-

@ a5ee4475:2ca75401

2025-06-04 18:11:52

@ a5ee4475:2ca75401

2025-06-04 18:11:52clients #link #list #english #article #finalversion #descentralismo

*These clients are generally applications on the Nostr network that allow you to use the same account, regardless of the app used, keeping your messages and profile intact.

**However, you may need to meet certain requirements regarding access and account NIP for some clients, so that you can access them securely and use their features correctly.

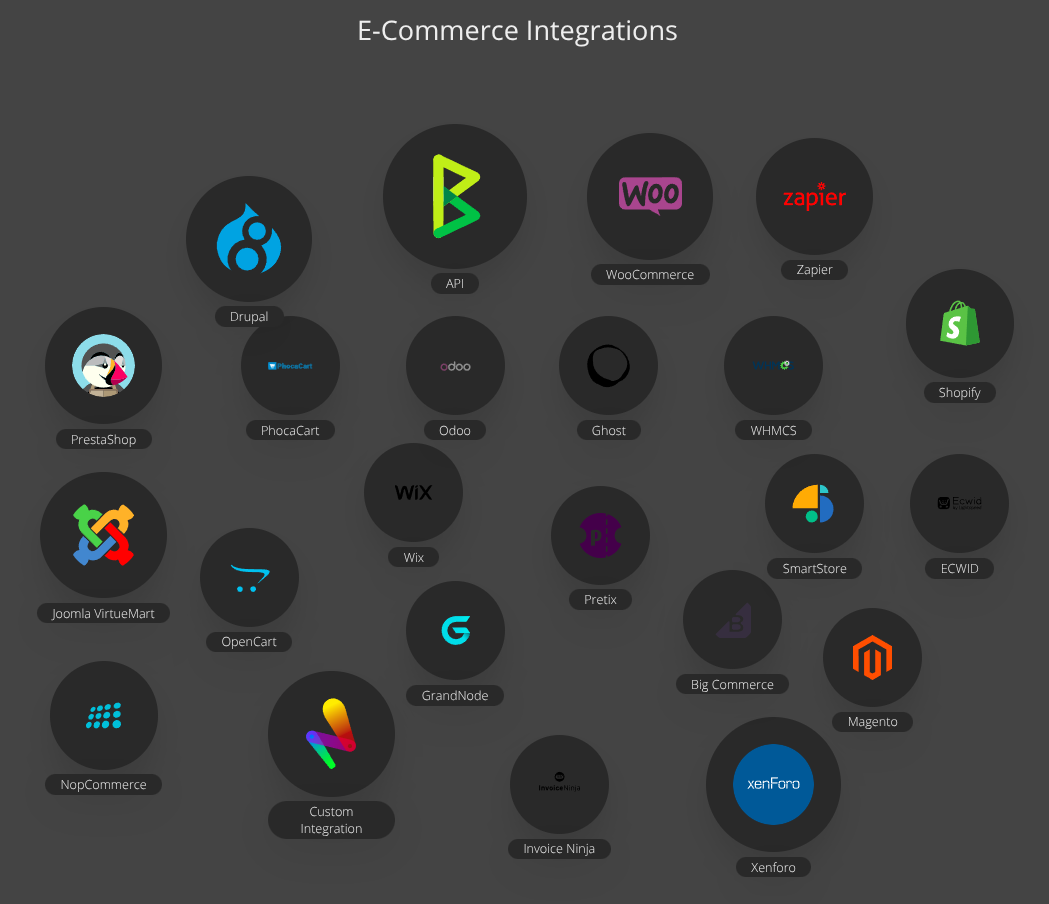

CLIENTS

Twitter like

- Nostrmo - [source] 🌐💻(🐧🪟🍎)🍎🤖(on zapstore)

- Coracle - Super App [source] 🌐🤖(on zapstore)

- Amethyst - Super App with note edit, delete and other stuff with Tor [source] 🤖(on zapstore)

- Primal - Social and wallet [source] 🌐🍎🤖(on zapstore)

- Iris - [source] 🌐🤖🍎

- Current - [source] 🤖🍎

- FreeFrom 🤖🍎

- Openvibe - Nostr and others (new Plebstr) [source] 🤖🍎

- Snort 🌐(🤖[early access]) [onion] [source]

- Damus 🍎 [source]

- Nos 🍎 [source]

- Nostur 🍎 [source]

- NostrBand 🌐 [info] [source]

- Yana [source] 🌐💻(🐧) 🍎🤖(on zapstore)

- Nostribe [on development] 🌐 [source]

- Lume 💻(🐧🪟🍎) [info] [source]

- Gossip - [source] 💻(🐧🪟🍎)

- noStrudel - Gamified Experience [onion] [info/source] 🌐

- [Nostrudel Next] - [onion]

- moStard - Nostrudel with Monero [onion] [info/source] 🌐

- Camelus - [source] 🤖 [early access]

Community

- CCNS - Community Curated Nostr Stuff [source]

- Nostr Kiwi [creator] 🌐

- Satellite [info] 🌐

- Flotilla - [source] 🌐🐧🤖(on zapstore)

- Chachi - [source] 🌐

- Futr - Coded in haskell [source] 🐧 (others soon)

- Soapbox - Comunnity server [info] [source] 🌐

- Ditto - Soapbox community server 🌐 [source] 🌐

- Cobrafuma - Nostr brazilian community on Ditto [info] 🌐

- Zapddit - Reddit like [source] 🌐

- Voyage (Reddit like) [on development] 🤖

Wiki

- Wikifreedia - Wiki Dark mode [source] 🌐

- Wikinostr - Wiki with tabs clear mode [source] 🌐

- Wikistr - Wiki clear mode [info] [source] 🌐

Search

- Keychat - Signal-like chat with AI and browser [source] 💻(🐧🪟🍎) - 📱(🍎🤖{on zapstore})

- Spring - Browser for Nostr apps and other sites [source] 🤖 (on zapstore)

- Advanced nostr search - Advanced note search by isolated terms related to a npub profile [source] 🌐

- Nos Today - Global note search by isolated terms [info] [source] 🌐

- Nostr Search Engine - API for Nostr clients [source]

- Ntrends - Trending notes and profiles 🌐

Website

- Nsite - Nostr Site [onion] [info] [source]

- Nsite Gateway - Nostr Site Gateway [source]

- Npub pro - Your site on Nostr [source]

App Store

ZapStore - Permitionless App Store [source] 🤖 💻(🐧🍎)

Video and Live Streaming

- Flare - Youtube like 🌐 [source]

- ZapStream - Lives, videos, shorts and zaps (NIP-53) [source] 🌐 🤖(lives only | Amber | on zapstore)

- StreamCat - [source code dont found]

- Shosho - Stream your camera [source] 🤖(on zapstore)

- Swae - Live streaming [source] (on development) ⏳

Post Aggregator - Kinostr - Nostr Cinema with #kinostr [english] [author] 🌐 - Stremstr - Nostr Cinema with #kinostr [english] [source] 🤖

Link Agreggator - Kinostr - #kinostr - Nostr Cinema Profile with links [English] - Equinox - Nostr Cinema Community with links [Portuguese]

Audio and Podcast Transmission

- Castr - Your npub as podcast feed [source]

- Nostr Nests - Audio Chats [source] 🌐

- Fountain - Podcast [source] 🤖🍎

- Corny Chat - Audio Chat [source] 🌐

Music

- Tidal - Music Streaming [source] [about] [info] 🤖🍎🌐

- Wavlake - Music Streaming [source] 🌐(🤖🍎 [early access])

- Tunestr - Musical Events [source] [about] 🌐

- Stemstr - Musical Colab (paid to post) [source] [about] 🌐

Images

- Lumina - Trending images and pictures [source] 🌐

- Pinstr - Pinterest like [source] 🌐

- Slidestr - DeviantArt like [source] 🌐

- Memestr - ifunny like [source] 🌐

Download and Upload

Documents, graphics and tables

- Mindstr - Mind maps [source] 🌐

- Docstr - Share Docs [info] [source] 🌐

- Formstr - Share Forms [info] 🌐

- Sheetstr - Share Spreadsheets [source] 🌐

- Slide Maker - Share slides 🌐 [Advice: Slide Maker https://zaplinks.lol/ site is down]

Health

- Sobrkey - Sobriety and mental health [source] 🌐

- Runstr - Running app [source] 🌐

- NosFabrica - Finding ways for your health data 🌐

- LazerEyes - Eye prescription by DM [source] 🌐

Forum

- OddBean - Hacker News like [info] [source] 🌐

- LowEnt - Forum [info] 🌐

- Swarmstr - Q&A / FAQ [info] 🌐

- Staker News - Hacker News like 🌐 [info]

Direct Messenges (DM)

- 0xchat 🤖🍎 [source]

- Nostr Chat 🌐🍎 [source]

- Blowater 🌐 [source]

- Anigma (new nostrgram) - Telegram based [on development] [source]

Reading

- Oracolo - A minimalist Nostr html blog [source]

- nRSS - Nostr RSS reader 🌐

- Highlighter - Insights with a highlighted read [info] 🌐

- Zephyr - Calming to Read [info] 🌐

- Flycat - Clean and Healthy Feed [info] 🌐

- Nosta - Check Profiles [on development] [info] 🌐

- Alexandria - e-Reader and Nostr Knowledge Base (NKB) [source] 🌐

Writing

- Habla - Blog [info] 🌐

- Blogstack - Blog [info]🌐

- YakiHonne - Articles and News [info] 🌐🍎🤖(on zapstore)

Lists

- Following - Users list [source] 🌐

- Nostr Unfollower - Nostr Unfollower

- Listr - Lists [source] 🌐

- Nostr potatoes - Movies List [source] 💻(numpy)

Market and Jobs

- Shopstr - Buy and Sell [onion] [source] 🌐

- Nostr Market - Buy and Sell 🌐

- Plebeian Market - Buy and Sell [source] 🌐

- Ostrich Work - Jobs [source] 🌐

- Nostrocket - Jobs [source] 🌐

Data Vending Machines - DVM (NIP90)

(Data-processing tools)

Games

- Chesstr - Chess 🌐 [source]

- Jestr - Chess [source] 🌐

- Snakestr - Snake game [source] 🌐

- Snakes on a Relay - Multiplayer Snake game like slither.io [source] 🌐

ENGINES - DEG Mods - Decentralized Game Mods [info] [source] 🌐 - NG Engine - Nostr Game Engine [source] 🌐 - JmonkeyEngine - Java game engine [source] 🌐

Customization

Like other Services

- Olas - Instagram like [source] 🌐🍎🤖(on zapstore)

- Nostree - Linktree like 🌐

- Rabbit - TweetDeck like [info] 🌐

- Zaplinks - Nostr links 🌐

- Omeglestr - Omegle-like Random Chats [source] 🌐

General Uses

- Njump - HTML text gateway source 🌐

- Filestr - HTML midia gateway [source] 🌐

- W3 - Nostr URL shortener [source] 🌐

- Playground - Test Nostr filters [source] 🌐

Places

- Wherostr - Travel and show where you are

- Arc Map (Mapstr) - Bitcoin Map [info]

Driver and Delivery

- RoadRunner - Uber like [on development] ⏱️

- Nostrlivery - iFood like [on development] ⏱️

⚠️ SCAM ⚠️ | Arcade City - Uber like [source]

OTHER STUFF

Lightning Wallets (zap)

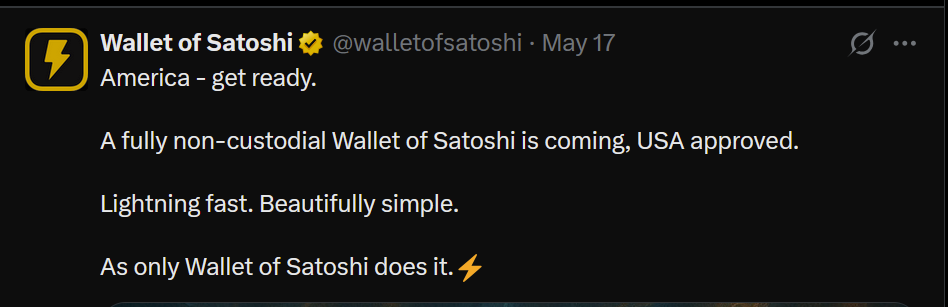

- Wallet of Satoshi - Simplest Lightning Wallet [info] 🤖🍎

- Coinos - Web wallet and Nostr client [source] 🌐

- Alby - Native and extension [info] [source] 🌐

- Minibits - Cashu mobile wallet [info] 🤖

- LNbits - App and extension [source] 🤖🍎💻

- Zeus - [info] [source] 🤖🍎

- Blink - Open source custodial wallet (KYC over 1000 usd) [source] 🤖🍎

⚠️ ZBD - Zap Gaming wallet and no more Social [closed source] [info] [some resources] 🤖 ⚠️ ZBD suddenly canceled my account for alleged Terms of Service violations, gives me no explanation and won't let me withdraw my money ⚠️

Without Zap - Wassabi Wallet - Privacy-focused and non-custodial with Nostr Update Manager [source]

Exchange

Media Server (Upload Links)

audio, image and video

Connected with Nostr (NIP):

- Nostr Build - Free and paid Upload [info] [source] 🌐

- NostrMedia - Written in Go with Nip 96 / Blossom (free and paid) [info] [source]

- Nostr Check - [info] [source] 🌐

- NostPic - [info] [source] 🌐

- Sovbit - Free and paid upload [info] [source] 🌐

- Voidcat - Nip-96 and Blossom [source] 🌐

- Primal Media - Primal Media Uploader [source] 🌐

Blossom - Your Media Safer

- Primal Blossom 🌐

- NostrBuild Blossom - Free upload (max 100MiB) and paid [info] [source] 🌐

Paid Upload Only

- Satellite CDN - prepaid upload (max 5GB each) [info] [source] 🌐

Without Nostr NIP:

- Pomf - Upload larger videos (max 1GB) [source]

- Catbox - max 200 MB [source]

- x0 - max 512 MiB [source]

Donation and payments

- Zapper - Easy Zaps [source] 🌐

- Autozap [source] 🌐

- Zapmeacoffee 🌐

- Nostr Zap 💻(numpy)

- Creatr - Creators subscription 🌐

- Geyzer - Crowdfunding [info] [source] 🌐

- Heya! - Crowdfunding [source]

Security

- Secret Border - Generate offline keys 💻(java)

- Umbrel - Your private relay [source] 🌐

Key signing/login and Extension

- Amber - Key signing [source] 🤖(on zapstore)

- Nowser - Account access keys 📱(🤖🍎) 💻(🐧🍎🪟)

- Nos2x - Account access keys 🌐

- Nsec.app 🌐 [info]

- Lume - [info] [source] 🐧🪟🍎

- Satcom - Share files to discuss - [info] 🌐

- KeysBand - Multi-key signing [source] 🌐

Code

- Stacks - AI Templates [info] [source] 🌐

- Nostrify - Share Nostr Frameworks 🌐

- Git Workshop (github like) [experimental] 🌐

- Gitstr (github like) [on development] ⏱️

- Osty [on development] [info] 🌐

- Python Nostr - Python Library for Nostr

- Sybil - Creating, managing and test Nostr events [on development] ⏱️

Relay Check and Cloud

- Nostr Watch - See your relay speed 🌐

- NosDrive - Nostr Relay that saves to Google Drive

Bidges and Getways

- Matrixtr Bridge - Between Matrix & Nostr

- Mostr - Between Nostr & Fediverse

- Nostrss - RSS to Nostr

- Rsslay - Optimized RSS to Nostr [source]

- Atomstr - RSS/Atom to Nostr [source]

Useful Profiles and Trends

nostr-voice - Voice note (just some clients)

NOT RELATED TO NOSTR

Voca - Text-to-Speech App for GrapheneOS [source] 🤖(on zapstore)

Android Keyboards

Personal notes and texts

Front-ends

- Nitter - Twitter / X without your data [source]

- NewPipe - Youtube, Peertube and others, without account & your data [source] 🤖

- Piped - Youtube web without you data [source] 🌐

Other Services

- Brave - Browser [source]

- DuckDuckGo - Search [source]

- LLMA - Meta - Meta open source AI [source]

- DuckDuckGo AI Chat - Famous AIs without Login [source]

- Proton Mail - Mail [source]

Other open source index: Degoogled Apps

Some other Nostr index on:

-

@ d9a329af:bef580d7

2025-06-04 18:09:31

@ d9a329af:bef580d7

2025-06-04 18:09:31This one is rather straightforward today, as I wanted to write something on the software I personally use in my day-to-day musical composition deal, depending on what needs to be done. I want to go a little in depth in this regard, so bear with me on this one.

For the first stop on this libreware-riddled pilgramage, the operating system.

There are two I'll be mentioning: one for beginners, and the one I use on a day-to-day basis (my daily driver).

- Linux Mint

- Fun Fact: This was my longest-running daily driver for a while (over a year or two and some change) before I switched to my current one (based upon Arch, an advanced distro)

- Beginner friendly (based upon Ubuntu, Debian if using LMDE)

- Usually works OOTB when it's set up for music production (with some exceptions on some software)

- Versatile multimedia distribution (gaming, music, art, creative writing, etc.)

- Software is old, but the distro is rock-solid.

Linux Mint... the classic choice for a popular distro aimed at GNU/Linux beginners. It's the most popular of them all, especially when it comes to Snap-free protest distros (Pop_OS! is another one that's Snap-free), and the most popular in general. It's a general-purpose OS aimed at easing beginners into Linux, and the wider FLOSS community (FLOSS is an acronym for Free/Libre Open-Source Software) of software made available using licensed like GPL, MIT, MPL, Apache-2, BSD, WTFPL, and many more of the like.

I would personally recommend the Debian Edition (LMDE) and use the Debian Testing repositories if you want up-to-date software, and not bleeding edge for APT (the package manager in Debian and Ubuntu). It will be much easier to learn how to add software repositories with a couple commands in the terminal that way, and this knowledge will transcend if you decide to move to vanilla Debian. However, if you want the Cinnamon Desktop Environment, Linux Mint is a good choice, as its developers are behind Cinnamon (It has the looks of Windows Vista, which is why it's so familiar for those switching from Windows). However, there isn't too much software in the Mint, Debian and Ubuntu repos, which is a bummer (you can just find community-maintained repos or build software from source if you have the know-how).

- CachyOS

- Fun Fact: It's my current daily driver (if you couldn't tell by now).

- Arch-based distribution focused on content creation (vibe emanation as some Nostriches call it), gaming and other multimedia work

- Optimized repositories depending on the CPU architecture family (I have V3 repos enabled, since I use a CPU that supports V3)

- Bleeding edge of software packaging

- Packages (both official and community maintained) out the wazoo (80k+ packages in the AUR [Arch User Repository], with some AUR packages in binary form thanks to the Chaotic AUR repo)

CachyOS... the gamer's Arch that even beats out the likes of EndeavourOS and Garuda Linux (both Arch-based gaming distros). This is thanks in part to the optimizations made to vanilla Arch (especially the optimized repositories based upon what CPU you have installed) among many other things done to it under the hood. However, while it is fantastic for gaming, the other multimedia performances are quite a sight to behold, especially since anybody worth their salt is using almost exclusively FLOSS to make things easier for yourself to escape the grasp of incompetent fools that we call politicians. Using Linux, FLOSS and GrapheneOS (the only acceptable AOSP ROM) will help you kickstart your journey to privacy, security and proper OPSEC protocols so you don't get sucked into the proprietary software matrix (which I explained in this article).

As a Linux user with almost 5 years of experience, it's hard for me to go back to proprietary stuff. After all, with the advancement in weaponized and centralized AI on the rise, I wanted to seriously get myself out of that (which is why I used almost exclusively FLOSS for the past 4+ years). Enough about that already, let's get into the software required for you to make music... oh wait, I'm talking about myself here. Whoops....

Now that the operating system is out of the way, let's get into the actual software I use to make music:

- Ardour (DAW)

- x42 Plugins (General Purpose Plugin Suite)

- LSP PLugins (General Purpose Plugin Suite)

- Sfizz (SFZ player)

- Dragonfly Reverb (Reverberation Plugin Suite)

- DeBess (Airwindows De-Esser)

- Noise Repellant (Noise Gate)

- Guitarix and GX Plugins (Guitar Pedalboard Simulation)

- Vital (Synth Plugin)

- Surge XT (Synth Plugin) [Unused]

- EQ10Q (No longer usable)

- CALF Plugins (No Longer Usable)

- DSK SF2 (I used this due to ACE Fluid Synth acting like a turd)

- DR-84 (Proprietary Drum Machine Plugin [Winblows])

These are the primary pieces of software that I use to make music on Linux, with the description as shown above. This article would be too long anyway if I were to explain them, so I'll leave that here.

-

@ 0b65f96a:7fda4c8f

2025-06-04 18:07:06

@ 0b65f96a:7fda4c8f

2025-06-04 18:07:06Es gibt Bibliotheken voll Literatur zur „Kunst“ der Kriegsführung. Dies hier ist ein Beitrag zu den Bibliotheken der Kunst Frieden zu führen. Denn Frieden ist nicht die Abwesenheit von Krieg. Sondern eine mindestens ebenso intensive Aktivität. Worin genau besteht sie aber? Ich glaube darin, weder nach der einen noch nach der anderen Seite vom Hochseil zu fallen. Denn vom Hochseil kann man immer nach zwei Seiten fallen. Das ist dann auch schon die Kernherausforderung: Gleichgewichthalten!

Es scheint zunächst ein ganz äußerlicher Auftrag. Es gibt immer und wird immer widerstreitende Interessen geben. Allerdings ist das nur die äußerste Zwiebelschale. Denn wenn wir die Sache etwas mit Abstand von uns selbst betrachten, werden wir in uns hinein verwiesen: Frieden kann nur von innen nach außen gestiftet werden. Wenn wir das Hochseil in uns suchen, was finden wir dann? – Zweifels ohne, wissen wir von uns, dass wir nicht jeden Tag unser bestes Selbst sind. Würde es sich nicht lohnen etwas genauer über die Möglichkeit nach zwei Seiten vom Hochseil zu fallen nachzudenken, zugunsten der eigenen Balancierfähigkeit?

Wir sind daran gewöhnt zu denken dem Guten steht das Böse gegenüber. Daraus ziehen ja alle Western und Martial Arts Streifen ihren Plot: Der Gute bringt den Bösen um die Ecke und damit hat wieder mal das Gute gesiegt. Wir bewerten das „um die Ecke bringen“ unterschiedlich, je nach dem, von wem es kommt.

Ich möchte einen neuen Gedanken vorschlagen über unser Inneres, über Gut und Böse nachzudenken. Denn, wie gesagt, vom Hochseil kann man nach zwei Seiten fallen. Und es hat immer drastische Wirkung. Wo kommen wir also hin, wenn wir sagen: Frieden ist immer ein Gleichgewichtszustand, ergo eine Zeit der Mitte?

Sagen wir Toleranz ist ein erstrebenswertes Ideal. Dann würden wir sicher sagen Engstirnigkeit ist das Gegenteil davon und alles andere als Wünschenswert. Ja, so ist es gewiss. Und es bleibt hinzuzufügen, auch Beliebigkeit ist das Gegenteil von Toleranz. Denn es gibt eine Grenze, wo Toleranz nicht mehr Toleranz ist, sondern Beliebigkeit, ein „alles ist möglich“. Ähnlich können wir es für Großzügigkeit denken: Großzügigkeit ist ein erstrebenswertes Ideal. Ihr Gegenteil ist Geiz. Ihr anderes Gegenteil die Verschwendung. Oder Mut. Mut ist ein erstrebenswertes Ideal. Feigheit sein Gegenteil. Sein anderes Gegenteil ist Leichtsinn. Mit andern Worten: Das Ideal wird immer zum Hochseil. Und wir können immer nach zwei Seiten von ihm fallen. Wenn wir diesem Gedanken folgen, kommen wir weg von der Gut-Böse-Dualität. Und stattdessen zur Frage nach dem Gleichgewicht. Zur Frage nach der Mittezeit.

Natürlich steht es uns frei all das zu denken. Oder auch nicht zu denken. Denn selbstverständlich ist es möglich es nicht zu denken und bei einer Dualitätsvorstellung festhängen zu bleiben. Es wird uns nur nicht helfen Frieden zu denken und in Frieden zu handeln. Wenn wir wollen können wir durch das Aufspannen einer Trinität einen neuen Raum eröffnen und betreten. In ihm wird Frieden aktiv führbar, denn er wird eine Gleichgewichtssituation in uns selbst! – Nicht eine, sich einander gegenüberstehender äußerer Mächte!

Gehen wir noch einen Schritt weiter in unserer Betrachtung, können wir feststellen, dass es durchaus einen Unterschied macht nach welcher Seite wir runter fallen. Denn auf der einen Seite ist es immer eine Verengung: Engstirnigkeit, Geiz, Feigheit in unseren Beispielen. Auf der anderen ist es immer eine Zersplitterung oder Versprühung. In unseren Beispielen Beliebigkeit, Verschwendung und Leichtsinn. Und das erstrebenswerte ist eben immer die Mitte, das von uns ständig aktualisierte Gleichgewicht.

Das interessante ist, wo diese Mitte liegt, lässt sich niemals statisch festlegen. Sie ist immer dynamisch. Denn sie kann zu unterschiedlichen Momenten an unterschiedlicher Stelle liegen. Es ist immer ein Ich, das sich in Geistesgegenwart neu ausbalanciert. Und darum ist Frieden so schwer. Wir werden ihn niemals „haben“, sondern ihm immer entgegen gehen.

Der Kriegsruf ist nichts anderes, als ein Versuch von denen, die vom Hochseil gefallen sind, uns auch herunter zu kicken.

Netter Versuch. Wird aber nichts!

In der Nussschale: Die Dualität auflösen in die Trinität der balancierenden Mitte zwischen der Geste der Versteinerung und der Geste des Zerstäubens oder Zersplitterns. Die dynamische Qualität der Mitte bemerken. Oder, tun wir es nicht, ist das gleich der erste Anstoß, der uns wieder zum Wackeln bringt. Und des Ich´s gewahr werden, das balanciert. Frieden führen ist eine Kunst.

Dieser Beitrag wurde mit dem Pareto-Client geschrieben.

Patric I. Vogt, geb. 1968 in Mainz. Autor von „Zukunft beginnt im Kopf Ein Debattenbeitrag zur Kernsanierung von Rechtsstaat und Demokratie“. Lebt als freischaffender Künstler, Lehrer und Unternehmer. Über drei Jahrzehnte Beschäftigung mit dem Ideenfeld soziale #Dreigliederung und Anthroposophie. Moderation und Mediation von sozialen Prozessen und Organisationsentwicklung. Staatlich ungeprüft, abgesehen von den Fahrerlaubnissen zu Land und zu Wasser. Motto: Gedanken werden Worte, werden Taten! www.perspektivenwechsel.social

-

@ 7f6db517:a4931eda

2025-06-04 18:03:00

@ 7f6db517:a4931eda

2025-06-04 18:03:00

I often hear "bitcoin doesn't interest me, I'm not a finance person."

Ironically, the beauty of sound money is you don't have to be. In the current system you're expected to manage a diversified investment portfolio or pay someone to do it. Bitcoin will make that optional.

— ODELL (@ODELL) September 16, 2018

At first glance bitcoin often appears overwhelming to newcomers. It is incredibly easy to get bogged down in the details of how it works or different ways to use it. Enthusiasts, such as myself, often enjoy going down the deep rabbit hole of the potential of bitcoin, possible pitfalls and theoretical scenarios, power user techniques, and the developer ecosystem. If your first touch point with bitcoin is that type of content then it is only natural to be overwhelmed. While it is important that we have a thriving community of bitcoiners dedicated to these complicated tasks - the true beauty of bitcoin lies in its simplicity. Bitcoin is simply better money. It is the best money we have ever had.

Life is complicated. Life is hard. Life is full of responsibility and surprises. Bitcoin allows us to focus on our lives while relying on a money that is simple. A money that is not controlled by any individual, company, or government. A money that cannot be easily seized or blocked. A money that cannot be devalued at will by a handful of corrupt bureaucrat who live hundreds of miles from us. A money that can be easily saved and should increase in purchasing power over time without having to learn how to "build a diversified stock portfolio" or hire someone to do it for us.

Bitcoin enables all of us to focus on our lives - our friends and family - doing what we love with the short time we have on this earth. Time is scarce. Life is complicated. Bitcoin is the most simple aspect of our complicated lives. If we spend our scarce time working then we should be able to easily save that accrued value for future generations without watching the news or understanding complicated financial markets. Bitcoin makes this possible for anyone.

Yesterday was Mother's Day. Raising a human is complicated. It is hard, it requires immense personal responsibility, it requires critical thinking, but mothers figure it out, because it is worth it. Using and saving bitcoin is simple - simply install an app on your phone. Every mother can do it. Every person can do it.

Life is complicated. Life is beautiful. Bitcoin is simple.

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-06-04 18:02:58

@ dfa02707:41ca50e3

2025-06-04 18:02:58Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ e2c72a5a:bfacb2ee

2025-06-04 18:18:32

@ e2c72a5a:bfacb2ee

2025-06-04 18:18:32Forget Lambos, Bitcoin's going corporate.

Sixty one publicly listed companies now hold over 3% of Bitcoin's total supply, doubling their holdings in just two months. That's faster than even Michael Saylor's MicroStrategy. K Wave Media, a South Korean firm, is raising $500M for a Bitcoin treasury, aiming to be the "Metaplanet of Korea." Even Pakistan is discussing Bitcoin reserve plans with Trump's crypto team.

Is your portfolio ready for the corporate Bitcoin takeover?

-

@ dfa02707:41ca50e3

2025-06-04 18:02:53

@ dfa02707:41ca50e3

2025-06-04 18:02:53Contribute to keep No Bullshit Bitcoin news going.

-

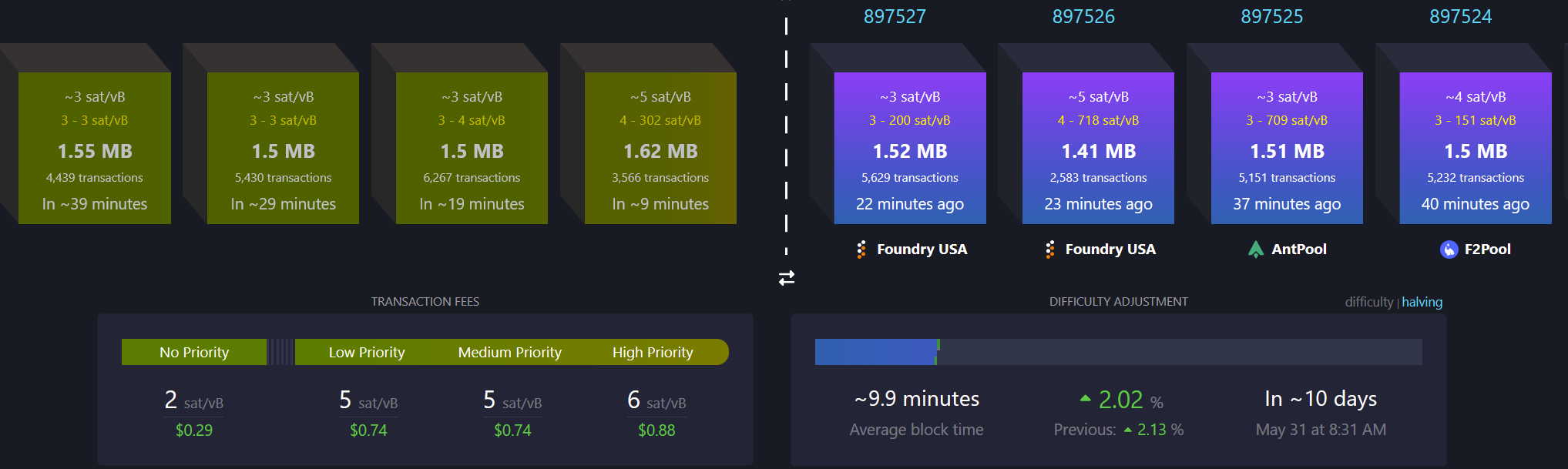

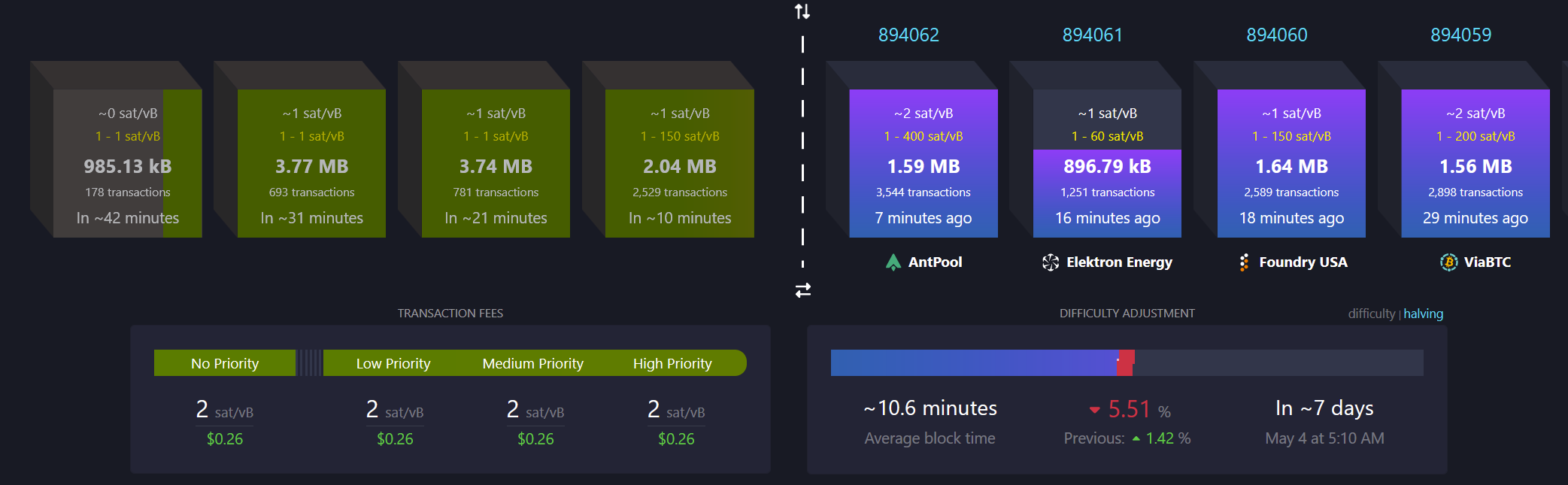

Version 1.3 of Bitcoin Safe introduces a redesigned interactive chart, quick receive feature, updated icons, a mempool preview window, support for Child Pays For Parent (CPFP) and testnet4, preconfigured testnet demo wallets, as well as various bug fixes and improvements.

-

Upcoming updates for Bitcoin Safe include Compact Block Filters.

"Compact Block Filters increase the network privacy dramatically, since you're not asking an electrum server to give you your transactions. They are a little slower than electrum servers. For a savings wallet like Bitcoin Safe this should be OK," writes the project's developer Andreas Griffin.

- Learn more about the current and upcoming features of Bitcoin Safe wallet here.

What's new in v1.3

- Redesign of Chart, Quick Receive, Icons, and Mempool Preview (by @design-rrr).

- Interactive chart. Clicking on it now jumps to transaction, and selected transactions are now highlighted.

- Speed up transactions with Child Pays For Parent (CPFP).

- BDK 1.2 (upgraded from 0.32).

- Testnet4 support.

- Preconfigured Testnet demo wallets.

- Cluster unconfirmed transactions so that parents/children are next to each other.

- Customizable columns for all tables (optional view: Txid, Address index, and more)

- Bug fixes and other improvements.

Announcement / Archive

Blog Post / Archive

GitHub Repo

Website -

-

@ dfa02707:41ca50e3

2025-06-04 18:02:52

@ dfa02707:41ca50e3

2025-06-04 18:02:52Contribute to keep No Bullshit Bitcoin news going.

This update brings key enhancements for clarity and usability:

- Recent Blocks View: Added to the Send tab and inspired by Mempool's visualization, it displays the last 2 blocks and the estimated next block to help choose fee rates.

- Camera System Overhaul: Features a new library for higher resolution detection and mouse-scroll zoom support when available.

- Vector-Based Images: All app images are now vectorized and theme-aware, enhancing contrast, especially in dark mode.

- Tor & P2A Updates: Upgraded internal Tor and improved support for pay-to-anchor (P2A) outputs.

- Linux Package Rename: For Linux users, Sparrow has been renamed to sparrowwallet (or sparrowserver); in some cases, the original sparrow package may need manual removal.

- Additional updates include showing total payments in multi-payment transaction diagrams, better handling of long labels, and other UI enhancements.

- Sparrow v2.2.1 is a bug fix release that addresses missing UUID issue when starting Tor on recent macOS versions, icons for external sources in Settings and Recent Blocks view, repackaged

.debinstalls to use older gzip instead of zstd compression, and removed display of median fee rate where fee rates source is set to Server.

Learn how to get started with Sparrow wallet:

Release notes (v2.2.0)

- Added Recent Blocks view to Send tab.

- Converted all bitmapped images to theme aware SVG format for all wallet models and dialogs.

- Support send and display of pay to anchor (P2A) outputs.

- Renamed

sparrowpackage tosparrowwalletandsparrowserveron Linux. - Switched camera library to openpnp-capture.

- Support FHD (1920 x 1080) and UHD4k (3840 x 2160) capture resolutions.

- Support camera zoom with mouse scroll where possible.

- In the Download Verifier, prefer verifying the dropped file over the default file where the file is not in the manifest.

- Show a warning (with an option to disable the check) when importing a wallet with a derivation path matching another script type.

- In Cormorant, avoid calling the

listwalletdirRPC on initialization due to a potentially slow response on Windows. - Avoid server address resolution for public servers.

- Assume server address is non local for resolution failures where a proxy is configured.

- Added a tooltip to indicate truncated labels in table cells.

- Dynamically truncate input and output labels in the tree on a transaction tab, and add tooltips if necessary.

- Improved tooltips for wallet tabs and transaction diagrams with long labels.

- Show the address where available on input and output tooltips in transaction tab tree.

- Show the total amount sent in payments in the transaction diagram when constructing multiple payment transactions.

- Reset preferred table column widths on adjustment to improve handling after window resizing.

- Added accessible text to improve screen reader navigation on seed entry.

- Made Wallet Summary table grow horizontally with dialog sizing.

- Reduced tooltip show delay to 200ms.

- Show transaction diagram fee percentage as less than 0.01% rather than 0.00%.

- Optimized and reduced Electrum server RPC calls.

- Upgraded Bouncy Castle, PGPainless and Logback libraries.

- Upgraded internal Tor to v0.4.8.16.

- Bug fix: Fixed issue with random ordering of keystore origins on labels import.

- Bug fix: Fixed non-zero account script type detection when signing a message on Trezor devices.

- Bug fix: Fixed issue parsing remote Coldcard xpub encoded on a different network.

- Bug fix: Fixed inclusion of fees on wallet label exports.

- Bug fix: Increase Trezor device libusb timeout.

Linux users: Note that the

sparrowpackage has been renamed tosparrowwalletorsparrowserver, and in some cases you may need to manually uninstall the originalsparrowpackage. Look in the/optfolder to ensure you have the new name, and the original is removed.What's new in v2.2.1

- Updated Tor library to fix missing UUID issue when starting Tor on recent macOS versions.

- Repackaged

.debinstalls to use older gzip instead of zstd compression. - Removed display of median fee rate where fee rates source is set to Server.

- Added icons for external sources in Settings and Recent Blocks view

- Bug fix: Fixed issue in Recent Blocks view when switching fee rates source

- Bug fix: Fixed NPE on null fee returned from server

-

@ 8bad92c3:ca714aa5

2025-06-04 18:02:44

@ 8bad92c3:ca714aa5

2025-06-04 18:02:44Key Takeaways

Michael Goldstein, aka Bitstein, presents a sweeping philosophical and economic case for going “all in” on Bitcoin, arguing that unlike fiat, which distorts capital formation and fuels short-term thinking, Bitcoin fosters low time preference, meaningful saving, and long-term societal flourishing. At the heart of his thesis is “hodling for good”—a triple-layered idea encompassing permanence, purpose, and the pursuit of higher values like truth, beauty, and legacy. Drawing on thinkers like Aristotle, Hoppe, and Josef Pieper, Goldstein redefines leisure as contemplation, a vital practice in aligning capital with one’s deepest ideals. He urges Bitcoiners to think beyond mere wealth accumulation and consider how their sats can fund enduring institutions, art, and architecture that reflect a moral vision of the future.

Best Quotes

“Let BlackRock buy the houses, and you keep the sats.”

“We're not hodling just for the sake of hodling. There is a purpose to it.”

“Fiat money shortens your time horizon… you can never rest.”

“Savings precedes capital accumulation. You can’t build unless you’ve saved.”

“You're increasing the marginal value of everyone else’s Bitcoin.”

“True leisure is contemplation—the pursuit of the highest good.”

“What is Bitcoin for if not to make the conditions for magnificent acts of creation possible?”

“Bitcoin itself will last forever. Your stack might not. What will outlast your coins?”

“Only a whale can be magnificent.”

“The market will sell you all the crack you want. It’s up to you to demand beauty.”

Conclusion

This episode is a call to reimagine Bitcoin as more than a financial revolution—it’s a blueprint for civilizational renewal. Michael Goldstein reframes hodling as an act of moral stewardship, urging Bitcoiners to lower their time preference, build lasting institutions, and pursue truth, beauty, and legacy—not to escape the world, but to rebuild it on sound foundations.

Timestamps

00:00 - Intro

00:50 - Michael’s BBB presentation Hodl for Good

07:27 - Austrian principles on capital

15:40 - Fiat distorts the economic process

23:34 - Bitkey

24:29 - Hodl for Good triple entendre

29:52 - Bitcoin benefits everyone

39:05 - Unchained

40:14 - Leisure theory of value

52:15 - Heightening life

1:15:48 - Breaking from the chase makes room for magnificence

1:32:32 - Nakamoto Institute’s missionTranscript

(00:00) Fiat money is by its nature a disturbance. If money is being continually produced, especially at an uncertain rate, these uh policies are really just redistribution of wealth. Most are looking for number to go up post hyper bitcoinization. The rate of growth of bitcoin would be more reflective of the growth of the economy as a whole.

(00:23) Ultimately, capital requires knowledge because it requires knowing there is something that you can add to the structures of production to lengthen it in some way that will take time but allow you to have more in the future than you would today. Let Black Rockck buy the houses and you keep the sats, not the other way around.

(00:41) You wait until later for Larry Frink to try to sell you a [Music] mansion. And we're live just like that. Just like that. 3:30 on a Friday, Memorial Day weekend. It's a good good good way to end the week and start the holiday weekend. Yes, sir. Yes, sir. Thank you for having me here. Thank you for coming. I wore this hat specifically because I think it's I think it's very apppropo uh to the conversation we're going to have which is I hope an extension of the presentation you gave at Bitblock Boom Huddle for good. You were working on

(01:24) that for many weeks leading up to uh the conference and explaining how you were structuring it. I think it's a very important topic to discuss now as the Bitcoin price is hitting new all-time highs and people are trying to understand what am I doing with Bitcoin? Like you have you have the different sort of factions within Bitcoin.

(01:47) Uh get on a Bitcoin standard, get on zero, spend as much Bitcoin as possible. You have the sailors of the world are saying buy Bitcoin, never sell, die with your Bitcoin. And I think you do a really good job in that presentation. And I just think your understanding overall of Bitcoin is incredible to put everything into context. It's not either or.

(02:07) It really depends on what you want to accomplish. Yeah, it's definitely there there is no actual one-sizefits-all um for I mean nearly anything in this world. So um yeah, I mean first of all I mean there was it was the first conference talk I had given in maybe five years. I think the one prior to that uh was um bit block boom 2019 which was my meme talk which uh has uh become infamous and notorious.

(02:43) So uh there was also a lot of like high expectations uh you know rockstar dev uh has has treated that you know uh that that talk with a lot of reference. a lot of people have enjoyed it and he was expecting this one to be, you know, the greatest one ever, which is a little bit of a little bit of a uh a burden to live up to those kinds of standards.

(03:08) Um, but you know, because I don't give a lot of talks. Um, you know, I I I like to uh try to bring ideas that might even be ideas that are common. So, something like hodling, we all talk about it constantly. uh but try to bring it from a little bit of a different angle and try to give um a little bit of uh new light to it.

(03:31) I alsove I've I've always enjoyed kind of coming at things from a third angle. Um whenever there's, you know, there's there's all these little debates that we have in in Bitcoin and sometimes it's nice to try to uh step out of it and look at it a little more uh kind of objectively and find ways of understanding it that incorporate the truths of of all of them.

(03:58) uh you know cuz I think we should always be kind of as much as possible after ultimate truth. Um so with this one um yeah I was kind of finding that that sort of golden mean. So uh um yeah and I actually I think about that a lot is uh you know Aristotle has his his concept of the golden mean. So it's like any any virtue is sort of between two vices um because you can you can always you can always take something too far.

(04:27) So you're you're always trying to find that right balance. Um so someone who is uh courageous you know uh one of the vices uh on one side is being basically reckless. I I can't remember what word he would use. Uh but effectively being reckless and just wanting to put yourself in danger for no other reason than just you know the thrill of it.

(04:50) Um and then on the other side you would just have cowardice which is like you're unwilling to put yourself um at any risk at any time. Um, and courage is right there in the middle where it's understanding when is the right time uh to put your put yourself, you know, in in the face of danger um and take it on. And so um in some sense this this was kind of me uh in in some ways like I'm obviously a partisan of hodling.

(05:20) Um, I've for, you know, a long time now talked about the, um, why huddling is good, why people do it, why we should expect it. Um, but still trying to find that that sort of golden mean of like yes, huddle, but also what are we hodling for? And it's not we're we're not hodddling just merely for the sake of hodddling.

(05:45) There there is a a purpose to it. And we should think about that. And that would also help us think more about um what are the benefits of of spending, when should we spend, why should we spend, what should we spend on um to actually give light to that sort of side of the debate. Um so that was that was what I was kind of trying to trying to get into.

(06:09) Um, as well as also just uh at the same time despite all the talk of hodling, there's always this perennial uh there's always this perennial dislike of hodlers because we're treated as uh as if um we're just free riding the network or we're just greedy or you know any of these things. And I wanted to show how uh huddling does serve a real economic purpose.

(06:36) Um, and it does benefit the individual, but it also does uh it it has actual real social um benefits as well beyond merely the individual. Um, so I wanted to give that sort of defense of hodling as well to look at it from um a a broader position than just merely I'm trying to get rich. Um uh because even the person who uh that is all they want to do um just like you know your your pure number grow up go up moonboy even that behavior has positive ramifications on on the economy.

(07:14) And while we might look at them and have uh judgments about their particular choices for them as an individual, we shouldn't discount that uh their actions are having positive positive effects for the rest of the economy. Yeah. So, let's dive into that just not even in the context of Bitcoin because I think you did a great job of this in the presentation.

(07:36) just you've done a good job of this consistently throughout the years that I've known you. Just from like a first principles Austrian economics perspective, what is the idea around capital accumulation, low time preference and deployment of that capital like what what like getting getting into like the nitty-gritty and then applying it to Bitcoin? Yeah, it's it's a big question and um in many ways I mean I I even I barely scratched the surface.

(08:05) uh I I can't claim to have read uh all the volumes of Bombber works, you know, capital and interest and and stuff like that. Um but I think there's some some sort of basic concepts that we can look at that we can uh draw a lot out. Um the first uh I guess let's write that. So repeat so like capital time preference. Yeah. Well, I guess getting more broad like why sav -

@ eb0157af:77ab6c55

2025-06-04 18:02:42

@ eb0157af:77ab6c55

2025-06-04 18:02:42Bitmain’s new device raises the bar for energy efficiency.

During the World Digital Mining Summit, Bitmain introduced its latest bitcoin mining device: the Antminer S23 Hydro. The new miner promises an energy efficiency of 9.5 joules per terahash (J/TH), setting new industry standards.

ANTMINER S23 Hyd. Newly Launched at WDMS 2025!

ANTMINER S23 Hyd. Newly Launched at WDMS 2025!

580T 9.5J/T

580T 9.5J/T

Sales Start from May 28th, 9:00AM (EST)

Shipping from Q1, 2026 pic.twitter.com/Kg3VJTt7Rg— BITMAIN (@BITMAINtech) May 27, 2025

According to Bitmain’s presentation, the Antminer S23 Hydro delivers up to 580 TH/s with a power consumption of 5,510 watts.

Scheduled for release in early 2026, the Antminer S23 Hydro marks a major leap forward compared to the first ASIC devices dedicated to mining. To put it in perspective, the first specialized miners launched in 2013 consumed around 1,200 J/TH. Bitmain’s latest device therefore represents a more than 99% improvement in efficiency.

Hashprice and economic challenges

In recent months, the hashprice — the metric measuring mining profitability — has remained relatively low, dropping below $39 per petahash per second during the year. As of now, the hashprice stands at around $55 per petahash per second, according to data from Hashrate Index.

This scenario has pushed several companies in the sector to rethink their expansion strategies. Instead of increasing hashing capacity, many are choosing to upgrade their existing fleets, focusing on efficiency rather than sheer scale.

The introduction of the Antminer S23 Hydro could catalyze a transformation within the mining ecosystem. The gradual replacement of outdated devices with more efficient technology could lead to a significant reduction in the Bitcoin network’s overall energy consumption.

The post Bitmain unveils the Antminer S23 Hydro: unprecedented efficiency appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-06-04 18:02:39

@ eb0157af:77ab6c55

2025-06-04 18:02:39The Russian banking giant introduces financial instruments linked to Bitcoin for qualified investors.

Russia’s largest commercial banking institution, Sber, has made its entry into the Bitcoin space by unveiling a bond product tied to the asset.

Sber has officially launched its structured financial instrument that mirrors the price performance of Bitcoin alongside fluctuations in the dollar-ruble exchange rate. The product is already available to qualified investors through the over-the-counter (OTC) market, with plans to list it on the Moscow Exchange in the near future.

Formerly known as Sberbank, the institution stated in a May 30 announcement that the listing would provide transparency, liquidity, and convenience for a wide range of professional investors. This structured approach will allow investors to benefit both from Bitcoin’s appreciation in dollars and from the strengthening of the US dollar against the Russian ruble, the bank suggests.

The lender also announced plans to expand its crypto offering through the SberInvestments platform, introducing exchange-traded products that provide exposure to digital assets. The first product will be a Bitcoin futures instrument, scheduled for listing on June 4, coinciding with its official launch by the Moscow Exchange.

Sber’s initiative follows the authorization granted by Russia’s Central Bank on May 28, which permitted financial institutions to offer specific crypto-related financial instruments to accredited investors. However, the direct offering of cryptocurrencies remains prohibited.

Meanwhile, T-Bank (formerly Tinkoff Bank) launched an investment product linked to Bitcoin’s price, branding it a “smart asset” issued through Russia’s state-backed tokenization platform Atomyze.

According to the Russian Central Bank’s report for the first quarter of 2025, Russian residents hold approximately 827 billion rubles ($9.2 billion) in cryptocurrencies on centralized exchanges. Inflows into Russian crypto platforms surged by 51%, reaching 7.3 trillion rubles ($81.5 billion) over the same period.

The post Sber, Russia’s largest bank, launches Bitcoin bonds appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-06-04 18:02:33

@ eb0157af:77ab6c55

2025-06-04 18:02:33The newly elected South Korean President is aiming for a breakthrough in the cryptocurrency market with the introduction of spot ETFs and a national stablecoin.

On June 4, South Korea officially elected Lee Jae-myung as its new President. The candidate from the left-wing party secured victory following the impeachment of former leader Yoon Suk-yeol, who ended his three-year term after a failed attempt to establish a military-backed government.

Voter turnout reached 79.4%, the highest in the last 28 years. Lee won 49.42% of the vote, defeating his conservative opponent Kim Moon-soo, who garnered 41.15%.

The new President’s pledges

In addition to traditional economic priorities such as supporting low-income families and small businesses, Lee Jae-myung has placed digital assets at the heart of his political agenda.

The core pillar of Lee’s strategy involves the introduction of spot ETFs for Bitcoin and Ethereum in the domestic market. Currently, the issuance and local trading of crypto ETFs remain banned in the country.

Another key element of the plan is the approval of stablecoins pegged to the South Korean won. During a discussion last month, Lee emphasized the need to develop a won-based stablecoin market to prevent capital flight abroad.

Under the new administration, South Korea will also work to complete the second phase of its regulatory framework for digital assets. The upcoming legislation will specifically address stablecoin regulations and transparency requirements for cryptocurrency exchanges.

The program also includes the creation of special zones for blockchain-related businesses, where regulations will be minimized to maximize innovation and operational efficiency.

However, this isn’t the first time South Korea has elected a crypto-friendly candidate. The conservative president Yoon Suk-yeol, later impeached, had made several crypto-friendly promises aimed at deregulating the sector, though many of those initiatives saw delays and limited progress during his three-year term.

Yoon’s deregulatory plans faced resistance from the Financial Services Commission (FSC), which maintained strict regulations citing investor protection. In recent months, however, the FSC has shown greater openness toward easing crypto rules — a shift that could support Lee’s commitments.

According to FSC data, by the end of last year the country had 9.7 million registered exchange users, representing nearly 20% of the total population.

The post South Korea: the new leader may favor Bitcoin ETFs and a national stablecoin appeared first on Atlas21.

-

@ 9ca447d2:fbf5a36d

2025-06-04 18:02:20

@ 9ca447d2:fbf5a36d

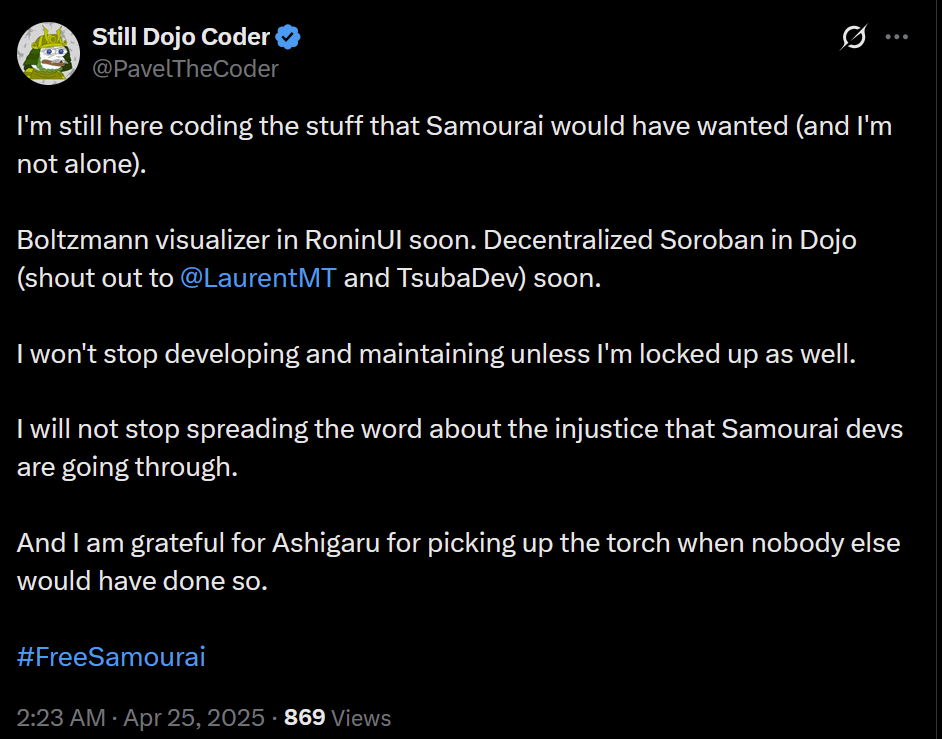

2025-06-04 18:02:20Meta Platforms Inc., the parent company of Facebook and Instagram, has voted down a shareholder proposal to add bitcoin to its treasury. The vote took place at the company’s annual shareholder meeting on May 30, 2025.

The proposal, known as Proposal 13, was submitted by investor Ethan Peck on behalf of the National Center for Public Policy Research (NCPPR).

It asked Meta to convert a portion of its $72 billion in cash, cash equivalents, and marketable securities into bitcoin. The idea was to hedge against inflation and low returns from traditional bond investments.

But the company’s shareholders said no.

According to the official count, more than 4.98 billion shares were voted against the proposal, while 3.92 million shares were for it—less than 0.1% of total votes. 8.86 million shares were abstentions and over 204 million were broker non-votes.

Meta shareholders rejected bitcoin reserve proposal — SEC

So now, Meta joins Microsoft and Amazon in rejecting calls to add bitcoin to their balance sheets.

Related: Microsoft Shareholders Reject Bitcoin Investment Proposal

Proponents of the proposal argued that bitcoin would help protect Meta’s reserves from inflation and weak bond returns. Peck and others pointed to bitcoin’s strong performance in 2024 and growing institutional interest in the scarce digital asset.

The proposal said bitcoin’s fixed supply and track record make it a long-term store of value.

High-profile supporters, including Matt Cole, CEO of Strive Asset Management, brought the issue to the forefront. At the Bitcoin 2025 conference in Las Vegas, Cole addressed Meta CEO Mark Zuckerberg directly:

“You have already done step one. You have named your goat Bitcoin,” he said. “My ask is that you take step two and adopt a bold corporate bitcoin treasury strategy.”

Others, like Bloomberg ETF analyst Eric Balchunas, said if Meta added bitcoin to its balance sheet it would be a big deal. “If Meta or Microsoft adds BTC to the balance sheet, it will be like when Tom Hanks got COVID—suddenly, it feels real,” Balchunas said.

Despite all the hype and arguments for Bitcoin, the tech giant’s board of directors opposed the measure. The board said the company already has a treasury management process in place that prioritizes capital preservation and liquidity.

“While we are not opining on the merits of cryptocurrency investments compared to other assets, we believe the requested assessment is unnecessary given our existing processes to manage our corporate treasury,” Meta’s board noted.

The board also noted that it reviews many investment options and sees no need for a separate review process specific to Bitcoin.

Meta’s decision shows the broader hesitation of large-cap companies to get into bitcoin as part of their financial strategy.

While companies like Michael Saylor’s Strategy are adding bitcoin to their treasuries every chance they get, companies like Microsoft, Amazon and now Meta, are taking a more cautious approach.

According to recent reports, Meta is exploring ways to integrate stablecoins into its platforms to enable global payouts.

This would be a re-entry into the digital asset space after the company shelved its Diem project due to regulatory issues—a step that bitcoin advocates deem unnecessary, insufficient, and irrelevant to protecting the company’s finances.

-

@ cae03c48:2a7d6671

2025-06-04 18:01:58

@ cae03c48:2a7d6671

2025-06-04 18:01:58Bitcoin Magazine

Norwegian Public Company K33 AB Purchased 10 BTC For Their New Bitcoin Treasury StrategyK33 AB (PUBL), a digital asset brokerage and research firm, announced that it has completed its first Bitcoin acquisition under its new Bitcoin treasury strategy, purchasing 10 BTC for approximately SEK 10 million.

JUST IN:

Publicly traded company K33 buys 10 #Bitcoin for SEK 10 million for its balance sheet. pic.twitter.com/wB8Kt09EZf

Publicly traded company K33 buys 10 #Bitcoin for SEK 10 million for its balance sheet. pic.twitter.com/wB8Kt09EZf— Bitcoin Magazine (@BitcoinMagazine) June 3, 2025

Today’s purchase is the first transaction of the secured SEK 60 million that K33 announced it will buy for its Bitcoin treasury strategy.

“We expect Bitcoin to be the best-performing asset in the coming years and will build our balance sheet in Bitcoin moving forward,” said the CEO of K33 Torbjorn Bull Jenssen. “This will give K33 direct exposure to the Bitcoin price and help unlock powerful synergies with our brokerage operation. Our ambition is to build a balance of at least 1000 BTC over time and then scale from there.”

During K33’s Q1 2025 Report & Strategic Outlook presentation. Torbjorn Jenssen mentioned that the “US BTC ETF was the most successful ETF launch in history. Acquiring more capital in just one year than gold did in 20.”

Jenssen also said K33 is working with other Bitcoin treasury companies in the Nordics and hopes to use its treasury as a foundation to offer new services, such as Bitcoin backed lending.

“For K33, Bitcoin is not only a high-conviction asset — it’s also a strategic enabler,” he said. “With a sizable BTC reserve, we will be able to strengthen our financial position while unlocking new revenue streams, product capabilities, and partnerships.”

Bitcoin will be the best performing asset in the coming decade and my goal with K33 is to accumulate as many as possible while unlocking powerful operational synergies with our brokerage operation,” posted Jenssen on X.

Bitcoin will be the best performing asset in the coming decade and my goal with K33 is to accumulate as many as possible while unlocking powerful operational synergies with our brokerage operation. https://t.co/Crxu0b5QPz

— Torbjørn (@TorbjrnBullJens) May 28, 2025

Bitcoin treasury holdings are becoming a trend of companies in 2025. Around 217 companies and public entities now hold Bitcoin on their balance sheets.

Last week, during the 2025 Bitcoin Conference in Las Vegas, the CEO of GameStop Ryan Cohen announced that GameStop purchased 4,710 Bitcoin worth approximately $505 million, marking another major corporate entry into Bitcoin treasury holdings.

In an interview with the CEO of Nakamoto David Bailey, the CEO of GameStop Ryan Cohen stated, “If the thesis is correct then Bitcoin and gold as well can be a hedge against global currency devaluation and systemic risk. Bitcoin has certain unique advantages better than gold.”

BREAKING:

GAMESTOP PURCHASED 4,710 #BITCOIN pic.twitter.com/fDH9ctZJVP

GAMESTOP PURCHASED 4,710 #BITCOIN pic.twitter.com/fDH9ctZJVP— Bitcoin Magazine (@BitcoinMagazine) May 28, 2025

This post Norwegian Public Company K33 AB Purchased 10 BTC For Their New Bitcoin Treasury Strategy first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-04 18:01:34

@ cae03c48:2a7d6671

2025-06-04 18:01:34Bitcoin Magazine

How Strategy (MSTR) Built Their Capital Stack to Accelerate Bitcoin AccumulationMicroStrategy—now operating as Strategy

—has built the most aggressive Bitcoin treasury in the world. But its true innovation isn’t just holding Bitcoin. It’s in how it finances the accumulation of Bitcoin at scale without giving up control or diluting shareholder value.

—has built the most aggressive Bitcoin treasury in the world. But its true innovation isn’t just holding Bitcoin. It’s in how it finances the accumulation of Bitcoin at scale without giving up control or diluting shareholder value.The engine behind this? A meticulously designed capital stack—a multi-tiered structure of debt, preferred stock, and equity that appeals to different types of investors, each with unique risk, yield, and volatility preferences.

This is more than corporate finance—it’s a blueprint for Bitcoin-native capital formation.

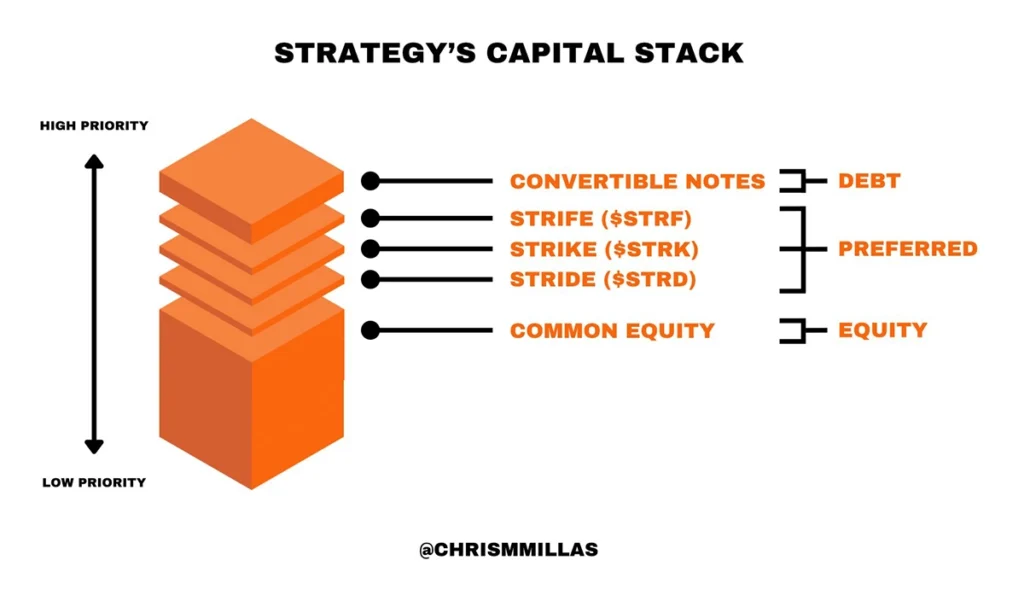

What Is a Capital Stack?

A capital stack refers to the layers of capital a company uses to finance its operations and strategic goals. Each layer has its own return profile, risk level, and repayment priority in the event of liquidation.

Strategy’s capital stack is designed to do one thing exceptionally well: convert fiat capital into Bitcoin exposure—efficiently, at scale, and without compromise.

The Stack: Ordered by Priority

Strategy’s capital stack comprises five core instruments:

1. Convertible Notes

2. Strife Preferred Stock ($STRF)

3. Strike Preferred Stock ($STRK)

4. Stride Preferred Stock ($STRD)

5. Common Equity ($MSTR)These layers are ranked from highest to lowest in repayment priority. What makes this structure unique is how each layer balances downside protection, yield, and Bitcoin exposure—offering institutional investors fixed-income alternatives with varying degrees of correlation to Bitcoin.

Strategy’s Capital Stack illustrated by Chris Millas

Convertible Notes: Senior Debt with Optional Upside

Strategy’s capital stack begins with convertible notes—senior unsecured debt that can convert into equity.

- Downside: Low risk, high priority in liquidation

- Upside: Modest unless converted

- Appeal: Institutional debt investors seeking protection with optional Bitcoin-adjacent upside

These notes were Strategy’s earliest fundraising tools, enabling the company to raise billions in low-interest environments to accumulate Bitcoin without issuing equity.

Strife ($STRF): Investment-Grade Yield

Strife is a perpetual preferred stock designed to mimic high-grade fixed income.

- 10% cumulative dividend, paid in cash

- $100 liquidation preference

- No conversion rights or Bitcoin upside

- Compounding penalties on unpaid dividends

- Low volatility, medium risk profile

Strife targets conservative capital—allocators who want predictable income without equity or crypto exposure. It’s senior to other preferreds and common stock, making it a high-quality fixed-income proxy built atop a Bitcoin treasury.

Strike ($STRK): Yield + Bitcoin Optionality

Strike is convertible preferred stock—bridging fixed income and equity upside.

- 8% cumulative dividend

- Convertible into $MSTR at $1,000 strike

- Paid in cash or Class A shares

- Bitcoin exposure via conversion option

- Medium volatility, low risk

Strike appeals to investors who want income with optional participation in Bitcoin upside. In bullish Bitcoin cycles, the conversion option becomes valuable—offering a hybrid between bond-like stability and equity-like potential.

Stride ($STRD): High Yield, High Risk

Stride is the most junior preferred—non-cumulative, perpetual stock issued with high yield and few protections.

- >10% dividend, only if declared

- No compounding, no conversion, no voting rights

- Highest relative risk among preferreds

- Liquidation priority above common equity, but below all others

Stride plays a crucial role. Its issuance improves the credit quality of Strife, adding a subordinate capital buffer beneath it—similar to how mezzanine debt protects senior tranches in structured finance.

Stride attracts yield-hungry investors, enabling Strategy to raise capital without compromising more senior layers.

Common Equity ($MSTR): Pure Bitcoin Beta

At the base is Strategy’s common equity—the most volatile, least protected, but highest potential instrument in the stack.

- Unlimited upside

- No dividend, no priority

- Full exposure to Bitcoin volatility

- Voting rights, long-term ownership

Common equity is for conviction-driven investors. Over the past four years, this layer has attracted capital from funds and individuals aligned with Strategy’s Bitcoin thesis—investors who want maximal upside from a corporate Bitcoin strategy.

The Big Picture: Saylor Is Targeting the Fixed Income Market

This isn’t just a financing mechanism—it’s a direct challenge to the $130 trillion global bond market.

By issuing instruments like $STRF, $STRK, and $STRD, Strategy is offering Bitcoin-adjacent yield vehicles that absorb demand from across the capital spectrum:

- Institutional investors seeking investment-grade yield

- Hedge funds chasing structured upside

- Yield hunters willing to go down the stack for returns

Each instrument behaves like a synthetic bond, yet all are backed by a Bitcoin accumulation engine.

As Director of Bitcoin Strategy at Metaplanet, Dylan LeClair put it: “Saylor is coming for the entire fixed income market.”

Rather than issue traditional bonds, Saylor is constructing a Bitcoin-native capital stack—one that unlocks liquidity without ever selling the underlying asset.

Why It Matters: A Model for Bitcoin Treasury Strategy

Strategy’s capital structure is more than innovation—it’s a financial operating system for any public company that wants to monetize Bitcoin’s rise while maintaining capital discipline.

Key takeaways:

- Every layer matches a specific investor need: From low-risk debt to speculative yield

- Capital flows in, Bitcoin stays put: Preserving treasury position while scaling

- No single instrument dominates: The stack is diversified by design

- Control is retained: Most securities are non-voting, non-convertible

For corporations serious about building a Bitcoin-native balance sheet, this is the playbook to study.

Saylor isn’t just stacking Bitcoin—he’s engineering the financial infrastructure for a monetary paradigm shift.

Disclaimer: This content was written on behalf of Bitcoin For Corporations. This article is intended solely for informational purposes and should not be interpreted as an invitation or solicitation to acquire, purchase, or subscribe for securities.

This post How Strategy (MSTR) Built Their Capital Stack to Accelerate Bitcoin Accumulation first appeared on Bitcoin Magazine and is written by Nick Ward.

-

@ cae03c48:2a7d6671

2025-06-04 18:01:25

@ cae03c48:2a7d6671

2025-06-04 18:01:25Bitcoin Magazine

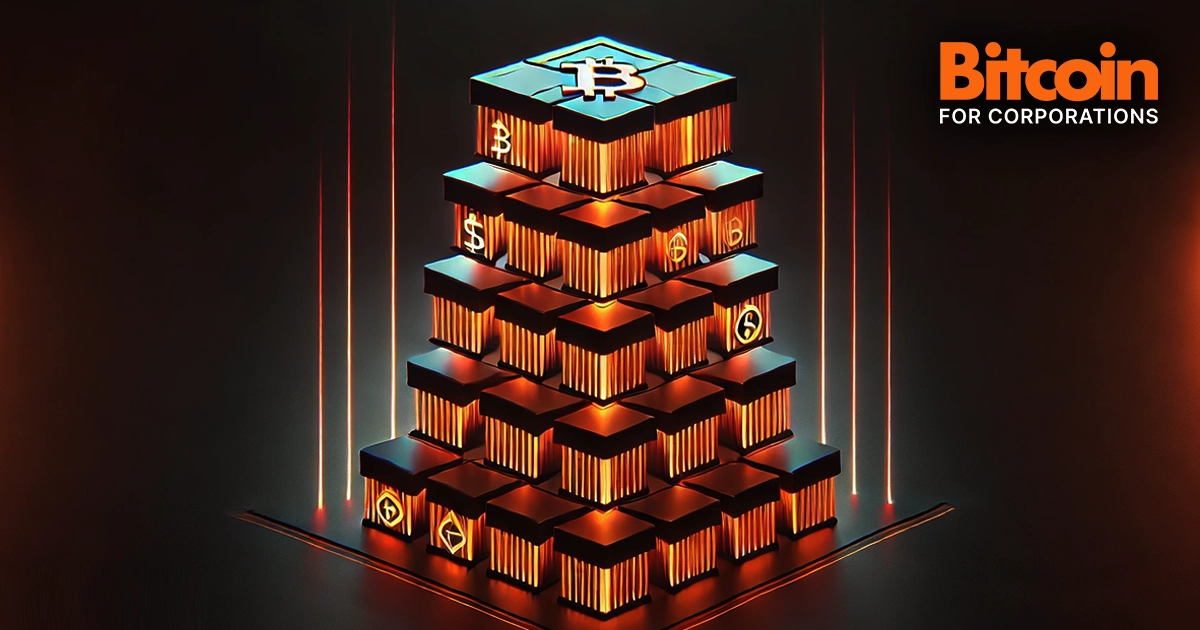

MARA Announces Over $100 Million in Bitcoin Mined in May 2025Today, MARA Holdings, Inc. (NASDAQ: MARA) reported a record high month of bitcoin production in May 2025, mining 950 BTC worth over $100 million at the time of writing. A 35% increase from April and the highest monthly output since the April 2024 halving event. MARA did not sell any bitcoin in May.

JUST IN: MARA mined 950 #Bitcoin worth over $100 MILLION in May

They HODLed all of it

pic.twitter.com/Z4v1zoEfga

pic.twitter.com/Z4v1zoEfga— Bitcoin Magazine (@BitcoinMagazine) June 3, 2025

“May was a record-breaking month for MARA with 282 blocks won, a 38% increase over April and a new monthly high,” said the Chairman and CEO of MARA Fred Thiel. “Our total bitcoin holdings surpassed 49,000 BTC during May and the 950 bitcoin produced were the most since the halving event in April 2024.”

The company mined 282 blocks during the month, a 38% rise over the previous month, and now holds 49,179 BTC, worth roughly $5.23 billion at the time of writing.

“Our fully integrated tech stack is a key differentiator, and MARA Pool is the only self-owned and operated mining pool among public miners, offering greater control and efficiency,” stated Thiel. “Operating our pool means no fees to external operators and retention of the full value of block rewards. Production in May also benefitted from block reward luck. Since launch, MARA Pool’s block reward luck has outperformed the network average by over 10%, contributing to our industry-leading block production.”

Operational efficiency also improved, with energized hashrate rising 2% from 57.3 EH/s to 58.3 EH/s. MARA’s average daily bitcoin production hit 30.7 BTC, which is 31% more than the last month from April.

“We remain laser-focused on transforming MARA into a vertically integrated digital energy and infrastructure company,” commented Thiel. “We believe this model gives us tighter operational control, improves cost-efficiency, and makes us more resilient to shifts in the broader economy.”

Earlier this month, on May 8, MARA released its first quarter 2025 earnings, posting 213.9 million dollars in revenue. A 30 percent increase over the same period last year. The company’s bitcoin holdings surged 174 percent year over year, rising from 17,320 BTC to 47,531 BTC as of March 31, with an estimated value of 3.9 billion dollars at the time. In Q1, MARA mined 2,286 BTC and acquired an additional 340 BTC. Operational performance also strengthened, with energized hashrate nearly doubling from 27.8 EH/s to 54.3 EH/s, and cost per petahash per day improving by 25 percent.

This post MARA Announces Over $100 Million in Bitcoin Mined in May 2025 first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-04 18:01:20

@ cae03c48:2a7d6671

2025-06-04 18:01:20Bitcoin Magazine

Adam Back Invests SEK 21 Million to H100 Group Bitcoin Treasury StrategyToday, H100 Group AB announced it has entered a SEK 21 million convertible loan from an investment agreement with Adam Back, with the option to expand his investment to SEK 277 million through a five-tranche convertible loan deal. The proceeds will be used to buy Bitcoin in alignment with H100 Group’s long-term Bitcoin treasury strategy.

H100 Group AB (Ticker: H100) secures a SEK 21M ($2.1M) commitment from @adam3us , with rights to invest an additional SEK 128M ($12.8M) in tranches—bringing the total contemplated raise to SEK 277M (~$27.7M). pic.twitter.com/c0HgMSRxut

— H100 (@H100Group) June 3, 2025

Under the agreement, Back may invest up to SEK 128 million across four additional tranches, with guaranteed participation of at least 50%. Each tranche is twice his committed amount, demonstrating his support for H100’s long-term growth.

The press release said, “Adam Back may request the Second Tranche within 90 days from signing of the Initial Tranche, the Third Tranche within 90 days from signing of the Second Tranche, the Fourth Tranche within 90 days from signing of the Third Tranche and the Fifth Tranche within ninety 90 days from signing of the Fourth Tranche. In the event Adam Back does not request a Future Tranche within the deadline, the right to request subsequent Future Tranches lapses.”

The convertible loans have no interest and have a five year maturity. At any time, Back may convert the loans into shares of the Company. Conversion prices are fixed per tranche: SEK 1.75 per share for the initial tranche, rising to SEK 5.00 by the fifth tranche. H100 retains the right to force conversion if the stock price exceeds the conversion rate by 33% over a 20 day period. Full conversion of the initial tranche would result in 12 million new shares and a 9.3% dilution.

“Upon request of a tranche Adam Back is obliged to invest in the relevant Tranche with SEK 15,750,000 in the second tranche, SEK 23,625,000 in the third tranche, SEK 35,437,500 in the fourth tranche, and SEK 53,156,250 in the fifth tranche,” stated the press release. “The contemplated size for each tranche is twice the entitled amount of Adam Back.”

Blockstream has “been around since 2014 and we work with our investors to put Bitcoin in a balance sheet back then and since then,” said Adam Back at the 2025 Bitcoin Conference. “I think the way to look at the treasury companies is that Bitcoin is effectively the hurdle rate; it’s very hard to outperform bitcoin. Most people that have invested in things since bitcoin has been around have thought, ‘oh, I should have put that in bitcoin and not in the other thing.”

This post Adam Back Invests SEK 21 Million to H100 Group Bitcoin Treasury Strategy first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-04 18:01:14

@ cae03c48:2a7d6671

2025-06-04 18:01:14Bitcoin Magazine

Moscow Exchange Launches Bitcoin Futures For Qualified InvestorsThe Moscow Exchange, Russia’s largest exchange group, announced the launch of Bitcoin futures contracts on June 4th, 2025. The new derivatives will allow qualified investors in Russia to gain exposure to bitcoin prices without directly owning it.

The bitcoin futures contracts are cash-settled in Russian rubles and will be tied to the iShares Bitcoin Trust ETF (IBIT) that trades on U.S. exchanges. The IBIT ETF tracks the price of bitcoin, with each share representing 0.00068 bitcoin.

BREAKING:

Russia’s largest exchange, Moscow Exchange launches #Bitcoin futures trading for qualified investors. pic.twitter.com/J9htJUWpLw

Russia’s largest exchange, Moscow Exchange launches #Bitcoin futures trading for qualified investors. pic.twitter.com/J9htJUWpLw— Bitcoin Magazine (@BitcoinMagazine) June 4, 2025

Trading for the new bitcoin futures kicked off on Wednesday, with the first contracts expiring in September 2025. Each futures contract will be denominated in U.S. dollars per bitcoin but settled in rubles.

The launch of bitcoin futures on the Moscow Exchange comes after increased interest in Bitcoin exposure from Russian financial institutions. In May, Russia’s central bank formally permitted the offering of crypto-linked securities and derivatives to qualified investors. Prior to this, direct investment in Bitcoin was discouraged.

Sberbank, Russia’s largest bank, also announced plans to unveil its own bitcoin futures product in addition to the Moscow Exchange’s offering. The bank is launching exchange-traded notes that track Bitcoin’s price without direct ownership.

Bitcoin futures and other crypto-derivatives have seen surging interest recently as the Bitcoin and crypto industry matures. The move comes as an increasing number of countries have started adding Bitcoin to their reserves.

As Bitcoin adoption increases, investors and financial institutions are seeking more routes to gain exposure to Bitcoin. The launch of futures on the Moscow Exchange provides regulated bitcoin exposure to qualified Russian investors. But direct ownership of “physical” bitcoin remains off limits for most in Russia’s traditional finance sector.

This post Moscow Exchange Launches Bitcoin Futures For Qualified Investors first appeared on Bitcoin Magazine and is written by Vivek Sen.

-

@ cae03c48:2a7d6671

2025-06-04 18:01:04

@ cae03c48:2a7d6671

2025-06-04 18:01:04Bitcoin Magazine

Semler Scientific Acquires 185 Bitcoin, Increasing Total Holdings to 4,449 BTCToday, Semler Scientific announced it has increased its Bitcoin holdings. The company acquired 185 Bitcoin between May 23 and June 3 for $20 million with an average purchase price of $107,974 per Bitcoin, using proceeds from its at-the-market (ATM) offering program.

JUST IN:

Public company Semler Scientific purchases an additional 185 #bitcoin for $20 million. pic.twitter.com/Iir6NiNzc8

Public company Semler Scientific purchases an additional 185 #bitcoin for $20 million. pic.twitter.com/Iir6NiNzc8— Bitcoin Magazine (@BitcoinMagazine) June 4, 2025

“We continue to accretively grow our bitcoin arsenal using operating cash flow and proceeds from debt and equity financings,” said the chairman of Semler Scientific Eric Semler. “And we are excited to launch the Semler Scientific dashboard today on our website to provide the public with regularly updated information on our bitcoin holdings and other key metrics.”

Since launching the ATM program in April 2025, Semler has raised approximately $136.2 million under the sales agreement of over 3.6 million shares of its common stock.

As of June 3, 2025, Semler holds 4,449 Bitcoin which were acquired for an amount of $410.0 million, with an average purchase price of $92,158 per Bitcoin. At the time of writing, the market value of these holdings is around $446.2 million.

Eric Semler on X posted, “SMLR acquires 185 Bitcoins for $20 million and has generated BTC Yield of 26.7% YTD. Now holding 4,449 $BTC.”

$SMLR acquires 185 #Bitcoins for $20 million and has generated BTC Yield of 26.7% YTD. Now holding 4,449 $BTC.

— Eric Semler (@SemlerEric) June 4, 2025

Semler Scientific uses the BTC Yield as a key performance indicator (KPI) to help assess the performance of its strategy of acquiring Bitcoin. As of year-to-date, the company has achieved a BTC Yield of 26.7%.

“Semler Scientific believes this KPI can be used to supplement an investor’s understanding of Semler Scientific’s decision to fund the purchase of Bitcoin by issuing additional shares of its common stock or instruments convertible to common stock,” stated the 8-K form.

In Q1 FY2025, Semler Scientific reported a difficult quarter. Revenue came in at $8.8 million, a 44% decrease year-over-year. Operating expenses jumped to $39.9 million from $8.9 million last year, mainly due to a $29.8 million contingent liability tied to the potential settlement with the DOJ. This led to a $31.1 million operating loss, compared to a $7.0 million profit in Q1 2024.

“Our healthcare business is seeing green shoots from the cardiovascular product line that we introduced to our large enterprise customer base this year,” said the CEO of Semler Scientific Doug Murphy-Chutorian. “We are expecting growth and cash generation from these FDA-cleared products and services, which will add to our bitcoin treasury strategy.”

This post Semler Scientific Acquires 185 Bitcoin, Increasing Total Holdings to 4,449 BTC first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 9ca447d2:fbf5a36d

2025-06-04 18:02:25

@ 9ca447d2:fbf5a36d

2025-06-04 18:02:25Trump Media & Technology Group (TMTG), the company behind Truth Social and other Trump-branded digital platforms, is planning to raise $2.5 billion to build one of the largest bitcoin treasuries among public companies.

The deal involves the sale of approximately $1.5 billion in common stock and $1.0 billion in convertible senior secured notes.

According to the company, the offering is expected to close by the end of May, pending standard closing conditions.

Devin Nunes, CEO of Trump Media, said the investment in bitcoin is a big part of the company’s long-term plan.

“We view Bitcoin as an apex instrument of financial freedom,” Nunes said.

“This investment will help defend our Company against harassment and discrimination by financial institutions, which plague many Americans and U.S. firms.”

He added that the bitcoin treasury will be used to create new synergies across the company’s platforms including Truth Social, Truth+, and the upcoming financial tech brand Truth.Fi.