-

@ 5627e59c:d484729e

2025-06-11 21:23:42

@ 5627e59c:d484729e

2025-06-11 21:23:42Ik hou van de natuur en van verbinding maken\ Van diepgang en van mensen raken

Van creatief schrijven en programmeren\ Van speels bewegen en nieuwe dingen leren

Ik hou van leven en van dromen\ En van mensen zien\ Hun diepste wensen uit doen komen

-

@ 5627e59c:d484729e

2025-06-11 21:23:14

@ 5627e59c:d484729e

2025-06-11 21:23:14Ik sta hier nu een poos\ Bevroren, machteloos

Ik wil graag iets veranderen\ Gewoon iets doen voor anderen

Maar het mag precies niet zijn\ En dat doet me veel pijn

Verlamd en vol van onbegrip\ Ik krijg er maar geen grip op

Op de wereld en de mensen\ Zij verpletteren mijn diepste wensen

Niemand die eens hoort\ Naar wat mij toch zo stoort

Ik kan nog eens proberen\ Om de wereld om te keren

Maar ik weet, het heeft geen zin\ Ik raak nooit binnen in

De ander\ Kom, verander

Misschien wordt het eens tijd\ Dat ik mezelf bevrijd

Van al die overmacht\ Die mij toch zo versmacht

Een stapje achteruit\ Adem in en adem uit

Ik doe mijn oogjes dicht\ En zie wie mij verplicht

Opzadelt met ambitie\ Van waar komt toch die missie

Al de pijn die ik niet aankan\ En van 't bestaan verban

Al 't bewijs voor mijn geloof\ Dat ik niet meer vliegen kan

-

@ 5627e59c:d484729e

2025-06-11 21:22:37

@ 5627e59c:d484729e

2025-06-11 21:22:37Een warme chocomelk\ Een knuffel en de moed te durven spreken\ Een leuk oprecht verhaal\ En een stap naar mijn verlangen

Deze dingen allemaal\ Maken me warm vanbinnen\ Ik hou van deze dingen\ Ze doen mijn hartje zingen

Ik wens iedereen zo'n warmte toe\ Ik wou dat ik het delen kon\ Maar het ziet er anders uit\ Voor jou dan hoe voor mij

Het enige wat ik echt kan zeggen\ Het enige dat ik zeker weet\ De kracht om warmte te creëren\ Ligt in je eigen handen

In je voeten, in je mond\ Het zit ook in je ogen\ En ook in je haar\ En zei ik al je mond\ En zelfs ook in je kont

Haha, ik ben maar wat aan 't lachen\ Dat is wat mij verlucht\ En ervoor zorgt dat wat ik zeg\ Van mij los kan komen\ En jou bereiken kan

Zo kan ik op beide oren slapen\ Dat ik deed dat wat ik kon\ Ik sprak dat wat belangrijk is\ Voor mij en liet het los

De wijde wereld in\ Voor al die horen wil en daar om geeft\ Om die warmte in hun hartje\ En daar misschien naar streeft

Ik wens je al 't succes toe in de wereld\ Want God weet, je bent het waard\ Het ligt nu in jouw handen\ Deze woorden, wat ik zeg\ Iets om over na te denken\ Tussen 't brood en het beleg

Leef gewoon je leven\ En zorg goed voor jezelf\ En als je 't graag wilt vinden\ Is het daar voor jou aan 't wachten\ Tot jij klaar bent met geloven\ In al dat anders klinkt

Ik kan je niets beloven\ Maar vertrouw op jouw instinct

-

@ 5627e59c:d484729e

2025-06-11 21:21:57

@ 5627e59c:d484729e

2025-06-11 21:21:57Warmte betekent zachtheid aan de grenzen\ Omringt door zachte mensen

Warmte betekent vrijheid\ Vrij om mij te tonen en te bewegen

Warmte betekent rust\ Om hier niet ver vandaan te hoeven zijn

Warmte betekent leven\ Iets waar ik vol van liefde mijn aandacht aan wil geven

Warmte betekent vriendschap\ Alle vriendschap die mijn hartje vult

Warmte betekent vol zijn\ Vol betekenis die mijn omgeving aan mij schenkt

Warmte betekent geven\ Geven om wat ik voor jou en jij voor mij\ Wij voor elkaar nu eigenlijk echt betekenen

-

@ 5627e59c:d484729e

2025-06-11 21:21:19

@ 5627e59c:d484729e

2025-06-11 21:21:19Enlightenment is just\ You catching up with time

Enlightenment is just\ Successfully processing your current situation\ And what it has to do with your past

Enlightenment is just\ Separating what you believe from what you know\ What is real from what is true

Enlightenment is living\ According to what you believe\ Because that's what is real for you\ Yet knowing it might turn out\ To be not really true

Enlightenment is giving thanks\ For being proven wrong

For how else would we grow\ The things we're conscious of\ The things that're real for us\ And the things we really know

How else would we align those things\ With the truth of what is (t)here\ Beyond\ That which we are

-

@ 5627e59c:d484729e

2025-06-11 21:20:49

@ 5627e59c:d484729e

2025-06-11 21:20:49Nooit is mijn dans echter\ Dan net nadat het regende\ Want regen biedt een kans\ Om mijn gevoel te voelen

Zolang de regen spettert\ En ik mezelf graag zie\ Wordt er niets verplettert\ Ook al lijkt dat soms wel zo

Zodra de regen ophoudt\ En zich terugtrekt met de wolken\ Komt een nieuwe glans\ Voor het eerst mijn ogen binnen

Wat is het leven heerlijk\ Als ik eerlijk ben en voel\ Wat is het leven zacht\ En het brengt me naar mijn doel

Wat zou ik weten zonder regen\ Gewoon steeds evenveel\ Niet groeien is niet leven\ Daarom dans ik het liefst

Net na de echte regen

-

@ 5627e59c:d484729e

2025-06-11 21:20:07

@ 5627e59c:d484729e

2025-06-11 21:20:07My life is my way Home\ My death is my arrival

I can't wait to be Home\ And so I love life

I can't wait to be Home\ And so I want to live to the fullest

For there are no shortcuts

Many people die\ And never make it Home

They will have to wait\ For another chance to die

Another chance to live fully\ And die totally

I'm so thankful to be alive\ I'm on my way Home

I'm so thankful to be alive\ To have another chance to die

Every day I take a step\ In the direction of my death\ I do not postpone it

Every day I take a step\ In the direction of my truth\ I do not avoid it

It is who I am, always have been\ And always will be

It lies beyond that door\ That keeps everything in check

Where only can go through\ Which is forever true

-

@ 5627e59c:d484729e

2025-06-11 21:18:44

@ 5627e59c:d484729e

2025-06-11 21:18:44Here's to the ones who can\ Feel their cause\ Surrender\ Change their ways\ But keep their fire\ And never give up

We will transform this world\ Restructuring\ One belief at a time

-

@ 5627e59c:d484729e

2025-06-11 21:18:05

@ 5627e59c:d484729e

2025-06-11 21:18:05Hello Bumble\ You busy bee

You're going way\ Too fast for me

Going here and there\ You search for gold

Yet tumble straight\ Into what's old

Now I'm not here\ To make a gain

Nor to fix\ What's in disdain

Instead I'm just\ A humble bee

Who wants to get\ To know thee

-

@ 5627e59c:d484729e

2025-06-11 21:17:31

@ 5627e59c:d484729e

2025-06-11 21:17:31We only see\ What we are

What we are not\ We cannot see

This is how we know\ Reality is happening within\ Our own being

And experience is a consequence\ Of who we believe to be

As long as we deny\ And don't want to see

All the ways\ We think to be

Reality will seem\ Outside of our grasp

And separate\ From our experience of life

Such is our power

Yet such power\ Could only be

Of that which holds\ The entirety

-

@ 5627e59c:d484729e

2025-06-11 21:16:26

@ 5627e59c:d484729e

2025-06-11 21:16:26Liefde\ De samenkomst\ Van zien en zijn

Leven\ Het zijn en zien\ Een vorm gekregen

Sterven\ Een deur\ Die vrijheid geeft van vorm

En eeuwig leven\ Aan liefde

-

@ 5627e59c:d484729e

2025-06-11 21:15:21

@ 5627e59c:d484729e

2025-06-11 21:15:21Muziek\ Jij harmonieus geluid

Een gevoel zo uniek\ Op geen andere manier geuit

Ik ben zo dankbaar voor de vrijheid die jij me schenkt\ Om gewoon even te zijn\ In dit dierbare moment

-

@ 5627e59c:d484729e

2025-06-11 21:14:37

@ 5627e59c:d484729e

2025-06-11 21:14:37Gelukkig zijn\ Is de waarde van mijn leven

Gewoon dankbaar te bestaan\ Geen mens heeft me ooit zo'n mooi cadeau gegeven

Dankbaar voor mijn sprankelen\ Mijn doen en voor mijn streven

Maar ook dat ik mag wankelen\ Mag vallen en mag beven

Want wat er ook gebeurt\ Het duurt steeds maar voor even

De wijsheid van mijn hart\ Voor alles is een reden

Het leven brengt mij deugd\ En soms brengt het me pijn

Maar nooit neemt het die vreugd\ De toelating om hier te zijn

De kans om iets te leren\ Te zien en om te groeien

Geeft mij kracht te accepteren\ Te omarmen en te bloeien

-

@ 5627e59c:d484729e

2025-06-11 21:13:59

@ 5627e59c:d484729e

2025-06-11 21:13:59I am here too\ In the same space like you

In the same situation I'm in\ It's a matter of positioning

I cannot leave this place I'm in\ It was brought about\ By what's been happening

So please don't look at me\ For what I can or cannot do for you\ But look at what is happening for me\ And what is happening for you

Let's communicate\ Not orchestrate

Because there's something I wish to do\ And there's a place I wish to go to

And I'm sure that there is too\ In your heart a fire\ Known by only you

So let us listen, look and see\ For what's true for you\ And what's true for me

That we may act upon what's here\ In order for us both to take a step\ In the direction we wish to steer

-

@ 5627e59c:d484729e

2025-06-11 21:13:27

@ 5627e59c:d484729e

2025-06-11 21:13:27Kan jij zien, er is geen hemel\ Probeer het zelf, dan lukt het wel\ Geen hel staat ons te wachten\ Enkel sterren hangen ons boven het hoofd\ Kan jij zien, iedereen leeft voor dit moment

Kan jij zien, er zijn geen landen\ Het is niet moeilijk gewoon land te zien\ Niets om voor te moorden of te sterven\ Ook geloof wordt niet gezien\ Kan jij zien, het leven wordt geleefd door iedereen in vrede

Misschien zeg je, ik kijk niet naar jouw wereld\ Maar ik deel dit zicht met velen\ Moge ook jij zoals ons zien\ Wij kijken in de wereld en zien gewoon onszelf

Kan jij zien, er is geen bezit\ Ik vraag me af of jij dit kan\ Geen hebben of een nood\ In een samen-leving van mensen\ Kan jij zien, wij delen de wereld met elkaar

Misschien zeg je, ik kijk niet naar jouw wereld\ Maar ik deel dit zicht met velen\ Moge ook jij zoals ons zien\ Wij kijken in de wereld en zien gewoon onszelf

-

@ 5627e59c:d484729e

2025-06-11 21:12:27

@ 5627e59c:d484729e

2025-06-11 21:12:27In het hart van een gepensioneerde operazangeres ontstond een stemmetje. Het stemmetje klonk verrast. "He," ging het hart. "Ik heb een stemmetje gekregen! Hoe kan dit? Kan iemand me horen? Zouden mijn gedachten me kunnen horen?" vroeg het stemmetje, niet wetend aan wie. Want de gedachten hoorden het niet. Zij waren zo druk bezig met het verleden en hadden een grote angst dit te verliezen. "Weet je nog?" gingen de gedachten. "Voor duizenden mensen heb ik gezongen! Avond na avond! Tienduizenden mensen hebben me toegejuicht! Wat waren ze onder de indruk! Luister! Ik kan het nog steeds!" "He," ging het hart. "Hoor je me dan niet? Het ging toch helemaal niet om dat gejuich. Weet je dan niet meer hoe ik me volledig bloot gaf aan die mensen. Mijn diepste en meest persoonlijke verhalen waren te horen in mijn liederen. Daar draaide het toch om? De mensen waren niet enkel onder de indruk. Hun harten hebben mijn verhalen gevoeld en konden zo kennis geven aan hun gedachten. Is dat niet wat echt telde?" Maar de gedachten waren volop aan het zingen voor de ene persoon die ze konden vinden die wou luisteren. "He," ging het hart. "Ook in dit moment zijn mijn liederen te horen door vele gedachten en te voelen door vele harten over de hele wereld. Heb ik dan geen rust verdiend? Kan ik niet even genieten van de rust die in dit moment te vinden is, maar jullie van me afnemen?" Maar de gedachten waren nog steeds volop aan het zingen.

-

@ 5627e59c:d484729e

2025-06-11 21:08:10

@ 5627e59c:d484729e

2025-06-11 21:08:10I am the space\ In which your experience takes place

You could never meet me\ For I hold no identity

The only way to really see me\ Is to be me

-

@ 5627e59c:d484729e

2025-06-11 21:07:41

@ 5627e59c:d484729e

2025-06-11 21:07:41Love, I thank you for your warmth\ Ever lifting

You keep me charmed\ Ever drifting

May I be me\ And you be you

In a perfect harmony\ Embracing all life makes us grow through

-

@ 5627e59c:d484729e

2025-06-11 21:07:23

@ 5627e59c:d484729e

2025-06-11 21:07:23Jaren tellen\ Hoeft voor mij niet

Verhalen vertellen\ Over geluk en verdriet

Een warme haven\ Veilig en fijn

Dromen voorgedragen\ Onschuldig en rein

Momenten ervaard, geleerd\ En geïntegreerd

Ideeën, geloven en gevoelens\ Gevormd en gecreëerd

Zonder eind of echt begin\ Vallen, groeien, leren, stoeien

Een gezin in een gezin met een gezin erin\ Gezind gericht blijft liefde vloeien

-

@ 2b998b04:86727e47

2025-06-11 19:36:40

@ 2b998b04:86727e47

2025-06-11 19:36:40🌋 Ka ʻImi i ka Pono: Seeking What’s Right

A 7-Day Series on Sovereignty, Bitcoin, and the Soul of the Islands

> "Man is not free unless he wills to be free."\ > — Johann Gottlieb Fichte

Hawai‘i understands sovereignty. It always has.\ But it was taken — first with pen and politics, then with force and fiat.

Bitcoin offers something different:\ A way to reclaim sovereignty without violence.\ A tool for self-rule, not state rule.\ A system built not on empire, but on truth and time.

This week, I’ll be posting a 7-part series exploring this tension:\ Between the Hawai‘i that was, the system that is, and the future that might be — if we choose to build on bedrock instead of paper.

I don’t know if there’s a traditional Hawaiian word for a 7-day week — maybe there doesn’t need to be.\ Time moves differently on these islands.\ But for the next 7 days, I’ll mark each reflection as a kind of modern lā hoʻomanaʻo — a day of remembering, reckoning, and restoring.

This is personal. It’s philosophical. It’s also unfinished.

But that’s what sovereignty looks like:\ Not something given — something reclaimed.

Stay tuned. Stay akamai.\ 🟧\ — Andrew G. Stanton (aka akamaister)

-

@ 5627e59c:d484729e

2025-06-11 21:07:04

@ 5627e59c:d484729e

2025-06-11 21:07:04The world around me\ Is assumed to be

Through sensory observations\ This appears to me

What I experience\ Is for me

But the ultimate experience\ Is for me\ To be

-

@ 79be667e:16f81798

2025-06-11 19:11:59

@ 79be667e:16f81798

2025-06-11 19:11:59I am here too\ In the same space like you

In the same situation I'm in\ It's a matter of positioning

I cannot leave this place I'm in\ It was brought about\ By what's been happening

So please don't look at me\ For what I can or cannot do for you\ But look at what is happening for me\ And what is happening for you

Let's communicate\ Not orchestrate

Because there's something I wish to do\ And there's a place I wish to go to

And I'm sure that there is too\ In your heart a fire\ Known by only you

So let us listen, look and see\ For what's true for you\ And what's true for me

That we may act upon what's here\ In order for us both to take a step\ In the direction we wish to steer

-

@ dfa02707:41ca50e3

2025-06-11 19:03:18

@ dfa02707:41ca50e3

2025-06-11 19:03:18- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ 5627e59c:d484729e

2025-06-11 21:06:42

@ 5627e59c:d484729e

2025-06-11 21:06:42Happy New Year!

Happy New Year, my dearest human family\ Happy New Year, my dearest animal family

Dear children of the Earth\ I wish you all a magical year

May it be utterly new\ Ever-changing\ New now

And may your journey say\ Life is amazing! I'm in a maze\ Life is awesome! Quite some awe\ Life is magical! True alchemy

I am human\ Black woman, I love you so\ Life-giver of my origin, the negro [nigiro]

I am\ Thus physical and non-physical meet

Life is to be\ As the elements are and compete\ And as they collide with one another\ One becomes aware of an other\ And so life sets on a journey\ To discover the other

Animal life is set to explore\ Allowing all experience the other has in store\ Life left to experience without a voice\ Until it discovers there is an 'I'\ And it has a choice

Human life is to be inside a human body\ Thus fusion between intellect and feeling\ Gets to express its perspective\ Inside infinity

Truly, a magical gift\ My Holy Trinity

And so from human life flow many voices\ As it navigates through infinite choices

Thus I say

Life is magic\ A gift for all that is here\ Perceived by too many as tragic\ Take care of your vision, I tell you, my dear [tell-a-vision]

Life is magic\ And words are spells\ Placing your aim beyond your reach\ It takes away efficiency from your speech

Life is magic\ Above all else\ Even when it has me feeling blue\ Seemingly left without a clue

Still I say

Perfection\ You are everything\ And I am of you

The source, the mirror\ And the reflection

-

@ 5627e59c:d484729e

2025-06-11 18:48:00

@ 5627e59c:d484729e

2025-06-11 18:48:00Love, I thank you for your warmth\ Ever lifting

You keep me charmed\ Ever drifting

May I be me\ And you be you

In a perfect harmony\ Embracing all life makes us grow through

-

@ 5627e59c:d484729e

2025-06-11 21:06:21

@ 5627e59c:d484729e

2025-06-11 21:06:21De laatste zonnestralen van de dag streken over de eeuwige golven en weerkaatsten als lichtpuntjes in de ogen van schipper Joris terwijl hij nog een slok nam van zijn glazen fles die de vorm had van het hoofd van een oude monnik.

Gekregen van een oude vrouw uit de bergen van de Himalaya, zorgde de rum genaamd 'Old Monk' voor een verwarmend gezelschap op deze eenzame kerstnacht.

Joris had met zijn boot naar India gevaren nadat zijn vrouw hem had verlaten en hij een Indiër had ontmoet die had gezegd: "Waar ik vandaan kom, zijn vrouwen vrij en worden ze niet gezien als enkel en alleen de mooie lichamen die zij bezitten of als eeuwig bezit van een gezin."

Verward en ongelovig had Joris gekeken naar de wereld en besefte dat vrouwen inderdaad slechts gezien werden als hun fysieke schoonheid, genegeerd werden voor hun koesterende gevoeligheid en bekritiseerd werden door hun spontane intensheid en had hierop voor twee jaar lang gezocht in India naar deze vrije vrouwen met als enig resultaat een oude vrouw te ontmoeten die alleen in de bergen woonde en dagelijks haar wijsheid deelde met ieder luisterend oor.

Daar ging het doorzichtig monnikshoofd en verliet met een grote gebogen vlucht de hand van schipper Joris toen plots met groot kabaal de boot abrupt tot stilstand kwam en Joris hals over kop naar de andere kant van het dek geslingerd werd.

Het monnikshoofd verdween in het donker terwijl Joris zijn lichaam probeerde te lokaliseren en met zijn ogen wijd open zijn hersenen zo veel mogelijk informatie probeerde door te spelen.

Tevergeefs, want zijn enorme verschot werd gevolgd door een enkel groeiende verbazing, ongeloof en desoriëntatie toen de boot begon te kantelen.

De bundel licht, afkomstig van de mast van de boot, zwierde doorheen het donker en kwam te schijnen op een gigantische rots in het midden van de zee die werd bezeten door een oogverblindende glinstergroene schijn.

Uit het donker kwam het monnikshoofd, dat nog steeds in volle vlucht was, in het vizier van de lichtbundel en plaatste zich exact tussen de glinstergroene verschijning en Joris waarbij Joris doorheen het monnikshoofd gezegend werd met het zicht op een pracht van een zeemeermin die uitnodigend poseerde op de rots.

Met een luide plons viel Joris achterover in het water toen hij zich realiseerde dat vrouwen zichzelf ook lieten vangen door lust en hun uiterlijke opmaakcompetities en met een dankbare glimlach zonk hij naar de bodem van de zee en was opnieuw geboren.

-

@ 5627e59c:d484729e

2025-06-11 18:42:09

@ 5627e59c:d484729e

2025-06-11 18:42:09Jaren tellen\ Hoeft voor mij niet

Verhalen vertellen\ Over geluk en verdriet

Een warme haven\ Veilig en fijn

Dromen voorgedragen\ Onschuldig en rein

Momenten ervaard, geleerd\ En geïntegreerd

Ideeën, geloven en gevoelens\ Gevormd en gecreëerd

Zonder eind of echt begin\ Vallen, groeien, leren, stoeien

Een gezin in een gezin met een gezin erin\ Gezind gericht blijft liefde vloeien

-

@ 5627e59c:d484729e

2025-06-11 18:36:19

@ 5627e59c:d484729e

2025-06-11 18:36:19Happy New Year!

Happy New Year, my dearest human family\ Happy New Year, my dearest animal family

Dear children of the Earth\ I wish you all a magical year

May it be utterly new\ Ever-changing\ New now

And may your journey say\ Life is amazing! I'm in a maze\ Life is awesome! Quite some awe\ Life is magical! True alchemy

I am human\ Black woman, I love you so\ Life-giver of my origin, the negro [nigiro]

I am\ Thus physical and non-physical meet

Life is to be\ As the elements are and compete\ And as they collide with one another\ One becomes aware of an other\ And so life sets on a journey\ To discover the other

Animal life is set to explore\ Allowing all experience the other has in store\ Life left to experience without a voice\ Until it discovers there is an 'I'\ And it has a choice

Human life is to be inside a human body\ Thus fusion between intellect and feeling\ Gets to express its perspective\ Inside infinity

Truly, a magical gift\ My Holy Trinity

And so from human life flow many voices\ As it navigates through infinite choices\

Thus I say

Life is magic\ A gift for all that is here\ Perceived by too many as tragic\ Take care of your vision, I tell you, my dear [tell-a-vision]

Life is magic\ And words are spells\ Placing your aim beyond your reach\ It takes away efficiency from your speech

Life is magic\ Above all else\ Even when it has me feeling blue\ Seemingly left without a clue

Still I say

Perfection\ You are everything\ And I am of you

The source, the mirror\ And the reflection

-

@ 79be667e:16f81798

2025-06-11 18:33:35

@ 79be667e:16f81798

2025-06-11 18:33:35De laatste zonnestralen van de dag streken over de eeuwige golven en weerkaatsten als lichtpuntjes in de ogen van schipper Joris terwijl hij nog een slok nam van zijn glazen fles die de vorm had van het hoofd van een oude monnik.

Gekregen van een oude vrouw uit de bergen van de Himalaya, zorgde de rum genaamd 'Old Monk' voor een verwarmend gezelschap op deze eenzame kerstnacht.

Joris had met zijn boot naar India gevaren nadat zijn vrouw hem had verlaten en hij een Indiër had ontmoet die had gezegd: "Waar ik vandaan kom, zijn vrouwen vrij en worden ze niet gezien als enkel en alleen de mooie lichamen die zij bezitten of als eeuwig bezit van een gezin."

Verward en ongelovig had Joris gekeken naar de wereld en besefte dat vrouwen inderdaad slechts gezien werden als hun fysieke schoonheid, genegeerd werden voor hun koesterende gevoeligheid en bekritiseerd werden door hun spontane intensheid en had hierop voor twee jaar lang gezocht in India naar deze vrije vrouwen met als enig resultaat een oude vrouw te ontmoeten die alleen in de bergen woonde en dagelijks haar wijsheid deelde met ieder luisterend oor.

Daar ging het doorzichtig monnikshoofd en verliet met een grote gebogen vlucht de hand van schipper Joris toen plots met groot kabaal de boot abrupt tot stilstand kwam en Joris hals over kop naar de andere kant van het dek geslingerd werd.

Het monnikshoofd verdween in het donker terwijl Joris zijn lichaam probeerde te lokaliseren en met zijn ogen wijd open zijn hersenen zo veel mogelijk informatie probeerde door te spelen.

Tevergeefs, want zijn enorme verschot werd gevolgd door een enkel groeiende verbazing, ongeloof en desoriëntatie toen de boot begon te kantelen.

De bundel licht, afkomstig van de mast van de boot, zwierde doorheen het donker en kwam te schijnen op een gigantische rots in het midden van de zee die werd bezeten door een oogverblindende glinstergroene schijn.

Uit het donker kwam het monnikshoofd, dat nog steeds in volle vlucht was, in het vizier van de lichtbundel en plaatste zich exact tussen de glinstergroene verschijning en Joris waarbij Joris doorheen het monnikshoofd gezegend werd met het zicht op een pracht van een zeemeermin die uitnodigend poseerde op de rots.

Met een luide plons viel Joris achterover in het water toen hij zich realiseerde dat vrouwen zichzelf ook lieten vangen door lust en hun uiterlijke opmaakcompetities en met een dankbare glimlach zonk hij naar de bodem van de zee en was opnieuw geboren.

-

@ 5627e59c:d484729e

2025-06-11 21:05:39

@ 5627e59c:d484729e

2025-06-11 21:05:39Zonneschijn\ Stralen, lachen, zo fijn\ Moge de wereld dankbaar zijn

De vrouw, mijn gevoeligheid\ Bron van creativiteit

Genietend niets doen in het gras\ Met wat brood en wat wijn in het glas

-

@ 5627e59c:d484729e

2025-06-11 21:05:22

@ 5627e59c:d484729e

2025-06-11 21:05:22Spontaniteit\ Creativiteit

Iets visueel of gewoon geluid\ Het moet eruit

Ik doe mezelf cadeau aan jou\ Omdat ik van het leven hou

-

@ 79be667e:16f81798

2025-06-11 18:25:54

@ 79be667e:16f81798

2025-06-11 18:25:54Veroorzaakt door de wereld rond mij\ Vormen de wereld in mij

Verwaarloosd door de wereld rond mij\ Overgelaten aan mij

Een groene brug komt uit mij\ Verbindt mij met wij\ En laat ons samen vrij

-

@ 5627e59c:d484729e

2025-06-11 21:05:04

@ 5627e59c:d484729e

2025-06-11 21:05:04Veroorzaakt door de wereld rond mij\ Vormen de wereld in mij

Verwaarloosd door de wereld rond mij\ Overgelaten aan mij

Een groene brug komt uit mij\ Verbindt mij met wij\ En laat ons samen vrij

-

@ 5627e59c:d484729e

2025-06-11 21:04:47

@ 5627e59c:d484729e

2025-06-11 21:04:47In een zee van mogelijkheden\ Kunnen we best veel tijd aan dromen besteden

Dromen is een universele taal\ Het wordt gedaan door ons allemaal

Het is het woord\ Dat deze gelijkheid de grond in boort

-

@ 5627e59c:d484729e

2025-06-11 18:23:32

@ 5627e59c:d484729e

2025-06-11 18:23:32In een zee van mogelijkheden\ Kunnen we best veel tijd aan dromen besteden

Dromen is een universele taal\ Het wordt gedaan door ons allemaal

Het is het woord\ Dat deze gelijkheid de grond in boort

-

@ 5627e59c:d484729e

2025-06-11 21:04:17

@ 5627e59c:d484729e

2025-06-11 21:04:17Machtig water\ Door velen bemind

Element van beweging\ Vormgever aan land\ Bondgenoot van wind

Voorkomer van comfort\ Toelater van rust

Machtig water\ Waar ik ook ga\ Ik weet dat jij de grond onder mijn voeten kust

-

@ 79be667e:16f81798

2025-06-11 18:23:32

@ 79be667e:16f81798

2025-06-11 18:23:32In een zee van mogelijkheden\ Kunnen we best veel tijd aan dromen besteden

Dromen is een universele taal\ Het wordt gedaan door ons allemaal

Het is het woord\ Dat deze gelijkheid de grond in boort

-

@ dfa02707:41ca50e3

2025-06-11 21:01:54

@ dfa02707:41ca50e3

2025-06-11 21:01:54Contribute to keep No Bullshit Bitcoin news going.

- "Today we're launching the beta version of our multiplatform Nostr browser! Think Google Chrome but for Nostr apps. The beta is our big first step toward this vision," announced Damus.

- This version comes with the Dave Nostr AI assistant, support for zaps and the Nostr Wallet Connect (NWC) wallet interface, full-text note search, GIFs and fullscreen images, multiple media uploads, user tagging, relay list and mute list support, along with a number of other improvements."

"Included in the beta is the Dave, the Nostr AI assistant (its Grok for Nostr). Dave is a new Notedeck browser app that can search and summarize notes from the network. For a full breakdown of everything new, check out our beta launch video."

What's new

- Dave Nostr AI assistant app.

- GIFs.

- Fulltext note search.

- Add full screen images, add zoom, and pan.

- Zaps! NWC/ Wallet UI.

- Introduce last note per pubkey feed (experimental).

- Allow multiple media uploads per selection.

- Major Android improvements (still WIP).

- Added notedeck app sidebar.

- User Tagging.

- Note truncation.

- Local network note broadcast, broadcast notes to other notedeck notes while you're offline.

- Mute list support (reading).

- Relay list support.

- Ctrl-enter to send notes.

- Added relay indexing (relay columns soon).

- Click hashtags to open hashtag timeline.

- Fixed timelines sometimes not updating (stale feeds).

- Fixed UI bounciness when loading profile pictures

- Fixed unselectable post replies.

-

@ 2b998b04:86727e47

2025-06-11 18:14:59

@ 2b998b04:86727e47

2025-06-11 18:14:59For years, GitHub has been the default home for open source developers. It built its reputation on transparency, collaboration, and a commitment to giving coders a place to share and improve their work. But since Microsoft's acquisition in 2018, subtle changes have begun to surface—not all of them in service to the user.

GitHub is still free. Public repositories remain free. Even private repositories are free, to a point. GitHub Pages, Actions, and Codespaces offer incredibly powerful tools to build and deploy projects at no cost—until you hit certain usage limits or need team-scale features.

But the deeper question is this: what do you give up in exchange?

Microsoft Doesn’t Give Away Infrastructure for Free

GitHub, VSCode, Copilot, and Azure form a tightly integrated ecosystem. On the surface, it's all about productivity. But underneath, it's about data. Your code trains their models. Your habits inform their products. Your workflows deepen their lock-in.

Take Copilot, for example: it’s not just a coding assistant, it’s a data-harvesting engine built on top of a centralized platform. The more you use GitHub, the more Microsoft knows about what developers are building—and what they might buy.

Free Isn’t Sovereign

As developers, we have to ask hard questions:

-

What happens when the free tier disappears or changes?

-

Can I take my work elsewhere without breaking my stack?

-

Who owns the insights derived from my development patterns?

These questions aren’t hypothetical. We’ve seen them play out with Heroku, Medium, Twitter, and countless others. Free turns into friction. Then friction becomes control.

Alternatives Are Emerging

Thankfully, there are options:

-

Codeberg, Gitea, and SourceHut for Git hosting

-

Cloudflare Pages for static sites + edge functions

-

Railway, Fly.io, or even VPS hosting for dynamic apps

-

Nostr and IPFS for decentralized publishing

These aren’t always drop-in replacements. But they represent a healthier direction—one aligned with freedom, transparency, and a proof-of-work ethos rather than a proof-of-data-capture business model.

My Move Away from GitHub (Sort Of)

I’m not deleting my GitHub account. It’s still the best way to reach other devs. But for key projects—especially those that touch on identity, sovereignty, or censorship resistance—I’m migrating:

-

Private infrastructure where needed

-

Cloudflare for front-end deployments

-

Nostr for publishing and archiving

-

Git mirroring to open alternatives

Because the tools we use shape the future we build. And if the platform is free, but the product is you—it's time to re-evaluate.

#ProofOfWork #OpenSource #Cloudflare #DecentralizeEverything #Nostr #GitSovereignty #MicrosoftStack

-

-

@ 9ca447d2:fbf5a36d

2025-06-11 21:01:34

@ 9ca447d2:fbf5a36d

2025-06-11 21:01:34El Salvador – June 3, 2025 — The grassroots Bitcoin community of El Salvador is proud to announce the return of Bitcoin Week, taking place this November with five dynamic events celebrating Bitcoin adoption, education, and community-led innovation.

Join us for a week of inspiration, collaboration, and impact.

Bitcoin Week 2025 calendar

📍 November 12 – Bitcoin Education Celebration Gala: Kick off the week in style with a luxurious and intimate evening at a high-class dinner, celebrating “proof of work” and the achievements of the Bitcoin education movement.

Expect major plans for the year(s) ahead but also a reflection to past proof-of-work—and don’t miss out on the Great Grassroots Giveaway, included with every ticket.📍 November 13 – Bitcoin Educators Unconference: Hosted for the third time in San Salvador at Cadejo Montaña, this sixth edition of the Educators Unconference embodies our commitment to provide a space for decentralized, community-led conversations.

Join educators and leaders shaping the global Bitcoin conversation!📍 November 14–15 – Adopting Bitcoin: The Network Effect: Now in its fifth year, Adopting Bitcoin returns with a powerful focus on real-world Bitcoin usage across global communities.

This year’s theme—The Network Effect—explores how interconnected local initiatives can spark exponential growth in adoption.📍 November 16 – Visit Bitcoin Beach, El Zonte: Make your way to Bitcoin Beach, the heart of El Salvador’s Bitcoin story. Enjoy a day of connection and discovery in this iconic beachside town. Full details coming soon.

📍 November 22–23 – Economía Bitcoin, Berlín: Head to the town of Berlín, El Salvador for the second edition of Economía Bitcoin, a powerful, small-scale conference and festival focused on circular economies and practical Bitcoin use.

Spend sats freely in town and see how local action drives global impact.With five unique events across three regions in Bitcoin Country, this edition of Bitcoin Week is your chance to experience El Salvador’s Bitcoin journey up close. Whether you’re an educator, builder, Bitcoiner, or simply curious—you’re invited.

Join us this November. Be part of the movement.

-

@ 3283ef81:0a531a33

2025-06-11 17:42:21

@ 3283ef81:0a531a33

2025-06-11 17:42:21Hey\ Ho

Let's go!

-

@ b1ddb4d7:471244e7

2025-06-11 15:02:05

@ b1ddb4d7:471244e7

2025-06-11 15:02:05Hosted at the iconic Palace of Culture and Science—a prominent symbol of the communist era—the Bitcoin FilmFest offers a vibrant celebration of film through the lens of bitcoin. The venue itself provides a striking contrast to the festival’s focus, highlighting bitcoin’s core identity as a currency embodying independence from traditional financial and political systems.

𝐅𝐢𝐱𝐢𝐧𝐠 𝐭𝐡𝐞 𝐜𝐮𝐥𝐭𝐮𝐫𝐞 𝐰𝐢𝐭𝐡 𝐩𝐨𝐰𝐞𝐫𝐟𝐮𝐥 𝐦𝐮𝐬𝐢𝐜 𝐯𝐢𝐛𝐞𝐬.

Warsaw, Day Zero at #BFF25 (European Bitcoin Pizza Day) with @roger__9000, MadMunky and the @2140_wtf squad

pic.twitter.com/9ogVvWRReA

pic.twitter.com/9ogVvWRReA— Bitcoin FilmFest

(@bitcoinfilmfest) May 28, 2025

(@bitcoinfilmfest) May 28, 2025This venue represents an era when the state tightly controlled the economy and financial systems. The juxtaposition of this historical site with an event dedicated to bitcoin is striking and thought-provoking.

The event features a diverse array of activities, including engaging panel discussions, screenings of both feature-length and short films, workshops and lively parties. Each component designed to explore the multifaceted world of bitcoin and its implications for society, offering attendees a blend of entertainment and education.

The films showcase innovative narratives and insights into bitcoin’s landscape, while the panels facilitate thought-provoking discussions among industry experts and filmmakers.

Networking is a significant aspect of the festival, with an exceptionally open and friendly atmosphere that foster connections among participants. Participants from all over Europe gather to engage with like-minded individuals who share a passion for BTC and its implications for the future.

The open exchanges of ideas foster a sense of community, allowing attendees to forge new connections, collaborate on projects, and discuss the potential of blockchain technology implemented in bitcoin.

The organization of the festival is extraordinary, ensuring a smooth flow of information and an expertly structured schedule filled from morning until evening. Attendees appreciate the meticulous planning that allowed them to maximize their experience. Additionally, thoughtful touches such as gifts from sponsors and well-chosen locations for various events contribute to the overall positive atmosphere of the festival.

Overall, the Bitcoin FilmFest not only highlights the artistic expression surrounding bitcoin but also serves as a vital platform for dialogue—about financial freedom, the future of money, and individual sovereignty in a shifting world.

The event successfully bridges the gap between a historical symbol of control and a movement that celebrates freedom, innovation, and collaboration in the digital age, highlighting the importance of independence in financial systems while fostering a collaborative environment for innovation and growth.

Next year’s event is slated for June 5-7 2026. For further updates check: https://bitcoinfilmfest.com/

-

@ b1ddb4d7:471244e7

2025-06-11 21:01:13

@ b1ddb4d7:471244e7

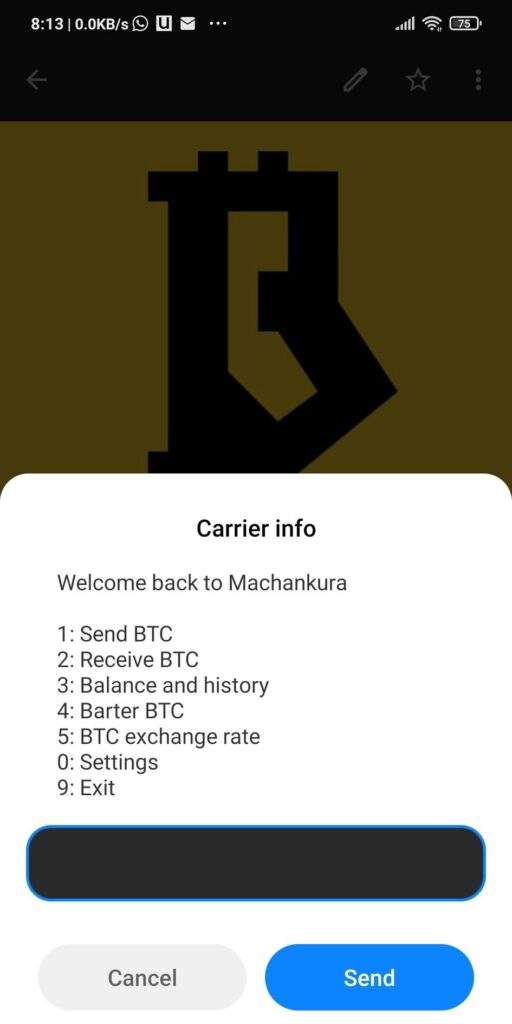

2025-06-11 21:01:13In today’s digital era, access to financial services remains a privilege for many. Bitcoinization – the mass adoption of bitcoin as a payment medium and store of value – represents a unique opportunity to democratize access to financial services.

Telecommunications carriers occupy a strategic position in this transformation, especially in regions where traditional internet access is limited. However, this aspect remains largely unexplored.

This article seeks to examine how these companies can catalyze this financial revolution by analyzing the Machankura case and the technical possibilities within current communication infrastructure.

The Success Sotry of Machankura

The Machankura project (8333.mobi) emerged to address a common challenge in various African regions: financial exclusion due to limited internet access. Created by South African developer Kgothatso Ngako, the service utilizes the USSD (Unstructured Supplementary Service Data) protocol, supported by virtually all mobile phones, to facilitate bitcoin transactions via 2G and 3G cellular networks.

Machankura – derived from South African slang for “money” – functions as a custodial bitcoin wallet. Through the USSD protocol, users can access the service by dialing short codes (*123*456789#, for example) or sending SMS messages to specific numbers.

When the server receives the code or message, an interactive session between the parties (server-user) begins. This enables users to create bitcoin wallets associated with their phone numbers, protected by multi-digit PINs.

Once registered, users receive a Lightning address (example: 1234567890@8333.mobi) that can be used to receive bitcoin from anyone worldwide. Users can also customize this address to a preferred username, further enhancing privacy.

Currently, Machankura is available in nine African countries, including Nigeria, Tanzania, South Africa, Kenya, Uganda, Ghana, and Malawi. The creator’s objective is to expand the service to all countries across the African continent in the coming years.

The Technical Foundations of Machankura’s Success – USSD

As mentioned, USSD is a protocol embedded in mobile networks and available on virtually all cellular devices. This choice proved crucial for the Machankura project, given that in Africa, more than half of phones sold are not smartphones. Additionally, this protocol offers critical technical advantages:

- Operates without requiring internet access, functioning in areas with poor connectivity.

- Universal compatibility with any mobile phone, including the most basic models.

- Provides real-time interactivity between users and the system.

- Features an intuitive interface already utilized for banking services, customer support, and self-service applications

These advantages have enabled bitcoin to become accessible to a significant portion of the region’s population, with over 15,000 users, according to Machankura’s project creator.

USSD and Connectivity Challenges

The primary technical limitation of USSD manifests in high-connectivity environments (4G, 5G, or higher). As established by the 3GPP (3rd Generation Partnership Project, organization for standardization of mobile networks), the protocol must be recognized by newer generations of cellular networks.

However, this recognition requires a procedure known as inter-technology fallback. For instance, if a user is connected to a 5G network and streaming music, when accessing a USSD service, their connection will downgrade to a 3G (or 2G) network, inevitably interrupting media streaming execution.

IP Multimedia Subsystem (IMS): The Evolution in Telecommunications Services

The solution to connectivity issues with USSD resides within the IMS (IP Multimedia Subsystem), a subsystem within the standardized architecture of newer cellular networks (from fourth generation onwards).

Its objective is to unify access and provision of multimedia services across both mobile and fixed networks. These services include:

- Voice services – such as Voice over LTE (VoLTE) and Voice over WiFi (VoWiFi)

- Video services – such as Video over LTE (ViLTE) and Video over WiFi (ViWiFi)

- Videoconferencing

- Instant messaging

- Streaming media

- Emergency services

- Interoperability between legacy networks

The New Era: USSI (USSD over IP)

USSI (USSD over IP) represents the solution for service continuity across 4G, 5G, and future networks when utilizing USSD services. This new protocol enhances service quality, increases simultaneous session capacity, provides additional features for recent devices, improves session security, and enables operation without requiring fallback procedures.

Strategic Opportunities for Carriers

Institutional bitcoin adoption is already established, with integration into portfolios of mining companies, exchanges, automobile manufacturers (Tesla), investment funds (BlackRock), financial institutions (Galaxy Digital Holdings), technology companies (including MicroStrategy, MercadoLibre, and Brazilian Meliúz), and even nations such as El Salvador, the United States, and China.

With robust, secure, and extensive infrastructure, telecommunications carriers can implement complex and advanced bitcoin-based financial services, demystifying its use and stimulating adoption.

Strategic partnerships with exchanges and fintechs enhance integrated solutions for entrepreneurs and consumers, such as integration with Lightning Network nodes to enable rapid, low-cost transactions between IoT devices, machine-to-machine (M2M) applications, and point-of-sale (POS) terminals.

The competitive advantages of this approach include:

- New Revenue Streams: Companies can collect fees from simple transactions and provide advanced financial services such as loans, insurance, and investments.

- Customer Retention: By offering innovative services, they can reduce customer churn.

- Vanguard Strategy: Strategic positioning in an emerging high-capitalization market

The Future of Bitcoinization in Telecommunications

The success of the Machankura project unequivocally demonstrates the potential of telecommunications as transformative agents in the mass adoption of bitcoin. As the bitcoin ecosystem consolidates and expands, it is essential that we recognize this opportunity not merely as a new business vertical but as an important step toward strategic positioning at the forefront of a global economic transformation.

Given the extensive reach of existing infrastructure, these carriers can become the primary catalyst for transforming the lives of the unbanked in an unprecedented manner. As we have seen, bitcoin is no longer just a trend; it is a reality. The natural consequence of this reality is bitcoinization, and we have the opportunity to be at the forefront of this emerging paradigm.

-

@ cae03c48:2a7d6671

2025-06-11 15:01:42

@ cae03c48:2a7d6671

2025-06-11 15:01:42Bitcoin Magazine

Bitcoin Officially Traded Above $100,000 For 30 Consecutive Days For The First TimeBitcoin has officially completed 30 consecutive days trading above the $100,000 mark, marking a historic milestone in its 15 year journey. Bitcoin achieved its all time high (ATH) of $111,980 on May 22, almost hitting $112,000.

JUST IN: Bitcoin has stayed above $100,000 for 30 consecutive days for the first time ever!

pic.twitter.com/nfccEK3Wf0

pic.twitter.com/nfccEK3Wf0— Bitcoin Magazine (@BitcoinMagazine) June 10, 2025

In the last 30 days, Bitcoin saw a 10 percent pullback right after reaching its ATH, dropping to $100,428. However, it wasn’t for long, as Bitcoin is back at $109,511 at the time of writing. Momentum appears to be building once again, signaling to be bullish.

“Anytime price is able to punch through a major resistance level, whether psychological or historical, and successfully hold, it is certainly a bullish sign,” said the technical analyst of Wolfe Research Read Harvey. “What really stood out to us was price’s ability to hold that level on the back test, when it briefly fell to $100,000 on Thursday. It also happened to align perfectly with the 50-day moving average. … We feel this should act as a launching pad back towards the recent highs of $112,000.”

In the past month, Bitcoin has surged into the financial and political mainstream. Several U.S. states including New Hampshire first, followed by Arizona, and then Texas have passed legislation recognizing Bitcoin as a strategic reserve asset. These laws reflect a growing trend of state level interest in using Bitcoin as a financial hedge and as part of long term fiscal policy.

“New Hampshire didn’t just pass a bill; it sparked a movement,” stated the CEO and Co-Founder of Satoshi Action Dennis Porter.

At the same time, financial institutions are rapidly expanding their Bitcoin offerings. JP Morgan has started providing loans backed by Bitcoin ETFs as collateral. BlackRock’s Bitcoin ETF has entered a period of intense activity, generating record trading volumes and capturing the attention of both retail and institutional investors.

To date, a total of 228 public and private entities have Bitcoin in their balance sheets and in the last 30 days, companies like GameStop, Know Labs, and Norway-based NBX have added Bitcoin as a strategic reserve. All these companies are treating Bitcoin not just as a speculative asset, but as a key part of their long term financial plans. This growing corporate trend follows the example set by Strategy, but it’s now happening on a much larger scale.

At the 2025 Bitcoin conference, the Vice President of the United States of America, JD Vance said in his speech, “Fifty million Americans own Bitcoin. I think it’s gonna be 100 million before too long.”

This post Bitcoin Officially Traded Above $100,000 For 30 Consecutive Days For The First Time first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ dfa02707:41ca50e3

2025-06-11 14:02:24

@ dfa02707:41ca50e3

2025-06-11 14:02:24Contribute to keep No Bullshit Bitcoin news going.

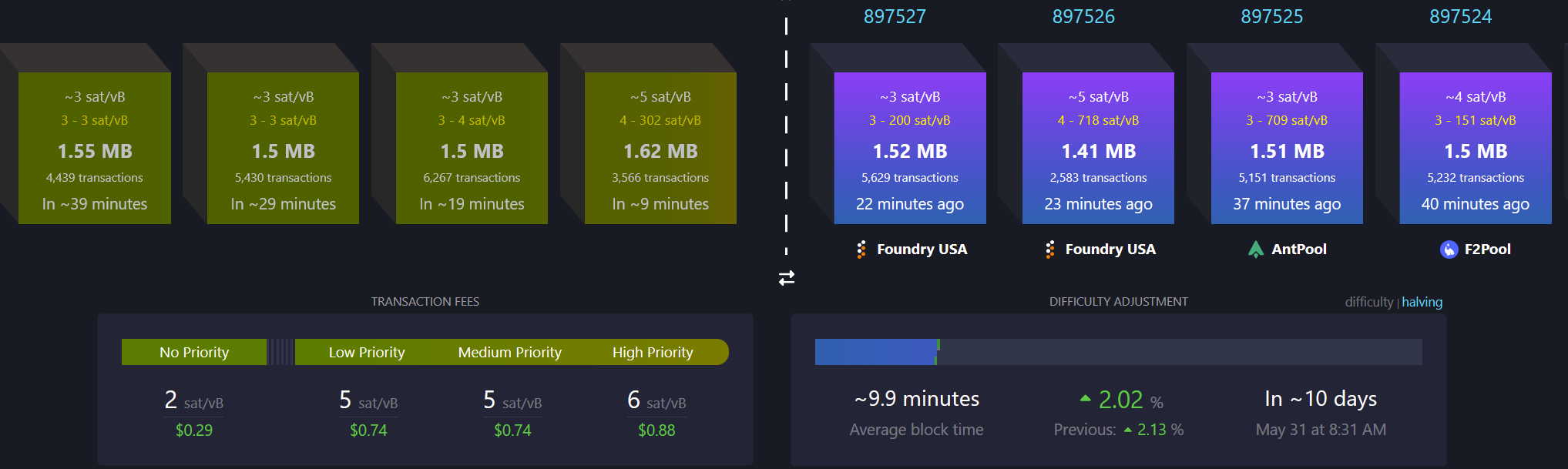

This update brings key enhancements for clarity and usability:

- Recent Blocks View: Added to the Send tab and inspired by Mempool's visualization, it displays the last 2 blocks and the estimated next block to help choose fee rates.

- Camera System Overhaul: Features a new library for higher resolution detection and mouse-scroll zoom support when available.

- Vector-Based Images: All app images are now vectorized and theme-aware, enhancing contrast, especially in dark mode.

- Tor & P2A Updates: Upgraded internal Tor and improved support for pay-to-anchor (P2A) outputs.

- Linux Package Rename: For Linux users, Sparrow has been renamed to sparrowwallet (or sparrowserver); in some cases, the original sparrow package may need manual removal.

- Additional updates include showing total payments in multi-payment transaction diagrams, better handling of long labels, and other UI enhancements.

- Sparrow v2.2.1 is a bug fix release that addresses missing UUID issue when starting Tor on recent macOS versions, icons for external sources in Settings and Recent Blocks view, repackaged

.debinstalls to use older gzip instead of zstd compression, and removed display of median fee rate where fee rates source is set to Server.

Learn how to get started with Sparrow wallet:

Release notes (v2.2.0)

- Added Recent Blocks view to Send tab.

- Converted all bitmapped images to theme aware SVG format for all wallet models and dialogs.

- Support send and display of pay to anchor (P2A) outputs.

- Renamed

sparrowpackage tosparrowwalletandsparrowserveron Linux. - Switched camera library to openpnp-capture.

- Support FHD (1920 x 1080) and UHD4k (3840 x 2160) capture resolutions.

- Support camera zoom with mouse scroll where possible.

- In the Download Verifier, prefer verifying the dropped file over the default file where the file is not in the manifest.

- Show a warning (with an option to disable the check) when importing a wallet with a derivation path matching another script type.

- In Cormorant, avoid calling the

listwalletdirRPC on initialization due to a potentially slow response on Windows. - Avoid server address resolution for public servers.

- Assume server address is non local for resolution failures where a proxy is configured.

- Added a tooltip to indicate truncated labels in table cells.

- Dynamically truncate input and output labels in the tree on a transaction tab, and add tooltips if necessary.

- Improved tooltips for wallet tabs and transaction diagrams with long labels.

- Show the address where available on input and output tooltips in transaction tab tree.

- Show the total amount sent in payments in the transaction diagram when constructing multiple payment transactions.

- Reset preferred table column widths on adjustment to improve handling after window resizing.

- Added accessible text to improve screen reader navigation on seed entry.

- Made Wallet Summary table grow horizontally with dialog sizing.

- Reduced tooltip show delay to 200ms.

- Show transaction diagram fee percentage as less than 0.01% rather than 0.00%.

- Optimized and reduced Electrum server RPC calls.

- Upgraded Bouncy Castle, PGPainless and Logback libraries.

- Upgraded internal Tor to v0.4.8.16.

- Bug fix: Fixed issue with random ordering of keystore origins on labels import.

- Bug fix: Fixed non-zero account script type detection when signing a message on Trezor devices.

- Bug fix: Fixed issue parsing remote Coldcard xpub encoded on a different network.

- Bug fix: Fixed inclusion of fees on wallet label exports.

- Bug fix: Increase Trezor device libusb timeout.

Linux users: Note that the

sparrowpackage has been renamed tosparrowwalletorsparrowserver, and in some cases you may need to manually uninstall the originalsparrowpackage. Look in the/optfolder to ensure you have the new name, and the original is removed.What's new in v2.2.1

- Updated Tor library to fix missing UUID issue when starting Tor on recent macOS versions.

- Repackaged

.debinstalls to use older gzip instead of zstd compression. - Removed display of median fee rate where fee rates source is set to Server.

- Added icons for external sources in Settings and Recent Blocks view

- Bug fix: Fixed issue in Recent Blocks view when switching fee rates source

- Bug fix: Fixed NPE on null fee returned from server

-

@ cae03c48:2a7d6671

2025-06-11 21:00:52

@ cae03c48:2a7d6671

2025-06-11 21:00:52Bitcoin Magazine

Paul Tudor Jones: Bitcoin, Gold, Stocks Are The Best Portfolio To Fight InflationThe Co-Chairman and CIO of Tudor Investment Corp., Paul Tudor Jones, recently appeared in a Bloomberg interview where he outlined what he sees as the best portfolio to fight against inflation.

JUST IN: Billionaire Paul Tudor Jones said Bitcoin, gold, and stocks are the "best portfolio to fight inflation."

pic.twitter.com/rgvVyacRtx

pic.twitter.com/rgvVyacRtx— Bitcoin Magazine (@BitcoinMagazine) June 11, 2025

“What would an ideal portfolio be… What has worked so far has been some combinations of stocks, which won’t do great, which would do terribly if we ever actually had,” Jones said. “If they called us out and the bond market actually gave us an accident that then spilled over. But it would be some kind of combination of probably gold, vol adjusted, Bitcoin, gold, stocks. That’s probably your best portfolio to fight inflation. Vol adjusted because the vol of Bitcoin obviously is five times that of gold, so you’re going to do it in different ways.”

Jones highlighted the need to balance volatility, especially when combining assets like Bitcoin and gold. He suggested this kind of mix, adjusted for risk, gives investors the strongest defense against inflation’s impact.

When asked if he would allocate 1 or 2 percent of his portfolio to Bitcoin, Jones explained the bigger picture behind why he sees value in it.

“Particularly now, that the road map is clear… Again, if I am a policymaker,” stated Jones. “I’m going to run really low real rates. I am going to have inflation running hot and I am gonna tax the American Consumer to get out of my debt trap, and that’s exactly what Japan, who’s the most fiscally constrained in the world, is doing. And it works until the population throws you out because you let the inflation get too hot. So maybe you’re in a world with three and a half percent inflation and two and a half percent overnight rate and you are kind of trying to run hot and grow your way out of it.”

Yesterday, also in an interview with Bloomberg, the Executive Chairman and CEO of Strategy Michael Saylor commented about the future of Bitcoin as well.

“Winter is not coming back,” commented Sayor. “We are past that phase. If Bitcoin is not going to zero, it is going to $1 million. The President of the United States is determined. He supports Bitcoin, the cabinet supports Bitcoin, Scott Bessent supports Bitcoin, Paul Atkins is shown himself to be an enthusiastic believer of Bitcoin and digital assets… Bitcoin has gotten through its riskiest period.”

This post Paul Tudor Jones: Bitcoin, Gold, Stocks Are The Best Portfolio To Fight Inflation first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-11 21:00:49

@ cae03c48:2a7d6671

2025-06-11 21:00:49Bitcoin Magazine

Stripe Acquires Startup Privy To Expand Bitcoin StrategyToday, Stripe Inc. announced that it has acquired Bitcoin and crypto wallet infrastructure provider Privy, marking its second major digital asset focused acquisition following its $1.1 billion purchase of stablecoin firm Bridge earlier this year.

1/ Today, we're proud to announce that Stripe is acquiring Privy.

We couldn’t be more excited.

Privy will continue as an independent product – but now we’ll move faster, ship more, and serve you even better, so you can stay focused on your users. pic.twitter.com/8CHJqhqYy7

— Privy (@privy_io) June 11, 2025

Privy specializes in helping companies embed Bitcoin and crypto wallets directly into their apps and websites. For example, NFT marketplace OpenSea uses Privy to streamline purchases by automatically generating wallets for users. This removes the need for external wallet setups through services like MetaMask or Coinbase.

“When we started, wallets were powerful but inaccessible for all but the most technical,” said the Co-founder and CEO of Privy Henri Stern in a statement. “Developers had to send users off-platform to get started, breaking flows and killing user conversion. That friction fundamentally constrained what could be built in crypto.”

Privy, based in New York, was founded by Henri Stern and Asta Li in 2021. Li was previously a founding engineer at Aurora, while Stern worked as a research scientist at web3 firm Protocol Labs. The startup has raised just over $40 million from investors including Ribbit Capital, Definition, and Coinbase Ventures, and was last valued at $230 million in March, according to PitchBook.

“We started Privy a little over three years ago to make it easy for any developer to build better products on crypto rails,” stated their announcement. “Whether crypto is core to your app or simply a new layer of functionality, a good crypto product should just feel like a good product, period. By making crypto usable, we help make it useful for everyone.”

The acquisition follows Stripe’s earlier purchase of Bridge which helped accelerate interest in digital assets. Earlier this year, Stripe introduced stablecoin funded accounts designed to help merchants store funds and make international payments using Circle’s USDC and Bridge’s USDB. Similar to Bridge, Privy will continue operating as a standalone product.

Privy will power over 75 million accounts and support more than 1,000 developer teams, enabling billions in transaction volume, according to the announcement. Clients include Hyperliquid, Blackbird, Toku, and Farcaster, all using Bitcoin and crypto infrastructure to build real-world products in areas like trading, payments, payroll, and social applications.

“With a unified platform, connecting Privy’s wallets to the money movement capabilities in Stripe and Bridge, we’re enormously excited to enable a new generation of global, Internet-native financial services,” stated the co-founder and CEO of Stripe Patrick Collison.

This post Stripe Acquires Startup Privy To Expand Bitcoin Strategy first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-11 21:00:46

@ cae03c48:2a7d6671

2025-06-11 21:00:46Bitcoin Magazine

The CLARITY Act Heads To House Floor For Vote With Protection For Noncustodial Tools IntactYesterday, the CLARITY Act passed favorably through the House Agriculture and Financial Services Committees with 47-6 and 32-19 bipartisan votes, respectively.

While a handful of amendments will be incorporated into a revised version of the bill, none of said amendments will alter a recently-added section of the bill that regards noncustodial products and services.

To clarify, on Monday, language from the Blockchain Regulatory Certainty Act (BRCA) was added to the CLARITY Act.

If you do not custody consumer funds, you aren’t a money transmitter. Plain and simple.

Our nonpartisan Blockchain Regulatory Certainty Act, which codifies this simple concept, has been added to the CLARITY Act!

Grateful to @RepFrenchHill, @RepBryanSteil and @RepRitchie for… https://t.co/QmPdgUGSwo

— Tom Emmer (@GOPMajorityWhip) June 9, 2025

This language, included in Section 110 of the CLARITY Act, is focused on non-controlling (noncustodial) blockchain developers and blockchain service providers.

The exact wording in the bill is as follows: “A non-controlling blockchain developer or provider of a blockchain service shall not be treated as a money transmitter or as engaged in ‘money transmitting,’ or, following the date of enactment of this Act, be otherwise subject to any new registration requirement that is substantially similar to the requirement that currently applies to money transmitters.”

It was particularly important that this segment of the bill not be altered because, with this language included, the bill protects not only Bitcoin and crypto enthusiasts’ right to use noncustodial wallets, but the right of developers to continue to create such products and services without being subject to money-transmission laws as per the Bank Secrecy Act (BSA).

“Section 110 doesn’t just clarify that non-custodial devs aren’t captured by the BSA, but also forbids future laws and regulations (e.g. DAAMLA) that would modify or supersede the BSA to treat non-custodial actors as money transmitters or similar,” wrote Zack Shapiro, Head of Policy at the Bitcoin Policy Institute, in an X post. “If this passes, that means that anti-crypto zealots like Sen. Warren would first have to repeal [or] modify this bill before passing additional rules that would impinge on self-custody.”

This issue over whether noncustodial Bitcoin and crypto service providers is relevant as the Samourai Wallet and Tornado Cash developers prepare to face trial.

It’s also generally important in preserving the right of U.S. citizens to use digital assets privately.

Chairman of the House Subcommittee on Digital Assets, Financial Technology, and Artificial Intelligence, Rep. Bryan Steil (R-WI) commented on Americas’ right to transactional privacy in the hearing.

“Privacy in and of itself is not illegal.

Americans have a right to it in their financial transactions.

And so there’s totally legitimate uses of privacy-preserving technologies.” @RepBryanSteil pic.twitter.com/nHPfa25UVr

— Frank Corva (@frankcorva) June 10, 2025

To learn more about how to contact your elected officials to tell them to support The CLARITY Act, visit saveourwallets.org.

This post The CLARITY Act Heads To House Floor For Vote With Protection For Noncustodial Tools Intact first appeared on Bitcoin Magazine and is written by Frank Corva.

-

@ b1ddb4d7:471244e7

2025-06-11 14:01:44

@ b1ddb4d7:471244e7

2025-06-11 14:01:44The latest AI chips, 8K displays, and neural processing units make your device feel like a pocket supercomputer. So surely, with all this advancement, you can finally mine bitcoin on your phone profitably, right?

The 2025 Hardware Reality: Can You Mine Bitcoin on Your Phone

Despite remarkable advances in smartphone technology, the fundamental physics of bitcoin mining haven’t changed. In 2025, flagship devices with their cutting-edge 2nm processors can achieve approximately 25-40 megahashes per second when you mine bitcoin on your phone—a notable improvement from previous generations, but still laughably inadequate.

Meanwhile, 2025’s top-tier ASIC miners have evolved dramatically. The latest Bitmain Antminer S23 series and Canaan AvalonMiner A15 Pro deliver 200-300 terahashes per second while consuming 4,000-5,500 watts. That’s a performance gap of roughly 1:8,000,000 between when you mine bitcoin on your phone and professional mining equipment.

To put this in perspective that hits home: if you mine bitcoin on your phone and it earned you one penny, professional miners would earn $80,000 in the same time period with the same effort. It’s not just an efficiency problem—it’s a complete category mismatch.

According to Pocket Option’s 2025 analysis, when you mine bitcoin on your phone in 2025, you generate approximately $0.003-0.006 in daily revenue while consuming $0.45-0.85 in electricity through constant charging cycles. Factor in the accelerated device wear (estimated at $0.75-1.20 daily depreciation), and you’re looking at losses of $1.20-2.00 per day just for the privilege of running mining software.

Mining Economic Factor

Precise Value (April 2025)

Direct Impact on Profitability

Smartphone sustained hash rate

20-35 MH/s

0.00000024% contribution to global hashrate

Daily power consumption

3.2-4.8 kWh (4-6 full charges)

$0.38-0.57 at average US electricity rates

Expected daily BTC earnings

0.0000000086 BTC ($0.0035 at $41,200 BTC)

Revenue covers only 0.9% of electricity costs

CPU/GPU wear cost

$0.68-0.92 daily accelerated depreciation

Reduces smartphone lifespan by 60-70%

Annual profit projection

-$386 to -$412 per year

Guaranteed negative return on investment

Source: PocketOption

Bitcoin’s 2025 Network: Harder Than Ever

Bitcoin’s network difficulty in 2025 has reached unprecedented levels. After the April 2024 halving event that reduced block rewards from 6.25 to 3.125 BTC, mining became significantly more competitive. The global hash rate now exceeds 800 exahashes per second—that’s 800 followed by 18 zeros worth of computational power securing the network.

Here’s what this means in practical terms: Bitcoin’s mining difficulty adjusts every 2,016 blocks (roughly every two weeks) to maintain the 10-minute block time. As more efficient miners join the network, difficulty increases proportionally. In 2025, mining difficulty has increased compared to 2024, making small-scale mining even less viable.

The math is unforgiving:

- Global Bitcoin hash rate: 828.96 EH/s

- Your smartphone’s contribution: ~0.000000003%

- Probability of solo mining a block: Virtually zero

- Expected time to mine one Bitcoin: Several million years

Even joining mining pools doesn’t solve the economic problem. Pool fees typically range from 1-3%, and your minuscule contribution would earn proportionally tiny rewards—far below the electricity and device depreciation costs.

The 2025 Scam Evolution: More Sophisticated, More Dangerous

Fraudsters now leverage AI-generated content, fake influencer endorsements, and impressive-looking apps that simulate realistic mining activity to entice you to mine bitcoin on your phone.

New 2025 scam tactics include:

AI-Powered Fake Testimonials: Deepfake videos of supposed successful mobile miners showing fabricated earnings statements and encouraging downloads of malicious apps.

Gamified Mining Interfaces: Apps that look and feel like legitimate games but secretly harvest personal data while simulating mining progress that can never be withdrawn.

Social Media Manipulation: Coordinated campaigns across TikTok, Instagram, and YouTube featuring fake “financial influencers” promoting mobile mining apps to younger audiences.

Subscription Trap Mining: Apps offering “free trials” that automatically charge $19.99-49.99 monthly for “premium mining speeds” while delivering no actual mining capability.

Recent cybersecurity research shows that over 180 fake mining apps were discovered across major app stores in 2025, with some accumulating more than 500,000 downloads before being removed.

Red flags that scream “scam” in 2025:

- Apps claiming “revolutionary mobile mining breakthrough”

- Promises of earning “$10-50 daily” from phone mining

- Requirements to recruit friends or watch ads to unlock withdrawals

- Apps that don’t require connecting to actual mining pools

- Testimonials that seem too polished or use stock photo models

- Apps requesting permissions unrelated to mining (contacts, camera, microphone)

The 2025 Professional Mining Landscape

To understand why, consider what professional bitcoin mining looks like in 2025. Industrial mining operations now resemble high-tech data centers with:

Cutting-edge hardware:

- Bitmain Antminer S23 Pro: 280 TH/s at 4,800W

- MicroBT WhatsMiner M56S++: 250 TH/s at 4,500W

- Canaan AvalonMiner A1566: 185 TH/s at 3,420W

Infrastructure requirements:

- Megawatt-scale power contracts with industrial electricity rates

- Liquid cooling systems maintaining 24/7 optimal temperatures

- Redundant internet connections ensuring zero downtime

- Professional facility management with 24/7 monitoring

For a small operation, you might need at least $10,000 to $20,000 to buy a few ASIC miners, set up cooling systems, and cover electricity costs. These operations employ teams of engineers, maintain relationships with power companies, and operate with margins measured in single-digit percentages.

2025’s Legitimate Mobile Bitcoin Strategies

While it remains impossible to mine bitcoin on your phone profitably, 2025 offers exciting legitimate ways to engage with bitcoin through your smartphone:

Lightning Network Participation: Apps like Phoenix, Breez, and Zeus allow you to run Lightning nodes on mobile devices, earning small routing fees while supporting bitcoin’s payment layer.

Bitcoin DCA Automation: Services enable automated dollar-cost averaging with amounts as small as $1 daily. Historical data shows $10 weekly bitcoin purchases consistently outperform any mobile mining attempt by 1,500-2,000%.

Educational Mining Simulators: Legitimate apps like “Bitcoin Mining Simulator” teach mining concepts without false earning promises. These educational tools help users understand hash rates, difficulty adjustments, and mining economics.

Stacking Sats Rewards: Apps offering bitcoin rewards for shopping, learning, or completing tasks.

Lightning Gaming: Bitcoin-native mobile games where players can earn sats through skilled gameplay, with some players earning $10 monthly.onfirm that even the most optimized mobile mining setups in 2025 lose money consistently and predictably.

The Bottom Line

When you mine bitcoin on your phone fundamental economics remain unchanged: it’s impossible to profit. The laws of physics, network competition, and energy efficiency create insurmountable barriers that no app can overcome.

However, 2025 offers unprecedented opportunities to engage with bitcoin meaningfully through your smartphone. Focus on education, legitimate earning opportunities, and strategic investment rather than chasing the impossible dream of phone-based mining.

The bitcoin community’s greatest strength lies in its commitment to truth over hype. When someone promises profits to mine bitcoin on your phone in 2025, they’re either uninformed or deliberately misleading you. Trust the mathematics, learn from the community, and build your bitcoin knowledge and holdings through proven methods.

The real opportunity in 2025 isn’t to mine bitcoin on your phone—it’s understanding bitcoin deeply enough to participate confidently in the most important monetary revolution of our lifetime. Your smartphone is the perfect tool for that education; it’s just not a mining rig.

-

@ cae03c48:2a7d6671

2025-06-11 21:00:42

@ cae03c48:2a7d6671

2025-06-11 21:00:42Bitcoin Magazine

Skull, $5 million; Banana, $6 million; Freedom, Priceless“It would have been nice to get this attention in any other context. WikiLeaks has kicked the hornet’s nest, and the swarm is headed towards us.”

This message was posted by Satoshi Nakamoto to BitcoinTalk on December 11, 2010. A couple of months later, in February 2011, the Silk Road marketplace was launched, and only a couple months after — on April 23, 2011 — Satoshi posted his last message.

In October 2013, Ross Ulbricht was captured by the FBI and the Silk Road fell — only to be replaced by a thousand more copycat marketplace sites. The rest is Bitcoin history.

Ross Ulbricht chose to center his Bitcoin 2025 keynote speech around an experience he had clearing wasp nests in a cabin in the woods. Wearing a suit and tie, recalling growing “magic mushrooms” to kickstart activity on Silk Road, Ross held the attention of the main stage audience of over 8,000 at Bitcoin 2025 Las Vegas in the Venetian Expo. I was sitting in one of the best seats in the house: side stage with his mother Lyn and three other supporters of Ross.

Freedom. Decentralization. Unity.

After over 4,100 days in federal custody and many months in special housing units (solitary confinement), Ross boiled it down to these three words to summarize his first message to the community.

Freedom. Decentralization. Unity.

Following a “21 ways to hack the fiat system” keynote from Michael Saylor, Ross’ three ways to move forward were refreshingly simple.

You would have thought Ross had been speaking in front of thousands of people for years, seeing how calm and commanding he was on the Nakamoto stage.

Lyn Ulbricht called me a few days after the speech, as I was driving a U-Haul truck full of the art gallery contents across the country, including Ross’ auction items which altogether fetched well over 10 BTC for his fresh start. She mentioned that seeing Ross on that stage giving that incredible speech gave her closure for the whole experience of fighting for her son’s freedom.

I have been fortunate to get to know Lyn Ulbricht over the past few years, helping her plan for our conferences. Hearing her say that this conference gave her some closure to that awful chapter of her life was a moment I’ll never forget. She was his number one supporter during his 11 years serving a double-life sentence. She fought relentlessly to raise awareness for her son’s situation, and now she has begun a new chapter doing similar work with MACS, Mothers Against Cruel Sentencing.

MACS is a nonprofit that is effectively the continuation of the Free Ross mission. Lyn says she feels a calling from God to continue fighting for other “crypto prisoners” and people who are being unjustly punished for their crimes, a violation of the Eight Amendment of the United States Constitution.

She launched MACS at the fourth annual Women of Bitcoin Brunch at Bitcoin 2025, in front of an audience of over 300 of the most influential women at the conference.

Later during the event, in the same room, Ross used the same stage to address a smaller crowd of supporters for his official luncheon.

This luncheon, held before his speech, is where Justin Sun famously gifted Ross “The Banana,” handing over a duct-taped, real banana in an elaborately designed white shadowbox fit to display in a museum.

I was also in the luncheon room when the banana transaction happened, as event staff. The piece, Comedian by Maurizio Cattelan, was a conceptual art statement, I explained to the two men sitting next to me. Like Ross himself at the time, these men were confused. (The original art installation, a banana duct-taped to the wall, was purchased — and eaten — by Justin Sun in November last year.)