-

@ eb0157af:77ab6c55

2025-06-17 18:01:34

@ eb0157af:77ab6c55

2025-06-17 18:01:34The banking giant is exploring an expansion of its blockchain services, focusing on digital payments and currencies.

JPMorgan Chase has filed a new trademark application for the name “JPMD.” The filing was submitted on June 15 to the United States Patent and Trademark Office (USPTO).

The application, filed by JPMorgan Chase Bank, N.A., covers a broad range of services related to digital assets and blockchain technology. These include the issuance of digital currencies, electronic payment processing, and financial custody services — all of which suggest a possible new stablecoin initiative for JPMorgan.

Experience with JPM Coin

This move wouldn’t be JPMorgan’s first foray into blockchain-based finance. The bank already operates JPM Coin, a dollar-pegged stablecoin used to enable instant transactions between institutional clients. The token runs on Quorum, a private blockchain network developed in-house by JPMorgan and based on Ethereum’s technology.

The registration of the JPMD trademark comes as JPMorgan and other major U.S. banks are considering a collaborative stablecoin project through their jointly owned entities: Early Warning Services and The Clearing House.

Similarly, corporations like Walmart and Amazon are mulling the creation of their own stablecoins.

The post JPMorgan files trademark for ‘JPMD’: a new stablecoin on the horizon for the American bank appeared first on Atlas21.

-

@ 4ba8e86d:89d32de4

2025-06-17 17:37:05

@ 4ba8e86d:89d32de4

2025-06-17 17:37:05O protocolo Matrix é um sistema de comunicação descentralizado de código aberto que fornece uma plataforma para mensageiros descentralizados. O Element foi lançado em 2014 como uma implementação do protocolo Matrix, originalmente conhecido como Riot.im , A ideia do Element nasceu quando Matthew Hodgson e Amandine Le Pape, dois desenvolvedores de software, decidiram criar uma plataforma de comunicação aberta e segura, que permitisse aos usuários terem total controle sobre suas informações. Eles acreditavam que a internet deveria ser um lugar onde as pessoas pudessem se comunicar livremente, sem se preocupar com a privacidade de suas informações.

O Element é um aplicativo de chat gratuito e de código aberto disponível em várias plataformas, incluindo desktop, web e aplicativos móveis. Ele oferece criptografia de ponta a ponta, o que significa que as mensagens são protegidas e só podem ser lidas pelo remetente e pelo destinatário. Além disso, o Element é descentralizado, o que significa que ele não é controlado por uma única entidade, mas sim por uma rede global de servidores.

O Element é amplamente utilizado por indivíduos e empresas que desejam ter uma comunicação segura e privada. É frequentemente usado por equipes de projetos, organizações sem fins lucrativos e grupos ativistas que precisam compartilhar informações confidenciais e se comunicar de forma segura. O Element também é conhecido por seu recurso de salas públicas, que permite que os usuários se juntem a grupos de discussão sobre vários tópicos de interesse.

Uma das principais vantagens do Element é sua arquitetura descentralizada. Ao contrário das plataformas de mensagens convencionais que centralizam os dados em seus próprios servidores, o Element utiliza uma rede descentralizada, distribuindo as informações em diversos servidores espalhados pelo mundo. Isso significa que os dados dos usuários são menos suscetíveis a ataques cibernéticos e invasões, já que não são centralizados em um único ponto vulnerável.

Para usar o Element, normalmente os usuários precisam se registrar em um servidor Matrix. Existem várias opções disponíveis, incluindo servidores públicos e privados. No entanto, outra opção é criar um servidor próprio para usar o Element.

O Element também utiliza criptografia de ponta a ponta para proteger as mensagens e arquivos trocados entre os usuários. Isso significa que apenas o remetente e o destinatário das mensagens podem ler o conteúdo, garantindo que as informações permaneçam seguras e privadas.

Outra vantagem do Element é sua ampla variedade de recursos, incluindo videochamadas criptografadas, compartilhamento de tela e integração com outros serviços, como calendários e aplicativos de produtividade. Isso torna o Element uma plataforma completa de comunicação e colaboração, adequada para uso pessoal e empresarial.

O Element também é fácil de usar e possui uma interface intuitiva e personalizável. Os usuários podem personalizar a aparência do aplicativo e acessar diferentes configurações e recursos com apenas alguns cliques.

https://element.io/

https://github.com/vector-im/element-android

-

@ 31a4605e:cf043959

2025-06-17 17:35:10

@ 31a4605e:cf043959

2025-06-17 17:35:10Desde a sua criação em 2008, Bitcoin tem sido visto como um desafio direto ao sistema bancário tradicional. Desenvolvido como uma alternativa descentralizada ao dinheiro fiduciário, Bitcoin oferece uma forma de armazenar e transferir valor sem depender de bancos, governos ou outras instituições financeiras. Essa característica faz com que seja considerado um símbolo de resistência contra um sistema financeiro que, ao longo do tempo, tem sido marcado por crises, manipulações e restrições impostas aos cidadãos.

Crise financeira de 2008 e o nascimento de Bitcoin

Bitcoin surgiu em resposta à crise financeira de 2008, um colapso que revelou as falhas do sistema bancário global. Bancos centrais imprimiram grandes quantidades de dinheiro para resgatar instituições financeiras irresponsáveis, enquanto milhões de pessoas perderam as suas casas, poupanças e empregos. Nesse contexto, Bitcoin foi criado como um sistema financeiro alternativo, onde não existe uma entidade central com o poder de manipular a economia em benefício próprio.

No primeiro bloco da blockchain ou timechain de Bitcoin, Satoshi Nakamoto incluiu a seguinte mensagem:

"The Times 03/Jan/2009 Chancellor on brink of second bailout for banks."

Essa frase, retirada de uma manchete de jornal da época, simboliza a intenção de Bitcoin de oferecer um sistema financeiro fora do controlo dos bancos e dos governos.

Principais razões pelas quais Bitcoin resiste ao sistema bancário

Descentralização: Ao contrário do dinheiro emitido por bancos centrais, Bitcoin não pode ser criado ou controlado por nenhuma entidade específica. A rede de utilizadores valida as transações de forma transparente e independente.

Oferta limitada: Enquanto os bancos centrais podem imprimir dinheiro sem limites, causando inflação e desvalorização da moeda, Bitcoin tem uma oferta fixa de 21 milhões de unidades, tornando-o resistente à depreciação artificial.

Impossibilidade de censura: Bancos podem bloquear contas e impedir transações a qualquer momento. Com Bitcoin, qualquer pessoa pode enviar e receber fundos sem pedir permissão a terceiros.

Autocustódia: Em vez de confiar os seus fundos a um banco, os utilizadores de Bitcoin podem armazenar as suas próprias moedas, sem risco de congelamento de contas ou falências bancárias.

Conflito entre bancos e Bitcoin

Ataques mediáticos: Grandes instituições financeiras frequentemente classificam Bitcoin como arriscado, volátil ou inútil, tentando desincentivar a sua adoção.

Regulação e repressão: Alguns governos, influenciados pelo setor bancário, têm criado restrições ao uso de Bitcoin, dificultando a sua compra e venda.

Criação de alternativas centralizadas: Muitos bancos centrais estão a desenvolver moedas digitais (CBDCs) que mantêm o controlo do dinheiro digital, mas sem oferecer a liberdade e a descentralização de Bitcoin.

Resumindo, o Bitcoin não é apenas uma moeda digital, mas um movimento de resistência contra um sistema financeiro que falhou repetidamente em proteger o cidadão comum. Ao oferecer uma alternativa descentralizada, transparente e resistente à censura, Bitcoin representa a liberdade financeira e desafia o monopólio dos bancos sobre o dinheiro. Enquanto o sistema bancário tradicional continuar a impor restrições e a controlar o fluxo de capital, Bitcoin permanecerá como um símbolo de independência e soberania financeira.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ a88f35c7:7b121d83

2025-06-17 18:31:38

@ a88f35c7:7b121d83

2025-06-17 18:31:38Como si de resolver un crimen se tratase, en este artículo he querido reflexionar sobre el futuro de los pagos en un mundo cada vez más digital, centrándome en la más que probable desaparición del dinero efectivo, con las monedas digitales de bancos centrales (CBDCs) actuando como arma homicida y los bancos centrales como los verdaderos 'asesinos' de este tipo de dinero. Como veis, sería un pésimo novelista, ya que en el primer párrafo ya he revelado toda la trama.

Introducción.

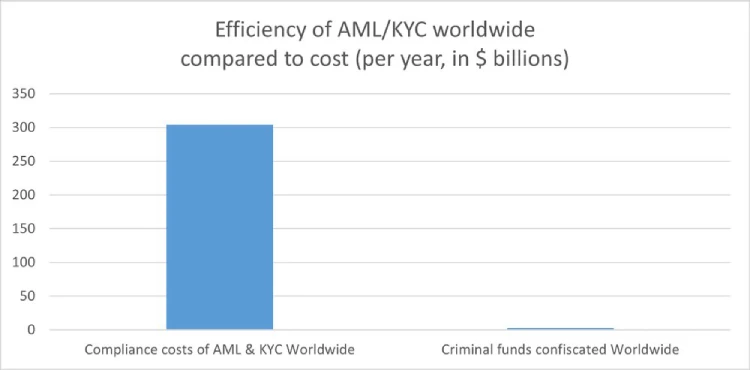

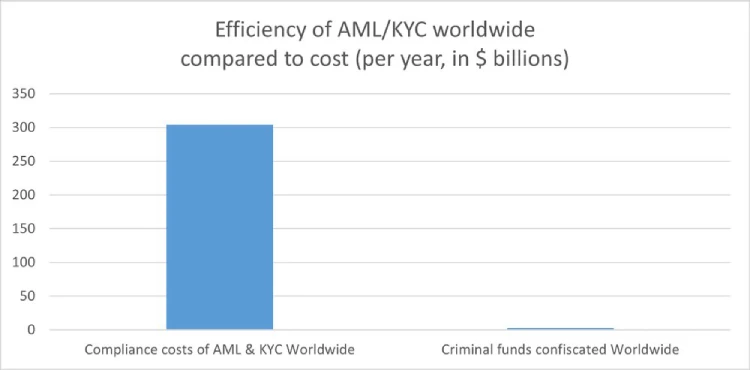

La mayoría de las transacciones realizadas a diario ya son electrónicas y están gestionadas por bancos o empresas tecnológicas, ya sea a través de ventas de comercio electrónico, pagos presenciales con terminales EMV, tarjetas sin contacto o aplicaciones móviles. Estos pagos son fácilmente rastreables, susceptibles de confiscación y sujetos a censura. A pesar de ello, durante las últimas tres décadas se ha intentado desacreditar al otro tipo de dinero que aún se utiliza hoy en día: el efectivo. Gobiernos de todo el mundo han defendido que eliminar el efectivo es necesario para combatir el lavado de dinero, reducir la evasión fiscal y asegurar una mayor estabilidad de la economía.

¿Cuál puede ser la motivación detrás de todo esto? ¿Es posible que, al analizar al candidato destinado a sustituir al efectivo, encontremos una respuesta?

En este artículo me propongo explorar cuál será el formato del dinero del futuro y si las monedas digitales de bancos centrales (CBDC), cuya implementación está siendo investigada e impulsada actualmente por muchos gobiernos, podrían ser las que acaben definitivamente con el efectivo.

Soy consciente de que hay mucho material e información disponible pero para realizar este artículo me he basado en los siguientes papers:

-

The technology of retail central bank digital currency de Raphael Auer y Rainer Boehme

-

Financial Freedom and Privacy in the Post-Cash World de Alex Gladstein

El crímen a resolver.

La víctima.

El dinero en efectivo (la víctima de este crimen) es el medio de pago físico que utilizamos para realizar transacciones, como billetes y monedas. Es emitido y respaldado por un banco central (en Europa, el BCE, y en Estados Unidos, la Fed), lo que le otorga valor y aceptación general en una economía. Además, representa una deuda del banco central con quien lo posee: al tener un billete, esencialmente el banco central te debe ese valor, comprometiéndose a respaldarlo.

Tener “una deuda del banco central” en el bolsillo ha permitido, durante décadas, realizar transacciones diarias en todo el mundo sin que el comprador deba revelar información al vendedor. Esto es posible porque el sistema se basa en la confianza de que el vendedor podrá intercambiar ese dinero por bienes y servicios en el futuro (confianza mutua en su aceptación futura). Al entregar efectivo, la transacción se liquida al instante, sin intermediarios, verificaciones adicionales ni exposición de datos sensibles como nombres, direcciones o información financiera, lo que facilita el comercio incluso entre desconocidos.

Como en cualquier serie de asesinatos, el detective debe conocer todos los detalles posibles de la víctima para elaborar el perfil del asesino y determinar el móvil del crimen. Siguiendo esta lógica, a continuación presento un conjunto de características del dinero en efectivo que podrían haberle generado "enemigos":

-

Resistente a la censura: El efectivo se intercambia directamente entre dos partes sin necesidad de intermediarios (bancos, plataformas digitales o gobiernos). Esto significa que ninguna entidad puede bloquear o revertir una transacción hecha en persona.

-

Difícilmente rastreable: Las transacciones en efectivo son anónimas, ya que no requieren identificación ni dejan un rastro digital.

-

Difícilmente confiscable: El efectivo, al ser un activo físico, solo puede ser confiscado mediante posesión física directa.

-

Permite cierto nivel de privacidad: El uso de efectivo preserva la privacidad de las personas, ya que no expone datos personales ni patrones de gasto.

-

Independencia de infraestructuras tecnológicas: El efectivo no depende de redes de comunicación, electricidad, internet o sistemas bancarios. En escenarios de apagones, desastres naturales o fallos tecnológicos, el efectivo sigue siendo funcional.

-

Aceptación universal sin intermediarios: El efectivo es aceptado prácticamente en cualquier lugar, sin necesidad de cuentas, dispositivos o aplicaciones.

El arma.

En las series de asesinatos o crímenes en general, hay 3 aspectos clave para resolver un caso y estos son el móvil (es la razón detrás del crimen), la oportunidad(posibilidad real que tuvo el sospechoso para cometer el crimen) y los medios disponibles (capacidad física, técnica o arma para llevar a cabo el crimen). En el crimen a resolver en este artículo he creído conveniente empezar por este último y por tanto como buen amante de los avances tecnológicos, he pedido a chatpgt que me defina una CBDC. Su respuesta debajo:

Una CBDC (Central Bank Digital Currency) o Moneda Digital de Banco Central es una forma de dinero digital emitida y respaldada directamente por el banco central de un país (o países). Es similar al dinero en efectivo (como los billetes y monedas) pero existe únicamente en formato digital.

En resumen, una CBDC es dinero digital seguro, accesible y regulado, diseñado para modernizar los sistemas financieros y facilitar los pagos digitales en la economía. 😊💸

Sin embargo, y muy a mi pesar..., hay un par de puntos que no me han convencido (imagino que sabréis cuáles pero por si acaso, los he marcado en negrita). Por ello, he decidido buscarme las habichuelas por mi cuenta y he encontrado este paper, que creo que puede ser de ayuda: “Central Bank Digital Currencies” del Committee on Payments and Market Infrastructures del Bank for International Settlements. Según se indica en dicho paper;

Establecer una definición precisa de la Central Bank Digital Currency (CBDC) resulta complejo, ya que el concepto abarca diversas ideas y posibilidades. No obstante, su característica esencial es que se trata de una forma de dinero digital emitida directamente por el banco central (una obligación del banco central, denominada en una unidad de cuenta existente) que funciona como medio de intercambio y depósito de valor, y está destinada al público general. Esta característica la distingue del dinero digital utilizado por los bancos comerciales, como las reservas o cuentas de liquidación mantenidas en el banco central.

Llegados aquí, he vuelto a preguntar a chatgpt cuál podría ser el motivo u objetivopara que los bancos centrales estén tan interesados por las CBDCs. Su respuesta, como en el caso anterior, tampoco me ha acabado de convencer:

El Banco Central Europeo busca crear una CBDC, conocida como Euro Digital, con varios objetivos clave; en primer lugar, busca aumentar la inclusión financiera al ofrecer una forma de dinero digital segura y gratuita, accesible para toda la población. Otro objetivo es reforzar la estabilidad financiera, proporcionando una alternativa segura al dinero depositado en bancos privados. Por último, el BCE aspira a promover la innovación en servicios financieros y facilitar pagos transfronterizos más rápidos y eficientes. En conjunto, el Euro Digital busca modernizar la economía europea, proteger su sistema financiero y mantener el liderazgo europeo en la era digital.

Así que, una vez más, me toca aplicar el conocido dicho DYOR (Do Your Own Research). A continuación, mi enfoque:

-

Partiendo de la premisa de que muchos objetos utilizados en crímenes no fueron diseñados originalmente para causar daño, sino que tienen múltiples usos, es evidente que ciertos objetos resultan más propensos a ser utilizados con fines dañinos debido a su diseño. Por ejemplo, un cuchillo de caza, con su hoja afilada y puntiaguda, tiene una capacidad de hacer daño superior a la de un cuchillo de punta redonda.

-

De forma análoga, al analizar las diferentes alternativas de diseño de una CBDC, podríamos identificar aquellos elementos que, intencionadamente o no, facilitan ciertos usos indebidos o riesgos asociados y por ende podríamos intuir también las motivaciones de su creador.

Diseñando una CBDC.

En el artículo titulado “The Technology of Retail Central Bank Digital Currency” de Raphael Auer y Rainer Böhme, los autores analizan el desarrollo de una CBDC mediante un enfoque que parte de las necesidades de los consumidores para fundamentar las decisiones de diseño. Para ilustrar este enfoque, introducen la “CBDC Pyramid”, un modelo que organiza jerárquicamente los aspectos clave del diseño de una moneda digital emitida por un banco central:

En el lado izquierdo de la pirámide exponen las necesidades de los consumidores y seis características asociadas que harían útil a una CBDC:

-

Similar al efectivo con funcionalidad peer-to-peer.

-

Pagos en tiempo real.

-

Operaciones resilientes y robustas.

-

Privacidad.

-

Amplia accesibilidad.

-

Capacidad para pagos transfronterizos.

Y en el lado derecho de la pirámide se describen las decisiones de diseño asociadas a cada una de estas características:

-

Reclamaciones indirectas o directas, y ¿qué papel operativo tendrá el banco central?

-

El modelo de centralización (centralizado o descentralizado).

-

Basado en tokens o en balances.

-

Permitir la integración con otras CBDCs.

La tesis sobre la que se construye el paper de Raphael y Rainer se basa en considerar que la principal necesidad del consumidor debe ser poder contar con una CBDC que represente un derecho similar al efectivo y que idealmente sea fácilmente transferible en entornos de transacciones P2P.

A continuación el paper analiza, para cada una de las capas de la pirámide las elecciones disponibles para determinar cuál de ellas es la que acercaría más a una CBDC a las características del cash:

Nivel 1. CBDC directa o indirecta.

A bajo del todo de la pirámide Raphael Auer y Rainer Böhme sitúan la elección de la arquitectura operacional y como se atenderá la demanda del consumidor final. ¿El consumidor "hablará" directamente con el Banco Central y será este quien centralice todo el proceso? ¿o lo hará a través de intermediarios (banca privada)? En cualquiera de los casos, en el paper se asume que solo el banco central podrá emitir la CBCD.

Las principales diferencias en la elección en la base de la pirámide radican en la estructura de los reclamos legales y en los registros mantenidos por el banco central. En el modelo de “CBDC indirecta”, el consumidor tiene un reclamo sobre un intermediario, mientras que el banco central solo lleva un registro de las cuentas mayoristas. En el modelo de “CBDC directa”, la CBDC representa un reclamo directo sobre el banco central, que mantiene un registro de todos los saldos y los actualiza con cada transacción.

Es importante tener en cuenta que los pagos electrónicos deben afrontar interrupciones de conectividad o pagos sin conexión, lo que implica asumir riesgos por parte de los intermediarios y la relación con el cliente, basada en los procesos de Know Your Customer (KYC), permite al intermediario asumir dichos riesgos. Por lo tanto, a menos que un banco central asumiera la responsabilidad del KYC y la debida diligencia del cliente (lo que requeriría una expansión masiva de sus operaciones, muy por encima de sus mandatos actuales), le resultaría difícil asumir un modelo de "CBDC directa".

Nivel 2. Base de datos centralizada o descentralizada.

En el segundo nivel de la pirámide se encuentra la elección de tener un libro mayor centralizado o distribuido.

En un modelo de CBCD directa con base de datos centralizada, las capacidades tecnológicas del banco central deberían ser enormes ya que sería él solo quien procesaría todas las transacciones de todos los ciudadanos (lo que dificulta enormemente su implementación). Además, la principal vulnerabilidad de una arquitectura con un libro mayor centralizado de esta envergadura es la falla del nodo principal.

Por otro lado, actualmente disponer de un libro mayor distribuido (DLT) implica un rendimiento de transacciones menor que las arquitecturas convencionales debido a las dificultades para ejecutar un mecanismo de consenso eficiente y seguro ya que cada actualización del libro mayor debe armonizarse entre los nodos de todas las entidades. Estos modelos podrían ser válidos para jurisdicciones muy pequeñas pero complicado en jurisdicciones más grandes debido al alto número de transacciones que deberían procesar.

Por otro lado, en un modelo de CBCD indirecta ambos enfoques podrían ser factibles.

Nivel 3. Basado en tokens o en balances.

Una vez que se haya elegido la arquitectura y la infraestructura de la CBDC, surge la cuestión de quién tiene la custodia de los fondos y de cómo y a quién se debe otorgar acceso a dichos fondos.

Los activos en moneda digital son fungibles (bienes o activos que pueden intercambiarse entre sí sin que haya una diferencia en su valor o utilidad), por lo que, en principio, pueden tomar la forma de saldos (“acceso basado en cuentas”) o de tokens (“acceso basado en tokens”).

En un sistema de moneda digital basado en saldos (account based access), se debe registrar en algún lugar un número que represente el tamaño de un conjunto de activos, y las transacciones sucesivas deben resultar en cambios en ese número. En este tipo de sistemas, el propietario de los activos debe proporcionar una identificación (derecho basado en la identidad) para acceder al saldo y realizar una transacción, de ahí entre otras, la necesidad del proceso de KYC.

Por el contrario, con los tokens, todo lo que se necesita para realizar una transacción es el conocimiento de las claves criptográficas que los desbloquean. En este tipo de sistemas, los fondos son de quien es capaz de desbloquearlos y las transacciones realizadas no tienen porque estar directamente asociadas a una identidad por lo que es un sistema mucho más parecido al efectivo.

Nivel 4. Integración entre CBDCs.

¿Será posible utilizar la CBDC emitida por el banco central exclusivamente en territorio nacional o también en el extranjero? ¿Estarán dispuestos los bancos centrales a coordinar esfuerzos en el diseño de estas monedas digitales para permitir que los consumidores gestionen múltiples divisas en una sola wallet? De ser así, se facilitaría un comercio internacional más ágil y se eliminaría el vínculo actual entre un pago en el extranjero y la necesidad de realizar una transacción de cambio de divisas (junto con las comisiones asociadas).

En el sistema actual, primero se adquiere moneda nacional, que luego debe ser cambiada por la divisa extranjera, lo que implica costos y demoras. El modelo con pagos transfronterizos integrados permitiría a los consumidores comprar directamente la CBDC del país extranjero antes de realizar sus compras, eliminando así ese paso innecesario e ineficiente y reduciendo los costos asociados al tipo de cambio.

El diseño previsible (mi apuesta personal).

Aquí perdonadme pero voy a ir al grano con mi predicción:

- Creo que la implementación final será el de una CBDC indirecta ofrecida por intermediarios (los bancos privados) con libro mayor centralizado, basada en cuentas en lugar de tokens y con ciertas restricciones en la interoperabilidad entre CBDCs de distintos países.

¿Por qué pienso esto? En primer lugar, como se mencionó anteriormente, una CBDC directa implicaría un cambio significativo en el sistema financiero al transferir gran parte de las responsabilidades de los bancos privados al banco central. En el sistema actual, los bancos privados desempeñan un papel clave en la creación de dinero a través del proceso de concesión de préstamos y la gestión de depósitos. Sin embargo, con una CBDC directa, el banco central sería responsable de emitir dinero digital directamente a los ciudadanos, lo que reduciría drásticamente la necesidad de que los bancos privados gestionen depósitos minoristas.

Esto no solo limitaría su capacidad de crear dinero a través del crédito, sino que también afectaría su modelo de negocio, ya que se reducirían sus fuentes tradicionales de ingresos. Además, podría disminuir su relevancia en el sistema financiero, dejándolos casi fuera de la ecuación en cuanto a la emisión de dinero.

Por otro lado, considero que el modelo con libro mayor centralizado se impondrá principalmente por dos razones: las limitaciones actuales en cuanto a la capacidad de procesamiento de los sistemas distribuidos (DLT) por las reglas de consenso y el interés de los estados en mantener sus capacidades de monitoreo financiero.

En cuanto a la elección entre un sistema basado en tokens o en balances, es importante destacar que, dado que las transacciones en un sistema basado en tokens no están directamente vinculadas a una identidad, resulta más complejo utilizar una CBDC como herramienta de vigilancia o perfilado por parte del banco central o los intermediarios financieros. Este enfoque preserva en mayor medida la privacidad de los usuarios, alineándose con principios similares a los del efectivo digital.

Por tanto, es altamente probable que tanto el Banco Central Europeo como la Reserva Federal opten por un sistema vinculado a una identidad, ya que, además de facilitar el cumplimiento normativo en materia de prevención de delitos financieros, guarda mayor similitud con el modelo de cuentas corrientes tradicional. De hecho, diversos informes, han señalado que la identificación de los usuarios en una CBDC es un factor clave para garantizar la trazabilidad y evitar el anonimato absoluto, lo que refuerza la posibilidad de que el sistema basado en balances sea el elegido.

Finalmente, pienso que facilitar el acceso sencillo a monedas de otros países que se perciben como más seguras podría llevar a una fuga de capitales hacia estas divisas y la ley de Gresham está a mi favor:

La ley de Gresham establece que, cuando en un mercado circulan simultáneamente dos tipos de dinero con el mismo valor nominal pero diferente valor percibido o estabilidad, la “moneda mala” desplaza a la “moneda buena”: los consumidores prefieren conservar la moneda con mayor valor intrínseco como reserva de valor, utilizándola menos en transacciones diarias, lo que eventualmente lleva a su retirada del mercado como medio de pago.

Básicamente esto quiere decir que en el escenario planteado, si los ciudadanos tuvieran acceso directo y fácil a CBDCs de países con economías más estables o con menor inflación, podrían optar por ahorrar en estas monedas más fuertes mientras usan la moneda local para pagos diarios. Esto no solo reduciría la demanda de la moneda nacional, sino que también podría debilitar su estabilidad y aumentar la fuga de capitales.

El móvil.

¿Podrán las personas poseer y controlar su propio dinero y decidir qué hacer con él, o estarán todas sus opciones de pago sujetas a la supervisión y el permiso de intermediarios?

Para ser capaz de contestar a esta pregunta me he basado en el artículo “Retail Central Bank Digital Currency: Motivations, Opportunities, and Mistakes” de Geoffrey Goodell, Hazem Danny Al Nakib y Tomaso Aste que sugiere que los gobiernos buscaran mantener el control sobre su sistema financiero y facilitar la supervisión y regulación de las transacciones a través de las CBDCs y de ahí el diseño con el que las están desarrollando. Dicho esto y aunque en el apartado anterior ya se han podido vislumbrar algunas posibles motivaciones, estas las voy a resumir a continuación:

-

Soberanía monetaria y financiera: Uno de los principales motores detrás de la exploración de las CBDCs son las preocupaciones institucionales sobre los riesgos emergentes para la soberanía monetaria y financiera. Esto es particularmente relevante para los bancos centrales y los gobiernos, que observan cómo el panorama de los pagos evoluciona rápidamente debido a innovaciones tecnológicas y cambios en las preferencias de los consumidores. Además, la creciente facilidad para acceder a divisas extranjeras, especialmente aquellas consideradas más estables o fuertes, está disminuyendo el uso de la moneda local en algunos países. Esto representa un riesgo directo para la soberanía monetaria, ya que reduce la efectividad de las políticas monetarias nacionales.

-

Control total sobre los estímulos económicos: Un sistema de CBDC plenamente operativo podría otorgar a los bancos centrales un control detallado sobre el estímulo fiscal, permitiéndoles distribuir fondos de manera segmentada con solo presionar un botón. En un escenario donde el efectivo físico desapareciera, las CBDC podrían facilitar la aplicación de tasas de interés negativas, obligando a los ciudadanos a pagar una tarifa por mantener ahorros en sus cuentas. Además, este tipo de moneda digital podría proporcionar a los gobiernos la capacidad de confiscar fondos con mayor facilidad, sancionar a disidentes políticos o incluso automatizar multas por infracciones menores, lo que ha suscitado preocupaciones sobre el potencial abuso de estas herramientas. Finalmente, y por si esto fuera poco, existen estudios que exploran la posibilidad de que las CBDCs puedan utilizarse para rastrear y potencialmente restringir o desincentivar ciertas compras con una alta huella de carbono, integrándolas en un sistema de créditos de carbono personales. Un posible escenario podría ser el siguiente:

-

Al intentar comprar gasolina o diésel, la CBDC verifica la huella de carbono acumulada del usuario.

-

Si el usuario ha superado su límite mensual de emisiones, la transacción podría ser rechazada automáticamente o estar sujeta a un recargo adicional por exceder su cuota.

-

Como alternativa, el usuario podría adquirir créditos de carbono de otros ciudadanos que hayan consumido menos, creando así un mercado de intercambio de emisiones a nivel individual.

Esto no debe sorprender a nadie considerando que el sistema Cap and Trade ya se encuentra implementado en la actualidad. Bajo este esquema, empresas con altas emisiones de CO₂ (como aerolíneas, fábricas e industrias de transporte) deben comprar créditos de carbono cuando superan su límite permitido de emisiones. Por tanto el sistema sería el mismo pero aplicado directamente a los ciudadanos.

-

Oportunidades para el sector privado: Lo primero que hay que tener en cuenta es que hoy en día, las compras diarias realizadas a través de aplicaciones móviles o tarjetas de crédito tienen poca semejanza con las compras hechas en efectivo y los usuarios de plataformas como Visa, Apple Pay, WeChat o PayPal intercambian su libertad y privacidad por conveniencia o "usabilidad". En este tipo de transacciones se exige y se comparte información personal en lugar de protegerla. Todo esto nos ha de hacer reflexionar sobre la gran oportunidad que se presenta para el sector privado y en concreto para las "Big Tech" si consiguen monetizar toda la información del consumidor que una moneda tipo CBDC podría proporcionar. No es de extrañar entonces que empresas como Google, Amazon, Stripe o Mastercard sean partners de proyectos de investigación de este tipo de monedas digitales. Como "Data harvesters" experimentados son conscientes del tremendo valor en la creación de perfiles de usuarios.

-

Crimen y evasión fiscal: Como comentamos anteriormente, algunos gobiernos intentan asociar el uso del efectivo con el lavado de dinero y la corrupción, lo que les permite justificar la implementación de las CBDCs como una estrategia para combatir estos problemas. Un ejemplo es el Banco Central de Bangladesh, que busca digitalizar todas las transacciones minoristas para 2027, argumentando que esto mejorará la eficiencia, promoverá la inclusión financiera y reducirá la criminalidad. En Nigeria, el e-Naira fue introducido con el objetivo de facilitar el rastreo de fondos, pero la población respondió con protestas y una baja adopción de la moneda digital.

Conclusiones.

Desde mi punto de vista, es poco probable que las democracias aprendan pronto a diseñar CBDCs que garanticen la privacidad, y aún menos que tengan el incentivo de ofrecerlas a sus ciudadanos. Al fin y al cabo, muchas de las características que atraen tanto a políticos como a banqueros centrales son incompatibles con el dinero anónimo. Por ello, creo que la única alternativa viable para preservar la privacidad financiera que ofrece el efectivo es desarrollar herramientas monetarias resistentes al abuso gubernamental.

Pocas veces se ha expresado este problema con tanta claridad como lo hizo Wei Dai en un correo electrónico enviado en febrero de 1995 a la lista de correo de Cypherpunks donde Dai escribió:

"Nunca ha existido un gobierno que, tarde o temprano, no haya intentado reducir la libertad de sus ciudadanos y obtener más control sobre ellos, y probablemente nunca existirá uno.

Por lo tanto, en lugar de tratar de convencer a nuestro gobierno actual de que no lo intente, desarrollaremos la tecnología que hará imposible que el gobierno tenga éxito.

Los esfuerzos para influir en el gobierno (por ejemplo, a través del lobby y la propaganda) son importantes solo en la medida en que retrasen lo suficiente su intento de represión como para que la tecnología madure y se adopte ampliamente.”

-

-

@ 31a4605e:cf043959

2025-06-17 17:33:02

@ 31a4605e:cf043959

2025-06-17 17:33:02Bitcoin tem vindo a desempenhar um papel cada vez mais relevante em protestos e movimentos sociais em todo o mundo. Graças à sua natureza descentralizada, resistente à censura e independente do controlo governamental, Bitcoin tornou-se uma ferramenta valiosa para ativistas, organizações e cidadãos que lutam contra regimes opressivos ou sistemas financeiros restritivos.

Bitcoin como alternativa ao sistema financeiro tradicional

Nos últimos anos, governos e instituições bancárias têm utilizado restrições financeiras como uma forma de repressão política. Contas bancárias congeladas, doações bloqueadas e limitações a transações são algumas das estratégias utilizadas para enfraquecer movimentos sociais e protestos. Bitcoin oferece uma alternativa, permitindo que fundos sejam transferidos e armazenados sem a interferência de bancos ou governos.

Uma das principais vantagens de Bitcoin nestes contextos é a sua resistência à censura. Enquanto contas bancárias podem ser encerradas e serviços de pagamento centralizados podem ser pressionados a bloquear transações, Bitcoin funciona numa rede descentralizada, onde ninguém pode impedir que um utilizador envie ou receba fundos.

Exemplos do uso do Bitcoin em protestos

Hong Kong (2019-2020): Durante os protestos pró-democracia, ativistas enfrentaram restrições financeiras ao tentarem organizar manifestações e campanhas. Muitos recorreram a Bitcoin para evitar o rastreamento do governo chinês e garantir financiamento para as suas ações.

Canadá (2022): O movimento dos camionistas que protestavam contra restrições governamentais viu as suas contas bancárias congeladas. Como alternativa, doações em Bitcoin foram utilizadas para contornar a repressão financeira.

Bielorrússia (2020): Após as eleições presidenciais contestadas, manifestantes usaram Bitcoin para financiar atividades e ajudar aqueles que perderam os seus empregos devido à repressão estatal.

Nigéria (2020): Durante os protestos contra a brutalidade policial, conhecidos como #EndSARS, doações internacionais para os manifestantes foram bloqueadas. Bitcoin tornou-se um dos principais meios de financiamento do movimento.

Desafios do uso do Bitcoin em movimentos sociais

Educação e acessibilidade: Muitos ainda desconhecem como utilizar Bitcoin de forma segura e eficiente. A falta de conhecimento pode dificultar a sua adoção em larga escala.

Segurança digital: Movimentos sociais muitas vezes operam sob vigilância intensa. Se as medidas de segurança adequadas não forem seguidas, os fundos podem ser comprometidos.

Volatilidade: O preço de Bitcoin pode variar significativamente num curto período, o que pode afetar o valor das doações e dos fundos arrecadados.

Resumindo, o Bitcoin tem demonstrado ser uma ferramenta essencial para a resistência contra a censura financeira e a repressão governamental. Ao permitir que movimentos sociais e ativistas financiem as suas causas sem depender de intermediários, Bitcoin fortalece a luta pela liberdade e pela justiça. No entanto, a adoção eficaz da tecnologia exige conhecimento, segurança e adaptação às suas características únicas. À medida que mais pessoas aprendem a utilizar Bitcoin, o seu papel nos protestos e movimentos sociais continuará a crescer, reforçando a importância da soberania financeira na luta por direitos e liberdades.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 8bad92c3:ca714aa5

2025-06-17 18:01:50

@ 8bad92c3:ca714aa5

2025-06-17 18:01:50MicroStrategy's Debt-Financed Bitcoin Strategy Will Force a Reckoning Within 18 Months - Jessy Gilger

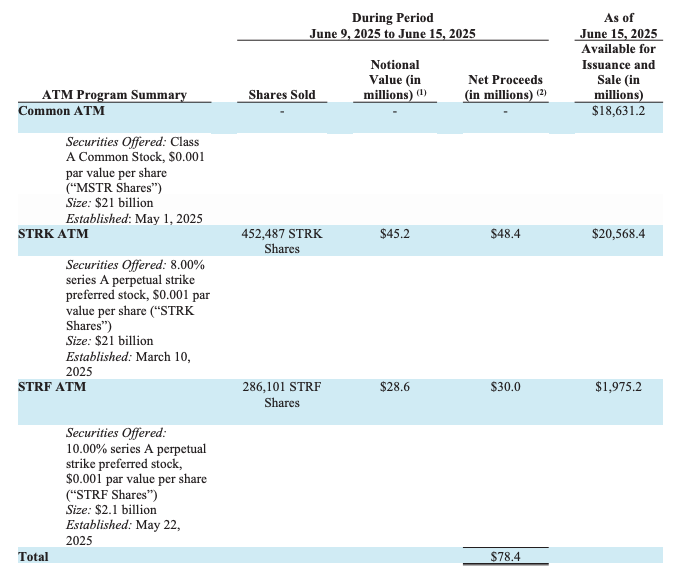

Jessy Gilger from Unchained Capital warned about the sustainability of MicroStrategy's model and its derivatives like MSTY. He predicts that as more companies adopt Bitcoin treasury strategies, "the P&L will matter more as the balance sheet gets commoditized." Within the next 18 months, he expects the current arbitrage opportunities that MicroStrategy exploits will diminish as Bitcoin reaches higher liquidity levels and more competitors enter the space.

His most concerning prediction involves MSTY specifically, which currently offers distributions annualized at 120% - far exceeding the 16-22% he calculates as reasonable from covered call strategies. "If a whale wants out of MSTY in size... they could sell those derivative positions into an illiquid market where there's no bid," potentially causing a 95% collapse similar to what happened with gold mining ETFs during COVID. He advises investors to consider "private pools" for options strategies rather than pooled products where "you're in the pool with everyone else" and subject to forced liquidations.

Pensions Will Drive the Next Major Bitcoin Adoption Wave in 2026-2027 - Adam Back

Adam Back sees institutional adoption accelerating dramatically as pension funds begin allocating to Bitcoin. "The institutional cover of some of the bigger entities that people would reference... you don't get fired for following BlackRock's recommendation," he explained. With BlackRock now suggesting 2% portfolio allocations and the infrastructure finally in place through Blockstream's new Gannett Trust Company, the barriers for institutional adoption are falling rapidly.

Back predicts this will create a "snowball" effect as pension funds realize Bitcoin can help address their massive unfunded liabilities. He noted that financial institutions offering Bitcoin products are "slow movers" with "policies and training materials and guidance that they got to get through," but once activated, the scale will dwarf current retail and ETF flows. The combination of pension fund allocations, continued nation-state adoption, and the mathematical scarcity of Bitcoin leads him to view even $100,000 as "cheap" given where the market is headed.

Traditional Bond Markets Will Collapse as Bitcoin Becomes the Escape Hatch - Sean Bill

Sean Bill sees a massive shift coming as bond markets deteriorate globally. "You peel back the onion. So who benefits from financial repression, right. And inflating your way out of assets," he explained. With Japanese bond yields blowing out and U.S. 30-year yields jumping 10 basis points in a single day, Bill predicts we're witnessing the early stages of a sovereign debt crisis that will drive unprecedented flows into Bitcoin.

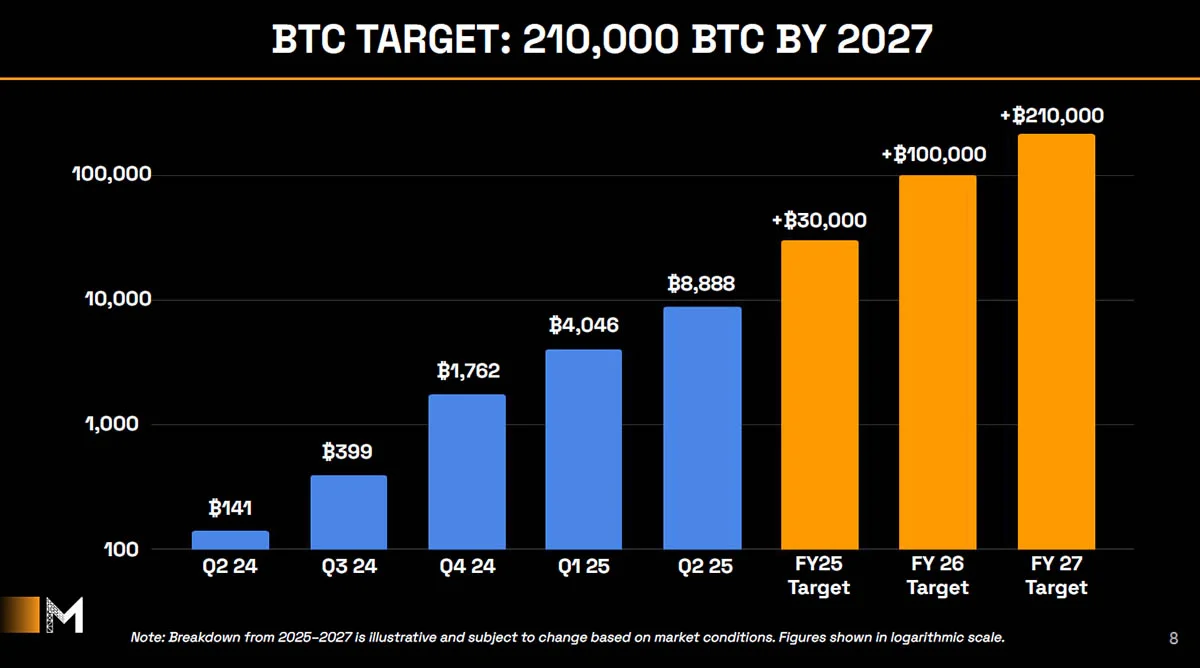

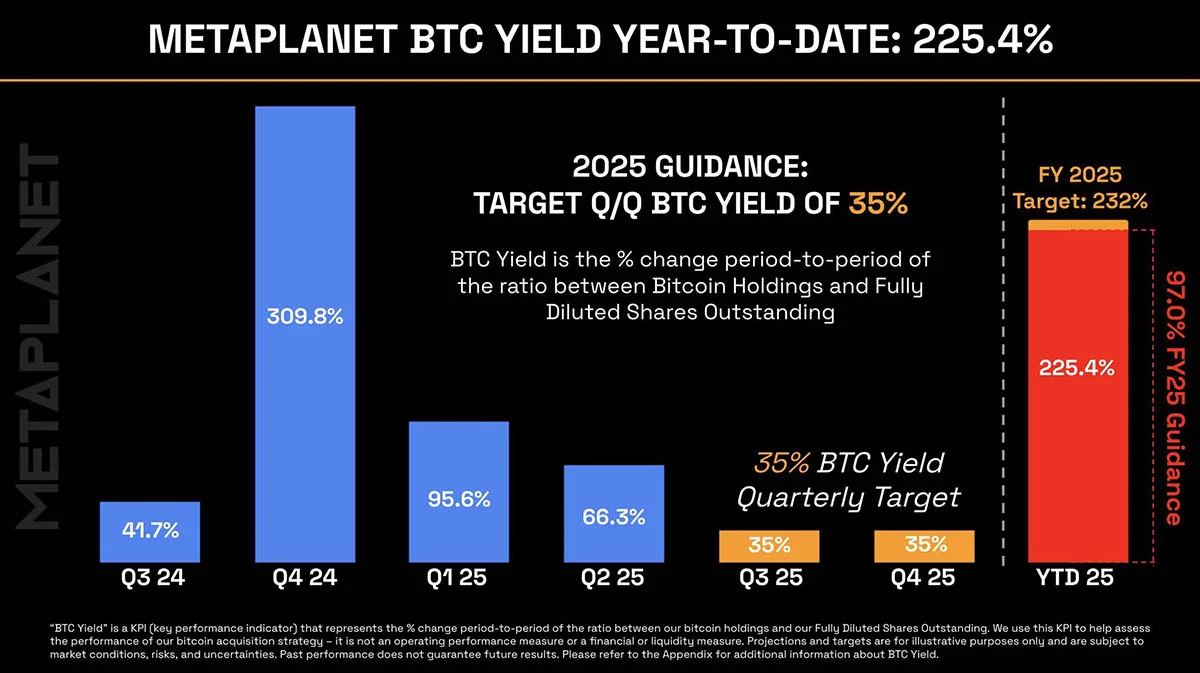

He pointed to Japan's MetaPlanet as a preview of what's coming: "The whole bond market of Japan just flowed into a hotel company." As pension funds and institutions realize they can't meet obligations through traditional fixed income, Bitcoin will become the only viable alternative. Bill believes this transition will accelerate once fiduciaries understand Bitcoin's role as "pristine collateral" that can help them "chip away at those unfunded liabilities." His experience getting Santa Clara County's pension into Bitcoin in 2021 showed him firsthand how a 1-3% allocation at $17,000 could have "wiped out the unfunded liability" as Bitcoin approached $100,000.

Adam Back & Sean Bill Podcast Here

Blockspace conducts cutting-edge proprietary research for investors.

New Bitcoin Mining Pool Flips Industry Model: "Plebs Eat First" Could Threaten Corporate Dominance

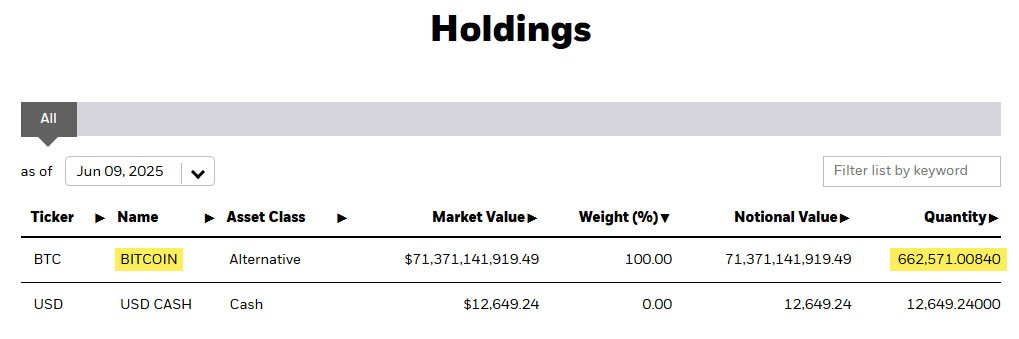

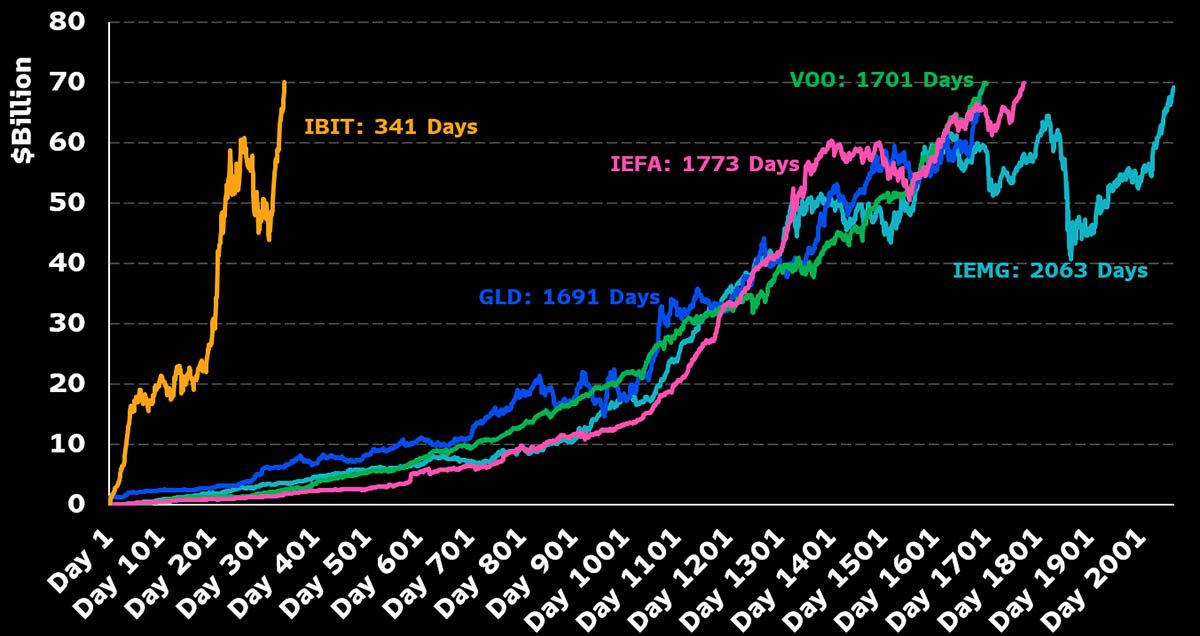

UTXO Management's explosive report forecasts unprecedented institutional demand that could absorb 20% of Bitcoin's circulating supply by 2026. Bitcoin ETFs shattered records with $36.2 billion in year-one inflows, crushing every commodity ETF launch—and they're projected to hit $100 billion annually by 2027.

The real story? ETFs are just the appetizer. Five massive catalysts are converging: wealth platforms eyeing $120 billion from a modest 0.5% allocation across $60 trillion AUM; corporations following MicroStrategy's playbook now holding 803,143 BTC; potential U.S. Strategic Reserve of 1 million BTC; 13 states with active Bitcoin reserve bills; and the rise of BTCfi yield strategies offering 2-15% returns.

The game-changer: these aren't day traders. CFOs, treasurers, and governments are structurally locked buyers seeking BTC-denominated yields, not quick profits. With FASB mark-to-market accounting removing impairment headaches and regulatory clarity accelerating globally, institutions face a stark reality—allocate now or chase exposure at dramatically higher prices.

This isn't another cycle. It's the institutional colonization of Bitcoin.

Subscribe to them here (seriously, you should): https://newsletter.blockspacemedia.com/

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

STACK SATS hat: https://tftcmerch.io/

Subscribe to our YouTube channels and follow us on Nostr and X:

@media screen and (max-width: 480px) { .mobile-padding { padding: 10px 0 !important; } .social-container { width: 100% !important; max-width: 260px !important; } .social-icon { padding: 0 !important; } .social-icon img { height: 32px !important; width: 32px !important; } .icon-cell { padding: 0 4px !important; } } .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } .moz-text-html .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } /* Helps with rendering in various email clients */ body { margin: 0 !important; padding: 0 !important; -webkit-text-size-adjust: 100% !important; -ms-text-size-adjust: 100% !important; } img { -ms-interpolation-mode: bicubic; } /* Prevents Gmail from changing the text color in email threads */ .im { color: inherit !important; }

-

@ 31a4605e:cf043959

2025-06-17 17:31:08

@ 31a4605e:cf043959

2025-06-17 17:31:08Milhões de pessoas em todo o mundo ainda não têm acesso a serviços bancários básicos, seja por falta de infraestrutura, requisitos burocráticos ou instabilidade económica nos seus países. Bitcoin surge como uma solução inovadora para este problema, permitindo que qualquer pessoa com acesso à internet tenha controlo sobre o seu dinheiro, sem depender de bancos ou governos. Ao oferecer um sistema financeiro aberto e acessível, Bitcoin torna-se uma ferramenta poderosa para a inclusão financeira global.

O problema da exclusão financeira

Em muitos países em desenvolvimento, grande parte da população não possui conta bancária. Isto pode acontecer por diversas razões, como:

Falta de acesso a bancos: Muitas comunidades, especialmente em áreas rurais, não têm instituições financeiras próximas.

Exigências burocráticas: Alguns bancos exigem documentação específica ou um histórico de crédito que muitas pessoas não conseguem fornecer.

Custos elevados: As taxas bancárias podem ser proibitivas para quem ganha pouco dinheiro.

Instabilidade económica e política: Em países com alta inflação ou governos instáveis, os bancos podem não ser uma opção segura para guardar dinheiro.

Estas dificuldades deixam milhões de pessoas à margem do sistema financeiro, impossibilitadas de poupar, investir ou realizar transações de forma eficiente.

Bitcoin como alternativa

Bitcoin resolve muitos dos problemas da exclusão financeira ao oferecer um sistema acessível e descentralizado. Com Bitcoin, qualquer pessoa com um telemóvel e acesso à internet pode armazenar e transferir dinheiro sem necessidade de um banco. Entre as principais vantagens estão:

Acessibilidade global: Bitcoin pode ser usado em qualquer lugar do mundo, independentemente da localização do utilizador.

Sem necessidade de intermediários: Diferente dos bancos, que impõem taxas e regras, Bitcoin permite transações diretas entre pessoas.

Baixo custo para transferências internacionais: Enviar dinheiro para outro país pode ser caro e demorado com os métodos tradicionais, enquanto Bitcoin oferece uma alternativa mais rápida e acessível.

Proteção contra a inflação: Em países com moedas instáveis, Bitcoin pode ser usado como reserva de valor, protegendo o poder de compra da população.

Casos de uso na inclusão financeira

Bitcoin já tem sido utilizado para promover a inclusão financeira em diversas partes do mundo. Alguns exemplos incluem:

África e América Latina: Em países como Nigéria, Venezuela e Argentina, onde a inflação é elevada e o acesso a dólares é limitado, muitas pessoas usam Bitcoin para preservar o seu dinheiro e realizar transações internacionais.

Remessas internacionais: Trabalhadores que enviam dinheiro para as suas famílias no estrangeiro evitam as elevadas taxas das empresas de transferências tradicionais ao utilizarem Bitcoin.

Microeconomia digital: Pequenos comerciantes e freelancers que não têm acesso a contas bancárias podem receber pagamentos em Bitcoin de forma direta e segura.

Desafios da inclusão financeira com Bitcoin

Apesar das suas vantagens, a adoção de Bitcoin como ferramenta de inclusão financeira ainda enfrenta alguns desafios, tais como:

Acesso à internet: Muitas regiões pobres ainda não têm uma infraestrutura digital adequada.

Educação financeira: Para que mais pessoas utilizem Bitcoin, é necessário maior conhecimento sobre a tecnologia e as melhores práticas de segurança.

Volatilidade do preço: As oscilações de valor podem dificultar o uso de Bitcoin no dia a dia, especialmente em países onde as pessoas vivem com rendimentos instáveis.

Resumindo, o Bitcoin oferece uma solução viável para milhões de pessoas excluídas do sistema financeiro tradicional. Ao proporcionar acesso global, transações baratas e segurança contra a inflação, torna-se um instrumento poderoso para promover a inclusão financeira. No entanto, para que o seu potencial seja totalmente aproveitado, é essencial investir na educação digital e expandir a infraestrutura tecnológica, permitindo que mais pessoas tenham autonomia financeira através de Bitcoin.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 31a4605e:cf043959

2025-06-17 17:29:01

@ 31a4605e:cf043959

2025-06-17 17:29:01Desde a sua criação, Bitcoin tem sido associado à ideia de liberdade financeira e individual. Diferente do dinheiro tradicional, controlado por governos e bancos centrais, Bitcoin permite que qualquer pessoa no mundo transacione e armazene valor sem depender de intermediários. Essa característica torna-se especialmente relevante em contextos de instabilidade económica, censura financeira e falta de acesso ao sistema bancário.

Bitcoin como ferramenta de autonomia financeira

A principal promessa de Bitcoin é devolver às pessoas o controlo sobre o seu próprio dinheiro. No sistema financeiro tradicional, os bancos e governos têm o poder de congelar contas, restringir transações e desvalorizar moedas através da impressão excessiva de dinheiro. Com Bitcoin, cada utilizador tem total posse dos seus fundos, desde que armazene as suas chaves privadas de forma segura. Isso significa que ninguém pode confiscar ou bloquear o acesso ao seu dinheiro.

Além disso, Bitcoin permite transações internacionais rápidas e baratas, sem depender de bancos ou plataformas de pagamento centralizadas. Em países onde as transferências internacionais são burocráticas e caras, Bitcoin representa uma alternativa eficiente e acessível.

Proteção contra a censura e o controlo estatal

Governos e instituições financeiras podem restringir o acesso ao dinheiro por motivos políticos ou económicos. Em regimes autoritários, dissidentes e jornalistas frequentemente enfrentam bloqueios financeiros como forma de repressão. Bitcoin oferece uma solução para esse problema, pois a sua rede descentralizada impede que qualquer entidade tenha controlo total sobre as transações.

Isto já foi demonstrado em diversos casos ao redor do mundo. Em momentos de crise, quando governos impõem restrições a saques bancários ou impõem limites às remessas de dinheiro, Bitcoin tem sido usado para contornar essas barreiras e garantir que as pessoas possam manter a sua liberdade financeira.

Desafios e responsabilidades da liberdade financeira

Embora Bitcoin ofereça mais liberdade individual, também exige maior responsabilidade por parte do utilizador. Diferente de uma conta bancária, onde um cliente pode recuperar o acesso à sua conta com um simples pedido, em Bitcoin a posse das chaves privadas é essencial. Se um utilizador perde as suas chaves, perde o acesso aos seus fundos para sempre.

Além disso, a volatilidade do preço de Bitcoin pode representar um desafio para quem pretende utilizá-lo como reserva de valor no curto prazo. No entanto, essa característica é compensada pelo seu modelo deflacionário, que protege a poupança a longo prazo contra a desvalorização causada pela inflação das moedas fiduciárias.

Resumindo, o Bitcoin representa uma revolução na forma como as pessoas gerem e protegem o seu dinheiro. Ao permitir transações livres de intermediários e resistir à censura financeira, Bitcoin fortalece a liberdade individual e oferece uma alternativa viável a sistemas financeiros centralizados e controlados por governos. No entanto, essa liberdade vem acompanhada da necessidade de maior responsabilidade, uma vez que cada utilizador é o único responsável pela segurança dos seus fundos. Para aqueles que valorizam a soberania financeira, Bitcoin é uma ferramenta poderosa que pode redefinir o conceito de dinheiro e autonomia pessoal no mundo moderno.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 31a4605e:cf043959

2025-06-17 17:01:31

@ 31a4605e:cf043959

2025-06-17 17:01:31Desde a sua criação, Bitcoin tem sido alvo de debates sobre a sua utilização em atividades ilícitas. muitos críticos afirmam que Bitcoin facilita crimes como lavagem de dinheiro e financiamento de atividades ilegais, devido à sua natureza descentralizada e à possibilidade de realizar transações sem intermediários. no entanto, a realidade é mais complexa e muitas dessas alegações são exageradas ou baseadas em mitos. na verdade, a maioria das transações com Bitcoin são legítimas e até mais rastreáveis do que muitos imaginam.

O mito: Bitcoin é a principal moeda para criminosos

Um dos maiores mitos sobre Bitcoin é a ideia de que ele é amplamente utilizado por criminosos devido ao seu suposto anonimato. este argumento tornou-se popular principalmente devido a casos como o da Silk Road, um mercado negro online desmantelado pelas autoridades em 2013, onde Bitcoin era usado para transações ilegais. no entanto, os dados mais recentes mostram que apenas uma pequena fração das transações em Bitcoin está relacionada com atividades ilícitas.

Além disso, ao contrário do dinheiro em espécie, que é quase impossível de rastrear, todas as transações de Bitcoin são registadas publicamente na blockchain ou timechain. isto significa que qualquer pagamento feito com Bitcoin pode ser analisado e seguido, tornando mais difícil esconder transações suspeitas a longo prazo.

A realidade: Bitcoin é transparente e rastreável

Ao contrário do que muitos pensam, Bitcoin não é completamente anónimo, mas sim pseudónimo. todas as transações ficam registadas na blockchain ou timechain, permitindo que autoridades e analistas de dados consigam seguir os fluxos de dinheiro com precisão. várias empresas especializadas em análise forense de blockchain ou timechain já ajudaram a identificar e desmantelar redes criminosas que tentavam utilizar Bitcoin para fins ilícitos.

Governos e autoridades, como o FBI e a Europol, têm utilizado esta característica para combater crimes financeiros. na prática, criminosos que tentam usar Bitcoin acabam frequentemente por ser apanhados devido à transparência do sistema. por isso, a ideia de que Bitcoin é um refúgio seguro para criminosos não corresponde à realidade.

O uso ilícito de moedas fiduciárias é muito maior

Se compararmos Bitcoin com as moedas fiduciárias tradicionais, como o euro ou o dólar, percebemos que estas são muito mais utilizadas para atividades ilícitas. segundo relatórios de organizações internacionais, a lavagem de dinheiro e o financiamento de crimes organizados ocorrem predominantemente através de bancos, empresas fictícias e dinheiro em espécie.

Por exemplo, em escândalos financeiros globais, como o Panama Papers e o caso do banco HSBC envolvido em lavagem de dinheiro para cartéis, os meios tradicionais foram os preferidos para esconder fortunas ilegais. apesar disso, Bitcoin continua a ser injustamente associado ao crime, enquanto os verdadeiros mecanismos de financiamento ilícito continuam a operar dentro do sistema financeiro convencional.

Resumindo, o mito de que Bitcoin é um meio privilegiado para atividades ilícitas tem sido amplamente desmentido por dados e investigações. apesar de alguns criminosos terem tentado usá-lo no passado, a realidade é que Bitcoin é um sistema financeiro mais transparente e rastreável do que o dinheiro tradicional. a grande maioria das suas transações é legítima e, à medida que a adoção cresce, Bitcoin continua a provar o seu valor como um meio seguro e descentralizado para transações financeiras.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 31a4605e:cf043959

2025-06-17 16:31:03

@ 31a4605e:cf043959

2025-06-17 16:31:03O Bitcoin tem revolucionado a forma como as pessoas realizam transações financeiras em todo o mundo. Sendo uma moeda digital descentralizada, oferece novas oportunidades para pagamentos no comércio eletrónico e transferências internacionais de dinheiro. A sua rapidez, segurança e baixos custos tornam-no uma alternativa eficiente aos métodos tradicionais, eliminando intermediários e facilitando transações globais.

Bitcoin no comércio eletrónico

O comércio eletrónico tem crescido exponencialmente, e o Bitcoin surge como uma solução inovadora para pagamentos online. Grandes retalhistas e pequenas empresas estão a começar a aceitar Bitcoin como forma de pagamento, oferecendo benefícios tanto para os comerciantes como para os consumidores.

Vantagens do Bitcoin para o comércio eletrónico:

Baixas taxas de transação: ao contrário dos cartões de crédito e plataformas de pagamento que cobram taxas elevadas, as transações em Bitcoin apresentam, geralmente, custos mais reduzidos. Isto beneficia os comerciantes, que podem diminuir despesas e oferecer preços mais competitivos aos clientes.

Eliminação de chargebacks: no sistema tradicional, os chargebacks (reembolsos forçados pelos bancos ou operadoras de cartão) representam uma preocupação para os lojistas. Como as transações em Bitcoin são irreversíveis, os comerciantes evitam fraudes e disputas.

Acesso global: qualquer pessoa com acesso à Internet pode pagar com Bitcoin, independentemente da sua localização. Isto permite às empresas expandirem o seu mercado internacionalmente, sem depender de bancos ou sistemas de pagamento locais.

Privacidade e segurança: as transações em Bitcoin protegem a identidade do utilizador, oferecendo maior privacidade em comparação com pagamentos através de cartão de crédito ou transferências bancárias. Além disso, como não há necessidade de partilhar dados pessoais, o risco de roubo de informações é reduzido.

Desafios do Uso do Bitcoin no Comércio Eletrónico:

Volatilidade: o preço do Bitcoin pode oscilar rapidamente, o que dificulta a fixação de preços para produtos e serviços. No entanto, alguns comerciantes utilizam serviços de pagamento que convertem automaticamente Bitcoin em moeda fiduciária, minimizando esse risco.

Adoção limitada: apesar do crescimento, a aceitação do Bitcoin ainda não é universal. Muitas lojas e plataformas populares ainda não o adotaram, o que pode dificultar a sua utilização em compras diárias.

Tempo de confirmação: embora o Bitcoin seja mais rápido do que as transferências bancárias tradicionais, o tempo de confirmação pode variar consoante a taxa de rede paga. Algumas soluções, como a Lightning Network, estão a ser desenvolvidas para tornar os pagamentos instantâneos.

Bitcoin na remessa de dinheiro

O envio de dinheiro para o estrangeiro sempre foi um processo burocrático, dispendioso e demorado. Serviços tradicionais, como os bancos e empresas de transferência de dinheiro, cobram taxas elevadas e podem demorar dias a concluir uma transação. O Bitcoin, por outro lado, oferece uma alternativa eficiente para remessas globais, permitindo que qualquer pessoa envie e receba dinheiro de forma rápida e económica.

Benefícios do Bitcoin para remessas:

Custos reduzidos: enquanto os bancos e empresas como a Western Union cobram elevadas taxas para transferências internacionais, o Bitcoin permite o envio de dinheiro com custos mínimos, independentemente do montante ou do destino.

Velocidade nas transações: as transferências bancárias internacionais podem demorar vários dias a serem concluídas, especialmente em países com uma infraestrutura financeira limitada. Com o Bitcoin, o dinheiro pode ser enviado para qualquer parte do mundo em poucos minutos ou horas.

Acessibilidade global: em regiões onde o sistema bancário é restrito ou ineficiente, o Bitcoin possibilita que as pessoas recebam dinheiro sem depender de bancos. Isto é particularmente útil em países em desenvolvimento, onde as remessas internacionais são uma fonte essencial de rendimento.

Independência de intermediários: o Bitcoin opera de forma descentralizada, sem necessidade de recorrer a bancos ou empresas de transferência. Isto significa que as pessoas podem enviar dinheiro diretamente para amigos e familiares sem intermediários.

Desafios das remessas com Bitcoin:

Conversão para moeda local: apesar de o Bitcoin poder ser recebido instantaneamente, muitas pessoas ainda precisam de convertê-lo em moeda local para o utilizar. Isso pode envolver custos adicionais e depender da disponibilidade de serviços de câmbio.

Adoção e conhecimento: nem todos compreendem o funcionamento do Bitcoin, o que pode dificultar a sua adoção generalizada para remessas. No entanto, a crescente educação financeira sobre o tema pode ajudar a ultrapassar essa barreira.

Regulamentação e restrições: alguns governos impõem restrições ao uso do Bitcoin, tornando as remessas mais complicadas. A evolução das regulamentações pode afetar a facilidade de uso em determinados países.

Resumindo, o Bitcoin está a transformar o comércio eletrónico e as remessas de dinheiro em todo o mundo. A sua capacidade de eliminar intermediários, reduzir custos e oferecer pagamentos rápidos e seguros torna-o uma alternativa viável aos sistemas financeiros tradicionais.

No comércio eletrónico, proporciona benefícios para lojistas e consumidores, reduzindo taxas e melhorando a privacidade. No setor das remessas, facilita a transferência de dinheiro para qualquer parte do mundo, especialmente para aqueles que vivem em países com sistemas bancários pouco eficientes.

Apesar dos desafios, a adoção do Bitcoin continua a crescer, impulsionada por soluções inovadoras e pelo reconhecimento do seu potencial como meio de pagamento global. À medida que mais empresas e indivíduos aderirem a esta tecnologia, a sua presença no comércio eletrónico e nas remessas internacionais será cada vez mais relevante.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

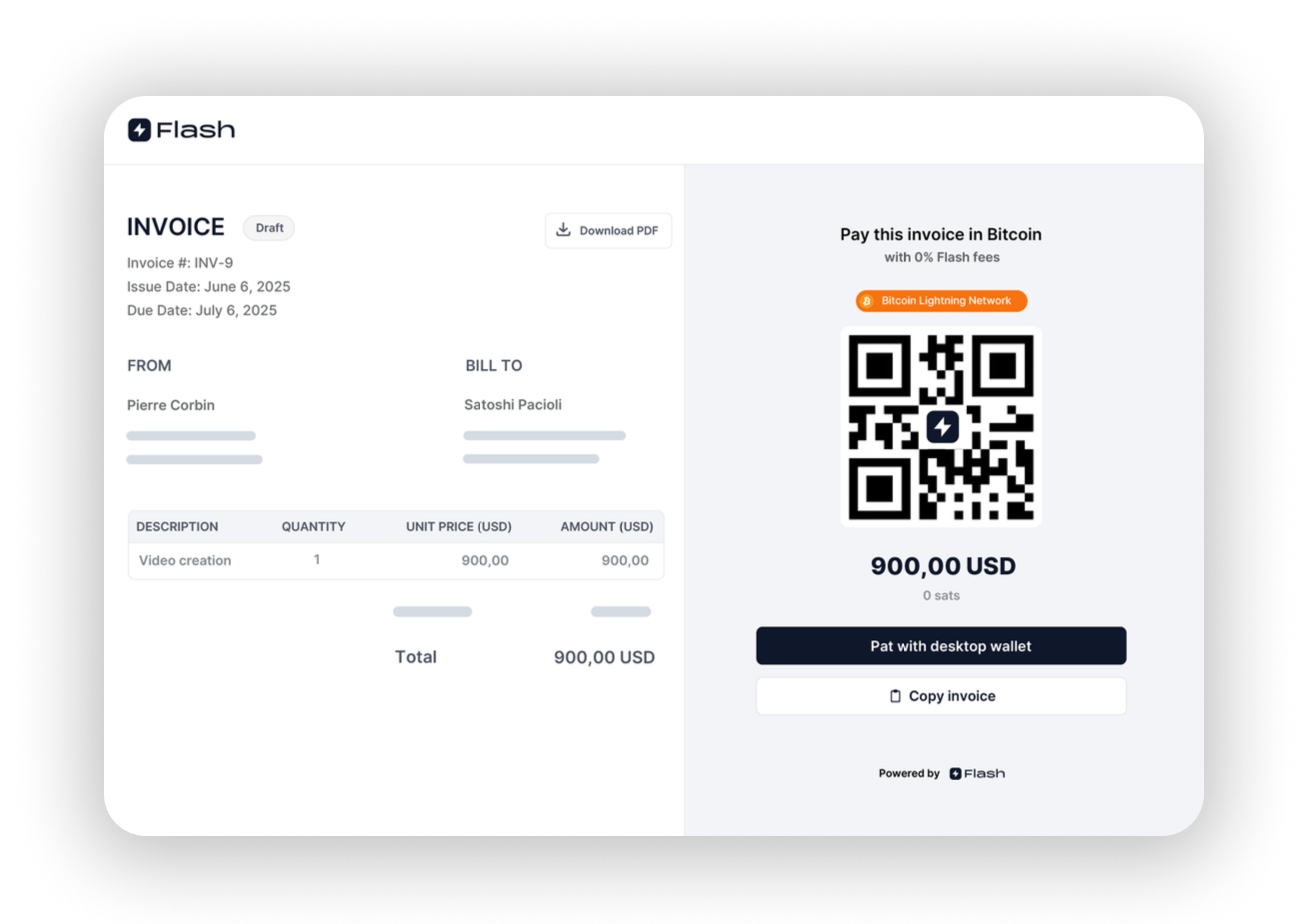

@ cae03c48:2a7d6671

2025-06-17 15:00:39

@ cae03c48:2a7d6671

2025-06-17 15:00:39Bitcoin Magazine

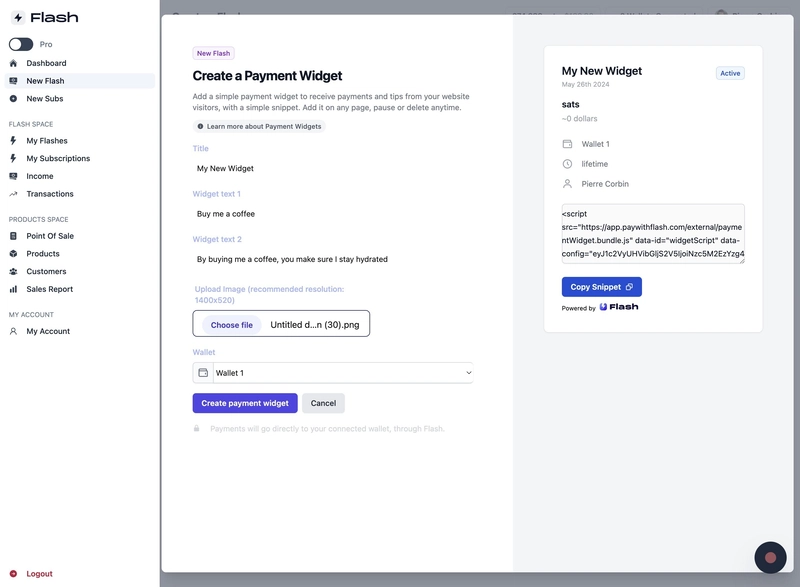

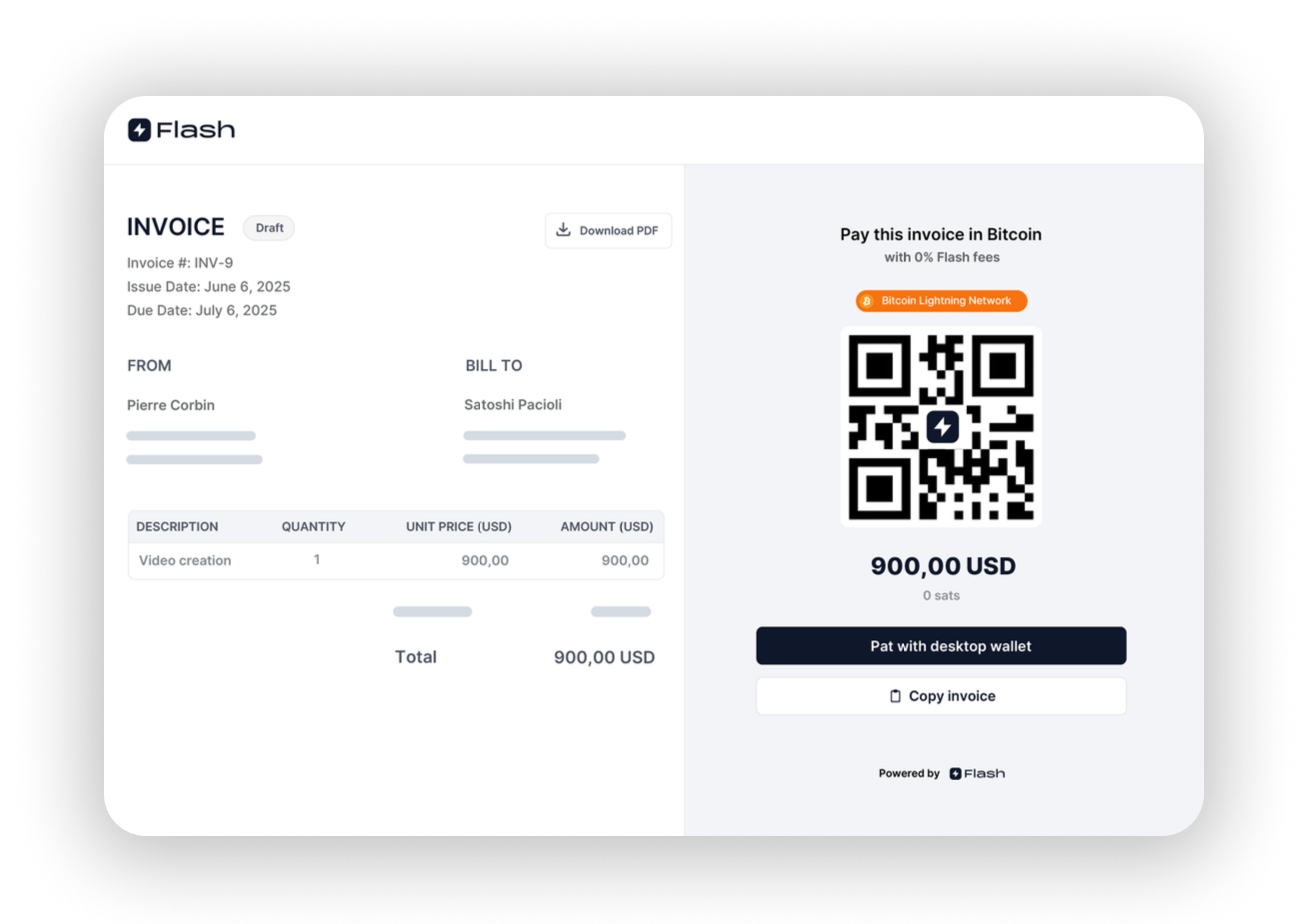

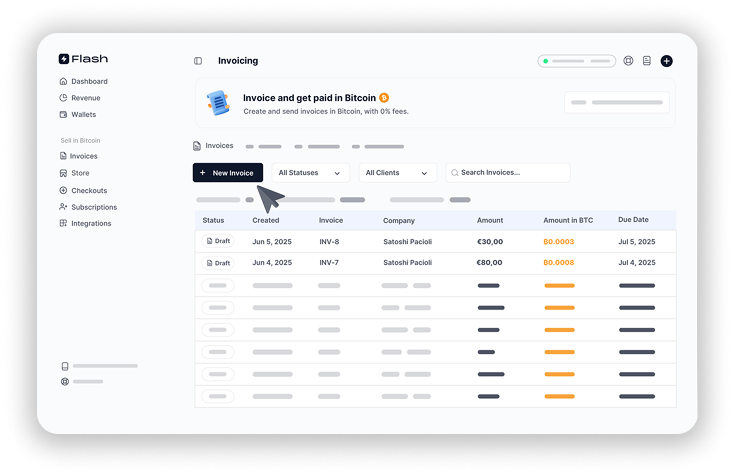

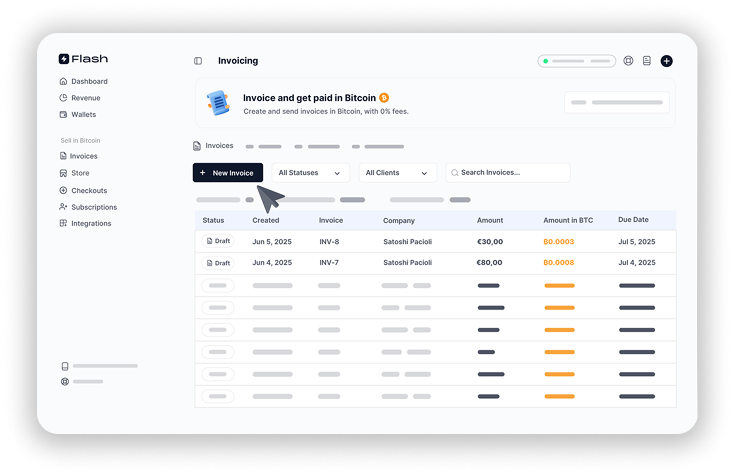

Flash Releases Free Bitcoin Invoicing Tool with No Fees, KYC, or CustodyFlash, a Bitcoin payment platform, just announced it has launched Flash Invoicing, a completely free, non-custodial, and KYC-free Bitcoin invoicing tool. Designed for freelancers, the platform allows users to send professional invoices without platform fees, identity checks, or third party custody.

According to Deel, a crypto payments company for freelancers, Bitcoin is the most used cryptocurrency in the world for payments. Despite this growth, many freelancers continue to use basic methods such as pasting Bitcoin addresses into PDFs or emails. Some rely on custodial platforms that deduct fees or require identity verification, which can affect both earnings and data privacy.

“We’ve seen too many people paste BTC addresses into documents and call it invoicing,” said the CEO of Flash Pierre Corbin. “It’s messy. It’s risky. And it’s time for something better.”

Flash Invoicing Features:

- 0% platform fees: no subscriptions or commission

- Non-custodial: Bitcoin goes straight to the user’s wallet

- No KYC: users maintain full privacy

- Professional output: branded PDFs and secure payment links

- Integrated dashboard: manage payments, clients, and revenue

- Works with Flash ecosystem: including Stores, Donations, Paywalls, and POS

Many Bitcoin invoicing tools charge a percentage per transaction or require a subscription. As a result, freelancers often lose part of their income simply to issue an invoice and receive payment. Flash is aiming to solve this issue.

“Freelancers work hard enough. The last thing they need is a platform skimming off their earnings,” said Corbin. “That’s why we dropped our fee from 1.5% to 0% — and launched the first invoicing tool that’s truly free, without compromising on privacy or control.”

Flash Invoicing allows users to accept Bitcoin payments without relinquishing control, privacy, or revenue. It is integrated with the broader Flash suite, enabling users to manage invoicing alongside features such as setting up stores, receiving donations, or gating premium content.

“As a freelancer myself, I love using the Flash invoicing feature,” stated a freelancer & Flash user. ”It keeps all my clients in one place, allows me to easily edit invoices and track payments. Much more professional than sending a lightning address in the footer of a PDF invoice.”

This post Flash Releases Free Bitcoin Invoicing Tool with No Fees, KYC, or Custody first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ e5cfb5dc:0039f130

2025-06-17 11:00:35

@ e5cfb5dc:0039f130

2025-06-17 11:00:35はりまメンタルクリニック:GIDの大手そう。丸の内線ならパムくんちが近い。

わらびメンタルクリニック:GIDの大手そう?公式サイトには影もかたちも

ナグモクリニック:SRS手術までしてるところ。GID精神科外来が月1第1木曜日だけ?

狭山メンタルクリニック:距離・時間的にはまま近い。サイトの記述が思想的にちょとあやしげ。新患受付がだいぶ先。GIDは専門外か?

川島領診療所:オンライン診療あり!強迫性障害や美容皮膚科をやっている。雰囲気よさそうなところ。GIDは専門外か?

Jこころのクリニック:電車いっぽんなので楽。GIDは専門外か?

ハッピースマイルクリニック:オンライン診療あり!GIDは専門外か?

-

@ 4ba8e86d:89d32de4

2025-06-17 18:01:47

@ 4ba8e86d:89d32de4

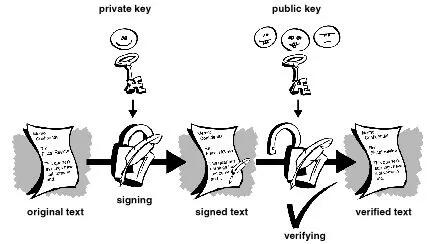

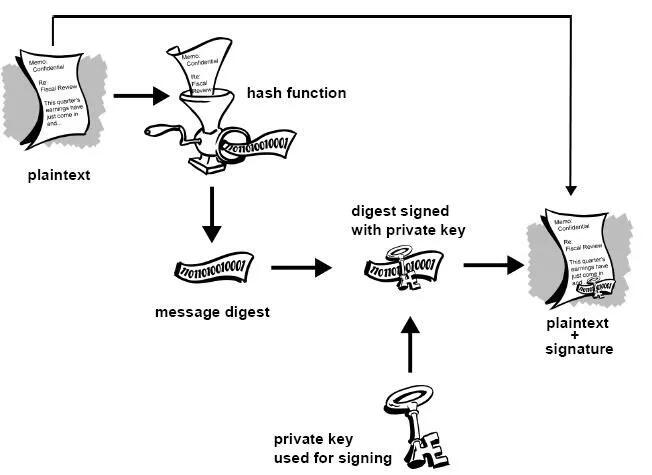

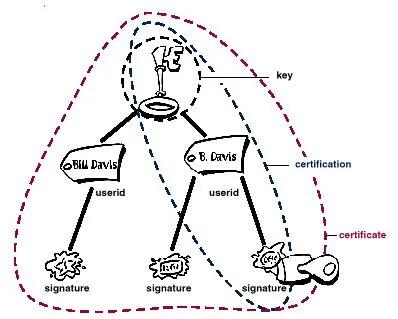

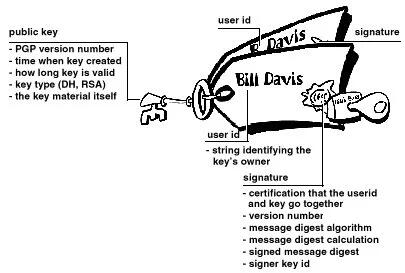

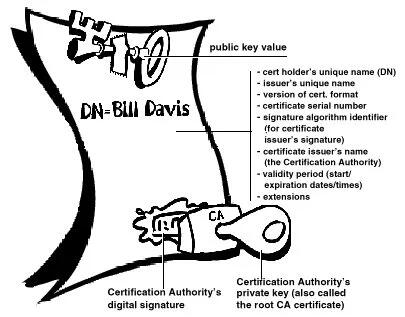

2025-06-17 18:01:47Como funciona o PGP.

GP 6.5.1. Copyright © 1990-1999 Network Associates, Inc. Todos os direitos reservados.

-O que é criptografia? -Criptografia forte -Como funciona a criptografia? -Criptografia convencional -Cifra de César -Gerenciamento de chaves e criptografia convencional -Criptografia de chave pública -Como funciona o PGP - Chaves • Assinaturas digitais -Funções hash • Certificados digitais -Distribuição de certificados -Formatos de certificado •Validade e confiança -Verificando validade -Estabelecendo confiança -Modelos de confiança • Revogação de certificado -Comunicar que um certificado foi revogado -O que é uma senha? -Divisão de chave

Os princípios básicos da criptografia.

Quando Júlio César enviou mensagens aos seus generais, ele não confiou nos seus mensageiros. Então ele substituiu cada A em suas mensagens por um D, cada B por um E, e assim por diante através do alfabeto. Somente alguém que conhecesse a regra “shift by 3” poderia decifrar suas mensagens. E assim começamos.

Criptografia e descriptografia.

Os dados que podem ser lidos e compreendidos sem quaisquer medidas especiais são chamados de texto simples ou texto não criptografado. O método de disfarçar o texto simples de forma a ocultar sua substância é chamado de criptografia. Criptografar texto simples resulta em um jargão ilegível chamado texto cifrado. Você usa criptografia para garantir que as informações sejam ocultadas de qualquer pessoa a quem não se destinam, mesmo daqueles que podem ver os dados criptografados. O processo de reverter o texto cifrado ao texto simples original é chamado de descriptografia . A Figura 1-1 ilustra esse processo.

https://image.nostr.build/0e2fcb71ed86a6083e083abbb683f8c103f44a6c6db1aeb2df10ae51ec97ebe5.jpg

Figura 1-1. Criptografia e descriptografia

O que é criptografia?

Criptografia é a ciência que usa a matemática para criptografar e descriptografar dados. A criptografia permite armazenar informações confidenciais ou transmiti-las através de redes inseguras (como a Internet) para que não possam ser lidas por ninguém, exceto pelo destinatário pretendido. Embora a criptografia seja a ciência que protege os dados, a criptoanálise é a ciência que analisa e quebra a comunicação segura. A criptoanálise clássica envolve uma combinação interessante de raciocínio analítico, aplicação de ferramentas matemáticas, descoberta de padrões, paciência, determinação e sorte. Os criptoanalistas também são chamados de atacantes. A criptologia abrange tanto a criptografia quanto a criptoanálise.

Criptografia forte.

"Existem dois tipos de criptografia neste mundo: a criptografia que impedirá a sua irmã mais nova de ler os seus arquivos, e a criptografia que impedirá os principais governos de lerem os seus arquivos. Este livro é sobre o último." --Bruce Schneier, Criptografia Aplicada: Protocolos, Algoritmos e Código Fonte em C. PGP também trata deste último tipo de criptografia. A criptografia pode ser forte ou fraca, conforme explicado acima. A força criptográfica é medida no tempo e nos recursos necessários para recuperar o texto simples. O resultado de uma criptografia forte é um texto cifrado que é muito difícil de decifrar sem a posse da ferramenta de decodificação apropriada. Quão díficil? Dado todo o poder computacional e o tempo disponível de hoje – mesmo um bilhão de computadores fazendo um bilhão de verificações por segundo – não é possível decifrar o resultado de uma criptografia forte antes do fim do universo. Alguém poderia pensar, então, que uma criptografia forte resistiria muito bem até mesmo contra um criptoanalista extremamente determinado. Quem pode realmente dizer? Ninguém provou que a criptografia mais forte disponível hoje resistirá ao poder computacional de amanhã. No entanto, a criptografia forte empregada pelo PGP é a melhor disponível atualmente.

Contudo, a vigilância e o conservadorismo irão protegê-lo melhor do que as alegações de impenetrabilidade.

Como funciona a criptografia?

Um algoritmo criptográfico, ou cifra, é uma função matemática usada no processo de criptografia e descriptografia. Um algoritmo criptográfico funciona em combinação com uma chave – uma palavra, número ou frase – para criptografar o texto simples. O mesmo texto simples é criptografado em texto cifrado diferente com chaves diferentes. A segurança dos dados criptografados depende inteiramente de duas coisas: a força do algoritmo criptográfico e o sigilo da chave. Um algoritmo criptográfico, mais todas as chaves possíveis e todos os protocolos que o fazem funcionar constituem um criptossistema. PGP é um criptossistema.

Criptografia convencional.

Na criptografia convencional, também chamada de criptografia de chave secreta ou de chave simétrica , uma chave é usada tanto para criptografia quanto para descriptografia. O Data Encryption Standard (DES) é um exemplo de criptossistema convencional amplamente empregado pelo Governo Federal. A Figura 1-2 é uma ilustração do processo de criptografia convencional. https://image.nostr.build/328b73ebaff84c949df2560bbbcec4bc3b5e3a5163d5fbb2ec7c7c60488f894c.jpg

Figura 1-2. Criptografia convencional

Cifra de César.

Um exemplo extremamente simples de criptografia convencional é uma cifra de substituição. Uma cifra de substituição substitui uma informação por outra. Isso é feito com mais frequência compensando as letras do alfabeto. Dois exemplos são o Anel Decodificador Secreto do Capitão Meia-Noite, que você pode ter possuído quando era criança, e a cifra de Júlio César. Em ambos os casos, o algoritmo serve para compensar o alfabeto e a chave é o número de caracteres para compensá-lo. Por exemplo, se codificarmos a palavra "SEGREDO" usando o valor chave de César de 3, deslocaremos o alfabeto para que a terceira letra abaixo (D) comece o alfabeto. Então começando com A B C D E F G H I J K L M N O P Q R S T U V W X Y Z e deslizando tudo para cima em 3, você obtém DEFGHIJKLMNOPQRSTUVWXYZABC onde D=A, E=B, F=C e assim por diante. Usando este esquema, o texto simples, "SECRET" é criptografado como "VHFUHW". Para permitir que outra pessoa leia o texto cifrado, você diz a ela que a chave é 3. Obviamente, esta é uma criptografia extremamente fraca para os padrões atuais, mas, ei, funcionou para César e ilustra como funciona a criptografia convencional.

Gerenciamento de chaves e criptografia convencional.

A criptografia convencional tem benefícios. É muito rápido. É especialmente útil para criptografar dados que não vão a lugar nenhum. No entanto, a criptografia convencional por si só como meio de transmissão segura de dados pode ser bastante cara, simplesmente devido à dificuldade de distribuição segura de chaves. Lembre-se de um personagem do seu filme de espionagem favorito: a pessoa com uma pasta trancada e algemada ao pulso. Afinal, o que há na pasta? Provavelmente não é o código de lançamento de mísseis/fórmula de biotoxina/plano de invasão em si. É a chave que irá descriptografar os dados secretos. Para que um remetente e um destinatário se comuniquem com segurança usando criptografia convencional, eles devem chegar a um acordo sobre uma chave e mantê-la secreta entre si. Se estiverem em locais físicos diferentes, devem confiar em um mensageiro, no Bat Phone ou em algum outro meio de comunicação seguro para evitar a divulgação da chave secreta durante a transmissão. Qualquer pessoa que ouvir ou interceptar a chave em trânsito poderá posteriormente ler, modificar e falsificar todas as informações criptografadas ou autenticadas com essa chave. Do DES ao Anel Decodificador Secreto do Capitão Midnight, o problema persistente com a criptografia convencional é a distribuição de chaves: como você leva a chave ao destinatário sem que alguém a intercepte?

Criptografia de chave pública.

Os problemas de distribuição de chaves são resolvidos pela criptografia de chave pública, cujo conceito foi introduzido por Whitfield Diffie e Martin Hellman em 1975. (Há agora evidências de que o Serviço Secreto Britânico a inventou alguns anos antes de Diffie e Hellman, mas a manteve um segredo militar - e não fez nada com isso.

[JH Ellis: The Possibility of Secure Non-Secret Digital Encryption, CESG Report, January 1970]) A criptografia de chave pública é um esquema assimétrico que usa um par de chaves para criptografia: uma chave pública, que criptografa os dados, e uma chave privada ou secreta correspondente para descriptografia. Você publica sua chave pública para o mundo enquanto mantém sua chave privada em segredo. Qualquer pessoa com uma cópia da sua chave pública pode criptografar informações que somente você pode ler. Até mesmo pessoas que você nunca conheceu. É computacionalmente inviável deduzir a chave privada da chave pública. Qualquer pessoa que possua uma chave pública pode criptografar informações, mas não pode descriptografá-las. Somente a pessoa que possui a chave privada correspondente pode descriptografar as informações. https://image.nostr.build/fdb71ae7a4450a523456827bdd509b31f0250f63152cc6f4ba78df290887318b.jpg

Figura 1-3. Criptografia de chave pública O principal benefício da criptografia de chave pública é que ela permite que pessoas que não possuem nenhum acordo de segurança pré-existente troquem mensagens com segurança. A necessidade de remetente e destinatário compartilharem chaves secretas através de algum canal seguro é eliminada; todas as comunicações envolvem apenas chaves públicas e nenhuma chave privada é transmitida ou compartilhada. Alguns exemplos de criptossistemas de chave pública são Elgamal (nomeado em homenagem a seu inventor, Taher Elgamal), RSA (nomeado em homenagem a seus inventores, Ron Rivest, Adi Shamir e Leonard Adleman), Diffie-Hellman (nomeado, você adivinhou, em homenagem a seus inventores). ) e DSA, o algoritmo de assinatura digital (inventado por David Kravitz). Como a criptografia convencional já foi o único meio disponível para transmitir informações secretas, o custo dos canais seguros e da distribuição de chaves relegou a sua utilização apenas àqueles que podiam pagar, como governos e grandes bancos (ou crianças pequenas com anéis descodificadores secretos). A criptografia de chave pública é a revolução tecnológica que fornece criptografia forte para as massas adultas. Lembra do mensageiro com a pasta trancada e algemada ao pulso? A criptografia de chave pública o tira do mercado (provavelmente para seu alívio).

Como funciona o PGP.

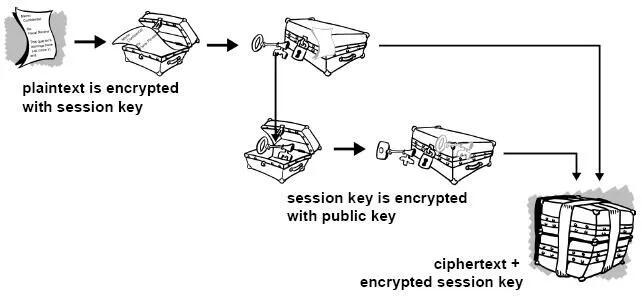

O PGP combina alguns dos melhores recursos da criptografia convencional e de chave pública. PGP é um criptossistema híbrido. Quando um usuário criptografa texto simples com PGP, o PGP primeiro compacta o texto simples. A compactação de dados economiza tempo de transmissão do modem e espaço em disco e, mais importante ainda, fortalece a segurança criptográfica. A maioria das técnicas de criptoanálise explora padrões encontrados no texto simples para quebrar a cifra. A compressão reduz esses padrões no texto simples, aumentando assim enormemente a resistência à criptoanálise. (Arquivos que são muito curtos para compactar ou que não são compactados bem não são compactados.) O PGP então cria uma chave de sessão, que é uma chave secreta única. Esta chave é um número aleatório gerado a partir dos movimentos aleatórios do mouse e das teclas digitadas. Esta chave de sessão funciona com um algoritmo de criptografia convencional rápido e muito seguro para criptografar o texto simples; o resultado é texto cifrado. Depois que os dados são criptografados, a chave da sessão é criptografada na chave pública do destinatário. Essa chave de sessão criptografada com chave pública é transmitida junto com o texto cifrado ao destinatário.

Figura 1-4. Como funciona a criptografia PGP A descriptografia funciona ao contrário. A cópia do PGP do destinatário usa sua chave privada para recuperar a chave de sessão temporária, que o PGP usa para descriptografar o texto cifrado criptografado convencionalmente.

Figura 1-5. Como funciona a descriptografia PGP A combinação dos dois métodos de criptografia combina a conveniência da criptografia de chave pública com a velocidade da criptografia convencional. A criptografia convencional é cerca de 1.000 vezes mais rápida que a criptografia de chave pública. A criptografia de chave pública, por sua vez, fornece uma solução para

problemas de distribuição de chaves e transmissão de dados. Usados em conjunto, o desempenho e a distribuição de chaves são melhorados sem qualquer sacrifício na segurança.

Chaves.