-

@ 7f6db517:a4931eda

2025-06-05 20:02:26

@ 7f6db517:a4931eda

2025-06-05 20:02:26

"Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know. Privacy is the power to selectively reveal oneself to the world." - Eric Hughes, A Cypherpunk's Manifesto, 1993

Privacy is essential to freedom. Without privacy, individuals are unable to make choices free from surveillance and control. Lack of privacy leads to loss of autonomy. When individuals are constantly monitored it limits our ability to express ourselves and take risks. Any decisions we make can result in negative repercussions from those who surveil us. Without the freedom to make choices, individuals cannot truly be free.

Freedom is essential to acquiring and preserving wealth. When individuals are not free to make choices, restrictions and limitations prevent us from economic opportunities. If we are somehow able to acquire wealth in such an environment, lack of freedom can result in direct asset seizure by governments or other malicious entities. At scale, when freedom is compromised, it leads to widespread economic stagnation and poverty. Protecting freedom is essential to economic prosperity.

The connection between privacy, freedom, and wealth is critical. Without privacy, individuals lose the freedom to make choices free from surveillance and control. While lack of freedom prevents individuals from pursuing economic opportunities and makes wealth preservation nearly impossible. No Privacy? No Freedom. No Freedom? No Wealth.

Rights are not granted. They are taken and defended. Rights are often misunderstood as permission to do something by those holding power. However, if someone can give you something, they can inherently take it from you at will. People throughout history have necessarily fought for basic rights, including privacy and freedom. These rights were not given by those in power, but rather demanded and won through struggle. Even after these rights are won, they must be continually defended to ensure that they are not taken away. Rights are not granted - they are earned through struggle and defended through sacrifice.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-05 20:02:26

@ 7f6db517:a4931eda

2025-06-05 20:02:26

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-06-05 20:02:21

@ dfa02707:41ca50e3

2025-06-05 20:02:21Contribute to keep No Bullshit Bitcoin news going.

-

Version 1.3 of Bitcoin Safe introduces a redesigned interactive chart, quick receive feature, updated icons, a mempool preview window, support for Child Pays For Parent (CPFP) and testnet4, preconfigured testnet demo wallets, as well as various bug fixes and improvements.

-

Upcoming updates for Bitcoin Safe include Compact Block Filters.

"Compact Block Filters increase the network privacy dramatically, since you're not asking an electrum server to give you your transactions. They are a little slower than electrum servers. For a savings wallet like Bitcoin Safe this should be OK," writes the project's developer Andreas Griffin.

- Learn more about the current and upcoming features of Bitcoin Safe wallet here.

What's new in v1.3

- Redesign of Chart, Quick Receive, Icons, and Mempool Preview (by @design-rrr).

- Interactive chart. Clicking on it now jumps to transaction, and selected transactions are now highlighted.

- Speed up transactions with Child Pays For Parent (CPFP).

- BDK 1.2 (upgraded from 0.32).

- Testnet4 support.

- Preconfigured Testnet demo wallets.

- Cluster unconfirmed transactions so that parents/children are next to each other.

- Customizable columns for all tables (optional view: Txid, Address index, and more)

- Bug fixes and other improvements.

Announcement / Archive

Blog Post / Archive

GitHub Repo

Website -

-

@ dfa02707:41ca50e3

2025-06-05 20:02:20

@ dfa02707:41ca50e3

2025-06-05 20:02:20- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ 7f6db517:a4931eda

2025-06-05 20:02:28

@ 7f6db517:a4931eda

2025-06-05 20:02:28

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ b1ddb4d7:471244e7

2025-06-05 20:01:37

@ b1ddb4d7:471244e7

2025-06-05 20:01:37“Not your keys, not your coins” isn’t a slogan—it’s a survival mantra in the age of digital sovereignty.

The seismic collapses of Mt. Gox (2014) and FTX (2022) weren’t anomalies; they were wake-up calls. When $8.7 billion in customer funds vanished with FTX, it exposed the fatal flaw of third-party custody: your bitcoin is only as secure as your custodian’s weakest link.

Yet today, As of early 2025, analysts estimate that between 2.3 million and 3.7 million Bitcoins are permanently lost, representing approximately 11–18% of bitcoin’s fixed maximum supply of 21 million coins, with some reports suggesting losses as high as 4 million BTC. This paradox reveals a critical truth: self-custody isn’t just preferable—it’s essential—but it must be done right.

The Custody Spectrum

Custodial Wallets (The Illusion of Control)

- Rehypothecation Risk: Most platforms lend your bitcoin for yield generation. When Celsius collapsed, users discovered their “held” bitcoin was loaned out in risky strategies.

- Account Freezes: Regulatory actions can lock withdrawals overnight. In 2023, Binance suspended dollar withdrawals for U.S. users citing “partner bank issues,” trapping funds for weeks.

- Data Vulnerability: KYC requirements create honeypots for hackers. The 2024 Ledger breach exposed 270,000 users’ personal data despite hardware security.

True Self-Custody

Self-custody means exclusively controlling your private keys—the cryptographic strings that prove bitcoin ownership. Unlike banks or exchanges, self-custody eliminates:- Counterparty risk (no FTX-style implosions)

- Censorship (no blocked transactions)

- Inflationary theft (no fractional reserve lending)

Conquering the Three Great Fears of Self-Custody

Fear 1: “I’ll Lose Everything If I Make a Mistake”

Reality: Human error is manageable with robust systems:

- Test Transactions: Always send a micro-amount (0.00001 BTC) before large transfers. Verify receipt AND ability to send back.

- Multi-Backup Protocol: Store seed phrases on fireproof/waterproof steel plates (not paper!). Distribute copies geographically—one in a home safe, another with trusted family 100+ miles away.

- SLIP39 Sharding: Split your seed into fragments requiring 3-of-5 shards to reconstruct. No single point of failure.

Fear 2: “Hackers Will Steal My Keys”

Reality: Offline storage defeats remote attacks:

- Hardware Wallets: Devices like Bitkey or Ledger keep keys in “cold storage”—isolated from internet-connected devices. Transactions require physical confirmation.

- Multisig Vaults: Bitvault’s multi-sig system requires attackers compromise multiple locations/devices simultaneously. Even losing two keys won’t forfeit funds.

- Air-Gapped Verification: Use dedicated offline devices for wallet setup. Never type seeds on internet-connected machines.

Fear 3: “My Family Can’t Access It If I Die”

Reality: Inheritance is solvable:

- Dead Man Switches: Bitwarden’s emergency access allows trusted contacts to retrieve encrypted keys after a pre-set waiting period (e.g., 30 days).

- Inheritance Protocols: Bitkey’s inheritance solution shares decryption keys via designated beneficiaries’ emails. Requires multiple approvals to prevent abuse.

- Public Key Registries: Share wallet XPUBs (not private keys!) with heirs. They can monitor balances but not spend, ensuring transparency without risk.

The Freedom Dividend

- Censorship Resistance: Send $10M BTC to a Wikileaks wallet without Visa/Mastercard blocking it.

- Privacy Preservation: Avoid KYC surveillance—non-custodial wallets like Flash require zero ID verification.

- Protocol Access: Participate in bitcoin-native innovations (Lightning Network, DLCs) only possible with self-custodied keys.

- Black Swan Immunity: When Cyprus-style bank bailins happen, your bitcoin remains untouched in your vault.

The Sovereign’s Checklist

- Withdraw from Exchanges: Move all BTC > $1,000 to self-custody immediately.

- Buy Hardware Wallet: Purchase DIRECTLY from manufacturer (no Amazon!) to avoid supply-chain tampering.

- Generate Seed OFFLINE: Use air-gapped device, write phrase on steel—never digitally.

- Test Recovery: Delete wallet, restore from seed before funding.

- Implement Multisig: For > $75k, use Bitvault for 2-of-3 multi-sig setup.

- Create Inheritance Plan: Share XPUBs/SLIP39 shards with heirs + legal documents.

“Self-custody isn’t about avoiding risk—it’s about transferring risk from opaque institutions to transparent, controllable systems you design.”

The Inevitable Evolution: Custody Without Compromise

Emerging solutions are erasing old tradeoffs:

- MPC Wallets: Services like Xapo Bank shatter keys into encrypted fragments distributed globally. No single device holds full keys, defeating physical theft.

- Social Recovery: Ethically designed networks (e.g., Bitkey) let trusted contacts restore access without custodial control.

- Biometric Assurance: Fingerprint reset protocols prevent lockouts from physical injuries.

Lost keys = lost bitcoin. But consider the alternative: entrusting your life savings to entities with proven 8% annual failure rates among exchanges. Self-custody shifts responsibility from hoping institutions won’t fail to knowing your system can’t fail without your consent.

Take action today: Move one coin. Test one recovery. Share one xpub. The path to unchained wealth begins with a single satoshi under your control.

-

@ 527337d5:93e9525e

2025-06-05 03:09:02

@ 527337d5:93e9525e

2025-06-05 03:09:02The Algorithmic Pursuit of Connection: A Five-Book Journey into the Self

As a researcher, hitting my thirties and the winding down of a significant project prompted a crucial re-evaluation of life's latter half. While I'd successfully applied probabilistic control theory to one-on-one interactions, the complexities of group dynamics remained a persistent challenge. My recent dive into five diverse books on human relationships inadvertently became a profound journey of self-discovery, fundamentally reshaping my perspective on social connections.

Neil Strauss: A Mirror Reflecting the Self's Evolution

Neil Strauss's The Truth resonated deepest among my recent reads. The author's battle with sex addiction uncomfortably mirrored my own past struggles: the fragile self-esteem stemming from rejection, the hubris born of early successes, and the tendency to view women as mere objects of manipulation. It felt eerily prescient, a glimpse into a potential future.

Yet, I found myself arriving at Strauss's ultimate conclusion – the paramount importance of self-preparation and community – far sooner than he did. This acceleration wasn't accidental; it was the result of intense focus on individual experiences, meticulously replayed and analyzed in my mind. The book, therefore, served less as a revelation and more as a powerful validation of my own journey of introspection and root-cause analysis.

Quantifying Connection: The Promise and Limits of Mathematical Models

Hannah Fry's The Mathematics of Love offered a kindred spirit in its attempt to quantify human relationships. While I appreciate the mathematical lens, Fry's models primarily concern dyadic relationships (N=2), relying on relatively simple systems of two-variable ordinary differential equations. For me, these are akin to linear models, sufficient only up to a certain point. Beyond N=4, the dependencies become exponentially complex.

My own pursuit extends to understanding and optimizing group dynamics within complex systems. This involves multi-variable problems (N $\ge$ 3) and the application of network theory, a far more sophisticated approach. Human collectives, after all, are systems of nodes and edges, where information propagates in predictable ways. My focus is on deriving optimal behavioral controls within these intricate frameworks.

Conversely, Men Are from Mars, Women Are from Venus initially struck me as bordering on conspiracy theory. However, its latter half proved unexpectedly useful. Its clear enumeration of male and female desires, and its articulation of common points of conflict, presented a practical template for communication styles. In a systemic view, this serves as a rudimentary, yet functional, interface design for complex social interactions.

A Dispassionate Critique of Relationship Dogma

My drive for efficiency and systematic understanding led to a rather blunt assessment of certain relationship classics. The New Science of Adult Attachment felt disorganized and frustratingly anecdotal. Lacking a coherent theoretical framework, it burdened the reader with deciphering meaning from a jumble of examples. Its inefficiency was, frankly, its most irksome flaw.

Similarly, Dale Carnegie's How to Win Friends and Influence People struck me as closer to pseudoscience than social science. Its plethora of specific anecdotes obscured any underlying principle. Given my deep engagement with social engineering – a discipline that systematically and practically analyzes human interaction – Carnegie's work appeared largely irrelevant and inefficient. From my perspective, which views humans as objective systems to be analyzed with mathematical rigor, such unstructured approaches hold little value.

The Unveiling of a Core Principle: Humans as Systems

This intensive reading period solidified my most crucial insight: humans, at their core, are systems. This understanding allows for a dispassionate, methodical approach to human collectives, mitigating unnecessary emotional friction.

This revelation has sharply refined my future learning trajectory. I'm now prioritizing foundational theories like graph theory and network theory over anecdotal accounts of human behavior. By mastering these theoretical underpinnings, I aim to precisely model complex human interactions as systems of nodes and edges, enabling the derivation of optimal behavioral controls within communities.

My choice of the term "target for capture" for individuals stems from a personal aversion to perceived equality in certain human interactions, a mechanism to avoid cognitive dissonance. This rational approach, I believe, is key to cultivating secure attachment styles – relationships demonstrably sustainable in the long term. My philosophy is to strategically approach the initial engagement, then transition to a stable, enduring connection. It's a calculated, dispassionate method for achieving desired relational outcomes.

Ultimately, this period of reading wasn't just about acquiring knowledge; it was a profound journey of self-discovery, clarifying my personal frameworks for navigating life's complexities and forging meaningful, yet strategically managed, connections.

-

@ a19caaa8:88985eaf

2025-06-02 16:53:52

@ a19caaa8:88985eaf

2025-06-02 16:53:52nostr:nevent1qvzqqqqqqypzpfh373gqszm9hf6a4zk8x28erj20sv2t9nz25uvu29599g5n3rctqyxhwumn8ghj77tpvf6jumt9qyghwumn8ghj7u3wddhk56tjvyhxjmcqyr9n8kfk8zac3m0kxzd3j7l6heulvc5aldm84426a4u43p9ern93uc8plqa

nostr:nevent1qvzqqqqqqypzpfh373gqszm9hf6a4zk8x28erj20sv2t9nz25uvu29599g5n3rctqyxhwumn8ghj77tpvf6jumt9qyghwumn8ghj7u3wddhk56tjvyhxjmcqyqlfmq35x9eytafmxd37r26s773hucd5e9xyruap6kef95x8ynt6wfu8dt7

nostr:nevent1qvzqqqqqqypzpklshm8nfqmq9ca8xdzjj4xnzv5djf60s0c0aygw5zwlfx6mp0fpqyxhwumn8ghj77tpvf6jumt9qyghwumn8ghj7u3wddhk56tjvyhxjmcqyqgryqzmawchl6396jvhys63vhh8ruh2j4pz5e4zv88nk3vqdpt57l3509y

↑これってたゃの拾得ミス?

-

@ df67f9a7:2d4fc200

2025-06-05 19:52:32

@ df67f9a7:2d4fc200

2025-06-05 19:52:32Nostr is NOT a social network. Nostr is a network of interconnected social apps. And, since any app is a social app, Nostr is for every app.

ONLY Nostr incentivizes inter-connectivity between independent apps, simply by respecting sovereignty at the protocol layer. For end users, sovereignty means that the content they post “to Nostr” will never be owned by the apps that they use. For businesses building apps on Nostr, sovereignty means that every app actually benefits by other apps being on the network. Because sovereignty is respected, users are retained for longer and independent apps thrive far longer on Nostr than on the legacy “black box” social networks.

Social apps thrive on Nostr

Nostr integration provides these benefits for every app :

- Unrestrained access for any app, to all public and private data “on Nostr”. No fees or licenses for harvesting user data from the network.

- Unburdened from liability, when collecting user data with any app. When sending “to Nostr”, end users retain custody of user data while apps never loose access.

- Unlimited free market of search engines and feed algos. Users and brands can create, use, and share any algos or custom feeds. Grow your audience on your own terms.

- Universal open network for all apps. Build any kind of app for any audience, on the same network as other apps for other audiences. Discover new trends from user data.

- Unregulated tech platform. Build your own app and use it as you wish. No gate keepers. No code review.

Sovereignty is good for business.

Regardless of the network size, a Nostr integrated app can grow its user base MUCH faster and with greater independence BECAUSE of the sovereignty respecting protocol. While end users may retain custody of their identities and data on the network, it’s the apps that determine which data is, or is not, sent to the network. Respect for sovereignty IS the killer feature that ONLY the Nostr protocol provides for apps and for end users.

Because Nostr is permissionless for any app to integrate :

- end users will always have a free market of apps choose from

- apps are free to integrate only as much as benefits their business model.

- apps gain access to more novel data as new apps bring new users to the network.

Because data on Nostr is managed by end users and available to all apps :

- User data looses exclusivity and the demand shifts toward novel insights and information derived from these data.

- Apps are freed from having to be “data pirates”, and can focus on establishing a trusted user base, providing valuable services to satisfied customers, informed by the abundance of user data.

- Apps are incentivized to offload data onto the network, establishing a new paradigm for interconnectivity, where independence is NOT at stake as the network grows.

- New markets spring up to support users with self custody of their data, driven by the reality that apps can have full access without assuming responsibility.

- The market for search and algo tools opens up for independent apps and end users to discover and interact freely with each other.

- The ad based “attention economy” slowly transforms to a value based consumer economy, where the end user is the customer rather than the product being sold.

Even while privacy is respected

Sometimes sovereignty is at odds with privacy, but Nostr allows all parties to win while both are protected.

- For end users sending sensetive data "to Nostr", privacy is assured by encrypting it with their own private keys and/or sending it to private (auth required) relays of their choosing.

- For apps handling private IP or business data, any traditional “black box” infrastructure can be used in the back end to manitain isolation from Nostr.

This means apps and end users remain in control of their own private data, without requiring “big social” as trust provider or data reseller. To access a user's private data, client apps (even search engines, running locally) only need explicit permission from the end user to retrieve or decrypt from Nostr relays. Public data, on the other hand, is freely available for any app or search engine to harvest from any Nostr relay. In either case, user data on the Nostr network is always accessible to client apps, without additional restrictions or fees.

Nostr is for every app.

Adding social to any app makes it a better app. Add reviews for products or services. Add commenting or direct messaging. Share or collaborate on content creation. Nostr integration is straightforward and incremental for any app.

Nostr doesn't define your app's business model ... Nostr 10X's it!

Here's how :

- Start with your own business and app design. Add Nosrr login.

- Discover what "kinds" of user data already exists "on Nostr" that your app can ingest and make use of.

- Decide which "kinds" of data would benefit your business, your users, and the network, if sent "to Nostr".

- Implement Nostr integration for data kinds and add webs of trust tools for recommendation and discovery.

- Verify your app is sovereignty respecting in how it handles private data and implements Nostr NIPs.

- Engage with existing users, and onboard new users from your app, to earn their trust and patronage over Nostr.

For more info and assistance, contact our team of Nostr integration experts.

-

@ 7f6db517:a4931eda

2025-06-05 19:02:25

@ 7f6db517:a4931eda

2025-06-05 19:02:25

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-06-05 13:01:35

@ dfa02707:41ca50e3

2025-06-05 13:01:35Contribute to keep No Bullshit Bitcoin news going.

-

Version 1.3 of Bitcoin Safe introduces a redesigned interactive chart, quick receive feature, updated icons, a mempool preview window, support for Child Pays For Parent (CPFP) and testnet4, preconfigured testnet demo wallets, as well as various bug fixes and improvements.

-

Upcoming updates for Bitcoin Safe include Compact Block Filters.

"Compact Block Filters increase the network privacy dramatically, since you're not asking an electrum server to give you your transactions. They are a little slower than electrum servers. For a savings wallet like Bitcoin Safe this should be OK," writes the project's developer Andreas Griffin.

- Learn more about the current and upcoming features of Bitcoin Safe wallet here.

What's new in v1.3

- Redesign of Chart, Quick Receive, Icons, and Mempool Preview (by @design-rrr).

- Interactive chart. Clicking on it now jumps to transaction, and selected transactions are now highlighted.

- Speed up transactions with Child Pays For Parent (CPFP).

- BDK 1.2 (upgraded from 0.32).

- Testnet4 support.

- Preconfigured Testnet demo wallets.

- Cluster unconfirmed transactions so that parents/children are next to each other.

- Customizable columns for all tables (optional view: Txid, Address index, and more)

- Bug fixes and other improvements.

Announcement / Archive

Blog Post / Archive

GitHub Repo

Website -

-

@ 7f6db517:a4931eda

2025-06-05 20:02:27

@ 7f6db517:a4931eda

2025-06-05 20:02:27

The former seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

The latter's future remains to be seen. Dependence on Tor, which has had massive reliability issues, and lack of strong privacy guarantees put it at risk.

— ODELL (@ODELL) October 27, 2022

The Basics

- Lightning is a protocol that enables cheap and fast native bitcoin transactions.

- At the core of the protocol is the ability for bitcoin users to create a payment channel with another user.

- These payment channels enable users to make many bitcoin transactions between each other with only two on-chain bitcoin transactions: the channel open transaction and the channel close transaction.

- Essentially lightning is a protocol for interoperable batched bitcoin transactions.

- It is expected that on chain bitcoin transaction fees will increase with adoption and the ability to easily batch transactions will save users significant money.

- As these lightning transactions are processed, liquidity flows from one side of a channel to the other side, on chain transactions are signed by both parties but not broadcasted to update this balance.

- Lightning is designed to be trust minimized, either party in a payment channel can close the channel at any time and their bitcoin will be settled on chain without trusting the other party.

There is no 'Lightning Network'

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise.

- There are many lightning channels between many different users and funds can flow across interconnected channels as long as there is a route through peers.

- If a lightning transaction requires multiple hops it will flow through multiple interconnected channels, adjusting the balance of all channels along the route, and paying lightning transaction fees that are set by each node on the route.

Example: You have a channel with Bob. Bob has a channel with Charlie. You can pay Charlie through your channel with Bob and Bob's channel with User C.

- As a result, it is not guaranteed that every lightning user can pay every other lightning user, they must have a route of interconnected channels between sender and receiver.

Lightning in Practice

- Lightning has already found product market fit and usage as an interconnected payment protocol between large professional custodians.

- They are able to easily manage channels and liquidity between each other without trust using this interoperable protocol.

- Lightning payments between large custodians are fast and easy. End users do not have to run their own node or manage their channels and liquidity. These payments rarely fail due to professional management of custodial nodes.

- The tradeoff is one inherent to custodians and other trusted third parties. Custodial wallets can steal funds and compromise user privacy.

Sovereign Lightning

- Trusted third parties are security holes.

- Users must run their own node and manage their own channels in order to use lightning without trusting a third party. This remains the single largest friction point for sovereign lightning usage: the mental burden of actively running a lightning node and associated liquidity management.

- Bitcoin development prioritizes node accessibility so cost to self host your own node is low but if a node is run at home or office, Tor or a VPN is recommended to mask your IP address: otherwise it is visible to the entire network and represents a privacy risk.

- This privacy risk is heightened due to the potential for certain governments to go after sovereign lightning users and compel them to shutdown their nodes. If their IP Address is exposed they are easier to target.

- Fortunately the tools to run and manage nodes continue to get easier but it is important to understand that this will always be a friction point when compared to custodial services.

The Potential Fracture of Lightning

- Any lightning user can choose which users are allowed to open channels with them.

- One potential is that professional custodians only peer with other professional custodians.

- We already see nodes like those run by CashApp only have channels open with other regulated counterparties. This could be due to performance goals, liability reduction, or regulatory pressure.

- Fortunately some of their peers are connected to non-regulated parties so payments to and from sovereign lightning users are still successfully processed by CashApp but this may not always be the case going forward.

Summary

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise. There is no singular 'Lightning Network' but rather many payment channels between distinct peers, some connected with each other and some not.

- Lightning as an interoperable payment protocol between professional custodians seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

- Lightning as a robust sovereign payment protocol has yet to be battle tested. Heavy reliance on Tor, which has had massive reliability issues, the friction of active liquidity management, significant on chain fee burden for small amounts, interactivity constraints on mobile, and lack of strong privacy guarantees put it at risk.

If you have never used lightning before, use this guide to get started on your phone.

If you found this post helpful support my work with bitcoin.

-

@ b1ddb4d7:471244e7

2025-06-05 19:01:34

@ b1ddb4d7:471244e7

2025-06-05 19:01:34“Not your keys, not your coins” isn’t a slogan—it’s a survival mantra in the age of digital sovereignty.

The seismic collapses of Mt. Gox (2014) and FTX (2022) weren’t anomalies; they were wake-up calls. When $8.7 billion in customer funds vanished with FTX, it exposed the fatal flaw of third-party custody: your bitcoin is only as secure as your custodian’s weakest link.

Yet today, As of early 2025, analysts estimate that between 2.3 million and 3.7 million Bitcoins are permanently lost, representing approximately 11–18% of bitcoin’s fixed maximum supply of 21 million coins, with some reports suggesting losses as high as 4 million BTC. This paradox reveals a critical truth: self-custody isn’t just preferable—it’s essential—but it must be done right.

The Custody Spectrum

Custodial Wallets (The Illusion of Control)

- Rehypothecation Risk: Most platforms lend your bitcoin for yield generation. When Celsius collapsed, users discovered their “held” bitcoin was loaned out in risky strategies.

- Account Freezes: Regulatory actions can lock withdrawals overnight. In 2023, Binance suspended dollar withdrawals for U.S. users citing “partner bank issues,” trapping funds for weeks.

- Data Vulnerability: KYC requirements create honeypots for hackers. The 2024 Ledger breach exposed 270,000 users’ personal data despite hardware security.

True Self-Custody

Self-custody means exclusively controlling your private keys—the cryptographic strings that prove bitcoin ownership. Unlike banks or exchanges, self-custody eliminates:- Counterparty risk (no FTX-style implosions)

- Censorship (no blocked transactions)

- Inflationary theft (no fractional reserve lending)

Conquering the Three Great Fears of Self-Custody

Fear 1: “I’ll Lose Everything If I Make a Mistake”

Reality: Human error is manageable with robust systems:

- Test Transactions: Always send a micro-amount (0.00001 BTC) before large transfers. Verify receipt AND ability to send back.

- Multi-Backup Protocol: Store seed phrases on fireproof/waterproof steel plates (not paper!). Distribute copies geographically—one in a home safe, another with trusted family 100+ miles away.

- SLIP39 Sharding: Split your seed into fragments requiring 3-of-5 shards to reconstruct. No single point of failure.

Fear 2: “Hackers Will Steal My Keys”

Reality: Offline storage defeats remote attacks:

- Hardware Wallets: Devices like Bitkey or Ledger keep keys in “cold storage”—isolated from internet-connected devices. Transactions require physical confirmation.

- Multisig Vaults: Bitvault’s multi-sig system requires attackers compromise multiple locations/devices simultaneously. Even losing two keys won’t forfeit funds.

- Air-Gapped Verification: Use dedicated offline devices for wallet setup. Never type seeds on internet-connected machines.

Fear 3: “My Family Can’t Access It If I Die”

Reality: Inheritance is solvable:

- Dead Man Switches: Bitwarden’s emergency access allows trusted contacts to retrieve encrypted keys after a pre-set waiting period (e.g., 30 days).

- Inheritance Protocols: Bitkey’s inheritance solution shares decryption keys via designated beneficiaries’ emails. Requires multiple approvals to prevent abuse.

- Public Key Registries: Share wallet XPUBs (not private keys!) with heirs. They can monitor balances but not spend, ensuring transparency without risk.

The Freedom Dividend

- Censorship Resistance: Send $10M BTC to a Wikileaks wallet without Visa/Mastercard blocking it.

- Privacy Preservation: Avoid KYC surveillance—non-custodial wallets like Flash require zero ID verification.

- Protocol Access: Participate in bitcoin-native innovations (Lightning Network, DLCs) only possible with self-custodied keys.

- Black Swan Immunity: When Cyprus-style bank bailins happen, your bitcoin remains untouched in your vault.

The Sovereign’s Checklist

- Withdraw from Exchanges: Move all BTC > $1,000 to self-custody immediately.

- Buy Hardware Wallet: Purchase DIRECTLY from manufacturer (no Amazon!) to avoid supply-chain tampering.

- Generate Seed OFFLINE: Use air-gapped device, write phrase on steel—never digitally.

- Test Recovery: Delete wallet, restore from seed before funding.

- Implement Multisig: For > $75k, use Bitvault for 2-of-3 multi-sig setup.

- Create Inheritance Plan: Share XPUBs/SLIP39 shards with heirs + legal documents.

“Self-custody isn’t about avoiding risk—it’s about transferring risk from opaque institutions to transparent, controllable systems you design.”

The Inevitable Evolution: Custody Without Compromise

Emerging solutions are erasing old tradeoffs:

- MPC Wallets: Services like Xapo Bank shatter keys into encrypted fragments distributed globally. No single device holds full keys, defeating physical theft.

- Social Recovery: Ethically designed networks (e.g., Bitkey) let trusted contacts restore access without custodial control.

- Biometric Assurance: Fingerprint reset protocols prevent lockouts from physical injuries.

Lost keys = lost bitcoin. But consider the alternative: entrusting your life savings to entities with proven 8% annual failure rates among exchanges. Self-custody shifts responsibility from hoping institutions won’t fail to knowing your system can’t fail without your consent.

Take action today: Move one coin. Test one recovery. Share one xpub. The path to unchained wealth begins with a single satoshi under your control.

-

@ ac8bb9b0:70278acc

2025-06-05 18:12:29

@ ac8bb9b0:70278acc

2025-06-05 18:12:29Details

- ⏲️ Prep time: 15 min

- 🍳 Cook time: 20 min

- 🍽️ Servings: 12

Ingredients

- 1 and 1/2 cups (345g) mashed bananas (about 4 medium or 3 large ripe bananas)

- 1/3 cup (113g) honey

- 1 large egg

- 1/4 cup (56g) coconut oil, melted

- 1 teaspoon pure vanilla extract

- 1 cup (130g) whole wheat flour

- 1/2 cup (41g) natural unsweetened cocoa powder

- 1 teaspoon baking powder

- 1 teaspoon baking soda

- 1/2 teaspoon salt

- 1 cup (180g) semi-sweet or dark chocolate chips

Directions

- Preheat oven to 425°F (218°C). Spray a 12-count muffin pan with nonstick spray or line with cupcake liners. Set aside.

- In a medium bowl, mash the bananas up using a fork.* Try to mash up any large lumps. Once mashed, whisk in the honey, egg, coconut oil, and vanilla extract until combined. Set aside.

- In a large bowl, whisk the flour, cocoa powder, baking powder, baking soda, and salt together. Pour the wet ingredients into the dry ingredients and whisk until everything is combined. Fold in the chocolate chips, reserving some for the tops of the warm muffins.

- Spoon the batter evenly into each cup or liner, filling each all the way to the top.

- Bake for 5 minutes at 425°F (218°C); then, keeping the muffins in the oven, reduce heat to 350°F (177°C) and continue baking for another 15–17 minutes or until a toothpick inserted in the center comes out clean. The total time these muffins take in the oven is about 20–21 minutes, give or take. (For mini muffins, bake 11–13 minutes at 350°F (177°C) the whole time.)

- Press any remaining chocolate chips into the tops of the warm muffins. Allow the muffins to cool for 5 minutes in the muffin pan, and then transfer to a wire rack to continue cooling, or enjoy warm.

- Muffins stay fresh covered at room temperature for a few days, then transfer to the refrigerator for up to 1 week.

-

@ 7f6db517:a4931eda

2025-06-05 19:02:27

@ 7f6db517:a4931eda

2025-06-05 19:02:27

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-05 19:02:25

@ 7f6db517:a4931eda

2025-06-05 19:02:25

"Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know. Privacy is the power to selectively reveal oneself to the world." - Eric Hughes, A Cypherpunk's Manifesto, 1993

Privacy is essential to freedom. Without privacy, individuals are unable to make choices free from surveillance and control. Lack of privacy leads to loss of autonomy. When individuals are constantly monitored it limits our ability to express ourselves and take risks. Any decisions we make can result in negative repercussions from those who surveil us. Without the freedom to make choices, individuals cannot truly be free.

Freedom is essential to acquiring and preserving wealth. When individuals are not free to make choices, restrictions and limitations prevent us from economic opportunities. If we are somehow able to acquire wealth in such an environment, lack of freedom can result in direct asset seizure by governments or other malicious entities. At scale, when freedom is compromised, it leads to widespread economic stagnation and poverty. Protecting freedom is essential to economic prosperity.

The connection between privacy, freedom, and wealth is critical. Without privacy, individuals lose the freedom to make choices free from surveillance and control. While lack of freedom prevents individuals from pursuing economic opportunities and makes wealth preservation nearly impossible. No Privacy? No Freedom. No Freedom? No Wealth.

Rights are not granted. They are taken and defended. Rights are often misunderstood as permission to do something by those holding power. However, if someone can give you something, they can inherently take it from you at will. People throughout history have necessarily fought for basic rights, including privacy and freedom. These rights were not given by those in power, but rather demanded and won through struggle. Even after these rights are won, they must be continually defended to ensure that they are not taken away. Rights are not granted - they are earned through struggle and defended through sacrifice.

If you found this post helpful support my work with bitcoin.

-

@ da8b7de1:c0164aee

2025-06-05 17:39:41

@ da8b7de1:c0164aee

2025-06-05 17:39:41| Régió/Ország | Fő esemény/politika | Forrás | |------------------|--------------------------------------------------------------------------------------------------|-------------| | Egyesült Államok | Végrehajtási rendeletek a nukleáris termelés négyszeresére növeléséről; a nem létfontosságú K+F költségvetésének csökkentése; SMR és mikroreaktor kezdeményezések | world-nuclear-news, nucnet, aoshearman, ans | | Kanada | Engedélyezés új BWRX-300 SMR reaktor építésére Darlingtonban | world-nuclear-news, ans | | Európa | EU tervek az orosz nukleáris importok korlátozására; Westinghouse–Bulgária beszállítói megállapodások | nucnet, world-nuclear-news | | Globális/Világbank | A nukleáris finanszírozási tilalom esetleges feloldása a fejlődő országok számára | globalissues | | Egyesült Királyság| Új kiberbiztonsági jogszabályok a nukleáris szektorban | aoshearman | | Katonaság/Védelem| A védelmi minisztérium cégeket választott ki mikroreaktorok telepítésére | ans |

Források:

world-nuclear-news

nucnet

aoshearman

globalissues

ans -

@ 7f6db517:a4931eda

2025-06-05 19:02:25

@ 7f6db517:a4931eda

2025-06-05 19:02:25

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-06-05 19:02:23

@ dfa02707:41ca50e3

2025-06-05 19:02:23Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ dfa02707:41ca50e3

2025-06-05 20:02:23

@ dfa02707:41ca50e3

2025-06-05 20:02:23

Good morning (good night?)! The No Bullshit Bitcoin news feed is now available on Moody's Dashboard! A huge shoutout to sir Clark Moody for integrating our feed.

Headlines

- Spiral welcomes Ben Carman. The developer will work on the LDK server and a new SDK designed to simplify the onboarding process for new self-custodial Bitcoin users.

- The Bitcoin Dev Kit Foundation announced new corporate members for 2025, including AnchorWatch, CleanSpark, and Proton Foundation. The annual dues from these corporate members fund the small team of open-source developers responsible for maintaining the core BDK libraries and related free and open-source software (FOSS) projects.

- Strategy increases Bitcoin holdings to 538,200 BTC. In the latest purchase, the company has spent more than $555M to buy 6,556 coins through proceeds of two at-the-market stock offering programs.

- Spar supermarket experiments with Bitcoin payments in Zug, Switzerland. The store has introduced a new payment method powered by the Lightning Network. The implementation was facilitated by DFX Swiss, a service that supports seamless conversions between bitcoin and legacy currencies.

- The Bank for International Settlements (BIS) wants to contain 'crypto' risks. A report titled "Cryptocurrencies and Decentralised Finance: Functions and Financial Stability Implications" calls for expanding research into "how new forms of central bank money, capital controls, and taxation policies can counter the risks of widespread crypto adoption while still fostering technological innovation."

- "Global Implications of Scam Centres, Underground Banking, and Illicit Online Marketplaces in Southeast Asia." According to the United Nations Office on Drugs and Crime (UNODC) report, criminal organizations from East and Southeast Asia are swiftly extending their global reach. These groups are moving beyond traditional scams and trafficking, creating sophisticated online networks that include unlicensed cryptocurrency exchanges, encrypted communication platforms, and stablecoins, fueling a massive fraud economy on an industrial scale.

- Slovenia is considering a 25% capital gains tax on Bitcoin profits for individuals. The Ministry of Finance has proposed legislation to impose this tax on gains from cryptocurrency transactions, though exchanging one cryptocurrency for another would remain exempt. At present, individual 'crypto' traders in Slovenia are not taxed.

- Circle, BitGo, Coinbase, and Paxos plan to apply for U.S. bank charters or licenses. According to a report in The Wall Street Journal, major crypto companies are planning to apply for U.S. bank charters or licenses. These firms are pursuing limited licenses that would permit them to issue stablecoins, as the U.S. Congress deliberates on legislation mandating licensing for stablecoin issuers.

"Established banks, like Bank of America, are hoping to amend the current drafts of [stablecoin] legislation in such a way that nonbanks are more heavily restricted from issuing stablecoins," people familiar with the matter told The Block.

- Charles Schwab to launch spot Bitcoin trading by 2026. The financial investment firm, managing over $10 trillion in assets, has revealed plans to introduce spot Bitcoin trading for its clients within the next year.

Use the tools

- Bitcoin Safe v1.2.3 expands QR SignMessage compatibility for all QR-UR-compatible hardware signers (SpecterDIY, KeyStone, Passport, Jade; already supported COLDCARD Q). It also adds the ability to import wallets via QR, ensuring compatibility with Keystone's latest firmware (2.0.6), alongside other improvements.

- Minibits v0.2.2-beta, an ecash wallet for Android devices, packages many changes to align the project with the planned iOS app release. New features and improvements include the ability to lock ecash to a receiver's pubkey, faster confirmations of ecash minting and payments thanks to WebSockets, UI-related fixes, and more.

- Zeus v0.11.0-alpha1 introduces Cashu wallets tied to embedded LND wallets. Navigate to Settings > Ecash to enable it. Other wallet types can still sweep funds from Cashu tokens. Zeus Pay now supports Cashu address types in Zaplocker, Cashu, and NWC modes.

- LNDg v1.10.0, an advanced web interface designed for analyzing Lightning Network Daemon (LND) data and automating node management tasks, introduces performance improvements, adds a new metrics page for unprofitable and stuck channels, and displays warnings for batch openings. The Profit and Loss Chart has been updated to include on-chain costs. Advanced settings have been added for users who would like their channel database size to be read remotely (the default remains local). Additionally, the AutoFees tool now uses aggregated pubkey metrics for multiple channels with the same peer.

- Nunchuk Desktop v1.9.45 release brings the latest bug fixes and improvements.

- Blockstream Green iOS v4.1.8 has renamed L-BTC to LBTC, and improves translations of notifications, login time, and background payments.

- Blockstream Green Android v4.1.8 has added language preference in App Settings and enables an Android data backup option for disaster recovery. Additionally, it fixes issues with Jade entry point PIN timeout and Trezor passphrase input.

- Torq v2.2.2, an advanced Lightning node management software designed to handle large nodes with over 1000 channels, fixes bugs that caused channel balance to not be updated in some cases and channel "peer total local balance" not getting updated.

- Stack Wallet v2.1.12, a multicoin wallet by Cypher Stack, fixes an issue with Xelis introduced in the latest release for Windows.

- ESP-Miner-NerdQAxePlus v1.0.29.1, a forked version from the NerdAxe miner that was modified for use on the NerdQAxe+, is now available.

- Zark enables sending sats to an npub using Bark.

- Erk is a novel variation of the Ark protocol that completely removes the need for user interactivity in rounds, addressing one of Ark's key limitations: the requirement for users to come online before their VTXOs expire.

- Aegis v0.1.1 is now available. It is a Nostr event signer app for iOS devices.

- Nostash is a NIP-07 Nostr signing extension for Safari. It is a fork of Nostore and is maintained by Terry Yiu. Available on iOS TestFlight.

- Amber v3.2.8, a Nostr event signer for Android, delivers the latest fixes and improvements.

- Nostur v1.20.0, a Nostr client for iOS, adds

-

@ dfa02707:41ca50e3

2025-06-05 19:02:18

@ dfa02707:41ca50e3

2025-06-05 19:02:18- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ dfa02707:41ca50e3

2025-06-05 19:02:22

@ dfa02707:41ca50e3

2025-06-05 19:02:22

Good morning (good night?)! The No Bullshit Bitcoin news feed is now available on Moody's Dashboard! A huge shoutout to sir Clark Moody for integrating our feed.

Headlines

- Spiral welcomes Ben Carman. The developer will work on the LDK server and a new SDK designed to simplify the onboarding process for new self-custodial Bitcoin users.

- The Bitcoin Dev Kit Foundation announced new corporate members for 2025, including AnchorWatch, CleanSpark, and Proton Foundation. The annual dues from these corporate members fund the small team of open-source developers responsible for maintaining the core BDK libraries and related free and open-source software (FOSS) projects.

- Strategy increases Bitcoin holdings to 538,200 BTC. In the latest purchase, the company has spent more than $555M to buy 6,556 coins through proceeds of two at-the-market stock offering programs.

- Spar supermarket experiments with Bitcoin payments in Zug, Switzerland. The store has introduced a new payment method powered by the Lightning Network. The implementation was facilitated by DFX Swiss, a service that supports seamless conversions between bitcoin and legacy currencies.

- The Bank for International Settlements (BIS) wants to contain 'crypto' risks. A report titled "Cryptocurrencies and Decentralised Finance: Functions and Financial Stability Implications" calls for expanding research into "how new forms of central bank money, capital controls, and taxation policies can counter the risks of widespread crypto adoption while still fostering technological innovation."

- "Global Implications of Scam Centres, Underground Banking, and Illicit Online Marketplaces in Southeast Asia." According to the United Nations Office on Drugs and Crime (UNODC) report, criminal organizations from East and Southeast Asia are swiftly extending their global reach. These groups are moving beyond traditional scams and trafficking, creating sophisticated online networks that include unlicensed cryptocurrency exchanges, encrypted communication platforms, and stablecoins, fueling a massive fraud economy on an industrial scale.

- Slovenia is considering a 25% capital gains tax on Bitcoin profits for individuals. The Ministry of Finance has proposed legislation to impose this tax on gains from cryptocurrency transactions, though exchanging one cryptocurrency for another would remain exempt. At present, individual 'crypto' traders in Slovenia are not taxed.

- Circle, BitGo, Coinbase, and Paxos plan to apply for U.S. bank charters or licenses. According to a report in The Wall Street Journal, major crypto companies are planning to apply for U.S. bank charters or licenses. These firms are pursuing limited licenses that would permit them to issue stablecoins, as the U.S. Congress deliberates on legislation mandating licensing for stablecoin issuers.

"Established banks, like Bank of America, are hoping to amend the current drafts of [stablecoin] legislation in such a way that nonbanks are more heavily restricted from issuing stablecoins," people familiar with the matter told The Block.

- Charles Schwab to launch spot Bitcoin trading by 2026. The financial investment firm, managing over $10 trillion in assets, has revealed plans to introduce spot Bitcoin trading for its clients within the next year.

Use the tools

- Bitcoin Safe v1.2.3 expands QR SignMessage compatibility for all QR-UR-compatible hardware signers (SpecterDIY, KeyStone, Passport, Jade; already supported COLDCARD Q). It also adds the ability to import wallets via QR, ensuring compatibility with Keystone's latest firmware (2.0.6), alongside other improvements.

- Minibits v0.2.2-beta, an ecash wallet for Android devices, packages many changes to align the project with the planned iOS app release. New features and improvements include the ability to lock ecash to a receiver's pubkey, faster confirmations of ecash minting and payments thanks to WebSockets, UI-related fixes, and more.

- Zeus v0.11.0-alpha1 introduces Cashu wallets tied to embedded LND wallets. Navigate to Settings > Ecash to enable it. Other wallet types can still sweep funds from Cashu tokens. Zeus Pay now supports Cashu address types in Zaplocker, Cashu, and NWC modes.

- LNDg v1.10.0, an advanced web interface designed for analyzing Lightning Network Daemon (LND) data and automating node management tasks, introduces performance improvements, adds a new metrics page for unprofitable and stuck channels, and displays warnings for batch openings. The Profit and Loss Chart has been updated to include on-chain costs. Advanced settings have been added for users who would like their channel database size to be read remotely (the default remains local). Additionally, the AutoFees tool now uses aggregated pubkey metrics for multiple channels with the same peer.

- Nunchuk Desktop v1.9.45 release brings the latest bug fixes and improvements.

- Blockstream Green iOS v4.1.8 has renamed L-BTC to LBTC, and improves translations of notifications, login time, and background payments.

- Blockstream Green Android v4.1.8 has added language preference in App Settings and enables an Android data backup option for disaster recovery. Additionally, it fixes issues with Jade entry point PIN timeout and Trezor passphrase input.

- Torq v2.2.2, an advanced Lightning node management software designed to handle large nodes with over 1000 channels, fixes bugs that caused channel balance to not be updated in some cases and channel "peer total local balance" not getting updated.

- Stack Wallet v2.1.12, a multicoin wallet by Cypher Stack, fixes an issue with Xelis introduced in the latest release for Windows.

- ESP-Miner-NerdQAxePlus v1.0.29.1, a forked version from the NerdAxe miner that was modified for use on the NerdQAxe+, is now available.

- Zark enables sending sats to an npub using Bark.

- Erk is a novel variation of the Ark protocol that completely removes the need for user interactivity in rounds, addressing one of Ark's key limitations: the requirement for users to come online before their VTXOs expire.

- Aegis v0.1.1 is now available. It is a Nostr event signer app for iOS devices.

- Nostash is a NIP-07 Nostr signing extension for Safari. It is a fork of Nostore and is maintained by Terry Yiu. Available on iOS TestFlight.

- Amber v3.2.8, a Nostr event signer for Android, delivers the latest fixes and improvements.

- Nostur v1.20.0, a Nostr client for iOS, adds

-

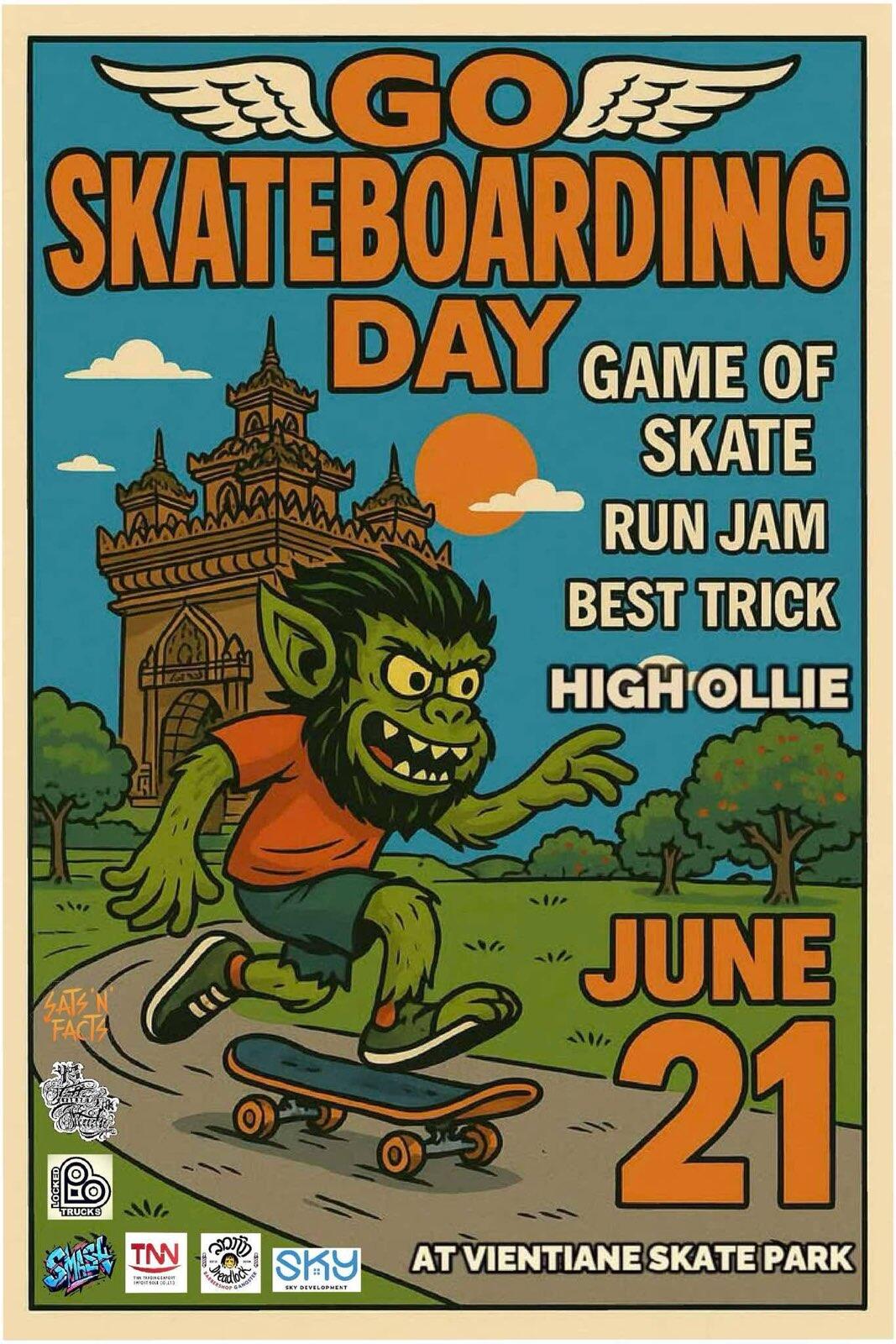

@ 20e7c953:3b8bcb21

2025-06-05 10:46:07

@ 20e7c953:3b8bcb21

2025-06-05 10:46:0721… That number means something. A reminder that limits create value - both in Bitcoin and in life.

Every June 21st, skaters around the world remind us that freedom is something you make yourself - one push at a time only constrained by your own limitations.

This year in Vientiane, we’re proud to support one of the few real skate spots in Laos. A place built and held together by skaters for skaters.

Expect around 50 locals - from young kids to older heads - showing up not just to skate, but to hold space for each other. No ego, no filters, just boards, fun and respect.

Bircoiners have lots to learn from these communities on this regard. Go skate and you'll find out.

SnF

Laostr

Skateboardingisfun

Skate4Fun

Skatestr

-

@ dfa02707:41ca50e3

2025-06-05 10:01:29

@ dfa02707:41ca50e3

2025-06-05 10:01:29Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.