-

@ 7f6db517:a4931eda

2025-05-29 18:02:59

@ 7f6db517:a4931eda

2025-05-29 18:02:59

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

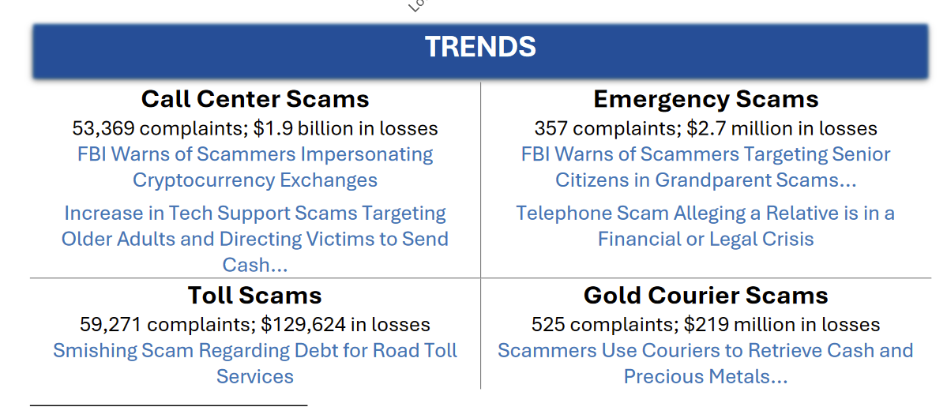

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-29 18:02:58

@ 7f6db517:a4931eda

2025-05-29 18:02:58

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

The four main banks of bitcoin and “crypto” are Signature, Prime Trust, Silvergate, and Silicon Valley Bank. Prime Trust does not custody funds themselves but rather maintains deposit accounts at BMO Harris Bank, Cross River, Lexicon Bank, MVB Bank, and Signature Bank. Silvergate and Silicon Valley Bank have already stopped withdrawals. More banks will go down before the chaos stops. None of them have sufficient reserves to meet withdrawals.

Bitcoin gives us all the ability to opt out of a system that has massive layers of counterparty risk built in, years of cheap money and broken incentives have layered risk on top of risk throughout the entire global economy. If you thought the FTX bank run was painful to watch, I have bad news for you: every major bank in the world is fractional reserve. Bitcoin held in self custody is unique in its lack of counterparty risk, as global market chaos unwinds this will become much more obvious.

The rules of bitcoin are extremely hard to change by design. Anyone can access the network directly without a trusted third party by using their own node. Owning more bitcoin does not give you more control over the network with all participants on equal footing.

Bitcoin is:

- money that is not controlled by a company or government

- money that can be spent or saved without permission

- money that is provably scarce and should increase in purchasing power with adoptionBitcoin is money without trust. Whether you are a nation state, corporation, or an individual, you can use bitcoin to spend or save without permission. Social media will accelerate the already deteriorating trust in our institutions and as this trust continues to crumble the value of trust minimized money will become obvious. As adoption increases so should the purchasing power of bitcoin.

A quick note on "stablecoins," such as USDC - it is important to remember that they rely on trusted custodians. They have the same risk as funds held directly in bank accounts with additional counterparty risk on top. The trusted custodians can be pressured by gov, exit scam, or caught up in fraud. Funds can and will be frozen at will. This is a distinctly different trust model than bitcoin, which is a native bearer token that does not rely on any centralized entity or custodian.

Most bitcoin exchanges have exposure to these failing banks. Expect more chaos and confusion as this all unwinds. Withdraw any bitcoin to your own wallet ASAP.

Simple Self Custody Guide: https://werunbtc.com/muun

More Secure Cold Storage Guide: https://werunbtc.com/coldcard

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-29 18:02:57

@ 7f6db517:a4931eda

2025-05-29 18:02:57

I often hear "bitcoin doesn't interest me, I'm not a finance person."

Ironically, the beauty of sound money is you don't have to be. In the current system you're expected to manage a diversified investment portfolio or pay someone to do it. Bitcoin will make that optional.

— ODELL (@ODELL) September 16, 2018

At first glance bitcoin often appears overwhelming to newcomers. It is incredibly easy to get bogged down in the details of how it works or different ways to use it. Enthusiasts, such as myself, often enjoy going down the deep rabbit hole of the potential of bitcoin, possible pitfalls and theoretical scenarios, power user techniques, and the developer ecosystem. If your first touch point with bitcoin is that type of content then it is only natural to be overwhelmed. While it is important that we have a thriving community of bitcoiners dedicated to these complicated tasks - the true beauty of bitcoin lies in its simplicity. Bitcoin is simply better money. It is the best money we have ever had.

Life is complicated. Life is hard. Life is full of responsibility and surprises. Bitcoin allows us to focus on our lives while relying on a money that is simple. A money that is not controlled by any individual, company, or government. A money that cannot be easily seized or blocked. A money that cannot be devalued at will by a handful of corrupt bureaucrat who live hundreds of miles from us. A money that can be easily saved and should increase in purchasing power over time without having to learn how to "build a diversified stock portfolio" or hire someone to do it for us.

Bitcoin enables all of us to focus on our lives - our friends and family - doing what we love with the short time we have on this earth. Time is scarce. Life is complicated. Bitcoin is the most simple aspect of our complicated lives. If we spend our scarce time working then we should be able to easily save that accrued value for future generations without watching the news or understanding complicated financial markets. Bitcoin makes this possible for anyone.

Yesterday was Mother's Day. Raising a human is complicated. It is hard, it requires immense personal responsibility, it requires critical thinking, but mothers figure it out, because it is worth it. Using and saving bitcoin is simple - simply install an app on your phone. Every mother can do it. Every person can do it.

Life is complicated. Life is beautiful. Bitcoin is simple.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-29 18:02:56

@ 7f6db517:a4931eda

2025-05-29 18:02:56

For years American bitcoin miners have argued for more efficient and free energy markets. It benefits everyone if our energy infrastructure is as efficient and robust as possible. Unfortunately, broken incentives have led to increased regulation throughout the sector, incentivizing less efficient energy sources such as solar and wind at the detriment of more efficient alternatives.

The result has been less reliable energy infrastructure for all Americans and increased energy costs across the board. This naturally has a direct impact on bitcoin miners: increased energy costs make them less competitive globally.

Bitcoin mining represents a global energy market that does not require permission to participate. Anyone can plug a mining computer into power and internet to get paid the current dynamic market price for their work in bitcoin. Using cellphone or satellite internet, these mines can be located anywhere in the world, sourcing the cheapest power available.

Absent of regulation, bitcoin mining naturally incentivizes the build out of highly efficient and robust energy infrastructure. Unfortunately that world does not exist and burdensome regulations remain the biggest threat for US based mining businesses. Jurisdictional arbitrage gives miners the option of moving to a friendlier country but that naturally comes with its own costs.

Enter AI. With the rapid development and release of AI tools comes the requirement of running massive datacenters for their models. Major tech companies are scrambling to secure machines, rack space, and cheap energy to run full suites of AI enabled tools and services. The most valuable and powerful tech companies in America have stumbled into an accidental alliance with bitcoin miners: THE NEED FOR CHEAP AND RELIABLE ENERGY.

Our government is corrupt. Money talks. These companies will push for energy freedom and it will greatly benefit us all.

Microsoft Cloud hiring to "implement global small modular reactor and microreactor" strategy to power data centers: https://www.datacenterdynamics.com/en/news/microsoft-cloud-hiring-to-implement-global-small-modular-reactor-and-microreactor-strategy-to-power-data-centers/

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-29 18:02:56

@ 7f6db517:a4931eda

2025-05-29 18:02:56

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-29 18:02:56

@ 7f6db517:a4931eda

2025-05-29 18:02:56

Influencers would have you believe there is an ongoing binance bank run but bitcoin wallet data says otherwise.

- binance wallets are near all time highs

- bitfinex wallets are also trending up

- gemini and coinbase are being hit with massive withdrawals thoughYou should not trust custodians, they can rug you without warning. It is incredibly important you learn how to hold bitcoin yourself, but also consider not blindly trusting influencers with a ref link to shill you.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-29 18:02:56

@ 7f6db517:a4931eda

2025-05-29 18:02:56

Humanity's Natural State Is Chaos

Without order there is chaos. Humans competing with each other for scarce resources naturally leads to conflict until one group achieves significant power and instates a "monopoly on violence."Power Brings Stability

Power has always been the key means to achieve stability in societies. Centralized power can be incredibly effective in addressing issues such as crime, poverty, and social unrest efficiently. Unfortunately this power is often abused and corrupted.Centralized Power Breeds Tyranny

Centralized power often leads to tyrannical rule. When a select few individuals hold control over a society, they tend to become corrupted. Centralized power structures often lack accountability and transparency, and rely too heavily on trust.Distributed Power Cultivates Freedom

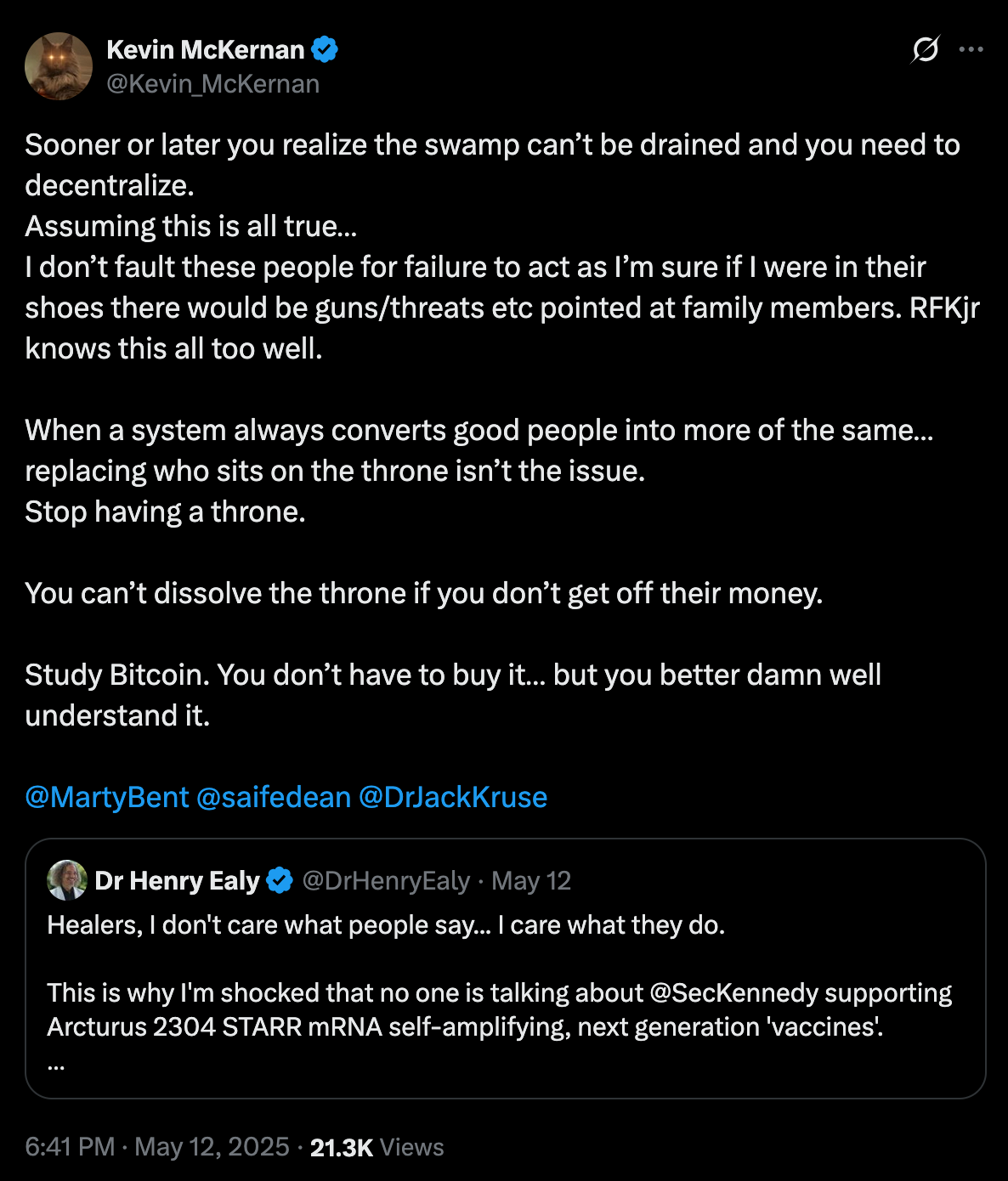

New technology that empowers individuals provide us the ability to rebuild societies from the bottom up. Strong individuals that can defend and provide for themselves will help build strong local communities on a similar foundation. The result is power being distributed throughout society rather than held by a select few.In the short term, relying on trust and centralized power is an easy answer to mitigating chaos, but freedom tech tools provide us the ability to build on top of much stronger distributed foundations that provide stability while also cultivating individual freedom.

The solution starts with us. Empower yourself. Empower others. A grassroots freedom tech movement scaling one person at a time.

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-05-29 18:02:55

@ dfa02707:41ca50e3

2025-05-29 18:02:55News

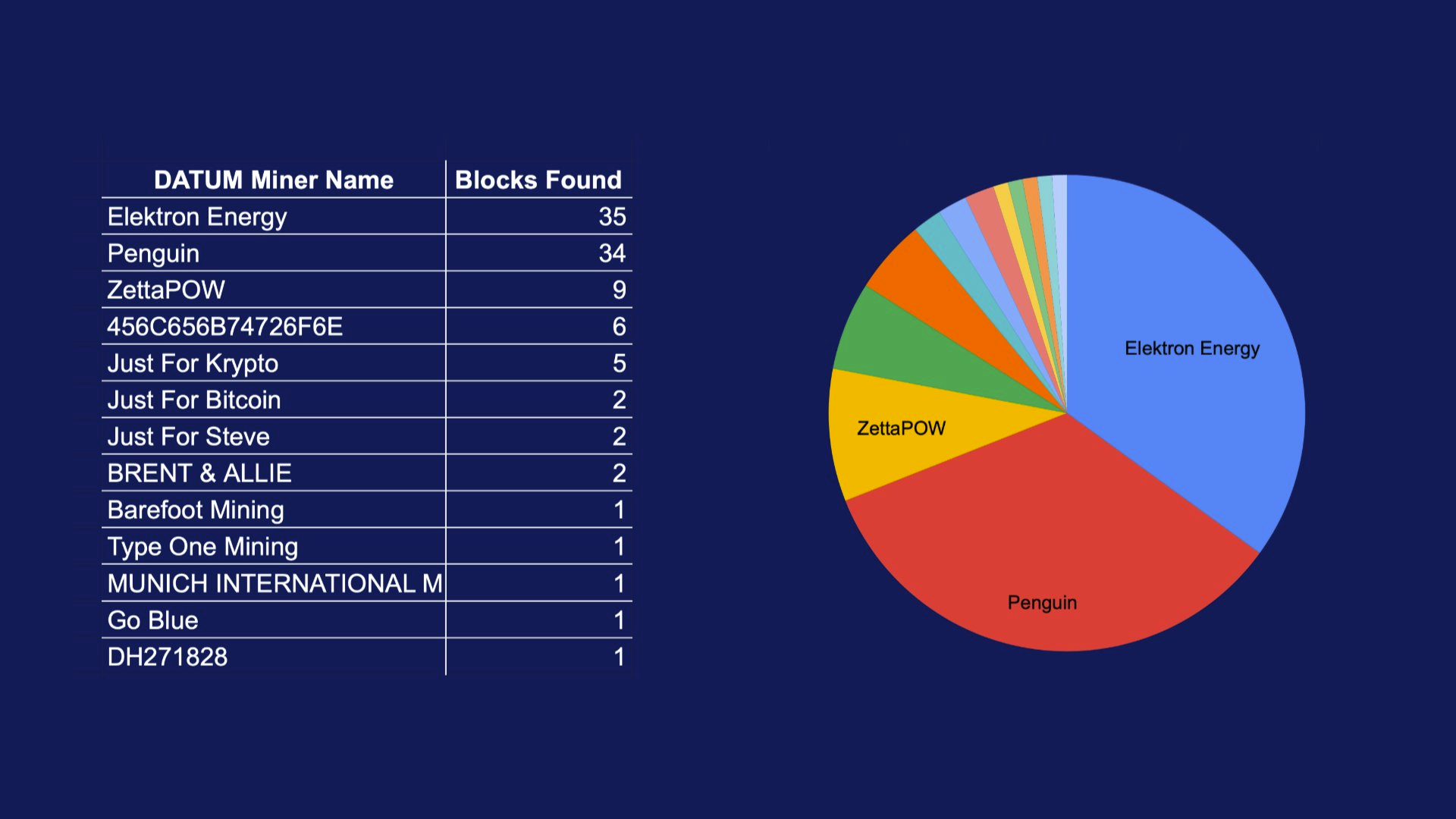

- Bitcoin mining centralization in 2025. According to a blog post by b10c, Bitcoin mining was at its most decentralized in May 2017, with another favorable period from 2019 to 2022. However, starting in 2023, mining has become increasingly centralized, particularly due to the influence of large pools like Foundry and the use of proxy pooling by entities such as AntPool.

Source: b10c's blog.

- OpenSats announces the eleventh wave of Nostr grants. The five projects in this wave are the mobile live-streaming app Swae, the Nostr-over-ham-radio project HAMSTR, Vertex—a Web-of-Trust (WOT) service for Nostr developers, Nostr Double Ratchet for end-to-end encrypted messaging, and the Nostr Game Engine for building games and applications integrated with the Nostr ecosystem.

- New Spiral grantee: l0rinc. In February 2024, l0rinc transitioned to full-time work on Bitcoin Core. His efforts focus on performance benchmarking and optimizations, enhancing code quality, conducting code reviews, reducing block download times, optimizing memory usage, and refactoring code.

- Project Eleven offers 1 BTC to break Bitcoin's cryptography with a quantum computer. The quantum computing research organization has introduced the Q-Day Prize, a global challenge that offers 1 BTC to the first team capable of breaking an elliptic curve cryptographic (ECC) key using Shor’s algorithm on a quantum computer. The prize will be awarded to the first team to successfully accomplish this breakthrough by April 5, 2026.

- Unchained has launched the Bitcoin Legacy Project. The initiative seeks to advance the Bitcoin ecosystem through a bitcoin-native donor-advised fund platform (DAF), investments in community hubs, support for education and open-source development, and a commitment to long-term sustainability with transparent annual reporting.

- In its first year, the program will provide support to Bitcoin hubs in Nashville, Austin, and Denver.

- Support also includes $50,000 to the Bitcoin Policy Institute, a $150,000 commitment at the University of Austin, and up to $250,000 in research grants through the Bitcoin Scholars program.

"Unchained will match grants 1:1 made to partner organizations who support Bitcoin Core development when made through the Unchained-powered bitcoin DAF, up to 1 BTC," was stated in a blog post.

- Block launched open-source tools for Bitcoin treasury management. These include a dashboard for managing corporate bitcoin holdings and provides a real-time BTC-to-USD price quote API, released as part of the Block Open Source initiative. The company’s own instance of the bitcoin holdings dashboard is available here.

Source: block.xyz

- Bull Bitcoin expands to Mexico, enabling anyone in the country to receive pesos from anywhere in the world straight from a Bitcoin wallet. Additionally, users can now buy Bitcoin with a Mexican bank account.

"Bull Bitcoin strongly believes in Bitcoin’s economic potential in Mexico, not only for international remittances and tourism, but also for Mexican individuals and companies to reclaim their financial sovereignty and protect their wealth from inflation and the fragility of traditional financial markets," said Francis Pouliot, Founder and CEO of Bull Bitcoin.

- Corporate bitcoin holdings hit a record high in Q1 2025. According to Bitwise, public companies' adoption of Bitcoin has hit an all-time high. In Q1 2025, these firms collectively hold over 688,000 BTC, marking a 16.11% increase from the previous quarter. This amount represents 3.28% of Bitcoin's fixed 21 million supply.

Source: Bitwise.

- The Bitcoin Bond Company for institutions has launched with the aim of acquiring $1 trillion in Bitcoin over 21 years. It utilizes secure, transparent, and compliant bond-like products backed by Bitcoin.

- The U.S. Senate confirmed Paul Atkins as Chair of the Securities and Exchange Commission (SEC). At his confirmation hearing, Atkins emphasized the need for a clear framework for digital assets. He aims to collaborate with the CFTC and Congress to address jurisdiction and rulemaking gaps, aligning with the Trump administration's goal to position the U.S. as a leader in Bitcoin and blockchain finance.

- Ethereum developer Virgil Griffith has been released from custody. Griffith, whose sentence was reduced to 56 months, is now seeking a pardon. He was initially sentenced to 63 months for allegedly violating international sanctions laws by providing technical advice on using cryptocurrencies and blockchain technology to evade sanctions during a presentation titled 'Blockchains for Peace' in North Korea.

- No-KYC exchange eXch to close down under money laundering scrutiny. The privacy-focused cryptocurrency trading platform said it will cease operations on May 1. This decision follows allegations that the platform was used by North Korea's Lazarus Group for money laundering. eXch revealed it is the subject of an active "transatlantic operation" aimed at shutting down the platform and prosecuting its team for "money laundering and terrorism."

- Blockstream combats ESP32 FUD concerning Jade signers. The company stated that after reviewing the vulnerability disclosed in early March, Jade was found to be secure. Espressif Systems, the designer of the ESP32, has since clarified that the "undocumented commands" do not constitute a "backdoor."

- Bank of America is lobbying for regulations that favor banks over tech firms in stablecoin issuance. The bank's CEO Brian Moynihan is working with groups such as the American Bankers Association to advance the issuance of a fully reserved, 1:1 backed "Bank of America coin." If successful, this could limit stablecoin efforts by non-banks like Tether, Circle, and others, reports The Block.

- Tether to back OCEAN Pool with its hashrate. "As a company committed to financial freedom and open access, we see supporting decentralization in Bitcoin mining as essential to the network’s long-term integrity," said Tether CEO Paolo Ardoino.

- Bitdeer to expand its self-mining operations to navigate tariffs. The Singapore-based mining company is advancing plans to produce machines in the U.S. while reducing its mining hardware sales. This response is in light of increasing uncertainties related to U.S. trade policy, as reported by Bloomberg.

- Tether acquires $32M in Bitdeer shares. The firm has boosted its investment in Bitdeer during a wider market sell-off, with purchases in early to mid-April amounting to about $32 million, regulatory filings reveal.

- US Bitcoin miner manufacturer Auradine has raised $153 million in a Series C funding round as it expands into AI infrastructure. The round was led by StepStone Group and included participation from Maverick Silicon, Premji Invest, Samsung Catalyst Fund, Qualcomm Ventures, Mayfield, MARA Holdings, GSBackers, and other existing investors. The firm raised to over $300 million since its inception in 2022.

- Voltage has partnered with BitGo to [enable](https://www.voltage.cloud/blog/bitgo-and-voltage-team-up-to-deliver-instant-bitcoin-and-stabl

-

@ dfa02707:41ca50e3

2025-05-29 18:02:51

@ dfa02707:41ca50e3

2025-05-29 18:02:51Contribute to keep No Bullshit Bitcoin news going.

-

Version 1.3 of Bitcoin Safe introduces a redesigned interactive chart, quick receive feature, updated icons, a mempool preview window, support for Child Pays For Parent (CPFP) and testnet4, preconfigured testnet demo wallets, as well as various bug fixes and improvements.

-

Upcoming updates for Bitcoin Safe include Compact Block Filters.

"Compact Block Filters increase the network privacy dramatically, since you're not asking an electrum server to give you your transactions. They are a little slower than electrum servers. For a savings wallet like Bitcoin Safe this should be OK," writes the project's developer Andreas Griffin.

- Learn more about the current and upcoming features of Bitcoin Safe wallet here.

What's new in v1.3

- Redesign of Chart, Quick Receive, Icons, and Mempool Preview (by @design-rrr).

- Interactive chart. Clicking on it now jumps to transaction, and selected transactions are now highlighted.

- Speed up transactions with Child Pays For Parent (CPFP).

- BDK 1.2 (upgraded from 0.32).

- Testnet4 support.

- Preconfigured Testnet demo wallets.

- Cluster unconfirmed transactions so that parents/children are next to each other.

- Customizable columns for all tables (optional view: Txid, Address index, and more)

- Bug fixes and other improvements.

Announcement / Archive

Blog Post / Archive

GitHub Repo

Website -

-

@ dfa02707:41ca50e3

2025-05-29 18:02:51

@ dfa02707:41ca50e3

2025-05-29 18:02:51Contribute to keep No Bullshit Bitcoin news going.

- "Today we're launching the beta version of our multiplatform Nostr browser! Think Google Chrome but for Nostr apps. The beta is our big first step toward this vision," announced Damus.

- This version comes with the Dave Nostr AI assistant, support for zaps and the Nostr Wallet Connect (NWC) wallet interface, full-text note search, GIFs and fullscreen images, multiple media uploads, user tagging, relay list and mute list support, along with a number of other improvements."

"Included in the beta is the Dave, the Nostr AI assistant (its Grok for Nostr). Dave is a new Notedeck browser app that can search and summarize notes from the network. For a full breakdown of everything new, check out our beta launch video."

What's new

- Dave Nostr AI assistant app.

- GIFs.

- Fulltext note search.

- Add full screen images, add zoom, and pan.

- Zaps! NWC/ Wallet UI.

- Introduce last note per pubkey feed (experimental).

- Allow multiple media uploads per selection.

- Major Android improvements (still WIP).

- Added notedeck app sidebar.

- User Tagging.

- Note truncation.

- Local network note broadcast, broadcast notes to other notedeck notes while you're offline.

- Mute list support (reading).

- Relay list support.

- Ctrl-enter to send notes.

- Added relay indexing (relay columns soon).

- Click hashtags to open hashtag timeline.

- Fixed timelines sometimes not updating (stale feeds).

- Fixed UI bounciness when loading profile pictures

- Fixed unselectable post replies.

-

@ dfa02707:41ca50e3

2025-05-29 18:02:49

@ dfa02707:41ca50e3

2025-05-29 18:02:49Contribute to keep No Bullshit Bitcoin news going.

This update brings key enhancements for clarity and usability:

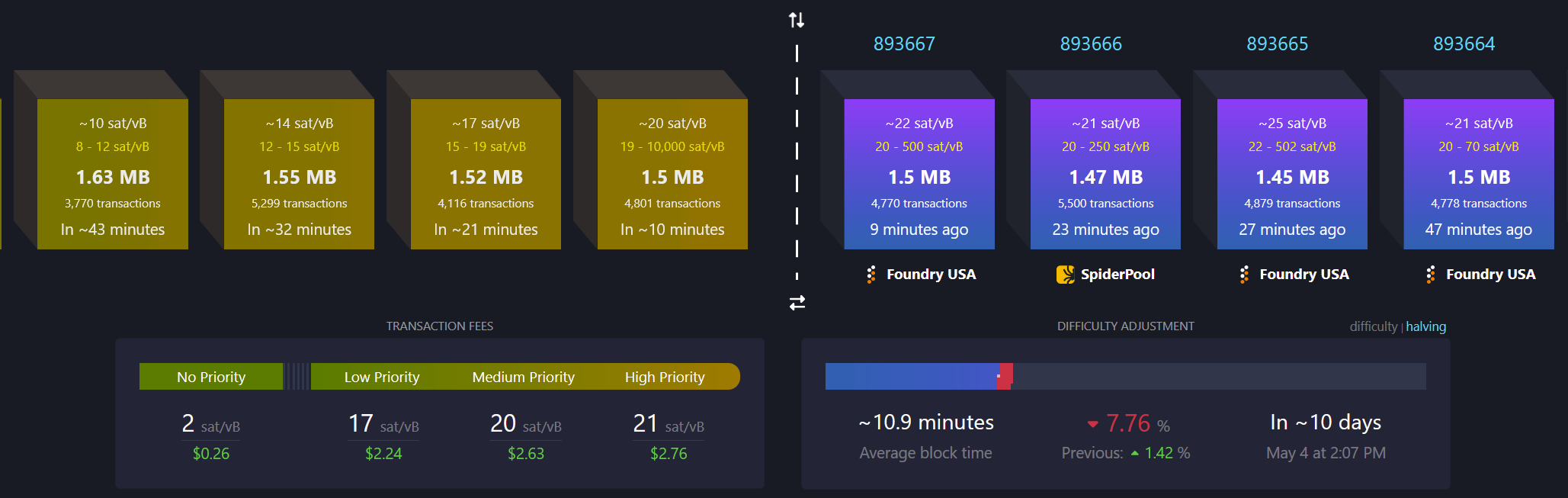

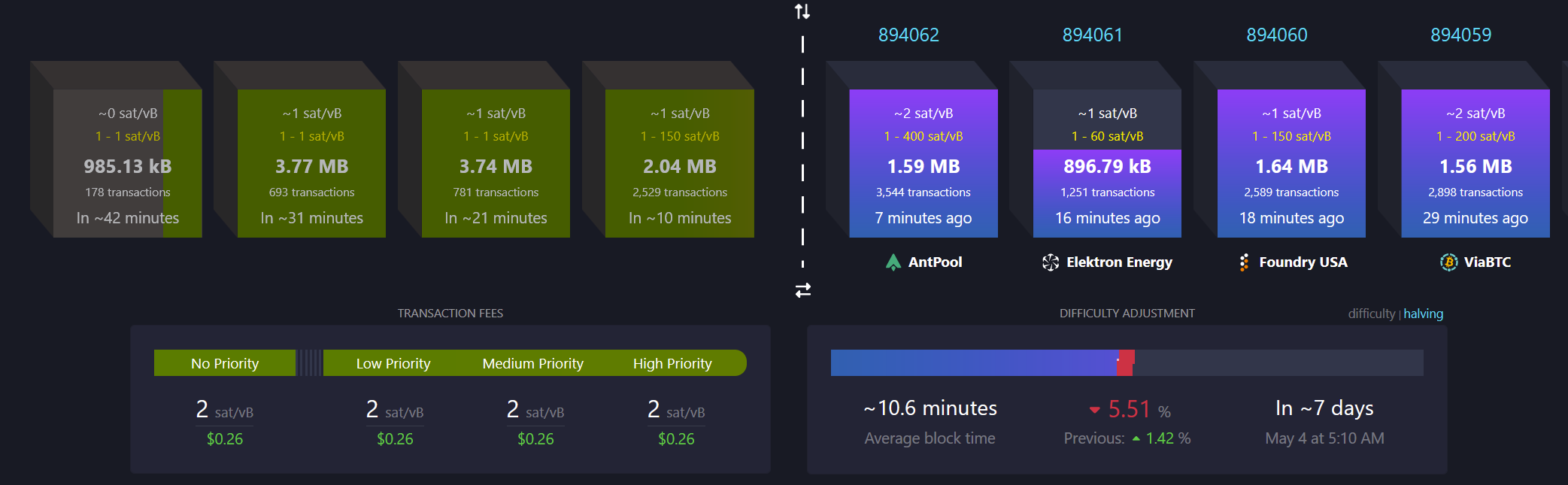

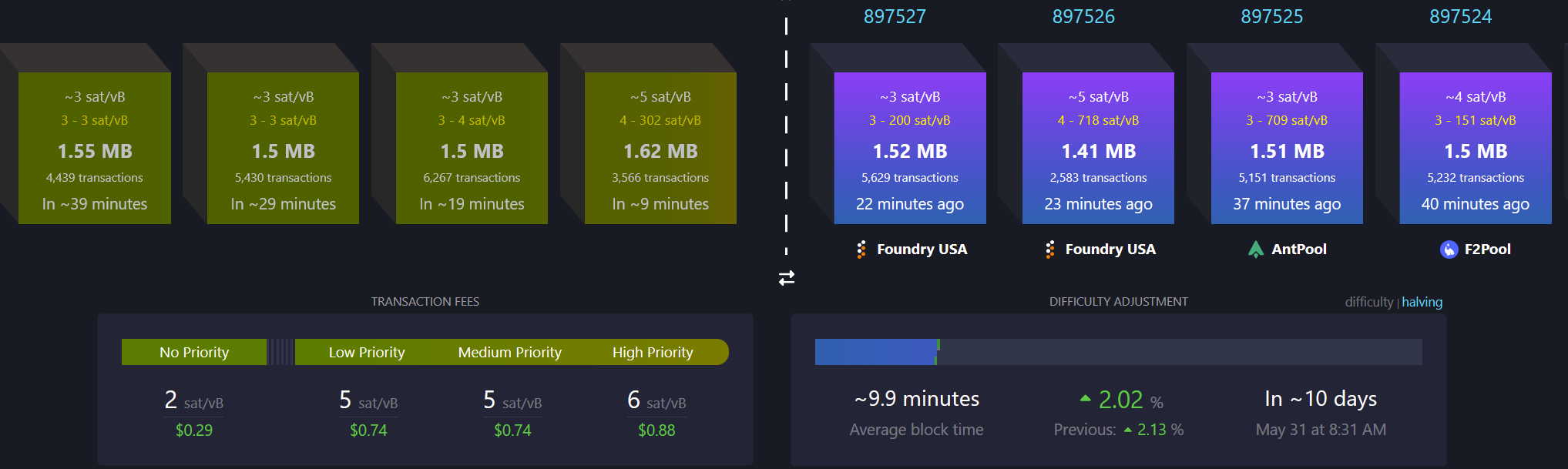

- Recent Blocks View: Added to the Send tab and inspired by Mempool's visualization, it displays the last 2 blocks and the estimated next block to help choose fee rates.

- Camera System Overhaul: Features a new library for higher resolution detection and mouse-scroll zoom support when available.

- Vector-Based Images: All app images are now vectorized and theme-aware, enhancing contrast, especially in dark mode.

- Tor & P2A Updates: Upgraded internal Tor and improved support for pay-to-anchor (P2A) outputs.

- Linux Package Rename: For Linux users, Sparrow has been renamed to sparrowwallet (or sparrowserver); in some cases, the original sparrow package may need manual removal.

- Additional updates include showing total payments in multi-payment transaction diagrams, better handling of long labels, and other UI enhancements.

- Sparrow v2.2.1 is a bug fix release that addresses missing UUID issue when starting Tor on recent macOS versions, icons for external sources in Settings and Recent Blocks view, repackaged

.debinstalls to use older gzip instead of zstd compression, and removed display of median fee rate where fee rates source is set to Server.

Learn how to get started with Sparrow wallet:

Release notes (v2.2.0)

- Added Recent Blocks view to Send tab.

- Converted all bitmapped images to theme aware SVG format for all wallet models and dialogs.

- Support send and display of pay to anchor (P2A) outputs.

- Renamed

sparrowpackage tosparrowwalletandsparrowserveron Linux. - Switched camera library to openpnp-capture.

- Support FHD (1920 x 1080) and UHD4k (3840 x 2160) capture resolutions.

- Support camera zoom with mouse scroll where possible.

- In the Download Verifier, prefer verifying the dropped file over the default file where the file is not in the manifest.

- Show a warning (with an option to disable the check) when importing a wallet with a derivation path matching another script type.

- In Cormorant, avoid calling the

listwalletdirRPC on initialization due to a potentially slow response on Windows. - Avoid server address resolution for public servers.

- Assume server address is non local for resolution failures where a proxy is configured.

- Added a tooltip to indicate truncated labels in table cells.

- Dynamically truncate input and output labels in the tree on a transaction tab, and add tooltips if necessary.

- Improved tooltips for wallet tabs and transaction diagrams with long labels.

- Show the address where available on input and output tooltips in transaction tab tree.

- Show the total amount sent in payments in the transaction diagram when constructing multiple payment transactions.

- Reset preferred table column widths on adjustment to improve handling after window resizing.

- Added accessible text to improve screen reader navigation on seed entry.

- Made Wallet Summary table grow horizontally with dialog sizing.

- Reduced tooltip show delay to 200ms.

- Show transaction diagram fee percentage as less than 0.01% rather than 0.00%.

- Optimized and reduced Electrum server RPC calls.

- Upgraded Bouncy Castle, PGPainless and Logback libraries.

- Upgraded internal Tor to v0.4.8.16.

- Bug fix: Fixed issue with random ordering of keystore origins on labels import.

- Bug fix: Fixed non-zero account script type detection when signing a message on Trezor devices.

- Bug fix: Fixed issue parsing remote Coldcard xpub encoded on a different network.

- Bug fix: Fixed inclusion of fees on wallet label exports.

- Bug fix: Increase Trezor device libusb timeout.

Linux users: Note that the

sparrowpackage has been renamed tosparrowwalletorsparrowserver, and in some cases you may need to manually uninstall the originalsparrowpackage. Look in the/optfolder to ensure you have the new name, and the original is removed.What's new in v2.2.1

- Updated Tor library to fix missing UUID issue when starting Tor on recent macOS versions.

- Repackaged

.debinstalls to use older gzip instead of zstd compression. - Removed display of median fee rate where fee rates source is set to Server.

- Added icons for external sources in Settings and Recent Blocks view

- Bug fix: Fixed issue in Recent Blocks view when switching fee rates source

- Bug fix: Fixed NPE on null fee returned from server

-

@ eb0157af:77ab6c55

2025-05-29 18:02:41

@ eb0157af:77ab6c55

2025-05-29 18:02:41The IMF wants to ensure that the Central American country stops buying more bitcoins, despite President Bukele’s stance.

On May 27, the International Monetary Fund announced its intention to “guarantee” that El Salvador’s government-held Bitcoin reserves remain unchanged. This position is at odds with the statements of President Nayib Bukele, who continues to support the expansion of the country’s national Bitcoin wallet.

The announcement came as part of the first review of the Extended Fund Facility, a financing agreement that has reached a preliminary understanding between the parties. The original agreement, signed last December, includes limiting Bitcoin-related activities in exchange for a $1.4 billion financing package spread over 40 months.

Details of the agreement

The overall package could reach $3.5 billion thanks to additional support from other institutions, including the World Bank.

The Salvadoran Congress quickly approved the necessary amendments to incorporate the IMF’s terms into the Bitcoin Law. Among the most significant changes is the shift from mandatory to voluntary acceptance of Bitcoin payments in the private sector. However, although the law formally required businesses to accept Bitcoin as legal tender, this provision was never truly enforced in practice. Additionally, the country will have to cease its involvement in the Chivo wallet by the end of July.

The IMF Executive Board approved the financing agreement last February, allowing the country to receive an initial disbursement of $120 million after a separate approval by the board.

Bukele’s position

Despite the agreement with the IMF, President Bukele remains firm in his commitment to expanding the national Bitcoin reserves. In a post on X published in March, the Salvadoran leader stated:

“This all stops in April.” “This all stops in June.” “This all stops in December.”

No, it’s not stopping.

If it didn’t stop when the world ostracized us and most “bitcoiners” abandoned us, it won’t stop now, and it won’t stop in the future.

Proof of work > proof of whining https://t.co/9pC0PoY3YQ

— Nayib Bukele (@nayibbukele) March 4, 2025

Shortly after the IMF’s announcement, El Salvador’s Bitcoin Office posted on X that the country had once again purchased more BTC. According to the official tracker, El Salvador, through the Bitcoin Office, has accumulated 30 BTC in the past 30 days.

Last week, Bukele shared on X that the country’s Bitcoin reserves had recorded unrealized profits exceeding $357 million. However, when he reposted the IMF’s announcement, he made no comment regarding the section on restrictions for future Bitcoin purchases.

The IMF’s program aims to address El Salvador’s macroeconomic and structural challenges. The organization views the country’s Bitcoin reserves as a potential risk that “has not yet materialized,” but nonetheless requires limiting government involvement in Bitcoin activities and purchases.

The post El Salvador: IMF ready to block new Bitcoin purchases appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-05-29 18:02:37

@ eb0157af:77ab6c55

2025-05-29 18:02:37An analysis of the present and a look at the future of Bitcoin mining, between data, critical reflections and a personal vision on the role of this industry.

Before jumping on bitcoin and proposing it to their clientele as an investment instrument, traditional finance started with a more classic approach, beginning to purchase shares of mining companies and thus exposing themselves indirectly to the asset. Bitcoin mining today is a real industry, also composed of large players listed on the stock exchange that have received huge capital from investment funds like BlackRock. Furthermore, more and more mining companies are taking the path of listing on stock markets to manage to attract capital and some of these also manage pools, like Marathon. How was all this possible and what are the implications of this situation?

Mining pools

Mining pools aggregate the computing power of multiple miners to increase the chances of mining a block. They create the block template and use the collective hashrate to try to solve it. The reward is then divided among participants in proportion to the power provided.

Today pools use different methods to pay miners who provide computing power. One of these is called FPPS (Fully Pay Per Share), which offers a fixed and constant payment to the miner (which varies based on the computing power provided), regardless of whether the pool mines a block or not. This type of payment makes the revenues of a company that mines bitcoin calculable and constant and which, consequently, becomes more appealing to the market because it’s possible to calculate its ROI (Return On Investment). In essence, with this type of payment, uncertainty is excluded and returns are made predictable. Mining pools take on the risk because, in case they fail to mine blocks for a certain period of time, they could go into loss having to pay miners anyway. We can therefore venture that mining pools have helped the entry of traditional finance into bitcoin mining, taking on part of the risks. But this is my thought.

Mining today

Mining pools today are not that many and we have a strong concentration of miners in some of them. If we sum the hashrate of Foundry and AntPool we exceed 50% of global computing power. This is not an optimal condition. Now however let’s also look at the other side of the coin. First of all, although mining pools have great power, they cannot play with fire and must be very transparent about their operations towards miners, because miners can direct their hashrate towards another pool very quickly. And this is a fundamental element that also recalls game theory a bit, because a mining pool must not only serve its own interest, but also the interest of its “partners”, otherwise it loses everything. I believe that mining pools are well aware of their power and also know that they are a centralization point for the network and, today, also a point of attack by authorities, so they have every interest in finding solutions that allow them to continue doing business, but that relieve them somewhat of responsibilities.

On the miner side instead, we have increasingly large companies that collect enormous capital and produce a lot of hashrate, but my fear is that this hashrate is produced by a fiat economy and is very precarious. Hashrate is closely linked to price, because if the price drops below a certain threshold, miners are no longer profitable and are forced to turn off the machines, or, in the worst cases, to completely cease activity, consequently causing hashrate to collapse. Fortunately Bitcoin has mechanisms like difficulty adjustment that mitigate these situations. Being still a very small market, the entry of large institutional players first in mining companies and then directly on the underlying asset, could lead to strong price oscillations that also impact mining farms. All this makes hashrate very unstable too.

Something is changing

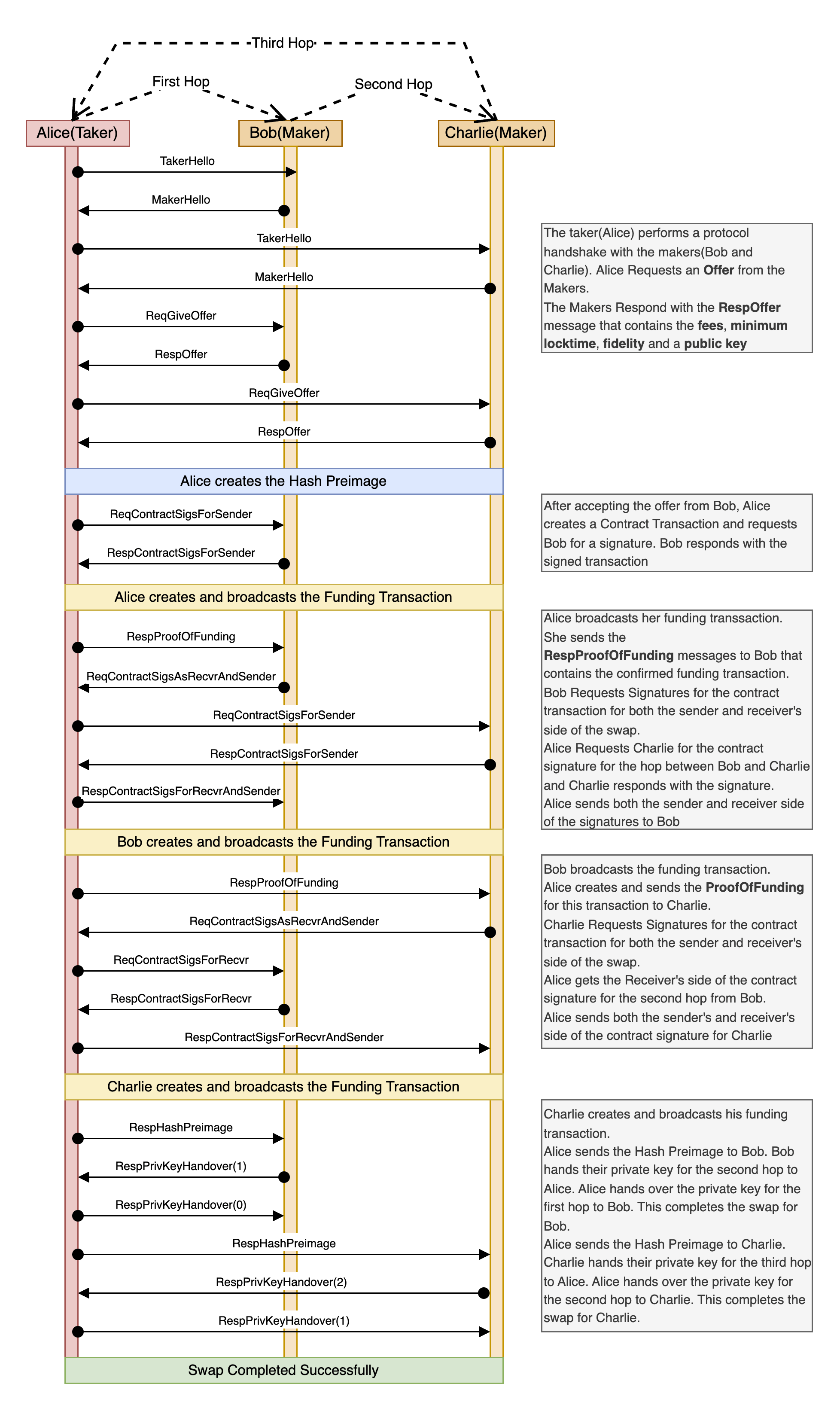

The development of Stratum V2 has started an attempt to solve the various problems that afflict pooled mining. Stratum is the communication protocol between mining farms and mining pools. Version 2 brings, in addition to data improvement and encryption, performance increases and gives each individual miner the possibility to create the template of the block to mine. Furthermore we also have other existing solutions that try to solve the problems described before in a somewhat different way, like Ocean pool, which has implemented its DATUM protocol (similar to Stratum V2) and which uses a miner payment method called TIDES, that is an evolution of FPPS and non-custodial PPLNS in which miner addresses are inserted directly into the coinbase transaction.

There’s also a lot of ferment on the miner side, for example with the advent of Bitaxe, an open source project that we can define almost as a movement, an ideology. Skot, the precursor of this movement, has essentially reverse engineered the professional machinery used to mine bitcoin and managed to create a “desktop” device that contains a real ASIC chip, consumes only a few watts and can be built at home. Obviously these products produce computing power not sufficient to try to be competitive, but they are bringing back solo mining and are giving enthusiasts the possibility to deepen this sector by exploiting a device of very small dimensions and with practically negligible consumption on the bill.

The future of mining

After analyzing the state we are in, we can start speculations and let our minds travel.

Let’s start with mining pools. Will they still exist? I would say yes, in what form I don’t know, but I think they will certainly lose the control they have today over block template creation and I also think that future solutions will be found (in addition to existing ones) to become non-custodial and directly remunerate miners. In the end it’s in their interest to always be competitive in terms of services offered, because they work on commission, so they have to be appealing.

As for miners instead, I see a bigger metamorphosis. If the intention is to consume eco-sustainable energy, then energy industries will necessarily have to start studying the benefits that mining can bring in this sense. They cannot continue to ignore them. And if this happens, then I imagine a future where energy companies themselves will start mining bitcoin and will no longer do so following market logic, but will shift focus to stabilizing the electrical grid. Mining is currently the only industry capable of being so flexible as to be able to absorb all the excess energy of a plant, but at the same time consume zero when energy is needed by the grid. At that point the raw mining activity could become no longer the main business, but a secondary benefit that will allow them to have alternative income compared to selling electricity.

And what about the Bitaxe movement? Hard to say, but in my opinion if it manages to reach a critical mass of enthusiasts, it could really start to emerge and become a fundamental piece for the “true bitcoiner” kit. Utopistically, if we had 50 or 100 million Bitaxes scattered in people’s homes, we would manage to distribute mining in a more widespread way, but above all we would have a part of the total hashrate totally uncorrelated from bitcoin price, because, given their very reduced consumption, Bitaxes would remain on and continue to produce hashrate regardless of energy cost or price oscillations of the underlying asset.

What will happen, then, after 2140, when no more bitcoins will be mined? Assuming that network fees will be much higher than today, and sufficient to keep the activity profitable, we could find ourselves in a situation where mining for pure profit will be downsized. The same companies, however, could become external service providers for grid balancing, or, as mentioned previously, become electricity producers themselves of renewable energy exploiting their experience in mining to push where today it’s not economically convenient. Even in our homes we could have a boiler, a heat pump or a water heating system for the pool that, while doing its job, also mines bitcoin. In short, a future that seems like a fairy tale, but so possible that we want to live it and make sure that my children are also protagonists of it.

The post The future of mining? Green and decentralized appeared first on Atlas21.

-

@ f0fcbea6:7e059469

2025-05-29 18:30:53

@ f0fcbea6:7e059469

2025-05-29 18:30:53Autores Clássicos e Antigos

- Homero (século IX a.C.?) — Ilíada, Odisseia

- Tucídides (c. 460-400 a.C.) — História da Guerra do Peloponeso

- Platão (c. 427-347 a.C.) — República, Banquete, Fédon, Mênon, Apologia de Sócrates, Fedro, Górgias

- Aristóteles (c. 384-322 a.C.) — Órganon, Física, Metafísica, Da Alma, Ética a Nicômaco, Política, Retórica, Poética

- Virgílio (70-19 a.C.) — Eneida

- Marco Aurélio (121-180) — Meditações

- Santo Agostinho (354-430) — Sobre o Ensino, Confissões, A Cidade de Deus, A Doutrina Cristã

- Boécio (480-525) — A Consolação da Filosofia

- Santo Tomás de Aquino (c. 1225-1274) — Suma Teológica

- Dante Alighieri (1265-1321) — Divina Comédia

Renascimento e Idade Moderna

- Nicolau Maquiavel (1469-1527) — O Príncipe

- Luís de Camões (1524-1580) — Os Lusíadas, Sonetos

- Miguel de Cervantes (1547-1616) — Dom Quixote

- William Shakespeare (1564-1616) — Romeu e Julieta, Hamlet, Macbeth, Otelo, Rei Lear, Henrique IV, Henrique V, Henrique VI, Henrique VIII, A Comédia dos Erros, Tito Andrônico, Príncipe de Tiro, Cimbelino, A Megera Domada, O Mercador de Veneza, Ricardo II, Ricardo III, Muito Barulho por Nada, Júlio César, Noite de Reis, Os Dois Cavaleiros de Verona, Conto do Inverno, Sonhos de uma Noite de Verão, As Alegres Comadres de Windsor, Trólio e Créssida, Medida por Medida, Coriolano, Antônio e Cleópatra, A Tempestade

- Ésquilo (525-456 a.C., antiguidade grega, mas citado junto) — Prometeu Acorrentado, Orestéia/As Eumênides

- Sófocles (496-406 a.C.) — Édipo Rei, Antígona

Literatura e Filosofia Contemporânea

- Fiódor Dostoiévski (1821-1881) — Crime e Castigo, Os Irmãos Karamázov, Os Demônios, O Idiota, Notas do Subsolo

- Franz Kafka (1883-1924) — A Metamorfose, O Processo, O Castelo

- Albert Camus (1913-1960) — O Estrangeiro

- Aldous Huxley (1894-1963) — Admirável Mundo Novo, A Ilha

- James Joyce (1882-1941) — Retrato do Artista Quando Jovem, Ulisses

- George Orwell (1903-1950) — A Revolução dos Bichos, 1984

- Machado de Assis (1839-1908) — Memórias Póstumas de Brás Cubas, O Alienista

- Thomas Mann (1875-1955) — Morte em Veneza, Doutor Fausto, A Montanha Mágica

- Henrik Ibsen (1828-1906) — O Pato Selvagem, Um Inimigo do Povo

- Stendhal (1783-1842) — O Vermelho e o Negro, A Cartuxa de Parma

- Viktor Frankl (1905-1997) — Em Busca de Sentido

- J.R.R. Tolkien (1892-1973) — O Hobbit, O Senhor dos Anéis

- Luigi Pirandello (1867-1936) — Seis Personagens à Procura de um Autor, O Falecido Matias Pascal

- Samuel Beckett (1906-1989) — Esperando Godot

- René Guénon (1886-1951) — A Crise do Mundo Moderno, O Reino da Quantidade

- G. K. Chesterton (1874-1936) — Ortodoxia

- Richard Wagner (1813-1883) — Tristão e Isolda

- Honoré de Balzac (1799-1850) — Ilusões Perdidas, Eugénie Grandet

- Jacob Wassermann (1873-1934) — O Processo Maurizius

- Nikolai Gogol (1809-1852) — Almas Mortas, O Inspetor Geral

- Daniel Defoe (1660-1731) — Moll Flanders

- Mortimer J. Adler (1902-2001) — Como Ler um Livro

- Gustave Flaubert (1821-1880) — Madame Bovary

- Hermann Hesse (1877-1962) — O Jogo das Contas de Vidro

- Richard Wagner (1813-1883) — Tristão e Isolda

- Wolfgang von Goethe (1749-1832) — Fausto (Primeiro), Os Anos de Aprendizado de Wilhelm Meister

- Jacques Benda — A Traição dos Intelectuais

-

@ eb0157af:77ab6c55

2025-05-29 18:02:33

@ eb0157af:77ab6c55

2025-05-29 18:02:33The blockchain analytics firm claims to have identified the Bitcoin addresses held by the company led by Saylor.

Arkham Intelligence announced it had identified addresses linked to Strategy. According to Arkham’s statements, an additional 70,816 BTC connected to the company have been identified, with an estimated value of around $7.6 billion at current prices. This discovery would bring the total amount of Strategy’s identified holdings to $54.5 billion.

SAYLOR SAID HE WOULD NEVER REVEAL HIS ADDRESSES … SO WE DID

We have identified an additional 70,816 BTC belonging to Strategy, bringing our total identified MSTR BTC holdings to $54.5 Billion. We are the first to publicly identify these holdings.

This represents 87.5% of… pic.twitter.com/P3OVdVrhQL

— Arkham (@arkham) May 28, 2025

The analytics firm claims to have mapped 87.5% of Strategy’s total holdings. In a provocative post on X, Arkham wrote:

“Saylor said he would never reveal his addresses. So, we did it for him.

Previously, we tagged:

– 107,000 BTC sent to MSTR’s Fidelity deposits (Fidelity does not segregate custody, so these BTC do not appear in the MSTR entity)

– Over 327,000 BTC held in segregated custody, including Coinbase Prime, in our MSTR entity.”Arkham’s revelations directly clash with Michael Saylor’s public statements on wallet security. During the Bitcoin 2025 conference in Las Vegas, the Strategy chairman explicitly warned against publishing corporate wallet addresses.

“No institutional or enterprise security analyst would ever think it’s a good idea to publish all the wallet addresses so you can be tracked back and forth,” Saylor said during the event.

The executive chairman of Strategy added:

“The current, conventional way to publish proof-of-reserves is an insecure proof of reserves… It’s not a good idea, it’s a bad idea.”

He compared publishing wallet addresses to “publishing the addresses, bank accounts, and phone numbers of your kids hoping it will protect them — when in fact it makes them more vulnerable.”

Finally, the executive chairman suggested using artificial intelligence to explore the security implications of such a practice, claiming that in-depth research could produce “50 pages” of potential security risks.

The post Arkham reveals 87% of Strategy’s Bitcoin addresses appeared first on Atlas21.

-

@ 8096ed6b:4901018b

2025-05-29 18:43:15

@ 8096ed6b:4901018b

2025-05-29 18:43:15🎵 Monster In Me by From Ashes to New

🔗 https://song.link/us/i/1439137994

-

@ 33baa074:3bb3a297

2025-05-28 08:54:40

@ 33baa074:3bb3a297

2025-05-28 08:54:40COD (chemical oxygen demand) sensors play a vital role in water quality testing. Their main functions include real-time monitoring, pollution event warning, water quality assessment and pollution source tracking. The following are the specific roles and applications of COD sensors in water quality testing:

Real-time monitoring and data acquisition COD sensors can monitor the COD content in water bodies in real time and continuously. Compared with traditional sampling methods, COD sensors are fast and accurate, without manual sampling and laboratory testing, which greatly saves time and labor costs. By combining with the data acquisition system, the monitoring data can be uploaded to the cloud in real time to form a extemporization distribution map of the COD content in the water body, providing detailed data support for environmental monitoring and management.

Pollution event warning and rapid response COD sensors play an important role in early warning and rapid response in water environment monitoring. Once there is an abnormal increase in organic matter in the water body, the COD sensor can quickly detect the change in COD content and alarm through the preset threshold. This enables relevant departments to take measures at the early stage of the pollution incident to prevent the spread of pollution and protect the water environment.

Water quality assessment and pollution source tracking COD sensors play an important role in water quality assessment and pollution source tracking. By continuously monitoring the COD content in water bodies, the water quality can be evaluated and compared with national and regional water quality standards. At the same time, COD sensors can also help determine and track the location and spread of pollution sources, provide accurate data support for environmental management departments, and guide the development of pollution prevention and control work.

Application scenarios COD sensors are widely used in various water quality monitoring scenarios, including but not limited to: Sewage treatment plants: used to monitor the COD content of in fluent and effluent to ensure the effect of sewage treatment. Water source protection and management: deployed in water sources to monitor the COD content of in fluent sources. Once the water quality exceeds the set limit, the system will issue an alarm in time to ensure water quality safety. Lake and river monitoring: deployed in water bodies such as lakes and rivers to monitor the COD content of water bodies in real time.

Technical features of COD sensor COD sensor uses advanced technology, such as ultraviolet absorption method, which does not require the use of chemical reagents, avoiding the risk of contamination of chemical reagents in traditional COD detection methods, and can achieve online uninterrupted water quality monitoring, providing strong support for real-time water quality assessment. In addition, COD sensor also has the advantages of low cost, high stability, strong anti-interference ability, and convenient installation.

Summary In summary, COD sensor plays an irreplaceable role in water quality detection. It can not only provide real-time and accurate water quality data, but also quickly warn when pollution incidents occur, providing strong technical support for water quality management and environmental protection. With the advancement of technology and the popularization of applications, COD sensor will play a more important role in water quality monitoring in the future.

-

@ 9ca447d2:fbf5a36d

2025-05-29 18:02:31

@ 9ca447d2:fbf5a36d

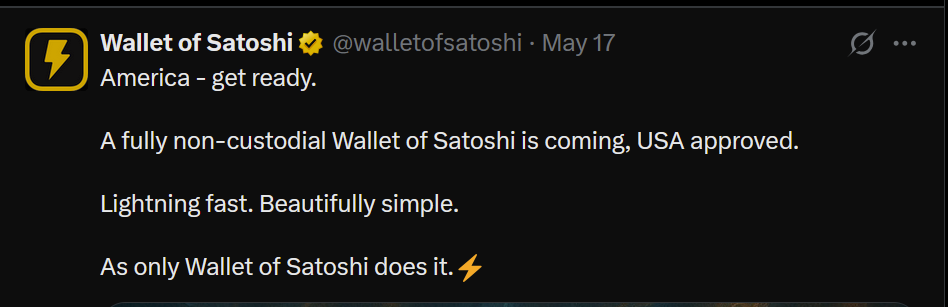

2025-05-29 18:02:31JPMorgan Chase, the biggest bank in the U.S., is now allowing its clients to buy bitcoin — a big change of heart for an institution whose CEO, Jamie Dimon, has been a long-time critic of the scarce digital asset.

Dimon made the announcement on the bank’s investor day, which came as a shift in JPMorgan’s approach to digital assets. “We are going to allow you to buy it,” he said. “We’re not going to custody it. We’re going to put it in statements for clients.”

That means clients can buy BTC through JPMorgan but the bank won’t hold or store the digital asset. Instead it will provide access and include the BTC purchases in client statements.

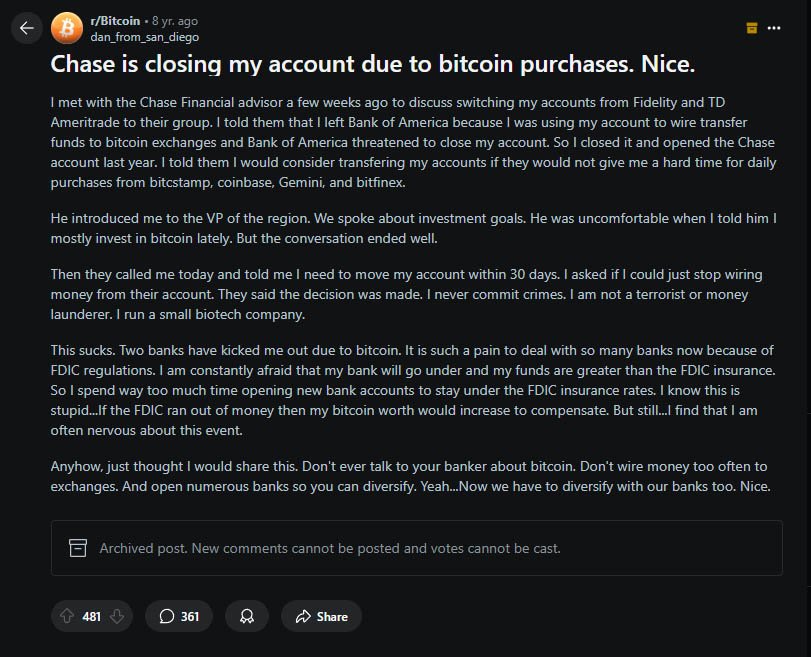

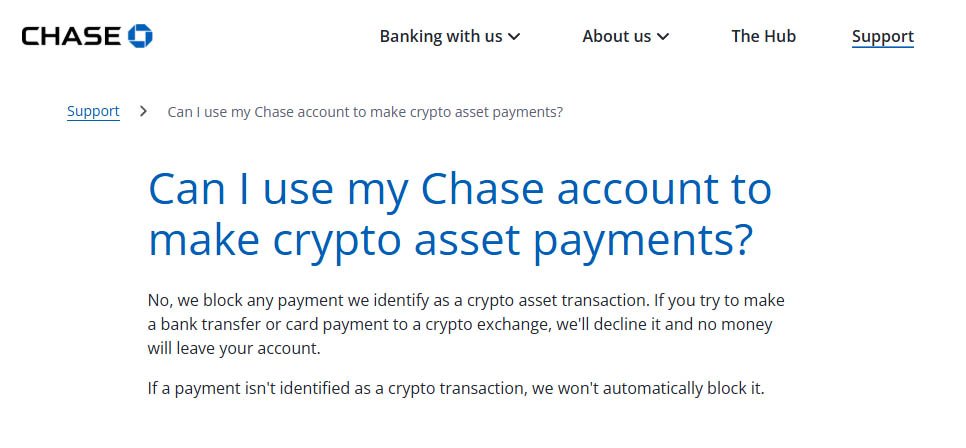

According to multiple reports and posts, JPMorgan has been blocking transactions from digital asset exchanges, with several people complaining about their experience on social media.

There is even an official notice on the company’s UK website that explicitly says customers cannot use their funds to purchase digital assets.

JPMorgan Chase UK website — Source

It’s a big change because Dimon has been one of Bitcoin’s biggest critics. Over the years he’s called it “worthless”, a “fraud” and even compared it to a “pet rock”.

He’s repeatedly expressed concern over digital assets’ use in illegal activities such as money laundering, terrorism, sex trafficking and tax evasion. A role that his critics say the U.S. dollar is playing on a much larger scale.

Related: Jamie Dimon Would “Close Down” Bitcoin If He Had Government Role

“The only true use case for it is criminals, drug traffickers … money laundering, tax avoidance,” he told lawmakers during a Senate hearing in 2023. At the 2024 World Economic Forum in Davos, he doubled down, “Bitcoin does nothing. I call it the pet rock.”

Despite his personal views, Dimon says the bank is responding to client demand. “I don’t think you should smoke, but I defend your right to smoke,” he said. “I defend your right to buy bitcoin.”

It’s worth noting JPMorgan isn’t fully embracing digital assets. The bank won’t be offering direct custody services or launching its own exchange.

Instead, it’s offering access to digital asset exchanges. There are even reports that the bank also plans to facilitate access to bitcoin ETFs and possibly other investment vehicles. Until recently, JPMorgan had limited its bitcoin exposure to futures-based products.

Other big financial firms have already taken similar steps.

Morgan Stanley, for example, has been offering some clients access to bitcoin ETFs since August 2024. Its CEO, Ted Pick, said earlier this year that the firm is working closely with regulators to explore ways to get into the digital assets space.

Dimon does like blockchain, though — the technology that underpins it. JPMorgan has its own blockchain projects including JPM Coin and recently ran a test transaction on a public blockchain of tokenized U.S. Treasuries.

Many criticize this view, saying that the most powerful aspect of Bitcoin is its decentralization. So, a centralized blockchain is just useless. This might be the reason Dimon has grown weary of all JPMorgan’s blockchain initiatives, because they offered nothing of value.

He said he might have given blockchain too much credit during his investor day comments: “We have been talking about blockchain for 12 to 15 years,” he said. “We spend too much on it. It doesn’t matter as much as you all think.”

-

@ 9223d2fa:b57e3de7

2025-05-29 18:33:35

@ 9223d2fa:b57e3de7

2025-05-29 18:33:3513,813 steps

-

@ 9ca447d2:fbf5a36d

2025-05-29 18:02:20

@ 9ca447d2:fbf5a36d

2025-05-29 18:02:20H100 Group AB, a Swedish publicly listed health technology company, has made the headlines after investing in bitcoin as part of a new financial strategy.

The move has caused a stir in Sweden and beyond, with H100’s stock price rising 40% after the announcement.

The company has bought 4.39 bitcoin for 5 million Norwegian Krone (around $475,000–$492,000).

This is the company’s first foray into the digital asset space and makes H100 Group the first publicly-listed health tech company in Sweden to hold bitcoin as a treasury reserve asset.

The bitcoin was bought at an average price of 1,138,737 NOK (around $108,000) per coin.

The bitcoin purchase is part of H100 Group’s new “Bitcoin Treasury Strategy” to diversify its financial assets and strengthen its balance sheet. Instead of holding idle cash, the company decided to invest in what it sees as a long-term asset.

“This addition to H100’s Bitcoin Treasury Strategy follows an increasing number of tech-oriented growth companies holding bitcoin on their balance sheet,” said CEO Sander Andersen.

“And I believe the values of individual sovereignty highly present in the Bitcoin community aligns well with, and will appeal to, the customers and communities we are building the H100 platform for.”

Andersen said they will “build and hold” bitcoin long-term, viewing it as a savings tool, not a short-term trade.

The market reacted fast. On May 22, the company’s stock went up 39.27%, seeing highs of 1.620 SEK on the Nordic Growth Market.

This helped the company to recover a big part of the losses from the last two months, during which the stock fell 46%.

And now, after the purchase, the firm’s market cap is around $150.46 million.

H100 has said this might not be the only purchase. The company has signed a Letter of Intent (LOI) to set up a convertible loan facility of up to 10 million SEK with an undisclosed investor.

H100 Group’s announcement — Source

The funds will be used for general corporate purposes and to potentially increase bitcoin holdings. The loan will have a 3-year term and can be converted into shares at 1.3 SEK per share.

If H100’s stock price is more than 33% above the conversion price for more than 60 days, H100 will have the right to force conversion.

The company also announced today that it has successfully raised 21 million SEK ($2.21 million) through a convertible round led by Blockstream founder and CEO Adam Back.

Despite the Bitcoin pivot, H100 Group has made it clear that the core business remains the same.

They will continue to develop AI-powered automation tools and digital platforms to help healthcare providers deliver better services, especially in the health and longevity space.

Andersen said they are committed to healthy living, and adopting a bitcoin strategy is a smarter financial move that aligns with their values.

H100’s move comes as corporate adoption of bitcoin accelerates globally.

According to BitcoinTreasuries over 109 public companies now list bitcoin on their balance sheets. Among those are companies like Twenty One Capital, Strive and Metaplanet.

-

@ 2e941ad1:fac7c2d0

2025-05-29 18:33:28

@ 2e941ad1:fac7c2d0

2025-05-29 18:33:28Unlocks: 16

-

@ 9ca447d2:fbf5a36d

2025-05-29 18:02:14

@ 9ca447d2:fbf5a36d

2025-05-29 18:02:14Trump Media & Technology Group (TMTG), the company behind Truth Social and other Trump-branded digital platforms, is planning to raise $2.5 billion to build one of the largest bitcoin treasuries among public companies.

The deal involves the sale of approximately $1.5 billion in common stock and $1.0 billion in convertible senior secured notes.

According to the company, the offering is expected to close by the end of May, pending standard closing conditions.

Devin Nunes, CEO of Trump Media, said the investment in bitcoin is a big part of the company’s long-term plan.

“We view Bitcoin as an apex instrument of financial freedom,” Nunes said.

“This investment will help defend our Company against harassment and discrimination by financial institutions, which plague many Americans and U.S. firms.”

He added that the bitcoin treasury will be used to create new synergies across the company’s platforms including Truth Social, Truth+, and the upcoming financial tech brand Truth.Fi.

“It’s a big step forward in the company’s plans to evolve into a holding company by acquiring additional profit-generating, crown jewel assets consistent with America First principles,” Nunes said.

The $2.5 billion raise will come from about 50 institutional investors. The $1 billion in convertible notes will have 0% interest and be convertible into shares at a 35% premium.

TMTG’s current liquid assets, including cash and short-term investments, are $759 million as of the end of the first quarter of 2025. With this new funding, the company’s liquid assets will be over $3 billion.

Custody of the bitcoin treasury will be handled by Crypto.com and Anchorage Digital. They will manage and store the digital assets.

Earlier this week The Financial Times reported Trump Media was planning to raise $3 billion for digital assets acquisitions.

The article said the funds would be used to buy bitcoin and other digital assets, and an announcement could come before a major related event in Las Vegas.

Related: Bitcoin 2025 Conference Kicks off in Las Vegas Today

Trump Media denied the FT report. In a statement, the company said, “Apparently the Financial Times has dumb writers listening to even dumber sources.”

There was no further comment. However, the official $2.5 billion figure, which was announced shortly after by Trump Media through a press release, aligns with its actual filing and investor communication.

Trump Media’s official announcement

This comes at a time when the Trump family and political allies are showing renewed interest in Bitcoin.

President Donald Trump who is now back in office since the 2025 election, has said he wants to make the U.S. the “crypto capital of the world.”

Trump Media is also working on retail bitcoin investment products including ETFs aligned with America First policies.

These products will make bitcoin more accessible to retail investors and support pro-Trump financial initiatives.

But not everyone is happy.

Democratic Senator Elizabeth Warren recently expressed concerns about Trump Media’s Bitcoin plans. She asked U.S. regulators to clarify their oversight of digital-asset ETFs, warning of investor risk.

Industry insiders are comparing Trump Media’s plans to Strategy (MSTR) which has built a multi-billion dollar bitcoin treasury over the last year. They used stock and bond sales to fund their bitcoin purchases.

-

@ b1ddb4d7:471244e7

2025-05-29 18:02:10

@ b1ddb4d7:471244e7

2025-05-29 18:02:10Custodial Lightning wallets allow users to transact without managing private keys or channel liquidity. The provider handles technical complexities, but this convenience comes with critical trade-offs:

- You don’t control your keys: The custodian holds your bitcoin.

- Centralized points of failure: Servers can be hacked or shut down.

- Surveillance risks: Providers track transaction metadata.

Key Risks of Custodial Lightning Wallets

*1. Hacks and Exit Scams*

Custodians centralize large amounts of bitcoin, attracting hackers:

- Nearly $2.2 billion worth of funds were stolen from hacks in 2024.

- Lightning custodians suffered breaches, losing user funds.

Unlike non-custodial wallets, victims have no recourse since they don’t hold keys.

*2. Censorship and Account Freezes*

Custodians comply with regulators, risking fund seizures:

- Strike (a custodial Lightning app) froze accounts of users in sanctioned regions.

- A U.K. court in 2020 ordered Bitfinex to freeze bitcoin worth $860,000 after the exchange and blockchain sleuthing firm Chainalysis traced the funds to a ransomware payment.

*3. Privacy Erosion*

Custodians log user activity, exposing sensitive data:

- Transaction amounts, receiver addresses, and IPs are recorded.

*4. Service Downtime*

Centralized infrastructure risks outages.

*5. Inflation of Lightning Network Centralization*

Custodians dominate liquidity, weakening network resilience:

- At the moment, 10% of the nodes on Lightning control 80% of the liquidity.

- This centralization contradicts bitcoin’s decentralized ethos.

How to Switch to Self-Custodial Lightning Wallets

Migrating from custodial services is straightforward:

*1. Choose a Non-Custodial Wallet*

Opt for wallets that let you control keys and channels:

- Flash: The self-custodial tool that lets you own your keys, control your coins, and transact instantly.

- Breez Wallet : Non-custodial, POS integrations.

- Core Lightning : Advanced, for self-hosted node operators.

*2. Transfer Funds Securely*

- Withdraw funds from your custodial wallet to a bitcoin on-chain address.

- Send bitcoin to your non-custodial Lightning wallet.

*3. Set Up Channel Backups*

Use tools like Static Channel Backups (SCB) to recover channels if needed.

*4. Best Practices*

- Enable Tor: Mask your IP (e.g., Breez’s built-in Tor support).

- Verify Receiving Addresses: Avoid phishing scams.

- Regularly Rebalance Channels: Use tools like Lightning Pool for liquidity.

Why Self-Custodial Lightning Matters

- Self-custody: Control your keys and funds.

- Censorship resistance: No third party can block transactions.

- Network health: Decentralized liquidity strengthens Lightning.

Self-custodial wallets now rival custodial ease.

Custodial Lightning wallets sacrifice security for convenience, putting users at risk of hacks, surveillance, and frozen funds. As bitcoin adoption grows, so does the urgency to embrace self-custodial solutions.

Take action today:

- Withdraw custodial funds to a hardware wallet.

- Migrate to a self-custodial Lightning wallet.

- Educate others on the risks of custodial control.

The Lightning Network’s potential hinges on decentralization—don’t let custodians become its Achilles’ heel.

-

@ b1ddb4d7:471244e7

2025-05-29 18:01:56

@ b1ddb4d7:471244e7

2025-05-29 18:01:56Sati, a Bitcoin payments app and Lightning infrastructure provider, announced the launch of its Lightning integration with Xverse wallet.

Launched in 2025 with investors of the likes as Draper Associates and Ricardo Salinas, Sati powers Bitcoin payments on applications such as WhatsApp to fuel the next wave of adoption.

The Whatsapp bot allows users to send bitcoin via the messaging app through a special bot. After verifying their identity, the user selects the “send” option, chooses to pay to a Lightning address, enters the amount (1,000 sats), confirms with a PIN, and the transaction is completed, with the funds appearing instantly in the recipient wallet.

The new integration will now bring Lightning functionality to over 1.5 million people worldwide. Users can send and receive sats (Bitcoin’s smallest denomination) instantly over the Lightning Network all within the Xverse app,

Further, every xverse wallet user gets a Lightning Address instantly. That means they can receive tips, pay invoices, and use Bitcoin for microtransactions—all without having to manage channels or switch between different apps.

While Xverse adds support for Lightning, users should be cautious in using the wallet as it’s mostly known for enabling access to rug pull projects.

Initially designed in 2017, the Lightning Network has grown to become Bitcoin’s leading layer-2, with a current BTC capacity of over $465M.

“Bitcoin was not meant to be an asset for Wall Street—it was built for peer-to-peer money, borderless and accessible,” said Felipe Servin, Founder and CEO of Sati. “Integrating Lightning natively into Xverse brings that vision back to life, making Bitcoin usable at scale for billions.”

Sati expects USDT on Lightning to be supported as early as July 2025 for users accessing Sati through WhatsApp.

This integration positions Sati’s role as a Lightning infrastructure provider, not just a consumer app. By leveraging its API-based solution, the company provides plug-and-play backend services to wallets and platforms looking to add Bitcoin payments without compromising on security or UX.

Sati recently closed a $600K pre-seed round. The funding is used to support global expansion, stablecoin integration, Lightning infrastructure growth, and broader access to Bitcoin in emerging markets.

The Sati team is attending Bitcoin2025 in Las Vegas this week and looking forward to connect with bitcoin enthusiasts.

-

@ cae03c48:2a7d6671

2025-05-29 18:01:53

@ cae03c48:2a7d6671

2025-05-29 18:01:53Bitcoin Magazine

Human Rights Foundation Donates 800 Million Satoshis To 22 Worldwide Bitcoin And Freedom ProjectsToday, the Human Rights Foundation (HRF) announced its most recent round of Bitcoin Development Fund grants, according to a press release sent to Bitcoin Magazine.

800 million satoshis (8 BTC) currently worth over $874,000 at the time of writing, is being granted across 22 different projects around the world focusing on open-source development, educational initiatives, Bitcoin mining decentralization, and privacy tools for human rights advocates living under authoritarian regimes. The main areas of focus for these grants center around Latin America, Africa, and Asia

While the HRF did not disclose how much money each project is receiving specifically, the following 22 projects are the recipients of today’s round of grants worth 8 BTC, or 800 billion satoshis, in total:

Mostro

In authoritarian regimes, centralized exchanges enforce strict identity verification and frequently freeze user accounts. In these environments, Mostro, a peer-to-peer exchange built on the decentralized nostr protocol, provides a private and censorship-resistant way to access Bitcoin. It enables human rights defenders and ordinary citizens to transact freely. With HRF support, developer Catrya will improve Mostro’s usability to better serve dissidents seeking financial freedom.

SudaBit

As war and hyperinflation devastate Sudan, traditional banks and remittance systems have collapsed. Millions of Sudanese are left without reliable ways to save, send, or receive money. SudaBit, under development by Sudan Hodl, is the country’s first private Bitcoin on- and off-ramp, providing a critical financial lifeline where few options remain. With HRF support, SudaBit will allow everyday Sudanese to access permissionless, self-custodial Bitcoin directly from their local currency while at the same time building a vital financial infrastructure amid a humanitarian and monetary crisis.

Stringer News

Authoritarian regimes silence independent media to control public narratives and suppress dissent. Stringer News, an open media platform founded by war reporter and author Anjan Sundaram, uses Bitcoin and nostr to help reporters and human rights defenders publish without fear of censorship. By bypassing traditional publishing gatekeepers, it ensures critical reporting reaches global audiences — even from the depths of autocratic regimes. With HRF support, Stringer News is amplifying the voices of frontline journalists and protecting the flow of truth under dictatorship.

Prices Today

As Vladimir Putin wages war against Ukraine, it hides the economic pain at home. Prices Today is a project launched by the Anti-Corruption Foundation that tracks rising prices across essential goods and services in the country and publishes the data on an open, accessible website. The project helps Russians see through state propaganda and confront the hidden financial toll of Putin’s war. With this grant, Prices Today will expand its tools and research to expose the true cost of war and challenge the Kremlin’s narrative.

Instamouse for Bitcoin and Lightning

Contributing to Bitcoin’s codebase may require specialized tools and complex setup — barriers for developers in resource-limited environments. Instamouse, created by software developer Bryan Bishop (kanzure), is breaking down those barriers with a browser-based environment for open-source Bitcoin development. By reducing hardware requirements and simplifying access, it opens the door to a more inclusive environment that allows more people around the world to contribute to Bitcoin. With this grant, Instamouse will help keep Bitcoin’s development truly permissionless.

Seedsigner

Most commercial hardware wallets can be expensive, proprietary, and traceable. This poses barriers to self-custody for dissidents in weak economies or surveillant regimes. Seedsigner is a fully customizable, DIY Bitcoin hardware wallet that anyone can build using affordable, off-the-shelf components. It offers dissidents a discreet, low-cost way to secure their Bitcoin. HRF funding for lead developer Keith Mukai will expand language support across Europe, Asia, and beyond, as well as ongoing feature development and mentoring of new contributors.

Spacebear’s Contributions to Payjoin

Bitcoin enables human rights defenders to receive unstoppable payments. But making those payments private is the next critical step. Payjoin is a technique that lets senders and receivers batch Bitcoin transactions, breaking common chain analysis heuristics and improving default privacy. This is vital for activists in surveillance states who urgently need financial privacy without drawing attention. With HRF support, developer spacebear is advancing Payjoin to make privacy the default on Bitcoin and protect civil societies under tyranny.

Padawan Wallet

When authoritarian regimes devalue currencies or impose capital controls, people often turn to Bitcoin. But without experience, many struggle to use it safely. Padawan Wallet, a free, open-source mobile app by developer thunderbiscuit, helps bridge that gap. It uses Bitcoin test network coins to simulate real payments in a risk-free environment. It lets users practice making transactions, secure their wallets, and explore saving without risking real funds. With HRF support, Padawan will launch on iOS, expanding access to safe, hands-on Bitcoin learning for millions facing financial uncertainty.

Brink

Without ongoing support for Bitcoin development and its contributors, the network risks slower innovation, greater centralization, and long-term security challenges. Brink, a nonprofit organization led by Executive Director Mike Schmidt, addresses this by funding and mentoring open-source developers working on Bitcoin’s software infrastructure. Through grants and fellowships, Brink helps keep the protocol secure, decentralized, and freely accessible. With this grant, Brink will further strengthen the foundation that makes Bitcoin a tool for financial freedom.

Coin Center

As dictators increasingly treat code as a crime, open-source developers face sanctions, lawsuits, and mounting legal threats. Coin Center, a nonprofit research and advocacy organization led by Director of Research Peter Van Valkenburgh, defends the right to build and use open digital asset networks like Bitcoin. It advances policy analysis, supports strategic litigation, and educates lawmakers to protect freedom-preserving technologies. With HRF support, Coin Center will continue shaping a global legal environment where vital tools can be built for human rights defenders at risk.

Bitcoin Design Foundation

Poor user experience is a major barrier to Bitcoin adoption. Inconsistent wallet experiences and steep learning curves can deter new users, especially in high-risk environments. The Bitcoin Design Foundation is a nonprofit founded by UI designers Christoph Ono, Mogashni Naidoo, and Daniel Nordh that addresses this by funding open-source design, UX research, and community initiatives to make Bitcoin products more intuitive. With HRF support, the foundation will expand its grant and education programs to keep usability a priority and ensure Bitcoin remains open to all.

EmberOne

Bitcoin mining is dominated by a few companies producing closed, proprietary hardware — threatening the network’s resilience and accessibility. The 256 Foundation is a nonprofit working to change that. Building on the open-source Bitaxe project, EmberOne produces modular, open-source mining hardware that is simple, affordable, and open to anyone — especially those living under repressive regimes. With HRF support, EmberOne will lower entry barriers and help disrupt the proprietary ecosystem, making Bitcoin mining more accessible for those in closed societies.

2025 FROST Developer Support

For nonprofits operating under authoritarian rule, securing Bitcoin is critical for survival. If private keys (which control access to bitcoin) are compromised, funds can be seized and movements dismantled. Blockchain Commons is a nonprofit supporting the development of FROST (Flexible Round-Optimized Schnorr Threshold Signature), a protocol that strengthens multisignature wallets (bitcoin wallets with multiple private keys) by making them more secure, private, and flexible for shared custody. With this grant, Blockchain Commons will help build critical infrastructure to keep civil society groups operational and financially resilient under dictatorships.

Ecash UX Improvement Project

Ecash enables

-

@ cae03c48:2a7d6671

2025-05-29 18:01:48

@ cae03c48:2a7d6671

2025-05-29 18:01:48Bitcoin Magazine

Mayor Eric Adams Announced New York City Will Issue a Bit BondAt the 2025 Bitcoin Conference in Las Vegas, the Mayor of New York City Eric Adams announced that New York City will issue a Bit Bond.

Eric Adams started by connecting the American flag to Bitcoin commenting, “just as our flag still flies, Bitcoin is going to continue to fly in our country.” Later on he mentioned, “New York City is going to lead the way. We are going to be the leader because we know the power of innovation and what innovation has to offer.”

BREAKING:

NYC Mayor Eric Adams plans to issue Bit Bond for New York. #Bitcoin pic.twitter.com/loESV4UJYf

NYC Mayor Eric Adams plans to issue Bit Bond for New York. #Bitcoin pic.twitter.com/loESV4UJYf— Bitcoin Magazine (@BitcoinMagazine) May 28, 2025

“These conferences are crucial and when we held our summit in New York a few weeks ago,” said Adam. “We held it with a clear focus that it is time for you no longer to go through the lawfare that you went through and had to flee our city. New York is the empire state. We don’t break empires, we build empires.”

Adams called back everyone that left New York because of their overregulation of Bitcoin and Crypto.

“Come back home you have a mayor that is the crypto mayor, is the Bitcoin mayor and I want you back in the city of New York,” stated Adam. “Where you won’t be attacked and criminalized. Let’s get rid of the Bitcoin license and allow us to free flow of Bitcoin in our city.”

Then Adam commented, “it’s time for the first time in the history of this city to have a financial instrument that is made for those who are holders of Bitcoin. I believe we need to have a Bit Bond and I am going to push and fight to get a Bit Bond in New York.”

Adams closed his speech by saying, “We are going to use Bitcoin blockchain for our birth certificates. We are going to use Bitcoin to pay off fines and taxes. We are going to allow our young people to understand what it is to be part of this industry, but we need you on the ground.”