-

@ 9ca447d2:fbf5a36d

2025-05-31 07:00:45

@ 9ca447d2:fbf5a36d

2025-05-31 07:00:45Michael Saylor, executive chairman of Strategy, has stirred up the Bitcoin community with his recent comments on proof-of-reserves, calling it a “bad idea” that puts institutional security at risk.

Speaking at a side event at the Bitcoin 2025 conference in Las Vegas, Saylor expressed strong concerns about the security implications of on-chain proof of reserves (PoR), a method used by many bitcoin companies to show they actually hold the assets they claim.

“The conventional way of issuing proof of reserves today is actually insecure,” Saylor said.

“It actually dilutes the security of the issuer, the custodians, the exchanges and the investors. It’s not a good idea, it’s a bad idea.”

Proof-of-reserves is a process where companies with bitcoin reserves share public wallet addresses or use cryptographic methods to prove how much bitcoin they hold.

This practice gained popularity after the collapse of major exchanges like FTX and Mt. Gox to build trust through transparency.

Many big players in the digital asset space, including Binance, Kraken, OKX and asset manager Bitwise, have adopted PoR to reassure users and stakeholders.

Related: Bitwise Announces On-Chain Address, Donations Go to Shareholders

Saylor’s objections boil down to two main points.

First, he believes publishing wallet addresses creates serious security risks. By exposing institutional wallet structures, companies may open themselves up to attacks from hackers, hostile governments or malicious actors.

“[It’s like] publishing the address and the bank accounts of all your kids and the phone numbers of all your kids and then thinking somehow that makes your family better,” Saylor said.

“(It becomes) an attack vector for hackers, nation-state actors, every type of troll imaginable.”

He even asked the audience to try a thought experiment:

“Go to AI, put it in deep think mode and then ask it ‘what are the security problems of publishing your wallet addresses?’ and ‘how might it undermine the security of your company over time’ … It will write you a book. It will be fifty pages of security problems.”

Second, Saylor pointed out that proof of reserves only shows what a company owns, not what it owes. In his view, that’s incomplete.

“It’s proof of assets that is insecure, and it is not proof of liabilities… So you own $63 billion worth of bitcoin—do you have a hundred billion dollars of liabilities?” he asked rhetorically.

For large institutions and investors, this view of financial health is not enough.

Instead of publishing wallet addresses, Saylor thinks the better approach is to use institutional-grade audits by trusted firms.

“The best practice… would be to have a Big Four auditor that checks to make sure you actually have the bitcoin, then checks to make sure the company hasn’t rehypothecated or pledged the bitcoin,” he said.

“Then you have to wash it through a public company where the CFO signs, then the CEO signs, then the chairman and all the outside directors are civilly and criminally liable for it.”

He believes the legal consequences of corporate auditing — including prison time for fraud under the Sarbanes-Oxley Act — are stronger than cryptographic proof alone.

He did admit that a more secure, future version of PoR might be possible if it involved zero-knowledge proofs that protect wallet privacy while still confirming ownership.

Not everyone agrees with Saylor’s opinion. While some praised his focus on security, others accused Saylor of hiding something.

Speculations resurfaced about whether Strategy truly holds all the bitcoin it claims, or if it’s involved in so-called “paper bitcoin” — claims to BTC without physical backing.

Others pointed out that exchanges like Kraken and asset managers like Bitwise have implemented PoR systems without major breaches.

-

@ cae03c48:2a7d6671

2025-05-31 07:00:24

@ cae03c48:2a7d6671

2025-05-31 07:00:24Bitcoin Magazine

Panama City Mayor Mizrachi: “Bitcoin Is Not Just Safe, It’s Prosperous”At the 2025 Bitcoin Conference in Las Vegas, the Director of Bitcoin Beach Mike Peterson, the Presidential Advisors of Building Bitcoin Country El Salvador Max & Stacy and the Mayor City of Panama Mayer Mizrachi discussed Bitcoins future in Panama.

At the beginning of the panel, Is Panama Next? El Salvador Leading The Region For Bitcoin Adoption, Mayor Mizrachi started by mentioning, “We accept Bitcoin. The city gets paid in Bitcoin, but it receives in dollars through an intermediary processing, payments processor. Bitcoin is not just safe. It’s prosperous.”

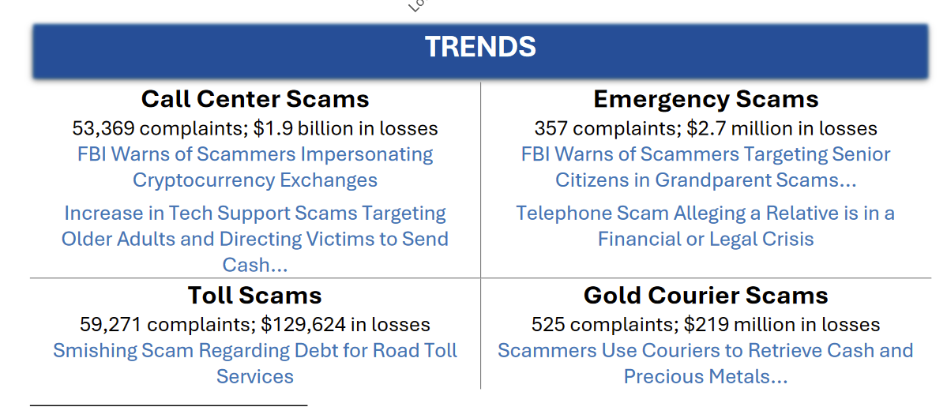

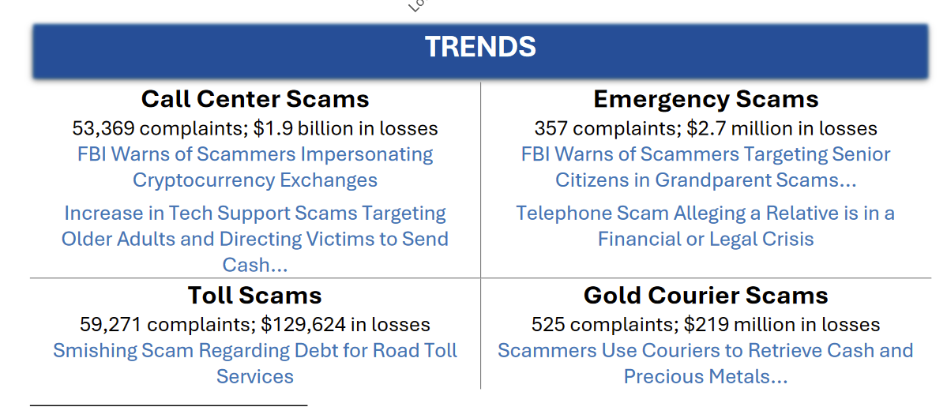

Max commented about the scammers in crypto and how El Salvador is managing it.

“We did a couple of things early on, one was to create The Bitcoin Office which will be directly reporting to the President, and then also we passed a law which will say bitcoin is money and everything else is an unregistered security,” said Max.

Mike Peterson stated, “the access of Bitcoin in Central America to do battle against the globalists that have always looked at the regionist back yard. This is intolerable and this is going to change right now.” After Mizrachi commented, “Imagine yourself in an economic block powered by El Salvador, supported by Panama and the rest will come.”

Stacy reminded everybody about El Salvador’s School system.

“El Salvador is the first country in the world to have a comprehensive public school financial literacy education program from 7 years old,” mentioned Stacy. “These are little kids, learning financial literacy.”

Max ended the panel by saying, “the US game theory right? Because the US wants to buy a lot of Bitcoin, so if Panama wants to buy a lot of bitcoin then it helps everybody in the US. This is the beautiful expression of game theory perfectly aligned in the protocol that is changing the world that we live in. And on the street level what bitcoin does to the population is to go from a spending mentality to a saving mentality.”

You can watch the full panel discussion and the rest of the Bitcoin 2025 Conference Day 3 below:

This post Panama City Mayor Mizrachi: “Bitcoin Is Not Just Safe, It’s Prosperous” first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-05-31 07:00:24

@ cae03c48:2a7d6671

2025-05-31 07:00:24Bitcoin Magazine

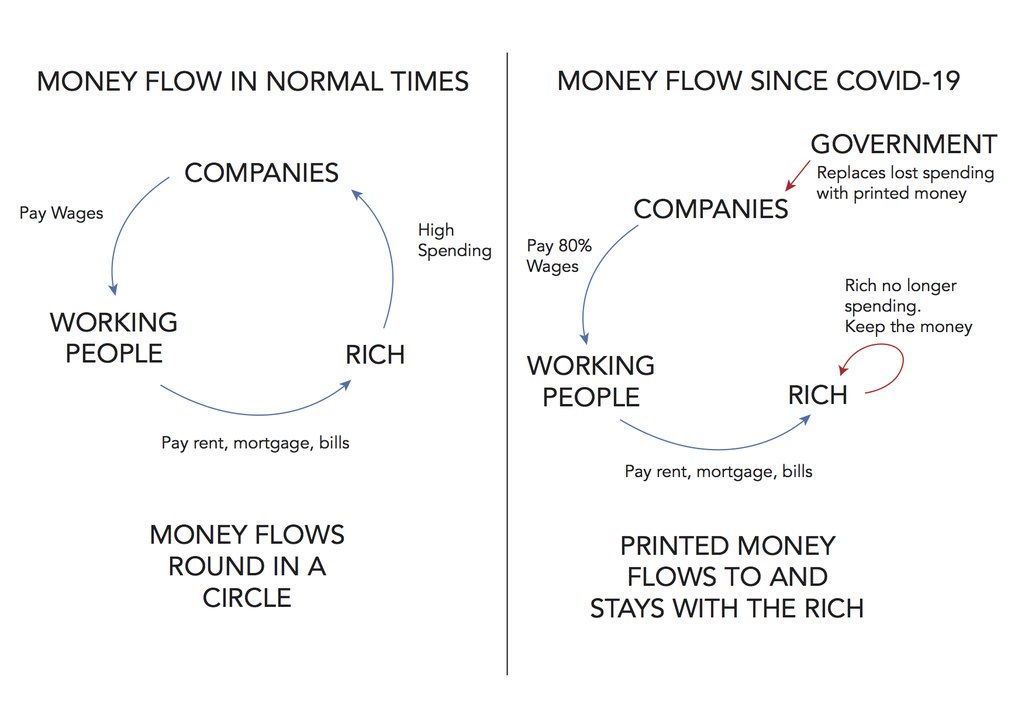

The Debt Train Has No Brakes: Lyn Alden Makes the Case for BTC at Bitcoin 2025“Nothing stops this train,” Lyn Alden initially stated at Bitcoin 2025, walking the audience through a data-rich presentation that made one thing clear: the U.S. fiscal system is out of control—and Bitcoin is more necessary than ever.

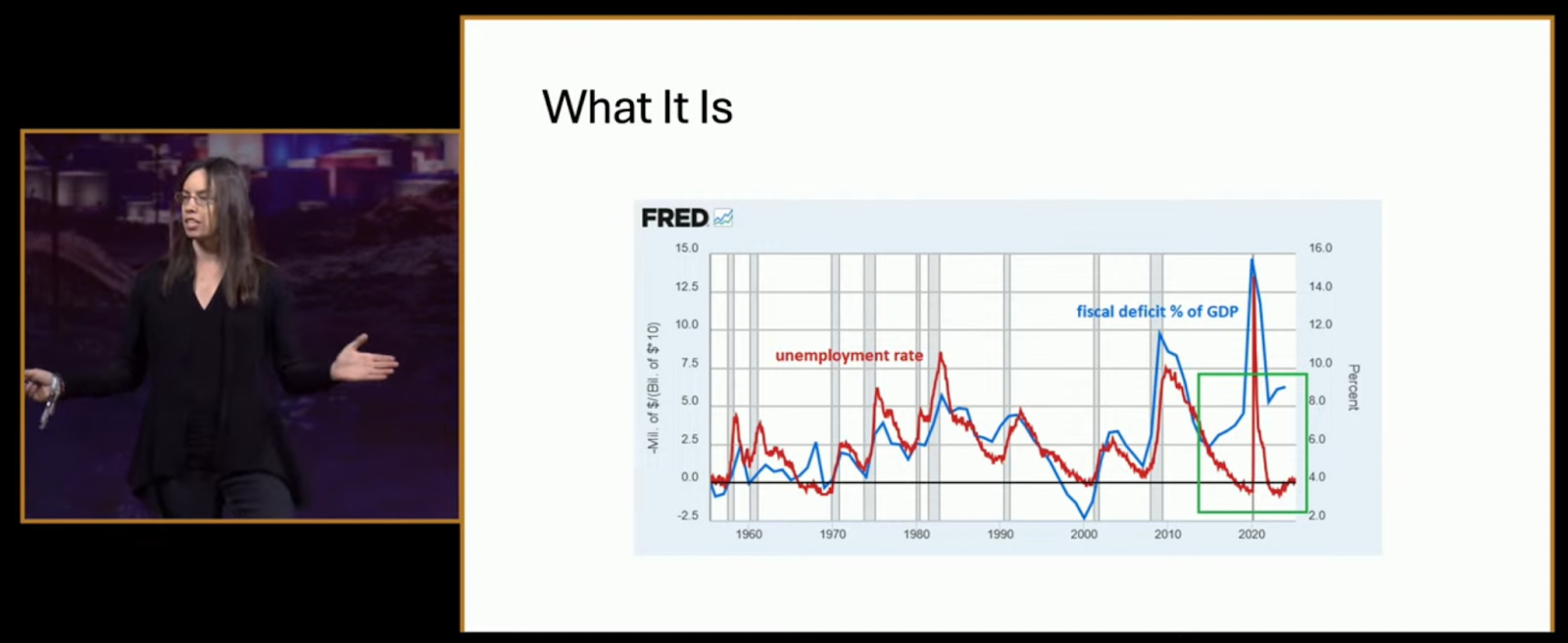

Her first chart, sourced from the Federal Reserve’s FRED database, displayed a stark decoupling: the unemployment rate is down, yet the fiscal deficit has surged past 7% of GDP. “This started around 2017, went into overdrive during the pandemic, and hasn’t corrected,” Alden said. “That’s not normal. We’re in a new era.”

She didn’t mince words. “Nothing stops this train because there are no brakes attached to it anymore. The brakes are heavily impaired.

Why should Bitcoiners care? Because, as Alden explained, “it matters for asset prices—especially anything scarce.” She displayed a gold vs. real rates chart that showed gold soaring as real interest rates plunged. “Five years ago, most would have said Bitcoin couldn’t thrive in a high-rate environment. Yet here we are—Bitcoin over $100K, gold at new highs, and banks breaking under pressure.”

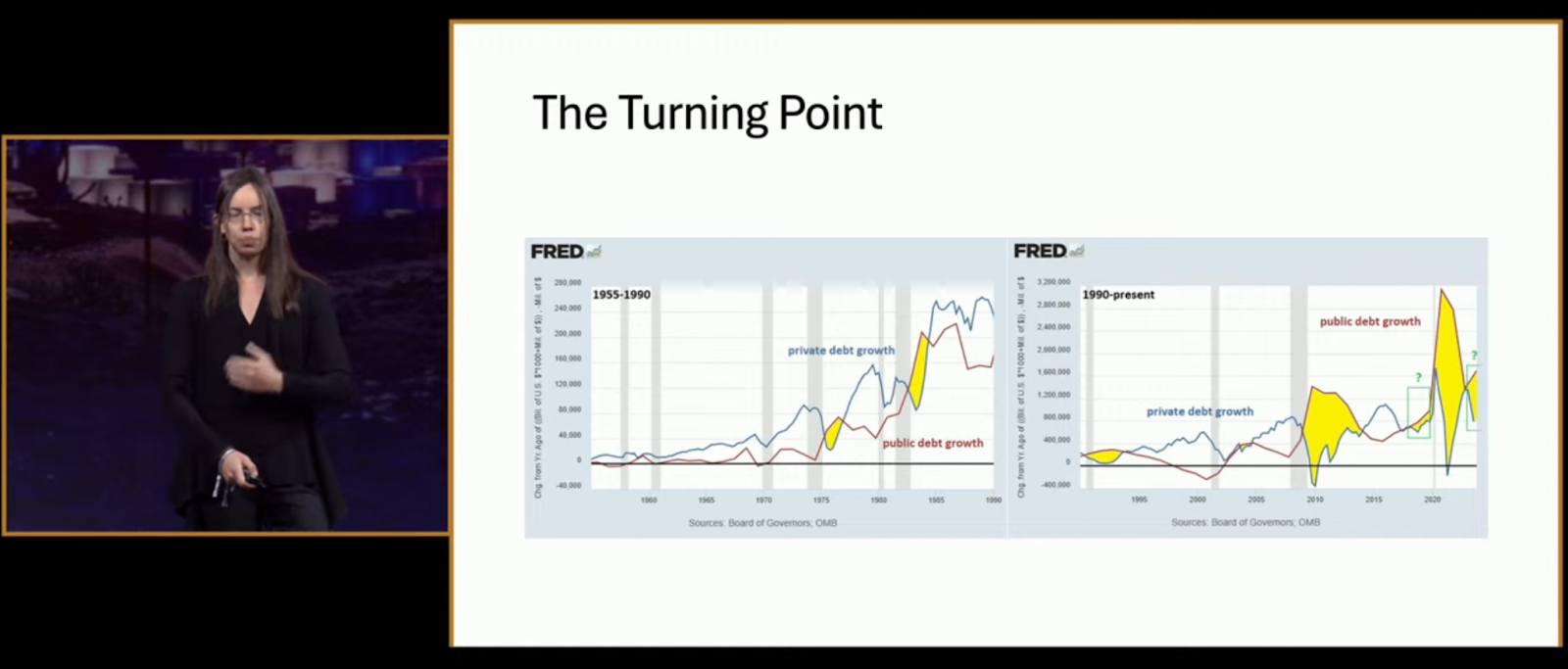

Next came what she called “The Turning Point”—a side-by-side showing how public debt growth overtook private sector debt post-2008, flipping a decades-long norm. “This is inflationary, persistent, and it means the Fed can’t slow things down anymore.”

Another chart revealed why rising interest rates are now accelerating the deficit. “They’ve lost their brakes. Raising rates just makes the federal interest bill explode faster than it slows bank lending.”

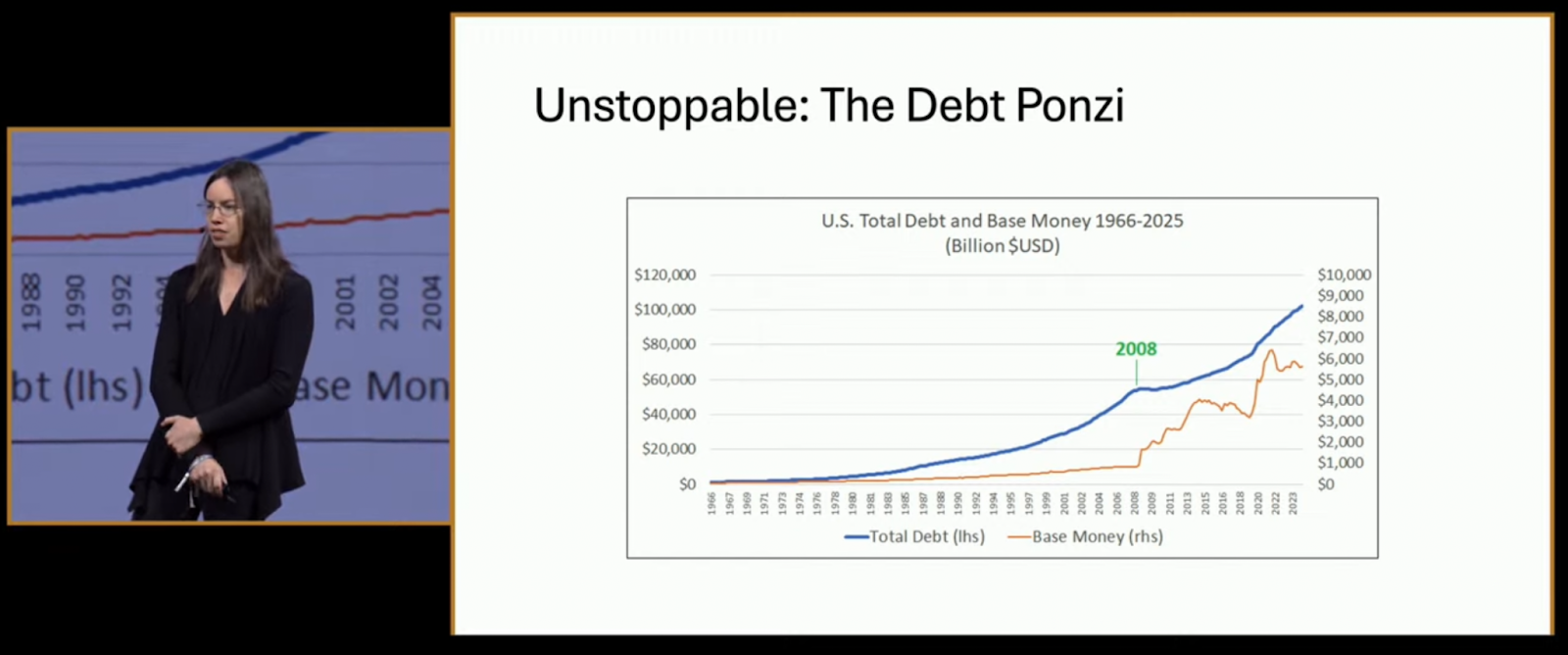

Alden called it a ponzi: “The system is built on constant growth. Like a shark, it dies if it stops swimming.”

Her slide showed a relentless rise in total debt versus base money—except for a jolt in 2008, and again after 2020. “This isn’t going backward. Ever.”

So why Bitcoin? “Because it’s the opposite. Scarce, decentralized, and mathematically capped,” Alden concluded. “There are two reasons nothing stops this train: math and human nature. Bitcoin is the mirror of this system—and the best protection from it.”

You can watch the full panel discussion and the rest of the Bitcoin 2025 Conference Day 3 below:

This post The Debt Train Has No Brakes: Lyn Alden Makes the Case for BTC at Bitcoin 2025 first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-05-31 07:00:23

@ cae03c48:2a7d6671

2025-05-31 07:00:23Bitcoin Magazine

Jack Mallers Announced A New System of Bitcoin Backed Loans at StrikeThe Founder and CEO of Strike, Jack Mallers, at the 2025 Bitcoin Conference in Las Vegas, announced a new system of Bitcoin backed loans at Strike with one digit interest rate.

Jack Mallers began his keynote by pointing at the biggest problem. Fiat currency.

“The best time to go to Whole Foods and buy eggs with your dollars was 1913,” said Mallers. “Every other time after, you are getting screwed.”

What’s the solution?

“The solution is Bitcoin,” stated Mallers. “Bitcoin is the money that we coincide that nobody can print. You can’t print, you can’t debase my time and energy, you cannot deprive me of owning assets, of getting out of debt, of living sovereignly and protecting my future, my family, my priced possessions. Bitcoin is what we invented to do that.”

Mallers gave a power message to the audience by explaining that people should HODL every dollar they have in Bitcoin. People should also spend a little of it to have a nice life.

“You can’t HODL forever,” said Jack.

While talking about loans that people borrow against their Bitcoin. He explained why he thinks banks putting 20% in interest for loans backed with Bitcoin is outrageous.

“All these professional economists, they are like Bitcoin is risky and volatile,” stated Mallers. “No it’s not. This is the magnificent 7 one year volatility and the orange one in the middle is Bitcoin. It’s no more risky and volatile. It’s a little bit more volatile than Apple, but is far less more volatile than Tesla.”

“As Bitcoin matures, its volatility goes down,” continued Jack. “Bitcoin volatility is at a point where it is no more risky than a Tesla Stock. We should not be paying double digits rates for a loan.”

Mallers announced his new system of loans at Strike of 9-13% in interest rates. It will allow people to get loans from $10,000 to $1 billion.

Mallers closed by saying, “please be responsible. This is debt. Debt is like fire in my opinion. It can heat a civilization. It can warm your home, but if you go too crazy it can burn your house down.”

“Life is short,” said Jack. “Take the trip, but with bitcoin you just get to take a better one.”

This post Jack Mallers Announced A New System of Bitcoin Backed Loans at Strike first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-05-31 07:00:22

@ cae03c48:2a7d6671

2025-05-31 07:00:22Bitcoin Magazine

Michael Saylor Presents The 21 Ways to Wealth at Bitcoin 2025Michael Saylor, Executive Chairman of Strategy, took the stage at Bitcoin 2025 delivering a keynote titled “21 Ways to Wealth.” He stated: “This speech is for you. I’ve traveled the world and told countries, institutional investors, and even the disembodied spirits of our children’s children why they need Bitcoin. This is for every individual, every family, every small business. It’s for everybody.”

He began with clarity. “The first way to wealth is clarity,” he said. “Clarity comes the moment you realize Bitcoin is capital—perfected capital, programmable capital, incorruptible capital.” For Saylor, every thoughtful individual on Earth will ultimately seek such pristine capital, and every AI system will prefer it as well.

The second path is conviction. Bitcoin, he said, will appreciate faster than every other asset, because it’s engineered for performance. “It’s going to grow faster than real estate or collectibles. It is the most efficient store of value in human history.”

The third way is courage. “If you’re going to get rich on Bitcoin, you need courage,” he warned. “Wealth favors those who embrace intelligent monetary risk. Some people will get left behind. Others will juggle it. But the bold will feed the fire—sell your bonds, buy Bitcoin. An extraordinary explosion of value is coming.”

Fourth comes cooperation. “You are more powerful if you have the full support of your family. Your children have time and potential. The secret is transferring capital into their hands. Families that move in unity are unstoppable.”

The fifth is capability. “Master AI,” he said. “In 2025, everything you can imagine is at your fingertips—wisdom, analysis, creativity. Ask AI, argue with it, use it. You can become a super genius. Don’t put your ego first—put your interests first. Your family will thank you.”

Saylor’s sixth way to wealth is composition: construct legal entities that scale your strategy and protect your assets. “Ask the AI and figure it out. You can work hard, or you can work smart. This year, everyone should be operating like the most sophisticated millionaire family office.”

The seventh is citizenship. Choose your economic nexus carefully—“domicile where sovereignty respects your freedom,” he said. “This isn’t just about this year—it’s about this century.”

Eighth is civility. “Respect the natural power structures of the world. Respect the force of nature,” he explained. “If you want to generate wealth in the Bitcoin universe, don’t fight unnecessarily. Find common ground. Inflation and distraction are your enemies.”

Ninth is corporation. “A well-structured corporation is the most powerful wealth engine on Earth. Families are powerful. Partnerships are even more powerful. But corporations can scale globally. What is your vehicle? What is your path?”

The tenth way is focus. “Just because you can do a thing doesn’t mean you should,” he warned. “If you invest in Bitcoin, there’s a 90% chance it will succeed over five years. Don’t confuse ambition with accomplishment. Come up with a strategy—and stick to it.”

The eleventh is equity. “Share your opportunities with investors who will share your risk,” he said, pointing to MicroStrategy’s own rise from $10 million to a $5 billion market cap by aligning with equity partners who believed in the Bitcoin mission.

The twelfth is credit. “There are people in the world who are afraid of the future—they want small yield, certainty. Offer that. Give creditors security in return for capital. Convert their fear into fuel and turn risk into yield by investing in Bitcoin.”

The thirteenth is compliance. “Create the best company you can within the rules of your market. Learn the rules of the road. If you know them, you can drive faster. You can scale legally and sustainably.”

The fourteenth way is capitalization. “Velocity compounds wealth,” Saylor said. “Raise and reinvest capital as fast and as often as you can. The faster your money moves into productive Bitcoin strategies, the more it multiplies.”

Fifteenth is communication. “Speak with candor. Act with transparency. And repeat your message often,” he urged. “Creating wealth with Bitcoin is simple—but only if people understand what you’re doing and why you’re doing it.”

Sixteenth is commitment. “Don’t allow yourself to be distracted,” he said. “Don’t chase your own ideas. Don’t feed the trolls. Stay committed to Bitcoin. It’s the greatest idea in the world. The world probably doesn’t care what you think—but it will care when you win.”

The Seventeenth way is competence. “You’re not competing with noise—you’re competing with someone who is laser-focused, who executes flawlessly,” he said. “You must deliver consistent, precise, and reliable performance. That’s how you win.”

The Eighteenth is adaptation. “Circumstances change. Every structure you trust today will eventually fail. A wise person is prepared to abandon their baggage and adjust plans when needed. Rigidity is ruin.”

Nineteenth is evolution. “Build on your core strengths. You don’t need to start over—you need to level up. Leverage what you already do best, and expand it through Bitcoin and advanced technologies.”

Twentieth is advocacy. “Inspire others to walk the Bitcoin path,” he said. “Become an evangelist for economic freedom. Show others what this revolution really means. Show them the way.”

Finally, the twenty-first way is generosity. “When you’re successful—and you will be successful—spread happiness. Share security. Deliver hope. That light inside you will shine. And others will be drawn to it.”

As he ended, Saylor smiled and quoted the very origin of it all:

“It might make sense to get some, in case it catches on.” – Satoshi.

In Michael Saylor’s worldview, Bitcoin is not a get-rich-quick scheme—it’s the ultimate long-term play. It is the foundation of generational wealth, the engine of personal and institutional freedom, and the tool for those bold enough to lead humanity into a more sovereign, secure future.

You can watch the full panel discussion and the rest of the Bitcoin 2025 Conference Day 3 below:

This post Michael Saylor Presents The 21 Ways to Wealth at Bitcoin 2025 first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-05-31 07:00:21

@ cae03c48:2a7d6671

2025-05-31 07:00:21Bitcoin Magazine

Bitcoin Builders Exist Because Of UsersBuilder: Nicholas Gregory

Language(s): C++, Rust

Contribute(s/ed) To: Ocean Sidechain, Mainstay, Mercury Wallet, Mercury Layer

Work(s/ed) At: CommerceBlock (formerly)

Prior to Bitcoin, Nicholas was a software developer working in the financial system for banking firms developing trading and derivatives platforms. After the 2008 financial crisis he began to consider alternatives to the legacy financial system in the fallout.

Like many from that time, he completely ignored the original Slashdot article featuring the Bitcoin whitepaper due to the apparent focus on Windows as an application platform (Nicholas was a UNIX/Linux developer). Thankfully someone he knew introduced him to Bitcoin later on.

The thing that captured his interest about Bitcoin rather than other alternatives at the time was its specific architecture as a distributed computer network.

“The fact that it was like an alternative way. It was all based around [a] kind of […] network. And what I mean by that, building financial systems, people always wanted a system that was 24-7.

And how do you deal with someone interacting [with] it in different geographical parts of the world without it being centralized?

And I’d seen various ways of people solving that problem, but it never had been done, you know, in a kind of […] scalable solution. And using […] cryptography and proof of work to solve that issue was just weird, to be honest. It was totally weird for me.”

All of the other systems he had designed, and some that he built, were systems distributed across multiple parts of the world. Unlike Bitcoin however, these systems were permissioned and restricted who could update the relevant database(s) despite that fact that copies of them were redundantly distributed globally.

“The fact that in Bitcoin you had everyone kind of doing this proof of work game, which is what it is. And whoever wins does the [database] write. That mess[ed] with my head. That was […] very unique.”

Beginning To Build

Nicholas’s path to building in the space was an organic one. At the time he was living in New York City, and being a developer he of course found the original Bitdevs founded in NYC. Back then meetups were incredibly small, sometimes even less than a dozen people, so the environment was much more conducive to in-depth conversations than some larger meetups these days.

He first began building a “hobbyist” Over The Counter (OTC) trading software stack for some people (back then a very significant volume of bitcoin was traded OTC for cash or other fiat mediums). From here Nicholas and Omar Shibli, whom he met at Bitdevs, worked together on Pay To Contract (BIP 175).

BIP 175 specifies a scheme where a customer purchasing a good participates in generating the address the merchant provides. This is done by the two first agreeing on a contract describing what is being paid for, afterwards the merchant sends a master public key to the consumer, who uses the hash of that description of the item or service to generate an individual address using the hash and master public key.

This allows the customer to prove what the merchant agreed to sell them, and that the payment for the good or service has been made. Simply publishing the master public key and contract allows any third party to generate the address that was paid, and verify that the appropriate amount of funds were sent there.

Ocean and Mainstay

Nicholas and Omar went on to found CommerceBlock, a Bitcoin infrastructure company. Commerceblock took a similar approach to business as Blockstream, building technological platforms to facilitate the use of Bitcoin and blockchains in general in commerce and finance. Shortly afterwards Nicholas met Tom Trevethan who came on board.

“I met Tom via, yeah, a mutual friend, happy to say who it is. There’s a guy called, who, new people probably don’t know who he is, but OGs do, John Matonis. John Matonis was a good friend of mine, [I’d] known him for a while. He introduced me to Tom, who was, you know, kind of more on the cryptography side. And it kind of went from there.”

The first major project they worked on was Ocean, a fork of the Elements sidechain platform developed by Blockstream that the Liquid sidechain was based on. The companies CoinShares and Blockchain in partnership with others launched an Ocean based sidechain in 2019 to issue DGLD, a gold backed digital token.

“So we, you know, we were working on forks of Elements, doing bespoke sidechains. […] Tom had some ideas around cryptography. And I think one of our first ideas was about how to bolt on these forks of Elements onto […] the Bitcoin main chain. […] We thought the cleanest way to do that was […] using some sort of, I can’t remember, but it was something [based on] single-use sealed sets, which was an invention by Peter Todd. And I think we implemented that fairly well with Mainstay.”

The main distinction between Ocean and Liquid as a sidechain platform is Ocean’s use of a protocol designed at Commerceblock called Mainstay. Mainstay is a timestamping protocol that, unlike Opentimestamps, strictly orders the merkle tree it builds instead of randomly adding items in whatever order they are submitted in. This allows each sidechain to timestamp its current blockheight into the Bitcoin blockchain everytime mainchain miners find a block.

While this is useless for any bitcoin pegged into the sidechain, for regulated real world assets (RWA), this provides a singular history of ownership that even the federation operating the sidechain cannot change. This removes ambiguity of ownership during legal disputes.

When asked about the eventually shuttering of the project, Nicholas had this to say:

“I don’t know if we were early, but we had a few clients. But it was, yeah, there wasn’t much adoption. I mean, Liquid wasn’t doing amazing. And, you know, being based in London/Europe, whenever we met clients to do POCs, we were competing against other well-funded projects.

It shows how many years ago they’d either received money from people like IBM or some of the big consultancies and were promoting Hyperledger. Or it was the days when we would be competing against EOS and Tezos. So because we were like a company that needed money to build prototypes or build sidechains, it kind of made it very hard. And back then there wasn’t much adoption.”

Mercury Wallet and Mercury Layer

After shutting down Ocean, Nicholas and Tom eventually began working on a statechain implementation, though the path to this was not straightforward.

“[T]here were a few things happening at the same time that led to it. So the two things were we were involved in a [proof of concept], a very small […]POC for like a potential client. But this rolled around Discreet Log Contracts. And one of the challenges of Discreet Log Contracts, they’re very capital inefficient. So we wanted a way to novate those contracts. And it just so happened that Ruben Sampson, you know, wrote this kind of white paper/Medium post about statechains. And […] those two ideas, that kind of solved potentially that issue around DLCs.”

In the end they did not wind up deploying a statechain solution for managing DLCs, but went in a different direction.

Well, there was another thing happening at the same time, coinswaps. And, yeah, bear in mind, in those days, everyone worried that by […] 2024/2025 […] network fees could be pretty high. And to do […] coin swaps, you kind of want to do multiple rounds. So […] state chains felt perfect because […] you basically take a UTXO, you put it off the chain, and then you can swap it as much as you want.”

Mercury Wallet was fully built out and functional, but sadly never gained any user adoption. Samourai Wallet and Wasabi Wallet at the time dominated the privacy tool ecosystem, and Mercury Wallet was never able to successfully take a bite out of the market.

Rather than completely give up, they went back to the drawing board to build a statechain variant using Schnorr with the coordinator server blind signing, meaning it could not see what it was signing. When asked why those changes were made, he had this to say: “That would give us a lot more flexibility to do other things in Bitcoin with L2s. You know, the moment you have a blinded solution, we thought, well, this could start having interoperability with Lightning.”

Rather than building a user facing wallet this time, they built out a Software Development Kit (SDK) that could be integrated with other wallets.

“{…] I guess with Mercury Layer, it was very much building a kind of […] full-fledged Layer 2 that anyone could use. So we [built] it as an SDK. We did have a default wallet that people could run. But we were hoping that other people would integrate it.”

The End of CommerceBlock

In the end, CommerceBlock shuttered its doors after many years of brilliant engineering work. Nicholas and the rest of the team built numerous systems and protocols that were very well engineered, but at the end of the day they seemed to always be one step ahead of the curve. That’s not necessarily a good thing when it comes to building systems for end users.

If your work is too far ahead of the demand from users, then in the end that isn’t a sustainable strategy.

“…being in the UK, which is not doing that well from a regulatory point of view, played into it. If I

-

@ 57d1a264:69f1fee1

2025-05-31 06:19:55

@ 57d1a264:69f1fee1

2025-05-31 06:19:55Knowledge- Pattern knowledge- Trend knowledge- A desire to learn more- A desire to explore good designExperience- A sense of where to start/what will work- Good taste- Good judge of your own design and others’- Comfortable working in many styles- Willing to have a strong opinionCreativity- Novel ideas- Exhaustive exploration of options/approaches- Exhaustive iterationQuality- A preference for quality- A preference to test designs- Open to feedback- Able to balance classical and expressive aesthetics- Able to balance aesthetics and usability- Obsessed with details- RigorousTechnical skills- Good typography- Good composition/layout- Good colour choices- Good at some associated skills (e.g. prototyping, animation, imagery, writing)- Tool expertiseWider picture- Informed by understanding of the product (e.g. research)- System thinking (how the work is connected to other things)- Product thinking (what makes a successful product)- Development thinking (how a design might be implemented)- Practical mindset when necessary- Believes in importance of accessibilityCommunication- Able to articulate your design “feelings”- Able to explain design principles to others- Can clearly document/explain the design (e.g. specifications, mockups)- Good relationship-building, especially with developers- Able to “sell” a design idea

Read more aboutAnthony Hobday.https://stacker.news/items/993319

-

@ cae03c48:2a7d6671

2025-05-31 07:00:20

@ cae03c48:2a7d6671

2025-05-31 07:00:20Bitcoin Magazine

Amboss Launches Rails, a Self-Custodial Bitcoin Yield ServiceAmboss, a leader in AI-driven solutions for the Bitcoin Lightning Network, today announced Rails, a groundbreaking self-custodial Bitcoin yield service. According to a press release sent to Bitcoin Magazine, it’s designed to empower companies, custodians, and high net worth individuals. This allows participants to earn a yield on their Bitcoin.

Big news from @TheBitcoinConf !

We’re thrilled to announce Rails—a self-custodial Bitcoin yield service that empowers you to earn on your BTC while supercharging the Lightning Network.Let’s bring Bitcoin to the World.https://t.co/3WYYvB95hP

— AMBOSS

(@ambosstech) May 29, 2025

(@ambosstech) May 29, 2025Rails also launched a secure way for Liquidity Providers (LPs) to hold all custody of their Bitcoin while generating returns from liquidity leases and payment routing, although they are not guaranteed. The implementation of Amboss’ AI technology, Rails strengthened their Lighting Network with more dependable transactions and larger payment volumes.

“Rails is a transformative force for the Lightning Network,” said the CEO and Co-Founder of Amboss Jesse Shrader. “It’s not just about yield—it’s about enabling businesses to strengthen the network while earning on their Bitcoin. This is a critical step in Bitcoin’s evolution as a global medium of exchange.”

The service offers two options:

- Rails LP is designed for high net worth individuals, custodians, and companies with Bitcoin treasuries, requiring a minimum commitment of 1 BTC for one year.

- Liquidity subscriptions are designed for businesses that receive Bitcoin payments, with fees starting at 0.5%.

Amboss partnered with CoinCorner and Flux (a joint venture between Axiom and CoinCorner), to bring Rails to the market. CoinCorner has incorporated it into both its exchange platform and daily payment services in the Isle of Man. Flux is jointly focused on advancing the Lightning Network’s presence in global payments. Their participation highlights growing industry trust in Rails as a tool to scale Bitcoin effectively.

“Rails offers a practical way for businesses like ours to participate in the Lightning Network’s growth,” said the CFO of CoinCorner David Boylan. “We’ve been using the Lightning Network for years, and Rails provides a structured approach to engaging with its economy, particularly through liquidity leasing and payment routing. This aligns with our goal of making Bitcoin more accessible and practical for everyday use.”

This post Amboss Launches Rails, a Self-Custodial Bitcoin Yield Service first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 3770c235:16042bcc

2025-05-31 05:30:22

@ 3770c235:16042bcc

2025-05-31 05:30:22In a world full of constant stimulation, overflowing schedules, and ever-growing to-do lists, our physical spaces often bear the brunt of our busy lives. The clutter in our homes and workplaces can slowly pile up until it becomes overwhelming, contributing not only to a chaotic environment but also to increased levels of stress and anxiety.

But what if the simple act of removing junk and organizing your space could bring clarity to your mind, lift your mood, and create a lasting positive impact on your mental health? Decluttering isn't just about aesthetics—it’s about mental wellness. Junk removal can be a powerful tool to help you take control of your space and, in turn, your mindset. Let’s explore how clearing the clutter can boost mental health and transform your daily life.

The Psychological Impact of Clutter Clutter isn’t just stuff—it’s unmade decisions and postponed actions. Psychologists have long understood the connection between our environment and our emotional well-being. Clutter bombards our minds with excessive stimuli, making it difficult to focus or relax. It sends a signal that work is never done, which can lead to chronic stress.

A study published in the Personality and Social Psychology Bulletin found that women who described their homes as cluttered or full of unfinished projects were more likely to be fatigued and depressed than those who described their homes as restorative and restful. The same study found that cortisol levels—the body’s main stress hormone—were significantly higher in women living in cluttered environments.

Additionally, according to a UCLA study, families living in homes with a high density of household objects experienced increased levels of anxiety. The psychological toll of clutter isn’t minor; it has real, measurable effects on our mental health.

Junk Removal as an Act of Self-Care Self-care isn't just about spa days or bubble baths—it's about creating systems and habits that support your well-being. Removing clutter and excess junk from your living or working space can be an essential act of self-care, sending your brain a clear message: you deserve a clean, peaceful environment.

The physical act of junk removal creates a sense of accomplishment. Whether it’s donating unused clothing, throwing away broken items, or clearing out the garage, every bag removed is a step toward emotional relief. The process can be surprisingly cathartic, especially for those dealing with stress, grief, or major life transitions.

Why Clutter Creates Mental Clutter Clutter and disorganization can reduce our ability to process information. Researchers at Princeton University Neuroscience Institute found that physical clutter competes for your attention, resulting in decreased performance and increased stress. When your environment is chaotic, your mind tends to mimic that chaos.

Every time you walk past a cluttered desk or disorganized closet, your brain registers it as a task you haven't completed. Over time, this leads to mental fatigue. You might find yourself feeling constantly behind, overwhelmed, or unable to concentrate—even when you're not consciously thinking about the mess.

On the flip side, a tidy, clutter-free environment can promote mental clarity, boost productivity, and help foster a greater sense of control and calm.

How Junk Removal Enhances Mood There’s a distinct emotional payoff to junk removal. Many people report feeling lighter, freer, and happier after decluttering a space. Here's why: 1. Reduces Anxiety and Stress Too much clutter can create a constant low-grade stress that gnaws away at your peace of mind. By physically removing items that no longer serve a purpose, you're also removing sources of tension. 2. Improves Focus and Productivity When your environment is clear, your mind follows suit. A cleaner space supports sharper thinking and better decision-making. Whether you're working from home or studying, a decluttered area can significantly enhance your ability to concentrate. 3. Boosts Self-Esteem Clutter can carry feelings of guilt or shame—reminders of undone tasks, unused purchases, or poor organizational habits. Taking the step to clean up can restore confidence and create a sense of achievement.

- Encourages Mindfulness Decluttering forces you to be present. You have to examine each item, reflect on its usefulness, and make a conscious decision about its place in your life. This process promotes mindfulness and intentional living.

The Decluttering Process: Step-by-Step for Mental Clarity If the idea of decluttering your entire home feels overwhelming, start small. Begin with one drawer, one shelf, or one room. Here's a practical approach to get started:

Step 1: Set a Clear Intention Know why you're decluttering. Is it to feel less stressed? To improve your focus? Having a specific goal will keep you motivated. Step 2: Sort Items into Categories Use the classic “keep, donate, toss” system. Be honest with yourself about what adds value to your life. Step 3: Focus on One Area at a Time Avoid jumping from room to room. Focus your energy on one space to see progress quickly and stay motivated.

Step 4: Remove the Junk Promptly Once you've sorted items for removal, don’t let them linger. Hire a junk removal service or take them to a donation center right away. Step 5: Maintain Your Space Set a monthly reminder to reassess clutter. Make it a habit, not a one-time task.

Professional Help: The Role of Junk Removal Services For some people, the physical and emotional burden of clearing out clutter is too overwhelming to tackle alone. This is where professional junk removal services come in. These services not only handle the heavy lifting but also offer a judgment-free way to transform your space quickly and efficiently. By outsourcing the task, you reduce stress and avoid decision fatigue. It’s a practical solution for busy professionals, seniors downsizing, or those recovering from emotional trauma like the loss of a loved one.

The mental relief from seeing a room go from chaotic to clean in just a few hours is worth the investment. Plus, many services are eco-friendly and donate reusable items to charities, adding another layer of purpose to the process.

Real-Life Impacts: Statistics that Speak Decluttering doesn’t just feel good—it’s backed by data. Consider this: • According to a study by the National Association of Professional Organizers, 54% of Americans are overwhelmed by clutter, and 78% have no idea what to do with it [source]. • A report from the Journal of Environmental Psychology found that people with clean homes are happier and more relaxed, with higher activity levels and lower levels of cortisol [source]. These statistics highlight how deeply our environment influences our emotional health—and how important it is to reclaim control of your space.

Decluttering in the Digital Age While physical clutter is the most obvious, digital clutter can also affect your mental state. Overflowing email inboxes, unorganized files, and constant notifications can leave you feeling scattered and distracted. Take time to regularly clean up your digital life by: • Unsubscribing from unwanted emails • Deleting unused apps • Organizing desktop files and folders • Turning off non-essential notifications Just like physical spaces, a clean digital environment supports a clearer, more focused mind.

When Clutter Signals Something Deeper While decluttering is beneficial, it’s important to recognize when excessive clutter or hoarding behavior may be a sign of deeper mental health issues. Conditions such as depression, anxiety, and obsessive-compulsive disorder (OCD) can manifest in the inability to discard items or maintain an organized space. If clutter feels insurmountable or leads to distress and dysfunction, it may be time to seek support from a mental health professional. Therapy can help address the root causes and develop strategies for long-term change.

Final Thoughts: Clearing the Path to Mental Well-Being Junk removal and decluttering may seem like simple tasks, but their effects on your mental health can be profound. By reducing chaos in your environment, you invite peace, focus, and emotional clarity into your life. Whether you choose to tackle the clutter yourself or enlist the help of professionals, taking the first step is often the hardest—and the most transformative. Your environment is a mirror of your mind. Clear the clutter, and you’ll often find that clarity, joy, and calm aren’t far behind.

-

@ dfa02707:41ca50e3

2025-05-31 06:01:33

@ dfa02707:41ca50e3

2025-05-31 06:01:33Contribute to keep No Bullshit Bitcoin news going.

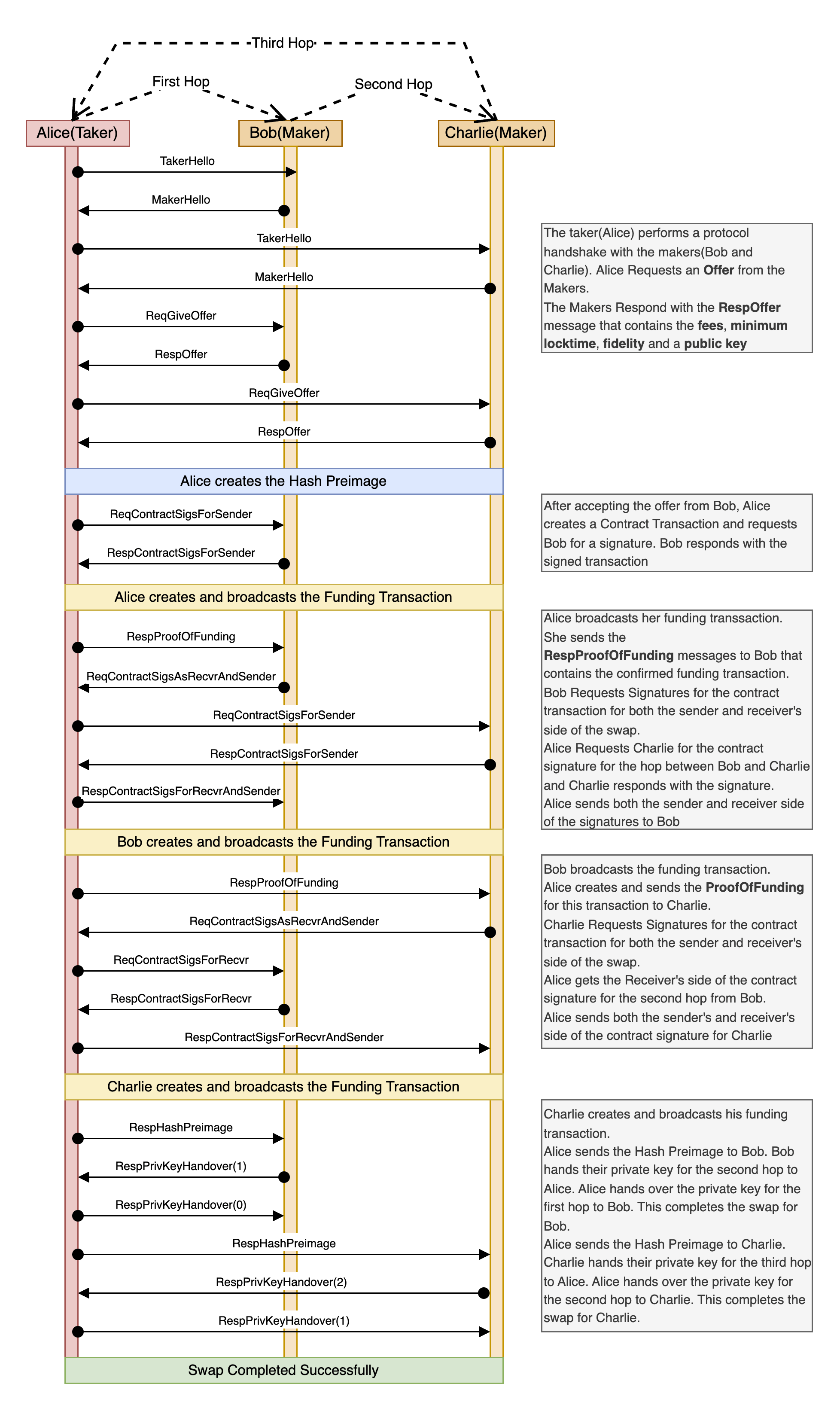

- Coinswap is a decentralized protocol for private, trustless cryptocurrency swaps. It allows participants to securely swap digital assets without intermediaries, using advanced cryptographic techniques and atomic swaps to ensure privacy and security.

- This release introduces major improvements to the protocol's efficiency, security, and usability, including custom in-memory UTXO indexes, more advanced coin-selection algorithms, fidelity bond management and more.

- The update also improves user experience with full Mac support, faster Tor connections, enhanced UI/UX, a unified API, and improved protocol documentation.

"The Project is under active beta development and open for contributions and beta testing. The Coinswap market place is live in testnet4. Bug fixes and feature requests are very much welcome."

- Manuals and demo docs are available here.

What's new

- Core protocol and performance improvements:

- Custom in-memory UTXO indexes. Frequent Core RPC calls, which caused significant delays, have been eliminated by implementing custom in-memory UTXO indexes. These indexes are also saved to disk, leading to faster wallet synchronization.

- Coin selection. Advanced coin-selection algorithms, like those in Bitcoin Core, have been incorporated, enhancing the efficiency of creating different types of transactions.

- Fidelity management. Maker servers now automate tasks such as checking bond expiries, redemption, and recreation for Fidelity Bonds, reducing the user's management responsibilities.

- Taker liveness. The

WaitingFundingConfirmationmessage has been added to keep swap connections between Takers and Makers, assisting with variable block confirmation delays.

-

User experience and compatibility:

- Mac compatibility. The crate and apps now fully support Mac.

- Tor operations are streamlined for faster, more resilient connections. Tor addresses are now consistently linked to the wallet seed, maintaining the same onion address through system reboots.

- The UI/UX improvements enhance the display of balances, UTXOs, offer data, fidelity bonds, and system logs. These updates make the apps more enjoyable and provide clearer coin swap logs during the swap process.

-

API design improvements. Transaction creation routines have been streamlined to use a single common API, which reduces technical debt and eliminates redundant code.

- Protocol spec documentation now details how Coinswap breaks the transaction graph and improves privacy through routed swaps and amount splitting, and includes diagrams for clarity.

Source: Coinswap Protocol specification.

-

@ c230edd3:8ad4a712

2025-05-31 01:51:38

@ c230edd3:8ad4a712

2025-05-31 01:51:38Chef's notes

Most Santa Maria tri tip roast recipes call for red wine vinegar and dijon mustard. I prefer other ingredients in place of those, but should you like those flavors and textures, they are more traditional.

Keep in mind when cooking and slicing, that the grain of tri-tip runs in 3 directions and the meat is unevenly thick. Pulling the roast when the thin end achieves well done, the thicker end will be a nice medium rare. When slicing, change direction to cut against the grain as you transition through for the most tender outcome.

Details

- ⏲️ Prep time: 10 minutes

- 🍳 Cook time: 1 hour ( with grill heating time)

- 🍽️ Servings: 4-6

Ingredients

- 1.5 - 2 lb Tri-Tip Roast

- 1 Tbsp Kosher Salt

- 1 tsp Black Pepper

- 1 tsp Cayanne Pepper ( substitute all or some with smoked paprika for a milder taste)

- 1 tsp Garlic Powder

- 1 tsp Onion Powder

- 1 Tbsp Rosemary

- 2 Tbsp Stone Ground Mustard

- 1 Tbsp Rice Vinegar

- 2-3 Cloves Garlic, Minced

Directions

- Mix all dry spices.

- Pat the roast dry and coat on all sides with seasdoning mix.

- Cover loosely and allow to sit in fridge for 8-12 hours.

- Preheat grill to 475 degrees F, allow meat to sit at room temp during this process.

- Mix vinegar, mustard, and minced garlic.

- Place meat on hot grill, fat side down and coat the upward side with mustard mix

- Grill approximately 7-10 minutes.

- Flip meat, repeat coating and grilling.

- Flip once more and grill for 2-3 minutes to caramelize the glaze and until the fat begins to render.

- Remove from grill and let the roast rest for 5 minutes before slicing,

- Serve with grilled veggies or any side of your choice. This is a bit spicy so it goes well with a salsa fresca and tortillas, too.

-

@ eb0157af:77ab6c55

2025-05-31 06:01:13

@ eb0157af:77ab6c55

2025-05-31 06:01:13Bitmain’s new device raises the bar for energy efficiency.

During the World Digital Mining Summit, Bitmain introduced its latest bitcoin mining device: the Antminer S23 Hydro. The new miner promises an energy efficiency of 9.5 joules per terahash (J/TH), setting new industry standards.

ANTMINER S23 Hyd. Newly Launched at WDMS 2025!

ANTMINER S23 Hyd. Newly Launched at WDMS 2025!

580T 9.5J/T

580T 9.5J/T

Sales Start from May 28th, 9:00AM (EST)

Shipping from Q1, 2026 pic.twitter.com/Kg3VJTt7Rg— BITMAIN (@BITMAINtech) May 27, 2025

According to Bitmain’s presentation, the Antminer S23 Hydro delivers up to 580 TH/s with a power consumption of 5,510 watts.

Scheduled for release in early 2026, the Antminer S23 Hydro marks a major leap forward compared to the first ASIC devices dedicated to mining. To put it in perspective, the first specialized miners launched in 2013 consumed around 1,200 J/TH. Bitmain’s latest device therefore represents a more than 99% improvement in efficiency.

Hashprice and economic challenges

In recent months, the hashprice — the metric measuring mining profitability — has remained relatively low, dropping below $39 per petahash per second during the year. As of now, the hashprice stands at around $55 per petahash per second, according to data from Hashrate Index.

This scenario has pushed several companies in the sector to rethink their expansion strategies. Instead of increasing hashing capacity, many are choosing to upgrade their existing fleets, focusing on efficiency rather than sheer scale.

The introduction of the Antminer S23 Hydro could catalyze a transformation within the mining ecosystem. The gradual replacement of outdated devices with more efficient technology could lead to a significant reduction in the Bitcoin network’s overall energy consumption.

The post Bitmain unveils the Antminer S23 Hydro: unprecedented efficiency appeared first on Atlas21.

-

@ 7f6db517:a4931eda

2025-05-31 06:01:37

@ 7f6db517:a4931eda

2025-05-31 06:01:37

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

The four main banks of bitcoin and “crypto” are Signature, Prime Trust, Silvergate, and Silicon Valley Bank. Prime Trust does not custody funds themselves but rather maintains deposit accounts at BMO Harris Bank, Cross River, Lexicon Bank, MVB Bank, and Signature Bank. Silvergate and Silicon Valley Bank have already stopped withdrawals. More banks will go down before the chaos stops. None of them have sufficient reserves to meet withdrawals.

Bitcoin gives us all the ability to opt out of a system that has massive layers of counterparty risk built in, years of cheap money and broken incentives have layered risk on top of risk throughout the entire global economy. If you thought the FTX bank run was painful to watch, I have bad news for you: every major bank in the world is fractional reserve. Bitcoin held in self custody is unique in its lack of counterparty risk, as global market chaos unwinds this will become much more obvious.

The rules of bitcoin are extremely hard to change by design. Anyone can access the network directly without a trusted third party by using their own node. Owning more bitcoin does not give you more control over the network with all participants on equal footing.

Bitcoin is:

- money that is not controlled by a company or government

- money that can be spent or saved without permission

- money that is provably scarce and should increase in purchasing power with adoptionBitcoin is money without trust. Whether you are a nation state, corporation, or an individual, you can use bitcoin to spend or save without permission. Social media will accelerate the already deteriorating trust in our institutions and as this trust continues to crumble the value of trust minimized money will become obvious. As adoption increases so should the purchasing power of bitcoin.

A quick note on "stablecoins," such as USDC - it is important to remember that they rely on trusted custodians. They have the same risk as funds held directly in bank accounts with additional counterparty risk on top. The trusted custodians can be pressured by gov, exit scam, or caught up in fraud. Funds can and will be frozen at will. This is a distinctly different trust model than bitcoin, which is a native bearer token that does not rely on any centralized entity or custodian.

Most bitcoin exchanges have exposure to these failing banks. Expect more chaos and confusion as this all unwinds. Withdraw any bitcoin to your own wallet ASAP.

Simple Self Custody Guide: https://werunbtc.com/muun

More Secure Cold Storage Guide: https://werunbtc.com/coldcard

If you found this post helpful support my work with bitcoin.

-

@ ef53426a:7e988851

2025-05-29 12:26:43

@ ef53426a:7e988851

2025-05-29 12:26:43Saturday 9AM It’s a chilly Saturday morning in Warsaw, and I don’t want to get out of bed. This is not because of the hangover; it’s because I feel like a failure.

The first day of Bitcoin FilmFest was a whirlwind of workshops, panels and running between stages. The pitch competition did not go my way. Another ‘pitching rabbit’ (an actual experienced film-maker) was selected to win the €3,000 of funding.

Rather than get up and search for coffee, I replay the scenes in my head. What could I have done differently? Will investors ever believe in me: I’m just a writer with no contacts in the industry. Do I have what it takes to produce a film?

Eventually, I haul myself out of bed and walk to Amondo, the festival’s morning HQ (and technically, the smallest cinema in Europe). Upon arrival, I find Bitcoin psychonaut Ioni Appelberg holding court in front of around a dozen enraptured disciples. Soon, the conversation spills out to the street to free up space for more workshops.

I attend a talk on film funding, then pay for coffee using bitcoin. I see familiar faces from the two previous nights. We compare notes on Friday night and check the day’s schedule. The morning clouds burn off, and things feel a little brighter.

The afternoon session begins just a few blocks away in the towering Palace of Culture and Science. My role in today's proceedings is to present my freedom fiction project, 21 Futures, on the community stage. Other presentations range from rap videos and advice on finding jobs in bitcoin to hosting ‘Bitcoin Walks’. This is how we are fixing the culture.

Saturday 8PM I feel a tap on my shoulder. ‘Excuse me, Mr. Philip. Your car is waiting. The Producers’ Dinner is starting soon’.

What? Me, a producer? I’ve been taking part in some panels and talks, but I assumed my benefits as a guest were limited to a comped ticket and generous goodie bag.

Soon, I am sharing a taxi with a Dubai-based journalist, a Colombian director, and the cypherpunk sponsor of the pitch competition I didn’t win.

The pierogies I dreamed of earlier that day somehow manifest (happy endings do exist), and we enjoy a raucous dinner including obligatory slivovitz.

Sunday 2AM The last few hours of blur include a bracing city-bike ride in a crew of nine attendees back to the Palace of Culture, chatting with a fellow bitcoin meetup organiser, and vaguely promising to attend a weekend rave with a crew of Polish artists and musicians on the outskirts of London.

I leave the party while it’s still in full swing. In five hours, I have to wake up to complete my Run for Hal in Marshal Edward Rydz-Śmigły Park.

Thursday 9PM The festival kicks off in Samo Centrum on Pizza Day. I arrive in a taxi straight from a cramped flight (fix the airlines!), having not eaten for around ten hours.

The infectious sounds of softly spoken Aussie bitrocker Roger9000 pound into the damp night. I’m three beers in, being presented by the organisers to attendees like a (very tall) show pony. I try to explain more about my books, my publishing connections, my short film.

When I search for the food I ordered an hour ago, I find it has been given away. The stern-faced Polish pizza maker shrugs. ‘You not here.’

I’m so hungry I could cry (six hours of Ryanair can do that to a man). And then, a heroic Czech pleb donates half a pizza to me. Side note: this same heroic pleb accidentally locked me out of my film-funds while trying to fix a wallet bug on Sunday night.

I step out into the rain. Roger9000 reminds us we should have laser eyes well past 100k. I take a bite of pizza and life tastes good.

The Films Side events, artists, late nights, and pitcher’s regret is all well and good, but what of the films?

My highlights included Golden Rabbit winner No More Inflation — a moving narrative with interviews from two dozen economists, visionaries, and inflation survivors.

Hotel Bitcoin, was a surprisingly funny comedy romp about a group of idiots who happen across a valuable laptop.

Revolución Bitcoin — an approachable and thorough documentary aimed to bring greater adoption in the Spanish-speaking world.

And, as a short-fiction guy, I enjoyed the short films The Man Who Wouldn’t Cry, a visit to New York’s only Somali restaurant in Finding Home.

Sunday 7PM The award ceremony has just finished. I head to Amondo for the final time to pay for mojitos in bitcoin and say goodbye to newly made friends. I feel like I’ve met almost everyone in attendance. Are you going to BTC Prague?!? we ask as we part ways.

Of course, the best thing about any festival is the people, and BFF25 had a cast of characters worthy of any art house flick:

- The bright-eyed and confident frontwoman of the metal band Scardust

- A nostr-native artist selling his intricate canvases to the highest zapper

- A dreadlocked DJ who wears a pair of flying goggles on his head at all times

- An affable British filmmaker explaining the virtues of the word ‘chucklesome’

- A Duracell-powered organiser who seems to know every song, person, film, book, and guest at the festival.

Warsaw itself feels like it has a role to play, too. Birdsong and green parks contrast the foreboding Communist-era architecture. The weather changes faster than my mood — heavy greys transform to bright sunshine. The roads around the venue close on Sunday for a political rally. And there we are in the middle, watching our bitcoin films.

Tuesday 10AM I’m at home now, squinting at my email inbox and piles of washing, wondering when the hell I’ll find time. The festival Telegram group is still buzzing with activity. Side events like martial arts tutorials, trips to a shooting range, boat tours. 5AM photos of street graffiti, lost and found items, and people asking ‘is anyone still around?’

This was not just a film festival. BFF is truly a celebration of culture — Art. Books. Comedy. Music. Video. Talk. Connection.

All this pure signal has lifted my spirits so much that despite me being a newbie filmmaker, armed only with a biro, a couple of powerpoints and a Geyser fund page, I know I will succeed in my mission. It turns out you can just film things.

You may have attended bitcoin conferences before — you know, the ones with ‘fireside chats’, VIP areas, and overpriced merch. Bitcoin FilmFest is a moment in time. We are fixing the culture, year after year, until art can flourish again.

As fellow author Aaron Koenig commented during a panel session, ‘In twenty years, we won’t be drawing laser eyes and singing about honey badgers. Our grandchildren won’t understand the change we went through.’

Would I do it all again? Of course!

Join me next June in Warsaw.

I’ll be the tall one presenting his short animation premiere.

Philip Charter is a full-time writer and part-time cat herder. As well as writing for bitcoin founders and companies, he runs the 21 Futures fiction project.

Find out more about theNoderoid Saga animation projecton Geyser.

-

@ b1ddb4d7:471244e7

2025-05-31 06:00:53

@ b1ddb4d7:471244e7

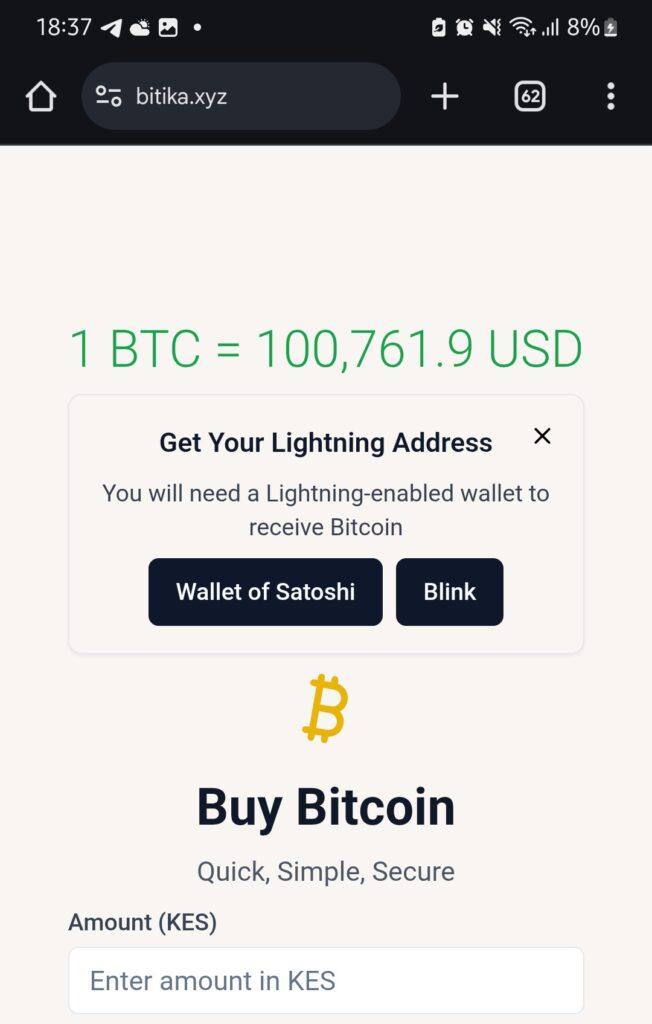

2025-05-31 06:00:53In the heart of East Africa, where M-Pesa reigns supreme and innovation pulses through bustling markets, a quiet revolution is brewing—one that could redefine how millions interact with money.

Enter Bitika, the Kenyan startup turning bitcoin’s complexity into a three-step dance, merging the lightning speed of sats with the trusted rhythm of mobile money.

At the helm is a founder whose “aha” moment came not in a boardroom, but at his kitchen table, watching his father grapple with the gap between understanding bitcoin and actually using it.

Bitika was born from that friction—a bridge between M-Pesa’s ubiquity and bitcoin’s borderless promise, wrapped in a name as playful as the Swahili slang that inspired it.

But this isn’t just a story about simplifying transactions. It’s about liquidity battles, regulatory tightropes, and a vision to turn Bitika into the invisible rails powering Africa’s Bitcoin future.

Building on Bitcoin

- Tell us a bit about yourself and how you got into bitcoin/fintech, and what keeps you passionate about this space?

I first came across bitcoin in 2020, but like many at that time, I didn’t fully grasp what it really was. It sounded too complicated, probably with the heavy terminologies. Over time, I kept digging deeper and became more curious.

I started digging into finance and how money works and realised this was what I needed to understand bitcoin’s objectives. I realized that bitcoin wasn’t just a new type of money—it was a breakthrough in how we think about freedom, ownership, and global finance.

What keeps me passionate is how bitcoin can empower people—especially in Africa—to take control of their wealth, without relying on unstable systems or middlemen.

- What pivotal moment or experience inspired you to create Bitika? Was there a specific gap in Kenya’s financial ecosystem that sparked the idea?

Yes, this idea was actually born right in my own home. I’ve always been an advocate for bitcoin, sharing it with friends, family, and even strangers. My dad and I had countless conversations about it. Eventually, he understood the concept. But when he asked, “How do I even buy bitcoin?” or “Can you just buy it for me?” and after taking him through binance—that hit me.

If someone I’d educated still found the buying process difficult, how many others were feeling the same way? That was the lightbulb moment. I saw a clear gap: the process of buying bitcoin was too technical for the average Kenyan. That’s the problem Bitika set out to solve.

- How did you identify the synergy between bitcoin and M-Pesa as a solution for accessibility?

M-Pesa is at the center of daily life in Kenya. Everyone uses it—from buying groceries to paying rent. Instead of forcing people to learn new tools, I decided to meet them where they already are. That synergy between M-Pesa and bitcoin felt natural. It’s about bridging what people already trust with something powerful and new.

- Share the story behind the name “Bitika” – does it hold a cultural or symbolic meaning?

Funny enough, Bitika isn’t a deeply planned name. It came while I was thinking about bitcoin and the type of transformation it brings to individuals. In Swahili, we often add “-ka” to words for flair—like “bambika” from “bamba.”

So, I just coined Bitika as a playful and catchy way to reflect something bitcoin-related, but also uniquely local. I stuck with it because thinking of an ideal brand name is the toughest challenge for me.

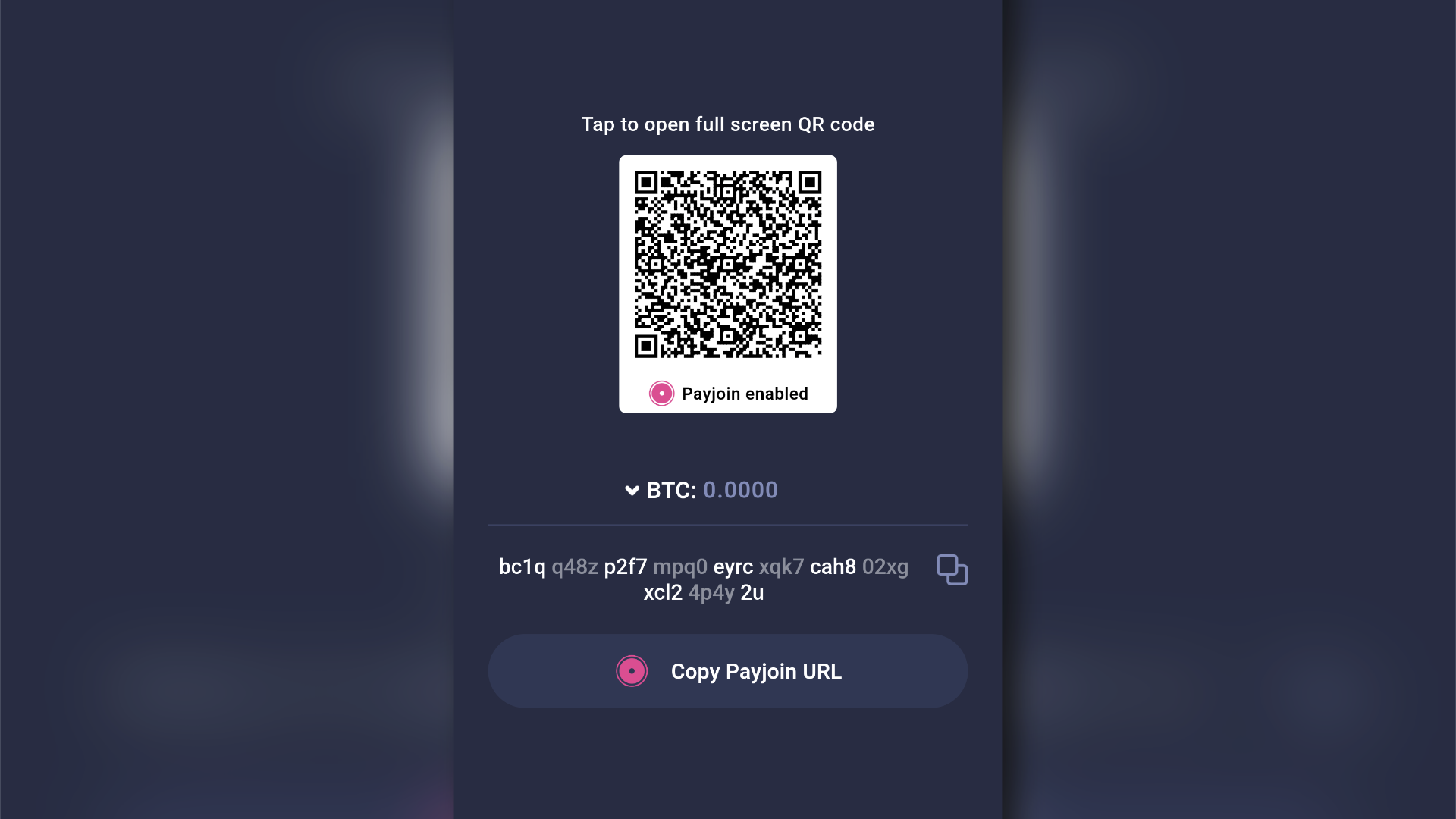

- Walk us through the user journey – how does buying bitcoin via M-Pesa in “3 simple steps” work under the hood?

It’s beautifully simple.

1. The user enters the amount they want to spend in KES—starting from as little as 50 KES (about $0.30).

2. They input their Lightning wallet address.

3. They enter their M-Pesa number, which triggers an STK push (payment prompt) on their phone. Once confirmed—pap!—they receive bitcoin almost instantly.

Under the hood, we fetch the live BTC price, validate wallet addresses, check available liquidity, process the mobile payment, and send sats via the Lightning Network—all streamlined into a smooth experience for the user.

- Who’s Bitika’s primary audience? Are you focusing on unbanked populations, tech enthusiasts, or both?

Both. Bitika is designed for everyday people—especially the unbanked and underbanked who are excluded from traditional finance. But we also attract bitcoiners who just want a faster, easier way to buy sats. What unites them is the desire for a seamless and low-barrier bitcoin experience.

Community and Overcoming Challenges

- What challenges has Bitika faced navigating Kenya’s bitcoin regulations, and how do you build trust with regulators?

Regulation is still evolving here. Parliament has drafted bills, but none have been passed into law yet. We’re currently in a revision phase where policymakers are trying to strike a balance between encouraging innovation and protecting the public.

We focus on transparency and open dialogue—we believe that building trust with regulators starts with showing how bitcoin can serve the public good.

- What was the toughest obstacle in building Bitika, and how did you overcome it?

Liquidity. Since we don’t have deep capital reserves, we often run into situations where we have to pause operations often to manually restock our bitcoin supply. It’s frustrating—for us and for users. We’re working on automating this process and securing funding to maintain consistent liquidity so users can access bitcoin at any time, without disruption.

This remains our most critical issue—and the primary reason we’re seeking support.

- Are you eyeing new African markets? What’s next for Bitika’s product?

Absolutely. The long-term vision is to expand Bitika into other African countries facing similar financial challenges. But first, we want to turn Bitika into a developer-first tool—infrastructure that others can build on. Imagine local apps, savings products, or financial tools built using Bitika’s simple bitcoin rails. That’s where we’re heading.

- What would you tell other African entrepreneurs aiming to disrupt traditional finance?

Disrupting finance sounds exciting—but the reality is messy. People fear what they don’t understand. That’s why simplicity is everything. Build tools that hide the complexity, and focus on making the user’s life easier. Most importantly, stay rooted in local context—solve problems people actually face.

What’s Next?

- What’s your message to Kenyans hesitant to try bitcoin, and to enthusiasts watching Bitika?

To my fellow Kenyans: bitcoin isn’t just an investment—it’s a sovereign tool. It’s money you truly own. Start small, learn, and ask questions.

To the bitcoin community: Bitika is proof that bitcoin is working in Africa. Let’s keep pushing. Let’s build tools that matter.

- How can the bitcoin community, both locally and globally, support Bitika’s mission?

We’re currently fundraising on Geyser. Support—whether it’s financial, technical, or simply sharing our story—goes a long way. Every sat you contribute helps us stay live, grow our liquidity, and continue building a tool that brings bitcoin closer to the everyday person in Africa.

Support here: https://geyser.fund/project/bitika

-

@ 1d7ff02a:d042b5be

2025-05-28 04:02:47

@ 1d7ff02a:d042b5be

2025-05-28 04:02:47For those who still don't truly understand Bitcoin, it means you still don't understand what money is, who creates it, and why humans need money.

It's a scam that the education system doesn't teach this important subject, while we spend almost our entire lives trying to earn money. Therefore, I recommend following the money and studying Bitcoin seriously.

Why Bitcoin Matters

Saving is the greatest discovery in human history

Before humans learned to save, we were just animals living day to day. Saving is what makes humans different from other animals — the ability to think about the future and store for later.

Saving created civilization itself

Without saving, there would be no cities, no science, no art. Everything we call "progress" comes from the ability to save.

Money is the greatest creation in human history

It is the tool that has allowed human civilization to advance to this day. Money is the best tool humans use for saving.

Bitcoin is the best money ever created

It is the most perfect money humans have ever created. No one can control, manipulate, destroy it, and it is truly limited like time in life.

Bitcoin is like a black hole

That will absorb all value from the damaged financial system. It will draw stability and value to itself. Everything of value will flow into Bitcoin eventually.

Bitcoin is like Buddhism discovering truth

It helps understand the root problems of the current financial system and the emergence of many problems in society, just like Buddha who understood all suffering and the causes of suffering.

Bitcoin is freedom

Money is power, money controls human behavior. When we have money that preserves value and cannot be controlled, we will have intellectual freedom, freedom of expression, and the power to choose.

The debt that humanity has created today would take another thousand years to pay off completely

There is no way out and it's heading toward serious collapse. Bitcoin is the light that will help prevent humanity from entering another dark age.

Bitcoin cannot steal your time

It cannot be created from nothing. Every Bitcoin requires real energy and time to create.

Bitcoin is insurance that protects against mismanagement

It helps protect against currency debasement, economic depression, and failed policies. Bitcoin will protect your value.

Bitcoin is going to absorb the world's value

Eventually, Bitcoin will become the store of value for the entire world. It will absorb wealth from all assets, all prices, and all investments.

Exit The Matrix

We live in a financial Matrix. Every day we wake up and go to work, thinking we're building a future for ourselves. But in reality, we're just giving energy to a system that extracts value from us every second. Bitcoin is the red pill — it will open your eyes to see the truth of the financial world. Central banks are the architects of this Matrix — they create money from nothing, and we have to work hard to get it.

The education system has deceived us greatly. They teach us to work for money, but never teach us what money is. We spend 12-16 years in school, then spend our entire lives earning money, but never know what it is, who creates it, and why it has value. This is the biggest scam in human history.

We are taught to be slaves of the system, but not taught to understand the system.

The Bitcoin standard will end war

When you can't print money for war anymore, war becomes too expensive.

We are entering the Bitcoin Renaissance era

An era of financial and intellectual revival. Bitcoin is creating a new class of humans. People who understand and hold Bitcoin will become a new class with true freedom.

The Path to Financial Truth

Follow the money trail and you will see the truth: - Who controls money printing? - Why do prices keep getting higher? - Why are the poor getting poorer and the rich getting richer?

All the answers lie in understanding money and Bitcoin.

Studying Bitcoin is not just about investment — it's about understanding the future of currency and human society.

Don't just work for money. Understand money. Study Bitcoin.

If you don't understand money, you will be a slave to the system forever. If you understand Bitcoin, you will gain freedom.

-

@ b1ddb4d7:471244e7

2025-05-31 06:00:49

@ b1ddb4d7:471244e7

2025-05-31 06:00:49Bitcoin FilmFest (BFF25) returns to Warsaw for its third edition, blending independent cinema—from feature films and commercials to AI-driven experimental visuals—with education and entertainment.

Hundreds of attendees from around the world will gather for three days of screenings, discussions, workshops, and networking at the iconic Kinoteka Cinema (PKiN), the same venue that hosted the festival’s first two editions in March 2023 and April 2024.

This year’s festival, themed “Beyond the Frame,” introduces new dimensions to its program, including an extra day on May 22 to celebrate Bitcoin Pizza Day, the first real-world bitcoin transaction, with what promises to be one of Europe’s largest commemorations of this milestone.

BFF25 bridges independent film, culture, and technology, with a bold focus on decentralized storytelling and creative expression. As a community-driven cultural experience with a slightly rebellious spirit, Bitcoin FilmFest goes beyond movies, yet cinema remains at its heart.

Here’s a sneak peek at the lineup, specially curated for movie buffs:

Generative Cinema – A special slot with exclusive shorts and a thematic debate on the intersection of AI and filmmaking. Featured titles include, for example: BREAK FREE, SATOSHI: THE CREATION OF BITCOIN, STRANGE CURRENCIES, and BITCOIN IS THE MYCELIUM OF MONEY, exploring financial independence, traps of the fiat system, and a better future built on sound money.

Generative Cinema – A special slot with exclusive shorts and a thematic debate on the intersection of AI and filmmaking. Featured titles include, for example: BREAK FREE, SATOSHI: THE CREATION OF BITCOIN, STRANGE CURRENCIES, and BITCOIN IS THE MYCELIUM OF MONEY, exploring financial independence, traps of the fiat system, and a better future built on sound money. Upcoming Productions Preview – A bit over an hour-long block of unreleased pilots and works-in-progress. Attendees will get exclusive first looks at projects like FINDING HOME (a travel-meets-personal-journey series), PARALLEL SPACES (a story about alternative communities), and THE LEGEND OF LANDI (a mysterious narrative).

Upcoming Productions Preview – A bit over an hour-long block of unreleased pilots and works-in-progress. Attendees will get exclusive first looks at projects like FINDING HOME (a travel-meets-personal-journey series), PARALLEL SPACES (a story about alternative communities), and THE LEGEND OF LANDI (a mysterious narrative). Freedom-Focused Ads & Campaigns – Unique screenings of video commercials, animations, and visual projects, culminating in “The PoWies” (Proof of Work-ies)—the first ever awards show honoring the best Bitcoin-only awareness campaigns.

Freedom-Focused Ads & Campaigns – Unique screenings of video commercials, animations, and visual projects, culminating in “The PoWies” (Proof of Work-ies)—the first ever awards show honoring the best Bitcoin-only awareness campaigns.To get an idea of what might come up at the event, here, you can preview 6 selected ads combined into two 2 videos:

Open Pitch Competition – A chance for filmmakers to present fresh ideas and unfinished projects to an audience of a dedicated jury, movie fans and potential collaborators. This competitive block isn’t just entertaining—it’s a real opportunity for creators to secure funding and partnerships.

Open Pitch Competition – A chance for filmmakers to present fresh ideas and unfinished projects to an audience of a dedicated jury, movie fans and potential collaborators. This competitive block isn’t just entertaining—it’s a real opportunity for creators to secure funding and partnerships. Golden Rabbit Awards: A lively gala honoring films from the festival’s Official Selection, with awards in categories like Best Feature, Best Story, Best Short, and Audience Choice.

Golden Rabbit Awards: A lively gala honoring films from the festival’s Official Selection, with awards in categories like Best Feature, Best Story, Best Short, and Audience Choice.BFF25 Main Screenings

Sample titles from BFF25’s Official Selection:

REVOLUCIÓN BITCOIN – A documentary by Juan Pablo, making its first screening outside the Spanish-speaking world in Warsaw this May. Three years of important work, 80 powerful minutes to experience. The film explores Bitcoin’s impact across Argentina, Colombia, Mexico, El Salvador, and Spain through around 40 diverse perspectives. Screening in Spanish with English subtitles, followed by a Q&A with the director.

REVOLUCIÓN BITCOIN – A documentary by Juan Pablo, making its first screening outside the Spanish-speaking world in Warsaw this May. Three years of important work, 80 powerful minutes to experience. The film explores Bitcoin’s impact across Argentina, Colombia, Mexico, El Salvador, and Spain through around 40 diverse perspectives. Screening in Spanish with English subtitles, followed by a Q&A with the director. UNBANKABLE – Luke Willms’ directorial debut, drawing from his multicultural roots and his father’s pioneering HIV/AIDS research. An investigative documentary based on Luke’s journeys through seven African countries, diving into financial experiments and innovations—from mobile money and digital lending to Bitcoin—raising smart questions and offering potential lessons for the West. Its May appearance at BFF25 marks its largest European event to date, following festival screenings and nominations across multiple continents over the past year.

UNBANKABLE – Luke Willms’ directorial debut, drawing from his multicultural roots and his father’s pioneering HIV/AIDS research. An investigative documentary based on Luke’s journeys through seven African countries, diving into financial experiments and innovations—from mobile money and digital lending to Bitcoin—raising smart questions and offering potential lessons for the West. Its May appearance at BFF25 marks its largest European event to date, following festival screenings and nominations across multiple continents over the past year. HOTEL BITCOIN – A Spanish comedy directed by Manuel Sanabria and Carlos “Pocho” Villaverde. Four friends, 4,000 bitcoins , and one laptop spark a chaotic adventure of parties, love, crime, and a dash of madness. Exploring sound money, value, and relationships through a twisting plot. The film premiered at the Tarazona and Moncayo Comedy Film Festival in August 2024. Its Warsaw screening at BFF25 (in Spanish with English subtitles) marks its first public showing outside the Spanish-speaking world.

HOTEL BITCOIN – A Spanish comedy directed by Manuel Sanabria and Carlos “Pocho” Villaverde. Four friends, 4,000 bitcoins , and one laptop spark a chaotic adventure of parties, love, crime, and a dash of madness. Exploring sound money, value, and relationships through a twisting plot. The film premiered at the Tarazona and Moncayo Comedy Film Festival in August 2024. Its Warsaw screening at BFF25 (in Spanish with English subtitles) marks its first public showing outside the Spanish-speaking world.Check out trailers for this year’s BFF25 and past editions on YouTube.

Tickets & Info:

- Detailed program and tickets are available at bitcoinfilmfest.com/bff25.

- Stay updated via the festival’s official channels (links provided on the website).

- Use ‘LN-NEWS’ to get 10% of tickets

-

@ 7f6db517:a4931eda

2025-05-31 06:01:37

@ 7f6db517:a4931eda

2025-05-31 06:01:37

The former seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

The latter's future remains to be seen. Dependence on Tor, which has had massive reliability issues, and lack of strong privacy guarantees put it at risk.

— ODELL (@ODELL) October 27, 2022

The Basics

- Lightning is a protocol that enables cheap and fast native bitcoin transactions.

- At the core of the protocol is the ability for bitcoin users to create a payment channel with another user.

- These payment channels enable users to make many bitcoin transactions between each other with only two on-chain bitcoin transactions: the channel open transaction and the channel close transaction.

- Essentially lightning is a protocol for interoperable batched bitcoin transactions.

- It is expected that on chain bitcoin transaction fees will increase with adoption and the ability to easily batch transactions will save users significant money.

- As these lightning transactions are processed, liquidity flows from one side of a channel to the other side, on chain transactions are signed by both parties but not broadcasted to update this balance.

- Lightning is designed to be trust minimized, either party in a payment channel can close the channel at any time and their bitcoin will be settled on chain without trusting the other party.

There is no 'Lightning Network'

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise.

- There are many lightning channels between many different users and funds can flow across interconnected channels as long as there is a route through peers.

- If a lightning transaction requires multiple hops it will flow through multiple interconnected channels, adjusting the balance of all channels along the route, and paying lightning transaction fees that are set by each node on the route.

Example: You have a channel with Bob. Bob has a channel with Charlie. You can pay Charlie through your channel with Bob and Bob's channel with User C.