-

@ 86dfbe73:628cef55

2025-06-19 08:30:41

@ 86dfbe73:628cef55

2025-06-19 08:30:41Das Konzept der Netzwerk-Öffentlichkeit geht davon aus, dass sich im Internet Suböffentlichkeiten bilden, die als Gruppe über ganz eigene Wissensbestände verfügen. Es handelt sich dabei um einen weiteren Kommunikationsraum neben der massenmedial geprägten Öffentlichkeit.

In den Netzwerk-Öffentlichkeiten wird sich mit Gleichgesinnten ausgetauscht und spezifische Informationen und Sichtweisen werden verbreitet. Politische Akteure werden durch Netzwerk-Öffentlichkeiten autarker. Während das Konzept der Netzwerk-Öffentlichkeit den Schwerpunkt auf das neue Verhältnis zwischen politischem Akteur und Teil- bzw. Gegenöffentlichkeiten legt, konzentriert sich das Konzept der persönlichen Öffentlichkeit primär auf die Nutzer.

Sie oder er sucht sich im Internet Inhalte nach Kriterien der persönlichen Relevanz. Digital können Informationsquellen nach eigenen Bedürfnissen selbst zusammengestellt werden. Gleichzeitig richtet sich die persönliche Öffentlichkeit an ein Publikum aus sozialen Kontakten, wie beispielsweise Freunden, Bekannte, Kollegen oder Familienmitglieder. Eine ‘große’ Öffentlichkeit wird in der Regel nicht angestrebt, obwohl die technischen Voraussetzungen gegeben sind. Zudem ist persönliche Öffentlichkeit durch einen wechselseitigen Austausch und durch Dialog gekennzeichnet. Somit verschwindet in der persönlichen Öffentlichkeit allmählich das massenmediale Sender-Empfänger-Modell.

Das frühere Twitter wäre dafür ein gutes Beispiel. Aus netzwerktheoretischer Sicht bestand es aus den wesentlichen Hubs, relevanten Clustern und Akteuren der öffentlichen Sphäre. Auf Twitter tummelten sich (fast) alle, die an den Semantiken arbeiten: Wissenschaftler, Autor, Künstler, Aktivisten, Politiker aller Ränge, Juristen, Medienleute, allerlei Prominente und Public Figures und Experen für praktisch alles. Das, was wir digitale Öffentlichkeit nennen, fand nicht ausschließlich, aber zu einem bedeutenden Teil auf Twitter statt

Die digitale Öffentlichkeit hat, auf den kommerziellen Plattformen, allerdings aufgehört eine vernetzte Öffentlichkeit zu sein und geht zunehmend in den „For you“-Algorithmen der kommerziellen Plattformen auf. Das bedeutet, dass die neue digitale Öffentlichkeit nicht mehr durch menschliche Beziehungen und vernetztes Vertrauen getragen wird, sondern vollends den opaken Steuerungsinstrumenten einer Hand voll Konzernen ausgeliefert ist.

-

@ 9c9d2765:16f8c2c2

2025-06-19 08:26:28

@ 9c9d2765:16f8c2c2

2025-06-19 08:26:28In the middle of a sun-drenched village stood an old tree. Its trunk was crooked, its bark rough, and its branches reached out like tired arms.

Children ran past it. Elders sat under it. But no one gave it much thought.

Except for Ben.

Every day after school, he sat at its roots and read aloud. He didn’t know why but the tree made him feel listened to.

One day, the mayor announced a new plaza would be built.

“We’ll remove the old tree,” he said. “It’s taking up space.”

No one protested.

Except Ben.

“But it gives shade, and memories, and peace,” he pleaded. “It just… waits. That means something.”

The mayor chuckled. “It’s a tree, boy.”

That night, a storm unlike any the village had seen tore through the valley. Homes were shaken. Roofs blown. People cried.

But one house, a small cottage stood untouched.

The next morning, they saw why.

The old tree, though battered, had shielded it with its branches. Its roots had absorbed the flood. Its strength had held.

Ben stood before it, smiling through tears.

“You didn’t wait for nothing.”

The mayor planted a bench beneath it the next day.

Moral/Theme:

What seems unimportant often becomes the very thing that saves us.

-

@ 9c9d2765:16f8c2c2

2025-06-19 08:13:19

@ 9c9d2765:16f8c2c2

2025-06-19 08:13:19In a quiet village nestled between mountains, lived a humble shoemaker named Ali. He wasn’t rich, but every pair of shoes he made carried a touch of magic crafted not for fashion, but for the journey of the soul.

One stormy night, a little girl named Rita entered his shop. Her dress was torn, her feet bare and muddy.

“I don’t have money,” she whispered, shivering.

Ali smiled gently. “Money doesn’t buy kindness. Sit.”

He made her a pair of soft brown boots. On the inside of each sole, he stitched a star.

“These will guide your steps when the road feels too long,” he said.

She looked up. “Why are you so kind?”

He paused. “Because someone once did the same for me.”

Rita hugged him and disappeared into the storm.

Years passed. The village changed. Ali grew older. His hands slowed. Fewer people came.

One night, as the snow fell heavily, he closed the shop for what he thought would be the last time.

A knock echoed at the door.

There stood a young woman, dressed in fine clothes, holding a pair of worn-out boots brown, with faded stars inside.

“You helped me walk through life when I had nothing,” she said. “Now, let me walk you home.”

Tears welled in his eyes.

Moral: When you give from the heart, the return may take time, but it always finds its way back.

-

@ 9c9d2765:16f8c2c2

2025-06-19 08:02:09

@ 9c9d2765:16f8c2c2

2025-06-19 08:02:09Susan was a quiet librarian in a fading town where people no longer visited the library. Dust coated shelves, and the old wooden chairs creaked from disuse, not presence.

But every week, an old man named Mr. Mark came in. Always alone. Always carrying a black leather journal.

He never borrowed books. Just sat in the corner, writing slowly, thoughtfully.

One day, Susan’s curiosity got the better of her.

"Excuse me," she said gently. "What do you write in there?"

Mr. Mark looked up with a soft smile. "Letters. To people I’ve never met."

She blinked. "Why?"

"Because not all wisdom should die quietly."

He closed the journal and handed her a letter.

To the one who feels invisible: You are not unseen. Sometimes, the quietest souls carry the brightest lights. Don’t dim yours because others don’t notice. Shine anyway.

Susan’s throat tightened. She kept the letter.

Weeks passed. Then one day, Mr. Mark didn’t come.

Nor the next.

After a month, she found a small package on her desk, his journal, wrapped in string.

Inside the cover:

To Miss Susan For those who listen. Keep passing the ink along.

Susan placed the journal on the library counter with a new sign: "Take a letter. Leave a truth."

Years later, the library was no longer silent. People came, not just for books but for the ink that stayed.

Moral:

Words, once shared, can echo longer than a voice ever could.

-

@ dfa02707:41ca50e3

2025-06-19 08:01:52

@ dfa02707:41ca50e3

2025-06-19 08:01:52Headlines

- Twenty One Capital is set to launch with over 42,000 BTC in its treasury. This new Bitcoin-native firm, backed by Tether and SoftBank, is planned to go public via a SPAC merger with Cantor Equity Partners and will be led by Jack Mallers, co-founder and CEO of Strike. According to a report by the Financial Times, the company aims to replicate the model of Michael Saylor with his company, MicroStrategy.

- Florida's SB 868 proposes a backdoor into encrypted platforms. The bill and its House companion have both passed through their respective committees and are headed to a full vote. If enacted, SB 868 would require social media companies to decrypt teens' private messages, ban disappearing messages, allow unrestricted parental access to private messages, and likely eliminate encryption for all minors altogether.

- Paul Atkins has officially assumed the role of the 34th Chairman of the US Securities and Exchange Commission (SEC). This is a return to the agency for Atkins, who previously served as an SEC Commissioner from 2002 to 2008 under the George W. Bush administration. He has committed to advancing the SEC’s mission of fostering capital formation, safeguarding investors, and ensuring fair and efficient markets.

- Solosatoshi.com has sold over 10,000 open-source miners, adding more than 10 PH of hashpower to the Bitcoin network.

"Thank you, Bitaxe community. OSMU developers, your brilliance built this. Supporters, your belief drives us. Customers, your trust powers 10,000+ miners and 10PH globally. Together, we’re decentralizing Bitcoin’s future. Last but certainly not least, thank you@skot9000 for not only creating a freedom tool, but instilling the idea into thousands of people, that Bitcoin mining can be for everyone again," said the firm on X.

- OCEAN's DATUM has found 100 blocks. "Over 65% of OCEAN’s miners are using DATUM, and that number is growing every day. This means block template construction is making its way back into the hands of the miners, which is not only the most profitable for miners on OCEAN but also one of the best things for Bitcoin," stated the mining pool.

Source: orangesurf

- Arch Labs has secured $13 million to develop "ArchVM" and integrate smart-contract functionality with Bitcoin. The funding round, valuing the company at $200 million, was led by Pantera Capital, as announced on Tuesday.

- Tesla still holds nearly $1 billion in bitcoin. According to the automaker's latest earnings report, the firm reported digital asset holdings worth $951 million as of March 31.

- The European Central Bank is pushing for amendments to the European Union's Markets in Crypto Assets legislation (MiCA), just months after its implementation. According to Politico's report on Tuesday, the ECB is concerned that U.S. support for cryptocurrency, particularly stablecoins, could cause economic harm to the 27-nation bloc.

- TABConf 2025 is scheduled to take place from October 13-16, 2025. This prominent technical Bitcoin conference is dedicated to community building, education, and developer support, and it is set to return in October. Get your tickets here.

- Kaduna Lightning Development Bootcamp. From May 14th to 17th, the Bitcoin Lightning Developer Bootcamp will take place in Kaduna, Nigeria. Thisevent offers four dynamic days of coding, learning, and networking. Organized by Africa Free Routing and supported by Btrust, Tether, and African Bitcoiners, this bootcamp is designed as a gateway for African developers eager to advance their skills in Bitcoin and Lightning development. Apply here.

Source: African Bitcoiners.

Use the tools

- Core Lightning (CLN) v25.02.2 as been released to fix a broken Docker image. The issue was caused by an SQLite version that did not support an advanced query.

- Blitz wallet v0.4.4-beta introduces several updates and improvements, including the prevention of duplicate ecash payments, fixes for background ecash invoice handling, the ability for users to send payments to BOLT12 invoices from their Liquid balance, support for Blink QR codes, a lowered minimum amount for Lightning-to-Liquid payments to 100 sats, the option to initiate a node sync via a swipe gesture on the wallet's home screen, and the introduction of opt-in or opt-out functionality for newly implemented crash analytics via settings.

- Utreexo v0.5.0, a hash-based dynamic accumulator, is now available.

- Specter v2.1.1 is now available on StartOS. "This update brings compatibility with Bitcoin Core v28 and incorporates several upstream improvements," said developer Alex71btc.

- ESP-Miner (AxeOS) v2.7.0b1 is now available for testing.

- NodeGuard v0.16.1, a treasury management solution for Lightning nodes, has been released.

- The latest stacker.news updates include prompts to add a receiving wallet when posting or making comments (for new users), an option to randomize poll choices, improved URL search, and a few other enhancements. A bug fix for territories created after 9/19/24 has been implemented to reward 70% of their revenue to owners instead of 50%.

Other stuff

- The April edition of the 256 Foundation's newsletter is now available. It includes the latest mining news, Bitcoin network health updates, project developments, and a tutorial on how to update FutureBit's Apollo 1 to the Apollo 2 software.

- Siggy47 has posted a comprehensive RoboSats guide on stacker.news.

- Learn how to run your own Nostr relay using Citrine and Cloudflare Tunnels by following this step-by-step guide by Dhalism.

- Max Guise has written a Bitkey roadmap update for April 2025.

-

PlebLab has uploaded a video on how to build a Rust wallet with LDK Node by Ben Carman.

-

Do you want more? Subscribe and get No Bullshit GM report straight to your mailbox and No Bullshit Bitcoin on Nostr.

- Feedback or tips? Drop it here.

- #FREESAMOURAI

Sign up for No Bullshit Bitcoin

No Bullshit Bitcoin Is a Bitcoin News Desk Without Ads, Paywalls, or Clickbait.

Subscribe .nc-loop-dots-4-24-icon-o{--animation-duration:0.8s} .nc-loop-dots-4-24-icon-o *{opacity:.4;transform:scale(.75);animation:nc-loop-dots-4-anim var(--animation-duration) infinite} .nc-loop-dots-4-24-icon-o :nth-child(1){transform-origin:4px 12px;animation-delay:-.3s;animation-delay:calc(var(--animation-duration)/-2.666)} .nc-loop-dots-4-24-icon-o :nth-child(2){transform-origin:12px 12px;animation-delay:-.15s;animation-delay:calc(var(--animation-duration)/-5.333)} .nc-loop-dots-4-24-icon-o :nth-child(3){transform-origin:20px 12px} @keyframes nc-loop-dots-4-anim{0%,100%{opacity:.4;transform:scale(.75)}50%{opacity:1;transform:scale(1)}}

Email sent! Check your inbox to complete your signup.

No spam. Unsubscribe anytime.

-

@ 472f440f:5669301e

2025-06-19 03:35:39

@ 472f440f:5669301e

2025-06-19 03:35:39Marty's Bent

via me

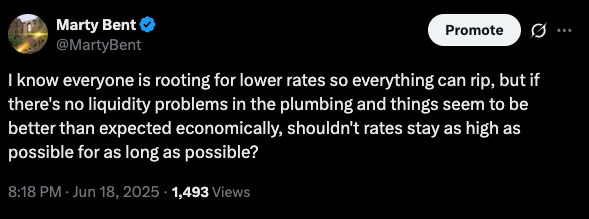

Here's a thought that's been rattling around in my head this week and especially today after the FOMC meeting, during which Jerome Powell announced that the Federal Reserve will hold the Fed Funds rate where it is. Much to the chagrin of President Trump, who has been begging Jerome Powell to lower rates since before he even got into office.

A lot of my thoughts around this particular subject are anchored in conversations I've had with our good friend Parker Lewis on the podcast over the last year. When I ask him about when the Fed will lower rates and potentially revert to quantitative easing, he always responds, "When a liquidity crisis emerges." The Fed is always late to respond and it won't lower rates and turn the money printer on until something breaks in the plumbing of the financial system.

As it stands today, and to my shock, no structural liquidity crisis has materialized in the plumbing and the financial system. We've covered many topics over the course of the last six months. Everything from the yen carry trade blowing out to the treasury carry trade blowing out to the micro-financing of DoorDash deliveries to the increase in delinquency rates for credit card and car loans to the dislocation that currently exists between sellers, buyers, and prices in the real estate market. In aggregate, all these disparate indicators signal to me that there certainly are different sectors of the global economy that are experiencing stress. But if we're being honest with ourselves and looking at the empirical data, there have only been tremors of a liquidity crisis, particularly around the yen and treasury carry trades. Which bubbled up, but then quickly went away.

Inflation is still coming in above the Fed's arbitrary target. The unemployment rate is within range of the Fed's arbitrary target. And the stock market is not too far from all-time highs. Granted, we all know too well that the government reported inflation numbers are severely under-reported and do not reflect actual inflation. The same can be said with the unemployment rate which is typically under-reported because economists refuse to acknowledge the participation rate, which is still below pre-COVID levels. When you factor in this data manipulation, the case for keeping rates higher for longer only gets stronger. Especially when you factor in Trump's immigration policy focused on mass deportation, which should be beneficial for American jobs, increase real wages, increase demand for goods and services in the economy and put upward pressure on prices.

Many who are calling for lower rates will feign worry about economic growth and investment, but it's not too hard to read through the lines and see that many of those cheerleaders just want to return to the asset price acceleration that we experienced at the end of 2020, 2021, and the first half of 2022. Worries of inflation and mass misallocation of capital be damned. Start blowing the bubble again.

There were many responses to the tweet I sent out above saying that we need to lower rates as soon as possible due to the amount of federal debt via the treasury market that is being rolled over in the coming years. I can certainly see that argument, but also believe that these people have extremely short memories considering the fact that treasury yields went up significantly last September after the Fed began to lower rates from the 5.5% target that was set previously. Another set of responses to this tweet pointed to the real estate market claiming that American citizens cannot buy houses due to elevated mortgage rates, which is only half true. The other part of the real estate market equation is the prices of the actual homes, which are also elevated. And as I mentioned earlier, there is currently a wide chasm between the number of sellers and number of buyers in the market at the moment, favoring buyers who have a ton of supply to choose from.

Prices are beginning to come down in major markets across the country, which should make conditions more favorable for those looking to buy, even with elevated mortgage rates. It's also important to understand that mortgage rates are derived in part from Treasury yields, which, as we explained earlier, are not guaranteed to fall with a cut of the Fed Funds rate. I am under the impression that to guarantee a lowering of treasury yields alongside a cut of the Fed Funds rate any cuts would have to be paired with QE to bolster demand and artificially increase the price of treasury bonds (which lowers the yield), and QE can't really be justified without a systemic liquidity crisis.

So for those out there shaking their fists at the sky and damning Jerome Powell and the Federal Reserve Board for not lowering the Fed funds rate, I think you're showing your true bias, which is you want to see financial assets artificially skyrocket and for inflation to increase at a faster clip. Saifedean Ammous made a very good point at the end of The Bitcoin Standard, which was that if the only thing Bitcoin succeeded in doing was to force central banks to practice better, more conservative monetary policy than it will have succeeded.

Now, to be clear, I'm not saying that Bitcoin is guiding the decisions of the Federal Reserve, but I think keeping rates higher for longer, increasing the cost of capital so that allocators are forced to weigh the opportunity costs of where they're investing and demanding that entrepreneurs produce truly innovative, productive, and profitable businesses is a good thing in the long run. The vociferous nagging for lower rates is a product of the ZIRP derp that people became accustomed and addicted to post-2008. It's important to recognize that this period of monetary policy is an anomaly and will be remembered as a grave injustice.

I'm not saying ZIRP derp won't return. I still believe it's inevitable at some point in the future. I'm just saying that it seems a bit odd to me to be cheering it on and wishing it would come ASAP. ZIRP derp is a signal that things are terribly broken. Being able to hold rates higher for longer is a signal that people are being forced to make more calculated decisions and they're doing that successfully. Either that or stealth QE in the form of reverse repo markets and amended reserve requirements for banks are delaying the liquidity crisis despite higher rates.

Why the U.S. Won't Go Bankrupt Despite Record Debt Levels

Mel Mattison presented a compelling case that U.S. bankruptcy fears are overblown, emphasizing that America "has a printing press" and can create dollars at will. He argued that the Fed's balance sheet has significant room to expand, currently holding only 13% of Treasury debt—the same percentage it's maintained since the 1940s. Most importantly, Mattison highlighted that deflationary forces from AI productivity gains and demographic shifts (baby boomers leaving the workforce) will allow continued deficit spending without triggering runaway inflation.

"The U.S. cannot go bankrupt. I mean, like we have a printing press." - Mel Mattison

Mattison's analysis shows that interest expense stabilizing around 3% of GDP mirrors the prosperous 1985-1996 period when stocks rose 350%. He views government spending not as reckless, but as necessary stimulus to prevent deflationary collapse in an aging economy. While this perspective challenges conventional fiscal hawks, the historical precedents and structural changes he cites suggest our debt concerns may be fighting yesterday's battles.

Check out the full podcast here for more on AI's impact on jobs, Bitcoin hitting $150k, and why higher interest rates won't crash markets.

Headlines of the Day

Davis Commodities Puts 40% of $30M Into Bitcoin - via X

Ukraine Bill Adds Bitcoin to National Reserves - via X

Vinanz Raises £3.58M to Expand Bitcoin Mining - via X

Get our new STACK SATS hat - via tftcmerch.io

Bitcoin’s Next Parabolic Move: Could Liquidity Lead the Way?

Is bitcoin’s next parabolic move starting? Global liquidity and business cycle indicators suggest it may be.

Read the latest report from Unchained and TechDev, analyzing how global M2 liquidity and the copper/gold ratio—two historically reliable macro indicators—are aligning once again to signal that a new bitcoin bull market may soon begin.

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Ground beef, guacamole and eggs over medium is an elite dinner.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ eb0157af:77ab6c55

2025-06-19 08:01:32

@ eb0157af:77ab6c55

2025-06-19 08:01:32The world’s leading bitcoin mining rig manufacturers are moving to build facilities in the U.S. to sidestep tariffs imposed by President Trump.

According to Reuters, the three Chinese giants dominating global ASIC device production — Bitmain, Canaan, and MicroBT — have launched a strategic shift toward the United States, driven by steep tariffs enforced by the Trump administration.

The move is a direct response to American protectionist policies. Trump introduced 30% tariffs on Chinese tech products, heavily impacting a sector where China controls over 90% of global mining hardware production.

Bitmain led the way, starting device assembly on U.S. soil last December, just weeks after Trump’s election victory. Canaan quickly followed, launching a pilot production line in the U.S. to bypass the heavy import taxes.

Leo Wang, Canaan’s VP of Business Development, called the American project “exploratory,” highlighting the unpredictability of current trade policies. MicroBT, the world’s third-largest player, announced it was actively rolling out a U.S.-based “localization strategy.”

Guang Yang, Chief Technology Officer of Conflux Network, noted that “the U.S.-China trade war is triggering structural, not superficial, changes in Bitcoin’s supply chains.”

For American firms, this shift represents “a strategic pivot toward ‘politically acceptable’ hardware sources,” Yang added. The near-monopoly of the three Chinese mining giants — which, according to Frost & Sullivan, accounted for 95.4% of the global hashrate sold in 2023 — has raised national security concerns in the U.S.

Sanjay Gupta, Chief Strategy Officer at Auradine, pointed out the imbalance:

“While over 30% of global bitcoin mining occurs in North America, more than 90% of mining hardware originates from China representing a major imbalance of geographic demand and supply.”

The post Bitmain, Canaan, and MicroBT open U.S. factories to dodge Trump’s tariffs appeared first on Atlas21.

-

@ 8d34bd24:414be32b

2025-06-18 15:41:52

@ 8d34bd24:414be32b

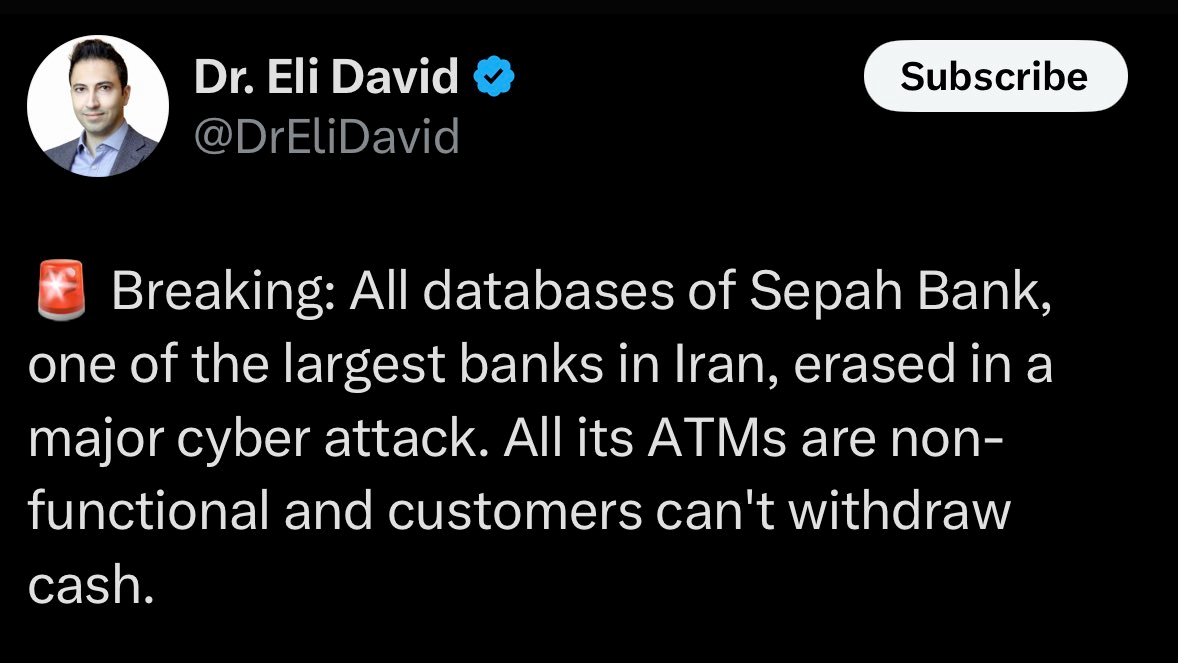

2025-06-18 15:41:52As I read the news over the past week, we’ve heard of Ukrainian drone attacks on Russia’s nuclear attack planes and Russia’s threats of retaliation. We’ve heard of Israel attacking Iran’s nuclear facilities and Iran returning attacks on Israel’s major cities. I’ve read of AI taking jobs, threatening someone trying to turn it off, and refusing to turn off. There are threats of inflation, market crashes, housing crashes, and monetary crashes. There are riots across the US. There are warnings of potential new pandemics or of calls for terrorist cells to awaken and attack. It is easy to get overwhelmed by everything happening in the world. It is easy to become fearful of everything, but God does not call us to be afraid. He repeatedly tells us to “trust him” and to “fear not.”

Do not fear, for I am with you;\ Do not anxiously look about you, for I am your God.\ I will strengthen you, surely I will help you,\ Surely I will uphold you with My righteous right hand.’ (Isaiah 41:10)

With all of the crazy going on in the world, it is easy to worry about our jobs, our families, our country, and even our lives, but God does not want us to worry. He wants us to trust in Him in all things.

And He said to His disciples, “For this reason I say to you, do not worry about your life, as to what you will eat; nor for your body, as to what you will put on. For life is more than food, and the body more than clothing. Consider the ravens, for they neither sow nor reap; they have no storeroom nor barn, and yet God feeds them; how much more valuable you are than the birds! And which of you by worrying can add a single hour to his life’s span? If then you cannot do even a very little thing, why do you worry about other matters? Consider the lilies, how they grow: they neither toil nor spin; but I tell you, not even Solomon in all his glory clothed himself like one of these. But if God so clothes the grass in the field, which is alive today and tomorrow is thrown into the furnace, how much more will He clothe you? You men of little faith! And do not seek what you will eat and what you will drink, and do not keep worrying. For all these things the nations of the world eagerly seek; but your Father knows that you need these things. But seek His kingdom, and these things will be added to you. Do not be afraid, little flock, for your Father has chosen gladly to give you the kingdom. (Luke 12:22-32) {emphasis mine}

God provides for His own. He doesn’t always provide in the way we wish, but He does provide when we trust in Him. Even when believers die, He provides them a place in heaven.

When we look at the world around us, where everything seems like it is falling apart and/or turning to evil, we need to keep our eyes on Jesus and on eternity.

Therefore we do not lose heart, but though our outer man is decaying, yet our inner man is being renewed day by day. For momentary, light affliction is producing for us an eternal weight of glory far beyond all comparison, while we look not at the things which are seen, but at the things which are not seen; for the things which are seen are temporal, but the things which are not seen are eternal. (2 Corinthians 4:16-18) {emphasis mine}

What we experience here on earth may sometimes be unpleasant, but it is a “momentary, light affliction” compared to the glory of heaven. Just as labor and delivery of a child is hard and unpleasant, but is worth every effort and pain when you hold your child, in the same way our suffering on earth will seem like nothing compared to the joy of being in the presence of our Creator God and Savior.

My Experiences

I used to try to prepare for everything. When I was young, I would say, “a good Girl Scout is always prepared.” When I got married and had kids, I started trying to prepare for anything that might possibly go wrong. I had extra food, water, and medical supplies. I started a garden. I got chickens. I got rid of chickens when I developed a lung allergy and couldn’t breathe.

None of that was wrong in itself. I’d even argue it could be wise actions, but I was relying on myself and stuff to face the troubles of this world instead of relying on God. That was definitely not good and was not the way to peace.

We also got involved in politics. My husband was in the state legislature. I was a precinct person and involved in precinct, county, state, and national meetings. I helped set the platform for our state political party in two elections and helped set the resolutions in another.

None of that was wrong in itself. I’d even argue that Christians are called to be a blessing to our earthly nations, but it wasn’t the way to peace, nor was it putting my time in effort into the most important things.

I’ve been reading my Bible daily for 40+ years and reading the Bible in a year for 20+ years. For more than a decade I intensely studied the beginnings, Genesis and how science and archaeology support every fact in Genesis. That study really taught me the power of God and how He always keeps His promises.

For the past several years, I’ve switched to spending most of my intense study on end times prophecy. Despite the fact that the end times prophecies predict a time of unimaginable hardship, the promises of the rapture, the millennial kingdom, and eternity with Jesus in heaven brings great peace. The crazy, evil, and agony in the world is not the world falling apart, but God’s controlled, merciful judgment on the world. I can see the light at the end of the tunnel. I don’t just see everything that can possibly go wrong. I trust God with my life and that of my family.

I still have extra food, water, and medical supplies on hand, but I don’t obsess about it, nor do I put all my trust in my preparations. I still vote, but I have pulled back from political life. I have learned to trust Jesus in these difficult times. I try to be wise, but not worry about every thing that could possibly go wrong. I have gained peace.

But the Helper, the Holy Spirit, whom the Father will send in My name, He will teach you all things, and bring to your remembrance all that I said to you. Peace I leave with you; My peace I give to you; not as the world gives do I give to you. Do not let your heart be troubled, nor let it be fearful. You heard that I said to you, ‘I go away, and I will come to you.’ If you loved Me, you would have rejoiced because I go to the Father, for the Father is greater than I. Now I have told you before it happens, so that when it happens, you may believe. (John 14:26-29) {emphasis mine}

Studying God’s word enables me to know God’s power, trust His promises, and know His predictions. I don’t need to worry because God is in control of everything that happens in the world.

Let your gentle spirit be known to all men. The Lord is near. Be anxious for nothing, but in everything by prayer and supplication with thanksgiving let your requests be made known to God. And the peace of God, which surpasses all comprehension, will guard your hearts and your minds in Christ Jesus. (Philippians 4:5-7) {emphasis mine}

I really can know the “peace of God, which surpasses all comprehension.”

What We Need for Peace

Knowing God’s word can give us peace. We can bring Bible verses to mind as reminders of His promises given and His promises fulfilled. I am going to go through a bunch of verses that we can bring to mind when we are feeling worried and fearful. I’ll probably make a few comments, but I want God’s word to speak to you.

When I am afraid,\ I will put my trust in You.\ In God, whose word I praise,\ In God I have put my trust;\ I shall not be afraid.\ What can mere man do to me? (Psalm 56:3-4)

It is hard to be afraid when you are praising God.

While He was still speaking, they came from the house of the synagogue official, saying, “Your daughter has died; why trouble the Teacher anymore?” But Jesus, overhearing what was being spoken, said to the synagogue official, “Do not be afraid any longer, only believe.” (Mark 5:35-36)

Once trusting Jesus as Savior, we don’t need to be afraid of anything, just believe.

The Lord also will be a stronghold for the oppressed,\ A stronghold in times of trouble;\ And those who know Your name will put their trust in You,\ For You, O Lord, have not forsaken those who seek You. (Psalm 9:9-10)

No matter what we are going through, God is with us and working through us for good. We are never left alone.

And we know that God causes all things to work together for good to those who love God, to those who are called according to His purpose. (Romans 8:28)

God may allow hard times to come, but it is always for good. There is no pointless pain.

Be strong and courageous, do not be afraid or tremble at them, for the Lord your God is the one who goes with you. He will not fail you or forsake you. (Deuteronomy 31:6)

It is amazing how we can deal with hardships when we rely on God and not our own power.

For the eyes of the Lord are toward the righteous,\ And His ears attend to their prayer,\ But the face of the Lord is against those who do evil.

Who is there to harm you if you prove zealous for what is good? But even if you should suffer for the sake of righteousness, you are blessed. And do not fear their intimidation, and do not be troubled, but sanctify Christ as Lord in your hearts, always being ready to make a defense to everyone who asks you to give an account for the hope that is in you, yet with gentleness and reverence; and keep a good conscience so that in the thing in which you are slandered, those who revile your good behavior in Christ will be put to shame. (1 Peter 3:12-16) {emphasis mine}

How amazing is it that suffering can actually be a blessing. There is no witness stronger than the person who keeps the faith and has joy and hope in suffering.

Do not fret because of evildoers,\ Be not envious toward wrongdoers.\ For they will wither quickly like the grass\ And fade like the green herb.\ *Trust in the Lord and do good*;\ Dwell in the land and cultivate faithfulness.\ Delight yourself in the Lord;\ And He will give you the desires of your heart.\ *Commit your way to the Lord*,\ Trust also in Him, and He will do it. (Psalm 37:1-5) {emphasis mine}

When we trust in God, commit our way to Him, and delight in Him, we can have joy in any situation.

Open the gates, that the righteous nation may enter,\ The one that remains faithful.\ **The steadfast of mind You will keep in perfect peace,\ Because he trusts in You.\ Trust in the Lord forever,\ For in God the Lord, we have an everlasting Rock. (Isaiah 26:2-4) {emphasis mine}

What a promise! “The steadfast of mind You will keep in perfect peace, because he trusts in You.”

I know your tribulation and your poverty (but you are rich), and the blasphemy by those who say they are Jews and are not, but are a synagogue of Satan. Do not fear what you are about to suffer. Behold, the devil is about to cast some of you into prison, so that you will be tested, and you will have tribulation for ten days. Be faithful until death, and I will give you the crown of life. (Revelation 2:9-10) {emphasis mine}

Do you think of tribulation and poverty as riches? If you trust Jesus, then you are rich in blessings when you experience tribulation and poverty. God does not promise His people ease in this life, but He does promise to use every pain and hardship for good — for our good, the good of others, and His glory. We need to trust Jesus and not fear.

Trust in the Lord with all your heart\ And do not lean on your own understanding.\ In all your ways acknowledge Him,\ And He will make your paths straight.\ *Do not be wise in your own eyes;\ Fear the Lord* and turn away from evil.\ It will be healing to your body\ And refreshment to your bones.** (Proverbs 3:5-8) {emphasis mine}

I need this verse: “Trust in the Lord with all your heart, and do not lean on your own understanding.” I definitely want to lean on my own power and understanding and have to remind myself of God’s power, wisdom, and goodness continually so I lean on Him. You have to love what God promises when we trust in Him alone: “healing to your body and refreshment to your bones.” Doesn’t that sound wonderful?

For this reason I remind you to kindle afresh the gift of God which is in you through the laying on of my hands. For God has not given us a spirit of timidity, but of power and love and discipline.

Therefore do not be ashamed of the testimony of our Lord or of me His prisoner, but join with me in suffering for the gospel according to the power of God, who has saved us and called us with a holy calling, not according to our works, but according to His own purpose and grace which was granted us in Christ Jesus from all eternity, (2 Timothy 1:6-9) {emphasis mine}

If you haven’t relied on God for everything for a long time, a call to “join with me in suffering for the gospel” probably sounds crazy, but when we live a life “not according to our works, but according to His own purpose and grace” we quickly learn how everything in life brings more peace and joy. It doesn’t make it easier or nicer necessarily, but it does bring peace and joy like you can’t imagine.

Whoever confesses that Jesus is the Son of God, God abides in him, and he in God. We have come to know and have believed the love which God has for us. God is love, and the one who abides in love abides in God, and God abides in him. By this, love is perfected with us, so that we may have confidence in the day of judgment; because as He is, so also are we in this world. There is no fear in love; but perfect love casts out fear, because fear involves punishment, and the one who fears is not perfected in love. (1 John 4:15-18) {emphasis mine}

If we repent of our sins and confess Jesus as Lord, the God and Creator of the universe lives in us. Is there anything more magnificent? When we trust in Jesus, “we may have confidence in the day of judgment.” When we love God, He loves us and “perfect love casts out fear.”

What Would I Do?

My son with Down Syndrome loves watching this show called “Mayday, Air Disaster.” It goes through different, real plane crashes and reviews how they figured out why the plane crashed. Sometimes everyone dies. Sometimes everyone lives. Sometimes some live and some die.

Watching this show and seeing the people (in reenactments) screaming in terror as the plane plummets to the ground makes me wonder how I would react in a similar circumstance. If I wasn’t a Christian, I’d probably never set foot on a plane again after watching the show. I’d like to think I would be like Jesus calmly praying “into thy hands I commit my spirit,” but I might be frantically gripping the armrests and screaming like the rest. I don’t guess anyone truly knows until they experience something like that.

Whatever the case, whether we act in perfect faith or whether we have a moment of weakness in fear of danger, pain, and the unknown, Jesus will be there with us, if we have trusted in Jesus as Savior. Everything is better with Jesus.

May our Lord, Creator, and Savior keep us in total faith, love, peace, and joy in Him so that we do not fear, no matter what trials we face. May He help us to lean on Him and not try to do everything ourselves or rely on stuff. May our faithful service and hope during trial glorify Him and draw many to Him.

Trust Jesus

-

@ 39cc53c9:27168656

2025-06-16 06:25:50

@ 39cc53c9:27168656

2025-06-16 06:25:50After almost 3 months of work, we've completed the redesign of kycnot.me. More modern and with many new features.

Privacy remains the foundation - everything still works with JavaScript disabled. If you enable JS, you will get some nice-to-have features like lazy loading and smoother page transitions, but nothing essential requires it.

User Accounts

We've introduced user accounts that require zero personal information:

- Secret user tokens - no email, no phone number, no personal data

- Randomly generated usernames for default privacy and fairness

- Karma system that rewards contributions and unlocks features: custom display names, profile pictures, and more.

Reviews and Community Discussions

On the previous sites, I was using third party open source tools for the comments and discussions. This time, I've built my own from scratch, fully integrated into the site, without JavaScript requirements.

Everyone can share their experiences and help others make informed decisions:

- Ratings: Comments can have a 1-5 star rating attached. You can have one rating per service and it will affect the overall user score.

- Discussions: These are normal comments, you can add them on any listed service.

Comment Moderation

I was strugling to keep up with moderation on the old site. For this, we've implemented an AI-powered moderation system that:

- Auto-approves legitimate comments instantly

- Flags suspicious content for human review

- Keeps discussions valuable by minimizing spam

The AI still can mark comments for human review, but most comments will get approved automatically by this system. The AI also makes summaries of the comments to help you understand the overall sentiment of the community.

Powerful Search & Filtering

Finding exactly what you need is now easier:

- Advanced filtering system with many parameters. You can even filter by attributes to pinpoint services with specific features.

The results are dynamic and shuffle services with identical scores for fairness.

See all listings

Listings are now added as 'Community Contributed' by default. This means that you can still find them in the search results, but they will be clearly marked as such.

Updated Scoring System

New dual-score approach provides more nuanced service evaluations:

- Privacy Score: Measures how well a service protects your personal information and data

-

Trust Score: Assesses reliability, security, and overall reputation

-

Combined into a weighted Overall Score for quick comparisons

- Completely transparent and open source calculation algorithm. No manual tweaking or hidden factors.

AI-Powered Terms of Service Analysis

Basically, a TLDR summary for Terms of Service:

- Automated system extracts the most important points from complex ToS documents

- Clear summaries

- Updated monthly to catch any changes

The ToS document is hashed and only will be updated if there are any changes.

Service Events and Timelines

Track the complete history of any service, on each service page you can see the timeline of events. There are two types of events:

- Automatic events: Created by the system whenever something about a service changes, like its description, supported currencies, attributes, verification status…

- Manual events: Added by admins when there’s important news, such as a service going offline, being hacked, acquired, shut down, or other major updates.

There is also a global timeline view available at /events

Notification System

Since we now have user accounts, we built a notifiaction system so you can stay informed about anything:

- Notifications for comment replies and status changes

- Watch any comment to get notified for new replies.

- Subscribe to services to monitor events and updates

- Notification customization.

Coming soon: Third-party privacy-preserving notifications integration with Telegram, Ntfy.sh, webhooks...

Service Suggestions

Anyone with an account can suggest a new service via the suggestion form. After submitting, you'll receive a tracking page where you can follow the status of your suggestion and communicate directly with admins.

All new suggestions start as "unlisted" — they won't appear in search results until reviewed. Our team checks each submission to ensure it's not spam or inappropriate. If similar services already exist, you'll be shown possible duplicates and can choose to submit your suggestion as an edit instead.

You can always check the progress of your suggestion, respond to moderator questions, and see when it goes live, everything will also be notified to your account. This process ensures high-quality listings and a collaborative approach to building the directory.

These are some of the main features we already have, but there are many more small changes and improvements that you will find when using the site.

What's Next?

This is just the beginning. We will be constantly working to improve KYCnot.me and add more features that help you preserve your privacy.

Remember: True financial freedom requires the right to privacy. Stay KYC-free!

-

@ 0a80b7ba:cabb9ba4

2025-06-19 06:16:27

@ 0a80b7ba:cabb9ba4

2025-06-19 06:16:27Life doesn’t always go as planned. Even in the most loving families, challenges arise—whether it’s growing distance between partners, a child struggling emotionally, or the daily stress that builds up into anxiety. When these moments feel too big to handle alone, therapy can offer a path toward healing, understanding, and reconnection.

At Evolution Psychotherapy, we’re proud to support families across Toronto with compassionate, personalized care. From couples counselling to child therapy and evidence-based anxiety treatment in Toronto residents can rely on, we help individuals and families find strength, stability, and clarity—together and within.

When Relationships Feel Stuck: How Couples Therapy Helps

All relationships go through ups and downs. But when communication starts to break down, arguments become more frequent, or emotional intimacy fades, it may be time to seek outside support. Couples counselling is not about choosing sides—it’s about learning how to work together again.

At Evolution Psychotherapy, our therapists provide a safe, neutral space where both partners can express themselves openly and feel heard. Using proven techniques such as Emotionally Focused Therapy (EFT), we help couples uncover deeper emotional needs, resolve conflict with empathy, and rebuild trust. Whether you’re dealing with major life transitions, parenting stress, or simply want to reconnect, couples counselling can be the reset your relationship needs.

Supporting Kids Through Big Feelings

Children feel things deeply, but they often struggle to express those emotions in words. As a result, stress, anxiety, or grief may show up as tantrums, withdrawal, or changes in behavior. That’s where child therapy can play a powerful role in helping young minds process their world.

Our therapists work with children using age-appropriate approaches, such as play therapy and expressive arts, to help them feel safe and understood. We collaborate closely with parents too—offering guidance, insight, and strategies to support your child’s emotional well-being at home. Whether your child is coping with family changes, school stress, or emotional challenges, child therapy provides the tools to help them grow, adapt, and thrive.

Managing Anxiety with Care and Confidence

Anxiety is one of the most common mental health challenges in today’s fast-paced world—and it doesn’t discriminate by age or background. If you or a loved one find yourself overwhelmed by racing thoughts, panic, or constant worry, you’re not alone. Fortunately, effective anxiety treatment Toronto residents trust is available.

At Evolution Psychotherapy, we tailor treatment plans to each client’s unique experience with anxiety. Our approach often includes Cognitive Behavioural Therapy (CBT), mindfulness strategies, and emotion regulation techniques to help reduce symptoms and promote resilience. Whether you're navigating social anxiety, generalized worry, or panic attacks, anxiety treatment Toronto programs offer hope and relief.

A Holistic Approach to Family Wellness

Mental health doesn’t exist in a vacuum. That’s why we take a holistic view—recognizing how individuals, relationships, and family dynamics all interact. Whether it’s through couples counselling, child therapy, or focused anxiety treatment Toronto clients seek out for lasting change, our goal is always the same: to help you move forward with greater clarity, connection, and peace of mind. When you’re ready, we’re here. At Evolution Psychotherapy, we walk alongside you—offering the support, tools, and insights you need to build a healthier future, one step at a time.

-

@ b1ddb4d7:471244e7

2025-06-19 08:01:11

@ b1ddb4d7:471244e7

2025-06-19 08:01:11Why are Stripe Alternatives are growing like mushrooms? When it comes to online payment processing, Stripe has long dominated the conversation.

However, with its complex pricing structure, strict policies and first-world focus, many entrepreneurs and companies are actively seeking viable Stripe alternatives.

Whether you’re a SaaS startup, e-commerce store, or global enterprise, choosing the right payment processor can significantly impact your bottom line and customer experience.

Table of Contents

- Why Consider Stripe Alternatives?

- The Complete List of Stripe Alternatives

- Additional Notable Mentions

- How to Choose the Right Stripe Alternative

- Conclusion

Why Consider Stripe Alternatives?

Before diving into our comprehensive list, it’s worth understanding why businesses are exploring alternatives to Stripe. While Stripe offers robust features and excellent developer tools, some businesses face challenges with pricing transparency, limited global coverage, or specific industry requirements that Stripe doesn’t fully address.

The Complete List of Stripe Alternatives

Based on extensive research and analysis of the payment processing landscape, here are 27 proven Stripe alternatives that could be the perfect fit for your business:

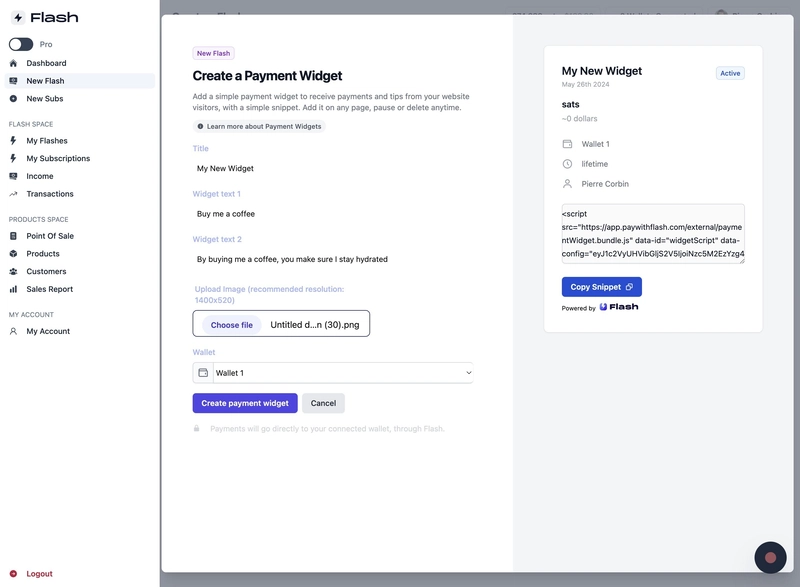

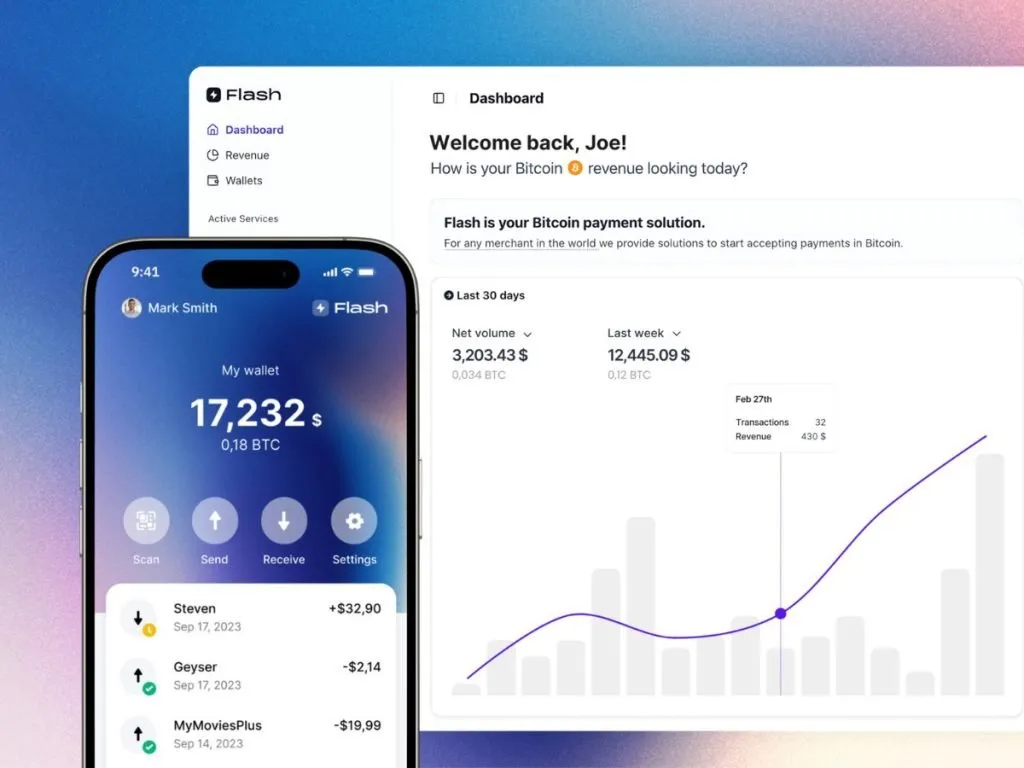

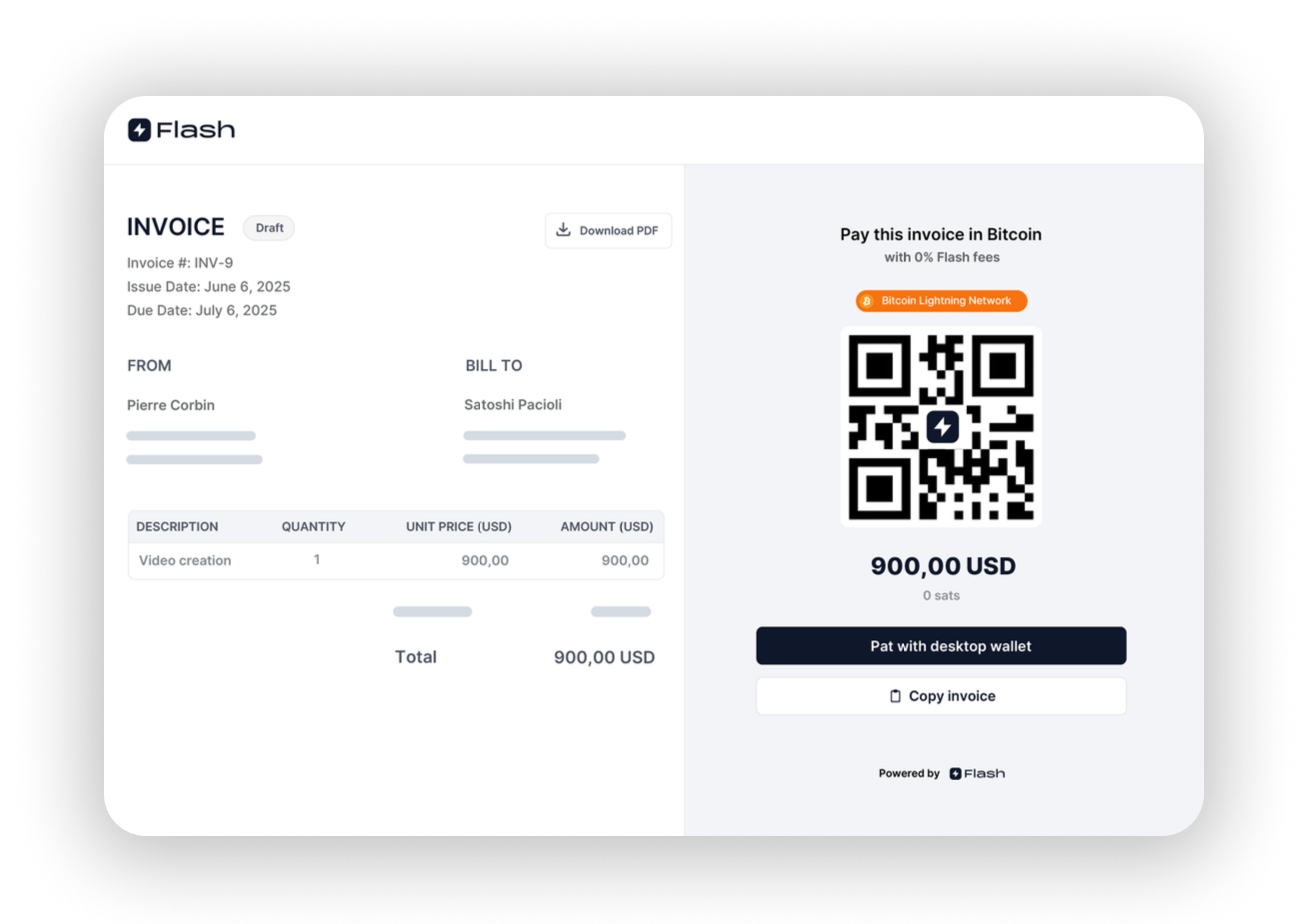

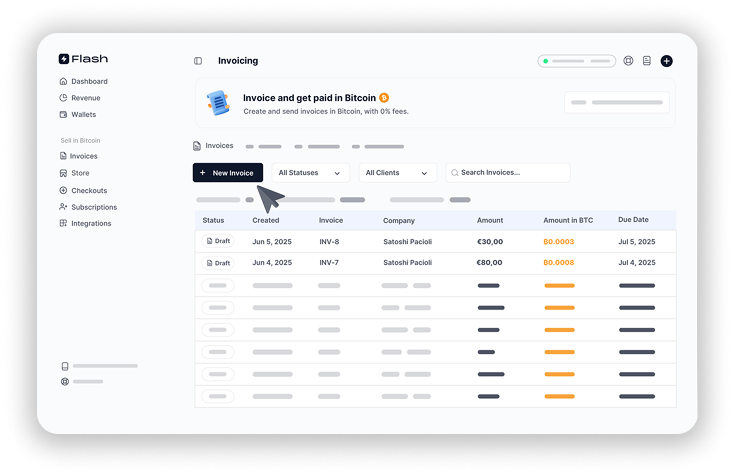

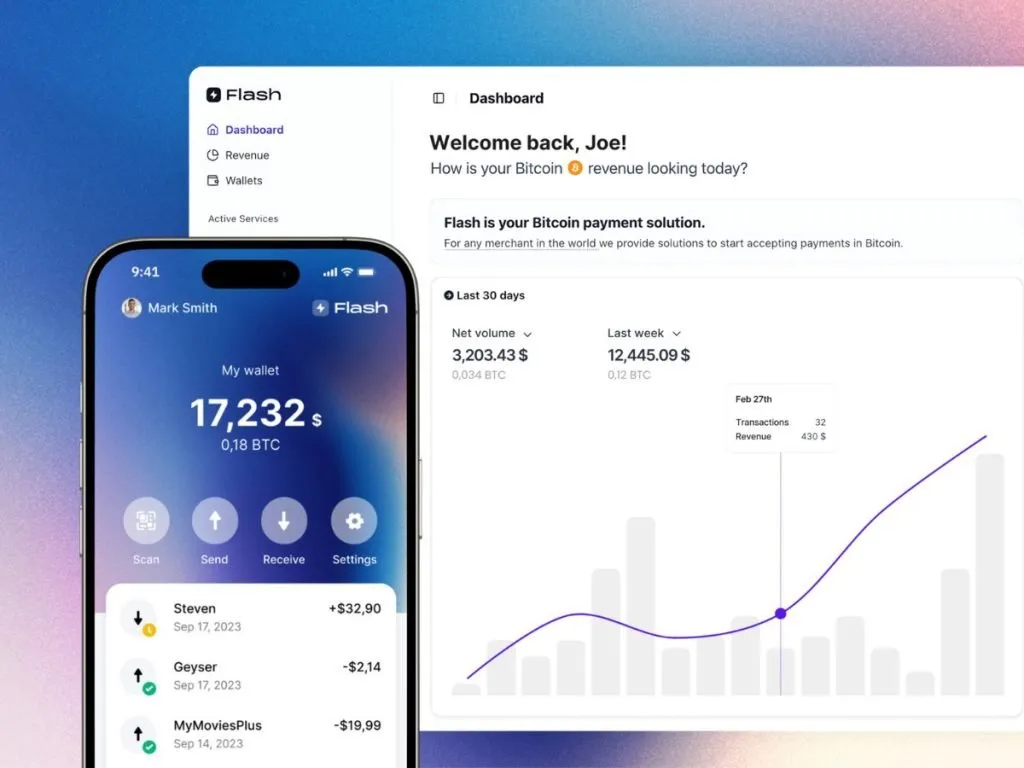

1. Flash – Easiest Bitcoin Payment Solution

Flash is the easiest Bitcoin payment gateway for businesses to accept payments. Supporting both digital and physical enterprises, Flash leverages the Lightning Network to enable fast, low-cost Bitcoin transactions. Launched in its 2.0 version in March 2025, Flash is at the forefront of driving Bitcoin adoption in e-commerce.

2. Lemon Squeezy – The SaaS-Focused Alternative

Dubbed as “acq’d by Stripe,” Lemon Squeezy offers a comprehensive solution specifically designed for digital product sales and SaaS businesses. It provides strong customer support, built-in analytics, and handles payments, subscriptions, global tax compliance, and fraud prevention in one platform.

3. Gumroad – Creator Economy Champion

Gumroad has carved out a niche serving creators and small businesses by providing tools for selling digital products, physical goods, and subscriptions. It’s particularly popular among content creators, artists, and independent entrepreneurs who want to experiment with various ideas and formats. They also open-sourced their code which is quite the ‘chad-move’.

4. Paddle – All-in-One SaaS Commerce

Paddle caters to SaaS and software companies by offering a comprehensive platform with billing, licensing, and global tax handling capabilities. It’s designed to be a complete solution for subscription-based businesses, handling payments, tax, and subscription management in one platform.

5. FastSpring – Global E-commerce Specialist

FastSpring specializes in e-commerce solutions for software and SaaS companies, with a focus on global payments and subscription management. According to TechnologyAdvice, it’s particularly strong for international transactions and helps companies sell more, stay lean, and compete big.

6. 2Checkout – Versatile Payment Solutions

2Checkout (now part of Verifone) offers versatile payment solutions excelling in global payments, subscription billing, and digital commerce. One of the best stripe alternatives as it’s an all-in-one monetization platform that maximizes revenues and makes global online sales easier, supporting over 200 countries and territories.

7. Payoneer – Cross-Border Payment Expert

Payoneer simplifies cross-border payment solutions, offering local payment ease globally with a focus on market expansion and multi-currency support. It’s trusted by small to medium-sized businesses for global payment solutions and international money transfers.

8. Chargebee – Subscription Management Leader

Chargebee is a subscription management platform perfect for SaaS and SMBs, with robust billing and revenue management features. If you were looking for stripe alternatives to setup subscriptions, Chargebee might be right for you. It streamlines revenue operations and helps businesses grow efficiently with comprehensive subscription billing capabilities.

9. Maxio (formerly Chargify) – B2B SaaS Billing

Maxio offers a robust platform for B2B SaaS billing and financial operations, focusing on growth and efficiency for subscription businesses. It’s the most complete financial operations platform for B2B SaaS, bringing core financial operations into one platform.

10. Recurly – Dynamic Subscription Management

Recurly offers dynamic subscription management platform, excelling in churn management and data insights for subscription growth. It’s the only proven platform that expands and protects your recurring revenue with subscription management, recurring billing, and payments orchestration.

11. Braintree – PayPal’s Enterprise Solution

Braintree (by PayPal) provides a versatile global payments platform, integrating multiple payment methods with a focus on conversion and security. It delivers end-to-end checkout experiences for businesses, offering single-touch payments and mobile optimization.

12. PayKickstart – Modern Commerce Platform

PayKickstart offers a modern commerce platform for online billing and affiliates, focusing on revenue maximization and churn minimization. It’s the most complete checkout, recurring billing, affiliate management, and retention solution with global capabilities.

13. PayPro Global – Full-Service E-commerce

PayPro Global offers a full-service eCommerce solution for selling software and SaaS, focusing on global payments, tax compliance, and customer support. It provides flexible solutions with over 70 payment methods and great support for software companies.

14. Shopify Payments – E-commerce Integration

Integrated with Shopify, this service is ideal for SMBs in eCommerce, offering a seamless shopping cart and payment experience. It’s the simplest way to accept online payments, automatically set up for major methods with no fees for some payment types.

15. Square – Versatile POS and Payment Solutions

Square provides versatile POS and payment solutions for small businesses with a strong focus on retail and mobile payments. Forbes Advisor notes it as one of the top alternatives for businesses needing both online and offline payment capabilities.

16. Zoho Billing – Integrated Business Solution

Zoho Billing is an online recurring billing and subscription management solution, ideal for small and medium-sized businesses seeking professional invoice creation, time and expense tracking, and improved cash flow management. Zoho isn’t just competing for stripe alternatives, they offer a ton of other products and services.

17. WePay – Chase Company Integration

WePay, a Chase company, provides integrated payment solutions for ISVs and SaaS companies with customizable payment solutions. It’s designed for platforms like marketplaces and small business tools, offering seamless user experience and fraud protection.

18. QuickBooks Payments – SMB Accounting Integration

This service provides seamless accounting and payment solutions for SMBs and SaaS businesses, featuring real-time tracking and automated bookkeeping. It lets small businesses accept payments online from anywhere with easy integration into QuickBooks accounting.

19. Mangopay – Marketplace Payment Infrastructure

Mangopay offers a modular payment infrastructure for marketplaces and platforms, emphasizing flexibility, global payouts, and AI-powered anti-fraud. It uses flexible wallets built to orchestrate fund flows and monetize payment experiences.

20. Coinbase Commerce – Cryptocurrency Payments

Coinbase Commerce enables businesses to accept payments from around the world using cryptocurrency. It offers instant settlement, low fees, and broad asset support, making it easy for merchants to accept digital currency payments globally.

21. BTCPay Server – Open-Source Bitcoin Processor

BTCPay Server is a self-hosted, open-source cryptocurrency payment processor with 0% fees and no third-party involvement. It’s secure, private, censorship-resistant, and completely free for businesses wanting full control over their Bitcoin payments.

22. Lago – Open-Source Billing Alternative

Lago is an open-source alternative to Stripe Billing and Chargebee, specializing in billing and metering in one place for usage-b

-

@ 39cc53c9:27168656

2025-06-15 14:46:35

@ 39cc53c9:27168656

2025-06-15 14:46:35The new website is finally live! I put in a lot of hard work over the past months on it. I'm proud to say that it's out now and it looks pretty cool, at least to me!

Why rewrite it all?

The old kycnot.me site was built using Python with Flask about two years ago. Since then, I've gained a lot more experience with Golang and coding in general. Trying to update that old codebase, which had a lot of design flaws, would have been a bad idea. It would have been like building on an unstable foundation.

That's why I made the decision to rewrite the entire application. Initially, I chose to use SvelteKit with JavaScript. I did manage to create a stable site that looked similar to the new one, but it required Jav aScript to work. As I kept coding, I started feeling like I was repeating "the Python mistake". I was writing the app in a language I wasn't very familiar with (just like when I was learning Python at that mom ent), and I wasn't happy with the code. It felt like spaghetti code all the time.

So, I made a complete U-turn and started over, this time using Golang. While I'm not as proficient in Golang as I am in Python now, I find it to be a very enjoyable language to code with. Most aof my recent pr ojects have been written in Golang, and I'm getting the hang of it. I tried to make the best decisions I could and structure the code as well as possible. Of course, there's still room for improvement, which I'll address in future updates.

Now I have a more maintainable website that can scale much better. It uses a real database instead of a JSON file like the old site, and I can add many more features. Since I chose to go with Golang, I mad e the "tradeoff" of not using JavaScript at all, so all the rendering load falls on the server. But I believe it's a tradeoff that's worth it.

What's new

- UI/UX - I've designed a new logo and color palette for kycnot.me. I think it looks pretty cool and cypherpunk. I am not a graphic designer, but I think I did a decent work and I put a lot of thinking on it to make it pleasant!

- Point system - The new point system provides more detailed information about the listings, and can be expanded to cover additional features across all services. Anyone can request a new point!

- ToS Scrapper: I've implemented a powerful automated terms-of-service scrapper that collects all the ToS pages from the listings. It saves you from the hassle of reading the ToS by listing the lines that are suspiciously related to KYC/AML practices. This is still in development and it will improve for sure, but it works pretty fine right now!

- Search bar - The new search bar allows you to easily filter services. It performs a full-text search on the Title, Description, Category, and Tags of all the services. Looking for VPN services? Just search for "vpn"!

- Transparency - To be more transparent, all discussions about services now take place publicly on GitLab. I won't be answering any e-mails (an auto-reply will prompt to write to the corresponding Gitlab issue). This ensures that all service-related matters are publicly accessible and recorded. Additionally, there's a real-time audits page that displays database changes.

- Listing Requests - I have upgraded the request system. The new form allows you to directly request services or points without any extra steps. In the future, I plan to enable requests for specific changes to parts of the website.

- Lightweight and fast - The new site is lighter and faster than its predecessor!

- Tor and I2P - At last! kycnot.me is now officially on Tor and I2P!

How?

This rewrite has been a labor of love, in the end, I've been working on this for more than 3 months now. I don't have a team, so I work by myself on my free time, but I find great joy in helping people on their private journey with cryptocurrencies. Making it easier for individuals to use cryptocurrencies without KYC is a goal I am proud of!

If you appreciate my work, you can support me through the methods listed here. Alternatively, feel free to send me an email with a kind message!

Technical details

All the code is written in Golang, the website makes use of the chi router for the routing part. I also make use of BigCache for caching database requests. There is 0 JavaScript, so all the rendering load falls on the server, this means it needed to be efficient enough to not drawn with a few users since the old site was reporting about 2M requests per month on average (note that this are not unique users).

The database is running with mariadb, using gorm as the ORM. This is more than enough for this project. I started working with an

sqlitedatabase, but I ended up migrating to mariadb since it works better with JSON.The scraper is using chromedp combined with a series of keywords, regex and other logic. It runs every 24h and scraps all the services. You can find the scraper code here.

The frontend is written using Golang Templates for the HTML, and TailwindCSS plus DaisyUI for the CSS classes framework. I also use some plain CSS, but it's minimal.

The requests forms is the only part of the project that requires JavaScript to be enabled. It is needed for parsing some from fields that are a bit complex and for the "captcha", which is a simple Proof of Work that runs on your browser, destinated to avoid spam. For this, I use mCaptcha.

-

@ cae03c48:2a7d6671

2025-06-19 08:00:50

@ cae03c48:2a7d6671

2025-06-19 08:00:50Bitcoin Magazine

The Blockchain Group Buys $20 Million Worth Of BitcoinThe Blockchain Group has acquired an additional 182 Bitcoin for approximately €17 million ($19.6 million), further expanding its position as Europe’s first Bitcoin treasury company amid accelerating institutional adoption of Bitcoin reserves.

According to a press release issued June 18, the Euronext Growth Paris-listed company completed the purchases through multiple convertible bond issuances totalling over €18 million, subscribed by several investors, including UTXO Management, Moonlight Capital, and asset manager TOBAM.

JUST IN:

French publicly traded, The Blockchain Group buys an additional 182 #Bitcoin for €17.0 million

French publicly traded, The Blockchain Group buys an additional 182 #Bitcoin for €17.0 million Nothing stops this train

pic.twitter.com/fwIqq934Yy

pic.twitter.com/fwIqq934Yy— Bitcoin Magazine (@BitcoinMagazine) June 18, 2025

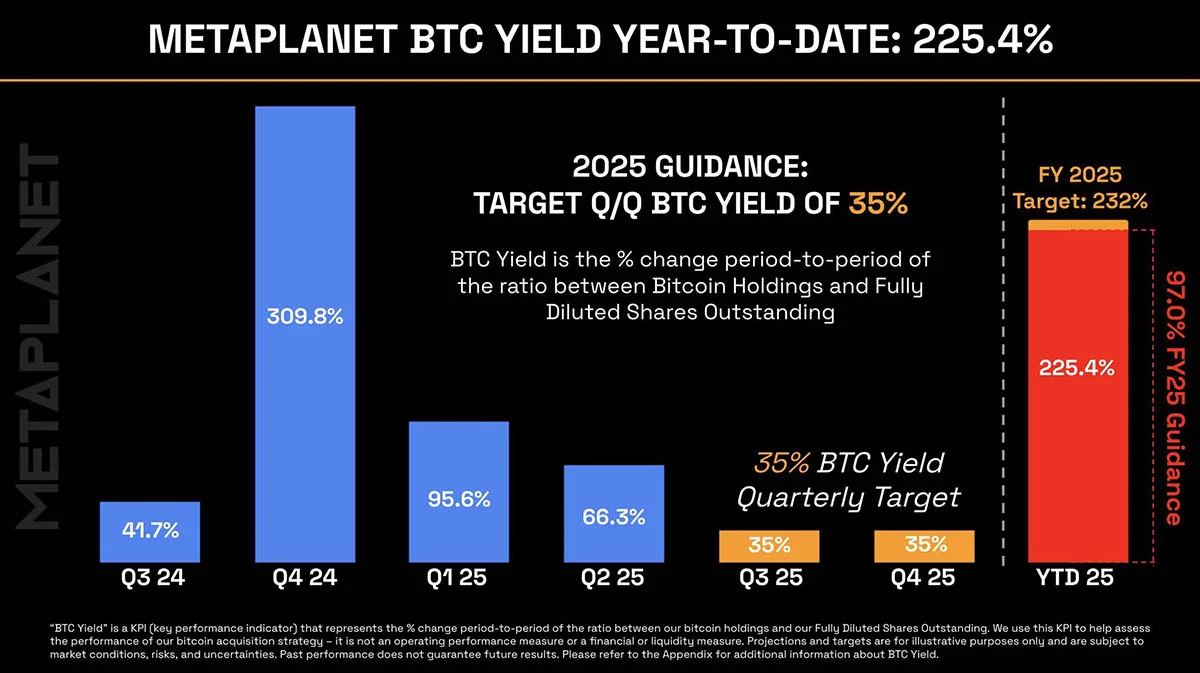

The acquisitions bring The Blockchain Group’s total Bitcoin holdings to 1,653 BTC, purchased at an average price of €90,081 ($104,000) per coin. The company reported a “BTC Yield” – measuring Bitcoin holdings relative to fully diluted shares – of 1,173.2% year-to-date, significantly outpacing other major corporate holders.

The company’s latest purchases were executed through Swissquote Bank Europe and Banque Delubac, with custody provided by Swiss infrastructure provider Taurus. Additional funding came from the conversion of share warrants into 2.98 million ordinary shares, raising €1.6 million.

We’re seeing unprecedented growth in corporate Bitcoin treasury strategies. The Blockchain Group’s success has created a model for European companies, with new organizations announcing Bitcoin purchases almost weekly.

The company indicated potential plans to acquire an additional 70 BTC through ongoing transactions, which could bring its total holdings to 1,723 BTC. This follows recent Bitcoin treasury announcements from companies including Metaplanet, which now holds 10,000 BTC, and Strategy’s latest acquisition of 10,1000 BTC.

At press time, Bitcoin trades at $104,021, down 1.26% over the past 24 hours, as markets continue to process the implications of growing institutional adoption. The Blockchain Group’s shares were down 3.9% to €4.80 on Wednesday, trading on Euronext Paris.

This post The Blockchain Group Buys $20 Million Worth Of Bitcoin first appeared on Bitcoin Magazine and is written by Vivek Sen.

-

@ 39cc53c9:27168656

2025-06-15 14:13:58

@ 39cc53c9:27168656

2025-06-15 14:13:58Bitcoin enthusiasts frequently and correctly remark how much value it adds to Bitcoin not to have a face, a leader, or a central authority behind it. This particularity means there isn't a single person to exert control over, or a single human point of failure who could become corrupt or harmful to the project.

Because of this, it is said that no other coin can be equally valuable as Bitcoin in terms of decentralization and trustworthiness. Bitcoin is unique not just for being first, but also because of how the events behind its inception developed. This implies that, from Bitcoin onwards, any coin created would have been created by someone, consequently having an authority behind it. For this and some other reasons, some people refer to Bitcoin as "The Immaculate Conception".

While other coins may have their own unique features and advantages, they may not be able to replicate Bitcoin's community-driven nature. However, one other cryptocurrency shares a similar story of mystery behind its creation: Monero.

History of Monero

Bytecoin and CryptoNote

In March 2014, a Bitcointalk thread titled "Bytecoin. Secure, private, untraceable since 2012" was initiated by a user under the nickname "DStrange"^1^. DStrange presented Bytecoin (BCN) as a unique cryptocurrency, in operation since July 2012. Unlike Bitcoin, it employed a new algorithm known as CryptoNote.

DStrange apparently stumbled upon the Bytecoin website by chance while mining a dying bitcoin fork, and decided to create a thread on Bitcointalk^1^. This sparked curiosity among some users, who wondered how could Bytecoin remain unnoticed since its alleged launch in 2012 until then^2^.

Some time after, a user brought up the "CryptoNote v2.0" whitepaper for the first time, underlining its innovative features^4^. Authored by the pseudonymous Nicolas van Saberhagen in October 2013, the CryptoNote v2 whitepaper^5^ highlighted the traceability and privacy problems in Bitcoin. Saberhagen argued that these flaws could not be quickly fixed, suggesting it would be more efficient to start a new project rather than trying to patch the original^5^, an statement simmilar to the one from Satoshi Nakamoto^6^.

Checking with Saberhagen's digital signature, the release date of the whitepaper seemed correct, which would mean that Cryptonote (v1) was created in 2012^7^, although there's an important detail: "Signing time is from the clock on the signer's computer" ^9^.

Moreover, the whitepaper v1 contains a footnote link to a Bitcointalk post dated May 5, 2013^10^, making it impossible for the whitepaper to have been signed and released on December 12, 2012.

As the narrative developed, users discovered that a significant 80% portion of Bytecoin had been pre-mined^11^ and blockchain dates seemed to be faked to make it look like it had been operating since 2012, leading to controversy surrounding the project.

The origins of CryptoNote and Bytecoin remain mysterious, leaving suspicions of a possible scam attempt, although the whitepaper had a good amount of work and thought on it.

The fork

In April 2014, the Bitcointalk user

thankful_for_today, who had also participated in the Bytecoin thread^12^, announced plans to launch a Bytecoin fork named Bitmonero^13^.The primary motivation behind this fork was "Because there is a number of technical and marketing issues I wanted to do differently. And also because I like ideas and technology and I want it to succeed"^14^. This time Bitmonero did things different from Bytecoin: there was no premine or instamine, and no portion of the block reward went to development.

However, thankful_for_today proposed controversial changes that the community disagreed with. Johnny Mnemonic relates the events surrounding Bitmonero and thankful_for_today in a Bitcointalk comment^15^:

When thankful_for_today launched BitMonero [...] he ignored everything that was discussed and just did what he wanted. The block reward was considerably steeper than what everyone was expecting. He also moved forward with 1-minute block times despite everyone's concerns about the increase of orphan blocks. He also didn't address the tail emission concern that should've (in my opinion) been in the code at launch time. Basically, he messed everything up. Then, he disappeared.

After disappearing for a while, thankful_for_today returned to find that the community had taken over the project. Johnny Mnemonic continues:

I, and others, started working on new forks that were closer to what everyone else was hoping for. [...] it was decided that the BitMonero project should just be taken over. There were like 9 or 10 interested parties at the time if my memory is correct. We voted on IRC to drop the "bit" from BitMonero and move forward with the project. Thankful_for_today suddenly resurfaced, and wasn't happy to learn the community had assumed control of the coin. He attempted to maintain his own fork (still calling it "BitMonero") for a while, but that quickly fell into obscurity.

The unfolding of these events show us the roots of Monero. Much like Satoshi Nakamoto, the creators behind CryptoNote/Bytecoin and thankful_for_today remain a mystery^17^, having disappeared without a trace. This enigma only adds to Monero's value.

Since community took over development, believing in the project's potential and its ability to be guided in a better direction, Monero was given one of Bitcoin's most important qualities: a leaderless nature. With no single face or entity directing its path, Monero is safe from potential corruption or harm from a "central authority".

The community continued developing Monero until today. Since then, Monero has undergone a lot of technological improvements, migrations and achievements such as RingCT and RandomX. It also has developed its own Community Crowdfundinc System, conferences such as MoneroKon and Monerotopia are taking place every year, and has a very active community around it.

Monero continues to develop with goals of privacy and security first, ease of use and efficiency second. ^16^

This stands as a testament to the power of a dedicated community operating without a central figure of authority. This decentralized approach aligns with the original ethos of cryptocurrency, making Monero a prime example of community-driven innovation. For this, I thank all the people involved in Monero, that lead it to where it is today.

If you find any information that seems incorrect, unclear or any missing important events, please contact me and I will make the necessary changes.

Sources of interest

- https://forum.getmonero.org/20/general-discussion/211/history-of-monero

- https://monero.stackexchange.com/questions/852/what-is-the-origin-of-monero-and-its-relationship-to-bytecoin

- https://en.wikipedia.org/wiki/Monero

- https://bitcointalk.org/index.php?topic=583449.0

- https://bitcointalk.org/index.php?topic=563821.0

- https://bitcointalk.org/index.php?action=profile;u=233561

- https://bitcointalk.org/index.php?topic=512747.0

- https://bitcointalk.org/index.php?topic=740112.0

- https://monero.stackexchange.com/a/1024

- https://inspec2t-project.eu/cryptocurrency-with-a-focus-on-anonymity-these-facts-are-known-about-monero/

- https://medium.com/coin-story/coin-perspective-13-riccardo-spagni-69ef82907bd1

- https://www.getmonero.org/resources/about/

- https://www.wired.com/2017/01/monero-drug-dealers-cryptocurrency-choice-fire/

- https://www.monero.how/why-monero-vs-bitcoin

- https://old.reddit.com/r/Monero/comments/u8e5yr/satoshi_nakamoto_talked_about_privacy_features/

-

@ 6ad3e2a3:c90b7740

2025-06-18 12:00:52

@ 6ad3e2a3:c90b7740

2025-06-18 12:00:52"Whereof one cannot speak, thereof one must be silent."

— Ludwig Wittgenstein

Simulation Theory, the idea our entire existence is part of a simulation, that we are just code running on some more advanced civilization’s supercomputer has come up in conversations of late. I’m writing to say it’s not just wrong, but bullshit. A category error, at best, and cover for a nefarious agenda at worst.

The first problem with Simulation Theory is unless there’s some way to get outside the simulation, to access base reality, so to speak, the theory has no meaning. It’s just a semantic game.

Consider for example the theory (one I came up with on my walk back from the track) that you are actually a sleeping elephant dreaming of this human life. You are sleeping peacefully under a quiet grove of trees, and you won’t wake into elephant consciousness for another four hours when the sun rises. Moreover, the pace of your dream is glacial — you will experience tens of thousands of human incarnations, full lifetimes, before daybreak. You will not wake up before then as your elephant self.

Maybe this theory is true, maybe it’s not, there’s no way to know. Anything that could possibly happen in this lifetime would not invalidate it. When there is nothing that could possibly falsify a theory, it’s neither true nor false, but meaningless. Elephant Dream and Simulation Theory are similar in this respect. You might as well call them The Universe. It’s just substituting one word-concept for another to describe an inaccessible structure containing all of reality.

Now some proponents of Simulation Theory posit a base reality beyond our simulation, namely that of the simulators. But there are two problems with that: (1) If you can’t access it because you’re just code within their closed system, you are stuck back at Elephant Dream; and (2) Even if you could somehow figure this out and access the “reality” of the simulators, why would you assume they too were not a simulation of some even yet more advanced civilization?

If they could simulate us, why couldn’t someone else simulate them? Why would their reality be any more real than ours for the exact same reasons? There could conceivably be an infinite regress of simulations within simulations, and even worse it could turn out to be circular, i.e., we will one day create a simulation that becomes the “base” simulation for all the simulations all the way down, eventually including our own.

So not being able to falsify any simulators’ reality, n-simulations deep, you are back to Elephant Dream. The elephant when he awakes similarly could himself be the dream of a person, who is the dream of another elephant ad infinitum. These are just empty words that don’t describe or affect the content of your “reality.”

(As an aside I like the infinite circular loop simulation theory as a short-circuit to the false logic it purports. It reminds me of that scene in Animal House where the students get high with Donald Sutherland (their professor.) When they opine his new book must be amazing, he says, “piece of shit” and they talk about how each atom in their hands could be an entire universe, and our entire universe might be an atom in the hand of some giant being. I always thought this could also be an infinite regress of universes as atoms in yet larger universes, and also circular wherein our universe could actually reside in one of the atoms in our own hand.)

These thought experiments reveal category errors in that they purport to describe something that’s outside the range of describability. To describe something is to distinguish it from the things that it is not, so to describe everything is the same as describing nothing in particular. You cannot describe the totality of reality any better than you can its absence. It’s like imagining how it is to be dead.

. . .

What I wrote above is the most generous interpretation of Simulation Theory, but at worst it’s actually being pushed to further an agenda. Just as a “science-based” materialism (everything is atoms) underpinned communist ideology where material resources were the only thing, and their equitable distribution at all costs the moral imperative, a code-based reality supports its own distorted, dark worldview.

If we are merely code in a simulation, then humans have no special claim to individual rights and resources any more than artificially intelligent robots. It’s only a small step from there to trans-humanism, utilitarianism and a technocratic state that subverts the principle of the individual being an end in himself.

The category error, in this view, is a convenient one — it removes the obstacles for the power-mad autists into quite literally playing God.

. . .