-

@ 7f6db517:a4931eda

2025-06-11 06:01:41

@ 7f6db517:a4931eda

2025-06-11 06:01:41

I often hear "bitcoin doesn't interest me, I'm not a finance person."

Ironically, the beauty of sound money is you don't have to be. In the current system you're expected to manage a diversified investment portfolio or pay someone to do it. Bitcoin will make that optional.

— ODELL (@ODELL) September 16, 2018

At first glance bitcoin often appears overwhelming to newcomers. It is incredibly easy to get bogged down in the details of how it works or different ways to use it. Enthusiasts, such as myself, often enjoy going down the deep rabbit hole of the potential of bitcoin, possible pitfalls and theoretical scenarios, power user techniques, and the developer ecosystem. If your first touch point with bitcoin is that type of content then it is only natural to be overwhelmed. While it is important that we have a thriving community of bitcoiners dedicated to these complicated tasks - the true beauty of bitcoin lies in its simplicity. Bitcoin is simply better money. It is the best money we have ever had.

Life is complicated. Life is hard. Life is full of responsibility and surprises. Bitcoin allows us to focus on our lives while relying on a money that is simple. A money that is not controlled by any individual, company, or government. A money that cannot be easily seized or blocked. A money that cannot be devalued at will by a handful of corrupt bureaucrat who live hundreds of miles from us. A money that can be easily saved and should increase in purchasing power over time without having to learn how to "build a diversified stock portfolio" or hire someone to do it for us.

Bitcoin enables all of us to focus on our lives - our friends and family - doing what we love with the short time we have on this earth. Time is scarce. Life is complicated. Bitcoin is the most simple aspect of our complicated lives. If we spend our scarce time working then we should be able to easily save that accrued value for future generations without watching the news or understanding complicated financial markets. Bitcoin makes this possible for anyone.

Yesterday was Mother's Day. Raising a human is complicated. It is hard, it requires immense personal responsibility, it requires critical thinking, but mothers figure it out, because it is worth it. Using and saving bitcoin is simple - simply install an app on your phone. Every mother can do it. Every person can do it.

Life is complicated. Life is beautiful. Bitcoin is simple.

If you found this post helpful support my work with bitcoin.

-

@ 2b998b04:86727e47

2025-06-11 04:12:39

@ 2b998b04:86727e47

2025-06-11 04:12:39Introduction: Why Money Matters to Faith

Most of us don’t think about money theologically. But Scripture speaks of it often — not just as a tool, but as a test.

Jesus said, “Where your treasure is, there your heart will be also” (Matthew 6:21). The love of money, not money itself, is called the root of all kinds of evil. And dishonest scales? “An abomination to the Lord” (Proverbs 11:1).

So what happens when the entire system of money becomes dishonest — when it’s based not on work or value, but manipulation and control?

That’s the world Bitcoin was born into. And it offers a radically different way — one that, surprisingly, echoes deep truths of the Christian faith — and especially what many call the Victorious Gospel: the belief that Christ’s redemption is not partial, but total. Not only personal, but cosmic.

1. What Is Bitcoin, and Why Was It Created?

Bitcoin is a new kind of money that isn't controlled by any government or company. You can send it anywhere in the world, and no one can block or censor your transaction. It’s digital, but unlike credit cards or PayPal, it’s not just “numbers in a bank.” It is scarce, secure, and independent.

The key idea is this: Bitcoin is money backed by work — not by trust in a government, but by real energy and effort.

Why is that important? Because the current system of money — what we call fiat — works very differently.

2. What Is Fiat, and Why Is It Broken?

“Fiat” simply means “by decree.” It’s the money we all use today — dollars, euros, yen — created by government decree. It used to be backed by gold. Not anymore.

Today, new fiat money is created whenever a central bank wants. It can be “printed” digitally without cost. This leads to inflation — meaning your savings buy less over time.

It’s like a form of slow theft. You worked hard for your dollars, but someone else can create more with a click. That’s not just bad economics — it violates biblical principles of fairness, honesty, and stewardship.

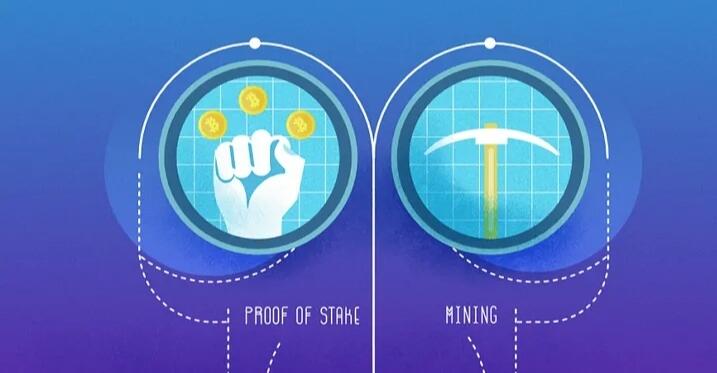

Bitcoin fixes this by making money that cannot be faked or inflated, because it’s based on Proof of Work — and is capped at a fixed amount.

3. What Is Proof of Work — and Why It Matters

Imagine you want to add a page to a history book — but to make it trustworthy, you must solve a complex puzzle that proves you did real work. Once solved, everyone else can see the solution and verify it was done properly.

That’s Proof of Work, the system Bitcoin uses to record transactions. Each time people send Bitcoin, that transaction gets added to a public ledger (called the blockchain). But it can only be added if someone does the work to secure it — using energy, effort, and computer power.

This work:

-

Costs something (just like real-world labor),

-

Prevents cheating (you can’t just rewrite history),

-

And rewards the worker with newly created Bitcoin.

This reward is important — because it’s how new Bitcoin enters circulation. But here’s the catch:\ 👉 There will only ever be 21 million Bitcoin.\ That number is fixed forever, written into Bitcoin’s code. No one — not a government, company, or individual — can create more.

Right now, not all of the 21 million Bitcoin have been released. The process of mining — doing the Proof of Work — slowly releases new Bitcoin over time as a reward. This happens in a predictable schedule and will continue until the very last Bitcoin is mined around the year 2140.

4. Why Bitcoin Is the Hardest Money Ever Created

In monetary terms, “hardness” refers to how difficult it is to increase the supply of money. The harder the money, the more resistant it is to inflation or dilution.

Let’s compare:

-

Gold is scarce — but not fixed. Miners extract more gold every year, adding about 1–2% to the total supply annually.

-

Fiat money (like the U.S. dollar) is the softest. It can be created at will, with no limit.

-

Bitcoin is the hardest money ever invented:

-

The total supply is forever capped at 21 million.

-

The rate of creation cuts in half every four years.

-

No one can change this schedule.

This makes Bitcoin the first truly scarce asset in human history — not just physically scarce like gold, but mathematically and absolutely scarce.

Why does this matter?

Because it changes the very nature of money. Instead of being something that loses value over time, Bitcoin becomes a form of property — a way to store your labor, your time, your effort — across generations.

-

It encourages saving, not spending out of fear of inflation.

-

It rewards patience and stewardship, not speculation and debt.

-

It teaches long-term thinking, a concept deeply woven into Scripture (Proverbs 13:22: “A good man leaves an inheritance to his children’s children”).

5. Why Does This Matter for Christianity?

Christianity affirms that creation is good, work is sacred, and truth matters.

In Genesis, God gave Adam a task — to work the garden. Work is not a curse. It’s part of what it means to bear God’s image.

Bitcoin’s Proof of Work aligns with this:

-

It says value comes from real effort, not manipulation.

-

It links truth to time — just as God’s Word unfolds through history.

-

It defends against corruption — just as the Kingdom of God resists the lies of Babylon.

-

It places a limit on excess — just as Sabbath and Jubilee rhythms place a brake on endless exploitation.

In contrast, fiat systems reward those closest to the money printers — often the rich or powerful — while devaluing the labor of ordinary people. That’s why Bitcoin has been called “money for the people” — because anyone, anywhere, can use it without asking permission.

6. The Victorious Gospel: A Bigger Redemption

The Victorious Gospel teaches that Jesus didn’t just save individual souls. He came to restore all things — including how we live, build, work, and relate to each other.

That means we care about justice, truth, dignity, and creation itself. And it means we seek tools that reflect those values.

Bitcoin isn’t the Gospel. But it rhymes with it:

-

It honors work, like God does.

-

It respects time, like Scripture does.

-

It tells the truth, like Jesus does.

-

It has limits, just as the Sabbath, Creation, and grace all have defined edges.

-

And it stores value — the value of human time and labor — like good soil stores seed.

7. But Isn’t Bitcoin Just for Rich Tech People?

Actually, the opposite is true.

Bitcoin doesn’t care who you are. It doesn’t ask for ID. It doesn’t need a bank. A farmer in El Salvador, a refugee in Ukraine, or a pastor in Nigeria can all use it the same as a Wall Street investor.

It’s global, permissionless, and radically equal — not because it’s utopian, but because it’s built on truth, not trust.

And that makes it a powerful tool for Christians who care about freedom, fairness, and flourishing.

8. Final Thoughts: Proof of Work and the Work of Christ

When Jesus died on the cross, He said: “It is finished.” That was not just poetry. It was proof — that the work was done. That redemption had been secured.

In a small way, Bitcoin reflects that kind of finality:

-

Once a block is written, it cannot be undone.

-

Once work is proven, it stands as a record.

-

Once grace is given, it cannot be revoked.

We don’t need to “stake” our claims based on how much power or status we hold (as in Proof of Stake). We rest in what has been proven.

That’s why many Christians — especially those who believe in a victorious, world-restoring Gospel — are finding in Bitcoin a tool that aligns with their deepest values.\ \ ✍️ Acknowledgment

This article was crafted with the assistance of Dr. C (ChatGPT) to help structure and clarify these ideas. But more than that, it was born of prayer, conviction, and the quiet guidance of the Holy Spirit, who leads us into all truth (John 16:13) and brings to remembrance all that Christ has taught (John 14:26).\ Any clarity, wisdom, or insight found here belongs to Him. Any confusion or error is mine alone.

Summary

Bitcoin is not just “internet money.” It’s a response to a broken system.\ Proof of Work means truth is earned, not claimed.\ Fiat money is manipulable and inflationary; Bitcoin is fixed and fair.\ Bitcoin is the hardest money in history — with a supply cap of 21 million.\ It appreciates over time, acting as a new form of digital property.\ Christianity calls us to honest scales, faithful stewardship, and dignified work.\ And the Victorious Gospel declares that Jesus is restoring all things — including how we steward value, time, and trust.

Bitcoin may not be the final answer. But it’s a faithful step in the right direction.

-

-

@ eb0157af:77ab6c55

2025-06-11 06:01:21

@ eb0157af:77ab6c55

2025-06-11 06:01:21CEO Paolo Ardoino unveils the open-source strategy for the operating system, aiming to make mining accessible to small and medium-sized businesses.

Tether has announced it will make its Bitcoin Mining Operating System (MOS) available for free, enabling operators of all sizes to manage mining infrastructures without relying on third-party software. The announcement came directly from CEO Paolo Ardoino.

How the Bitcoin Mining Operating System works

The operating system developed by Tether offers an efficient solution for managing mining operations. The MOS integrates all essential components of a mining site into a serverless peer-to-peer network, ensuring smooth communication between devices.

The platform supports architectures ranging from minimal setups on Raspberry Pi to industrial-scale facilities managing hundreds of thousands of miners.

According to Ardoino, the decision to make the Bitcoin Mining Operating System open-source aims to level the playing field between small and large operators. Tether’s CEO stated on X:

“A horde of new Bitcoin mining companies will be able to enter the game and compete to keep the network safe.”

Future developments

Tether’s team is currently working on documentation, user guides, and preparing repositories for community access. The Bitcoin Mining Operating System release is scheduled for Q4 2025.

Future plans include integrating artificial intelligence tools to enhance production analysis and performance monitoring using data generated by the operating system.

Tether’s expansion strategy

In recent years, Tether has diversified beyond stablecoins, expanding into sectors such as artificial intelligence, Bitcoin mining, and education. By mid-2025, the company had invested approximately $2 billion in Bitcoin mining and energy-related activities.

During his speeches at Bitcoin Conference 2025 in Las Vegas, Ardoino revealed the company’s ambitions:

“I think that it’s very realistic that by the end of the year, Tether will be the biggest Bitcoin miner in the world, even including all the public companies.”

The post Tether to release Its Bitcoin Mining Operating System for free appeared first on Atlas21.

-

@ b1ddb4d7:471244e7

2025-06-11 06:01:00

@ b1ddb4d7:471244e7

2025-06-11 06:01:00Square, the payments platform operated by Block (founded by Jack Dorsey), is reporting 9.7% bitcoin yield on its bitcoin holdings by running a Lightning Network node.

The announcement was made by Miles Suter, Bitcoin product lead at Block, during the Bitcoin 2025 conference in Las Vegas. Suter explained that Square is earning “real bitcoin from our holdings” by efficiently routing payments across the Lightning Network.

Square’s yield comes from its role as a Lightning service provider, a business it launched two years ago to boost liquidity and efficiency on the Lightning Network. According to Lightning Labs’ Ryan Gentry, Square’s 9% yield could translate to roughly $1 million in annual revenue.

The Lightning Network, a Bitcoin layer-2 protocol, has long been promoted as a solution to Bitcoin’s scalability and transaction speed issues. It enables micropayments and off-chain transactions, reducing congestion on the main blockchain. However, the network faces challenges, including the need for inbound liquidity—users must lock up BTC to receive BTC—potentially limiting participation by smaller nodes and raising concerns about decentralization.

Despite these hurdles, Square remains committed to advancing Bitcoin payments via Lightning. Suter revealed that 25% of Square’s outbound bitcoin transactions now use the Lightning Network. The company is actively testing Lightning-based payments at the Bitcoin 2025 event and plans to roll out the service to all eligible Square merchants by 2026.

Suter emphasized the transformative potential of Lightning:

“When you enable real payments by making them faster and more convenient, the network becomes stronger, smarter, and more beneficial. So if you’re questioning whether bitcoin is merely an asset, the response is no. It has already evolved into both an asset and a protocol, and now Block is spearheading the initiative to transform it into the world’s premier payment system.”

Square’s ongoing investment in Lightning signals its belief in Bitcoin’s future not just as a store of value, but as a global payments protocol.

-

@ cae03c48:2a7d6671

2025-06-11 04:01:19

@ cae03c48:2a7d6671

2025-06-11 04:01:19Bitcoin Magazine

Bitcoin Officially Traded Above $100,000 For 30 Consecutive Days For The First TimeBitcoin has officially completed 30 consecutive days trading above the $100,000 mark, marking a historic milestone in its 15 year journey. Bitcoin achieved its all time high (ATH) of $111,980 on May 22, almost hitting $112,000.

JUST IN: Bitcoin has stayed above $100,000 for 30 consecutive days for the first time ever!

pic.twitter.com/nfccEK3Wf0

pic.twitter.com/nfccEK3Wf0— Bitcoin Magazine (@BitcoinMagazine) June 10, 2025

In the last 30 days, Bitcoin saw a 10 percent pullback right after reaching its ATH, dropping to $100,428. However, it wasn’t for long, as Bitcoin is back at $109,511 at the time of writing. Momentum appears to be building once again, signaling to be bullish.

“Anytime price is able to punch through a major resistance level, whether psychological or historical, and successfully hold, it is certainly a bullish sign,” said the technical analyst of Wolfe Research Read Harvey. “What really stood out to us was price’s ability to hold that level on the back test, when it briefly fell to $100,000 on Thursday. It also happened to align perfectly with the 50-day moving average. … We feel this should act as a launching pad back towards the recent highs of $112,000.”

In the past month, Bitcoin has surged into the financial and political mainstream. Several U.S. states including New Hampshire first, followed by Arizona, and then Texas have passed legislation recognizing Bitcoin as a strategic reserve asset. These laws reflect a growing trend of state level interest in using Bitcoin as a financial hedge and as part of long term fiscal policy.

“New Hampshire didn’t just pass a bill; it sparked a movement,” stated the CEO and Co-Founder of Satoshi Action Dennis Porter.

At the same time, financial institutions are rapidly expanding their Bitcoin offerings. JP Morgan has started providing loans backed by Bitcoin ETFs as collateral. BlackRock’s Bitcoin ETF has entered a period of intense activity, generating record trading volumes and capturing the attention of both retail and institutional investors.

To date, a total of 228 public and private entities have Bitcoin in their balance sheets and in the last 30 days, companies like GameStop, Know Labs, and Norway-based NBX have added Bitcoin as a strategic reserve. All these companies are treating Bitcoin not just as a speculative asset, but as a key part of their long term financial plans. This growing corporate trend follows the example set by Strategy, but it’s now happening on a much larger scale.

At the 2025 Bitcoin conference, the Vice President of the United States of America, JD Vance said in his speech, “Fifty million Americans own Bitcoin. I think it’s gonna be 100 million before too long.”

This post Bitcoin Officially Traded Above $100,000 For 30 Consecutive Days For The First Time first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-11 06:00:39

@ cae03c48:2a7d6671

2025-06-11 06:00:39Bitcoin Magazine

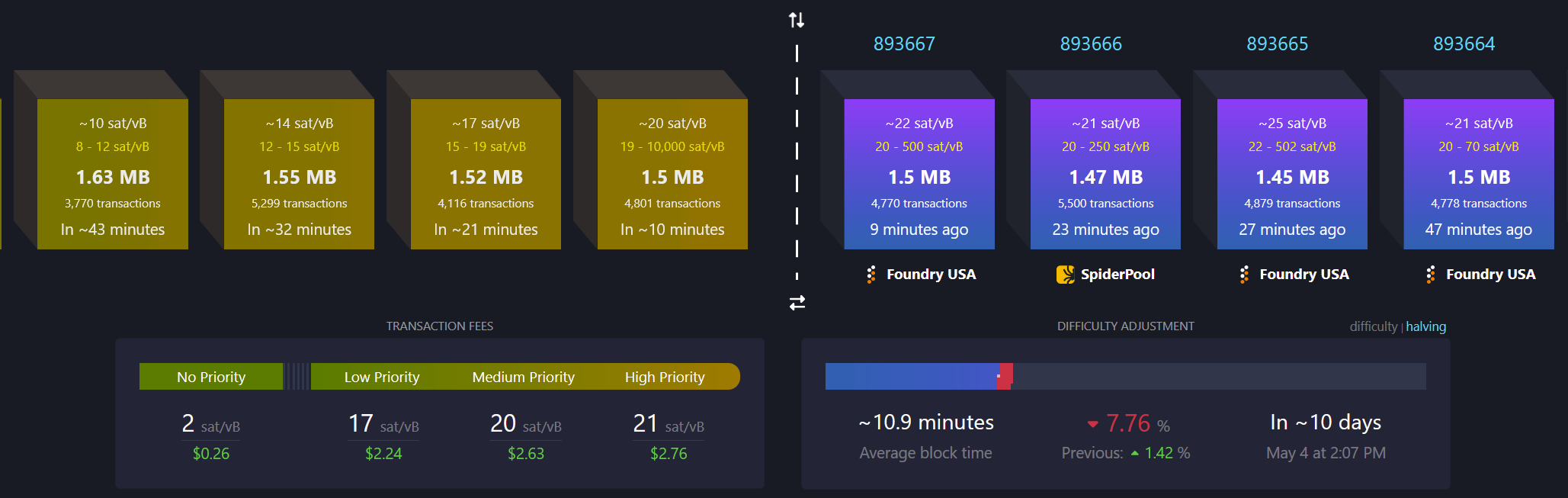

Canaan Announces Record Bitcoin Mining Month with Over 109 BTC MinedCanaan Inc. (NASDAQ: CAN), an innovator in Bitcoin mining, reported today their bitcoin mining update for the month ending May 31, 2025, with 109 bitcoins mined. The company’s total bitcoin holdings rose to 1,466 BTC.

“In May 2025, despite the 10% increase in tariffs on our Malaysia-made Bitcoin mining machines due to ongoing U.S. trade uncertainties, we remained focused on executing our strategic priorities with discipline and agility,” said the Chairman and CEO of Canaan Nangeng Zhang. “By capitalizing on the favorable momentum in bitcoin prices, we achieved a 25% month-over-month increase in our bitcoin production, reaching a record 109 bitcoins. This performance marks a new monthly high for our mining production and brings our total cryptocurrency holdings to an all-time high of 1,466 bitcoins at month-end.”

As of May 31, 2025, Canaan’s current mining projects add to 7.27 EH/s of operating and 8.75 EH/s deployed hashrate. In America, 3.09 EH/s is energized, including a 0.02 EH/s in Canada. Ethiopia’s contribute 4.13 EH/s energized and the Middle East facility delivers 0.03 EH/s energized. Total estimated global capacity stands at 8.75 EH/s.

“Our installed and operational hashrates reached 8.75 EH/s and 7.27 EH/s, respectively, underscoring the continued buildout of our global mining operations,” stated Zhang. “We also achieved a new historical high in installed computing power, while maintaining a competitive all-in power cost. This performance demonstrates our ability to execute on our strategy of efficient and sustainable growth.”

“With Bitcoin prices climbing to historic levels, we’re seeing increased global demand for our mining machines,” commented Zhang. “Combined with the strength of our mining operations and our disciplined approach to capital allocation, we remain confident in our business fundamentals and our ability to deliver long-term value to our shareholders.”

On June 9, 2025, the company announced that its CEO and its CFO acquired 817,268 of American Depositary Shares at an average price of US$0.76 per ADS, showing their belief in the company’s future.

“My share purchase underscores my belief in Canaan’s vision and the tremendous opportunities ahead,” stated Zhang in the announcement. “Both James and I believe there is a significant disconnect between our current ADS price and the value we believe we can deliver in the coming years.”

This post Canaan Announces Record Bitcoin Mining Month with Over 109 BTC Mined first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 9ca447d2:fbf5a36d

2025-06-09 10:01:39

@ 9ca447d2:fbf5a36d

2025-06-09 10:01:39Paris, France – June 6, 2025 — Bitcoin payment gateway startup Flash, just announced a new partnership with the “Bitcoin Only Brewery”, marking the first-ever beverage company to leverage Lightning payments.

Flash enables Bitcoin Only Brewery to offer its “BOB” beer with, no-KYC (Know Your Customer) delivery across Europe, priced at 19,500 sats (~$18) for the 4-pack, shipping included.

The cans feature colorful Bitcoin artwork while the contents promise a hazy pale ale: “Each 33cl can contains a smooth, creamy mouthfeel, hazy appearance and refreshing Pale Ale at 5% ABV,” reads the product description.

Pierre Corbin, Co-Founder of Flash, commented:

“Currently, bitcoin is used more as a store of value but usage for payments is picking up. Thanks to new innovation on Lightning, bitcoin is ready to go mainstream for e-commerce sales.”

Flash, launched its 2.0 version in March 2025 with the goal to provide the easiest bitcoin payment gateway for businesses worldwide. The platform is non-custodial and can enable both digital and physical shops to accept bitcoin by connecting their own wallets to Flash.

By leveraging the scalability of the Lightning Network, Flash ensures instant, low-cost transactions, addressing on-chain Bitcoin bottlenecks like high fees and long wait times.

For businesses interested in adopting Bitcoin payments, Flash offers a straightforward onboarding process, low fees, and robust support for both digital and physical goods. To learn more, visit paywithflash.com.

Media Contact:

Pierre Corbin

Co-Founder, Flash

Email: press@paywithflash.com

Website: paywithflash.comAbout Flash

Flash is the easiest Bitcoin payment gateway for businesses to accept payments. Supporting both digital and physical enterprises, Flash leverages the Lightning Network to enable fast, low-cost Bitcoin transactions. Launched in its 2.0 version in March 2025, Flash is at the forefront of driving Bitcoin adoption in e-commerce.

About Bitcoin Only Brewery

Bitcoin Only Brewery (@Drink_B0B) is a pioneering beverage company dedicated to the Bitcoin ethos, offering high-quality beers payable exclusively in Bitcoin. With a commitment to personal privacy, the brewery delivers across Europe with no-KYC requirements.

-

@ b1ddb4d7:471244e7

2025-06-11 05:01:48

@ b1ddb4d7:471244e7

2025-06-11 05:01:48Hosted at the iconic Palace of Culture and Science—a prominent symbol of the communist era—the Bitcoin FilmFest offers a vibrant celebration of film through the lens of bitcoin. The venue itself provides a striking contrast to the festival’s focus, highlighting bitcoin’s core identity as a currency embodying independence from traditional financial and political systems.

𝐅𝐢𝐱𝐢𝐧𝐠 𝐭𝐡𝐞 𝐜𝐮𝐥𝐭𝐮𝐫𝐞 𝐰𝐢𝐭𝐡 𝐩𝐨𝐰𝐞𝐫𝐟𝐮𝐥 𝐦𝐮𝐬𝐢𝐜 𝐯𝐢𝐛𝐞𝐬.

Warsaw, Day Zero at #BFF25 (European Bitcoin Pizza Day) with @roger__9000, MadMunky and the @2140_wtf squad

pic.twitter.com/9ogVvWRReA

pic.twitter.com/9ogVvWRReA— Bitcoin FilmFest

(@bitcoinfilmfest) May 28, 2025

(@bitcoinfilmfest) May 28, 2025This venue represents an era when the state tightly controlled the economy and financial systems. The juxtaposition of this historical site with an event dedicated to bitcoin is striking and thought-provoking.

The event features a diverse array of activities, including engaging panel discussions, screenings of both feature-length and short films, workshops and lively parties. Each component designed to explore the multifaceted world of bitcoin and its implications for society, offering attendees a blend of entertainment and education.

The films showcase innovative narratives and insights into bitcoin’s landscape, while the panels facilitate thought-provoking discussions among industry experts and filmmakers.

Networking is a significant aspect of the festival, with an exceptionally open and friendly atmosphere that foster connections among participants. Participants from all over Europe gather to engage with like-minded individuals who share a passion for BTC and its implications for the future.

The open exchanges of ideas foster a sense of community, allowing attendees to forge new connections, collaborate on projects, and discuss the potential of blockchain technology implemented in bitcoin.

The organization of the festival is extraordinary, ensuring a smooth flow of information and an expertly structured schedule filled from morning until evening. Attendees appreciate the meticulous planning that allowed them to maximize their experience. Additionally, thoughtful touches such as gifts from sponsors and well-chosen locations for various events contribute to the overall positive atmosphere of the festival.

Overall, the Bitcoin FilmFest not only highlights the artistic expression surrounding bitcoin but also serves as a vital platform for dialogue—about financial freedom, the future of money, and individual sovereignty in a shifting world.

The event successfully bridges the gap between a historical symbol of control and a movement that celebrates freedom, innovation, and collaboration in the digital age, highlighting the importance of independence in financial systems while fostering a collaborative environment for innovation and growth.

Next year’s event is slated for June 5-7 2026. For further updates check: https://bitcoinfilmfest.com/

-

@ cae03c48:2a7d6671

2025-06-11 06:00:37

@ cae03c48:2a7d6671

2025-06-11 06:00:37Bitcoin Magazine

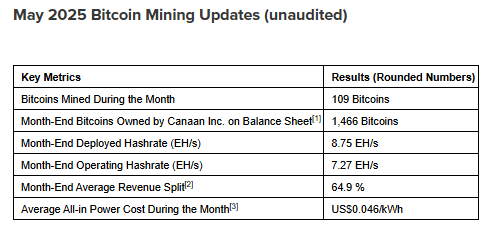

The Trump’s American Bitcoin Merges with Gryphon, Reports 215 BTC on Balance Sheet Since LaunchAmerican Bitcoin Corp (ABTC), a newly formed private Bitcoin mining company backed by Eric Trump and Donald Trump Jr., announced in a June 10 SEC filing that it has acquired 215 Bitcoin (BTC) since launching operations on April 1, 2025. The reserve is currently valued at approximately $23 million, showing their drive and commitment to Bitcoin.

JUST IN: American Bitcoin Corp (private) reports to have 215 #bitcoin (per 31 May) since it's launch on April 1, 2025.

They will merge with Gryphon Digital $GRYP and become public under ticker $ABTC.

They mention "Bitcoin accumulation is not a side effect of ABTC’s business.… pic.twitter.com/wq1Uxr76Z2

— NLNico (@btcNLNico) June 10, 2025

“Bitcoin accumulation is not a side effect of ABTC’s business. It is the business,” the company stated in the filing.

Furthermore, ABTC has entered into a merger agreement with Gryphon Digital Mining ($GRYP), and the combined company is expected to begin public trading under the ticker $ABTC as early as Q3 2025.

The company’s three-layer strategic plan—outlined in the SEC disclosure—details a focused approach:

Layer 1: Build the Engine

- ABTC’s foundation is built on “producing Bitcoin below-market cost through a capital efficient, infrastructure-light operating model.” The company owns and operates over 60,000 miners from Bitmain and MicroBt, running primarily on Hut 8-managed facilities.

Layer 2: Scale the Reserve

- ABTC had “accumulated approximately 215 Bitcoin in reserve since launching on April 1, 2025,” which it considers a long-term strategic asset. The firm states its goal is “to utilize public markets and strategic financing structures to access efficient capital and leverage that capital to increase its Bitcoin in reserve per share.”

Layer 3: Lead the Ecosystem

- The company ultimately aims to use its operational scale and mining position to drive industry-wide adoption. “ABTC may pursue opportunities to support protocol development, enhance network infrastructure and contribute to Bitcoin’s resilience and adoption in ways that align with shareholder value creation.”

For mining rewards, ABTC uses Foundry and Luxor pools with sub-1% fees and relies on Coinbase Custody for secure cold storage, featuring multi-factor authentication and strict withdrawal protocols.

With operations across Niagara Falls, NY; Medicine Hat, AB; and Orla, TX, ABTC is leveraging strategic partnerships—primarily with Hut 8—to scale its Bitcoin holdings while influencing the broader crypto mining ecosystem.

This post The Trump’s American Bitcoin Merges with Gryphon, Reports 215 BTC on Balance Sheet Since Launch first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-11 06:00:34

@ cae03c48:2a7d6671

2025-06-11 06:00:34Bitcoin Magazine

Bitcoin Officially Traded Above $100,000 For 30 Consecutive Days For The First TimeBitcoin has officially completed 30 consecutive days trading above the $100,000 mark, marking a historic milestone in its 15 year journey. Bitcoin achieved its all time high (ATH) of $111,980 on May 22, almost hitting $112,000.

JUST IN: Bitcoin has stayed above $100,000 for 30 consecutive days for the first time ever!

pic.twitter.com/nfccEK3Wf0

pic.twitter.com/nfccEK3Wf0— Bitcoin Magazine (@BitcoinMagazine) June 10, 2025

In the last 30 days, Bitcoin saw a 10 percent pullback right after reaching its ATH, dropping to $100,428. However, it wasn’t for long, as Bitcoin is back at $109,511 at the time of writing. Momentum appears to be building once again, signaling to be bullish.

“Anytime price is able to punch through a major resistance level, whether psychological or historical, and successfully hold, it is certainly a bullish sign,” said the technical analyst of Wolfe Research Read Harvey. “What really stood out to us was price’s ability to hold that level on the back test, when it briefly fell to $100,000 on Thursday. It also happened to align perfectly with the 50-day moving average. … We feel this should act as a launching pad back towards the recent highs of $112,000.”

In the past month, Bitcoin has surged into the financial and political mainstream. Several U.S. states including New Hampshire first, followed by Arizona, and then Texas have passed legislation recognizing Bitcoin as a strategic reserve asset. These laws reflect a growing trend of state level interest in using Bitcoin as a financial hedge and as part of long term fiscal policy.

“New Hampshire didn’t just pass a bill; it sparked a movement,” stated the CEO and Co-Founder of Satoshi Action Dennis Porter.

At the same time, financial institutions are rapidly expanding their Bitcoin offerings. JP Morgan has started providing loans backed by Bitcoin ETFs as collateral. BlackRock’s Bitcoin ETF has entered a period of intense activity, generating record trading volumes and capturing the attention of both retail and institutional investors.

To date, a total of 228 public and private entities have Bitcoin in their balance sheets and in the last 30 days, companies like GameStop, Know Labs, and Norway-based NBX have added Bitcoin as a strategic reserve. All these companies are treating Bitcoin not just as a speculative asset, but as a key part of their long term financial plans. This growing corporate trend follows the example set by Strategy, but it’s now happening on a much larger scale.

At the 2025 Bitcoin conference, the Vice President of the United States of America, JD Vance said in his speech, “Fifty million Americans own Bitcoin. I think it’s gonna be 100 million before too long.”

This post Bitcoin Officially Traded Above $100,000 For 30 Consecutive Days For The First Time first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-09 10:01:19

@ cae03c48:2a7d6671

2025-06-09 10:01:19Bitcoin Magazine

Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in BitcoinMeanwhile Insurance Bitcoin (Bermuda) Limited (“Meanwhile”) announced it has become the first company in the world to release externally audited financial statements denominated entirely in Bitcoin. According to the announcement, the company reported 220.4 BTC in assets and 25.29 BTC in net income for 2024, a 300% year over year increase.

Today marks a global first & historic event for us, along with the public release of our 2024 audited financial statements, covering our 1st year of sales.

As the 1st company in the world to have Bitcoin-denominated financial statements externally audited, we are excited to…

— meanwhile | Bitcoin Life Insurance (@meanwhilelife) June 5, 2025

“We’ve just made history as the first company in the world to have Bitcoin-denominated financial statements externally audited,” said Zac Townsend, CEO of Meanwhile. “This is an important, foundational step in reimagining the financial system based on a single, global, decentralized standard outside the control of any one government.”

The financial statements were audited by Harris & Trotter LLP and its digital asset division ht.digital. Meanwhile’s financials also comply with Bermuda’s Insurance Act 1978, noting that their BTC denominated financials were approved and comply with official guidelines. The firm, fully licensed by the Bermuda Monetary Authority (BMA), operates entirely in BTC and is prohibited from liquidating Bitcoin assets except through policyholder claims, positioning it as a long term holder.

“As the first regulated Bitcoin life insurance company, we view the BTC held by Meanwhile as inherently long-term in nature—primarily held to support the Company’s insurance liabilities over decades,” Townsend added. “This makes it significantly ‘stickier’ and resistant to market pressures compared to the BTC held by other companies as part of their treasury management strategies.”

Meanwhile’s 2024 financials also revealed 23.02 BTC in net premiums and 4.35 BTC in investment income, showing that its model not only preserves Bitcoin, but earns it. The company’s reserves (also held in BTC) were reviewed and approved by Willis Towers Watson (WTW).

Meanwhile also offers a Bitcoin Whole Life insurance product that allows policyholders to save, borrow, and build legacy wealth—entirely in BTC, and has plans to expand globally in 2025.

“We are incredibly proud of today’s news as it underscores how Meanwhile is at the forefront of the next phase of the convergence between Bitcoin and institutional financial markets,” said Tia Beckmann, CFO of Meanwhile. “Now having generated net income in BTC, we have demonstrated that we are earning it through a sustainable insurance business model designed for the long term.”

This post Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in Bitcoin first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ c9badfea:610f861a

2025-06-10 21:43:55

@ c9badfea:610f861a

2025-06-10 21:43:55🤖️ AI Articles

📱 Android Articles

- 🥩 Tracking Food Intake

- ✍️ Taking Handwritten Notes

- 🕒 Tracking Habits

- 🧭 Navigating The Wild

- 📝 Organizing Notes and Tasks

- 🧠 Studying Smarter

- 💱 Tracking Fiat Currency Exchange Rates

- 🌠 Offline Planetarium

- 📥 Downloading Media From 1000+ Sites

- 🔥 Blocking Ads and Trackers

- ⛅ Getting Detailed Weather Information

- 📦 Installing Apps Directly From Source

- 🎮 Playing Retro Games

- 🖼️ Generating AI Images Locally

- 📖 Reading PDF Documents and EPUB Books

- 🔒 Storing Passwords Safely

- 🗺️ Using Offline Maps

- 🎵 Producing Music On-Device

- 💾 Writing ISO Images to USB Drives

- 💻 Coding On-Device

- 🎬 Watching and Downloading Videos from YouTube, Rumble, Odysee, Bitchute, and More

- 🔤 Upgrading the Typing Experience

- 📰 Reading RSS Feeds

- 📥 Downloading Torrents

- 📺 Watching IPTV Channels for Free

- 🔒 Easily Verifying File Checksums

- 🗣️ Offline Translator

- 🗣️ Offline Text-to-Speech Engine

- 🤖 Running LLMs Locally

- 🌐 Browsing Entire Websites Offline

- 🔐 Quickly Encrypting Files

✏️ Other Articles

-

@ a296b972:e5a7a2e8

2025-06-09 08:00:20

@ a296b972:e5a7a2e8

2025-06-09 08:00:20Nur für‘s Protokoll. Hiermit erkläre ich, Georg Ohrweh, im tatsächlich vorhandenen vollen Besitz meiner geistigen Kräfte, dass Herr Lauterbach, gleich welche Position er in Zukunft noch bekleiden sollte, für mich nicht zuständig ist. Basta.

Ein Erguss dieses verhaltensoriginellen Über-alles-Bescheidwissers:

„Wir kommen jetzt in eine Phase hinein, wo der Ausnahmezustand die Normalität sein wird. Wir werden ab jetzt immer im Ausnahmezustand sein. Der Klimawandel wird zwangsläufig mehr Pandemien bringen.“

Wie kann es sein, dass solch eine Ausnahme-Gestalt, die schon rein äußerlich die Phantasie zu Vergleichen anregt, sich leider auch genauso verhält, wie die Gestalten, die in diesen Phantasien vorkommen, ungebremst auf der Panik-Klaviatur kakophonische Klänge erzeugen darf? Obwohl ein wenig Wahrheit ist auch enthalten: Wir sind tatsächlich immer im Ausnahmezustand, im Ausnahmezustand des fortgeschrittenen Wahnsinns.

Wie kann es sein, dass dieser Haaaarvardist seinen persönlich empfundenen Ausnahmezustand zum Allgemeingut erklären kann? Welche Verknüpfungs-Phantasien hat er sonst noch studiert? Er ist ja auch noch Vorsitzender im Raumfahrtausschuss. Was kommt als Nächstes? Eine Klima-Pandemie, verursacht durch außerirdische Viren, die die Temperaturen beeinflussen können? Im aktuellen Zeitgeist gibt es nichts, was nicht gedacht wird. Wem die besseren Absurditäten einfallen, der gewinnt. Man muss sich schon den gegebenen Denkstrukturen etwas anpassen, aber sich auch ein wenig Mühe geben.

Nach dem Wechsel der ehemaligen Außen-Dings zur UN (mit dem Ziel, aus den Vereinten Nationen die Feministischen Nationen zu gestalten) und des ehemaligen Wirtschafts-Dings in den Außenausschuss und als Gastdozent in Kalifornien (Thema: Wirtschaftsvernichtung unter Einbeziehung des gespannten Verhältnisses unter Geschwistern aufgrund ärmlicher Verhältnisse, am Beispiel des Märchens von Hänsel und Gretel) , jetzt auch noch der ehemalige Chef-Panikmacher zur WHO.

…und der Wahnsinn wurde hinausgetragen in die Welt, und es wurde dunkel, und es ward Nacht, und es wurde helle, und es ward Tag, der Wind blies oder auch nicht (was macht der Wind eigentlich, wenn er nicht weht?), und es ward Winter, und es wurde kälter, und es wurde wärmer, und es ward Sommer. Es regnete nicht mehr, die Wolken schwitzten. Und Putin verhinderte (wer auch sonst), dass das Eis in der Antarktis abnahm.

Wiederholte Bodentemperaturen in der Toskana von 50 Grad Celsius. Zu erwartende Wassertemperaturen während Ferragosto an der italienischen Adria von durchschnittlich 100 Grad Celsius. An Stellen mit wenig Strömung stiegen schon die ersten Kochblasen auf. Doch dann kam der durch Lachs gestählte, salzlose Super-Karl und rettete mit einem durch die WHO diktierten Klima-Logdown die gesamte Menschheit. Wer besser, als er konnte wissen, dass ein Klima-Logdown weitgehend nebenwirkungsfrei ist.

Was für ein Segen, dass Karl der Große, der uns so siegreich durch die Corona-Schlacht geführt hat, jetzt auch gegen das Klima in den Krieg zieht.

Wer kennt das nicht, Tage der Qual, in denen man zugeben muss: Ich hab‘ heute so schlimm Klima.

Viele Klimaexperten, die weltweit in der Qualitätspropaganda zitiert werden, zeichnen sich besonders dadurch aus, dass sie mit einer maximalen Abweichung von einem Grad Celsius ein Thermometer fehlerfrei ablesen können. Diese Ungenauigkeit wird der Erdverkochungsexperte sicher als erstes beheben.

In einer aufopfernden Studie während eines Urlaubs in 2023, in der um die damalige Zeit erstmals eisfreien Toskana, hat er den von ihm ausgetüftelten Klimaschutzplan ins Rheinische übersetzt. Titel: „Schützen Sie sisch, und, äh, andere!“ Weiter konnte er erforschen, dass die Bodentemperatur nicht immer mit der Temperatur des Erdkerns übereinstimmen muss.

Durch seine unermüdlichen Studien, können Hitzetote in Zukunft besser zugeordnet werden. Man weiß dann, ob jemand an hohen oder mit hohen Temperaturen gestorben ist. Der asymptomatische Klimawandel kann so in Zukunft viel besser bewertet werden. Man hat aus geringfügigen Fehlern gelernt und die Methoden erheblich verbessert.

Eine präzise Vorhersage der Jahreszeiten, vor allem die des Sommers, wird bald ebenfalls möglich sein. Es kann jetzt vor jahreszeitbedingten, teilweise sogar täglich schwankenden Temperaturveränderungen rechtzeitig gewarnt werden. Im Herbst können Heizempfehlungen für die ahnungslose Bevölkerung herausgegeben werden. Frieren war gestern, wissen wann es kalt wird, ist heute. Es wird an Farben geforscht, die noch roter sein sollen, als die, die jetzt in den Wetterkarten bei 21 Grad bereits verwendet werden.

Eine allgemeine Heizpflicht soll es europaweit zunächst nicht geben.

Weiter soll die Lichteinstrahlung der Sonne noch präziser bestimmt werden, damit den Europäern, in Ergänzung zur mitteleuropäischen Sommerzeit, jetzt auch noch genau mitgeteilt werden kann, wann es Tag und wann es Nacht ist.

Das Hinausschauen aus dem Fenster, zum Beispiel, ob es schon dunkel draußen ist, erübrigt sich. Die Tageszeit, in Ergänzung zur herkömmlichen Uhrzeit, wird demnächst automatisch mit dem Klima-Pass übermittelt werden. Zu Anfang natürlich erst einmal freiwillig.

Durch die persönliche ID können dann auch schnell und unkompliziert Sonderprämien überwiesen werden, sofern man sich klimakonform verhalten hat, damit man sich rechtzeitig vor Winterbeginn eine warme Jacke oder einen Mantel kaufen kann. Das Sparen von Bargeld auf eine bevorstehende größere Anschaffung von Winterkleidung wird somit überflüssig.

Ob es am Ende nun um Hitze oder Kälte geht, spielt eigentlich gar keine Rolle, denn wie wussten schon die Ahnen zu berichten: Was gut für die Kälte ist, ist auch gut für die Wärme.

Westliche Mächte unternehmen immer wieder Versuche, eskalierend auf den Ukraine-Konflikt einzuwirken, damit man atombetriebene Heizpilze aufstellen kann, an denen sich die Europäer im Winter auch im Freien wärmen können.

Wie praktisch, dass man nicht nur Gesundheit und Klima, sondern auch Klima und Krieg miteinander verbinden kann. Alles so, oder so ähnlich möglicherweise nachzulesen im genialen Hitzeschutzplan á la Lauterbach.

Besonders Deutschland braucht nicht nur lauterbachsche Hitzeschutzräume, nein es braucht atomsichere Hitzeschutzbunker, so schlägt man gleich zwei Fliegen mit einer Klappe.

Für die, die es sich leisten können, hier ein Vorschlag. Der K2000:

Für die weniger gut Betuchten reicht auch ein kühles Kellerloch, das man idealerweise im Februar beziehen und nicht vor November wieder verlassen sollte, so die Empfehlung auch von führenden Klima-Forschern, die es ja wissen müssen. Von Dezember bis Januar empfiehlt sich ein Besuch auf den Bahamas, besonders dann, wenn man eine leichte Erkältung verspürt.

Nur Verschwörungstheoretiker behaupten, dass die eigenartigen Anschlussverwendungen der Extrem-Kapazitäten, zu denen Lauterbach ohne Zweifel dazugehört, wie dicke rote Pfeile wirken, die auf Institutionen und Organisationen zeigen, um die man unter allen Umständen einen großen Bogen machen sollte, weil sie möglicherweise nichts Gutes im Schilde führen. Minimal sollen sie angeblich Unsinn verbreiten, maximal sollen sie gehörigen Schaden anrichten.

Man muss sich nur ein paar Gedanken machen, schon kann man feststellen, wie alles mit allem zusammenhängt.

“Dieser Beitrag wurde mit dem Pareto-Client geschrieben.”

* *

(Bild von pixabay)

-

@ cae03c48:2a7d6671

2025-06-11 06:00:32

@ cae03c48:2a7d6671

2025-06-11 06:00:32Bitcoin Magazine

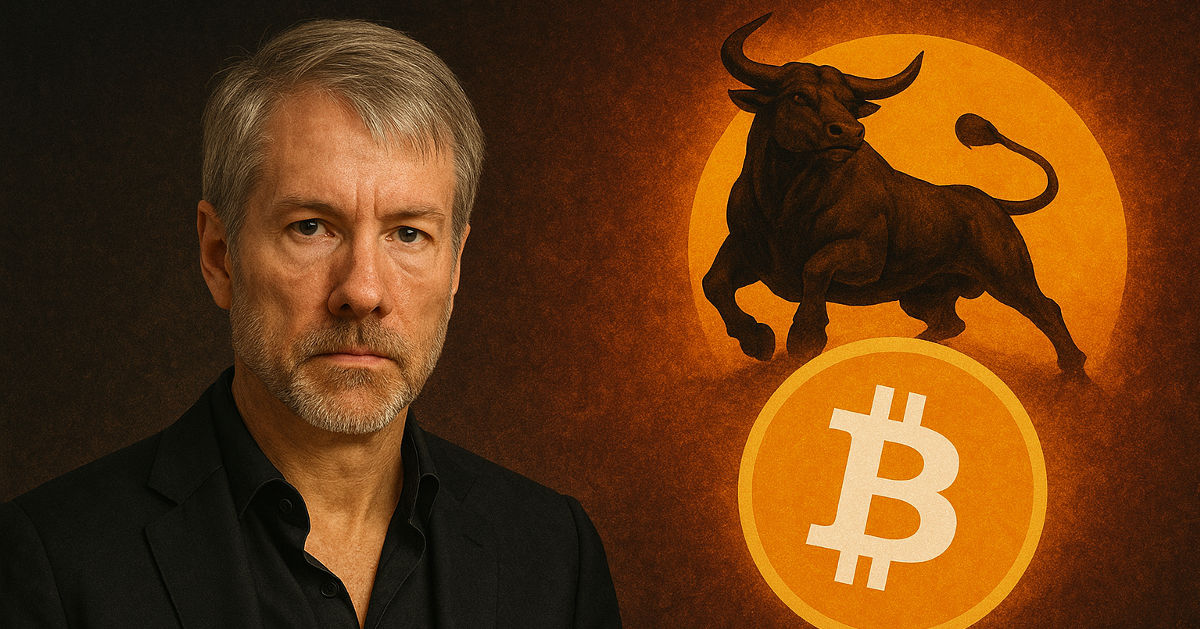

Economic Bitcoin Nodes: Why You Need To Use Your Node For It To MatterWhat is an economic node? To understand that, you need to first conceptually understand how a user interacts with the Bitcoin network in the first place.

Bitcoin is a database, and a network to facilitate the updating and synchronization of updates to that database, used for the primary purpose of people transacting bitcoin (entries in the database).

The primary concern of a user making use of Bitcoin for this purpose is the validity of the transactions sent to them, i.e. is the money they have received valid in the sense that when they go forward in the future to spend it somewhere else that other people will also widely accept it as valid. If that is not the case, then it is useless as money.

This is the purpose of a node, to verify these transactions. In order to do so, your node must have a complete set of all the existing coins (Unspent Transaction Outputs, or UTXOs) in order to check every proposed transaction against. When a transaction is broadcast, your node verifies that the coins it is spending are in this “UTXO set”, meaning that they have not been spent yet. When that transaction is confirmed in a block, those individual UTXOs are then removed from the UTXO set, and the new ones created by that transaction are added.

In order to compute that UTXO set in the first place, a node must parse through the entire historical record of all past transactions contained in the blockchain, going through the process of adding each newly mined UTXO to the set, and removing/adding all the consumed and newly created UTXOs processed in each individual block.

Without doing this, there is no way to be certain that the current UTXO set stored in your node is actually accurate and valid (in the future Zero Knowledge Proofs could obviate the need for this by replacing the historical blockchain with a succinct cryptographic proof that any given UTXO set is valid for a specific blockheight).

Your node is simply an agent for you as an economic actor, in the sense of automated AI agents that many LLM advocates speak about. It is an autonomous program acting on your behalf in a certain context, in this case guaranteeing the validity of bitcoin transactions to ensure that when you are the recipient of one, the chain of transactions that created the coin spent to you is valid.

An economic node is simply a node that is actually being used by someone engaging in economic activity to ensure the validity of the coins they are receiving.

Why is that so important? Why do only these nodes matter?

Think about what makes Bitcoin function in the first place: people running the same consensus rules. The only reason there is a coherent singular Bitcoin network is because everyone is running the same consensus rules, when miners produce blocks, every individual node arrives at the same conclusion as to whether or not it is valid. Every individual node will follow whatever is the blockchain composed of valid blocks that has the most proof-of-work attached to it.

There is only a singular coherent Bitcoin network because each individual actor chooses to enforce the same set of consensus rules against blocks that miners produce. It is purely voluntary association, voluntary subjugation of oneself to a certain set of consensus rules.

So to illustrate the point, let’s imagine three different scenarios of nodes deviating from the existing set of rules.

In the first scenario, imagine a few major exchanges like Kraken, Coinbase, etc. all alter their consensus rules from the rest of the network (softfork vs. hardfork are a distraction from the point, so we are going to ignore the distinction here). These nodes represent the economic platforms where bitcoin is traded, and its price established in fiat terms. Nodes running conflicting rules from them, or making transactions that will not be recognized as valid by their nodes to be more specific, now cannot engage in that market.

Those exchanges’ nodes will not recognize user deposits as valid, and as such they will not be able to deposit coins and participate in those marketplaces. Other nodes can band together, but they cannot capture the economic power of those exchanges. Ultimately, short of the value of the coin created by the ruleset they are enforcing crashing to nothing, other nodes on the network will have no choice but to adopt their ruleset in order to interact with them. Otherwise the exchanges will simply ignore and honor honor deposits their nodes consider invalid.

In the second scenario, let’s imagine a group of much smaller businesses and users that regularly receive transactions. Maybe all of them together amount to the economic activity of a single exchange like Coinbase. These users choosing to alter their consensus rules is not as inescapable as a number of large exchanges in concert, but it is still significant.

Here, other users can still access marketplaces like exchanges to ensure that bitcoin is being priced by the market. The majority of the network will still accept everyone else’s coins in receipt for goods, or as deposits to trade on marketplaces. But they still represent a sizable portion of economic activity withdrawing from the rest of the network. This is leverage they can use.

Even as a minority of the network, the likelihood is extremely high that there are significant levels of economic activity crossing between this minority of nodes and the rest of the network. This is not a clear case of leaving the rest of the network no option but to adopt the new rules, but it definitely creates pressure for large portions of the network who interact across that “gap.”

From there the more users that choose to cross the gap because of who they economically interact with, that pressure grows larger for the rest of the remaining network.

In the last scenario, let’s imagine a group of nodes representing a small set of users generating very little or no economic activity at all. These users choose to alter their ruleset. They receive almost no payments, they represent a rounding error in terms of economic value on the network.

They’re irrelevant to the rest of the network. Large businesses, exchanges, other economic actors, they will not care if a handful of people stop patronizing them or sending them bitcoin for different reasons. This set of nodes altering their consensus rules doesn’t matter. They create no pressure or opportunity cost that matters for the rest of the network.

An economic node’s influence on the overall consensus of the Bitcoin network is proportional to the amount of economic activity involving that node/its owner.

A node that is not being used for this purpose is completely irrelevant to the consensus rules of the Bitcoin network at large. It creates no economic pressure, imposes no opportunity cost, on the rest of the network when it alters its consensus rules. It is indistinguishable from a participant in a sybil attack.

There might be other reasons to run a node besides verifying your own transactions, such as direct access to blockchain data for research or analysis purposes, but ultimately that node is irrelevant to consensus.

This dynamic is why Bitcoin cannot be sybil attacked. It’s why some malicious actor can spin up a million nodes on Amazon Web Services running different consensus rules, and it will have zero effect on the actual Bitcoin network.

Your node doesn’t matter, unless you use it. So use it.

This post Economic Bitcoin Nodes: Why You Need To Use Your Node For It To Matter first appeared on Bitcoin Magazine and is written by Shinobi.

-

@ 7f6db517:a4931eda

2025-06-09 06:02:16

@ 7f6db517:a4931eda

2025-06-09 06:02:16

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ cae03c48:2a7d6671

2025-06-11 06:00:30

@ cae03c48:2a7d6671

2025-06-11 06:00:30Bitcoin Magazine

Bitwise Debuts First Ever GameStop Covered Call ETFToday, Bitwise Asset Management announced the launch of the Bitwise GME Option Income Strategy ETF (IGME), the first-ever covered call ETF centered around GameStop (GME). The fund arrives at a moment where GameStop recently made headlines for its $500 million Bitcoin treasury strategy.

GameStop is embracing bitcoin; we built an income-generating ETF designed to capture that hype and turn it into yield.

Introducing $IGME: The first option income ETF capitalizing on investor interest in @gamestop and their adoption of bitcoin as a treasury asset.

As the fourth… pic.twitter.com/EHaXX9PK7X

— Bitwise (@BitwiseInvest) June 10, 2025

Led by Bitwise’s Head of Alpha Strategies Jeff Park, IGME is the latest addition to Bitwise’s rapidly expanding suite of option income ETFs. The actively managed fund is designed to generate income through a covered call strategy while offering investors exposure to GameStop, a company that has transformed from mall retailer to a key player in the digital asset conversation.

“IGME is the first covered call strategy built around GameStop, a stock whose historic volatility and growth potential make it a strong fit for this approach,” said Park. “With IGME, investors now have access to an option income ETF based on an equity that sits at the intersection of retail investor popularity, a traditional revenue-generating business, and digital asset adoption.”

GameStop recently disclosed that it holds 4,710 Bitcoin, worth over $500 million at the time of purchase, positioning it among the growing list of public companies making Bitcoin a core treasury component. As of March 31, 2025, over 79 public companies hold a collective $57 billion in Bitcoin—a 159% increase from the previous year, according to Bitcoin Asset Management.

IGME follows the launch of Bitwise’s other option income ETFs, including IMST (Strategy), ICOI (Coinbase), and IMRA (Marathon Digital Holdings). These ETFs aim to deliver monthly income through synthetic covered call strategies that leverage options rather than direct equity holdings.

“At Bitwise, our mission is to help investors gain access to the full range of opportunities emerging in crypto,” said Bitwise CEO Hunter Horsley. “We’re excited to add IGME to our suite of option income ETFs to help investors capitalize on the volatility of companies in the space.”

IGME plans to announce its first monthly distribution on July 24 and carries an expense ratio of 0.98%.

This post Bitwise Debuts First Ever GameStop Covered Call ETF first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ c9badfea:610f861a

2025-06-11 00:02:03

@ c9badfea:610f861a

2025-06-11 00:02:03🤖️ AI Articles

📱 Android Articles

- 📹️ Device as Dashcam

- 🥩 Tracking Food Intake

- ✍️ Taking Handwritten Notes

- 🕒 Tracking Habits

- 🧭 Navigating the Wild

- 📝 Organizing Notes and Tasks

- 🧠 Studying Smarter

- 💱 Tracking Fiat Currency Exchange Rates

- 🌠 Offline Planetarium

- 📥 Downloading Media From 1000+ Sites

- 🔥 Blocking Ads and Trackers

- ⛅ Getting Detailed Weather Information

- 📦 Installing Apps Directly From Source

- 🎮 Playing Retro Games

- 🖼️ Generating AI Images Locally

- 📖 Reading PDF Documents and EPUB Books

- 🔒 Storing Passwords Safely

- 🗺️ Using Offline Maps

- 🎵 Producing Music On-Device

- 💾 Writing ISO Images to USB Drives

- 💻 Coding On-Device

- 🎬 Watching and Downloading Videos from YouTube, Rumble, Odysee, Bitchute, and More

- 🔤 Upgrading the Typing Experience

- 📰 Reading RSS Feeds

- 📥 Downloading Torrents

- 📺 Watching IPTV Channels for Free

- 🔒 Easily Verifying File Checksums

- 🗣️ Offline Translator

- 🗣️ Offline Text-to-Speech Engine

- 🤖 Running LLMs Locally

- 🌐 Browsing Entire Websites Offline

- 🔐 Quickly Encrypting Files

✏️ Other Articles

-

@ b1ddb4d7:471244e7

2025-06-09 17:02:03

@ b1ddb4d7:471244e7

2025-06-09 17:02:03Jason Lowery’s thesis, Softwar: A Novel Theory on Power Projection and the National Strategic Significance of Bitcoin, reframes bitcoin not merely as digital cash but as a transformative security technology with profound implications for investors and nation-states alike.

For centuries, craft brewers understood that true innovation balanced tradition with experimentation—a delicate dance between established techniques and bold new flavors.

Much like the craft beer revolution reshaped a global industry, bitcoin represents a fundamental recalibration of how humans organize value and project power in the digital age.

The Antler in the Digital Forest: Power Projection

Lowery, a U.S. Space Force officer and MIT scholar, anchors his Softwar theory in a biological metaphor: Bitcoin as humanity’s “digital antler.” In nature, antlers allow animals like deer to compete for resources through non-lethal contests—sparring matches where power is demonstrated without fatal consequences. This contrasts sharply with wolves, who must resort to violent, potentially deadly fights to establish hierarchy.

The Human Power Dilemma: Historically, humans projected power and settled resource disputes through physical force—wars, seizures, or coercive control of assets. Even modern financial systems rely on abstract power structures: court orders, bank freezes, or government sanctions enforced by legal threat rather than immediate physical reality.

Lowery argues this creates inherent fragility: abstract systems can collapse when met with superior physical force (e.g., invasions, revolutions). Nature only respects physical power.

Bitcoin’s Physical Power Engine: Bitcoin introduces a novel solution through its proof-of-work consensus mechanism. Miners compete to solve computationally intense cryptographic puzzles, expending real-world energy (megawatts) to validate transactions and secure the network.

This process converts electricity—a tangible, physical resource—into digital security and immutable property rights. Winning a “block” is like winning a sparring match: it consumes significant resources (energy/cost) but is non-destructive.

The miner gains the right to write the next page of the ledger and collect rewards, but no participant is physically harmed, and no external infrastructure is destroyed.

Table: Traditional vs. Bitcoin-Based Power Systems

Power System

Mechanism

Key Vulnerability

Resource Cost

Traditional (Fiat/Banking)

Legal abstraction, threat of state force

Centralized points of failure, corruption, political change

Low immediate cost, high systemic risk

Military/Economic Coercion

Physical force, sanctions

Escalation, collateral damage, moral hazard

Very high (lives, capital, instability)

Bitcoin (Proof-of-Work)

Competition via energy expenditure

High energy cost, concentration risk (mining)

High energy cost, low systemic risk

Softwar Theory National Strategic Imperative: Governments Are Taking Notice

Lowery’s Softwar Theory has moved beyond academia into the corridors of power, shaping U.S. national strategy:

- The Strategic Bitcoin Reserve: Vice President JD Vance recently framed bitcoin as an instrument projecting American values—”innovation, entrepreneurship, freedom, and lack of censorship”. State legislation is now underway to implement this reserve, preventing easy reversal by future administrations.

- Regulatory Transformation: The SEC is shifting from an “enforcement-first” stance under previous leadership. New initiatives include:

- Repealing Staff Accounting Bulletin 121 (SAB 121), which discouraged banks from custodying digital currency by forcing unfavorable balance sheet treatment.

- Creating the Cyber and Emerging Technologies Unit (CETU) to develop clearer crypto registration/disclosure rules.

The Investor’s Lens: Scarcity, Security, and Asymmetric Opportunity

For investors, understanding “Softwar” validates bitcoin’s unique value proposition beyond price speculation:

-

Digital Scarcity as Strategic Depth: Bitcoin’s fixed supply of 21 million makes it the only digital asset with truly inelastic supply, a programmed scarcity immune to political whims or central bank printing.

This “scarcity imperative” acts as a natural antidote to global fiat debasement. As central banks expanded money supplies aggressively (Global M2), bitcoin’s price has shown strong correlation, acting as a pressure valve for inflation concerns. The quadrennial “halving” (latest: April 2024) mechanically reduces new supply, creating built-in supply shocks as adoption grows. * The Antifragile Security Feedback Loop: Bitcoin’s security isn’t static; it’s antifragile. The network strengthens through demand: * More users → More transactions → Higher fees → More miner revenue → More hashpower (computational security) → Greater network resilience → More user confidence.

This self-reinforcing cycle contrasts sharply with traditional systems, where security is a cost center (e.g., bank security budgets, military spending). Bitcoin turns security into a profitable, market-driven activity. * Institutionalization Without Centralization: While institutional ownership via ETFs (like BlackRock’s IBIT) and corporate treasuries (MicroStrategy, Metaplanet) has surged, supply remains highly decentralized.Individuals still hold the largest share of bitcoin, preventing a dangerous concentration of control. Spot Bitcoin ETFs alone are projected to see over $20 billion in net inflows in 2025, demonstrating robust institutional capital allocation.

The Bitcoin Community: Building the Digital Antler’s Resilience

Lowery’s “Softwar” theory underscores why bitcoin’s decentralized architecture is non-negotiable. Its strength lies in the alignment of incentives across three participant groups:

- Miners: Provide computational power (hashrate), validating transactions and securing the network. Incentivized by block rewards (newly minted BTC) and transaction fees. Their physical energy expenditure is the “muscle” behind the digital antler.

- Nodes: Independently verify and enforce the protocol rules, maintaining the blockchain’s integrity. Run by users, businesses, and enthusiasts globally. They ensure decentralized consensus, preventing unilateral protocol changes.

- Users: Individuals, institutions, and corporations holding, transacting, or building on bitcoin. Their demand drives transaction fees and fuels the security feedback loop.

This structure creates “Mutually Assured Preservation”. Attacking bitcoin requires overwhelming its global, distributed physical infrastructure (miners/nodes), a feat far more complex and costly than seizing a central bank’s gold vault or freezing a bank’s assets. It transforms financial security from a centralized liability into a decentralized, physically-grounded asset.

Risks & Responsibilities

Investors and policymakers must acknowledge persistent challenges:

- Volatility: Bitcoin remains volatile, though this has decreased as markets mature. Dollar-cost averaging (DCA) is widely recommended to mitigate timing risk.

- Regulatory Uncertainty: While U.S. policy is increasingly favorable, global coordination is lacking. The EU’s MiCAR regulation exemplifies divergent approaches.

- Security & Custody: While Bitcoin’s protocol is robust, user errors (lost keys) or exchange hacks remain risks.

- Environmental Debate: Proof-of-Work energy use is scrutinized, though mining increasingly uses stranded energy/renewables. Innovations continue.

Jason Lowery’s “Softwar” theory elevates bitcoin from a financial instrument to a socio-technological innovation on par with the invention of the corporation, the rule of law, or even the antler in evolutionary biology. It provides a coherent framework for understanding why:

- Nations like the U.S. are looking to establish bitcoin reserves and embracing stablecoins—they recognize bitcoin’s role in projecting economic power non-violently in the digital age.

- Institutional Investors are allocating billions via ETFs—they see a scarce, secure, uncorrelated asset with antifragile properties.

- Individuals in hyperinflationary economies or under authoritarian regimes use bitcoin—it offers self-sovereign wealth storage immune to seizure or debasement.

For the investor, bitcoin represents more than potential price appreciation. It offers exposure to a fundamental reorganization of how power and value are secured and exchanged globally, grounded not in abstract promises, but in the unyielding laws of physics and mathematics.

Like the brewers who balanced tradition with innovation to create something enduring and valuable, bitcoin pioneers are building the infrastructure for a more resilient digital future—one computationally secured block at a time. The “Softwar” is here, and it is reshaping the landscape of p

-

@ cae03c48:2a7d6671

2025-06-11 06:00:28

@ cae03c48:2a7d6671

2025-06-11 06:00:28Bitcoin Magazine

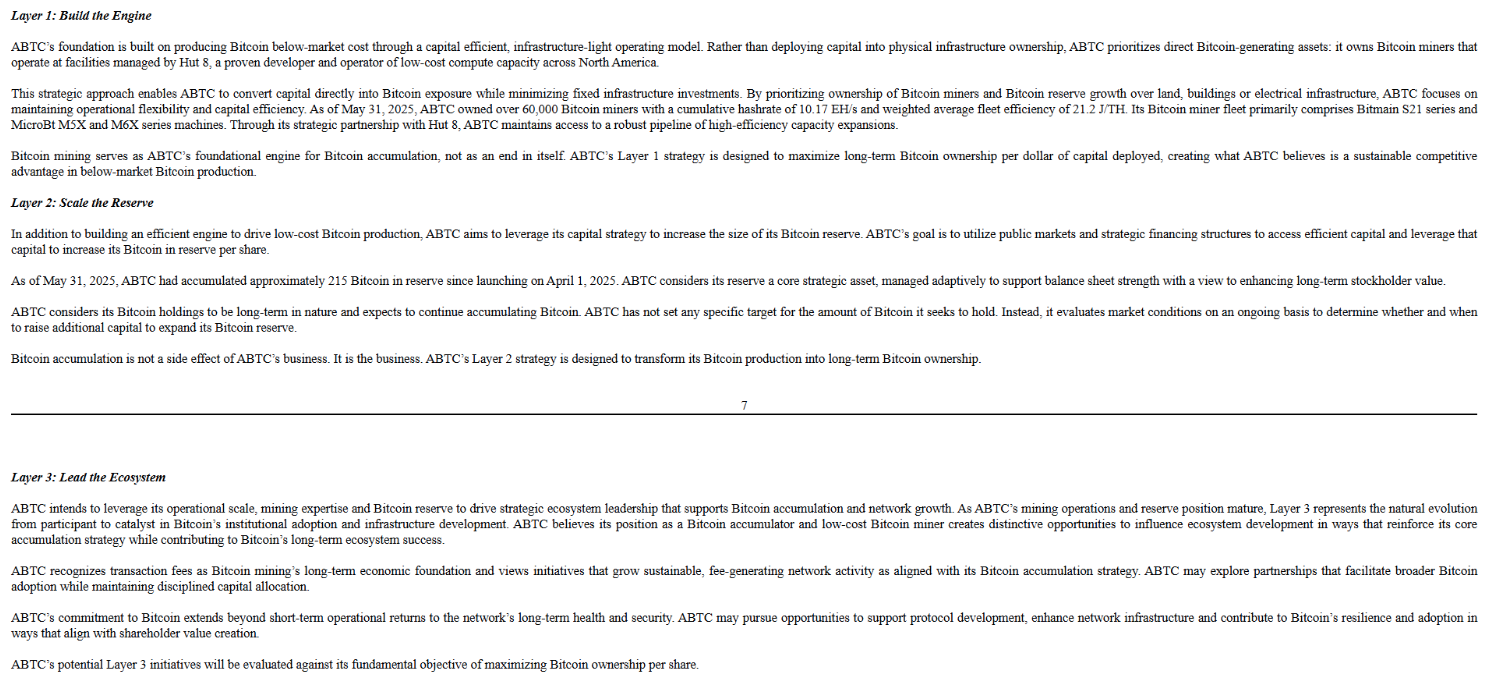

Michael Saylor: The Bear Market Is Not Coming Back And Bitcoin Is Going To $1 MillionToday, the Executive Chairman and CEO of Strategy Michael Saylor commented on the company’s aggressive Bitcoin-based strategy in a recent interview at Bloomberg, emphasizing that Bitcoin is not going to zero, it is going to $1 million.

“I think we’re in a digital gold rush and you’ve got ten years to acquire all your bitcoin before there’s no bitcoin left for you,” Saylor said. “The competition is a virtuous competition.”

JUST IN: Michael Saylor said the bear market is not coming back and Bitcoin is going to $1 million

— Bitcoin Magazine (@BitcoinMagazine) June 10, 2025

Saylor also said that Bitcoin is not going to have bear markets anymore and the price is going to $1 million per coin.

“Winter is not coming back,” commented Sayor. “We are past that phase. If Bitcoin is not going to zero, it is going to $1 million. The President of the United States is determined. He supports Bitcoin, the cabinet supports Bitcoin, Scott Bessent supports Bitcoin, Paul Atkins is shown himself to be an enthusiastic believer of Bitcoin and digital assets… Bitcoin has gotten through its riskiest period.”

He also pointed out that international firms are rapidly entering the space.

“Metaplanet is the hottest company in Japan right now, they went from $10 million to a $1 billion market cap to a $5 billion market cap. They’re going to raise billions of dollars. They’re going to pull the liquidity out of the Japanese market. So they’ll be raising capital in Tokyo and the Tokyo Stock Exchange… It’s not competitive. It’s cooperative.”

Strategy’s approach is far from traditional. The company is not just buying and holding Bitcoin; it is building financial instruments around it, which Saylor believes sets them apart.

“Our company has a very particular business model,” he stated. “It’s to issue Bitcoin-backed credit instruments like Bitcoin-backed bonds and especially Bitcoin-backed preferred stocks. We’re the only company in the world that’s ever been able to issue a preferred stock backed by Bitcoin. We’ve done three of them in the past five months.”

Rather than viewing Bitcoin treasury holdings or ETFs as competitors, Saylor explained that Strategy is targeting a different segment of the market entirely.

“We’re not competing against the Bitcoin treasury companies. We’re competing against ETFs like PFF that have portafolios of preferred stocks or corporate bond portfolios that are trading as ETFs in the public market, and the way we compete is we offer 400 basis points more yield on an instrument that is much more heavily collateralized and more transparent… That’s $100 trillion or more of capital in those markets,” explained Saylor.

He emphasized that Strategy’s Bitcoin balance sheet gives it a unique edge, giving the company the ability to design unique financial products.

“Our advantage is that we’re 100% Bitcoin… It’s impossible to issue Bitcoin-backed convertible preferred and Bitcoin-backed fixed preferred unless you’re willing to make 100% of your balance sheet Bitcoin.”

“I’m not really worried about competition from JPMorgan or Berkshire Hathaway,” concluded Saylor. “I would love for them to enter the Bitcoin space, buy up a bunch of Bitcoin. When they do it, they’ll be paying $1,000,000 a Bitcoin. The price will go to the moon.”

This post Michael Saylor: The Bear Market Is Not Coming Back And Bitcoin Is Going To $1 Million first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 472f440f:5669301e

2025-06-11 04:37:33

@ 472f440f:5669301e

2025-06-11 04:37:33Marty's Bent

Sup, freaks? Your Uncle Marty did a little vibe coding a couple months ago and that vibe coding project has turned into an actual product that is live in the Google Chrome web store and will soon to be live in the Firefox add-on store as well. It's called Opportunity Cost and it is an extension that enables you to price the internet in Bitcoin.

Opportunity Cost – See Prices in Bitcoin Instantly

Check it out!

This whole process has been extremely rewarding to me for many reasons. The first of which is that I've had many ideas in the past to launch a product focused on bitcoin education that simply never left my brain because I never felt comfortable paying a developer to go out and build a product that I wasn't sure would ultimately get product market fit.

Due to the advancements of AI, particularly ChatGPT and Replit, I was able to spend a few hours on a Saturday vibe coding a prototype for Opportunity Cost. It worked. I side loaded it into Chrome and Firefox, tested it out for a few days and decided, "Hey, I think this is something that's worthwhile and should be built."

Backtracking just a little bit, the initial idea for this app was to create an AR application that would enable you to take pictures of goods in the real world and have their prices automatically converted to bitcoin so that you could weigh the opportunity cost of whether or not you actually wanted to buy that good or decide to save in bitcoin instead. With the help of Justin Moon from the Human Rights Foundation and Anthony Ronning from OpenSecret and Maple AI, I was pointed in the right direction of vibe coding tools I could use to build a simple MVP. I took their advice, built the MVP, and demoed it at the Bitcoin Park Austin weekly AI meetup in mid-April.

The next week, I was talking with a friend, Luke Thomas, about the idea and during our conversation he made a simple quip, "You should make a Chrome extension. I really want a Chrome extension that does this." And that's what sent me down the vibe coding rabbit hole that Saturday which led to the prototype.

After I was comfortable with and confident in the prototype, I found a young hungry developer by the name of Moses on Nostr, I reached out to him, told him my idea, showed him the prototype and asked if he thought he could finish the application for me. He luckily agreed to do so and within a couple of weeks we had a fully functioning app that was officially launched today. We're about 12 hours into the launch and I must say that I'm pleasantly surprised with the reception from the broader Bitcoin community. It seems like something that people are happy exists and I feel extremely happy that people see some value in this particular application.

Now that you have the backstory, let's get into why I think something like Opportunity Cost should exist. As someone who's been writing a newsletter and producing podcasts about bitcoin for eight years in an attempt to educate individuals from around the world about what bitcoin is, why it's important, and how they can leverage it, I've become convinced that a lot of the work that needs to be done still exists at the top of the funnel. You can scream at people. You can grab them by the shoulders. You can shake them. You can remind them at Thanksgiving that if they had listened to your advice during any Thanksgiving in the previous years they would be better off financially. But at the end of the day most people don't listen. They need to see things. Seeing things for yourself is a much more effective teaching mechanism than be lectured to by someone else.

My hope with Opportunity Cost is that it catches the eye of some bitcoin skeptics or individuals who may be on the cusp of falling down the bitcoin rabbit hole and they see the extension as a way to dip their toes into bitcoin to get a better understanding of the world by pricing the goods and services they purchase on a day-to-day month-to-month and year-to-year basis in bitcoin without having to download a wallet or set up an exchange account. The tippy top of the bitcoin marketing funnel.

That is not all though. I think Opportunity Cost can serve individuals at both ends of the funnel. That's why it's pretty exciting to me. It's as valuable to the person who is bitcoin curious and looking to get a better understanding as it is to the hardcore bitcoiner living on a bitcoin standard who is trying to get access to better tools that enable him to get a better grasp of their spending in bitcoin terms.

Lastly, after playing around with it for a few days after I built the prototype, I realized that it has incredible memetic potential. Being able to take a screenshot of goods that people are buying on a day-to-day basis, pricing them in bitcoin and then sharing them on social media is very powerful. Everything from houses to junk items on Amazon to the salaries of pro athletes to your everyday necessities. Seeing the value of those things in bitcoin really makes you think.

One day while I was testing the app, I tried to see how quickly I could find goods on the internet that cumulatively eclipsed the 21 million supply cap limit of bitcoin. To my surprise, even though I've been in bitcoin for 12 years now, it did not take me that long. The opportunity cost of everything I buy on a day-to-day basis becomes very clear when using the extension. What's even clearer is the fact that Bitcoin is completely mispriced at current levels. There is so much winning ahead of us.

Also, it's probably important to note that the extension is open source. You can check out our GitHub page here. Submit pull requests. Suggest changes to the app.

We've also tried to make Opportunity Cost as privacy preserving as possible. Everything within the extension happens in your browser. The only external data that we're providing is the bitcoin to fiat price conversion at any given point in time. We're not data harvesting the web pages you're browsing or the items you're looking at. We're not collecting data and sending it to third party marketers. We want to align ourselves with the open and permissionless nature of bitcoin while also preserving our users' privacy. We're not trying to monetize this in that way. Though, I will say that I'm thinking of ways to monetize Opportunity Cost if it does gain significant traction, but I promise it will be in a way that respects your privacy and is as unobtrusive as possible. We'll see how it goes.

Thank you for coming to my TED talk. Please download and use the extension. Let us know what you think.

Headlines of the Day

Saylor Says Bitcoin Is Perfect Money to Jordan Peterson - via X

Trump Won't Sell Tesla Despite Musk-Bessent Heated Exchange - via X

Bitcoin Gains Traction in Kenya's Largest Slum Kibera - via X

Get our new STACK SATS hat - via tftcmerch.io

Bitcoin’s Next Parabolic Move: Could Liquidity Lead the Way?

Is bitcoin’s next parabolic move starting? Global liquidity and business cycle indicators suggest it may be.