-

@ 3a851978:ff85e003

2025-06-10 15:35:43

@ 3a851978:ff85e003

2025-06-10 15:35:43Testing LaTeX support in different Clients

Just testing how it all will be formated

First section

Something inline $k_i$ like that. And other longer stuff below:

$$ \gamma_A = \frac{e^{-R_A}}{\mathrm{Tr}\,e^{-10}},\qquad \delta S = K\delta L $$

The end

-

@ 93bfc86d:fc8e91f5

2025-06-10 15:27:43

@ 93bfc86d:fc8e91f5

2025-06-10 15:27:43질서자유주의가 자유주의 세상을 만드는 방법

안캡의 전략에는 크게 두 가지, 호페의 질서자유주의와 새뮤얼 콘킨 3세의 아고리즘이 있다.

로스바드-호페 라인의 질서자유주의는 논리를 기반으로 자연권을 정당화하고, 이를 통해 국가의 부당함을 설파한다. 미제스의 "인간은 행동한다."라는 제1공리부터 시작해서, 행동의 제1수단인 신체가 그 자신에게 소유되어야 한다는 자기 소유를 증명하고 자연권을 철저하게 연역적으로 정당화해간다. 안캡의 세상을 만들려는 이들의 방법론도 논리적이다.

예를 들어 호페의 『자유주의자는 무엇을 해야 하는가』 책에서는 위로부터의 전환이 불가능함에 따라 아래로부터의 전환을 해야 한다는 주장이 나온다. 과거에는 이런 자유로운 세상이 도래하기 위해서는 왕 한 명이 "앞으로 자기가 원하는 대로 보안 기업을 자유롭게 선택하고, 더 이상의 강제는 없다!"라고 선언만 하면 됐다. 따라서 왕 한 명만 어떻게 설득을 하거나, 압박을 하든 주리를 틀든 일단 왕이 이렇게 선언하게 하기만 하면 됐다. '마그나 카르타'도 결국 귀족 연합이 왕 한 명을 압박해 왕이 서명했던 것 아닌가?

반면에 현대 민주주의 사회를 보자. 대한민국에서 대통령 한 명이 최저임금을 폐지할 수 있는가? 최저임금은 헌법에 보장되는데(헌법 32조) 따라서 이를 폐지하는 것은 거의 개헌만큼이나 어렵다. 대통령이나 국회의원 과반이 발의를 해야 하고, 국회에서 재적 3분의 2 이상이 찬성해야 겨우 통과되며, 이렇게 통과해도 국민투표에서 과반수가 동의해야 겨우 없어지는 것이다. 즉, 거의 불가능에 가깝다.

따라서 호페는 위로부터의 전환이 불가능함에 따라 전국적인 중앙 정부의 투표를 거부할 것을 제안한다. 대통령 선거나 국회의원 선거 등 말이다. 여기서 중앙 정부 단위의 투표를 거부하는 이유는 중앙 정부의 부당성도 있지만, 이 투표를 통해 세상을 바꾸는 게 현실성이 없어서 그렇다.

같은 맥락에서 지역 선거의 투표는 항상 거부하는 건 아닌데, 자유주의자들이 한 국가 전체에서 과반을 얻는 것은 불가능하지만, 한 지역에 점점 몰리는 경우에는 적어도 그 지역에서는 과반이 될 수도 있기 때문이다. 따라서 아주 작은 지역에서 자유주의자들이 다수결이 된다면 적어도 그 지역에 한해서는 위로부터의 전환이 가능해진다. 그러면 투표를 거부하다가 지역구에서 본격적으로 투표를 하기 전에 선행되어야 할 일은 자유주의가 많이 퍼지고, 자유주의를 지지하는 사람들이 특정 지역에 몰리기 시작해야 하는 것일 것이다. 비트코이너들이 특정 지역에 몰려 시타델을 건설하는 상황을 생각하면 될 것 같다.

그 이후에는? 지역구의 대표로 선출된 인물이 해당 지역구의 투표권을 재산 소유자에게 재산 크기(지분)대로 다시 분배해야 한다. 즉, 재산이 없는 사람은 투표권이 없다. 모든 공공 인프라(도로, 수도, 전기, 교육, 치안, 사법 등등)는 전부 주식으로 판매되어 민영화된다(지방 정부는 이를 통해 재원을 마련한다). 이에 따라 공공 인프라는 완전히 사적 소유로 전환된다. 치안, 사법, 교육 모두 민간 영역으로 전환된다.

현재 세계에서 자유주의자들이 이런 관점을 취한다면 무엇을 해야 할까? 일단 자유주의를 더 많은 사람에게 퍼뜨려야 한다. 또한, 자유주의자들이 모일 지역을 물색해야 할 것이다. 그리고 중앙 정부 단위의 투표를 거부해야 할 것이다.

그림 1. 질서 자유주의의 상징인 아나코 캐피탈리즘 깃발

현대 민주주의 투표의 부당함

아고리즘의 전략을 이야기하기 전에 먼저 현대 민주주의 투표의 부당함에 대해 살펴보고 가자. 개인적인 생각도 들어가 있다.

투표 행위 자체는 유권자의 권리 행사로 전혀 나쁠 것이 없다. 다수결의 원칙도 당연히 마찬가지다. 투표 당사자들이 다수결의 원칙에 동의하기 때문에 참여하는 것이기 때문이다. 그래서 민주주의는 선거에서 져도 그 결과에 승복하는 것이 그 시스템의 규칙이다. 예를 들어 주주총회에서 주주들이 지분대로 의결권을 행사하거나 행사하지 않아서 생기는 결과는 그 행위 자체로는 전혀 문제가 없다.

투표의 정당성은 투표라는 행위 자체로부터 판단되는 것이 아니라 그 투표가 어떤 시스템 아래서 이뤄지는 투표인지로부터 판단해야 한다. 나는 두 가지 관점에서 살펴볼 것이다.

현대 민주주의의 투표는 유권자가 자신의 권리를 당선자에게 위임하는 행위다. 한 후보가 당선되면 다수결의 원칙에 따라서 그 후보는 그 후보를 찍지 않은 유권자들의 권리까지 모두 가져간다. 여기까지는 문제가 없다. 투표 행위 참여자들이 다수결의 원칙이라는 그 시스템에 동의하기 때문에 투표하기 때문이다.

그런데 현대 민주주의는 당선된 후보가 그 후보에게 투표했든, 투표하지 않았든, 기권을 했든 간에 다른 사람의 소유권을 마음껏 유린할 수 있는 권한도 가져간다. 이건 아주 큰 문제다. 국회의원이 세금을 늘리는 입법 권한을 행사하거나, 대통령이나 국회에서 예산을 편성해 정부 지출을 늘리고, 돈을 찍어내서 사람들의 소유권을 유린하는 행위가 용인된다.

어떤 사람도 다른 사람의 소유권을 침해할 수는 없다. 소유권은 단순히 희소한 재화의 분배 문제를 해결하는 실용적 대안이라서 중요한 것이 아니다. 인간 행동이라는 공리로부터 자기 소유 원칙을 이끌어내고, 그가 소유한 신체와 삶을 써서 획득한 재화(원초적 점유)에 대한 소유권을 보장하는 것이며, 그리고 이미 소유권이 있는 재화를 교환의 양 당사자가 자유롭게 교환하는 행위를 보장하는 것이다.

따라서 소유권은 인간에게 이성이 있다는 존엄성의 표현이자 인간 시간(삶)의 희소성과 귀중함을 인정하는 것이다. 어느 누구도 이를 모독할 권리는 없다. 이를 침해하는 것은 보편 원리에 따라 그 자신의 소유권도 포기한다는 뜻과 같으며, 이는 결국 자기 신체의 자기 소유도 부정하는 셈이 된다.

현대 민주주의에서 투표하는 것은 다른 누군가의 소유권을 유린할 사람을 뽑는 것과 같다. 애초에 이런 권한은 누구에게도 주어지지 않았으며 당연히 누구에게도 없으니 넘겨줄 수도 없는 권한이다.

현대 민주주의의 삼권분립 체제는 당선자에게 이러한 강탈의 권한이 보장된다. 설령 후보자가 이런 권한을 행사하지 않는다고 하더라도 이 시스템이 그러한 권한을 발동할 수 있다는 것을 언제든지 보장한다면 이러한 시스템은 폐기되어야 한다.

따라서 현대 민주주의에서 투표하는 행위는 누군가가 이러한 권한을 행사하는 것에 대한 동의로 간주될 수 있다. 어떤 후보가 이런 행위를 다른 후보보다 '덜' 한다고 해서 그 후보에 투표하는 것에 대한 정당성은 당연히 확보될 수 없다. 더하는지 덜하는지에 따라 이 약탈이 정당화될 수는 없기 때문이다.

심지어 어떤 후보가 이런 약탈 행위를 절대 안 할 것이라고 공언한다고 해도, 시스템에 이러한 권한이 보장되어 있는 이상 투표하는 행위는 이 시스템에 동의하는 행위이다. 그 후보가 당선된 이후 갑자기 돌변해 세금을 걷거나 국채를 팔아 예산을 확보하고 돈을 찍어내는 것이 시스템 상에서는 문제가 없기 때문이다. 이것은 간접 민주주의의 단점이라기 보다는, 애초에 이런 다른 사람에 대한 약탈 권한을 행사할 수 있는 시스템 자체가 잘못된 것이다.

현대 민주주의가 부당한 두 번째 이유는 이 시스템에 동의하지 않는 사람들조차 이 시스템의 피해자가 된다는 점이다.

도박에 참여하고 있는 사람들을 생각해보자. 승리자가 나머지 베팅한 모든 사람들의 베팅 금액을 약탈하는 것은 전혀 문제가 되지 않는다. 왜냐하면 도박 참여자들은 패배 시 자신이 베팅한 재산이 승자에게 몰수될 수도 있다는 것에 동의하고 도박에 참여하기 때문이다(따라서 이는 약탈이 아니다). 이에 동의하지 않는다면 도박을 그만하면 된다. 도박사는 언제든지 도박을 그만둘 자유가 있다.

그러나 현대 민주주의는 이 시스템에 동의하지 않더라도 그 나라에서 태어났다는 이유만으로 이러한 약탈에 강제 당할 수밖에 없다. '분배'하기 위해 투표를 할 거면 그 시스템에 동의하는 사람들끼리 서로의 재산을 놓고 분배하면 될 일이다. 그러나 이 시스템은 모든 사람들에게 이 시스템에 참여하는 것이 강제된다.

즉, 이 시스템은 애초에 잘못된 시스템인데 이 안에서 좌니 우니, 대통령제니 내각제니 사람들이 서로 경쟁하게 한다. 시스템 자체에 대한 의문을 품기는 매우 어려운 구조다.

이 시스템이 마음에 안 들면 이민을 가면 된다고 하는 주장은 전혀 설득력이 없다. 이민에 비용이 들고 다양한 현실적인 제약이 있다는 것은 차치하고서 이야기해보자. 만약 이러한 분배(?) 혹은 세금의 권한 행사자가 해당 지역 토지의 소유자고, 그 토지의 사용자가 소유자가 정한 분배 규칙에 동의하는 조건으로 토지를 사용한다면 이러한 세금과 같은 분배는 약탈은 아니다. 사용자가 그 규칙에 자발적으로 동의했으므로 정당화될 수 있는 것이다.

만약 국토의 모든 땅이 사실상 소유자가 있는 게 아니라, 사실상 국가의 소유이며 국가가 국민들에게 사용권을 나눠주는 것이라는 미친 주장을 해도(참고로 이건 토지의 사적 소유권을 부정하는 공산주의다!) 여전히 이 주장은 정당하지 않다.

토지의 소유권을 획득하는 방법은 두 가지가 있는데 첫째, 소유권이 없는 땅을 점유함으로써 소유권을 주장할 수 있게 되는 것, 둘째, 이미 소유권이 있는 토지를 자발적인 교환이나 기부를 통해 획득하는 것이다. 소유권이 있는 생산 수단을 통해 생산된 생산물도 소유권이 인정되는데, 토지는 생산이 불가능하니(우주정거장 같이 새로운 공간을 건설하는 게 아니라면...) 토지를 획득하는 방법은 언급한 두 가지 뿐이다.

그런데 현대 국가가 토지를 소유한 것의 기원을 살펴보자. 식민지화를 통해 강제로 점유하는 것은 대한민국은 해당이 없는 것 같다. 그러면 이미 소유자가 있는 사유지를 각종 규제와 사용 제한을 통해 사실상의 지배권을 확보하거나, 세금으로 축적한 재정으로 구입한 것이다. 그 기원이 모두 약탈에 있다는 점에서 국가의 토지 소유는 정당하지 않다.

따라서 규칙이 싫으면 이민을 가면 된다는 주장은 도둑이 도둑질을 하는데, 도둑질을 당하기 싫으면 멀리 도망가라는 식의 궤변과 같다.

그러나 국가의 계약은 완전히 비자발적이다. 단지 그 신체가 어디서 탄생했다는 이유만으로 그 시스템에 동의한 것이 될 수는 없다. 갓 태어난 아기는 다른 사람의 보호가 있어야만 생존할 수 있다는 점에서 완전히 비자발적인데, 이에 따라 당연히 탄생의 위치도 완전히 비자발적인 것이었기 때문이다.

또한 국가는 국토의 소유자가 아니다. 그보다는 국토의 소유권을 보장'해야' 하는 존재일 뿐이다. 누군가가 규칙을 정하고 싶다면 그 규칙의 영향권은 자신의 사유지 내에서만 영향력이 있으며, 당연히 그 규칙에 자발적으로 동의하는 사람들만 그 사유지를 이용하는 조건으로 계약할 수 있다.

정리해보자. 지금까지 현대 민주주의의 투표의 부당함에 대해 두 가지 관점에서 살펴봤다. 첫째는 투표가 약탈이 가능한 이 시스템에 동의한다는 행위라서 부당하다는 것이고, 둘째는 이 시스템에 동의하지 않는 사람들까지 약탈의 대상이 되는 이 시스템에 동의한다는 행위이므로 부당하다는 것이었다.

투표하지 않는 행위가 혹시 반대 세력이 활개치게 두게 되는 것은 아닐까? 그렇지 않다. 투표하지 않는 행위는 이 시스템의 정당성을 약화시킨다. 현대 민주주의의 큰 속임수가 있다. 민주주의에서 비롯된 통치 행위는 51%를 넘은 사람들이 그 통치 행위에 동의했기 때문에 자행되어도 된다는 매우 비논리적인 주장에 입각하고 있다. 이는 당연히 정당성이 없다. 그런데 진짜 큰 속임수는 그 통치 행위에 동의한 사람이 심지어 과반도 아니라는 것이다.

만약 어떤 후보가 생산에 적대적인 수준의 세금 부과와 보편 복지, 최저임금 인상 등의 모두가 고통받는 정책을 공약으로 내세워 당선이 되었다고 해보자. 해당 후보의 득표율이 51%라고 한다면 이는 전국의 51% 국민이 해당 후보를 지지하는 것과 같은 착각을 일으킨다. 그렇지 않다. 만약 투표율이 75%라면, 해당 후보에 동의한 사람은 0.75 x 0.51 = 38%가 된다. 즉, 38%의 동의로 인해 모든 사람이 함께 고통 받게 되는 것이다.

그래서 민주주의는 이러한 사실을 감추면서 사람들에게 투표를 독려할 수밖에 없다. 투표율이 조금만 낮아져도 이에 대한 정당성이 심각하게 낮아지기 때문이다. 투표율이 50%인 상황에서 어떤 후보가 51%의 표를 얻어 당선된다면 전 국민의 25%의 지지로 당선된 것과 같은데 이는 통치 행위에 대한 정당성을 매우 약화시킨다.

소비자 주권 행사

그러면 투표라는 행위가 없다면 일반 시민들은 어떻게 주권을 행사할 수 있을까? 사실 우리는 매일매일 자발적으로 투표를 하고 있다. 바로 미제스가 말한 '소비자 주권' 행사다.

우리는 기업들이 우리에게 어떤 효용을 주는지에 따라 계속 투표한다. 어떤 기업을 살리고, 어떤 기업을 죽일지, 어떤 기업을 거지 기업에서 부자 기업으로 만들지, 또는 어떤 기업을 부자 기업에서 거지 기업으로 만들지 투표한다. 바로 '소비'를 통해서 말이다.

이러한 소비라는 투표 방식은 완전히 자발적이라는 점에서 소유권을 제대로 보장한다. 약탈과는 완전히 동떨어진 행위다.

또한, 이러한 투표 방식은 각자가 원하는 대로 효용을 누릴 수 있다. 사법과 치안도 시장의 영역으로 들어오면 우리는 어떤 규칙 아래서 살아갈지 자유롭게 선택할 수 있다. 즉, 내가 선택한 규칙이 다른 사람에게도 강제되지 않고, 다른 사람이 선택한 규칙이 나에게 강제되지도 않는다. 서로 다른 규칙이 충돌하면 그 규칙들의 간극을 중재하는 기업이 나타난다. 자연적으로 질서가 꽃 피는 것이다.

생산 권한은 기업에게 달려있지만 심판은 소비자가 한다. 생산자가 소비자의 의지에 반하는 생산을 하면 바로 시장에서 퇴출되기 때문이다. 기업은 소비자에게 어떤 도덕적 의무를 강요할 수도 없다. 기업은 소비자가 원하는 것이 있다면 생산할 뿐이다. 소비자는 기업에게 자신들이 원하는 것을 최대한 효율적으로 자원을 분배하여 생산할 것을 명령하고 생산 권한을 위임하는 셈이다. 그 기업이 소비자가 원하는 것을 생산하지 않으면 어차피 다른 어떤 기업이 생산하여 거기서 챙길 수 있는 소비자의 표, 즉 이익을 가져갈 것이다.

만약 '소비'라는 투표 행위 자체에 반대한다면 오지에 있는 땅을 사서 문명을 떠나 자급자족하며 사는 것도 가능하다. 각자가 자신만의 방식으로 삶을 선택할 수 있는 것이다.

이 투표 시스템에서 표는 돈이다. 돈으로 투표를 한다는 것이 비인간적으로 느껴질지도 모르겠다. 그러나 돈으로 투표하는 것은 지극히 인간적인데, 그 투표권을 얻기 위해서는 먼저 다른 사람들이 원하는 것을 해줘서 그 표를 얻어야 하기 때문이다. 소비하려면 먼저 생산해야 한다. 이건 완전히 약탈 없는 시스템이고, 모든 인간 시간에 대한 존중이다.

이러한 이유들로 나는 이제 현대 민주주의에 대한 투표를 거부하지만, 동시에 매일 소비를 통해 투표하고 있다.

아고리즘이 자유주의 세상을 만드는 방법

이제 아고리즘의 전략을 살펴보자. 로스바드-호페의 질서 자유주의를 살펴본 뒤, 현대 민주주의의 투표에 대한 부당함을 살펴본 것이 뜬금 없는 이야기는 아니었는데, 아고리즘은 이러한 이유로 어떠한 투표도 거부하기 때문이다. 아고리즘의 창시자인 새뮤얼 콘킨 3세가 로스바드와 갈라선 것도 로스바드가 정치와 연대하는 전략적 행보를 보이면서부터였다.

아고리즘은 자유로운 세상을 만들기 위해 자유 시장인 아고라를 적극 활용할 것을 주장한다. 이들은 정부가 추적할 수 없는 자유로운 암시장을 확대해서 정부의 힘을 약화시키는 방법을 써야 한다고 주장한다. 이 암시장은 당연히 무기, 마약, 성매매 등을 포함한 시장을 말한다.

그래서 자유지상주의를 도래시키기 위한 이들의 전략은 정부가 추적할 수 없는 시장을 만들고, 하나의 병렬 경제(대항 경제)를 만들어 정부의 힘을 지속적으로 약화시키는 것이다. 이들은 납세 거부 운동, 투표 거부 운동을 장려하며 암시장과 암호 기술을 적극 활용한다. 참고로 사이퍼펑크 같은 기술 자유주의는 분류하자면 질서자유주의보다 아고리즘 쪽에 더 가깝다(로스 울브리히트의 실크로드를 생각해보자...!)

로스바드-호페의 질서자유주의와 콘킨의 아고리즘은 둘 다 자유지상주의의 실현을 목표로 하지만, 질서자유주의는 논리적으로 윤리적 정당성을 확보하고, 그러한 정당성을 바탕으로 자유지상주의를 실현시키기 위해 현실 세계에 이미 존재하는 제도들도 전략적으로 이용한다. 반면 콘킨의 아고리즘은 자유지상주의의 윤리적 정당성보다는 그걸 도래시키기 위한 전략들에 치중하며, 정치와 절대 타협하지 않고, 전략적으로 이용하려고도 하지 않는다. 목표는 같지만 서로 다른 방법을 취하는 것이다.

1980년 공개된 콘킨의 「신 자유주의자 선언」은 미제스와 로스바드, 르페브르에 대한 감사로 시작하지만, 1장에서 다음과 같은 문구도 나온다. (이것도 언제 다 번역해봐야겠다!)

"처음 나타난 반격은 ... 개혁주의—국가주의를—'개선'하겠다는 명분으로 국가의 직책을 받아들이는 것까지 포함한다!—이 모든 반反 원칙들에 대해서... 그중 가장 끔찍한 것은 '정당주의'인데, 이는 자유지상주의적 목적을 국가주의적 수단, 특히 정당을 통해 달성하려는 반反 개념이다. '자유지상주의' 정당은 국가가 이제 막 출현한 자유지상주의자들에게 퍼부은 두 번째 반격이었다. 처음에는 터무니 없는 모순으로, 그 다음에는 침략군으로 등장했다."

로스바드가 1992년 공화당 경선 후보였던 팻 뷰캐넌을 공개적으로 지지했을 때(이때 공화당 경선에서 뷰캐넌은 아버지 부시한테 졌고, 대선은 민주당 빌 클린턴 승리), 콘킨이 어떤 반응을 보였을지 상상해보자. 저런 선언문을 썼는데 말이다. 콘킨은 로스바드가 자유지상주의 원칙을 저버렸다면서 자신이 편집하는 잡지 『신 자유지상주의자』에서 로스바드의 행위를 "자유의 원칙을 포기한 행위"라고 비난했다.

반면 로스바드는 소수의 자유지상주의 지식인들만으로는 자유지상주의 사회를 건설할 수 없으므로 대중과 연합해야 한다고 주장했다. 팻 뷰캐넌 같은 인물을 통해 중산층이나 노동계층의 지지를 얻을 수 있고, 자유지상주의 목표를 달성할 수 있다고 했다. 이때 나온 전략이 자유주의적 경제 질서와 보수적 문화 질서를 결합한 '팔레오 자유지상주의'다. 로스바드는 아고리즘 세력에게 순수성만을 강조하며 현실 세계와 단절된 사람들은 무기력한 이상주의자들이라고 반박하며, 자신은 국가주의를 지지하는 게 아니라 그 세력 안에 있는 반국가적 잠재력을 이끌어내는 것이라고 했다.

그림 2. 아고리즘의 깃발

질서자유주의와 아고리즘의 공동체적 배제에 관한 입장 차이

콘킨의 아고리즘과 로스바드-호페 라인의 질서자유주의의 차이는 정치 같은 기존 제도들을 전략적으로 이용할 수 있는지뿐만 아니라 공동체적 배제에 관한 입장에서도 약간 갈라진다.

자유주의에서는 자유로운 수용과 자유로운 '배제'도 보장되어야 한다. 즉, 예를 들어 어떤 사람이 장사를 하는데 동성애자나 흑인이나 채식주의자를 직원이나 손님으로 받지 않는 것도 장사하는 사람의 자유로운 배제 권리라는 것이다. 자신의 사유지에 어떤 사람을 들일지, 들이지 않을지는 전적으로 소유자의 몫이다. 그리고 여기서 배제는 당연히 폭력으로 이어지지 않는 선에서의 자유로운 배제다.

이러한 배제가 한 공동체 전체로 퍼졌다고 해보자. 지금은 동성애자에 대한 예시만 들겠다(필자는 동성애에 대해 부정적 감정이 전혀 없으니 동성애자 분들은 오해 마시길). 만약 한 지역 소유자 공동체 전체가 동성애자에 대한 배제를 주장한다면 당연히 동성애자는 그 공동체에 들어갈 수가 없다.

여기서 이를 다루는 뉘앙스가 약간 다른데, 호페는 이를 자유로운 계약에 의한 공동체적 질서의 탄생이라 보며 긍정적으로 본다. 물론 절대로 이러한 배제가 폭력으로 이어져서는 안 된다. 폭력으로 이어지면 비침해성 공리 위반이므로 정당성이 없다.

아고리즘은 개인들의 자발적인 배제는 자유지만, 이것이 공동체적 배제로 발전하고 구조적 차별이나 집단적 억압으로 발전하는 건 국가의 또 다른 형태일 뿐이라 생각하여 이를 경계한다. 그래서 개인 차원의 자율적 배제는 정당하지만, 공동체 차원의 배제는 경계한다. 그렇다고 이걸 없애야 한다 이런 건 아니다(개인들의 자유로운 배제가 공동체 배제로도 이어질 수 있는 것이므로). 콘킨은 공동체적 배제가 탄생할 수 있지만 그것이 비합리적인 배제라면 대안 시장이 탄생할 것으로 본다. 동성애자들을 위한 시장과 마을이 생길 것이고, 비합리적인 배제는 이러한 고객들을 놓친 것에 대한 손실로 이어질 것이라고 본다. 즉, 모든 개인이 자유 시장 아고라에서 자발적으로 교환할 권리를 가져야 하며, 차별적인 배제들은 시장 안에서 경쟁할 수 있을 거라 본다. 만약 대안 시장이 없는 상황에서 모두가 배제한다면 이는 실질적 강제처럼 작동할 수 있기 때문이다.

자유지상주의 안에서 콘킨의 아고리즘은 차별이나 수용을 대하는 태도에서 좀 더 좌파적인 것처럼 보인다. 실제로 콘킨의 「신 자유주의자 선언」에 등장하는 용어들도 약간 그러한 뉘앙스가 있다. 콘킨은 전통적인 좌파 단어들을 전략적으로 차용했다. 예를 들면 혁명, 착취, 해방운동, 불복종, 저항, 암시장, 아나키즘 등의 단어다. 당연히 전통적인 좌파 단어의 뜻과는 완전히 다르다. 혁명은 아고라를 통한 "비정치적" 자유주의 혁명을 의미하며, 착취는 마르크스의 자본가가 노동자를 착취한다고 했던 그 착취가 아니라, 국가주의와 결탁한 크로니 자본주의자들의 제도적 진입장벽을 만들고, 캉티용 효과의 수혜를 누리는 그러한 오염된 자본주의자들이 하는 것을 착취라고 했다(아고리즘은 국가에 의존하지 않는 기업가와 국가로부터 특혜를 받는 착취적 기업가를 구분한다. 선언문 참고).

정리하자! 로스바드-호페의 질서 자유주의와 콘킨의 아고리즘의 차이점은 다음과 같다.

로스바드-호페의 질서 자유주의는 정치 등을 전략적으로 이용하는 것을 허용한다. 로스바드는 공화당 경선 후보를 공개적으로 지지하여 우파 사람들로부터 자유지상주의에 대한 관심을 끌려고 했고, 호페는 전국단위의 투표나 정당 활동은 거부해도 지역 단위의 투표는 승리 가능성에 따라 조건부로 허용한다. 반면 아고리즘은 어떠한 정치 활동도 거부하며 오직 국가의 통제로부터 동떨어진 자유로운 시장에 의한 혁명을 추구한다.

얼마 전에 있었던 비트코이너들이 보수 우파 스페이스에 들어가서 비트코인에 대해 전파하는 걸 상상해보면 쉽다. 우파 국가주의자들은 국가 시스템에 의한 문제 해결을 강력한 지도자가 등장해 모든 것을 해결해줘야 한다는 잘못된 방법론에 빠져있는 경우가 많은데(문제를 더 큰 문제로 해결하려는 셈...), 누군가는 이걸 보고 저런 사람들과 협력하면 안 된다고 할 것이고, 누군가는 비트코인과 자유주의를 전파하기 위해 그래도 가능성이 높은 이들 사회에 섞여들어가 이야기도 하고, 전파도 하려고 할 것이기 때문이다.

또한 한 가지 차이점은 질서 자유주의와 아고리즘 모두 공동체적 배제는 인정하나, 질서 자유주의는 이를 자유로운 계약에 의해 등장한 공동체적 질서로 보고, 아고리즘은 공동체적 배제가 집단적 억압으로 발전할 것을 경계한다. 아고리즘에서는 비합리적 차별에 의한 배제는 대안 시장이 생겨 극복될 수 있다고 본다.

자유주의 세상을 만들기 위해서는 어떻게 해야 하는가

이제 무엇이 옳은지 스스로 판단해보자. 지금부터는 개인적인 생각이 매우 많이 들어가있으므로 주의하라.

콘킨의 아고리즘은 암시장의 확대를 노려 정부 권한을 약화시키려 하지만 이는 대중의 지지를 얻기 어렵다. 또한, 이러한 병렬 경제는 한 곳에 집중되기 어렵고 넓고 약하게 퍼져있을 수밖에 없다.

로스바드-호페의 질서자유주의는 현실에 이미 존재하는 제도들을 전략적으로 활용한다. 현실적으로 대중의 지지를 얻을 가능성이 있고, 한 지역에 자유주의자들이 집중되면 적어도 그 지역에서는 지역 투표를 통해 위로부터의 전환이 가능하다. 하나의 자유지상주의적인 지역이 좋은 모범이 되면 다른 지역도 채택할 가능성이 커진다.

어떤 전략을 택해야 하는가? 나는 자유지상주의가 도래하게 하기 위해서는 두 전략 다 써야 한다고 생각한다. 질서자유주의자들의 주장대로 대중의 지지 없이는 자유지상주의가 도래하게 할 수 없다. 대한민국에 있는 "진짜" 비트코이너+자유지상주의자들이 대략 몇 명쯤 될까? 높게 잡아 1,000명 정도 된다고 해보자. 이들 전부가 특정 지역에 모인다고 해도 자유지상주의 질서를 건립할 수는 없다. 찾아보니 대한민국에서 인구가 가장 적은 시가 충남 계룡시라고 한다. 여기 인구는 약 4만3천 명인데, 여기에 51% 공격을 가하려고 해도 적어도 4만 명이 필요하다는 뜻이다. 따라서 아고리스트들처럼 대중의 지지를 얻기 위한 전략을 완고하게 거부하다간 어떠한 힘도 얻지 못하고 선민 의식에만 갇힐 수 있다.

반면 아고리스트들의 주장대로 병렬 경제도 필요하다. 잘 세뇌된 대중은 폭력 집단의 강탈이 있어야만 사회가 유지될 수 있다는 환상에 사로잡혀있다. 병렬 경제는 이러한 환상을 깨뜨릴 좋은 수단이다. 정부 추적이나 제3자 없이 부의 보존이 가능하고, 당사자끼리의 직접 결제가 가능하다는 것을 사람들이 경험하면 생각이 크게 바뀔 것이다. 비트코인으로 결제를 해본 사람과 한 번도 해본 적 없는 사람은 이런 자유지상주의 세상에 대한 이해의 폭이 다를 수밖에 없다. 또한, 비트코인은 개인들에게 큰 힘이 되는데 국가 시스템의 폭력으로부터 개인들이 생산 가치를 지킬 수 있는 강력한 방패이자 동시에 무기가 되기 때문이다.

그러나 아고리즘의 주장인 병렬 경제 중 특히 암시장 전략—국가의 통제가 미치지 않는 무기, 마약, 성매매 등을 확장하는 것—에는 동의하지 않는다. 당연히 자유지상주의자인 나는 총기나 마약, 성매매 등도 자발적인 계약에 의해 시장에서 더 건전하게 다뤄질 수 있다고 생각한다. 지금처럼 불법화되어있는 사회와 다르게 자유시장에서는 마약의 순도나 안정성에 대해 인증해주는 기관, 의사들도 등장할 것이고, 성매매도 비슷한 방식으로 질서화될 수 있다고 생각한다. 혹은 이러한 시장은 시간 선호를 지나치게 높이고 전통적인 가족 질서를 해칠 수 있으므로 공동체적 배제가 일어날 수도 있다. 무기, 마약, 성매매는 일반 대중들이 생각하는 '질서'와는 거리가 있다. 우리는 더 많은 사람들을 끌어들여야 하는데 이는 처음에 일단 거부감을 일으킬 수 있다.

따라서 자극적인 암시장보다는 사람들의 반감이 없는 상품들을 먼저 비트코인으로 거래하고, 국가가 추적하지 못하게 함으로써 납세 거부의 물결이 퍼지게 해야 한다. 동시에 더 많은 사람들에게 자유주의를 전파해야 한다. 더 많은 개인과 비트코인을 통한 병렬 경제라는 두 가지 무기가 함께 생겨야 지역 단위에서의 자유주의 세상을 만들 수 있을 것이다. 먼저 자유주의를 많은 사람들에게 전파해야 한다. 이 과정에서 좌파, 맑시즘, 케인지언들보다는 상대적으로 자유에 대한 이해가 좀 더 있는 집단인 우파 국가주의자들이나 기독교적 종교관을 가진 사람들 속에 섞여 들어가 거기서 전파를 할 수도 있다. 이러한 과정을 통해 자유주의자들이 많아지고, 한 지역에 모여야 한다. 비트코인이라는 무기를 가진 개인들이 한 지역에 모여 자유로운 시장을 형성하면, 호페가 말했던 것처럼 그 지역에서의 투표를 통해 작은 자유지상주의 세상을 만들 수 있다.

그림 3. 자유주의 세상을 만들기 위해서는 두 전략을 적절히 함께 써야 한다.

-

@ 8bad92c3:ca714aa5

2025-06-10 15:02:34

@ 8bad92c3:ca714aa5

2025-06-10 15:02:34Key Takeaways

In this episode, Bram Kanstein delivers a powerful exploration of how studying money for thousands of hours led him to a single, life-changing conclusion: Bitcoin is the key to preserving value and reclaiming personal agency in an increasingly unstable world. Through the lens of a disillusioned millennial generation—raised with technological optimism but betrayed by economic reality—Bram exposes the fiat system as one built on illusion, debt, and diminishing returns. He explains how Bitcoin’s transparent, rule-based design offers a principled alternative, especially for those wired to question systems and seek truth. Describing the fiat economy as a “high-velocity trash system” that undermines innovation and long-term planning, he argues Bitcoin creates the time and space to think, build, and live freely. As AI reshapes the labor market, Bram sees Bitcoin as a vital foundation for individuals to adapt, maintain sovereignty, and thrive in a future defined by rapid technological disruption.

Best Quotes

“Anything that you would want to fix in the world is broken because the money is broken.”

“You’re stacking nothing. Literal paper.”

“You have to red pill before you orange pill.”

“The only thing you need to do is move to the other money that they cannot mess with.”

“One Bitcoin is one Bitcoin. That’s the whole point.”

“Millennials are primed to understand Bitcoin.”

“Bitcoin lets you get out of the rat race and start walking your own path.”

“The fiat mindset is a zero-sum game. In Bitcoin, value is created.”

“We should stop asking how to value Bitcoin—and start asking how to value everything else in Bitcoin.”

“Even with a master’s in economics, people still don’t understand what money is.”

Conclusion

This episode delivers a powerful call to rethink everything we assume about money, arguing that understanding Bitcoin is less about profit and more about reclaiming personal agency in a world defined by uncertainty. Bram Kanstein shows how asking fundamental questions—like “What is money?”—can lead to a deeper sense of purpose and autonomy. As AI and systemic instability accelerate, Bitcoin emerges not just as sound money, but as a life tool for intentional living, long-term thinking, and individual sovereignty.

Timestamps

0:00 - Intro

0:36 - INTJ bitcoiners

4:58 - The millennial headspace is primed for bitcoin

7:25 - Bitcoin gives time and space to build

15:29 - Fold & Bitkey

17:05 - Seeing systemic problems

26:25 - Bitcoin’s positive feedback loop

33:55 - Recognize your agency

37:58 - Unchained

38:27 - Fiat money creates uncertainty

44:41 - What is money?

54:04 - Money and energy

1:03:43 - Bitcoin allows growth

1:09:02 - Bitcoin/AI

1:31:34 - Optimistic noteTranscript

(00:00) Let's say you're a millennial and mid-30s and you want to retire in 30 years. If you calculate the amount of dollar, pound the euro, yen units. You need way more units of that money than you think right now. They are funding pension funds, but the pension funds are using that money for the people that are actually retiring.

(00:17) No one knows about money. They don't know how debt works, how finance works. But that's kind of how it's designed, right? Like that's what eventually keeps the Ponzi alive. And I just started with the question, what do you think happens if you call the bank and say like, hey, can I get 100 or 200k in cash? Man, you got an editor like in house.

(00:39) That's That's pro. That's uh it's because this setup I'm so far away from the computer. I just need somebody to hit the button. Okay. Okay. the extent the extent of of Logan's job extends far beyond just hitting the button. But yeah, INTJ I think uh I think it was as we rear into what looks to be another bull market.

(01:05) I think getting back to first principles and discussing the challenges of studying and understanding Bitcoin, it's important to to highlight the archetype of individuals who have studied fallen down the rabbit hole and really dedicated their lives to Bitcoin. And this INTJ cohort that exists within Bitcoin seems pretty material apparently. Yeah.

(01:35) I mean, I have many moments where I just realize that I'm lucky that my brain is wired in a certain way, you know. I feel like crazy blessed that I figured out this Bitcoin thing, you know, and that when I ran into certain realizations along the way in my Bitcoin journey that I was like, hm, you know, how does this actually work? you know, do I actually understand the systems I'm participating in, the things that I believe, you know, the the the the people that I abstracted um or or outsourced certain responsibilities to to take care of, for example, my money

(02:10) in the bank. You know, I I think um being wired in a certain way definitely helps in grasping Bitcoin to a degree where you're like, okay, this is the only thing I need to pay attention to, you know, in my life. And yeah, we we jokingly started talking about this because I have the hat here, but there was this um I think it was like like a Twitter poll actually or someone shared it on Twitter and this is already like two or three years old where where someone investigated these MyersBriggs um personality types and I think there's

(02:42) only like 2% of people that have INTJ but like 20% of Bitcoiners have that personality type. So it um it apparently helps. So yeah, I just I just quickly Googled it actually. It says uh the INTJ is the architect. It's a personality type with the introverted intuitive thinking and judging traits. These thoughtful tacticians love perfecting the details of life, applying creativity and rationality to everything they do.

(03:09) I think the rationality part here is what um what uh I think helps you to to gro Bitcoin eventually. Yeah, it reminds me of I forget what the study was, but postco it was a similar distribution of just like 2% of people were highly skeptical of what was going on with the lockdowns and the attack on bodily autonomy.

(03:38) And there was a study that was done about I forget it was bees or some type of fly that they they have like the horde of um the horde of the particular fly I think it was bees has like 2% act as these sort of alarm bells that are on the outside the outskirts of the community and they'll start communicating like hey something's wrong here and people the other flies or bees will be skeptical at first but then eventually uh the alarm bells will be proven to be right that there was some sort of danger around the corner. That's fascinating.

(04:09) Yeah. Yeah, that's fascinating. I I think we're not that special eventually, you know, like we think we have all this autonomy, but but um yeah, we're we're just wired in a certain way. And I think I don't know where you want to take this conversation, but I think, you know, part of growing up and being an adult is figuring out, you know, how do I actually work and how do I work with how I work, you know? Yeah. No, it is.

(04:36) And as I get older, creep into my mid-30s, which is hard hard to come to grips with, it is uh really falling back on like, all right, I I feel like I have a good perspective on the world and my place in it, and how do I just optimize to make sure I'm aligning my my work and my career, I guess, if you call it that, with what I'm passionate about. Yeah.

(05:00) Well, I also think that is actually why our generation, you know, my my podcast is Bitcoin for millennials. I think uh the millennials are primed to understand Bitcoin. You know, we are in this life phase where big things happen, you know, starting a family or settling somewhere or or making big career moves or decide Yeah.

(05:25) like deciding what am I going to spend like the next 10 20 years on and uh I think it's an interesting phase actually I I don't know how that was for you but but for me like the the 30s were really where I dove more and more into Bitcoin like got got that stronger conviction and also yeah kind of was invited to go further down that that rabbit hole you know and like how I see it now is that that Bitcoin is really the foundation for the rest of my life, you know, like it it gives me time and space to look forward and enthusiasm, you know, like I sometimes lurk on the

(06:01) millennial subreddit, you know, or the finance sub subreddit. And many people in our generation are very nihilistic, you know, they're very unsure about the future. Like some people aren't even having kids because they think they cannot afford it, you know. And uh whenever I read that, I just think like, yeah, I I don't really have those things.

(06:22) But I know it's because of Bitcoin, you know. I I know that Bitcoin gives me, yeah, like I said, the time and space to figure out what's next, like what should I focus on? Like it gives time and space to to try out stuff, to build something, you know, to to to really attempt at at doing something. Where I see many people that don't see that, they are more in the consumer type, you know, like they they just spend the money that's worth the most today, you know, like that's what they're incentivized to do. Yeah.

(06:49) And is is that why you started Bitcoin for millennials is to number one put the put the message out there. Millennials come listen to this. One of you Yes. that is trying to educate you about this. But because this is something I think about a lot is somebody's like dead smack in the middle of the millennial generation and has observed many of the things you just described in my own life, my own network.

(07:13) And that's part of the reason why this podcast exists. And um what I'm trying to do at TFTC is just try to figure out a way to reach into the minds of millennials, hopefully c -

@ 9ca447d2:fbf5a36d

2025-06-10 15:02:14

@ 9ca447d2:fbf5a36d

2025-06-10 15:02:14El Salvador – June 3, 2025 — The grassroots Bitcoin community of El Salvador is proud to announce the return of Bitcoin Week, taking place this November with five dynamic events celebrating Bitcoin adoption, education, and community-led innovation.

Join us for a week of inspiration, collaboration, and impact.

Bitcoin Week 2025 calendar

📍 November 12 – Bitcoin Education Celebration Gala: Kick off the week in style with a luxurious and intimate evening at a high-class dinner, celebrating “proof of work” and the achievements of the Bitcoin education movement.

Expect major plans for the year(s) ahead but also a reflection to past proof-of-work—and don’t miss out on the Great Grassroots Giveaway, included with every ticket.📍 November 13 – Bitcoin Educators Unconference: Hosted for the third time in San Salvador at Cadejo Montaña, this sixth edition of the Educators Unconference embodies our commitment to provide a space for decentralized, community-led conversations.

Join educators and leaders shaping the global Bitcoin conversation!📍 November 14–15 – Adopting Bitcoin: The Network Effect: Now in its fifth year, Adopting Bitcoin returns with a powerful focus on real-world Bitcoin usage across global communities.

This year’s theme—The Network Effect—explores how interconnected local initiatives can spark exponential growth in adoption.📍 November 16 – Visit Bitcoin Beach, El Zonte: Make your way to Bitcoin Beach, the heart of El Salvador’s Bitcoin story. Enjoy a day of connection and discovery in this iconic beachside town. Full details coming soon.

📍 November 22–23 – Economía Bitcoin, Berlín: Head to the town of Berlín, El Salvador for the second edition of Economía Bitcoin, a powerful, small-scale conference and festival focused on circular economies and practical Bitcoin use.

Spend sats freely in town and see how local action drives global impact.With five unique events across three regions in Bitcoin Country, this edition of Bitcoin Week is your chance to experience El Salvador’s Bitcoin journey up close. Whether you’re an educator, builder, Bitcoiner, or simply curious—you’re invited.

Join us this November. Be part of the movement.

-

@ 5eaeca3b:75c1954f

2025-06-10 13:25:41

@ 5eaeca3b:75c1954f

2025-06-10 13:25:41Ingredienti:

Olio EVO di qualità, Peperoncino, Aglio (possibilmente fresco), Spaghetti (di qualità). Per la variazione: Menta (ho usato foglie di menta marocchina) e formaggio pecorino.

Procedimento:

Ho usato (come si vede nella foto in alto) pasta "La Molisana" che ha 14 minuti di cottura, quindi appena l'acqua bolle occorre salarla e buttare la pasta. Poi, in una padella, far riscaldare un fondo di olio EVO e quando è caldo far imbiondire 2/3 spicchi di aglio tagliati a pezzi e il peperoncino (si può usare quello fresco oppure quello secco tritato). Quando l'aglio comincia ad imbiondire, aggiungere la mentuccia e un mestolo di acqua di cottura (come in foto)

Togliere la padella dal fuoco e lasciare risposare. Appena il tempo di cottura è trascorso tirare gli spaghetti dall'acqua e metterli in padella e farli saltare leggermente. attendere qualche istante in modo che la temperatura della pasta si abbassi (non deve raffreddarsi ma semplicemente perdere un po' di calore affinché il formaggio che andiamo ad aggiungere non faccia grumi ma diventi una bella crema...) e quindi aggiungere il pecorino grattato e saltare bene.. se vediamo che si asciuga troppo aggiungere poca acqua di cottura e continuare a spolverare di pecorino e saltare in padella. Così da ottenere una fantastica cremosità...

Buon appetito!

Un piccolo trucco: ho aggiunto anche uno spicchio (molto piccolo) di aglio spremuto. Perchè non risulti troppo aggressivo ho messo una foglia di mentuccia sotto allo spremiaglio.. (vedi sotto in foto)

-

@ 623893fc:f8e3eaad

2025-06-09 22:32:00

@ 623893fc:f8e3eaad

2025-06-09 22:32:00testing something

-

@ efc2b6e5:99c53c19

2025-06-10 09:12:13

@ efc2b6e5:99c53c19

2025-06-10 09:12:13AI companies massively influence society by projecting their values on ML models, whether we want it or not. It'd be great if at least some people in the companies knew how exactly they influence society, could make certain predictions, or even make ML models themselves predict users' worldviews and some of their behavior.

Some might argue that AI systems already do something like that. I believe they could do it much better: chatbots could be more balanced in terms of security (they are definitely overcensored) and recommender systems, for instance, could contribute to healthy personal and collective transformations (rather than just competing in ability to steal users' attention and trap it in the echo chambers).

Reductionism is an obstacle in AI development

Even most reliable knowledge doesn't solve some of the problems that are already in demand. Even least reliable knowledge still may contain something useful for our problems. While we lack reliable and noncontradictory knowledge, we can still benefit from certain synthesis of working ideas. There's approach that makes it possible to look at the knowledge from a very broad perspective, do such synthesis, and benefit from emergent properties of the synthesis.

Integral (Meta-)Theory created by Ken Wilber is probably the best known attempt to enable the possibility to form and navigate the big picture understanding in a hope to address issues of the epoch we've recently entered.

IMO it has certain challenges that make it repellent to IT:

- Fundamental psychological theories on which the Integral Theory is based are still pretty fragile; they need time to become mature enough and recognized (while it doesn't look like we have that time). There are endless edit wars on Wikipedia, which makes me feel depressing about possibilities to even introduce Spiral Dynamics and Multiple Intelligences to IT people.

- Emphasis on controversial interpretations of certain arational states of consciousness.

It's hard to address the first challenge; however, I recently discovered a new “secularized” Non-Reductionist Philosophy launched by David Long, which, among other things, uses wisdom from Integral Theory and attempts to address the second challenge. I'm glad that there are people who don't just criticize the Integral Theory, its community and Wilber's positions but are also developing the new meta-theories.

NR can also be a good way to get familiar with other meta-theories, so one could choose whatever works the best for their problems. For instance, if you're working on something as exotic as some competitor to EEG-powered meditation device, perhaps you will find Integral Theory relevant to study as well, since it's more focused on the states.

I'd like to point out a couple of moments I noticed in the video "Why Non-Reductionism Is A Better Meta-Theory" that caught my attention, as well as in some other older videos. There's not much to comment on the content itself rather than on the form of the content. This feedback might be used for improvements/elaborations in the next videos and just for everyone curious about the new meta-theory. But first

Why do I post here?

Specifically for the deep topics that relate to the current epoch, I no longer find engaging in the YouTube/FB/Reddit/Diqus/Giscus/etc. discussions useful anymore, at least due to broken and almost omnipresent AI-based censorship, that keeps “improving” at randomly shadow-banning people. How many deep and valuable opinions we no longer see?

BTW, it's possible to create Reddit-like communities here at Nostr as well, using Satellite client for example. I believe it's a better place for NR, Rebel Wisdom and many others.

References to full materials used for criticism

There are curious clips with Wilber in the video. It'd be great to have links in the description (or at least titles of the full videos if it's copyrighted material) so viewers could easier form their own independent opinions. I find it important during the age of information overload and narrative warfare. This will also improve SEO.

Emergentism FAQ

There's a strong position on emergence of consciousness; it seems it's not even a hypothesis in NR and I guess that makes some people so reactive.

I think it would be great to have an FAQ page to possibly make future debates more ecological and fruitful. Some of the things that could be elaborated in the FAQ:

- importance of distinction between philosophical theory (inductive reasoning? or actually deductive reasoning? I'm confused here) and scientific theory (deductive reasoning)

- the fact that for now counterarguments usually fall into the categories of “ignorance fallacy”, “false equivalency fallacy” and “God of the gaps” which aren't something sufficient; the whole point of challenge was to find at least a logically valid counterposition (ideally a counterposition that is sound with currently available scientific facts), not the nitpicking attacks

- what kind of emergence is meant, is it important here at all and why.

Debates moderation

Probably most of the debates converge to consensus, which are fruitful anyway. There are a few interesting conflicting debates as well. However, I found this specific conflicting debate with Matt Segall quite exceptional.

Matt's position was not understood. He was more interested in a dialogue rather than debates and I think it would be more productive. However, in this specific case, my guess is it would literally take hours to just figure out the common language on a certain concept he mentions.

My humble guess is that a combination of negotiator and moderator with a strong perceiving personality type (if typologies work at all) could be a step to more meaningful and ecological dialogues in the future. But such negotiator/moderator should also be skilled enough to reflect most challenging parts using more “rational language” as best as possible. These people are rare. Basically I mean the style of dialogues that happened between theoretical physicist David Bohm and Indian philosopher Jiddu Krishnamurti: IMO these were the talks where both sides at some point were barely transcending limitations of their languages and focusing more on intuition in order to understand each other. Much fuzzier and spontaneous dialogues, which aren't prematurely limited by too harsh rationality. Similar thing (with shorter periods of negotiation) could be combined with debating as well.

I hope NR community will be open to understanding more perspectives and won't end up turning into something like a cold and scary crystallization of rational arrogance; that would be damaging and quite opposite to the healthy intentions of the whole project.

Final thoughts

I like the clarity and density of the presented ideas in the video, the choice of lines of development in the map and the alternative to the Integral Methodological Pluralism. I like the mentioned interpretation of “free” will, very much resonates with how I personally interpret it. Tritone-ish devilish sounds in the cons sections is a nice aesthetic choice as well.

I guess there's a lot to learn from NR, no matter what positions we hold on the “rational spirituality” and that sort of stuff. Just to avoid projections and misunderstandings: I'm at a neutral position to all of the NR, Integral and Metamodernism; what any of these philosophies claim to be somehow naive and unhealthy doesn't necessarily match my own positions.

Thank you David Long for launching this philosophy and the movement; I'm looking forward to the next videos!

I'd appreciate reposts and all this as well, thanks!

-

@ b1ddb4d7:471244e7

2025-06-10 15:01:54

@ b1ddb4d7:471244e7

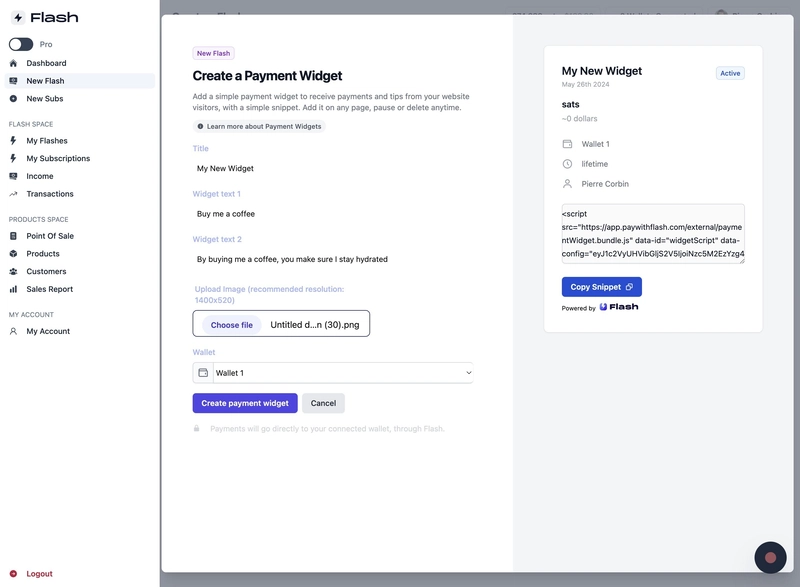

2025-06-10 15:01:54The latest AI chips, 8K displays, and neural processing units make your device feel like a pocket supercomputer. So surely, with all this advancement, you can finally mine bitcoin on your phone profitably, right?

The 2025 Hardware Reality: Can You Mine Bitcoin on Your Phone

Despite remarkable advances in smartphone technology, the fundamental physics of bitcoin mining haven’t changed. In 2025, flagship devices with their cutting-edge 2nm processors can achieve approximately 25-40 megahashes per second when you mine bitcoin on your phone—a notable improvement from previous generations, but still laughably inadequate.

Meanwhile, 2025’s top-tier ASIC miners have evolved dramatically. The latest Bitmain Antminer S23 series and Canaan AvalonMiner A15 Pro deliver 200-300 terahashes per second while consuming 4,000-5,500 watts. That’s a performance gap of roughly 1:8,000,000 between when you mine bitcoin on your phone and professional mining equipment.

To put this in perspective that hits home: if you mine bitcoin on your phone and it earned you one penny, professional miners would earn $80,000 in the same time period with the same effort. It’s not just an efficiency problem—it’s a complete category mismatch.

According to Pocket Option’s 2025 analysis, when you mine bitcoin on your phone in 2025, you generate approximately $0.003-0.006 in daily revenue while consuming $0.45-0.85 in electricity through constant charging cycles. Factor in the accelerated device wear (estimated at $0.75-1.20 daily depreciation), and you’re looking at losses of $1.20-2.00 per day just for the privilege of running mining software.

Mining Economic Factor

Precise Value (April 2025)

Direct Impact on Profitability

Smartphone sustained hash rate

20-35 MH/s

0.00000024% contribution to global hashrate

Daily power consumption

3.2-4.8 kWh (4-6 full charges)

$0.38-0.57 at average US electricity rates

Expected daily BTC earnings

0.0000000086 BTC ($0.0035 at $41,200 BTC)

Revenue covers only 0.9% of electricity costs

CPU/GPU wear cost

$0.68-0.92 daily accelerated depreciation

Reduces smartphone lifespan by 60-70%

Annual profit projection

-$386 to -$412 per year

Guaranteed negative return on investment

Source: PocketOption

Bitcoin’s 2025 Network: Harder Than Ever

Bitcoin’s network difficulty in 2025 has reached unprecedented levels. After the April 2024 halving event that reduced block rewards from 6.25 to 3.125 BTC, mining became significantly more competitive. The global hash rate now exceeds 800 exahashes per second—that’s 800 followed by 18 zeros worth of computational power securing the network.

Here’s what this means in practical terms: Bitcoin’s mining difficulty adjusts every 2,016 blocks (roughly every two weeks) to maintain the 10-minute block time. As more efficient miners join the network, difficulty increases proportionally. In 2025, mining difficulty has increased compared to 2024, making small-scale mining even less viable.

The math is unforgiving:

- Global Bitcoin hash rate: 828.96 EH/s

- Your smartphone’s contribution: ~0.000000003%

- Probability of solo mining a block: Virtually zero

- Expected time to mine one Bitcoin: Several million years

Even joining mining pools doesn’t solve the economic problem. Pool fees typically range from 1-3%, and your minuscule contribution would earn proportionally tiny rewards—far below the electricity and device depreciation costs.

The 2025 Scam Evolution: More Sophisticated, More Dangerous

Fraudsters now leverage AI-generated content, fake influencer endorsements, and impressive-looking apps that simulate realistic mining activity to entice you to mine bitcoin on your phone.

New 2025 scam tactics include:

AI-Powered Fake Testimonials: Deepfake videos of supposed successful mobile miners showing fabricated earnings statements and encouraging downloads of malicious apps.

Gamified Mining Interfaces: Apps that look and feel like legitimate games but secretly harvest personal data while simulating mining progress that can never be withdrawn.

Social Media Manipulation: Coordinated campaigns across TikTok, Instagram, and YouTube featuring fake “financial influencers” promoting mobile mining apps to younger audiences.

Subscription Trap Mining: Apps offering “free trials” that automatically charge $19.99-49.99 monthly for “premium mining speeds” while delivering no actual mining capability.

Recent cybersecurity research shows that over 180 fake mining apps were discovered across major app stores in 2025, with some accumulating more than 500,000 downloads before being removed.

Red flags that scream “scam” in 2025:

- Apps claiming “revolutionary mobile mining breakthrough”

- Promises of earning “$10-50 daily” from phone mining

- Requirements to recruit friends or watch ads to unlock withdrawals

- Apps that don’t require connecting to actual mining pools

- Testimonials that seem too polished or use stock photo models

- Apps requesting permissions unrelated to mining (contacts, camera, microphone)

The 2025 Professional Mining Landscape

To understand why, consider what professional bitcoin mining looks like in 2025. Industrial mining operations now resemble high-tech data centers with:

Cutting-edge hardware:

- Bitmain Antminer S23 Pro: 280 TH/s at 4,800W

- MicroBT WhatsMiner M56S++: 250 TH/s at 4,500W

- Canaan AvalonMiner A1566: 185 TH/s at 3,420W

Infrastructure requirements:

- Megawatt-scale power contracts with industrial electricity rates

- Liquid cooling systems maintaining 24/7 optimal temperatures

- Redundant internet connections ensuring zero downtime

- Professional facility management with 24/7 monitoring

For a small operation, you might need at least $10,000 to $20,000 to buy a few ASIC miners, set up cooling systems, and cover electricity costs. These operations employ teams of engineers, maintain relationships with power companies, and operate with margins measured in single-digit percentages.

2025’s Legitimate Mobile Bitcoin Strategies

While it remains impossible to mine bitcoin on your phone profitably, 2025 offers exciting legitimate ways to engage with bitcoin through your smartphone:

Lightning Network Participation: Apps like Phoenix, Breez, and Zeus allow you to run Lightning nodes on mobile devices, earning small routing fees while supporting bitcoin’s payment layer.

Bitcoin DCA Automation: Services enable automated dollar-cost averaging with amounts as small as $1 daily. Historical data shows $10 weekly bitcoin purchases consistently outperform any mobile mining attempt by 1,500-2,000%.

Educational Mining Simulators: Legitimate apps like “Bitcoin Mining Simulator” teach mining concepts without false earning promises. These educational tools help users understand hash rates, difficulty adjustments, and mining economics.

Stacking Sats Rewards: Apps offering bitcoin rewards for shopping, learning, or completing tasks.

Lightning Gaming: Bitcoin-native mobile games where players can earn sats through skilled gameplay, with some players earning $10 monthly.onfirm that even the most optimized mobile mining setups in 2025 lose money consistently and predictably.

The Bottom Line

When you mine bitcoin on your phone fundamental economics remain unchanged: it’s impossible to profit. The laws of physics, network competition, and energy efficiency create insurmountable barriers that no app can overcome.

However, 2025 offers unprecedented opportunities to engage with bitcoin meaningfully through your smartphone. Focus on education, legitimate earning opportunities, and strategic investment rather than chasing the impossible dream of phone-based mining.

The bitcoin community’s greatest strength lies in its commitment to truth over hype. When someone promises profits to mine bitcoin on your phone in 2025, they’re either uninformed or deliberately misleading you. Trust the mathematics, learn from the community, and build your bitcoin knowledge and holdings through proven methods.

The real opportunity in 2025 isn’t to mine bitcoin on your phone—it’s understanding bitcoin deeply enough to participate confidently in the most important monetary revolution of our lifetime. Your smartphone is the perfect tool for that education; it’s just not a mining rig.

-

@ cae03c48:2a7d6671

2025-06-10 15:01:33

@ cae03c48:2a7d6671

2025-06-10 15:01:33Bitcoin Magazine

Investment Holding Company Belgravia Hartford Capital Makes First Bitcoin Purchase as Part of Treasury StrategyBelgravia Hartford Capital Inc. (CSE:BLGV) announced that it has made its first Bitcoin acquisition as part of the company’s Bitcoin treasury strategy as well as other corporate developments.

JUST IN: Publicly traded investment holding company Belgravia Hartford announces its first Bitcoin purchase for its reserves

pic.twitter.com/TUfPCvGuBk

pic.twitter.com/TUfPCvGuBk— Bitcoin Magazine (@BitcoinMagazine) June 9, 2025

The company confirmed the purchase of 4.86 BTC for USD $500,000 at an average price of $102,848 per BTC. The move follows a previously announced $5 million credit facility with Round13 Digital Asset Fund L.P., from which Belgravia has drawn its first full tranche.

“We are very pleased to have entered the market at this time,” stated CEO of Belgravia Mehdi Azodi. “Belgravia and Round 13 DAF will continue to monitor the Facility and our holdings of BTC as we move into the anticipated active Summer for Belgravia, cryptocurrencies and BTC in particular.”

Belgravia also reported a CAD $44.1 million non-capital tax loss after filing its 2023 return. This loss can be carried forward for up to 20 years. The company is now working with advisors to explore ways to monetize the tax asset to support its Bitcoin treasury strategy and overall balance sheet.

“Belgravia’s accounting, legal and business advisors are exploring a number of options and opportunities in order to monetize this CAD $44 million Non-Capital Loss for the benefit of shareholders and further strengthen our balance sheet to match our stated BTC treasury strategy,” Azodi stated.

The adoption of Bitcoin as a treasury reserve asset has dramatically increased over the course of the last year, expanding globally. To date, there are 226 companies and other entities with Bitcoin in their balance sheets.

Last week, Know Labs, Inc. (NYSE American: KNW) also announced the adoption of a Bitcoin treasury strategy, starting with 1,000 Bitcoin as part of a deal with Goldeneye 1995 LLC and Ripple Chief Risk Officer Greg Kidd, who is the CEO and Chairman of the Board of Directors of Know Labs. The Bitcoin will represent about 82% of Know Labs’ $128 million market cap at a BTC price of $105,000.

“I’m thrilled to deploy a Bitcoin treasury strategy with the support of a forward-looking organization like Know Labs at a time when market and regulatory conditions are particularly favorable,” said Mr. Kidd. “We believe this approach will generate sustainable growth and long-term shareholder value.”

JUST IN: Know Labs, Inc. announces its adopting a Bitcoin Treasury Strategy and holds 1,000 Bitcoin

pic.twitter.com/NSn2xFZYx0

pic.twitter.com/NSn2xFZYx0— Bitcoin Magazine (@BitcoinMagazine) June 6, 2025

This post Investment Holding Company Belgravia Hartford Capital Makes First Bitcoin Purchase as Part of Treasury Strategy first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ b1ddb4d7:471244e7

2025-06-09 17:02:03

@ b1ddb4d7:471244e7

2025-06-09 17:02:03Jason Lowery’s thesis, Softwar: A Novel Theory on Power Projection and the National Strategic Significance of Bitcoin, reframes bitcoin not merely as digital cash but as a transformative security technology with profound implications for investors and nation-states alike.

For centuries, craft brewers understood that true innovation balanced tradition with experimentation—a delicate dance between established techniques and bold new flavors.

Much like the craft beer revolution reshaped a global industry, bitcoin represents a fundamental recalibration of how humans organize value and project power in the digital age.

The Antler in the Digital Forest: Power Projection

Lowery, a U.S. Space Force officer and MIT scholar, anchors his Softwar theory in a biological metaphor: Bitcoin as humanity’s “digital antler.” In nature, antlers allow animals like deer to compete for resources through non-lethal contests—sparring matches where power is demonstrated without fatal consequences. This contrasts sharply with wolves, who must resort to violent, potentially deadly fights to establish hierarchy.

The Human Power Dilemma: Historically, humans projected power and settled resource disputes through physical force—wars, seizures, or coercive control of assets. Even modern financial systems rely on abstract power structures: court orders, bank freezes, or government sanctions enforced by legal threat rather than immediate physical reality.

Lowery argues this creates inherent fragility: abstract systems can collapse when met with superior physical force (e.g., invasions, revolutions). Nature only respects physical power.

Bitcoin’s Physical Power Engine: Bitcoin introduces a novel solution through its proof-of-work consensus mechanism. Miners compete to solve computationally intense cryptographic puzzles, expending real-world energy (megawatts) to validate transactions and secure the network.

This process converts electricity—a tangible, physical resource—into digital security and immutable property rights. Winning a “block” is like winning a sparring match: it consumes significant resources (energy/cost) but is non-destructive.

The miner gains the right to write the next page of the ledger and collect rewards, but no participant is physically harmed, and no external infrastructure is destroyed.

Table: Traditional vs. Bitcoin-Based Power Systems

Power System

Mechanism

Key Vulnerability

Resource Cost

Traditional (Fiat/Banking)

Legal abstraction, threat of state force

Centralized points of failure, corruption, political change

Low immediate cost, high systemic risk

Military/Economic Coercion

Physical force, sanctions

Escalation, collateral damage, moral hazard

Very high (lives, capital, instability)

Bitcoin (Proof-of-Work)

Competition via energy expenditure

High energy cost, concentration risk (mining)

High energy cost, low systemic risk

Softwar Theory National Strategic Imperative: Governments Are Taking Notice

Lowery’s Softwar Theory has moved beyond academia into the corridors of power, shaping U.S. national strategy:

- The Strategic Bitcoin Reserve: Vice President JD Vance recently framed bitcoin as an instrument projecting American values—”innovation, entrepreneurship, freedom, and lack of censorship”. State legislation is now underway to implement this reserve, preventing easy reversal by future administrations.

- Regulatory Transformation: The SEC is shifting from an “enforcement-first” stance under previous leadership. New initiatives include:

- Repealing Staff Accounting Bulletin 121 (SAB 121), which discouraged banks from custodying digital currency by forcing unfavorable balance sheet treatment.

- Creating the Cyber and Emerging Technologies Unit (CETU) to develop clearer crypto registration/disclosure rules.

The Investor’s Lens: Scarcity, Security, and Asymmetric Opportunity

For investors, understanding “Softwar” validates bitcoin’s unique value proposition beyond price speculation:

-

Digital Scarcity as Strategic Depth: Bitcoin’s fixed supply of 21 million makes it the only digital asset with truly inelastic supply, a programmed scarcity immune to political whims or central bank printing.

This “scarcity imperative” acts as a natural antidote to global fiat debasement. As central banks expanded money supplies aggressively (Global M2), bitcoin’s price has shown strong correlation, acting as a pressure valve for inflation concerns. The quadrennial “halving” (latest: April 2024) mechanically reduces new supply, creating built-in supply shocks as adoption grows. * The Antifragile Security Feedback Loop: Bitcoin’s security isn’t static; it’s antifragile. The network strengthens through demand: * More users → More transactions → Higher fees → More miner revenue → More hashpower (computational security) → Greater network resilience → More user confidence.

This self-reinforcing cycle contrasts sharply with traditional systems, where security is a cost center (e.g., bank security budgets, military spending). Bitcoin turns security into a profitable, market-driven activity. * Institutionalization Without Centralization: While institutional ownership via ETFs (like BlackRock’s IBIT) and corporate treasuries (MicroStrategy, Metaplanet) has surged, supply remains highly decentralized.Individuals still hold the largest share of bitcoin, preventing a dangerous concentration of control. Spot Bitcoin ETFs alone are projected to see over $20 billion in net inflows in 2025, demonstrating robust institutional capital allocation.

The Bitcoin Community: Building the Digital Antler’s Resilience

Lowery’s “Softwar” theory underscores why bitcoin’s decentralized architecture is non-negotiable. Its strength lies in the alignment of incentives across three participant groups:

- Miners: Provide computational power (hashrate), validating transactions and securing the network. Incentivized by block rewards (newly minted BTC) and transaction fees. Their physical energy expenditure is the “muscle” behind the digital antler.

- Nodes: Independently verify and enforce the protocol rules, maintaining the blockchain’s integrity. Run by users, businesses, and enthusiasts globally. They ensure decentralized consensus, preventing unilateral protocol changes.

- Users: Individuals, institutions, and corporations holding, transacting, or building on bitcoin. Their demand drives transaction fees and fuels the security feedback loop.

This structure creates “Mutually Assured Preservation”. Attacking bitcoin requires overwhelming its global, distributed physical infrastructure (miners/nodes), a feat far more complex and costly than seizing a central bank’s gold vault or freezing a bank’s assets. It transforms financial security from a centralized liability into a decentralized, physically-grounded asset.

Risks & Responsibilities

Investors and policymakers must acknowledge persistent challenges:

- Volatility: Bitcoin remains volatile, though this has decreased as markets mature. Dollar-cost averaging (DCA) is widely recommended to mitigate timing risk.

- Regulatory Uncertainty: While U.S. policy is increasingly favorable, global coordination is lacking. The EU’s MiCAR regulation exemplifies divergent approaches.

- Security & Custody: While Bitcoin’s protocol is robust, user errors (lost keys) or exchange hacks remain risks.

- Environmental Debate: Proof-of-Work energy use is scrutinized, though mining increasingly uses stranded energy/renewables. Innovations continue.

Jason Lowery’s “Softwar” theory elevates bitcoin from a financial instrument to a socio-technological innovation on par with the invention of the corporation, the rule of law, or even the antler in evolutionary biology. It provides a coherent framework for understanding why:

- Nations like the U.S. are looking to establish bitcoin reserves and embracing stablecoins—they recognize bitcoin’s role in projecting economic power non-violently in the digital age.

- Institutional Investors are allocating billions via ETFs—they see a scarce, secure, uncorrelated asset with antifragile properties.

- Individuals in hyperinflationary economies or under authoritarian regimes use bitcoin—it offers self-sovereign wealth storage immune to seizure or debasement.

For the investor, bitcoin represents more than potential price appreciation. It offers exposure to a fundamental reorganization of how power and value are secured and exchanged globally, grounded not in abstract promises, but in the unyielding laws of physics and mathematics.

Like the brewers who balanced tradition with innovation to create something enduring and valuable, bitcoin pioneers are building the infrastructure for a more resilient digital future—one computationally secured block at a time. The “Softwar” is here, and it is reshaping the landscape of p

-

@ cae03c48:2a7d6671

2025-06-10 15:01:31

@ cae03c48:2a7d6671

2025-06-10 15:01:31Bitcoin Magazine

Japan’s ANAP Holdings Launches Full Bitcoin Business Strategy with Goal of Over 1,000 BTC by August 2025ANAP Holdings, Inc. (3189: Tokyo Standard Market) has officially announced the launch of its “Bitcoin Business” in a formal corporate filing, detailing an entry into Bitcoin focused operations across treasury, finance, fashion, and mining.

JUST IN: fashion brand

JUST IN: fashion brand  ANAP, previously purchased 102.9 BTC, goes into FULL #bitcoin Treasury Strategy mode and aims for 1,000+ BTC by August 2025.

ANAP, previously purchased 102.9 BTC, goes into FULL #bitcoin Treasury Strategy mode and aims for 1,000+ BTC by August 2025. They have raised capital to increase their treasury, including an in-kind investment of 584.9135 BTC, which would bring their… pic.twitter.com/k6L8snzmtY

— NLNico (@btcNLNico) June 9, 2025

In a statement signed by President and CEO Yuta Sawaki, the company confirmed that its consolidated subsidiary ANAP Lightning Channel will lead the initiative, with plans to hold more than 1,000 BTC by August 2025. “We aim to strengthen our balance sheet by acquiring Bitcoin in stages as a strategic reserve asset,” the company said.

The company’s pivot toward Bitcoin is rooted in a belief that the asset, like gold, represents a global store of value amid rising inflation and macroeconomic instability. “Bitcoin is a decentralized digital currency… called ‘digital gold’ for its scarcity and durability, and is gaining attention as a store of value,” the document states.

A significant portion of the strategy includes a planned in-kind capital contribution of 584.9135 BTC from Capital T Coin Co., Ltd., scheduled for July 2025. This builds on ANAP’s prior acquisition of 102.9 BTC, bringing its total to 687.8136 BTC, pending shareholder approval on July 18. The group aims to reach 1,000 BTC through further purchases.

Beyond treasury accumulation, the group’s Bitcoin Business will also encompass:

-

A Bitcoin trading desk targeting both institutional and retail participants.

-

A Bitcoin x Fashion/Lifestyle division, which will develop Bitcoin-themed apparel and premium consumer goods.

-

A Bitcoin mining-related business offering software, consulting, and operational support.

As part of its capital strategy, ANAP is executing a ¥7.625 billion Debt-to-Equity Swap (DES) in July 2025, with contributions from stakeholders including Net Prize GK, Q.L.Land, and Tiger Japan Investment.

“Through the in-kind contribution from Capital T Coin, we will strategically hold Bitcoin within the group,” the company wrote. “We aim to maintain a low-cost position with an average acquisition fee of approximately 0.3% including market and spread costs.”

With global institutional interest rising, ANAP’s pivot may position it as a pioneer among Asian consumer brands adopting Bitcoin as a reserve asset and innovation platform.

This post Japan’s ANAP Holdings Launches Full Bitcoin Business Strategy with Goal of Over 1,000 BTC by August 2025 first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

-

@ 623893fc:f8e3eaad

2025-06-09 22:27:16

@ 623893fc:f8e3eaad

2025-06-09 22:27:16testing some top secret business

-

@ cae03c48:2a7d6671

2025-06-10 15:01:27

@ cae03c48:2a7d6671

2025-06-10 15:01:27Bitcoin Magazine

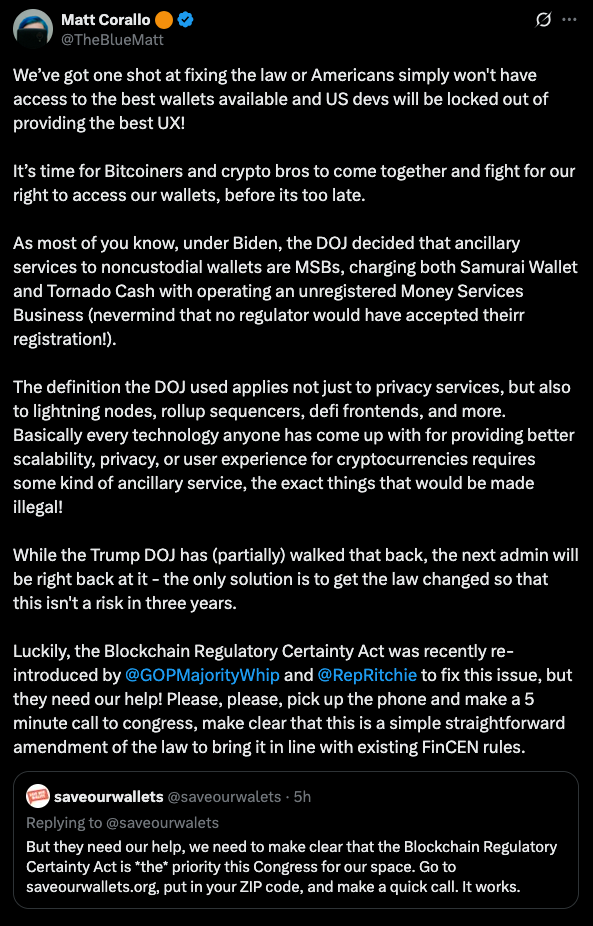

New York City Won’t Be Issuing BitBonds Anytime SoonSince 2021, Mayor Eric Adams has been talking about how he’s going to make New York City the center of the crypto industry, though this hasn’t materialized. (Some Bitcoin and crypto companies are based here, but this has little to do with Adams’ efforts — or lack thereof.)

So, when I heard the mayor propose issuing BitBonds in New York City at Bitcoin 2025, I was far from convinced that this would actually happen.

And then when I read a statement from NYC Comptroller Brad Lander on the topic, it became even more clear to me that Adams was merely posturing when it came to BitBonds.

“New York City will not be issuing any bitcoin-backed bonds on my watch,” said Lander in the statement.

“Mayor Eric Adams may be willing to bet our future on crypto in exchange for a trip to Vegas, but my job is to ensure our City’s financial stability. Cryptocurrencies are not sufficiently stable to finance our City’s infrastructure, affordable housing, or schools,” he added.

“Proposing that New York City should open its capital planning to crypto could expose our City to new risks and erode bond buyers’ trust in our City.”

In the statement, Lander went on to discuss how BitBonds would work at the federal level (90% of the funds go to government expenditures, while 10% goes to buying bitcoin for a Strategic Bitcoin Reserve), before noting a key difference between federal bonds and the bonds that New York City issues.

“While the federal government issues bonds to fund traditional expenditures, New York City primarily issues bonds to fund capital assets and in only very narrow circumstances can the City finance other purposes,” wrote Lander.

Lander then went on to lay out a number of other reasons why New York City will not be issuing BitBonds anytime soon, including that ”New York City would have to be able to take transactions in Bitcoin in order to issue bonds backed by Bitcoin” because “New York City has neither any mechanism to pay for its Capital Assets in any other currency besides the US Dollar nor any means to convert Bitcoin to US Dollars.”

(If I read that correctly, Lander says that New York City doesn’t know how to set up a Bitcoin wallet or trade bitcoin for U.S. dollars. Just about on par for an elected official in New York.)

Now, pardon my cynicism here, but I’m a New Yorker — a resident of one of the most restrictive jurisdictions in the world when it comes to Bitcoin and crypto, thanks to the BitLicense — and there are two things you can bet on at this point in time in New York.

- Mayor Eric Adams will talk a good game about Bitcoin and crypto while not taking any action behind the scenes.

- Bureaucrats and elected officials alike in New York will continue to throw cold water on anything that challenges Wall Street’s power, while still claiming that New York is the “financial capital of the world.” (Laughable.)

So, Mayor Adams can make all the proposals he wants from stages in Las Vegas to NYC-sponsored crypto summits, but until I see his administration actually do something substantial for New York City residents as it pertains to Bitcoin and crypto, I’ll just assume that New York will continue to stagnate financially.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

This post New York City Won’t Be Issuing BitBonds Anytime Soon first appeared on Bitcoin Magazine and is written by Frank Corva.

-

@ cae03c48:2a7d6671

2025-06-10 15:01:24

@ cae03c48:2a7d6671

2025-06-10 15:01:24Bitcoin Magazine

BlackRock’s iShares Bitcoin Trust Shatters ETF Growth Record, Surpassing $70 Billion in Just 341 DaysBlackRock’s iShares Bitcoin Trust (IBIT) has officially made history. The Bitcoin ETF surged past $70 billion in assets under management (AUM), reaching the milestone in just 341 trading days. This achievement makes IBIT the fastest ETF to ever hit that threshold.

JUST IN: BlackRock's spot Bitcoin ETF becomes the fastest ETF in history to surpass $70 billion AUM

pic.twitter.com/kZkXhjEvq0

pic.twitter.com/kZkXhjEvq0— Bitcoin Magazine (@BitcoinMagazine) June 9, 2025

To put that into perspective, the previous record-holder—SPDR Gold Shares (GLD)—took 1,691 days to reach the same milestone. “5x faster than the old record held by GLD of 1,691 days,” Bloomberg ETF analyst Eric Balchunas wrote in a post on X. Other ETFs like VOO (1,701 days), IEFA (1,773 days), and IEMG (2,063 days) also lag far behind IBIT’s rapid growth.

The explosive rise in IBIT’s AUM coincides with Bitcoin’s continued rally. At the time of reporting, Bitcoin (BTC) is trading above $108,000, up more than 2.06%, and sitting just under 4% below its all-time high of nearly $112,000 set last month.

BlackRock’s accumulation strategy has placed it at the forefront of institutional Bitcoin investment. According to blockchain analytics firm Arkham Intelligence, the firm now holds over 663,000 bitcoin—more than Michael Saylor’s MicroStrategy, which famously owns 582,000 BTC.

The price surge and ETF milestone reflect a broader institutional embrace of Bitcoin as a legitimate and increasingly preferred asset class. The record breaking pace of IBIT’s growth underscores the demand from investors looking for regulated exposure to Bitcoin through traditional financial products.

The chart clearly visualizes the disparity in ETF adoption timelines, with IBIT’s steep, vertical ascent dramatically outpacing its peers in the race to $70 billion. It’s a testament to the accelerating pace at which capital is flowing into Bitcoin markets.

As Bitcoin continues to hold just below its peak, and institutional products like IBIT grow at unprecedented speeds, all eyes are on what comes next—not just for Bitcoin, but for the legacy financial industry now being reshaped by it.

This post BlackRock’s iShares Bitcoin Trust Shatters ETF Growth Record, Surpassing $70 Billion in Just 341 Days first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-10 15:01:21

@ cae03c48:2a7d6671

2025-06-10 15:01:21Bitcoin Magazine

KULR Technology Group Announces $300 Million ATM Offering To Invest in Their Bitcoin TreasuryKULR Technology Group, Inc. (NYSE American: KULR) announced it has entered into a Controlled Equity Offering Sales Agreement with Cantor Fitzgerald & Co. and Craig-Hallum Capital Group LLC, enabling the company to sell up to $300 million of its common stock in an at-the-market (ATM) offering to support its Bitcoin treasury reserve.

JUST IN: Public company KULR is raising up to $300 million to buy more #Bitcoin

pic.twitter.com/Jg0yaAFkI7

pic.twitter.com/Jg0yaAFkI7— Bitcoin Magazine (@BitcoinMagazine) June 9, 2025

Under the agreement, Cantor Fitzgerald will act as the sole sales agent, using commercially reasonable efforts to sell shares at market prices. The offering will be made under an existing shelf registration and may occur from time to time based on market conditions and company discretion.

As of June 6, 2025, KULR’s common stock was trading at $1.18 per share. The total number of shares issued under the agreement will not exceed the company’s authorized but unissued shares, after accounting for shares already reserved or committed.

“Our common stock is listed and traded on the NYSE American LLC under the symbol ‘KULR,’” stated the filing.

KULR will pay the sales agents a commission of up to 3.0% of the gross sales proceeds. The agents are considered underwriters under the Securities Act of 1933, and KULR has agreed to indemnify them against certain liabilities.

“Our business and an investment in our common stock involve significant risks,” stated the filing. “These risks are described under the caption “Risk Factors” beginning on page S-6 of this prospectus supplement, and the risk factors incorporated by reference into this prospectus supplement and the accompanying base prospectus.”

KULR started adopting bitcoin as their primary treasury reserve asset in December 2024. Their strategy focuses on acquiring and holding bitcoin by using cash flows that exceed working capital requirements, issuing equity debt securities or raising more capital to purchase more Bitcoin.

“We view our bitcoin holdings as long term holdings and expect to continue to accumulate bitcoin,” mentioned the filing on page S-2. “We have not set any specific target for the amount of bitcoin we seek to hold, and we will continue to monitor market conditions in determining whether to engage in additional bitcoin purchases. This overall strategy also contemplates that we may periodically sell bitcoin for general corporate purposes or in connection with strategies that generate tax benefits in accordance with applicable law, enter into additional capital raising transactions, including those that could be collateralized by our bitcoin holdings, and consider pursuing strategies to create income streams or otherwise generate funds using our bitcoin holdings.”

This post KULR Technology Group Announces $300 Million ATM Offering To Invest in Their Bitcoin Treasury first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-10 15:01:17

@ cae03c48:2a7d6671

2025-06-10 15:01:17Bitcoin Magazine

Robert Mitchnick Discusses BlackRock’s Bitcoin ETF IBIT Success On BloombergToday, the Head of Digital Assets of BlackRock Robert Mitchnick, at the Bloomberg ETF IQ, talked about what’s really driving the surge in Bitcoin ETFs.

“It’s a lot of things coming together. Out of the gate was retail and investor demand…” said Mitchnick. “Now, more recently, we’ve seen just steady progress of more wealth advisor adoption, more institutional adoption. It’s been a mix of people who it’s the first time that they’ve invested in anything in the crypto space. And then on the other hand, you have lots of people who’ve been invested in Bitcoin for a long time and they’re taking advantage of the ETP wrapper.”

JUST IN: $11.5 trillion BlackRock's Robert Mitchnick said wealth advisor adoption of Bitcoin is "very early"

pic.twitter.com/UqiarMWEvV

pic.twitter.com/UqiarMWEvV— Bitcoin Magazine (@BitcoinMagazine) June 9, 2025

When it comes to institutional adoption, Mitchnick says we’re still early. ETF approvals usually take years, but some firms are fast-tracking the process.

“We’ve seen that fast tracked by a number of firms, and we talk about fast tracking,” stated Mitchnick. “We’re talking about, you know, quarters, not months. And slowly but surely, you’ve seen, I think, an acceleration, particularly in the last couple of months of more notable firms lowering barriers, granting approvals to their advisors to use these.”

Bitcoin’s volatility has declined recently, making it more appealing for institutions seeking diversification. However, it remains volatile, but its risk and return profile differs from traditional assets.

“There’s no question it’s relatively novel technology,” Mitchnick commented. “Even though the volatility has come down, it’s still volatile, but at the same time its risk and return drivers are markedly different from most of the rest of the assets in a traditional portfolio, and that’s important. And so when institutions are looking at this, they’re heavily focused on that correlation and whether it’s zero or even in some periods negative, because then the portfolio construction case is very compelling to them.”

About a dozen Bitcoin ETFs currently compete in the market, and demand remains strong.

“Well, a lot of them have been, you know, very successful, too,” stated Mitchnick. “Obviously, it has been the leader in the category by a fair margin. But there’s been such demand that, you know, it’s been exciting and there’s lots of products in the space and that’s a good thing.”

This post Robert Mitchnick Discusses BlackRock’s Bitcoin ETF IBIT Success On Bloomberg first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ e968e50b:db2a803a

2025-06-10 14:59:23

@ e968e50b:db2a803a

2025-06-10 14:59:23Traveling with a miner...

I recently traveled over 13,000 kilometers to see a bitcoin circular economy of which I had developed some friendships and decided to bring a small miner to donate to one of the organizations spurring on this community. But every moment that thing was unplugged was a missed hash! So........

Let's first discuss, is mining in the terminal, using the airport's energy ethical?

I would say that the answer is unequivocally yes. They provide the outlets there so that you can charge your devices. I feel like if I want to use that to verify the transactions of freedom fighters fleeing Myanmar and preserve the savings of merchants in Zimbabwe instead of playing Candy Crush or doomscrolling Facebook, that's my prerogative. Am I wrong?

Is it allowed?

Well...I guess this post may bring that to light...

But is is possible?

Short answer, yes, but I couldn't quite figure it out in time with the miner I was using. The hard problem is the way you sign in to Wifi at the airport. There's no password and instead you normally open up a browser and agree to the terms there. I couldn't figure out in time (across multiple airports) how to circumvent this, but I think I would have been able to do it with a different device.

How about at a bnb?

Easy-peasy! Oddly enough, I was a little more torn on the ethics here. It was in fact pretty cold, and this thing was functioning as a space heater while I was at that desk. Also, you can't see it, but that cord on the right was for a blow dryer that consumes almost ten times the energy of my miner. Alas, you don't use a blow dryer continuously throughout the night and I really didn't want to risk offending the owner. She had actually only charged me 26,000 sats for the night, and even though she was a bitcoiner, I didn't want to risk any chance that she might feel I was taking advantage of her business. I ran it for a little bit to warm my hands while I wrote and then unplugged it until it was time to present the gift.

Have you ever mined like this?

I kept reminding myself that I wasn't using someone else's electricity, but in fact, using electricity that I already paid for. Nevertheless, it's an odd feeling. Am I wrong? I definitely think bitcoiners that run rental spots should be heating them with miners. If nothing else, what a cool education opportunity for the renters. Anyone ever mine anywhere weirder than this? It seems that as solo miners become more prevalent, there will be more instances of people travel mining, mining at work, or mining using power that they don't necessarily "own" or have full control over.

https://stacker.news/items/1002559

-

@ a4043831:3b64ac02

2025-06-10 14:55:39

@ a4043831:3b64ac02

2025-06-10 14:55:39Retirement planning is like laying down the blueprint for your future, where financial security meets your personal dreams and desires. It's about taking a proactive approach to ensure that your golden years are truly golden, filled with comfort and freedom rather than financial stress. The process of creating a retirement plan includes identifying your income sources, adding up your expenses, putting a savings plan into effect, and managing your assets.

It is essential for several reasons:

- Securing Your Financial Future:

Retirement marks the start of a phase where financial worries should no longer dominate your life. Thoughtful retirement planning ensures a consistent income to support your lifestyle and manage unexpected costs.

- Achieving Your Personal Goals:

Retirement offers the chance to focus on passions, hobbies, and experiences delayed during your career. Early preparation makes aspirations such as travel, making new hobbies and spending time with your loved ones, achievable.

- Managing Health Care Needs:

Healthcare often becomes a major expense with age. Without proper planning, medical costs can strain your finances. A comprehensive retirement plan accounts for healthcare needs, helping you manage these expenses while maintaining your standard of living.

- Leaving a Legacy:

Many people wish to leave something behind for their loved ones or give to charity. This minimizes burdens on your family and maximizes your impact.

Elements of a Retirement Plan

A well-structured retirement plan involves several key elements to ensure a comprehensive approach to financial security:

1. Fact-Finding Conversations:

Critical fact-finding discussions are the foundation of retirement planning. Understanding your retirement goals and desires helps shape the path to achieve them. This involves listening to your stories and defining your minimum and optimal retirement lifestyles, including estimating the associated costs.

2. Retirement Income Sources:

Diversifying your income streams is crucial. This includes pensions, social security benefits, annuities, and passive income sources like rental properties or dividends. Understanding the tax implications of each source is also important.

3. Investment Strategy Determination:

Allocating assets based on your specific retirement goals is essential. This involves aligning your investments with the time frame and nature of your retirement aspirations, whether immediate income or long-term growth. Your investment strategy is customized to support your desired lifestyle and factors in your risk tolerance and the returns needed to fund your retirement adequately.

4. Specific Asset Recommendations:

A mix of equities, bonds, real estate, and other assets is often recommended. Diverse portfolios are crucial for mitigating risk while aiming for growth. The portfolio recommendation will support your retirement objectives and be well-equipped to handle market fluctuations and economic changes. Regular reviews and adjustments to your asset allocation ensure your plan remains aligned with your life circumstances.

Benefits of Retirement Planning

- Retirement planning offers numerous benefits that contribute to a secure and fulfilling retirement:

- Financial Security: Ensures a steady flow of income to maintain your standard of living.

- Peace of Mind: Reduces financial stress and uncertainty, allowing you to enjoy your retirement years.

- Goal Fulfillment: Helps you achieve personal aspirations and pursue activities that you are passionate about.

- Healthcare Preparedness: Provides strategies to manage healthcare expenses without depleting savings.