-

@ dfa02707:41ca50e3

2025-06-14 20:02:28

@ dfa02707:41ca50e3

2025-06-14 20:02:28Contribute to keep No Bullshit Bitcoin news going.

News

- Spiral welcomes Ben Carman. The developer will work on the LDK server and a new SDK designed to simplify the onboarding process for new self-custodial Bitcoin users.

- Spiral renews support for Dan Gould and Joschisan. The organization has renewed support for Dan Gould, who is developing the Payjoin Dev Kit (PDK), and Joschisan, a Fedimint developer focused on simplifying federations.

- The Bitcoin Dev Kit Foundation announced new corporate members for 2025, including AnchorWatch, CleanSpark, and Proton Foundation. The annual dues from these corporate members fund the small team of open-source developers responsible for maintaining the core BDK libraries and related free and open-source software (FOSS) projects.

- The European Central Bank is pushing for amendments to the European Union's Markets in Crypto Assets legislation (MiCA), just months after its implementation. According to Politico's report on Tuesday, the ECB is concerned that U.S. support for cryptocurrency, particularly stablecoins, could cause economic harm to the 27-nation bloc.

- Slovenia is considering a 25% capital gains tax on Bitcoin profits for individuals. The Ministry of Finance has proposed legislation to impose this tax on gains from cryptocurrency transactions, though exchanging one cryptocurrency for another would remain exempt. At present, individual 'crypto' traders in Slovenia are not taxed.

- The Virtual Asset Service Providers (VASP) Bill 2025 introduced in Kenya. The new legislation aims to establish a comprehensive legal framework for licensing, regulating, and supervising virtual asset service providers (VASPs), with strict penalties for non-compliant entities.

- Circle, BitGo, Coinbase, and Paxos plan to apply for U.S. bank charters or licenses. According to a report in The Wall Street Journal, major crypto companies are planning to apply for U.S. bank charters or licenses. These firms are pursuing limited licenses that would permit them to issue stablecoins, as the U.S. Congress deliberates on legislation mandating licensing for stablecoin issuers.

"Established banks, like Bank of America, are hoping to amend the current drafts of [stablecoin] legislation in such a way that nonbanks are more heavily restricted from issuing stablecoins," people familiar with the matter told The Block.

- Paul Atkins has officially assumed the role of the 34th Chairman of the US Securities and Exchange Commission (SEC). This is a return to the agency for Atkins, who previously served as an SEC Commissioner from 2002 to 2008 under the George W. Bush administration. He has committed to advancing the SEC’s mission of fostering capital formation, safeguarding investors, and ensuring fair and efficient markets.

- Federal Reserve retracts guidance discouraging banks from engaging in 'crypto.' The U.S. Federal Reserve withdrew guidance that discouraged banks from crypto and stablecoin activities, as announced by its Board of Governors on Thursday. This includes rescinding a 2022 supervisory letter requiring prior notification of crypto activities and 2023 stablecoin requirements.

"As a result, the Board will no longer expect banks to provide notification and will instead monitor banks' crypto-asset activities through the normal supervisory process," reads the FED statement.

- Russian government to launch a cryptocurrency exchange. The country's Ministry of Finance and Central Bank announced plans to establish a trading platform for "highly qualified investors" that "will legalize crypto assets and bring crypto operations out of the shadows."

- Twenty One Capital is set to launch with over 42,000 BTC in its treasury. This new Bitcoin-native firm, backed by Tether and SoftBank, is planned to go public via a SPAC merger with Cantor Equity Partners and will be led by Jack Mallers, co-founder and CEO of Strike. According to a report by the Financial Times, the company aims to replicate the model of Michael Saylor with his company, MicroStrategy.

- Strategy increases Bitcoin holdings to 538,200 BTC. In the latest purchase, the company has spent more than $555M to buy 6,556 coins through proceeds of two at-the-market stock offering programs.

- Metaplanet buys another 145 BTC. The Tokyo-listed company has purchased an additional 145 BTC for $13.6 million. Their total bitcoin holdings now stand at 5,000 coins, worth around $428.1 million.

- Semler Scientific has increased its bitcoin holdings to 3,303 BTC. The company acquired an additional 111 BTC at an average price of $90,124. The purchase was funded through proceeds from an at-the-market offering and cash reserves, as stated in a press release.

- Tesla still holds nearly $1 billion in bitcoin. According to the automaker's latest earnings report, the firm reported digital asset holdings worth $951 million as of March 31.

- Spar supermarket experiments with Bitcoin payments in Zug, Switzerland. The store has introduced a new payment method powered by the Lightning Network. The implementation was facilitated by DFX Swiss, a service that supports seamless conversions between bitcoin and legacy currencies.

- Charles Schwab to launch spot Bitcoin trading by 2026. The financial investment firm, managing over $10 trillion in assets, has revealed plans to introduce spot Bitcoin trading for its clients within the next year.

- Arch Labs has secured $13 million to develop "ArchVM" and integrate smart-contract functionality with Bitcoin. The funding round, valuing the company at $200 million, was led by Pantera Capital, as announced on Tuesday.

- Citrea deployed its Clementine Bridge on the Bitcoin testnet. The bridge utilizes the BitVM2 programming language to inherit validity from Bitcoin, allegedly providing "the safest and most trust-minimized way to use BTC in decentralized finance."

- UAE-based Islamic bank ruya launches Shari’ah-compliant bitcoin investing. The bank has become the world’s first Islamic bank to provide direct access to virtual asset investments, including Bitcoin, via its mobile app, per Bitcoin Magazine.

- Solosatoshi.com has sold over 10,000 open-source miners, adding more than 10 PH of hashpower to the Bitcoin network.

"Thank you, Bitaxe community. OSMU developers, your brilliance built this. Supporters, your belief drives us. Customers, your trust powers 10,000+ miners and 10PH globally. Together, we’re decentralizing Bitcoin’s future. Last but certainly not least, thank you@skot9000 for not only creating a freedom tool, but instilling the idea into thousands of people, that Bitcoin mining can be for everyone again," said the firm on X.

- OCEAN's DATUM has found 100 blocks. "Over 65% of OCEAN’s miners are using DATUM, and that number is growing every day. This means block template construction is making its way back into the hands of the miners, which is not only the most profitable

-

@ eb0157af:77ab6c55

2025-06-14 20:02:08

@ eb0157af:77ab6c55

2025-06-14 20:02:08The new communication protocol aims to improve the industry with measurable advantages in terms of efficiency and security.

A new study conducted by Hashlabs, in collaboration with the SRI (Stratum V2 Reference Implementation) team and figures like Matt Corallo, Alejandro De La Torre and others reveals how the Stratum V2 protocol can increase miner profitability compared to the current Stratum V1 standard, used for over a decade.

Speaking to Atlas21, Gabriele Vernetti, Stratum V2 maintainer, declared:

“This first case study demonstrates how much Stratum V2 can help miners as well, securing and increasing their profits, in addition to the rest of the network. It’s just a first study aimed at demonstrating how decentralization can be aligned with the profit dynamics typical of the mining sector.

In the future we will also focus on the benefits for mining pool operators, who can benefit from the protocol’s efficiency to lower their operating costs (such as those for bandwidth used by their servers).

The feedback has been very positive: this first study was a joint work with various market players, including miners and mining pool operators. As SRI we want to continue working together with the entire community as done in this case, becoming a reference point for all actors interested in innovating the Bitcoin mining field”.

The research, based on controlled tests with two identical ASIC S19k Pro, with stock firmware, demonstrates that Stratum V2 can increase net profits by up to 7.4%. For an industry that often operates with 10% margins, this could represent a substantial competitive advantage.

The V2 protocol reduces various inefficiencies that plague the current system. The latency in block switching, that is the waiting time created when a miner must change block template after a new block has been mined on the network, goes from 325 milliseconds to just 1.42 milliseconds, a speed 228 times higher. This translates to about 4.9 hours of completely wasted hash power less per year.

Another problem of modern mining concerns “stale shares” – proofs of work that arrive too late to be remunerated, often due to network latency or inefficient communication. However, not all stale shares depend on inefficiency problems. On average, about 2% are rejected for expected reasons, such as when the share doesn’t reach the minimum difficulty required by the pool. This value is considered normal in the sector. The remaining 98%, instead, is caused by avoidable delays. With Stratum V1, miners lose between 0.1% and 0.2% of their computing power this way. Stratum V2 with Job Declaration completely eliminates this waste, provided that the miner and the pool node have the same level of connectivity. This step could translate into a net profit increase of up to 2% by fully adopting Stratum V2 with Job Declaration.

In the Stratum V2 protocol, the Job Declaration Client (JDC) is software that allows miners to receive mining jobs directly from their local Bitcoin node, that is the block templates to work on. The JDC communicates directly with the miner’s local node, receiving updated data for new block construction and immediately sending them to the mining software via Stratum V2. This allows miners to receive jobs in real time from their own node, without having to wait for them from the pool, reducing latency and the risk of working on obsolete jobs. Furthermore, if the pool allows it, miners can build custom templates choosing which transactions to include in the block.

The research also highlights an often overlooked aspect: the loss of transaction fees. With the Stratum V1 protocol, miners lose about 0.75% of potential fees for each block due to the delay in receiving new jobs. Considering that about 52,560 blocks are mined each year, this loss per block adds up to a total of about 74 bitcoins per year, equivalent to over $8 million at current prices.

Beyond economic advantages, Stratum V2 solves a critical vulnerability of the current system: hashrate hijacking. The V1 protocol doesn’t encrypt communications, allowing attackers to intercept and steal up to 2% of computing power without the miner noticing. The new protocol eliminates this risk through end-to-end encryption and authentication.

According to the study, by reducing latency, optimizing share sending and improving security, Stratum V2 enables a potential net profit increase of 7.4%, derived exclusively from technical improvements.

The post Stratum V2 increases profits by 7.4%: “The study shows that profit and decentralization can coexist”, says Vernetti, SV2 maintainer appeared first on Atlas21.

-

@ b1ddb4d7:471244e7

2025-06-14 20:01:48

@ b1ddb4d7:471244e7

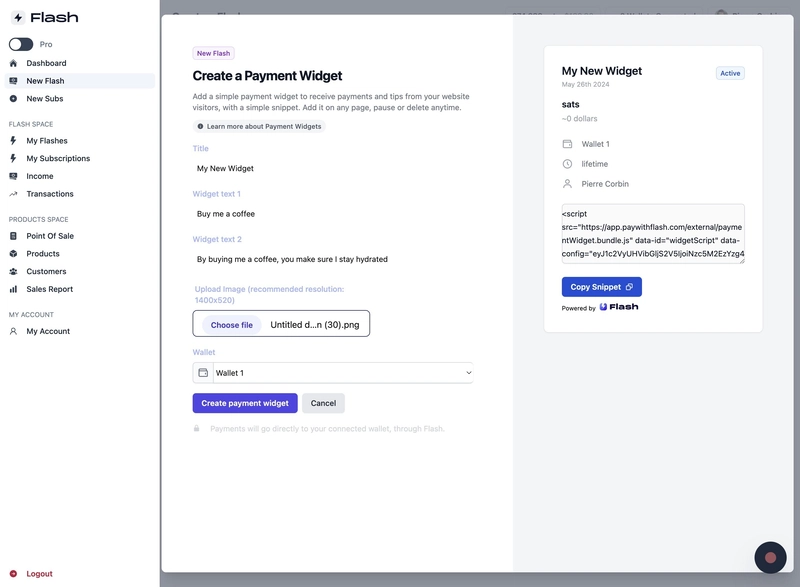

2025-06-14 20:01:48Paris, France – June 6, 2025 – Flash, the easiest Bitcoin payment gateway for businesses, just announced a new partnership with the Bitcoin Only Brewery, marking the first-ever beverage company to leverage Flash for seamless Bitcoin payments.

Bitcoin Buys Beer Thanks to Flash!

As Co-Founder of Flash, it's not every day we get to toast to a truly refreshing milestone.

Okay, jokes aside.

We're super buzzed to see our friends at @Drink_B0B

Bitcoin Only Brewery using Flash to power their online sales!The first… pic.twitter.com/G7TWhy50pX

— Pierre Corbin (@CierrePorbin) June 3, 2025

Flash enables Bitcoin Only Brewery to offer its “BOB” beer with, no-KYC (Know Your Customer) delivery across Europe, priced at 19,500 sats (~$18) for the 4-pack – shipping included.

The cans feature colorful Bitcoin artwork while the contents promise a hazy pale ale: “Each 33cl can contains a smooth, creamy mouthfeel, hazy appearance and refreshing Pale Ale at 5% ABV,” reads the product description.

Pierre Corbin, Co-Founder of Flash, commented: “Currently, bitcoin is used more as a store of value but usage for payments is picking up. Thanks to new innovation on Lightning, bitcoin is ready to go mainstream for e-commerce sales.”

Flash, launched its 2.0 version in March 2025 with the goal to provide the easiest Bitcoin payment gateway for businesses worldwide. The platform is non-custodial and can enable both digital and physical shops to accept Bitcoin by connecting their own wallets to Flash.

By leveraging the scalability of the Lightning Network, Flash ensures instant, low-cost transactions, addressing on-chain Bitcoin bottlenecks like high fees and long wait times.

Bitcoin payment usage is growing thanks to Lightning

In May, fast-food chain Steak ‘N Shake went viral for integrating bitcoin at their restaurants around the world. In the same month, the bitcoin2025 conference in Las Vegas set a new world record with 4,000 Lightning payments in one day.

According to a report by River Intelligence, public Lightning payment volume surged by 266% from August 2023 to August 2024. This growth is also reflected in the overall accessibility of lighting infrastructure for consumers. According to Lightning Service Provider Breez, over 650 Million users now have access to the Lightning Network through apps like CashApp, Kraken or Strike.

Bitcoin Only Brewery’s adoption of Flash reflects the growing trend of businesses integrating Bitcoin payments to cater to a global, privacy-conscious customer base. By offering no-KYC delivery across Europe, the brewery aligns with the ethos of decentralization and financial sovereignty, appealing to the increasing number of consumers and businesses embracing Bitcoin as a legitimate payment method.

“Flash is committed to driving innovation in the Bitcoin ecosystem,” Corbin added. “We’re building a future where businesses of all sizes can seamlessly integrate Bitcoin payments, unlocking new opportunities in the global market. It’s never been easier to start selling in bitcoin and we invite retailers globally to join us in this revolution.”

For businesses interested in adopting Bitcoin payments, Flash offers a straightforward onboarding process, low fees, and robust support for both digital and physical goods. To learn more, visit paywithflash.com.

About Flash

Flash is the easiest Bitcoin payment gateway for businesses to accept payments. Supporting both digital and physical enterprises, Flash leverages the Lightning Network to enable fast, low-cost Bitcoin transactions. Launched in its 2.0 version in March 2025, Flash is at the forefront of driving Bitcoin adoption in e-commerce.

About Bitcoin Only Brewery

Bitcoin Only Brewery (@Drink_B0B) is a pioneering beverage company dedicated to the Bitcoin ethos, offering high-quality beers payable exclusively in Bitcoin. With a commitment to personal privacy, the brewery delivers across Europe with no-KYC requirements.

Media Contact:

Pierre Corbin

Co-Founder, Flash

Email: press@paywithflash.com

Website: paywithflash.comPhotos paywithflash.com/about/pressHow Flash Enables Interoperable, Self-Custodial Bitcoin Commerce

-

@ cae03c48:2a7d6671

2025-06-14 20:01:27

@ cae03c48:2a7d6671

2025-06-14 20:01:27Bitcoin Magazine

France’s The Blockchain Group Secures €9.7 Million More For Its Bitcoin Treasury StrategyToday, The Blockchain Group (ALTBG), listed on Euronext Growth Paris and recognized as Europe’s first Bitcoin Treasury Company, announced it has raised around €9.7 million through a mix of equity and convertible bond issuances. This move is part of their continued push to build out their Bitcoin Treasury Company strategy.

The Blockchain Group announces an equity and convertible bond issuance for a total amount of ~€9.7M to pursue its Bitcoin Treasury Company strategy

The Blockchain Group announces an equity and convertible bond issuance for a total amount of ~€9.7M to pursue its Bitcoin Treasury Company strategy

Full Press Release (EN): https://t.co/jjGOBswJsd

Full Press Release (FR): https://t.co/0Jwuv2sP7W

BTC Strategy (EN):… pic.twitter.com/mUVLHJduX5

— The Blockchain Group (@_ALTBG) June 12, 2025

The funding comes from multiple sources and was carried out through their wholly-owned Luxembourg subsidiary, “The Blockchain Group Luxembourg SA.” A major portion, about €6 million, was raised through a convertible bond issuance to TOBAM, with bonds priced at €6.24 per share. That price reflects a 30 percent premium over ALTBG’s closing price on June 9, 2025.

Ludovic Chechin-Laurans also came in with around €2.4 million, subscribing in BTC at a conversion price of about €0.7072 per share. This was part of a deal originally set up back in March 2025. If the stock price climbs 30 percent above that level, to around €0.919 over 20 consecutive trading days, he’ll have the option to convert into up to 3.4 million new ALTBG shares.

Adam Back also finalized his conversion of all OCA Tranche 1 bonds into 14.9 million ALTBG shares and subscribed to an additional 2.1 million shares for €1.16 million at €0.544 per share.

“The Company recalls that Adam Back notified The Blockchain Group of his intention to convert all OCA Tranche 1 he holds, in accordance with the terms of the OCA Issuance Agreement entered into on March 4, 2025, the details of which were disclosed in a press release dated March 6, 2025, and which the Company now confirms has been definitively completed,” stated the press release.

TOBAM did the same, converting 1 million Tranche 1 bonds into 1.84 million shares and subscribing to 262,605 new shares for €0.14 million.

“Given the recent high volatility in the Company’s share price observed since the signing of the OCA Issuance Agreement, the conversion price of €0.544 reflects a discount of 89.52% compared to the closing price on June 12, 2025,” the press release added.

“These operations could allow for the potential acquisition of ~80 BTC, bringing the Company’s total potential holdings to ~1,611 BTC, including the proceeds from the potential completion of remaining operations announced in the press release dated May 26, 2025,” said the press release.

This post France’s The Blockchain Group Secures €9.7 Million More For Its Bitcoin Treasury Strategy first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-14 20:01:04

@ cae03c48:2a7d6671

2025-06-14 20:01:04Bitcoin Magazine

JPMorgan Reports Record Profits for Bitcoin Miners in Q1Bitcoin mining companies in the U.S. have kicked off 2025 with record performance, according to a recent report. The first quarter of the year was “one of Bitcoin miners’ best quarters to date,” analysts Reginald Smith and Charles Pearce stated.

JUST IN:

JPMorgan reported Q1 2025 was one of the best periods on record for publicly traded bitcoin mining companies

JPMorgan reported Q1 2025 was one of the best periods on record for publicly traded bitcoin mining companies  pic.twitter.com/gs9fGiTbZV

pic.twitter.com/gs9fGiTbZV— Bitcoin Magazine (@BitcoinMagazine) June 13, 2025

“Four of the five operators in our coverage reported record revenue and profits,” the report stated, underscoring the sector’s impressive rebound in profitability amid continued institutional adoption and high bitcoin prices, currently hovering around $105,462.87.

In total, U.S.-listed miners brought in $2.0 billion in gross profit during Q1 2025, with average gross margins reaching 53%—a jump from $1.7 billion and 50% in the previous quarter.

MARA Holdings (MARA) once again led the pack in Bitcoin production, mining the most BTC for the ninth consecutive quarter. However, despite its output dominance, MARA also posted the highest cost per coin, estimated at $72,600, JPMorgan noted.

On the profitability front, IREN (IREN) was the standout performer. For the first time, IREN earned the most gross profit among the tracked firms. The company also reported the lowest all-in cash cost per Bitcoin, around $36,400, helping to boost margins significantly.

CleanSpark (CLSK), another major player, did not raise any equity in the quarter—one of the more capital-disciplined moves seen among its peers. In fact, JPMorgan reported that the five miners it tracks issued only $310 million in equity for Q1, marking a steep decline from $1.3 billion in Q4 2024.

On the operational expense side, miners spent an estimated $1.8 billion on power, up $50 million from the previous quarter—demonstrating the energy-intensive nature of mining.

JPMorgan’s outlook on the industry remains bullish for select players. The bank maintains overweight ratings for CleanSpark, IREN, and Riot Platforms (RIOT), while assigning neutral ratings to Cipher Mining (CIFR) and MARA.

As profitability surges and strategic spending remains in check, 2025 may very well be remembered as a turning point in mining economics—especially for companies navigating cost discipline and scaling production.

This post JPMorgan Reports Record Profits for Bitcoin Miners in Q1 first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-14 20:00:59

@ cae03c48:2a7d6671

2025-06-14 20:00:59Bitcoin Magazine

UK Gold Mining Company Bluebird to Convert Gold Revenues into BitcoinBluebird Mining Ventures Ltd., a pan Asian gold project development company, recently announced a major strategic shift. It plans to convert future revenues from its gold mining projects into bitcoin and adopt bitcoin as a treasury reserve asset.

Strategy shift to covert gold into digital gold – #bitcoin #goldmining #goldequities #investinbitcoin #investingold

"Combining income streams from gold mining projects and recycling these revenues into a proactive "Bitcoin in Treasury" management approach, whilst maintaining a… pic.twitter.com/BpJA6hFU9Y— Bluebird Mining Ventures Ltd (LSE:BMV.L) (@bluebirdIR) June 5, 2025

“By adopting a ‘gold plus a digital gold’ strategy, it offers the Company an opportunity to turn the page and look to the future and seek to attract a new type of shareholder,” said the Executive Director and CEO of Bluebird Aidan Bishop. “Under the leadership of a new CEO, once identified, it is my sincere hope that Bluebird will finally realise its ambitions for which it was initially established for.”

The announcement comes as Bluebird progresses towards a key agreement on its flagship Philippine project. The company expects to finalize a deal in the coming weeks that will grant it a net profit interest throughout the life of the mine, with no ongoing capital costs. The company said it believes bitcoin offers a modern alternative to traditional store of value assets like gold.

“I am very pleased with the progress of discussions in the Philippines which are looking very positive and will enable, if successfully completed, Bluebird to maintain an ongoing exposure with zero future cash commitments,” stated Bishop.

Bluebird plans to recycle revenues from its mining operations directly into bitcoin, aligning with what they describe as an innovative treasury approach. The company cited bitcoin’s fixed supply of 21 million, increasing global adoption, and role as a hedge against inflation and monetary instability as key reasons for its decision.

“Combining income streams from gold mining projects and recycling these revenues into a proactive ‘Bitcoin in Treasury’ management approach…” the company said. “Companies that have adopted bitcoin into their treasury strategy globally across public markets have been enjoying significant investor interest as well as substantial premiums to Net Asset Value (NAV) that have challenged traditional financial metrics as a basis of valuation.”

To lead this new phase, Bluebird is actively searching for a new CEO with experience in digital assets.

“On a personal level, I embarked some time ago on a journey to understand and learn about bitcoin,” added Bishop. “I am convinced that we are witnessing a tectonic shift in global markets and that bitcoin will reshape the landscape of financial markets on every level.”

This post UK Gold Mining Company Bluebird to Convert Gold Revenues into Bitcoin first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-14 20:00:53

@ cae03c48:2a7d6671

2025-06-14 20:00:53Bitcoin Magazine

The 30,000-Foot View of the Oslo Freedom ForumAs I step onto the plane leaving Gardermoen Airport in Oslo, Norway, the weight and warmth of the past week settles into my chest.

The Oslo Freedom Forum is not a conference. It’s not a summit. It’s something harder to name and even harder to describe — a convergence of courage, truth and defiance that burns through the noise of the modern world and gives you no choice but to listen, feel and act.

For the second time, I leave this city more convinced than ever that something unstoppable is rising. That amid the censorship, surveillance and state repression spreading across the globe, there is a countervailing force rooted in humanity, accelerated by technology and led by those who’ve already paid the price for speaking out.

The Forum doesn’t trade in empty optimism. It delivers a different kind of hope, forged from lived experience and stitched together by people who have been in the dark and still choose to see the light. A hope borne from the stories of individuals who have lived through the worst an authoritarian regime can do and still choose to fight for the freedom of others. The experiences shared were hard. At times, devastating. But they weren’t offered for pity. They were calls to action.

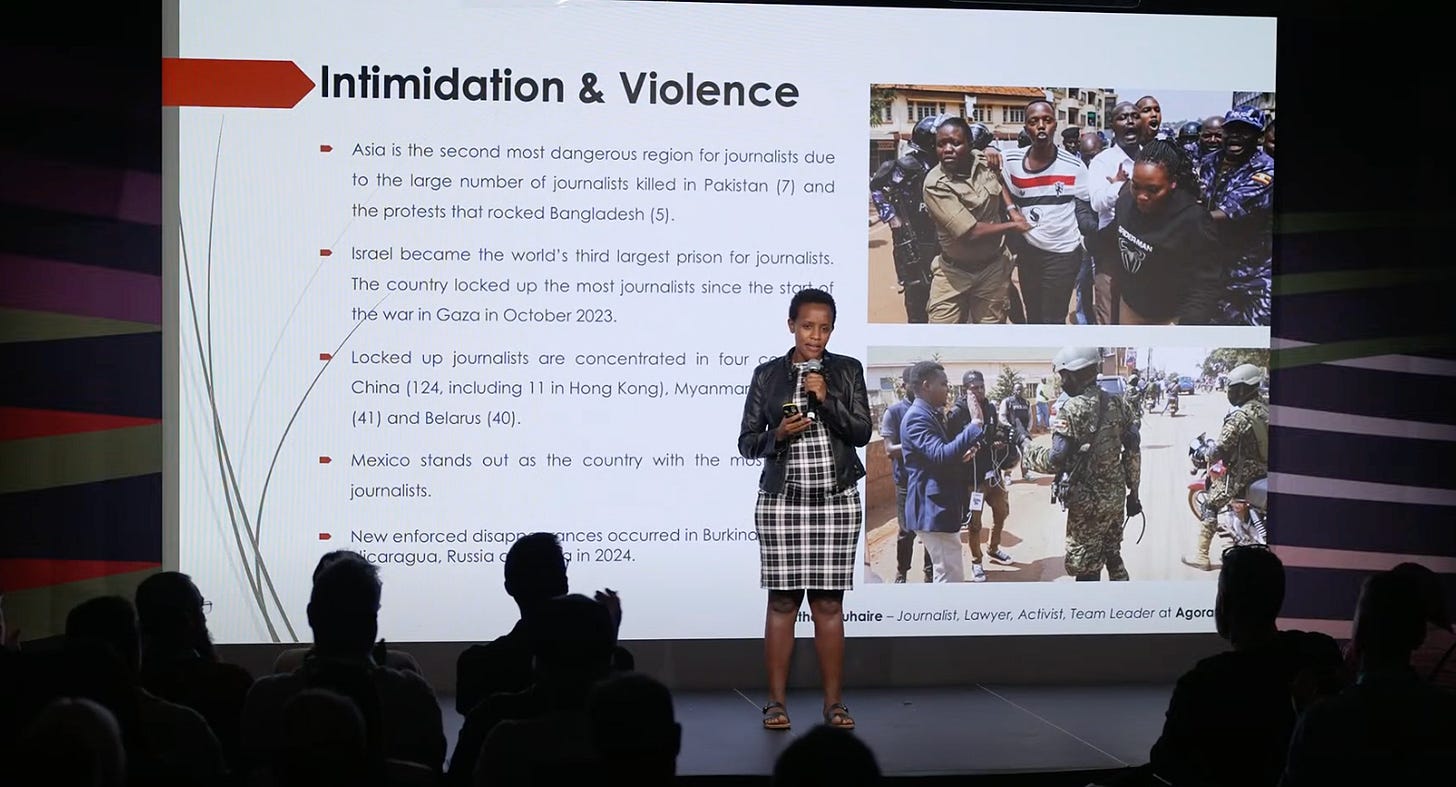

Just days after she was abducted, blindfolded, tortured, and sexually assaulted in a Tanzanian prison cell, Agather Atuhaire stood in front of a crowd of strangers and told her story.

Her voice did not tremble.

The Ugandan journalist and lawyer had traveled to Tanzania in solidarity with fellow East African dissidents, only to be disappeared in a black van alongside Kenyan activist Boniface Mwangi.

And yet, against all odds, she came back. Not just to her home in Uganda, but also to the stage in Oslo, where she spoke calmly and clearly about what it means to tell the truth under a dictatorship.

Her presentation, “The Digital Free Speech Crackdown in Uganda,” laid bare the authoritarian playbook: social media blackouts, propaganda campaigns, surveillance of journalists and the slow financial asphyxiation of independent media. When the government doesn’t like a story, it simply blocks the platform or website. When a journalist digs too deep, they disappear for a while. Or forever. Atuhaire painted a picture many struggle to even imagine.

And yet, after everything, she didn’t just recount these struggles. She looked out at the crowd and thanked the open source builders and contributors who write code and create tools that make it possible for activists like her to speak, move money and organize under regimes that want them silenced, or worse.

(Ugandan journalist and lawyer, Agather Atuhaire, speaks during the Freedom Tech track at the 2025 Oslo Freedom Forum.)

From Iran, independent Bitcoin educator Ziya Sadr reminded us that financial privacy is not a luxury but a necessary lifeline for those facing the financial repression by oppressive rulers. Sadr’s detainment during the 2022 Women, Life, Freedom movement following the murder of Mahsa Amini by the Iranian regime is a testament to that. Without financial privacy, activists’ actions, connections and finances are exposed to a regime equipped with widespread financial controls and a sophisticated, restrictive internet firewall that rivals even China’s.

The result is one of the most repressive digital environments in the world. And if that wasn’t enough, the Iranian rial currency has lost more than 80% of its value in just a few years.

Against this backdrop, Iranians are using bitcoin as undebasable savings, and to buy digital services like VPNs in order to access the open internet. But even that act, just reaching the outside world, requires a level of privacy most of us take for granted.

In his presentation, “Securing Lifelines: The Bitcoin Privacy Imperative,” Sadr shared that many Iranians turn to Bitcoin Coinjoins, a privacy technique that breaks the link between Bitcoin transaction inputs. Coinjoins preserve user transaction privacy and, more importantly, shield Iranians from the surveillance and retaliation of a regime who punishes anyone trying to access information beyond its tightly controlled digital spaces. The use of Coinjoins is becoming more difficult as global legal pressure mounts against open source developers, and in the aftermath of the Samourai developer arrests, privacy protocols like Whirlpool are unworkable.

Today, Sadr is learning more about additional Bitcoin privacy tools, including Paykoin, a privacy method that allows two users to contribute an input to a Bitcoin transaction. Payjoin breaks common chain analysis heuristics and conceals the sender and receiver of a transaction as well as the payment amount. Then there is ecash, a form of digital cash backed by Bitcoin that enables very private, everyday payments with the custodial trade-off of trusting mints (entities that issue and redeem ecash tokens) to store user funds.

The continued development of these protocols is crucial for Iranians, who live under a government that not only tracks and surveils digital behavior, but also imposes automatic fines on women for violating hijab rules and manipulates currency exchange rates to profit off citizens’ savings. For millions in Iran, bitcoin offers a last line of defense against a collapsing currency, intrusive surveillance and total financial repression.

(Independent Iranian Bitcoin educator, Ziya Sadr, speaks during the Freedom Tech track at the Oslo Freedom Forum.)

Venezuelan opposition leader Leopoldo López took the stage at the 2025 Oslo Freedom Forum not as a politician, but as a witness to what happens when a state turns its institutions into further tendrils of its repression machine.

After Nicolás Maduro stole Venezuela’s 2024 elections, López watched thousands of his fellow people — activists, students, journalists, opposition members and lawyers — get arrested, disappeared or forced into exile. The regime blocked access to social media, revoked passports, criminalized dissent and used the financial system as a means of controlling the population.

Amid this digital repression and Venezuela’s 162% inflation rate, López sees bitcoin (decentralized money) and Nostr (decentralized social media) as lifelines. When dictators shut down the internet or freeze your bank account, alternatives that are open source, decentralized, uncensorable and accessible become more important than ever for the survival of democracy and freedom.

**“Decentralized resistance is the convergence of people, Bitcoin, Nostr, and AI.

People, it’s about the center and the end of what we are doing.

Brave women and men who sacrifice their freedom, who take risks, who are willing to fight for other people.

If it’s not about people, technology wouldn’t be something worth fighting for.

Bitcoin is freedom money. It’s decentralized, nobody controls it, nobody can stop it, it can move around without borders.”**

(Venezuelan Opposition Leader Leopoldo López during the Freedom Tech track at the 2025 Oslo Freedom Forum.)

For decades, Paraguay’s greatest natural resource, hydroelectric power, has flowed out of the country through international contracts, fueling development in neighboring countries like Brazil and Argentina while one in four Paraguayans remained trapped in poverty. Paraguay’s Itaipu Dam, one of the largest in the world, has long symbolized this paradox: a river of energy diverted away from the very people who need it most.

Björn Schmidtke and Delia Garcete of Penguin Group are flipping that script.

In a landmark move, they secured Paraguay’s first 100-megawatt power purchase agreement, marking the beginning of a bold experiment to reclaim that energy for the people of Paraguay. Instead of selling it off to foreign powers, they use it to mine Bitcoin — and the proc

-

@ cae03c48:2a7d6671

2025-06-14 20:00:46

@ cae03c48:2a7d6671

2025-06-14 20:00:46Bitcoin Magazine

Pakistan’s Strategic Bitcoin Reserve: A Step Toward Orange-Pilling a Nation?Pakistan’s relationship with Bitcoin has been marked by inconsistency and confusion over the past few years. Initially, the country outright banned bitcoin trading in 2018, citing concerns over fraud, money laundering and lack of regulation. However, over time, their stance softened and regulators began exploring the technology behind Bitcoin with courts even questioning the legality of the ban. Eventually, citizens were allowed to hold bitcoin, though trading remained murky and unregulated. This back-and-forth approach has created a confusing environment, where Bitcoin exists in a legal gray area. It is technically allowed, yet not fully embraced or regulated, reflecting the state’s struggle to balance innovation with control.

PAKISTAN TO ESTABLISH NATIONAL STRATEGIC #BITCOIN RESERVE

PAKISTAN TO ESTABLISH NATIONAL STRATEGIC #BITCOIN RESERVE Honored to have had the Pakistan Minister Bilal Bin Saqib at the Bitcoin Conference

pic.twitter.com/7WunP5fuZm

pic.twitter.com/7WunP5fuZm— The Bitcoin Conference (@TheBitcoinConf) May 29, 2025

This muddled relationship with Bitcoin seems to have turned a corner in recent weeks as Bilal Bin Saqib, head of the Pakistan Crypto Council, at the Bitcoin 2025 Conference in Las Vegas announced that the country is moving to establish a strategic Bitcoin reserve. Furthermore, he announced the allocation of 2,000 megawatts of excess energy to Bitcoin mining and high-performance computer data centers. The Ministry of Finance has also commissioned the establishment of an entirely new agency to oversee digital asset regulation which could lead to a less opaque legal framework around bitcoin ownership and usage in everyday transactions.

Critics have argued that this is merely an attempt by Pakistan to cozy up to Trump in the aftermath of the recent skirmish with India. After all, Saqib did state that Pakistan was inspired by the Trump administration when he spoke at the recent Las Vegas Bitcoin conference. Others have asserted that Pakistan is merely seeking to build resistance to possible sanctions in the future over its support for terrorist groups. I believe that such a geopolitically focused critique overlooks a deeper economic reality that has been staring Pakistan in the face for many years.

I wrote an article for a Pakistani newspaper about a year ago in which I argued that the country is uniquely situated, in economic terms, to take advantage of Bitcoin and unlock the benefits that come with adoption. Pakistan suffers from rampant inflation, stagnant capital formation, depleted foreign reserves, an inefficient bureaucracy and an overreliance on remittances from abroad. These systemic issues have eroded citizens’ faith in traditional financial systems, leaving many Pakistanis disillusioned and seeking alternative means to safeguard their wealth and economic autonomy.

Thus, nurturing a culture of Bitcoin adoption could go a long way toward alleviating much of these economic ills and empowering citizens to take control of their financial future. By earning and trading a form of currency that is deflationary in nature, Pakistanis can protect themselves from the downsides of the macroeconomic trends that have decimated the living standards of this once proud nation. Bitcoin adoption could transform the country’s lively remittance sector, with receivers keeping more of the money they are sent. It could also emancipate people from the inefficient banking system that is such a drain on the people. Permissionless transactions could also empower the beleaguered minorities who often struggle to achieve financial freedom.

The announcement of a strategic Bitcoin reserve, as well as promises to introduce pro-Bitcoin regulation and a mining strategy, are steps in the right direction. They show that the mood is shifting and the country is starting to take a serious look at the only real digital currency in town. These steps also point to a much broader, global shift in attitudes toward Bitcoin — especially in nations where hyperinflation is a daily reality and the banking system struggles to meet citizens’ needs.

However, real change will only come when Pakistan fully legalizes bitcoin as a digital currency and takes steps toward mass adoption. Only then will ordinary Pakistani citizens be free to trade with people from all over the world without the need to rely on the local banking system. Only then will financial autonomy become an achievable goal for those living far away from the big cities where banks are based. Only then will women be free to earn, store and transact in a digital currency that is resistant to cultural barriers.

Creating a national strategic reserve merely signals that a nation believes in bitcoin as an asset with the potential to offer a reliable return. It does not signal that a nation has adopted the digital currency as a means to overcome the obstacles imposed by fiat. Strategic national reserves also hoard bitcoin and bring it too close to the state, even though the digital currency was designed to be a hedge against state-controlled money. As such, a reserve does not unlock the true potential of bitcoin to act as a buffer against domestic inflation, currency devaluation and a cumbersome banking system.

A strategic Bitcoin reserve is a step in the right direction for Pakistan, as it would be for any nation that suffers from hyperinflation. But only mass adoption will truly unlock the immense potential Bitcoin can offer to a nation such as Pakistan and we have a long way to go before that becomes a reality.

In my view, strategic reserves are not what bitcoin is all about, but let’s hope this is merely the first step in a long and prosperous journey toward orange-pilling a nation.

This post Pakistan’s Strategic Bitcoin Reserve: A Step Toward Orange-Pilling a Nation? first appeared on Bitcoin Magazine and is written by Ghaffar Hussain.

-

@ cae03c48:2a7d6671

2025-06-14 20:00:41

@ cae03c48:2a7d6671

2025-06-14 20:00:41Bitcoin Magazine

Bitcoin Layer 2: StatechainsStatechains are an original second layer protocol originally developed by Ruben Somsen in 2018, depending on the eltoo (or LN Symmetry) proposal. In 2021 a variation of the original proposal, Mercury, was built by CommerceBlock. In 2024, a further iteration of the original Mercury scheme was built, Mercury Layer.

The Statechain protocol is a bit more complicated to discuss compared to other systems such as Ark or Lightning because of the range of variations that are possible between the original proposed design, the two that have been actually implemented, and other possible designs that have been loosely proposed.

Like Ark, Statechains depend on a centralized coordinating server in order to function. Unlike Ark, they have a slightly different trust model than a vUTXO in an Ark batch. They depend on the coordinating server to delete previously generated shares of a private key in order to remain trustless, but as long as the server follows the defined protocol and does so, they provide a strong security guarantee.

The general idea of a Statechain is to be able to transfer ownership of an entire UTXO between different users off-chain, facilitated by the coordinator. There is no requirement for receiving liquidity like Lightning, or the coordinator server to provide any liquidity like Ark.

To begin, we will look at the original protocol proposed by Ruben Somsen.

The Original Statechain

Statechains are effectively a pre-signed transaction allowing the current owner of the Statechain to unilaterally withdraw on-chain whenever they want, and a history signed messages cryptographically proving that past owners and the receivers they sent the Statechain to approved those transfers.

The original design was built on eltoo using ANYPREVOUT, but the current plans on how to enable the same functionality make use of CHECKTEMPLATEVERIFY and CHECKSIGFROMSTACK (a high level explanation of this is at the end of the CHECKSIGFROMSTACK article). The basic idea is a script enabling a pre-signed transaction to spend any UTXO that has that script and locks the appropriate amount of bitcoin, rather than being tied to spending a single specific UTXO.

In the protocol, a user wishing to deposit their coins to a Statechain approaches a coordinator server and goes through a deposit protocol. The depositing user, Bob, generates a key that will be uniquely owned by him, but also a second “transitory” key that will eventually be shared (more on this soon). They then craft a deposit transaction locking their coin to a multisig requiring the coordinator’s key and the transitory key to sign.

Using this multisig, Bob and the coordinator sign a transaction that spends that coin and creates a UTXO that can either be spent by any other transaction signed by the transitory key and the coordinator’s key using LN Symmetry, or Bob’s unique key after a timelock. Bob can now fund the multisig with the appropriate amount, and the Statechain has been created.

To transfer a Statechain to Charlie, Bob must go through a multistep process. First, Bob signs a message with his unique private key that attests to the fact he is going to transfer the Statechain to Charlie. Charlie must also sign a message attesting to the fact that he has received the Statechain from Bob. Finally, the coordinator server must sign a new transaction allowing Charlie to unilaterally claim the Statechain on-chain before Bob sends Charlie a copy of the transitory key.

All of this is made atomic using adapter signatures. These are signatures that are modified in such a way using a random piece of data that renders them invalid, but can be made valid again once the holder of the signature receives that piece of information. All of the messages, and the new pre-signed transaction are signed with adapter signatures, and atomically made valid at the same time through the release of the adapter data.

Holders of a Statechain must trust that the coordinator server never conspires with a previous owner to sign an immediate closure of the Statechain and steal funds from the current owner, but the chain of pre-signed messages can prove that a coordinator has participated in theft if they were to do so. If a past owner attempts to use their pre-signed transaction to steal the funds, the timelock on the spend path using only their key allows the current owner to submit their pre-signed transaction and correctly claim the funds on chain.

Mercury and Mercury Layer

The original Statechain architecture requires a softfork in order to function. CommerceBlock designed their variant of Statechains to function without a softfork, but in order to do so tradeoffs were made in terms of functionality.

The basic idea is the same as the original design, all users hold a pre-signed transaction that allows them to claim their funds unilaterally, and the coordinator server still plays a role in facilitating off-chain transfers that requires them to be trusted to behave honestly. The two major differences are how those transactions are signed, and the structure of the pre-signed transaction users are given.

Where the signing is concerned, there is no longer a transitory private key that is passed from user to user. Instead of this, a multiparty-computation protocol (MPC) is used so that the original owner and the coordinator server are able to collaboratively generate partial pieces of a private key without either of them ever possessing the full key. This key is used to sign the pre-signed transactions. The MPC protocol allows the current owner and coordinator to engage in a second protocol with a third party, the receiver of a transfer, to regenerate different pieces that add up to the same private key. In both the Mercury and Mercury Layer protocol, after completing a transfer an honest coordinator server deletes the key material corresponding to the previous owner. As long as this is done, it is no longer possible for the coordinator to sign a transaction with a previous owner, as the new piece of key material they have is not compatible with the piece any previous owner might still have. This is actually a stronger guarantee, as long as the coordinator is honest, than the original proposal.

The pre-signed transaction structure for Mercury and Mercury Layer can’t use LN Symmetry, as this is not possible without a softfork. In lieu of this, CommerceBlock opted to use decrementing timelocks. The original owner’s pre-signed transaction is timelocked using nLocktime to a time far out in the future from the point of the Statechain’s creation. As each subsequent user receives the Statechain during a transfer, the nLocktime value of their transaction is some pre-determined length of time shorter than the previous owner. This guarantees that a previous owner is incapable of even trying to submit their transaction on-chain before the current owner can, but it also means that eventually at some point the current owner must close their Statechain on-chain before previous owners’ transactions start becoming valid.

The major difference between Mercury and Mercury Layer is how these transactions are signed. In the case of Mercury, the coordinator server simply sees the transaction proposed, verifies it, and then signs it. Mercury Layer uses a blind-signing protocol, meaning that they do not actually see any details of the transaction they are signing. This necessitates the server tracking Statechains using anonymized records on the server, and a special authorization key of the current owner so that they can be sure they are only signing valid transfers.

Synergy With Other Layers

Statechains can synergize with other Layer 2s that are based on pre-signed transactions. For instance, part of the original proposal suggested a combination of Statechains and Lightning Channels. Because both are simply pre-signed transactions, it is possible to actually nest a Lightning channel on top of a Statechain. This simply requires the current owner’s unilateral exit key to be a multisig, and the creation of the pre-signed transactions spending that output into a Lightning channel. This allows Lightning channels to be opened and closed entirely off-chain.

In a similar fashion, it is possible to nest a Statechain on top of a vUTXO in an Ark batch. This simply requires the pre-signed transactions necessary for a Statechain to be constructed, spending the vUTXO output.

Wrapping Up

Statechains are not entirely trustless, but they are a very trust minimized scheme that is very liquidity efficient and allows freely transferring UTXOs off-chain between any users willing to accept the trust model of Statechains.

While the original proposal has yet to be built, the two implementations designed by CommerceBlock have been completely implemented. Both failed to achieve anything more than marginal use in the real world. Whether this is due to users being unwilling to accept the trust model involved, or simply a failure in marketing or awareness is something that cannot be fully ascertained.

Regardless, given that there are two full implementations and designs for a more flexible variation should LN Symmetry ever become possible on Bitcoin, this an option

-

@ 3ffac3a6:2d656657

2025-06-14 19:37:17

@ 3ffac3a6:2d656657

2025-06-14 19:37:17🛡️ Tutorial: Secure SSH Access over Cloudflare Tunnel (Docker Optional)

🎯 Objective

Set up a Cloudflare Tunnel to securely expose SSH access to your system without revealing your home IP or requiring port forwarding. This enables secure remote access even behind NAT, CGNAT, or dynamic IP environments.

This guide:

- Uses Cloudflare Tunnels to proxy traffic

- Does not expose your home IP address

- Uses Docker + Docker Compose for orchestration (optional)

- Can be adapted to run under systemd directly if preferred

🔧 Prerequisites

- A domain managed via Cloudflare DNS

- SSH server running on your machine (default port

22) - Temporary access to the

cloudflaredCLI (for tunnel creation) -

Either:

-

Docker and Docker Compose (used in this example), or

- A native

systemdservice (alternative not covered here)

🪜 Step-by-Step Instructions

1. Install and Authenticate

cloudflaredInstall

cloudflared(temporary):bash curl -L https://github.com/cloudflare/cloudflared/releases/latest/download/cloudflared-linux-amd64 \ -o cloudflared && chmod +x cloudflared && sudo mv cloudflared /usr/local/bin/Login with your Cloudflare account:

bash cloudflared tunnel loginThis will open a browser and link the machine to your Cloudflare zone.

2. Create the Tunnel

Create a named tunnel:

bash cloudflared tunnel create ssh-tunnelThis creates a credential file, e.g.:

~/.cloudflared/5f84da12-e91b-4d2e-b4f0-7ca842f622f1.json

3. Define the Tunnel Routing Configuration

Create the tunnel config:

bash nano ~/.cloudflared/config.ymlExample:

```yaml tunnel: ssh-tunnel credentials-file: /etc/cloudflared/5f84da12-e91b-4d2e-b4f0-7ca842f622f1.json

ingress: - hostname: secure-ssh.example.com service: ssh://localhost:22 - service: http_status:404 ```

Then bind the hostname to the tunnel:

bash cloudflared tunnel route dns ssh-tunnel secure-ssh.example.comReplace

secure-ssh.example.comwith your own subdomain under Cloudflare management.

4. Prepare File Permissions for Docker Use (Optional)

If using Docker,

cloudflaredruns as a non-root user (UID 65532), so grant it access to your config and credentials:bash sudo chown 65532:65532 ~/.cloudflared sudo chown 65532:65532 ~/.cloudflared/*

5. Define

docker-compose.yml(Optional)yaml version: "3.8" services: cloudflared: image: cloudflare/cloudflared:latest container_name: cloudflared-ssh-tunnel restart: unless-stopped volumes: - ${HOME}/.cloudflared:/etc/cloudflared:ro - ${HOME}/.cloudflared:/home/nonroot/.cloudflared:ro command: tunnel run ssh-tunnel network_mode: host📝 Docker is used here for convenience and automation. You may alternatively run

cloudflared tunnel run ssh-tunneldirectly undersystemdor a background process.

6. Start the Tunnel

Start the container:

bash cd ~/docker/sshtunnel docker compose up -d docker logs -f cloudflared-ssh-tunnelYou should see

Registered tunnel connectionand other success logs.

7. Connect to the Tunnel from Remote Systems

Option A: Ad-hoc connection with

cloudflared access tcpbash cloudflared access tcp --hostname secure-ssh.example.com --url localhost:2222In another terminal:

bash ssh -p 2222 youruser@localhostOption B: Permanent SSH Configuration

Edit

~/.ssh/config:ssh Host secure-home HostName secure-ssh.example.com User youruser IdentityFile ~/.ssh/id_rsa ProxyCommand cloudflared access ssh --hostname %hThen connect with:

bash ssh secure-home

✅ Result

- Secure SSH access via a public domain (e.g.,

secure-ssh.example.com) - No ports open to the public Internet

- IP address of your machine remains hidden from Cloudflare clients

- Easily extendable to expose other services in future

🔁 Optional Enhancements

- Run as a

systemdservice instead of Docker for lower overhead - Use

autosshorsystemdto maintain persistent reverse tunnels - Expand to forward additional ports (e.g., Bitcoin RPC, application APIs)

- Apply strict firewall rules to limit SSH access to

localhostonly

-

@ 8671a6e5:f88194d1

2025-06-14 19:34:37

@ 8671a6e5:f88194d1

2025-06-14 19:34:37

ParentCoin; limitless

There's this almost altcoin-like pitch of parenthood these days. I might’ve fallen for the shiny marketing of parenthood — cute baby pics, promises of legacy, the whole “you’ll change the world” vibe. I even heard a would-be mom tell me once (true story) "You know having children, you don't have to be afraid of it, as a dad it doesn't cost as much as you think". \ These people actually believe that. Just like they've fallen for every fiat-scam out there: housing, cars, holidays in France, Nike shoes, 50% taxation, religion and main stream media subscriptions.\ \ It’s 2025, and I’m revisiting this like I’d revisit an old Lightning Network post. \ \ Having kids is like chasing an altcoin airdrop with a slick but buzzword laden whitepaper and a charismatic founder who’s probably exit-scamming as soon as he gets enough of your money in their bank account (yeah you see what I did there). If you're lucky that founder might twerk from time to time to get your attention. But don't hope for too much. Now change that diaper and work an extra job to pay for all of it while inflation murders you.\ \ While you do all that, the most damaging thing about the Having Children Shitcoin (HCS) is the time it takes. It literally can't be shorted like some token on an exchange. It laughs, plays around with your tech gadgets, has to be potty trained (like some altcoin founders) and needs attention, education and a lot of proof of work.\ But the damage is the time. \ The time it takes to do all that, is actually replacing value with time. \ Bitcoin might be a product of proof of work, HCS is not a product but the actual proof of work without the value proposition.\ On top of that, the founder usually lives rent-free in your head your whole life, or even worse: you literally live together with her/him.\ Imagine Satoshi Nakamoto living at your house right now. Like... hi Satoshi.. love your bitcoin man.\ "Yeah, thanks moth**f****r, when are going to buy more skittle and some toilet paper? We ran out 10 minutes ago when I shit all over your dirty toilet, ..."\ "Eh, But Satoshi, why don't you go to the shop to..."\ "Shut up you f'ing a--hole, you made me! You made me what I am today! You liked me when I invented thàh bitcoin right? Now get me some toilet paper and here's a list of items I want from the supermarket! Lazy dumb idiot."\ "You'll clean up the kitchen right?"\ "Yeah yeah, rolls eyes, after my Netflix series man... now get out"\ \ This might sound far-fetched but founders of shitcoins steal your money, while children steal your time ànd money while you have to endure the founders as well.

Time is slowly damaging you while you live your life further and further away from the hard-money proposition. Hell, you even will need to sell some hard money to get by. Because it's a rotten world and children make you short sighted about the future (it limits you to maximum 3 years ahead in my experience with people around me).

Long-term is your enemy Short-term is your prison

You’re hyped for the long-term gains—multi-generational dynasties, just like the elites—but the fine print? It’s a mess. I’m here to unpack the hope, the scepticism, and the grim reality of raising kids in a world that feels like it’s speedrunning towards the absolute bottom. Let me make that clearer:

Our power (as bitcoiners) doesn't grow with these new generations, because we're being out-Idiocracy'd at a rate we can’t reproduce our way out of. Bitcoiners don’t scale. Even if you produce two children that both become die-hard bitcoin maximalists (with a nasal voice and a fondness for TD-sequential analysis.

The Mirage of Birth Having a kid is like snagging a hyped-up crypto airdrop. You’re told it’s “free” value — new life, pure joy, a legacy token dropped into your wallet. Everyone’s tweeting about it, posting ultrasound pics like they just scored 10,000 USDC worth of free shitcoin tokens.

But then the transaction fees hit, getting another place to live more accommodating, getting a school, adopt a dad body demeaner while torpedoing your social life and having no fun other than baking cakes and getting less pussy than a laser pointer with dead batteries. Adjust for inflation), sleepless nights, a vortex of money being vaporized and a lifetime of HODLing a position you can’t dump nor short. You’re basically the holder of last resort for a diatribe of chaos. You’re the entry, the trade, and exit liquidity. The real kicker? Society’s cheering you on while you’re stuck debugging your life and seeing your time drained. You’re frozen in time, while you should be scaling ideas. \ Or getting more out of life than being the channelling of funds to a future fiat oppressed kid. Meanwhile, parents (if they stay together that is... with relations with kids having their own version of the bitcoin “halving”, be it every 7 years or so. The parents follow the higher noble goal and get some love and nice moments in return. They’re stacking diapers instead of sats, living above a dry cleaner next to a subway station that rattles your soul. You can’t short kids, no matter how much you see the “childfree” crowd thriving. The childfree crowd is also not always that neutral, as many of them want this same life, because the marketing, as with many shitcoins is excellent. It makes life more fun, more fulfilling, more whole, while promising you cheap, fast and always immutable transactions. You’re getting duped. You buy more stuff, more hobbies no one cares about, and smile at other parents at these gatherings like you’re at the whale room at a bitcoin conference in a bear market. Keep smiling, bitches. That’s you’re life now. The numbers don’t lie. Society sells parenthood as a Bitcoin-level HODL, but the safety net is thinner than a layer-2 solution created by an Albanian exchange.

Raising kids is like betting your airdropped tokens will moon into a blue-chip asset that takes care of you when you’re old. You’re hoping they’ll HODL your hand, not rug-pull you into a nursing home when their “value” spikes. It’s a gamble: will they be decent humans or turn into TikTok zombies? Back in the day, kids were economic assets, working the farm or whatever. Now? You’re praying they don’t ghost you after college or at least recognize all the proof of work you did for them. And yes, you can have a big impact on them, that’s something to be proud of if it works out. But in the end, you are you, a person, with dreams, hopes and needs. And your children are too,... they’ll always win. Teaching them to ride a bike is fun, but it’s like a shitcoin pumping on a founder’s tweet: fleeting, followed by a crash whenever you see the effects of your years of de-progress and social isolation. Socializing with other parents is like making friends with a fellow prisoner of war in some jungle camp, ... you’ll have to be nice because it’s all you have left of society’s pleasantries. So you make small talk or a little joke about a toy someone’s kid has brought to the playground. The real world would see these people piss all over your grave if they could. They’re the figurehead on a ship of fools. And you play along because you’re a total bitch that got stuck in the routine of the famous HCS. Finding trust is hard, certainly in a city’s virtual prison camp where you play Russian roulette for other people’s amusement. It’s like running a Lightning node — fun in theory, but you’re babysitting a system that crashes when you need it most. The highs are real, but “kinda fun” doesn’t cut it when you’re debugging life. The 35k to 200k € it will cost you throughout your life, is not measurable as gains or losses. Look at the lovely baby pictures, look at their school results, the painting they made especially for you saying “I love you, for the best dad/mom in the whole world”. It hits straight to your brain’s nucleus accumbens. It’s all the balanced injection of the right shot of chemical balanced reward center (ventral tegmental area) food. And people with kids wanted that because that’s what the system and urges are. Kids are a leveraged position with no stop-loss, unlike an airdrop you can dump when the hype fades. You’re all-in, praying society doesn’t crash before your “asset” matures. In the meanwhile, you get the occasional surprise through your mesolimbic pathway. Happy you proof of stakes the unhappy you later. You could be in the Maldives diving into clear water while talking to another “founder”. Funny how that works. Meanwhile, the childfree are staking their tokens and chilling. Parents aren’t building dynasties; we’re just trying not to get rug-pulled by daycare costs and rotten school-systems that learn our kids to be obedient consumers and non-thinking parrots. It’s a financial social anti-grind with no cure, and the charts, unlike fiat-corporate nonsense, don’t lie.

The elites stack power like blue-chip stocks, minting wealth across centuries. Us? Our kids might be fighting over the leftovers while they battle their way through university diversity and mediocracy. Future generations are supposed to carry the torch, but consumerism and cultural decay make it feel like we’re being out-Idiocracy’d. \ We need to think long-term, teach kids to code, stack sats, and question the system. But above all else, we need them to learn that being more evil is more just. Being complacent in this farce of a system means always, and I mean always, that the multi-generational monsters will prevail. \ \ They’re more stubborn, faster, better educated and they take the shortcuts you can’t have. We have hard money, they have “hard world”.

Conclusion

Eighteen years into this parenting thing (or eight minutes—who’s counting?), it’s clear: kids are a shitcoin airdrop with no exit strategy for you. \ The highs are sweet, the costs are brutal, and the long-term. A gamble on humanity in a world trending toward a broad brush of average things made normal.

Maybe it’s not about winning the bitcoin standard, but betting on something bigger than yourself within yourself, even if that market’s rigged with traps and detractors everywhere. Stack sats, stack diapers, and pray your kids don’t rug-pull your heart. \ Because, let’s face it, we’re not the Rothschilds — we’re just HODLing and hoping. \ While we should be fighting with the hardest money. \ While your baby cries for more food, I hear Michael Jackson sing “If you can’t feed your baby hi hee-hee, then don’t have a baybaah”. \ \ The sad part is, that we're all torn between chasing the fiat-created dreams and the reality that everything is in fact a shitcoin sapping either your time, money or effort. \ Even within the bitcoin space, we don't realize what the next step should be.\ It certainly isn't big families. That's for sure.

AVB

-

@ 7f6db517:a4931eda

2025-06-14 19:01:49

@ 7f6db517:a4931eda

2025-06-14 19:01:49

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ eb0157af:77ab6c55

2025-06-14 19:01:29

@ eb0157af:77ab6c55

2025-06-14 19:01:29Treasury Secretary Bessent foresees a promising future for stablecoins pegged to the US dollar.

During a US Senate hearing held on June 11, Treasury Secretary Scott Bessent confirmed that the market for US dollar-backed stablecoins has the potential to surpass the $2 trillion mark within the next three years.

“I believe that stablecoin legislation backed by U.S. treasuries or T-bills will create a market that will expand U.S. dollar usage via these stablecoins all around the world,” the government official stated.

Bessent reiterated the administration’s commitment to strengthening the dollar’s status through USD-denominated stablecoins.

GENIUS Act gains ground

The legislative process received a boost after the Senate voted to advance the stablecoin bill, moving it closer to a final vote. The GENIUS Act, once approved, will establish strict requirements for the stable digital currency sector.

The bill mandates that stablecoins must be fully backed by US dollars or assets with equivalent liquidity (Treasuries). It also requires annual audits for issuers with a market capitalization exceeding $50 billion and includes specific provisions regarding the issuance of these cryptocurrencies abroad.

Stablecoins and the financial system

The stablecoin sector is drawing increasing interest from banking institutions. Bank of America is preparing to launch its own stablecoin, while Circle — issuer of USDC — went public this month, with shares surging 235% on its first trading day.

Currently, US dollar-pegged stablecoins account for over 96% of the entire stable digital currency market.

The post Stablecoins: market could reach $2 trillion by 2028, says Bessent appeared first on Atlas21.

-

@ 9ca447d2:fbf5a36d

2025-06-14 19:01:08

@ 9ca447d2:fbf5a36d

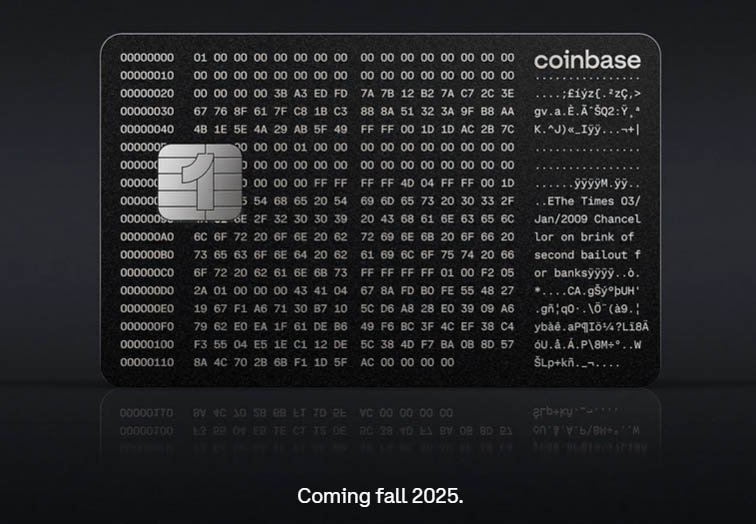

2025-06-14 19:01:08Coinbase is launching its first-ever credit card — the Coinbase One Card — with up to 4% back in bitcoin on everyday purchases.

The announcement was made at the 2025 State of Crypto Summit in New York and marks a big step towards making bitcoin more accessible and rewarding for everyday use.

The card is being released in partnership with American Express and will roll out in the U.S. this fall. It’s only available to Coinbase One members, the company’s growing subscription service.

“Whether you’re buying groceries or booking a trip, the Coinbase One Card lets you earn rewards in Bitcoin — making everyday spending more rewarding than ever,” Coinbase said in a blog post.

The Coinbase One Card lets you earn 2-4% back in bitcoin, depending on how much you have in assets on the Coinbase platform. All cardholders will start at 2%, but those with more assets can unlock higher cashback rates.

The card also has a metal design with text from Bitcoin’s original Genesis Block engraved on it, representing its connection to the birth of the scarce digital asset.

Coinbase One Card

The bitcoin rewards are a first for Coinbase, which previously only released a prepaid debit card with Visa in 2020. The new card is a shift from traditional digital asset trading tools to everyday financial products that integrate with the blockchain.

The card is on the American Express Network, which provides access to travel protections, exclusive offers, personalized experiences and the secure infrastructure of one of the most trusted brands in payments.

Will Stredwick, SVP of Global Network Services at American Express said:

“We see real potential in the combination of Coinbase and crypto with the powerful backing of American Express, and what the card offers is an excellent mix of what customers are looking for right now.”

Luke Gebb, Executive Vice President of Amex Digital Labs added that Amex is committed to “practical, compliant applications” of the blockchain and Bitcoin technology.

The Coinbase One Card is issued by First Electronic Bank and offered through a partnership with fintech company Cardless. A waitlist is open now on Coinbase’s website and more info will be shared as the fall launch approaches.

To use the card, you need to be enrolled in Coinbase One, a subscription program launched in 2023. There are now two options:

- Standard Coinbase One: $29.99/month, with zero trading fees, priority customer support and enhanced staking rewards.

- Coinbase One Basic: $4.99/month or $49.99/year, to make it more affordable. Basic members also get the card and the same bitcoin rewards.

Both tiers get up to 4% bitcoin back, zero-fee trading on eligible assets (up to $500/month for Basic), and 4.5% APY on the first $10,000 in USDC holdings.

“Our customers are graduating from just creating [accounts] to now using Coinbase as a primary financial account,” said Max Branzburg, Coinbase’s VP of Product.

The Coinbase One Card launch comes as more digital asset platforms are entering the credit and debit card space. Rivals like Gemini have launched cards with similar cashback features and payments giants like Mastercard are exploring bitcoin integrations.

-

@ cae03c48:2a7d6671

2025-06-14 19:00:46

@ cae03c48:2a7d6671

2025-06-14 19:00:46Bitcoin Magazine

Where Could Bitcoin Peak This Cycle?With Bitcoin looking as bullish as ever, the inevitable question arises of how high could BTC realistically go in this market cycle? Here we’ll explore a wide range of on-chain valuation models and cycle timing tools to identify plausible price targets for a Bitcoin peak. Although prediction is never a substitute for disciplined data reaction, this analysis gives us frameworks to better understand where we are and where we might be heading.

Price Forecast Tools

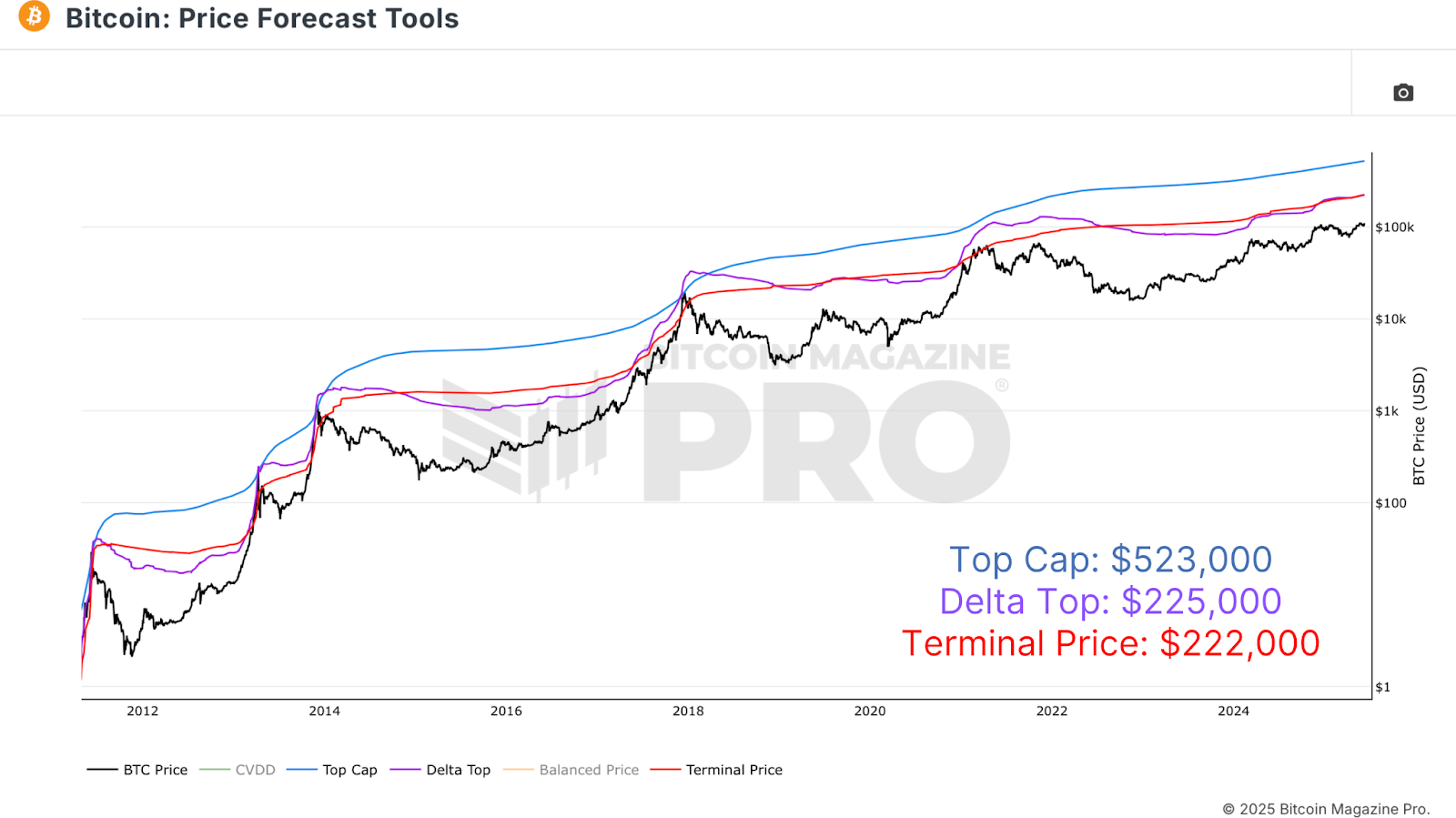

The journey begins with Bitcoin Magazine Pro’s free Price Forecast Tools, which compile several historically accurate valuation models. While it’s always more effective to react to data rather than blindly predict prices, studying these metrics can still provide powerful context for market behavior. If macro, derivative, and on-chain data all start flashing warnings, it’s usually a solid time to take profit, regardless of whether a specific price target has been hit. Still, exploring these valuation tools is informative and can guide strategic decision-making when used alongside broader market analysis.

Figure 1: Applying Price Forecast Tools to calculate potential cycle tops. View Live Chart

Among the key models, the Top Cap multiplies the average cap over time by 35 to project peak valuations. It accurately forecasted 2017’s top, but missed the 2020–2021 cycle, estimating over $200k while Bitcoin peaked around $69k. It now targets over $500k, which feels increasingly unrealistic. A step further is the Delta Top, subtracting the average cap from the realized cap, based on the cost basis of all circulating BTC, to generate a more grounded projection. This model suggested an $80k–$100k top last cycle. The most consistently accurate, however, is the Terminal Price, based on Supply Adjusted Coin Days Destroyed, which has closely aligned with each prior peak, including the $64k top in 2021. Currently projecting around $221k, it could rise to $250k or more, and remains arguably the most credible model for forecasting macro Bitcoin tops. Of course, more information regarding all of these metrics and their calculation logic can be found beneath the charts on the site.

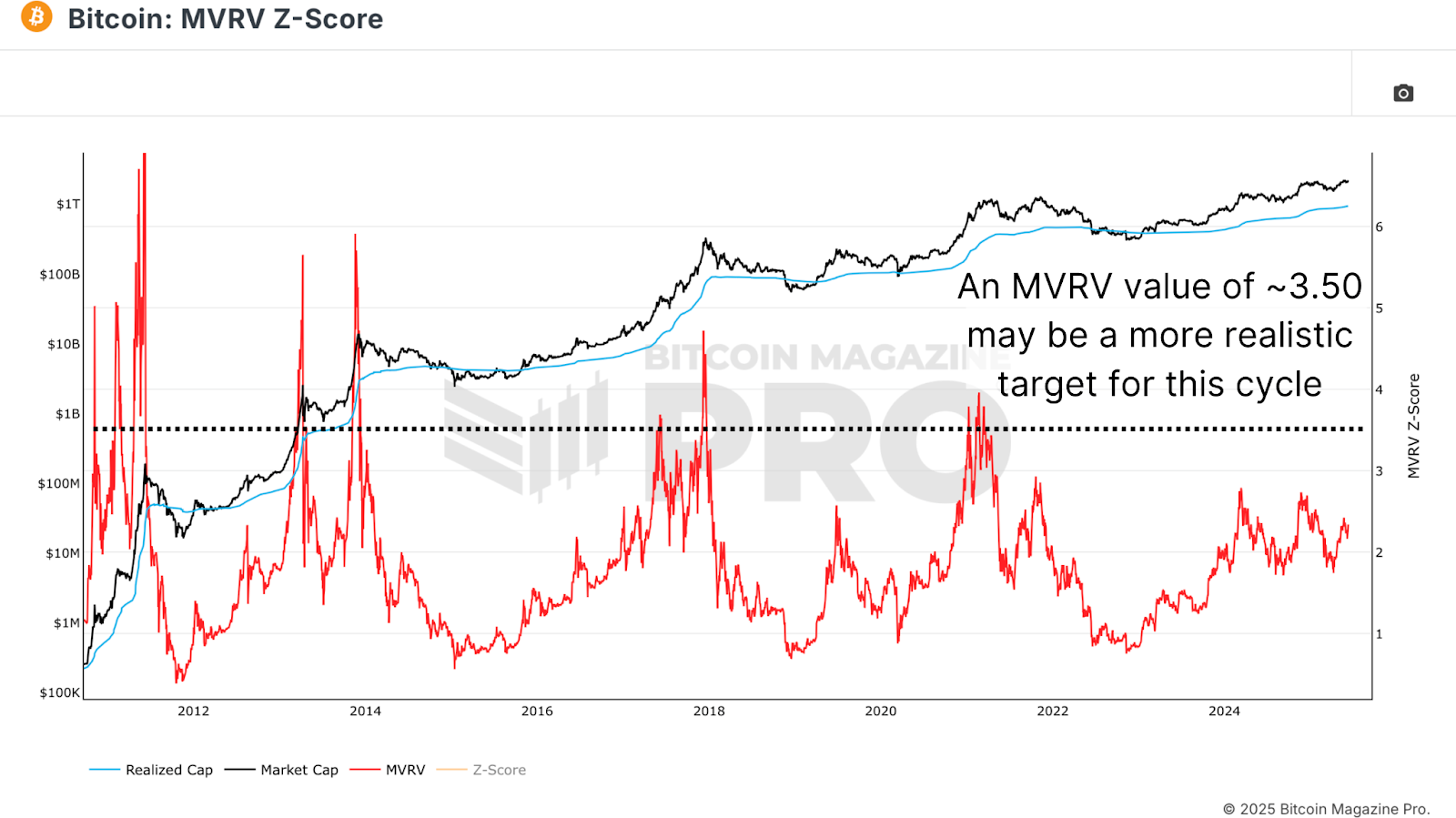

Peak Forecasting

Another powerful metric is the MVRV ratio, which compares market cap to realized cap. It offers a psychological window into investor sentiment, typically peaking near a value of 4 in major cycles. The ratio currently sits at 2.34, suggesting there may still be room for significant upside. Historically, as MVRV nears 3.5 to 4, long-term holders begin to realize substantial gains, often signaling cycle maturity. However, with diminishing returns, we might not reach a full 4 this time around. Instead, using a more conservative estimate of 3.5, we can begin projecting more grounded peak values.

Figure 2: A view of the MVRV ratio predicts further cycle growth to reach historical 4+ and even more conservative 3.5 target values. View Live Chart

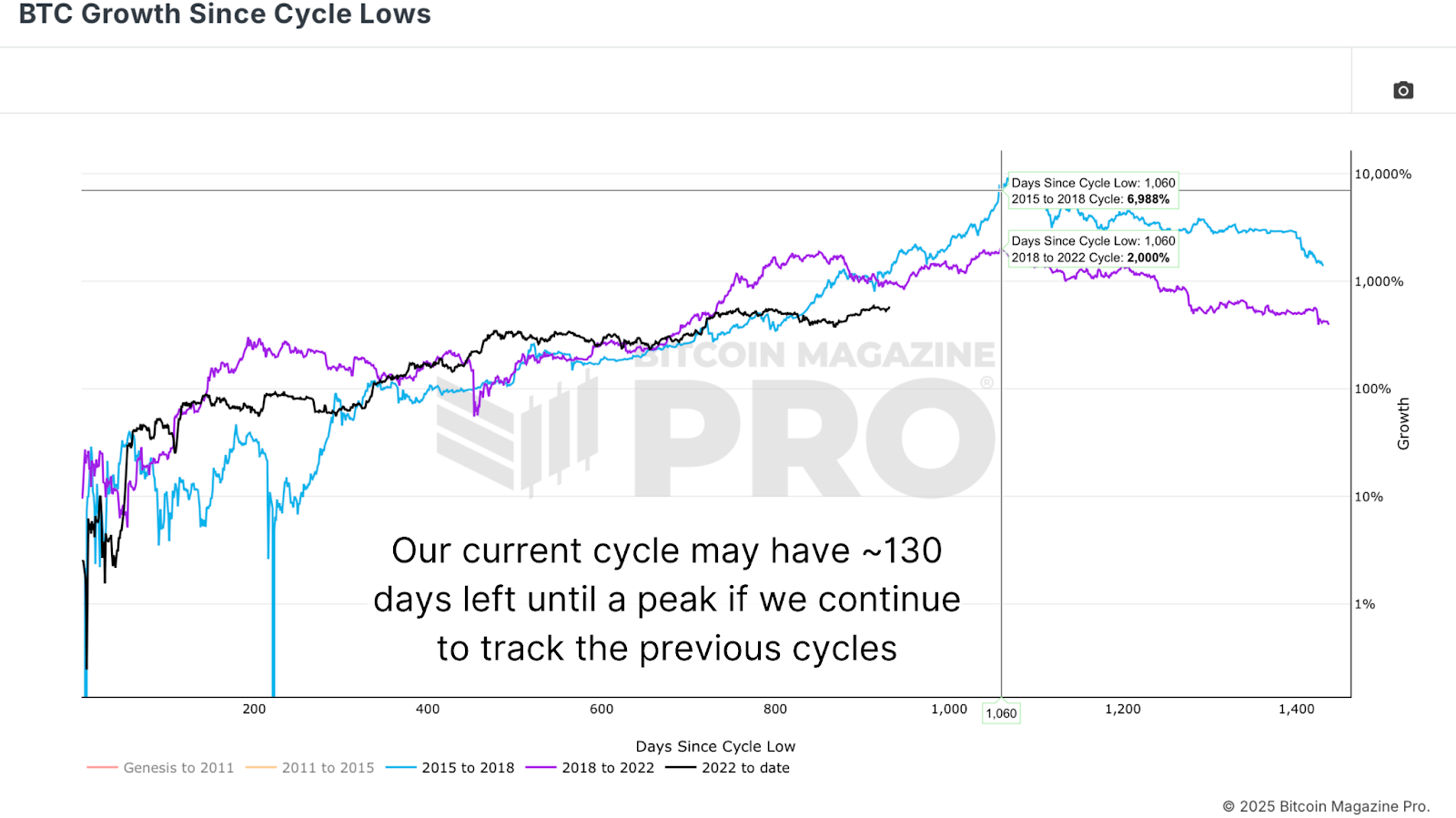

Calculating A Target

Timing is as important as valuation. Analysis of BTC Growth Since Cycle Lows illustrates that previous Bitcoin cycles peaked almost exactly 1,060 days from their respective lows. Currently, we are about 930 days into this cycle. If the pattern holds, we can estimate the peak may arrive in roughly 130 days. Historical FOMO-driven price increases often happen late in the cycle, causing Realized Price, a proxy for average investor cost basis, to rise rapidly. For instance, in the final 130 days of the 2017 cycle, realized price grew 260%. In 2021, it increased by 130%. If we assume a further halving of growth due to diminishing returns, a 65% rise from the current $47k realized price brings us to around $78k by October 18.

Figure 3: Based on the peak rate of previous cycles, this cycle is far from over. View Live Chart

With a projected $78k realized price and a conservative MVRV target of 3.5, we arrive at a potential Bitcoin price peak of $273,000. While that may feel ambitious, historical parabolic blowoff tops have shown that such moves can happen in weeks, not months. While it may seem more realistic to expect a peak closer to $150k to $200k, the math and on-chain evidence suggest that a higher valuation is at least within the realm of possibility. It’s also worth noting that these models dynamically adjust, and if late-cycle euphoria kicks in, projections could quickly accelerate further.

Figure 4: Combining projected realized price and a possible MVRV target to predict this cycle’s peak.

Conclusion

Forecasting Bitcoin’s exact peak is inherently uncertain, with too many variables to account for. What we can do is position ourselves with probabilistic frameworks grounded in historical precedent and on-chain data. Tools like the MVRV ratio, Terminal Price, and Delta Top have repeatedly demonstrated their value in anticipating market exhaustion. While a $273,000 target might seem optimistic, it is rooted in past patterns, current network behavior, and cycle-timing logic. Ultimately, the best strategy is to react to data, not rigid price levels. Use these tools to inform your thesis, but stay nimble enough to take profits when the broader ecosystem starts signaling the top.

For more deep-dive research, technical indicators, real-time market alerts, and access to a growing community of analysts, visit BitcoinMagazinePro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

This post Where Could Bitcoin Peak This Cycle? first appeared on Bitcoin Magazine and is written by Matt Crosby.

-

@ dfa02707:41ca50e3

2025-06-14 18:01:58

@ dfa02707:41ca50e3

2025-06-14 18:01:58News

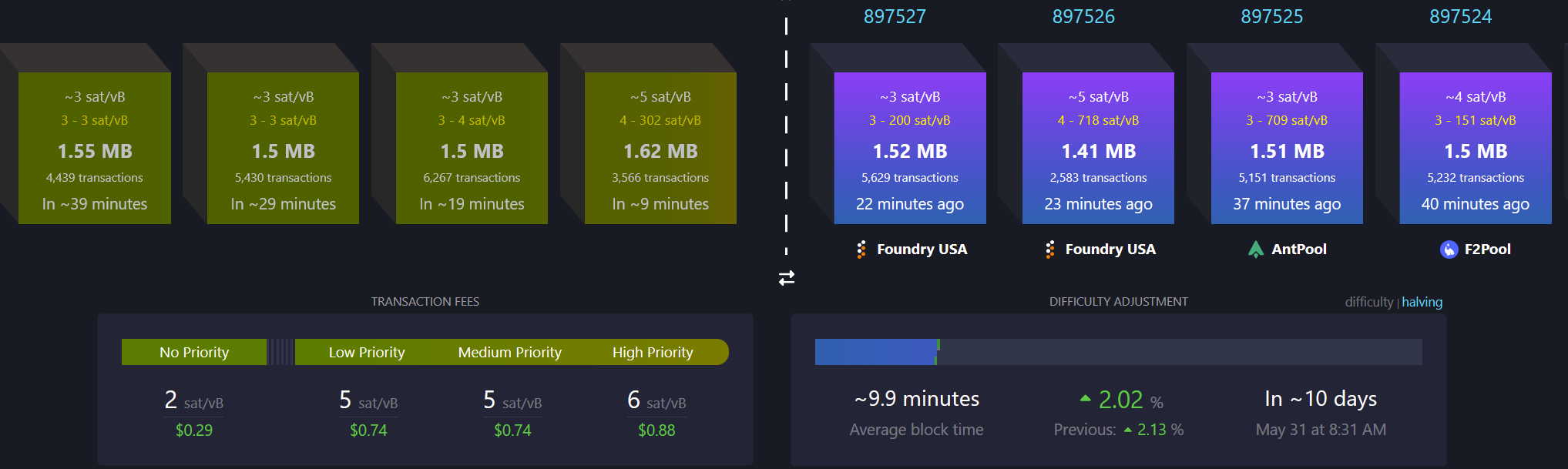

- Bitcoin mining centralization in 2025. According to a blog post by b10c, Bitcoin mining was at its most decentralized in May 2017, with another favorable period from 2019 to 2022. However, starting in 2023, mining has become increasingly centralized, particularly due to the influence of large pools like Foundry and the use of proxy pooling by entities such as AntPool.

Source: b10c's blog.

- OpenSats announces the eleventh wave of Nostr grants. The five projects in this wave are the mobile live-streaming app Swae, the Nostr-over-ham-radio project HAMSTR, Vertex—a Web-of-Trust (WOT) service for Nostr developers, Nostr Double Ratchet for end-to-end encrypted messaging, and the Nostr Game Engine for building games and applications integrated with the Nostr ecosystem.

- New Spiral grantee: l0rinc. In February 2024, l0rinc transitioned to full-time work on Bitcoin Core. His efforts focus on performance benchmarking and optimizations, enhancing code quality, conducting code reviews, reducing block download times, optimizing memory usage, and refactoring code.

- Project Eleven offers 1 BTC to break Bitcoin's cryptography with a quantum computer. The quantum computing research organization has introduced the Q-Day Prize, a global challenge that offers 1 BTC to the first team capable of breaking an elliptic curve cryptographic (ECC) key using Shor’s algorithm on a quantum computer. The prize will be awarded to the first team to successfully accomplish this breakthrough by April 5, 2026.

- Unchained has launched the Bitcoin Legacy Project. The initiative seeks to advance the Bitcoin ecosystem through a bitcoin-native donor-advised fund platform (DAF), investments in community hubs, support for education and open-source development, and a commitment to long-term sustainability with transparent annual reporting.

- In its first year, the program will provide support to Bitcoin hubs in Nashville, Austin, and Denver.

- Support also includes $50,000 to the Bitcoin Policy Institute, a $150,000 commitment at the University of Austin, and up to $250,000 in research grants through the Bitcoin Scholars program.

"Unchained will match grants 1:1 made to partner organizations who support Bitcoin Core development when made through the Unchained-powered bitcoin DAF, up to 1 BTC," was stated in a blog post.