-

@ cae03c48:2a7d6671

2025-06-04 10:01:03

@ cae03c48:2a7d6671

2025-06-04 10:01:03Bitcoin Magazine

Norwegian Public Company K33 AB Purchased 10 BTC For Their New Bitcoin Treasury StrategyK33 AB (PUBL), a digital asset brokerage and research firm, announced that it has completed its first Bitcoin acquisition under its new Bitcoin treasury strategy, purchasing 10 BTC for approximately SEK 10 million.

JUST IN:

Publicly traded company K33 buys 10 #Bitcoin for SEK 10 million for its balance sheet. pic.twitter.com/wB8Kt09EZf

Publicly traded company K33 buys 10 #Bitcoin for SEK 10 million for its balance sheet. pic.twitter.com/wB8Kt09EZf— Bitcoin Magazine (@BitcoinMagazine) June 3, 2025

Today’s purchase is the first transaction of the secured SEK 60 million that K33 announced it will buy for its Bitcoin treasury strategy.

“We expect Bitcoin to be the best-performing asset in the coming years and will build our balance sheet in Bitcoin moving forward,” said the CEO of K33 Torbjorn Bull Jenssen. “This will give K33 direct exposure to the Bitcoin price and help unlock powerful synergies with our brokerage operation. Our ambition is to build a balance of at least 1000 BTC over time and then scale from there.”

During K33’s Q1 2025 Report & Strategic Outlook presentation. Torbjorn Jenssen mentioned that the “US BTC ETF was the most successful ETF launch in history. Acquiring more capital in just one year than gold did in 20.”

Jenssen also said K33 is working with other Bitcoin treasury companies in the Nordics and hopes to use its treasury as a foundation to offer new services, such as Bitcoin backed lending.

“For K33, Bitcoin is not only a high-conviction asset — it’s also a strategic enabler,” he said. “With a sizable BTC reserve, we will be able to strengthen our financial position while unlocking new revenue streams, product capabilities, and partnerships.”

Bitcoin will be the best performing asset in the coming decade and my goal with K33 is to accumulate as many as possible while unlocking powerful operational synergies with our brokerage operation,” posted Jenssen on X.

Bitcoin will be the best performing asset in the coming decade and my goal with K33 is to accumulate as many as possible while unlocking powerful operational synergies with our brokerage operation. https://t.co/Crxu0b5QPz

— Torbjørn (@TorbjrnBullJens) May 28, 2025

Bitcoin treasury holdings are becoming a trend of companies in 2025. Around 217 companies and public entities now hold Bitcoin on their balance sheets.

Last week, during the 2025 Bitcoin Conference in Las Vegas, the CEO of GameStop Ryan Cohen announced that GameStop purchased 4,710 Bitcoin worth approximately $505 million, marking another major corporate entry into Bitcoin treasury holdings.

In an interview with the CEO of Nakamoto David Bailey, the CEO of GameStop Ryan Cohen stated, “If the thesis is correct then Bitcoin and gold as well can be a hedge against global currency devaluation and systemic risk. Bitcoin has certain unique advantages better than gold.”

BREAKING:

GAMESTOP PURCHASED 4,710 #BITCOIN pic.twitter.com/fDH9ctZJVP

GAMESTOP PURCHASED 4,710 #BITCOIN pic.twitter.com/fDH9ctZJVP— Bitcoin Magazine (@BitcoinMagazine) May 28, 2025

This post Norwegian Public Company K33 AB Purchased 10 BTC For Their New Bitcoin Treasury Strategy first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-04 10:00:58

@ cae03c48:2a7d6671

2025-06-04 10:00:58Bitcoin Magazine

Canadian Company SolarBank Adopts Bitcoin Treasury StrategyToday, SolarBank Corporation (NASDAQ: SUUN), a leader in distributed solar energy, battery storage, and clean energy infrastructure across North America, has announced the integration of Bitcoin as a strategic reserve asset into its corporate treasury strategy, following the footsteps of MicroStrategy and SharpLink Gaming.

SolarBank has also applied to open an institutional account with Coinbase Prime (NASDAQ: COIN), enabling secure Bitcoin custody, USDC services, and a self-custodial wallet for its Bitcoin holdings.

JUST IN: North American construction engineering company SolarBank adopts a Strategic Bitcoin Reserve

pic.twitter.com/b2xvVARjZZ

pic.twitter.com/b2xvVARjZZ— Bitcoin Magazine (@BitcoinMagazine) June 3, 2025

The company cited several strategic advantages for adopting Bitcoin as a reserve asset:

- Financial Resilience: Bitcoin holdings will serve as a hedge against inflation and currency debasement.

- Clean Energy Off-set: Emissions tied to Bitcoin mining will be counterbalanced by SolarBank’s renewable energy generation.

- Market Appeal: The move targets tech-savvy investors interested in digital assets, DeFi, and blockchain.

- Competitive Differentiation: SolarBank aims to differentiate itself as a first-mover in combining renewable energy with Web3 and DeFi principles.

“As the adoption of Bitcoin continues to grow, SolarBank believes that establishing a Bitcoin treasury strategy taps into a growing sector that is seeing increasing adoption,” commented Dr. Richard Lu. “In a world of ever-increasing energy demand and treasury complexity, SolarBank delivers renewable energy solutions and recurring revenues, now combined with all of the benefits of holding Bitcoin.”

SolarBank further emphasized that its core focus remains on renewable energy development, highlighting several recent achievements:

- A $100 million U.S. solar deal with CIM Group targeting 97 MW of projects.

- A $49.5 million agreement with Qcells to deploy US made solar technology.

- A $41 million partnership with Honeywell to develop landfill-based solar farms.

- A $25 million credit facility from RBC to expand its battery energy storage portfolio.

With over 1 GW of projects in development and partnerships with Fortune 500 companies, SolarBank continues to generate recurring revenues through long-term contracts while accelerating decarbonization efforts.

“The actual timing and value of Bitcoin purchases, under the allocation strategy will be determined by management,” stated the company in the press release. “Purchases will also depend on several factors, including, among others, general market and business conditions, the trading price of Bitcoin and the anticipated cash needs of SolarBank. The allocation strategy may be suspended, discontinued or modified at any time for any reason. As of the date of this press release, no Bitcoin purchases have been made.”

This post Canadian Company SolarBank Adopts Bitcoin Treasury Strategy first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-04 10:00:54

@ cae03c48:2a7d6671

2025-06-04 10:00:54Bitcoin Magazine

Vegas Comedown, or Was Bitcoin 2025 Too Noisy?

“Shitcoin Magazine,” tweeted Bitcoin educator and author Knut Svanholm about the event that BTC Inc, the parent company of Bitcoin Magazine, organized in Las Vegas last week. Dancing cows dashed across my feed. “It’s a political convention now,” I overheard two attendees saying as they exited the Nakamoto stage, heads shaking. Nigel Farage, the inflammatory British politician and leader of Reform UK, was shouting on stage about becoming prime minister. A somewhat calmer personality, Vice President JD Vance spoke about “crypto” and thanked Coinbase.

Word on the (online) street is that Bitcoin 2025 was captured by political and shitcoin-y interests. Our own technical editor, Shinobi, opted out of mass surveillance and bailed for freer pastures at the Oslo Freedom Forum. Erik Cason was uncharacteristically polite (“shitcoin adjacent”), though he was there in person, happily signing the Cryptosovereignty book that Bitcoin Magazine Books published in 2023.

“None of my Bitcoiner friends come here anymore,” said Ben, an entrepreneur who runs a Bitcoin business, on the fence about coming back next year.

Whenever I mention that I work for Bitcoin Magazine, I usually have to field questions about shitcoinery and political shilling (Are you a MAGA dude now?!). Coming to Vegas was inspection time for me — or at least a chance to see what it is that troubles so many people.

With the glamor of the Strip itself and its sensory overload, it’d be easy to be dazzled — plus, it was the first time I had left Fort Europa for the land of the free in years, first time in Vegas, and first time at an American Bitcoin event. It’d be easy for me to simply dismiss the haters by paraphrasing Taylor (“haters gonna hate, hate, hate, hate…”).

While sitting down in the whale pass area the Deep, a hipster-looking gentleman started talking to me about how Bitcoin is fundamentally broken and that I should investigate his energy-based shitcoin instead. Waiting for Vance’s speech in the main hall, I was introduced to three young dudes dressed up to perfection and barely out of college, at the conference “to land a job in the industry” — i.e., grifters. A mid-60s technology dude interjected himself into the conversation, bragged about how he worked on tech for Microsoft in the ’90s, and explained how blockchain (not Bitcoin) is the future — only to have us scan the NFC card he had implanted in his left hand. Ugh.

Thus, it wasn’t difficult to see the things all these people online had objected to: Our conference was a party, or “an elaborate Bitcoin extraction scheme,” a “circus, shitcoin fest,” or stablecoin mania. Plus:

— Daniel Prince (@Princey21M) May 30, 2025

They’re not wrong. But honestly, you don’t have to look.

Here’s an underappreciated order to the known universe: To each successful movement or phenomenon, parasites and fraudsters are drawn. It’s why the shitcoin guys are around Bitcoin events and why the politicians are pandering to our cause. Vegas itself is the center of gravity for that sort of thing — gambling, nudity, alcohol, prostitution, and other dopamine-inducing stimulants. I first titled this tak_e_ What Hookers in Vegas Can Teach Us About Politicians at Bitcoin 2025; the simple observation is that fraudsters, grifters, and scammers go to where the value is. Parasites feed off healthy, growing, flourishing organisms.

“Scammers flooding in,” as Tomer Strolight post-conference tweeted, is thus the least surprising thing ever.

We’re succeeding, growing, and becoming if not respectable then at least a household name. The FT and WSJ covering us feel somewhere between “…then they laugh at you“ and “…then they fight you” stages.

Running around meeting people — hardcore Bitcoiners I’ve only ever met online, authors and writers and editors I’ve worked with (they were all in Vegas, since that was the place to be…) — and attending the sum total of three presentations, I felt what Wayne Vaughan of Bitcoin First described:

The Bitcoin Conference 2025 was different and in many ways disappointing.

Good:

The private events were excellent opportunities to reconnect with old friends and meet new people.Bitcoin has grown up. We’re finally legit.

Neutral:

The conference was dominated by politics and…— Wayne Vaughan (@WayneVaughan) May 30, 2025

You can just meet people, just do things.

To make an obvious analogy: The internet is littered with porn, gambling, and cat videos, and it’s the most successful technology in a generation. You don’t have to look; you can just work and provide value instead of wasting away your life talking to shitcoiners or being annoyed at politicians and other fraudsters doing their things.

“Cozying up to any government is a bad idea,” concluded the WSJ piece, citing a “wing” of purist Bitcoin that we all feel. Yes, agreed. But the puritism that its opposite requires condemns us to irrelevancy — belittles and betrays the broader mission.

So yeah: the grifters, the parasites, the politicians, and the financial engineers are here. Good for them. That they’re here is a sign of victory.

Knock me over with a feather, haters.

Come join us for Bitcoin 2026 and see for yourself.

This post Vegas Comedown, or Was Bitcoin 2025 Too Noisy? first appeared on Bitcoin Magazine and is written by Joakim Book.

-

@ cae03c48:2a7d6671

2025-06-04 10:00:49

@ cae03c48:2a7d6671

2025-06-04 10:00:49Bitcoin Magazine

How Strategy (MSTR) Built Their Capital Stack to Accelerate Bitcoin AccumulationMicroStrategy—now operating as Strategy

—has built the most aggressive Bitcoin treasury in the world. But its true innovation isn’t just holding Bitcoin. It’s in how it finances the accumulation of Bitcoin at scale without giving up control or diluting shareholder value.

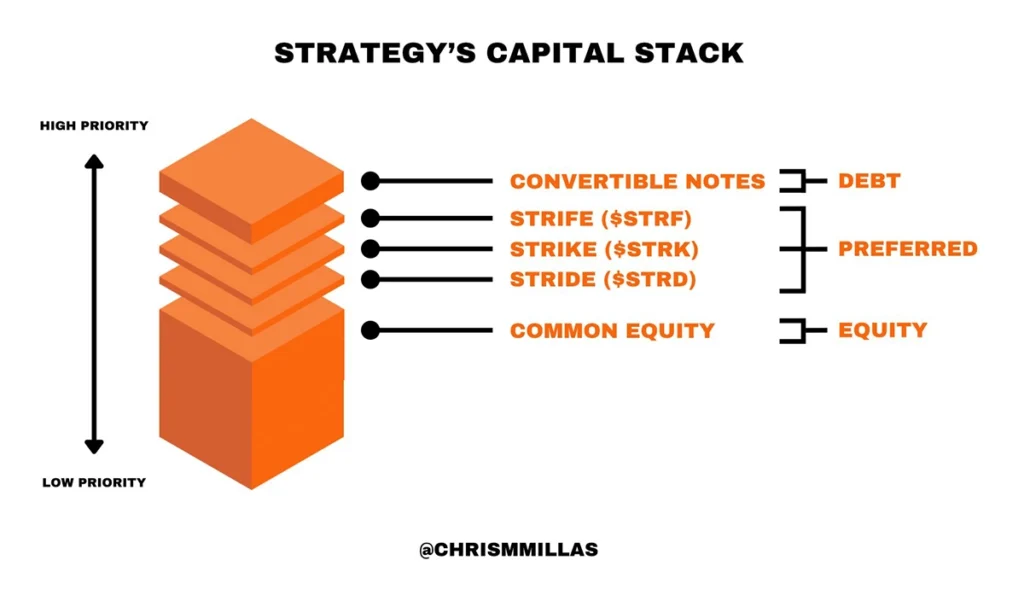

—has built the most aggressive Bitcoin treasury in the world. But its true innovation isn’t just holding Bitcoin. It’s in how it finances the accumulation of Bitcoin at scale without giving up control or diluting shareholder value.The engine behind this? A meticulously designed capital stack—a multi-tiered structure of debt, preferred stock, and equity that appeals to different types of investors, each with unique risk, yield, and volatility preferences.

This is more than corporate finance—it’s a blueprint for Bitcoin-native capital formation.

What Is a Capital Stack?

A capital stack refers to the layers of capital a company uses to finance its operations and strategic goals. Each layer has its own return profile, risk level, and repayment priority in the event of liquidation.

Strategy’s capital stack is designed to do one thing exceptionally well: convert fiat capital into Bitcoin exposure—efficiently, at scale, and without compromise.

The Stack: Ordered by Priority

Strategy’s capital stack comprises five core instruments:

1. Convertible Notes

2. Strife Preferred Stock ($STRF)

3. Strike Preferred Stock ($STRK)

4. Stride Preferred Stock ($STRD)

5. Common Equity ($MSTR)These layers are ranked from highest to lowest in repayment priority. What makes this structure unique is how each layer balances downside protection, yield, and Bitcoin exposure—offering institutional investors fixed-income alternatives with varying degrees of correlation to Bitcoin.

Strategy’s Capital Stack illustrated by Chris Millas

Convertible Notes: Senior Debt with Optional Upside

Strategy’s capital stack begins with convertible notes—senior unsecured debt that can convert into equity.

- Downside: Low risk, high priority in liquidation

- Upside: Modest unless converted

- Appeal: Institutional debt investors seeking protection with optional Bitcoin-adjacent upside

These notes were Strategy’s earliest fundraising tools, enabling the company to raise billions in low-interest environments to accumulate Bitcoin without issuing equity.

Strife ($STRF): Investment-Grade Yield

Strife is a perpetual preferred stock designed to mimic high-grade fixed income.

- 10% cumulative dividend, paid in cash

- $100 liquidation preference

- No conversion rights or Bitcoin upside

- Compounding penalties on unpaid dividends

- Low volatility, medium risk profile

Strife targets conservative capital—allocators who want predictable income without equity or crypto exposure. It’s senior to other preferreds and common stock, making it a high-quality fixed-income proxy built atop a Bitcoin treasury.

Strike ($STRK): Yield + Bitcoin Optionality

Strike is convertible preferred stock—bridging fixed income and equity upside.

- 8% cumulative dividend

- Convertible into $MSTR at $1,000 strike

- Paid in cash or Class A shares

- Bitcoin exposure via conversion option

- Medium volatility, low risk

Strike appeals to investors who want income with optional participation in Bitcoin upside. In bullish Bitcoin cycles, the conversion option becomes valuable—offering a hybrid between bond-like stability and equity-like potential.

Stride ($STRD): High Yield, High Risk

Stride is the most junior preferred—non-cumulative, perpetual stock issued with high yield and few protections.

- >10% dividend, only if declared

- No compounding, no conversion, no voting rights

- Highest relative risk among preferreds

- Liquidation priority above common equity, but below all others

Stride plays a crucial role. Its issuance improves the credit quality of Strife, adding a subordinate capital buffer beneath it—similar to how mezzanine debt protects senior tranches in structured finance.

Stride attracts yield-hungry investors, enabling Strategy to raise capital without compromising more senior layers.

Common Equity ($MSTR): Pure Bitcoin Beta

At the base is Strategy’s common equity—the most volatile, least protected, but highest potential instrument in the stack.

- Unlimited upside

- No dividend, no priority

- Full exposure to Bitcoin volatility

- Voting rights, long-term ownership

Common equity is for conviction-driven investors. Over the past four years, this layer has attracted capital from funds and individuals aligned with Strategy’s Bitcoin thesis—investors who want maximal upside from a corporate Bitcoin strategy.

The Big Picture: Saylor Is Targeting the Fixed Income Market

This isn’t just a financing mechanism—it’s a direct challenge to the $130 trillion global bond market.

By issuing instruments like $STRF, $STRK, and $STRD, Strategy is offering Bitcoin-adjacent yield vehicles that absorb demand from across the capital spectrum:

- Institutional investors seeking investment-grade yield

- Hedge funds chasing structured upside

- Yield hunters willing to go down the stack for returns

Each instrument behaves like a synthetic bond, yet all are backed by a Bitcoin accumulation engine.

As Director of Bitcoin Strategy at Metaplanet, Dylan LeClair put it: “Saylor is coming for the entire fixed income market.”

Rather than issue traditional bonds, Saylor is constructing a Bitcoin-native capital stack—one that unlocks liquidity without ever selling the underlying asset.

Why It Matters: A Model for Bitcoin Treasury Strategy

Strategy’s capital structure is more than innovation—it’s a financial operating system for any public company that wants to monetize Bitcoin’s rise while maintaining capital discipline.

Key takeaways:

- Every layer matches a specific investor need: From low-risk debt to speculative yield

- Capital flows in, Bitcoin stays put: Preserving treasury position while scaling

- No single instrument dominates: The stack is diversified by design

- Control is retained: Most securities are non-voting, non-convertible

For corporations serious about building a Bitcoin-native balance sheet, this is the playbook to study.

Saylor isn’t just stacking Bitcoin—he’s engineering the financial infrastructure for a monetary paradigm shift.

Disclaimer: This content was written on behalf of Bitcoin For Corporations. This article is intended solely for informational purposes and should not be interpreted as an invitation or solicitation to acquire, purchase, or subscribe for securities.

This post How Strategy (MSTR) Built Their Capital Stack to Accelerate Bitcoin Accumulation first appeared on Bitcoin Magazine and is written by Nick Ward.

-

@ 2dd9250b:6e928072

2025-06-04 10:01:11

@ 2dd9250b:6e928072

2025-06-04 10:01:11Durante a década de 1990, houve o aumento da globalização da economia, determinando a adição do fluxo internacional de capitais, de produtos e serviços. Este fenômeno levou a uma interdependência maior entre as economias dos países. Justamente por causa da possibilidade de que um eventual colapso econômico em um país resulte no contágio dos demais. Diante disso, aumentou a preocupação com os riscos incentivando a utilização de sofisticados modelos e estratégias de avaliação de gestão de risco.

Na década, ganharam destaque ainda os graves problemas financeiros enfrentados, entre outros, pelo banco inglês Barings Bank, e pelo fundo de investimento norte-americano Long Term Capital Management.

Outro grande destaque foi a fraude superior a US$ 7 bilhões sofrida pelo banco Société Generale em Janeiro de 2008.

O Barings Bank é um banco inglês que faliu em 1995 em razão de operações financeiras irregulares e mal-sucedidas realizadas pelo seu principal operador de mercado. O rombo da instituição foi superior à US$ 1,3 Bilhão e causado por uma aposta equivocada no desempenho futuro no índice de ações no Japão. Na realidade, o mercado acionário japonês caiu mais de 15% na época, determinando a falência do banco. O Baring Bank foi vendido a um grupo financeiro holandês (ING) pelo valor simbólico de uma libra esterlina.

O Long Term Capital Management era um fundo de investimento de que perdeu em 1998 mais de US$ 4,6 bilhões em operações nos mercados financeiros internacionais. O LTCM foi socorrido pelo Banco Central dos Estados Unidos (Federal Reserve ), que coordenou uma operação de socorro financeiro à instituição. A justificativa do Banco Central para esta decisão era "o receio das possíveis consequências mundiais da falência do fundo de investimento".

O banco francês Société Generale informou, em janeiro de 2008, uma perda de US$ 7,16 bilhões determinadas por fraudes efetuadas por um operador do mercado financeiro. Segundo revelou a instituição, o operador assumiu posições no mercado sem o conhecimento da direção do banco. A instituição teve que recorrer a uma urgente captação de recursos no mercado próxima a US$ 5,0 bilhões.

E finalmente chegamos ao caso mais problemático da era das finanças modernas anterior ao Bitcoin, o caso Lehman Brothers.

O Lehman Brothers era o 4° maior de investimentos dos EUA quando pediu concordata em 15/09/2008 com dívidas que superavam inacreditáveis US$ 600 bilhões.

Não se tinha contas correntes ou talão de cheques do Lehman Brothers. Era um banco especializado em investimentos e complexas operações financeiras. Havia feito pesados investimentos em empréstimos a juros fixos no famigerado mercado subprime, e o crédito imobiliário voltado a pessoas consideradas de forte risco de inadimplência.

Com essa carteira de investimentos que valia bem menos que o estimado e o acúmulo de projetos financeiros, minou a confiança dos investidores na instituição de 158 anos. Suas ações passaram de US$ 80 a menos de US$ 4. Acumulando fracassos nas negociações para levantar fundos; a instituição de cerca de 25 mil funcionários entrou em concordata.

O Federal Reserve resgatou algumas instituições financeiras grandes e tradicionais norte-americanas como a seguradora AIG no meio da crise. O Fed injetou um capital de US$ 182, 3 bilhões no American International Group (AIG).

Foi exatamente essa decisão do Fed em salvar alguns bancos e deixar quebrar outros, que causou insegurança por parte dos clientes. E os clientes ficaram insatisfeitos tanto com os bancos de investimentos quanto com as agências de classificação de risco, como a Standard & Poor's que tinha dado uma nota alta para o Lehman Brothers no mesmo dia em que ele quebrou.

E essa foi uma das razões pelo qual o Bitcoin foi criado. Satoshi Nakamoto entendeu que as pessoas não estavam mais confiando nem no Governo, nem nos Bancos Privados que o Governo federal restagatava quando eles quebravam e isso prejudicou muita gente. Tanto que o “hash” do Genesis Block contém o título do artigo “Chancellor on brink of second bailout for banks” (Chanceler à beira de segundo resgate para bancos, em português) da edição britânica do The Times.

Esse texto foi parcialmente editado do texto de ASSAF Neto, CAF (2014).

-

@ cae03c48:2a7d6671

2025-06-04 10:00:43

@ cae03c48:2a7d6671

2025-06-04 10:00:43Bitcoin Magazine

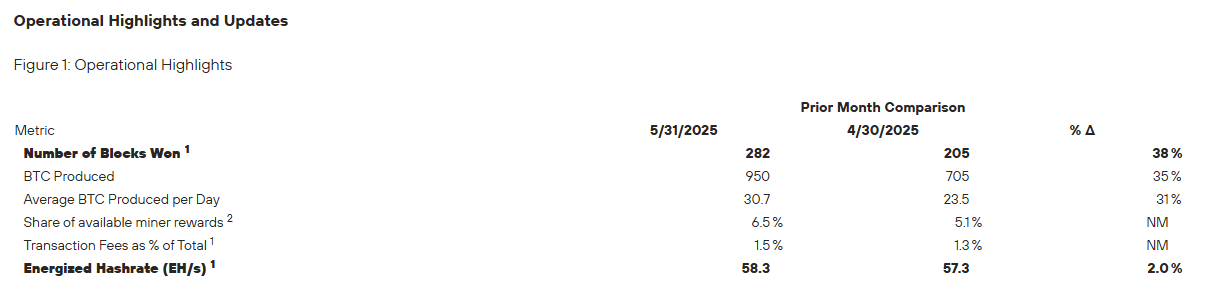

MARA Announces Over $100 Million in Bitcoin Mined in May 2025Today, MARA Holdings, Inc. (NASDAQ: MARA) reported a record high month of bitcoin production in May 2025, mining 950 BTC worth over $100 million at the time of writing. A 35% increase from April and the highest monthly output since the April 2024 halving event. MARA did not sell any bitcoin in May.

JUST IN: MARA mined 950 #Bitcoin worth over $100 MILLION in May

They HODLed all of it

pic.twitter.com/Z4v1zoEfga

pic.twitter.com/Z4v1zoEfga— Bitcoin Magazine (@BitcoinMagazine) June 3, 2025

“May was a record-breaking month for MARA with 282 blocks won, a 38% increase over April and a new monthly high,” said the Chairman and CEO of MARA Fred Thiel. “Our total bitcoin holdings surpassed 49,000 BTC during May and the 950 bitcoin produced were the most since the halving event in April 2024.”

The company mined 282 blocks during the month, a 38% rise over the previous month, and now holds 49,179 BTC, worth roughly $5.23 billion at the time of writing.

“Our fully integrated tech stack is a key differentiator, and MARA Pool is the only self-owned and operated mining pool among public miners, offering greater control and efficiency,” stated Thiel. “Operating our pool means no fees to external operators and retention of the full value of block rewards. Production in May also benefitted from block reward luck. Since launch, MARA Pool’s block reward luck has outperformed the network average by over 10%, contributing to our industry-leading block production.”

Operational efficiency also improved, with energized hashrate rising 2% from 57.3 EH/s to 58.3 EH/s. MARA’s average daily bitcoin production hit 30.7 BTC, which is 31% more than the last month from April.

“We remain laser-focused on transforming MARA into a vertically integrated digital energy and infrastructure company,” commented Thiel. “We believe this model gives us tighter operational control, improves cost-efficiency, and makes us more resilient to shifts in the broader economy.”

Earlier this month, on May 8, MARA released its first quarter 2025 earnings, posting 213.9 million dollars in revenue. A 30 percent increase over the same period last year. The company’s bitcoin holdings surged 174 percent year over year, rising from 17,320 BTC to 47,531 BTC as of March 31, with an estimated value of 3.9 billion dollars at the time. In Q1, MARA mined 2,286 BTC and acquired an additional 340 BTC. Operational performance also strengthened, with energized hashrate nearly doubling from 27.8 EH/s to 54.3 EH/s, and cost per petahash per day improving by 25 percent.

This post MARA Announces Over $100 Million in Bitcoin Mined in May 2025 first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-04 10:00:34

@ cae03c48:2a7d6671

2025-06-04 10:00:34Bitcoin Magazine

Adam Back Invests SEK 21 Million to H100 Group Bitcoin Treasury StrategyToday, H100 Group AB announced it has entered a SEK 21 million convertible loan from an investment agreement with Adam Back, with the option to expand his investment to SEK 277 million through a five-tranche convertible loan deal. The proceeds will be used to buy Bitcoin in alignment with H100 Group’s long-term Bitcoin treasury strategy.

H100 Group AB (Ticker: H100) secures a SEK 21M ($2.1M) commitment from @adam3us , with rights to invest an additional SEK 128M ($12.8M) in tranches—bringing the total contemplated raise to SEK 277M (~$27.7M). pic.twitter.com/c0HgMSRxut

— H100 (@H100Group) June 3, 2025

Under the agreement, Back may invest up to SEK 128 million across four additional tranches, with guaranteed participation of at least 50%. Each tranche is twice his committed amount, demonstrating his support for H100’s long-term growth.

The press release said, “Adam Back may request the Second Tranche within 90 days from signing of the Initial Tranche, the Third Tranche within 90 days from signing of the Second Tranche, the Fourth Tranche within 90 days from signing of the Third Tranche and the Fifth Tranche within ninety 90 days from signing of the Fourth Tranche. In the event Adam Back does not request a Future Tranche within the deadline, the right to request subsequent Future Tranches lapses.”

The convertible loans have no interest and have a five year maturity. At any time, Back may convert the loans into shares of the Company. Conversion prices are fixed per tranche: SEK 1.75 per share for the initial tranche, rising to SEK 5.00 by the fifth tranche. H100 retains the right to force conversion if the stock price exceeds the conversion rate by 33% over a 20 day period. Full conversion of the initial tranche would result in 12 million new shares and a 9.3% dilution.

“Upon request of a tranche Adam Back is obliged to invest in the relevant Tranche with SEK 15,750,000 in the second tranche, SEK 23,625,000 in the third tranche, SEK 35,437,500 in the fourth tranche, and SEK 53,156,250 in the fifth tranche,” stated the press release. “The contemplated size for each tranche is twice the entitled amount of Adam Back.”

“We have been around since 2014 and we work with our investors to put Bitcoin in a balance sheet back then and since then,” said Adam Back at the 2025 Bitcoin Conference. “I think the way to look at the treasury companies is that Bitcoin is effectively the harder rate. It’s very hard to outperform Bitcoin most people that invest in things since Bitcoin around thought I should put that in Bitcoin and not in the other thing.”

This post Adam Back Invests SEK 21 Million to H100 Group Bitcoin Treasury Strategy first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 7f6db517:a4931eda

2025-06-04 09:01:27

@ 7f6db517:a4931eda

2025-06-04 09:01:27

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-04 09:01:28

@ 7f6db517:a4931eda

2025-06-04 09:01:28

"Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know. Privacy is the power to selectively reveal oneself to the world." - Eric Hughes, A Cypherpunk's Manifesto, 1993

Privacy is essential to freedom. Without privacy, individuals are unable to make choices free from surveillance and control. Lack of privacy leads to loss of autonomy. When individuals are constantly monitored it limits our ability to express ourselves and take risks. Any decisions we make can result in negative repercussions from those who surveil us. Without the freedom to make choices, individuals cannot truly be free.

Freedom is essential to acquiring and preserving wealth. When individuals are not free to make choices, restrictions and limitations prevent us from economic opportunities. If we are somehow able to acquire wealth in such an environment, lack of freedom can result in direct asset seizure by governments or other malicious entities. At scale, when freedom is compromised, it leads to widespread economic stagnation and poverty. Protecting freedom is essential to economic prosperity.

The connection between privacy, freedom, and wealth is critical. Without privacy, individuals lose the freedom to make choices free from surveillance and control. While lack of freedom prevents individuals from pursuing economic opportunities and makes wealth preservation nearly impossible. No Privacy? No Freedom. No Freedom? No Wealth.

Rights are not granted. They are taken and defended. Rights are often misunderstood as permission to do something by those holding power. However, if someone can give you something, they can inherently take it from you at will. People throughout history have necessarily fought for basic rights, including privacy and freedom. These rights were not given by those in power, but rather demanded and won through struggle. Even after these rights are won, they must be continually defended to ensure that they are not taken away. Rights are not granted - they are earned through struggle and defended through sacrifice.

If you found this post helpful support my work with bitcoin.

-

@ 32e18276:5c68e245

2025-06-03 14:45:17

@ 32e18276:5c68e245

2025-06-03 14:45:176 years ago I created some tools for working with peter todd's opentimestamps proof format. You can do some fun things like create plaintext and mini ots proofs. This short post is just a demo of what these tools do and how to use them.

What is OTS?

OpenTimestamps is a protocol for stamping information into bitcoin in a minimal way. It uses OP_RETURN outputs so that it has minimal impact on chain, and potentially millions of documents are stamped all at once with a merkle tree construction.

Examples

Here's the proof of the

ots.csource file getting stamped into the ots calendar merkle tree. We're simply printing the ots proof file here withotsprint:``` $ ./otsprint ots.c.ots

version 1 file_hash sha256 f76f0795ff37a24e566cd77d1996b64fab9c871a5928ab9389dfc3a128ec8296 append 2e9943d3833768bdb9a591f1d2735804 sha256 | --> append 2d82e7414811ecbf | sha256 | append a69d4f93e3e0f6c9b8321ce2cdd90decd34d260ea3f8b55e83d157ad398b7843 | sha256 | append ac0b5896401478eb6d88a408ec08b33fd303b574fb09b503f1ac1255b432d304 | sha256 | append 8aa9fd0245664c23d31d344243b4e8b0 | sha256 | prepend 414db5a1cd3a3e6668bf2dca9007e7c0fc5aa6dc71a2eab3afb51425c3acc472 | sha256 | append 5355b15d88d4dece45cddb7913f2c83d41e641e8c1d939dac4323671a4f8e197 | sha256 | append a2babd907ca513ab561ce3860e64a26b7df5de117f1f230bc8f1a248836f0c25 | sha256 | prepend 683f072f | append 2a4cdf9e9e04f2fd | attestation calendar https://alice.btc.calendar.opentimestamps.org | --> append 7c8764fcaba5ed5d | sha256 | prepend f7e1ada392247d3f3116a97d73fcf4c0994b5c22fff824736db46cd577b97151 | sha256 | append 3c43ac41e0281f1dbcd7e713eb1ffaec48c5e05af404bca2166cdc51966a921c | sha256 | append 07b18bd7f4a5dc72326416aa3c8628ca80c8d95d7b1a82202b90bc824974da13 | sha256 | append b4d641ab029e7d900e92261c2342c9c9 | sha256 | append 4968b89b02b534f33dc26882862d25cca8f0fa76be5b9d3a3b5e2d77690e022b | sha256 | append 48c54e30b3a9ec0e6339b88ed9d04b9b1065838596a4ec778cbfc0dfc0f8c781 | sha256 | prepend 683f072f | append 8b2b4beda36c18dc | attestation calendar https://bob.btc.calendar.opentimestamps.org | --> append baa878b42ef3e0d45b324cc3a39a247a | sha256 | prepend 4fb1bc663cd641ad18e5c73fb618de1ae3d28fb5c3c224b7f9888fd52feb09ec | sha256 | append 731329278830c9725497d70e9f5a02e4b2d9c73ff73560beb3a896a2f180fdbf | sha256 | append 689024a9d57ad5daad669f001316dd0fc690ac4520410f97a349b05a3f5d69cb | sha256 | append 69d42dcb650bb2a690f850c3f6e14e46c2b0831361bac9ec454818264b9102fd | sha256 | prepend 683f072f | append bab471ba32acd9c3 | attestation calendar https://btc.calendar.catallaxy.com append c3ccce274e2f9edfa354ec105cb1a749 sha256 append 6297b54e3ce4ba71ecb06bd5632fd8cbd50fe6427b6bfc53a0e462348cc48bab sha256 append c28f03545a2948bd0d8102c887241aff5d4f6cf1e0b16dfd8787bf45ca2ab93d sha256 prepend 683f072f append 7f3259e285891c8e attestation calendar https://finney.calendar.eternitywall.com ```

The tool can create a minimal version of the proofs:

``` $ ./otsmini ots.c.ots | ./otsmini -d | ./otsprint

version 1 file_hash sha256 f76f0795ff37a24e566cd77d1996b64fab9c871a5928ab9389dfc3a128ec8296 append 2e9943d3833768bdb9a591f1d2735804 sha256 append c3ccce274e2f9edfa354ec105cb1a749 sha256 append 6297b54e3ce4ba71ecb06bd5632fd8cbd50fe6427b6bfc53a0e462348cc48bab sha256 append c28f03545a2948bd0d8102c887241aff5d4f6cf1e0b16dfd8787bf45ca2ab93d sha256 prepend 683f072f append 7f3259e285891c8e attestation calendar https://finney.calendar.eternitywall.com ```

which can be shared on social media as a string:

5s1L3tTWoTfUDhB1MPLXE1rnajwUdUnt8pfjZfY1UWVWpWu5YhW3PGCWWoXwWBRJ16B8182kQgxnKyiJtGQgRoFNbDfBss19seDnco5sF9WrBt8jQW7BVVmTB5mmAPa8ryb5929w4xEm1aE7S3SGMFr9rUgkNNzhMg4VK6vZmNqDGYvvZxBtwDMs2PRJk7y6wL6aJmq6yoaWPvuxaik4qMp76ApXEufP6RnWdapqGGsKy7TNE6ZzWWz2VXbaEXGwgjrxqF8bMstZMdGo2VzpVuEyou can even do things like gpg-style plaintext proofs:

``` $ ./otsclear -e CONTRIBUTING.ots -----BEGIN OPENTIMESTAMPS MESSAGE-----

Email patches to William Casarin jb55@jb55.com

-----BEGIN OPENTIMESTAMPS PROOF-----

AE9wZW5UaW1lc3RhbXBzAABQcm9vZgC/ieLohOiSlAEILXj4GSagG6fRNnR+CHj9e/+Mdkp0w1us gV/5dmlX2NrwEDlcBMmQ723mI9sY9ALUlXoI//AQRXlCd716J60FudR+C78fkAjwIDnONJrj1udi NDxQQ8UJiS4ZWfprUxbvaIoBs4G+4u6kCPEEaD8Ft/AIeS/skaOtQRoAg9/jDS75DI4pKGh0dHBz Oi8vZmlubmV5LmNhbGVuZGFyLmV0ZXJuaXR5d2FsbC5jb23/8AhMLZVzYZMYqwjwEPKWanBNPZVm kqsAYV3LBbkI8CCfIVveDh/S8ykOH1NC6BKTerHoPojvj1OmjB2LYvdUbgjxBGg/BbbwCGoo3fi1 A7rjAIPf4w0u+QyOLi1odHRwczovL2FsaWNlLmJ0Yy5jYWxlbmRhci5vcGVudGltZXN0YW1wcy5v cmf/8Aik+VP+n3FhCwjwELfTdHAfYQNa49I3CYycFbkI8QRoPwW28AgCLn93967lIQCD3+MNLvkM jiwraHR0cHM6Ly9ib2IuYnRjLmNhbGVuZGFyLm9wZW50aW1lc3RhbXBzLm9yZ/AQ3bEwg7mjQyKR PykGgiJewAjwID5Q68dY4m+XogwTJx72ecQEe5lheCO1RnlcJSTFokyRCPEEaD8Ft/AIw1WWPe++ 8N4Ag9/jDS75DI4jImh0dHBzOi8vYnRjLmNhbGVuZGFyLmNhdGFsbGF4eS5jb20= -----END OPENTIMESTAMPS PROOF-----

$ ./otsclear -v <<<proof_string... # verify the proof string ```

I've never really shared these tools before, I just remembered about it today. Enjoy!

Try it out: https://github.com/jb55/ots-tools

-

@ dfa02707:41ca50e3

2025-06-04 09:01:25

@ dfa02707:41ca50e3

2025-06-04 09:01:25Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ 7f6db517:a4931eda

2025-06-04 09:01:25

@ 7f6db517:a4931eda

2025-06-04 09:01:25

Humanity's Natural State Is Chaos

Without order there is chaos. Humans competing with each other for scarce resources naturally leads to conflict until one group achieves significant power and instates a "monopoly on violence."Power Brings Stability

Power has always been the key means to achieve stability in societies. Centralized power can be incredibly effective in addressing issues such as crime, poverty, and social unrest efficiently. Unfortunately this power is often abused and corrupted.Centralized Power Breeds Tyranny

Centralized power often leads to tyrannical rule. When a select few individuals hold control over a society, they tend to become corrupted. Centralized power structures often lack accountability and transparency, and rely too heavily on trust.Distributed Power Cultivates Freedom

New technology that empowers individuals provide us the ability to rebuild societies from the bottom up. Strong individuals that can defend and provide for themselves will help build strong local communities on a similar foundation. The result is power being distributed throughout society rather than held by a select few.In the short term, relying on trust and centralized power is an easy answer to mitigating chaos, but freedom tech tools provide us the ability to build on top of much stronger distributed foundations that provide stability while also cultivating individual freedom.

The solution starts with us. Empower yourself. Empower others. A grassroots freedom tech movement scaling one person at a time.

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-06-04 09:01:23

@ dfa02707:41ca50e3

2025-06-04 09:01:23Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ 32e18276:5c68e245

2025-06-02 20:58:05

@ 32e18276:5c68e245

2025-06-02 20:58:05Damus OpenSats Grant Q1 2025 Progress Report

This period of the Damus OpenSats grant has been productive, and encompasses the work our beta release of Notedeck. Since we sent our last report on January, this encompasses all the work after then.

Damus Notedeck

We released the Beta version of Notedeck, which has many new features:

Dave

We've added a new AI-powered nostr assistant, similar to Grok on X. We call him Dave.

Dave is integrated with tooling that allows it to query the local relay for posts and profiles:

Search

The beta release includes a fulltext search interface powered by nostrdb:

Zaps

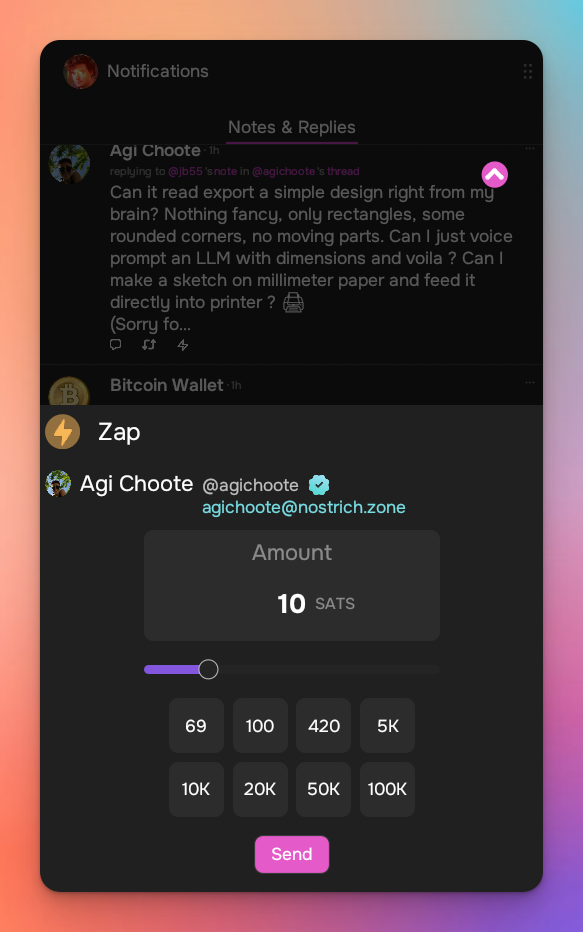

You can now zap with NWC!

And More!

- GIFs!

- Add full screen images, add zoom & pan

- Introduce last note per pubkey feed (experimental)

- Allow multiple media uploads per selection

- Major Android improvements (still wip)

- Added notedeck app sidebar

- User Tagging

- Note truncation

- Local network note broadcast, broadcast notes to other notedeck notes while you're offline

- Mute list support (reading)

- Relay list support

- Ctrl-enter to send notes

- Added relay indexing (relay columns soon)

- Click hashtags to open hashtag timeline

Damus iOS

Work continued on the iOS side. While I was not directly involved in the work since the last report, I have been directing and managing its development.

What's new:

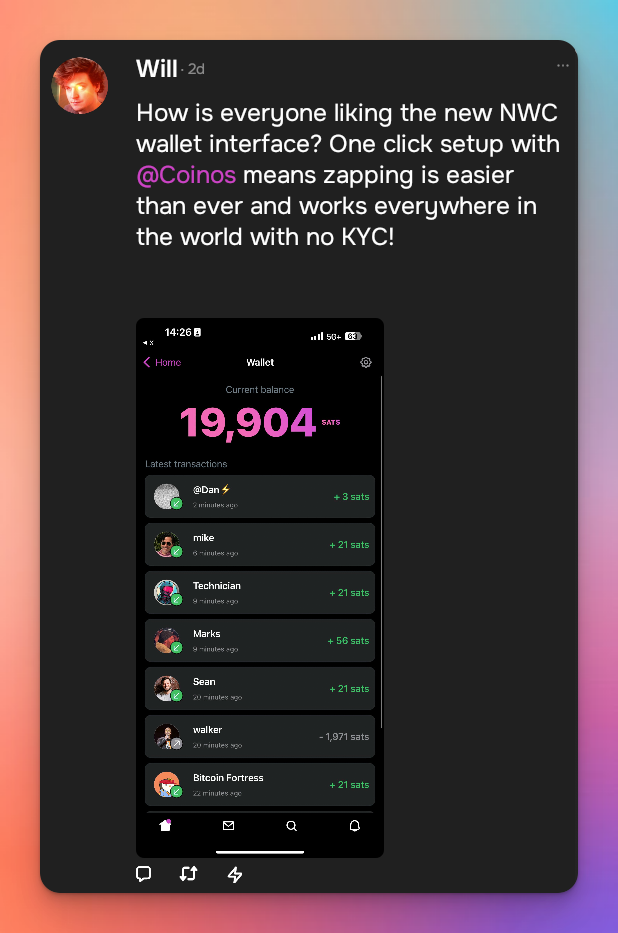

Coinos Wallet + Interface

We've partnered with coinos to enable a one-click, non-KYC lightning wallet!

We now have an NWC wallet interface, and we've re-enabled zaps as per the new appstore guidelines!

Now you can see all incoming and outgoing NWC transactions and start zapping right away.

Enhanced hellthread muting

Damus can now automatically mute hellthreads, instead of having to do that manually.

Drafts

We now locally persist note drafts so that they aren't lost on app restart!

Profile editing enhancements

We now have a profile picture editing tool so that profile pictures are optimized and optionally cropped

Conversations tab

We now have a conversations tab on user profiles, allowing you to see all of your past conversations with that person!

Enhanced push notifications

We've updated our push notifications to include profile pictures, and they are also now grouped by the thread that they came from.

And lots more!

Too many to list here, check out the full changelog

Nostrdb

nostrdb, the engine that powers notecrumbs, damus iOS, and notedeck, continued to improve:

Custom filters

We've added the ability to include custom filtering logic during any nostrdb query. Dave uses this to filter replies from kind1 results to keep the results small and to avoid doing post-processing.

Relay index + queries

There is a new relay index! Now when ingesting notes, you can include extra metadata such as where the note came from. You can use this index to quickly list all of the relays for a particular note, or for relay timelines.

NIP50 profile searches

To assist dave in searching for profiles, we added a new query plan for {kind:0, search:} queries to scan the profile search index.

How money was used

- relay.damus.io server costs

- Living expenses

Next quarter

We're making a strong push to get our Android version released, so that is the main focus for me.

-

@ dfa02707:41ca50e3

2025-06-04 09:01:22

@ dfa02707:41ca50e3

2025-06-04 09:01:22Contribute to keep No Bullshit Bitcoin news going.

-

Version 1.3 of Bitcoin Safe introduces a redesigned interactive chart, quick receive feature, updated icons, a mempool preview window, support for Child Pays For Parent (CPFP) and testnet4, preconfigured testnet demo wallets, as well as various bug fixes and improvements.

-

Upcoming updates for Bitcoin Safe include Compact Block Filters.

"Compact Block Filters increase the network privacy dramatically, since you're not asking an electrum server to give you your transactions. They are a little slower than electrum servers. For a savings wallet like Bitcoin Safe this should be OK," writes the project's developer Andreas Griffin.

- Learn more about the current and upcoming features of Bitcoin Safe wallet here.

What's new in v1.3

- Redesign of Chart, Quick Receive, Icons, and Mempool Preview (by @design-rrr).

- Interactive chart. Clicking on it now jumps to transaction, and selected transactions are now highlighted.

- Speed up transactions with Child Pays For Parent (CPFP).

- BDK 1.2 (upgraded from 0.32).

- Testnet4 support.

- Preconfigured Testnet demo wallets.

- Cluster unconfirmed transactions so that parents/children are next to each other.

- Customizable columns for all tables (optional view: Txid, Address index, and more)

- Bug fixes and other improvements.

Announcement / Archive

Blog Post / Archive

GitHub Repo

Website -

-

@ dfa02707:41ca50e3

2025-06-04 09:01:21

@ dfa02707:41ca50e3

2025-06-04 09:01:21Contribute to keep No Bullshit Bitcoin news going.

This update brings key enhancements for clarity and usability:

- Recent Blocks View: Added to the Send tab and inspired by Mempool's visualization, it displays the last 2 blocks and the estimated next block to help choose fee rates.

- Camera System Overhaul: Features a new library for higher resolution detection and mouse-scroll zoom support when available.

- Vector-Based Images: All app images are now vectorized and theme-aware, enhancing contrast, especially in dark mode.

- Tor & P2A Updates: Upgraded internal Tor and improved support for pay-to-anchor (P2A) outputs.

- Linux Package Rename: For Linux users, Sparrow has been renamed to sparrowwallet (or sparrowserver); in some cases, the original sparrow package may need manual removal.

- Additional updates include showing total payments in multi-payment transaction diagrams, better handling of long labels, and other UI enhancements.

- Sparrow v2.2.1 is a bug fix release that addresses missing UUID issue when starting Tor on recent macOS versions, icons for external sources in Settings and Recent Blocks view, repackaged

.debinstalls to use older gzip instead of zstd compression, and removed display of median fee rate where fee rates source is set to Server.

Learn how to get started with Sparrow wallet:

Release notes (v2.2.0)

- Added Recent Blocks view to Send tab.

- Converted all bitmapped images to theme aware SVG format for all wallet models and dialogs.

- Support send and display of pay to anchor (P2A) outputs.

- Renamed

sparrowpackage tosparrowwalletandsparrowserveron Linux. - Switched camera library to openpnp-capture.

- Support FHD (1920 x 1080) and UHD4k (3840 x 2160) capture resolutions.

- Support camera zoom with mouse scroll where possible.

- In the Download Verifier, prefer verifying the dropped file over the default file where the file is not in the manifest.

- Show a warning (with an option to disable the check) when importing a wallet with a derivation path matching another script type.

- In Cormorant, avoid calling the

listwalletdirRPC on initialization due to a potentially slow response on Windows. - Avoid server address resolution for public servers.

- Assume server address is non local for resolution failures where a proxy is configured.

- Added a tooltip to indicate truncated labels in table cells.

- Dynamically truncate input and output labels in the tree on a transaction tab, and add tooltips if necessary.

- Improved tooltips for wallet tabs and transaction diagrams with long labels.

- Show the address where available on input and output tooltips in transaction tab tree.

- Show the total amount sent in payments in the transaction diagram when constructing multiple payment transactions.

- Reset preferred table column widths on adjustment to improve handling after window resizing.

- Added accessible text to improve screen reader navigation on seed entry.

- Made Wallet Summary table grow horizontally with dialog sizing.

- Reduced tooltip show delay to 200ms.

- Show transaction diagram fee percentage as less than 0.01% rather than 0.00%.

- Optimized and reduced Electrum server RPC calls.

- Upgraded Bouncy Castle, PGPainless and Logback libraries.

- Upgraded internal Tor to v0.4.8.16.

- Bug fix: Fixed issue with random ordering of keystore origins on labels import.

- Bug fix: Fixed non-zero account script type detection when signing a message on Trezor devices.

- Bug fix: Fixed issue parsing remote Coldcard xpub encoded on a different network.

- Bug fix: Fixed inclusion of fees on wallet label exports.

- Bug fix: Increase Trezor device libusb timeout.

Linux users: Note that the

sparrowpackage has been renamed tosparrowwalletorsparrowserver, and in some cases you may need to manually uninstall the originalsparrowpackage. Look in the/optfolder to ensure you have the new name, and the original is removed.What's new in v2.2.1

- Updated Tor library to fix missing UUID issue when starting Tor on recent macOS versions.

- Repackaged

.debinstalls to use older gzip instead of zstd compression. - Removed display of median fee rate where fee rates source is set to Server.

- Added icons for external sources in Settings and Recent Blocks view

- Bug fix: Fixed issue in Recent Blocks view when switching fee rates source

- Bug fix: Fixed NPE on null fee returned from server

-

@ dfa02707:41ca50e3

2025-06-04 09:01:21

@ dfa02707:41ca50e3

2025-06-04 09:01:21- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ 7f6db517:a4931eda

2025-06-04 09:01:27

@ 7f6db517:a4931eda

2025-06-04 09:01:27

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-06-04 09:01:24

@ dfa02707:41ca50e3

2025-06-04 09:01:24

Good morning (good night?)! The No Bullshit Bitcoin news feed is now available on Moody's Dashboard! A huge shoutout to sir Clark Moody for integrating our feed.

Headlines

- Spiral welcomes Ben Carman. The developer will work on the LDK server and a new SDK designed to simplify the onboarding process for new self-custodial Bitcoin users.

- The Bitcoin Dev Kit Foundation announced new corporate members for 2025, including AnchorWatch, CleanSpark, and Proton Foundation. The annual dues from these corporate members fund the small team of open-source developers responsible for maintaining the core BDK libraries and related free and open-source software (FOSS) projects.

- Strategy increases Bitcoin holdings to 538,200 BTC. In the latest purchase, the company has spent more than $555M to buy 6,556 coins through proceeds of two at-the-market stock offering programs.

- Spar supermarket experiments with Bitcoin payments in Zug, Switzerland. The store has introduced a new payment method powered by the Lightning Network. The implementation was facilitated by DFX Swiss, a service that supports seamless conversions between bitcoin and legacy currencies.

- The Bank for International Settlements (BIS) wants to contain 'crypto' risks. A report titled "Cryptocurrencies and Decentralised Finance: Functions and Financial Stability Implications" calls for expanding research into "how new forms of central bank money, capital controls, and taxation policies can counter the risks of widespread crypto adoption while still fostering technological innovation."

- "Global Implications of Scam Centres, Underground Banking, and Illicit Online Marketplaces in Southeast Asia." According to the United Nations Office on Drugs and Crime (UNODC) report, criminal organizations from East and Southeast Asia are swiftly extending their global reach. These groups are moving beyond traditional scams and trafficking, creating sophisticated online networks that include unlicensed cryptocurrency exchanges, encrypted communication platforms, and stablecoins, fueling a massive fraud economy on an industrial scale.

- Slovenia is considering a 25% capital gains tax on Bitcoin profits for individuals. The Ministry of Finance has proposed legislation to impose this tax on gains from cryptocurrency transactions, though exchanging one cryptocurrency for another would remain exempt. At present, individual 'crypto' traders in Slovenia are not taxed.

- Circle, BitGo, Coinbase, and Paxos plan to apply for U.S. bank charters or licenses. According to a report in The Wall Street Journal, major crypto companies are planning to apply for U.S. bank charters or licenses. These firms are pursuing limited licenses that would permit them to issue stablecoins, as the U.S. Congress deliberates on legislation mandating licensing for stablecoin issuers.

"Established banks, like Bank of America, are hoping to amend the current drafts of [stablecoin] legislation in such a way that nonbanks are more heavily restricted from issuing stablecoins," people familiar with the matter told The Block.

- Charles Schwab to launch spot Bitcoin trading by 2026. The financial investment firm, managing over $10 trillion in assets, has revealed plans to introduce spot Bitcoin trading for its clients within the next year.

Use the tools

- Bitcoin Safe v1.2.3 expands QR SignMessage compatibility for all QR-UR-compatible hardware signers (SpecterDIY, KeyStone, Passport, Jade; already supported COLDCARD Q). It also adds the ability to import wallets via QR, ensuring compatibility with Keystone's latest firmware (2.0.6), alongside other improvements.

- Minibits v0.2.2-beta, an ecash wallet for Android devices, packages many changes to align the project with the planned iOS app release. New features and improvements include the ability to lock ecash to a receiver's pubkey, faster confirmations of ecash minting and payments thanks to WebSockets, UI-related fixes, and more.

- Zeus v0.11.0-alpha1 introduces Cashu wallets tied to embedded LND wallets. Navigate to Settings > Ecash to enable it. Other wallet types can still sweep funds from Cashu tokens. Zeus Pay now supports Cashu address types in Zaplocker, Cashu, and NWC modes.

- LNDg v1.10.0, an advanced web interface designed for analyzing Lightning Network Daemon (LND) data and automating node management tasks, introduces performance improvements, adds a new metrics page for unprofitable and stuck channels, and displays warnings for batch openings. The Profit and Loss Chart has been updated to include on-chain costs. Advanced settings have been added for users who would like their channel database size to be read remotely (the default remains local). Additionally, the AutoFees tool now uses aggregated pubkey metrics for multiple channels with the same peer.

- Nunchuk Desktop v1.9.45 release brings the latest bug fixes and improvements.

- Blockstream Green iOS v4.1.8 has renamed L-BTC to LBTC, and improves translations of notifications, login time, and background payments.

- Blockstream Green Android v4.1.8 has added language preference in App Settings and enables an Android data backup option for disaster recovery. Additionally, it fixes issues with Jade entry point PIN timeout and Trezor passphrase input.

- Torq v2.2.2, an advanced Lightning node management software designed to handle large nodes with over 1000 channels, fixes bugs that caused channel balance to not be updated in some cases and channel "peer total local balance" not getting updated.

- Stack Wallet v2.1.12, a multicoin wallet by Cypher Stack, fixes an issue with Xelis introduced in the latest release for Windows.

- ESP-Miner-NerdQAxePlus v1.0.29.1, a forked version from the NerdAxe miner that was modified for use on the NerdQAxe+, is now available.

- Zark enables sending sats to an npub using Bark.

- Erk is a novel variation of the Ark protocol that completely removes the need for user interactivity in rounds, addressing one of Ark's key limitations: the requirement for users to come online before their VTXOs expire.

- Aegis v0.1.1 is now available. It is a Nostr event signer app for iOS devices.

- Nostash is a NIP-07 Nostr signing extension for Safari. It is a fork of Nostore and is maintained by Terry Yiu. Available on iOS TestFlight.

- Amber v3.2.8, a Nostr event signer for Android, delivers the latest fixes and improvements.

- Nostur v1.20.0, a Nostr client for iOS, adds

-

@ c1e9ab3a:9cb56b43

2025-06-01 13:54:06

@ c1e9ab3a:9cb56b43

2025-06-01 13:54:061. Introduction

Over the last 250 years the world’s appetite for energy has soared along an unmistakably exponential trajectory, transforming societies and economies alike. After a half‑century of relative deceleration, a new mix of technological, demographic and political forces now hints at an impending catch‑up phase that could push demand back onto its centuries‑long growth curve. This post knits together the history, the numbers and the newest policy signals to explore what that rebound might look like—and how Gen‑4 nuclear power could meet it.

2. The Long Exponential: 1750 – 1975

Early industrialisation replaced muscle, wood and water with coal‑fired steam, pushing global primary energy use from a few exajoules per year in 1750 to roughly 60 EJ by 1900 and 250 EJ by 1975. Over that span aggregate consumption doubled roughly every 25–35 years, equivalent to a long‑run compound growth rate of ~3 % yr‑¹. Per‑capita use climbed even faster in industrialised economies as factories, railways and electric lighting spread.

3. 1975 – 2025: The Great Slowdown

3.1 Efficiency & Structural Change

• Oil shocks (1973, 1979) and volatile prices pushed OECD economies to squeeze more GDP from each joule.

• Services displaced heavy industry in rich countries, trimming energy intensity.

• Refrigerators, motors and vehicles became dramatically more efficient.3.2 Policy & Technology

• The Inflation Reduction Act (U.S.) now layers zero‑emission production credits and technology‑neutral tax incentives on top of existing nuclear PTCs citeturn1search0turn1search2.

• The EU’s Net‑Zero Industry Act aims to streamline siting and finance for “net‑zero technologies”, explicitly naming advanced nuclear citeturn0search1.3.3 Result

Global primary energy in 2024 stands near 600 EJ (≈ 167 000 TWh)—still growing, but the line has flattened versus the pre‑1975 exponential.

4. Population & Per‑Capita Demand

World population tripled between 1950 and today, yet total energy use grew roughly six‑fold. The imbalance reflects rising living standards and electrification. Looking ahead, the UN projects population to plateau near 10.4 billion in the 2080s, but per‑capita demand is poised to climb as the Global South industrialises.

5. The Policy Pivot of 2023‑2025

| Region | Signal | Year | Implication | |--------|--------|------|-------------| | COP 28 Declaration | 20+ nations pledge to triple nuclear capacity by 2050 | 2023 | High‑level political cover for rapid nuclear build‑out citeturn0search2 | | Europe | Post‑crisis sentiment shifts; blackout in Iberia re‑opens nuclear debate | 2025 | Spain, Germany, Switzerland and others revisit phase‑outs citeturn0news63 | | United States | TVA submits first SMR construction permit; NRC advances BWRX‑300 review | 2025 | Regulatory pathway for fleet deployment citeturn1search9turn1search1 | | Global Strategy Report | “Six Dimensions for Success” playbook for new nuclear entrants | 2025 | Practical roadmap for emerging economies citeturn0search0 | | U.S. Congress | Proposed cuts to DOE loan office threaten build‑out pace | 2025 | Finance bottleneck remains a risk citeturn1news28 |

6. The Catch‑Up Scenario

Suppose the recent 50‑year pause ends in 2025, and total energy demand returns to a midpoint historical doubling period of 12.5 years (the average of the 10–15 year rebound window).

6.1 Consumption Trajectory

| Year | Doublings since 2024 | Demand (TWh) | |------|----------------------|--------------| | 2024 | 0 | 167 000 | | 2037 | 1 | 334 000 | | 2050 | 2 | 668 000 | | 2062 | 3 | 1 336 000 |

(Table ignores efficiency gains from electrification for a conservative, supply‑side sizing.)

7. Nuclear‑Only Supply Model

7.1 Reactor Math

- 1 GWᵉ Gen‑4 reactor → 8.76 TWh yr‑¹ at 100 % capacity factor.

- 2062 requirement: 1 336 000 TWh yr‑¹ → ≈ 152 500 reactors in steady state.

- Build rate (2025‑2062, linear deployment):

152 500 ÷ 38 years ≈ 4 000 reactors per year globally.

(Down from the earlier 5 000 yr‑¹ estimate because the deployment window now stretches 38 years instead of 30.)

7.2 Policy Benchmarks

- COP 28 triple target translates to +780 GW (if baseline 2020 ≈ 390 GW). That is <100 1 GW units per year—two orders of magnitude lower than the theoretical catch‑up requirement, highlighting just how aggressive our thought experiment is.

7.3 Distributed vs Grid‑Centric

Small Modular Reactors (300 MW class) can be sited on retiring coal plants, using existing grid interconnects and cooling, vastly reducing new transmission needs. Ultra‑large “gigawatt corridors” become optional rather than mandatory, though meshed regional grids still improve resilience and market liquidity.

8. Challenges & Unknowns

- Finance: Even with IRA‑style credits, first‑of‑a‑kind Gen‑4 builds carry high cost of capital.

- Supply Chain: 4 000 reactors a year means a reactor‑grade steel output roughly 20× today’s level.

- Waste & Public Trust: Advanced reactors can burn actinides, but geologic repositories remain essential.

- Workforce: Nuclear engineers, welders and regulators are already in short supply.

- Competing Technologies: Cheap renewables + storage and prospective fusion could displace part of the projected load.

9. Conclusions

Recent policy shifts—from Europe’s Net‑Zero Industry Act to the COP 28 nuclear declaration—signal that governments once again see nuclear energy as indispensable to deep decarbonisation. Yet meeting an exponential catch‑up in demand would require deployment rates an order of magnitude beyond today’s commitments, testing manufacturing capacity, finance and political resolve.

Whether the future follows the modest path now embedded in policy or the steeper curve sketched here, two convictions stand out:

- Electrification will dominate new energy demand.

- Scalable, dispatchable low‑carbon generation—likely including large fleets of Gen‑4 fission plants—must fill much of that gap if net‑zero targets are to remain credible.

Last updated 1 June 2025.

-

@ 8bad92c3:ca714aa5

2025-06-04 09:01:14

@ 8bad92c3:ca714aa5

2025-06-04 09:01:14Key Takeaways

Michael Goldstein, aka Bitstein, presents a sweeping philosophical and economic case for going “all in” on Bitcoin, arguing that unlike fiat, which distorts capital formation and fuels short-term thinking, Bitcoin fosters low time preference, meaningful saving, and long-term societal flourishing. At the heart of his thesis is “hodling for good”—a triple-layered idea encompassing permanence, purpose, and the pursuit of higher values like truth, beauty, and legacy. Drawing on thinkers like Aristotle, Hoppe, and Josef Pieper, Goldstein redefines leisure as contemplation, a vital practice in aligning capital with one’s deepest ideals. He urges Bitcoiners to think beyond mere wealth accumulation and consider how their sats can fund enduring institutions, art, and architecture that reflect a moral vision of the future.

Best Quotes

“Let BlackRock buy the houses, and you keep the sats.”

“We're not hodling just for the sake of hodling. There is a purpose to it.”

“Fiat money shortens your time horizon… you can never rest.”

“Savings precedes capital accumulation. You can’t build unless you’ve saved.”

“You're increasing the marginal value of everyone else’s Bitcoin.”

“True leisure is contemplation—the pursuit of the highest good.”

“What is Bitcoin for if not to make the conditions for magnificent acts of creation possible?”

“Bitcoin itself will last forever. Your stack might not. What will outlast your coins?”

“Only a whale can be magnificent.”

“The market will sell you all the crack you want. It’s up to you to demand beauty.”

Conclusion

This episode is a call to reimagine Bitcoin as more than a financial revolution—it’s a blueprint for civilizational renewal. Michael Goldstein reframes hodling as an act of moral stewardship, urging Bitcoiners to lower their time preference, build lasting institutions, and pursue truth, beauty, and legacy—not to escape the world, but to rebuild it on sound foundations.

Timestamps

00:00 - Intro

00:50 - Michael’s BBB presentation Hodl for Good

07:27 - Austrian principles on capital

15:40 - Fiat distorts the economic process

23:34 - Bitkey

24:29 - Hodl for Good triple entendre

29:52 - Bitcoin benefits everyone

39:05 - Unchained

40:14 - Leisure theory of value

52:15 - Heightening life

1:15:48 - Breaking from the chase makes room for magnificence

1:32:32 - Nakamoto Institute’s missionTranscript

(00:00) Fiat money is by its nature a disturbance. If money is being continually produced, especially at an uncertain rate, these uh policies are really just redistribution of wealth. Most are looking for number to go up post hyper bitcoinization. The rate of growth of bitcoin would be more reflective of the growth of the economy as a whole.

(00:23) Ultimately, capital requires knowledge because it requires knowing there is something that you can add to the structures of production to lengthen it in some way that will take time but allow you to have more in the future than you would today. Let Black Rockck buy the houses and you keep the sats, not the other way around.

(00:41) You wait until later for Larry Frink to try to sell you a [Music] mansion. And we're live just like that. Just like that. 3:30 on a Friday, Memorial Day weekend. It's a good good good way to end the week and start the holiday weekend. Yes, sir. Yes, sir. Thank you for having me here. Thank you for coming. I wore this hat specifically because I think it's I think it's very apppropo uh to the conversation we're going to have which is I hope an extension of the presentation you gave at Bitblock Boom Huddle for good. You were working on

(01:24) that for many weeks leading up to uh the conference and explaining how you were structuring it. I think it's a very important topic to discuss now as the Bitcoin price is hitting new all-time highs and people are trying to understand what am I doing with Bitcoin? Like you have you have the different sort of factions within Bitcoin.

(01:47) Uh get on a Bitcoin standard, get on zero, spend as much Bitcoin as possible. You have the sailors of the world are saying buy Bitcoin, never sell, die with your Bitcoin. And I think you do a really good job in that presentation. And I just think your understanding overall of Bitcoin is incredible to put everything into context. It's not either or.