-

@ c9badfea:610f861a

2025-05-20 17:05:41

@ c9badfea:610f861a

2025-05-20 17:05:41- Install YTDLnis (it's free and open source)

- Launch the app and allow notifications and storage access if prompted

- Go to any supported website or use the YouTube, Instagram, X, or Facebook app

- Tap Share on the post or website URL and select YTDLnis as the sharing destination

- Adjust the settings if desired and tap Download

- You'll be notified when the download finishes

- Enjoy uninterrupted watching!

ℹ️ This app uses

yt-dlpinternally and it's also available as a standalone CLI tool -

@ cae03c48:2a7d6671

2025-05-20 17:01:30

@ cae03c48:2a7d6671

2025-05-20 17:01:30Bitcoin Magazine

KULR Expands Bitcoin Treasury to $78M, Cites 220% BTC Yield YTDToday, KULR Technology Group, Inc. (NYSE American: KULR) announced a $9 million expansion of its Bitcoin Treasury, bringing total acquisitions to $78 million. The latest purchase was made at a weighted average price of $103,234 per bitcoin, bringing the company’s total holdings to 800.3 BTC.

$KULR has acquired 83.3 BTC for ~ 9 million To learn more about our acquistion and our Bitcoin Treasury Strategy, check out today's press release.https://t.co/vuQk90DCgh pic.twitter.com/KrW3E4e700

— KULR Technology (@KULRTech) May 20, 2025

The move follows KULR’s December 2024 strategy to allocate up to 90% of surplus cash reserves to bitcoin. Year-to-date, the company reports a BTC Yield of 220.2%, a proprietary performance metric reflecting growth in BTC holdings relative to assumed fully diluted shares outstanding.

In Q1 2025, KULR reported revenue of $2.45 million, a 40% increase driven by product sales totaling approximately $1.16 million. Gross margin declined to 8%, while combined cash and accounts receivable stood at $27.59 million. Operating expenses rose, with Selling, General and Administrative (SG&A) Expenses at $7.20 million and Research and Development (R&D) Expenses at $2.45 million, contributing to an operating loss of $9.44 million. Net loss widened to $18.81 million, mainly due to a mark-to-market adjustment on bitcoin holdings.

“2025 is a transformational year for KULR and the transformation is well on its way,” commented KULR CEO Michael Mo. “With over $100M in cash and Bitcoin holdings on our balance sheet as of the present day and virtually no debt, we are well capitalized to grow our battery and AI Robotics businesses, while our capital market activities in the foreseeable future are geared to turbocharge our Bitcoin acquisition strategy, establishing KULR as a pioneer BTC-First Bitcoin Treasury Company.”

CEO @michaelmokulr speaks about the origins of KULR’s Bitcoin treasury strategy and how it will shape the future of the company’s growth.

Watch here:$KULR pic.twitter.com/UTq3iKkF0u

— KULR Technology (@KULRTech) May 15, 2025

This surge in bitcoin holdings by companies like KULR and Metaplanet highlights a growing trend among firms embracing BTC as a core treasury asset, reflecting confidence in bitcoin’s long-term value and utility as part of broader financial strategies.

Last week, Metaplanet reported its strongest quarter to date for Q1 FY2025. Metaplanet’s bitcoin holdings rose to 6,796 BTC—a 3.9x increase year-to-date and over 5,000 BTC added in 2025 alone. Despite a temporary ¥7.4 billion valuation loss from a bitcoin price dip in March, the company rebounded with ¥13.5 billion in unrealized gains as of May 12. Since adopting the Bitcoin Treasury Standard, Metaplanet’s BTC net asset value has surged 103.1x, and its market cap has grown 138.1x.

This post KULR Expands Bitcoin Treasury to $78M, Cites 220% BTC Yield YTD first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 0971cd37:53c969f4

2025-05-20 17:00:53

@ 0971cd37:53c969f4

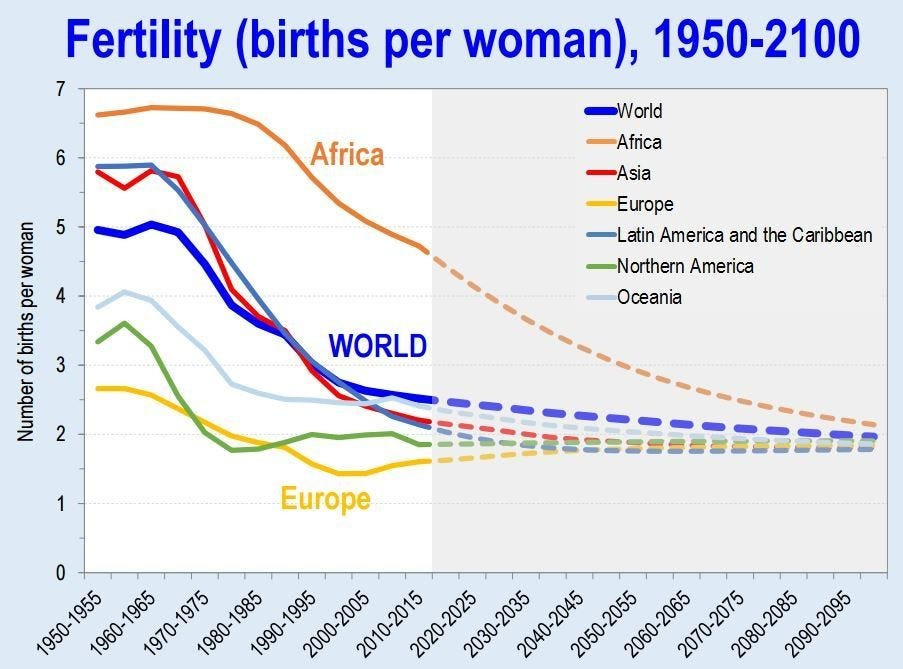

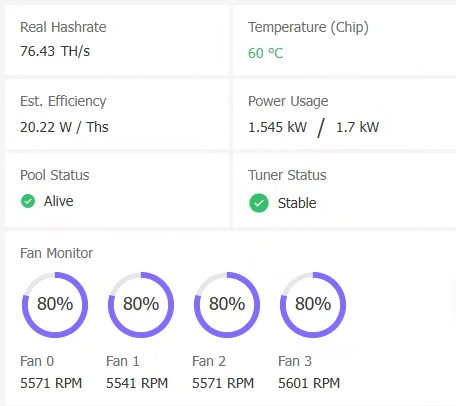

2025-05-20 17:00:53ลดต้นทุนค่าไฟ เพิ่มความคุ้มค่าให้การขุด Bitcoin ที่บ้าน ในยุคที่ต้นทุนพลังงานสูงขึ้นอย่างต่อเนื่อง นักขุด Bitcoin ที่บ้าน หรือ Home Miner ต้องคิดให้รอบคอบก่อนเลือกเครื่องขุด เพราะ “แรงขุดสูงสุด” ไม่ได้แปลว่า “กำไรดีที่สุด” อีกต่อไป การเลือกเครื่องขุดไม่ใช่แค่ดูแค่แรงขุด (Hashrate) สูงสุดเท่านั้น แต่ต้องพิจารณาเรื่อง "การกินไฟ" และ "ความคุ้มค่าในการใช้งานระยะยาว" ด้วย ซึ่งสายหนึ่งที่ได้รับความนิยมมากขึ้นเรื่อย ๆ ก็คือ สาย Tuning Power หรือการจูนเครื่องขุดเพื่อให้ได้อัตราส่วน Hashrate/Watt ที่ดีที่สุด

เทรนด์ใหม่ของวงการขุดคือสาย Tuning Power หรือการปรับแต่งพลังงานของเครื่องขุด Bitcoin (ASIC) ให้ได้ ประสิทธิภาพ Hashrate ต่อการใช้พลังงาน (Efficiency) สูงที่สุด ซึ่งเหมาะอย่างยิ่งสำหรับการขุดในบ้านที่มีข้อจำกัดด้านค่าไฟ ความร้อน และ เสียงรบกวน

Tuning Power คืออะไร? Tuning Power คือการปรับลดแรงขุดของเครื่อง ASIC ลงเล็กน้อย เพื่อให้กินไฟน้อยลงแบบชัดเจน

ตัวอย่างเช่น Custom Firmware Braiins OS ใช้กับ Antminer S19jpro จากเดิมแรงขุด 104 TH/s กินไฟ 3,500W เมื่อปรับแต่งในส่วน Power Target จูนเหลือ 75 TH/s อาจกินไฟแค่ 1,600W-1,800W หลังจาก Tuning ค่าประสิทธิภาพ(Efficiency)ดีขึ้น เช่น จาก 32 J/TH เหลือเพียง 22–20 J/TH

หมายเหตุ: ค่า Efficiency ยิ่งต่ำ ยิ่งดี แปลว่าใช้พลังงานน้อยต่อ 1 TH

หมายเหตุ: ค่า Efficiency ยิ่งต่ำ ยิ่งดี แปลว่าใช้พลังงานน้อยต่อ 1 THทำไมต้อง Tuning Power? การจูนพลังงาน (Tuning Power) คือการปรับแต่งเครื่องขุด เช่น ASIC ให้ทำงานที่แรงขุดไม่เต็ม 100% แต่กินไฟน้อยลงอย่างชัดเจน ส่งผลให้:

- ประหยัดค่าไฟ โดยเฉพาะถ้าขุดในพื้นที่ต้นทุนพลังงานค่าไฟสูงหรือไม่มี TOU (Time of Use) และ เหมาะสำหรับผู้ใช้ไฟแบบ TOU ที่ค่าไฟกลางวัน ON-Peak แพง ต้องการขุดเลือกช่วงกลางคืนและวันหยุดเสาร์-อาทิตย์ และ วันหยุดราชการตามปกติ Off-Peak , ที่ใช้ระบบ Solar หรือมีระบบ Battery ต้องการประหยัดไฟ

- ลดความร้อนของเครื่อง ทำให้ยืดอายุการใช้งานและลดค่าใช้จ่ายด้าน ซำบำรุง ระบบระบายความร้อน

- เพิ่มความคุ้มค่า ในช่วงตลาดหมี ที่กำไรจากการขุดต่ำ การลดต้นทุนไฟฟ้าคือทางรอดหลัก

เครื่องขุด Bitcoin (ASIC) รุ่นไหน ที่เหมาะกับสาย Tuning Power

-

Antminer รองรับ Custom Firmware เช่น Braiins OS ที่เป็นยอดนิยมในการ Tuning Power

-

WhatsMiner M30-M60s Series ขึ้นไป ใช้โปรแกรม WhatsMinerTool เพื่อทำการ Tuning Power ได้โดยตรงไม่จำเป็นต้อง Custom Firmware

สรุป การเป็น Home Miner ที่ยั่งยืนไม่ได้ขึ้นกับว่าเครื่องขุดแรงแค่ไหน แต่ขึ้นกับว่า “จ่ายค่าไฟแล้วเหลือกำไรหรือไม่ หรือ จ่ายค่าไฟแล้วคุ้มค้ารายได้ Bitcoin จากการขุดจำนวนที่ได้รับมากขึ้นหรือไม่” การเลือกเครื่องขุดสำหรับสาย Tuning Power จึงเป็นทางเลือกที่ตอบโจทย์ผู้ที่ต้องการประสิทธิภาพสูงในต้นทุนที่ควบคุมได้โดยเฉพาะในยุคที่ตลาดผันผวน และ ค่าไฟฟ้าคือศัตรูตัวจริงของนักขุด

-

@ cae03c48:2a7d6671

2025-05-20 16:55:46

@ cae03c48:2a7d6671

2025-05-20 16:55:46Bitcoin Magazine

Magic Eden Partners with Spark to Bring Fast, Cheap Bitcoin SettlementsMagic Eden is integrating with Spark to improve Bitcoin trading by addressing issues like slow transaction times, high fees, and poor user experience. According to a press release sent to Bitcoin Magazine, the integration will introduce a native settlement system aimed at making transactions faster and more cost-effective, without using bridges or synthetic assets.

Big day: @MagicEden is coming to Spark. New native Bitcoin experiences coming to you very soon.

Alpha → https://t.co/KPWZ7Ndagg pic.twitter.com/c4nSlhP3Rt

— Spark (@buildonspark) May 20, 2025

The integration will enable users to buy, sell, and earn Bitcoin-native assets more efficiently through Spark’s infrastructure, starting with support for stablecoin-to-BTC swaps and expanding to additional use cases over time.

Spark is built entirely on Bitcoin’s base layer. It provides transaction finality in under a second and fees below one cent.

“We’re proud to be betting on BTC DeFi,” said the CEO of Magic EdenJack Lu. “We’re going to lead the forefront of all Bitcoin DeFi to make BTC fast, fun, and for everyone with Magic Eden as the #1 BTC native app on-chain.”

Huge News: We're partnering with @buildonspark

Spark enables instant Bitcoin transactions, creating a fast and secure experience for everyone.

Get ready for a new wave of BTC-Defi

pic.twitter.com/FXmHfATnJz

pic.twitter.com/FXmHfATnJz— Magic Eden

(@MagicEden) May 20, 2025

(@MagicEden) May 20, 2025The collaboration between Spark and Magic Eden will officially begin at BitGala on May 26th. At this event, they will host a joint gathering to mark their partnership and engage with the Bitcoin community. This event will also serve as the starting point for further integration, the development of new tools for developers, and expanded opportunities within the Bitcoin ecosystem.

“Spark is a completely agnostic protocol, it’s purpose-built for developers to create the next generation of financial applications,” said the CEO & Co-founder of Lightspark David Marcus. “We’re incredibly excited to see Magic Eden building the future of on-chain Bitcoin DeFi directly on Spark.”

This post Magic Eden Partners with Spark to Bring Fast, Cheap Bitcoin Settlements first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-05-20 16:44:24

@ cae03c48:2a7d6671

2025-05-20 16:44:24Bitcoin Magazine

Tribalism Is Not The Core ProblemThe United States government stands mere months, if not weeks, from the passing of stablecoin legislation that will set the playing field for the global economy for decades, if not centuries, to come.

During this crucial moment, in which we should all be keeping our eyes locked with precision on the prize, the best and brightest defenders of the one neutral digital asset have once again bifurcated into the trenches of “Us. Vs Them.” As sure as the next block, seemingly every ten minutes there’s another attempt from a faction within the group to imbue an intense ethical intention over the invention of Bitcoin. These groups converge to share interpretations of the Sacred Text –– Satoshi’s Whitepaper ––or pour over his forum posts on BitcoinTalk, hoping to find a path forward. It seems without fail, no matter when looking at the factional Part, or the amorphous Whole, the selected writings of Bitcoin’s inventor always conveniently enable the exact behavior and optionality –– or lack thereof –– that is best for the current arguing party.

This is to say, the observer of Bitcoin, when attempting to gain influence over more users, simply projects and amplifies their own reflection upon the monetary protocol, as it relates to their own position via their specific stake within the system. There is no neutral reflection or position to be expressed –– every voice and every idea fundamentally must come from a place of origin. While many attempt to go to great lengths to curb this bias from their publicly articulated analysis –– not to mention the many more that could claim ignorance entirely –– whether you are able, willing, or aware, your beliefs are beheld by the context you witness, and cannot be separated to create an objective meaning from a subjective experience. In short, everyone talks their own book. It’s a requirement to talking.

On today’s social media platforms, the actualization of one talking their book is even further manipulated beyond strictly fundamental financial incentives, and each idea becomes a piece of content competing for air in the rough seas of algorithmic influence. To not have an opinion on the latest thing, to not express and articulate said opinion publicly, is to drown in the void of irrelevancy. On Twitter, a Bluecheck raft is seen as a necessity, normalized by the supposed dissidents and mainstream alike. The digital front, while an important one, has been eroded not by the proverbial stick, but by the poisoned carrot. Payouts, likes, and followers have replaced credibility as the currency of relevance, not due to actions by the consumers, but by the creators. Even worse, many creators have off-shored their creative capabilities –– i.e., their ideas –– to AI Chat Bots and Large Language Models, removing the humanity entirely from the output, rendering the content ocean littered with homogenous globs of unthought thoughts. The late-stage creator economy has ultimately failed to promote originality, and instead has given rise to an multi-headed hydra of next-up influencers ready and able to churn out the freshest of ChatGPT chum at the behest of curtained algorithmic masters out of sight.

The unseen incentives will be our downfall –– not our ideologies, not our intellect, and not our preparedness, nor the lack of any of these things. While applicable to many mediums and masteries, the hidden incentives of programmable money demonstrate this concept far greater than, say, independent media figures, fitness and health gurus, or dissident philosophers.

Today’s Bitcoin culture war comes at a dangerous time, when the single greatest threat to its neutrality of incentives comes to the protocol layer. While hours and hours of podcasts from both sides of the divorce might lead you to believe this attack vector comes from JPEGs or the filters that discourage them, in fact, the imminent corrupting agent comes from the reintroduction of dollar stablecoins to the blockchain as Bitcoin itself remains infeasible as a medium of exchange that can service billions.

Both sides of the debate, the Knots/Pro-Filters or the Core/Filters-Agnostics, are not dealing with the core of the real problem brewing in Bitcoin today. The Knotsians claim all non-monetary use cases of Bitcoin are against the nature of the protocol, while remaining absolutely silent on whether or not these same ethics are to be applied to Tether’s homecoming –– “Bitcoin-native” USDT dollar stablecoins via Taproot Assets –– being stored in the distributed database known as the blockchain. The Core defenders, who claim to rightfully stand beside the most ambitious and successful open source project of all time, have little to say about the maintainers lack of interest in pursuing optionality that would enable billions of users to benefit from Bitcoin’s disinflationary monetary policy, rather than simply the millions of already-adopters. Both sides are, at best, silent partners in the scaling-by-financialization of Bitcoin via stocks and debt-instruments, custodians, exchange traded funds, and tokenized dollars, rather than by making UTXO ownership feasible and efficient. Filters, spam, Core, Knots, are all distractions from the real problem brewing on the horizon: the incentive distortion of stablecoins.

If Bitcoin remains programmable money, and the mere existence of this protocol-level debate perpetuates the idea that ossification has not yet arrived, why must we pledge allegiance between two teams that directly serve neither of the issues at hand? Bitcoin deserves more client optionality, and Knots is not innately a bad idea, nor are many of the mining concepts marketed by OCEAN employees. Bitcoin Core has secured trillions of dollars of value with an unparalleled up-time for a financial protocol. But Bitcoin will fail to stablecoins, inadvertently perpetuating the United States’ Treasury ponzi across the globe, while introducing dollarized, perverse incentives to the entire game theory of Bitcoin’s block production –– and thus unstoppable transaction settlement –– if we are slothful and distracted in failing to maximize self-custody and keep dollar tokens off the only currently-decentralized chain.

Did inscriptions create a newly-found demand for blockspace that directly competes with the companies enabling Larry Fink’s vision for Bitcoin as “a technology for asset storage?” Do Dickbutts and Monkey JPEGs make the Tether-ification –– i.e., the dollarization –– of Bitcoin more expensive? Perhaps. But there is simply no evidence that the players on either side of this culture war are actively or willingly compromised, and to suggest such is a dangerous game.

As we wrote nearly two years ago in a previous call to action, “the network must remain practically useful for anyone, or it risks becoming practically useless for everyone.” The only responsibility today’s Bitcoiner must uphold is to leave the protocol as permissionless and as serviceable as it was when they found it. Part of this innately involves the mission Core sets out to achieve with its tireless approach to perpetuating an extremely complicated, novel piece of software across an ever-changing landscape of hardware and software updates. Part of this, also, innately involves the mission Knots and OCEAN attempts to achieve with its pursuit of purity of financial activity and mining decentralization via block construction and payout methods.

Blindly opposing or supporting the Current Thing because of Twitter posts and podcasts will not deliver us from the known evils, nor prepare us for the unknown. Ultimately, both paths forward on their own will fail to achieve the promise of Bitcoin to its fullest extent.

Reject the binary presented by the culture war and think for yourself.

This is a guest post by Mark Goodwin. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine_._

This post Tribalism Is Not The Core Problem first appeared on Bitcoin Magazine and is written by Mark Goodwin.

-

@ 04c915da:3dfbecc9

2025-05-20 15:53:48

@ 04c915da:3dfbecc9

2025-05-20 15:53:48This piece is the first in a series that will focus on things I think are a priority if your focus is similar to mine: building a strong family and safeguarding their future.

Choosing the ideal place to raise a family is one of the most significant decisions you will ever make. For simplicity sake I will break down my thought process into key factors: strong property rights, the ability to grow your own food, access to fresh water, the freedom to own and train with guns, and a dependable community.

A Jurisdiction with Strong Property Rights

Strong property rights are essential and allow you to build on a solid foundation that is less likely to break underneath you. Regions with a history of limited government and clear legal protections for landowners are ideal. Personally I think the US is the single best option globally, but within the US there is a wide difference between which state you choose. Choose carefully and thoughtfully, think long term. Obviously if you are not American this is not a realistic option for you, there are other solid options available especially if your family has mobility. I understand many do not have this capability to easily move, consider that your first priority, making movement and jurisdiction choice possible in the first place.

Abundant Access to Fresh Water

Water is life. I cannot overstate the importance of living somewhere with reliable, clean, and abundant freshwater. Some regions face water scarcity or heavy regulations on usage, so prioritizing a place where water is plentiful and your rights to it are protected is critical. Ideally you should have well access so you are not tied to municipal water supplies. In times of crisis or chaos well water cannot be easily shutoff or disrupted. If you live in an area that is drought prone, you are one drought away from societal chaos. Not enough people appreciate this simple fact.

Grow Your Own Food

A location with fertile soil, a favorable climate, and enough space for a small homestead or at the very least a garden is key. In stable times, a small homestead provides good food and important education for your family. In times of chaos your family being able to grow and raise healthy food provides a level of self sufficiency that many others will lack. Look for areas with minimal restrictions, good weather, and a culture that supports local farming.

Guns

The ability to defend your family is fundamental. A location where you can legally and easily own guns is a must. Look for places with a strong gun culture and a political history of protecting those rights. Owning one or two guns is not enough and without proper training they will be a liability rather than a benefit. Get comfortable and proficient. Never stop improving your skills. If the time comes that you must use a gun to defend your family, the skills must be instinct. Practice. Practice. Practice.

A Strong Community You Can Depend On

No one thrives alone. A ride or die community that rallies together in tough times is invaluable. Seek out a place where people know their neighbors, share similar values, and are quick to lend a hand. Lead by example and become a good neighbor, people will naturally respond in kind. Small towns are ideal, if possible, but living outside of a major city can be a solid balance in terms of work opportunities and family security.

Let me know if you found this helpful. My plan is to break down how I think about these five key subjects in future posts.

-

@ 3bf0c63f:aefa459d

2025-02-22 17:05:13

@ 3bf0c63f:aefa459d

2025-02-22 17:05:13P2Panda and the super-peer curse

Recently was suggested to me that https://p2panda.org/ was a great protocol and that maybe Nostr wouldn't be necessary if we could just use that. After making the blind remark that p2p doesn't work I was pointed to https://github.com/p2panda/aquadoggo which acts as a "node" in some ways similar to a "relay", and it all looks somewhat well, cool, maybe they're into something:

Then I realized that Aquadoggo isn't really a relay, it is more like an "app server". There are still no relays in the Nostr sense in p2panda, the base of communication is still p2p between "nodes", and, as Aquadoggo's readme say, it could be run both as a client and as a server. In other words, we could easily have an "Nostr Aquadoggo" that abstracts all communication with relays, relay selection, event and tag parsing and signatures then stores filtered, ordered, indexed data locally: it is just a Nostr client.

That you can put one of these in a server doesn't change that fact that it will be still a client -- and that underlings behind it consuming its API will be controlled, censored, mislead and tricked. This design that requires trust in one single server from a dumb client in exchange for massaged, sorted, filtered, ordered data is seen not only in p2panda, but it's also a fundamental part of the design in many of the supposed decentralized protocols out there, including Bluesky, Farcaster and Pubky. It has also found its way even into RSS, with feed aggregators, and into IRC with bouncers. It can also be seen being experimented with inside Nostr, with ZBD Social, Primal, Ditto, Satlantis and others I forgot, and even behind the ideas of some pseudo-relays like Bostr and filter.nostr.wine (although I'm not sure). Notably, though, this design is not a part of SSB or Mastodon and these two weren't ever corrupted by it as far as I know.

In any case, should we accept that such architecture will eventually find its way into Nostr and completely dominate it? If I believed the answer was "yes" I would immediately declare Nostr a failed experiment, but I don't. As the main author of one such experiment (ZBD Social), I still think this architecture isn't necessarily bad as long as it's limited and restricted to certain circumstances, but it does pose a risk of Nostr becoming almost as bad as Bluesky, so the path has to be threaded carefully.

Ultimately, though, what all these protocols are trying to achieve by injecting these dangerous super-peers into their architecture is the reliability that pure p2p cannot provide, along with filtering and discovery features. And Nostr's multi-relay architecture, as cumbersome and weird as it is, represents a very different approach to solving the same problems, one that none of these other protocols can even begin to consider emulating, and I believe we have to accept that, embrace it and lean on it more.

We can go there by having whitelisted relays as communities, relays that enforce group rules automatically, relays that provide fulltext search, relays that provide AI-based personalized custom feeds, relays that filter out reply spam or harassment (or enforce blocks at the server-side), relays that restrict reads to a certain selected group, relays that perform curation and make valuable content reemerge from the abyss of the ongoing stream; and of course clients that surface all these different types of relays and their features.

Why is this complex madness better than the super-peer architecture? Because, well, even though custom relays give us all these cool weird features, The basic Nostr feature of being able to follow anyone you want and not giving a super-peer the power to break that link between follower and followed, i.e. the outbox model, is still the most basic function of relays.

-

@ 554ab6fe:c6cbc27e

2025-05-20 15:51:33

@ 554ab6fe:c6cbc27e

2025-05-20 15:51:33Introduction

It is becoming increasingly evident that sunlight is an essential nutrient for the body. To be more precise, the various wavelengths coming from the sun provide different benefits to the body, and each play a vital role in human health. Even more so, they work in concert with one another, as one wavelength may help reduce the potentially harmful effects of another. Benefits are maximized and harm reduced when we are exposed to the full breadth of this rainbow. This article will attempt to shed light on these various benefits and synergies.

To put this discussion into context, it is important to consider the overall health benefits of sunlight exposure. In a Swedish study that followed 29,000 women over 20 years, it was found that the mortality rate was doubled in those who avoided sun exposure when compared to those that didn’t (Lindqvist et al. 2016). Women who avoided the sun were twice as likely to die, primarily from cardiovascular disease, and there was no difference between death from malignant melanoma between the two groups (Lindqvist et al. 2016).

To understand why sunlight is so beneficial to health, it is important to make clear the diverse range of wavelengths that come from the sun. We typically think of the sun as a provider of both visible light and warmth. However, the spectrum of light visible to the human eye is a narrow band of the wavelengths actually emitted by the sun.

As wavelengths become shorter, visible light becomes more blue. Beyond the visible spectrum on the blue end, we arrive at ultraviolet (UV) light. On the other end of the spectrum are the longer red wavelengths. Outside of the visible window on the red side is infrared (IR) light, which provides heat. For helpful context, consider how shorter wavelengths have a harder time penetrating our atmosphere. So, the skies of dawn and dusk are predominately filled with red and near-infrared (NIR) light, while the middle of the day contains more blue and UV light. The bulk of wavelengths from the sun throughout the day are on the NIR end. The entire spectrum of visible and non-visible light between UV and IR plays critical roles in human health, especially towards mitochondrial health and metabolism. To summarize these benefits and provide a general overview for the following article, the benefits are as follows:

- UV – aids in the production of vitamin D and melanin, but also causes DNA damage

- Vitamin D improves immune system function and can repair DNA damage

- Melanin stores electrons for use within mitochondria

- Blue – involved in our circadian rhythm as the absence of blue light triggers the production of melatonin, an important antioxidant.

- Near-infrared (NIR) – improves mitochondria function and energy production while also protecting us from the harms of blue and UV light.

Ultraviolet Light

Let’s begin with a discussion around the widely misunderstood light of UV. UV is often viewed as a dangerous form of light, given that it can cause DNA damage and lead to cancer. While true, this myopic point of view ignores the crucial benefits of UV light. UV light produces vitamin D, which counteracts the DNA damage caused by UV while providing many other benefits. Additionally, UV light triggers the production of melanin, which aids in mitochondrial function. Like all physiological processes in the body that are vital to survival, there is a release of POMC-derived endorphins when skin comes into contact with UV light (Fell et al. 2014). Any person likely reading this article can agree that sitting under the sun simply feels amazing. We are drawn to it in a deeply meaningful sense.

Vitamin D is one of the most important chemicals regarding health, and it is poorly named. The term ‘vitamin’ refers to a compound that is important for health but cannot be adequately made within the body and must be retrieved externally. Peoples of the Northern and Southern hemisphere who are exposed to less UV light during winter would, for example, historically retrieve their vitamin D from foods such as oily fish, seal blubber, whale blubber, and polar bear liver (Wacker and Holick 2013). In a similar way, vitamin D was given its name 100 years ago when it was found that cod-liver oil was capable of curing rickets, when it was found that the so-called vitamin could promote calcium deposition in bones (McCollum et al. 1922). It was only until much later, in 1981, when scientists discovered that human skin could also synthesize vitamin D (M. F. Holick 1981). A majority of human vitamin D is produced by the skin when exposed to UVB (280 – 315 nm), while a minor amount is gained through food (Prietl et al. 2013; Wacker and Holick 2013). Most cells and organs in the human body have vitamin D receptors and many organs also have the ability to produce it, this speaks to the incredibly important nature of this compound towards our health (Prietl et al. 2013; Wacker and Holick 2013). Vitamin D deficiency has been associated with various types of cancer, autoimmune disorders, type 1 diabetes mellitus, multiple sclerosis (MS), cardiovascular disease, and even schizophrenia (Michael F. Holick 2007; Wacker and Holick 2013). Multiple studies have also found that vitamin D deficiency increases all-cause mortality (Garland et al. 2014; Yang et al. 2011; Chowdhury et al. 2014).

Though the historical benefits to vitamin D were attributed mainly to bone health, it is far more important. Vitamin D plays a critical role in protecting against invasive pathogens, reducing autoimmunity, and maintaining overall health (Wimalawansa 2023). Regarding immunity, one way it does this is by causing a shift away from proinflammatory responses to one more centered around T cell activation (Prietl et al. 2013). Vitamin D has therefore been shown to benefit other disorders that are related to immunity, such as a study that found vitamin D supplementation during pregnancy reduced asthmatic symptoms in children (Litonjua et al. 2016). That being said, it is important to highlight how there is no substitution for natural sunlight as a means of getting vitamin D. Naturally produced vitamin D from the skin lasts 2-3 times longer in the body (Wacker and Holick 2013). This is one of many likely reasons why the natural avenue should always be preferred over the supplemental. A similar line of reasoning follows in methods of getting UV light, as natural sun exposure leads to a decrease of all-cause mortality while the use of artificial tanning beds has been shown to increase all-cause and cancer mortality (Yang et al. 2011). More on why this likely occurs later.

Beyond vitamin D’s benefits to the immune system, it is important to focus on the compound’s role in mitochondrial health. In a previous article I wrote titled “Sunlight and Health”, I delve deeper into the importance of mitochondria and the science of how they work. In simplicity, imagine how all life on earth centers around energy. The sun provides energy to the earth, and the plethora of life on earth harness and facilitate the flow of that energy. Plants and animals share a symbiotic relationship within this system. Plants, through photosynthesis, take in sunlight, CO2, and water and create a glucose precursor and oxygen. This occurs within the chloroplast of plant cells. Within human cells, we have mitochondria. Our mitochondria, in turn, take in oxygen and glucose and produce CO2, water, and energy for our bodies in the form of ATP. What the plant breathes out, we breathe in, and vice versa. Mitochondria are central to all animal life on earth, and the ATP produced is central to all physiologic function. If your mitochondria are unhealthy, you are unhealthy and will experience disease.

Vitamin D plays a role in mitochondrial health at a DNA level. Our cells have DNA, which we inherited from our mother and father. On top of that, the mitochondria within our cells have their own set of DNA (mtDNA). Our mitochondria come from our mother’s egg, and therefore our mtDNA always is inherited from our mother. UV light can cause damage to both our DNA and mtDNA (Birch-Machin, Russell, and Latimer 2013). This is what gives UV light the ability to cause cancer. Additionally, damage to the mtDNA within our mitochondria can lead to mitochondrial dysfunction. The more poorly our mitochondria function, the less energy we produce for our cells, and the less healthy our cells become. There is research being developed that suggests the role of vitamin D is to counterbalance this danger by regulating gene transcription and reducing mtDNA damage. A mouse study conducted in 2011, for example, found that different shapes of vitamin D reduce the development of tumors in mice following UV exposure (Dixon et al. 2011). It is not unlike nature to create a system of checks and balances, to ensure that the damaging effects of UV light are counterbalanced by a compound produced by the body when exposure to that same light.

While vitamin D may be important for mitochondrial health by protecting against mtDNA damage, melanin potentially plays a much larger role. Melanin is the pigment in our skin that make us darker. Not only is the diversity in skin tones across humans due to variations in melanin content, but a tan is also the creation of more melanin. To be more specific, the skin’s exposure to UVA (315-400nm) leads to the creation of melanin (Wicks et al. 2011). The most obvious benefit to the production of melanin, which most people could appreciate, is that the darker or tanner our skin is, the less damage we will receive from UV light. In this way, melanin shares a similar responsibility to vitamin D, where both are protecting the body against the very thing that forms them. Even more crucially however, melanin acts as a battery for the mitochondria.

During cellular respiration, where mitochondria turn oxygen and glucose into energy, electrons are stripped from the glucose for use. In other words, what our mitochondria really need are oxygen and electrons, and the glucose is simply a means to an end. If the mitochondria are the engine, then the electrons are the fuel (assuming you are still breathing). Due to its chemical structure, melanin is a natural reversible oxidation-reduction system (Figge 1939). In other words, it can both store and release electrons. Melanin is therefore a kind of battery, retrieving electrons from various sources, and storing them for future use in our mitochondria as a substitute for food. When stated this way, and considering how food is important because both fats and carbohydrates fuel the body by providing electrons to our mitochondria, one can imagine how vitally important melanin is. Melanin is central towards the availability of electrons for use in our body to produce the energy to live. Without adequate melanin, your mitochondria will starve for fuel and not provide your body with the energy it needs to thrive.

Blue Light

To contextualize the role blue light plays in human health, it is important to revisit an important byproduct of cellular respiration within mitochondria. When mitochondria turn electrons and oxygen into energy, there is a byproduct formed known as reactive oxygen species (ROS). ROS play important roles in the body, but in excess they can cause DNA damage and disrupt various cellular processes. For example, UV light causes cancer due to the ROS generated, and studies have found that blue light does the same in both the skin and eyes (Nakashima, Ohta, and Wolf 2017; Abdouh et al. 2024). This research suggests that excess blue light or blue light in isolation can damage the eyes and cause harm like UV light.

Blue and UV light are predominant during the middle of the day. Though both may cause oxidative stress on the body, the body simultaneously counteracts this damage through melatonin. Think of melatonin as the junk remover for mitochondria. Throughout the day mitochondria produce energy, and ROS is formed. During our nighttime sleep, melatonin plays an important role as an antioxidant and removes the excess ROS (Leon et al. 2004).

The relationship between blue light and melatonin is important. During the day, when blue light is present, our body suppresses the production of melatonin (West et al. 2011). When the sun sets and there is no longer a heavy presence of blue light, our body begins to produce melatonin for sleep. This is a central function for how our body gets tired at night and gets ready for sleep. This is also why artificial light at night, from our modern technology, is harmful to human health because it tricks the body into the continual suppression of melatonin production. Without proper melatonin production, our cells buildup too much ROS and this can cause mitochondrial dysfunction and other sleep related issues.

Beyond the importance of getting good sleep and producing melatonin to remove excess ROS from our cells, the existence of artificial light and excess blue light is problematic during the day as well. As stated previously, blue light causes ROS buildup in both the skin and eyes (Nakashima, Ohta, and Wolf 2017; Abdouh et al. 2024). As with most harms from sunlight, our body has adapted with a backup plan. During the day, when blue and UV light is present, there is simultaneous exposure to NIR light (650-1200nm). Recent research suggests that NIR also counterbalances the harm of blue light by increasing melatonin synthesis in the mitochondria (Tan et al. 2023). This highlights the importance of receiving the full spectrum of light from the sun, as one wavelength counterbalances the damages of the other.

Near-Infrared Light

While indoor living has been commonplace for humans across generations, and modern technology has over saturated our bodies with blue light, some recent changes to our technology have made things worse. Incandescent light bulbs emit NIR light, this is why they got warm. However, LED lights do not emit NIR light. Therefore, where people of past generations were potentially exposed to a lot of artificial light at night, this was counterbalanced by the NIR emitted by those same lightbulbs. Now, modern humans use LEDs and spend 93% of our time indoors with zero exposure to NIR, which is 90% of the light emitted by the sun (Tan et al. 2023).

Not only does NIR light protect our bodies from the damaging consequences of blue light, but it similarly protects us against UV light. As stated previously, NIR may result in the production of melatonin within mitochondria during the day, helping protect against the ROS buildup and mtDNA damage. Additionally, research has also found that NIR light protects from UV light in other ways. For example, a study in 2008 found that pretreating skin with NIR light (660nm) prevented sunburns (Barolet and Boucher 2008). Another study found that red and NIR light (620-690nm) altered gene expression and upregulated DNA repair (Kim et al. 2019). Again, this highlights the theme that the body has produced the means to protect itself from the harms of the sun via other rays emitted. However, the protection from harmful rays is best achieved when exposed to the full spectrum of light wavelengths as they change throughout the day. The light of dawn and dusk is predominately red and NIR. Therefore, this research suggests that being exposed to morning light will protect the body from the potentially cancer-causing effects of the UV light later in the day. A human being who lived outside would naturally be exposed to this spectrum of light every day. However, modern humans may be inside in the morning, go to the beach during the middle of the day, and get sunburned because they do not properly receive the full spectrum of light as nature intended every day.

Lastly, it is important to explore the ways NIR improves mitochondrial function. If electrons are the fuel source for this engine, and melatonin is the junk removal, then NIR is the lubricant. NIR improves the energy output of mitochondria, and there are various hypotheses for how this occurs. One hypothesis is that NIR boosts the functionality of cytochrome c oxidase, one of the chromophores used in the electron transport chain (ETC) of cellular respiration within mitochondria (De Freitas and Hamblin 2016). Another involves NIR light’s ability to modify the viscosity of water which increases the efficiency of the final step in the ETC, the ATP synthase (Sommer, Haddad, and Fecht 2015). ATP synthase can be thought of as a kind of pump that produces ATP, in this way NIR can be thought of almost literally as a lubricant for this pump.

Summary

In summary, the research involving how sunlight affects mitochondrial health highlights the importance of the full spectrum of wavelengths, each of which plays a vital role in human health throughout the day. Having exposure to one, without the other, can lead to imbalances and mitochondrial disease. The red and NIR light in the morning helps our mitochondria produce more energy throughout the day, while also preparing our bodies for the beneficial yet dangerous wavelengths to come. In the middle of the day, we receive much more UV and blue light, which help us produce vitamin D and melanin, both central to health and wellness. Once the sun sets, and blue light is absent, we produce melatonin for sleep. During our sleep, the melatonin removes the dangerous byproducts of our energy-producing day, protecting us from disease and preparing us for the following day. Mitochondria are central to human health and life on earth, and the rays from the sun are central to mitochondrial health.

Respecting nature and its cycles is vital for us humans who are increasingly immersing ourselves in a world dominated by technology. Our ancestors did not have to reconcile with these ideas, because life forced these exposures upon them. If we wish to maintain health in our modern world, we must be able to find balance. Even though some might think they can escape into the virtual world, our bodies will always and forever be connected and reliant upon the natural one.

References

Abdouh, Mohamed, Yunxi Chen, Alicia Goyeneche, and Miguel N. Burnier. 2024. “Blue Light-Induced Mitochondrial Oxidative Damage Underlay Retinal Pigment Epithelial Cell Apoptosis.” International Journal of Molecular Sciences 25 (23): 12619.

Barolet, Daniel, and Annie Boucher. 2008. “LED Photoprevention: Reduced MED Response Following Multiple LED Exposures.” Lasers in Surgery and Medicine 40 (2): 106–12.

Birch-Machin, M. A., E. V. Russell, and J. A. Latimer. 2013. “Mitochondrial DNA Damage as a Biomarker for Ultraviolet Radiation Exposure and Oxidative Stress.” The British Journal of Dermatology 169 (s2): 9–14.

Chowdhury, Rajiv, Setor Kunutsor, Anna Vitezova, Clare Oliver-Williams, Susmita Chowdhury, Jessica C. Kiefte-de-Jong, Hassan Khan, et al. 2014. “Vitamin D and Risk of Cause Specific Death: Systematic Review and Meta-Analysis of Observational Cohort and Randomised Intervention Studies.” BMJ (Clinical Research Ed.) 348 (apr01 2): g1903.

De Freitas, Lucas Freitas, and Michael R. Hamblin. 2016. “Proposed Mechanisms of Photobiomodulation or Low-Level Light Therapy.” IEEE Journal of Selected Topics in Quantum Electronics: A Publication of the IEEE Lasers and Electro-Optics Society 22 (3): 348–64.

Dixon, Katie M., Anthony W. Norman, Vanessa B. Sequeira, Ritu Mohan, Mark S. Rybchyn, Vivienne E. Reeve, Gary M. Halliday, and Rebecca S. Mason. 2011. “1α,25(OH)₂-Vitamin D and a Nongenomic Vitamin D Analogue Inhibit Ultraviolet Radiation-Induced Skin Carcinogenesis.” Cancer Prevention Research (Philadelphia, Pa.) 4 (9): 1485–94.

Fell, Gillian L., Kathleen C. Robinson, Jianren Mao, Clifford J. Woolf, and David E. Fisher. 2014. “Skin β-Endorphin Mediates Addiction to UV Light.” Cell 157 (7): 1527–34.

Figge, Frank H. J. 1939. “Melanin: A Natural Reversible Oxidation-Reduction System and Indicator.” Experimental Biology and Medicine (Maywood, N.J.) 41 (1): 127.

Garland, Cedric F., June Jiwon Kim, Sharif Burgette Mohr, Edward Doerr Gorham, William B. Grant, Edward L. Giovannucci, Leo Baggerly, et al. 2014. “Meta-Analysis of All-Cause Mortality According to Serum 25-Hydroxyvitamin D.” American Journal of Public Health 104 (8): e43-50.

Holick, M. F. 1981. “The Cutaneous Photosynthesis of Previtamin D3: A Unique Photoendocrine System.” The Journal of Investigative Dermatology 77 (1): 51–58.

Holick, Michael F. 2007. “Vitamin D Deficiency.” The New England Journal of Medicine 357 (3): 266–81.

Kim, Hyun Soo, Yeo Jin Kim, Su Ji Kim, Doo Seok Kang, Tae Ryong Lee, Dong Wook Shin, Hyoung-June Kim, and Young Rok Seo. 2019. “Transcriptomic Analysis of Human Dermal Fibroblast Cells Reveals Potential Mechanisms Underlying the Protective Effects of Visible Red Light against Damage from Ultraviolet B Light.” Journal of Dermatological Science 94 (2): 276–83.

Leon, Josefa, Dario Acuña-Castroviejo, Rosa M. Sainz, Juan C. Mayo, Dun Xian Tan, and Russel J. Reiter. 2004. “Melatonin and Mitochondrial Function.” Life Sciences. Elsevier Inc. https://doi.org/10.1016/j.lfs.2004.03.003.

Lindqvist, P. G., E. Epstein, K. Nielsen, M. Landin-Olsson, C. Ingvar, and H. Olsson. 2016. “Avoidance of Sun Exposure as a Risk Factor for Major Causes of Death: A Competing Risk Analysis of the Melanoma in Southern Sweden Cohort.” Journal of Internal Medicine 280 (4): 375–87.

Litonjua, Augusto A., Vincent J. Carey, Nancy Laranjo, Benjamin J. Harshfield, Thomas F. McElrath, George T. O’Connor, Megan Sandel, et al. 2016. “Effect of Prenatal Supplementation with Vitamin D on Asthma or Recurrent Wheezing in Offspring by Age 3 Years: The VDAART Randomized Clinical Trial.” JAMA: The Journal of the American Medical Association 315 (4): 362–70.

McCollum, E. V., Nina Simmonds, J. Ernestine Becker, and P. G. Shipley. 1922. “Studies on Experimental Rickets.” The Journal of Biological Chemistry 53 (2): 293–312.

Nakashima, Yuya, Shigeo Ohta, and Alexander M. Wolf. 2017. “Blue Light-Induced Oxidative Stress in Live Skin.” Free Radical Biology & Medicine 108 (July): 300–310.

Prietl, Barbara, Gerlies Treiber, Thomas R. Pieber, and Karin Amrein. 2013. “Vitamin D and Immune Function.” Nutrients 5 (7): 2502–21.

Sommer, Andrei P., Mike Kh Haddad, and Hans Jörg Fecht. 2015. “Light Effect on Water Viscosity: Implication for ATP Biosynthesis.” Scientific Reports 5 (July). https://doi.org/10.1038/srep12029.

Tan, Dun-Xian, Russel J. Reiter, Scott Zimmerman, and Ruediger Hardeland. 2023. “Melatonin: Both a Messenger of Darkness and a Participant in the Cellular Actions of Non-Visible Solar Radiation of near Infrared Light.” Biology 12 (1): 89.

Wacker, Matthias, and Michael F. Holick. 2013. “Sunlight and Vitamin D: A Global Perspective for Health: A Global Perspective for Health.” Dermato-Endocrinology 5 (1): 51–108.

West, Kathleen E., Michael R. Jablonski, Benjamin Warfield, Kate S. Cecil, Mary James, Melissa A. Ayers, James Maida, et al. 2011. “Blue Light from Light-Emitting Diodes Elicits a Dose-Dependent Suppression of Melatonin in Humans.” Journal of Applied Physiology (Bethesda, Md.: 1985) 110 (3): 619–26.

Wicks, Nadine L., Jason W. Chan, Julia A. Najera, Jonathan M. Ciriello, and Elena Oancea. 2011. “UVA Phototransduction Drives Early Melanin Synthesis in Human Melanocytes.” Current Biology: CB 21 (22): 1906.

Wimalawansa, Sunil J. 2023. “Infections and Autoimmunity-the Immune System and Vitamin D: A Systematic Review.” Nutrients 15 (17): 3842.

Yang, Ling, Marie Lof, Marit Bragelien Veierød, Sven Sandin, Hans-Olov Adami, and Elisabete Weiderpass. 2011. “Ultraviolet Exposure and Mortality among Women in Sweden.” Cancer Epidemiology, Biomarkers & Prevention: A Publication of the American Association for Cancer Research, Cosponsored by the American Society of Preventive Oncology 20 (4): 683–90.

- UV – aids in the production of vitamin D and melanin, but also causes DNA damage

-

@ 04c915da:3dfbecc9

2025-05-20 15:47:16

@ 04c915da:3dfbecc9

2025-05-20 15:47:16Here’s a revised timeline of macro-level events from The Mandibles: A Family, 2029–2047 by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes.

Part One: 2029–2032

-

2029 (Early Year)\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor.

-

2029 (Mid-Year: The Great Renunciation)\ Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive.

-

2029 (Late Year)\ Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant.

-

2030–2031\ Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness.

-

2032\ By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured.

Time Jump: 2032–2047

- Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies.

Part Two: 2047

-

2047 (Early Year)\ The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum.

-

2047 (Mid-Year)\ Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency.

-

2047 (Late Year)\ The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society.

Key Differences

- Currency Dynamics: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control.

- Government Power: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities.

- Societal Outcome: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots.

This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory.

-

-

@ 04c915da:3dfbecc9

2025-05-20 15:50:48

@ 04c915da:3dfbecc9

2025-05-20 15:50:48For years American bitcoin miners have argued for more efficient and free energy markets. It benefits everyone if our energy infrastructure is as efficient and robust as possible. Unfortunately, broken incentives have led to increased regulation throughout the sector, incentivizing less efficient energy sources such as solar and wind at the detriment of more efficient alternatives.

The result has been less reliable energy infrastructure for all Americans and increased energy costs across the board. This naturally has a direct impact on bitcoin miners: increased energy costs make them less competitive globally.

Bitcoin mining represents a global energy market that does not require permission to participate. Anyone can plug a mining computer into power and internet to get paid the current dynamic market price for their work in bitcoin. Using cellphone or satellite internet, these mines can be located anywhere in the world, sourcing the cheapest power available.

Absent of regulation, bitcoin mining naturally incentivizes the build out of highly efficient and robust energy infrastructure. Unfortunately that world does not exist and burdensome regulations remain the biggest threat for US based mining businesses. Jurisdictional arbitrage gives miners the option of moving to a friendlier country but that naturally comes with its own costs.

Enter AI. With the rapid development and release of AI tools comes the requirement of running massive datacenters for their models. Major tech companies are scrambling to secure machines, rack space, and cheap energy to run full suites of AI enabled tools and services. The most valuable and powerful tech companies in America have stumbled into an accidental alliance with bitcoin miners: THE NEED FOR CHEAP AND RELIABLE ENERGY.

Our government is corrupt. Money talks. These companies will push for energy freedom and it will greatly benefit us all.

-

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28A violência é uma forma de comunicação

A violência é uma forma de comunicação: um serial killer, um pai que bate no filho, uma briga de torcidas, uma sessão de tortura, uma guerra, um assassinato passional, uma briga de bar. Em todos esses se pode enxergar uma mensagem que está tentando ser transmitida, que não foi compreendida pelo outro lado, que não pôde ser expressa, e, quando o transmissor da mensagem sentiu que não podia ser totalmente compreendido em palavras, usou essa outra forma de comunicação.

Quando uma ofensa em um bar descamba para uma briga, por exemplo, o que há é claramente uma tentativa de uma ofensa maior ainda pelo lado do que iniciou a primeira, a briga não teria acontecido se ele a tivesse conseguido expressar em palavras tão claras que toda a audiência de bêbados compreendesse, o que estaria além dos limites da linguagem, naquele caso, o soco com o mão direita foi mais eficiente. Poderia ser também a defesa argumentativa: "eu não sou um covarde como você está dizendo" -- mas o bar não acreditaria nessa frase solta, a comunicação não teria obtido o sucesso desejado.

A explicação para o fato da redução da violência à medida em que houve progresso da civilização está na melhora da eficiência da comunicação humana: a escrita, o refinamento da expressão lingüística, o aumento do alcance da palavra falada com rádio, a televisão e a internet.

Se essa eficiência diminuir, porque não há mais acordo quanto ao significado das palavras, porque as pessoas não estão nem aí para se o que escrevem é bom ou não, ou porque são incapazes de compreender qualquer coisa, deve aumentar proporcionalmente a violência.

-

@ 04c915da:3dfbecc9

2025-05-20 15:50:22

@ 04c915da:3dfbecc9

2025-05-20 15:50:22There is something quietly rebellious about stacking sats. In a world obsessed with instant gratification, choosing to patiently accumulate Bitcoin, one sat at a time, feels like a middle finger to the hype machine. But to do it right, you have got to stay humble. Stack too hard with your head in the clouds, and you will trip over your own ego before the next halving even hits.

Small Wins

Stacking sats is not glamorous. Discipline. Stacking every day, week, or month, no matter the price, and letting time do the heavy lifting. Humility lives in that consistency. You are not trying to outsmart the market or prove you are the next "crypto" prophet. Just a regular person, betting on a system you believe in, one humble stack at a time. Folks get rekt chasing the highs. They ape into some shitcoin pump, shout about it online, then go silent when they inevitably get rekt. The ones who last? They stack. Just keep showing up. Consistency. Humility in action. Know the game is long, and you are not bigger than it.

Ego is Volatile

Bitcoin’s swings can mess with your head. One day you are up 20%, feeling like a genius and the next down 30%, questioning everything. Ego will have you panic selling at the bottom or over leveraging the top. Staying humble means patience, a true bitcoin zen. Do not try to "beat” Bitcoin. Ride it. Stack what you can afford, live your life, and let compounding work its magic.

Simplicity

There is a beauty in how stacking sats forces you to rethink value. A sat is worth less than a penny today, but every time you grab a few thousand, you plant a seed. It is not about flaunting wealth but rather building it, quietly, without fanfare. That mindset spills over. Cut out the noise: the overpriced coffee, fancy watches, the status games that drain your wallet. Humility is good for your soul and your stack. I have a buddy who has been stacking since 2015. Never talks about it unless you ask. Lives in a decent place, drives an old truck, and just keeps stacking. He is not chasing clout, he is chasing freedom. That is the vibe: less ego, more sats, all grounded in life.

The Big Picture

Stack those sats. Do it quietly, do it consistently, and do not let the green days puff you up or the red days break you down. Humility is the secret sauce, it keeps you grounded while the world spins wild. In a decade, when you look back and smile, it will not be because you shouted the loudest. It will be because you stayed the course, one sat at a time. \ \ Stay Humble and Stack Sats. 🫡

-

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28Formula for making games with satoshis

I think the only way to do in-game sats and make the game more interesting instead of breaking the mechanics is by doing something like

- Asking everybody to pay the same amount to join;

- They get that same amount inside the game as balances;

- They must use these balances to buy items to win the game;

- The money they used becomes available as in-game rewards for other players;

- They must spend some money otherwise they just lose all the time;

- They can't use too much because if they run out of money they are eliminated.

If you think about it, that's how poker mostly works, and it's one of the few games in which paying money to play makes the game more interesting and not less.

In Poker:

- Everybody pays the same amount to join.

- Everybody gets that amount in tokens or whatever, I don't know, this varies;

- Everybody must pay money to bet on each hand;

- The money used on each round is taken by the round winner;

- If you don't bet you can't play the rounds, you're just eliminated;

- If you go all-in all the time like a mad person you'll lose.

In a game like Worms, for example, this could be something like:

- Idem;

- Idem;

- You must use money to buy guns and ammunitions;

- Whatever you spent goes to a pot for the winners or each round -- or maybe it goes to the people that contributed in killing you;

- If you don't buy any guns you're useless;

- If you spend everything on a single gun that's probably unwise.

You can also apply this to games like Counter-Strike or Dota or even Starcraft or Bolo and probably to most games as long as they have a fixed duration with a fixed set of players.

The formula is not static nor a panacea. There is room for creativity on what each player can spend their money in and how the spent money is distributed during the game. Some hard task of balancing and incentivizing is still necessary so the player that starts winning doesn't automatically win for having more money as the game goes on.

-

@ 6ad3e2a3:c90b7740

2025-05-20 13:49:50

@ 6ad3e2a3:c90b7740

2025-05-20 13:49:50I’ve written about MSTR twice already, https://www.chrisliss.com/p/mstr and https://www.chrisliss.com/p/mstr-part-2, but I want to focus on legendary short seller James Chanos’ current trade wherein he buys bitcoin (via ETF) and shorts MSTR, in essence to “be like Mike” Saylor who sells MSTR shares at the market and uses them to add bitcoin to the company’s balance sheet. After all, if it’s good enough for Saylor, why shouldn’t everyone be doing it — shorting a company whose stock price is more than 2x its bitcoin holdings and using the proceeds to buy the bitcoin itself?

Saylor himself has said selling shares at 2x NAV (net asset value) to buy bitcoin is like selling dollars for two dollars each, and Chanos has apparently decided to get in while the getting (market cap more than 2x net asset value) is good. If the price of bitcoin moons, sending MSTR’s shares up, you are more than hedged in that event, too. At least that’s the theory.

The problem with this bet against MSTR’s mNAV, i.e., you are betting MSTR’s market cap will converge 1:1 toward its NAV in the short and medium term is this trade does not exist in a vacuum. Saylor has described how his ATM’s (at the market) sales of shares are accretive in BTC per share because of this very premium they carry. Yes, we’ll dilute your shares of the company, but because we’re getting you 2x the bitcoin per share, you are getting an ever smaller slice of an ever bigger overall pie, and the pie is growing 2x faster than your slice is reducing. (I https://www.chrisliss.com/p/mstr how this works in my first post.)

But for this accretion to continue, there must be a constant supply of “greater fools” to pony up for the infinitely printable shares which contain only half their value in underlying bitcoin. Yes, those shares will continue to accrete more BTC per share, but only if there are more fools willing to make this trade in the future. So will there be a constant supply of such “fools” to keep fueling MSTR’s mNAV multiple indefinitely?

Yes, there will be in my opinion because you have to look at the trade from the prospective fools’ perspective. Those “fools” are not trading bitcoin for MSTR, they are trading their dollars, selling other equities to raise them maybe, but in the end it’s a dollars for shares trade. They are not selling bitcoin for them.

You might object that those same dollars could buy bitcoin instead, so they are surely trading the opportunity cost of buying bitcoin for them, but if only 5-10 percent of the market (or less) is buying bitcoin itself, the bucket in which which those “fools” reside is the entire non-bitcoin-buying equity market. (And this is not considering the even larger debt market which Saylor has yet to tap in earnest.)

So for those 90-95 percent who do not and are not presently planning to own bitcoin itself, is buying MSTR a fool’s errand, so to speak? Not remotely. If MSTR shares are infinitely printable ATM, they are still less so than the dollar and other fiat currencies. And MSTR shares are backed 2:1 by bitcoin itself, while the fiat currencies are backed by absolutely nothing. So if you hold dollars or euros, trading them for MSTR shares is an errand more sage than foolish.

That’s why this trade (buying BTC and shorting MSTR) is so dangerous. Not only are there many people who won’t buy BTC buying MSTR, there are many funds and other investment entities who are only able to buy MSTR.

Do you want to get BTC at 1:1 with the 5-10 percent or MSTR backed 2:1 with the 90-95 percent. This is a bit like medical tests that have a 95 percent accuracy rate for an asymptomatic disease that only one percent of the population has. If someone tests positive, it’s more likely to be a false one than an indication he has the disease*. The accuracy rate, even at 19:1, is subservient to the size of the respective populations.

At some point this will no longer be the case, but so long as the understanding of bitcoin is not widespread, so long as the dollar is still the unit of account, the “greater fools” buying MSTR are still miles ahead of the greatest fools buying neither, and the stock price and mNAV should only increase.

. . .

One other thought: it’s more work to play defense than offense because the person on offense knows where he’s going, and the defender can only react to him once he moves. Similarly, Saylor by virtue of being the issuer of the shares knows when more will come online while Chanos and other short sellers are borrowing them to sell in reaction to Saylor’s strategy. At any given moment, Saylor can pause anytime, choosing to issue convertible debt or preferred shares with which to buy more bitcoin, and the shorts will not be given advance notice.

If the price runs, and there is no ATM that week because Saylor has stopped on a dime, so to speak, the shorts will be left having to scramble to change directions and buy the shares back to cover. Their momentum might be in the wrong direction, though, and like Allen Iverson breaking ankles with a crossover, Saylor might trigger a massive short squeeze, rocketing the share price ever higher. That’s why he actually welcomes Chanos et al trying this copycat strategy — it becomes the fuel for outsized gains.

For that reason, news that Chanos is shorting MSTR has not shaken my conviction, though there are other more pertinent https://www.chrisliss.com/p/mstr-part-2 with MSTR, of which one should be aware. And as always, do your own due diligence before investing in anything.

* To understand this, consider a population of 100,000, with one percent having a disease. That means 1,000 have it, 99,000 do not. If the test is 95 percent accurate, and everyone is tested, 950 of the 1,000 will test positive (true positives), 50 who have it will test negative (false negatives.) Of the positives, 95 percent of 99,000 (94,050) will test negative (true negatives) and five percent (4,950) will test positive (false positives). That means 4,950 out of 5,900 positives (84%) will be false.

-

@ 57d1a264:69f1fee1

2025-05-20 06:15:51

@ 57d1a264:69f1fee1

2025-05-20 06:15:51Deliberate (?) trade-offs we make for the sake of output speed.

... By sacrificing depth in my learning, I can produce substantially more work. I’m unsure if I’m at the correct balance between output quantity and depth of learning. This uncertainty is mainly fueled by a sense of urgency due to rapidly improving AI models. I don’t have time to learn everything deeply. I love learning, but given current trends, I want to maximize immediate output. I’m sacrificing some learning in classes for more time doing outside work. From a teacher’s perspective, this is obviously bad, but from my subjective standpoint, it’s unclear.

Finding the balance between learning and productivity. By trade, one cannot be productive in specific areas without first acquire the knowledge to define the processes needed to deliver. Designing the process often come on a try and fail dynamic that force us to learn from previous mistakes.

I found this little journal story fun but also little sad. Vincent's realization, one of us trading his learnings to be more productive, asking what is productivity without quality assurance?

Inevitably, parts of my brain will degenerate and fade away, so I need to consciously decide what I want to preserve or my entire brain will be gone. What skills am I NOT okay with offloading? What do I want to do myself?

Read Vincent's journal https://vvvincent.me/llms-are-making-me-dumber/

https://stacker.news/items/984361

-

@ 57d1a264:69f1fee1

2025-05-20 06:02:26

@ 57d1a264:69f1fee1

2025-05-20 06:02:26Digital Psychology ↗Wall of impact website showcase a collection of success metrics and micro case studies to create a clear, impactful visual of your brand's achievements. It also displays a Wall of love with an abundance of testimonials in one place, letting the sheer volume highlight your brand's popularity and customer satisfaction.

And like these, many others collections like Testimonial mashup that combine multiple testimonials into a fast-paced, engaging reel that highlights key moments of impact in an attention-grabbing format.

Awards and certifications of websites highlighting third-party ratings and verification to signal trust and quality through industry-recognized achievements and standards.

View them all at https://socialproofexamples.com/

https://stacker.news/items/984357

-

@ 91117f2b:111207d6

2025-05-20 15:27:21

@ 91117f2b:111207d6

2025-05-20 15:27:21

Mata mask is a very popular digital wallet and power extension which allows users to interact with etherium the blockchain and other compatible networks. In this article we will explore the benefits and features of using Meta mask,as and also provide a step by step on how to get started.

WHAT IS META MASK MANY will ask what is meta mask, it is a soft ware wallet which allows the users to receive store and also send etherium and other tokens. You can find them in your browsers like playstore Google chrome and so on.

THEY ARE KEY FEATURES WHEN USING A META MASK 1. BLOCKCHAIN INTERACTIONS : meta mask allows you to interact with decentralized applications and also smart contracts on etherium blockchain. 2. CUSTOMIZABLE:meta mask allows the user to hod or her experience and choosing which networks to interact with. 3. SECURE STORAGE: metamask stores your privately key securely, allowing you to make use of your digital assets with confidence.

THE BENEFITS OF USING META MASK 1. NFTs: meta mask allows you to buy, sell and store no fungible tokens 'nft' on platforms like rarible and so on.

-

DECENTRALIZED FINANCE: meta mask allows you to access a large range of decentralized applications including trading, and borrowing and also trading platforms.

-

SMART CONTRACTS INTERACTIONS: meta mask also allows you to interact with decentralized governance and other blockchain-based applications.

WHEN GETTING STARTED WITH META MASK 1. Install the meta mask app 2. Create a wallet. 3. Fund your wallet by transferring etherium or other supported tokens to your wallet. 4. Explore the app by browsing decentralized applications and smart contracts on the etherium blockchain.

IN conclusion, meta mask is suitable for anyone looking to interact with etherium blockchain and other compatible networks. It is also suitable for anyone who is interested in decentralized finance, smart contracts interactions even NFTs.

-

-

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28The problem with ION

ION is a DID method based on a thing called "Sidetree".

I can't say for sure what is the problem with ION, because I don't understand the design, even though I have read all I could and asked everybody I knew. All available information only touches on the high-level aspects of it (and of course its amazing wonders) and no one has ever bothered to explain the details. I've also asked the main designer of the protocol, Daniel Buchner, but he may have thought I was trolling him on Twitter and refused to answer, instead pointing me to an incomplete spec on the Decentralized Identity Foundation website that I had already read before. I even tried to join the DIF as a member so I could join their closed community calls and hear what they say, maybe eventually ask a question, so I could understand it, but my entrance was ignored, then after many months and a nudge from another member I was told I had to do a KYC process to be admitted, which I refused.

One thing I know is:

- ION is supposed to provide a way to rotate keys seamlessly and automatically without losing the main identity (and the ION proponents also claim there are no "master" keys because these can also be rotated).

- ION is also not a blockchain, i.e. it doesn't have a deterministic consensus mechanism and it is decentralized, i.e. anyone can publish data to it, doesn't have to be a single central server, there may be holes in the available data and the protocol doesn't treat that as a problem.

- From all we know about years of attempts to scale Bitcoins and develop offchain protocols it is clear that you can't solve the double-spend problem without a central authority or a kind of blockchain (i.e. a decentralized system with deterministic consensus).

- Rotating keys also suffer from the double-spend problem: whenever you rotate a key it is as if it was "spent", you aren't supposed to be able to use it again.

The logic conclusion of the 4 assumptions above is that ION is flawed: it can't provide the key rotation it says it can if it is not a blockchain.

See also

-

@ cae03c48:2a7d6671

2025-05-20 15:26:52

@ cae03c48:2a7d6671

2025-05-20 15:26:52Bitcoin Magazine

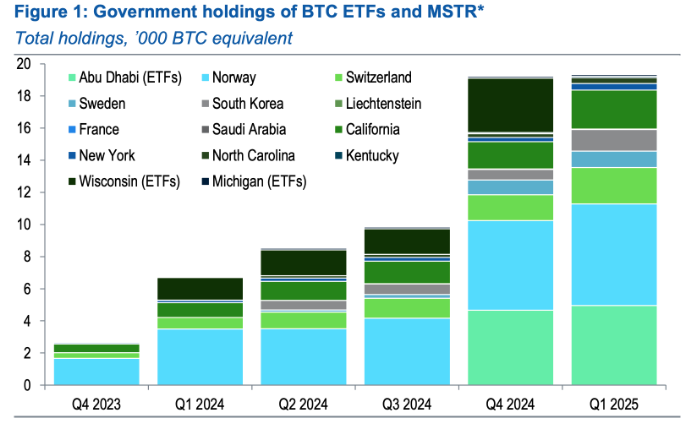

Standard Chartered Backs $500K Bitcoin Target, Citing Growing Government Exposure Through MSTRSovereign investment in Bitcoin is accelerating—just not always in the most direct way. In a new report, Standard Chartered Bank says indirect exposure via Strategy (formerly MicroStrategy) is quietly increasing among government entities, reinforcing the bank’s long-standing price prediction that Bitcoin will reach $500,000 before President Donald Trump leaves office in 2029.

JUST IN:

Standard Chartered says SEC 13F fillings support #Bitcoin reaching $500,000 by 2028

Standard Chartered says SEC 13F fillings support #Bitcoin reaching $500,000 by 2028  pic.twitter.com/MURg9bxLka

pic.twitter.com/MURg9bxLka— Bitcoin Magazine (@BitcoinMagazine) May 20, 2025

“The latest 13F data from the U.S. Securities and Exchange Commission (SEC) supports our core thesis that Bitcoin (BTC) will reach the $500,000 level before Trump leaves office as it attracts a wider range of institutional buyers,” wrote Geoffrey Kendrick, Standard Chartered’s global head of digital assets research. “As more investors gain access to the asset and as volatility falls, we believe portfolios will migrate towards their optimal level from an underweight starting position in BTC.”

Q1 13F filings revealed a slowdown in direct bitcoin ETF buying—Wisconsin’s state fund exited its entire 3,400 BTC-equivalent IBIT position—while government-linked purchases of MSTR shares were on the rise. Abu Dhabi’s Mubadala, for instance, upped its IBIT exposure to 5,000 BTC equivalent, but Kendrick says the bigger story is elsewhere.

“We believe that in some cases, MSTR holdings by government entities reflect a desire to gain Bitcoin exposure where local regulations do not allow direct BTC holdings,” he said.

France and Saudi Arabia took first-time MSTR positions in Q1. Meanwhile, Norway’s Government Pension Fund, the Swiss National Bank, and South Korea’s public funds each added exposure equivalent to 700 BTC. U.S. retirement funds in states like California and New York added a combined 1,000 BTC equivalent via MSTR. Kendrick called the trend “very encouraging.”

“The quarterly 13F data is the best test of our thesis that BTC will attract new institutional buyer types as the market matures, helping the price reach our USD 500,000 level,” Kendrick said. “When institutions buy Bitcoin, prices tend to rise.”

SEC DATA BACKS BITCOIN $500K TARGET BY 2028: STANDARD CHARTERED

Standard Chartered's Geoff Kendrick says recent SEC 13F filings support a possible rise in Bitcoin to $500,000 by end-2028. While direct ETF holdings dipped in Q1, government entities boosted stakes in Strategy…

— *Walter Bloomberg (@DeItaone) May 20, 2025

This isn’t Kendrick’s first bullish call. Last month, he admitted his prior $120K forecast for Q2 2025 was “too low,” citing surging inflows into U.S. spot BTC ETFs—totaling $5.3 billion over just three weeks. At the time, Kendrick revised his 2025 year-end target to $200,000.

Standard Chartered’s latest analysis shows that Bitcoin’s role in institutional portfolios is maturing beyond tech volatility correlation—now increasingly seen as a macro hedge. “It is now all about flows,” Kendrick said. “And flows are coming in many forms.”

This post Standard Chartered Backs $500K Bitcoin Target, Citing Growing Government Exposure Through MSTR first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28The illusion of note-taking

Most ideas come to me while I'm nowhere near a computer, so it's impossible to note them all down.