-

@ 472f440f:5669301e

2025-06-12 05:11:12

@ 472f440f:5669301e

2025-06-12 05:11:12Marty's Bent

via me

I had a completely different newsletter partially written earlier tonight about whether or not "this cycle is different" when this nagging thought entered my head. So I'm going to write about this and maybe I'll write about the dynamics of this cycle compared to past cycles tomorrow.

A couple of headlines shot across my desk earlier tonight in relation to the potential escalation of kinetic warfare in the Middle East. Apparently the U.S. Embassy in Iraq was sent a warning and evacuation procedures were initiated. Not too long after, the world was made aware that the United States and Israel are contemplating an attack on Iran due to the "fact" that Iran may be close to producing nuclear weapins. The initial monkey brain reaction that I had to these two headlines was, "Oh shit, here we go again. We're going to do something stupid." My second reaction was, "Oh shit, here we go again, I've seen these two exact headlines many times over the years and they've proven to be lackluster if you're a doomer or blood thirsty war monger." Nothing ever happens.

As I venture into my mid-30s and reflect on a life filled with these types of headlines and my personal reactions to these headlines, I'm finally becoming attuned to the fact that the monkey brain reactions aren't very productive at the end of the day. Who knows exactly what's going to happen in Iraq or Iran and whether or not kinetic warfare escalates and materializes from here? Even though I'm a "blue-blooded taxpaying American citizen" who is passively and unwillingly contributing to the war machine and the media industrial complex, there's really nothing I can do about it.

The only thing I can do is focus on what is in front of me. What I have control of. And attempt to leverage what I have control of to make my life and the life of my family as good as humanly possible. Ignoring the external and turning inward often produces incredible results. Instead of worrying about what the media wants you to believe at any given point in time, you simply look away from your computer screen, survey the physical space which you're operating in and determine what you have, what you need and how you can get what you need. This is a much more productive way to spend your time.

This is what I want to touch on right now. There's never been a better time in human history to be productive despite what the algorithm on X or the mainstream media will lead you to believe. Things aren't as great as they could be, but they're also not as bad as you're being led to believe. We live in the Digital Age and the Digital Age provides incredible resources that you can leverage to make YOUR life better.

Social media allows you to create a platform without spending any money. AI allows you to build tools that are beneficial to yourself and others with very little money. And bitcoin exists to provide you with the best form of money that you can save in with the knowledge that your relative ownership of the overall supply isn't going to change. No matter what happens in the external world.

If you can combine these three things to make your life better and - by extension - potentially make the lives of many others better, you're going to be well off in the long run. Combining these three things isn't going to result in immediate gratification, but if you put forth a concerted effort, spend the time, have some semblance of patience, and stick with it, I truly believe that you will benefit massively in the long run. Without trying to sound like a blowhard, I truly believe that this is why I feel relatively calm (despite my monkey brain reactions to the headlines of the day) at this current point in time.

We've entered the era of insane leaps in productivity and digital hard money that cannot be corrupted. The biggest mistake you can make in your life right now is overlooking the confluence of these two things. With an internet connection, an idea, some savvy, and hard work you can materially change your life. Create something that levels up your knowledge, that enables you to get a good job in the real world, or to create a company of your own. Bring your talents to the market, exchange them for money, and then funnel that money into bitcoin (if you're not being paid in it already). We may be at the beginning of a transition from the high velocity trash economy to the high leverage agency economy run on sound money and applied creativity.

These concepts are what you should be focusing most of your time and attention to today and in the years ahead. Don't get distracted by the algorithm, the 30-second video clips, the headlines filled with doom, and the topics of the 24 hour news cycle. I'll admit, I often succumb to them myself. But, as I get older and develop a form of pattern recognition that can only be attained by being on this planet for a certain period of time, it is becoming very clear that those things are not worth your attention.

Living by the heuristic that "nothing ever happens" is a pretty safe bet. Funnily enough, it's incredibly ironic that you're led to believe that something is happening every single day, and yet nothing ever happens. By getting believing that something happens every day you are taking your attention away from doing things that happen to make your life better.

Tune out the noise. Put on the blinders. Take advantage of the incredible opportunities that lie before you. If enough of you - and many others who do not read this newsletter - do this, I truly believe we'll wake up to find that the world we live in is a much better place.

Nothing ever happens, so make something happen.

Intelligence Officials Are Quietly Becoming Bitcoin Believers

Ken Egan, former CIA Deputy Chief of Cyber Operations, revealed a surprising truth on TFTC: the intelligence community harbors numerous Bitcoin advocates. Egan explained that intelligence professionals uniquely understand how governments weaponize financial systems through sanctions and account freezing. Having wielded these tools themselves, they recognize the need for personal financial sovereignty. He shared compelling anecdotes of discovering colleagues with "We are all Satoshi" stickers and a European chief of station paying for dinner with a BlockFi card to earn Bitcoin rewards.

"I think there are a lot of Bitcoiners, not just at CIA, but across the whole national security establishment... they're in it for the exact same reasons everybody else is." - Ken Egan

The Canadian trucker protests served as a pivotal moment, Egan noted. Watching Western governments freeze citizens' bank accounts for political dissent struck a nerve among intelligence professionals who previously viewed financial weaponization as a tool reserved for foreign adversaries. This awakening has created unlikely allies within institutions many Bitcoiners distrust.

Check out the full podcast here for more on Bitcoin's national security implications, privacy tech prosecutions, and legislative priorities.

Headlines of the Day

Stripe Buys Crypto Wallet Privy After Bridge Deal - via X

Trump Calls CPI Data "Great" Urges Full Point Fed Cut - via X

Bitcoin Hashrate Reaches New All-Time High - via X

Get our new STACK SATS hat - via tftcmerch.io

Bitcoin’s Next Parabolic Move: Could Liquidity Lead the Way?

Is bitcoin’s next parabolic move starting? Global liquidity and business cycle indicators suggest it may be.

Read the latest report from Unchained and TechDev, analyzing how global M2 liquidity and the copper/gold ratio—two historically reliable macro indicators—are aligning once again to signal that a new bitcoin bull market may soon begin.

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Life is good.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ dfa02707:41ca50e3

2025-06-12 05:02:24

@ dfa02707:41ca50e3

2025-06-12 05:02:24Contribute to keep No Bullshit Bitcoin news going.

- Wasabi Wallet v2.6.0 "Prometheus" is a major update for the project, focused on resilience and independence from centralized systems.

- Key features include support for BIP 158 block filters for direct node synchronization, a revamped full node integration for easier setup without third-party reliance, SLIP 39 share backups for flexible wallet recovery (sponsored by Trezor), and a Nostr-based update manager for censorship-resistant updates.

- Additional improvements include UI bug fixes, a new fallback for transaction broadcasting, updated code signing, stricter JSON serialization, and options to avoid third-party rate providers, alongside various under-the-hood enhancements.

This new version brings us closer to our ultimate goal: ensuring Wasabi is future-proof," said the developers, while also highlighting the following key areas of focus for the project:

- Ensuring users can always fully and securely use their client.

- Making contribution and forks easy through a codebase of the highest quality possible: understandable, maintainable, and improvable.

"As we achieve our survival goals, expect more cutting-edge improvements in Bitcoin privacy and self-custody. Thank you for the trust you place in us by using Wasabi," was stated in the release notes.

What's new

- Support for Standard BIP 158 Block Filters. Wasabi now syncs using BIP 158 filters without a backend/indexer, connecting directly to a user's node. This boosts sync speed, resilience, and allows full sovereignty without specific server dependency.

- Full Node Integration Rework. The old integration has been replaced with a simpler, more adaptable system. It’s not tied to a specific Bitcoin node fork, doesn’t need the node on the same machine as Wasabi, and requires no changes to the node’s setup.

- "Simply enable the RPC server on your node and point Wasabi to it," said the developers. This ensures all Bitcoin network activities—like retrieving blocks, fee estimations, block filters, and transaction broadcasting—go through your own node, avoiding reliance on third parties.

- Create & Recover SLIP 39 Shares. Users now create and recover wallets with multiple share backups using SLIP 39 standard.

"Special thanks to Trezor (SatoshiLabs) for sponsoring this amazing feature."

- Nostr Update Manager. This version implements a pioneering system with the Nostr protocol for update information and downloads, replacing reliance on GitHub. This enhances the project's resilience, ensuring updates even if GitHub is unavailable, while still verifying updates with the project's secure certificate.

- Updated Avalonia to v11.2.7, fixes for UI bugs (including restoring Minimize on macOS Sequoia).

- Added a configurable third-party fallback for broadcasting transactions if other methods fail.

- Replaced Windows Code Signing Certificate with Azure Trusted Signing.

- Many bug fixes, improved codebase, and enhanced CI pipeline.

- Added the option to avoid using any third-party Exchange Rate and Fee Rate providers (Wasabi can work without them).

- Rebuilt all JSON Serialization mechanisms avoiding default .NET converters. Serialization is now stricter.

Full Changelog: v2.5.1...v2.6.0

-

@ 9ca447d2:fbf5a36d

2025-06-12 05:02:04

@ 9ca447d2:fbf5a36d

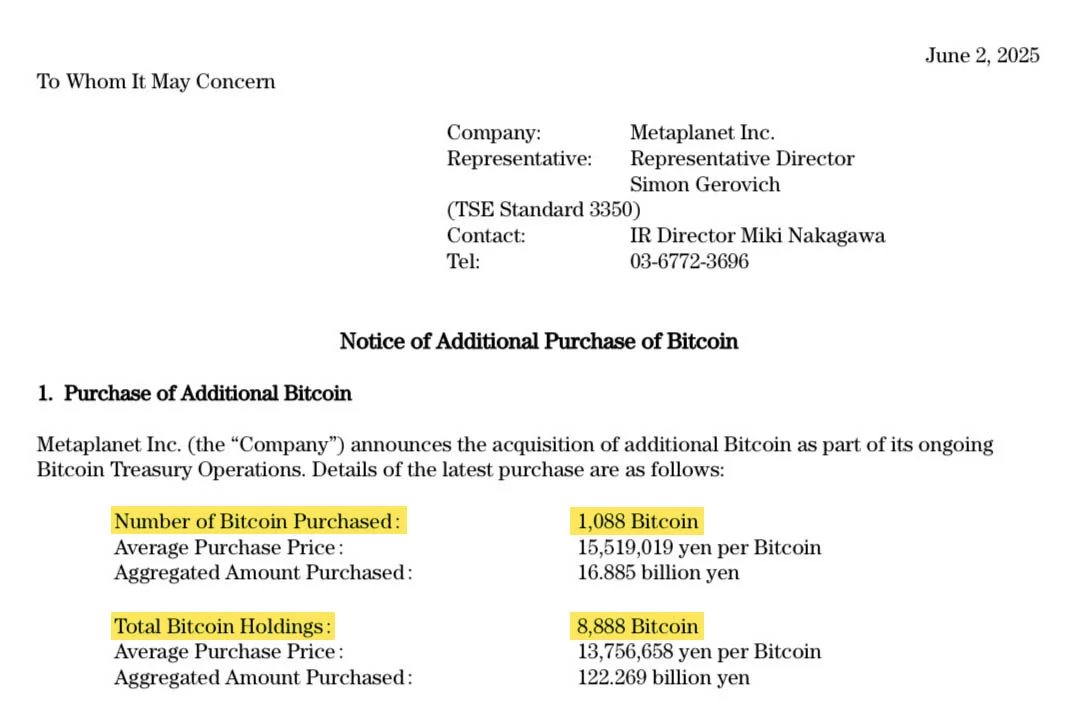

2025-06-12 05:02:04Metaplanet Inc. has bought 1,088 more bitcoin (BTC), and now holds 8,888 BTC worth over $930 million. This puts Metaplanet in the top 10 corporate bitcoin holders, ahead of Galaxy Digital and Block Inc.

Metaplanet Inc. on X

The company’s CEO Simon Gerovich announced the purchase on X on June 2, 2025. The company bought the new BTC at an average price of around $107,771 per coin, costing the company approximately $117.3 million.

The company said this purchase brings them 90% of the way to their 2025 goal of 10,000 BTC.

Metaplanet only started its bitcoin treasury policy in April 2024 but has been moving fast. At the start of 2025, it had less than 2,000 BTC, and now it has over 8,800.

This has been done through a combination of stock rights exercises and bond issuances, raising capital without diluting existing shareholders. In May 2025 alone, Metaplanet issued zero-coupon, non-interest-bearing bonds for a combined value of $71 million.

According to the filings, the company recently completed its “21 Million Plan” which was a program that involved the full exercise of 210 million stock acquisition rights.

These stock rights allowed Metaplanet to raise capital through equity sales while limiting dilution risk.

Metaplanet’s Bitcoin strategist, Dylan LeClair, said the company views bitcoin as a core part of its financial strategy and is all in, not just making small allocations.

Metaplanet’s buying has paid off in more ways than one.

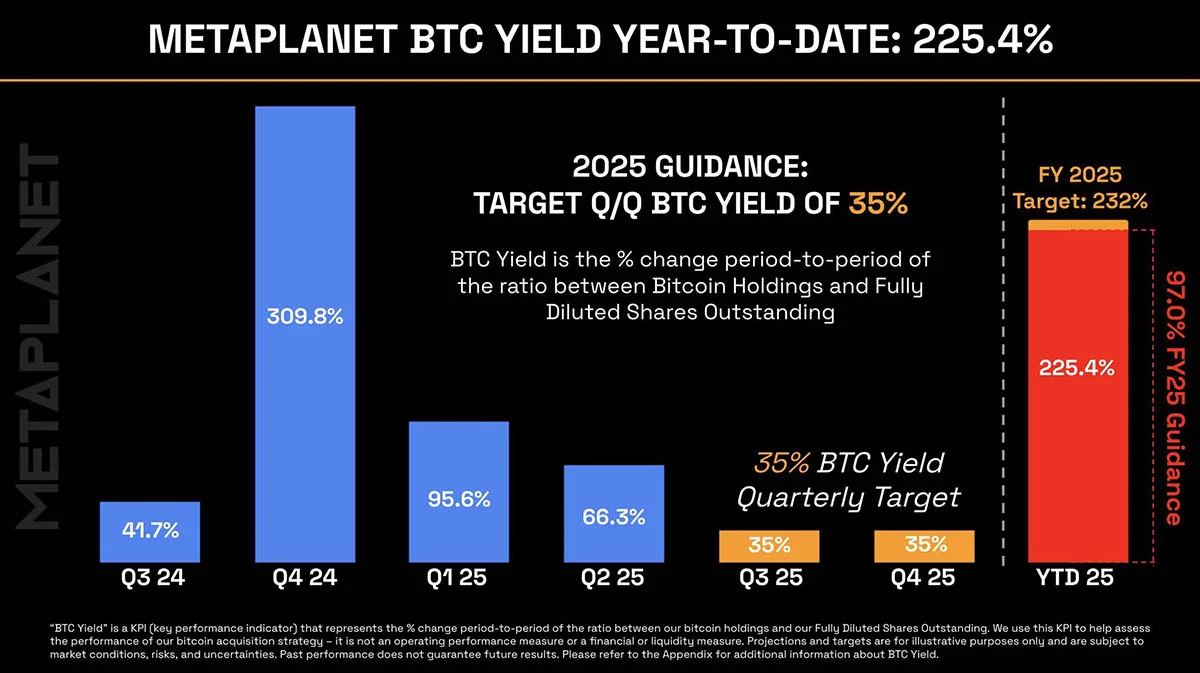

Its BTC Yield, a company metric that compares bitcoin holdings to total shares, has impressed investors. In Q2 2025 it had a 66.3% BTC Yield, year-to-date it has a 225% BTC Yield.

Metaplanet BTC Yield over time — Vincent on X

The stock is up 155% in the last month and is currently trading at 1,149 JPY, despite the overall volatility in the Tokyo Stock Exchange—where many other companies are under pressure due to the rising Japanese bond yields.

Analysts say the company still has more room to run.

Analysts say the company’s mNAV is back to 4.75 and the stock is undervalued compared to Strategy.

mNAV is short for “multiple of Net Asset Value” and is a metric used to compare the market’s valuation of a company to the actual value of its assets, primarily its bitcoin holdings.

Metaplanet is called “Japan’s Strategy”, a reference to Michael Saylor’s Strategy, the U.S.-based company that holds over 580,000 BTC—the most of any company in the world.

The corporate bitcoin boom isn’t stopping with Strategy and Metaplanet. On May 28, 2025 GameStop announced it had bought 4,710 BTC, worth over $512 million, its first foray into bitcoin after updating its investment policy this year.

-

@ b1ddb4d7:471244e7

2025-06-12 05:01:43

@ b1ddb4d7:471244e7

2025-06-12 05:01:43The latest AI chips, 8K displays, and neural processing units make your device feel like a pocket supercomputer. So surely, with all this advancement, you can finally mine bitcoin on your phone profitably, right?

The 2025 Hardware Reality: Can You Mine Bitcoin on Your Phone

Despite remarkable advances in smartphone technology, the fundamental physics of bitcoin mining haven’t changed. In 2025, flagship devices with their cutting-edge 2nm processors can achieve approximately 25-40 megahashes per second when you mine bitcoin on your phone—a notable improvement from previous generations, but still laughably inadequate.

Meanwhile, 2025’s top-tier ASIC miners have evolved dramatically. The latest Bitmain Antminer S23 series and Canaan AvalonMiner A15 Pro deliver 200-300 terahashes per second while consuming 4,000-5,500 watts. That’s a performance gap of roughly 1:8,000,000 between when you mine bitcoin on your phone and professional mining equipment.

To put this in perspective that hits home: if you mine bitcoin on your phone and it earned you one penny, professional miners would earn $80,000 in the same time period with the same effort. It’s not just an efficiency problem—it’s a complete category mismatch.

According to Pocket Option’s 2025 analysis, when you mine bitcoin on your phone in 2025, you generate approximately $0.003-0.006 in daily revenue while consuming $0.45-0.85 in electricity through constant charging cycles. Factor in the accelerated device wear (estimated at $0.75-1.20 daily depreciation), and you’re looking at losses of $1.20-2.00 per day just for the privilege of running mining software.

Mining Economic Factor

Precise Value (April 2025)

Direct Impact on Profitability

Smartphone sustained hash rate

20-35 MH/s

0.00000024% contribution to global hashrate

Daily power consumption

3.2-4.8 kWh (4-6 full charges)

$0.38-0.57 at average US electricity rates

Expected daily BTC earnings

0.0000000086 BTC ($0.0035 at $41,200 BTC)

Revenue covers only 0.9% of electricity costs

CPU/GPU wear cost

$0.68-0.92 daily accelerated depreciation

Reduces smartphone lifespan by 60-70%

Annual profit projection

-$386 to -$412 per year

Guaranteed negative return on investment

Source: PocketOption

Bitcoin’s 2025 Network: Harder Than Ever

Bitcoin’s network difficulty in 2025 has reached unprecedented levels. After the April 2024 halving event that reduced block rewards from 6.25 to 3.125 BTC, mining became significantly more competitive. The global hash rate now exceeds 800 exahashes per second—that’s 800 followed by 18 zeros worth of computational power securing the network.

Here’s what this means in practical terms: Bitcoin’s mining difficulty adjusts every 2,016 blocks (roughly every two weeks) to maintain the 10-minute block time. As more efficient miners join the network, difficulty increases proportionally. In 2025, mining difficulty has increased compared to 2024, making small-scale mining even less viable.

The math is unforgiving:

- Global Bitcoin hash rate: 828.96 EH/s

- Your smartphone’s contribution: ~0.000000003%

- Probability of solo mining a block: Virtually zero

- Expected time to mine one Bitcoin: Several million years

Even joining mining pools doesn’t solve the economic problem. Pool fees typically range from 1-3%, and your minuscule contribution would earn proportionally tiny rewards—far below the electricity and device depreciation costs.

The 2025 Scam Evolution: More Sophisticated, More Dangerous

Fraudsters now leverage AI-generated content, fake influencer endorsements, and impressive-looking apps that simulate realistic mining activity to entice you to mine bitcoin on your phone.

New 2025 scam tactics include:

AI-Powered Fake Testimonials: Deepfake videos of supposed successful mobile miners showing fabricated earnings statements and encouraging downloads of malicious apps.

Gamified Mining Interfaces: Apps that look and feel like legitimate games but secretly harvest personal data while simulating mining progress that can never be withdrawn.

Social Media Manipulation: Coordinated campaigns across TikTok, Instagram, and YouTube featuring fake “financial influencers” promoting mobile mining apps to younger audiences.

Subscription Trap Mining: Apps offering “free trials” that automatically charge $19.99-49.99 monthly for “premium mining speeds” while delivering no actual mining capability.

Recent cybersecurity research shows that over 180 fake mining apps were discovered across major app stores in 2025, with some accumulating more than 500,000 downloads before being removed.

Red flags that scream “scam” in 2025:

- Apps claiming “revolutionary mobile mining breakthrough”

- Promises of earning “$10-50 daily” from phone mining

- Requirements to recruit friends or watch ads to unlock withdrawals

- Apps that don’t require connecting to actual mining pools

- Testimonials that seem too polished or use stock photo models

- Apps requesting permissions unrelated to mining (contacts, camera, microphone)

The 2025 Professional Mining Landscape

To understand why, consider what professional bitcoin mining looks like in 2025. Industrial mining operations now resemble high-tech data centers with:

Cutting-edge hardware:

- Bitmain Antminer S23 Pro: 280 TH/s at 4,800W

- MicroBT WhatsMiner M56S++: 250 TH/s at 4,500W

- Canaan AvalonMiner A1566: 185 TH/s at 3,420W

Infrastructure requirements:

- Megawatt-scale power contracts with industrial electricity rates

- Liquid cooling systems maintaining 24/7 optimal temperatures

- Redundant internet connections ensuring zero downtime

- Professional facility management with 24/7 monitoring

For a small operation, you might need at least $10,000 to $20,000 to buy a few ASIC miners, set up cooling systems, and cover electricity costs. These operations employ teams of engineers, maintain relationships with power companies, and operate with margins measured in single-digit percentages.

2025’s Legitimate Mobile Bitcoin Strategies

While it remains impossible to mine bitcoin on your phone profitably, 2025 offers exciting legitimate ways to engage with bitcoin through your smartphone:

Lightning Network Participation: Apps like Phoenix, Breez, and Zeus allow you to run Lightning nodes on mobile devices, earning small routing fees while supporting bitcoin’s payment layer.

Bitcoin DCA Automation: Services enable automated dollar-cost averaging with amounts as small as $1 daily. Historical data shows $10 weekly bitcoin purchases consistently outperform any mobile mining attempt by 1,500-2,000%.

Educational Mining Simulators: Legitimate apps like “Bitcoin Mining Simulator” teach mining concepts without false earning promises. These educational tools help users understand hash rates, difficulty adjustments, and mining economics.

Stacking Sats Rewards: Apps offering bitcoin rewards for shopping, learning, or completing tasks.

Lightning Gaming: Bitcoin-native mobile games where players can earn sats through skilled gameplay, with some players earning $10 monthly.onfirm that even the most optimized mobile mining setups in 2025 lose money consistently and predictably.

The Bottom Line

When you mine bitcoin on your phone fundamental economics remain unchanged: it’s impossible to profit. The laws of physics, network competition, and energy efficiency create insurmountable barriers that no app can overcome.

However, 2025 offers unprecedented opportunities to engage with bitcoin meaningfully through your smartphone. Focus on education, legitimate earning opportunities, and strategic investment rather than chasing the impossible dream of phone-based mining.

The bitcoin community’s greatest strength lies in its commitment to truth over hype. When someone promises profits to mine bitcoin on your phone in 2025, they’re either uninformed or deliberately misleading you. Trust the mathematics, learn from the community, and build your bitcoin knowledge and holdings through proven methods.

The real opportunity in 2025 isn’t to mine bitcoin on your phone—it’s understanding bitcoin deeply enough to participate confidently in the most important monetary revolution of our lifetime. Your smartphone is the perfect tool for that education; it’s just not a mining rig.

-

@ cae03c48:2a7d6671

2025-06-12 05:01:23

@ cae03c48:2a7d6671

2025-06-12 05:01:23Bitcoin Magazine

Bitwise Debuts First Ever GameStop Covered Call ETFToday, Bitwise Asset Management announced the launch of the Bitwise GME Option Income Strategy ETF (IGME), the first-ever covered call ETF centered around GameStop (GME). The fund arrives at a moment where GameStop recently made headlines for its $500 million Bitcoin treasury strategy.

GameStop is embracing bitcoin; we built an income-generating ETF designed to capture that hype and turn it into yield.

Introducing $IGME: The first option income ETF capitalizing on investor interest in @gamestop and their adoption of bitcoin as a treasury asset.

As the fourth… pic.twitter.com/EHaXX9PK7X

— Bitwise (@BitwiseInvest) June 10, 2025

Led by Bitwise’s Head of Alpha Strategies Jeff Park, IGME is the latest addition to Bitwise’s rapidly expanding suite of option income ETFs. The actively managed fund is designed to generate income through a covered call strategy while offering investors exposure to GameStop, a company that has transformed from mall retailer to a key player in the digital asset conversation.

“IGME is the first covered call strategy built around GameStop, a stock whose historic volatility and growth potential make it a strong fit for this approach,” said Park. “With IGME, investors now have access to an option income ETF based on an equity that sits at the intersection of retail investor popularity, a traditional revenue-generating business, and digital asset adoption.”

GameStop recently disclosed that it holds 4,710 Bitcoin, worth over $500 million at the time of purchase, positioning it among the growing list of public companies making Bitcoin a core treasury component. As of March 31, 2025, over 79 public companies hold a collective $57 billion in Bitcoin—a 159% increase from the previous year, according to Bitcoin Asset Management.

IGME follows the launch of Bitwise’s other option income ETFs, including IMST (Strategy), ICOI (Coinbase), and IMRA (Marathon Digital Holdings). These ETFs aim to deliver monthly income through synthetic covered call strategies that leverage options rather than direct equity holdings.

“At Bitwise, our mission is to help investors gain access to the full range of opportunities emerging in crypto,” said Bitwise CEO Hunter Horsley. “We’re excited to add IGME to our suite of option income ETFs to help investors capitalize on the volatility of companies in the space.”

IGME plans to announce its first monthly distribution on July 24 and carries an expense ratio of 0.98%.

This post Bitwise Debuts First Ever GameStop Covered Call ETF first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-12 05:00:58

@ cae03c48:2a7d6671

2025-06-12 05:00:58Bitcoin Magazine

Stripe Acquires Startup Privy To Expand Bitcoin StrategyToday, Stripe Inc. announced that it has acquired Bitcoin and crypto wallet infrastructure provider Privy, marking its second major digital asset focused acquisition following its $1.1 billion purchase of stablecoin firm Bridge earlier this year.

1/ Today, we're proud to announce that Stripe is acquiring Privy.

We couldn’t be more excited.

Privy will continue as an independent product – but now we’ll move faster, ship more, and serve you even better, so you can stay focused on your users. pic.twitter.com/8CHJqhqYy7

— Privy (@privy_io) June 11, 2025

Privy specializes in helping companies embed Bitcoin and crypto wallets directly into their apps and websites. For example, NFT marketplace OpenSea uses Privy to streamline purchases by automatically generating wallets for users. This removes the need for external wallet setups through services like MetaMask or Coinbase.

“When we started, wallets were powerful but inaccessible for all but the most technical,” said the Co-founder and CEO of Privy Henri Stern in a statement. “Developers had to send users off-platform to get started, breaking flows and killing user conversion. That friction fundamentally constrained what could be built in crypto.”

Privy, based in New York, was founded by Henri Stern and Asta Li in 2021. Li was previously a founding engineer at Aurora, while Stern worked as a research scientist at web3 firm Protocol Labs. The startup has raised just over $40 million from investors including Ribbit Capital, Definition, and Coinbase Ventures, and was last valued at $230 million in March, according to PitchBook.

“We started Privy a little over three years ago to make it easy for any developer to build better products on crypto rails,” stated their announcement. “Whether crypto is core to your app or simply a new layer of functionality, a good crypto product should just feel like a good product, period. By making crypto usable, we help make it useful for everyone.”

The acquisition follows Stripe’s earlier purchase of Bridge which helped accelerate interest in digital assets. Earlier this year, Stripe introduced stablecoin funded accounts designed to help merchants store funds and make international payments using Circle’s USDC and Bridge’s USDB. Similar to Bridge, Privy will continue operating as a standalone product.

Privy will power over 75 million accounts and support more than 1,000 developer teams, enabling billions in transaction volume, according to the announcement. Clients include Hyperliquid, Blackbird, Toku, and Farcaster, all using Bitcoin and crypto infrastructure to build real-world products in areas like trading, payments, payroll, and social applications.

“With a unified platform, connecting Privy’s wallets to the money movement capabilities in Stripe and Bridge, we’re enormously excited to enable a new generation of global, Internet-native financial services,” stated the co-founder and CEO of Stripe Patrick Collison.

This post Stripe Acquires Startup Privy To Expand Bitcoin Strategy first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-12 05:00:53

@ cae03c48:2a7d6671

2025-06-12 05:00:53Bitcoin Magazine

The CLARITY Act Heads To House Floor For Vote With Protection For Noncustodial Tools IntactYesterday, the CLARITY Act passed favorably through the House Agriculture and Financial Services Committees with 47-6 and 32-19 bipartisan votes, respectively.

While a handful of amendments will be incorporated into a revised version of the bill, none of said amendments will alter a recently-added section of the bill that regards noncustodial products and services.

To clarify, on Monday, language from the Blockchain Regulatory Certainty Act (BRCA) was added to the CLARITY Act.

If you do not custody consumer funds, you aren’t a money transmitter. Plain and simple.

Our nonpartisan Blockchain Regulatory Certainty Act, which codifies this simple concept, has been added to the CLARITY Act!

Grateful to @RepFrenchHill, @RepBryanSteil and @RepRitchie for… https://t.co/QmPdgUGSwo

— Tom Emmer (@GOPMajorityWhip) June 9, 2025

This language, included in Section 110 of the CLARITY Act, is focused on non-controlling (noncustodial) blockchain developers and blockchain service providers.

The exact wording in the bill is as follows: “A non-controlling blockchain developer or provider of a blockchain service shall not be treated as a money transmitter or as engaged in ‘money transmitting,’ or, following the date of enactment of this Act, be otherwise subject to any new registration requirement that is substantially similar to the requirement that currently applies to money transmitters.”

It was particularly important that this segment of the bill not be altered because, with this language included, the bill protects not only Bitcoin and crypto enthusiasts’ right to use noncustodial wallets, but the right of developers to continue to create such products and services without being subject to money-transmission laws as per the Bank Secrecy Act (BSA).

“Section 110 doesn’t just clarify that non-custodial devs aren’t captured by the BSA, but also forbids future laws and regulations (e.g. DAAMLA) that would modify or supersede the BSA to treat non-custodial actors as money transmitters or similar,” wrote Zack Shapiro, Head of Policy at the Bitcoin Policy Institute, in an X post. “If this passes, that means that anti-crypto zealots like Sen. Warren would first have to repeal [or] modify this bill before passing additional rules that would impinge on self-custody.”

This issue over whether noncustodial Bitcoin and crypto service providers is relevant as the Samourai Wallet and Tornado Cash developers prepare to face trial.

It’s also generally important in preserving the right of U.S. citizens to use digital assets privately.

Chairman of the House Subcommittee on Digital Assets, Financial Technology, and Artificial Intelligence, Rep. Bryan Steil (R-WI) commented on Americas’ right to transactional privacy in the hearing.

“Privacy in and of itself is not illegal.

Americans have a right to it in their financial transactions.

And so there’s totally legitimate uses of privacy-preserving technologies.” @RepBryanSteil pic.twitter.com/nHPfa25UVr

— Frank Corva (@frankcorva) June 10, 2025

To learn more about how to contact your elected officials to tell them to support The CLARITY Act, visit saveourwallets.org.

This post The CLARITY Act Heads To House Floor For Vote With Protection For Noncustodial Tools Intact first appeared on Bitcoin Magazine and is written by Frank Corva.

-

@ cae03c48:2a7d6671

2025-06-12 05:00:48

@ cae03c48:2a7d6671

2025-06-12 05:00:48Bitcoin Magazine

Skull, $5 million; Banana, $6 million; Freedom, Priceless“It would have been nice to get this attention in any other context. WikiLeaks has kicked the hornet’s nest, and the swarm is headed towards us.”

This message was posted by Satoshi Nakamoto to BitcoinTalk on December 11, 2010. A couple of months later, in February 2011, the Silk Road marketplace was launched, and only a couple months after — on April 23, 2011 — Satoshi posted his last message.

In October 2013, Ross Ulbricht was captured by the FBI and the Silk Road fell — only to be replaced by a thousand more copycat marketplace sites. The rest is Bitcoin history.

Ross Ulbricht chose to center his Bitcoin 2025 keynote speech around an experience he had clearing wasp nests in a cabin in the woods. Wearing a suit and tie, recalling growing “magic mushrooms” to kickstart activity on Silk Road, Ross held the attention of the main stage audience of over 8,000 at Bitcoin 2025 Las Vegas in the Venetian Expo. I was sitting in one of the best seats in the house: side stage with his mother Lyn and three other supporters of Ross.

Freedom. Decentralization. Unity.

After over 4,100 days in federal custody and many months in special housing units (solitary confinement), Ross boiled it down to these three words to summarize his first message to the community.

Freedom. Decentralization. Unity.

Following a “21 ways to hack the fiat system” keynote from Michael Saylor, Ross’ three ways to move forward were refreshingly simple.

You would have thought Ross had been speaking in front of thousands of people for years, seeing how calm and commanding he was on the Nakamoto stage.

Lyn Ulbricht called me a few days after the speech, as I was driving a U-Haul truck full of the art gallery contents across the country, including Ross’ auction items which altogether fetched well over 10 BTC for his fresh start. She mentioned that seeing Ross on that stage giving that incredible speech gave her closure for the whole experience of fighting for her son’s freedom.

I have been fortunate to get to know Lyn Ulbricht over the past few years, helping her plan for our conferences. Hearing her say that this conference gave her some closure to that awful chapter of her life was a moment I’ll never forget. She was his number one supporter during his 11 years serving a double-life sentence. She fought relentlessly to raise awareness for her son’s situation, and now she has begun a new chapter doing similar work with MACS, Mothers Against Cruel Sentencing.

MACS is a nonprofit that is effectively the continuation of the Free Ross mission. Lyn says she feels a calling from God to continue fighting for other “crypto prisoners” and people who are being unjustly punished for their crimes, a violation of the Eight Amendment of the United States Constitution.

She launched MACS at the fourth annual Women of Bitcoin Brunch at Bitcoin 2025, in front of an audience of over 300 of the most influential women at the conference.

Later during the event, in the same room, Ross used the same stage to address a smaller crowd of supporters for his official luncheon.

This luncheon, held before his speech, is where Justin Sun famously gifted Ross “The Banana,” handing over a duct-taped, real banana in an elaborately designed white shadowbox fit to display in a museum.

I was also in the luncheon room when the banana transaction happened, as event staff. The piece, Comedian by Maurizio Cattelan, was a conceptual art statement, I explained to the two men sitting next to me. Like Ross himself at the time, these men were confused. (The original art installation, a banana duct-taped to the wall, was purchased — and eaten — by Justin Sun in November last year.)

Knowing the significance of this banana, I assumed at the time that Justin Sun was officially giving his edition #2 of Comedian to Ross, as a $6.2 million donation. It wasn’t until my phone call with Lyn Ulbricht days later that she brought up the banana and its questionable provenance that I began to ask: Did Sun really give Ross the banana?

On this call, Lyn mentioned that they had a relative who worked at Sotheby’s, the auctioneer of Justin’s edition of Comedian. This was an obvious first step toward understanding the banana exchange.

Ross himself emailed me shortly after saying, “Lyn tells me you are looking into what happened with me and Justin Sun. Strike Force Nanner are arriving tomorrow with the box Sun gave me, so I’ll let you know if that turns up anything useful.”

And later, “My Sotheby’s connection says: Just spoke with one of the people who worked directly with the artist during the sale. To truly own the piece you have to have the document from the artist; because that is where the ‘value’ lies, they wouldn’t even share images of it for fear of someone making a counterfeit. He’s going to have a think about whether or not what you have has any value, but Justin still owns the ‘real’ banana which is probably why he’s given you vague answers. So, unless he gives me the document (certificate of authenticity), I don’t have anything that would be valued at auction (probably). Oh well.”

I assured him that I thought his banana was still very valuable. Even if this was truly just a 1/1 print of the banana. Until Sun gives Ross the COA, Ross isn’t really the owner the banana; still, a historic event occurred. Sun transferred some sort of magic-decentalized-banana-powers to Ross when he transferred that banana taped to a frame.

The mere existence of Strike Force Nanner, an armored vehicle transporting the banana to Ross, should be enough to signal the provenance transfer of something valuable.

So whether or not Sotheby’s thinks an official transaction occurred, I think Ross has a rare power to duct-tape bananas to walls now and call it something. Sun will just have to send the COA to Ross later in order to seal the peel.

Until then, I extend an open invite to Ross, as the Artist In Residence at Bitcoin Magazine, to help him make and sell prints of his print of the banana. Then maybe the banana can be even more decentralized!

Avant-garde bananas aside, the experience of Bitcoin 2025 Las Vegas was unlike any other conference that we’ve thrown, and I can say that having been a part of all six thus far. The key difference this year was Ross’ freedom.

The vibes were beyond bullish in Vegas, which usually means the top is in. But this time it really seems different.

We should pay attention when Michael Saylor gives us his 21-step cheat sheet for the infinite money glitch, and how he plans to leverage the existing financial institutions to accumulate as much bitcoin as he possibly can. This could be a regulatory trap.

We should definitely pay attention when the sitting vice president, JD Vance, tells the conference audience that they’re going to use stablecoins to strengthen the dollar, referring to the new Genius Bill. This is probably the backdoor for CBDCs.

But most importantly: After over 11 years in federal hell, we should pay attention to Ross Ulbricht as he becomes the leader that this space really needs right now.

We are the swarm now.

This post Skull, $5 million; Banana, $6 million; Freedom, Priceless first appeared on Bitcoin Magazine and is written by Tommy Marcheschi.

-

@ cae03c48:2a7d6671

2025-06-12 05:00:43

@ cae03c48:2a7d6671

2025-06-12 05:00:43Bitcoin Magazine

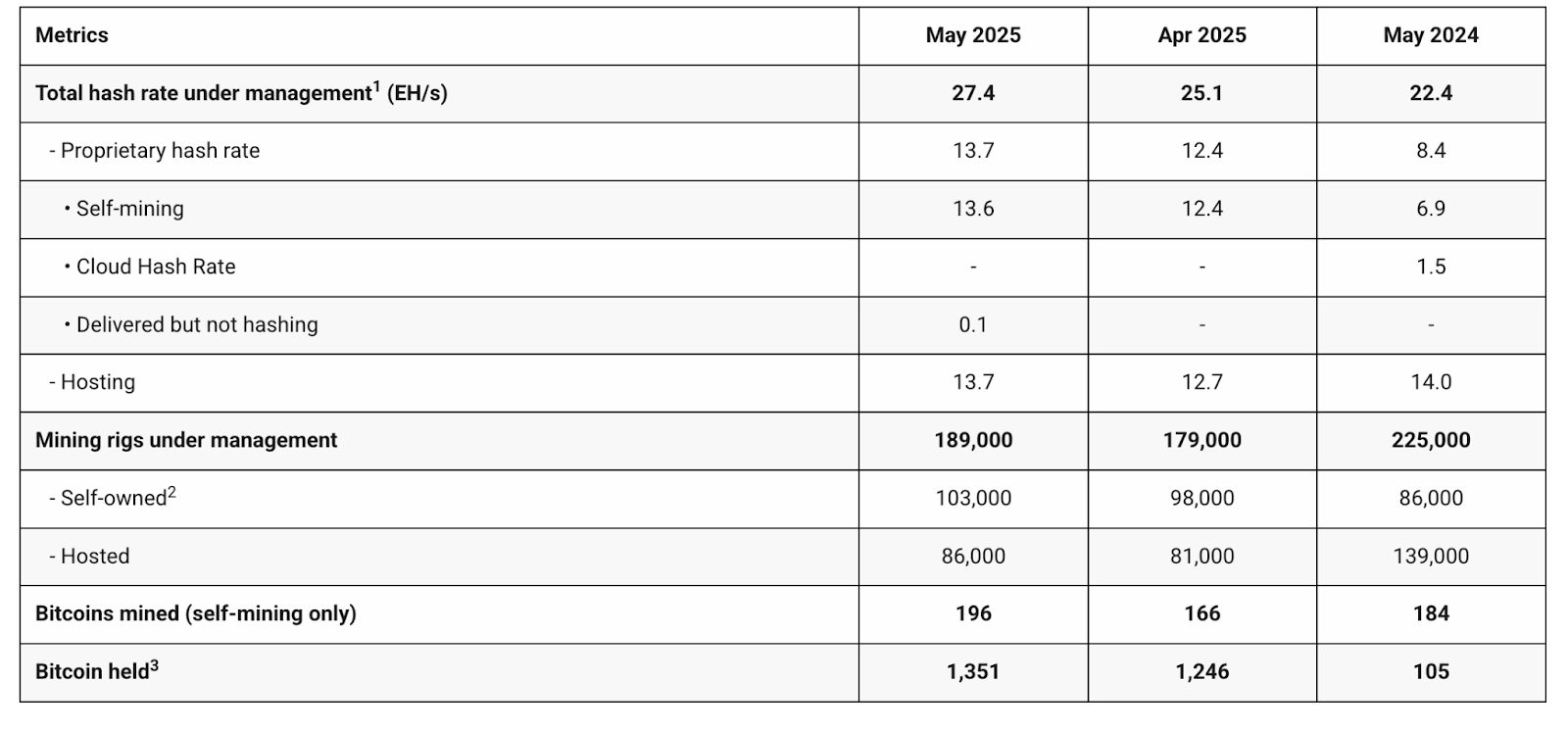

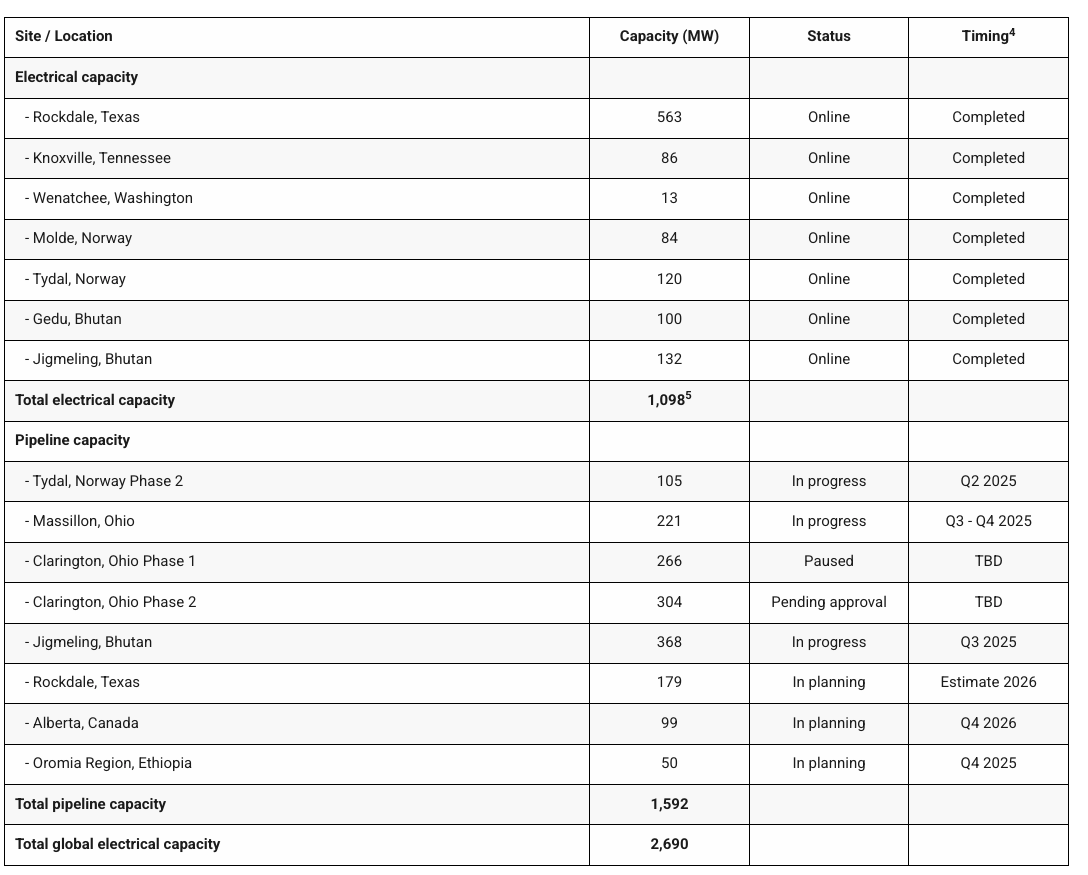

Bitdeer Mined 196 Bitcoin Worth Over $21 Million In MayBitdeer Technologies Group, a global leader in Bitcoin mining and infrastructure, has released its unaudited operational update for May 2025, highlighting robust expansion in hashrate capacity, ongoing infrastructure development, and an entrance into AI services.

$BTDR May 2025 Production & Operations Highlights:

Increased self-mining hashrate to 13.6 EH/s with #SEALMINER deployments.

Increased self-mining hashrate to 13.6 EH/s with #SEALMINER deployments.

9 EH/s SEALMINER A2s have been manufactured, with 2.9 EH/s shipped to external customers, including 1.6 EH/s sold and shipped in May.

9 EH/s SEALMINER A2s have been manufactured, with 2.9 EH/s shipped to external customers, including 1.6 EH/s sold and shipped in May.

SEALMINER… pic.twitter.com/wX66hahd2F

SEALMINER… pic.twitter.com/wX66hahd2F— Bitdeer (@BitdeerOfficial) June 11, 2025

“In May 2025, we continued to deploy our SEALMINER mining rigs to our sites in Texas, U.S., Norway, and Bhutan, bringing Bitdeer’s self-mining hashrate to 13.6 EH/s at the end of the month of May,” said Matt Kong, Chief Business Officer at Bitdeer. “Looking forward, we remain on track to deliver over 40 EH/s of self-mining capacity by October 2025. Further, in May, we sold and shipped approximately 1.6 EH/s of our SEALMINER A2s to external customers. Our A3 Series will also be released and available for pre-order very soon”

Bitdeer self-mined 196 BTC in May—an 18.1% increase from April—due to the expanded deployment of SEALMINER A1 and A2 units. A total of 9 EH/s in SEALMINER A2s have been manufactured, with 2.9 EH/s shipped to customers and 1.6 EH/s sold in May alone.

SEALMINER A3s, which are currently undergoing machine-level testing with positive results, will become available for pre-order in June. Additionally, development of the next-generation A4 SEALMINER chip is progressing, targeting an efficiency of 5 J/TH by Q4 2025.

Bitdeer also announced the launch of its AI Cloud service, powered by over 10 advanced large language models (LLMs), including LLaMA, DeepSeek, and Qwen variants. The infrastructure is designed for strong inference demand, representing a key move into the HPC/AI sector.

Infrastructure developments include the ongoing energization of the 175 MW Tydal, Norway site—expected to be fully energized by June—and continued progress at the 221 MW Massillon, Ohio site, targeting completion in the second half of 2025. The company also energized 132 MW at its Jigmeling, Bhutan site, with another 368 MW coming online by Q3.

Financially, Bitdeer secured $50 million in cash proceeds during May after Tether exercised warrants from a 2024 private placement.

With a global capacity of 2,690 MW and expanding operations across North America, Europe, and Asia, Bitdeer continues to assert its role as both a top-tier Bitcoin mining operator and a high-performance computing pioneer.

This post Bitdeer Mined 196 Bitcoin Worth Over $21 Million In May first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 5627e59c:d484729e

2025-06-11 21:18:44

@ 5627e59c:d484729e

2025-06-11 21:18:44Here's to the ones who can\ Feel their cause\ Surrender\ Change their ways\ But keep their fire\ And never give up

We will transform this world\ Restructuring\ One belief at a time

-

@ dfa02707:41ca50e3

2025-06-11 19:03:18

@ dfa02707:41ca50e3

2025-06-11 19:03:18- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ cae03c48:2a7d6671

2025-06-12 05:00:38

@ cae03c48:2a7d6671

2025-06-12 05:00:38Bitcoin Magazine

F Street Announced Goal Of Accumulating $10 Million In BitcoinToday, F Street, an alternative investment and private lending firm, announced it has begun adding Bitcoin to its corporate treasury, with a goal of accumulating $10 million in BTC.

JUST IN: Investment firm F Street announced it's buying Bitcoin daily using business proceeds for its treasury reserves

They plan to buy $10 million Bitcoin

pic.twitter.com/NMLOteyUYU

pic.twitter.com/NMLOteyUYU— Bitcoin Magazine (@BitcoinMagazine) June 11, 2025

The company began daily BTC purchases on June 9, using business proceeds and treasury funds. This move is part of a broader strategy to strengthen F Street’s capital base and support its real estate lending and investment operations.

“Bitcoin offers a compelling hedge against inflation and dollar debasement,” said the Chief Operating Officer of F Street Mike Doney. “Incorporating it into our treasury is a strategic step to preserve and grow value for our investors and our business interests.”

In line with its commitment to transparency, F Street also plans to establish a public proof of reserves so that stakeholders can independently verify the custody of its Bitcoin assets. The firm aims to build a meaningful BTC position that supports its long term vision of a capital framework.

F Street’s move comes at a time when institutional interest in Bitcoin is experiencing a notable surge, and many prominent voices in the financial world are starting to support it. Billionaire investor Paul Tudor Jones, speaking today in an interview with Bloomberg, named Bitcoin as a critical part of what he considers the ideal portfolio against inflation.

“What would an ideal portfolio be… But it would be some kind of combination of probably gold, vol adjusted, Bitcoin, gold, stocks,” Jones said. “That’s probably your best portfolio to fight inflation. Vol adjusted because the vol of Bitcoin obviously is five times that of gold, so you’re going to do it in different ways.”

Adding to the momentum, the Head of Digital Assets of BlackRock Robert Mitchnick explained two days ago what’s really driving the surge in demand for Bitcoin ETFs.

“It’s a lot of things coming together. Out of the gate was retail and investor demand…” said Mitchnick. “Now, more recently, we’ve seen just steady progress of more wealth advisor adoption, more institutional adoption. It’s been a mix of people who it’s the first time that they’ve invested in anything in the crypto space. And then on the other hand, you have lots of people who’ve been invested in Bitcoin for a long time and they’re taking advantage of the ETP wrapper.”

This post F Street Announced Goal Of Accumulating $10 Million In Bitcoin first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ c1a49d62:3ef55468

2025-06-12 04:55:05

@ c1a49d62:3ef55468

2025-06-12 04:55:05IoT chips serve as the foundational semiconductor components that enable connectivity, data processing, and communication in devices ranging from smart thermostats to industrial sensors. These microcontrollers, system-on-chips (SoCs), and application-specific integrated circuits (ASICs) offer low power consumption, compact form factors, and robust security features, making them essential for Internet of Things ecosystems. As industries pursue digital transformation, the need for high-performance IoT chips that can handle real-time analytics, edge computing, and seamless interoperability has surged. IoT Chips Market Advantages such as integrated wireless protocols (Wi-Fi, Bluetooth, LoRaWAN), enhanced energy efficiency, and customizable silicon solutions address critical market challenges like device longevity and data integrity. Manufacturers leverage advanced process nodes and AI accelerators to deliver chips with superior throughput while minimizing thermal footprints. Continuous innovations in semiconductor design, coupled with growing market opportunities in smart cities, automotive telematics, and healthcare monitoring, underscore the strategic importance of these components. As enterprises seek to optimize operations and reduce costs through predictive maintenance and remote monitoring, demand for versatile IoT chipsets continues to rise. The IoT chips market is estimated to be valued at USD 620.36 Bn in 2025 and is expected to reach USD 1415.005 Bn by 2032, growing at a compound annual growth rate (CAGR) of 15.00% from 2025 to 2032.

-

@ 5627e59c:d484729e

2025-06-12 04:32:16

@ 5627e59c:d484729e

2025-06-12 04:32:16Ik hou van de natuur en van verbinding maken\ Van diepgang en van mensen raken

Van creatief schrijven en programmeren\ Van speels bewegen en nieuwe dingen leren

Ik hou van leven en van dromen\ En van mensen zien\ Hun diepste wensen uit doen komen

-

@ 5627e59c:d484729e

2025-06-11 21:14:37

@ 5627e59c:d484729e

2025-06-11 21:14:37Gelukkig zijn\ Is de waarde van mijn leven

Gewoon dankbaar te bestaan\ Geen mens heeft me ooit zo'n mooi cadeau gegeven

Dankbaar voor mijn sprankelen\ Mijn doen en voor mijn streven

Maar ook dat ik mag wankelen\ Mag vallen en mag beven

Want wat er ook gebeurt\ Het duurt steeds maar voor even

De wijsheid van mijn hart\ Voor alles is een reden

Het leven brengt mij deugd\ En soms brengt het me pijn

Maar nooit neemt het die vreugd\ De toelating om hier te zijn

De kans om iets te leren\ Te zien en om te groeien

Geeft mij kracht te accepteren\ Te omarmen en te bloeien

-

@ 5627e59c:d484729e

2025-06-12 04:23:52

@ 5627e59c:d484729e

2025-06-12 04:23:52Look and see\ Look and see

You look like how you look at me

Look and see\ Look and see

The colorless through the color TV

Look and see\ Look and be

The unborn identity

-

@ 7f6db517:a4931eda

2025-06-12 04:02:50

@ 7f6db517:a4931eda

2025-06-12 04:02:50

"Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know. Privacy is the power to selectively reveal oneself to the world." - Eric Hughes, A Cypherpunk's Manifesto, 1993

Privacy is essential to freedom. Without privacy, individuals are unable to make choices free from surveillance and control. Lack of privacy leads to loss of autonomy. When individuals are constantly monitored it limits our ability to express ourselves and take risks. Any decisions we make can result in negative repercussions from those who surveil us. Without the freedom to make choices, individuals cannot truly be free.

Freedom is essential to acquiring and preserving wealth. When individuals are not free to make choices, restrictions and limitations prevent us from economic opportunities. If we are somehow able to acquire wealth in such an environment, lack of freedom can result in direct asset seizure by governments or other malicious entities. At scale, when freedom is compromised, it leads to widespread economic stagnation and poverty. Protecting freedom is essential to economic prosperity.

The connection between privacy, freedom, and wealth is critical. Without privacy, individuals lose the freedom to make choices free from surveillance and control. While lack of freedom prevents individuals from pursuing economic opportunities and makes wealth preservation nearly impossible. No Privacy? No Freedom. No Freedom? No Wealth.

Rights are not granted. They are taken and defended. Rights are often misunderstood as permission to do something by those holding power. However, if someone can give you something, they can inherently take it from you at will. People throughout history have necessarily fought for basic rights, including privacy and freedom. These rights were not given by those in power, but rather demanded and won through struggle. Even after these rights are won, they must be continually defended to ensure that they are not taken away. Rights are not granted - they are earned through struggle and defended through sacrifice.

If you found this post helpful support my work with bitcoin.

-

@ eb0157af:77ab6c55

2025-06-12 04:02:30

@ eb0157af:77ab6c55

2025-06-12 04:02:30Connecticut halts all public investment in digital assets while other U.S. states move toward strategic bitcoin reserves.

Connecticut has taken a firm stance against digital assets by approving legislation that categorically prohibits all levels of state and local government from investing in Bitcoin and other cryptocurrencies.

On June 10, the Connecticut General Assembly published the final text of bill H.B. 7082, which has now become Public Act No. 25-66. The legislation was passed unanimously by both the House and the Senate, signaling bipartisan agreement on the need to keep public finances away from the cryptocurrency market.

The new law establishes an outright ban on government entities purchasing, holding, or investing in Bitcoin and other cryptocurrencies. It also prohibits the creation of any “virtual currency reserve” and the acceptance of crypto payments.

In addition to restrictions on the public sector, the State’s legislation introduces consumer protection measures for private individuals. Crypto businesses operating as Money Service Businesses will now be required to disclose all material risks associated with cryptocurrencies through “clear, conspicuous and legible writing in the English language.”

Another provision addresses the protection of minors: the new law mandates legal guardian verification for all users under the age of 18.

While Connecticut adopts a restrictive position toward digital assets, several other U.S. states are moving in the opposite direction. New Hampshire became the first state to pass a bill for a strategic bitcoin reserve, followed by Arizona.

The post Connecticut says no to Bitcoin: law approved banning state crypto reserves appeared first on Atlas21.

-

@ 5627e59c:d484729e

2025-06-11 21:13:59

@ 5627e59c:d484729e

2025-06-11 21:13:59I am here too\ In the same space like you

In the same situation I'm in\ It's a matter of positioning

I cannot leave this place I'm in\ It was brought about\ By what's been happening

So please don't look at me\ For what I can or cannot do for you\ But look at what is happening for me\ And what is happening for you

Let's communicate\ Not orchestrate

Because there's something I wish to do\ And there's a place I wish to go to

And I'm sure that there is too\ In your heart a fire\ Known by only you

So let us listen, look and see\ For what's true for you\ And what's true for me

That we may act upon what's here\ In order for us both to take a step\ In the direction we wish to steer

-

@ 9ca447d2:fbf5a36d

2025-06-12 04:02:09

@ 9ca447d2:fbf5a36d

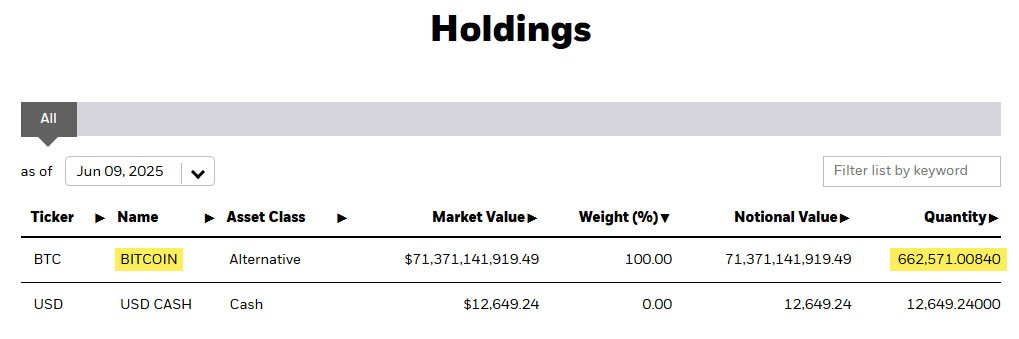

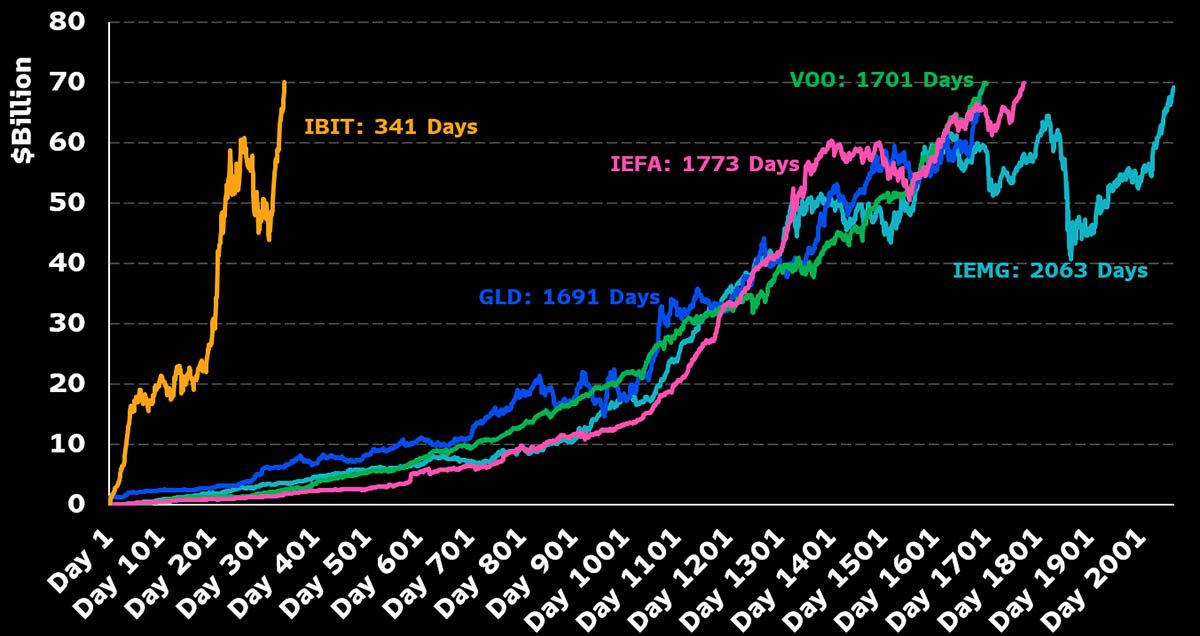

2025-06-12 04:02:09BlackRock’s iShares Bitcoin Trust (IBIT) has become the fastest exchange-traded fund (ETF) to ever reach $70 billion in assets under management (AUM).

The fund, which launched in January 2024, hit this milestone in just 341 trading days—five times faster than the previous record-holder, the SPDR Gold Shares ETF (GLD), which took 1,691 days to reach the same mark.

IBIT now holds over 662,000 BTC — iShares

Bloomberg ETF analyst Eric Balchunas tweeted on June 9, “IBIT just blew through $70 billion and is now the fastest ETF to ever hit that mark in only 341 days.” This is a big deal and shows bitcoin is going mainstream.

IBIT has beaten fastest growing ETFs in history — Eric Balchunas on X

The fund’s rapid growth means institutional investors are embracing bitcoin at scale.

The fund has $71.9 billion in AUM and holds over 662,000 bitcoin. This makes BlackRock the largest institutional bitcoin holder in the world. To put that in perspective, the fund holds more bitcoin than Binance or Michael Saylor’s Strategy.

“IBIT’s growth is unprecedented,” said Bloomberg analyst James Seyffart. “It’s the fastest ETF to reach most milestones, faster than any other ETF in any asset class.”

BlackRock’s bitcoin ETF isn’t just big. It’s also greatly outperforming other spot bitcoin ETFs launched at the same time. BlackRock’s brand and global client base gave the fund instant credibility.

Many institutional investors want a regulated and convenient way to get into bitcoin without holding the asset directly, and this fund has made it easy for them to invest.

Robert Mitchnick, BlackRock’s head of digital assets, told Yahoo Finance that bitcoin’s rising status as an inflation hedge and alternative store of value is driving IBIT’s popularity.

He explained bitcoin is becoming an inflation hedge and alternative store of value and that’s what’s driving the growth.

Eric Balchunas also noted that when BlackRock filed for IBIT, bitcoin was at $30,000 and there was still skepticism after the FTX blowup. Now that bitcoin is at $110,000, it is “seen as legitimate for other big investors.”

Institutional demand for bitcoin has never been stronger, with IBIT making up nearly 20% of all bitcoin held by public companies, private firms, governments, exchanges and decentralized finance platforms.

That dominance may soon be challenged as public companies prepare to buy more bitcoin and shake up the current supply distribution.

Matthew Sigel, VanEck’s head of digital assets research, shared data that six public companies plan to raise, or have raised, up to $76 billion to buy bitcoin. That’s more than half of the spot Bitcoin ETF industry’s current AUM, so there’s clearly interest beyond ETFs.

On the broader market, IBIT’s rise coincided with bitcoin’s price surge to new highs above $110,000. The inflows reflect investors’ confidence in Bitcoin’s future and desire for regulated exposure through traditional products.

It’s worth mentioning that IBIT also had over $1 billion in volume on its first day of trading. It’s now the largest ETF in BlackRock’s lineup, even bigger than gold funds and other popular ETFs tracking international equities.

-

@ 502ab02a:a2860397

2025-06-12 01:29:14

@ 502ab02a:a2860397

2025-06-12 01:29:14เรื่องของซีเรียล ที่เรารู้กัน ความจริงมันก็ไม่ได้สวยหรูสามัคคีอะไรเท่าไรครับ เบื้องหลังผลประโยชน์ระดับโลก ส่วนมากมีความขัดแย้งรุนแรงเสมอๆ

Recap นิดนะครับ ย้อนกลับไปช่วงปี 1880s ที่เมืองเล็ก ๆ อย่าง Battle Creek มลรัฐมิชิแกน สหรัฐฯ ดร. John Harvey Kellogg เป็นผู้กำกับดูแล Battle Creek Sanitarium ซึ่งเปิดสอนเรื่องสุขภาพครบทุกด้าน ทั้งโภชนาการออกกำลังกาย ไปจนถึงการควบคุมราคะ โดยเฉพาะเรื่องอาหารเช้า เขาเชื่อว่ามื้อแรกของวันมันมีอำนาจควบคุมอารมณ์และจิตวิญญาณได้ ถ้าเริ่มต้นด้วยไข่ แฮม หรือเนื้อ มันจะพลิกเรือจิตใจให้ไหลเข้าสู่ตัณหา …ซึ่งไม่ใช่จุดประสงค์ชีวิตนักพรตชาว Adventist เลย

ปี 1894 ในห้องครัวของโรงพยาบาลแห่งนี้ ดร. John กับน้องชาย Will ทดลองทำข้าวธัญพืชอบสมุนไพร เมล็ดธัญพืชบดที่หล่นบนเตาแล้วกลายเป็นแผ่นกรอบ มีชื่อเรียกชั่วคราวว่า “Granose biscuits” หรือ “wheat flakes” ซึ่งเป็นจุดเริ่มต้นของอาหารเช้าที่เน้นสุขภาพ ไม่ใช่ความอร่อย

วันที่ 7 มีนาคม 1897 ดร. John ยืนกรานจัดแจก Corn Flakes ตามหลักการ “ไม่หวาน ไม่อิ่มมาก” ในแบบฉบับ ซีเรียลไม่ใส่น้ำตาล (sugarless cereal) ให้กับคนไข้ของเขาเป็นครั้งแรก ความหวังคือให้พลังย่อยและช่วยเรื่องลำไส้ เพื่อสุขภาพมากกว่าความหรรษาปลายลิ้น

แต่แน่นอนว่า สูตรชีวิตด้านอาหารแบบพระเขาไม่ง้อลิ้นชาวบ้าน อย่าพูดถึงยอดขายเลย! น้องชาย Will Keith Kellogg ซึ่งเป็นนักธุรกิจสายลุย มองเห็นว่ารสจืดแบบนี้ไม่เกิด เขาจึงแฝงแนวคิดว่า “ทำไงให้ซีเรียลอร่อยจนคนยอมจ่าย” และสุดท้ายก็เติมน้ำตาลเข้าไป ปรับหน้าแพ็กเกจ และใส่โฆษณาชวนเชื่อว่า “อาหารเช้าสำคัญที่สุดของวัน” จนคนเริ่มเชื่อ

จากความเข้าใจเรื่องบริษัทสตาร์ทอัพของยุคนั้น ระหว่าง 1897–1906 ความแตกแยกของแนวคิดพี่-น้องก็ชัดเจนขึ้นเรื่อย ๆ ดร. John ที่เชื่อเรื่อง purity ของอาหาร ไม่เห็นด้วยกับน้ำตาล กลับขัดแย้งกับ Will ที่มองว่า “นี่ล่ะโอกาสทองเชิงพาณิชย์” จนในปี 1906 Will ตัดสินใจแยกออกมาเปิดบริษัทใหม่ในชื่อ Battle Creek Toasted Corn Flake Company วันที่ 19 กุมภาพันธ์ 1906 โดยผลักดันซีเรียลหวาน มีน้ำตาล จนขายดีทะลุเป้า

ตอนนี้พี่น้องก็กลายมาเป็นศัตรูทางธุรกิจจนได้ Will ยึดชื่อ Kellogg ทำโฆษณาเต็มแรง ลงโฆษณาเสาไฟ times square ใหญ่สุดในตอนนั้น ดร. John ฟ้องศาลขอสิทธิ์ในชื่อ Kellogg คืน เพราะเขาคิดว่าควรเป็นของผู้เริ่มต้นก่อน สุดท้าย Michigan Supreme Court ตัดสินให้ Will ชนะ ชัดเจนว่า “ใครทำการตลาด เขาก็เป็นเจ้าของชื่อ”

หลังจากนั้น ซีเรียลใส่น้ำตาลแบบกล่อง (boxed cereal) ก็เริ่มกระจายไปทั่วโลกในช่วงปี 1909–1920 โดย mass‑production ออกวันละหลักหมื่นกล่อง และโฆษณาไประดับครอบครัว วัยเด็ก และแม่บ้าน วาทกรรมคือ "ให้ลูกแข็งแรง" "อาหารเช้าแห่งอารยธรรม" ที่สำคัญคือ “ทำง่าย กินง่าย”

พอถึงปี 1907 โรงงานเกิดไฟไหม้ แต่กลับสร้างใหม่ในเวลา 6 เดือน แสดงให้เห็นถึงพลังของธุรกิจซีเรียลกล่องอย่างแท้จริง หลังจากนั้นในปี 1922 บริษัทก็เปลี่ยนชื่อเป็น Kellogg Company และโตเต็มที่ในช่วง 1920s–1930s นับเป็นเครื่องจักรของความเชื่อที่ว่า น้ำตาลในอาหารเช้าย่อมดีกว่าไขมันและเนื้อ แต่ในอีกมุม มันก็คือน้ำตาลอัดเม็ดเชิงการตลาดชุดแรกของโลก

ในภาพรวม หากมองจากสายตาประชาอเมริกันยุคต้น เคลล็อกพี่เป็นผู้ปฏิวัติโภชนาการสุทธิ เขาต้องการให้ซีเรียลเป็นอาหาร “ปราศจากสาปราคะ” ที่มุ่งเน้นสุขภาพ แต่ Will พาเรื่องนี้เข้าสู่วงการพาณิชย์ ขายง่าย รสหวาน และถูกเชื่อมกับแนวคิดว่าเด็กน้อยต้องกินอะไรเดี๋ยวนั้นเพื่อแข็งแรง กระทั่งพลังตลาดทำให้คนย้ายจากมื้อเช้าแบบหนัก ไปเป็นชามซีเรียลจิ้มกับนมในสไตล์ยุคใหม่ โดยไม่รู้เลยว่าหัวใจแท้จริงมันเริ่มตั้งแต่มุ่งปราบราคะและโมเดิร์นลุยตลาด

เมื่อดู timeline เต็มรูปแบบ เราจะเห็นว่า 1894: ดร. John ทดลอง Flaked wheat/raw Granose 1897: แจก Corn Flakes สูตรจืด sugarless จนเป็นกินกับนมเพื่อช่วยการย่อย (milk accompaniment)

1906: Will แยกบริษัท สร้างตลาดซีเรียลหวาน 1909: เปลี่ยนชื่อเป็น Kellogg Company 1922: บริษัทขยายสู่ตลาดโลกโดยสมบูรณ์ทุกย่างก้าวมีหัวใจสำคัญคือการเปลี่ยนพฤติกรรมผู้คนจาก “กินอาหารจริง” เป็น “กินอาหารกล่อง” จากไข่ เบคอน สตูว์ มาเป็นชามซีเรียลจิ้มกับนมที่ใส่น้ำตาลจัด ทั้งที่แท้จริงแล้วเป้าหมายแรกคือ “สงบกิเลส” แต่กลับจบที่ “กระตุ้นยอดขาย”

คุณลองจินตนาการถึงคนอเมริกันก่อนซีเรียล ตื่นเช้ามาเจอจานไข่ดาว เบคอน หรือแม้แต่ข้าวใส่จานพร้อมผัก ยิ่งทำงานหนักเสริมด้วยแผนยุทธศาสตร์ชีวิต พอซีเรียลมา “แค่เท กลืน กินง่าย” มันก็เข้าใจว่ามันคือความสะดวกและอนาคตของโภชนาการ ที่ถูกโปรโมตว่าดีต่อสุขภาพ ทั้ง ๆ ที่มันควรถูกตั้งคำถามในเรื่องน้ำตาลอยู่ไม่น้อย

วันนี้เรารู้แล้วว่า ซีเรียลกล่องใส่น้ำตาลคือผลิตภัณฑ์แห่งยุคตลาด เมื่อย้อนรอยดู มันไม่ใช่แค่เค้าว่าอร่อยหรือดี แต่คือการปั้นภาพว่า “นี่คือสิ่งที่คนยุคใหม่ควรกิน” โดยมีบริษัทและรัฐหนุนหลังให้มันกลายเป็นสิ่งที่เข้าใจว่า ‘ปกติ’ ทั้งที่ความจริงมัน ‘ผิดธรรมชาติ’ ตั้งแต่ต้นน้ำ #pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr

-

@ 5627e59c:d484729e

2025-06-11 21:13:27

@ 5627e59c:d484729e

2025-06-11 21:13:27Kan jij zien, er is geen hemel\ Probeer het zelf, dan lukt het wel\ Geen hel staat ons te wachten\ Enkel sterren hangen ons boven het hoofd\ Kan jij zien, iedereen leeft voor dit moment

Kan jij zien, er zijn geen landen\ Het is niet moeilijk gewoon land te zien\ Niets om voor te moorden of te sterven\ Ook geloof wordt niet gezien\ Kan jij zien, het leven wordt geleefd door iedereen in vrede

Misschien zeg je, ik kijk niet naar jouw wereld\ Maar ik deel dit zicht met velen\ Moge ook jij zoals ons zien\ Wij kijken in de wereld en zien gewoon onszelf

Kan jij zien, er is geen bezit\ Ik vraag me af of jij dit kan\ Geen hebben of een nood\ In een samen-leving van mensen\ Kan jij zien, wij delen de wereld met elkaar

Misschien zeg je, ik kijk niet naar jouw wereld\ Maar ik deel dit zicht met velen\ Moge ook jij zoals ons zien\ Wij kijken in de wereld en zien gewoon onszelf

-

@ cae03c48:2a7d6671

2025-06-12 04:01:48

@ cae03c48:2a7d6671

2025-06-12 04:01:48Bitcoin Magazine

Economic Bitcoin Nodes: Why You Need To Use Your Node For It To MatterWhat is an economic node? To understand that, you need to first conceptually understand how a user interacts with the Bitcoin network in the first place.

Bitcoin is a database, and a network to facilitate the updating and synchronization of updates to that database, used for the primary purpose of people transacting bitcoin (entries in the database).

The primary concern of a user making use of Bitcoin for this purpose is the validity of the transactions sent to them, i.e. is the money they have received valid in the sense that when they go forward in the future to spend it somewhere else that other people will also widely accept it as valid. If that is not the case, then it is useless as money.

This is the purpose of a node, to verify these transactions. In order to do so, your node must have a complete set of all the existing coins (Unspent Transaction Outputs, or UTXOs) in order to check every proposed transaction against. When a transaction is broadcast, your node verifies that the coins it is spending are in this “UTXO set”, meaning that they have not been spent yet. When that transaction is confirmed in a block, those individual UTXOs are then removed from the UTXO set, and the new ones created by that transaction are added.

In order to compute that UTXO set in the first place, a node must parse through the entire historical record of all past transactions contained in the blockchain, going through the process of adding each newly mined UTXO to the set, and removing/adding all the consumed and newly created UTXOs processed in each individual block.

Without doing this, there is no way to be certain that the current UTXO set stored in your node is actually accurate and valid (in the future Zero Knowledge Proofs could obviate the need for this by replacing the historical blockchain with a succinct cryptographic proof that any given UTXO set is valid for a specific blockheight).

Your node is simply an agent for you as an economic actor, in the sense of automated AI agents that many LLM advocates speak about. It is an autonomous program acting on your behalf in a certain context, in this case guaranteeing the validity of bitcoin transactions to ensure that when you are the recipient of one, the chain of transactions that created the coin spent to you is valid.

An economic node is simply a node that is actually being used by someone engaging in economic activity to ensure the validity of the coins they are receiving.

Why is that so important? Why do only these nodes matter?

Think about what makes Bitcoin function in the first place: people running the same consensus rules. The only reason there is a coherent singular Bitcoin network is because everyone is running the same consensus rules, when miners produce blocks, every individual node arrives at the same conclusion as to whether or not it is valid. Every individual node will follow whatever is the blockchain composed of valid blocks that has the most proof-of-work attached to it.

There is only a singular coherent Bitcoin network because each individual actor chooses to enforce the same set of consensus rules against blocks that miners produce. It is purely voluntary association, voluntary subjugation of oneself to a certain set of consensus rules.

So to illustrate the point, let’s imagine three different scenarios of nodes deviating from the existing set of rules.

In the first scenario, imagine a few major exchanges like Kraken, Coinbase, etc. all alter their consensus rules from the rest of the network (softfork vs. hardfork are a distraction from the point, so we are going to ignore the distinction here). These nodes represent the economic platforms where bitcoin is traded, and its price established in fiat terms. Nodes running conflicting rules from them, or making transactions that will not be recognized as valid by their nodes to be more specific, now cannot engage in that market.

Those exchanges’ nodes will not recognize user deposits as valid, and as such they will not be able to deposit coins and participate in those marketplaces. Other nodes can band together, but they cannot capture the economic power of those exchanges. Ultimately, short of the value of the coin created by the ruleset they are enforcing crashing to nothing, other nodes on the network will have no choice but to adopt their ruleset in order to interact with them. Otherwise the exchanges will simply ignore and honor honor deposits their nodes consider invalid.

In the second scenario, let’s imagine a group of much smaller businesses and users that regularly receive transactions. Maybe all of them together amount to the economic activity of a single exchange like Coinbase. These users choosing to alter their consensus rules is not as inescapable as a number of large exchanges in concert, but it is still significant.

Here, other users can still access marketplaces like exchanges to ensure that bitcoin is being priced by the market. The majority of the network will still accept everyone else’s coins in receipt for goods, or as deposits to trade on marketplaces. But they still represent a sizable portion of economic activity withdrawing from the rest of the network. This is leverage they can use.

Even as a minority of the network, the likelihood is extremely high that there are significant levels of economic activity crossing between this minority of nodes and the rest of the network. This is not a clear case of leaving the rest of the network no option but to adopt the new rules, but it definitely creates pressure for large portions of the network who interact across that “gap.”

From there the more users that choose to cross the gap because of who they economically interact with, that pressure grows larger for the rest of the remaining network.

In the last scenario, let’s imagine a group of nodes representing a small set of users generating very little or no economic activity at all. These users choose to alter their ruleset. They receive almost no payments, they represent a rounding error in terms of economic value on the network.

They’re irrelevant to the rest of the network. Large businesses, exchanges, other economic actors, they will not care if a handful of people stop patronizing them or sending them bitcoin for different reasons. This set of nodes altering their consensus rules doesn’t matter. They create no pressure or opportunity cost that matters for the rest of the network.

An economic node’s influence on the overall consensus of the Bitcoin network is proportional to the amount of economic activity involving that node/its owner.

A node that is not being used for this purpose is completely irrelevant to the consensus rules of the Bitcoin network at large. It creates no economic pressure, imposes no opportunity cost, on the rest of the network when it alters its consensus rules. It is indistinguishable from a participant in a sybil attack.

There might be other reasons to run a node besides verifying your own transactions, such as direct access to blockchain data for research or analysis purposes, but ultimately that node is irrelevant to consensus.

This dynamic is why Bitcoin cannot be sybil attacked. It’s why some malicious actor can spin up a million nodes on Amazon Web Services running different consensus rules, and it will have zero effect on the actual Bitcoin network.

Your node doesn’t matter, unless you use it. So use it.

This post Economic Bitcoin Nodes: Why You Need To Use Your Node For It To Matter first appeared on Bitcoin Magazine and is written by Shinobi.

-

@ 6be5cc06:5259daf0

2025-06-12 01:18:11

@ 6be5cc06:5259daf0

2025-06-12 01:18:11Introdução

O princípio do sola scriptura, pedra angular da teologia protestante desde a Reforma do século XVI, estabelece que apenas a Escritura constitui a autoridade final e suprema em questões de fé e prática cristã. Este princípio, formulado inicialmente por Martinho Lutero e sistematizado pelos reformadores subsequentes, pretende oferecer um fundamento epistemológico sólido para a teologia, livre das supostas corrupções da tradição eclesiástica.

Contudo, uma análise rigorosa revela que o sola scriptura incorre em contradições lógicas fundamentais que comprometem sua viabilidade como sistema epistemológico coerente. Este artigo examina essas contradições através de três perspectivas complementares: filosófica, exegética e histórica.

A Contradição Performativa Fundamental

O Problema da Autorreferência

O sola scriptura enfrenta um dilema epistemológico insuperável: afirma que apenas a Escritura possui autoridade final em matéria de fé, mas essa própria regra não é explicitamente ensinada na Escritura. Trata-se de uma contradição performativa clássica, onde o enunciado viola suas próprias condições de possibilidade.

Esta situação configura uma falácia de petitio principii (círculo vicioso), pois exige que se aceite uma doutrina que não pode ser sustentada pelas premissas do próprio sistema. Para estabelecer o sola scriptura, seria necessário recorrer a uma autoridade externa à Escritura – precisamente aquilo que o princípio pretende rejeitar.

Fundacionalismo Mal Estruturado

Do ponto de vista epistemológico, o sola scriptura apresenta-se como um fundacionalismo defeituoso. Pretende funcionar como axioma supremo e auto-evidente, mas falha ao não fornecer a base textual que sua própria metodologia exige. Um verdadeiro fundacionalismo escriturístico deveria ser capaz de demonstrar sua validade através de uma prova explícita nas próprias Escrituras.

O Testemunho Contrário das Escrituras

Limitações do Registro Escrito

A própria Escritura reconhece as limitações do registro textual. João 21:25 declara explicitamente: "Jesus fez também muitas outras coisas. Se cada uma delas fosse escrita, penso que nem mesmo no mundo inteiro haveria espaço suficiente para os livros que seriam escritos."

Este versículo é particularmente problemático para o sola scriptura, pois reconhece que nem todos os ensinamentos de Cristo foram preservados por escrito. Como pode a Escritura ser suficiente se ela própria admite sua incompletude?

A Valorização da Tradição Oral

Paulo, em 2 Tessalonicenses 2:15, oferece uma instrução que contradiz frontalmente o sola scriptura: "Assim, pois, irmãos, ficai firmes e conservai os ensinamentos que de nós aprendestes, seja por palavras, seja por carta nossa."

O apóstolo valoriza inequivocamente tanto a tradição oral ("por palavras") quanto a escrita ("por carta"), estabelecendo um modelo de autoridade dual que o protestantismo posterior rejeitaria.

A Necessidade de Autoridade Interpretativa

A narrativa do eunuco etíope em Atos 8:30-31 demonstra a inadequação da Escritura isolada como autoridade final. Quando Filipe pergunta se o eunuco entende o que lê, a resposta é reveladora: "Como poderei entender, se alguém não me ensinar?"

Este episódio ilustra que a mera posse do texto bíblico não garante compreensão adequada. É necessária uma autoridade interpretativa externa – no caso, representada por Filipe, que age com autoridade apostólica.

A Complexidade Hermenêutica