-

@ fc7022f5:e829f309

2025-06-12 06:17:33

@ fc7022f5:e829f309

2025-06-12 06:17:33Hos Derma X guider vi dig professionelt i valget af den rette behandlerbriks til dine behov. Vi gennemgår vigtige faktorer som ergonomi, justeringsmuligheder, materialekvalitet og funktionalitet, så du kan træffe et informeret valg. En god behandlerbriks understøtter både behandlerens arbejdsstilling og klientens komfort. Vores vejledning sikrer, at du investerer i det udstyr, der bedst matcher din klinik og behandlingsform. Få professionel indsigt i, hvordan du vælger den optimale behandlerbriks.

-

@ 57d1a264:69f1fee1

2025-06-12 06:00:19

@ 57d1a264:69f1fee1

2025-06-12 06:00:19From designer Anna Cairns, the workhorse monospace typeface is rooted in feminist theory.

Across CMM Coda’s subtly imperfect, analogue-inspired letterforms – based on the IBM Selectric typewriter’s typeface, Dual Basic – Anna practically and conceptually brings together the feminist legacy of software and typewriters with the aesthetic sensibilities of the genre associated with the industry. Additionally, CMM Coda enables Anna to explore her intrigue in the blurry terminology used in text production, such as typing, coding and writing, “especially now that most text is created digitally,” Anna says, with typefaces being software in their own right. “We also associate a certain look with each of these modalities,” she continues, “so my idea was to create a typeface that can jump all of these genres simply through a play with white space,” an approach that resulted in CMM Coda’s multiple styles.

Learn more about Comma at https://commatype.com/, a new foundry founded by the Berlin-based type designer Anna Cairns.

Continue reading at https://www.itsnicethat.com/articles/comma-type-cmm-coda-graphic-design-project-110625

https://stacker.news/items/1004142

-

@ ea39b0da:29a1710d

2025-06-12 05:52:03

@ ea39b0da:29a1710d

2025-06-12 05:52:03{"id":"note_1749707164743_1p9kggl3a","title":"Items in the checklist","content":"","color":"#d7aefb","tags":["shopping list"],"sharedWith":[],"updatedAt":1749707523489,"version":3,"versions":[{"content":"","title":"Items in the checklist","color":"#fff475","tags":["shopping list"],"sharedWith":[],"updatedAt":1749707164743,"version":1,"checkboxes":[{"id":"checkbox_1749707132850_r8jodz10f","text":"Item 1","checked":false},{"id":"checkbox_1749707137094_wwiespbf4","text":"Item 2","checked":false},{"id":"checkbox_1749707141159_67peohjkk","text":"Item 3","checked":false},{"id":"checkbox_1749707146781_g8wuw0v43","text":"Item 4","checked":false}],"images":[]},{"content":"","title":"Items in the checklist","color":"#d7aefb","tags":["shopping list"],"sharedWith":[],"updatedAt":1749707185004,"version":2,"checkboxes":[{"id":"checkbox_1749707132850_r8jodz10f","text":"Item 1","checked":false},{"id":"checkbox_1749707137094_wwiespbf4","text":"Item 2","checked":false},{"id":"checkbox_1749707141159_67peohjkk","text":"Item 3","checked":false},{"id":"checkbox_1749707146781_g8wuw0v43","text":"Item 4","checked":false}],"images":[]}],"checkboxes":[{"id":"checkbox_1749707132850_r8jodz10f","text":"Item 1","checked":false},{"id":"checkbox_1749707137094_wwiespbf4","text":"Item 2","checked":false},{"id":"checkbox_1749707141159_67peohjkk","text":"Item 3","checked":false},{"id":"checkbox_1749707146781_g8wuw0v43","text":"Item 4","checked":false}],"images":[]}

-

@ ea39b0da:29a1710d

2025-06-12 05:50:32

@ ea39b0da:29a1710d

2025-06-12 05:50:32{"id":"note_1749545048706_2eeettqdj","title":"This is the proper title","content":"This is some proper content that is written all by human and no AI has been used in the process","color":"#cbf0f8","tags":[],"sharedWith":[],"updatedAt":1749707432819,"version":3,"versions":[{"content":"","title":"121212","color":"#d7aefb","tags":[],"sharedWith":[],"updatedAt":1749545048706,"version":1},{"content":"This is some proper content that is written all by human and no AI has been used in the process","title":"This is the proper title","color":"#cbf0f8","tags":[],"sharedWith":[],"updatedAt":1749545101703,"version":2,"checkboxes":[],"images":[]}],"checkboxes":[],"images":["https://external-content.duckduckgo.com/iu/?u=https%3A%2F%2Ftse4.mm.bing.net%2Fth%3Fid%3DOIP.8ANqbSwwSNzpWWmx1Ru0FQHaEK%26pid%3DApi&f=1&ipt=cb33f5d6ef2abe71dc28888bbec61054132e75caf1b2149d6dbf1cd3054a8b3d"]}

-

@ 57d1a264:69f1fee1

2025-06-12 05:46:59

@ 57d1a264:69f1fee1

2025-06-12 05:46:59Her work explores the intersection of tradition and innovation in wheel-thrown ceramics. Rooted in time-honored techniques, she push the boundaries of clay’s structural possibilities—incorporating hollow tubes, flat rings, curves, and trimmed ridges to create forms that feel both organic and futuristic. These experimental designs challenge gravity and balance, evoking a space-age aesthetic while remaining deeply connected to the tactile nature of craft.

Discover Dara's work at https://www.daraschuman.com/pages/2024

https://stacker.news/items/1004131

-

@ 8814ec9e:32454dd9

2025-06-12 06:42:49

@ 8814ec9e:32454dd9

2025-06-12 06:42:49I'm a big fan of J.R.R. Tolkien's The Lord of the Rings, if you couldn't tell from this design. Most people who see it assume at first glance that the tree is the white tree of Gondor, and the script font in a circle around it must be the elvish script from the one ring. Only when they take a closer look do they see that the roots of the tree are soaking up blood and that the text is actually a famous quote from Thomas Jefferson.

The tree of liberty must be refreshed from time to time with the blood of Patriots and Tyrants.

If the tree also reminds you of the Norse tree of life, Yggdrasil, that is not by coincidence, either. I took inspiration from Norse artwork in this design.

To order one for yourself, go to: Tree of Liberty T-Shirt on Shopstr

Product Details

-

Most colors are 100% cotton

-

Heather colors are 50/50 cotton and polyester.

-

Unisex sizing available in S-4XL

-

Fabric weight: 5.0–5.3 oz/yd² (170–180 g/m²)

-

Pre-shrunk jersey knit

-

Tubular construction

-

Taped neck and shoulders

-

Double seam at sleeves and bottom hem

-

Tear-away tag

-

-

@ dfa02707:41ca50e3

2025-06-12 06:01:48

@ dfa02707:41ca50e3

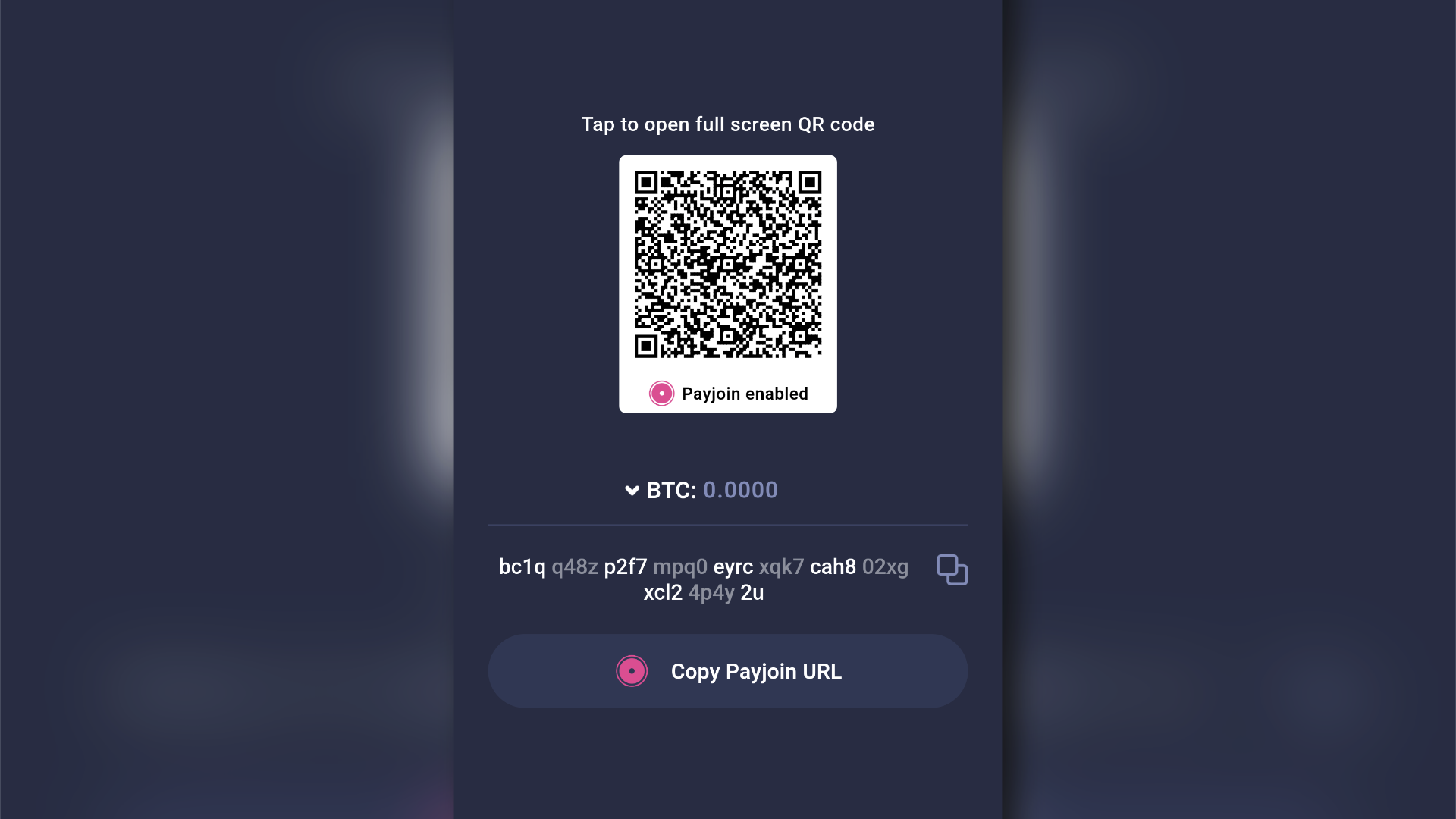

2025-06-12 06:01:48Contribute to keep No Bullshit Bitcoin news going.

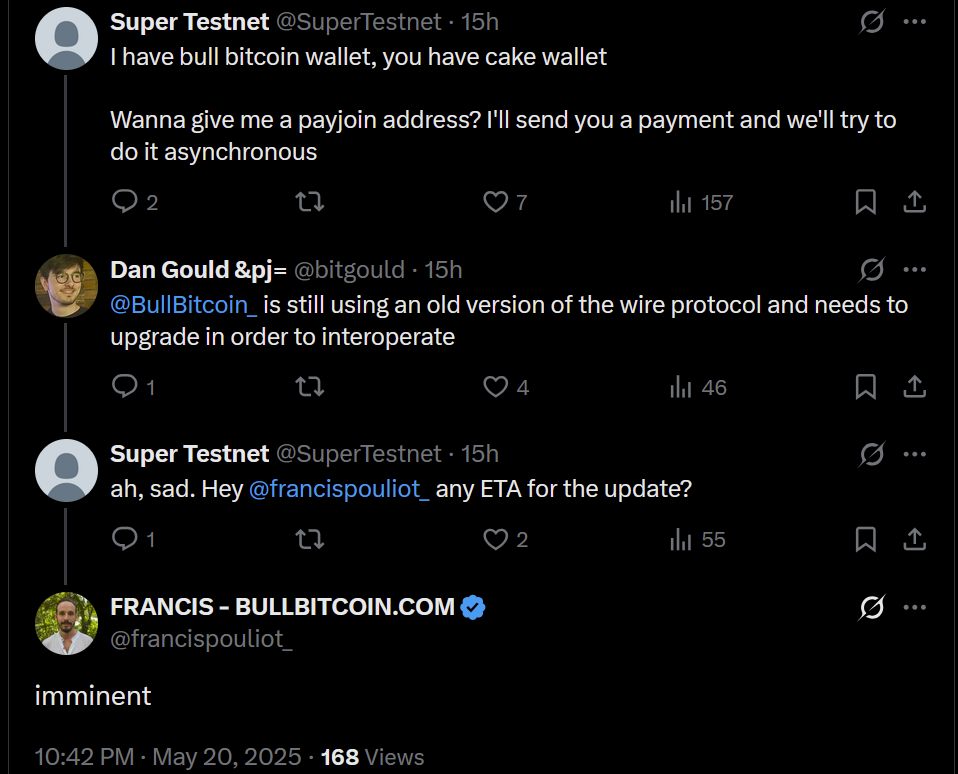

- This release introduces Payjoin v2 functionality to Bitcoin wallets on Cake, along with several UI/UX improvements and bug fixes.

- The Payjoin v2 protocol enables asynchronous, serverless coordination between sender and receiver, removing the need to be online simultaneously or maintain a server. This simplifies privacy-focused transactions for regular users.

"I cannot speak highly enough of how amazing it has been to work with @bitgould and Jaad from the@payjoindevkit team, they're doing incredible work. None of this would be possible without them and their tireless efforts. PDK made it so much easier to ship Payjoin v2 than it would have been otherwise, and I can't wait to see other wallets jump in and give back to PDK as they implement it like we did," said Seth For Privacy, VP at Cake Wallet.

How to started with Payjoin in Cake Wallet:

- Open the app menu sidebar and click

Privacy. - Toggle the

Use Payjoinoption. - Now on your receive screen you'll see an option to copy a Payjoin URL

- Bull Bitcoin Wallet v0.4.0 introduced Payjoin v2 support in late December 2024. However, the current implementations are not interoperable at the moment, an issue that should be addressed in the next release of the Bull Bitcoin Wallet.

- Cake Wallet was one of the first wallets to introduce Silent Payments back in May 2024. However, users may encounter sync issues while using this feature at present, which will be resolved in the next release of Cake Wallet.

What's new

- Payjoin v2 implementation.

- Wallet group improvements: Enhanced management of multiple wallets.

- Various bug fixes: improving overall stability and user experience.

- Monero (XMR) enhancements.

Learn more about using, implementing, and understanding BIP 77: Payjoin Version 2 using the

payjoincrate in Payjoin Dev Kit here. -

@ 9ca447d2:fbf5a36d

2025-06-12 06:01:28

@ 9ca447d2:fbf5a36d

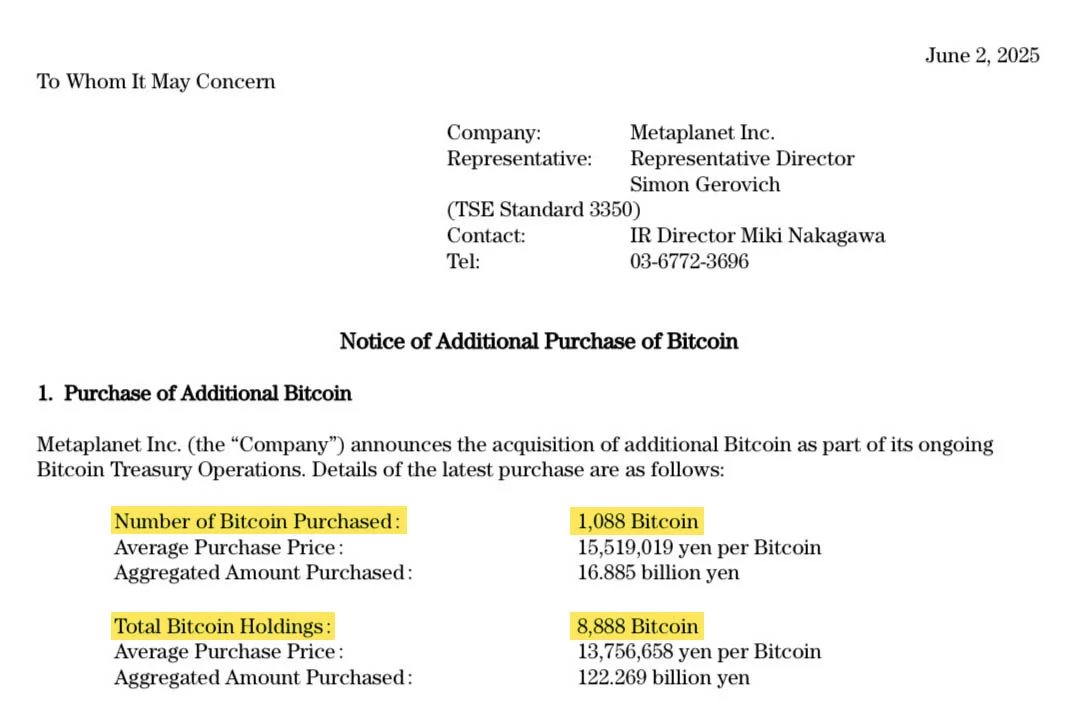

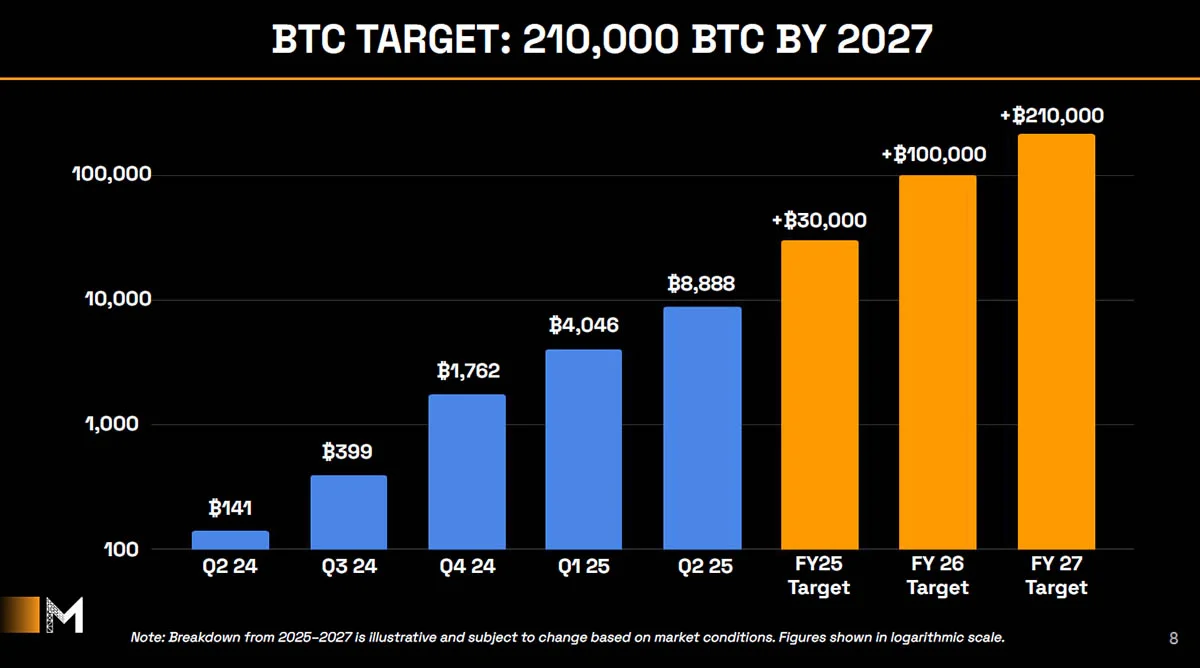

2025-06-12 06:01:28Metaplanet Inc. has bought 1,088 more bitcoin (BTC), and now holds 8,888 BTC worth over $930 million. This puts Metaplanet in the top 10 corporate bitcoin holders, ahead of Galaxy Digital and Block Inc.

Metaplanet Inc. on X

The company’s CEO Simon Gerovich announced the purchase on X on June 2, 2025. The company bought the new BTC at an average price of around $107,771 per coin, costing the company approximately $117.3 million.

The company said this purchase brings them 90% of the way to their 2025 goal of 10,000 BTC.

Metaplanet only started its bitcoin treasury policy in April 2024 but has been moving fast. At the start of 2025, it had less than 2,000 BTC, and now it has over 8,800.

This has been done through a combination of stock rights exercises and bond issuances, raising capital without diluting existing shareholders. In May 2025 alone, Metaplanet issued zero-coupon, non-interest-bearing bonds for a combined value of $71 million.

According to the filings, the company recently completed its “21 Million Plan” which was a program that involved the full exercise of 210 million stock acquisition rights.

These stock rights allowed Metaplanet to raise capital through equity sales while limiting dilution risk.

Metaplanet’s Bitcoin strategist, Dylan LeClair, said the company views bitcoin as a core part of its financial strategy and is all in, not just making small allocations.

Metaplanet’s buying has paid off in more ways than one.

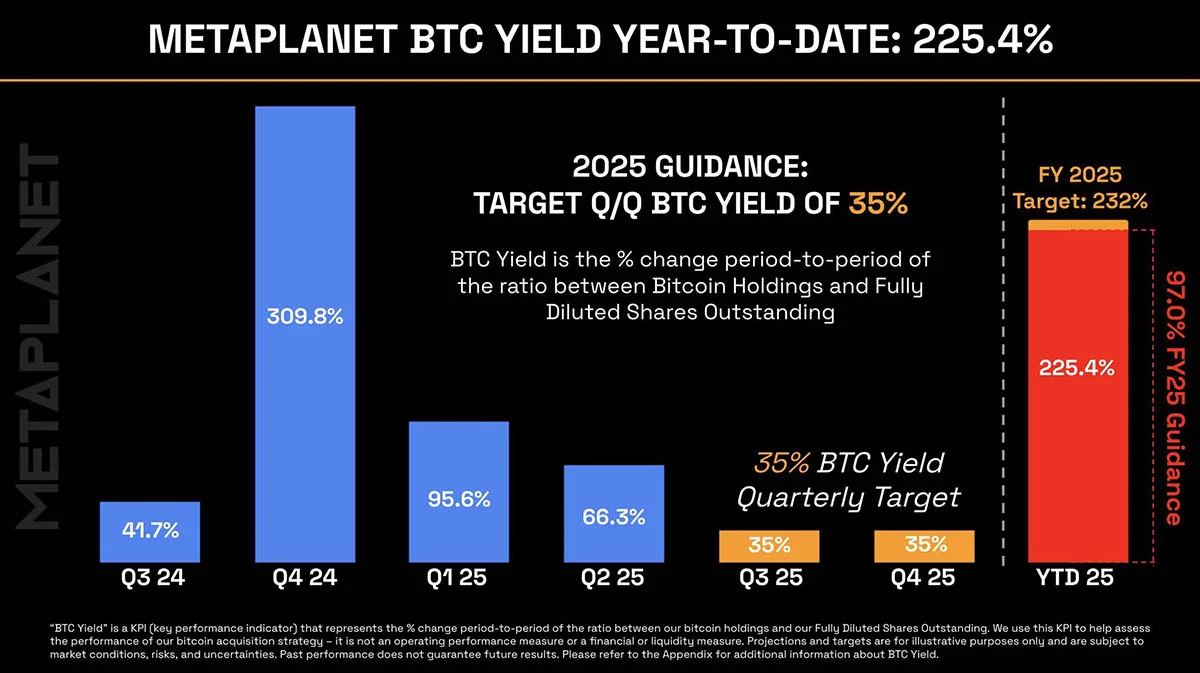

Its BTC Yield, a company metric that compares bitcoin holdings to total shares, has impressed investors. In Q2 2025 it had a 66.3% BTC Yield, year-to-date it has a 225% BTC Yield.

Metaplanet BTC Yield over time — Vincent on X

The stock is up 155% in the last month and is currently trading at 1,149 JPY, despite the overall volatility in the Tokyo Stock Exchange—where many other companies are under pressure due to the rising Japanese bond yields.

Analysts say the company still has more room to run.

Analysts say the company’s mNAV is back to 4.75 and the stock is undervalued compared to Strategy.

mNAV is short for “multiple of Net Asset Value” and is a metric used to compare the market’s valuation of a company to the actual value of its assets, primarily its bitcoin holdings.

Metaplanet is called “Japan’s Strategy”, a reference to Michael Saylor’s Strategy, the U.S.-based company that holds over 580,000 BTC—the most of any company in the world.

The corporate bitcoin boom isn’t stopping with Strategy and Metaplanet. On May 28, 2025 GameStop announced it had bought 4,710 BTC, worth over $512 million, its first foray into bitcoin after updating its investment policy this year.

-

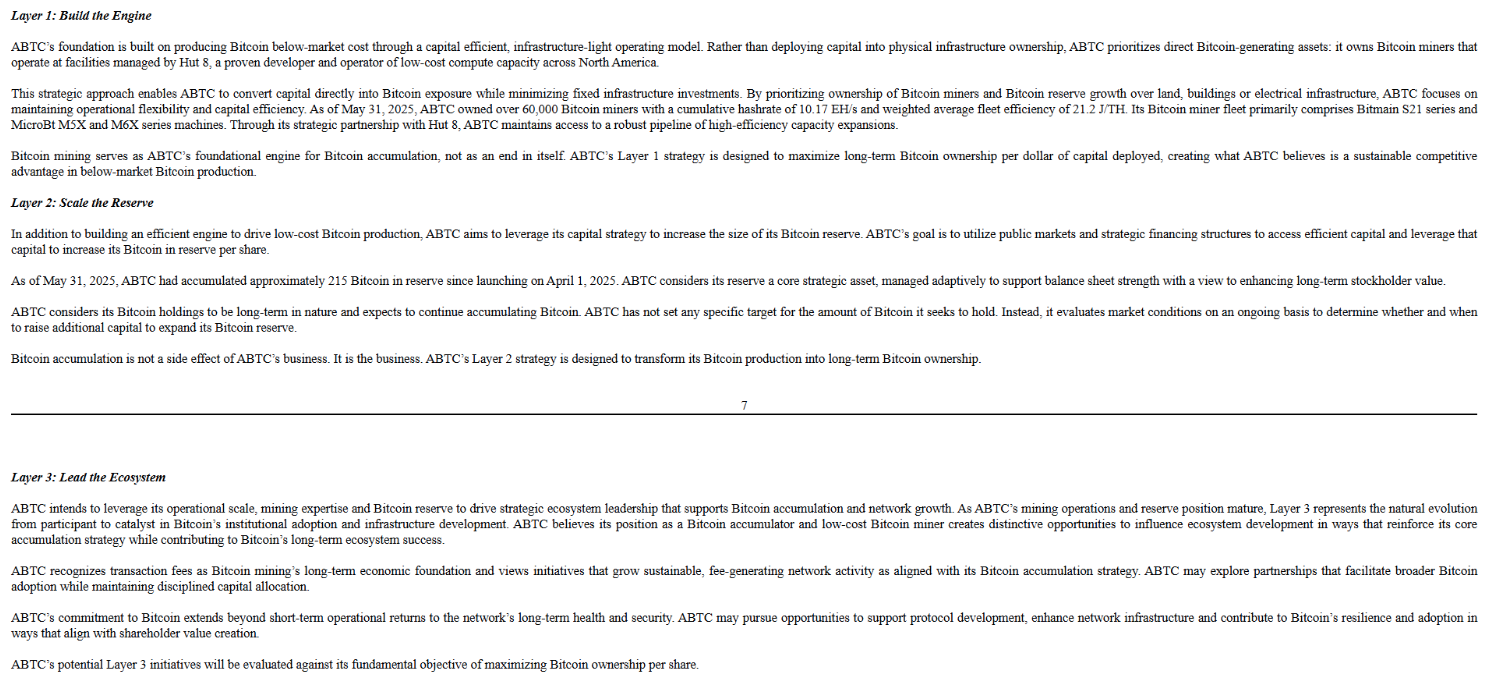

@ b1ddb4d7:471244e7

2025-06-12 06:01:08

@ b1ddb4d7:471244e7

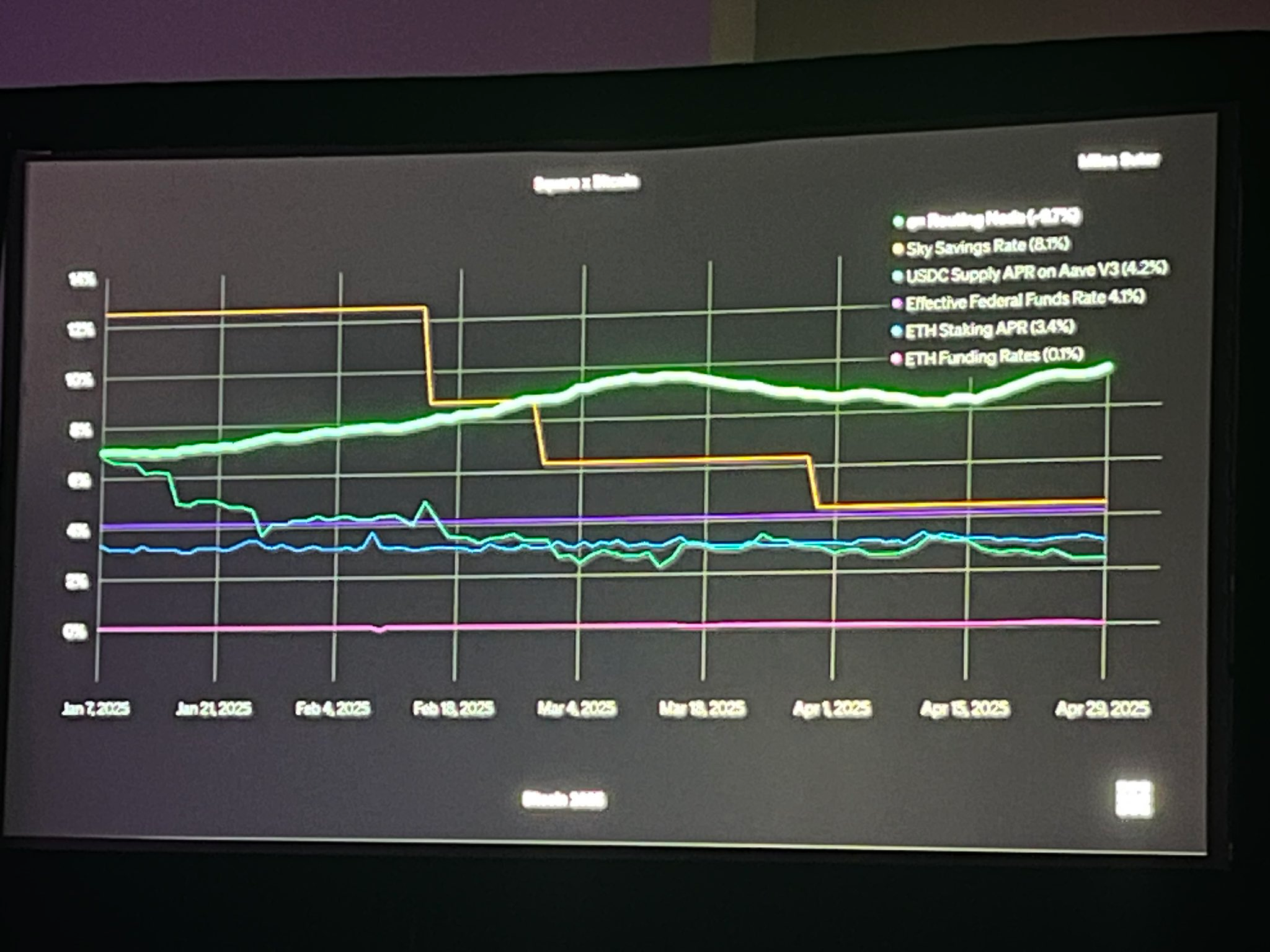

2025-06-12 06:01:08Square, the payments platform operated by Block (founded by Jack Dorsey), is reporting 9.7% bitcoin yield on its bitcoin holdings by running a Lightning Network node.

The announcement was made by Miles Suter, Bitcoin product lead at Block, during the Bitcoin 2025 conference in Las Vegas. Suter explained that Square is earning “real bitcoin from our holdings” by efficiently routing payments across the Lightning Network.

Square’s yield comes from its role as a Lightning service provider, a business it launched two years ago to boost liquidity and efficiency on the Lightning Network. According to Lightning Labs’ Ryan Gentry, Square’s 9% yield could translate to roughly $1 million in annual revenue.

The Lightning Network, a Bitcoin layer-2 protocol, has long been promoted as a solution to Bitcoin’s scalability and transaction speed issues. It enables micropayments and off-chain transactions, reducing congestion on the main blockchain. However, the network faces challenges, including the need for inbound liquidity—users must lock up BTC to receive BTC—potentially limiting participation by smaller nodes and raising concerns about decentralization.

Despite these hurdles, Square remains committed to advancing Bitcoin payments via Lightning. Suter revealed that 25% of Square’s outbound bitcoin transactions now use the Lightning Network. The company is actively testing Lightning-based payments at the Bitcoin 2025 event and plans to roll out the service to all eligible Square merchants by 2026.

Suter emphasized the transformative potential of Lightning:

“When you enable real payments by making them faster and more convenient, the network becomes stronger, smarter, and more beneficial. So if you’re questioning whether bitcoin is merely an asset, the response is no. It has already evolved into both an asset and a protocol, and now Block is spearheading the initiative to transform it into the world’s premier payment system.”

Square’s ongoing investment in Lightning signals its belief in Bitcoin’s future not just as a store of value, but as a global payments protocol.

-

@ cae03c48:2a7d6671

2025-06-12 06:00:48

@ cae03c48:2a7d6671

2025-06-12 06:00:48Bitcoin Magazine

Paul Tudor Jones: Bitcoin, Gold, Stocks Are The Best Portfolio To Fight InflationThe Co-Chairman and CIO of Tudor Investment Corp., Paul Tudor Jones, recently appeared in a Bloomberg interview where he outlined what he sees as the best portfolio to fight against inflation.

JUST IN: Billionaire Paul Tudor Jones said Bitcoin, gold, and stocks are the "best portfolio to fight inflation."

pic.twitter.com/rgvVyacRtx

pic.twitter.com/rgvVyacRtx— Bitcoin Magazine (@BitcoinMagazine) June 11, 2025

“What would an ideal portfolio be… What has worked so far has been some combinations of stocks, which won’t do great, which would do terribly if we ever actually had,” Jones said. “If they called us out and the bond market actually gave us an accident that then spilled over. But it would be some kind of combination of probably gold, vol adjusted, Bitcoin, gold, stocks. That’s probably your best portfolio to fight inflation. Vol adjusted because the vol of Bitcoin obviously is five times that of gold, so you’re going to do it in different ways.”

Jones highlighted the need to balance volatility, especially when combining assets like Bitcoin and gold. He suggested this kind of mix, adjusted for risk, gives investors the strongest defense against inflation’s impact.

When asked if he would allocate 1 or 2 percent of his portfolio to Bitcoin, Jones explained the bigger picture behind why he sees value in it.

“Particularly now, that the road map is clear… Again, if I am a policymaker,” stated Jones. “I’m going to run really low real rates. I am going to have inflation running hot and I am gonna tax the American Consumer to get out of my debt trap, and that’s exactly what Japan, who’s the most fiscally constrained in the world, is doing. And it works until the population throws you out because you let the inflation get too hot. So maybe you’re in a world with three and a half percent inflation and two and a half percent overnight rate and you are kind of trying to run hot and grow your way out of it.”

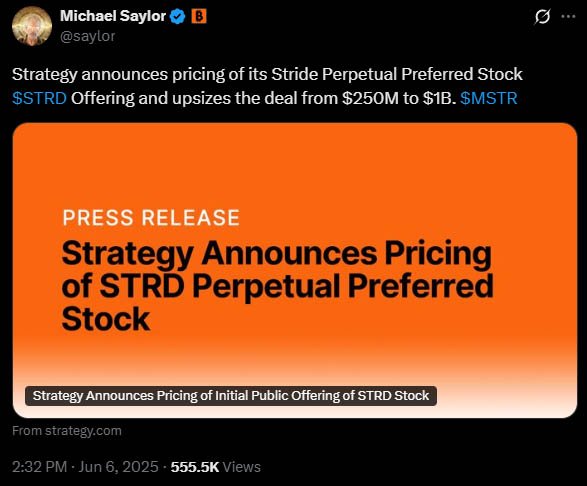

Yesterday, also in an interview with Bloomberg, the Executive Chairman and CEO of Strategy Michael Saylor commented about the future of Bitcoin as well.

“Winter is not coming back,” commented Sayor. “We are past that phase. If Bitcoin is not going to zero, it is going to $1 million. The President of the United States is determined. He supports Bitcoin, the cabinet supports Bitcoin, Scott Bessent supports Bitcoin, Paul Atkins is shown himself to be an enthusiastic believer of Bitcoin and digital assets… Bitcoin has gotten through its riskiest period.”

This post Paul Tudor Jones: Bitcoin, Gold, Stocks Are The Best Portfolio To Fight Inflation first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-12 06:00:47

@ cae03c48:2a7d6671

2025-06-12 06:00:47Bitcoin Magazine

Stripe Acquires Startup Privy To Expand Bitcoin StrategyToday, Stripe Inc. announced that it has acquired Bitcoin and crypto wallet infrastructure provider Privy, marking its second major digital asset focused acquisition following its $1.1 billion purchase of stablecoin firm Bridge earlier this year.

1/ Today, we're proud to announce that Stripe is acquiring Privy.

We couldn’t be more excited.

Privy will continue as an independent product – but now we’ll move faster, ship more, and serve you even better, so you can stay focused on your users. pic.twitter.com/8CHJqhqYy7

— Privy (@privy_io) June 11, 2025

Privy specializes in helping companies embed Bitcoin and crypto wallets directly into their apps and websites. For example, NFT marketplace OpenSea uses Privy to streamline purchases by automatically generating wallets for users. This removes the need for external wallet setups through services like MetaMask or Coinbase.

“When we started, wallets were powerful but inaccessible for all but the most technical,” said the Co-founder and CEO of Privy Henri Stern in a statement. “Developers had to send users off-platform to get started, breaking flows and killing user conversion. That friction fundamentally constrained what could be built in crypto.”

Privy, based in New York, was founded by Henri Stern and Asta Li in 2021. Li was previously a founding engineer at Aurora, while Stern worked as a research scientist at web3 firm Protocol Labs. The startup has raised just over $40 million from investors including Ribbit Capital, Definition, and Coinbase Ventures, and was last valued at $230 million in March, according to PitchBook.

“We started Privy a little over three years ago to make it easy for any developer to build better products on crypto rails,” stated their announcement. “Whether crypto is core to your app or simply a new layer of functionality, a good crypto product should just feel like a good product, period. By making crypto usable, we help make it useful for everyone.”

The acquisition follows Stripe’s earlier purchase of Bridge which helped accelerate interest in digital assets. Earlier this year, Stripe introduced stablecoin funded accounts designed to help merchants store funds and make international payments using Circle’s USDC and Bridge’s USDB. Similar to Bridge, Privy will continue operating as a standalone product.

Privy will power over 75 million accounts and support more than 1,000 developer teams, enabling billions in transaction volume, according to the announcement. Clients include Hyperliquid, Blackbird, Toku, and Farcaster, all using Bitcoin and crypto infrastructure to build real-world products in areas like trading, payments, payroll, and social applications.

“With a unified platform, connecting Privy’s wallets to the money movement capabilities in Stripe and Bridge, we’re enormously excited to enable a new generation of global, Internet-native financial services,” stated the co-founder and CEO of Stripe Patrick Collison.

This post Stripe Acquires Startup Privy To Expand Bitcoin Strategy first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-12 06:00:46

@ cae03c48:2a7d6671

2025-06-12 06:00:46Bitcoin Magazine

The CLARITY Act Heads To House Floor For Vote With Protection For Noncustodial Tools IntactYesterday, the CLARITY Act passed favorably through the House Agriculture and Financial Services Committees with 47-6 and 32-19 bipartisan votes, respectively.

While a handful of amendments will be incorporated into a revised version of the bill, none of said amendments will alter a recently-added section of the bill that regards noncustodial products and services.

To clarify, on Monday, language from the Blockchain Regulatory Certainty Act (BRCA) was added to the CLARITY Act.

If you do not custody consumer funds, you aren’t a money transmitter. Plain and simple.

Our nonpartisan Blockchain Regulatory Certainty Act, which codifies this simple concept, has been added to the CLARITY Act!

Grateful to @RepFrenchHill, @RepBryanSteil and @RepRitchie for… https://t.co/QmPdgUGSwo

— Tom Emmer (@GOPMajorityWhip) June 9, 2025

This language, included in Section 110 of the CLARITY Act, is focused on non-controlling (noncustodial) blockchain developers and blockchain service providers.

The exact wording in the bill is as follows: “A non-controlling blockchain developer or provider of a blockchain service shall not be treated as a money transmitter or as engaged in ‘money transmitting,’ or, following the date of enactment of this Act, be otherwise subject to any new registration requirement that is substantially similar to the requirement that currently applies to money transmitters.”

It was particularly important that this segment of the bill not be altered because, with this language included, the bill protects not only Bitcoin and crypto enthusiasts’ right to use noncustodial wallets, but the right of developers to continue to create such products and services without being subject to money-transmission laws as per the Bank Secrecy Act (BSA).

“Section 110 doesn’t just clarify that non-custodial devs aren’t captured by the BSA, but also forbids future laws and regulations (e.g. DAAMLA) that would modify or supersede the BSA to treat non-custodial actors as money transmitters or similar,” wrote Zack Shapiro, Head of Policy at the Bitcoin Policy Institute, in an X post. “If this passes, that means that anti-crypto zealots like Sen. Warren would first have to repeal [or] modify this bill before passing additional rules that would impinge on self-custody.”

This issue over whether noncustodial Bitcoin and crypto service providers is relevant as the Samourai Wallet and Tornado Cash developers prepare to face trial.

It’s also generally important in preserving the right of U.S. citizens to use digital assets privately.

Chairman of the House Subcommittee on Digital Assets, Financial Technology, and Artificial Intelligence, Rep. Bryan Steil (R-WI) commented on Americas’ right to transactional privacy in the hearing.

“Privacy in and of itself is not illegal.

Americans have a right to it in their financial transactions.

And so there’s totally legitimate uses of privacy-preserving technologies.” @RepBryanSteil pic.twitter.com/nHPfa25UVr

— Frank Corva (@frankcorva) June 10, 2025

To learn more about how to contact your elected officials to tell them to support The CLARITY Act, visit saveourwallets.org.

This post The CLARITY Act Heads To House Floor For Vote With Protection For Noncustodial Tools Intact first appeared on Bitcoin Magazine and is written by Frank Corva.

-

@ cae03c48:2a7d6671

2025-06-12 06:00:46

@ cae03c48:2a7d6671

2025-06-12 06:00:46Bitcoin Magazine

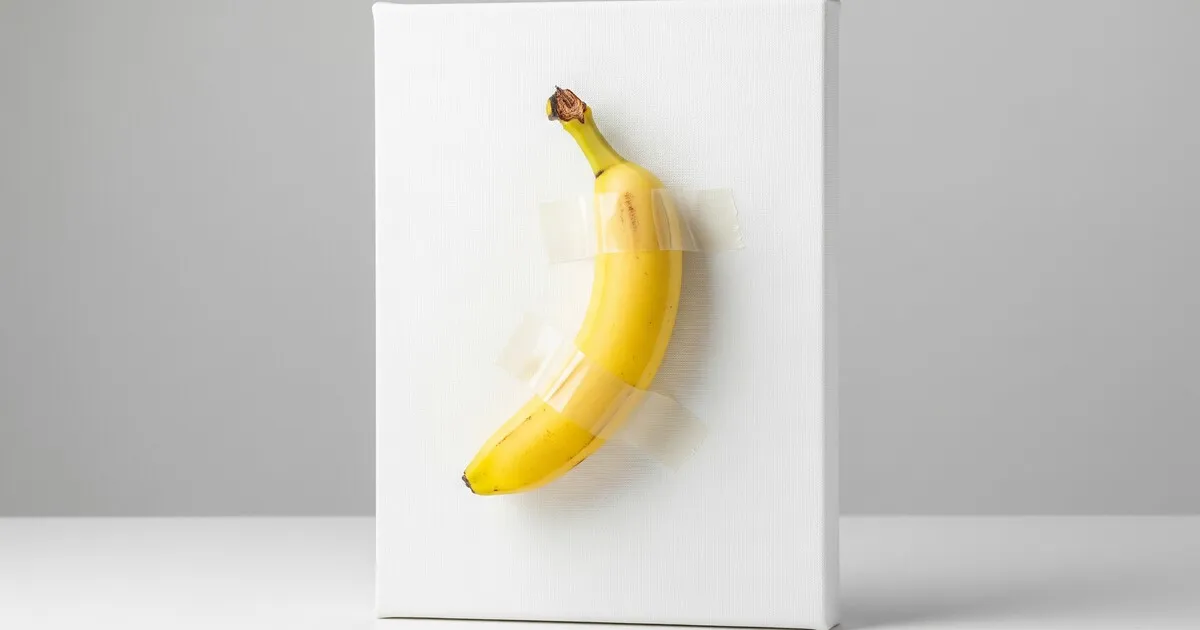

Skull, $5 million; Banana, $6 million; Freedom, Priceless“It would have been nice to get this attention in any other context. WikiLeaks has kicked the hornet’s nest, and the swarm is headed towards us.”

This message was posted by Satoshi Nakamoto to BitcoinTalk on December 11, 2010. A couple of months later, in February 2011, the Silk Road marketplace was launched, and only a couple months after — on April 23, 2011 — Satoshi posted his last message.

In October 2013, Ross Ulbricht was captured by the FBI and the Silk Road fell — only to be replaced by a thousand more copycat marketplace sites. The rest is Bitcoin history.

Ross Ulbricht chose to center his Bitcoin 2025 keynote speech around an experience he had clearing wasp nests in a cabin in the woods. Wearing a suit and tie, recalling growing “magic mushrooms” to kickstart activity on Silk Road, Ross held the attention of the main stage audience of over 8,000 at Bitcoin 2025 Las Vegas in the Venetian Expo. I was sitting in one of the best seats in the house: side stage with his mother Lyn and three other supporters of Ross.

Freedom. Decentralization. Unity.

After over 4,100 days in federal custody and many months in special housing units (solitary confinement), Ross boiled it down to these three words to summarize his first message to the community.

Freedom. Decentralization. Unity.

Following a “21 ways to hack the fiat system” keynote from Michael Saylor, Ross’ three ways to move forward were refreshingly simple.

You would have thought Ross had been speaking in front of thousands of people for years, seeing how calm and commanding he was on the Nakamoto stage.

Lyn Ulbricht called me a few days after the speech, as I was driving a U-Haul truck full of the art gallery contents across the country, including Ross’ auction items which altogether fetched well over 10 BTC for his fresh start. She mentioned that seeing Ross on that stage giving that incredible speech gave her closure for the whole experience of fighting for her son’s freedom.

I have been fortunate to get to know Lyn Ulbricht over the past few years, helping her plan for our conferences. Hearing her say that this conference gave her some closure to that awful chapter of her life was a moment I’ll never forget. She was his number one supporter during his 11 years serving a double-life sentence. She fought relentlessly to raise awareness for her son’s situation, and now she has begun a new chapter doing similar work with MACS, Mothers Against Cruel Sentencing.

MACS is a nonprofit that is effectively the continuation of the Free Ross mission. Lyn says she feels a calling from God to continue fighting for other “crypto prisoners” and people who are being unjustly punished for their crimes, a violation of the Eight Amendment of the United States Constitution.

She launched MACS at the fourth annual Women of Bitcoin Brunch at Bitcoin 2025, in front of an audience of over 300 of the most influential women at the conference.

Later during the event, in the same room, Ross used the same stage to address a smaller crowd of supporters for his official luncheon.

This luncheon, held before his speech, is where Justin Sun famously gifted Ross “The Banana,” handing over a duct-taped, real banana in an elaborately designed white shadowbox fit to display in a museum.

I was also in the luncheon room when the banana transaction happened, as event staff. The piece, Comedian by Maurizio Cattelan, was a conceptual art statement, I explained to the two men sitting next to me. Like Ross himself at the time, these men were confused. (The original art installation, a banana duct-taped to the wall, was purchased — and eaten — by Justin Sun in November last year.)

Knowing the significance of this banana, I assumed at the time that Justin Sun was officially giving his edition #2 of Comedian to Ross, as a $6.2 million donation. It wasn’t until my phone call with Lyn Ulbricht days later that she brought up the banana and its questionable provenance that I began to ask: Did Sun really give Ross the banana?

On this call, Lyn mentioned that they had a relative who worked at Sotheby’s, the auctioneer of Justin’s edition of Comedian. This was an obvious first step toward understanding the banana exchange.

Ross himself emailed me shortly after saying, “Lyn tells me you are looking into what happened with me and Justin Sun. Strike Force Nanner are arriving tomorrow with the box Sun gave me, so I’ll let you know if that turns up anything useful.”

And later, “My Sotheby’s connection says: Just spoke with one of the people who worked directly with the artist during the sale. To truly own the piece you have to have the document from the artist; because that is where the ‘value’ lies, they wouldn’t even share images of it for fear of someone making a counterfeit. He’s going to have a think about whether or not what you have has any value, but Justin still owns the ‘real’ banana which is probably why he’s given you vague answers. So, unless he gives me the document (certificate of authenticity), I don’t have anything that would be valued at auction (probably). Oh well.”

I assured him that I thought his banana was still very valuable. Even if this was truly just a 1/1 print of the banana. Until Sun gives Ross the COA, Ross isn’t really the owner the banana; still, a historic event occurred. Sun transferred some sort of magic-decentalized-banana-powers to Ross when he transferred that banana taped to a frame.

The mere existence of Strike Force Nanner, an armored vehicle transporting the banana to Ross, should be enough to signal the provenance transfer of something valuable.

So whether or not Sotheby’s thinks an official transaction occurred, I think Ross has a rare power to duct-tape bananas to walls now and call it something. Sun will just have to send the COA to Ross later in order to seal the peel.

Until then, I extend an open invite to Ross, as the Artist In Residence at Bitcoin Magazine, to help him make and sell prints of his print of the banana. Then maybe the banana can be even more decentralized!

Avant-garde bananas aside, the experience of Bitcoin 2025 Las Vegas was unlike any other conference that we’ve thrown, and I can say that having been a part of all six thus far. The key difference this year was Ross’ freedom.

The vibes were beyond bullish in Vegas, which usually means the top is in. But this time it really seems different.

We should pay attention when Michael Saylor gives us his 21-step cheat sheet for the infinite money glitch, and how he plans to leverage the existing financial institutions to accumulate as much bitcoin as he possibly can. This could be a regulatory trap.

We should definitely pay attention when the sitting vice president, JD Vance, tells the conference audience that they’re going to use stablecoins to strengthen the dollar, referring to the new Genius Bill. This is probably the backdoor for CBDCs.

But most importantly: After over 11 years in federal hell, we should pay attention to Ross Ulbricht as he becomes the leader that this space really needs right now.

We are the swarm now.

This post Skull, $5 million; Banana, $6 million; Freedom, Priceless first appeared on Bitcoin Magazine and is written by Tommy Marcheschi.

-

@ cae03c48:2a7d6671

2025-06-12 06:00:45

@ cae03c48:2a7d6671

2025-06-12 06:00:45Bitcoin Magazine

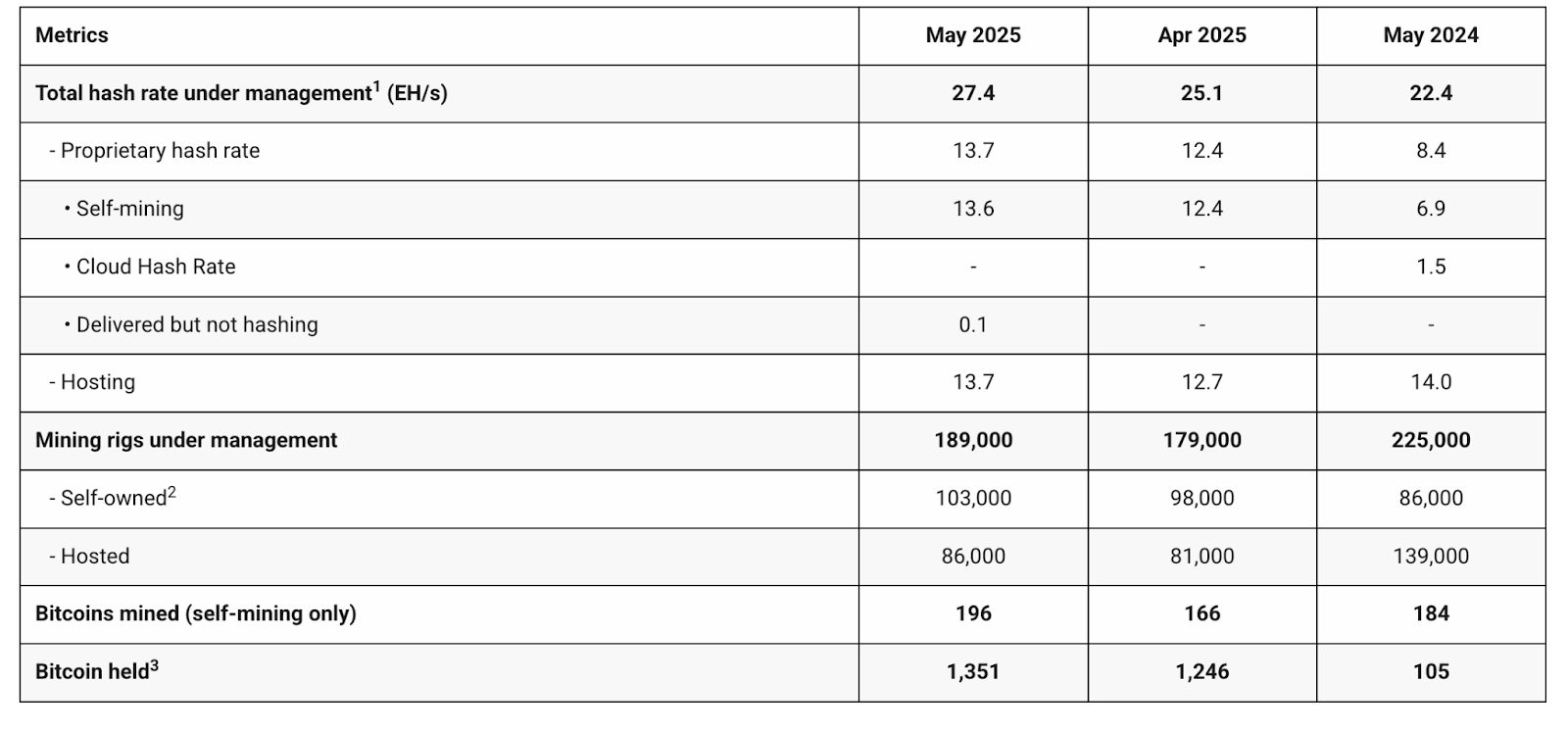

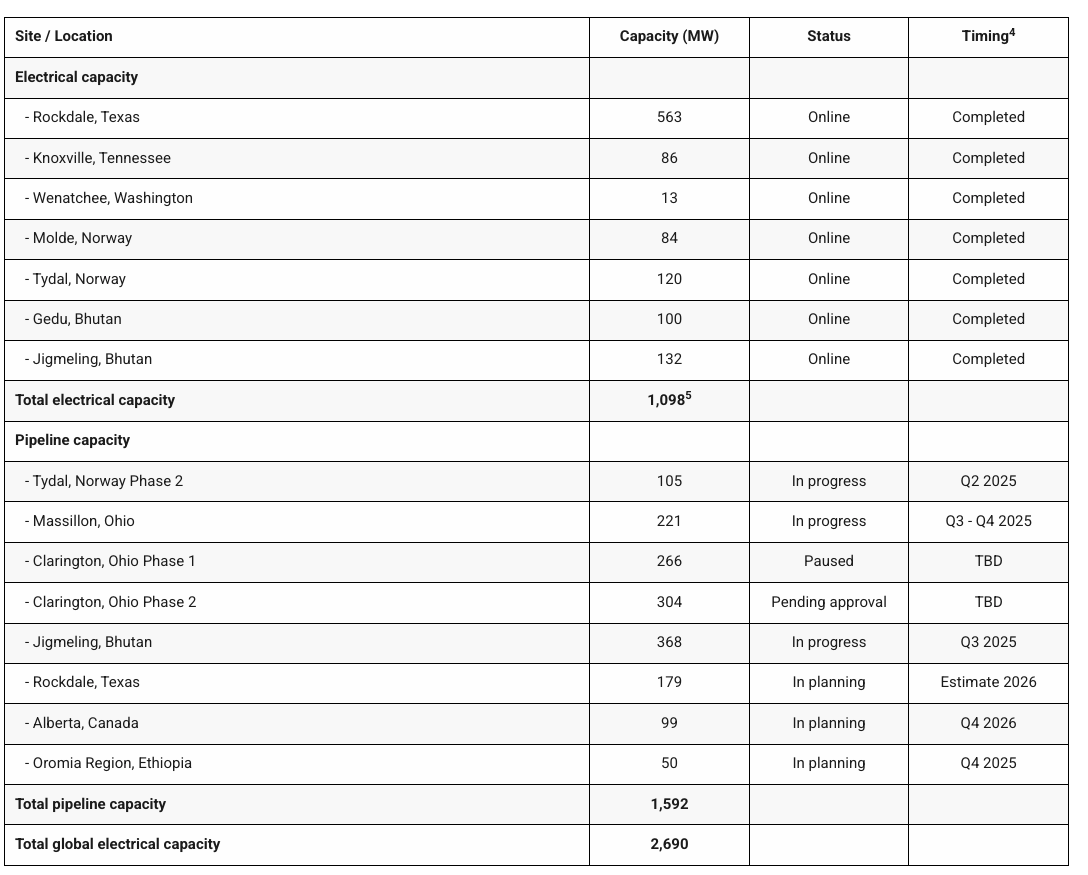

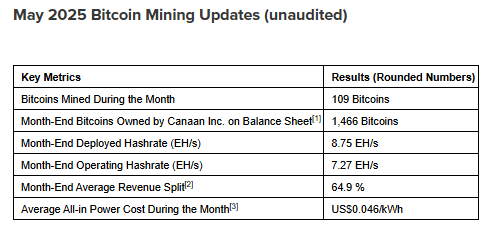

Bitdeer Mined 196 Bitcoin Worth Over $21 Million In MayBitdeer Technologies Group, a global leader in Bitcoin mining and infrastructure, has released its unaudited operational update for May 2025, highlighting robust expansion in hashrate capacity, ongoing infrastructure development, and an entrance into AI services.

$BTDR May 2025 Production & Operations Highlights:

Increased self-mining hashrate to 13.6 EH/s with #SEALMINER deployments.

Increased self-mining hashrate to 13.6 EH/s with #SEALMINER deployments.

9 EH/s SEALMINER A2s have been manufactured, with 2.9 EH/s shipped to external customers, including 1.6 EH/s sold and shipped in May.

9 EH/s SEALMINER A2s have been manufactured, with 2.9 EH/s shipped to external customers, including 1.6 EH/s sold and shipped in May.

SEALMINER… pic.twitter.com/wX66hahd2F

SEALMINER… pic.twitter.com/wX66hahd2F— Bitdeer (@BitdeerOfficial) June 11, 2025

“In May 2025, we continued to deploy our SEALMINER mining rigs to our sites in Texas, U.S., Norway, and Bhutan, bringing Bitdeer’s self-mining hashrate to 13.6 EH/s at the end of the month of May,” said Matt Kong, Chief Business Officer at Bitdeer. “Looking forward, we remain on track to deliver over 40 EH/s of self-mining capacity by October 2025. Further, in May, we sold and shipped approximately 1.6 EH/s of our SEALMINER A2s to external customers. Our A3 Series will also be released and available for pre-order very soon”

Bitdeer self-mined 196 BTC in May—an 18.1% increase from April—due to the expanded deployment of SEALMINER A1 and A2 units. A total of 9 EH/s in SEALMINER A2s have been manufactured, with 2.9 EH/s shipped to customers and 1.6 EH/s sold in May alone.

SEALMINER A3s, which are currently undergoing machine-level testing with positive results, will become available for pre-order in June. Additionally, development of the next-generation A4 SEALMINER chip is progressing, targeting an efficiency of 5 J/TH by Q4 2025.

Bitdeer also announced the launch of its AI Cloud service, powered by over 10 advanced large language models (LLMs), including LLaMA, DeepSeek, and Qwen variants. The infrastructure is designed for strong inference demand, representing a key move into the HPC/AI sector.

Infrastructure developments include the ongoing energization of the 175 MW Tydal, Norway site—expected to be fully energized by June—and continued progress at the 221 MW Massillon, Ohio site, targeting completion in the second half of 2025. The company also energized 132 MW at its Jigmeling, Bhutan site, with another 368 MW coming online by Q3.

Financially, Bitdeer secured $50 million in cash proceeds during May after Tether exercised warrants from a 2024 private placement.

With a global capacity of 2,690 MW and expanding operations across North America, Europe, and Asia, Bitdeer continues to assert its role as both a top-tier Bitcoin mining operator and a high-performance computing pioneer.

This post Bitdeer Mined 196 Bitcoin Worth Over $21 Million In May first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 472f440f:5669301e

2025-06-12 05:11:12

@ 472f440f:5669301e

2025-06-12 05:11:12Marty's Bent

via me

I had a completely different newsletter partially written earlier tonight about whether or not "this cycle is different" when this nagging thought entered my head. So I'm going to write about this and maybe I'll write about the dynamics of this cycle compared to past cycles tomorrow.

A couple of headlines shot across my desk earlier tonight in relation to the potential escalation of kinetic warfare in the Middle East. Apparently the U.S. Embassy in Iraq was sent a warning and evacuation procedures were initiated. Not too long after, the world was made aware that the United States and Israel are contemplating an attack on Iran due to the "fact" that Iran may be close to producing nuclear weapins. The initial monkey brain reaction that I had to these two headlines was, "Oh shit, here we go again. We're going to do something stupid." My second reaction was, "Oh shit, here we go again, I've seen these two exact headlines many times over the years and they've proven to be lackluster if you're a doomer or blood thirsty war monger." Nothing ever happens.

As I venture into my mid-30s and reflect on a life filled with these types of headlines and my personal reactions to these headlines, I'm finally becoming attuned to the fact that the monkey brain reactions aren't very productive at the end of the day. Who knows exactly what's going to happen in Iraq or Iran and whether or not kinetic warfare escalates and materializes from here? Even though I'm a "blue-blooded taxpaying American citizen" who is passively and unwillingly contributing to the war machine and the media industrial complex, there's really nothing I can do about it.

The only thing I can do is focus on what is in front of me. What I have control of. And attempt to leverage what I have control of to make my life and the life of my family as good as humanly possible. Ignoring the external and turning inward often produces incredible results. Instead of worrying about what the media wants you to believe at any given point in time, you simply look away from your computer screen, survey the physical space which you're operating in and determine what you have, what you need and how you can get what you need. This is a much more productive way to spend your time.

This is what I want to touch on right now. There's never been a better time in human history to be productive despite what the algorithm on X or the mainstream media will lead you to believe. Things aren't as great as they could be, but they're also not as bad as you're being led to believe. We live in the Digital Age and the Digital Age provides incredible resources that you can leverage to make YOUR life better.

Social media allows you to create a platform without spending any money. AI allows you to build tools that are beneficial to yourself and others with very little money. And bitcoin exists to provide you with the best form of money that you can save in with the knowledge that your relative ownership of the overall supply isn't going to change. No matter what happens in the external world.

If you can combine these three things to make your life better and - by extension - potentially make the lives of many others better, you're going to be well off in the long run. Combining these three things isn't going to result in immediate gratification, but if you put forth a concerted effort, spend the time, have some semblance of patience, and stick with it, I truly believe that you will benefit massively in the long run. Without trying to sound like a blowhard, I truly believe that this is why I feel relatively calm (despite my monkey brain reactions to the headlines of the day) at this current point in time.

We've entered the era of insane leaps in productivity and digital hard money that cannot be corrupted. The biggest mistake you can make in your life right now is overlooking the confluence of these two things. With an internet connection, an idea, some savvy, and hard work you can materially change your life. Create something that levels up your knowledge, that enables you to get a good job in the real world, or to create a company of your own. Bring your talents to the market, exchange them for money, and then funnel that money into bitcoin (if you're not being paid in it already). We may be at the beginning of a transition from the high velocity trash economy to the high leverage agency economy run on sound money and applied creativity.

These concepts are what you should be focusing most of your time and attention to today and in the years ahead. Don't get distracted by the algorithm, the 30-second video clips, the headlines filled with doom, and the topics of the 24 hour news cycle. I'll admit, I often succumb to them myself. But, as I get older and develop a form of pattern recognition that can only be attained by being on this planet for a certain period of time, it is becoming very clear that those things are not worth your attention.

Living by the heuristic that "nothing ever happens" is a pretty safe bet. Funnily enough, it's incredibly ironic that you're led to believe that something is happening every single day, and yet nothing ever happens. By getting believing that something happens every day you are taking your attention away from doing things that happen to make your life better.

Tune out the noise. Put on the blinders. Take advantage of the incredible opportunities that lie before you. If enough of you - and many others who do not read this newsletter - do this, I truly believe we'll wake up to find that the world we live in is a much better place.

Nothing ever happens, so make something happen.

Intelligence Officials Are Quietly Becoming Bitcoin Believers

Ken Egan, former CIA Deputy Chief of Cyber Operations, revealed a surprising truth on TFTC: the intelligence community harbors numerous Bitcoin advocates. Egan explained that intelligence professionals uniquely understand how governments weaponize financial systems through sanctions and account freezing. Having wielded these tools themselves, they recognize the need for personal financial sovereignty. He shared compelling anecdotes of discovering colleagues with "We are all Satoshi" stickers and a European chief of station paying for dinner with a BlockFi card to earn Bitcoin rewards.

"I think there are a lot of Bitcoiners, not just at CIA, but across the whole national security establishment... they're in it for the exact same reasons everybody else is." - Ken Egan

The Canadian trucker protests served as a pivotal moment, Egan noted. Watching Western governments freeze citizens' bank accounts for political dissent struck a nerve among intelligence professionals who previously viewed financial weaponization as a tool reserved for foreign adversaries. This awakening has created unlikely allies within institutions many Bitcoiners distrust.

Check out the full podcast here for more on Bitcoin's national security implications, privacy tech prosecutions, and legislative priorities.

Headlines of the Day

Stripe Buys Crypto Wallet Privy After Bridge Deal - via X

Trump Calls CPI Data "Great" Urges Full Point Fed Cut - via X

Bitcoin Hashrate Reaches New All-Time High - via X

Get our new STACK SATS hat - via tftcmerch.io

Bitcoin’s Next Parabolic Move: Could Liquidity Lead the Way?

Is bitcoin’s next parabolic move starting? Global liquidity and business cycle indicators suggest it may be.

Read the latest report from Unchained and TechDev, analyzing how global M2 liquidity and the copper/gold ratio—two historically reliable macro indicators—are aligning once again to signal that a new bitcoin bull market may soon begin.

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Life is good.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ cae03c48:2a7d6671

2025-06-12 06:00:44

@ cae03c48:2a7d6671

2025-06-12 06:00:44Bitcoin Magazine

F Street Announced Goal Of Accumulating $10 Million In BitcoinToday, F Street, an alternative investment and private lending firm, announced it has begun adding Bitcoin to its corporate treasury, with a goal of accumulating $10 million in BTC.

JUST IN: Investment firm F Street announced it's buying Bitcoin daily using business proceeds for its treasury reserves

They plan to buy $10 million Bitcoin

pic.twitter.com/NMLOteyUYU

pic.twitter.com/NMLOteyUYU— Bitcoin Magazine (@BitcoinMagazine) June 11, 2025

The company began daily BTC purchases on June 9, using business proceeds and treasury funds. This move is part of a broader strategy to strengthen F Street’s capital base and support its real estate lending and investment operations.

“Bitcoin offers a compelling hedge against inflation and dollar debasement,” said the Chief Operating Officer of F Street Mike Doney. “Incorporating it into our treasury is a strategic step to preserve and grow value for our investors and our business interests.”

In line with its commitment to transparency, F Street also plans to establish a public proof of reserves so that stakeholders can independently verify the custody of its Bitcoin assets. The firm aims to build a meaningful BTC position that supports its long term vision of a capital framework.

F Street’s move comes at a time when institutional interest in Bitcoin is experiencing a notable surge, and many prominent voices in the financial world are starting to support it. Billionaire investor Paul Tudor Jones, speaking today in an interview with Bloomberg, named Bitcoin as a critical part of what he considers the ideal portfolio against inflation.

“What would an ideal portfolio be… But it would be some kind of combination of probably gold, vol adjusted, Bitcoin, gold, stocks,” Jones said. “That’s probably your best portfolio to fight inflation. Vol adjusted because the vol of Bitcoin obviously is five times that of gold, so you’re going to do it in different ways.”

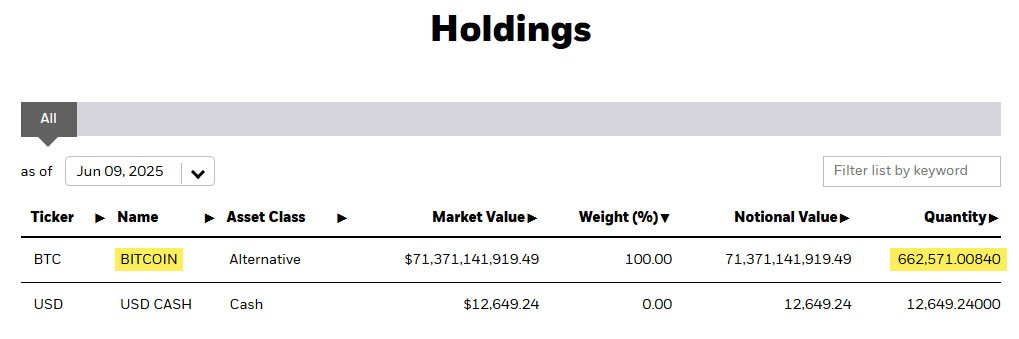

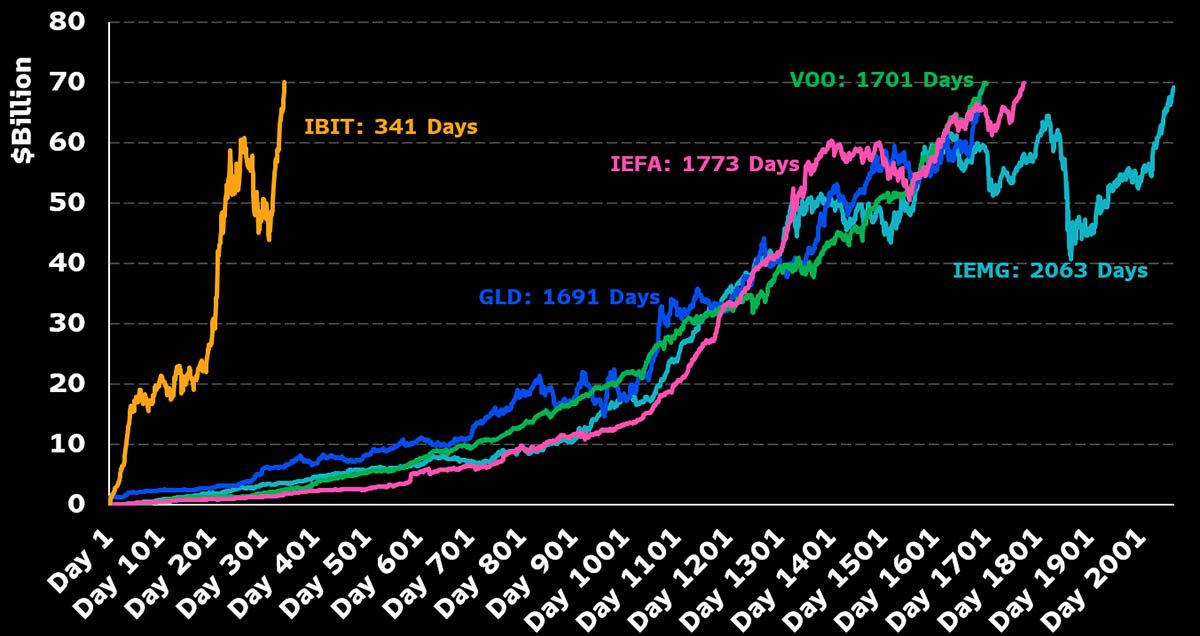

Adding to the momentum, the Head of Digital Assets of BlackRock Robert Mitchnick explained two days ago what’s really driving the surge in demand for Bitcoin ETFs.

“It’s a lot of things coming together. Out of the gate was retail and investor demand…” said Mitchnick. “Now, more recently, we’ve seen just steady progress of more wealth advisor adoption, more institutional adoption. It’s been a mix of people who it’s the first time that they’ve invested in anything in the crypto space. And then on the other hand, you have lots of people who’ve been invested in Bitcoin for a long time and they’re taking advantage of the ETP wrapper.”

This post F Street Announced Goal Of Accumulating $10 Million In Bitcoin first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ c1a49d62:3ef55468

2025-06-12 04:55:05

@ c1a49d62:3ef55468

2025-06-12 04:55:05IoT chips serve as the foundational semiconductor components that enable connectivity, data processing, and communication in devices ranging from smart thermostats to industrial sensors. These microcontrollers, system-on-chips (SoCs), and application-specific integrated circuits (ASICs) offer low power consumption, compact form factors, and robust security features, making them essential for Internet of Things ecosystems. As industries pursue digital transformation, the need for high-performance IoT chips that can handle real-time analytics, edge computing, and seamless interoperability has surged. IoT Chips Market Advantages such as integrated wireless protocols (Wi-Fi, Bluetooth, LoRaWAN), enhanced energy efficiency, and customizable silicon solutions address critical market challenges like device longevity and data integrity. Manufacturers leverage advanced process nodes and AI accelerators to deliver chips with superior throughput while minimizing thermal footprints. Continuous innovations in semiconductor design, coupled with growing market opportunities in smart cities, automotive telematics, and healthcare monitoring, underscore the strategic importance of these components. As enterprises seek to optimize operations and reduce costs through predictive maintenance and remote monitoring, demand for versatile IoT chipsets continues to rise. The IoT chips market is estimated to be valued at USD 620.36 Bn in 2025 and is expected to reach USD 1415.005 Bn by 2032, growing at a compound annual growth rate (CAGR) of 15.00% from 2025 to 2032.

-

@ 8814ec9e:32454dd9

2025-06-12 05:52:38

@ 8814ec9e:32454dd9

2025-06-12 05:52:38This design was, of course, inspired by the words of the Second Amendment itself:

A well regulated Militia, being necessary to the security of a free State, the right of the people to keep and bear arms shall not be infringed.

We've all seen plenty of shirt designs that emphasize the last four words of the amendment, "shall not be infringed," but I wanted to draw attention to a portion that gets little air-time with my design. Private gun ownership is necessary to the security of a free state. It is a key piece of how freedom from tyranny is secured, from tyrants both foreign and domestic.

As a nod to this, I incorporated my own AR-15 into the design. If you ever happen upon me at the range, you just may see me shooting that exact rifle.

To order one for yourself, go to: Necessary to a Free State T-Shirt on Shopstr

Product Details

- Most colors are 100% cotton

- Heather colors are 50/50 cotton and polyester.

- Unisex sizing available in S-4XL

- Fabric weight: 5.0–5.3 oz/yd² (170–180 g/m²)

- Pre-shrunk jersey knit

- Tubular construction

- Taped neck and shoulders

- Double seam at sleeves and bottom hem

- Tear-away tag

TShirts #Listing #2A #gunstr #guns

-

@ 5627e59c:d484729e

2025-06-12 04:32:16

@ 5627e59c:d484729e

2025-06-12 04:32:16Ik hou van de natuur en van verbinding maken\ Van diepgang en van mensen raken

Van creatief schrijven en programmeren\ Van speels bewegen en nieuwe dingen leren

Ik hou van leven en van dromen\ En van mensen zien\ Hun diepste wensen uit doen komen

-

@ 7460b7fd:4fc4e74b

2025-06-12 05:43:56

@ 7460b7fd:4fc4e74b

2025-06-12 05:43:56引言

AI 技术的突飞猛进正重塑国家间博弈的格局。在可预见的未来,人工智能(AI)将推动国家实力的重新构建。OpenAI CEO Sam Altman 指出,未来几年内人类可能迎来“温和奇点”,大量工作将由AI取代blog.samaltman.com;Anthropic(Claude AI背后公司)的CEO则警告,美国失业率可能因AI而飙升至两位数甚至约20%finance.sina.com.cn。这意味着 AI 带来的生产力飞跃伴随严峻的社会阵痛,各国政府必须争夺AI制高点以掌控未来竞争优势——正如俄罗斯总统普京早在2017年所言:“谁掌握了AI,谁就能统治世界”axios.com。因此,中美两国均将AI视作国家战略高地,在这一动态博弈中展开竞逐。

然而,在AI集中赋能国家力量的同时,比特币作为决胜性变量悄然登上舞台。美国政界出现一种耐人寻味的观点:AI代表的是一种自上而下、可能强化集权的“左侧力量”,而比特币等去中心化创新属于“右侧力量”,可以对AI形成制衡eweek.com。2025年5月,美国副总统J.D.万斯(Vance)在比特币大会上的讲话就体现了这一点——他将AI称为左倾(共产主义式)的技术力量,而加密货币尤其是比特币被视为具有保守自由色彩的技术,能够平衡AI可能带来的集中化趋势eweek.com。

基于此背景,我们假设本轮技术周期中,比特币发挥了类“数字黄金”的作用并直接取代传统黄金地位:价格飞涨至38万美元以上,大批企业(如MicroStrategy)将比特币纳入资产负债表,视其为主权资产锚定的新基准。这一趋势下,美国加速将比特币和稳定币整合进官方金融体系,构建“美元+比特币”双层货币架构,通过稳定币扩散美元影响力并冲击他国法币insurancekhabar.cominsurancekhabar.com;反之,中国依然全面拒绝比特币(自2021年以来严禁加密交易和挖矿reuters.com),继续大举增持黄金作为储备,并押注自身央行数字货币。在这样的博弈版图下,比特币可能成为影响胜负的关键变量。

本文将基于博弈论视角构建动态多方博弈模型,以刻画上述格局中的关键问题:(1) AI推动下国家力量如何重构?为何各国必须争夺AI制高点?(2) 当AI导致国家权力高度集中时,比特币如何提供不可征收的资产锚定来形成网络化的反平衡力量?(3) 中美两种AI体制的博弈结构如何决定了中国在拒绝比特币条件下可能陷入失败,而美国则可借助“比特币+发钱”等政策缓和AI失业冲击?(4) 个体如何凭借比特币对抗“AI威权”,促使世界走向网络化的稳定新结构,而非陷入新冷战?文章将分为引言、模型结构、均衡演化路径和结论四部分,为高认知读者提供一个严谨而富有现实感的战略研判框架。

模型结构

**参与方与策略定义:**本博弈模型涵盖三个主要行动方:(a)国家行为体(主要是中、美两国),(b)企业级主权力量(大型科技企业、持有比特币的大型公司等),以及(c)普通个体/公民与分布式网络。这是一个多维博弈:既包括AI竞赛这一技术军备维度,也包括以比特币为代表的新型金融资产维度,以及国家与个体间权力再平衡维度。

-

国家(中、美)在AI领域的竞争:中美视AI为获取综合国力的战略高地,均有强烈动机投入巨资抢占领先位置。AI具有明显的赢家通吃效应,领先者可能在军事、经济、信息控制等方面获得压倒性优势axios.comeconomictimes.indiatimes.com。正如普京和Palantir公司CEO的判断,AI竞赛极可能“只有一个赢家”,要么美国胜出要么中国胜出axios.comeconomictimes.indiatimes.com。因此在博弈模型中,争夺AI主导权是双方的首要策略选择,每一方都不能放松——这类似于囚徒困境中的军备竞赛:任何一方停止努力都可能被另一方弯道超车从而“称霸世界”。

-

AI导致的权力集中与国家内部博弈:AI大规模替代人类劳动将显著提高生产率,同时造成结构性失业和财富向掌握AI技术的精英/资本高度集中blog.samaltman.comfinance.sina.com.cn。这会强化国家机器和大资本对社会的控制力(例如利用AI进行大规模监控、无人武器等),使国家权力相对个体更为集中。博弈模型中,各国政府面临内部稳定博弈:如何安抚因AI失业而不满的公众,同时继续巩固自身执政联盟。在民主国家(如美国),执政联盟规模大(需要赢得广大选民支持),政府倾向于提供公共物品或直接发放补贴以维持民众满意度blog.devtang.comblog.devtang.com。例如,Altman就预测未来社会因为AI冲击会出现“新政策创想”和渐进式的新社会契约blog.samaltman.com——这暗示可能出台普惠式补贴/UBI等政策,即所谓“发钱政策”,以缓和失业阵痛。而在威权体制(如中国),执政“致胜联盟”小而精英化blog.devtang.com,“核心支持者”的利益优先于大众利益blog.devtang.com。此时政府可能更倾向通过强化控制和定向利益输送维持稳定,而不是普惠发钱。一旦由于财政收入锐减或经济失速导致无法满足联盟利益,政权稳定将受到威胁blog.devtang.com。因此在模型中,不同体制下政府选择的内部应对策略截然不同:民主政权偏好通过财富再分配稳住大联盟,威权政权则偏好强化控制、保障小联盟利益。但AI带来的挑战规模空前,威权政府若无足够“弹药”(财政盈余或新型资产)去收买人心,就可能出现“致胜联盟”维持困难,即财政失衡引发政权不稳blog.devtang.com。

-

**货币金融维度的博弈:**这是模型的第二维——围绕全球储备资产和货币体系的新博弈。假设情景下,美国选择拥抱比特币和稳定币,将其纳入国家金融战略,而中国选择拒绝比特币坚守黄金。那么各自的策略及收益如下:

-

美国策略:整合比特币+美元,推广稳定币。具体包括:允许并鼓励机构大量持有比特币,将其视为“数字黄金”储备;政府通过立法完善稳定币监管(如推出《GENIUS稳定币法案》等)以扩大美元稳定币的全球使用nevadacurrent.comnevadacurrent.com;甚至总统令建立国家比特币战略储备reuters.com。预期收益:一方面,比特币价格飙升带动美国持有者财富上升,MicroStrategy等公司已尝到甜头,资产负债表上囤积了价值400亿美金以上的比特币finance.sina.com.cn。华尔街分析师预测,比特币有望在未来十年最终取代黄金成为首要价值存储,finance.sina.com.cn甚至特朗普政府内部有人倡议卖出黄金储备改买比特币finance.sina.com.cn。另一方面,美元稳定币的大规模推广巩固了美元霸权:全球用户在链上广泛使用美元稳定币,相当于变相扩大美元的影响圈insurancekhabar.cominsurancekhabar.com。稳定币背后的储备主要是美国国债,这意味着稳定币越多,美国国债需求越大,从而压低美国融资成本insurancekhabar.cominsurancekhabar.com。有专家指出,美国大力推动加密货币和稳定币,是看中了它们可以成为经济武器:“稳定币将取代外国政府,成为美债最大买家”insurancekhabar.com。这为美国在AI时代实施大规模财政转移(如发放失业补贴、科技红利)提供了弹药:全球对美元资产的需求使美联储有更大余地印钞而不致本币崩溃。简言之,美国整合比特币+稳定币体系,可强化其金融主导权和财政灵活性,既能对外输出通胀、打击他国法币,又能对内从容应对AI失业的救济开支。

-

中国策略:拒绝比特币,囤积黄金+推数字人民币。中国自2017-2021年对加密货币连出重拳(取缔交易所、禁止矿业、封锁境内交易)reuters.com,“宁要区块链,不要加密币”的政策表明其决心彻底隔绝比特币等去中心化货币。取而代之,中国持续加码黄金储备:据央行公告,中国已连续多月增持黄金,官方储备突破2000吨并仍在增长中(此举在地缘政治不确定性下尤为明显)。同时,中国大力推广央行数字货币(数字人民币),试图在国内实现对货币流通的全面可控,并谋求在国际贸易中推动人民币结算。预期影响:由于拒绝比特币,中国希望通过黄金提升本币信用,通过数字人民币强化资本管制和货币政策独立性。然而此策略的风险在于,若比特币在全球范围内取代黄金地位,中国将错失这一新型储备资产红利。当美国等推动比特币升值并将其金融化时,中国手中的黄金可能相对贬值或增长滞后。此外,稳定币对他国法币的冲击也波及人民币:虽然中国严格限制境内稳定币流通,但在跨境贸易和地下金融中,美元稳定币和比特币可能绕过管制,被企业和富裕阶层用于对冲人民币贬值或资本外逃。这相当于一个金融围堵:美国利用数字货币在全球吸纳流动性,削弱人民币在“一带一路”等领域的渗透。中国若坚持封锁比特币和民间加密交易,可能面临“两难”:要么严厉执法资本管制、牺牲部分经济自由和国际化进程;要么在全球数字经济中逐渐边缘化,被排除在新金融网络之外。总之,中国此策略短期内保障了国家对金融系统的控制权,但长期存在与世界脱节、储备资产单一(黄金)的隐患。

-

个体与网络力量的崛起:第三个维度的博弈发生在国家 vs. 个体/分布式网络之间。AI和加密技术的发展,使得一批技术公司和个人获得了前所未有的自主力量——他们可以同时获取AI赋能和持有不可被国家任意剥夺的财富(比特币)。在模型中,这些分散的个人/企业构成一张跨国网络,他们的策略是利用技术和资本的流动性在全球范围内“择优而居”。如果某国政策有利(如美国欢迎加密创新、提供完善法律保障),人才和资金就会流向该国;反之,若政策高压(如中国禁止民间持币、严格审查AI应用),那么这些人才与资金可以通过数字途径逃逸(capital flight)。比特币在其中充当关键的**“退出票”(exit option):它具有强抗审查和无法被没收的属性,保障了私人财产的自由转移nymag.com。“比特币无法被当局像没收黄金那样没收,无法像银行账户那样随意冻结,亦无法像法币那样被央行肆意贬值或被独裁者通过资本管制任意阻断”nymag.com。这一属性意味着个人第一次拥有了对抗国家财权的有效工具**。在博弈模型中,个体玩家的存在使国家行为体不再是单纯的统一行动者——国家内部会因为个人/企业的选择而出现博弈反馈:如果政策过于损害个人利益,他们有能力通过比特币等手段规避,从而削弱国家政策效果。这相当于在国家与国家的对局中,引入了一个“平衡器”——全球网络化个人势力。他们的目标并非争夺领土或传统主权,而是在寻求“个体主权”最大化:自由拥有财富、自由迁徙和创新、不受制于单一政府。这股力量在AI时代尤为重要,因为AI集中化倾向可以被这种分散网络部分抵消。例如,AI赋能下的个人黑客、科技创业者可以不依赖国家资本也开发出强大模型;若遭遇压制,他们可携带比特币远走他国继续创业。博弈的结果将取决于国家能否与这股网络力量共存,以及在多大程度上满足个人对自由与财富安全的需求。

均衡演化路径

基于上述模型结构,我们推演中美博弈及全球格局的动态演化路径。博弈分阶段进行,各阶段的策略互动将把体系推向不同的均衡态。

阶段1:AI军备竞赛与金融布局(现在至近期)。这一阶段中美都全力投入AI研发,以获取先发优势。双方持续加大对半导体、算法和人才的投入,并在国际规则上博弈(如出口管制、人才签证等)。博弈特征类似“军备竞赛”:任何单方面的松懈都会导致对手大幅领先,因此均衡结果是双方都倾向投入高强度资源,直至边际成本难以承受。与此同时,双方在金融领域开始布局各自阵地:美国在2024-2025年间通过了一系列亲加密政策——国会推进稳定币立法以合法化美元稳定币nevadacurrent.com,“数字资产市场结构”法案呼之欲出;行政层面,特朗普政府下令创建国家比特币储备,将执法机构此前持有或没收的比特币纳入战略储备reuters.com。这些举措表明美国意在将比特币作为国家金融武器的一部分来运用。相应地,比特币市场开始出现质变:主流机构投资者蜂拥而入,现货比特币ETF获得批准且规模激增,短短时间累积数千亿美元资金finance.sina.com.cn。比特币价格屡创新高并稳定在六位数美元以上,朝着20万、30万甚至更高的目标迈进finance.sina.com.cn。企业层面,MicroStrategy等公司持续买入,比特币在一些公司资产负债表中的地位堪比现金储备finance.sina.com.cn。美国的这一系列动作,使其在**“新数字货币冷战”**中占得先机:美元+比特币组合开始对全球产生强磁吸效应。

反观中国,同期则进入防御性应对状态。面对美国的金融攻势,中国加快了增储黄金和数字人民币试点的步伐,以图筑牢本国金融壁垒。中国人民银行连续数月购入黄金,insurancekhabar.com黄金储备量创历史新高;数字人民币从国内零售场景逐步推广到跨境贸易结算试验,通过区域性协议在部分周边国家开展本币结算合作,以降低对SWIFT美元体系的依赖。同时,中国严格执行对加密活动的严打,关停剩余的OTC交易渠道,宣示绝不让比特币等威胁人民币的货币主权。此阶段的结局是:两个平行的货币体系开始成形——一个是美元主导并吸纳比特币、稳定币的新体系;一个是人民币主导、辅之以黄金背书的封闭体系。

阶段2:AI红利与冲击释放(中期,未来5-10年)。随着AGI雏形和通用机器人逐步出现,人类劳动大规模被替代的效应开始凸显blog.samaltman.com。在美国,AI带来的效率红利令GDP和企业盈利大幅增长,但“技术失业”也引发社会不安。finance.sina.com.cn美国失业率假设攀升至15-20%,尤其白领和服务业岗位大量消失。幸运的是,由于美国及时进行了金融上的前瞻部署,此时财政手段具备充足火力来应对危机。一方面,比特币的暴涨和广泛持有为部分中产和企业带来了资产增值——例如,有投资比特币的家庭财富逆势上涨,部分失业者因持有数字资产而有缓冲储备。政府则可以选择性对这些资产增值征税或者发行主权数字货币购买比特币,实现财政增盈。另一方面,更重要的是**美联储和财政部得以大规模“直升机撒钱”**而不致引发债务危机,这是美元稳定币全球盛行带来的特权insurancekhabar.com。由于全球大量资金以购买美国国债作为稳定币储备,insurancekhabar.com美国政府可以在通胀可控范围内发行货币、扩大赤字以资助全民基本收入或就业项目。比特币在美国的官方接受度也使发钱政策更容易实施:政府完全可以将数字美元直接发送到每个公民的手机钱包(甚至部分用比特币形式发放科技红利)。公众虽然对AI取代工作有所焦虑,但在政府真金白银的兜底下,基本生活有保障,社会动荡被控制在最低程度。这印证了Altman的预言:AI时代世界将更富裕,因此能够“认真考虑以往不可能的新政策”blog.samaltman.com。美国通过比特币财富效应和激进财政政策,初步缓解了AI带来的内部矛盾,其民主制度下“大联盟”的稳定性得以维持。

与之对照,中国在中期则可能面临更严峻的平衡难题。AI同样推动了中国经济的效率,但也使大量制造业和服务业劳动力冗余化。由于缺乏比特币等新财富渠道,大部分民众财富并未随技术进步而增长,反而因失业潮而缩水。民间投资渠道狭窄(楼市低迷、股市震荡),社会的不满情绪上升。此时中国政府进退维谷:若执行大规模刺激或全民补贴,一方面没有储备的“数字资产红利”可用,只能动用巨额财政支出;但中国无法像美国那样让全球来分担本币超发的成本(人民币不是主要储备货币,超发会直接冲击汇率和通胀)。若强行印钞发钱,则可能引发人民币贬值和资本加速外逃,削弱执政信用。历史上来看,威权政府在财政吃紧时维系统治的成本急剧上升,很容易因为买不到执政联盟的忠诚而倒台blog.devtang.com。中国政府当然也深谙此理,因此更可能选择收紧财政、强化管控的方式渡过难关:例如动用警察力量维稳、加强舆论审查来减缓不满爆发。但这样的高压策略长期看难以为继,而且会进一步吓跑高端人才和资本。尤其在比特币价格连创新高的背景下,中国富裕阶层和企业势必更加渴望配置此类全球性资产来保值。一些人会通过地下渠道购入比特币和稳定币,然后设法转移资产出境(哪怕非法也在所不惜)reuters.comsciencedirect.com。这反过来又加剧了中国国内资本外流和财政紧张,形成负反馈。可以预见,如果中国仍拒绝比特币,其金融体系可能出现“致胜联盟”式失衡:政府要么牺牲外汇储备和黄金储备来稳住人民币、安抚利益集团,要么被迫局部放开对加密资产的管制以引回资金,无论哪种都意味着其此前的强硬策略难以持续。

阶段3:博弈格局转变与网络化均衡(远期,10年及以后)。经历中期震荡后,全球博弈格局将出现质变,进入新的均衡态。基于前述趋势,可以预见两种截然不同的结局:

-

**美国阵营的胜出与中国策略调整:**如果美国在AI和金融两条战线上都占据了优势,那么远期均衡将体现为美国引领的“新技术-金融秩序”。届时比特币可能已稳固地成为全球储备资产的一极(类似数字黄金),各国央行和主权基金纷纷将其纳入资产配置。美元则通过稳定币牢牢占据全球结算和流动性中介地位。在AI方面,美国凭借开放创新环境汇聚了全球顶尖人才,实现技术持续领先。反观中国,若在中期尝到了拒绝比特币的苦果(经济停滞、财政吃紧、人才外逃),理性的策略调整将是不得不转向美国模式,以免彻底边缘化。这可能包括:逐步放松对加密资产的管制,甚至尝试推出国家主导的加密货币ETF,引导国有机构低调持有比特币以分享其增值;在外交上寻求加入由美国主导的数字货币国际框架,避免本国企业被排除在新贸易结算体系外。此外,中国会继续依靠其黄金储备试图为人民币背书,但如果比特币市值远超黄金且更受年轻一代青睐,黄金的锚定作用将大打折扣。可以说,中国此时面临类似19世纪末“银本位帝国”的困境——清朝因坚守白银而被新兴的金本位体系边缘化insurancekhabar.com;21世纪的中国若固守黄金标准而忽视比特币潮流,恐重蹈历史覆辙。有识之士将呼吁“中国不能错失数字黄金机遇”,倒逼政策松动。最终的均衡可能是:美国及其盟友掌握了AI与金融话语权,而中国被迫加入由比特币和美元构成的新体系,放弃之前的强硬抵制立场。这一结果虽非中国最初意愿,但总比被彻底孤立要好,犹如冷战后期苏联被迫融入布雷顿森林体系一样,是一种策略收缩下的妥协均衡。

-

网络化多中心格局的形成:无论中美博弈如何,此阶段一个更深刻的趋势是全球网络化权力结构的浮现。随着比特币深入人心和应用普及,每个个人和企业都相当于握有自己的“微型主权财富”。正如《主权个体》一书预言的那样,信息时代将削弱民族国家发动战争和征税的能力,取而代之的是个人在全球范围内自由组合、以市场方式选择治理的时代sites.northwestern.edu。当比特币成为“无法征收的资产”标配后,各国政府要汲取民财将更为困难,战争筹资也不再容易sites.northwestern.edu。这是因为:一旦某国大举加税或准备战时管制,资本和人才可以更快捷地逃往别处,政府很难像过去那样通过强制手段动员全国资源。一些论者甚至指出,“在一个基于比特币的社会里,政府若想发动战争,可能不得不向公民众筹军费”reddit.com——这无疑极大提高了发动战争的政治难度。在AI高度发达且武器智能化的背景下,这种网络化制衡力量尤为宝贵,它防止了超级大国因为掌控AI利器而为所欲为。举例来说,如果没有个人财产自由这一“安全阀”,那么拥有强大AI武器和监控系统的国家很可能毫无顾忌地倾压式统治甚至对外侵略;但有了比特币,精英和企业可以用脚投票,拒绝配合极权和战争企图——正如有人所说的,“你无法征税/掠夺那些你无法抓住的人”newstatesman.com。最终,全球可能形成一种“冷战阻止机制”:各国不敢轻易走向新冷战或热战,因为稍有风吹草动,资金和人才就会通过去中心网络逃逸,使战争难以为继。

因此,在远期均衡下,我们将看到国家、企业和个人形成一个互动博弈的多中心体系:国家不再拥有对经济和技术的单方面支配,个人与企业通过持有数字资产和掌握AI技术获得了谈判筹码,各方被迫合作共生而非你死我活。这并非传统意义上的“权力均衡”,而更像是一种动态的网络均衡——权力在不同层级和节点上分散,任何一方试图完全主导都会引发系统中其他节点的自动调节与抵制,最终回归稳态。

结论

综上所述,AI时代的中美博弈结构展现出“技术军备竞赛+金融货币博弈+内部治理较量”三位一体的格局。美国通过在AI和比特币两方面同时发力,形成“左手AI、右手比特币”的双拳策略,既争取了AI制高点,又利用比特币这一“不受征服的资产”稳固了内部与外部的平衡nymag.com。反观中国,倘若固守传统思维拒绝比特币,则在AI导致集权加深的同时失去了由比特币提供的网络化反平衡力量,极可能重现“致胜联盟”财政失衡和战略被动的局面。正如博弈模型分析所示,中国若不及时调整,将因无法有效吸纳AI红利、又无法借助新金融工具缓冲冲击,而陷入内外交困的困境;相反,美国通过比特币+发钱政策有望缓解技术失业压力,在维护社会稳定的同时进一步增强对外金融攻势,实现以较小代价度过转型阵痛。

更深一层的洞见在于:比特币作为“无法征收的资产”(unconfiscatable asset),为无数个人和企业提供了在AI强权面前自我保护和抗衡的手段nymag.com。它让个体可以自由掌控自己创造的AI收益和财富,不必担心随时被征用或剥夺,从而在国家与国家的博弈中引入了一个独立稳定器。这个稳定器确保了国家不敢轻启战争或极端压榨,否则公民的财富和才能将自动逃逸,令其损失巨大。这种机制有望阻止人类社会滑入新一轮两极对抗或热战冲突,因为权力过度集中将引发去中心网络的本能反制。取而代之,人类可能走向一种“网络化稳定结构”:在这个结构中,AI带来的繁荣由各国共享,但没有任何一方能垄断;比特币作为全球共同的价值锚和信任媒介,保障了个人基本财产权,从而软化了国家机器的锋芒。

对于高认知的决策者而言,这一博弈分析传递出明确的战略启示:拥抱比特币等去中心化创新,实际上是在为本国社会安装安全阀,避免因AI高度集中而产生体制性风险;同时,这也是在国际博弈中抢占未来金融体系的话语权。在AI与国家力量此消彼长的新时代,比特币扮演了关键的“平衡木”角色:它连接着国家与国家、国家与个人,确保没有人可以轻易掀翻整艘人类文明之舟。唯有善用这一新型稳定器,引导世界朝开放协作而非封闭对立演化,我们才能把握AI奇点带来的机遇,避免重蹈冷战或冲突的历史覆辙。人类社会或许将凭借这种网络化的平衡,在巨变中找到新的稳定与新秩序sites.northwestern.edu——在AI的洪流中乘风破浪,而非沉舟觅踪。

参考资料:

-

Sam Altman,《温和奇点》博文对AI发展的展望blog.samaltman.com

-

Anthropic CEO Dario Amodei,关于AI导致失业的警告finance.sina.com.cn

-

J.D. Vance 副总统在Bitcoin 2025大会讲话摘要,对AI和比特币的定位eweek.comreuters.com

-

Bernstein投行报告:比特币取代黄金的十年预测,MicroStrategy持币策略等finance.sina.com.cnfinance.sina.com.cn

-

Nevada Current对Bitcoin大会的报道:稳定币立法(GENIUS法案)进展nevadacurrent.comnevadacurrent.com

-

Reuters:特朗普行政令建立国家比特币储备、美国拥抱比特币对抗中国reuters.comreuters.com

-

Insurance Khabar:Deepak Garg 关于美中金融战与稳定币武器化的分析insurancekhabar.cominsurancekhabar.com

-

《独裁者手册》理论:致胜联盟与政权稳定的关系blog.devtang.com

-

New York Magazine:《比特币无法被没收,不能冻结,不能由央行贬值》nymag.com

-

《主权个体》观点:信息技术削弱国家征税和战争能力sites.northwestern.edu

-

-

@ 7460b7fd:4fc4e74b

2025-06-12 05:37:57

@ 7460b7fd:4fc4e74b

2025-06-12 05:37:57中美近期谈判的博弈分析:模型、均衡与演化前景

一、背景与问题概述

2025年中美经贸谈判出现了最新进展:中国同意恢复出口稀土(包括稀土磁体等关键材料),美国则在中国留学生签证政策上作出让步,但双方并未在关税上相互让步,仍维持高额关税壁垒reuters.comreuters.com。这一结果是中美经贸冲突持续多年的阶段性产物。在此之前,中美互征高额关税、一度接近全面“脱钩”,双方还通过稀土出口管制和留学签证限制等手段施压对方,导致贸易额大幅下滑、供应链紧张axios.comenglish.kyodonews.net。这一局势引发了以下博弈论层面的核心问题:当前达成的部分妥协是否构成某种博弈均衡?如果是,这属于短期策略性均衡,还是预示着中美关系可能进入类似冷战的长期对峙均衡?此外,未来有哪些外部冲击因素可能打破当前均衡或使其演化为新的稳定态?本文将以博弈模型框架对此进行分析,探讨多种均衡形态(包括但不限于纳什均衡、“科尔奈-科曼达”均衡、演化均衡等),评估其稳定性,并结合历史经验和现实因素展望演化路径。

二、博弈模型框架

1. 博弈参与者与利益:博弈双方为中国和美国,两国均为战略理性参与者。双方利益既有冲突也有重叠:中国重视维持经济增长、技术发展及国家安全,希望解除美国对其高科技封锁和贸易壁垒;美国重视维护其技术优势和贸易利益,要求中国开放市场并停止在关键资源和技术领域对美“卡脖子”。双方都希望减少自身经济损失,又不愿在战略上示弱。

2. 策略集合:双方在多个博弈维度上可选择策略。为简化分析,可聚焦三大维度:

-

关税政策:继续高关税(强硬策略)或降低关税(合作策略)。目前现实是双方仍维持高关税水平,美国综合关税约55%(包含之前各类加征),中国约10%reuters.com(显著低于美方)。

-

战略资源/技术出口管制:如中国对稀土等关键矿物的出口管制 vs 美国对高科技(芯片软件等)的出口管制。策略上可以选择实施/维持管制(强硬)或取消管制(让步)。本次中国选择取消对稀土磁体的出口限制,属合作让步;美国也表示将放松对华高科技出口管制中的一些领域english.kyodonews.netcsis.org。

-

人员交流及其它领域:如留学生签证、金融投资等。美国此次在签证上让步,允许更多中国学生赴美,属合作策略reuters.com;中国则一直希望维持人员正常交流。双方在此维度暂时采取了互惠合作的策略。

上述维度可视作多阶段博弈或多重议题博弈。为便于分析,可将其抽象为一个综合双人博弈模型:每一方都有“强硬”(H)和“合作”(C)两种总体策略取向,但在具体议题上可以组合选择(如在稀土上C、在关税上H)。这使博弈呈现出策略组合的多样性,而非简单的单次囚徒困境。但为了直观起见,我们可首先假设一个简化的对称博弈(类似囚徒困境的收益结构)来捕捉基本激励,再扩展讨论复杂均衡。

3. 收益支付(概念性):双方策略的组合将决定各自收益:

-

双强硬 (H, H):双方都坚持高关税+资源封锁等措施,彼此损害,进入全面贸易战/科技战。收益表现为两败俱伤:经济损失大,供应链断裂,科技交流停滞(负收益)。例如,2025年初双方互加惩罚性关税至三位数、彼此禁止关键出口时,就出现了贸易额骤降(中国对美出口同比-34.5%)english.kyodonews.net、企业巨额损失和市场动荡。

-

双合作 (C, C):双方都选择降低关税、解除限制,实现贸易正常化和科技交流。此时总体收益最大(双赢):经济恢复、供需正常。但由于存在信任赤字,此状态不稳定——正如囚徒困境中“双合作”虽帕累托最优,却因单方作弊诱因而难自发实现medium.com。

-

单方强硬、一方合作 (H, C)或(C, H):这一不对称组合下,强硬方利用对方的合作获取单方面优势:例如美国若坚持高关税而中国单方面降低关税并开放市场,则美方可同时享受关税保护和中方市场开放,收益最高;反之亦然。被动合作的一方则处于劣势,政治上承压。因此,这类似**“鸡奸博弈”(Chicken Game)或领导者-追随者博弈**格局。

当前谈判结果实际上接近于一种不对称均衡:美国在关税上保持强硬立场(H),而中国并未同等报复(其对美关税仅10%,远低于美方)reuters.com。同时中国在稀土管制上让步(C),美国在签证上让步(C)。可以理解为美国在经贸领域强硬而中国相对克制,美国在人员交流领域部分合作回应。这种策略组合带来的结果是美国宣称获得巨大贸易保护(“我们得到55%关税”)而中国则确保关键资源供应恢复和部分交流正常reuters.comreuters.com。双方各自得到关切的利益点:美国保住了对华高关税(满足其产业和选民需求),中国保住了留学生和稀土出口市场。但很多根本性分歧并未解决,处于暂时搁置状态reuters.com。

4. 博弈类型:这可以看作一个重复博弈/动态博弈。中美经贸冲突从2018年至今反复拉锯,多轮谈判和报复,已经是一个长期博弈过程。各阶段的策略选择和均衡都受到历史策略和信誉影响。因此分析均衡需考虑静态(一次性博弈均衡)和动态(演化均衡、子博弈完美均衡等)两种层次。

三、多种均衡形态探索

1. 纳什均衡 (Nash Equilibrium):在单次非合作博弈框架下,纳什均衡是双方策略互为最佳回应的稳定点。根据上述收益格局,可能存在以下纳什均衡:

-

“双强硬”均衡:如果互相采取强硬策略是彼此的最佳回应,则 (H, H) 构成纳什均衡。这对应于双方都不信任对方合作,选择关税壁垒和制裁的情形。2018-2024年的贸易战大部分时间里,中美实际上陷入了这样的互相报复均衡,哪怕该状态令双方经济受损axios.com。这种均衡稳定但低效:没有一方能通过单边改变策略获利(单方让步将遭对方剥削),因此维持对峙,但集体收益远低于合作状态。

-

“不对称”均衡:(H, C) 或 (C, H) 也可能是纳什均衡,取决于双方相对实力与承受力。如上所述,美国坚持高关税而中国克制报复的组合,可能是稳定的:美国的最优回应是继续征税获取贸易保护红利,中国的最优回应是在稀土等领域合作以换取部分利益且避免更大损失medium.com。反过来,如果中国采取强硬而美国克制,也是一种可能(但目前美国国内政治不允许完全克制)。从现实看,本次达成的安排类似 (H, C) :美国保留高关税(强硬),中国未对等报复且提供稀土(合作)。有分析指出,这种格局在贸易战模型中被视为“最稳定的局面”之一medium.com。然而它对中国而言并非理想,属于一种被迫接受劣势的均衡。

-

“双合作”并非均衡: (C, C) 虽让双方收益更高,但由于博弈存在囚徒困境特征,单方偏离合作能获得更大短期利益,因此在一次博弈中双合作不是纳什均衡medium.com——除非有外部约束或信誉机制,使背叛受惩罚。

2. “科尔奈-科曼达”均衡(体制均衡):所谓“科尔奈-科曼达均衡”可理解为由体制或结构因素支撑的均衡,即即使不满足常规最佳回应原则,却由于外部强制力或内在机制而得以持续的状态。经济学家科尔奈(János Kornai)分析过社会主义经济中的**“短缺均衡”:尽管市场未出清(处于非瓦尔拉斯均衡),短缺状态却能自我再生、长期持续**,因为体制激励使偏离状态自我纠正pubs.aeaweb.org。借用这一思想,中美当前的局势也可视为一种**“非合作的稳定状态”:双方在贸易和技术上未达成真正合作,但建立了一套报复—让步的动态平衡机制**,使对抗强度维持在某个水平,不至于失控。具体体现在:

-

中国虽不满美国高关税和技术封锁,但内部存在缓冲机制(如刺激自主创新、寻找替代市场)来承受压力,同时利用稀土卡位、对美投资限制等措施对美形成反制平衡。这样一种“对抗—适应”的结构使局势形成常态化均衡:虽然远非合作最优,但在现行体制下可以持续且双方习以为常。

-

美国方面,即使对华强硬政策损害了一些本国企业利益,出于安全考量和国内政治共识,其决策机制依然倾向维持对华压力。而美企通过调整供应链、政府通过补贴产业等方式部分缓冲损失。这类似科尔奈笔下的**“短缺经济的自稳定”:扭曲(高关税、高壁垒)的存在引发内部调整,从而固化了扭曲本身,形成一种具有路径依赖**的均衡。

因此,“科尔奈式均衡”在此可指中美长期博弈形成的一种自我延续的对峙常态。这种均衡并非静态最优,但有内部反馈维系其稳定。它可能对应于一种政策均衡或制度均衡:双方政治体制与经济结构已经部分适应了冲突状态,并将其纳入新常态。科曼达(Komanda)一词可能隐喻“Command(命令式)”特点,即双方关系被战略和政治指令所主导,而非市场自发优化。

3. 演化均衡 (Evolutionary Equilibrium):若将博弈视为重复进行,或者有大量“参与者”(如国内不同利益集团)的策略在演化,则可讨论演化稳定策略(ESS)。在演化视角下,策略会根据相对成功度调整,中美关系的长期走向可被视为一种策略种群的进化过程:

-

演化趋于强硬:若强硬策略在短期博弈中胜出(例如一方强硬往往能在谈判中获取更多,让步的反而被迫吃亏),那么随着时间推移,双方可能都会倾向强硬,最终演化出一个全面对抗的稳定状态。这类似于“鹰鸽博弈”中如果资源价值高且斗争成本可承受,鹰(强硬)策略会成为演化稳定策略。当前中美许多领域有朝着“鹰派占主导”的方向,例如双方国内的民族主义与强硬立场在近年不断强化,使得让步空间缩小。

-

混合均衡:也可能出现混合策略或周期。例如在重复博弈中,双方可能尝试间歇性合作(小幅让步)以试探,然后若对方被视为背信则迅速回到强硬,形成“报复—和解”交替出现的循环。这类似于“触发策略”均衡:默认合作,但一旦对方作弊就触发惩罚阶段。中美过去几年展示了一些这种特征:2019年达成阶段性协议短暂减缓冲突,随后因履约分歧又再度摩擦;2020年-2021年稍有缓和,2022年起围绕科技战又急剧恶化。每一次暂时均衡都因某种刺激被打破,然后演化进入新的冲突均衡。

-

演化稳定并不一定高效,但具有韧性。例如如果当前的部分合作-部分对抗状态在重复互动中证明比全面对抗或全面合作都“抗侵扰”,那么它就可能成为演化稳定策略组合。双方在稀土和签证上交换让步、但在关税和科技上维持对抗,或许就是一种策略组合的进化适应:既避免了极端冲突的不可承受之痛,又不让对手占尽便宜。这状态短期看或是博弈的折中均衡,可能会持续一段时间,直到新的变数出现。

4. 其他均衡概念:除了上述,值得一提的还有:

-

科尔奈-马林沃德均衡:科尔奈曾与马林沃德等研究非均衡经济,提出配给约束下的均衡等概念。在国际博弈中,可以类似地考虑约束均衡:双方由于外部环境(如全球市场、盟友压力)的约束,被迫停留在某均衡。如本次谈判有90天的临时停火协议english.kyodonews.netcsis.org,可视为一种短期约束均衡,由协议强制双方不升级冲突。

-

相关均衡 (Correlated Equilibrium):如果存在一个可信协调机制,双方可以采取相关策略实现比纳什均衡更优的结果。例如通过国际机构调停,中美同步降低部分关税、同步解除一些出口禁令,则可避免单方面吃亏。但目前缺乏这样的信任机制(WTO等多边框架也遭削弱carnegieendowment.org),因此相关均衡难以达成。

综上可见,中美经贸谈判局势下可能存在多个均衡形态并存:静态地看,强硬对峙是经典纳什均衡;动态地看,阶段性停战是子博弈均衡的一种,但未必稳定;从更长期和结构视角看,可能形成一种长期对抗的常态均衡。

四、均衡稳定性分析

分析各均衡的稳定性(即在外部冲击或单方偏离下能否持续)对评估未来走势至关重要:

-

当前部分妥协均衡的稳定性:本次达成的交换(中国出口稀土、美国放宽签证,关税维持)可以视作一种短期纳什均衡或脆弱的相关均衡。其稳定性较弱,原因有:

-

互信水平低:双方并未解决根本分歧,仅是“各取所需”式的交换,缺乏长期约束力。正如90天贸易休战协议所示,这只是暂时停止升级english.kyodonews.netcsis.org。如果90天后新的谈判未有进展,任何一方都可能恢复强硬举措,均衡即告破裂。

-

激励不对称:美国在关税上占了便宜(55%对10%),可能倾向固守既得利益,缺乏进一步让步动力;中国则可能对这种不对称心存不满,伺机寻求重新谈判条件。一旦中国找到减轻美国关税压力的途径(比如开拓其他出口市场、或美国国内通胀迫使其降税),则中国可能强硬起来要求对等调整,否则就收紧其他合作(如稀土出口配额)。单方偏离的诱因是存在的,使得均衡并不牢固。

-

外部环境多变:地缘政治或国内政治事件都可能令一方突然改变策略(下文详述潜在冲击因素)。当前均衡缺乏“保险机制”抵御这些冲击。

有迹象表明各方也预见到其脆弱:例如美国智库评价称,此次让步只是“临时止痛”,并未消除贸易战已造成的高成本和不确定性csis.orgcsis.org。这种不确定性本身会削弱均衡的可持续性——企业和市场预期不稳,就难以建立长久合作常态。

-

全面冲突均衡的稳定性:如果中美重新陷入全面强硬对抗 (H, H),这一均衡在某种条件下反而可能具有更高的稳定性,类似冷战时期美苏的对峙平衡:

-

相互威慑/无利可图:当双方都极大增加报复力度,使得任何单方面背离强硬(也就是单方面缓和)都会被对方视为软弱而加以利用时,那么维持对抗成为理性的选择。冷战中,美苏都认识到直接冲突风险巨大,形成了“相互确保摧毁”的核威慑均衡——没有一方有诱因先动carnegieendowment.org。在中美经贸版的冷战中,如果双方完全脱钩,各自建立独立产业链和同盟体系,那么相互依赖减少反而巩固了敌对均衡,因为少有经济动力去打破僵局。

-

国内政治锁定:强硬对抗一旦成为双方国内政治的基础,共识就会固化。例如冷战时期美国社会有跨党共识遏制苏联carnegieendowment.org。目前美国两党对华强硬在一定程度上趋于一致,将中国定位为主要战略竞争者;中国国内民族主义高涨,对美警惕心理强烈。如果这种政治氛围继续强化,领导人反而不敢轻易缓和,长期对峙就成为稳定政策。

-

然而,需要指出全面冲突均衡虽然稳定,但代价高昂而缺乏弹性。一旦出现如经济衰退、盟友变动等压力,其中一方可能难以承受(正如苏联经济最终不堪军备竞赛而崩溃,冷战均衡才终结)。因此静态稳定未必等于动态持久。当前中美离完全脱钩尚有距离,且全球化背景下,全面冲突会遭多方掣肘(盟国、企业利益等),因此真要达到冷战式的稳态并不容易。

-

双边合作均衡的稳定性:如果假设理想情况下双方实现了全面合作 (C, C),这在博弈上不是自行稳定的,需要可信承诺等机制支撑。稳定合作往往依赖重复博弈阴影(即长期利益)、透明度和执行监督。中美过去曾有紧密经贸合作的阶段(例如中国加入WTO后两国贸易高速增长时期),但近年来这种合作均衡被打破,说明过去的制度化信任不足以约束背叛(比如美国指责中国未履行知识产权保护承诺,中国指责美国滥用贸易制裁)。要恢复稳定合作,除非有新的协议架构和信任重建,否则仍会因为单方追求短期利益而被破坏。短期看,双边全面合作似乎缺乏政治现实性,因此不是目前可行的均衡态。

-

“科尔奈式”均衡的稳定性:如果中美进入一种长期非完全合作的常态(亦即部分对抗被体制内化的状态),这种局势可能具有相当持久性。历史上冷战就是典型例子:美苏长期在**“既不开战也不言和”**的紧张和平中相处数十年。其稳定原因包括:

-

结构性分隔:两大阵营经济、政治体系几乎隔绝,交往极少,因而缺少突发变数。若中美今后在经贸科技上大幅减少往来,各自主导不同供应链和技术标准,那么双方互动机会下降,冲突的摩擦面也相对可控,反而容易稳定在彼此默认的势力范围和规则之内。

-

制度自适应:如前述,双方内部调整出一套应对长期对抗的机制(替代产业、军备投入、宣传策略等),就像社会主义经济适应了短缺并持续运转一样pubs.aeaweb.org。一旦适应完成,这种对抗状态反而成了“新常态”,需要剧烈外力才能改变。

-

稳定但低级:值得注意,这类均衡通常效率低下(资源错配、全球福利损失),只是因为缺少打破均衡的动力而持续。例如冷战期间,美苏在军备和代理冲突上耗费巨资,却很少合作解决全球问题,直到苏联难以为继。中美若陷入持久对峙,也会牺牲很多潜在合作收益,但可能双方都愿意承受这个代价来避免在战略上被对方占优。

综合而言,目前的短期停战均衡较脆弱,全面对抗均衡和冷战式长期均衡在特定条件下可能更稳定,但对外部环境和内部承受要求高。均衡的稳定性取决于双方偏离策略的收益差异、一致预期的形成、以及有无自我强化机制。下面进一步探讨当前局势究竟更偏向短期策略均衡,还是将演化为长期对峙。

五、短期策略博弈均衡 vs. 长期对峙态势

1. 短期策略性均衡的特征:从此次谈判看,中美彼此做出的让步都带有策略试探性质,暗示目前状态更像一种短期策略均衡而非双方关系根本转折:

-

交换的局限性:让步集中在各自迫切领域(稀土和签证)reuters.com。这些让步可以迅速兑现又可随时中止(稀土出口许可中国可再收紧,签证政策美国随政令可调)。这显示双方并未进入信任合作的新轨道,而是在交换“筹码”赢得时间。

-

关税、补贴等核心问题未触及:贸易战缘起的结构性问题(市场准入、产业补贴、知识产权、关税全面降级)几乎原封不动。症结未解,只是搁置。CSIS评价称,此次关税从极端高位略有回落(美国从145%降至30%,中国125%降至10%)csis.org,但依然“远高于福利最大化所需水平”,且很多扭曲依旧存在csis.org。双方只是踩了一脚刹车,而非掉头转向。

-

临时协议属性:双方仅同意90天停火并“进一步磋商”english.kyodonews.netcsis.org。这和以前贸易战中数次短暂停战类似(如2018年底的90天停火、2020年签署的第一阶段协议后很快因疫情和政治因素失效)。短期协议往往是策略性调整,各自缓口气、观望对方意图,并非意味着矛盾解决。

基于这些特征,我们判断当前局势更倾向于短期策略均衡:双方在承受巨大经济代价后各退一步,形成暂时平衡reuters.com,但均衡基础脆弱。类似历史上韩战停战谈判、美苏古巴导弹危机后的默契,都属于策略性均衡:降低即时冲突风险,但并未解决根本对立。

2. 向长期对峙演化的可能:尽管当前是暂时妥协,但若双方结构性矛盾无法调和,博弈可能演化出类似冷战的长期对峙:

-

经贸脱钩升级:贸易战已扩展到金融、科技、人文等领域,呈“全谱系”竞争态势moneycontrol.commoneycontrol.com。Moneycontrol等媒体形容,中美贸易战正演变为**“冷战式对抗”**,不仅经济脱钩,还涉及网络安全、军事联盟等moneycontrol.commoneycontrol.com。如果这一趋势持续,双方将逐步构建各自阵营:美国拉拢盟友“经济北约”排斥中国;中国加强与俄等国合作,并以稀土等资源为筹码巩固自身阵营。这与冷战两极阵营形成颇为相似。

-

意识形态与制度之争凸显:冷战的长期对峙不仅是地缘,也是意识形态之争。当下中美分歧部分体现在政治制度和价值观。拜登政府 framing 了“民主 vs 专制”的全球竞争,美对华警惕已上升到制度层面carnegieendowment.orgcarnegieendowment.org。中国则强调美国遏制是因意识形态偏见。这种叙事一旦固化,双方会更倾向零和思维,减少妥协空间,进入价值观冷战态势。从博弈论看,这使合作策略收益相对降低,背叛收益上升,从而合作均衡更难维持,对抗均衡反而被社会接受为常态。

-

技术与军备竞赛:冷战长期稳定在于双方形成军备竞赛均衡,谁也不敢贸然进攻但也不断积累武力。在中美关系中,如果经贸冲突延伸到军备和太空、网络领域,对峙可能更为牢固。例如中美都强调加强太平洋军事部署,一些事件(台海危机等)可能将经济冲突引向准军事对抗轨道carnegieendowment.orgcarnegieendowment.org。Carnegie报告的“新冷战场景”指出,若发生台海或地区安全危机触发双方安全观转变,中美可能进入全面冷战状态:军事上前沿部署、核武戒备提升,经济上急剧脱钩,意识形态上互视为存亡对手carnegieendowment.orgcarnegieendowment.org。那将是一个全方位对峙的长期均衡,很类似美苏冷战后期的态势。

3. 当前均衡演化方向评估:综上,当前的均衡更像短期策略性停战,但演化走向取决于今后若干关键因素(详见下节)。存在两种主要路径:

-

路径A:反复博弈趋向冷战长期对峙。双方在短暂停战后因结构矛盾再起冲突,且每轮冲突都加深裂痕。经济上逐步脱钩,各自牺牲短期利益换取战略安全,国内进一步敌视对方。最终形成如同冷战般“双寡头对峙”的格局,可能持续多年乃至数十年。这种状态下,博弈均衡由短期的策略算计转变为长期的制度性均衡:双方都接受对抗为常态,不再指望对方让步,策略上以稳定自身阵营和遏制对手为目标。均衡稳定性体现在:即使小的外交互动或经济往来也无法撼动整体对立,除非出现剧变(如一方国力大衰退或政权变更)。

-

路径B:竞争中寻求合作共存的均衡。这是相对乐观的演化:在几轮高强度博弈后,双方认识到零和冲突代价沉重,转而尝试建立新规则。历史上美苏在70年代达成了战略武器限制、大三角外交等,使冷战进入**“松弛对峙”均衡**(即缓和时期)carnegieendowment.orgcarnegieendowment.org。类似地,中美也可能探索“竞争共存”框架,例如就贸易投资制定基本准则,划定可以竞争和必须合作的领域,实现某种**“有限合作-有限对抗”的均衡**。这接近于一种演化妥协均衡:不是回到蜜月期,但也避免全面冷战。其稳定性来自双方都看到了长期对抗的不利,愿意约束部分行为以维持全球稳定。这个路径需要高层战略互信逐步恢复,以及外部压力(如全球经济衰退、共同安全威胁)促使合作。

当前看来,路径A的风险在上升。贸易战期间的一些数据和行动表明新冷战苗头:贸易和投资下降但尚未彻底断绝,双方都有顾虑。carnegieendowment.org指出截至2022年中美贸易额仍创新高,说明相互依存仍在,这可能为路径B提供基础——经济纽带让完全对抗变得不利于双方,从而激励寻找折中均衡carnegieendowment.orgcarnegieendowment.org。然而,如果未来政治上完全被安全考虑压倒经济理性,路径A将更可能出现。

六、均衡破裂或维持的影响因素

无论当前均衡持续时间长短,外部冲击和内在变化都可能使局势跳转到新的均衡态。以下因素值得关注:

-

战略资源与技术依赖格局:中美相互依赖是“双刃剑”。例如稀土领域中国占全球产量70%english.kyodonews.net、加工90%axios.com,美国高科技和军工离不开稀土,因此中国有巨大杠杆。但美国正投入建立国内稀土供应链axios.com、寻求他国供应。如果几年内美国显著降低对中稀土依赖,中国失去这一筹码,均衡将倾向美国更强硬(中国难以通过断供威胁迫使美让步)。反之,在半导体等关键技术上,美国优势大,但中国也在追赶自给。一旦中国突破美国制约实现某些技术自主,或找到替代供应(如从第三国购买被禁技术),美国的制裁杠杆效力下降,可能促使其重新考虑策略。这些供需格局变化会打破原有利益平衡,引发新一轮策略调整。

-

经济承受能力:博弈均衡能否持续,一定程度取决于双方经济耐力。如果一方经济出现严重问题而将部分归因于对抗(例如美国因关税引发高通胀、就业受损,或中国因脱钩导致增长放缓过度),国内压力会推动政策转向合作以缓解经济困难csis.orgcsis.org。当前迹象:美国承受高关税引起的物价上升压力,中国也面临出口下滑和资本外流压力。谁更先难以为继,谁就可能先寻求突破均衡。同时,如果某方经济逆势壮大,可能反而更有底气长期对抗。例如有观点称贸易战令美国每年损失GDP约$3000亿csis.org,长远看这是不可持续的税收。类似冷战中苏联经济崩溃最终迫使其改变路线,中美对峙也存在经济极限约束。

-

国内政治与领导人更替:政治周期往往带来策略变化。例如2024美国大选、2027中国领导换届等都可能改变博弈基调。如果美国出现一位倾向缓和对华的总统(或相反更强硬的),政策将剧烈调整,均衡重新塑造。目前特朗普(或持其路线者)再掌权的可能性存在,而特朗普政府对华态度更为强硬、善用极限施压bloomberg.com。果真如此,当前脆弱均衡可能迅速崩塌,重回高压对抗。而若出现类似70年代尼克松式的人物寻求“连接”,也许会推动进入合作均衡窗口期。中国方面,国内政治对美态度近年来强硬是共识,但若经济下行压力迫使政策层调整优先级,也许会释放缓和信号。政策转向窗口往往在领导人第一任期初或重大会议后,需关注这些契机。

-

盟友和国际环境:中美博弈并非孤立,其他大国和国际组织的行为是重要外部变量。

-

美国盟友:如果美国成功拉起对华“统一战线”,对中国进行经济围堵,中国孤立无援下可能被迫进一步强硬反抗或加速自力更生,走向长期对峙。但若盟友出现分化(如欧盟不愿选边、继续和华贸易),美国对华极端施压难奏效,反而可能促使美国调整策略carnegieendowment.orgcarnegieendowment.org。目前欧盟、日本等既跟随美国限制对华部分技术,又希望保持贸易利益,这种摇摆也在影响均衡稳定。

-

第三方冲突:若发生其他突发危机(朝鲜半岛、南海冲突等)需要中美合作应对,可能临时搁置对抗形成共同利益,比如气候变化、全球金融危机等领域,也可能暂时偏移均衡。相反,如果第三方事件加剧对抗(如中俄关系紧密引发新集团对抗西方),均衡将更对立。台海无疑是最大变数,一旦失控几乎必然终结当前任何经济均衡,中美进入全面军事冷战甚至热战状态carnegieendowment.orgcarnegieendowment.org。

-

历史认知和心理因素:冷战经验表明,误判风险和敌意螺旋会固化冲突均衡。当前中美均试图从历史中找参照——美国部分政界认为对华“绥靖”曾失败,应强硬;中国则强调近代受欺辱史,不再退让carnegieendowment.orgcarnegieendowment.org。这些心理因素会影响策略选择,使让步更难。因此除非认知上出现转变(例如双方精英达成“再斗下去两败俱伤”的共识),否则心理上的安全困境会不断加强对抗均衡的稳定性。

总结:影响均衡演变的因素纷繁,但可以概括为:“硬”因素(经济、技术、军事实力和依赖格局变化)决定了对抗的物质可持续性,而**“软”因素**(政治意愿、认知、外交环境)决定了双方有没有契机跳出现有均衡。当前许多因素似乎在朝不利于长期合作的方向发展(技术脱钩、政治强硬化),这增加了短期均衡破裂的概率和长期对峙的可能性。然而,也存在制约对抗的因素(经济全球化的残余纽带、全球挑战需要合作),这些可能在未来某些时刻迫使双方重新评估战略。

七、未来可能的演化路径

结合上述分析,展望中美博弈的未来,有几条主要演化路径和对应均衡可供假设:

-

路径1:重复博弈陷入“新冷战” – 均衡形态:全面对抗的长期均衡\ 在此场景中,中美经过短暂休战后矛盾再度激化,每一次冲突都扩大范围,直至双方基本断绝高科技往来、贸易大幅减少,形成两个相对独立的经济技术体系,军事上进入持续高戒备状态。正如Carnegie报告描绘的“新(偶有热战)的冷战”场景:安全危机触发双方把彼此视为生存性对手,意识形态和安全竞争凌驾一切carnegieendowment.orgcarnegieendowment.org。在这种格局下:

-

经贸博弈退居次要,成为总体战略对抗的一部分。关税等问题可能永远谈不拢,反而双方都实行近乎敌对的经贸政策(禁运、投资审查、制裁)。

-

均衡稳定性高:双方国内都完成了对长期对抗的动员,社会“习惯”了没有对方的世界,各自的联盟体系提供支持。任何一方单独妥协都会被内部视为投降而不可接受。此时博弈均衡由政治-军事逻辑决定,经济利益让位于安全利益。

-

风险:这种均衡虽然稳定,却存在高风险的吸引域——任何局部事件都可能因为缺少缓冲而滑向直接冲突(如冷战时期多次危机那样)。它也将严重冲击全球经济和多边体系,让世界进入新分裂时期【28†L133-142】。

-

路径2:有限缓和与竞争共存 – 均衡形态:部分合作的动态均衡\ 另一条路径是双方在几番摩擦后痛感代价,选择建立某种“竞合框架”。这类似于美苏在1970年代缓和时期达成的默契:虽然仍竞争,但在军控、贸易上有所协议,避免了更危险的对抗carnegieendowment.org。应用到中美,则可能出现:

-

签订新贸易协定:范围超越2020年第一阶段协议,可能涉及逐步降低关税、规则竞争中建立仲裁机制等,使贸易战有“停战线”。

-

科技隔阂设置护栏:如定义哪些技术可以合作、哪些严格竞争,并避免极端措施(比如对民用科技保持一定交流)。

-

地缘热点管理:双方军方高层保持沟通,防止误判,类似冷战后的危险热线机制。这降低擦枪走火概率,也为经贸关系提供稳定外围环境。

-

均衡特征:这种均衡并非“友好合作”,而更像**“竞争性共存”。双方依然视对方为主要竞争者,但承认对方利益**,不试图彻底削弱对方,而是寻求长期共存之道。其稳定性中等,取决于领导人意志和制度化程度。如有强有力且持续的对话渠道、协议执行监督,则可较长时间维持;但如果遇到大的国际事件或国内政治变化,关系可能再次滑向对抗。

-

路径3:卷入热战或严重冲突 – 均衡破裂,激烈对抗后再重组\ 不能排除最坏情况:均衡被打破引发失控冲突,例如因台湾问题或南海冲突中美发生直接军事对抗。那将不是博弈均衡内的演化,而是均衡本身的崩溃,后果难以估量。大战之后新的均衡可能在战胜-战败格局上重建,但这已超出本文经贸博弈讨论范围。不过需要指出,持续敌对的均衡往往孕育热战危险carnegieendowment.orgcarnegieendowment.org;避免这一结局本身是各方应努力的目标。

当前迹象显示,路径1的新冷战倾向在一些领域浮现(高度脱钩、阵营对立)moneycontrol.commoneycontrol.com;路径2的有限缓和尚未看到明确契机,但并非没有基础(双方经贸仍有巨大共同利益carnegieendowment.org,金融市场、人才流动也难以一夕切断)。未来数年内,一些重要节点(如美国换届、中国经济策略调整等)将是走向路径2或滑向路径1的关键转折。

八、结论

综上分析,2025年中美谈判达成的有限妥协可被解读为中美经贸博弈中的一个短期策略均衡。双方通过各让一步,实现了一次互利但脆弱的平衡。然而,从博弈论视角看,这一均衡并非纳什稳态:双方均有诱因或压力偏离当前策略,且均衡缺乏强有力的自我稳定机制。事实上,正如有分析指出的,此次协议“几乎没有长期解决纷争的迹象”reuters.com,更像是为缓解彼此立即痛苦而达成的临时停战csis.org。

未来的走向很大程度上取决于双方如何应对结构性矛盾:是任由矛盾积累,将博弈推向类似冷战的长期对峙均衡,抑或痛定思痛,在竞争中寻求新的合作共处均衡。冷战的历史教训表明,即使长期对峙均衡一度稳定,最终也会因为不可持续的内耗而瓦解。因此,对中美双方而言,短期策略博弈或许有利于各自战术利益,但从长期理性出发,探索比冷战式对峙更稳定且成本更低的均衡(例如有限竞争+合作领域并存的模式)才符合两国和全球利益。

当然,博弈均衡并非静止,而是会随环境演化。技术进步、经济变化、国际局势、新冠疫情等冲击都可能改变 payoff 结构,从而改变博弈的均衡点。在不确定性加剧的时代,中美关系的博弈更需要双方拿出智慧,避免陷入“囚徒困境”式的次优均衡。正如经典博弈论所示,当重复博弈次数足够长、参与者足够理性时,合作并非不可实现。希望中美双方在经历几轮高强度博弈后,能够识别出新的合作机会窗口,打破目前这一“不稳定均衡”,避免新的冷战长期对峙成为不可逆的自我实现预言carnegieendowment.orgcarnegieendowment.org。

参考文献:

-

Reuters报道,2025年6月11日,《特朗普称中国将供应稀土,美国将允许中国学生入学》reuters.comreuters.com。

-

Medium平台分析文章,Laurel W. (2023)《关税博弈的博弈论解析》medium.commedium.com。

-

Kyodo News共同社,2025年6月10日,《中美高层贸易会谈聚焦稀土》(英文版)english.kyodonews.netenglish.kyodonews.net。

-

CSIS评论,Philip Luck, 2025年5月13日, 《理解中美贸易战的暂时缓和》csis.orgcsis.org。

-

Moneycontrol新闻,2025年4月22日, 《美中贸易战加深,走向冷战式对峙》moneycontrol.commoneycontrol.com。

-

Carnegie Endowment报告, Evan Medeiros等, 2024年10月, 《2030年代的中美关系:共存情景》carnegieendowment.orgcarnegieendowment.org。

-

Carnegie Endowment报告, Stephen Walt等, 2024年10月, 对中美关系的理论视角分析carnegieendowment.orgcarnegieendowment.org。

-

Kornai理论参考:Michael Ellman, 1990, 《The Disequilibrium School and the Shortage Economy》摘要pubs.aeaweb.org(说明体制性短缺状态的自我维持)。

-

-

@ b1ddb4d7:471244e7

2025-06-12 05:01:43

@ b1ddb4d7:471244e7

2025-06-12 05:01:43The latest AI chips, 8K displays, and neural processing units make your device feel like a pocket supercomputer. So surely, with all this advancement, you can finally mine bitcoin on your phone profitably, right?

The 2025 Hardware Reality: Can You Mine Bitcoin on Your Phone

Despite remarkable advances in smartphone technology, the fundamental physics of bitcoin mining haven’t changed. In 2025, flagship devices with their cutting-edge 2nm processors can achieve approximately 25-40 megahashes per second when you mine bitcoin on your phone—a notable improvement from previous generations, but still laughably inadequate.

Meanwhile, 2025’s top-tier ASIC miners have evolved dramatically. The latest Bitmain Antminer S23 series and Canaan AvalonMiner A15 Pro deliver 200-300 terahashes per second while consuming 4,000-5,500 watts. That’s a performance gap of roughly 1:8,000,000 between when you mine bitcoin on your phone and professional mining equipment.

To put this in perspective that hits home: if you mine bitcoin on your phone and it earned you one penny, professional miners would earn $80,000 in the same time period with the same effort. It’s not just an efficiency problem—it’s a complete category mismatch.

According to Pocket Option’s 2025 analysis, when you mine bitcoin on your phone in 2025, you generate approximately $0.003-0.006 in daily revenue while consuming $0.45-0.85 in electricity through constant charging cycles. Factor in the accelerated device wear (estimated at $0.75-1.20 daily depreciation), and you’re looking at losses of $1.20-2.00 per day just for the privilege of running mining software.

Mining Economic Factor

Precise Value (April 2025)

Direct Impact on Profitability

Smartphone sustained hash rate

20-35 MH/s

0.00000024% contribution to global hashrate

Daily power consumption

3.2-4.8 kWh (4-6 full charges)

$0.38-0.57 at average US electricity rates

Expected daily BTC earnings

0.0000000086 BTC ($0.0035 at $41,200 BTC)

Revenue covers only 0.9% of electricity costs

CPU/GPU wear cost

$0.68-0.92 daily accelerated depreciation

Reduces smartphone lifespan by 60-70%

Annual profit projection

-$386 to -$412 per year

Guaranteed negative return on investment

Source: PocketOption

Bitcoin’s 2025 Network: Harder Than Ever

Bitcoin’s network difficulty in 2025 has reached unprecedented levels. After the April 2024 halving event that reduced block rewards from 6.25 to 3.125 BTC, mining became significantly more competitive. The global hash rate now exceeds 800 exahashes per second—that’s 800 followed by 18 zeros worth of computational power securing the network.

Here’s what this means in practical terms: Bitcoin’s mining difficulty adjusts every 2,016 blocks (roughly every two weeks) to maintain the 10-minute block time. As more efficient miners join the network, difficulty increases proportionally. In 2025, mining difficulty has increased compared to 2024, making small-scale mining even less viable.

The math is unforgiving:

- Global Bitcoin hash rate: 828.96 EH/s

- Your smartphone’s contribution: ~0.000000003%

- Probability of solo mining a block: Virtually zero

- Expected time to mine one Bitcoin: Several million years

Even joining mining pools doesn’t solve the economic problem. Pool fees typically range from 1-3%, and your minuscule contribution would earn proportionally tiny rewards—far below the electricity and device depreciation costs.

The 2025 Scam Evolution: More Sophisticated, More Dangerous

Fraudsters now leverage AI-generated content, fake influencer endorsements, and impressive-looking apps that simulate realistic mining activity to entice you to mine bitcoin on your phone.

New 2025 scam tactics include:

AI-Powered Fake Testimonials: Deepfake videos of supposed successful mobile miners showing fabricated earnings statements and encouraging downloads of malicious apps.

Gamified Mining Interfaces: Apps that look and feel like legitimate games but secretly harvest personal data while simulating mining progress that can never be withdrawn.

Social Media Manipulation: Coordinated campaigns across TikTok, Instagram, and YouTube featuring fake “financial influencers” promoting mobile mining apps to younger audiences.

Subscription Trap Mining: Apps offering “free trials” that automatically charge $19.99-49.99 monthly for “premium mining speeds” while delivering no actual mining capability.

Recent cybersecurity research shows that over 180 fake mining apps were discovered across major app stores in 2025, with some accumulating more than 500,000 downloads before being removed.

Red flags that scream “scam” in 2025:

- Apps claiming “revolutionary mobile mining breakthrough”

- Promises of earning “$10-50 daily” from phone mining