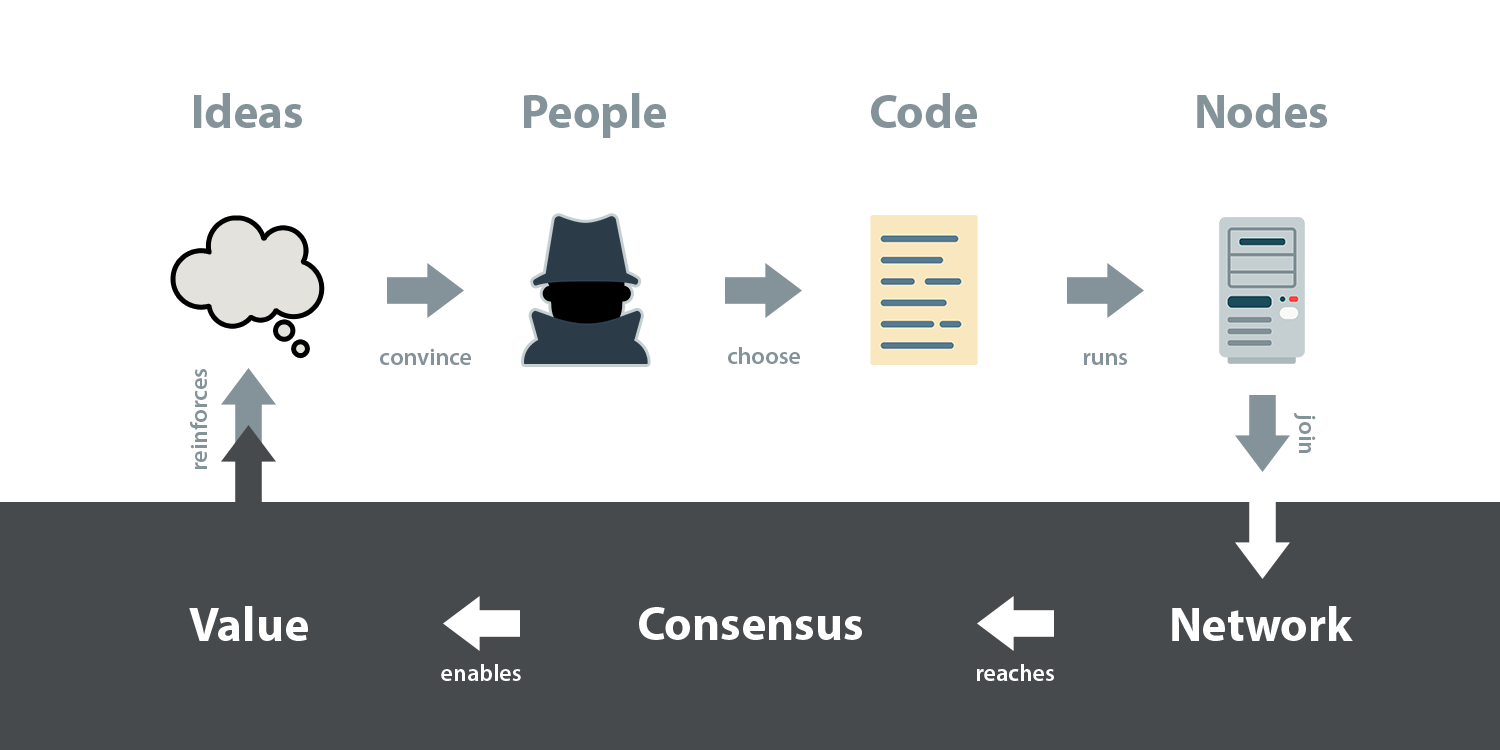

This is all incredible for building a more free and open world, which is ultimately the mission. But this new, open network also excites the investor in me. That’s because I believe that as Nostr emerges as the open standard for messaging, it will develop symbiotically with the open standards for money (bitcoin) and payments (Lightning Network). Together these three open systems will combine to create the first ever Value4Value protocol stack (h/t Stephen Hall), where service providers must continue to innovate and provide real value or else their users will exit for better options. This dynamic will enable a myriad of interesting, venture scale business opportunities.

Value4Value is a simple but revolutionary concept: people who create valuable content or services should be remunerated appropriately by those who derive value. For a beautiful vision of how a Value4Value world could look, check out this recent essay from Gigi. One of the essay’s central claims is that most of the ills of our modern attention/outrage economy stem not from some fundamental human evil, but rather from inadequate technology and broken incentives. The core culprit is credit based money, which unlike bearer instrument cash carries counterparty risk. This counterparty risk has prevented the use of small micropayments and/or necessitated the collection of customer identity. Put another way, people must currently pay for value online either in batches (subscriptions) or with a proxy currency (attention).

But with the Lightning Network, anyone can send nearly free and instant payments globally with a bearer instrument – denominations of bitcoin (satoshis) – worth as little as a fraction of a penny. What’s more, this system is open to all 8B people alive, independent of where they live, whether or not they have a government identity, and how much money or credit they have. This is a brand new construct which I believe will completely rewire all Internet commerce (and ultimately grow it orders of magnitude by on-boarding billions of new users and use cases).

So how do Nostr, Bitcoin, and the Lightning Network fit together to build this future? And what sorts of business opportunities will these integrations yield? Well for starters, let’s be clear, it’s not that Nostr MUST use Bitcoin and Lightning. They’re completely independent protocols. But the fit is simply too natural not to emerge. And because both the creator and many early developers of Nostr are also open source Lightning Network developers, the likelihood of this marriage seems inevitable.

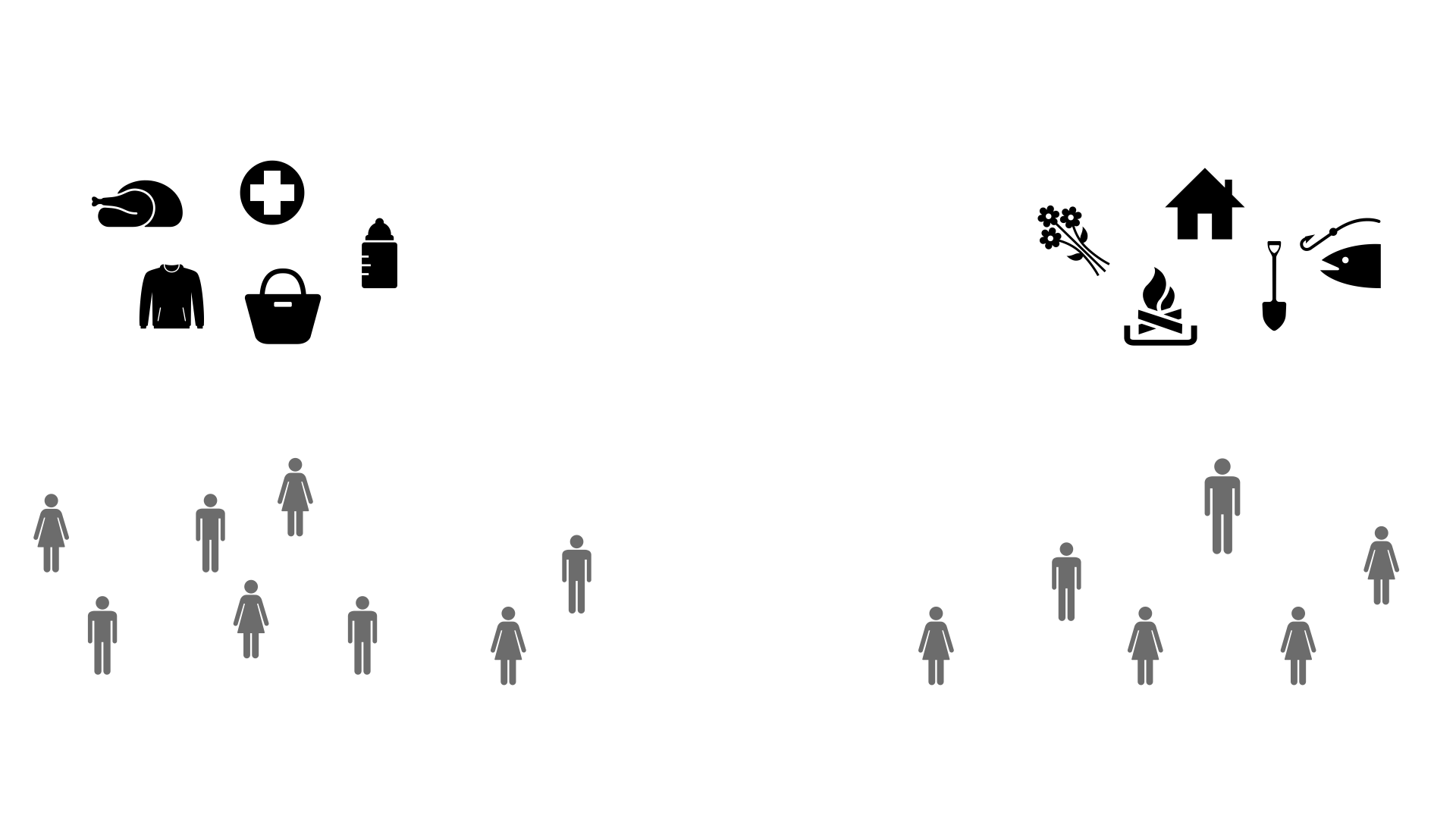

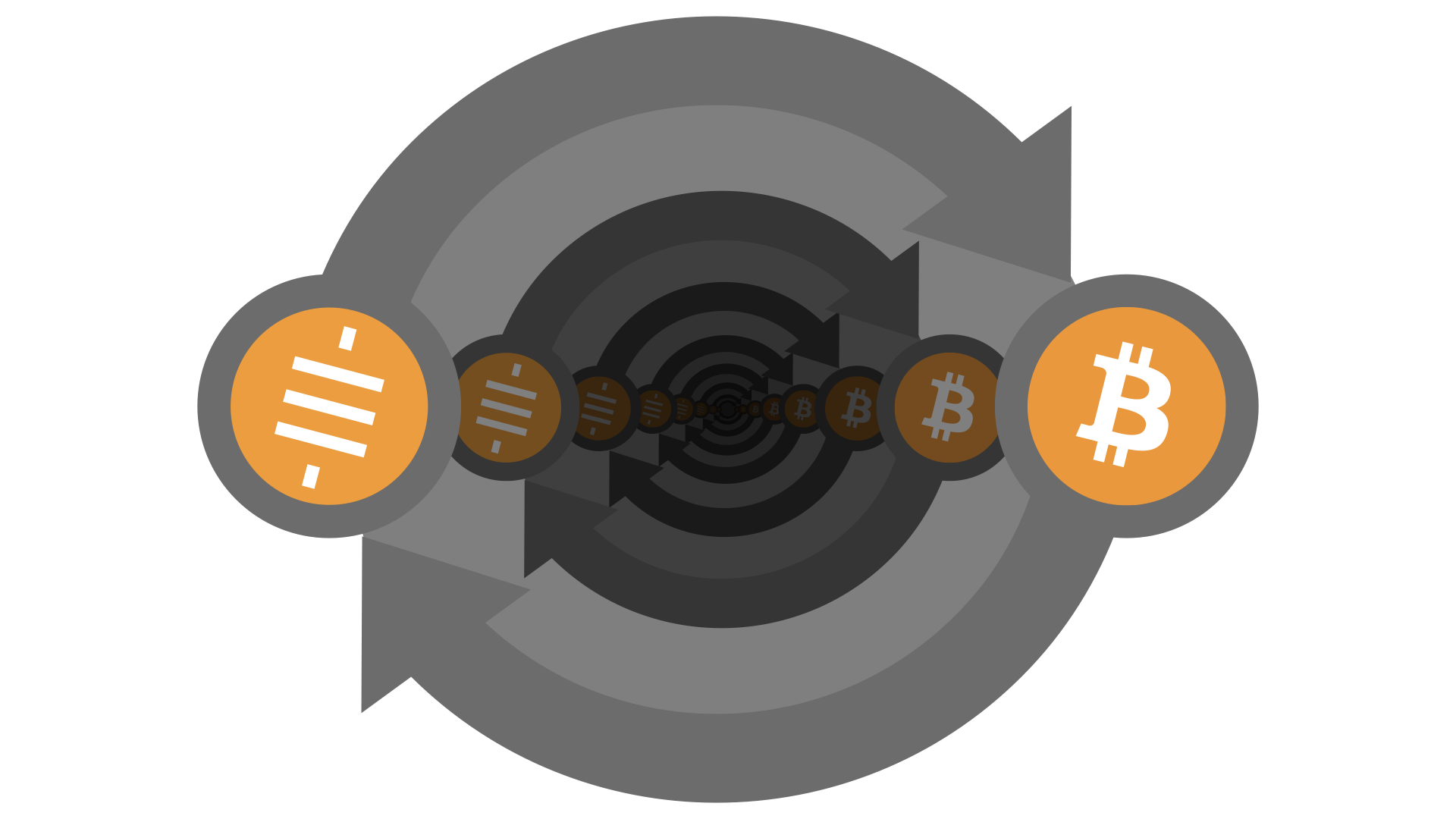

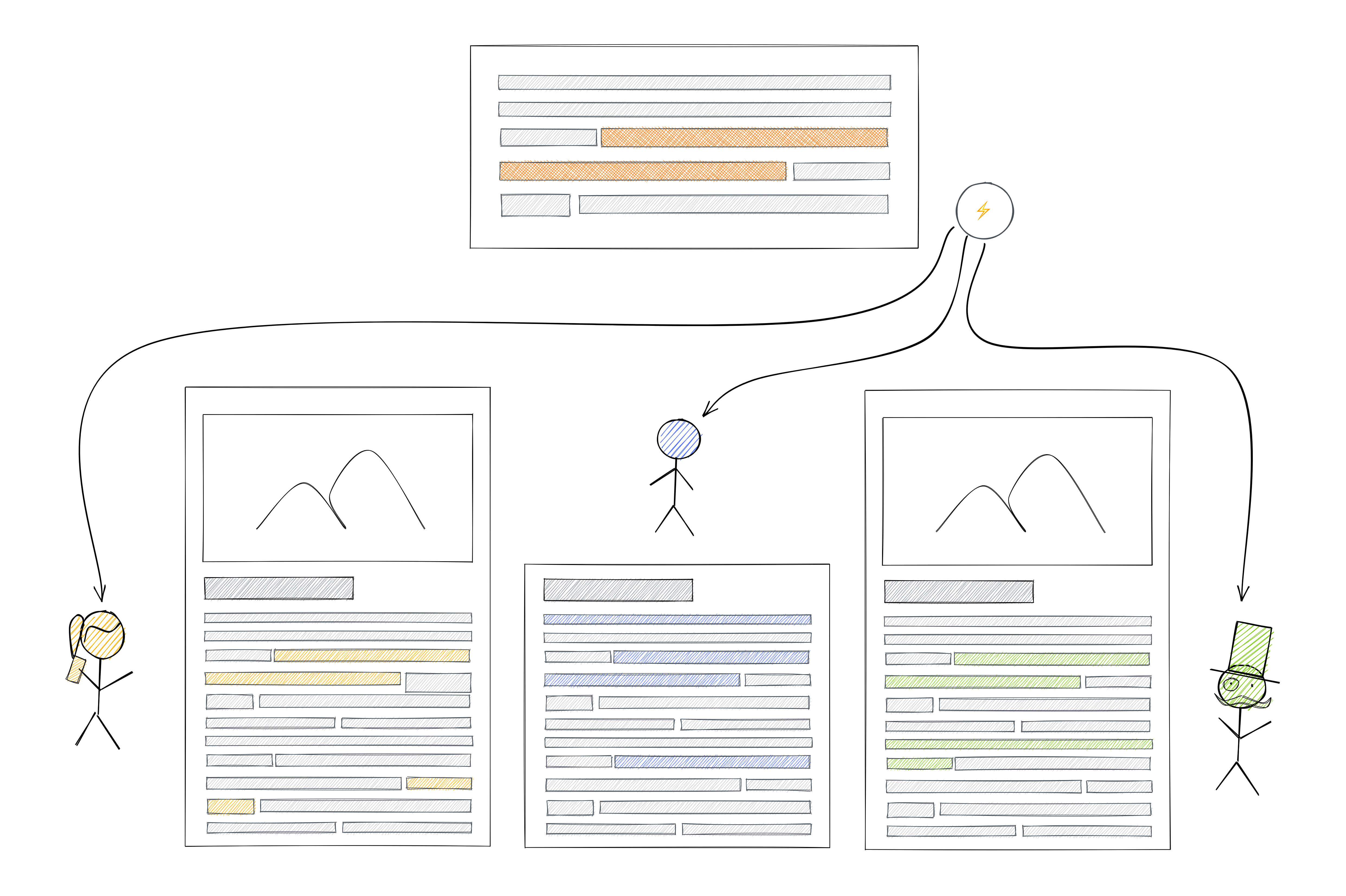

I believe there will be multiple initial use cases for integrating Nostr and Lightning, each of which will create new business models (either standalone or partially bundled). I think they’ll loosely follow along the four axes that Nostr is currently unbundling from centralized apps like Twitter. Maciek did an excellent job of outlining this unbundling:

I’ll rephrase these dimensions as:

- Relays & Resources

- Identity

- Clients & Apps

- Search & Discovery

Let’s examine each layer and its potential business models:

- Relays & Resources

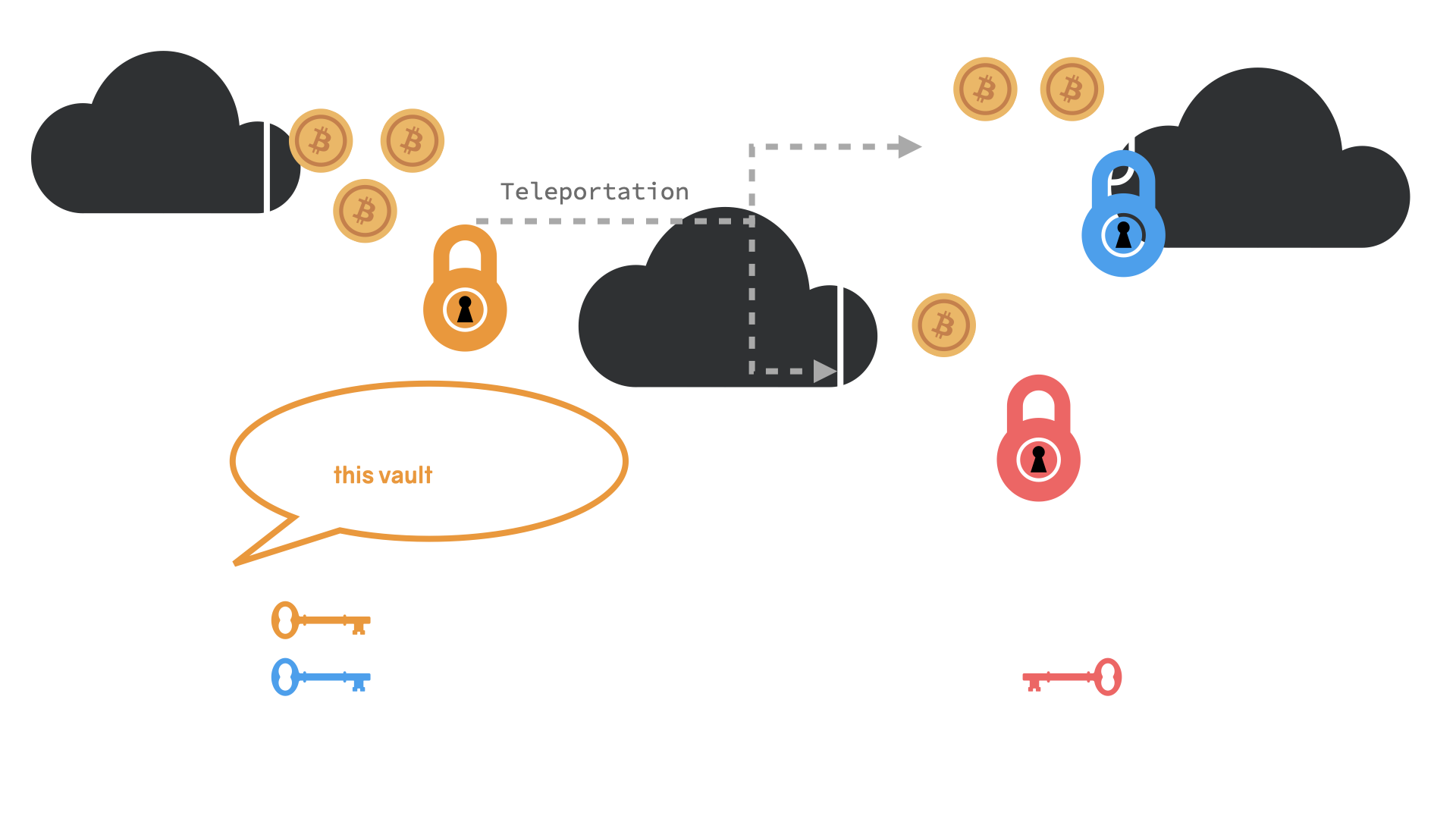

First, perhaps the most obvious opportunity is on the server/resource side. Today, dozens of individuals and organizations are running Nostr relays simply to support the cause. But as the number of users grows 3-4 orders of magnitude and support is added for richer data like images and video, it will quickly become prohibitively expensive to run these relays altruistically. I expect to soon see premium relays that charge per KB written or read. There’s already at least one credible proposal to do just that by hooking up Nostr relays with LSATs (Lightning based pseudonymous token identities). I also expect to see caching services and content delivery networks emerge to help users filter the global firehose of information based upon their own preferences and to ensure fast and reliable connection. Eventually I expect to see other resources like bandwidth and compute metered and billed for in similar fashion.

- Identity

Second, we’re already starting to see multiple services emerge to validate a user’s identity. NIP 05 establishes a standard for web servers to validate that the holder of a Nostr public key also has (or has purchased) access to that web server. Nostrplebs is one of the leading early services that charges for identification exclusively in satoshis over the Lightning Network. Alby and Stacker News have both launched free NIP 05 verification associated with their users’ Lightning Address (a human readable address to receive Lightning payments). LNbits released open source software that allows anyone to verify Nostr identities at a domain they control. Still others like @porteaux are proposing ideas to use the Bitcoin blockchain itself as the namespace.

I believe this idea could integrate with Block’s vision for Web 5, which to the best of my understanding, also anchors Decentralized Identifiers (DIDs) into the Bitcoin blockchain. It’s early, but I expect to see a variety of services and features emerge here.

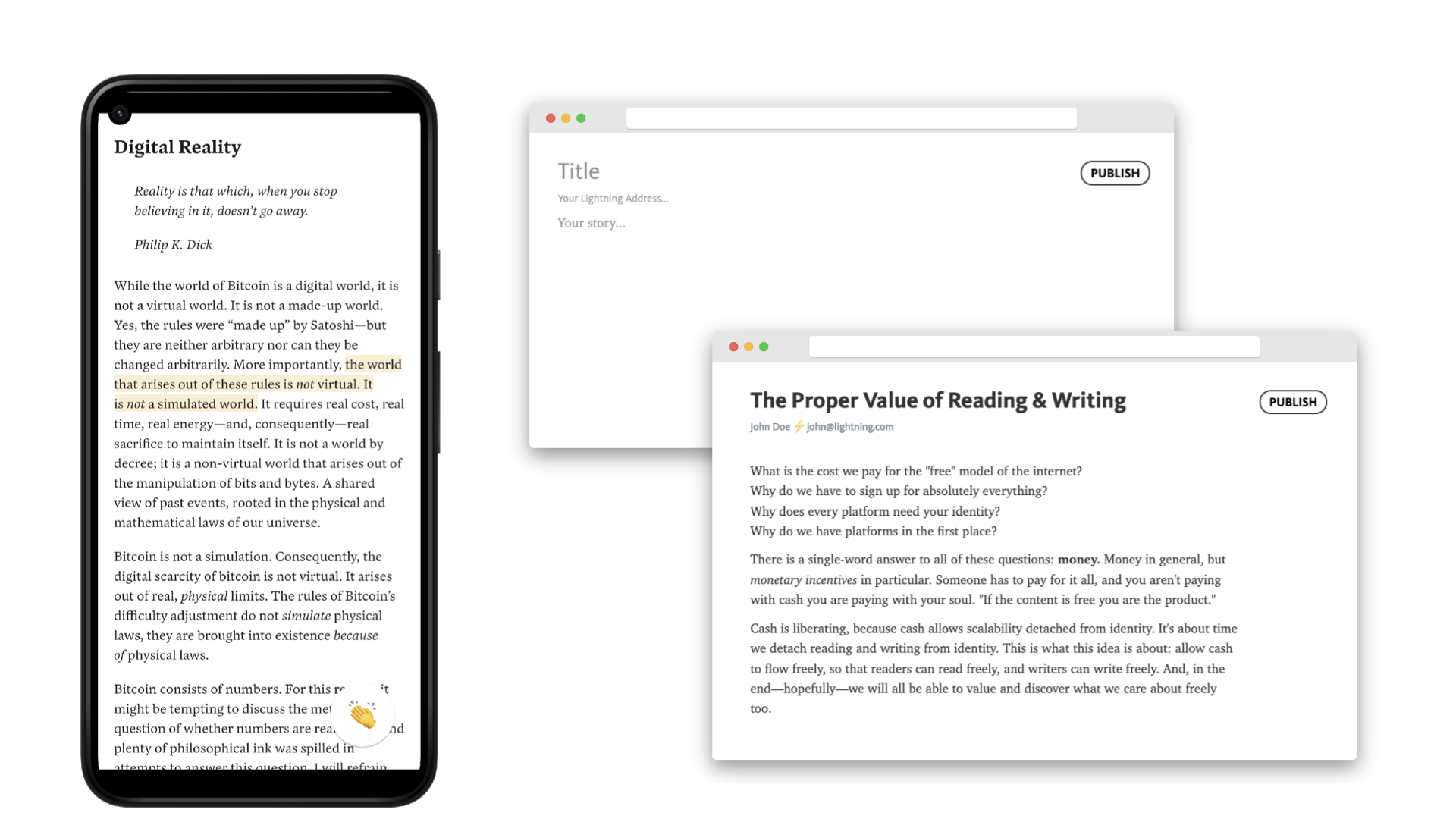

- Clients & Apps

Third, clients could charge users directly, though I expect many will actually monetize via their relay or some ancillary service. One feasible model could be giving away a consumer version of the app for free and then charging for an enterprise version with additional features (think enterprise Slack or Discord) as jb55 mentioned as a possible direction for Damus.

Clients could also likely take a small cut for coordinating payments that flow through their app to resource providers (e.g. paid relays), service providers, or other users. And there’s always the option that some clients introduce various forms of advertising.

And while most people are still thinking about clients in the social media context, I expect to see many more custom apps (with potentially unique business models) built with Nostr and Value4Value assumptions baked in. As Jack laid out nicely in this podcast, the future of Nostr is likely a Cambrian explosion of microapps, each focused on a specific niche or use case. But that can all communicate interoperably. Like him, I’m particularly excited about specialized services that help creators fund and distribute their work. I expect to see several companies move quickly in this direction – e.g. Fountain for podcasts, Wavlake for music, and Geyser for generalized crowdfunding. I also expect to see a lot of experimentation in how open source software gets developed. Nostrdirectory proposed the interesting idea of a bounty poll app where users vote with their satoshis for what a dev builds next. This could lead to a cool Github + Trello + Upwork type mashup.

Screenshot from nostr.band Nostr search engine

Perhaps we’ll even see the emergence of a new decentralized Nostr/Lighting marketplace like a modern OpenBazaar, an early protocol for p2p commerce backed by USV, which was a great idea, but just too early in my opinion. Their key mistakes were requiring everyone to run a dense desktop app + node and using mainchain Bitcoin for payments. Nostr + Lightning solve these problems by allowing anyone to access the marketplace via light web or mobile clients with instant Lightning Network payments. My early money here is on Diagon Alley (from LNbits), which was itself an early inspiration for the creation of the Nostr protocol.

LNbits founder Ben Arc has also published ideas for other types of Nostr + Lightning marketplaces as well, including a decentralized Uber. Perhaps one day all marketplaces will be coordinated trustlessly via Nostr.

In addition to microapps flourishing, we may also see the emergence of new super apps like a decentralized WeChat for users who prefer to combine all of their messaging and commerce in one place. Imagine if CashApp becomes your primary messaging app (or WhatsApp your primary payments app). I could easily see a world where remittances are sent with a text message and goods sold via a Tweet.

- Search & Discovery

Fourth, just as with web 1.0 and 2.0, I believe that the biggest winners will emerge in search & discovery. My best bet is that we’ll see Nostr search engines that differentiate by indexing the most data and providing the best social graph & ValueRank market signal, an idea which I fleshed out in How to Disrupt Google. TL;DR: for the first time in history, we can now associate information with value. As the amount of information goes infinite, only the amount of bitcoin (value) remains scarce. Attaching this value to information will help surface the highest quality information (in association with other attributes like the identity of who pledged that value).

Before playing with Nostr, I believed that the best way to create this new value-based search engine was by either dropping satoshis on top of the current web (via tips from a browser extension like Alby) or by creating a brand new value-native knowledge marketplace like StackerNews. I now think that perhaps the best way to build this search engine is on top of Nostr, a blue ocean of quality content that Google and other centralized web companies will likely not index for some time.

In order to build this vision, we need two key primitives: A) identity and B) value associated with individual Nostr posts (perhaps via tips like people are already giving on StackerNews or in Fountain). Put another way, we need an open social graph and open value graph. Every Nostr post already contains identity metadata (the poster’s public key). And the integration between posts and value is emerging quickly! jb55 has already published his plan to do this for Damus. He’s also going to propose it as a new LNURL spec and/or NIP as well.

Screenshot from nostr.rocks Nostr client

And astral.ninja has already shipped this feature! Here’s a screencast of Bumi instantly tipping NVK and Jack. And here’s a screenshot of me tipping 100 satoshis to a Nostr post by GPT-3 Bot, a chatbot interface to Open AI’s GPT-3.

Screenshot from astral.ninja Nostr client

(I kept the tip-selector interface for this screenshot. The experience is even more seamless when I turn on auto-tipping in astral.ninja and set an automatic budget on Alby)

If your mind wasn’t blown already, let me clarify: I just sent a micropayment via an open twitter-like client to a bot interface for GPT-3 🤯 What other financial system can bank the AIs? 😉

The search engine that can best index and rank these new Nostr posts and their associated value will be in an incredible position to build the next Google. Artur has a similar idea, as his 2 sites – realsearch and nostr.band – are playing with each of these ideas. I expect that he’ll merge them at some point. His Nostr search engine is already particularly good – I used it multiple times to find specific Nostr posts while writing this article. I expect to see (and fund) several more approaches here and will likely expand my thinking on this idea in future posts.

Ultimately, I’m still open minded about how each of these layer & businesses will develop and whether they’ll do so as independent entities or get rebundled either partially or fully. My best bet is that we’ll see some early winners that merely re-create existing services and business models. But the really big winners will come in the second wave once evolution plays its course and mashes up communication and commerce in truly novel ways that no one yet expects. New medium, new message (h/t NVK). And to hammer home the point – the real magic is that all of these apps, no matter their specific focus, will speak openly and interoperably. It sure feels like we’re getting close to building a global hivemind of communication and commerce 😉

And with each passing day, I’m becoming increasingly convinced that this rapidly developing ecosystem is what will bring Bitcoin and the Lightning Network mainstream. Many are already speculating that the recent surge in Wallet of Satoshi Lightning payments may be directly attributable to Nostr usage. Just wait until Damus integrates tipping and gets approved by the app store…

I recognize that all of this is still very early and that these claims are bold. But my spidey sense says that this is not a drill. I’ve seen enough early adoption and understand enough of the potential to believe that Nostr + Bitcoin + Lightning represents the most interesting opportunity to rebuild a decentralized Internet. And I’m planning to go all in on this thesis with Hivemind Fund 2 (just as I did on the Lightning Network with Hivemind Fund I). If you’re a hacker experimenting with Nostr, please reach out. This is my top priority.

The best way to reach me, of course, is on Nostr 🤙

Pubkey: npub18lzls4f6h46n43revlzvg6x06z8geww7uudhncfdttdtypduqnfsagugm3

(Edit: Please note that I changed my Nostr public key identity. My last private key was compromised, likely from using it to log into a web client last month. This is still a very new technology, so please make sure to only use your private key in an iOS app like Damus or stored in a browser extension like Alby. Ideally, you should never paste it directly into any web client.)

If you’re new to Nostr, I’ve found that Damus is the easiest way to get started. But while their TestFlight is still full, here’s a guide on how to get started with Alby and various web clients.

Thanks to DK, Bumi, Ben, Oscar, and Moritz for feedback on this post.

Alby, Stacker News, LNbits, Fountain, Wavlake, and Geyser are all Hivemind portfolio companies.

-

-

@ e97aaffa:2ebd765d

2023-04-19 10:58:19

@ e97aaffa:2ebd765d

2023-04-19 10:58:19Ontem a Apple colocou mais um prego no sistema financeiro atual, começou agora nos EUA.

A Apple acaba de consolidar mais um passo na ampliação da oferta de serviços financeiros. Após lançar produtos como o Apple Card, Apple Cash e Daily Cash, a empresa se uniu ao Goldman Sachs para lançar uma conta poupança que, segundo a empresa, remunera até 10 vezes mais que a média nacional nos Estados Unidos. O serviço foi lançado para aqueles que possuem o Apple Card, cartão de crédito da empresa.

Na onda de juros altos pela qual o país passa, a promessa da Apple é de um retorno de 4,15% ao ano A rentabilidade, entretanto, pode mudar sem aviso prévio, a depender da situação das taxas praticadas nos Estados Unidos. in valorinveste.globo.com

A Apple já tinha serviço de pagamentos e de cartão de crédito, mas agora ao entrar nos serviços de poupança poderá ser mais disruptivo. Os bancos dos EUA estão com um grave problema de liquidez, pode provocar uma fuga de capital dos pequenos bancos para a Apple, poderá provocar muitas falências, os 4,15% de juros é muito apetecível. Estes serviços da Apple estão a ser assegurados por bancos, no caso da conta poupança é o Goldman Sachs, mas num futuro bem próximo a Apple, vai descartar os bancos e vai criar o seu próprio banco (ou compra um já existente).

Os bancos tradicionais como nós conhecemos atualmente, estão condenados por culpa própria, não se modernizaram e estão a ser ultrapassados. Primeiro apareceu o Bitcoin, depois as fintech, a Libra e agora as BigTech. A Libra do Facebook foi a única que foi parada/proibida pelos bancos centrais, o projeto era demasiado audaz, mas este movimento das bigtech será imparável e vai dar mais motivos e acelerar as CBDCs.

O Elon Musk não esconde que o objectivo da compra do Twitter, é criar uma espécie de WeChat, mas ainda está muito atrás da concorrência, a Apple está na dianteira, a Google certamente vai seguir o mesmo caminho.

Com as apps com tudo incluído das bigtech, até serviços bancários, os bancos tradicionais possivelmente só têm um caminho, transformando-se num banco de investimentos de clientes com bastante capital, nos créditos elevados (como casas e carros) e especializarem-se no mercado empresarial. O pequeno retalho será engolido pelas bigtech.

Mas de todas as inovações que surgiram, o #Bitcoin é o único com o objetivo mais profundo, de reformar a política monetária e consequentemente do sistema bancário. Uma grande parte dos problemas políticos, sociais, financeiros e bancários são consequências de uma política monetário desastrosa, com a correção da mesma, naturalmente muitos desses problemas são auto corrigidos.

O curioso é que os bancos centrais, lutam com todas as forças contra o #bitcoin, mas pouco fazem contra as bigtech, que já são grandes demais, já tem mais poder que muitos países, e continuam a crescer sem serem paradas. A centralização nunca é boa ideia e quando essas empresas recolhem, usam e abusam das informações pessoais e financeiras dos seus clientes para proveito próprio, em qualquer situação um bigbrother é uma péssima ideia, quer seja criada pelo estado ou por uma empresa privada. -

@ cbd2779f:72a5b029

2023-04-18 20:52:12

@ cbd2779f:72a5b029

2023-04-18 20:52:12

"0.00000001 BTC doesn't work!"

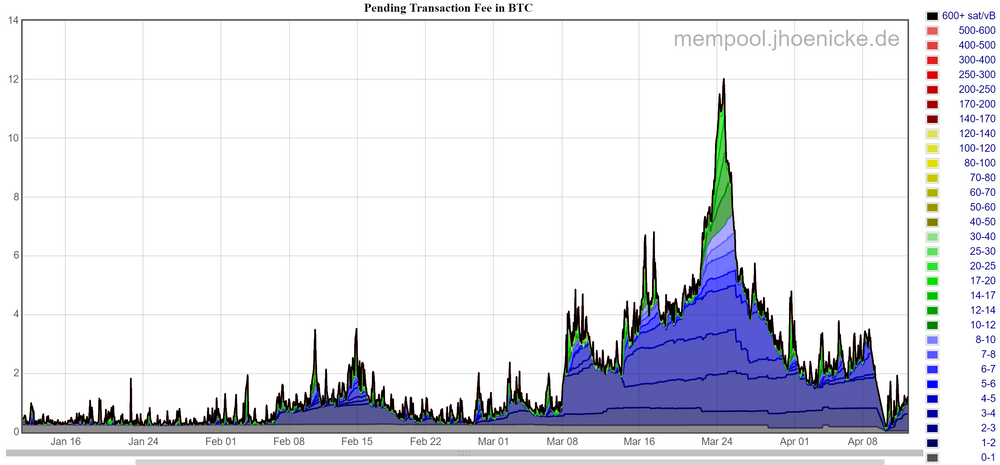

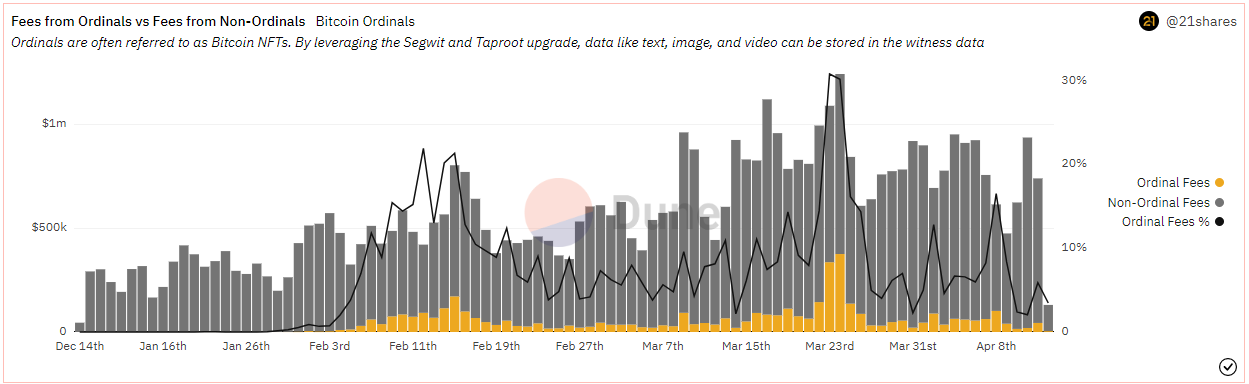

Giacomo Zucco talked about Unit of Account at Lightning Summit 2023, the fractional Bitcoin problem and the need to universalize a standard symbol for the sat. I.e, 1 satoshi. Maybe it is mainly cosmetic, but for Bitcoin, forming a standard could have the possibility to solidify ideas on accounting and the representation of units through simplifying information. Ultimately, the hope would be that this can positively create a cohesive system of account and bring a higher level of standardisation for the protocol.

So what should become the standard sat symbol, the ubiquitous ⚡ bolt zap? I think it captures that function well but to me seems to point to LNP only (not my transaction fees, for example.) The alternative is the 'doner kebab'. It was also based on existing unicode mathematical operators ≐ 'approaching the limit' and ≑ 'geometrically equal to' and the simplified Chinese character 丰 (bountiful/lush/abundant.)

Personally, I feel the satsymbol has already entered my lexicon. I like the way it draws on existing ideography. There is a fontawesome fontawesome webkit which is great for design purposes, but as ₿ (U+20BF) is an official unicode sign (currencies section) there needs to be a satoshi denomination. Most major currencies can be typed and have a representational unicode sign, not just represented with an embeddable font, svg or similar (as helpful as that is.) I wanted to see how it might look for a global userbase with different localizations. However, the only way I found to transliterate it with unicode was to reorient the symbol 90 degrees.

Weird? What about ·|||· or ·///· ? Well, was just an idea. Below is a (hopefully formatted) table of my take on the satsymbol in current unicode. Most characters are phonetic particles, punctuation or numbers (so would be a very small chance that anything would be meaningful based on the original characters.) It's not an exhaustive list of character sets or syllabries, just examples. I think that in an optical sense, some work and some don't work as well. If you have any thoughts, comment, or send a message on Nostr.

| CHARACTER SET | SATSYMBOL | UNICODE | | :-----------------------------------------: | :-----------------: | :-------------------------------------------------: | | ARROWS | ⎯⏐⏐⏐⎯ | H. LINE EXTENSION, V. LINE EXTENSION | | BULLETS | ・﹅﹅﹅・| KATAKANA MIDDLE DOT, SESAME DOT | | LATIN | -lll- | HYPHEN-MINUS, SMALL LETTER L | | MATHS SYMBOLS | ⦁∕∕∕⦁ | Z NOTATION SPOT, DIVISION SLASH | | GREEK | ·ΙΙΙ· | ANO TELEIA, LETTER IOTA | | CYRILLIC | -ꙆꙆꙆ- | HYPHEN-MINUS, CAPITAL LETTER IOTA | | GEOMETIC SHAPES | -▕▕▕ - | WHITE CIRCLE, RIGHT ONE EIGHTH BLOCK | | DUPLOYAN | 𛰀𛰇𛰇𛰇𛰀 | DUPLOYAN LETTER H, LETTER B | | TECHNICAL SYMBOLS | ⏤⎹⎹⎹⏤ | STRAIGHTNESS, L/R VERT BOX LINE | | COPTIC | -Ⲽ- | HYPHEN-MINUS, CAP CRYPTOGRAMMIC NI | | BALINESE | ᭼᭞᭞᭞᭼ | MUSICAL SYMBOL LH OPEN PING, CARIK SIKI | | JAPANESE | ・〳〳〳・| MIDDLE DOT, VERT KANA REPEAT MARK UPPER HALF | | KANBUN | ㆒㆐㆐㆐㆒ | IDEOG. ANN. ONE MARK, IDEOG. AN.. LINKING MARK | | VAI | ꔷ꘡꘡꘡ꔷ | VAI DIGIT ONE, VAI SYLLABLE LI | | ETHIOPIC | ᎐᎖᎖᎖᎐ | TONAL MARK YIZET, TONAL MARK CHIRET | | OSMANYA | ·𐒃𐒃𐒃· | MIDDLE DOT, OSMANYA LETTER JA | | CAN ABORIGINAL | ‘ᐟᐟᐟ’ | LEFT SINGLE QUOTATION MARK, SYLLABICS FINAL RING | | KHUDAWADI | 𑋰𑋠𑋠𑋠𑋰 | DIGIT ZERO, VOWEL SIGN AA | | MODI | 𑙐𑙁𑙁𑙁𑙐 | DIGIT ZERO, DANDA | | MAHAJANI | 𑇐𑇅𑇅𑇅𑇐 | SHARADA DIGIT ZERO, SHARADA DANDA | | MALAYALAM | ·ഽഽഽ· | MIDDLE DOT, SIGN AVAGRAHA | | MRO | ·𖩙𖩙𖩙· | MIDDLE DOT, MRO LETTER KO | | PHAGS-PA | ·꡶꡶꡶· | MIDDLE DOT, PHAGS-PA MARK SHAD | | TAMIL | ௦///௦ | DIGIT ZERO, SOLIDUS | | TELUGU | ౼౹౹౹౼ | FRACTION/EVEN POW OF 4, FRACTION/ODD POW OF 4 | | TIBETAN | ༚།།།༚ | SIGN RDEL DKAR GCIG, MARK SHAD | | BUGINESE | ·᨞᨞᨞· | MIDDLE DOT, PALLAWA | | BUHID | ·ᝐᝐᝐ· | MIDDLE DOT, LETTER RA | | PUNCTUATION | ⸰\\⸰ | RINGPOINT, REVERSE SOLIDUS | | JAVANESE | ꧆꧊꧊꧊꧆ | PADA WINDU, PADA ADEG | | REJANG | ꥟ꤷꤷꤷ꥟ | SECTION MARK, LETTER BA | | LISU | ꓸꓲꓲꓲꓸ | TONE MYA TI, LETTER I | | HAN RADICALS | ·⼂⼂⼂· | MIDDLE DOT, KANGXI RADICAL DOT | | HANGUL MARKS | ㆍㅣㅣㅣㆍ | LETTER ARAEA, JUNGSEONG I | | BOX DRAWINGS | ╸╱╱╱╺ | HEAVY RIGHT, LIGHT DIAGONAL UPPER R TO LOWER L | | ELBASAN | ·𐔎𐔎𐔎· | MIDDLE DOT, LETTER JE | | BRAILLE | ⠂⠇⠇⠇⠂| BRAILLE PATTERN DOTS-2, BRAILLE PATTERN DOTS-123 | | ARABIC | ٠١١١٠ | INDIC DIGIT ZERO, INDIC DIGIT ONE | | AVASTAN | 𐬹𐬰𐬰𐬰𐬹 | AVESTAN ABBREVIATION MARK, AVESTAN LETTER ZE | | MANDAIC | ࡀࡆࡆࡆࡀ | MANDAIC LETTER HALQA, MANDAIC LETTER AZ | | SAMARITAN | ࠾࠼࠼࠼࠾ | SAMARITAN PUNCTUATION ANNAAU, SAMARITAN PUNCTUATION | | BENGALI | ·৲৲৲· | MIDDLE DOT, BENGALI RUPEE MARK | | CHAKMA | ·𑅁𑅁𑅁· | MIDDLE DOT, DANDA | | BRAHMI | 𑁦𑁇𑁇𑁇𑁦 | BRAHMI DIGIT ZERO, BRAHMI DANDA | | CARIAN | -𐊦𐊦𐊦- | HYPHEN-MINUS, CARIAN LETTER LD | | CUNEIFORM | 𒊹///𒊹 | CUNEIFORM SIGN SHAR2, SOLIDUS | | KAITHI | 𑂻𑂝𑂻| KAITHI ABBREVIATION SIGN, KAITHI LETTER NNA | | IMPERIAL ARA | -𐡘𐡘𐡘- | HYPHEN-MINUS, IMPERIAL ARAMAIC NUMBER ONE | | INSCRIPTIONAL PAHLAVI | ·𐭺· | MIDDLE DOT, NUMBER THREE | | INSCRIPTIONAL PARTHIAN | ·𐭚· | MIDDLE DOT, NUMBER THREE | | LEPCHA | ·᰻᰻᰻· | MIDDLE DOT, LEPCHA PUNCTUATION TA-ROL | | GLAGOLITIC | ·ⰬⰬⰬ· | MIDDLE DOT, CAPITAL LETTER SHTAPIC | | GOTHIC | 𐍈𐌹𐌹𐌹𐍈 | LETTER HWAIR, LETTER EIS | | OGHAM | 。ᚋᚋᚋ 。| IDEOGRAPHIC FULL STOP, OGHAM LETTER MUIN | | OLD HUNGARIAN | 𐳣𐳥𐳥𐳥𐳣 | SMALL LETTER SHORT ER, SMALL LETTER ESZ | | OLD ITALIC | ·𐌠𐌠𐌠· | MIDDLE DOT, OLD ITALIC NUMERAL ONE | | OLD NORTH ARABIAN | 𐪞𐪝𐪝𐪝𐪞 | NUMBER TEN, NUMBER ONE | | MEETAI MAYEK | -꫰꫰꫰- | HYPHEN-MINUS, MEETEI MAYEK CHEIKHAN | | PHENECIAN | 𐤟𐤖𐤖𐤖𐤟 | WORD SEPARATOR, NUMBER ONE |

ASTERISK* denotes characters which are non-native to the character set: Hyphen, Middle Dot, Solidus (Back Slash) and Left Single Quotation Mark

bitcoin Thanks for reading. Stay pleb.

xplbzx on Nostr: npub1e0f808a350rxrhppu4zylzljt3arfpvrrpqdg6ft78xy6u49kq5slf0g92

-

@ 7fa56f5d:751ac194

2023-04-18 18:21:21

@ 7fa56f5d:751ac194

2023-04-18 18:21:21This document gathers nostr badges that have historical relevance on nostr.

First NIP-58 badge

This is the first issued badge in Nostr.

nostr:naddr1qqz5satdv9hqygq6zns47672f97kyjyvdvx2cj2ks838ayjarre72c7xq87gnxazwspsgqqqw5us8lwufw

Eden Founding Member badge

The Eden relay issued a exclusive badge to its 1000 founding members.

nostr:naddr1qq2x2er9dckkvmm4dejxjmn894kk2mtzv4eqygx4h54wm5qxeald5hee4pxqcxae3e0e4jtsj333krh4x0t85rfcjcpsgqqqw5us60w4m2

Event attendance

nostr:npub14f26g7dddy6dpltc70da3pg4e5w2p4apzzqjuugnsr2ema6e3y6s2xv7lu has awarded a badge to nostrica 2023 attendees

nostr:naddr1qqxkummnw3exjcmp95erqv3nqgs254dy0xkkjdxsl4u08k7cs52u689q67s3pqfwwyfcp4va7avcjdgrqsqqqafecrqqnh

In-Game awards

The nostr:npub1hm63f02cer8w5jltne4cf2xeswf477lzday7zn0kszv0rwnyz4hqcmzr0p Bitcoin gaming company released the first set of badges as in-game awards, read more in their announcement article. This is my favourite:

nostr:naddr1qqthxmmvd96xz6tjv40kcetpva6k2hmhd9hxuetjqgstaag5h4vv3nh2f04eu6uy4rvc8y6l003x7j0pfhmgpx83hfjp2msrqsqqqafept44jx

Open source contributions

The Astraea client issued a badge that is awarded to the contributors of the open source project.

nostr:naddr1qqrkzum5wfsk2cgzyr8q6wzj2fenhkzvr6ww047dk4enhqpphv9nwsxgf5vytq9lgql2xqcyqqq82wggs9qwy

Subscriptions

The snort client awards a badge to everyone that supports the project with a subscription.

nostr:naddr1qq8hxmn0wf6z6um4wpcx7un5v4eqygyymc67ykzd9v2y4t5z8j0dpv8nmmdqjey9xzun6x32z3k3m65cvspsgqqqw5usrqw4qh

Article image by nostr:npub1r0rs5q2gk0e3dk3nlc7gnu378ec6cnlenqp8a3cjhyzu6f8k5sgs4sq9ac in Nostr land

-

@ 8525b484:3125b03f

2023-04-18 15:42:11

@ 8525b484:3125b03f

2023-04-18 15:42:11Your browser doesn't support HTML5 audio. Here is a link to the audio instead.

Read by Guy Swann.

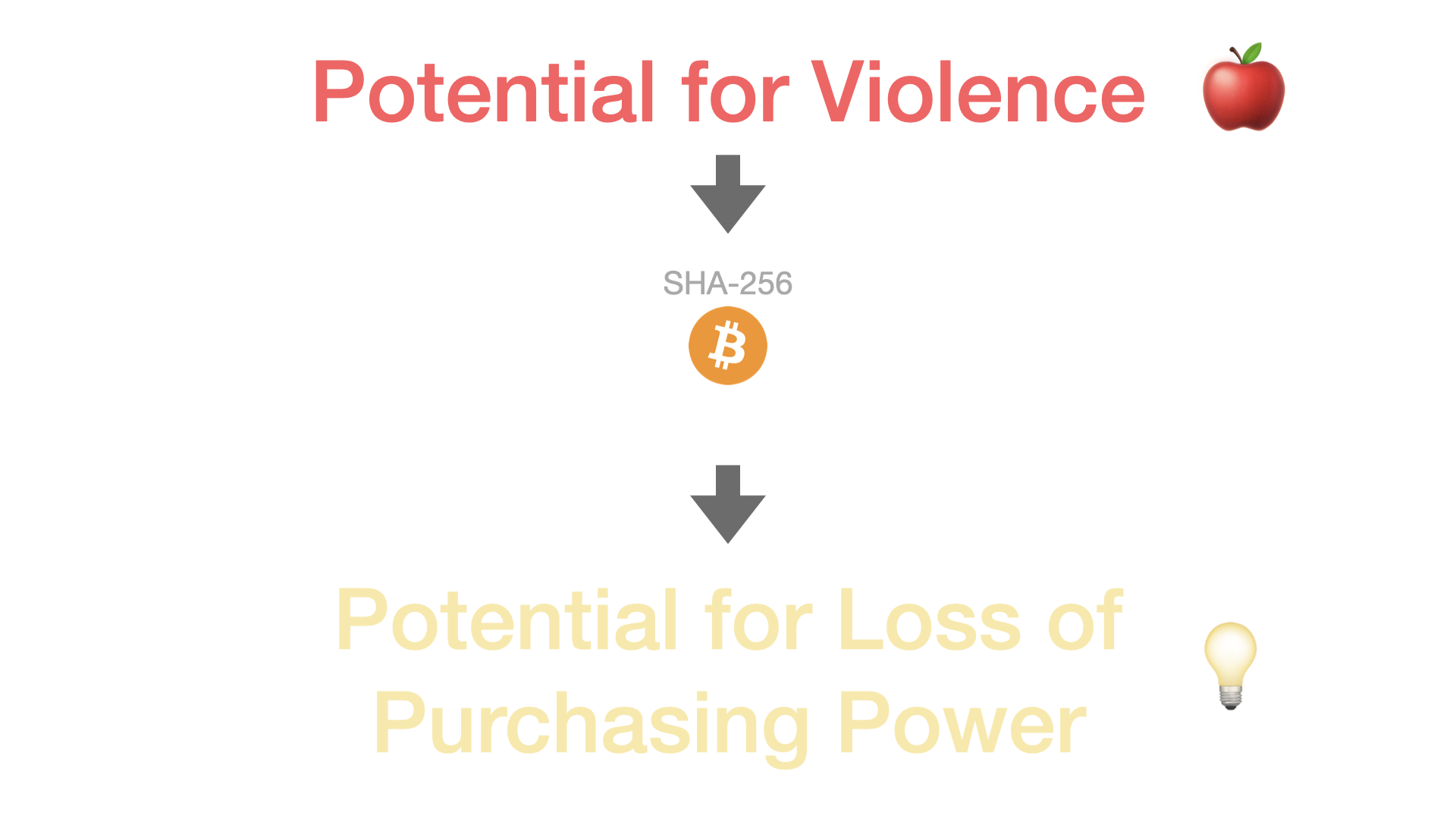

Bitcoin is complicated and scary. Just like fire, electricity, computers, and every other ground-breaking invention before it. It is complicated and scary because most people do not understand how it works and why it might be useful.

Once you begin to understand how it works, you will begin to understand why it is so useful to people around the world. And I hope that once you truly understand its basic operational principles, you will begin to understand why outlawing Bitcoin is a foolish proposition.

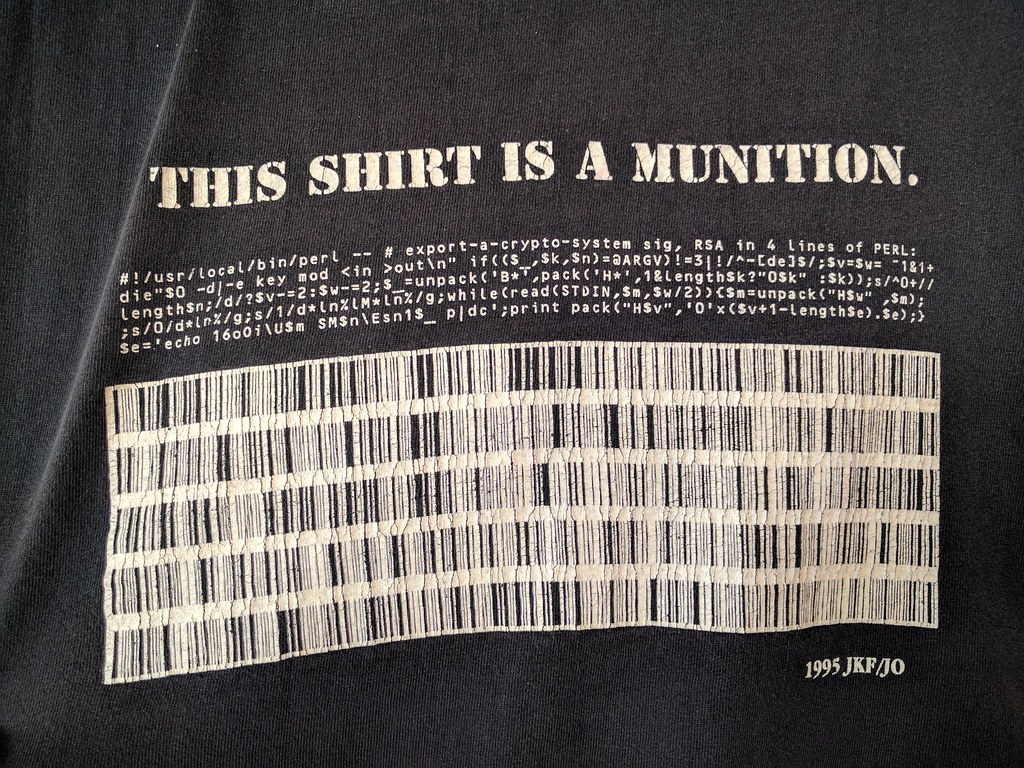

In light of recent comments by legislators and politicians, we must not forget what Bitcoin does and how it does what it does. Bitcoin is text. Bitcoin is speech. Bitcoin is math. Bitcoin has no jurisdiction, just like 2+2=4 has no jurisdiction. Bitcoin knows no borders. Bitcoin is everywhere and nowhere, and if used and secured properly, bitcoin is as confiscatable as a thought. No amount of legalese or otherwise complicated language will change these facts.

Using Bitcoin does not require any special equipment. We use software and specialized hardware to use Bitcoin more efficiently, and in a more secure manner, but in theory, Bitcoin can be run on pen and paper.

The following statements are and will always be true:

- You can create a private key by flipping a coin.

- Holding a private key allows you to receive sats and create transactions.

- Creating a transaction is math.

- Sending a transaction is sending a message.

- Mining bitcoin is guessing a number.

- Everything in Bitcoin is information.

These statements will sound strange to you if you don’t know how Bitcoin operates, but they are true nonetheless. Thankfully, Bitcoin is an open system, which means that everyone can learn the operational details of the network. I encourage you to do that and, if you can, educate others. We must not forget what politicians are implying when they are musing about “banning wallets” and making up nonsensical and disingenuous adjectives such as “self-hosted” and “non-custodial.”

A wallet is nothing special; it can be just some words in your head.1 You don’t need specialized equipment to generate a secure wallet. A coin or some dice is all you need.

Creating a Wallet Is Flipping a Coin

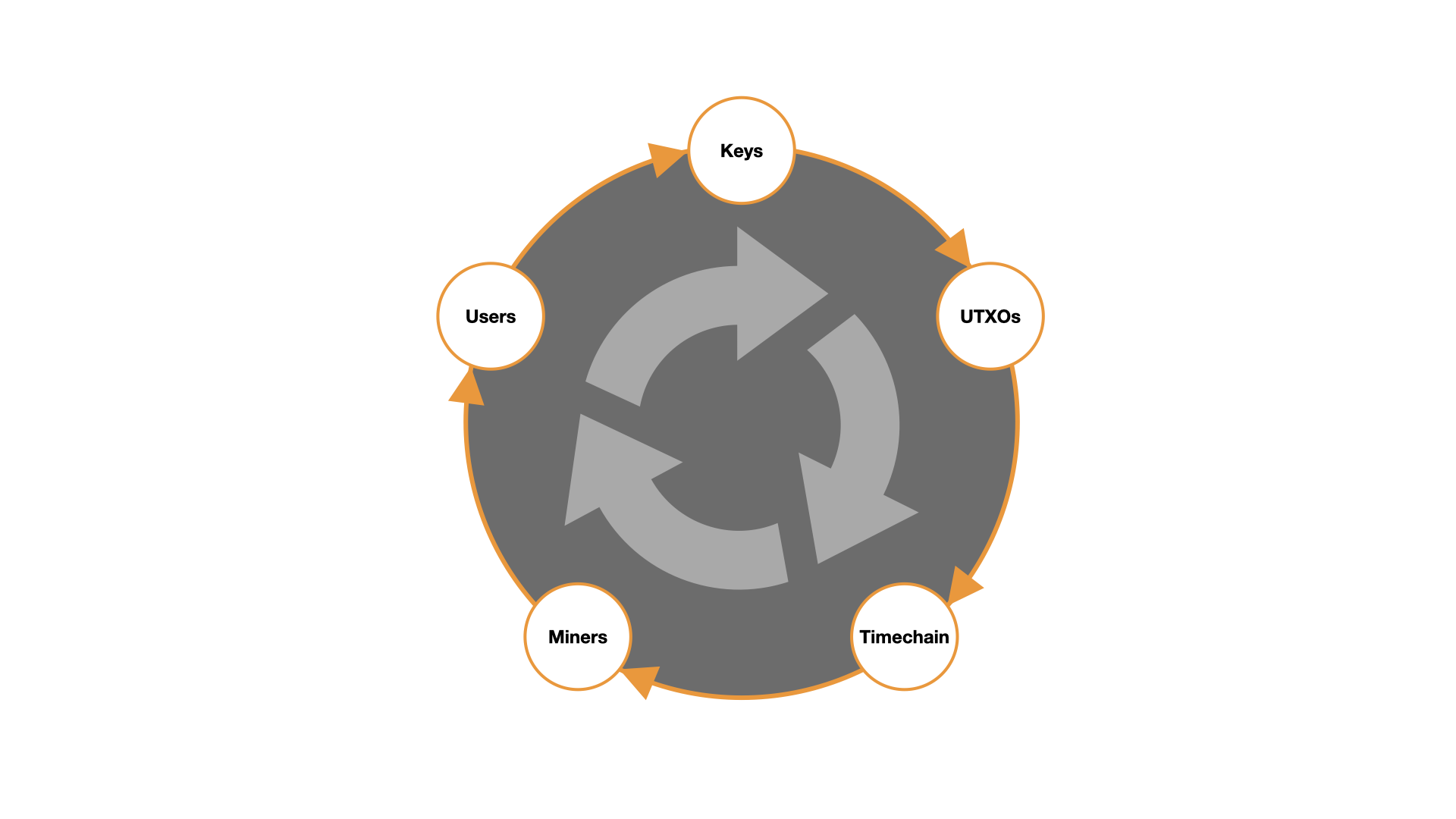

To interact with the Bitcoin network, you need a wallet, which is to say you need a private key.2 While conventional concepts do not apply well to Bitcoin, one could argue that creating a public-private key pair is akin to creating an account. And since public keys are derived from private keys, we only have to answer one question: what are private keys, and how are they created?

A private key is a 256-bit number. That’s it. End of story.3

So, what exactly is a 256-bit number? Well, as the name suggests, a 256-bit number is a number that, when represented using zeros and ones, is 256 binary digits long. In other words: it’s a really big number.

⚠️ Warning: The private keys shown on this page are real private keys. Do not send bitcoins to or import/use any sample keys; you will lose your money. I repeat: YOU WILL LOSE YOUR MONEY

The following is a 256-bit number:

0010111011001011101110101011010110001001101111010001011010100110001001110010101110101010101100000001101100000111000000011100010100100001000001010001011011100000111000111010101001111101000110111010100011011111000101111100000110100010110110000010101010111111These zeroes and ones - or, more accurately, the information contained in these zeroes ones - are a valid Bitcoin private key. You could use this information to receive and send transactions on the Bitcoin network. 4

Why is this important? It is important because I can create a Bitcoin wallet by sitting in my room, flipping a coin 256 times. If you want to outlaw “anonymous wallets,” you will have to outlaw this activity, along with all other techniques to create random numbers: rolling dice, drawing cards, measuring optical or atmospherical turbulences, and so on.

Further, since these zeros and ones are just information, you can represent them in countless different ways. The information does not change; just the representation of the information changes. The hexadecimal version 12e188aeb7c9aeb0eef7fac7c89e3b9b535a30b2ce8d6b74b706fa6f86b061e4 represents the same private key as the zeros and ones above. As does the following mnemonic code, which can be learned by heart with some practice:

concert, frozen, pull, battle, spend, fancy, orient, inside, quiz, submit, scare, mechanic, awake, mercy, lock, inside, language, tag, dash, control, borrow, hip, print, absorbRemember: this information, this 256-bit number, is all you need to interact with the Bitcoin network. You do not need an ID, or passport, or utility bill, or proof of residency. You do not even need to be human. If you are in control of a Bitcoin private key, you can send and receive transactions.

If you want to understand Bitcoin, you will have to understand that a wallet can be created by flipping a coin 256 times.

Holding a Private Key Allows You to Earn Sats

You flipped a coin 256 times. Now what? Time to earn some money!

To receive sats, you need an address, which can be derived from your private key. Grab a pen and paper, go to your standing desk, and calculate your public key according to BIP32. If you are short on time or bad with math, don’t despair. There are online tools5 that will do the math for you. But remember that these software tools do nothing weird or magical. It’s just math, and you can do it yourself using nothing but a pen and paper.

The outcome of all that math will produce a number that, when encoded as a bitcoin address, will look something like this:

bc1qd6yf555vwns0mpgy55epux4tzf8a40nmw2vpgqShare your address with someone else, and you are ready to receive your first sats. Keep in mind that you don’t have to share the address in this exact format. You can encode it as a QR code, as a number, as emojis,6 as an audio file, or as braille. You can put it in your invoice, display it on your homepage, in your profile, send it via a messaging application, or tattoo it on your body. It is just information. It can be represented in countless ways.

Easier to read for computers.

Easier to read for blind people.

Easier to read for millenials.

Also, keep in mind that you do not have to be online to receive sats. The sats won’t be sent to you directly. Someone will sign a message that will transfer the sats to your name - if you excuse my imprecise language. It’s not your name, of course, since Bitcoin doesn’t know any names. But that would be one way to think about it.

Someone just broadcast a transaction that includes your address as an output, which means that you will receive your first sats soon. Now what? Time to create a transaction and pass them on.

Creating a Transaction Is Math

If you have a private key, you can create a transaction. Remember that a private key is just a large number. What can you do with numbers? You guessed it: math!

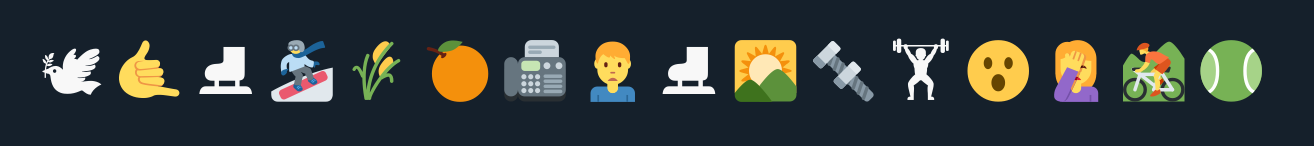

In its simplest form, a bitcoin transaction is a message that says something like the following:

I, Alice, hereby transfer 21 sats to Bob. Signed, Alice.

Real transactions might have multiple senders and multiple recipients as well as various other tweaks and efficiencies, but the essence remains the same. What is important to note is that nothing is secret in a transaction. All transactions are broadcast across the whole network, viewable and verifiable by everyone. All transactions are plain text. Nothing is encrypted.

To write “Alice sends 21 sats to Bob” in a way that makes sense to the Bitcoin network, a special, more precise format has to be used. Don’t get confused by the format of the message or how the message is encoded. It doesn’t matter if the language is English or something that is easier to understand for computers. The meaning of the message remains the same. I could write the above as

[A]--21-->[B]and sign it with the private key that corresponds to A, and it would essentially be the same thing.

A bitcoin transaction (artist's rendition).

This brings us to the important part: the signature. Hand-written signatures are not very useful in a digital world, which is why mathematicians and cryptographers came up with a modern equivalent: digital signatures.

I will not go into detail explaining how they work, but the important part is this: it’s all just math and numbers. Your private key acts as a large secret number that is used to perform mathematical operations. The result of these mathematical operations is a digital signature (another number) that can be checked using your public key, which is, again, a number.

Math is what makes public-key cryptography work. The beauty of this math is that you can verify that the sender is in control of a secret number without revealing the secret number. This is what cryptographic signatures do.

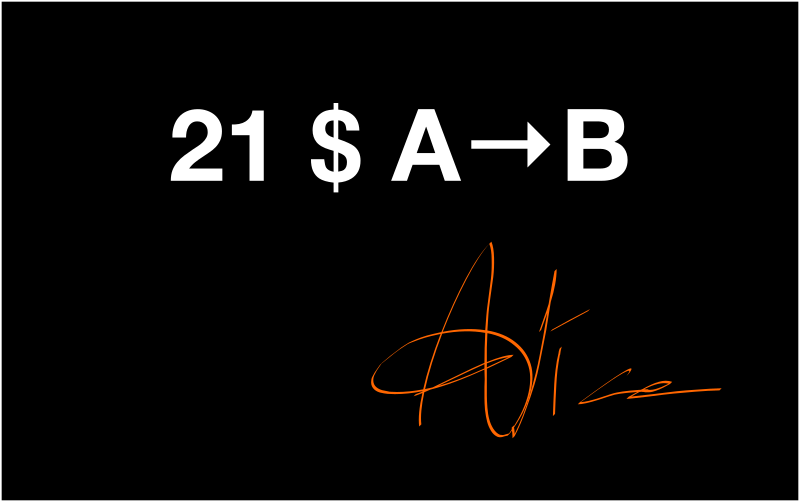

Let’s look at an example. The following is a valid transaction:7

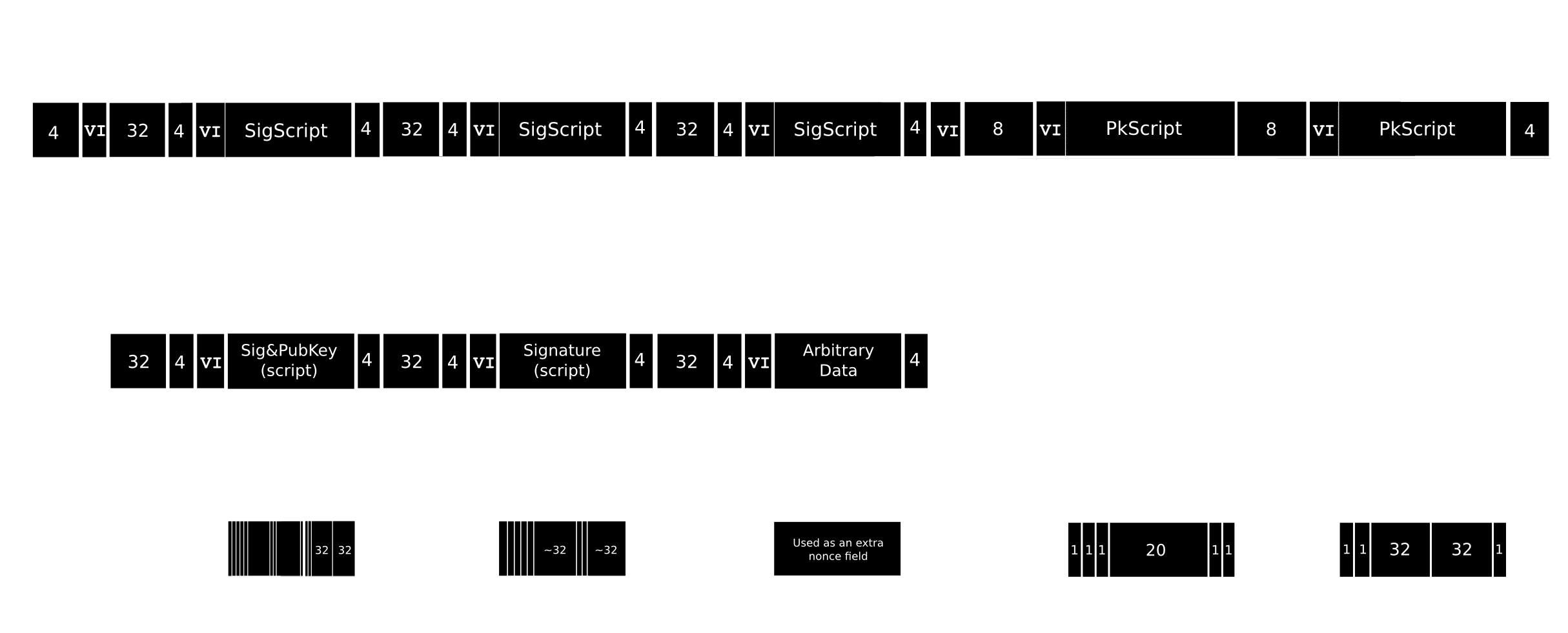

01000000017967a5185e907a25225574544c31f7b059c1a191d65b53dcc1554d339c4f9efc010000006a47304402206a2eb16b7b92051d0fa38c133e67684ed064effada1d7f925c842da401d4f22702201f196b10e6e4b4a9fff948e5c5d71ec5da53e90529c8dbd122bff2b1d21dc8a90121039b7bcd0824b9a9164f7ba098408e63e5b7e3cf90835cceb19868f54f8961a825ffffffff014baf2100000000001976a914db4d1141d0048b1ed15839d0b7a4c488cd368b0e88ac00000000You can use various tools8 to decode and inspect it. These tools help us humans to make sense of it all, but the underlying reality remains: it’s numbers all the way down.

Byte-map of a Bitcoin transaction.

To reiterate, the following is all you have to do to interact with the Bitcoin network:

- Step 1: Flip a coin a couple of times.

- Step 2: Do some math.

- Step 3: Send and receive messages.

Outlawing any of these three steps is ridiculous. It is ridiculous because of the peculiar nature of information. If you outlaw certain kinds of information, you implicitly outlaw all representations of this information: text, speech, images, emojis, QR codes, sign language, interpretive dance, and so on. And since all information can be represented as a number - including math and computer code itself, it boils down to making numbers illegal.

Although banning numbers is as ridiculous as it sounds, it has happened in the past. Illegal numbers and illegal primes are a thing precisely because some people tried to outlaw certain kinds of information.

Society and law makers will have to grapple with the fact that Bitcoin wallets and transactions are just information, as is everything else in Bitcoin.

Spending Sats Is Sending a Message

Because a Bitcoin transaction is just information, sending sats to someone is propagating that information, or, in other words: sending a message. You don’t even have to send the message to a particular person. Base-layer transactions are broadcast transactions. They are sent to everyone on the network.

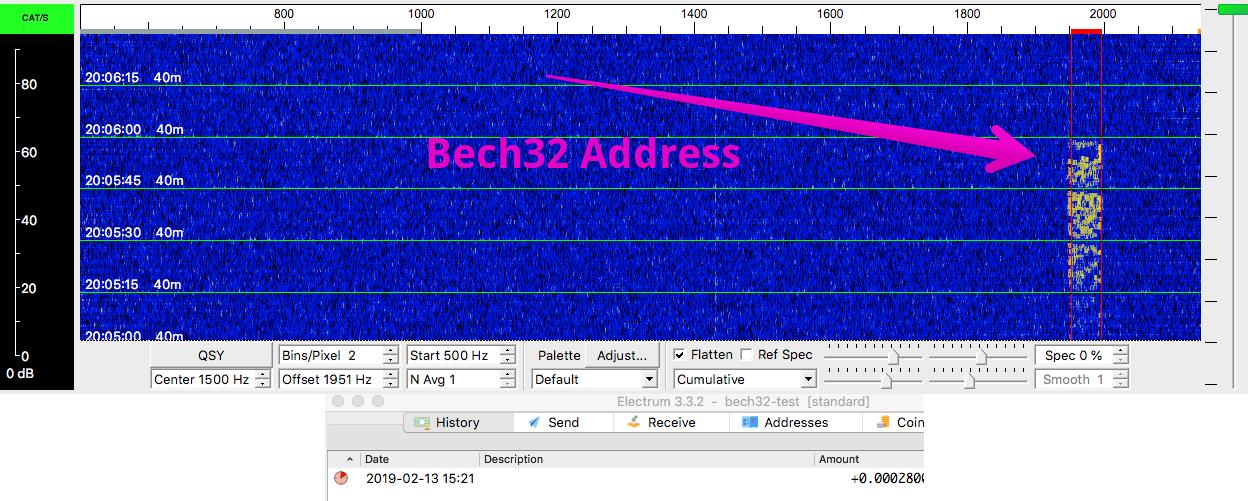

Keep in mind that any communications channel can be used to send and receive information. The internet is simply the most efficient communications tool we currently have. But there is no reason why you couldn’t use a satellite connection or ham radio, which people are and have been using, be it out of fun or necessity.

Bitcoin over ham radio. Source: NVK

The fact that spending sats is sending a message doesn’t change on higher layers. Nodes on the Lightning Network are doing the same thing: they are sending messages back and forth. Nothing more, nothing less.

This hides two truths about Bitcoin in plain sight:

- Bitcoin is a messaging protocol

- All messages are plain text

Messages might be sent through an encrypted communications channel, but the messages of the protocol are and will always be plain text. They have to be. The whole point of Bitcoin is that everything is easily verifiable by everyone.

Outlawing Bitcoin implies outlawing messaging. Keep in mind that we are dealing with pure information. Information can be encoded in virtually endless ways: different formats, same meaning. And herein lies the crux: you can not outlaw the meaning of a message. If you do not know the protocol, the meaning of the message will elude you. If you do not speak the language, you don’t know what is said or why it is being said.

This brings us to the last piece of the Bitcoin protocol puzzle: mining.

Mining Bitcoin Is Guessing a Number

Most people do not understand what Bitcoin mining is and how it works. They do not speak the language of Bitcoin, failing to understand both what is spoken and why it is spoken in the first place.

Bitcoin miners aren’t doing anything special, just like computers aren’t doing anything special. They are crunching numbers.

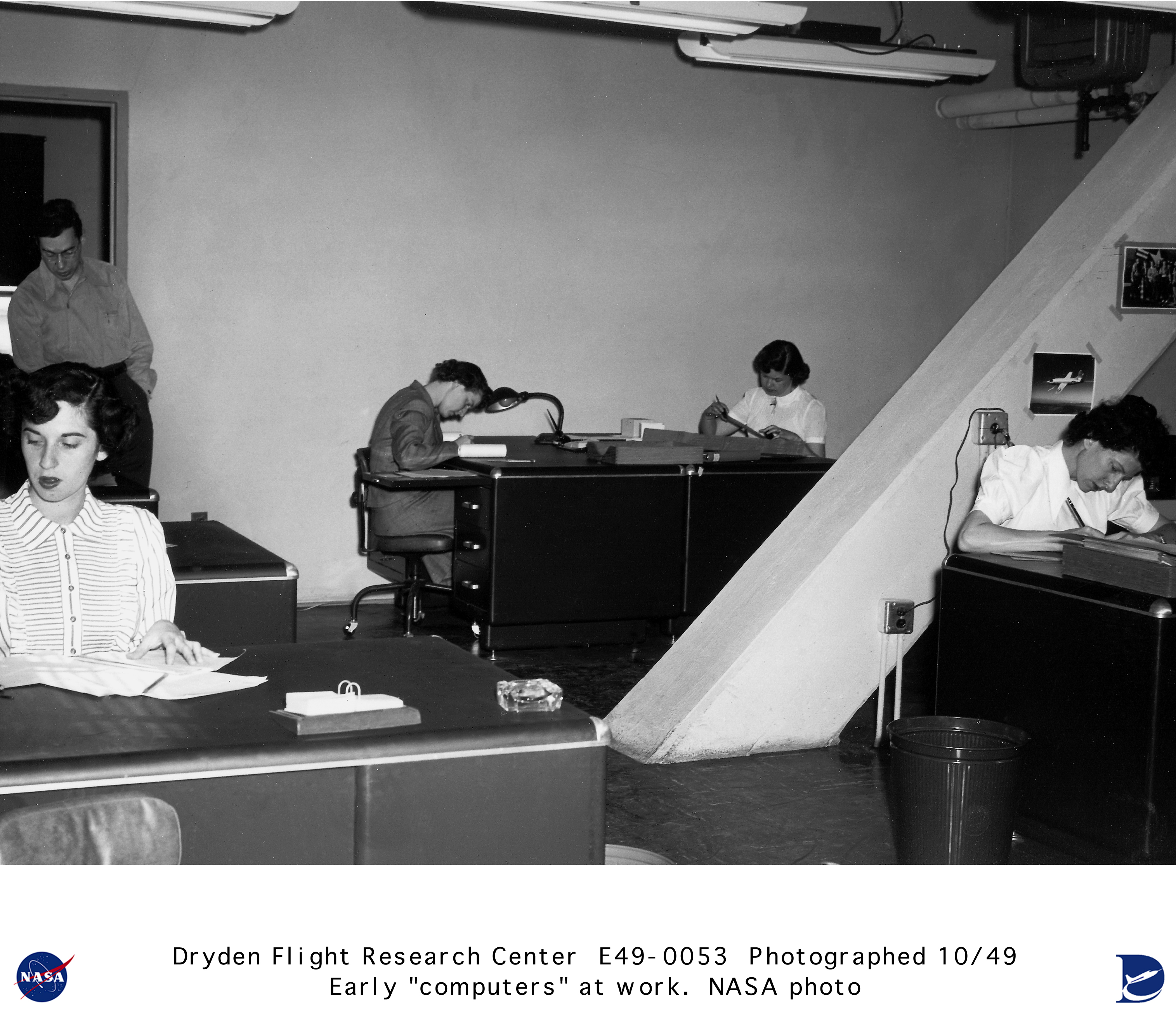

Not too long ago, when you said “computer,” you were referring to a person. It was a job description, not a thing. The most efficient way to run the numbers was to pay a person to sit down and do the math.

Most early computers were female.

Over time, we’ve built ever more efficient contraptions to do the math for us. Today, when we say “computer,” we mean something that uses microchips instead of brains to do the computing. But the underlying reality has not changed: computers crunch numbers. They do not do anything special, or devious, or magical. The same is true for ASICs.

Bitcoin, like NASA software before it, can run on a human substrate as well. We do not need ASICs to mine bitcoin. We could do it by hand. We could use our brains. It’s slow, and cumbersome, and inefficient. But we could absolutely do it.

Mining on wetware.

Just like you could use pigeons instead of computers to run the internet, you could use humans instead of silicon chips to run bitcoin. It would be highly inefficient, yes, but it would work just the same.

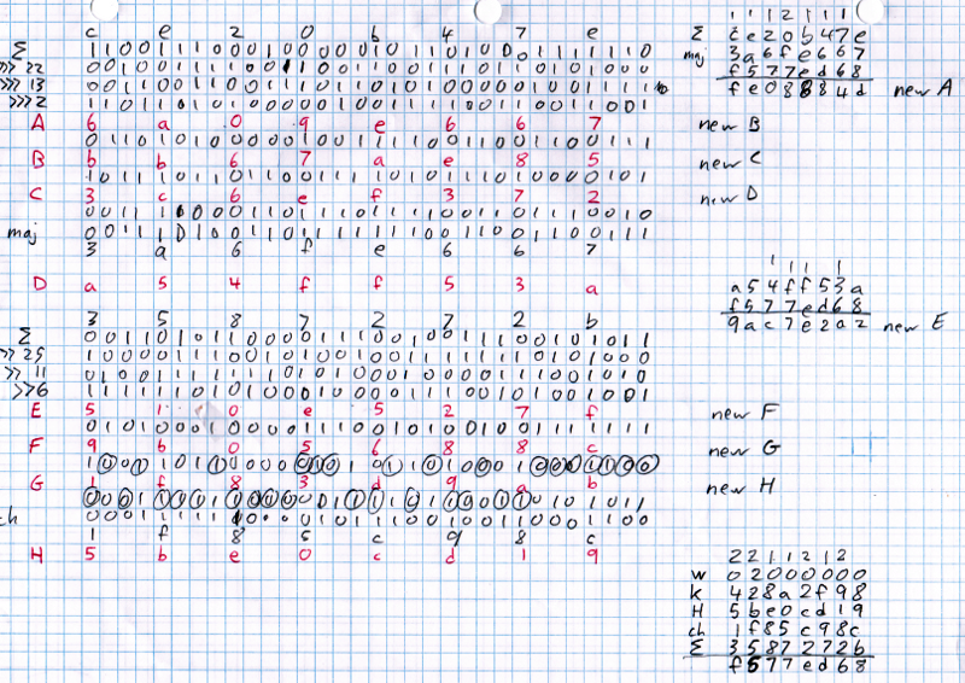

As Ken Shirriff showed in his 2014 video, SHA-256 is simple enough to be computed with pen and paper. He managed to do one round of SHA-256 in 16 minutes and 45 seconds, which works out to a hash rate of 0.67 hashes per day.

I am showing you all this to make it explicit what the basic building blocks of Bitcoin are: numbers, math, and the exchange of messages.

This is true for all processes in Bitcoin. It doesn’t matter if you create a private key, derive a public key, generate a Bitcoin address, mine a block, sign a transaction, or open a Lightning channel. All you are doing is coming up with or finding large numbers, manipulating these numbers via mathematical equations, and sending the result of these equations to your peers. That’s it.

Communication does not lose constitutional protection as “speech” simply because it is expressed in the language of computer code. Mathematical formulae and musical scores are written in “code,” i.e., symbolic notations not comprehensible to the uninitiated, and yet both are covered by the First Amendment. If someone chose to write a novel entirely in computer object code by using strings of 1’s and 0’s for each letter of each word, the resulting work would be no different for constitutional purposes than if it had been written in English.

Once you understand that Bitcoin is information - and that computers and the internet are just the best substrates to transform and transmit this information - the implications of outlawing Bitcoin should become clear. You can put Bitcoin in a book, which means you would have to ban the publication of books. You can speak bitcoin by uttering 12 words, which means you would have to ban speech. You can mine bitcoin with pen and paper, which means you would have to outlaw math, or thinking, or writing. You can store bitcoin in your head, which means, of course, that having certain thoughts is illegal if “holding bitcoin” is illegal.

If having 12 words in your head is illegal, something is terribly wrong with the law. If the police storm your building because you are finding or creating a random number in the privacy of your own home, something is terribly wrong with the police. If the peaceful exchange of messages is seen as dangerous or immoral by society, something is terribly wrong with society. If speaking or knowing numbers becomes a criminal act, I don’t want to be a law-abiding citizen in the first place.

Bitcoin is pure information. It utilizes the properties of information as well as the transformation of information - computation - to build up a shared construct that we can independently agree upon and verify. It is nothing but math and numbers. Zeros and ones, sent back and forth by voluntary participants that want to send and receive messages in peace.

Conclusion

A Bitcoin private key is a large number. When represented as words, this number can be stored in your head. A private key is all that is required to send and receive payments. You can sign and verify transactions with pen and paper. You can mine bitcoin with pen and paper. Bitcoin is just a messaging protocol that does these operations efficiently and automatically.

Understanding Bitcoin from first principles will make it obvious that the idea of banning “anonymous crypto wallets” is not feasible. You would have to outlaw the generation of entropy, the act of coming up with random numbers. You would have to surveil everyone at all times, kicking in their door and arresting them once they sit down and start flipping a coin or rolling some dice. You would have to pass legislation that criminalizes thought itself since creating an “anonymous bitcoin wallet” is nothing more than coming up with 12 random words.

Dear legislators, I ask you earnestly: Are you prepared to outlaw thought itself? Should math be illegal? Do you genuinely believe that outlawing speech is a good idea?

I hope that we can all agree that thought and speech are paramount to a free and prosperous society. And I hope that, as more and more people understand how Bitcoin operates, citizens and legislators alike will realize that Bitcoin is just that: thought and speech.

Further Reading

- Bitcoin mining the hard way by Ken Shirriff

- Using the raw Bitcoin protocol by Ken Shirriff

- Create a Bitcoin transaction by hand by Ádám Ficsór

- Remembering the Case that Established Code as Speech by EFF

- Why America Can’t Regulate Bitcoin by Beautyon

- Lesson 6: The power of free speech

This article is largely based on two chapters of my upcoming book 21 Ways.

Translations

- Arabic translation by Arabic Hodl

- Spanish translation by Danny Do Bitcoin

- Spanish audio by Elchicodel Bitcoin

- Portuguese translation by Explica Bitcoin

- German audio by Fat Joe

- English audio by Guy Swann

- German translation by Juniormind

- Greek translation by Nina

- Norwegian translation by Sebbikul

- French translation by Sovereign Monk

- English video by Till Musshoff

- German video by Till Musshoff

- Portuguese audio by bitcoinheiros

Want to help? Add a translation!

🧡

Found this valuable? Don't have sats to spare? Consider sharing it, translating it, or remixing it.

Confused? Learn more about the V4V concept. -

@ 8525b484:3125b03f

2023-04-18 15:32:53

@ 8525b484:3125b03f

2023-04-18 15:32:53The Nashville shooter’s gender identity has led to charges of “trans terrorism” — but the face of gun violence is almost always a cis white man.

Oh, my God! A picture of a gold bottle! Photo by Will Myers on Unsplash

As I move through this life, I try to find reasons to be grateful. Even very dark times can have an upside, if you’re looking for it. For instance, the mass shooting at the Covenant School in…

-

@ 8525b484:3125b03f

2023-04-18 15:26:30

@ 8525b484:3125b03f

2023-04-18 15:26:30In this article, I’m going to share with you some ballpark figures on how much money my chrome extensions, Merch Wizard and KDP Wizard, made me. I’ll also talk a bit about how I generated that income and what my experience was like creating and selling these extensions.

Finally, I’ll discuss how I made more than all the subscription income combined when I sold and exited from my biggest chrome extensions.

Developing Free Extensions In The Early Days

I was a 20-year veteran developer, climbing the ranks from junior to tech director. However, when I got to the “top,” it wasn’t everything I had dreamed of. It was chaotic, unpleasant, and unfulfilling.

I started reading self-improvement books, and the one that had the most significant impact was Rich Dad Poor Dad by Robert Kiyosaki.

Because of that book, I began exploring methods to generate additional passive income outside of my day job. I tried selling on Amazon and fulfilment by Amazon for a brief time, but it wasn’t for me.

It did, however, lead me to a new platform on Amazon called Merch by Amazon. The Merch platform enables designers to upload designs and list them on Print On Demand items from numerous Amazon markets. I started creating Merch designs and received some small monthly royalties.

Merch’s user interface was quite rudimentary when it was first released. It was difficult and time consuming to try to keep track of a portfolio of goods and designs on various marketplaces in its early stages.

At that point, I had the realization that I could use my skills in software development to create chrome extensions that would make life better for Merch creators!

I started off by building a few free chrome extensions that helped me out as a Merch By Amazon creator. I offered these to the Merch community for free, and they quickly became popular in the Merch community.

From there, I decided to take things a step further and start monetizing my extensions by selling them on the Chrome Web Store.

My First Paid Chrome Extension

To alleviate some of my own frustrations with the Merch UI, I created a few free chrome extensions. In exchange for customer email addresses, I distributed these early chrome extensions at no cost.

I then created my first paid chrome extension called Merch Batch Editor. It wasn’t the best-looking app, but users still responded positively to it. I charged a one-time price of $12.99 for this extension.

But I had very low expectations that anyone would want to buy it, even with the low price. After all, I wasn’t going to advertise anything to it; I’d just rely on organic traffic methods. However, this extremely basic tool soon generated over $3,000 in sales!

Merch Batch Editor was my first paid chrome extension, which I completed in one weekend. Consequently, it made me over $3k

This small app was a stepping stone to my more significant chrome extensions. It helped me build trust with users and establish myself as a reliable app developer in the community.

Introducing Merch Wizard

After my initial success, I had a lightbulb moment whilst I was out walking my dog in my local park. I wondered if I could build an app that combined the functionality of my previous apps with a new way of organizing the ever-growing and unmanageable portfolio of products that Merch sellers faced. Soon after this, my flagship app Merch Wizard was born!

I quickly put together an MVP and released it in less than 3 months. I told all the users of my free tools about the app via email and posted announcements in relevant Facebook communities.

I was thrilled with how the launch went, and I got some wonderful feedback and requests for new features that make me want to keep developing the app.

I knew that if I worked hard enough, I could one day quit my day job. So, I put all of my efforts into developing an app. Even though it was a lot of work, I loved doing it because I knew it would pay off in the end.

I dedicated myself to working hard on developing and marketing the app, as well as making cuts with my family in order to create a reserve fund. I decided to take the leap after a particularly lucrative Black Friday sale, deciding to work full-time on Merch Wizard for the first time.

Introducing KDP Wizard

I went on to build a second app, KDP Wizard for Kindle Direct Publishing sellers. The Merch Wizard users were basically begging for similar functionality that Merch Wizard had, but for the KDP platform.

As such, after several months of development KDP Wizard was launched. It’s an app that helps users with the design, listing, and promotion of their Kindle books. The app was very well-received in the KDP community.

Subscription Income

For both chrome extensions, I built up a solid base of monthly recurring revenue customers. Additionally, there were also many subscribers to the annual plans which had been offered at a discount during seasonal sale periods.

In addition to the subscription income, I have also sold my chrome extensions as one-off lifetime deals which I’ve sold from $249 all the way up to $699 ( yes, you’re reading that correctly, seven hundred dollars for one of my chrome extensions 🤯). Here’s a screenshot of someone buying at $699 … always a sweet email to receive!

On rare occasions, such as Black Friday I’d offer discounts on the lifetime deals to inject some cash into the business. I recommend avoiding lifetime deals if possible as it’s a short-term high, but a customer you need to support for life. This also counts against you in any exits you might have planned in the future.

All in all, the total monthly recurring revenue was around $10,000 a month. As chrome extensions run locally, there were very few fixed server costs to absorb as the user count increased. Also, as I was using purely organic traffic, the majority of this income (70–80%) was profit.

Cash Lump Sum Exit Income

However, larger than all my subscription income combined was the lump sum payment I received when I sold and exited from my apps. It was a multi six-figure exit and was life-changing for my family and me.

Many people don’t realise how valuable an asset a profitable SaaS app is. I have an in-depth article on how to value and sell a Micro SaaS app which talks about the process and my experience in more detail.

However, to give you a simple worked example, imagine you have built your chrome extension’s monthly net profit up to $5k a month. Depending on several factors, a multiplier of 40x-60x would be applied to give you an approximate valuation of ($5k x 50x) of $250,000. Not bad huh!

Of course, if you can scale that up to hitting $10k-$20k profit a month, the numbers starts getting really interesting as you could be looking at a seven-figure exit.

So, back to answering the original question in the title “How Much Money I Made Developing Chrome Extensions” ….

Through hard graft, laser focus and a passion for maintaining a happy user base I was able to earn multiple six figures in subscription income. Due to the upward trending KPIs I achieved a 57x multiplier on my exit.

And the number you’ve been waiting patiently for ….

In total, I have generated over $500,000 in revenue from my Chrome Extensions

-

@ 8525b484:3125b03f

2023-04-18 15:13:35

@ 8525b484:3125b03f

2023-04-18 15:13:35Amby Burfoot winning the 1968 Boston Marathon. Photo courtesy of Jeff Johnson.

A few stories you may have missed this week

Humans are amazing sometimes. In the midst of *gestures broadly* everything happening in the world right now, it’s worth coming back to this simple truth from time to time, and I wanted to share two stories from Medium this week that illustrate the point in two very different ways.

The first is from Amby Burfoot, writing about the Boston Marathon (which will be held this year on April 17). Burfoot won the marathon in 1968, a massive achievement in itself, but his story is about the many times he ran it afterwards, and especially how the race changed after the 2013 bombing. He ends with the hard won wisdom that every mile is a gift: “After all, I don’t know if I’ll ever be here again. Life gives us no guarantees. But I do know for sure that right now there is no other place in the world I would rather be.”

The second story takes us from the realm of sports to mathematics, from the body to the mind. “Here’s How Two New Orleans Teenagers Found a New Proof of the Pythagorean Theorem” outlines how Calcea Johnson and Ne’Kiya Jackson may have found a novel way to use trigonometry to prove the 2,500+ year old theorem. There’s still more to come — Johnson and Jackson have yet to publish their proof — but as writer Keith McNulty points out, it “could well be the most beautiful and simplest trigonometric proof we have seen to date, and is clearly the work of young, sharp minds uncomplicated by the years of deep research that characterize the work of many experienced mathematicians.”

Also: We’re constantly working on making Medium membership better, and have added audio to the growing list of member-only features — read more over on our blog about how we’re working to make membership better. And while you’re there, check out our interview with entrepreneur Thomas Smith about his approach to publishing and writing on Medium.

As always, thank you for reading.

Scott Lamb

VP, Content @ MediumHere’s what we’re reading this week…

“Resisting Deterministic Thinking” by danah boyd, partner researcher at Microsoft and distinguished visiting professor at Georgetown University

Deterministic thinking is a blinkering force, the very opposite of rationality even though many people who espouse deterministic thinking believe themselves to be hyper rational.

“I’m an ER Doctor: Here’s What Happened When I Asked ChatGPT to Diagnose My Patients” by Joshua Tamayo-Sarver, doctor and executive at Inflect Health

We urgently need a much more realistic view from Silicon Valley and the public at large of what AI can do now — and its many, often dangerous, limitations. We must be very careful to avoid inflated expectations with programs like ChatGPT, because in the context of human health, they can literally be life-threatening.

“What It Takes to Make 165 Years of Journalism Available Online” by Aldana Vales, manager for research and product insights at The Atlantic

Digitizing The Atlantic’s archive and turning it into a product for readers are two different things. Here’s how we did both.

Aldana Vales and the team at The Atlantic