-

@ 57d1a264:69f1fee1

2025-06-07 05:38:49

@ 57d1a264:69f1fee1

2025-06-07 05:38:49Every purchase we make ties us to a vast, hidden network of people, machines, and resources — whether we see it or not.

Supply chains are large industrial systems. They are composed of heterogeneous elements, such as ships, aircraft, trains, and trucks, but also systems of labor, information, and finance that build them and connect them together. Usually the goods flow in one direction and money flows in the opposite direction. Their physical substrates are themselves industrial products, relying on ships, trucks, cranes, fossil fuels, and electric power, tied together by skilled human operators, supervisors, managers, and other industrial roles.

Few of us would likely condone every moment of every supply chain for every product we consume.

Consider any product in your home. Where was it made? (That should be written on the label somewhere.) Where were the parts made? Who put them all together? How did it get to your doorstep?

Continue reading at https://thereader.mitpress.mit.edu/supply-chains-are-us/

https://stacker.news/items/999509

-

@ 57d1a264:69f1fee1

2025-06-07 05:28:26

@ 57d1a264:69f1fee1

2025-06-07 05:28:26In the early days of computer vision, when memory was scarce and every byte counted, innovation thrived under constraint. “An Efficient Chain-Linking Algorithm,” developed at Inria in the late 1980s, is a brilliant example of this spirit. Now preserved and shared by Software Heritage, this compact yet powerful piece of C code showcases how elegance and efficiency went hand in hand in outlining the future of image processing—one pixel chain at a time.

The code resulted from research work carried out between 1985 and 1991 at Inria, by Gérard Giraudon (research and principal investigator), Philippe Garnesson (a PhD student), and Patrick Cipière (software engineer). Down in sunny Sophia Antipolis, a tech park 20 minutes inland from Antibes, the team tackled computer vision with a distinctly local flavor. They called themselves PASTIS, a playful nod to the anise drink. Still, the acronym – Scene Analysis and Symbolic Image Processing Project (Projet d’Analyse de Scène et de Traitement d’Image Symbolique) – hinted at their serious mission.

Continue reading at https://www.softwareheritage.org/2025/06/04/history_computer_vision/

https://stacker.news/items/999507

-

@ 7f6db517:a4931eda

2025-06-07 05:02:25

@ 7f6db517:a4931eda

2025-06-07 05:02:25

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-06-07 05:02:24

@ dfa02707:41ca50e3

2025-06-07 05:02:24Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ 523a8281:fc94329a

2025-06-07 05:11:07

@ 523a8281:fc94329a

2025-06-07 05:11:07The Darkest Hour of the GameFi Market and the Glimmer of Hope Amid the prolonged downturn of the cryptocurrency market, the GameFi sector is undergoing an unprecedented trial. According to CoinGecko data, the total market capitalization of the GameFi sector shrank by 35% from its peak in the first half of 2024. DappRadar statistics further confirm the industry's decline—numerous projects have struggled to maintain sustainable economic models, leading to severe user attrition. Although the number of daily active users has grown by 18%, this "volume up, price down" phenomenon reflects the market's painful transition from speculation-driven to value-driven development.

Even more alarming is that 93% of projects in the industry have either stagnated or perished, with the average project lifespan lasting a mere four months. Token prices have fallen more than 95% from their historical highs, extinguishing the enthusiasm of countless investors and players. The once-glorious "Play-to-Earn" and "X to Earn" models collapsed after the profit bubbles burst, exposing the fatal flaws of over-reliance on financial speculation while neglecting the essence of gaming.

However, crises often breed opportunities. The GameFi sector has not been crushed by the bear market but has instead started to clarify its future direction amid the turbulence. This deep market adjustment acts as a brutal filter, leaving only those projects that abandon token speculation, focus on player experience, and build sustainable economic systems to stand out during this industry-wide reshuffle.

- Neo Fantasy: A Game-Changer Breaking the Deadlock Neo Fantasy is not just a blockchain game; it is a gateway to the ACGN metaverse. In the mysterious land of Loren, players become brave adventurers tasked with reclaiming wealth from the forces of darkness. The game seamlessly integrates compelling storylines with cutting-edge blockchain technology, allowing players to immerse themselves in epic adventures while earning significant rewards through diverse gameplay. From the moment players step into the game, they are captivated by its unique charm—whether it's the vividly designed characters or the grand battle scenes, everything reflects Neo Fantasy's relentless pursuit of quality.

Looking back at the development trajectory of the GameFi industry, its collapse was no accident. Many past projects focused entirely on speculative financial incentives, neglecting the refinement of game content and the construction of community ecosystems. Complex and obscure tokenomics and flashy but impractical DeFi concepts attracted attention in the short term but failed to mask the lack of gameplay. Once token rewards diminished, users quickly scattered, leading to the project's rapid decline. This blind pursuit of short-term gains ultimately triggered a full-blown industry crisis, serving as a wake-up call for future projects.

Neo Fantasy has keenly identified these industry pitfalls and introduced a series of innovative measures to break the deadlock:

Enhancing User Experience: The team accurately addressed traditional gamers' aversion to complex blockchain interfaces by developing an independent application that combines the seamless operation of traditional games with the "play-to-earn" features of Web3. New players can easily get started without deep knowledge of blockchain technology. This low-barrier design significantly broadens the user base, attracting many players who were previously deterred by blockchain games.

Community and Market Expansion: Neo Fantasy has demonstrated strong strategic foresight by establishing deep collaborations with renowned platforms like Nextype, quickly amassing a large user base. Moreover, its plan to launch on mainstream app stores such as Google Play and the App Store aims to tap into the billion-user Web2 gaming market. This move will undoubtedly break the barriers of blockchain gaming, allowing more ordinary players to experience Neo Fantasy's unique charm and paving the way for broader growth.

Innovative Gameplay: Sustained innovation in gameplay is key to Neo Fantasy's vitality. The team has abandoned the outdated model of solely relying on token-driven user engagement and continuously introduces new features. PvE dungeons are filled with challenges and surprises, requiring strategic cooperation to overcome; the PvP arena is packed with skilled players, offering intense real-time battles; auto chess combines strategy and luck, making each match unpredictable; and guild tournaments emphasize teamwork, fostering strong bonds among players. Future plans for open-world and virtual-world experiences will further expand the game's boundaries, delivering unprecedented immersive experiences.

Sustainable Tokenomics: The construction of the token economy showcases the team's wisdom and vision. Centered around the ERT token, the system serves as both a governance tool and a utility token. Through a carefully designed economic cycle model, every in-game action—whether upgrading heroes, enhancing equipment, or participating in events—is closely tied to ERT. This design ensures the token's utility while avoiding unsustainable high-yield promises, achieving self-sufficient and healthy economic circulation. Additionally, offering free hero characters to new players lowers the participation barrier, attracting a diverse and loyal community of traditional gamers.

-

Breaking Through the Bear Market: Neo Fantasy's Keys to Success and Industry Insights Under the severe challenges of the bear market, Neo Fantasy's development strategy has pointed the way forward for GameFi projects. Gameplay is the foundation of survival; only with outstanding fun and playability can players truly immerse themselves. A strong community is the cornerstone of development; an active player community not only enhances user retention but also injects continuous vitality into the project. Leveraging mainstream platforms to expand the market is the necessary path to breaking through barriers and achieving large-scale growth. Meanwhile, a sustainable and transparent tokenomics model is the core element to ensure the long-term stability of the project. Continuous innovation is the key to standing out in a fiercely competitive market; only by consistently introducing new features can a project retain players' attention and maintain its competitiveness.

-

Looking Ahead: Concrete Actions to Lead the Next GameFi Revolution While the GameFi sector has suffered significant losses during the bear market, Neo Fantasy's rise offers hope for the industry's recovery. In the future, Neo Fantasy will take a series of practical actions to solidify its strengths and drive industry transformation:

Expanding Community Collaboration and Listening to Players: Neo Fantasy will broaden its community partnerships, working with global gaming forums, blockchain communities, and player groups. By hosting regular online and offline events and conducting surveys, the project will gather feedback on gameplay, economic systems, and social features. These insights will guide targeted improvements to ensure the game aligns with player needs, enhancing satisfaction and loyalty.

Optimizing Game Content for Premium Experiences: Resources will continue to be invested in developing and refining game content. This includes enriching storylines for immersive narratives, fine-tuning PvE dungeon difficulty curves and reward mechanisms, and improving PvP balance and fairness. The development of open-world and virtual-world features will also be accelerated, introducing innovative gameplay and interaction elements to provide players with more opportunities for exploration and creativity.

Strengthening Guild Systems to Promote Ecosystem Prosperity: Neo Fantasy will actively support in-game guild development by offering exclusive benefits and activities such as guild quests and rewards. A guild ranking system will incentivize growth, while cross-game and cross-platform collaborations will encourage interaction among players from different communities, expanding the game's influence and ecosystem.

Expanding the Ecosystem and Exploring New Possibilities: Beyond core gameplay, Neo Fantasy will actively expand its ecosystem. On the technical side, it will accelerate cross-chain compatibility to enable seamless flow of $ERT tokens and game assets across networks, attracting more external resources and users. In content creation, the project will support an ACGN creator program, encouraging community members to produce comics, novels, animations, and other content related to Neo Fantasy, enriching the game's cultural value and building a diverse ecosystem.

By focusing on player experience, community building, and sustainable development, Neo Fantasy has proven that GameFi can thrive even in a bear market. The future belongs to projects that prioritize high-quality gaming content and earn players' trust. Neo Fantasy not only survives but actively positions itself as a leader, driving the next GameFi revolution. For the GameFi industry, abandoning hype and focusing on quality is the key to standing out in a fiercely competitive market. Neo Fantasy is steadfastly walking this path, writing its own legend.

Follow Neo Fantasy on: Twitter: https://x.com/NeoFantasy_Game

Telegram: https://t.me/NeoFantasy2024

Youtube: https://www.youtube.com/@NeoFantasy2024

Medium: https://medium.com/@neofantasy419

-

@ dfa02707:41ca50e3

2025-06-07 05:02:22

@ dfa02707:41ca50e3

2025-06-07 05:02:22Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ dfa02707:41ca50e3

2025-06-06 20:02:21

@ dfa02707:41ca50e3

2025-06-06 20:02:21Contribute to keep No Bullshit Bitcoin news going.

-

Version 1.3 of Bitcoin Safe introduces a redesigned interactive chart, quick receive feature, updated icons, a mempool preview window, support for Child Pays For Parent (CPFP) and testnet4, preconfigured testnet demo wallets, as well as various bug fixes and improvements.

-

Upcoming updates for Bitcoin Safe include Compact Block Filters.

"Compact Block Filters increase the network privacy dramatically, since you're not asking an electrum server to give you your transactions. They are a little slower than electrum servers. For a savings wallet like Bitcoin Safe this should be OK," writes the project's developer Andreas Griffin.

- Learn more about the current and upcoming features of Bitcoin Safe wallet here.

What's new in v1.3

- Redesign of Chart, Quick Receive, Icons, and Mempool Preview (by @design-rrr).

- Interactive chart. Clicking on it now jumps to transaction, and selected transactions are now highlighted.

- Speed up transactions with Child Pays For Parent (CPFP).

- BDK 1.2 (upgraded from 0.32).

- Testnet4 support.

- Preconfigured Testnet demo wallets.

- Cluster unconfirmed transactions so that parents/children are next to each other.

- Customizable columns for all tables (optional view: Txid, Address index, and more)

- Bug fixes and other improvements.

Announcement / Archive

Blog Post / Archive

GitHub Repo

Website -

-

@ 7f6db517:a4931eda

2025-06-07 05:02:28

@ 7f6db517:a4931eda

2025-06-07 05:02:28

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

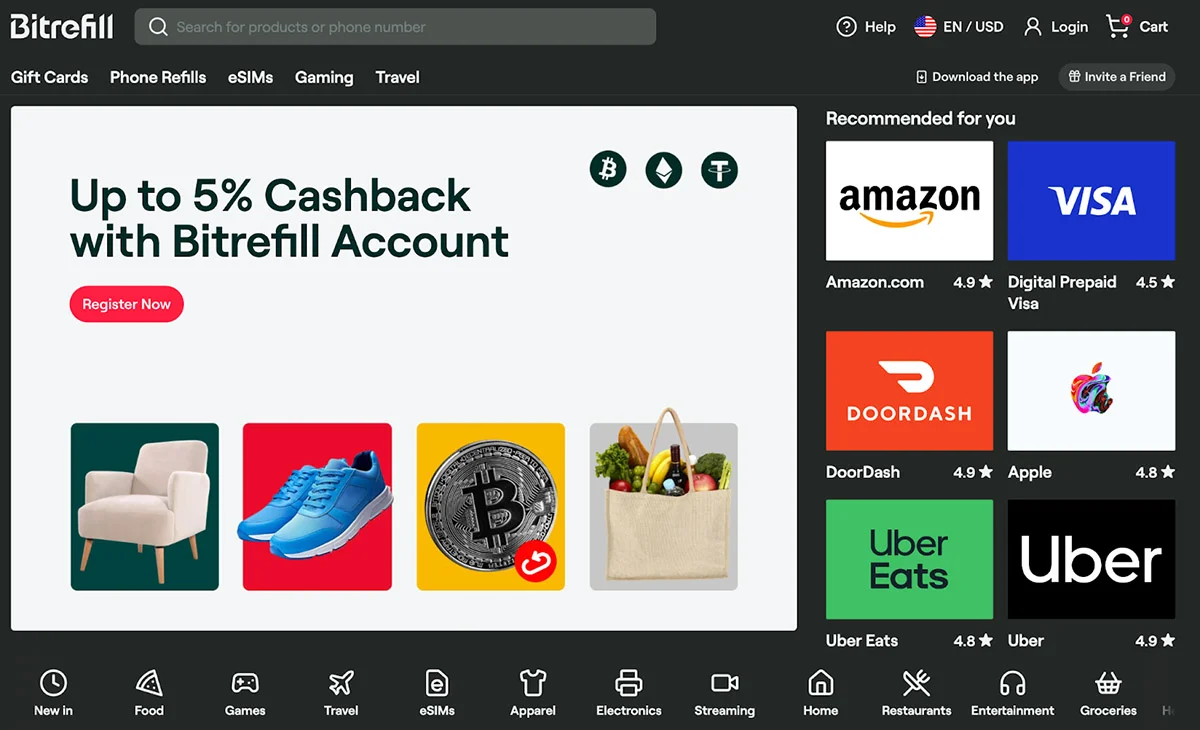

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-06-07 05:02:21

@ dfa02707:41ca50e3

2025-06-07 05:02:21Contribute to keep No Bullshit Bitcoin news going.

-

Version 1.3 of Bitcoin Safe introduces a redesigned interactive chart, quick receive feature, updated icons, a mempool preview window, support for Child Pays For Parent (CPFP) and testnet4, preconfigured testnet demo wallets, as well as various bug fixes and improvements.

-

Upcoming updates for Bitcoin Safe include Compact Block Filters.

"Compact Block Filters increase the network privacy dramatically, since you're not asking an electrum server to give you your transactions. They are a little slower than electrum servers. For a savings wallet like Bitcoin Safe this should be OK," writes the project's developer Andreas Griffin.

- Learn more about the current and upcoming features of Bitcoin Safe wallet here.

What's new in v1.3

- Redesign of Chart, Quick Receive, Icons, and Mempool Preview (by @design-rrr).

- Interactive chart. Clicking on it now jumps to transaction, and selected transactions are now highlighted.

- Speed up transactions with Child Pays For Parent (CPFP).

- BDK 1.2 (upgraded from 0.32).

- Testnet4 support.

- Preconfigured Testnet demo wallets.

- Cluster unconfirmed transactions so that parents/children are next to each other.

- Customizable columns for all tables (optional view: Txid, Address index, and more)

- Bug fixes and other improvements.

Announcement / Archive

Blog Post / Archive

GitHub Repo

Website -

-

@ 7f6db517:a4931eda

2025-06-07 05:02:28

@ 7f6db517:a4931eda

2025-06-07 05:02:28

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

The four main banks of bitcoin and “crypto” are Signature, Prime Trust, Silvergate, and Silicon Valley Bank. Prime Trust does not custody funds themselves but rather maintains deposit accounts at BMO Harris Bank, Cross River, Lexicon Bank, MVB Bank, and Signature Bank. Silvergate and Silicon Valley Bank have already stopped withdrawals. More banks will go down before the chaos stops. None of them have sufficient reserves to meet withdrawals.

Bitcoin gives us all the ability to opt out of a system that has massive layers of counterparty risk built in, years of cheap money and broken incentives have layered risk on top of risk throughout the entire global economy. If you thought the FTX bank run was painful to watch, I have bad news for you: every major bank in the world is fractional reserve. Bitcoin held in self custody is unique in its lack of counterparty risk, as global market chaos unwinds this will become much more obvious.

The rules of bitcoin are extremely hard to change by design. Anyone can access the network directly without a trusted third party by using their own node. Owning more bitcoin does not give you more control over the network with all participants on equal footing.

Bitcoin is:

- money that is not controlled by a company or government

- money that can be spent or saved without permission

- money that is provably scarce and should increase in purchasing power with adoptionBitcoin is money without trust. Whether you are a nation state, corporation, or an individual, you can use bitcoin to spend or save without permission. Social media will accelerate the already deteriorating trust in our institutions and as this trust continues to crumble the value of trust minimized money will become obvious. As adoption increases so should the purchasing power of bitcoin.

A quick note on "stablecoins," such as USDC - it is important to remember that they rely on trusted custodians. They have the same risk as funds held directly in bank accounts with additional counterparty risk on top. The trusted custodians can be pressured by gov, exit scam, or caught up in fraud. Funds can and will be frozen at will. This is a distinctly different trust model than bitcoin, which is a native bearer token that does not rely on any centralized entity or custodian.

Most bitcoin exchanges have exposure to these failing banks. Expect more chaos and confusion as this all unwinds. Withdraw any bitcoin to your own wallet ASAP.

Simple Self Custody Guide: https://werunbtc.com/muun

More Secure Cold Storage Guide: https://werunbtc.com/coldcard

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-06-07 05:02:21

@ dfa02707:41ca50e3

2025-06-07 05:02:21Contribute to keep No Bullshit Bitcoin news going.

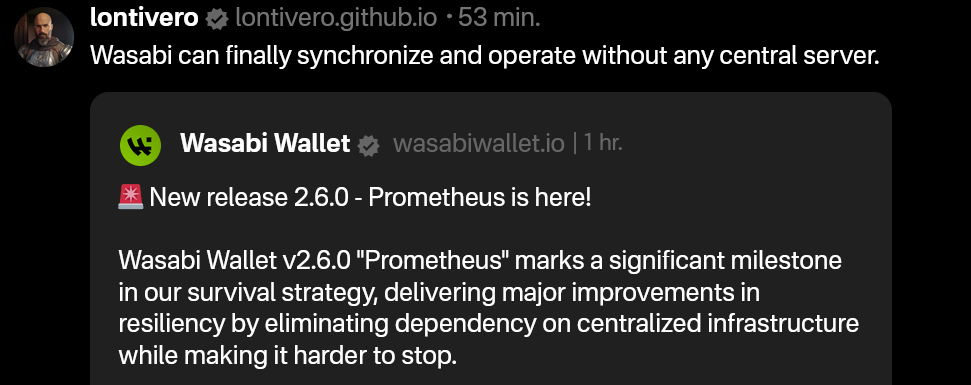

- Wasabi Wallet v2.6.0 "Prometheus" is a major update for the project, focused on resilience and independence from centralized systems.

- Key features include support for BIP 158 block filters for direct node synchronization, a revamped full node integration for easier setup without third-party reliance, SLIP 39 share backups for flexible wallet recovery (sponsored by Trezor), and a Nostr-based update manager for censorship-resistant updates.

- Additional improvements include UI bug fixes, a new fallback for transaction broadcasting, updated code signing, stricter JSON serialization, and options to avoid third-party rate providers, alongside various under-the-hood enhancements.

This new version brings us closer to our ultimate goal: ensuring Wasabi is future-proof," said the developers, while also highlighting the following key areas of focus for the project:

- Ensuring users can always fully and securely use their client.

- Making contribution and forks easy through a codebase of the highest quality possible: understandable, maintainable, and improvable.

"As we achieve our survival goals, expect more cutting-edge improvements in Bitcoin privacy and self-custody. Thank you for the trust you place in us by using Wasabi," was stated in the release notes.

What's new

- Support for Standard BIP 158 Block Filters. Wasabi now syncs using BIP 158 filters without a backend/indexer, connecting directly to a user's node. This boosts sync speed, resilience, and allows full sovereignty without specific server dependency.

- Full Node Integration Rework. The old integration has been replaced with a simpler, more adaptable system. It’s not tied to a specific Bitcoin node fork, doesn’t need the node on the same machine as Wasabi, and requires no changes to the node’s setup.

- "Simply enable the RPC server on your node and point Wasabi to it," said the developers. This ensures all Bitcoin network activities—like retrieving blocks, fee estimations, block filters, and transaction broadcasting—go through your own node, avoiding reliance on third parties.

- Create & Recover SLIP 39 Shares. Users now create and recover wallets with multiple share backups using SLIP 39 standard.

"Special thanks to Trezor (SatoshiLabs) for sponsoring this amazing feature."

- Nostr Update Manager. This version implements a pioneering system with the Nostr protocol for update information and downloads, replacing reliance on GitHub. This enhances the project's resilience, ensuring updates even if GitHub is unavailable, while still verifying updates with the project's secure certificate.

- Updated Avalonia to v11.2.7, fixes for UI bugs (including restoring Minimize on macOS Sequoia).

- Added a configurable third-party fallback for broadcasting transactions if other methods fail.

- Replaced Windows Code Signing Certificate with Azure Trusted Signing.

- Many bug fixes, improved codebase, and enhanced CI pipeline.

- Added the option to avoid using any third-party Exchange Rate and Fee Rate providers (Wasabi can work without them).

- Rebuilt all JSON Serialization mechanisms avoiding default .NET converters. Serialization is now stricter.

Full Changelog: v2.5.1...v2.6.0

-

@ dfa02707:41ca50e3

2025-06-06 20:02:20

@ dfa02707:41ca50e3

2025-06-06 20:02:20Contribute to keep No Bullshit Bitcoin news going.

This update brings key enhancements for clarity and usability:

- Recent Blocks View: Added to the Send tab and inspired by Mempool's visualization, it displays the last 2 blocks and the estimated next block to help choose fee rates.

- Camera System Overhaul: Features a new library for higher resolution detection and mouse-scroll zoom support when available.

- Vector-Based Images: All app images are now vectorized and theme-aware, enhancing contrast, especially in dark mode.

- Tor & P2A Updates: Upgraded internal Tor and improved support for pay-to-anchor (P2A) outputs.

- Linux Package Rename: For Linux users, Sparrow has been renamed to sparrowwallet (or sparrowserver); in some cases, the original sparrow package may need manual removal.

- Additional updates include showing total payments in multi-payment transaction diagrams, better handling of long labels, and other UI enhancements.

- Sparrow v2.2.1 is a bug fix release that addresses missing UUID issue when starting Tor on recent macOS versions, icons for external sources in Settings and Recent Blocks view, repackaged

.debinstalls to use older gzip instead of zstd compression, and removed display of median fee rate where fee rates source is set to Server.

Learn how to get started with Sparrow wallet:

Release notes (v2.2.0)

- Added Recent Blocks view to Send tab.

- Converted all bitmapped images to theme aware SVG format for all wallet models and dialogs.

- Support send and display of pay to anchor (P2A) outputs.

- Renamed

sparrowpackage tosparrowwalletandsparrowserveron Linux. - Switched camera library to openpnp-capture.

- Support FHD (1920 x 1080) and UHD4k (3840 x 2160) capture resolutions.

- Support camera zoom with mouse scroll where possible.

- In the Download Verifier, prefer verifying the dropped file over the default file where the file is not in the manifest.

- Show a warning (with an option to disable the check) when importing a wallet with a derivation path matching another script type.

- In Cormorant, avoid calling the

listwalletdirRPC on initialization due to a potentially slow response on Windows. - Avoid server address resolution for public servers.

- Assume server address is non local for resolution failures where a proxy is configured.

- Added a tooltip to indicate truncated labels in table cells.

- Dynamically truncate input and output labels in the tree on a transaction tab, and add tooltips if necessary.

- Improved tooltips for wallet tabs and transaction diagrams with long labels.

- Show the address where available on input and output tooltips in transaction tab tree.

- Show the total amount sent in payments in the transaction diagram when constructing multiple payment transactions.

- Reset preferred table column widths on adjustment to improve handling after window resizing.

- Added accessible text to improve screen reader navigation on seed entry.

- Made Wallet Summary table grow horizontally with dialog sizing.

- Reduced tooltip show delay to 200ms.

- Show transaction diagram fee percentage as less than 0.01% rather than 0.00%.

- Optimized and reduced Electrum server RPC calls.

- Upgraded Bouncy Castle, PGPainless and Logback libraries.

- Upgraded internal Tor to v0.4.8.16.

- Bug fix: Fixed issue with random ordering of keystore origins on labels import.

- Bug fix: Fixed non-zero account script type detection when signing a message on Trezor devices.

- Bug fix: Fixed issue parsing remote Coldcard xpub encoded on a different network.

- Bug fix: Fixed inclusion of fees on wallet label exports.

- Bug fix: Increase Trezor device libusb timeout.

Linux users: Note that the

sparrowpackage has been renamed tosparrowwalletorsparrowserver, and in some cases you may need to manually uninstall the originalsparrowpackage. Look in the/optfolder to ensure you have the new name, and the original is removed.What's new in v2.2.1

- Updated Tor library to fix missing UUID issue when starting Tor on recent macOS versions.

- Repackaged

.debinstalls to use older gzip instead of zstd compression. - Removed display of median fee rate where fee rates source is set to Server.

- Added icons for external sources in Settings and Recent Blocks view

- Bug fix: Fixed issue in Recent Blocks view when switching fee rates source

- Bug fix: Fixed NPE on null fee returned from server

-

@ 8bad92c3:ca714aa5

2025-06-07 05:02:18

@ 8bad92c3:ca714aa5

2025-06-07 05:02:18Key Takeaways

In this episode, Bitcoin Core veteran James O’Beirne delivers a sharp critique of Bitcoin’s developmental stagnation, attributing it to political dysfunction, post-fork trauma, and resistance within Bitcoin Core to critical upgrades like CheckTemplateVerify (CTV). He argues that while institutional adoption accelerates, internal innovation is being stifled by misplaced controversies—such as the OP_RETURN policy debate—and a bottlenecked governance model. O’Beirne warns that without urgent progress on scaling solutions like CTV, congestion control, and vaulting systems, Bitcoin risks ossifying and becoming vulnerable to institutional capture. Advocating a more adversarial posture, he suggests forking or building alternative clients to pressure progress but remains hopeful, seeing rising momentum for protocol upgrades from developers outside the Core elite.

Best Quotes

“Everybody has mempool derangement syndrome… it’s such a small issue in the grand scheme of challenges Bitcoin is facing.”

“Bitcoin is as much an experiment in technical human organization as it is a pure technology.”

“If we don’t figure out how to scale trustless Bitcoin self-custody, we’re toast. Right now, only about 2.5% of Americans could actually use Bitcoin monthly in a meaningful way.”

“CTV isn’t sexy—it just works. It keeps getting reinvented because it's so useful. At this point, it’s essential.”

“If Core isn’t going to evaluate these proposals, someone has to. Otherwise, we need to build the social justification for forking.”

“Lightning didn’t scale Bitcoin the way we expected. Let’s stop assuming a silver bullet is coming and start building the bridges ourselves.”

“You could onboard someone with just a phone and a vault… and give them more security than most hardware wallets.”

Conclusion

While Bitcoin gains traction with institutions and governments, its internal development is stalling under political inertia and misplaced focus. James O’Beirne urges the community to prioritize impactful upgrades like CTV and CCV, challenge the bottleneck of Bitcoin Core if needed, and recommit to Bitcoin’s foundational principles. This episode underscores the urgent need to bridge technical and social divides to ensure Bitcoin remains a decentralized, censorship-resistant tool for global value transfer.

Timestamps

0:00 - Intro

0:41 - Multi axis issue

5:12 - Core governance

9:41 - Derailing productive discussions

17:05 - Fold & Bitkey

18:32 - CTV

29:24 - Unchained

29:53 - Magnitude of change

41:45 - Covenant proposals

50:16 - CTV benefits

57:56 - Institutional ownership

1:05:26 - Moving forwardTranscript

(00:00) I think I have a somewhat different take than 99% of the people in the discussion. What freaks me out is if you've got Sailor owning half million coins or whatever and Black Rockck owning however many, people forget that Bitcoin is as much an experiment in technical human organization as it is, you know, as a sort of pure technology.

(00:17) The undernowledged reality is I'm actually interested to see if we have like a black swan adoption event from the machines. the risk given the increased scrutiny that things like the strategic Bitcoin reserve introduce there's a shot clock on getting to trustless decentralized value storage technology and I think we really have to be thinking about that combination of physically tired and mentally tired it's also tiresome James it's it's I was looking at that picture today and I was actually going to tweet it absent any caption just because it's

(00:52) a really good Uh yeah, it's a really good epitome of uh of a lot of stuff. But I'm with you, man. I'm tired. It's Friday. Who is it? Is that a just some random Japanese guy? I think it's it's I actually think it's from a documentary about I don't know if it's Africa, but Oh, yes. Yes.

(01:13) It's there's a little bit of a kind of like racy connotation there. Um yeah, the uh it's been long. It was interesting for me. We had Texas Energy Mining Summit here in Austin the beginning of the week. It sort of blended with Bitcoin plus I was over at Bitcoin++ Wednesday and yesterday doing the live desk and obviously topic of conversation is OP return this policy decision and this policy change that that core wants to make and many people are uh angry about and it's just again it's also tiresome.

(01:52) spoke with people on both sides over the two days and I I think I came away more confused than than I entered entered the week like what is the optimal path and somebody who's worked on Bitcoin core worked on Bitcoin core for for many years I've seen you tweeting about it seems like I won't put words in your mouth I'll let you say like what is your perspective on this whole policy debate around op return yeah so in general I think I have a somewhat different take than um 99% of the people in in the discussion which is basically that this

(02:25) is a really stupid discussion um everybody has mempool derangement syndrome like at every layer um and uh what what frustrates me a little bit about the conversation not not to not to uh get like um grumpy right off the bat but it's just it's it's such a small issue in the in the grand scheme of challenges that are being presented to Bitcoin that like spending all this drama on it um is is really a silly use of time and uh kind of emotion, but I can break it down for you.

(03:02) I mean, I think I think like largely the argument is happening on a few layers. Um the change itself technically I'm totally in favor of it. It makes sense. you know, basically the rationale is like, well, you know, um, people want to include exogenous data into the chain. Um, you can't really stop them from doing that.

(03:23) Um and so let's basically minimize the damage by saying hey you know we're going to make it easier for people to actually make use of op return as a data carrier which uh lets us avoid bloat in the UTXO set which is like one of the precious resources we have to take care of for the node.

(03:44) Um, so that's all good and the and the other thing too is that as we've seen with the ordinal stuff is um, you know, data is going to wait make its way into the chain and actually it hurts the whole network when um, there are transactions that most nodes haven't seen yet but they come through a block. Basically that slows down block propagation time.

(04:06) And so the whole idea is if you bring policy closer to the actual consensus rules, closer to the actual transactions that are going to come through and be mined, then you're going to have better network performance. You're going to have lower latency when it comes to actually broadcasting a new block around. So that's like the the sort of technical layer of the discussion.

(04:25) It's it's really a minute non-controversial change if you kind of have fluency with the the technical end of the mempool. Um, but I think there's this this higher layer to the conversation which is sort of a readjudication of spam in Bitcoin. And it's, you know, I think a lot of the the old animal spirits and sentiments are emerging about like, well, we don't like spam.

(04:49) And I think for a lot of people who kind of get lost in the technical details, it's very easy to latch on to the sentiment of I don't like spam. Um and so uh so that makes the sort of ocean knots camp maybe more appealing. Uh so that's yeah that's I guess a summary if you want to jump in anything in particular we can that's what I was saying I came out more confused than I went in.

(05:20) So last week on RHR, hey, I agree. You want policy to be aligned with consensus. Like whether we like it or not, these transactions are getting into blocks. They're non-standard, but they are valid within consensus rules and policy just isn't aligning with that. And like you said, this is disrupting the P2P layer and potentially the fee uh estimation process that that many nodes use, many applications use.

(05:49) And it makes sense to me to align policy with consensus. These things are happening. And if you can make it so Bitcoin full nodes are operating as efficiently and optimally as possible by changing this, it makes sense to me. I think my one like push back was like makes sense to me. However, I think how it was communicated to people and the whole mess with the PR.

(06:12) I think it's I think it's it was it's it's just a tactical error. Like even if this change gets in the the the real benefit of is is not material. You know, nobody was really clamoring for it. um this stuff always, you know, gets the hackles up of everybody who cares at all about, you know, spamming Bitcoin. So, it was a real tactical error.

(06:36) And I think that's that's one place where I mean it's kind of I had a little bit of shot in Freud seeing it because I'm fairly critical of core as a project along you know a variety of axes at this point and it was just kind of a demonstration of the the disconnection and kind of ineptitude of um publicity management kind of on on their end.

(06:58) Um, and so like there's part of me that enjoys seeing that because I I'm kind of convinced that that group has a lot less efficacy than they have credibility. And so to to see that kind of catch up was was interesting. The uh let's dive into that like what you said multiple axes you have a problem. I think we've throughout the years like we've been discussing the issues that Bitcoin like yourself particularly as a Bitcoin core developer for many years trying to get things through not only in the context of the way core works from a governance

(07:35) structure but just the way Bitcoin works as a distributed open source protocol like trying to get changes in and I will say like -

@ 8bad92c3:ca714aa5

2025-06-07 05:02:14

@ 8bad92c3:ca714aa5

2025-06-07 05:02:14Key Takeaways

Michael Goldstein, aka Bitstein, presents a sweeping philosophical and economic case for going “all in” on Bitcoin, arguing that unlike fiat, which distorts capital formation and fuels short-term thinking, Bitcoin fosters low time preference, meaningful saving, and long-term societal flourishing. At the heart of his thesis is “hodling for good”—a triple-layered idea encompassing permanence, purpose, and the pursuit of higher values like truth, beauty, and legacy. Drawing on thinkers like Aristotle, Hoppe, and Josef Pieper, Goldstein redefines leisure as contemplation, a vital practice in aligning capital with one’s deepest ideals. He urges Bitcoiners to think beyond mere wealth accumulation and consider how their sats can fund enduring institutions, art, and architecture that reflect a moral vision of the future.

Best Quotes

“Let BlackRock buy the houses, and you keep the sats.”

“We're not hodling just for the sake of hodling. There is a purpose to it.”

“Fiat money shortens your time horizon… you can never rest.”

“Savings precedes capital accumulation. You can’t build unless you’ve saved.”

“You're increasing the marginal value of everyone else’s Bitcoin.”

“True leisure is contemplation—the pursuit of the highest good.”

“What is Bitcoin for if not to make the conditions for magnificent acts of creation possible?”

“Bitcoin itself will last forever. Your stack might not. What will outlast your coins?”

“Only a whale can be magnificent.”

“The market will sell you all the crack you want. It’s up to you to demand beauty.”

Conclusion

This episode is a call to reimagine Bitcoin as more than a financial revolution—it’s a blueprint for civilizational renewal. Michael Goldstein reframes hodling as an act of moral stewardship, urging Bitcoiners to lower their time preference, build lasting institutions, and pursue truth, beauty, and legacy—not to escape the world, but to rebuild it on sound foundations.

Timestamps

00:00 - Intro

00:50 - Michael’s BBB presentation Hodl for Good

07:27 - Austrian principles on capital

15:40 - Fiat distorts the economic process

23:34 - Bitkey

24:29 - Hodl for Good triple entendre

29:52 - Bitcoin benefits everyone

39:05 - Unchained

40:14 - Leisure theory of value

52:15 - Heightening life

1:15:48 - Breaking from the chase makes room for magnificence

1:32:32 - Nakamoto Institute’s missionTranscript

(00:00) Fiat money is by its nature a disturbance. If money is being continually produced, especially at an uncertain rate, these uh policies are really just redistribution of wealth. Most are looking for number to go up post hyper bitcoinization. The rate of growth of bitcoin would be more reflective of the growth of the economy as a whole.

(00:23) Ultimately, capital requires knowledge because it requires knowing there is something that you can add to the structures of production to lengthen it in some way that will take time but allow you to have more in the future than you would today. Let Black Rockck buy the houses and you keep the sats, not the other way around.

(00:41) You wait until later for Larry Frink to try to sell you a [Music] mansion. And we're live just like that. Just like that. 3:30 on a Friday, Memorial Day weekend. It's a good good good way to end the week and start the holiday weekend. Yes, sir. Yes, sir. Thank you for having me here. Thank you for coming. I wore this hat specifically because I think it's I think it's very apppropo uh to the conversation we're going to have which is I hope an extension of the presentation you gave at Bitblock Boom Huddle for good. You were working on

(01:24) that for many weeks leading up to uh the conference and explaining how you were structuring it. I think it's a very important topic to discuss now as the Bitcoin price is hitting new all-time highs and people are trying to understand what am I doing with Bitcoin? Like you have you have the different sort of factions within Bitcoin.

(01:47) Uh get on a Bitcoin standard, get on zero, spend as much Bitcoin as possible. You have the sailors of the world are saying buy Bitcoin, never sell, die with your Bitcoin. And I think you do a really good job in that presentation. And I just think your understanding overall of Bitcoin is incredible to put everything into context. It's not either or.

(02:07) It really depends on what you want to accomplish. Yeah, it's definitely there there is no actual one-sizefits-all um for I mean nearly anything in this world. So um yeah, I mean first of all I mean there was it was the first conference talk I had given in maybe five years. I think the one prior to that uh was um bit block boom 2019 which was my meme talk which uh has uh become infamous and notorious.

(02:43) So uh there was also a lot of like high expectations uh you know rockstar dev uh has has treated that you know uh that that talk with a lot of reference. a lot of people have enjoyed it and he was expecting this one to be, you know, the greatest one ever, which is a little bit of a little bit of a uh a burden to live up to those kinds of standards.

(03:08) Um, but you know, because I don't give a lot of talks. Um, you know, I I I like to uh try to bring ideas that might even be ideas that are common. So, something like hodling, we all talk about it constantly. uh but try to bring it from a little bit of a different angle and try to give um a little bit of uh new light to it.

(03:31) I alsove I've I've always enjoyed kind of coming at things from a third angle. Um whenever there's, you know, there's there's all these little debates that we have in in Bitcoin and sometimes it's nice to try to uh step out of it and look at it a little more uh kind of objectively and find ways of understanding it that incorporate the truths of of all of them.

(03:58) uh you know cuz I think we should always be kind of as much as possible after ultimate truth. Um so with this one um yeah I was kind of finding that that sort of golden mean. So uh um yeah and I actually I think about that a lot is uh you know Aristotle has his his concept of the golden mean. So it's like any any virtue is sort of between two vices um because you can you can always you can always take something too far.

(04:27) So you're you're always trying to find that right balance. Um so someone who is uh courageous you know uh one of the vices uh on one side is being basically reckless. I I can't remember what word he would use. Uh but effectively being reckless and just wanting to put yourself in danger for no other reason than just you know the thrill of it.

(04:50) Um and then on the other side you would just have cowardice which is like you're unwilling to put yourself um at any risk at any time. Um, and courage is right there in the middle where it's understanding when is the right time uh to put your put yourself, you know, in in the face of danger um and take it on. And so um in some sense this this was kind of me uh in in some ways like I'm obviously a partisan of hodling.

(05:20) Um, I've for, you know, a long time now talked about the, um, why huddling is good, why people do it, why we should expect it. Um, but still trying to find that that sort of golden mean of like yes, huddle, but also what are we hodling for? And it's not we're we're not hodddling just merely for the sake of hodddling.

(05:45) There there is a a purpose to it. And we should think about that. And that would also help us think more about um what are the benefits of of spending, when should we spend, why should we spend, what should we spend on um to actually give light to that sort of side of the debate. Um so that was that was what I was kind of trying to trying to get into.

(06:09) Um, as well as also just uh at the same time despite all the talk of hodling, there's always this perennial uh there's always this perennial dislike of hodlers because we're treated as uh as if um we're just free riding the network or we're just greedy or you know any of these things. And I wanted to show how uh huddling does serve a real economic purpose.

(06:36) Um, and it does benefit the individual, but it also does uh it it has actual real social um benefits as well beyond merely the individual. Um, so I wanted to give that sort of defense of hodling as well to look at it from um a a broader position than just merely I'm trying to get rich. Um uh because even the person who uh that is all they want to do um just like you know your your pure number grow up go up moonboy even that behavior has positive ramifications on on the economy.

(07:14) And while we might look at them and have uh judgments about their particular choices for them as an individual, we shouldn't discount that uh their actions are having positive positive effects for the rest of the economy. Yeah. So, let's dive into that just not even in the context of Bitcoin because I think you did a great job of this in the presentation.

(07:36) just you've done a good job of this consistently throughout the years that I've known you. Just from like a first principles Austrian economics perspective, what is the idea around capital accumulation, low time preference and deployment of that capital like what what like getting getting into like the nitty-gritty and then applying it to Bitcoin? Yeah, it's it's a big question and um in many ways I mean I I even I barely scratched the surface.

(08:05) uh I I can't claim to have read uh all the volumes of Bombber works, you know, capital and interest and and stuff like that. Um but I think there's some some sort of basic concepts that we can look at that we can uh draw a lot out. Um the first uh I guess let's write that. So repeat so like capital time preference. Yeah. Well, I guess getting more broad like why sav -

@ 7f6db517:a4931eda

2025-06-07 05:02:28

@ 7f6db517:a4931eda

2025-06-07 05:02:28

The former seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

The latter's future remains to be seen. Dependence on Tor, which has had massive reliability issues, and lack of strong privacy guarantees put it at risk.

— ODELL (@ODELL) October 27, 2022

The Basics

- Lightning is a protocol that enables cheap and fast native bitcoin transactions.

- At the core of the protocol is the ability for bitcoin users to create a payment channel with another user.

- These payment channels enable users to make many bitcoin transactions between each other with only two on-chain bitcoin transactions: the channel open transaction and the channel close transaction.

- Essentially lightning is a protocol for interoperable batched bitcoin transactions.

- It is expected that on chain bitcoin transaction fees will increase with adoption and the ability to easily batch transactions will save users significant money.

- As these lightning transactions are processed, liquidity flows from one side of a channel to the other side, on chain transactions are signed by both parties but not broadcasted to update this balance.

- Lightning is designed to be trust minimized, either party in a payment channel can close the channel at any time and their bitcoin will be settled on chain without trusting the other party.

There is no 'Lightning Network'

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise.

- There are many lightning channels between many different users and funds can flow across interconnected channels as long as there is a route through peers.

- If a lightning transaction requires multiple hops it will flow through multiple interconnected channels, adjusting the balance of all channels along the route, and paying lightning transaction fees that are set by each node on the route.

Example: You have a channel with Bob. Bob has a channel with Charlie. You can pay Charlie through your channel with Bob and Bob's channel with User C.

- As a result, it is not guaranteed that every lightning user can pay every other lightning user, they must have a route of interconnected channels between sender and receiver.

Lightning in Practice

- Lightning has already found product market fit and usage as an interconnected payment protocol between large professional custodians.

- They are able to easily manage channels and liquidity between each other without trust using this interoperable protocol.

- Lightning payments between large custodians are fast and easy. End users do not have to run their own node or manage their channels and liquidity. These payments rarely fail due to professional management of custodial nodes.

- The tradeoff is one inherent to custodians and other trusted third parties. Custodial wallets can steal funds and compromise user privacy.

Sovereign Lightning

- Trusted third parties are security holes.

- Users must run their own node and manage their own channels in order to use lightning without trusting a third party. This remains the single largest friction point for sovereign lightning usage: the mental burden of actively running a lightning node and associated liquidity management.

- Bitcoin development prioritizes node accessibility so cost to self host your own node is low but if a node is run at home or office, Tor or a VPN is recommended to mask your IP address: otherwise it is visible to the entire network and represents a privacy risk.

- This privacy risk is heightened due to the potential for certain governments to go after sovereign lightning users and compel them to shutdown their nodes. If their IP Address is exposed they are easier to target.

- Fortunately the tools to run and manage nodes continue to get easier but it is important to understand that this will always be a friction point when compared to custodial services.

The Potential Fracture of Lightning

- Any lightning user can choose which users are allowed to open channels with them.

- One potential is that professional custodians only peer with other professional custodians.

- We already see nodes like those run by CashApp only have channels open with other regulated counterparties. This could be due to performance goals, liability reduction, or regulatory pressure.

- Fortunately some of their peers are connected to non-regulated parties so payments to and from sovereign lightning users are still successfully processed by CashApp but this may not always be the case going forward.

Summary

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise. There is no singular 'Lightning Network' but rather many payment channels between distinct peers, some connected with each other and some not.

- Lightning as an interoperable payment protocol between professional custodians seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

- Lightning as a robust sovereign payment protocol has yet to be battle tested. Heavy reliance on Tor, which has had massive reliability issues, the friction of active liquidity management, significant on chain fee burden for small amounts, interactivity constraints on mobile, and lack of strong privacy guarantees put it at risk.

If you have never used lightning before, use this guide to get started on your phone.

If you found this post helpful support my work with bitcoin.

-

@ 8bad92c3:ca714aa5

2025-06-06 12:01:54

@ 8bad92c3:ca714aa5

2025-06-06 12:01:54Key Takeaways

Michael Goldstein, aka Bitstein, presents a sweeping philosophical and economic case for going “all in” on Bitcoin, arguing that unlike fiat, which distorts capital formation and fuels short-term thinking, Bitcoin fosters low time preference, meaningful saving, and long-term societal flourishing. At the heart of his thesis is “hodling for good”—a triple-layered idea encompassing permanence, purpose, and the pursuit of higher values like truth, beauty, and legacy. Drawing on thinkers like Aristotle, Hoppe, and Josef Pieper, Goldstein redefines leisure as contemplation, a vital practice in aligning capital with one’s deepest ideals. He urges Bitcoiners to think beyond mere wealth accumulation and consider how their sats can fund enduring institutions, art, and architecture that reflect a moral vision of the future.

Best Quotes

“Let BlackRock buy the houses, and you keep the sats.”

“We're not hodling just for the sake of hodling. There is a purpose to it.”

“Fiat money shortens your time horizon… you can never rest.”

“Savings precedes capital accumulation. You can’t build unless you’ve saved.”

“You're increasing the marginal value of everyone else’s Bitcoin.”

“True leisure is contemplation—the pursuit of the highest good.”

“What is Bitcoin for if not to make the conditions for magnificent acts of creation possible?”

“Bitcoin itself will last forever. Your stack might not. What will outlast your coins?”

“Only a whale can be magnificent.”

“The market will sell you all the crack you want. It’s up to you to demand beauty.”

Conclusion

This episode is a call to reimagine Bitcoin as more than a financial revolution—it’s a blueprint for civilizational renewal. Michael Goldstein reframes hodling as an act of moral stewardship, urging Bitcoiners to lower their time preference, build lasting institutions, and pursue truth, beauty, and legacy—not to escape the world, but to rebuild it on sound foundations.

Timestamps

00:00 - Intro

00:50 - Michael’s BBB presentation Hodl for Good

07:27 - Austrian principles on capital

15:40 - Fiat distorts the economic process

23:34 - Bitkey

24:29 - Hodl for Good triple entendre

29:52 - Bitcoin benefits everyone

39:05 - Unchained

40:14 - Leisure theory of value

52:15 - Heightening life

1:15:48 - Breaking from the chase makes room for magnificence

1:32:32 - Nakamoto Institute’s missionTranscript

(00:00) Fiat money is by its nature a disturbance. If money is being continually produced, especially at an uncertain rate, these uh policies are really just redistribution of wealth. Most are looking for number to go up post hyper bitcoinization. The rate of growth of bitcoin would be more reflective of the growth of the economy as a whole.

(00:23) Ultimately, capital requires knowledge because it requires knowing there is something that you can add to the structures of production to lengthen it in some way that will take time but allow you to have more in the future than you would today. Let Black Rockck buy the houses and you keep the sats, not the other way around.

(00:41) You wait until later for Larry Frink to try to sell you a [Music] mansion. And we're live just like that. Just like that. 3:30 on a Friday, Memorial Day weekend. It's a good good good way to end the week and start the holiday weekend. Yes, sir. Yes, sir. Thank you for having me here. Thank you for coming. I wore this hat specifically because I think it's I think it's very apppropo uh to the conversation we're going to have which is I hope an extension of the presentation you gave at Bitblock Boom Huddle for good. You were working on

(01:24) that for many weeks leading up to uh the conference and explaining how you were structuring it. I think it's a very important topic to discuss now as the Bitcoin price is hitting new all-time highs and people are trying to understand what am I doing with Bitcoin? Like you have you have the different sort of factions within Bitcoin.

(01:47) Uh get on a Bitcoin standard, get on zero, spend as much Bitcoin as possible. You have the sailors of the world are saying buy Bitcoin, never sell, die with your Bitcoin. And I think you do a really good job in that presentation. And I just think your understanding overall of Bitcoin is incredible to put everything into context. It's not either or.

(02:07) It really depends on what you want to accomplish. Yeah, it's definitely there there is no actual one-sizefits-all um for I mean nearly anything in this world. So um yeah, I mean first of all I mean there was it was the first conference talk I had given in maybe five years. I think the one prior to that uh was um bit block boom 2019 which was my meme talk which uh has uh become infamous and notorious.

(02:43) So uh there was also a lot of like high expectations uh you know rockstar dev uh has has treated that you know uh that that talk with a lot of reference. a lot of people have enjoyed it and he was expecting this one to be, you know, the greatest one ever, which is a little bit of a little bit of a uh a burden to live up to those kinds of standards.

(03:08) Um, but you know, because I don't give a lot of talks. Um, you know, I I I like to uh try to bring ideas that might even be ideas that are common. So, something like hodling, we all talk about it constantly. uh but try to bring it from a little bit of a different angle and try to give um a little bit of uh new light to it.

(03:31) I alsove I've I've always enjoyed kind of coming at things from a third angle. Um whenever there's, you know, there's there's all these little debates that we have in in Bitcoin and sometimes it's nice to try to uh step out of it and look at it a little more uh kind of objectively and find ways of understanding it that incorporate the truths of of all of them.

(03:58) uh you know cuz I think we should always be kind of as much as possible after ultimate truth. Um so with this one um yeah I was kind of finding that that sort of golden mean. So uh um yeah and I actually I think about that a lot is uh you know Aristotle has his his concept of the golden mean. So it's like any any virtue is sort of between two vices um because you can you can always you can always take something too far.

(04:27) So you're you're always trying to find that right balance. Um so someone who is uh courageous you know uh one of the vices uh on one side is being basically reckless. I I can't remember what word he would use. Uh but effectively being reckless and just wanting to put yourself in danger for no other reason than just you know the thrill of it.

(04:50) Um and then on the other side you would just have cowardice which is like you're unwilling to put yourself um at any risk at any time. Um, and courage is right there in the middle where it's understanding when is the right time uh to put your put yourself, you know, in in the face of danger um and take it on. And so um in some sense this this was kind of me uh in in some ways like I'm obviously a partisan of hodling.

(05:20) Um, I've for, you know, a long time now talked about the, um, why huddling is good, why people do it, why we should expect it. Um, but still trying to find that that sort of golden mean of like yes, huddle, but also what are we hodling for? And it's not we're we're not hodddling just merely for the sake of hodddling.

(05:45) There there is a a purpose to it. And we should think about that. And that would also help us think more about um what are the benefits of of spending, when should we spend, why should we spend, what should we spend on um to actually give light to that sort of side of the debate. Um so that was that was what I was kind of trying to trying to get into.

(06:09) Um, as well as also just uh at the same time despite all the talk of hodling, there's always this perennial uh there's always this perennial dislike of hodlers because we're treated as uh as if um we're just free riding the network or we're just greedy or you know any of these things. And I wanted to show how uh huddling does serve a real economic purpose.

(06:36) Um, and it does benefit the individual, but it also does uh it it has actual real social um benefits as well beyond merely the individual. Um, so I wanted to give that sort of defense of hodling as well to look at it from um a a broader position than just merely I'm trying to get rich. Um uh because even the person who uh that is all they want to do um just like you know your your pure number grow up go up moonboy even that behavior has positive ramifications on on the economy.

(07:14) And while we might look at them and have uh judgments about their particular choices for them as an individual, we shouldn't discount that uh their actions are having positive positive effects for the rest of the economy. Yeah. So, let's dive into that just not even in the context of Bitcoin because I think you did a great job of this in the presentation.

(07:36) just you've done a good job of this consistently throughout the years that I've known you. Just from like a first principles Austrian economics perspective, what is the idea around capital accumulation, low time preference and deployment of that capital like what what like getting getting into like the nitty-gritty and then applying it to Bitcoin? Yeah, it's it's a big question and um in many ways I mean I I even I barely scratched the surface.

(08:05) uh I I can't claim to have read uh all the volumes of Bombber works, you know, capital and interest and and stuff like that. Um but I think there's some some sort of basic concepts that we can look at that we can uh draw a lot out. Um the first uh I guess let's write that. So repeat so like capital time preference. Yeah. Well, I guess getting more broad like why sav -

@ b1ddb4d7:471244e7

2025-06-06 08:01:27

@ b1ddb4d7:471244e7

2025-06-06 08:01:27When Sergei talks about bitcoin, he doesn’t sound like someone chasing profits or followers. He sounds like someone about to build a monastery in the ruins.

While the mainstream world chases headlines and hype, Sergei shows up in local meetups from Sacramento to Cleveland, mentors curious minds, and shares what he knows is true – hoping that, with the right spark, someone will light their own way forward.

We interviewed Sergei to trace his steps: where he started, what keeps him going, and why teaching bitcoin is far more than explaining how to set up a node – it’s about reaching the right minds before the noise consumes them. So we began where most journeys start: at the beginning.

First Steps

- So, where did it all begin for you and what made you stay curious?

I first heard about bitcoin from a friend’s book recommendation, American Kingpin, the book about Silk Road (online drug marketplace). He is still not a true bitcoiner, although I helped him secure private keys with some bitcoin.

I was really busy at the time – focused on my school curriculum, running a 7-bedroom Airbnb, and working for a standardized test prep company. Bitcoin seemed too technical for me to explore, and the pace of my work left no time for it.

After graduating, while pursuing more training, I started playing around with stocks and maximizing my savings. Passive income seemed like the path to early retirement, as per the promise of the FIRE movement (Financial Independence, Retire Early). I mostly followed the mainstream news and my mentor’s advice – he liked preferred stocks at the time.

I had some Coinbase IOUs and remember sending bitcoin within the Coinbase ledger to a couple friends. I also recall the 2018 crash; I actually saw the legendary price spike live but couldn’t benefit because my funds were stuck amidst the frenzy. I withdrew from that investment completely for some time. Thankfully, my mentor advised to keep en eye on bitcoin.

Around late 2019, I started DCA-ing cautiously. Additionally, my friend and I were discussing famous billionaires, and how there was no curriculum for becoming a billionaire. So, I typed “billionaires” into my podcast app, and landed on We Study Billionaires podcast.

That’s where I kept hearing Preston Pysh mention bitcoin, before splitting into his own podcast series, Bitcoin Fundamentals. I didn’t understand most of the terminology of stocks, bonds, etc, yet I kept listening and trying to absorb it thru repetition. Today, I realize all that financial talk was mostly noise.

When people ask me for a technical explanation of fiat, I say: it’s all made up, just like the fiat price of bitcoin! Starting in 2020, during the so-called pandemic, I dove deeper. I religiously read Bitcoin Magazine, scrolled thru Bitcoin Twitter, and joined Simply Bitcoin Telegram group back when DarthCoin was an admin.

DarthCoin was my favorite bitcoiner – experienced, knowledgeable, and unapologetic. Watching him shift from rage to kindness, from passion to despair, gave me a glimpse at what a true educator’s journey would look like.

The struggle isn’t about adoption at scale anymore. It’s about reaching the few who are willing to study, take risks, and stay out of fiat traps. The vast majority won’t follow that example – not yet at least… if I start telling others the requirements for true freedom and prosperity, they would certainly say “Hell no!”

- At what point did you start teaching others, and why?

After college, I helped teach at a standardized test preparation company, and mentored some students one-on-one. I even tried working at a kindergarten briefly, but left quickly; Babysitting is not teaching.

What I discovered is that those who will succeed don’t really need my help – they would succeed with or without me, because they already have the inner drive.

Once you realize your people are perishing for lack of knowledge, the only rational thing to do is help raise their level of knowledge and understanding. That’s the Great Work.

I sometimes imagine myself as a political prisoner. If that were to happen, I’d probably start teaching fellow prisoners, doctors, janitors, even guards. In a way we already live in an open-air prison, So what else is there to do but teach, organize, and conspire to dismantle the Matrix?

Building on Bitcoin

- You hosted some in-person meetups in Sacramento. What did you learn from those?

My first presentation was on MultiSig storage with SeedSigner, and submarine swaps through Boltz.exchange.

I realized quickly that I had overestimated the group’s technical background. Even the meetup organizer, a financial advisor, asked, “How is anyone supposed to follow these steps?” I responded that reading was required… He decided that Unchained is an easier way.

At a crypto meetup, I gave a much simpler talk, outlining how bitcoin will save the world, based on a DarthCoin’s guide. Only one person stuck around to ask questions – a man who seemed a little out there, and did not really seem to get the message beyond the strength of cryptographic security of bitcoin.

Again, I overestimated the audience’s readiness. That forced me to rethink my strategy. People are extremely early and reluctant to study.

- Now in Ohio, you hold sessions via the Orange Pill App. What’s changed?

My new motto is: educate the educators. The corollary is: don’t orange-pill stupid normies (as DarthCoin puts it).

I’ve shifted to small, technical sessions in order to raise a few solid guardians of this esoteric knowledge who really get it and can carry it forward.

The youngest attendee at one of my sessions is a newborn baby – he mostly sleeps, but maybe he still absorbs some of the educational vibes.

- How do local groups like Sactown and Cleveland Bitcoiners influence your work?

Every meetup reflects its local culture. Sacramento and Bay Area Bitcoiners, for example, do camping trips – once we camped through a desert storm, shielding our burgers from sand while others went to shoot guns.

Cleveland Bitcoiners are different. They amass large gatherings. They recently threw a 100k party. They do a bit more community outreach. Some are curious about the esoteric topics such as jurisdiction, spirituality, and healthful living.

I have no permanent allegiance to any state, race, or group. I go where I can teach and learn. I anticipate that in my next phase, I’ll meet Bitcoiners so advanced that I’ll have to give up my fiat job and focus full-time on serious projects where real health and wealth are on the line.

Hopefully, I’ll be ready. I believe the universe always challenges you exactly to your limit – no less, no more.

- What do people struggle with the most when it comes to technical education?

The biggest struggle isn’t technical – it’s a lack of deep curiosity. People ask “how” and “what” – how do I set up a node, what should one do with the lightning channels? But very few ask “why?”