-

@ 19497234:86e67560

2025-06-02 17:18:45

@ 19497234:86e67560

2025-06-02 17:18:45By: Morris Kuol Yoll

South Sudan’s political landscape has undergone significant shifts, with Bol Mel’s rapid rise sparking intense debate. His appointment as First Vice President by President Salva Kiir, along with his roles as Special Presidential Envoy for Sudan, Deputy Secretary for the SPLM Party, and his promotion to General, has led many to speculate that Kiir is grooming him as his successor.

This shift in leadership strategy contrasts sharply with South Sudan’s historical pattern of political succession, traditionally shaped by military and revolutionary credentials. Bol Mel’s path to power, however, appears orchestrated through political favoritism rather than earned through military or democratic legitimacy. His ascent has raised fundamental questions about his leadership capabilities, legitimacy, and public acceptance in a country where succession has long been determined by hierarchical seniority within the SPLM/A.

As South Sudan approaches another critical political transition, understanding the historical foundations of leadership in the SPLM/A and contrasting past leaders’ paths to power against Bol Mel’s political trajectory offers valuable insight into whether his leadership will be accepted or challenged by the South Sudanese people.

The Rise of the SPLM and Dr. John Garang’s Leadership

Before the armed struggle erupted in 1983, Southern Sudanese practiced multiparty democracy, electing their High Executive Council leaders through a democratic system, despite periodic interference from the Sudanese regime. However, the formation of the Sudan People’s Liberation Movement (SPLM) fundamentally altered South Sudan’s political direction.

The SPLM was both a liberation movement and a military force, led by Dr. John Garang, who simultaneously held the positions of political leader and Commander-in-Chief of the SPLA. Unlike previous leaders who championed South Sudanese autonomy, Garang pursued the New Sudan ideology, advocating for unity rather than separation. Under his leadership, alternative ideologies, including independence, were discouraged, forcing veteran Southern Sudanese politicians who had joined the liberation struggle to align with the SPLM’s ideological framework.

Dr. John Garang’s Path to Leadership

Despite being a colonel in the Sudanese army, Dr. John Garang had never held a political position in either the Sudanese government or Southern Sudan’s administration. He was largely unknown to Southern Sudanese civilians, except for his military colleagues, who recognized his political inclinations.

In 1983, following Major Kerbino Kuanyin Bol’s rebellion, Garang, along with other commanders, joined the armed struggle. While South Sudan had numerous seasoned politicians from various parties, they were excluded from forming the SPLM, consolidating Garang’s political and military dominance.

Resistance from veterans of Anyanya-Two initially challenged Garang’s leadership, but his close allies—Kerbino Kuanyin Bol, William Nyuon Bany, and Salva Kiir Mayardit—helped secure his authority, allowing him to establish both the SPLM and SPLA as the defining forces of Southern Sudan and the Sudan’s liberation movement.

Garang’s Leadership and Public Acceptance

Garang’s ability to lead the liberation struggle was rooted in his military training and higher education, qualities that Southern Sudanese recognized and embraced. Unlike other leaders, he did not rely on political favoritism—his success was a result of his charisma, strategic thinking, and ability to define South Sudan’s grievances on a national platform.

Under Garang, Southern Sudanese felt politically represented for the first time in Sudanese politics. His leadership allowed him to articulate the injustices faced by South Sudan and marginalized regions, gaining him widespread support.

Upon his tragic death, the leadership baton was passed to Salva Kiir, who inherited power through the traditional military succession line, marking a stark contrast to the political path Bol Mel is now taking.

Salva Kiir’s Rise to Power and the Contrast with Bol Mel’s Leadership

Following Dr. Garang’s death, General Salva Kiir, as Garang’s Vice President, was swiftly confirmed as his successor. His rise to power followed the SPLM/A’s hierarchical line of succession, making his leadership widely accepted by South Sudanese.

Unlike Garang, who pursued unity with Sudan, Kiir was widely perceived as a champion of Southern Sudan’s independence. This belief helped solidify his leadership, ensuring broad public support as he led the country through the 2011 Referendum, ultimately becoming South Sudan’s first President.

In stark contrast, Bol Mel’s rise lacks revolutionary legitimacy, as his leadership appears imposed rather than organically earned. His absence from the liberation struggle, coupled with allegations of corruption, places his acceptance at serious risk.

Bol Mel’s Business and Political Credibility: Challenges to His Legitimacy

Bol Mel’s business background, rather than military credentials, forms the foundation of his political presence. Questions surrounding how he amassed his wealth, particularly his control over major government-funded projects, oil exports, and road construction, have made his legitimacy a contentious issue.

Public concerns over his business dealings, particularly his alleged involvement in crude oil quotas meant for infrastructure development, fuel accusations of corruption, as roads promised through oil-funded projects remain unfinished despite years of revenue collection.

Unlike past SPLM leaders, whose military and revolutionary credentials secured their leadership, Bol Mel’s reputation is largely built on financial power, making his credibility in leading the country questionable.

Question of Bol Mel’s Political and Generational Positioning

While Bol Mel is portrayed as a younger generation leader, the SPLM has many capable younger members who would warrant legitimate public support. His rise does not represent a merit-based generational shift, but rather political favoritism engineered by President Kiir.

Furthermore, the SPLM party has gradually lost its ideological foundation, existing more in name than in practice. Loyal SPLM/A veterans have been sidelined, while outsiders, who joined after the peace agreement, now dominate political leadership.

Kiir’s systematic removal of key SPLM/A officers appears to be clearing the path for Bol Mel, making his transition controversial rather than widely accepted.

Conclusion & Summary

Bol Mel’s rise to power significantly challenges South Sudan’s traditional leadership structure. Unlike previous leaders who earned legitimacy through revolutionary struggle, Bol Mel’s leadership appears as favoritism rather than earned.

His military credentials are weak, his business empire is tied to corruption allegations, and his public support base is limited.

The South Sudanese people yearn for strong leadership—one that fights corruption, invests in development, and fosters peace in a deeply divided country. Bol Mel does not exhibit these qualities at present, which will complicate his acceptance if he ascends to power.

Ultimately, South Sudan’s next leader must unify the country, promote development, and restore political trust—qualities that Bol Mel has yet to demonstrate. This raises questions about whether his leadership will bring stability or intensify political turmoil.

Morris Kuol Yoll is a South Sudanese Canadian who resides in Alberta, Canada, and can be reached at: myoll2002@yahoo.com

-

@ 0c65eba8:4a08ef9a

2025-06-02 17:18:50

@ 0c65eba8:4a08ef9a

2025-06-02 17:18:50If you’ve been following me, you know I only offer what I live. I’ve created something life-changing for fathers with sons aged 10–14, and I want you to join me.

I’m doing this with my own son. And I’m looking for just ten other fathers to join us. This will be an exclusive group. You’ll meet my son. Your sons will interact with each other. That means I’m only choosing men I’d personally want around. Men who will protect, challenge, and elevate each other and our boys.

This is not a retreat. It's not a weekend workshop. It's not a fun hike with your kid.

This is a one-year rite of passage designed to initiate your son, and yourself, into manhood. It's a call to fathers ready to lead on a new level.

If you're a father with a son aged 10–14, and you already know that modern culture is not going to turn him into a man, you need to read this.

What we're offering is not mainstream. It is not ideological. It is not religious, though it is fully compatible with your religious beliefs. It's the revival of a lost tradition: the intentional, demanding, and sacred transfer of masculine responsibility from father to son.

The Program

-

Starts October. Ends with a 170km Mont Blanc trek in late June 2025.

-

Includes bi-weekly training for fathers on how to teach masculinity, logic, discipline, and legacy.

-

Includes physical training plans, intellectual and moral development, and the cultivation of sovereignty.

-

Ends with a 10–14 day hike and formal coming-of-age ceremony on the trail.

What You’ll Get as a Father

-

A framework to build your family legacy

-

The tools to teach your son how to think, speak, and act like a man

-

A tribe of other fathers walking the same road

-

A transformation in your own identity as a sovereign leader, not just a provider

What Your Son Will Gain

-

A year of direct male mentorship

-

Physical, emotional, and spiritual preparation for adolescence

-

A clear initiation into manhood acknowledged by his father and peers

-

The confidence that comes from being tested and affirmed in his masculinity and sovereignty

Why This Matters Now

We live in a culture that infantilizes boys, vilifies men, and offers no clear path from one to the other. If you don’t initiate your son, the culture will, and it will do so with screens, porn, weakness, and shame.

If you're the kind of man who:

-

Knows something is deeply wrong with how boys are being raised today

-

Has the courage and discipline to lead

-

Wants to pass on strength, clarity, and purpose, not confusion

...then this may be the most important investment you ever make.

We are looking for 8 to 10 fathers for the first cohort.

If you're interested in learning more, message me. No price is listed yet, but this is for fathers ready to invest in themselves to become better leaders and in their sons' future as men. If you're looking for a bargain, this isn't for you. If you're looking to make a generational impact, it might be.

🔥 Only 10 Fathers Will Be Chosen

This is not for everyone. This is for fathers who want to lead, fully, unapologetically, and with purpose. If that’s you, don’t wait.

Book your discovery call now and let’s talk. I want to hear your story, meet you man-to-man, and see if you belong in this first cohort.

Let’s build men. One father, one son, one rite at a time.

-

-

@ 2cde0e02:180a96b9

2025-06-02 17:03:04

@ 2cde0e02:180a96b9

2025-06-02 17:03:04pen; monochromized

https://stacker.news/items/995339

-

@ ef53426a:7e988851

2025-06-02 17:06:54

@ ef53426a:7e988851

2025-06-02 17:06:54Welcome back to the SWC, folks. We’re about to witness the Money in the Bank title eliminator. The wrestler who climbs the ladder and grabs the briefcase filled with money will be next in line to challenge for the Shitcoin World Championship belt.

Special guest referee ‘Risk-Free’ Raúl Mal starts the action between Sergeant Sol Anna and The Ethereal Ghoul. There’s the bell. The Coinbase Arena is a complete sellout tonight. Who will emerge as the next contender?

The ghoul runs at the ropes and flies at his opponent with a clothesline. Sol Anna dips under, then dips again on the return. The ghoul crashes into the referee instead, and he is down. A ripple of laughter from the audience. Looks like Mal took a knee to the nuts.

Great counter by the sergeant, and the ghoul hits the canvas face-first. A quick elbow drop, then another. My god, she goes down hard. The ghoul blocks through muscle memory, and Sol Anna crosses the ring to take a run-up. Bam. Proof of Stake! What a move. Now she turns her focus to setting up the ladder.

The referee is back up and checks on the downed wrestler.

Sol Anna gets one foot on the ladder. She’s climbing up, but back comes the ghoul.

A blow to the face. And another. No effect. The ghoul latches on and drags Sol Anna back to the canvas.

They lock up, and Sol Anna whips the ghoul into the ladder. By gawd, he’s broken in half! Now what’s she doing? She’s out of the ring, looking under the skirting. What’s that? No. Somebody stop her. Weapons aren’t part of this. That metal could do some serious damage — it’s a hard fork!

The referee comes over to put a stop to this. It’s not legal, even in a hardcore ladder match.

She’s got three seconds to get back in the ring, or it’ll be a count-out. The hard fork will have to wait.

Ethereal Ghoul OUTTA NOWHERE with the NFT! And the referee is down again. Mal’s back was turned. Oh, the humanity. What a dirty trick. And again, a boot to the nether regions. That man is writhing in pain on the floor.

Sol Anna slides back into the ring. She sets up a second ladder while the ghoul doles out more punishment to Raúl Mal.

Now he spots the green of the sergeant’s uniform halfway to the briefcase. Ethereal drags her down. A roundhouse kick connects. He gets into position behind Sol Anna. He lifts her up, looking for the Omega Candle, but no, she reverses and gets his neck. Ooh, the ghoul is in serious trouble here. The tether choke is locked in, but the ghoul can’t tap. The guest referee is still sprawled on the canvas, a mess of black and white stripes.

Sol Anna releases and goes for the first ladder. She gets halfway up, and the Ethereal Ghoul gets to his feet. He’s on the other ladder. How does this work? Will they both go for it? That dangling briefcase is so close—

Wait. Is that the Strategy music? It is. Yes, it is! Sexy Sailor comes sprinting down the ramp. The crowd erupts. Listen to that roar. “Sailor. Sailor!”

Can they still make it to the briefcase? One more step for Sol Anna. The ghoul is close, but Sailor scoots into the ring. He’s got the ladder by the bottom rungs.

Oh, the crowd knows what’s coming. Sol Anna shakes her head. Don’t do it.

“Do it. Do it,” the crowd chants.

Sailor grins at the camera. The rugpull! RUGPULL! He rips the ladder away and Sergeant Sol Anna bounces off the turnbuckle and crashes to the canvas. Oh brother, that looked painful.

Now he’s got the ghoul in his sights. Another rugpull. Ethereal Ghoul is down. I think he fell right on top of the referee.

“Michael. Michael,” the crowd sings.

Both contenders look completely out of gas. And then there’s this guy. He’s got a microphone. What’s Sexy Sailor going to tell us?

“I’m going to set up this ladder here and teach these two shitcoiners a lesson.”

Chants of “SWC, SWC,” ring out.

Sailor scales the ladder, mic in hand.

There’s a hush in the arena.

“What do we say when some contender claims to be the next big thing?”

Still quiet.

“We say this. THERE IS NO SECOND BEST.” Sailor drinks in the atmosphere and puts his hand to his ear, motioning for the crowd to continue.

60,000 people in unison chant, “THERE IS NO SECOND BEST CRYPTO ASSET.”

Sailor reaches for the briefcase. He has it. Sexy Sailor wins the Money in the Bank match. Confetti falls and he climbs back down to the canvas. Ethereal Ghoul and Sergeant Sol Anna slink out of the ring, hobbling back up the ramp.

“Wait,” he says. “Let’s see what’s in this briefcase.”

Oh my, he’s tossing banknotes everywhere. Covering the ring. Some have floated in the crowd. It’s like an ATM explosion.

“Hey, ghoul. Sol Anna. You see this paper? It’s even more worthless than you.”

Finally, the guest referee Raúl Mal gets back to his feet. He raises Sexy Sailor’s hand, confirming the winner of the Money in the Bank match CryptoSlam 2025.

Oh no! Not again. Sailor takes aim at Mal’s groin. Blam. Money shot. And again. Mal is down again. Surely he can’t come back from this.

“I’ve still got this mic. It’s over when I say it’s over.”

A few more shouts of “Sailor” ring out.

“This is what I think of your worthless fiat.”

He’s dropping his pants. Not again. Oh no. This is not what SWC audiences want to see.

“All these banknotes are good for… is wiping my gray hairy ass.” He turns to the contenders still fleeing the scene. “Have fun staying poor, shitcoiners,” he screams, and then drops the mic.

What an event. What a match, people!

Keep watching. We’ve got the Royal Rugpull coming right up. Thirty-two of SWC’s top memecoins are battling it out here at CryptoSlam 25. Don’t go ANYWHERE.

-

@ dfa02707:41ca50e3

2025-06-02 17:02:13

@ dfa02707:41ca50e3

2025-06-02 17:02:13Contribute to keep No Bullshit Bitcoin news going.

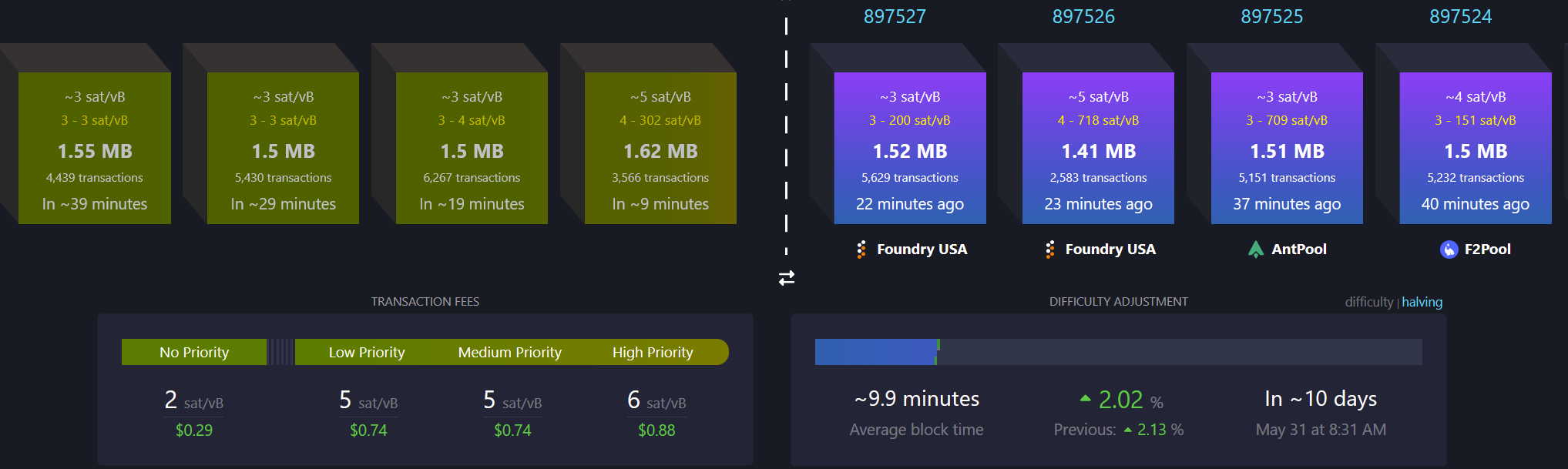

This update brings key enhancements for clarity and usability:

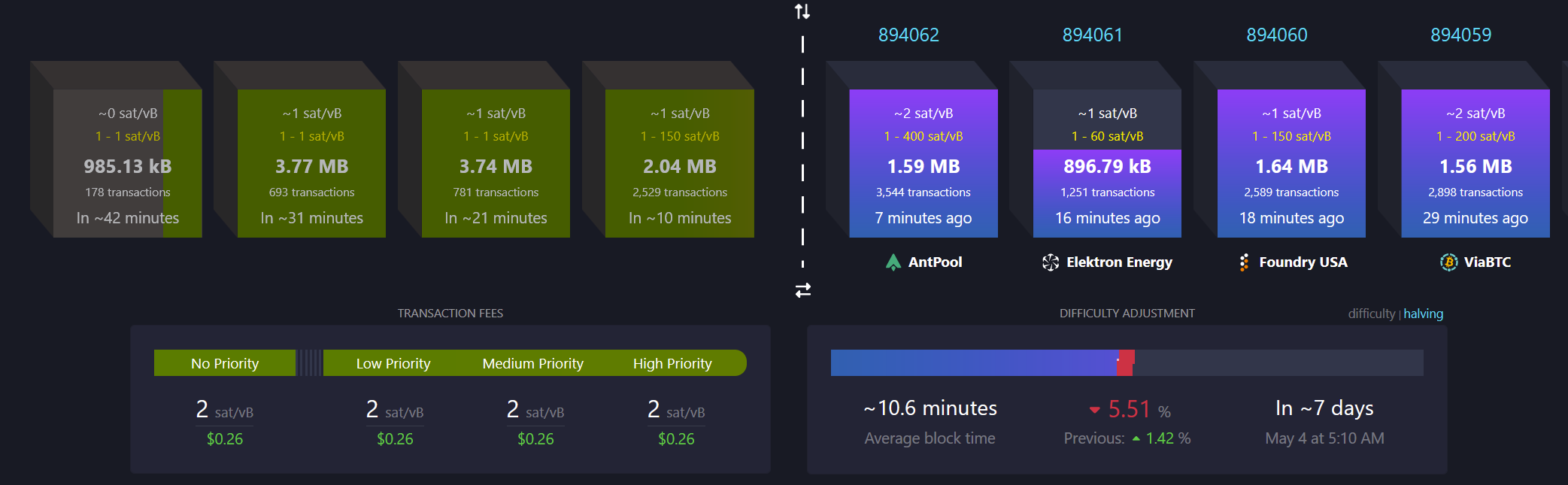

- Recent Blocks View: Added to the Send tab and inspired by Mempool's visualization, it displays the last 2 blocks and the estimated next block to help choose fee rates.

- Camera System Overhaul: Features a new library for higher resolution detection and mouse-scroll zoom support when available.

- Vector-Based Images: All app images are now vectorized and theme-aware, enhancing contrast, especially in dark mode.

- Tor & P2A Updates: Upgraded internal Tor and improved support for pay-to-anchor (P2A) outputs.

- Linux Package Rename: For Linux users, Sparrow has been renamed to sparrowwallet (or sparrowserver); in some cases, the original sparrow package may need manual removal.

- Additional updates include showing total payments in multi-payment transaction diagrams, better handling of long labels, and other UI enhancements.

- Sparrow v2.2.1 is a bug fix release that addresses missing UUID issue when starting Tor on recent macOS versions, icons for external sources in Settings and Recent Blocks view, repackaged

.debinstalls to use older gzip instead of zstd compression, and removed display of median fee rate where fee rates source is set to Server.

Learn how to get started with Sparrow wallet:

Release notes (v2.2.0)

- Added Recent Blocks view to Send tab.

- Converted all bitmapped images to theme aware SVG format for all wallet models and dialogs.

- Support send and display of pay to anchor (P2A) outputs.

- Renamed

sparrowpackage tosparrowwalletandsparrowserveron Linux. - Switched camera library to openpnp-capture.

- Support FHD (1920 x 1080) and UHD4k (3840 x 2160) capture resolutions.

- Support camera zoom with mouse scroll where possible.

- In the Download Verifier, prefer verifying the dropped file over the default file where the file is not in the manifest.

- Show a warning (with an option to disable the check) when importing a wallet with a derivation path matching another script type.

- In Cormorant, avoid calling the

listwalletdirRPC on initialization due to a potentially slow response on Windows. - Avoid server address resolution for public servers.

- Assume server address is non local for resolution failures where a proxy is configured.

- Added a tooltip to indicate truncated labels in table cells.

- Dynamically truncate input and output labels in the tree on a transaction tab, and add tooltips if necessary.

- Improved tooltips for wallet tabs and transaction diagrams with long labels.

- Show the address where available on input and output tooltips in transaction tab tree.

- Show the total amount sent in payments in the transaction diagram when constructing multiple payment transactions.

- Reset preferred table column widths on adjustment to improve handling after window resizing.

- Added accessible text to improve screen reader navigation on seed entry.

- Made Wallet Summary table grow horizontally with dialog sizing.

- Reduced tooltip show delay to 200ms.

- Show transaction diagram fee percentage as less than 0.01% rather than 0.00%.

- Optimized and reduced Electrum server RPC calls.

- Upgraded Bouncy Castle, PGPainless and Logback libraries.

- Upgraded internal Tor to v0.4.8.16.

- Bug fix: Fixed issue with random ordering of keystore origins on labels import.

- Bug fix: Fixed non-zero account script type detection when signing a message on Trezor devices.

- Bug fix: Fixed issue parsing remote Coldcard xpub encoded on a different network.

- Bug fix: Fixed inclusion of fees on wallet label exports.

- Bug fix: Increase Trezor device libusb timeout.

Linux users: Note that the

sparrowpackage has been renamed tosparrowwalletorsparrowserver, and in some cases you may need to manually uninstall the originalsparrowpackage. Look in the/optfolder to ensure you have the new name, and the original is removed.What's new in v2.2.1

- Updated Tor library to fix missing UUID issue when starting Tor on recent macOS versions.

- Repackaged

.debinstalls to use older gzip instead of zstd compression. - Removed display of median fee rate where fee rates source is set to Server.

- Added icons for external sources in Settings and Recent Blocks view

- Bug fix: Fixed issue in Recent Blocks view when switching fee rates source

- Bug fix: Fixed NPE on null fee returned from server

-

@ da8b7de1:c0164aee

2025-06-02 16:24:06

@ da8b7de1:c0164aee

2025-06-02 16:24:06Amerikai nukleáris végrehajtási rendeletek és szakpolitikai fejlemények

2025.05.23-án az amerikai kormány négy jelentős végrehajtási rendeletet adott ki, amelyek célja egy „nukleáris reneszánsz” felgyorsítása a következő 25 évben. Ezek a rendeletek egy, az egész kormányzatra kiterjedő tervet határoznak meg a 400 GW nukleáris kapacitás elérésére 2050-ig, lefedve az ipar minden területét: engedélyezés, üzemanyagciklus, reaktortechnológia, ellátási lánc, munkaerő, hulladékkezelés, finanszírozás és nemzetközi megállapodások. Azonnali intézkedések között szerepel a biztonságos hazai üzemanyag-ellátás megteremtése, szabályozási reformok, a reaktor-telepítések felgyorsítása, valamint pénzügyi és diplomáciai eszközök alkalmazása az amerikai nukleáris technológia belföldi és nemzetközi előmozdítására. A rendeletek gyorsított szabályozási eljárásokat írnak elő – például az NRC-nek (Nuclear Regulatory Commission) 18 hónapon belül kell elbírálnia az új reaktorokra vonatkozó kérelmeket –, valamint kibővített szerepet adnak az Energiaügyi és Védelmi Minisztériumoknak az engedélyezésben és telepítésben, beleértve a szövetségi földeken való elhelyezést is.

Az NRC jóváhagyta a NuScale kis moduláris reaktor (SMR) tervét

Az amerikai NRC jóváhagyta a NuScale Power 462 MW kapacitású kis moduláris reaktor (SMR) erőművének tervét, ami jelentős mérföldkő az új típusú nukleáris technológiák bevezetésében. Ez az engedélyezés a tervezettnél korábban történt, így a NuScale az egyetlen SMR, amely NRC-tervjóváhagyással rendelkezik, és technológiája hivatkozási alap lehet a jövőbeli építési és üzemeltetési engedélykérelmekben. A tervet kifejezetten nagy adatközpontok és ipari ügyfelek számára fejlesztették, a gyártási kapacitás már elérhető a dél-koreai Doosan vállalatnál. A NuScale várhatóan 2025 végéig szerzi meg első amerikai ügyfelét, és az első erőmű akár 2030-ra üzembe léphet, ha sikerül gyorsan szerződést kötni. Az NRC jóváhagyása szélesebb körű lendületet ad az amerikai fejlett nukleáris iparnak, beleértve a közelmúltbeli végrehajtási rendeleteket is, amelyek célja a reaktor-telepítések bővítése és a hazai ellátási láncok megerősítése.

Amerikai uránellátás és piaci helyzet

Az amerikai uránszektor kritikus ponthoz érkezett, kétpárti politikai támogatással és az adatközpontok, valamint az alapvető villamosenergia-igények növekvő keresletével. Az iparági vezetők egy közelgő kínálati hiányra figyelmeztetnek, mivel a magas minőségű készletek kimerülnek, és az új termelés beindítása nehézségekbe ütközik. Az új termelés ösztönző ára jelenleg 100 dollár felett van fontonként, ami meghaladja a jelenlegi spot árakat, így a már működő termelők előnyben vannak. A legutóbbi végrehajtási rendeletek és a Section 232 vizsgálatok megerősítik a kormány elkötelezettségét a hazai urántermelés és az ellátási lánc biztonsága mellett. Az orosz urán tilalom, amely 2028-ban lép teljesen életbe, tovább szűkíti a nyugati ellátást, a mentességek várhatóan a geopolitikai feszültségek miatt hamarabb megszűnnek. Kína gyors nukleáris fejlesztése tovább növeli a keresletet, ami kettéosztott globális uránpiacot eredményez.

Az amerikai urándúsítási kapacitás bővítése

Az Urenco USA megkezdte a termelést legújabb gázcentrifuga-egységében a New Mexico-i National Enrichment Facility-ben, ezzel mintegy 15%-kal bővítve a hazai dúsítási kapacitást. Ez a bővítés célja, hogy csökkentse az orosz ellátástól való függőséget, és támogassa az amerikai nukleáris üzemanyag-ellátási láncot. Az Urenco USA, az ország egyetlen kereskedelmi dúsított urán előállítója, jelenleg az amerikai atomerőművek szükségletének mintegy egyharmadát fedezi, és további bővítést fontolgat a piaci kereslet függvényében.

Nemzetközi nukleáris energetikai fejlemények

Globális nukleáris reaktor-építési hullám van kibontakozóban, élen az Egyesült Királysággal, Törökországgal, Lengyelországgal, valamint ázsiai és afrikai országokkal. Több mint 30 ország vállalta, hogy 2050-ig megháromszorozza a globális nukleáris kapacitást a nettó zéró kibocsátás és az energiabiztonság érdekében. Az atomtechnológia exportja továbbra is jelentős bevételi forrás Oroszország számára, miközben az Egyesült Államok jogalkotási és szakpolitikai lépéseket tesz a nukleáris export és együttműködés vezető szerepének biztosítására; a Szenátus Külügyi Bizottsága hamarosan tárgyalja azt a törvényjavaslatot, amely az amerikai nukleáris exportot hivatott erősíteni, hogy Kínát és Oroszországot megelőzze a globális piacon.

Ipari partnerségek és katonai alkalmazások

Az amerikai Védelmi Minisztérium nyolc céget választott ki mikroreaktor-technológiák fejlesztésére katonai létesítmények számára, azzal a céllal, hogy decentralizált, skálázható mikroreaktor-rendszereket hozzanak létre kritikus energiaigények kielégítésére. Ez a kezdeményezés a kereskedelmi mikroreaktor-fejlesztést és a kapcsolódó ellátási láncok megerősítését is ösztönzi, az NRC szabályozási útvonalainak kihasználásával.

Érintetti bevonás és konferenciák

A Nemzetközi Atomenergia Ügynökség (IAEA) nemrégiben zárta első, a nukleáris programok érintetti bevonásáról szóló nemzetközi konferenciáját Bécsben, amely hangsúlyozta a nyilvánosság és az érintettek bevonásának fontosságát a nukleáris energiafejlesztés minden szakaszában, hogy bizalmat építsenek és megalapozott döntéshozatalt támogassanak.

Források:

- world-nuclear-news.org

- nucnet.org

- iaea.org

- utilitydive.com

- observer.co.uk

- ans.org

-

@ 2e8970de:63345c7a

2025-06-02 16:18:59

@ 2e8970de:63345c7a

2025-06-02 16:18:59https://www.wsj.com/tech/europe-global-tech-race-ff910a94

https://stacker.news/items/995308

-

@ dfa02707:41ca50e3

2025-06-02 17:02:12

@ dfa02707:41ca50e3

2025-06-02 17:02:12- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ 7f6db517:a4931eda

2025-06-02 17:02:21

@ 7f6db517:a4931eda

2025-06-02 17:02:21

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ eb0157af:77ab6c55

2025-06-02 17:02:06

@ eb0157af:77ab6c55

2025-06-02 17:02:06The Wall Street financial institution has signed strategic agreements for bitcoin-backed loans with Maple Finance and FalconX.

According to Bloomberg, on May 27 Cantor Fitzgerald officially launched its new division dedicated to Bitcoin lending, announcing the completion of the first transactions of its Bitcoin Financing Business. The Wall Street firm confirmed it has finalized a first round of deals with two crypto sector players: Maple Finance and FalconX.

The company initially plans to make up to $2 billion in financing available to institutional clients.

Brandon Lutnick, President of Cantor Fitzgerald, commented:

“From the start, Cantor recognized the transformative impact that financial services for digital assets would have on the global economy. This milestone highlights how the combination of Cantor’s deep expertise and entrepreneurial spirit creates a distinctive advantage on Wall Street.”

The partnership with Maple Finance is part of Cantor’s broader expansion strategy. Sidney Powell, Co-Founder and CEO of Maple Finance, emphasized how the deal will expand his company’s ability to serve clients looking to access the digital asset market:

“We’re seeing strong and growing demand from institutions seeking to enter the crypto market through trusted and regulated channels.”

Josh Barkhordar, Head of U.S. Sales at FalconX, stated:

“Digital assets have lacked the institutional-grade credit infrastructure essential for healthy capital markets. This collaboration between Cantor and a crypto-native firm is a meaningful step toward building that framework.”

To ensure the security and reliability of its bitcoin-backed financing services, Cantor Fitzgerald has selected Anchorage Digital and Copper.co for custody solutions.

The post Cantor Fitzgerald launches first bitcoin-backed loans appeared first on Atlas21.

-

@ 9ca447d2:fbf5a36d

2025-06-02 17:01:45

@ 9ca447d2:fbf5a36d

2025-06-02 17:01:45Trump Media & Technology Group (TMTG), the company behind Truth Social and other Trump-branded digital platforms, is planning to raise $2.5 billion to build one of the largest bitcoin treasuries among public companies.

The deal involves the sale of approximately $1.5 billion in common stock and $1.0 billion in convertible senior secured notes.

According to the company, the offering is expected to close by the end of May, pending standard closing conditions.

Devin Nunes, CEO of Trump Media, said the investment in bitcoin is a big part of the company’s long-term plan.

“We view Bitcoin as an apex instrument of financial freedom,” Nunes said.

“This investment will help defend our Company against harassment and discrimination by financial institutions, which plague many Americans and U.S. firms.”

He added that the bitcoin treasury will be used to create new synergies across the company’s platforms including Truth Social, Truth+, and the upcoming financial tech brand Truth.Fi.

“It’s a big step forward in the company’s plans to evolve into a holding company by acquiring additional profit-generating, crown jewel assets consistent with America First principles,” Nunes said.

The $2.5 billion raise will come from about 50 institutional investors. The $1 billion in convertible notes will have 0% interest and be convertible into shares at a 35% premium.

TMTG’s current liquid assets, including cash and short-term investments, are $759 million as of the end of the first quarter of 2025. With this new funding, the company’s liquid assets will be over $3 billion.

Custody of the bitcoin treasury will be handled by Crypto.com and Anchorage Digital. They will manage and store the digital assets.

Earlier this week The Financial Times reported Trump Media was planning to raise $3 billion for digital assets acquisitions.

The article said the funds would be used to buy bitcoin and other digital assets, and an announcement could come before a major related event in Las Vegas.

Related: Bitcoin 2025 Conference Kicks off in Las Vegas Today

Trump Media denied the FT report. In a statement, the company said, “Apparently the Financial Times has dumb writers listening to even dumber sources.”

There was no further comment. However, the official $2.5 billion figure, which was announced shortly after by Trump Media through a press release, aligns with its actual filing and investor communication.

Trump Media’s official announcement

This comes at a time when the Trump family and political allies are showing renewed interest in Bitcoin.

President Donald Trump who is now back in office since the 2025 election, has said he wants to make the U.S. the “crypto capital of the world.”

Trump Media is also working on retail bitcoin investment products including ETFs aligned with America First policies.

These products will make bitcoin more accessible to retail investors and support pro-Trump financial initiatives.

But not everyone is happy.

Democratic Senator Elizabeth Warren recently expressed concerns about Trump Media’s Bitcoin plans. She asked U.S. regulators to clarify their oversight of digital-asset ETFs, warning of investor risk.

Industry insiders are comparing Trump Media’s plans to Strategy (MSTR) which has built a multi-billion dollar bitcoin treasury over the last year. They used stock and bond sales to fund their bitcoin purchases.

-

@ 7f6db517:a4931eda

2025-06-02 17:02:21

@ 7f6db517:a4931eda

2025-06-02 17:02:21

The former seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

The latter's future remains to be seen. Dependence on Tor, which has had massive reliability issues, and lack of strong privacy guarantees put it at risk.

— ODELL (@ODELL) October 27, 2022

The Basics

- Lightning is a protocol that enables cheap and fast native bitcoin transactions.

- At the core of the protocol is the ability for bitcoin users to create a payment channel with another user.

- These payment channels enable users to make many bitcoin transactions between each other with only two on-chain bitcoin transactions: the channel open transaction and the channel close transaction.

- Essentially lightning is a protocol for interoperable batched bitcoin transactions.

- It is expected that on chain bitcoin transaction fees will increase with adoption and the ability to easily batch transactions will save users significant money.

- As these lightning transactions are processed, liquidity flows from one side of a channel to the other side, on chain transactions are signed by both parties but not broadcasted to update this balance.

- Lightning is designed to be trust minimized, either party in a payment channel can close the channel at any time and their bitcoin will be settled on chain without trusting the other party.

There is no 'Lightning Network'

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise.

- There are many lightning channels between many different users and funds can flow across interconnected channels as long as there is a route through peers.

- If a lightning transaction requires multiple hops it will flow through multiple interconnected channels, adjusting the balance of all channels along the route, and paying lightning transaction fees that are set by each node on the route.

Example: You have a channel with Bob. Bob has a channel with Charlie. You can pay Charlie through your channel with Bob and Bob's channel with User C.

- As a result, it is not guaranteed that every lightning user can pay every other lightning user, they must have a route of interconnected channels between sender and receiver.

Lightning in Practice

- Lightning has already found product market fit and usage as an interconnected payment protocol between large professional custodians.

- They are able to easily manage channels and liquidity between each other without trust using this interoperable protocol.

- Lightning payments between large custodians are fast and easy. End users do not have to run their own node or manage their channels and liquidity. These payments rarely fail due to professional management of custodial nodes.

- The tradeoff is one inherent to custodians and other trusted third parties. Custodial wallets can steal funds and compromise user privacy.

Sovereign Lightning

- Trusted third parties are security holes.

- Users must run their own node and manage their own channels in order to use lightning without trusting a third party. This remains the single largest friction point for sovereign lightning usage: the mental burden of actively running a lightning node and associated liquidity management.

- Bitcoin development prioritizes node accessibility so cost to self host your own node is low but if a node is run at home or office, Tor or a VPN is recommended to mask your IP address: otherwise it is visible to the entire network and represents a privacy risk.

- This privacy risk is heightened due to the potential for certain governments to go after sovereign lightning users and compel them to shutdown their nodes. If their IP Address is exposed they are easier to target.

- Fortunately the tools to run and manage nodes continue to get easier but it is important to understand that this will always be a friction point when compared to custodial services.

The Potential Fracture of Lightning

- Any lightning user can choose which users are allowed to open channels with them.

- One potential is that professional custodians only peer with other professional custodians.

- We already see nodes like those run by CashApp only have channels open with other regulated counterparties. This could be due to performance goals, liability reduction, or regulatory pressure.

- Fortunately some of their peers are connected to non-regulated parties so payments to and from sovereign lightning users are still successfully processed by CashApp but this may not always be the case going forward.

Summary

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise. There is no singular 'Lightning Network' but rather many payment channels between distinct peers, some connected with each other and some not.

- Lightning as an interoperable payment protocol between professional custodians seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

- Lightning as a robust sovereign payment protocol has yet to be battle tested. Heavy reliance on Tor, which has had massive reliability issues, the friction of active liquidity management, significant on chain fee burden for small amounts, interactivity constraints on mobile, and lack of strong privacy guarantees put it at risk.

If you have never used lightning before, use this guide to get started on your phone.

If you found this post helpful support my work with bitcoin.

-

@ b1ddb4d7:471244e7

2025-06-02 17:01:25

@ b1ddb4d7:471244e7

2025-06-02 17:01:25It’s 3 AM, and you’re staring at your phone screen, watching bitcoin’s price fluctuate by thousands of dollars in real-time. Your heart races as you see green candles shooting upward, and suddenly you’re questioning every financial decision you’ve ever made. Should you buy? Should you sell? Are you already too late to the party?

Welcome to the wild psychological rollercoaster that is bitcoin investing, where emotions often override logic, and where the ancient human drives of fear and greed play out on digital exchanges 24/7.

Community Driven by Emotion

Recent research reveals just how deeply psychology permeates the bitcoin ecosystem. According to a comprehensive 2024 survey by Kraken, 84% of digital currency holders have made investment decisions based on FOMO (Fear of Missing Out), while 81% admitted to making choices driven by FUD (Fear, Uncertainty, and Doubt). Perhaps most telling of all: 63% of holders acknowledged that emotional decisions have significantly damaged their portfolios.

With over 560 million digital currency users worldwide as of 2024, and bitcoin maintaining its position as the flagship digital asset, these psychological patterns affect hundreds of millions of investors globally. In the United States alone, approximately 36 million adults own bitcoin, making this psychological phenomenon a mainstream financial reality.

The FOMO Factor: When Missing Out Becomes an Obsession

FOMO in bitcoin isn’t just about missing a quick profit—it’s about missing what many believers see as a once-in-a-generation wealth transfer. The Kraken study found that 60% of bitcoin holders fear missing a significant price surge more than they fear missing a buying opportunity during dips. This reveals a fascinating bias: investors are more concerned with unrealized gains from assets they already own than with strategic accumulation during downturns.

This psychological quirk explains why bitcoin often experiences explosive rallies followed by sharp corrections. When FOMO kicks in, rational decision-making goes out the window. Investors chase green candles, buying at peaks instead of strategically accumulating during valleys. The irony? This behavior often ensures they miss the very opportunities they’re trying to catch.

Consider bitcoin’s journey past $100,000 in late 2024. As the price breached this psychological barrier, social media exploded with FOMO-driven content, creating a feedback loop where seeing others’ gains intensified the fear of being left behind. Yet historically, many of these late-stage buyers found themselves underwater when inevitable corrections followed.

The Fear and Greed Index

Bitcoin’s psychological state is so influential that it has its own emotional barometer: the Crypto Fear and Greed Index. This fascinating tool measures market sentiment on a scale from 0 (Extreme Fear) to 100 (Extreme Greed), incorporating factors like volatility, trading volume, social media sentiment, market dominance, and Google search trends.

The index reveals a counterintuitive truth: the best buying opportunities often occur during periods of “Extreme Fear,” while “Extreme Greed” frequently signals market tops. Yet human psychology drives us to do the opposite—buying when everyone’s greedy and selling when fear dominates.

This emotional inversion creates what researchers call “behavioral arbitrage”—opportunities for those who can master their psychology to profit from others’ emotional mistakes. The index serves as a mirror, reflecting our collective psychological state and often predicting market movements with surprising accuracy.

The HODL Culture

Perhaps nowhere is bitcoin’s unique psychology more evident than in its “HODL” culture. What began as a misspelled “hold” has evolved into a sophisticated psychological framework that shapes market dynamics in ways traditional finance has never seen.

Research into Bitcoin’s HODL phenomenon reveals that volatility actually strengthens conviction rather than weakening it. Unlike traditional investors who might panic-sell during 30-50% corrections, bitcoin holders often view these drops as validation of their long-term thesis rather than reasons to exit.

This creates a unique market structure where the supply of available bitcoin for trading continuously shrinks. Long-term holders remove coins from circulation, creating artificial scarcity that amplifies price movements in both directions. It’s not just code that makes bitcoin scarce—it’s psychology.

The HODL mentality represents a form of collective resistance to short-term market dynamics. Holders refuse to participate in what they see as irrational price discovery, instead betting on long-term adoption and monetary debasement. This isn’t passive investing; it’s active rebellion against traditional financial thinking.

Social Media: The Amplifier of Emotions

The role of social media in bitcoin psychology cannot be overstated. The Kraken study found a strong correlation between social media usage and FOMO-driven decisions: 85% of investors who rely on social media for investment information reported that emotional decisions had negatively impacted their portfolios.

Platforms like Twitter (now X), Reddit, and Discord function as emotional echo chambers where bullish sentiment gets amplified during rallies and bearish fears spread like wildfire during corrections. Memes become market-moving forces, and influential personalities can trigger massive buying or selling waves with single tweets.

This creates a fascinating paradox: the democratization of financial information through social media empowers individual investors, but it also makes them more susceptible to emotional manipulation and herd mentality. The speed and scale of information flow intensify psychological responses, compressing emotional cycles that might have taken weeks in traditional markets into mere hours or minutes.

The Gender and Age Divide in Bitcoin Psychology

Fascinating demographic patterns emerge when examining bitcoin’s psychological landscape. The Kraken research revealed significant gender differences in emotional investing: 66% of male bitcoin holders frequently made FOMO-driven decisions, compared to only 42% of female holders. Similarly, 83% of men reported FUD-influenced decisions versus 75% of women.

Age also plays a crucial role. Investors aged 45-60 showed the most extreme psychological patterns: 78% felt they had missed bitcoin’s biggest gains, yet 75% remained optimistic about future opportunities. This suggests that FOMO and hope can coexist, creating a complex emotional state that drives continued participation despite feelings of regret.

These demographic differences highlight how personal psychology intersects with market dynamics. Understanding these patterns can help investors recognize their own biases and develop more rational strategies.

The Neuroscience of Bitcoin Volatility

Recent academic research reveals the neurological basis of bitcoin’s psychological appeal. Studies on digital currency trading psychology show that bitcoin’s extreme volatility triggers the same reward pathways associated with gambling, creating potentially addictive patterns of behavior.

The unpredictability of bitcoin’s price movements creates what psychologists call “intermittent reinforcement”—the most powerful form of behavioral conditioning. Like slot machines, bitcoin provides irregular rewards that keep investors engaged far longer than consistent returns would.

This neurological response explains why many bitcoin investors check prices obsessively. The survey found that 55% of digital asset holders check markets significantly more frequently than traditional markets, suggesting an almost compulsive relationship with price monitoring.

Breaking Free from Emotional Cycles

Understanding bitcoin’s psychology isn’t just academic—it’s practical. Successful bitcoin investors develop strategies to counteract their emotional biases:

Dollar-Cost Averaging (DCA) has emerged as the most popular emotion-neutral strategy, with 59% of U.S. digital currency users employing this approach. By making regular purchases regardless of price, DCA removes the emotional burden of timing the market.

Automated trading tools and scheduled purchases help investors stick to predetermined strategies without succumbing to FOMO or FUD. These tools essentially outsource emotional decision-making to algorithms, reducing the psychological burden of active trading.

Education and community engagement in healthy bitcoin communities can provide emotional anchoring during volatile periods. Understanding bitcoin’s long-term value proposition helps investors maintain perspective during short-term chaos.

Bitcoin investing isn’t just about understanding technology, economics, or market analysis—it’s about understanding yourself. The statistics are clear: emotional decision-making significantly damages portfolio performance, yet the vast majority of investors continue making emotion-driven choices.

The key insight? Bitcoin’s psychology isn’t a bug—it’s a feature. The emotional volatility that terrifies traditional investors creates opportunities for th

-

@ 7f6db517:a4931eda

2025-06-02 17:02:20

@ 7f6db517:a4931eda

2025-06-02 17:02:20

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

The four main banks of bitcoin and “crypto” are Signature, Prime Trust, Silvergate, and Silicon Valley Bank. Prime Trust does not custody funds themselves but rather maintains deposit accounts at BMO Harris Bank, Cross River, Lexicon Bank, MVB Bank, and Signature Bank. Silvergate and Silicon Valley Bank have already stopped withdrawals. More banks will go down before the chaos stops. None of them have sufficient reserves to meet withdrawals.

Bitcoin gives us all the ability to opt out of a system that has massive layers of counterparty risk built in, years of cheap money and broken incentives have layered risk on top of risk throughout the entire global economy. If you thought the FTX bank run was painful to watch, I have bad news for you: every major bank in the world is fractional reserve. Bitcoin held in self custody is unique in its lack of counterparty risk, as global market chaos unwinds this will become much more obvious.

The rules of bitcoin are extremely hard to change by design. Anyone can access the network directly without a trusted third party by using their own node. Owning more bitcoin does not give you more control over the network with all participants on equal footing.

Bitcoin is:

- money that is not controlled by a company or government

- money that can be spent or saved without permission

- money that is provably scarce and should increase in purchasing power with adoptionBitcoin is money without trust. Whether you are a nation state, corporation, or an individual, you can use bitcoin to spend or save without permission. Social media will accelerate the already deteriorating trust in our institutions and as this trust continues to crumble the value of trust minimized money will become obvious. As adoption increases so should the purchasing power of bitcoin.

A quick note on "stablecoins," such as USDC - it is important to remember that they rely on trusted custodians. They have the same risk as funds held directly in bank accounts with additional counterparty risk on top. The trusted custodians can be pressured by gov, exit scam, or caught up in fraud. Funds can and will be frozen at will. This is a distinctly different trust model than bitcoin, which is a native bearer token that does not rely on any centralized entity or custodian.

Most bitcoin exchanges have exposure to these failing banks. Expect more chaos and confusion as this all unwinds. Withdraw any bitcoin to your own wallet ASAP.

Simple Self Custody Guide: https://werunbtc.com/muun

More Secure Cold Storage Guide: https://werunbtc.com/coldcard

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-02 17:02:20

@ 7f6db517:a4931eda

2025-06-02 17:02:20

@matt_odell don't you even dare not ask about nostr!

— Kukks (Andrew Camilleri) (@MrKukks) May 18, 2021

Nostr first hit my radar spring 2021: created by fellow bitcoiner and friend, fiatjaf, and released to the world as free open source software. I was fortunate to be able to host a conversation with him on Citadel Dispatch in those early days, capturing that moment in history forever. Since then, the protocol has seen explosive viral organic growth as individuals around the world have contributed their time and energy to build out the protocol and the surrounding ecosystem due to the clear need for better communication tools.

nostr is to twitter as bitcoin is to paypal

As an intro to nostr, let us start with a metaphor:

twitter is paypal - a centralized platform plagued by censorship but has the benefit of established network effects

nostr is bitcoin - an open protocol that is censorship resistant and robust but requires an organic adoption phase

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

- Anyone can run a relay.

- Anyone can interact with the protocol.

- Relays can choose which messages they want to relay.

- Users are identified by a simple public private key pair that they can generate themselves.Nostr is often compared to twitter since there are nostr clients that emulate twitter functionality and user interface but that is merely one application of the protocol. Nostr is so much more than a mere twitter competitor. Nostr clients and relays can transmit a wide variety of data and clients can choose how to display that information to users. The result is a revolution in communication with implications that are difficult for any of us to truly comprehend.

Similar to bitcoin, nostr is an open and permissionless protocol. No person, company, or government controls it. Anyone can iterate and build on top of nostr without permission. Together, bitcoin and nostr are incredibly complementary freedom tech tools: censorship resistant, permissionless, robust, and interoperable - money and speech protected by code and incentives, not laws.

As censorship throughout the world continues to escalate, freedom tech provides hope for individuals around the world who refuse to accept the status quo. This movement will succeed on the shoulders of those who choose to stand up and contribute. We will build our own path. A brighter path.

My Nostr Public Key: npub1qny3tkh0acurzla8x3zy4nhrjz5zd8l9sy9jys09umwng00manysew95gx

If you found this post helpful support my work with bitcoin.

-

@ e516ecb8:1be0b167

2025-06-02 15:22:40

@ e516ecb8:1be0b167

2025-06-02 15:22:40Bitcoin was born as a middle finger to the financial establishment. Its 2008 whitepaper, penned by the enigmatic Satoshi Nakamoto, promised a peer-to-peer (P2P) electronic cash system—a decentralized rebellion against state-controlled money, sparked in the ashes of the global financial crisis. It was a cypherpunk dream: a currency free from banks, governments, and middlemen. But somewhere along the way, Bitcoin lost its soul. What was meant to be a fluid, practical currency has morphed into a clunky, expensive digital vault—a gilded cage for your wealth. Let’s unpack why Bitcoin is broken, why its fixes are flimsy, and why its rebellious spirit is fading into a state-backed shadow of its former self.

The P2P Promise: Shattered by Sky-High Fees Bitcoin’s core idea was simple: send money directly to anyone, anywhere, without a bank skimming off the top. Fast forward to today, and that vision is in tatters. Imagine you’ve got $34 in Bitcoin to send to a friend. By the time it arrives, after transaction fees, they might get a measly $2. According to data from BitInfoCharts, the average Bitcoin transaction fee in early 2025 hovers around $20–$30, with spikes as high as $60 during network congestion. For context, that’s more than the cost of a Venmo transfer or even some international wire fees.

This isn’t a one-off issue. Wallets like Guarda, Exodus, or even hardware wallets like Ledger face the same problem: Bitcoin’s base layer (Layer 1) is so congested that fees make small transactions absurdly impractical. Want to buy a $5 coffee with Bitcoin? You’d lose more in fees than the coffee’s worth. This isn’t P2P money—it’s confiscatory, inefficient, and anything but user-friendly.

Lightning Network: A Band-Aid on a Broken System Cue the Bitcoin maximalists: “But we have the Lightning Network!” Sure, Lightning was introduced as a second-layer solution to scale Bitcoin for smaller, faster transactions. It’s a network of off-chain payment channels designed to handle microtransactions with lower fees. Sounds great, right? Except it’s a patchwork fix that betrays Bitcoin’s original vision.

First, Lightning wasn’t part of Satoshi’s plan—it’s an afterthought, a kludge to address the base layer’s limitations. Second, it’s not universally adopted. According to 1ML, as of early 2025, only about 15% of Bitcoin wallets natively support Lightning. Major wallets like Coinbase Wallet and Trust Wallet still require workarounds or third-party integrations. Why? Because implementing Lightning is complex, and for most users, it involves trusting third-party nodes or custodians to route payments. So much for “be your own bank.”

Worse, running your own Lightning node requires technical know-how—think Linux commands, channel management, and constant monitoring. A 2024 survey by Bitcoin Magazine found that only 8% of Bitcoin users run their own nodes, Lightning or otherwise. For the average person, Lightning isn’t a solution; it’s a hurdle. And if you’re relying on a third party, you’re back to square one: trusting someone else with your money.

Take Adrián Bernabeu, author of Bitcoinismo, who preaches the gospel of self-custody while simultaneously hyping Lightning for micropayments. It’s a contradiction. You can’t champion “not your keys, not your crypto” while pushing a system that often requires third-party intermediaries for practical use. It’s like telling someone to live off-grid but handing them a generator that only works with a utility company’s permission.

A Gilded Cage: Bitcoin as a Store of Value So, if Bitcoin isn’t practical for payments, what’s it good for? The narrative has shifted: Bitcoin is now a “store of value,” a digital gold. Its price has soared—hitting $80,000 in late 2024, per CoinGecko—and its fixed supply of 21 million coins makes it a hedge against inflation. But this shift isn’t just about market dynamics; it’s a consequence of Bitcoin’s own flaws.

Moving Bitcoin is so expensive that it’s often smarter to hodl than to spend. Your wallet becomes an orange-tinted cage, trapping your wealth in a system where transferring value eats away at your holdings. Sure, you could wait for fees to drop, but that’s another nail in the P2P coffin. Real money doesn’t make you wait for a discount to use it. Imagine telling someone, “Hold off on buying groceries until the dollar’s transaction fees go down.” It’s absurd.

OP_RETURN and the Spam Problem: A Network Clogged with Junk Bitcoin’s blockchain isn’t just struggling with fees; it’s also drowning in digital clutter. The OP_RETURN function, meant for embedding small amounts of data (like metadata for smart contracts), has become a dumping ground for everything from NFT inscriptions to random spam. In 2023, Glassnode reported that OP_RETURN transactions accounted for nearly 20% of Bitcoin’s block space during peak periods, crowding out legitimate transactions and driving up fees.

Proposed fixes from Bitcoin Core and Knots—like limiting OP_RETURN data size or tweaking mempool rules—are more Band-Aids. They don’t address the root issue: Bitcoin’s block size limit. Capped at 1MB (or roughly 4MB with SegWit), Bitcoin can only process about 3–7 transactions per second, compared to Visa’s 24,000. Increasing the block size could ease congestion and lower fees, but Bitcoin Core developers have resisted this for years, citing concerns about centralization.

Here’s the kicker: Bitcoin Cash (BCH), a 2017 fork of Bitcoin, raised its block size to 32MB and processes transactions at a fraction of the cost. BCH’s average fee in 2025 is under $0.01, per BitInfoCharts. Bitcoin maximalists dismiss BCH as a failed experiment, but it’s hard to argue with the numbers. A larger block size reduces spam’s impact because legitimate transactions dominate. Admitting this, though, would mean conceding defeat in a years-long ideological battle. And Bitcoiners hate losing.

From Rebellion to Regulatory Lapdog Bitcoin’s cypherpunk roots are fading fast. What started as a revolt against state control is cozying up to governments. El Salvador made Bitcoin legal tender in 2021, but its state-backed Chivo wallet (built on Lightning) is riddled with bugs and usability issues, according to a 2024 Reuters report. Meanwhile, Bitcoin Core developers have lobbied for institutional adoption, with figures like Michael Saylor advocating for Bitcoin as a strategic reserve asset for governments and corporations.

This is a far cry from Satoshi’s vision. A 2023 post on X revealed that Core developers met with U.S. regulators to discuss Bitcoin’s role in national reserves—a move that reeks of compromise. The same system Bitcoin was meant to disrupt is now being courted. If governments start subsidizing Bitcoin mining to protect their reserves, as some speculate, the irony will be complete: a decentralized dream bankrolled by fiat.

The Looming Threats: Quantum and Mining Woes Bitcoin’s problems don’t end with fees and politics. Quantum computing looms on the horizon. A 2024 MIT Technology Review article estimated that quantum computers capable of breaking Bitcoin’s ECDSA cryptography could emerge by 2030. This threatens “Satoshi-era” wallets—those holding early, unspent coins—potentially undermining trust in the entire blockchain.

Then there’s mining. Bitcoin’s proof-of-work system is energy-intensive, with global mining consuming 150 TWh annually, per the Cambridge Bitcoin Electricity Consumption Index. As block rewards halve (the next halving is in 2028), miners will rely more on transaction fees. Higher fees mean even less practicality for P2P payments, locking Bitcoin further into its “digital gold” trap. If states step in to subsidize mining, as some X posts have speculated, Bitcoin’s anti-establishment ethos will be dead in the water.

The Final Irony: Paying for Freedom with Fiat Bitcoin promised to replace fiat currency, but its flaws are pushing it toward a bizarre dependency on the very system it sought to destroy. If governments subsidize mining or adopt Bitcoin as a reserve asset, we’ll be left with a bitter irony: a supposedly revolutionary asset propped up by fiat. The cypherpunk dream will have come full circle, not as a triumph, but as a compromise.

So, is Bitcoin broken? Yes. It’s a victim of its own success—too valuable to spend, too clunky to use, and too compromised to stay true to its roots. The question isn’t whether Bitcoin can be fixed; it’s whether its community has the courage to admit what’s wrong. Until then, your Bitcoin wallet remains a shiny, orange prison—a relic of a rebellion that forgot how to fight.

-

@ cae03c48:2a7d6671

2025-06-02 17:01:05

@ cae03c48:2a7d6671

2025-06-02 17:01:05Bitcoin Magazine

Amboss Launches Rails, a Self-Custodial Bitcoin Yield ServiceAmboss, a leader in AI-driven solutions for the Bitcoin Lightning Network, today announced Rails, a groundbreaking self-custodial Bitcoin yield service. According to a press release sent to Bitcoin Magazine, it’s designed to empower companies, custodians, and high net worth individuals. This allows participants to earn a yield on their Bitcoin.

Big news from @TheBitcoinConf !

We’re thrilled to announce Rails—a self-custodial Bitcoin yield service that empowers you to earn on your BTC while supercharging the Lightning Network.Let’s bring Bitcoin to the World.https://t.co/3WYYvB95hP

— AMBOSS

(@ambosstech) May 29, 2025

(@ambosstech) May 29, 2025Rails also launched a secure way for Liquidity Providers (LPs) to hold all custody of their Bitcoin while generating returns from liquidity leases and payment routing, although they are not guaranteed. The implementation of Amboss’ AI technology, Rails strengthened their Lighting Network with more dependable transactions and larger payment volumes.

“Rails is a transformative force for the Lightning Network,” said the CEO and Co-Founder of Amboss Jesse Shrader. “It’s not just about yield—it’s about enabling businesses to strengthen the network while earning on their Bitcoin. This is a critical step in Bitcoin’s evolution as a global medium of exchange.”

The service offers two options:

- Rails LP is designed for high net worth individuals, custodians, and companies with Bitcoin treasuries, requiring a minimum commitment of 1 BTC for one year.

- Liquidity subscriptions are designed for businesses that receive Bitcoin payments, with fees starting at 0.5%.

Amboss partnered with CoinCorner and Flux (a joint venture between Axiom and CoinCorner), to bring Rails to the market. CoinCorner has incorporated it into both its exchange platform and daily payment services in the Isle of Man. Flux is jointly focused on advancing the Lightning Network’s presence in global payments. Their participation highlights growing industry trust in Rails as a tool to scale Bitcoin effectively.

“Rails offers a practical way for businesses like ours to participate in the Lightning Network’s growth,” said the CFO of CoinCorner David Boylan. “We’ve been using the Lightning Network for years, and Rails provides a structured approach to engaging with its economy, particularly through liquidity leasing and payment routing. This aligns with our goal of making Bitcoin more accessible and practical for everyday use.”

This post Amboss Launches Rails, a Self-Custodial Bitcoin Yield Service first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-02 17:01:02

@ cae03c48:2a7d6671

2025-06-02 17:01:02Bitcoin Magazine

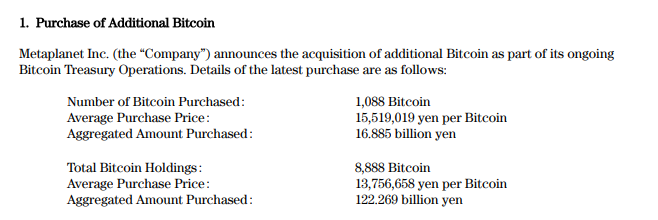

Strategy Buys $75 Million Worth of BitcoinStrategy has acquired an additional 705 Bitcoin for approximately $75 million, further expanding its position as the largest corporate holder of Bitcoin as more public companies continue to adopt Bitcoin treasury strategies.

According to a Form 8-K filed with the SEC on June 2, the company purchased the Bitcoin at an average price of $106,495 per coin between May 26 and June 1, bringing its total holdings to 580,955 BTC. The acquisition was funded through Strategy’s at-the-market (ATM) equity offerings of perpetual preferred shares.

BREAKING:

STRATEGY BUYS ANOTHER 705 #BITCOIN FOR $75 MILLION pic.twitter.com/WBgKUcbbEP

STRATEGY BUYS ANOTHER 705 #BITCOIN FOR $75 MILLION pic.twitter.com/WBgKUcbbEP— Bitcoin Magazine (@BitcoinMagazine) June 2, 2025

The company raised $74.6 million by selling a combination of its preferred stock classes, including 353,511 shares of STRK preferred stock for $36.2 million and 374,968 shares of STRF preferred stock for $38.4 million. With this purchase, Strategy’s average acquisition price across all its Bitcoin holdings stands at $70,023 per coin.

The continued expansion of corporate Bitcoin treasuries reflects growing institutional confidence in Bitcoin. We’re seeing unprecedented adoption in 2025, with over 60 public companies now holding Bitcoin on their balance sheets.

At current market prices of approximately $104,165, Strategy’s Bitcoin holdings are valued at more than $60 billion, reinforcing its dominant position in corporate Bitcoin holdings. The company has consistently accumulated Bitcoin through various market conditions since adopting its treasury strategy in 2020.

The purchase comes amid a broader trend of corporate Bitcoin adoption, with recent entrants including GameStop’s $513 million acquisition of 4,710 BTC and Semler Scientific’s $50 million purchase of 455 BTC. Total corporate Bitcoin holdings have surpassed $100 billion in 2025, marking a significant shift in traditional treasury management practices.

At press time, Bitcoin trades at $104,165, down 0.07% over the past 24 hours, as the market processes this latest institutional development and its implications for broader corporate adoption of Bitcoin as a treasury asset.

This post Strategy Buys $75 Million Worth of Bitcoin first appeared on Bitcoin Magazine and is written by Vivek Sen.

-

@ 10f7c7f7:f5683da9

2025-06-02 15:10:30

@ 10f7c7f7:f5683da9

2025-06-02 15:10:30Unfortunately, I’m yet to be approached by either friends or family to enquire about bitcoin, I have very few friends, and my family are generally comfortable in their fiat lives. However, I often feel the need to prepare myself if the situation arises where I’m asked and I don’t do my usual, “ah, it’s just a hat” response and say nothing about bitcoin. As a result, I’m thinking through scenarios when I get asked, maybe even asked for advice and work out how to respond to people I care about, or even people I’m less bothered about, but I really don’t want to be the asshole who says; “have fun staying poor”. As Tuur Demeester mentioned, we need to prepare ourselves mentally for when price goes crazy, so we don’t immediate start acting up with ridiculous Lambo shaped purchases but also not realise the cash to do something that will benefit you and your loved ones. We also need to prepare ourselves for the phonecalls we may receive “wen moon”. I’m not going to suggest that anyone should or should not do anything, but I’m going to try and work some things out, so that when I’m asked, I can respond in a way that is balanced, constructive and will help the person I’m speaking to make progress in their journey.

Firstly, if they say that I’m just luck to have found bitcoin before them, there are many useful quotes that can be used as a response to this, but one of my favourites has to be from Thomas Jefferson:

“I find that the harder I work, the more luck I seem to have”

Short, simple and to the point, while also bringing the idea back from success being related to some magical concept that some people have and some people don’t, that removes the individual’s agency to positively impact their lot in life.

After this, the next suggestion may be related to luck, but at least this can be measured; how early did you first hear about bitcoin? Obviously, there could be some factors that may be outside of one’s immediate control, such as whether your name was on the cypherpunk mailing list in late 2009. Saying this, very few individuals chose to act on the contribution of one of the unknown contributors (Satoshi Nakamoto) who suddenly appeared on the mailing list, so started directing resources towards the network at the start. Even those that did and accumulated large stockpiles in the early days may have not initially known what they had or may have simply lost what they accumulated (poor old James Howells is still trying to dig up a Welsh refuse site). There are also those infamous episodes where individuals were given bitcoin early on and didn’t understand what they had or were simply careless with the necessary information (Alex Jones once received 10k bitcoin from Max Keiser). Even more recently, Dave Portnoy purchased a significant amount of bitcoin, was walked through the whole process by Marty Bent, but later lost his keys, suggesting it is not sufficient to simply be earlier to bitcoin to benefit from it, but something else.