-

@ 21c71bfa:e28fa0f6

2025-05-29 15:09:17

@ 21c71bfa:e28fa0f6

2025-05-29 15:09:17Book *Bangalore to Tirupati cab* online at best price. CabBazar provides car rental services for all cab types AC, Non AC, Hatchback, SUV, Sedan, Innova and Tempo Traveller. Both One way taxi and round trip cab available at lowest price. Price starts Rs. 9/Km.

-

@ 21c71bfa:e28fa0f6

2025-05-29 15:08:51

@ 21c71bfa:e28fa0f6

2025-05-29 15:08:51Book *Tirupati to Srikalahasti cab* online at best price. CabBazar provides car rental services for all cab types AC, Non AC, Hatchback, SUV, Sedan, Innova and Tempo Traveller. Both One way taxi and round trip cab available at lowest price. Price starts Rs. 9/Km.

-

@ 21c71bfa:e28fa0f6

2025-05-29 14:52:10

@ 21c71bfa:e28fa0f6

2025-05-29 14:52:10Book *Tirupati to Srikalahasti cab* online at best price. CabBazar provides car rental services for all cab types AC, Non AC, Hatchback, SUV, Sedan, Innova and Tempo Traveller. Both One way taxi and round trip cab available at lowest price. Price starts Rs. 9/Km.

-

@ 21c71bfa:e28fa0f6

2025-05-29 14:51:46

@ 21c71bfa:e28fa0f6

2025-05-29 14:51:46Book *Tirupati to Vellore cab* online at best price. CabBazar provides car rental services for all cab types AC, Non AC, Hatchback, SUV, Sedan, Innova and Tempo Traveller. Both One way taxi and round trip cab available at lowest price. Price starts Rs. 9/Km.

-

@ 21c71bfa:e28fa0f6

2025-05-29 14:51:23

@ 21c71bfa:e28fa0f6

2025-05-29 14:51:23Book *Tirupati to Tirumala cab* online at best price. CabBazar provides car rental services for all cab types AC, Non AC, Hatchback, SUV, Sedan, Innova and Tempo Traveller. Both One way taxi and round trip cab available at lowest price. Price starts Rs. 9/Km.

-

@ 21c71bfa:e28fa0f6

2025-05-29 14:51:04

@ 21c71bfa:e28fa0f6

2025-05-29 14:51:04Book *Bhubaneswar to Konark cab* online at best price. CabBazar provides car rental services for all cab types AC, Non AC, Hatchback, SUV, Sedan, Innova and Tempo Traveller. Both One way taxi and round trip cab available at lowest price. Price starts Rs. 9/Km.

-

@ 21c71bfa:e28fa0f6

2025-05-29 14:50:44

@ 21c71bfa:e28fa0f6

2025-05-29 14:50:44Book *Mcleodganj to Amritsar cab* online at best price. CabBazar provides car rental services for all cab types AC, Non AC, Hatchback, SUV, Sedan, Innova and Tempo Traveller. Both One way taxi and round trip cab available at lowest price. Price starts Rs. 9/Km.

-

@ 21c71bfa:e28fa0f6

2025-05-29 14:50:23

@ 21c71bfa:e28fa0f6

2025-05-29 14:50:23Book *Manali to Amritsar cab* online at best price. CabBazar provides car rental services for all cab types AC, Non AC, Hatchback, SUV, Sedan, Innova and Tempo Traveller. Both One way taxi and round trip cab available at lowest price. Price starts Rs. 9/Km.

-

@ 21c71bfa:e28fa0f6

2025-05-29 14:50:05

@ 21c71bfa:e28fa0f6

2025-05-29 14:50:05Book *Amritsar to Phagwara cab* online at best price. CabBazar provides car rental services for all cab types AC, Non AC, Hatchback, SUV, Sedan, Innova and Tempo Traveller. Both One way taxi and round trip cab available at lowest price. Price starts Rs. 9/Km.

-

@ 21c71bfa:e28fa0f6

2025-05-29 14:49:42

@ 21c71bfa:e28fa0f6

2025-05-29 14:49:42Book *Chandigarh to Amritsar cab* online at best price. CabBazar provides car rental services for all cab types AC, Non AC, Hatchback, SUV, Sedan, Innova and Tempo Traveller. Both One way taxi and round trip cab available at lowest price. Price starts Rs. 9/Km.

-

@ 21c71bfa:e28fa0f6

2025-05-29 14:49:20

@ 21c71bfa:e28fa0f6

2025-05-29 14:49:20Book *Amritsar to Pathankot cab* online at best price. CabBazar provides car rental services for all cab types AC, Non AC, Hatchback, SUV, Sedan, Innova and Tempo Traveller. Both One way taxi and round trip cab available at lowest price. Price starts Rs. 9/Km.

-

@ 21c71bfa:e28fa0f6

2025-05-29 14:49:01

@ 21c71bfa:e28fa0f6

2025-05-29 14:49:01Book *Amritsar to Manali cab* online at best price. CabBazar provides car rental services for all cab types AC, Non AC, Hatchback, SUV, Sedan, Innova and Tempo Traveller. Both One way taxi and round trip cab available at lowest price. Price starts Rs. 9/Km.

-

@ cf8c27f4:c95b9b5c

2025-05-29 15:21:33

@ cf8c27f4:c95b9b5c

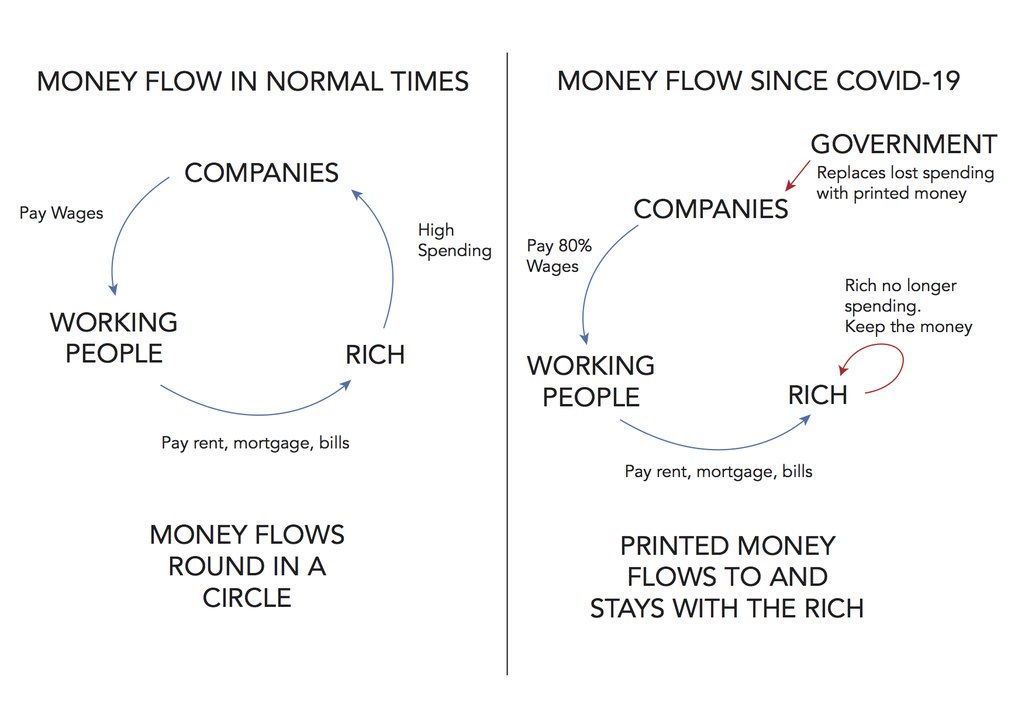

2025-05-29 15:21:33What’s Happening in Japan? Japan has the highest debt-to-GDP ratio in the developed world — over 260%. For decades, it got away with this by keeping interest rates near zero and having the Bank of Japan (BoJ) purchase most of its government bonds. This was known as Yield Curve Control — a desperate attempt to keep borrowing costs low.

But now, global bond markets are revolting.

🔺 Japanese 30-year yields have exploded past 3.18%

🔺 The worst bond auction since 1987 just occurred

🔺 Demand for JGBs (Japanese Government Bonds) is collapsing

When demand for bonds falls, prices drop and yields rise. This signals fear. Big fear.

As Taylor Kenney noted in a widely shared thread:

“This isn’t just a Japan problem — Japan is the largest foreign holder of U.S. debt.” The Contagion Risk: U.S. Debt and Global Collapse

Here’s where this gets truly global.

In 2025 alone, $9.2 trillion of U.S. debt will mature — 70% of it between January and June. That debt must be refinanced, and as interest rates remain elevated, the cost of servicing this debt balloons, potentially straining the U.S. government’s finances.

If yields rise further, it only worsens the cycle:

-

Yields rise

-

Interest costs balloon

-

Governments print more to cover deficits

-

Currencies debase

-

Confidence dies

-

Collapse follows

Japan may just be the canary in the coal mine. Gold Is Surging. Bitcoin Is Outpacing It.

Smart money is already moving.

Bitcoin is closing in on its all-time high — and closely tracking the M2 Global Liquidity Index, historically lagging it by 60–90 days.

Gold has also had a stellar run in 2025, signalling institutional flight to hard assets.

People are scared. And they should be.

The global financial system is built on an unsustainable foundation of debt, inflation, and artificial suppression of interest rates. That system is now cracking in Japan — but it won’t stop there. ₿ Bitcoin: The Exit Plan

Bitcoin doesn’t rely on a central bank.

It doesn’t need to be refinanced.

It doesn’t have a yield curve to control.

It’s decentralised, scarce, and incorruptible.

While fiat currencies spiral under the weight of debt and monetary debasement, Bitcoin offers an escape — a monetary protocol with a fixed supply and no political manipulation.

It’s not just an investment.

It’s an exit strategy from the madness. Final Thoughts

-

Japan is flashing red.

-

The U.S. is next in line.

-

The debt system is spiralling — fast.

Gold is insurance.

Bitcoin is the lifeboat.

-

-

@ cf8c27f4:c95b9b5c

2025-05-29 15:19:56

@ cf8c27f4:c95b9b5c

2025-05-29 15:19:56The Weimar Hyperinflation Nightmare

It’s 1921. Germany’s reeling from World War I, crushed by reparations and a wrecked economy. The government’s solution? Print money. Lots of it. The German mark starts tanking. By 1923, it’s a joke—4.2 trillion marks to one U.S. dollar. A loaf of bread costs wheelbarrows of cash. Savings? Wiped out. Middle-class families? Pauperized. Chaos.

Enter Hugo Stinnes, a coal and steel magnate with a sharp mind and sharper instincts. He sees the game: when a currency’s dying, debt is your friend. Why? Because the real value of your loans shrinks as inflation skyrockets. Borrow 1 million marks today, buy a factory, and by next year, that million’s worth a few pennies. Pay it back, keep the factory, repeat.

Stinnes’ Master Play

Stinnes goes all in. He borrows billions of marks, snapping up hard assets—steel mills, shipping lines, factories, real estate. Tangible stuff that holds value while paper marks turn to confetti. By 1923, his empire is a beast: over 1,500 companies, from coal mines to newspapers. Estimates say he controlled 15-20% of Germany’s industry, maybe more. A third of the economy? Probably an exaggeration, but the guy was a titan.

He wasn’t just lucky. Stinnes played 4D chess. He diversified his holdings to weather the storm, employed tens of thousands (keeping unrest at bay), and even argued his empire stabilized the economy. Critics, like British diplomat Lord D’Abernon, weren’t buying it—they called him a profiteer who thrived while others starved. Truth? Probably somewhere in the middle.

The Fall

Hyperinflation couldn’t last forever. In November 1923, Germany introduced the Rentenmark, a new currency backed by land and assets. The mark’s freefall stopped. Stinnes’ debt-fueled strategy hit a wall—stable currencies make loans harder to game. His health was failing too. He died in 1924, and his conglomerate started unraveling, with parts sold off or restructured. The Inflation King’s reign was over.

Why This Matters Today: Enter Bitcoin

Stinnes’ story isn’t just a history lesson—it’s a warning. Hyperinflation destroys trust in fiat money. When governments print cash to cover debts, savers get crushed, and the clever (or ruthless) like Stinnes exploit the chaos. Sound familiar? Look at today: global debt’s at $315 trillion, central banks are juggling interest rates, and inflation’s eating purchasing power. Argentina’s peso lost 50% of its value in 2024 alone. Venezuela’s bolívar? Toast.

This is where Bitcoin comes in. Born in 2009 after the financial crisis, Bitcoin is a hedge against fiat’s flaws. Unlike marks or dollars, it’s decentralised—no government can print more to pay its bills. Its supply is capped at 21 million coins, making it “digital gold.” When fiat currencies wobble, Bitcoin’s value often spikes—check its 2021 and 2024 bull runs during inflation fears.

Stinnes gamed a broken system by betting on hard assets. Today, Bitcoiners are doing the same, but instead of factories, they’re stacking sats. Why? Because in a world where fiat can be printed to oblivion, a deflationary asset like Bitcoin holds appeal. It’s not perfect—volatility’s a beast, and governments hate what they can’t control—but it’s a response to the same problem Stinnes faced: untrustworthy money.

The Lesson

Stinnes saw the Weimar collapse coming and turned it into wealth. Most didn’t. Today, you don’t need to be a tycoon to protect yourself, but you do need to understand the game. Fiat’s not collapsing tomorrow, but cracks are showing. Bitcoin’s one tool—maybe not the only one—to hedge against that risk. Study history, question the system, and don’t get caught holding the bag.

-

@ 21c71bfa:e28fa0f6

2025-05-29 14:48:43

@ 21c71bfa:e28fa0f6

2025-05-29 14:48:43Book *Amritsar to Katra cab* online at best price. CabBazar provides car rental services for all cab types AC, Non AC, Hatchback, SUV, Sedan, Innova and Tempo Traveller. Both One way taxi and round trip cab available at lowest price. Price starts Rs. 9/Km.

-

@ 21c71bfa:e28fa0f6

2025-05-29 14:48:21

@ 21c71bfa:e28fa0f6

2025-05-29 14:48:21Book *Amritsar to Kapurthala cab* online at best price. CabBazar provides car rental services for all cab types AC, Non AC, Hatchback, SUV, Sedan, Innova and Tempo Traveller. Both One way taxi and round trip cab available at lowest price. Price starts Rs. 9/Km.

-

@ 21c71bfa:e28fa0f6

2025-05-29 14:47:56

@ 21c71bfa:e28fa0f6

2025-05-29 14:47:56Book *Amritsar to Delhi cab* online at best price. CabBazar provides car rental services for all cab types AC, Non AC, Hatchback, SUV, Sedan, Innova and Tempo Traveller. Both One way taxi and round trip cab available at lowest price. Price starts Rs. 9/Km.

-

@ 21c71bfa:e28fa0f6

2025-05-29 14:47:33

@ 21c71bfa:e28fa0f6

2025-05-29 14:47:33Book *Amritsar to Chandigarh cab* online at best price. CabBazar provides car rental services for all cab types AC, Non AC, Hatchback, SUV, Sedan, Innova and Tempo Traveller. Both One way taxi and round trip cab available at lowest price. Price starts Rs. 9/Km.

-

@ 21c71bfa:e28fa0f6

2025-05-29 14:47:08

@ 21c71bfa:e28fa0f6

2025-05-29 14:47:08Book *Cuttack to Puri cab* online at best price. CabBazar provides car rental services for all cab types AC, Non AC, Hatchback, SUV, Sedan, Innova and Tempo Traveller. Both One way taxi and round trip cab available at lowest price. Price starts Rs. 9/Km.

-

@ 21c71bfa:e28fa0f6

2025-05-29 14:46:31

@ 21c71bfa:e28fa0f6

2025-05-29 14:46:31Book *Puri to Konark cab* online at best price. CabBazar provides car rental services for all cab types AC, Non AC, Hatchback, SUV, Sedan, Innova and Tempo Traveller. Both One way taxi and round trip cab available at lowest price. Price starts Rs. 9/Km.

-

@ 2e8970de:63345c7a

2025-05-29 13:40:19

@ 2e8970de:63345c7a

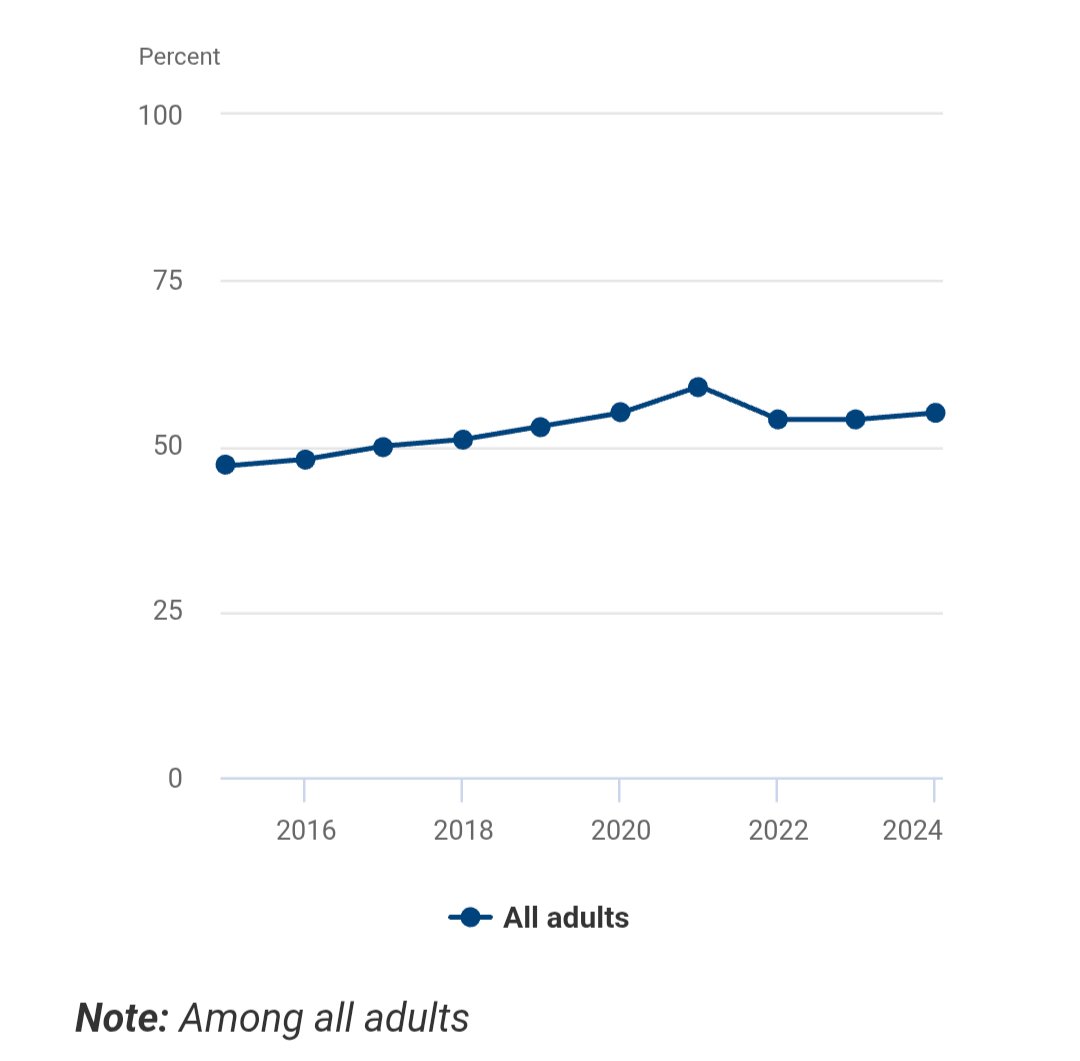

2025-05-29 13:40:19(and that's the highest ever outside the covid era)

https://www.federalreserve.gov/consumerscommunities/sheddataviz/emergency-savings.html

https://stacker.news/items/991909

-

@ fbf0e434:e1be6a39

2025-05-29 13:09:48

@ fbf0e434:e1be6a39

2025-05-29 13:09:48Hackathon 概述

ETH Dublin 2025 黑客松圆满落幕,活动共吸引 84 名开发者参与,共有 31 个项目通过审核。活动核心是借助多家赞助商技术,打造具有影响力的区块链解决方案。活动鼓励参与者组建技能多元的平衡团队,运用技术工具及赞助商支持 —— 如 Chainlink 进行数据验证、Ledger 保障安全、Filecoin 提供存储方案等。

多个项目聚焦社会影响领域:ÉireEncrypt 致力于开发符合 GDPR 合规要求的隐私保护区块链工具;SafeRoads Ireland 则通过智能合约推动安全驾驶。此外,部分项目借助以太坊实现租金管控与去中心化住房市场,还有以移民为主题的数字解决方案促进社区融合,充分展现区块链技术在解决隐私保护、公共安全、教育改革等实际问题中的潜力。

总体而言,ETH Dublin 2025 黑客松不仅促进了开发者与合作伙伴的协作,更激发了诸多借助区块链技术创造社会价值的创新项目。

Hackathon 获奖者

奖项得主

- 一等奖: RecEth

RecEth 通过提供电子邮件确认和清晰的收据,增强了用户对加密交易的信任,将用户体验与传统支付系统的透明度相对齐。 - 二等奖: Latinum

Latinum 作为支付中间件,允许MCP构建者通过兼容钱包实现由代理发起的交易来实现服务器货币化,简化了货币化过程。 - 三等奖: Fundraisely

FundRaisely 利用区块链技术帮助慈善机构进行合法合规的筹款,以及透明的审计,确保捐款流程的清晰和负责。

欲了解所有项目的更多信息,请访问这里。

关于组织者

ETH Ireland

ETH Ireland 致力于区块链技术的创新和发展。该组织在Ethereum方面有着丰富的专业知识,通过举办会议和工作坊促进区块链教育和社区参与。ETH Ireland 的使命是扩大区块链知识普及,推广去中心化技术到各个领域。

- 一等奖: RecEth

-

@ ef53426a:7e988851

2025-05-29 12:26:43

@ ef53426a:7e988851

2025-05-29 12:26:43Saturday 9AM It’s a chilly Saturday morning in Warsaw, and I don’t want to get out of bed. This is not because of the hangover; it’s because I feel like a failure.

The first day of Bitcoin FilmFest was a whirlwind of workshops, panels and running between stages. The pitch competition did not go my way. Another ‘pitching rabbit’ (an actual experienced film-maker) was selected to win the €3,000 of funding.

Rather than get up and search for coffee, I replay the scenes in my head. What could I have done differently? Will investors ever believe in me: I’m just a writer with no contacts in the industry. Do I have what it takes to produce a film?

Eventually, I haul myself out of bed and walk to Amondo, the festival’s morning HQ (and technically, the smallest cinema in Europe). Upon arrival, I find Bitcoin psychonaut Ioni Appelberg holding court in front of around a dozen enraptured disciples. Soon, the conversation spills out to the street to free up space for more workshops.

I attend a talk on film funding, then pay for coffee using bitcoin. I see familiar faces from the two previous nights. We compare notes on Friday night and check the day’s schedule. The morning clouds burn off, and things feel a little brighter.

The afternoon session begins just a few blocks away in the towering Palace of Culture and Science. My role in today's proceedings is to present my freedom fiction project, 21 Futures, on the community stage. Other presentations range from rap videos and advice on finding jobs in bitcoin to hosting ‘Bitcoin Walks’. This is how we are fixing the culture.

Saturday 8PM I feel a tap on my shoulder. ‘Excuse me, Mr. Philip. Your car is waiting. The Producers’ Dinner is starting soon’.

What? Me, a producer? I’ve been taking part in some panels and talks, but I assumed my benefits as a guest were limited to a comped ticket and generous goodie bag.

Soon, I am sharing a taxi with a Dubai-based journalist, a Colombian director, and the cypherpunk sponsor of the pitch competition I didn’t win.

The pierogies I dreamed of earlier that day somehow manifest (happy endings do exist), and we enjoy a raucous dinner including obligatory slivovitz.

Sunday 2AM The last few hours of blur include a bracing city-bike ride in a crew of nine attendees back to the Palace of Culture, chatting with a fellow bitcoin meetup organiser, and vaguely promising to attend a weekend rave with a crew of Polish artists and musicians on the outskirts of London.

I leave the party while it’s still in full swing. In five hours, I have to wake up to complete my Run for Hal in Marshal Edward Rydz-Śmigły Park.

Thursday 9PM The festival kicks off in Samo Centrum on Pizza Day. I arrive in a taxi straight from a cramped flight (fix the airlines!), having not eaten for around ten hours.

The infectious sounds of softly spoken Aussie bitrocker Roger9000 pound into the damp night. I’m three beers in, being presented by the organisers to attendees like a (very tall) show pony. I try to explain more about my books, my publishing connections, my short film.

When I search for the food I ordered an hour ago, I find it has been given away. The stern-faced Polish pizza maker shrugs. ‘You not here.’

I’m so hungry I could cry (six hours of Ryanair can do that to a man). And then, a heroic Czech pleb donates half a pizza to me. Side note: this same heroic pleb accidentally locked me out of my film-funds while trying to fix a wallet bug on Sunday night.

I step out into the rain. Roger9000 reminds us we should have laser eyes well past 100k. I take a bite of pizza and life tastes good.

The Films Side events, artists, late nights, and pitcher’s regret is all well and good, but what of the films?

My highlights included Golden Rabbit winner No More Inflation — a moving narrative with interviews from two dozen economists, visionaries, and inflation survivors.

Hotel Bitcoin, was a surprisingly funny comedy romp about a group of idiots who happen across a valuable laptop.

Revolución Bitcoin — an approachable and thorough documentary aimed to bring greater adoption in the Spanish-speaking world.

And, as a short-fiction guy, I enjoyed the short films The Man Who Wouldn’t Cry, a visit to New York’s only Somali restaurant in Finding Home.

Sunday 7PM The award ceremony has just finished. I head to Amondo for the final time to pay for mojitos in bitcoin and say goodbye to newly made friends. I feel like I’ve met almost everyone in attendance. Are you going to BTC Prague?!? we ask as we part ways.

Of course, the best thing about any festival is the people, and BFF25 had a cast of characters worthy of any art house flick:

- The bright-eyed and confident frontwoman of the metal band Scardust

- A nostr-native artist selling his intricate canvases to the highest zapper

- A dreadlocked DJ who wears a pair of flying goggles on his head at all times

- An affable British filmmaker explaining the virtues of the word ‘chucklesome’

- A Duracell-powered organiser who seems to know every song, person, film, book, and guest at the festival.

Warsaw itself feels like it has a role to play, too. Birdsong and green parks contrast the foreboding Communist-era architecture. The weather changes faster than my mood — heavy greys transform to bright sunshine. The roads around the venue close on Sunday for a political rally. And there we are in the middle, watching our bitcoin films.

Tuesday 10AM I’m at home now, squinting at my email inbox and piles of washing, wondering when the hell I’ll find time. The festival Telegram group is still buzzing with activity. Side events like martial arts tutorials, trips to a shooting range, boat tours. 5AM photos of street graffiti, lost and found items, and people asking ‘is anyone still around?’

This was not just a film festival. BFF is truly a celebration of culture — Art. Books. Comedy. Music. Video. Talk. Connection.

All this pure signal has lifted my spirits so much that despite me being a newbie filmmaker, armed only with a biro, a couple of powerpoints and a Geyser fund page, I know I will succeed in my mission. It turns out you can just film things.

You may have attended bitcoin conferences before — you know, the ones with ‘fireside chats’, VIP areas, and overpriced merch. Bitcoin FilmFest is a moment in time. We are fixing the culture, year after year, until art can flourish again.

As fellow author Aaron Koenig commented during a panel session, ‘In twenty years, we won’t be drawing laser eyes and singing about honey badgers. Our grandchildren won’t understand the change we went through.’

Would I do it all again? Of course!

Join me next June in Warsaw.

I’ll be the tall one presenting his short animation premiere.

Philip Charter is a full-time writer and part-time cat herder. As well as writing for bitcoin founders and companies, he runs the 21 Futures fiction project.

Find out more about theNoderoid Saga animation projecton Geyser.

-

@ cf8c27f4:c95b9b5c

2025-05-29 15:17:06

@ cf8c27f4:c95b9b5c

2025-05-29 15:17:06Bitcoin’s Path to Global Dominance: Store of Value, Medium of Exchange, and the Road to a Bitcoin Standard

Bitcoin has ignited a financial revolution, captivating everyone from tech enthusiasts to institutional investors. Yet, amidst its meteoric rise, a tantalising question emerges: Could Bitcoin become the world’s reserve currency, relegating fiat currencies to the history books? This vision—a global Bitcoin standard—stirs intense debate within the community. Some champion Bitcoin as a Store of Value (SOV), a digital equivalent to gold, while others insist its future lies in becoming a Medium of Exchange (MOE), used for everyday transactions. With conflicting perspectives and community members at varying points in their Bitcoin journey, it’s time to unpack these ideas and chart a unified course.

This article delves into the interplay between Bitcoin’s SOV and MOE roles, examines the hurdles to widespread adoption, and proposes a roadmap for Bitcoin to claim global reserve status. My goal is to ignite a vibrant discussion, bridge divides, and encourage the Bitcoin community to rally around a shared vision for the future.

The Building Blocks: What Are SOV and MOE?

To kick things off, let’s define the two pillars of this debate:

• Store of Value (SOV): An asset that holds or grows its worth over time, offering a dependable way to preserve wealth. Think gold, a classic example cherished for millennia.

• Medium of Exchange (MOE): A tool for transactions, enabling the seamless exchange of goods and services. Today, fiat currencies like the pound or dollar reign supreme in this domain.

Bitcoin’s allure stems from its unique traits: a capped supply of 21 million coins, a decentralised network, and immunity to censorship. These qualities position it as a contender to replace both gold and fiat money—but the journey is complex, and the community’s views are far from aligned.

Where We Stand: Bitcoin as Digital Gold

Bitcoin’s ascent has been propelled by its prowess as a Store of Value. Early adopters, savvy investors, and even big institutions have embraced it as a shield against inflation, economic turmoil, and the erosion of fiat value. Its scarcity—hardwired into its code—has cemented the “digital gold” narrative, drawing in those seeking a safe haven in uncertain times.

But here’s the rub: while Bitcoin shines as an SOV, it’s rarely used as an MOE. Its price swings, technical limitations, and patchy acceptance by merchants make it a tough sell for buying a pint or a loaf of bread. Many in the community—think of figures like Michael Saylor—preach the gospel of “hodling,” urging followers to stash Bitcoin away and watch its value soar. This strategy has paid off handsomely for some, but it begs a bigger question: Can Bitcoin rule the world if it remains a speculative treasure rather than a working currency?

The Adoption Puzzle: Bridging SOV and MOE

For Bitcoin to leap from a niche asset to the global reserve currency, it must become a widely accepted Medium of Exchange. This evolution matters for several reasons:

• Real-World Use Fuels Demand: When Bitcoin powers transactions, its value ties to tangible activity, not just market hype.

• Network Strength: More users mean a tougher, more valuable network—a classic network effect.

• Price Stability: Broader adoption could smooth out Bitcoin’s wild price rides, making it more practical for daily use.

Yet, hurdles abound. Bitcoin’s volatility is a dealbreaker for many—who’d spend it on a takeaway if it might double in value overnight? Then there’s the issue of “whales” or “max hodlers,” those holding vast swathes of Bitcoin. If too much of the supply sits idle, it starves the liquidity needed for an MOE to thrive.

The Hodler Debate: To Spend or Not to Spend?

A spirited clash within the community revolves around these large holders. Should they—like Saylor or early adopters—dip into their stacks to kickstart adoption? Hodling bolsters Bitcoin’s scarcity and SOV credentials, no doubt. But if the bulk of Bitcoin stays locked up, it could stall the growth of a bustling, transactional ecosystem.

Let’s be fair: hodling has been a winning play for many, turning small investments into fortunes. It’s a stretch to demand these pioneers shoulder the adoption burden alone. As Bitcoin weaves into the fabric of commerce—think businesses accepting it or workers earning it—transactional demand will rise organically. Over time, this could nudge even the staunchest hodlers to spend a bit, striking a balance between saving and circulating.

Growth and Stability: A Natural Progression

Bitcoin’s Compound Annual Growth Rate (CAGR) offers another angle. As its market cap balloons, its explosive growth is likely to taper off—a standard pattern for any asset. This slowdown could usher in greater stability, a boon for its MOE ambitions. Less volatility means less risk when spending Bitcoin, paving the way for it to move beyond investment portfolios and into wallets for everyday use.

This shift could redefine Bitcoin’s story, transforming it from a rollercoaster ride to a dependable currency. Voices like Jeff Booth and Jack Dorsey argue that MOE success is the key to sustaining Bitcoin’s SOV status. In short, while SOV lit the fuse, MOE could keep the fire burning.

The Blueprint: Steps to a Bitcoin Standard

So, how does Bitcoin ascend to world reserve status and birth a Bitcoin standard? Here’s a five-step vision:

1. SOV Momentum: Bitcoin’s allure as an inflation hedge and wealth preserver keeps drawing in holders, boosting its market cap and global clout.

2. MOE Infrastructure: Innovations like the Lightning Network must deliver fast, cheap transactions, making Bitcoin a practical choice for daily spending.

3. Value Stability: As adoption spreads and the market matures, Bitcoin’s price swings dampen, earning trust from users and merchants alike.

4. MOE Takeoff: With better tools and steadier value, Bitcoin becomes a go-to for transactions, amplifying its worth through a powerful network effect.

5. Global Crown: Governments and central banks start holding Bitcoin in reserves, using it for trade and settlements, cementing its place as the world’s reserve currency.

This isn’t a cakewalk. Scalability bottlenecks, regulatory pushback, and rival cryptocurrencies loom large. But if Bitcoin can clear these obstacles, it could become the backbone of global finance.

Harmony Over Division: SOV and MOE Together

Here’s the crux: SOV and MOE aren’t at odds—they’re partners in Bitcoin’s rise. Holding Bitcoin safeguards its scarcity and value; spending it spreads its reach and usefulness. Both are vital for the long haul.

At this pivotal moment, the Bitcoin community must rally around a dual-purpose ethos. We can:

• Educate: Help newcomers grasp Bitcoin’s twin roles as SOV and MOE.

• Innovate: Back tech that makes Bitcoin spending as easy as swiping a card.

• Talk: Host open forums to wrestle with differences and find unity.

The Final Word: Our Collective Challenge

Bitcoin’s shot at becoming the world’s reserve currency—and forging a Bitcoin standard—is as exhilarating as it is daunting. Its Store of Value roots have set the stage, but its Medium of Exchange potential will decide if it can topple fiat and redefine money itself.

The path is long, but the prize is transformative. By embracing both SOV and MOE, we can propel Bitcoin to new heights. Let’s grab this chance, dive into the debate, and build a future where Bitcoin leads the charge.

Your Turn: What’s the best way forward for Bitcoin? Should we lean harder into SOV, push MOE, or blend the two? Drop your thoughts below an

-

@ 7f6db517:a4931eda

2025-05-29 15:02:28

@ 7f6db517:a4931eda

2025-05-29 15:02:28

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-29 15:02:27

@ 7f6db517:a4931eda

2025-05-29 15:02:27

The former seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

The latter's future remains to be seen. Dependence on Tor, which has had massive reliability issues, and lack of strong privacy guarantees put it at risk.

— ODELL (@ODELL) October 27, 2022

The Basics

- Lightning is a protocol that enables cheap and fast native bitcoin transactions.

- At the core of the protocol is the ability for bitcoin users to create a payment channel with another user.

- These payment channels enable users to make many bitcoin transactions between each other with only two on-chain bitcoin transactions: the channel open transaction and the channel close transaction.

- Essentially lightning is a protocol for interoperable batched bitcoin transactions.

- It is expected that on chain bitcoin transaction fees will increase with adoption and the ability to easily batch transactions will save users significant money.

- As these lightning transactions are processed, liquidity flows from one side of a channel to the other side, on chain transactions are signed by both parties but not broadcasted to update this balance.

- Lightning is designed to be trust minimized, either party in a payment channel can close the channel at any time and their bitcoin will be settled on chain without trusting the other party.

There is no 'Lightning Network'

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise.

- There are many lightning channels between many different users and funds can flow across interconnected channels as long as there is a route through peers.

- If a lightning transaction requires multiple hops it will flow through multiple interconnected channels, adjusting the balance of all channels along the route, and paying lightning transaction fees that are set by each node on the route.

Example: You have a channel with Bob. Bob has a channel with Charlie. You can pay Charlie through your channel with Bob and Bob's channel with User C.

- As a result, it is not guaranteed that every lightning user can pay every other lightning user, they must have a route of interconnected channels between sender and receiver.

Lightning in Practice

- Lightning has already found product market fit and usage as an interconnected payment protocol between large professional custodians.

- They are able to easily manage channels and liquidity between each other without trust using this interoperable protocol.

- Lightning payments between large custodians are fast and easy. End users do not have to run their own node or manage their channels and liquidity. These payments rarely fail due to professional management of custodial nodes.

- The tradeoff is one inherent to custodians and other trusted third parties. Custodial wallets can steal funds and compromise user privacy.

Sovereign Lightning

- Trusted third parties are security holes.

- Users must run their own node and manage their own channels in order to use lightning without trusting a third party. This remains the single largest friction point for sovereign lightning usage: the mental burden of actively running a lightning node and associated liquidity management.

- Bitcoin development prioritizes node accessibility so cost to self host your own node is low but if a node is run at home or office, Tor or a VPN is recommended to mask your IP address: otherwise it is visible to the entire network and represents a privacy risk.

- This privacy risk is heightened due to the potential for certain governments to go after sovereign lightning users and compel them to shutdown their nodes. If their IP Address is exposed they are easier to target.

- Fortunately the tools to run and manage nodes continue to get easier but it is important to understand that this will always be a friction point when compared to custodial services.

The Potential Fracture of Lightning

- Any lightning user can choose which users are allowed to open channels with them.

- One potential is that professional custodians only peer with other professional custodians.

- We already see nodes like those run by CashApp only have channels open with other regulated counterparties. This could be due to performance goals, liability reduction, or regulatory pressure.

- Fortunately some of their peers are connected to non-regulated parties so payments to and from sovereign lightning users are still successfully processed by CashApp but this may not always be the case going forward.

Summary

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise. There is no singular 'Lightning Network' but rather many payment channels between distinct peers, some connected with each other and some not.

- Lightning as an interoperable payment protocol between professional custodians seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

- Lightning as a robust sovereign payment protocol has yet to be battle tested. Heavy reliance on Tor, which has had massive reliability issues, the friction of active liquidity management, significant on chain fee burden for small amounts, interactivity constraints on mobile, and lack of strong privacy guarantees put it at risk.

If you have never used lightning before, use this guide to get started on your phone.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-29 15:02:27

@ 7f6db517:a4931eda

2025-05-29 15:02:27

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

The four main banks of bitcoin and “crypto” are Signature, Prime Trust, Silvergate, and Silicon Valley Bank. Prime Trust does not custody funds themselves but rather maintains deposit accounts at BMO Harris Bank, Cross River, Lexicon Bank, MVB Bank, and Signature Bank. Silvergate and Silicon Valley Bank have already stopped withdrawals. More banks will go down before the chaos stops. None of them have sufficient reserves to meet withdrawals.

Bitcoin gives us all the ability to opt out of a system that has massive layers of counterparty risk built in, years of cheap money and broken incentives have layered risk on top of risk throughout the entire global economy. If you thought the FTX bank run was painful to watch, I have bad news for you: every major bank in the world is fractional reserve. Bitcoin held in self custody is unique in its lack of counterparty risk, as global market chaos unwinds this will become much more obvious.

The rules of bitcoin are extremely hard to change by design. Anyone can access the network directly without a trusted third party by using their own node. Owning more bitcoin does not give you more control over the network with all participants on equal footing.

Bitcoin is:

- money that is not controlled by a company or government

- money that can be spent or saved without permission

- money that is provably scarce and should increase in purchasing power with adoptionBitcoin is money without trust. Whether you are a nation state, corporation, or an individual, you can use bitcoin to spend or save without permission. Social media will accelerate the already deteriorating trust in our institutions and as this trust continues to crumble the value of trust minimized money will become obvious. As adoption increases so should the purchasing power of bitcoin.

A quick note on "stablecoins," such as USDC - it is important to remember that they rely on trusted custodians. They have the same risk as funds held directly in bank accounts with additional counterparty risk on top. The trusted custodians can be pressured by gov, exit scam, or caught up in fraud. Funds can and will be frozen at will. This is a distinctly different trust model than bitcoin, which is a native bearer token that does not rely on any centralized entity or custodian.

Most bitcoin exchanges have exposure to these failing banks. Expect more chaos and confusion as this all unwinds. Withdraw any bitcoin to your own wallet ASAP.

Simple Self Custody Guide: https://werunbtc.com/muun

More Secure Cold Storage Guide: https://werunbtc.com/coldcard

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-29 15:02:27

@ 7f6db517:a4931eda

2025-05-29 15:02:27

The newly proposed RESTRICT ACT - is being advertised as a TikTok Ban, but is much broader than that, carries a $1M Fine and up to 20 years in prison️! It is unconstitutional and would create massive legal restrictions on the open source movement and free speech throughout the internet.

The Bill was proposed by: Senator Warner, Senator Thune, Senator Baldwin, Senator Fischer, Senator Manchin, Senator Moran, Senator Bennet, Senator Sullivan, Senator Gillibrand, Senator Collins, Senator Heinrich, and Senator Romney. It has broad support across Senators of both parties.

Corrupt politicians will not protect us. They are part of the problem. We must build, support, and learn how to use censorship resistant tools in order to defend our natural rights.

The RESTRICT Act, introduced by Senators Warner and Thune, aims to block or disrupt transactions and financial holdings involving foreign adversaries that pose risks to national security. Although the primary targets of this legislation are companies like Tik-Tok, the language of the bill could potentially be used to block or disrupt cryptocurrency transactions and, in extreme cases, block Americans’ access to open source tools or protocols like Bitcoin.

The Act creates a redundant regime paralleling OFAC without clear justification, it significantly limits the ability for injured parties to challenge actions raising due process concerns, and unlike OFAC it lacks any carve-out for protected speech. COINCENTER ON THE RESTRICT ACT

If you found this post helpful support my work with bitcoin.

-

@ 7e538978:a5987ab6

2025-05-29 10:32:34

@ 7e538978:a5987ab6

2025-05-29 10:32:34This article gives an overview and comparison of the various funding sources that are available for LNbits.

LNbits is compatible with many Lightning Network wallets and can be on anything from a small VPS to a raspberry Pi on your home network or the LNbits SaaS platform.

Why your funding source matters

There are trade-offs between the various funding sources, for example funding LNbits using Strike requires the user to KYC themselves and has some privacy compromises versus funding LNbits from your own LND node. However the technical barrier to entry and node maintenance of using Strike is lower than using LND.

Self-custodial vs custodial connectors

Self-custodial Funding Sources

You run the node or service, keep the keys, and may need to manage LN channels. Good if you want control and have the skills to look after a server. Examples: LND (gRPC/REST), CoreLightning, Spark.

Self-custodial funding sources with an LSP

These funding sources offer a reasonable compromise between self-custody and some privacy trade offs. Examples: Phoenixd, Breez SDK, Boltz.

Custodial (or semi-custodial) funding sources

A third party runs the node. You plug LNbits into their API. Setup is quick and costs are low, but you trust the provider with your funds and privacy. Examples: Alby, OpenNode, Blink, ZBD, LNPay or another LNbits instance.

Funding sources compared

Below is a summary of the main options and how they stack up.

LNbits Lightning Network Funding Sources Comparison Table

| Funding Source | Custodial Type | KYC Required | Technical Knowledge Needed | Node Hosting Required | Privacy Level | Liquidity Management | Ease of Setup | Maintenance Effort | Cost Implications | Scalability | Notes | |----------------------------|--------------------|---------------------|--------------------------------|---------------------------|-------------------|--------------------------|-------------------|------------------------|----------------------------------------------|-----------------|------------------------------------------------------------------| | LND (gRPC) | Self-custodial | ❌ | Higher | ✅ | High | Manual | Moderate | High | Infrastructure cost and channel opening fees | High | gRPC interface for LND; suitable for advanced integrations. | | CoreLightning (CLN) | Self-custodial | ❌ | Higher | ✅ | High | Manual | Moderate | High | Infrastructure cost and channel opening fees | High | Requires setting up and managing your own CLN node. | | Phoenixd | Self-custodial | ❌ | Medium | ❌ | Medium | Automatic | Moderate | Low | Minimal fees | Medium | Mobile wallet backend; suitable for mobile integrations. | | Nostr Wallet Connect (NWC) | Custodial | Depends on provider | Low | ❌ | Variable | Provider-managed | Easy | Low | May incur fees | Medium | Connects via Nostr protocol; depends on provider's policies. | | Boltz | Self-custodial | ❌ | Medium | ❌ | Medium | Provider-managed | Moderate | Moderate | Minimal fees | Medium | Uses submarine swaps; connects to Boltz client. | | LND (REST) | Self-custodial | ❌ | Higher | ✅ | High | Manual | Moderate | High | Infrastructure cost and channel opening fees | High | REST interface for LND; suitable for web integrations. | | CoreLightning REST | Self-custodial | ❌ | Higher | ✅ | High | Manual | Moderate | High | Infrastructure cost and channel opening fees | High | REST interface for CLN; suitable for web integrations. | | LNbits (another instance) | Custodial | Depends on host | Low | ❌ | Variable | Provider-managed | Easy | Low | May incur hosting fees | Medium | Connects to another LNbits instance; depends on host's policies. | | Alby | Custodial | ✅ | Low | ❌ | Low | Provider-managed | Easy | Low | Transaction fees apply | Medium | Browser extension wallet; suitable for web users. | | Breez SDK | Self-custodial | ❌ | Medium | ❌ | High | Automatic | Moderate | Low | Minimal fees | Medium | SDK for integrating Breez wallet functionalities. | | OpenNode | Custodial | ✅ | Low | ❌ | Low | Provider-managed | Easy | Low | Transaction fees apply | Medium | Third-party service; suitable for merchants. | | Blink | Custodial | ✅ | Low | ❌ | Low | Provider-managed | Easy | Low | Transaction fees apply | Medium | Third-party service; focuses on mobile integrations. | | ZBD | Custodial | ✅ | Low | ❌ | Low | Provider-managed | Easy | Low | Transaction fees apply | Medium | Gaming-focused payment platform. | | Spark (CLN) | Self-custodial | ❌ | Higher | ✅ | High | Manual | Moderate | High | Infrastructure cost and channel opening fees | High | Web interface for CLN; requires Spark server setup. | | Cliche Wallet | Self-custodial | ❌ | Medium | ❌ | Medium | Manual | Moderate | Moderate | Minimal fees | Medium | Lightweight wallet; suitable for embedded systems. | | Strike | Custodial | ✅ | Low | ❌ | Low | Provider-managed | Easy | Low | Transaction fees apply | Medium | Third-party service; suitable for quick setups. | | LNPay | Custodial | ✅ | Low | ❌ | Low | Provider-managed | Easy | Low | Transaction fees apply | Medium | Third-party service; suitable for quick setups. |

Which source suits you?

| Scenario | Good fit | Why | | ------------------------------------------- | ---------------------------------------------------------------------- | ------------------------------------------------------ | | Business running its own infrastructure | LND or CoreLightning on a Dell Optiplex or other dedicated machine | Full control, high throughput, best privacy. | | Independent node runner | Spark (CLN) or LND (REST/gRPC) | You already run a node and want a clean web interface. | | Quick proof of concept | Alby, LNPay, or another hosted LNbits | No hardware needed, lets you test ideas fast. |

Run LNbits

Ready to run LNbits?

Choose a funding source, follow the guides, and start today.

Further reading

- LNbits documentation

- LND – gRPC and REST guides

- CoreLightning – setup and Spark info

- Breez SDK

- Phoenixd

- Nostr Wallet Connect

-

@ 5f078e90:b2bacaa3

2025-05-29 09:33:22

@ 5f078e90:b2bacaa3

2025-05-29 09:33:22Frog named Gus

This is a test from Hive to Nostr, longform script, some markdown included. google link, 400 char. story.

In a lush pond, a green frog named Gus lived among lily pads. Each dawn, he croaked a cheerful tune, waking the dragonflies. One day, a heron eyed him hungrily. Gus, clever and quick, hopped beneath a broad leaf, blending perfectly. The heron, fooled, flew off. That evening, Gus sang louder, celebrating his escape. His friends—turtles and minnows—joined the chorus under the moon's glow. Gus’s courage inspired them all, proving wit outshines size. The pond thrived, with Gus as its spirited guardian, forever hopping and croaking in joy.

This was a test, please ignore.

-

@ 5f078e90:b2bacaa3

2025-05-29 09:23:18

@ 5f078e90:b2bacaa3

2025-05-29 09:23:18May 29 badger test story

h2n, bi, some md, >380

In a dusty savanna, a honey badger named Hank prowled with fearless grit. Each night, he raided beehives, dodging stings with cunning twists. One day, a lion blocked his path, roaring fiercely. Hank, unfazed, bared his teeth and charged, startling the beast. The lion fled, and Hank strutted on, claws clicking. His boldness rallied jackals and birds, who sang his tale under starry skies. Hank’s fierce heart made him the savanna’s legend, guarding its wild spirit with every fearless step.

This is just a test, please ignore.

-

@ 5f078e90:b2bacaa3

2025-05-29 09:10:54

@ 5f078e90:b2bacaa3

2025-05-29 09:10:54Gecky story - just a test

In a sun-dappled jungle, Zippy the gecko darted across a broad leaf, his emerald scales glinting. Chasing a juicy cricket, he leaped, only to slip into a pitcher plant’s slippery trap. With sticky toes, Zippy clung to the edge, heart racing. A curious frog peered in, offering a vine. Grateful, Zippy climbed out, sharing his cricket with his new friend. Under the moon’s glow, they danced on the leaves, tales of their adventure echoing through the jungle night.

Character count: 408

This was just a test. Ignore it.

-

@ 7d33ba57:1b82db35

2025-05-29 08:40:35

@ 7d33ba57:1b82db35

2025-05-29 08:40:35Lingen (Ems) is a peaceful town in Lower Saxony, near the Dutch border, known for its historic old town, green surroundings, and relaxed pace of life. It may not be on the typical tourist radar, but it offers a taste of small-town Germany with plenty of charm and local culture.

🏘️ What to See and Do in Lingen

🏛️ Old Town & Market Square

- Stroll through the historic town center, where you’ll find half-timbered houses, cozy cafés, and the lovely St. Boniface Church

- The Rathaus (Town Hall) and its square are perfect for a slow coffee or people-watching

🚲 Nature & Outdoor Activities

- The region around Lingen is great for cycling and walking, especially along the Ems River

- Explore the Emsland countryside, filled with forests, meadows, and quiet villages

- Visit the nearby Emsland Moormuseum to learn about local peatland history

🎓 Student Vibes

- Thanks to the presence of a university, Lingen has a young and vibrant side, with cultural events and small live music scenes

🍺 Local Food & Drink

- Try regional dishes like Grünkohl (kale with sausage in winter) and Schnitzel in a local tavern

- Enjoy a drink at a beer garden or riverside café, especially in warmer months

🚆 Getting There

- Well connected by train, especially to Osnabrück, Münster, and the Dutch city of Enschede

- Great stop on a northern Germany road or rail trip

Lingen is ideal for travelers looking for peaceful towns, regional culture, and access to beautiful natural areas. It’s a place where you can slow down, bike along a river, and enjoy the local way of life.

-

@ 866e0139:6a9334e5

2025-05-29 07:29:43

@ 866e0139:6a9334e5

2025-05-29 07:29:43Autor: Anna Nagel. (Bild: Lukas Karl). Dieser Beitrag wurde mit dem Pareto-Client geschrieben. Sie finden alle Texte der Friedenstaube und weitere Texte zum Thema Frieden hier. Die neuesten Pareto-Artikel finden Sie auch in unserem Telegram-Kanal.

Die neuesten Artikel der Friedenstaube gibt es jetzt auch im eigenen Friedenstaube-Telegram-Kanal.

Wem in seinem Leben Schmerz zugefügt wurde, wer sich ungerecht behandelt fühlt oder wachen Auges in der Welt umschaut, kommt wahrscheinlich irgendwann mit der Frage in Berührung, wie das alles noch einmal «gut» werden kann. Wie kann die Welt sich mit sich selbst versöhnen? Und wie kann ich es selbst schaffen, mich mit ihr und den Menschen, die schlimme Taten vollbringen, wieder in harmonischer Akzeptanz zu verbinden? Kann und will ich gewisse Gräueltaten verzeihen oder gibt es das «Unverzeihliche»? Und selbst wenn ich wollte, wie könnte mir das gelingen?

Perspektivwechsel

Wenn wir an dem Zorn über begangenes Unrecht festhalten, schauen wir in der Regel aus immer derselben Perspektive auf das Geschehen. Mal um Mal erzürnen und empören wir uns darüber, erzählen uns und anderen stets die gleiche Geschichte, die uns allerdings – ebenfalls ein ums andere Mal – wieder selbst verletzt. Das Destruktive holt uns so ständig wieder ein; wir sehen und fühlen das unschuldige Kind und empfinden Verachtung für die Täter.

Die Perspektive zu wechseln lädt uns dazu ein, das Geschehen aus anderen Blickwinkeln zu betrachten und unser Bewusstsein von der schmerzlichen Wiederholung zu lösen. Wir können einmal weit rauszoomen und einen spirituellen Blickwinkel einnehmen, beispielsweise aus Sicht des All-ein-Bewusstseins, das sich in unzählige Seelen teilt, von denen wiederum Milliarden derzeit auf der Erde inkarniert sind. Dieses eine Bewusstsein möchte jede auch nur mögliche Erfahrung machen und durch die Trennung – die Erschaffung der Dualität – kann es sich selbst aus diesen Milliarden Persönlichkeiten heraus erfahren, um zu lernen. Während dieser scheinbaren Trennung vergessen wir, dass wir alle eins sind, dass wir alle aus demselben «Stoff» gemacht sind und nach diesem Spiel hier auf Erden unsere Erinnerung zurückerlangen und unsere Erfahrungen zurück geben in die eine «Quelle».

Unser aller Reise geht letztlich darum, hier auf der Erde aus diesem Zustand des Vergessens zu erwachen. Um dies zu erreichen und all diese Erfahrungen machen zu können und uns auch unter widrigsten Umständen an unsere wahre Essenz, an die Liebe, erinnern können, braucht es auch Akteure, die die Dunkelheit verkörpern – denn nur so haben wir die Wahl, ob wir uns von ihr einnehmen lassen oder uns für die Liebe und das Mitgefühl entscheiden. Der Täter sowie das Opfer sind dabei stets Aspekte unserer selbst – im Innen wie im Außen – und jeder einzelne verändert die Welt, indem er Liebe und Mitgefühl oder Hass und Verachtung wählt.

Eine etwas rationalere Herangehensweise wäre, zu schauen, was dazu führt, dass ein Mensch sich derart unmenschlich verhalten kann; also der Zugang über die Psychologie. Hier werden wir uns bewusst, dass jeder Täter auch einmal ein Kind war. Symbolisch sogar das Kind, mit dem wir jetzt im Beispiel mitfühlen und das wir gleichzeitig heute als erwachsenen Täter verachten. Natürlich kann man hier einwenden, dass nicht jedes Opfer zum Täter wird, aber man kann ebenso anerkennen, dass uns bei dieser Haltung das größte Stück fehlt; und zwar die Geschichte desjenigen, die Jahre dazwischen, sowie jeder einzelne Reiz und jedes Detail der Umstände.

Wie viel Schmerz und Leid muss ein Mensch erfahren, bis er unmenschlich wird? Mit Einbezug aller Umstände und Faktoren, der psychischen Schutzmechanismen traumatischer Erfahrungen sowie fehlender Ausbildung sozialer und empathischer Fähigkeiten auch im neuronalen Bereich kann man auch auf diesem Wege Verständnis erlangen. Sichtbar wird hierdurch auch, dass emotionaler Schmerz über Generationen weitergegeben wird und es schwer ersichtlich ist, wo denn die eigentliche Ursache liegt. Auch hier wird erkennbar, dass nur jeder bei sich anfangen kann und Verantwortung für seine Heilung – und damit gleichzeitig die anderer – übernehmen müsste, anstatt auf die Suche nach dem oder der «Schuldigen» zu gehen.

Was bedarf eigentlich der Vergebung?

Wenn es uns schwerfällt zu vergeben, also Groll und Verachtung loszulassen und Mitgefühl zu empfinden, ist es ebenfalls hilfreich, einmal hinzuschauen, worum es genau geht. Wenn es uns selbst betrifft, handelt es sich in der Regel um Schmerz, der uns willentlich, manchmal auch unbewusst, zugefügt wurde und den wir (noch) nicht loslassen können, weil er noch nicht verheilt ist. Darauf gehe ich später noch einmal ein. Oft geht es aber auch um uns unbekannte Menschen, von deren Verbrechen wir Kenntnis haben und deren Ungeheuerlichkeit uns aus der Fassung bringt. Es geht um Taten, die wir nicht nachvollziehen können, weder rational noch emotional. Wir meinen, selbst wenn jemand nicht spürte, was er anderen antut, so müsse er es doch wenigstens besser wissen. Das ist das, was uns Menschen ausmacht, mit anderen mitzufühlen und sie zu verstehen. Doch anscheinend gibt es Menschen, deren Persönlichkeit oder auch Psyche dazu absolut nicht in der Lage sind. Die keinen moralischen Kompass besitzen und keinerlei soziales Empfinden, denn sonst könnten sie bestimmte Taten nicht ausführen. Möglicherweise dissoziieren sie sich selbst so stark, dass diese für sie eine Normalität darstellen, sie diese entschuldigen beziehungsweise vor sich selbst rechtfertigen oder im extremen Fall keine Erinnerung mehr daran haben.

Uns erscheinen die fehlende Empathie sowie das fehlende Verständnis so fremd, dass wir es nicht nachvollziehen können. Uns fehlt die Nachvollziehbarkeit der Nichtnachvollziehbarkeit des Erlebens des anderen, und wir erachten diesen dadurch als unmenschlich. Denn menschlich wären doch eben diese Fähigkeiten wie Mitgefühl, Güte, Reflexion, Warmherzigkeit, Verständnis und Liebe. Zugleich erzeugen wir hier aber einen Konflikt, wenn wir sagen: «Da diese Menschen sich so unmenschlich verhalten, soll ihnen kein Mitgefühl und keine Vergebung entgegengebracht werden, sollen auch sie nicht menschlich behandelt werden», wodurch wir uns allerdings selbst unserer Menschlichkeit berauben.

«Aber der Täter hatte doch die freie Wahl, er hätte doch anders entscheiden können!» Ja, möglicherweise schon, aber jetzt haben wir die Wahl. Und wir haben viel leichtere Voraussetzungen dafür, menschlich zu handeln, weil wir gesunden Zugang zu unserer Empathie, Moral und unserer Ratio haben.

Hätte der Täter es geschafft, seinen Tätern zu verzeihen, würde er die Destruktivität, die er ab einem gewissen Zeitpunkt nicht mehr in sich tragen oder verdrängen konnte, nicht an anderen ausagieren. Es ist ihm nicht gelungen, vielleicht sogar weil etwas in ihm es für unmöglich hielt, Unmenschliches, das ihm zugefügt wurde, zu verzeihen. Aber uns kann es gelingen, diesen Kreislauf zu durchbrechen und uns nicht in ihn hineinziehen zu lassen; wir können dem «Dunklen» den Nährboden entziehen.

Manchmal nehmen wir an, würden wir das Unbeschreibliche verzeihen, bedeutete dies, dass wir es tolerieren oder gar gutheißen. Dem ist nicht so. Analog dazu habe ich manches Mal die Angst gehabt, würde ich aufhören, um meinen Freund zu trauern, bedeute dies, dass ich ihn nicht mehr vermisse. Auch das ist nicht richtig. Ich heile lediglich das, was mir Schmerzen zufügt, bis am Ende nur noch die Liebe bleibt. Und wenn wir verzeihen, ist es kein Gutheißen der Taten, es bedeutet ein Loslassen dessen, was uns damit verstrickt und das Destruktive nährt.

Mitgefühl beginnt bei uns selbst

«Daß ich dem Hungrigen zu essen gebe, dem vergebe, der mich beleidigt, und meinen Feind liebe- das sind große Tugenden. Was aber, wenn ich nun entdecken sollte, daß der armselige Bettler und der unverschämteste Beleidiger alle in mir selber sind und ich bedürftig bin, Empfänger meiner eigenen Wohltaten zu sein? Daß ich der Feind bin, den ich lieben muß - was dann?» – C. G. Jung

Mit diesem Zitat beginnt Dan Millman das Kapitel «Das Gesetz des Mitgefühls» in seinem Buch «Die universellen Lebensgesetze des friedvollen Kriegers». Die weise Frau lehrt dem Wanderer das Gesetz des Mitgefühls und erklärt, es sei «eine liebevolle Aufforderung, über unsere begrenzte Sichtweise hinauszuwachsen», auch wenn die Last dieser Aufgabe zuweilen sehr schwer wiegen könne. Genau deshalb müsse man daran denken, dass sie bei uns selbst beginnt und wir «geduldig» und «sanft» mit uns, unseren Gefühlen und Gedanken sein sollten.

Um dem – noch skeptischen – Wanderer zu veranschaulichen, wie wir Mitgefühl auch mit unseren Gegnern empfinden können, bat sie ihn, sich an eine Auseinandersetzung zu erinnern, in der er zornig, neidisch oder eifersüchtig war und sich diese Gefühle noch einmal zu vergegenwärtigen. Als er das tat, den Schmerz und die Wut wieder spürte, sagte sie zu ihm: «Und nun stell dir vor, daß der Mensch, mit dem du dich streitest, mitten in eurer erregten Auseinandersetzung plötzlich nach seinem Herzen faßt, einen Schrei ausstößt und zu deinen Füßen tot zu Boden sinkt.» Der Wanderer erschrak und auf Nachfrage der weisen Frau stellte er fest, dass er nun keinerlei Schmerz oder Wut mehr empfand. Sogleich aber kam ihm der Gedanke: «Aber – aber was wäre, wenn ich mich über den Tod dieses Menschen freuen würde? Wenn ich ihm nicht verzeihen könnte?», worauf die weise Frau antwortete: «Dann verzeih dir wenigstens selber deine Unversöhnlichkeit. Und in dieser Vergebung wirst du das Mitgefühl finden, das deinen Schmerz heilt, als Mensch in dieser Welt zu leben.»

Weiter erinnert uns die weise Frau daran, dass wir alle, während wir hier auf der Erde sind, Träume, Hoffnungen und Enttäuschungen haben; und dass diese, sowie letztlich der Tod, uns alle verbinden.

Es ist ein Prozess

Dan Millman sagt hier in Gestalt der Weisen Frau, dass Mitgefühl bei uns selbst beginnt und diesen Aspekt möchte ich noch einmal hervorheben. Es kann nämlich passieren, dass wir uns in einer oberflächlichen Vergebung wieder finden, weil wir meinen, es sei richtig und moralisch, anderen zu verzeihen, ohne aber die tieferen Schichten dabei zu fühlen. Das ist dann leider nichts anderes, als Verdrängung. Gerade wenn wir selbst Opfer von Ungerechtigkeit, physischer oder mentaler Gewalt wurden, ist es unerlässlich den Heilungsweg in Gänze zu durchschreiten, und in den Wachstumsprozess zu verwandeln, der uns Mitgefühl und Weisheit lehrt. Und dazu gehören die Wut auf das Begangene, die Verzweiflung, die Ungerechtigkeit und Ohnmacht zu fühlen, uns auf «unsere Seite» zu stellen und Partei für uns selbst zu ergreifen, bevor es ernstlich möglich wird, zu verzeihen. Zunächst fühlen wir mit uns selbst den Schmerz und befreien die Gefühle, die wir uns möglicherweise nie trauten zu fühlen, all die Wut und den Groll. Erst später kann dann aus dem Inneren heraus das weitere Erkennen stattfinden und Heilung und Vergebung geschehen.

Vergebung findet im Herzen statt

Die hier in diesem Text von mir aufgeführten Perspektiven sind nur zwei, drei kleine Beispiele für Sichtweisen, die man einnehmen könnte, um zu neuen Einsichten zu gelangen. Sie sollen niemanden von irgendetwas überzeugen, sondern als Anregung dienen. Denn letztlich geht es darum, Vergebung in sich selbst zu finden. Vergebung ist also etwas, das aus dem Inneren heraus entsteht; ein Ergebnis eines tiefen Verständnisses und Fühlens, ja eines Erkennens. Auf dieser Reise gehen wir unterschiedliche Blickwinkel und Versionen ab, bis wir im Herzen ankommen, es sich öffnet und wir plötzlich «klar» sehen. Daraufhin breitet sich Wärme im Körper aus, Liebe durchströmt uns, begleitet möglicherweise von einem Gefühl leiser Euphorie, möglicherweise auch einem leichten Schmerz und Tränen – sowohl ein paar der Traurigkeit als auch welchen der Dankbarkeit. Das Loslassen und die Befreiung sind spürbar und nur für jeden persönlich erfahrbar, der sich auf diesen Weg begibt und seine individuelle Ansicht findet, die ihn befreit und erlöst.

Meiner Meinung nach bedeutet also Vergebung eine Öffnung des Herzens, ein Erkennen und ein Hineinwachsen in die Perspektive der Liebe. Sie ist nicht auf rationaler Ebene zu finden; die rationale Ebene kann nur dabei helfen, den Weg zum Mitgefühl zu beschreiten, denn:

«Man sieht nur mit dem Herzen gut. Das Wesentliche ist für die Augen unsichtbar.»

– Antoine de Saint-Exupéry

Anna Nagel veröffentlicht auf ihrem Blog „Heimwärts“ seit Jahren zu den Themen Heilung, Bewusstsein, kollektives Erwachen, Gefühle, Spiritualität, Psyche, Kundalini und Philosophie.

LASSEN SIE DER FRIEDENSTAUBE FLÜGEL WACHSEN!

Hier können Sie die Friedenstaube abonnieren und bekommen die Artikel zugesandt.

Schon jetzt können Sie uns unterstützen:

- Für 50 CHF/EURO bekommen Sie ein Jahresabo der Friedenstaube.

- Für 120 CHF/EURO bekommen Sie ein Jahresabo und ein T-Shirt/Hoodie mit der Friedenstaube.

- Für 500 CHF/EURO werden Sie Förderer und bekommen ein lebenslanges Abo sowie ein T-Shirt/Hoodie mit der Friedenstaube.

- Ab 1000 CHF werden Sie Genossenschafter der Friedenstaube mit Stimmrecht (und bekommen lebenslanges Abo, T-Shirt/Hoodie).

Für Einzahlungen in CHF (Betreff: Friedenstaube):

Für Einzahlungen in Euro:

Milosz Matuschek

IBAN DE 53710520500000814137

BYLADEM1TST

Sparkasse Traunstein-Trostberg

Betreff: Friedenstaube

Wenn Sie auf anderem Wege beitragen wollen, schreiben Sie die Friedenstaube an: friedenstaube@pareto.space

Sie sind noch nicht auf Nostr and wollen die volle Erfahrung machen (liken, kommentieren etc.)? Zappen können Sie den Autor auch ohne Nostr-Profil! Erstellen Sie sich einen Account auf Start. Weitere Onboarding-Leitfäden gibt es im Pareto-Wiki.

-

@ 83279ad2:bd49240d

2025-05-29 04:05:29

@ 83279ad2:bd49240d

2025-05-29 04:05:29 -

@ 83279ad2:bd49240d

2025-05-29 04:03:54

@ 83279ad2:bd49240d

2025-05-29 04:03:54 -

@ d3d74124:a4eb7b1d

2025-05-29 02:19:14

@ d3d74124:a4eb7b1d

2025-05-29 02:19:14language is a funny thing. the English grammar is one of the most, if the not THE most complicated grammars to learn.

https://en.wikipedia.org/wiki/Defense_Language_Aptitude_Battery\ DLAB. it's the test you take to see if you have a gift for language learning.

in my exploration of languages, first Chinese Mandarin, then software languages, context is king (Jesus is King). the surrounding context is different every where you go.

physical space context. we can't be two places at once. nostr allows for many languages, because you can provide your own digital context. our physical perspective give us a field of view. NOSTR clients give us a field of view into digital context.

math is a language.

bitcoin will be called a lot of things.

wizardry

some elections results are anchored in time. using bitcoin. what else should be? legal documents seem obvious. other cryptographic proofs.

zero knowledge proofs. something about curve trees.

Find your local BitDevs.

Shenandoah Bitcoin Club

pondering a Veteran's Day live music event in Frederick County, VA. who would show up to a lunch and learn with hardware wallets in testnet4 mode? to try shit out? local only, but you should do it where you are too if you're not local.

mining

getting better? Bitmain announces a "decentralized mining pool" but I doubt we'll see open source code if history follows. 256Foundation getting to business. working prototypes for the Ember One using USB and python are out there for those that know where to look. i am very bullish on mujina. very bullish. fun coinbase tricks happening too with CTV+CSFS.

p.s. written on primal's new article publishing UI.

-

@ 502ab02a:a2860397

2025-05-29 01:40:28

@ 502ab02a:a2860397

2025-05-29 01:40:28เรามาดู แลคเชอร์ประวัติศาสตร์ ที่พลิกโลกแห่งการเกษตรและอาหารของมนุษย์ชาติกันครับ เรามาดูความแยบยลที่สามารถจูงใจคนมากมายให้เห็นถึงข้อดีของเนื้อจากแลบ เขาทำได้ยังไง เรามาศึกษาการสื่อสารกันครับ

เรื่องมันเริ่มจากการประชุม World Economic Forum ปี 2015 ที่ศาสตราจารย์ Mark Post นักเภสัชวิทยาชาวดัตช์ ที่เรารู้จักกันไปแล้ว ซึ่งตอนนั้นเป็นศาสตราจารย์ด้านสรีรวิทยาของหลอดเลือดอยู่ที่ Maastricht University และเป็นผู้ร่วมก่อตั้งบริษัท Mosa Meat ได้ลุกขึ้นมาเล่าเรื่อง "เนื้อเพาะเลี้ยง" หรือ cultured meat ให้คนทั้งห้องฟัง

สิ่งที่เขาพูดมันไม่ใช่แค่นวัตกรรมใหม่ แต่คือคำเตือนที่จริงจัง ว่าถ้ามนุษย์ยังผลิตเนื้อสัตว์แบบเดิม เรากำลังวิ่งเข้าใกล้ปัญหาใหญ่ที่รออยู่ข้างหน้า

ศาสตราจารย์ Post เล่าไว้ได้น่าสนใจมาก เขาบอกว่าแค่จะได้แฮมเบอร์เกอร์ 1 ชิ้นขนาดหนึ่งในสี่ปอนด์ เราต้องใช้เมล็ดธัญพืช 7 ปอนด์ ใช้น้ำจืด 50 แกลลอน และพื้นที่ดินอีก 70 ตารางฟุต นั่นแปลว่าเรากำลังเปลี่ยนของดีในธรรมชาติ ข้าว น้ำ ดิน ไปเป็นของที่กินหมดใน 10 นาที แล้วหิวใหม่ได้ในอีกครึ่งชั่วโมง

เหตุผลก็เพราะวัวมันไม่ได้แปลงโปรตีนพืชมาเป็นเนื้อได้มีประสิทธิภาพนัก พูดอีกแบบคือ มันเปลืองเกินไป

ตอนนี้พื้นที่เพาะปลูกของโลกกว่า 70% ถูกใช้ไปในการผลิตเนื้อสัตว์ คิดดูสิว่าถ้าเราหาทางที่ดีกว่านี้ได้ เราจะมีพื้นที่ว่างกลับคืนมาแค่ไหน

แถมวัวไม่ใช่แค่กินเก่งนะ ยังปล่อยก๊าซเก่งด้วย โดยเฉพาะมีเทนที่ทำให้โลกร้อนพอๆ กับอุตสาหกรรมการขนส่งเลยทีเดียว ศาสตราจารย์ Post เล่าว่า ทุกครั้งที่เขาเห็นวัวยืนเคี้ยวหญ้า เขาไม่ได้เห็นแค่วัว...แต่เห็นเมฆก๊าซมีเทนลอยมาด้วย

และที่น่าคิดคือ เมื่อรายได้ของคนในอินเดียหรือจีนสูงขึ้น พวกเขาจะกินเนื้อเพิ่มตามรายได้ ซึ่งสถิติบอกว่าภายในปี 2050 ความต้องการเนื้อสัตว์จะเพิ่มขึ้นเป็น สองเท่า จากปัจจุบัน

แต่ศาสตราจารย์ก็ไม่ได้มองว่าเนื้อเป็นปีศาจ เขาบอกว่า มนุษย์ถูกสร้างมาให้รักเนื้อ เนื้อคือสิ่งที่มาพร้อมวิวัฒนาการ เราได้พลังงานจากมัน สมองเราใหญ่ขึ้นเพราะมัน และกลายเป็นมนุษย์เพราะมัน

แม้จะมีคนอีกกว่าสองพันล้านที่เป็นมังสวิรัติ ส่วนใหญ่อาจเพราะไม่มีทางเลือก แต่อย่างน้อยพวกเขาก็อยู่รอดได้ แต่ก็ปฏิเสธไม่ได้ว่า คนที่เคยล่า เคยกินเนื้อ จะรู้สึกตื่นเต้นทุกครั้งที่ได้แบ่งเนื้อกันบนโต๊ะ

ศาสตราจารย์ Post เองก็ยังชอบกินเนื้อ แต่เขาอยากได้เนื้อที่ได้มาจากทางเลือกที่ดีกว่า ไม่ใช่ทางที่พาโลกเข้า ICU

เนื้อเพาะเลี้ยงเริ่มจากหลักการง่ายๆ ที่เรารู้มาตั้งแต่ช่วงปี 2000 ว่า ในกล้ามเนื้อของสัตว์มี สเต็มเซลล์ รอคอยจะซ่อมแซมเนื้อเยื่อหากมันได้รับบาดเจ็บ

แค่เอาชิ้นกล้ามเนื้อเล็กๆ จากวัว ขนาดแค่ 1 ซม. x 1 มม. มาแยกสเต็มเซลล์ออกมาเลี้ยงให้ขยายตัว

เฮียว่าอันนี้น่าทึ่งมาก เพราะจากตัวอย่างเล็กๆ ชิ้นเดียว สามารถผลิตเนื้อวัวได้ถึง 10,000 กิโลกรัม เลยนะ!

แปลว่าเราสามารถลดจำนวนวัวทั้งโลกจากครึ่งพันล้านตัว เหลือแค่ประมาณ 30,000 ตัวได้เลย

และถ้าให้เซลล์กล้ามเนื้อพวกนี้อยู่ในสภาพแวดล้อมที่เหมาะสม มันก็จะเริ่มสร้างกล้ามเนื้อขึ้นมาเอง โดยเฉพาะถ้าเรากระตุ้นให้มันรู้สึกเหมือนกำลัง “ออกกำลัง” อยู่ เช่น ใส่แรงตึงเข้าไป

ทีมนักวิจัยของเขาเลี้ยงเซลล์เหล่านี้ให้เติบโตในรูปวงแหวนคล้ายโดนัท ครบ 3 สัปดาห์ กล้ามเนื้อจะเริ่มหดตัว สร้างความตึง และกลายเป็นเนื้อกล้ามเนื้อแบบเต็มตัวที่ดูไม่ต่างจากกล้ามเนื้อในสเต็กจริงๆ เลย

ปี 2013 ทีมของ Mark Post ผลิตเส้นใยกล้ามเนื้อจำนวน 10,000 เส้น เอามาทำแฮมเบอร์เกอร์ และนำไปเปิดตัวในงานแถลงข่าวที่ลอนดอน เป็นเหมือนการโชว์ทำอาหารผสมกับเปิดงานวิจัย

จุดประสงค์คือจะพิสูจน์ให้โลกเห็นว่า “เฮ้ย! สิ่งนี้ไม่ใช่แค่ไอเดียลอยๆ แต่มันทำได้จริง และจำเป็นต้องทำจริงๆ เพราะเรากำลังจะเจอวิกฤต”

ราคาแฮมเบอร์เกอร์ตอนนั้นคือ 250,000 ยูโร

มีเชฟผู้กล้าปรุง และอาสาสมัครสองคนลองชิม พวกเขาบอกว่า “ก็โอเคในฐานะเบอร์เกอร์ราคาเท่านี้ แต่ก็อยากได้รสเข้มกว่านี้หน่อย” เพราะยังไม่มีไขมัน เลยรสจืดไปหน่อย

แต่ที่สำคัญคือ พวกเขายืนยันว่า “มันคือเนื้อจริงๆ” ทั้งเนื้อสัมผัสและโครงสร้าง

แค่มีต้นแบบยังไม่พอ เพราะจะทำให้ขายได้จริง ต้องผ่านด่านสำคัญ เนื้อต้องผลิตได้โดยใช้ทรัพยากรน้อยกว่าการเลี้ยงวัวจริง การประเมินเบื้องต้นจาก University of Oxford พบว่า เนื้อเพาะเลี้ยงใช้พื้นที่น้อยลง 90% น้ำลดลง 90% พลังงานลดลง 60–70%

ทุกอย่างที่ใช้ในการเลี้ยงเซลล์ต้องมีจำนวนมากพอหรือหมุนเวียนใช้ได้ ที่น่าหนักใจคือ การเลี้ยงเซลล์ต้องใช้ “ซีรั่มจากลูกวัว” ซึ่งได้มาจากเลือดวัว ถ้าลดจำนวนวัว เราก็ไม่มีซีรั่ม แต่ตอนนี้มีงานพัฒนาไปเยอะแล้ว กำลังหาวิธีทำเซลล์กล้ามเนื้อโดยไม่ต้องพึ่งซีรั่มจากสัตว์

ไม่ใช่แค่โปรตีน แต่ต้องเป็น "เนื้อ" ในทุกความรู้สึก นักวิจัยพยายามปรับสภาพแวดล้อมการเพาะเลี้ยง เช่น ความเข้มข้นของออกซิเจน เพื่อให้เซลล์แสดงโปรตีนสำคัญ เช่น myoglobin ที่ทำให้เนื้อมีสีและรสชาติเหมือนเนื้อจริง

การยอมรับของผู้บริโภคเป็นอีกด่านสำคัญที่เนื้อเพาะเลี้ยงต้องข้ามผ่านให้ได้ ไม่ใช่แค่เรื่องรสชาติหรือคุณค่าทางโภชนาการเท่านั้น แต่ยังเป็นเรื่องของ "ใจ" ที่ต้องเปิดรับสิ่งใหม่ที่ไม่คุ้นเคย ศาสตราจารย์ Post เล่าว่า ในการสำรวจผู้บริโภคในอังกฤษและเนเธอร์แลนด์ พบว่ามีคนไม่น้อยที่ยินดีจะลองกินเนื้อเพาะเลี้ยง ถึง 52% ของชาวดัตช์ และ 60% ของชาวอังกฤษเลยทีเดียว

เขาเปรียบเทียบว่า จริงๆ แล้ว คนเรายอมกินฮอทดอกโดยไม่รู้ด้วยซ้ำว่าทำมาจากอะไร หรือผ่านอะไรมาบ้าง ขอแค่มัน "อร่อย ถูก และดูปลอดภัย" ก็เพียงพอแล้วสำหรับคนส่วนใหญ่ ดังนั้นเนื้อเพาะเลี้ยงจึงไม่ต่างกันมากนัก ขอเพียงให้คนรู้สึกว่า “กินแล้วไม่ตาย” และ “ไม่ได้แปลกจนใจฝ่อ” เท่านั้นแหละ วันหนึ่งมันก็จะกลายเป็นของธรรมดาในตู้เย็นเหมือนกับโยเกิร์ตหรือไส้กรอกนั่นเอง

ในด้านของราคา แม้จะยังไม่ถูกเท่าไส้กรอกในซูเปอร์ แต่ก็ลดลงมาไกลจากจุดเริ่มต้นแบบสุดๆ จากชิ้นต้นแบบราคา 250,000 ดอลลาร์ในปี 2013 ตอนนี้ต้นทุนลดลงมาเหลือประมาณ 65 ดอลลาร์ต่อกิโลกรัม (ยังไม่รวมเทคโนโลยีล้ำหน้าอื่นๆ ที่กำลังพัฒนาอยู่) ซึ่งก็ถือว่าอยู่ในระดับเดียวกับเนื้อวากิวหรือสเต๊กเกรดพรีเมียมเลยทีเดียว เป้าหมายคือทำให้ถูกลงอีก และผลิตได้ในระดับอุตสาหกรรมให้เพียงพอกับคนทั้งโลก ไม่ใช่ของฟุ่มเฟือยสำหรับคนรวยเท่านั้น

แต่วิสัยทัศน์ที่น่าสนใจจริงๆ คือ ภาพของอนาคตที่ศาสตราจารย์ Post วาดไว้ เขาเชื่อว่าเทคโนโลยีนี้เรียบง่ายพอที่จะขยายไปสู่ครัวเรือนหรือชุมชนเล็กๆ ได้ วันหนึ่งเราอาจได้เห็นการเพาะเลี้ยงเซลล์จากหมูที่เลี้ยงอยู่ข้างบ้าน แล้วเอาไปปั่นเป็นหมูสับแบบสดใหม่ ไม่ต้องฆ่าสัตว์ ไม่ต้องส่งโรงงาน ไม่ต้องตัดต่อพันธุกรรม แค่นั่งรอเหมือนหมักแป้งเปรี้ยว แล้วได้เนื้อสดๆ มาใส่ต้มจืด

และนั่นแหละคือ "การเปลี่ยนกรอบคิดเรื่องเนื้อสัตว์" แบบพลิกฝ่ามือ

มันจะไม่ใช่เรื่องการฆ่าอีกต่อไป ไม่ใช่เรื่องของฟาร์มกลิ่นฉี่ หรือสายพานโรงฆ่าสัตว์ มันจะเป็น "ผลิตภัณฑ์ใหม่" ที่เราสร้างได้ ควบคุมได้ และปรับแต่งได้ เช่น เพิ่มโอเมก้า 3 ในเซลล์ไขมันให้สูงขึ้น หรือทำให้เนื้อไม่มีคอเลสเตอรอลเลยก็ยังได้

แม้ศาสตราจารย์ Post จะเน้นเรื่องความมั่นคงทางอาหารและผลกระทบต่อสิ่งแวดล้อมเป็นหลัก แต่เขาก็ยอมรับว่า สำหรับคนกินทั่วๆ ไป ประเด็นที่ "ไม่มีสัตว์ต้องเจ็บปวด" จะกลายเป็นจุดขายที่สำคัญในใจของผู้บริโภค

เขาเชื่อว่า เมื่อวันนั้นมาถึง วันที่เรายืนอยู่หน้าตู้แช่ในซูเปอร์ แล้วเห็นผลิตภัณฑ์สองชิ้นวางข้างกัน — หนึ่งคือเนื้อวัวที่มาจากฟาร์ม และอีกหนึ่งคือเนื้อเพาะเลี้ยงที่ไม่เคยมีวัวต้องร้องไห้แม้แต่นิดเดียว — การตัดสินใจอาจจะไม่ง่าย แต่ "จะมีคนจำนวนมากขึ้นเรื่อยๆ ที่เลือกแบบไม่ต้องฆ่า"

เพราะสุดท้าย เราไม่ได้แค่กินเนื้อ… เรากำลังกิน “ความเชื่อ” ลงไปด้วย #pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr

ใครสนใจดูคลิปก็กดตรงนี้ได้ครับ https://youtu.be/1lI9AwxKfTY?si=6CDBUl2yGBoHWc-P

-

@ 7f6db517:a4931eda

2025-05-29 15:02:27

@ 7f6db517:a4931eda

2025-05-29 15:02:27

@matt_odell don't you even dare not ask about nostr!

— Kukks (Andrew Camilleri) (@MrKukks) May 18, 2021

Nostr first hit my radar spring 2021: created by fellow bitcoiner and friend, fiatjaf, and released to the world as free open source software. I was fortunate to be able to host a conversation with him on Citadel Dispatch in those early days, capturing that moment in history forever. Since then, the protocol has seen explosive viral organic growth as individuals around the world have contributed their time and energy to build out the protocol and the surrounding ecosystem due to the clear need for better communication tools.

nostr is to twitter as bitcoin is to paypal

As an intro to nostr, let us start with a metaphor:

twitter is paypal - a centralized platform plagued by censorship but has the benefit of established network effects

nostr is bitcoin - an open protocol that is censorship resistant and robust but requires an organic adoption phase

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

- Anyone can run a relay.

- Anyone can interact with the protocol.

- Relays can choose which messages they want to relay.

- Users are identified by a simple public private key pair that they can generate themselves.Nostr is often compared to twitter since there are nostr clients that emulate twitter functionality and user interface but that is merely one application of the protocol. Nostr is so much more than a mere twitter competitor. Nostr clients and relays can transmit a wide variety of data and clients can choose how to display that information to users. The result is a revolution in communication with implications that are difficult for any of us to truly comprehend.

Similar to bitcoin, nostr is an open and permissionless protocol. No person, company, or government controls it. Anyone can iterate and build on top of nostr without permission. Together, bitcoin and nostr are incredibly complementary freedom tech tools: censorship resistant, permissionless, robust, and interoperable - money and speech protected by code and incentives, not laws.

As censorship throughout the world continues to escalate, freedom tech provides hope for individuals around the world who refuse to accept the status quo. This movement will succeed on the shoulders of those who choose to stand up and contribute. We will build our own path. A brighter path.

My Nostr Public Key: npub1qny3tkh0acurzla8x3zy4nhrjz5zd8l9sy9jys09umwng00manysew95gx

If you found this post helpful support my work with bitcoin.

-

@ 048ecb14:7c28ac78

2025-05-29 00:49:55

@ 048ecb14:7c28ac78

2025-05-29 00:49:55I recently set up a Raspberry Pi camera server that's so minimal and straightforward, I thought it was worth sharing. This isn't one of those over-engineered solutions with fancy features - it's just a basic, reliable camera feed accessible from any browser on my local network.

The Goal