-

@ 472f440f:5669301e

2025-06-19 03:35:39

@ 472f440f:5669301e

2025-06-19 03:35:39Marty's Bent

via me

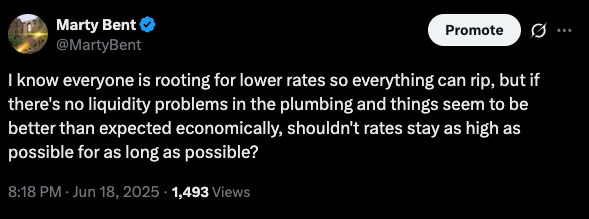

Here's a thought that's been rattling around in my head this week and especially today after the FOMC meeting, during which Jerome Powell announced that the Federal Reserve will hold the Fed Funds rate where it is. Much to the chagrin of President Trump, who has been begging Jerome Powell to lower rates since before he even got into office.

A lot of my thoughts around this particular subject are anchored in conversations I've had with our good friend Parker Lewis on the podcast over the last year. When I ask him about when the Fed will lower rates and potentially revert to quantitative easing, he always responds, "When a liquidity crisis emerges." The Fed is always late to respond and it won't lower rates and turn the money printer on until something breaks in the plumbing of the financial system.

As it stands today, and to my shock, no structural liquidity crisis has materialized in the plumbing and the financial system. We've covered many topics over the course of the last six months. Everything from the yen carry trade blowing out to the treasury carry trade blowing out to the micro-financing of DoorDash deliveries to the increase in delinquency rates for credit card and car loans to the dislocation that currently exists between sellers, buyers, and prices in the real estate market. In aggregate, all these disparate indicators signal to me that there certainly are different sectors of the global economy that are experiencing stress. But if we're being honest with ourselves and looking at the empirical data, there have only been tremors of a liquidity crisis, particularly around the yen and treasury carry trades. Which bubbled up, but then quickly went away.

Inflation is still coming in above the Fed's arbitrary target. The unemployment rate is within range of the Fed's arbitrary target. And the stock market is not too far from all-time highs. Granted, we all know too well that the government reported inflation numbers are severely under-reported and do not reflect actual inflation. The same can be said with the unemployment rate which is typically under-reported because economists refuse to acknowledge the participation rate, which is still below pre-COVID levels. When you factor in this data manipulation, the case for keeping rates higher for longer only gets stronger. Especially when you factor in Trump's immigration policy focused on mass deportation, which should be beneficial for American jobs, increase real wages, increase demand for goods and services in the economy and put upward pressure on prices.

Many who are calling for lower rates will feign worry about economic growth and investment, but it's not too hard to read through the lines and see that many of those cheerleaders just want to return to the asset price acceleration that we experienced at the end of 2020, 2021, and the first half of 2022. Worries of inflation and mass misallocation of capital be damned. Start blowing the bubble again.

There were many responses to the tweet I sent out above saying that we need to lower rates as soon as possible due to the amount of federal debt via the treasury market that is being rolled over in the coming years. I can certainly see that argument, but also believe that these people have extremely short memories considering the fact that treasury yields went up significantly last September after the Fed began to lower rates from the 5.5% target that was set previously. Another set of responses to this tweet pointed to the real estate market claiming that American citizens cannot buy houses due to elevated mortgage rates, which is only half true. The other part of the real estate market equation is the prices of the actual homes, which are also elevated. And as I mentioned earlier, there is currently a wide chasm between the number of sellers and number of buyers in the market at the moment, favoring buyers who have a ton of supply to choose from.

Prices are beginning to come down in major markets across the country, which should make conditions more favorable for those looking to buy, even with elevated mortgage rates. It's also important to understand that mortgage rates are derived in part from Treasury yields, which, as we explained earlier, are not guaranteed to fall with a cut of the Fed Funds rate. I am under the impression that to guarantee a lowering of treasury yields alongside a cut of the Fed Funds rate any cuts would have to be paired with QE to bolster demand and artificially increase the price of treasury bonds (which lowers the yield), and QE can't really be justified without a systemic liquidity crisis.

So for those out there shaking their fists at the sky and damning Jerome Powell and the Federal Reserve Board for not lowering the Fed funds rate, I think you're showing your true bias, which is you want to see financial assets artificially skyrocket and for inflation to increase at a faster clip. Saifedean Ammous made a very good point at the end of The Bitcoin Standard, which was that if the only thing Bitcoin succeeded in doing was to force central banks to practice better, more conservative monetary policy than it will have succeeded.

Now, to be clear, I'm not saying that Bitcoin is guiding the decisions of the Federal Reserve, but I think keeping rates higher for longer, increasing the cost of capital so that allocators are forced to weigh the opportunity costs of where they're investing and demanding that entrepreneurs produce truly innovative, productive, and profitable businesses is a good thing in the long run. The vociferous nagging for lower rates is a product of the ZIRP derp that people became accustomed and addicted to post-2008. It's important to recognize that this period of monetary policy is an anomaly and will be remembered as a grave injustice.

I'm not saying ZIRP derp won't return. I still believe it's inevitable at some point in the future. I'm just saying that it seems a bit odd to me to be cheering it on and wishing it would come ASAP. ZIRP derp is a signal that things are terribly broken. Being able to hold rates higher for longer is a signal that people are being forced to make more calculated decisions and they're doing that successfully. Either that or stealth QE in the form of reverse repo markets and amended reserve requirements for banks are delaying the liquidity crisis despite higher rates.

Why the U.S. Won't Go Bankrupt Despite Record Debt Levels

Mel Mattison presented a compelling case that U.S. bankruptcy fears are overblown, emphasizing that America "has a printing press" and can create dollars at will. He argued that the Fed's balance sheet has significant room to expand, currently holding only 13% of Treasury debt—the same percentage it's maintained since the 1940s. Most importantly, Mattison highlighted that deflationary forces from AI productivity gains and demographic shifts (baby boomers leaving the workforce) will allow continued deficit spending without triggering runaway inflation.

"The U.S. cannot go bankrupt. I mean, like we have a printing press." - Mel Mattison

Mattison's analysis shows that interest expense stabilizing around 3% of GDP mirrors the prosperous 1985-1996 period when stocks rose 350%. He views government spending not as reckless, but as necessary stimulus to prevent deflationary collapse in an aging economy. While this perspective challenges conventional fiscal hawks, the historical precedents and structural changes he cites suggest our debt concerns may be fighting yesterday's battles.

Check out the full podcast here for more on AI's impact on jobs, Bitcoin hitting $150k, and why higher interest rates won't crash markets.

Headlines of the Day

Davis Commodities Puts 40% of $30M Into Bitcoin - via X

Ukraine Bill Adds Bitcoin to National Reserves - via X

Vinanz Raises £3.58M to Expand Bitcoin Mining - via X

Get our new STACK SATS hat - via tftcmerch.io

Bitcoin’s Next Parabolic Move: Could Liquidity Lead the Way?

Is bitcoin’s next parabolic move starting? Global liquidity and business cycle indicators suggest it may be.

Read the latest report from Unchained and TechDev, analyzing how global M2 liquidity and the copper/gold ratio—two historically reliable macro indicators—are aligning once again to signal that a new bitcoin bull market may soon begin.

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Ground beef, guacamole and eggs over medium is an elite dinner.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 31a4605e:cf043959

2025-06-18 19:28:26

@ 31a4605e:cf043959

2025-06-18 19:28:26Você já ouviu isso antes. Um bitcoiner é questionado sobre seus sats e, com um sorriso irônico, responde: “Perdi tudo num acidente de barco.” Mas de onde vem essa frase? Por que tantos bitcoiners fazem essa piada? E mais importante: o que ela realmente significa?

A origem do meme

A expressão "Lost all my Bitcoin in a boating accident" nasceu nos fóruns americanos de entusiastas de armas e metais preciosos, muito antes do Bitcoin ganhar notoriedade mainstream. O contexto original era o seguinte: alguém perguntava se você ainda tinha sua coleção de armas (ou ouro), e a resposta sarcástica era "infelizmente, perdi tudo num acidente de barco".

Essa desculpa servia como uma forma de recusar-se a declarar posse de bens aos olhos do governo ou de outras autoridades. Afinal, o que não se pode provar que existe, não pode ser confiscado, taxado ou regulado. Com o tempo, essa lógica encontrou um terreno fértil entre os defensores da soberania individual, um grupo no qual os bitcoiners naturalmente se encaixam.

A metáfora da resistência

Quando os maximalistas de Bitcoin adotaram a frase, ela passou a representar mais do que apenas uma desculpa para evitar perguntas incômodas: virou um símbolo de resistência contra um sistema financeiro cada vez mais invasivo e coercitivo. Dizer que “perdeu os seus Bitcoin num acidente de barco” é, muitas vezes, um eufemismo para dizer:

“Não é da sua conta quantos sats eu tenho.”

“Não reconheço a autoridade de quem tenta confiscar meu patrimônio digital.”

“Meus ativos são soberanos, autocustodiados e inalcançáveis por meios tradicionais.”

Bitcoin é liberdade, não compliance

O meme também toca num ponto central da filosofia bitcoin: a autocustódia e o direito à privacidade financeira. Em um mundo onde governos congelam contas, censuram transações e imprimem moeda ao bel-prazer, possuir Bitcoin é uma forma de resistência civil. Mas para que isso tenha valor real, é necessário que o indivíduo assuma a responsabilidade pela custódia e, inevitavelmente, pelo silêncio.

Dizer que você “perdeu seus Bitcoin” também é um lembrete: não fale sobre suas chaves privadas. Não ostente seus sats. Não coloque um alvo nas suas costas.

Um meme com propósito

No fim das contas, o “acidente de barco” é uma piada com um fundo muito sério. Ele nos relembra que, num sistema verdadeiramente soberano, a posse de ativos digitais é algo íntimo, pessoal e — se necessário — negável. É uma forma de reafirmar que o Bitcoin não é apenas uma ferramenta de investimento, mas um instrumento de liberdade.

Então da próxima vez que alguém te perguntar onde estão seus bitcoins, sorria e diga:

“Infelizmente, perdi tudo num acidente de barco…”

E deixe que fiquem imaginando.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 1eb5d2c9:ee9e8d5f

2025-06-18 21:20:26lol this motherfucker 🔻

@ 1eb5d2c9:ee9e8d5f

2025-06-18 21:20:26lol this motherfucker 🔻 -

@ df478ecd:495107a7

2025-06-18 15:02:44☠️ nostr:note14vz9qlapldpncsqegkettcak4y44e0drnkwqrcx78nptdmw0p9dqse297p

@ df478ecd:495107a7

2025-06-18 15:02:44☠️ nostr:note14vz9qlapldpncsqegkettcak4y44e0drnkwqrcx78nptdmw0p9dqse297p -

@ df478ecd:495107a7

2025-06-18 11:48:40Ah, that makes more sense. Separate those concerns.

@ df478ecd:495107a7

2025-06-18 11:48:40Ah, that makes more sense. Separate those concerns. -

@ df478ecd:495107a7

2025-06-18 11:32:19Would you add an index to libbitcoinkernel? I thought I heard that somewhere

@ df478ecd:495107a7

2025-06-18 11:32:19Would you add an index to libbitcoinkernel? I thought I heard that somewhere -

@ df478ecd:495107a7

2025-06-18 11:15:51Do I need to read them all or can this list be pruned down?

@ df478ecd:495107a7

2025-06-18 11:15:51Do I need to read them all or can this list be pruned down? -

@ df478ecd:495107a7

2025-06-18 10:52:40Legend nostr:note1tr79jxc0ky5u0uf3xu2pgce3e36cfxhzmnjamtyxpdtnydf2tk6qsl4dks

@ df478ecd:495107a7

2025-06-18 10:52:40Legend nostr:note1tr79jxc0ky5u0uf3xu2pgce3e36cfxhzmnjamtyxpdtnydf2tk6qsl4dks