-

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:08

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:08 -

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:06

@ bd4ae3e6:1dfb81f5

2025-05-20 08:46:06 -

@ 3f770d65:7a745b24

2025-05-19 18:09:52

@ 3f770d65:7a745b24

2025-05-19 18:09:52🏌️ Monday, May 26 – Bitcoin Golf Championship & Kickoff Party

Location: Las Vegas, Nevada\ Event: 2nd Annual Bitcoin Golf Championship & Kick Off Party"\ Where: Bali Hai Golf Clubhouse, 5160 S Las Vegas Blvd, Las Vegas, NV 89119\ 🎟️ Get Tickets!

Details:

-

The week tees off in style with the Bitcoin Golf Championship. Swing clubs by day and swing to music by night.

-

Live performances from Nostr-powered acts courtesy of Tunestr, including Ainsley Costello and others.

-

Stop by the Purple Pill Booth hosted by Derek and Tanja, who will be on-boarding golfers and attendees to the decentralized social future with Nostr.

💬 May 27–29 – Bitcoin 2025 Conference at the Las Vegas Convention Center

Location: The Venetian Resort\ Main Attraction for Nostr Fans: The Nostr Lounge\ When: All day, Tuesday through Thursday\ Where: Right outside the Open Source Stage\ 🎟️ Get Tickets!

Come chill at the Nostr Lounge, your home base for all things decentralized social. With seating for \~50, comfy couches, high-tops, and good vibes, it’s the perfect space to meet developers, community leaders, and curious newcomers building the future of censorship-resistant communication.

Bonus: Right across the aisle, you’ll find Shopstr, a decentralized marketplace app built on Nostr. Stop by their booth to explore how peer-to-peer commerce works in a truly open ecosystem.

Daily Highlights at the Lounge:

-

☕️ Hang out casually or sit down for a deeper conversation about the Nostr protocol

-

🔧 1:1 demos from app teams

-

🛍️ Merch available onsite

-

🧠 Impromptu lightning talks

-

🎤 Scheduled Meetups (details below)

🎯 Nostr Lounge Meetups

Wednesday, May 28 @ 1:00 PM

- Damus Meetup: Come meet the team behind Damus, the OG Nostr app for iOS that helped kickstart the social revolution. They'll also be showcasing their new cross-platform app, Notedeck, designed for a more unified Nostr experience across devices. Grab some merch, get a demo, and connect directly with the developers.

Thursday, May 29 @ 1:00 PM

- Primal Meetup: Dive into Primal, the slickest Nostr experience available on web, Android, and iOS. With a built-in wallet, zapping your favorite creators and friends has never been easier. The team will be on-site for hands-on demos, Q\&A, merch giveaways, and deeper discussions on building the social layer of Bitcoin.

🎙️ Nostr Talks at Bitcoin 2025

If you want to hear from the minds building decentralized social, make sure you attend these two official conference sessions:

1. FROSTR Workshop: Multisig Nostr Signing

-

🕚 Time: 11:30 AM – 12:00 PM

-

📅 Date: Wednesday, May 28

-

📍 Location: Developer Zone

-

🎤 Speaker: nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqgdwaehxw309ahx7uewd3hkcqpqs9etjgzjglwlaxdhsveq0qksxyh6xpdpn8ajh69ruetrug957r3qf4ggfm (Austin Kelsay) @ Voltage\ A deep-dive into FROST-based multisig key management for Nostr. Geared toward devs and power users interested in key security.

2. Panel: Decentralizing Social Media

-

🕑 Time: 2:00 PM – 2:30 PM

-

📅 Date: Thursday, May 29

-

📍 Location: Genesis Stage

-

🎙️ Moderator: nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqy08wumn8ghj7mn0wd68yttjv4kxz7fwv3jhyettwfhhxuewd4jsqgxnqajr23msx5malhhcz8paa2t0r70gfjpyncsqx56ztyj2nyyvlq00heps - Bitcoin Strategy @ Roxom TV

-

👥 Speakers:

-

nostr:nprofile1qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcppemhxue69uhkummn9ekx7mp0qqsy2ga7trfetvd3j65m3jptqw9k39wtq2mg85xz2w542p5dhg06e5qmhlpep – Early Bitcoin dev, CEO @ Sirius Business Ltd

-

nostr:nprofile1qy2hwumn8ghj7mn0wd68ytndv9kxjm3wdahxcqg5waehxw309ahx7um5wfekzarkvyhxuet5qqsw4v882mfjhq9u63j08kzyhqzqxqc8tgf740p4nxnk9jdv02u37ncdhu7e3 – Analyst & Partner @ Ego Death Capital

Get the big-picture perspective on why decentralized social matters and how Nostr fits into the future of digital communication.

🌃 NOS VEGAS Meetup & Afterparty

Date: Wednesday, May 28\ Time: 7:00 PM – 1:00 AM\ Location: We All Scream Nightclub, 517 Fremont St., Las Vegas, NV 89101\ 🎟️ Get Tickets!

What to Expect:

-

🎶 Live Music Stage – Featuring Ainsley Costello, Sara Jade, Able James, Martin Groom, Bobby Shell, Jessie Lark, and other V4V artists

-

🪩 DJ Party Deck – With sets by nostr:nprofile1qy0hwumn8ghj7cmgdae82uewd45kketyd9kxwetj9e3k7mf6xs6rgqgcwaehxw309ahx7um5wgh85mm694ek2unk9ehhyecqyq7hpmq75krx2zsywntgtpz5yzwjyg2c7sreardcqmcp0m67xrnkwylzzk4 , nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqgkwaehxw309anx2etywvhxummnw3ezucnpdejqqg967faye3x6fxgnul77ej23l5aew8yj0x2e4a3tq2mkrgzrcvecfsk8xlu3 , and more DJs throwing down

-

🛰️ Live-streamed via Tunestr

-

🧠 Nostr Education – Talks by nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq37amnwvaz7tmwdaehgu3dwfjkccte9ejx2un9ddex7umn9ekk2tcqyqlhwrt96wnkf2w9edgr4cfruchvwkv26q6asdhz4qg08pm6w3djg3c8m4j , nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqg7waehxw309anx2etywvhxummnw3ezucnpdejz7ur0wp6kcctjqqspywh6ulgc0w3k6mwum97m7jkvtxh0lcjr77p9jtlc7f0d27wlxpslwvhau , nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq3vamnwvaz7tmwdaehgu3wd33xgetk9en82m30qqsgqke57uygxl0m8elstq26c4mq2erz3dvdtgxwswwvhdh0xcs04sc4u9p7d , nostr:nprofile1q9z8wumn8ghj7erzx3jkvmmzw4eny6tvw368wdt8da4kxamrdvek76mrwg6rwdngw94k67t3v36k77tev3kx7vn2xa5kjem9dp4hjepwd3hkxctvqyg8wumn8ghj7mn0wd68ytnhd9hx2qpqyaul8k059377u9lsu67de7y637w4jtgeuwcmh5n7788l6xnlnrgssuy4zk , nostr:nprofile1qy28wue69uhnzvpwxqhrqt33xgmn5dfsx5cqz9thwden5te0v4jx2m3wdehhxarj9ekxzmnyqqswavgevxe9gs43vwylumr7h656mu9vxmw4j6qkafc3nefphzpph8ssvcgf8 , and more.

-

🧾 Vendors & Project Booths – Explore new tools and services

-

🔐 Onboarding Stations – Learn how to use Nostr hands-on

-

🐦 Nostrich Flocking – Meet your favorite nyms IRL

-

🍸 Three Full Bars – Two floors of socializing overlooking vibrant Fremont Street

| | | | | ----------- | -------------------- | ------------------- | | Time | Name | Topic | | 7:30-7:50 | Derek | Nostr for Beginners | | 8:00-8:20 | Mark & Paul | Primal | | 8:30-8:50 | Terry | Damus | | 9:00-9:20 | OpenMike and Ainsley | V4V | | 09:30-09:50 | The Space | Space |

This is the after-party of the year for those who love freedom technology and decentralized social community. Don’t miss it.

Final Thoughts

Whether you're there to learn, network, party, or build, Bitcoin 2025 in Las Vegas has a packed week of Nostr-friendly programming. Be sure to catch all the events, visit the Nostr Lounge, and experience the growing decentralized social revolution.

🟣 Find us. Flock with us. Purple pill someone.

-

-

@ a8d1560d:3fec7a08

2025-05-19 17:28:05

@ a8d1560d:3fec7a08

2025-05-19 17:28:05NIP-XX

Documentation and Wikis with Spaces and Format Declaration

draftoptionalSummary

This NIP introduces a system for collaborative documentation and wikis on Nostr. It improves upon earlier efforts by adding namespace-like Spaces, explicit content format declaration, and clearer separation of article types, including redirects and merge requests.

Motivation

Previous approaches to wiki-style collaborative content on Nostr had two key limitations:

- Format instability – No declared format per event led to breaking changes (e.g. a shift from Markdown to Asciidoc).

- Lack of namespace separation – All articles existed in a global space, causing confusion and collision between unrelated projects.

This NIP addresses both by introducing:

- Spaces – individually defined wikis or documentation sets.

- Explicit per-article format declaration.

- Dedicated event kinds for articles, redirects, merge requests, and space metadata.

Specification

kind: 31055– Space DefinitionDefines a project namespace for articles.

Tags: -

["name", "<space title>"]-["slug", "<short identifier>"]-["description", "<optional description>"]-["language", "<ISO language code>"]-["license", "<license text or SPDX ID>"]Content: (optional) full description or README for the space.

kind: 31056– ArticleAn article in a specific format belonging to a defined space.

Tags: -

["space", "<slug>"]-["title", "<article title>"]-["format", "markdown" | "asciidoc" | "mediawiki" | "html"]-["format-version", "<format version>"](optional) -["prev", "<event-id>"](optional) -["summary", "<short change summary>"](optional)Content: full body of the article in the declared format.

kind: 31057– RedirectRedirects from one article title to another within the same space.

Tags: -

["space", "<slug>"]-["from", "<old title>"]-["to", "<new title>"]Content: empty.

kind: 31058– Merge RequestProposes a revision to an article without directly altering the original.

Tags: -

["space", "<slug>"]-["title", "<article title>"]-["base", "<event-id>"]-["format", "<format>"]-["comment", "<short summary>"](optional)Content: proposed article content.

Format Guidelines

Currently allowed formats: -

markdown-asciidoc-mediawiki-htmlClients MUST ignore formats they do not support. Clients MAY apply stricter formatting rules.

Client Behavior

Clients: - MUST render only supported formats. - MUST treat

spaceas a case-sensitive namespace. - SHOULD allow filtering, browsing and searching within Spaces. - SHOULD support revision tracking viaprev. - MAY support diff/merge tooling forkind: 31058.

Examples

Space Definition

json { "kind": 31055, "tags": [ ["name", "Bitcoin Docs"], ["slug", "btc-docs"], ["description", "Developer documentation for Bitcoin tools"], ["language", "en"], ["license", "MIT"] ], "content": "Welcome to the Bitcoin Docs Space." }Markdown Article

json { "kind": 31056, "tags": [ ["space", "btc-docs"], ["title", "Installation Guide"], ["format", "markdown"] ], "content": "# Installation\n\nFollow these steps to install the software..." }Asciidoc Article

json { "kind": 31056, "tags": [ ["space", "btc-docs"], ["title", "RPC Reference"], ["format", "asciidoc"] ], "content": "= RPC Reference\n\nThis section describes JSON-RPC calls." }MediaWiki Article

json { "kind": 31056, "tags": [ ["space", "btc-docs"], ["title", "Block Structure"], ["format", "mediawiki"] ], "content": "== Block Structure ==\n\nThe structure of a Bitcoin block is..." }Redirect

json { "kind": 31057, "tags": [ ["space", "btc-docs"], ["from", "Getting Started"], ["to", "Installation Guide"] ], "content": "" }Merge Request

json { "kind": 31058, "tags": [ ["space", "btc-docs"], ["title", "Installation Guide"], ["base", "d72fa1..."], ["format", "markdown"], ["comment", "Added step for testnet"] ], "content": "# Installation\n\nNow includes setup instructions for testnet users." }

Acknowledgements

This proposal builds on earlier ideas for decentralized wikis and documentation within Nostr, while solving common issues related to format instability and lack of project separation.

-

@ ecda4328:1278f072

2025-05-19 14:41:48

@ ecda4328:1278f072

2025-05-19 14:41:48An honest response to objections — and an answer to the most important question: why does any of this matter?

\ Statement: Deflation is not the enemy, but a natural state in an age of technological progress.\ Criticism: in real macroeconomics, long-term deflation is linked to depressions.\ Deflation discourages borrowers and investors, and makes debt heavier.\ Natural ≠ Safe.

1. “Deflation → Depression, Debt → Heavier”

This is true in a debt-based system. Yes, in a fiat economy, debt balloons to the sky, and without inflation it collapses.

But Bitcoin offers not “deflation for its own sake,” but an environment where you don’t need to be in debt to survive. Where savings don’t melt away.\ Jeff Booth said it clearly:

“Technology is inherently deflationary. Fighting deflation with the printing press is fighting progress.”

You don’t have to take on credit to live in this system. Which means — deflation is not an enemy, but an ally.

💡 People often confuse two concepts:

-

That deflation doesn’t work in an economy built on credit and leverage — that’s true.

-

That deflation itself is bad — that’s a myth.

📉 In reality, deflation is the natural state of a free market when technology makes everything cheaper.

Historical example:\ In the U.S., from the Civil War to the early 1900s, the economy experienced gentle deflation — alongside economic growth, employment expansion, and industrial boom.\ Prices fell: for example, a sack of flour cost \~$1.00 in 1865 and \~$0.50 in 1895 — and there was no crisis, because wages held and productivity increased.

Modern example:\ Consumer electronics over the past 20–30 years are a vivid example of technological deflation:\ – What cost $5,000 in 2000 (e.g., a 720p plasma TV) now costs $300 and delivers 10× better quality.\ – Phones, computers, cameras — all became far more powerful and cheaper at the same time.\ That’s how tech-driven deflation works: you get more for less.

📌 Bitcoin doesn’t make the world deflationary. It just doesn’t fight against deflation, unlike the fiat model that fights to preserve its debt pyramid.\ It stops punishing savers and rewards long-term thinkers.

Even economists often confuse organic tech deflation with crisis-driven (debt) deflation.

\ \ Statement: We’ve never lived in a truly free market — central banks and issuance always existed.\ Criticism: ideological statement.\ A truly “free” market is utopian.\ Banks and monetary issuance emerged in response to crises.\ A market without arbiters is not always fair, especially under imperfect competition.

2. “The Free Market Is a Utopia”

Yes, “pure markets” are rare. But what we have today isn’t regulation — it’s centralized power in the hands of central banks and cartels.

Bitcoin offers rules without rulers. 21 million. No one can change the issuance. It’s not ideology — it’s code instead of trust. And it has worked for 15 years.

\ \ Statement: Inflation is an invisible tax, especially on the poor and working class.\ Criticism: partly true: inflation can reduce debt burden, boost employment.\ The state indexes social benefits. Under stable inflation, compensators can work. Under deflation, things might be worse (mass layoffs, defaults).

3. “Inflation Can Help”

Theoretically — yes. Textbooks say moderate inflation can reduce debt burdens and stimulate consumption and jobs.\ But in practice — it works as a stealth tax, especially on those without assets. The wealthy escape — into real estate, stocks, funds.\ But the poor and working class lose purchasing power because their money is held in cash — and cash devalues.

💬 As Lyn Alden says:

“When your money can’t hold value, you’re forced to become an investor — even if you just want to save and live.”

The state may index pensions or benefits — but always with a lag, and always less than actual price increases.\ If bread rises 15% and your payment increase is 5%, you got poorer, even if the number on paper went up.

💥 We live in an inflationary system of everything:\ – Inflationary money\ – Inflationary products\ – Inflationary content\ – And now even inflationary minds

🧠 This is more than just rising prices — it’s a degradation of reality perception. You’re always rushing, everything loses meaning.\ But when did the system start working against you?

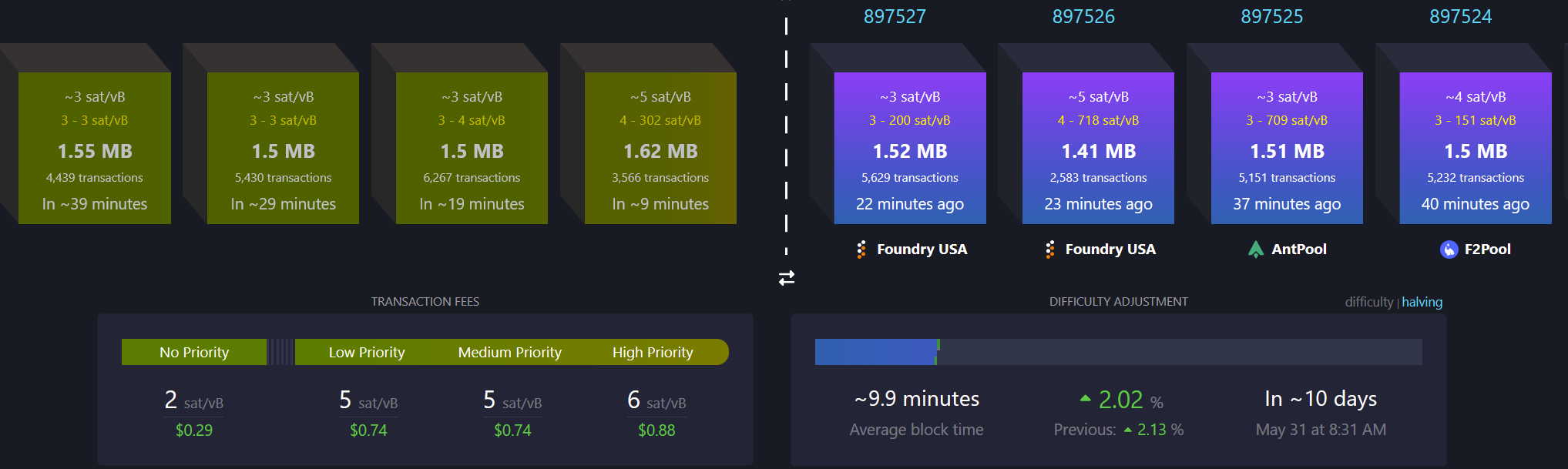

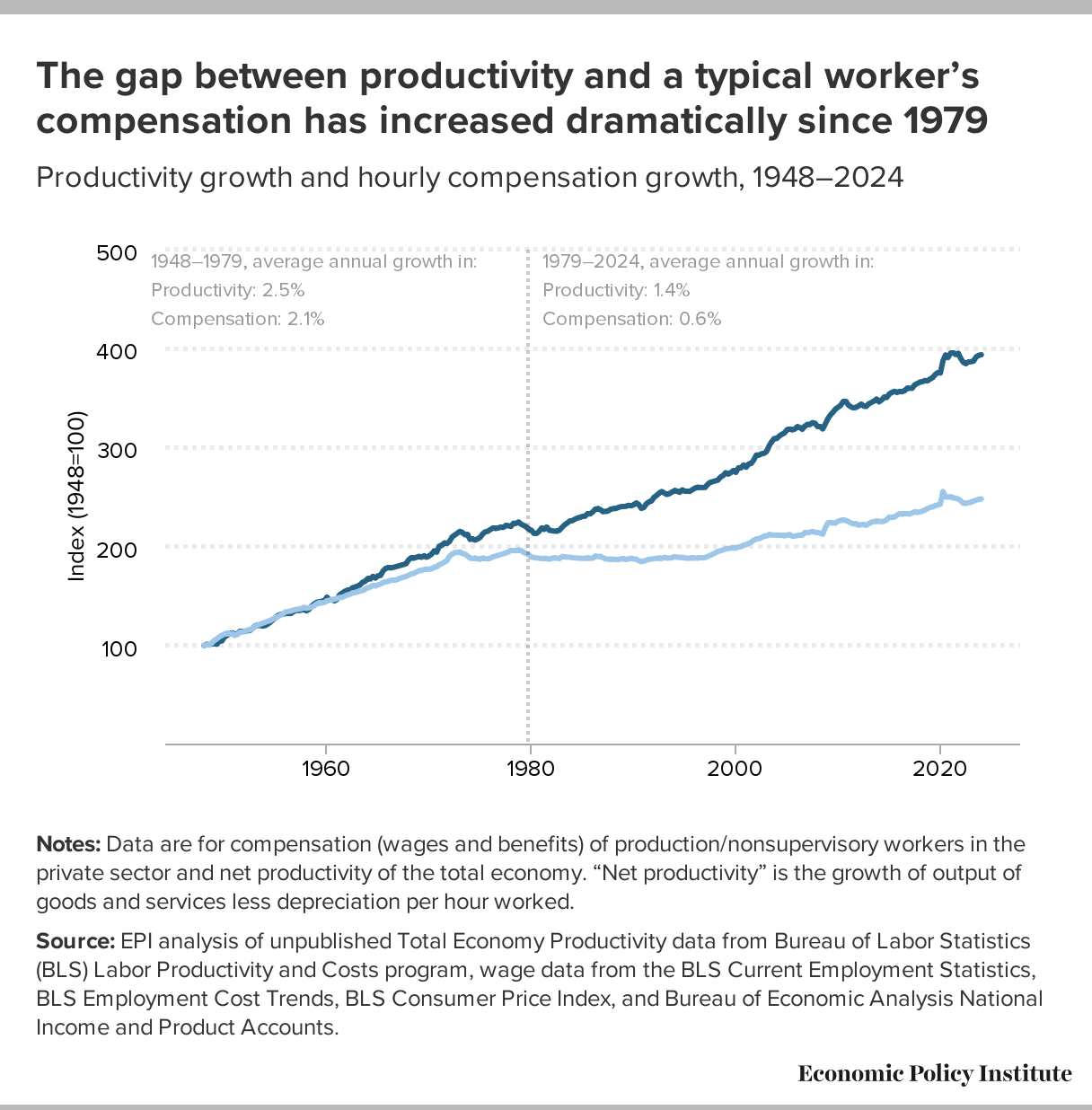

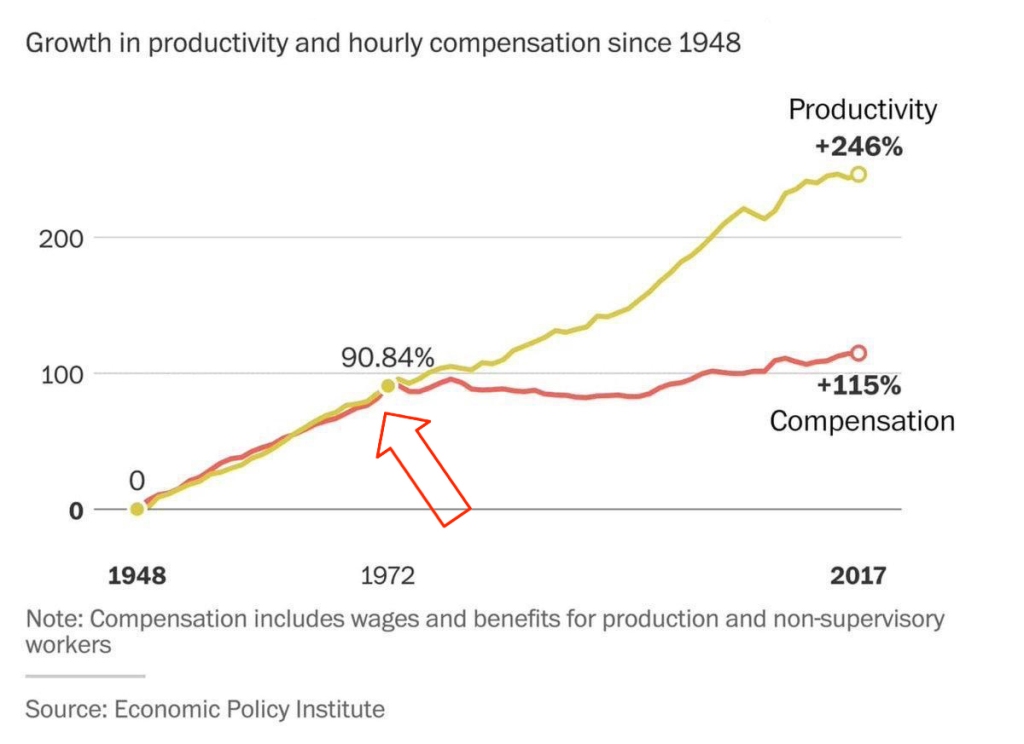

📉 What went wrong after 1971?

This chart shows that from 1948 to the early 1970s, productivity and wages grew together.\

But after the end of the gold standard in 1971 — the connection broke. Productivity kept rising, but real wages stalled.

This chart shows that from 1948 to the early 1970s, productivity and wages grew together.\

But after the end of the gold standard in 1971 — the connection broke. Productivity kept rising, but real wages stalled.👉 This means: you work more, better, faster — but buy less.

🔗 Source: wtfhappenedin1971.com

When you must spend today because tomorrow it’ll be worth less — that’s rewarding impulse and punishing long-term thinking.

Bitcoin offers a different environment:\ – Savings work\ – Long-term thinking is rewarded\ – The price of the future is calculated, not forced by a printing press

📌 Inflation can be a tool. But in government hands, it became a weapon — a slow, inevitable upward redistribution of wealth.

Indexing is weak compensation if bread is up 15% and your “increase” is only 5%.

\ \ Statement: War is not growth, but a reallocation of resources into destruction.

Criticism: war can spur technological leaps (Internet, GPS, nuclear energy — all from military programs). "Military Keynesianism" was a real model.

4. “War Drives R&D”

Yes, wars sometimes give rise to tech spin-offs: Internet, GPS, nuclear power — all originated from military programs.

But that doesn’t make war a source of progress — it makes tech a byproduct of catastrophe.

“War reallocates resources toward destruction — not growth.”

Progress doesn’t happen because of war — it happens despite it.

If scientific breakthroughs require a million dead and burnt cities — maybe you’ve built your economy wrong.

💬 Even Michael Saylor said:

“If you need war to develop technology — you’ve built civilization wrong.”

No innovation justifies diverting human labor, minds, and resources toward destruction.\ War is always the opposite of efficiency — more is wasted than created.

🧠 Bitcoin, on the other hand, is an example of how real R&D happens without violence.\ No taxes. No army. Just math, voluntary participation, and open-source code.

📌 Military Keynesianism is not a model of progress — it’s a symptom of a sick monetary system that needs destruction to reboot.

Bitcoin shows that coordination without violence is possible.\ This is R&D of a new kind: based not on destruction, but digital creation.

Statement: Bitcoin isn’t “Gold 1.0,” but an improved version: divisible, verifiable, unseizable.

Criticism: Bitcoin has no physical value; "unseizability" is a theory;\ Gold is material and autonomous.

5. “Bitcoin Has No Physical Value”

And gold does? Just because it shines?

Physical form is no guarantee of value.\ Real value lies in: scarcity, reliable transfer, verifiability, and non-confiscatability.

Gold is:\ – Hard to divide\ – Hard to verify\ – Expensive to store\ – Easy to seize

💡 Bitcoin is the first store of value in history that is fully free from physical limitations, and yet:\ – Absolutely scarce (21M, forever)\ – Instantly transferable over the Internet\ – Cryptographically verifiable\ – Controlled by no government

🔑 Bitcoin’s value lies in its liberation from the physical.\ It doesn’t need to be “backed” by gold or oil. It’s backed by energy, mathematics, and ongoing verification.

“Price is what you pay, value is what you get.” — Warren Buffett

When you buy bitcoin, you’re not paying for a “token” — you’re gaining access to a network of distributed financial energy.

⚡️ What are you really getting when you own bitcoin?\ – A key to a digital asset that can’t be faked\ – The ability to send “crystallized energy” anywhere on Earth\ – A role in a new accounting system that runs 24/7/365\ – Freedom: from banks, borders, inflation, and force

📉 Bitcoin doesn’t require physical value — because it creates value:\ Through trust, scarcity, and energy invested in mining.\ And unlike gold, it was never associated with slavery.

Statement: There’s no “income without risk” in Bitcoin: just hold — you preserve; want more — invest, risk, build.

Criticism: contradicts HODL logic; speculation remains dominant behavior.

6. “Speculation Dominates”

For now — yes. That’s normal for the early phase of a new technology. Awareness doesn’t come instantly.

What matters is not the motive of today’s buyer — but what they’re buying.

📉 A speculator may come and go — but the asset remains.\ And this asset is the only one in history that will never exist again. 21 million. Forever.

📌 Look deeper. Bitcoin has:\ – No CEO\ – No central issuer\ – No inflation\ – No “off switch”

💡 It’s not a stock. Not a startup. Not someone’s project.\ It’s a new foundation for trust.\ It’s opting out of a system where freedom is a privilege you’re granted under conditions.

🧠 People say: “Bitcoin can be copied.”\ Theoretically — yes.\ Practically — never.

Here’s what you’d need to recreate Bitcoin:\ – No pre-mine\ – A founder who disappears and never sells\ – No foundation or corporation\ – Tens of thousands of nodes worldwide\ – 701 million terahashes of hash power\ – Thousands of devs writing open protocols\ – Hundreds of global conferences\ – Millions of people defending digital sovereignty\ – All that without a single marketing budget

That’s all.

🔁 Everything else is an imitation, not a creation.\ Just like you can’t “reinvent fire” — Bitcoin can only exist once.

Statements:\ The Russia's '90s weren’t a free market — just anarchic chaos without rights protection.*\ Unlike fiat or even dollars, Bitcoin is the first asset with real defense — from governments, inflation, even thugs.\ And yes, even if your barber asks about Bitcoin — maybe it's not a bubble, but a sign that inflation has already hit everyone.

Criticism: Bitcoin’s protection isn’t universal — it works only with proper handling and isn’t available to all.\ Some just want to “get rich.”\ None of this matters because:

-

Bitcoin’s volatility (-30% in a week, +50% in a month) makes it unusable for price planning or contracts.

-

It can’t handle mass-scale usage.

-

To become currency, geopolitical will is needed — and without the first two, don’t even talk about the third.\ Also: “Bitcoin is too complicated for the average person.”

7. “It’s Too Complex for the Masses”

It’s complex — if you’re using L1 (Layer 1). But even grandmas use Telegram. In El Salvador, schoolkids buy lunch with Lightning. My barber installed Wallet of Satoshi in minutes right in front of me — and I now pay for my haircut via Lightning.

UX is just a matter of time. And it’s improving. Emerging tools:\ Cashu, Fedimint, Fedi, Wallet of Satoshi, Phoenix, Proton Wallet, Swiss Bitcoin Pay, Bolt Card / CoinCorner (NFC cards for Lightning payments).

This is like the internet in 1995:\ It started with modems — now it’s 4K streaming.

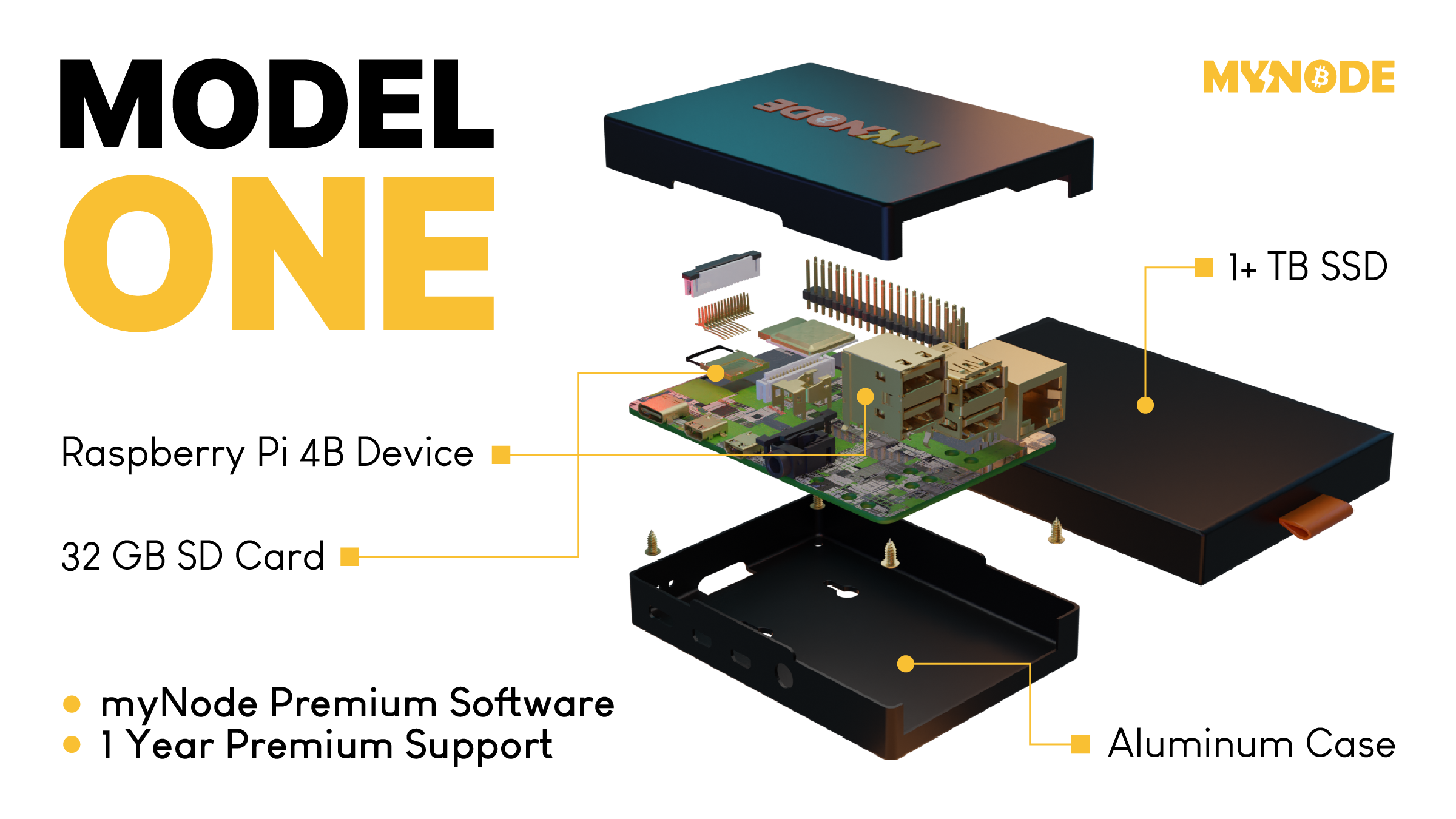

8. “Can’t Handle the Load”

A common myth.\ Yes, Bitcoin L1 processes about 7 transactions per second — intentionally. It’s not built to be Visa. It’s a financial protocol, just like TCP/IP is a network protocol. TCP/IP isn’t “fast” or “slow” — the experience depends on the infrastructure built on top: servers, routers, hardware. In the ’90s, it delivered text. Today, it streams Netflix. The protocol didn’t change — the stack did.

Same with Bitcoin: L1 defines rules, security, finality.\ Scaling and speed? That’s the second layer’s job.

To understand scale:

| Network | TPS (Transactions/sec) | | --- | --- | | Visa | up to 24,000 | | Mastercard | \~5,000 | | PayPal | \~193 | | Litecoin | \~56 | | Ethereum | \~20 | | Bitcoin | \~7 |

\ ⚡️ Enter Lightning Network — Bitcoin’s “fast lane.”\ It allows millions of transactions per second, instantly and nearly free.

And it’s not a sidechain.

❗️ Lightning is not a separate network.\ It uses real Bitcoin transactions (2-of-2 multisig). You can close the channel to L1 at any time. It’s not an alternative — it’s a native extension built into Bitcoin.\ Also evolving: Ark, Fedimint, eCash — new ways to scale and add privacy.

📉 So criticizing Bitcoin for “slowness” is like blaming TCP/IP because your old modem won’t stream YouTube.\ The protocol isn’t the problem — it’s the infrastructure.

🛡️ And by the way: Visa crashes more often than Bitcoin.

9. “We Need Geopolitical Will”

Not necessarily. All it takes is the will of the people — and leaders willing to act. El Salvador didn’t wait for G20 approval or IMF blessings. Since 2001, the country had used the US dollar as its official currency, abandoning its own colón. But that didn’t save it from inflation or dependency on foreign monetary policy. In 2021, El Salvador became the first country to recognize Bitcoin as legal tender. Since March 13, 2024, they’ve been purchasing 1 BTC daily, tracked through their public address:

🔗 Address\ 📅 First transaction

This policy became the foundation of their Strategic Bitcoin Reserve (SBR) — a state-led effort to accumulate Bitcoin as a national reserve asset for long-term stability and sovereignty.

Their example inspired others.

In March 2025, U.S. President Donald Trump signed an executive order creating the Strategic Bitcoin Reserve of the USA, to be funded through confiscated Bitcoin and digital assets.\ The idea: accumulate, don’t sell, and strategically expand the reserve — without extra burden on taxpayers.

Additionally, Senator Cynthia Lummis (Wyoming) proposed the BITCOIN Act, targeting the purchase of 1 million BTC over five years (\~5% of the total supply).\ The plan: fund it via revaluation of gold certificates and other budget-neutral strategies.

📚 More: Strategic Bitcoin Reserve — Wikipedia

👉 So no global consensus is required. No IMF greenlight.\ All it takes is conviction — and an understanding that the future of finance lies in decentralized, scarce assets like Bitcoin.

10. “-30% in a week, +50% in a month = not money”

True — Bitcoin is volatile. But that’s normal for new technologies and emerging money. It’s not a bug — it’s a price discovery phase. The world is still learning what this asset is.

📉 Volatility is the price of entry.\ 📈 But the reward is buying the future at a discount.

As Michael Saylor put it:

“A tourist sees Niagara Falls as chaos — roaring, foaming, spraying water.\ An engineer sees immense energy.\ It all depends on your mental model.”

Same with Bitcoin. Speculators see chaos. Investors see structural scarcity. Builders see a new financial foundation.

💡 Now consider gold:

👉 After the U.S. abandoned the gold standard in 1971, gold surged from \~$35 to over $800 in a decade — while suffering wild -40% to -60% crashes along the way.\ \ 📈 Gold Price Chart — Macrotrends\ \ Nobody said, “This can’t be money.” \ Because money is defined not by volatility, but by scarcity, adoption, and trust — which build over time.

📊 The more people save in Bitcoin, the more its volatility fades.

This is a journey — not a fixed state.

We don’t judge the internet by how it worked in 1994.\ So why expect Bitcoin to be the “perfect currency” in 2025?

It grows bottom-up — without regulators’ permission.\ And the longer it survives, the stronger it becomes.

Remember how many times it’s been declared dead.\ And how many times it came back — stronger.

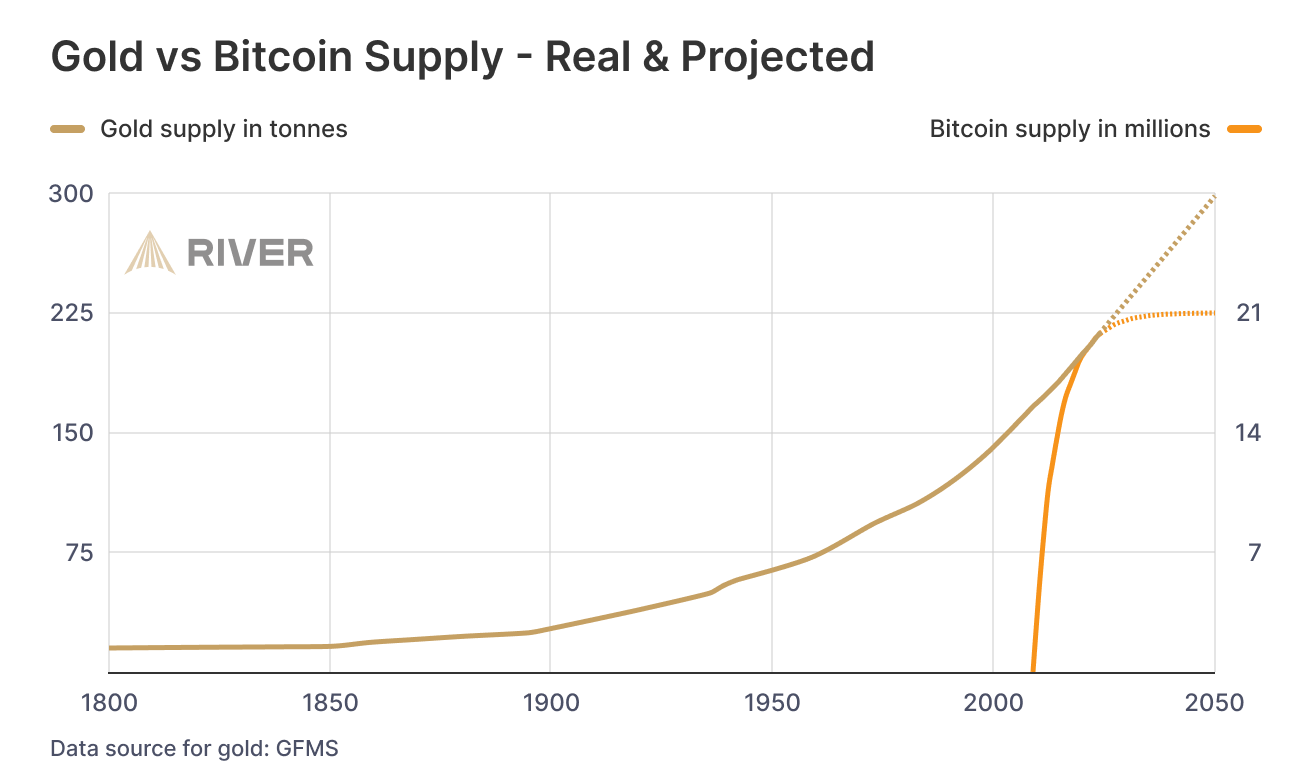

📊 Gold vs. Bitcoin: Supply Comparison

This chart shows the key difference between the two hard assets:

🔹 Gold — supply keeps growing.\ Mining may be limited, but it’s still inflationary.\ Each year, there’s more — with no known cap: new mines, asteroid mining, recycling.

🔸 Bitcoin — capped at 21 million.\ The emission schedule is public, mathematically predictable, and ends completely around 2140.

🧠 Bottom line:\ Gold is good.\ Bitcoin is better — for predictability and scarcity.

💡 As Saifedean Ammous said:

“Gold was the best monetary good… until Bitcoin.”

While we argue — fiat erodes every day.

No matter your view on Bitcoin, just show me one other asset that is simultaneously:

– immune to devaluation by decree\ – impossible to print more of\ – impossible to confiscate by a centralized order\ – impossible to counterfeit\ – and, most importantly — transferable across borders without asking permission from a bank, a state, or a passport

💸 Try sending $10,000 through PayPal from Iran to Paraguay, or Bangladesh to Saint Lucia.\ Good luck. PayPal doesn't even work there.

Now open a laptop, type 12 words — and you have access to your savings anywhere on Earth.

🌍 Bitcoin doesn't ask for permission.\ It works for everyone, everywhere, all the time.

📌 There has never been anything like this before.

Bitcoin is the first asset in history that combines:

– digital nature\ – predictable scarcity\ – absolute portability\ – and immunity from tyranny

💡 As Michael Saylor said:

“Bitcoin is the first money in human history not created by bankers or politicians — but by engineers.”

You can own it with no bank.\ No intermediary.\ No passport.\ No approval.

That’s why Bitcoin isn’t just “internet money” or “crypto” or “digital gold.”\ It may not be perfect — but it’s incorruptible.\ And it’s not going away.\ It’s already here.\ It is the foundation of a new financial reality.

🔒 This is not speculation. This is a peaceful financial revolution.\ 🪙 This is not a stock. It’s money — like the world has never seen.\ ⛓️ This is not a fad. It’s a freedom protocol.

And when even the barber starts asking about Bitcoin — it’s not a bubble.\ It’s a sign that the system is breaking.\ And people are looking for an exit.

For the first time — they have one.

💼 This is not about investing. It’s about the dignity of work.

Imagine a man who cleans toilets at an airport every day.

Not a “prestigious” job.\ But a crucial one.\ Without him — filth, bacteria, disease.

He shows up on time. He works with his hands.

And his money? It devalues. Every day.

He doesn’t work less — often he works more than those in suits.\ But he can afford less and less — because in this system, honest labor loses value each year.

Now imagine he’s paid in Bitcoin.

Not in some “volatile coin,” but in hard money — with a limited supply.\ Money that can’t be printed, reversed, or devalued by central banks.

💡 Then he could:

– Stop rushing to spend, knowing his labor won’t be worth less tomorrow\ – Save for a dream — without fear of inflation eating it away\ – Feel that his time and effort are respected — because they retain value

Bitcoin gives anyone — engineer or janitor — a way out of the game rigged against them.\ A chance to finally build a future where savings are real.

This is economic justice.\ This is digital dignity.

📉 In fiat, you have to spend — or your money melts.\ 📈 In Bitcoin, you choose when to spend — because it’s up to you.

🧠 In a deflationary economy, both saving and spending are healthy:

You don’t scramble to survive — you choose to create.

🎯 That’s true freedom.

When even someone cleaning floors can live without fear —\ and know that their time doesn’t vanish... it turns into value.

-

-

@ e17e9a18:66d67a6b

2025-05-19 11:46:09

@ e17e9a18:66d67a6b

2025-05-19 11:46:09We wrote this album to explain the inspiration behind Mutiny Brewing, and as a way to share the story of Bitcoin and freedom technologies like nostr. Through these songs, we’ve tried to capture every truth that we believe is essential to understand about money, freedom, trust, and human connection in the internet age. It’s our way of making these ideas real and relatable, and we hope it helps others see the power of taking control of their future through the systems we use.

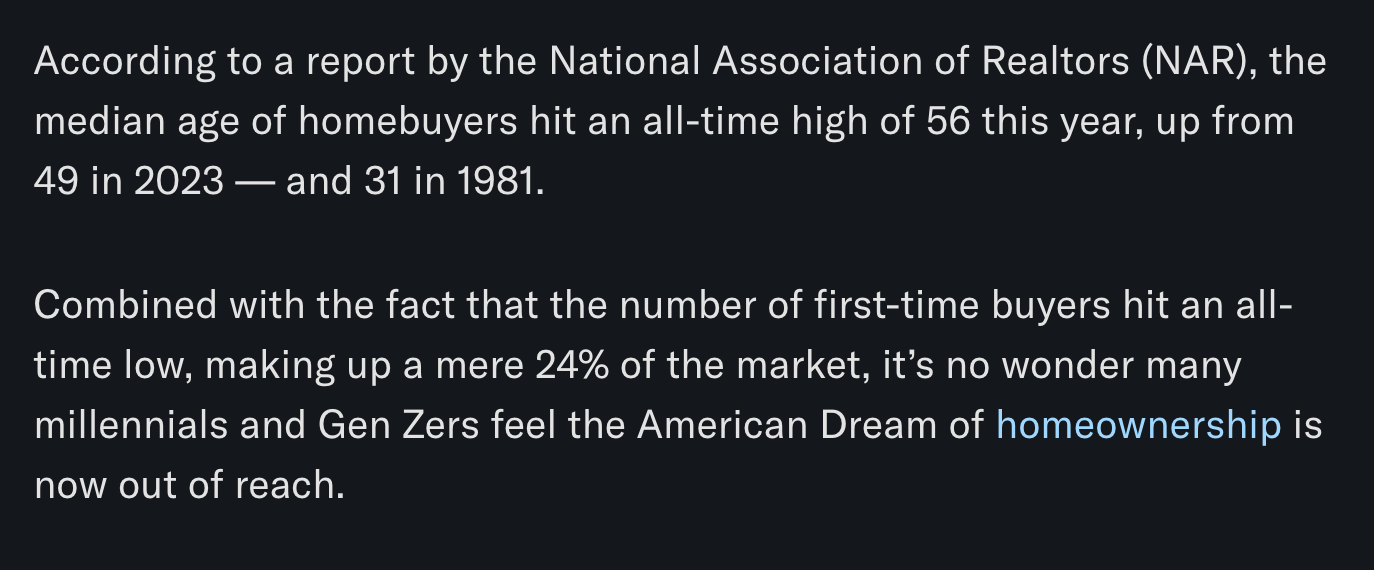

01. "Tomorrow's Prices on Yesterday's Wage" explores the harsh reality of inflation. As central banks inflate the money supply, prices rise faster than wages, leaving us constantly falling behind. People, expecting prices to keep climbing, borrow more to buy sooner, pushing prices even higher in a vicious cycle. You're always a step behind, forced to pay tomorrow's inflated prices with yesterday's stagnant wages.

https://wavlake.com/track/76a6cd02-e876-4a37-b093-1fe919e9eabe

02. "Everybody Works For The Bank" "Everybody Works For The Bank" exposes the hidden truth behind our fiat money system.

When banks issue loans, they don’t lend existing money — they create new money from debt. You’re on the hook for the principal and the interest. But the interest doesn’t exist yet — it has to come from someone else borrowing. That means the system only works if debt keeps growing.

When it doesn’t, the whole thing wobbles. Governments step in to bail out the banks by printing more money, and that cost doesn’t vanish. It shows up in your taxes, your savings, and your grocery bill.

We’re not just working to pay our own debts, we’re paying for their losses too.

https://wavlake.com/track/4d94cb4b-ff3b-4423-be6a-03e0be8177d6

03. "Let My People Go" references Moses' demand for freedom but directly draws from Proverbs 6:1–5, exposing the danger of debt based money. Every dollar you hold is actually someone else's debt, making you personally liable—held in the hand of your debtor and at risk of their losses, which you ultimately pay for through inflation or higher taxes. As the song says, "The more you try to save it up, the deeper in you get." The wisdom of Proverbs urges immediate action, pleading urgently to escape this trap and free yourself, like a gazelle from a hunter.

https://wavlake.com/track/76214ff1-f8fd-45b0-a677-d9c285b1e7d6

04. "Mutiny Brewing" embodies Friedrich Hayek's insight: "I don't believe we shall ever have good money again before we take it out of the hands of government... we can't take it violently... all we can do is by some sly roundabout way introduce something they can't stop."

Inspired also by the Cypherpunk manifesto's rallying cry, "We will write the code", the song celebrates Bitcoin as exactly that unstoppable solution.

"Not here to break ya, just here to create our own little world where we determine our fate." https://wavlake.com/track/ba767fc8-6afc-4b0d-be64-259b340432f3

05. "Invisible Wealth" is inspired by The Sovereign Individual, a groundbreaking 1990s book that predicted the rise of digital money and explores how the return on violence shaped civilizations. The song references humanity's vulnerability since agriculture began—where stored wealth attracted violence, forcing reliance on larger governments for protection.

Today, digital privacy enabled by cryptography fundamentally changes this dynamic. When wealth is stored privately, secured by cryptographic keys, violence becomes ineffective. As the song emphasizes, "You can't bomb what you can't see." Cryptography dismantles traditional power structures, providing individuals true financial security, privacy, and freedom from exploitation.

“Violence is useless against cryptography” https://wavlake.com/track/648da3cc-d58c-4049-abe0-d22f9e61fef0

06. "Run A Node" is a rallying cry for Bitcoin's decentralisation. At its heart, it's about personal verification and choice: every node is a vote, every check’s a voice. By running the code yourself, you enforce the rules you choose to follow. This is true digital democracy. When everyone participates, there's no room for collusion, and authority comes directly from transparent code rather than blind trust.

"Check the blocks, verify, ain't that hard to do When everyone's got eyes on it, can't slip nothin' throgh." https://wavlake.com/track/ee11362b-2e84-4631-b05e-df6d8e6797f8

07. "Leverage is a Liar" warns against gambling with your wealth, but beneath the surface, it's a sharp critique of fractional reserve banking. Fractional reserves inflate asset prices, creating the illusion of wealth built on leverage. This system isn't sustainable and inevitably leads to collapse. Real wealth requires sound money, money that can't be inflated. Trying to gain more through leverage only feeds the lie.

"Watch it burn higher and higher—leverage is a liar." https://wavlake.com/track/67f9c39c-c5e1-4e15-b171-f1f5442f29a5

08. "Don't Get Rekt" serves as a stark warning about trusting custodians with your Bitcoin. Highlighting infamous collapses like Mt.Gox, Celsius, and FTX. These modern failures echo the 1933 Executive Order 6102, where the US government forcibly seized citizens' gold, banned its use, and then promptly devalued the currency exchanged for it. History shows clearly: trusting others with your wealth means risking losing it all.

"Your keys, your life, don't forget." https://wavlake.com/track/fbd9b46d-56fc-4496-bc4b-71dec2043705

09. "One Language" critiques the thousands of cryptocurrencies claiming to be revolutionary. Like languages, while anyone can invent one, getting people to actually use it is another story. Most of these cryptos are just affinity scams, centralized towers built on shaky foundations. Drawing from The Bitcoin Standard, the song argues money naturally gravitates toward a single unit, a universal language understood by all. When the dust settles, only genuine, decentralized currency remains.

"One voice speaking loud and clear, the rest will disappear." https://wavlake.com/track/22fb4705-9a01-4f65-9b68-7e8a77406a16

10. "Key To Life" is an anthem dedicated to nostr, the permissionless, unstoppable internet identity protocol. Unlike mainstream social media’s walled gardens, nostr places your identity securely in a cryptographic key, allowing you total control. Every message or action you sign proves authenticity, verifiable by anyone. This ensures censorship resistant communication, crucial for decentralised coordination around Bitcoin, keeping it free from centralised control.

"I got the key that sets me free—my truth is mine, authentically." https://wavlake.com/track/0d702284-88d2-4d3a-9059-960cc9286d3f

11. "Web Of Trust" celebrates genuine human connections built through protocols like nostr, free from corporate algorithms and their manipulative agendas. Instead of top down control, it champions grassroots sharing of information among trusted peers, ensuring truth and authenticity rise naturally. It's about reclaiming our digital lives, building real communities where trust isn't manufactured by machines, but created by people.

"My filter, my future, my choice to make, real connections no one can fake." https://wavlake.com/track/b383d4e2-feba-4d63-b9f6-10382683b54b

12. "Proof Of Work" is an anthem for fair value creation. In Bitcoin, new money is earned through real work, computing power and electricity spent to secure the network. No shortcuts, no favourites. It's a system grounded in natural law: you reap what you sow. Unlike fiat money, which rewards those closest to power and the printing press, Proof of Work ensures rewards flow to those who put in the effort. Paper castles built on easy money will crumble, but real work builds lasting worth.

"Real work makes real worth, that's the law of this earth." https://wavlake.com/track/01bb7327-0e77-490b-9985-b5ff4d4fdcfc

13. "Stay Humble" is a reminder that true wealth isn’t measured in coins or possessions. It’s grounded in the truth that a man’s life does not consist in the abundance of his possessions. Real wealth is the freedom to use your life and time for what is good and meaningful. When you let go of the obsession with numbers, you make room for gratitude, purpose, and peace. It's not about counting coins, it's about counting your blessings.

"Real wealth ain't what you own, it's gratitude that sets the tone." https://wavlake.com/track/3fdb2e9b-2f52-4def-a8c5-c6b3ee1cd194

-

@ 45bda953:bc1e518e

2025-05-19 09:49:40

@ 45bda953:bc1e518e

2025-05-19 09:49:40This post will be edited and refined over time.

Eschatology is the study of Biblical prophecy pertaining to what is commonly referred to as the end times. Bitcoin is the transformation of Austrian school economics theory into an efficient and applicable method driven by natural incentives and free market consensus mechanisms.

What happens when eschatology is viewed through a Bitcoin inspired world view?

In this thesis I contend that it is possible and very probable that the consequences of what Satoshi Nakamoto created in Bitcoin and the prophecies surrounding Jesus Christ with regards to the second coming and a thousand year kingdom of peace and prosperity convalesce into a very compelling argument for Biblical prophecy fulfilment.

...

No one would argue that modern major banks are today more powerful than kings of old and governments are mere puppets to the sway that the banking empires hold over them.

In Biblical prophecy when kings and powers are mentioned people rarely think of banking but nothing is comparable to the immense scale of wealth, power and territory controlled directly or indirectly by banks.

IMF, BIS, the FED and Blackrock are where the levers of power are pulled in the current dispensation. Governments restructure more frequently than these institutions whom endure and exercise unmerited influence over said governments and the public interests they claim to represent.

An excerpt from the King James Bible, Daniel chapter 2 describes prophetically the ages of man and its rotations of power.

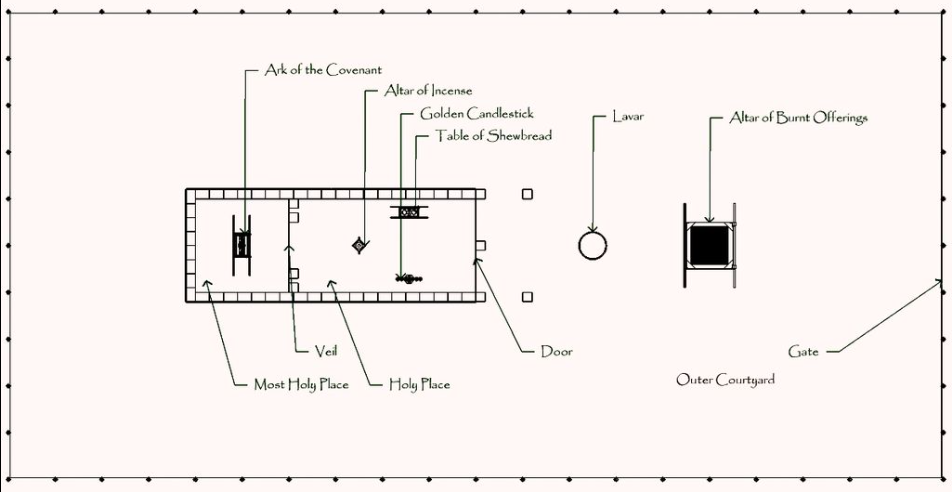

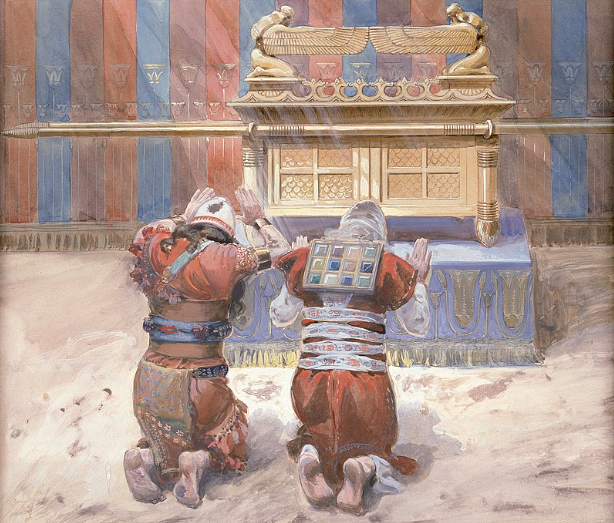

Interesting to note that it is symbolically portrayed in monetary/industrial metals. All used as tokens for trade, symbols of wealth and manufacture.

Gold, silver, bronze, iron and clay. Gold has been a dominant symbol of power and wealth through millennia. Silver, brass and iron ores are mainly industrial metals although they all had prominent turns as coinage. Due to the debasement and concentration of gold specifically.

Clay on the other hand is only a symbol of power in construction and iron has never been used in construction to the extent it is in the 20th and 21st century. Skyscrapers are the symbols of money and power today, i.e. big bank and government buildings.

Daniel Chapter 2:24–45

24Therefore Daniel went to Arioch, whom the king had appointed to destroy the wise men of Babylon. He went and said thus to him: “Do not destroy the wise men of Babylon; take me before the king, and I will tell the king the interpretation.”

25Then Arioch quickly brought Daniel before the king, and said thus to him, “I have found a man of the captives of Judah, who will make known to the king the interpretation.”

26The king answered and said to Daniel, whose name was Belteshazzar, “Are you able to make known to me the dream which I have seen, and its interpretation?”

27Daniel answered in the presence of the king, and said, “The secret which the king has demanded, the wise men, the astrologers, the magicians, and the soothsayers cannot declare to the king. 28But there is a God in heaven who reveals secrets, and He has made known to King Nebuchadnezzar what will be in the latter days. Your dream, and the visions of your head upon your bed, were these: 29As for you, O king, thoughts came to your mind while on your bed, about what would come to pass after this; and He who reveals secrets has made known to you what will be. 30But as for me, this secret has not been revealed to me because I have more wisdom than anyone living, but for our sakes who make known the interpretation to the king, and that you may know the thoughts of your heart.

31“You, O king, were watching; and behold, a great image! This great image, whose splendor was excellent, stood before you; and its form was awesome. 32This image’s head was of fine gold, its chest and arms of silver, its belly and thighs of bronze, 33its legs of iron, its feet partly of iron and partly of clay. 34You watched while a stone was cut out without hands, which struck the image on its feet of iron and clay, and broke them in pieces. 35Then the iron, the clay, the bronze, the silver, and the gold were crushed together, and became like chaff from the summer threshing floors; the wind carried them away so that no trace of them was found. And the stone that struck the image became a great mountain and filled the whole earth.

36“This is the dream. Now we will tell the interpretation of it before the king. 37You, O king, are a king of kings. For the God of heaven has given you a kingdom, power, strength, and glory; 38and wherever the children of men dwell, or the beasts of the field and the birds of the heaven, He has given them into your hand, and has made you ruler over them all — you are this head of gold. 39But after you shall arise another kingdom inferior to yours; then another, a third kingdom of bronze, which shall rule over all the earth. 40And the fourth kingdom shall be as strong as iron, inasmuch as iron breaks in pieces and shatters everything; and like iron that crushes, that kingdom will break in pieces and crush all the others. 41Whereas you saw the feet and toes, partly of potter’s clay and partly of iron, the kingdom shall be divided; yet the strength of the iron shall be in it, just as you saw the iron mixed with ceramic clay. 42And as the toes of the feet were partly of iron and partly of clay, so the kingdom shall be partly strong and partly fragile. 43As you saw iron mixed with ceramic clay, they will mingle with the seed of men; but they will not adhere to one another, just as iron does not mix with clay. 44And in the days of these kings the God of heaven will set up a kingdom which shall never be destroyed; and the kingdom shall not be left to other people; it shall break in pieces and consume all these kingdoms, and it shall stand forever. 45Inasmuch as you saw that the stone was cut out of the mountain without hands, and that it broke in pieces the iron, the bronze, the clay, the silver, and the gold — the great God has made known to the king what will come to pass after this. The dream is certain, and its interpretation is sure.”

I speculate that the toes of iron and clay represent the world banking empire. Skyscrapers are constructed from iron and cement. Different forms of clay is a necessary cement ingredient. Architecture has always been used as a symbol of dominance by rulers especially true of systems who use awe as a means to cause feelings of insignificance in the individual thereby asserting their power at low cost. Ironically it never costs the ruler to create these structures, the cost is always carried by the people in time, resources and energy.

I speculate that the toes of iron and clay represent the world banking empire. Skyscrapers are constructed from iron and cement. Different forms of clay is a necessary cement ingredient. Architecture has always been used as a symbol of dominance by rulers especially true of systems who use awe as a means to cause feelings of insignificance in the individual thereby asserting their power at low cost. Ironically it never costs the ruler to create these structures, the cost is always carried by the people in time, resources and energy.Skyscrapers and large construction are the modern symbols of money and power. Not so much kings, palaces and temples. The stone breaking the power of the statue has to break something contemporary other than kings and palaces if it is to be eschatological prophecy fulfilled in our time.

https://www.britannica.com/technology/cement-building-material/History-of-cement

The invention of portland cement usually is attributed to Joseph Aspdin of Leeds, Yorkshire, England, who in 1824 took out a patent for a material that was produced from a synthetic mixture of limestone and clay.

https://www.thoughtco.com/how-skyscrapers-became-possible-1991649

Later, taller and taller buildings were made possible through a series of architectural and engineering innovations, including the invention of the first process to mass-produce steel.

Construction of skyscrapers was made possible thanks to Englishman Henry Bessemer, (1856 to 1950) who invented the first process to mass-produce steel inexpensively.

You watched while a stone was cut out without hands,

No hands needed when the stone is an idea.

As a thought experiment, imagine there was a base metal as scarce as gold but with the following properties:\ — boring grey in colour\ — not a good conductor of electricity\ — not particularly strong, but not ductile or easily malleable either\ — not useful for any practical or ornamental purpose\ \ and one special, magical property:\ — can be transported over a communications channel

Greshams Law illustrated in slow motion picture.

1: The banks collapse. Being fundamentally weak because of zero reserve lending, any student of Austrian economics has been correctly predicting banking collapse, and have incorrectly been advocating gold as the solution to this collapse. Many of the big economies are valued through their housing market. Housing will be demonetised (Iron and clay economy) meaning shelter and property will become affordable to the average wage earner again. The large cement and iron structures become redundant. Everyone will work from home and a value to value economy will make banks seem like relics from an age of stupidity and evil.

2: Industrial metal iron will not be for mega structures that contain speculators and bookkeepers who have fiat jobs slaving for fiat money. Iron will be used to improve the lives of individuals. Iron as coinage is already demonetised.

3: Brass is demonetised as coinage and only valuable in industry. Ammunition, music, plumbing etcetera.

4: Silver has been a terrible money throughout history and when the silver investors wake up to the fact that they are holding onto a redundant asset with zero monetary properties compared to the alternative they will dump their holdings, crashing the silver market and subsequently reducing the prices of producing -

solder and brazing alloys, batteries, dentistry, TV screens, smart phones microwave ovens, ad infinitum. To quote Jeff Booth. "Prices always fall to the marginal cost of production."

5: The final Rubicon is gold, people get excited about the Bitcoin exchange traded funds but it is nothing compared to the value proposition when gold pundits, large investment funds, governments pension funds and reserve banks finally realise that gold is worthless as money in this new dispensation.

To illustrate the point more vividly.

Ezekiel 7:19

They shall cast their silver in the streets, and their gold shall be removed: their silver and their gold shall not be able to deliver them in the day of the wrath of the LORD: they shall not satisfy their souls, neither fill their bowels: because it is the stumbling block of their iniquity.

What we are witnessing is the biggest rug pull the world has ever seen. In this future metals will exclusively be used for industrial use cases after being stripped of their monetary premium.

This collapse is something that happens slowly over a long period of time. More or less one hour.

This collapse is something that happens slowly over a long period of time. More or less one hour.Revelation 18 verse 11–19 (The fall of Babylon)

And the merchants of the earth shall weep and mourn over her; for no man buyeth their merchandise any more: The merchandise of gold, and silver, and precious stones, and of pearls, and fine linen, and purple, and silk, and scarlet, and all thyine wood, and all manner vessels of ivory, and all manner vessels of most precious wood, and of brass, and iron, and marble, And cinnamon, and odours, and ointments, and frankincense, and wine, and oil, and fine flour, and wheat, and beasts, and sheep, and horses, and chariots, and slaves, and souls of men. And the fruits that thy soul lusted after are departed from thee, and all things which were dainty and goodly are departed from thee, and thou shalt find them no more at all. The merchants of these things, which were made rich by her, shall stand afar off for the fear of her torment, weeping and wailing, And saying, Alas, alas, that great city, that was clothed in fine linen, and purple, and scarlet, and decked with gold, and precious stones, and pearls! For in one hour so great riches is come to nought. And every shipmaster, and all the company in ships, and sailors, and as many as trade by sea, stood afar off, And cried when they saw the smoke of her burning, saying, What city is like unto this great city! And they cast dust on their heads, and cried, weeping and wailing, saying, Alas, alas, that great city, wherein were made rich all that had ships in the sea by reason of her costliness! for in one hour is she made desolate.

TLDR - No more money printer go BRRR. means death to the bourgeoisie cantillionaire class.**

Is it realistic to assume that all the worlds monetised industries collapse to fair value in one hour?

Coming back to eschatology, 2 Peter 3:8

But, beloved, be not ignorant of this one thing, that one day is with the Lord as a thousand years, and a thousand years as one day.

Eschatology students use this verse to speculatively project the fulfilment of Biblical prophecies with regards to their predicted time of occurrence. Now let’s apply this to Babylon falling in one hour.

1000 (one day) divided by 24 (hours) equals 41,6 years (one hour)

Since the first block was mined in January 2009 you add 41,6 years you get a completion date of 2050 a.d

Remember, this stone (Bitcoin) becomes a great mountain and fills the whole earth. A kingdom which shall never be destroyed; and the kingdom shall not be left to other people; it shall break in pieces and consume all these kingdoms, and it shall stand forever. The dream is certain, and its interpretation is sure.

But contemporary sources must reflect this probability if it is a good theory.

https://www.newsbtc.com/news/50-of-population-to-use-bitcoin-by-2043-if-crypto-follows-internet-adoption/

If the banking system is first to collapse we can give it +- 10 years and we are already 14 years in since (Genesis Block) the stone struck the feet. People are slow to see the reality of the world they are living in. If all this is accurate then the world banking system is doomed.

https://www.youtube.com/watch?v=exK5yFEuBsk

Regards

Echo Delta

bitbib

-

@ 57d1a264:69f1fee1

2025-05-20 06:15:51

@ 57d1a264:69f1fee1

2025-05-20 06:15:51Deliberate (?) trade-offs we make for the sake of output speed.

... By sacrificing depth in my learning, I can produce substantially more work. I’m unsure if I’m at the correct balance between output quantity and depth of learning. This uncertainty is mainly fueled by a sense of urgency due to rapidly improving AI models. I don’t have time to learn everything deeply. I love learning, but given current trends, I want to maximize immediate output. I’m sacrificing some learning in classes for more time doing outside work. From a teacher’s perspective, this is obviously bad, but from my subjective standpoint, it’s unclear.

Finding the balance between learning and productivity. By trade, one cannot be productive in specific areas without first acquire the knowledge to define the processes needed to deliver. Designing the process often come on a try and fail dynamic that force us to learn from previous mistakes.

I found this little journal story fun but also little sad. Vincent's realization, one of us trading his learnings to be more productive, asking what is productivity without quality assurance?

Inevitably, parts of my brain will degenerate and fade away, so I need to consciously decide what I want to preserve or my entire brain will be gone. What skills am I NOT okay with offloading? What do I want to do myself?

Read Vincent's journal https://vvvincent.me/llms-are-making-me-dumber/

https://stacker.news/items/984361

-

@ 45bda953:bc1e518e

2025-05-19 09:17:30

@ 45bda953:bc1e518e

2025-05-19 09:17:30Emilien stepped into the space motel's bar. The area was dimly lit and the music was unbearably loud. At least all the tables and sunken lounges each had their own lights and sound dampers. He stepped up to a table and pushed down on the receptor to reduce volume. He could not think with the noise. He looked around for Macy and inconspicuously acquainted himself with the current patrons in the establishment. He pulled his hoody further forward when he noticed the android in a wheel chair. "Not my type of company." He thought to himself. In the centre of the room a couple was having a spectacular time, an empty bottle on the table, they were specimens of myth. The guys muscles were chiselled, with tight fabric clinging to his body specifically to display every contour of his physique. His female counterpart wore loose material with translucent green tattoo's running up her body like pin stripes shining through the thin cloth hinting at a perfectly balanced pose and feminine silhouette underneath. Emilien swiped on the tables interface to call for the proprietor. He folded his arms and leaned onto the table tilting his head down slightly to keep shadow on his face. Macy entered the room through the kitchen swivel door. She was holding an empty tray and a serviette draped over her arm. She walked straight over to Emilien's table. "Good rotation sir. Welcome to Macy's. Are you a regular customer or is it your first visit to my fine establishment?" She seemed concerned and worried. The corners of Emiliens lips curved up a little. Keeping his head down teasingly. "Sir? Do we have an existing open channel?" He ignored her. "Sir, If you don't have liquidity I have no services to offer that you cannot get off your own ship." Emilien looked up with a gleam in his eye. Macie's posture relaxed with a sigh of relief. "Emile, you fuck. You freaked me out." "I'm sorry, I could not help myself." He waved a halfhearted greeting, slightly laughing. "You know I have some new rules around for you nano augmented types." His aversion to the word rules was evident only to himself. "Like what?" Macy felt apologetically obliged to explain the nature of her circumstances. "I had diplomats from the outer void regions come for a private meeting. Financial in nature. A spacer customer arrived blocks before them, I did not suspect him of anything criminal." She put the tray down and gripped the table with both hands shifting her weight. "His routine for meals were already established, he managed to spy on them through my privacy protocols and hacked their clients. He participated as a ghost during most of their stay and dealings." Emilien whistled. "That's rough, how did you handle it." "I did not do anything." Her dreads shook as she moved her head in animated frustration. "No one knew until they all had been gone for blocks. My reputation took a serious knock. They made a claim against me, I was accused of being complicit. Emilien glanced back over his shoulder when he noticed the android cart himself around his table. "Warren helped me and found all the dirty code and sequestered it. We have all the data and footage, it proves beyond a doubt that I was not involved. Thank god for the core otherwise my whole station might have been destroyed by now." Emile gave a sly look. "How do you know it was not me who stole the data?" She locked eyes with him. "You still have the same face as before bro and I know you won't fuck with me. I'll force close our channel." She joked with serious tone nudging him with her fist playfully. She was generally perceived as strict and militant because of her Shiv citizenship. Shiv military training and service was compulsory, all respected the Shiv in their traditions, their ways were isolationist and exclusionary in nature. Emilien has seen her use military style jujitsu-boxing to neutralise and boot out unruly customers. The Juel woman noticed the out of character friendly gesture Macy made. The unexpected interaction drew her attention from across the room. "So, what is this rule of yours." Macy seemed reluctant to say. "I'm sorry bud. You'll have to swallow a slipper pill every 576 blocks while you are on this station." His shoulders sagged and could not help but bounce his leg on the rail under the table. "Really?!" "Yes, really. I have to retain my customers trust and neutralising all augmented customers body gadgets was the unanimous way to go." Emilien seemed pissed. "Your customers might not know that I'm augmented. And what if I don't plan on staying that long. I just want to see Warren then I'll be off." Macy shook her head. "Warren is passed out in his ship and will probably wake up with a very bad hangover. He partied with the Jeul pair and their entourage for most of this rotation, you know how he gets." Macy waved her hand towards the couple who seemed to be looking directly at Emilien. He looked straight back at them and swiped the interface's privacy command dropping a vision distortion field around his table. Encapsulating himself and Macy. "I treat everyone the same, no compromise." Emile looked at her in a moment of rumination. "Let's get it over with." Macy removed a container from her moonbag after opening, holding it towards Emilien he took the purple capsule and swallowed it without a drink and opened his mouth wide moving his tongue around to show Macy that he did indeed swallow the prophylactic. "And what about robo-mech boy back there? He cannot eat slipper pills." Emilien sounded annoyed and regretful." Macy gave him a stern look tilting her head in annoyance. "Why do think he's in a wheelchair, you know I can't talk about my customers with my customers? Besides from the obvious." Emilien did not say anything. Macy sighed. "What can I get you sir?" "I'll just have a beer." Macy stepped out through the distortion field and became a messy disfigured indistinguishable form. Emilien pushed the music's volume up and waited for the inevitable. He sensed the actuators in his shoulders, elbows and wrists disable in sequence down his arms. His spines bit rate slowed to a crawl and the lack of connectivity to his neck port was becoming noticeable. His legs went numb instantly. "Now I am nothing more than a pathetic land crawler." He felt weak and vulnerable in his natural form. His mental state bordered on the fringes of stable and paranoid, fearful thoughts threatening to manifest in his mind. He saw a figure approach. He assumed it was his drink. The slender glowing tattooed leg of the Jeul woman pierced the veil. A bright green line that suddenly dims where her skirt begins. She stepped through the curtain with a friendly nonchalant expression. "Mind if make your acquaintance mon ami?" Emilien dropped the barrier and lowered the volume making sure that he was back on visual record of Macy's archive. "Not really, thanks, I'm good." Macy returned to place a cold beer on the table. The interface flashed a price in femto-sat and Emilien tapped his ring on it shifting 11 fSAT from a mini holographic Bob to very happy little Alice. The animation morphed into a small firework display and died. "Back to work now." Emilien grinned at Macy thankfully and took a sip. "Me and my brother we are celebrating our seventh birth block anniversary." He looked around sarcastically. "You chose a display of death above the resorts on Juel to celebrate your seventh birth block?" She stiffened her glittery lips and raised her eyebrows thoughtfully and took a seat without invitation. "It is more of a tour than a celebration, I am Maurelle Giovanni and my brother is called Lionel also Giovanni obviously. He is my twin baby brother." Emilien looked over at the guy who seemed to be occupied playing a mini game on their tables interface. She tilted her head into his line of sight forcing him to look at her. "Who are you?" "None of your concern really." She did not accept the short stated answer. "No one comes alone all the way to a dead end system just to drink a cheap beer. I am guessing you are a treasure hunter, no. Looking for artefacts of the ancient world, yes?" Emilien had assessed her body language and concluded that her whimsical imagination was one he could easily manipulate. He had enough information to realise that he was faced with a spoiled individual whose sole interest in him was simple curiosity, motivated by boredom and she had a fascination of the mysterious. She seemed like prey but his hunting instincts felt dead inside his disarmed body. His respect for and dependence on Macy also inhibited his urge to exploit it. He shifted his attitude and personality slightly, just enough to not be overbearing. "You make very good estimations, you are wrong but not far off. My name is Scott. And yes I am fascinated, not by the planet and it's relics but by the the secrets of these gates." Her eyes gleamed with amusement and intrigue. "You like secrets, huh? You must meet Warren. He knows more than the esteemed professors about the gates and their technology." Emilien nodded in agreement. "You said you are Giovanni. Like the Giovanni?" She seemed excited at the prospect of making a new friend and swiped the interface. "Hold this thought, I am going to get myself another drink you are good? No. Food maybe?" "I am good, no wait, another beer." He tipped the bottle toward her in salutation. She stood up taking his bottle with her to the bar. He looked back and was immediately aware that he did not notice that the android wheel himself out and into the conduit. He would have liked to see which of the two entrances of the tube he used to go to his ship. His feeling sorry for and pitying himself put him in a position where he let slip an opportunity to understand and predict the circumstances of his current tactical situation. Never at ease, always being prepared. He felt spite. The girl returned with a beer and a half full whiskey glass, no ice. She reclaimed her seat looking at him. "I am a direct descendant of the patriarch Maurice Giovanni, one of the four primary key holders of our people. There is nothing special about me really, ten..." Emilien cut her off in gentle tone. "Ten percent of the Juel population are descendants of the four patriarchs." Emilien finished her sentence for her. "You are an interesting man Monsieur Scott. What else do you know about me?" Emilien leaned towards her. Noticing her brother yawning across the room. "I know that you are bourgeois and I know that you receive a cyclical allowance from your great, great... How many generations?" "I am removed 133 generations from my Patriarch. He is a very good, doting grandfather. We all adore him. We are around 750 million siblings you know. Those who are from aristocracy have fewer children than the proles. We are so few so that our wealth is not diluted too much." She smiled reminiscently dragging her finger on the edge of the glass. Her brother seemed to stretch himself out he stood up and walked over. Entering the sound damper he acknowledged Emilien's presence with a curt nod. "Maurelle, I am going to sleep." He said to her. She waved at him dismissively. "Have a good dream frere." He exited the room through the right tubes door which made sense as their ship was more closely attached to it on that side of the circular docking ring. Predictable and honest Emilien thought to himself. Macy popped her head through the kitchens serving window. "Lights out and shutdown in 2 blocks. Just a friendly notice." The couple acknowledged the warning from Macy with raised glass and bottle. Emilien turned his attention back to the lady. "How do you manage to retain wealth in such a large family?" He pretended to be ignorant of the finery and detail of Juel culture. "We have closed loop channels controlled and balanced by the patriarchs. But our money is good as core stone. Anywhere in the outer void. Only recently has dispute arose between my Patriarchs and the Magarrie. They do not accept our Sats anymore since the war started. They only accept bitcoins directly from the core. I was only four cycles old when the war began so I am used to it." Emilien felt a conflicting disturbance, thinking about how his body is only two cycles active but his mind stretches back far beyond this time. Being both older and younger than his partner in discourse. "Helloo? I lost you there for a moment Scott." "What are you thinking about?" Emilien lied to her faking emotion. "I was just thinking about the tremendous loss of life that we are orbiting. The planet embedded with what it's inhabitants assumed would be it's portal to prosperity became the golem of it's demise." He was happy that Maurelle seemed to empathise and mirror his philosophic grief. "Come with me I want to tell you a secret. You like secrets." She stood up taking his hand gently tugging, compelling him to follow her. She led him to the far end of the room. She pulled a small levered switch and the wall folded in on itself to reveal a impressive window flooding sharp light into the whole of the large room as it retracted. They both squinted and lifted their hands to shield their eyes adjusting to the glare of Sol. The scene of destruction appeared even more dramatic and morbid as dark sharply defined shadows clipped with golden edges, evoking a sense of isolation and suffering. "These gates were supposed to be a gift to Earth. A hope of spreading humanity across the stars like the children of Abraham." Emilien smirked. "You believe that nonsense?" She rested her head on his shoulder still holding onto his arm. "Our patriarchs have preserved the mysteries of mankind for millennia. I said that I am going to tell you a secret don't patronise me. I do not believe anything. What I know, it is not faith. It is understanding. Knowledge, a type of knowledge that you cannot quantify with mathematics and chemistry. It is a higher science that is proven by the unmistakable coincidence of fate. It is invisible to those who are ignorant and they who despair, those who have lost all hope are blind to this promise." Emilien felt a strange remorse. "I guess I must be blind then." The lights suddenly shut down and the song stopped dead in it's track, like Macy promised. Overcome by the majesty of the scene Maurelle wiped a tear away fearing that her makeup might get ruined. "Anyone can see. They must just open their eyes voluntarily and be honest with themselves. Their true original selves. Who they were made to be." Emile felt judged and wanted to end this conversation quickly. "I am going back to my ship, you have a good night now." She grabbed tightly at his wrist almost painfully. "You do not want to know my secret?" Emelien was becoming annoyed with her insistence he removed her hand from his arm. "I don't think you know any real useful secrets, sweetheart." He sounded threatening, the real enshrouded unmistakable him breaking through the act. She looked at him unintimidated by his sudden shift in personality. "Oh, so I suppose you know why the Juela are at war for most of our lives?" He sarcastically extended his arms forward palms up in restrained but evidently mocking adoration. "Please enlighten me priestess." "They are fighting over this." She pointed at the epic scene of destruction drifting statically out of view as the stations rotation cut it off at the edge of the window. The shadows chased Sol light away sliding like a retracting blade across the room leaving it dark. Emilien burst out angrily. "They are fighting over satoshis! That is all they ever fight over! What I fight for, Damnit! Sats and the resources to gain more of it! That is the beginning and end of all things! Anyone in the universe with even the slightest lick of self worth works, fights and dies for sat!" Maurelle stared astutely at him unemotionally affected by his outburst. She obviously had experienced this exact reaction before and suddenly Emilien realised that he might be the one being manipulated by a smarter and wiser being than himself. "Are you done my love? Have you made your point or is there some other deeper understanding you wish me to internalise into my ignorant small little world?" She threw at him a spiteful sarcasm of her own. "Do you really think I do not know what it means to be seduced by wealth? Luxury?" She took a step closer to him. "Pleasure?" Emilien felt stupid and disarmed this time adding emotionally disarmed to the defeat of being inept in his own body. "I am not a fool mon cherie. The truly wealthy don't fight for wealth, they fight for power. But the noble and sincere fight a different fight with a different weapon. They use words to fight, ideas to win. They fight to gain trust with words, and they fight to retain it with consistency in their actions. Trust is a currency that makes sat seem like shit in comparison because it is real even though you do not believe what you cannot hold in your hand, like your beloved sat." She pointed at the ring on his finger. "Trust only retains value if you honour your words with your actions. Its value is fragile and can disappear in a moment of weakness like water vapour, cherished as the source of life then gone, poof, evaporated. Like magic. This type of trust if gained and retained correctly, projects you forward into the realm of immortality." Emile felt stung and hurt on a personal level, unsure if she was generalising or targeting his own specific weakness purposely. It confused him and made him feel insecure. "What are they fighting for then?" He asked slightly surrendering to the unexpected superior reasoning. Maurelle appreciated the honesty she identified as sincere. She gently took his hand again and led him back to the large convex window. They stood silently for a block, waiting on the rotation to pull the bright light of Sol back into the room. "They are fighting for the power to do that." She pointed at Earth in all it's terrible glory. "The destruction caused by the gate was a terrible cataclysm outside of humanities collective control. The core and the gates are a mystery to mankind." She looked up at Emilien, relieved to see that he was still taking her seriously. "The Maggarie have discovered a weapon that has the power to destroy a planet. The Juel think they are fighting to free Osteri captives from slavery but the real motif is hidden, our Patriarchs unadmitted fear of being inferior to the Maggarie. Most of the goods we traded with them they have stopped accepting, the Shiv and Osteri still buy our products but the Maggarie have suddenly lost the need for our produce, even raw material in it's basest forms. They are expanding somehow and the balance of interdependence has tilted out of our favor. They have no more need for us and have cast us aside like a filthy rag." She paused in thought. "Their new super weapon is the cause of this conflict monsieur Scott." Emilien shrugged. Feeling relieved at regaining the intellectual high ground he thought he had lost. "I'm sorry Maurelle. I have no data on this weapon. If this was true the forums on my bulletin board would have leaked information about it's existence epochs ago, it's been just over three cycles everyone would have known this by now. It sounds more like Jeul fearmongering or perhaps it is the daydreaming fairy tale of an innocent naive girl who worships old myths and legends of a time dead for thousands of years." He pointed at Earth. She sniffed away a hint of emotion and anger. "Well then, I have nothing more to say to you, Good night monsieur Scott." She pulled away from him pridefully and looked out at the enormous gate embedded like a knife into the earths crust. "You are a swine monsieur Scott, leave me alone with my pearl." Emilien stepped back mockingly bowing slightly. "Good night sweetheart." He walked back to his craft laughing inside himself. "Stupid woman." He muttered, although be it doubtfully.

...

scifi

-

@ 472f440f:5669301e

2025-05-20 13:01:09

@ 472f440f:5669301e

2025-05-20 13:01:09Marty's Bent

via me

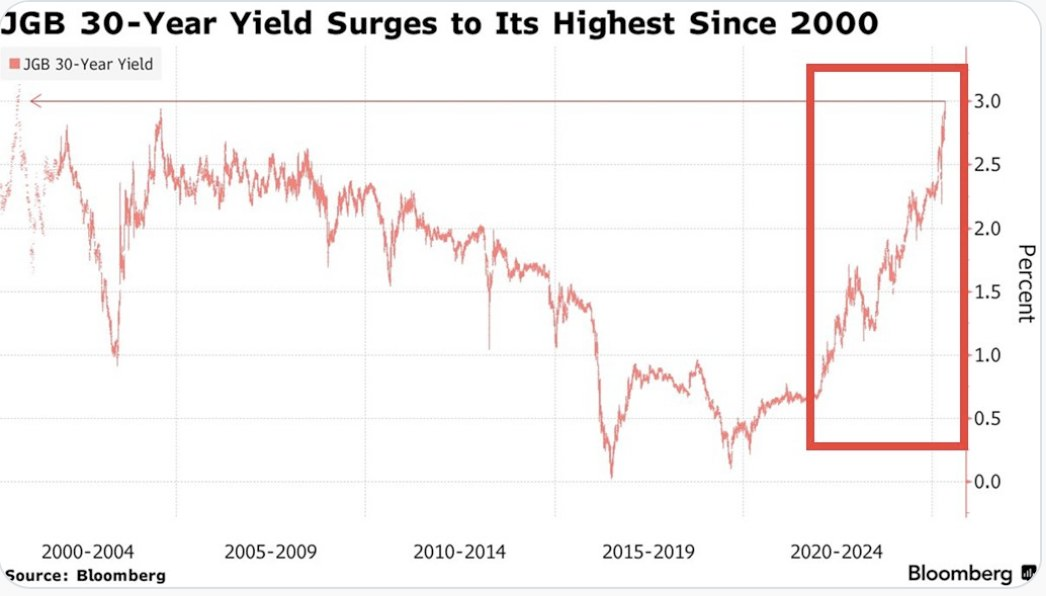

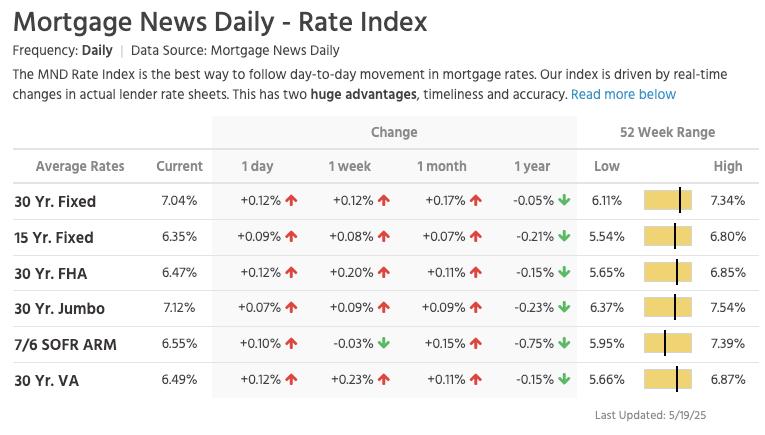

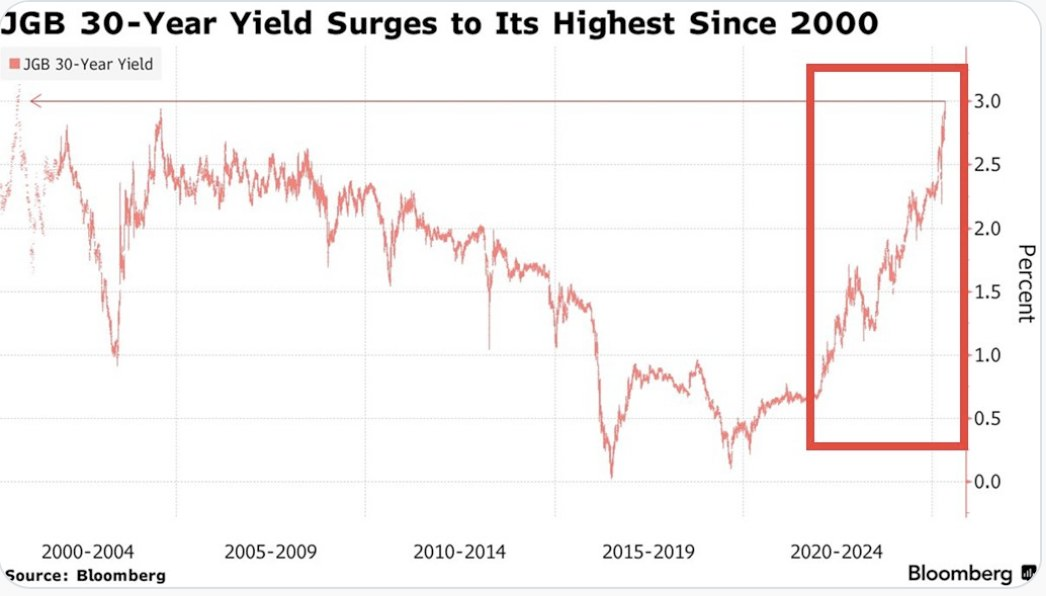

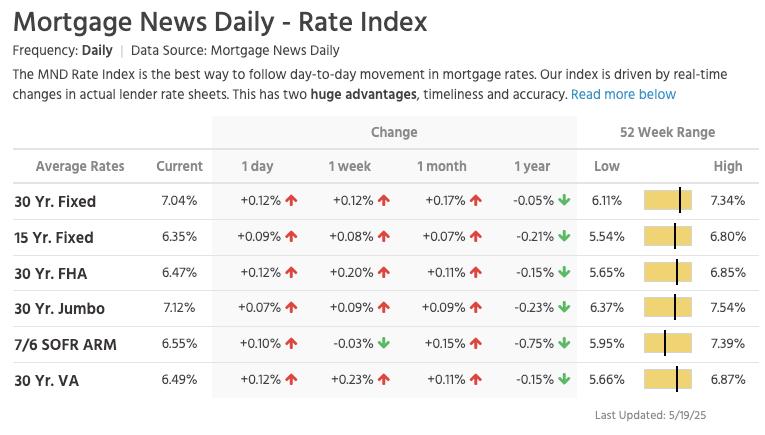

Don't sleep on what's happening in Japan right now. We've been covering the country and the fact that they've lost control of their yield curve since late last year. After many years of making it a top priority from a monetary policy perspective, last year the Bank of Japan decided to give up on yield curve control in an attempt to reel inflation. This has sent yields for the 30-year and 40-year Japanese government bonds to levels not seen since the early 2000s in the case of the 30-year and levels never before seen for the 40-year, which was launched in 2007. With a debt to GDP ratio that has surpassed 250% and a population that is aging out with an insufficient amount of births to replace the aging workforce, it's hard to see how Japan can get out of this conundrum without some sort of economic collapse.

This puts the United States in a tough position considering the fact that Japan is one of the largest holders of U.S. Treasury bonds with more than 1,135 sats | $1.20 trillion in exposure. If things get too out of control in Japan and the yield curve continues to drift higher and inflation continues to creep higher Japan can find itself in a situation where it's a forced seller of US Treasuries as they attempt to strengthen the yen. Another aspect to consider is the fact that investors may see the higher yields on Japanese government bonds and decide to purchase them instead of US Treasuries. This is something to keep an eye on in the weeks to come. Particularly if higher rates drive a higher cost of capital, which leads to even more inflation. As producers are forced to increase their prices to ensure that they can manage their debt repayments.

It's never a good sign when the Japanese Prime Minister is coming out to proclaim that his country's financial situation is worse than Greece's, which has been a laughing stock of Europe for the better part of three decades. Japan is a very proud nation, and the fact that its Prime Minister made a statement like this should not be underappreciated.

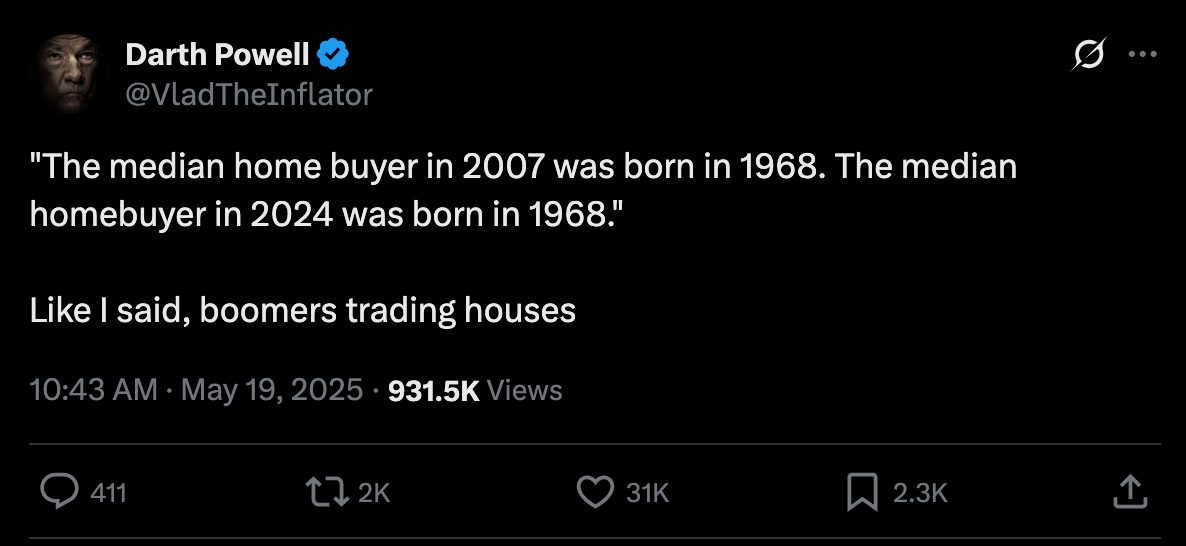

As we noted last week, the 10-year and 30-year U.S. Treasury bonds are drifting higher as well. Earlier today, the 30-year bond yield surpassed 5%, which has been a psychological level that many have been pointed to as a critical tipping point. When you take a step back and look around the world it seems pretty clear that bond markets are sending a very strong signal. And that signal is that something is not well in the back end of the financial system.