-

@ 6e0ea5d6:0327f353

2025-06-19 04:48:06

@ 6e0ea5d6:0327f353

2025-06-19 04:48:06Ascolta! There is an illusion nurtured by the weak that worrying about everything and everyone is a virtue. A great mistake.

Excessive compassion is often just an excuse for incompetence. While you waste away over the country’s woes, the problems of those around you, or a friend’s existential crisis, your own life rots.

Let every man carry the cross he forged. Do not become a dumping ground for tears that are not yours. Other people’s problems are like dirty laundry — each one should wash their own. Your duty is to your own name, your own blood, your own honor. While you spend sleepless nights worrying about national unemployment or the chronic heartbreak of a friend, someone else, quietly, is building the wealth you’ll never have. Because in the end, my friend, the one who drowns trying to save others is always remembered as a well-meaning fool.

Stop with the cheap sentimentalism. True selfishness is what they do to you: placing on your back the weight of responsibilities that were never yours to bear. They make mistakes, wreak havoc, reap the storms they’ve sown... and like rats fleeing a sinking ship, they come seeking refuge in your boat. They want you to solve everything, clean up their mess, pay their bills, carry their shame. And they call it “heartlessness” when you refuse.

Davvero, when it’s you in the gutter, dignity shattered and pockets empty, few — very few — will even bother to ask if you’re still alive. And even those few will first measure the value of your fall before deciding whether to help.

Make money. Gain power. Build a wall between your family and the emotional misery of others. It’s not selfishness — it’s intelligence. The real mistake is trying to carry the world on your back when you can barely support your own spine.

And if some hypocrite dares to call you selfish, smile with contempt. Better to be called cold by those who build nothing than to be dragged into the mud by those who already live in it.

Thank you for reading, my friend!

If this message resonated with you, consider leaving your "🥃" as a token of appreciation.

A toast to our family!

-

@ dfa02707:41ca50e3

2025-06-19 04:02:11

@ dfa02707:41ca50e3

2025-06-19 04:02:11

Good morning (good night?)! The No Bullshit Bitcoin news feed is now available on Moody's Dashboard! A huge shoutout to sir Clark Moody for integrating our feed.

Headlines

- Spiral welcomes Ben Carman. The developer will work on the LDK server and a new SDK designed to simplify the onboarding process for new self-custodial Bitcoin users.

- The Bitcoin Dev Kit Foundation announced new corporate members for 2025, including AnchorWatch, CleanSpark, and Proton Foundation. The annual dues from these corporate members fund the small team of open-source developers responsible for maintaining the core BDK libraries and related free and open-source software (FOSS) projects.

- Strategy increases Bitcoin holdings to 538,200 BTC. In the latest purchase, the company has spent more than $555M to buy 6,556 coins through proceeds of two at-the-market stock offering programs.

- Spar supermarket experiments with Bitcoin payments in Zug, Switzerland. The store has introduced a new payment method powered by the Lightning Network. The implementation was facilitated by DFX Swiss, a service that supports seamless conversions between bitcoin and legacy currencies.

- The Bank for International Settlements (BIS) wants to contain 'crypto' risks. A report titled "Cryptocurrencies and Decentralised Finance: Functions and Financial Stability Implications" calls for expanding research into "how new forms of central bank money, capital controls, and taxation policies can counter the risks of widespread crypto adoption while still fostering technological innovation."

- "Global Implications of Scam Centres, Underground Banking, and Illicit Online Marketplaces in Southeast Asia." According to the United Nations Office on Drugs and Crime (UNODC) report, criminal organizations from East and Southeast Asia are swiftly extending their global reach. These groups are moving beyond traditional scams and trafficking, creating sophisticated online networks that include unlicensed cryptocurrency exchanges, encrypted communication platforms, and stablecoins, fueling a massive fraud economy on an industrial scale.

- Slovenia is considering a 25% capital gains tax on Bitcoin profits for individuals. The Ministry of Finance has proposed legislation to impose this tax on gains from cryptocurrency transactions, though exchanging one cryptocurrency for another would remain exempt. At present, individual 'crypto' traders in Slovenia are not taxed.

- Circle, BitGo, Coinbase, and Paxos plan to apply for U.S. bank charters or licenses. According to a report in The Wall Street Journal, major crypto companies are planning to apply for U.S. bank charters or licenses. These firms are pursuing limited licenses that would permit them to issue stablecoins, as the U.S. Congress deliberates on legislation mandating licensing for stablecoin issuers.

"Established banks, like Bank of America, are hoping to amend the current drafts of [stablecoin] legislation in such a way that nonbanks are more heavily restricted from issuing stablecoins," people familiar with the matter told The Block.

- Charles Schwab to launch spot Bitcoin trading by 2026. The financial investment firm, managing over $10 trillion in assets, has revealed plans to introduce spot Bitcoin trading for its clients within the next year.

Use the tools

- Bitcoin Safe v1.2.3 expands QR SignMessage compatibility for all QR-UR-compatible hardware signers (SpecterDIY, KeyStone, Passport, Jade; already supported COLDCARD Q). It also adds the ability to import wallets via QR, ensuring compatibility with Keystone's latest firmware (2.0.6), alongside other improvements.

- Minibits v0.2.2-beta, an ecash wallet for Android devices, packages many changes to align the project with the planned iOS app release. New features and improvements include the ability to lock ecash to a receiver's pubkey, faster confirmations of ecash minting and payments thanks to WebSockets, UI-related fixes, and more.

- Zeus v0.11.0-alpha1 introduces Cashu wallets tied to embedded LND wallets. Navigate to Settings > Ecash to enable it. Other wallet types can still sweep funds from Cashu tokens. Zeus Pay now supports Cashu address types in Zaplocker, Cashu, and NWC modes.

- LNDg v1.10.0, an advanced web interface designed for analyzing Lightning Network Daemon (LND) data and automating node management tasks, introduces performance improvements, adds a new metrics page for unprofitable and stuck channels, and displays warnings for batch openings. The Profit and Loss Chart has been updated to include on-chain costs. Advanced settings have been added for users who would like their channel database size to be read remotely (the default remains local). Additionally, the AutoFees tool now uses aggregated pubkey metrics for multiple channels with the same peer.

- Nunchuk Desktop v1.9.45 release brings the latest bug fixes and improvements.

- Blockstream Green iOS v4.1.8 has renamed L-BTC to LBTC, and improves translations of notifications, login time, and background payments.

- Blockstream Green Android v4.1.8 has added language preference in App Settings and enables an Android data backup option for disaster recovery. Additionally, it fixes issues with Jade entry point PIN timeout and Trezor passphrase input.

- Torq v2.2.2, an advanced Lightning node management software designed to handle large nodes with over 1000 channels, fixes bugs that caused channel balance to not be updated in some cases and channel "peer total local balance" not getting updated.

- Stack Wallet v2.1.12, a multicoin wallet by Cypher Stack, fixes an issue with Xelis introduced in the latest release for Windows.

- ESP-Miner-NerdQAxePlus v1.0.29.1, a forked version from the NerdAxe miner that was modified for use on the NerdQAxe+, is now available.

- Zark enables sending sats to an npub using Bark.

- Erk is a novel variation of the Ark protocol that completely removes the need for user interactivity in rounds, addressing one of Ark's key limitations: the requirement for users to come online before their VTXOs expire.

- Aegis v0.1.1 is now available. It is a Nostr event signer app for iOS devices.

- Nostash is a NIP-07 Nostr signing extension for Safari. It is a fork of Nostore and is maintained by Terry Yiu. Available on iOS TestFlight.

- Amber v3.2.8, a Nostr event signer for Android, delivers the latest fixes and improvements.

- Nostur v1.20.0, a Nostr client for iOS, adds

-

@ eb0157af:77ab6c55

2025-06-19 04:01:51

@ eb0157af:77ab6c55

2025-06-19 04:01:51Only 1% of stablecoin transactions in 2024 are linked to criminal activity.

A recent report by TRM Labs has revealed new data on stablecoin usage in 2024. Contrary to widespread perception, 99% of stablecoin transactions were entirely legal and compliant with existing regulations.

The research shows that over 60% of last year’s total transaction volume was conducted using dollar-pegged tokens.

One key point highlighted in the report is the intrinsic traceability of stablecoins. Operating on public blockchains, these digital currencies allow for highly precise transaction monitoring through specialized analytics tools.

Issuers of centralized tokens like USDT and USDC also have the ability to freeze or permanently remove tokens associated with illicit activities.

TRM Labs data shows a 24% decrease in crypto-related criminal activity compared to 2023, with a total of $45 billion representing just 0.4% of overall crypto transaction volume. This decline is attributed to increased law enforcement efforts, stronger industry collaboration, and the growing adoption of advanced analytics tools.

According to TRM Labs, regulatory clarity provided by legislation such as the GENIUS Act could accelerate stablecoin adoption among major banks, financial institutions, and corporations. Many of these entities are already testing stablecoin-based infrastructures for cross-border payments, supply chain management, and programmable finance.

The post Stablecoins: new report debunks myths about illicit use appeared first on Atlas21.

-

@ b1ddb4d7:471244e7

2025-06-19 04:01:30

@ b1ddb4d7:471244e7

2025-06-19 04:01:30In a quiet corner of the world, bitcoin mining operations in Africa are turning electricity into digital currency and in the process, redefining how value is created.

At its core, bitcoin mining involves validating transaction information before adding new blocks to the Bitcoin blockchain by competing to solve a cryptographic puzzle that meets a specific criterion.

Globally, mining plays a key role in keeping the blockchain decentralized and secure. The system depends on miners to verify and record transactions, mainly to prevent a problem called double spending, the digital version of using the same money twice.

To understand this better, imagine Charles sends $5 to Amanda. With physical cash, Amanda can trust the note is real and hasn’t been used elsewhere. But with digital currency, copying data is easy, so how can she be sure that the same $5 wasn’t sent to someone else too? That’s the exact problem Bitcoin mining helps solve.

In recent years, Africa has started to draw attention in this space, positioning itself as a key hub in global bitcoin mining. While there may be less than 2 million bitcoin left to be mined from the total 21 million supply, the rise of mining operations in Africa has sparked excitement, creating new jobs and drawing in foreign capital.

Although some countries still grapple with power shortages and the energy demands of mining, many citizens view bitcoin as a more stable store of value and a safeguard against the volatility of their local currencies.

At the same time, Africa’s wealth of hydro, solar, wind, and geothermal resources makes the continent one of the most promising regions for cost-effective and sustainable mining.

What Makes a Large-Scale Bitcoin Mining Operation in Africa?

It all starts with difficulty. Bitcoin mining isn’t just about solving a puzzle, it’s about solving one that keeps getting harder. Mining difficulty refers to how much computational work is needed to generate a number lower than the target hash.

This difficulty automatically adjusts every 2,016 blocks (about every two weeks), depending on how quickly miners solved the previous batch. If mining is fast and efficient, the network increases the difficulty; if miners drop off and block times slow, it reduces it, all to maintain a consistent block production time of roughly 10 minutes.

The significance of mining difficulty lies in the increased demands it places on mining operations. As difficulty rises, miners require more powerful hardware, cost-effective energy sources, advanced infrastructure, and substantial financial investment. These requirements distinguish large-scale mining operations from smaller, casual miners.

In short, it’s the difficulty of mining that births the need for large facilities, massive energy inputs, industrial-grade hardware, and significant financial investment, the very traits that define a “large” bitcoin mining operation.

This leads us to the 4 key factors that define large Bitcoin mining operations in Africa, each one a direct response to the growing demands of the network:

1. Facility size and infrastructure:

The physical size of a mining facility is a direct reflection of its capacity to house mining equipment and support systems. Larger operations typically have thousands of mining rigs installed, supported by extensive infrastructure such as advanced cooling systems and stable power supplies.

These are critical to ensure that the equipment runs continuously and efficiently, given the intense heat and electricity demands of mining.

While it is possible to mine Bitcoin using desktop computers or gaming rigs by joining mining pools, these setups are limited in profitability. Mining pools distribute rewards based on the computational power contributed, meaning small or less efficient machines earn only modest returns.

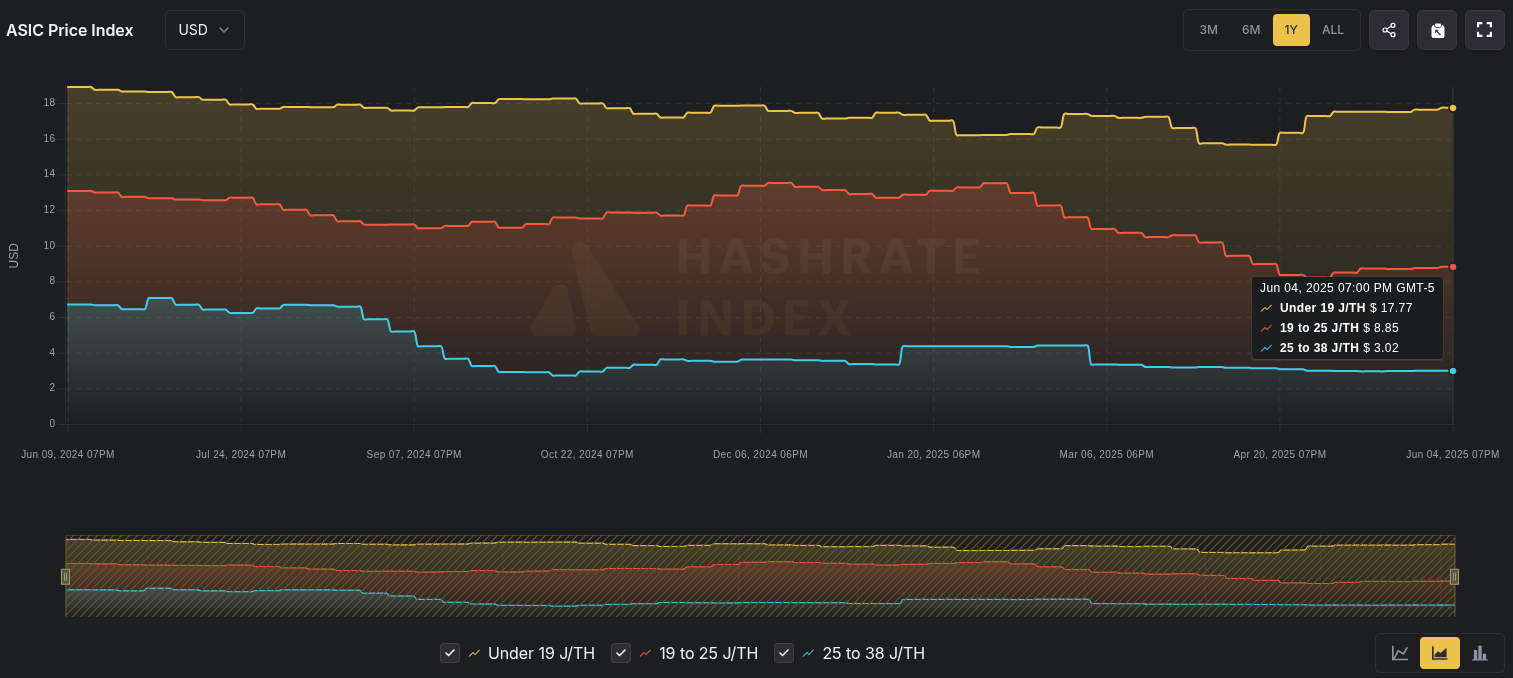

To compete effectively, mining operations invest in specialized hardware known as Application-Specific Integrated Circuit (ASIC) miners. These machines are far more powerful and energy-efficient than regular computers but require significant capital investment, with prices ranging from $4,000 to $12,000 per rig depending on their performance.

Large-scale operations typically deploy hundreds or thousands of these ASIC miners, which necessitates the large facilities and sophisticated infrastructure mentioned earlier. In this way, the size of the facility and the sophistication of the mining equipment are tightly linked, together defining the overall scale and capability of a bitcoin mining operation.

2. Hashrate contribution:

Hashrate refers to the computational power used to mine and process transactions on the Bitcoin network. A higher hashrate indicates a more significant contribution to the network’s security and transaction processing.

Large mining operations often possess substantial hashrate, measured in exa hashes per second (EH/s). For instance, as of July 2024, the Bitcoin network’s hashrate was approximately 733.41 EH/s.

3. Energy consumption and power source:

Bitcoin mining is energy-intensive. The total energy consumption of the Bitcoin network has been estimated at 175.87 terawatt-hours annually, comparable to the power consumption of Poland. Large mining operations often seek locations with access to cheap and reliable energy sources, such as hydroelectric, solar, or wind power, to reduce operational costs and environmental impact.

4. Financial banking and investor interest:

Significant financial investment is required to establish and maintain large-scale mining operations. This includes the cost of mining hardware, facility construction, energy procurement, and operational expenses. Companies with substantial financial backing can invest in cutting-edge technology and infrastructure, enhancing their mining capabilities.

Overview of Bitcoin Mining in Africa

Africa is beginning to carve out its share of the global Bitcoin mining market, which was valued at $2.45 billion in 2024 and is projected to reach $8.24 billion by 2034.

As Bitcoin’s value continues to rise, countries across the continent are positioning themselves to benefit, many by tapping into abundant renewable energy sources and taking advantage of regulatory ambiguity or excess energy production.

Ethiopia currently leads the continent in Bitcoin mining activity, with around 2.5% of the global hashrate reportedly coming from operations powered entirely by renewable energy.

This energy mismatch has attracted major miners from China and other regions, who see an opportunity to monetize surplus electricity. Ethiopia’s success showcases how renewable energy and mining can coexist sustainably while contributing meaningfully to state revenue.

Kenya follows closely behind. As the top geothermal energy producer in Africa, with an installed capacity of 863 MW, the country is using its energy advantage to support sustainable mining.

Nigeria is emerging as a serious contender. While not yet dominant, its large population, increasing tech engagement, and growing interest in using flared gas for mining signal potential for expansion. Nigeria’s complex but evolving regulatory landscape also leaves room for further mining developments as the government explores clearer crypto frameworks.

Malawi represents a more localized model of Bitcoin mining. By converting rainfall-powered microgrids into revenue-generating infrastructure, Malawi shows how small-scale mining can play a powerful role in community development and rural electrification.

In Libya, Bitcoin mining is technically illegal, but that hasn’t stopped it. Despite the ban, underground mining continues to thrive thanks to heavily subsidized electricity. In 2021, Libyan miners accounted for an estimated 0.6% of the global Bitcoin production, the highest in both the Arab world and Africa at the time. Today, mining reportedly consumes around 2% of the country’s electricity, even as it operates in the shadows.

Angola rounds out the list with limited public data but notable potential. The country struggles with energy inefficiencies, losing nearly 40% of its hydroelectric power during transmission. Some reports suggest Bitcoin miners are beginning to capitalize on this otherwise stranded energy, though large-scale operations are yet to surface.

What unites these countries is a shared set of conditions: untapped or mismanaged energy resources, an openness or gray area in regulation, and the growing understanding that Bitcoin mining can serve as a financial incentive to build and stabilize decentralized energy systems.

Whether through massive hydroelectric projects or rural microgrids, Bitcoin mining is emerging as both an energy monetization strategy and a bridge to infrastructure development across Africa.

Profiles of the Largest Bitcoin Mining Operations in Africa

1. BitCluster (Ethiopia)

As of 2024, Bitcoin mining in Africa is largely concentrated in

-

@ cae03c48:2a7d6671

2025-06-19 04:01:09

@ cae03c48:2a7d6671

2025-06-19 04:01:09Bitcoin Magazine

The Blockchain Group Buys $20 Million Worth Of BitcoinThe Blockchain Group has acquired an additional 182 Bitcoin for approximately €17 million ($19.6 million), further expanding its position as Europe’s first Bitcoin treasury company amid accelerating institutional adoption of Bitcoin reserves.

According to a press release issued June 18, the Euronext Growth Paris-listed company completed the purchases through multiple convertible bond issuances totalling over €18 million, subscribed by several investors, including UTXO Management, Moonlight Capital, and asset manager TOBAM.

JUST IN:

French publicly traded, The Blockchain Group buys an additional 182 #Bitcoin for €17.0 million

French publicly traded, The Blockchain Group buys an additional 182 #Bitcoin for €17.0 million Nothing stops this train

pic.twitter.com/fwIqq934Yy

pic.twitter.com/fwIqq934Yy— Bitcoin Magazine (@BitcoinMagazine) June 18, 2025

The acquisitions bring The Blockchain Group’s total Bitcoin holdings to 1,653 BTC, purchased at an average price of €90,081 ($104,000) per coin. The company reported a “BTC Yield” – measuring Bitcoin holdings relative to fully diluted shares – of 1,173.2% year-to-date, significantly outpacing other major corporate holders.

The company’s latest purchases were executed through Swissquote Bank Europe and Banque Delubac, with custody provided by Swiss infrastructure provider Taurus. Additional funding came from the conversion of share warrants into 2.98 million ordinary shares, raising €1.6 million.

We’re seeing unprecedented growth in corporate Bitcoin treasury strategies. The Blockchain Group’s success has created a model for European companies, with new organizations announcing Bitcoin purchases almost weekly.

The company indicated potential plans to acquire an additional 70 BTC through ongoing transactions, which could bring its total holdings to 1,723 BTC. This follows recent Bitcoin treasury announcements from companies including Metaplanet, which now holds 10,000 BTC, and Strategy’s latest acquisition of 10,1000 BTC.

At press time, Bitcoin trades at $104,021, down 1.26% over the past 24 hours, as markets continue to process the implications of growing institutional adoption. The Blockchain Group’s shares were down 3.9% to €4.80 on Wednesday, trading on Euronext Paris.

This post The Blockchain Group Buys $20 Million Worth Of Bitcoin first appeared on Bitcoin Magazine and is written by Vivek Sen.

-

@ cae03c48:2a7d6671

2025-06-19 04:01:08

@ cae03c48:2a7d6671

2025-06-19 04:01:08Bitcoin Magazine

K33 Announces Plans To Purchase Up To 1,000 BitcoinK33 AB, a leading digital asset brokerage and research firm, announced today the launch of a SEK 85 million direct share issue to fund the purchase of Bitcoin. The company aims to build Bitcoin as a core asset on its balance sheet, targeting the accumulation of up to 1,000 BTC as a strategic reserve.

PRESS RELEASE: K33 launches a share issue to finance the purchase of up to 1000 Bitcoin, with a minimum of SEK 85 million secured through pre-commitments pic.twitter.com/sG1LZjR6EI

PRESS RELEASE: K33 launches a share issue to finance the purchase of up to 1000 Bitcoin, with a minimum of SEK 85 million secured through pre-commitments pic.twitter.com/sG1LZjR6EI— K33 (@K33HQ) June 18, 2025

The share issue, priced at SEK 0.1036 per share, is fully backed by existing shareholders and new investors. Proceeds from the raise will be used exclusively to acquire BTC, supporting K33’s accumulation strategy revealed in May. By acquiring BTC, the company aims to strengthen its balance sheet, boost brokerage margins, launch new products, and attract more investors.

“This raise marks a major milestone towards our initial goal of acquiring 1000 BTC before scaling further,” commented the CEO of the Company Torbjørn Bull Jenssen. “We strongly believe that Bitcoin represents the future of global finance and are positioning K33 to benefit maximally from this. A strong balance sheet built on Bitcoin enables us to significantly improve our brokerage operation while maintaining full exposure to Bitcoin’s upside potential.”

As part of the strategy, K33 recently completed its first Bitcoin acquisition, purchasing 10 BTC for approximately SEK 10 million on June 3. This transaction is the initial deployment of capital from the SEK 60 million investment commitment announced earlier this year to support the company’s BTC treasury.

“We expect Bitcoin to be the best-performing asset in the coming years and will build our balance sheet in Bitcoin moving forward,” stated Jenssen. “This will give K33 direct exposure to the Bitcoin price and help unlock powerful synergies with our brokerage operation. Our ambition is to build a balance of at least 1000 BTC over time and then scale from there.”

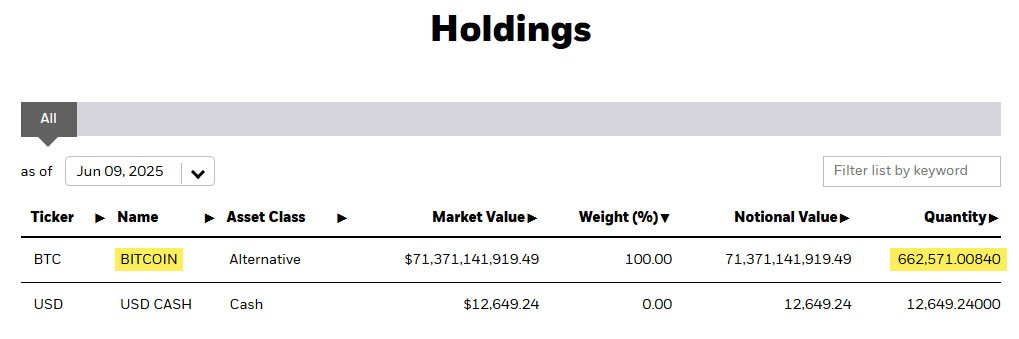

During its Q1 2025 Report and Strategic Outlook presentation, K33 underscored the accelerating institutional adoption of Bitcoin, referencing the rapid growth of the US Bitcoin ETFs, which attracted more capital in its first year than gold ETFs had in the past two decades.

“For K33, Bitcoin is not only a high-conviction asset — it’s also a strategic enabler,” Jenssen said. “With a sizable BTC reserve, we will be able to strengthen our financial position while unlocking new revenue streams, product capabilities, and partnerships.”

This post K33 Announces Plans To Purchase Up To 1,000 Bitcoin first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-19 04:01:08

@ cae03c48:2a7d6671

2025-06-19 04:01:08Bitcoin Magazine

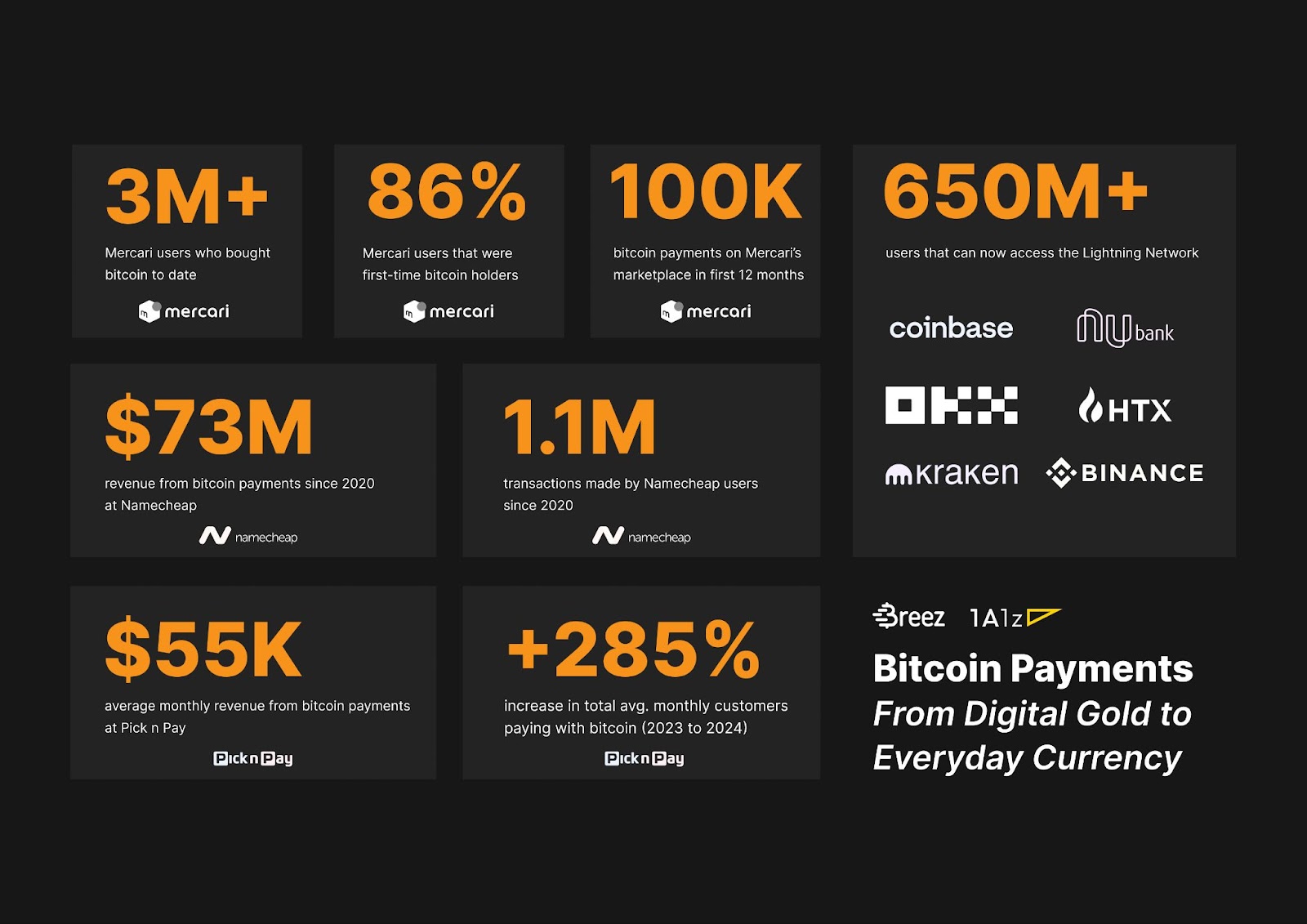

Bitcoin Tech Booms: Lightning Data Defies Digital Gold NarrativeEgo Death Capital’s portfolio reveals adoption metrics including $1.5 billion in Lightning-powered trading volume, as Block shocks the industry with their 9.7% Lightning Network yield.

While bitcoin treasury companies, debates about market structure bills, and strategic bitcoin reserve advocacy dominate the headlines in 2025, a trend is quietly growing in the background: the success of Bitcoin technology companies.

Increasingly recognized as digital gold and a long-term store of value, bitcoin is far more than just a shiny rock in cyberspace. As a software technology, Bitcoin is programmable and has unlocked a new paradigm of payments, custody, settlement and trading possibilities.

Nevertheless, some critics point to the empty blocks on the Bitcoin base layer and historically low transaction fees as implicit proof that Bitcoin is failing as a medium of exchange. Others claim that the Lightning Network has failed to get mainstream adoption and even argue that it suffers from significant privacy problems. But the opposite may be true.

New data coming out of various companies throughout the industry is starting to paint a different picture. Perhaps the Lightning Network has been so successful in drawing transactions off chain and making them more private that it is hard to quantify success metrics without companies involved sharing the data.

But, a variety of Bitcoin start-ups and companies using bitcoin to build out new financial infrastructure are now starting to boast of their success metrics, claiming numbers that suggest there is a strong product market fit beyond treasury strategies.

Jeff Booth, author of The Price Of Tomorrow and co-founder of the Bitcoin-focused VC firm Ego Death Capital, told Bitcoin Magazine he doesn’t “think the general public has any clue with how fast the Bitcoin ecosystem is growing.” Adding that, “They keep on hearing treasury companies this and politics that, and they’re missing the forest for the trees.”

Below follows a summary of various companies and projects demonstrating Bitcoin adoption in significant numbers, many of them within the Ego Death Capital portfolio.

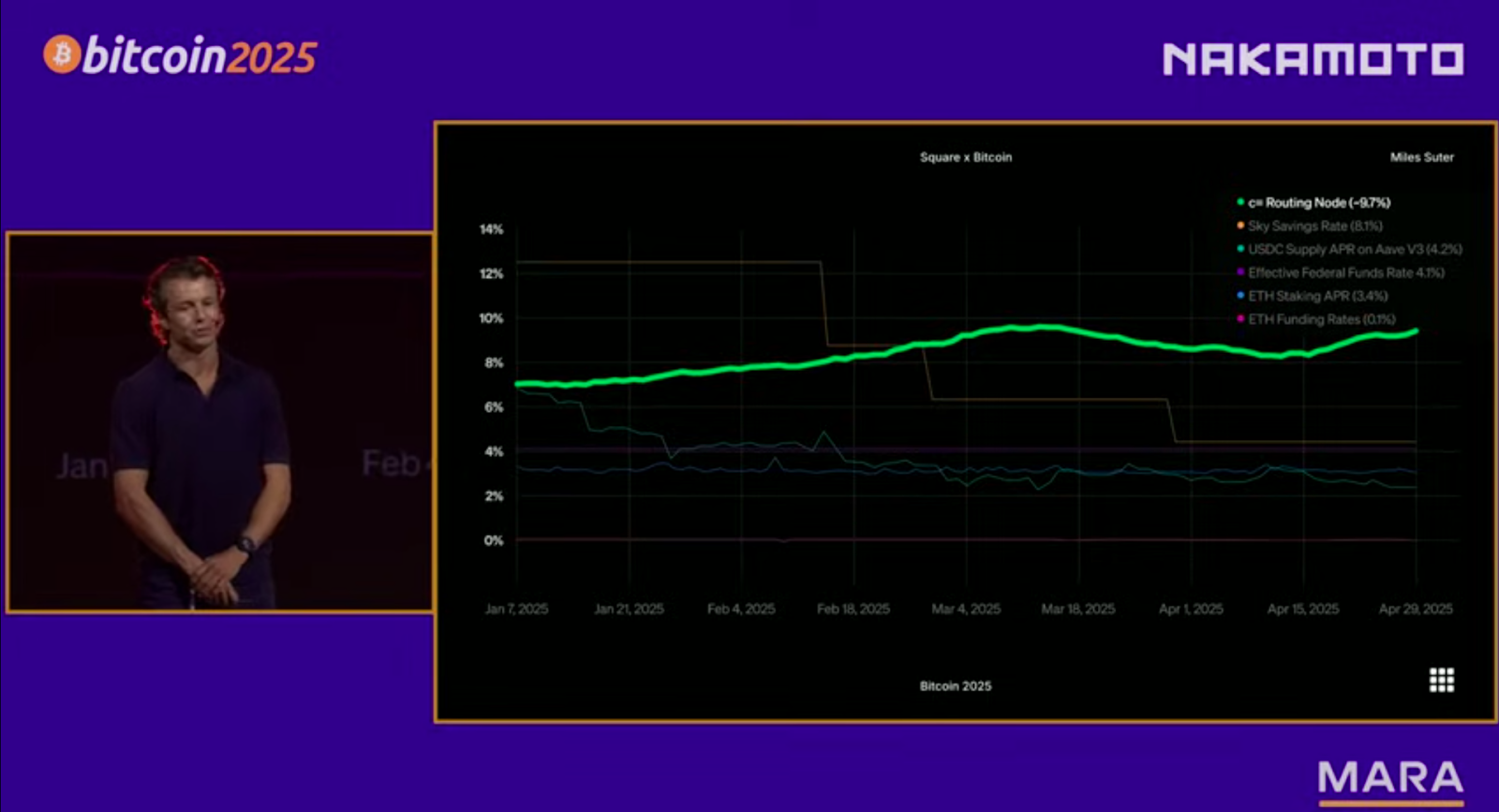

Block: Earning Big on Lightning and Bitcoin Payments

The contrast in perspectives between the digital gold thesis and those that believe in Bitcoin as a payments technology was most recently seen at Bitcoin Vegas 2025 where Block, the parent company of Cash App, disclosed that they are earning 9.7% yield off their Bitcoin Lightning node.

Miles Suter, Bitcoin Product Lead at Block, told the live audience that “at the infrastructure layer, we’re earning nearly 10% bitcoin-on-bitcoin returns by efficiently routing real payments across the Lightning network. This isn’t yield from altcoin staking or reckless speculation; it’s from solving hard, real-time routing problems, and its real bitcoin-on-bitcoin returns from our corporate holdings via supporting real payments use cases.”

Besides Block’s stunning 9.7% figure announcement, which stood out as one of the most lasting impressions from the conference, Suter claimed that Cash App ranks “among the top bitcoin on-ramps in the U.S., accounting for nearly 10% of on-chain block space at any time,” adding that in 2024, its Lightning usage grew 7x and one in four of their outbound Bitcoin payments are processed on Lightning. These numbers highlight Block’s growth as a Bitcoin payments giant, now perhaps the most common merchant payments terminal and consumer payments app that integrates bitcoin.

Ego Death Capital

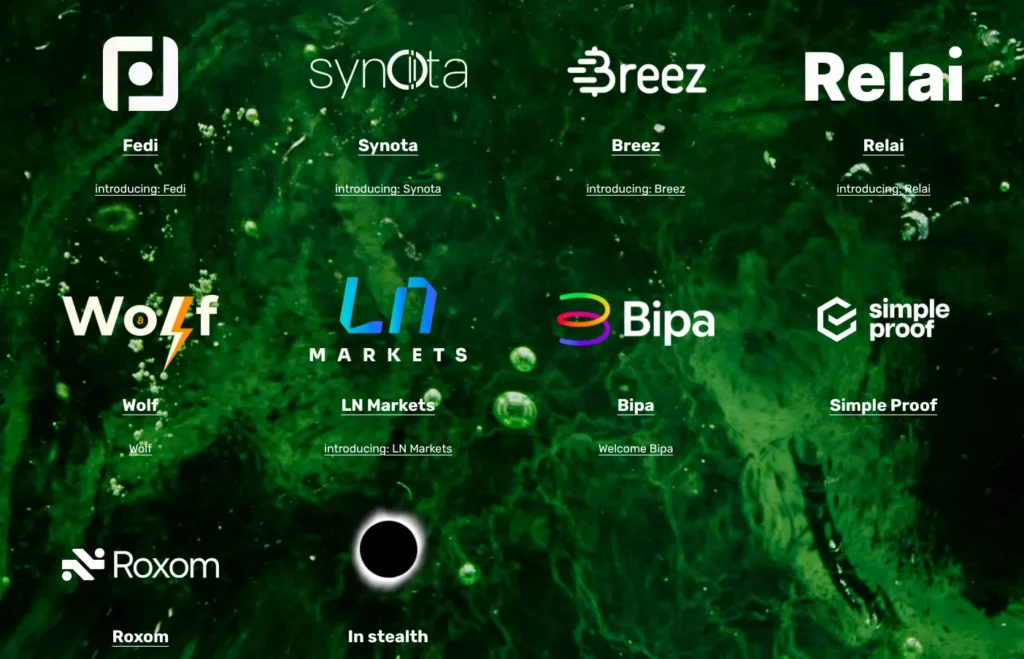

Ego Death Capital has been investing in Bitcoin infrastructure start-ups since 2022, initially raising a tactical 30 million dollar fund amid a boom in crypto and altcoin VC investments.

“When we first raised money, we actually targeted 30 million because the ecosystem at that time was really early. We realized we had to lean into these companies to help them scale. There were a lot of big crypto funds at that time, but they were spraying money everywhere else. And it was largely the exact opposite of what we believed would happen on Bitcoin.” Booth recalled that “Bitcoin was a protocol. It was developing in layers and it was early. And if you realized that and leaned in to help those companies that were developing in the layers, helping the infrastructure be created, then you would accelerate that. You would accelerate what we saw Bitcoin being, a currency, a store of value, an entirely new network.”

“We don’t have a failure in that fund,” Booth said of the firm’s first investment cohort, which included companies like Breez, Relai, LN Markets, Fedi, Wolf and Simple Proof. “That fund is just over three years old. It’s staggering. A number of those companies, I think three of those companies are already profitable — and profitable in bitcoin terms. So adding bitcoin to their treasury each month and growing incredibly fast.”

Breez: Powering a Global Lightning Payments Network

Breez, founded in 2018, is a self-custodial Lightning-as-a-service provider that enables developers to integrate Bitcoin payments into apps using its open source Breez SDK. By simplifying Lightning’s complexities, Breez has been driving widespread adoption across diverse industries.

“Over 40 apps have already implemented our SDK in production or beta since we launched it less than 18 months ago. Collectively, ~1.5 million users now have access to self-custodial, peer-to-peer bitcoin payments through these apps. These apps processed over $4.5 million in gross transaction volume in 2024,” wrote Roy Sheinfeld, CEO of Breez, in a January 2025 blog post.

The “Bitcoin Payments Report” by Breez and 1A1z, released February 2025, added, “The Lightning Network now reaches over 650 million users; driven by integrations with mainstream products, new developer tools, and growing merchant adoption.” A month later Sheinfeld published that “Lightning Pay’s user base has been growing with users moving a billion sats monthly.” Additionally, Breez’s integration with Klever Wallet brought Lightning to “100,000 monthly active users,” as stated in a December, 2024, blog post.

LN Markets: Lightning-Fueled Trading Takes Off

LN Markets, launched in 2020, is a Bitcoin-native derivatives trading platform, leveraging the Lightning Network for instant settlements and minimized counterparty risk.

Its Lightning-native login interface demonstrates they are on the cutting edge of Bitcoin technologies and unlocks user experience features that differentiate it from most other advanced trading platforms. The fast payment rails that result from this deep integration with the Lightning Network unlock faster settlement, lower withdrawal fees and provides access to smaller traders throughout the third world, with many users in South America in countries like Mexico, Brazil and Colombia.

“Basically we’ve gone from 50 million in monthly trading volume to 1.5 billion last month in May,” co-founder Romain Rouphael told Bitcoin Magazine, adding that they have gone from “one billion dollar yearly trading volume in 2023 to six billion last year to 12 billion this year.” Profitability is also strong, with Romain stating, “We double our revenue each year and we double our EBITDA as well every year,” and “We are doing millions of Lightning transactions every year” These figures highlight LN Markets’ strong and active user base as well as Lightning’s scalability.

The exchange focuses on

-

@ cae03c48:2a7d6671

2025-06-19 04:01:07

@ cae03c48:2a7d6671

2025-06-19 04:01:07Bitcoin Magazine

Bitdeer Raises $330M to Expand Bitcoin Mining and AI OperationsSingapore-based Bitcoin mining firm Bitdeer Technologies Group has launched a $330 million convertible notes offering, aiming to strengthen its mining operations, develop ASIC rigs, and scale its AI infrastructure.

The notes, due in 2031, carry an annual interest rate of 4.875% and may be converted into Bitdeer Class A shares at a 25% premium to the current stock price of $11.84, placing the conversion price at approximately $15.88 per share.

The offering is targeted at qualified institutional buyers under Rule 144A of the Securities Act. If investors exercise an option to buy more within 13 days, the offering could reach $375 million.

This is Bitdeer’s third convertible notes raise. Previously, the company secured $150 million in August and $360 million in November last year. According to Bitdeer, the offering is expected to close on June 23, 2025.

Net proceeds are expected to total roughly $319.6 million. Around $129.6 million will go toward a zero-strike call option, with $36.1 million allocated for concurrent note exchanges. The remaining funds will support datacenter expansion, new ASIC rig development, and general corporate needs.

Bitdeer is also conducting a note exchange, offering cash and equity to holders of its 8.50% convertible notes due 2029. That transaction includes approximately $36.1 million in cash and 8.1 million shares, exchanged for $75.7 million in outstanding notes.

This announcement follows Bitdeer’s recent growth. As previously reported, the company mined 196 BTC in May (worth over $21 million) and expanded its self mining hashrate to 13.6 EH/s. New SEALMINER rigs were deployed across sites in Texas, Norway, and Bhutan, and its AI cloud platform, powered by large language models, officially launched.

“In May 2025, we continued to deploy our SEALMINER mining rigs to our sites in Texas, U.S., Norway, and Bhutan, bringing Bitdeer’s self-mining hashrate to 13.6 EH/s,” said Matt Kong, Chief Business Officer at Bitdeer.

Bitdeer also raised capital from Tether in 2024 and secured $40 million from a debt facility with Matrix Finance in May. Both Bitdeer and Matrix are led by Jihan Wu, co-founder of Bitmain.

With its market cap now exceeding $2.3 billion, Bitdeer continues to invest in scaling its infrastructure and technology as competition in Bitcoin mining and AI computing intensifies.

This post Bitdeer Raises $330M to Expand Bitcoin Mining and AI Operations first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-19 04:01:06

@ cae03c48:2a7d6671

2025-06-19 04:01:06Bitcoin Magazine

The Trolls Are Coming: Defending Bitcoin Mining from Patent TrollsIntroduction: Patent Trolls Targeting Bitcoin Mining

Bitcoin’s use of elliptic curve cryptography (ECC), which is essential for generating key pairs and validating digital signatures, has drawn the attention of a nonpracticing entity (NPE), more commonly known as a patent troll. In May 2025, Malikie Innovations Ltd., a troll that acquired thousands of patents from BlackBerry’s portfolio, filed lawsuits against major mining firms Core Scientific (CORZ) and Marathon Digital Holdings (MARA). (Some considered MARA an original patent troll itself and thus have expressed schadenfreude at the current attacks.) Malikie claims that routine Bitcoin operations (like verifying transactions with ECC-based signatures) infringe on several ECC-related patents originally developed by Certicom (later owned by BlackBerry). The patents cover techniques for accelerated digital signature verification, finite field math optimizations and other ECC improvements.

Malikie’s lawsuits, in Texas’ Eastern District against CORZ and Western District against MARA, demand damages for past infringement and an injunction against further use of the patented methods. In essence, Malikie seeks to impose a licensing regime on Bitcoin’s core cryptographic functions, a move that could set a dangerous precedent for the entire industry. If Malikie succeeds, virtually anyone running Bitcoin software (miners, node operators and potentially even wallet providers) could be exposed to patent liability. This threat has galvanized the Bitcoin and open source communities to explore every available defensive tool. In this preparatory briefing, we examine:

- Historical legal strategies used to fend off troll lawsuits.

- The mechanics, costs and effectiveness of Inter Partes Review (IPR) in challenging software/crypto patents.

- Community-led responses (EFF, Linux Foundation, COPA, etc.) that help defendants by funding prior-art searches or legal defenses.

- The potential ramifications for Bitcoin mining if Malikie’s claims prevail, drawing parallels from other industries.

1. Historical Strategies Against NPE Patent Lawsuits

Over the past two decades, tech companies and industries have developed several tactics to combat patent trolls. Key strategies include challenging patent validity, shifting lawsuits to favorable venues via declaratory judgment actions, leveraging recent case law to dismiss abstract patents and simply refusing to settle in order to deter trolls.

While not all strategies will apply to these cases, for completeness I’ll outline these approaches:

Rigorous Invalidity Challenges (Prior Art – §102/103): The most direct way to neutralize a troll’s patent is to demonstrate that the patent should never have been granted in the first place because earlier technology already taught the same invention. Defendants search for prior art — such as earlier publications, academic papers, standards (RFCs) or open source code — that predate the patent’s priority date and disclose the claimed invention. If a single prior art reference embodies every element of a patent claim, the claim is “anticipated” (invalid for lack of novelty under 35 U.S.C. §102). If no one reference is complete but a combination of references would have been obvious to a skilled person, the claim is invalid for obviousness (§103). In the Malikie cases, for example, Bitcoiners have been called to urgently collect publications from before January 18, 2005 (the priority date of one asserted patent, U.S. 8,788,827), and before December 31, 2001 (for U.S. 7,372,960). to prove the patented ECC techniques were already known. The Bitcoin community has noted that Hal Finney and others actively tracked ECC patents and even delayed certain optimizations in Bitcoin until patents expired — for instance, the famed “GLV endomorphism” speedup was only added to Bitcoin Core after its patent lapsed (and caution on the GLV issue was taken by developers, which Malikie itself acknowledged in its complaint — paragraphs 20 and 21 of the MARA complaint, for instance). Unearthing such prior art may not only win the case at hand but invalidate the patent for everyone.

-

Inter Partes Review (IPR) and Post-Grant Proceedings: Beyond raising invalidity in court, since 2012 defendants have relied on IPR at the Patent Trial and Appeal Board (PTAB) as a powerful forum to knock out bad patents. IPR is an administrative trial within the U.S. Patent Office where challengers can present prior patents or publications to show a granted patent is invalid. We detail IPR’s mechanics in Section 2, but historically it has been a favored tool against NPEs because of its high success rate (around 70%+ of patents see claims canceled when reviewed) and lower burden of proof (“preponderance of the evidence,” 51%, rather than the “clear and convincing,” 75%, standard in court). Companies sued by trolls often file IPR petitions early and then move to stay (or pause) the litigation pending the PTAB’s decision — a stay which many courts grant once an IPR is instituted, given the likelihood that the patent may be invalidated. Notably, in the landmark Personal Audio “podcasting patent” case, the Electronic Frontier Foundation (EFF) filed an IPR that successfully invalidated a troll’s patent on podcast distribution, even as the troll was suing podcasters in East Texas. That IPR, funded by over a thousand small donations from the community, culminated in the Patent Office canceling all claims of the patent in 2015, a result later affirmed on appeal. This victory protected not just the sued targets (like comedian Adam Carolla) but all podcasters going forward. Similarly, the best path for the Bitcoin ecosystem may be to file IPR (or the related Post-Grant Review) against Malikie’s ECC patents, leveraging the mountain of cryptography literature from the 1990s and early 2000s to demonstrate that Bitcoin’s use of ECC was not novel to Malikie’s assignors.

-

Declaratory Judgment (DJ) Actions: Another defensive tactic is to preempt the troll by filing a declaratory judgment lawsuit in a preferred court, seeking a ruling that your product does not infringe or that the patent is invalid. Under U.S. law, a company that feels threatened by a patent (e.g., it received a demand letter or sees peers being sued) can sometimes sue first if it can show a substantial controversy. The goal is to avoid being haled into the NPE’s chosen venue (historically, the Eastern District of Texas was favored by trolls) and instead litigate in a more neutral or defendant-friendly forum. For instance, when notorious troll Lodsys threatened dozens of small app developers over in-app purchase patents, one strategy (supported indirectly by Apple and Google) was to seek declaratory rulings outside of East Texas to undermine the troll’s jurisdiction. In practice, DJ actions can prompt a faster resolution or even settlement on better terms. However, the patent owner must have made a concrete infringement assertion to establish the requisite “case or controversy.” In Malikie’s situation, if other Bitcoin companies (exchanges, wallet providers, smaller miners) suspect they are next in line, those companies could file a declaratory suit in a jurisdiction of their choice. This would flip the script, making Malikie the defendant and potentially consolidating the fight in a forum less favorable to NPEs.

-

Motions to Dismiss Under Alice (35 U.S.C. §101): Since the 2014 Alice Corp. v. CLS Bank decision, many software patents have been invalidated early in litigation for claiming unpatentable abstract ideas. Courts now examine whether a patent is directed to a fundamental abstract idea (like a mathematical formula) without an “inventive concept.” Defendants often file Rule 12(b)(6) motions to dismiss, arguing the patent is invalid on its face under §101. While cryptographic algorithms can be viewed as mathematical computations (a classic abstract idea), success with an Alice motion depends on how the patent claims are drafted. If the claims merely cover a generalized math formula or the concept of using ECC on a computer, a judge could void them as abstract. Indeed, some defendants have beaten trolls this way, sparing the cost of trial. In Malikie’s case, their patents seem to cover specific techniques to speed up ECC computations (like endomorphisms, modular reduction optimizations, etc.) — arguably “technical improvements” in cryptography rather than a naked abstract idea. That may make an Alice challenge less straigh

-

@ cae03c48:2a7d6671

2025-06-19 04:01:05

@ cae03c48:2a7d6671

2025-06-19 04:01:05Bitcoin Magazine

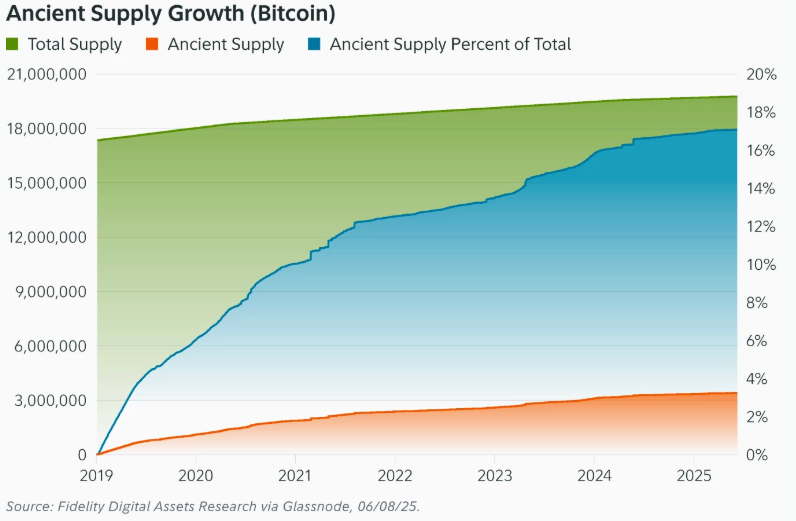

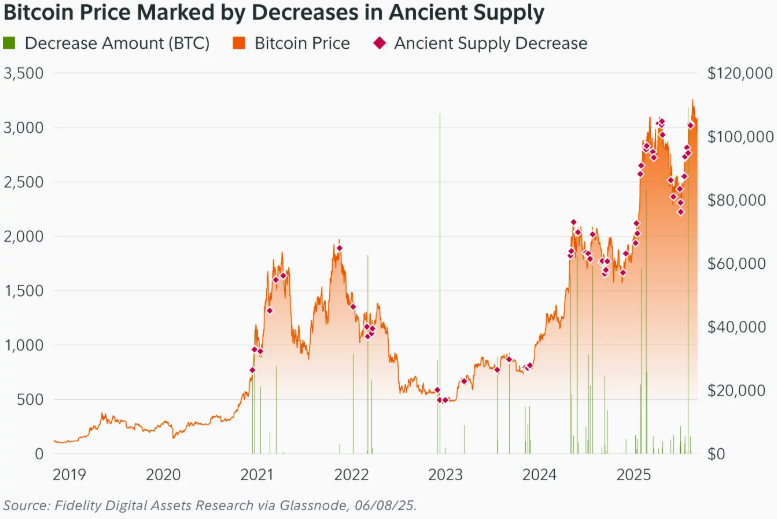

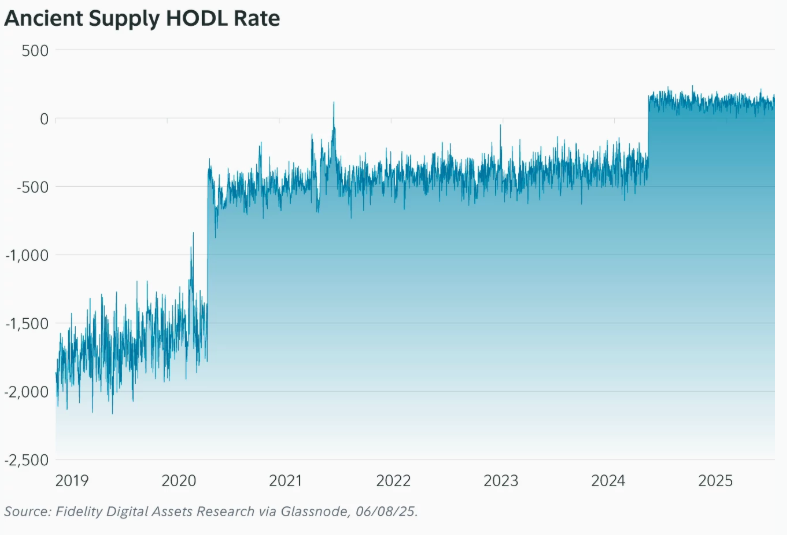

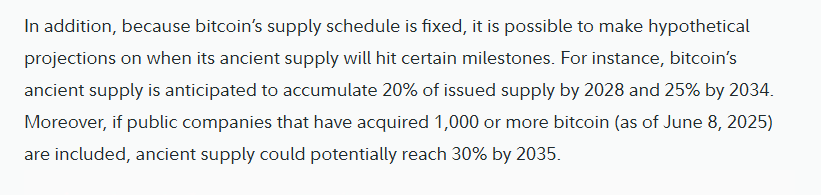

‘Ancient’ Bitcoin Supply Now Outpacing Newly Mined BTC: Fidelity ReportFidelity Digital Assets released a new report that reveals that for the first time in history, more bitcoin is entering “ancient supply,” which refers to coins that have remained unmoved for 10 years or more, than are being mined.

As of June 8, 17% of all bitcoin falls into the category of “ancient supply”—meaning these coins have not moved in a decade or more. What could this mean for scarcity, market dynamics, and investors’ conviction? Find our team’s thoughts: https://t.co/EALzrfS92c pic.twitter.com/Ckm3MylTLY

— Fidelity Digital Assets (@DigitalAssets) June 18, 2025

As of June 8, an average of 566 BTC per day is crossing the 10 year threshold, while only 450 BTC is being issued daily following the 2024 halving. 3

“The share of ancient supply also tends to increase each day, with daily decreases observed less than 3% of the time,” the report says. “In contrast, that number increases to 13% when the threshold is lowered to bitcoin holders of five years or more.”

Bitcoin’s ancient supply has grown since January 1, 2019, when Satoshi Nakamoto became the first 10 year holder. Today, over 3.4 million BTC fall into this category, worth more than $360 billion. Around 1/3 is believed to belong to Nakamoto.

Despite their rising value, long-term holders are not cashing out. Ancient supply makes up over 17 percent of all bitcoin, and that share continues to grow.

Since the 2024 halving, the number of coins entering ancient supply has consistently outpaced the number of new coins being mined, according to the report. This shift highlights growing long-term conviction among holders and reflects a broader tightening of bitcoin’s liquid supply.

Following the 2024 U.S. election, ancient supply declined on 10% of days, which is nearly four times higher than the historical average. Movement among the holders was even more pronounced, with daily declines occurring 39% of the time.

To better track this trend, Fidelity uses a metric called the ancient supply HODL rate. It measures how many coins are entering the 10 year category each day, adjusted for new issuance. This rate turned positive in April 2024 and has remained that way, reinforcing the long-term supply shift.

Looking ahead, Fidelity Digital Assets projections that ancient supply could reach 20 percent of total bitcoin by 2028 and 25 percent by 2034. If public companies holding at least 1,000 BTC are included, it could reach 30 percent by 2035.

As of June 8, 27 public companies hold more than 800,000 BTC combined, according to the report. This growing institutional presence may further tighten supply and increase the influence of long-term holders over time.

This post ‘Ancient’ Bitcoin Supply Now Outpacing Newly Mined BTC: Fidelity Report first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 472f440f:5669301e

2025-06-19 03:35:39

@ 472f440f:5669301e

2025-06-19 03:35:39Marty's Bent

via me

Here's a thought that's been rattling around in my head this week and especially today after the FOMC meeting, during which Jerome Powell announced that the Federal Reserve will hold the Fed Funds rate where it is. Much to the chagrin of President Trump, who has been begging Jerome Powell to lower rates since before he even got into office.

A lot of my thoughts around this particular subject are anchored in conversations I've had with our good friend Parker Lewis on the podcast over the last year. When I ask him about when the Fed will lower rates and potentially revert to quantitative easing, he always responds, "When a liquidity crisis emerges." The Fed is always late to respond and it won't lower rates and turn the money printer on until something breaks in the plumbing of the financial system.

As it stands today, and to my shock, no structural liquidity crisis has materialized in the plumbing and the financial system. We've covered many topics over the course of the last six months. Everything from the yen carry trade blowing out to the treasury carry trade blowing out to the micro-financing of DoorDash deliveries to the increase in delinquency rates for credit card and car loans to the dislocation that currently exists between sellers, buyers, and prices in the real estate market. In aggregate, all these disparate indicators signal to me that there certainly are different sectors of the global economy that are experiencing stress. But if we're being honest with ourselves and looking at the empirical data, there have only been tremors of a liquidity crisis, particularly around the yen and treasury carry trades. Which bubbled up, but then quickly went away.

Inflation is still coming in above the Fed's arbitrary target. The unemployment rate is within range of the Fed's arbitrary target. And the stock market is not too far from all-time highs. Granted, we all know too well that the government reported inflation numbers are severely under-reported and do not reflect actual inflation. The same can be said with the unemployment rate which is typically under-reported because economists refuse to acknowledge the participation rate, which is still below pre-COVID levels. When you factor in this data manipulation, the case for keeping rates higher for longer only gets stronger. Especially when you factor in Trump's immigration policy focused on mass deportation, which should be beneficial for American jobs, increase real wages, increase demand for goods and services in the economy and put upward pressure on prices.

Many who are calling for lower rates will feign worry about economic growth and investment, but it's not too hard to read through the lines and see that many of those cheerleaders just want to return to the asset price acceleration that we experienced at the end of 2020, 2021, and the first half of 2022. Worries of inflation and mass misallocation of capital be damned. Start blowing the bubble again.

There were many responses to the tweet I sent out above saying that we need to lower rates as soon as possible due to the amount of federal debt via the treasury market that is being rolled over in the coming years. I can certainly see that argument, but also believe that these people have extremely short memories considering the fact that treasury yields went up significantly last September after the Fed began to lower rates from the 5.5% target that was set previously. Another set of responses to this tweet pointed to the real estate market claiming that American citizens cannot buy houses due to elevated mortgage rates, which is only half true. The other part of the real estate market equation is the prices of the actual homes, which are also elevated. And as I mentioned earlier, there is currently a wide chasm between the number of sellers and number of buyers in the market at the moment, favoring buyers who have a ton of supply to choose from.

Prices are beginning to come down in major markets across the country, which should make conditions more favorable for those looking to buy, even with elevated mortgage rates. It's also important to understand that mortgage rates are derived in part from Treasury yields, which, as we explained earlier, are not guaranteed to fall with a cut of the Fed Funds rate. I am under the impression that to guarantee a lowering of treasury yields alongside a cut of the Fed Funds rate any cuts would have to be paired with QE to bolster demand and artificially increase the price of treasury bonds (which lowers the yield), and QE can't really be justified without a systemic liquidity crisis.

So for those out there shaking their fists at the sky and damning Jerome Powell and the Federal Reserve Board for not lowering the Fed funds rate, I think you're showing your true bias, which is you want to see financial assets artificially skyrocket and for inflation to increase at a faster clip. Saifedean Ammous made a very good point at the end of The Bitcoin Standard, which was that if the only thing Bitcoin succeeded in doing was to force central banks to practice better, more conservative monetary policy than it will have succeeded.

Now, to be clear, I'm not saying that Bitcoin is guiding the decisions of the Federal Reserve, but I think keeping rates higher for longer, increasing the cost of capital so that allocators are forced to weigh the opportunity costs of where they're investing and demanding that entrepreneurs produce truly innovative, productive, and profitable businesses is a good thing in the long run. The vociferous nagging for lower rates is a product of the ZIRP derp that people became accustomed and addicted to post-2008. It's important to recognize that this period of monetary policy is an anomaly and will be remembered as a grave injustice.

I'm not saying ZIRP derp won't return. I still believe it's inevitable at some point in the future. I'm just saying that it seems a bit odd to me to be cheering it on and wishing it would come ASAP. ZIRP derp is a signal that things are terribly broken. Being able to hold rates higher for longer is a signal that people are being forced to make more calculated decisions and they're doing that successfully. Either that or stealth QE in the form of reverse repo markets and amended reserve requirements for banks are delaying the liquidity crisis despite higher rates.

Why the U.S. Won't Go Bankrupt Despite Record Debt Levels

Mel Mattison presented a compelling case that U.S. bankruptcy fears are overblown, emphasizing that America "has a printing press" and can create dollars at will. He argued that the Fed's balance sheet has significant room to expand, currently holding only 13% of Treasury debt—the same percentage it's maintained since the 1940s. Most importantly, Mattison highlighted that deflationary forces from AI productivity gains and demographic shifts (baby boomers leaving the workforce) will allow continued deficit spending without triggering runaway inflation.

"The U.S. cannot go bankrupt. I mean, like we have a printing press." - Mel Mattison

Mattison's analysis shows that interest expense stabilizing around 3% of GDP mirrors the prosperous 1985-1996 period when stocks rose 350%. He views government spending not as reckless, but as necessary stimulus to prevent deflationary collapse in an aging economy. While this perspective challenges conventional fiscal hawks, the historical precedents and structural changes he cites suggest our debt concerns may be fighting yesterday's battles.

Check out the full podcast here for more on AI's impact on jobs, Bitcoin hitting $150k, and why higher interest rates won't crash markets.

Headlines of the Day

Davis Commodities Puts 40% of $30M Into Bitcoin - via X

Ukraine Bill Adds Bitcoin to National Reserves - via X

Vinanz Raises £3.58M to Expand Bitcoin Mining - via X

Get our new STACK SATS hat - via tftcmerch.io

Bitcoin’s Next Parabolic Move: Could Liquidity Lead the Way?

Is bitcoin’s next parabolic move starting? Global liquidity and business cycle indicators suggest it may be.

Read the latest report from Unchained and TechDev, analyzing how global M2 liquidity and the copper/gold ratio—two historically reliable macro indicators—are aligning once again to signal that a new bitcoin bull market may soon begin.

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Ground beef, guacamole and eggs over medium is an elite dinner.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 7f6db517:a4931eda

2025-06-19 03:02:01

@ 7f6db517:a4931eda

2025-06-19 03:02:01

Influencers would have you believe there is an ongoing binance bank run but bitcoin wallet data says otherwise.

- binance wallets are near all time highs

- bitfinex wallets are also trending up

- gemini and coinbase are being hit with massive withdrawals thoughYou should not trust custodians, they can rug you without warning. It is incredibly important you learn how to hold bitcoin yourself, but also consider not blindly trusting influencers with a ref link to shill you.

If you found this post helpful support my work with bitcoin.

-

@ 56a18512:78772baf

2025-06-19 02:19:49

@ 56a18512:78772baf

2025-06-19 02:19:49Lots of wars, soon Christ will come! Repent you sons of sinners!

-

@ dfa02707:41ca50e3

2025-06-19 02:02:03

@ dfa02707:41ca50e3

2025-06-19 02:02:03Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ eb0157af:77ab6c55

2025-06-19 02:01:42

@ eb0157af:77ab6c55

2025-06-19 02:01:42The world’s leading bitcoin mining rig manufacturers are moving to build facilities in the U.S. to sidestep tariffs imposed by President Trump.

According to Reuters, the three Chinese giants dominating global ASIC device production — Bitmain, Canaan, and MicroBT — have launched a strategic shift toward the United States, driven by steep tariffs enforced by the Trump administration.

The move is a direct response to American protectionist policies. Trump introduced 30% tariffs on Chinese tech products, heavily impacting a sector where China controls over 90% of global mining hardware production.

Bitmain led the way, starting device assembly on U.S. soil last December, just weeks after Trump’s election victory. Canaan quickly followed, launching a pilot production line in the U.S. to bypass the heavy import taxes.

Leo Wang, Canaan’s VP of Business Development, called the American project “exploratory,” highlighting the unpredictability of current trade policies. MicroBT, the world’s third-largest player, announced it was actively rolling out a U.S.-based “localization strategy.”

Guang Yang, Chief Technology Officer of Conflux Network, noted that “the U.S.-China trade war is triggering structural, not superficial, changes in Bitcoin’s supply chains.”

For American firms, this shift represents “a strategic pivot toward ‘politically acceptable’ hardware sources,” Yang added. The near-monopoly of the three Chinese mining giants — which, according to Frost & Sullivan, accounted for 95.4% of the global hashrate sold in 2023 — has raised national security concerns in the U.S.

Sanjay Gupta, Chief Strategy Officer at Auradine, pointed out the imbalance:

“While over 30% of global bitcoin mining occurs in North America, more than 90% of mining hardware originates from China representing a major imbalance of geographic demand and supply.”

The post Bitmain, Canaan, and MicroBT open U.S. factories to dodge Trump’s tariffs appeared first on Atlas21.

-

@ 20986fb8:cdac21b3

2025-06-19 01:58:32

@ 20986fb8:cdac21b3

2025-06-19 01:58:32Build your AI-powered MiniApp, unlock new possibilities in decentralized social and payment experiences

📅 Timeline & Prize Pool

- Kickoff: June 20, 2025

- Development Phase: June 20 – July 15

- Demo & Community Review: July 15 – July 31

- Final Results: Early August

💰 Total Prize Pool: 10,000,000 sats (paid in BTC), awarded across three rounds:

- 🥇 1st Prize: 1,000,000 sats 1

- 🥈 2nd Prize: 700,000 sats 1

- 🥉 3rd Prize: 500,000 sats 2

- 🎁 Participation Rewards – All successfully deployed MiniApps will receive rewards (details TBA)

🛠 Hackathon Tracks

- Nostr Tools: Nip-05 services, Relay tools, Short notes services, plugins and more.

- Payment Solutions – Innovations in Payments: BTC, Lightning, Stablecoins, and Local Currencies; Red packets, tipping, QR pay, content paywalls, merchant tools

- AI Interaction – AI bots, content recommenders, smart media MiniApps

- Other Innovative Use Cases – Any decentralized application idea is welcome

How to participate?

✅ Nostr Version: - Submit your application to YakiHonne Smart Widgets GitHub - Deploy your MiniApp via YakiHonne (new or adapted from an existing app) - Your MiniApp must be usable and testable in Nostr posts

🧑⚖️ Judging Criteria

- Technical implementation & innovation

- UX/UI design quality

- Level of decentralization

- Integration with Nostr / YakiHonne

- Community votes

- Expert panel evaluation

🎉 Why Join?

- Build the next generation of AI-powered decentralized MiniApps

- Deploy on the most open and composable network: Nostr + Lightning + AI

- Gain global exposure, community traffic, and funding

- Rapidly validate your ideas in the real world

- Pioneer the Agentic MiniApp development track

🚀 Why Join the Agentic Mini Apps Hack on Nostr?

The Nostr network is rapidly growing, opening up unprecedented opportunities for innovation in decentralized social and payment systems. At the same time, AI is revolutionizing how we interact—with intelligent agents, social assistants, and content recommendations.

Agentic MiniApps represent a new generation of applications designed for this future: ✅ Lightweight, open, and composable. ✅ Natively support AI, payments, and social interaction. ✅ Decentralized deployment—no downloads needed, users access them directly from Nostr posts.

Agentic Mini Apps Hack on Nostr – Round 1 is the first hackathon centered on this emerging format. It combines Nostr + Bitcoin/Lightning payments + AI to explore the next generation of decentralized apps, enriching Nostr with advanced social, payment, and intelligent interaction capabilities—powering the open ecosystem forward.

What is a Mini App?

A MiniApp as a Smart Widgets are interactive graphical components encapsulated as Nostr events, designed for seamless integration into applications. Each widget type serves a specific purpose, with well-defined structures and behaviors to support various use cases.

Refer to https://yakihonne.com/docs/sw/intro for full documentation.

Widget Types

Basic Widget (Does not concern the current Hackathon)

- Description: A versatile widget comprising multiple UI components for flexible display and interaction.

- Components:

- Images (mandatory, maximum of one).

- Input Field (optional, maximum of one).

- Buttons (optional, maximum of six).

- Use Case: Ideal for scenarios requiring a combination of visual elements and user inputs, such as forms or dashboards.

Action Widget

- Description: A streamlined widget designed to trigger an action by embedding a URL in an iframe.

- Components:

- Image (single, for visual representation).

- Button (single, type: app).

- Behavior:

- Clicking the button opens the specified URL within an iframe.

- The iframe does not return any data to the parent application.

- Use Case: Suitable for launching external applications or resources without expecting a response, such as opening a third-party tool.

Tool Widget

- Description: A widget that facilitates interaction with an external application via an iframe, with data exchange capabilities.

- Components:

- Image (single, for visual representation).

- Button (single, type: app).

- Behavior:

- Clicking the button opens the specified URL within an iframe.

- The iframe is configured to return data to the parent application upon interaction.

- Use Case: Perfect for scenarios requiring data retrieval or feedback from an external tool, such as a configuration interface or a data picker.

Technical Notes

- Nostr Event Structure: Each widget is represented as a Nostr event, ensuring compatibility with the Nostr protocol for decentralized communication.

- Iframe Integration: For Action and Tool widgets, the iframe must adhere to standard web security practices (e.g., sandboxing, CORS policies) to ensure safe URL embedding.

- Extensibility: Developers can customize widget appearance and behavior within the defined constraints (e.g., maximum button limits, single input field) to align with application requirements.

🔧 How to Deploy Your MiniApp?

Developers will build and deploy via the YakiHonne Programmable Smart Widgets Product: 1. Build your mini app using YakiHonne provided packages 1. Smart widget handler package: https://yakihonne.com/docs/sw/smart-widget-handler 2. Smart widget previewer package (required for clients): https://yakihonne.com/docs/sw/smart-widget-previewer 2. Deploy to a hosting service: 1. Vercel, Netflify, GitHub Pages, etc. 2. Ensure the

/.well-known/widget.jsonfile is accessible (Widget Manifest)JSON { "pubkey": "your-nostr-pubkey-in-hex", "widget": { "title": "My Amazing Widget", "appUrl": " https://your-app-url.com", "iconUrl": " https://your-app-url.com/icon.png", "imageUrl": " https://your-app-url.com/thumbnail.png", "buttonTitle": "Launch Widget", "tags": ["tool", "utility", "nostr"] } } // This manifest serves two important purposes: // 1. Verifies the authenticity of your mini app // 2. Provides metadata for Nostr clients to display your widget (miniapp)3. Register with YakiHonne Widget Editor 1. Go to the YakiHonne Widget Editor 2. SelectActionorToolbased on your mini app type 3. Enter your mini app URL 4. The editor will fetch your manifest and validate it 5. Configure any additional settings 6. Publish to NostrSide notes:

- Smart widget previewer is required by Nostr client to preview all types of smart widgets whether: Action/Tool or even the Basic ones (Please refer to Smart widget previewer for more details)

- Smart widget builder is only used to created embedde

Basicsmart widgets types, which out of scope for this hackathon (Please refer to Smart widget builder for more details) - Smart widget handler is necessary for the

MiniAppsdevelopers to build and deploy theirMini-Apps(Smart widgets from types: Action/Tool) (Please refer to Smart widget handler for more details)

Common Use Cases

Action Mini Apps

- Note composers with special formatting

- Media uploaders

- Event creators

- NFT minters

- Payment widgets

Tool Mini Apps

- Analytics providers

- Search tools

- Data aggregators

- Content recommendation engines

- Information lookup services

💡 YakiHonne Smart Widgets are programmable micro-app components enabling real-time social interaction, on-chain payments, and AI features—creating a seamless “scroll-and-use” experience.

🎯 Why Choose YakiHonne Smart Widgets?

⚡ Fast deployment, viral reach – Go live instantly, no app store approval, spread via Nostr posts 🤖 Deep AI + Payment + Social integration – Build immersive, smart and transactional MiniApps

🔐 One-click login – Use Nostr, a pubkey with no KYC hassle

📈 High visibility – Your MiniApp lives in nostr events, clients, posts, DMs, and community feeds

🌍 Open ecosystem – Supports Lightning / BTC / stablecoins, accessible across clientsReference Links

- Smart widgets full documentation: https://yakihonne.com/docs/sw/intro

- Smart widgets builder package a package for NodeJS to build Nostr Smart Widgets:

- https://yakihonne.com/docs/sw/smart-widget-builder

- https://www.npmjs.com/package/smart-widget-builder

- Smart widgets previewer a React component for previewing and interacting with Nostr-based Smart Widgets:

- https://yakihonne.com/docs/sw/smart-widget-previewer

- https://www.npmjs.com/package/smart-widget-previewer

- Smart widgets handler an sdk to communicate with embeded apps on nostr smart widgets:

- https://yakihonne.com/docs/sw/smart-widget-handler

- https://www.npmjs.com/package/smart-widget-handler

Quick Tutorials

Action/Tool smart widgets mini-apps Part 1

Action/Tool smart widgets mini-apps Part 1](https://www.youtube.com/watch?v=SS-5N-LVCPM)

Action/Tool smart widgets mini-apps Part 2

Action/Tool smart widgets mini-apps Part 2](https://www.youtube.com/watch?v=4NfMqjkRKnQ)

Action/Tool smart widgets mini-apps Part 3

Action/Tool smart widgets mini-apps Part 3](https://www.youtube.com/watch?v=VGCEEGfIo_I)

-

@ 52524fbb:ae4025dc

2025-06-19 01:50:14

@ 52524fbb:ae4025dc

2025-06-19 01:50:14GBP/JPY currency pair dubbed Beast or Widowmaker by traders is notoriously renowned for exceptional volatility with rather unpredictable price swings occurring rapidly. Potent combination of British Pound sensitivity to UK economic turmoil post-Brexit and Japanese Yen's safe-haven status fuels this characteristic globally. This potent mix further amplified by sizable interest rate differentials spawns a wildly volatile trading environment often fraught with unpredictability quickly. British Pound GBP remains inherently vulnerable mostly due to fluctuations triggered by sudden domestic political developments or sporadic releases of economic data. Post-Brexit UK economy grapples with gnarly structural issues and Pound sterling reacts violently to trade negotiation headlines and BoE monetary policy moves. Unexpected economic data releases or leadership changes in UK often trigger substantial moves in Pound rapidly amidst brewing political instability.

Japanese Yen JPY exhibits traditionally quirky safe-haven traits conversely under radically uncertain market conditions very quietly. Capital flows into Yen rapidly during global market turmoil or severe geopolitical crises triggering risk-off sentiment and making it surge in value. GBP might weaken due to UK-specific woes but some concurrent global risk-off event could catapult JPY higher against major currencies including Pound. Extreme volatility characterizing GBP/JPY stems largely from interaction between two forces that frequently amplify each other violently somehow. Envision a situation where lackluster UK economic data sends Pound tumbling lower and concurrently some major geopolitical kerfuffle sparks frantic flight into safe-haven Yen. Both factors would aggressively push GBP/JPY downwards pretty rapidly and sharply downwards still further. Strong UK data paired with a risk-on vibe worldwide can send GBPJPY soaring as JPY gets thoroughly pummeled. Movements in GBP/JPY are often starkly more pronounced than those seen in other major currency pairs under normal market conditions.

Significant interest rate differentials between UK and Japan add another layer of complexity and opportunity pretty substantially nowadays. Bank of England has generally maintained significantly higher interest rates than ultra dovish Bank of Japan over past few decades mostly. GBP/JPY appears particularly attractive for carry trade strategies where traders borrow cheap JPY and invest heavily in higher yielding GBP. Traders can reap rewards from daily interest accrual and potential capital gains if global risk appetite keeps carry trade momentum trending higher. Risk of a massive carry trade unwind in GBP/JPY remains substantial pretty much nowadays. Sudden global risk appetite downturn or BoJ policy shift surprisingly triggers rapid reversal as borrowed Yen gets bought back and higher-yielding Pound positions liquidate rapidly overseas. Such unwind can precipitate precipitous downward plunges befitting their notorious Widowmaker moniker eerily. GBP/JPY trading brutally tests resolve of even seasoned investors daily. Geopolitical events and significant yield differentials heavily amplify its volatility stemming from disparate fundamental drivers of constituent currencies. Its large swings offer potentially rewarding opportunities in Forex for experienced traders who are well-prepared and willing to take considerable risks.

-

@ 52524fbb:ae4025dc

2025-06-19 01:40:59

@ 52524fbb:ae4025dc

2025-06-19 01:40:59NZD/USD currency pair affectionately known as Kiwi exemplifies commodity-sensitive currency behavior heavily influenced by New Zealand's hefty agricultural export reliance overseas. New Zealand economy heavily reliant on dairy products meat and other ag goods means Kiwi dances wildly to global food prices and China's whims. New Zealand's economy relies heavily on primary sector industries with dairy farming being a rather significant contributor somehow overseas. Fonterra its dominant dairy cooperative plays a significant role globally in various markets as one of world's largest dairy exporters. GDT auctions setting prices for various dairy products are keenly watched by NZD/USD traders fairly closely nowadays apparently. Strong global demand particularly from China drives up GDT auction prices directly translating into heftier export earnings for New Zealand bolstering NZD.

Meat and wool exports significantly bolster New Zealand's commodity currency status alongside dairy products reinforcing its robust export receipts quite substantially overseas. NZD/USD frequently acts as barometer for global agricultural demand and remains highly sensitive pretty much to economic shifts in China somehow. China being a huge consumer of New Zealand's farm produce its economic vitality and demand for imports heavily influence NZD exchange rates. Robust economic indicators from China or hints of surging demand for food imports frequently give Kiwi currency a welcome boost. Reserve Bank of New Zealand operates with such dynamics squarely in its mind evidently nowadays. RBNZ keenly aware of commodity price fluctuations impact on domestic economy while its mandate focuses on price stability and high employment levels. RBNZ may raise interest rates somewhat vigorously amid surging export prices and an extremely booming agricultural sector beset by inflationary pressures. A sharp downturn in commodity prices might prompt RBNZ to pivot towards dovish policies and possibly slash rates, thereby stimulating economic growth rapidly. Traders scrutinize RBNZ monetary policy statements and economic forecasts quite closely for cryptic insights into reaction functions amidst volatile commodity cycles.