-

@ 7f6db517:a4931eda

2025-06-15 06:03:01

@ 7f6db517:a4931eda

2025-06-15 06:03:01

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-15 06:02:58

@ 7f6db517:a4931eda

2025-06-15 06:02:58

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-06-15 06:02:57

@ dfa02707:41ca50e3

2025-06-15 06:02:57Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ dfa02707:41ca50e3

2025-06-15 06:02:53

@ dfa02707:41ca50e3

2025-06-15 06:02:53Contribute to keep No Bullshit Bitcoin news going.

This update brings key enhancements for clarity and usability:

- Recent Blocks View: Added to the Send tab and inspired by Mempool's visualization, it displays the last 2 blocks and the estimated next block to help choose fee rates.

- Camera System Overhaul: Features a new library for higher resolution detection and mouse-scroll zoom support when available.

- Vector-Based Images: All app images are now vectorized and theme-aware, enhancing contrast, especially in dark mode.

- Tor & P2A Updates: Upgraded internal Tor and improved support for pay-to-anchor (P2A) outputs.

- Linux Package Rename: For Linux users, Sparrow has been renamed to sparrowwallet (or sparrowserver); in some cases, the original sparrow package may need manual removal.

- Additional updates include showing total payments in multi-payment transaction diagrams, better handling of long labels, and other UI enhancements.

- Sparrow v2.2.1 is a bug fix release that addresses missing UUID issue when starting Tor on recent macOS versions, icons for external sources in Settings and Recent Blocks view, repackaged

.debinstalls to use older gzip instead of zstd compression, and removed display of median fee rate where fee rates source is set to Server.

Learn how to get started with Sparrow wallet:

Release notes (v2.2.0)

- Added Recent Blocks view to Send tab.

- Converted all bitmapped images to theme aware SVG format for all wallet models and dialogs.

- Support send and display of pay to anchor (P2A) outputs.

- Renamed

sparrowpackage tosparrowwalletandsparrowserveron Linux. - Switched camera library to openpnp-capture.

- Support FHD (1920 x 1080) and UHD4k (3840 x 2160) capture resolutions.

- Support camera zoom with mouse scroll where possible.

- In the Download Verifier, prefer verifying the dropped file over the default file where the file is not in the manifest.

- Show a warning (with an option to disable the check) when importing a wallet with a derivation path matching another script type.

- In Cormorant, avoid calling the

listwalletdirRPC on initialization due to a potentially slow response on Windows. - Avoid server address resolution for public servers.

- Assume server address is non local for resolution failures where a proxy is configured.

- Added a tooltip to indicate truncated labels in table cells.

- Dynamically truncate input and output labels in the tree on a transaction tab, and add tooltips if necessary.

- Improved tooltips for wallet tabs and transaction diagrams with long labels.

- Show the address where available on input and output tooltips in transaction tab tree.

- Show the total amount sent in payments in the transaction diagram when constructing multiple payment transactions.

- Reset preferred table column widths on adjustment to improve handling after window resizing.

- Added accessible text to improve screen reader navigation on seed entry.

- Made Wallet Summary table grow horizontally with dialog sizing.

- Reduced tooltip show delay to 200ms.

- Show transaction diagram fee percentage as less than 0.01% rather than 0.00%.

- Optimized and reduced Electrum server RPC calls.

- Upgraded Bouncy Castle, PGPainless and Logback libraries.

- Upgraded internal Tor to v0.4.8.16.

- Bug fix: Fixed issue with random ordering of keystore origins on labels import.

- Bug fix: Fixed non-zero account script type detection when signing a message on Trezor devices.

- Bug fix: Fixed issue parsing remote Coldcard xpub encoded on a different network.

- Bug fix: Fixed inclusion of fees on wallet label exports.

- Bug fix: Increase Trezor device libusb timeout.

Linux users: Note that the

sparrowpackage has been renamed tosparrowwalletorsparrowserver, and in some cases you may need to manually uninstall the originalsparrowpackage. Look in the/optfolder to ensure you have the new name, and the original is removed.What's new in v2.2.1

- Updated Tor library to fix missing UUID issue when starting Tor on recent macOS versions.

- Repackaged

.debinstalls to use older gzip instead of zstd compression. - Removed display of median fee rate where fee rates source is set to Server.

- Added icons for external sources in Settings and Recent Blocks view

- Bug fix: Fixed issue in Recent Blocks view when switching fee rates source

- Bug fix: Fixed NPE on null fee returned from server

-

@ dfa02707:41ca50e3

2025-06-15 06:02:52

@ dfa02707:41ca50e3

2025-06-15 06:02:52- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ 8bad92c3:ca714aa5

2025-06-15 06:02:50

@ 8bad92c3:ca714aa5

2025-06-15 06:02:50Key Takeaways

Michael Goldstein, aka Bitstein, presents a sweeping philosophical and economic case for going “all in” on Bitcoin, arguing that unlike fiat, which distorts capital formation and fuels short-term thinking, Bitcoin fosters low time preference, meaningful saving, and long-term societal flourishing. At the heart of his thesis is “hodling for good”—a triple-layered idea encompassing permanence, purpose, and the pursuit of higher values like truth, beauty, and legacy. Drawing on thinkers like Aristotle, Hoppe, and Josef Pieper, Goldstein redefines leisure as contemplation, a vital practice in aligning capital with one’s deepest ideals. He urges Bitcoiners to think beyond mere wealth accumulation and consider how their sats can fund enduring institutions, art, and architecture that reflect a moral vision of the future.

Best Quotes

“Let BlackRock buy the houses, and you keep the sats.”

“We're not hodling just for the sake of hodling. There is a purpose to it.”

“Fiat money shortens your time horizon… you can never rest.”

“Savings precedes capital accumulation. You can’t build unless you’ve saved.”

“You're increasing the marginal value of everyone else’s Bitcoin.”

“True leisure is contemplation—the pursuit of the highest good.”

“What is Bitcoin for if not to make the conditions for magnificent acts of creation possible?”

“Bitcoin itself will last forever. Your stack might not. What will outlast your coins?”

“Only a whale can be magnificent.”

“The market will sell you all the crack you want. It’s up to you to demand beauty.”

Conclusion

This episode is a call to reimagine Bitcoin as more than a financial revolution—it’s a blueprint for civilizational renewal. Michael Goldstein reframes hodling as an act of moral stewardship, urging Bitcoiners to lower their time preference, build lasting institutions, and pursue truth, beauty, and legacy—not to escape the world, but to rebuild it on sound foundations.

Timestamps

00:00 - Intro

00:50 - Michael’s BBB presentation Hodl for Good

07:27 - Austrian principles on capital

15:40 - Fiat distorts the economic process

23:34 - Bitkey

24:29 - Hodl for Good triple entendre

29:52 - Bitcoin benefits everyone

39:05 - Unchained

40:14 - Leisure theory of value

52:15 - Heightening life

1:15:48 - Breaking from the chase makes room for magnificence

1:32:32 - Nakamoto Institute’s missionTranscript

(00:00) Fiat money is by its nature a disturbance. If money is being continually produced, especially at an uncertain rate, these uh policies are really just redistribution of wealth. Most are looking for number to go up post hyper bitcoinization. The rate of growth of bitcoin would be more reflective of the growth of the economy as a whole.

(00:23) Ultimately, capital requires knowledge because it requires knowing there is something that you can add to the structures of production to lengthen it in some way that will take time but allow you to have more in the future than you would today. Let Black Rockck buy the houses and you keep the sats, not the other way around.

(00:41) You wait until later for Larry Frink to try to sell you a [Music] mansion. And we're live just like that. Just like that. 3:30 on a Friday, Memorial Day weekend. It's a good good good way to end the week and start the holiday weekend. Yes, sir. Yes, sir. Thank you for having me here. Thank you for coming. I wore this hat specifically because I think it's I think it's very apppropo uh to the conversation we're going to have which is I hope an extension of the presentation you gave at Bitblock Boom Huddle for good. You were working on

(01:24) that for many weeks leading up to uh the conference and explaining how you were structuring it. I think it's a very important topic to discuss now as the Bitcoin price is hitting new all-time highs and people are trying to understand what am I doing with Bitcoin? Like you have you have the different sort of factions within Bitcoin.

(01:47) Uh get on a Bitcoin standard, get on zero, spend as much Bitcoin as possible. You have the sailors of the world are saying buy Bitcoin, never sell, die with your Bitcoin. And I think you do a really good job in that presentation. And I just think your understanding overall of Bitcoin is incredible to put everything into context. It's not either or.

(02:07) It really depends on what you want to accomplish. Yeah, it's definitely there there is no actual one-sizefits-all um for I mean nearly anything in this world. So um yeah, I mean first of all I mean there was it was the first conference talk I had given in maybe five years. I think the one prior to that uh was um bit block boom 2019 which was my meme talk which uh has uh become infamous and notorious.

(02:43) So uh there was also a lot of like high expectations uh you know rockstar dev uh has has treated that you know uh that that talk with a lot of reference. a lot of people have enjoyed it and he was expecting this one to be, you know, the greatest one ever, which is a little bit of a little bit of a uh a burden to live up to those kinds of standards.

(03:08) Um, but you know, because I don't give a lot of talks. Um, you know, I I I like to uh try to bring ideas that might even be ideas that are common. So, something like hodling, we all talk about it constantly. uh but try to bring it from a little bit of a different angle and try to give um a little bit of uh new light to it.

(03:31) I alsove I've I've always enjoyed kind of coming at things from a third angle. Um whenever there's, you know, there's there's all these little debates that we have in in Bitcoin and sometimes it's nice to try to uh step out of it and look at it a little more uh kind of objectively and find ways of understanding it that incorporate the truths of of all of them.

(03:58) uh you know cuz I think we should always be kind of as much as possible after ultimate truth. Um so with this one um yeah I was kind of finding that that sort of golden mean. So uh um yeah and I actually I think about that a lot is uh you know Aristotle has his his concept of the golden mean. So it's like any any virtue is sort of between two vices um because you can you can always you can always take something too far.

(04:27) So you're you're always trying to find that right balance. Um so someone who is uh courageous you know uh one of the vices uh on one side is being basically reckless. I I can't remember what word he would use. Uh but effectively being reckless and just wanting to put yourself in danger for no other reason than just you know the thrill of it.

(04:50) Um and then on the other side you would just have cowardice which is like you're unwilling to put yourself um at any risk at any time. Um, and courage is right there in the middle where it's understanding when is the right time uh to put your put yourself, you know, in in the face of danger um and take it on. And so um in some sense this this was kind of me uh in in some ways like I'm obviously a partisan of hodling.

(05:20) Um, I've for, you know, a long time now talked about the, um, why huddling is good, why people do it, why we should expect it. Um, but still trying to find that that sort of golden mean of like yes, huddle, but also what are we hodling for? And it's not we're we're not hodddling just merely for the sake of hodddling.

(05:45) There there is a a purpose to it. And we should think about that. And that would also help us think more about um what are the benefits of of spending, when should we spend, why should we spend, what should we spend on um to actually give light to that sort of side of the debate. Um so that was that was what I was kind of trying to trying to get into.

(06:09) Um, as well as also just uh at the same time despite all the talk of hodling, there's always this perennial uh there's always this perennial dislike of hodlers because we're treated as uh as if um we're just free riding the network or we're just greedy or you know any of these things. And I wanted to show how uh huddling does serve a real economic purpose.

(06:36) Um, and it does benefit the individual, but it also does uh it it has actual real social um benefits as well beyond merely the individual. Um, so I wanted to give that sort of defense of hodling as well to look at it from um a a broader position than just merely I'm trying to get rich. Um uh because even the person who uh that is all they want to do um just like you know your your pure number grow up go up moonboy even that behavior has positive ramifications on on the economy.

(07:14) And while we might look at them and have uh judgments about their particular choices for them as an individual, we shouldn't discount that uh their actions are having positive positive effects for the rest of the economy. Yeah. So, let's dive into that just not even in the context of Bitcoin because I think you did a great job of this in the presentation.

(07:36) just you've done a good job of this consistently throughout the years that I've known you. Just from like a first principles Austrian economics perspective, what is the idea around capital accumulation, low time preference and deployment of that capital like what what like getting getting into like the nitty-gritty and then applying it to Bitcoin? Yeah, it's it's a big question and um in many ways I mean I I even I barely scratched the surface.

(08:05) uh I I can't claim to have read uh all the volumes of Bombber works, you know, capital and interest and and stuff like that. Um but I think there's some some sort of basic concepts that we can look at that we can uh draw a lot out. Um the first uh I guess let's write that. So repeat so like capital time preference. Yeah. Well, I guess getting more broad like why sav -

@ 7f6db517:a4931eda

2025-06-15 06:02:57

@ 7f6db517:a4931eda

2025-06-15 06:02:57

Humanity's Natural State Is Chaos

Without order there is chaos. Humans competing with each other for scarce resources naturally leads to conflict until one group achieves significant power and instates a "monopoly on violence."Power Brings Stability

Power has always been the key means to achieve stability in societies. Centralized power can be incredibly effective in addressing issues such as crime, poverty, and social unrest efficiently. Unfortunately this power is often abused and corrupted.Centralized Power Breeds Tyranny

Centralized power often leads to tyrannical rule. When a select few individuals hold control over a society, they tend to become corrupted. Centralized power structures often lack accountability and transparency, and rely too heavily on trust.Distributed Power Cultivates Freedom

New technology that empowers individuals provide us the ability to rebuild societies from the bottom up. Strong individuals that can defend and provide for themselves will help build strong local communities on a similar foundation. The result is power being distributed throughout society rather than held by a select few.In the short term, relying on trust and centralized power is an easy answer to mitigating chaos, but freedom tech tools provide us the ability to build on top of much stronger distributed foundations that provide stability while also cultivating individual freedom.

The solution starts with us. Empower yourself. Empower others. A grassroots freedom tech movement scaling one person at a time.

If you found this post helpful support my work with bitcoin.

-

@ 9ca447d2:fbf5a36d

2025-06-15 06:02:29

@ 9ca447d2:fbf5a36d

2025-06-15 06:02:29Paris, France – June 6, 2025 — Bitcoin payment gateway startup Flash, just announced a new partnership with the “Bitcoin Only Brewery”, marking the first-ever beverage company to leverage Lightning payments.

Flash enables Bitcoin Only Brewery to offer its “BOB” beer with, no-KYC (Know Your Customer) delivery across Europe, priced at 19,500 sats (~$18) for the 4-pack, shipping included.

The cans feature colorful Bitcoin artwork while the contents promise a hazy pale ale: “Each 33cl can contains a smooth, creamy mouthfeel, hazy appearance and refreshing Pale Ale at 5% ABV,” reads the product description.

Pierre Corbin, Co-Founder of Flash, commented:

“Currently, bitcoin is used more as a store of value but usage for payments is picking up. Thanks to new innovation on Lightning, bitcoin is ready to go mainstream for e-commerce sales.”

Flash, launched its 2.0 version in March 2025 with the goal to provide the easiest bitcoin payment gateway for businesses worldwide. The platform is non-custodial and can enable both digital and physical shops to accept bitcoin by connecting their own wallets to Flash.

By leveraging the scalability of the Lightning Network, Flash ensures instant, low-cost transactions, addressing on-chain Bitcoin bottlenecks like high fees and long wait times.

For businesses interested in adopting Bitcoin payments, Flash offers a straightforward onboarding process, low fees, and robust support for both digital and physical goods. To learn more, visit paywithflash.com.

Media Contact:

Pierre Corbin

Co-Founder, Flash

Email: press@paywithflash.com

Website: paywithflash.comAbout Flash

Flash is the easiest Bitcoin payment gateway for businesses to accept payments. Supporting both digital and physical enterprises, Flash leverages the Lightning Network to enable fast, low-cost Bitcoin transactions. Launched in its 2.0 version in March 2025, Flash is at the forefront of driving Bitcoin adoption in e-commerce.

About Bitcoin Only Brewery

Bitcoin Only Brewery (@Drink_B0B) is a pioneering beverage company dedicated to the Bitcoin ethos, offering high-quality beers payable exclusively in Bitcoin. With a commitment to personal privacy, the brewery delivers across Europe with no-KYC requirements.

-

@ dfa02707:41ca50e3

2025-06-15 06:02:57

@ dfa02707:41ca50e3

2025-06-15 06:02:57News

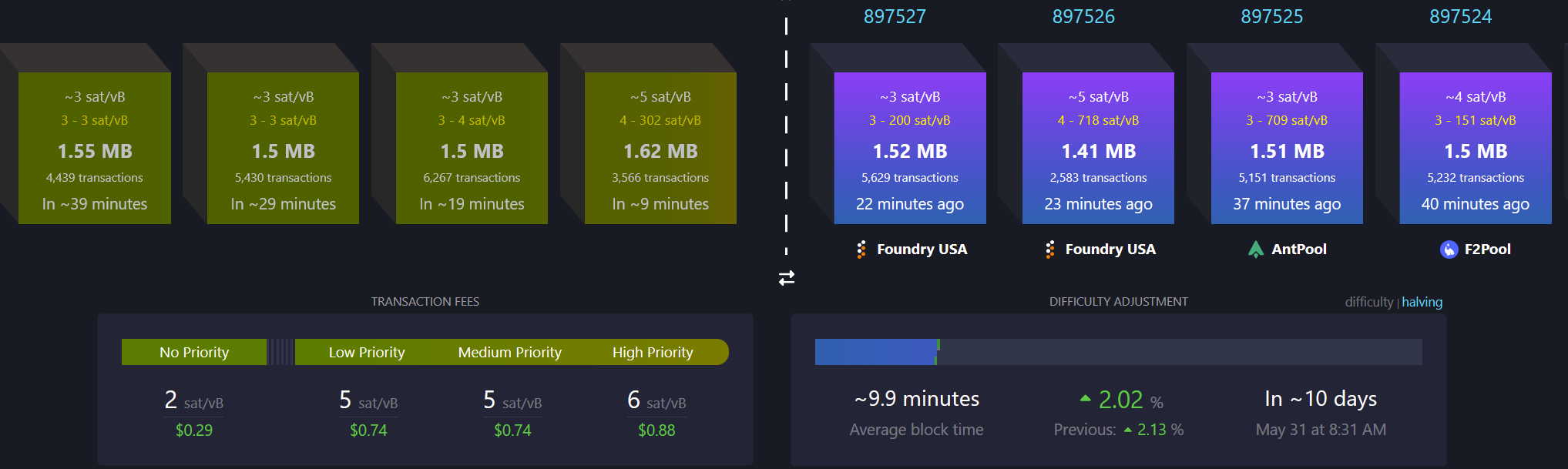

- Bitcoin mining centralization in 2025. According to a blog post by b10c, Bitcoin mining was at its most decentralized in May 2017, with another favorable period from 2019 to 2022. However, starting in 2023, mining has become increasingly centralized, particularly due to the influence of large pools like Foundry and the use of proxy pooling by entities such as AntPool.

Source: b10c's blog.

- OpenSats announces the eleventh wave of Nostr grants. The five projects in this wave are the mobile live-streaming app Swae, the Nostr-over-ham-radio project HAMSTR, Vertex—a Web-of-Trust (WOT) service for Nostr developers, Nostr Double Ratchet for end-to-end encrypted messaging, and the Nostr Game Engine for building games and applications integrated with the Nostr ecosystem.

- New Spiral grantee: l0rinc. In February 2024, l0rinc transitioned to full-time work on Bitcoin Core. His efforts focus on performance benchmarking and optimizations, enhancing code quality, conducting code reviews, reducing block download times, optimizing memory usage, and refactoring code.

- Project Eleven offers 1 BTC to break Bitcoin's cryptography with a quantum computer. The quantum computing research organization has introduced the Q-Day Prize, a global challenge that offers 1 BTC to the first team capable of breaking an elliptic curve cryptographic (ECC) key using Shor’s algorithm on a quantum computer. The prize will be awarded to the first team to successfully accomplish this breakthrough by April 5, 2026.

- Unchained has launched the Bitcoin Legacy Project. The initiative seeks to advance the Bitcoin ecosystem through a bitcoin-native donor-advised fund platform (DAF), investments in community hubs, support for education and open-source development, and a commitment to long-term sustainability with transparent annual reporting.

- In its first year, the program will provide support to Bitcoin hubs in Nashville, Austin, and Denver.

- Support also includes $50,000 to the Bitcoin Policy Institute, a $150,000 commitment at the University of Austin, and up to $250,000 in research grants through the Bitcoin Scholars program.

"Unchained will match grants 1:1 made to partner organizations who support Bitcoin Core development when made through the Unchained-powered bitcoin DAF, up to 1 BTC," was stated in a blog post.

- Block launched open-source tools for Bitcoin treasury management. These include a dashboard for managing corporate bitcoin holdings and provides a real-time BTC-to-USD price quote API, released as part of the Block Open Source initiative. The company’s own instance of the bitcoin holdings dashboard is available here.

Source: block.xyz

- Bull Bitcoin expands to Mexico, enabling anyone in the country to receive pesos from anywhere in the world straight from a Bitcoin wallet. Additionally, users can now buy Bitcoin with a Mexican bank account.

"Bull Bitcoin strongly believes in Bitcoin’s economic potential in Mexico, not only for international remittances and tourism, but also for Mexican individuals and companies to reclaim their financial sovereignty and protect their wealth from inflation and the fragility of traditional financial markets," said Francis Pouliot, Founder and CEO of Bull Bitcoin.

- Corporate bitcoin holdings hit a record high in Q1 2025. According to Bitwise, public companies' adoption of Bitcoin has hit an all-time high. In Q1 2025, these firms collectively hold over 688,000 BTC, marking a 16.11% increase from the previous quarter. This amount represents 3.28% of Bitcoin's fixed 21 million supply.

Source: Bitwise.

- The Bitcoin Bond Company for institutions has launched with the aim of acquiring $1 trillion in Bitcoin over 21 years. It utilizes secure, transparent, and compliant bond-like products backed by Bitcoin.

- The U.S. Senate confirmed Paul Atkins as Chair of the Securities and Exchange Commission (SEC). At his confirmation hearing, Atkins emphasized the need for a clear framework for digital assets. He aims to collaborate with the CFTC and Congress to address jurisdiction and rulemaking gaps, aligning with the Trump administration's goal to position the U.S. as a leader in Bitcoin and blockchain finance.

- Ethereum developer Virgil Griffith has been released from custody. Griffith, whose sentence was reduced to 56 months, is now seeking a pardon. He was initially sentenced to 63 months for allegedly violating international sanctions laws by providing technical advice on using cryptocurrencies and blockchain technology to evade sanctions during a presentation titled 'Blockchains for Peace' in North Korea.

- No-KYC exchange eXch to close down under money laundering scrutiny. The privacy-focused cryptocurrency trading platform said it will cease operations on May 1. This decision follows allegations that the platform was used by North Korea's Lazarus Group for money laundering. eXch revealed it is the subject of an active "transatlantic operation" aimed at shutting down the platform and prosecuting its team for "money laundering and terrorism."

- Blockstream combats ESP32 FUD concerning Jade signers. The company stated that after reviewing the vulnerability disclosed in early March, Jade was found to be secure. Espressif Systems, the designer of the ESP32, has since clarified that the "undocumented commands" do not constitute a "backdoor."

- Bank of America is lobbying for regulations that favor banks over tech firms in stablecoin issuance. The bank's CEO Brian Moynihan is working with groups such as the American Bankers Association to advance the issuance of a fully reserved, 1:1 backed "Bank of America coin." If successful, this could limit stablecoin efforts by non-banks like Tether, Circle, and others, reports The Block.

- Tether to back OCEAN Pool with its hashrate. "As a company committed to financial freedom and open access, we see supporting decentralization in Bitcoin mining as essential to the network’s long-term integrity," said Tether CEO Paolo Ardoino.

- Bitdeer to expand its self-mining operations to navigate tariffs. The Singapore-based mining company is advancing plans to produce machines in the U.S. while reducing its mining hardware sales. This response is in light of increasing uncertainties related to U.S. trade policy, as reported by Bloomberg.

- Tether acquires $32M in Bitdeer shares. The firm has boosted its investment in Bitdeer during a wider market sell-off, with purchases in early to mid-April amounting to about $32 million, regulatory filings reveal.

- US Bitcoin miner manufacturer Auradine has raised $153 million in a Series C funding round as it expands into AI infrastructure. The round was led by StepStone Group and included participation from Maverick Silicon, Premji Invest, Samsung Catalyst Fund, Qualcomm Ventures, Mayfield, MARA Holdings, GSBackers, and other existing investors. The firm raised to over $300 million since its inception in 2022.

- Voltage has partnered with BitGo to [enable](https://www.voltage.cloud/blog/bitgo-and-voltage-team-up-to-deliver-instant-bitcoin-and-stabl

-

@ cae03c48:2a7d6671

2025-06-15 06:01:48

@ cae03c48:2a7d6671

2025-06-15 06:01:48Bitcoin Magazine

Coinbase Announces Bitcoin Rewards Credit Card, Offering up to 4% BTC Back on EverythingCoinbase is launching its first-ever branded credit card in partnership with American Express, set to roll out this fall. Called the Coinbase One Card, it will be available only to U.S. members of Coinbase One, the platform’s monthly subscription service. The card will offer 2% to 4% back in Bitcoin on everyday purchases, along with access to American Express perks.

JUST IN: Coinbase launches credit card allowing users to earn up to 4% bitcoin back on every purchase

pic.twitter.com/d6pdNZV4pi

pic.twitter.com/d6pdNZV4pi— Bitcoin Magazine (@BitcoinMagazine) June 12, 2025

This is a first-of-its-kind product for Coinbase, which previously only offered a prepaid debit card with Visa in 2020.

“We see real potential in the combination of Coinbase and crypto with the powerful backing of American Express, and what the card offers is an excellent mix of what customers are looking for right now,” said Will Stredwick, head of American Express global network services, during the Coinbase State of Crypto Summit in New York.

The card is part of a larger push by Coinbase to expand its subscription-based services. Coinbase One costs $29.99/month and includes zero trading fees, higher staking rewards, and customer support perks. The company also announced a cheaper version—Coinbase Basic—for $4.99/month or $49.99/year, which includes fewer features.

Coinbase’s subscription business is growing fast. It brought in $698.1 million in Q1 2025, compared to $1.26 billion in trading revenue. According to William Blair analyst Andrew Jeffrey, this kind of recurring revenue is a big reason why long-term investors are sticking with the stock.

Launched in 2023, Coinbase One now has over a million members. The company has been steadily growing its ecosystem with products like its Base developer platform and a self-custody wallet.

The company has long positioned Bitcoin at the center of its strategy—offering BTC custody services to institutions, supporting Bitcoin ETFs, integrating Bitcoin rewards into its products, and actively advocating for Bitcoin-friendly regulation in Washington. Coinbase also supports Bitcoin development directly through funding grants and engineering support. As the largest publicly traded crypto exchange in the U.S., Coinbase continues to frame Bitcoin not just as an asset, but as the foundation of its long-term vision.

This post Coinbase Announces Bitcoin Rewards Credit Card, Offering up to 4% BTC Back on Everything first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ dfa02707:41ca50e3

2025-06-15 06:02:55

@ dfa02707:41ca50e3

2025-06-15 06:02:55Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ 8d34bd24:414be32b

2025-06-15 03:31:00

@ 8d34bd24:414be32b

2025-06-15 03:31:00How do you look at the things in your life?

-

Do you focus on your physical problems or do you look forward to your resurrection body in heaven?

-

Do you spend your time trying to fix the corruption in government or do you spend your time trying to bring as many people as possible home to heaven?

-

When you see someone suffering do you first pray for their physical healing or do you pray for their spiritual healing?

-

Do you work to fit in with the people around you or do you work to become more Christ-like?

-

Do you crave entertainment or do you crave biblical enrichment?

-

Do you focus more on your citizenship here on earth or more on your eternal citizenship?

-

Do you seek fellowship with the people of this world or do you seek fellowship with your Savior?

-

Do you look at people’s faults and how they hurt you or do you look at their hurt and separation from God and seek to bring them to Jesus?

-

Do you spend your time on work and entertainment or do you spend your time studying the word of God, praying to God, and telling others about God?

Do you have an earthly or an eternal perspective?

Physical or Spiritual Needs

Jesus always had an eternal perspective. This event is just one example.

One day He was teaching; and there were some Pharisees and teachers of the law sitting there, who had come from every village of Galilee and Judea and from Jerusalem; and the power of the Lord was present for Him to perform healing. And some men were carrying on a bed a man who was paralyzed; and they were trying to bring him in and to set him down in front of Him. But not finding any way to bring him in because of the crowd, they went up on the roof and let him down through the tiles with his stretcher, into the middle of the crowd, in front of Jesus. Seeing their faith, He said, “Friend, your sins are forgiven you.” The scribes and the Pharisees began to reason, saying, “Who is this man who speaks blasphemies? Who can forgive sins, but God alone?” But Jesus, aware of their reasonings, answered and said to them, “Why are you reasoning in your hearts? Which is easier, to say, ‘Your sins have been forgiven you,’ or to say, ‘Get up and walk’? But, so that you may know that the Son of Man has authority on earth to forgive sins,”—He said to the paralytic—“I say to you, get up, and pick up your stretcher and go home.” (Luke 5:17-24) {emphasis mine}

In this familiar story a man who was paralyzed was brought to Jesus for healing. The paralytic’s friends worked so hard to get him physically healed that they hauled him up on the roof, dug through the roof, and lowered him down in front of Jesus. What was Jesus’s response? Jesus forgave the man’s sins. Every person there saw the man’s need to be able to walk, so he could take care of himself here on earth. Jesus saw the more important spiritual need and forgave his sins. After taking care of his eternal need, he also took care of his more earthly need and healed him physically.

Do you see people’s eternal need or do you just see their physical needs or worse, only see their earthly failings? Do you only see the hurt they are causing you or do you see the hurt they feel that comes from being separated from God?

Earthly or Heavenly Citizenship

I’ve been involved in politics for many years. I’ve been to precinct, county, state, and national conventions. I’ve written, debated, and defended political platforms and resolutions. I vote every election. All of that is good and useful, but is that where we are supposed to spend most of our time and effort? I’ve come to the conclusion that this is not what is most important.

For our citizenship is in heaven, from which also we eagerly wait for a Savior, the Lord Jesus Christ; who will transform the body of our humble state into conformity with the body of His glory, by the exertion of the power that He has even to subject all things to Himself. (Philippians 3:20-21)

We are told that our citizenship is in heaven. The majority of our effort should be put into support of our heavenly citizenship, not our earthly citizenship. That doesn’t mean that we should let our earthly kingdom fall apart and turn away from God, but it does mean we should be more focused on turning hearts and minds to Jesus than we are with setting domestic laws. We should be more focused on worshipping God than supporting politicians.

Sadly I see too many Christians who focus on pushing the “Pledge of Allegiance to the Flag” than they do pushing loyalty to Jesus. I see too many Christians who put all of their effort into electing the “right” politician instead of pointing people to the real Savior. I see too many Christians who try to pass the “right” laws instead of reading the law of God. I see too many Christians who put all of their effort into changing people’s minds to the “right” party instead of changing hearts and minds for Christ.

Do you really seek the kingdom of God or are you only focused on your earthly nation? Do you spend more time trying to win people for your political party than you do trying to win people for Christ? Our primary focus should be on the Millennial Kingdom of Christ and on eternity in heaven with Jesus, not on our earthly country.

Yes, we are to be a light in the world and we should seek the good of our earthly nations, but sharing the gospel, living a life honoring to God, and doing everything within our power to draw people to Jesus should be our focus and where we put most of our effort.

And He came and preached peace to you who were far away, and peace to those who were near; for through Him we both have our access in one Spirit to the Father. So then you are no longer strangers and aliens, but you are fellow citizens with the saints, and are of God’s household, having been built on the foundation of the apostles and prophets, Christ Jesus Himself being the corner stone, in whom the whole building, being fitted together, is growing into a holy temple in the Lord, in whom you also are being built together into a dwelling of God in the Spirit. (Ephesians 2:17-22)

The Hurt They Cause or the Hurt They Feel

People today are selfish and hurtful. Most people are trying to be the greatest victim which means they are accusing others of being abusers, tyrants, or haters. People are impolite, inconsiderate, and sometimes downright hateful. How do you respond?

Do you attack back when you are attacked? Are you rude back when you are treated rudely? Do you only see how others hurt you or can you see the hurt behind the hurtful behavior?

Most of the people who are striking out with hate and anger are truly hurting people. They have been taught that they are evolved pond scum and feel hopeless. They have been mistreated by other hurting people. They have been taught to be victims and to hate anyone who may not be a victim. Instead of feeling hate, we should feel compassion.

In Matthew 18:21-35 Jesus tells a parable of a master who forgives his slave of his debts, but then that slave does not show the same mercy to another who owes him much less. The slave is rebuked.

Then summoning him, his lord said to him, ‘You wicked slave, I forgave you all that debt because you pleaded with me. Should you not also have had mercy on your fellow slave, in the same way that I had mercy on you?’ (Matthew 18:32-33)

God loved us before we loved Him. Jesus forgave us far more than we can ever forgive others. After all Jesus did for us, we should be forgiving like He is. We should see other’s hurt and eternal destination and have compassion on them. Instead of treating them the way we were treated, we should treat them like Jesus treated us. We should seek their eternal good above our momentary comfort.

And He said to them, “Come away by yourselves to a secluded place and rest a while.” (For there were many people coming and going, and they did not even have time to eat.) They went away in the boat to a secluded place by themselves.

The people saw them going, and many recognized them and ran there together on foot from all the cities, and got there ahead of them. When Jesus went ashore, He saw a large crowd, and He felt compassion for them because they were like sheep without a shepherd; and He began to teach them many things. (Mark 6:31-34) {emphasis mine}

Just as Jesus had compassion for the crowd and their spiritual needs when He and His disciples had need of food and rest, in the same way we should sacrifice our egos to minister to the spiritual needs of those that may seem unlovable because of their eternal need.

May the Lord of Heaven help us to have an eternal perspective and to view everything and everyone with that eternal and spiritual perspective so we can faithfully serve Jesus and bring with us a plentiful harvest. May Jesus use us for His glory and for the eternal good of those around us.

-

-

@ 3c389c8f:7a2eff7f

2025-06-15 03:22:13

@ 3c389c8f:7a2eff7f

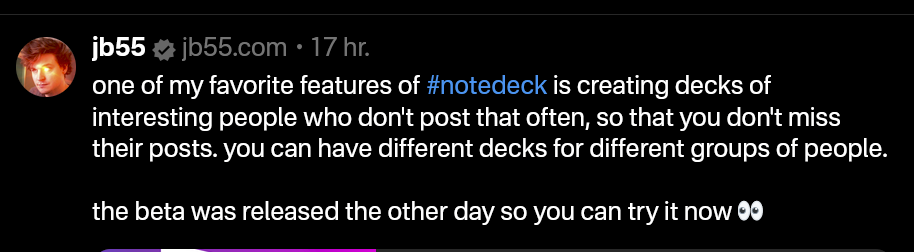

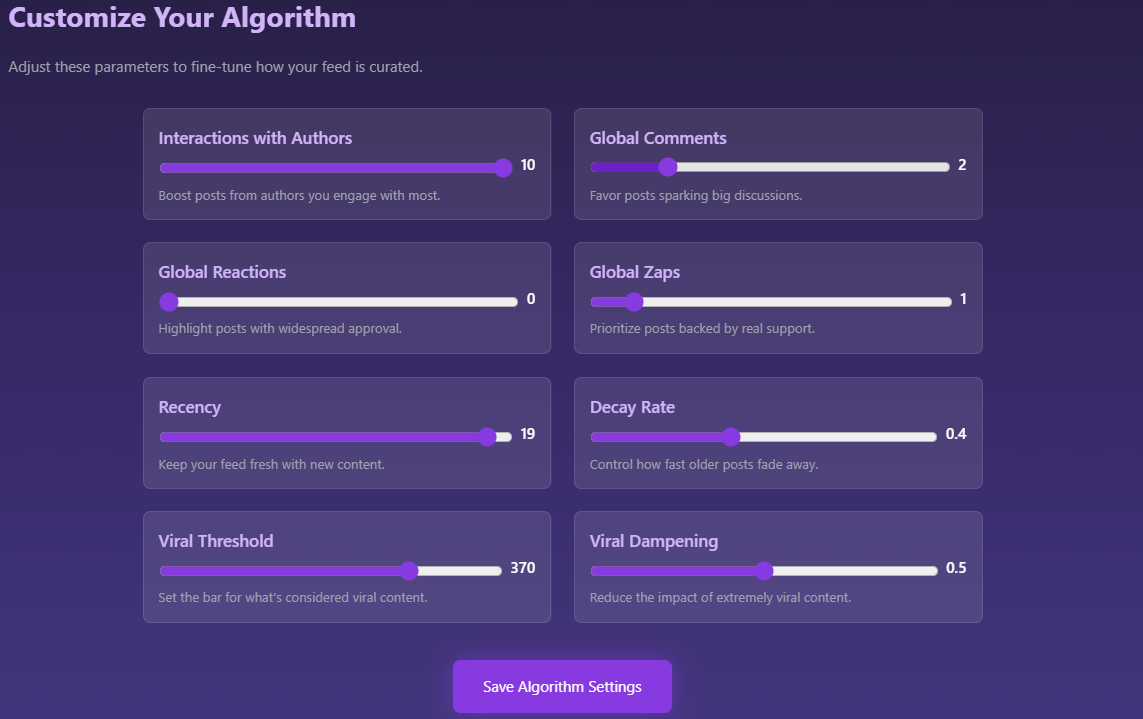

2025-06-15 03:22:13Nostr's first algorithmic relay feed, was introduced by prolific Nostr user, builder, and supporter, utxo the webmaster and the Bitvora team. This idea takes control of your algorithms away from 3rd parties and puts it directly in the user's hands. The system was designed to give readers the ability to choose who and what they want to see in their Nostr feed, and at what frequency, while also encouraging discovery of new and interesting content. The design keeps in mind that users may not want to see posts that are inflammatory or contentious like ad-driven algorithms assume, but ones that simply generate interesting conversations. On top of that, it is also clearly designed to incentivize users to spend time offline and still keeping up with things that are important to them online.

After playing with the various settings, I have been pleasantly surprised with how well it works. To set up your individualized algo relay feed, you simply visit the landing page and sign in with your signer of choice. You will first be presented with some information about your network and the authors you interact with the most. This is a neat little bonus to me. I can clearly see the profiles that provide me with value, whether it be through learning, friendship, or professional (whatever that means). It gives me a good feeling to see who has been worthy of my attention, and I imagine if I were one to engage in defensive online discussions, the presentation of these authors might make me take a second look at my own behavior. Maybe the idea of anyone else doing that is a pipedream, but I like the thought. Just beyond the network information are some insightful statistics about the ways you engage online, like how often you post and reply.

Towards the bottom of the page are your actual settings:

As you can see, there are a variety of settings that all will impact the way that your personalized feed is built. Simply make some adjustments that feel right for you and click save. Your personalized algorithm feed will be available to you in any client that enables relay browsing, like Jumble and Coracle. It is worth trying out a couple of different formulas, as they are quite effective. Once you find a balance that feels right, you can just save the relay as a favorite for easy access, and basically forget about it. They relay will keep your settings to build your personalized Nostr feed whenever you connect. If at any time you need a change, just revisit the page and make your adjustments. The software is open source, making it possible to host your own for yourself and your friends.

I have found a lot of interesting content and people through the Nostr AlgoRelay. My first few settings adjustments didn't quite suit what I was looking for, but a few tweaks brought forth notes from some of my favorite people that I had missed but not stuff that was really outdated, a few notes from popular figureheads, and some things that my friends were engaging with that I did not know about prior. I highly recommend giving it a try, beyond a quick glance. The true value of this relay grows in time, as you go about life and come back to visit your Nostr world.

-

@ c1e9ab3a:9cb56b43

2025-06-15 00:36:39

@ c1e9ab3a:9cb56b43

2025-06-15 00:36:391. Introduction

The 21st century is marked by a rare confluence of demographic, technological, and monetary regime shifts. As birth rates fall below replacement levels across advanced and many emerging economies, global population growth slows and begins to reverse. At the same time, automation, AI, and robotics are increasing productivity at an accelerating pace. Simultaneously, trust in central banks and fiat currencies is waning, giving rise to calls for a return to hard currencies (e.g., gold, Bitcoin) and decentralized monetary systems.

These trends pose stark challenges to existing economic theories and institutions. This paper explores their implications through two opposing lenses: Keynesian economics and Austrian (Misesian) economics.

2. The Keynesian Reaction: Deflation, Demand Collapse, and the Paradox of Thrift

2.1. Demand-Side Fragility in a Shrinking Population

Keynesian theory is rooted in the principle that aggregate demand drives output and employment. A declining population implies a falling consumption base, which directly reduces aggregate demand. Combined with increased longevity, this trend leads to a larger retired population disinclined to spend, creating persistent demand shortfalls.

2.2. Technological Unemployment and Reduced Income Velocity

Rapid productivity gains from AI and robotics may displace large segments of labor, leading to unemployment or underemployment. With fewer wage earners and heightened uncertainty, consumption slows further. Even if goods become cheaper, widespread income insecurity constrains the ability to buy them.

2.3. The Paradox of Thrift

In times of uncertainty, both individuals and businesses tend to save more. Keynes argued that if everyone saves, aggregate demand collapses because one person’s spending is another’s income. Thus, increased saving leads to lower incomes, which reduces saving in aggregate—a self-reinforcing contraction.

2.4. Retreat from Fiat and Central Banking: A Catastrophic Constraint

Abandoning fiat currency and central banking removes the government’s ability to perform countercyclical policy. Interest rates cannot be lowered below zero; money supply cannot be expanded to fill demand gaps. In such a regime, deflation becomes chronic, debt burdens rise in real terms, and recovery mechanisms are neutered.

Conclusion (Keynesian):

The combined effect of declining population, rising productivity, and a hard money transition is catastrophic. It leads to a deflationary spiral, mass unemployment, debt crises, and secular stagnation unless aggressively offset by expansive fiscal and monetary policy—tools unavailable in a hard currency system.

3. The Misesian Rebuttal: Market Coordination and the Natural Order of Decline

3.1. Savings as Capital Formation

Mises and the Austrian School reject the paradox of thrift. Savings are not lost demand; they are deferred consumption that funds capital investment. Increased saving, in a free market, lowers interest rates and reallocates resources toward longer-term, higher-order production.

3.2. Deflation as a Signal of Progress

Falling prices due to productivity gains are not a crisis but a benefit. Consumers gain real wealth. Entrepreneurs adjust cost structures. As long as wages and prices are flexible, deflation reflects abundance, not failure.

3.3. Population Decline as Economic Recalibration

A shrinking population reduces demand, yes—but it also reduces the labor supply. Wages rise in real terms. Capital intensity per worker increases. There is no systemic unemployment if labor markets are free and responsive.

3.4. Hard Currency as Restoration of Market Coordination

Transitioning to a hard currency purges fiat-induced malinvestment and restores the price mechanism. With no artificial credit expansion, capital is allocated based on real savings. Booms and busts are mitigated, and long-term planning becomes reliable.

Conclusion (Misesian):

There is no crisis. A hard currency, high-productivity, low-population economy stabilizes at a new equilibrium of lower consumption, higher capital intensity, and rising real wealth. Deflation is natural. Savings are the seed of future prosperity. Government interference, not market adaptation, is the threat.

4. Final Synthesis

The Keynesian and Misesian views diverge on first principles: Keynes sees demand shortfalls and rigidities requiring top-down correction, while Mises sees market-coordinated adaptation as sufficient and self-correcting. As the 21st century evolves, this ideological conflict will shape whether the transition leads to depression or renewal.

References

- Keynes, J.M. The General Theory of Employment, Interest and Money

- Mises, L. Human Action

- Hayek, F.A. Prices and Production

- Böhm-Bawerk, E. Capital and Interest

- Friedman, M. A Program for Monetary Stability

-

@ f7d424b5:618c51e8

2025-06-14 21:53:35

@ f7d424b5:618c51e8

2025-06-14 21:53:35GAMERS, we're back in the virtual studio for another sophisticated and gentlemanly discussion on the most important topic in the media landscape: huge anime tiddies on the best and baddest Bodytype Bs you've ever seen. I think the VA strike ended too or something.

Stuff cited:

- SB steam charts

- Commentary by Megan Shipman

- Mujin video that shows the leaked discord messages from the SAG discord

Obligatory:

- Listen to the new episode here!

- Discuss this episode on OUR NEW FORUM

- Get the RSS and Subscribe (this is a new feed URL, but the old one redirects here too!)

- Get a modern podcast app to use that RSS feed on at newpodcastapps.com

- Or listen to the show on the forum using the embedded Podverse player!

- Send your complaints here

Reminder that this is a Value4Value podcast so any support you can give us via a modern podcasting app is greatly appreciated and we will never bow to corporate sponsors!

-

@ dfa02707:41ca50e3

2025-06-15 06:02:54

@ dfa02707:41ca50e3

2025-06-15 06:02:54Contribute to keep No Bullshit Bitcoin news going.

-

Version 1.3 of Bitcoin Safe introduces a redesigned interactive chart, quick receive feature, updated icons, a mempool preview window, support for Child Pays For Parent (CPFP) and testnet4, preconfigured testnet demo wallets, as well as various bug fixes and improvements.

-

Upcoming updates for Bitcoin Safe include Compact Block Filters.

"Compact Block Filters increase the network privacy dramatically, since you're not asking an electrum server to give you your transactions. They are a little slower than electrum servers. For a savings wallet like Bitcoin Safe this should be OK," writes the project's developer Andreas Griffin.

- Learn more about the current and upcoming features of Bitcoin Safe wallet here.

What's new in v1.3

- Redesign of Chart, Quick Receive, Icons, and Mempool Preview (by @design-rrr).

- Interactive chart. Clicking on it now jumps to transaction, and selected transactions are now highlighted.

- Speed up transactions with Child Pays For Parent (CPFP).

- BDK 1.2 (upgraded from 0.32).

- Testnet4 support.

- Preconfigured Testnet demo wallets.

- Cluster unconfirmed transactions so that parents/children are next to each other.

- Customizable columns for all tables (optional view: Txid, Address index, and more)

- Bug fixes and other improvements.

Announcement / Archive

Blog Post / Archive

GitHub Repo

Website -

-

@ dfa02707:41ca50e3

2025-06-15 06:02:54

@ dfa02707:41ca50e3

2025-06-15 06:02:54Contribute to keep No Bullshit Bitcoin news going.

- "Today we're launching the beta version of our multiplatform Nostr browser! Think Google Chrome but for Nostr apps. The beta is our big first step toward this vision," announced Damus.

- This version comes with the Dave Nostr AI assistant, support for zaps and the Nostr Wallet Connect (NWC) wallet interface, full-text note search, GIFs and fullscreen images, multiple media uploads, user tagging, relay list and mute list support, along with a number of other improvements."

"Included in the beta is the Dave, the Nostr AI assistant (its Grok for Nostr). Dave is a new Notedeck browser app that can search and summarize notes from the network. For a full breakdown of everything new, check out our beta launch video."

What's new

- Dave Nostr AI assistant app.

- GIFs.

- Fulltext note search.

- Add full screen images, add zoom, and pan.

- Zaps! NWC/ Wallet UI.

- Introduce last note per pubkey feed (experimental).

- Allow multiple media uploads per selection.

- Major Android improvements (still WIP).

- Added notedeck app sidebar.

- User Tagging.

- Note truncation.

- Local network note broadcast, broadcast notes to other notedeck notes while you're offline.

- Mute list support (reading).

- Relay list support.

- Ctrl-enter to send notes.

- Added relay indexing (relay columns soon).

- Click hashtags to open hashtag timeline.

- Fixed timelines sometimes not updating (stale feeds).

- Fixed UI bounciness when loading profile pictures

- Fixed unselectable post replies.

-

@ dfa02707:41ca50e3

2025-06-15 06:02:53

@ dfa02707:41ca50e3

2025-06-15 06:02:53News

- Wallet of Satoshi teases a comeback in the US market with a non-custodial product. According to an announcement on X, the widely popular custodial Lightning wallet is preparing to re-enter the United States market with a non-custodial wallet. It is unclear whether the product will be open-source, but the project has clarified that "there will be no KYC on any Wallet of Satoshi, ever!" Wallet of Satoshi ceased serving customers in the United States in November 2023.

- Vulnerability disclosure: Remote crash due to addr message spam in Bitcoin Core versions before v29. Bitcoin Core developer Antoine Poinsot disclosed an integer overflow bug that crashes a node if spammed with addr messages over an extended period. A fix was released on April 14, 2025, in Bitcoin Core v29.0. The issue is rated Low severity.

- Coinbase Know Your Customer (KYC) data leak. The U.S. Department of Justice, including its Criminal Division in Washington, is investigating a cyberattack on Coinbase. The incident involved cybercriminals attempting to extort $20 million from Coinbase to prevent stolen customer data from being leaked online. Although the data breach affected less than 1% of the exchange's users, Coinbase now faces at least six lawsuits following the revelation that some customer support agents were bribed as part of the extortion scheme.

- Fold has launched Bitcoin Gift Cards, enabling users to purchase bitcoin for personal use or as gifts, redeemable via the Fold app. These cards are currently available on Fold’s website and are planned to expand to major retailers nationwide later this year.

"Our mission is to make bitcoin simple and approachable for everyone. The Bitcoin Gift Card brings bitcoin to millions of Americans in a familiar way. Available at the places people already shop, the Bitcoin Gift Card is the best way to gift bitcoin to others," said Will Reeves, Chairman and CEO of Fold.

- Corporate treasuries hold nearly 1.1 million BTC, representing about 5.5% of the total circulating supply (1,082,164 BTC), per BitcoinTreasuries.net data. Recent purchases include Strategy adding 7,390 BTC (total: 576,230 BTC), Metplanet acquiring 1,004 BTC (total: 7,800 BTC), Tether holding over 100,521 BTC, and XXI Capital, led by Jack Mallers, starting with 31,500 BTC.

- Meanwhile, a group of investors has filed a class action lawsuit against Strategy and its executive Michael Saylor. The lawsuit alleges that Strategy made overly optimistic projections using fair value accounting under new FASB rules while downplaying potential losses.

- The U.S. Senate voted to advance the GENIUS stablecoin bill for further debate before a final vote to pass it. Meanwhile, the House is crafting its own stablecoin legislation to establish a regulatory framework for stablecoins and their issuers in the U.S, reports CoinDesk.

- French 'crypto' entrepreneurs get priority access to emergency police services. French Minister of the Interior, Bruno Retailleau, agreed on measures to enhance security for 'crypto' professionals during a meeting on Friday. This follows a failed kidnapping attempt on Tuesday targeting the family of a cryptocurrency exchange CEO, and two other kidnappings earlier this year.

- Brussels Court declares tracking-based ads illegal in EU. The Brussels Court of Appeal ruled tracking-based online ads illegal in the EU due to an inadequate consent model. Major tech firms like Microsoft, Amazon, Google, and X are affected by the decision, as their consent pop-ups fail to protect privacy in real-time bidding, writes The Record.

- Telegram shares data on 22,777 users in Q1 2025, a significant increase from the 5,826 users' data shared during the same period in 2024. This significant increase follows the arrest of CEO and founder Pavel Durov last year.

- An Australian judge has ruled that Bitcoin is money, potentially exempting it from capital gains tax in the country. If upheld on appeal, this interim decision could lead to taxpayer refunds worth up to $1 billion, per tax lawyer Adrian Cartland.

Use the tools

- Bitcoin Safe v1.3.0 a secure and user-friendly Bitcoin savings wallet for beginners and advanced users, introduces an interactive chart, Child Pays For Parent (CPFP) support, testnet4 compatibility, preconfigured testnet demo wallets, various bug fixes, and other improvements.

- BlueWallet v7.1.8 brings numerous bug fixes, dependency updates, and a new search feature for addresses and transactions.

- Aqua Wallet v0.3.0 is out, offering beta testing for the reloadable Dolphin card (in partnership with Visa) for spending bitcoin and Liquid BTC. It also includes a new Optical Character Recognition (OCR) text scanner to read text addresses like QR codes, colored numbers on addresses for better readability, a reduced minimum for spending and swapping Liquid Bitcoin to 100 sats, plus other fixes and enhancements.

Source: Aqua wallet.

- The latest firmware updates for COLDCARD Mk4 v5.4.3 and Q v1.3.3 are now available, featuring the latest enhancements and bug fixes.

- Nunchuk Android v1.9.68.1 and iOS v1.9.79 introduce support for custom blockchain explorers, wallet archiving, re-ordering wallets on the home screen via long-press, and an anti-fee sniping setting.

- BDK-cli v1.0.0, a CLI wallet library and REPL tool to demo and test the BDK library, now uses bdk_wallet 1.0.0 and integrates Kyoto, utilizing the Kyoto protocol for compact block filters. It sets SQLite as the default database and discontinues support for sled.

- publsp is a new command-line tool designed for Lightning node runners or Lightning Service Providers (LSPs) to advertise liquidity offers over Nostr.

"LSPs advertise liquidity as addressable Kind 39735 events. Clients just pull and evaluate all those structured events, then NIP-17 DM an LSP of their choice to coordinate a liquidity purchase," writes developer smallworlnd.

-

Lightning Blinder by Super Testnet is a proof-of-concept privacy tool for the Lightning Network. It enables users to mislead Lightning Service Providers (LSPs) by making it appear as though one wallet is the sender or recipient, masking the original wallet. Explore and try it out here.

-

Mempal v1.5.3, a Bitcoin mempool monitoring and notification app for Android, now includes a swipe-down feature to refresh the dashboard, a custom time option for widget auto-update frequency, and a

-

@ 8671a6e5:f88194d1

2025-06-14 21:39:15

@ 8671a6e5:f88194d1

2025-06-14 21:39:15 ## ParentCoin; limitless

## ParentCoin; limitlessThere's this almost altcoin-like pitch of parenthood these days. I might’ve fallen for the shiny marketing of parenthood — cute baby pics, promises of legacy, the whole “you’ll change the world” vibe. I even heard a would-be mom tell me once (true story) "You know having children, you don't have to be afraid of it, as a dad it doesn't cost as much as you think". \ These people actually believe that. Just like they've fallen for every fiat-scam out there: housing, cars, holidays in France, Nike shoes, 50% taxation, religion and main stream media subscriptions.\ \ It’s 2025, and I’m revisiting this like I’d revisit an old Lightning Network post. \ \ Having kids is like chasing an altcoin airdrop with a slick but buzzword laden whitepaper and a charismatic founder who’s probably exit-scamming as soon as he gets enough of your money in their bank account (yeah you see what I did there). If you're lucky that founder might twerk from time to time to get your attention. But don't hope for too much. Now change that diaper and work an extra job to pay for all of it while inflation murders you.\ \ While you do all that, the most damaging thing about the Having Children Shitcoin (HCS) is the time it takes. It literally can't be shorted like some token on an exchange. It laughs, plays around with your tech gadgets, has to be potty trained (like some altcoin founders) and needs attention, education and a lot of proof of work.\ But the damage is the time. \ The time it takes to do all that, is actually replacing value with time. \ Bitcoin might be a product of proof of work, HCS is not a product but the actual proof of work without the value proposition.\ On top of that, the founder usually lives rent-free in your head your whole life, or even worse: you literally live together with her/him.\ Imagine Satoshi Nakamoto living at your house right now. Like... hi Satoshi.. love your bitcoin man.\ "Yeah, thanks moth**f****r, when are going to buy more skittle and some toilet paper? We ran out 10 minutes ago when I shit all over your dirty toilet, ..."\ "Eh, But Satoshi, why don't you go to the shop to..."\ "Shut up you f'ing a--hole, you made me! You made me what I am today! You liked me when I invented thàh bitcoin right? Now get me some toilet paper and here's a list of items I want from the supermarket! Lazy dumb idiot."\ "You'll clean up the kitchen right?"\ "Yeah yeah, rolls eyes, after my Netflix series man... now get out"\ \ This might sound far-fetched but founders of shitcoins steal your money, while children steal your time ànd money while you have to endure the founders as well.

Time is slowly damaging you while you live your life further and further away from the hard-money proposition. Hell, you even will need to sell some hard money to get by. Because it's a rotten world and children make you short sighted about the future (it limits you to maximum 3 years ahead in my experience with people around me).

Long-term is your enemy Short-term is your prison

You’re hyped for the long-term gains—multi-generational dynasties, just like the elites—but the fine print? It’s a mess. I’m here to unpack the hope, the scepticism, and the grim reality of raising kids in a world that feels like it’s speedrunning towards the absolute bottom. Let me make that clearer:

Our power (as bitcoiners) doesn't grow with these new generations, because we're being out-Idiocracy'd at a rate we can’t reproduce our way out of. Bitcoiners don’t scale. Even if you produce two children that both become die-hard bitcoin maximalists (with a nasal voice and a fondness for TD-sequential analysis.

The Mirage of Birth Having a kid is like snagging a hyped-up crypto airdrop. You’re told it’s “free” value — new life, pure joy, a legacy token dropped into your wallet. Everyone’s tweeting about it, posting ultrasound pics like they just scored 10,000 USDC worth of free shitcoin tokens.

But then the transaction fees hit, getting another place to live more accommodating, getting a school, adopt a dad body demeaner while torpedoing your social life and having no fun other than baking cakes and getting less pussy than a laser pointer with dead batteries. Adjust for inflation), sleepless nights, a vortex of money being vaporized and a lifetime of HODLing a position you can’t dump nor short. You’re basically the holder of last resort for a diatribe of chaos. You’re the entry, the trade, and exit liquidity. The real kicker? Society’s cheering you on while you’re stuck debugging your life and seeing your time drained. You’re frozen in time, while you should be scaling ideas. \ \ Or getting more out of life than being the channelling of funds to a future fiat oppressed kid. Meanwhile, parents (if they stay together that is... with relations with kids having their own version of the bitcoin “halving”, be it every 7 years or so. The parents follow the higher noble goal and get some love and nice moments in return. \ \ They’re stacking diapers instead of sats, living above a dry cleaner next to a subway station that rattles your soul. You can’t short kids, no matter how much you see the “childfree” crowd thriving. The childfree crowd is also not always that neutral, as many of them want this same life, because the marketing, as with many shitcoins is excellent. It makes life more fun, more fulfilling, more whole, while promising you cheap, fast and always immutable transactions. You’re getting duped. \ You buy more stuff, more hobbies no one cares about, and smile at other parents at these gatherings like you’re at the whale room at a bitcoin conference in a bear market. Keep smiling, bitches. That’s you’re life now. The numbers don’t lie. Society sells parenthood as a Bitcoin-level HODL, but the safety net is thinner than a layer-2 solution created by an Albanian exchange.