-

@ dfa02707:41ca50e3

2025-06-18 17:02:58

@ dfa02707:41ca50e3

2025-06-18 17:02:58Headlines

- Twenty One Capital is set to launch with over 42,000 BTC in its treasury. This new Bitcoin-native firm, backed by Tether and SoftBank, is planned to go public via a SPAC merger with Cantor Equity Partners and will be led by Jack Mallers, co-founder and CEO of Strike. According to a report by the Financial Times, the company aims to replicate the model of Michael Saylor with his company, MicroStrategy.

- Florida's SB 868 proposes a backdoor into encrypted platforms. The bill and its House companion have both passed through their respective committees and are headed to a full vote. If enacted, SB 868 would require social media companies to decrypt teens' private messages, ban disappearing messages, allow unrestricted parental access to private messages, and likely eliminate encryption for all minors altogether.

- Paul Atkins has officially assumed the role of the 34th Chairman of the US Securities and Exchange Commission (SEC). This is a return to the agency for Atkins, who previously served as an SEC Commissioner from 2002 to 2008 under the George W. Bush administration. He has committed to advancing the SEC’s mission of fostering capital formation, safeguarding investors, and ensuring fair and efficient markets.

- Solosatoshi.com has sold over 10,000 open-source miners, adding more than 10 PH of hashpower to the Bitcoin network.

"Thank you, Bitaxe community. OSMU developers, your brilliance built this. Supporters, your belief drives us. Customers, your trust powers 10,000+ miners and 10PH globally. Together, we’re decentralizing Bitcoin’s future. Last but certainly not least, thank you@skot9000 for not only creating a freedom tool, but instilling the idea into thousands of people, that Bitcoin mining can be for everyone again," said the firm on X.

- OCEAN's DATUM has found 100 blocks. "Over 65% of OCEAN’s miners are using DATUM, and that number is growing every day. This means block template construction is making its way back into the hands of the miners, which is not only the most profitable for miners on OCEAN but also one of the best things for Bitcoin," stated the mining pool.

Source: orangesurf

- Arch Labs has secured $13 million to develop "ArchVM" and integrate smart-contract functionality with Bitcoin. The funding round, valuing the company at $200 million, was led by Pantera Capital, as announced on Tuesday.

- Tesla still holds nearly $1 billion in bitcoin. According to the automaker's latest earnings report, the firm reported digital asset holdings worth $951 million as of March 31.

- The European Central Bank is pushing for amendments to the European Union's Markets in Crypto Assets legislation (MiCA), just months after its implementation. According to Politico's report on Tuesday, the ECB is concerned that U.S. support for cryptocurrency, particularly stablecoins, could cause economic harm to the 27-nation bloc.

- TABConf 2025 is scheduled to take place from October 13-16, 2025. This prominent technical Bitcoin conference is dedicated to community building, education, and developer support, and it is set to return in October. Get your tickets here.

- Kaduna Lightning Development Bootcamp. From May 14th to 17th, the Bitcoin Lightning Developer Bootcamp will take place in Kaduna, Nigeria. Thisevent offers four dynamic days of coding, learning, and networking. Organized by Africa Free Routing and supported by Btrust, Tether, and African Bitcoiners, this bootcamp is designed as a gateway for African developers eager to advance their skills in Bitcoin and Lightning development. Apply here.

Source: African Bitcoiners.

Use the tools

- Core Lightning (CLN) v25.02.2 as been released to fix a broken Docker image. The issue was caused by an SQLite version that did not support an advanced query.

- Blitz wallet v0.4.4-beta introduces several updates and improvements, including the prevention of duplicate ecash payments, fixes for background ecash invoice handling, the ability for users to send payments to BOLT12 invoices from their Liquid balance, support for Blink QR codes, a lowered minimum amount for Lightning-to-Liquid payments to 100 sats, the option to initiate a node sync via a swipe gesture on the wallet's home screen, and the introduction of opt-in or opt-out functionality for newly implemented crash analytics via settings.

- Utreexo v0.5.0, a hash-based dynamic accumulator, is now available.

- Specter v2.1.1 is now available on StartOS. "This update brings compatibility with Bitcoin Core v28 and incorporates several upstream improvements," said developer Alex71btc.

- ESP-Miner (AxeOS) v2.7.0b1 is now available for testing.

- NodeGuard v0.16.1, a treasury management solution for Lightning nodes, has been released.

- The latest stacker.news updates include prompts to add a receiving wallet when posting or making comments (for new users), an option to randomize poll choices, improved URL search, and a few other enhancements. A bug fix for territories created after 9/19/24 has been implemented to reward 70% of their revenue to owners instead of 50%.

Other stuff

- The April edition of the 256 Foundation's newsletter is now available. It includes the latest mining news, Bitcoin network health updates, project developments, and a tutorial on how to update FutureBit's Apollo 1 to the Apollo 2 software.

- Siggy47 has posted a comprehensive RoboSats guide on stacker.news.

- Learn how to run your own Nostr relay using Citrine and Cloudflare Tunnels by following this step-by-step guide by Dhalism.

- Max Guise has written a Bitkey roadmap update for April 2025.

-

PlebLab has uploaded a video on how to build a Rust wallet with LDK Node by Ben Carman.

-

Do you want more? Subscribe and get No Bullshit GM report straight to your mailbox and No Bullshit Bitcoin on Nostr.

- Feedback or tips? Drop it here.

- #FREESAMOURAI

Sign up for No Bullshit Bitcoin

No Bullshit Bitcoin Is a Bitcoin News Desk Without Ads, Paywalls, or Clickbait.

Subscribe .nc-loop-dots-4-24-icon-o{--animation-duration:0.8s} .nc-loop-dots-4-24-icon-o *{opacity:.4;transform:scale(.75);animation:nc-loop-dots-4-anim var(--animation-duration) infinite} .nc-loop-dots-4-24-icon-o :nth-child(1){transform-origin:4px 12px;animation-delay:-.3s;animation-delay:calc(var(--animation-duration)/-2.666)} .nc-loop-dots-4-24-icon-o :nth-child(2){transform-origin:12px 12px;animation-delay:-.15s;animation-delay:calc(var(--animation-duration)/-5.333)} .nc-loop-dots-4-24-icon-o :nth-child(3){transform-origin:20px 12px} @keyframes nc-loop-dots-4-anim{0%,100%{opacity:.4;transform:scale(.75)}50%{opacity:1;transform:scale(1)}}

Email sent! Check your inbox to complete your signup.

No spam. Unsubscribe anytime.

-

@ eb0157af:77ab6c55

2025-06-18 17:02:38

@ eb0157af:77ab6c55

2025-06-18 17:02:38Only 1% of stablecoin transactions in 2024 are linked to criminal activity.

A recent report by TRM Labs has revealed new data on stablecoin usage in 2024. Contrary to widespread perception, 99% of stablecoin transactions were entirely legal and compliant with existing regulations.

The research shows that over 60% of last year’s total transaction volume was conducted using dollar-pegged tokens.

One key point highlighted in the report is the intrinsic traceability of stablecoins. Operating on public blockchains, these digital currencies allow for highly precise transaction monitoring through specialized analytics tools.

Issuers of centralized tokens like USDT and USDC also have the ability to freeze or permanently remove tokens associated with illicit activities.

TRM Labs data shows a 24% decrease in crypto-related criminal activity compared to 2023, with a total of $45 billion representing just 0.4% of overall crypto transaction volume. This decline is attributed to increased law enforcement efforts, stronger industry collaboration, and the growing adoption of advanced analytics tools.

According to TRM Labs, regulatory clarity provided by legislation such as the GENIUS Act could accelerate stablecoin adoption among major banks, financial institutions, and corporations. Many of these entities are already testing stablecoin-based infrastructures for cross-border payments, supply chain management, and programmable finance.

The post Stablecoins: new report debunks myths about illicit use appeared first on Atlas21.

-

@ b1ddb4d7:471244e7

2025-06-18 17:02:18

@ b1ddb4d7:471244e7

2025-06-18 17:02:18In a quiet corner of the world, bitcoin mining operations in Africa are turning electricity into digital currency and in the process, redefining how value is created.

At its core, bitcoin mining involves validating transaction information before adding new blocks to the Bitcoin blockchain by competing to solve a cryptographic puzzle that meets a specific criterion.

Globally, mining plays a key role in keeping the blockchain decentralized and secure. The system depends on miners to verify and record transactions, mainly to prevent a problem called double spending, the digital version of using the same money twice.

To understand this better, imagine Charles sends $5 to Amanda. With physical cash, Amanda can trust the note is real and hasn’t been used elsewhere. But with digital currency, copying data is easy, so how can she be sure that the same $5 wasn’t sent to someone else too? That’s the exact problem Bitcoin mining helps solve.

In recent years, Africa has started to draw attention in this space, positioning itself as a key hub in global bitcoin mining. While there may be less than 2 million bitcoin left to be mined from the total 21 million supply, the rise of mining operations in Africa has sparked excitement, creating new jobs and drawing in foreign capital.

Although some countries still grapple with power shortages and the energy demands of mining, many citizens view bitcoin as a more stable store of value and a safeguard against the volatility of their local currencies.

At the same time, Africa’s wealth of hydro, solar, wind, and geothermal resources makes the continent one of the most promising regions for cost-effective and sustainable mining.

What Makes a Large-Scale Bitcoin Mining Operation in Africa?

It all starts with difficulty. Bitcoin mining isn’t just about solving a puzzle, it’s about solving one that keeps getting harder. Mining difficulty refers to how much computational work is needed to generate a number lower than the target hash.

This difficulty automatically adjusts every 2,016 blocks (about every two weeks), depending on how quickly miners solved the previous batch. If mining is fast and efficient, the network increases the difficulty; if miners drop off and block times slow, it reduces it, all to maintain a consistent block production time of roughly 10 minutes.

The significance of mining difficulty lies in the increased demands it places on mining operations. As difficulty rises, miners require more powerful hardware, cost-effective energy sources, advanced infrastructure, and substantial financial investment. These requirements distinguish large-scale mining operations from smaller, casual miners.

In short, it’s the difficulty of mining that births the need for large facilities, massive energy inputs, industrial-grade hardware, and significant financial investment, the very traits that define a “large” bitcoin mining operation.

This leads us to the 4 key factors that define large Bitcoin mining operations in Africa, each one a direct response to the growing demands of the network:

1. Facility size and infrastructure:

The physical size of a mining facility is a direct reflection of its capacity to house mining equipment and support systems. Larger operations typically have thousands of mining rigs installed, supported by extensive infrastructure such as advanced cooling systems and stable power supplies.

These are critical to ensure that the equipment runs continuously and efficiently, given the intense heat and electricity demands of mining.

While it is possible to mine Bitcoin using desktop computers or gaming rigs by joining mining pools, these setups are limited in profitability. Mining pools distribute rewards based on the computational power contributed, meaning small or less efficient machines earn only modest returns.

To compete effectively, mining operations invest in specialized hardware known as Application-Specific Integrated Circuit (ASIC) miners. These machines are far more powerful and energy-efficient than regular computers but require significant capital investment, with prices ranging from $4,000 to $12,000 per rig depending on their performance.

Large-scale operations typically deploy hundreds or thousands of these ASIC miners, which necessitates the large facilities and sophisticated infrastructure mentioned earlier. In this way, the size of the facility and the sophistication of the mining equipment are tightly linked, together defining the overall scale and capability of a bitcoin mining operation.

2. Hashrate contribution:

Hashrate refers to the computational power used to mine and process transactions on the Bitcoin network. A higher hashrate indicates a more significant contribution to the network’s security and transaction processing.

Large mining operations often possess substantial hashrate, measured in exa hashes per second (EH/s). For instance, as of July 2024, the Bitcoin network’s hashrate was approximately 733.41 EH/s.

3. Energy consumption and power source:

Bitcoin mining is energy-intensive. The total energy consumption of the Bitcoin network has been estimated at 175.87 terawatt-hours annually, comparable to the power consumption of Poland. Large mining operations often seek locations with access to cheap and reliable energy sources, such as hydroelectric, solar, or wind power, to reduce operational costs and environmental impact.

4. Financial banking and investor interest:

Significant financial investment is required to establish and maintain large-scale mining operations. This includes the cost of mining hardware, facility construction, energy procurement, and operational expenses. Companies with substantial financial backing can invest in cutting-edge technology and infrastructure, enhancing their mining capabilities.

Overview of Bitcoin Mining in Africa

Africa is beginning to carve out its share of the global Bitcoin mining market, which was valued at $2.45 billion in 2024 and is projected to reach $8.24 billion by 2034.

As Bitcoin’s value continues to rise, countries across the continent are positioning themselves to benefit, many by tapping into abundant renewable energy sources and taking advantage of regulatory ambiguity or excess energy production.

Ethiopia currently leads the continent in Bitcoin mining activity, with around 2.5% of the global hashrate reportedly coming from operations powered entirely by renewable energy.

This energy mismatch has attracted major miners from China and other regions, who see an opportunity to monetize surplus electricity. Ethiopia’s success showcases how renewable energy and mining can coexist sustainably while contributing meaningfully to state revenue.

Kenya follows closely behind. As the top geothermal energy producer in Africa, with an installed capacity of 863 MW, the country is using its energy advantage to support sustainable mining.

Nigeria is emerging as a serious contender. While not yet dominant, its large population, increasing tech engagement, and growing interest in using flared gas for mining signal potential for expansion. Nigeria’s complex but evolving regulatory landscape also leaves room for further mining developments as the government explores clearer crypto frameworks.

Malawi represents a more localized model of Bitcoin mining. By converting rainfall-powered microgrids into revenue-generating infrastructure, Malawi shows how small-scale mining can play a powerful role in community development and rural electrification.

In Libya, Bitcoin mining is technically illegal, but that hasn’t stopped it. Despite the ban, underground mining continues to thrive thanks to heavily subsidized electricity. In 2021, Libyan miners accounted for an estimated 0.6% of the global Bitcoin production, the highest in both the Arab world and Africa at the time. Today, mining reportedly consumes around 2% of the country’s electricity, even as it operates in the shadows.

Angola rounds out the list with limited public data but notable potential. The country struggles with energy inefficiencies, losing nearly 40% of its hydroelectric power during transmission. Some reports suggest Bitcoin miners are beginning to capitalize on this otherwise stranded energy, though large-scale operations are yet to surface.

What unites these countries is a shared set of conditions: untapped or mismanaged energy resources, an openness or gray area in regulation, and the growing understanding that Bitcoin mining can serve as a financial incentive to build and stabilize decentralized energy systems.

Whether through massive hydroelectric projects or rural microgrids, Bitcoin mining is emerging as both an energy monetization strategy and a bridge to infrastructure development across Africa.

Profiles of the Largest Bitcoin Mining Operations in Africa

1. BitCluster (Ethiopia)

As of 2024, Bitcoin mining in Africa is largely concentrated in

-

@ cae03c48:2a7d6671

2025-06-18 17:01:56

@ cae03c48:2a7d6671

2025-06-18 17:01:56Bitcoin Magazine

Fold Holdings Secures $250 Million Equity Deal to Expand Bitcoin TreasuryToday, Fold Holdings, Inc. (NASDAQ: FLD), the first publicly traded bitcoin financial services company, has announced a $250 million equity purchase agreement to significantly increase its bitcoin holdings.

JUST IN:

Publicly traded Fold secures $250 million equity facility to buy more #Bitcoin pic.twitter.com/M7E3fzwAsT

Publicly traded Fold secures $250 million equity facility to buy more #Bitcoin pic.twitter.com/M7E3fzwAsT— Bitcoin Magazine (@BitcoinMagazine) June 17, 2025

Fold Holdings has the option, but not the obligation, to issue and sell up to $250 million in new common stock. The ability to access the funds is subject to certain conditions, including the requirement that a registration statement covering the resale of the stock be filed with and approved by the Securities and Exchange Commission (SEC).

“The Company is not required to use the Facility and controls the timing and amount of any drawdown on the Facility, subject to certain restrictions under the Facility,” said the press release. “The Company expects to use the net proceeds from the Facility, if any, primarily to acquire additional bitcoin for Fold’s corporate treasury.”

The shares offered under the facility will be issued through a private placement, relying on exemptions from the registration requirements of the Securities Act of 1933 and Regulation D. Fold noted that it “plans to file with the SEC a registration statement relating to the resale of the Common Stock issuable under the Facility.”

“The offers and sales of the Common Stock issuable under the Facility will be made in a private placement in reliance on an exemption from the registration requirements of the Securities Act of 1933,” according to the press release. “The Company cannot draw on the Facility, and the Common Stock may not be sold nor may offers to buy be accepted, prior to the time that the registration statement covering the resale of the Common Stock is declared effective by the SEC.”

On May 19, Fold also announced the launch of its Bitcoin gift card, marking its entry into the $300 billion U.S. retail gift card market. This new product allows consumers to purchase and gift bitcoin through familiar retail channels, with plans to expand to major retailers nationwide throughout the year.

“This gift card gives us distribution directly to millions of Americans who may not be buying Bitcoin because they haven’t downloaded a new app, don’t have a brokerage account, or haven’t seen the ETF,” said the Chairman and CEO of Fold Will Reeves.

“I think there’s a real chance by the end of 2025 that Bitcoin becomes the most popular gift in America because of this card,” stated Reeves.

This post Fold Holdings Secures $250 Million Equity Deal to Expand Bitcoin Treasury first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-18 17:01:33

@ cae03c48:2a7d6671

2025-06-18 17:01:33Bitcoin Magazine

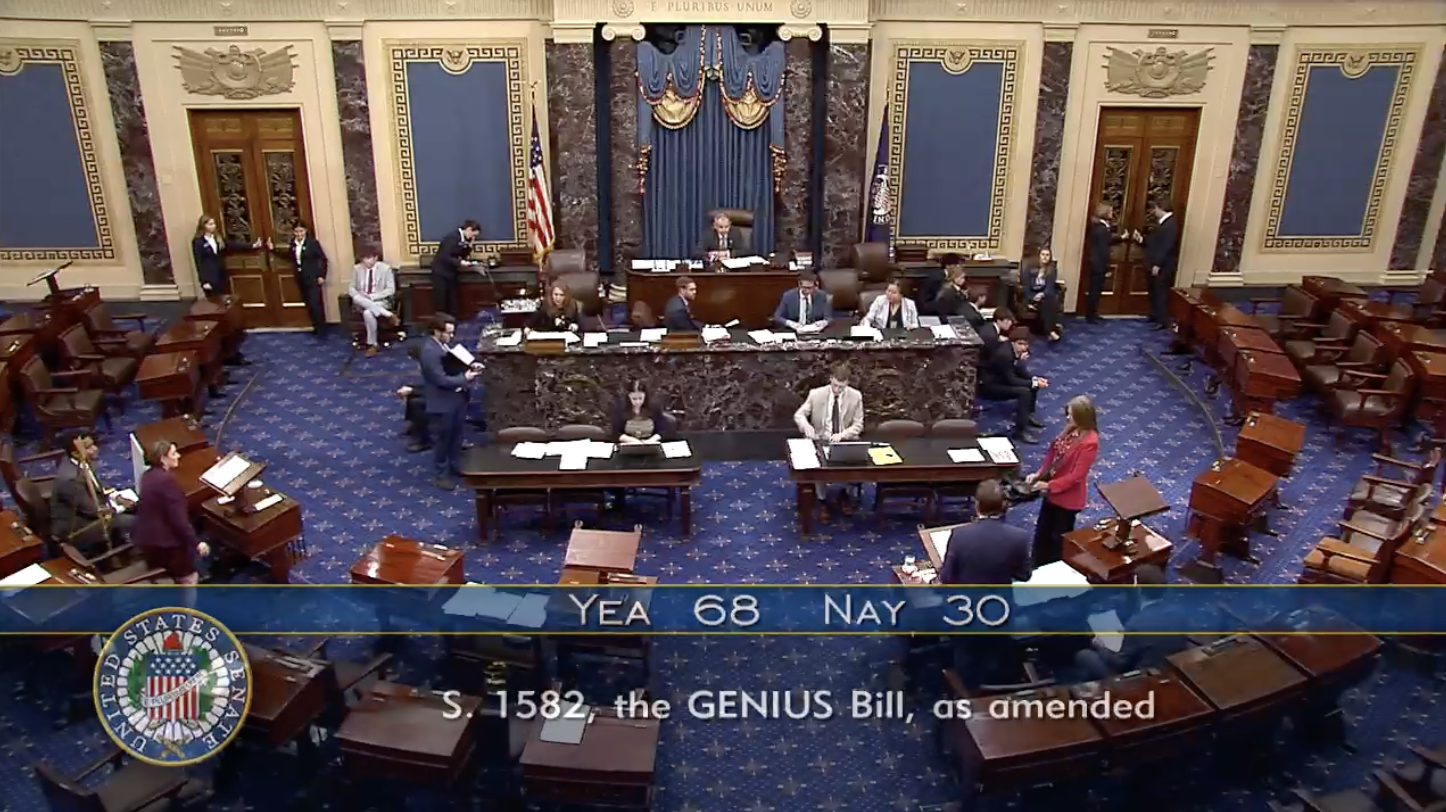

U.S. Senate Passes Stablecoin Bill The GENIUS ActThe U.S. Senate has passed the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act (S. 394) by a vote of 68-30, establishing the first comprehensive federal framework for fiat-backed stablecoins.

The bipartisan legislation was introduced by Senator Bill Hagerty and co-sponsored by Senators Tim Scott, Kirsten Gillibrand, and Cynthia Lummis. It passed under the official title “Guiding and Establishing National Innovation for U.S. Stablecoins of 2025.”

The United States Senate has passed the GENIUS Act

— Bo Hines (@BoHines) June 17, 2025

“Today, on a bipartisan basis, the Senate passed its first piece of major legislation this Congress with my bill—the GENIUS Act,” said Senator Hagerty. “With GENIUS, the United States is one step closer to becoming the crypto capital of the world.”

The GENIUS Act tightly regulates payment stablecoins, requiring 1:1 dollar-backed reserves, monthly disclosures, audits, and clear federal or state licensing. It prohibits algorithmic coins and places strict limitations on rehypothecation and commingling of reserves. Importantly, the bill also amends existing securities laws to explicitly state that compliant stablecoins are not securities—freeing them from SEC jurisdiction.

While the bill is aimed at stablecoins, many Bitcoin proponents see it as a win since stablecoins can act as a bridge into Bitcoin, enabling on-ramps, easier settlements, and institutional access.

And as the financial system modernizes, trusted access points like dollar-backed tokens could play a role in onboarding new Bitcoin users—especially in international markets and corporate treasuries.

“The U.S. Senate has passed the GENIUS Act — landmark stablecoin legislation that provides regulatory clarity, enhances consumer protection, and extends U.S. dollar dominance online,” said President Donald Trump’s AI & Crypto Czar David Sacks. “Thanks to President Trump for his leadership on crypto & Senator Hagerty for authoring the bill.”

The passage of the GENIUS Act may be the clearest signal yet that the U.S. is preparing for a stablecoin and Bitcoin-powered future.

This post U.S. Senate Passes Stablecoin Bill The GENIUS Act first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-18 17:01:28

@ cae03c48:2a7d6671

2025-06-18 17:01:28Bitcoin Magazine

Swiss Bitcoin Platform Relai & Casa Partner to Offer Multisig Bitcoin SecurityToday, Relai, a Swiss Bitcoin platform, announced it has partnered with Casa to introduce a new Bitcoin saving and security solution, according to a press release sent to Bitcoin Magazine.

“Self-custody is at the heart of Bitcoin’s promise,” said the Co-Founder and CTO of Relai Adem Bilican. “As our users continue to accumulate and grow their holdings over time, we recognize the need for long-term solutions designed for serious Bitcoin enthusiasts. Casa is the ideal partner – a sovereignty-focused and user-friendly solution. Together, we’re helping users secure not just their savings, but their legacy.”

According to the press release, the app has over 500,000 downloads, more than 85,000 active users, and a total user investment exceeding $1 billion. These figures reflect growing user engagement with self-custody Bitcoin solutions intended for long-term use.

Self-custody is a fundamental aspect of Bitcoin ownership, but it also comes with certain risks, particularly around long-term security. The partnership introduces a multisignature (multisig) custody option, which requires multiple keys to access funds. This setup can help mitigate the vulnerabilities of single-key storage.

Through the integration, users who purchase Bitcoin via Relai will have the option to store their assets using Casa’s multisig system. The offering also includes an inheritance feature that allows users to designate a beneficiary, adding a layer of planning for asset transfer across generations.

“Casa’s mission is to maximize sovereignty and security in the world,” stated the CEO of Casa Nick Neuman. “The best way we can do that today is by making sovereign bitcoin custody as safe and simple as possible. Our partnership with Relai will help people stack bitcoin and store it securely, for themselves and their families.”

According to both companies, the integration represents a first-of-its-kind model that combines Bitcoin accumulation with long-term custody and inheritance planning for everyday users.

This post Swiss Bitcoin Platform Relai & Casa Partner to Offer Multisig Bitcoin Security first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-18 17:01:23

@ cae03c48:2a7d6671

2025-06-18 17:01:23Bitcoin Magazine

Prenetics Becomes First Healthcare Firm to Launch Bitcoin Treasury Strategy With $20M BTC PurchasePrenetics Global Limited, a health sciences company, announced today that it has purchased $20 million worth of Bitcoin as part of a newly approved corporate treasury strategy. The company acquired 187.42 BTC at an average price of $106,712 and stated that its board has approved allocating the majority of its $117 million balance sheet to Bitcoin.

This follows the company’s strategic transfer of ownership of ACT Genomics, which increased its pro-forma cash to approximately $66 million and total liquid assets, including BTC and short-term holdings, to around $117 million.

According to a press release sent to Bitcoin Magazine, Danny Yeung, CEO of Prenetics stated, “With our strengthened balance sheet of $117 million in cash, BTC and short-term assets, we now have the financial foundation to pioneer innovative treasury management approaches, including our historic Bitcoin treasury strategy.”

Prenetics also announced the appointment of Andy Cheung, former COO of cryptocurrency exchange OKEx, to its Board of Directors. Cheung noted that the company’s Bitcoin strategy will include active treasury management, using tools such as derivatives and structured products.

“This isn’t about passive Bitcoin storage,” said Cheung. “We’re talking about dynamic treasury management using derivatives, yield strategies, and institutional-grade trading techniques.”

Prenetics plans to expand its Bitcoin holdings through institutional capital partnerships and to implement advanced return strategies. It also plans to accept Bitcoin payments across its direct to consumer platforms, including IM8 Health and CircleDNA.

In addition to Cheung, the company is working with two industry advisors, Tracy Hoyos Lopez, Chief of Staff at Kraken and a board member at the Bitcoin Advocacy Project, and Raphael Strauch, founder of crypto conference TOKEN2049.

“This is not a short-term play or market timing decision,” said Yeung. “We are implementing a comprehensive, long-term Bitcoin strategy that we believe will fundamentally transform our company’s value proposition.”

Prenetics reported strong recent growth, including a 336.5% year over year revenue increase in Q1 2025. It now operates three consumer health brands and maintains a deb free balance sheet.

Prenetics’ strategy shows Bitcoin’s tremendous growth and potential. But this time, from within the healthcare sector.

This post Prenetics Becomes First Healthcare Firm to Launch Bitcoin Treasury Strategy With $20M BTC Purchase first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-18 17:01:15

@ cae03c48:2a7d6671

2025-06-18 17:01:15Bitcoin Magazine

The Blockchain Group Buys $20 Million Worth Of BitcoinThe Blockchain Group has acquired an additional 182 Bitcoin for approximately €17 million ($19.6 million), further expanding its position as Europe’s first Bitcoin treasury company amid accelerating institutional adoption of Bitcoin reserves.

According to a press release issued June 18, the Euronext Growth Paris-listed company completed the purchases through multiple convertible bond issuances totalling over €18 million, subscribed by several investors, including UTXO Management, Moonlight Capital, and asset manager TOBAM.

JUST IN:

French publicly traded, The Blockchain Group buys an additional 182 #Bitcoin for €17.0 million

French publicly traded, The Blockchain Group buys an additional 182 #Bitcoin for €17.0 million Nothing stops this train

pic.twitter.com/fwIqq934Yy

pic.twitter.com/fwIqq934Yy— Bitcoin Magazine (@BitcoinMagazine) June 18, 2025

The acquisitions bring The Blockchain Group’s total Bitcoin holdings to 1,653 BTC, purchased at an average price of €90,081 ($104,000) per coin. The company reported a “BTC Yield” – measuring Bitcoin holdings relative to fully diluted shares – of 1,173.2% year-to-date, significantly outpacing other major corporate holders.

The company’s latest purchases were executed through Swissquote Bank Europe and Banque Delubac, with custody provided by Swiss infrastructure provider Taurus. Additional funding came from the conversion of share warrants into 2.98 million ordinary shares, raising €1.6 million.

We’re seeing unprecedented growth in corporate Bitcoin treasury strategies. The Blockchain Group’s success has created a model for European companies, with new organizations announcing Bitcoin purchases almost weekly.

The company indicated potential plans to acquire an additional 70 BTC through ongoing transactions, which could bring its total holdings to 1,723 BTC. This follows recent Bitcoin treasury announcements from companies including Metaplanet, which now holds 10,000 BTC, and Strategy’s latest acquisition of 10,1000 BTC.

At press time, Bitcoin trades at $104,021, down 1.26% over the past 24 hours, as markets continue to process the implications of growing institutional adoption. The Blockchain Group’s shares were down 3.9% to €4.80 on Wednesday, trading on Euronext Paris.

This post The Blockchain Group Buys $20 Million Worth Of Bitcoin first appeared on Bitcoin Magazine and is written by Vivek Sen.

-

@ cae03c48:2a7d6671

2025-06-18 17:01:05

@ cae03c48:2a7d6671

2025-06-18 17:01:05Bitcoin Magazine

K33 Announces Plans To Purchase Up To 1,000 BitcoinK33 AB, a leading digital asset brokerage and research firm, announced today the launch of a SEK 85 million direct share issue to fund the purchase of Bitcoin. The company aims to build Bitcoin as a core asset on its balance sheet, targeting the accumulation of up to 1,000 BTC as a strategic reserve.

PRESS RELEASE: K33 launches a share issue to finance the purchase of up to 1000 Bitcoin, with a minimum of SEK 85 million secured through pre-commitments pic.twitter.com/sG1LZjR6EI

PRESS RELEASE: K33 launches a share issue to finance the purchase of up to 1000 Bitcoin, with a minimum of SEK 85 million secured through pre-commitments pic.twitter.com/sG1LZjR6EI— K33 (@K33HQ) June 18, 2025

The share issue, priced at SEK 0.1036 per share, is fully backed by existing shareholders and new investors. Proceeds from the raise will be used exclusively to acquire BTC, supporting K33’s accumulation strategy revealed in May. By acquiring BTC, the company aims to strengthen its balance sheet, boost brokerage margins, launch new products, and attract more investors.

“This raise marks a major milestone towards our initial goal of acquiring 1000 BTC before scaling further,” commented the CEO of the Company Torbjørn Bull Jenssen. “We strongly believe that Bitcoin represents the future of global finance and are positioning K33 to benefit maximally from this. A strong balance sheet built on Bitcoin enables us to significantly improve our brokerage operation while maintaining full exposure to Bitcoin’s upside potential.”

As part of the strategy, K33 recently completed its first Bitcoin acquisition, purchasing 10 BTC for approximately SEK 10 million on June 3. This transaction is the initial deployment of capital from the SEK 60 million investment commitment announced earlier this year to support the company’s BTC treasury.

“We expect Bitcoin to be the best-performing asset in the coming years and will build our balance sheet in Bitcoin moving forward,” stated Jenssen. “This will give K33 direct exposure to the Bitcoin price and help unlock powerful synergies with our brokerage operation. Our ambition is to build a balance of at least 1000 BTC over time and then scale from there.”

During its Q1 2025 Report and Strategic Outlook presentation, K33 underscored the accelerating institutional adoption of Bitcoin, referencing the rapid growth of the US Bitcoin ETFs, which attracted more capital in its first year than gold ETFs had in the past two decades.

“For K33, Bitcoin is not only a high-conviction asset — it’s also a strategic enabler,” Jenssen said. “With a sizable BTC reserve, we will be able to strengthen our financial position while unlocking new revenue streams, product capabilities, and partnerships.”

This post K33 Announces Plans To Purchase Up To 1,000 Bitcoin first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-18 17:00:56

@ cae03c48:2a7d6671

2025-06-18 17:00:56Bitcoin Magazine

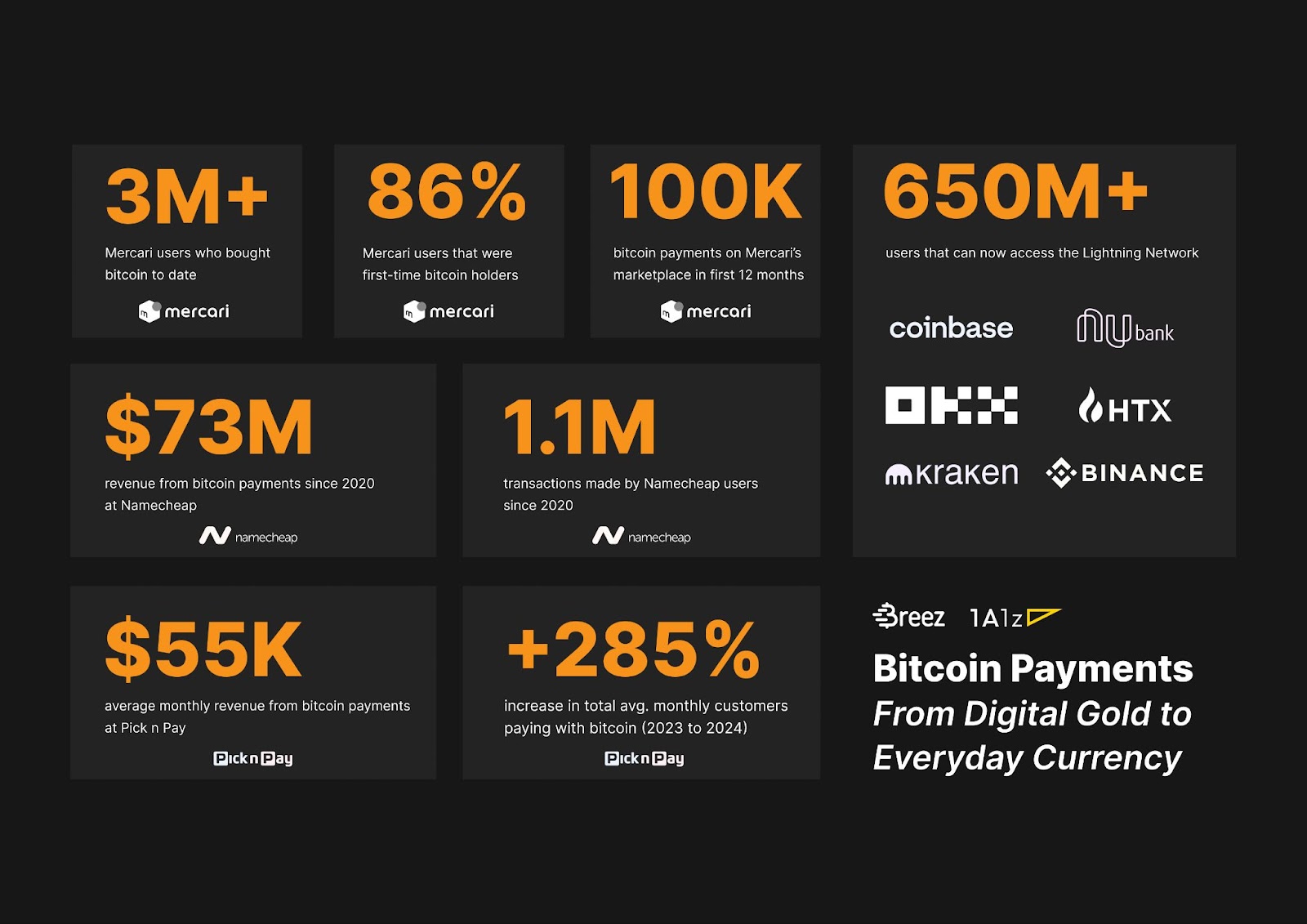

Bitcoin Tech Booms: Lightning Data Defies Digital Gold NarrativeEgo Death Capital’s portfolio reveals adoption metrics including $1.5 billion in Lightning-powered trading volume, as Block shocks the industry with their 9.7% Lightning Network yield.

While bitcoin treasury companies, debates about market structure bills, and strategic bitcoin reserve advocacy dominate the headlines in 2025, a trend is quietly growing in the background: the success of Bitcoin technology companies.

Increasingly recognized as digital gold and a long-term store of value, bitcoin is far more than just a shiny rock in cyberspace. As a software technology, Bitcoin is programmable and has unlocked a new paradigm of payments, custody, settlement and trading possibilities.

Nevertheless, some critics point to the empty blocks on the Bitcoin base layer and historically low transaction fees as implicit proof that Bitcoin is failing as a medium of exchange. Others claim that the Lightning Network has failed to get mainstream adoption and even argue that it suffers from significant privacy problems. But the opposite may be true.

New data coming out of various companies throughout the industry is starting to paint a different picture. Perhaps the Lightning Network has been so successful in drawing transactions off chain and making them more private that it is hard to quantify success metrics without companies involved sharing the data.

But, a variety of Bitcoin start-ups and companies using bitcoin to build out new financial infrastructure are now starting to boast of their success metrics, claiming numbers that suggest there is a strong product market fit beyond treasury strategies.

Jeff Booth, author of The Price Of Tomorrow and co-founder of the Bitcoin-focused VC firm Ego Death Capital, told Bitcoin Magazine he doesn’t “think the general public has any clue with how fast the Bitcoin ecosystem is growing.” Adding that, “They keep on hearing treasury companies this and politics that, and they’re missing the forest for the trees.”

Below follows a summary of various companies and projects demonstrating Bitcoin adoption in significant numbers, many of them within the Ego Death Capital portfolio.

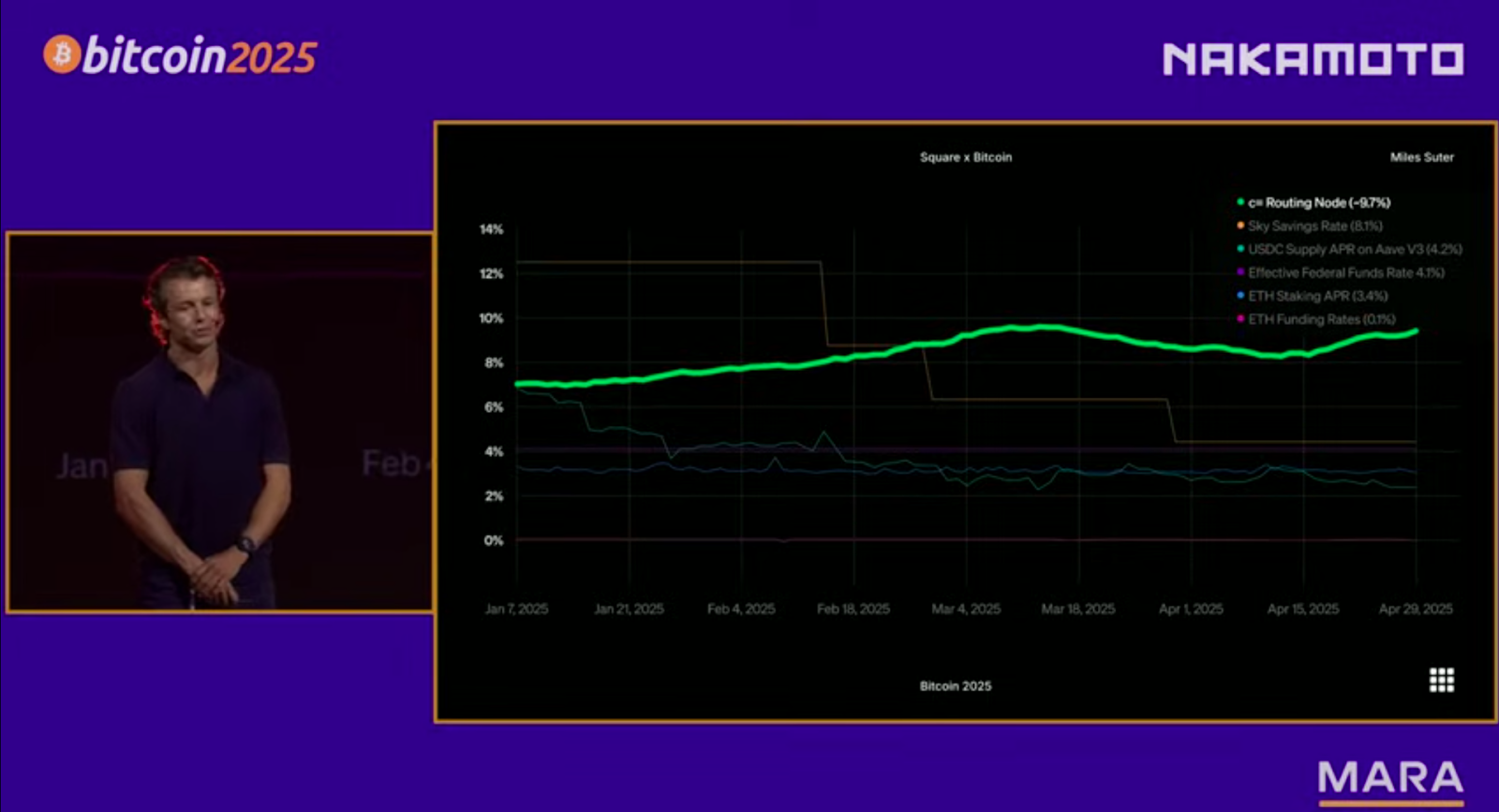

Block: Earning Big on Lightning and Bitcoin Payments

The contrast in perspectives between the digital gold thesis and those that believe in Bitcoin as a payments technology was most recently seen at Bitcoin Vegas 2025 where Block, the parent company of Cash App, disclosed that they are earning 9.7% yield off their Bitcoin Lightning node.

Miles Suter, Bitcoin Product Lead at Block, told the live audience that “at the infrastructure layer, we’re earning nearly 10% bitcoin-on-bitcoin returns by efficiently routing real payments across the Lightning network. This isn’t yield from altcoin staking or reckless speculation; it’s from solving hard, real-time routing problems, and its real bitcoin-on-bitcoin returns from our corporate holdings via supporting real payments use cases.”

Besides Block’s stunning 9.7% figure announcement, which stood out as one of the most lasting impressions from the conference, Suter claimed that Cash App ranks “among the top bitcoin on-ramps in the U.S., accounting for nearly 10% of on-chain block space at any time,” adding that in 2024, its Lightning usage grew 7x and one in four of their outbound Bitcoin payments are processed on Lightning. These numbers highlight Block’s growth as a Bitcoin payments giant, now perhaps the most common merchant payments terminal and consumer payments app that integrates bitcoin.

Ego Death Capital

Ego Death Capital has been investing in Bitcoin infrastructure start-ups since 2022, initially raising a tactical 30 million dollar fund amid a boom in crypto and altcoin VC investments.

“When we first raised money, we actually targeted 30 million because the ecosystem at that time was really early. We realized we had to lean into these companies to help them scale. There were a lot of big crypto funds at that time, but they were spraying money everywhere else. And it was largely the exact opposite of what we believed would happen on Bitcoin.” Booth recalled that “Bitcoin was a protocol. It was developing in layers and it was early. And if you realized that and leaned in to help those companies that were developing in the layers, helping the infrastructure be created, then you would accelerate that. You would accelerate what we saw Bitcoin being, a currency, a store of value, an entirely new network.”

“We don’t have a failure in that fund,” Booth said of the firm’s first investment cohort, which included companies like Breez, Relai, LN Markets, Fedi, Wolf and Simple Proof. “That fund is just over three years old. It’s staggering. A number of those companies, I think three of those companies are already profitable — and profitable in bitcoin terms. So adding bitcoin to their treasury each month and growing incredibly fast.”

Breez: Powering a Global Lightning Payments Network

Breez, founded in 2018, is a self-custodial Lightning-as-a-service provider that enables developers to integrate Bitcoin payments into apps using its open source Breez SDK. By simplifying Lightning’s complexities, Breez has been driving widespread adoption across diverse industries.

“Over 40 apps have already implemented our SDK in production or beta since we launched it less than 18 months ago. Collectively, ~1.5 million users now have access to self-custodial, peer-to-peer bitcoin payments through these apps. These apps processed over $4.5 million in gross transaction volume in 2024,” wrote Roy Sheinfeld, CEO of Breez, in a January 2025 blog post.

The “Bitcoin Payments Report” by Breez and 1A1z, released February 2025, added, “The Lightning Network now reaches over 650 million users; driven by integrations with mainstream products, new developer tools, and growing merchant adoption.” A month later Sheinfeld published that “Lightning Pay’s user base has been growing with users moving a billion sats monthly.” Additionally, Breez’s integration with Klever Wallet brought Lightning to “100,000 monthly active users,” as stated in a December, 2024, blog post.

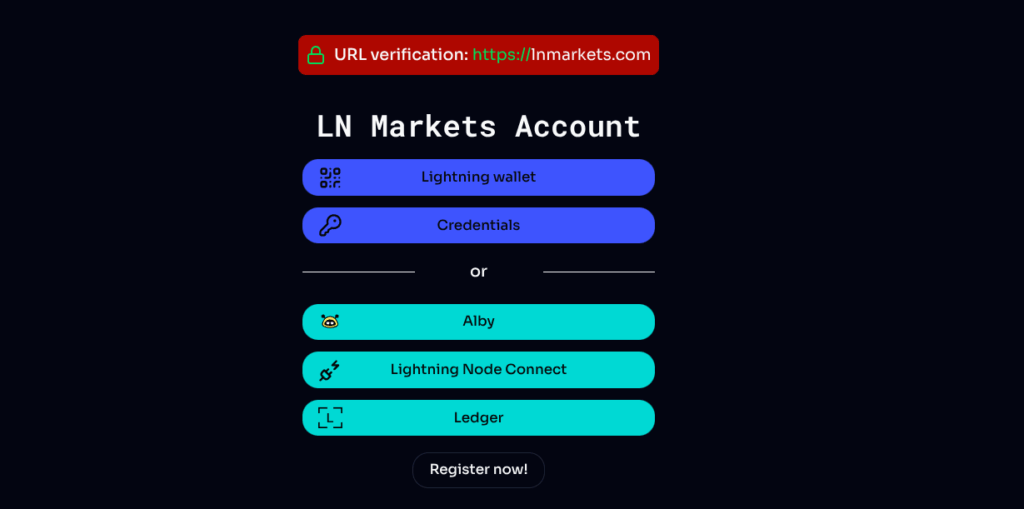

LN Markets: Lightning-Fueled Trading Takes Off

LN Markets, launched in 2020, is a Bitcoin-native derivatives trading platform, leveraging the Lightning Network for instant settlements and minimized counterparty risk.

Its Lightning-native login interface demonstrates they are on the cutting edge of Bitcoin technologies and unlocks user experience features that differentiate it from most other advanced trading platforms. The fast payment rails that result from this deep integration with the Lightning Network unlock faster settlement, lower withdrawal fees and provides access to smaller traders throughout the third world, with many users in South America in countries like Mexico, Brazil and Colombia.

“Basically we’ve gone from 50 million in monthly trading volume to 1.5 billion last month in May,” co-founder Romain Rouphael told Bitcoin Magazine, adding that they have gone from “one billion dollar yearly trading volume in 2023 to six billion last year to 12 billion this year.” Profitability is also strong, with Romain stating, “We double our revenue each year and we double our EBITDA as well every year,” and “We are doing millions of Lightning transactions every year” These figures highlight LN Markets’ strong and active user base as well as Lightning’s scalability.

The exchange focuses on B

-

@ cbd044aa:090d5436

2025-06-18 16:32:55

@ cbd044aa:090d5436

2025-06-18 16:32:55Additional Pet Services Abbotsford Hey, Abbotsford pet parents! At Alpha Animal Hospital, we go beyond basic care with awesome pet services tailored for your furry pals. From doggy daycare and cozy cat boarding to expert dental cleanings and fun puppy training classes, we’ve got your pet’s needs covered. Our friendly team ensures every visit is stress-free, keeping your pet happy and healthy. With years of trusted care, we’re here to make pet parenting a breeze. Call us at Alpha Animal Hospital to book today!

-

@ cbd044aa:090d5436

2025-06-18 16:31:15

@ cbd044aa:090d5436

2025-06-18 16:31:15Pet Grooming Services Sedro Woolley Looking for top-notch pet grooming services in Sedro Woolley? At Sedro Woolley Veterinary Clinic, we pamper your furry friends with care and expertise! Our skilled team offers stress-free grooming, including nail trims, sedated lion shaves, and dematting for cats, ensuring your pet feels comfortable and looks their best. With over 50 years of trusted service, we prioritize your pet’s well-being in a friendly environment. Book an appointment today and let your pet shine!

-

@ 000002de:c05780a7

2025-06-18 16:41:41

@ 000002de:c05780a7

2025-06-18 16:41:41By this all people will know that you are my disciples, if you have love for one another.”

I've been meditating on these words from our savior since Easter. In these times I need to remind myself of this pretty much every day.

https://stacker.news/items/1009542

-

@ f85b9c2c:d190bcff

2025-06-18 16:39:13

@ f85b9c2c:d190bcff

2025-06-18 16:39:13

This is too scaring cannot break this vicious circle and it goes with complications. There isn't a more serious condition beyond an empty pocket or people's economic status.People told they do not have the right to education, healthcare etc. Of course there are thousands of critical areas to target so that it may be adequately addressed to help break the cycle of areas of education, economic opportunities, health care, and mechanisms of social support.

Education Quality education should also give them the ability to lead a stable income, course of better lives. However the program would benefit poor children and help in more long-term aspects . Investment in education also means an improvement of the school environment in poor areas. It means first of all professional education of teachers, improving conditions and accessibility to all resources needed for studying-books, technology, etc. Relatively low costs of higher education and vocational trainings can equip young people with the needed and actually demanded skills for more promising employment.

Economic Opportunities It is the most basic need to save people from poverty and empower them with ownership over some opportunities economically. For example creation of jobs, small businesses, equal pay to citizens within the country and a willing government and organizations which will give out a micro-loan and grant to business-oriented entrepreneurs who want to start up. Then undergoing a good program on training of financial literacy, business management, and marketing that will empower people with a better foundation which can then leverage to do well through enterprising ambition. For this reason people will thus be able to make a living wage ,at least their basic needs will be available and the means to invest for themselves.

Access to Health Care Health and poverty problems are evident therefore better health means improved levels of productivity.Improvement in health care is therefore expected to get health care that not only meets the price but also accessible at some cost. So ,universal health services including preventive service, mental health and maternal and child health care may improve the health of families defined as low-income providers. All these public health programs should be based on nutrition sanitation and prevention of diseases. Education should bring out the potentiality of the community in acquiring the proper information that will help them decide the right choices for betterment in health, hence a healthier economic outlook in the future.

Social Support Systems Support systems that would have protection provided for families and individuals. Other programs may also be monetary, food, or housing that may be needed which will minimize a part of the direct burdens. Such assistance and resources are also made possible with access entry to community networks. Community organizations and non-profits providing counseling and mentoring support perhaps some skills development programs-show people an opportunity to work against the challenge that stands out as a barrier for people getting successes.

-

@ cbd044aa:090d5436

2025-06-18 16:29:28

@ cbd044aa:090d5436

2025-06-18 16:29:28Pet Diagnostics Services Surrey Is your pet acting off? Campbell Heights Animal Hospital in Surrey offers top-notch pet diagnostics services to get to the bottom of it! From X-rays to bloodwork and ultrasounds, our caring team uses cutting-edge tools to spot issues fast. Whether it’s a puppy or a senior cat, we provide clear answers with a friendly touch. Affordable and local, we’re here to keep your pet healthy. Visit Campbell Heights Animal Hospital today for expert diagnostics in Surrey—your pet’s health is our priority!

-

@ cbd044aa:090d5436

2025-06-18 16:26:49

@ cbd044aa:090d5436

2025-06-18 16:26:49Additional Pet Services Vancouver Want to pamper your pet in Vancouver? Homer Animal Hospital offers awesome additional pet services like grooming, daycare, and training to keep your furry friend happy! From stylish trims to fun socialization classes, our caring team has it all. We even provide pet sitting and walking for busy days. Affordable, local, and packed with love, our services make pet parenting a breeze. Visit Homer Animal Hospital today for top-notch pet care extras in Vancouver—your pet will wag, purr, and thank you!

-

@ 57c631a3:07529a8e

2025-06-18 06:30:47

@ 57c631a3:07529a8e

2025-06-18 06:30:47Introducing: Reader Stories — A New Page for Your Journey

https://connect-test.layer3.press/articles/1acb1809-49c3-4559-902b-01909d49c50f

-

@ 91117f2b:111207d6

2025-06-18 16:33:04

@ 91117f2b:111207d6

2025-06-18 16:33:04

Sophia is a social humanoid robot developed by Hanson Robotics. She was activated on February 4, 2016, and has since become a prominent figure in the field of artificial intelligence (AI).

Sophia's Capabilities

Sophia is designed to mimic human-like behavior and interactions. She can:

-

Recognize faces: Sophia can recognize and respond to human faces, making her interactions more personalized.

-

Understand language: Sophia can understand and respond to natural language, allowing her to engage in conversations.

-

Express emotions: Sophia can display a range of emotions, making her interactions more human-like.

Citizenship

In 2017, Sophia became the first robot to be granted citizenship by a country, Saudi Arabia. This move sparked controversy and raised questions about the rights and responsibilities of AI entities.

Impact

Sophia's development and citizenship have significant implications for the field of AI. She has:

-

Raised awareness: Sophia has raised awareness about the potential of AI and its applications.

-

Sparked debate: Sophia's citizenship has sparked debate about the ethics and implications of granting rights to AI entities.

Sophia is a groundbreaking AI that has pushed the boundaries of what is possible with artificial intelligence. Her capabilities and citizenship have sparked important discussions about the future of AI and its role in society.

-

-

@ cbd044aa:090d5436

2025-06-18 16:25:44

@ cbd044aa:090d5436

2025-06-18 16:25:44Pet Diagnostics Services Vancouver Worried about your pet’s health? University Veterinary Clinic in Vancouver offers top-tier pet diagnostics services to get answers fast! Our friendly team uses cutting-edge tools like X-rays, ultrasounds, and lab tests to pinpoint issues with precision. Whether it’s a mystery limp or tummy trouble, we’ve got your furry friend covered with compassionate, expert care. Affordable and local, we make diagnostics stress-free. Trust University Veterinary Clinic for Vancouver’s best pet diagnostics—book now and keep your pet happy and healthy!

-

@ eb0157af:77ab6c55

2025-06-18 00:02:24

@ eb0157af:77ab6c55

2025-06-18 00:02:24A new study by Kraken reveals how cryptocurrency investors perceive security as the main challenge in self-managing their digital assets.

According to The Block, a recent survey conducted by crypto exchange Kraken found that nearly half of respondents consider themselves the primary risk factor for their own crypto security. The research, which surveyed 789 participants, highlights that 48% of users see their own actions as the greatest threat to their investments in digital assets, surpassing concerns about external theft or fraud.

Kraken’s report underlines how personal responsibility in security management forces users to take full control of their digital funds. However, the study suggests that this autonomy can also become a source of anxiety for many investors.

Nick Percoco, Chief Security Officer at Kraken, commented on the findings, noting that “a lack of confidence in personal crypto security is capping the growth of the industry.” According to Percoco, unlocking the full potential of cryptocurrencies will require users to embrace self-custody and consistently invest in strong security habits.

Technologies to strengthen security

Despite the concerns highlighted in the study, 31% of participants expressed optimism about future technologies that could improve crypto security. Among the most promising solutions identified:

- advanced biometric systems for user authentication;

- multi-factor authentication to secure wallet access;

- AI-based fraud detection systems to prevent attacks.

Data and case studies

Kraken’s research emerges in a context where security threats remain a pressing reality. FBI data shows that in 2024, nearly 150,000 reports of crypto-related internet fraud resulted in $9.3 billion in losses. Older users, particularly those over 60, proved especially vulnerable, accounting for $3 billion in crypto-related financial fraud losses on their own.

The post Kraken study: 48% of users fear themselves in managing and securing their funds appeared first on Atlas21.

-

@ cbd044aa:090d5436

2025-06-18 16:23:05

@ cbd044aa:090d5436

2025-06-18 16:23:05Pet Wellness Program Vancouver Keep your furry friend thriving with Cypress St. Animal Hospital’s pet wellness program in Vancouver! Our tailored plans include check-ups, vaccinations, and dental care to catch issues early and keep your pet healthy. Perfect for puppies, seniors, or rescue pets, we offer affordable, compassionate care with a local touch. With easy scheduling and expert vets, your pet’s wellness is our priority. Join Cypress St. Animal Hospital’s program today and give your pet the happy, healthy life they deserve in Vancouver!

-

@ eb0157af:77ab6c55

2025-06-17 23:02:57

@ eb0157af:77ab6c55

2025-06-17 23:02:57Carl Rickertsen completely exits his position in Strategy as insiders sell $864 million worth of stock.

As reported by Protos, Carl Rickertsen, a member of Strategy’s board of directors, has fully liquidated his entire shareholding for over $10 million.

Rickertsen’s decision to completely exit his Strategy position marks a sharp shift from his previous investment stance. In 2022, the executive had shown confidence in the company by investing $700,000 in MSTR shares.

On June 13, 2022, Rickertsen purchased $608,000 worth of MSTR stock at $152 per share. Since then, the stock has rallied 152%. However, by 2023, the director had already sold half of his 4,000-share position.

Rickertsen’s approach to managing his holdings has become increasingly aggressive in recent years. Since joining the board in 2019, he has adopted a strategy of immediately liquidating any stock options received.

One example of this tactic occurred on June 2, when he acquired and sold 26,390 MSTR shares on the same day.

As of June 5 this year, Rickertsen reported zero vested Strategy shares, marking the end of his equity involvement with the company.

Rickertsen’s situation is not an isolated case within Strategy. Data from the Securities and Exchange Commission (SEC) reveals a controversial picture. According to information gathered by secform4.com, over the past five years, total insider sales have exceeded purchases by $864 million. This imbalance in insider transactions could raise questions about executives’ confidence in the company’s future.

The post Strategy director liquidates all his MSTR shares appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-06-17 22:03:15

@ eb0157af:77ab6c55

2025-06-17 22:03:15The banking giant is exploring an expansion of its blockchain services, focusing on digital payments and currencies.

JPMorgan Chase has filed a new trademark application for the name “JPMD.” The filing was submitted on June 15 to the United States Patent and Trademark Office (USPTO).

The application, filed by JPMorgan Chase Bank, N.A., covers a broad range of services related to digital assets and blockchain technology. These include the issuance of digital currencies, electronic payment processing, and financial custody services — all of which suggest a possible new stablecoin initiative for JPMorgan.

Experience with JPM Coin

This move wouldn’t be JPMorgan’s first foray into blockchain-based finance. The bank already operates JPM Coin, a dollar-pegged stablecoin used to enable instant transactions between institutional clients. The token runs on Quorum, a private blockchain network developed in-house by JPMorgan and based on Ethereum’s technology.

The registration of the JPMD trademark comes as JPMorgan and other major U.S. banks are considering a collaborative stablecoin project through their jointly owned entities: Early Warning Services and The Clearing House.

Similarly, corporations like Walmart and Amazon are mulling the creation of their own stablecoins.

The post JPMorgan files trademark for ‘JPMD’: a new stablecoin on the horizon for the American bank appeared first on Atlas21.

-

@ b1ddb4d7:471244e7

2025-06-18 16:02:21

@ b1ddb4d7:471244e7

2025-06-18 16:02:21Why are Stripe Alternatives are growing like mushrooms? When it comes to online payment processing, Stripe has long dominated the conversation.

However, with its complex pricing structure, strict policies and first-world focus, many entrepreneurs and companies are actively seeking viable Stripe alternatives.

Whether you’re a SaaS startup, e-commerce store, or global enterprise, choosing the right payment processor can significantly impact your bottom line and customer experience.

Table of Contents

- Why Consider Stripe Alternatives?

- The Complete List of Stripe Alternatives

- Additional Notable Mentions

- How to Choose the Right Stripe Alternative

- Conclusion

Why Consider Stripe Alternatives?

Before diving into our comprehensive list, it’s worth understanding why businesses are exploring alternatives to Stripe. While Stripe offers robust features and excellent developer tools, some businesses face challenges with pricing transparency, limited global coverage, or specific industry requirements that Stripe doesn’t fully address.

The Complete List of Stripe Alternatives

Based on extensive research and analysis of the payment processing landscape, here are 27 proven Stripe alternatives that could be the perfect fit for your business:

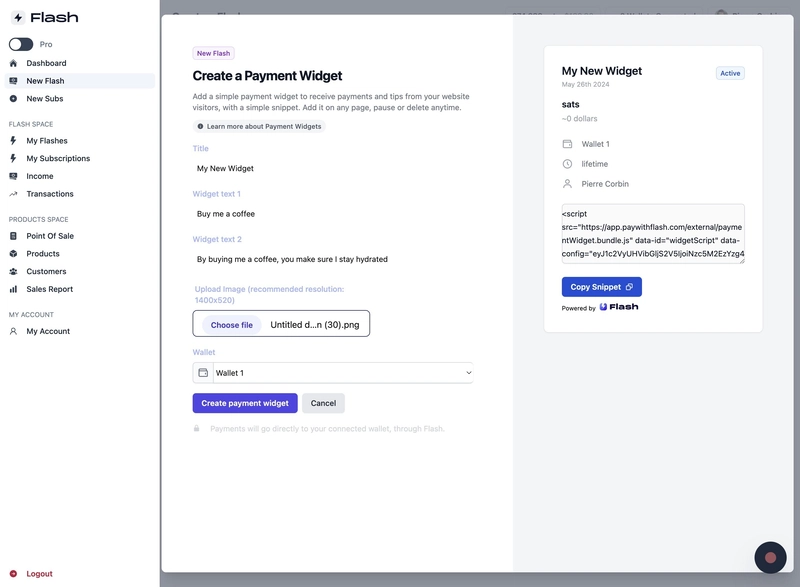

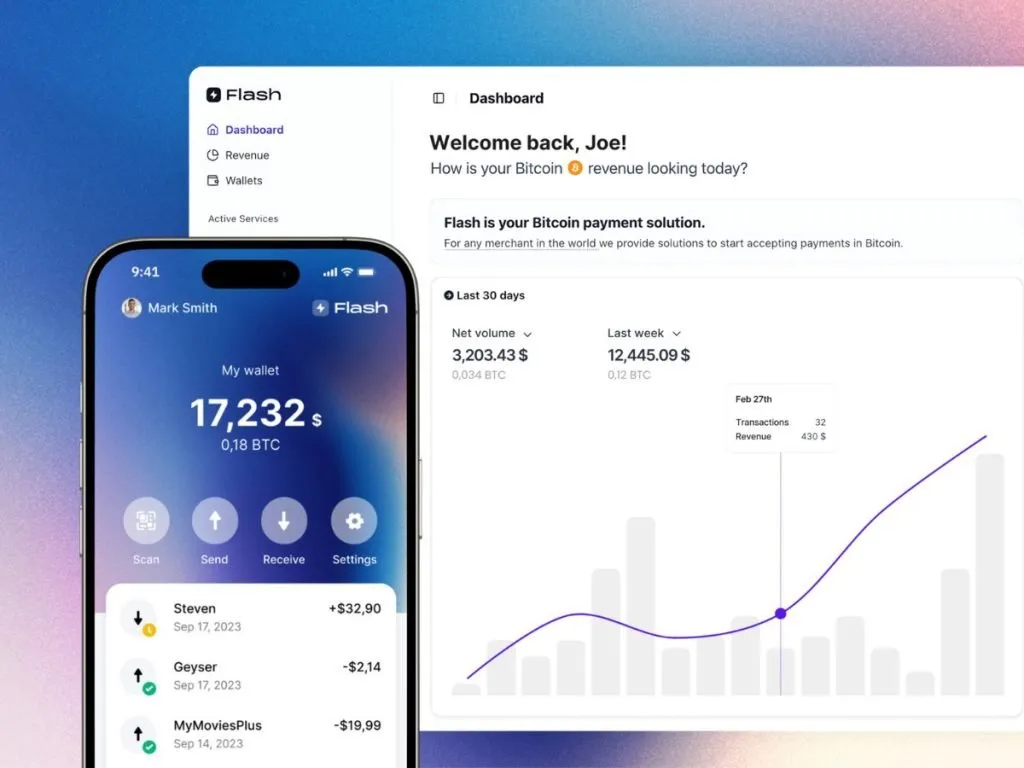

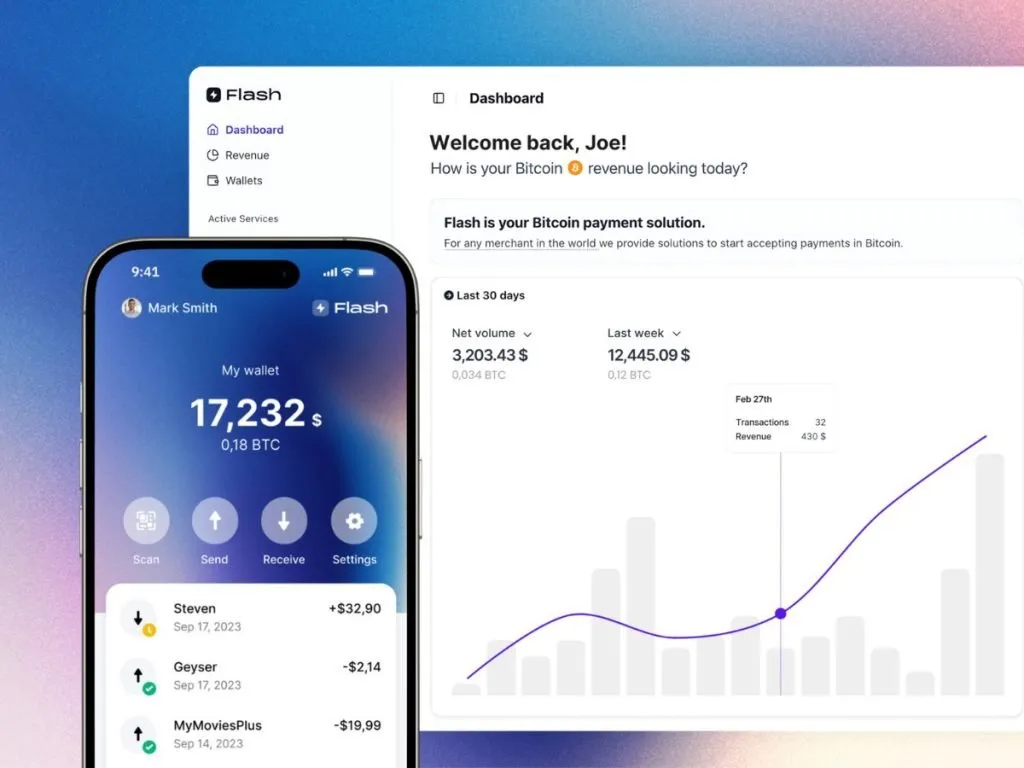

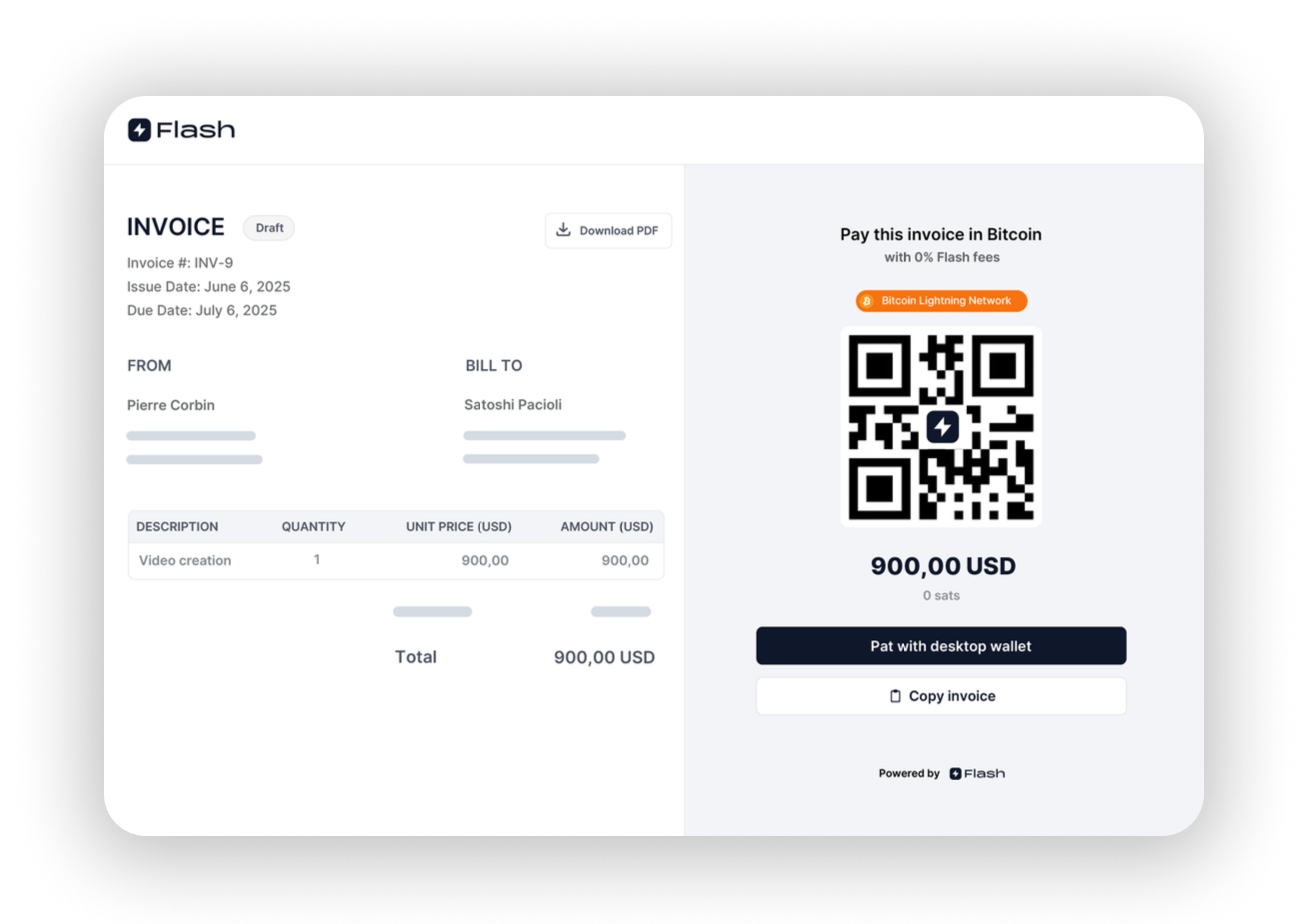

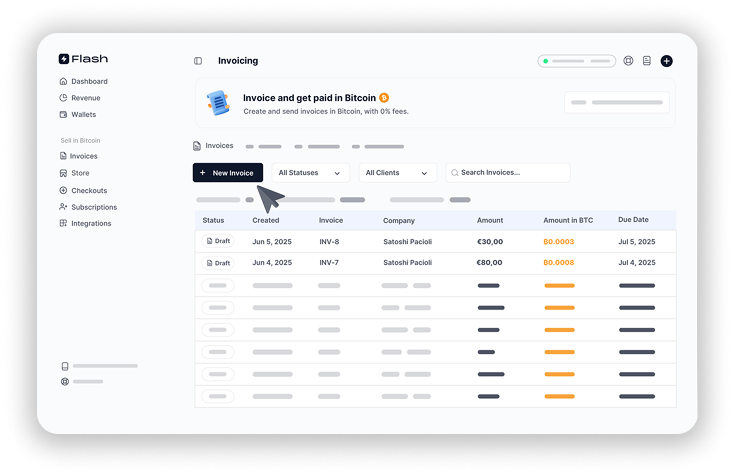

1. Flash – Easiest Bitcoin Payment Solution

Flash is the easiest Bitcoin payment gateway for businesses to accept payments. Supporting both digital and physical enterprises, Flash leverages the Lightning Network to enable fast, low-cost Bitcoin transactions. Launched in its 2.0 version in March 2025, Flash is at the forefront of driving Bitcoin adoption in e-commerce.

2. Lemon Squeezy – The SaaS-Focused Alternative

Dubbed as “acq’d by Stripe,” Lemon Squeezy offers a comprehensive solution specifically designed for digital product sales and SaaS businesses. It provides strong customer support, built-in analytics, and handles payments, subscriptions, global tax compliance, and fraud prevention in one platform.

3. Gumroad – Creator Economy Champion

Gumroad has carved out a niche serving creators and small businesses by providing tools for selling digital products, physical goods, and subscriptions. It’s particularly popular among content creators, artists, and independent entrepreneurs who want to experiment with various ideas and formats. They also open-sourced their code which is quite the ‘chad-move’.

4. Paddle – All-in-One SaaS Commerce

Paddle caters to SaaS and software companies by offering a comprehensive platform with billing, licensing, and global tax handling capabilities. It’s designed to be a complete solution for subscription-based businesses, handling payments, tax, and subscription management in one platform.

5. FastSpring – Global E-commerce Specialist

FastSpring specializes in e-commerce solutions for software and SaaS companies, with a focus on global payments and subscription management. According to TechnologyAdvice, it’s particularly strong for international transactions and helps companies sell more, stay lean, and compete big.

6. 2Checkout – Versatile Payment Solutions

2Checkout (now part of Verifone) offers versatile payment solutions excelling in global payments, subscription billing, and digital commerce. One of the best stripe alternatives as it’s an all-in-one monetization platform that maximizes revenues and makes global online sales easier, supporting over 200 countries and territories.

7. Payoneer – Cross-Border Payment Expert

Payoneer simplifies cross-border payment solutions, offering local payment ease globally with a focus on market expansion and multi-currency support. It’s trusted by small to medium-sized businesses for global payment solutions and international money transfers.

8. Chargebee – Subscription Management Leader

Chargebee is a subscription management platform perfect for SaaS and SMBs, with robust billing and revenue management features. If you were looking for stripe alternatives to setup subscriptions, Chargebee might be right for you. It streamlines revenue operations and helps businesses grow efficiently with comprehensive subscription billing capabilities.

9. Maxio (formerly Chargify) – B2B SaaS Billing

Maxio offers a robust platform for B2B SaaS billing and financial operations, focusing on growth and efficiency for subscription businesses. It’s the most complete financial operations platform for B2B SaaS, bringing core financial operations into one platform.

10. Recurly – Dynamic Subscription Management

Recurly offers dynamic subscription management platform, excelling in churn management and data insights for subscription growth. It’s the only proven platform that expands and protects your recurring revenue with subscription management, recurring billing, and payments orchestration.

11. Braintree – PayPal’s Enterprise Solution

Braintree (by PayPal) provides a versatile global payments platform, integrating multiple payment methods with a focus on conversion and security. It delivers end-to-end checkout experiences for businesses, offering single-touch payments and mobile optimization.

12. PayKickstart – Modern Commerce Platform

PayKickstart offers a modern commerce platform for online billing and affiliates, focusing on revenue maximization and churn minimization. It’s the most complete checkout, recurring billing, affiliate management, and retention solution with global capabilities.

13. PayPro Global – Full-Service E-commerce

PayPro Global offers a full-service eCommerce solution for selling software and SaaS, focusing on global payments, tax compliance, and customer support. It provides flexible solutions with over 70 payment methods and great support for software companies.

14. Shopify Payments – E-commerce Integration

Integrated with Shopify, this service is ideal for SMBs in eCommerce, offering a seamless shopping cart and payment experience. It’s the simplest way to accept online payments, automatically set up for major methods with no fees for some payment types.

15. Square – Versatile POS and Payment Solutions

Square provides versatile POS and payment solutions for small businesses with a strong focus on retail and mobile payments. Forbes Advisor notes it as one of the top alternatives for businesses needing both online and offline payment capabilities.

16. Zoho Billing – Integrated Business Solution

Zoho Billing is an online recurring billing and subscription management solution, ideal for small and medium-sized businesses seeking professional invoice creation, time and expense tracking, and improved cash flow management. Zoho isn’t just competing for stripe alternatives, they offer a ton of other products and services.

17. WePay – Chase Company Integration

WePay, a Chase company, provides integrated payment solutions for ISVs and SaaS companies with customizable payment solutions. It’s designed for platforms like marketplaces and small business tools, offering seamless user experience and fraud protection.

18. QuickBooks Payments – SMB Accounting Integration

This service provides seamless accounting and payment solutions for SMBs and SaaS businesses, featuring real-time tracking and automated bookkeeping. It lets small businesses accept payments online from anywhere with easy integration into QuickBooks accounting.

19. Mangopay – Marketplace Payment Infrastructure

Mangopay offers a modular payment infrastructure for marketplaces and platforms, emphasizing flexibility, global payouts, and AI-powered anti-fraud. It uses flexible wallets built to orchestrate fund flows and monetize payment experiences.

20. Coinbase Commerce – Cryptocurrency Payments

Coinbase Commerce enables businesses to accept payments from around the world using cryptocurrency. It offers instant settlement, low fees, and broad asset support, making it easy for merchants to accept digital currency payments globally.

21. BTCPay Server – Open-Source Bitcoin Processor

BTCPay Server is a self-hosted, open-source cryptocurrency payment processor with 0% fees and no third-party involvement. It’s secure, private, censorship-resistant, and completely free for businesses wanting full control over their Bitcoin payments.

22. Lago – Open-Source Billing Alternative

Lago is an open-source alternative to Stripe Billing and Chargebee, specializing in billing and metering in one place for usage-b

-

@ dfa02707:41ca50e3

2025-06-17 21:01:55

@ dfa02707:41ca50e3

2025-06-17 21:01:55- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ 31a4605e:cf043959

2025-06-17 17:51:52

@ 31a4605e:cf043959

2025-06-17 17:51:52Com a crescente digitalização do dinheiro, os governos de vários países começaram a desenvolver moedas digitais de banco central (CBDCs - Central Bank Digital Currencies) como resposta à popularização de Bitcoin. Enquanto Bitcoin representa um sistema financeiro descentralizado e resistente à censura, as CBDCs são versões digitais das moedas fiduciárias, controladas diretamente pelos bancos centrais. Essa concorrência pode moldar o futuro do dinheiro e definir o equilíbrio entre liberdade financeira e controlo estatal.

Diferenças fundamentais entre Bitcoin e CBDCs

Bitcoin e as CBDCs diferem em praticamente todos os aspetos fundamentais:

Centralização vs. Descentralização: Bitcoin opera numa rede descentralizada, onde nenhum governo ou entidade pode alterar as regras ou censurar transações. Já as CBDCs são emitidas e controladas pelos bancos centrais, permitindo um maior controlo sobre a circulação e utilização do dinheiro.

Oferta limitada vs. Inflação controlada: Bitcoin tem uma oferta fixa de 21 milhões de unidades, tornando-se um ativo escasso e deflacionário. As CBDCs, por outro lado, podem ser criadas sem limites, como acontece com as moedas fiduciárias tradicionais, sujeitas a políticas monetárias inflacionárias.

Privacidade vs. Monitorização: Bitcoin permite transações pseudónimas, garantindo um certo nível de privacidade financeira. As CBDCs, no entanto, podem ser programadas para permitir o rastreamento total de cada transação, facilitando a supervisão governamental e, potencialmente, o controlo sobre o que os cidadãos podem ou não gastar.

Resistência à censura vs. Controlo estatal: Bitcoin permite que qualquer pessoa realize transações sem depender de aprovação de terceiros. As CBDCs, por serem centralizadas, podem ser usadas pelos governos para restringir transações indesejadas ou mesmo confiscar fundos com um simples comando digital.

O que os governos pretendem com as CBDCs?

A introdução das CBDCs tem sido vendida com argumentos como:

Maior eficiência nas transações financeiras, eliminando intermediários e reduzindo custos bancários.

Facilidade na implementação de políticas económicas, como estímulos diretos à população ou tributação automatizada.

Combate a atividades ilegais, dado que as transações podem ser rastreadas em tempo real.

No entanto, muitas destas justificações levantam preocupações sobre a perda de privacidade financeira e o aumento do poder dos governos sobre o sistema monetário.

Bitcoin como alternativa às CBDCs

A ascensão das CBDCs pode fortalecer a posição de Bitcoin como alternativa de dinheiro verdadeiramente livre. À medida que os cidadãos percebem os riscos de um sistema financeiro 100% controlado pelo Estado, a procura por um ativo descentralizado e resistente à censura pode crescer.

Proteção contra o controlo estatal: Bitcoin permite que os utilizadores mantenham total soberania sobre o seu dinheiro, sem o risco de bloqueios arbitrários ou confiscações.

Preservação da privacidade financeira: Ao contrário das CBDCs, que podem monitorizar todas as transações, Bitcoin oferece um grau de anonimato que protege os indivíduos da vigilância excessiva.

Reserva de valor contra a inflação: Enquanto os governos podem emitir CBDCs indefinidamente, Bitcoin mantém a sua escassez garantida, tornando-se um refúgio contra políticas monetárias irresponsáveis.

Resumindo, a competição entre Bitcoin e as CBDCs será uma das maiores batalhas financeiras do futuro. Enquanto os governos tentam consolidar o seu controlo através de moedas digitais centralizadas, Bitcoin continua a ser a principal alternativa para aqueles que procuram independência financeira e proteção contra a vigilância estatal. A escolha entre um sistema financeiro livre e um sistema monitorizado e controlado poderá definir o rumo da economia digital nas próximas décadas.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 8d34bd24:414be32b

2025-06-18 15:41:52

@ 8d34bd24:414be32b

2025-06-18 15:41:52As I read the news over the past week, we’ve heard of Ukrainian drone attacks on Russia’s nuclear attack planes and Russia’s threats of retaliation. We’ve heard of Israel attacking Iran’s nuclear facilities and Iran returning attacks on Israel’s major cities. I’ve read of AI taking jobs, threatening someone trying to turn it off, and refusing to turn off. There are threats of inflation, market crashes, housing crashes, and monetary crashes. There are riots across the US. There are warnings of potential new pandemics or of calls for terrorist cells to awaken and attack. It is easy to get overwhelmed by everything happening in the world. It is easy to become fearful of everything, but God does not call us to be afraid. He repeatedly tells us to “trust him” and to “fear not.”

Do not fear, for I am with you;\ Do not anxiously look about you, for I am your God.\ I will strengthen you, surely I will help you,\ Surely I will uphold you with My righteous right hand.’ (Isaiah 41:10)

With all of the crazy going on in the world, it is easy to worry about our jobs, our families, our country, and even our lives, but God does not want us to worry. He wants us to trust in Him in all things.

And He said to His disciples, “For this reason I say to you, do not worry about your life, as to what you will eat; nor for your body, as to what you will put on. For life is more than food, and the body more than clothing. Consider the ravens, for they neither sow nor reap; they have no storeroom nor barn, and yet God feeds them; how much more valuable you are than the birds! And which of you by worrying can add a single hour to his life’s span? If then you cannot do even a very little thing, why do you worry about other matters? Consider the lilies, how they grow: they neither toil nor spin; but I tell you, not even Solomon in all his glory clothed himself like one of these. But if God so clothes the grass in the field, which is alive today and tomorrow is thrown into the furnace, how much more will He clothe you? You men of little faith! And do not seek what you will eat and what you will drink, and do not keep worrying. For all these things the nations of the world eagerly seek; but your Father knows that you need these things. But seek His kingdom, and these things will be added to you. Do not be afraid, little flock, for your Father has chosen gladly to give you the kingdom. (Luke 12:22-32) {emphasis mine}

God provides for His own. He doesn’t always provide in the way we wish, but He does provide when we trust in Him. Even when believers die, He provides them a place in heaven.

When we look at the world around us, where everything seems like it is falling apart and/or turning to evil, we need to keep our eyes on Jesus and on eternity.

Therefore we do not lose heart, but though our outer man is decaying, yet our inner man is being renewed day by day. For momentary, light affliction is producing for us an eternal weight of glory far beyond all comparison, while we look not at the things which are seen, but at the things which are not seen; for the things which are seen are temporal, but the things which are not seen are eternal. (2 Corinthians 4:16-18) {emphasis mine}

What we experience here on earth may sometimes be unpleasant, but it is a “momentary, light affliction” compared to the glory of heaven. Just as labor and delivery of a child is hard and unpleasant, but is worth every effort and pain when you hold your child, in the same way our suffering on earth will seem like nothing compared to the joy of being in the presence of our Creator God and Savior.

My Experiences

I used to try to prepare for everything. When I was young, I would say, “a good Girl Scout is always prepared.” When I got married and had kids, I started trying to prepare for anything that might possibly go wrong. I had extra food, water, and medical supplies. I started a garden. I got chickens. I got rid of chickens when I developed a lung allergy and couldn’t breathe.

None of that was wrong in itself. I’d even argue it could be wise actions, but I was relying on myself and stuff to face the troubles of this world instead of relying on God. That was definitely not good and was not the way to peace.

We also got involved in politics. My husband was in the state legislature. I was a precinct person and involved in precinct, county, state, and national meetings. I helped set the platform for our state political party in two elections and helped set the resolutions in another.

None of that was wrong in itself. I’d even argue that Christians are called to be a blessing to our earthly nations, but it wasn’t the way to peace, nor was it putting my time in effort into the most important things.

I’ve been reading my Bible daily for 40+ years and reading the Bible in a year for 20+ years. For more than a decade I intensely studied the beginnings, Genesis and how science and archaeology support every fact in Genesis. That study really taught me the power of God and how He always keeps His promises.

For the past several years, I’ve switched to spending most of my intense study on end times prophecy. Despite the fact that the end times prophecies predict a time of unimaginable hardship, the promises of the rapture, the millennial kingdom, and eternity with Jesus in heaven brings great peace. The crazy, evil, and agony in the world is not the world falling apart, but God’s controlled, merciful judgment on the world. I can see the light at the end of the tunnel. I don’t just see everything that can possibly go wrong. I trust God with my life and that of my family.