-

@ dfa02707:41ca50e3

2025-06-06 11:02:12

@ dfa02707:41ca50e3

2025-06-06 11:02:12Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ 8bad92c3:ca714aa5

2025-06-06 11:02:01

@ 8bad92c3:ca714aa5

2025-06-06 11:02:01Marty's Bent

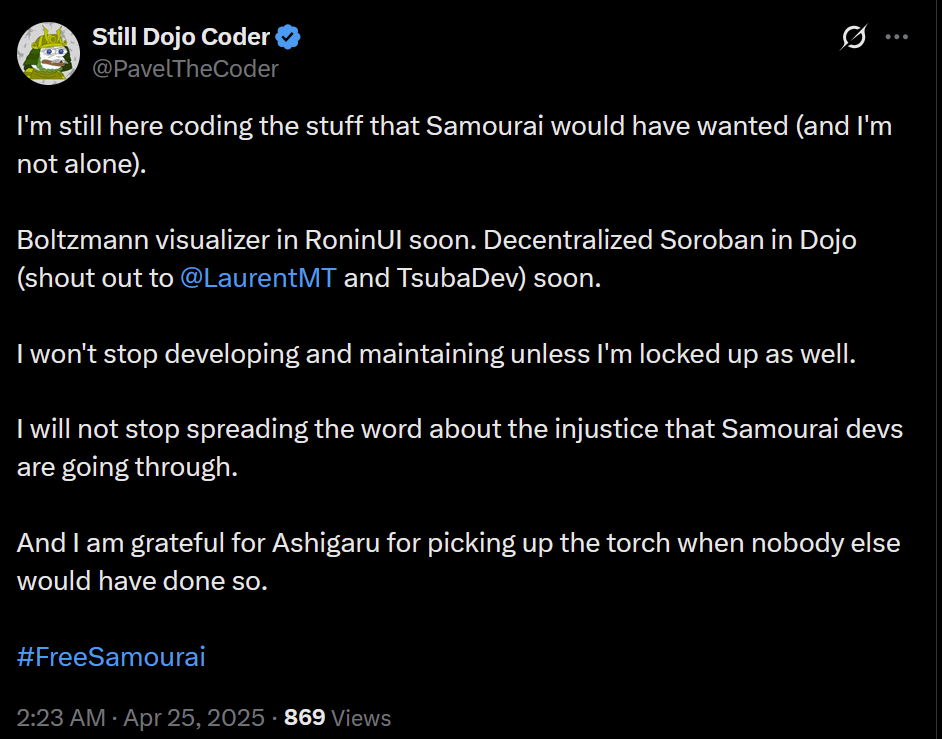

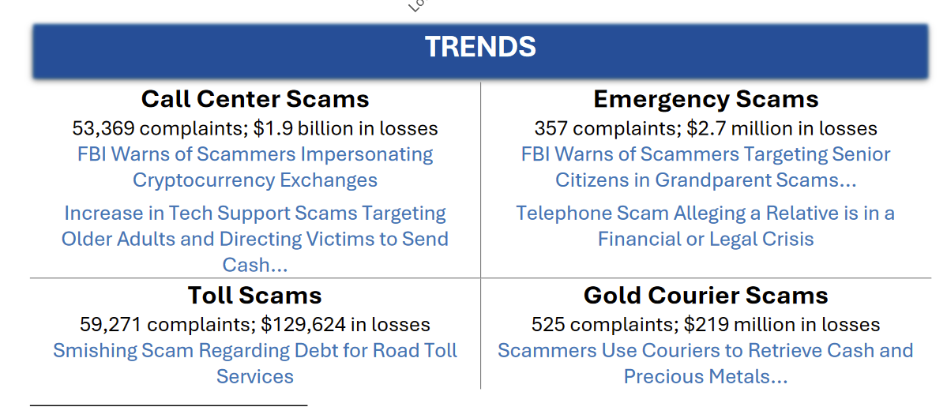

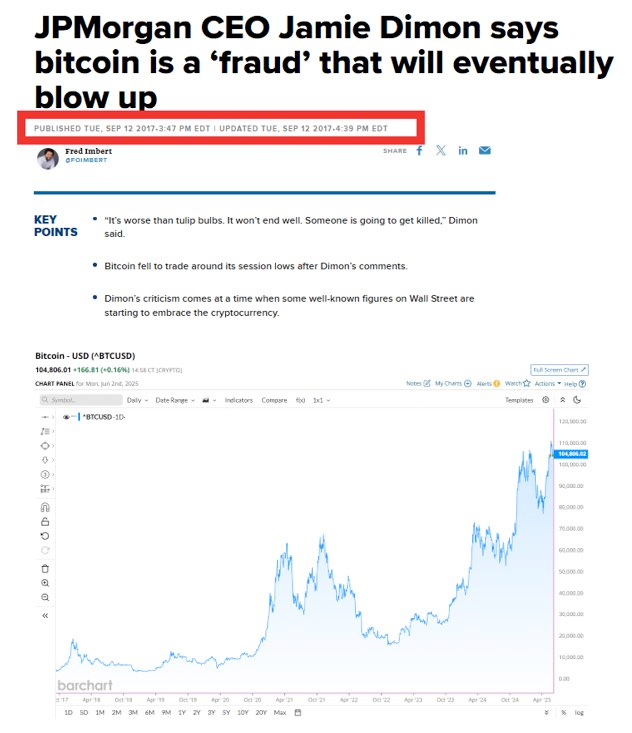

J.P. Morgan CEO Jamie Dimon has long been an outspoken skeptic and critic of bitcoin. He has called Bitcoin a speculative asset, a fraud, a pet rock, and has opined that it will inevitably blow up. A couple of years ago, he was on Capitol Hill saying that if he were the government, he would "close it down". Just within the last month, he was on Fox Business News talking with Maria Bartiromo, proclaiming that the U.S. should be stockpiling bullets and rare earth metals instead of bitcoin. It's pretty clear that Jamie Dimon, who is at the helm of the most powerful and largest bank in the world, does not like bitcoin one bit.

Evidence below:

via Bitcoin Magazine

via me

via CNBC

Despite Dimon's distinguished disdain for Bitcoin, J.P. Morgan cannot deny reality. The CEO of the largest bank in the world is certainly a powerful man, but no one individual, even in the position that Jamie Dimon is in, is more powerful than the market. And the market has spoken very clearly, it is demanding bitcoin. The Bitcoin ETFs have been the most successful ETFs in terms of pace of growth since their launch. They've accumulated tens of billions of dollars in AUM in a very short period of time. Outpacing the previous record set by the gold ETF, GLD.

Whether or not Jamie Dimon himself likes Bitcoin doesn't matter. J.P. Morgan, as the largest bank in the world and a publicly traded company, has a duty to shareholders. And that duty is to increase shareholder value by any ethical and legal means necessary. Earlier today, J.P. Morgan announced plans to offer clients financing against their Bitcoin ETFs, as well as some other benefits, including having their bitcoin holdings recognized in their overall net worth and liquid assets, similar to stocks, cars, and art, which will be massive for bitcoiners looking to get mortgages and other types of loans.

via Bloomberg

I've talked about this recently, but trying to buy a house when most of your liquid net worth is held in bitcoin is a massive pain in the ass. Up until this point, if you wanted to have your bitcoin recognized as part of your net worth and count towards your overall credit profile, you would need to sell some bitcoin, move it to a bank account, and have it sit there for a certain period of time before it was recognized toward your net worth. This is not ideal for bitcoiners who have sufficient cash flows and don't want to sell their bitcoin, pay the capital gains tax, and risk not being able to buy back the amount of sats they were forced to sell just to get a mortgage.

It's not yet clear to me whether or not J.P. Morgan will recognize bitcoin in cold storage toward their clients' net worth and credit profile, or if this is simply for bitcoin ETFs only. However, regardless, this is a step in the right direction and a validation of something that many bitcoiners have been saying for years. Inevitably, everyone will have to bend the knee to bitcoin. Today, it just happened to be the largest bank in the world. I expect more of this to come in the coming months, years, and decades.

Lyn Alden likes to say it in the context of the U.S. national debt and the fiscal crisis, but it also applies to bitcoin adoption and the need for incumbents to orient themselves around the demands of individual bitcoiners; nothing stops this train.

Real Estate Correction Coming

Real estate expert Leon Wankum shared his perspective on why property prices need to find a new equilibrium by 2026. He pointed to the 18-year property cycle theory, noting we're at the end of the current cycle with a massive imbalance - 34% more sellers than buyers, the highest gap since records began in 2013. Leon explained that sellers still have unrealistic expectations based on 2021-2022 peaks, while buyers face a fundamentally different reality with higher borrowing costs.

"We need a price equilibrium. We need demand and supply prices to match. It's going to take a long time, I think." - Leon Wankum

Leon doesn't expect a catastrophic crash, however. He emphasized that the financial system depends too heavily on real estate as collateral for authorities to allow a complete collapse. With interest rates likely staying above 3% to combat inflation, he sees a healthy correction rather than devastation - a necessary adjustment that creates opportunities for patient buyers who understand the new market dynamics.

Check out the full podcast here for more on Bitcoin treasury strategies, dual collateralization, and corporate BTC adoption

Headlines of the Day

California May Seize Idle Bitcoin After 3 Years - via X

Semler Scientific Buys $20M More Bitcoin, Holds $467M - via X

US Home Sellers Surge as Buyers Hit 4-Year Low - via X

Get our new STACK SATS hat - via tftcmerch.io

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code *“TFTC20”* during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

I feel old.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

@media screen and (max-width: 480px) { .mobile-padding { padding: 10px 0 !important; } .social-container { width: 100% !important; max-width: 260px !important; } .social-icon { padding: 0 !important; } .social-icon img { height: 32px !important; width: 32px !important; } .icon-cell { padding: 0 4px !important; } } .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } .moz-text-html .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } /* Helps with rendering in various email clients */ body { margin: 0 !important; padding: 0 !important; -webkit-text-size-adjust: 100% !important; -ms-text-size-adjust: 100% !important; } img { -ms-interpolation-mode: bicubic; } /* Prevents Gmail from changing the text color in email threads */ .im { color: inherit !important; }

-

@ eb0157af:77ab6c55

2025-06-06 11:02:00

@ eb0157af:77ab6c55

2025-06-06 11:02:00Singapore’s central bank has set a June 30 deadline for crypto companies operating abroad, with penalties of up to $200,000.

The Monetary Authority of Singapore (MAS) has issued a firm ultimatum to the crypto industry. Local firms providing digital asset services to international markets must cease those operations by June 30, 2025.

MAS announced the directive in response to industry feedback on the new regulatory framework for Digital Token Service Providers (DTSPs) under the Financial Services and Markets Act (FSM Act) of 2022.

The new rules offer no transition period for local firms operating overseas. Any company or individual based in Singapore offering digital asset services abroad must choose one of two options: either halt all operations or obtain a specific license before the June deadline.

The regulation makes it clear that “DTSPs subject to licensing requirements under section 137 of the FSM Act must cease or suspend providing DT services outside Singapore by June 30, 2025.”

Penalties for non-compliance

Companies that fail to comply with the new requirements face fines of up to 250,000 Singapore dollars (around $200,000) and prison terms of up to three years.

Under section 137 of the FSM Act, all Singapore-based firms are automatically considered to be operating from the country and are therefore subject to licensing obligations.

Licenses will be rare, legal experts warn

Securing licenses to continue overseas operations will be difficult, according to industry analysts. Hagen Rooke, Partner at Gibson, Dunn & Crutcher, explained in a LinkedIn post that authorizations will only be granted in exceptional cases.

“The MAS will grant licences under the new framework only in extremely limited circumstances (as this type of operating model generally gives rise to regulatory concerns, e.g. AML/CFT-related),” Rooke stated.

The only exemptions apply to companies already licensed under existing financial regulations: the Securities and Futures Act, Financial Advisers Act, or Payment Services Act.

The Financial Services and Markets Act, passed in April 2022, granted MAS broader powers to regulate crypto firms that, while headquartered in Singapore, primarily serve foreign markets.

The post Singapore orders crypto firms to halt overseas operations by June appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-06-06 11:01:56

@ eb0157af:77ab6c55

2025-06-06 11:01:56The newly elected South Korean President is aiming for a breakthrough in the cryptocurrency market with the introduction of spot ETFs and a national stablecoin.

On June 4, South Korea officially elected Lee Jae-myung as its new President. The candidate from the left-wing party secured victory following the impeachment of former leader Yoon Suk-yeol, who ended his three-year term after a failed attempt to establish a military-backed government.

Voter turnout reached 79.4%, the highest in the last 28 years. Lee won 49.42% of the vote, defeating his conservative opponent Kim Moon-soo, who garnered 41.15%.

The new President’s pledges

In addition to traditional economic priorities such as supporting low-income families and small businesses, Lee Jae-myung has placed digital assets at the heart of his political agenda.

The core pillar of Lee’s strategy involves the introduction of spot ETFs for Bitcoin and Ethereum in the domestic market. Currently, the issuance and local trading of crypto ETFs remain banned in the country.

Another key element of the plan is the approval of stablecoins pegged to the South Korean won. During a discussion last month, Lee emphasized the need to develop a won-based stablecoin market to prevent capital flight abroad.

Under the new administration, South Korea will also work to complete the second phase of its regulatory framework for digital assets. The upcoming legislation will specifically address stablecoin regulations and transparency requirements for cryptocurrency exchanges.

The program also includes the creation of special zones for blockchain-related businesses, where regulations will be minimized to maximize innovation and operational efficiency.

However, this isn’t the first time South Korea has elected a crypto-friendly candidate. The conservative president Yoon Suk-yeol, later impeached, had made several crypto-friendly promises aimed at deregulating the sector, though many of those initiatives saw delays and limited progress during his three-year term.

Yoon’s deregulatory plans faced resistance from the Financial Services Commission (FSC), which maintained strict regulations citing investor protection. In recent months, however, the FSC has shown greater openness toward easing crypto rules — a shift that could support Lee’s commitments.

According to FSC data, by the end of last year the country had 9.7 million registered exchange users, representing nearly 20% of the total population.

The post South Korea: the new leader may favor Bitcoin ETFs and a national stablecoin appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-06-06 11:01:52

@ eb0157af:77ab6c55

2025-06-06 11:01:52Romania’s national postal service embraces digital assets by installing the first Bitcoin ATM at its Tulcea branch.

Romania has witnessed the inauguration of the first Bitcoin ATM within the offices of Poșta Română, the country’s national postal service.

The installation took place at the Tulcea branch, the result of a strategic collaboration between Poșta Română and Bitcoin Romania (BTR), one of the country’s leading exchanges. According to the official announcement from the postal service, this marks only the first step in a broader project.

Source: Poșta Română

The next locations set to host these ATMs will be Alexandria, Piatra Neamț, Botoșani, and Nădlac, confirming the postal service’s commitment to widespread distribution of these devices.

The integration of Bitcoin ATMs in post offices is part of a wider strategy to modernize the existing infrastructure through cutting-edge digital technologies. The initiative also aims to expand the range of services available in areas of the country traditionally underserved.

Global adoption

In recent months, global Bitcoin adoption has continued to grow through various channels: individual investors, companies accepting BTC as a payment method, corporations and institutions accumulating Bitcoin as a treasury asset, and nation-states acquiring BTC for strategic reserves.

According to Binance data from January, the number of Bitcoin wallets holding more than $100 in value reached nearly 30 million, marking a 25% year-on-year increase.

Despite this growth, overall Bitcoin adoption remains limited worldwide, even in countries with the highest adoption rates. A Q1 2025 report by River, a Bitcoin financial services company, found that only 4% of the global population owns Bitcoin.

The United States retains the highest concentration of Bitcoin holders, with around 14% of individuals holding BTC in 2025. The total addressable Bitcoin market remains below 1%, due to low retail adoption and under-allocation from institutions, the U.S.-based company noted.

According to River, Bitcoin could absorb 50% of the store-of-value market, equivalent to roughly $225 trillion in value. These asset classes include cash, stocks, real estate, precious metals, and art held for price appreciation or savings. With a current market capitalization slightly above $2 trillion, Bitcoin still has significant room for growth, River suggests.

The post Poșta Română launches the first Bitcoin ATM in post offices appeared first on Atlas21.

-

@ 5d4b6c8d:8a1c1ee3

2025-06-06 11:01:44

@ 5d4b6c8d:8a1c1ee3

2025-06-06 11:01:44This week, on The Stacker Sports Podcast, we will mourn the loss of episode 34, but we'll also probably talk about new sports stuff.

For example, the NBA Finals got off to an amazing start. My "top 5 Hali" take is looking less and less dumb. Do we really believe in the Pacers yet, though?

We might also start our NBA off-season speculation. Which big stars are on the move? Which good teams are making big changes?

I actually did watch some of the NHL Finals game, but I didn't stay up for the end. Why are these games on so late?

Aaron Rodgers finally has a team for next season and the Steelers finally have a QB for next season. Does this match make sense?

@grayruby also has some hopium to share about why the 49ers big offseason acquisition will be much better than he was last year, when he "played for" the Super Bowl champs.

The Rockies are still historically bad, but they're no longer on pace to catch the Cleveland Spiders for the MLB record.

There might also be some MLB trade talk.

And, of course, we'll recap the ~Stacker_Sports contests.

What else do you want to hear about, stackers?

https://stacker.news/items/998734

-

@ dfa02707:41ca50e3

2025-06-06 10:01:34

@ dfa02707:41ca50e3

2025-06-06 10:01:34Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ 9ca447d2:fbf5a36d

2025-06-06 11:01:36

@ 9ca447d2:fbf5a36d

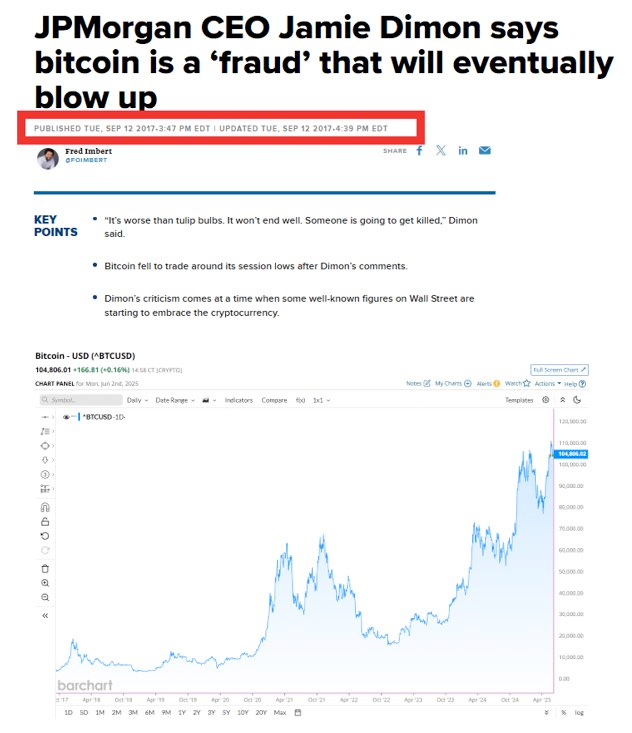

2025-06-06 11:01:36President Donald Trump’s media company, Trump Media & Technology Group (TMTG), is doubling down on its Bitcoin bet, partnering with Crypto.com and Yorkville America Digital to launch its own bitcoin exchange-traded fund (ETF), called the Truth Social Bitcoin ETF.

On June 3, a division of the New York Stock Exchange, NYSE Arca, filed a 19b-4 form with the Securities and Exchange Commission (SEC).

This is the final regulatory hurdle before an ETF can be launched. If approved, this new fund will allow everyday investors to buy shares tied to the price of bitcoin, without having to hold the asset themselves.

The Truth Social Bitcoin ETF will track the price of bitcoin and give investors a simple, regulated way to invest in the digital money.

It will be listed and traded on NYSE Arca, and Foris DAX Trust Company (the custodian for Crypto.com’s assets) has been named as the proposed custodian for this new fund.

According to the filings, the ETF is “designed to remove the obstacles represented by the complexities and operational burdens involved in a direct investment in bitcoin.”

This is part of a bigger plan by Trump Media to offer a full suite of digital-asset-based financial products.

The company has also applied to trademark six investment products and has plans for additional ETFs under its Truth.Fi fintech platform, which will focus on digital assets and energy sectors.

Trump Media also recently announced a $2.5 billion bitcoin treasury plan and raised $2.4 billion in stock and debt to support its bitcoin initiatives.

Related: Trump Media Will Raise $2.5 Billion to Build Bitcoin Treasury

Now that the 19b-4 has been filed, the SEC has 45 days to approve, reject or delay the application. This can be extended several times, but a final decision must be made by January 29, 2026.

In addition to the 19b-4, Yorkville America Digital must also file an S-1 registration statement. This will outline exactly how the ETF will work, what it offers to investors, how funds will be used, and the risks involved.

Since January 2024, bitcoin ETFs have been all the rage, with over $130 billion in assets. Big players like BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s FBTC dominate the space. BlackRock alone has $69 billion in assets through its bitcoin ETF.

Even though Trump’s ETF is entering a crowded field, its name will get attention. The Truth Social bitcoin ETF is expected to generate media buzz, political controversy and divided investor opinions, making it a cultural and financial statement.

Donald Trump is the majority owner of Trump Media, although his shares are in a trust controlled by his son, Donald Trump Jr. The ETF filing doesn’t mention Trump by name, but most people see it as a Trump product.

The President is getting more and more involved in the digital asset space. He has NFT collections, meme coins, a bitcoin mining company, a digital asset wallet, and now a potential bitcoin ETF.

But not everyone is happy. Some argue that a sitting president’s involvement in regulated financial products, especially one that could benefit from political influence, is unethical.

An SEC-approved digital asset product from Trump could blur the lines between politics, personal gain and digital assets.

Others, however, see this as a calculated move to boost Trump’s image and position him as a leader in the digital asset and tech space.

-

@ b1ddb4d7:471244e7

2025-06-06 11:01:32

@ b1ddb4d7:471244e7

2025-06-06 11:01:32Breez, a leader in Lightning Network infrastructure, and Spark, a bitcoin-native Layer 2 (L2) platform, today announced a groundbreaking collaboration to empower developers with tools to seamlessly integrate self-custodial bitcoin payments into everyday applications.

The partnership introduces a new implementation of the Breez SDK built on Spark’s bitcoin-native infrastructure, accelerating the evolution of bitcoin from “digital gold” to a global, permissionless currency.

The Breez SDK is expanding

We’re joining forces with @buildonspark to release a new nodeless implementation of the Breez SDK — giving developers the tools they need to bring Bitcoin payments to everyday apps.

Bitcoin-Native

Powered by Spark’s…— Breez

(@Breez_Tech) May 22, 2025

(@Breez_Tech) May 22, 2025A Bitcoin-Native Leap for Developers

The updated Breez SDK leverages Spark’s L2 architecture to deliver a frictionless, bitcoin-native experience for developers.

Key features include:

- Universal Compatibility: Bindings for all major programming languages and frameworks.

- LNURL & Lightning Address Support: Streamlined integration for peer-to-peer transactions.

- Real-Time Interaction: Instant mobile notifications for payment confirmations.

- No External Reliance: Built directly on bitcoin via Spark, eliminating bridges or third-party consensus.

This implementation unlocks use cases such as streaming content payments, social app monetization, in-game currencies, cross-border remittances, and AI micro-settlements—all powered by Bitcoin’s decentralized network.

Quotes from Leadership

Roy Sheinfeld, CEO of Breez:

“Developers are critical to bringing bitcoin into daily life. By building the Breez SDK on Spark’s revolutionary architecture, we’re giving builders a bitcoin-native toolkit to strengthen Lightning as the universal language of bitcoin payments.”Kevin Hurley, Creator of Spark:

“This collaboration sets the standard for global peer-to-peer transactions. Fast, open, and embedded in everyday apps—this is bitcoin’s future. Together, we’re equipping developers to create next-generation payment experiences.”David Marcus, Co-Founder and CEO of Lightspark:

“We’re thrilled to see developers harness Spark’s potential. This partnership marks an exciting milestone for the ecosystem.”Collaboration Details

As part of the agreement, Breez will operate as a Spark Service Provider (SSP), joining Lightspark in facilitating payments and expanding Spark’s ecosystem. Technical specifications for the SDK will be released later this year, with the full implementation slated for launch in 2025.About Breez

Breez pioneers Lightning Network solutions, enabling developers to embed self-custodial bitcoin payments into apps. Its SDK powers seamless, secure, and decentralized financial interactions.About Spark

Spark is a bitcoin-native Layer 2 infrastructure designed for payments and settlement, allowing developers to build directly on Bitcoin’s base layer without compromises. -

@ 7f6db517:a4931eda

2025-06-06 09:01:36

@ 7f6db517:a4931eda

2025-06-06 09:01:36

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-06 09:01:35

@ 7f6db517:a4931eda

2025-06-06 09:01:35

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-06 09:01:35

@ 7f6db517:a4931eda

2025-06-06 09:01:35

"Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know. Privacy is the power to selectively reveal oneself to the world." - Eric Hughes, A Cypherpunk's Manifesto, 1993

Privacy is essential to freedom. Without privacy, individuals are unable to make choices free from surveillance and control. Lack of privacy leads to loss of autonomy. When individuals are constantly monitored it limits our ability to express ourselves and take risks. Any decisions we make can result in negative repercussions from those who surveil us. Without the freedom to make choices, individuals cannot truly be free.

Freedom is essential to acquiring and preserving wealth. When individuals are not free to make choices, restrictions and limitations prevent us from economic opportunities. If we are somehow able to acquire wealth in such an environment, lack of freedom can result in direct asset seizure by governments or other malicious entities. At scale, when freedom is compromised, it leads to widespread economic stagnation and poverty. Protecting freedom is essential to economic prosperity.

The connection between privacy, freedom, and wealth is critical. Without privacy, individuals lose the freedom to make choices free from surveillance and control. While lack of freedom prevents individuals from pursuing economic opportunities and makes wealth preservation nearly impossible. No Privacy? No Freedom. No Freedom? No Wealth.

Rights are not granted. They are taken and defended. Rights are often misunderstood as permission to do something by those holding power. However, if someone can give you something, they can inherently take it from you at will. People throughout history have necessarily fought for basic rights, including privacy and freedom. These rights were not given by those in power, but rather demanded and won through struggle. Even after these rights are won, they must be continually defended to ensure that they are not taken away. Rights are not granted - they are earned through struggle and defended through sacrifice.

If you found this post helpful support my work with bitcoin.

-

@ a296b972:e5a7a2e8

2025-06-06 10:53:57

@ a296b972:e5a7a2e8

2025-06-06 10:53:57Wie schon gewohnt durch die Empfänge von Baerbock und von der Leyen im Ausland, in Washington ein Empfang etwas oberhalb der 1. Class, von Staatsempfang keine Spur. Passt eigentlich auch nicht für den 51. Bundesstaat der USA. Aber immerhin flog die „Bundesrepublik Deutschland“ ohne Pannen, das ist ja auch schon mal was. Und bei solch einem erfahrenen Chef-Co-Piloten an Bord, der auch mal schnell einspringen könnte, sozusagen als 2. Wahl, kann eigentlich gar nichts mehr schief gehen. Vielleicht hat Fritzchen den Kapitän auch gefragt, ob er auch mal ans Steuer darf, wenn sich die Gelegenheit schon bietet.

Im Gepäck die eingerahmte Geburtsurkunde von Großvater Trump. Als ob Donald die sich nicht selbst besorgen könnte, wenn er Interesse daran hätte. Vielleicht hat er sie auch schon.

Die Übergabe, kurz und schmerzlos. Sie erinnert an einen Sketch von Loriot, „Weihnachten bei Hoppenstedts“:…oh, eine Krawatte! Der versprochene Ehrenplatz wird sich vermutlich in einer der unteren Etagen des Weißen Hauses befinden.

Man muss auch erst einmal darauf kommen, so typisch deutsch: Eine Geburtsurkunde als Geschenk. Das könnte man auch als einen Wink mit dem Zaunpfahl ansehen: Erinnere Dich an Deine deutschen Wurzeln (und lass uns gefälligst nicht fallen?).

Jetzt zur Einschätzung des Treffens: Vorfahrt mit frisch gewaschenem Auto, Schwarz-Rot-Gold vorne am Kotflügel, wie es sich gehört, Schwarz-Rot-Gold am Eingang. Ganz schön rechts. Warum eigentlich nicht die Regenbogenfahne?

Begrüßung durch Trump auf Nachfrage eines Reporters: „I love the People of Germany.“

Und Merz nutzt die Gelegenheit sich in Biedermeier-Style einzuschmeicheln: „And I love the People of America.“

Und Trump erwidert: „That‘s good!“

In welcher Atmosphäre findet das Treffen statt?

Trump hat ein Elefantengedächtnis. Er weiß um die abwertenden, diplomatiefreien Aussagen, die Merz über ihn gemacht hat. Er weiß, dass Merz ihn mehrfach persönlich beleidigend angegriffen hat. Als Präsident der USA steht man darüber. Aber man weiß es! Trump ist sich darüber im Klaren, mit welcher Geisteshaltung er es bei Merz zu tun hat.

Vor dem Hintergrund passt seine Aussage zur Presse: „Ich liebe die Deutschen.“ Das ist eine demokratische und höfliche Sympathiebekundung gegenüber der deutschen Bevölkerung, die Merz zwar miteinschließt, aber nicht direkt an ihn gerichtet ist.

Trump begrüßt Merz mit Handschlag, begrüßt aber eigentlich nicht den Kanzler, sondern die Deutschen.

Andererseits darf der Äußerung „Ich liebe die Deutschen“ auch nicht zu viel Bedeutung beigemessen werden, denn die Amerikaner sind ja dafür bekannt, dass sie gerne und schnell alles lieben: I love America, I love Coca-Cola, I love Peanuts und eben auch I love the People of Germany.

Merz nutzt gleich die Gelegenheit, sich anzubiedern, in dem er pariert: „Und ich liebe die Amerikaner.“, worauf Trump antwortet: „That’s good!“ Das kann man übersetzen mit „Das ist gut!“, aber auch mit „Das ist auch gut so!“, bei letzterem wäre es eine versteckte Drohung. Mach Dir bewusst, wo Du bist und mit wem Du es zu tun hast und verhalte Dich danach!

Nonverbal wird dem sonst in Deutschland so eloquent wirken wollenden, akzentuiert sprechenden Merz die Bedeutung zugedacht, die ihm aus Sicht von Trump gebührt. In Frankfurt heißen sie Wiener, in Wien heißen sie Frankfurter.

Somit sind die Voraussetzungen, unter denen das Treffen stattfinden soll, schon einmal von amerikanischer Seite aus geklärt.

Du bist hier Gast in meinem Haus, also benimm Dich auch entsprechend! Ich bin der Präsident der Vereinigten Staaten von Amerika und Du bist klein Fritzchen aus dem Sauerland. Die Machtverhältnisse sind unausgesprochen geklärt.

Man hat in gewohnter Manier Platz genommen. Die Journalisten stellen Ihre Fragen ausschließlich an Trump. Zufall, oder Teil einer orchestrierten Aufführung, das wird man nie erfahren.

So oder so, die Journalisten signalisieren durch ihre Fragen an Trump, auf welcher Seite sie stehen, es weht der Geist von „America first“. Was Germany dazu zu sagen hat, interessiert niemanden, warum auch?

Die Einseitigkeit ist schon sehr auffällig. Eigentlich hätte es die Journalisten interessieren müssen, wie Deutschland zu verschiedenen Themen steht. Keine Fragen an Merz zu Zöllen, zur Ukraine, zur Meinungsfreiheit, zur Opposition. Mit dem Anspruch, ein breites Spektrum an Meinungen abbilden zu wollen, hat das eigentlich nichts zu tun. Wenn das die Vorstellung von „Freedom of Speach“ ist, dann können hier Zweifel aufkommen.

Falls diese Fragerunde in Hollywood-Manier gestaltet wurde, dann spräche das eher für Propaganda pro Trump. Wäre es Propaganda, dann wäre das Ziel allerdings erreicht worden: Kein Mensch interessiert sich für das, was Deutschland, vertreten durch Merz, zu sagen hat.

Trump setzt dem Ganzen zum Schluss noch die Krone auf, in dem er die Journalisten auffordert, nun endlich doch auch noch ein paar Fragen an Merz zu richten. Das unterstreicht nochmals das (geplante oder ungeplante) Desinteresse der anwesenden Journalisten, die sich nun fast schon genötigt fühlen, anstandshalber etwas zu fragen.

Merz, der bisher brav wie ein Schüler dem Lehrer zugehört hat, muss nun blitzschnell entscheiden, wie er die „künstlich“ hergestellte Möglichkeit nutzen kann, um, etwas unter Druck, durch die Kürze der Zeit, mit wenigen Worten seinen Standpunkt nach außen zu tragen. Seine konzentrierte Kernbotschaft, die Essenz, die Deutschland aus den USA und die übrige Welt hören soll, ist: Er steht weiter an der Seite der Ukraine und Russland ist ausschließlich das Böse.

Ganz schön raffiniert, denn so hat Trump es geschafft, das Konzentrat der Merz’schen Logik aus ihm herauszupressen.

Beide bekunden den Willen zum Frieden. Gleichzeitig wird jedoch auch klar, was jeder unter Frieden versteht: Merz will „Frieden durch Krieg“ und Trump will „Frieden durch Frieden“.

Auf rund 45 Minuten Trump kommen rund 4 Minuten Merz. Die Minuten drücken exakt die Machtverhältnisse aus.

Hätte Trump vorgehabt, Merz vorzuführen, ihm die Ohren langzuziehen, ihn bis auf die Knochen zu blamieren, er hätte reichlich Möglichkeiten dazu gehabt.

Er hätte Merz fragen können, warum er seinerzeit meinte, dass ihn, Trump, als Arschloch zu bezeichnen, noch gelinde sei. Er hätte ihn fragen können, warum er Trump als Gefahr für die Demokratie ansieht. Trump weiß darum, er hat es jedoch nicht angesprochen, was ist der Grund dafür?

Und Vance, der ebenfalls anwesend war, hätte seine Feststellungen zur Meinungsfreiheit und der „Fire-Wall“ gegen die Opposition, die er auf der Sicherheitskonferenz in München klar formuliert hat, wiederholen können, jetzt, wo doch der Kanzler, als erster Ansprechpartner für Deutschland, persönlich hätte gefragt werden können.

Beim Besuch von Selenskyj haben beide ja auch gewaltig gezeigt, wer hier das Sagen hat.

Nichts! Keine schallende Ohrfeige für Merz, doch nur Erdnussbutter auf’s Sandwich geschmiert. Kein „You don’t have the cards…“, was den Tatsachen entsprechen würde.

Auf politischer Ebene bleibt in den USA nichts, rein gar nichts dem Zufall überlassen. Je länger man darüber nachdenkt, desto klarer kann einem werden, dass das Treffen genau so geplant war, wie es sich abgespielt hat. Aber was genau ist der Plan, der dahintersteckt? Es gibt einen, dass ist so sicher, wie das Amen in der Kirche.

Sollen sich die Deutschen, vor allem die deutsche Politik in Sicherheit wiegen? Wenn das Teil eines Planes wäre, wäre er gelungen, denn in Deutschland wird der Besuch als gelungen und erfolgreich bewertet, aus welchen Gründen auch immer. Inzwischen ist Deutschland ja Weltmeister im Schönreden.

Spannend auch die Vorstellung, wenn man die Phantasie anregt, wie das Gespräch verlaufen wäre, wenn die deutsche Opposition auf dem Stuhl von Merz gesessen hätte.

Es widerspräche der Realität, wenn nicht im Hintergrund ganz andere Ziele verfolgt und Absprachen getroffen würden. Welchen Einfluss auf das Treffen hat der bevorstehende NATO-Gipfel am 24. und 25. Juni 2025 in Den Haag?

Es drängt sich immer mehr der Verdacht auf, dass man es mit zwei Realitäten zu tun hat. Eine, die offiziell verkündet wird, und eine, die den Tatsachen entspricht, die aus welchen Gründen auch immer jedoch zunächst noch im Verborgenen bleibt. Ob das vielleicht sogar gut oder eher schlecht ist, wird die Zukunft zeigen. Klar ist jedoch, dass eine gesteuerte Realität in der Öffentlichkeit verbreitet werden soll, die man durchaus als Propaganda von allen Beteiligten bewerten kann. Da hackt eine Krähe der anderen kein Auge aus. Da heißt es wachsam bleiben und nicht der Versuchung zu erliegen, dass zu glauben, was man gerne glauben möchte und von dem man sich wünscht, dass es eintritt.

„Bediene Dich Deines eigenen Verstandes.“ Das ist die Aufgabe der Zeit.

“Dieser Beitrag wurde mit dem Pareto-Client geschrieben.”

* *

(Bild von pixabay)

-

@ b1ddb4d7:471244e7

2025-06-06 11:01:31

@ b1ddb4d7:471244e7

2025-06-06 11:01:31When Sergei talks about bitcoin, he doesn’t sound like someone chasing profits or followers. He sounds like someone about to build a monastery in the ruins.

While the mainstream world chases headlines and hype, Sergei shows up in local meetups from Sacramento to Cleveland, mentors curious minds, and shares what he knows is true – hoping that, with the right spark, someone will light their own way forward.

We interviewed Sergei to trace his steps: where he started, what keeps him going, and why teaching bitcoin is far more than explaining how to set up a node – it’s about reaching the right minds before the noise consumes them. So we began where most journeys start: at the beginning.

First Steps

- So, where did it all begin for you and what made you stay curious?

I first heard about bitcoin from a friend’s book recommendation, American Kingpin, the book about Silk Road (online drug marketplace). He is still not a true bitcoiner, although I helped him secure private keys with some bitcoin.

I was really busy at the time – focused on my school curriculum, running a 7-bedroom Airbnb, and working for a standardized test prep company. Bitcoin seemed too technical for me to explore, and the pace of my work left no time for it.

After graduating, while pursuing more training, I started playing around with stocks and maximizing my savings. Passive income seemed like the path to early retirement, as per the promise of the FIRE movement (Financial Independence, Retire Early). I mostly followed the mainstream news and my mentor’s advice – he liked preferred stocks at the time.

I had some Coinbase IOUs and remember sending bitcoin within the Coinbase ledger to a couple friends. I also recall the 2018 crash; I actually saw the legendary price spike live but couldn’t benefit because my funds were stuck amidst the frenzy. I withdrew from that investment completely for some time. Thankfully, my mentor advised to keep en eye on bitcoin.

Around late 2019, I started DCA-ing cautiously. Additionally, my friend and I were discussing famous billionaires, and how there was no curriculum for becoming a billionaire. So, I typed “billionaires” into my podcast app, and landed on We Study Billionaires podcast.

That’s where I kept hearing Preston Pysh mention bitcoin, before splitting into his own podcast series, Bitcoin Fundamentals. I didn’t understand most of the terminology of stocks, bonds, etc, yet I kept listening and trying to absorb it thru repetition. Today, I realize all that financial talk was mostly noise.

When people ask me for a technical explanation of fiat, I say: it’s all made up, just like the fiat price of bitcoin! Starting in 2020, during the so-called pandemic, I dove deeper. I religiously read Bitcoin Magazine, scrolled thru Bitcoin Twitter, and joined Simply Bitcoin Telegram group back when DarthCoin was an admin.

DarthCoin was my favorite bitcoiner – experienced, knowledgeable, and unapologetic. Watching him shift from rage to kindness, from passion to despair, gave me a glimpse at what a true educator’s journey would look like.

The struggle isn’t about adoption at scale anymore. It’s about reaching the few who are willing to study, take risks, and stay out of fiat traps. The vast majority won’t follow that example – not yet at least… if I start telling others the requirements for true freedom and prosperity, they would certainly say “Hell no!”

- At what point did you start teaching others, and why?

After college, I helped teach at a standardized test preparation company, and mentored some students one-on-one. I even tried working at a kindergarten briefly, but left quickly; Babysitting is not teaching.

What I discovered is that those who will succeed don’t really need my help – they would succeed with or without me, because they already have the inner drive.

Once you realize your people are perishing for lack of knowledge, the only rational thing to do is help raise their level of knowledge and understanding. That’s the Great Work.

I sometimes imagine myself as a political prisoner. If that were to happen, I’d probably start teaching fellow prisoners, doctors, janitors, even guards. In a way we already live in an open-air prison, So what else is there to do but teach, organize, and conspire to dismantle the Matrix?

Building on Bitcoin

- You hosted some in-person meetups in Sacramento. What did you learn from those?

My first presentation was on MultiSig storage with SeedSigner, and submarine swaps through Boltz.exchange.

I realized quickly that I had overestimated the group’s technical background. Even the meetup organizer, a financial advisor, asked, “How is anyone supposed to follow these steps?” I responded that reading was required… He decided that Unchained is an easier way.

At a crypto meetup, I gave a much simpler talk, outlining how bitcoin will save the world, based on a DarthCoin’s guide. Only one person stuck around to ask questions – a man who seemed a little out there, and did not really seem to get the message beyond the strength of cryptographic security of bitcoin.

Again, I overestimated the audience’s readiness. That forced me to rethink my strategy. People are extremely early and reluctant to study.

- Now in Ohio, you hold sessions via the Orange Pill App. What’s changed?

My new motto is: educate the educators. The corollary is: don’t orange-pill stupid normies (as DarthCoin puts it).

I’ve shifted to small, technical sessions in order to raise a few solid guardians of this esoteric knowledge who really get it and can carry it forward.

The youngest attendee at one of my sessions is a newborn baby – he mostly sleeps, but maybe he still absorbs some of the educational vibes.

- How do local groups like Sactown and Cleveland Bitcoiners influence your work?

Every meetup reflects its local culture. Sacramento and Bay Area Bitcoiners, for example, do camping trips – once we camped through a desert storm, shielding our burgers from sand while others went to shoot guns.

Cleveland Bitcoiners are different. They amass large gatherings. They recently threw a 100k party. They do a bit more community outreach. Some are curious about the esoteric topics such as jurisdiction, spirituality, and healthful living.

I have no permanent allegiance to any state, race, or group. I go where I can teach and learn. I anticipate that in my next phase, I’ll meet Bitcoiners so advanced that I’ll have to give up my fiat job and focus full-time on serious projects where real health and wealth are on the line.

Hopefully, I’ll be ready. I believe the universe always challenges you exactly to your limit – no less, no more.

- What do people struggle with the most when it comes to technical education?

The biggest struggle isn’t technical – it’s a lack of deep curiosity. People ask “how” and “what” – how do I set up a node, what should one do with the lightning channels? But very few ask “why?”

Why does on-chain bitcoin not contribute to the circular economy? Why is it essential to run Lightning? Why did humanity fall into mental enslavement in the first place?

I’d rather teach two-year-olds who constantly ask “why” than adults who ask how to flip a profit. What worries me most is that most two-year-olds will grow up asking state-funded AI bots for answers and live according to its recommendations.

- One Cleveland Bitcoiner shows up at gold bug meetups. How valuable is face-to-face education?

I don’t think the older generation is going to reverse the current human condition. Most of them have been under mind control for too long, and they just don’t have the attention span to study and change their ways.

They’re better off stacking gold and helping fund their grandkids’ education. If I were to focus on a demographic, I’d go for teenagers – high school age – because by college, the indoctrination is usually too strong, and they’re chasing fiat mastery.

As for the gold bug meetup? Perhaps one day I will show up with a ukulele to sing some bitcoin-themed songs. Seniors love such entertainment.

- How do you choose what to focus on in your sessions, especially for different types of learners?

I don’t come in with a rigid agenda. I’ve collected a massive library of resources over the years and never stopped reading. My browser tab and folder count are exploding.

At the meetup, people share questions or topics they’re curious about, then I take that home, do my homework, and bring back a session based on those themes. I give them the key takeaways, plus where to dive deeper.

Most people won’t – or can’t – study the way I do, and I expect attendees to put in the work. I suspect that it’s more important to reach those who want to learn but don’t know how, the so-called nescient (not knowing), rather than the ignorant.

There are way too many ignorant bitcoiners, so my mission is to find those who are curious what’s beyond the facade of fake reality and superficial promises.

That naturally means that fewer people show up, and that’s fine. I’m not here for the crowds; I’m here to educate the educators. One bitcoiner who came decided to branch off into self-custody sessions and that’s awesome. Personally, I’m much more focused on Lightning.

I want to see broader adoption of tools like auth, sign-message, NWC, and LSPs. Next month, I’m going deep into eCash solutions, because let’s face it – most newcomers won’t be able to afford their own UTXO or open a lightning channel; additionally, it has to be fun and easy for them to transact sats, otherwise they won’t do it. Additionally, they’ll need to rely on

-

@ 7f6db517:a4931eda

2025-06-06 09:01:34

@ 7f6db517:a4931eda

2025-06-06 09:01:34

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-06-06 09:01:30

@ dfa02707:41ca50e3

2025-06-06 09:01:30Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ dfa02707:41ca50e3

2025-06-06 08:02:06

@ dfa02707:41ca50e3

2025-06-06 08:02:06Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ b1ddb4d7:471244e7

2025-06-06 11:01:26

@ b1ddb4d7:471244e7

2025-06-06 11:01:26It’s 3 AM, and you’re staring at your phone screen, watching bitcoin’s price fluctuate by thousands of dollars in real-time. Your heart races as you see green candles shooting upward, and suddenly you’re questioning every financial decision you’ve ever made. Should you buy? Should you sell? Are you already too late to the party?

Welcome to the wild psychological rollercoaster that is bitcoin investing, where emotions often override logic, and where the ancient human drives of fear and greed play out on digital exchanges 24/7.

Community Driven by Emotion

Recent research reveals just how deeply psychology permeates the bitcoin ecosystem. According to a comprehensive 2024 survey by Kraken, 84% of digital currency holders have made investment decisions based on FOMO (Fear of Missing Out), while 81% admitted to making choices driven by FUD (Fear, Uncertainty, and Doubt). Perhaps most telling of all: 63% of holders acknowledged that emotional decisions have significantly damaged their portfolios.

With over 560 million digital currency users worldwide as of 2024, and bitcoin maintaining its position as the flagship digital asset, these psychological patterns affect hundreds of millions of investors globally. In the United States alone, approximately 36 million adults own bitcoin, making this psychological phenomenon a mainstream financial reality.

The FOMO Factor: When Missing Out Becomes an Obsession

FOMO in bitcoin isn’t just about missing a quick profit—it’s about missing what many believers see as a once-in-a-generation wealth transfer. The Kraken study found that 60% of bitcoin holders fear missing a significant price surge more than they fear missing a buying opportunity during dips. This reveals a fascinating bias: investors are more concerned with unrealized gains from assets they already own than with strategic accumulation during downturns.

This psychological quirk explains why bitcoin often experiences explosive rallies followed by sharp corrections. When FOMO kicks in, rational decision-making goes out the window. Investors chase green candles, buying at peaks instead of strategically accumulating during valleys. The irony? This behavior often ensures they miss the very opportunities they’re trying to catch.

Consider bitcoin’s journey past $100,000 in late 2024. As the price breached this psychological barrier, social media exploded with FOMO-driven content, creating a feedback loop where seeing others’ gains intensified the fear of being left behind. Yet historically, many of these late-stage buyers found themselves underwater when inevitable corrections followed.

The Fear and Greed Index

Bitcoin’s psychological state is so influential that it has its own emotional barometer: the Crypto Fear and Greed Index. This fascinating tool measures market sentiment on a scale from 0 (Extreme Fear) to 100 (Extreme Greed), incorporating factors like volatility, trading volume, social media sentiment, market dominance, and Google search trends.

The index reveals a counterintuitive truth: the best buying opportunities often occur during periods of “Extreme Fear,” while “Extreme Greed” frequently signals market tops. Yet human psychology drives us to do the opposite—buying when everyone’s greedy and selling when fear dominates.

This emotional inversion creates what researchers call “behavioral arbitrage”—opportunities for those who can master their psychology to profit from others’ emotional mistakes. The index serves as a mirror, reflecting our collective psychological state and often predicting market movements with surprising accuracy.

The HODL Culture

Perhaps nowhere is bitcoin’s unique psychology more evident than in its “HODL” culture. What began as a misspelled “hold” has evolved into a sophisticated psychological framework that shapes market dynamics in ways traditional finance has never seen.

Research into Bitcoin’s HODL phenomenon reveals that volatility actually strengthens conviction rather than weakening it. Unlike traditional investors who might panic-sell during 30-50% corrections, bitcoin holders often view these drops as validation of their long-term thesis rather than reasons to exit.

This creates a unique market structure where the supply of available bitcoin for trading continuously shrinks. Long-term holders remove coins from circulation, creating artificial scarcity that amplifies price movements in both directions. It’s not just code that makes bitcoin scarce—it’s psychology.

The HODL mentality represents a form of collective resistance to short-term market dynamics. Holders refuse to participate in what they see as irrational price discovery, instead betting on long-term adoption and monetary debasement. This isn’t passive investing; it’s active rebellion against traditional financial thinking.

Social Media: The Amplifier of Emotions

The role of social media in bitcoin psychology cannot be overstated. The Kraken study found a strong correlation between social media usage and FOMO-driven decisions: 85% of investors who rely on social media for investment information reported that emotional decisions had negatively impacted their portfolios.

Platforms like Twitter (now X), Reddit, and Discord function as emotional echo chambers where bullish sentiment gets amplified during rallies and bearish fears spread like wildfire during corrections. Memes become market-moving forces, and influential personalities can trigger massive buying or selling waves with single tweets.

This creates a fascinating paradox: the democratization of financial information through social media empowers individual investors, but it also makes them more susceptible to emotional manipulation and herd mentality. The speed and scale of information flow intensify psychological responses, compressing emotional cycles that might have taken weeks in traditional markets into mere hours or minutes.

The Gender and Age Divide in Bitcoin Psychology

Fascinating demographic patterns emerge when examining bitcoin’s psychological landscape. The Kraken research revealed significant gender differences in emotional investing: 66% of male bitcoin holders frequently made FOMO-driven decisions, compared to only 42% of female holders. Similarly, 83% of men reported FUD-influenced decisions versus 75% of women.

Age also plays a crucial role. Investors aged 45-60 showed the most extreme psychological patterns: 78% felt they had missed bitcoin’s biggest gains, yet 75% remained optimistic about future opportunities. This suggests that FOMO and hope can coexist, creating a complex emotional state that drives continued participation despite feelings of regret.

These demographic differences highlight how personal psychology intersects with market dynamics. Understanding these patterns can help investors recognize their own biases and develop more rational strategies.

The Neuroscience of Bitcoin Volatility

Recent academic research reveals the neurological basis of bitcoin’s psychological appeal. Studies on digital currency trading psychology show that bitcoin’s extreme volatility triggers the same reward pathways associated with gambling, creating potentially addictive patterns of behavior.

The unpredictability of bitcoin’s price movements creates what psychologists call “intermittent reinforcement”—the most powerful form of behavioral conditioning. Like slot machines, bitcoin provides irregular rewards that keep investors engaged far longer than consistent returns would.

This neurological response explains why many bitcoin investors check prices obsessively. The survey found that 55% of digital asset holders check markets significantly more frequently than traditional markets, suggesting an almost compulsive relationship with price monitoring.

Breaking Free from Emotional Cycles

Understanding bitcoin’s psychology isn’t just academic—it’s practical. Successful bitcoin investors develop strategies to counteract their emotional biases:

Dollar-Cost Averaging (DCA) has emerged as the most popular emotion-neutral strategy, with 59% of U.S. digital currency users employing this approach. By making regular purchases regardless of price, DCA removes the emotional burden of timing the market.

Automated trading tools and scheduled purchases help investors stick to predetermined strategies without succumbing to FOMO or FUD. These tools essentially outsource emotional decision-making to algorithms, reducing the psychological burden of active trading.

Education and community engagement in healthy bitcoin communities can provide emotional anchoring during volatile periods. Understanding bitcoin’s long-term value proposition helps investors maintain perspective during short-term chaos.

Bitcoin investing isn’t just about understanding technology, economics, or market analysis—it’s about understanding yourself. The statistics are clear: emotional decision-making significantly damages portfolio performance, yet the vast majority of investors continue making emotion-driven choices.

The key insight? Bitcoin’s psychology isn’t a bug—it’s a feature. The emotional volatility that terrifies traditional investors creates opportunities for th

-

@ b1ddb4d7:471244e7

2025-06-06 11:01:25

@ b1ddb4d7:471244e7

2025-06-06 11:01:25“Not your keys, not your coins” isn’t a slogan—it’s a survival mantra in the age of digital sovereignty.

The seismic collapses of Mt. Gox (2014) and FTX (2022) weren’t anomalies; they were wake-up calls. When $8.7 billion in customer funds vanished with FTX, it exposed the fatal flaw of third-party custody: your bitcoin is only as secure as your custodian’s weakest link.

Yet today, As of early 2025, analysts estimate that between 2.3 million and 3.7 million Bitcoins are permanently lost, representing approximately 11–18% of bitcoin’s fixed maximum supply of 21 million coins, with some reports suggesting losses as high as 4 million BTC. This paradox reveals a critical truth: self-custody isn’t just preferable—it’s essential—but it must be done right.

The Custody Spectrum

Custodial Wallets (The Illusion of Control)

- Rehypothecation Risk: Most platforms lend your bitcoin for yield generation. When Celsius collapsed, users discovered their “held” bitcoin was loaned out in risky strategies.

- Account Freezes: Regulatory actions can lock withdrawals overnight. In 2023, Binance suspended dollar withdrawals for U.S. users citing “partner bank issues,” trapping funds for weeks.

- Data Vulnerability: KYC requirements create honeypots for hackers. The 2024 Ledger breach exposed 270,000 users’ personal data despite hardware security.

True Self-Custody

Self-custody means exclusively controlling your private keys—the cryptographic strings that prove bitcoin ownership. Unlike banks or exchanges, self-custody eliminates:- Counterparty risk (no FTX-style implosions)

- Censorship (no blocked transactions)

- Inflationary theft (no fractional reserve lending)

Conquering the Three Great Fears of Self-Custody

Fear 1: “I’ll Lose Everything If I Make a Mistake”

Reality: Human error is manageable with robust systems:

- Test Transactions: Always send a micro-amount (0.00001 BTC) before large transfers. Verify receipt AND ability to send back.

- Multi-Backup Protocol: Store seed phrases on fireproof/waterproof steel plates (not paper!). Distribute copies geographically—one in a home safe, another with trusted family 100+ miles away.

- SLIP39 Sharding: Split your seed into fragments requiring 3-of-5 shards to reconstruct. No single point of failure.

Fear 2: “Hackers Will Steal My Keys”

Reality: Offline storage defeats remote attacks:

- Hardware Wallets: Devices like Bitkey or Ledger keep keys in “cold storage”—isolated from internet-connected devices. Transactions require physical confirmation.

- Multisig Vaults: Bitvault’s multi-sig system requires attackers compromise multiple locations/devices simultaneously. Even losing two keys won’t forfeit funds.

- Air-Gapped Verification: Use dedicated offline devices for wallet setup. Never type seeds on internet-connected machines.

Fear 3: “My Family Can’t Access It If I Die”

Reality: Inheritance is solvable:

- Dead Man Switches: Bitwarden’s emergency access allows trusted contacts to retrieve encrypted keys after a pre-set waiting period (e.g., 30 days).

- Inheritance Protocols: Bitkey’s inheritance solution shares decryption keys via designated beneficiaries’ emails. Requires multiple approvals to prevent abuse.

- Public Key Registries: Share wallet XPUBs (not private keys!) with heirs. They can monitor balances but not spend, ensuring transparency without risk.

The Freedom Dividend

- Censorship Resistance: Send $10M BTC to a Wikileaks wallet without Visa/Mastercard blocking it.

- Privacy Preservation: Avoid KYC surveillance—non-custodial wallets like Flash require zero ID verification.

- Protocol Access: Participate in bitcoin-native innovations (Lightning Network, DLCs) only possible with self-custodied keys.

- Black Swan Immunity: When Cyprus-style bank bailins happen, your bitcoin remains untouched in your vault.

The Sovereign’s Checklist

- Withdraw from Exchanges: Move all BTC > $1,000 to self-custody immediately.

- Buy Hardware Wallet: Purchase DIRECTLY from manufacturer (no Amazon!) to avoid supply-chain tampering.

- Generate Seed OFFLINE: Use air-gapped device, write phrase on steel—never digitally.

- Test Recovery: Delete wallet, restore from seed before funding.

- Implement Multisig: For > $75k, use Bitvault for 2-of-3 multi-sig setup.

- Create Inheritance Plan: Share XPUBs/SLIP39 shards with heirs + legal documents.

“Self-custody isn’t about avoiding risk—it’s about transferring risk from opaque institutions to transparent, controllable systems you design.”

The Inevitable Evolution: Custody Without Compromise

Emerging solutions are erasing old tradeoffs:

- MPC Wallets: Services like Xapo Bank shatter keys into encrypted fragments distributed globally. No single device holds full keys, defeating physical theft.

- Social Recovery: Ethically designed networks (e.g., Bitkey) let trusted contacts restore access without custodial control.

- Biometric Assurance: Fingerprint reset protocols prevent lockouts from physical injuries.

Lost keys = lost bitcoin. But consider the alternative: entrusting your life savings to entities with proven 8% annual failure rates among exchanges. Self-custody shifts responsibility from hoping institutions won’t fail to knowing your system can’t fail without your consent.

Take action today: Move one coin. Test one recovery. Share one xpub. The path to unchained wealth begins with a single satoshi under your control.

-

@ dfa02707:41ca50e3

2025-06-06 09:01:28

@ dfa02707:41ca50e3

2025-06-06 09:01:28Contribute to keep No Bullshit Bitcoin news going.

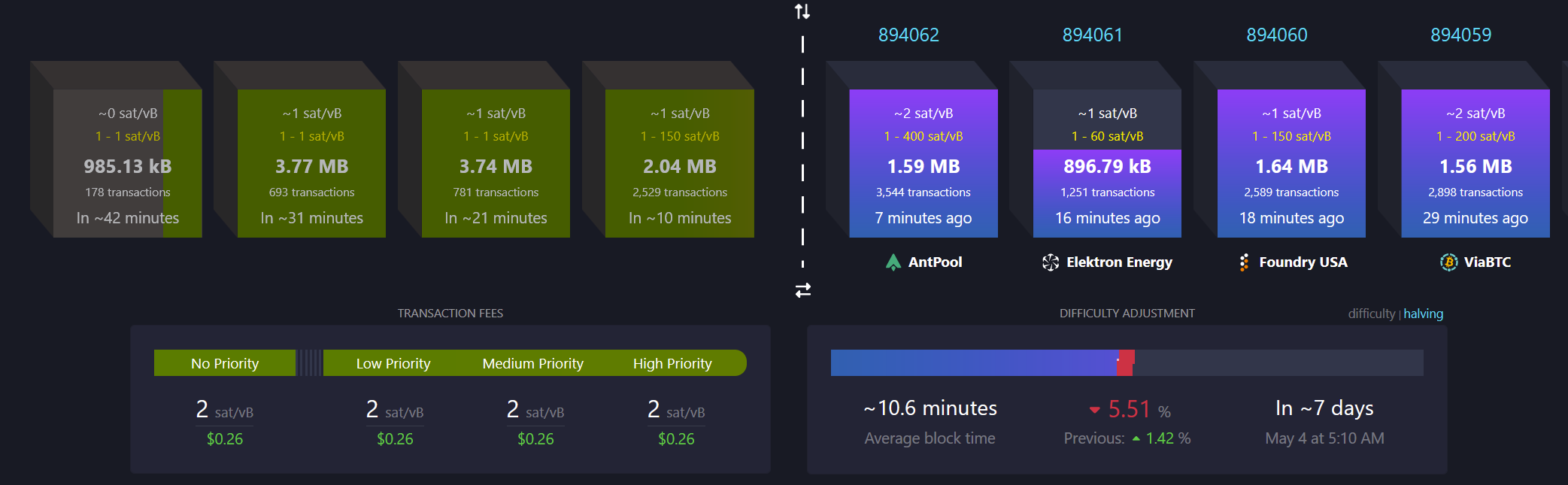

This update brings key enhancements for clarity and usability:

- Recent Blocks View: Added to the Send tab and inspired by Mempool's visualization, it displays the last 2 blocks and the estimated next block to help choose fee rates.

- Camera System Overhaul: Features a new library for higher resolution detection and mouse-scroll zoom support when available.

- Vector-Based Images: All app images are now vectorized and theme-aware, enhancing contrast, especially in dark mode.

- Tor & P2A Updates: Upgraded internal Tor and improved support for pay-to-anchor (P2A) outputs.