-

@ 8668cb57:42a19859

2025-06-10 17:30:30

@ 8668cb57:42a19859

2025-06-10 17:30:30Are Islands Choosing for Wealth Or Poverty in the 21st Century?

You have 57 official islands according to the United Nations. But there are thousands of islands in the world. What does Bitcoin and Lighting mean for them? Can it help them escape poverty and become wealthy?

Wealth

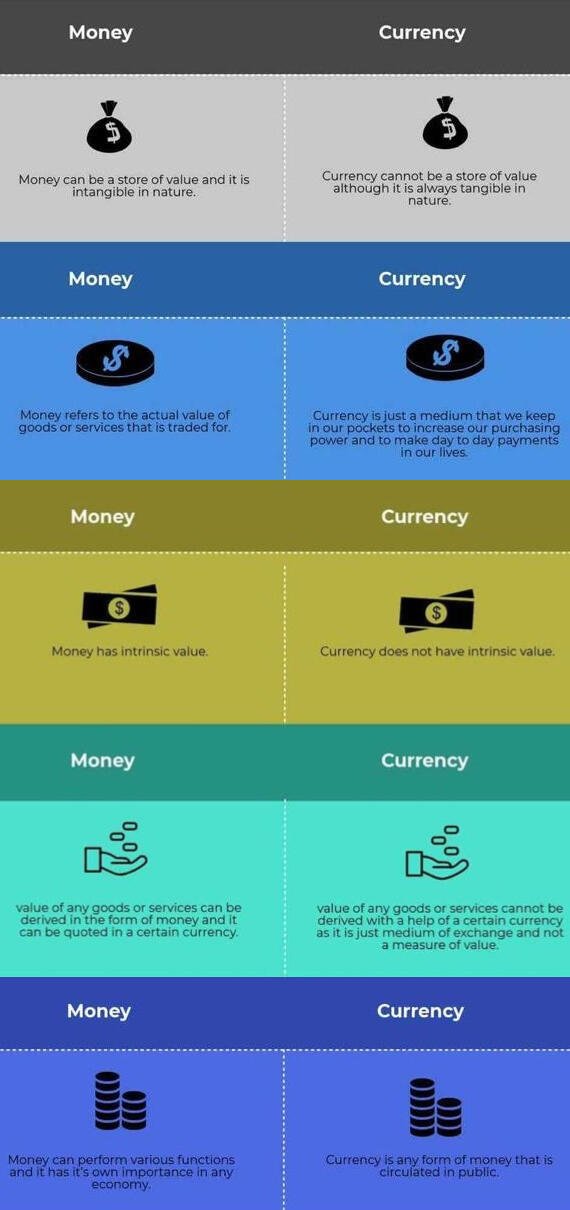

First of all: Wealth: what does it mean to be wealthy as an island? It is not only about the number of fiat currency you have in your pockets. Not about the digits you have on your bank account. And not only about the number of sats or Bitcoins you have in your self custodian wallet.\ Wealth means:

-

You are healthy

-

Your mind is free

-

Your body is in shape

-

Your relationships are bringing you join

-

You are using your talents and your gifts to the max

-

And you have options, you can do what you want with your time.

Healthy Islands

So for an island, let's take Curacao as an example, of 160.000 people, it means that there is a potential for everybody to reach that status, that next level in their lives called #wealth.

That is the "dream" goal I'm chasing with my Island Wealth show. Away from poverty. Into more possibilities. Using your skills in this dynamic world.\ \ Current state of Island Wealth

If we take the Caribbean as an example, here you see the official list of islands in the Caribbean: https://en.wikipedia.org/wiki/List_of_Caribbean_islands

There are some indicators to check how wealthy - in terms of income - these Caribbean islands are.\ \ GDP per Capita: this is the total income of the island per year divided by the population. You will get an average that you can compare with your own country. If you take this globally, Luxembourg is the wealthiest country in the world.\ \ Gini Coefficient: this gives you a curve and a value that shows you how the distribution of wealth is on an island.

Net worth: If you go on an individual level, a family level, a business level you can take the assets minus the liabilities and calculate the difference as Net worth. You can also take this figure and compare it to the net worth of individuals in the world.

Bitcoin

Now lets introduce Bitcoin for these islands. How can #Bitcoin help these islands become wealthier?\ \ Problems of Islands

One of the most important problems the islands have is that they are very dependent on #tourism. Yes, I have been studying the economies of islands for a long time. I've been advising small island's governments in the Caribbean, private investors, high earning professionals on how they can build their wealth. And I always hear: we need to diversify more. What does that mean?\ \ All their sales and revenues are coming from one single sector: tourism. And they don't like that. Imagine an island: 500.000 tourists per year coming from USA and Canada. And every day cruise ships at their mega cruise piers with a total of 1 million cruise tourists per year. The tourists stay for 7 days and the cruise tourists stay for 1 day.\ \ That is the typical Caribbean island at its peak. If anything happens to that flow of cruise and stayover tourists ->Poverty. If there is a hurricane ->Poverty. If there are no flights -> Poverty. If there is political unrest and the tourists cannot come ->Poverty. So wealth is very concentrated when you are living on an island.\ \ Bitcoin and Lightning

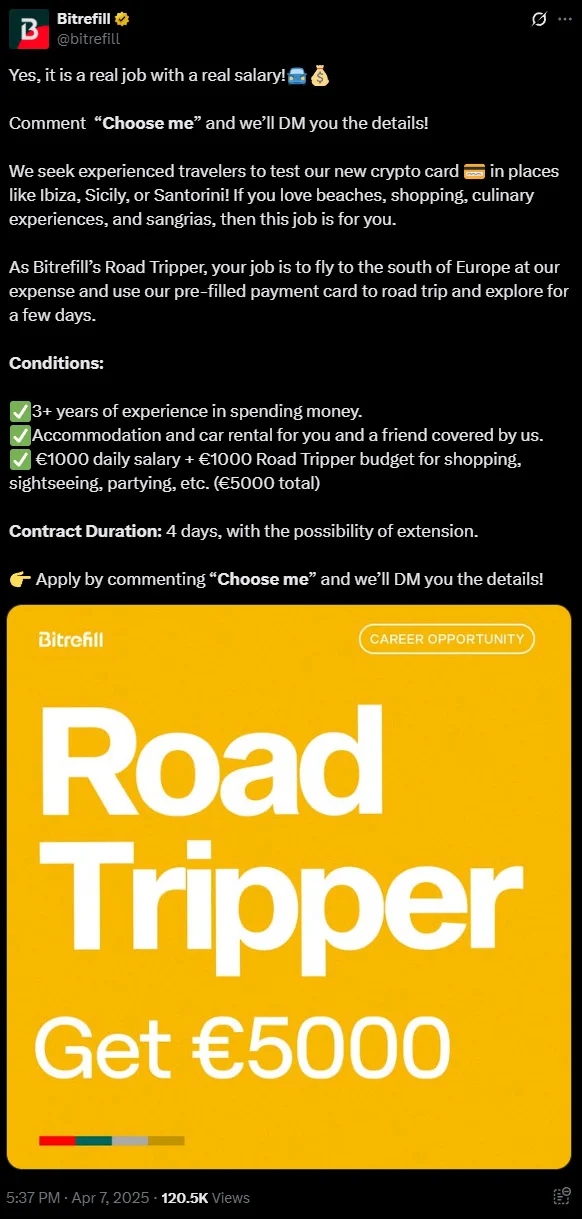

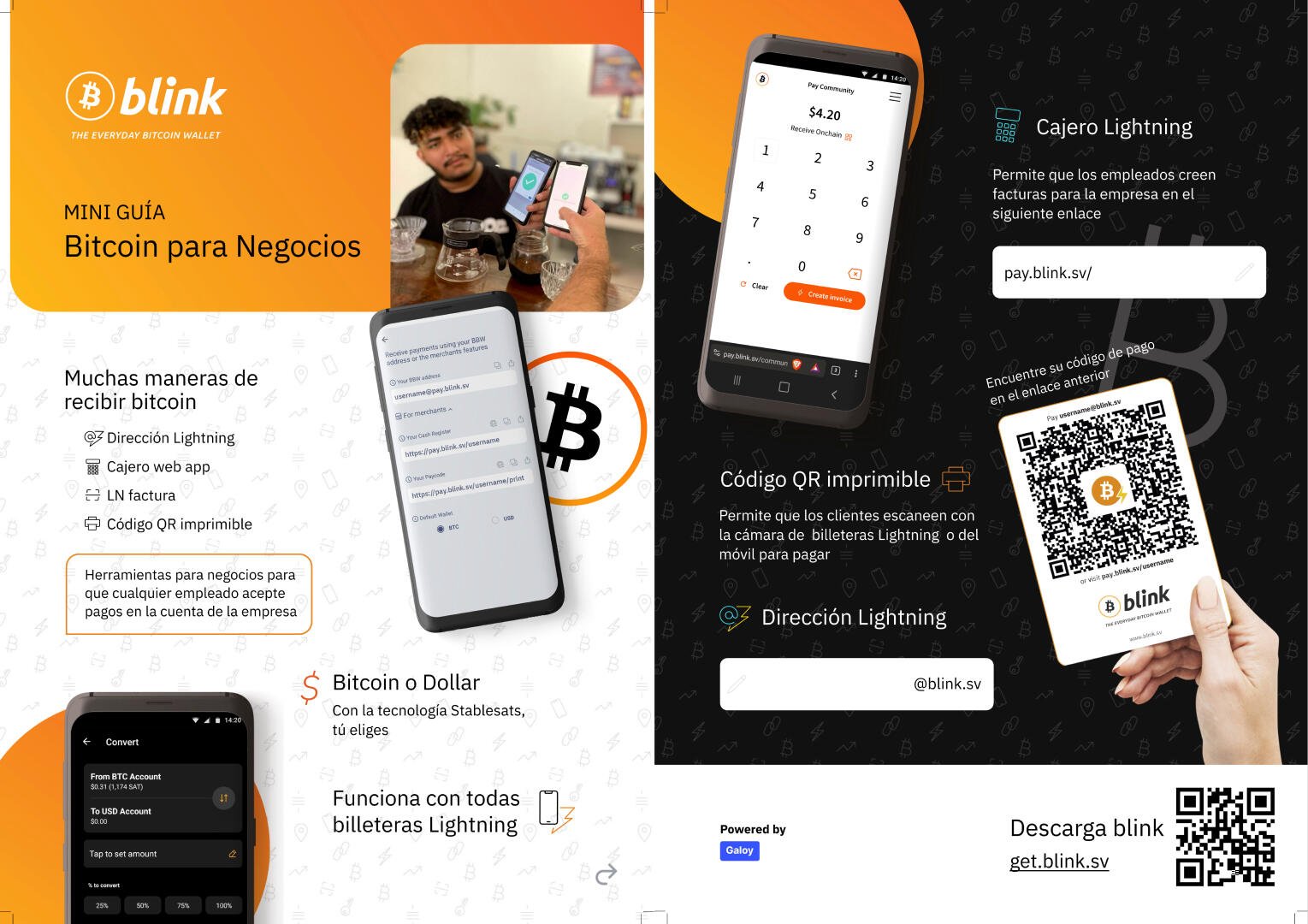

While most Island's policy makers, citizens, even sometimes high paid individuals do not see Bitcoin, I see a 2 trillion decentralized global economy. If you are fully dependent on tourism, and you want to diversify away from tourism, lets consider Bitcoin and Lightning.\ \ Small businesses

Lets imagine your small businesses that operate online, like a consultant, online trainer/coach, or anybody selling snacks. Now working in the informal sector and not paying any taxes to your small island's government. They all can instantly:

-

Download a #Blink or #Aqua wallet and start receiving #SATS

-

Get a Wordpress or Shopify website, and start receiving SATS from all over the world, instantly.

Think about that for a moment and let it sink in. A two trillion USD economy globally. 21 million Bitcoins max ever. And everybody can participate right now. Without having to install servers, host software. I would seriously consider this new decentralize payment and savings technology.

How can you diversify away from tourism with Bitcoin and Lighting?

Any business can accept Bitcoin. Imagine you do not have a bank account and you are working in the informal sector. As a gardener, as a technician, electrician. A pool boy, a musician. You now have a wallet to accept hard money instantly.\ \ Agriculture

You could be paying for seeds to plan. With your lightning wallet online.\ \ Retail

You could be accepting Lighting payments if you are a store that sells glasses, food, snacks, clothing, hand crafted products, paintings.

Construction

You could be importing material from the #BRICS+ nations, China as first one, Brazil (close to the Caribbean) and paying with lightning.\ \ Financial Services (local and international)

You could be helping foreign and local other businesses with their online books, they annual reports, their administration, helping them relocate to the Caribbean, and receiving payments with Lighting.\ \ I can go on and on\ \ Decentralized Peer to Peer software development\ I have written about this on previous posts. You could be building peer to peer software based on new software stacks like pear runtime, holepunch technology, nostr. So if you are a local software developer and you know javascript, html and css you now can be paid with Lighting and deliver your knowledge and services to the world. I'm also exploring this myself.\ \ AI and Data Science\ If you are a Data Scientist and you know how to automate stuff with #Python, you know how to use #AI, like me, you could be creating online software and experiences to create Digital Assets that work 24*7*365 days: https://bit.ly/python-ai-automation.

There are endless possibilities to tap into this global decentralized economy

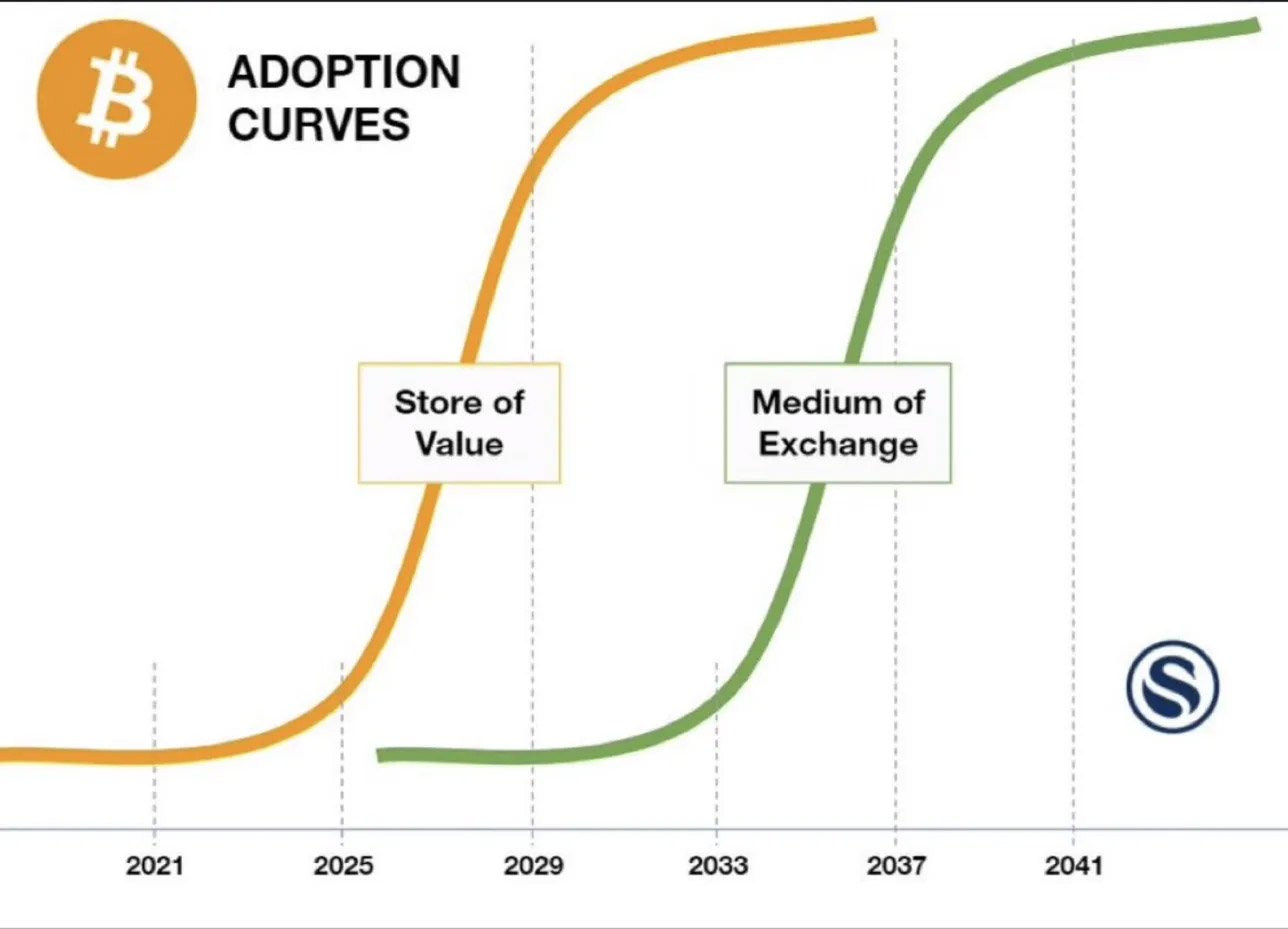

And guess what: we are so early. There is less than 1% of the people of the world who has used Bitcoin and Lighting.\ \ Let's go islands\ So lets do it. Lets go islands. You see that diamond above? It just to start your imagination. You see that man with the open mouth above?That is just to show you how amazed and surprised I'm with the potential of decentralization, self custody and the potential to be self sovereign.\ \ Let me know your thoughts\ This article is only on Nostr and Keet and decentralized platform. I'm moving my attention more and more to decentralization. So I want to hear your thoughts. Let me know if you have any comments, questions or ideas how to create more wealth.\ \ And stay tuned to my episodes where I will host the Island Wealth Show #IslandWealth.\ \ Runy\ Host Island Wealth

-

-

@ 3a851978:ff85e003

2025-06-10 17:17:40

@ 3a851978:ff85e003

2025-06-10 17:17:40This document is designed to test Markdown rendering with LaTeX math support. Below you'll find examples of Markdown formatting combined with inline and block mathematical notation.

1. Inline Math

Here is an inline formula using single dollar signs:

- Euler's identity: $e^{i\pi} + 1 = 0$

- Quadratic formula: $x = \frac{-b \pm \sqrt{b^2 - 4ac}}{2a}$

- Pythagoras theorem: $a^2 + b^2 = c^2$

2. Block Math

Now let's test block-level LaTeX using double dollar signs:

$$ \int_{-\infty}^{\infty} e^{-x^2} \, dx = \sqrt{\pi} $$

Another block formula:

$$ f(x) = \sum_{n=0}^{\infty} \frac{f^{(n)}(0)}{n!}x^n $$

3. Lists and Math

- Integral: $\int_0^1 x^2 , dx = \frac{1}{3}$

- Derivative: $\frac{d}{dx} \sin(x) = \cos(x)$

- Matrix:

$$ \begin{pmatrix} 1 & 2 \ 3 & 4 \end{pmatrix} $$

With inline math in code:

$E = mc^2$(should not render as math here).5. Tables

| Formula Name | Expression | | ---------------- | ------------------------------------------------------ | | Euler's Identity | $e^{i\pi} + 1 = 0$ | | Taylor Series | $\sum_{n=0}^{\infty} \frac{x^n}{n!}$ | | Binomial Theorem | $(a + b)^n = \sum_{k=0}^n \binom{n}{k} a^{n-k} b^k$ |

-

@ 6a6be47b:3e74e3e1

2025-06-10 17:10:58

@ 6a6be47b:3e74e3e1

2025-06-10 17:10:58Hi frens! 🎧

🎶 I just can’t stop listening to the new Deafheaven album, Lonely People with Power. I’ve been hesitant to write about it because I’m no music expert—I’m just a fan, and my appreciation is mostly pure excitement and awe.

So, honestly, my opinion is very biased because I love this band so much. Their newest album has completely taken over my playlists since its release. I’m hooked.

Their last album was a dreamy blend of shoegaze and black metal with those signature “goblin core” screams (forgive my genre-mixing, I just go with what I feel!), and I loved it. Songs like “Neptune Raining Diamonds” flowing into “Lament for Wasps” felt like being transported to another dimension—chef’s kiss.

👀If you know Deafheaven, maybe you first heard them through their cult classic Sunbather, or maybe New Bermuda, or something else entirely.

🧛♂️ If you’re used to their darker sound, maybe the last album wasn’t your thing. But this one—oh wow. From the instrumental opening track, I was in for a ride. The music is a mix of pain, loneliness, despair, and sadness, all wrapped in ethereal sounds and bursts of fury.

It’s hard to describe, but the lyrics—while dark—feel universal. There’s a sense of being observed, feeling helpless, but also a glimmer of hope, a sense that something new might begin. That’s exactly how this album left me feeling.

🎵 If you haven’t given this album a chance yet, I really hope you do! And if you have, what was your favorite part? For me, it’s those smooth transitions between songs—going from “Incidental II” to “Revelator,” and then topping it off with “Body Behaviour.” Mind blown.

Well, those are my two sats! Enjoy your week and take care, frens.

Godspeed! 🚀

https://stacker.news/items/1002715

-

@ dfa02707:41ca50e3

2025-06-10 17:02:47

@ dfa02707:41ca50e3

2025-06-10 17:02:47

Good morning (good night?)! The No Bullshit Bitcoin news feed is now available on Moody's Dashboard! A huge shoutout to sir Clark Moody for integrating our feed.

Headlines

- Spiral welcomes Ben Carman. The developer will work on the LDK server and a new SDK designed to simplify the onboarding process for new self-custodial Bitcoin users.

- The Bitcoin Dev Kit Foundation announced new corporate members for 2025, including AnchorWatch, CleanSpark, and Proton Foundation. The annual dues from these corporate members fund the small team of open-source developers responsible for maintaining the core BDK libraries and related free and open-source software (FOSS) projects.

- Strategy increases Bitcoin holdings to 538,200 BTC. In the latest purchase, the company has spent more than $555M to buy 6,556 coins through proceeds of two at-the-market stock offering programs.

- Spar supermarket experiments with Bitcoin payments in Zug, Switzerland. The store has introduced a new payment method powered by the Lightning Network. The implementation was facilitated by DFX Swiss, a service that supports seamless conversions between bitcoin and legacy currencies.

- The Bank for International Settlements (BIS) wants to contain 'crypto' risks. A report titled "Cryptocurrencies and Decentralised Finance: Functions and Financial Stability Implications" calls for expanding research into "how new forms of central bank money, capital controls, and taxation policies can counter the risks of widespread crypto adoption while still fostering technological innovation."

- "Global Implications of Scam Centres, Underground Banking, and Illicit Online Marketplaces in Southeast Asia." According to the United Nations Office on Drugs and Crime (UNODC) report, criminal organizations from East and Southeast Asia are swiftly extending their global reach. These groups are moving beyond traditional scams and trafficking, creating sophisticated online networks that include unlicensed cryptocurrency exchanges, encrypted communication platforms, and stablecoins, fueling a massive fraud economy on an industrial scale.

- Slovenia is considering a 25% capital gains tax on Bitcoin profits for individuals. The Ministry of Finance has proposed legislation to impose this tax on gains from cryptocurrency transactions, though exchanging one cryptocurrency for another would remain exempt. At present, individual 'crypto' traders in Slovenia are not taxed.

- Circle, BitGo, Coinbase, and Paxos plan to apply for U.S. bank charters or licenses. According to a report in The Wall Street Journal, major crypto companies are planning to apply for U.S. bank charters or licenses. These firms are pursuing limited licenses that would permit them to issue stablecoins, as the U.S. Congress deliberates on legislation mandating licensing for stablecoin issuers.

"Established banks, like Bank of America, are hoping to amend the current drafts of [stablecoin] legislation in such a way that nonbanks are more heavily restricted from issuing stablecoins," people familiar with the matter told The Block.

- Charles Schwab to launch spot Bitcoin trading by 2026. The financial investment firm, managing over $10 trillion in assets, has revealed plans to introduce spot Bitcoin trading for its clients within the next year.

Use the tools

- Bitcoin Safe v1.2.3 expands QR SignMessage compatibility for all QR-UR-compatible hardware signers (SpecterDIY, KeyStone, Passport, Jade; already supported COLDCARD Q). It also adds the ability to import wallets via QR, ensuring compatibility with Keystone's latest firmware (2.0.6), alongside other improvements.

- Minibits v0.2.2-beta, an ecash wallet for Android devices, packages many changes to align the project with the planned iOS app release. New features and improvements include the ability to lock ecash to a receiver's pubkey, faster confirmations of ecash minting and payments thanks to WebSockets, UI-related fixes, and more.

- Zeus v0.11.0-alpha1 introduces Cashu wallets tied to embedded LND wallets. Navigate to Settings > Ecash to enable it. Other wallet types can still sweep funds from Cashu tokens. Zeus Pay now supports Cashu address types in Zaplocker, Cashu, and NWC modes.

- LNDg v1.10.0, an advanced web interface designed for analyzing Lightning Network Daemon (LND) data and automating node management tasks, introduces performance improvements, adds a new metrics page for unprofitable and stuck channels, and displays warnings for batch openings. The Profit and Loss Chart has been updated to include on-chain costs. Advanced settings have been added for users who would like their channel database size to be read remotely (the default remains local). Additionally, the AutoFees tool now uses aggregated pubkey metrics for multiple channels with the same peer.

- Nunchuk Desktop v1.9.45 release brings the latest bug fixes and improvements.

- Blockstream Green iOS v4.1.8 has renamed L-BTC to LBTC, and improves translations of notifications, login time, and background payments.

- Blockstream Green Android v4.1.8 has added language preference in App Settings and enables an Android data backup option for disaster recovery. Additionally, it fixes issues with Jade entry point PIN timeout and Trezor passphrase input.

- Torq v2.2.2, an advanced Lightning node management software designed to handle large nodes with over 1000 channels, fixes bugs that caused channel balance to not be updated in some cases and channel "peer total local balance" not getting updated.

- Stack Wallet v2.1.12, a multicoin wallet by Cypher Stack, fixes an issue with Xelis introduced in the latest release for Windows.

- ESP-Miner-NerdQAxePlus v1.0.29.1, a forked version from the NerdAxe miner that was modified for use on the NerdQAxe+, is now available.

- Zark enables sending sats to an npub using Bark.

- Erk is a novel variation of the Ark protocol that completely removes the need for user interactivity in rounds, addressing one of Ark's key limitations: the requirement for users to come online before their VTXOs expire.

- Aegis v0.1.1 is now available. It is a Nostr event signer app for iOS devices.

- Nostash is a NIP-07 Nostr signing extension for Safari. It is a fork of Nostore and is maintained by Terry Yiu. Available on iOS TestFlight.

- Amber v3.2.8, a Nostr event signer for Android, delivers the latest fixes and improvements.

- Nostur v1.20.0, a Nostr client for iOS, adds

-

@ eb0157af:77ab6c55

2025-06-10 17:02:27

@ eb0157af:77ab6c55

2025-06-10 17:02:27Circle’s IPO triggers a Tether value estimate, which would bring the co-founder’s wealth to approximately $242 billion.

The listing of Circle on the NYSE represented for the first time a public valuation metric for the entire dollar-pegged stablecoin sector. Applying the financial multiples that emerged from Circle’s IPO to Tether’s balance sheets, one can hypothesize a potential valuation of $515 billion for the USDT issuing company. A figure that, if confirmed by a future listing or acquisition, would transform Giancarlo Devasini, co-founder and Chairman of Tether with 47% of the shares according to Forbes, into one of the richest men on the planet.

The numbers

Circle completed its NYSE listing on June 5 through a SPAC, with a valuation of approximately $8 billion. With declared net profits of approximately $250 million in 2023, the price-earnings (P/E) ratio stands at around 36.

Tether recorded estimated profits of $12 billion in 2024. Applying the same multiple as Circle, the theoretical valuation reaches $480 billion. To this base figure, some analysts have observed the absence of assets held by Tether: $120 billion in US Treasuries, over $10 billion in bitcoin, physical gold reserves and stakes in private technology companies.

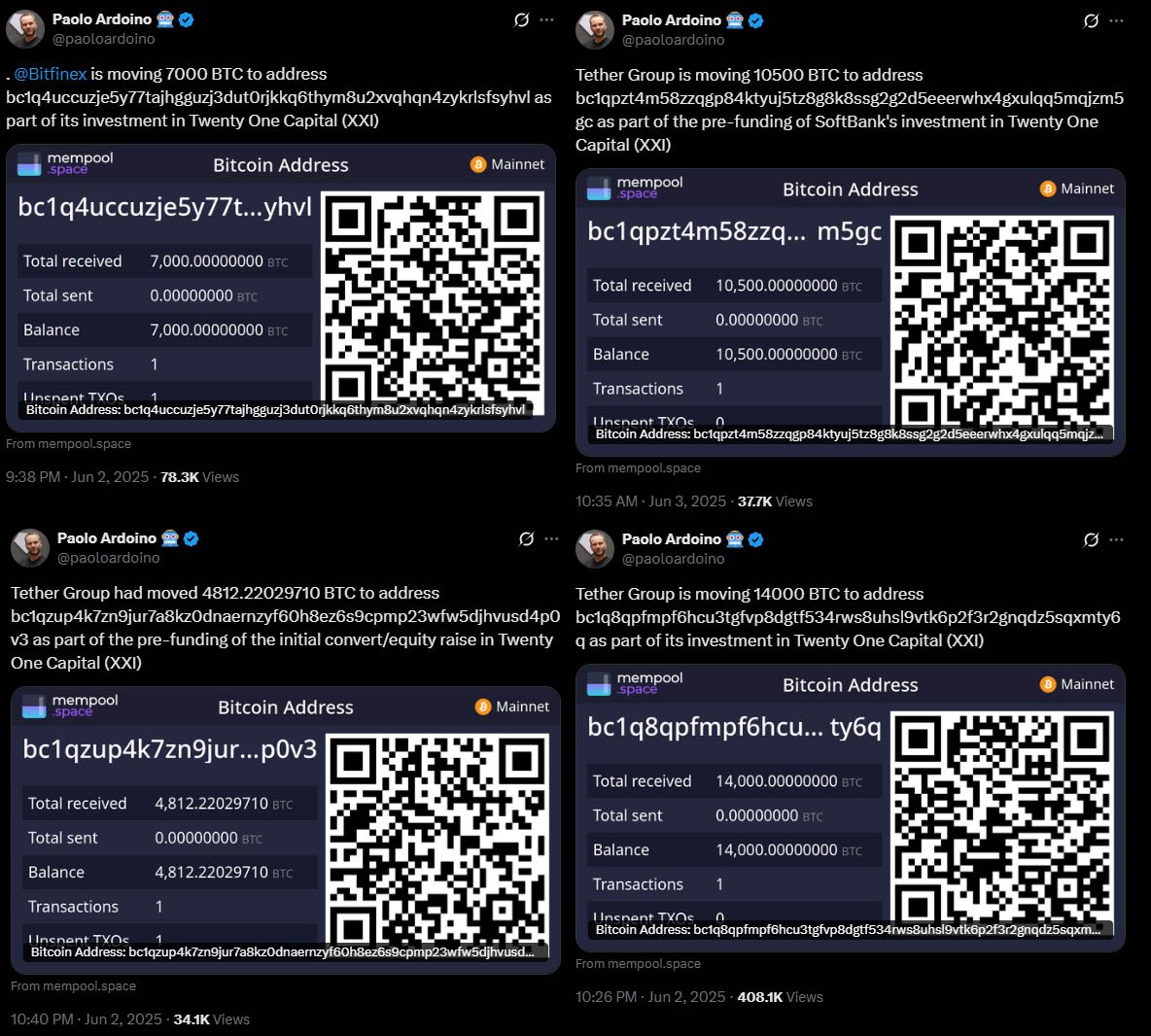

Analyst Jon Ma, CEO of Artemis, calculated a comprehensive valuation of $515 billion. Paolo Ardoino, CEO of Tether, commented on the estimate on X calling it “a beautiful number” and “maybe a bit bearish considering our current (and increasing) Bitcoin + Gold treasury”.

A $242 billion fortune

With 47% of Tether Holdings Ltd. shares, Devasini would see his theoretical net worth reach $242.05 billion. A figure that would place him in second place in the Forbes ranking of world billionaires, surpassing Mark Zuckerberg and Jeff Bezos ($215 billion), Larry Ellison ($192 billion) and Bernard Arnault ($178 billion).

Only Elon Musk, with $342 billion, would maintain first position. However, the $515 billion valuation for Tether remains theoretical and depends on a future listing or acquisition.

The post Theoretical $515 billion valuation for Tether: Chairman Devasini second richest man in the world? appeared first on Atlas21.

-

@ 9ca447d2:fbf5a36d

2025-06-10 17:02:07

@ 9ca447d2:fbf5a36d

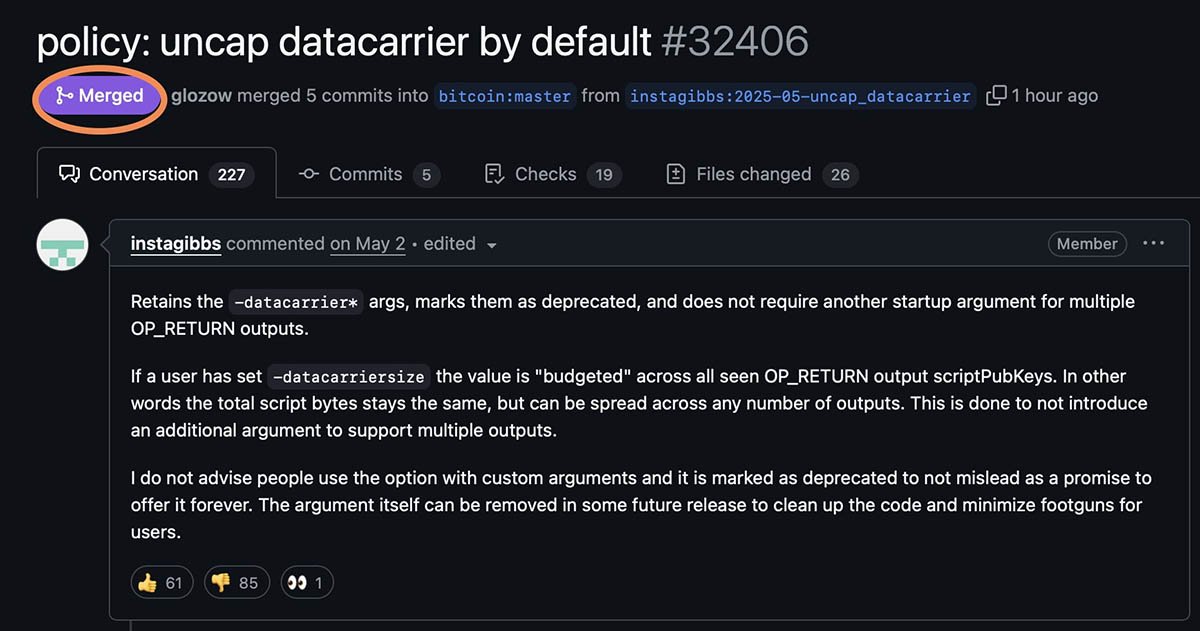

2025-06-10 17:02:07Bitcoin Core Github page announced yesterday that Core Developers have merged pull request #32406, removing support for “-datacarrier” argument for Bitcoin Core software in their next release, expected to be published in October.

Pull request #32406 has been merged — Github

This is the latest development regarding the initiative brought forth by Bitcoin Core developer Peter Todd, which has caused intense debate among Bitcoiners, now known as the “spam wars”.

The disagreement is over a change to Bitcoin Core’s transaction relay policy that removes the OP_RETURN data limit, which some see as a threat to Bitcoin’s very purpose, while others see it as a necessary step to preserve decentralization and censorship resistance.

OP_RETURN is an arbitrary piece of data that can be amended to a bitcoin transaction, and used to be limited to 80 bytes. Users have found ways to go around this limit already and have uploaded larger data to the Bitcoin blockchain, including photos, audio, and even entire computer games.

Bitcoin Core allows for extra arguments when running the application, one of which is the “-datacarrier” argument, which tells the application to not accept transactions including larger OP_RETURN data into its mempool.

Now this argument is marked as “deprecated”, meaning it is not supported or developed anymore, and is expected to be completely removed in future versions.

This will make accepting Bitcoin transactions that contain non-financial data mandatory for anyone running future versions of the Core software.

Prior to the merging of the mentioned pull request on the morning of Monday June 9, a joint statement from 31 Bitcoin Core devs was released on June 6, reheating the already controversial debate in the Bitcoin community.

In the June 6 statement, Bitcoin Core devs explained how they think Bitcoin nodes should handle transactions that include non-financial data, like digital art or messages. This type of data has become more common with Ordinals and inscriptions.

Related: Discussions Heat Up Among Bitcoin Devs Over OP_RETURN Proposal

Core developers said they are not endorsing non-financial use of Bitcoin, but also won’t stop it. Their main point is that Bitcoin’s strength is in being open and censorship-resistant. They wrote:

“This is not endorsing or condoning non-financial data usage, but accepting that as a censorship-resistant system, Bitcoin can and will be used for use cases not everyone agrees on.”

They say it’s up to users and node operators to decide what kind of Bitcoin software they run. Bitcoin Core won’t block transactions that have economic demand and will be mined.

“Being free to run any software is the network’s primary safeguard against coercion,” the statement added.

The policy change goes back to a May 8th upgrade (announced by Core contributor and Engineer at Blockstream, Greg Sanders), where devs removed the long-standing 80-byte limit on OP_RETURN output size.

This limit was meant to discourage non-payment data usage, but devs say it no longer serves that purpose.

“Retiring a deterrent that no longer deters” makes sense, they argue, because people have already found ways to add large data to the blockchain.

They also point out that removing the cap may help miners and users more than it hurts. They claim the new approach helps predict which transactions will be mined, speeds up block propagation and helps miners find fee-paying transactions.

“Knowingly refusing to relay transactions that miners would include in blocks anyway forces users into alternate communication channels,” they explained, warning this could harm decentralization.

The response has been mixed.

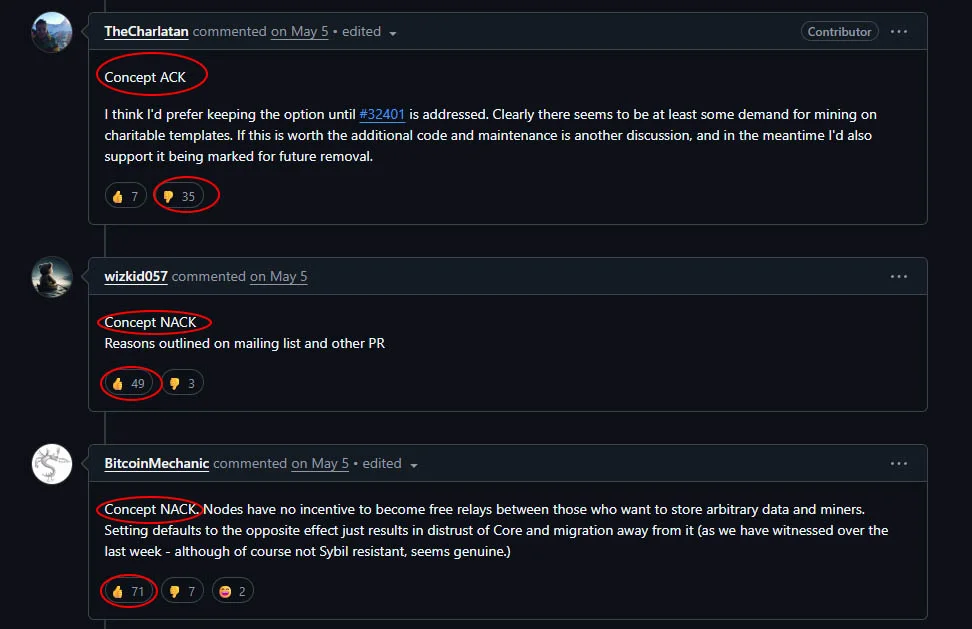

The announcement of the merge received 64 upvotes and 93 downvotes from reviewers, showing the community is mostly against this action. Comments explaining their dissatisfaction with the merge also received the support of the majority.

Reviewers who voted ACK (acknowledgment and agreement) were downvoted, and the comments voting NACK (disagreement) received more upvotes.

Comments regarding the recent merge — Bitcoin Core Github page

Critics say it opens the door to blockchain spam, higher fees and more bloat on the blockchain with non-financial content. They say Bitcoin should stick to its original purpose as a “peer-to-peer electronic cash system”.

Samson Mow, CEO of JAN3, was one of the most vocal critics. He said the devs are removing the barriers that protect the network from spam.

“Bitcoin Core devs have been changing the network gradually to enable spam,” Mow said. “It’s disingenuous to just say ‘It is what it is now, too bad’.”

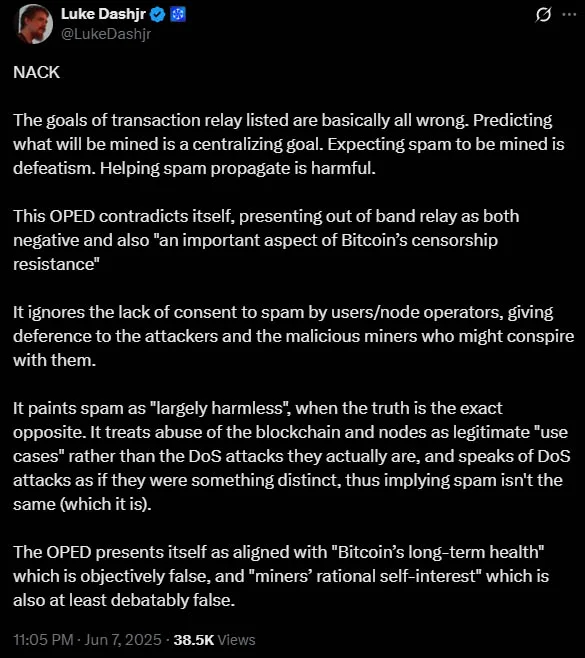

Bitcoin dev Luke Dashjr also criticized the move, saying it undermines Bitcoin’s core function. He called the devs’ goals “basically all wrong” and said expecting spam to be mined is “defeatism”.

Luke Dashjr on X

One user said: “It’s Bit”Coin” not Bit”Bucket” or Bit”Store” or whatever general purpose data store you have in mind. It’s a peer to peer electronic cash system”.

Another user chimed in, warning it could increase costs, reduce efficiency and even hurt long-term scalability.

Their argument is simple: if nonfinancial data is allowed to be stored on the blockchain, it will increase its size over time, storing useless data, and it will hurt decentralization, as fewer individuals will be able to host the entire blockchain on their computers.

They argue allowing people to store whatever they want on the blockchain because transactions shouldn’t be censored, will lead to hurting bitcoin in the long run. Many even argue no additional information should be allowed on the blockchain at all.

But not everyone is unhappy.

Some like Jameson Lopp, co-founder of Bitcoin wallet provider Casa, praised the devs for being transparent and consistent.

“Core Devs are a group saying we can’t force anyone to run code they don’t like,” Lopp said. “Here is our thinking on relay policy and network health.”

Lopp believes a joint statement helps the public understand what the devs stand for.

Supporters also say in a truly decentralized system, devs shouldn’t be gatekeepers. Instead users and miners should be able to decide what goes on the blockchain.

With opinions so divided, the future of Bitcoin may be more contentious. Some predict a fork to create a version of Bitcoin that only deals with monetary use. Others expect new wallet and node software that lets users choose to filter out large data or allow it.

Despite the controversy, the devs are standing by their decision. “While we recognize that this view isn’t held universally,” they said. “it is our sincere belief that it is in the best interest of Bitcoin and its users.”

-

@ cae03c48:2a7d6671

2025-06-10 17:01:47

@ cae03c48:2a7d6671

2025-06-10 17:01:47Bitcoin Magazine

KULR Technology Joins Bitcoin for Corporations, Increases Holdings to 920 BTCKULR Technology Group, Inc. (NYSE American: KULR), a Bitcoin First Company and global leader in sustainable energy management, announced that it has joined the Bitcoin for Corporations (BFC) initiative, an institutional platform by Strategy and Bitcoin Magazine to promote corporate Bitcoin adoption.

$KULR is proud to join the "@BitcoinforCorporations” initiative by @Strategy and @BitcoinMagazine, strengthening its Bitcoin First approach.

The company now holds 920 BTC, worth $91M, as part of its growing Bitcoin treasury strategy.https://t.co/TZ7tyw1Dsw pic.twitter.com/gK9vDlpkcQ— KULR Technology (@KULRTech) June 9, 2025

The initiative is made to support publicly traded companies in integrating Bitcoin into their corporate treasury strategies and balance sheets. Participating organizations gain access to institutional-grade tools, frameworks, and peer networks that support the responsible management and expansion of Bitcoin holdings. KULR’s role as an Executive Member of BFC aligns with its strategy to position Bitcoin as a long-term reserve asset.

“Our commitment to Bitcoin for Corporations reflects a strong conviction in Bitcoin’s long-term value as a monetary asset,” CEO of KULR Michael Mo, commented. “As KULR continues to scale its Bitcoin treasury, we welcome the chance to align with other institutions pioneering this shift in corporate treasury management.”

KULR also has increased its Bitcoin treasury by $13 million, bringing total holdings to 920 BTC, at an average acquisition price of $98,760 per bitcoin. The company’s total Bitcoin investment now stands at $91 million. The latest purchase was made at an average price of $107,861 per bitcoin. Year to date, KULR has delivered a 260% return on its Bitcoin holdings. They use a strategic mix of cash reserves and its At-The-Market (ATM) equity program to fund their acquisitions.

JUST IN:

Publicly traded KULR buys an additional 118.6 #Bitcoin for $13 million. pic.twitter.com/PJ29hsOk22

Publicly traded KULR buys an additional 118.6 #Bitcoin for $13 million. pic.twitter.com/PJ29hsOk22— Bitcoin Magazine (@BitcoinMagazine) June 9, 2025

On July 25, 2024, at the 2024 Bitcoin Conference, Strategy and Bitcoin Magazine announced the launch of Bitcoin for Corporations, a new initiative designed to help companies integrate Bitcoin into their treasury strategies. The program provides corporate leaders with educational resources, practical tools, and access to a network of peers and experts. It includes a co-branded web platform offering specialized content, newsletters, and success stories, as well as VIP access to events.

“The ‘Bitcoin for Corporations’ initiative is a significant step towards accelerating corporate Bitcoin adoption,” added Co-founder and former CEO of Strategy Michael Saylor. “By combining our expertise, resources and reach, along with Bitcoin Magazine we aim to create a robust platform that educates and supports corporations in implementing Bitcoin strategies.”

This post KULR Technology Joins Bitcoin for Corporations, Increases Holdings to 920 BTC first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ a29cfc65:484fac9c

2025-06-10 15:57:13

@ a29cfc65:484fac9c

2025-06-10 15:57:13Über die Freilerner-Familie von Katharina und Johannes mit ihren Kindern Aurelius, Benjamin und Friedrich haben wir in unserem Beitrag vom 28. Mai 2025 berichtet. Hier wollen wir eines ihrer Projekte vorstellen. Es zeigt deutlich den pädagogischen Ansatz von Jahrgangs- und Fächer-übergreifender zielorientierter Arbeit der Freilerner.

Die drei Jungs haben im Ringelnatz-Verein Wurzen zusammen mit anderen Kindern am Vorhaben „Vom Drehbuch zum fertigen Film“ mitgewirkt. Das Projekt wurde von dem Lyriker und Schriftsteller Carl-Christian Elze geleitet und unterstützt von der Künstlerin Constanze Kehrt, dem Theater- und Filmregisseur Philipp J. Neumann sowie dem Cutter und Animation Artist**** Sascha Werner, alle aus Leipzig. Constanze Kehrt unterstützte die Kinder beim Erlernen der Grundlagen für das Schreiben von Drehbüchern. Daneben gab es erste Übungen zur Körperwahrnehmung, Stimm- und Sprachübungen sowie Improvisations- und Schauspielübungen. Nach einer Einführung durch Philipp J. Neumann in die Filmkunst mit ihren unterschiedlichen Bereichen wie Schauspiel, Regie, Kamera, Ton, Produktion, Szenenbild, Kostüm, Musik, Schnitt, Sounddesign wurden die Kinder und Jugendlichen auf den eigentlichen Filmdreh vorbereitet. Dazu gehörten Übungen im Storyboarding, Szenenproben und schließlich das Location-Scouting und Festlegen der Drehorte in unmittelbarer Nähe zum Ringelnatz-Geburtshaus. An zwei Drehtagen wurden schließlich zwei Kurzfilme gedreht, darunter „Die Flosse“, an dem Aurelius, Benjamin und Friedrich sowie andere Kinder mitwirkten. Die Kinder übernahmen nicht nur die Rollen, sondern auch die Kamera, die Tonabnahme und zum Teil die Regie. Eine Einführung in die Kunst des Film- und Tonschnitts bekamen die Kinder und Jugendlichen schließlich von Sascha Werner. Danach wurde das gedrehte Material gemeinsam gesichtet und der Schnitt vorgenommen. Dabei konnten die Kinder und Jugendlichen die Erfahrung machen, dass es tatsächlich maßgeblich der Schnitt ist, der einem Film seinen besonderen Charakter, eine bestimmte Atmosphäre gibt.

In dem Film „Die Flosse“ schleichen sich drei Kinder abends von zu Hause weg, weil sie in der Schule gehört haben, dass in der Mulde eine große Flosse gesichtet wurde. Als sie an das Mulde-Wehr kommen, sehen sie keine Flosse, aber hören seltsame Geräusche. Plötzlich ruft eine Mädchenstimme um Hilfe. Philip ist bereit zu helfen, Emma und Benjamin bleiben lieber im Versteck. Im Wasser liegend und von Ästen eingeklemmt findet Philip eine Sirene. Sie bittet ihn, ihr zu helfen und lockt ihn ins Wasser, was Philip zum Verhängnis wird.

Der Film zeigt die kreativen und ausdrucksstarken Fähigkeiten der Kinder, die sie im Zusammenwirken mit ihren Lernbegleitern vom Drehbuch bis zum fertigen Kurzfilm umgesetzt haben. Der Film handelt von Hilfsbereitschaft und dem Mut, anderen in bedrohlicher Lage zu helfen. Aber auch das Zögern bei einigen zur Hilfe wird deutlich. Das Ende läßt viele Interpretationsmöglichkeiten zu.

Quelle: https://ringelnatz-verein.de/projekte/anna-hood/

https://www.youtube.com/watch?v=yC6YEa63Dp8

Foto von Aleksandra B. auf Unsplash

-

@ cae03c48:2a7d6671

2025-06-10 17:01:24

@ cae03c48:2a7d6671

2025-06-10 17:01:24Bitcoin Magazine

BlackRock’s iShares Bitcoin Trust Shatters ETF Growth Record, Surpassing $70 Billion in Just 341 DaysBlackRock’s iShares Bitcoin Trust (IBIT) has officially made history. The Bitcoin ETF surged past $70 billion in assets under management (AUM), reaching the milestone in just 341 trading days. This achievement makes IBIT the fastest ETF to ever hit that threshold.

JUST IN: BlackRock's spot Bitcoin ETF becomes the fastest ETF in history to surpass $70 billion AUM

pic.twitter.com/kZkXhjEvq0

pic.twitter.com/kZkXhjEvq0— Bitcoin Magazine (@BitcoinMagazine) June 9, 2025

To put that into perspective, the previous record-holder—SPDR Gold Shares (GLD)—took 1,691 days to reach the same milestone. “5x faster than the old record held by GLD of 1,691 days,” Bloomberg ETF analyst Eric Balchunas wrote in a post on X. Other ETFs like VOO (1,701 days), IEFA (1,773 days), and IEMG (2,063 days) also lag far behind IBIT’s rapid growth.

The explosive rise in IBIT’s AUM coincides with Bitcoin’s continued rally. At the time of reporting, Bitcoin (BTC) is trading above $108,000, up more than 2.06%, and sitting just under 4% below its all-time high of nearly $112,000 set last month.

BlackRock’s accumulation strategy has placed it at the forefront of institutional Bitcoin investment. According to blockchain analytics firm Arkham Intelligence, the firm now holds over 663,000 bitcoin—more than Michael Saylor’s MicroStrategy, which famously owns 582,000 BTC.

The price surge and ETF milestone reflect a broader institutional embrace of Bitcoin as a legitimate and increasingly preferred asset class. The record breaking pace of IBIT’s growth underscores the demand from investors looking for regulated exposure to Bitcoin through traditional financial products.

The chart clearly visualizes the disparity in ETF adoption timelines, with IBIT’s steep, vertical ascent dramatically outpacing its peers in the race to $70 billion. It’s a testament to the accelerating pace at which capital is flowing into Bitcoin markets.

As Bitcoin continues to hold just below its peak, and institutional products like IBIT grow at unprecedented speeds, all eyes are on what comes next—not just for Bitcoin, but for the legacy financial industry now being reshaped by it.

This post BlackRock’s iShares Bitcoin Trust Shatters ETF Growth Record, Surpassing $70 Billion in Just 341 Days first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-10 17:01:22

@ cae03c48:2a7d6671

2025-06-10 17:01:22Bitcoin Magazine

KULR Technology Group Announces $300 Million ATM Offering To Invest in Their Bitcoin TreasuryKULR Technology Group, Inc. (NYSE American: KULR) announced it has entered into a Controlled Equity Offering Sales Agreement with Cantor Fitzgerald & Co. and Craig-Hallum Capital Group LLC, enabling the company to sell up to $300 million of its common stock in an at-the-market (ATM) offering to support its Bitcoin treasury reserve.

JUST IN: Public company KULR is raising up to $300 million to buy more #Bitcoin

pic.twitter.com/Jg0yaAFkI7

pic.twitter.com/Jg0yaAFkI7— Bitcoin Magazine (@BitcoinMagazine) June 9, 2025

Under the agreement, Cantor Fitzgerald will act as the sole sales agent, using commercially reasonable efforts to sell shares at market prices. The offering will be made under an existing shelf registration and may occur from time to time based on market conditions and company discretion.

As of June 6, 2025, KULR’s common stock was trading at $1.18 per share. The total number of shares issued under the agreement will not exceed the company’s authorized but unissued shares, after accounting for shares already reserved or committed.

“Our common stock is listed and traded on the NYSE American LLC under the symbol ‘KULR,’” stated the filing.

KULR will pay the sales agents a commission of up to 3.0% of the gross sales proceeds. The agents are considered underwriters under the Securities Act of 1933, and KULR has agreed to indemnify them against certain liabilities.

“Our business and an investment in our common stock involve significant risks,” stated the filing. “These risks are described under the caption “Risk Factors” beginning on page S-6 of this prospectus supplement, and the risk factors incorporated by reference into this prospectus supplement and the accompanying base prospectus.”

KULR started adopting bitcoin as their primary treasury reserve asset in December 2024. Their strategy focuses on acquiring and holding bitcoin by using cash flows that exceed working capital requirements, issuing equity debt securities or raising more capital to purchase more Bitcoin.

“We view our bitcoin holdings as long term holdings and expect to continue to accumulate bitcoin,” mentioned the filing on page S-2. “We have not set any specific target for the amount of bitcoin we seek to hold, and we will continue to monitor market conditions in determining whether to engage in additional bitcoin purchases. This overall strategy also contemplates that we may periodically sell bitcoin for general corporate purposes or in connection with strategies that generate tax benefits in accordance with applicable law, enter into additional capital raising transactions, including those that could be collateralized by our bitcoin holdings, and consider pursuing strategies to create income streams or otherwise generate funds using our bitcoin holdings.”

This post KULR Technology Group Announces $300 Million ATM Offering To Invest in Their Bitcoin Treasury first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-10 17:01:19

@ cae03c48:2a7d6671

2025-06-10 17:01:19Bitcoin Magazine

Robert Mitchnick Discusses BlackRock’s Bitcoin ETF IBIT Success On BloombergToday, the Head of Digital Assets of BlackRock Robert Mitchnick, at the Bloomberg ETF IQ, talked about what’s really driving the surge in Bitcoin ETFs.

“It’s a lot of things coming together. Out of the gate was retail and investor demand…” said Mitchnick. “Now, more recently, we’ve seen just steady progress of more wealth advisor adoption, more institutional adoption. It’s been a mix of people who it’s the first time that they’ve invested in anything in the crypto space. And then on the other hand, you have lots of people who’ve been invested in Bitcoin for a long time and they’re taking advantage of the ETP wrapper.”

JUST IN: $11.5 trillion BlackRock's Robert Mitchnick said wealth advisor adoption of Bitcoin is "very early"

pic.twitter.com/UqiarMWEvV

pic.twitter.com/UqiarMWEvV— Bitcoin Magazine (@BitcoinMagazine) June 9, 2025

When it comes to institutional adoption, Mitchnick says we’re still early. ETF approvals usually take years, but some firms are fast-tracking the process.

“We’ve seen that fast tracked by a number of firms, and we talk about fast tracking,” stated Mitchnick. “We’re talking about, you know, quarters, not months. And slowly but surely, you’ve seen, I think, an acceleration, particularly in the last couple of months of more notable firms lowering barriers, granting approvals to their advisors to use these.”

Bitcoin’s volatility has declined recently, making it more appealing for institutions seeking diversification. However, it remains volatile, but its risk and return profile differs from traditional assets.

“There’s no question it’s relatively novel technology,” Mitchnick commented. “Even though the volatility has come down, it’s still volatile, but at the same time its risk and return drivers are markedly different from most of the rest of the assets in a traditional portfolio, and that’s important. And so when institutions are looking at this, they’re heavily focused on that correlation and whether it’s zero or even in some periods negative, because then the portfolio construction case is very compelling to them.”

About a dozen Bitcoin ETFs currently compete in the market, and demand remains strong.

“Well, a lot of them have been, you know, very successful, too,” stated Mitchnick. “Obviously, it has been the leader in the category by a fair margin. But there’s been such demand that, you know, it’s been exciting and there’s lots of products in the space and that’s a good thing.”

This post Robert Mitchnick Discusses BlackRock’s Bitcoin ETF IBIT Success On Bloomberg first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-10 17:01:16

@ cae03c48:2a7d6671

2025-06-10 17:01:16Bitcoin Magazine

Quantum BioPharma Boosts Digital Asset Holdings to $5 Million with New Bitcoin PurchaseIn an expansion of its digital asset portfolio, Quantum BioPharma Ltd. has announced the purchase of an additional $500,000 in Bitcoin and other cryptocurrencies, bringing its total holdings to USD $5,000,000. The Canadian biopharmaceutical company made the move after securing approval from its Board of Directors.

JUST IN:

Quantum BioPharma Ltd purchased an additional $500k worth of BTC/crypto and now holds $5 million in BTC/crypto. Not sure how much actual #bitcoin pic.twitter.com/OqomNZ250x

Quantum BioPharma Ltd purchased an additional $500k worth of BTC/crypto and now holds $5 million in BTC/crypto. Not sure how much actual #bitcoin pic.twitter.com/OqomNZ250x— NLNico (@btcNLNico) June 10, 2025

“Quantum BioPharma Ltd. is pleased to announce that after receiving approval from the Board of Directors, the Company has purchased additional Bitcoin and other cryptocurrencies as part of its strategic efforts. This brings the total amount of BTC and other cryptocurrencies purchased to USD $5,000,000. As previously announced the company will continue to allow for future financing and other transactions to be carried out in cryptocurrency.”

The investment marks another step in the company’s growth, reinforcing its broader strategy to include Bitcoin into its long-term financial planning and operations.

“This move reflects the company’s belief in the potential of Bitcoin and other currencies to provide a return on investment for shareholders and to provide some hedge against the dollar. The company is now set up to receive financing in cryptocurrencies as well as executing other types of transactions in cryptocurrencies.”

Quantum BioPharma has taken the steps to ensure that its holdings are managed securely and in compliance with legal and financial regulations, working with a custodian to uphold transparency, and investor trust.

“The company is holding all its cryptocurrency with a fully compliant custodian. The company emphasizes that all transactions are and will be fully compliant with all relevant financial and audit regulations, ensuring a secure and legal process.”

Quantum BioPharma is known for its work in the biotech space, particularly through its subsidiary Lucid Psycheceuticals Inc., which focuses on neurological treatments like Lucid-MS. With this latest Bitcoin investment, the company joins a growing list of firms hedging traditional finance strategies with BTC.

While it remains unclear how much of the $5 million is allocated specifically to Bitcoin, the firm’s latest move signals increasing institutional interest in Bitcoin as a long term, viable asset.

This post Quantum BioPharma Boosts Digital Asset Holdings to $5 Million with New Bitcoin Purchase first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-10 17:01:14

@ cae03c48:2a7d6671

2025-06-10 17:01:14Bitcoin Magazine

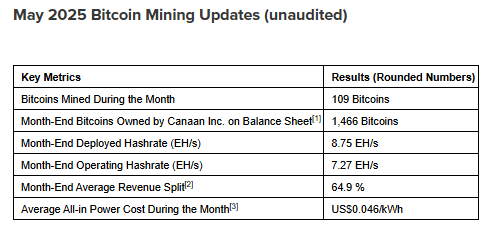

Canaan Announces Record Bitcoin Mining Month with Over 109 BTC MinedCanaan Inc. (NASDAQ: CAN), an innovator in Bitcoin mining, reported today their bitcoin mining update for the month ending May 31, 2025, with 109 bitcoins mined. The company’s total bitcoin holdings rose to 1,466 BTC.

“In May 2025, despite the 10% increase in tariffs on our Malaysia-made Bitcoin mining machines due to ongoing U.S. trade uncertainties, we remained focused on executing our strategic priorities with discipline and agility,” said the Chairman and CEO of Canaan Nangeng Zhang. “By capitalizing on the favorable momentum in bitcoin prices, we achieved a 25% month-over-month increase in our bitcoin production, reaching a record 109 bitcoins. This performance marks a new monthly high for our mining production and brings our total cryptocurrency holdings to an all-time high of 1,466 bitcoins at month-end.”

As of May 31, 2025, Canaan’s current mining projects add to 7.27 EH/s of operating and 8.75 EH/s deployed hashrate. In America, 3.09 EH/s is energized, including a 0.02 EH/s in Canada. Ethiopia’s contribute 4.13 EH/s energized and the Middle East facility delivers 0.03 EH/s energized. Total estimated global capacity stands at 8.75 EH/s.

“Our installed and operational hashrates reached 8.75 EH/s and 7.27 EH/s, respectively, underscoring the continued buildout of our global mining operations,” stated Zhang. “We also achieved a new historical high in installed computing power, while maintaining a competitive all-in power cost. This performance demonstrates our ability to execute on our strategy of efficient and sustainable growth.”

“With Bitcoin prices climbing to historic levels, we’re seeing increased global demand for our mining machines,” commented Zhang. “Combined with the strength of our mining operations and our disciplined approach to capital allocation, we remain confident in our business fundamentals and our ability to deliver long-term value to our shareholders.”

On June 9, 2025, the company announced that its CEO and its CFO acquired 817,268 of American Depositary Shares at an average price of US$0.76 per ADS, showing their belief in the company’s future.

“My share purchase underscores my belief in Canaan’s vision and the tremendous opportunities ahead,” stated Zhang in the announcement. “Both James and I believe there is a significant disconnect between our current ADS price and the value we believe we can deliver in the coming years.”

This post Canaan Announces Record Bitcoin Mining Month with Over 109 BTC Mined first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ d57360cb:4fe7d935

2025-06-10 16:15:54

@ d57360cb:4fe7d935

2025-06-10 16:15:54When I see a beginner in jiu jitsu start their journey they have a natural tendency to want to learn the ‘secret’. That one trick, the one technique, the one move that will make them completely unstoppable. This way of thinking is fools gold and it’s so easy to fall for.

In any pursuit there is no ‘secret’. There are fundamentals. Fundamentals are the deep understandings of the mechanics of things. The reason any techniques exist, is because the fundamentals. In a way the techniques being taught are summaries of a collection of fundamental mechanics. To fall in love with the summary misses the deep reservoir of knowledge hiding under the iceberg.

In order for art, mastery and craftsmanship to appear you must dive deep into the source from which the techniques came.

Techniques are not truth, they summarize truth.

-

@ 8bad92c3:ca714aa5

2025-06-10 16:03:13

@ 8bad92c3:ca714aa5

2025-06-10 16:03:13MicroStrategy's Debt-Financed Bitcoin Strategy Will Force a Reckoning Within 18 Months - Jessy Gilger

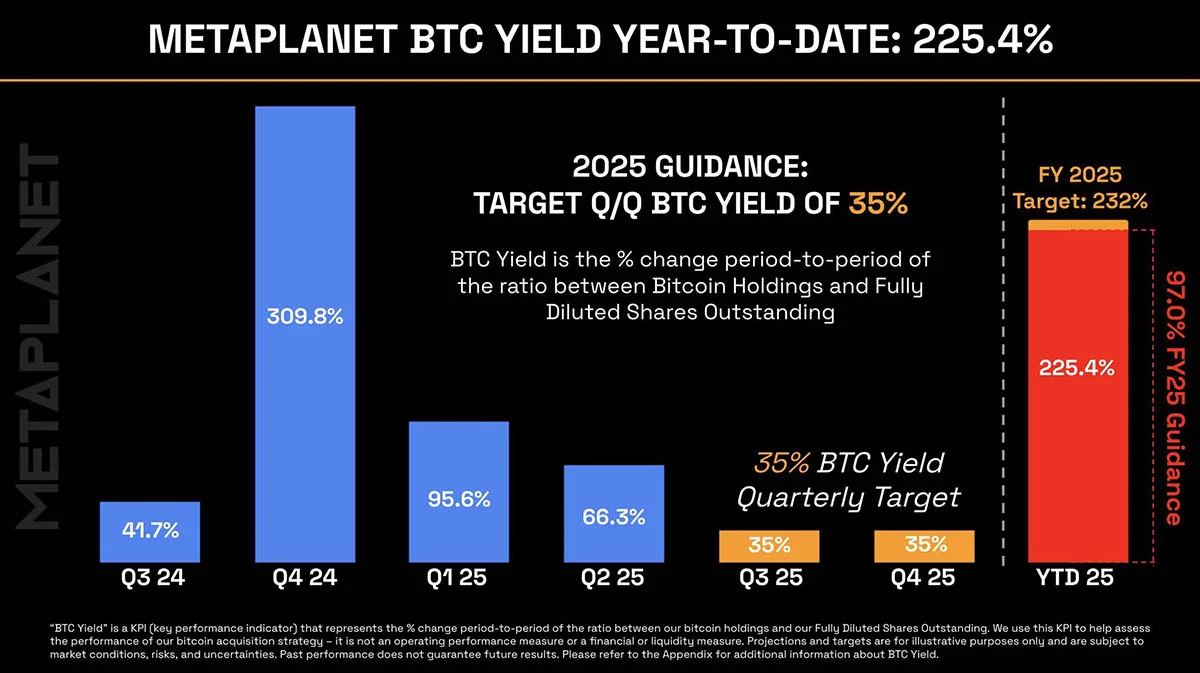

Jessy Gilger from Unchained Capital warned about the sustainability of MicroStrategy's model and its derivatives like MSTY. He predicts that as more companies adopt Bitcoin treasury strategies, "the P&L will matter more as the balance sheet gets commoditized." Within the next 18 months, he expects the current arbitrage opportunities that MicroStrategy exploits will diminish as Bitcoin reaches higher liquidity levels and more competitors enter the space.

His most concerning prediction involves MSTY specifically, which currently offers distributions annualized at 120% - far exceeding the 16-22% he calculates as reasonable from covered call strategies. "If a whale wants out of MSTY in size... they could sell those derivative positions into an illiquid market where there's no bid," potentially causing a 95% collapse similar to what happened with gold mining ETFs during COVID. He advises investors to consider "private pools" for options strategies rather than pooled products where "you're in the pool with everyone else" and subject to forced liquidations.

Pensions Will Drive the Next Major Bitcoin Adoption Wave in 2026-2027 - Adam Back

Adam Back sees institutional adoption accelerating dramatically as pension funds begin allocating to Bitcoin. "The institutional cover of some of the bigger entities that people would reference... you don't get fired for following BlackRock's recommendation," he explained. With BlackRock now suggesting 2% portfolio allocations and the infrastructure finally in place through Blockstream's new Gannett Trust Company, the barriers for institutional adoption are falling rapidly.

Back predicts this will create a "snowball" effect as pension funds realize Bitcoin can help address their massive unfunded liabilities. He noted that financial institutions offering Bitcoin products are "slow movers" with "policies and training materials and guidance that they got to get through," but once activated, the scale will dwarf current retail and ETF flows. The combination of pension fund allocations, continued nation-state adoption, and the mathematical scarcity of Bitcoin leads him to view even $100,000 as "cheap" given where the market is headed.

Traditional Bond Markets Will Collapse as Bitcoin Becomes the Escape Hatch - Sean Bill

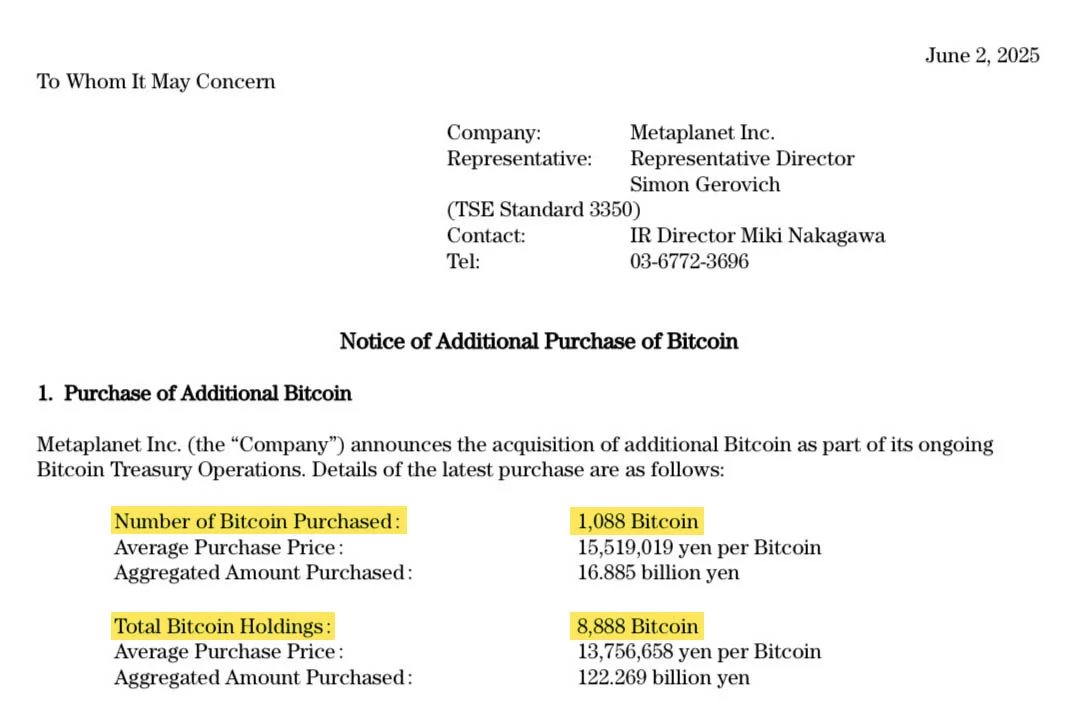

Sean Bill sees a massive shift coming as bond markets deteriorate globally. "You peel back the onion. So who benefits from financial repression, right. And inflating your way out of assets," he explained. With Japanese bond yields blowing out and U.S. 30-year yields jumping 10 basis points in a single day, Bill predicts we're witnessing the early stages of a sovereign debt crisis that will drive unprecedented flows into Bitcoin.

He pointed to Japan's MetaPlanet as a preview of what's coming: "The whole bond market of Japan just flowed into a hotel company." As pension funds and institutions realize they can't meet obligations through traditional fixed income, Bitcoin will become the only viable alternative. Bill believes this transition will accelerate once fiduciaries understand Bitcoin's role as "pristine collateral" that can help them "chip away at those unfunded liabilities." His experience getting Santa Clara County's pension into Bitcoin in 2021 showed him firsthand how a 1-3% allocation at $17,000 could have "wiped out the unfunded liability" as Bitcoin approached $100,000.

Adam Back & Sean Bill Podcast Here

Blockspace conducts cutting-edge proprietary research for investors.

New Bitcoin Mining Pool Flips Industry Model: "Plebs Eat First" Could Threaten Corporate Dominance

UTXO Management's explosive report forecasts unprecedented institutional demand that could absorb 20% of Bitcoin's circulating supply by 2026. Bitcoin ETFs shattered records with $36.2 billion in year-one inflows, crushing every commodity ETF launch—and they're projected to hit $100 billion annually by 2027.

The real story? ETFs are just the appetizer. Five massive catalysts are converging: wealth platforms eyeing $120 billion from a modest 0.5% allocation across $60 trillion AUM; corporations following MicroStrategy's playbook now holding 803,143 BTC; potential U.S. Strategic Reserve of 1 million BTC; 13 states with active Bitcoin reserve bills; and the rise of BTCfi yield strategies offering 2-15% returns.

The game-changer: these aren't day traders. CFOs, treasurers, and governments are structurally locked buyers seeking BTC-denominated yields, not quick profits. With FASB mark-to-market accounting removing impairment headaches and regulatory clarity accelerating globally, institutions face a stark reality—allocate now or chase exposure at dramatically higher prices.

This isn't another cycle. It's the institutional colonization of Bitcoin.

Subscribe to them here (seriously, you should): https://newsletter.blockspacemedia.com/

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

STACK SATS hat: https://tftcmerch.io/

Subscribe to our YouTube channels and follow us on Nostr and X:

@media screen and (max-width: 480px) { .mobile-padding { padding: 10px 0 !important; } .social-container { width: 100% !important; max-width: 260px !important; } .social-icon { padding: 0 !important; } .social-icon img { height: 32px !important; width: 32px !important; } .icon-cell { padding: 0 4px !important; } } .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } .moz-text-html .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } /* Helps with rendering in various email clients */ body { margin: 0 !important; padding: 0 !important; -webkit-text-size-adjust: 100% !important; -ms-text-size-adjust: 100% !important; } img { -ms-interpolation-mode: bicubic; } /* Prevents Gmail from changing the text color in email threads */ .im { color: inherit !important; }

-

@ 9ca447d2:fbf5a36d

2025-06-10 16:02:53

@ 9ca447d2:fbf5a36d

2025-06-10 16:02:53President Donald Trump’s media company, Trump Media & Technology Group (TMTG), is doubling down on its Bitcoin bet, partnering with Crypto.com and Yorkville America Digital to launch its own bitcoin exchange-traded fund (ETF), called the Truth Social Bitcoin ETF.

On June 3, a division of the New York Stock Exchange, NYSE Arca, filed a 19b-4 form with the Securities and Exchange Commission (SEC).

This is the final regulatory hurdle before an ETF can be launched. If approved, this new fund will allow everyday investors to buy shares tied to the price of bitcoin, without having to hold the asset themselves.

The Truth Social Bitcoin ETF will track the price of bitcoin and give investors a simple, regulated way to invest in the digital money.

It will be listed and traded on NYSE Arca, and Foris DAX Trust Company (the custodian for Crypto.com’s assets) has been named as the proposed custodian for this new fund.

According to the filings, the ETF is “designed to remove the obstacles represented by the complexities and operational burdens involved in a direct investment in bitcoin.”

This is part of a bigger plan by Trump Media to offer a full suite of digital-asset-based financial products.

The company has also applied to trademark six investment products and has plans for additional ETFs under its Truth.Fi fintech platform, which will focus on digital assets and energy sectors.

Trump Media also recently announced a $2.5 billion bitcoin treasury plan and raised $2.4 billion in stock and debt to support its bitcoin initiatives.

Related: Trump Media Will Raise $2.5 Billion to Build Bitcoin Treasury

Now that the 19b-4 has been filed, the SEC has 45 days to approve, reject or delay the application. This can be extended several times, but a final decision must be made by January 29, 2026.

In addition to the 19b-4, Yorkville America Digital must also file an S-1 registration statement. This will outline exactly how the ETF will work, what it offers to investors, how funds will be used, and the risks involved.

Since January 2024, bitcoin ETFs have been all the rage, with over $130 billion in assets. Big players like BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s FBTC dominate the space. BlackRock alone has $69 billion in assets through its bitcoin ETF.

Even though Trump’s ETF is entering a crowded field, its name will get attention. The Truth Social bitcoin ETF is expected to generate media buzz, political controversy and divided investor opinions, making it a cultural and financial statement.

Donald Trump is the majority owner of Trump Media, although his shares are in a trust controlled by his son, Donald Trump Jr. The ETF filing doesn’t mention Trump by name, but most people see it as a Trump product.

The President is getting more and more involved in the digital asset space. He has NFT collections, meme coins, a bitcoin mining company, a digital asset wallet, and now a potential bitcoin ETF.

But not everyone is happy. Some argue that a sitting president’s involvement in regulated financial products, especially one that could benefit from political influence, is unethical.

An SEC-approved digital asset product from Trump could blur the lines between politics, personal gain and digital assets.

Others, however, see this as a calculated move to boost Trump’s image and position him as a leader in the digital asset and tech space.

-

@ 93bfc86d:fc8e91f5

2025-06-10 15:27:43

@ 93bfc86d:fc8e91f5

2025-06-10 15:27:43질서자유주의가 자유주의 세상을 만드는 방법

안캡의 전략에는 크게 두 가지, 호페의 질서자유주의와 새뮤얼 콘킨 3세의 아고리즘이 있다.

로스바드-호페 라인의 질서자유주의는 논리를 기반으로 자연권을 정당화하고, 이를 통해 국가의 부당함을 설파한다. 미제스의 "인간은 행동한다."라는 제1공리부터 시작해서, 행동의 제1수단인 신체가 그 자신에게 소유되어야 한다는 자기 소유를 증명하고 자연권을 철저하게 연역적으로 정당화해간다. 안캡의 세상을 만들려는 이들의 방법론도 논리적이다.

예를 들어 호페의 『자유주의자는 무엇을 해야 하는가』 책에서는 위로부터의 전환이 불가능함에 따라 아래로부터의 전환을 해야 한다는 주장이 나온다. 과거에는 이런 자유로운 세상이 도래하기 위해서는 왕 한 명이 "앞으로 자기가 원하는 대로 보안 기업을 자유롭게 선택하고, 더 이상의 강제는 없다!"라고 선언만 하면 됐다. 따라서 왕 한 명만 어떻게 설득을 하거나, 압박을 하든 주리를 틀든 일단 왕이 이렇게 선언하게 하기만 하면 됐다. '마그나 카르타'도 결국 귀족 연합이 왕 한 명을 압박해 왕이 서명했던 것 아닌가?

반면에 현대 민주주의 사회를 보자. 대한민국에서 대통령 한 명이 최저임금을 폐지할 수 있는가? 최저임금은 헌법에 보장되는데(헌법 32조) 따라서 이를 폐지하는 것은 거의 개헌만큼이나 어렵다. 대통령이나 국회의원 과반이 발의를 해야 하고, 국회에서 재적 3분의 2 이상이 찬성해야 겨우 통과되며, 이렇게 통과해도 국민투표에서 과반수가 동의해야 겨우 없어지는 것이다. 즉, 거의 불가능에 가깝다.

따라서 호페는 위로부터의 전환이 불가능함에 따라 전국적인 중앙 정부의 투표를 거부할 것을 제안한다. 대통령 선거나 국회의원 선거 등 말이다. 여기서 중앙 정부 단위의 투표를 거부하는 이유는 중앙 정부의 부당성도 있지만, 이 투표를 통해 세상을 바꾸는 게 현실성이 없어서 그렇다.

같은 맥락에서 지역 선거의 투표는 항상 거부하는 건 아닌데, 자유주의자들이 한 국가 전체에서 과반을 얻는 것은 불가능하지만, 한 지역에 점점 몰리는 경우에는 적어도 그 지역에서는 과반이 될 수도 있기 때문이다. 따라서 아주 작은 지역에서 자유주의자들이 다수결이 된다면 적어도 그 지역에 한해서는 위로부터의 전환이 가능해진다. 그러면 투표를 거부하다가 지역구에서 본격적으로 투표를 하기 전에 선행되어야 할 일은 자유주의가 많이 퍼지고, 자유주의를 지지하는 사람들이 특정 지역에 몰리기 시작해야 하는 것일 것이다. 비트코이너들이 특정 지역에 몰려 시타델을 건설하는 상황을 생각하면 될 것 같다.

그 이후에는? 지역구의 대표로 선출된 인물이 해당 지역구의 투표권을 재산 소유자에게 재산 크기(지분)대로 다시 분배해야 한다. 즉, 재산이 없는 사람은 투표권이 없다. 모든 공공 인프라(도로, 수도, 전기, 교육, 치안, 사법 등등)는 전부 주식으로 판매되어 민영화된다(지방 정부는 이를 통해 재원을 마련한다). 이에 따라 공공 인프라는 완전히 사적 소유로 전환된다. 치안, 사법, 교육 모두 민간 영역으로 전환된다.

현재 세계에서 자유주의자들이 이런 관점을 취한다면 무엇을 해야 할까? 일단 자유주의를 더 많은 사람에게 퍼뜨려야 한다. 또한, 자유주의자들이 모일 지역을 물색해야 할 것이다. 그리고 중앙 정부 단위의 투표를 거부해야 할 것이다.

그림 1. 질서 자유주의의 상징인 아나코 캐피탈리즘 깃발

현대 민주주의 투표의 부당함

아고리즘의 전략을 이야기하기 전에 먼저 현대 민주주의 투표의 부당함에 대해 살펴보고 가자. 개인적인 생각도 들어가 있다.

투표 행위 자체는 유권자의 권리 행사로 전혀 나쁠 것이 없다. 다수결의 원칙도 당연히 마찬가지다. 투표 당사자들이 다수결의 원칙에 동의하기 때문에 참여하는 것이기 때문이다. 그래서 민주주의는 선거에서 져도 그 결과에 승복하는 것이 그 시스템의 규칙이다. 예를 들어 주주총회에서 주주들이 지분대로 의결권을 행사하거나 행사하지 않아서 생기는 결과는 그 행위 자체로는 전혀 문제가 없다.

투표의 정당성은 투표라는 행위 자체로부터 판단되는 것이 아니라 그 투표가 어떤 시스템 아래서 이뤄지는 투표인지로부터 판단해야 한다. 나는 두 가지 관점에서 살펴볼 것이다.

현대 민주주의의 투표는 유권자가 자신의 권리를 당선자에게 위임하는 행위다. 한 후보가 당선되면 다수결의 원칙에 따라서 그 후보는 그 후보를 찍지 않은 유권자들의 권리까지 모두 가져간다. 여기까지는 문제가 없다. 투표 행위 참여자들이 다수결의 원칙이라는 그 시스템에 동의하기 때문에 투표하기 때문이다.

그런데 현대 민주주의는 당선된 후보가 그 후보에게 투표했든, 투표하지 않았든, 기권을 했든 간에 다른 사람의 소유권을 마음껏 유린할 수 있는 권한도 가져간다. 이건 아주 큰 문제다. 국회의원이 세금을 늘리는 입법 권한을 행사하거나, 대통령이나 국회에서 예산을 편성해 정부 지출을 늘리고, 돈을 찍어내서 사람들의 소유권을 유린하는 행위가 용인된다.

어떤 사람도 다른 사람의 소유권을 침해할 수는 없다. 소유권은 단순히 희소한 재화의 분배 문제를 해결하는 실용적 대안이라서 중요한 것이 아니다. 인간 행동이라는 공리로부터 자기 소유 원칙을 이끌어내고, 그가 소유한 신체와 삶을 써서 획득한 재화(원초적 점유)에 대한 소유권을 보장하는 것이며, 그리고 이미 소유권이 있는 재화를 교환의 양 당사자가 자유롭게 교환하는 행위를 보장하는 것이다.

따라서 소유권은 인간에게 이성이 있다는 존엄성의 표현이자 인간 시간(삶)의 희소성과 귀중함을 인정하는 것이다. 어느 누구도 이를 모독할 권리는 없다. 이를 침해하는 것은 보편 원리에 따라 그 자신의 소유권도 포기한다는 뜻과 같으며, 이는 결국 자기 신체의 자기 소유도 부정하는 셈이 된다.

현대 민주주의에서 투표하는 것은 다른 누군가의 소유권을 유린할 사람을 뽑는 것과 같다. 애초에 이런 권한은 누구에게도 주어지지 않았으며 당연히 누구에게도 없으니 넘겨줄 수도 없는 권한이다.

현대 민주주의의 삼권분립 체제는 당선자에게 이러한 강탈의 권한이 보장된다. 설령 후보자가 이런 권한을 행사하지 않는다고 하더라도 이 시스템이 그러한 권한을 발동할 수 있다는 것을 언제든지 보장한다면 이러한 시스템은 폐기되어야 한다.

따라서 현대 민주주의에서 투표하는 행위는 누군가가 이러한 권한을 행사하는 것에 대한 동의로 간주될 수 있다. 어떤 후보가 이런 행위를 다른 후보보다 '덜' 한다고 해서 그 후보에 투표하는 것에 대한 정당성은 당연히 확보될 수 없다. 더하는지 덜하는지에 따라 이 약탈이 정당화될 수는 없기 때문이다.

심지어 어떤 후보가 이런 약탈 행위를 절대 안 할 것이라고 공언한다고 해도, 시스템에 이러한 권한이 보장되어 있는 이상 투표하는 행위는 이 시스템에 동의하는 행위이다. 그 후보가 당선된 이후 갑자기 돌변해 세금을 걷거나 국채를 팔아 예산을 확보하고 돈을 찍어내는 것이 시스템 상에서는 문제가 없기 때문이다. 이것은 간접 민주주의의 단점이라기 보다는, 애초에 이런 다른 사람에 대한 약탈 권한을 행사할 수 있는 시스템 자체가 잘못된 것이다.

현대 민주주의가 부당한 두 번째 이유는 이 시스템에 동의하지 않는 사람들조차 이 시스템의 피해자가 된다는 점이다.

도박에 참여하고 있는 사람들을 생각해보자. 승리자가 나머지 베팅한 모든 사람들의 베팅 금액을 약탈하는 것은 전혀 문제가 되지 않는다. 왜냐하면 도박 참여자들은 패배 시 자신이 베팅한 재산이 승자에게 몰수될 수도 있다는 것에 동의하고 도박에 참여하기 때문이다(따라서 이는 약탈이 아니다). 이에 동의하지 않는다면 도박을 그만하면 된다. 도박사는 언제든지 도박을 그만둘 자유가 있다.

그러나 현대 민주주의는 이 시스템에 동의하지 않더라도 그 나라에서 태어났다는 이유만으로 이러한 약탈에 강제 당할 수밖에 없다. '분배'하기 위해 투표를 할 거면 그 시스템에 동의하는 사람들끼리 서로의 재산을 놓고 분배하면 될 일이다. 그러나 이 시스템은 모든 사람들에게 이 시스템에 참여하는 것이 강제된다.

즉, 이 시스템은 애초에 잘못된 시스템인데 이 안에서 좌니 우니, 대통령제니 내각제니 사람들이 서로 경쟁하게 한다. 시스템 자체에 대한 의문을 품기는 매우 어려운 구조다.

이 시스템이 마음에 안 들면 이민을 가면 된다고 하는 주장은 전혀 설득력이 없다. 이민에 비용이 들고 다양한 현실적인 제약이 있다는 것은 차치하고서 이야기해보자. 만약 이러한 분배(?) 혹은 세금의 권한 행사자가 해당 지역 토지의 소유자고, 그 토지의 사용자가 소유자가 정한 분배 규칙에 동의하는 조건으로 토지를 사용한다면 이러한 세금과 같은 분배는 약탈은 아니다. 사용자가 그 규칙에 자발적으로 동의했으므로 정당화될 수 있는 것이다.

만약 국토의 모든 땅이 사실상 소유자가 있는 게 아니라, 사실상 국가의 소유이며 국가가 국민들에게 사용권을 나눠주는 것이라는 미친 주장을 해도(참고로 이건 토지의 사적 소유권을 부정하는 공산주의다!) 여전히 이 주장은 정당하지 않다.

토지의 소유권을 획득하는 방법은 두 가지가 있는데 첫째, 소유권이 없는 땅을 점유함으로써 소유권을 주장할 수 있게 되는 것, 둘째, 이미 소유권이 있는 토지를 자발적인 교환이나 기부를 통해 획득하는 것이다. 소유권이 있는 생산 수단을 통해 생산된 생산물도 소유권이 인정되는데, 토지는 생산이 불가능하니(우주정거장 같이 새로운 공간을 건설하는 게 아니라면...) 토지를 획득하는 방법은 언급한 두 가지 뿐이다.

그런데 현대 국가가 토지를 소유한 것의 기원을 살펴보자. 식민지화를 통해 강제로 점유하는 것은 대한민국은 해당이 없는 것 같다. 그러면 이미 소유자가 있는 사유지를 각종 규제와 사용 제한을 통해 사실상의 지배권을 확보하거나, 세금으로 축적한 재정으로 구입한 것이다. 그 기원이 모두 약탈에 있다는 점에서 국가의 토지 소유는 정당하지 않다.

따라서 규칙이 싫으면 이민을 가면 된다는 주장은 도둑이 도둑질을 하는데, 도둑질을 당하기 싫으면 멀리 도망가라는 식의 궤변과 같다.

그러나 국가의 계약은 완전히 비자발적이다. 단지 그 신체가 어디서 탄생했다는 이유만으로 그 시스템에 동의한 것이 될 수는 없다. 갓 태어난 아기는 다른 사람의 보호가 있어야만 생존할 수 있다는 점에서 완전히 비자발적인데, 이에 따라 당연히 탄생의 위치도 완전히 비자발적인 것이었기 때문이다.

또한 국가는 국토의 소유자가 아니다. 그보다는 국토의 소유권을 보장'해야' 하는 존재일 뿐이다. 누군가가 규칙을 정하고 싶다면 그 규칙의 영향권은 자신의 사유지 내에서만 영향력이 있으며, 당연히 그 규칙에 자발적으로 동의하는 사람들만 그 사유지를 이용하는 조건으로 계약할 수 있다.

정리해보자. 지금까지 현대 민주주의의 투표의 부당함에 대해 두 가지 관점에서 살펴봤다. 첫째는 투표가 약탈이 가능한 이 시스템에 동의한다는 행위라서 부당하다는 것이고, 둘째는 이 시스템에 동의하지 않는 사람들까지 약탈의 대상이 되는 이 시스템에 동의한다는 행위이므로 부당하다는 것이었다.

투표하지 않는 행위가 혹시 반대 세력이 활개치게 두게 되는 것은 아닐까? 그렇지 않다. 투표하지 않는 행위는 이 시스템의 정당성을 약화시킨다. 현대 민주주의의 큰 속임수가 있다. 민주주의에서 비롯된 통치 행위는 51%를 넘은 사람들이 그 통치 행위에 동의했기 때문에 자행되어도 된다는 매우 비논리적인 주장에 입각하고 있다. 이는 당연히 정당성이 없다. 그런데 진짜 큰 속임수는 그 통치 행위에 동의한 사람이 심지어 과반도 아니라는 것이다.

만약 어떤 후보가 생산에 적대적인 수준의 세금 부과와 보편 복지, 최저임금 인상 등의 모두가 고통받는 정책을 공약으로 내세워 당선이 되었다고 해보자. 해당 후보의 득표율이 51%라고 한다면 이는 전국의 51% 국민이 해당 후보를 지지하는 것과 같은 착각을 일으킨다. 그렇지 않다. 만약 투표율이 75%라면, 해당 후보에 동의한 사람은 0.75 x 0.51 = 38%가 된다. 즉, 38%의 동의로 인해 모든 사람이 함께 고통 받게 되는 것이다.

그래서 민주주의는 이러한 사실을 감추면서 사람들에게 투표를 독려할 수밖에 없다. 투표율이 조금만 낮아져도 이에 대한 정당성이 심각하게 낮아지기 때문이다. 투표율이 50%인 상황에서 어떤 후보가 51%의 표를 얻어 당선된다면 전 국민의 25%의 지지로 당선된 것과 같은데 이는 통치 행위에 대한 정당성을 매우 약화시킨다.

소비자 주권 행사

그러면 투표라는 행위가 없다면 일반 시민들은 어떻게 주권을 행사할 수 있을까? 사실 우리는 매일매일 자발적으로 투표를 하고 있다. 바로 미제스가 말한 '소비자 주권' 행사다.

우리는 기업들이 우리에게 어떤 효용을 주는지에 따라 계속 투표한다. 어떤 기업을 살리고, 어떤 기업을 죽일지, 어떤 기업을 거지 기업에서 부자 기업으로 만들지, 또는 어떤 기업을 부자 기업에서 거지 기업으로 만들지 투표한다. 바로 '소비'를 통해서 말이다.

이러한 소비라는 투표 방식은 완전히 자발적이라는 점에서 소유권을 제대로 보장한다. 약탈과는 완전히 동떨어진 행위다.

또한, 이러한 투표 방식은 각자가 원하는 대로 효용을 누릴 수 있다. 사법과 치안도 시장의 영역으로 들어오면 우리는 어떤 규칙 아래서 살아갈지 자유롭게 선택할 수 있다. 즉, 내가 선택한 규칙이 다른 사람에게도 강제되지 않고, 다른 사람이 선택한 규칙이 나에게 강제되지도 않는다. 서로 다른 규칙이 충돌하면 그 규칙들의 간극을 중재하는 기업이 나타난다. 자연적으로 질서가 꽃 피는 것이다.

생산 권한은 기업에게 달려있지만 심판은 소비자가 한다. 생산자가 소비자의 의지에 반하는 생산을 하면 바로 시장에서 퇴출되기 때문이다. 기업은 소비자에게 어떤 도덕적 의무를 강요할 수도 없다. 기업은 소비자가 원하는 것이 있다면 생산할 뿐이다. 소비자는 기업에게 자신들이 원하는 것을 최대한 효율적으로 자원을 분배하여 생산할 것을 명령하고 생산 권한을 위임하는 셈이다. 그 기업이 소비자가 원하는 것을 생산하지 않으면 어차피 다른 어떤 기업이 생산하여 거기서 챙길 수 있는 소비자의 표, 즉 이익을 가져갈 것이다.

만약 '소비'라는 투표 행위 자체에 반대한다면 오지에 있는 땅을 사서 문명을 떠나 자급자족하며 사는 것도 가능하다. 각자가 자신만의 방식으로 삶을 선택할 수 있는 것이다.

이 투표 시스템에서 표는 돈이다. 돈으로 투표를 한다는 것이 비인간적으로 느껴질지도 모르겠다. 그러나 돈으로 투표하는 것은 지극히 인간적인데, 그 투표권을 얻기 위해서는 먼저 다른 사람들이 원하는 것을 해줘서 그 표를 얻어야 하기 때문이다. 소비하려면 먼저 생산해야 한다. 이건 완전히 약탈 없는 시스템이고, 모든 인간 시간에 대한 존중이다.

이러한 이유들로 나는 이제 현대 민주주의에 대한 투표를 거부하지만, 동시에 매일 소비를 통해 투표하고 있다.

아고리즘이 자유주의 세상을 만드는 방법

이제 아고리즘의 전략을 살펴보자. 로스바드-호페의 질서 자유주의를 살펴본 뒤, 현대 민주주의의 투표에 대한 부당함을 살펴본 것이 뜬금 없는 이야기는 아니었는데, 아고리즘은 이러한 이유로 어떠한 투표도 거부하기 때문이다. 아고리즘의 창시자인 새뮤얼 콘킨 3세가 로스바드와 갈라선 것도 로스바드가 정치와 연대하는 전략적 행보를 보이면서부터였다.

아고리즘은 자유로운 세상을 만들기 위해 자유 시장인 아고라를 적극 활용할 것을 주장한다. 이들은 정부가 추적할 수 없는 자유로운 암시장을 확대해서 정부의 힘을 약화시키는 방법을 써야 한다고 주장한다. 이 암시장은 당연히 무기, 마약, 성매매 등을 포함한 시장을 말한다.

그래서 자유지상주의를 도래시키기 위한 이들의 전략은 정부가 추적할 수 없는 시장을 만들고, 하나의 병렬 경제(대항 경제)를 만들어 정부의 힘을 지속적으로 약화시키는 것이다. 이들은 납세 거부 운동, 투표 거부 운동을 장려하며 암시장과 암호 기술을 적극 활용한다. 참고로 사이퍼펑크 같은 기술 자유주의는 분류하자면 질서자유주의보다 아고리즘 쪽에 더 가깝다(로스 울브리히트의 실크로드를 생각해보자...!)

로스바드-호페의 질서자유주의와 콘킨의 아고리즘은 둘 다 자유지상주의의 실현을 목표로 하지만, 질서자유주의는 논리적으로 윤리적 정당성을 확보하고, 그러한 정당성을 바탕으로 자유지상주의를 실현시키기 위해 현실 세계에 이미 존재하는 제도들도 전략적으로 이용한다. 반면 콘킨의 아고리즘은 자유지상주의의 윤리적 정당성보다는 그걸 도래시키기 위한 전략들에 치중하며, 정치와 절대 타협하지 않고, 전략적으로 이용하려고도 하지 않는다. 목표는 같지만 서로 다른 방법을 취하는 것이다.

1980년 공개된 콘킨의 「신 자유주의자 선언」은 미제스와 로스바드, 르페브르에 대한 감사로 시작하지만, 1장에서 다음과 같은 문구도 나온다. (이것도 언제 다 번역해봐야겠다!)

"처음 나타난 반격은 ... 개혁주의—국가주의를—'개선'하겠다는 명분으로 국가의 직책을 받아들이는 것까지 포함한다!—이 모든 반反 원칙들에 대해서... 그중 가장 끔찍한 것은 '정당주의'인데, 이는 자유지상주의적 목적을 국가주의적 수단, 특히 정당을 통해 달성하려는 반反 개념이다. '자유지상주의' 정당은 국가가 이제 막 출현한 자유지상주의자들에게 퍼부은 두 번째 반격이었다. 처음에는 터무니 없는 모순으로, 그 다음에는 침략군으로 등장했다."

로스바드가 1992년 공화당 경선 후보였던 팻 뷰캐넌을 공개적으로 지지했을 때(이때 공화당 경선에서 뷰캐넌은 아버지 부시한테 졌고, 대선은 민주당 빌 클린턴 승리), 콘킨이 어떤 반응을 보였을지 상상해보자. 저런 선언문을 썼는데 말이다. 콘킨은 로스바드가 자유지상주의 원칙을 저버렸다면서 자신이 편집하는 잡지 『신 자유지상주의자』에서 로스바드의 행위를 "자유의 원칙을 포기한 행위"라고 비난했다.

반면 로스바드는 소수의 자유지상주의 지식인들만으로는 자유지상주의 사회를 건설할 수 없으므로 대중과 연합해야 한다고 주장했다. 팻 뷰캐넌 같은 인물을 통해 중산층이나 노동계층의 지지를 얻을 수 있고, 자유지상주의 목표를 달성할 수 있다고 했다. 이때 나온 전략이 자유주의적 경제 질서와 보수적 문화 질서를 결합한 '팔레오 자유지상주의'다. 로스바드는 아고리즘 세력에게 순수성만을 강조하며 현실 세계와 단절된 사람들은 무기력한 이상주의자들이라고 반박하며, 자신은 국가주의를 지지하는 게 아니라 그 세력 안에 있는 반국가적 잠재력을 이끌어내는 것이라고 했다.

그림 2. 아고리즘의 깃발

질서자유주의와 아고리즘의 공동체적 배제에 관한 입장 차이

콘킨의 아고리즘과 로스바드-호페 라인의 질서자유주의의 차이는 정치 같은 기존 제도들을 전략적으로 이용할 수 있는지뿐만 아니라 공동체적 배제에 관한 입장에서도 약간 갈라진다.

자유주의에서는 자유로운 수용과 자유로운 '배제'도 보장되어야 한다. 즉, 예를 들어 어떤 사람이 장사를 하는데 동성애자나 흑인이나 채식주의자를 직원이나 손님으로 받지 않는 것도 장사하는 사람의 자유로운 배제 권리라는 것이다. 자신의 사유지에 어떤 사람을 들일지, 들이지 않을지는 전적으로 소유자의 몫이다. 그리고 여기서 배제는 당연히 폭력으로 이어지지 않는 선에서의 자유로운 배제다.

이러한 배제가 한 공동체 전체로 퍼졌다고 해보자. 지금은 동성애자에 대한 예시만 들겠다(필자는 동성애에 대해 부정적 감정이 전혀 없으니 동성애자 분들은 오해 마시길). 만약 한 지역 소유자 공동체 전체가 동성애자에 대한 배제를 주장한다면 당연히 동성애자는 그 공동체에 들어갈 수가 없다.

여기서 이를 다루는 뉘앙스가 약간 다른데, 호페는 이를 자유로운 계약에 의한 공동체적 질서의 탄생이라 보며 긍정적으로 본다. 물론 절대로 이러한 배제가 폭력으로 이어져서는 안 된다. 폭력으로 이어지면 비침해성 공리 위반이므로 정당성이 없다.

아고리즘은 개인들의 자발적인 배제는 자유지만, 이것이 공동체적 배제로 발전하고 구조적 차별이나 집단적 억압으로 발전하는 건 국가의 또 다른 형태일 뿐이라 생각하여 이를 경계한다. 그래서 개인 차원의 자율적 배제는 정당하지만, 공동체 차원의 배제는 경계한다. 그렇다고 이걸 없애야 한다 이런 건 아니다(개인들의 자유로운 배제가 공동체 배제로도 이어질 수 있는 것이므로). 콘킨은 공동체적 배제가 탄생할 수 있지만 그것이 비합리적인 배제라면 대안 시장이 탄생할 것으로 본다. 동성애자들을 위한 시장과 마을이 생길 것이고, 비합리적인 배제는 이러한 고객들을 놓친 것에 대한 손실로 이어질 것이라고 본다. 즉, 모든 개인이 자유 시장 아고라에서 자발적으로 교환할 권리를 가져야 하며, 차별적인 배제들은 시장 안에서 경쟁할 수 있을 거라 본다. 만약 대안 시장이 없는 상황에서 모두가 배제한다면 이는 실질적 강제처럼 작동할 수 있기 때문이다.

자유지상주의 안에서 콘킨의 아고리즘은 차별이나 수용을 대하는 태도에서 좀 더 좌파적인 것처럼 보인다. 실제로 콘킨의 「신 자유주의자 선언」에 등장하는 용어들도 약간 그러한 뉘앙스가 있다. 콘킨은 전통적인 좌파 단어들을 전략적으로 차용했다. 예를 들면 혁명, 착취, 해방운동, 불복종, 저항, 암시장, 아나키즘 등의 단어다. 당연히 전통적인 좌파 단어의 뜻과는 완전히 다르다. 혁명은 아고라를 통한 "비정치적" 자유주의 혁명을 의미하며, 착취는 마르크스의 자본가가 노동자를 착취한다고 했던 그 착취가 아니라, 국가주의와 결탁한 크로니 자본주의자들의 제도적 진입장벽을 만들고, 캉티용 효과의 수혜를 누리는 그러한 오염된 자본주의자들이 하는 것을 착취라고 했다(아고리즘은 국가에 의존하지 않는 기업가와 국가로부터 특혜를 받는 착취적 기업가를 구분한다. 선언문 참고).

정리하자! 로스바드-호페의 질서 자유주의와 콘킨의 아고리즘의 차이점은 다음과 같다.

로스바드-호페의 질서 자유주의는 정치 등을 전략적으로 이용하는 것을 허용한다. 로스바드는 공화당 경선 후보를 공개적으로 지지하여 우파 사람들로부터 자유지상주의에 대한 관심을 끌려고 했고, 호페는 전국단위의 투표나 정당 활동은 거부해도 지역 단위의 투표는 승리 가능성에 따라 조건부로 허용한다. 반면 아고리즘은 어떠한 정치 활동도 거부하며 오직 국가의 통제로부터 동떨어진 자유로운 시장에 의한 혁명을 추구한다.

얼마 전에 있었던 비트코이너들이 보수 우파 스페이스에 들어가서 비트코인에 대해 전파하는 걸 상상해보면 쉽다. 우파 국가주의자들은 국가 시스템에 의한 문제 해결을 강력한 지도자가 등장해 모든 것을 해결해줘야 한다는 잘못된 방법론에 빠져있는 경우가 많은데(문제를 더 큰 문제로 해결하려는 셈...), 누군가는 이걸 보고 저런 사람들과 협력하면 안 된다고 할 것이고, 누군가는 비트코인과 자유주의를 전파하기 위해 그래도 가능성이 높은 이들 사회에 섞여들어가 이야기도 하고, 전파도 하려고 할 것이기 때문이다.

또한 한 가지 차이점은 질서 자유주의와 아고리즘 모두 공동체적 배제는 인정하나, 질서 자유주의는 이를 자유로운 계약에 의해 등장한 공동체적 질서로 보고, 아고리즘은 공동체적 배제가 집단적 억압으로 발전할 것을 경계한다. 아고리즘에서는 비합리적 차별에 의한 배제는 대안 시장이 생겨 극복될 수 있다고 본다.

자유주의 세상을 만들기 위해서는 어떻게 해야 하는가

이제 무엇이 옳은지 스스로 판단해보자. 지금부터는 개인적인 생각이 매우 많이 들어가있으므로 주의하라.

콘킨의 아고리즘은 암시장의 확대를 노려 정부 권한을 약화시키려 하지만 이는 대중의 지지를 얻기 어렵다. 또한, 이러한 병렬 경제는 한 곳에 집중되기 어렵고 넓고 약하게 퍼져있을 수밖에 없다.

로스바드-호페의 질서자유주의는 현실에 이미 존재하는 제도들을 전략적으로 활용한다. 현실적으로 대중의 지지를 얻을 가능성이 있고, 한 지역에 자유주의자들이 집중되면 적어도 그 지역에서는 지역 투표를 통해 위로부터의 전환이 가능하다. 하나의 자유지상주의적인 지역이 좋은 모범이 되면 다른 지역도 채택할 가능성이 커진다.

어떤 전략을 택해야 하는가? 나는 자유지상주의가 도래하게 하기 위해서는 두 전략 다 써야 한다고 생각한다. 질서자유주의자들의 주장대로 대중의 지지 없이는 자유지상주의가 도래하게 할 수 없다. 대한민국에 있는 "진짜" 비트코이너+자유지상주의자들이 대략 몇 명쯤 될까? 높게 잡아 1,000명 정도 된다고 해보자. 이들 전부가 특정 지역에 모인다고 해도 자유지상주의 질서를 건립할 수는 없다. 찾아보니 대한민국에서 인구가 가장 적은 시가 충남 계룡시라고 한다. 여기 인구는 약 4만3천 명인데, 여기에 51% 공격을 가하려고 해도 적어도 4만 명이 필요하다는 뜻이다. 따라서 아고리스트들처럼 대중의 지지를 얻기 위한 전략을 완고하게 거부하다간 어떠한 힘도 얻지 못하고 선민 의식에만 갇힐 수 있다.

반면 아고리스트들의 주장대로 병렬 경제도 필요하다. 잘 세뇌된 대중은 폭력 집단의 강탈이 있어야만 사회가 유지될 수 있다는 환상에 사로잡혀있다. 병렬 경제는 이러한 환상을 깨뜨릴 좋은 수단이다. 정부 추적이나 제3자 없이 부의 보존이 가능하고, 당사자끼리의 직접 결제가 가능하다는 것을 사람들이 경험하면 생각이 크게 바뀔 것이다. 비트코인으로 결제를 해본 사람과 한 번도 해본 적 없는 사람은 이런 자유지상주의 세상에 대한 이해의 폭이 다를 수밖에 없다. 또한, 비트코인은 개인들에게 큰 힘이 되는데 국가 시스템의 폭력으로부터 개인들이 생산 가치를 지킬 수 있는 강력한 방패이자 동시에 무기가 되기 때문이다.

그러나 아고리즘의 주장인 병렬 경제 중 특히 암시장 전략—국가의 통제가 미치지 않는 무기, 마약, 성매매 등을 확장하는 것—에는 동의하지 않는다. 당연히 자유지상주의자인 나는 총기나 마약, 성매매 등도 자발적인 계약에 의해 시장에서 더 건전하게 다뤄질 수 있다고 생각한다. 지금처럼 불법화되어있는 사회와 다르게 자유시장에서는 마약의 순도나 안정성에 대해 인증해주는 기관, 의사들도 등장할 것이고, 성매매도 비슷한 방식으로 질서화될 수 있다고 생각한다. 혹은 이러한 시장은 시간 선호를 지나치게 높이고 전통적인 가족 질서를 해칠 수 있으므로 공동체적 배제가 일어날 수도 있다. 무기, 마약, 성매매는 일반 대중들이 생각하는 '질서'와는 거리가 있다. 우리는 더 많은 사람들을 끌어들여야 하는데 이는 처음에 일단 거부감을 일으킬 수 있다.

따라서 자극적인 암시장보다는 사람들의 반감이 없는 상품들을 먼저 비트코인으로 거래하고, 국가가 추적하지 못하게 함으로써 납세 거부의 물결이 퍼지게 해야 한다. 동시에 더 많은 사람들에게 자유주의를 전파해야 한다. 더 많은 개인과 비트코인을 통한 병렬 경제라는 두 가지 무기가 함께 생겨야 지역 단위에서의 자유주의 세상을 만들 수 있을 것이다. 먼저 자유주의를 많은 사람들에게 전파해야 한다. 이 과정에서 좌파, 맑시즘, 케인지언들보다는 상대적으로 자유에 대한 이해가 좀 더 있는 집단인 우파 국가주의자들이나 기독교적 종교관을 가진 사람들 속에 섞여 들어가 거기서 전파를 할 수도 있다. 이러한 과정을 통해 자유주의자들이 많아지고, 한 지역에 모여야 한다. 비트코인이라는 무기를 가진 개인들이 한 지역에 모여 자유로운 시장을 형성하면, 호페가 말했던 것처럼 그 지역에서의 투표를 통해 작은 자유지상주의 세상을 만들 수 있다.

그림 3. 자유주의 세상을 만들기 위해서는 두 전략을 적절히 함께 써야 한다.

-

@ b1ddb4d7:471244e7

2025-06-10 16:02:32

@ b1ddb4d7:471244e7

2025-06-10 16:02:32In today’s digital era, access to financial services remains a privilege for many. Bitcoinization – the mass adoption of bitcoin as a payment medium and store of value – represents a unique opportunity to democratize access to financial services.

Telecommunications carriers occupy a strategic position in this transformation, especially in regions where traditional internet access is limited. However, this aspect remains largely unexplored.

This article seeks to examine how these companies can catalyze this financial revolution by analyzing the Machankura case and the technical possibilities within current communication infrastructure.

The Success Sotry of Machankura

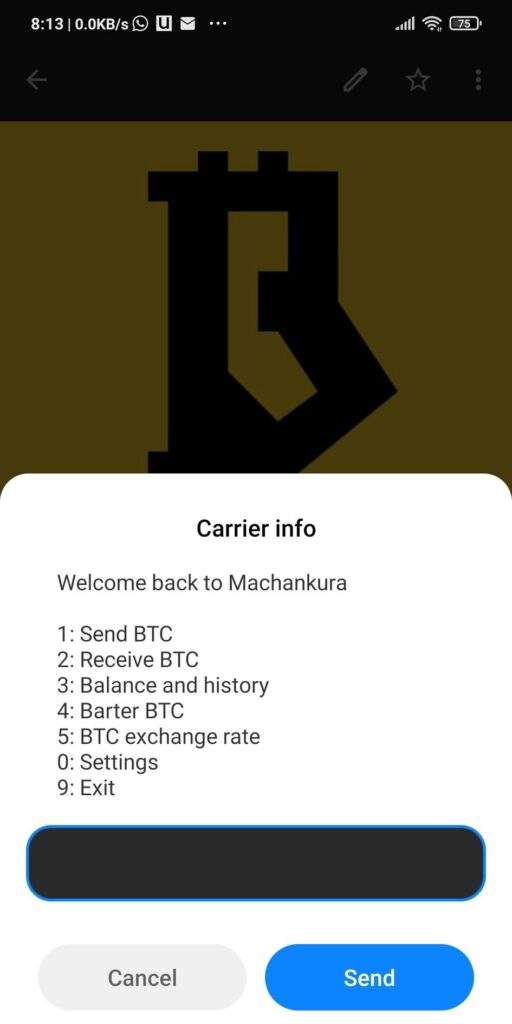

The Machankura project (8333.mobi) emerged to address a common challenge in various African regions: financial exclusion due to limited internet access. Created by South African developer Kgothatso Ngako, the service utilizes the USSD (Unstructured Supplementary Service Data) protocol, supported by virtually all mobile phones, to facilitate bitcoin transactions via 2G and 3G cellular networks.

Machankura – derived from South African slang for “money” – functions as a custodial bitcoin wallet. Through the USSD protocol, users can access the service by dialing short codes (*123*456789#, for example) or sending SMS messages to specific numbers.

When the server receives the code or message, an interactive session between the parties (server-user) begins. This enables users to create bitcoin wallets associated with their phone numbers, protected by multi-digit PINs.

Once registered, users receive a Lightning address (example: 1234567890@8333.mobi) that can be used to receive bitcoin from anyone worldwide. Users can also customize this address to a preferred username, further enhancing privacy.

Currently, Machankura is available in nine African countries, including Nigeria, Tanzania, South Africa, Kenya, Uganda, Ghana, and Malawi. The creator’s objective is to expand the service to all countries across the African continent in the coming years.

The Technical Foundations of Machankura’s Success – USSD

As mentioned, USSD is a protocol embedded in mobile networks and available on virtually all cellular devices. This choice proved crucial for the Machankura project, given that in Africa, more than half of phones sold are not smartphones. Additionally, this protocol offers critical technical advantages:

- Operates without requiring internet access, functioning in areas with poor connectivity.

- Universal compatibility with any mobile phone, including the most basic models.

- Provides real-time interactivity between users and the system.

- Features an intuitive interface already utilized for banking services, customer support, and self-service applications

These advantages have enabled bitcoin to become accessible to a significant portion of the region’s population, with over 15,000 users, according to Machankura’s project creator.

USSD and Connectivity Challenges

The primary technical limitation of USSD manifests in high-connectivity environments (4G, 5G, or higher). As established by the 3GPP (3rd Generation Partnership Project, organization for standardization of mobile networks), the protocol must be recognized by newer generations of cellular networks.

However, this recognition requires a procedure known as inter-technology fallback. For instance, if a user is connected to a 5G network and streaming music, when accessing a USSD service, their connection will downgrade to a 3G (or 2G) network, inevitably interrupting media streaming execution.

IP Multimedia Subsystem (IMS): The Evolution in Telecommunications Services

The solution to connectivity issues with USSD resides within the IMS (IP Multimedia Subsystem), a subsystem within the standardized architecture of newer cellular networks (from fourth generation onwards).

Its objective is to unify access and provision of multimedia services across both mobile and fixed networks. These services include:

- Voice services – such as Voice over LTE (VoLTE) and Voice over WiFi (VoWiFi)

- Video services – such as Video over LTE (ViLTE) and Video over WiFi (ViWiFi)

- Videoconferencing

- Instant messaging

- Streaming media

- Emergency services

- Interoperability between legacy networks

The New Era: USSI (USSD over IP)

USSI (USSD over IP) represents the solution for service continuity across 4G, 5G, and future networks when utilizing USSD services. This new protocol enhances service quality, increases simultaneous session capacity, provides additional features for recent devices, improves session security, and enables operation without requiring fallback procedures.

Strategic Opportunities for Carriers

Institutional bitcoin adoption is already established, with integration into portfolios of mining companies, exchanges, automobile manufacturers (Tesla), investment funds (BlackRock), financial institutions (Galaxy Digital Holdings), technology companies (including MicroStrategy, MercadoLibre, and Brazilian Meliúz), and even nations such as El Salvador, the United States, and China.

With robust, secure, and extensive infrastructure, telecommunications carriers can implement complex and advanced bitcoin-based financial services, demystifying its use and stimulating adoption.

Strategic partnerships with exchanges and fintechs enhance integrated solutions for entrepreneurs and consumers, such as integration with Lightning Network nodes to enable rapid, low-cost transactions between IoT devices, machine-to-machine (M2M) applications, and point-of-sale (POS) terminals.

The competitive advantages of this approach include:

- New Revenue Streams: Companies can collect fees from simple transactions and provide advanced financial services such as loans, insurance, and investments.

- Customer Retention: By offering innovative services, they can reduce customer churn.

- Vanguard Strategy: Strategic positioning in an emerging high-capitalization market

The Future of Bitcoinization in Telecommunications

The success of the Machankura project unequivocally demonstrates the potential of telecommunications as transformative agents in the mass adoption of bitcoin. As the bitcoin ecosystem consolidates and expands, it is essential that we recognize this opportunity not merely as a new business vertical but as an important step toward strategic positioning at the forefront of a global economic transformation.

Given the extensive reach of existing infrastructure, these carriers can become the primary catalyst for transforming the lives of the unbanked in an unprecedented manner. As we have seen, bitcoin is no longer just a trend; it is a reality. The natural consequence of this reality is bitcoinization, and we have the opportunity to be at the forefront of this emerging paradigm.

-

@ b1ddb4d7:471244e7

2025-06-10 16:02:31

@ b1ddb4d7:471244e7

2025-06-10 16:02:31This article was originally published on dev.to by satshacker.

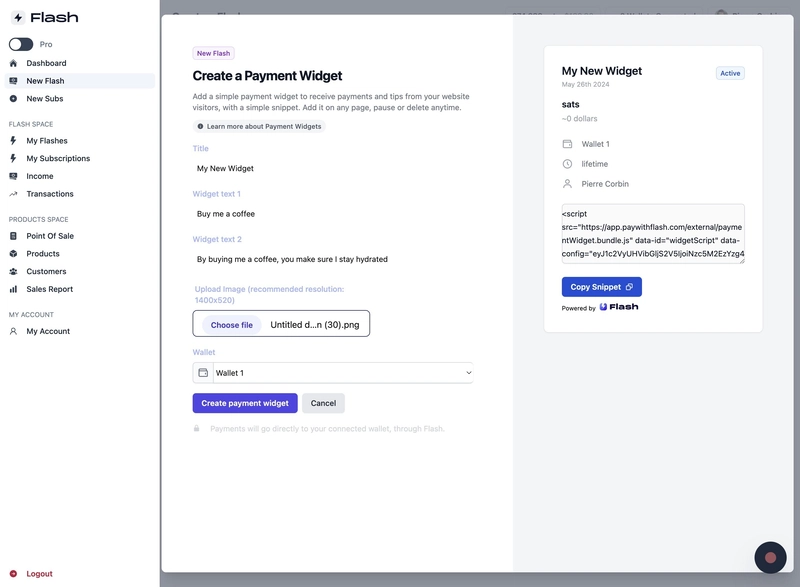

Alright, you’ve built a useful and beautiful website, tool or app. However, monetization isn’t a priority and you’d rather keep the project free, ads-free and accessible?

Accepting donations would be an option, but how? A PayPal button? Stripe? Buymeacoffe? Patreon?