-

@ eb0157af:77ab6c55

2025-05-31 14:01:32

@ eb0157af:77ab6c55

2025-05-31 14:01:32The Wall Street financial institution has signed strategic agreements for bitcoin-backed loans with Maple Finance and FalconX.

According to Bloomberg, on May 27 Cantor Fitzgerald officially launched its new division dedicated to Bitcoin lending, announcing the completion of the first transactions of its Bitcoin Financing Business. The Wall Street firm confirmed it has finalized a first round of deals with two crypto sector players: Maple Finance and FalconX.

The company initially plans to make up to $2 billion in financing available to institutional clients.

Brandon Lutnick, President of Cantor Fitzgerald, commented:

“From the start, Cantor recognized the transformative impact that financial services for digital assets would have on the global economy. This milestone highlights how the combination of Cantor’s deep expertise and entrepreneurial spirit creates a distinctive advantage on Wall Street.”

The partnership with Maple Finance is part of Cantor’s broader expansion strategy. Sidney Powell, Co-Founder and CEO of Maple Finance, emphasized how the deal will expand his company’s ability to serve clients looking to access the digital asset market:

“We’re seeing strong and growing demand from institutions seeking to enter the crypto market through trusted and regulated channels.”

Josh Barkhordar, Head of U.S. Sales at FalconX, stated:

“Digital assets have lacked the institutional-grade credit infrastructure essential for healthy capital markets. This collaboration between Cantor and a crypto-native firm is a meaningful step toward building that framework.”

To ensure the security and reliability of its bitcoin-backed financing services, Cantor Fitzgerald has selected Anchorage Digital and Copper.co for custody solutions.

The post Cantor Fitzgerald launches first bitcoin-backed loans appeared first on Atlas21.

-

@ 9ca447d2:fbf5a36d

2025-05-31 14:01:11

@ 9ca447d2:fbf5a36d

2025-05-31 14:01:11DDC Enterprise, a consumer brand and e-commerce company with operations in the U.S. and China, has launched a big plan to make bitcoin (BTC) a key part of its financial strategy.

The company just bought 21 BTC as the first step in a plan to buy up to 5,000 BTC over the next 3 years.

The move was announced in a press release and a letter to shareholders by DDC’s founder, chairwoman and CEO Norma Chu.

The 21 BTC, worth around $2.28 million at current prices, was bought through a share exchange. DDC issued 254,333 class A ordinary shares.

“We are fully committed to ensuring the success of this strategy, which aligns with our vision to drive long-term value for our shareholders,” said Norma Chu. “Today marks a pivotal moment in DDC’s evolution.”

Chu is the first female founder and CEO of a U.S.-listed public company to lead a bitcoin-only treasury strategy. DDC is one of the first companies in its industry to adopt this strategy in such a structured way.

DDC’s plan is being rolled out in phases. The company will buy another 79 BTC soon and will have 100 BTC in the short term.

In the next 6 months, it will buy 500 BTC, and long-term, it expects to build a 5,000 BTC reserve over 36 months.

This phased approach may allow DDC to manage market volatility and take advantage of price movements.

In her recent letter to shareholders, Chu called the bitcoin strategy “a cornerstone of our long-term value creation plan”.

She said bitcoin’s qualities – especially as a hedge against macroeconomic uncertainty and inflation – make it the perfect reserve asset for DDC. She added:

“Bitcoin’s unique properties as a store of value and hedge against macroeconomic uncertainty align perfectly with our vision to diversify reserves and enhance shareholder returns.”

The announcement comes on the back of a record-breaking year for DDC.

In 2024, the company made $37.4 million in revenue—a 33% increase from 2023.

Gross margin improved from 25.0% in 2023 to 28.4% in 2024 due to strategic acquisitions in the U.S. and more efficient operations in China.

As of March 31, 2025 the company had $11.3 million in shareholder equity and $23.6 million in cash, cash equivalents and short-term investments.

This gives DDC the flexibility and credibility to do something as bold as this bitcoin accumulation plan.

DDC’s announcement comes as corporations are getting increasingly interested in adding bitcoin to their balance sheet.

While giants like Strategy have made headlines with large bitcoin purchases, DDC is the first e-commerce company to do so.

The company’s dual presence in China and the U.S. also adds complexity, especially with the different regulatory environments surrounding Bitcoin in each region.

To ensure proper execution, DDC has expanded its treasury and advisory teams to include experts in the bitcoin markets.

The company will use a mix of dollar cost averaging and tactical buying, adjusting purchases based on market conditions.

-

@ b1ddb4d7:471244e7

2025-05-31 14:00:50

@ b1ddb4d7:471244e7

2025-05-31 14:00:50This article was originally published on aier.org

Even after eleven years experience, and a per Bitcoin price of nearly $20,000, the incredulous are still with us. I understand why. Bitcoin is not like other traditional financial assets.

Even describing it as an asset is misleading. It is not the same as a stock, as a payment system, or a money. It has features of all these but it is not identical to them.

What Bitcoin is depends on its use as a means of storing and porting value, which in turn rests of secure titles to ownership of a scarce good. Those without experience in the sector look at all of this and get frustrated that understanding why it is valuable is not so easy to grasp.

In this article, I’m updating an analysis I wrote six years ago. It still holds up. For those who don’t want to slog through the entire article, my thesis is that Bitcoin’s value obtains from its underlying technology, which is an open-source ledger that keeps track of ownership rights and permits the transfer of these rights. Bitcoin managed to bundle its unit of account with a payment system that lives on the ledger. That’s its innovation and why it obtained a value and that value continues to rise.

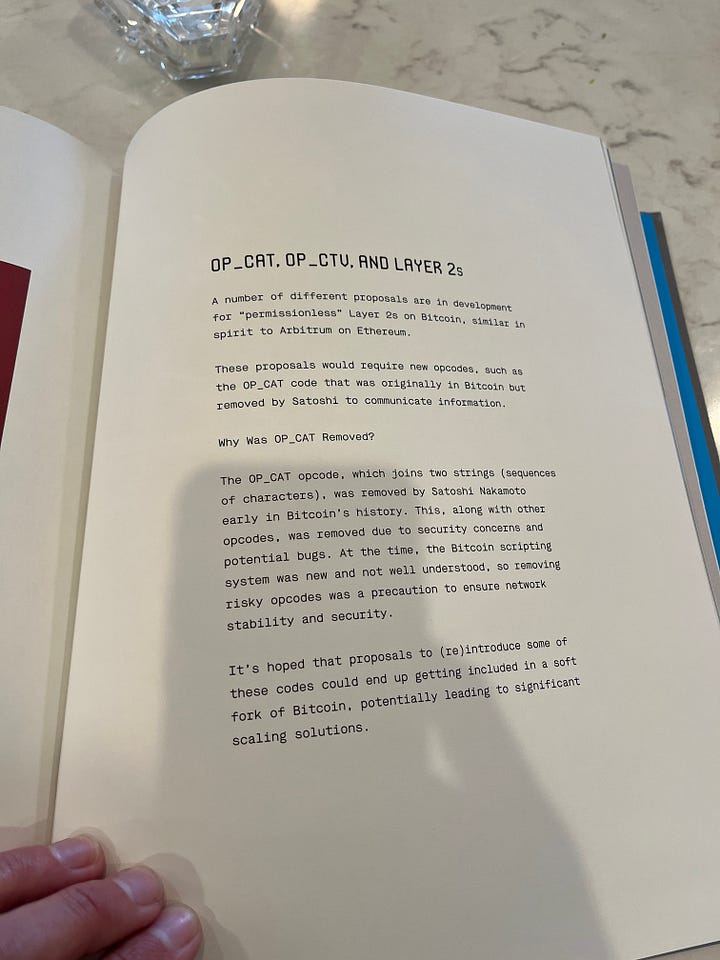

Consider the criticism offered by traditional gold advocates, who have, for decades, pushed the idea that sound money must be backed by something real, hard, and independently valuable. Bitcoin doesn’t qualify, right? Maybe it does.

Bitcoin first emerged as a possible competitor to national, government-managed money in 2009. Satoshi Nakamoto’s white paper was released October 31, 2008. The structure and language of this paper sent the message: This currency is for computer technicians, not economists nor political pundits. The paper’s circulation was limited; novices who read it were mystified.

But the lack of interest didn’t stop history from moving forward. Two months later, those who were paying attention saw the emergence of the “Genesis Block,” the first group of bitcoins generated through Nakamoto’s concept of a distributed ledger that lived on any computer node in the world that wanted to host it.

Here we are all these years later and a single bitcoin trades at $18,500. The currency is held and accepted by many thousands of institutions, both online and offline. Its payment system is very popular in poor countries without vast banking infrastructures but also in developed countries. And major institutions—including the Federal Reserve, the OECD, the World Bank, and major investment houses—are paying respectful attention and weaving blockchain technology into their operations.

Enthusiasts, who are found in every country, say that its exchange value will soar even more in the future because its supply is strictly limited and it provides a system vastly superior to government money. Bitcoin is transferred between individuals without a third party. It is relatively low-cost to exchange. It has a predictable supply. It is durable, fungible, and divisible: all crucial features of money. It creates a monetary system that doesn’t depend on trust and identity, much less on central banks and government. It is a new system for the digital age.

Hard lessons for hard money

To those educated in the “hard money” tradition, the whole idea has been a serious challenge. Speaking for myself, I had been reading about bitcoin for two years before I came anywhere close to understanding it. There was just something about the whole idea that bugged me. You can’t make money out of nothing, much less out of computer code. Why does it have value then? There must be something amiss. This is not how we expected money to be reformed.

There’s the problem: our expectations. We should have been paying closer attention to Ludwig von Mises’ theory of money’s origins—not to what we think he wrote, but to what he actually did write.

In 1912, Mises released The Theory of Money and Credit. It was a huge hit in Europe when it came out in German, and it was translated into English. While covering every aspect of money, his core contribution was in tracing the value and price of money—and not just money itself—to its origins. That is, he explained how money gets its price in terms of the goods and services it obtains. He later called this process the “regression theorem,” and as it turns out, bitcoin satisfies the conditions of the theorem.

Mises’ teacher, Carl Menger, demonstrated that money itself originates from the market—not from the State and not from social contract. It emerges gradually as monetary entrepreneurs seek out an ideal form of commodity for indirect exchange. Instead of merely bartering with each other, people acquire a good not to consume, but to trade. That good becomes money, the most marketable commodity.

But Mises added that the value of money traces backward in time to its value as a bartered commodity. Mises said that this is the only way money can have value.

The theory of the value of money as such can trace back the objective exchange value of money only to that point where it ceases to be the value of money and becomes merely the value of a commodity…. If in this way we continually go farther and farther back we must eventually arrive at a point where we no longer find any component in the objective exchange value of money that arises from valuations based on the function of money as a common medium of exchange; where the value of money is nothing other than the value of an object that is useful in some other way than as money…. Before it was usual to acquire goods in the market, not for personal consumption, but simply in order to exchange them again for the goods that were really wanted, each individual commodity was only accredited with that value given by the subjective valuations based on its direct utility.

Mises’ explanation solved a major problem that had long mystified economists. It is a narrative of conjectural history, and yet it makes perfect sense. Would salt have become money had it otherwise been completely useless? Would beaver pelts have obtained monetary value had they not been useful for clothing? Would silver or gold have had money value if they had no value as commodities first? The answer in all cases of monetary history is clearly no. The initial value of money, before it becomes widely traded as money, originates in its direct utility. It’s an explanation that is demonstrated through historical reconstruction. That’s Mises’ regression theorem.

Bitcoin’s Use Value

At first glance, bitcoin would seem to be an exception. You can’t use a bitcoin for anything other than money. It can’t be worn as jewelry. You can’t make a machine out of it. You can’t eat it or even decorate with it. Its value is only realized as a unit that facilitates indirect exchange. And yet, bitcoin already is money. It’s used every day. You can see the exchanges in real time. It’s not a myth. It’s the real deal.

It might seem like we have to choose. Is Mises wrong? Maybe we have to toss out his whole theory. Or maybe his point was purely historical and doesn’t apply in the future of a digital age. Or maybe his regression theorem is proof that bitcoin is just an empty mania with no staying power, because it can’t be reduced to its value as a useful commodity.

And yet, you don’t have to resort to complicated monetary theory in order to understand the sense of alarm surrounding bitcoin. Many people, as I did, just have a feeling of uneasiness about a money that has no basis in anything physical. Sure, you can print out a bitcoin on a piece of paper, but having a paper with a QR code or a public key is not enough to relieve that sense of unease.

How can we resolve this problem? In my own mind, I toyed with the issue for more than a year. It puzzled me. I wondered if Mises’ insight applied only in a pre-digital age. I followed the speculations online that the value of bitcoin would be zero but for the national currencies into which it is converted. Perhaps the demand for bitcoin overcame the demands of Mises’ scenario because of a desperate need for something other than the dollar.

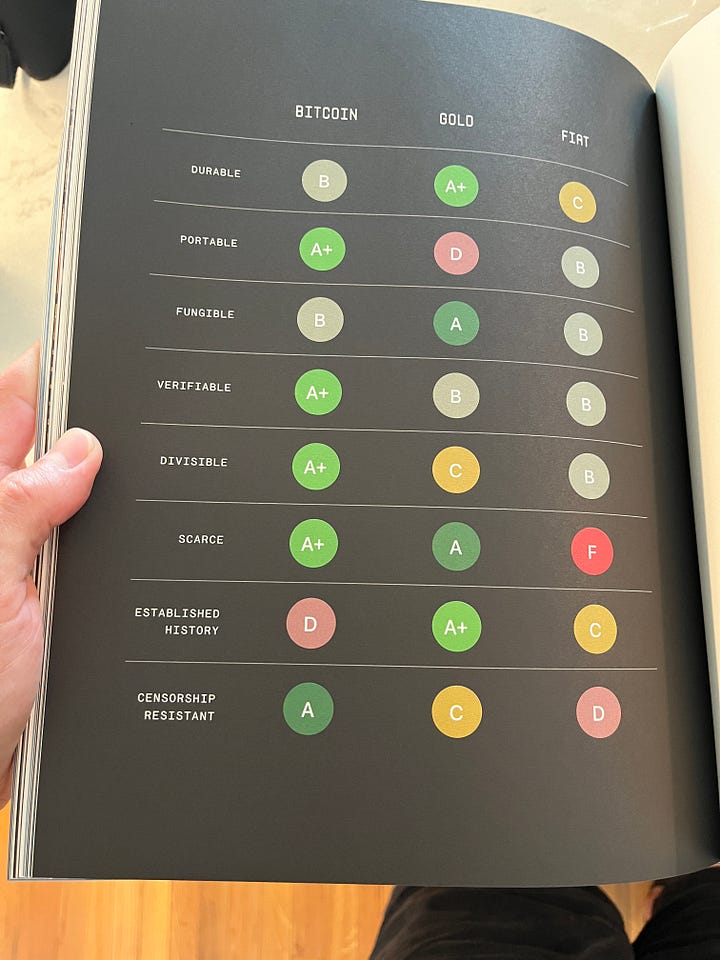

As time passed—and I read the work of Konrad Graf, Peter Surda, and Daniel Krawisz—finally the resolution came. Bitcoin is both a payment system and a money. The payment system is the source of value, while the accounting unit merely expresses that value in terms of price. The unity of money and payment is its most unusual feature, and the one that most commentators have had trouble wrapping their heads around.

We are all used to thinking of currency as separate from payment systems. This thinking is a reflection of the technological limitations of history. There is the dollar and there are credit cards. There is the euro and there is PayPal. There is the yen and there are wire services. In each case, money transfer relies on third-party service providers. In order to use them, you need to establish what is called a “trust relationship” with them, which is to say that the institution arranging the deal has to believe that you are going to pay.

This wedge between money and payment has always been with us, except for the case of physical proximity.

If I give you a dollar for your pizza slice, there is no third party. But payment systems, third parties, and trust relationships become necessary once you leave geographic proximity. That’s when companies like Visa and institutions like banks become indispensable. They are the application that makes the monetary software do what you want it to do.

The hitch is that

-

@ dfa02707:41ca50e3

2025-05-31 12:01:45

@ dfa02707:41ca50e3

2025-05-31 12:01:45Contribute to keep No Bullshit Bitcoin news going.

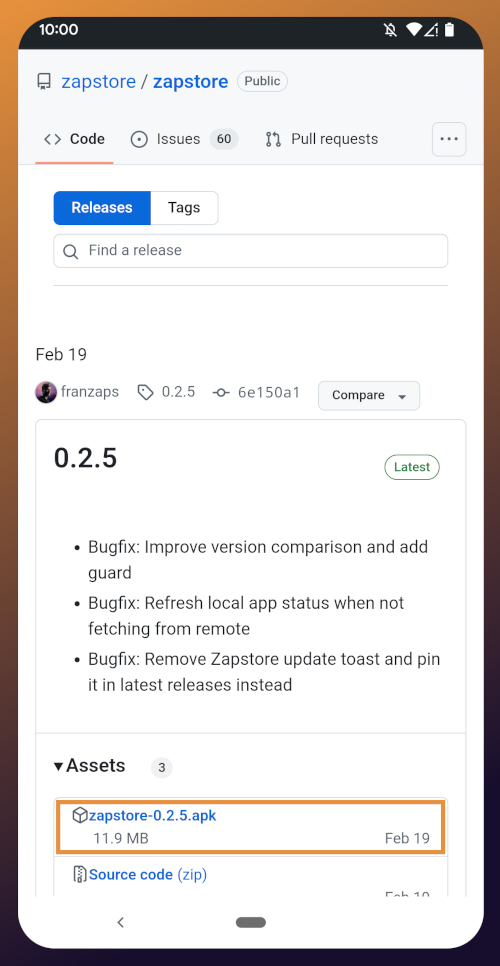

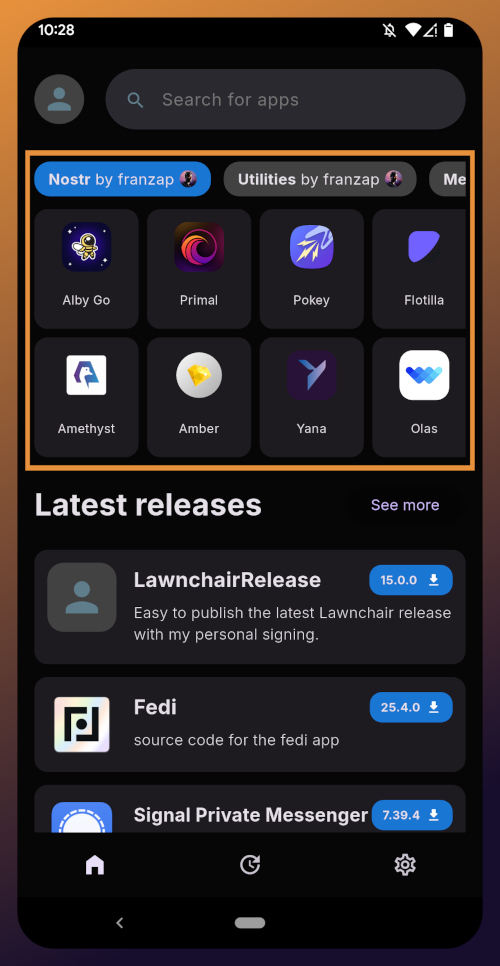

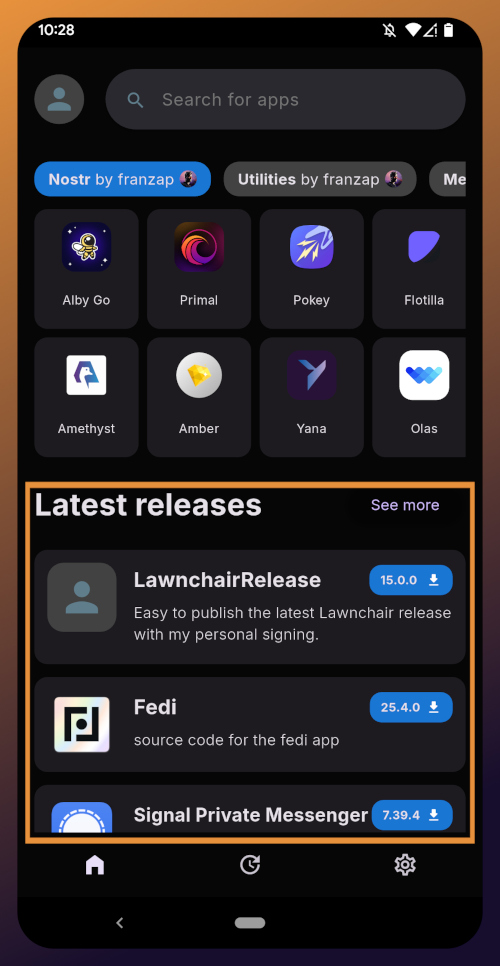

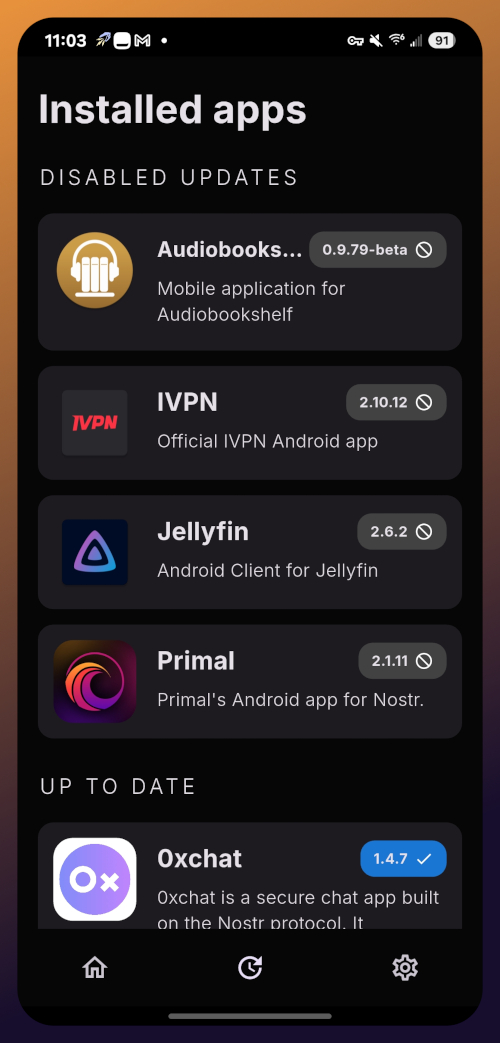

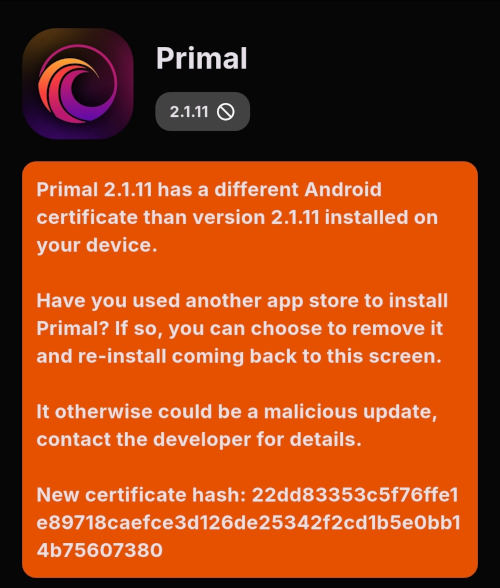

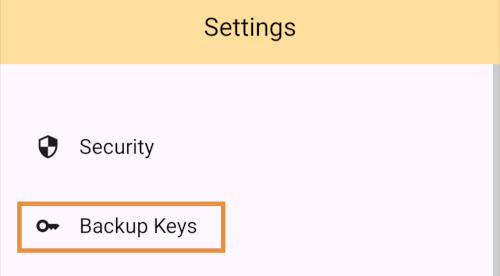

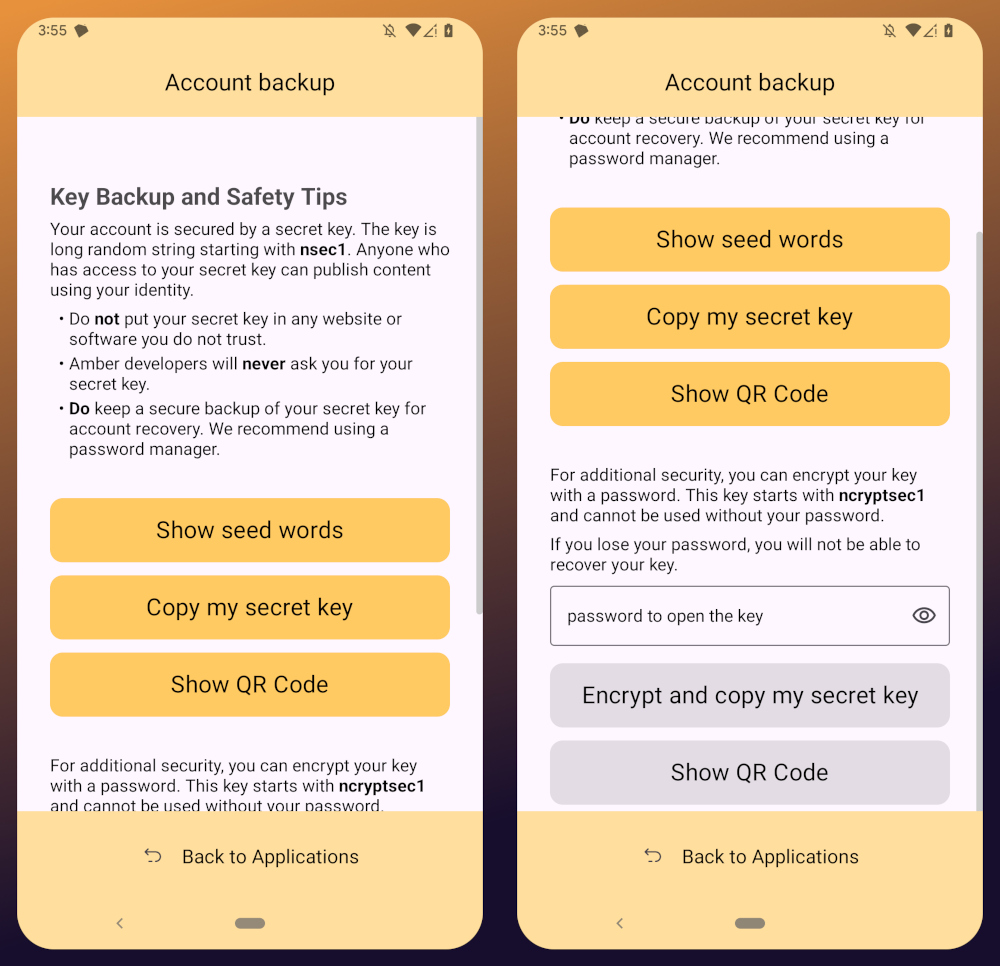

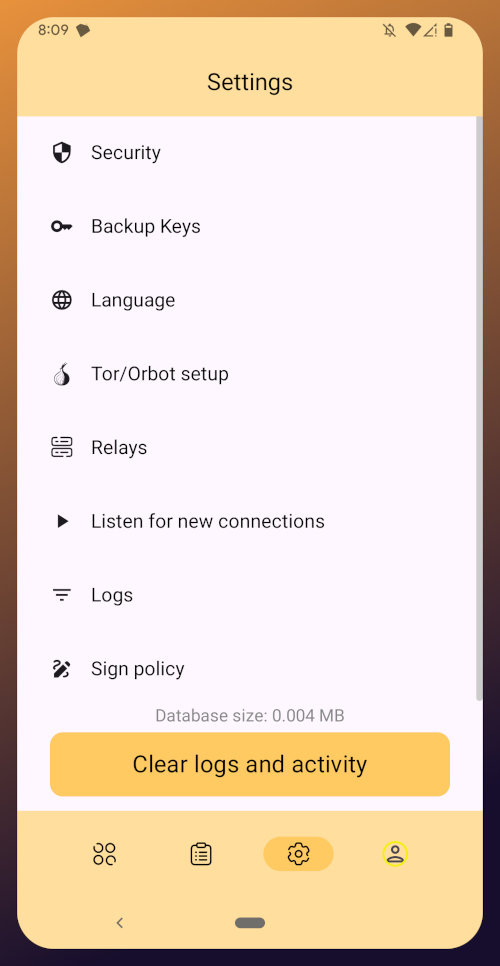

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ 6a6be47b:3e74e3e1

2025-05-31 12:18:17

@ 6a6be47b:3e74e3e1

2025-05-31 12:18:17Hi frens! 🦖

📖 How’s your weekend starting out? I’ve been painting and reading, and I’m super excited to share that I finally finished Jurassic Park by Michael Crichton!

😜 I’m still working on the art of convincing people to read a book without spoiling it, but I’ll do my best here.

📕 Let me just say: the book is so much better than the movie (and that’s saying something, because the movie will always have a special place in my heart). The novel is basically one cliffhanger after another—I was absolutely hooked! There’s nonstop adventure and so much tension as the characters dodge dinosaurs at every turn.

I was pleasantly surprised by how the characters react to the dinosaurs in the book. I love Ian Malcolm’s character even more here—his warnings about the park being a disaster waiting to happen are even sharper and more compelling. I thought Dr. Grant would come to the same conclusion as Malcolm a bit sooner, but as a paleontologist, he’s understandably in awe—this is the pinnacle of his career, after all! Unlike Malcolm, he has less time to process the reality of prehistoric creatures walking the earth again.

The characters are all a bit different (sometimes a LOT different) from their movie versions, but it works so well. If I could change one thing, I would have loved to see Dr. Sattler play a bigger role throughout the novel.

📝 All in all, I’m so glad I finally read it. There’s action, adventure, dinosaurs, humans being humans, and a sprinkle of science and deep questions about the consequences of our actions. I was hooked from start to finish.

If you haven’t read it yet, I hope you give yourself the chance—don’t wait as long as I did!

See you later, alligator 🐊

Godspeed! By the way, I wrote and painted some dinosaurs here 👀 just in case you want to know more about dinosaurs, just like it happened to me!

https://stacker.news/items/993455

-

@ 1bc70a01:24f6a411

2025-05-31 04:34:37

@ 1bc70a01:24f6a411

2025-05-31 04:34:37{"title":"SVG Bee Logo","description":"Bee ready with a nice bee logo for your beeloved app!","price":35000,"contentUrl":"https://d.nostr.build/HRcgBzWongPHkSYT.svg","imageUrl":"data:image/png;base64,iVBORw0KGgoAAAANSUhEUgAACSgAAASUCAYAAABu9HH1AAAACXBIWXMAABYlAAAWJQFJUiTwAAAAAXNSR0IArs4c6QAAAARnQU1BAACxjwv8YQUAAI8dSURBVHgB7N3PblX32ffhXwvCsgsKNQWJKKlJ0kStGqkOo84CR4A5gsCow5gjwB51GHvWGfYRYEYdxjkAFFeKlAoUgiVLSI6MsGzhgmLl1b1ebcSThMTG+157/bkuacsuT5U63mvybH343r+5ePHiDwUAAAAADuju3bsFAAAAAA7qtwUAAAAAAAAAACCJQAkAAAAAAAAAAEgjUAIAAAAAAAAAANIIlAAAAAAAAAAAgDQCJQAAAAAAAAAAII1ACQAAAAAAAAAASCNQAgAAAAAAAAAA0giUAAAAAAAAAACANAIlAAAAAAAAAAAgjUAJAAAAAAAAAABII1ACAAAAAAAAAADSCJQAAAAAAAAAAIA0AiUAAAAAAAAAACCNQAkAAAAAAAAAAEgjUAIAAAAAAAAAANIIlAAAAAAAAAAAgDQCJQAAAAAAAAAAII1ACQAAAAAAAAAASCNQAgAAAAAAAAAA0giUAAAAAAAAAACANAIlAAAAAAAAAAAgjUAJAAAAAAAAAABII1ACAAAAAAAAAADSCJQAAAAAAAAAAIA0AiUAAAAAAAAAACCNQAkAAAAAAAAAAEgjUAIAAAAAAAAAANIIlAAAAAAAAAAAgDQCJQAAAAAAAAAAII1ACQAAAAAAAAAASCNQAgAAAAAAAAAA0giUAAAAAAAAAACANAIlAAAAAAAAAAAgjUAJAAAAAAAAAABII1ACAAAAAAAAAADSCJQAAAAAAAAAAIA0AiUAAAAAAAAAACCNQAkAAAAAAAAAAEgjUAIAAAAAAAAAANIIlAAAAAAAAAAAgDQCJQAAAAAAAAAAII1ACQAAAAAAAAAASCNQAgAAAAAAAAAA0giUAAAAAAAAAACANAIlAAAAAAAAAAAgjUAJAAAAAAAAAABII1ACAAAAAAAAAADSCJQAAAAAAAAAAIA0AiUAAAAAAAAAACCNQAkAAAAAAAAAAEgjUAIAAAAAAAAAANIIlAAAAAAAAAAAgDQCJQAAAAAAAAAAII1ACQAAAAAAAAAASCNQAgAAAAAAAAAA0giUAAAAAAAAAACANAIlAAAAAAAAAAAgjUAJAAAAAAAAAABII1ACAAAAAAAAAADSCJQAAAAAAAAAAIA0AiUAAAAAAAAAACCNQAkAAAAAAAAAAEgjUAIAAAAAAAAAANIIlAAAAAAAAAAAgDQCJQAAAAAAAAAAII1ACQAAAAAAAAAASCNQAgAAAAAAAAAA0giUAAAAAAAAAACANAIlAAAAAAAAAAAgjUAJAAAAAAAAAABII1ACAAAAAAAAAADSCJQAAAAAAAAAAIA0AiUAAAAAAAAAACCNQAkAAAAAAAAAAEgjUAIAAAAAAAAAANIIlAAAAAAAAAAAgDQCJQAAAAAAAAAAII1ACQAAAAAAAAAASCNQAgAAAAAAAAAA0giUAAAAAAAAAACANAIlAAAAAAAAAAAgjUAJAAAAAAAAAABII1ACAAAAAAAAAADSCJQAAAAAAAAAAIA0AiUAAAAAAAAAACCNQAkAAAAAAAAAAEgjUAIAAAAAAAAAANIIlAAAAAAAAAAAgDQCJQAAAAAAAAAAII1ACQAAAAAAAAAASCNQAgAAAAAAAAAA0giUAAAAAAAAAACANAIlAAAAAAAAAAAgjUAJAAAAAAAAAABII1ACAAAAAAAAAADSCJQAAAAAAAAAAIA0AiUAAAAAAAAAACCNQAkAAAAAAAAAAEgjUAIAAAAAAAAAANIIlAAAAAAAAAAAgDQCJQAAAAAAAAAAII1ACQAAAAAAAAAASCNQAgAAAAAAAAAA0giUAAAAAAAAAACANAIlAAAAAAAAAAAgjUAJAAAAAAAAAABII1ACAAAAAAAAAADSCJQAAAAAAAAAAIA0AiUAAAAAAAAAACCNQAkAAAAAAAAAAEgjUAIAAAAAAAAAANIIlAAAAAAAAAAAgDQCJQAAAAAAAAAAII1ACQAAAAAAAAAASCNQAgAAAAAAAAAA0giUAAAAAAAAAACANAIlAAAAAAAAAAAgjUAJAAAAAAAAAABII1ACAAAAAAAAAADSCJQAAAAAAAAAAIA0AiUAAAAAAAAAACCNQAkAAAAAAAAAAEgjUAIAAAAAAAAAANIIlAAAAAAAAAAAgDQCJQAAAAAAAAAAII1ACQAAAAAAAAAASCNQAgAAAAAAAAAA0giUAAAAAAAAAACANAIlAAAAAAAAAAAgjUAJAAAAAAAAAABII1ACAAAAAAAAAADSCJQAAAAAAAAAAIA0AiUAAAAAAAAAACCNQAkAAAAAAAAAAEgjUAIAAAAAAAAAANIIlAAAAAAAAAAAgDQCJQAAAAAAAAAAII1ACQAAAAAAAAAASCNQAgAAAAAAAAAA0giUAAAAAAAAAACANAIlAAAAAAAAAAAgjUAJAAAAAAAAAABII1ACAAAAAAAAAADSCJQAAAAAAAAAAIA0AiUAAAAAAAAAACCNQAkAAAAAAAAAAEgjUAIAAAAAAAAAANIIlAAAAAAAAAAAgDQCJQAAAAAAAAAAII1ACQAAAAAAAAAASCNQAgAAAAAAAAAA0giUAAAAAAAAAACANAIlAAAAAAAAAAAgjUAJAAAAAAAAAABII1ACAAAAAAAAAADSCJQAAAAAAAAAAIA0AiUAAAAAAAAAACCNQAkAAAAAAAAAAEgjUAIAAAAAAAAAANIIlAAAAAAAAAAAgDQCJQAAAAAAAAAAII1ACQAAAAAAAAAASCNQAgAAAAAAAAAA0giUAAAAAAAAAACANAIlAAAAAAAAAAAgjUAJAAAAAAAAAABII1ACAAAAAAAAAADSCJQAAAAAAAAAAIA0AiUAAAAAAAAAACCNQAkAAAAAAAAAAEgjUAIAAAAAAAAAANIIlAAAAAAAAAAAgDQCJQAAAAAAAAAAII1ACQAAAAAAAAAASCNQAgAAAAAAAAAA0giUAAAAAAAAAACANAIlAAAAAAAAAAAgjUAJAAAAAAAAAABII1ACAAAAAAAAAADSCJQAAAAAAAAAAIA0AiUAAAAAAAAAACCNQAkAAAAAAAAAAEgjUAIAAAAAAAAAANIIlAAAAAAAAAAAgDQCJQAAAAAAAAAAII1ACQAAAAAAAAAASCNQAgAAAAAAAAAA0giUAAAAAAAAAACANAIlAAAAAAAAAAAgjUAJAAAAAAAAAABII1ACAAAAAAAAAADSCJQAAAAAAAAAAIA0AiUAAAAAAAAAACCNQAkAAAAAAAAAAEgjUAIAAAAAAAAAANIIlAAAAAAAAAAAgDQCJQAAAAAAAAAAII1ACQAAAAAAAAAASCNQAgAAAAAAAAAA0giUAAAAAAAAAACANAIlAAAAAAAAAAAgjUAJAAAAAAAAAABII1ACAAAAAAAAAADSCJQAAAAAAAAAAIA0AiUAAAAAAAAAACCNQAkAAAAAAAAAAEgjUAIAAAAAAAAAANIIlAAAAAAAAAAAgDQCJQAAAAAAAAAAII1ACQAAAAAAAAAASCNQAgAAAAAAAAAA0giUAAAAAAAAAACANAIlAAoAAAAAAAAAZBEoAQAAAAAAAAAAaQRKAAAAAAAAAABAGoESAAAAAAAAAACQRqAEAAAAAAAAAACkESgBAAAAAAAAAABpBEoAAAAAAAAAAEAagRIAAAAAAAAAAJBGoAQAAAAAAAAAAKQRKAEAAAAAAAAAAGkESgAAAAAAAAAAQBqBEgAAAAAAAAAAkEagBAAAAAAAAAAApBEoAQAAAAAAAAAAaQRKAAAAAAAAAABAGoESAAAAAAAAAACQRqAEAAAAAAAAAACkESgBAAAAAAAAAABpBEoAAAAAAAAAAEAagRIAAAAAAAAAAJBGoAQAAAAAAAAAAKQRKAEAAAAAAAAAAGkESgAAAAAAAAAAQBqBEgAAAAAAAAAAkEagBAAAAAAAAAAApBEoAQAAAAAAAAAAaQRKAAAAAAAAAABAGoESAAAAAAAAAACQRqAEAAAAAAAAAACkESgBAAAAAAAAAABpBEoAAAAAAAAAAEAagRIAAAAAAAAAAJBGoAQAAAAAAAAAAKQRKAEAAAAAAAAAAGkESgAAAAAAAAAAQBqBEgAAAAAAAAAAkEagBAAAAAAAAAAApBEoAQAAAAAAAAAAaQRKAAAAAAAAAABAGoESAAAAAAAAAACQRqAEAAAAAAAAAACkESgBAAAAAAAAAABpBEoAAAAAAAAAAEAagRIAAAAAAAAAAJBGoAQAAAAAAAAAAKQRKAEAAAAAAAAAAGkESgAAAAAAAAAAQBqBEgAAAAAAAAAAkEagBAAAAAAAAAAApBEoAQAAAAAAAAAAaQRKAAAAAAAAAABAGoESAAAAAAAAAACQRqAEAAAAAAAAAACkESgBAAAAAAAAAABpBEoAAAAAAAAAAEAagRIAAAAAAAAAAJBGoAQAAAAAAAAAAKQRKAEAAAAAAAAAAGkESgAAAAAAAAAAQBqBEgAAAAAAAAAAkEagBAAAAAAAAAAApBEoAQAAAAAAAAAAaQRKAAAAAAAAAABAGoESAAAAAAAAAACQRqAEAAAAAAAAAACkESgBAAAAAAAAAABpBEoAAAAAAAAAAEAagRIAAAAAAAAAAJBGoAQAAAAAAAAAAKQRKAEAAAAAAAAAAGkESgAAAAAAAAAAQBqBEgAAAAAAAAAAkEagBAAAAAAAAAAApBEoAQAAAAAAAAAAaQRKAAAAAAAAAABAGoESAAAAAAAAAACQRqAEAAAAAAAAAACkESgBAAAAAAAAAABpBEoAAAAAAAAAAEAagRIAAAAAAAAAAJBGoAQAAAAAAAAAAKQRKAEAAAAAAAAAAGkESgAAAAAAAAAAQBqBEgAAAAAAAAAAkEagBAAAAAAAAAAApBEoAQAAAAAAAAAAaQRKAAAAAAAAAABAGoESAAAAAAAAAACQRqAEAAAAAAAAAACkESgBAAAAAAAAAABpBEoAAAAAAAAAAEAagRIAAAAAAAAAAJBGoAQAAAAAAAAAAKQRKAEAAAAAAAAAAGkESgAAAAAAAAAAQBqBEgAAAAAAAAAAkEagBAAAAAAAAAAApBEoAQAAAAAAAAAAaQRKAAAAAAAAAABAGoESAAAAAAAAAACQRqAEAAAAAAAAAACkESgBAAAAAAAAAABpBEoAAAAAAAAAAEAagRIAAAAAAAAAAJBGoAQAAAAAAAAAAKQRKAEAAAAAAAAAAGkESgAAAAAAAAAAQBqBEgAAAAAAAAAAkEagBAAAAAAAAAAApBEoAQAAAAAAAAAAaQRKAAAAAAAAAABAGoESAAAAAAAAAACQRqAEAAAAAAAAAACkESgBAAAAAAAAAABpBEoAAAAAAAAAAEAagRIAAAAAAAAAAJBGoAQAAAAAAAAAAKQRKAEAAAAAAAAAAGkESgAAAAAAAAAAQBqBEgAAAAAAAAAAkEagBAAAAAAAAAAApBEoAQAAAAAAAAAAaQRKAAAAAAAAAABAGoESAAAAAAAAAACQRqAEAAAAAAAAAACkESgBAAAAAAAAAABpBEoAAAAAAAAAAEAagRIAAAAAAAAAAJBGoAQAAAAAAAAAAKQRKAEAAAAAAAAAAGkESgAAAAAAAAAAQBqBEgAAAAAAAAAAkEagBAAAAAAAAAAApBEoAQAAAAAAAAAAaQRKAAAAAAAAAABAGoESAAAAAAAAAACQRqAEAAAAAAAAAACkESgBAAAAAAAAAABpBEoAAAAAAAAAAEAagRIAAAAAAAAAAJBGoAQAAAAAAAAAAKQRKAEAAAAAAAAAAGkESgAAAAAAAAAAQBqBEgAAAAAAAAAAkEagBAAAAAAAAAAApBEoAQAAAAAAAAAAaQRKAAAAAAAAAABAGoESAAAAAAAAAACQRqAEAAAAAAAAAACkESgBAAAAAAAAAABpBEoAAAAAAAAAAEAagRIAAAAAAAAAAJBGoAQAAAAAAAAAAKQRKAEAAAAAAAAAAGkESgAAAAAAAAAAQBqBEgAAAAAAAAAAkOZ4AQBaZ39/v2xubpbd3d3y9OnT6j+/bGxsrPp64sSJcuzYseprvOLP4+v4+HiBw4hn7Pnz52Vvb688e/as+n7wZ4PnL/78ZRMTE9Xz9sYbb5QzZ84UAAAAYHSePHlSFhcXy+rqallbW6v+88suXLjw4uvp06err/Gampqqvk5PTxc4jHjGHj58WD1v6+vr1feDPxs8f/H9y+I5i+dtZmamfPLJJwUA6I7fXLx48YcCALRChCAbGxtla2urHNUgHjl58mT1fXyFEM9ZxG87Ozv/J0o6injWzp8/L1QCgI64e/duAQDaIUKQGzdulKWlpXJUg3jk0qVL5W9/+1v1FUI8ZxG/ffHFFy+ipB/HR4cVz9rc3JxQCQA6QqAEAC0Rkcg333xTBSMZYmkpQqVYu4m/JRdBCf0RQVJ8kDRY5cpy6tSp8u6771bPGwDQXgIlAGiHiESuXr165FDkVeIzpIiWYu3mypUrL1aY6IcIku7cufNilStLhHC3b9+unjcAoL0ESgDQAhEn3bt37yen3DJFoBT/T38s3jgJ1z3xLMVzFWtcESbV+WxFCPf++++LlACgxQRKANB8EYxcvnz5J6fcMr18mstJuO6JZymeq+Xl5bKyslLrsxXP0+effy5SAoAWEygBQMPFYlLESVnLSQcxOM8V6zeWldptsJQUYVKdUdKPxYdJsaQEALSTQAkAmi0WkyJOylpOOojBea6PP/7YslLLDZaS4kxgnVHSj0X8FktKAEA7CZQAoOHW19ermKQpYlEpXidPniy0Q4RI8Qxtb2+XnZ2d0hTvvfdedVIQAGgfgRIANNv169ermKQprl27Vq0qxaku2iFCpMFSUgRKTRGBUoRKAED7CJQAoMFi7SbWk5oo1pQmJyerWIlmijBpc3Ozeo1yLelVYo3rww8/LABA+wiUAKC5IiaJ9aQmikBpECvRTBEmLS4uloWFhZGuJb1KrHF9++23BQBon98WAKCxmrSc9GOxxBPrTl999VWjf84+ihjp0aNH1XsTX5sYJ4U4WxgRHgAAADA8sXrTVBFPRaD0zjvvNPrn7KOIkebn56v3Jk7zNTFOCnG2sEmLTgDAwQmUAKDBmnSO61UiMhmESnt7e4XRakOY9LKmftgFAAAAbdWGeCMik0GotLa2VhitNoRJL7tz504BANpHoAQADRVxScQ/bRE/69dff13FSm36ubsilojaFCYNeFYAAABgeCIuifinLeJn/eijj8r169db9XN3RcRsbQqTBjwrANBOAiUAaKg2RSYvi3NvESpFKEO+CHzu379f7t2718rYR6AEAAAAw9PWpeKlpaUqVIolH/JF4HP16tVy+fLlVsY+AiUAaCeBEgAwdBFXDU6NCVDybG5uVjFYG04BvsqxY8cKAAAAQMRVseQTiz4ClDyLi4tVDLayslLa6vTp0wUAaB+BEgA0VBfCjYiTBmfHGJ7BatLGxkZrl7YAAACA4etCuBFxUkRK1pSGK36vsZg0Ozvb2qUtAKDdBEoA0FARKHVlXSYCpQhqrCkd3e7ubnXOrc2rSS8bHx8vAAAAwHBEoHThwoXSBbGm1NYTZE2zurpa/S7jaxdMT08XAKB9BEoA0GBnzpwpXRFBTYQ1e3t7hdcToVf8DrsUepnkBgAAgOGamZkpXTEIa9bW1gqvJ5aouhZ6XblypQAA7SNQAoAG61q8EWHN119/7eTbIcUZtwcPHnTu9zY2NlZOnjxZAAAAgOHpWrwRYc1HH33k5NshxRm3q1evVktUXRILYZcuXSoAQPsIlACgwSLeOHXqVOmaCG1ESgcziLriQ6WuOX/+fAEAAACGK+KNLgYcEdqIlA5mEHWtrKyUrrl582YBANpJoAQADTc1NVWOHTtWuiYCpVgFinUgfl6cw+vaSbeBOF84OTlZAAAAgOG7detWJ8+qR6QUq0Bd/ItcwxLn8Lp20m3g2rVr1QsAaCeBEgA03IkTJ8oHH3zQyUgpPky6f/++SOlndDlOmpiYKG+99VYBAAAAcsQZrM8//7yTkVKsAkWAI1L6qS7HSfFMf/bZZwUAaC+BEgC0wPj4eBUpjY2Nla55+vRpdcKsiyHO69ra2qripC6GW3Gy8P333+9kcAcAAABNMj09XUVKEXZ0TYQ4ccKsiyHO6+pyuBUnC7/88stOBncA0CcCJQBoiYiUIuyI01hdE3FSV9eCDivipPX19c7FScePH69Wk8RJAAAAUJ9BpNTFs1gRJ3V1LeiwIk7q4um7CJJiNamra2AA0De/uXjx4g8FAGiVCHm2t7erDx3iFNj3339fuiBOf/U5YBmcdetKnBSLXydPnqxWk9544w1hEgB0yN27dwsA0C4R8kTIcufOnWqBqCsxyyDC6mvAMjjr1pX3Mxa/YjHp448/LjMzM8IkAOgQgRIAdEzELfGKiCm+xgm1CF/i+52dndJ0fY2U2hInxRJSrHnFKwKkEydOVK94vwYvAKD7BEoA0C0Rt8QrIqb4+p///OdFxLS6ulqarq+RUlvipHhf4j2K19TUVBUhxSv+fPACALpPoAQAPbO7u1vFMPHBRVODpThjFx9W9EWTT9xFkBTrR7GCFGtIESMBAAiUAKBfIlKKGCbWl5oaLMUZu1u3bpW+aPKJuwiOYv0oVpBiDSliJAAAgRIA9Fis9QxOxTXtb1qdP3++enVdE+OkiJImJyerD5MiSgIA+DGBEgD0V3yGNDgVF1+bZG5urty8ebN0XRPjpPgcKSKxK1euVFESAMCPCZQAgEoEMrGu9OjRo/Ls2bPSBG+99VY5d+5c6bL79+83ZskqVpIiChMlAQC/RqAEAIQIZGJRaX5+vjGxzMLCQvn0009Ll0Wc1JQlq4iRIgoTJQEAv0agBAD8xOPHjxsRKh07dqx88MEHZXx8vHRR/I7jNWpxUi/CJOfbAICDEigBAD+2tLRUFhcXq1NwoxRLPp9//nmZnp4uXRQxWCxFjVqsJUWY5HwbAHBQAiUA4JWaECpFNPOXv/ylipW6ZGtrq6yvr5dREiYBAK9LoAQAvEqESqNeVIpo5ssvv6xipS6J3+3169fLKAmTAIDX9dsCAPAKk5OT5a9//Wv1gcPY2FgZhTg9N+qQZ9ji32mUy0lxyi2WqaampsRJAAAAwFBFwPLtt9+WW7dujSxiiThq1CHPsMW/U4RfoxIn3GKZapTvKwDQbsfOnz8/VwAAfkGcWIu/cba/v1/29vZK3f73v/9VC0q/+93vShc8ePBgJL/H48ePlzfffLP88Y9/FCYBAEfyj3/8owAA/JI4sTYzM1O2t7dHcvbtv//9b/n9739f/v73v5cuuHr16kh+j/GZ4D//+c/yr3/9S5gEAByJBSUA4EAiaInFnVGtKcXiUCwPtV38e+zs7JS6xWrSn//853Lu3LkCAAAAUIf4HCkWd0a1ujM3NzfSU3PDEstJq6urpW6xmhSn8mZnZwsAwFEJlACAQ4mzb++//36ZmJgodYr1prafehvVabfz589X75nVJAAAAGAU4uxbnAeL4KVOT548af2ptwisIrSq282bN6v3zGoSADAsTrwBAIcW59b+8Ic/VN/v7u6WukTg0+ZTb3Harc4VqDjp9qc//amcOXOmAAAMkxNvAMBhxamwCJXCF198UeoSgU+bT73Fabc6V6Diffr3v//94r0CABgWC0oAwGuLZZ6333671CkWiGJNqW22trZqPe0WZ/jipNvJkycLAAAAQFPEGtBnn31W6hT/m7Gm1DZLS0u1nnaLtaQ46Vb30hUA0A8CJQDgSM6ePVt9eBHLRnWIOGkUZ9KOou6fOeIkJ90AAACAppqdnS23b9+u1nrqEHHS/Px8aZO6f+b4fM9JNwAgk0AJADiyycnJ8sEHH9QWKW1ubpa9vb3SFvHz1nXabWJiolpOEicBAAAATTYzM1MFMXVFSgsLC2Vtba20xeLiYm2n3aanp6vlJHESAJBJoAQADMX4+HitkdLGxkZpgwiT6lpPGiwn1fUeAAAAABxFhDF1Rko3btwobRBhUpylq8NgOamu9wAA6C+BEgAwNBEpvf3226UOOzs7ZXd3tzSdOAkAAADg1SJS+uyzz0odVldXq1fT1XXaTZwEANRJoAQADFWce6srUqor/nldsZ60tbVVsg3iJGfdAAAAgDa6du1abZFSXfHP64r1pKWlpZJtECc56wYA1EWgBAAM3dmzZ8u5c+dKtqavKNUVUL377rviJAAAAKDVZmdnq1e2pq8o1RVQ3b59W5wEANRKoAQApHjrrbfKxMREydbUFaW61pPOnz9fndYDAAAAaLtYUYqTb9mauqJU13rSzZs3a/k9AwC8TKAEAKSJZZ9jx46VTLGitL+/X5rmyZMnJduZM2eqQAkAAACgK2LZ5/Tp0yVTLCjV8dnNYa2srJRscU5vbm6uAADUTaAEAKSJs2Nvvvlmyba5uVmaJvtnGhsbEycBAAAAnRNnx2LhJ9vi4mJpmuyfqa7fLQDAzxEoAQCpzp49W06dOlUyRQzUpBWlOO0WJ94yRZwUARgAAABA18zOzpZLly6VTAsLC41aUYrTbnHiLVPESREpAQCMgkAJAEg3NTWVeuot4qQ49dYU29vbJVOcdpucnCwAAAAAXXXr1q3UU28RJ8Wpt6a4c+dOyRSn3eIFADAqAiUAIF0s/Zw7d65k+u6770oTxHJS9t++c9oNAAAA6LpY+oklpUxNOfMWy0krKyslk9NuAMCoCZQAgFpEoDQ2NlayxIJSE868ZS85xe/RaTcAAACgDz799NPUk2SxoNSEM2/ZS07Zv0cAgIMQKAEAtYgTb9nLP1tbW2XUHj9+XLJE4JW9RAUAAADQFHHiLXv5Z3l5uYxa5s9QxxIVAMBBCJQAgNpMTk6mrihtb2+XUYrzbpkLSvH7s54EAAAA9Mm1a9dS13+yT6v9mjjvlrmg9Mknn1hPAgAa4XgBAKjR2bNny8bGRsnw9OnT6sxbrDWF+D6iob29vfLs2bPq+xBfB99///33rzwNN4ipBlFQfI1/dnyN/1t8HR8ff/Hfzz7vdubMmQIAAADQN7EAlLUCtLa2Vp15i7WmEN9HNBR/vr6+Xn0f4uvg+/jvvOo03CAGevlr/LPj69TUVPV1enr6xX8/+7xbBF4AAE3wm4sXL/5QAABqEjHQV1999coo6Kgi4on4aBAr1WFiYqKKlQb/uxni3ys+xAIAaIK7d+8WAIC6RAz0zjvvvDIKOqqZmZnqnz2IleoQkVLESoMYKkPESbdu3SoAAE0gUAIAavfo0aPqxcF9+OGHzrsBAI0hUAIA6jY/P1/m5uYKB/ftt9867wYANMZvCwBAzQaT2RzMYKEJAAAAoK+uXLlSOLjBQhMAQFMIlACA2o2Pj5dTp04VDubcuXMFAAAAoM8iuLl06VLhYD799NMCANAkAiUAYCROnjxZOBi/KwAAAIBSZmZmCgcj5gIAmkagBACMxJkzZwq/LpamnHcDAAAAcObtoCJOct4NAGgagRIAMBIR3Qhvfp31JAAAAID/L6Ib4c2vs54EADSRQAkAGIn9/f0yNjZWAAAAAOAgnjx5IlACAGgpgRIAUKsIkx49elS++uqrsrOzU/hlg9/V1tZWAQAAAOijCJPm5+fLO++8U1ZXVwu/bG5urvpdLS8vFwCApvjNxYsXfygAADXY3NysgpuIlDi88fHx8t577zmNBwCM3N27dwsAQB0WFxer4CYiJQ5venq63L592/IUADByFpQAgHS7u7vl66+/LhsbG+KkI9jb26vWlNbX18vz588LAAAAQFfFUtJHH31UZmdnxUlHsLa2Vq0pXb9+vTx8+LAAAIyKQAkASBMxUsQ09+7dq+IahiPOvcXv1Nk3AAAAoGsiRoqY5vLly1Vcw3AsLS1Vv1Nn3wCAUXHiDQBIER8mRZxkMSmXs28AwCg48QYAZFhZWaniJItJuZx9AwBGwYISADBUESQ9ePCgeomT8sUyVZzP29zcLAAAAABtFEHS1atXq5c4KV8sU8X5vMXFxQIAUBeBEgAwNLu7u1Us44OkekUItrGxUUVhz58/LwAAAABtsbq6WsUysZ5EfeLzu9nZ2SoKe/jwYQEAyCZQAgCG4tGjR+XevXsCmRGKD5biPYhQDAAAAKDp5ufny+XLlwUyIxRhWLwHEYoBAGQSKAEARxLrPffv368CJUYvArGIlLwfAAAAQFPFX7KKKGZubq4wehGIxfsRwRgAQBaBEgDw2vb29qqTbjs7O4VmiUApzr5FQAYAAADQFGtra9VJN4s9zRPB2I0bN6qADABg2ARKAMBr2dractKt4TY3N6uAzHsEAAAANMHy8rKTbg23sLBQBWTeIwBg2ARKAMChxTrP+vq6dZ4WGJx8EykBAAAAoxTnw65du2adpwUGJ99ESgDAMAmUAIBDiTgpXrTHIFKKk3wAAAAAdYs4Kc6H0R4RJ8WSUpzkAwAYBoESAHBg4qT2GkRK29vbBQAAAKAu4qT2irWrWFJaWVkpAABHJVACAA4kTrqJk9otTvJ988035fHjxwUAAAAg2/Xr18VJLReR0tWrV8vy8nIBADgKgRIA8KsiTtra2ip0Q0x0i5QAAACATBEnLS0tFbrh2rVrIiUA4EgESgDAL4rVJHFS90SktLu7WwAAAACGLc66iZO6JyKl1dXVAgDwOgRKAMArRZzkrFt3xbm3vb29AgAAADAsESc569Zdce5tbW2tAAAclkAJAPhZ4qTu29/fL/fu3SvPnz8vAAAAAEclTuq+J0+elMuXL1fr3AAAhyFQAgB+Ik66iZP6QaQEAAAADMPy8rI4qSdESgDA6xAoAQD/R4QqGxsbhf6I9/zBgwdVrAQAAABwWBGqzM7OFvoj3vM49xaxEgDAQQiUAIAXIlSJNR2hSv88ffrUahYAAABwaBGqxJqOUKV/1tbWqrN+AAAHIVACAF745ptvnPrqsc3NzeoFAAAAcFCxouPUV38tLCyUxcXFAgDwawRKAEAl1nP29vYK/Rbn/TwHAAAAwEHEek6s6NBvcd7PcwAA/BqBEgBQtra2nPfihVjScuYPAAAA+CVLS0tlbm6uQIglLWf+AIBfIlACgJ6Lk27iJF4Wz8T6+noBAAAA+Dlx0i3Wk2Agnonr168XAIBXESgBQM9FiBJBCrws/sbb5uZmAQAAAPixGzduVEEKvGxlZaUsLi4WAICfI1ACgB6LAGVnZ6fAz4llLfEaAAAA8LIIUCJEgZ8TZ//EawDAzxEoAUBPOe3Gr9nf33fqDQAAAHghwpMIUOBVYpXbqTcA4OcIlACgpyJOigAFfkksbG1vbxcAAACA+fn5KkCBX7K6umplCwD4CYESAPTQ1tZW9YKDiL8dKWYDAACAfltaWqpecBCxoiRmAwBeJlACgB5y2o3DiDhpc3OzAAAAAP0V60lwUBEneWYAgJcJlACgZyJOev78eYHD8NwAAABAf0VoEgvLcBgLCwueGwDgBYESAPRIBCbWk3hd6+vrBQAAAOiXCEzm5uYKvI449QYAEARKANAj4iSOYmdnp+zu7hYAAACgP5zp4ihWV1erFwCAQAkAeiLWk7a2tgochcgNAAAA+iPWk5aWlgochcgNAAgCJQDoCWEJw2BFCQAAAPpDWMIwWFECAIJACQB6wHoSwyR2AwAAgO6znsQwid0AAIESAPSAoIRhsqIEAAAA3ScoYZisKAEAAiUA6DjrSWQQvQEAAEB3WU8ig+gNAPpNoAQAHffkyZMCwxYrSvv7+wUAAADonpWVlQLDFgtKEb8BAP0kUAKAjtvc3CyQwbMFAAAA3bS4uFggw/LycgEA+kmgBAAdFqfd4sQbZIhAyYoSAAAAdEucdrNyQ5aFhQWL7wDQUwIlAOiwx48fF8gScVKcegMAAAC6w8INmSJOilNvAED/CJQAoKNiOUk8QrbvvvuuAAAAAN0Qy0niEbI5IQgA/SRQAoCOEidRh3jOnHkDAACAbhAnUYd4zpx5A4D+ESgBQEdtbm4WqMPW1lYBAAAA2s+yDXVxShAA+kegBAAdFOfd9vb2CtRhe3u7AAAAAO0W593W1tYK1GFlZaUAAP0iUAKADjKRTJ2ceQMAAID2u3PnToG6OPMGAP0jUAKADrJoQ92ceQMAAIB2s2hD3Zx5A4B+ESgBQMfEkk0s2kCdRHEAAADQXrFkE4s2UCdRHAD0i0AJADpGnMQoPH36tAAAAADt9MUXXxSo29raWgEA+kOgBAAdY8mGUYjlrt3d3QIAAAC0jyUbRsFyFwD0i0AJADrGkg2j4tkDAACAdrJkw6hY7wKA/hAoAUCHPH/+vOzt7RUYBetdAAAA0D6xYiNQYlQsKAFAfwiUAKBDLNgwSp4/AAAAaB8LNoySOA4A+kOgBAAdYj2JUdrf369WvAAAAID2EIgwSrHg9fDhwwIAdJ9ACQA6ZHd3t8Ao7ezsFAAAAKA9nNhi1Kx4AUA/CJQAoEOc2GLUrHgBAABAu1hQYtQ8gwDQDwIlAOiIOK8VLxglJ94AAACgPeK8VrxglJx4A4B+ECgBQEdYrqEJrHgBAABAe1iuoQk8hwDQDwIlAOiIZ8+eFRg1C0oAAADQHpZraIJ4Di15AUD3CZQAoCOEITSFZxEAAADaYX19vUATCJQAoPsESgDQEU680RSeRQAAAGgHC0o0hTNvANB9AiUA6Ij9/f0CTfD9998XAAAAoPkESjTF9vZ2AQC6TaAEAB0hCqEpnHgDAACAdnBWi6YQywFA9wmUAKAjRCE0hTUvAAAAaAdRCE0hlgOA7hMoAUBHiEJoCs8iAAAAtIMohKbwLAJA9wmUAKADBCE0iecRAAAAmk8QQpN4HgGg+wRKANABghCaxPMIAAAAzScIoUk8jwDQfQIlAAAAAAAAAAAgjUAJAAAAAAAAGBkLSgDQfQIlAACG6tmzZwUAAAAADkqgBADdJ1ACAGCojh8/XgAAAAAAAGBAoAQAwFAdO3asAAAAAMBBXbhwoQAA3SZQAgAAAAAAAAAA0giUAAAAAAAAAACANAIlAOgAJ7UAAAAAOIzTp08XAACoi0AJADpAoESTnDhxogAAAADNJlCiSS5cuFAAgG4TKAFAR4iUaArPIgAAALSDSImm8CwCQPcJlACgI0QhNIVnEQAAANpBFEJTeBYBoPsESgDQEWNjYwWawIk3AAAAaAdntWgKzyIAdJ9ACQA6QhRCU4jlAAAAoB1EITTF1NRUAQC6TaAEAB0hUKIpnHgDAACAdhAo0RROvAFA9wmUAKAjBEo0xfj4eAEAAACaz2oNTTE9PV0AgG4TKAFAR0xMTBQYNc8hAAAAtIcohCbwHAJAPwiUAKAjLCjRBM67AQAAQHs48UYTOO8GAP0gUAKAjogwRBzCqDnvBgAAAO0RYYhIiVGzoAQA/SBQAoAOOXXqVIFR8gwCAABAu4hDGLWPP/64AADdJ1ACgA5x5o1R8wwCAABAu1hQYtQ8gwDQDwIlAOiQkydPFhiVODHoxBsAAAC0y6VLlwqMSpwZtOIFAP0gUAKADnFei1GamJgoAAAAQLs4r8UoiZMAoD8ESgDQIbFg48QWo2LBCwAAANonFmyc2GJULHgBQH8IlACgY+JDJRgFC14AAAD8P/buLlbL88wP/WVjg8FgMNgkuCZgO7GdOlMDldqMc5BFlbSTSo3hoGlyUAHZk3pvzUgsEk3mkLVOKs3MAWupGWlmS2NAW1UymkhAVLWT2JKxtJ1mtOVhRYqU2GkcPHZFywQPDgRiEuTN9ay8Cbb5WB/v/bzPx+8nvXrBib/Wx7P8/J//fV20044dOwJGwQQvAOgPBSUA6Jjly5cH1C2nd5mgBAAAAO30+OOPB9QtD1qaoAQA/aGgBAAdY4ISo2B6EgAAALSXCUqMgnISAPSLghIAdExOslEWoW6KcQAAANBeJtkwCk8++WQAAP2hoAQAHbR69eqAOlnvBgAAAO1mihJ1U4oDgH5RUAKADjLNhjrlxK6lS5cGAAAA0F6m2VCnLCdt3rw5AID+UFACgA7Ksog1b9Rl3bp1AQAAALRblkVMtKEuu3btCgCgXxSUAKCjrNyiLr7WAAAAoBsUlKiLrzUA6B8FJQDoqPXr1weUZr0bAAAAdMfevXsDSrPeDQD6SUEJADpqyZIl1rxRnPVuAAAA0B1r1qwx2YbirHcDgH5SUAKADtuwYUNAKcuWLYu1a9cGAAAA0B379+8PKCUnJ+3evTsAgP5RUAKADlu5cmU1SQlKyK8vAAAAoFtyglJOUoISTOgCgP5SUAKAjlu/fn1ACSZ0AQAAQDeNj48HlGBCFwD0l4ISAHRcFpRMUWLY1q1bF0uXLg0AAACge/bu3WuKEkOXq91yxRsA0E9LNmzYMBEAQGfdeuut8ctf/jJ+9rOfBQzLsmXL4he/+EW8/fbbVQEuv84AgP546qmnAgDorjvuuCP+9//+3/Gd73wnYFiynJRfVz//+c+rAlx+nQEA/XFbAACddfny5bh48WL1DsN09uzZ6jWwYsWKaqLS6tWrq18vX748AAAAgPbJ+/2ZmZl33PfDMBw9erR6DWzZsqUqLe3YsSMef/zx6vcAQHfdsm3btrcDAOiM8+fPx7lz5379DqOQZaUsKmVhadWqVdbBAUDHvPjiiwEAdMfx48fj+eefr97zBaOQZaUsKWVh6eMf/7h1cADQMQpKANByOR0py0iDiTamJdFEWVZauXJlNb473wGAdlNQAoB2ywwpi0jHjh2rJtqYlkQTZVlpbGwsnnzyyeodAGg3BSUAaKEsIb355ptx5syZuHDhglISrZLTlHKq0rp165SVAKClFJQAoH2yhJRlpMOHD1vhRuvkNKUsKe3atUtZCQBaSkEJAFoiS0gXL16MU6dOKSXRGYOy0oYNG6yBA4AWUVACgHbIElKWkSYnJ5WS6IxBWWnv3r3VlCUAoB0UlACg4Qbr23JaklISXZZr4O69996qsKSsBADNpqAEAM02WN926NAhpSQ6LQtK4+Pj8fGPf7wqLgEAzaWgBAANlEWkLCTlGrdz584F9E2uf7MCDgCaS0EJAJoni0i5vi3XuGVBCfpm9+7dVsABQIMpKAFAg5iWBO+Uk5Ry/ZupSgDQLApKANAcpiXBO+UkpYmJCVOVAKBhFJQAoAGykPTGG2+YlgQ3kBOVsqykqAQAo6egBACjl5OSpqenTUuCG8ipSvv371dUAoAGUFACgBHJCUmnT5+uXqYlwdzlNKW1a9dWhSUAYDQUlABgNHJCUpaSpqamTEuCeci1b4MVcADAaCgoAUDNLl26VJWSrHGDxRmsf1NUAoD6KSgBQL1OnjxZFZOscYPFGax/U1QCgPopKAFATc6fPx+nTp2yxg2GLItK69evjzVr1lj/BgA1UVACgHrk+rbJyUlr3GDIsqg0Pj4eTz75pPVvAFATBSUAKEwxCeqR5aRc/5ZTlRSVAKAsBSUAKEsxCeqR5aRc/7Z//35FJQAoTEEJAApRTILRybVvikoAUI6CEgCUoZgEo7N7925FJQAoSEEJAIZMMQmaQ1EJAMpQUAKA4VJMguZQVAKAMhSUAGBIFJOguRSVAGC4FJQAYDgUk6C5FJUAYLgUlABgkRSToB2ynJRFpXwpKgHA4igoAcDiKCZBO2Q5KYtKu3btUlQCgEVSUAKABbp06VJVTDpz5kx00ZoVEWcvBHROlpNymlIWlQCAhVFQAoCFOXnyZFVMOnToUHSRPImuynLSxMREVVQCABZGQQkA5uny5ctx+vTpqpwEtJeiEgAsnIISAMzP2bNnY3p6uio4AO2lqAQAC6egBABzNCgm5St/DXRDFpUyXFq5cmUAAHOjoAQAczMoJk1NTVW/Brohs6SDBw/G2NhYAABzo6AEAHOQa9xyYlKudeu6zffMjuNOM38X9NjYo7Nj2U/+pB/j2XOSUk5UysISAHBjCkoAcHO5xi3XueVat66TJzHQtzxp9+7dsX///qqwBADcmIISANzA+fPnq2LSuXPnomsyNMrAYPO6iMc3Xvn1I7Nh0sCxExE7vhL0VH4t/PiPfvP7DJRmXpt9vfqT2ffjP4hOWr9+ffVSVAKA61NQAoDrO378eFVMyveuuVmedPyliO1/HPRUn/Ok8fHx2Lt3r6ISANyAghIAXEOucHv99deryUldMQiQPn4lONqx5Z3h0bUceiFiz9NBj739Fzf//2Tw+PxLs+9dCpiynJTTlHKqEgDwXgpKAPBeucJt37591eSkrpAnMV99zpOynDQxMRG7du0KAOC9FJQA4F1yYtLp06erklLbZWi0Y2vEk1tnT7TNx+Q3IiaOBT2WJ95uFjxeLU/FHT0xGzDlexfGeGdR6eGHHzZNCQDeRUEJAN4pJyZNTU1VJaW2kyexGPKk2aLSkSNHYsuWLQEA/IaCEgD8Sq5zO3nyZFy6dCnabMsHZgOk3U/MLwx4t51/eiUU+Nugx478/mwguVAZKuWqwC6ESzlJKScqKSoBwCwFJQCYlWvc9uzZU2VKbSZPYlgWmyflVKXDL3QjT9q9e3fs37/f2jcA+JXbAgB6LgtJuc6tzSfcctz23k/Onmqb78m26zn5k6DnXl3khsMMo/J1MGZHvB+baW9Imesez507Z+0bAAAAlcyRsph09OjRaCt5EiUsNk8afD1mnpQlpcPfbm+elOses8Ro7RsAzDJBCYBey1VuudKtrevcxh6N2P/p4YVIV7vl/wh6bvfHroRBn4+hyqAyT8LlyPe2hpbWvgGACUoA9Nv09HRVOGjrYTd5EiXJk64tpyg999xzpikB0GsmKAHQS7nOLYtJORGlbQan28Y/MfvrEvKGH2b+LoYux8Tvvmc2rBqM7M7pSm2SU9e+973vxfr166uJSkuWLAkAAAC6b2ZmJvbt21dNRGkbeRJ1kSddW66BfOCBB2J8fLxa+7ZmzZoAgL4xQQmAXslJSVlMyslJbVPydNu7TT97JbD6akD8w38qF1wOtPkUXE5RsvYNgD4yQQmAPslJSZOTkzE1NRVtI09iFORJN5ZTlKx9A6CPFJQA6I2cmpQnVXL6SVvkjXyeDNp15bVlY9Rm55+2d7c7w/Xcl+sJMQfy9Nvhb18JmH4QrZIFpSwqWfsGQF8oKAHQFzktac+ePVWm1BbyJEZNnjQ3u3fvrqYpWfsGQF/cGgDQcTk16fXXX4+XX365NeWkDJL2Pxnx4z+KOPDZesOkVGIUM+30fM3j2TNAfe4PIk5MzP66Lc6cOVNdY/IdAACA9supSbnObfv27a0pJ8mTaIpjJ6JWbc2TDh06VF1jDh8+HADQByYoAdBpbZualPvU937yyo30E+XHIF/PzGsRWycCKnnaLU+9jUqO6M5R3XkSri1MUwKgD0xQAqDL2jY1KfOknJY0/gl5Es0gT5o/05QA6AMTlADopLZNTcog6eDnZ0+4jTJMSnVPzKHZjl/5ejh7IUbm6u+NtpyAM00JAACgndo2Nenqe+aJT8uTaA550vyZpgRAHygoAdA5OTXp+9//fpw+fTqabuzR2dNETbpZPvq3Ae9wbCZGrm3BUhYjX3311erVlgluAAAAfZZTk7Zu3RpTU1PRdPIk2kCeNH9ZjMxJSm2a4AYA86GgBEBntGlqUt4cZ5CUu9Fz5HFT5Mmm40688S7HfxCN0bZgyTQlAACAZmvT1KS8Jz7y+/Ik2kGetHCmKQHQVQpKAHRCW6YmXX0z3KQgaeDoiYD3aOLXRZuCJdOUAAAAmqktU5OuvgfesTUaR57EtciTFsc0JQC6SEEJgNZrw9SkNSsiDnyu+Te/TRi9TPM0+SRkm4KlwTSlLFQCAAAwWm2YmiRPos3kScMxmKaUhUoAaDsFJQBaKwtJTZ+alEHS/idnb3bHPxGN16TRyzTLsYafhmxLsJTXrSwpnTp1KgAAAKhfFpKaPjVJnkRXyJOGI69bWVKanJwMAGizW7Zt2/Z2AEDLZCkpH/Bfvnw5mmrvJyMmPj0bKrXBoRci9jwdcE35dfwP/ylaI0/o5dfzyZ9EYy1dujQefvjh6h0A2ubFF18MAGib6enpmJiYiLNnz0ZTyZPoEnnS8G3evDmee+656h0A2sYEJQBaJQtJr776arXWranlpLFHZ0/dTH22PWFSMo6bG2nyWO5rGXtk9vswT8HlabgmasMUOAAAgC7IQtKePXtifHy8seUkeRJdJE8avsEUuCxcAkDbLNmwYcNEAEALXLx4sVqNdP78+WiiLRsjvvp/tuuU20CeCvq//p+AG7rlymvH1miVLR+IGP9kVP/wzzcwEHv77bfjpz/9aVVWWrVqVdx6q/MDALTDU089FQDQBjMzM9VqpOPHj0cTyZPoOnnS8P385z+Pv/7rv64O8o6NjcUdd9wRANAGnoAA0Ao5YSQnjeRD/KbJ8OjA5yJOTMyesmmjNp1kYnSOnpg9+dZGGfTmCbjdH4tGOnPmTGOvcQAAAG2VE0Zy0khOHGkaeRJ9IU8q59ChQ429xgHAtSgoAdBoucbtlVdeqVa6NdHeT87epI5/Ilrt8AsBN5Vh0uFvR2vlaO4c0Z3hbxPHdGc56Xvf+56VbwAAAIuUa9x27txZrXRrInkSfSJPKivLSQ888ICVbwC0goISAI2VK91yokiGSk0z9mjEc1+OmPps+8Zvv1uO43bijbk6+rfRejk+P4PgPKnaxGApC5n5yoImAAAA85Mr3XKiyNGjR6Np5En0lTypvCxk7tu3r5FZOgAMKCgB0Eg5QeTll19u3Lqjwfjt5/6gveO3323yGwFzluHjzGvRCXlSNb+Xmzimu8lrLQEAAJoqJ4hs3769ceuO5En0nTypHlNTU1a+AdBoCkoANE5Tp4fkTWcXxm+/m9NuzNexE9EZgzHdR36/eaffspyURc0333wzAAAAuLGcHJITRJo2PUSeBLPkSfXIclIWNZs4RQ4AFJQAaIx8GJ8TQ3JySJPkTWaO386bzraP3363Qy/MjuSG+Zh6JuLsheiUHVtnA+P9T0aj5HXxRz/6UZw6dSoAAAB4r3wYnxNDcnJIk8iT4J3kSfXJ6+LOnTtjcnIyAKBJFJQAaISLFy9Wk0LyvUny5vLE/u6M3363wy8EzFuGSV09KTnx6dlgqWmn37Kg9MorrzRushwAAMAozczMVJNC8r1J5EnwXpkndWmK0tWamidNTExURaWmTZYDoL8UlAAYuZyYlJOTclJIU2zZeCVImpi9uezaKbeBPOlmHDcLNf1MdFaGSRkqHfhcs77/M0xq2rUSAABgVKanp6vJSTkppCnkSXBjhzpcbmtqnpSr3pp2rQSgvxSUABip119/vXo1Rd485k1khkkZKnXZ5DcCFizDyK4HkuOfaN6J1ywnNXHaHAAAQJ327dsX4+Pj0RSZJ1VTkybkSXAjfcqTdmyLxshyUhOnzQHQPwpKAIxErin64Q9/WE1PaoqxR2dvHvMmsuvytNvRjo5Upj5dHct9tTz99tyXIw5+vjmn37KklJOUmnT9BAAAqENOls11RVNTU9EUgzwppyZ1nTyJYejDisDMk4783mye1JS1b1lSyklKOX0OAEZFQQmA2g0erp87dy6aIqcmPfcHzdsTXkqeVMq977AYOZa7L19Huz/WvGlKOX3u1KlTAQAA0AeDh+u5rqgp5Ekwf1ly61OelNeIJuVJOX1ucnIyAGAUlmzYsGEiAKAmuZbof/yP/1GVlJogx27/ty9G7NgavbLzTwVKLN7PfxGxfGmzQpaScoJSBktr7oz4m1dm//1H7fz589X1dNWqVXHrrc4eAFCfp556KgCgLrmW6FOf+lRVUmoCeRIsnDwpRu748ePx6quvxtjYWNxxxx0BAHXxFAOA2uQY7pdffrkx5aS9n4w4MTEbKvVJTr3JkdwwDFPP9C+czDWQOU2pKSdkz5w5U63MbMq1FQAAYJhyYtL27dsbU06SJ8HiyZNG79ChQ426tgLQDwpKANTi9OnT8corr8Tly5dj1PIm8LkvX7kR/mz0Uh/2vFOfDJOOnYjeyevIj/8oYv+T0QgXLlxoVAEUAABgGKanp2Pnzp3VobdRkycFDE3mSYe/Hb3TtDwpp9MpKQFQJwUlAIo7depUvP7669EEuz42e1KlLyOE3+34S7MvGKZDPQ4pJz49Gyw14fRblpOUlAAAgK6YnJyM8fHxaAJ5kjyJ4Tv0/0ZvNSlPynKSkhIAdVFQAqCoLCfla9Ry1/eBz1258f387K/7ymk3Suh7UJlhUgbVuz8WI5flpO9///tx8eLFAAAAaKssJ01MTMSoyZNmyZMoYeY1eVJT8qQsJ23durWaqAQAJS3ZsGHDRABAAa+++mq12m3UtmycHcH9Ox+JXjv5k4g9TwcU8epPmhGojModt0fs2HolsL4z4m9eifj5L2Jk3n777fiHf/iHWLp0aSxfvjwAoISnnnoqAKCEPXv2xNTUVIyaPGmWPImS5EnNyZN+/vOfx1/+5V/GlefGsWXLlgCAEkxQAqCILCedOXMmRm3vJyNOTDRjXO6oTX4joBjj3meNf2L29NuorzmXL1+uTr+98cYbAQAA0BZZTjp06FCMmjzpN+RJlCRPmtWUPOns2bOxe/fuOHz4cABACQpKAAxVPhT/4Q9/OPJyUo7dPvL7EVOfDWL2tNsh47gpbPJYELNh0o//6Eq49MkYuSwpNWGSHQAAwI3kQ/Ht27ePvJwkT3oneRJ1kCfNalKelCWl6enpAIBhs+INgKHJctLLL78cP/vZz2KUBiO4P/pQ8Cv7vja71x1KOnkmYuxRJ0wHcg1AE0Z0//SnP63eV61aFQAwLFa8ATAsg3LSd77znRgledJ7yZOogzzpnZqSJ/31X/913HLLLTE2NhYAMCwmKAEwFINy0sWLF2OUcgR3hkluaH/DaTfq5NTbOzVlRPepU6eqFwAAQJMMykkzMzMxSvKk95InUSd50js1JU+amJiIycnJAIBhUVACYNGaUE7KEdwHPjc7gjt/zW9MfiOgNsdfcrry3TJMylBp98dipJSUAACAJmlCOUmedH3yJOqUeVK++I2m5ElKSgAMkxVvACzaSy+9NNJyUt6s/bd9ETu2Bu+Sp932PB1Qq7d+4fvx3e64/Vcfk1sinh9h4Hb+/PlYtmxZLF++PABgMax4A2CxPvWpT410rZs86frkSYzClcjE9+O7NCVPOn78eDzwwAOxZcuWAIDFMEEJgEV59dVXR1pOyv3kz/1BxJaNwTU47cYo5Aj4DDN5r4lPRxz5/dGezD158mS88cYbAQAAMCp79uypHniPijzpxuRJjII86foGedIoV77t3r07Dh8+HACwGApKACzY66+/HmfOnIlR2fvJ2TBp1Lu4mypv6PPGHkZBmHl9efItR3SP8tqVJaWcpgQAAFC3ffv2xaFDh2JU5Ek3Jk9ilORJ15d50qivXVlSGmW5FID2U1ACYEFOnToVp0+fjlE58LmIqc8GN+CGnlFy6u3GMkzKUGnskRiZH/3oRyOdgAcAAPTP5ORkTE1NxajIk25OnsQoyZNubJAnjXIV3s6dO2NmZiYAYCEUlACYtywn5WsUci3Sc1+OGP9EcANOu9EE+74W3EAVKl25nu1/Mkbi8uXLVUnp0qVLAQAAUFqWkyYmJmIU5ElzI0+iCfY8HdxA5km57m1UedLZs2erklJO5waA+VJQAmBe8gZkVOWkvPnKtUijnDjSFk670QRHT0Qcfym4iYlPjy5UynLSyy+/XJWVAAAASjl69OjIyknypLmTJ9EEmSXJk25ulHlSlpO2b99ePSsAgPlQUAJgzvJB9quvvhqjsGXj6Hdst4XTbjTJ5LFgDjJUytNveaq3bnltf+WVVwIAAKCEfJC9Z8+eGAV50tzJk2gSedLcjDJPymt7TlICgPlQUAJgTkY5ZWPXx2bHcAuT5sZpN5rEqbe527F1dNe6c+fOxeuvvx4AAADDNMopG/Kk+ZEn0STypLkbZZ50/Pjx2LdvXwDAXCkoATAnP/rRj6qSUt32fjLi0OdHcwqkjZx2o4mcepu7UZ7uPX36dPUCAAAYlpyukSWlusmT5keeRBPJk+ZulHnS1NRUTE9PBwDMhYISADd16tSpuHjxYtQtd2hPfTaYB6fdaCKn3uYnw6RRhUqjut4DAADdMzk5GTMzM1E3edL8yZNoInnS/IwyTxofHx/J9R6A9lFQAuCGzpw5Uz2wrluGSblDm7lz2o0mc+ptfjJMOrF/9gRcnXKNZ07MG8U6TwAAoDsOHToUExMTUTd50vzJk2gyedL8jCpPSjkxbxTrPAFoFwUlAK4rV7qNopx04HPCpIVw2o0mc+pt/nIVwXNfrj9Uymv/q6++GgAAAAuRK91yelLd5EkLI0+iyeRJ8zeqPCmv/Xv27AkAuBEFJQCuK6do5IPqOh38fMT4J4J5yht1p91ouj1PB/OUodKJiYhdH4ta5Ym306dPBwAAwHzlA+p8UF0nedLCyJNoA3nS/I0qTzp69GhMT08HAFyPghIA15STky5evBh1yjBpd803TV3hRp02yLHx088EC3Do8/WHSvlzoO6SKgAA0G45Oen48eNRJ3nSwsmTaAN50sKNIk/K9Z51l1QBaA8FJQDeYxSr3YRJC5cn3fJGHdpg4hsRZy8EC1B3qHT58mWr3gAAgDnLB9L5YLpO8qSFkyfRJvKkhas7T8qp3Fa9AXA9CkoAvMfrr78edRImLc7kNwJaI8Ok6WeDBcpQacfWqM25c+fizTffDAAAgJvZt29f1EmetDjyJNpEnrQ4dZeUcpJernsDgHdTUALgHc6cOVOdcqjL/ieFSYvhtBttNPWMU2+LkSH8lo1Rm9dee62apgQAAHA9hw4dqvVhtDxpceRJtJE8aXGmPltvnpSl1TqfMwDQDgpKALxDnavdMkya+HSwQBkkOe1GG2WYNHksWKA1KyKe+3J9oVKu/Tx9+nQAAABcz+TkZNRFnrQ48iTaSp60OHXnSbn2c3p6OgDgards27bt7QCAmJ2e9Oqrr0YdhEmLt++rEVOFRxv7PPXXA39Y/jTliYl6T251TX5+tv9JPadelyxZEh/5yEeqdwBIL774YgBAyulJe/bsiTrIKRZPnkRJ8qTmqzNPWrNmTfz4xz+u3gEgmaAEQCUnZNQ1PSn3XQspFidvIEuHSZvv8XnqswOfjeIyFGXh8nv0uT+YfS8tV7zVOWEPAABoh5yQUdf0JHnS4smTKC3X0pcmT1qcOvOkXPFW54Q9AJpPQQmASj54zpJSaXm65VANN6pdV8co7v3CpF7bsTVi7JEo6vhLsy8WLsOkI78ftcg1b+fPnw8AAICBfPCcJaXSMk+aquEgTdfJkygtsyR5UvPVmSdNTU3F8ePHAwCSghIAVTEp17uVVueNT5fNvBZx6IUoKj9Xuz8W9FyOZC/NqbfFy6D+wOeiFqYoAQAAA1lMyvVupQ3ypDUrgkWQJ1EXeVI71JknmaIEwICCEgDx8ssvRx3qGh3bdTu/EsU57Uaq49RbBqTTzwSLNP6JK69PRnHnzp2rpdAKAAA0386dO6MO8qThkCdRF3lSe9SVJ+UEpcOHDwcAKCgB9Fw+aK5jtVuexhAmLV6edDv5kyjKaTeuVsept4lvRJy9ECzSgc/Onn4r7fXXX4/Lly8HAADQXzk5aWZmJkqTJw2HPIm6yZPao648aXx8PM6ePRsA9JuCEkDP1bGuJ8OJPI3B4uQN9+Q3oriDnw/4tTzxtmNrFJVf29PPBkNQx9qDLCedPn06AACA/qpjXY88aTjqypOy5AADdeVJk8eCIagjT8py0vT0dADQbwpKAD1Wx/SkPD1lvPNw5Nji0qfdMvwrPYKZ9qkjZJw4Vv7ruw+qa24NpxSzoGSKEgAA9FNOTzp58mSUJE8anjrypB3bypdRaJ868qSpZ+VJw1BXnjQ1NWWKEkDPKSgB9Fgd05MyTDKKe/HyRnuihtNuwj+uJb+HJ2oIKfY8HQxBnjAuXTQ0RQkAAPqrjulJ8qThqCtPOvDvAt5DntQudeRJpigBoKAE0FN1TE/KaTx2zw9HHaO483Ml/ON69n6i/Kjn4y/Nvli8OlY1KigBAED/HDt2rPj0pJzGI08aDnkSoyZPapfMk0p/vnKKEgD9paAE0FNvvPFGlGYaz3AcemH2VZrPFzeS4cT4J6O4PPV29kKwSHWcUswpSsZyAwBAv9TxYNk0nuGQJ9EE8qR2yTyp9Ocrs6SjR48GAP2koATQQzk56dy5c1GS01PDU8dpt9wx7vPFzeSpt9JfJzl+fvrZYAjqOKX493//9wEAAPRDTk46fvx4lCRPGh55Ek0hT2qXOvIka94A+ktBCaCHTp06FaU5PTUck8dmb7BLqk7GfCLgpjKcOPDZKG7qmfJf931QxynFLLtevHgxAACA7pucnIzS5EnDIU+iSeRJ7VJHnpRl15mZmQCgfxSUAHqo9PQkp6eGI2+op2o4+ZPhX+lTMXTHjq0RY49EUTmSe9/XgiGo45SiNW8AANAPpacnyZOGQ55EE8mT2iW/v0tfj48dOxYA9I+CEkDPnD9/vlrxVkreuEw47TYUOYq79O70/Hzl+HSYjwyNSzt64kr4/VKwSBkWH/x8FHX69OkAAAC6LctJueKtFHnS8MiTaCp5UruUzpOmpqYCgP5RUALomTNnzkRJRnEPR95MH3ohiit9o0k35Ym3OoLIPU8HQ5Cfr5KnFC9fvlyVXwEAgO46fPhwlCRPGo6Z1+RJNJc8qV1K50k5kbv0ZD4AmkdBCaBnSq53G3vU6alhqWMccX6uSo9WprvqGOWeY+nz5CeLVzo8Lr06FAAAGK2SD5HlScOz8ytRnDyJxZAntUvpPMmaN4D+UVAC6JHS692cdhuOyWOzN9Kl+XyxGDnOffyTUdzUM/V8P3Rd6fH7b775ZgAAAN1Uer2bfGI45Em0gTypXUrnSSYoAfSPghJAj5SenuT01OLljfPUs1Fc7nzPG0xYjL2fKP91dPZCPRPF+mBXwUDpwoUL1ao3AACge55//vkoRZ40HPIk2kSe1C4l86SZmZlq1RsA/aGgBNAjOUGplF1PBEOQ44fzBrqk6qTSJwIWLUdyH/hsFHf0RMTxl4JFytC/ZPAvUAIAgG4qOeFCnjQc8iTaRJ7ULqXzJGveAPpFQQmgR0pNUCo96rUvDr0w+yqtjl3v9MeOrfWcdt3zdPmwtQ/2FhyjfvHixQAAALqnVEFJnjQc8iTaSJ7ULiXzpJyiBEB/KCgB9ETJ6UlGcQ9HnnYrbcsHhH8M34HPRXE5rn66hnH1XZfX61KBcsmfMwAAwGiUnJ4kTxqOOvIkZTJKkCe1R8k86ejRowFAfygoAfTEhQvljorsElAs2uSx2Rvm0o78XsDQbdkYMV7wJNXA1DP1fJ90WYZJeUqxhPw5c/ny5QAAALrju9/9bpQiT1q8uvKk5/4gYOjkSe1RMk86efJknD17NgDoBwUlgJ64dOlSlJA3J068LU7eIE/UcNotT7rliTcooY5R7zmSO0dzszgfL3jNLvWzBgAAGI18cFyCPGnx5El0gTypPUrmSaV+1gDQPApKAD1x8eLFKEGYtHh13CBnkJQ3/FBKhkn7n4zijr8UcfiFYBFKnXhLJaf1AQAA9ZuZmYkS5EmLJ0+iC+RJ7VEyTyo5rQ+AZlFQAuiJUg+Nxx4NFuHQC7M3yKVlmOS0G6WNf6KekHn8a7On31iYDP9KXQ9KlWEBAIDRKFZQkictijyJLpEntUPmSVs+EEWU+lkDQPMoKAH0wOXLl6tXCY9vDBYoR3FP1jCKO4OkHMcNdajj1FuGSZPHgkUoFfyV+lkDAADU7+zZs9WrBHnSwsmT6CJ5UjtsKXTtLvWzBoDmUVAC6IFLly5FKVsESguWYVKGSqU99wcBtcniy/gno7ipZ+s5LdpVpU68maAEAADdcfLkyShFnrRw8iS6SJ7UDiYoAbBYCkoAPVBqokWGSTnalfnLG+FDNew9z9NuRnFTt72fiFrseTpYoM3roohf/vKXAQAAdEOpiRbypIWTJ9Fl8qTmK5UnmaAE0B8KSgA98NZbb0UJa+4MFsiNMCxeXWPtu6jUOoWSE/sAAIB6lZqgJE9aOHkSLJ48aeFK5UklJ/YB0CwKSgA9UGqCUqkTE12Xu87rGMUNfTD1jO+nhXASFgAAuJk333wzSpAnLYw8CYZHnrQwJfMkU5QA+kFBCaAHihWUPOCet7zxnXBCB4bm7AUnSBeq1EoFU5QAAKAbSj0stt5t/uRJMFzypIUrdQ1XUALoBwUlAKjR9j8JYMiOvxQx/UwwTx4KAAAAo+BeZP7kSTB88qSFcQ0HYDEUlACgJtNGB0MxeZLU9xcAAABdI0+CcuRJAFAvBSUAqIFR3FBWjube97UAAACAzpAnQVnyJACol4ISANRg8huzN7xAOUdPzI7nBgAAgC6QJ0F5mSflCwAoT0EJAAo79MLsCyhvz9PC27nycQIAAGgueRLUJ6coyUnmxscJgMVQUALogSVLlkQJ9nPfXH6MJo3ihtpU33PHgjkoFSgtXbo0AACA9luzZk2UIE+6OXkS1EueNHel8qRSP3MAaBYFJYAeKFVQclri5jJMErxBvaaetertZlyXAACAm1m9enWUIE+6OXkS1E+edHMlr0sKSgD9oKAE0AOlCkozrwU3YBQ3jI5Vbzd28kwUYXoSAAB0x9133x0lyJNuTJ4EoyNPurFSedLmzZsDgH64LQDovGXLlkUJTnJdX1NGcec/xy3/R0DvDEZzH/hccA3fLfRA4Lbb3F4AAEBXbNq0KUqQJ12fPAlGS550Y6XyJNOTAPrDBCWAHig1QSk59XZtRnHD6BnNfX2lrk8mKAEAQHeUnGghT7o2eRKMnjzp+kpdnxSUAPpDQQmgB/KBcamS0ncFSu9hFDc0h9Hc1zbzd1GEghIAAHRHPjAu9dBYnvRe8iRoDnnStZXKk7Zs2RIA9IOCEkBPlHpofPwHwVWaMoobmJXfkxkq8RsZsJU6CaigBAAA3VJqipI86Z3kSdAs8qRrK5UnlZzYB0CzKCgB9MSKFSuihKMngqts/xOjuKFp8jo1/UzwKyVXKZT6WQMAAIxGqakW8qR3kidB88iT3qnk2rvHH388AOgHBSWAnli+fHmUUHISR9vs+6owCZpq/GuuVQOHC64MKPWzBgAAGI1SBSV50m/Ik6C55Em/UTJPsuINoD8UlAB6ouRUi+fdpMXksYipZwNosBzNLfQtF6zlz5klS5YEAADQHSWnWsiT5EnQBvKkWaXypCwnrVmzJgDoBwUlgJ4oOdXiUMHTE22Q434nvhHAAmWppY5iS4ZJOTY/T+r2VYZJpUK1pUuXBgAA0C0lp1rIk+RJsBh33XVX9SpNnlQ2T9q8eXMA0B8KSgA9kQ//S5WU8uakr6NuZ16bPUUDLFxen+65556oQxUq/XH0Vslx3E67AQBA9+R/55cqKcmTAliE1atXxxe+8IWogzwpinnyyScDgP5QUALokVWrVkUpOZK6b/LGdOdX+n16BoZl/fr1cccdd0Qd+hoE5zWr5AnlkpP6AACA0RkbG4tS5EnAYnzxi1+Mxx57LOogTyqj5KQ+AJpHQQmgR0pOtyg55rWJBqN97R+HxRusd7vvvvuiLhms9C1UKnnabdmyZQpKAADQUSWnW8iTgMWanp6OusiThivXuykoAfSLghJAj+TD40ERoITJb0QvCJNguAbXpZUrV1aTlOqSoVJfTutWp92+HcXk5w4AAOimfHhc8tCbPAlYiI0bN1bvjz/+eIyPj0dd5EnDU3JCHwDNpKAE0CNZAlixYkWUkjdnXQ9ZhElQ1oYNG6ppPHWZuBKE7/tqdN7hwtfndevWBQAA0E1ZTir5EFmeBCzW/v37q2k8dZEnDceuXbsCgH5RUALombVr10ZJXR5xK0yC8rJIuWnTpqjT1LPdv3ZNFDyRnIUyE5QAAKDbSq55S/IkYDGySHnw4MGokzxpcbJQZoISQP8oKAH0TN6slVzzdvyl2VfXzLwWsXVSmAR1qHvVW8oTu9v/OOLsheic0usSlJMAAKD7duzYUXTNmzwJWKwsu9S56i1lnrR1Qp60EMpJAP2koATQM1lOKhkopTw50qWbssMdvtGEJrj99tur91tuueXXf+z+++8vupLyWjIM71pwnEFZvkqy3g0AALovs6Tdu3dHSV3Mk7p6EAaaILOjdNttt/36jx04cCC2bNkSdepiEbGOPMl6N4B+UlAC6KHSD5PzZmzyWHRC/nvsHsGoXg/8IeLBBx8sOvHtWgaj9zNcarvqWlz4tJv1bgAA0B+l17x1MU+qu5yUJbLSBxOh6Y4cOVL794E8aX6sdwPoLwUlgB7Kh8mlJ5PkDu7pZ6K1MkDa+ZWye7avJx/4b9iwIZYuXRrQB4Ov9asnKA3+eAYWdcsgJqemtfkalvL0cenTe3mtAgAA+iEfJpd+oCxPWri8f96/f7+CEr2xcePG6v3dh9vye+HgwYNRN3nS3OW1CoB+UlAC6Km1a9dGaRnGtPHUyGAs79ETUbscSfyhD32oKmbUPTkGRuVGX+urV6+O9evXxyiMfy1i31fbOY4/T+vmyrqS8vNmehIAAPTLjh07ojR50vxlKem5556rihkKSvTFXXfdVb3feut7H3XmtWp8fDxGQZ50c6YnAfSXghJAT+UKsdIFmMGpsTbt384TLtv/eHT/zO9///t/PU0mJylBH9x+++3V+7snKA3cf//9sWrVqhiFPL2bAXObrmMZJtVxWjdDb5PeAACgX3bt2lW8ACNPmr+cRjKYQDyKScQwCpkXpetl3AcOHBhZEaaNeVJex+rIk3IVpesUQH8pKAH0VN641TGVZLB/u+k3Y9U/5x/PnnAZ1emWXJV09efEBCX6Yi5f6w8++ODISnt5fXjgD2eLP013+IX6VglY7wYAAP2T5aQ6ppLIk+Yuy0lXf05MUKIvcup2utYEpYEjR46MrAzTtjwpr2N1sN4NoN8UlAB6LMswdZRgmh4q5emQPNFSx/ja68mJVu9+2G8yCX0xl6/1vFbl+sNRFvey+JPBUlOvZRkm7X46apHXLNcoAADop71799ZSgpEn3VyusZqYmHjHHzOZhL7YuHFj9X6jrGiw/nCUxT150m+YngSAghJAj9U1RSk1MVTKAGnUp9zSihUrfj2S+Goe/tMXN1vxNpDfEw8//HCM0tWn30Z53Xi3OsOkZHoSAAD0V11TlJI86fq2bNkSBw8efM8f37RpU0Af3GzF20AWYkZdUpInzTI9CQAFJYCeq2uKUmpKqJQ3gfu+OhsmjfKUW8qVVbm66lqfgywuQdctX768er9ZOenq/38TTlrl6bc8KZtBzqhluFV3OUmBEgAA+i2nKNV1byZPeq/82OfqqmsVLrK4BF332GOPVe+DQ283k98XBw4ciFHrc55U588NAJpLQQmg57IYMxiHW4cMk/ImLMdg1y2DpLzxytMqU8/GyGU5KVdWXe9BvwIAfbCQguTatWtrvW5dT17PMsjJa8oogqW8pu15ejbcqktet3K9GwAA0G9ZjKlzEoY86TcG02Cu96BfAYA+WL16dfU+1wNvKdeLNaGk1Mc8Ka9LdU3eA6DZlmzYsGEiAOi1nEhy/vz5uHTpUtTh57+I+OvvRbx55Wboow9F3DG3gy4Lljddf/RfIz73f8/+ffPvP2o3KyelW2+9NU6fPh1vv/12QFfdddddsWrVqurrPV9zdeedd1bvee0atbzGHD1xJVT6dsTdKyK2fCCKy9O6n5qq/9RuFsNWrlwZAPDUU08FAP2WE0mef/75OHnyZNRBnnTzclK64447Ynp6On7+858HdNXv/M7vxNjYWJVrZ846Vx/96Eer97x2jdoo8qSZ12Yn0tWdJ2UxLD9fAKCgBEAl14n95Cf1zsr+zisRf/n/lbsByxutfV+bPRGSv25CkJTmUk4aOHfuXG3FMRiFe++9t/qeyElK8zn1lrLYlJpQUkpXB0sZmG++J2LNkDc1DgLyvK7lr+uUPyeaMLkKgGZQUAIgZUnpz//8z6NOfc2T5lJOGvjmN79ZW3EMRuH3fu/34oMf/GB1iOq2226b1587KMo0oaSU6syTPvfn9edJ+XPiz/7szwIAkoISAJXBvu66H/QPbsCef2n25itfi5HBUY7G3fmnEX9+POIH/ysaZT7lpHTx4sX42c9+FtBV69evr4KknJ4034JSalpJKeV1La9F08/OXtvy3yqDpcWES+8+uTsKjzzyyIJW8gHQTQpKAKT3v//91b3c8ePHo059y5PmU05K3/3ud+M73/lOQFdlQSkzpcFU7vlqWkkpdTVP+u///b9Xa0EBIN2ybds2e2MA+LUf/OAHceFCzccorpKB0o6tEU9eeW3ZeOMbsLzBOnlm9oZt5u9mg6mzo/tHv6n5lpPSmTNn4tVXXw3oqt/6rd+q3gclyYU6depU9WqysUdmT/d+/JHZa92WmwwjOvmT2WAqr3Gjvr5t2LChegHAwIsvvhgAMLB169aYmZmJUVlInpRZUhPut25mvuWkdOjQodizZ09AV/3P//k/q/f77rsvFmNiYiImJyejydqcJ+3fv7/6GAPAgIISAO+Q68S+//3vx+XLl6MJqlNw62Z/neFS3lBVr4uzN1ttsZByUsrPx/e+N6LjLVBYjuF+4IEHqtO28x3HfS1tKCldLa9peX0bBOdXX+MyLG9KQJ6nEfP6BQBXU1AC4Gq5TixLSmfPno0m6EqetJByUsrPR95vQxc98cQT8Vd/9VdVznrPPYscnxbtKCldrS15Uk6pyusXAFxt8U+CAOiUvLHLkyevvfZaNEGGRm0Kjq5loeWklH9OrlRqSmEMhumOO+6o3hey2u1acsJPfr9lENsGGRjNNPiUbsqP56ZNmwIAAOBGskCTkzL27dsXTdCFPGmh5aTBn5srlZpSGINheuyxx6r3hWSt15IFpfyeacvUsTbkSfnxPHjwYADAu81/MSsAnXfvvfdWO7xZvJw88uijjy7qhnnFikUsGocGu/POO6v3W28d3n+Srl27Nj784Q9XxT4W78EHHxxa4AcAAHTb+Ph49WLxcvLIiRMnFlROuvqvAV300Y9+tHofZl6xe/fu6nsui30s3pEjRxZ1/QKguxSUALimnESiGLM4WfLKyUmLLUqsXr06oIsGE5SGbfny5VVJKaf/sHD5cyA/lgAAAHOVU5S2bNkSLNzevXuryUmLLUooKNFVH/nIR6r322+/PYYpr12LLQbi5wAAN6agBMA1ZakmJ2d4wL8w+WD//vvvj2FQFKOLsviSJ91yvduwVrxdLf/aWRD0/bMweQ3LFwAAwHxkqcbkjIXLB/tTU1MxDI8//nhA12zcuLHKXDO7LjE9e7BaUcFmYfIalivzAOB6FJQAuK7BA36rkubutttui4cffnioD/ZXrlzpc0DnDKYnlSgnDeQ1LFcsWlk5P/lAQTkJAABYqMEDfquS5i4/VvkxG+aD/Zyg5HNA1/z2b/929V7yUG1ew3KSUpZtmLsdO3YoJwFwUwpKANxQPuDPwo2CzM3lpJYsQ2ShaNhWrVoV0CV33XVX9X7rreX/czRP1uUJO9exm8vr2KZNmwIAAGAxlJTmbrBWqsRKNmve6Jp/9a/+VfU+OPhWUpZtDhw44Do2B3kdO3jwYADAzdyybdu2twMAbuLixYvx8ssvx+XLl4P3ygktOXGkVAHi9OnT8frrr0dJz335SnD1SEDseTri0AtR1D/+x/+4+n65/fbboy6XLl2KH/7wh/HWW28F75XlJFPzAJirF198MQDgZmZmZmL79u1x9uzZ4L327t1blSBKFSCmp6djfHw8SpInMVBHnvT973+/OvT2/ve/v5ZDb+nkyZPVdSzfea8sJymkAjBXJigBMCfLly83SekacqXbQw899Ovd56WsW7cuSjt2IqBy/KUoarC2sOR6t2ux8u36lJMAAIASPLi+tvx4HDlyJKampop+bHbt2hWlyZMYKJ0nPfHEE1U5KfOduspJabDyrXTZr41c4wGYLwUlAOZsUFIqueO7TXLtWpYdVq9eHaVlaaD0mrc84XT2QtBz+XVw8idR1CC0qDNMGsjvpSwUZrjkWjYrry3KSQAAQCmDB9h5H8bs2rUsO+zYsSNKy/vv0mve5EmkOvKkf/tv/231noes6pbfS7nuLdeYuZbNymuLchIA86WgBMC8ZEkpH2T3+cF+Tk3KgkN+HPLETl1y6kxJGSZNPxv0XB1fA3feeWf1XvcEpautXbu2+h6uYzpZk+W/v3ISAABQmpLSbwoOdX8cSheh5EmkOr4GcoJSGmUuvXv37up7ON/7LKezKScBsBAKSgDMW5Zy8oH2KE6rjFredI1qRVQdf8/Se+JpthzFPfN3UVQW7fIakuWkURaUUv5zbNq0qbfTlDZs2FD9+wMAANQh773ygXaWlfomS0KjWhFVx5o3eVK/1ZEnZTkpD4xmljPqQ1Z5LctJSn2dprR///44dOhQAMBCKCgBsCB5Mziqos4oZHkh19s9+OCDtU5Nuloda95yFHPpffE01+EaAsVRrne7npym9Nhjj1WFnT7IKXAPPfRQb/59AQCA5siH+aMq6ozCoJR15MiRkRUZ6ljzJk/qtzrypFGud7uenKL04x//uCrs9EFeS7KUNTExEQCwUApKACxKnlzZuHFjdFU+yM+H+FleKL1ibS5Wr14dpU0eC3oow8Q6Tjw2Yb3b9eT3+kc+8pFOr33LIC/LpXVcSwAAAK4nV53lq6vrgfLfK0sLWV4oXQ6ai9Jr3pI8qZ/qypOasN7terKwk9/rXV77lpPvslza99V2ACyeghIAi3bvvfdWD/W7tCLp6mJSk6aMZHGi9BjjPPHm1Fv/TH4jirv77rurCWQ5PamJBaU0WPv24Q9/uPjEsrrlxLtczzmqKXAAAABXyylK+cC7SyuSri4mNWnKSK55K10Gkyf1Ux150mc+85nqkGweuhr1erfrGax9y2taE0qJw7R3795qElwf19kBMHwKSgAMRT7w7sKKpHcXk5p201vHmrfk1Fu/1HXaLQtKqUnr3a5n+fLlVZknVzu2vag0WFGZYV5TgzwAAKCf8oF3F1YkvbuY1LTJUHWseUvypH6pK0/KglJq0nq368lJQ1nmyVfbi0qDFZVTU1OdnXYHQP0UlAAYqsGKpDbcMF6t6cWkq+UUlNLyxNvRE0FP1HHaLUuMud4tJyc1dXrSteRqx0FRqY1hTF7PcqVbE1ZUAgAAXM9gRVI+3G+TpheTrpZTUEqTJ/VLHXnSxo0b47d/+7errLZNE6GznDQoKtWxYnHY8rrWxWlQAIzeLdu2bXs7AKCAN954I06dOhVvvfVWNFVORsnwaO3ata2aLPLDH/4wzp07FyVtvifixP4rYVu7umbMUwaHO78SxeX0npyglN9nbZigdD2XLl2qrmtvvvlm/PKXv4ymymtbrqqzzg2AUl588cUAgBIOHToUk5OTcfLkyWiqfGj/5JNPxu7du1t1mGX79u1x/PjxKEme1A9ZRtv+x1HcgQMHqglK+X3WtgOxV8vrWV7Xjh49GmfPno2mymtbrqqzzg2AUkxQAqCYLP3kRKK8ockVQ02R05JyClFORMnJKPfee2/r1h6tXr06SssxzdPPBh2372tRi5yelNo0PelasvCTxZ/Bta1p69/yn2dwbVNOAgAA2ihLPzmRqGkPybMgMT4+/uupKPnrtk3arWOSizypH/Y8HbV44oknqvcmZcsLkdeyvKYNrm1Nm0x09cQn5SQASjJBCYDanD9/Ps6cOVO96palpCz1rFu3LpYvX966QtK7Xb58Ob73ve9V7yXlabc89Zan3+ie6WcixmsoKOXkpJyglJOT2v69dy05VWlwfSs92exa8vqWRcssXnbx4wtAM5mgBEBdcuLP4cOHq8lKdcsCUpZ6du3aVa2fa+Pq76vl5JYHHnig+AQXeVK31ZUn5eSknKCUk5Pa/r13LTlVaXB9Kz3Z7FryY5qrH9tYtgSgvRSUAKhdlmpyPVKGIflQv9SapJwksnLlyl+/d02umcpXaWOPRDz35aBj8kTj1skr4eSFKO6RRx6ppvlkkabtE5RuZlBWyqJSvpdacZknB7N0mQFSF69vADSfghIAdcscKdcjHTt2rHqYX6pkk5NEsoyUK9yaNuVkGHLN1MTERJQmT+qmOvOkv/mbv6kOvL3vfe/r/IGsQVnp+eefr95LrbjM6UhZuuzq9Q2A5lNQAmDkLl68+OsH+lleyt/Pp7SUD+rzJjUnI+WJmnzvwpSkm6lrilI68vsRO7YGHZKjuA+9EMV1fXrSzWRhKa9pFy5cqN7z9/ma7zUur2lZ8sprXBaTTEoCYNQUlAAYtZmZmepB/ne/+93qYX7+fj6lpXxQn4c+soz0+OOPV+9dmJJ0M3VNUUrypO6pK0/q+vSkmxlc0/L6lu/5+3zN9xqX17R8z2tcFpNMSgJg1BSUAGikLN3kQ/yryzf5+3xAn/LhfL4Gv++ruqYoGc3dLRkkZaBUhz5NT5oP1zgA2k5BCYAmyof3736In7/PB/QpH87na/D7vqpripI8qVvqzJP6ND1pPlzjAGg7BSUAaLE6pygZzd0NdY7i7vv0JADoMgUlAGivOqcoyZO6oc48qe/TkwCgy24NAKC1svSxfv36qMPxlyKmnwlabvuf1BMmpcHXZhaUAAAAgGbI0sf4+HjUQZ7UDXXmSV/60peq91WrVgUA0C2eFgFAy2UJpK7pNONfi5h5LWipyWOzJ97qkNOTcj1ZlpOsdgMAAIBm2bt3b23TaeRJ7VZnnpTTk3Iad05PMo0bALpHQQkAWq7OKUpp51fqCyUYnkMvREx8I2pjehIAAAA0V51TlJI8qZ3qzpNMTwKAbvPECAA6IMsgy5YtizpkmJShEu2Rn7N9X4vavO997zM9CQAAABoupyht3rw56iBPap+686QsJ+X0pCwnmZ4EAN2koAQAHZA37Zs2bYq65FjufV8NWiDDpO1/EnH2QtQii0nr1q2rikmmJwEAAEBz5RSlgwcPRl3kSe1Rd560cePGar1bZpy53g0A6CZPjQCgI1auXFnr+OOpZ2d30NNcGSJlmFTnCPWc5pVhkulJAAAA0HxjY2PVqy7ypOYbRZ70xS9+0fQkAOgBBSUA6JCcolTnTXzuoJ9+Jmio7X9cb5i0evXquPvuu6tykulJAAAA0A45RSmnKdUl8yQlpeaqO0964oknqulJOZXb9CQA6DZPjgCgQ/JGPifY1Gn8axGHXwgaZs/Ts6PT6/T+97+/eldOAgAAgPbYvHlzjI+PR52ypCRPap5R5EkHDhyo3vPQGwDQbZ4eAUDHbNiwofbTRrufFio1SYZJh2r+fLzvfe+rCnJWuwEAAED77N+/P7Zs2RJ1kic1yyjypC996UtWuwFAjygoAUAH5aq3ugmVmmEUYdJgclcWk4RJAAAA0E656q1u8qRmGEWetHHjxvjiF79YZUlZUAIAum/Jhg0bJgIA6JTbb789brvttvjpT38adTp6IiJn54w9GtTs7IWITx2Y/RzUKUOkhx56qPp6y1+bngQA/fDUU08FANAtubp9zZo18c1vfjPqJE8anVHlSemZZ56Ju+66qzr0lhO5AYDu8xMfADrq3nvvHcnpo4lvREweC2p08icR2/844vhLUTur3QAAAKA7xsfHY2xsLOomT6rfKPOkycnJarXb6tWrTeMGgB5RUAKADstVb6O4yc9Qad9XgxpUYdKfRMy8FrW7++67Y926dVU5yUk3AAAA6IZc9ZaTlOomT6rPKPOkz3zmM/G7v/u7sWLFirjzzjsDAOgPT5IAoMNyss3mzZtjFKaejdg6MRt4UEaO3946OZqPcX5t5QjunJqknAQAAADdkVlSlpRGIfOkB/5QnlTSKPOkjRs3xpe+9KXqQOUoJr8DAKPlaRIAdFyOSs4iySjkKaw8jTWKUdFdl2PPd34l4uyFGIkHHnigKilloGS1GwAAAHTLjh07qnVvozCY7iNPGr5R50lf//rXq9Vu99xzj9VuANBDCkoA0AN54z+qU0mDffYZgLB4g49njj0flfvuu085CQAAADruwIEDMTY2FqMgTxquJuRJk5OTVUaZhymVkwCgnxSUAKAnNm3aFMuWLYtRyQDEyrfFGYzgHuUJwjzhtm7dumqtm9VuAAAA0G1HjhypVr6Nijxp8ZqQJ33hC1+I3/3d342VK1fGnXfeGQBAP92ybdu2twMA6IVLly7F97///bh8+XKMypoVV8KlT0fs/WQwRzl2e8/Ts4HSKC1fvjw++MEPVlOTbrvttgAA+uvFF18MAKAfTp48GVu3bo2zZ8/GqMiT5q8pedJjjz0W3/rWt+L222+Pe++9NwCA/nLsHQB6JNdyPfTQQzFKGY6Mf83pt7mafibigT8cfZiUXzsf+MAHqnKSMdwAAADQHzlBKScpjZI8aX4OvdCMPGnjxo3x9NNPV1nS2rVrAwDotyUbNmyYCACgN7JoktNvfvrTn8Yo/a8rf/vpZyPevBIwPbph9iQcv5Fjt/OU2589H/HzX8RI5dfMAw88UK0IzEApS0oAQL899dRTAQD0R5aU1qxZE9/85jdjlORJNzbIk/JjNOo8KctJX//612PTpk1xzz33OPAGACgoAUAfDXa9nz9/PkbtO69EHJuJuPtKoLTlA9F7eQpw39dmXyfPxMhleJRTt5STAICrKSgBQP989KMfrd6ff/75GDV50js1LU+666674r/8l/9STePOtW7KSQBAUlACgJ5atWpV9d6EklKO6c6R04e/3d9gKT8Gf/RfI/YcnA3ZmiDDo5yctHz5cuUkAOAdFJQAoJ/Gxsaq9yaUlORJzcyTspyUk5MefvjhWLduXTXJHQAg3bJt27a3AwDorVOnTlWvJtl8T8TEpyN2fSw6L0+45djtQy/MhkpNMSgnrVixQjkJAHiPF198MQCA/pqYmIjJycloEnlSM3zrW9+Kxx57rJqcdPvttwcAwICCEgDQyJJSymBp7JGI/Z+e/XWXHH8pYvLY7HvTZCHp/vvvj9WrV8ett95avQAArqagBAA0saSU5Emjc+DAgfjMZz4Ta9asqQ69AQBcTUEJAKg0taQ0kMHS7o+1+xRcnmibfibi0LdnT7o1kclJAMBcKCgBAKmpJaUBeVI9cq3b008/HR/72Mdi7dq1sXTp0gAAeDcFJQDg15peUkprVkTs2Brx5NbZ96bLEOnwlQDp6N8293TbgHISADBXCkoAwEDTS0pJnlROlpO+/vWvx2/91m/FunXrrHUDAK5LQQkAeIc2lJSutuNXwdLjH4jYsjFGLgOkmdcinv/BbIDU9BBpIE+2feADH1BOAgDmREEJALhaG0pKV5MnDcfGjRvjL/7iL+Kf/JN/Uk1OUk4CAG5EQQkAeI+///u/j9deey3aZvM9s6HS2KNXAqaNs79eU3jdfY7WztDou1c+XDN/NxsmZajUJllOyslJy5YtU04CAOZEQQkAeLepqanYt29ftI08aWGynJSTkzZt2hT33HNPlSkBANyIghIAcE3nz5+PH/3oR3H58uVoswyUMljKsClfm9bNvqfN6371fs97/7wMhQbB0Mkzv/n9d38VGGV4NPjjbbZ8+fKqnHTbbbcpJwEAc6agBABcy/Hjx2Pnzp1x9uzZaDN50o099thj8fTTT1eZUk5OUk4CAOZCQQkAuK5Lly7FD3/4w3jrrbeC7snTbRs2bIhbb71VkAQAzIuCEgBwPSdPnozt27dX73TPF77whWql38qVK+Ouu+4KAIC5ujUAAK4jV3996EMfijVr1gTdct9991XlpCwmKScBAAAAw7J58+Z47rnnYseOHUG3TE5OVuWk1atXKycBAPOmoAQA3FCWlB588MGqzEL7DT6fOT0p17rl9CQAAACAYcqS0pEjR2L//v1B+23cuDG+/vWvx1NPPVVlSnfeeWcAAMyXJ1IAwJxkQemhhx6KZcuWBe2Uo7cfeOCBWLVqVTU16ZZbbgkAAACAUnLaThaVsrBEOz3xxBNVOenjH/94VU7Kw28AAAuhoAQAzFmOb7byrZ1ypVuWk5YvX66cBAAAANQmV71Z+dZOudLtr/7qr+Kxxx6rykmZKQEALJSCEgAwL4MVYTnaWSjRfPn5+uAHP2ilGwAAADAyg5VvBw4ccPCtBTL3+9a3vlWtdLv33nutdAMAhsITKgBgQTKc+PCHPxwrVqwImilLSVlOyhDJ1CQAAABg1MbHx+PEiRMxNjYWNNMXvvCFqpz0z//5P6/yv9tvvz0AAIZBQQkAWLCczvPoo49Wp6qWLVsWNMPKlSurYtI/+kf/qPq8KCcBAAAATZHTlHLl28GDB6tf0wxPPPFEVUz6j//xP8ZDDz0Ud911l0ncAMBQ3bJt27a3AwBgkS5duhSnTp2KM2fOBKORRaT3ve991eSkDJCESABAKS+++GIAACzWyZMnY3JyMg4dOhSMRhaRvvSlL8V/+A//IVatWmWdGwBQjIISADBUFy9ejFdeeSXeeuutoD5ZSlq/fn01djuLSSYmAQAlKSgBAMM0MzMTO3furApL1CfXuX3xi1+M++67r5rI7bAbAFCS/9IAAIZq+fLl8dhjj1Ujuq19Ky/DowcffNA6NwAAAKC1tmzZEj/+8Y+tfatJrnP7+te/Xq1zy1zJOjcAoA4mKAEARb3xxhvV6jcTlYYri0k5MSlHb5uYBADUzQQlAKCkXPmWq99MVBquLCblxKSPf/zjVSlp6dKlAQBQFwUlAKAWikrDoZgEADSBghIAUAdFpeFQTAIAmkBBCQColaLSwigmAQBNoqAEANRJUWlhFJMAgCZRUAIARuLNN9+M06dPx7lz54JrW7JkSdx9991xzz33xLJlyxSTAIDGUFACAEbh6NGjMT09HcePHw+uLYtI/+7f/bv4whe+EI888kjceeedVcYEADBqCkoAwEhdunSpmqh0/vx5U5V+Jacl5aSkdevWxW233VaVkhSTAIAmUVACAEYpJynlRKUsKpmqNCunJf3Lf/kv49//+39fTeFesWJFddgNAKApFJQAgMbIqUpnz56NM2fORN/kSbaclJSn3PJkm1ISANBkCkoAQFPkVKVjx45Va+D6JnOknJT0qU99Kv7ZP/tnsXz58uqwGwBAEykoAQCNc/ny5aqslOvf8v2Xv/xldNHSpUurIGn16tXV1CQr3ACAtlBQAgCaJg+9ZVnp+eefr97z9120cePG+J3f+Z341//6X8e/+Bf/Iu64444qYwIAaDoFJQCg8XL9W4ZK+X7hwoVoq5ySlCfZBqWkZcuWmZQEALSSghIA0HS5/i0nK+X7zMxMtFXmSB/5yEeqUtK/+Tf/Jj74wQ9W+VLmTAAAbaKgBAC0yqVLl+LixYvVdKXBe1NdXUjK91zdNgiPlJIAgDZTUAIA2uTkyZNVSSmnK+V7lpaa6upC0pYtW+Kf/tN/Gvfcc0+1ui2nbwMAtJWCEgDQeqdOnapeTZGTkTZv3hwrVqyofq+MBAB0jYISANB2ExMTMTk5GU2RWdJ//s//ObZu3VqtbDMhCQDoGlVrAKD1NmzYEKtWrYqmyH+enJZkfRsAAABAM2VBaWxsLJpi//798cQTT1jfBgB0loISANAJWQpqgpyetHbt2gAAAACg2bIU1AQ5PWn37t0BANBlCkoAQCesXLky1q1bF6N2//33BwAAAADNlxOUmlAMOnDgQAAAdJ2CEgDQGTlFaZQjsLMgtXr16gAAAACgHbIctGbNmhiVLEjt2LEjAAC6TkEJAOiMpUuXxvr162NUmrJmDgAAAIC5yXLS+Ph4jEpT1swBAJSmoAQAdEoWlJYtWxZ1y3JSFqQAAAAAaJe9e/fG5s2bo25ZThrF3xcAYBQUlACATskVb5s2bYo6ZSEq17sBAAAA0D45RengwYNRpywm5Xo3AIC+UFACADpn5cqVsWrVqqiL6UkAAAAA7TY2Nla96mJ6EgDQNwpKAEAnZWmoDjk9ae3atQEAAABAux04cCDqYHoSANBHCkoAQCflFKX169dHaQ8++GAAAAAA0H5btmyJ8fHxKO3IkSMBANA3CkoAQGflFKUlS5ZEKevWrYvly5cHAAAAAN2Qq9fWrFkTpeTkpCxCAQD0jYISANBZWU4qOUWprjVyAAAAANQjy0lZUiql5F8bAKDJFJQAgE7LEtGyZcti2PKvu3Tp0gAAAACgW3LN2+bNm2PYspxU4q8LANAGCkoAQOdt2rQphikLT6YnAQAAAHTXwYMHY5iymDQxMREAAH2loAQAdN7KlStj1apVMSzKSQAAAADdNjY2Vr2GxWo3AKDvFJQAgF4Y1hSlFStWxNq1awMAAACAbhvWFKUtW7bE7t27AwCgzxSUAIBeWLp06VAmHz344IMBAAAAQPcNay3bkSNHAgCg7xSUAIDeWL9+fSxZsiQWat26dVXRCQAAAIB+2Lt3b6xZsyYWKicnZdEJAKDvFJQAgN7IctJ9990XC7Fs2bKhTGACAAAAoD2ynLR///5YiCwmLfTPBQDoGgUlAKBX7r333li1alXM19q1a01PAgAAAOih8fHxGBsbi/natWuX6UkAAL+ioAQA9M58JyGZngQAAADQb/OdhJTFpImJiQAAYJaCEgDQOytXrqzGc8+VchIAAABAv+UEpR07dsz5/2+1GwDAOykoAQC9dP/998eSJUtu+v9bt25dtd4NAAAAgH47cODAnA697d69u3oBAPAbCkoAQC8tXbo0Hn744Wp92/WsWrWqKjIBAAAAQK5te+6556r368lJS1lkAgDgnRSUAIDeWr58eXzoQx+qpiStWLGi+mO33XZbVUzKoCn/t7lMWQIAAACgH7Zs2VKVlHJCUv465VSlLCYdPHiw+t/mMmUJAKBvbtm2bdvbAQAAAABz9OKLLwYAAAAAzJUJSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAAAAAAQDEKSgAAAAAA/P/t2jEBAAAAwiD7pzbFPsgBAAAAZAQlAAAAAAAAAAAgIygBAAAAAAAAAAAZQQkAAAAAAAAAAMgISgAAAAAAAAAAQEZQAgAAAAAAAAAAMoISAAAAAAAAAACQEZQAAAAAAAAAAICMoAQAAAAAAAAAAGQEJQAAAAAAAAAAICMoAQAAAAAAAAAAGUEJAAAAAAAAAADICEoAAAAAAAAAAEBGUAIAAABgAAAAAFARlAAAAAAAAAAAgIygBAAAAAAAAAAAZAQlAAAAAAAAAAAgIygBAAAAAAAAAAAZQQkAAAAAAAAAAMgISgAAAAAAAAAAQEZQAgAAAAAAAAAAMoISAAAAAAAAAACQEZQAAAAAAAAAAICMoAQAAAAAAAAAAGQEJQAAAAAAAAAAICMoAQAAAAAAAAAAGUEJAAAAAAAAAADICEoAAAAAAAAAAEBGUAIAAAAAAAAAADKCEgAAAAAAAAAAkBGUAAAAAAAAAACAjKAEAAAAAAAAAABkBCUAAAAAAAAAACAjKAEAAAAAAAAAABlBCQAAAAAAAAAAyAhKAAAAAAAAAABARlACAAAAAAAAAAAyghIAAAAAAAAAAJARlAAAAAAAAAAAgIygBAAAAAAAAAAAZAQlAAAAAAAAAAAgIygBAAAAAAAAAAAZQQkAAAAAAAAAAMgISgAAAAAAAAAAQEZQAgAAAAAAAAAAMoISAAAAAAAAAACQEZQAAAAAAAAAAICMoAQAAAAAAAAAAGQEJQAAAAAAAAAAICMoAQAAAAAAAAAAGUEJAAAAAAAAAADICEoAAAAAAAAAAEBGUAIAAAAAAAAAADKCEgAAAAAAAAAAkBGUAAAAAAAAAACAjKAEAAAAAAAAAABkBCUAAAAAAAAAACAjKAEAAAAAAAAAABlBCQAAAAAAAAAAyAhKAAAAAAAAAABARlACAAAAAAAAAAAyghIAAAAAAAAAAJARlAAAAAAAAAAAgIygBAAAAAAAAAAAZAQlAAAAAAAAAAAgIygBAAAAAAAAAAAZQQkAAAAAAAAAAMgISgAAAAAAAAAAQEZQAgAAAAAAAAAAMoISAAAAAAAAAACQEZQAAAAAAAAAAICMoAQAAAAAAAAAAGQEJQAAAAAAAAAAICMoAQAAAAAAAAAAGUEJAAAAAAAAAADICEoAAAAAAAAAAEBGUAIAAAAAAAAAADKCEgAAAAAAAAAAkBGUAAAAAAAAAACAjKAEAAAAAAAAAABkBCUAAAAAAAAAACAjKAEAAAAAAAAAABlBCQAAAAAAAAAAyAhKAAAAAAAAAABARlACAAAAAAAAAAAyghIAAAAAAAAAAJARlAAAAAAAAAAAgIygBAAAAAAAAAAAZAQlAAAAAAAAAAAgIygBAAAAAAAAAAAZQQkAAAAAAAAAAMgISgAAAAAAAAAAQEZQAgAAAAAAAAAAMoISAAAAAAAAAACQEZQAAAAAAAAAAICMoAQAAAAAAAAAAGQEJQAAAAAAAAAAICMoAQAAAAAAAAAAGUEJAAAAAAAAAADICEoAAAAAAAAAAEBGUAIAAAAAAAAAADKCEgAAAAAAAAAAkBGUAAAAAAAAAACAjKAEAAAAAAAAAABkBCUAAAAAAAAAACAjKAEAAAAAAAAAABlBCQAAAAAAAAAAyAhKAAAAAAAAAABARlACAAAAAAAAAAAyghIAAAAAAAAAAJARlAAAAAAAAAAAgIygBAAAAAAAAAAAZAQlAAAAAAAAAAAgIygBAAAAAAAAAAAZQQkAAAAAAAAAAMgISgAAAAAAAAAAQEZQAgAAAAAAAAAAMoISAAAAAAAAAACQEZQAAAAAAAAAAICMoAQAAAAAAAAAAGQEJQAAAAAAAAAAICMoAQAAAAAAAAAAGUEJAAAAAAAAAADICEoAAAAAAAAAAEBGUAIAAAAAAAAAADKCEgAAAAAAAAAAkBGUAAAAAAAAAACAjKAEAAAAAAAAAABkBCUAAAAAAAAAACAjKAEAAAAAAAAAABlBCQAAAAAAAAAAyAhKAAAAAAAAAABARlACAAAAAAAAAAAyghIAAAAAAAAAAJARlAAAAAAAAAAAgIygBAAAAAAAAAAAZAQlAAAAAAAAAAAgIygBAAAAAAAAAAAZQQkAAAAAAAAAAMgISgAAAAAAAAAAQEZQAgAAAAAAAAAAMoISAAAAAAAAAACQEZQAAAAAAAAAAICMoAQAAAAAAAAAAGQEJQAAAAAAAAAAICMoAQAAAAAAAAAAGUEJAAAAAAAAAADICEoAAAAAAAAAAEBGUAIAAAAAAAAAADKCEgAAAAAAAAAAkBGUAAAAAAAAAACAjKAEAAAAAAAAAABkBCUAAAAAAAAAACAjKAEAAAAAAAAAABlBCQAAAAAAAAAAyAhKAAAAAAAAAABARlACAAAAAAAAAAAyghIAAAAAAAAAAJARlAAAAAAAAAAAgIygBAAAAAAAAAAAZAQlAAAAAAAAAAAgIygBAAAAAAAAAAAZQQkAAAAAAAAAAMgISgAAAAAAAAAAQEZQAgAAAAAAAAAAMoISAAAAAAAAAACQEZQAAAAAAAAAAICMoAQAAAAAAAAAAGQEJQAAAAAAAAAAICMoAQAAAAAAAAAAGUEJAAAAAAAAAADICEoAAAAAAAAAAEBGUAIAAAAAAAAAADKCEgAAAAAAAAAAkBGUAAAAAAAAAACAjKAEAAAAAAAAAABkBCUAAAAAAAAAACAjKAEAAAAAAAAAABlBCQAAAAAAAAAAyAhKAAAAAAAAAABARlACAAAAAAAAAAAyghIAAAAAAAAAAJARlAAAAAAAAAAAgIygBAAAAAAAAAAAZAQlAAAAAAAAAAAgIygBAAAAAAAAAAAZQQkAAAAAAAAAAMgISgAAAAAAAAAAQEZQAgAAAAAAAAAAMoISAAAAAAAAAACQEZQAAAAAAAAAAICMoAQAAAAAAAAAAGQEJQAAAAAAAAAAICMoAQAAAAAAAAAAGUEJAAAAAAAAAADICEoAAAAAAAAAAEBGUAIAAAAAAAAAADKCEgAAAAAAAAAAkBGUAAAAAAAAAACAjKAEAAAAAAAAAABkBCUAAAAAAAAAACAjKAEAAAAAAAAAABlBCQAAAAAAAAAAyAhKAAAAAAAAAABARlACAAAAAAAAAAAyghIAAAAAAAAAAJARlAAAAAAAAAAAgIygBAAAAAAAAAAAZAQlAAAAAAAAAAAgIygBAAAAAAAAAAAZQQkAAAAAAAAAAMgISgAAAAAAAAAAQEZQAgAAAAAAAAAAMoISAAAAAAAAAACQEZQAAAAAAAAAAICMoAQAAAAAAAAAAGQEJQAAAAAAAAAAICMoAQAAAAAAAAAAGUEJAAAAAAAAAADICEoAAAAAAAAAAEBGUAIAAAAAAAAAADKCEgAAAAAAAAAAkBGUAAAAAAAAAACAjKAEAAAAAAAAAABkBCUAAAAAAAAAACAjKAEAAAAAAAAAABlBCQAAAAAAAAAAyAhKAAAAAAAAAABA5rcwQPH6Y8W9AAAAAElFTkSuQmCC","lightningAddress":"fd5ce42fc3e44e17@coinos.io","zapSplits":[{"pubkey":"1bc70a0148b3f316da33fe3c89f23e3e71ac4ff998027ec712b905cd24f6a411","weight":95,"relay":"wss://relay.damus.io"},{"pubkey":"1bc70a0148b3f316da33fe3c89f23e3e71ac4ff998027ec712b905cd24f6a411","weight":5,"relay":"wss://nos.lol"}]}

-

@ c230edd3:8ad4a712

2025-05-31 01:51:38

@ c230edd3:8ad4a712

2025-05-31 01:51:38Chef's notes

Most Santa Maria tri tip roast recipes call for red wine vinegar and dijon mustard. I prefer other ingredients in place of those, but should you like those flavors and textures, they are more traditional.

Keep in mind when cooking and slicing, that the grain of tri-tip runs in 3 directions and the meat is unevenly thick. Pulling the roast when the thin end achieves well done, the thicker end will be a nice medium rare. When slicing, change direction to cut against the grain as you transition through for the most tender outcome.

Details

- ⏲️ Prep time: 10 minutes

- 🍳 Cook time: 1 hour ( with grill heating time)

- 🍽️ Servings: 4-6

Ingredients

- 1.5 - 2 lb Tri-Tip Roast

- 1 Tbsp Kosher Salt

- 1 tsp Black Pepper

- 1 tsp Cayanne Pepper ( substitute all or some with smoked paprika for a milder taste)

- 1 tsp Garlic Powder

- 1 tsp Onion Powder

- 1 Tbsp Rosemary

- 2 Tbsp Stone Ground Mustard

- 1 Tbsp Rice Vinegar

- 2-3 Cloves Garlic, Minced

Directions

- Mix all dry spices.

- Pat the roast dry and coat on all sides with seasdoning mix.

- Cover loosely and allow to sit in fridge for 8-12 hours.

- Preheat grill to 475 degrees F, allow meat to sit at room temp during this process.

- Mix vinegar, mustard, and minced garlic.

- Place meat on hot grill, fat side down and coat the upward side with mustard mix

- Grill approximately 7-10 minutes.

- Flip meat, repeat coating and grilling.

- Flip once more and grill for 2-3 minutes to caramelize the glaze and until the fat begins to render.

- Remove from grill and let the roast rest for 5 minutes before slicing,

- Serve with grilled veggies or any side of your choice. This is a bit spicy so it goes well with a salsa fresca and tortillas, too.

-

@ cae03c48:2a7d6671

2025-05-31 14:00:30

@ cae03c48:2a7d6671

2025-05-31 14:00:30Bitcoin Magazine

The Debt Train Has No Brakes: Lyn Alden Makes the Case for BTC at Bitcoin 2025“Nothing stops this train,” Lyn Alden initially stated at Bitcoin 2025, walking the audience through a data-rich presentation that made one thing clear: the U.S. fiscal system is out of control—and Bitcoin is more necessary than ever.

Her first chart, sourced from the Federal Reserve’s FRED database, displayed a stark decoupling: the unemployment rate is down, yet the fiscal deficit has surged past 7% of GDP. “This started around 2017, went into overdrive during the pandemic, and hasn’t corrected,” Alden said. “That’s not normal. We’re in a new era.”

She didn’t mince words. “Nothing stops this train because there are no brakes attached to it anymore. The brakes are heavily impaired.

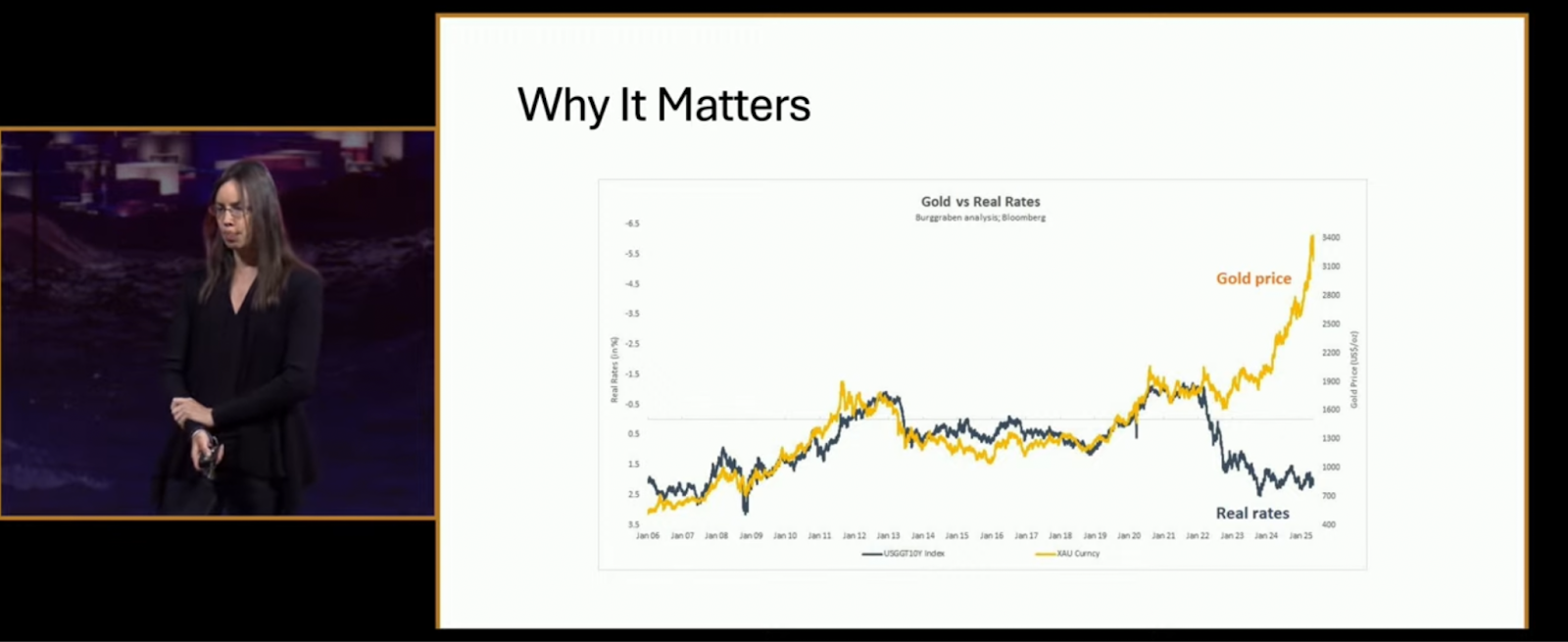

Why should Bitcoiners care? Because, as Alden explained, “it matters for asset prices—especially anything scarce.” She displayed a gold vs. real rates chart that showed gold soaring as real interest rates plunged. “Five years ago, most would have said Bitcoin couldn’t thrive in a high-rate environment. Yet here we are—Bitcoin over $100K, gold at new highs, and banks breaking under pressure.”

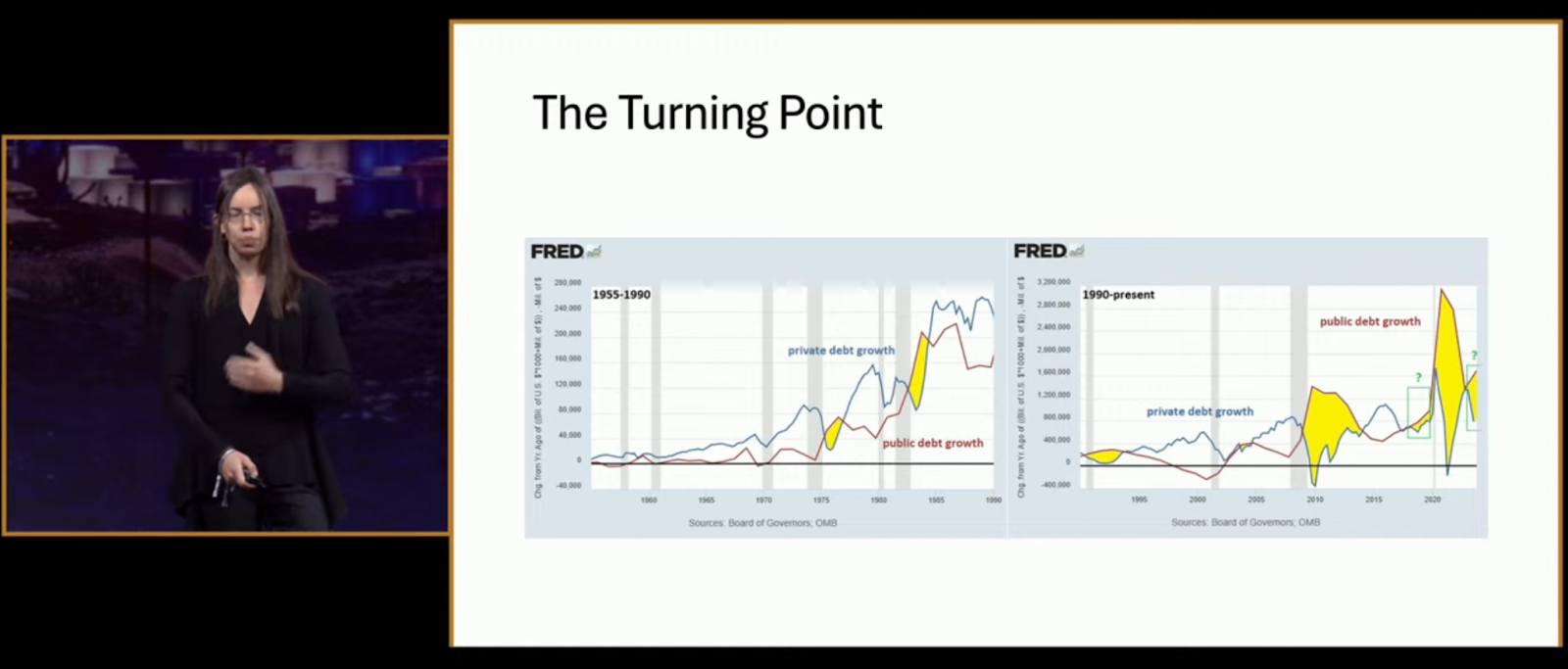

Next came what she called “The Turning Point”—a side-by-side showing how public debt growth overtook private sector debt post-2008, flipping a decades-long norm. “This is inflationary, persistent, and it means the Fed can’t slow things down anymore.”

Another chart revealed why rising interest rates are now accelerating the deficit. “They’ve lost their brakes. Raising rates just makes the federal interest bill explode faster than it slows bank lending.”

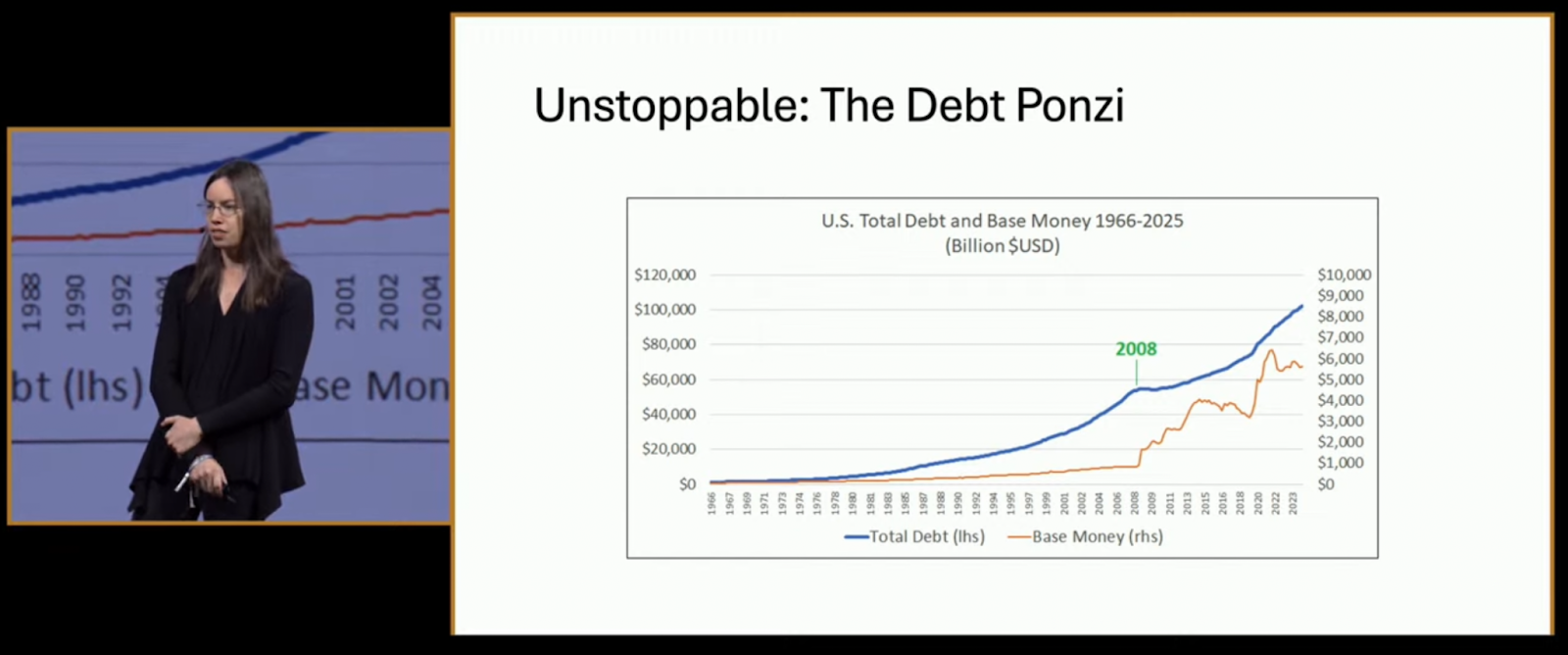

Alden called it a ponzi: “The system is built on constant growth. Like a shark, it dies if it stops swimming.”

Her slide showed a relentless rise in total debt versus base money—except for a jolt in 2008, and again after 2020. “This isn’t going backward. Ever.”

So why Bitcoin? “Because it’s the opposite. Scarce, decentralized, and mathematically capped,” Alden concluded. “There are two reasons nothing stops this train: math and human nature. Bitcoin is the mirror of this system—and the best protection from it.”

You can watch the full panel discussion and the rest of the Bitcoin 2025 Conference Day 3 below:

This post The Debt Train Has No Brakes: Lyn Alden Makes the Case for BTC at Bitcoin 2025 first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 005bc4de:ef11e1a2

2025-05-31 10:55:47

@ 005bc4de:ef11e1a2

2025-05-31 10:55:47LUV and Hivebits/HBIT/Wusang pause tl;dr LUV and HBIT (aka, Hivebits and the Wusang game) are on a pause at the moment, taking a break. https://files.peakd.com/file/peakd-hive/crrdlx/23x1SY8Vx8j1mVGnDFtq7ebuzKNGd8K9Ssex51AEerxks1VYikxGPShM7bjNhmSrEZ2wf.png Image from pixabay.com Why? There are odd things going on. I have a theory, but here's what is known... May 28, 2025, at about 1:30 pm GMT (8:30 AM EDT), a second attack (for lack of better term) hit HBIT in about a week. It seemed to start with @tyler45 with this comment https://peakd.com/blog/@tyler45/comment-20250528125108033 tx: https://he.dtools.dev/tx/7e7d4126196ca5b6dbe0a04dcded0e25d3bcc7f4 See tyler45's activity at https://he.dtools.dev/@tyler45 Notice the reply and WUSANG command is to a post by @olivia897 and how many of the other WUSANG comments on the explorer are in reply to olivia897. It seems these are all auto-generated accounts. The names and "birthdates" and interactions all point to automation. Once initiated, things happened very fast on the back end, clearly not being done manually. In this way, this seems rather sophisticated technically. I estimate just over 400 HBIT were pilfered the other day from the @Hivebits account before I noticed and was able to shut things down. Just for a little background, after the first attack May 21, 2025. I wrote a small bit of info: https://peakd.com/hivebits/@crrdlx/hbit-resource-credits A couple of days ago this post by @holoz0r was interesting: https://peakd.com/hive-133987/@holoz0r/text-analytics-reveal-thirty-two-percent-of-comments-on-hive-are-not-unique-and-at-least-ten-percent-add-no-value-to-discussion The thing that caught my eye was that the WUSANG comment was the largest by far, along with BBH (hello @bradleyarrow), because the attackers used both commands. Then, a few days later, things happened again: sudden start, repetitive bot attack, until I shut things down. So, a pause This is a period in my personal calendar where I simply don't have time to sit down at a computer for an extended period and try fiddle with this stuff. So, for now @Luvshares and @Hivebits (HBIT) and the @Wusang game are on hold. Plus, there's other fun stuff to do. https://files.peakd.com/file/peakd-hive/crrdlx/AJL43SREA1EuyqPXhydmqaq1RHhRVoYd12PfiBN5vDMu2WSKUtGeYWgKJyuRwV8.jpg I go by @crrdlx or "CR" for short. See all my links or contact info at https://linktr.ee/crrdlx.

Originally posted on Hive at https://peakd.com/@crrdlx/luv-and-hivebitshbitwusang-pause

Auto cross-post via Hostr v0.1.48 (br) at https://hostr-home.vercel.app

-

@ 33baa074:3bb3a297

2025-05-28 08:54:40

@ 33baa074:3bb3a297

2025-05-28 08:54:40COD (chemical oxygen demand) sensors play a vital role in water quality testing. Their main functions include real-time monitoring, pollution event warning, water quality assessment and pollution source tracking. The following are the specific roles and applications of COD sensors in water quality testing:

Real-time monitoring and data acquisition COD sensors can monitor the COD content in water bodies in real time and continuously. Compared with traditional sampling methods, COD sensors are fast and accurate, without manual sampling and laboratory testing, which greatly saves time and labor costs. By combining with the data acquisition system, the monitoring data can be uploaded to the cloud in real time to form a extemporization distribution map of the COD content in the water body, providing detailed data support for environmental monitoring and management.

Pollution event warning and rapid response COD sensors play an important role in early warning and rapid response in water environment monitoring. Once there is an abnormal increase in organic matter in the water body, the COD sensor can quickly detect the change in COD content and alarm through the preset threshold. This enables relevant departments to take measures at the early stage of the pollution incident to prevent the spread of pollution and protect the water environment.

Water quality assessment and pollution source tracking COD sensors play an important role in water quality assessment and pollution source tracking. By continuously monitoring the COD content in water bodies, the water quality can be evaluated and compared with national and regional water quality standards. At the same time, COD sensors can also help determine and track the location and spread of pollution sources, provide accurate data support for environmental management departments, and guide the development of pollution prevention and control work.