-

@ 6d8e2a24:5faaca4c

2025-06-06 04:26:58

@ 6d8e2a24:5faaca4c

2025-06-06 04:26:58

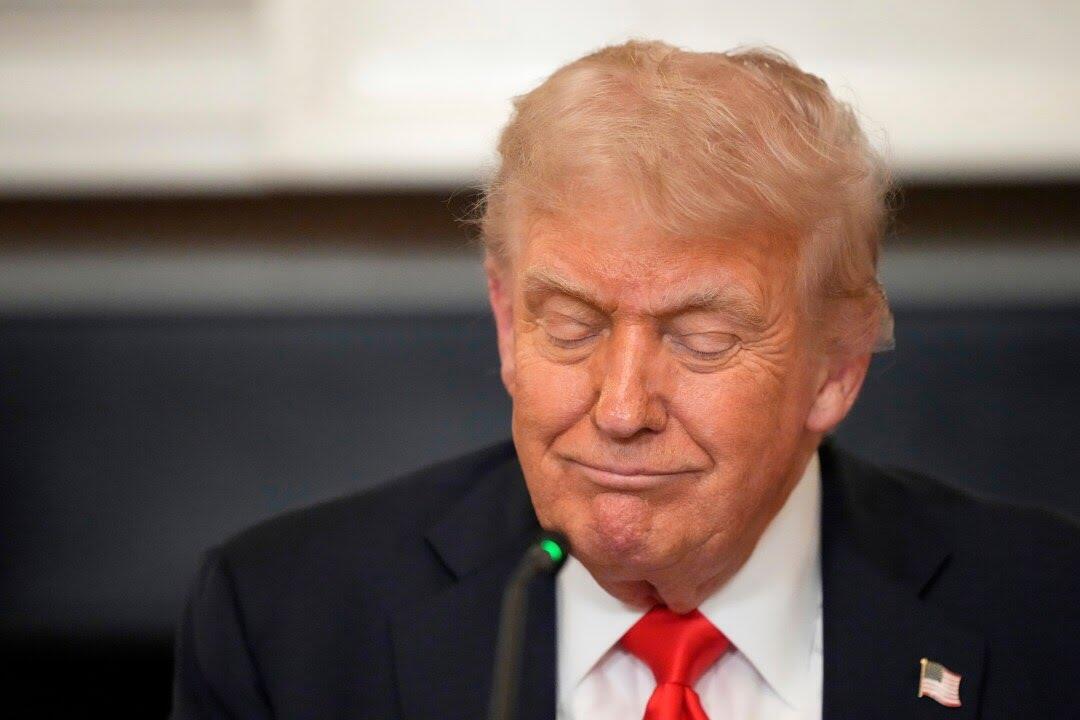

President Donald Trump attends a meeting with the Fraternal Order of Police in the State Dinning Room of the White House, Thursday, June 5, 2025, in Washington. (AP Photo/Alex Brandon)

Last Friday, President Donald Trump heaped praise on Elon Musk as the tech billionaire prepared to leave his unorthodox White House job.

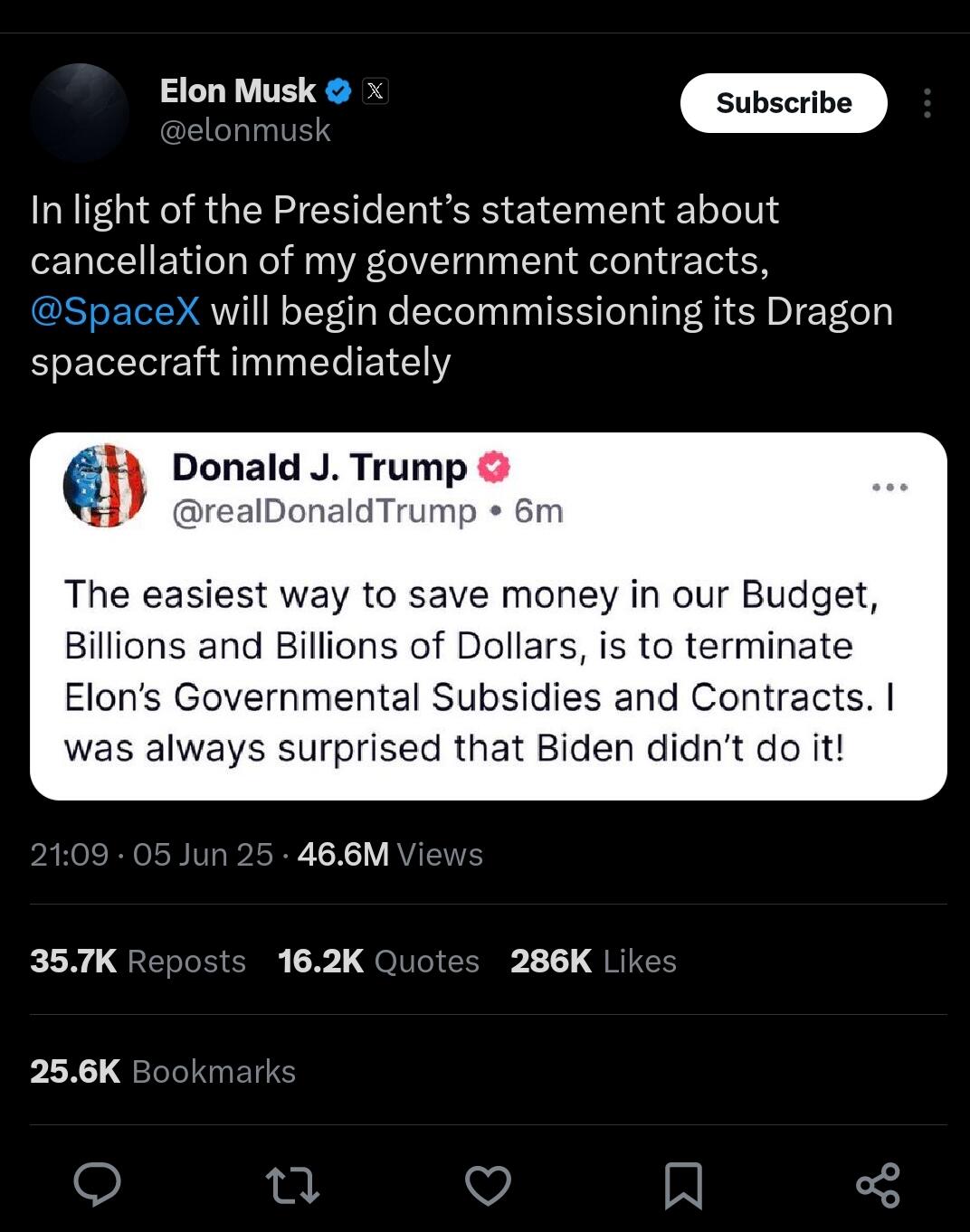

Less than a week later, their potent political alliance met a dramatic end Thursday when the men attacked each other with blistering epithets. Trump threatened to go after Musk’s business interests. Musk called for Trump’s impeachment.

social media posts urging lawmakers to oppose deficit spending and increasing the debt ceiling.

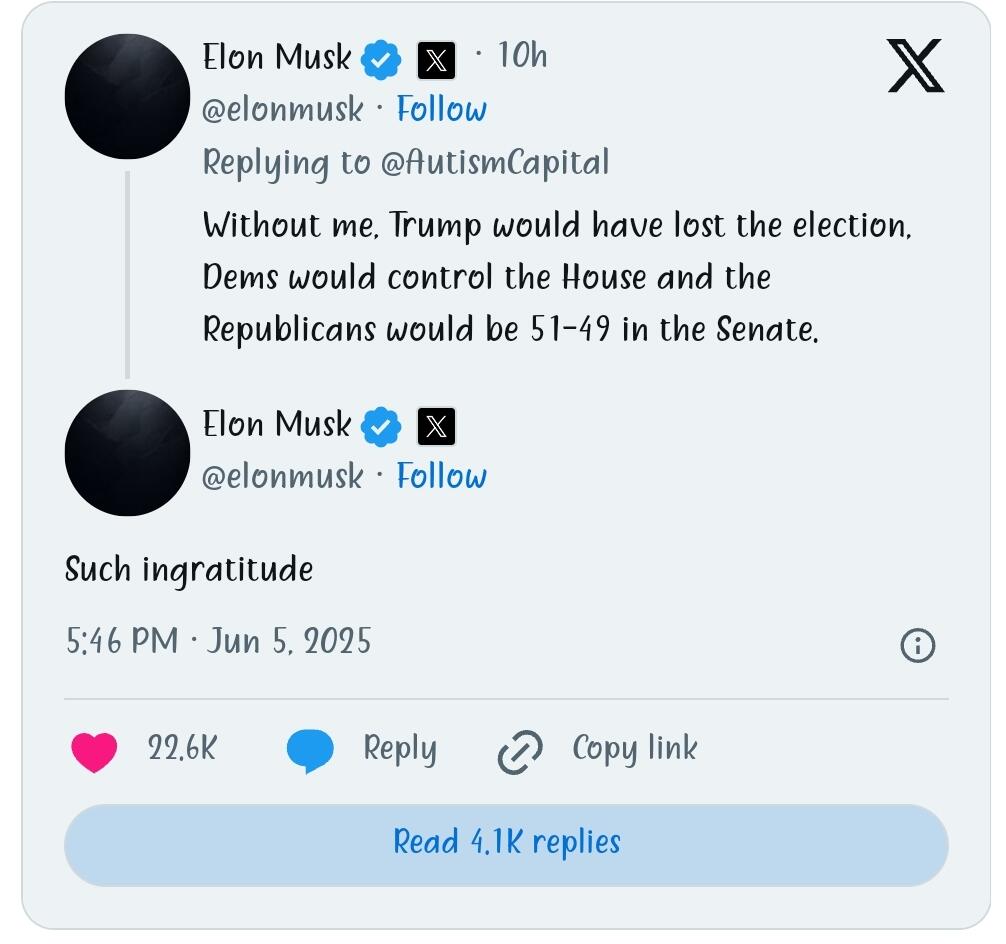

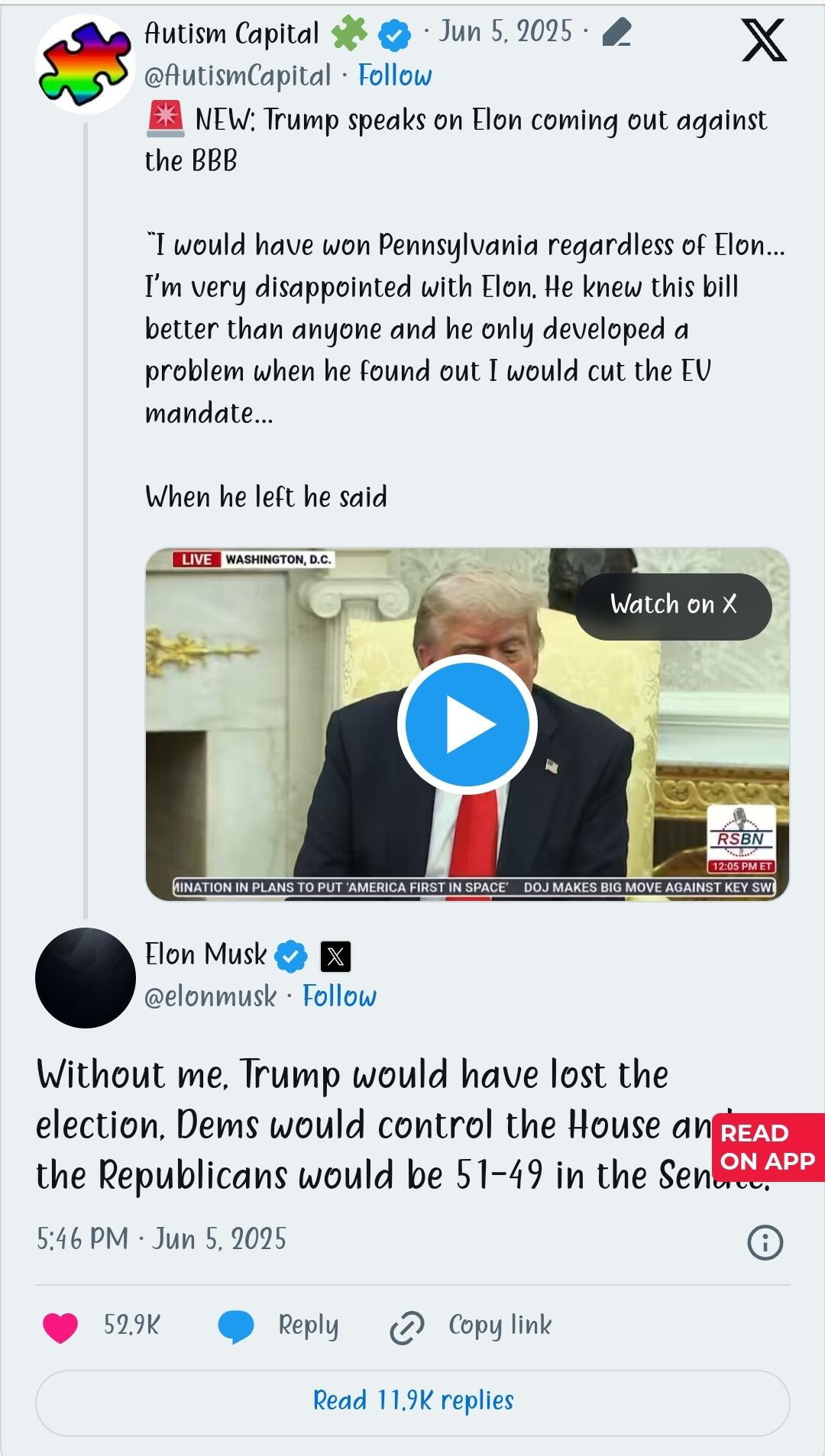

“Without me, Trump would have lost the election, Dems would control the House and the Republicans would be 51-49 in the Senate,” Musk posted, a reference to Musk’s record political spending last year, which topped $250 million.

“Such ingratitude,” he added.

Trump said Musk had worn out his welcome at the White House and was mad that Trump was changing electric vehicle policies in ways that would financially harm Musk-led Tesla.

“Elon was ‘wearing thin,’ I asked him to leave, I took away his EV Mandate that forced everyone to buy Electric Cars that nobody else wanted (that he knew for months I was going to do!), and he just went CRAZY!” Trump wrote.

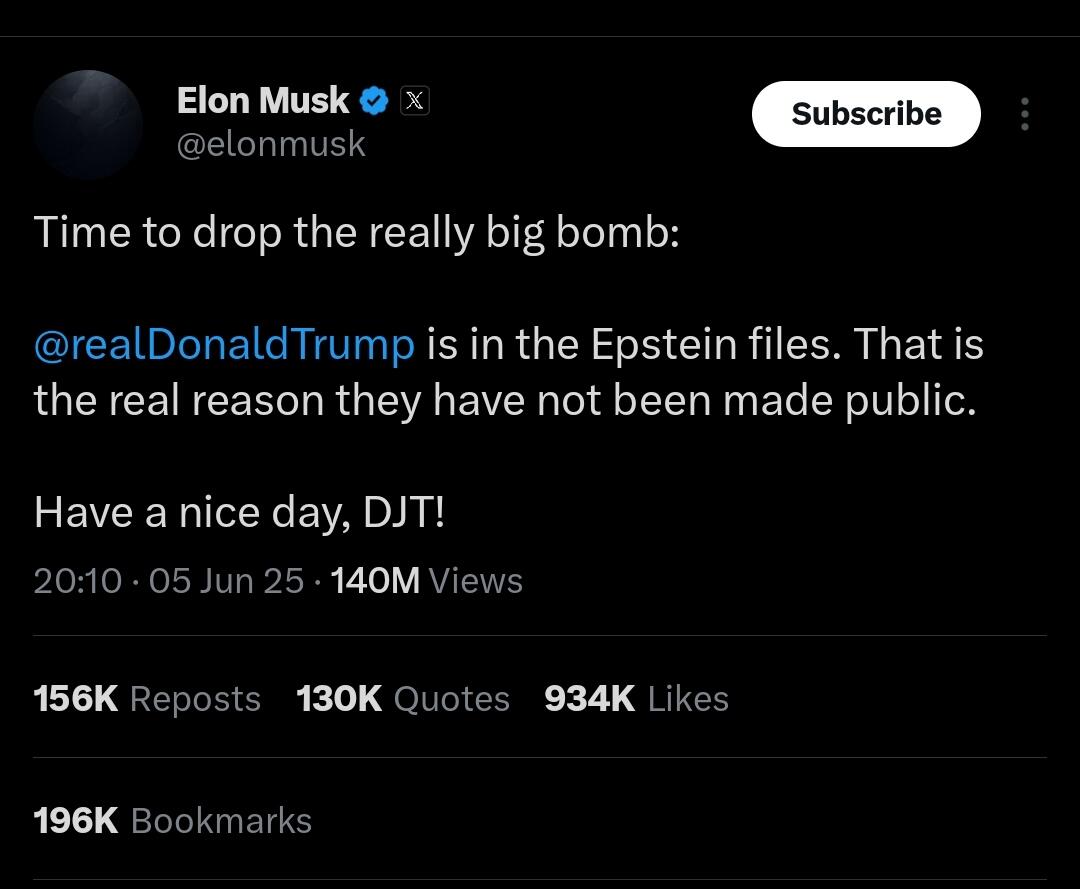

Musk goes nuclear “Time to drop the really big bomb: Trump is in the Epstein files. That is the real reason they have not been made public. Have a nice day, DJT!” — Musk, Thursday, X post.

In a series of posts, he shined a spotlight on ties between Trump and Jeffrey Epstein, the financier who killed himself while awaiting trial on federal sex trafficking charges. Some loud voices in Trump’s “Make America Great Again” movement claim Epstein’s suicide was staged by powerful figures, including prominent Democrats, who feared Epstein would expose their involvement in trafficking. Trump’s own FBI leaders have dismissed such speculation and there’s no evidence supporting it.

Later, when an X user suggested Trump be impeached and replaced by Vice President JD Vance, Musk agreed.

“Yes,” he wrote.

“I don’t mind Elon turning against me, but he should have done so months ago,” Trump wrote. He went on to promote his budget bill.

https://www.google.com/amp/s/www.wavy.com/news/politics/ap-the-implosion-of-a-powerful-political-alliance-trump-and-musk-in-their-own-words/amp/

-

@ 7f6db517:a4931eda

2025-06-06 04:01:30

@ 7f6db517:a4931eda

2025-06-06 04:01:30

"Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know. Privacy is the power to selectively reveal oneself to the world." - Eric Hughes, A Cypherpunk's Manifesto, 1993

Privacy is essential to freedom. Without privacy, individuals are unable to make choices free from surveillance and control. Lack of privacy leads to loss of autonomy. When individuals are constantly monitored it limits our ability to express ourselves and take risks. Any decisions we make can result in negative repercussions from those who surveil us. Without the freedom to make choices, individuals cannot truly be free.

Freedom is essential to acquiring and preserving wealth. When individuals are not free to make choices, restrictions and limitations prevent us from economic opportunities. If we are somehow able to acquire wealth in such an environment, lack of freedom can result in direct asset seizure by governments or other malicious entities. At scale, when freedom is compromised, it leads to widespread economic stagnation and poverty. Protecting freedom is essential to economic prosperity.

The connection between privacy, freedom, and wealth is critical. Without privacy, individuals lose the freedom to make choices free from surveillance and control. While lack of freedom prevents individuals from pursuing economic opportunities and makes wealth preservation nearly impossible. No Privacy? No Freedom. No Freedom? No Wealth.

Rights are not granted. They are taken and defended. Rights are often misunderstood as permission to do something by those holding power. However, if someone can give you something, they can inherently take it from you at will. People throughout history have necessarily fought for basic rights, including privacy and freedom. These rights were not given by those in power, but rather demanded and won through struggle. Even after these rights are won, they must be continually defended to ensure that they are not taken away. Rights are not granted - they are earned through struggle and defended through sacrifice.

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-06-06 03:01:36

@ dfa02707:41ca50e3

2025-06-06 03:01:36Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ eb0157af:77ab6c55

2025-06-06 04:01:10

@ eb0157af:77ab6c55

2025-06-06 04:01:10The newly elected South Korean President is aiming for a breakthrough in the cryptocurrency market with the introduction of spot ETFs and a national stablecoin.

On June 4, South Korea officially elected Lee Jae-myung as its new President. The candidate from the left-wing party secured victory following the impeachment of former leader Yoon Suk-yeol, who ended his three-year term after a failed attempt to establish a military-backed government.

Voter turnout reached 79.4%, the highest in the last 28 years. Lee won 49.42% of the vote, defeating his conservative opponent Kim Moon-soo, who garnered 41.15%.

The new President’s pledges

In addition to traditional economic priorities such as supporting low-income families and small businesses, Lee Jae-myung has placed digital assets at the heart of his political agenda.

The core pillar of Lee’s strategy involves the introduction of spot ETFs for Bitcoin and Ethereum in the domestic market. Currently, the issuance and local trading of crypto ETFs remain banned in the country.

Another key element of the plan is the approval of stablecoins pegged to the South Korean won. During a discussion last month, Lee emphasized the need to develop a won-based stablecoin market to prevent capital flight abroad.

Under the new administration, South Korea will also work to complete the second phase of its regulatory framework for digital assets. The upcoming legislation will specifically address stablecoin regulations and transparency requirements for cryptocurrency exchanges.

The program also includes the creation of special zones for blockchain-related businesses, where regulations will be minimized to maximize innovation and operational efficiency.

However, this isn’t the first time South Korea has elected a crypto-friendly candidate. The conservative president Yoon Suk-yeol, later impeached, had made several crypto-friendly promises aimed at deregulating the sector, though many of those initiatives saw delays and limited progress during his three-year term.

Yoon’s deregulatory plans faced resistance from the Financial Services Commission (FSC), which maintained strict regulations citing investor protection. In recent months, however, the FSC has shown greater openness toward easing crypto rules — a shift that could support Lee’s commitments.

According to FSC data, by the end of last year the country had 9.7 million registered exchange users, representing nearly 20% of the total population.

The post South Korea: the new leader may favor Bitcoin ETFs and a national stablecoin appeared first on Atlas21.

-

@ 9ca447d2:fbf5a36d

2025-06-06 04:00:49

@ 9ca447d2:fbf5a36d

2025-06-06 04:00:49CANNES, FRANCE – May 2025 — Bitcoin mining made its mark at the world’s most prestigious film gathering this year as Puerto Rican director and producer Alana Mediavilla introduced her feature documentary Dirty Coin: The Bitcoin Mining Documentary at the Marché du Film during the Cannes Film Festival.

The film puts bitcoin mining at the center of a rising global conversation about energy, technology, and economic freedom.

Dirty Coin is the first feature-length documentary to explore bitcoin mining through immersive, on-the-ground case studies.

From rural towns in the United States to hydro-powered sites in Latin America and the Congo, the film follows miners and communities navigating what may be one of the most misunderstood technologies of our time.

The result is a human-centered look at how bitcoin mining is transforming local economies and energy infrastructure in real ways.

To mark its Cannes debut, Mediavilla and her team hosted a packed industry event that brought together leaders from both film and finance.

Dirty Coin debut ceremony at the Marché du Film

Sponsors Celestial Management, Sangha Renewables, Nordblock, and Paystand.org supported the program, which featured panels on mining, energy use, and decentralized infrastructure.

Attendees had the rare opportunity to engage directly with pioneers in the space. A special session in French led by Seb Gouspillou spotlighted mining efforts in the Congo’s Virunga region.

Dirty Coin builds on Mediavilla’s award-winning short film Stranded, which won over 20 international prizes, including Best Short Documentary at Cannes in 2024.

That success helped lay the foundation for the feature and positioned Mediavilla as one of the boldest new voices in global documentary filmmaking.

Alana Mediavilla speaks at the Marché du Film — Cannes Film Festival

“If we’ve found an industry that can unlock stranded energy and turn it into real power for people—especially in regions with energy poverty—why wouldn’t we look into it?” says Mediavilla. “Our privilege blinds us.

“The same thing we criticize could be the very thing that lifts the developing world to our standard of living. Ignoring that potential is a failure of imagination.”

Much like the decentralized network it explores, Dirty Coin is spreading globally through grassroots momentum.

Local leaders are hosting independent screenings around the world, from Roatán and Berlin to São Paulo and Madrid. Upcoming events include Toronto and Zurich, with more cities joining each month.

Mediavilla, who previously worked in creative leadership roles in the U.S. — including as a producer at Google — returned to Puerto Rico to found Campo Libre, a studio focused on high-caliber, globally relevant storytelling from the Caribbean.

She was also accepted into the Cannes Producers Network, a selective program open only to producers with box office releases in the past four years.

Mediavilla qualified after independently releasing Dirty Coin in theaters across Puerto Rico. Her participation in the network gave her direct access to meetings, insights, and connections with the most active distributors and producers working today.

The film’s next public screening will take place at the Anthem Film Festival in Palm Springs on Saturday, June 14 at 2 PM. Additional screenings and market appearances are planned throughout the year at Bitcoin events and international film platforms.

Dirty Coin at the Cannes Film Festival

Watch the Trailer + Access Press Materials

📂 EPK

🎬 Screener

🌍 Host a Screening

Follow the Movement

Instagram: https://www.instagram.com/dirty_coin_official/

Twitter: https://x.com/DirtyCoinDoc

Website: www.dirtycointhemovie.com -

@ b1ddb4d7:471244e7

2025-06-06 04:00:43

@ b1ddb4d7:471244e7

2025-06-06 04:00:43Picture this: you’re trying to buy coffee with Bitcoin, but instead of waiting 10 minutes for blockchain confirmation and paying $5 in fees, your transaction completes instantly for a fraction of a penny.

That’s the promise of the Lightning Network, Bitcoin’s most ambitious scaling solution.

But here’s the thing that most people don’t realize – the entire system only works because of an intricate web of technical standards that most users never see.

These standards, known as BOLTs (Basis of Lightning Technology), are the invisible foundation that makes Lightning’s magic possible. Without them, we’d have a fragmented mess of incompatible systems rather than the seamless payment network that’s processing millions of transactions today.

The Protocol Puzzle: Why Lightning Needed Standards

When Lightning Network was first conceived in 2015, it faced a classic chicken-and-egg problem. Multiple development teams were working on implementations – Lightning Labs with LND, Blockstream with c-lightning, and ACINQ with Eclair – but they all had slightly different ideas about how things should work. Without coordination, these would have become isolated islands of functionality.

Think about the early days of instant messaging, when AOL Instant Messenger users couldn’t talk to Yahoo Messenger users. That’s exactly what Lightning developers wanted to avoid. The solution was BOLT – a comprehensive set of technical specifications that would ensure any Lightning implementation could talk to any other, regardless of who built it.

The first BOLT specifications emerged in 2016, but they weren’t just academic exercises. These documents had to solve real engineering challenges: How do you route payments through a network of payment channels? How do you ensure privacy when every transaction could potentially be monitored? How do you handle the inevitable network failures and channel closures?

Inside the BOLT Specifications: A Technical Breakdown

The BOLT specifications read like a blueprint for building a parallel financial system. Each document tackles a specific piece of the Lightning puzzle, and together they create something remarkably sophisticated.

BOLT #1 establishes the foundation – the basic message formats and communication rules that every Lightning node must understand. It’s like defining the grammar of a new language that computers use to talk about money. This specification covers everything from how nodes identify themselves to the basic structure of Lightning messages.

BOLT #2 gets into the nitty-gritty of channel management, the heart of Lightning’s functionality. Payment channels are essentially shared cryptocurrency wallets between two parties, and managing them securely requires incredibly precise coordination. This specification defines exactly how nodes negotiate channel parameters, handle updates, and gracefully close channels when needed. One wrong step here, and funds could be lost forever.

The routing problem gets its due attention in BOLT #4, which implements something called “onion routing” – the same privacy technique used by Tor. When you send a Lightning payment, each node in the path only knows the previous and next hop, never the full route. The sender wraps the payment instructions in multiple layers of encryption, like nested Russian dolls, with each node peeling off one layer to reveal just enough information to forward the payment.

BOLT #7 tackles network discovery – how nodes find each other in the first place. Unlike traditional payment networks with centralized directories, Lightning is completely peer-to-peer. Nodes gossip about available channels and routing fees, creating a constantly updating map of the network that every participant shares.

Perhaps the most user-facing specification is BOLT #11, which standardizes Lightning invoices. Those QR codes you scan to make Lightning payments? They’re not just random data – they’re precisely formatted requests that include payment amounts, destination information, and routing hints, all encoded in a way that any Lightning wallet can understand.

But BOLT #11 is just the beginning of Lightning’s invoice evolution. BOLT #12 represents the next generation of Lightning payments with “offers” – a revolutionary approach that makes Lightning payments as easy as traditional online shopping.

The User Experience Revolution: BOLT #11 and the Invoice Problem

To understand why BOLT #11 was so crucial, you need to appreciate just how clunky early Lightning payments were. Before standardized invoices, sending a Lightning payment required manually entering node public keys, payment hashes, and routing information – a process so error-prone that one wrong character could send your Bitcoin into the digital void.

BOLT #11 changed everything by creating a standardized invoice format that packs all necessary payment information into a single, human-readable string. These invoices use a clever encoding scheme called Bech32 (the same format used for modern Bitcoin addresses) that includes built-in error detection. If you accidentally change a character when copying an invoice, your wallet will immediately know something’s wrong.

But the real genius of BOLT #11 lies in its flexibility. Lightning invoices can include optional routing hints that help wallets find paths to the recipient, even if they’re not well-connected to the broader network. They can specify exact amounts or leave them open for the sender to choose. They can include expiration times, descriptions of what’s being purchased, and even fallback Bitcoin addresses for when Lightning payments fail.

The specification also solved a crucial privacy problem. Early Lightning implementations often revealed too much information about recipients in their invoices. BOLT #11 carefully balances the need for routing information with privacy protection, ensuring that invoices contain just enough data to enable payments without exposing unnecessary details about the recipient’s node or channels.

The Next Evolution: BOLT #12 and the Promise of Offers

While BOLT #11 invoices solved the immediate usability problem, they still had significant limitations that became apparent as Lightning adoption grew. Traditional invoices are single-use, expire relatively quickly, and require the recipient to generate a new one for each payment. Try to explain to your grandmother why she needs to create a new QR code every time someone wants to send her money, and you’ll quickly understand the problem.

BOLT #12, currently being implemented across Lightning software, introduces “offers” – a completely new approach to requesting Lightning payments that works more like traditional payment systems. Instead of creating single-use invoices, merchants and individuals can create reusable offers that work like persistent payment addresses.

The technical innovation behind offers is fascinating. When someone wants to pay an offer, their wallet first contacts the recipient’s node and requests a fresh invoice specifically for that payment. This happens automatically and invisibly to the user, but it solves several critical problems that plagued BOLT #11 invoices.

First, offers enable recurring payments. A subscription service can create a single offer that customers’ wallets can automatically pay monthly, weekly, or on any schedule. The recipient generates a fresh invoice for each payment, maintaining security while enabling the convenience of automated billing.

Second, offers dramatically improve privacy. Because each payment uses a freshly generated invoice, it’s much harder for external observers to correlate multiple payments to the same recipient. Someone monitoring the Lightning network might see that Alice paid 50,000 satoshis to some node, but they can’t easily determine if this was her first payment to that merchant or her hundredth.

The specification also introduces “offer chains” – a way to create offers that can be paid multiple times with different amounts. A coffee shop could create a single offer that customers can pay for any amount, with their wallets automatically calculating tips or adjusting for different menu items.

Behind the Scenes: The Technical Complexity of Simple Payments

What makes BOLT #12 particularly impressive is how it maintains simplicity for users while handling incredible complexity behind the scenes. When your wallet processes an offer, it’s actually engaging in a sophisticated cryptographic dance with the recipient’s node.

The process starts when you scan an offer QR code. Your wallet extracts the recipient’s node information and initiates a connection using the encrypted transport protocol defined in BOLT #8. It then sends a specially formatted request for an invoice, including details about how much you want to pay and any additional information required by the offer.

The recipient’s node validates your request, generates a fresh BOLT #11 invoice specifically for your payment, and sends it back to your wallet. Your wallet then processes this invoice and completes the payment using the standard Lightning routing protocols. The entire process typically takes a few seconds, but it involves multiple round-trips between nodes and several cryptographic operations.

This two-step process – request invoice, then pay invoice – might seem unnecessarily complex, but it elegantly solves problems that plagued earlier Lightning payment systems. It prevents invoice reuse attacks, enables advanced privacy features, and allows for much more flexible payment scenarios.

The Merchant Revolution: From Invoices to Commerce

The evolution from BOLT #11

-

@ dfa02707:41ca50e3

2025-06-06 03:01:35

@ dfa02707:41ca50e3

2025-06-06 03:01:35Contribute to keep No Bullshit Bitcoin news going.

-

Version 1.3 of Bitcoin Safe introduces a redesigned interactive chart, quick receive feature, updated icons, a mempool preview window, support for Child Pays For Parent (CPFP) and testnet4, preconfigured testnet demo wallets, as well as various bug fixes and improvements.

-

Upcoming updates for Bitcoin Safe include Compact Block Filters.

"Compact Block Filters increase the network privacy dramatically, since you're not asking an electrum server to give you your transactions. They are a little slower than electrum servers. For a savings wallet like Bitcoin Safe this should be OK," writes the project's developer Andreas Griffin.

- Learn more about the current and upcoming features of Bitcoin Safe wallet here.

What's new in v1.3

- Redesign of Chart, Quick Receive, Icons, and Mempool Preview (by @design-rrr).

- Interactive chart. Clicking on it now jumps to transaction, and selected transactions are now highlighted.

- Speed up transactions with Child Pays For Parent (CPFP).

- BDK 1.2 (upgraded from 0.32).

- Testnet4 support.

- Preconfigured Testnet demo wallets.

- Cluster unconfirmed transactions so that parents/children are next to each other.

- Customizable columns for all tables (optional view: Txid, Address index, and more)

- Bug fixes and other improvements.

Announcement / Archive

Blog Post / Archive

GitHub Repo

Website -

-

@ dfa02707:41ca50e3

2025-06-06 03:01:34

@ dfa02707:41ca50e3

2025-06-06 03:01:34Contribute to keep No Bullshit Bitcoin news going.

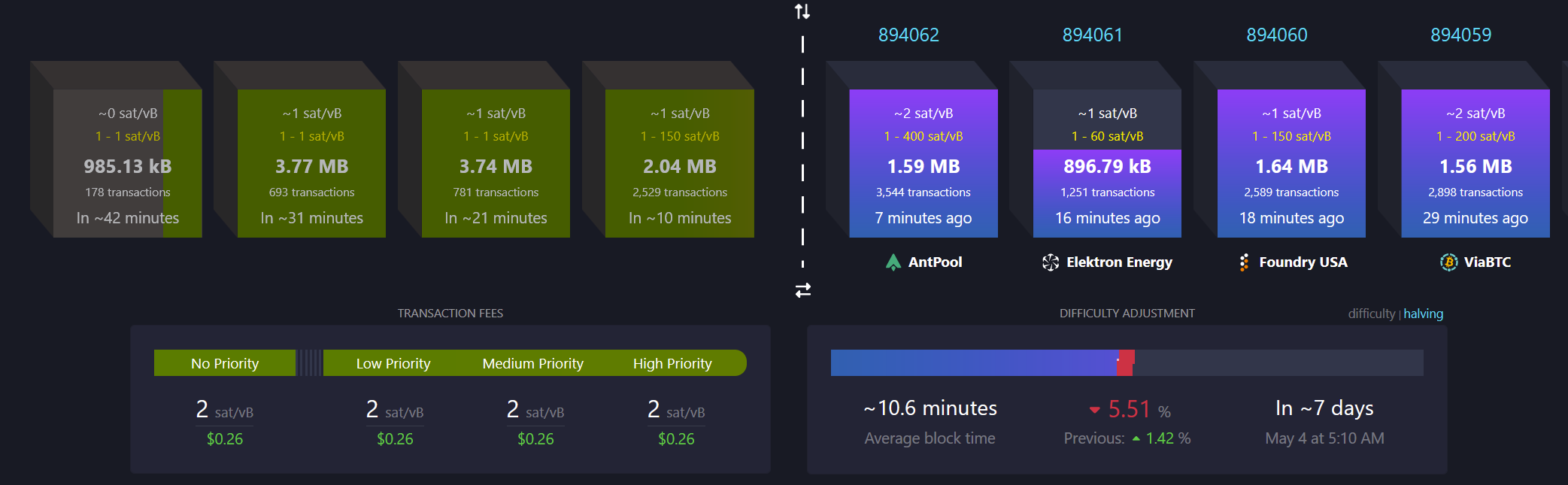

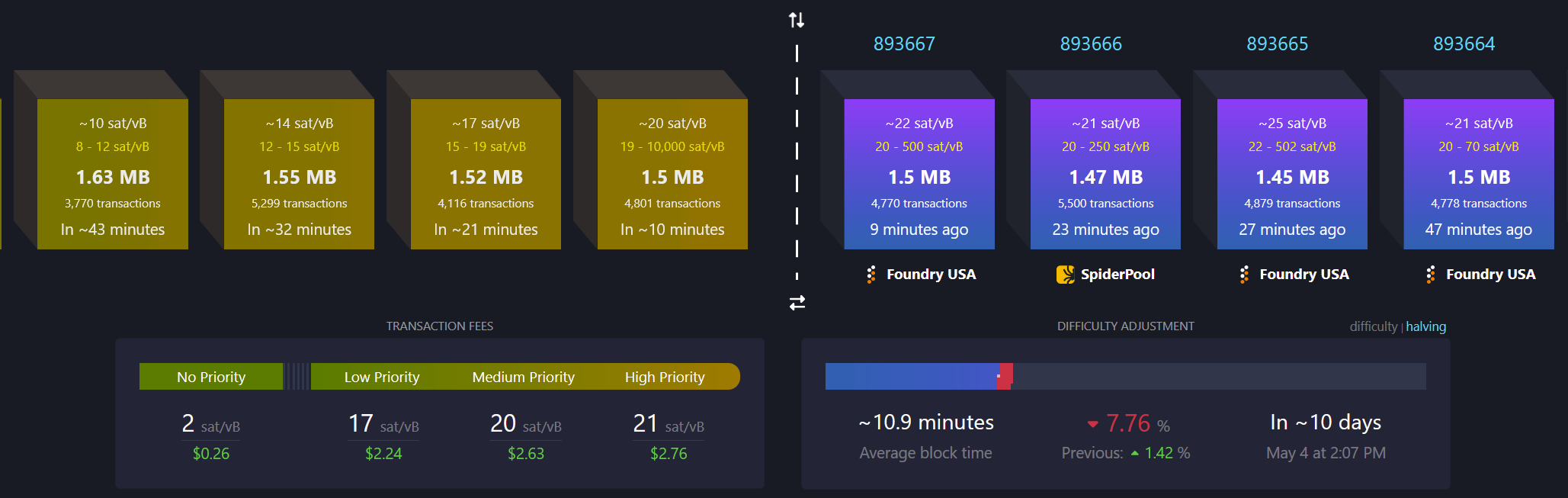

This update brings key enhancements for clarity and usability:

- Recent Blocks View: Added to the Send tab and inspired by Mempool's visualization, it displays the last 2 blocks and the estimated next block to help choose fee rates.

- Camera System Overhaul: Features a new library for higher resolution detection and mouse-scroll zoom support when available.

- Vector-Based Images: All app images are now vectorized and theme-aware, enhancing contrast, especially in dark mode.

- Tor & P2A Updates: Upgraded internal Tor and improved support for pay-to-anchor (P2A) outputs.

- Linux Package Rename: For Linux users, Sparrow has been renamed to sparrowwallet (or sparrowserver); in some cases, the original sparrow package may need manual removal.

- Additional updates include showing total payments in multi-payment transaction diagrams, better handling of long labels, and other UI enhancements.

- Sparrow v2.2.1 is a bug fix release that addresses missing UUID issue when starting Tor on recent macOS versions, icons for external sources in Settings and Recent Blocks view, repackaged

.debinstalls to use older gzip instead of zstd compression, and removed display of median fee rate where fee rates source is set to Server.

Learn how to get started with Sparrow wallet:

Release notes (v2.2.0)

- Added Recent Blocks view to Send tab.

- Converted all bitmapped images to theme aware SVG format for all wallet models and dialogs.

- Support send and display of pay to anchor (P2A) outputs.

- Renamed

sparrowpackage tosparrowwalletandsparrowserveron Linux. - Switched camera library to openpnp-capture.

- Support FHD (1920 x 1080) and UHD4k (3840 x 2160) capture resolutions.

- Support camera zoom with mouse scroll where possible.

- In the Download Verifier, prefer verifying the dropped file over the default file where the file is not in the manifest.

- Show a warning (with an option to disable the check) when importing a wallet with a derivation path matching another script type.

- In Cormorant, avoid calling the

listwalletdirRPC on initialization due to a potentially slow response on Windows. - Avoid server address resolution for public servers.

- Assume server address is non local for resolution failures where a proxy is configured.

- Added a tooltip to indicate truncated labels in table cells.

- Dynamically truncate input and output labels in the tree on a transaction tab, and add tooltips if necessary.

- Improved tooltips for wallet tabs and transaction diagrams with long labels.

- Show the address where available on input and output tooltips in transaction tab tree.

- Show the total amount sent in payments in the transaction diagram when constructing multiple payment transactions.

- Reset preferred table column widths on adjustment to improve handling after window resizing.

- Added accessible text to improve screen reader navigation on seed entry.

- Made Wallet Summary table grow horizontally with dialog sizing.

- Reduced tooltip show delay to 200ms.

- Show transaction diagram fee percentage as less than 0.01% rather than 0.00%.

- Optimized and reduced Electrum server RPC calls.

- Upgraded Bouncy Castle, PGPainless and Logback libraries.

- Upgraded internal Tor to v0.4.8.16.

- Bug fix: Fixed issue with random ordering of keystore origins on labels import.

- Bug fix: Fixed non-zero account script type detection when signing a message on Trezor devices.

- Bug fix: Fixed issue parsing remote Coldcard xpub encoded on a different network.

- Bug fix: Fixed inclusion of fees on wallet label exports.

- Bug fix: Increase Trezor device libusb timeout.

Linux users: Note that the

sparrowpackage has been renamed tosparrowwalletorsparrowserver, and in some cases you may need to manually uninstall the originalsparrowpackage. Look in the/optfolder to ensure you have the new name, and the original is removed.What's new in v2.2.1

- Updated Tor library to fix missing UUID issue when starting Tor on recent macOS versions.

- Repackaged

.debinstalls to use older gzip instead of zstd compression. - Removed display of median fee rate where fee rates source is set to Server.

- Added icons for external sources in Settings and Recent Blocks view

- Bug fix: Fixed issue in Recent Blocks view when switching fee rates source

- Bug fix: Fixed NPE on null fee returned from server

-

@ cae03c48:2a7d6671

2025-06-06 04:00:27

@ cae03c48:2a7d6671

2025-06-06 04:00:27Bitcoin Magazine

Support The Blockchain Regulatory Certainty Act (BRCA) To Protect Noncustodial ServicesWith a lot of regulatory talk centered around The GENIUS Act and The CLARITY Act (the market structure bill) right now, it’s important that Bitcoin enthusiasts also pay attention to and support The Blockchain Regulatory Certainty Act (BRCA) — H.R. 1747.

The act, which was reintroduced to Congress on May 21, 2025 by Rep. Tom Emmer (R-MN) and Rep. Ritchie Torres (D-NY), provides “safe harbor from licensing and registration for certain non-controlling blockchain developers and providers of blockchain services.”

Critical Bitcoin legislation was introduced last week & it needs our support

The Blockchain Regulatory Certainty Act (BRCA) by @GOPMajorityWhip and @RitchieTorres protects self-custody developers, miners, and nodes from being classified as money transmitters.

Thread

pic.twitter.com/cJ8Ogno3h5

pic.twitter.com/cJ8Ogno3h5— Nick Neuman (@Nneuman) May 30, 2025

It also stipulates that no blockchain developer or provider of a blockchain service shall be treated as a money transmitter unless the developers or providers behind the project have control over user funds.

This bill is relevant because the developers for both Samourai Wallet and Tornado Cash are currently facing charges for operating unlicensed money transmitter businesses, despite the fact that the developers for neither of these technologies ever had control over user funds.

It’s also important because, under the Biden administration, the U.S. Department of Justice (DoJ) didn’t just classify privacy services as money transmitters, but ancillary services such as Lightning nodes, rollup sequencers, and other Bitcoin and blockchain technology, as well.

If the BRCA isn’t enacted into law, there is a risk that all Bitcoin and crypto wallets as well as other noncustodial services and technologies will be made illegal and/or subject to KYC/AML laws.

While Rep. Emmer and Rep. Torres’ reintroducing this bill is a positive step, the congressmen need our help in making the BRCA a priority for this current Congress.

To help, go to SaveOurWallets.org and follow the directions on the website to contact the elected officials that represent your district and state in the federal government and tell them that you would like to see them support the BRCA.

But they need our help, we need to make clear that the Blockchain Regulatory Certainty Act is *the* priority this Congress for our space. Go to https://t.co/fXVqSQ2nUv, put in your ZIP code, and make a quick call. It works.

— saveourwallets (@saveourwalets) June 3, 2025

If this act doesn’t pass, we will face significant hurdles regarding the scaling of Bitcoin and other blockchains as well as around privacy.

Yes, yes, I know some of you are saying to yourselves Bitcoin will win regardless of our actions (or that it’s already won) and that we don’t need to engage with politicians in the process.

I’m here to say 1.) this isn’t necessarily true, 2.) there are four developers currently facing trial (the Samourai and Tornado Cash developers) and pushing to get this bill passed may help them, 3.) if this bill doesn’t pass, scaling Bitcoin may be much more difficult, and 4.) there’s a reality in which we give up a lot of our legal right to privacy when using Bitcoin if the bill doesn’t pass.

So, with these points in mind, pick up the phone and/or send an email to your elected representatives and tell them you’d like to see them support the BRCA.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

This post Support The Blockchain Regulatory Certainty Act (BRCA) To Protect Noncustodial Services first appeared on Bitcoin Magazine and is written by Frank Corva.

-

@ dfa02707:41ca50e3

2025-06-06 03:01:33

@ dfa02707:41ca50e3

2025-06-06 03:01:33- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ 9ca447d2:fbf5a36d

2025-06-06 03:01:13

@ 9ca447d2:fbf5a36d

2025-06-06 03:01:13Trump Media & Technology Group (TMTG), the company behind Truth Social and other Trump-branded digital platforms, is planning to raise $2.5 billion to build one of the largest bitcoin treasuries among public companies.

The deal involves the sale of approximately $1.5 billion in common stock and $1.0 billion in convertible senior secured notes.

According to the company, the offering is expected to close by the end of May, pending standard closing conditions.

Devin Nunes, CEO of Trump Media, said the investment in bitcoin is a big part of the company’s long-term plan.

“We view Bitcoin as an apex instrument of financial freedom,” Nunes said.

“This investment will help defend our Company against harassment and discrimination by financial institutions, which plague many Americans and U.S. firms.”

He added that the bitcoin treasury will be used to create new synergies across the company’s platforms including Truth Social, Truth+, and the upcoming financial tech brand Truth.Fi.

“It’s a big step forward in the company’s plans to evolve into a holding company by acquiring additional profit-generating, crown jewel assets consistent with America First principles,” Nunes said.

The $2.5 billion raise will come from about 50 institutional investors. The $1 billion in convertible notes will have 0% interest and be convertible into shares at a 35% premium.

TMTG’s current liquid assets, including cash and short-term investments, are $759 million as of the end of the first quarter of 2025. With this new funding, the company’s liquid assets will be over $3 billion.

Custody of the bitcoin treasury will be handled by Crypto.com and Anchorage Digital. They will manage and store the digital assets.

Earlier this week The Financial Times reported Trump Media was planning to raise $3 billion for digital assets acquisitions.

The article said the funds would be used to buy bitcoin and other digital assets, and an announcement could come before a major related event in Las Vegas.

Related: Bitcoin 2025 Conference Kicks off in Las Vegas Today

Trump Media denied the FT report. In a statement, the company said, “Apparently the Financial Times has dumb writers listening to even dumber sources.”

There was no further comment. However, the official $2.5 billion figure, which was announced shortly after by Trump Media through a press release, aligns with its actual filing and investor communication.

Trump Media’s official announcement

This comes at a time when the Trump family and political allies are showing renewed interest in Bitcoin.

President Donald Trump who is now back in office since the 2025 election, has said he wants to make the U.S. the “crypto capital of the world.”

Trump Media is also working on retail bitcoin investment products including ETFs aligned with America First policies.

These products will make bitcoin more accessible to retail investors and support pro-Trump financial initiatives.

But not everyone is happy.

Democratic Senator Elizabeth Warren recently expressed concerns about Trump Media’s Bitcoin plans. She asked U.S. regulators to clarify their oversight of digital-asset ETFs, warning of investor risk.

Industry insiders are comparing Trump Media’s plans to Strategy (MSTR) which has built a multi-billion dollar bitcoin treasury over the last year. They used stock and bond sales to fund their bitcoin purchases.

-

@ cae03c48:2a7d6671

2025-06-06 04:00:26

@ cae03c48:2a7d6671

2025-06-06 04:00:26Bitcoin Magazine

Matador Technologies Raises C$1.64M To Invest in Their Bitcoin ReserveMatador Technologies Inc. (TSXV: MATA, OTCQB: MATAF), a Bitcoin-focused tech company, announced that it has closed the second tranche of its non-brokered private placement, raising C$1,644,300 through the issuance of 2,652,097 units at a price of $0.62 per unit, with the proceeds going towards investing in their Bitcoin reserve.

Matador (TSXV: MATA | OTCQB: MATAF | FSE: IU3) closes $1.64M second tranche at $0.62/unit

Matador (TSXV: MATA | OTCQB: MATAF | FSE: IU3) closes $1.64M second tranche at $0.62/unit

Each unit: 1 share + ½ warrant @ $0.77

Each unit: 1 share + ½ warrant @ $0.77

Proceeds:

Buy more Bitcoin

Buy more Bitcoin

Expand gold & Grammies

Expand gold & Grammies

General corporate growth

General corporate growth  https://t.co/nUm0bFWtO0#Bitcoin #TreasuryStrategy…

https://t.co/nUm0bFWtO0#Bitcoin #TreasuryStrategy…— Matador Technologies (@buymatador) June 4, 2025

“Each Unit consists of one common share and one-half of one common share purchase warrant,” stated in the press release. “Each Warrant entitles the holder to acquire one additional common share of the Company at a price of $0.77 for a period of twelve months from the date of issuance.”

The warrants are subject to acceleration if Matador’s shares trade at or above $1.15 for five consecutive trading days at any time following the date which is four months and one day after the closing date.

The securities from the second tranche are under a hold period that lasts until October 5, 2025. As part of the deal, the company also paid finder’s fees totaling $95,582 and issued 152,165 broker warrants on the same terms.

This follows the first tranche of the offering, announced on May 30, 2025, which included a CAD$1.5 million investment from Arrington Capital, a digital asset management firm co-founded by Michael Arrington.

“We’re thrilled to welcome Arrington Capital as a strategic investor,” said the CEO of Matador Technologies Inc. Deven Soni. “Their deep conviction in the Bitcoin ecosystem and global perspective on digital assets align perfectly with Matador’s vision. This investment enhances our ability to accelerate development of Bitcoin-native financial products and scale our platform globally.”

In that tranche, Matador issued 2,419,354 units under the same terms. Each including one common share and one-half warrant, with full warrants exercisable at $0.77 for one year. Like the second tranche, those warrants are also subject to acceleration if the share price hits $1.15 for five consecutive trading days following the initial four-month period.

“This is more than just a capital raise—it’s a signal that the world’s top digital asset investors see the same future we do,” said the Chief Visionary Officer of Matador Mark Moss.

“At Matador, we believe the next wave of global financial infrastructure will be built on digital assets,” commented Moss. “By aligning with HODL, we’re not just expanding geographically—we’re expanding the reach of the digital assets’ ecosystem into a key innovation hub.”

This post Matador Technologies Raises C$1.64M To Invest in Their Bitcoin Reserve first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 7f6db517:a4931eda

2025-06-06 02:01:44

@ 7f6db517:a4931eda

2025-06-06 02:01:44

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ cae03c48:2a7d6671

2025-06-06 04:00:25

@ cae03c48:2a7d6671

2025-06-06 04:00:25Bitcoin Magazine

Botanix Launches Federated Sidechain with 16 Members On TestnetBotanix Labs has launched Botanix on testnet as a federated sidechain built on Bitcoin with a 16-node founding federation that includes XBTO, Fireblocks, Antpool, UTXO Management, and other entities (full list below).

The federation ensures that no single entity — including Botanix Labs — controls the network. Botanix Labs has relinquished operational responsibilities, transferring governance and consensus to the node operators. The network plans to evolve into a dynamic federation that supports hundreds of nodes, with the long-term goal of enabling anyone to run a Botanix node. The network’s mainnet is scheduled to launch later this quarter.

Willem Schroé, CEO and co-founder of Botanix Labs, stated in a press release that, “The Bitcoin economy cannot be built on centralized rails. With this 16-node founding federation, we’ve stripped out centralized control and laid the groundwork for a fully permissionless future.”

Botanix’s design emphasizes resilience, with geographically distributed nodes and different kinds of security hardware to minimize single points of failure. The goal is to support consistent availability and uncensorable transaction processing, aligning with Bitcoin’s principles of security and open access. Their use of what they call the “Spiderchain” protocol enables Ethereum Virtual Machine compatibility, allowing applications like lending and staking directly on the network without wrapped assets or bridges.

Philippe Bekhazi, co-founder and CEO of XBTO, commented, “Institutional interest in Bitcoin continues to grow, but that growth depends on secure, decentralized infrastructure that can meet the standards of professional markets.”

Bekhazi also noted XBTO’s commitment to supporting Botanix.

Founded in 2023, Botanix Labs developed the Spiderchain protocol and initiated Botanix. With the network now independently operated, the lab focuses on research, developer tools, and ecosystem support. Botanix enables developers to build financial applications while maintaining Bitcoin’s base layer integrity.

The network’s decentralized structure supports scalability and security for Bitcoin-related applications. As Botanix prepares for its mainnet launch, it aims to expand its federation and move toward further decentralization.

The full founding Botanix federation includes Botanix, Galaxy, Fireblocks, Alchemy, XBTO, Antpool, UTXO Management, Kiln, Chorus One, UndefinedXBlockPI, DAIC, Pier Two, Stakin, Vertex, Stake.fish, and Hashkey Cloud.

Bitcoin Magazine is wholly owned by BTC Inc., which operates UTXO Management, a regulated capital allocator focused on the digital assets industry. UTXO invests in a variety of Bitcoin businesses, and maintains significant holdings in digital assets.

This post Botanix Launches Federated Sidechain with 16 Members On Testnet first appeared on Bitcoin Magazine and is written by Juan Galt.

-

@ 7f6db517:a4931eda

2025-06-06 02:01:43

@ 7f6db517:a4931eda

2025-06-06 02:01:43

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ cae03c48:2a7d6671

2025-06-06 04:00:25

@ cae03c48:2a7d6671

2025-06-06 04:00:25Bitcoin Magazine

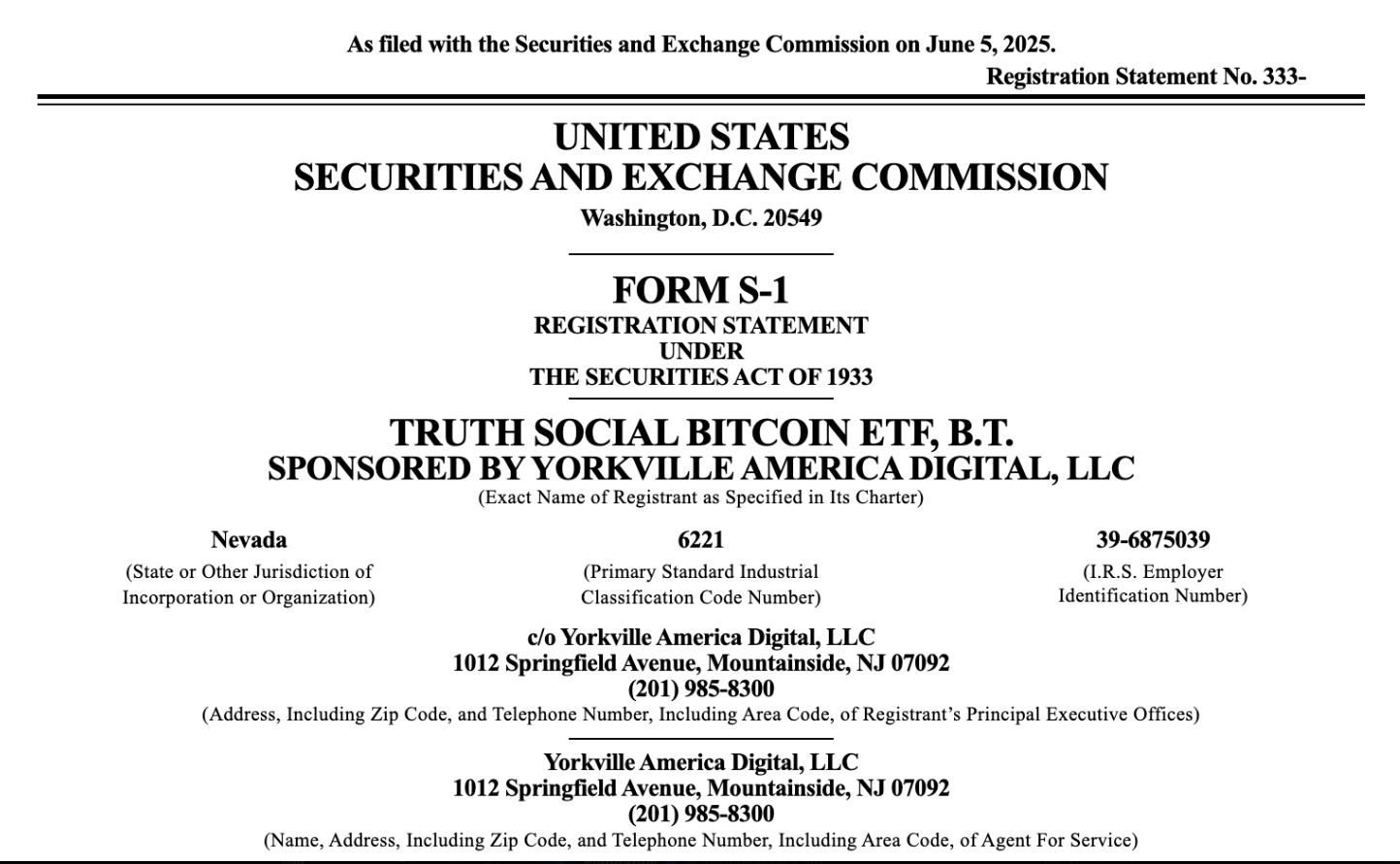

President Trump’s Truth Social Files S-1 Form For Bitcoin ETFToday, Trump Media and Technology Group Corp. (Nasdaq, NYSE Texas: DJT) filed with the US Securities and Exchange Commission (SEC) a Form S-1 for their upcoming Truth Social Bitcoin ETF.

The ETF, which will hold bitcoin directly, is designed to track the bitcoin’s price performance.

“Truth Social Bitcoin ETF, B.T. is a Nevada business trust that issues beneficial interests in its net assets,” stated the Form S-1. “The assets of the Trust consist primarily of bitcoin held by a custodian on behalf of the Trust. The Trust seeks to reflect generally the performance of the price of bitcoin.”

The ETF is sponsored by Yorkville America Digital, LLC and will trade under NYSE Arca. The Trust’s assets primarily consist of bitcoin held by Foris DAX Trust Company, LLC, the designated bitcoin custodian. Crypto.com will act as the ETF’s prime execution agent and liquidity provider.

“Shares will be offered to the public from time to time at varying prices that will reflect the price of bitcoin and the trading price of the Shares on New York Stock Exchange Arca, Inc. at the time of the offer,” mentioned the Form S-1.

While the ETF offers investors a regulated avenue for bitcoin exposure, the Trust warned of several risks related to digital assets:

- Loss, theft, or compromise of private keys could result in permanent loss of bitcoin.

- Bitcoin’s reliance on blockchain and Internet technologies makes it vulnerable to disruptions and cyber threats.

- Environmental and regulatory pressures tied to high electricity use in bitcoin mining could impact market stability.

- Potential forks or protocol failures in the Bitcoin Network may lead to volatility and uncertainty in asset value.

Last week, during an interview at the 2025 Bitcoin Conference, Donald Trump Jr. announced that TMTG and Truth Social were forming a Bitcoin treasury with $2.5 billion. “We’re seriously on crypto—we’re seriously on Bitcoin,” said Trump Jr. “We’re in three major deals. I believe we’re at the beginning of what will be the future of finance. And the opportunity is massive.”

The day after that interview, Eric Trump and Donald Trump Jr., joined by American Bitcoin Executive Chairman and Board Member Mike Ho, CEO Matt Prusak, and Altcoin Daily founder Aaron Arnold, discussed the future of Bitcoin.

“The whole system is broken and now all of the sudden you have crypto which solves all the problems,” commented Eric Trump. “It makes everything cheaper, it makes everything faster, it makes it safer, it makes it more transparent. It makes the whole system more functional.“

“Everybody wants Bitcoin. Everybody is buying Bitcoin,” Eric added.

This post President Trump’s Truth Social Files S-1 Form For Bitcoin ETF first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 7f6db517:a4931eda

2025-06-06 00:02:18

@ 7f6db517:a4931eda

2025-06-06 00:02:18

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ cae03c48:2a7d6671

2025-06-06 04:00:24

@ cae03c48:2a7d6671

2025-06-06 04:00:24Bitcoin Magazine

Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in BitcoinMeanwhile Insurance Bitcoin (Bermuda) Limited (“Meanwhile”) announced it has become the first company in the world to release externally audited financial statements denominated entirely in Bitcoin. According to the announcement, the company reported 220.4 BTC in assets and 25.29 BTC in net income for 2024, a 300% year over year increase.

Today marks a global first & historic event for us, along with the public release of our 2024 audited financial statements, covering our 1st year of sales.

As the 1st company in the world to have Bitcoin-denominated financial statements externally audited, we are excited to…

— meanwhile | Bitcoin Life Insurance (@meanwhilelife) June 5, 2025

“We’ve just made history as the first company in the world to have Bitcoin-denominated financial statements externally audited,” said Zac Townsend, CEO of Meanwhile. “This is an important, foundational step in reimagining the financial system based on a single, global, decentralized standard outside the control of any one government.”

The financial statements were audited by Harris & Trotter LLP and its digital asset division ht.digital. Meanwhile’s financials also comply with Bermuda’s Insurance Act 1978, noting that their BTC denominated financials were approved and comply with official guidelines. The firm, fully licensed by the Bermuda Monetary Authority (BMA), operates entirely in BTC and is prohibited from liquidating Bitcoin assets except through policyholder claims, positioning it as a long term holder.

“As the first regulated Bitcoin life insurance company, we view the BTC held by Meanwhile as inherently long-term in nature—primarily held to support the Company’s insurance liabilities over decades,” Townsend added. “This makes it significantly ‘stickier’ and resistant to market pressures compared to the BTC held by other companies as part of their treasury management strategies.”

Meanwhile’s 2024 financials also revealed 23.02 BTC in net premiums and 4.35 BTC in investment income, showing that its model not only preserves Bitcoin, but earns it. The company’s reserves (also held in BTC) were reviewed and approved by Willis Towers Watson (WTW).

Meanwhile also offers a Bitcoin Whole Life insurance product that allows policyholders to save, borrow, and build legacy wealth—entirely in BTC, and has plans to expand globally in 2025.

“We are incredibly proud of today’s news as it underscores how Meanwhile is at the forefront of the next phase of the convergence between Bitcoin and institutional financial markets,” said Tia Beckmann, CFO of Meanwhile. “Now having generated net income in BTC, we have demonstrated that we are earning it through a sustainable insurance business model designed for the long term.”

This post Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in Bitcoin first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 7f6db517:a4931eda

2025-06-06 02:01:43

@ 7f6db517:a4931eda

2025-06-06 02:01:43

"Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know. Privacy is the power to selectively reveal oneself to the world." - Eric Hughes, A Cypherpunk's Manifesto, 1993

Privacy is essential to freedom. Without privacy, individuals are unable to make choices free from surveillance and control. Lack of privacy leads to loss of autonomy. When individuals are constantly monitored it limits our ability to express ourselves and take risks. Any decisions we make can result in negative repercussions from those who surveil us. Without the freedom to make choices, individuals cannot truly be free.

Freedom is essential to acquiring and preserving wealth. When individuals are not free to make choices, restrictions and limitations prevent us from economic opportunities. If we are somehow able to acquire wealth in such an environment, lack of freedom can result in direct asset seizure by governments or other malicious entities. At scale, when freedom is compromised, it leads to widespread economic stagnation and poverty. Protecting freedom is essential to economic prosperity.

The connection between privacy, freedom, and wealth is critical. Without privacy, individuals lose the freedom to make choices free from surveillance and control. While lack of freedom prevents individuals from pursuing economic opportunities and makes wealth preservation nearly impossible. No Privacy? No Freedom. No Freedom? No Wealth.

Rights are not granted. They are taken and defended. Rights are often misunderstood as permission to do something by those holding power. However, if someone can give you something, they can inherently take it from you at will. People throughout history have necessarily fought for basic rights, including privacy and freedom. These rights were not given by those in power, but rather demanded and won through struggle. Even after these rights are won, they must be continually defended to ensure that they are not taken away. Rights are not granted - they are earned through struggle and defended through sacrifice.

If you found this post helpful support my work with bitcoin.

-

@ cae03c48:2a7d6671

2025-06-06 04:00:23

@ cae03c48:2a7d6671

2025-06-06 04:00:23Bitcoin Magazine

Bitcoin vs Stablecoins: Bitcoin is an Unreplicable Lifeline in Authoritarian RegimesEight years ago, I wrote a book about pitching technology. The core lesson was simple: To convince skeptics, you must show your solution’s value isn’t just better — it’s uniquely better. Years later, as I began advocating for Bitcoin’s role in humanitarian crises, this lesson resurfaced with urgency. Skeptical friends asked “Can’t stablecoins do the same?”, “What’s so unique about Bitcoin?”

The answer lies not in theory, but in the protest rallies of Abuja, the blackouts of Caracas and the underground schools that girls secretly attend in Kabul — places where 1.7 billion unbanked, 250 million battling high inflation or hyperinflation and 2.3 billion under authoritarian rule fight to survive. These stories rarely breach Western media algorithms, which act as a shadow-ban of the developing world, favoring headlines about ETFs over existential financial struggles.

It doesn’t take too deep a look into these parts of the world to discover that Bitcoin is not only vital but uniquely vital in a way stablecoins and other altcoins do not and cannot replicate. Let’s look at three nations that are adopting Bitcoin over stablecoins and why.

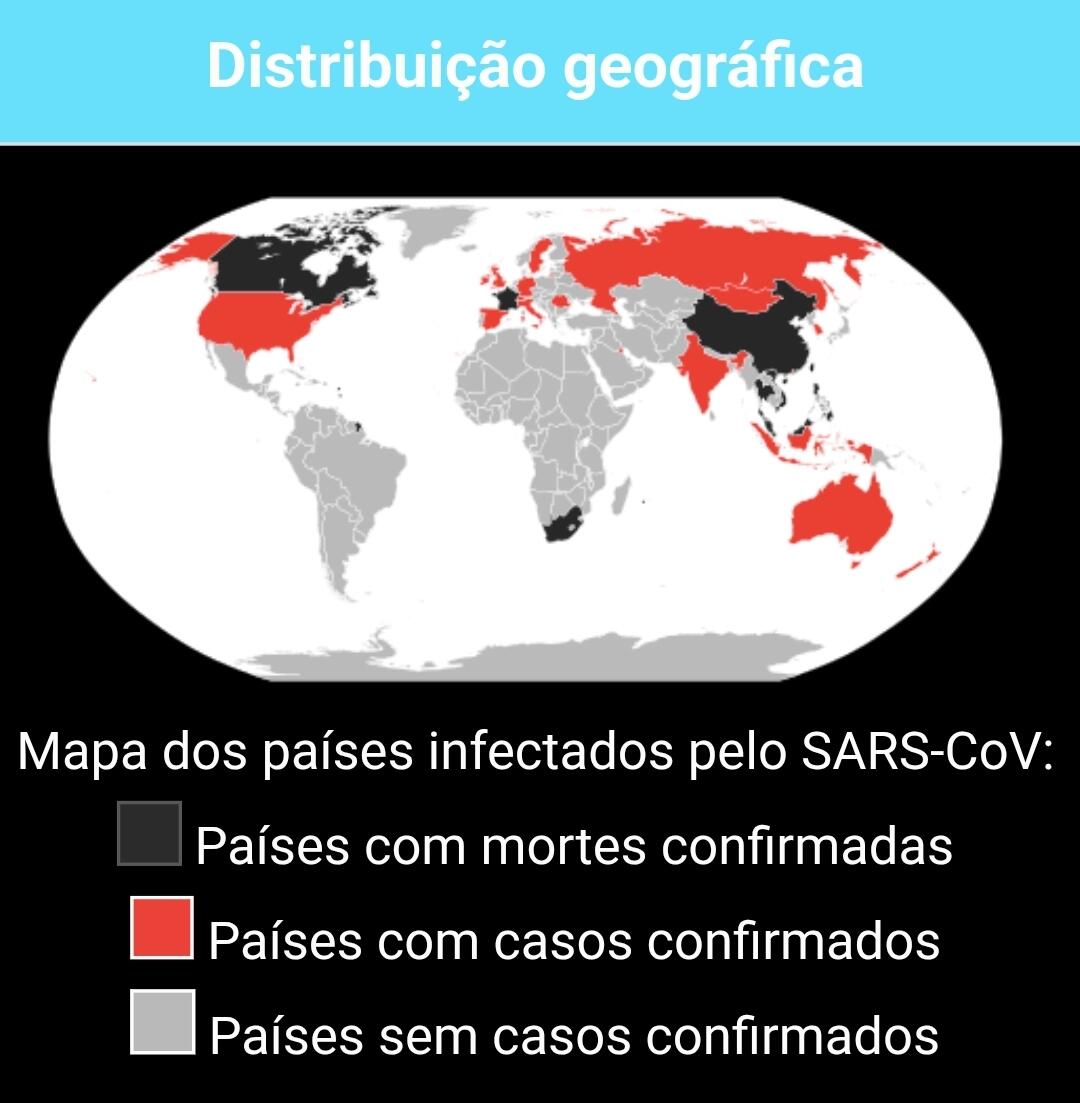

Nigeria: Where Sovereignty Outweighs Stability

Context: 223 million people, 95 million live on less than $1.90 a day. 23.71% inflation (April 2025), 18.3-20 million children not in school. Only 30% have access to safe drinking water.

In 2024, Nigeria faced severe economic and political upheaval, with the local currency naira crashing to a record 1,643 per dollar by August — down from 460 in early 2023. This not only eroded savings and purchasing power, it eroded trust in the government and led to widespread protests over soaring inflation and fuel costs. These protests were triggered by widespread anger at government economic mismanagement and policies that failed to halt the economic slide.

On occasion a stable currency, the naira’s collapse left families and businesses struggling to afford imports into a dollar-dependent economy. Public frustration intensified and with it, political instability. This volatile climate of currency devaluation, restricted financial access and social unrest set the stage for Nigerians to turn to alternative financial systems like cryptocurrencies, seeking solutions to safeguard their wealth amid a crumbling economic framework.

But the government wasn’t about to make that easy for its citizens. Nigeria’s government restricted stablecoin. “Illicit flows,” aka money laundering, was often used as the government’s official reason for anti-stablecoin actions. More likely the Nigerian government took action because they viewed stablecoins as undermining its monetary policy by enabling unregulated capital flows and currency substitution, reducing its central bank’s control over money supply and exchange rates.

No doubt, bitcoin can be seen as undermining monetary policy in some similar ways, the difference being, Nigeria’s government was not able to curtail bitcoin’s usage as effectively due to its decentralized nature.

The specific actions Nigeria’s government took came in three forms:

- Banking Restrictions and U.S. dollar supply shortages had the effect of limiting fiat on-ramps/off-ramps for stablecoins like USDT, which required KYC-compliant exchanges. P2P bitcoin trading soared after the restrictions, as users bypassed banking controls using private wallets and DEXs.

- Regulatory Crackdowns: Nigeria’s government took specific legal action to sue unlicensed USDT traders. Nigerian authorities then launched a broader attack, accusing crypto-trading platform Binance of “exploitation, devaluation of the naira and money laundering.”

- Premiums and Volatility: Regulatory pressures and FX shortages likely inflated premiums, making them less practical than bitcoin, which operates without centralized dependencies.

All three measures — banking restrictions, regulatory crackdowns and premiums/volatility — impacted bitcoin a lot less than it impacted stablecoins. Stablecoins’ reliance on centralized issuers, banking rails and KYC-compliant exchanges made them vulnerable to government actions, as we saw when USDT trading was disrupted. By contrast, Bitcoin’s decentralized, permissionless nature enabled Nigerians to bypass restrictions via P2P platforms and private wallets, sustaining its adoption.

Afghanistan: How Bitcoin Was a Financial Lifeline After the Taliban Takeover

Context: Taliban rule, most women are unbanked, Afghanistan’s currency devalued 50% between 2021 and 2022. Eighty-five percent live on less than $1 a day, 80% of school-aged Afghan girls and young women are out of school.

When the Taliban seized control in August 2021, Afghanistan’s banking system collapsed under sanctions, leaving citizens — especially women — with few options. Traditional remittance networks like Hawala charged exorbitant fees (5-20%), while frozen central bank reserves made dollar access nearly impossible. In this vacuum, bitcoin emerged as a critical tool for survival. In 2021, Bitcoin Magazine previously reported how women were safeguarding Bitcoin seed phrases as a last line of financial defense. After the Taliban banned crypto in 2022, peer-to-peer bitcoin trading persisted underground.

Why Bitcoin Outperformed Stablecoins in Crisis

Stablecoins, reliant on centralized issuers and dollar-backed banking rails, faltered under Afghanistan’s unique constraints. U.S. sanctions froze $7 billion in central bank funds, which cut off the dollar liquidity needed for stablecoins like USDT. While Forbes India noted isolated cases of stablecoin use for salaries, most Afghans found them unusable. Meanwhile, sanctions blocked fiat conversions and the Taliban’s November 2021 foreign currency ban further restricted access. Bitcoin, by contrast, once again thrived precisely because of its decentralized design: no intermediaries to freeze transactions, no KYC to expose users and a global network that resisted shutdowns. Where stablecoins were hobbled by their ties to traditional finance, Bitcoin enabled direct, pseudonymous transfers.Venezuela: Scarcity Trumps “Stability”

Context: The Venezuelan bolívar has lost 99.99% value since 2018; 76% of Venezuelans live on $1.90/day. Over 7.7 million Venezuelans have fled the country since 2014 due to economic collapse and political instability. Over 10% of children under five in Venezuela suffer from stunting due to chronic malnutrition.

Carlos, a Caracas mechanic, measures his life in bolívars — or rather, the absence of them. Since 2018, Venezuela’s currency has shed 99.99% of its value, Carlos explains, Carlos is an example of many Venezuelans who used bitcoin, not stablecoins, to preserve wealth as the bolívar continued to lose value. The government introduced strict capital controls into the market so that even if you somehow manage to earn USD, you can’t get the money transferred to your bank account.

Bitcoin provides a financial lifeline for people like Carlos, unlike stablecoins that are pegged to a USD that itself lost 18% in purchasing power since 2020.

That’s right: People like Carlos, schooled in the hard knocks of currency hyper-debasement, realized earlier than many in the West that stablecoins are not really stable.

Stablecoins by their name present the appearance of being a safe harbor, becau

-

@ dfa02707:41ca50e3

2025-06-06 00:02:12

@ dfa02707:41ca50e3

2025-06-06 00:02:12Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

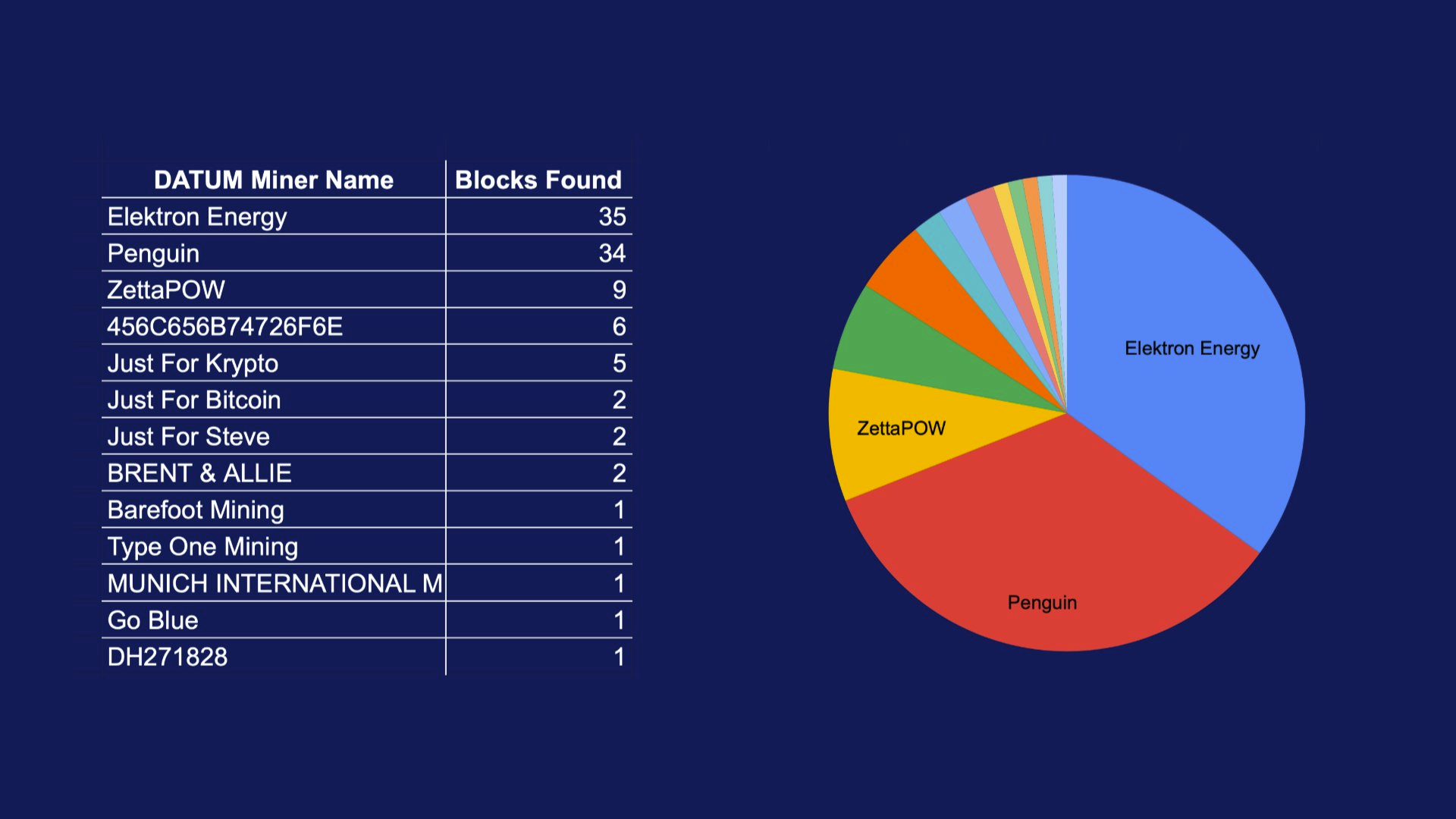

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ 6d8e2a24:5faaca4c

2025-06-06 03:09:51

@ 6d8e2a24:5faaca4c

2025-06-06 03:09:51by Claire Mom June 5, 2025 6:54 pm

*Elon Musk, the tech mogul, says US President Donald Trump would have lost the 2024 election without him.*

Musk made the comment on X in response to Trump’s criticism against him.

Musk, who led the department of government efficiency (DOGE), quit his role a day after he spoke out against a Trump-backed spending bill. The president called it a “Big Beautiful Bill”.

The controversial bill is a centrepiece of Trump’s second-term domestic agenda, combining major tax cuts, stricter immigration enforcement, welfare programme overhauls, and significant increases in border security funding.

The legislation sparked intense debate across the country and in Congress and was only passed after a nail-biting 215-214 vote.

The plan revived the US-Mexico border wall with a $46.5 billion budget, $350 billion for deportation efforts and border security, and a hiring spree of 10,000 new ICE agents, 5,000 customs officers, and 3,000 border patrol agents.

For the first time, migrants will be charged a $1,000 fee to apply for asylum.

The bill also authorises a $4 trillion increase to the national debt ceiling, while the estate tax exemption jumped to $15 million, benefiting wealthier Americans.

Critics including Musk called the bill fiscally irresponsible and “a disgusting abomination” due to its combination of large tax cuts and spending increases.

Musk had clamoured for DOGE’s creation to save taxpayers $2 trillion. Only $160 billion has been saved so far.

*TRUMP: I’M VERY DISAPPOINTED WITH ELON*

Since Musk’s exit from the White House last week, his criticism of the bill has grown louder.

Speaking on the issue, Trump said he was “very disappointed with Elon”.

The US president said the Tesla CEO was satisfied with the bill but only grew discontent after he found out electric vehicles would be impacted.

“I’m very disappointed because Elon knew the inner workings of this bill better than almost anybody sitting here. He knew everything about it, and all of a sudden he had a problem, and he only developed a problem when he found out I was going to cut the EV mandate because that’s billions and billions of dollars,” the president said

“And it really is unfair; we want to have cars of all types.

“He said the most beautiful things about me, and he hasn’t said anything bad about me personally, but I’m sure that will be next. But I’m really disappointed with Elon. I’ve helped Elon a lot.”

Trump praised Musk for his work at DOGE but blamed his tantrums on missing the office.

“Elon worked hard at DOGE, and I think he misses the place. I think he got out there, and all of a sudden, he’s no longer in this beautiful Oval Office,” he said.

“He’s not the first. People leave my administration, and they love us, and then at some point they miss it so badly, and some of them embrace it, and some of them actually become hostile. I don’t know what it is, some sort of Trump derangement syndrome.”

The president also said he would have won Pennsylvania, a key state, without Musk’s help.

In reaction, the billionaire businessman countered Trump.

“Without me, Trump would have lost the election, Dems would control the House, and the Republicans would be 51-49 in the Senate,” Musk tweeted.

“Such ingratitude.”

The exchange marks yet another dent in the tumultuous relationship between the two-time American president and the world’s richest man.

https://www.thecable.ng/trump-would-have-lost-election-without-me-says-elon-musk/

-

@ 7f6db517:a4931eda

2025-06-06 02:01:42

@ 7f6db517:a4931eda

2025-06-06 02:01:42

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-06 02:01:41

@ 7f6db517:a4931eda

2025-06-06 02:01:41

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats