-

@ dfa02707:41ca50e3

2025-06-18 23:02:15

@ dfa02707:41ca50e3

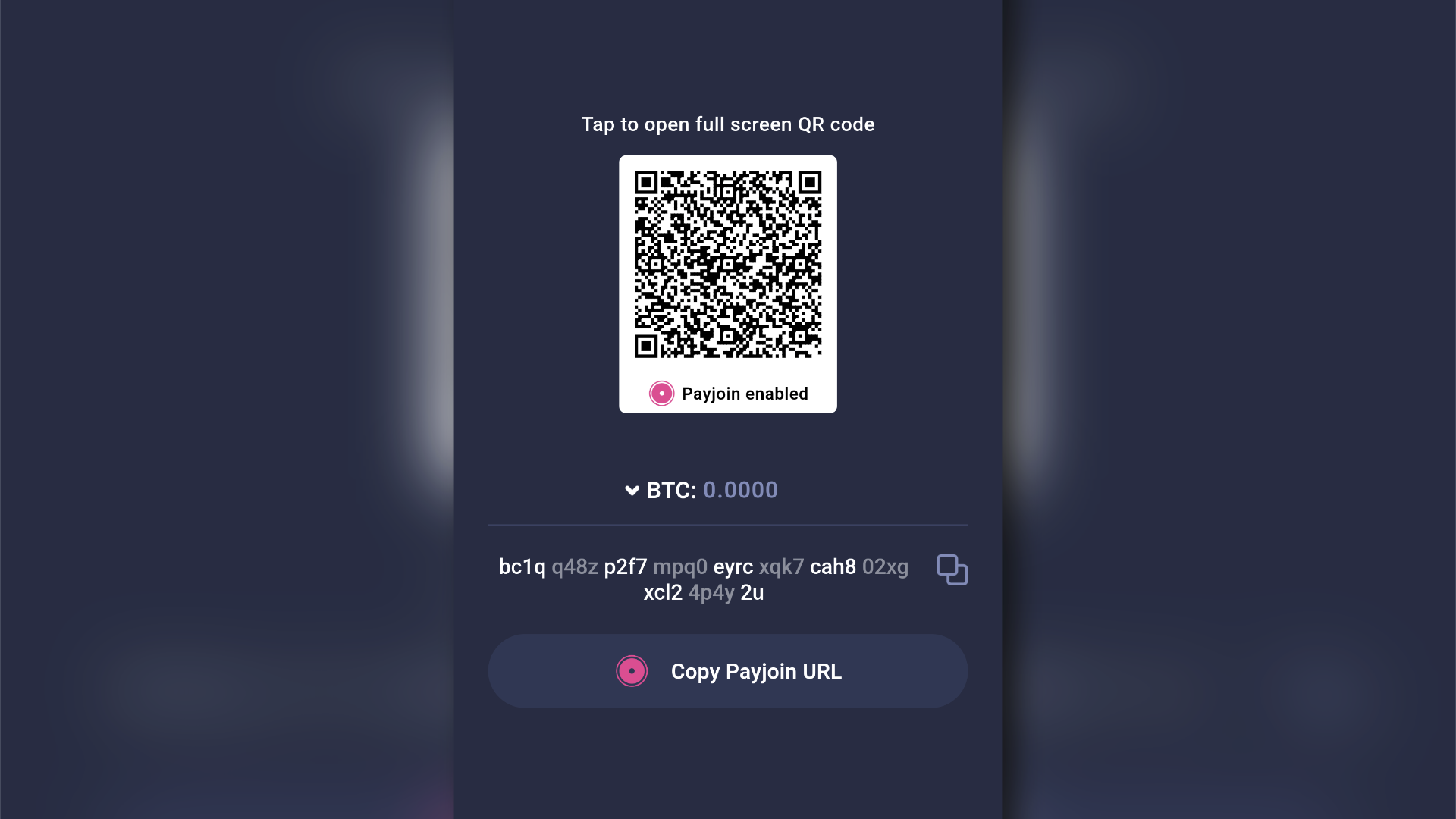

2025-06-18 23:02:15- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ 9ca447d2:fbf5a36d

2025-06-18 23:01:55

@ 9ca447d2:fbf5a36d

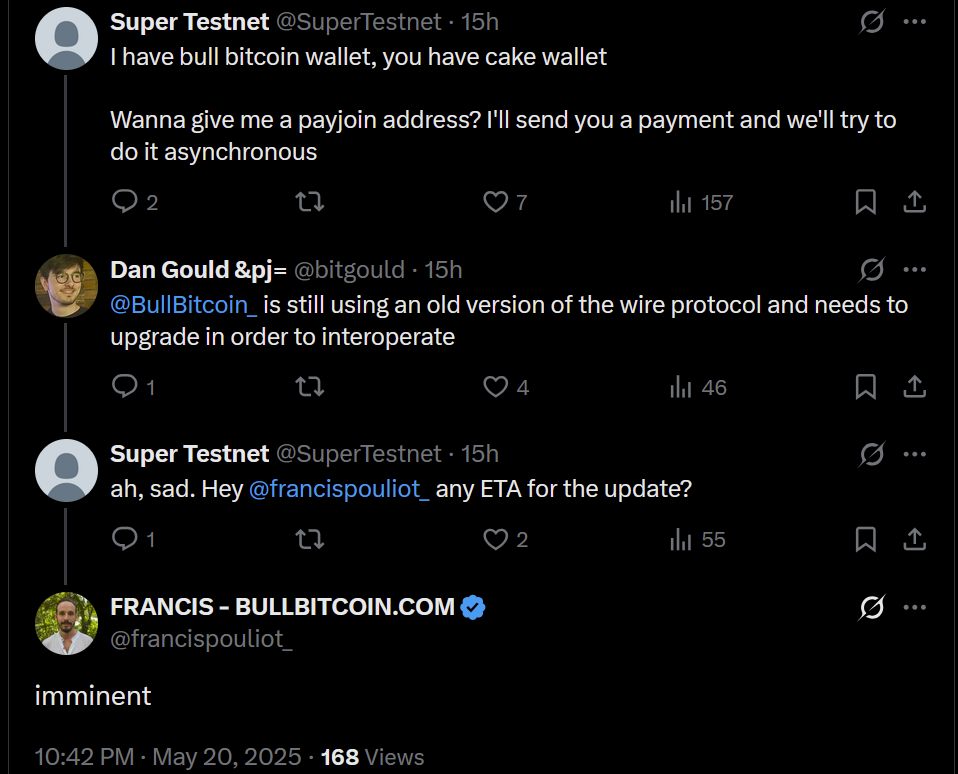

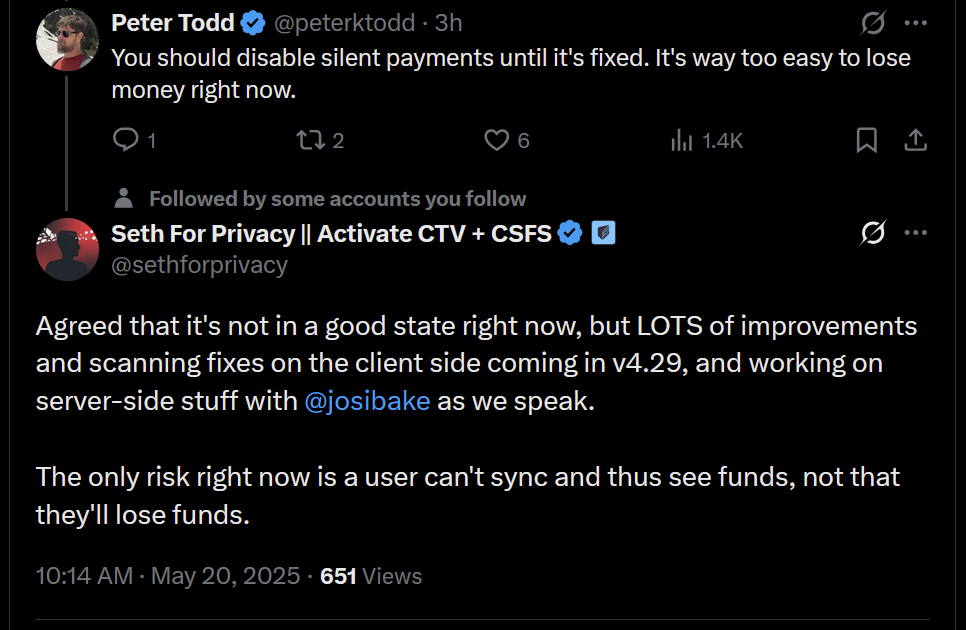

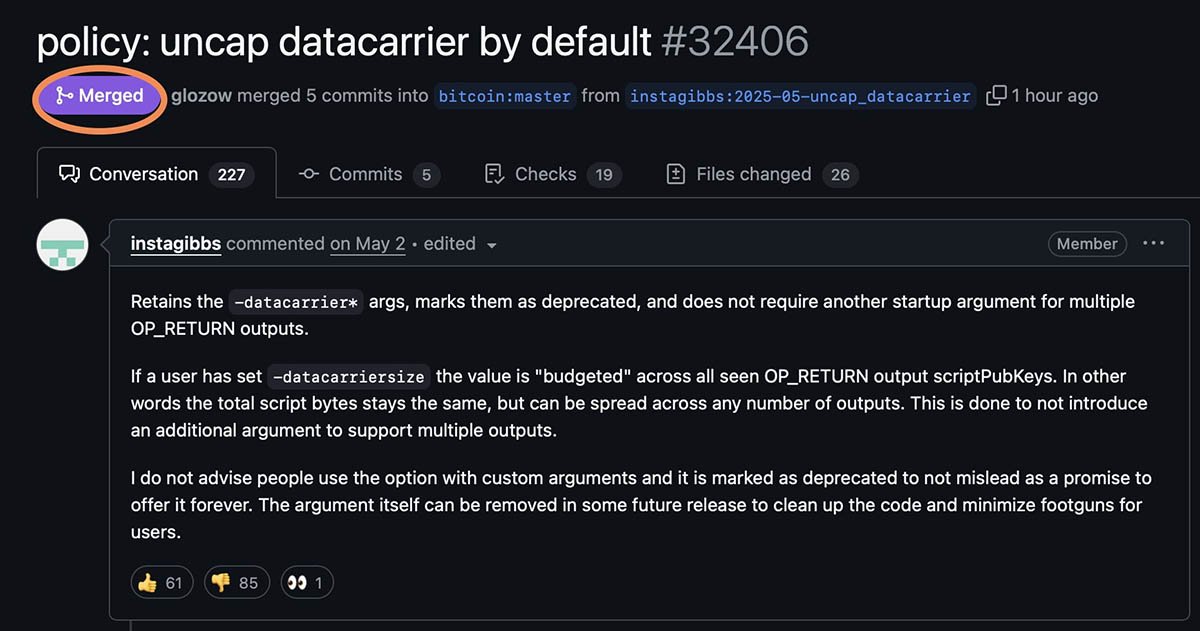

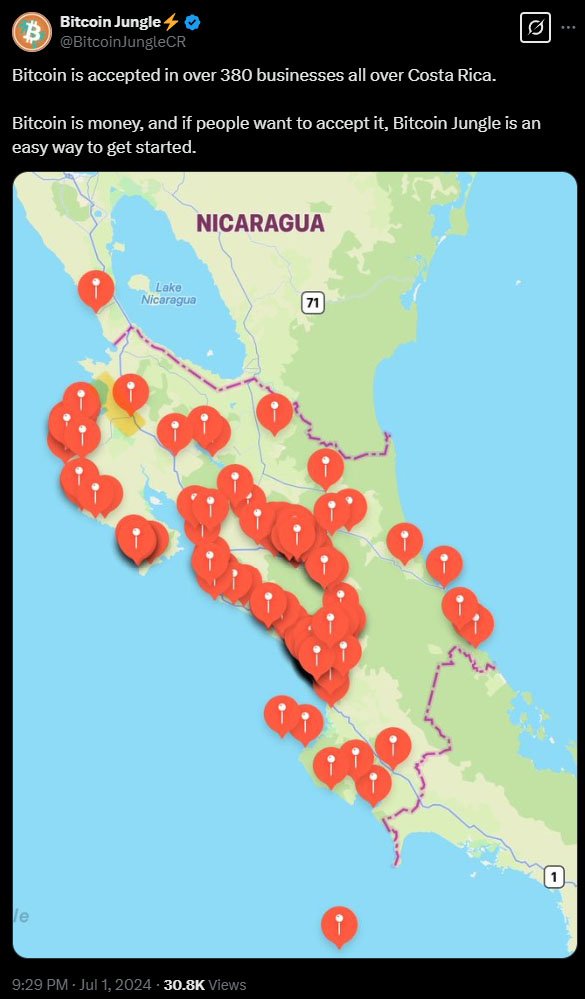

2025-06-18 23:01:55Bitcoin Core Github page announced yesterday that Core Developers have merged pull request #32406, removing support for “-datacarrier” argument for Bitcoin Core software in their next release, expected to be published in October.

Pull request #32406 has been merged — Github

This is the latest development regarding the initiative brought forth by Bitcoin Core developer Peter Todd, which has caused intense debate among Bitcoiners, now known as the “spam wars”.

The disagreement is over a change to Bitcoin Core’s transaction relay policy that removes the OP_RETURN data limit, which some see as a threat to Bitcoin’s very purpose, while others see it as a necessary step to preserve decentralization and censorship resistance.

OP_RETURN is an arbitrary piece of data that can be amended to a bitcoin transaction, and used to be limited to 80 bytes. Users have found ways to go around this limit already and have uploaded larger data to the Bitcoin blockchain, including photos, audio, and even entire computer games.

Bitcoin Core allows for extra arguments when running the application, one of which is the “-datacarrier” argument, which tells the application to not accept transactions including larger OP_RETURN data into its mempool.

Now this argument is marked as “deprecated”, meaning it is not supported or developed anymore, and is expected to be completely removed in future versions.

This will make accepting Bitcoin transactions that contain non-financial data mandatory for anyone running future versions of the Core software.

Prior to the merging of the mentioned pull request on the morning of Monday June 9, a joint statement from 31 Bitcoin Core devs was released on June 6, reheating the already controversial debate in the Bitcoin community.

In the June 6 statement, Bitcoin Core devs explained how they think Bitcoin nodes should handle transactions that include non-financial data, like digital art or messages. This type of data has become more common with Ordinals and inscriptions.

Related: Discussions Heat Up Among Bitcoin Devs Over OP_RETURN Proposal

Core developers said they are not endorsing non-financial use of Bitcoin, but also won’t stop it. Their main point is that Bitcoin’s strength is in being open and censorship-resistant. They wrote:

“This is not endorsing or condoning non-financial data usage, but accepting that as a censorship-resistant system, Bitcoin can and will be used for use cases not everyone agrees on.”

They say it’s up to users and node operators to decide what kind of Bitcoin software they run. Bitcoin Core won’t block transactions that have economic demand and will be mined.

“Being free to run any software is the network’s primary safeguard against coercion,” the statement added.

The policy change goes back to a May 8th upgrade (announced by Core contributor and Engineer at Blockstream, Greg Sanders), where devs removed the long-standing 80-byte limit on OP_RETURN output size.

This limit was meant to discourage non-payment data usage, but devs say it no longer serves that purpose.

“Retiring a deterrent that no longer deters” makes sense, they argue, because people have already found ways to add large data to the blockchain.

They also point out that removing the cap may help miners and users more than it hurts. They claim the new approach helps predict which transactions will be mined, speeds up block propagation and helps miners find fee-paying transactions.

“Knowingly refusing to relay transactions that miners would include in blocks anyway forces users into alternate communication channels,” they explained, warning this could harm decentralization.

The response has been mixed.

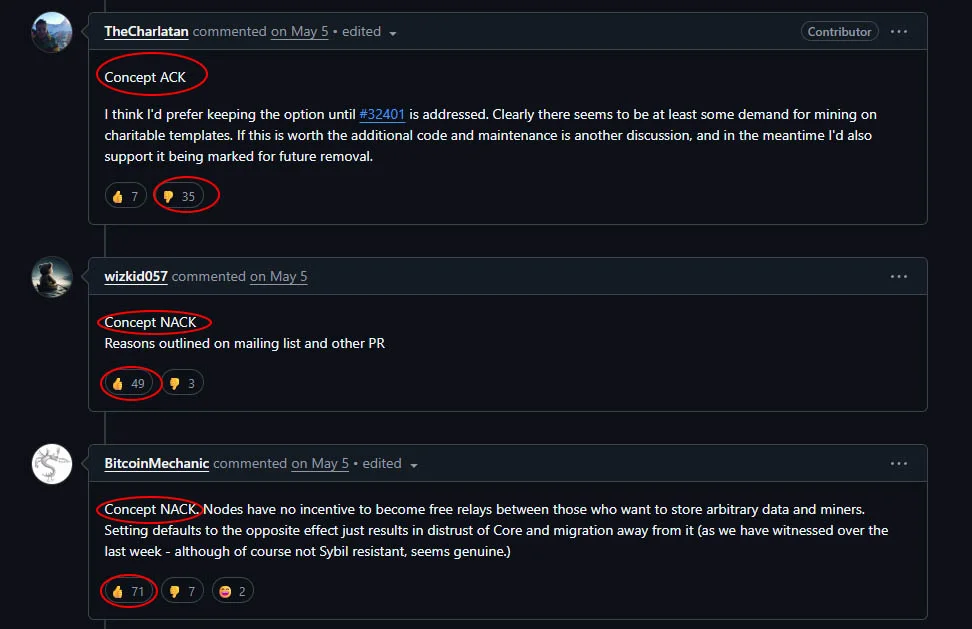

The announcement of the merge received 64 upvotes and 93 downvotes from reviewers, showing the community is mostly against this action. Comments explaining their dissatisfaction with the merge also received the support of the majority.

Reviewers who voted ACK (acknowledgment and agreement) were downvoted, and the comments voting NACK (disagreement) received more upvotes.

Comments regarding the recent merge — Bitcoin Core Github page

Critics say it opens the door to blockchain spam, higher fees and more bloat on the blockchain with non-financial content. They say Bitcoin should stick to its original purpose as a “peer-to-peer electronic cash system”.

Samson Mow, CEO of JAN3, was one of the most vocal critics. He said the devs are removing the barriers that protect the network from spam.

“Bitcoin Core devs have been changing the network gradually to enable spam,” Mow said. “It’s disingenuous to just say ‘It is what it is now, too bad’.”

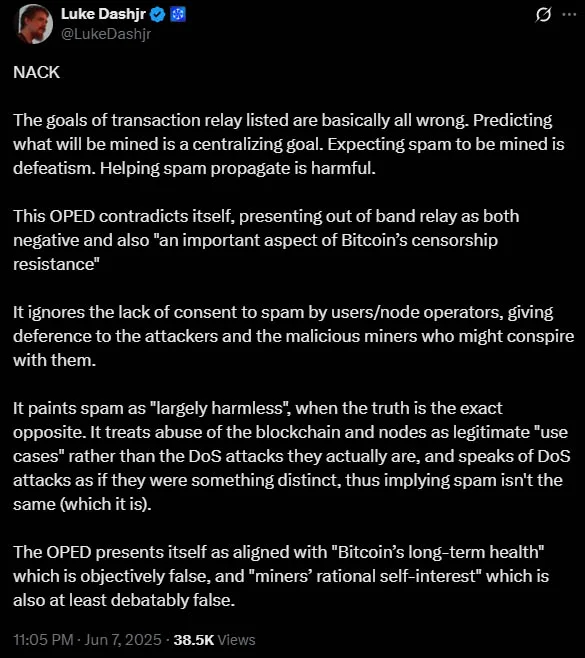

Bitcoin dev Luke Dashjr also criticized the move, saying it undermines Bitcoin’s core function. He called the devs’ goals “basically all wrong” and said expecting spam to be mined is “defeatism”.

Luke Dashjr on X

One user said: “It’s Bit”Coin” not Bit”Bucket” or Bit”Store” or whatever general purpose data store you have in mind. It’s a peer to peer electronic cash system”.

Another user chimed in, warning it could increase costs, reduce efficiency and even hurt long-term scalability.

Their argument is simple: if nonfinancial data is allowed to be stored on the blockchain, it will increase its size over time, storing useless data, and it will hurt decentralization, as fewer individuals will be able to host the entire blockchain on their computers.

They argue allowing people to store whatever they want on the blockchain because transactions shouldn’t be censored, will lead to hurting bitcoin in the long run. Many even argue no additional information should be allowed on the blockchain at all.

But not everyone is unhappy.

Some like Jameson Lopp, co-founder of Bitcoin wallet provider Casa, praised the devs for being transparent and consistent.

“Core Devs are a group saying we can’t force anyone to run code they don’t like,” Lopp said. “Here is our thinking on relay policy and network health.”

Lopp believes a joint statement helps the public understand what the devs stand for.

Supporters also say in a truly decentralized system, devs shouldn’t be gatekeepers. Instead users and miners should be able to decide what goes on the blockchain.

With opinions so divided, the future of Bitcoin may be more contentious. Some predict a fork to create a version of Bitcoin that only deals with monetary use. Others expect new wallet and node software that lets users choose to filter out large data or allow it.

Despite the controversy, the devs are standing by their decision. “While we recognize that this view isn’t held universally,” they said. “it is our sincere belief that it is in the best interest of Bitcoin and its users.”

-

@ b1ddb4d7:471244e7

2025-06-18 23:01:34

@ b1ddb4d7:471244e7

2025-06-18 23:01:34That’s exactly what Simplified Privacy VPN is offering: a new kind of privacy tool that feels more like spinning up a secure, disposable virtual browser than using a traditional VPN.

Most of us know what a VPN is: it hides your IP address, encrypts your traffic, and gives you a bit more control over your privacy online. But what if you could go way beyond that—without setting up a complicated system, running a full virtual machine, or revealing anything about yourself?

What Makes It Different?

When I tried it myself, I realized this wasn’t just another VPN. It didn’t just route my traffic—it gave me access to a completely separate browsing environment. Imagine logging into a private, anonymous machine in the cloud, one that:

- Has its own browser and system settings

- Can’t see your personal files, history, or identity

- Randomizes details like screen size and timezone

- Leaves no trace once you’re done

This isn’t just hiding your IP—it’s giving you a fresh, secure web session that’s disconnected from your actual device.

Simplified Privacy VPN: The Lightning-Powered Twist

Here’s where it gets even cooler for us in the Lightning world: access costs just $1 in bitcoin via the Lightning Network.

You send a few sats, and within seconds you get access to a private browser session that lasts for a full month. Want a different profile or setup? Just pay another dollar and spin up a new one—no account, no email, no friction.

You can create as many instances as you like, each with its own identity. This is microtransaction-based privacy in action—exactly the kind of innovation Lightning enables.

Excellent Support, Secure Channels

I also tested their support team with a couple of questions—one technical issue and one feature request. Support is offered through secure, privacy-respecting channels, including Session chat. Responses were fast, friendly, and helpful. Even more impressive: my feature request was implemented not long after I sent it in.

In a space where many privacy tools leave you to figure things out on your own, this kind of responsive support makes a big difference.

Why This Matters

For journalists, activists, developers, or just regular folks who don’t want Big Tech watching their every move, this setup is a game-changer:

- More realistic protection than just using incognito mode or a VPN

- No need to trust the website, since this system isolates the browser to its own filesystem

- No need to trust the app, since it doesn’t require root access or your system password.

- Instant access with no signup or personal info

- Perfect match for Lightning’s low-cost, no-middleman model

One Note of Caution

While the system is impressive and genuinely different from anything I’ve seen, the project is still early and niche. The website and team aren’t as well-known as major VPN providers. So use it like any experimental tool—test it, learn from it, but don’t put all your trust in one basket yet.

Final Thoughts

In a world where online tracking is getting creepier and centralized control is tightening, SimplifiedPrivacy.com is pushing in the opposite direction: easy, user-controlled privacy with zero setup and lightning-fast access.

If you’ve got a dollar and a need for a little online invisibility, this might be one of the best ways to spend your sats.

-

@ cae03c48:2a7d6671

2025-06-18 23:01:13

@ cae03c48:2a7d6671

2025-06-18 23:01:13Bitcoin Magazine

K33 Announces Plans To Purchase Up To 1,000 BitcoinK33 AB, a leading digital asset brokerage and research firm, announced today the launch of a SEK 85 million direct share issue to fund the purchase of Bitcoin. The company aims to build Bitcoin as a core asset on its balance sheet, targeting the accumulation of up to 1,000 BTC as a strategic reserve.

PRESS RELEASE: K33 launches a share issue to finance the purchase of up to 1000 Bitcoin, with a minimum of SEK 85 million secured through pre-commitments pic.twitter.com/sG1LZjR6EI

PRESS RELEASE: K33 launches a share issue to finance the purchase of up to 1000 Bitcoin, with a minimum of SEK 85 million secured through pre-commitments pic.twitter.com/sG1LZjR6EI— K33 (@K33HQ) June 18, 2025

The share issue, priced at SEK 0.1036 per share, is fully backed by existing shareholders and new investors. Proceeds from the raise will be used exclusively to acquire BTC, supporting K33’s accumulation strategy revealed in May. By acquiring BTC, the company aims to strengthen its balance sheet, boost brokerage margins, launch new products, and attract more investors.

“This raise marks a major milestone towards our initial goal of acquiring 1000 BTC before scaling further,” commented the CEO of the Company Torbjørn Bull Jenssen. “We strongly believe that Bitcoin represents the future of global finance and are positioning K33 to benefit maximally from this. A strong balance sheet built on Bitcoin enables us to significantly improve our brokerage operation while maintaining full exposure to Bitcoin’s upside potential.”

As part of the strategy, K33 recently completed its first Bitcoin acquisition, purchasing 10 BTC for approximately SEK 10 million on June 3. This transaction is the initial deployment of capital from the SEK 60 million investment commitment announced earlier this year to support the company’s BTC treasury.

“We expect Bitcoin to be the best-performing asset in the coming years and will build our balance sheet in Bitcoin moving forward,” stated Jenssen. “This will give K33 direct exposure to the Bitcoin price and help unlock powerful synergies with our brokerage operation. Our ambition is to build a balance of at least 1000 BTC over time and then scale from there.”

During its Q1 2025 Report and Strategic Outlook presentation, K33 underscored the accelerating institutional adoption of Bitcoin, referencing the rapid growth of the US Bitcoin ETFs, which attracted more capital in its first year than gold ETFs had in the past two decades.

“For K33, Bitcoin is not only a high-conviction asset — it’s also a strategic enabler,” Jenssen said. “With a sizable BTC reserve, we will be able to strengthen our financial position while unlocking new revenue streams, product capabilities, and partnerships.”

This post K33 Announces Plans To Purchase Up To 1,000 Bitcoin first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-18 23:01:11

@ cae03c48:2a7d6671

2025-06-18 23:01:11Bitcoin Magazine

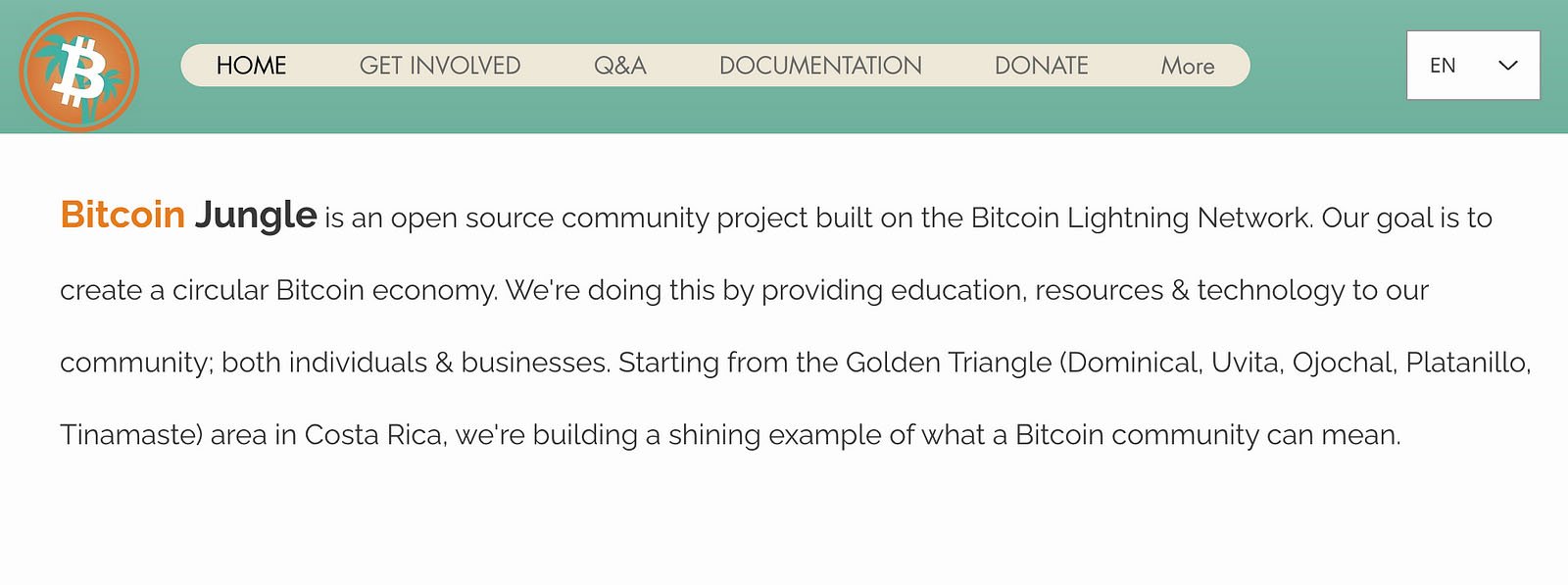

Bitcoin Tech Booms: Lightning Data Defies Digital Gold NarrativeEgo Death Capital’s portfolio reveals adoption metrics including $1.5 billion in Lightning-powered trading volume, as Block shocks the industry with their 9.7% Lightning Network yield.

While bitcoin treasury companies, debates about market structure bills, and strategic bitcoin reserve advocacy dominate the headlines in 2025, a trend is quietly growing in the background: the success of Bitcoin technology companies.

Increasingly recognized as digital gold and a long-term store of value, bitcoin is far more than just a shiny rock in cyberspace. As a software technology, Bitcoin is programmable and has unlocked a new paradigm of payments, custody, settlement and trading possibilities.

Nevertheless, some critics point to the empty blocks on the Bitcoin base layer and historically low transaction fees as implicit proof that Bitcoin is failing as a medium of exchange. Others claim that the Lightning Network has failed to get mainstream adoption and even argue that it suffers from significant privacy problems. But the opposite may be true.

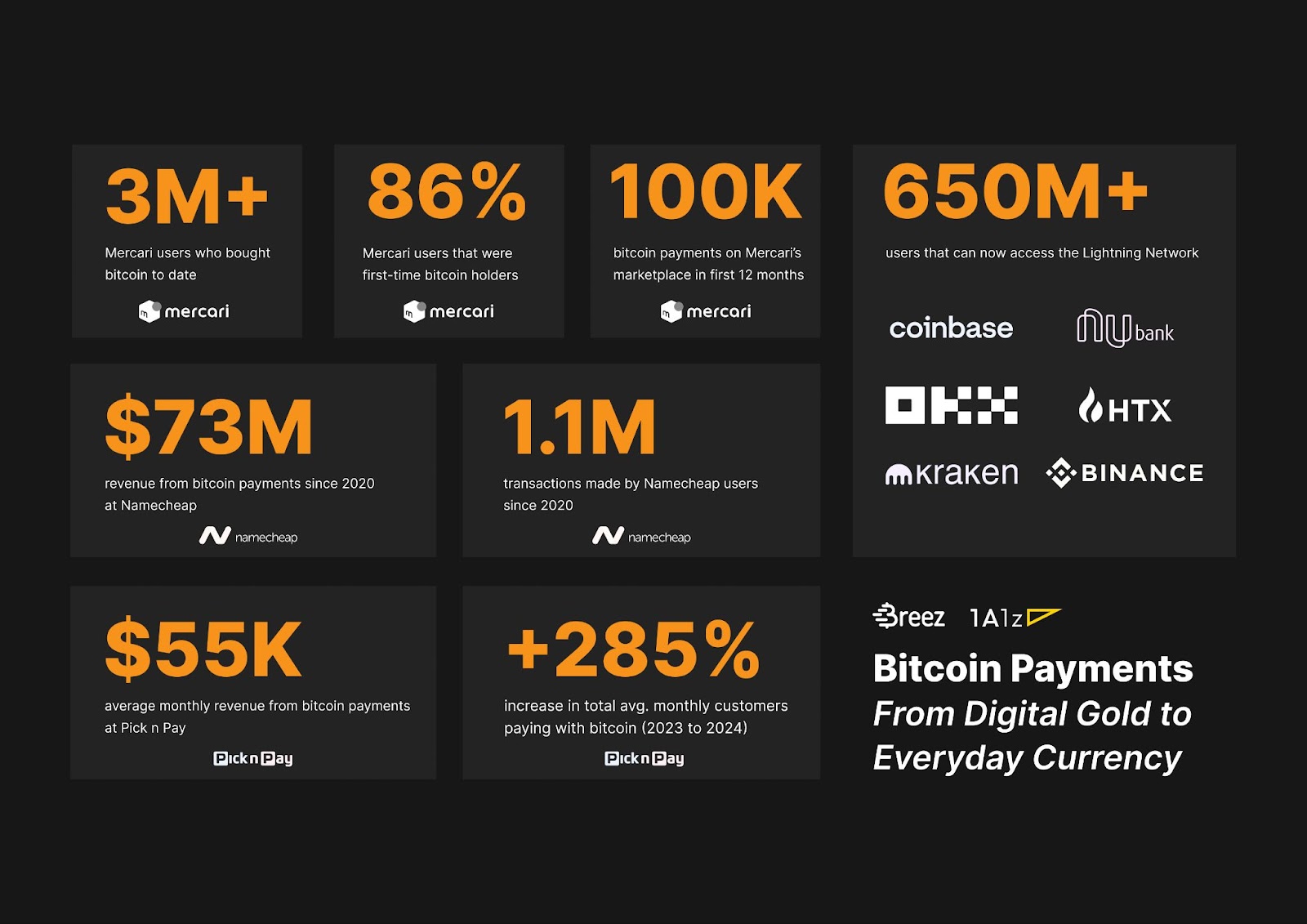

New data coming out of various companies throughout the industry is starting to paint a different picture. Perhaps the Lightning Network has been so successful in drawing transactions off chain and making them more private that it is hard to quantify success metrics without companies involved sharing the data.

But, a variety of Bitcoin start-ups and companies using bitcoin to build out new financial infrastructure are now starting to boast of their success metrics, claiming numbers that suggest there is a strong product market fit beyond treasury strategies.

Jeff Booth, author of The Price Of Tomorrow and co-founder of the Bitcoin-focused VC firm Ego Death Capital, told Bitcoin Magazine he doesn’t “think the general public has any clue with how fast the Bitcoin ecosystem is growing.” Adding that, “They keep on hearing treasury companies this and politics that, and they’re missing the forest for the trees.”

Below follows a summary of various companies and projects demonstrating Bitcoin adoption in significant numbers, many of them within the Ego Death Capital portfolio.

Block: Earning Big on Lightning and Bitcoin Payments

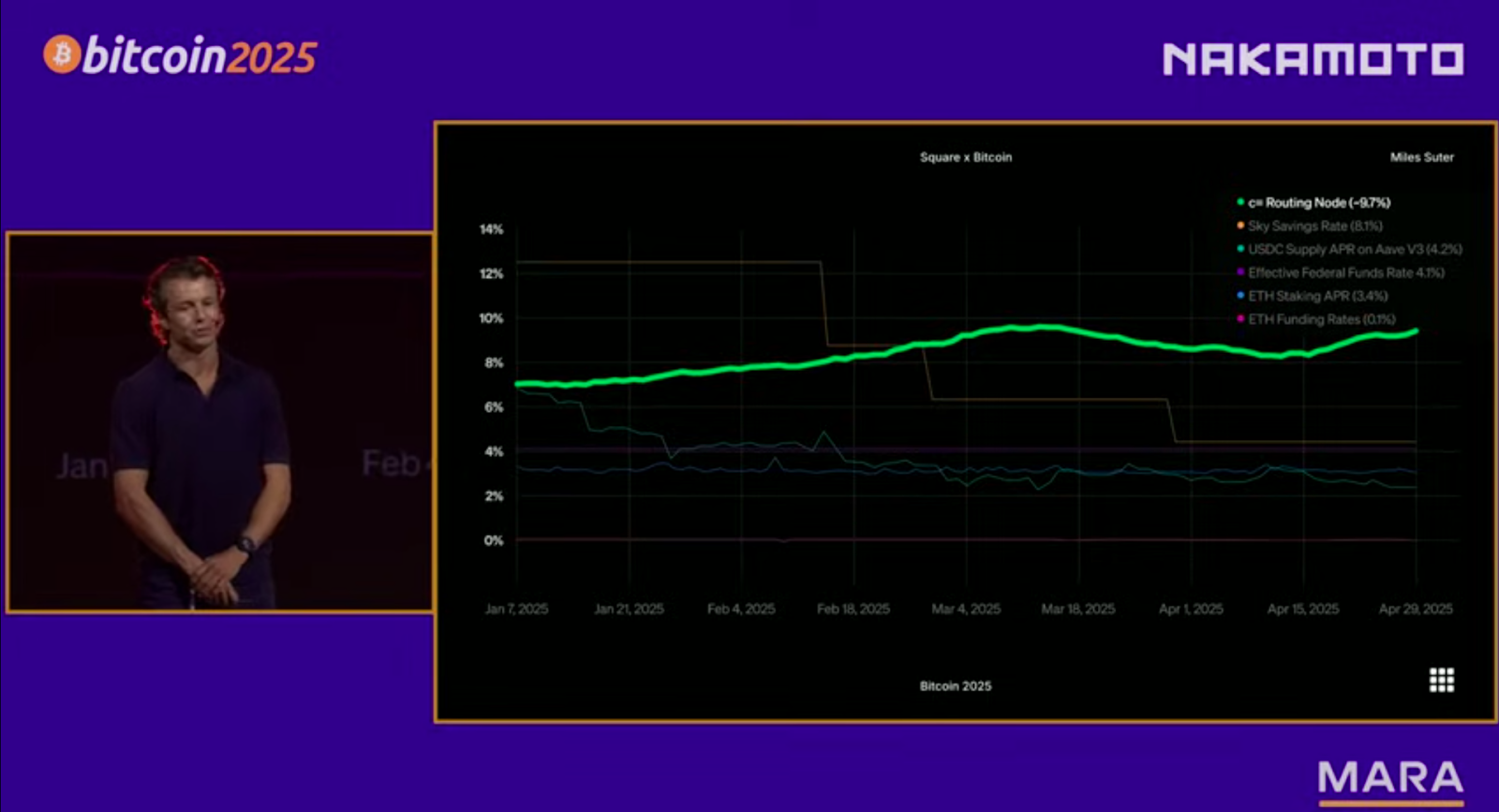

The contrast in perspectives between the digital gold thesis and those that believe in Bitcoin as a payments technology was most recently seen at Bitcoin Vegas 2025 where Block, the parent company of Cash App, disclosed that they are earning 9.7% yield off their Bitcoin Lightning node.

Miles Suter, Bitcoin Product Lead at Block, told the live audience that “at the infrastructure layer, we’re earning nearly 10% bitcoin-on-bitcoin returns by efficiently routing real payments across the Lightning network. This isn’t yield from altcoin staking or reckless speculation; it’s from solving hard, real-time routing problems, and its real bitcoin-on-bitcoin returns from our corporate holdings via supporting real payments use cases.”

Besides Block’s stunning 9.7% figure announcement, which stood out as one of the most lasting impressions from the conference, Suter claimed that Cash App ranks “among the top bitcoin on-ramps in the U.S., accounting for nearly 10% of on-chain block space at any time,” adding that in 2024, its Lightning usage grew 7x and one in four of their outbound Bitcoin payments are processed on Lightning. These numbers highlight Block’s growth as a Bitcoin payments giant, now perhaps the most common merchant payments terminal and consumer payments app that integrates bitcoin.

Ego Death Capital

Ego Death Capital has been investing in Bitcoin infrastructure start-ups since 2022, initially raising a tactical 30 million dollar fund amid a boom in crypto and altcoin VC investments.

“When we first raised money, we actually targeted 30 million because the ecosystem at that time was really early. We realized we had to lean into these companies to help them scale. There were a lot of big crypto funds at that time, but they were spraying money everywhere else. And it was largely the exact opposite of what we believed would happen on Bitcoin.” Booth recalled that “Bitcoin was a protocol. It was developing in layers and it was early. And if you realized that and leaned in to help those companies that were developing in the layers, helping the infrastructure be created, then you would accelerate that. You would accelerate what we saw Bitcoin being, a currency, a store of value, an entirely new network.”

“We don’t have a failure in that fund,” Booth said of the firm’s first investment cohort, which included companies like Breez, Relai, LN Markets, Fedi, Wolf and Simple Proof. “That fund is just over three years old. It’s staggering. A number of those companies, I think three of those companies are already profitable — and profitable in bitcoin terms. So adding bitcoin to their treasury each month and growing incredibly fast.”

Breez: Powering a Global Lightning Payments Network

Breez, founded in 2018, is a self-custodial Lightning-as-a-service provider that enables developers to integrate Bitcoin payments into apps using its open source Breez SDK. By simplifying Lightning’s complexities, Breez has been driving widespread adoption across diverse industries.

“Over 40 apps have already implemented our SDK in production or beta since we launched it less than 18 months ago. Collectively, ~1.5 million users now have access to self-custodial, peer-to-peer bitcoin payments through these apps. These apps processed over $4.5 million in gross transaction volume in 2024,” wrote Roy Sheinfeld, CEO of Breez, in a January 2025 blog post.

The “Bitcoin Payments Report” by Breez and 1A1z, released February 2025, added, “The Lightning Network now reaches over 650 million users; driven by integrations with mainstream products, new developer tools, and growing merchant adoption.” A month later Sheinfeld published that “Lightning Pay’s user base has been growing with users moving a billion sats monthly.” Additionally, Breez’s integration with Klever Wallet brought Lightning to “100,000 monthly active users,” as stated in a December, 2024, blog post.

LN Markets: Lightning-Fueled Trading Takes Off

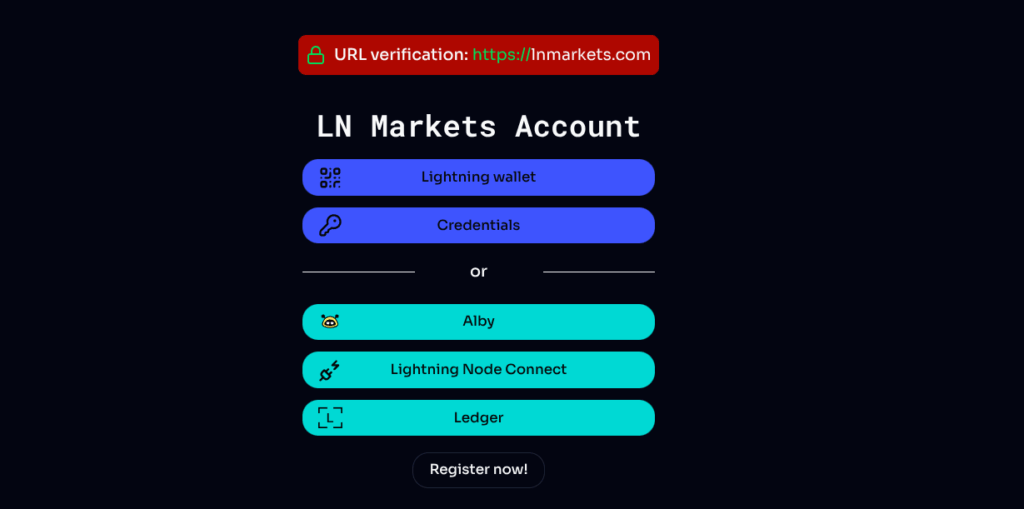

LN Markets, launched in 2020, is a Bitcoin-native derivatives trading platform, leveraging the Lightning Network for instant settlements and minimized counterparty risk.

Its Lightning-native login interface demonstrates they are on the cutting edge of Bitcoin technologies and unlocks user experience features that differentiate it from most other advanced trading platforms. The fast payment rails that result from this deep integration with the Lightning Network unlock faster settlement, lower withdrawal fees and provides access to smaller traders throughout the third world, with many users in South America in countries like Mexico, Brazil and Colombia.

“Basically we’ve gone from 50 million in monthly trading volume to 1.5 billion last month in May,” co-founder Romain Rouphael told Bitcoin Magazine, adding that they have gone from “one billion dollar yearly trading volume in 2023 to six billion last year to 12 billion this year.” Profitability is also strong, with Romain stating, “We double our revenue each year and we double our EBITDA as well every year,” and “We are doing millions of Lightning transactions every year” These figures highlight LN Markets’ strong and active user base as well as Lightning’s scalability.

The exchange focuses on

-

@ cae03c48:2a7d6671

2025-06-18 23:01:09

@ cae03c48:2a7d6671

2025-06-18 23:01:09Bitcoin Magazine

Bitdeer Raises $330M to Expand Bitcoin Mining and AI OperationsSingapore-based Bitcoin mining firm Bitdeer Technologies Group has launched a $330 million convertible notes offering, aiming to strengthen its mining operations, develop ASIC rigs, and scale its AI infrastructure.

The notes, due in 2031, carry an annual interest rate of 4.875% and may be converted into Bitdeer Class A shares at a 25% premium to the current stock price of $11.84, placing the conversion price at approximately $15.88 per share.

The offering is targeted at qualified institutional buyers under Rule 144A of the Securities Act. If investors exercise an option to buy more within 13 days, the offering could reach $375 million.

This is Bitdeer’s third convertible notes raise. Previously, the company secured $150 million in August and $360 million in November last year. According to Bitdeer, the offering is expected to close on June 23, 2025.

Net proceeds are expected to total roughly $319.6 million. Around $129.6 million will go toward a zero-strike call option, with $36.1 million allocated for concurrent note exchanges. The remaining funds will support datacenter expansion, new ASIC rig development, and general corporate needs.

Bitdeer is also conducting a note exchange, offering cash and equity to holders of its 8.50% convertible notes due 2029. That transaction includes approximately $36.1 million in cash and 8.1 million shares, exchanged for $75.7 million in outstanding notes.

This announcement follows Bitdeer’s recent growth. As previously reported, the company mined 196 BTC in May (worth over $21 million) and expanded its self mining hashrate to 13.6 EH/s. New SEALMINER rigs were deployed across sites in Texas, Norway, and Bhutan, and its AI cloud platform, powered by large language models, officially launched.

“In May 2025, we continued to deploy our SEALMINER mining rigs to our sites in Texas, U.S., Norway, and Bhutan, bringing Bitdeer’s self-mining hashrate to 13.6 EH/s,” said Matt Kong, Chief Business Officer at Bitdeer.

Bitdeer also raised capital from Tether in 2024 and secured $40 million from a debt facility with Matrix Finance in May. Both Bitdeer and Matrix are led by Jihan Wu, co-founder of Bitmain.

With its market cap now exceeding $2.3 billion, Bitdeer continues to invest in scaling its infrastructure and technology as competition in Bitcoin mining and AI computing intensifies.

This post Bitdeer Raises $330M to Expand Bitcoin Mining and AI Operations first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-18 23:01:07

@ cae03c48:2a7d6671

2025-06-18 23:01:07Bitcoin Magazine

The Trolls Are Coming: Defending Bitcoin Mining from Patent TrollsIntroduction: Patent Trolls Targeting Bitcoin Mining

Bitcoin’s use of elliptic curve cryptography (ECC), which is essential for generating key pairs and validating digital signatures, has drawn the attention of a nonpracticing entity (NPE), more commonly known as a patent troll. In May 2025, Malikie Innovations Ltd., a troll that acquired thousands of patents from BlackBerry’s portfolio, filed lawsuits against major mining firms Core Scientific (CORZ) and Marathon Digital Holdings (MARA). (Some considered MARA an original patent troll itself and thus have expressed schadenfreude at the current attacks.) Malikie claims that routine Bitcoin operations (like verifying transactions with ECC-based signatures) infringe on several ECC-related patents originally developed by Certicom (later owned by BlackBerry). The patents cover techniques for accelerated digital signature verification, finite field math optimizations and other ECC improvements.

Malikie’s lawsuits, in Texas’ Eastern District against CORZ and Western District against MARA, demand damages for past infringement and an injunction against further use of the patented methods. In essence, Malikie seeks to impose a licensing regime on Bitcoin’s core cryptographic functions, a move that could set a dangerous precedent for the entire industry. If Malikie succeeds, virtually anyone running Bitcoin software (miners, node operators and potentially even wallet providers) could be exposed to patent liability. This threat has galvanized the Bitcoin and open source communities to explore every available defensive tool. In this preparatory briefing, we examine:

- Historical legal strategies used to fend off troll lawsuits.

- The mechanics, costs and effectiveness of Inter Partes Review (IPR) in challenging software/crypto patents.

- Community-led responses (EFF, Linux Foundation, COPA, etc.) that help defendants by funding prior-art searches or legal defenses.

- The potential ramifications for Bitcoin mining if Malikie’s claims prevail, drawing parallels from other industries.

1. Historical Strategies Against NPE Patent Lawsuits

Over the past two decades, tech companies and industries have developed several tactics to combat patent trolls. Key strategies include challenging patent validity, shifting lawsuits to favorable venues via declaratory judgment actions, leveraging recent case law to dismiss abstract patents and simply refusing to settle in order to deter trolls.

While not all strategies will apply to these cases, for completeness I’ll outline these approaches:

Rigorous Invalidity Challenges (Prior Art – §102/103): The most direct way to neutralize a troll’s patent is to demonstrate that the patent should never have been granted in the first place because earlier technology already taught the same invention. Defendants search for prior art — such as earlier publications, academic papers, standards (RFCs) or open source code — that predate the patent’s priority date and disclose the claimed invention. If a single prior art reference embodies every element of a patent claim, the claim is “anticipated” (invalid for lack of novelty under 35 U.S.C. §102). If no one reference is complete but a combination of references would have been obvious to a skilled person, the claim is invalid for obviousness (§103). In the Malikie cases, for example, Bitcoiners have been called to urgently collect publications from before January 18, 2005 (the priority date of one asserted patent, U.S. 8,788,827), and before December 31, 2001 (for U.S. 7,372,960). to prove the patented ECC techniques were already known. The Bitcoin community has noted that Hal Finney and others actively tracked ECC patents and even delayed certain optimizations in Bitcoin until patents expired — for instance, the famed “GLV endomorphism” speedup was only added to Bitcoin Core after its patent lapsed (and caution on the GLV issue was taken by developers, which Malikie itself acknowledged in its complaint — paragraphs 20 and 21 of the MARA complaint, for instance). Unearthing such prior art may not only win the case at hand but invalidate the patent for everyone.

-

Inter Partes Review (IPR) and Post-Grant Proceedings: Beyond raising invalidity in court, since 2012 defendants have relied on IPR at the Patent Trial and Appeal Board (PTAB) as a powerful forum to knock out bad patents. IPR is an administrative trial within the U.S. Patent Office where challengers can present prior patents or publications to show a granted patent is invalid. We detail IPR’s mechanics in Section 2, but historically it has been a favored tool against NPEs because of its high success rate (around 70%+ of patents see claims canceled when reviewed) and lower burden of proof (“preponderance of the evidence,” 51%, rather than the “clear and convincing,” 75%, standard in court). Companies sued by trolls often file IPR petitions early and then move to stay (or pause) the litigation pending the PTAB’s decision — a stay which many courts grant once an IPR is instituted, given the likelihood that the patent may be invalidated. Notably, in the landmark Personal Audio “podcasting patent” case, the Electronic Frontier Foundation (EFF) filed an IPR that successfully invalidated a troll’s patent on podcast distribution, even as the troll was suing podcasters in East Texas. That IPR, funded by over a thousand small donations from the community, culminated in the Patent Office canceling all claims of the patent in 2015, a result later affirmed on appeal. This victory protected not just the sued targets (like comedian Adam Carolla) but all podcasters going forward. Similarly, the best path for the Bitcoin ecosystem may be to file IPR (or the related Post-Grant Review) against Malikie’s ECC patents, leveraging the mountain of cryptography literature from the 1990s and early 2000s to demonstrate that Bitcoin’s use of ECC was not novel to Malikie’s assignors.

-

Declaratory Judgment (DJ) Actions: Another defensive tactic is to preempt the troll by filing a declaratory judgment lawsuit in a preferred court, seeking a ruling that your product does not infringe or that the patent is invalid. Under U.S. law, a company that feels threatened by a patent (e.g., it received a demand letter or sees peers being sued) can sometimes sue first if it can show a substantial controversy. The goal is to avoid being haled into the NPE’s chosen venue (historically, the Eastern District of Texas was favored by trolls) and instead litigate in a more neutral or defendant-friendly forum. For instance, when notorious troll Lodsys threatened dozens of small app developers over in-app purchase patents, one strategy (supported indirectly by Apple and Google) was to seek declaratory rulings outside of East Texas to undermine the troll’s jurisdiction. In practice, DJ actions can prompt a faster resolution or even settlement on better terms. However, the patent owner must have made a concrete infringement assertion to establish the requisite “case or controversy.” In Malikie’s situation, if other Bitcoin companies (exchanges, wallet providers, smaller miners) suspect they are next in line, those companies could file a declaratory suit in a jurisdiction of their choice. This would flip the script, making Malikie the defendant and potentially consolidating the fight in a forum less favorable to NPEs.

-

Motions to Dismiss Under Alice (35 U.S.C. §101): Since the 2014 Alice Corp. v. CLS Bank decision, many software patents have been invalidated early in litigation for claiming unpatentable abstract ideas. Courts now examine whether a patent is directed to a fundamental abstract idea (like a mathematical formula) without an “inventive concept.” Defendants often file Rule 12(b)(6) motions to dismiss, arguing the patent is invalid on its face under §101. While cryptographic algorithms can be viewed as mathematical computations (a classic abstract idea), success with an Alice motion depends on how the patent claims are drafted. If the claims merely cover a generalized math formula or the concept of using ECC on a computer, a judge could void them as abstract. Indeed, some defendants have beaten trolls this way, sparing the cost of trial. In Malikie’s case, their patents seem to cover specific techniques to speed up ECC computations (like endomorphisms, modular reduction optimizations, etc.) — arguably “technical improvements” in cryptography rather than a naked abstract idea. That may make an Alice challenge less straigh

-

@ cae03c48:2a7d6671

2025-06-18 23:01:05

@ cae03c48:2a7d6671

2025-06-18 23:01:05Bitcoin Magazine

‘Ancient’ Bitcoin Supply Now Outpacing Newly Mined BTC: Fidelity ReportFidelity Digital Assets released a new report that reveals that for the first time in history, more bitcoin is entering “ancient supply,” which refers to coins that have remained unmoved for 10 years or more, than are being mined.

As of June 8, 17% of all bitcoin falls into the category of “ancient supply”—meaning these coins have not moved in a decade or more. What could this mean for scarcity, market dynamics, and investors’ conviction? Find our team’s thoughts: https://t.co/EALzrfS92c pic.twitter.com/Ckm3MylTLY

— Fidelity Digital Assets (@DigitalAssets) June 18, 2025

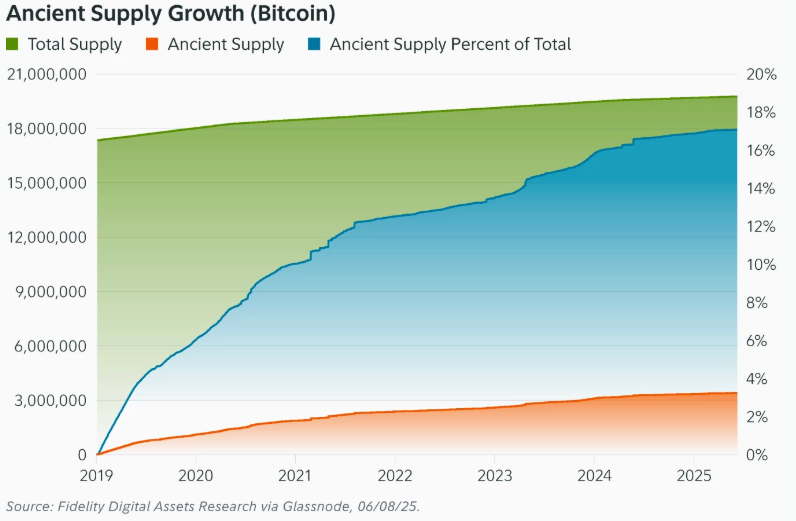

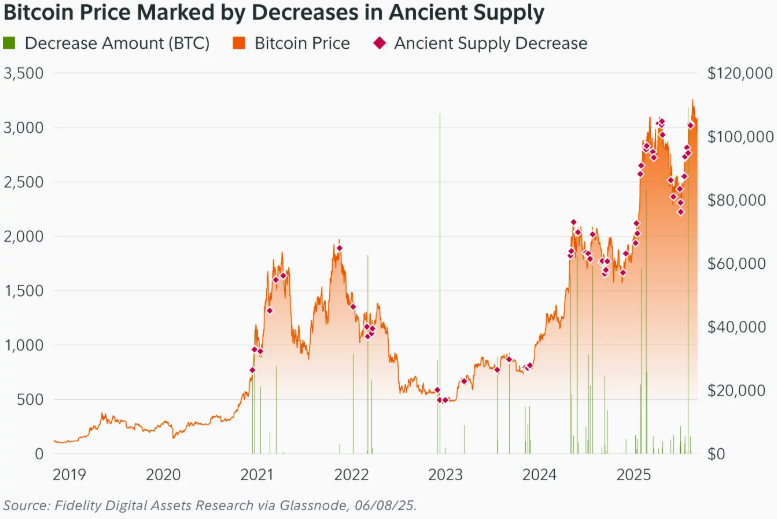

As of June 8, an average of 566 BTC per day is crossing the 10 year threshold, while only 450 BTC is being issued daily following the 2024 halving. 3

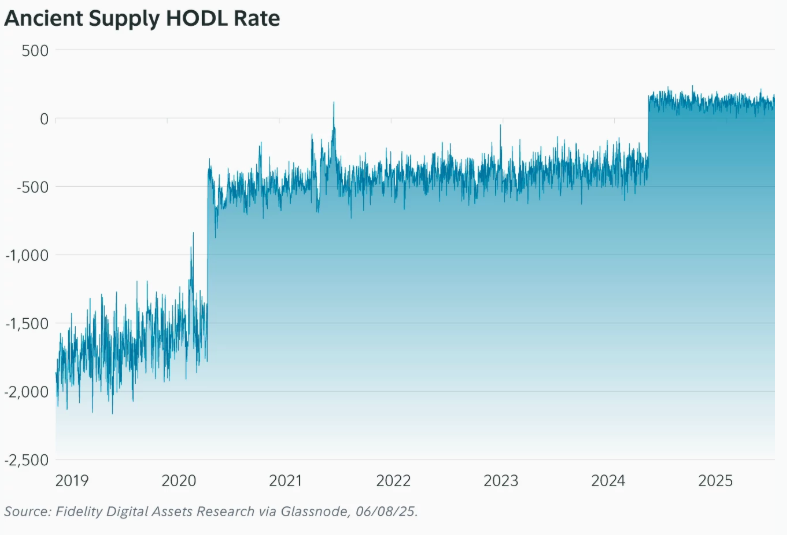

“The share of ancient supply also tends to increase each day, with daily decreases observed less than 3% of the time,” the report says. “In contrast, that number increases to 13% when the threshold is lowered to bitcoin holders of five years or more.”

Bitcoin’s ancient supply has grown since January 1, 2019, when Satoshi Nakamoto became the first 10 year holder. Today, over 3.4 million BTC fall into this category, worth more than $360 billion. Around 1/3 is believed to belong to Nakamoto.

Despite their rising value, long-term holders are not cashing out. Ancient supply makes up over 17 percent of all bitcoin, and that share continues to grow.

Since the 2024 halving, the number of coins entering ancient supply has consistently outpaced the number of new coins being mined, according to the report. This shift highlights growing long-term conviction among holders and reflects a broader tightening of bitcoin’s liquid supply.

Following the 2024 U.S. election, ancient supply declined on 10% of days, which is nearly four times higher than the historical average. Movement among the holders was even more pronounced, with daily declines occurring 39% of the time.

To better track this trend, Fidelity uses a metric called the ancient supply HODL rate. It measures how many coins are entering the 10 year category each day, adjusted for new issuance. This rate turned positive in April 2024 and has remained that way, reinforcing the long-term supply shift.

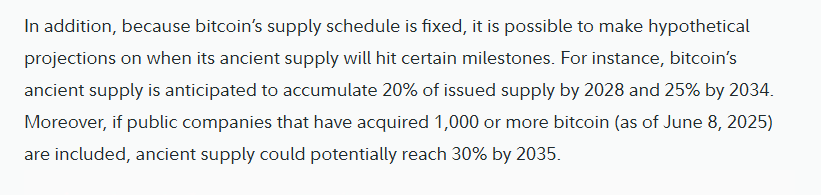

Looking ahead, Fidelity Digital Assets projections that ancient supply could reach 20 percent of total bitcoin by 2028 and 25 percent by 2034. If public companies holding at least 1,000 BTC are included, it could reach 30 percent by 2035.

As of June 8, 27 public companies hold more than 800,000 BTC combined, according to the report. This growing institutional presence may further tighten supply and increase the influence of long-term holders over time.

This post ‘Ancient’ Bitcoin Supply Now Outpacing Newly Mined BTC: Fidelity Report first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ f85b9c2c:d190bcff

2025-06-18 22:03:04

@ f85b9c2c:d190bcff

2025-06-18 22:03:04

You must have been hearing something like ‘coin’ and ‘token’ in the cryptocurrency space right? And you start wondering if they are the same thing. Yes they are similar but not the same.

A coin is any cryptocurrency that is fueling transactions on a native blockchain, it is also used to reward those who provide some kind of computational power to keep the blockchain alive. An example is PoW (Proof of Work) blockchains like Bitcoin. Ethereum is a coin on the Ethereum blockchain. XLM is a coin on the Lumen blockchain.

Now a token is any cryptocurrency that is created on a blockchain. Anyone who can create a smart contract can do this. I can deploy a token before I go to bed this night😃. It is that easy.

96% of cryptocurrencies that are in the market are tokens. You don’t need to build a blockchain to create a token but you must build a blockchain to have a coin.

I will give you a scenario you can relate to. ✔️Blockchain is like a hectare of land ✔️ Coin is the giant mansion or skyscraper on it ✔️Tokens are small rooms in the mansion.

I hope you gained something today as you are just getting familiar with the industry.

-

@ 8bad92c3:ca714aa5

2025-06-18 22:01:50

@ 8bad92c3:ca714aa5

2025-06-18 22:01:50Marty's Bent

via me

I had a completely different newsletter partially written earlier tonight about whether or not "this cycle is different" when this nagging thought entered my head. So I'm going to write about this and maybe I'll write about the dynamics of this cycle compared to past cycles tomorrow.

A couple of headlines shot across my desk earlier tonight in relation to the potential escalation of kinetic warfare in the Middle East. Apparently the U.S. Embassy in Iraq was sent a warning and evacuation procedures were initiated. Not too long after, the world was made aware that the United States and Israel are contemplating an attack on Iran due to the "fact" that Iran may be close to producing nuclear weapins. The initial monkey brain reaction that I had to these two headlines was, "Oh shit, here we go again. We're going to do something stupid." My second reaction was, "Oh shit, here we go again, I've seen these two exact headlines many times over the years and they've proven to be lackluster if you're a doomer or blood thirsty war monger." Nothing ever happens.

As I venture into my mid-30s and reflect on a life filled with these types of headlines and my personal reactions to these headlines, I'm finally becoming attuned to the fact that the monkey brain reactions aren't very productive at the end of the day. Who knows exactly what's going to happen in Iraq or Iran and whether or not kinetic warfare escalates and materializes from here? Even though I'm a "blue-blooded taxpaying American citizen" who is passively and unwillingly contributing to the war machine and the media industrial complex, there's really nothing I can do about it.

The only thing I can do is focus on what is in front of me. What I have control of. And attempt to leverage what I have control of to make my life and the life of my family as good as humanly possible. Ignoring the external and turning inward often produces incredible results. Instead of worrying about what the media wants you to believe at any given point in time, you simply look away from your computer screen, survey the physical space which you're operating in and determine what you have, what you need and how you can get what you need. This is a much more productive way to spend your time.

This is what I want to touch on right now. There's never been a better time in human history to be productive despite what the algorithm on X or the mainstream media will lead you to believe. Things aren't as great as they could be, but they're also not as bad as you're being led to believe. We live in the Digital Age and the Digital Age provides incredible resources that you can leverage to make YOUR life better.

Social media allows you to create a platform without spending any money. AI allows you to build tools that are beneficial to yourself and others with very little money. And bitcoin exists to provide you with the best form of money that you can save in with the knowledge that your relative ownership of the overall supply isn't going to change. No matter what happens in the external world.

If you can combine these three things to make your life better and - by extension - potentially make the lives of many others better, you're going to be well off in the long run. Combining these three things isn't going to result in immediate gratification, but if you put forth a concerted effort, spend the time, have some semblance of patience, and stick with it, I truly believe that you will benefit massively in the long run. Without trying to sound like a blowhard, I truly believe that this is why I feel relatively calm (despite my monkey brain reactions to the headlines of the day) at this current point in time.

We've entered the era of insane leaps in productivity and digital hard money that cannot be corrupted. The biggest mistake you can make in your life right now is overlooking the confluence of these two things. With an internet connection, an idea, some savvy, and hard work you can materially change your life. Create something that levels up your knowledge, that enables you to get a good job in the real world, or to create a company of your own. Bring your talents to the market, exchange them for money, and then funnel that money into bitcoin (if you're not being paid in it already). We may be at the beginning of a transition from the high velocity trash economy to the high leverage agency economy run on sound money and applied creativity.

These concepts are what you should be focusing most of your time and attention to today and in the years ahead. Don't get distracted by the algorithm, the 30-second video clips, the headlines filled with doom, and the topics of the 24 hour news cycle. I'll admit, I often succumb to them myself. But, as I get older and develop a form of pattern recognition that can only be attained by being on this planet for a certain period of time, it is becoming very clear that those things are not worth your attention.

Living by the heuristic that "nothing ever happens" is a pretty safe bet. Funnily enough, it's incredibly ironic that you're led to believe that something is happening every single day, and yet nothing ever happens. By getting believing that something happens every day you are taking your attention away from doing things that happen to make your life better.

Tune out the noise. Put on the blinders. Take advantage of the incredible opportunities that lie before you. If enough of you - and many others who do not read this newsletter - do this, I truly believe we'll wake up to find that the world we live in is a much better place.

Nothing ever happens, so make something happen.

Intelligence Officials Are Quietly Becoming Bitcoin Believers

Ken Egan, former CIA Deputy Chief of Cyber Operations, revealed a surprising truth on TFTC: the intelligence community harbors numerous Bitcoin advocates. Egan explained that intelligence professionals uniquely understand how governments weaponize financial systems through sanctions and account freezing. Having wielded these tools themselves, they recognize the need for personal financial sovereignty. He shared compelling anecdotes of discovering colleagues with "We are all Satoshi" stickers and a European chief of station paying for dinner with a BlockFi card to earn Bitcoin rewards.

"I think there are a lot of Bitcoiners, not just at CIA, but across the whole national security establishment... they're in it for the exact same reasons everybody else is." - Ken Egan

The Canadian trucker protests served as a pivotal moment, Egan noted. Watching Western governments freeze citizens' bank accounts for political dissent struck a nerve among intelligence professionals who previously viewed financial weaponization as a tool reserved for foreign adversaries. This awakening has created unlikely allies within institutions many Bitcoiners distrust.

Check out the full podcast here for more on Bitcoin's national security implications, privacy tech prosecutions, and legislative priorities.

Headlines of the Day

Stripe Buys Crypto Wallet Privy After Bridge Deal - via X

Trump Calls CPI Data "Great" Urges Full Point Fed Cut - via X

Bitcoin Hashrate Reaches New All-Time High - via X

Get our new STACK SATS hat - via tftcmerch.io

Bitcoin’s Next Parabolic Move: Could Liquidity Lead the Way?

Is bitcoin’s next parabolic move starting? Global liquidity and business cycle indicators suggest it may be.

Read the latest report from Unchained and TechDev, analyzing how global M2 liquidity and the copper/gold ratio—two historically reliable macro indicators—are aligning once again to signal that a new bitcoin bull market may soon begin.

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Life is good.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

@media screen and (max-width: 480px) { .mobile-padding { padding: 10px 0 !important; } .social-container { width: 100% !important; max-width: 260px !important; } .social-icon { padding: 0 !important; } .social-icon img { height: 32px !important; width: 32px !important; } .icon-cell { padding: 0 4px !important; } } .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } .moz-text-html .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } /* Helps with rendering in various email clients */ body { margin: 0 !important; p

-

@ 9ca447d2:fbf5a36d

2025-06-18 22:01:29

@ 9ca447d2:fbf5a36d

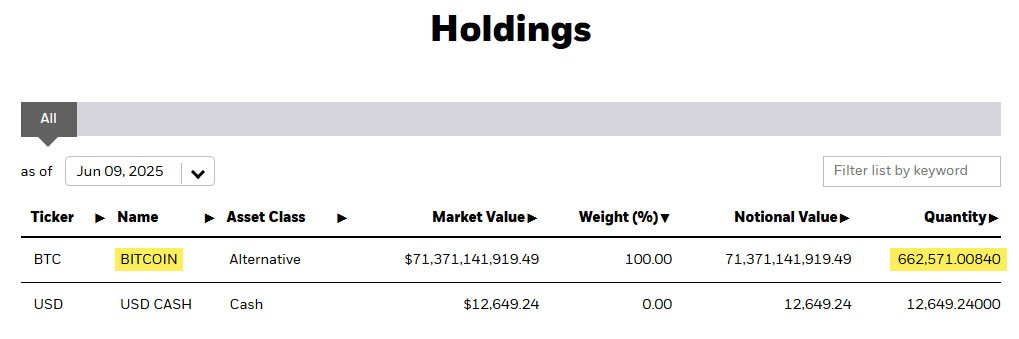

2025-06-18 22:01:29BlackRock’s iShares Bitcoin Trust (IBIT) has become the fastest exchange-traded fund (ETF) to ever reach $70 billion in assets under management (AUM).

The fund, which launched in January 2024, hit this milestone in just 341 trading days—five times faster than the previous record-holder, the SPDR Gold Shares ETF (GLD), which took 1,691 days to reach the same mark.

IBIT now holds over 662,000 BTC — iShares

Bloomberg ETF analyst Eric Balchunas tweeted on June 9, “IBIT just blew through $70 billion and is now the fastest ETF to ever hit that mark in only 341 days.” This is a big deal and shows bitcoin is going mainstream.

IBIT has beaten fastest growing ETFs in history — Eric Balchunas on X

The fund’s rapid growth means institutional investors are embracing bitcoin at scale.

The fund has $71.9 billion in AUM and holds over 662,000 bitcoin. This makes BlackRock the largest institutional bitcoin holder in the world. To put that in perspective, the fund holds more bitcoin than Binance or Michael Saylor’s Strategy.

“IBIT’s growth is unprecedented,” said Bloomberg analyst James Seyffart. “It’s the fastest ETF to reach most milestones, faster than any other ETF in any asset class.”

BlackRock’s bitcoin ETF isn’t just big. It’s also greatly outperforming other spot bitcoin ETFs launched at the same time. BlackRock’s brand and global client base gave the fund instant credibility.

Many institutional investors want a regulated and convenient way to get into bitcoin without holding the asset directly, and this fund has made it easy for them to invest.

Robert Mitchnick, BlackRock’s head of digital assets, told Yahoo Finance that bitcoin’s rising status as an inflation hedge and alternative store of value is driving IBIT’s popularity.

He explained bitcoin is becoming an inflation hedge and alternative store of value and that’s what’s driving the growth.

Eric Balchunas also noted that when BlackRock filed for IBIT, bitcoin was at $30,000 and there was still skepticism after the FTX blowup. Now that bitcoin is at $110,000, it is “seen as legitimate for other big investors.”

Institutional demand for bitcoin has never been stronger, with IBIT making up nearly 20% of all bitcoin held by public companies, private firms, governments, exchanges and decentralized finance platforms.

That dominance may soon be challenged as public companies prepare to buy more bitcoin and shake up the current supply distribution.

Matthew Sigel, VanEck’s head of digital assets research, shared data that six public companies plan to raise, or have raised, up to $76 billion to buy bitcoin. That’s more than half of the spot Bitcoin ETF industry’s current AUM, so there’s clearly interest beyond ETFs.

On the broader market, IBIT’s rise coincided with bitcoin’s price surge to new highs above $110,000. The inflows reflect investors’ confidence in Bitcoin’s future and desire for regulated exposure through traditional products.

It’s worth mentioning that IBIT also had over $1 billion in volume on its first day of trading. It’s now the largest ETF in BlackRock’s lineup, even bigger than gold funds and other popular ETFs tracking international equities.

-

@ 88cc134b:5ae99079

2025-06-18 22:26:00

@ 88cc134b:5ae99079

2025-06-18 22:26:00 -

@ 31a4605e:cf043959

2025-06-18 19:28:26

@ 31a4605e:cf043959

2025-06-18 19:28:26Você já ouviu isso antes. Um bitcoiner é questionado sobre seus sats e, com um sorriso irônico, responde: “Perdi tudo num acidente de barco.” Mas de onde vem essa frase? Por que tantos bitcoiners fazem essa piada? E mais importante: o que ela realmente significa?

A origem do meme

A expressão "Lost all my Bitcoin in a boating accident" nasceu nos fóruns americanos de entusiastas de armas e metais preciosos, muito antes do Bitcoin ganhar notoriedade mainstream. O contexto original era o seguinte: alguém perguntava se você ainda tinha sua coleção de armas (ou ouro), e a resposta sarcástica era "infelizmente, perdi tudo num acidente de barco".

Essa desculpa servia como uma forma de recusar-se a declarar posse de bens aos olhos do governo ou de outras autoridades. Afinal, o que não se pode provar que existe, não pode ser confiscado, taxado ou regulado. Com o tempo, essa lógica encontrou um terreno fértil entre os defensores da soberania individual, um grupo no qual os bitcoiners naturalmente se encaixam.

A metáfora da resistência

Quando os maximalistas de Bitcoin adotaram a frase, ela passou a representar mais do que apenas uma desculpa para evitar perguntas incômodas: virou um símbolo de resistência contra um sistema financeiro cada vez mais invasivo e coercitivo. Dizer que “perdeu os seus Bitcoin num acidente de barco” é, muitas vezes, um eufemismo para dizer:

“Não é da sua conta quantos sats eu tenho.”

“Não reconheço a autoridade de quem tenta confiscar meu patrimônio digital.”

“Meus ativos são soberanos, autocustodiados e inalcançáveis por meios tradicionais.”

Bitcoin é liberdade, não compliance

O meme também toca num ponto central da filosofia bitcoin: a autocustódia e o direito à privacidade financeira. Em um mundo onde governos congelam contas, censuram transações e imprimem moeda ao bel-prazer, possuir Bitcoin é uma forma de resistência civil. Mas para que isso tenha valor real, é necessário que o indivíduo assuma a responsabilidade pela custódia e, inevitavelmente, pelo silêncio.

Dizer que você “perdeu seus Bitcoin” também é um lembrete: não fale sobre suas chaves privadas. Não ostente seus sats. Não coloque um alvo nas suas costas.

Um meme com propósito

No fim das contas, o “acidente de barco” é uma piada com um fundo muito sério. Ele nos relembra que, num sistema verdadeiramente soberano, a posse de ativos digitais é algo íntimo, pessoal e — se necessário — negável. É uma forma de reafirmar que o Bitcoin não é apenas uma ferramenta de investimento, mas um instrumento de liberdade.

Então da próxima vez que alguém te perguntar onde estão seus bitcoins, sorria e diga:

“Infelizmente, perdi tudo num acidente de barco…”

E deixe que fiquem imaginando.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ cae03c48:2a7d6671

2025-06-18 22:00:48

@ cae03c48:2a7d6671

2025-06-18 22:00:48Bitcoin Magazine

The Blockchain Group Buys $20 Million Worth Of BitcoinThe Blockchain Group has acquired an additional 182 Bitcoin for approximately €17 million ($19.6 million), further expanding its position as Europe’s first Bitcoin treasury company amid accelerating institutional adoption of Bitcoin reserves.

According to a press release issued June 18, the Euronext Growth Paris-listed company completed the purchases through multiple convertible bond issuances totalling over €18 million, subscribed by several investors, including UTXO Management, Moonlight Capital, and asset manager TOBAM.

JUST IN:

French publicly traded, The Blockchain Group buys an additional 182 #Bitcoin for €17.0 million

French publicly traded, The Blockchain Group buys an additional 182 #Bitcoin for €17.0 million Nothing stops this train

pic.twitter.com/fwIqq934Yy

pic.twitter.com/fwIqq934Yy— Bitcoin Magazine (@BitcoinMagazine) June 18, 2025

The acquisitions bring The Blockchain Group’s total Bitcoin holdings to 1,653 BTC, purchased at an average price of €90,081 ($104,000) per coin. The company reported a “BTC Yield” – measuring Bitcoin holdings relative to fully diluted shares – of 1,173.2% year-to-date, significantly outpacing other major corporate holders.

The company’s latest purchases were executed through Swissquote Bank Europe and Banque Delubac, with custody provided by Swiss infrastructure provider Taurus. Additional funding came from the conversion of share warrants into 2.98 million ordinary shares, raising €1.6 million.

We’re seeing unprecedented growth in corporate Bitcoin treasury strategies. The Blockchain Group’s success has created a model for European companies, with new organizations announcing Bitcoin purchases almost weekly.

The company indicated potential plans to acquire an additional 70 BTC through ongoing transactions, which could bring its total holdings to 1,723 BTC. This follows recent Bitcoin treasury announcements from companies including Metaplanet, which now holds 10,000 BTC, and Strategy’s latest acquisition of 10,1000 BTC.

At press time, Bitcoin trades at $104,021, down 1.26% over the past 24 hours, as markets continue to process the implications of growing institutional adoption. The Blockchain Group’s shares were down 3.9% to €4.80 on Wednesday, trading on Euronext Paris.

This post The Blockchain Group Buys $20 Million Worth Of Bitcoin first appeared on Bitcoin Magazine and is written by Vivek Sen.

-

@ 8bad92c3:ca714aa5

2025-06-18 21:02:08

@ 8bad92c3:ca714aa5

2025-06-18 21:02:08Key Takeaways

In this episode, host Marty speaks with Ken, a former CIA deputy chief and now head of government affairs at the Bitcoin Policy Institute, about Bitcoin’s growing relevance in U.S. national security and policy circles. Ken traces his Bitcoin journey from professional curiosity within the CIA, studying adversarial use cases like the Lazarus Group, to personal conviction following events like the Canadian trucker protests, which exposed the dangers of financial censorship. Contrary to popular belief, he reveals that many in the intelligence community support Bitcoin for its alignment with American values such as sovereignty and freedom. The conversation highlights a major cultural shift in Washington, where policymakers now view Bitcoin as a strategic asset rather than a criminal tool. Ken stresses that the future hinges on whether Bitcoin shapes institutions or is co-opted by them, and that political engagement is crucial to ensure the former. He argues Bitcoin can help solve systemic problems from fiscal irresponsibility to geopolitical instability, but only if the industry continues to organize, advocate, and embed its values into national policy.

Best Quotes

"Either institutions are going to win, or Bitcoin is going to win."

"Bitcoin naturally washes out leverage… it's what makes Bitcoin antifragile."

"The CIA didn’t create Bitcoin, but they sure are paying attention now."

"We were all Satoshi."

"Let’s not test the resistance-money thesis in the United States."

"Bitcoin strengthens U.S. values, freedom, private property, sovereignty."

"Bitcoin is political, but it doesn't have to be partisan."

"If you're in a federal agency, the only incentive is to spend more. Bitcoin changes that."

"Don't underestimate your voice. If you keep the phones ringing, they listen."

Conclusion

This episode offers a rare glimpse into how Bitcoin is increasingly viewed as a serious strategic asset within the U.S. intelligence and policy communities. Ken, with his high-level government background and current role in Bitcoin advocacy, underscores the shift from skepticism to engagement among policymakers. His message is clear: Bitcoiners are no longer outsiders, they have a seat at the table, and with sustained political action and education, they can shape the future of Bitcoin policy. The time to engage is now, because the battle for Bitcoin’s role in society is already in motion.

Timestamps

0:00 - Intro

0:26 - Ken's background

6:58 - Tornado/Samourai, surveillance state

11:53 - Reestablishing trust

14:23 - Bitkey

15:18 - CIA bitcoin theory

18:42 - Neutral reserve asset

23:52 - Unchained

24:20 - BPI

29:49 - CLARITY and Secret Service message

33:54 - Withstanding a change in administration

40:03 - Institutions win or bitcoin wins

46:43 - Shrinking gov with bitcoin

57:47 - BPI summitTranscript

00:00:00 compared to China or Russia, do we have a comparable advantage in gold? How do we compete with China? And this is what the kinds of things CI will think about. Bitcoin is a natural option. At the end of the day, Bitcoin undermines the authority of the Chinese Communist Party. Either institutions are going to win or Bitcoin is going to win. But we do fundamentally on some level need institutions to make the country run. We want those institutions to be properly incentivized. In 10 years, Bitcoin is

00:00:19 either at a million dollars or is zero dollars. Ken, it's great to have you on the show. Thank you for joining me. Marty, finally. We've been we've been kicking us around for a few weeks. I'm glad we uh glad we were finally able to make it work. As I was telling you, in the middle of a move, conference in the middle of that move. It's been a hectic week, so I think I'm finally settling in. As you can see, no bookshelf, but we have stacked books behind me. Hopefully, they will be on on shelves soon.

00:00:52 No, there there are definitely ways there are ways in the world to get you know to get credits on um you know uh what do you call it? Um uh we're good Catholics, you know, when you when you pass and don't go to heaven. Um come on. Thank you. Well, moving is purgatory credit. So, I've done it many times in my life. So, I uh I feel for you. Well, thank you. But I'm really excited for this conversation and likewise the event in a few weeks, the BPI event down in DC, the summit, we met about a month ago, two months ago now at

00:01:26 this point in Austin during the takeover. And Zach was very eager to introduce you to me considering the the history of the show, topics we covered. And I think I'm excited for this cuz I'm infinitely curious to learn how somebody with your pedigree and your resume got into Bitcoin is now working for the Bitcoin Policy Institute as a director of government affairs. So for anybody listening who was unaware of Ken's resume, he did 20 years in government culminating as deputy chief of operations at the CIA Center for Cyber

00:02:01 Intelligence. uh you've worked overseas for the US State Department and now you're advocating on behalf of Bitcoin on Capitol Hill. So, how does somebody with that resume go from statecraft to cipher punk sort of ideas? Yeah. No, so I um like everybody else, I uh I um my my Bitcoin journey is a little bit everybody everybody has a unique journey, right? Um mine actually started at CIA, believe it or not. And it was for purely professional reasons. I um so I was an operations officer. I spent most of my career overseas um as

00:02:37 most of us do. Um but my last two years, my last two turn tours at CIA, I was at the center for cyber intelligence, which is CIA's cyber unit. Um and my first job there, I was group ch I was a operations chief for a group that worked on cyber threat issues. And this was in 2018. So you remember this was when Lazarus group the North Koreans figured out that stealing crypto was a lot easier than like you know trying to rob banks. Um this is when ransomware broke out as a serious problem just preceded you may

00:03:04 remember the Colonial Pipeline hack that shut down you know gasoline shipments to the east coast. So in 2018 um and it's kind of funny like I this is people say did the CIA create Bitcoin. I can tell you in 2018 when policy makers first had to confront its use by actors as an issue like nobody was ready for it. Like if they created it, it was tucked away and hidden in the basement cuz the the bench for people with crypto knowledge in general, digital assets, certainly Bitcoin was really really really shallow. Um I remember we had two

00:03:33 guys um who kind of had background in it and then you they became superstars because all of a sudden we were calling upon them to teach us about Bitcoin and digital assets in general. Um, but yeah, that's so I learned and like everything else, I learned about it because I had to because people we cared people we cared about were using it. Um, but like everything else there there was sort of a mind virus to it. Um, and I I admit, you know, I during co I was in the uh I was in the altcoin casino. I was defying

00:04:00 and memecoining and it was it was fun, you know. No, I I I don't hold any hate for the uh for the alcoiners. People do what they want with their money. Um but I you know that that was when it was during co um I had been sort of buying in 2018 but during co when I really started learning because this is what everybody learned right um and I you know for me Bitcoin was immediately attracted me to it and I was sort of inspired by um I mean the co Kenny trucker protest was something really important to me um I saw how it was

00:04:29 being used um but also sort of in my day job you know I I had a pretty good understanding of how the government uses financial financial tools as a weapon. Um, freezing bank accounts, OFAC sanctions, that kind of thing. And if you're on the, you know, on the giving end of that, that's great. Those are great tools to have if you're the government. Uh, not so great if you're on the other end of it. And, you know, watching these Canadian truckers the first time, you know, you'll be able to, it's very easy

00:04:54 to say, "Yeah, sanction the Iranian, sanction North Korea, whatever." You know, I'm not Iranian. Um but when you see all of a sudden Kat and Trucker people you had some sympathy with being targets of financial you know weaposition of the financial system it you know it struck it struck a it struck a nerve like a really really profound stinging shot to my consciousness my conscious about this issue. Um so for me for the first thing about Bitcoin was um was permissionless transactions that that's that's what got me into it. Um

00:05:23 then of course you go from there and by the time I left the government 2022 I had I was f I was you know full boore I was you know attending meetups and um that's when I started doing some advocacy stuff on Capitol Hill and and and messing around with uh David and Granny PPI doing some advocacy stuff but yeah but it it comes from my time at CIA and yeah I think the um the uh I think what might surprise some people is there are a lot of Bitcoiners um not just at CIA but across the whole national

00:05:52 security establishment And I think they're into it for the same reason that you know that everybody most of your listeners are right like it's you see what's happening in the world. You see the challenges we're facing. You see how governments use financial tools to weaponize them against opposition. You know it's it's very natural that if you have that kind of insight that you look for things to protect yourself and Bitcoin is obvious. So I I I tell a funny story when I um when I was first into it there was um cubicle one of the

00:06:17 guys and he had a bumper

-

@ 6a6be47b:3e74e3e1

2025-06-18 19:08:49

@ 6a6be47b:3e74e3e1

2025-06-18 19:08:49Howdy frens! 🤠

☀️ With summer just around the corner, I started wondering—do any of you have “summer reads”? I don’t really have a set list myself, but I’d love to hear if you do, or if you have any books you’re planning to dive into as the days get longer. Please share your picks if you have them!

Thinking back, I realized I don’t always read seasonally, but last summer I finished the final volume of The Boys comic series. I absolutely loved the comics—the show is okay, but the original has more than just shock value. There’s real history and depth, and even though it has its moments of pure ridiculousness, I was hooked from start to finish.

📖 But the book that really stuck with me was one I read three summers ago: Unorthodox, The Scandalous Rejection of My Hasidic Roots by Deborah Feldman. What a ride! I couldn’t put it down until I finished. Even when it was painful and I was suffering right along with her, I just had to know what happened next.

🖋️The book follows Feldman’s childhood and her escape from her tightly knit Satmar Hasidic community. She was born into a world where every aspect of her life was dictated by strict Orthodox Jewish practice, leaving her with almost no control over her own choices or body. While her story is deeply rooted in her religious upbringing, the struggle for autonomy and self-determination is something many women around the world can relate to, regardless of background or belief.

Feldman’s storytelling is gripping—she takes you by the hand and doesn’t let go until the very end.

There’s a Netflix adaptation, but honestly, I prefer the book. The series is very loosely based on her story, and for me, it loses the intense claustrophobia and emotional impact that made the memoir so powerful.

Reading about her life—how so many things were decided for her, from school to marriage—was truly heartbreaking. It made me reflect on how difficult it can be to break free from a path that seems set in stone.

So, have you read Unorthodox? Do you have any recommendations to add to my never-ending list of books? Or maybe a summer favourite you’d like to share?

See y’all soon, and godspeed!

https://stacker.news/items/1009645

-

@ 9ca447d2:fbf5a36d

2025-06-18 21:01:47

@ 9ca447d2:fbf5a36d

2025-06-18 21:01:47In a move that diverges from many other U.S. states, Connecticut has passed a new law that bars state and local governments from investing in bitcoin or any other digital currency.

The bill, HB7082, passed unanimously in both the House and Senate with zero opposing votes.

The law, officially titled “An Act Concerning the Regulation of Virtual Currency and State Investments,” was signed into law recently and is causing a stir in the Bitcoin and financial communities.

HB7082 prohibits the state of Connecticut and its political subdivisions from accepting, holding or investing in digital currencies. This includes bitcoin, ethereum and other digital assets. It also bars the state from creating a bitcoin reserve, a concept being explored by other states.

The law goes further by imposing strict rules on digital asset businesses operating in the state. These rules enforce anti-money laundering (AML) compliance and parental consent verification for digital asset users under 18.

It also requires 1:1 reserve requirements for bitcoin custodians.

Businesses that handle Bitcoin transactions must now provide users with clear information about risks and fees and provide receipts with full transaction details.

No business can let a minor use a money-sharing app without first getting proof of consent from a parent or guardian.

Lawmakers in Connecticut say it’s about protecting public funds and minimizing financial risk. They say Connecticut’s new law bars state investments in bitcoin to protect its financial assets from market risk.

Supporters argue that the high volatility of bitcoin makes it a risky investment for public money like pension funds and state reserves.

The law also looks to bring bitcoin businesses under tighter control, to make them follow the same rules as the traditional financial system.

While Connecticut is cracking down on digital assets, other states are going the other way.

States like Texas, New Hampshire and Arizona have already passed laws or proposed bills to create a bitcoin reserve, which allows public funds to be invested in bitcoin.

Texas has even described bitcoin as a “forward-thinking investment opportunity” and a long-term store of value.

The new law has caused mixed reactions in the financial world. Some think it’s too cautious, others think it’s part of a bigger plan.

Matt Hougan, CIO of Bitwise, responded with sarcasm, “The hedge fund managers got so upset they couldn’t beat Bitcoin…”

Matt Hougan on X

Some states like Florida, South Dakota and Oklahoma have either killed or vetoed Bitcoin bills this year. Others like Louisiana are still exploring the tech. Louisiana just announced it would create a special committee to study AI, blockchain and digital assets.

-

@ b1ddb4d7:471244e7

2025-06-18 21:01:27

@ b1ddb4d7:471244e7

2025-06-18 21:01:27The Present Ecosystem It Is Not Just Calls

The role of telecommunications carriers has long since evolved beyond that of simple call connectors. Currently, they serve as actual digital centers that penetrate practically every facet of our interconnected lives. With more than 5.7 billion mobile service subscribers and 4.7 billion mobile internet users worldwide (roughly 58% of the global population), telecommunications are the foundation of the digital economy. It is anticipated that by 2030, this figure will rise to an astounding 5.5 billion mobile internet users, or 64% of the world’s population.

A variety of connectivity options are available in the current telecommunications ecosystem, ranging from home fiber optics to 5th generation of mobile networks, which is expected to be adopted globally by 57% by 2030, creating roughly 5.3 billion connections. Collaborations with streaming services that provide on-demand entertainment.

Current Telecom Ecosystem

From fiber optics to 5G technology, telecommunications companies have focused on diversifying global connectivity. By 2030, they are expected to reach 57% global adoption, resulting in around 5.3 billion connections.

There are partnerships with streaming platforms that have transformed carriers into true content gateways. This has helped the explosive growth of data traffic, which reached the mark of 26.53 exabytes per month in 2018.

These companies are offering some personalized business services, such as IoT, security and cloud solutions.

Furthermore, many carriers already provide basic financial services like mobile payments and device financing. This last one is the perfect starting point for a further revolution: the integration of Bitcoin into the telecom ecosystem.

Telecommunications and Bitcoin: A Perfect Match

Carriers’ use of Bitcoin is a radical rethinking of the business-customer relationship, not merely a new mode of payment. Here is how this new ecosystem could work:

-

Customer Experience and Infrastructure – Before implementing Bitcoin, an carrier must build the necessary infrastructure. This entails creating mechanisms that may not only receive cryptocurrency payments but alsoIf companies want to lessen their exposure to volatility, they can automatically convert Bitcoin to fiat money. Companies can also easily integrate with current invoicing systems and provide a more straightforward user experience.

Imagine launching the app for your carrier, scanning a QR code, and having your bill paid or your monthly plan renewed in a matter of seconds. Without waiting for business days, without banking middlemen, and without exorbitant costs.

-

Bringing in New Segments – In addition to making life easier for current clients, Bitcoin’s acceptance draws in entirely new demographics:

Those that appreciate innovation and wish to back trailblazing businesses are known as technology enthusiasts.

Advocates for privacy: Customers who favor transactions that need less personal information to be shared

Global clientele are tourists from other countries who can pay for services without worrying about regional restrictions or exchange rates.Carrier might develop targeted marketing, such as “early access to new devices for customers who use cryptocurrencies” or “10% discount on data top-ups when paid with Bitcoin,” to attract these demographics.

Ongoing Innovation: What Will Happen After Bitcoin?

When businesses embrace Bitcoin and fully utilize blockchain technology, the real revolution will take place. This strategy creates opportunities for developments like:

- Creative Smart Contracts – Smart contracts are self-executing, blockchain-based programs that eliminate middlemen and automate processes. This could be interpreted by carriers as:

- Instant service activation – Your Bitcoin payment has been validated and your international data package is activated automatically even before you land at the airport.Contracts that automatically expire at the designated time eliminate the need for a constant call to the call center.

- Simplified termination – Mini-smart contracts enable family members to automatically transfer excess mobile data.

This was recently illustrated by the Japanese carrier Rakuten Mobile, which unveiled a system that enables users to temporarily increase their bandwidth through smart contracts for a few hours (for instance, to broadcast live events) without modifying their primary plan.

- Creative Partnerships in the World Ecosystem – The carriers are able to establish strategic alliances with:

- Fintech companies that specialize in bitcoin to create integrated digital wallets.

- Startups creating telecom-specific decentralized applications (DApps).

- Academic institutions will investigate novel applications of blockchain technology in the telecommunications sector.