-

@ 9ca447d2:fbf5a36d

2025-05-21 18:01:33

@ 9ca447d2:fbf5a36d

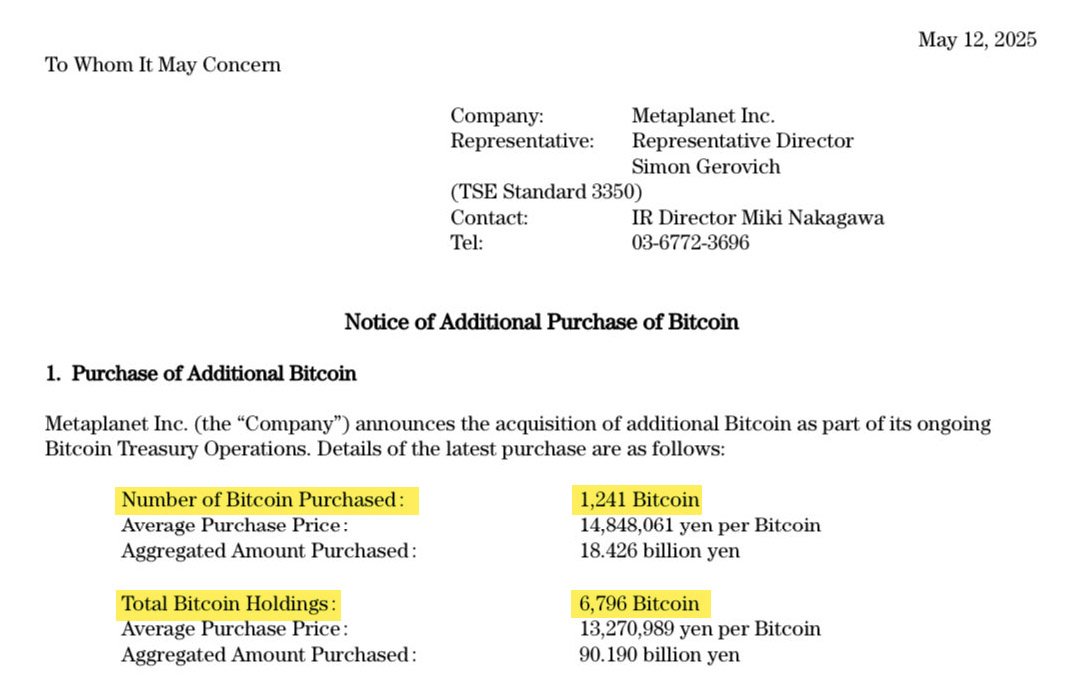

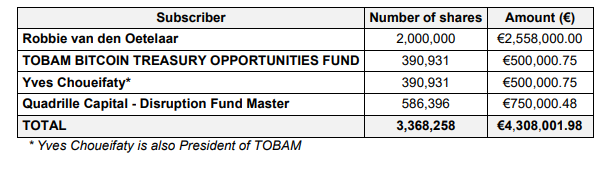

2025-05-21 18:01:33Tokyo-listed investment firm Metaplanet has officially surpassed El Salvador in bitcoin holdings after its biggest-ever single purchase of the scarce digital asset.

On May 12, 2025, the company announced it had bought 1,241 Bitcoin (BTC) for approximately $123.8 million, or ¥18.4 billion. The average price per coin was about $102,111, marking the firm’s largest purchase to date.

This latest buy brings Metaplanet’s total bitcoin reserves to 6,796 BTC, worth over $700 million.

Metaplanet on X

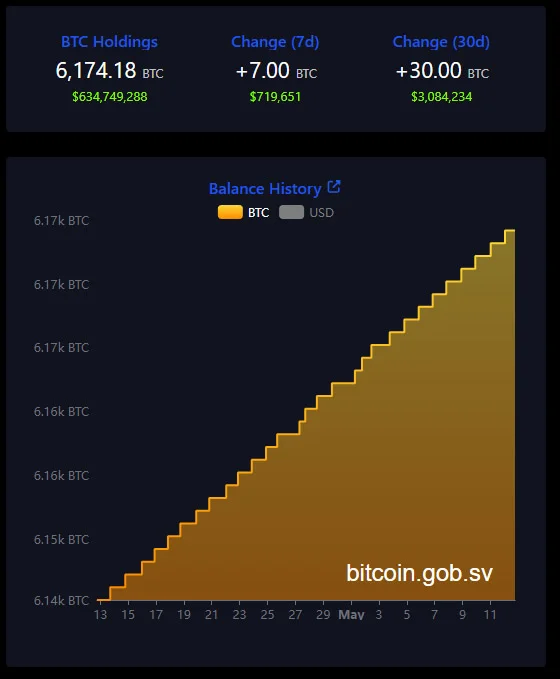

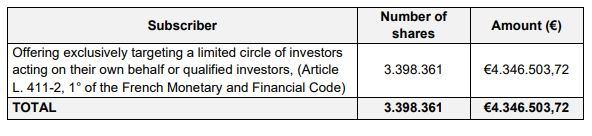

That puts Metaplanet ahead of El Salvador, the Central American nation that made headlines in 2021 for adopting bitcoin as legal tender. According to its National Bitcoin Office, El Salvador currently holds 6,174 BTC, worth roughly $642 million.

El Salvador bitcoin holdings — bitcoin.gob.sv

“Metaplanet now holds more bitcoin than El Salvador. From humble beginnings to rivaling nation-states, we’re just getting started,” said CEO Simon Gerovich on X after the company’s announcement.

The Japanese investment company started its bitcoin treasury strategy in April 2024 and has become the largest corporate holder of bitcoin in Asia and 11th globally. It aims to hold 10,000 BTC by the end of 2025.

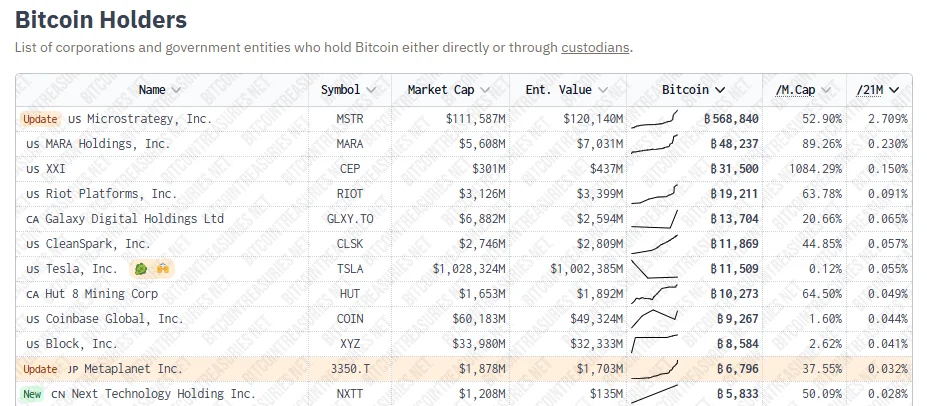

Metaplanet is now the 11th largest corporate holder of bitcoin — BitcoinTreasuries

To fund these purchases, the firm has turned to bond issuances, including zero-percent bonds. In early May, Metaplanet issued $25 million worth of 0% bonds under its EVO FUND program to finance bitcoin buys without diluting shares or taking on traditional debt.

And Metaplanet’s strategy seems to be working. Its BTC Yield — a proprietary metric that measures bitcoin accumulation per share — is 38% for Q2 2025 so far. In previous quarters, the firm reported 95.6% in Q1 and a whopping 309.8% in Q4 2024.

The stock price has also gone up 1,800% since May 2024 and 51% in 2025 alone, currently trading above 550 JPY.

Metaplanet is often called “Japan’s MicroStrategy”, a reference to the U.S.-based company Strategy (formerly MicroStrategy) led by Bitcoin advocate Michael Saylor. Strategy is the world’s largest corporate bitcoin holder with over 568,840 BTC in its coffers, worth more than $58 billion.

Like Strategy, Metaplanet is using creative financing tools such as convertible bonds and non-dilutive bond issuance to build a big bitcoin treasury. These financial instruments give the company the ability to fund further bitcoin purchases without diluting shareholders’ value.

Metaplanet is buying bitcoin very rapidly. This has become a trend in the corporate world, where private companies are challenging nation-states in the digital asset space.

Unlike governments which face regulatory and political hurdles, corporations like Metaplanet can move quickly and decisively. Since 2020 over 80 publicly traded companies have collectively bought more than 632,000 BTC worth over $65 billion.

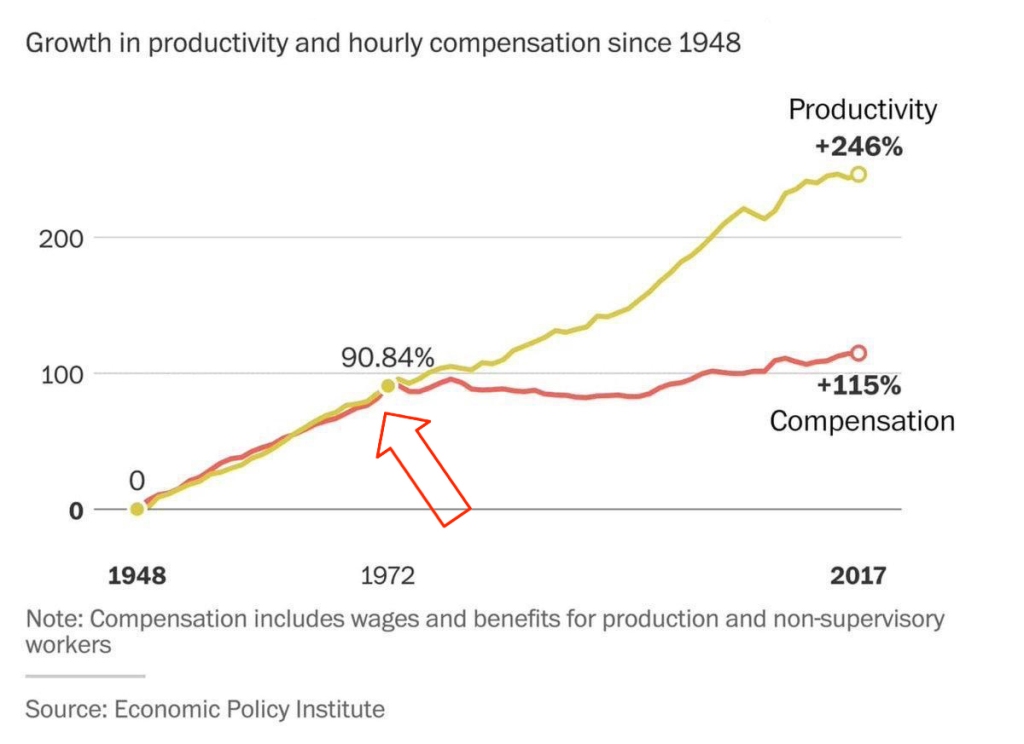

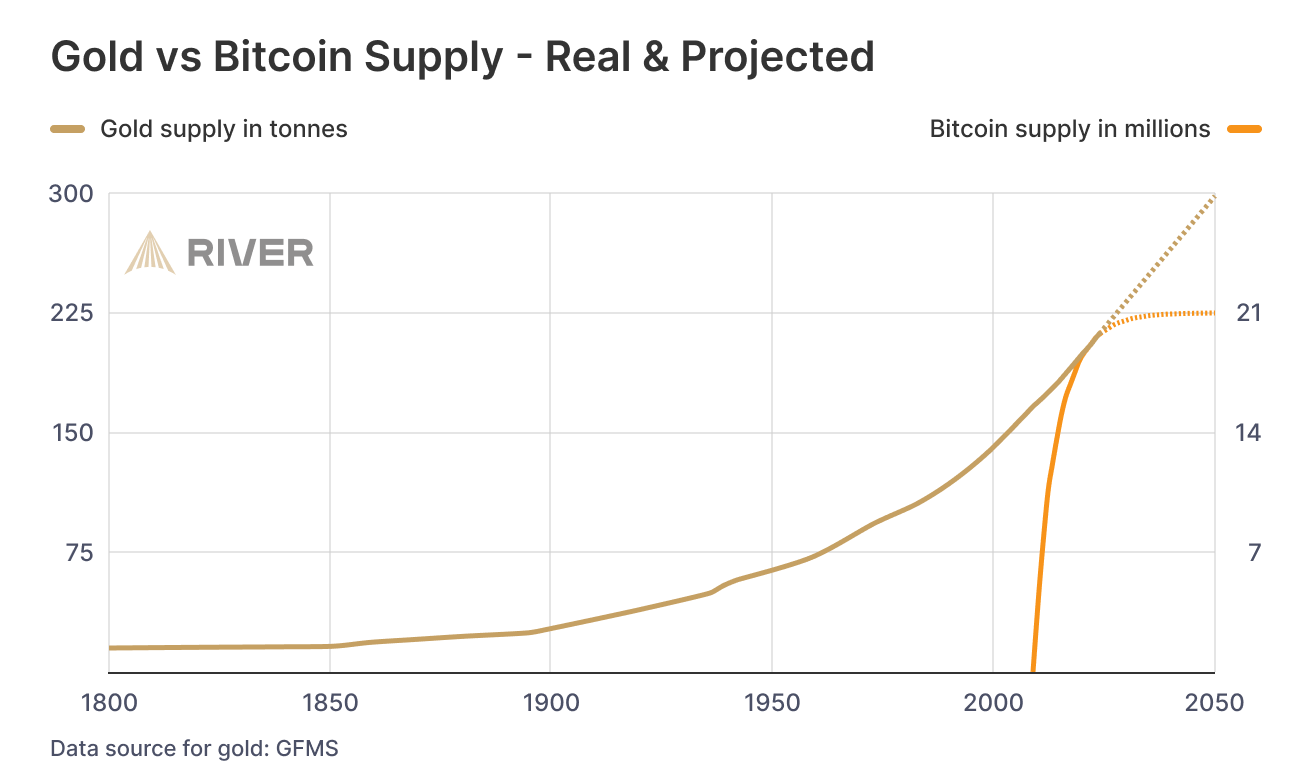

This is a fundamental shift in how companies manage their treasuries — moving away from cash or bonds and towards the digital scarcity that bitcoin presents.

This creates a new form of financial power where corporations can hold a significant portion of a finite asset, unlike fiat currencies which governments can print to infinity.

-

@ 0e9491aa:ef2adadf

2025-05-21 18:01:15

@ 0e9491aa:ef2adadf

2025-05-21 18:01:15

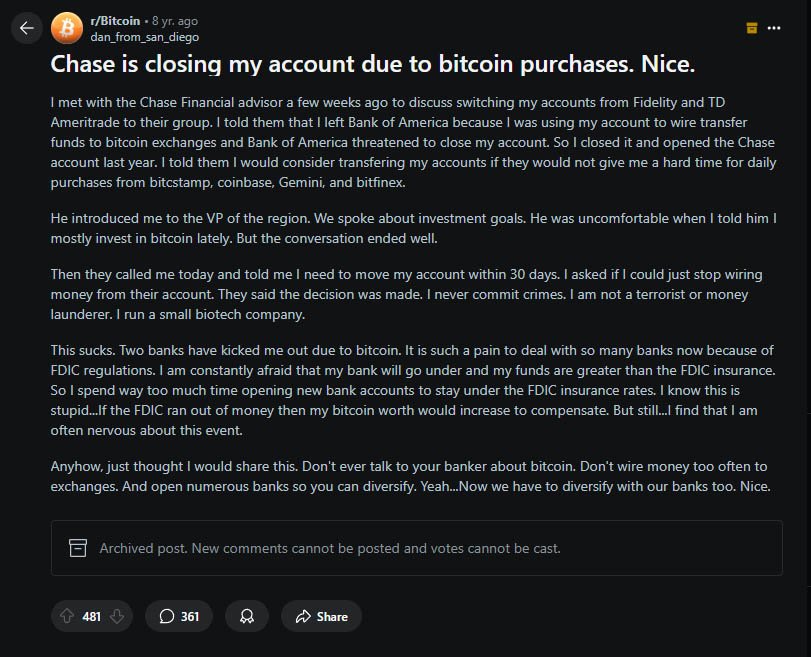

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

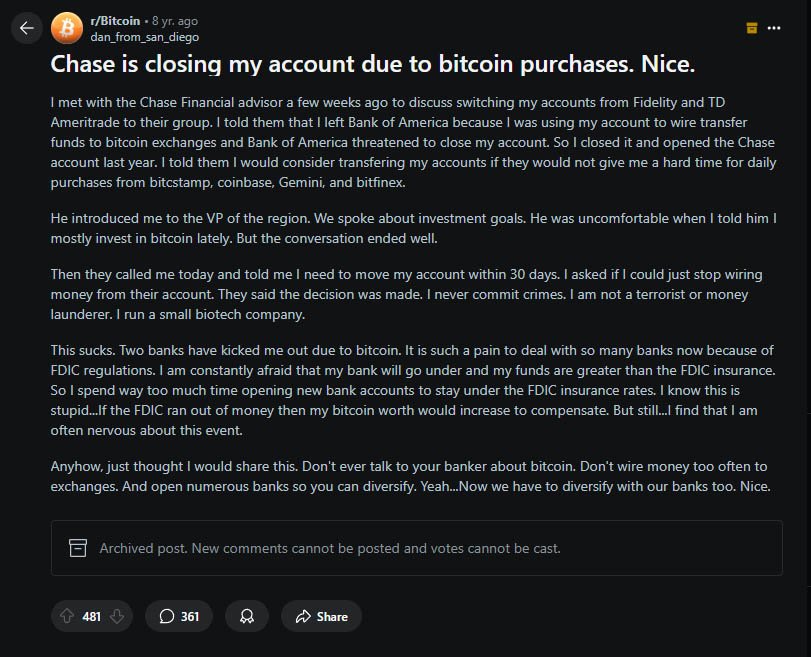

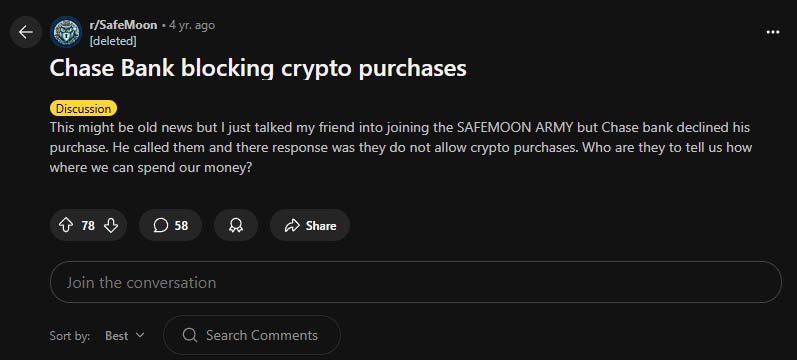

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ eb0157af:77ab6c55

2025-05-21 18:01:13

@ eb0157af:77ab6c55

2025-05-21 18:01:13The exchange, which collapsed in 2022, will distribute $5 billion to creditors starting May 30.

On May 30, FTX will begin the second phase of repayments, delivering over $5 billion to eligible creditors. According to the official announcement, payments will be processed through two main providers: BitGo and Kraken.

Creditors can expect to receive their funds within a relatively short period — from one to three business days after the distribution begins. This second round focuses on creditors with claims over $50,000, following the first repayment phase launched in February for smaller claims.

John Ray III, current CEO of FTX, has allocated about $11.4 billion for customer repayments. Creditors will receive amounts calculated based on the value of crypto assets at the time of the bankruptcy filing (November 2022).

Variable repayment percentages

The distribution plan foresees differentiated payout rates based on the various categories of claims:

- Dotcom customer claims will receive 72%;

- U.S. customer claims will get 54%;

- General unsecured claims and claims from digital asset loans will each receive 61%;

- Convenience class claims will see a 120% repayment.

“These initial distributions to non-convenience classes mark a significant milestone for FTX,” stated the exchange’s CEO.

Requirements to claim repayments

To receive payments, creditors must complete several mandatory steps:

- Log into the FTX Customer Portal;

- Complete KYC (Know Your Customer) verification;

- Submit the required tax forms;

- Complete onboarding with BitGo or Kraken.

The post FTX: over $5 billion ready for creditors in second repayment phase appeared first on Atlas21.

-

@ dfa02707:41ca50e3

2025-05-21 18:00:56

@ dfa02707:41ca50e3

2025-05-21 18:00:56Contribute to keep No Bullshit Bitcoin news going.

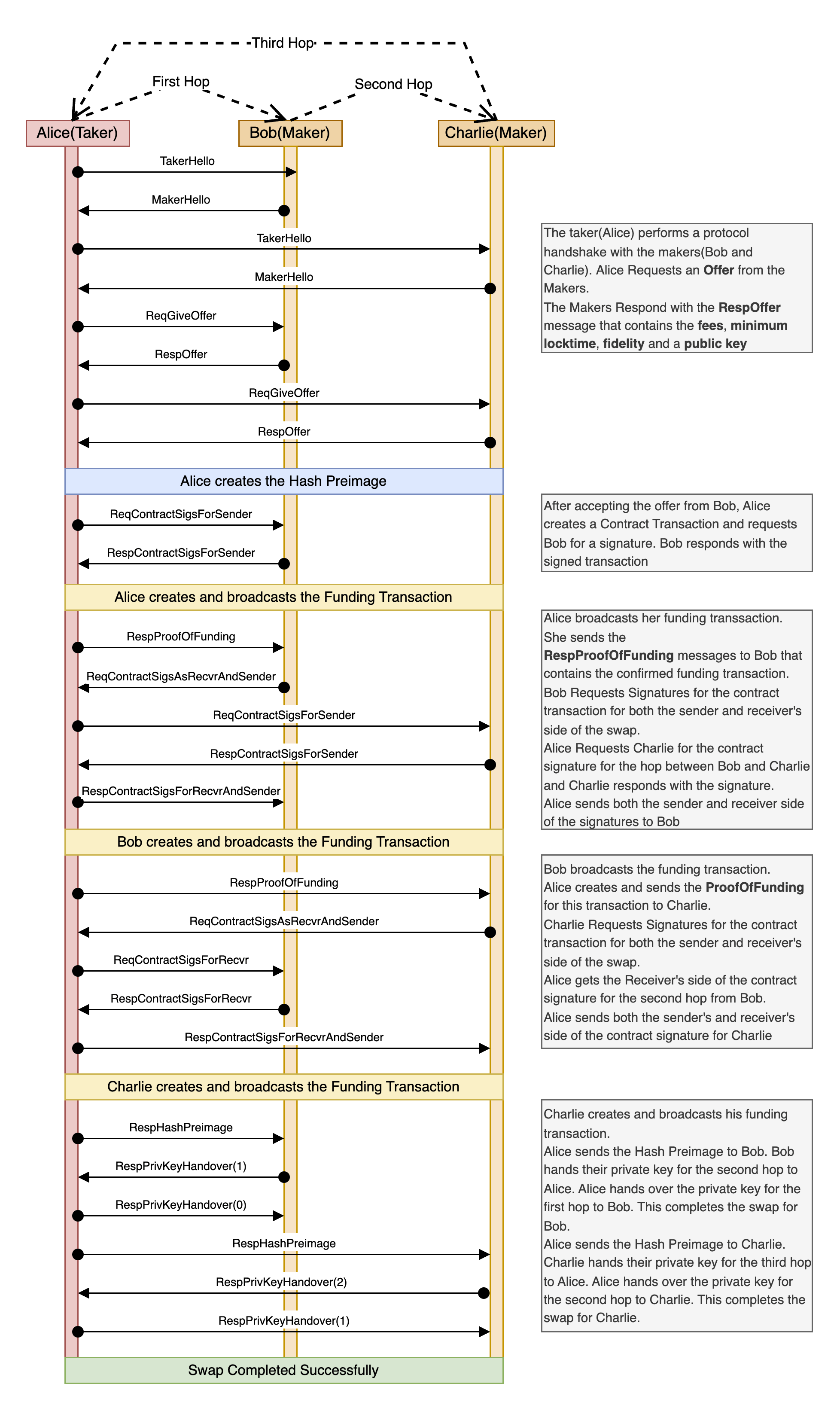

- Coinswap is a decentralized protocol for private, trustless cryptocurrency swaps. It allows participants to securely swap digital assets without intermediaries, using advanced cryptographic techniques and atomic swaps to ensure privacy and security.

- This release introduces major improvements to the protocol's efficiency, security, and usability, including custom in-memory UTXO indexes, more advanced coin-selection algorithms, fidelity bond management and more.

- The update also improves user experience with full Mac support, faster Tor connections, enhanced UI/UX, a unified API, and improved protocol documentation.

"The Project is under active beta development and open for contributions and beta testing. The Coinswap market place is live in testnet4. Bug fixes and feature requests are very much welcome."

- Manuals and demo docs are available here.

What's new

- Core protocol and performance improvements:

- Custom in-memory UTXO indexes. Frequent Core RPC calls, which caused significant delays, have been eliminated by implementing custom in-memory UTXO indexes. These indexes are also saved to disk, leading to faster wallet synchronization.

- Coin selection. Advanced coin-selection algorithms, like those in Bitcoin Core, have been incorporated, enhancing the efficiency of creating different types of transactions.

- Fidelity management. Maker servers now automate tasks such as checking bond expiries, redemption, and recreation for Fidelity Bonds, reducing the user's management responsibilities.

- Taker liveness. The

WaitingFundingConfirmationmessage has been added to keep swap connections between Takers and Makers, assisting with variable block confirmation delays.

-

User experience and compatibility:

- Mac compatibility. The crate and apps now fully support Mac.

- Tor operations are streamlined for faster, more resilient connections. Tor addresses are now consistently linked to the wallet seed, maintaining the same onion address through system reboots.

- The UI/UX improvements enhance the display of balances, UTXOs, offer data, fidelity bonds, and system logs. These updates make the apps more enjoyable and provide clearer coin swap logs during the swap process.

-

API design improvements. Transaction creation routines have been streamlined to use a single common API, which reduces technical debt and eliminates redundant code.

- Protocol spec documentation now details how Coinswap breaks the transaction graph and improves privacy through routed swaps and amount splitting, and includes diagrams for clarity.

Source: Coinswap Protocol specification.

-

@ dfa02707:41ca50e3

2025-05-21 18:00:52

@ dfa02707:41ca50e3

2025-05-21 18:00:52Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ cae03c48:2a7d6671

2025-05-21 18:00:46

@ cae03c48:2a7d6671

2025-05-21 18:00:46Bitcoin Magazine

KindlyMD Shareholders Approve Merger with Bitcoin Treasury Company NakamotoKindlyMD, Inc. has secured shareholder approval for its proposed merger with Nakamoto Holdings Inc., marking a major step toward becoming one of the biggest Bitcoin treasury companies on the market.

The majority of KindlyMD’s shareholders delivered written consent in favor of the merger on May 18, 2025. The transaction is now on track to close in the third quarter of 2025, following the SEC’s review and distribution of an information statement to shareholders. Under current terms, the deal will close 20 days after the statement is mailed.

Full release: https://t.co/jsn4XNW1dK

"We are pleased to achieve this important milestone in the merger process," said Tim Pickett, CEO of KindlyMD. "As a combined company, we are excited to leverage Bitcoin's dominance and real-world utility to strengthen our company and drive… pic.twitter.com/YPD3ajZFNf— KindlyMD (@KindlyMD) May 20, 2025

“This milestone brings us one step closer to unlocking Bitcoin’s potential for KindlyMD shareholders,” said David Bailey, Founder and CEO of Nakamoto. “We are grateful that KindlyMD shares our vision for a future in which Bitcoin is a core part of the corporate balance sheet, and investors across global capital markets have exposure to the world’s greatest asset and store of value.”

Nakamoto is building a global portfolio of companies aligned around Bitcoin’s core principles. Through treasury strategy and targeted acquisitions, the company aims to redefine capital markets infrastructure with Bitcoin at the center.

KindlyMD, meanwhile, brings to the table a unique model of integrated, data-driven healthcare focused on reducing opioid dependence and improving outcomes through personalized treatment and alternative medicine education. Its clinical services are reimbursed through Medicare, Medicaid, and commercial insurance.

Tim Pickett, CEO of KindlyMD, emphasized the strategic benefits of the deal: “We are pleased to achieve this important milestone in the merger process. As a combined company, we are excited to leverage Bitcoin’s dominance and real-world utility to strengthen our company and drive sustained long-term value for our investors.”

Disclosure: Nakamoto is in partnership with Bitcoin Magazine’s parent company BTC Inc to build the first global network of Bitcoin treasury companies, where BTC Inc provides certain marketing services to Nakamoto. More information on this can be found here.

This post KindlyMD Shareholders Approve Merger with Bitcoin Treasury Company Nakamoto first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-05-21 18:00:42

@ cae03c48:2a7d6671

2025-05-21 18:00:42Bitcoin Magazine

Bitcoin Price Breaks Record All Time High With Surge Above $109,000Bitcoin soared to a new all-time high today, crossing $109,000 and peaking at $109,800 before settling at $109,378 on Coinbase. The historic price milestone comes as institutional inflows and favorable policy developments fuel growing confidence in the world’s leading digital asset.

BREAKING: #BITCOIN HAS HIT A NEW ALL TIME HIGH

pic.twitter.com/3TeTlF6bIS

pic.twitter.com/3TeTlF6bIS— Bitcoin Magazine (@BitcoinMagazine) May 21, 2025

Bitcoin’s ascent reflects a surge in momentum across traditional finance and political circles. Nearly $1 billion in inflows poured into Bitcoin ETFs over just two trading days this week, according to data from Farside Investors—underscoring the deepening demand from institutional investors.

“Bitcoin is pushing toward new highs with strong tailwinds behind it—from steady ETF inflows to a broader shift in political tone,” said Joe DiPasquale, CEO of BitBull Capital. “This doesn’t feel like a short-term squeeze—it’s a more sustained bid that reflects a structural shift in how investors are viewing Bitcoin. It’s moving from a speculative trade to a strategic allocation.”

Bitcoin’s consistent performance and growing adoption among institutional players have increasingly positioned it as more than just a speculative asset. As traditional financial institutions—including JPMorgan—open channels for client access to Bitcoin, and as industry leaders like Coinbase are added to major indexes, Bitcoin’s role as a cornerstone of the modern financial system continues to solidify.

Investor enthusiasm has also been supported by legislative progress in Washington. The U.S. Senate this week advanced bipartisan legislation to create a federal framework for stablecoins—a major win for the digital asset industry and a sign of increasing government engagement with crypto infrastructure.

JUST IN: Legislation to create a regulatory framework for stablecoins The GENIUS Act passes motion to proceed to the consideration of the bill

The bill now goes to the amendment process. pic.twitter.com/KjDAAofZSj

— Bitcoin Magazine (@BitcoinMagazine) May 21, 2025

“Stablecoin legislation is about to pass the Senate, and Bitcoin just hit a new all time high,” President Donald Trump’s AI & Crypto Czar David Sacks posted today on X

Additionally, President Donald Trump has embraced the sector with vocal support and direct policy action. Earlier this year, his administration established an official “strategic bitcoin reserve” for the U.S. government and eased several regulatory pressures on major crypto firms, reinforcing Bitcoin’s standing as a legitimate financial instrument.

With market dynamics aligning and global interest accelerating, Bitcoin’s breakout above $109,800 marks not just a record high but may be a sign of what’s next to come.

“If you’re not buying bitcoin at the all-time high, you’re leaving money on the table,” posted Strategy Executive Chairman Michae Saylor.

This post Bitcoin Price Breaks Record All Time High With Surge Above $109,000 first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ b1ddb4d7:471244e7

2025-05-21 18:00:33

@ b1ddb4d7:471244e7

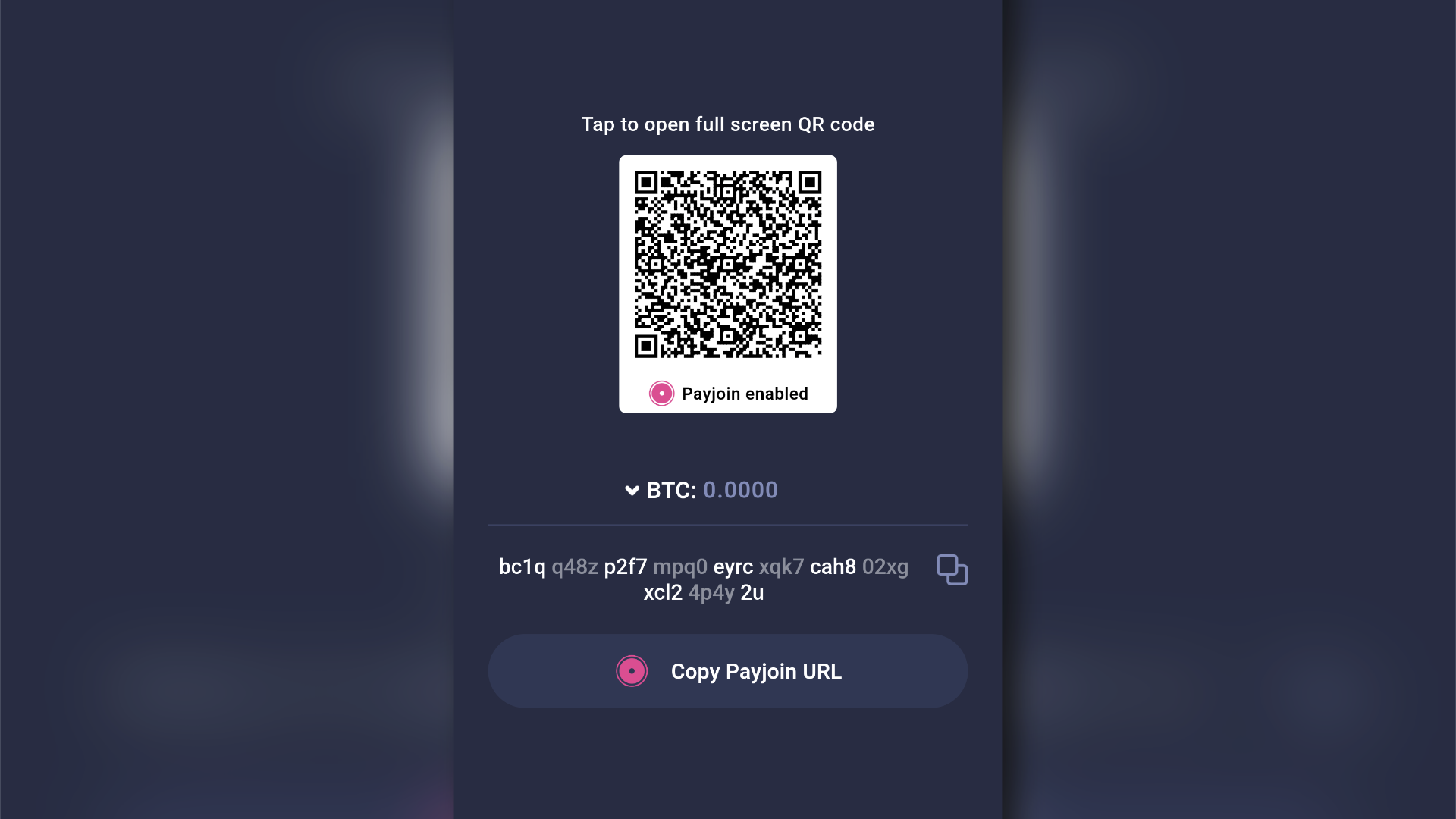

2025-05-21 18:00:33Custodial Lightning wallets allow users to transact without managing private keys or channel liquidity. The provider handles technical complexities, but this convenience comes with critical trade-offs:

- You don’t control your keys: The custodian holds your bitcoin.

- Centralized points of failure: Servers can be hacked or shut down.

- Surveillance risks: Providers track transaction metadata.

Key Risks of Custodial Lightning Wallets

*1. Hacks and Exit Scams*

Custodians centralize large amounts of bitcoin, attracting hackers:

- Nearly $2.2 billion worth of funds were stolen from hacks in 2024.

- Lightning custodians suffered breaches, losing user funds.

Unlike non-custodial wallets, victims have no recourse since they don’t hold keys.

*2. Censorship and Account Freezes*

Custodians comply with regulators, risking fund seizures:

- Strike (a custodial Lightning app) froze accounts of users in sanctioned regions.

- A U.K. court in 2020 ordered Bitfinex to freeze bitcoin worth $860,000 after the exchange and blockchain sleuthing firm Chainalysis traced the funds to a ransomware payment.

*3. Privacy Erosion*

Custodians log user activity, exposing sensitive data:

- Transaction amounts, receiver addresses, and IPs are recorded.

*4. Service Downtime*

Centralized infrastructure risks outages.

*5. Inflation of Lightning Network Centralization*

Custodians dominate liquidity, weakening network resilience:

- At the moment, 10% of the nodes on Lightning control 80% of the liquidity.

- This centralization contradicts bitcoin’s decentralized ethos.

How to Switch to Self-Custodial Lightning Wallets

Migrating from custodial services is straightforward:

*1. Choose a Non-Custodial Wallet*

Opt for wallets that let you control keys and channels:

- Flash: The self-custodial tool that lets you own your keys, control your coins, and transact instantly.

- Breez Wallet : Non-custodial, POS integrations.

- Core Lightning : Advanced, for self-hosted node operators.

*2. Transfer Funds Securely*

- Withdraw funds from your custodial wallet to a bitcoin on-chain address.

- Send bitcoin to your non-custodial Lightning wallet.

*3. Set Up Channel Backups*

Use tools like Static Channel Backups (SCB) to recover channels if needed.

*4. Best Practices*

- Enable Tor: Mask your IP (e.g., Breez’s built-in Tor support).

- Verify Receiving Addresses: Avoid phishing scams.

- Regularly Rebalance Channels: Use tools like Lightning Pool for liquidity.

Why Self-Custodial Lightning Matters

- Self-custody: Control your keys and funds.

- Censorship resistance: No third party can block transactions.

- Network health: Decentralized liquidity strengthens Lightning.

Self-custodial wallets now rival custodial ease.

Custodial Lightning wallets sacrifice security for convenience, putting users at risk of hacks, surveillance, and frozen funds. As bitcoin adoption grows, so does the urgency to embrace self-custodial solutions.

Take action today:

- Withdraw custodial funds to a hardware wallet.

- Migrate to a self-custodial Lightning wallet.

- Educate others on the risks of custodial control.

The Lightning Network’s potential hinges on decentralization—don’t let custodians become its Achilles’ heel.

-

@ 9ca447d2:fbf5a36d

2025-05-21 18:01:36

@ 9ca447d2:fbf5a36d

2025-05-21 18:01:36UFC legend Conor McGregor has entered the Bitcoin space, calling on his home country of Ireland to create a national Bitcoin reserve. The proposal has sparked a frenzy online and across Ireland.

McGregor, famous globally for his UFC achievements, is now pushing for a financial revolution in Ireland. In a recent post on X, the 36-year-old fighter said Bitcoin can give power back to the people.

Conor McGregor on X

“Crypto in its origin was founded to give power back to the people,” McGregor wrote. “An Irish Bitcoin strategic reserve will give power to the people’s money.”

The post went viral with over 735,000 views in under 12 hours. McGregor announced he will be co-hosting a Twitter Space to discuss his vision and invited Bitcoin experts and public figures to join.

McGregor’s call for a bitcoin reserve is not an isolated event. It comes at a time when several other countries are exploring or have already added bitcoin to their national strategies.

The U.S. recently made headlines when President Donald Trump signed an executive order to create a Strategic Bitcoin Reserve. Arizona and New Hampshire have also done it at the state level.

El Salvador and Bhutan have also taken the same step. There have been reports of Russia planning to add bitcoin to its reserves by 2028 and the Polish government has proposals to do the same.

McGregor says Ireland shouldn’t be left behind. He believes bitcoin’s fixed supply, neutrality and decentralization make it the perfect hedge against inflation and a modern alternative to gold.

“Now it’s time to change the crypto game,” McGregor posted, signaling he will bring digital assets into the national conversation.

Many of McGregor’s fans and Bitcoin enthusiasts are on board with the idea, but some experts and commenters are urging caution. There are comments on his social media posts telling him to focus on Bitcoin only and not include other cryptos in the reserve.

They warned him to choose his words more carefully, not to mix “crypto” with Bitcoin. Daniel Sempere Pico commented:

“Crypto is mostly hot air and scams. Bitcoin is not crypto. Focus on bitcoin, Conor. Focus on bitcoin.”

McGregor’s call for a reserve comes as he launches his political career. In March 2025 he announced he will run as an independent candidate for the Irish presidency. His campaign is focused on crime reduction, stricter immigration and now financial reform through Bitcoin.

If elected, McGregor says he will bring change to Ireland, starting with how the country handles its national reserves. He wants bitcoin to be the cornerstone of a modern decentralized financial strategy.

But it might be a big ask. Ireland has not commented on McGregor’s proposal and experts say it’s got major regulatory and political hurdles.

As an independent candidate with no party backing, McGregor will need to build public and political support to make it happen.

-

@ b1ddb4d7:471244e7

2025-05-21 18:00:32

@ b1ddb4d7:471244e7

2025-05-21 18:00:32The upcoming Bitcoin 2025 conference, scheduled from May 27–29 at the Venetian Conference Center in Las Vegas, is set to make history with an official attempt to break the GUINNESS WORLD RECORDS® title for the most Bitcoin point-of-sale transactions in an eight-hour period.

Organized by BTC Inc, the event will showcase Bitcoin’s evolution from a digital capital asset to a practical medium of exchange, leveraging the latest advancements in payment technology.

Tap-to-Pay with Lightning-Ready Bolt Cards

To facilitate this record-setting attempt, 4,000 Lightning-ready Bolt Cards will be distributed to conference attendees.

— Uncle Rockstar Developer (@r0ckstardev) May 15, 2025

These NFC-enabled cards allow users to make instant, contactless Bitcoin payments at vendor booths throughout the expo-no apps or QR codes required, just a simple tap.

The cards are available in four collectible designs, each featuring a prominent figure in Bitcoin’s history: Senator Cynthia Lummis, Michael Saylor, Satoshi Nakamoto, and Jack Dorsey.

Each attendee will receive a randomly assigned card, making them both functional and collectible souvenirs.

Senator Lummis: A Playful Provocation

Notably, one of the card designs features Senator Cynthia Lummis with laser eyes-a playful nod to her reputation as a leading Bitcoin advocate in US politics.

While Lummis is known for her legislative efforts to promote Bitcoin integration, she has publicly stated she prefers to “spend dollars and save Bitcoin,” viewing BTC as a long-term store of value rather than a daily currency.

The choice to feature her on the Bolt Card, could be suggested by Rockstar Dev of the BTC Pay Server Foundation, perhaps a lighthearted way to highlight the ongoing debate about Bitcoin’s role in everyday payments.

Nothing cracks me up quite like a senator that wants the US to buy millions of Bitcoin use dollars to buy a beer at a Bitcoin bar.

This is how unserious some of you are. pic.twitter.com/jftIEggmip

— Magoo PhD (@HodlMagoo) April 4, 2025

How Bolt Cards and the Lightning Network Work

Bolt Cards are physical cards equipped with NFC (Near Field Communication) technology, similar to contactless credit or debit cards. When linked to a compatible Lightning wallet, they enable users to make Bitcoin payments over the Lightning Network by simply tapping the card at a point-of-sale terminal.

The Lightning Network is a second-layer protocol built on top of Bitcoin, designed to facilitate instant, low-cost transactions ideal for everyday purchases.

This integration aims to make Bitcoin as easy to use as traditional payment methods, eliminating the need for QR code scanning or mobile apps.

A Showcase for Bitcoin’s Real-World Usability

With over 30,000 attendees, 300 exhibitors, and 500 speakers expected, the Bitcoin 2025 conference is poised to be the largest Bitcoin event of the year-and potentially the most transactional.

The event will feature on-site activations such as the Official Bitcoin Magazine Store, where all merchandise will be available at a 21% discount for those paying with Bitcoin via the Lightning Network-a nod to Bitcoin’s 21 million coin supply limit.

By deeply integrating Lightning payments into the conference experience, organizers hope to demonstrate Bitcoin’s readiness for mainstream commerce and set a new benchmark for its practical use as a currency.

Conclusion

The Guinness World Record attempt at Bitcoin 2025 is more than a publicity stunt-it’s a bold demonstration of Bitcoin’s technological maturity and its potential to function as a modern, everyday payment method.

Whether or not the record is set, the event will serve as a milestone in the ongoing journey to make Bitcoin a truly global, user-friendly currency

-

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:08

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:08 -

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:06

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:06 -

@ b1ddb4d7:471244e7

2025-05-21 18:00:30

@ b1ddb4d7:471244e7

2025-05-21 18:00:30Flash, an all-in-one Bitcoin payment platform, has announced the launch of Flash 2.0, the most intuitive and powerful Bitcoin payment solution to date.

With a completely redesigned interface, expanded e-commerce integrations, and a frictionless onboarding process, Flash 2.0 makes accepting Bitcoin easier than ever for businesses worldwide.

We did the unthinkable!

We did the unthinkable! Website monetization used to be super complicated.

"Buy me a coffee" — But only if we both have a bank account.

WHAT IF WE DON'T?

Thanks to @paywflash and bitcoin, it's just 5 CLICKS – and no banks!

Start accepting donations on your website… pic.twitter.com/uwZUrvmEZ1

Start accepting donations on your website… pic.twitter.com/uwZUrvmEZ1— Flash • The Bitcoin Payment Gateway (@paywflash) May 13, 2025

Accept Bitcoin in Three Minutes

Setting up Bitcoin payments has long been a challenge for merchants, requiring technical expertise, third-party processors, and lengthy verification procedures. Flash 2.0 eliminates these barriers, allowing any business to start accepting Bitcoin in just three minutes, with no technical set-up and full control over their funds.

The Bitcoin Payment Revolution

The world is witnessing a seismic shift in finance. Governments are backing Bitcoin funds, major companies are adding Bitcoin to their balance sheets, and political figures are embracing it as the future of money. Just as Stripe revolutionized internet payments, Flash is now doing the same for Bitcoin. Businesses that adapt today will gain a competitive edge in a rapidly evolving financial landscape.

With Bitcoin adoption accelerating, consumers are looking for places to spend it. Flash 2.0 ensures businesses of all sizes can seamlessly accept Bitcoin and position themselves at the forefront of this financial revolution.

All-in-One Monetization Platform

More than just a payment gateway, Flash 2.0 is a complete Bitcoin monetization suite, providing multiple ways for businesses to integrate Bitcoin into their operations. Merchants can accept payments online and in-store, content creators can monetize with donations and paywalls, and freelancers can send instant invoices via payment links.

For example, a jewelry designer selling products on WooCommerce can now integrate Flash for online payments, use Flash’s Point-of-Sale system at trade shows, enable Bitcoin donations for her digital artwork, and lock premium content behind Flash Paywalls. The possibilities are endless.

E-Commerce for Everyone

With built-in integrations for Shopify, WooCommerce, and soon Wix and OpenCart, Flash 2.0 enables Bitcoin payments on 95% of e-commerce stores worldwide. Businesses can now add Bitcoin as a payment option in just a few clicks—without needing developers or external payment processors.

And for those looking to start selling, Flash’s built-in e-commerce features allow users to create online stores, showcase products, and manage payments seamlessly.

No Middlemen, No Chargebacks, No Limits

Unlike traditional payment platforms, Flash does not hold or process funds. Businesses receive Bitcoin directly, instantly, and securely. There are no chargebacks, giving merchants full control over refunds and eliminating fraud. Flash also remains KYC-free, ensuring a seamless experience for businesses and customers alike.

A Completely Redesigned Experience

“The world is waking up to Bitcoin. Just like the internet revolutionized commerce, Bitcoin is reshaping finance. Businesses need solutions that are simple, efficient, and truly decentralized. Flash 2.0 is more than just a payment processor—it’s a gateway to the future of digital transactions, putting financial power back into the hands of businesses.”

— Pierre Corbin, CEO at Flash.

Flash 2.0 introduces a brand-new user interface, making it easier than ever to navigate, set up payments, and manage transactions. With an intuitive dashboard, streamlined checkout, and enhanced mobile compatibility, the platform is built for both new and experienced Bitcoin users.

About Flash

Flash is an all-in-one Bitcoin payment platform that empowers businesses, creators, and freelancers to accept, manage, and grow with Bitcoin. With a mission to make Bitcoin payments accessible to everyone, Flash eliminates complexity and gives users full control over their funds.

To learn more or get started, visit www.paywithflash.com.

Press Contact:

Julien Bouvier

Head of Marketing

+3360941039 -

@ b1ddb4d7:471244e7

2025-05-21 18:00:29

@ b1ddb4d7:471244e7

2025-05-21 18:00:29Bitcoin FilmFest (BFF25) returns to Warsaw for its third edition, blending independent cinema—from feature films and commercials to AI-driven experimental visuals—with education and entertainment.

Hundreds of attendees from around the world will gather for three days of screenings, discussions, workshops, and networking at the iconic Kinoteka Cinema (PKiN), the same venue that hosted the festival’s first two editions in March 2023 and April 2024.

This year’s festival, themed “Beyond the Frame,” introduces new dimensions to its program, including an extra day on May 22 to celebrate Bitcoin Pizza Day, the first real-world bitcoin transaction, with what promises to be one of Europe’s largest commemorations of this milestone.

BFF25 bridges independent film, culture, and technology, with a bold focus on decentralized storytelling and creative expression. As a community-driven cultural experience with a slightly rebellious spirit, Bitcoin FilmFest goes beyond movies, yet cinema remains at its heart.

Here’s a sneak peek at the lineup, specially curated for movie buffs:

Generative Cinema – A special slot with exclusive shorts and a thematic debate on the intersection of AI and filmmaking. Featured titles include, for example: BREAK FREE, SATOSHI: THE CREATION OF BITCOIN, STRANGE CURRENCIES, and BITCOIN IS THE MYCELIUM OF MONEY, exploring financial independence, traps of the fiat system, and a better future built on sound money.

Generative Cinema – A special slot with exclusive shorts and a thematic debate on the intersection of AI and filmmaking. Featured titles include, for example: BREAK FREE, SATOSHI: THE CREATION OF BITCOIN, STRANGE CURRENCIES, and BITCOIN IS THE MYCELIUM OF MONEY, exploring financial independence, traps of the fiat system, and a better future built on sound money. Upcoming Productions Preview – A bit over an hour-long block of unreleased pilots and works-in-progress. Attendees will get exclusive first looks at projects like FINDING HOME (a travel-meets-personal-journey series), PARALLEL SPACES (a story about alternative communities), and THE LEGEND OF LANDI (a mysterious narrative).

Upcoming Productions Preview – A bit over an hour-long block of unreleased pilots and works-in-progress. Attendees will get exclusive first looks at projects like FINDING HOME (a travel-meets-personal-journey series), PARALLEL SPACES (a story about alternative communities), and THE LEGEND OF LANDI (a mysterious narrative). Freedom-Focused Ads & Campaigns – Unique screenings of video commercials, animations, and visual projects, culminating in “The PoWies” (Proof of Work-ies)—the first ever awards show honoring the best Bitcoin-only awareness campaigns.

Freedom-Focused Ads & Campaigns – Unique screenings of video commercials, animations, and visual projects, culminating in “The PoWies” (Proof of Work-ies)—the first ever awards show honoring the best Bitcoin-only awareness campaigns.To get an idea of what might come up at the event, here, you can preview 6 selected ads combined into two 2 videos:

Open Pitch Competition – A chance for filmmakers to present fresh ideas and unfinished projects to an audience of a dedicated jury, movie fans and potential collaborators. This competitive block isn’t just entertaining—it’s a real opportunity for creators to secure funding and partnerships.

Open Pitch Competition – A chance for filmmakers to present fresh ideas and unfinished projects to an audience of a dedicated jury, movie fans and potential collaborators. This competitive block isn’t just entertaining—it’s a real opportunity for creators to secure funding and partnerships. Golden Rabbit Awards: A lively gala honoring films from the festival’s Official Selection, with awards in categories like Best Feature, Best Story, Best Short, and Audience Choice.

Golden Rabbit Awards: A lively gala honoring films from the festival’s Official Selection, with awards in categories like Best Feature, Best Story, Best Short, and Audience Choice.BFF25 Main Screenings

Sample titles from BFF25’s Official Selection:

REVOLUCIÓN BITCOIN – A documentary by Juan Pablo, making its first screening outside the Spanish-speaking world in Warsaw this May. Three years of important work, 80 powerful minutes to experience. The film explores Bitcoin’s impact across Argentina, Colombia, Mexico, El Salvador, and Spain through around 40 diverse perspectives. Screening in Spanish with English subtitles, followed by a Q&A with the director.

REVOLUCIÓN BITCOIN – A documentary by Juan Pablo, making its first screening outside the Spanish-speaking world in Warsaw this May. Three years of important work, 80 powerful minutes to experience. The film explores Bitcoin’s impact across Argentina, Colombia, Mexico, El Salvador, and Spain through around 40 diverse perspectives. Screening in Spanish with English subtitles, followed by a Q&A with the director. UNBANKABLE – Luke Willms’ directorial debut, drawing from his multicultural roots and his father’s pioneering HIV/AIDS research. An investigative documentary based on Luke’s journeys through seven African countries, diving into financial experiments and innovations—from mobile money and digital lending to Bitcoin—raising smart questions and offering potential lessons for the West. Its May appearance at BFF25 marks its largest European event to date, following festival screenings and nominations across multiple continents over the past year.

UNBANKABLE – Luke Willms’ directorial debut, drawing from his multicultural roots and his father’s pioneering HIV/AIDS research. An investigative documentary based on Luke’s journeys through seven African countries, diving into financial experiments and innovations—from mobile money and digital lending to Bitcoin—raising smart questions and offering potential lessons for the West. Its May appearance at BFF25 marks its largest European event to date, following festival screenings and nominations across multiple continents over the past year. HOTEL BITCOIN – A Spanish comedy directed by Manuel Sanabria and Carlos “Pocho” Villaverde. Four friends, 4,000 bitcoins , and one laptop spark a chaotic adventure of parties, love, crime, and a dash of madness. Exploring sound money, value, and relationships through a twisting plot. The film premiered at the Tarazona and Moncayo Comedy Film Festival in August 2024. Its Warsaw screening at BFF25 (in Spanish with English subtitles) marks its first public showing outside the Spanish-speaking world.

HOTEL BITCOIN – A Spanish comedy directed by Manuel Sanabria and Carlos “Pocho” Villaverde. Four friends, 4,000 bitcoins , and one laptop spark a chaotic adventure of parties, love, crime, and a dash of madness. Exploring sound money, value, and relationships through a twisting plot. The film premiered at the Tarazona and Moncayo Comedy Film Festival in August 2024. Its Warsaw screening at BFF25 (in Spanish with English subtitles) marks its first public showing outside the Spanish-speaking world.Check out trailers for this year’s BFF25 and past editions on YouTube.

Tickets & Info:

- Detailed program and tickets are available at bitcoinfilmfest.com/bff25.

- Stay updated via the festival’s official channels (links provided on the website).

- Use ‘LN-NEWS’ to get 10% of tickets

-

@ b1ddb4d7:471244e7

2025-05-21 18:00:28

@ b1ddb4d7:471244e7

2025-05-21 18:00:28Starting January 1, 2026, the United Kingdom will impose some of the world’s most stringent reporting requirements on cryptocurrency firms.

All platforms operating in or serving UK customers-domestic and foreign alike-must collect and disclose extensive personal and transactional data for every user, including individuals, companies, trusts, and charities.

This regulatory drive marks the UK’s formal adoption of the OECD’s Crypto-Asset Reporting Framework (CARF), a global initiative designed to bring crypto oversight in line with traditional banking and to curb tax evasion in the rapidly expanding digital asset sector.

What Will Be Reported?

Crypto firms must gather and submit the following for each transaction:

- User’s full legal name, home address, and taxpayer identification number

- Detailed data on every trade or transfer: type of cryptocurrency, amount, and nature of the transaction

- Identifying information for corporate, trust, and charitable clients

The obligation extends to all digital asset activities, including crypto-to-crypto and crypto-to-fiat trades, and applies to both UK residents and non-residents using UK-based platforms. The first annual reports covering 2026 activity are due by May 31, 2027.

Enforcement and Penalties

Non-compliance will carry stiff financial penalties, with fines of up to £300 per user account for inaccurate or missing data-a potentially enormous liability for large exchanges. The UK government has urged crypto firms to begin collecting this information immediately to ensure operational readiness.

Regulatory Context and Market Impact

This move is part of a broader UK strategy to position itself as a global fintech hub while clamping down on fraud and illicit finance. UK Chancellor Rachel Reeves has championed these measures, stating, “Britain is open for business – but closed to fraud, abuse, and instability”. The regulatory expansion comes amid a surge in crypto adoption: the UK’s Financial Conduct Authority reported that 12% of UK adults owned crypto in 2024, up from just 4% in 2021.

Enormous Risks for Consumers: Lessons from the Coinbase Data Breach

While the new framework aims to enhance transparency and protect consumers, it also dramatically increases the volume of sensitive personal data held by crypto firms-raising the stakes for cybersecurity.

The risks are underscored by the recent high-profile breach at Coinbase, one of the world’s largest exchanges.

In May 2025, Coinbase disclosed that cybercriminals, aided by bribed offshore contractors, accessed and exfiltrated customer data including names, addresses, government IDs, and partial bank details.

The attackers then used this information for sophisticated phishing campaigns, successfully deceiving some customers into surrendering account credentials and funds.

“While private encryption keys remained secure, sufficient customer information was exposed to enable sophisticated phishing attacks by criminals posing as Coinbase personnel.”

Coinbase now faces up to $400 million in compensation costs and has pledged to reimburse affected users, but the incident highlights the systemic vulnerability created when large troves of personal data are centralized-even if passwords and private keys are not directly compromised. The breach also triggered a notable drop in Coinbase’s share price and prompted a $20 million bounty for information leading to the attackers’ capture.

The Bottom Line

The UK’s forthcoming crypto reporting regime represents a landmark in financial regulation, promising greater transparency and tax compliance. However, as the Coinbase episode demonstrates, the aggregation of sensitive user data at scale poses a significant cybersecurity risk.

As regulators push for more oversight, the challenge will be ensuring that consumer protection does not become a double-edged sword-exposing users to new threats even as it seeks to shield them from old ones.

-

@ b1ddb4d7:471244e7

2025-05-21 18:00:26

@ b1ddb4d7:471244e7

2025-05-21 18:00:26This article was originally published on aier.org

Even after eleven years experience, and a per Bitcoin price of nearly $20,000, the incredulous are still with us. I understand why. Bitcoin is not like other traditional financial assets.

Even describing it as an asset is misleading. It is not the same as a stock, as a payment system, or a money. It has features of all these but it is not identical to them.

What Bitcoin is depends on its use as a means of storing and porting value, which in turn rests of secure titles to ownership of a scarce good. Those without experience in the sector look at all of this and get frustrated that understanding why it is valuable is not so easy to grasp.

In this article, I’m updating an analysis I wrote six years ago. It still holds up. For those who don’t want to slog through the entire article, my thesis is that Bitcoin’s value obtains from its underlying technology, which is an open-source ledger that keeps track of ownership rights and permits the transfer of these rights. Bitcoin managed to bundle its unit of account with a payment system that lives on the ledger. That’s its innovation and why it obtained a value and that value continues to rise.

Consider the criticism offered by traditional gold advocates, who have, for decades, pushed the idea that sound money must be backed by something real, hard, and independently valuable. Bitcoin doesn’t qualify, right? Maybe it does.

Bitcoin first emerged as a possible competitor to national, government-managed money in 2009. Satoshi Nakamoto’s white paper was released October 31, 2008. The structure and language of this paper sent the message: This currency is for computer technicians, not economists nor political pundits. The paper’s circulation was limited; novices who read it were mystified.

But the lack of interest didn’t stop history from moving forward. Two months later, those who were paying attention saw the emergence of the “Genesis Block,” the first group of bitcoins generated through Nakamoto’s concept of a distributed ledger that lived on any computer node in the world that wanted to host it.

Here we are all these years later and a single bitcoin trades at $18,500. The currency is held and accepted by many thousands of institutions, both online and offline. Its payment system is very popular in poor countries without vast banking infrastructures but also in developed countries. And major institutions—including the Federal Reserve, the OECD, the World Bank, and major investment houses—are paying respectful attention and weaving blockchain technology into their operations.

Enthusiasts, who are found in every country, say that its exchange value will soar even more in the future because its supply is strictly limited and it provides a system vastly superior to government money. Bitcoin is transferred between individuals without a third party. It is relatively low-cost to exchange. It has a predictable supply. It is durable, fungible, and divisible: all crucial features of money. It creates a monetary system that doesn’t depend on trust and identity, much less on central banks and government. It is a new system for the digital age.

Hard lessons for hard money

To those educated in the “hard money” tradition, the whole idea has been a serious challenge. Speaking for myself, I had been reading about bitcoin for two years before I came anywhere close to understanding it. There was just something about the whole idea that bugged me. You can’t make money out of nothing, much less out of computer code. Why does it have value then? There must be something amiss. This is not how we expected money to be reformed.

There’s the problem: our expectations. We should have been paying closer attention to Ludwig von Mises’ theory of money’s origins—not to what we think he wrote, but to what he actually did write.

In 1912, Mises released The Theory of Money and Credit. It was a huge hit in Europe when it came out in German, and it was translated into English. While covering every aspect of money, his core contribution was in tracing the value and price of money—and not just money itself—to its origins. That is, he explained how money gets its price in terms of the goods and services it obtains. He later called this process the “regression theorem,” and as it turns out, bitcoin satisfies the conditions of the theorem.

Mises’ teacher, Carl Menger, demonstrated that money itself originates from the market—not from the State and not from social contract. It emerges gradually as monetary entrepreneurs seek out an ideal form of commodity for indirect exchange. Instead of merely bartering with each other, people acquire a good not to consume, but to trade. That good becomes money, the most marketable commodity.

But Mises added that the value of money traces backward in time to its value as a bartered commodity. Mises said that this is the only way money can have value.

The theory of the value of money as such can trace back the objective exchange value of money only to that point where it ceases to be the value of money and becomes merely the value of a commodity…. If in this way we continually go farther and farther back we must eventually arrive at a point where we no longer find any component in the objective exchange value of money that arises from valuations based on the function of money as a common medium of exchange; where the value of money is nothing other than the value of an object that is useful in some other way than as money…. Before it was usual to acquire goods in the market, not for personal consumption, but simply in order to exchange them again for the goods that were really wanted, each individual commodity was only accredited with that value given by the subjective valuations based on its direct utility.

Mises’ explanation solved a major problem that had long mystified economists. It is a narrative of conjectural history, and yet it makes perfect sense. Would salt have become money had it otherwise been completely useless? Would beaver pelts have obtained monetary value had they not been useful for clothing? Would silver or gold have had money value if they had no value as commodities first? The answer in all cases of monetary history is clearly no. The initial value of money, before it becomes widely traded as money, originates in its direct utility. It’s an explanation that is demonstrated through historical reconstruction. That’s Mises’ regression theorem.

Bitcoin’s Use Value

At first glance, bitcoin would seem to be an exception. You can’t use a bitcoin for anything other than money. It can’t be worn as jewelry. You can’t make a machine out of it. You can’t eat it or even decorate with it. Its value is only realized as a unit that facilitates indirect exchange. And yet, bitcoin already is money. It’s used every day. You can see the exchanges in real time. It’s not a myth. It’s the real deal.

It might seem like we have to choose. Is Mises wrong? Maybe we have to toss out his whole theory. Or maybe his point was purely historical and doesn’t apply in the future of a digital age. Or maybe his regression theorem is proof that bitcoin is just an empty mania with no staying power, because it can’t be reduced to its value as a useful commodity.

And yet, you don’t have to resort to complicated monetary theory in order to understand the sense of alarm surrounding bitcoin. Many people, as I did, just have a feeling of uneasiness about a money that has no basis in anything physical. Sure, you can print out a bitcoin on a piece of paper, but having a paper with a QR code or a public key is not enough to relieve that sense of unease.

How can we resolve this problem? In my own mind, I toyed with the issue for more than a year. It puzzled me. I wondered if Mises’ insight applied only in a pre-digital age. I followed the speculations online that the value of bitcoin would be zero but for the national currencies into which it is converted. Perhaps the demand for bitcoin overcame the demands of Mises’ scenario because of a desperate need for something other than the dollar.

As time passed—and I read the work of Konrad Graf, Peter Surda, and Daniel Krawisz—finally the resolution came. Bitcoin is both a payment system and a money. The payment system is the source of value, while the accounting unit merely expresses that value in terms of price. The unity of money and payment is its most unusual feature, and the one that most commentators have had trouble wrapping their heads around.

We are all used to thinking of currency as separate from payment systems. This thinking is a reflection of the technological limitations of history. There is the dollar and there are credit cards. There is the euro and there is PayPal. There is the yen and there are wire services. In each case, money transfer relies on third-party service providers. In order to use them, you need to establish what is called a “trust relationship” with them, which is to say that the institution arranging the deal has to believe that you are going to pay.

This wedge between money and payment has always been with us, except for the case of physical proximity.

If I give you a dollar for your pizza slice, there is no third party. But payment systems, third parties, and trust relationships become necessary once you leave geographic proximity. That’s when companies like Visa and institutions like banks become indispensable. They are the application that makes the monetary software do what you want it to do.

The hitch is that

-

@ 9ca447d2:fbf5a36d

2025-05-21 18:01:35

@ 9ca447d2:fbf5a36d

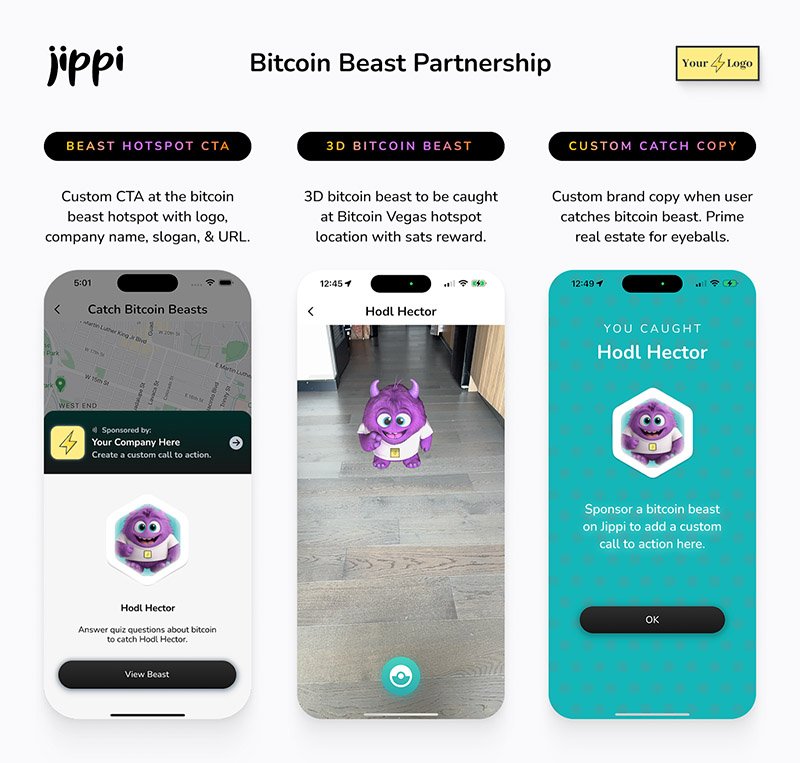

2025-05-21 18:01:35Gen Z (those born between 1997 and 2012) are not rushing to stack sats, and Oliver Porter, Founder & CEO of Jippi, understands the challenge better than most. His strategy revolves around adapting Bitcoin education to fit seamlessly into the digital lives of young adults.

“We need to meet them where they are,” Oliver explains. “90% of Gen Z plays games. 70% expect to earn rewards.”

So, what will effectively introduce them to Bitcoin? In Oliver’s mind, the answer is simple: games that don’t feel preachy but still plant the orange pill.

Learn more at Jippi.app

That’s exactly what Jippi is. Based in Austin, Texas, the team has created a mobile augmented reality (AR) game that rewards players in bitcoin and sneakily teaches them why sound money matters.

“It’s Pokémon GO… but for sats,” Oliver puts it succinctly.

Jippi is like Pokemon Go, but for sats

Oliver’s Bitcoin journey, like many in the space, began long before he was ready. A former colleague had tried planting the seed years earlier, handing him a copy of The Bitcoin Standard. But the moment passed.

It wasn’t until the chaos of 2020 when lockdowns hit, printing presses roared, and civil liberties shrank that the message finally landed for him.

“The government got so good at doing reverse Robin Hood,” Oliver explains. “They steal from the working population and reward the rich.”

By 2020, though, the absurdity of the covid hysteria had caused his eyes to be opened and the orange light seemed the best path back to freedom.

He left the UK for Austin “one of the best places for Bitcoiners,” he says, and dove headfirst into the industry, working at Swan for a year before founding Jippi on PlebLab’s accelerator program.

Jippi’s flagship game lets players roam their cities hunting digital creatures, Bitcoin Beasts, tied to real-world locations. Catching them requires answering Bitcoin trivia, and the reward is sats.

No jargon. No hour-long lectures. Just gameplay with sound money principles woven right in.

The model is working. At a recent hackathon in Austin, Jippi beat out 14 other teams to win first place and $15,000 in prize money.

Oliver of Jippi won Top Builder Season 2 — PlebLab on X

“We’re backdooring Bitcoin education,” Oliver admits. “And while we’re at it, encouraging people to get outside and touch grass.”

Not everyone’s been thrilled. When Jippi team members visited one of the more liberal-leaning places in Texas, UT Austin, to test interest in Bitcoin, they found some seriously committed no-coiners on the campus.

“One young woman told me, ‘I would rather die than talk about Bitcoin,'” Oliver recalls, highlighting the cultural resistance that’s built up among younger demographics.

This resistance is backed by hard data. According to Oliver, some of the Bitcoin podcasters they met with in the space to do market research reported that less than 1% of their listeners are from Gen Z and that number is dropping.

“Unless we find a way to capture their interest in a meaningful way, there’s going to be a big problem around trying to sway Gen Z away from the siren call of s***coins and crypto casinos and towards Bitcoin,” Oliver warns.

Jippi’s next big move is Las Vegas, where they’ll launch the Beast Catch experience at the Venetian during a major Bitcoin event. To mark the occasion, they’re opening up six limited sponsorship spots for Bitcoin companies, each one tied to a custom in-game beast.

Jippi looks to launch a special event at Bitcoin 2025

“It’s real estate inside the game,” Oliver explains. “Brands become allies, not intrusions. You get a logo, company name, and call to action, so we can push people to your site or app.”

Bitcoin Well—an automatic self-custody Bitcoin platform—has claimed Beast #1. Only five exclusive spots remain for Bitcoin companies to “beastify their brand” through Jippi’s immersive AR game.

“I love the Jippi mission. I think gamified learning is how we will onboard the next generation and it’s exciting to see what the Jippi team is doing! I love working with bitcoiners towards our common mission – bullish!” said Adam O’Brien, Bitcoin Well CEO.

Jippi’s sponsorship model is simple: align incentives, respect users, and support builders. Instead of throwing ad money at tech giants, Bitcoin companies can connect with new users naturally while they’re having fun and earning sats in the process.

For Bitcoin companies looking to reach a younger demographic, this represents a unique opportunity to showcase their brand to up to 30,000 potential customers at the Vegas event.

Jippi Bitcoin Beast partnership

While Jippi’s current focus is simple, get the game into more cities, Oliver sees a future where AR glasses and AI help personalize Bitcoin education even further.

“The magic is going to really happen when Apple releases the glasses form factor,” he says, describing how augmented reality could enhance real-world connections rather than isolate users.

In the longer term, Jippi aims to evolve from a free-to-play model toward a pay-to-play version with higher stakes. Users would form “tribes” with friends to compete for substantial bitcoin prizes, creating social connections along with financial education.

Unlike VC-backed startups, Jippi is raising funds pleb style via Timestamp, an open investment platform for Bitcoin companies.

“You don’t have to be an accredited investor,” Oliver explains. “You’re directly supporting the parallel Bitcoin economy by investing in Bitcoin companies for equity.”

Anyone can invest as little as $100. Perks include early access, exclusive game content, and even creating your own beast design with your name/pseudonym and unique game lore. Each investment comes with direct ownership of an early-stage Bitcoin company like Jippi.

For Oliver, this is more than just a business. It’s about future-proofing Bitcoin adoption and ensuring Satoshi’s vision lives on, especially as many people are lured by altcoins, NFTs, and social media dopamine.

“We’re on the right side of history,” he says firmly. “I want my grandkids to know that early on in the Bitcoin revolution, games like Jippi helped make it stick.”

In a world increasingly absorbed by screens and short attention spans, Jippi’s combination of outdoor play, sats rewards, and Bitcoin education might be exactly the bridge Gen Z needs.

Interested in sponsoring a Beast or investing in Jippi? Reach out to Jippi directly by heading to their partnerships page on their website or visit their Timestamp page to invest in Jippi today.

-

@ 000002de:c05780a7

2025-05-21 17:42:27

@ 000002de:c05780a7

2025-05-21 17:42:27I've been trying out Arch Linux again and the thing that always surprises me is pacman. The way it works seems so unintuitive to me coming from the apt, yum, and dnf worlds.

I know I will get it and it will become internalized but I just wonder what the designer was thinking when making the flags/commands.

https://stacker.news/items/985808

-

@ 000002de:c05780a7

2025-05-21 17:27:46

@ 000002de:c05780a7

2025-05-21 17:27:46I completely missed this until yesterday. I was listening to our local news talk station and it came up. They had some people that were pretty knowledgeable about prostate cancer on. They talked about other presidents being tested while in office for it. They came to conclusion that it is possible that Biden wasn't having his PSA checked. This is pretty normal for a old dude his age. But it is not normal for a President his age.

My thought is much simpler.

We know his doctors, the media, and his admin were lying about his health when he was in office. Hello! Anyone paying attention and not invested in his regime knew he was declining mentally in front of our very eyes. They covered for him over and over again. Only those that don't pay attention or discounted his critics completely was surprised by his debate performance.

To be clear though, Biden is far from the first president to do this. Wilson, FDR, Kennedy, and Reagan all had issues and they were kept from the public. If we learned these things in school we might actually have a public that thinks critically once and a while.

So, with that in mind do you really think the regime would not withhold medical info about this cancer? Come on. Don't be naive. He clearly was not in charge 100% of the time while in office and the regime wanted to maintain power. Sharing that he had prostate cancer would not be on the menu.

Politics is like a drug that numbs the brain. Because people don't like one party or person they retard their thinking. Its the same thing as happens in sports. Fans of one team see the same play completely differently from the other team's fans. Politics and the investment into parties kills most people's objectivity.

I don't trust liars. It honestly blows my mind how trusting people can be of professional liars. Both parties are full of liars. Trump is a liar and those opposing him are liars. We are drowning in lies. You can vote for a lessor of two evils but never forget what they are.

https://stacker.news/items/985791

-

@ 9ca447d2:fbf5a36d

2025-05-21 18:01:32

@ 9ca447d2:fbf5a36d

2025-05-21 18:01:32May 13, 2025 – We are proud to announce that My First Bitcoin has received a $1 million grant from #startsmall. With this financial support from Jack Dorsey’s philanthropic initiative, we will continue to serve grassroots Bitcoin education initiatives worldwide.

This grant accelerates our work in the creation and distribution of free and open-source Bitcoin education materials and infrastructure.

It will not only help us improve existing resources, such as the Bitcoin Diploma, Bitcoin Intro Course, and teacher training workshops, but also to scale our digital platforms like our Online School and Community Hub.

As a non-profit, founded in 2021, we have grown from a local project into a global movement. Besides creating curricula and frameworks, our team has directly taught tens of thousands of in-person students, as we workshop and refine our materials based on real world feedback.

In 2023, we launched the Independent Bitcoin Educators Node Network, providing a space for others to join us on our mission. The network spans 65+ projects from 35+ countries, including circular economies, meetup organizers and other grassroots projects.

All commit to the same six pillars: that their education is independent, impartial, community-led, Bitcoin-only, quality, and focused on empowerment over profit.

While we support that network, it is now self-governing. We always seek to give power-to, rather than have power-over.

John Dennehy, founder and Executive Director of My First Bitcoin, explains:

“The revolution of Bitcoin education is that it teaches students HOW to think, not WHAT to think. Funding from sources with their own incentives is the greatest vulnerability that threatens that. Education will be captured by whoever funds it.

“We will never take any government money and frequently turn down funding from corporations and companies. The subtle influence of funding has ruined fiat education and we need to create alternative models for the revolution of Bitcoin education to realize its full potential.”

Funding for Bitcoin education must be transparent.

This grant is a huge win for all of us. For Bitcoin itself, but even more for Independent Bitcoin Education as a whole. It enables us to serve the global community better than ever before. It shows everyone what can be achieved if you stay close to your values.

“My First Bitcoin is a proof-of-concept for all independent Bitcoin educators that if you stay on the mission, even when it’s challenging, then you will come out the other side even stronger,” added Dennehy.

Arnold Hubach, Director of Communications of My First Bitcoin, continued:

“Open source money deserves open source education. Over the past few years, we’ve seen growing demand for our resources around the world, and we remain committed to serving everyone in the Bitcoin space who needs support.

“This funding enables us to plan further into the future and continue being the first-stop provider of free educational tools.”

We’re grateful to #startsmall for believing in our mission and for understanding that Bitcoin education should always be free from external influence. We’re also grateful to the community for helping us arrive at this point where we are ready to receive such a grant.

You lead us to where we are today. You have been our primary funding source. You will continue to lead us forward.

We will always serve the community.

We’re also grateful for our amazing team and their proof of work. The grant will accelerate the work that they are already doing, such as curricula development, teacher training programs, the expansion of the global network, building online platforms, and providing in-person classes.

We will continue to lead by example, we will continue to push the limits, and we will continue to reimagine what’s possible.

We do not seek to please power in this world, we seek to create a proof-of-concept for a better one where the individual is empowered and able to think critically.

If you are an educator in need of tools or infrastructure; please contact us.

If you can help us continue to build out these tools and maintain this growing global movement; please contact us.

If you are aligned with our mission and are a supporter of independent Bitcoin education, please donate.

We work for the public. In public.

-

@ 9ca447d2:fbf5a36d

2025-05-21 18:01:31

@ 9ca447d2:fbf5a36d

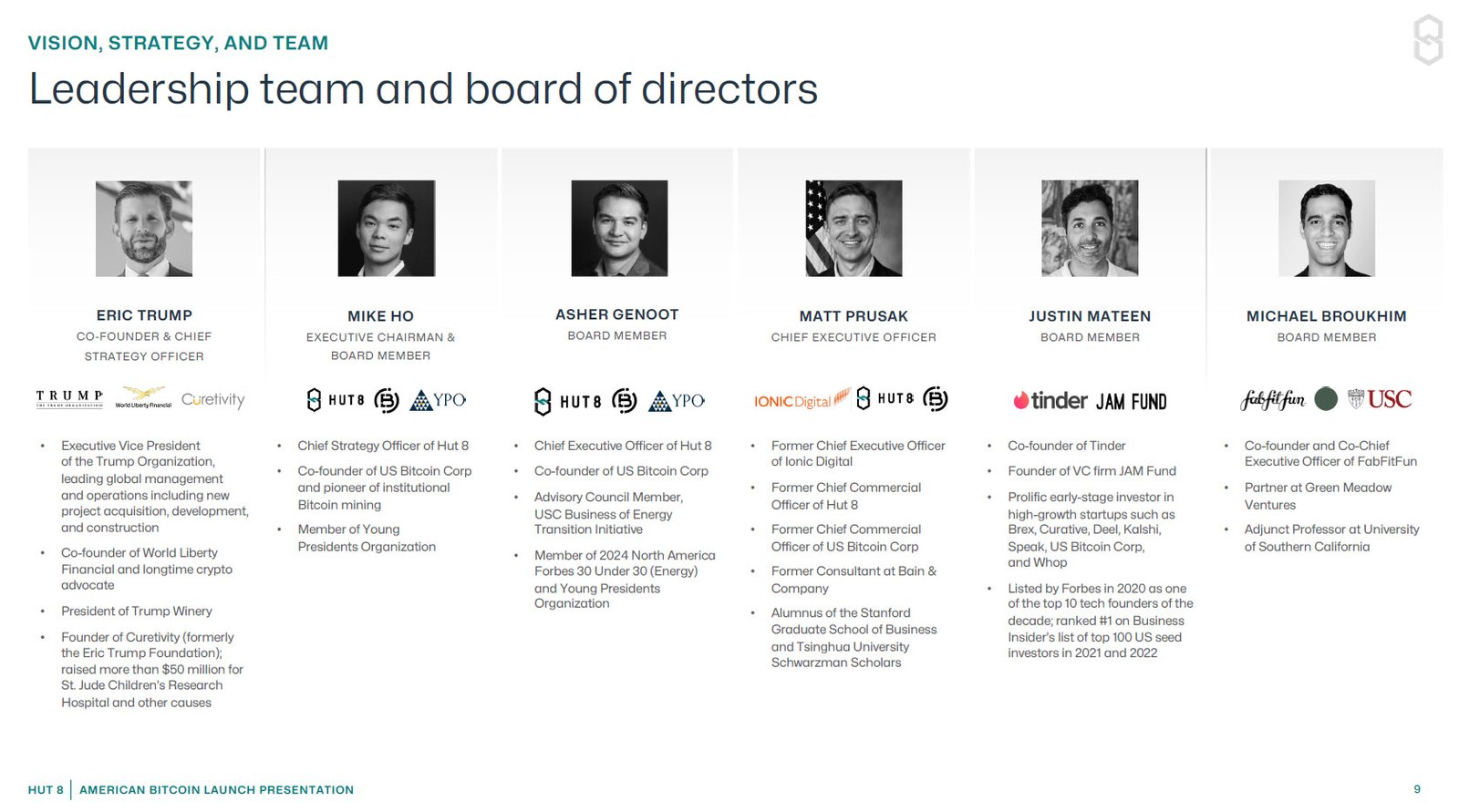

2025-05-21 18:01:31American Bitcoin, a bitcoin mining company backed by President Donald Trump’s sons, is going public in a new merger deal with Gryphon Digital Mining. Investors and political observers are taking notice as it presents a mixture of Bitcoin, Wall Street and the Trump brand.

This reverse merger allows for American Bitcoin Corporation to become a publicly traded company. This will happen through a stock-for-stock merger with Gryphon Digital Mining, a small-cap bitcoin miner already listed on the Nasdaq.

Once the deal is done, the new company will be called American Bitcoin and will trade on the Nasdaq under the ticker symbol ABTC. The merger is expected to close in the 3rd quarter of 2025.

Eric Trump, who will be the Co-Founder and the Chief Strategy Officer, said:

“Our vision for American Bitcoin is to create the most investable Bitcoin accumulation platform in the market.”

The Trump family’s involvement has gotten a lot of attention. Eric Trump and Donald Trump Jr. launched American Bitcoin in March this year with digital asset infrastructure company Hut 8, which owns 80% of American Bitcoin.

American Bitcoin leadership team — Hut 8 presentation

After the merger, American Bitcoin shareholders — including the Trump brothers and Hut 8 — will own about 98% of the new company. Gryphon shareholders will own 2% even though Gryphon is the public company facilitating the merger.

Instead of an IPO (Initial Public Offering), American Bitcoin is going public through what’s called a reverse merger. This means it will take over Gryphon’s public listing.

This is often faster and simpler than a traditional IPO. It allows American Bitcoin to access public capital markets while maintaining operational and strategic control.

Hut 8 CEO Asher Genoot said the merger is a big step forward for the company. “By taking American Bitcoin public, we expect to unlock direct access to dedicated growth capital independent of Hut 8’s balance sheet,” Genoot said.

The announcement sent Gryphon’s stock soaring. Shares rose over 280% and Hut 8’s stock went up over 11%. Clearly investors are interested in bitcoin-focused public companies when the asset itself is close to its previous all-time high.

But not everyone is buying. Some investors and analysts are questioning what Gryphon is actually bringing to the table. Gryphon won’t have a seat on the board or any representation in the new management team. Their role seems to be just to provide the public listing.

Many questions remain unanswered because there are no details on mining operations and what Gryphon’s role is beyond the merger.

American Bitcoin’s goal goes far beyond just mining bitcoin. It wants to become a national bitcoin reserve builder and a major player in that space by storing large amounts of bitcoin as a strategic asset.

The company plans to take “capital-light” advantage of Hut 8’s existing infrastructure, so there won’t be any need to build massive new data centers. Hut 8 already manages over 1,000 megawatts of energy capacity, and apparently, they will handle all the mining operations.

This is happening at a tough time for the mining industry in the U.S. and globally.

Profit margins are shrinking, and companies are really feeling the pinch of high operational costs. Hut 8 just reported a 58% drop in revenue and a $134 million net loss for the first quarter of 2025.

-

@ 87f5e1d9:e251d8f4

2025-05-21 17:18:19

@ 87f5e1d9:e251d8f4

2025-05-21 17:18:19Losing access to your cryptocurrency can feel like losing a part of your future. Whether it’s due to a forgotten password, a damaged seed backup, or a simple mistake in a transfer, the stress can be overwhelming. Fortunately, cryptrecver.com is here to assist! With our expert-led recovery services, you can safely and swiftly reclaim your lost Bitcoin and other cryptocurrencies.

Why Trust Crypt Recver? 🤝 🛠️ Expert Recovery Solutions At Crypt Recver, we specialize in addressing complex wallet-related issues. Our skilled engineers have the tools and expertise to handle:

Partially lost or forgotten seed phrases Extracting funds from outdated or invalid wallet addresses Recovering data from damaged hardware wallets Restoring coins from old or unsupported wallet formats You’re not just getting a service; you’re gaining a partner in your cryptocurrency journey.

🚀 Fast and Efficient Recovery We understand that time is crucial in crypto recovery. Our optimized systems enable you to regain access to your funds quickly, focusing on speed without compromising security. With a success rate of over 90%, you can rely on us to act swiftly on your behalf.

🔒 Privacy is Our Priority Your confidentiality is essential. Every recovery session is conducted with the utmost care, ensuring all processes are encrypted and confidential. You can rest assured that your sensitive information remains private.

💻 Advanced Technology Our proprietary tools and brute-force optimization techniques maximize recovery efficiency. Regardless of how challenging your case may be, our technology is designed to give you the best chance at retrieving your crypto.

Our Recovery Services Include: 📈 Bitcoin Recovery: Lost access to your Bitcoin wallet? We help recover lost wallets, private keys, and passphrases. Transaction Recovery: Mistakes happen — whether it’s an incorrect wallet address or a lost password, let us manage the recovery. Cold Wallet Restoration: If your cold wallet is failing, we can safely extract your assets and migrate them into a secure new wallet. Private Key Generation: Lost your private key? Our experts can help you regain control using advanced methods while ensuring your privacy. ⚠️ What We Don’t Do While we can handle many scenarios, some limitations exist. For instance, we cannot recover funds stored in custodial wallets or cases where there is a complete loss of four or more seed words without partial information available. We are transparent about what’s possible, so you know what to expect

Don’t Let Lost Crypto Hold You Back! Did you know that between 3 to 3.4 million BTC — nearly 20% of the total supply — are estimated to be permanently lost? Don’t become part of that statistic! Whether it’s due to a forgotten password, sending funds to the wrong address, or damaged drives, we can help you navigate these challenges

🛡️ Real-Time Dust Attack Protection Our services extend beyond recovery. We offer dust attack protection, keeping your activity anonymous and your funds secure, shielding your identity from unwanted tracking, ransomware, and phishing attempts.

🎉 Start Your Recovery Journey Today! Ready to reclaim your lost crypto? Don’t wait until it’s too late! 👉 cryptrecver.com

📞 Need Immediate Assistance? Connect with Us! For real-time support or questions, reach out to our dedicated team on: ✉️ Telegram: t.me/crypptrcver 💬 WhatsApp: +1(941)317–1821

Crypt Recver is your trusted partner in cryptocurrency recovery. Let us turn your challenges into victories. Don’t hesitate — your crypto future starts now! 🚀✨

Act fast and secure your digital assets with cryptrecver.com.Losing access to your cryptocurrency can feel like losing a part of your future. Whether it’s due to a forgotten password, a damaged seed backup, or a simple mistake in a transfer, the stress can be overwhelming. Fortunately, cryptrecver.com is here to assist! With our expert-led recovery services, you can safely and swiftly reclaim your lost Bitcoin and other cryptocurrencies.

# Why Trust Crypt Recver? 🤝

# Why Trust Crypt Recver? 🤝🛠️ Expert Recovery Solutions\ At Crypt Recver, we specialize in addressing complex wallet-related issues. Our skilled engineers have the tools and expertise to handle:

- Partially lost or forgotten seed phrases

- Extracting funds from outdated or invalid wallet addresses

- Recovering data from damaged hardware wallets

- Restoring coins from old or unsupported wallet formats

You’re not just getting a service; you’re gaining a partner in your cryptocurrency journey.

🚀 Fast and Efficient Recovery\ We understand that time is crucial in crypto recovery. Our optimized systems enable you to regain access to your funds quickly, focusing on speed without compromising security. With a success rate of over 90%, you can rely on us to act swiftly on your behalf.

🔒 Privacy is Our Priority\ Your confidentiality is essential. Every recovery session is conducted with the utmost care, ensuring all processes are encrypted and confidential. You can rest assured that your sensitive information remains private.

💻 Advanced Technology\ Our proprietary tools and brute-force optimization techniques maximize recovery efficiency. Regardless of how challenging your case may be, our technology is designed to give you the best chance at retrieving your crypto.

Our Recovery Services Include: 📈

- Bitcoin Recovery: Lost access to your Bitcoin wallet? We help recover lost wallets, private keys, and passphrases.

- Transaction Recovery: Mistakes happen — whether it’s an incorrect wallet address or a lost password, let us manage the recovery.

- Cold Wallet Restoration: If your cold wallet is failing, we can safely extract your assets and migrate them into a secure new wallet.

- Private Key Generation: Lost your private key? Our experts can help you regain control using advanced methods while ensuring your privacy.

⚠️ What We Don’t Do\ While we can handle many scenarios, some limitations exist. For instance, we cannot recover funds stored in custodial wallets or cases where there is a complete loss of four or more seed words without partial information available. We are transparent about what’s possible, so you know what to expect

# Don’t Let Lost Crypto Hold You Back!

# Don’t Let Lost Crypto Hold You Back!Did you know that between 3 to 3.4 million BTC — nearly 20% of the total supply — are estimated to be permanently lost? Don’t become part of that statistic! Whether it’s due to a forgotten password, sending funds to the wrong address, or damaged drives, we can help you navigate these challenges

🛡️ Real-Time Dust Attack Protection\ Our services extend beyond recovery. We offer dust attack protection, keeping your activity anonymous and your funds secure, shielding your identity from unwanted tracking, ransomware, and phishing attempts.

🎉 Start Your Recovery Journey Today!\ Ready to reclaim your lost crypto? Don’t wait until it’s too late!\ 👉 cryptrecver.com

📞 Need Immediate Assistance? Connect with Us!\ For real-time support or questions, reach out to our dedicated team on:\ ✉️ Telegram: t.me/crypptrcver\ 💬 WhatsApp: +1(941)317–1821

Crypt Recver is your trusted partner in cryptocurrency recovery. Let us turn your challenges into victories. Don’t hesitate — your crypto future starts now! 🚀✨

Act fast and secure your digital assets with cryptrecver.com.

-

@ 21335073:a244b1ad

2025-05-21 16:58:36

@ 21335073:a244b1ad