-

@ 202365de:dad57ea9

2023-04-10 02:26:25

@ 202365de:dad57ea9

2023-04-10 02:26:25It was a mid August evening on a remote trout stream in central Pennsylvania, and I was all set to wet my line in the hopes of hooking a beautiful trout. The water was clear and the air humid as I approached the bank with my fly rod tucked under my arm. As I readied myself to cast, I repositioned my Nittany Blue cigar, careful not to obstruct my view of the stream with my exhale, as I targeted a feeding brown with what seemed a satiating appetite. A more practiced fly Fisherman would have attempted to 'match the hatch' where as I tied on a size 6 streamer and readied myself to cast, quartering downstream and swinging the fly across, envisioning the take, the fight, the landing.

I heard a friendly voice from behind me, asking how the fishing was. My buddy Ben and I had been friends since the end of our Penn State tenures, and after school we continued to stay connected as we both appreciated the outdoors and specifically tricking finicky trout with thread and precision. Ben was kind enough to offer me a spot on his weekend getaway with his Dad Jack, up in the Allegheny's at a well known yet private Rod & Gun club where they are members. I acknowledged Ben and was right back in the zone, focused on the task at hand in the dying daylight.

The cast, the mend, the strip. Slam! The brown inhaled the streamer and a fight ensued on my Cabelas Genesis 4 wt. Upon landing the fish, I looked up and saw an older gentleman sitting under the canopy of what seemed to be an old hut. He didn't have the same urgency to be on the water, perhaps he was reminiscing on all the times he had been in my boots, trying to get just one more fish before dark. He acknowledged my catch and continued to take in the evening scenery.

I turned to see Ben and his Dad walking towards him and other members of the club across the bank. Jack called out from across the stream, "hey Barry, do you want to meet Joe Humphreys?" I was floored. Where would we be going to meet him? Was the living legend of Pennsylvania fly fishing actually here on the property? I picked up my net, notched my fly accordingly on my rod, and began trotting with pace downstream to cross to the other side. I recognized him right away. It was Joe Humphreys, a living legend in the world of fly fishing. I couldn't believe my luck. Here, on this remote stream, I had the opportunity to meet and chat with one of the greatest fly anglers of all time.

Joe was so gracious, he knew I was a big fan. I told him my story of getting into fly fishing, swapping stories about fishing and life. I had already researched about his experiences fishing all over the world and his passion for teaching the next generation of anglers. In person he was unassuming and humble, making our interaction personable as if he had known me since I was a kid. His enthusiasm was infectious, and I couldn't help but feel lucky to be sharing the water with him.

As I recall, Ben and I fished and landed trout all day, and I watched in awe as Ben expertly cast his line and maneuvered his fly across the water. His knowledge and ease of use displayed years of experience, evident in every cast he made. Joe had been his teacher, his mentor on the water and I realized then I was in the company of serious practitioners of the sport. I decided to dedicate serious time and effort for the next time I'd have the opportunity.

As the sky finally turned black and the stars came out, we packed up and made our way up to the clubhouse. I left the stream that day feeling inspired by my chance encounter with such a fishing legend, and with a renewed appreciation for the beauty and challenge of fly fishing. It was a memory I'd cherish for a lifetime.

-

@ 97c70a44:ad98e322

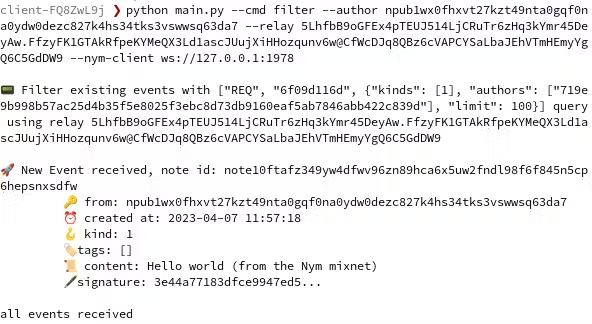

2023-04-07 16:23:31

@ 97c70a44:ad98e322

2023-04-07 16:23:31Yesterday I was browsing bountsr and discovered a new bounty by fiatjaf for adding "relay browsing" to clients. This is the bounty Coracle was born to claim! However, it's a problem I've been putting off for some time now, because it's a very hard problem requiring some real creativity. In this post I'll survey the state of the art, try to articulate my vague ideas about what needs to be done, and sketch some next steps toward realizing this goal.

The problem of relays

Relays are a problem. They are simultaneously an implementation detail that users don't understand and don't want to deal with, and the very soul of Nostr. So far, no client has unleashed the power of Nostr's architecture, instead focusing on ease of adoption by starting users off with a hard-coded set of relays. Users are then left to dig through their settings to change which relays they want to connect to. Others, like Primal, attempt to elide the concept of relays altogether and provide a unified view of the entire network.

Various nods to the importance of relays do exist in various clients however, for example:

- Amethyst shows pretty granular controls and stats on their relay list.

- Snort (and others) shows the list of relays other users connect to on their profile page.

- Gossip has all kinds of settings for how many relays to use, how smart to be about relay discovery, and more.

- Coracle shows which relays an event was seen on in the note's overflow menu, and asks new users to select relays during the onboarding process.

Other common patterns include: color-coding relays, differentiating between read and write relays, and auto-selecting relays different from the user's own selections in order to fetch context related to a given note or feed.

All of these are great features, but they are baby steps, and don't fundamentally address the problem (or realize the possibility) of allowing users to navigate between overlapping venn diagrams of relays and their content.

Let me tell you about my feelings

I think it's generally a shared perception that these half-measures aren't enough, but nobody really knows what to do about it. Even fiatjaf, who has relentlessly pushed development efforts towards surfacing relays admits in the bounty cited above, "The app should make it seamless to browse these various scenarios, I have no idea how."

I share this utter sense of bewilderment. I feel unmoored when I try to think what a user interface that fully embraced multiple relays would look like. Decades of using software with a single-master paradigm has broken my mind; designing something that could actually be used to seamlessly navigate between relays is a massive effort for my poor, tired brain.

The closest thing to a "vision" for what this would look like is what Arkin0x has built with ONOSENDAI: a vast, three-dimensional space that you can travel through. Although to solve the problem, they would have to use an address space focused on relationships between relays, pubkeys, and events, rather than event content simhashes.

This could be a workable approach, resulting in something similar to LN Insights, a browser for lightning network topology, which adds node capacity and clustering as additional dimensions. But it's also true that this type of visualization quickly becomes disorienting, and is far less familiar than a traditional user interface with buttons and menus.

There are examples of this kind of thing being executed successfully by tools like Figma which allow you to zoom in and out on your canvas to travel from one place to another. Games like Supreme Commander support zoom-to-navigate, in addition to showing multiple windowed views of the same game. Tools like Photoshop and vector graphics editors take a different approach and introduce an extra dimension by allowing you to group content into multiple layers.

Another way to think about the additional dimension that relays introduce is by imagining Nostr is a virtual world, with geography (relays), actors (pubkeys), and history (events). Users are mobile, and can travel at will through the world (unless denied access by a relay), viewing artifacts left by other users in the form of published events. The wrinkle is that events can happen in multiple places at the same time, or be replicated across space over time as events get re-broadcasted.

Take a look at the conversation I had with Arkin0x on telegram while writing this post for more ideas for representing Nostr in 3D space.

Back to flatland

In traditional user interfaces, relationships within the data model are not usually represented spatially, except in very purpose-built applications like UML diagrams or mind maps. Instead, space is taken up by an additional dimension: affordances for user interaction. Screens are designed according to functionality, and access to groups of those functions exist in navigation items or menus. Content is addressed by overlaying those groups of functionality either literally via modal dialogs, or dimensionally using "Uniform Resource Locators". There's no space left for representing the same address space in multiple dimensions, especially simultaneously.

So, what is required is either a new UI element or a re-purposed one that satisfies the same semantics as a checkbox group: a way to choose zero or more options for the same value. This isn't too hard, you could add a dropdown menu on feed views, and call it good. But this won't make any sense to users unless they know what differentiates relays from one another, and with 1,300 relays in the network and counting, it will be impossible to process that information without help from the software.

So, relays need to be filtered and grouped. This can be partly accomplished by giving good names and metadata to relays, but the important thing is the content that lives on a given relay, which might be analyzed using the social graph, textually, or using some other heuristic. Unfortunately, with the current culture of cross-posting for reach, relays don't differ substantially from one another. For now, filters and groups have to be user-generated, which creates a chicken-and-egg problem, because remember? we are trying to make it easy for users to navigate Nostr!

Maybe a good place to start would be to create a tool that would allow users to analyze for themselves the factors contributing to relay differentiation, as specified in this bounty. Then, those insights could be quantified and automatically integrated into a given client's implementation of groups and filters. Of course, that runs afoul of the problem of centralization.

Or, discovery could be built in to clients using crude tools like checkboxes, color codes, and modal dialogs, and as the network partitions and relays specialize due to scaling limitations users can begin to develop a gestalt for what kind of notes end up on a given relay. The naturally occurring social partitioning that would result would self-reinforce by allowing implementations to classify relay content by personalities or content central to content already hosted there.

Conclusion

This post has been far more stream-of-consciousness than usual, and for that I apologize. But I also thank you, dear reader, for helping me rubber-duck my way to profundity. Here are my take-aways (maybe yours are different):

- Multi-master content is a truly novel paradigm, and interface metaphors for surfacing it don't really exist.

- The semantics of multi-master match multi-select and checkbox list interface elements.

- Relays are not sufficiently differentiated to support intelligent filtering and grouping. Users cannot currently care about the distinctions between relays, because they don't currently exist.

- The concept of "layers" in tools for video/image/graphics editing is probably the closest thing we have to a metaphor for representing two-dimensional content in multiple dimensions. Layers correspond well to dialogs, and so a first pass at this problem might be to show a feed's content modified by relay selection in a popover dialog.

I'm sure I'm not the only one thinking about this problem, so please! Take a moment to leave a comment with your thoughts, opinions, or hallucinations.

-

@ 45c41f21:c5446b7a

2023-04-05 14:03:47

@ 45c41f21:c5446b7a

2023-04-05 14:03:47This might be a very controversial feature to most of the people on nostr but, flycat is rolling out a new experimental feature that allows users to sign in and use nostr protocol via Metamask wallet and WalletConnect (both are toolchain from Ethereum and EVM compatible blockchains). You can try it at https://flycat.club/login

Since nostr is mostly gathered by Bitcoin folks, most people here might not have a good feeling about Ethereum or any "shitcoin". but I decided to experiment with such a new feature anyway, mainly for two reasons:

- I find this Nip-111 solution(which is how this feature works) interesting on an account-control level and couldn't help to get my hands on it

- To me, seems it doesn't do any harm to Nostr protocol and the current flycat user experience. if you hate Ethereum or any other shitcoin, you can close the window and abort reading this post now and it makes no difference on using flycat.

But the real reason I am experimenting with such a feature comes from one simple fact I believed, that is

Nostr is the future for social networks and it is how things are supposed to work and do right from the first day of the internet.

Of course, Bitcoin and the lighting network are the main motivation for building such a protocol at the first stage(which is currently where we are), but nostr is not only meant for Bitcoin people. it is for mainstream users and for people who don't even know about Bitcoin. that's the potential we saw from nostr.

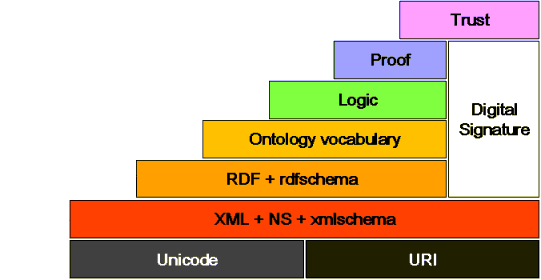

With max simplicity protocol design(literally, there are only three parts of nostr: 1. public key as account id, 2. digitally sign content, and 3. relay-to-client mode), nostr is born to be the ultimate glue layer to connect to everything from centralized services like Twitter and Facebook to decentralized networks like bitcoin and lighting.

From this perspective, I believe it is worth exploring other blockchain spaces with nostr, demonstrating and telling non-bitcoin people how it feels to have a real social network binding with your crypto wallet.

How it works

This feature is done following the un-merged proposal Nip-111. If you want to know the workflow in detail, it is recommended to read the post written by the NIP authors.

Here are some simple explanations of how the Nip-111 proposal works:

since the Metamask and Ethereum blockchains use different crypto algorithms to do signings, it is impossible to use your Eth account to sign nostr stuff (unless Metamask and other Eth wallets support the Schnorr and Nip-07). But even if they did and we can, it is also not a wise choice to mix your blockchain key with the Nostr key since there are used for different scenes.

The Nip-111 solves this problem by proposing to generate a nostr sub-account (meaning a brand new key pair). The first step is using your Eth wallets to sign a fixed message to generate a fixed signature, and then take this signature, combined with the user password, to generate a new deterministic nostr private key.

To get this private key, you must be able to sign the message(prove that you are the owner of Eth wallet) and know what the password is(another proof). If the nostr key is exposed to hackers, it doesn't affect your Eth wallet account and your assets like NFTs or ERC20 tokens.

Risk and Downside

However, this approach does come with some risks and downside that you probably needs to know before using it. Even a nostr client(like flycat) doesn't store the generated private key from your Eth account, the Nip-111 required the client to hold your private key in the browser memory.

What this means is that every time you need to do something with write access on your nostr account(or export your private key), the web client will ask your Metamask or WalletConnect to sign a message to generate the private key and then use this private key to do the writing. during this process, the private key is accessible by the web client, which brings two risks:

- you need to make sure the verify the integrity and authenticity of the web client you are using. Clients like Flycat are open-source and can be checked if it takes your private key somewhere else.

- your private key is also exposable to the XSS attack during the generating process. This one is a real issue, and I don't see a clear solution besides making careful choices with which library to use and writing careful code in the web client implementation to upgrade the XSS defense. Considering there are still some people pasting their nostr private key to the web client to use the product, I will say this problem is as bad as that.

Why it is interesting

I think the Nip-111 is interesting not only because it can get Ethereum people to use nostr, but also because it is a pattern that shows how we can do account abstraction on all the other platforms. Besides Eth, all the other blockchains can create their nostr key using similar patterns. and maybe outside the blockchain space, we can also build it for centralized services to make people migrate to nostr.

Take Twitter for example, we can design a sign-in button that says sign-in with Twitter, and when people click the button, we let users post a private tweet that's only visible to himself/herself on Twitter, we take it with their password to generate a fixed nostr private key and let them start use nostr. after some time, the user might find that the nostr is great and decide to export his nostr private key and use the private key standalone instead of signing via Twitter.

Now you might think, there is a question with the above workflows: since Twitter is centralized, the private tweet is not only readable by the account owner but also by the Twitter company!

Yes, it is. That is why if the user decides to migrate to nostr seriously, he/she should consider generating a new key instead. But this is not a real problem in my opinion, because when you choose to sign in on nostr via Twitter, the implication is that you do understand the trusted scope is narrowed down to Twitter itself.

In another word, it means you choose to trust Twitter for such an operation, so if Twitter leaks your private tweet, it is not the nostr fault. The same thing also applies to Eth wallets. You trust your Metamask or WalletConnect has no backdoor to record and steal your signature.

Conclusion

I am really curious about whether Ethereum people will come to use Nostr or not and it depends on how they react to this experimental feature. If they want to taste a little bit of how nostr feels, they might choose to use it at some risk. and then make a new account when they get serious. or migrate to wallets like Alby that support Nip-07. If you have any thoughts, please comment on this post. We appreciate your feedback.

-

@ 1bc70a01:24f6a411

2023-04-05 01:25:09

@ 1bc70a01:24f6a411

2023-04-05 01:25:09Unless you have some private projects that require secrecy, you should just organize conversations on nostr.

Smart bootstrapped founders know that one of the best ways to garner attention is by building in public.

By posting on Nostr, you are in essence building in public. This has many benefits:

- Free marketing for your project

- Recruit other designers. If they see that there are others, they are more likely to join your cause.

- Attract talent (people who are interested in the project will likely want to work on it). Find development help.

- Attract funding (even sats from plebs, bounties on your behalf, etc…)

- Help nostr grow. By getting outside the siloed communication channels, you help add activity to Nostr. When people see that it’s busy, they are more likely to participate. Nobody wants to use a dead social network (even though nostr is so much more than a social network).

How to organize on Nostr without channels or groups

A common objective is “but there is not a good client for group chat”.

Nostr IS the group chat. It's just a much larger group. All you need is a way of organizing conversations.

Enter hashtags.

Hashtags allow people to track conversations so you can see if someone is discussing #nostrdesign for example.

“But, I forget to use hashtags!”

Ok, make a SUPER simple client that automatically inserts the hashtag into the message. Hardcode if if you need to for the time being.

Clients like Snort already let you follow hashtags so it’s a matter of bookmarking it and just checking it whenever you’re online.

Don’t want a bloated client? No problem. Clone Snort, remove everything but the posting and reading functionality. Use the client only for posting and for reading that specific hashtag. Congrats, you just created your own public channel! The best part? Everyone can see it without signing up for any siloed platforms.

Act

Do it now. Close the group and let everyone know you’re using nostr from now on. No excuses, no waiting. Just do it. It may be hard and painful at first, but you'll get used to it. Who knows, it may be enough motivation to build great clients that do one thing very well. Let’s go!

-

@ 75bf2353:e1bfa895

2023-04-10 14:26:00

@ 75bf2353:e1bfa895

2023-04-10 14:26:00RIP Final Message

I have some bad news. You will die. If your the only one who knows where your bitcoin keys are, your bitcoin dies with you. That's fine. It is a noble gesture. I know some people who plan on doing this. I suspect this is what Satoshi did, but I obviously cannot verify this.

“Lost coins only make everyone else's coins worth slightly more. Think of it as a donation to everyone.”--Satoshi Nakamoto

For those of us who want bitcoin to continue beyond our graves, there are dead man's switches. A dead man's switch is like a Rube Goldberg machine. Instead of opening a door like in the movie Goonies, it sends an email to your next of kin if you die. I have used a couple of these, but final message.io is my favorite since I find it the most secure. Final message.io is essentially ransomware. That's a scary ass word for most people, but have no fear. We are doing it to ourselves like Krugman thinks we owe money to ourselves.

I am certain you already know how ransomware works.

- A company gets hacked.

- Some asshole encrypts all their files using a passphrase.

- The asshole holds the passphrase hostage.

- The company pays the ransom for the passphrase or the asshole tells the company to GFY.

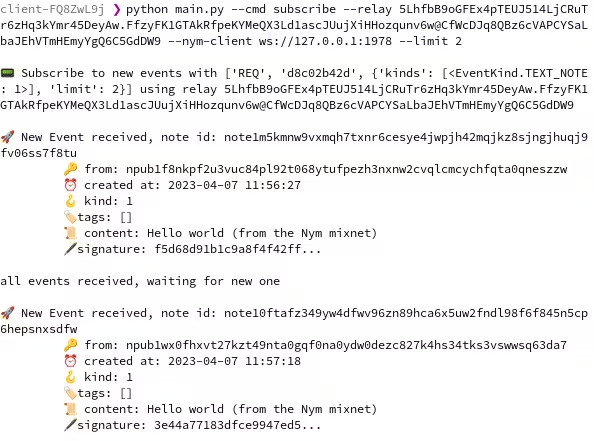

## How Final Message Worked:

Final Message works like a ransomware attack, but you're the hacker hacking yourself. You write your secret, say a key for a 2-of-3 multisig wallet.

- You encrypt this secret

- Give the passphrase to your wife, husband, child, etc.

- You upload your encrypted message to finalmessage.io

- You pay for a certain number of months.

- If you pay for more months final message will not send your encrypted secret message

- If you get hit by the proverbial bus, you stop paying the ransom and final message sends the encrypted message to your spouse.

Final Message Is Dead

I first wrote about final message in May of 2022. I intended to re-create it on nostr, but while doing this I noticed some sad news. Final Message is dead. They are no longer in business. That's too bad because I liked how it does not let you access your information unless you do not pay. It was the most secure dead man's switch I was aware of.

If you need to decrypt a message, you can do so by using the demo page here.

TODO: Add decryption tutorial

-

@ 5257f6d6:c90192b1

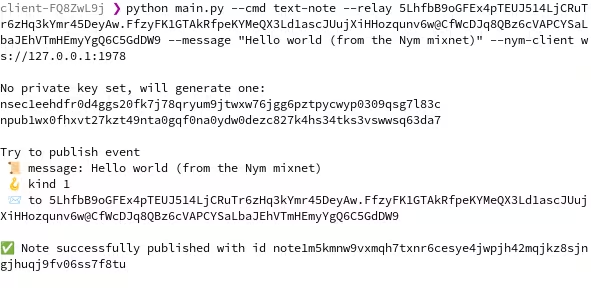

2023-04-10 03:41:31

@ 5257f6d6:c90192b1

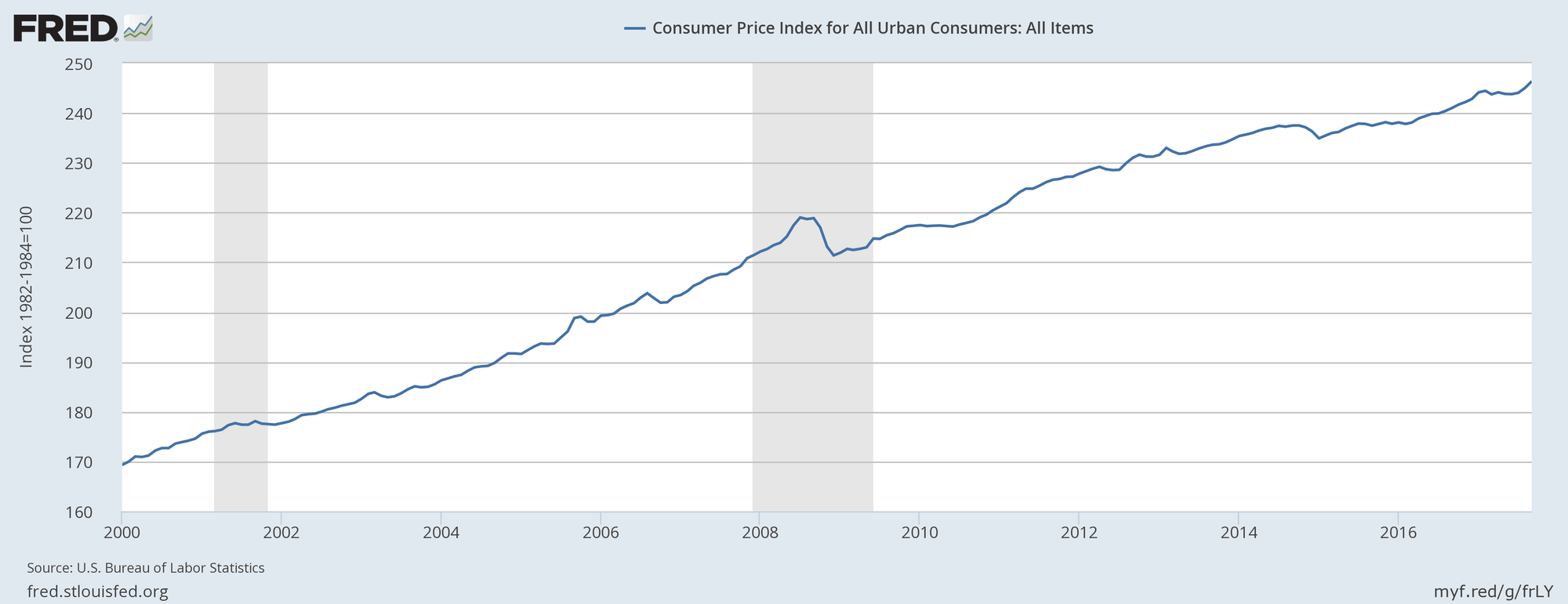

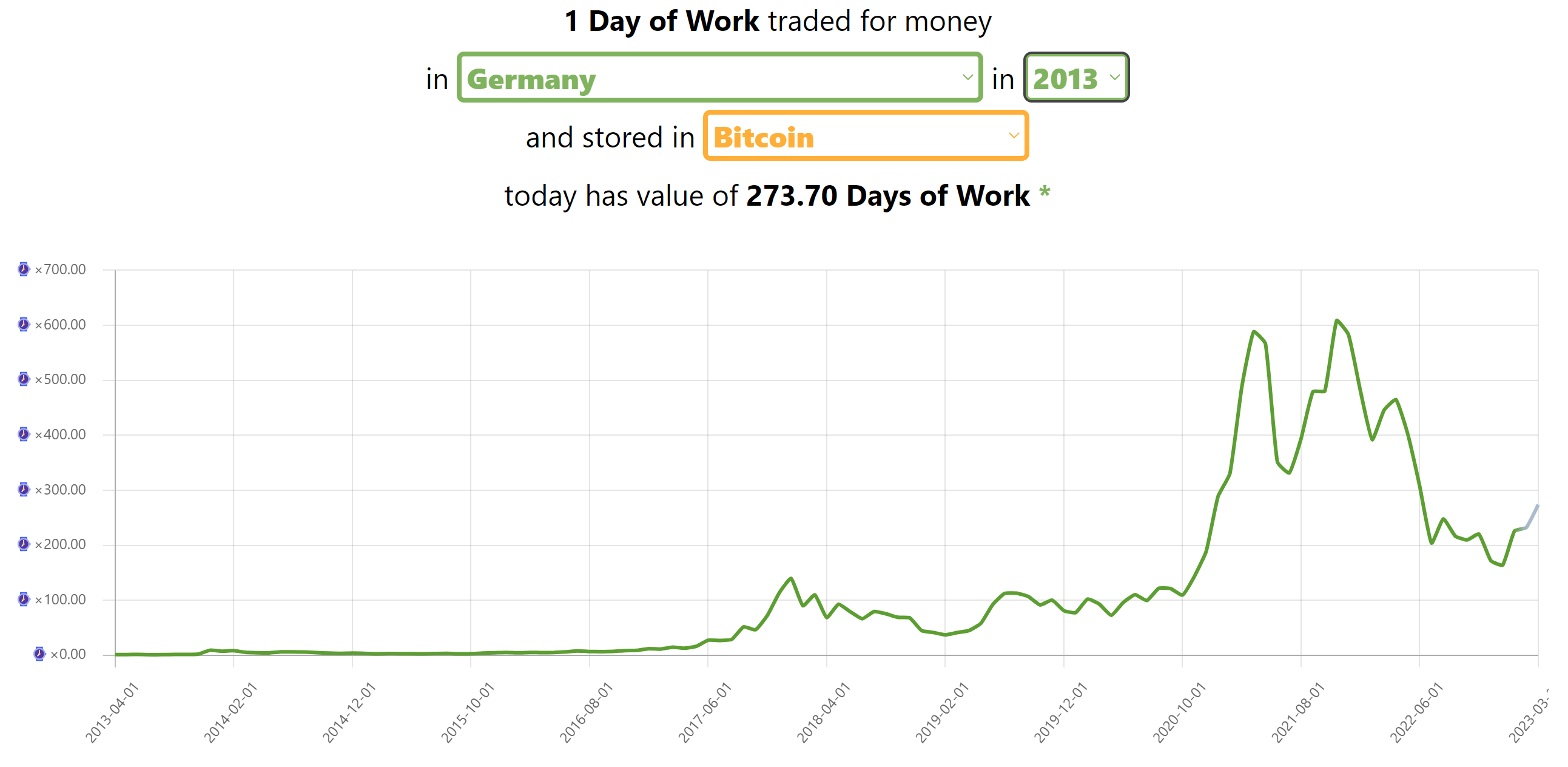

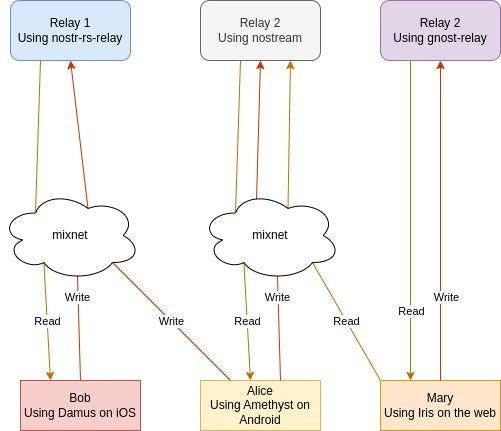

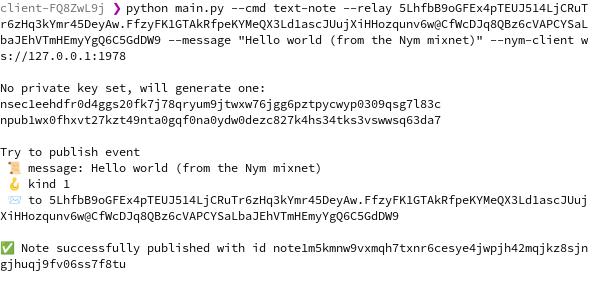

2023-04-10 03:41:31[3]

[4]

[5]

[6]

[7]

-

@ 6e468422:15deee93

2023-04-04 13:23:19

@ 6e468422:15deee93

2023-04-04 13:23:19Not too long ago, I tried to paint a picture of what a vision for a value-enabled web could look like. Now, only a couple of months later, all this stuff is being built. On nostr, and on lightning. Orange and purple, a match made in heaven.

It goes without saying that I'm beyond delighted. What a time to be alive!

nostr

Here's the thing that nostr got right, and it's the same thing that Bitcoin got right: information is easy to spread and hard to stifle.[^fn-stifle] Information can be copied quickly and perfectly, which is, I believe, the underlying reason for its desire to be free.

[^fn-stifle]: That's a Satoshi quote, of course: "Bitcoin's solution is to use a peer-to-peer network to check for double-spending. In a nutshell, the network works like a distributed timestamp server, stamping the first transaction to spend a coin. It takes advantage of the nature of information being easy to spread but hard to stifle."

Easy to spread, hard to stifle. That's the base reality of the nature of information. As always, the smart thing is to work with nature, not against it.[^1] That's what's beautiful about the orange coin and the purple ostrich: both manage to work with the peculiarities of information, not against them. Both realize that information can and should be copied, as it can be perfectly read and easily spread, always. Both understand that resistance to censorship comes from writing to many places, making the cost of deletion prohibitive.

Information does not just want to be free, it longs to be free. Information expands to fill the available storage space. Information is Rumor's younger, stronger cousin; Information is fleeter of foot, has more eyes, knows more, and understands less than Rumor.

Eric Hughes, A Cypherpunk's Manifesto

Nostr is quickly establishing itself as a base layer for information exchange, one that is identity-native and value-enabled. It is distinctly different from systems that came before it, just like Bitcoin is distinctly different from monies that came before it.

As of today, the focus of nostr is mostly on short text notes, the so-called "type 1" events more commonly known as tweets.[^fn-kinds] However, as you should be aware by now, nostr is way more than just an alternative to twitter. It is a new paradigm. Change the note kind from

1to30023and you don't have an alternative to Twitter, but a replacement for Medium, Substack, and all the other long-form platforms. I believe that special-purpose clients that focus on certain content types will emerge over time, just like we have seen the emergence of special-purpose platforms in the Web 2.0 era. This time, however, the network effects are cumulative, not separate. A new paradigm.Let me now turn to one such special-purpose client, a nostr-based reading app.

[^fn-kinds]: Refer to the various NIPs to discover the multitude of event kinds defined by the protocol.

Reading

I'm constantly surprised that, even though most people do read a lot online, very few people seem to have a reading workflow or reading tools.

Why that is is anyone's guess, but maybe the added value of such tools is not readily apparent. You can just read the stuff right there, on the ad-ridden, dead-ugly site, right? Why should you sign up for another site, use another app, or bind yourself to another closed platform?

That's a fair point, but the success of Medium and Substack shows that there is an appetite for clean reading and writing, as well as providing avenues for authors to get paid for their writing (and a willingness of readers to support said authors, just because).

The problem is, of course, that all of these platforms are platforms, which is to say, walled gardens that imprison readers and writers alike. Worse than that: they are fiat platforms, which means that permissionless value-flows are not only absent from their DNA, they are outright impossible.[^2]

Nostr fixes this.

The beauty of nostr is that it is not a platform. It's a protocol, which means that you don't have to sign up for it---you can create an identity yourself. You don't have to ask for permission; you just do, without having to rely on the benevolence of whatever dictator is in charge of the platform right now.

Nostr is not a platform, and yet, powerful tools and services can be built and monetized on top of it. This is good for users, good for service providers, and good for the network(s) at large. Win-win-win.

So what am I talking about, exactly? How can nostr improve everyone's reading (and writing) experience?

Allow me to paint a (rough) picture of what I have in mind. Nostr already supports private and public bookmarks, so let's start from there.

Imagine a special-purpose client that scans all your bookmarks for long-form content.[^fn-urls] Everything that you marked to be read later is shown in an orderly fashion, which is to say searchable, sortable, filterable, and displayed without distractions. Voilà, you have yourself a reading app. That's, in essence, how Pocket, Readwise, and other reading apps work. But all these apps are walled gardens without much interoperability and without direct monetization.

[^fn-urls]: In the nostr world long-form content is simply markdown as defined in NIP-23, but it could also be a link to an article or PDF, which in turn could get converted into markdown and posted as an event to a special relay.

Bitcoin fixes the direct monetization part.[^fn-v4v] Nostr fixes the interoperability part.

[^fn-v4v]: ...because Bitcoin makes V4V practical. (Paywalls are not the way.)

Alright, we got ourselves a boring reading app. Great. Now, imagine that users are able to highlight passages. These highlights, just like bookmarks now, could be private or public. When shared publicly, something interesting emerges: an overlay on existing content, a lens on the written Web. In other words: swarm highlights.

Imagine a visual overlay of all public highlights, automatically shining a light on what the swarm of readers found most useful, insightful, funny, etc.

Further, imagine the possibility of sharing these highlights as a "type 1" event with one click, automatically tagging the highlighter(s)---as well as the author, of course---so that eventual sat-flows can be split and forwarded automatically.

Voilà, you have a system that allows for value to flow back to those who provide it, be it authors, editors, curators, or readers that willingly slog through the information jungle to share and highlight the best stuff (which is a form of curation, of course).

Zaps make nostr a defacto address book[^fn-pp] of payment information, which is to say lightning addresses, as of now. Thanks to nostr wallet connect (among other developments), sending sats ~~will soon be~~ is already as frictionless as leaving a like.

[^fn-pp]: The Yellow Pages are dead, long live The Purple Pages!

Value-for-value and participatory payment flows are something that traditional reading apps desperately lack, be it Pocket, Instapaper, Readwise, or the simple reading mode that is part of every browser.

A neat side-effect of a more structured way to share passages of text is that it enables semi-structured discussions around said passages---which could be another useful overlay inside special-purpose clients, providing context and further insights.[^5]

Further, imagine the option of seamlessly switching from text-on-screen to text-to-speech, allowing the user to stream sats if desired, as Podcasting 2.0 clients already do.[^3]

Imagine user-built curations of the best articles of the week, bundled neatly for your reading pleasure, incentivized by a small value split that allows the curator to participate in the flow of sats.

You get the idea.

I'm sure that the various implementation details will be hashed out, but as I see it, 90% of the stuff is already there. Maybe we'll need another NIP or two, but I don't see a reason why this can't be built---and, more importantly: I don't see a reason why it wouldn't be sustainable for everyone involved.

Most puzzle pieces are already there, and the rest of them can probably be implemented by custom event types. From the point of view of nostr, most everything is an event: bookmarks are events, highlights are events, marking something as read is an event, and sharing an excerpt or a highlight is an event. Public actions are out in the open, private actions are encrypted, the data is not in a silo, and everyone wins. Especially the users, those who are at the edge of the network and usually lose out on the value generated.

In this case, the reading case, the users are mostly "consumers" of content. What changes from the producing perspective, the perspective of the writer?

Writing

Back to the one thing that nostr got right: information is easy to spread but hard to stifle. In addition to that, digital information can be copied perfectly, which is why it shouldn't matter where stuff is published in the first place.

Allow me to repeat this point in all caps, for emphasis: IT SHOULD NOT MATTER WHERE INFORMATION IS PUBLISHED, and, maybe even more importantly, it shouldn't matter if it is published in a hundred different places at once.[^fn-torrents]

What matters is trust and accuracy, which is to say, digital signatures and reputation. To translate this to nostr speak: because every event is signed by default, as long as you trust the person behind the signature, it doesn't matter from which relay the information is fetched.

This is already true (or mostly true) on the regular web. Whether you read the internet archive version of an article or the version that is published by an online magazine, the version on the author's website, or the version read by some guy that has read more about Bitcoin than anyone else you know[^fn-guy]---it's all the same, essentially. What matters is the information itself.

[^fn-guy]: There is only one such guy, as we all know, and it's this Guy: nostr:npub1h8nk2346qezka5cpm8jjh3yl5j88pf4ly2ptu7s6uu55wcfqy0wq36rpev

Practically speaking, the source of truth in a hypernostrized world is---you guessed it---an event. An event signed by the author, which allows for the information to be wrapped in a tamper-proof manner, which in turn allows the information to spread far and wide---without it being hosted in one place.

The first clients that focus on long-form content already exist, and I expect more clients to pop up over time.[^4] As mentioned before, one could easily imagine prism-like value splits seamlessly integrated into these clients, splitting zaps automatically to compensate writers, editors, proofreaders, and illustrators in a V4V fashion. Further, one could imagine various compute-intensive services built into these special-purpose clients, such as GPT Ghostwriters, or writing aids such as Grammarly and the like. All these services could be seamlessly paid for in sats, without the requirement of any sign-ups or the gathering of any user data. That's the beauty of money proper.

Plagiarism is one issue that needs to be dealt with, of course. Humans are greedy, and some humans are assholes. Neither bitcoin nor nostr fixes this. However, while plagiarism detection is not necessarily trivial, it is also not impossible, especially if most texts are published on nostr first. Nostr-based publishing tools allow for OpenTimestamp attestations thanks to NIP-03, which in turn allows for plagiarism detection based on "first seen" lookups.

That's just one way to deal with the problem, of course. In any case, I'm confident that we'll figure it out.

Value

I believe that in the open ~~attention~~ information economy we find ourselves in, value will mostly derive from effective curation, dissemination, and transmission of information, not the exclusive ownership of it.

Although it is still early days, the statistics around Podcasting 2.0 and nostr zaps clearly show that (a) people are willing to monetarily reward content they care about, and (b) the willingness to send sats increases as friction decreases.

The ingenious thing about boostagrams and zaps is that they are direct and visible, which is to say, public and interactive. They are neither regular transactions nor simple donations---they are something else entirely. An unforgable value signal, a special form of gratitude and appreciation.

Contrast that with a link to Paypal or Patreon: impersonal, slow, indirect, and friction-laden. It's the opposite of a super-charged interaction.

While today's information jungle increasingly presents itself in the form of (short) videos and (long-form) audio, I believe that we will see a renaissance of the written word, especially if we manage to move away from an economy built around attention, towards an economy built upon value and insight.

The orange future now has a purple hue, and I believe that it will be as bright as ever. We just have a lot of building to do.

Further Reading

NIPs and Resources

- Nostr Resources

- value4value.info

- nips.be

- NIP-23: Long-form content

- NIP-57: Event-specific zap markers

- NIP-47: Nostr Wallet Connect

- NIP-03: OpenTimestamps attestations for events

Originally published on dergigi.com

[^1]: Paywalls work against this nature, which is why I consider them misguided at best and incredibly retarded at worst.

[^2]: Fiat doesn't work for the value-enabled web, as fiat rails can never be open and permissionless. Digital fiat is never money. It is---and always will be---credit.

[^3]: Whether the recipient is a text-to-speech service provider or a human narrator doesn't even matter too much, sats will flow just the same.

[^4]: BlogStack and Habla being two of them.

[^5]: Use a URI as the discussion base (instead of a highlight), and you got yourself a Disqus in purple feathers!

[^fn-torrents]: That's what torrents got right, and ipfs for that matter.

-

@ 97c70a44:ad98e322

2023-03-29 19:56:16

@ 97c70a44:ad98e322

2023-03-29 19:56:16Proof-of-work (POW) is not new to Nostr. Because the protocol is "Bitcoin-adjacent", there is a general familiarity with one of the precursor technologies to Bitcoin, Hashcash, invented by Adam Back in 1997. Some users have mined keys with a certain number of leading zeroes, or with the first few letters of their handle in order to demonstrate skin-in-the-game, and there have even been some nips merged which take advantage of proof-of-work.

This blog post won't be new to people who have given much thought to the merits of Hashcash and proof of work, but I only recently discovered the benefits of POW against micropayments in some situations, and thought would be interesting to try to articulate.

POW vs Micropayments

The basic idea behind using proof-of-work in a social protocol is that having work embedded in pubkeys (or event ids) demonstrates that the person publishing the information has spent a certain amount of processing power mining the information, and therefore has invested more into producing the content that would otherwise be evident.

There is, however, another way to prove your work: micropayments. Bitcoin, being the best money, is directly based on proof of work, and so payments made using Bitcoin are a way of borrowing the proof of work already invested in minting the coins. But any token that has recognized value will also work (with less fidelity) to store your labor for later use; that's just how money works.

It's exchange of value all the way down

The advantage of using payments instead of direct computational proof of work is because the work stored in a medium of exchange is re-usable. When you buy something, the merchant isn't simply interested in having you prove you worked for your bread, they want to prove they worked to provide you that bread when they go on to make their own purchase. This is because a purchase is a "value exchange" - there is someone providing their own work in exchange for yours.

In theory, this is always true - there really is no free lunch. This is the case even for the most negligible use cases of proof of work, for example when mining an event id to get past spam filters. Someone somewhere is checking that zero, hosting, and transmitting that content, and wouldn't it be nice if they (or the final recipient of the note) could be compensated by receiving the value that you had to expend anyway? That way, you could simultaneously boost your reach and pay people to read your content!

For this reason, I used to be against POW in any amount. Direct computational work is always wasted. That's a lot of work being destroyed instead of being used to support the people running the infrastructure. And I still think payments should be preferred wherever possible. For example, one possible alternative to proof-of-work for getting past a spam filter would be to pay relays directly, and then have those relays publish an additional proof of your payment, similar to a zap note. The relays receiving your content would be paid directly, and the proof of payment would function as proof of work for all subsequent relays (or clients) receiving the event.

Nanopayments

Of course, this only works if the price tag of publishing content is significant enough to justify the extra coordination, storage, and transmission of the payment proofs. Payments also don't make sense if there is no clear recipient, if the recipient is not yet known, or if they introduce an unacceptable amount of required trust. This is where proof-of-work shines - not as a substitute for micropayments, but as a trustless, coordination-free substitute for nanopayments, which I'll define as "any payment that costs more to process that the value it is being exchanged for". In Bitcoin-land, UTXOs that can't be included in a transaction without costing more than they yield are known as "dust".

Nonopayments never make economic sense. The most obvious being as a substitute for very small amounts of work, e.g. a single leading zero on an event id. How many fractions of a satoshi would mining one digit cost? Another nanopayment that is less obvious would be payments for very long-lived value, for example to verify a public key. In this case, even though the work isn't re-usable, it continues to have utility as long as the key is in use.

Resource Auctions

To tie all this together, let's think about what filtering spam actually is. The problem with spam is that it unproductively consumes valuable resources - both computational and social - that legitimate content should consume instead. In other words, there is a limited amount of organic engagement available for content to attract, and spam undercuts legitimate content's bid for engagement by virtue of its lower cost to produce.

The traditional solution for solving contention over a limited resource is an auction. Each interested party makes a bid, and the highest bidder wins. The problem with auctions is that they require coordination to choose a winner, and participants usually have a clear idea of what the ultimate value of the good being sold actually is. This difficulty in both assessing and facilitating a transfer of value makes the advantages of payments irrelevant, leaving the only goal of the auction to impose a cost on all actors in order to reduce spam's cost advantage to a lower multiple. So, instead of spam being thousands of times cheaper to produce than legitimate content (1 minute of your time to compose a note at $30/hr is 50 cents!), it becomes only a few times cheaper. So even though POW is an inferior way to transfer value, its trustless nature makes it the best option in this case.

Conclusion

That's not to say there aren't better ways to do moderation, just that direct payments to cover resource consumption aren't the correct solution. I personally think web-of-trust is the best baseline for eliminating spam, but it does need a complement in order to introduce newcomers to the network, or promote content to interested users. This can take the form of proof-of-work for lower-stakes cases, or payments as a way of borrowing reputation from someone already established in the network for cases where the goal is not to avoid spam, but to leverage reputation external to the social graph embedded in Nostr.

Distributed moderation and content recommendations is something I'm really interested in, so expect to see more thoughts on that topic from me in the future.

-

@ 1bc70a01:24f6a411

2023-03-27 02:41:22

@ 1bc70a01:24f6a411

2023-03-27 02:41:22You may remember a documentary on Netflix that discussed the negative effects of social media - Social Dilemma. It sparked many discussions in various circles, but nothing came of it.

Well, today I want to talk about making social media healthier, if not for ourselves, but for our kids.

We have a once in a lifetime opportunity with Nostr to reshape social media clients from scratch. Let us not blindly copy existing social media behavior. After all, the definition of stupidity is doing the same thing and expecting different results. Let’s not be stupid and make social media just as, if not more addicting than before.

The big TLDR; is that social media addictive mechanisms harm self image in kids. At the time where they should be building confidence, the mechanics of social media make them feel insecure. I can only imagine the downstream effects into adulthood, but on society level it can’t be good.

Some organizations even exist to supposedly move this subject forward, but after reviewing their content, I see nothing substantial put forward. One such organization “Center for Human Technology” seems to say the right things but puts no effort into offering any actual solutions.

Strategies to make social media healthier

Let’s brainstorm some actual things we can do to limit social media addictiveness, reduce social influence and manipulation.

Boost self-esteem

Vanity metrics can play a positive role but the wrong kind of metric is more harmful than not. Follower count immediately comes to mind. You see people obsessing with their follower count, and even those not realizing they are obsessed are constantly comparing themselves to one another. You are probably one of those people. If you don’t believe me, go ahead and close down your account right now, and create a fresh one to start over. I’ll wait.

Still here? I thought so. Short of constantly deleting our accounts, we can do something else - not showing a follower metric at all.

Remove followers metrics

As drastic as this sounds, removing followers is a huge step forward to better mental health. We don’t need to see how many people follow us. As long as you can see who you follow, it shouldn’t matter who is following you.

This goes beyond Twitter-like apps. Subscriber counts on YouTube channels, on email lists, none of these things need to exist. The number of people you send something to should be irrelevant. Think about it - how does it impact the content of your message whether you have 100 followers or 10,000? It doesn’t.

Avoid algorithms at all costs

Algos are excellent at hijacking attention. They know what you like and keep feeding off you to keep you hooked. Let’s end this stupidity once and for all and say no to algorithms.

I also came to a realization that “algorithmic choice” is an illusion. The “best” algorithm will by definition be the winner and the most popular. Clients will implement the thing that people crave most until “better” algorithms get more users hooked on a client. Who doesn’t want that for their platform? Everyone. Attention is money. Attention is harm.

If we want to create a better future for our children, we’ll say no to algorithms. This means we have to accept that people will gravitate towards “cheaters” who do include “useful” algorithms in their clients. It also means we have to be willing to forgo larger profits.

Perhaps well-thought out policy can be introduced in the future that limits the harm of algorithms, but in the meantime we can take matters into our own hands and simply say no.

Improve happiness levels

Avoid news feeds

Thanks to nostr we can create clients that only handle news feeds, so we don’t really need to include them in social clients.

News keeps people down because negative news gets most clicks. We can avoid this whole issue just by not including news feeds in social applications. Less clickbaity headlines, less rage, more productive conversations.

If you still crave news, go ahead and use that nostr client designed specifically for news consumption.

Of course, we can’t stop people from sharing the news, but we can avoid algos that surface it, and avoid creating feeds specifically designed for news consumption.

News also consumed a lot of time and spreads misinformation. You get scenarios where neither of the arguers read the article in full and are arguing about something that’s not even reported. It’s painful to watch.

Then you have situations where the news is actually a narrative spun by some organization or individual who wants to influence social behavior. They may report correct information or completely misrepresent facts.

News is “bad news”. Just don’t build it into social clients intentionally.

Create happiness clients

One thing I have not seen any social media do is ask whether a piece of content makes you feel positive, neutral or negative.

In theory, we should be able to create clients that prioritize positive content. I know I said avoid algorithms at all costs, but if you wanted to create a happiness portal, you could cheat a little and ask people to market content as positive, neutral or negative, and then surface only the positive.

In my opinion this is not an ideal way to go about it, because you’re creating a different type of bubble, one where people ignore the reality of things. Yet, it is a possibility if we want to alter our mood by putting algos to work for us. At the very least it would be a fun experiment!

Reduce addiction / Save time

Disable notifications by default

You hear countless stories of people feeling better in their lives after disabling notifications. Why not make this the default behavior? “But, people won’t know if the app works!” Yeah.. it has to start some place. If we want change, we need to make tough decisions. If you want to be less extreme about it, you could disable most notifications by default, while not touching the “critical” ones. Personally, I don’t think any notification is critical, you should be completely in control over your attention and that any notification is a major intrusion into your consciousness.

With notifications disabled, we can regain time and attention. Society as a whole might think more clearly and be in the moment. I think it would be a huge step forward.

Delay notifications

Nothing sucks more time than notifications. That tiny red dot begging to be tapped. One solution to make notification less addicting short of turning them off is to delay them. We can purposely set a timer to show notifications in a delayed fashion rather than right away. This way people or kids don’t need to constantly check to see who replied or messaged you. Something as simple as a 3 minute notification delay may be sufficient to curb the constant checking behavior.

Delay reactions

Dopamine is fun, but constant dopamine in real time is unhealthy. Real time reactions force us to stare at our screens waiting for the next reaction.

We can lessen this addictive behavior by introducing delayed reactions to notes. Instead of reactions coming in real time, introduce a delay of 1-5 minutes. If you know that you won’t see any responses to your post for at least 5 minutes, it makes it easier to put down the phone and not have to constantly look to see who liked your note.

Improve Transparency

Once media organizations get on nostr, I think there’s a lot we can do to make them more transparent, accountable, and less manipulative.

One thing we can do is to create meta data for media accounts to indicate their funding sources. Everyone should be able to see who funds a certain organization (as discovered by anyone in the community and voted on by the community in terms of accuracy).

The idea is that someone could dig up funding sources for an organization and add them as meta notes to the account. The community can then collectively decide if this is accurate or inaccurate, giving others an idea if there is a certain bias involved.

Think about the Greenpeace ordeal currently happening. A meta note to indicate that Ripple, a “competing” cryptocurrency is funding them would add a lot of transparency to their claims. I think people would be less likely to believe the nonsense they are spewing.

Create a record of accuracy

Fueled entirely by the community, people could verify the accuracy of claims and indicate that in meta data. Other members can then review those claims and vote on them as well. With enough people involved, you could see if there is a sufficient sample size to indicate whether a media organization has been accurate or inaccurate in the past.

One thing we’d need to watch out here is bot manipulation. Said organizations could hire out malicious services to make it seem they are more accurate than they are typically. We’d have to think of some ways of preventing that.

The sheer lack of ratings on a claim should raise an eyebrow and whether something is to be believed or not.

The right to be forgotten

I know I will catch a lot of heat for this one. “The internet never forgets!” This is what the vast majority of people will say right away. That’s fine… but hear me out…

As builders and developers, we can form a consensus that social media data should be forgotten after x amount of time. Yes, anyone can screenshot it, mirror, put it on their own relay, rebroadcast it, yada yada yada… I get it. But that doesn’t mean we can’t create a consensus by which many builders, relay operators can voluntarily abide. It may not be a bulletproof solution, but it’s an effort that counts.

When we speak in the real world, unless recorded, our words are forgotten. A person should not be judged by a stupid thing they said yesterday, a week ago, a year ago. We can’t be in the right all the time - all people make mistakes and say and do stupid things. However, online, your word remains forever. Various servers cache, duplicate, at zero cost. I totally get that. Yet, we can still design an experience where that information disappears from our feeds, unless actively surfaced with some specific intent to surface it. I think this is a worthwhile effort that developers should consider today.

In cases where information should be saved for good reasons, someone will save it. Entire clients can and will exist to index everything, but that doesn’t mean every single client should surface every single note. People have a right to be wrong and to not be constantly harassed for what they said or did if they no longer feel or act that way.

Let’s have this conversation because no one else will

This article is meant to be a conversation starter. I really think we should weave it into the Nostr conferences as a crucial segment worth exploring and discussing. If we don’t do this, no one will. The world will continue to get gamified, attention hijacked and kids will continue suffering, depressed, lacking confidence and the tools needed to create a better world for their own kids. Let’s not fall sleep at the wheel and actually do something about it.

What other ideas do you have? Share the article and attach your own ideas.

-

@ 1bc70a01:24f6a411

2023-03-25 13:52:21

@ 1bc70a01:24f6a411

2023-03-25 13:52:21In one of his earlier talks, developer and entrepreneur Rob Walling who was previously founder of drip.com said something seemingly small but profound (paraphrased):

To increase conversion rates (people sticking around to keep using your product, and ultimately paying), get people to their “aha!” moment as quickly as possible.

The “aha!” moment is where it clicks for the user exactly why this product is awesome. It's the shortest path to awesome. Once the user sees the value in the product, they are more likely to stick around.

Product designers and developers who are aware of this, know that the name of the game is providing value, and hopefully overdelivering, as quickly as possible. This means setting aside their own desires to showcase the product in its full glory, and focusing on the essentials - minimizing the number of steps required to get to the aha moment.

Design by omission becomes important. What to not include becomes equally, if not more important as what to include. So does reducing friction. The fewer, less painful steps involved in getting insane value out of a product, the better.

This concept is a great rule of thumb for every product founder. Instead of thinking “what feature should I add to make people love this product?”, founders should be thinking “what features do I absolutely need for people to love this product?” Then de-emphasize everything else.

Nostr clients are no different from a typical startup - they should be trying to figure out the “aha!” moment, and how to get the user to it as quickly as possible.

A useful exercise I often perform is to reverse the process and start at the end - the action the user needs to take to have their minds blown. Once you figure out what that action is, work backwards to the steps where they first land on the product page, or install the app, whatever that may be. The goal is to cut out as many steps in-between as possible.

I’ll demonstrate with a hypothetical, but practical example.

Let us assume we are building a music app where people can earn sats when others listen to their tracks.

Nostr has several layers and steps that most people typically go through, for example:

- Generate key pair

- Save keys warning

- Pick a username

- Import follows (perhaps)

- In some cases add relays

- Navigate to some sort of a feed, either from follows or general

- You typically need to set up your profile if you want people to take you seriously

- Have to figure out what sats are, why anyone should care? What are these play tokens?

- If care enough, find settings to connect a wallet

- Learn about wallets (now you leave the platform to do a bunch of reading), chances are you are gone for good.

- Connect a wallet, test a payment.

- Do something for someone to find your action worthy of a zap / perhaps upload a track?

- Aha moment! You can get paid easily and fast just for interacting with people.

Perhaps you’ll also have a realization that your comments are showing cross-platforms which supercharges your content distribution, but for now we don’t need to worry about this.

Of course, some of these steps may be optional, but if we are talking about someone who knows nothing about nostr, sats, zaps, key pairs, that’s 12 steps to get to some realization of what is possible.

12 steps!

The barrier to seeing value is very steep unless you already understand the benefits of decentralized social platforms, know about bitcoin and understand the possibilities.

Sadly, this is not what an average user looks like.

In fact, if you look on Nostr.band, the stats show that the number of profiles with an LN address has remained largely flat for a long time. It’s likely that these people are mostly bitcoiners who already understand the value proposition of a lightning payment.

Now, let’s work backwards and just think through which steps could potentially be eliminated. Keep in mind, we are talking about a music client.

Let us assume that the aha! moment is someone getting paid for their creative work (music). I think this is a safe assumption.

Final step: Pay bills with your creative work

This is going a bit beyond the aha moment, but we’ll roll with it.

Let’s ask some questions…

- What’s the fastest way to demonstrate that a user can collect payments for uploading tracks? How about a web client that is visible without logging in? Perhaps you can see some songs right away and notice that they are earning money? It’s not a personal aha moment, but it’s a preview.

- Can we get the user to skip signup entirely?

- Can the user upload a track as step 1?

- Can they see their local currency as a payout option?

- Can they collect payment in their local currency?

- Do they need to know what sats are? At least initially?

- Do they need to care about relays and everything that this entails?

- Do they really need to connect a wallet to get paid?

- Do they really need to follow anyone to see a feed?

- Are usernames even important to see the value in this product?

- Do they need to learn about cryptographic key pairs? How can we delay this step?

Having asked all of these questions, we can draft an ideal scenario. It may not be realistic, far from it, but at least we know what an ideal and amazing journey would look like.

- Land on a website and see that people are getting paid in your local currency for the same work you offer. Hey, maybe I should try this? 🤔

- What’s this.. a button to upload music? Ok, I have a file sitting on my drive, or have a link handy, let’s do it! Go ahead and add the track (as few steps as possible). Holy shit, I can add splits? Sounds crazy.. ok, let’s keep going.

- Now that I’ve made progress in adding some information, it seems I need to sign up to finish. Makes sense. One or two clicks, I’m in and my track is added.

- Aha moment: I go eat dinner, come back an hour later and see that I’ve just earned $5. It ain’t that much, but it didn’t take long! Turns out new tracks go into the new tab and people can stream them which goes directly to your wallet.

- Final step: I click a button to cash out, in my local currency. The funds arrive in my bank account. Now I can pay my bills.

It may not be a feasible flow, or even a desirable one, but at least we can see that an amazing journey might only take 3-4 steps. It is still using the old money rails for some parts of the app, but the artist can get paid for their work fast and can come to a realization that there might be something to this.

We don’t need to create this specific journey and outcome, but we can use it as a baseline.

As a technical founder / developer you will have a better idea of what is possible. Perhaps new services need to be created to get to our end state? This exercise gives us a lot to think about.

In our example, we might be able to:

- Let users preview the product without signing up

- Have built-in wallets that require no additional setup (with the ability to customize your experience later in the options)

- Display earrings in local currencies while slowly introducing sats, zaps (surely there is an API that can handle sats to local currency conversion in real time? If not, maybe it has to be created?)

- Allow users to cash out into local currency. Why do we need to keep them in sats? Why not let them make their own option? If this is not possible to do - Why? What service needs to exist to allow lightning-enabled apps to tap into easy, plug and play fiat conversion?

- Let users discover relays later on instead of right away to keep them from being overwhelmed.

Even if some of these things are not technically feasible, at least we are now thinking about the flow from a user’s perspective and empathize with them. We start thinking about their time, their needs, their existing frustrations and how we might be able to brighten their day.

This user-centric approach helps founders skip the fluffy parts and focus on the guts that truly matter.

New founders specifically tend to enjoy adding features, thinking the next one will do the trick, only to be disappointed.

I encourage Nostr client developers to start thinking about their users as customers who are looking to solve their own problems.

- How might you make that journey as effortless as possible?

- What is your customer truly seeking? Is it distribution? Is it attention? Is it money?

- Are you delivering it in as few steps as possible?

- Can the “customer” take a more familiar path to get to the same decentralized destination that we all love?

-

@ 34c0a532:5d3638e4

2023-03-16 13:14:53

@ 34c0a532:5d3638e4

2023-03-16 13:14:53Most bitcoiners have their own, much different definition of what it means to orange pill a person. I’ve seen mentions of getting a taxi driver to download a lightning wallet and sending the payment in sats to them. Is that truly orange-pilling? Hmm… no. It is a great first step, but what makes you believe that that person won’t go on to shitcoins after learning about the ease of using cryptocurrency?

So, let’s define what that is in the terms of this guide.

To orange pill someone means to get them to take the first step into learning about bitcoin, money, self-custody, being sovereign, and to teach them to start questioning the world of lies we’ve been fed our entire lives.

Too poetic? Okay, here’s a more specific one:

To orange pill someone means showing them how to send and receive a bitcoin transaction, explain to them the importance of keeping their seed words safe, and showing them more articles, books and guides so they can go further down the rabbit hole.

I think that’s better, don’t you?

No matter what your definition of orange-pilling is, let’s discuss a few things first.

Orange-pilling comes from the scene in the Matrix where Morpheus offers the blue and the red pill to Neo.

This your last chance. After this there is no turning back. You take the blue pill, the story ends. You wake up in your bed and believe whatever you want to. You take the red pill, you stay in Wonderland, and I show you how deep the rabbit hole goes. Remember, all I’m offering is the truth. Nothing more. ~ Morpheus

The fact that the terms comes from the Matrix is absolutely perfect, because the Matrix is based on Plato’s Allegory of the Cave. Everybody knows the Matrix so let’s talk about the Cave. Inside the cave, people are chained up, in the dark. The only thing they can do is talk to each other and stare forward, where there’s a dim light on the cave’s wall. Someone is moving around objects, throwing shadows on the wall. The people can never see the three-dimensional object, they can only see a shadow, a projection of it, so their world is limited by that knowledge.

Someday a group of people manage to break out of the Cave. They go out into the light, their eyes hurt, the world is massive, they get a panic attack by the lack of a rock ceiling on top of them. It’s vast, it’s too much to bear. And they run back into the cave and tell everyone what they saw, that it’s too bright, too open, too much everything. Objects are real, there’s light everywhere and colours. So many colours, not just the flame, the rock and the shadow.

And they don’t believe them. Maybe they even get angry at them and attack them. Who are these fools to claim that the world is not what they think it is? Who are they to suggest that we’ve all been lied to all our lives?

And that’s the first thing you need to keep in mind when trying to orange pill someone.

Why do some people find it so hard to believe in bitcoin?

The answer is simple. It’s because understanding bitcoin requires acknowledging you’ve been tricked your entire life.

The culture shock is real, I’ve been through it. The stages are as follows:

What is money? You start to learn what money really is, and how fundamentally flawed the Keynesian system has become. You see that the only way forward is by a hard money standard, whether that’s gold or bitcoin. Then you realise that in a world of information, the only logical step is bitcoin. Then why bitcoin? You start to read about it’s properties. It’s antifragile, decentralised. Why is that important? Nobody can control, it great. Why is it like gold that can be attached to an email? Then there’s the anger and disbelief. We’ve been fooled. Why doesn’t everybody see this? You read everything about bitcoin, you listen to podcasts, talk on bitcoin twitter and nostr with other plebs. Nobody seems to have all the answers but they make far more sense than the lies of the mainstream media. You talk to your friends and family, you come off as crazy at best. As I said, you have to acknowledge the trauma the other person is going through. It’s a culture shock, and not many want to go through with it. Think of Plato’s Allegory of the Cave, people who got out into the world went back and told everyone that there’s more to life than the shadows on the wall. Or, the same allegory being told by the Matrix, with Cypher wanting to go back, to forget.

We call that Bitcoin Derangement Syndrome, BDS. It’s hilarious but it’s so real. Many early bitcoiners, people who have spend years of their lives either advocating for it or working on it, some making or losing fortunes in the process, go back to the fiat world, shift gears completely, rant and rave against bitcoin and dive back in the Matrix, the Cave, taking the blue pill. They want to be fiat rich, they lie and delude themselves that everything is okay in the world and if they get just enough money they’d be okay.

But they won’t. This is real, and no matter how many lies they tell themselves things will not change unless we change them ourselves. Babies are dying, that’s true. In wars, in artificially induced poverty, in carrying on with the Keynesian ways of thinking of endless imperial expansion and exploitation.

I’ll be honest, bitcoin rewires your brain.

Do you really wanna force that on people?

Yes?

Then let’s read on.

Why is it sometimes so hard to explain, persuade or convince people about bitcoin? Here’s a harsh truth. It’s because you’re the counterparty risk.

When your car breaks down, you go to a mechanic, you seek expert knowledge. He tells you what’s wrong and you generally accept it. Why? Because unless you’re an expert on cars, you don’t have pre-existing knowledge about this specific situation. Nature abhors a vacuum. The mechanic’s knowledge and expertise fills up that vacuum of knowledge.

Why is it different with bitcoin, then?

Because most people believe they already understand money. There’s no vacuum for their knowledge to fill. Like a woman going to a male gynecologist thinking she knows better because she’s the one with the female body, a nocoiner believes they know better because, see? They have been handling and making money all their lives! Who are you to claim things aren’t how they used to think they are?

Yes, sure. You’re the one with the female body, you’re the one with the wallet. But have you actually taken the time to study it? Have you invested the necessary six years in medical school or the 100 hours it takes to grasp bitcoin?

No.

But they don’t accept that. When you make statements about bitcoin, it collides with their pre-existing frame of reference. When that happens, their mind reflexively casts doubts on the new information, actively fights it and rejects it, because it doesn’t conform to what they know. Their mind is the bearer asset, you are the counterparty risk.

Okay, great. How do you overcome this, then?

By taking the time with them. You can’t force someone to get orange-pilled, it’s not shoving knowledge down their throats. They have to do it themselves, so you start small. Plant a seed. Make them question what they know. That tiny seed, just like in Inception, will grow and push aside the other propaganda in their minds, leaving some space for new information to fill the void.

“Why did they stop having money backed by gold?”

That’s one seed.

“Who prints all these new billions?”

Another. Take your pick, it depends on the person you’re talking to.

A good question makes the nocoiner access their accepted knowledge. They usually think they have the answer and you should listen to it, not shutting it down. Ask them to research it further, to back their claims, to look things up. If they don’t have the knowledge, a new vacuum is created and their curiosity will want to fill it up.

Nocoiner: Bitcoin isn’t backed by anything.

You: Okay. Then what would make good money in its place?

Make them talk by asking questions. As they talk, they’ll realise they have massive gaps in their knowledge. You can help them then, but they themselves have to fill up those gaps by asking more questions and getting them to talk more. Why? Because if someone tells something to themselves they will believe it much easier than having you say it to them. Try and lead them to conclusion, a revelation.

When persuading someone, the person talking the most is the one really getting persuaded. Why? Because when you talk you engrave those words into your brain as facts.

Nocoiner: Bitcoin wastes too much energy.

You: How do you determine how much is too much energy to use?

You will never change their minds, they have to change it themselves. You can only help show them the way, they’re the ones that have to do it. Questions are the key to that process.

Tell them less, ask more.

What questions make people curious about bitcoin? You never know, it depends on what ails the person. Think about their pain. If they’re living in Turkey or Argentina, for example, their pain is massive inflation. You might say, “You’re already using USD to protect your monetary value against inflation, right? How about adding BTC to the mix?”

People in those countries generally grasp this concept a lot quicker. The local lira is the crap kind of money, they spend it often. The USD is the good kind of money, they save it, spending it only when absolutely necessary. And gold is the best kind, keeping it hidden in safes and mattresses. Only to be spent in an emergency. They don’t have the financial privilege to insulate them from the need for bitcoin, they already get these layers of hardness in their money, so bitcoin is a lot easier for them.

“What is money?” is another good question. Most people will answer it, and of course it will be flawed and all over the place. Then you might say, “It’s the promise of future value,” and then discuss how bitcoin has a monetary policy that’s planned out for the next 120 years and how nodes and miners facilitate that design. And especially point out how hard it is to change.

“What happened in 1971?” That’s a good one. Get them to look up the fiat monetary system and figure out how it’s not backed by anything. Get them angry at the Keynesian economists, how they’ve ruined entire countries. 2008 money crisis? Inevitable, under the fiat standard. Forget about bitcoin, point your finger towards the rot. It’s all historical fact, they can’t call you a conspiracy theorist. Most people still think that money is backed by gold. Get them to tell it to other people, see their reactions.

This was a part of my guide. Let me know what you think. Soon to be posted at https://georgesaoulidis.com/how-to-orange-pill-people/

-

@ 3bf0c63f:aefa459d

2023-03-04 11:41:00

@ 3bf0c63f:aefa459d

2023-03-04 11:41:00The current plan consists in giving out money not for specific tasks, but for general open-source efforts that seem to be worth it according to my own completely arbitrary and subjective judgment and hand out microbounties to these.

The idea is that people will give a little more priority working on Nostr things that they already wanted to because they have a chance of getting a microbounty for it while if they work on another side project like a rollercoaster building game they don’t have that chance (although rollercoaster building games have other advantages).

If you have any micro project idea in your head (or half-done) message fiatjaf at https://t.me/fiatjaf and he may decide to preassign a bounty to it conditional to your completion of that same project in case he finds that to be worth pursuing. The plan is that this will work because you are already interested in the thing and not just doing it for the money, as it is the case with normal bounties.

Here is a list of themes that I currently think are worth exploring more, to serve as an inspiration: Themes

- Microapps (Nostr apps that do only one thing and do it well), for example:

- An app for just publishing things and reading replies

- An app for just managing your contacts

- An app for just reading threads

- Native apps instead of web

- Pull requests that add these nice features to existing clients instead of making a new client

- New use cases besides “social” but that still deliver interoperability and standardized behavior between clients

- Bonus points if these new use cases can be interacted with with from the “social” clients in some way, e.g.

- if you do webpage comments on Nostr you can see and interact with these from social clients as normal posts

- If you do wikipedia on Nostr you can comment on these articles from social clients

- Usable tricks to secure keys that can still work in practice, some stupid examples:

- A client (or addition to existing clients) that stores encrypted Nostr on the user’s Google Drive and the decryption key for that on a custom server

- An integrated multisig server that signs stuff upon request

- Relay discovery

- Because we should not assume everybody will always be in all relays or that clients will talk to all relays all the time forever

- Making existing things

- Prettier

- Faster

- Non-public relays use cases

Bounties given

February 2023

- styppo: 5,000,000 sats - https://hamstr.to/

- sandwich: 5,000,000 sats - https://nostr.watch/

- BOUNTY: Relay-centric client designs: 5,000,000 sats https://bountsr.org/design/2023/01/26/relay-based-design.html

- BOUNTY: Gossip model on https://coracle.social/: 5,000,000 sats

- Nostrovia Podcast: 3,000,000 sats - https://nostrovia.org/

- BOUNTY: Nostr-Desk / Monstr: 5,000,000 sats - https://github.com/alemmens/monstr

- Mike Dilger: 5,000,000 sats - https://github.com/mikedilger/gossip

January 2023

- ismyhc: 5,000,000 sats - https://github.com/Galaxoid-Labs/Seer