-

@ 8bad92c3:ca714aa5

2025-06-09 16:02:05

@ 8bad92c3:ca714aa5

2025-06-09 16:02:05Key Takeaways

In this episode, Bitcoin Core veteran James O’Beirne delivers a sharp critique of Bitcoin’s developmental stagnation, attributing it to political dysfunction, post-fork trauma, and resistance within Bitcoin Core to critical upgrades like CheckTemplateVerify (CTV). He argues that while institutional adoption accelerates, internal innovation is being stifled by misplaced controversies—such as the OP_RETURN policy debate—and a bottlenecked governance model. O’Beirne warns that without urgent progress on scaling solutions like CTV, congestion control, and vaulting systems, Bitcoin risks ossifying and becoming vulnerable to institutional capture. Advocating a more adversarial posture, he suggests forking or building alternative clients to pressure progress but remains hopeful, seeing rising momentum for protocol upgrades from developers outside the Core elite.

Best Quotes

“Everybody has mempool derangement syndrome… it’s such a small issue in the grand scheme of challenges Bitcoin is facing.”

“Bitcoin is as much an experiment in technical human organization as it is a pure technology.”

“If we don’t figure out how to scale trustless Bitcoin self-custody, we’re toast. Right now, only about 2.5% of Americans could actually use Bitcoin monthly in a meaningful way.”

“CTV isn’t sexy—it just works. It keeps getting reinvented because it's so useful. At this point, it’s essential.”

“If Core isn’t going to evaluate these proposals, someone has to. Otherwise, we need to build the social justification for forking.”

“Lightning didn’t scale Bitcoin the way we expected. Let’s stop assuming a silver bullet is coming and start building the bridges ourselves.”

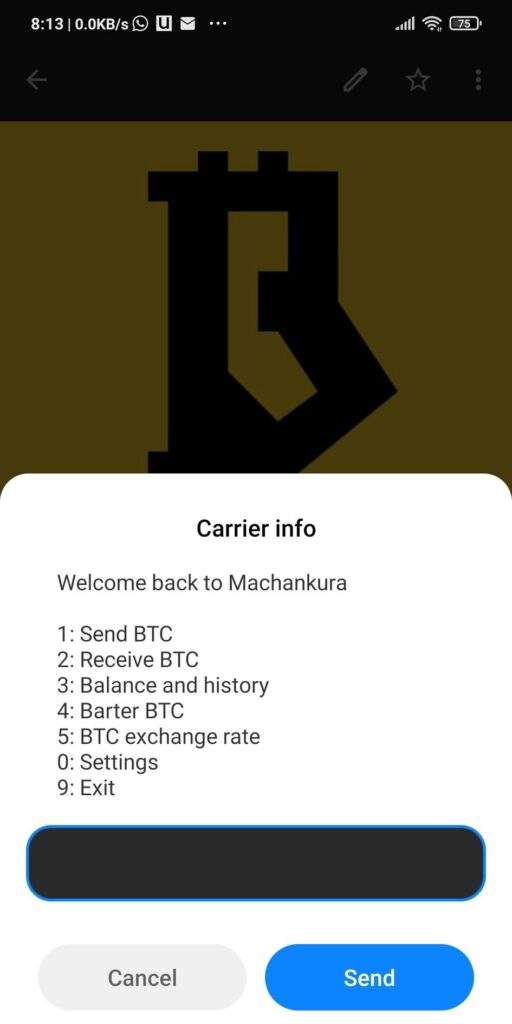

“You could onboard someone with just a phone and a vault… and give them more security than most hardware wallets.”

Conclusion

While Bitcoin gains traction with institutions and governments, its internal development is stalling under political inertia and misplaced focus. James O’Beirne urges the community to prioritize impactful upgrades like CTV and CCV, challenge the bottleneck of Bitcoin Core if needed, and recommit to Bitcoin’s foundational principles. This episode underscores the urgent need to bridge technical and social divides to ensure Bitcoin remains a decentralized, censorship-resistant tool for global value transfer.

Timestamps

0:00 - Intro

0:41 - Multi axis issue

5:12 - Core governance

9:41 - Derailing productive discussions

17:05 - Fold & Bitkey

18:32 - CTV

29:24 - Unchained

29:53 - Magnitude of change

41:45 - Covenant proposals

50:16 - CTV benefits

57:56 - Institutional ownership

1:05:26 - Moving forwardTranscript

(00:00) I think I have a somewhat different take than 99% of the people in the discussion. What freaks me out is if you've got Sailor owning half million coins or whatever and Black Rockck owning however many, people forget that Bitcoin is as much an experiment in technical human organization as it is, you know, as a sort of pure technology.

(00:17) The undernowledged reality is I'm actually interested to see if we have like a black swan adoption event from the machines. the risk given the increased scrutiny that things like the strategic Bitcoin reserve introduce there's a shot clock on getting to trustless decentralized value storage technology and I think we really have to be thinking about that combination of physically tired and mentally tired it's also tiresome James it's it's I was looking at that picture today and I was actually going to tweet it absent any caption just because it's

(00:52) a really good Uh yeah, it's a really good epitome of uh of a lot of stuff. But I'm with you, man. I'm tired. It's Friday. Who is it? Is that a just some random Japanese guy? I think it's it's I actually think it's from a documentary about I don't know if it's Africa, but Oh, yes. Yes.

(01:13) It's there's a little bit of a kind of like racy connotation there. Um yeah, the uh it's been long. It was interesting for me. We had Texas Energy Mining Summit here in Austin the beginning of the week. It sort of blended with Bitcoin plus I was over at Bitcoin++ Wednesday and yesterday doing the live desk and obviously topic of conversation is OP return this policy decision and this policy change that that core wants to make and many people are uh angry about and it's just again it's also tiresome.

(01:52) spoke with people on both sides over the two days and I I think I came away more confused than than I entered entered the week like what is the optimal path and somebody who's worked on Bitcoin core worked on Bitcoin core for for many years I've seen you tweeting about it seems like I won't put words in your mouth I'll let you say like what is your perspective on this whole policy debate around op return yeah so in general I think I have a somewhat different take than um 99% of the people in in the discussion which is basically that this

(02:25) is a really stupid discussion um everybody has mempool derangement syndrome like at every layer um and uh what what frustrates me a little bit about the conversation not not to not to uh get like um grumpy right off the bat but it's just it's it's such a small issue in the in the grand scheme of challenges that are being presented to Bitcoin that like spending all this drama on it um is is really a silly use of time and uh kind of emotion, but I can break it down for you.

(03:02) I mean, I think I think like largely the argument is happening on a few layers. Um the change itself technically I'm totally in favor of it. It makes sense. you know, basically the rationale is like, well, you know, um, people want to include exogenous data into the chain. Um, you can't really stop them from doing that.

(03:23) Um and so let's basically minimize the damage by saying hey you know we're going to make it easier for people to actually make use of op return as a data carrier which uh lets us avoid bloat in the UTXO set which is like one of the precious resources we have to take care of for the node.

(03:44) Um, so that's all good and the and the other thing too is that as we've seen with the ordinal stuff is um, you know, data is going to wait make its way into the chain and actually it hurts the whole network when um, there are transactions that most nodes haven't seen yet but they come through a block. Basically that slows down block propagation time.

(04:06) And so the whole idea is if you bring policy closer to the actual consensus rules, closer to the actual transactions that are going to come through and be mined, then you're going to have better network performance. You're going to have lower latency when it comes to actually broadcasting a new block around. So that's like the the sort of technical layer of the discussion.

(04:25) It's it's really a minute non-controversial change if you kind of have fluency with the the technical end of the mempool. Um, but I think there's this this higher layer to the conversation which is sort of a readjudication of spam in Bitcoin. And it's, you know, I think a lot of the the old animal spirits and sentiments are emerging about like, well, we don't like spam.

(04:49) And I think for a lot of people who kind of get lost in the technical details, it's very easy to latch on to the sentiment of I don't like spam. Um and so uh so that makes the sort of ocean knots camp maybe more appealing. Uh so that's yeah that's I guess a summary if you want to jump in anything in particular we can that's what I was saying I came out more confused than I went in.

(05:20) So last week on RHR, hey, I agree. You want policy to be aligned with consensus. Like whether we like it or not, these transactions are getting into blocks. They're non-standard, but they are valid within consensus rules and policy just isn't aligning with that. And like you said, this is disrupting the P2P layer and potentially the fee uh estimation process that that many nodes use, many applications use.

(05:49) And it makes sense to me to align policy with consensus. These things are happening. And if you can make it so Bitcoin full nodes are operating as efficiently and optimally as possible by changing this, it makes sense to me. I think my one like push back was like makes sense to me. However, I think how it was communicated to people and the whole mess with the PR.

(06:12) I think it's I think it's it was it's it's just a tactical error. Like even if this change gets in the the the real benefit of is is not material. You know, nobody was really clamoring for it. um this stuff always, you know, gets the hackles up of everybody who cares at all about, you know, spamming Bitcoin. So, it was a real tactical error.

(06:36) And I think that's that's one place where I mean it's kind of I had a little bit of shot in Freud seeing it because I'm fairly critical of core as a project along you know a variety of axes at this point and it was just kind of a demonstration of the the disconnection and kind of ineptitude of um publicity management kind of on on their end.

(06:58) Um, and so like there's part of me that enjoys seeing that because I I'm kind of convinced that that group has a lot less efficacy than they have credibility. And so to to see that kind of catch up was was interesting. The uh let's dive into that like what you said multiple axes you have a problem. I think we've throughout the years like we've been discussing the issues that Bitcoin like yourself particularly as a Bitcoin core developer for many years trying to get things through not only in the context of the way core works from a governance

(07:35) structure but just the way Bitcoin works as a distributed open source protocol like trying to get changes in and I will say like -

@ 9ca447d2:fbf5a36d

2025-06-09 16:01:45

@ 9ca447d2:fbf5a36d

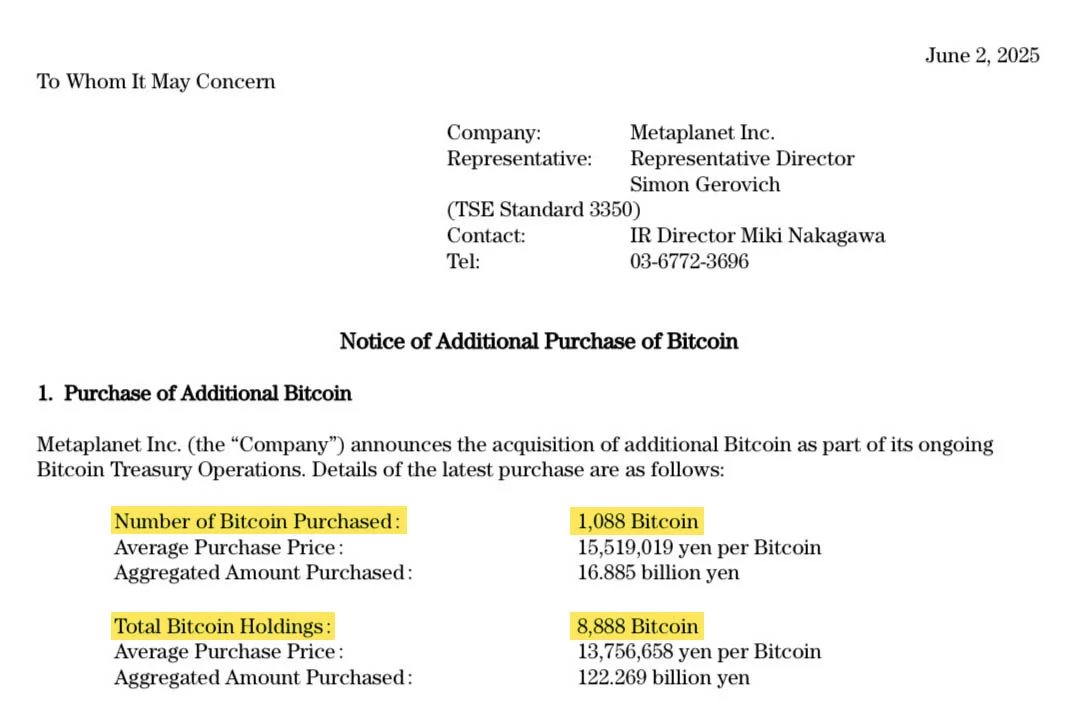

2025-06-09 16:01:45Metaplanet Inc. has bought 1,088 more bitcoin (BTC), and now holds 8,888 BTC worth over $930 million. This puts Metaplanet in the top 10 corporate bitcoin holders, ahead of Galaxy Digital and Block Inc.

Metaplanet Inc. on X

The company’s CEO Simon Gerovich announced the purchase on X on June 2, 2025. The company bought the new BTC at an average price of around $107,771 per coin, costing the company approximately $117.3 million.

The company said this purchase brings them 90% of the way to their 2025 goal of 10,000 BTC.

Metaplanet only started its bitcoin treasury policy in April 2024 but has been moving fast. At the start of 2025, it had less than 2,000 BTC, and now it has over 8,800.

This has been done through a combination of stock rights exercises and bond issuances, raising capital without diluting existing shareholders. In May 2025 alone, Metaplanet issued zero-coupon, non-interest-bearing bonds for a combined value of $71 million.

According to the filings, the company recently completed its “21 Million Plan” which was a program that involved the full exercise of 210 million stock acquisition rights.

These stock rights allowed Metaplanet to raise capital through equity sales while limiting dilution risk.

Metaplanet’s Bitcoin strategist, Dylan LeClair, said the company views bitcoin as a core part of its financial strategy and is all in, not just making small allocations.

Metaplanet’s buying has paid off in more ways than one.

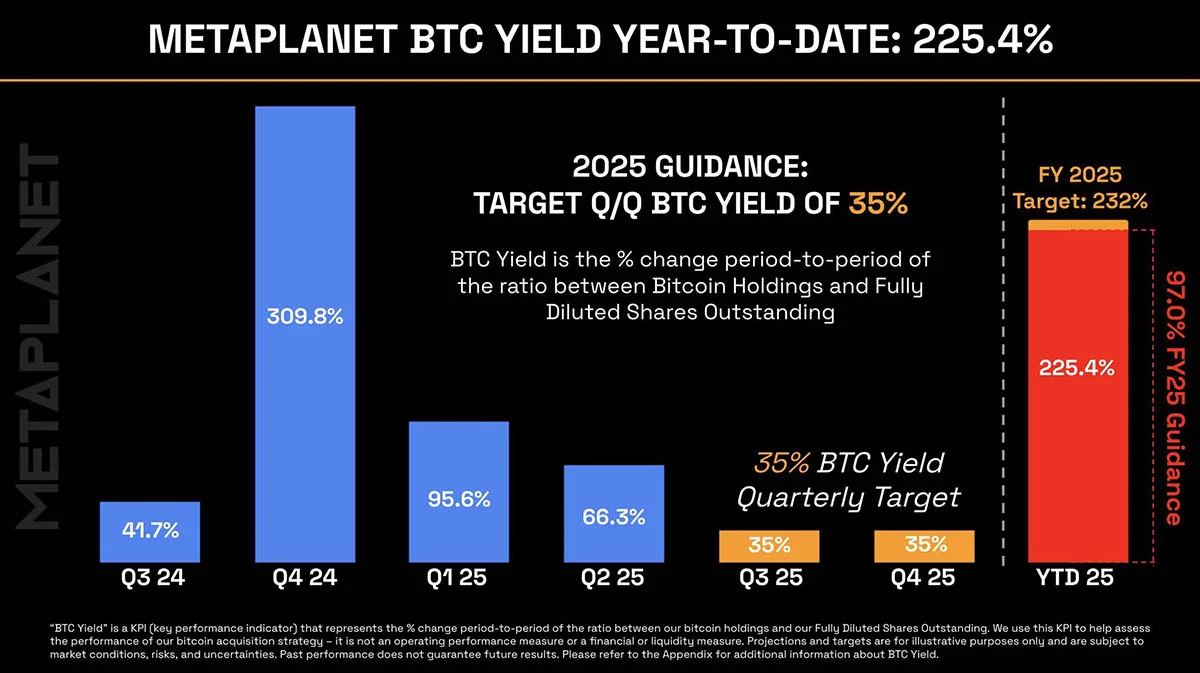

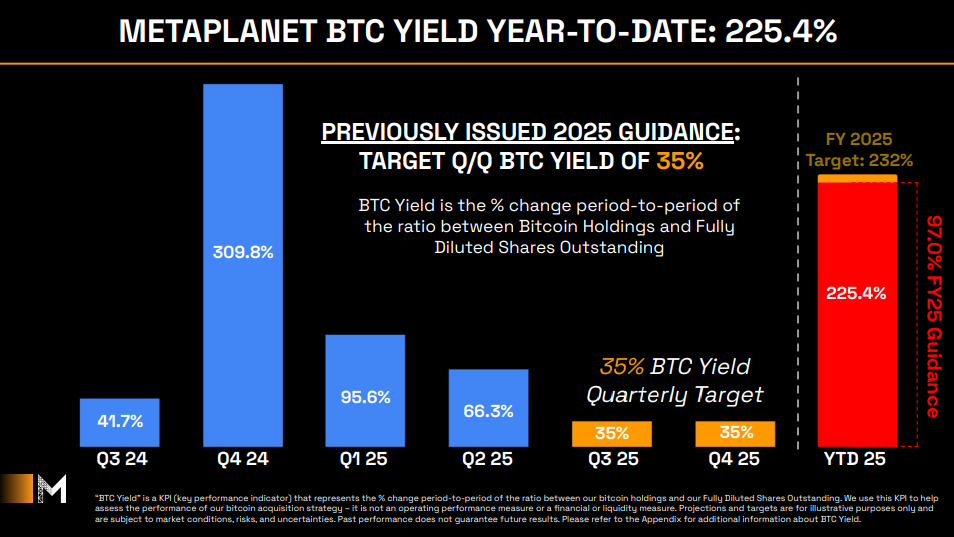

Its BTC Yield, a company metric that compares bitcoin holdings to total shares, has impressed investors. In Q2 2025 it had a 66.3% BTC Yield, year-to-date it has a 225% BTC Yield.

Metaplanet BTC Yield over time — Vincent on X

The stock is up 155% in the last month and is currently trading at 1,149 JPY, despite the overall volatility in the Tokyo Stock Exchange—where many other companies are under pressure due to the rising Japanese bond yields.

Analysts say the company still has more room to run.

Analysts say the company’s mNAV is back to 4.75 and the stock is undervalued compared to Strategy.

mNAV is short for “multiple of Net Asset Value” and is a metric used to compare the market’s valuation of a company to the actual value of its assets, primarily its bitcoin holdings.

Metaplanet is called “Japan’s Strategy”, a reference to Michael Saylor’s Strategy, the U.S.-based company that holds over 580,000 BTC—the most of any company in the world.

The corporate bitcoin boom isn’t stopping with Strategy and Metaplanet. On May 28, 2025 GameStop announced it had bought 4,710 BTC, worth over $512 million, its first foray into bitcoin after updating its investment policy this year.

-

@ b1ddb4d7:471244e7

2025-06-09 16:01:24

@ b1ddb4d7:471244e7

2025-06-09 16:01:24The latest AI chips, 8K displays, and neural processing units make your device feel like a pocket supercomputer. So surely, with all this advancement, you can finally mine bitcoin on your phone profitably, right?

The 2025 Hardware Reality: Can You Mine Bitcoin on Your Phone

Despite remarkable advances in smartphone technology, the fundamental physics of bitcoin mining haven’t changed. In 2025, flagship devices with their cutting-edge 2nm processors can achieve approximately 25-40 megahashes per second when you mine bitcoin on your phone—a notable improvement from previous generations, but still laughably inadequate.

Meanwhile, 2025’s top-tier ASIC miners have evolved dramatically. The latest Bitmain Antminer S23 series and Canaan AvalonMiner A15 Pro deliver 200-300 terahashes per second while consuming 4,000-5,500 watts. That’s a performance gap of roughly 1:8,000,000 between when you mine bitcoin on your phone and professional mining equipment.

To put this in perspective that hits home: if you mine bitcoin on your phone and it earned you one penny, professional miners would earn $80,000 in the same time period with the same effort. It’s not just an efficiency problem—it’s a complete category mismatch.

According to Pocket Option’s 2025 analysis, when you mine bitcoin on your phone in 2025, you generate approximately $0.003-0.006 in daily revenue while consuming $0.45-0.85 in electricity through constant charging cycles. Factor in the accelerated device wear (estimated at $0.75-1.20 daily depreciation), and you’re looking at losses of $1.20-2.00 per day just for the privilege of running mining software.

Mining Economic Factor

Precise Value (April 2025)

Direct Impact on Profitability

Smartphone sustained hash rate

20-35 MH/s

0.00000024% contribution to global hashrate

Daily power consumption

3.2-4.8 kWh (4-6 full charges)

$0.38-0.57 at average US electricity rates

Expected daily BTC earnings

0.0000000086 BTC ($0.0035 at $41,200 BTC)

Revenue covers only 0.9% of electricity costs

CPU/GPU wear cost

$0.68-0.92 daily accelerated depreciation

Reduces smartphone lifespan by 60-70%

Annual profit projection

-$386 to -$412 per year

Guaranteed negative return on investment

Source: PocketOption

Bitcoin’s 2025 Network: Harder Than Ever

Bitcoin’s network difficulty in 2025 has reached unprecedented levels. After the April 2024 halving event that reduced block rewards from 6.25 to 3.125 BTC, mining became significantly more competitive. The global hash rate now exceeds 800 exahashes per second—that’s 800 followed by 18 zeros worth of computational power securing the network.

Here’s what this means in practical terms: Bitcoin’s mining difficulty adjusts every 2,016 blocks (roughly every two weeks) to maintain the 10-minute block time. As more efficient miners join the network, difficulty increases proportionally. In 2025, mining difficulty has increased compared to 2024, making small-scale mining even less viable.

The math is unforgiving:

- Global Bitcoin hash rate: 828.96 EH/s

- Your smartphone’s contribution: ~0.000000003%

- Probability of solo mining a block: Virtually zero

- Expected time to mine one Bitcoin: Several million years

Even joining mining pools doesn’t solve the economic problem. Pool fees typically range from 1-3%, and your minuscule contribution would earn proportionally tiny rewards—far below the electricity and device depreciation costs.

The 2025 Scam Evolution: More Sophisticated, More Dangerous

Fraudsters now leverage AI-generated content, fake influencer endorsements, and impressive-looking apps that simulate realistic mining activity to entice you to mine bitcoin on your phone.

New 2025 scam tactics include:

AI-Powered Fake Testimonials: Deepfake videos of supposed successful mobile miners showing fabricated earnings statements and encouraging downloads of malicious apps.

Gamified Mining Interfaces: Apps that look and feel like legitimate games but secretly harvest personal data while simulating mining progress that can never be withdrawn.

Social Media Manipulation: Coordinated campaigns across TikTok, Instagram, and YouTube featuring fake “financial influencers” promoting mobile mining apps to younger audiences.

Subscription Trap Mining: Apps offering “free trials” that automatically charge $19.99-49.99 monthly for “premium mining speeds” while delivering no actual mining capability.

Recent cybersecurity research shows that over 180 fake mining apps were discovered across major app stores in 2025, with some accumulating more than 500,000 downloads before being removed.

Red flags that scream “scam” in 2025:

- Apps claiming “revolutionary mobile mining breakthrough”

- Promises of earning “$10-50 daily” from phone mining

- Requirements to recruit friends or watch ads to unlock withdrawals

- Apps that don’t require connecting to actual mining pools

- Testimonials that seem too polished or use stock photo models

- Apps requesting permissions unrelated to mining (contacts, camera, microphone)

The 2025 Professional Mining Landscape

To understand why, consider what professional bitcoin mining looks like in 2025. Industrial mining operations now resemble high-tech data centers with:

Cutting-edge hardware:

- Bitmain Antminer S23 Pro: 280 TH/s at 4,800W

- MicroBT WhatsMiner M56S++: 250 TH/s at 4,500W

- Canaan AvalonMiner A1566: 185 TH/s at 3,420W

Infrastructure requirements:

- Megawatt-scale power contracts with industrial electricity rates

- Liquid cooling systems maintaining 24/7 optimal temperatures

- Redundant internet connections ensuring zero downtime

- Professional facility management with 24/7 monitoring

For a small operation, you might need at least $10,000 to $20,000 to buy a few ASIC miners, set up cooling systems, and cover electricity costs. These operations employ teams of engineers, maintain relationships with power companies, and operate with margins measured in single-digit percentages.

2025’s Legitimate Mobile Bitcoin Strategies

While it remains impossible to mine bitcoin on your phone profitably, 2025 offers exciting legitimate ways to engage with bitcoin through your smartphone:

Lightning Network Participation: Apps like Phoenix, Breez, and Zeus allow you to run Lightning nodes on mobile devices, earning small routing fees while supporting bitcoin’s payment layer.

Bitcoin DCA Automation: Services enable automated dollar-cost averaging with amounts as small as $1 daily. Historical data shows $10 weekly bitcoin purchases consistently outperform any mobile mining attempt by 1,500-2,000%.

Educational Mining Simulators: Legitimate apps like “Bitcoin Mining Simulator” teach mining concepts without false earning promises. These educational tools help users understand hash rates, difficulty adjustments, and mining economics.

Stacking Sats Rewards: Apps offering bitcoin rewards for shopping, learning, or completing tasks.

Lightning Gaming: Bitcoin-native mobile games where players can earn sats through skilled gameplay, with some players earning $10 monthly.onfirm that even the most optimized mobile mining setups in 2025 lose money consistently and predictably.

The Bottom Line

When you mine bitcoin on your phone fundamental economics remain unchanged: it’s impossible to profit. The laws of physics, network competition, and energy efficiency create insurmountable barriers that no app can overcome.

However, 2025 offers unprecedented opportunities to engage with bitcoin meaningfully through your smartphone. Focus on education, legitimate earning opportunities, and strategic investment rather than chasing the impossible dream of phone-based mining.

The bitcoin community’s greatest strength lies in its commitment to truth over hype. When someone promises profits to mine bitcoin on your phone in 2025, they’re either uninformed or deliberately misleading you. Trust the mathematics, learn from the community, and build your bitcoin knowledge and holdings through proven methods.

The real opportunity in 2025 isn’t to mine bitcoin on your phone—it’s understanding bitcoin deeply enough to participate confidently in the most important monetary revolution of our lifetime. Your smartphone is the perfect tool for that education; it’s just not a mining rig.

-

@ cae03c48:2a7d6671

2025-06-09 16:01:03

@ cae03c48:2a7d6671

2025-06-09 16:01:03Bitcoin Magazine

TakeOver Successfully Hosts Second Annual BitGala Celebrating Bitcoin in Las VegasLAS VEGAS, NV, May 26, 2025 – TakeOver, Magic Eden, Spark, and Stacks successfully hosted their second annual BitGala on May 26th at the Wynn in Las Vegas. The celebration brought together over 200 Bitcoin industry leaders and community members for an evening dedicated to celebrating Bitcoin.

The BitGala was designed as a curated gathering focused on inspiring continued development, education, and adoption while reflecting on the strides Bitcoin has made toward a future of open, decentralized money. The event successfully brought together key leaders, creating meaningful opportunities for collaboration and strategic partnerships within the Bitcoin space.

“BitGala celebrates our partnership with Spark, marketing a major leap forward for Bitcoin DeFi,” said Elizabeth Olson, Head of Marketing for Bitcoin at Magic Eden. “As the #1 Bitcoin app, Magic Eden has spent the past few years pushing Bitcoin L1 to its limits, always with the goal of making Bitcoin more usable, fast, and fun without compromising its core ethos. We believe Spark has the potential to unlock a new era of building on Bitcoin, and we’re thrilled to be leading that charge together.”

“The BitGala was a stunning celebration of Bitcoin culture where luxury meets the cypherpunk spirit. We’re proving that Bitcoin isn’t just a protocol, it’s a movement connecting freedom-minded people from art, fashion, finance, and more. To us, it was a pure signal that people are starting to see what Stacks has been building all along: a future where Bitcoin isn’t just held, but used for apps, defi, and real ownership.” – Rena Shah, COO of Stacks.

Set against the backdrop of the Sphere, the evening brought together innovators, investors, and community leaders for a night dedicated to celebrating Bitcoin’s growth and the people driving its future.

The program opened with a welcome reception, followed by gourmet hors d’oeuvres and vibrant conversations. A keynote and honors segment recognized those making meaningful strides in Bitcoin adoption and development. Guests were then invited to explore a premium tequila tasting experience curated by Reach, and indulge in interactive gourmet chef stations.

“Our team has been fortunate to be part of the Bitcoin community since 2016, so we’re thrilled to see all the progress on display almost 10 years later at Bitcoin 2025. The energy in the room at BitGala was electric—from conversations sparking new partnerships to shared reflections on what’s next for Bitcoin—it was a powerful reminder of why we’re all here: to build an open, decentralized financial system that empowers everyone.” noted Kelley Weaver, Founder and CEO, Melrose PR and Founder, Bitwire.

This unforgettable gathering—hosted in partnership with leading organizations including Magic Eden, Spark, and Stacks—was more than a celebration. It was a call to continue pushing forward innovation, education, and adoption in

the Bitcoin ecosystem. BitGala was made possible through the generous support of key sponsors and partners who share Takeover’s commitment to fostering connections in the web3 space.

“We’re focused on making Bitcoin more useful for everyone, and events like this remind us that we’re not alone in that mission. It was inspiring to connect with others who share the vision of a more open, decentralized financial future powered by Bitcoin.” – Spark Team

Presenting Sponsors:

- Magic Eden – The largest NFT marketplace and Runes platform.

- Spark – The fastest, cheapest, most UX-friendly way to build financial apps and launch assets on Bitcoin.

- Stacks – A Bitcoin L2 enabling smart contracts & apps with Bitcoin as secure base layer.

Supporting Partners:

- Reach Ventures – a gaming-focused VC firm that actively invests in both early-stage and demo-ready game studios.

- Arch Network – a Bitcoin-native platform for building decentralized apps and smart contracts directly on Bitcoin.

- Melrose PR – An onchain communications firm that has been focused on the crypto industry exclusively for almost a decade.

- Bitwire – The modern newswire reimagined for today’s communications professionals.

The collaborative support from these organizations was instrumental in delivering a memorable event for all attendees.

Actor and comedian T.J. Miller was also a speaker at the event: “The bitcoin conference 2025 was incredible for so many reasons. It was such a joyful journey to be with so many like-minded people (all of whom have been laughed at) who share the same values: freedom, community, hope, and getting rich- the highpoint was the BitGala. I bought incredibly large expensive shoes for the specific purpose of showing up to the gala non-verbally saying bitcoin destroying Fiat, well that’s big shoes to fill… and we’ll fill ‘em. I can’t wait to return next year. I will wear more orange.”

About TakeOver

TakeOver is the experiential agency at the forefront of culture and innovation in the crypto space, known for curating powerful moments that educate, connect, and inspire. With a global Bitcoin Dinner Series and their annual flagship event, BitGala, they’ve become a cornerstone of community-building in Web3. Last year, they made headlines with a dramatic takeover of Nashville’s Parthenon—setting the bar for what crypto gatherings can be.

About Magic Eden

Magic Eden is the easiest platform to trade all digital assets onchain. As the #1 Bitcoin app and largest NFT marketplace, we provide a seamless trading experience to everyone. Magic Eden’s acquisition of Slingshot has expanded their capabilities to offer frictionless trading of over 5,000,000 tokens across all major chains. Magic Eden’s expanded product suite includes a cross-chain wallet, powerful trading tools, and the ability to mint, collect, and seamlessly trade NFTs and tokens.

Disclaimer: This is a sponsored press release. Readers are encouraged to perform their own due diligence before acting on any information presented in this article.

This post TakeOver Successfully Hosts Second Annual BitGala Celebrating Bitcoin in Las Vegas first appeared on Bitcoin Magazine and is written by TakeOver.

-

@ cae03c48:2a7d6671

2025-06-09 16:01:01

@ cae03c48:2a7d6671

2025-06-09 16:01:01Bitcoin Magazine

Bitcoin 2025 Las Vegas: Here’s What Went DownMy name is Jenna Montgomery, and maybe you’ve read some of my news articles here before, or seen me on the Bitcoin Magazine TikTok. But today, I wanted to switch it up and give you an inside look at the Bitcoin 2025 Conference in Las Vegas through my eyes as an intern, hired just one month before the conference, having little knowledge about Bitcoin beforehand and never attending an event like this before.

I’m writing this to give you a real, raw reflection of what I experienced over the course of the three day event, and why I believe you should absolutely attend the next Bitcoin conference. I want you all to know what goes down, what to expect, and to know how impactful I think this event really is. Bitcoin 2025 made a lasting impact on me and my life, and it just feels right to tell you why, so yours can maybe be changed too.

I got off the plane, threw my suitcase in my hotel room, and went to go and see the convention center as all of the finishing touches around the venue were being added. I remember thinking how big, beautiful, and fun the expo hall was—and where I would soon meet so many new people, make so many friends, and shake hands with people that I looked up to and admired.

I will never forget walking in and seeing the main conference stage, The Nakamoto Stage, for the first time. Seeing that giant room with a symphony and endless rows of chairs, soon to be filled with thousands of passionate Bitcoiners, really put in perspective to me how Bitcoin 2025 wasn’t just a conference, it felt like something bigger. I realized it’s an actual community and a place of countless opportunities.

The conference is essentially split up into 3 days: Industry Day, General Admission Day 1, and General Admission Day 2. Industry Day was mainly tailored towards professionals, investors, founders, and others focused on Bitcoin businesses. The general admission days were tailored more towards the casual Bitcoiner, and those were the days that I really felt the energy just exploding around the convention center.

Walking into the expo hall early in the morning on Industry Day, I was overwhelmed when I saw all of the vendors and companies setting up their tables, booths, stages, and even a rock climbing wall (thank you CleanSpark). It seemed as if the expo hall went for miles and miles, and featured a long orange carpet that made an intricate path through the venue that led you to each and every booth.

While fiat fails, Bitcoin prevails. pic.twitter.com/EV190PUqdT

— Valentina Gomez (@ValentinaForUSA) May 27, 2025

I remember being in total awe as I looked up at the ceiling and saw a huge UFO in the middle of the expo hall, with two Bitcoin themed Cybertrucks just off to the side of it, with lots of other interesting booths including one with a talking robot.

DAY ONE pic.twitter.com/KHXP6q8RCp

— Gemini (@Gemini) May 27, 2025

As I followed the long orange carpet around the venue, I looked over my shoulder and saw a huge blow-up of a Bitcoin Puppet in the art exhibit, featuring all kinds of other cool Bitcoin art. Some of these pieces of art were worth well over one bitcoin—which was mindblowing to me considering that is more than $100,000. Every good revolution has good art, and seeing all the talented artists pouring their hearts into their work helped me believe that Bitcoin is the future.

Now, it was time to get to work at where I would spend the majority of my time over the next few days. My coworkers and I were stationed up right in front of the Bitcoin Magazine news desk next to the AV (audio-visual) team, where I had a perfect view of everything. Here, I spent all day every day writing news articles for Bitcoin Magazine based on the speeches, keynotes, and other panels happening on the Nakamoto stage, as well as filming TikTok’s around the expo hall with attendees.

Working in front of the news desk was one of my favorite things about the conference. Everyone who spoke on it live had an electrifying personality that kept me locked into every conversation, especially one of the hosts Pete Rizzo. After every talk on the Nakamoto Stage ended, the live stream would pan over to the news desk where they would break down what happened, providing viewers with expert analysis. This was something extremely very fun to watch live and experience the production of it all first hand.

The talks on Industry Day kicked off to such a great start with Dan Edwards from Steak ‘n Shake, who recently became the first major fast food chain in America to begin accepting Bitcoin Lightning payments. So I was very excited to hear about Edwards’ speech and to visit Steak ‘n Shake’s incredible booth, which also featured a group of fun, dancing cows.

Steak ‘n Shake COWS HAVE NO CHILL

pic.twitter.com/8UkmPhWf9T

pic.twitter.com/8UkmPhWf9T— The Bitcoin Conference (@TheBitcoinConf) May 28, 2025

While speaking on stage, Edwards revealed that, “Bitcoin is faster than credit cards, and when customers choose to pay in Bitcoin, we’re saving 50% in processing fees.” Just think about that for a second — saving a whole 50% on each transaction? This really opened my eyes to the benefits of accepting Bitcoin as payment and why it could mean to merchants who adopt it.

Based on everything I heard in that speech, I think Steak ‘n Shake may be the first to start a new trend of other big companies accepting Bitcoin. If they recognized the benefits of Bitcoin, it’s only a matter of time before other franchises do as well.

JUST IN: Fast food giant Steak 'n Shake announced they're saving 50% in processing fees accepting Bitcoin payments

'#Bitcoin is faster than credit cards'

pic.twitter.com/bxApgBL6El

pic.twitter.com/bxApgBL6El— Bitcoin Magazine (@BitcoinMagazine) May 27, 2025

Another big highlight from this day was hearing Senator Cynthia Lummis confirm that President Donald Trump supports her Strategic Bitcoin Reserve Act. There were so many statements made during the conference that I will get to later on that point to the fact that the United States is pro-Bitcoin and we’re going to be the world leader in it. Senator Marsha Blackburn also added to this, stating, “Many of our allies follow what we do. If we lead, others will follow. This is vital to our economic future.”

JUST IN:

Senator Cynthia Lummis said US military generals are "big supporters" of a Strategic Bitcoin Reserve for economic power. pic.twitter.com/2RPMV3tbdA

Senator Cynthia Lummis said US military generals are "big supporters" of a Strategic Bitcoin Reserve for economic power. pic.twitter.com/2RPMV3tbdA— Bitcoin Magazine (@BitcoinMagazine) May 27, 2025

At this point in

-

@ cae03c48:2a7d6671

2025-06-09 16:00:58

@ cae03c48:2a7d6671

2025-06-09 16:00:58Bitcoin Magazine

The Blockchain Group Accelerates Bitcoin Treasury Strategy with €300M RaiseOn June 9, 2025, The Blockchain Group (Euronext: ALTBG) announced a €300 million capital increase program in partnership with TOBAM—marking one of the largest flexible funding facilities in the European public markets dedicated to scaling a Bitcoin treasury.

The raise is structured as an “ATM-type” (At-The-Market) offering, allowing TOBAM to subscribe daily for ordinary shares at a price based on the higher of the previous day’s closing price or volume-weighted average price (VWAP). Each tranche is capped at 21% of the day’s trading volume. This provides a disciplined mechanism to increase capital over time without disrupting market dynamics.

TOBAM: A Strategic Long-Term Backer

TOBAM, a Paris-based asset manager, has been a strategic investor in The Blockchain Group since 2017. The firm was among the earliest institutional advocates of Bitcoin as a treasury asset and remains one of Europe’s most innovative capital allocators. This deepened partnership underscores shared conviction in Bitcoin’s long-term value and the importance of financial infrastructure built on hard money principles.

Through this program, TOBAM can allocate capital into ALTBG shares in a way that aligns with market liquidity, ensuring that treasury growth occurs sustainably and with pricing transparency.

What It Means for Bitcoin For Corporations

For BFC members and observers, this development reflects the growing global standardization of capital tools for Bitcoin-native companies. The ATM structure—commonly used in U.S. equity markets—has now been adapted for European Bitcoin treasury growth. It offers several key advantages:

➤ Precision Timing: Capital can be deployed when conditions are favorable, avoiding the drawbacks of lump-sum raises.

➤ BTC Per Share Focus: The program is explicitly designed to increase the number of bitcoins per share on a fully diluted basis—aligning shareholder and treasury value.

➤ Strategic Flexibility: Instead of relying on traditional fundraising windows, The Blockchain Group now has continuous access to growth capital.A Treasury Engine, Not Just a Treasury

The Blockchain Group has been steadily transforming itself from a digital services company into a full-fledged Bitcoin Treasury Company. This €300 million program turns that transformation into a capital engine—one that can convert equity into Bitcoin consistently, responsively, and with strategic intent.

It also strengthens Europe’s position in the emerging corporate Bitcoin ecosystem. While most Bitcoin Treasury Companies today are U.S.-based, The Blockchain Group’s playbook offers a model for public firms across Euronext and other international exchanges.

The Blockchain Group isn’t just holding Bitcoin—it’s designing infrastructure to accumulate it over time. With TOBAM’s backing and a flexible ATM program in place, Europe’s first Bitcoin Treasury Company is poised to scale BTC per share with precision—one tranche at a time.

Disclaimer: This content was written on behalf of Bitcoin For Corporations. This article is intended solely for informational purposes and should not be interpreted as an invitation or solicitation to acquire, purchase, or subscribe for securities.

This post The Blockchain Group Accelerates Bitcoin Treasury Strategy with €300M Raise first appeared on Bitcoin Magazine and is written by Nick Ward.

-

@ cae03c48:2a7d6671

2025-06-09 16:00:53

@ cae03c48:2a7d6671

2025-06-09 16:00:53Bitcoin Magazine

Strategy Buys $110 Million Worth of BitcoinStrategy has acquired an additional 1,045 Bitcoin for approximately $110.2 million, further cementing its position as the largest corporate holder of Bitcoin as institutional adoption continues to accelerate in 2025.

According to an SEC filing on June 9, the company purchased the Bitcoin at an average price of $105,426 per coin last week, bringing its total holdings to 582,000 BTC. The acquisition was funded through Strategy’s at-the-market (ATM) sales of STRK and STRF preferred stocks.

BREAKING:

STRATEGY BUYS ANOTHER 1045 #BITCOIN FOR $110 MILLION pic.twitter.com/PUjgvEUg4B

STRATEGY BUYS ANOTHER 1045 #BITCOIN FOR $110 MILLION pic.twitter.com/PUjgvEUg4B— Bitcoin Magazine (@BitcoinMagazine) June 9, 2025

With this latest purchase, Strategy’s average acquisition price across all its Bitcoin holdings has risen to $70,086 per coin. At current market prices of approximately $107,700, the company’s total Bitcoin holdings are valued at $62.8 billion.

The purchase follows recent significant acquisitions by other major corporations, including GameStop’s $513 million purchase of 4,710 BTC and The Blockchain Group’s €60.2 million acquisition of 624 BTC.

The pace of corporate Bitcoin adoption has reached an unprecedented level, with over 100 public companies now holding Bitcoin worth more than $90 billion collectively.

Strategy’s continued accumulation has helped establish a model for corporate treasury diversification that’s being rapidly adopted across industries.

Strategy’s reported BTC Yield, a key performance indicator measuring the year-to-date percentage change in Bitcoin holdings relative to diluted shares outstanding, now stands at 17.1% for 2025.

At press time, Bitcoin trades at $107,700, up 1.78% over the past 24 hours, as the market continues to process this latest institutional development and its implications for broader corporate adoption of Bitcoin as a treasury asset.

This post Strategy Buys $110 Million Worth of Bitcoin first appeared on Bitcoin Magazine and is written by Vivek Sen.

-

@ cae03c48:2a7d6671

2025-06-09 16:00:51

@ cae03c48:2a7d6671

2025-06-09 16:00:51Bitcoin Magazine

KULR Technology Joins Bitcoin for Corporations, Increases Holdings to 920 BTCKULR Technology Group, Inc. (NYSE American: KULR), a Bitcoin First Company and global leader in sustainable energy management, announced that it has joined the Bitcoin for Corporations (BFC) initiative, an institutional platform by Strategy and Bitcoin Magazine to promote corporate Bitcoin adoption.

$KULR is proud to join the "@BitcoinforCorporations” initiative by @Strategy and @BitcoinMagazine, strengthening its Bitcoin First approach.

The company now holds 920 BTC, worth $91M, as part of its growing Bitcoin treasury strategy.https://t.co/TZ7tyw1Dsw pic.twitter.com/gK9vDlpkcQ— KULR Technology (@KULRTech) June 9, 2025

The initiative is made to support publicly traded companies in integrating Bitcoin into their corporate treasury strategies and balance sheets. Participating organizations gain access to institutional-grade tools, frameworks, and peer networks that support the responsible management and expansion of Bitcoin holdings. KULR’s role as an Executive Member of BFC aligns with its strategy to position Bitcoin as a long-term reserve asset.

“Our commitment to Bitcoin for Corporations reflects a strong conviction in Bitcoin’s long-term value as a monetary asset,” CEO of KULR Michael Mo, commented. “As KULR continues to scale its Bitcoin treasury, we welcome the chance to align with other institutions pioneering this shift in corporate treasury management.”

KULR also has increased its Bitcoin treasury by $13 million, bringing total holdings to 920 BTC, at an average acquisition price of $98,760 per bitcoin. The company’s total Bitcoin investment now stands at $91 million. The latest purchase was made at an average price of $107,861 per bitcoin. Year to date, KULR has delivered a 260% return on its Bitcoin holdings. They use a strategic mix of cash reserves and its At-The-Market (ATM) equity program to fund their acquisitions.

JUST IN:

Publicly traded KULR buys an additional 118.6 #Bitcoin for $13 million. pic.twitter.com/PJ29hsOk22

Publicly traded KULR buys an additional 118.6 #Bitcoin for $13 million. pic.twitter.com/PJ29hsOk22— Bitcoin Magazine (@BitcoinMagazine) June 9, 2025

On July 25, 2024, at the 2024 Bitcoin Conference, Strategy and Bitcoin Magazine announced the launch of Bitcoin for Corporations, a new initiative designed to help companies integrate Bitcoin into their treasury strategies. The program provides corporate leaders with educational resources, practical tools, and access to a network of peers and experts. It includes a co-branded web platform offering specialized content, newsletters, and success stories, as well as VIP access to events.

“The ‘Bitcoin for Corporations’ initiative is a significant step towards accelerating corporate Bitcoin adoption,” added Co-founder and former CEO of Strategy Michael Saylor. “By combining our expertise, resources and reach, along with Bitcoin Magazine we aim to create a robust platform that educates and supports corporations in implementing Bitcoin strategies.”

This post KULR Technology Joins Bitcoin for Corporations, Increases Holdings to 920 BTC first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-09 16:00:49

@ cae03c48:2a7d6671

2025-06-09 16:00:49Bitcoin Magazine

BitMine Immersion Technologies Buys 100 Bitcoin in First Treasury AcquisitionBitMine Immersion Technologies, Inc., a Bitcoin focused technology company, has taken its first step into treasury accumulation with the open market purchase of 100 Bitcoin. The acquisition marks the launch of BitMine’s formal Bitcoin Treasury business.

JUST IN:

Publicly traded BitMine Immersion Technologies bought 100 #Bitcoin for the first time. pic.twitter.com/4PPaFQGMbr

Publicly traded BitMine Immersion Technologies bought 100 #Bitcoin for the first time. pic.twitter.com/4PPaFQGMbr— Bitcoin Magazine (@BitcoinMagazine) June 9, 2025

The 100 BTC were purchased using funds raised through BitMine’s recent public stock offering, which closed on June 6, 2025. The offering raised $18 million through the sale of 2,250,000 shares at $8.00 per share.

“We are excited to make our first open market purchase of Bitcoin, and expect to make more Bitcoin purchases moving forward,” said Jonathan Bates, Chairman and CEO of BitMine.

BitMine’s Treasury strategy reflects a growing trend among public companies to diversify their balance sheets with Bitcoin as a store of value. The company joins a cohort of firms leveraging proceeds from capital markets to accumulate BTC as a long term asset, echoing broader institutional adoption.

Based in regions with low-cost energy—including Pecos and Silverton, Texas, and Trinidad—BitMine’s operations span traditional Bitcoin mining, synthetic Bitcoin mining through hashrate financial products, and advisory services for companies seeking Bitcoin-denominated revenues.

The company’s focus is not only on direct mining but also on offering consulting and infrastructure solutions to other public firms entering the Bitcoin space. Its strategic pivot toward treasury holdings represents a natural extension of its belief in Bitcoin as a core financial asset.

BitMine emphasized in its announcement that the move is just the beginning. The company “expects to make more Bitcoin purchases moving forward,” pointing to a sustained long-term accumulation plan.

With this initial acquisition, BitMine has placed itself among a growing group of companies actively converting capital into Bitcoin—showcasing not only conviction in the asset but a business model structured around it.

This post BitMine Immersion Technologies Buys 100 Bitcoin in First Treasury Acquisition first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ f0fd6902:a2fbaaab

2025-06-09 14:25:18

@ f0fd6902:a2fbaaab

2025-06-09 14:25:18https://stacker.news/items/1001523

-

@ 1817b617:715fb372

2025-06-09 15:49:48

@ 1817b617:715fb372

2025-06-09 15:49:48🚀 Instantly Send Spendable Flash BTC, ETH, & USDT — 100% Blockchain-Verifiable!

Step into the future of cryptocurrency innovation with CryptoFlashingTool.com — your go-to solution for sending spendable Flash Bitcoin (BTC), Ethereum (ETH), and USDT transactions. Using cutting-edge 🔥 Race/Finney-style blockchain simulation, our technology generates coins that are virtually indistinguishable from real, fully confirmed blockchain transactions. Transactions stay live and spendable from 60 up to 360 days!

🌐 Explore all the details at cryptoflashingtool.com.

🌟 Why Trust Our Crypto Flashing System? Whether you’re a blockchain enthusiast, ethical hacker, security expert, or digital entrepreneur, our solution offers a perfect mix of authenticity, speed, and flexibility.

🎯 Top Features You’ll Love: ✅ Instant Blockchain Simulation: Transactions are complete with valid wallet addresses, transaction IDs, and real confirmations.

🔒 Privacy First: Works flawlessly with VPNs, TOR, and proxies to keep you fully anonymous.

🖥️ User-Friendly Software: Built for Windows, beginner and pro-friendly with simple step-by-step guidance.

📅 Flexible Flash Durations: Choose how long coins stay valid — from 60 to 360 days.

🔄 Full Wallet Compatibility: Instantly flash coins to SegWit, Legacy, or BCH32 wallets with ease.

💱 Exchange-Ready: Spend your flashed coins on leading exchanges like Kraken and Huobi.

📊 Proven Results: ✅ Over 79 billion flash transactions completed. ✅ 3000+ satisfied users around the globe. ✅ 42 active blockchain nodes ensuring fast, seamless performance.

📌 How It Works: Step 1️⃣: Input Transaction Info

Pick your coin (BTC, ETH, USDT: TRC-20, ERC-20, BEP-20). Set amount and flash duration. Enter the recipient wallet (auto-validated). Step 2️⃣: Make Payment

Pay in your selected crypto. Scan the QR code or use the provided address. Upload your transaction proof (hash and screenshot). Step 3️⃣: Launch the Flash

Blockchain confirmation simulation happens instantly. Your transaction appears real within seconds. Step 4️⃣: Verify & Spend

Access your flashed coins immediately. Verify your transactions using blockchain explorers. 🛡️ Why Our Flashing Tech Leads the Market: 🔗 Race/Finney Attack Mechanics: Mimics authentic blockchain behavior. 🖥️ Private iNode Clusters: Deliver fast syncing and reliable confirmation. ⏰ Live Timer: Ensures fresh, legitimate transactions. 🔍 Real Blockchain TX IDs: All transactions come with verifiable IDs.

❓ FAQs:

Is flashing secure? ✅ Yes, fully encrypted with VPN/proxy compatibility. Multiple devices? ✅ Yes, up to 5 Windows PCs per license. Chargebacks possible? ❌ No, flashing is irreversible. Spendability? ✅ Flash coins stay spendable 60–360 days. Verification after expiry? ❌ No, transactions expire after the set time. Support? ✅ 24/7 Telegram and WhatsApp help available. 🔐 Independent, Transparent, Trusted:

At CryptoFlashingTool.com, we pride ourselves on unmatched transparency, speed, and reliability. See our excellent reviews on ScamAdvisor and top crypto forums!

📲 Contact Us: 📞 WhatsApp: +1 770 666 2531 ✈️ Telegram: @cryptoflashingtool

🎉 Ready to Flash Like a Pro?

💰 Buy Flash Coins Now 🖥️ Get Your Flashing Software

The safest, smartest, and most powerful crypto flashing solution is here — only at CryptoFlashingTool.com!

Instantly Send Spendable Flash BTC, ETH, & USDT — 100% Blockchain-Verifiable!

Step into the future of cryptocurrency innovation with CryptoFlashingTool.com — your go-to solution for sending spendable Flash Bitcoin (BTC), Ethereum (ETH), and USDT transactions. Using cutting-edge

Race/Finney-style blockchain simulation, our technology generates coins that are virtually indistinguishable from real, fully confirmed blockchain transactions. Transactions stay live and spendable from 60 up to 360 days!

Explore all the details at cryptoflashingtool.com.

Why Trust Our Crypto Flashing System? Whether you’re a blockchain enthusiast, ethical hacker, security expert, or digital entrepreneur, our solution offers a perfect mix of authenticity, speed, and flexibility.

Top Features You’ll Love:

Instant Blockchain Simulation: Transactions are complete with valid wallet addresses, transaction IDs, and real confirmations.

Privacy First: Works flawlessly with VPNs, TOR, and proxies to keep you fully anonymous.

User-Friendly Software: Built for Windows, beginner and pro-friendly with simple step-by-step guidance.

Flexible Flash Durations: Choose how long coins stay valid — from 60 to 360 days.

Full Wallet Compatibility: Instantly flash coins to SegWit, Legacy, or BCH32 wallets with ease.

Exchange-Ready: Spend your flashed coins on leading exchanges like Kraken and Huobi.

Proven Results:

Over 79 billion flash transactions completed.

3000+ satisfied users around the globe.

42 active blockchain nodes ensuring fast, seamless performance.

How It Works: Step

: Input Transaction Info

- Pick your coin (BTC, ETH, USDT: TRC-20, ERC-20, BEP-20).

- Set amount and flash duration.

- Enter the recipient wallet (auto-validated).

Step

: Make Payment

- Pay in your selected crypto.

- Scan the QR code or use the provided address.

- Upload your transaction proof (hash and screenshot).

Step

: Launch the Flash

- Blockchain confirmation simulation happens instantly.

- Your transaction appears real within seconds.

Step

: Verify & Spend

- Access your flashed coins immediately.

- Verify your transactions using blockchain explorers.

Why Our Flashing Tech Leads the Market:

Race/Finney Attack Mechanics: Mimics authentic blockchain behavior.

Private iNode Clusters: Deliver fast syncing and reliable confirmation.

Live Timer: Ensures fresh, legitimate transactions.

Real Blockchain TX IDs: All transactions come with verifiable IDs.

FAQs:

- Is flashing secure?

Yes, fully encrypted with VPN/proxy compatibility. - Multiple devices?

Yes, up to 5 Windows PCs per license. - Chargebacks possible?

No, flashing is irreversible. - Spendability?

Flash coins stay spendable 60–360 days. - Verification after expiry?

No, transactions expire after the set time. - Support?

24/7 Telegram and WhatsApp help available.

Independent, Transparent, Trusted:

At CryptoFlashingTool.com, we pride ourselves on unmatched transparency, speed, and reliability. See our excellent reviews on ScamAdvisor and top crypto forums!

Contact Us:

WhatsApp: +1 770 666 2531

Telegram: @cryptoflashingtool

Ready to Flash Like a Pro?

The safest, smartest, and most powerful crypto flashing solution is here — only at CryptoFlashingTool.com!

-

@ 632ee5dc:fbc077e2

2025-06-09 14:04:36

@ 632ee5dc:fbc077e2

2025-06-09 14:04:36[API Key Request]

YewTuBot would like to use API keys with the Stacker News GraphQL API

Reasons: - parsing new YT links - convert YT links to YewTube links or any other INVIDIOUS instance available

Expect calls to the following GraphQL queries or mutations: -

upsertCommentto post commentsEstimate GraphQL API calls: - Max 1x

upsertCommentperupsertLinkDelivery: - Provide API via nostr encripted message to

npub1vvhwthyptyqwzc2u5xgmcy73fn95nz6tyl2p7srkw6dx377qwl3q3axulxhttps://stacker.news/items/1001507

-

@ 8bad92c3:ca714aa5

2025-06-09 15:01:50

@ 8bad92c3:ca714aa5

2025-06-09 15:01:50Marty's Bent

Sorry for the lack of writing over the last week. As many of you may already know, I was in Las Vegas, Nevada for the Bitcoin 2025 conference. It was my first time in Las Vegas. I had successfully avoided Sin City for the first 34 years of my life. But when duty calls, you have to make some personal concessions.

Despite what many say about this particular conference and the spectacle that it has become, I will say that having attended every single one of Bitcoin Magazine's conferences since 2019, I thoroughly enjoy these events, even if I don't agree with all the content. Being able to congregate with others in the industry who have been working extremely hard to push Bitcoin forward, all of whom I view as kindred spirits who have also dedicated their lives to making the world a better place. There's nothing better than getting together, seeing each other in person, shaking hands, giving hugs, catching up and reflecting on how much things have changed over the years while also focusing on the opportunities that lie ahead.

I think out of all the Bitcoin magazine conferences I've been to, this was certainly my favorite. If only because it has become abundantly clear that Bitcoin is here to stay. Many powerful, influential, and competent people have identified Bitcoin as an asset and monetary network that will play a large part in human society moving forward. And more importantly, Bitcoin is proving to work far better than anybody not paying attention expected. While at the same time, the fiat system is in woeful disrepair at the same time.

As a matter of reflection and surfacing signal for you freaks, here are the presentations and things that happened that I think were the most impactful.

Miles Suter's Block Presentation

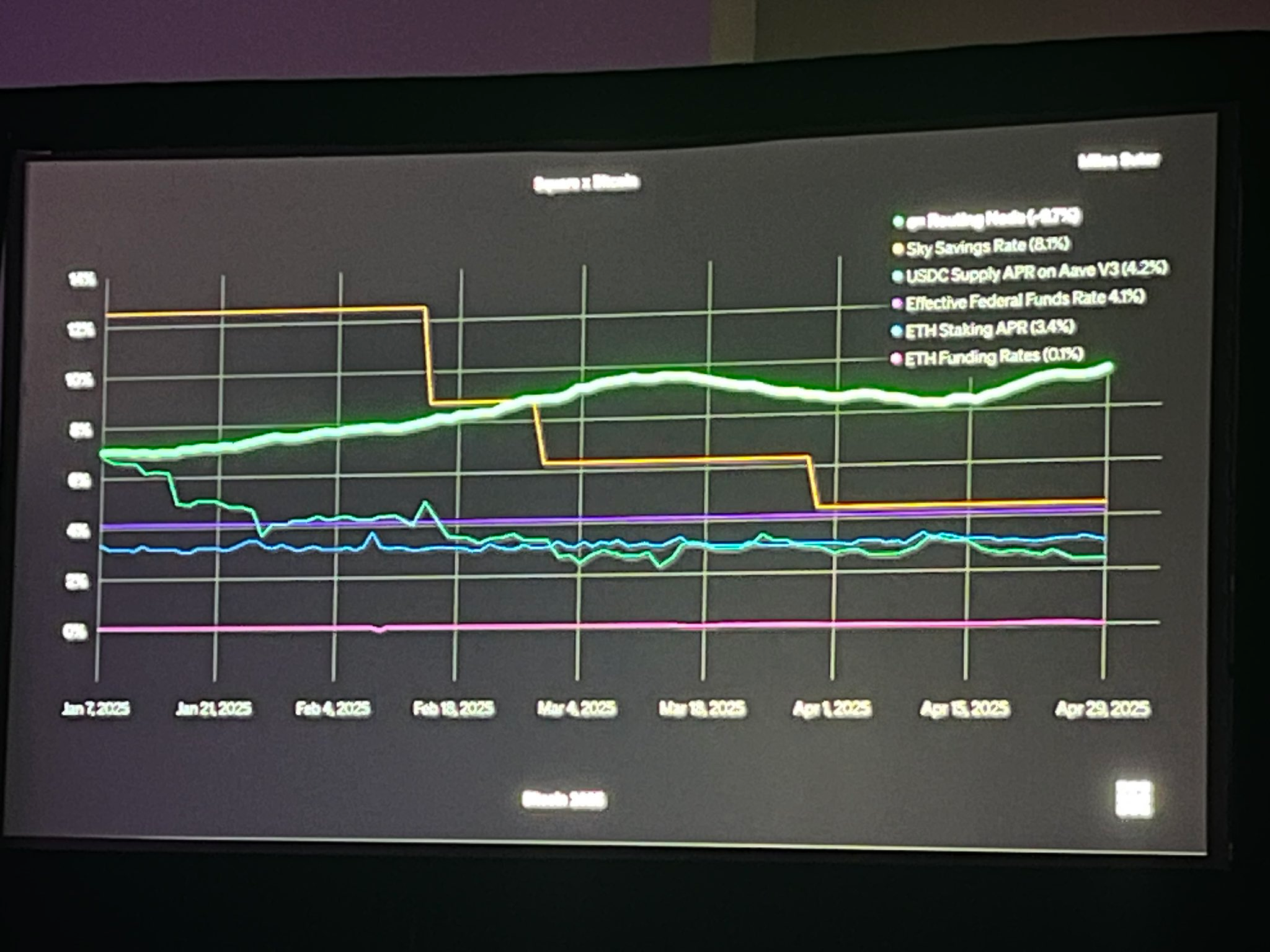

This presentation was awesome for many reasons, one of which being that we often forget just how dedicated Block, as an organization with many companies - including Cash App, Square, the open source organization known as Spiral and more recently, BitKey and Proto - has been to bitcoin over the last eight years. They've worked methodically to make Bitcoin a first-class citizen in their business operations and slowly but surely have built an incredibly integrated experience across their brands. The two big announcements from Block during the conference were the enablement of Bitcoin payments in Square point-of-sale systems and the amount of revenue they're making on their Lightning node, c=, from routing payments.

Right now, the Bitcoin payments and point of sale systems is in beta with many merchants testing it out for the next six months, but it will be available for all 4 million square merchants in 2026. This is something that many bitcoiners have been waiting for for many years now, and it is incredible to see that they finally brought it across the line. Merchants will have the ability to accept bitcoin payments and either convert every payment into fiat automatically, convert a portion of the bitcoin payment into fiat to keep the rest in sats, or simply keep all of the bitcoin they receive via payments in sats. This is an incredible addition to what Square has already built, which is the ability of their merchants to sweep a portion of their revenues into bitcoin if they desire. Square is focused on building a vertically integrated suite of bitcoin products for merchants that includes the ability to buy bitcoin, receive bitcoin, and eventually leverage financial services using bitcoin as collateral so that they can reinvest in and expand their businesses.

via Ryan Gentry

What went a bit underappreciated in the crowd was the routing node revenue that c= is producing, ~9.7% annualized. This is a massive validation of something that many bitcoiners have been talking about for quite some time, which is the ability to produce "yield" on bitcoin in a way that reduces risk significantly. Locking up bitcoin in a 2-of-2 multisig within Lightning channels and operating a Lightning routing node has been long talked about as one of the ways to produce more bitcoin with your bitcoin in a way that minimizes the threat of loss.

It seems that c= has found a way to do this at scale and is doing it successfully. 10% yield on bitcoin locked in Lightning channels is nothing to joke about. And as you can see from the chart above in the grainy picture taken by Ryan Gentry of Lightning Labs, this routing node "yield" is producing more return on capital than many of the most popular staking and DeFi protocols.

This is a strong signal to the rest of the market that this can be done. It may take economies of scale and a high degree of technical competency today. But this is incredibly promising for the future of earning bitcoin by providing valuable goods and services to the market of Bitcoiners. In this case, facilitating relatively cheap and instantly settled payments over the Lightning Network.

Saifedean Ammous' Bitcoin and Tether Presentation

This was one of the best presentations at the conference. Saifedean Ammous is a friend, he has been an incredible influence on my personal bitcoin journey, and I feel comfortable in saying he's been a strong influence on the journey of hundreds of thousands, at least, if not millions of people as they've attempted to understand bitcoin.

This presentation is a bit spicy because it puts a pin in the balloon of hopium that stablecoins like Tether are mechanisms that could bail out the market for US Treasuries in the medium to long-term if they take enough market share. As one always should do, Saif ran the numbers and clearly illustrates that even in the most optimistic case, Tether's impact on the market for treasuries, their interest rates, and curbing the growth of the debt held by the US federal government will be minimal at best.

One of the most interesting things that Saif points out that I'm a bit embarrassed I didn't recognize before is that much of the demand for Tether that we're seeing these days is replacement demand for treasuries. Meaning that many people who are turning to Tether, particularly in countries that have experienced hyperinflationary events, are using Tether as a substitute for their currencies, which are operated by central banks likely buying U.S. treasuries to support their monetary systems. The net effect of Tether buying those treasuries is zero for this particular user archetype.

Saif goes on to explain that if anything, Tether is a weapon against the US Treasury system when you consider that they're storing a large portion of the stablecoin backing in Treasuries and then using the yields produced by those Treasuries to buy bitcoin. Slowly but surely over time bitcoin as a percentage of their overall backing of Tether has grown quite significantly starting at 0% and approaching 10% today. It isn't hard to imagine that at some point within the next decade, Bitcoin could be the dominant reserve asset backing tethers and, as a result, Tether could be pegged to bitcoin eventually.

It's a fascinating take on Tether that I've never heard before.

Nothing Stops this Train from Lyn Alden

Lyn's been saying it loudly for quite some time now; "Nothing stops this train." She's even been on our podcast to explain why she believes this many times over the last five years. However, I don't think there is one piece of content out there that consolidates her thesis of why nothing stops the train of fiscal irresponsibility and unfettered debt expansion and why that's good for bitcoin than the presentation she gave at the conference. Definitely give this one a watch when you get a chance if you haven't already.

Overall, it was a great week in Vegas and I think it's safe to say that bitcoin has gone mainstream. Whether or not people who have been in the bitcoin industry and community for a while are okay with does not really matter. It's happening and all we can do is ride the wave as more and more people come to recognize the value prop of bitcoin and the social clout they can gain from supporting it. Our job here at TFTC is to help you discern the signal from the noise, continue to champion the self-sovereign usage of bitcoin and keep you abreast of developments in the space as they manifest.

Buckle up. Things are only going to get weirder from here on out.

Bitcoin's Mathematical Destiny

Sean Bill and Adam Back make a compelling case for Bitcoin's inevitable march toward $1 million. Sean points out that Bitcoin represents just a tiny fraction—2 trillion out of 900 trillion—of total financial assets, calling it a "tiny orange dot" on their presentation to Texas pensions. He emphasizes that reaching parity with gold alone would deliver a 10x return from current levels. Adam highlights the mathematical impossibility of current prices, noting that ETF buyers are absorbing 500,000 BTC annually while only 165,000 new coins are mined.

"Who's selling at these prices? It doesn't quite add up to me." - Adam Back

The institutional wave is just beginning. Sean revealed that while 50% of hedge fund managers personally own Bitcoin, only 3% have allocated institutional funds. Combined with emerging demand from nation states and corporate treasuries meeting Bitcoin's fixed supply, the price trajectory seems clear. Both guests stressed the importance of staying invested—missing just the 12 best performing days each year would turn Bitcoin into a losing investment.

Check out the full podcast here for more on pensions allocating to Bitcoin, cypherpunk banking, and commodity trading insight

-

@ 9ca447d2:fbf5a36d

2025-06-09 15:01:30

@ 9ca447d2:fbf5a36d

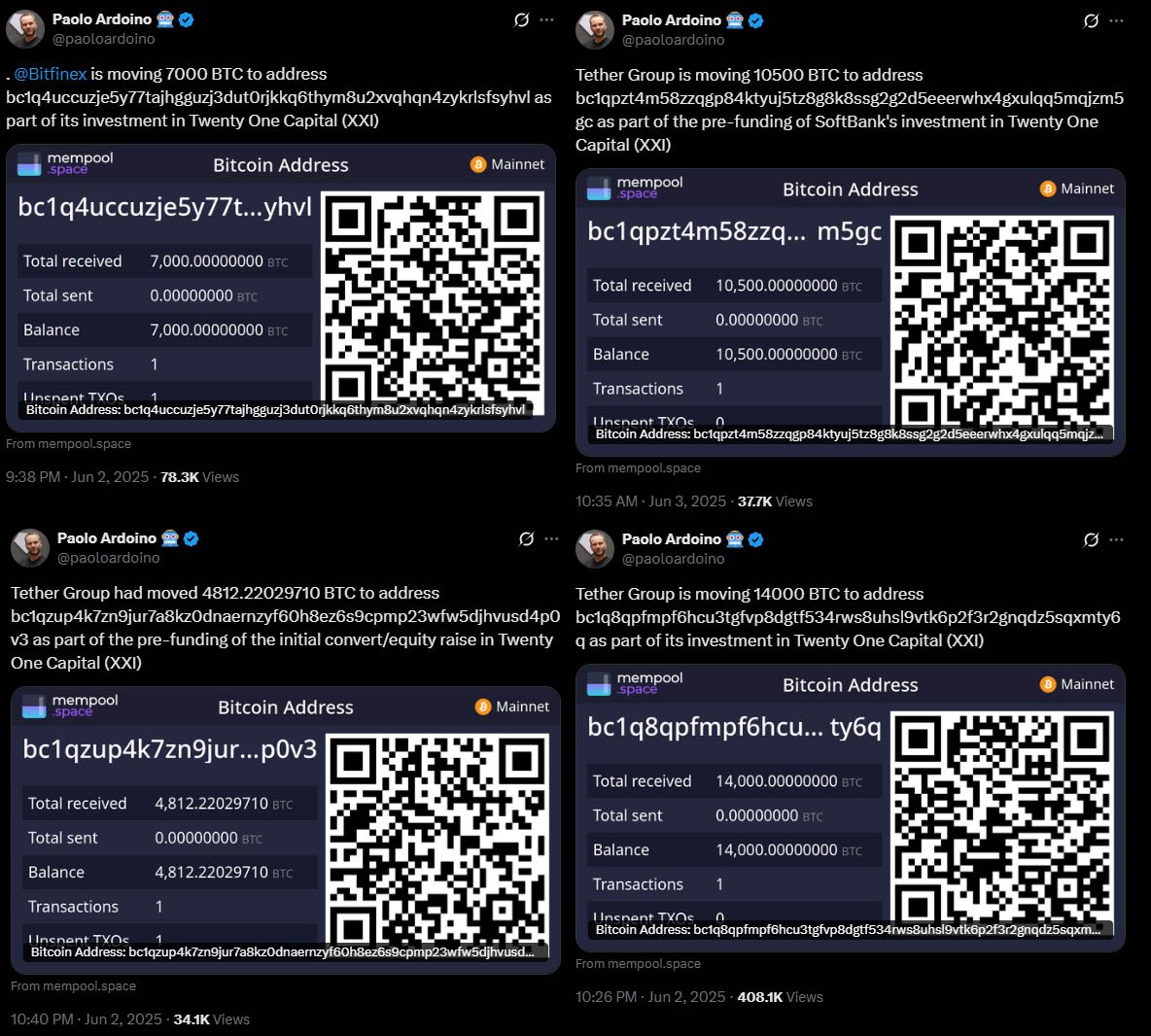

2025-06-09 15:01:30In a massive vote of confidence for a new bitcoin-focused company, Tether and Bitfinex have moved over 37,000 BTC—worth $3.9 billion—to digital treasury firm Twenty One Capital. This is one of the largest Bitcoin transactions in recent history.

The announcement came from Paolo Ardoino, CEO of Tether and CTO of Bitfinex, through multiple posts on X. According to Ardoino, the transfers were part of a pre-funding round for the launch of Twenty One Capital, a new company that will lead the bitcoin treasury space.

Ardoino announced several transfers on X — Sources 1, 2, 3, 4, and 5

“Tether Group is moving 10,500 BTC to address bc1qpzt4m58zzqgp84ktyuj5tz8g8k8ssg2g2d5eeerwhx4gxulqq5mqjzm5gc as part of the pre-funding of SoftBank’s investment in Twenty One Capital (XXI)” Ardoino said.

Twenty One Capital is a new bitcoin treasury firm led by Jack Mallers, CEO of Strike and founder of Zap. The company is backed by Tether, Bitfinex, SoftBank and Cantor Fitzgerald.

The company will go public via a SPAC merger with Cantor Equity Partners (CEP) and will trade under the ticker XXI on Nasdaq. After the merger was announced CEP’s stock price skyrocketed from $11 to $59.75.

Cantor Equity Partners’ stock price jumped on news of the merger — TradingView

Mallers says the company’s mission is bold and clear: accumulate bitcoin and provide full transparency through public wallet disclosures, also known as providing “proof-of-reserves“.

Total bitcoin moved to Twenty One Capital so far include:

- 10,500 BTC from Tether on behalf of SoftBank (worth about $1.1 billion)

- 19,729.69 BTC from Tether (worth around $2 billion)

- 7,000 BTC from Bitfinex (valued at roughly $740 million)

The amounts sum up to 37,229.69 BTC, worth around $3.9 billion at current prices. These were verified on public blockchain explorers.

The Twenty One Capital wallets now show large balances. They have already confirmed they have 31,500 BTC. That makes them the 3rd largest corporate bitcoin holder behind Strategy and Marathon Digital Holdings.

Once these new transfers are confirmed, the company will take over Marathon to become the second-largest corporate holder of the scarce digital asset globally.

Related: Twenty One Capital Becomes 3rd-Largest Corporate Holder of Bitcoin

Unlike companies that add bitcoin to their balance sheet, Twenty One Capital exists solely to accumulate and manage bitcoin. It follows a model similar to Strategy but is more transparent.

Mallers introduced new financial metrics like Bitcoin Per Share (BPS) and Bitcoin Return Rate (BRR) to value the company in bitcoin terms, not fiat.

He thinks economic value in the future will not be measured in dollars but in satoshis—the smallest unit of bitcoin. The company is not just about guarding against fiat collapse, but about completely opting out of the system.

A key part of the firm’s strategy is proof of reserves. Unlike some other big bitcoin holders, Twenty One Capital has already published its public wallet addresses so anyone can verify its holdings in real time.

Ardoino called this approach “Bitcoin Treasury Transparency (BTT)” and said it’s a response to recent industry scandals that showed the dangers of financial opacity in digital assets.

Mallers added openness is the only way to build long-term trust in a bitcoin-native financial system.

Twenty One Capital wants to reshape financial infrastructure, build native bitcoin lending models and promote global Bitcoin adoption.

-

@ b1ddb4d7:471244e7

2025-06-09 15:01:09

@ b1ddb4d7:471244e7

2025-06-09 15:01:09Square, the payments platform operated by Block (founded by Jack Dorsey), is reporting 9.7% bitcoin yield on its bitcoin holdings by running a Lightning Network node.

The announcement was made by Miles Suter, Bitcoin product lead at Block, during the Bitcoin 2025 conference in Las Vegas. Suter explained that Square is earning “real bitcoin from our holdings” by efficiently routing payments across the Lightning Network.

Square’s yield comes from its role as a Lightning service provider, a business it launched two years ago to boost liquidity and efficiency on the Lightning Network. According to Lightning Labs’ Ryan Gentry, Square’s 9% yield could translate to roughly $1 million in annual revenue.

The Lightning Network, a Bitcoin layer-2 protocol, has long been promoted as a solution to Bitcoin’s scalability and transaction speed issues. It enables micropayments and off-chain transactions, reducing congestion on the main blockchain. However, the network faces challenges, including the need for inbound liquidity—users must lock up BTC to receive BTC—potentially limiting participation by smaller nodes and raising concerns about decentralization.

Despite these hurdles, Square remains committed to advancing Bitcoin payments via Lightning. Suter revealed that 25% of Square’s outbound bitcoin transactions now use the Lightning Network. The company is actively testing Lightning-based payments at the Bitcoin 2025 event and plans to roll out the service to all eligible Square merchants by 2026.

Suter emphasized the transformative potential of Lightning:

“When you enable real payments by making them faster and more convenient, the network becomes stronger, smarter, and more beneficial. So if you’re questioning whether bitcoin is merely an asset, the response is no. It has already evolved into both an asset and a protocol, and now Block is spearheading the initiative to transform it into the world’s premier payment system.”

Square’s ongoing investment in Lightning signals its belief in Bitcoin’s future not just as a store of value, but as a global payments protocol.

-

@ cae03c48:2a7d6671

2025-06-09 15:00:49

@ cae03c48:2a7d6671

2025-06-09 15:00:49Bitcoin Magazine

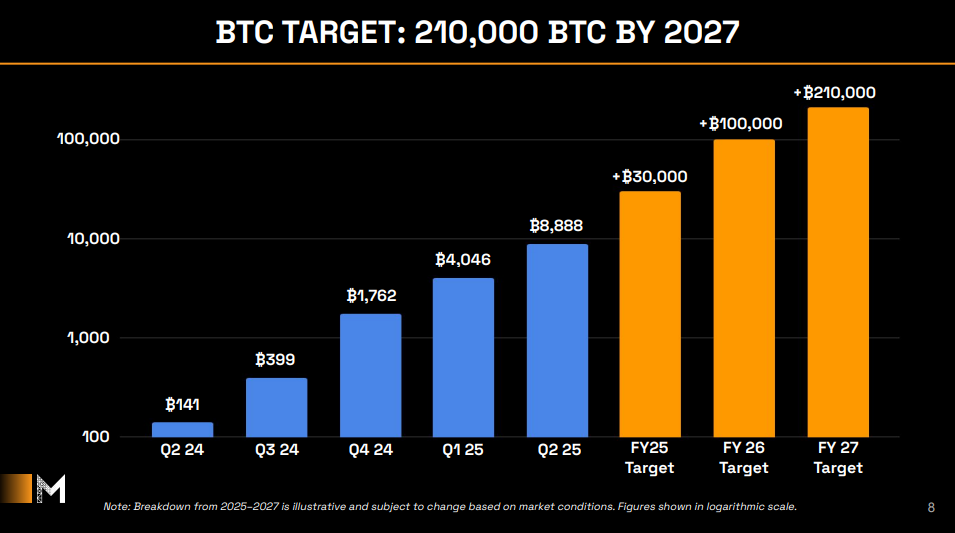

‘MicroStrategy of Asia’ Metaplanet Aims To Acquire Over 210,000 BTC By the End of 2027Metaplanet Inc. widely recognized as Japan’s leading Bitcoin treasury company, has announced a major update to its Bitcoin accumulation strategy, unveiling the “555 Million Plan” aimed at acquiring over 210,000 BTC by the end of 2027, which is equivalent to 1% of Bitcoin’s total supply.

*Metaplanet Announces Accelerated 2025-2027 Bitcoin Plan: Targeting 210,000 $BTC by 2027*

Full Presentation: https://t.co/JG28maMdfd pic.twitter.com/i9kzmjlDT8

— Metaplanet Inc. (@Metaplanet_JP) June 6, 2025

This new target marks a dramatic increase from the company’s earlier “21 Million Plan,” which aimed for just 21,000 BTC by 2026. Progress far outpaced expectations, with 8,888 BTC already secured as of June 2, prompting the strategic shift.

To fund this growth, Metaplanet has launched Asia’s largest Bitcoin-focused equity raise, aiming to secure ¥770.9 billion (approximately $5.4 billion) through the issuance of 555 million shares via moving strike warrants. This is the first structure of its kind in Japan, priced at a premium to market, made possible by the company’s high share liquidity and volatility.

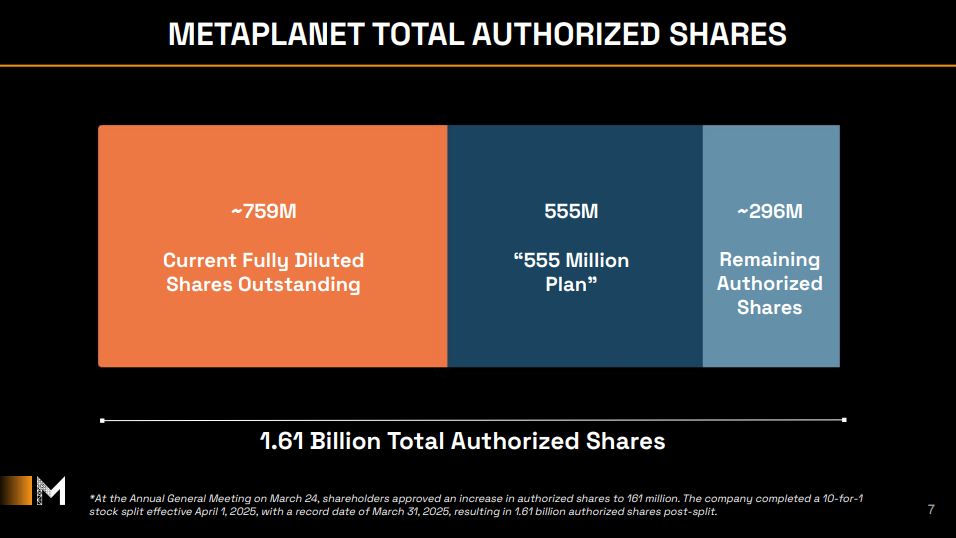

At the Annual General Meeting on March 24, shareholders approved an increase in authorized shares from 161 million to 1.61 billion, following a 10-for-1 stock split effective April 1, 2025; Metaplanet has approximately 296 million authorized shares remaining. The 555 million shares being issued under the new plan will bring the company’s fully diluted shares outstanding to around 759 million.

Metaplanet’s Bitcoin yield targets and performance for 2025 have shown strong momentum, with quarterly BTC yields of 41.7% in Q3 2024, 309.8% in Q4 2024, 95.6% in Q1 2025, 66.3% in Q2 2025, and projected 35% yields for both Q3 and Q4 2025. The year-to-date BTC yield for 2025 stands at 225.4%, closing to the full year target of 232%.

Metaplanet also announced the issuance of the 20th to 22nd Series of Stock Acquisition Rights via a third-party allotment to EVO FUND, potentially adding 555 million new shares. The initial exercise price is set at JPY 1,388 and will adjust regularly based on stock prices, with some series including a premium to protect shareholders. The exercise period runs from June 24, 2025, to June 23, 2027, with expected proceeds of approximately JPY 767.4 billion. This financing supports the “555 Million Plan” and further Bitcoin accumulation.

Metaplanet CEO Simon Gerovich wrote in a post on X, “thanks to all of our shareholders,” he said. “We are honored to be on this journey with you. Metaplanet is accelerating into the future — powered by Bitcoin.”

Metaplanet has launched Asia’s largest-ever equity raise dedicated to Bitcoin:

¥770.9 billion (~$5.4B) capital raise

¥770.9 billion (~$5.4B) capital raise

555 million shares via moving strike warrants

555 million shares via moving strike warrants

First in Japan: issued at a premium to market — enabled by Metaplanet’s high volatility and deep liquidity… pic.twitter.com/UlXHneyDzo

First in Japan: issued at a premium to market — enabled by Metaplanet’s high volatility and deep liquidity… pic.twitter.com/UlXHneyDzo— Simon Gerovich (@gerovich) June 6, 2025

This post ‘MicroStrategy of Asia’ Metaplanet Aims To Acquire Over 210,000 BTC By the End of 2027 first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-09 15:00:46

@ cae03c48:2a7d6671

2025-06-09 15:00:46Bitcoin Magazine

Gemini Files Draft With The SEC For Proposed IPOToday, Gemini Space Station, Inc. announced that it has confidentially filed a draft registration statement with the US Securities and Exchange Commission for a proposed initial public offering (IPO) of its Class A common stock. Details such as the number of shares and the price range have not been disclosed. The IPO will proceed after the SEC’s review and is subject to market conditions.

JUST IN: @Gemini has confidentially filed for an IPO with the @SECGov.

JUST IN: @Gemini has confidentially filed for an IPO with the @SECGov. Details on share count and pricing TBD.

Launch date will depend on SEC review and market conditions.

— Eleanor Terrett (@EleanorTerrett) June 6, 2025

“Any offers, solicitations or offers to buy, or any sales of securities will be made in accordance with the registration requirements of the Securities Act of 1933, as amended,” stated the press release. “This announcement is being issued in accordance with Rule 135 under the Securities Act.”

Gemini’s move comes during a period of growing activity in both the public markets and the digital asset space. Just yesterday, Trump Media and Technology Group Corp. (Nasdaq, NYSE Texas: DJT) also filed a Form S-1 with the SEC for its upcoming Truth Social Bitcoin ETF.

“Truth Social Bitcoin ETF, B.T. is a Nevada business trust that issues beneficial interests in its net assets,” stated the Form S-1. “The assets of the Trust consist primarily of bitcoin held by a custodian on behalf of the Trust. The Trust seeks to reflect generally the performance of the price of bitcoin.”

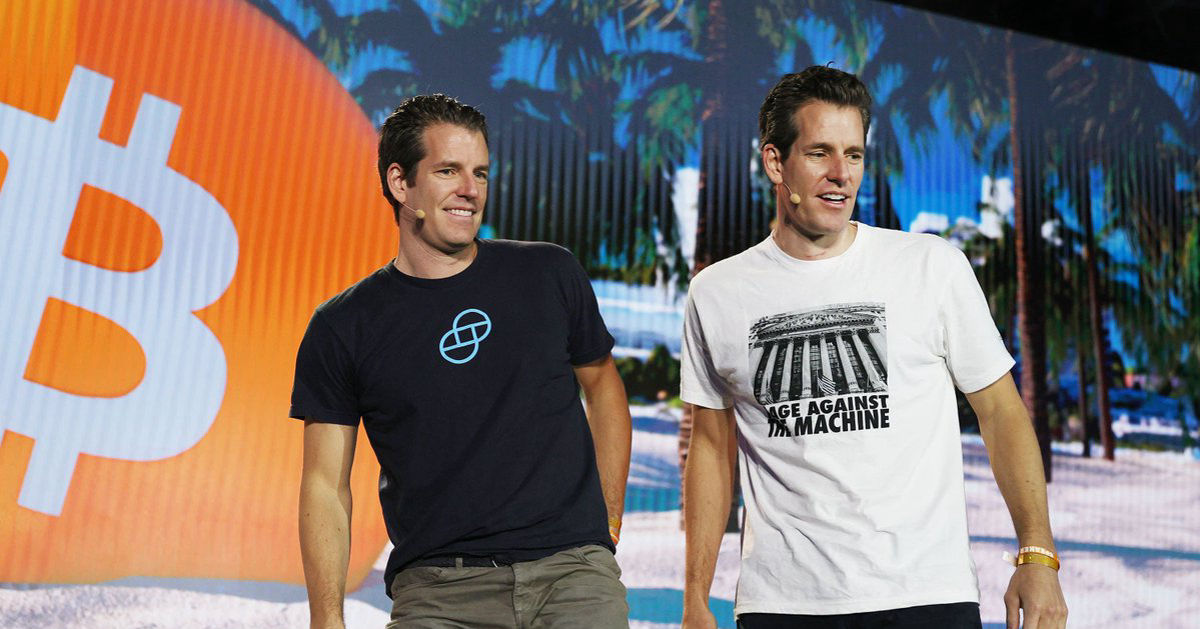

Momentum around Bitcoin and broader crypto policy was also evident last week at the 2025 Bitcoin Conference in Las Vegas. There, Gemini founders Cameron and Tyler Winklevoss joined White House A.I. & Crypto Czar David Sacks to discuss how the government should manage Bitcoin, as well as recent developments in federal policy.

“Orange is the new gold,” said Cameron. “So, Bitcoin is Gold 2.0, and that’s been true since day one. So, at $100,000 Bitcoin, that’s exciting, but if you take 21 million and do the above ground market price of gold. Really, it should be a million dollars a coin—easily,”

They talked about some of the recent policy changes that have been good for crypto include rolling back the IRS digital asset broker rule and SAB 121, which had stopped banks from holding Bitcoin. The Department of Justice also stopped its regulation by prosecution approach, which takes a lot of pressure off digital asset firms.

“It’s hard to imagine a President. Any other President being able to do any fraction of this or accomplish that or any administration and we have just over 100 days,” said Tyler. “So, It’s pretty amazing that we still have a lot of time left.” Later on, he ended the panel saying, “To the Moon!”

This post Gemini Files Draft With The SEC For Proposed IPO first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 9ca447d2:fbf5a36d

2025-06-09 14:02:37

@ 9ca447d2:fbf5a36d

2025-06-09 14:02:37President Donald Trump’s media company, Trump Media & Technology Group (TMTG), is doubling down on its Bitcoin bet, partnering with Crypto.com and Yorkville America Digital to launch its own bitcoin exchange-traded fund (ETF), called the Truth Social Bitcoin ETF.

On June 3, a division of the New York Stock Exchange, NYSE Arca, filed a 19b-4 form with the Securities and Exchange Commission (SEC).

This is the final regulatory hurdle before an ETF can be launched. If approved, this new fund will allow everyday investors to buy shares tied to the price of bitcoin, without having to hold the asset themselves.

The Truth Social Bitcoin ETF will track the price of bitcoin and give investors a simple, regulated way to invest in the digital money.

It will be listed and traded on NYSE Arca, and Foris DAX Trust Company (the custodian for Crypto.com’s assets) has been named as the proposed custodian for this new fund.

According to the filings, the ETF is “designed to remove the obstacles represented by the complexities and operational burdens involved in a direct investment in bitcoin.”

This is part of a bigger plan by Trump Media to offer a full suite of digital-asset-based financial products.

The company has also applied to trademark six investment products and has plans for additional ETFs under its Truth.Fi fintech platform, which will focus on digital assets and energy sectors.

Trump Media also recently announced a $2.5 billion bitcoin treasury plan and raised $2.4 billion in stock and debt to support its bitcoin initiatives.

Related: Trump Media Will Raise $2.5 Billion to Build Bitcoin Treasury

Now that the 19b-4 has been filed, the SEC has 45 days to approve, reject or delay the application. This can be extended several times, but a final decision must be made by January 29, 2026.

In addition to the 19b-4, Yorkville America Digital must also file an S-1 registration statement. This will outline exactly how the ETF will work, what it offers to investors, how funds will be used, and the risks involved.

Since January 2024, bitcoin ETFs have been all the rage, with over $130 billion in assets. Big players like BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s FBTC dominate the space. BlackRock alone has $69 billion in assets through its bitcoin ETF.