-

@ cf8c27f4:c95b9b5c

2025-05-29 15:21:33

@ cf8c27f4:c95b9b5c

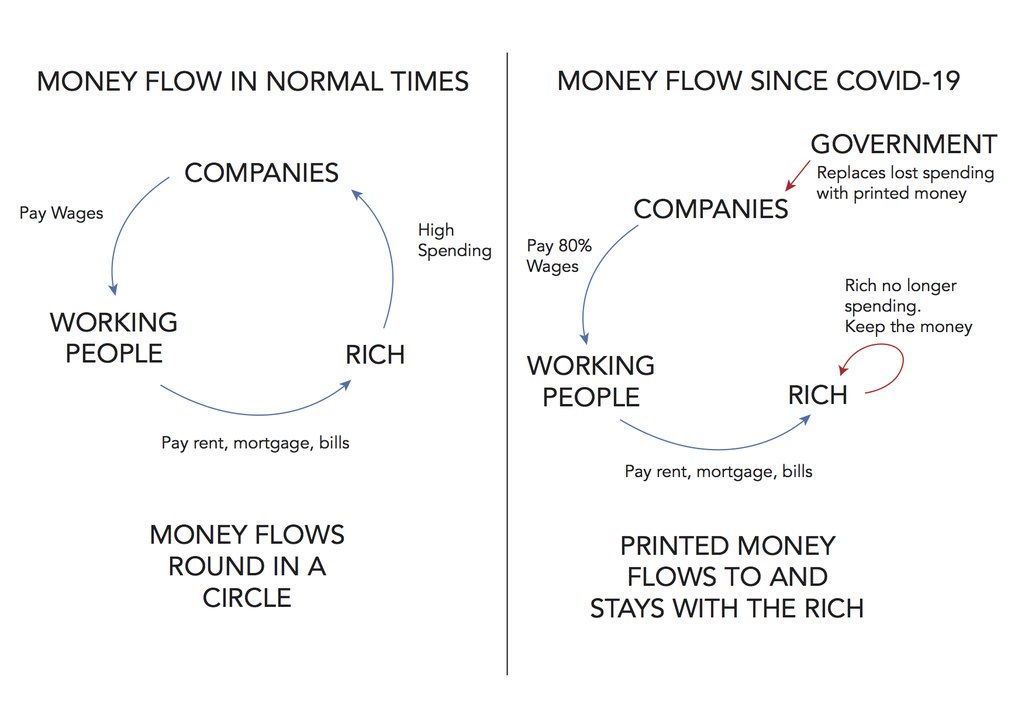

2025-05-29 15:21:33What’s Happening in Japan? Japan has the highest debt-to-GDP ratio in the developed world — over 260%. For decades, it got away with this by keeping interest rates near zero and having the Bank of Japan (BoJ) purchase most of its government bonds. This was known as Yield Curve Control — a desperate attempt to keep borrowing costs low.

But now, global bond markets are revolting.

🔺 Japanese 30-year yields have exploded past 3.18%

🔺 The worst bond auction since 1987 just occurred

🔺 Demand for JGBs (Japanese Government Bonds) is collapsing

When demand for bonds falls, prices drop and yields rise. This signals fear. Big fear.

As Taylor Kenney noted in a widely shared thread:

“This isn’t just a Japan problem — Japan is the largest foreign holder of U.S. debt.” The Contagion Risk: U.S. Debt and Global Collapse

Here’s where this gets truly global.

In 2025 alone, $9.2 trillion of U.S. debt will mature — 70% of it between January and June. That debt must be refinanced, and as interest rates remain elevated, the cost of servicing this debt balloons, potentially straining the U.S. government’s finances.

If yields rise further, it only worsens the cycle:

-

Yields rise

-

Interest costs balloon

-

Governments print more to cover deficits

-

Currencies debase

-

Confidence dies

-

Collapse follows

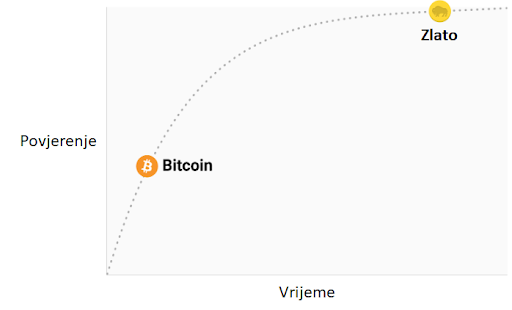

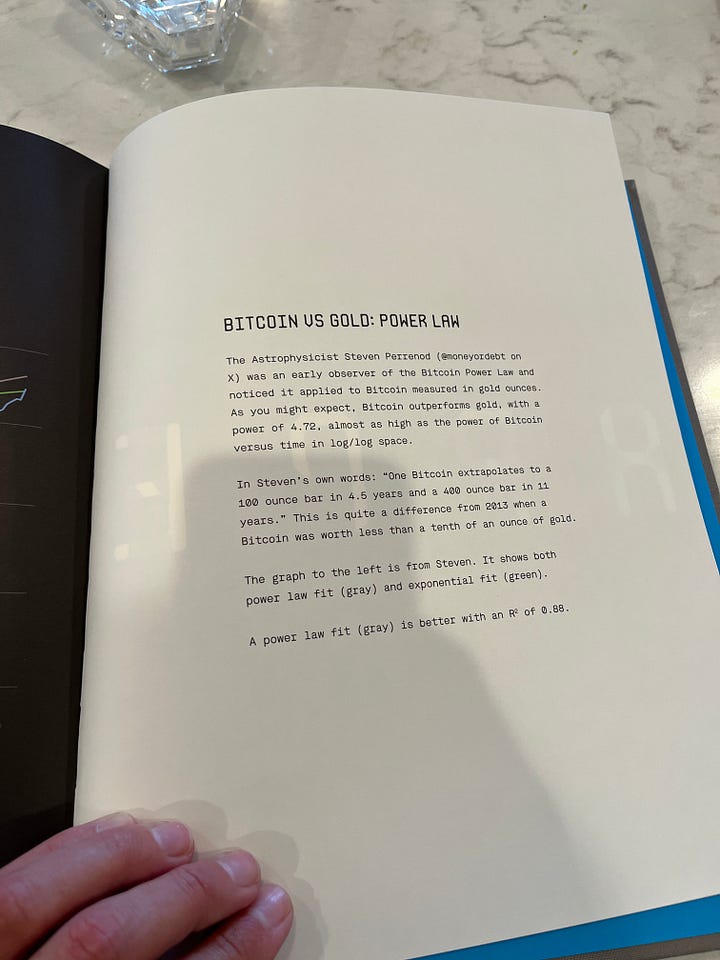

Japan may just be the canary in the coal mine. Gold Is Surging. Bitcoin Is Outpacing It.

Smart money is already moving.

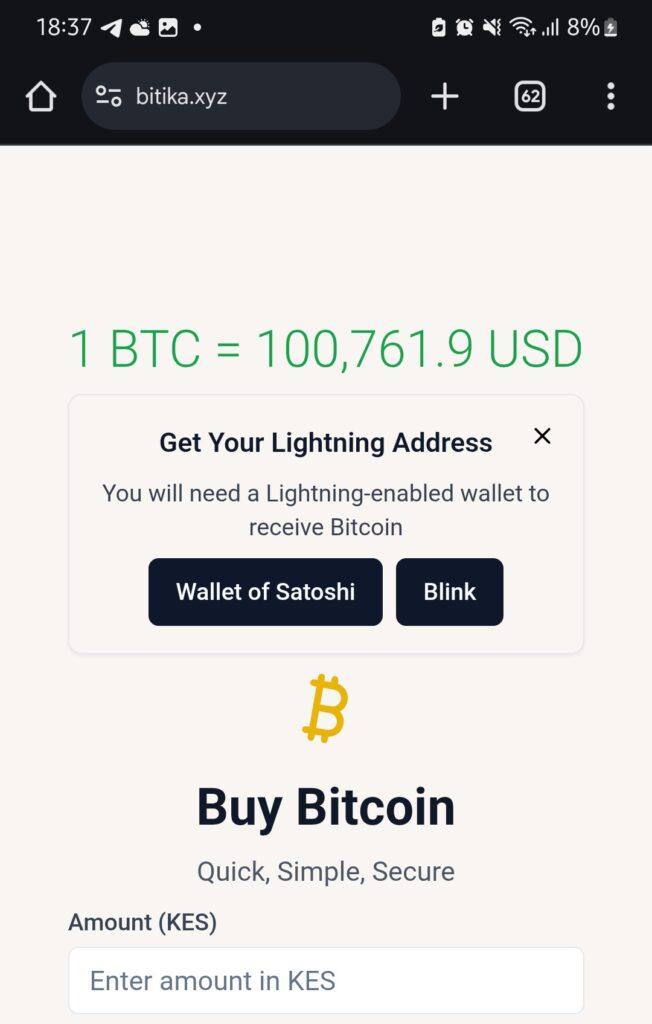

Bitcoin is closing in on its all-time high — and closely tracking the M2 Global Liquidity Index, historically lagging it by 60–90 days.

Gold has also had a stellar run in 2025, signalling institutional flight to hard assets.

People are scared. And they should be.

The global financial system is built on an unsustainable foundation of debt, inflation, and artificial suppression of interest rates. That system is now cracking in Japan — but it won’t stop there. ₿ Bitcoin: The Exit Plan

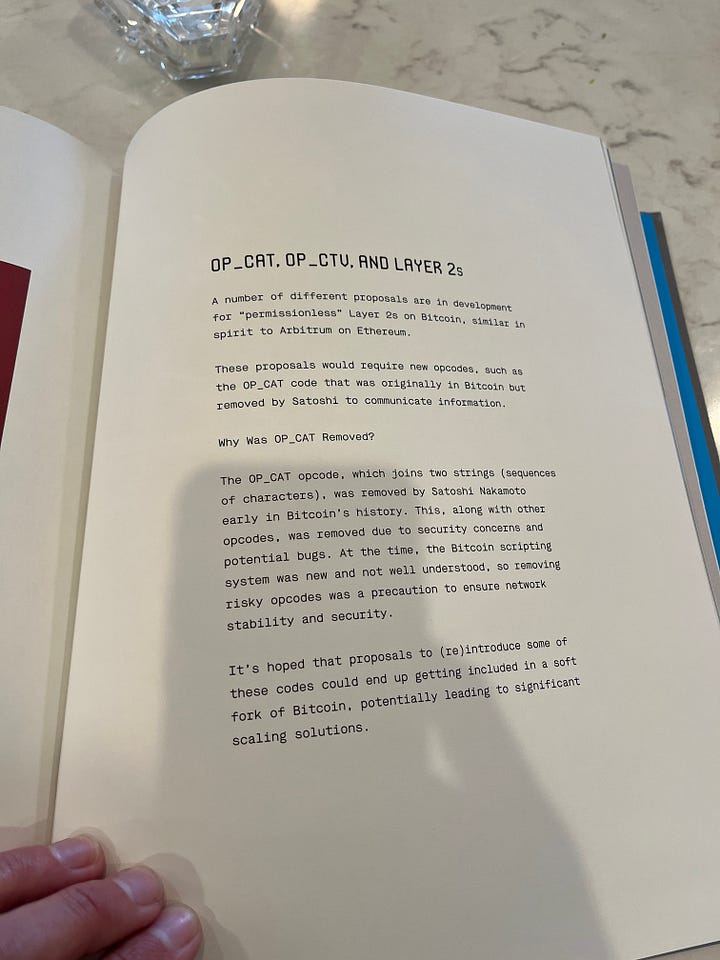

Bitcoin doesn’t rely on a central bank.

It doesn’t need to be refinanced.

It doesn’t have a yield curve to control.

It’s decentralised, scarce, and incorruptible.

While fiat currencies spiral under the weight of debt and monetary debasement, Bitcoin offers an escape — a monetary protocol with a fixed supply and no political manipulation.

It’s not just an investment.

It’s an exit strategy from the madness. Final Thoughts

-

Japan is flashing red.

-

The U.S. is next in line.

-

The debt system is spiralling — fast.

Gold is insurance.

Bitcoin is the lifeboat.

-

-

@ dfa02707:41ca50e3

2025-05-29 13:02:34

@ dfa02707:41ca50e3

2025-05-29 13:02:34Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ cf8c27f4:c95b9b5c

2025-05-29 15:19:56

@ cf8c27f4:c95b9b5c

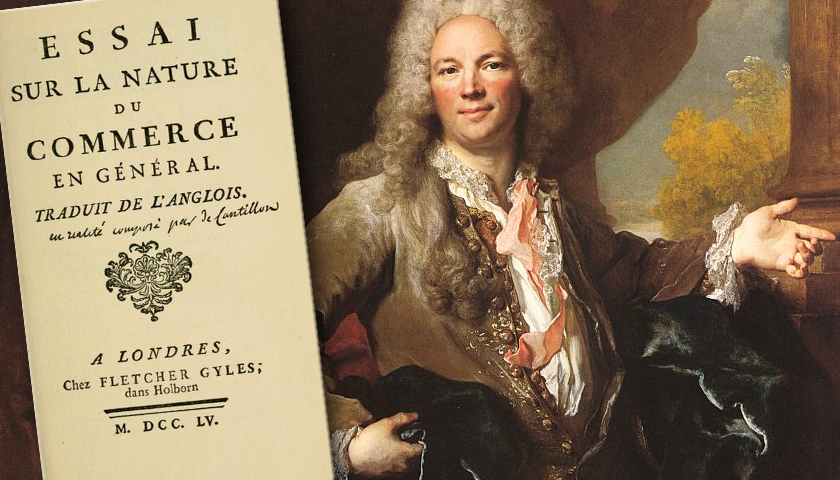

2025-05-29 15:19:56The Weimar Hyperinflation Nightmare

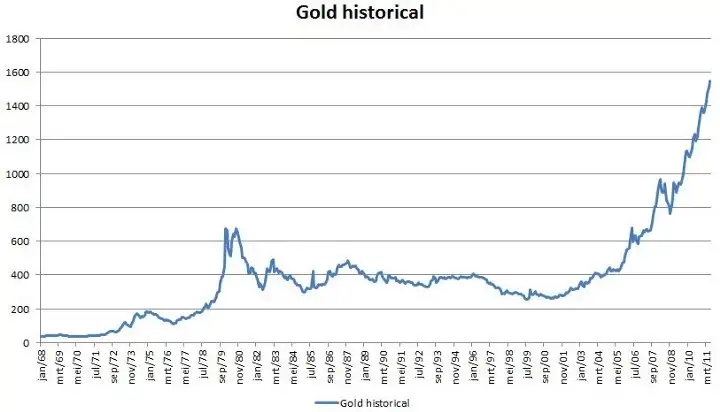

It’s 1921. Germany’s reeling from World War I, crushed by reparations and a wrecked economy. The government’s solution? Print money. Lots of it. The German mark starts tanking. By 1923, it’s a joke—4.2 trillion marks to one U.S. dollar. A loaf of bread costs wheelbarrows of cash. Savings? Wiped out. Middle-class families? Pauperized. Chaos.

Enter Hugo Stinnes, a coal and steel magnate with a sharp mind and sharper instincts. He sees the game: when a currency’s dying, debt is your friend. Why? Because the real value of your loans shrinks as inflation skyrockets. Borrow 1 million marks today, buy a factory, and by next year, that million’s worth a few pennies. Pay it back, keep the factory, repeat.

Stinnes’ Master Play

Stinnes goes all in. He borrows billions of marks, snapping up hard assets—steel mills, shipping lines, factories, real estate. Tangible stuff that holds value while paper marks turn to confetti. By 1923, his empire is a beast: over 1,500 companies, from coal mines to newspapers. Estimates say he controlled 15-20% of Germany’s industry, maybe more. A third of the economy? Probably an exaggeration, but the guy was a titan.

He wasn’t just lucky. Stinnes played 4D chess. He diversified his holdings to weather the storm, employed tens of thousands (keeping unrest at bay), and even argued his empire stabilized the economy. Critics, like British diplomat Lord D’Abernon, weren’t buying it—they called him a profiteer who thrived while others starved. Truth? Probably somewhere in the middle.

The Fall

Hyperinflation couldn’t last forever. In November 1923, Germany introduced the Rentenmark, a new currency backed by land and assets. The mark’s freefall stopped. Stinnes’ debt-fueled strategy hit a wall—stable currencies make loans harder to game. His health was failing too. He died in 1924, and his conglomerate started unraveling, with parts sold off or restructured. The Inflation King’s reign was over.

Why This Matters Today: Enter Bitcoin

Stinnes’ story isn’t just a history lesson—it’s a warning. Hyperinflation destroys trust in fiat money. When governments print cash to cover debts, savers get crushed, and the clever (or ruthless) like Stinnes exploit the chaos. Sound familiar? Look at today: global debt’s at $315 trillion, central banks are juggling interest rates, and inflation’s eating purchasing power. Argentina’s peso lost 50% of its value in 2024 alone. Venezuela’s bolívar? Toast.

This is where Bitcoin comes in. Born in 2009 after the financial crisis, Bitcoin is a hedge against fiat’s flaws. Unlike marks or dollars, it’s decentralised—no government can print more to pay its bills. Its supply is capped at 21 million coins, making it “digital gold.” When fiat currencies wobble, Bitcoin’s value often spikes—check its 2021 and 2024 bull runs during inflation fears.

Stinnes gamed a broken system by betting on hard assets. Today, Bitcoiners are doing the same, but instead of factories, they’re stacking sats. Why? Because in a world where fiat can be printed to oblivion, a deflationary asset like Bitcoin holds appeal. It’s not perfect—volatility’s a beast, and governments hate what they can’t control—but it’s a response to the same problem Stinnes faced: untrustworthy money.

The Lesson

Stinnes saw the Weimar collapse coming and turned it into wealth. Most didn’t. Today, you don’t need to be a tycoon to protect yourself, but you do need to understand the game. Fiat’s not collapsing tomorrow, but cracks are showing. Bitcoin’s one tool—maybe not the only one—to hedge against that risk. Study history, question the system, and don’t get caught holding the bag.

-

@ dfa02707:41ca50e3

2025-05-29 13:02:32

@ dfa02707:41ca50e3

2025-05-29 13:02:32Contribute to keep No Bullshit Bitcoin news going.

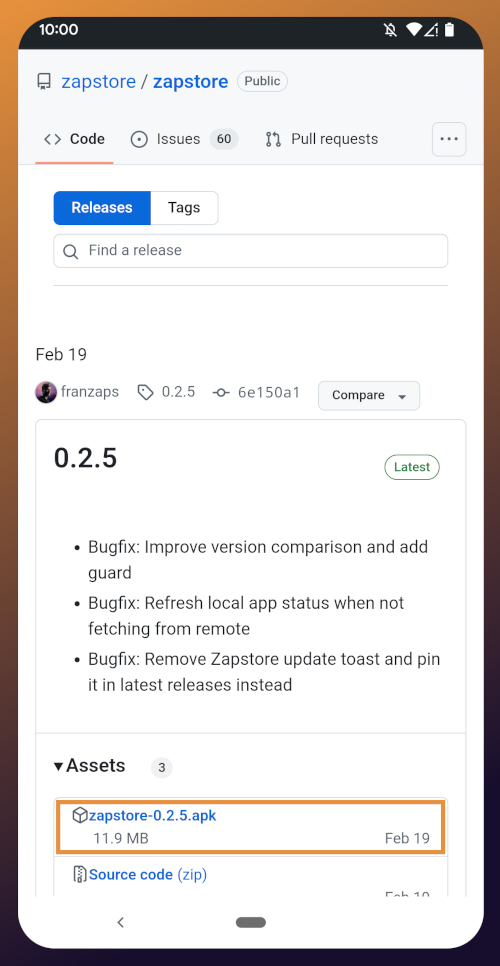

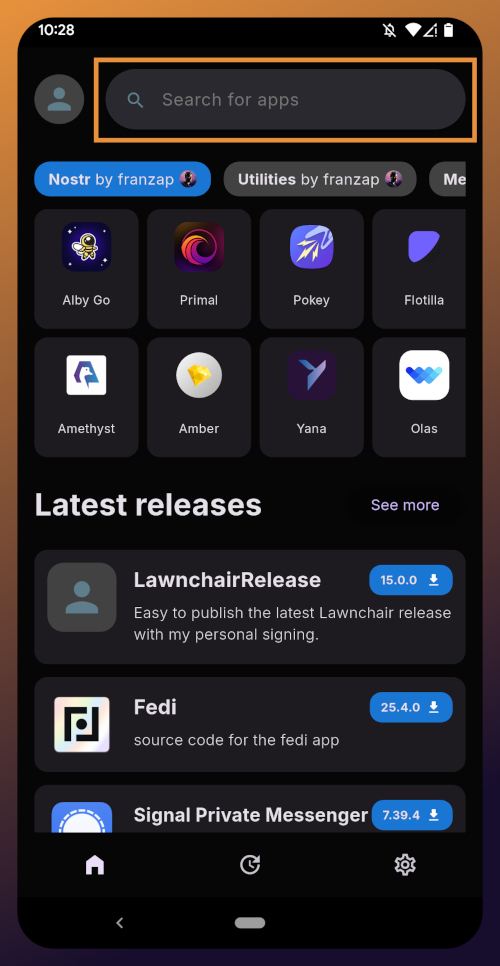

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

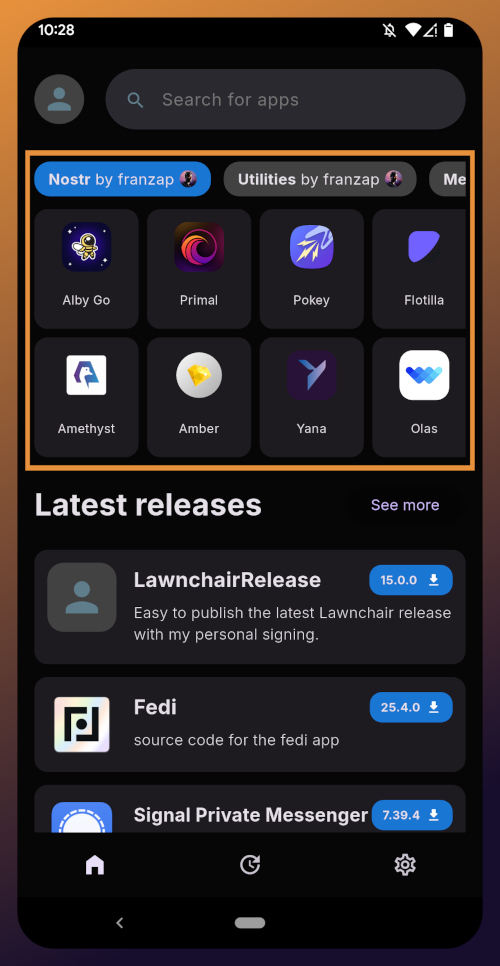

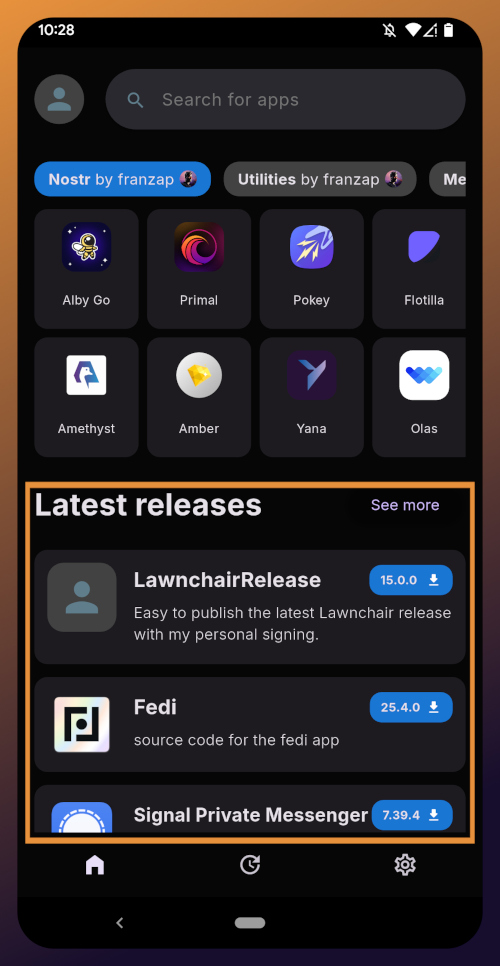

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ dfa02707:41ca50e3

2025-05-29 13:02:31

@ dfa02707:41ca50e3

2025-05-29 13:02:31Contribute to keep No Bullshit Bitcoin news going.

-

Version 1.3 of Bitcoin Safe introduces a redesigned interactive chart, quick receive feature, updated icons, a mempool preview window, support for Child Pays For Parent (CPFP) and testnet4, preconfigured testnet demo wallets, as well as various bug fixes and improvements.

-

Upcoming updates for Bitcoin Safe include Compact Block Filters.

"Compact Block Filters increase the network privacy dramatically, since you're not asking an electrum server to give you your transactions. They are a little slower than electrum servers. For a savings wallet like Bitcoin Safe this should be OK," writes the project's developer Andreas Griffin.

- Learn more about the current and upcoming features of Bitcoin Safe wallet here.

What's new in v1.3

- Redesign of Chart, Quick Receive, Icons, and Mempool Preview (by @design-rrr).

- Interactive chart. Clicking on it now jumps to transaction, and selected transactions are now highlighted.

- Speed up transactions with Child Pays For Parent (CPFP).

- BDK 1.2 (upgraded from 0.32).

- Testnet4 support.

- Preconfigured Testnet demo wallets.

- Cluster unconfirmed transactions so that parents/children are next to each other.

- Customizable columns for all tables (optional view: Txid, Address index, and more)

- Bug fixes and other improvements.

Announcement / Archive

Blog Post / Archive

GitHub Repo

Website -

-

@ cf8c27f4:c95b9b5c

2025-05-29 15:17:06

@ cf8c27f4:c95b9b5c

2025-05-29 15:17:06Bitcoin’s Path to Global Dominance: Store of Value, Medium of Exchange, and the Road to a Bitcoin Standard

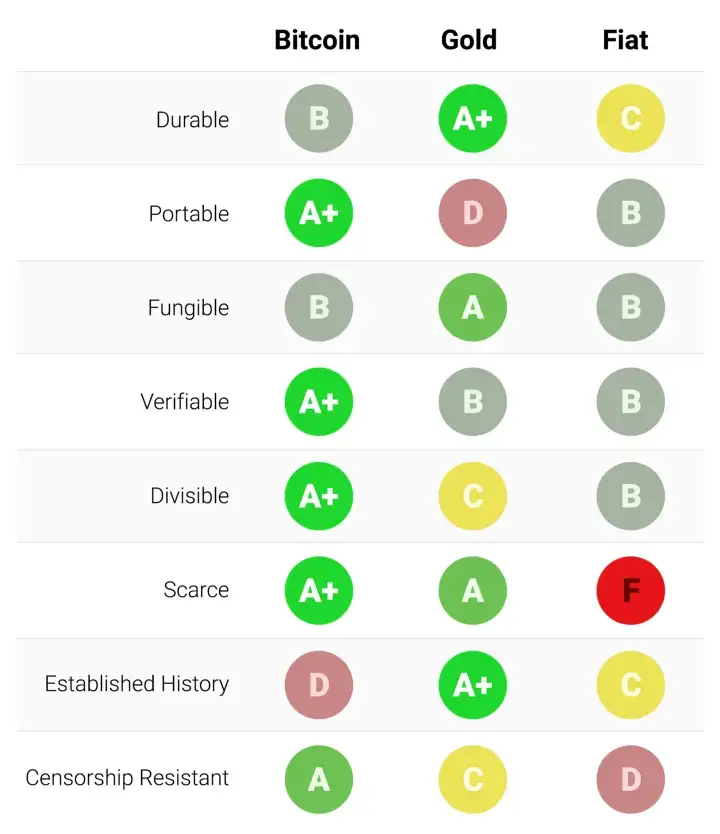

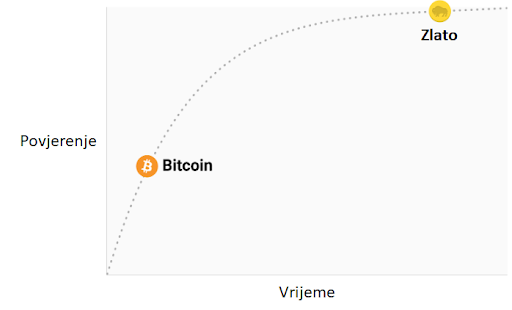

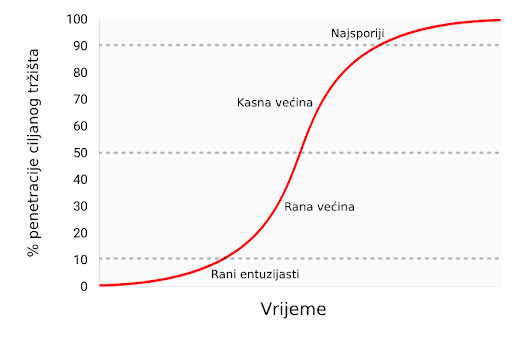

Bitcoin has ignited a financial revolution, captivating everyone from tech enthusiasts to institutional investors. Yet, amidst its meteoric rise, a tantalising question emerges: Could Bitcoin become the world’s reserve currency, relegating fiat currencies to the history books? This vision—a global Bitcoin standard—stirs intense debate within the community. Some champion Bitcoin as a Store of Value (SOV), a digital equivalent to gold, while others insist its future lies in becoming a Medium of Exchange (MOE), used for everyday transactions. With conflicting perspectives and community members at varying points in their Bitcoin journey, it’s time to unpack these ideas and chart a unified course.

This article delves into the interplay between Bitcoin’s SOV and MOE roles, examines the hurdles to widespread adoption, and proposes a roadmap for Bitcoin to claim global reserve status. My goal is to ignite a vibrant discussion, bridge divides, and encourage the Bitcoin community to rally around a shared vision for the future.

The Building Blocks: What Are SOV and MOE?

To kick things off, let’s define the two pillars of this debate:

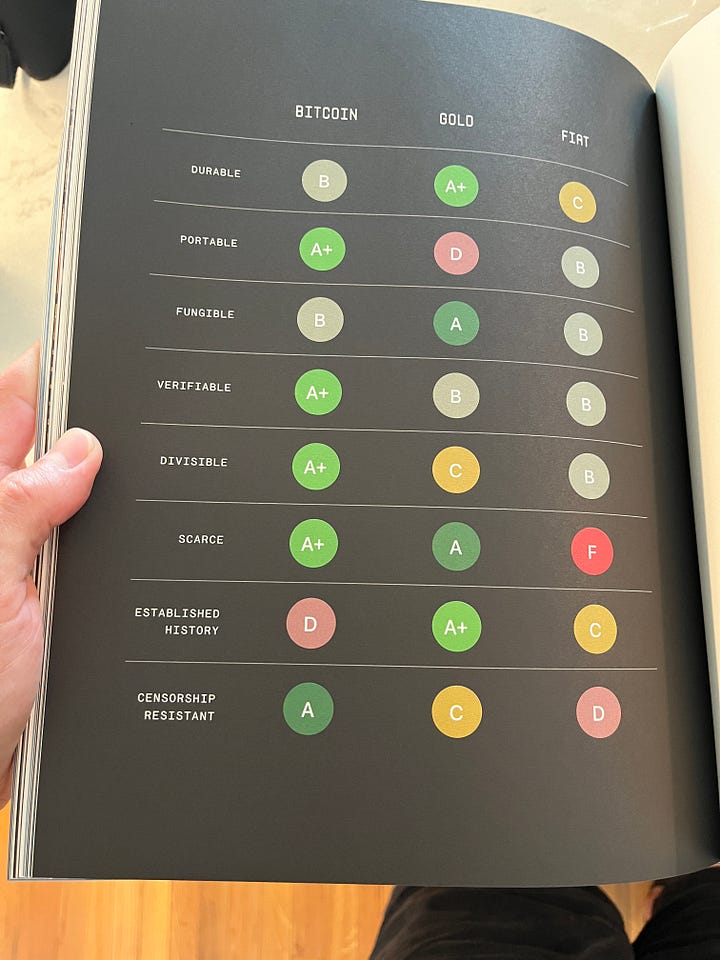

• Store of Value (SOV): An asset that holds or grows its worth over time, offering a dependable way to preserve wealth. Think gold, a classic example cherished for millennia.

• Medium of Exchange (MOE): A tool for transactions, enabling the seamless exchange of goods and services. Today, fiat currencies like the pound or dollar reign supreme in this domain.

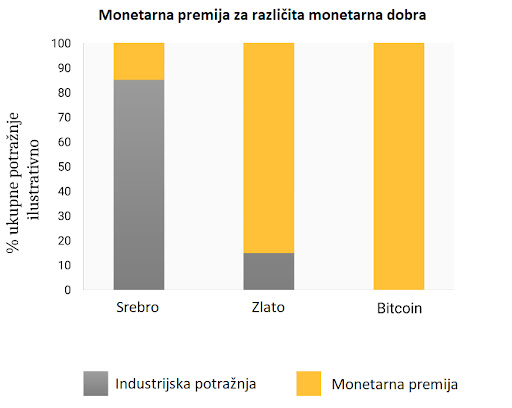

Bitcoin’s allure stems from its unique traits: a capped supply of 21 million coins, a decentralised network, and immunity to censorship. These qualities position it as a contender to replace both gold and fiat money—but the journey is complex, and the community’s views are far from aligned.

Where We Stand: Bitcoin as Digital Gold

Bitcoin’s ascent has been propelled by its prowess as a Store of Value. Early adopters, savvy investors, and even big institutions have embraced it as a shield against inflation, economic turmoil, and the erosion of fiat value. Its scarcity—hardwired into its code—has cemented the “digital gold” narrative, drawing in those seeking a safe haven in uncertain times.

But here’s the rub: while Bitcoin shines as an SOV, it’s rarely used as an MOE. Its price swings, technical limitations, and patchy acceptance by merchants make it a tough sell for buying a pint or a loaf of bread. Many in the community—think of figures like Michael Saylor—preach the gospel of “hodling,” urging followers to stash Bitcoin away and watch its value soar. This strategy has paid off handsomely for some, but it begs a bigger question: Can Bitcoin rule the world if it remains a speculative treasure rather than a working currency?

The Adoption Puzzle: Bridging SOV and MOE

For Bitcoin to leap from a niche asset to the global reserve currency, it must become a widely accepted Medium of Exchange. This evolution matters for several reasons:

• Real-World Use Fuels Demand: When Bitcoin powers transactions, its value ties to tangible activity, not just market hype.

• Network Strength: More users mean a tougher, more valuable network—a classic network effect.

• Price Stability: Broader adoption could smooth out Bitcoin’s wild price rides, making it more practical for daily use.

Yet, hurdles abound. Bitcoin’s volatility is a dealbreaker for many—who’d spend it on a takeaway if it might double in value overnight? Then there’s the issue of “whales” or “max hodlers,” those holding vast swathes of Bitcoin. If too much of the supply sits idle, it starves the liquidity needed for an MOE to thrive.

The Hodler Debate: To Spend or Not to Spend?

A spirited clash within the community revolves around these large holders. Should they—like Saylor or early adopters—dip into their stacks to kickstart adoption? Hodling bolsters Bitcoin’s scarcity and SOV credentials, no doubt. But if the bulk of Bitcoin stays locked up, it could stall the growth of a bustling, transactional ecosystem.

Let’s be fair: hodling has been a winning play for many, turning small investments into fortunes. It’s a stretch to demand these pioneers shoulder the adoption burden alone. As Bitcoin weaves into the fabric of commerce—think businesses accepting it or workers earning it—transactional demand will rise organically. Over time, this could nudge even the staunchest hodlers to spend a bit, striking a balance between saving and circulating.

Growth and Stability: A Natural Progression

Bitcoin’s Compound Annual Growth Rate (CAGR) offers another angle. As its market cap balloons, its explosive growth is likely to taper off—a standard pattern for any asset. This slowdown could usher in greater stability, a boon for its MOE ambitions. Less volatility means less risk when spending Bitcoin, paving the way for it to move beyond investment portfolios and into wallets for everyday use.

This shift could redefine Bitcoin’s story, transforming it from a rollercoaster ride to a dependable currency. Voices like Jeff Booth and Jack Dorsey argue that MOE success is the key to sustaining Bitcoin’s SOV status. In short, while SOV lit the fuse, MOE could keep the fire burning.

The Blueprint: Steps to a Bitcoin Standard

So, how does Bitcoin ascend to world reserve status and birth a Bitcoin standard? Here’s a five-step vision:

1. SOV Momentum: Bitcoin’s allure as an inflation hedge and wealth preserver keeps drawing in holders, boosting its market cap and global clout.

2. MOE Infrastructure: Innovations like the Lightning Network must deliver fast, cheap transactions, making Bitcoin a practical choice for daily spending.

3. Value Stability: As adoption spreads and the market matures, Bitcoin’s price swings dampen, earning trust from users and merchants alike.

4. MOE Takeoff: With better tools and steadier value, Bitcoin becomes a go-to for transactions, amplifying its worth through a powerful network effect.

5. Global Crown: Governments and central banks start holding Bitcoin in reserves, using it for trade and settlements, cementing its place as the world’s reserve currency.

This isn’t a cakewalk. Scalability bottlenecks, regulatory pushback, and rival cryptocurrencies loom large. But if Bitcoin can clear these obstacles, it could become the backbone of global finance.

Harmony Over Division: SOV and MOE Together

Here’s the crux: SOV and MOE aren’t at odds—they’re partners in Bitcoin’s rise. Holding Bitcoin safeguards its scarcity and value; spending it spreads its reach and usefulness. Both are vital for the long haul.

At this pivotal moment, the Bitcoin community must rally around a dual-purpose ethos. We can:

• Educate: Help newcomers grasp Bitcoin’s twin roles as SOV and MOE.

• Innovate: Back tech that makes Bitcoin spending as easy as swiping a card.

• Talk: Host open forums to wrestle with differences and find unity.

The Final Word: Our Collective Challenge

Bitcoin’s shot at becoming the world’s reserve currency—and forging a Bitcoin standard—is as exhilarating as it is daunting. Its Store of Value roots have set the stage, but its Medium of Exchange potential will decide if it can topple fiat and redefine money itself.

The path is long, but the prize is transformative. By embracing both SOV and MOE, we can propel Bitcoin to new heights. Let’s grab this chance, dive into the debate, and build a future where Bitcoin leads the charge.

Your Turn: What’s the best way forward for Bitcoin? Should we lean harder into SOV, push MOE, or blend the two? Drop your thoughts below an

-

@ dfa02707:41ca50e3

2025-05-29 13:02:30

@ dfa02707:41ca50e3

2025-05-29 13:02:30Contribute to keep No Bullshit Bitcoin news going.

This update brings key enhancements for clarity and usability:

- Recent Blocks View: Added to the Send tab and inspired by Mempool's visualization, it displays the last 2 blocks and the estimated next block to help choose fee rates.

- Camera System Overhaul: Features a new library for higher resolution detection and mouse-scroll zoom support when available.

- Vector-Based Images: All app images are now vectorized and theme-aware, enhancing contrast, especially in dark mode.

- Tor & P2A Updates: Upgraded internal Tor and improved support for pay-to-anchor (P2A) outputs.

- Linux Package Rename: For Linux users, Sparrow has been renamed to sparrowwallet (or sparrowserver); in some cases, the original sparrow package may need manual removal.

- Additional updates include showing total payments in multi-payment transaction diagrams, better handling of long labels, and other UI enhancements.

- Sparrow v2.2.1 is a bug fix release that addresses missing UUID issue when starting Tor on recent macOS versions, icons for external sources in Settings and Recent Blocks view, repackaged

.debinstalls to use older gzip instead of zstd compression, and removed display of median fee rate where fee rates source is set to Server.

Learn how to get started with Sparrow wallet:

Release notes (v2.2.0)

- Added Recent Blocks view to Send tab.

- Converted all bitmapped images to theme aware SVG format for all wallet models and dialogs.

- Support send and display of pay to anchor (P2A) outputs.

- Renamed

sparrowpackage tosparrowwalletandsparrowserveron Linux. - Switched camera library to openpnp-capture.

- Support FHD (1920 x 1080) and UHD4k (3840 x 2160) capture resolutions.

- Support camera zoom with mouse scroll where possible.

- In the Download Verifier, prefer verifying the dropped file over the default file where the file is not in the manifest.

- Show a warning (with an option to disable the check) when importing a wallet with a derivation path matching another script type.

- In Cormorant, avoid calling the

listwalletdirRPC on initialization due to a potentially slow response on Windows. - Avoid server address resolution for public servers.

- Assume server address is non local for resolution failures where a proxy is configured.

- Added a tooltip to indicate truncated labels in table cells.

- Dynamically truncate input and output labels in the tree on a transaction tab, and add tooltips if necessary.

- Improved tooltips for wallet tabs and transaction diagrams with long labels.

- Show the address where available on input and output tooltips in transaction tab tree.

- Show the total amount sent in payments in the transaction diagram when constructing multiple payment transactions.

- Reset preferred table column widths on adjustment to improve handling after window resizing.

- Added accessible text to improve screen reader navigation on seed entry.

- Made Wallet Summary table grow horizontally with dialog sizing.

- Reduced tooltip show delay to 200ms.

- Show transaction diagram fee percentage as less than 0.01% rather than 0.00%.

- Optimized and reduced Electrum server RPC calls.

- Upgraded Bouncy Castle, PGPainless and Logback libraries.

- Upgraded internal Tor to v0.4.8.16.

- Bug fix: Fixed issue with random ordering of keystore origins on labels import.

- Bug fix: Fixed non-zero account script type detection when signing a message on Trezor devices.

- Bug fix: Fixed issue parsing remote Coldcard xpub encoded on a different network.

- Bug fix: Fixed inclusion of fees on wallet label exports.

- Bug fix: Increase Trezor device libusb timeout.

Linux users: Note that the

sparrowpackage has been renamed tosparrowwalletorsparrowserver, and in some cases you may need to manually uninstall the originalsparrowpackage. Look in the/optfolder to ensure you have the new name, and the original is removed.What's new in v2.2.1

- Updated Tor library to fix missing UUID issue when starting Tor on recent macOS versions.

- Repackaged

.debinstalls to use older gzip instead of zstd compression. - Removed display of median fee rate where fee rates source is set to Server.

- Added icons for external sources in Settings and Recent Blocks view

- Bug fix: Fixed issue in Recent Blocks view when switching fee rates source

- Bug fix: Fixed NPE on null fee returned from server

-

@ ef53426a:7e988851

2025-05-29 12:26:43

@ ef53426a:7e988851

2025-05-29 12:26:43Saturday 9AM It’s a chilly Saturday morning in Warsaw, and I don’t want to get out of bed. This is not because of the hangover; it’s because I feel like a failure.

The first day of Bitcoin FilmFest was a whirlwind of workshops, panels and running between stages. The pitch competition did not go my way. Another ‘pitching rabbit’ (an actual experienced film-maker) was selected to win the €3,000 of funding.

Rather than get up and search for coffee, I replay the scenes in my head. What could I have done differently? Will investors ever believe in me: I’m just a writer with no contacts in the industry. Do I have what it takes to produce a film?

Eventually, I haul myself out of bed and walk to Amondo, the festival’s morning HQ (and technically, the smallest cinema in Europe). Upon arrival, I find Bitcoin psychonaut Ioni Appelberg holding court in front of around a dozen enraptured disciples. Soon, the conversation spills out to the street to free up space for more workshops.

I attend a talk on film funding, then pay for coffee using bitcoin. I see familiar faces from the two previous nights. We compare notes on Friday night and check the day’s schedule. The morning clouds burn off, and things feel a little brighter.

The afternoon session begins just a few blocks away in the towering Palace of Culture and Science. My role in today's proceedings is to present my freedom fiction project, 21 Futures, on the community stage. Other presentations range from rap videos and advice on finding jobs in bitcoin to hosting ‘Bitcoin Walks’. This is how we are fixing the culture.

Saturday 8PM I feel a tap on my shoulder. ‘Excuse me, Mr. Philip. Your car is waiting. The Producers’ Dinner is starting soon’.

What? Me, a producer? I’ve been taking part in some panels and talks, but I assumed my benefits as a guest were limited to a comped ticket and generous goodie bag.

Soon, I am sharing a taxi with a Dubai-based journalist, a Colombian director, and the cypherpunk sponsor of the pitch competition I didn’t win.

The pierogies I dreamed of earlier that day somehow manifest (happy endings do exist), and we enjoy a raucous dinner including obligatory slivovitz.

Sunday 2AM The last few hours of blur include a bracing city-bike ride in a crew of nine attendees back to the Palace of Culture, chatting with a fellow bitcoin meetup organiser, and vaguely promising to attend a weekend rave with a crew of Polish artists and musicians on the outskirts of London.

I leave the party while it’s still in full swing. In five hours, I have to wake up to complete my Run for Hal in Marshal Edward Rydz-Śmigły Park.

Thursday 9PM The festival kicks off in Samo Centrum on Pizza Day. I arrive in a taxi straight from a cramped flight (fix the airlines!), having not eaten for around ten hours.

The infectious sounds of softly spoken Aussie bitrocker Roger9000 pound into the damp night. I’m three beers in, being presented by the organisers to attendees like a (very tall) show pony. I try to explain more about my books, my publishing connections, my short film.

When I search for the food I ordered an hour ago, I find it has been given away. The stern-faced Polish pizza maker shrugs. ‘You not here.’

I’m so hungry I could cry (six hours of Ryanair can do that to a man). And then, a heroic Czech pleb donates half a pizza to me. Side note: this same heroic pleb accidentally locked me out of my film-funds while trying to fix a wallet bug on Sunday night.

I step out into the rain. Roger9000 reminds us we should have laser eyes well past 100k. I take a bite of pizza and life tastes good.

The Films Side events, artists, late nights, and pitcher’s regret is all well and good, but what of the films?

My highlights included Golden Rabbit winner No More Inflation — a moving narrative with interviews from two dozen economists, visionaries, and inflation survivors.

Hotel Bitcoin, was a surprisingly funny comedy romp about a group of idiots who happen across a valuable laptop.

Revolución Bitcoin — an approachable and thorough documentary aimed to bring greater adoption in the Spanish-speaking world.

And, as a short-fiction guy, I enjoyed the short films The Man Who Wouldn’t Cry, a visit to New York’s only Somali restaurant in Finding Home.

Sunday 7PM The award ceremony has just finished. I head to Amondo for the final time to pay for mojitos in bitcoin and say goodbye to newly made friends. I feel like I’ve met almost everyone in attendance. Are you going to BTC Prague?!? we ask as we part ways.

Of course, the best thing about any festival is the people, and BFF25 had a cast of characters worthy of any art house flick:

- The bright-eyed and confident frontwoman of the metal band Scardust

- A nostr-native artist selling his intricate canvases to the highest zapper

- A dreadlocked DJ who wears a pair of flying goggles on his head at all times

- An affable British filmmaker explaining the virtues of the word ‘chucklesome’

- A Duracell-powered organiser who seems to know every song, person, film, book, and guest at the festival.

Warsaw itself feels like it has a role to play, too. Birdsong and green parks contrast the foreboding Communist-era architecture. The weather changes faster than my mood — heavy greys transform to bright sunshine. The roads around the venue close on Sunday for a political rally. And there we are in the middle, watching our bitcoin films.

Tuesday 10AM I’m at home now, squinting at my email inbox and piles of washing, wondering when the hell I’ll find time. The festival Telegram group is still buzzing with activity. Side events like martial arts tutorials, trips to a shooting range, boat tours. 5AM photos of street graffiti, lost and found items, and people asking ‘is anyone still around?’

This was not just a film festival. BFF is truly a celebration of culture — Art. Books. Comedy. Music. Video. Talk. Connection.

All this pure signal has lifted my spirits so much that despite me being a newbie filmmaker, armed only with a biro, a couple of powerpoints and a Geyser fund page, I know I will succeed in my mission. It turns out you can just film things.

You may have attended bitcoin conferences before — you know, the ones with ‘fireside chats’, VIP areas, and overpriced merch. Bitcoin FilmFest is a moment in time. We are fixing the culture, year after year, until art can flourish again.

As fellow author Aaron Koenig commented during a panel session, ‘In twenty years, we won’t be drawing laser eyes and singing about honey badgers. Our grandchildren won’t understand the change we went through.’

Would I do it all again? Of course!

Join me next June in Warsaw.

I’ll be the tall one presenting his short animation premiere.

Philip Charter is a full-time writer and part-time cat herder. As well as writing for bitcoin founders and companies, he runs the 21 Futures fiction project.

Find out more about theNoderoid Saga animation projecton Geyser.

-

@ 2cde0e02:180a96b9

2025-05-29 11:19:56

@ 2cde0e02:180a96b9

2025-05-29 11:19:56pen; monochromized

https://stacker.news/items/991836

-

@ b1ddb4d7:471244e7

2025-05-29 13:01:44

@ b1ddb4d7:471244e7

2025-05-29 13:01:44When Sergei talks about bitcoin, he doesn’t sound like someone chasing profits or followers. He sounds like someone about to build a monastery in the ruins.

While the mainstream world chases headlines and hype, Sergei shows up in local meetups from Sacramento to Cleveland, mentors curious minds, and shares what he knows is true – hoping that, with the right spark, someone will light their own way forward.

We interviewed Sergei to trace his steps: where he started, what keeps him going, and why teaching bitcoin is far more than explaining how to set up a node – it’s about reaching the right minds before the noise consumes them. So we began where most journeys start: at the beginning.

First Steps

- So, where did it all begin for you and what made you stay curious?

I first heard about bitcoin from a friend’s book recommendation, American Kingpin, the book about Silk Road (online drug marketplace). He is still not a true bitcoiner, although I helped him secure private keys with some bitcoin.

I was really busy at the time – focused on my school curriculum, running a 7-bedroom Airbnb, and working for a standardized test prep company. Bitcoin seemed too technical for me to explore, and the pace of my work left no time for it.

After graduating, while pursuing more training, I started playing around with stocks and maximizing my savings. Passive income seemed like the path to early retirement, as per the promise of the FIRE movement (Financial Independence, Retire Early). I mostly followed the mainstream news and my mentor’s advice – he liked preferred stocks at the time.

I had some Coinbase IOUs and remember sending bitcoin within the Coinbase ledger to a couple friends. I also recall the 2018 crash; I actually saw the legendary price spike live but couldn’t benefit because my funds were stuck amidst the frenzy. I withdrew from that investment completely for some time. Thankfully, my mentor advised to keep en eye on bitcoin.

Around late 2019, I started DCA-ing cautiously. Additionally, my friend and I were discussing famous billionaires, and how there was no curriculum for becoming a billionaire. So, I typed “billionaires” into my podcast app, and landed on We Study Billionaires podcast.

That’s where I kept hearing Preston Pysh mention bitcoin, before splitting into his own podcast series, Bitcoin Fundamentals. I didn’t understand most of the terminology of stocks, bonds, etc, yet I kept listening and trying to absorb it thru repetition. Today, I realize all that financial talk was mostly noise.

When people ask me for a technical explanation of fiat, I say: it’s all made up, just like the fiat price of bitcoin! Starting in 2020, during the so-called pandemic, I dove deeper. I religiously read Bitcoin Magazine, scrolled thru Bitcoin Twitter, and joined Simply Bitcoin Telegram group back when DarthCoin was an admin.

DarthCoin was my favorite bitcoiner – experienced, knowledgeable, and unapologetic. Watching him shift from rage to kindness, from passion to despair, gave me a glimpse at what a true educator’s journey would look like.

The struggle isn’t about adoption at scale anymore. It’s about reaching the few who are willing to study, take risks, and stay out of fiat traps. The vast majority won’t follow that example – not yet at least… if I start telling others the requirements for true freedom and prosperity, they would certainly say “Hell no!”

- At what point did you start teaching others, and why?

After college, I helped teach at a standardized test preparation company, and mentored some students one-on-one. I even tried working at a kindergarten briefly, but left quickly; Babysitting is not teaching.

What I discovered is that those who will succeed don’t really need my help – they would succeed with or without me, because they already have the inner drive.

Once you realize your people are perishing for lack of knowledge, the only rational thing to do is help raise their level of knowledge and understanding. That’s the Great Work.

I sometimes imagine myself as a political prisoner. If that were to happen, I’d probably start teaching fellow prisoners, doctors, janitors, even guards. In a way we already live in an open-air prison, So what else is there to do but teach, organize, and conspire to dismantle the Matrix?

Building on Bitcoin

- You hosted some in-person meetups in Sacramento. What did you learn from those?

My first presentation was on MultiSig storage with SeedSigner, and submarine swaps through Boltz.exchange.

I realized quickly that I had overestimated the group’s technical background. Even the meetup organizer, a financial advisor, asked, “How is anyone supposed to follow these steps?” I responded that reading was required… He decided that Unchained is an easier way.

At a crypto meetup, I gave a much simpler talk, outlining how bitcoin will save the world, based on a DarthCoin’s guide. Only one person stuck around to ask questions – a man who seemed a little out there, and did not really seem to get the message beyond the strength of cryptographic security of bitcoin.

Again, I overestimated the audience’s readiness. That forced me to rethink my strategy. People are extremely early and reluctant to study.

- Now in Ohio, you hold sessions via the Orange Pill App. What’s changed?

My new motto is: educate the educators. The corollary is: don’t orange-pill stupid normies (as DarthCoin puts it).

I’ve shifted to small, technical sessions in order to raise a few solid guardians of this esoteric knowledge who really get it and can carry it forward.

The youngest attendee at one of my sessions is a newborn baby – he mostly sleeps, but maybe he still absorbs some of the educational vibes.

- How do local groups like Sactown and Cleveland Bitcoiners influence your work?

Every meetup reflects its local culture. Sacramento and Bay Area Bitcoiners, for example, do camping trips – once we camped through a desert storm, shielding our burgers from sand while others went to shoot guns.

Cleveland Bitcoiners are different. They amass large gatherings. They recently threw a 100k party. They do a bit more community outreach. Some are curious about the esoteric topics such as jurisdiction, spirituality, and healthful living.

I have no permanent allegiance to any state, race, or group. I go where I can teach and learn. I anticipate that in my next phase, I’ll meet Bitcoiners so advanced that I’ll have to give up my fiat job and focus full-time on serious projects where real health and wealth are on the line.

Hopefully, I’ll be ready. I believe the universe always challenges you exactly to your limit – no less, no more.

- What do people struggle with the most when it comes to technical education?

The biggest struggle isn’t technical – it’s a lack of deep curiosity. People ask “how” and “what” – how do I set up a node, what should one do with the lightning channels? But very few ask “why?”

Why does on-chain bitcoin not contribute to the circular economy? Why is it essential to run Lightning? Why did humanity fall into mental enslavement in the first place?

I’d rather teach two-year-olds who constantly ask “why” than adults who ask how to flip a profit. What worries me most is that most two-year-olds will grow up asking state-funded AI bots for answers and live according to its recommendations.

- One Cleveland Bitcoiner shows up at gold bug meetups. How valuable is face-to-face education?

I don’t think the older generation is going to reverse the current human condition. Most of them have been under mind control for too long, and they just don’t have the attention span to study and change their ways.

They’re better off stacking gold and helping fund their grandkids’ education. If I were to focus on a demographic, I’d go for teenagers – high school age – because by college, the indoctrination is usually too strong, and they’re chasing fiat mastery.

As for the gold bug meetup? Perhaps one day I will show up with a ukulele to sing some bitcoin-themed songs. Seniors love such entertainment.

- How do you choose what to focus on in your sessions, especially for different types of learners?

I don’t come in with a rigid agenda. I’ve collected a massive library of resources over the years and never stopped reading. My browser tab and folder count are exploding.

At the meetup, people share questions or topics they’re curious about, then I take that home, do my homework, and bring back a session based on those themes. I give them the key takeaways, plus where to dive deeper.

Most people won’t – or can’t – study the way I do, and I expect attendees to put in the work. I suspect that it’s more important to reach those who want to learn but don’t know how, the so-called nescient (not knowing), rather than the ignorant.

There are way too many ignorant bitcoiners, so my mission is to find those who are curious what’s beyond the facade of fake reality and superficial promises.

That naturally means that fewer people show up, and that’s fine. I’m not here for the crowds; I’m here to educate the educators. One bitcoiner who came decided to branch off into self-custody sessions and that’s awesome. Personally, I’m much more focused on Lightning.

I want to see broader adoption of tools like auth, sign-message, NWC, and LSPs. Next month, I’m going deep into eCash solutions, because let’s face it – most newcomers won’t be able to afford their own UTXO or open a lightning channel; additionally, it has to be fun and easy for them to transact sats, otherwise they won’t do it. Additionally, they’ll need to rely on

-

@ dfa02707:41ca50e3

2025-05-29 15:02:24

@ dfa02707:41ca50e3

2025-05-29 15:02:24Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ 7f6db517:a4931eda

2025-05-29 10:01:34

@ 7f6db517:a4931eda

2025-05-29 10:01:34

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ 33baa074:3bb3a297

2025-05-28 08:54:40

@ 33baa074:3bb3a297

2025-05-28 08:54:40COD (chemical oxygen demand) sensors play a vital role in water quality testing. Their main functions include real-time monitoring, pollution event warning, water quality assessment and pollution source tracking. The following are the specific roles and applications of COD sensors in water quality testing:

Real-time monitoring and data acquisition COD sensors can monitor the COD content in water bodies in real time and continuously. Compared with traditional sampling methods, COD sensors are fast and accurate, without manual sampling and laboratory testing, which greatly saves time and labor costs. By combining with the data acquisition system, the monitoring data can be uploaded to the cloud in real time to form a extemporization distribution map of the COD content in the water body, providing detailed data support for environmental monitoring and management.

Pollution event warning and rapid response COD sensors play an important role in early warning and rapid response in water environment monitoring. Once there is an abnormal increase in organic matter in the water body, the COD sensor can quickly detect the change in COD content and alarm through the preset threshold. This enables relevant departments to take measures at the early stage of the pollution incident to prevent the spread of pollution and protect the water environment.

Water quality assessment and pollution source tracking COD sensors play an important role in water quality assessment and pollution source tracking. By continuously monitoring the COD content in water bodies, the water quality can be evaluated and compared with national and regional water quality standards. At the same time, COD sensors can also help determine and track the location and spread of pollution sources, provide accurate data support for environmental management departments, and guide the development of pollution prevention and control work.

Application scenarios COD sensors are widely used in various water quality monitoring scenarios, including but not limited to: Sewage treatment plants: used to monitor the COD content of in fluent and effluent to ensure the effect of sewage treatment. Water source protection and management: deployed in water sources to monitor the COD content of in fluent sources. Once the water quality exceeds the set limit, the system will issue an alarm in time to ensure water quality safety. Lake and river monitoring: deployed in water bodies such as lakes and rivers to monitor the COD content of water bodies in real time.

Technical features of COD sensor COD sensor uses advanced technology, such as ultraviolet absorption method, which does not require the use of chemical reagents, avoiding the risk of contamination of chemical reagents in traditional COD detection methods, and can achieve online uninterrupted water quality monitoring, providing strong support for real-time water quality assessment. In addition, COD sensor also has the advantages of low cost, high stability, strong anti-interference ability, and convenient installation.

Summary In summary, COD sensor plays an irreplaceable role in water quality detection. It can not only provide real-time and accurate water quality data, but also quickly warn when pollution incidents occur, providing strong technical support for water quality management and environmental protection. With the advancement of technology and the popularization of applications, COD sensor will play a more important role in water quality monitoring in the future.

-

@ 348e7eb2:3b0b9790

2025-05-24 05:00:33

@ 348e7eb2:3b0b9790

2025-05-24 05:00:33Nostr-Konto erstellen - funktioniert mit Hex

Was der Button macht

Der folgende Code fügt einen Button hinzu, der per Klick einen Nostr-Anmeldedialog öffnet. Alle Schritte sind im Code selbst ausführlich kommentiert.

```html

```

Erläuterungen:

- Dynamisches Nachladen: Das Script

modal.jswird nur bei Klick nachgeladen, um Fehlermeldungen beim Initial-Load zu vermeiden. -

Parameter im Überblick:

-

baseUrl: Quelle für API und Assets. an: App-Name für den Modal-Header.aa: Farbakzent (Foerbico-Farbe als Hex).al: Sprache des Interfaces.am: Licht- oder Dunkelmodus.afb/asb: Bunker-Modi für erhöhten Datenschutz.aan/aac: Steuerung der Rückgabe privater Schlüssel.arr/awr: Primal Relay als Lese- und Schreib-Relay.-

Callbacks:

-

onComplete: Schließt das Modal, zeigt eine Bestätigung und bietet die Weiterleitung zu Primal an. onCancel: Schließt das Modal und protokolliert den Abbruch.

Damit ist der gesamte Code sichtbar, kommentiert und erklärt.

- Dynamisches Nachladen: Das Script

-

@ 7f6db517:a4931eda

2025-05-29 10:01:34

@ 7f6db517:a4931eda

2025-05-29 10:01:34

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-05-29 10:01:27

@ dfa02707:41ca50e3

2025-05-29 10:01:27- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ 7e538978:a5987ab6

2025-05-29 10:32:34

@ 7e538978:a5987ab6

2025-05-29 10:32:34This article gives an overview and comparison of the various funding sources that are available for LNbits.

LNbits is compatible with many Lightning Network wallets and can be on anything from a small VPS to a raspberry Pi on your home network or the LNbits SaaS platform.

Why your funding source matters

There are trade-offs between the various funding sources, for example funding LNbits using Strike requires the user to KYC themselves and has some privacy compromises versus funding LNbits from your own LND node. However the technical barrier to entry and node maintenance of using Strike is lower than using LND.

Self-custodial vs custodial connectors

Self-custodial Funding Sources

You run the node or service, keep the keys, and may need to manage LN channels. Good if you want control and have the skills to look after a server. Examples: LND (gRPC/REST), CoreLightning, Spark.

Self-custodial funding sources with an LSP

These funding sources offer a reasonable compromise between self-custody and some privacy trade offs. Examples: Phoenixd, Breez SDK, Boltz.

Custodial (or semi-custodial) funding sources

A third party runs the node. You plug LNbits into their API. Setup is quick and costs are low, but you trust the provider with your funds and privacy. Examples: Alby, OpenNode, Blink, ZBD, LNPay or another LNbits instance.

Funding sources compared

Below is a summary of the main options and how they stack up.

LNbits Lightning Network Funding Sources Comparison Table

| Funding Source | Custodial Type | KYC Required | Technical Knowledge Needed | Node Hosting Required | Privacy Level | Liquidity Management | Ease of Setup | Maintenance Effort | Cost Implications | Scalability | Notes | |----------------------------|--------------------|---------------------|--------------------------------|---------------------------|-------------------|--------------------------|-------------------|------------------------|----------------------------------------------|-----------------|------------------------------------------------------------------| | LND (gRPC) | Self-custodial | ❌ | Higher | ✅ | High | Manual | Moderate | High | Infrastructure cost and channel opening fees | High | gRPC interface for LND; suitable for advanced integrations. | | CoreLightning (CLN) | Self-custodial | ❌ | Higher | ✅ | High | Manual | Moderate | High | Infrastructure cost and channel opening fees | High | Requires setting up and managing your own CLN node. | | Phoenixd | Self-custodial | ❌ | Medium | ❌ | Medium | Automatic | Moderate | Low | Minimal fees | Medium | Mobile wallet backend; suitable for mobile integrations. | | Nostr Wallet Connect (NWC) | Custodial | Depends on provider | Low | ❌ | Variable | Provider-managed | Easy | Low | May incur fees | Medium | Connects via Nostr protocol; depends on provider's policies. | | Boltz | Self-custodial | ❌ | Medium | ❌ | Medium | Provider-managed | Moderate | Moderate | Minimal fees | Medium | Uses submarine swaps; connects to Boltz client. | | LND (REST) | Self-custodial | ❌ | Higher | ✅ | High | Manual | Moderate | High | Infrastructure cost and channel opening fees | High | REST interface for LND; suitable for web integrations. | | CoreLightning REST | Self-custodial | ❌ | Higher | ✅ | High | Manual | Moderate | High | Infrastructure cost and channel opening fees | High | REST interface for CLN; suitable for web integrations. | | LNbits (another instance) | Custodial | Depends on host | Low | ❌ | Variable | Provider-managed | Easy | Low | May incur hosting fees | Medium | Connects to another LNbits instance; depends on host's policies. | | Alby | Custodial | ✅ | Low | ❌ | Low | Provider-managed | Easy | Low | Transaction fees apply | Medium | Browser extension wallet; suitable for web users. | | Breez SDK | Self-custodial | ❌ | Medium | ❌ | High | Automatic | Moderate | Low | Minimal fees | Medium | SDK for integrating Breez wallet functionalities. | | OpenNode | Custodial | ✅ | Low | ❌ | Low | Provider-managed | Easy | Low | Transaction fees apply | Medium | Third-party service; suitable for merchants. | | Blink | Custodial | ✅ | Low | ❌ | Low | Provider-managed | Easy | Low | Transaction fees apply | Medium | Third-party service; focuses on mobile integrations. | | ZBD | Custodial | ✅ | Low | ❌ | Low | Provider-managed | Easy | Low | Transaction fees apply | Medium | Gaming-focused payment platform. | | Spark (CLN) | Self-custodial | ❌ | Higher | ✅ | High | Manual | Moderate | High | Infrastructure cost and channel opening fees | High | Web interface for CLN; requires Spark server setup. | | Cliche Wallet | Self-custodial | ❌ | Medium | ❌ | Medium | Manual | Moderate | Moderate | Minimal fees | Medium | Lightweight wallet; suitable for embedded systems. | | Strike | Custodial | ✅ | Low | ❌ | Low | Provider-managed | Easy | Low | Transaction fees apply | Medium | Third-party service; suitable for quick setups. | | LNPay | Custodial | ✅ | Low | ❌ | Low | Provider-managed | Easy | Low | Transaction fees apply | Medium | Third-party service; suitable for quick setups. |

Which source suits you?

| Scenario | Good fit | Why | | ------------------------------------------- | ---------------------------------------------------------------------- | ------------------------------------------------------ | | Business running its own infrastructure | LND or CoreLightning on a Dell Optiplex or other dedicated machine | Full control, high throughput, best privacy. | | Independent node runner | Spark (CLN) or LND (REST/gRPC) | You already run a node and want a clean web interface. | | Quick proof of concept | Alby, LNPay, or another hosted LNbits | No hardware needed, lets you test ideas fast. |

Run LNbits

Ready to run LNbits?

Choose a funding source, follow the guides, and start today.

Further reading

- LNbits documentation

- LND – gRPC and REST guides

- CoreLightning – setup and Spark info

- Breez SDK

- Phoenixd

- Nostr Wallet Connect

-

@ b1ddb4d7:471244e7

2025-05-29 10:00:44

@ b1ddb4d7:471244e7

2025-05-29 10:00:44Starting January 1, 2026, the United Kingdom will impose some of the world’s most stringent reporting requirements on cryptocurrency firms.

All platforms operating in or serving UK customers-domestic and foreign alike-must collect and disclose extensive personal and transactional data for every user, including individuals, companies, trusts, and charities.

This regulatory drive marks the UK’s formal adoption of the OECD’s Crypto-Asset Reporting Framework (CARF), a global initiative designed to bring crypto oversight in line with traditional banking and to curb tax evasion in the rapidly expanding digital asset sector.

What Will Be Reported?

Crypto firms must gather and submit the following for each transaction:

- User’s full legal name, home address, and taxpayer identification number

- Detailed data on every trade or transfer: type of cryptocurrency, amount, and nature of the transaction

- Identifying information for corporate, trust, and charitable clients

The obligation extends to all digital asset activities, including crypto-to-crypto and crypto-to-fiat trades, and applies to both UK residents and non-residents using UK-based platforms. The first annual reports covering 2026 activity are due by May 31, 2027.

Enforcement and Penalties

Non-compliance will carry stiff financial penalties, with fines of up to £300 per user account for inaccurate or missing data-a potentially enormous liability for large exchanges. The UK government has urged crypto firms to begin collecting this information immediately to ensure operational readiness.

Regulatory Context and Market Impact

This move is part of a broader UK strategy to position itself as a global fintech hub while clamping down on fraud and illicit finance. UK Chancellor Rachel Reeves has championed these measures, stating, “Britain is open for business – but closed to fraud, abuse, and instability”. The regulatory expansion comes amid a surge in crypto adoption: the UK’s Financial Conduct Authority reported that 12% of UK adults owned crypto in 2024, up from just 4% in 2021.

Enormous Risks for Consumers: Lessons from the Coinbase Data Breach

While the new framework aims to enhance transparency and protect consumers, it also dramatically increases the volume of sensitive personal data held by crypto firms-raising the stakes for cybersecurity.

The risks are underscored by the recent high-profile breach at Coinbase, one of the world’s largest exchanges.

In May 2025, Coinbase disclosed that cybercriminals, aided by bribed offshore contractors, accessed and exfiltrated customer data including names, addresses, government IDs, and partial bank details.

The attackers then used this information for sophisticated phishing campaigns, successfully deceiving some customers into surrendering account credentials and funds.

“While private encryption keys remained secure, sufficient customer information was exposed to enable sophisticated phishing attacks by criminals posing as Coinbase personnel.”

Coinbase now faces up to $400 million in compensation costs and has pledged to reimburse affected users, but the incident highlights the systemic vulnerability created when large troves of personal data are centralized-even if passwords and private keys are not directly compromised. The breach also triggered a notable drop in Coinbase’s share price and prompted a $20 million bounty for information leading to the attackers’ capture.

The Bottom Line

The UK’s forthcoming crypto reporting regime represents a landmark in financial regulation, promising greater transparency and tax compliance. However, as the Coinbase episode demonstrates, the aggregation of sensitive user data at scale poses a significant cybersecurity risk.

As regulators push for more oversight, the challenge will be ensuring that consumer protection does not become a double-edged sword-exposing users to new threats even as it seeks to shield them from old ones.

-

@ 7d33ba57:1b82db35

2025-05-29 08:40:35

@ 7d33ba57:1b82db35

2025-05-29 08:40:35Lingen (Ems) is a peaceful town in Lower Saxony, near the Dutch border, known for its historic old town, green surroundings, and relaxed pace of life. It may not be on the typical tourist radar, but it offers a taste of small-town Germany with plenty of charm and local culture.

🏘️ What to See and Do in Lingen

🏛️ Old Town & Market Square

- Stroll through the historic town center, where you’ll find half-timbered houses, cozy cafés, and the lovely St. Boniface Church

- The Rathaus (Town Hall) and its square are perfect for a slow coffee or people-watching

🚲 Nature & Outdoor Activities

- The region around Lingen is great for cycling and walking, especially along the Ems River

- Explore the Emsland countryside, filled with forests, meadows, and quiet villages

- Visit the nearby Emsland Moormuseum to learn about local peatland history

🎓 Student Vibes

- Thanks to the presence of a university, Lingen has a young and vibrant side, with cultural events and small live music scenes

🍺 Local Food & Drink

- Try regional dishes like Grünkohl (kale with sausage in winter) and Schnitzel in a local tavern

- Enjoy a drink at a beer garden or riverside café, especially in warmer months

🚆 Getting There

- Well connected by train, especially to Osnabrück, Münster, and the Dutch city of Enschede

- Great stop on a northern Germany road or rail trip

Lingen is ideal for travelers looking for peaceful towns, regional culture, and access to beautiful natural areas. It’s a place where you can slow down, bike along a river, and enjoy the local way of life.

-

@ cefb08d1:f419beff

2025-05-29 08:01:15

@ cefb08d1:f419beff

2025-05-29 08:01:15https://stacker.news/items/991778

-

@ 7f6db517:a4931eda

2025-05-29 07:02:50

@ 7f6db517:a4931eda

2025-05-29 07:02:50

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ 33baa074:3bb3a297

2025-05-28 08:25:13

@ 33baa074:3bb3a297

2025-05-28 08:25:13The oil-in-water sensoris an instrument specially used to detect oil substances in water bodies. Its working principle is mainly based on the characteristic that oil substances will produce fluorescence under ultraviolet light. The following is a detailed explanation:

Principle Overview The oil-in-water sensor uses the characteristic that oil substances will produce fluorescence under ultraviolet light, and measures the fluorescence intensity to infer the concentration of oil substances. Specifically, the sensor uses ultraviolet light as the excitation light source to irradiate the water sample to be tested. After the oil substance absorbs ultraviolet light, it will stimulate fluorescence, and the fluorescence signal is received by the photo detector and converted into an electrical signal. By measuring the strength of the electrical signal, the concentration of oil substances in the water sample can be inferred.

Workflow Ultraviolet light irradiation: The ultraviolet light source inside the sensor emits ultraviolet light and irradiates it into the water sample to be tested.

Fluorescence generation: After the oil substance in the water sample absorbs ultraviolet light, it will stimulate fluorescence.

Fluorescence detection: The photo detector in the sensor measures the intensity of this fluorescence.

Signal conversion: The signal processing circuit converts the output of the photo detector into an electrical signal proportional to the amount of oil in the water. Data analysis: By analyzing the strength of the electrical signal, the concentration of oil substances in the water sample can be obtained.

Features and applications The oil in water sensor has high sensitivity and can detect soluble and falsifiable oils. It is suitable for a variety of water quality monitoring scenarios, such as oil field monitoring, industrial circulating water, condensate water, wastewater treatment, surface water stations, etc. In addition, it can also monitor the content of crude oil (benzene and benzene homologous) in water sources such as reservoirs and water plants in real time online, play an early warning role, and protect the safety of water sources.

Practical application The oil in water sensor has a wide range of functions in practical applications, including but not limited to the following aspects: Monitoring the water quality of water sources: ensuring the safety of drinking water, and timely discovering pollution sources and ensuring water supply safety by continuously monitoring oil substances in water sources. Monitoring sewage treatment plant emissions: ensuring that the discharge water quality of sewage treatment plants meets the emission standards to avoid secondary pollution to the environment. Monitoring rivers, lakes and other water bodies: assessing the pollution status and providing a basis for pollution control. Early warning and emergency response: It has real-time monitoring and early warning functions, and can issue an alarm in time when abnormal conditions are found, providing valuable time for emergency response and reducing losses caused by pollution. Scientific research: Through the monitoring data of this sensor, we can deeply understand the distribution, migration and transformation of oil substances in water bodies, and provide a scientific basis for environmental protection and governance.

In summary, the oil in water sensor monitors the oil content in water bodies through ultraviolet fluorescence method, has high sensitivity and broad application prospects, and is an indispensable and important tool in modern environmental monitoring and industrial production.

-

@ 9e9085e9:2056af17

2025-05-29 07:51:18

@ 9e9085e9:2056af17

2025-05-29 07:51:18Part 5: Why You Should Join Yakihonne Today

🚀 Yakihonne: The Future of Free, Fair & Fast Social Interaction

Looking for a platform where you control everything—your posts, your data, your income?

Yakihonne is not just another app. It's a movement. A decentralized social payment network where:

Your voice can't be silenced

Your data isn't sold

Your followers are truly yours

Your creativity can be rewarded instantly

🔥 6 Reasons to Pay Attention to Yakihonne:

-